UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

--------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2024

Prologis, Inc.

Prologis, L.P.

(Exact name of registrant as specified in charter)

|

|

|

|

|

Maryland (Prologis, Inc.) |

|

001-13545 (Prologis, Inc.) |

|

94-3281941 (Prologis, Inc.) |

|

|

|

Pier 1, Bay 1, San Francisco, California |

|

94111 |

|

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrants’ Telephone Number, including Area Code: (415) 394-9000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Prologis, Inc. |

|

Common Stock, $0.01 par value |

|

PLD |

|

New York Stock Exchange |

Prologis, L.P. |

|

3.000% Notes due 2026 |

|

PLD/26 |

|

New York Stock Exchange |

Prologis, L.P. |

|

2.250% Notes due 2029 |

|

PLD/29 |

|

New York Stock Exchange |

Prologis, L.P. |

|

5.625% Notes due 2040 |

|

PLD/40 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition (Prologis, Inc.) and

Item 7.01. Regulation FD Disclosure (Prologis, Inc. and Prologis, L.P.).

On October 16, 2024, Prologis, Inc., the general partner of Prologis, L.P., issued a press release announcing third quarter 2024 financial results. A copy of the supplemental information as well as the press release is furnished with this report as Exhibit 99.1 and Exhibit 99.2, respectively, and incorporated herein by reference.

The information in this report and the exhibits attached hereto is being furnished, not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and pursuant to Items 2.02 and 7.01 of Form 8-K will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

99.1 Supplemental information, dated October 16, 2024.

99.2 Press release, dated October 16, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

PROLOGIS, INC. |

|

|

|

|

|

October 16, 2024 |

|

By: |

/s/ Timothy D. Arndt |

|

|

|

Name: Timothy D. Arndt |

|

|

|

Title: Chief Financial Officer |

|

|

PROLOGIS, L.P., |

|

October 16, 2024 |

|

By: Prologis, Inc., its general partner |

|

|

|

|

|

|

|

By: |

/s/ Timothy D. Arndt |

|

|

|

Name: Timothy D. Arndt |

|

|

|

Title: Chief Financial Officer |

Prologis Supplemental Information THIRD QUARTER 2024 Unaudited Hamburg Waltershof DC1, Hamburg, Germany

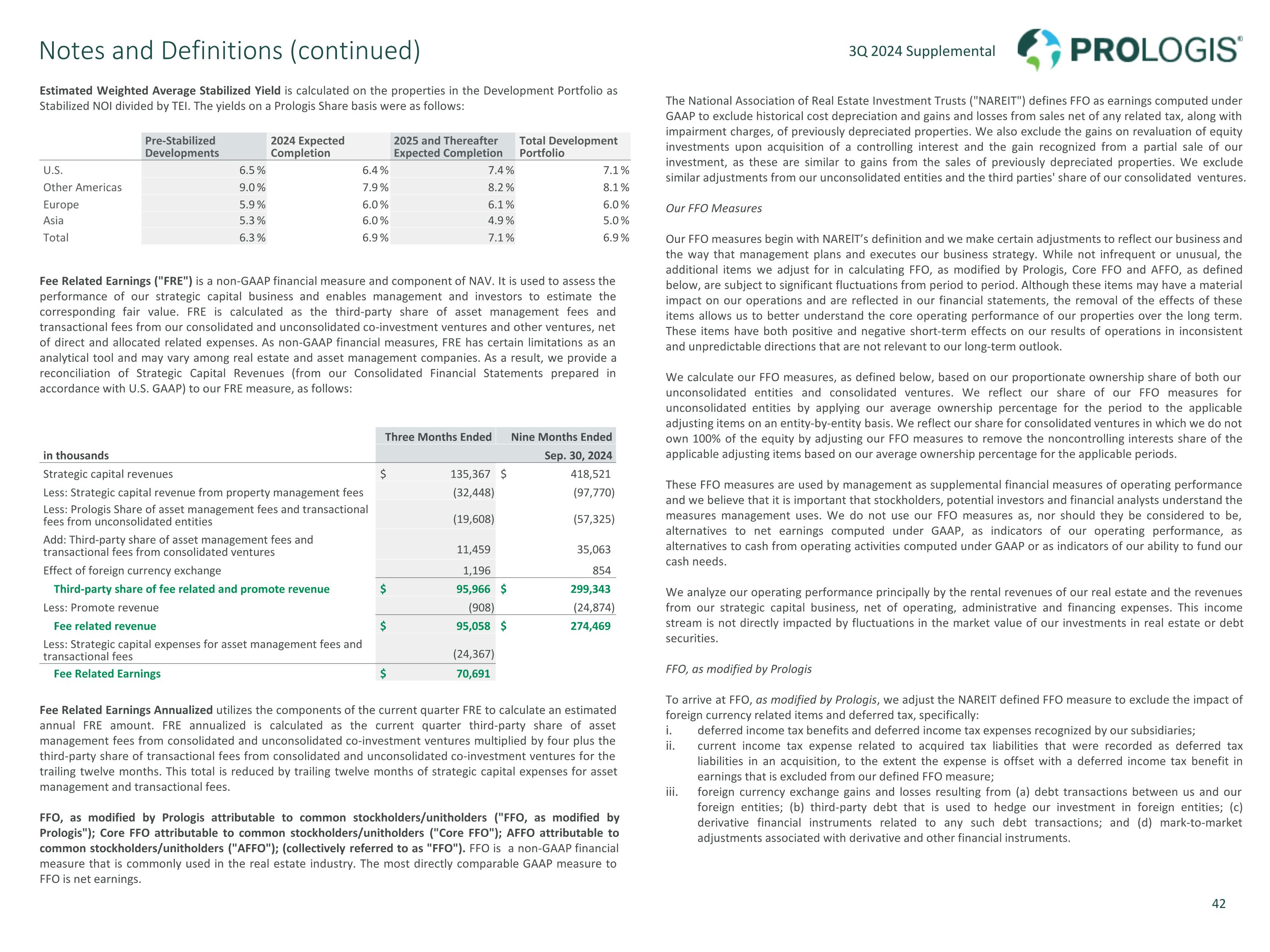

Contents Highlights 3 Company Profile 5 Company Performance 7 Prologis Leading Indicators and Proprietary Metrics 8 Guidance Financial Information 9 Consolidated Balance Sheets 10 Consolidated Statements of Income 11 Reconciliations of Net Earnings to FFO 12 Reconciliations of Net Earnings to Adjusted EBITDA Operations 13 Overview 14 Operating Metrics 16 Operating Portfolio 19 Customer Information Capital Deployment 20 Overview 21 Development Stabilizations 22 Development Starts 23 Development Portfolio 24 Third-Party Acquisitions 25 Dispositions and Contributions 26 Land Portfolio 28 Solar Operating and Development Portfolios Strategic Capital 29 Overview 30 Summary and Financial Highlights 31 Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures 32 Non-GAAP Pro-Rata Financial Information Capitalization 33 Overview 34 Debt Components - Consolidated 35 Debt Components - Noncontrolling Interests and Unconsolidated Net Asset Value 36 Components Notes and Definitions 38 Notes and Definitions

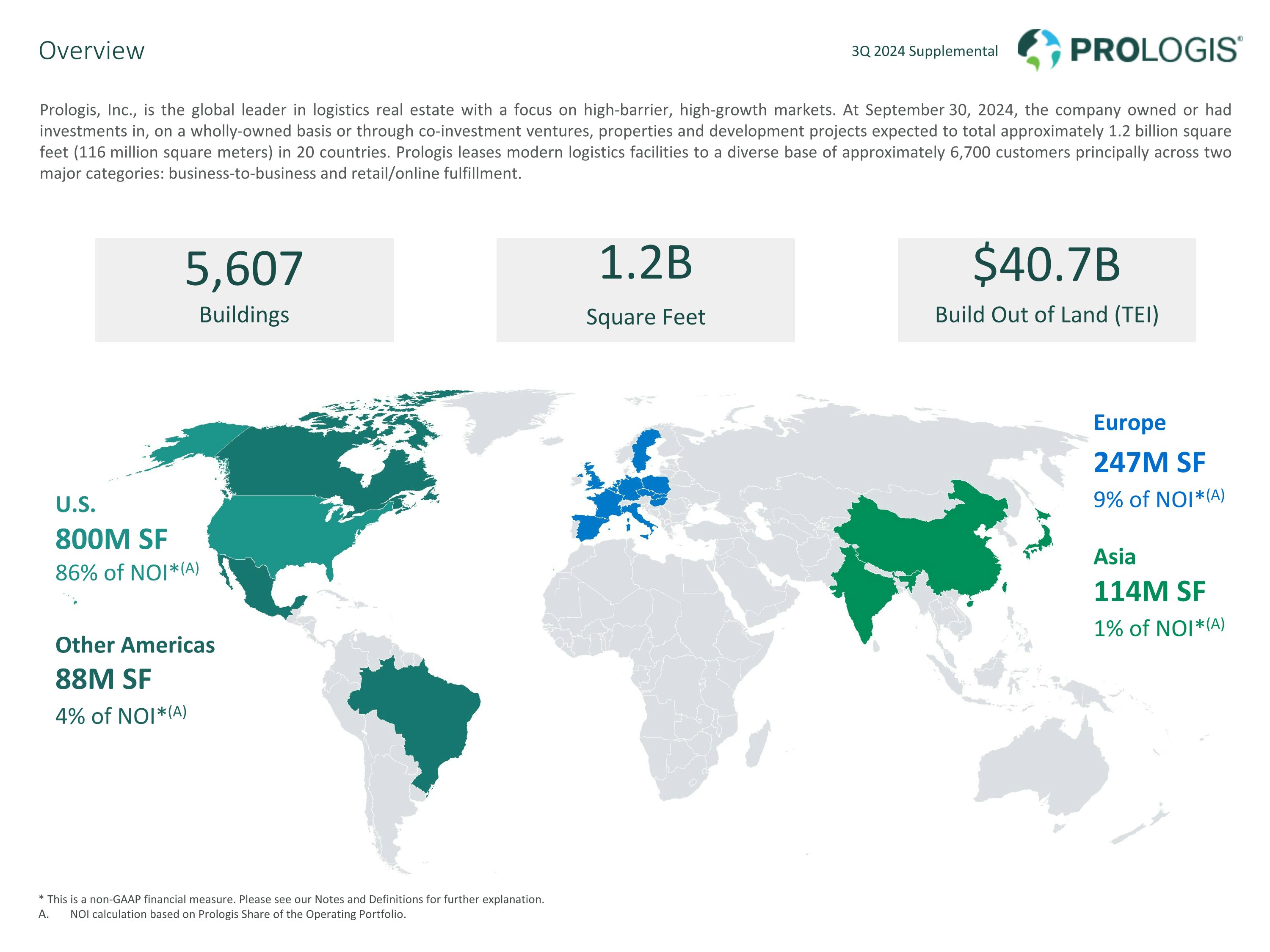

$40.7B Build Out of Land (TEI) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. NOI calculation based on Prologis Share of the Operating Portfolio. Overview Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At September 30, 2024, the company owned or had investments in, on a wholly-owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (116 million square meters) in 20 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,700 customers principally across two major categories: business-to-business and retail/online fulfillment. 5,607 Buildings 1.2B Square Feet Europe 247M SF 9% of NOI*(A) Asia 114M SF 1% of NOI*(A) U.S. 800M SF 86% of NOI*(A) Other Americas 88M SF 4% of NOI*(A)

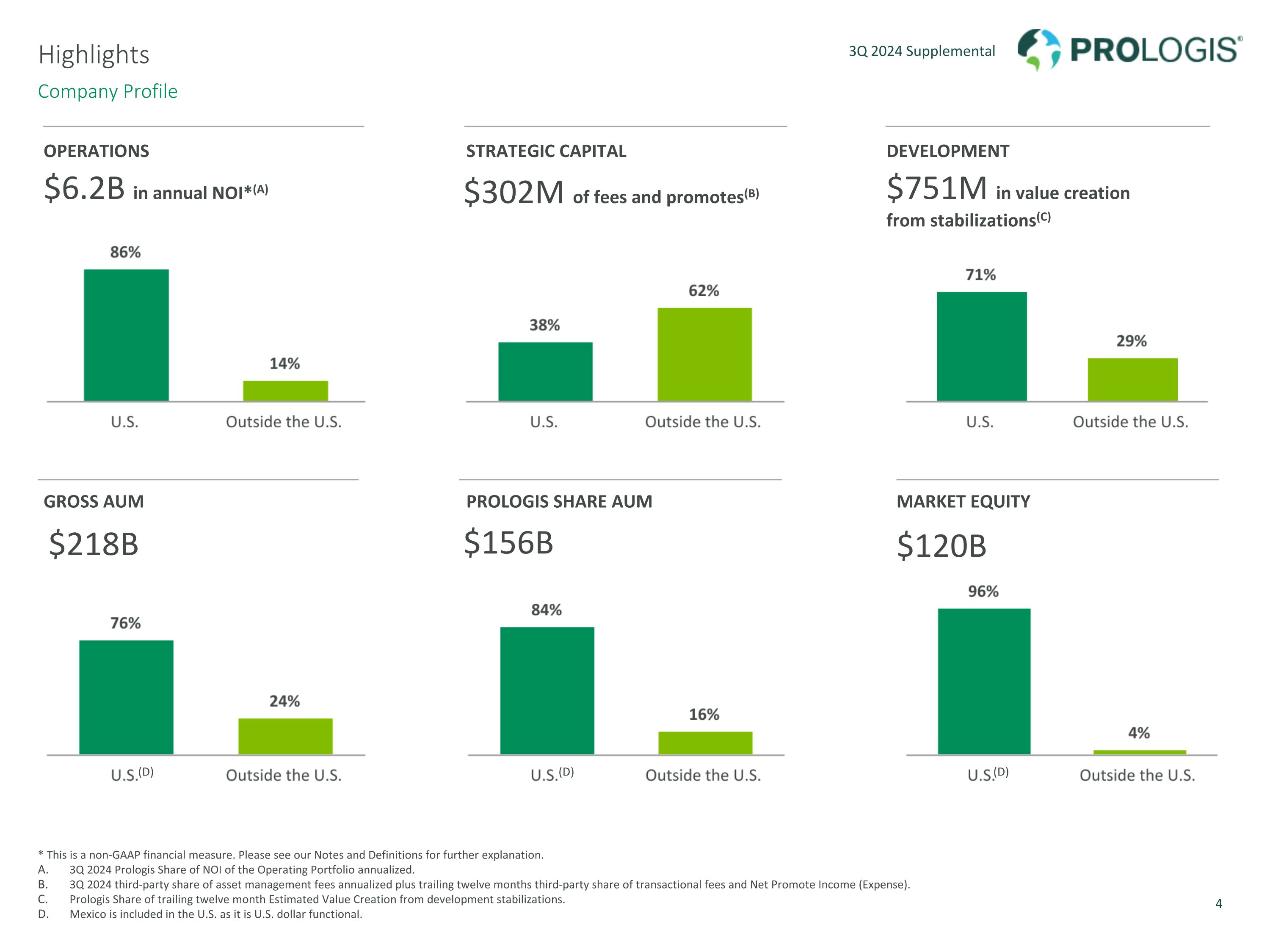

Company Profile * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2024 Prologis Share of NOI of the Operating Portfolio annualized. 3Q 2024 third-party share of asset management fees annualized plus trailing twelve months third-party share of transactional fees and Net Promote Income (Expense). Prologis Share of trailing twelve month Estimated Value Creation from development stabilizations. Mexico is included in the U.S. as it is U.S. dollar functional. Highlights OPERATIONS $6.2B in annual NOI*(A) DEVELOPMENT $751M in value creationfrom stabilizations(C) GROSS AUM $218B PROLOGIS SHARE AUM $156B MARKET EQUITY $120B STRATEGIC CAPITAL $302M of fees and promotes(B) (D) (D) (D)

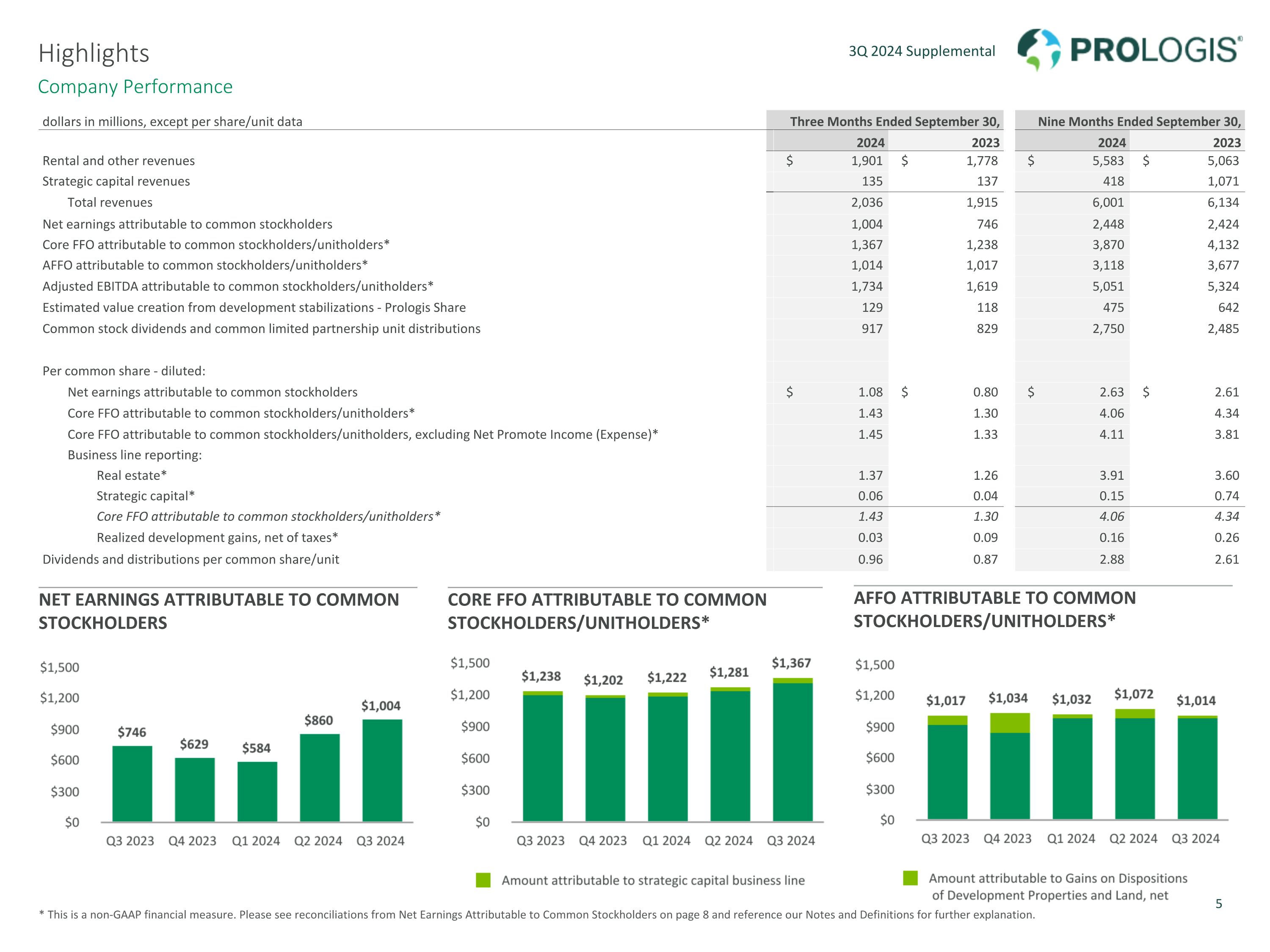

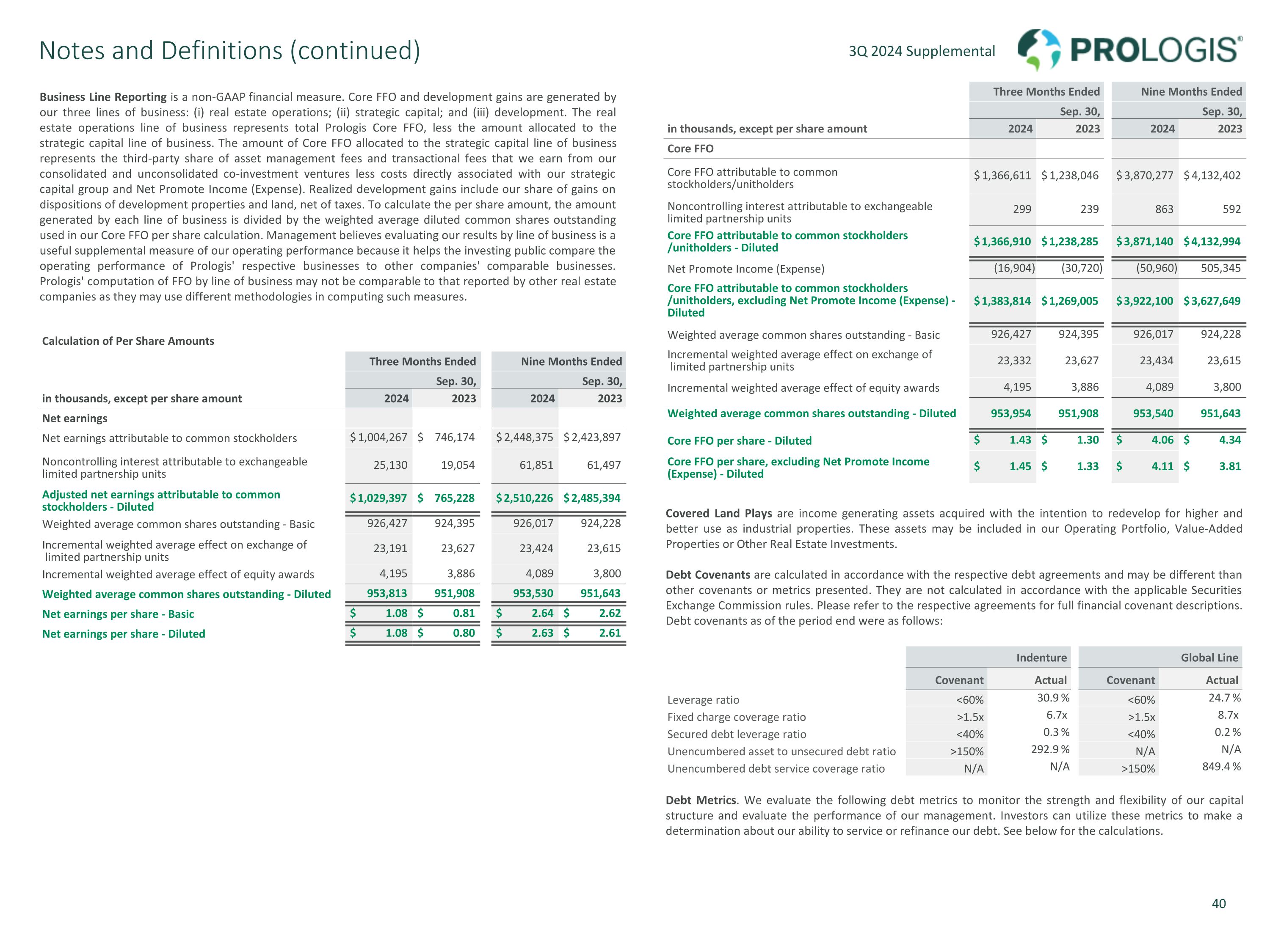

Company Performance * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. Highlights NET EARNINGS ATTRIBUTABLE TO COMMON STOCKHOLDERS CORE FFO ATTRIBUTABLE TO COMMON STOCKHOLDERS/UNITHOLDERS* AFFO ATTRIBUTABLE TO COMMONSTOCKHOLDERS/UNITHOLDERS* dollars in millions, except per share/unit data Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Rental and other revenues $ 1,901 $ 1,778 $ 5,583 $ 5,063 Strategic capital revenues 135 137 418 1,071 Total revenues 2,036 1,915 6,001 6,134 Net earnings attributable to common stockholders 1,004 746 2,448 2,424 Core FFO attributable to common stockholders/unitholders* 1,367 1,238 3,870 4,132 AFFO attributable to common stockholders/unitholders* 1,014 1,017 3,118 3,677 Adjusted EBITDA attributable to common stockholders/unitholders* 1,734 1,619 5,051 5,324 Estimated value creation from development stabilizations - Prologis Share 129 118 475 642 Common stock dividends and common limited partnership unit distributions 917 829 2,750 2,485 Per common share - diluted: Net earnings attributable to common stockholders $ 1.08 $ 0.80 $ 2.63 $ 2.61 Core FFO attributable to common stockholders/unitholders* 1.43 1.30 4.06 4.34 Core FFO attributable to common stockholders/unitholders, excluding Net Promote Income (Expense)* 1.45 1.33 4.11 3.81 Business line reporting: Real estate* 1.37 1.26 3.91 3.60 Strategic capital* 0.06 0.04 0.15 0.74 Core FFO attributable to common stockholders/unitholders* 1.43 1.30 4.06 4.34 Realized development gains, net of taxes* 0.03 0.09 0.16 0.26 Dividends and distributions per common share/unit 0.96 0.87 2.88 2.61

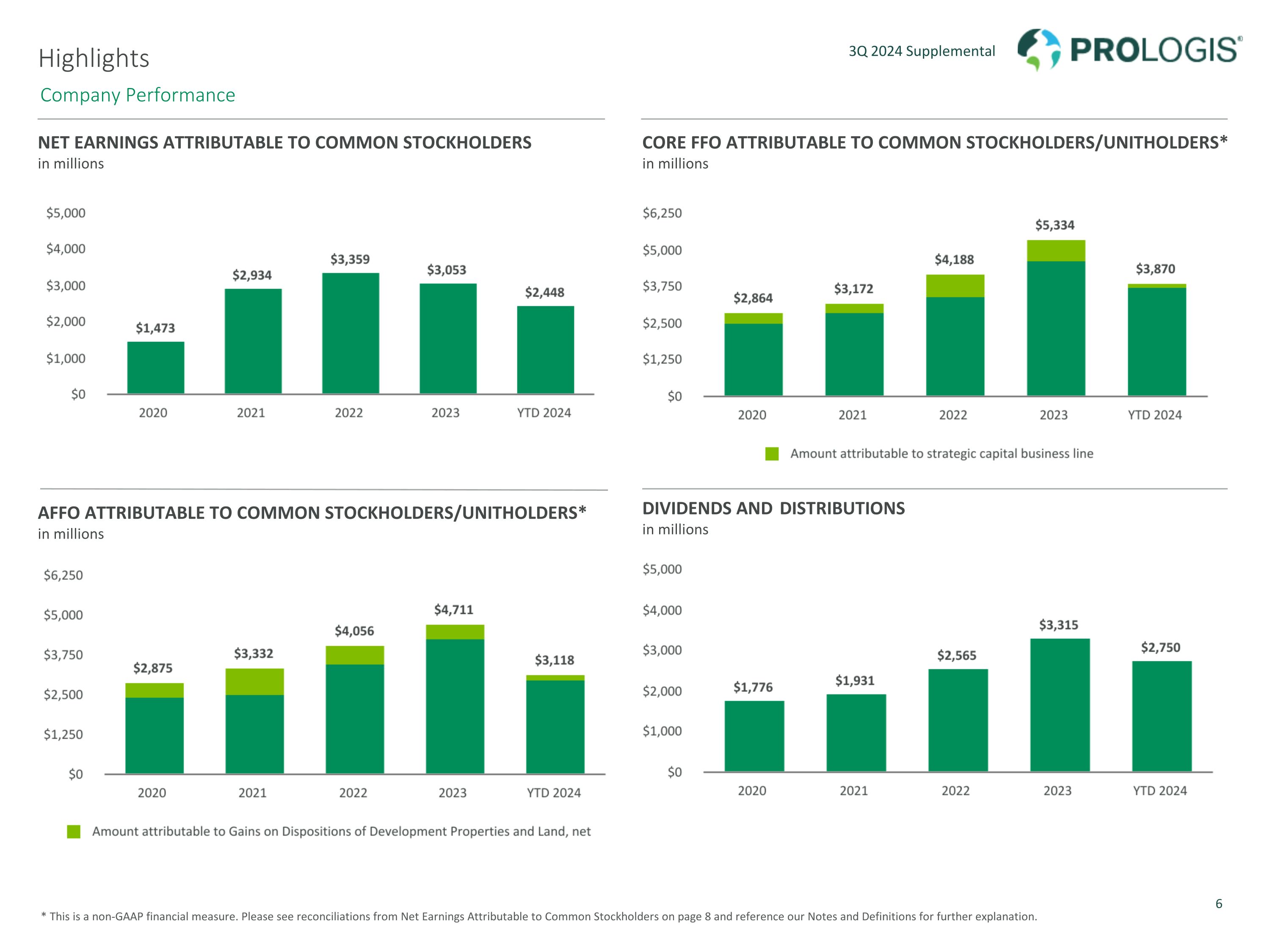

NET EARNINGS ATTRIBUTABLE TO COMMON STOCKHOLDERS in millions CORE FFO ATTRIBUTABLE TO COMMON STOCKHOLDERS/UNITHOLDERS* in millions AFFO ATTRIBUTABLE TO COMMON STOCKHOLDERS/UNITHOLDERS* in millions DIVIDENDS AND DISTRIBUTIONS in millions * This is a non-GAAP financial measure. Please see reconciliations from Net Earnings Attributable to Common Stockholders on page 8 and reference our Notes and Definitions for further explanation. Highlights Company Performance

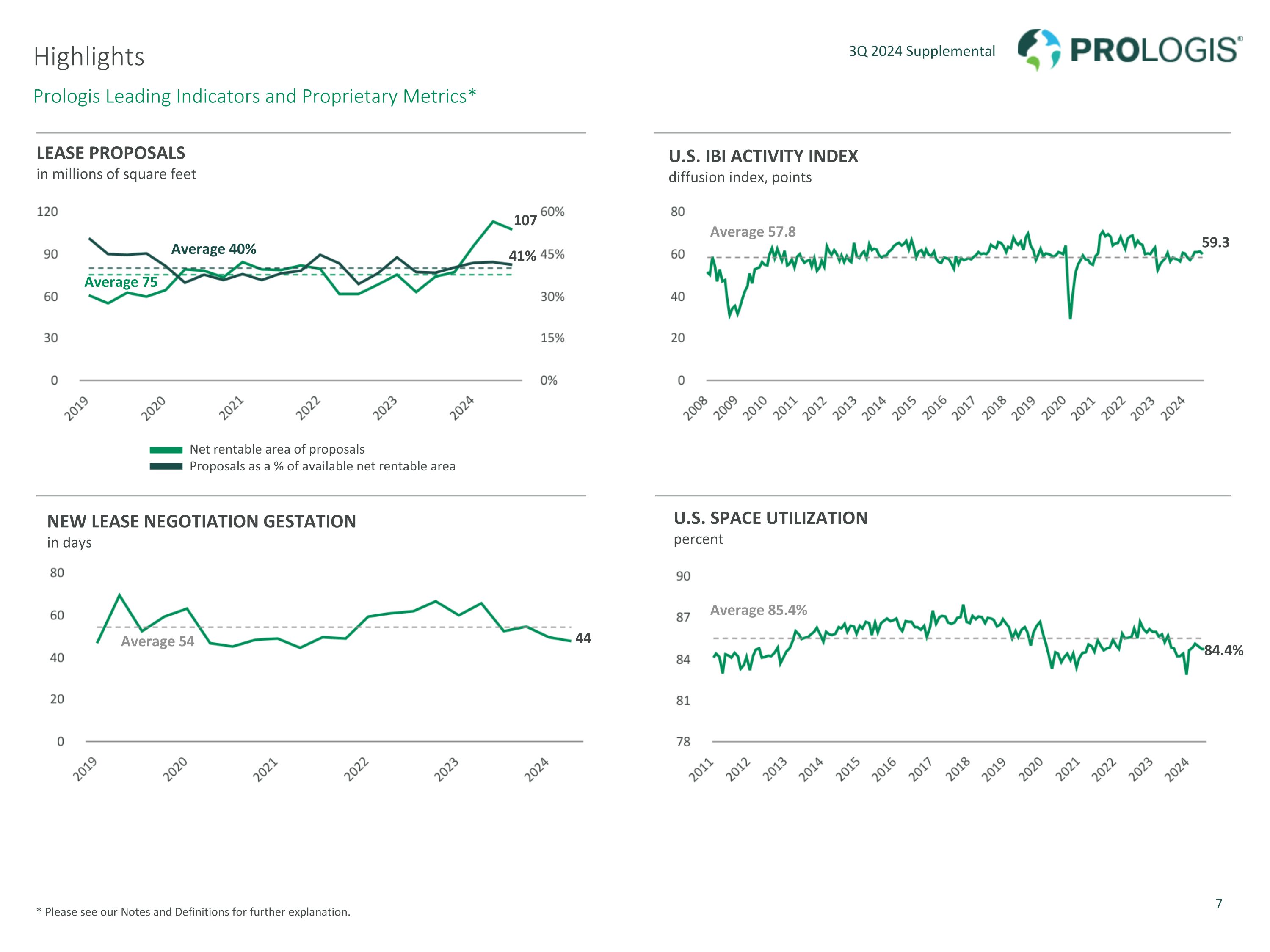

LEASE PROPOSALS in millions of square feet U.S. IBI ACTIVITY INDEX diffusion index, points NEW LEASE NEGOTIATION GESTATION in days U.S. SPACE UTILIZATION percent * Please see our Notes and Definitions for further explanation. Prologis Leading Indicators and Proprietary Metrics* Highlights 107 Average 75 59.3 Average 57.8 44 Average 54 84.4% Average 85.4% Average 40% 41% Net rentable area of proposals Proposals as a % of available net rentable area

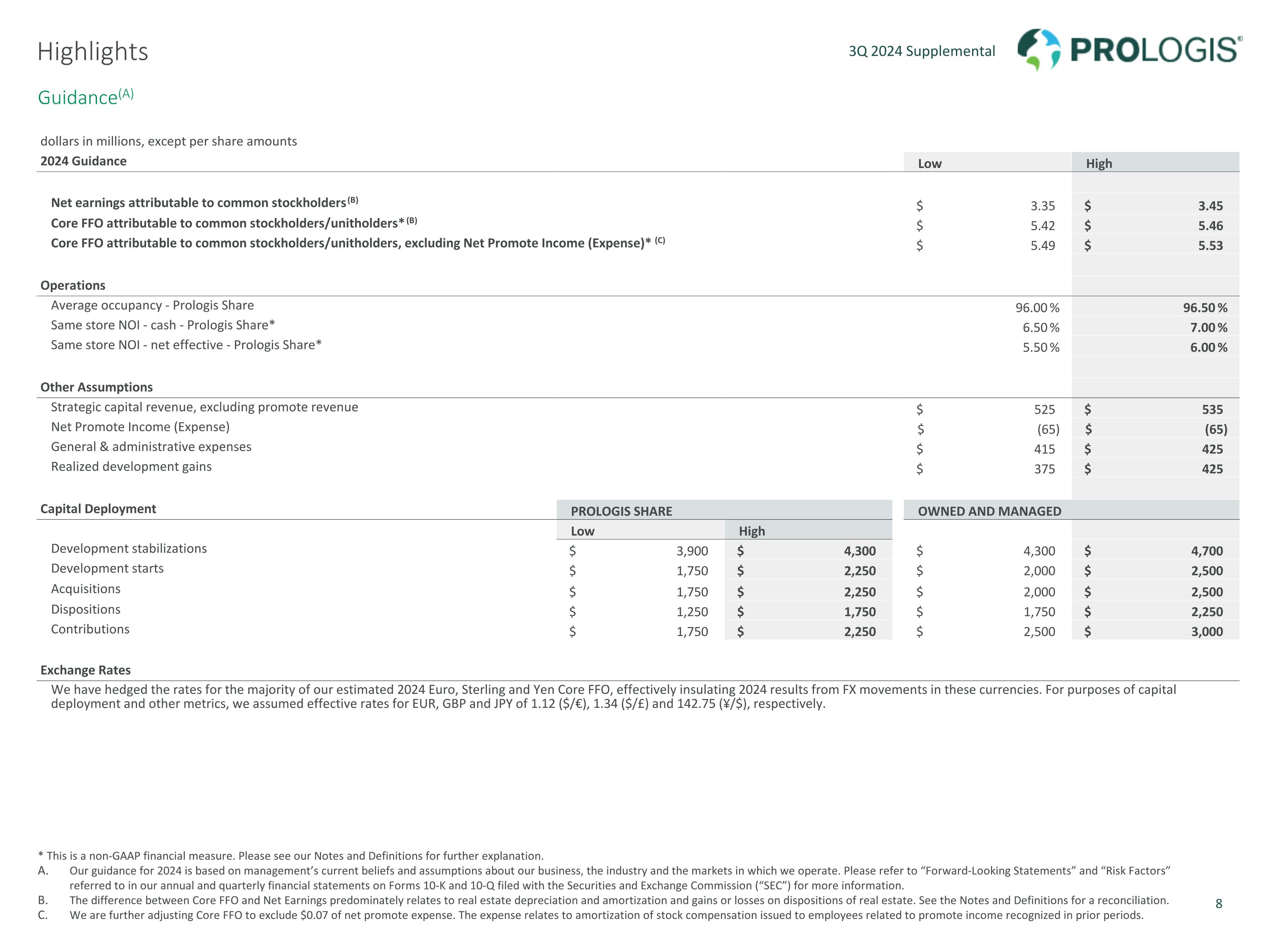

Guidance(A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Our guidance for 2024 is based on management’s current beliefs and assumptions about our business, the industry and the markets in which we operate. Please refer to “Forward-Looking Statements” and “Risk Factors” referred to in our annual and quarterly financial statements on Forms 10-K and 10-Q filed with the Securities and Exchange Commission (“SEC”) for more information. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation and amortization and gains or losses on dispositions of real estate. See the Notes and Definitions for a reconciliation. We are further adjusting Core FFO to exclude $0.07 of net promote expense. The expense relates to amortization of stock compensation issued to employees related to promote income recognized in prior periods. Highlights dollars in millions, except per share amounts 2024 Guidance Low High Net earnings attributable to common stockholders(B) $ 3.35 $ 3.45 Core FFO attributable to common stockholders/unitholders*(B) $ 5.42 $ 5.46 Core FFO attributable to common stockholders/unitholders, excluding Net Promote Income (Expense)*(C) $ 5.49 $ 5.53 Operations Average occupancy - Prologis Share 96.00 % 96.50 % Same store NOI - cash - Prologis Share* 6.50 % 7.00 % Same store NOI - net effective - Prologis Share* 5.50 % 6.00 % Other Assumptions Strategic capital revenue, excluding promote revenue $ 525 $ 535 Net Promote Income (Expense) $ (65) $ (65) General & administrative expenses $ 415 $ 425 Realized development gains $ 375 $ 425 Capital Deployment PROLOGIS SHARE OWNED AND MANAGED Low High Development stabilizations $ 3,900 $ 4,300 $ 4,300 $ 4,700 Development starts $ 1,750 $ 2,250 $ 2,000 $ 2,500 Acquisitions $ 1,750 $ 2,250 $ 2,000 $ 2,500 Dispositions $ 1,250 $ 1,750 $ 1,750 $ 2,250 Contributions $ 1,750 $ 2,250 $ 2,500 $ 3,000 Exchange Rates We have hedged the rates for the majority of our estimated 2024 Euro, Sterling and Yen Core FFO, effectively insulating 2024 results from FX movements in these currencies. For purposes of capital deployment and other metrics, we assumed effective rates for EUR, GBP and JPY of 1.12 ($/€), 1.34 ($/£) and 142.75 (¥/$), respectively.

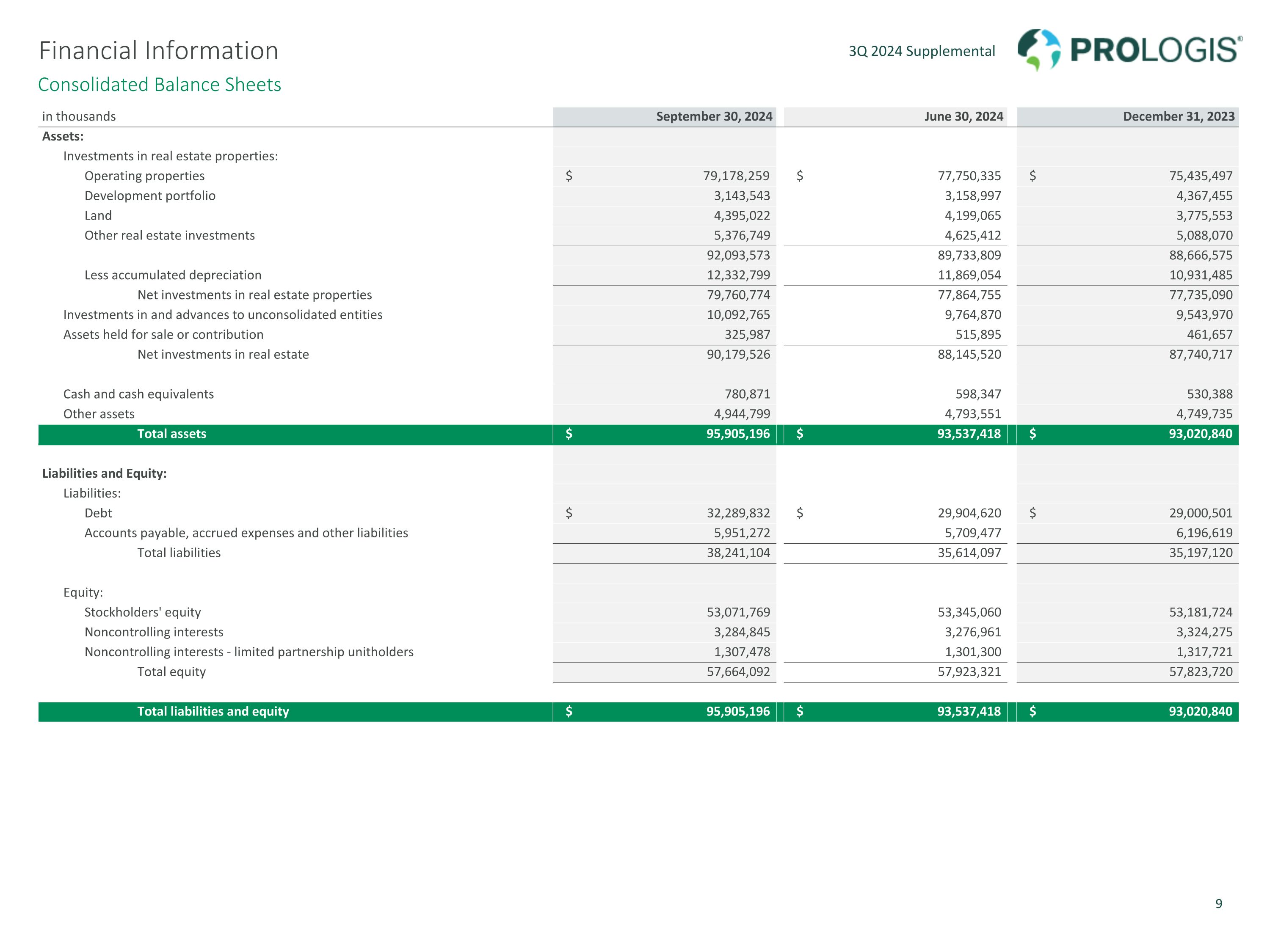

Consolidated Balance Sheets Financial Information in thousands September 30, 2024 June 30, 2024 December 31, 2023 Assets: Investments in real estate properties: Operating properties $ 79,178,259 $ 77,750,335 $ 75,435,497 Development portfolio 3,143,543 3,158,997 4,367,455 Land 4,395,022 4,199,065 3,775,553 Other real estate investments 5,376,749 4,625,412 5,088,070 92,093,573 89,733,809 88,666,575 Less accumulated depreciation 12,332,799 11,869,054 10,931,485 Net investments in real estate properties 79,760,774 77,864,755 77,735,090 Investments in and advances to unconsolidated entities 10,092,765 9,764,870 9,543,970 Assets held for sale or contribution 325,987 515,895 461,657 Net investments in real estate 90,179,526 88,145,520 87,740,717 Cash and cash equivalents 780,871 598,347 530,388 Other assets 4,944,799 4,793,551 4,749,735 Total assets $ 95,905,196 $ 93,537,418 $ 93,020,840 Liabilities and Equity: Liabilities: Debt $ 32,289,832 $ 29,904,620 $ 29,000,501 Accounts payable, accrued expenses and other liabilities 5,951,272 5,709,477 6,196,619 Total liabilities 38,241,104 35,614,097 35,197,120 Equity: Stockholders' equity 53,071,769 53,345,060 53,181,724 Noncontrolling interests 3,284,845 3,276,961 3,324,275 Noncontrolling interests - limited partnership unitholders 1,307,478 1,301,300 1,317,721 Total equity 57,664,092 57,923,321 57,823,720 Total liabilities and equity $ 95,905,196 $ 93,537,418 $ 93,020,840

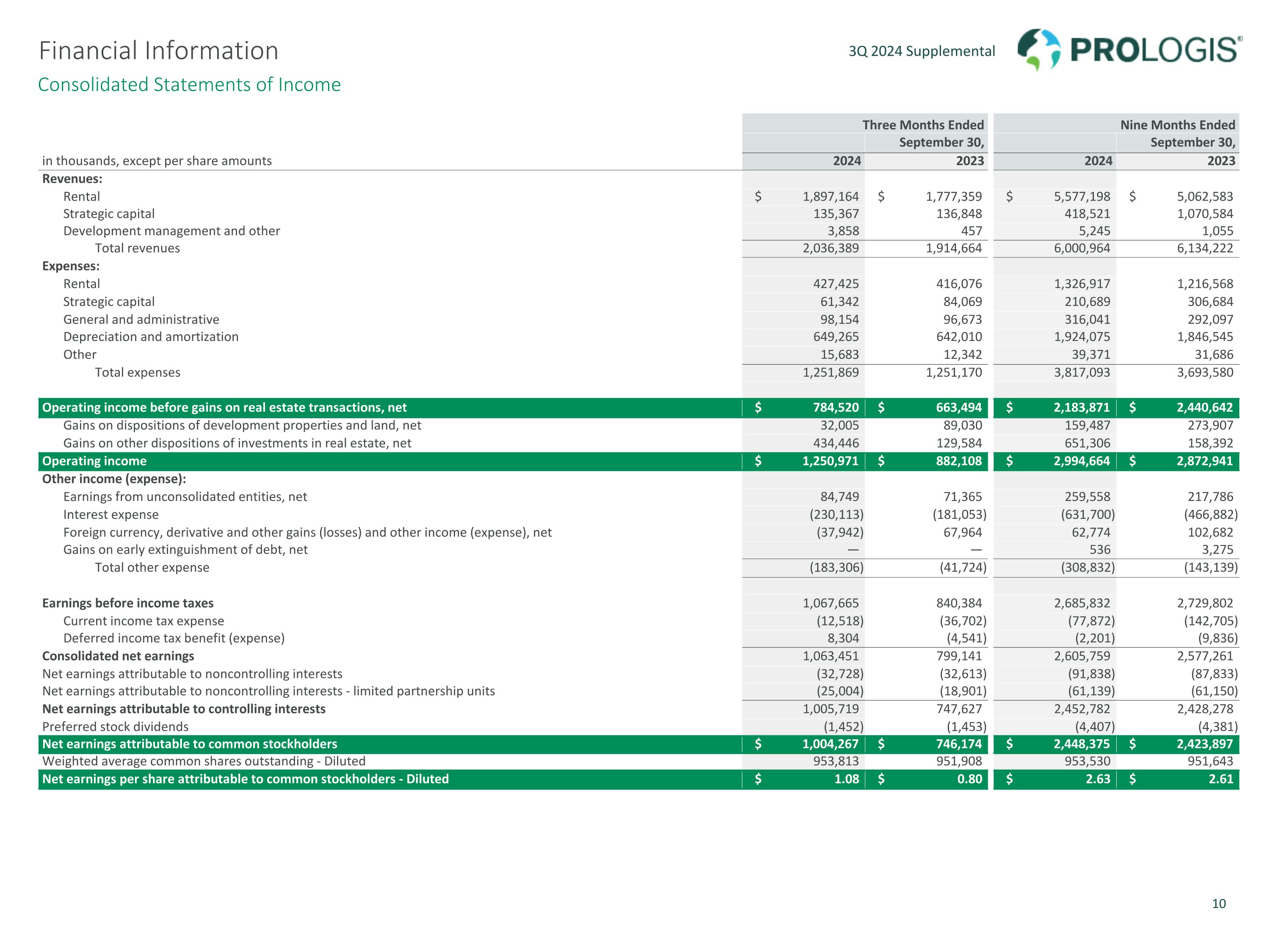

Consolidated Statements of Income Financial Information Three Months Ended Nine Months Ended September 30, September 30, in thousands, except per share amounts 2024 2023 2024 2023 Revenues: Rental $ 1,897,164 $ 1,777,359 $ 5,577,198 $ 5,062,583 Strategic capital 135,367 136,848 418,521 1,070,584 Development management and other 3,858 457 5,245 1,055 Total revenues 2,036,389 1,914,664 6,000,964 6,134,222 Expenses: Rental 427,425 416,076 1,326,917 1,216,568 Strategic capital 61,342 84,069 210,689 306,684 General and administrative 98,154 96,673 316,041 292,097 Depreciation and amortization 649,265 642,010 1,924,075 1,846,545 Other 15,683 12,342 39,371 31,686 Total expenses 1,251,869 1,251,170 3,817,093 3,693,580 Operating income before gains on real estate transactions, net $ 784,520 $ 663,494 $ 2,183,871 $ 2,440,642 Gains on dispositions of development properties and land, net 32,005 89,030 159,487 273,907 Gains on other dispositions of investments in real estate, net 434,446 129,584 651,306 158,392 Operating income $ 1,250,971 $ 882,108 $ 2,994,664 $ 2,872,941 Other income (expense): Earnings from unconsolidated entities, net 84,749 71,365 259,558 217,786 Interest expense (230,113) (181,053) (631,700) (466,882) Foreign currency, derivative and other gains (losses) and other income (expense), net (37,942) 67,964 62,774 102,682 Gains on early extinguishment of debt, net — — 536 3,275 Total other expense (183,306) (41,724) (308,832) (143,139) Earnings before income taxes 1,067,665 840,384 2,685,832 2,729,802 Current income tax expense (12,518) (36,702) (77,872) (142,705) Deferred income tax benefit (expense) 8,304 (4,541) (2,201) (9,836) Consolidated net earnings 1,063,451 799,141 2,605,759 2,577,261 Net earnings attributable to noncontrolling interests (32,728) (32,613) (91,838) (87,833) Net earnings attributable to noncontrolling interests - limited partnership units (25,004) (18,901) (61,139) (61,150) Net earnings attributable to controlling interests 1,005,719 747,627 2,452,782 2,428,278 Preferred stock dividends (1,452) (1,453) (4,407) (4,381) Net earnings attributable to common stockholders $ 1,004,267 $ 746,174 $ 2,448,375 $ 2,423,897 Weighted average common shares outstanding - Diluted 953,813 951,908 953,530 951,643 Net earnings per share attributable to common stockholders - Diluted $ 1.08 $ 0.80 $ 2.63 $ 2.61

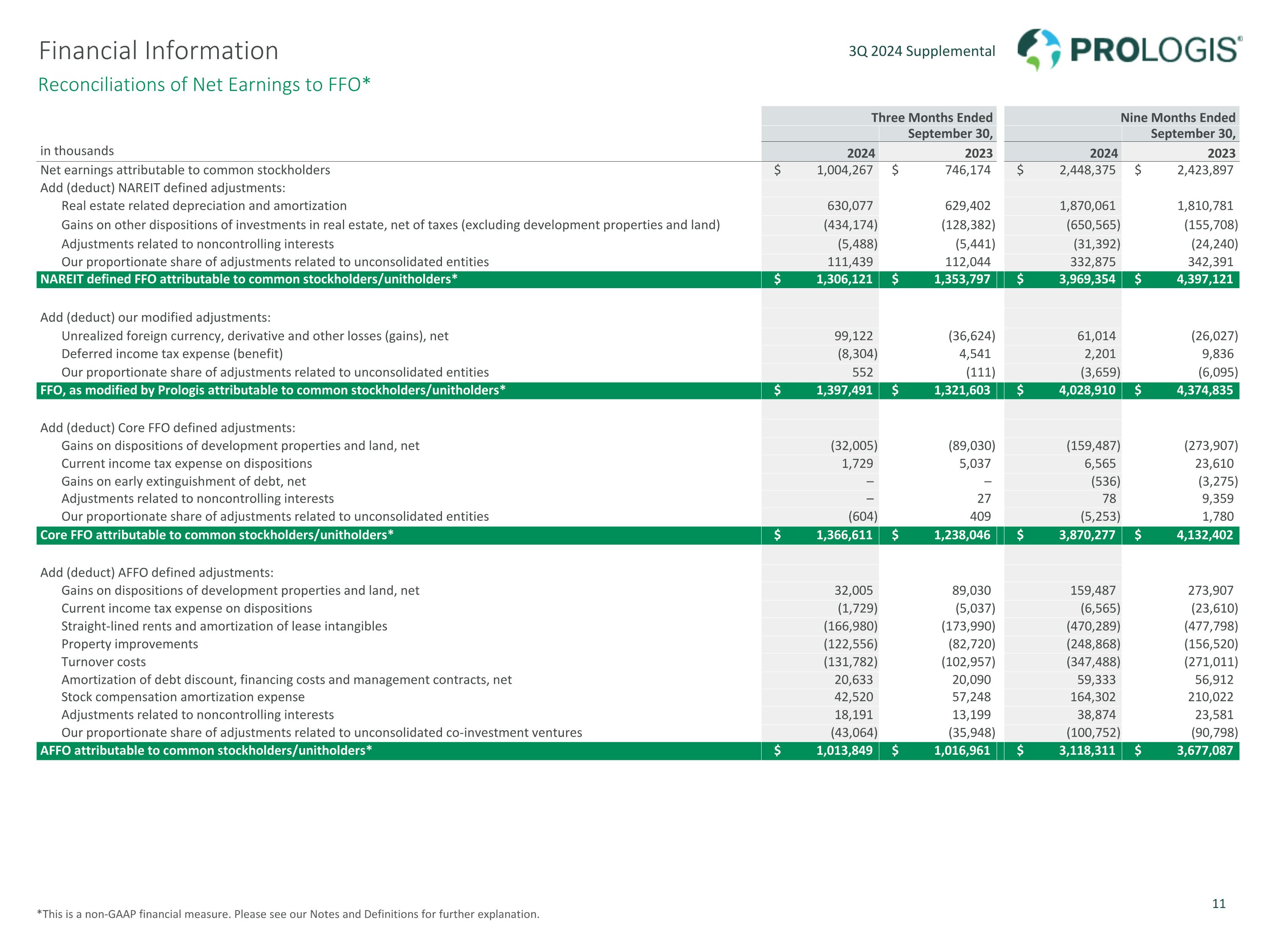

Reconciliations of Net Earnings to FFO* *This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Financial Information Three Months Ended Nine Months Ended September 30, September 30, in thousands 2024 2023 2024 2023 Net earnings attributable to common stockholders $ 1,004,267 $ 746,174 $ 2,448,375 $ 2,423,897 Add (deduct) NAREIT defined adjustments: Real estate related depreciation and amortization 630,077 629,402 1,870,061 1,810,781 Gains on other dispositions of investments in real estate, net of taxes (excluding development properties and land) (434,174) (128,382) (650,565) (155,708) Adjustments related to noncontrolling interests (5,488) (5,441) (31,392) (24,240) Our proportionate share of adjustments related to unconsolidated entities 111,439 112,044 332,875 342,391 NAREIT defined FFO attributable to common stockholders/unitholders* $ 1,306,121 $ 1,353,797 $ 3,969,354 $ 4,397,121 Add (deduct) our modified adjustments: Unrealized foreign currency, derivative and other losses (gains), net 99,122 (36,624) 61,014 (26,027) Deferred income tax expense (benefit) (8,304) 4,541 2,201 9,836 Our proportionate share of adjustments related to unconsolidated entities 552 (111) (3,659) (6,095) FFO, as modified by Prologis attributable to common stockholders/unitholders* $ 1,397,491 $ 1,321,603 $ 4,028,910 $ 4,374,835 Add (deduct) Core FFO defined adjustments: Gains on dispositions of development properties and land, net (32,005) (89,030) (159,487) (273,907) Current income tax expense on dispositions 1,729 5,037 6,565 23,610 Gains on early extinguishment of debt, net – – (536) (3,275) Adjustments related to noncontrolling interests – 27 78 9,359 Our proportionate share of adjustments related to unconsolidated entities (604) 409 (5,253) 1,780 Core FFO attributable to common stockholders/unitholders* $ 1,366,611 $ 1,238,046 $ 3,870,277 $ 4,132,402 Add (deduct) AFFO defined adjustments: Gains on dispositions of development properties and land, net 32,005 89,030 159,487 273,907 Current income tax expense on dispositions (1,729) (5,037) (6,565) (23,610) Straight-lined rents and amortization of lease intangibles (166,980) (173,990) (470,289) (477,798) Property improvements (122,556) (82,720) (248,868) (156,520) Turnover costs (131,782) (102,957) (347,488) (271,011) Amortization of debt discount, financing costs and management contracts, net 20,633 20,090 59,333 56,912 Stock compensation amortization expense 42,520 57,248 164,302 210,022 Adjustments related to noncontrolling interests 18,191 13,199 38,874 23,581 Our proportionate share of adjustments related to unconsolidated co-investment ventures (43,064) (35,948) (100,752) (90,798) AFFO attributable to common stockholders/unitholders* $ 1,013,849 $ 1,016,961 $ 3,118,311 $ 3,677,087

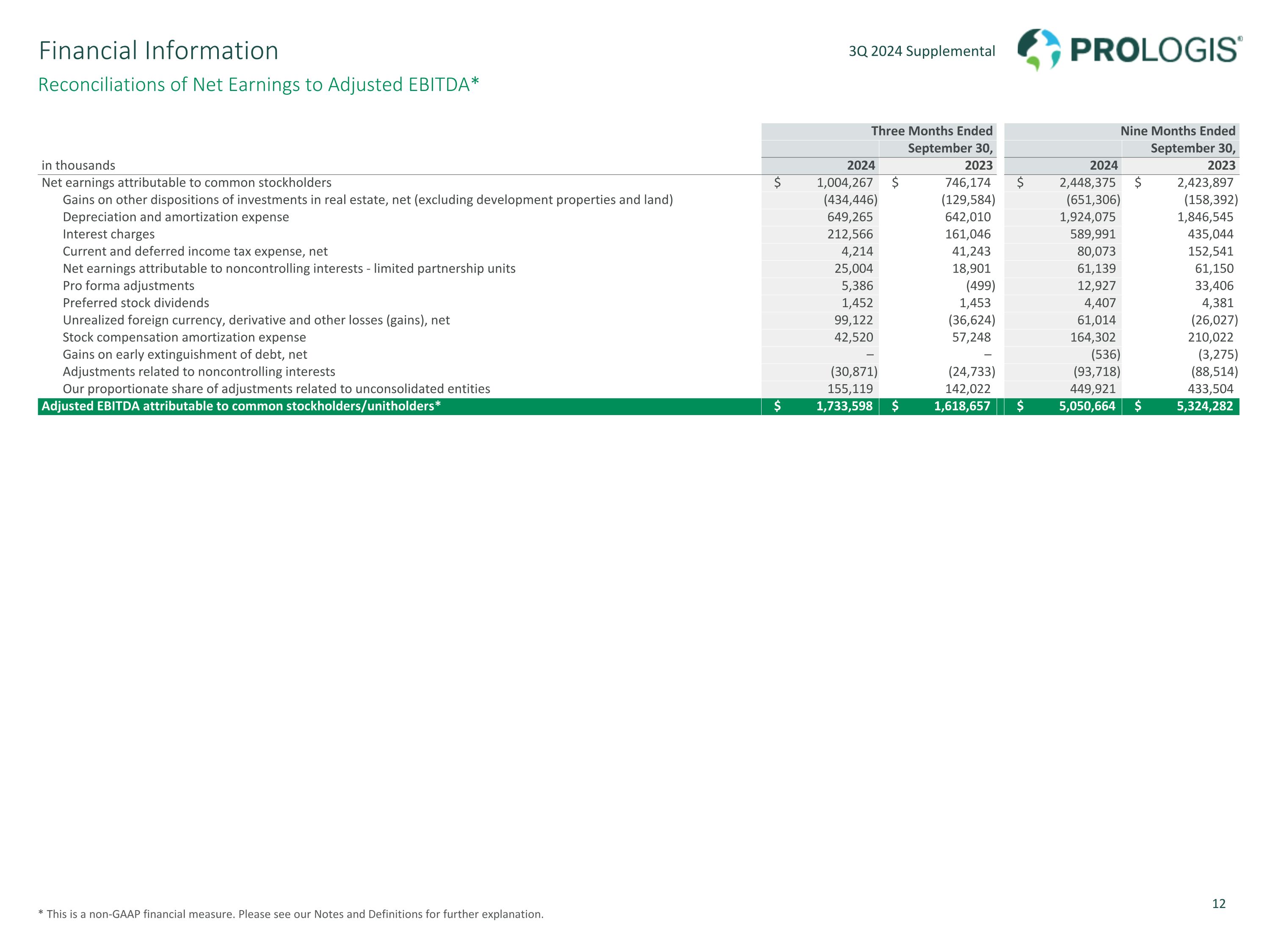

Reconciliations of Net Earnings to Adjusted EBITDA* * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Financial Information Three Months Ended Nine Months Ended September 30, September 30, in thousands 2024 2023 2024 2023 Net earnings attributable to common stockholders $ 1,004,267 $ 746,174 $ 2,448,375 $ 2,423,897 Gains on other dispositions of investments in real estate, net (excluding development properties and land) (434,446) (129,584) (651,306) (158,392) Depreciation and amortization expense 649,265 642,010 1,924,075 1,846,545 Interest charges 212,566 161,046 589,991 435,044 Current and deferred income tax expense, net 4,214 41,243 80,073 152,541 Net earnings attributable to noncontrolling interests - limited partnership units 25,004 18,901 61,139 61,150 Pro forma adjustments 5,386 (499) 12,927 33,406 Preferred stock dividends 1,452 1,453 4,407 4,381 Unrealized foreign currency, derivative and other losses (gains), net 99,122 (36,624) 61,014 (26,027) Stock compensation amortization expense 42,520 57,248 164,302 210,022 Gains on early extinguishment of debt, net – – (536) (3,275) Adjustments related to noncontrolling interests (30,871) (24,733) (93,718) (88,514) Our proportionate share of adjustments related to unconsolidated entities 155,119 142,022 449,921 433,504 Adjusted EBITDA attributable to common stockholders/unitholders* $ 1,733,598 $ 1,618,657 $ 5,050,664 $ 5,324,282

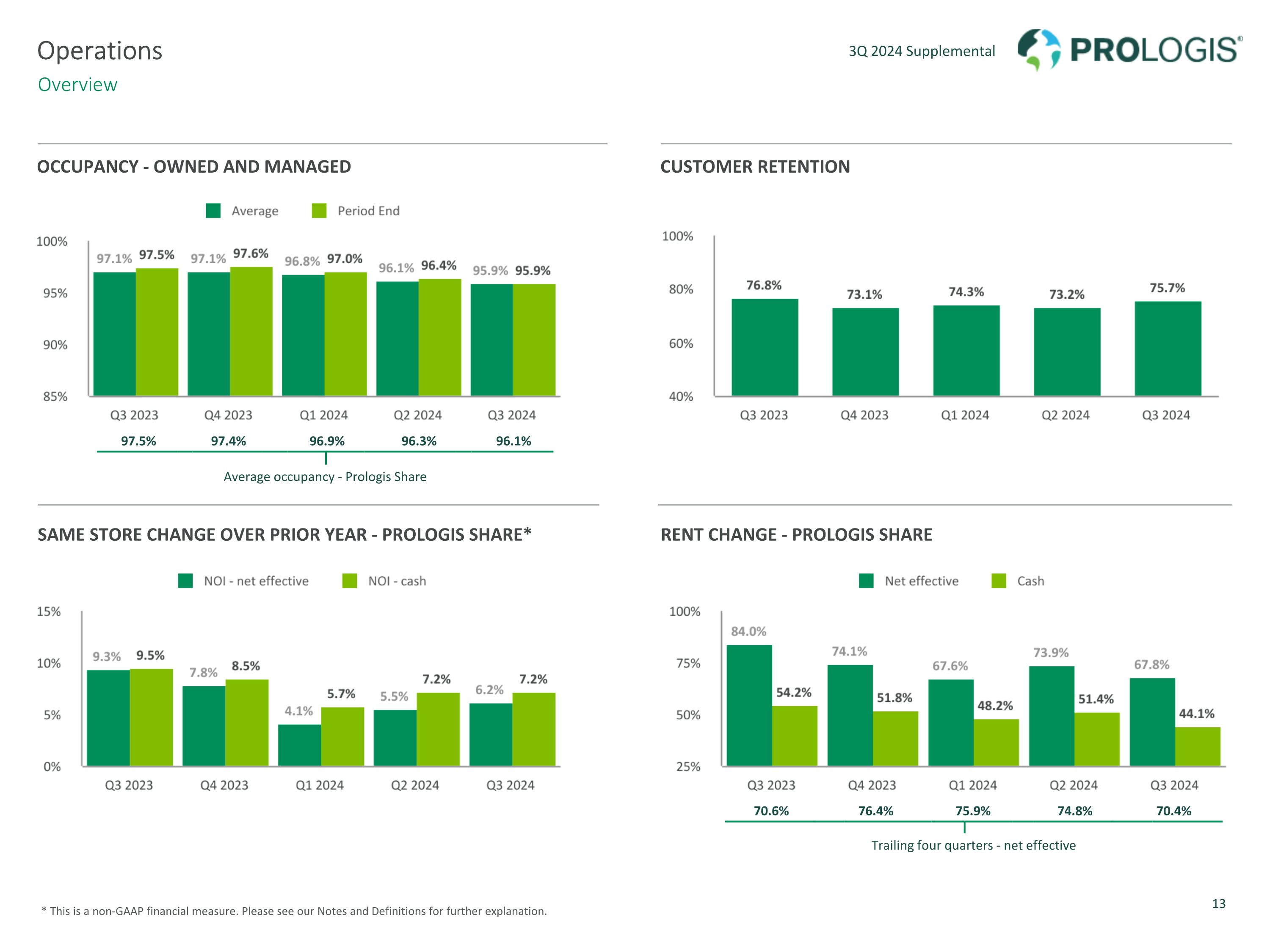

97.5% 97.4% 96.9% 96.3% 96.1% Average occupancy - Prologis Share OCCUPANCY - OWNED AND MANAGED CUSTOMER RETENTION SAME STORE CHANGE OVER PRIOR YEAR - PROLOGIS SHARE* RENT CHANGE - PROLOGIS SHARE * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operations Overview 70.6% 76.4% 75.9% 74.8% 70.4% Trailing four quarters - net effective

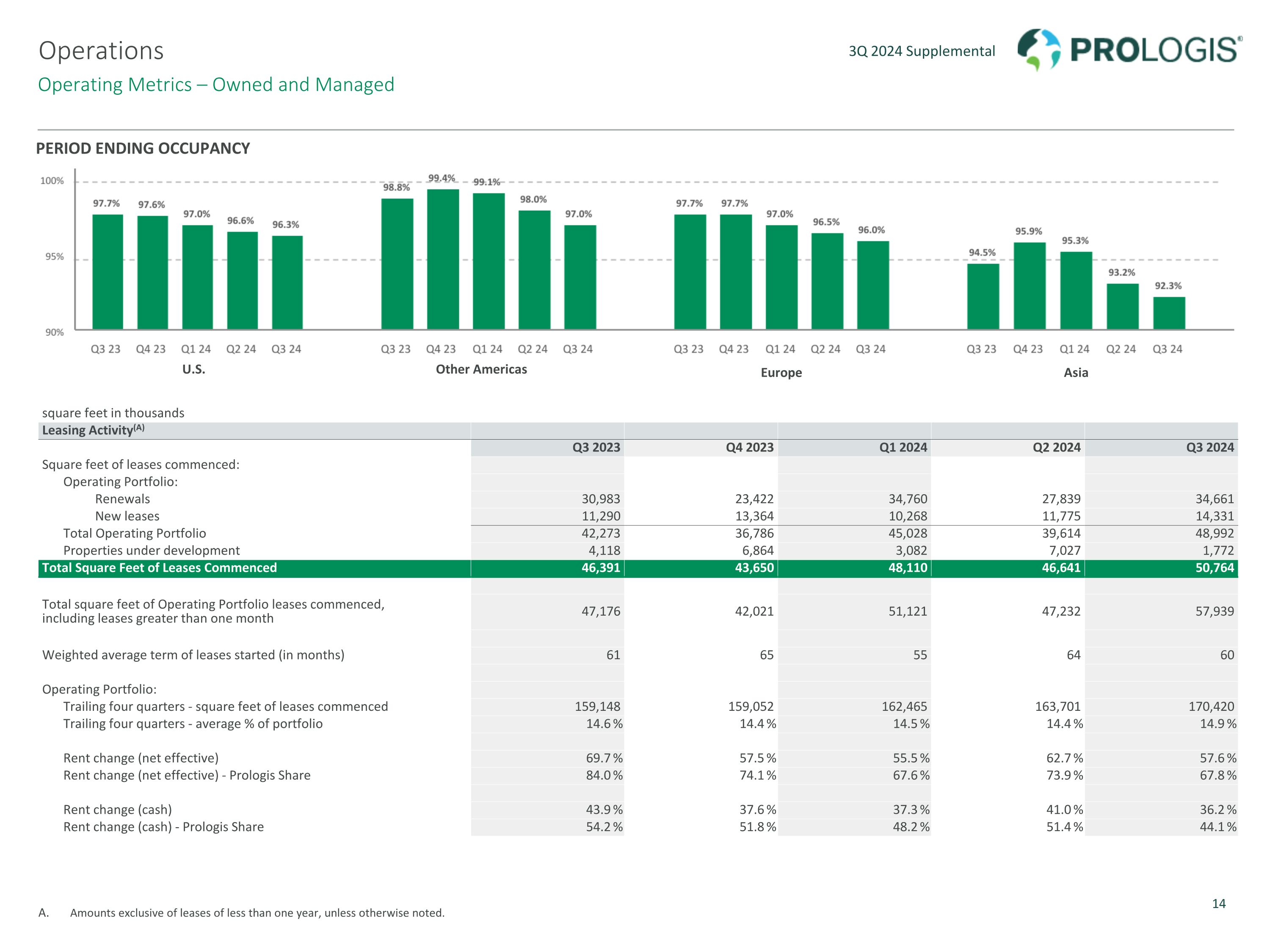

Operating Metrics – Owned and Managed Amounts exclusive of leases of less than one year, unless otherwise noted. Operations square feet in thousands Leasing Activity(A) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Square feet of leases commenced: Operating Portfolio: Renewals 30,983 23,422 34,760 27,839 34,661 New leases 11,290 13,364 10,268 11,775 14,331 Total Operating Portfolio 42,273 36,786 45,028 39,614 48,992 Properties under development 4,118 6,864 3,082 7,027 1,772 Total Square Feet of Leases Commenced 46,391 43,650 48,110 46,641 50,764 Total square feet of Operating Portfolio leases commenced, including leases greater than one month 47,176 42,021 51,121 47,232 57,939 Weighted average term of leases started (in months) 61 65 55 64 60 Operating Portfolio: Trailing four quarters - square feet of leases commenced 159,148 159,052 162,465 163,701 170,420 Trailing four quarters - average % of portfolio 14.6 % 14.4 % 14.5 % 14.4 % 14.9 % Rent change (net effective) 69.7 % 57.5 % 55.5 % 62.7 % 57.6 % Rent change (net effective) - Prologis Share 84.0 % 74.1 % 67.6 % 73.9 % 67.8 % Rent change (cash) 43.9 % 37.6 % 37.3 % 41.0 % 36.2 % Rent change (cash) - Prologis Share 54.2 % 51.8 % 48.2 % 51.4 % 44.1 % PERIOD ENDING OCCUPANCY U.S. Other Americas Europe Asia

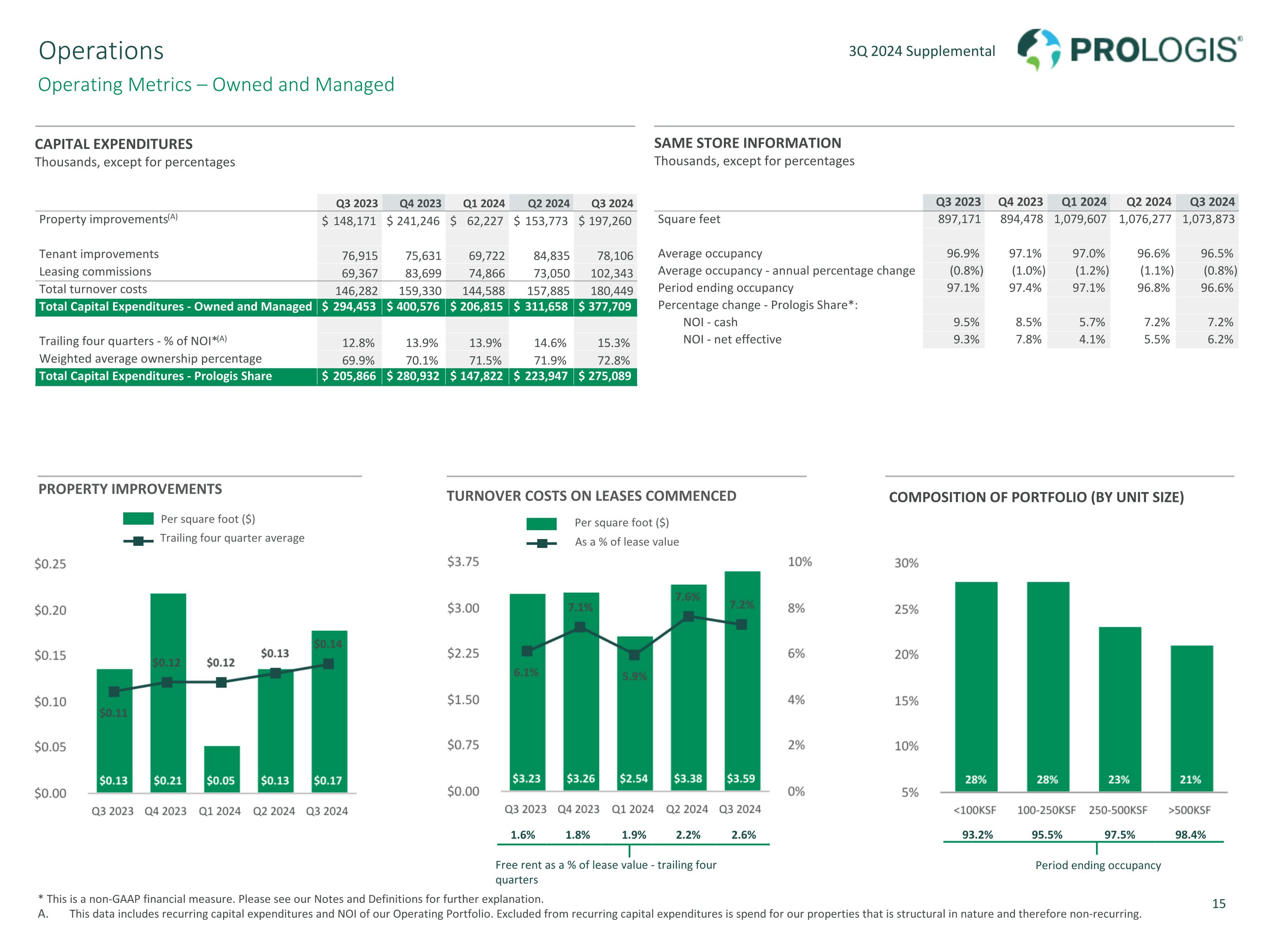

Operating Metrics – Owned and Managed * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data includes recurring capital expenditures and NOI of our Operating Portfolio. Excluded from recurring capital expenditures is spend for our properties that is structural in nature and therefore non-recurring. Operations CAPITAL EXPENDITURES Thousands, except for percentages SAME STORE INFORMATION Thousands, except for percentages PROPERTY IMPROVEMENTS TURNOVER COSTS ON LEASES COMMENCED COMPOSITION OF PORTFOLIO (BY UNIT SIZE) Trailing four quarter average Per square foot ($) As a % of lease value Per square foot ($) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Property improvements(A) $ 148,171 $ 241,246 $ 62,227 $ 153,773 $ 197,260 Tenant improvements 76,915 75,631 69,722 84,835 78,106 Leasing commissions 69,367 83,699 74,866 73,050 102,343 Total turnover costs 146,282 159,330 144,588 157,885 180,449 Total Capital Expenditures - Owned and Managed $ 294,453 $ 400,576 $ 206,815 $ 311,658 $ 377,709 Trailing four quarters - % of NOI*(A) 12.8% 13.9% 13.9% 14.6% 15.3% Weighted average ownership percentage 69.9% 70.1% 71.5% 71.9% 72.8% Total Capital Expenditures - Prologis Share $ 205,866 $ 280,932 $ 147,822 $ 223,947 $ 275,089 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Square feet 897,171 894,478 1,079,607 1,076,277 1,073,873 Average occupancy 96.9% 97.1% 97.0% 96.6% 96.5% Average occupancy - annual percentage change (0.8%) (1.0%) (1.2%) (1.1%) (0.8%) Period ending occupancy 97.1% 97.4% 97.1% 96.8% 96.6% Percentage change - Prologis Share*: NOI - cash 9.5% 8.5% 5.7% 7.2% 7.2% NOI - net effective 9.3% 7.8% 4.1% 5.5% 6.2% 1.6% 1.8% 1.9% 2.2% 2.6% 93.2% 95.5% 97.5% 98.4% Period ending occupancy Free rent as a % of lease value - trailing four quarters

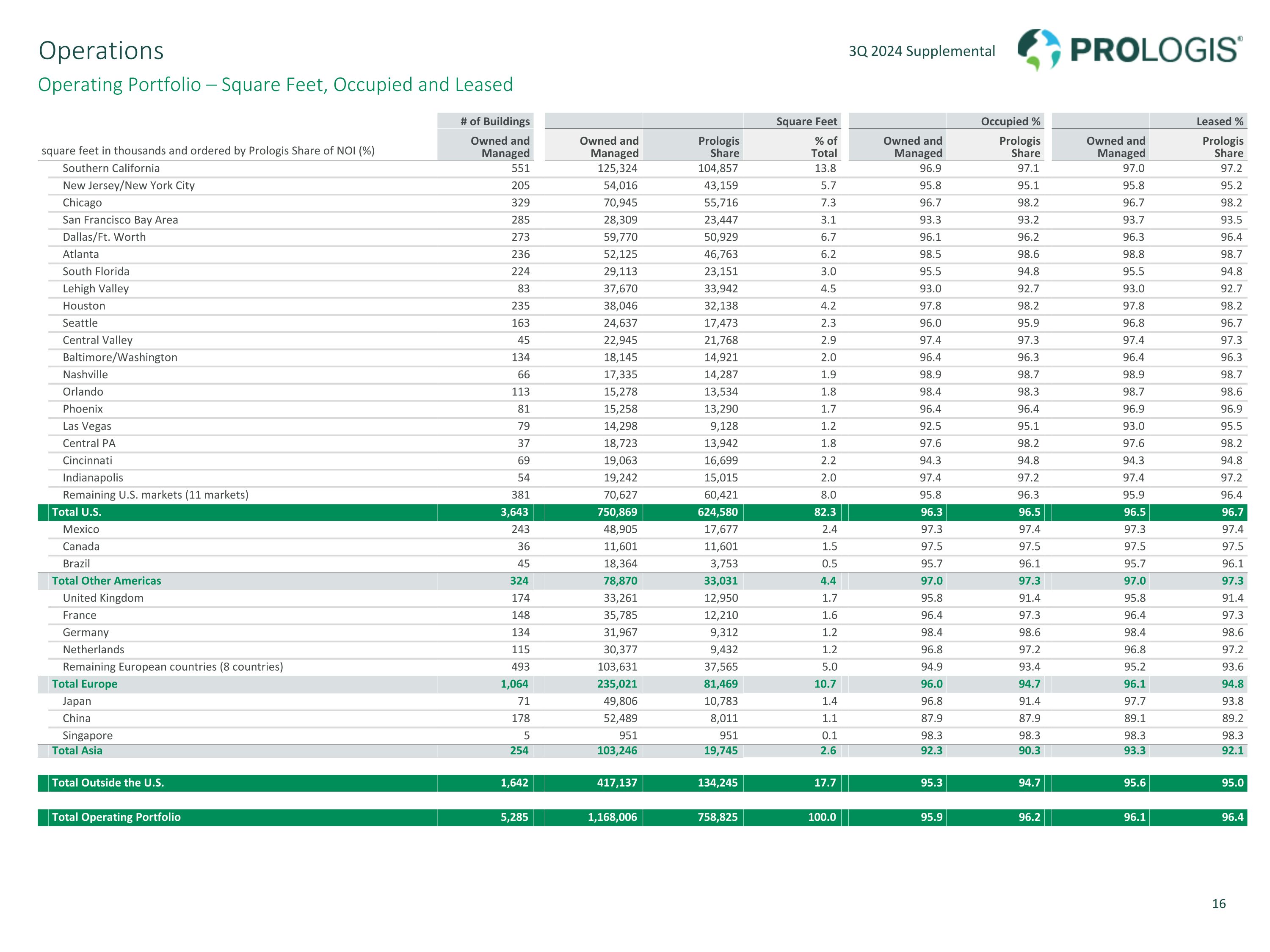

Operating Portfolio – Square Feet, Occupied and Leased Operations # of Buildings Square Feet Occupied % Leased % square feet in thousands and ordered by Prologis Share of NOI (%) Owned and Managed Owned and Managed Prologis Share % of Total Owned and Managed Prologis Share Owned and Managed Prologis Share Southern California 551 125,324 104,857 13.8 96.9 97.1 97.0 97.2 New Jersey/New York City 205 54,016 43,159 5.7 95.8 95.1 95.8 95.2 Chicago 329 70,945 55,716 7.3 96.7 98.2 96.7 98.2 San Francisco Bay Area 285 28,309 23,447 3.1 93.3 93.2 93.7 93.5 Dallas/Ft. Worth 273 59,770 50,929 6.7 96.1 96.2 96.3 96.4 Atlanta 236 52,125 46,763 6.2 98.5 98.6 98.8 98.7 South Florida 224 29,113 23,151 3.0 95.5 94.8 95.5 94.8 Lehigh Valley 83 37,670 33,942 4.5 93.0 92.7 93.0 92.7 Houston 235 38,046 32,138 4.2 97.8 98.2 97.8 98.2 Seattle 163 24,637 17,473 2.3 96.0 95.9 96.8 96.7 Central Valley 45 22,945 21,768 2.9 97.4 97.3 97.4 97.3 Baltimore/Washington 134 18,145 14,921 2.0 96.4 96.3 96.4 96.3 Nashville 66 17,335 14,287 1.9 98.9 98.7 98.9 98.7 Orlando 113 15,278 13,534 1.8 98.4 98.3 98.7 98.6 Phoenix 81 15,258 13,290 1.7 96.4 96.4 96.9 96.9 Las Vegas 79 14,298 9,128 1.2 92.5 95.1 93.0 95.5 Central PA 37 18,723 13,942 1.8 97.6 98.2 97.6 98.2 Cincinnati 69 19,063 16,699 2.2 94.3 94.8 94.3 94.8 Indianapolis 54 19,242 15,015 2.0 97.4 97.2 97.4 97.2 Remaining U.S. markets (11 markets) 381 70,627 60,421 8.0 95.8 96.3 95.9 96.4 Total U.S. 3,643 750,869 624,580 82.3 96.3 96.5 96.5 96.7 Mexico 243 48,905 17,677 2.4 97.3 97.4 97.3 97.4 Canada 36 11,601 11,601 1.5 97.5 97.5 97.5 97.5 Brazil 45 18,364 3,753 0.5 95.7 96.1 95.7 96.1 Total Other Americas 324 78,870 33,031 4.4 97.0 97.3 97.0 97.3 United Kingdom 174 33,261 12,950 1.7 95.8 91.4 95.8 91.4 France 148 35,785 12,210 1.6 96.4 97.3 96.4 97.3 Germany 134 31,967 9,312 1.2 98.4 98.6 98.4 98.6 Netherlands 115 30,377 9,432 1.2 96.8 97.2 96.8 97.2 Remaining European countries (8 countries) 493 103,631 37,565 5.0 94.9 93.4 95.2 93.6 Total Europe 1,064 235,021 81,469 10.7 96.0 94.7 96.1 94.8 Japan 71 49,806 10,783 1.4 96.8 91.4 97.7 93.8 China 178 52,489 8,011 1.1 87.9 87.9 89.1 89.2 Singapore 5 951 951 0.1 98.3 98.3 98.3 98.3 Total Asia 254 103,246 19,745 2.6 92.3 90.3 93.3 92.1 8.0 Total Outside the U.S. 1,642 417,137 134,245 17.7 95.3 94.7 95.6 95.0 97.7 98.2 Total Operating Portfolio 5,285 1,168,006 758,825 100.0 95.9 96.2 96.1 96.4

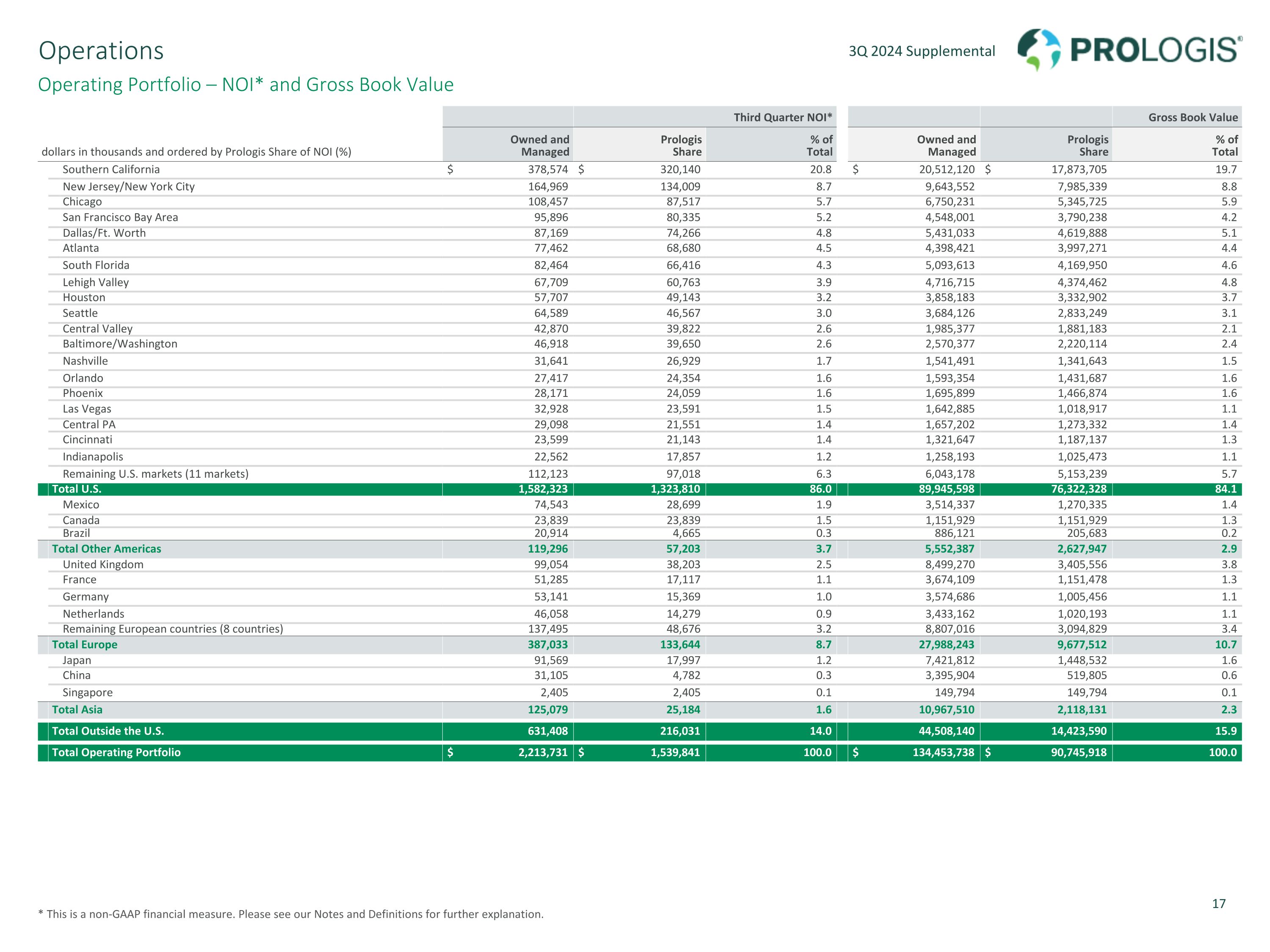

Operating Portfolio – NOI* and Gross Book Value * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operations Third Quarter NOI* Gross Book Value dollars in thousands and ordered by Prologis Share of NOI (%) Owned and Managed Prologis Share % of Total Owned and Managed Prologis Share % of Total Southern California $ 378,574 $ 320,140 20.8 $ 20,512,120 $ 17,873,705 19.7 New Jersey/New York City 164,969 134,009 8.7 9,643,552 7,985,339 8.8 Chicago 108,457 87,517 5.7 6,750,231 5,345,725 5.9 San Francisco Bay Area 95,896 80,335 5.2 4,548,001 3,790,238 4.2 Dallas/Ft. Worth 87,169 74,266 4.8 5,431,033 4,619,888 5.1 Atlanta 77,462 68,680 4.5 4,398,421 3,997,271 4.4 South Florida 82,464 66,416 4.3 5,093,613 4,169,950 4.6 Lehigh Valley 67,709 60,763 3.9 4,716,715 4,374,462 4.8 Houston 57,707 49,143 3.2 3,858,183 3,332,902 3.7 Seattle 64,589 46,567 3.0 3,684,126 2,833,249 3.1 Central Valley 42,870 39,822 2.6 1,985,377 1,881,183 2.1 Baltimore/Washington 46,918 39,650 2.6 2,570,377 2,220,114 2.4 Nashville 31,641 26,929 1.7 1,541,491 1,341,643 1.5 Orlando 27,417 24,354 1.6 1,593,354 1,431,687 1.6 Phoenix 28,171 24,059 1.6 1,695,899 1,466,874 1.6 Las Vegas 32,928 23,591 1.5 1,642,885 1,018,917 1.1 Central PA 29,098 21,551 1.4 1,657,202 1,273,332 1.4 Cincinnati 23,599 21,143 1.4 1,321,647 1,187,137 1.3 Indianapolis 22,562 17,857 1.2 1,258,193 1,025,473 1.1 Remaining U.S. markets (11 markets) 112,123 97,018 6.3 6,043,178 5,153,239 5.7 Total U.S. 1,582,323 1,323,810 86.0 89,945,598 76,322,328 84.1 Mexico 74,543 28,699 1.9 3,514,337 1,270,335 1.4 Canada 23,839 23,839 1.5 1,151,929 1,151,929 1.3 Brazil 20,914 4,665 0.3 886,121 205,683 0.2 Total Other Americas 119,296 57,203 3.7 5,552,387 2,627,947 2.9 United Kingdom 99,054 38,203 2.5 8,499,270 3,405,556 3.8 France 51,285 17,117 1.1 3,674,109 1,151,478 1.3 Germany 53,141 15,369 1.0 3,574,686 1,005,456 1.1 Netherlands 46,058 14,279 0.9 3,433,162 1,020,193 1.1 Remaining European countries (8 countries) 137,495 48,676 3.2 8,807,016 3,094,829 3.4 Total Europe 387,033 133,644 8.7 27,988,243 9,677,512 10.7 Japan 91,569 17,997 1.2 7,421,812 1,448,532 1.6 China 31,105 4,782 0.3 3,395,904 519,805 0.6 Singapore 2,405 2,405 0.1 149,794 149,794 0.1 Total Asia 125,079 25,184 1.6 10,967,510 2,118,131 2.3 Total Outside the U.S. 631,408 216,031 14.0 44,508,140 14,423,590 15.9 Total Operating Portfolio $ 2,213,731 $ 1,539,841 100.0 $ 134,453,738 $ 90,745,918 100.0

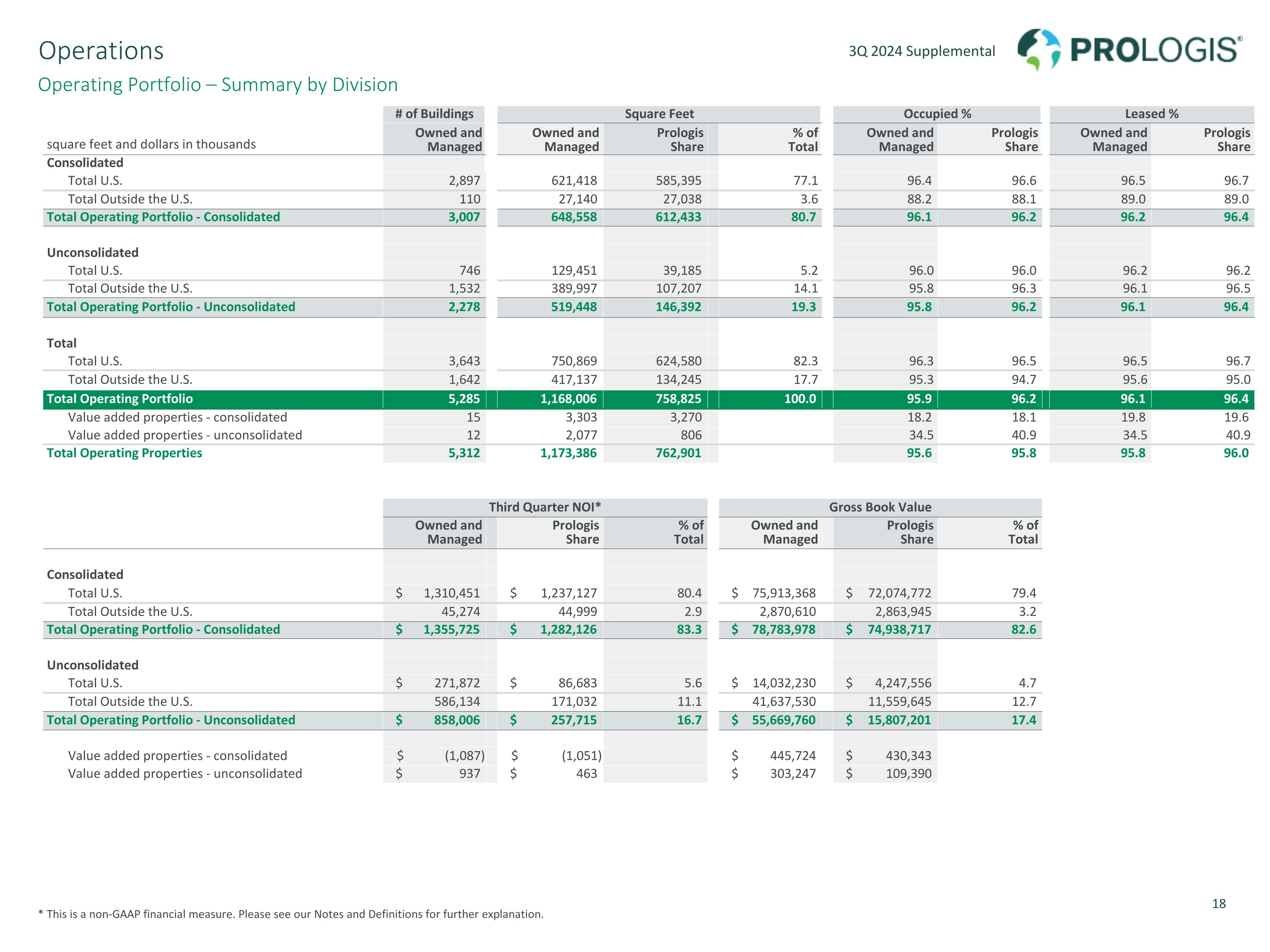

Operating Portfolio – Summary by Division * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operations # of Buildings Square Feet Occupied % Leased % square feet and dollars in thousands Owned and Managed Owned and Managed Prologis Share % of Total Owned and Managed Prologis Share Owned and Managed Prologis Share Consolidated Total U.S. 2,897 621,418 585,395 77.1 96.4 96.6 96.5 96.7 Total Outside the U.S. 110 27,140 27,038 3.6 88.2 88.1 89.0 89.0 Total Operating Portfolio - Consolidated 3,007 648,558 612,433 80.7 96.1 96.2 96.2 96.4 Unconsolidated Total U.S. 746 129,451 39,185 5.2 96.0 96.0 96.2 96.2 Total Outside the U.S. 1,532 389,997 107,207 14.1 95.8 96.3 96.1 96.5 Total Operating Portfolio - Unconsolidated 2,278 519,448 146,392 19.3 95.8 96.2 96.1 96.4 Total Total U.S. 3,643 750,869 624,580 82.3 96.3 96.5 96.5 96.7 Total Outside the U.S. 1,642 417,137 134,245 17.7 95.3 94.7 95.6 95.0 Total Operating Portfolio 5,285 1,168,006 758,825 100.0 95.9 96.2 96.1 96.4 Value added properties - consolidated 15 3,303 3,270 18.2 18.1 19.8 19.6 Value added properties - unconsolidated 12 2,077 806 34.5 40.9 34.5 40.9 Total Operating Properties 5,312 1,173,386 762,901 95.6 95.8 95.8 96.0 Third Quarter NOI* Gross Book Value Owned and Managed Prologis Share % of Total Owned and Managed Prologis Share % of Total Consolidated Total U.S. $ 1,310,451 $ 1,237,127 80.4 $ 75,913,368 $ 72,074,772 79.4 Total Outside the U.S. 45,274 44,999 2.9 2,870,610 2,863,945 3.2 Total Operating Portfolio - Consolidated $ 1,355,725 $ 1,282,126 83.3 $ 78,783,978 $ 74,938,717 82.6 Unconsolidated Total U.S. $ 271,872 $ 86,683 5.6 $ 14,032,230 $ 4,247,556 4.7 Total Outside the U.S. 586,134 171,032 11.1 41,637,530 11,559,645 12.7 Total Operating Portfolio - Unconsolidated $ 858,006 $ 257,715 16.7 $ 55,669,760 $ 15,807,201 17.4 Value added properties - consolidated $ (1,087) $ (1,051) $ 445,724 $ 430,343 Value added properties - unconsolidated $ 937 $ 463 $ 303,247 $ 109,390

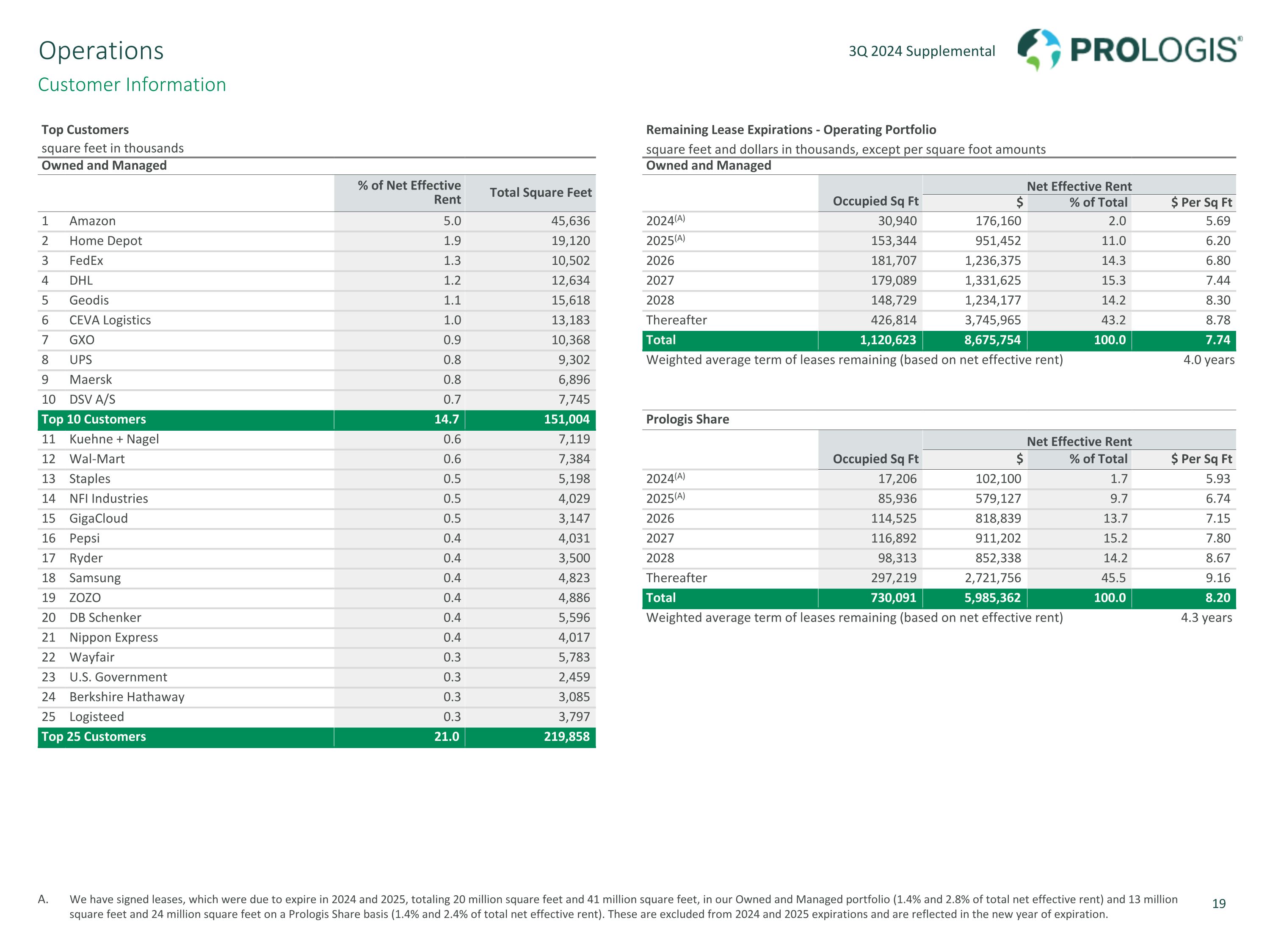

Customer Information We have signed leases, which were due to expire in 2024 and 2025, totaling 20 million square feet and 41 million square feet, in our Owned and Managed portfolio (1.4% and 2.8% of total net effective rent) and 13 million square feet and 24 million square feet on a Prologis Share basis (1.4% and 2.4% of total net effective rent). These are excluded from 2024 and 2025 expirations and are reflected in the new year of expiration. Operations Top Customers Remaining Lease Expirations - Operating Portfolio square feet in thousands square feet and dollars in thousands, except per square foot amounts Owned and Managed Owned and Managed % of Net Effective Rent Total Square Feet Occupied Sq Ft Net Effective Rent $ % of Total $ Per Sq Ft 1 Amazon 5.0 45,636 2024(A) 30,940 176,160 2.0 5.69 2 Home Depot 1.9 19,120 2025(A) 153,344 951,452 11.0 6.20 3 FedEx 1.3 10,502 2026 181,707 1,236,375 14.3 6.80 4 DHL 1.2 12,634 2027 179,089 1,331,625 15.3 7.44 5 Geodis 1.1 15,618 2028 148,729 1,234,177 14.2 8.30 6 CEVA Logistics 1.0 13,183 Thereafter 426,814 3,745,965 43.2 8.78 7 GXO 0.9 10,368 Total 1,120,623 8,675,754 100.0 7.74 8 UPS 0.8 9,302 Weighted average term of leases remaining (based on net effective rent) 4.0 years 9 Maersk 0.8 6,896 10 DSV A/S 0.7 7,745 Top 10 Customers 14.7 151,004 Prologis Share 11 Kuehne + Nagel 0.6 7,119 Occupied Sq Ft Net Effective Rent 12 Wal-Mart 0.6 7,384 $ % of Total $ Per Sq Ft 13 Staples 0.5 5,198 2024(A) 17,206 102,100 1.7 5.93 14 NFI Industries 0.5 4,029 2025(A) 85,936 579,127 9.7 6.74 15 GigaCloud 0.5 3,147 2026 114,525 818,839 13.7 7.15 16 Pepsi 0.4 4,031 2027 116,892 911,202 15.2 7.80 17 Ryder 0.4 3,500 2028 98,313 852,338 14.2 8.67 18 Samsung 0.4 4,823 Thereafter 297,219 2,721,756 45.5 9.16 19 ZOZO 0.4 4,886 Total 730,091 5,985,362 100.0 8.20 20 DB Schenker 0.4 5,596 Weighted average term of leases remaining (based on net effective rent) 4.3 years 21 Nippon Express 0.4 4,017 22 Wayfair 0.3 5,783 23 U.S. Government 0.3 2,459 24 Berkshire Hathaway 0.3 3,085 25 Logisteed 0.3 3,797 Top 25 Customers 21.0 219,858

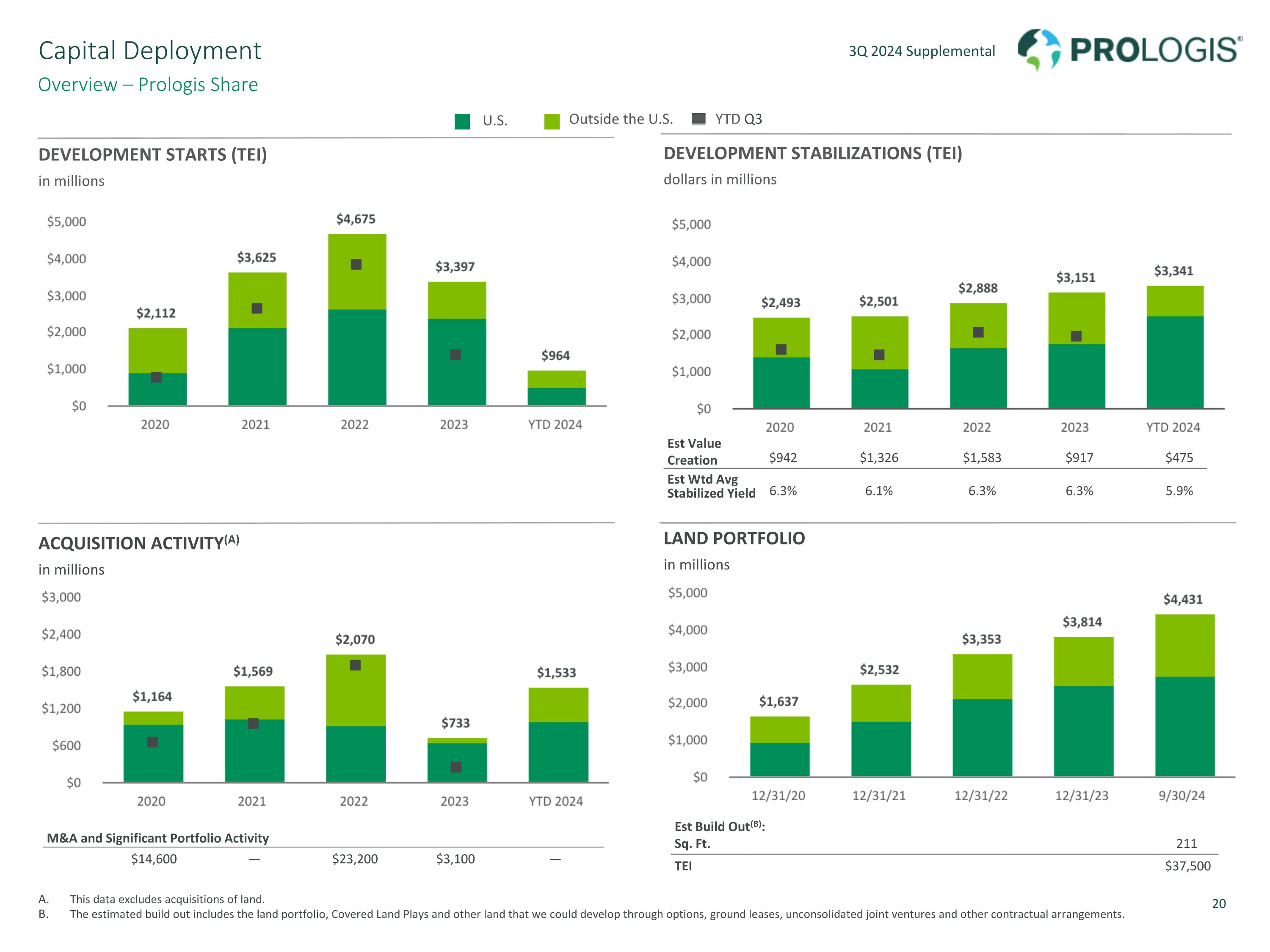

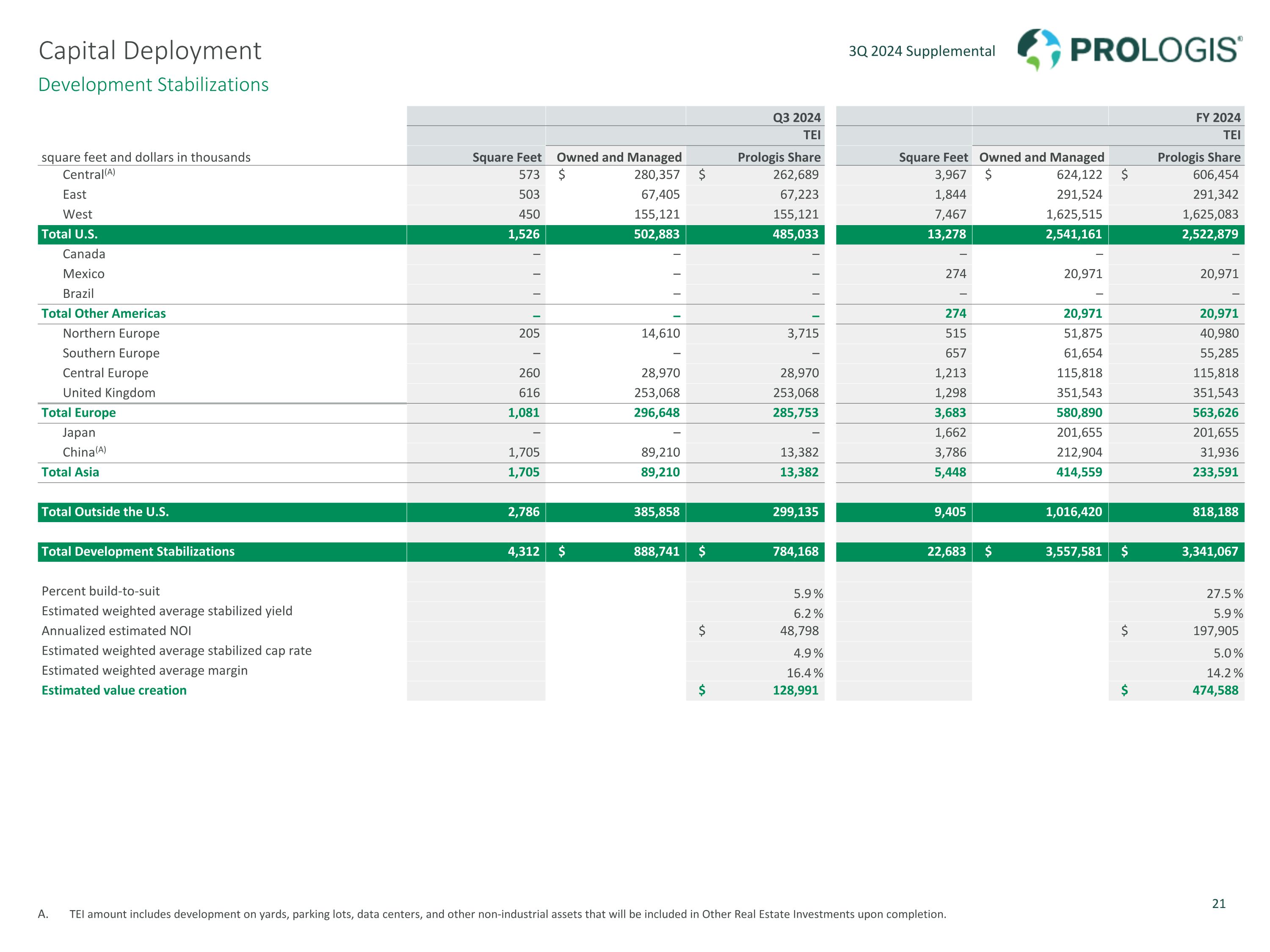

M&A and Significant Portfolio Activity $14,600 — $23,200 $3,100 — DEVELOPMENT STARTS (TEI) in millions DEVELOPMENT STABILIZATIONS (TEI) dollars in millions ACQUISITION ACTIVITY(A) in millions LAND PORTFOLIO in millions This data excludes acquisitions of land. The estimated build out includes the land portfolio, Covered Land Plays and other land that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Capital Deployment Overview – Prologis Share Outside the U.S. U.S. Est Value Creation $942 $1,326 $1,583 $917 $475 Est Wtd Avg Stabilized Yield 6.3% 6.1% 6.3% 6.3% 5.9% Est Build Out(B): Sq. Ft. 211 TEI $37,500 YTD Q3

Development Stabilizations Capital Deployment Q3 2024 FY 2024 TEI TEI square feet and dollars in thousands Square Feet Owned and Managed Prologis Share Square Feet Owned and Managed Prologis Share Central(A) 573 $ 280,357 $ 262,689 3,967 $ 624,122 $ 606,454 East 503 67,405 67,223 1,844 291,524 291,342 West 450 155,121 155,121 7,467 1,625,515 1,625,083 Total U.S. 1,526 502,883 485,033 13,278 2,541,161 2,522,879 Canada – – – – – – Mexico – – – 274 20,971 20,971 Brazil – – – – – – Total Other Americas – – – 274 20,971 20,971 Northern Europe 205 14,610 3,715 515 51,875 40,980 Southern Europe – – – 657 61,654 55,285 Central Europe 260 28,970 28,970 1,213 115,818 115,818 United Kingdom 616 253,068 253,068 1,298 351,543 351,543 Total Europe 1,081 296,648 285,753 3,683 580,890 563,626 Japan – – – 1,662 201,655 201,655 China(A) 1,705 89,210 13,382 3,786 212,904 31,936 Total Asia 1,705 89,210 13,382 5,448 414,559 233,591 Total Outside the U.S. 2,786 385,858 299,135 9,405 1,016,420 818,188 Total Development Stabilizations 4,312 $ 888,741 $ 784,168 22,683 $ 3,557,581 $ 3,341,067 Percent build-to-suit 5.9 % 27.5 % Estimated weighted average stabilized yield 6.2 % 5.9 % Annualized estimated NOI $ 48,798 $ 197,905 Estimated weighted average stabilized cap rate 4.9 % 5.0 % Estimated weighted average margin 16.4 % 14.2 % Estimated value creation $ 128,991 $ 474,588 TEI amount includes development on yards, parking lots, data centers, and other non-industrial assets that will be included in Other Real Estate Investments upon completion.

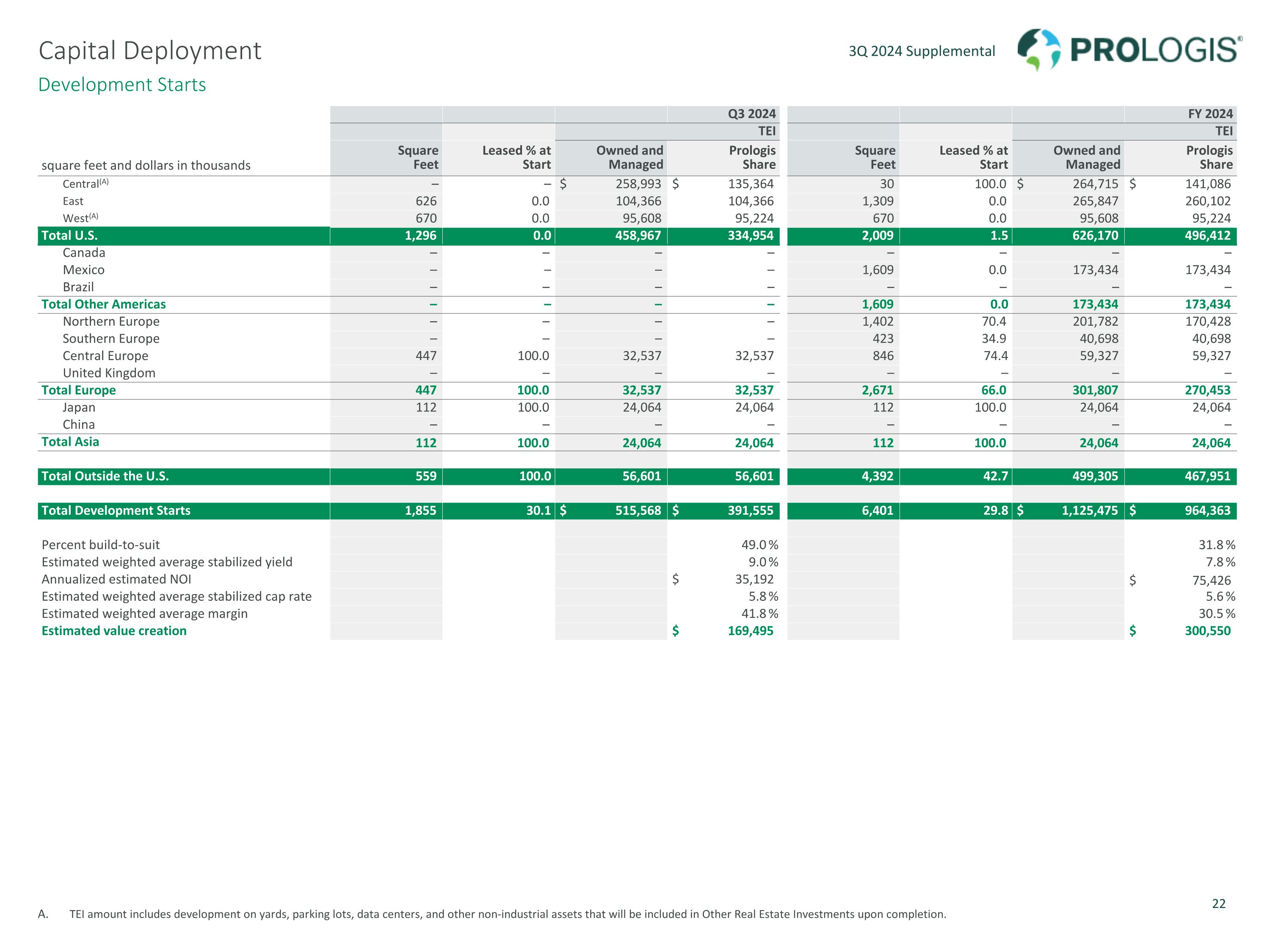

Development Starts Capital Deployment Q3 2024 FY 2024 TEI TEI square feet and dollars in thousands Square Feet Leased % at Start Owned and Managed Prologis Share Square Feet Leased % at Start Owned and Managed Prologis Share Central(A) – – $ 258,993 $ 135,364 30 100.0 $ 264,715 $ 141,086 East 626 0.0 104,366 104,366 1,309 0.0 265,847 260,102 West(A) 670 0.0 95,608 95,224 670 0.0 95,608 95,224 Total U.S. 1,296 0.0 458,967 334,954 2,009 1.5 626,170 496,412 Canada – – – – – – – – Mexico – – – – 1,609 0.0 173,434 173,434 Brazil – – – – – – – – Total Other Americas – – – – 1,609 0.0 173,434 173,434 Northern Europe – – – – 1,402 70.4 201,782 170,428 Southern Europe – – – – 423 34.9 40,698 40,698 Central Europe 447 100.0 32,537 32,537 846 74.4 59,327 59,327 United Kingdom – – – – – – – – Total Europe 447 100.0 32,537 32,537 2,671 66.0 301,807 270,453 Japan 112 100.0 24,064 24,064 112 100.0 24,064 24,064 China – – – – – – – – Total Asia 112 100.0 24,064 24,064 112 100.0 24,064 24,064 Total Outside the U.S. 559 100.0 56,601 56,601 4,392 42.7 499,305 467,951 Total Development Starts 1,855 30.1 $ 515,568 $ 391,555 6,401 29.8 $ 1,125,475 $ 964,363 Percent build-to-suit 49.0 % 31.8 % Estimated weighted average stabilized yield 9.0 % 7.8 % Annualized estimated NOI $ 35,192 $ 75,426 Estimated weighted average stabilized cap rate 5.8 % 5.6 % Estimated weighted average margin 41.8 % 30.5 % Estimated value creation $ 169,495 $ 300,550 TEI amount includes development on yards, parking lots, data centers, and other non-industrial assets that will be included in Other Real Estate Investments upon completion.

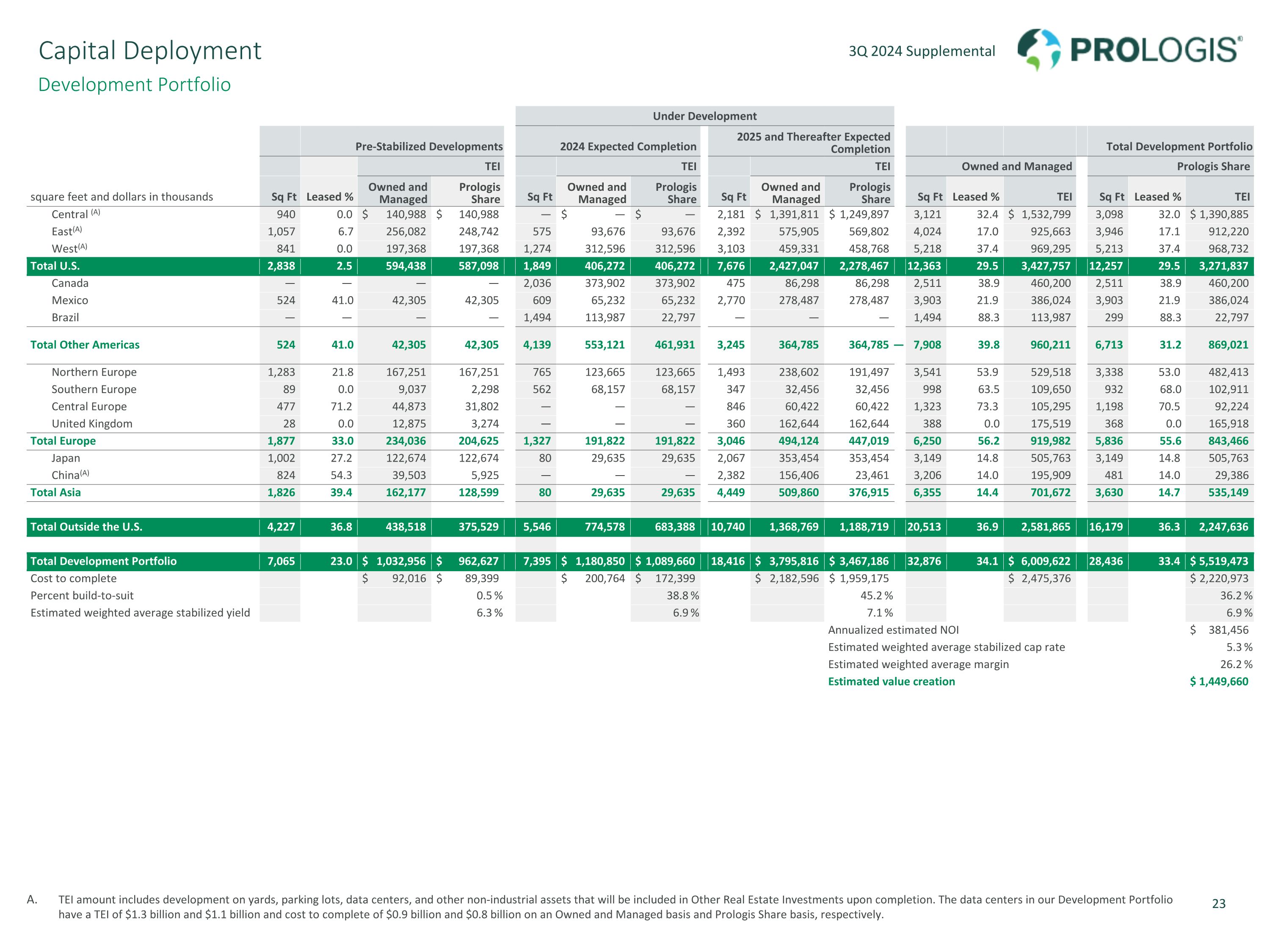

Development Portfolio TEI amount includes development on yards, parking lots, data centers, and other non-industrial assets that will be included in Other Real Estate Investments upon completion. The data centers in our Development Portfolio have a TEI of $1.3 billion and $1.1 billion and cost to complete of $0.9 billion and $0.8 billion on an Owned and Managed basis and Prologis Share basis, respectively. Capital Deployment Under Development Pre-Stabilized Developments 2024 Expected Completion 2025 and Thereafter Expected Completion Total Development Portfolio TEI TEI TEI Owned and Managed Prologis Share square feet and dollars in thousands Sq Ft Leased % Owned and Managed Prologis Share Sq Ft Owned and Managed Prologis Share Sq Ft Owned and Managed Prologis Share Sq Ft Leased % TEI Sq Ft Leased % TEI Central (A) 940 0.0 $ 140,988 $ 140,988 — $ — $ — 2,181 $ 1,391,811 $ 1,249,897 3,121 32.4 $ 1,532,799 3,098 32.0 $ 1,390,885 East(A) 1,057 6.7 256,082 248,742 575 93,676 93,676 2,392 575,905 569,802 4,024 17.0 925,663 3,946 17.1 912,220 West(A) 841 0.0 197,368 197,368 1,274 312,596 312,596 3,103 459,331 458,768 5,218 37.4 969,295 5,213 37.4 968,732 Total U.S. 2,838 2.5 594,438 587,098 1,849 406,272 406,272 7,676 2,427,047 2,278,467 12,363 29.5 3,427,757 12,257 29.5 3,271,837 Canada — — — — 2,036 373,902 373,902 475 86,298 86,298 2,511 38.9 460,200 2,511 38.9 460,200 Mexico 524 41.0 42,305 42,305 609 65,232 65,232 2,770 278,487 278,487 3,903 21.9 386,024 3,903 21.9 386,024 Brazil — — — — 1,494 113,987 22,797 — — — 1,494 88.3 113,987 299 88.3 22,797 Total Other Americas 524 41.0 42,305 42,305 4,139 553,121 461,931 3,245 364,785 364,785 — 7,908 39.8 960,211 6,713 31.2 869,021 Northern Europe 1,283 21.8 167,251 167,251 765 123,665 123,665 1,493 238,602 191,497 3,541 53.9 529,518 3,338 53.0 482,413 Southern Europe 89 0.0 9,037 2,298 562 68,157 68,157 347 32,456 32,456 998 63.5 109,650 932 68.0 102,911 Central Europe 477 71.2 44,873 31,802 — — — 846 60,422 60,422 1,323 73.3 105,295 1,198 70.5 92,224 United Kingdom 28 0.0 12,875 3,274 — — — 360 162,644 162,644 388 0.0 175,519 368 0.0 165,918 Total Europe 1,877 33.0 234,036 204,625 1,327 191,822 191,822 3,046 494,124 447,019 6,250 56.2 919,982 5,836 55.6 843,466 Japan 1,002 27.2 122,674 122,674 80 29,635 29,635 2,067 353,454 353,454 3,149 14.8 505,763 3,149 14.8 505,763 China(A) 824 54.3 39,503 5,925 — — — 2,382 156,406 23,461 3,206 14.0 195,909 481 14.0 29,386 Total Asia 1,826 39.4 162,177 128,599 80 29,635 29,635 4,449 509,860 376,915 6,355 14.4 701,672 3,630 14.7 535,149 Total Outside the U.S. 4,227 36.8 438,518 375,529 5,546 774,578 683,388 10,740 1,368,769 1,188,719 20,513 36.9 2,581,865 16,179 36.3 2,247,636 Total Development Portfolio 7,065 23.0 $ 1,032,956 $ 962,627 7,395 $ 1,180,850 $ 1,089,660 18,416 $ 3,795,816 $ 3,467,186 32,876 34.1 $ 6,009,622 28,436 33.4 $ 5,519,473 Cost to complete $ 92,016 $ 89,399 $ 200,764 $ 172,399 $ 2,182,596 $ 1,959,175 $ 2,475,376 $ 2,220,973 Percent build-to-suit 0.5 % 38.8 % 45.2 % 36.2 % Estimated weighted average stabilized yield 6.3 % 6.9 % 7.1 % 6.9 % Annualized estimated NOI $ 381,456 Estimated weighted average stabilized cap rate 5.3 % Estimated weighted average margin 26.2 % Estimated value creation $ 1,449,660

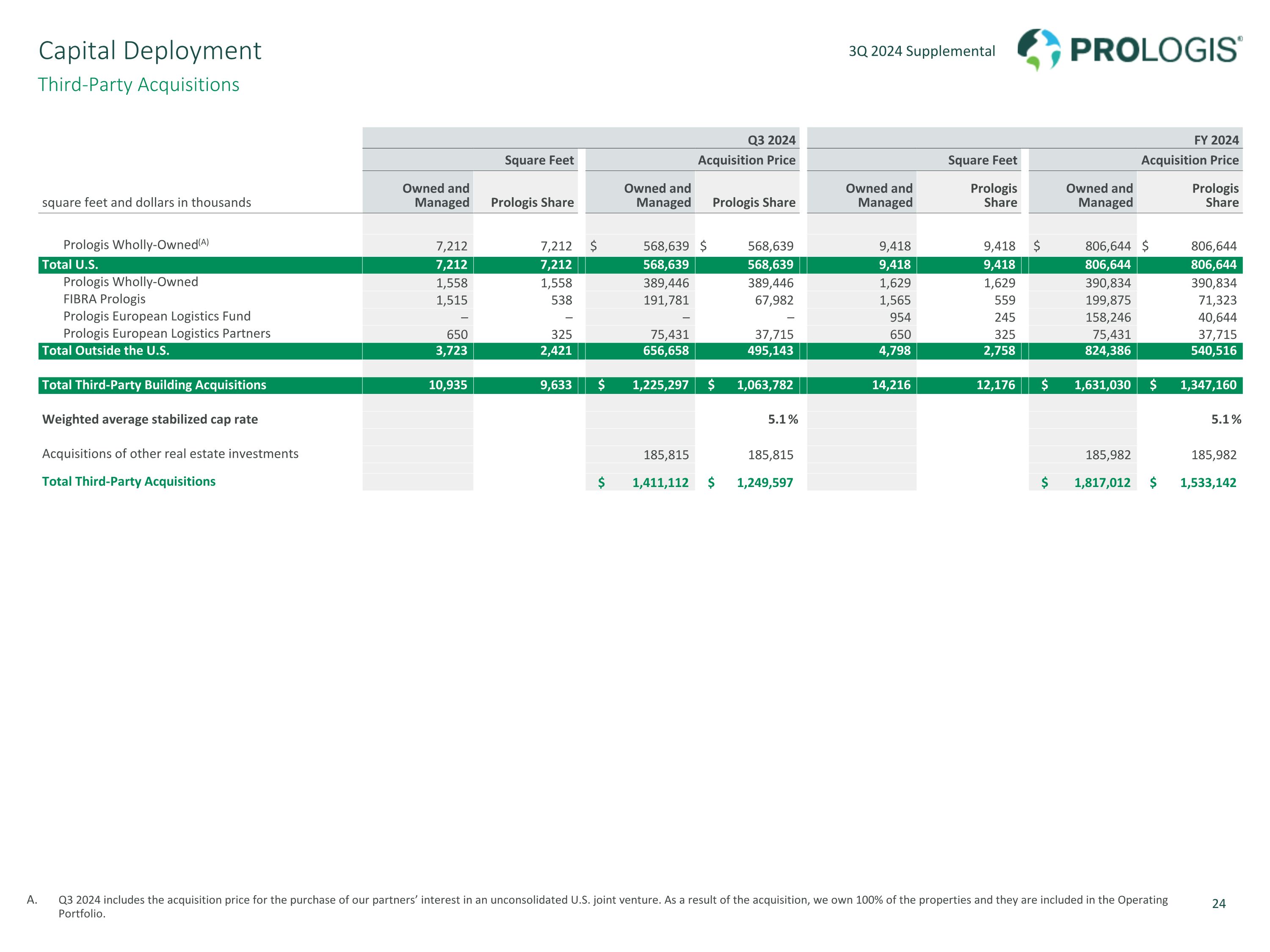

Third-Party Acquisitions Capital Deployment Q3 2024 FY 2024 Square Feet Acquisition Price Square Feet Acquisition Price square feet and dollars in thousands Owned and Managed Prologis Share Owned and Managed Prologis Share Owned and Managed Prologis Share Owned and Managed Prologis Share Prologis Wholly-Owned(A) 7,212 7,212 $ 568,639 $ 568,639 9,418 9,418 $ 806,644 $ 806,644 Total U.S. 7,212 7,212 568,639 568,639 9,418 9,418 806,644 806,644 Prologis Wholly-Owned 1,558 1,558 389,446 389,446 1,629 1,629 390,834 390,834 FIBRA Prologis 1,515 538 191,781 67,982 1,565 559 199,875 71,323 Prologis European Logistics Fund – – – – 954 245 158,246 40,644 Prologis European Logistics Partners 650 325 75,431 37,715 650 325 75,431 37,715 Total Outside the U.S. 3,723 2,421 656,658 495,143 4,798 2,758 824,386 540,516 Total Third-Party Building Acquisitions 10,935 9,633 $ 1,225,297 $ 1,063,782 14,216 12,176 $ 1,631,030 $ 1,347,160 Weighted average stabilized cap rate 5.1 % 5.1 % Acquisitions of other real estate investments 185,815 185,815 185,982 185,982 Total Third-Party Acquisitions $ 1,411,112 $ 1,249,597 $ 1,817,012 $ 1,533,142 Q3 2024 includes the acquisition price for the purchase of our partners’ interest in an unconsolidated U.S. joint venture. As a result of the acquisition, we own 100% of the properties and they are included in the Operating Portfolio.

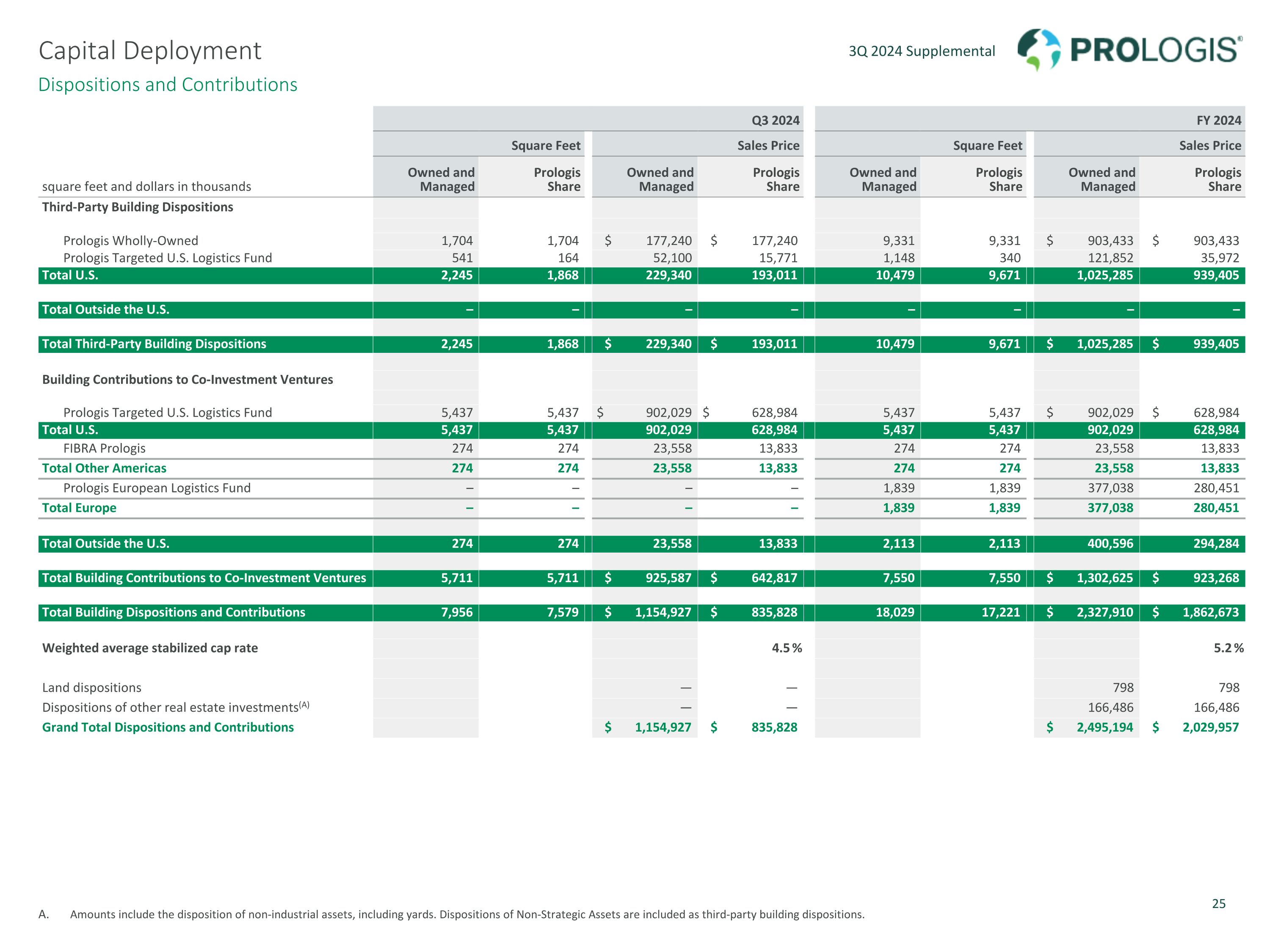

Dispositions and Contributions Capital Deployment Q3 2024 FY 2024 Square Feet Sales Price Square Feet Sales Price square feet and dollars in thousands Owned and Managed Prologis Share Owned and Managed Prologis Share Owned and Managed Prologis Share Owned and Managed Prologis Share Third-Party Building Dispositions Prologis Wholly-Owned 1,704 1,704 $ 177,240 $ 177,240 9,331 9,331 $ 903,433 $ 903,433 Prologis Targeted U.S. Logistics Fund 541 164 52,100 15,771 1,148 340 121,852 35,972 Total U.S. 2,245 1,868 229,340 193,011 10,479 9,671 1,025,285 939,405 Total Outside the U.S. – – – – – – – – Total Third-Party Building Dispositions 2,245 1,868 $ 229,340 $ 193,011 10,479 9,671 $ 1,025,285 $ 939,405 Building Contributions to Co-Investment Ventures Prologis Targeted U.S. Logistics Fund 5,437 5,437 $ 902,029 $ 628,984 5,437 5,437 $ 902,029 $ 628,984 Total U.S. 5,437 5,437 902,029 628,984 5,437 5,437 902,029 628,984 FIBRA Prologis 274 274 23,558 13,833 274 274 23,558 13,833 Total Other Americas 274 274 23,558 13,833 274 274 23,558 13,833 Prologis European Logistics Fund – – – – 1,839 1,839 377,038 280,451 Total Europe – – – – 1,839 1,839 377,038 280,451 Total Outside the U.S. 274 274 23,558 13,833 2,113 2,113 400,596 294,284 Total Building Contributions to Co-Investment Ventures 5,711 5,711 $ 925,587 $ 642,817 7,550 7,550 $ 1,302,625 $ 923,268 Total Building Dispositions and Contributions 7,956 7,579 $ 1,154,927 $ 835,828 18,029 17,221 $ 2,327,910 $ 1,862,673 Weighted average stabilized cap rate 4.5 % 5.2 % Land dispositions — — 798 798 Dispositions of other real estate investments(A) — — 166,486 166,486 Grand Total Dispositions and Contributions $ 1,154,927 $ 835,828 $ 2,495,194 $ 2,029,957 Amounts include the disposition of non-industrial assets, including yards. Dispositions of Non-Strategic Assets are included as third-party building dispositions.

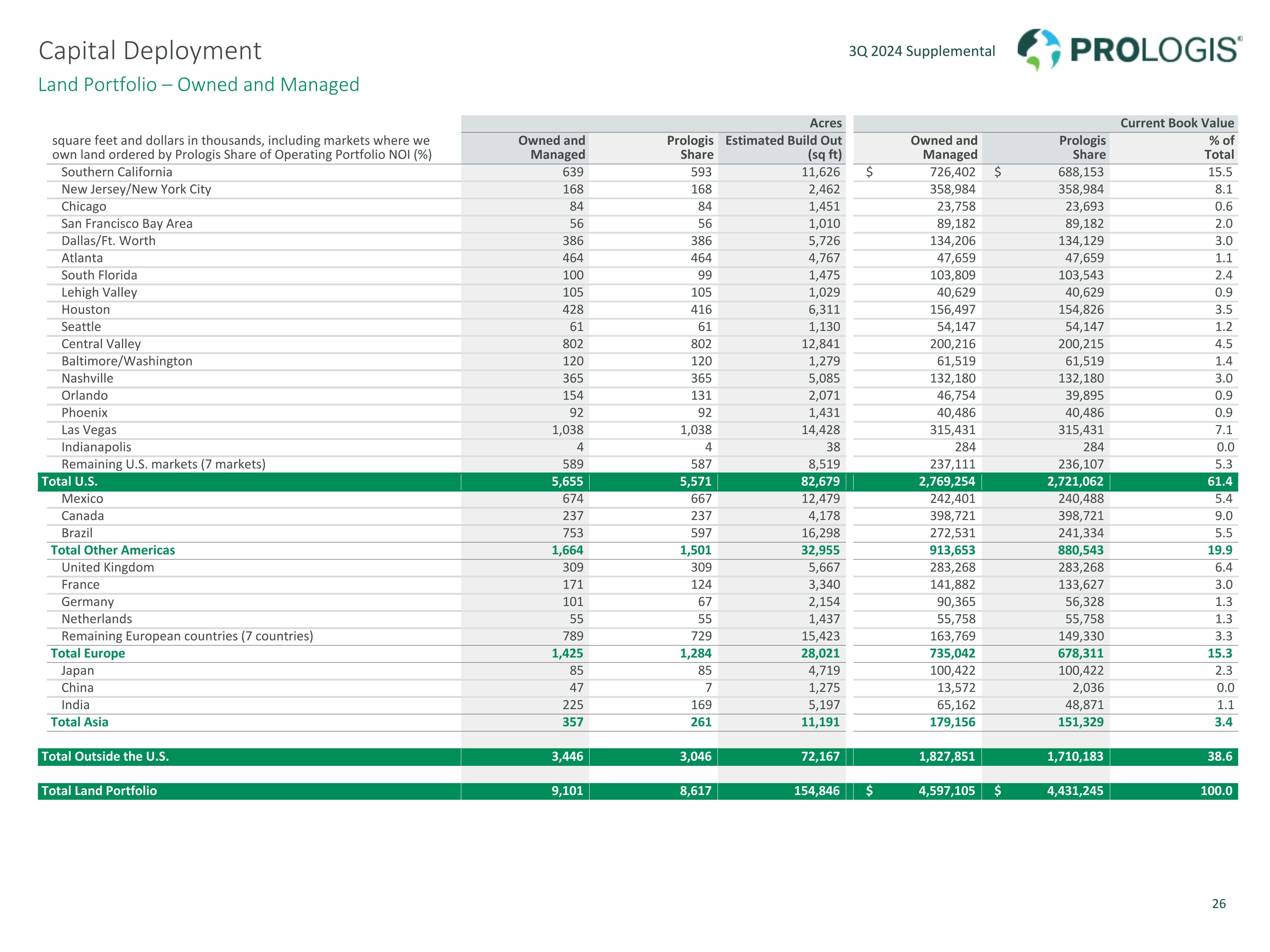

Land Portfolio – Owned and Managed Capital Deployment Acres Current Book Value square feet and dollars in thousands, including markets where we own land ordered by Prologis Share of Operating Portfolio NOI (%) Owned and Managed Prologis Share Estimated Build Out (sq ft) Owned and Managed Prologis Share % of Total Southern California 639 593 11,626 $ 726,402 $ 688,153 15.5 New Jersey/New York City 168 168 2,462 358,984 358,984 8.1 Chicago 84 84 1,451 23,758 23,693 0.6 San Francisco Bay Area 56 56 1,010 89,182 89,182 2.0 Dallas/Ft. Worth 386 386 5,726 134,206 134,129 3.0 Atlanta 464 464 4,767 47,659 47,659 1.1 South Florida 100 99 1,475 103,809 103,543 2.4 Lehigh Valley 105 105 1,029 40,629 40,629 0.9 Houston 428 416 6,311 156,497 154,826 3.5 Seattle 61 61 1,130 54,147 54,147 1.2 Central Valley 802 802 12,841 200,216 200,215 4.5 Baltimore/Washington 120 120 1,279 61,519 61,519 1.4 Nashville 365 365 5,085 132,180 132,180 3.0 Orlando 154 131 2,071 46,754 39,895 0.9 Phoenix 92 92 1,431 40,486 40,486 0.9 Las Vegas 1,038 1,038 14,428 315,431 315,431 7.1 Indianapolis 4 4 38 284 284 0.0 Remaining U.S. markets (7 markets) 589 587 8,519 237,111 236,107 5.3 Total U.S. 5,655 5,571 82,679 2,769,254 2,721,062 61.4 Mexico 674 667 12,479 242,401 240,488 5.4 Canada 237 237 4,178 398,721 398,721 9.0 Brazil 753 597 16,298 272,531 241,334 5.5 Total Other Americas 1,664 1,501 32,955 913,653 880,543 19.9 United Kingdom 309 309 5,667 283,268 283,268 6.4 France 171 124 3,340 141,882 133,627 3.0 Germany 101 67 2,154 90,365 56,328 1.3 Netherlands 55 55 1,437 55,758 55,758 1.3 Remaining European countries (7 countries) 789 729 15,423 163,769 149,330 3.3 Total Europe 1,425 1,284 28,021 735,042 678,311 15.3 Japan 85 85 4,719 100,422 100,422 2.3 China 47 7 1,275 13,572 2,036 0.0 India 225 169 5,197 65,162 48,871 1.1 Total Asia 357 261 11,191 179,156 151,329 3.4 Total Outside the U.S. 3,446 3,046 72,167 1,827,851 1,710,183 38.6 Total Land Portfolio 9,101 8,617 154,846 $ 4,597,105 $ 4,431,245 100.0

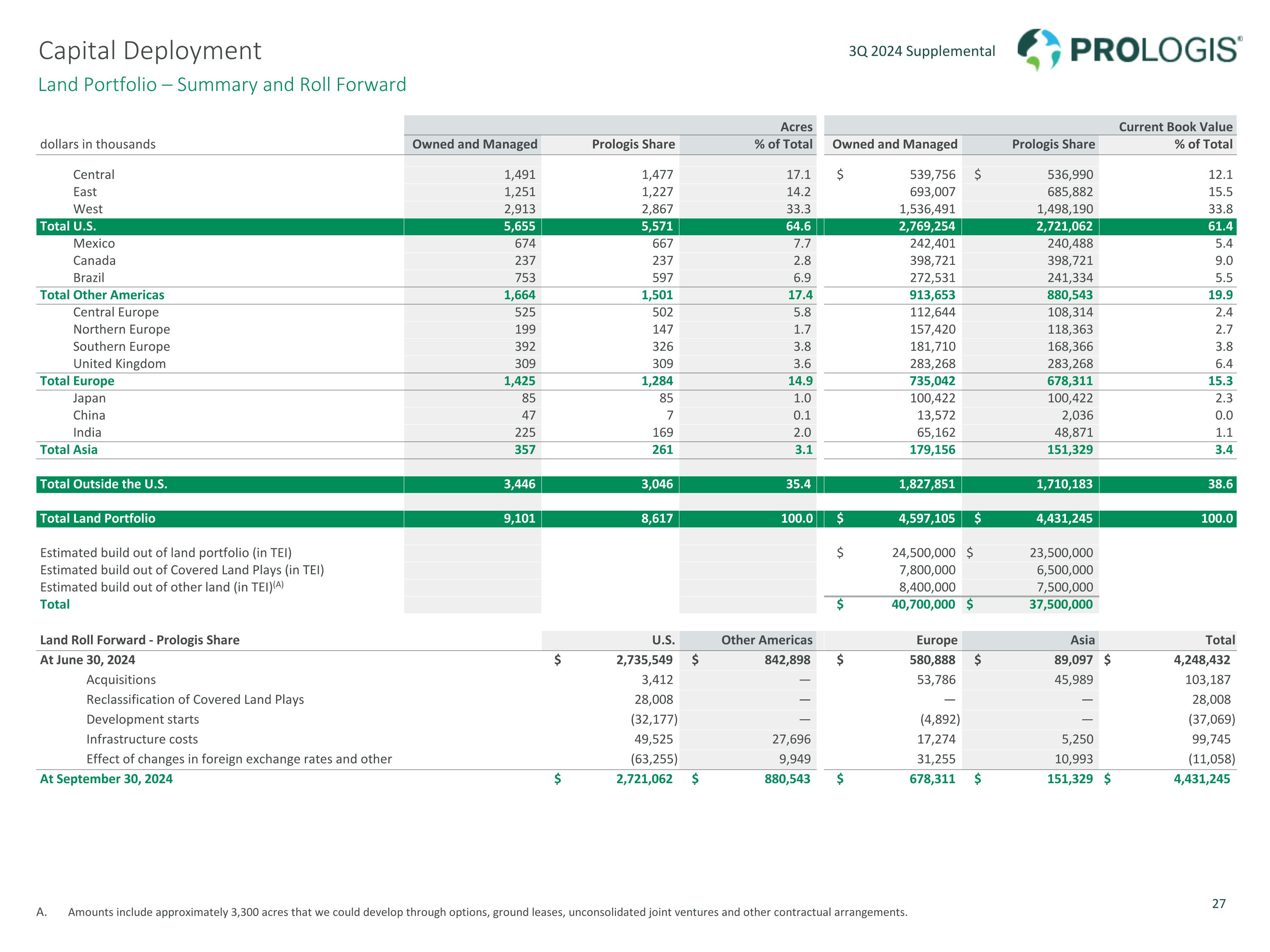

Land Portfolio – Summary and Roll Forward Amounts include approximately 3,300 acres that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Capital Deployment Acres Current Book Value dollars in thousands Owned and Managed Prologis Share % of Total Owned and Managed Prologis Share % of Total Central 1,491 1,477 17.1 $ 539,756 $ 536,990 12.1 East 1,251 1,227 14.2 693,007 685,882 15.5 West 2,913 2,867 33.3 1,536,491 1,498,190 33.8 Total U.S. 5,655 5,571 64.6 2,769,254 2,721,062 61.4 Mexico 674 667 7.7 242,401 240,488 5.4 Canada 237 237 2.8 398,721 398,721 9.0 Brazil 753 597 6.9 272,531 241,334 5.5 Total Other Americas 1,664 1,501 17.4 913,653 880,543 19.9 Central Europe 525 502 5.8 112,644 108,314 2.4 Northern Europe 199 147 1.7 157,420 118,363 2.7 Southern Europe 392 326 3.8 181,710 168,366 3.8 United Kingdom 309 309 3.6 283,268 283,268 6.4 Total Europe 1,425 1,284 14.9 735,042 678,311 15.3 Japan 85 85 1.0 100,422 100,422 2.3 China 47 7 0.1 13,572 2,036 0.0 India 225 169 2.0 65,162 48,871 1.1 Total Asia 357 261 3.1 179,156 151,329 3.4 Total Outside the U.S. 3,446 3,046 35.4 1,827,851 1,710,183 38.6 Total Land Portfolio 9,101 8,617 100.0 $ 4,597,105 $ 4,431,245 100.0 Estimated build out of land portfolio (in TEI) $ 24,500,000 $ 23,500,000 Estimated build out of Covered Land Plays (in TEI) 7,800,000 6,500,000 Estimated build out of other land (in TEI)(A) 8,400,000 7,500,000 Total $ 40,700,000 $ 37,500,000 Land Roll Forward - Prologis Share U.S. Other Americas Europe Asia Total At June 30, 2024 $ 2,735,549 $ 842,898 $ 580,888 $ 89,097 $ 4,248,432 Acquisitions 3,412 — 53,786 45,989 103,187 Reclassification of Covered Land Plays 28,008 — — — 28,008 Development starts (32,177) — (4,892) — (37,069) Infrastructure costs 49,525 27,696 17,274 5,250 99,745 Effect of changes in foreign exchange rates and other (63,255) 9,949 31,255 10,993 (11,058) At September 30, 2024 $ 2,721,062 $ 880,543 $ 678,311 $ 151,329 $ 4,431,245

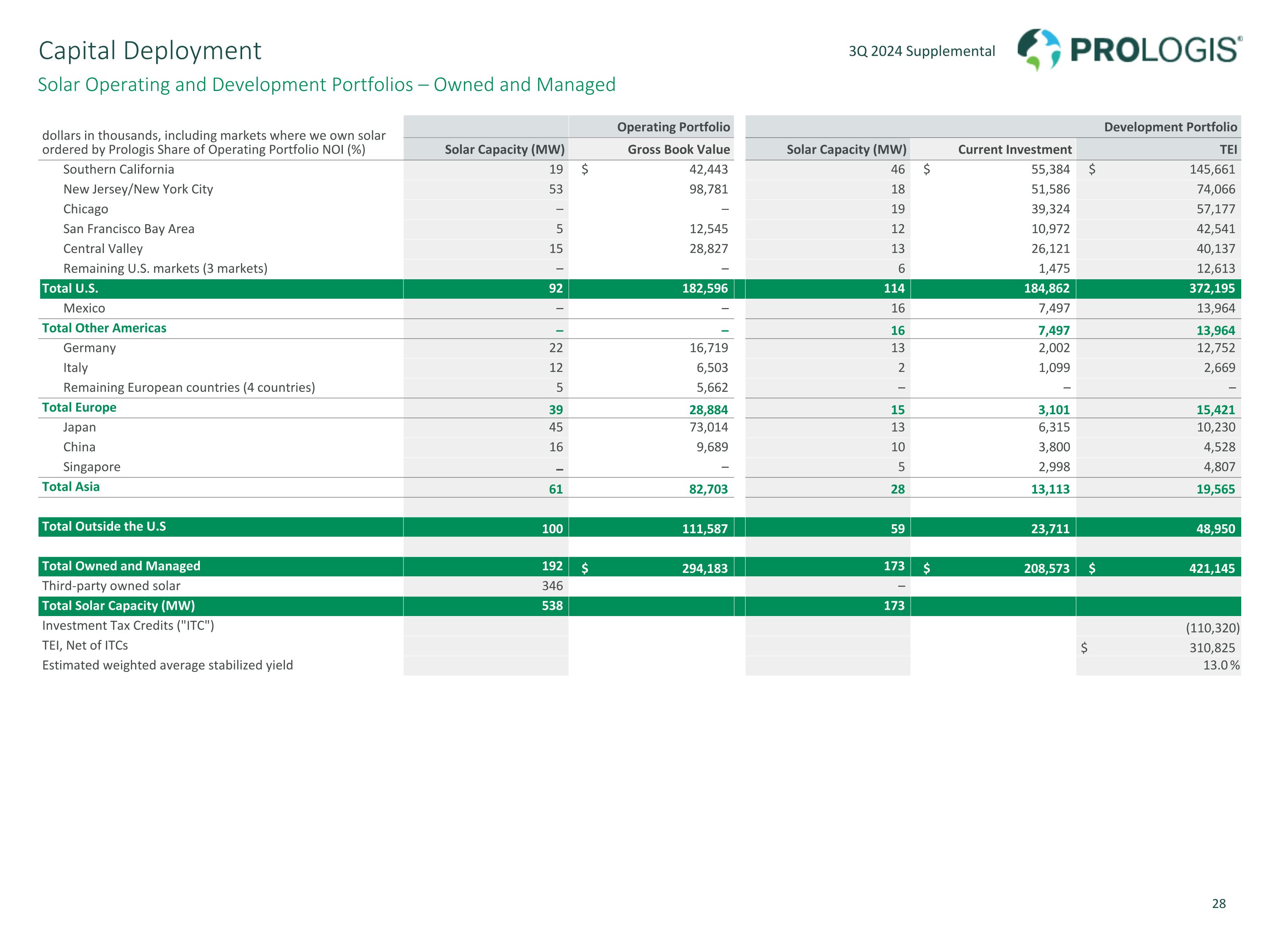

Solar Operating and Development Portfolios – Owned and Managed Capital Deployment dollars in thousands, including markets where we own solar ordered by Prologis Share of Operating Portfolio NOI (%) Operating Portfolio Development Portfolio Solar Capacity (MW) Gross Book Value Solar Capacity (MW) Current Investment TEI Southern California 19 $ 42,443 46 $ 55,384 $ 145,661 New Jersey/New York City 53 98,781 18 51,586 74,066 Chicago – – 19 39,324 57,177 San Francisco Bay Area 5 12,545 12 10,972 42,541 Central Valley 15 28,827 13 26,121 40,137 Remaining U.S. markets (3 markets) – – 6 1,475 12,613 Total U.S. 92 182,596 114 184,862 372,195 Mexico – – 16 7,497 13,964 Total Other Americas – – 16 7,497 13,964 Germany 22 16,719 13 2,002 12,752 Italy 12 6,503 2 1,099 2,669 Remaining European countries (4 countries) 5 5,662 – – – Total Europe 39 28,884 15 3,101 15,421 Japan 45 73,014 13 6,315 10,230 China 16 9,689 10 3,800 4,528 Singapore – – 5 2,998 4,807 Total Asia 61 82,703 28 13,113 19,565 Total Outside the U.S 100 111,587 59 23,711 48,950 Total Owned and Managed 192 $ 294,183 173 $ 208,573 $ 421,145 Third-party owned solar 346 – Total Solar Capacity (MW) 538 173 Investment Tax Credits ("ITC") (110,320) TEI, Net of ITCs $ 310,825 Estimated weighted average stabilized yield 13.0 %

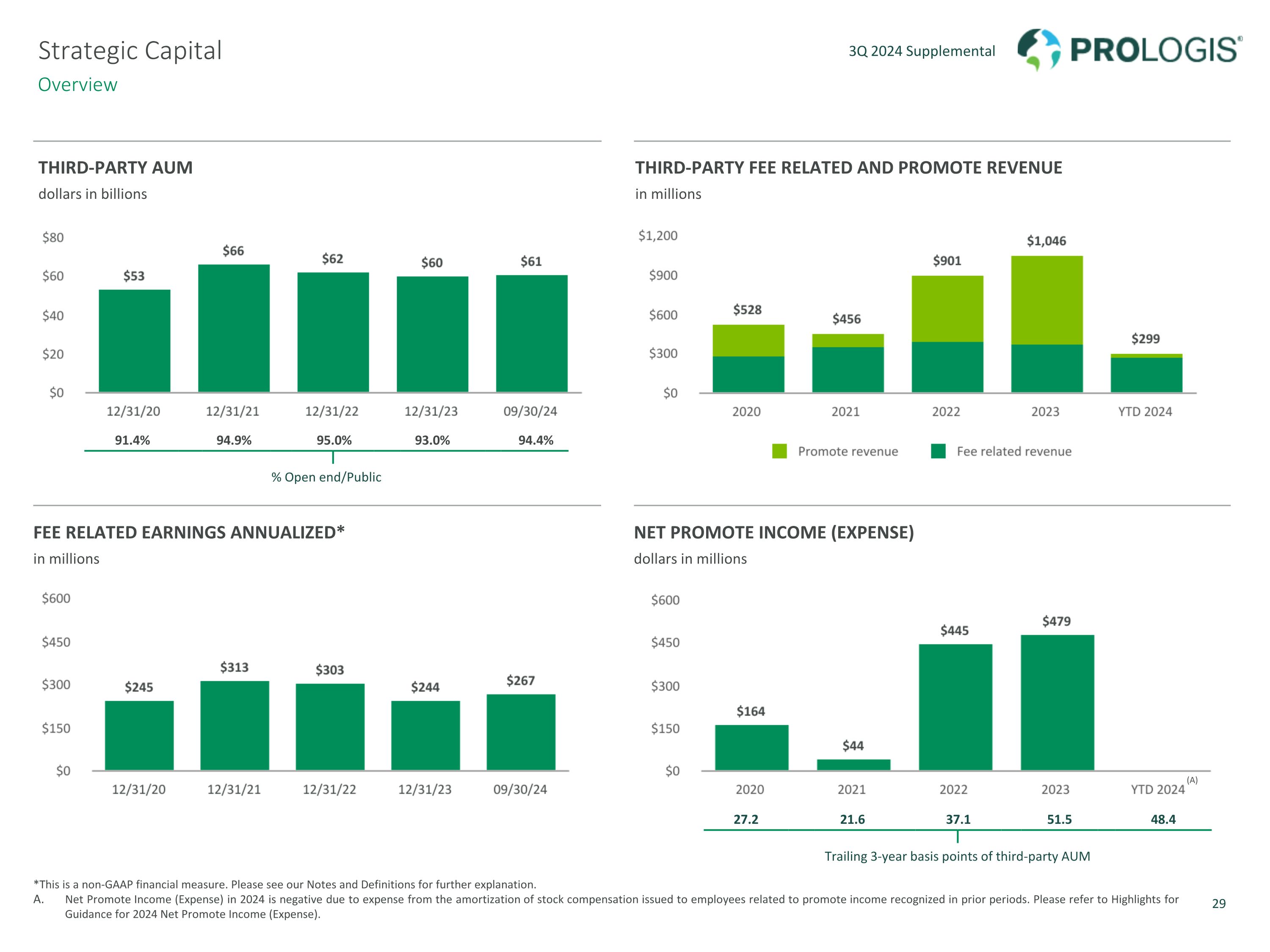

THIRD-PARTY AUM dollars in billions THIRD-PARTY FEE RELATED AND PROMOTE REVENUE in millions FEE RELATED EARNINGS ANNUALIZED* in millions NET PROMOTE INCOME (EXPENSE) dollars in millions *This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Net Promote Income (Expense) in 2024 is negative due to expense from the amortization of stock compensation issued to employees related to promote income recognized in prior periods. Please refer to Highlights for Guidance for 2024 Net Promote Income (Expense). Strategic Capital Overview 27.2 21.6 37.1 51.5 48.4 Trailing 3-year basis points of third-party AUM 91.4% 94.9% 95.0% 93.0% 94.4% % Open end/Public (A)

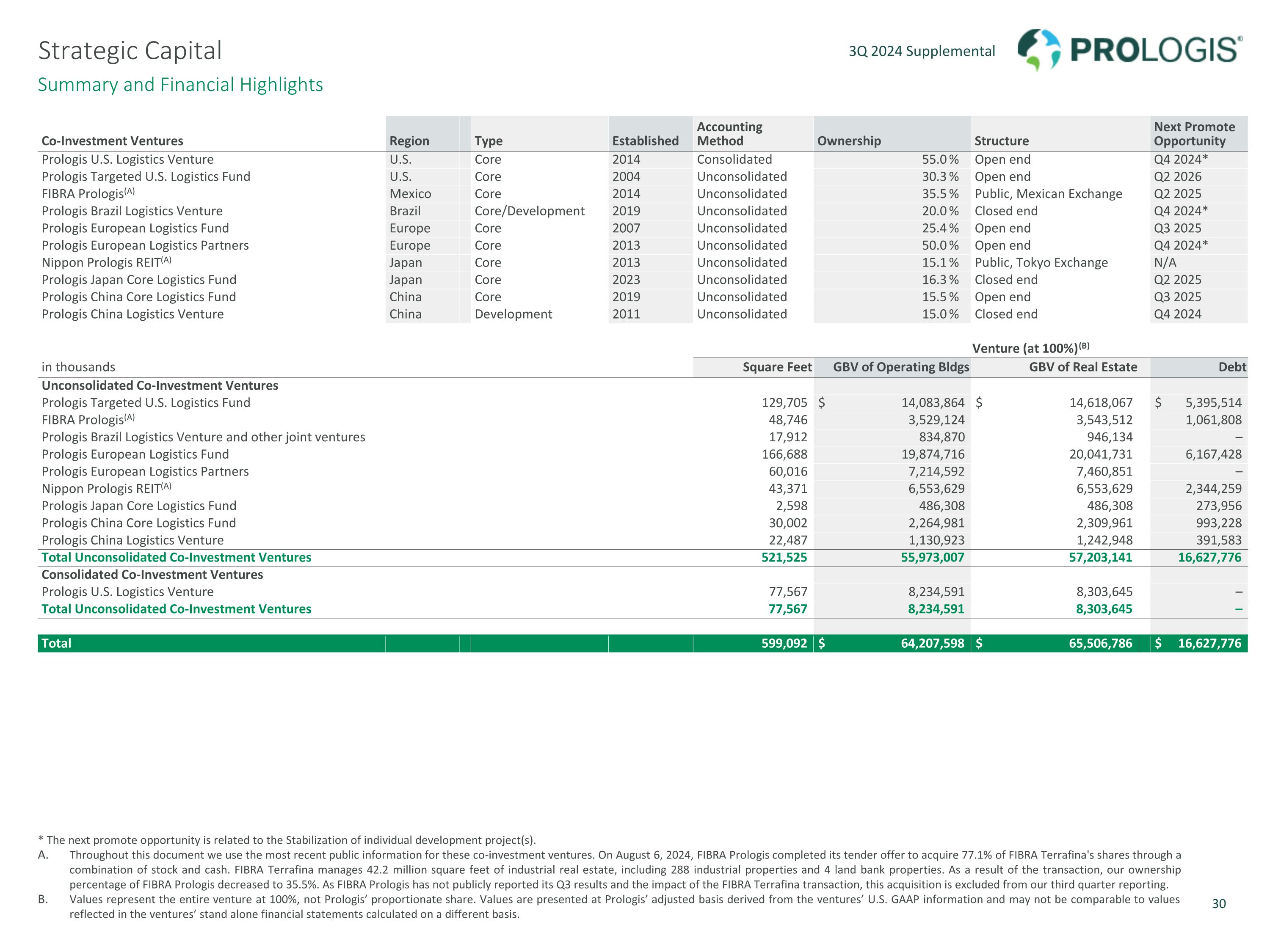

Summary and Financial Highlights * The next promote opportunity is related to the Stabilization of individual development project(s). Throughout this document we use the most recent public information for these co-investment ventures. On August 6, 2024, FIBRA Prologis completed its tender offer to acquire 77.1% of FIBRA Terrafina's shares through a combination of stock and cash. FIBRA Terrafina manages 42.2 million square feet of industrial real estate, including 288 industrial properties and 4 land bank properties. As a result of the transaction, our ownership percentage of FIBRA Prologis decreased to 35.5%. As FIBRA Prologis has not publicly reported its Q3 results and the impact of the FIBRA Terrafina transaction, this acquisition is excluded from our third quarter reporting. Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Strategic Capital Co-Investment Ventures Region Type Established Accounting Method Ownership Structure Next Promote Opportunity Prologis U.S. Logistics Venture U.S. Core 2014 Consolidated 55.0 % Open end Q4 2024* Prologis Targeted U.S. Logistics Fund U.S. Core 2004 Unconsolidated 30.3 % Open end Q2 2026 FIBRA Prologis(A) Mexico Core 2014 Unconsolidated 35.5 % Public, Mexican Exchange Q2 2025 Prologis Brazil Logistics Venture Brazil Core/Development 2019 Unconsolidated 20.0 % Closed end Q4 2024* Prologis European Logistics Fund Europe Core 2007 Unconsolidated 25.4 % Open end Q3 2025 Prologis European Logistics Partners Europe Core 2013 Unconsolidated 50.0 % Open end Q4 2024* Nippon Prologis REIT(A) Japan Core 2013 Unconsolidated 15.1 % Public, Tokyo Exchange N/A Prologis Japan Core Logistics Fund Japan Core 2023 Unconsolidated 16.3 % Closed end Q2 2025 Prologis China Core Logistics Fund China Core 2019 Unconsolidated 15.5 % Open end Q3 2025 Prologis China Logistics Venture China Development 2011 Unconsolidated 15.0 % Closed end Q4 2024 Venture (at 100%)(B) in thousands Square Feet GBV of Operating Bldgs GBV of Real Estate Debt Unconsolidated Co-Investment Ventures Prologis Targeted U.S. Logistics Fund 129,705 $ 14,083,864 $ 14,618,067 $ 5,395,514 FIBRA Prologis(A) 48,746 3,529,124 3,543,512 1,061,808 Prologis Brazil Logistics Venture and other joint ventures 17,912 834,870 946,134 – Prologis European Logistics Fund 166,688 19,874,716 20,041,731 6,167,428 Prologis European Logistics Partners 60,016 7,214,592 7,460,851 – Nippon Prologis REIT(A) 43,371 6,553,629 6,553,629 2,344,259 Prologis Japan Core Logistics Fund 2,598 486,308 486,308 273,956 Prologis China Core Logistics Fund 30,002 2,264,981 2,309,961 993,228 Prologis China Logistics Venture 22,487 1,130,923 1,242,948 391,583 Total Unconsolidated Co-Investment Ventures 521,525 55,973,007 57,203,141 16,627,776 Consolidated Co-Investment Ventures Prologis U.S. Logistics Venture 77,567 8,234,591 8,303,645 – Total Unconsolidated Co-Investment Ventures 77,567 8,234,591 8,303,645 – Total 599,092 $ 64,207,598 $ 65,506,786 $ 16,627,776

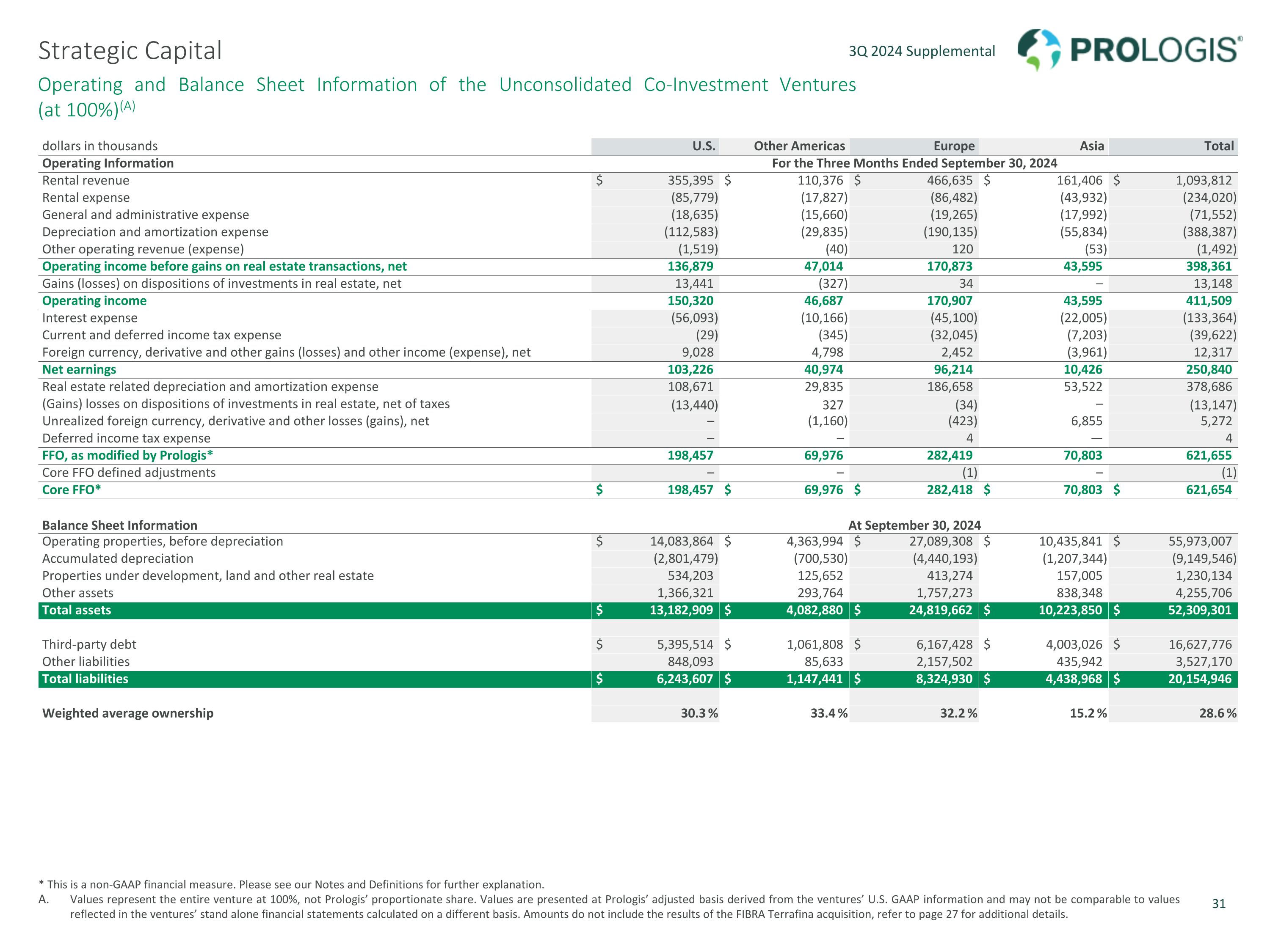

Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures (at 100%)(A) * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis’ proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Amounts do not include the results of the FIBRA Terrafina acquisition, refer to page 27 for additional details. Strategic Capital dollars in thousands U.S. Other Americas Europe Asia Total Operating Information For the Three Months Ended September 30, 2024 Rental revenue $ 355,395 $ 110,376 $ 466,635 $ 161,406 $ 1,093,812 Rental expense (85,779) (17,827) (86,482) (43,932) (234,020) General and administrative expense (18,635) (15,660) (19,265) (17,992) (71,552) Depreciation and amortization expense (112,583) (29,835) (190,135) (55,834) (388,387) Other operating revenue (expense) (1,519) (40) 120 (53) (1,492) Operating income before gains on real estate transactions, net 136,879 47,014 170,873 43,595 398,361 Gains (losses) on dispositions of investments in real estate, net 13,441 (327) 34 – 13,148 Operating income 150,320 46,687 170,907 43,595 411,509 Interest expense (56,093) (10,166) (45,100) (22,005) (133,364) Current and deferred income tax expense (29) (345) (32,045) (7,203) (39,622) Foreign currency, derivative and other gains (losses) and other income (expense), net 9,028 4,798 2,452 (3,961) 12,317 Net earnings 103,226 40,974 96,214 10,426 250,840 Real estate related depreciation and amortization expense 108,671 29,835 186,658 53,522 378,686 (Gains) losses on dispositions of investments in real estate, net of taxes (13,440) 327 (34) – (13,147) Unrealized foreign currency, derivative and other losses (gains), net – (1,160) (423) 6,855 5,272 Deferred income tax expense – – 4 — 4 FFO, as modified by Prologis* 198,457 69,976 282,419 70,803 621,655 Core FFO defined adjustments – – (1) – (1) Core FFO* $ 198,457 $ 69,976 $ 282,418 $ 70,803 $ 621,654 Balance Sheet Information At September 30, 2024 Operating properties, before depreciation $ 14,083,864 $ 4,363,994 $ 27,089,308 $ 10,435,841 $ 55,973,007 Accumulated depreciation (2,801,479) (700,530) (4,440,193) (1,207,344) (9,149,546) Properties under development, land and other real estate 534,203 125,652 413,274 157,005 1,230,134 Other assets 1,366,321 293,764 1,757,273 838,348 4,255,706 Total assets $ 13,182,909 $ 4,082,880 $ 24,819,662 $ 10,223,850 $ 52,309,301 Third-party debt $ 5,395,514 $ 1,061,808 $ 6,167,428 $ 4,003,026 $ 16,627,776 Other liabilities 848,093 85,633 2,157,502 435,942 3,527,170 Total liabilities $ 6,243,607 $ 1,147,441 $ 8,324,930 $ 4,438,968 $ 20,154,946 Weighted average ownership 30.3 % 33.4 % 32.2 % 15.2 % 28.6 %

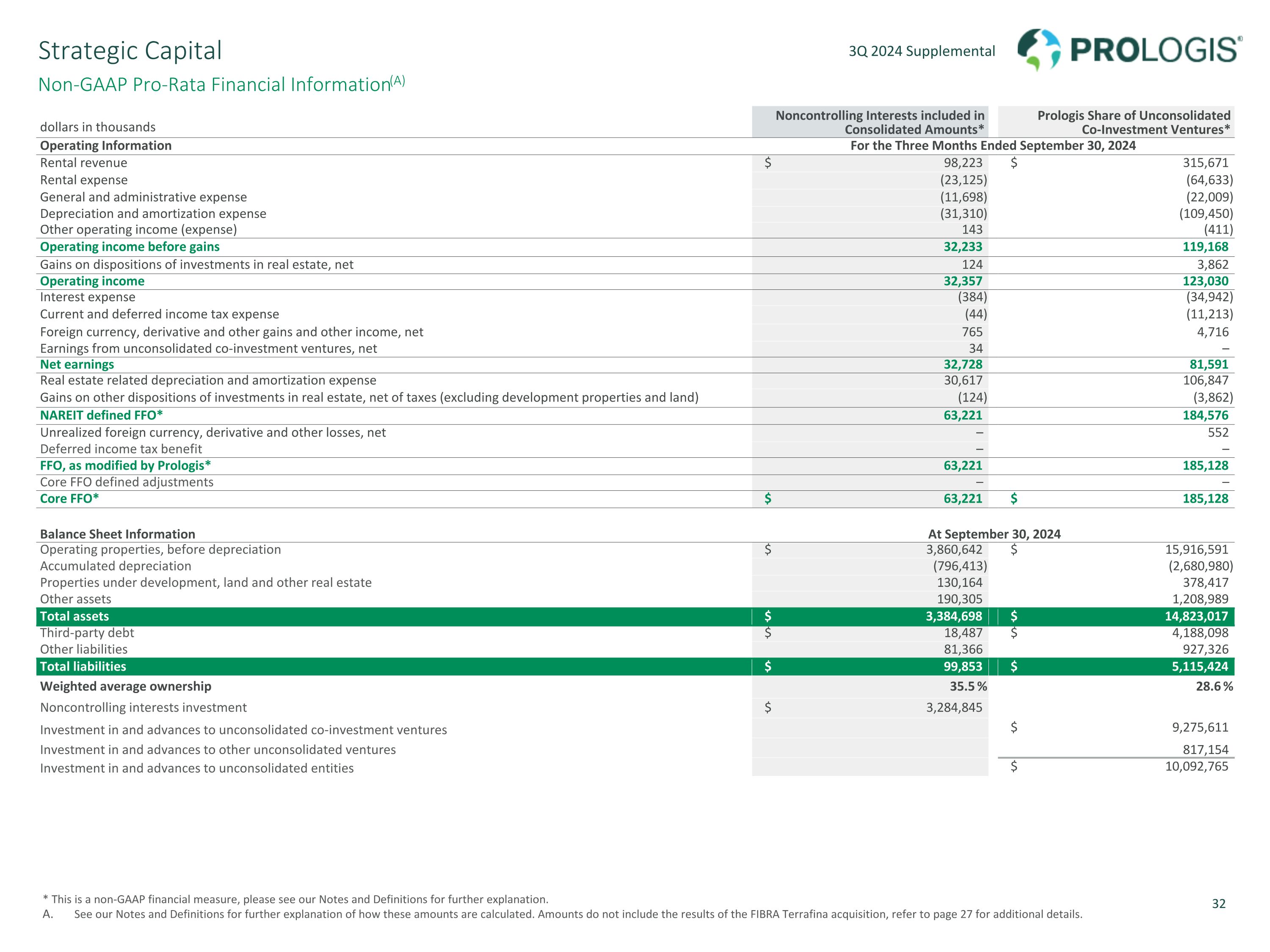

Non-GAAP Pro-Rata Financial Information(A) * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. Amounts do not include the results of the FIBRA Terrafina acquisition, refer to page 27 for additional details. Strategic Capital dollars in thousands Noncontrolling Interests included in Consolidated Amounts* Prologis Share of Unconsolidated Co-Investment Ventures* Operating Information For the Three Months Ended September 30, 2024 Rental revenue $ 98,223 $ 315,671 Rental expense (23,125) (64,633) General and administrative expense (11,698) (22,009) Depreciation and amortization expense (31,310) (109,450) Other operating income (expense) 143 (411) Operating income before gains 32,233 119,168 Gains on dispositions of investments in real estate, net 124 3,862 Operating income 32,357 123,030 Interest expense (384) (34,942) Current and deferred income tax expense (44) (11,213) Foreign currency, derivative and other gains and other income, net 765 4,716 Earnings from unconsolidated co-investment ventures, net 34 – Net earnings 32,728 81,591 Real estate related depreciation and amortization expense 30,617 106,847 Gains on other dispositions of investments in real estate, net of taxes (excluding development properties and land) (124) (3,862) NAREIT defined FFO* 63,221 184,576 Unrealized foreign currency, derivative and other losses, net – 552 Deferred income tax benefit – – FFO, as modified by Prologis* 63,221 185,128 Core FFO defined adjustments – – Core FFO* $ 63,221 $ 185,128 Balance Sheet Information At September 30, 2024 Operating properties, before depreciation $ 3,860,642 $ 15,916,591 Accumulated depreciation (796,413) (2,680,980) Properties under development, land and other real estate 130,164 378,417 Other assets 190,305 1,208,989 Total assets $ 3,384,698 $ 14,823,017 Third-party debt $ 18,487 $ 4,188,098 Other liabilities 81,366 927,326 Total liabilities $ 99,853 $ 5,115,424 Weighted average ownership 35.5 % 28.6 % Noncontrolling interests investment $ 3,284,845 Investment in and advances to unconsolidated co-investment ventures $ 9,275,611 Investment in and advances to other unconsolidated ventures 817,154 Investment in and advances to unconsolidated entities $ 10,092,765

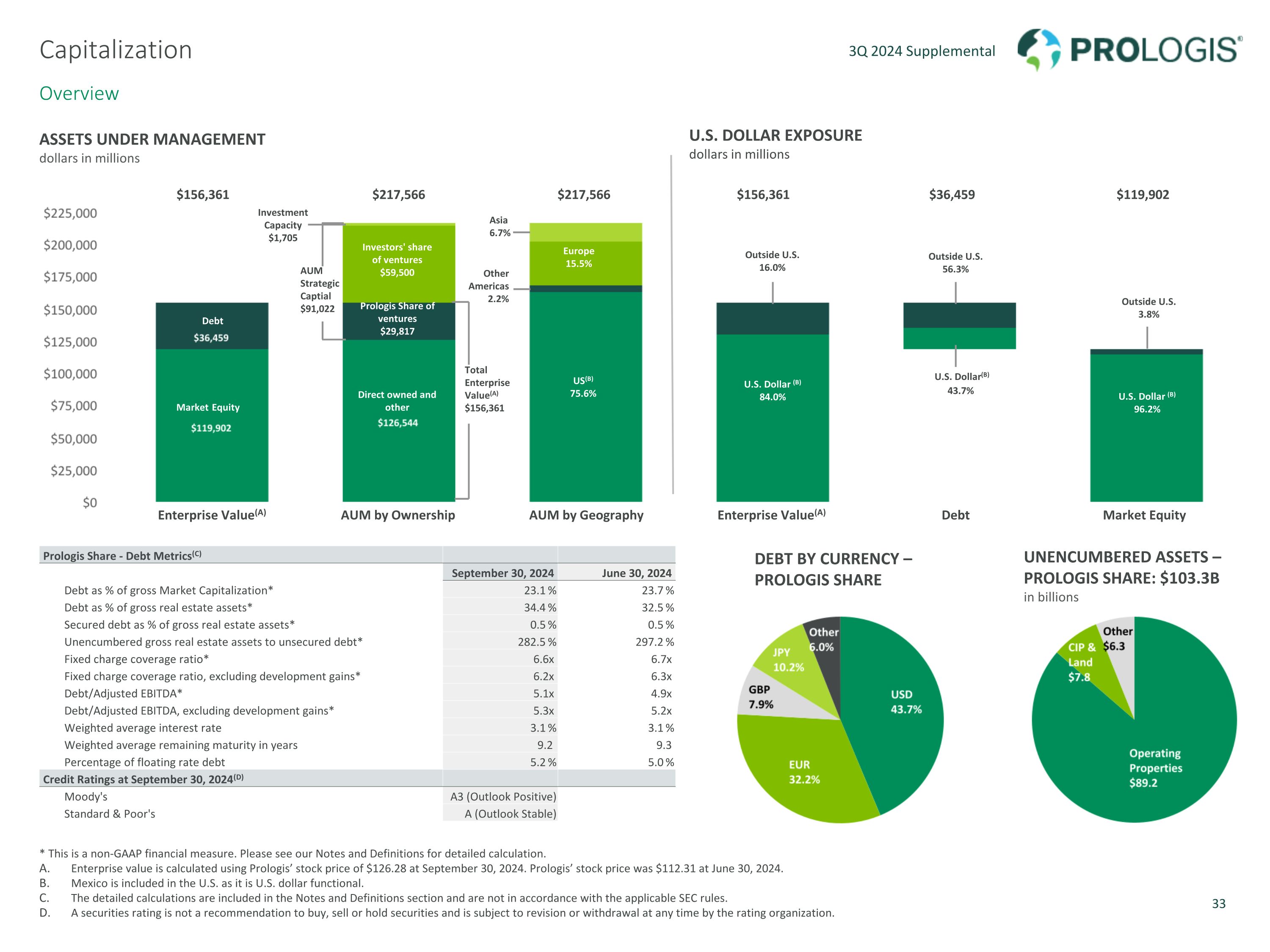

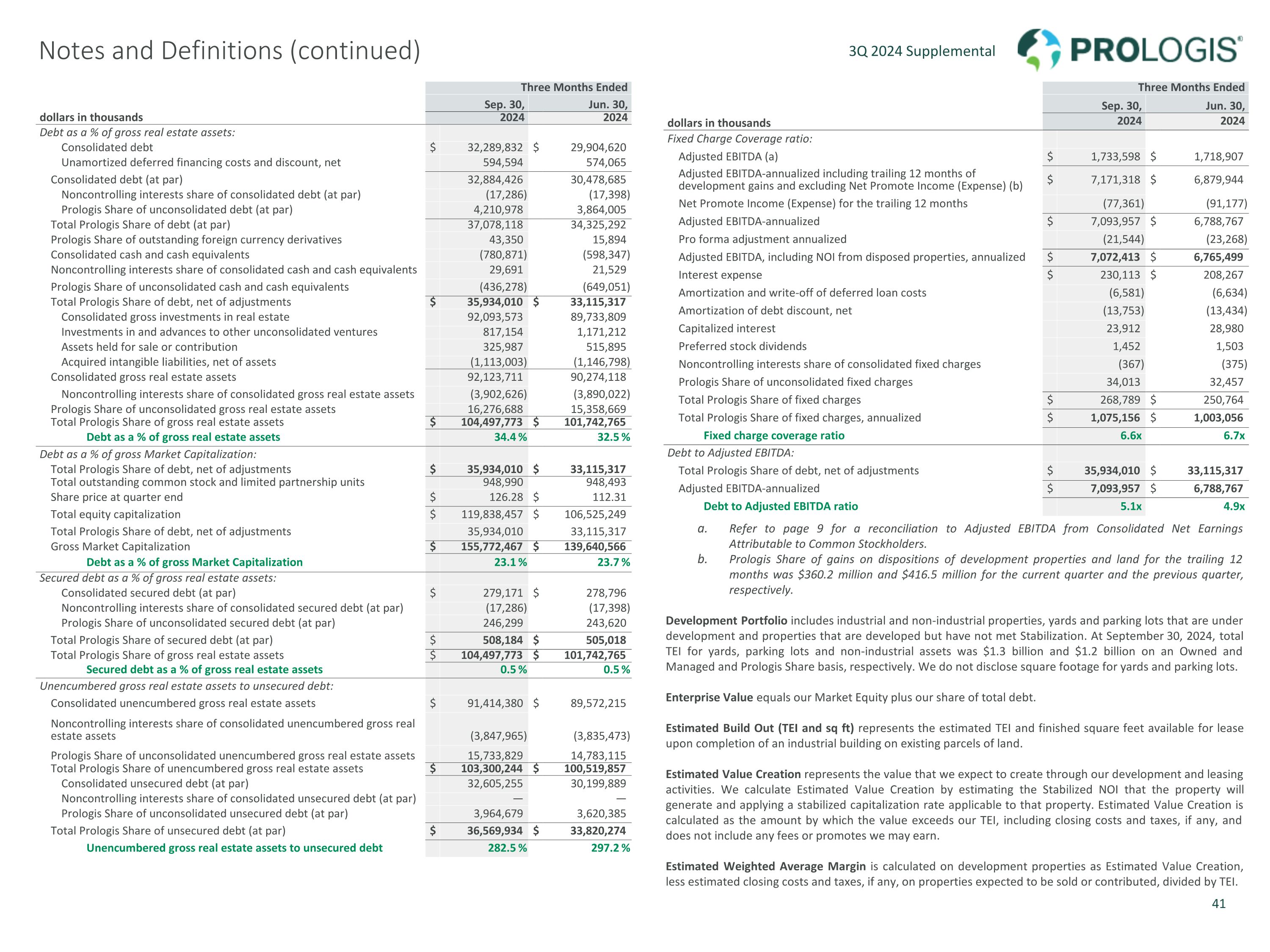

Overview * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Enterprise value is calculated using Prologis’ stock price of $126.28 at September 30, 2024. Prologis’ stock price was $112.31 at June 30, 2024. Mexico is included in the U.S. as it is U.S. dollar functional. The detailed calculations are included in the Notes and Definitions section and are not in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. Capitalization ASSETS UNDER MANAGEMENT dollars in millions U.S. DOLLAR EXPOSURE dollars in millions DEBT BY CURRENCY – PROLOGIS SHARE UNENCUMBERED ASSETS – PROLOGIS SHARE: $103.3B in billions Prologis Share - Debt Metrics(C) September 30, 2024 June 30, 2024 Debt as % of gross Market Capitalization* 23.1 % 23.7 % Debt as % of gross real estate assets* 34.4 % 32.5 % Secured debt as % of gross real estate assets* 0.5 % 0.5 % Unencumbered gross real estate assets to unsecured debt* 282.5 % 297.2 % Fixed charge coverage ratio* 6.6x 6.7x Fixed charge coverage ratio, excluding development gains* 6.2x 6.3x Debt/Adjusted EBITDA* 5.1x 4.9x Debt/Adjusted EBITDA, excluding development gains* 5.3x 5.2x Weighted average interest rate 3.1 % 3.1 % Weighted average remaining maturity in years 9.2 9.3 Percentage of floating rate debt 5.2 % 5.0 % Credit Ratings at September 30, 2024(D) Moody's A3 (Outlook Positive) Standard & Poor's A (Outlook Stable) $156,361 $217,566 $217,566 Investment Capacity $1,705 AUM Strategic Captial $91,022 Total Enterprise Value(A) $156,361 $156,361 $36,459 $119,902 Direct owned and other Market Equity Debt Prologis Share of ventures $29,817 Investors' share of ventures $59,500 US(B) 75.6% Europe 15.5% Other Americas 2.2% Asia 6.7% U.S. Dollar (B) 84.0% Outside U.S. 16.0% U.S. Dollar(B) Outside U.S. 56.3% U.S. Dollar (B) 96.2% Outside U.S. 3.8% 43.7% Enterprise Value(A) Debt Market Equity Enterprise Value(A) AUM by Ownership AUM by Geography

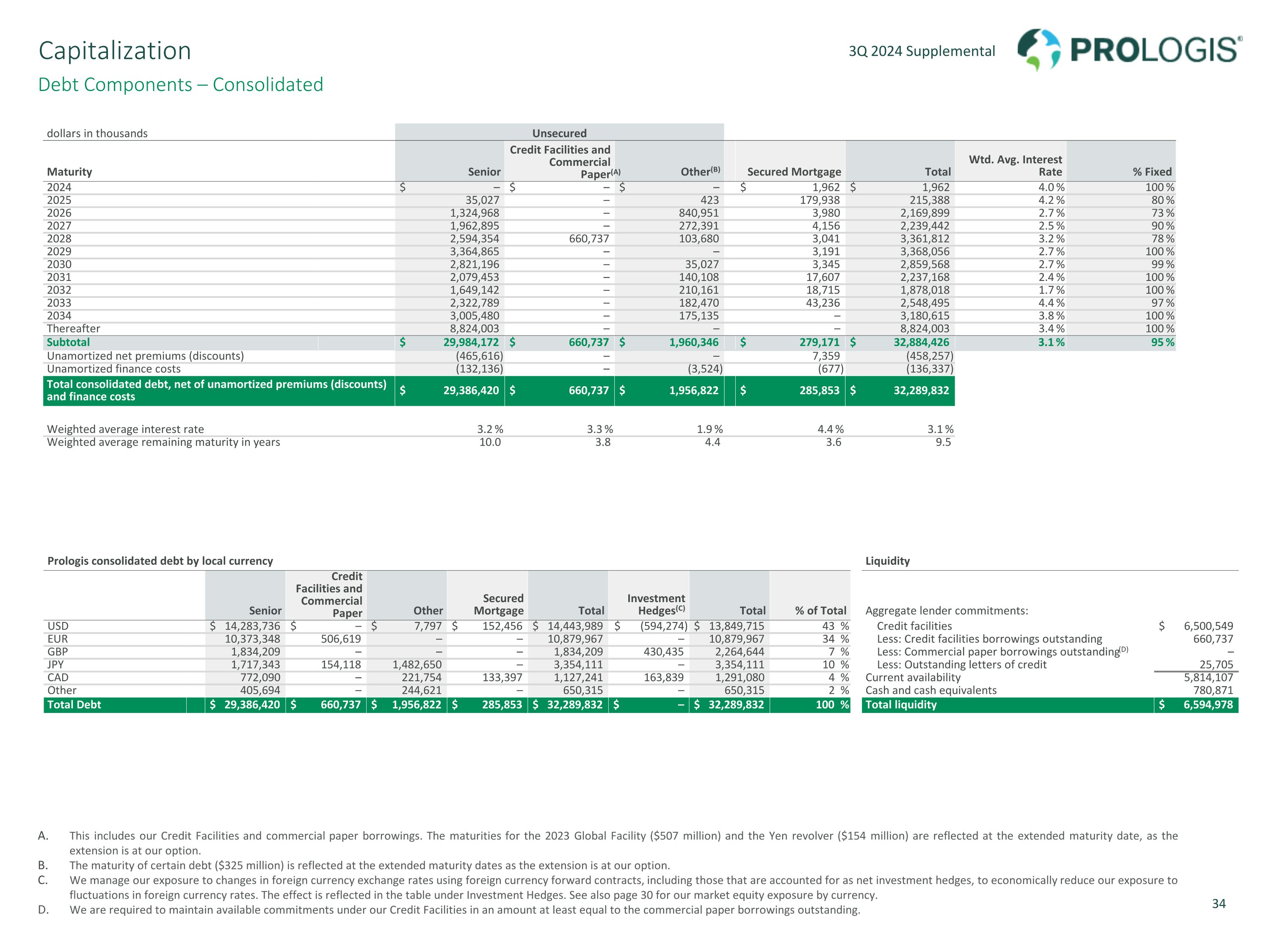

Debt Components – Consolidated This includes our Credit Facilities and commercial paper borrowings. The maturities for the 2023 Global Facility ($507 million) and the Yen revolver ($154 million) are reflected at the extended maturity date, as the extension is at our option. The maturity of certain debt ($325 million) is reflected at the extended maturity dates as the extension is at our option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 30 for our market equity exposure by currency. We are required to maintain available commitments under our Credit Facilities in an amount at least equal to the commercial paper borrowings outstanding. Capitalization dollars in thousands Unsecured Maturity Senior Credit Facilities and Commercial Paper(A) Other(B) Secured Mortgage Total Wtd. Avg. Interest Rate % Fixed 2024 $ – $ – $ – $ 1,962 $ 1,962 4.0 % 100 % 2025 35,027 – 423 179,938 215,388 4.2 % 80 % 2026 1,324,968 – 840,951 3,980 2,169,899 2.7 % 73 % 2027 1,962,895 – 272,391 4,156 2,239,442 2.5 % 90 % 2028 2,594,354 660,737 103,680 3,041 3,361,812 3.2 % 78 % 2029 3,364,865 – – 3,191 3,368,056 2.7 % 100 % 2030 2,821,196 – 35,027 3,345 2,859,568 2.7 % 99 % 2031 2,079,453 – 140,108 17,607 2,237,168 2.4 % 100 % 2032 1,649,142 – 210,161 18,715 1,878,018 1.7 % 100 % 2033 2,322,789 – 182,470 43,236 2,548,495 4.4 % 97 % 2034 3,005,480 – 175,135 – 3,180,615 3.8 % 100 % Thereafter 8,824,003 – – – 8,824,003 3.4 % 100 % Subtotal $ 29,984,172 $ 660,737 $ 1,960,346 $ 279,171 $ 32,884,426 3.1 % 95 % Unamortized net premiums (discounts) (465,616) – – 7,359 (458,257) Unamortized finance costs (132,136) – (3,524) (677) (136,337) Total consolidated debt, net of unamortized premiums (discounts) and finance costs $ 29,386,420 $ 660,737 $ 1,956,822 $ 285,853 $ 32,289,832 Weighted average interest rate 3.2 % 3.3 % 1.9 % 4.4 % 3.1 % Weighted average remaining maturity in years 10.0 3.8 4.4 3.6 9.5 Prologis consolidated debt by local currency Liquidity Senior Credit Facilities and Commercial Paper Other Secured Mortgage Total Investment Hedges(C) Total % of Total Aggregate lender commitments: USD $ 14,283,736 $ – $ 7,797 $ 152,456 $ 14,443,989 $ (594,274) $ 13,849,715 43 % Credit facilities $ 6,500,549 EUR 10,373,348 506,619 – – 10,879,967 – 10,879,967 34 % Less: Credit facilities borrowings outstanding 660,737 GBP 1,834,209 – – – 1,834,209 430,435 2,264,644 7 % Less: Commercial paper borrowings outstanding(D) – JPY 1,717,343 154,118 1,482,650 – 3,354,111 – 3,354,111 10 % Less: Outstanding letters of credit 25,705 CAD 772,090 – 221,754 133,397 1,127,241 163,839 1,291,080 4 % Current availability 5,814,107 Other 405,694 – 244,621 – 650,315 – 650,315 2 % Cash and cash equivalents 780,871 Total Debt $ 29,386,420 $ 660,737 $ 1,956,822 $ 285,853 $ 32,289,832 $ – $ 32,289,832 100 % Total liquidity $ 6,594,978

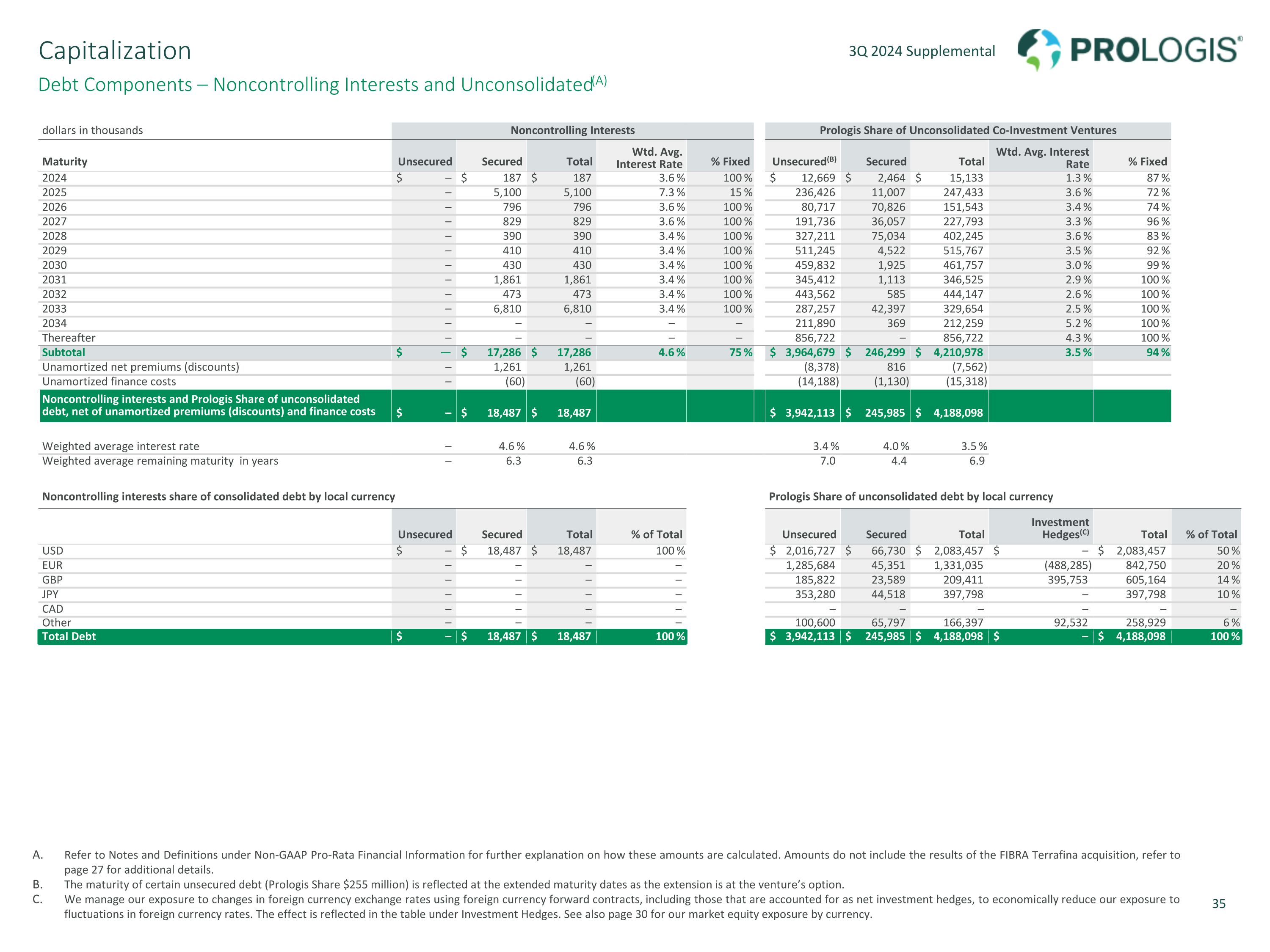

Debt Components – Noncontrolling Interests and Unconsolidated(A) Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. Amounts do not include the results of the FIBRA Terrafina acquisition, refer to page 27 for additional details. The maturity of certain unsecured debt (Prologis Share $255 million) is reflected at the extended maturity dates as the extension is at the venture’s option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 30 for our market equity exposure by currency. Capitalization dollars in thousands Noncontrolling Interests Prologis Share of Unconsolidated Co-Investment Ventures Maturity Unsecured Secured Total Wtd. Avg. Interest Rate % Fixed Unsecured(B) Secured Total Wtd. Avg. Interest Rate % Fixed 2024 $ – $ 187 $ 187 3.6 % 100 % $ 12,669 $ 2,464 $ 15,133 1.3 % 87 % 2025 – 5,100 5,100 7.3 % 15 % 236,426 11,007 247,433 3.6 % 72 % 2026 – 796 796 3.6 % 100 % 80,717 70,826 151,543 3.4 % 74 % 2027 – 829 829 3.6 % 100 % 191,736 36,057 227,793 3.3 % 96 % 2028 – 390 390 3.4 % 100 % 327,211 75,034 402,245 3.6 % 83 % 2029 – 410 410 3.4 % 100 % 511,245 4,522 515,767 3.5 % 92 % 2030 – 430 430 3.4 % 100 % 459,832 1,925 461,757 3.0 % 99 % 2031 – 1,861 1,861 3.4 % 100 % 345,412 1,113 346,525 2.9 % 100 % 2032 – 473 473 3.4 % 100 % 443,562 585 444,147 2.6 % 100 % 2033 – 6,810 6,810 3.4 % 100 % 287,257 42,397 329,654 2.5 % 100 % 2034 – – – – – 211,890 369 212,259 5.2 % 100 % Thereafter – – – – – 856,722 – 856,722 4.3 % 100 % Subtotal $ — $ 17,286 $ 17,286 4.6 % 75 % $ 3,964,679 $ 246,299 $ 4,210,978 3.5 % 94 % Unamortized net premiums (discounts) – 1,261 1,261 (8,378) 816 (7,562) Unamortized finance costs – (60) (60) (14,188) (1,130) (15,318) Noncontrolling interests and Prologis Share of unconsolidated debt, net of unamortized premiums (discounts) and finance costs $ – $ 18,487 $ 18,487 $ 3,942,113 $ 245,985 $ 4,188,098 Weighted average interest rate – 4.6 % 4.6 % 3.4 % 4.0 % 3.5 % Weighted average remaining maturity in years – 6.3 6.3 7.0 4.4 6.9 Noncontrolling interests share of consolidated debt by local currency Prologis Share of unconsolidated debt by local currency Unsecured Secured Total % of Total Unsecured Secured Total Investment Hedges(C) Total % of Total USD $ – $ 18,487 $ 18,487 100 % $ 2,016,727 $ 66,730 $ 2,083,457 $ – $ 2,083,457 50 % EUR – – – – 1,285,684 45,351 1,331,035 (488,285) 842,750 20 % GBP – – – – 185,822 23,589 209,411 395,753 605,164 14 % JPY – – – – 353,280 44,518 397,798 – 397,798 10 % CAD – – – – – – – – – – Other – – – – 100,600 65,797 166,397 92,532 258,929 6 % Total Debt $ – $ 18,487 $ 18,487 100 % $ 3,942,113 $ 245,985 $ 4,188,098 $ – $ 4,188,098 100 %

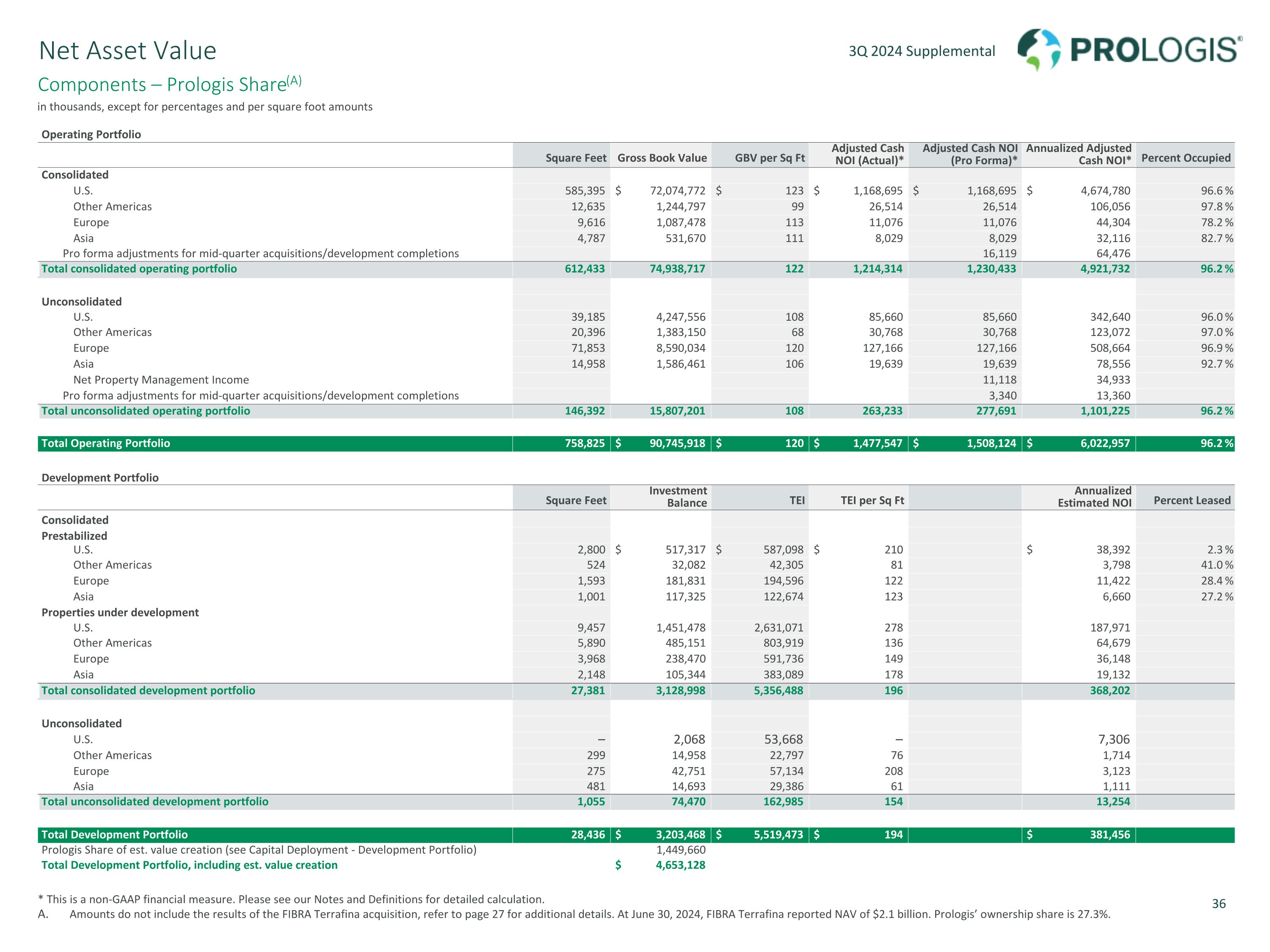

Components – Prologis Share(A) Net Asset Value Operating Portfolio Square Feet Gross Book Value GBV per Sq Ft Adjusted Cash NOI (Actual)* Adjusted Cash NOI (Pro Forma)* Annualized Adjusted Cash NOI* Percent Occupied Consolidated U.S. 585,395 $ 72,074,772 $ 123 $ 1,168,695 $ 1,168,695 $ 4,674,780 96.6 % Other Americas 12,635 1,244,797 99 26,514 26,514 106,056 97.8 % Europe 9,616 1,087,478 113 11,076 11,076 44,304 78.2 % Asia 4,787 531,670 111 8,029 8,029 32,116 82.7 % Pro forma adjustments for mid-quarter acquisitions/development completions 16,119 64,476 Total consolidated operating portfolio 612,433 74,938,717 122 1,214,314 1,230,433 4,921,732 96.2 % Unconsolidated U.S. 39,185 4,247,556 108 85,660 85,660 342,640 96.0 % Other Americas 20,396 1,383,150 68 30,768 30,768 123,072 97.0 % Europe 71,853 8,590,034 120 127,166 127,166 508,664 96.9 % Asia 14,958 1,586,461 106 19,639 19,639 78,556 92.7 % Net Property Management Income 11,118 34,933 Pro forma adjustments for mid-quarter acquisitions/development completions 3,340 13,360 Total unconsolidated operating portfolio 146,392 15,807,201 108 263,233 277,691 1,101,225 96.2 % Total Operating Portfolio 758,825 $ 90,745,918 $ 120 $ 1,477,547 $ 1,508,124 $ 6,022,957 96.2 % Development Portfolio Square Feet Investment Balance TEI TEI per Sq Ft Annualized Estimated NOI Percent Leased Consolidated Prestabilized U.S. 2,800 $ 517,317 $ 587,098 $ 210 $ 38,392 2.3 % Other Americas 524 32,082 42,305 81 3,798 41.0 % Europe 1,593 181,831 194,596 122 11,422 28.4 % Asia 1,001 117,325 122,674 123 6,660 27.2 % Properties under development U.S. 9,457 1,451,478 2,631,071 278 187,971 Other Americas 5,890 485,151 803,919 136 64,679 Europe 3,968 238,470 591,736 149 36,148 Asia 2,148 105,344 383,089 178 19,132 Total consolidated development portfolio 27,381 3,128,998 5,356,488 196 368,202 Unconsolidated U.S. – 2,068 53,668 – 7,306 Other Americas 299 14,958 22,797 76 1,714 Europe 275 42,751 57,134 208 3,123 Asia 481 14,693 29,386 61 1,111 Total unconsolidated development portfolio 1,055 74,470 162,985 154 13,254 Total Development Portfolio 28,436 $ 3,203,468 $ 5,519,473 $ 194 $ 381,456 Prologis Share of est. value creation (see Capital Deployment - Development Portfolio) 1,449,660 Total Development Portfolio, including est. value creation $ 4,653,128 in thousands, except for percentages and per square foot amounts * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Amounts do not include the results of the FIBRA Terrafina acquisition, refer to page 27 for additional details. At June 30, 2024, FIBRA Terrafina reported NAV of $2.1 billion. Prologis’ ownership share is 27.3%.

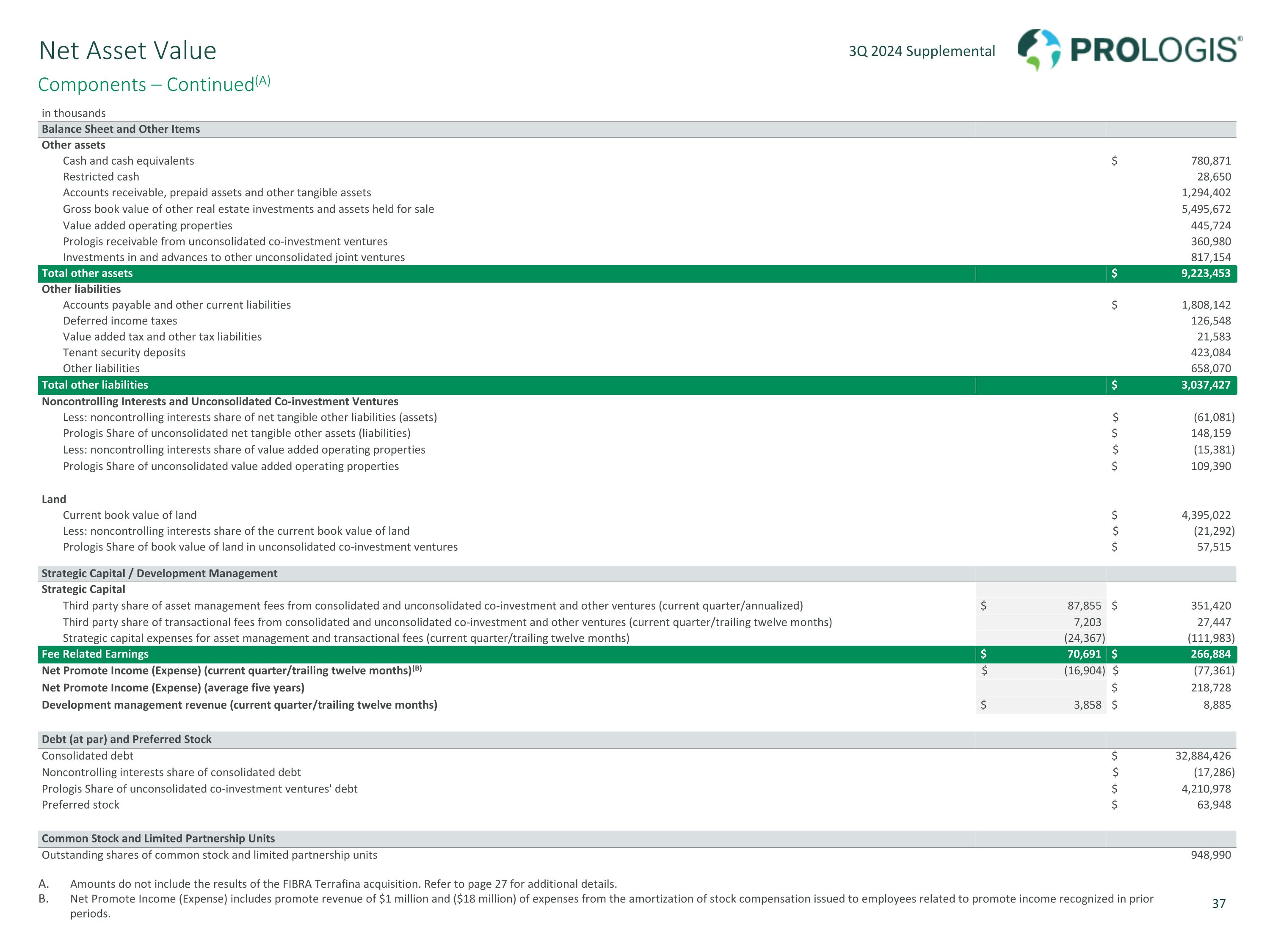

Components – Continued(A) Amounts do not include the results of the FIBRA Terrafina acquisition. Refer to page 27 for additional details. Net Promote Income (Expense) includes promote revenue of $1 million and ($18 million) of expenses from the amortization of stock compensation issued to employees related to promote income recognized in prior periods. Net Asset Value in thousands Balance Sheet and Other Items Other assets Cash and cash equivalents $ 780,871 Restricted cash 28,650 Accounts receivable, prepaid assets and other tangible assets 1,294,402 Gross book value of other real estate investments and assets held for sale 5,495,672 Value added operating properties 445,724 Prologis receivable from unconsolidated co-investment ventures 360,980 Investments in and advances to other unconsolidated joint ventures 817,154 Total other assets $ 9,223,453 Other liabilities Accounts payable and other current liabilities $ 1,808,142 Deferred income taxes 126,548 Value added tax and other tax liabilities 21,583 Tenant security deposits 423,084 Other liabilities 658,070 Total other liabilities $ 3,037,427 Noncontrolling Interests and Unconsolidated Co-investment Ventures Less: noncontrolling interests share of net tangible other liabilities (assets) $ (61,081) Prologis Share of unconsolidated net tangible other assets (liabilities) $ 148,159 Less: noncontrolling interests share of value added operating properties $ (15,381) Prologis Share of unconsolidated value added operating properties $ 109,390 Land Current book value of land $ 4,395,022 Less: noncontrolling interests share of the current book value of land $ (21,292) Prologis Share of book value of land in unconsolidated co-investment ventures $ 57,515 Strategic Capital / Development Management Strategic Capital Third party share of asset management fees from consolidated and unconsolidated co-investment and other ventures (current quarter/annualized) $ 87,855 $ 351,420 Third party share of transactional fees from consolidated and unconsolidated co-investment and other ventures (current quarter/trailing twelve months) 7,203 27,447 Strategic capital expenses for asset management and transactional fees (current quarter/trailing twelve months) (24,367) (111,983) Fee Related Earnings $ 70,691 $ 266,884 Net Promote Income (Expense) (current quarter/trailing twelve months)(B) $ (16,904) $ (77,361) Net Promote Income (Expense) (average five years) $ 218,728 Development management revenue (current quarter/trailing twelve months) $ 3,858 $ 8,885 Debt (at par) and Preferred Stock Consolidated debt $ 32,884,426 Noncontrolling interests share of consolidated debt $ (17,286) Prologis Share of unconsolidated co-investment ventures' debt $ 4,210,978 Preferred stock $ 63,948 Common Stock and Limited Partnership Units Outstanding shares of common stock and limited partnership units 948,990

Notes and Definitions Worms DC1, Worms, Germany

Notes and Definitions Please refer to our annual and quarterly financial statements filed with the Securities and Exchange Commission on Forms 10-K and 10-Q and other public reports for further information about us and our business. Certain amounts from previous periods presented in the Supplemental Information have been reclassified to conform to the current presentation. Acquisition Price, as presented for building acquisitions, represents economic cost. This amount includes the building purchase price plus 1) transaction closing costs, 2) due diligence costs, 3) immediate capital expenditures (including two years of property improvements and all leasing commissions and tenant improvements required to stabilize the property), and 4) the effects of marking assumed debt to market. Adjusted Cash NOI (Actual) is a non-Generally Accepted Accounting Principles ("GAAP") financial measure and a component of Net Asset Value ("NAV"). It is used to assess the operating performance of our properties and enables both management and investors to estimate the fair value of our Operating Portfolio. A reconciliation for the most recent quarter ended of our rental income and rental expenses included in our Consolidated Statement of Income to Adjusted Cash NOI for the consolidated Operating Portfolio is as follows (in thousands): Adjusted EBITDA. We use Adjusted EBITDA attributable to common stockholders/unitholders (“Adjusted EBITDA”), a non-GAAP financial measure, as a measure of our operating performance. The most directly comparable GAAP measure to Adjusted EBITDA is net earnings. We calculate Adjusted EBITDA by beginning with consolidated net earnings attributable to common stockholders and removing the effect of: interest charges, income taxes, depreciation and amortization, impairment charges, gains or losses from the disposition of investments in real estate (excluding development properties and land), gains from the revaluation of equity investments upon acquisition of a controlling interest, gains or losses on early extinguishment of debt and derivative contracts (including cash charges), similar adjustments we make to our FFO measures (see definition below), and other items, such as, amortization of stock based compensation and unrealized gains or losses on foreign currency and derivatives. We also include a pro forma adjustment to reflect a full period of NOI on the operating properties we acquire or stabilize during the quarter and to remove NOI on properties we dispose of during the quarter, assuming all transactions occurred at the beginning of the quarter. For properties we contribute, we make an adjustment to reflect NOI at the new ownership percentage for the full quarter. We believe Adjusted EBITDA provides investors relevant and useful information because it permits investors to view our operating performance, analyze our ability to meet interest payment obligations and make quarterly preferred stock dividends on an unleveraged basis before the effects of income tax, depreciation and amortization expense, gains and losses on the disposition of non-development properties and other items (outlined above), that affect comparability. While all items are not infrequent or unusual in nature, these items may result from market fluctuations that can have inconsistent effects on our results of operations. The economics underlying these items reflect market and financing conditions in the short-term but can obscure our performance and the value of our long-term investment decisions and strategies. We calculate our Adjusted EBITDA, based on our proportionate ownership share of both our unconsolidated and consolidated ventures. We reflect our share of our Adjusted EBITDA measures for unconsolidated ventures by applying our average ownership percentage for the period to the applicable adjusting items on an entity by entity basis. We reflect our share for consolidated ventures in which we do not own 100% of the equity by adjusting our Adjusted EBITDA measures to remove the noncontrolling interests share of the applicable adjusting items based on our average ownership percentage for the applicable periods. While we believe Adjusted EBITDA is an important measure, it should not be used alone because it excludes significant components of net earnings, such as our historical cash expenditures or future cash requirements for working capital, capital expenditures, distribution requirements, contractual commitments or interest and principal payments on our outstanding debt and is therefore limited as an analytical tool. Our computation of Adjusted EBITDA may not be comparable to EBITDA reported by other companies in both the real estate industry and other industries. We compensate for the limitations of Adjusted EBITDA by providing investors with financial statements prepared according to GAAP, along with this detailed discussion of Adjusted EBITDA and a reconciliation to Adjusted EBITDA from consolidated net earnings attributable to common stockholders. Annualized Estimated NOI for the properties in our Development Portfolio is based on current TEI multiplied by the Estimated Weighted Average Stabilized Yield. Assets Under Management (“AUM”) represents the estimated fair value of the real estate we own or manage through both our consolidated and unconsolidated entities. We calculate AUM by adding Investment Capacity and the third-party investors’ share of the estimated fair value of the assets in the co-investment ventures to Enterprise Value. Net termination fees generally represent the gross fee negotiated at the time a customer is allowed to terminate its lease agreement. The termination fee is offset by that customer's rent leveling asset or liability and fair value lease asset or liability write off, if any, that has been previously recognized. Removing the net termination fees from rental income allows for the calculation of Adjusted Cash NOI (Actual) to include only rental income that is indicative of the property's recurring operating performance. Actual NOI for properties that were contributed or sold during the three-month period is removed. Straight-line rents, free rent and amortization of lease intangibles (above and below market leases) are removed from the rental income of our Operating Portfolio to allow for the calculation of a cash yield. Actual NOI and related adjustments are calculated in local currency and translated at the period end rate to allow for consistency with other assets and liabilities as of the reporting date. Adjusted Cash NOI (Pro forma) is a non-GAAP financial measure and consists of Adjusted Cash NOI (Actual) for the properties in our Operating Portfolio adjusted to reflect NOI for a full quarter for operating properties that were acquired or stabilized during the quarter. Rental revenues $ 1,897,164 Rental expenses (427,425) NOI 1,469,739 Net termination fees and adjustments (a) (3,996) Less: actual NOI for Development Portfolio and Other Real Estate Investments and other (54,984) Less: Net Property Management Income (41,521) Less: properties contributed or sold (b) (12,052) Less: noncontrolling interests share of NOI less termination fees and adjustments (75,060) Prologis Share of adjusted NOI for consolidated Operating Portfolio at September 30, 2024 $ 1,282,126 Straight-line rents (c) (61,130) Free rent (c) 40,767 Amortization of lease intangibles (c) (88,977) Net Property Management Income 41,521 Effect of foreign currency exchange (d) 803 Less: noncontrolling interests (796) Third Quarter Adjusted Cash NOI (Actual) $ 1,214,314