UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 05, 2024 |

ORTHOFIX MEDICAL INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

0-19961 |

98-1340767 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

3451 Plano Parkway |

|

|||

Lewisville, Texas |

|

75056 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (214) 937-2000 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common stock, $0.10 par value per share |

|

OFIX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 5, 2024, Orthofix Medical Inc. (the “Company”) issued a press release announcing, among other things, its financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and attached hereto.

The information furnished in this Item 2.02, including the exhibit furnished herewith as Exhibit 99.1, will not be treated as “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information will not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or into another filing under the Exchange Act, unless that filing expressly incorporates by reference this Item 2.02 of this report.

Discussion of Non-GAAP Financial Measures

In addition to using standard measures of performance and liquidity that are recognized in accordance with accounting principles generally accepted in the United States of America ("GAAP"), the Company uses additional financial measures excluding certain GAAP items ("non-GAAP measures"), such as:

Constant Currency

Constant currency is a non-GAAP measure, which the Company calculates by using foreign currency rates from the comparable, prior-year period, to present net sales at comparable rates. Constant currency can be presented for numerous GAAP measures, but is most commonly used by management to analyze net sales without the impact of changes in foreign currency rates.

Free Cash Flow

Free cash flow is a non-GAAP financial measure, which is calculated by subtracting capital expenditures from cash flow from operating activities. Free cash flow is an important indicator of how much cash is generated or used by the Company's business operations, including capital expenditures. Management uses free cash flow to measure progress on its capital efficiency and cash flow initiatives.

Adjusted Gross Profit and Adjusted Gross Margin

Adjusted gross profit represents GAAP gross profit with adjustments to exclude the impact of the certain items recorded to cost of goods sold. Such potential adjustments are listed within the section below under the header "Non-GAAP Adjustments." Adjusted gross margin represents adjusted gross profit as a percentage of GAAP net sales.

EBITDA

EBITDA is a non-GAAP financial measure, which the Company calculates by adding interest expense (income), net; income tax expense (benefit); and depreciation and amortization to net income (loss). EBITDA provides management with additional insight to the Company's results of operations. Adjusted EBITDA, which is the primary metric used by the Company's Chief Operating Decision Maker in managing the business, consists of EBITDA with adjustments to exclude certain items listed within the section below under the header "Non-GAAP Adjustments."

Non-GAAP Adjustments

The Company's non-GAAP financial measures provide management with additional insight to the Company's results of operations and reflect the exclusion of the following items:

Usefulness and Limitations of Non-GAAP Financial Measures

Management uses non-GAAP measures to evaluate performance period-over-period, analyze the underlying trends in the Company's business, assess the Company's performance relative to its competitors, and establish operational goals and forecasts used in allocating resources. Management uses these non-GAAP measures as the basis for evaluating the ability of the Company's underlying operations to generate cash, prior to required investments in working capital, and to further its understanding of the performance of the Company's business units.

Material Limitations Associated with the Use of Non-GAAP Financial Measures

The non-GAAP financial measures described above may have limitations as analytical tools, and should not be considered in isolation or as a replacement for GAAP financial measures. Some of the limitations associated with the use of these non-GAAP financial measures are that they exclude items that reflect an economic cost and can have a material effect on cash flows.

Similarly, certain non-cash expenses, such as share-based compensation, do not directly impact cash flows, but are part of total compensation costs accounted for under GAAP.

Compensation for Limitations Associated with Use of Non-GAAP Financial Measures

The Company compensates for the limitations of its non-GAAP financial measures by relying upon GAAP results to gain a complete picture of the Company's performance. GAAP results provide management with the ability to understand the Company's performance based on a defined set of criteria. The Company provides reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures and encourages investors to review these reconciliations.

Usefulness of Non-GAAP Financial Measures to Investors

The Company believes that providing non-GAAP financial measures that exclude certain items provides investors with greater transparency to the information used by management in its financial and operational decision-making. Management believes it is important to provide investors with the same non-GAAP financial measures it uses to supplement information regarding the performance and underlying trends of the Company's business operations in order to facilitate comparisons to the Company's historical operating results and internally evaluate the effectiveness of the Company's operating strategies. The Company believes that these non-GAAP financial measures also facilitates comparisons of the Company's underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures.

Item 7.01 Regulation FD Disclosure.

The Company expects to use the corporate investor relations presentations furnished as Exhibit 99.2 and Exhibit 99.3 to this report, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts, and others during the fiscal year ending December 31, 2024.

The information furnished in this Item 7.01, including the exhibits furnished herewith as Exhibit 99.2 and Exhibit 99.3, will not be treated as “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. This information will not be deemed incorporated by reference into any filing under the Securities Act, or into another filing under the Exchange Act, unless that filing expressly incorporates by reference this Item 7.01 of this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 |

|

99.2 |

Corporate Investor Relations Presentation, dated March 5, 2024 |

99.3 |

Supplemental Financials - Q423 and FY23 Earnings, dated March 5, 2024 |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Orthofix Medical Inc. |

|

||

|

By: |

|

/s/ Kimberley Elting |

|

|

|

Kimberley Elting Interim Chief Legal Officer |

|

Date: March 5, 2024

Exhibit 99.1

Orthofix Reports Fourth Quarter and Full Year 2023 Results

Recent Highlights

LEWISVILLE, Texas — March 5, 2024 — Orthofix Medical Inc. (NASDAQ:OFIX) today reported its financial results for the fourth quarter and year ended December 31, 2023, and issued guidance for the full year 2024.

Fourth quarter net sales were $200.4 million, an increase of 64% on a reported basis and 7% on a pro forma constant currency basis. Net loss was $(22.2) million and earnings per share ("EPS") was $(0.59) on a reported basis, representing an improvement of 19% when compared to pro forma results for the prior year period. Non-GAAP adjusted EBITDA was $19.6 million for the fourth quarter, representing 96% growth over pro forma results for the fourth quarter of 2022.

Full year net sales were $746.6 million, an increase of 62% on a reported basis and 6% on a pro forma constant currency basis. Net loss was $(151.4) million and EPS was $(4.12). Non-GAAP adjusted EBITDA was $46.3 million for the full year, representing 69% growth over pro forma results for the full year of 2022.

“We are pleased to report another quarter of strong performance as Orthofix completes its first full year as a combined company with SeaSpine. We delivered accelerated growth exiting 2023 and demonstrated resilience, increased internal efficiencies and cost synergies,” said Massimo Calafiore, President and Chief Executive Officer of Orthofix. “I am thrilled to join Orthofix at such a pivotal moment in the Company’s story, wherein the business fundamentals are strong, we are well positioned to deliver profitable growth in 2024, and we are continuing to accelerate our leverage on revenue. After reflecting on my first two months in this role, it is evident that Orthofix’s balanced and complementary product mix offers a differentiated advantage across multiple markets. I look forward to leveraging that unique portfolio platform to drive future value through profitable growth.”

1 Spine fixation is comprised of the Company's Spinal Implants product category, excluding motion preservation product offerings

Financial Results Overview

Fourth Quarter 2023 Net Sales and Financial Results

The following table provides net sales by major product category by reporting segment on a reporting basis:

|

|

Three Months Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in millions) |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

Constant |

|

||||

Bone Growth Therapies |

|

$ |

58.8 |

|

|

$ |

51.0 |

|

|

|

15.3 |

% |

|

|

15.3 |

% |

Spinal Implants, Biologics, and Enabling Technologies |

|

|

111.0 |

|

|

|

42.5 |

|

|

|

161.2 |

% |

|

|

160.7 |

% |

Global Spine |

|

|

169.8 |

|

|

|

93.5 |

|

|

|

81.6 |

% |

|

|

81.4 |

% |

Global Orthopedics |

|

|

30.6 |

|

|

|

28.7 |

|

|

|

6.8 |

% |

|

|

2.7 |

% |

Net sales |

|

$ |

200.4 |

|

|

$ |

122.2 |

|

|

|

64.0 |

% |

|

|

62.9 |

% |

1

Further, the following table provides net sales by major product category by reporting segment on a pro forma basis:

|

|

Three Months Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in millions) |

|

2023 |

|

|

2022 Pro Forma |

|

|

Change |

|

|

Constant |

|

||||

Bone Growth Therapies |

|

$ |

58.8 |

|

|

$ |

51.0 |

|

|

|

15.3 |

% |

|

|

15.3 |

% |

U.S. Spinal Implants, Biologics and Enabling Technologies |

|

|

100.6 |

|

|

|

96.4 |

|

|

|

4.4 |

% |

|

|

4.4 |

% |

International Spinal Implants, Biologics, and Enabling Technologies |

|

|

10.4 |

|

|

|

10.3 |

|

|

|

0.7 |

% |

|

|

0.1 |

% |

Total Spinal Implants, Biologics, and Enabling Technologies |

|

|

111.0 |

|

|

|

106.7 |

|

|

|

4.0 |

% |

|

|

4.0 |

% |

Global Spine |

|

|

169.8 |

|

|

|

157.7 |

|

|

|

7.7 |

% |

|

|

7.6 |

% |

Global Orthopedics |

|

|

30.6 |

|

|

|

28.7 |

|

|

|

6.8 |

% |

|

|

2.7 |

% |

Net sales |

|

$ |

200.4 |

|

|

$ |

186.4 |

|

|

|

7.5 |

% |

|

|

6.9 |

% |

Gross margins were 68.2% for the fourth quarter ended December 31, 2023 and were 72.2% on a non-GAAP adjusted basis compared to pro-forma non-GAAP adjusted gross margin of 68.9% in the prior year period.

Net loss was $(22.2) million, or $(0.59) per share, compared to pro forma net loss of $(26.0) million, or $(0.73) per share in the prior year period. Non-GAAP adjusted EBITDA was $19.6 million, or 9.8% of net sales, compared to pro forma non-GAAP adjusted EBITDA of $10.0 million, or 5.4% of pro forma net sales, in the prior year period.

Full Year 2023 Net Sales and Financial Results

The following table provides net sales by major product category by reporting segment on a reporting basis:

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in millions) |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

Constant |

|

||||

Bone Growth Therapies |

|

$ |

212.5 |

|

|

$ |

187.2 |

|

|

|

13.5 |

% |

|

|

13.5 |

% |

Spinal Implants, Biologics, and Enabling Technologies |

|

|

418.8 |

|

|

|

166.0 |

|

|

|

152.4 |

% |

|

|

152.4 |

% |

Global Spine |

|

|

631.3 |

|

|

|

353.2 |

|

|

|

78.8 |

% |

|

|

78.7 |

% |

Global Orthopedics |

|

|

115.3 |

|

|

|

107.5 |

|

|

|

7.2 |

% |

|

|

5.2 |

% |

Net sales |

|

$ |

746.6 |

|

|

$ |

460.7 |

|

|

|

62.1 |

% |

|

|

61.6 |

% |

Further, the following table provides net sales by major product category by reporting segment on a pro forma basis:

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in millions) |

|

2023 |

|

|

2022 Pro Forma |

|

|

Change |

|

|

Constant |

|

||||

Bone Growth Therapies |

|

$ |

212.5 |

|

|

$ |

187.2 |

|

|

|

13.5 |

% |

|

|

13.5 |

% |

U.S. Spinal Implants, Biologics and Enabling Technologies |

|

|

379.4 |

|

|

|

352.5 |

|

|

|

7.6 |

% |

|

|

7.6 |

% |

International Spinal Implants, Biologics, and Enabling Technologies |

|

|

39.4 |

|

|

|

53.6 |

|

|

|

(26.5 |

%) |

|

|

(26.6 |

%) |

Total Spinal Implants, Biologics, and Enabling Technologies** |

|

|

418.8 |

|

|

|

406.0 |

|

|

|

3.1 |

% |

|

|

3.1 |

% |

Global Spine |

|

|

631.3 |

|

|

|

593.3 |

|

|

|

6.4 |

% |

|

|

6.4 |

% |

Global Orthopedics |

|

|

115.3 |

|

|

|

107.5 |

|

|

|

7.2 |

% |

|

|

5.2 |

% |

Net sales*** |

|

$ |

746.6 |

|

|

$ |

700.8 |

|

|

|

6.5 |

% |

|

|

6.2 |

% |

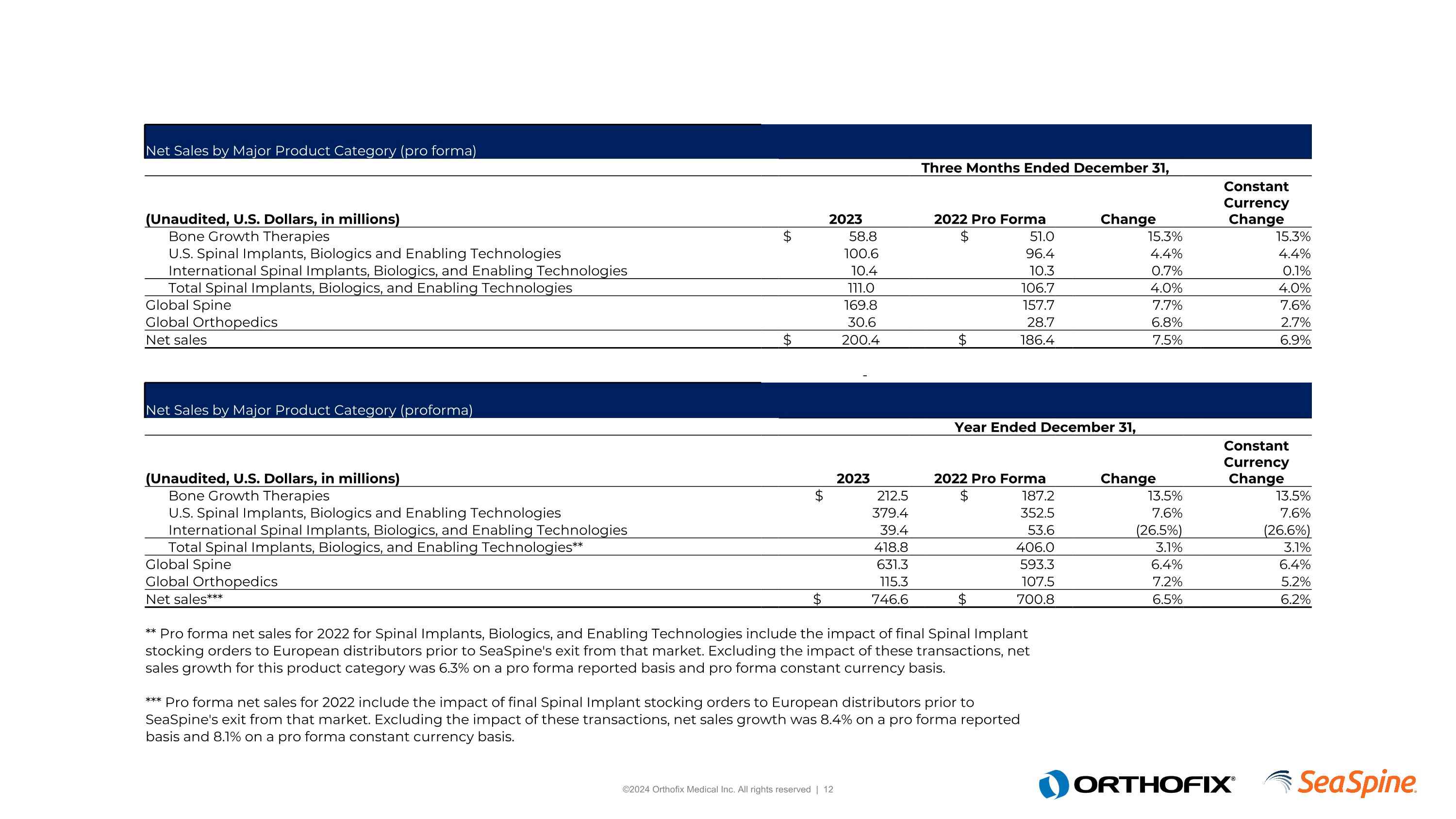

** Pro forma net sales for 2022 for Spinal Implants, Biologics, and Enabling Technologies include the impact of final Spinal Implant stocking orders to European distributors prior to SeaSpine's exit from that market. Excluding the impact of these transactions, net sales growth for this product category was 6.3% on a pro forma reported basis and pro forma constant currency basis.

*** Pro forma net sales for 2022 include the impact of final Spinal Implant stocking orders to European distributors prior to SeaSpine's exit from that market. Excluding the impact of these transactions, net sales growth was 8.4% on a pro forma reported basis and 8.1% on a pro forma constant currency basis.

2

Gross margins were 65.1% and were 71.4% on a non-GAAP adjusted basis compared to pro forma non-GAAP adjusted gross margin of 68.7% in the prior year.

Net loss was $(151.4) million, or $(4.12) per share, compared to pro forma net loss of $(84.8) million, or $(2.39) per share in the prior year. Non-GAAP adjusted EBITDA was $46.3 million, or 6.2% of net sales, compared to pro forma non-GAAP adjusted EBITDA of $27.4 million, or 3.9% of pro forma net sales, in the prior year period.

Liquidity

As of December 31, 2023, cash, cash equivalents, and restricted cash totaled $37.8 million compared to $50.7 million on December 31, 2022. As of December 31, 2023, the Company had $100.0 million in borrowings outstanding under its four year $150.0 million Financing Agreement. The Company subsequently borrowed an additional $15.0 million in January 2024.

Business Outlook

The Company is providing 2024 full year guidance as follows:

Conference Call

Orthofix will host a conference call today at 4:30 PM Eastern time to discuss the Company's financial results for the year ended December 31, 2023. Interested parties may access the conference call by dialing (888) 330-2508 in the U.S. and Canada, and (240) 789-2735 in all other locations, and referencing the access code 9556380. A replay of the call will be available for three weeks by dialing (800) 770-2030 in the U.S. and Canada, and (647) 362-9199 in all other locations, and entering the access code 9556380. A webcast of the conference call may be accessed at ir.Orthofix.com.

About Orthofix

Orthofix is a leading global spine and orthopedics company with a comprehensive portfolio of biologics, innovative spinal hardware, bone growth therapies, specialized orthopedic solutions and a leading surgical navigation system. Its products are distributed in more than 60 countries worldwide.

The Company is headquartered in Lewisville, Texas and has primary offices in Carlsbad, CA, with a focus on spine and biologics product innovation and surgeon education, and Verona, Italy, with an emphasis on product innovation, production, and medical education for orthopedics. The combined company’s global R&D, commercial and manufacturing footprint also includes facilities and offices in Irvine, CA, Toronto, Canada, Sunnyvale, CA, Wayne, PA, Olive Branch, MS, Maidenhead, UK, Munich, Germany, Paris, France, and São Paulo, Brazil. For more information, please visit www.orthofix.com.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” or “continue” or other comparable terminology. Forward-looking statements in this communication include the Company's expectations regarding net sales and adjusted EBITDA for the year ended December 31, 2024. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”). Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii)

3

risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to recruit and retain management and key personnel, (vii) global economic instability and potential supply chain disruption caused by Russia’s invasion of Ukraine and resulting sanctions, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements.

This list of risks, uncertainties, and other factors is not complete. We discuss some of these matters more fully, as well as certain risk factors that could affect our business, financial condition, results of operations, and prospects, in reports we file from time-to-time with the SEC, which are available to read at www.sec.gov. Any or all forward-looking statements that we make may turn out to be wrong (due to inaccurate assumptions that we make or otherwise), and our actual outcomes and results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any of these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. We undertake no obligation to update, and expressly disclaim any duty to update, our forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law.

The Company is unable to provide expectations of GAAP income (loss) before income taxes, the closest comparable GAAP measures to Adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict without unreasonable efforts the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating Adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

Company Contact |

|

|

Louisa Smith, Gilmartin Group |

|

|

ir@orthofix.com |

|

|

4

ORTHOFIX MEDICAL INC.

Condensed Consolidated Statements of Operations

|

|

Three Months Ended |

|

|

Year Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

(U.S. Dollars, in thousands, except share and per share data) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

|

|

(Unaudited) |

|

|

|

|

||||||||||

Net sales |

|

$ |

200,415 |

|

|

$ |

122,229 |

|

|

$ |

746,641 |

|

|

$ |

460,713 |

|

Cost of sales |

|

|

63,785 |

|

|

|

33,053 |

|

|

|

260,368 |

|

|

|

123,544 |

|

Gross profit |

|

|

136,630 |

|

|

|

89,176 |

|

|

|

486,273 |

|

|

|

337,169 |

|

Sales and marketing |

|

|

97,749 |

|

|

|

59,324 |

|

|

|

385,736 |

|

|

|

228,810 |

|

General and administrative |

|

|

34,535 |

|

|

|

25,470 |

|

|

|

144,659 |

|

|

|

79,966 |

|

Research and development |

|

|

18,941 |

|

|

|

13,152 |

|

|

|

80,231 |

|

|

|

49,065 |

|

Acquisition-related amortization and remeasurement |

|

|

3,720 |

|

|

|

2,274 |

|

|

|

14,757 |

|

|

|

(7,404 |

) |

Operating loss |

|

|

(18,315 |

) |

|

|

(11,044 |

) |

|

|

(139,110 |

) |

|

|

(13,268 |

) |

Interest expense, net |

|

|

(4,500 |

) |

|

|

(229 |

) |

|

|

(8,631 |

) |

|

|

(1,288 |

) |

Other income (expense), net |

|

|

766 |

|

|

|

4,286 |

|

|

|

(938 |

) |

|

|

(3,150 |

) |

Loss before income taxes |

|

|

(22,049 |

) |

|

|

(6,987 |

) |

|

|

(148,679 |

) |

|

|

(17,706 |

) |

Income tax expense |

|

|

(125 |

) |

|

|

(75 |

) |

|

|

(2,716 |

) |

|

|

(2,043 |

) |

Net loss |

|

$ |

(22,174 |

) |

|

$ |

(7,062 |

) |

|

$ |

(151,395 |

) |

|

$ |

(19,749 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

(0.59 |

) |

|

$ |

(0.35 |

) |

|

$ |

(4.12 |

) |

|

$ |

(0.98 |

) |

Diluted |

|

|

(0.59 |

) |

|

|

(0.35 |

) |

|

|

(4.12 |

) |

|

|

(0.98 |

) |

Weighted average number of common shares (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

37.3 |

|

|

|

20.2 |

|

|

|

36.7 |

|

|

|

20.1 |

|

Diluted |

|

|

37.3 |

|

|

|

20.2 |

|

|

|

36.7 |

|

|

|

20.1 |

|

5

ORTHOFIX MEDICAL INC.

Condensed Consolidated Balance Sheets

(U.S. Dollars, in thousands, except par value data) |

|

December 31, 2023 |

|

|

December 31, 2022 |

|

||

|

|

|

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

33,107 |

|

|

$ |

50,700 |

|

Restricted cash |

|

|

4,650 |

|

|

|

— |

|

Accounts receivable, net of allowances of $7,130 and $6,419, respectively |

|

|

128,098 |

|

|

|

82,857 |

|

Inventories |

|

|

222,166 |

|

|

|

100,150 |

|

Prepaid expenses and other current assets |

|

|

32,422 |

|

|

|

22,283 |

|

Total current assets |

|

|

420,443 |

|

|

|

255,990 |

|

Property, plant, and equipment, net |

|

|

159,060 |

|

|

|

58,229 |

|

Intangible assets, net |

|

|

117,490 |

|

|

|

47,388 |

|

Goodwill |

|

|

194,934 |

|

|

|

71,317 |

|

Other long-term assets |

|

|

33,388 |

|

|

|

25,705 |

|

Total assets |

|

$ |

925,315 |

|

|

$ |

458,629 |

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

58,357 |

|

|

$ |

27,598 |

|

Current portion of long-term debt |

|

|

1,250 |

|

|

|

— |

|

Current portion of finance lease liability |

|

|

708 |

|

|

|

652 |

|

Other current liabilities |

|

|

104,908 |

|

|

|

55,374 |

|

Total current liabilities |

|

|

165,223 |

|

|

|

83,624 |

|

Long-term debt |

|

|

93,107 |

|

|

|

— |

|

Long-term portion of finance lease liability |

|

|

18,532 |

|

|

|

19,239 |

|

Other long-term liabilities |

|

|

49,723 |

|

|

|

18,906 |

|

Total liabilities |

|

|

326,585 |

|

|

|

121,769 |

|

Contingencies |

|

|

|

|

|

|

||

Shareholders’ equity |

|

|

|

|

|

|

||

Common shares $0.10 par value; 100,000 shares authorized; |

|

|

3,717 |

|

|

|

2,016 |

|

Additional paid-in capital |

|

|

746,450 |

|

|

|

334,969 |

|

Retained earnings (accumulated deficit) |

|

|

(150,144 |

) |

|

|

1,251 |

|

Accumulated other comprehensive loss |

|

|

(1,293 |

) |

|

|

(1,376 |

) |

Total shareholders’ equity |

|

|

598,730 |

|

|

|

336,860 |

|

Total liabilities and shareholders’ equity |

|

$ |

925,315 |

|

|

$ |

458,629 |

|

6

ORTHOFIX MEDICAL INC.

Non-GAAP Financial Measures

The following tables present reconciliations of various financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), to various non-GAAP financial measures that exclude (or in the case of free cash flow, include) items specified in the tables. The GAAP measures shown in the tables below represent the most comparable GAAP measure to the applicable non-GAAP measure(s) shown in the table. For further information regarding the nature of these exclusions, why the Company believes that these non-GAAP financial measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the Company's Current Report on Form 8-K regarding this press release filed today with the SEC available on the SEC's website at www.sec.gov and on the “Investors” page of the Company’s website at www.orthofix.com.

Adjusted Gross Profit and Adjusted Gross Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Three Months Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Gross profit |

|

$ |

136,630 |

|

|

$ |

89,176 |

|

|

$ |

38,515 |

|

|

$ |

127,691 |

|

Share-based compensation expense |

|

|

462 |

|

|

|

217 |

|

|

|

102 |

|

|

|

319 |

|

SeaSpine merger-related costs |

|

|

214 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Strategic investments |

|

|

125 |

|

|

|

439 |

|

|

|

— |

|

|

|

439 |

|

Acquisition-related fair value adjustments |

|

|

7,037 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Amortization/Depreciation of Acquired Long-Lived Assets |

|

|

372 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Medical device regulation |

|

|

(72 |

) |

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

Adjusted gross profit |

|

$ |

144,768 |

|

|

$ |

89,833 |

|

|

$ |

38,617 |

|

|

$ |

128,450 |

|

Adjusted gross margin |

|

|

72.2 |

% |

|

|

73.5 |

% |

|

|

60.2 |

% |

|

|

68.9 |

% |

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Gross profit |

|

$ |

486,273 |

|

|

$ |

337,169 |

|

|

$ |

141,834 |

|

|

$ |

479,003 |

|

Share-based compensation expense |

|

|

1,878 |

|

|

|

827 |

|

|

|

365 |

|

|

|

1,192 |

|

SeaSpine merger-related costs |

|

|

6,861 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Strategic investments |

|

|

389 |

|

|

|

1,334 |

|

|

|

— |

|

|

|

1,334 |

|

Acquisition-related fair value adjustments |

|

|

36,044 |

|

|

|

— |

|

|

|

208 |

|

|

|

208 |

|

Amortization/Depreciation of Acquired Long-Lived Assets |

|

|

1,196 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Medical device regulation |

|

|

604 |

|

|

|

15 |

|

|

|

— |

|

|

|

15 |

|

Adjusted gross profit |

|

$ |

533,245 |

|

|

$ |

339,345 |

|

|

$ |

142,407 |

|

|

$ |

481,752 |

|

Adjusted gross margin |

|

|

71.4 |

% |

|

|

73.7 |

% |

|

|

59.3 |

% |

|

|

68.7 |

% |

7

Adjusted EBITDA

|

|

Three Months Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Loss before income taxes |

|

$ |

(22,049 |

) |

|

$ |

(6,987 |

) |

|

$ |

(20,287 |

) |

|

$ |

(27,274 |

) |

Interest expense, net |

|

|

4,500 |

|

|

|

229 |

|

|

|

202 |

|

|

|

431 |

|

Depreciation and amortization |

|

|

13,969 |

|

|

|

7,421 |

|

|

|

4,349 |

|

|

|

11,770 |

|

Share-based compensation expense |

|

|

3,167 |

|

|

|

4,923 |

|

|

|

3,412 |

|

|

|

8,335 |

|

Foreign exchange impact |

|

|

(2,638 |

) |

|

|

(4,195 |

) |

|

|

(147 |

) |

|

|

(4,342 |

) |

SeaSpine merger-related costs |

|

|

2,261 |

|

|

|

9,073 |

|

|

|

2,616 |

|

|

|

11,689 |

|

Strategic investments |

|

|

389 |

|

|

|

771 |

|

|

|

(16 |

) |

|

|

755 |

|

Acquisition-related fair value adjustments |

|

|

6,486 |

|

|

|

200 |

|

|

|

— |

|

|

|

200 |

|

(Gain) loss on investments |

|

|

1,781 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Litigation and investigation costs |

|

|

8,842 |

|

|

|

337 |

|

|

|

1,066 |

|

|

|

1,403 |

|

Medical device regulation |

|

|

1,927 |

|

|

|

3,481 |

|

|

|

— |

|

|

|

3,481 |

|

Business interruption - COVID-19 |

|

|

— |

|

|

|

513 |

|

|

|

— |

|

|

|

513 |

|

Succession charges |

|

|

1,006 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Spinal set instrument replacement expense |

|

|

— |

|

|

|

— |

|

|

|

2,630 |

|

|

|

2,630 |

|

European sales and marketing organization restructuring |

|

|

— |

|

|

|

— |

|

|

|

426 |

|

|

|

426 |

|

Adjusted EBITDA |

|

$ |

19,641 |

|

|

$ |

15,766 |

|

|

$ |

(5,749 |

) |

|

$ |

10,017 |

|

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Loss before income taxes |

|

$ |

(148,679 |

) |

|

$ |

(17,706 |

) |

|

$ |

(67,324 |

) |

|

$ |

(85,030 |

) |

Interest expense, net |

|

|

8,631 |

|

|

|

1,288 |

|

|

|

644 |

|

|

|

1,932 |

|

Depreciation and amortization |

|

|

53,063 |

|

|

|

29,019 |

|

|

|

17,187 |

|

|

|

46,206 |

|

Share-based compensation expense |

|

|

35,707 |

|

|

|

18,443 |

|

|

|

13,584 |

|

|

|

32,027 |

|

Foreign exchange impact |

|

|

(1,581 |

) |

|

|

3,291 |

|

|

|

387 |

|

|

|

3,678 |

|

SeaSpine merger-related costs |

|

|

36,623 |

|

|

|

12,010 |

|

|

|

4,028 |

|

|

|

16,038 |

|

Strategic investments |

|

|

2,272 |

|

|

|

4,018 |

|

|

|

362 |

|

|

|

4,380 |

|

Acquisition-related fair value adjustments |

|

|

33,393 |

|

|

|

(15,595 |

) |

|

|

208 |

|

|

|

(15,387 |

) |

(Gain) loss on investments |

|

|

1,781 |

|

|

|

188 |

|

|

|

— |

|

|

|

188 |

|

Litigation and investigation costs |

|

|

14,453 |

|

|

|

803 |

|

|

|

1,610 |

|

|

|

2,413 |

|

Medical device regulation |

|

|

9,446 |

|

|

|

10,261 |

|

|

|

— |

|

|

|

10,261 |

|

Business interruption - COVID-19 |

|

|

— |

|

|

|

2,387 |

|

|

|

— |

|

|

|

2,387 |

|

Succession charges |

|

|

1,176 |

|

|

|

146 |

|

|

|

— |

|

|

|

146 |

|

Spinal set instrument replacement expense |

|

|

— |

|

|

|

— |

|

|

|

7,179 |

|

|

|

7,179 |

|

European sales and marketing organization restructuring |

|

|

— |

|

|

|

— |

|

|

|

984 |

|

|

|

984 |

|

Adjusted EBITDA |

|

$ |

46,285 |

|

|

$ |

48,553 |

|

|

$ |

(21,151 |

) |

|

$ |

27,402 |

|

Cash Flow and Free Cash Flow

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Net cash from operating activities |

|

$ |

(45,753 |

) |

|

$ |

(11,538 |

) |

|

$ |

(38,157 |

) |

|

$ |

(49,695 |

) |

Net cash from investing activities |

|

|

(33,131 |

) |

|

|

(24,534 |

) |

|

|

(40,325 |

) |

|

|

(64,859 |

) |

Net cash from financing activities |

|

|

65,322 |

|

|

|

(78 |

) |

|

|

24,654 |

|

|

|

24,576 |

|

Effect of exchange rate changes on cash |

|

|

619 |

|

|

|

(997 |

) |

|

|

140 |

|

|

|

(857 |

) |

Net change in cash, cash equivalents, and restricted cash |

|

$ |

(12,943 |

) |

|

$ |

(37,147 |

) |

|

$ |

(53,688 |

) |

|

$ |

(90,835 |

) |

8

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Net cash from operating activities |

|

$ |

(45,753 |

) |

|

$ |

(11,538 |

) |

|

$ |

(38,157 |

) |

|

$ |

(49,695 |

) |

Capital expenditures |

|

|

(62,050 |

) |

|

|

(23,160 |

) |

|

|

(37,752 |

) |

|

|

(60,912 |

) |

Free cash flow |

|

$ |

(107,803 |

) |

|

$ |

(34,698 |

) |

|

$ |

(75,909 |

) |

|

$ |

(110,607 |

) |

Net Income and EPS

|

|

Three Months Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands, except share and per share data) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Net loss |

|

$ |

(22,174 |

) |

|

$ |

(7,062 |

) |

|

$ |

(18,958 |

) |

|

$ |

(26,020 |

) |

Weighted average shares outstanding (in millions) |

|

|

37.3 |

|

|

|

20.2 |

|

|

|

15.4 |

|

|

|

35.6 |

|

EPS |

|

$ |

(0.59 |

) |

|

$ |

(0.35 |

) |

|

$ |

(1.23 |

) |

|

$ |

(0.73 |

) |

|

|

Year Ended December 31, |

|

|||||||||||||

(Unaudited, U.S. Dollars, in thousands, except share and per share data) |

|

2023 |

|

|

Orthofix |

|

|

SeaSpine |

|

|

Pro Forma |

|

||||

Net loss |

|

$ |

(151,395 |

) |

|

$ |

(19,749 |

) |

|

$ |

(65,009 |

) |

|

$ |

(84,758 |

) |

Weighted average shares outstanding |

|

|

36.7 |

|

|

|

20.1 |

|

|

|

15.4 |

|

|

|

35.5 |

|

EPS |

|

$ |

(4.12 |

) |

|

$ |

(0.98 |

) |

|

$ |

(4.22 |

) |

|

$ |

(2.39 |

) |

Source

Orthofix Medical Inc.

9

Corporate Investor Deck March 2024

Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” or “continue” or other comparable terminology. Forward-looking statements in this communication include the Company's expectations regarding net sales and adjusted EBITDA for the year ended December 31, 2024. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K. Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii) risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to recruit and retain management and key personnel, (vii) global economic instability and potential supply chain disruption caused by Russia’s invasion of Ukraine and resulting sanctions, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements. This list of risks, uncertainties, and other factors is not complete. We discuss some of these matters more fully, as well as certain risk factors that could affect our business, financial condition, results of operations, and prospects, in reports we file from time-to-time with the SEC, which are available to read at www.sec.gov. Any or all forward-looking statements that we make may turn out to be wrong (due to inaccurate assumptions that we make or otherwise), and our actual outcomes and results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any of these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. We undertake no obligation to update, and expressly disclaim any duty to update, our forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law. The Company is unable to provide expectations of GAAP income (loss) before income taxes, the closest comparable GAAP measures to Adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict without unreasonable efforts the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating Adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

a Investment Highlights Building a Leading Global Spine & Orthopedics Company Extensive PortfolioSolutions with Complementary Technologies Improved Clinical Outcomes & Economic Value Expanded Distribution Channels & Global Commercial Reach $150M Credit Facility Provides Liquidity to Fund Growth and Scale Visionary Leadership Team with Deep Sector Experience Large Addressable Markets with High Growth Opportunities

Senior Leadership Team Experienced leadership with 250+ years in spine/orthopedics Julie Andrews Chief Financial Officer Roberto Donadello Senior Vice PresidentGlobal Operations Jason Shallenberger PresidentGlobal Enabling Technologies Beau Standish, PhD, Peng PresidentGlobal Enabling Technologies Kim Elting President Global Orthopedics Ehab Esmail Senior Vice President, Global Quality, Regulatory & Clinical Affairs Tyler Lipschultz PresidentGlobal Biologics Massimo Calafiore President and Chief Executive Officer Frank Vizesi, PhD Chief Scientific Officer Jill Mason VP , Corporate Counsel & Interim Chief Ethics & Compliance Officer Suzanne Armstrong Chief Human Resources Officer

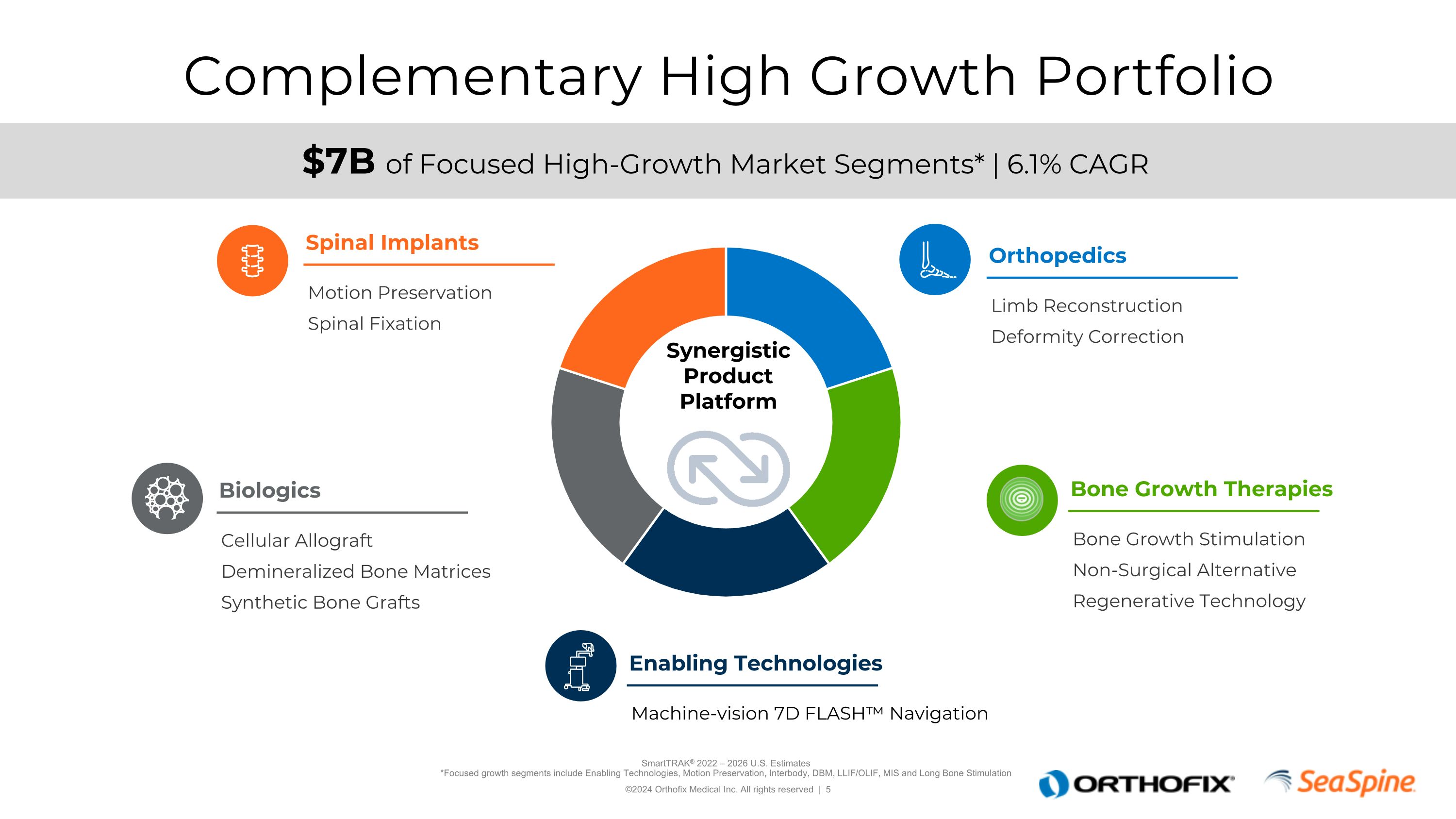

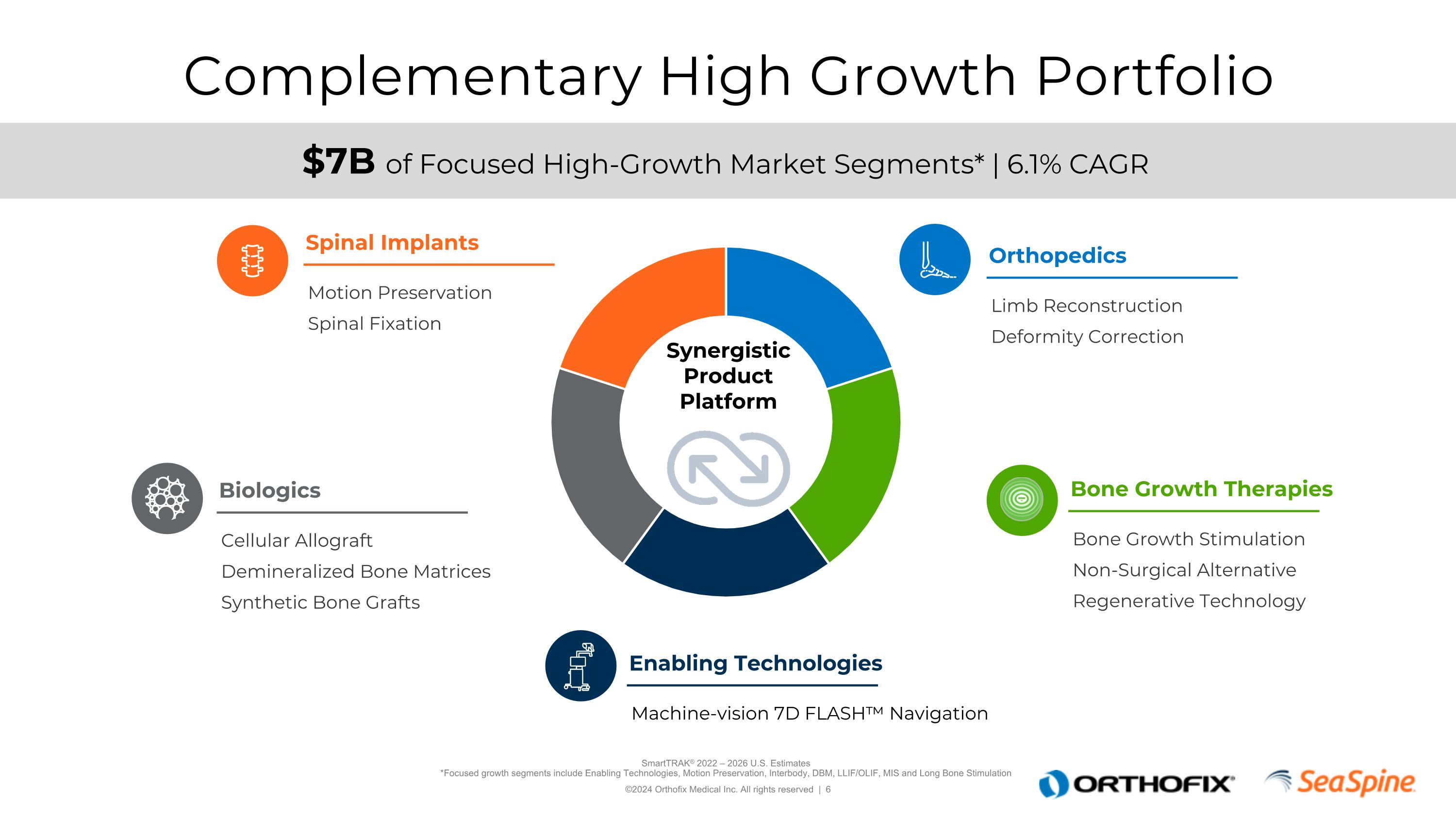

Complementary High Growth Portfolio SmartTRAK® 2022 – 2026 U.S. Estimates*Focused growth segments include Enabling Technologies, Motion Preservation, Interbody, DBM, LLIF/OLIF, MIS and Long Bone Stimulation $7B of Focused High-Growth Market Segments* | 6.1% CAGR Motion Preservation Spinal Fixation Spinal Implants Limb Reconstruction Deformity Correction Orthopedics Cellular Allograft Demineralized Bone Matrices Synthetic Bone Grafts Biologics Machine-vision 7D FLASH™ Navigation Enabling Technologies Bone Growth Stimulation Non-Surgical Alternative Regenerative Technology Bone Growth Therapies Synergistic Product Platform

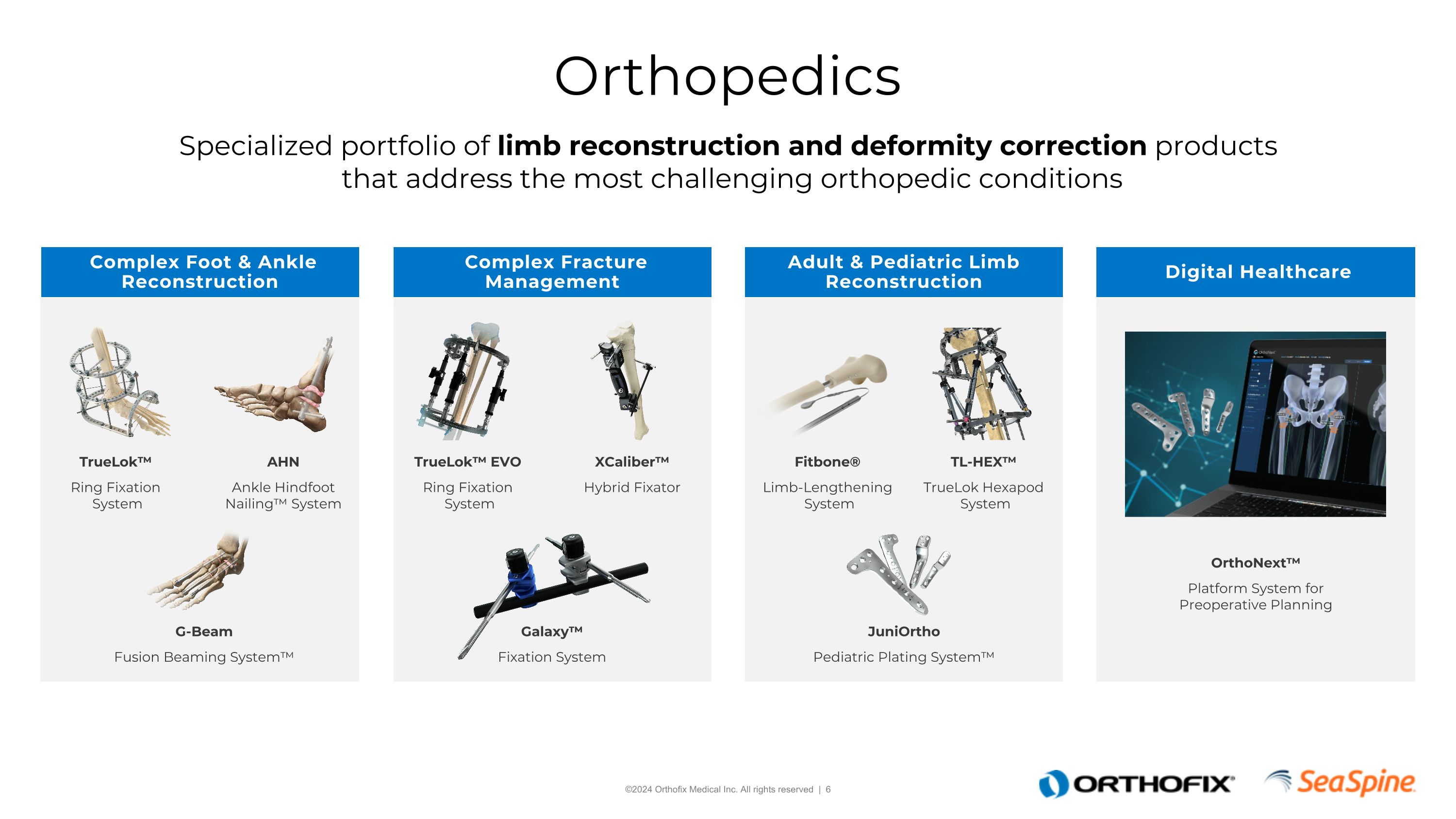

Orthopedics Specialized portfolio of limb reconstruction and deformity correction products that address the most challenging orthopedic conditions Complex Fracture Management Digital Healthcare Adult & Pediatric Limb Reconstruction Complex Foot & Ankle Reconstruction TrueLok™ Ring Fixation System TrueLok™ EVO Ring Fixation System Galaxy™ Fixation System XCaliber™ Hybrid Fixator AHN Ankle Hindfoot Nailing™ System G-Beam Fusion Beaming System™ TL-HEX™ TrueLok Hexapod System JuniOrtho Pediatric Plating System™ Fitbone® Limb-Lengthening System OrthoNext™ Platform System for Preoperative Planning

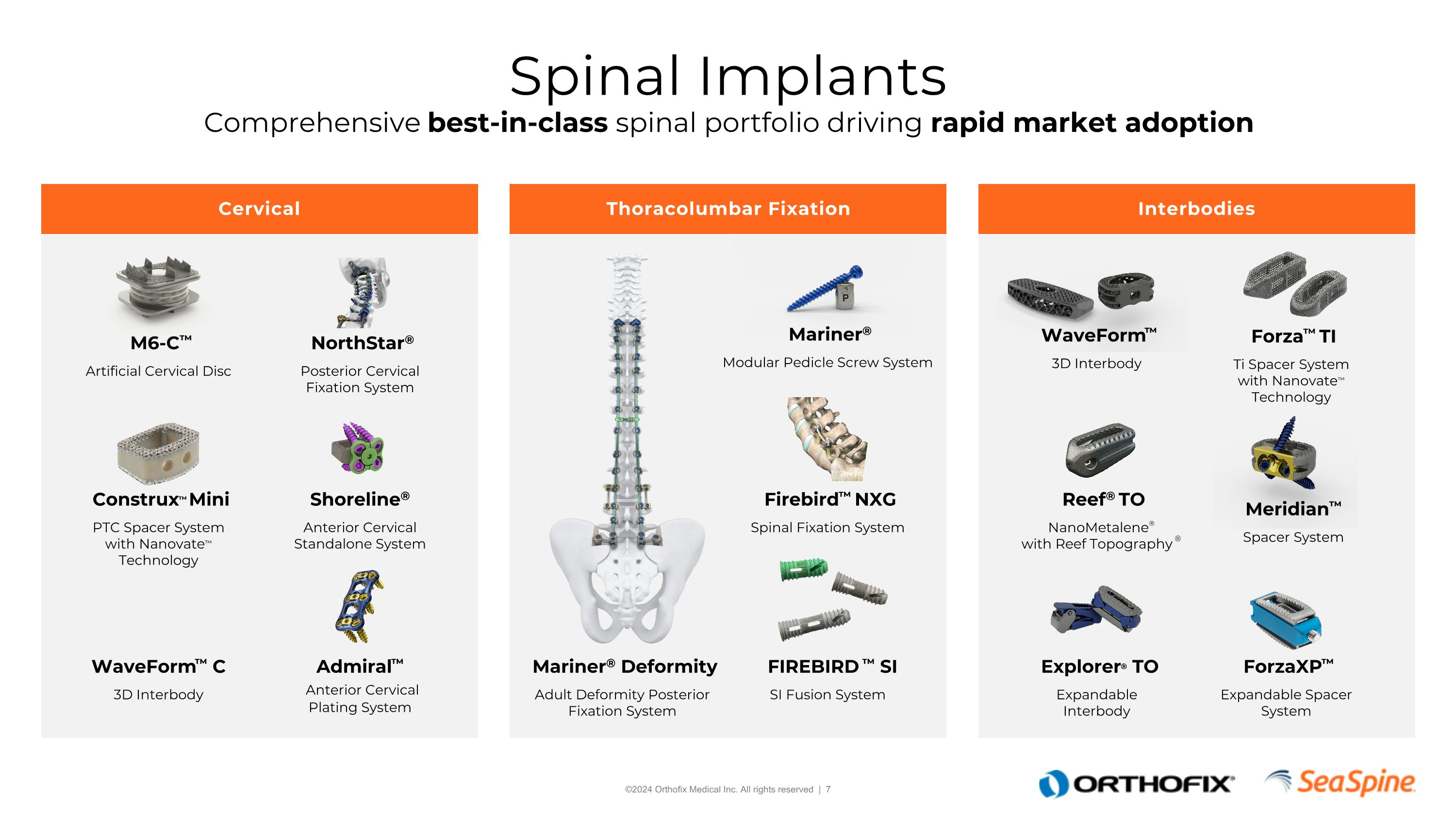

Cervical Thoracolumbar Fixation Interbodies Spinal Implants Comprehensive best-in-class spinal portfolio driving rapid market adoption M6-C™ Artificial Cervical Disc Explorer® TO Expandable Interbody Construx™ Mini PTC Spacer System with Nanovate™ Technology Reef® TO NanoMetalene® with Reef Topography ® Admiral™ Anterior Cervical Plating System Shoreline® Anterior Cervical Standalone System NorthStar® Posterior Cervical Fixation System Forza™ TI Ti Spacer System with Nanovate™ Technology Firebird™ NXG Spinal Fixation System Mariner® Modular Pedicle Screw System FIREBIRD ™ SI SI Fusion System Mariner® Deformity Adult Deformity Posterior Fixation System WaveForm™ 3D Interbody WaveForm™ C 3D Interbody ForzaXP™ Expandable Spacer System Meridian™ Spacer System

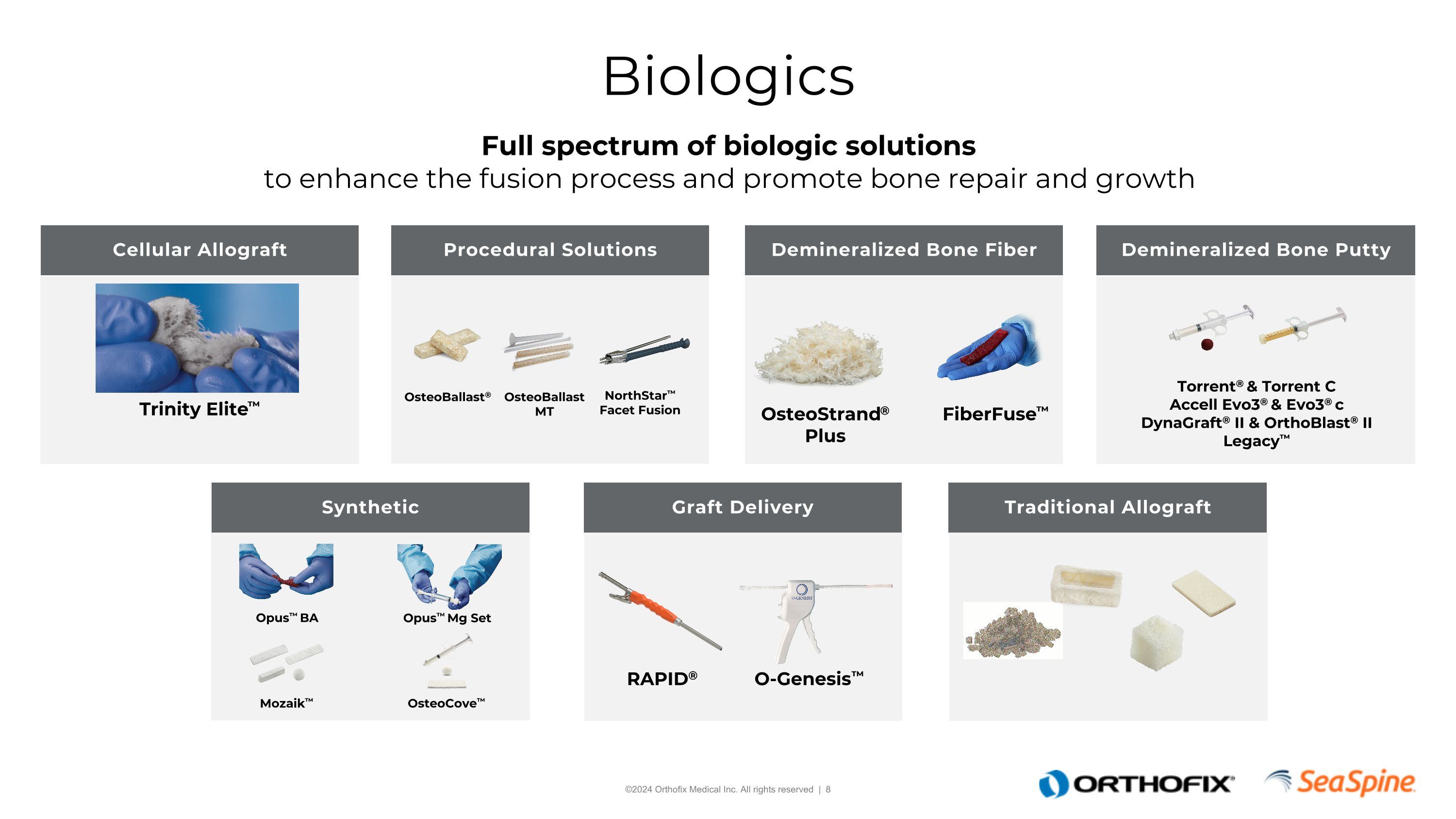

Demineralized Bone Putty Demineralized Bone Fiber Cellular Allograft Biologics Full spectrum of biologic solutions to enhance the fusion process and promote bone repair and growth Procedural Solutions Traditional Allograft Graft Delivery Synthetic Trinity Elite™ OsteoStrand® Plus Torrent® & Torrent CAccell Evo3® & Evo3® cDynaGraft® II & OrthoBlast® IILegacy™ Opus™ BA Opus™ Mg Set Mozaik™ RAPID® O-Genesis™ OsteoBallast® OsteoBallast MT NorthStar™Facet Fusion FiberFuse™ OsteoCove™

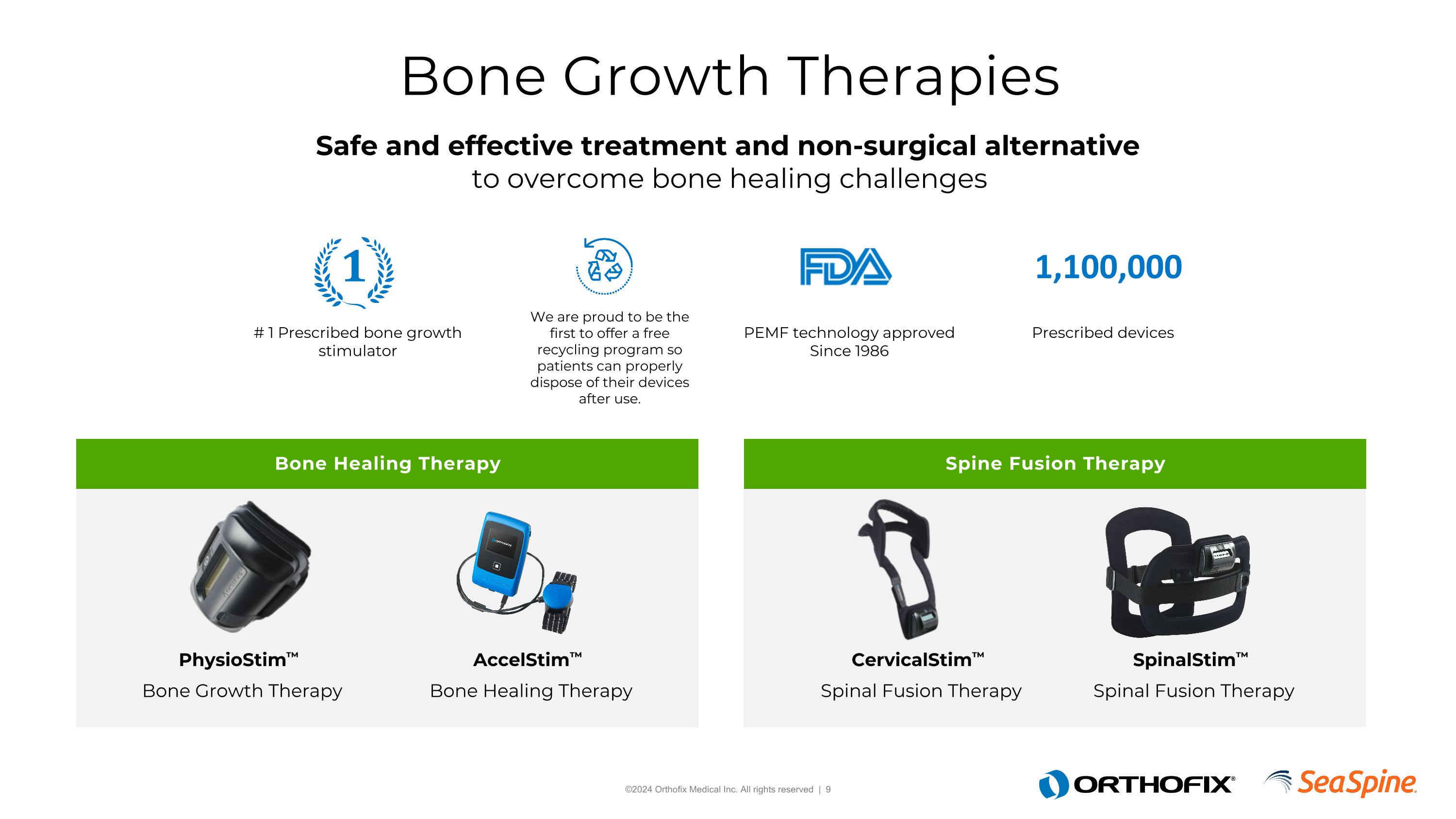

Bone Growth Therapies Bone Healing Therapy Spine Fusion Therapy Safe and effective treatment and non-surgical alternative to overcome bone healing challenges AccelStim™ Bone Healing Therapy PhysioStim™ Bone Growth Therapy CervicalStim™ Spinal Fusion Therapy SpinalStim™ Spinal Fusion Therapy # 1 Prescribed bone growth stimulator We are proud to be the first to offer a free recycling program so patients can properly dispose of their devices after use. PEMF technology approved Since 1986 Prescribed devices 1,100,000

Enabling Technologies Servicing the full continuum of surgical care FLASH™ Navigation with 7D Technology Machine-vision Navigation System

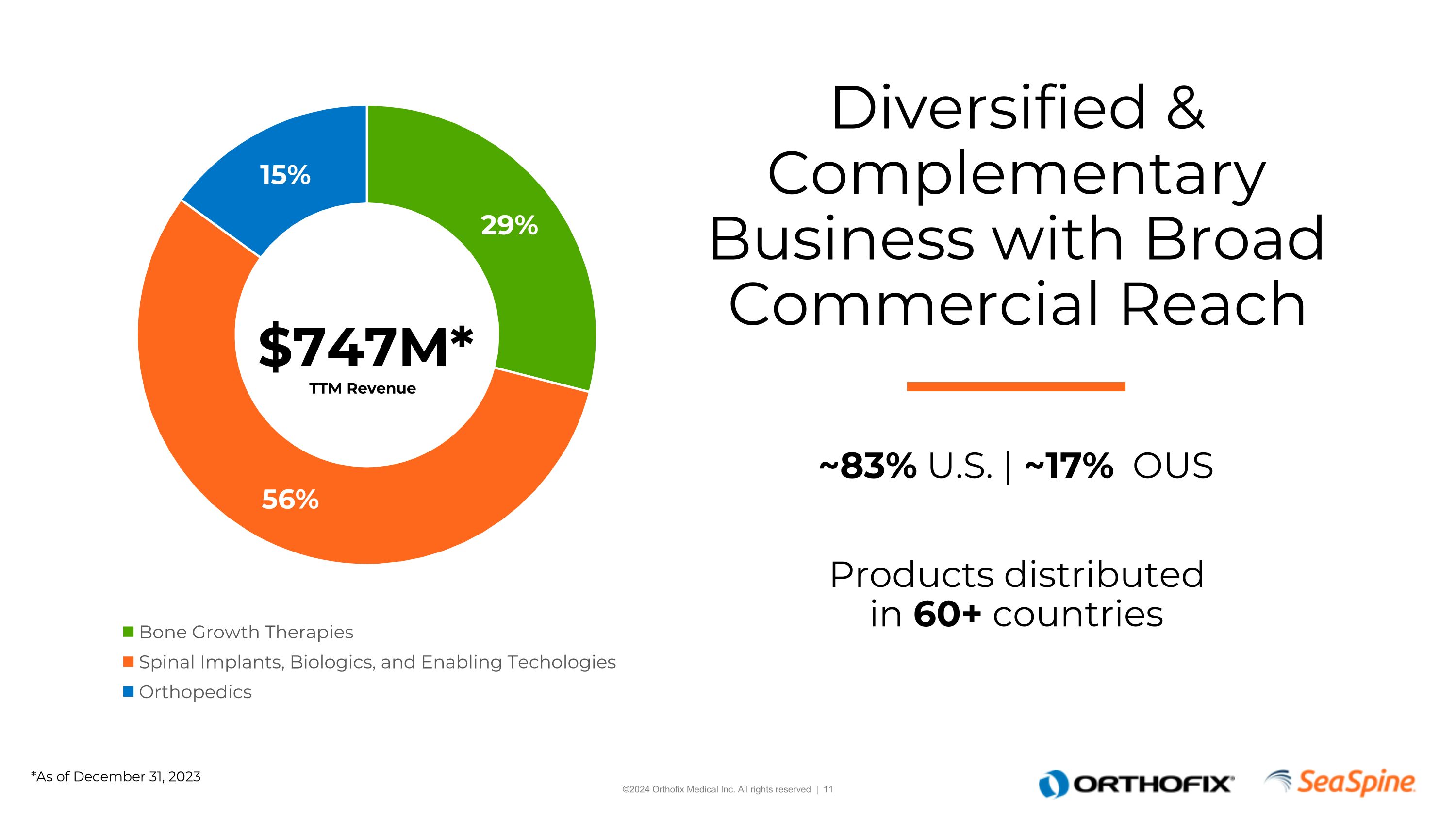

Diversified & Complementary Business with Broad Commercial Reach ~83% U.S. | ~17% OUS Products distributed in 60+ countries $747M* TTM Revenue *As of December 31, 2023

Commercial Strategy Framework Geographic FootprintDouble digit growth in global commercial reach Focused DistributorsExpanded market penetration with increased dedicated distribution Diverse Sales StrategyCross selling opportunities across direct and distribution-based sales channels Clinical RelevanceProven track record of procedural excellence, backed by compelling clinical evidence, spanning multiple markets Training and Education ProgramsComplementary training and education programs to deliver value to surgeons and distributors Continuum of Care Comprehensive product portfolio from pre-operative planning through post surgical COMMERCIAL STRATEGY FRAMEWORK

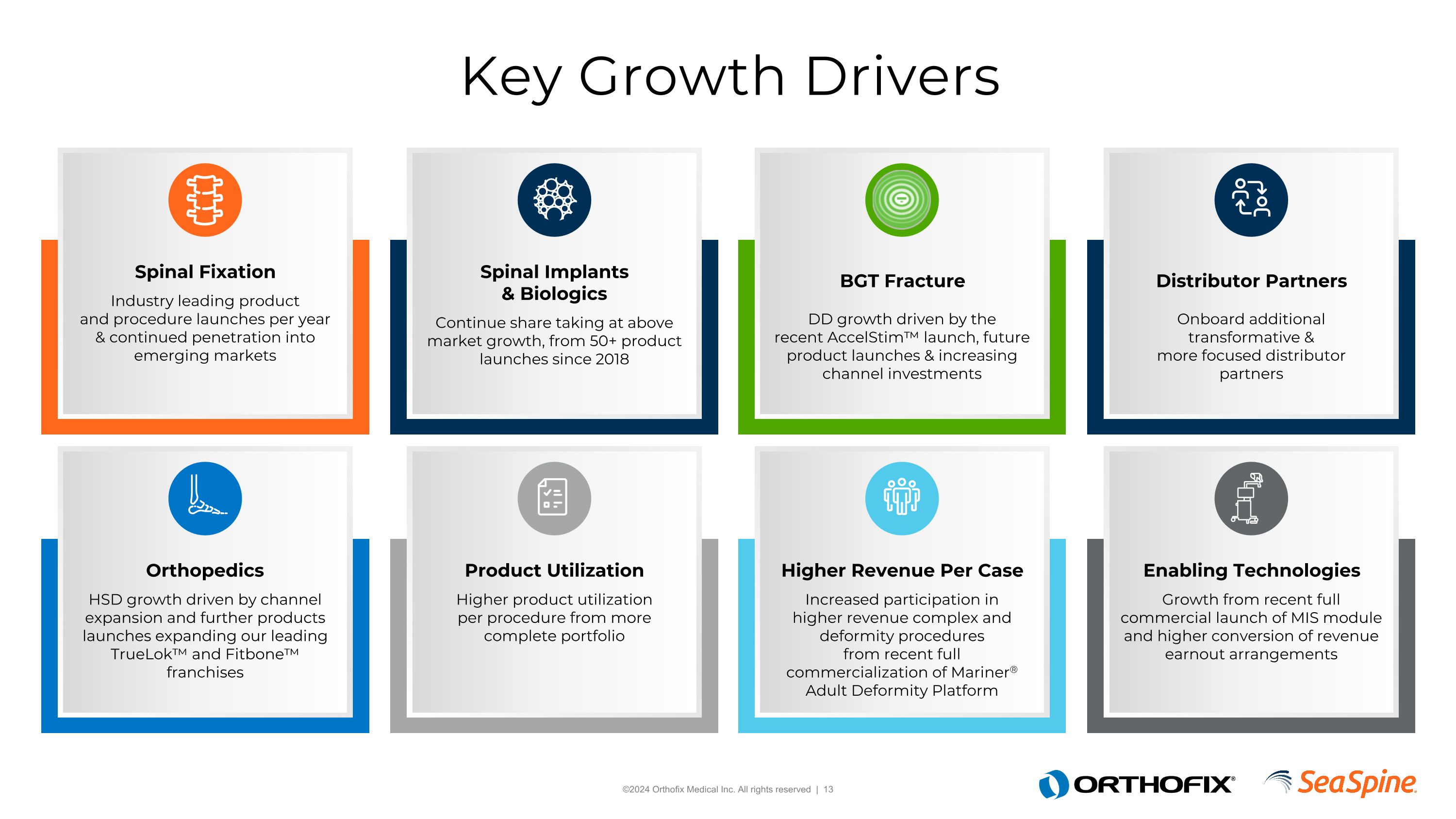

Key Growth Drivers Orthopedics HSD growth driven by channel expansion and further products launches expanding our leading TrueLok™ and Fitbone™ franchises Spinal Fixation Industry leading product and procedure launches per year & continued penetration into emerging markets Product Utilization Higher product utilization per procedure from more complete portfolio Spinal Implants & Biologics Continue share taking at above market growth, from 50+ product launches since 2018 Higher Revenue Per Case Increased participation in higher revenue complex and deformity procedures from recent full commercialization of Mariner® Adult Deformity Platform BGT Fracture DD growth driven by therecent AccelStim™ launch, future product launches & increasing channel investments Enabling Technologies Growth from recent full commercial launch of MIS module and higher conversion of revenue earnout arrangements Distributor Partners Onboard additional transformative & more focused distributor partners

Q4 and FY 2023 Highlights Constant Currency is calculated by applying foreign currency rates applicable to the comparable, prior-year period to present the current period net sales at comparable rates. Constant currency can be presented for numerous GAAP measures, but is commonly used by management to analyze net sales excluding the impact of changes in foreign currency rates. The reasons for and nature of non-GAAP disclosures by the Company, descriptions of the adjustments used to calculate those non-GAAP financial measures, and reconciliations of those non-GAAP financial measures to the most comparable GAAP financial measure, are provided in the Company’s press release issued and Current Report on Form 8-K filed on March 5, 2024. See Appendix A for calculation of proforma Adjusted EBITDA and proforma Adjusted Gross Margin for each quarterly period and full year of 2022. Pro forma net sales for 2022 include the impact of final Spinal Implant stocking orders to European distributors prior to SeaSpine's exit from that market. Excluding the impact of these transactions, net sales growth was +7.4% on a pro forma constant currency basis for Total Orthofix and +5.8% for Spinal Implants, Biologics, and Enabling Technologies. Orthofix $747M FY 2023 Revenue 62% Growth YoY as reported 6% Proforma Growth YoY at Constant Currency(2)(4) $200M Q4 2023 Revenue 64% Growth YoY as reported 7% Proforma Growth YoY at Constant Currency(2)(4) 72% Q4 2023 Adjusted Gross Margin(2) 71% FY 2023 Adjusted Gross Margin(2) $19.6M Q4 2023 Adjusted EBITDA 96% Proforma Growth YoY(2)(3) $37.8M Cash & Cash Equivalents, 12/31/2023 Includes $4.7M in restricted cash $46.3M FY 2023 Adjusted EBITDA 69% Proforma Growth YoY(2)(3)

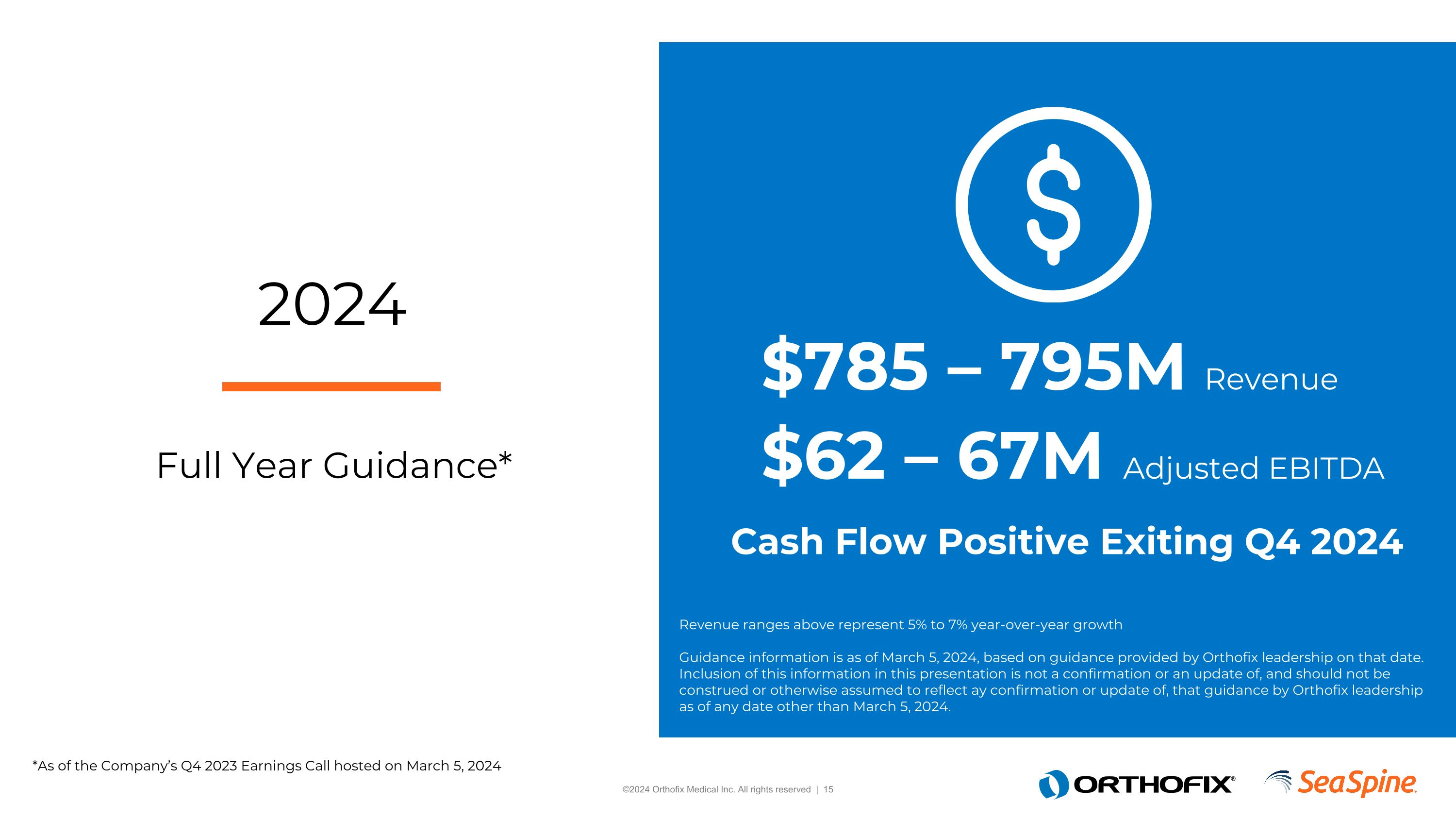

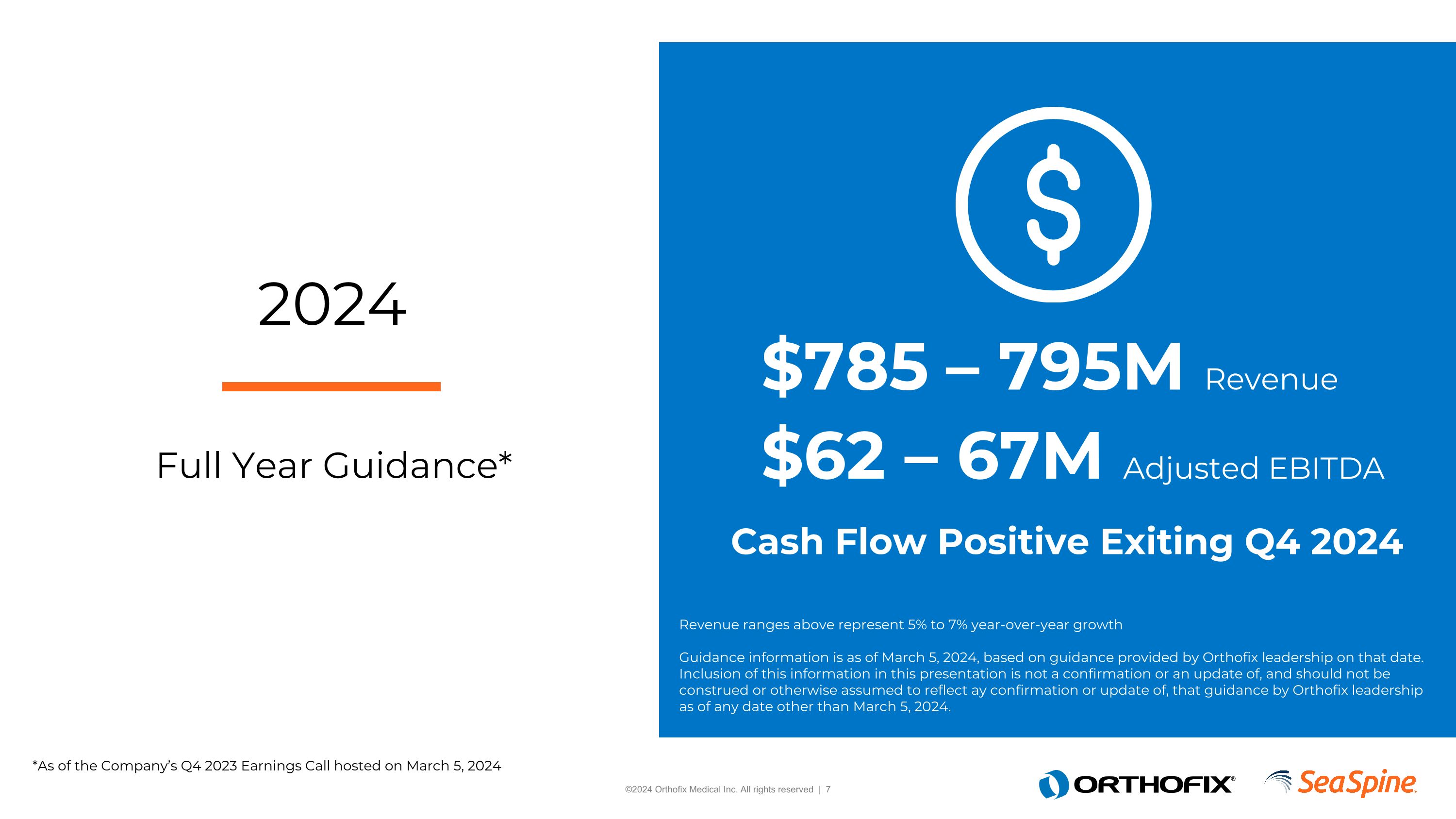

2024 Full Year Guidance* $785 – 795M Revenue $62 – 67M Adjusted EBITDA Revenue ranges above represent 5% to 7% year-over-year growth Guidance information is as of March 5, 2024, based on guidance provided by Orthofix leadership on that date. Inclusion of this information in this presentation is not a confirmation or an update of, and should not be construed or otherwise assumed to reflect ay confirmation or update of, that guidance by Orthofix leadership as of any date other than March 5, 2024. *As of the Company’s Q4 2023 Earnings Call hosted on March 5, 2024 Cash Flow Positive Exiting Q4 2024

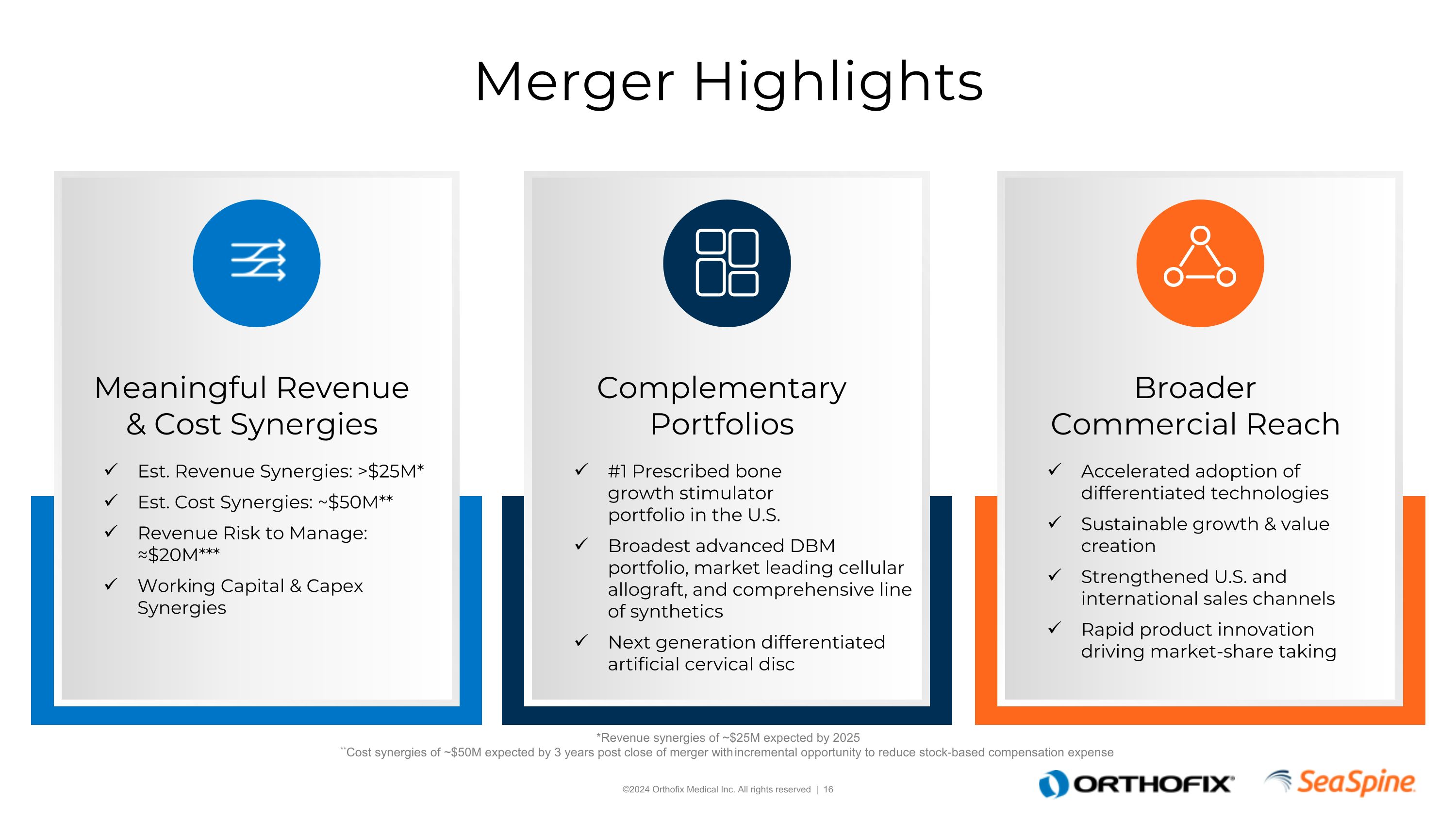

Broader Commercial Reach Accelerated adoption of differentiated technologies Sustainable growth & value creation Strengthened U.S. and international sales channels Rapid product innovation driving market-share taking Complementary Portfolios #1 Prescribed bone growth stimulator portfolio in the U.S. Broadest advanced DBM portfolio, market leading cellular allograft, and comprehensive line of synthetics Next generation differentiated artificial cervical disc Meaningful Revenue & Cost Synergies Est. Revenue Synergies: >$25M* Est. Cost Synergies: ~$50M** Revenue Risk to Manage: ≈$20M*** Working Capital & Capex Synergies Merger Highlights *Revenue synergies of ~$25M expected by 2025 **Cost synergies of ~$50M expected by 3 years post close of merger with incremental opportunity to reduce stock-based compensation expense **Based on due diligence, including revenue zip code analysis performed by 3rd party

a Investment Highlights Building a Leading Global Spine & Orthopedics Company Extensive PortfolioSolutions with Complementary Technologies Improved Clinical Outcomes & Economic Value Expanded Distribution Channels & Global Commercial Reach $150M Credit Facility Provides Liquidity to Fund Growth and Scale Visionary Leadership Team with Deep Sector Experience Large Addressable Markets with High Growth Opportunities

Click to edit Master title style THANK YOU

APPENDIX A

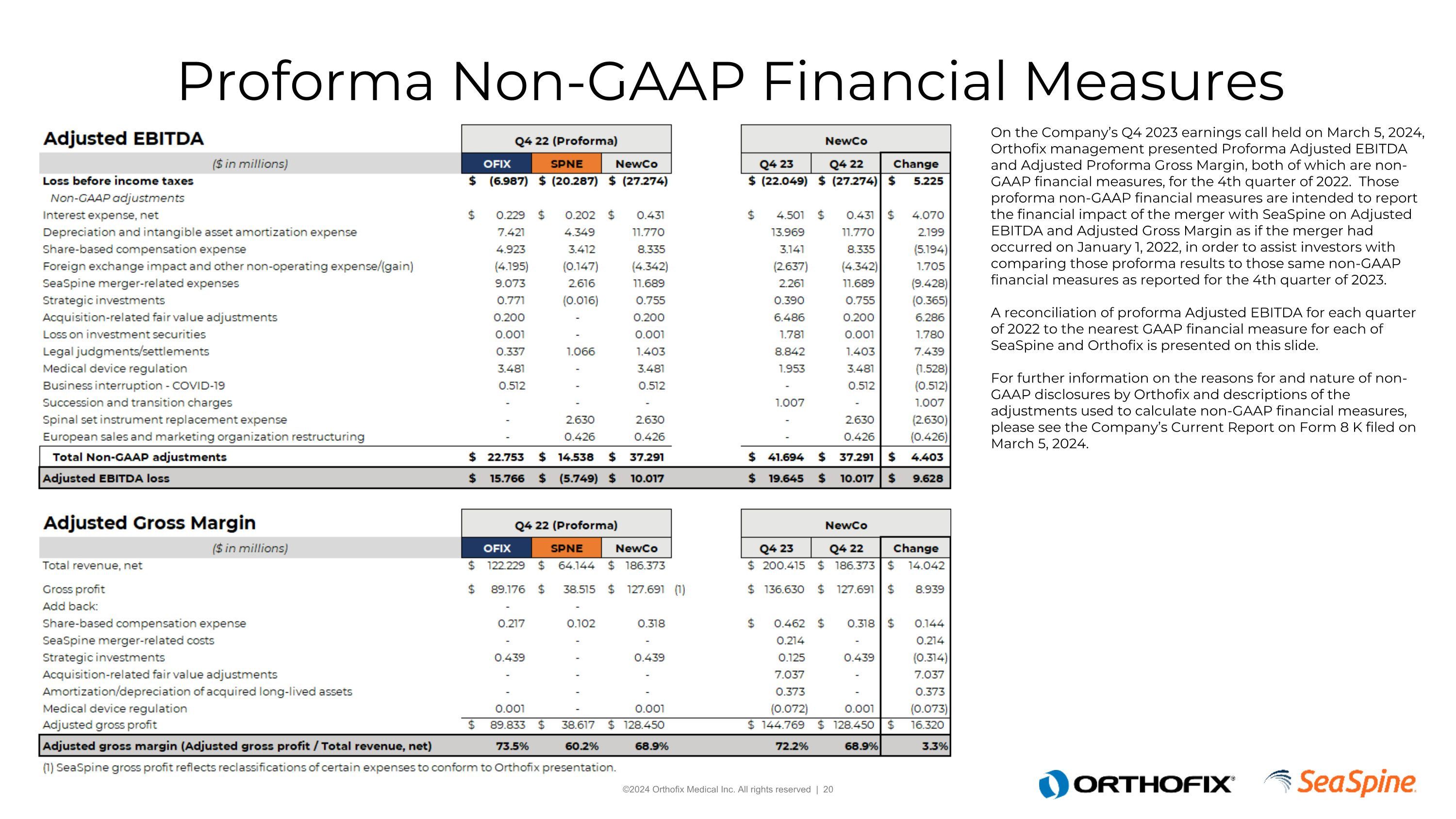

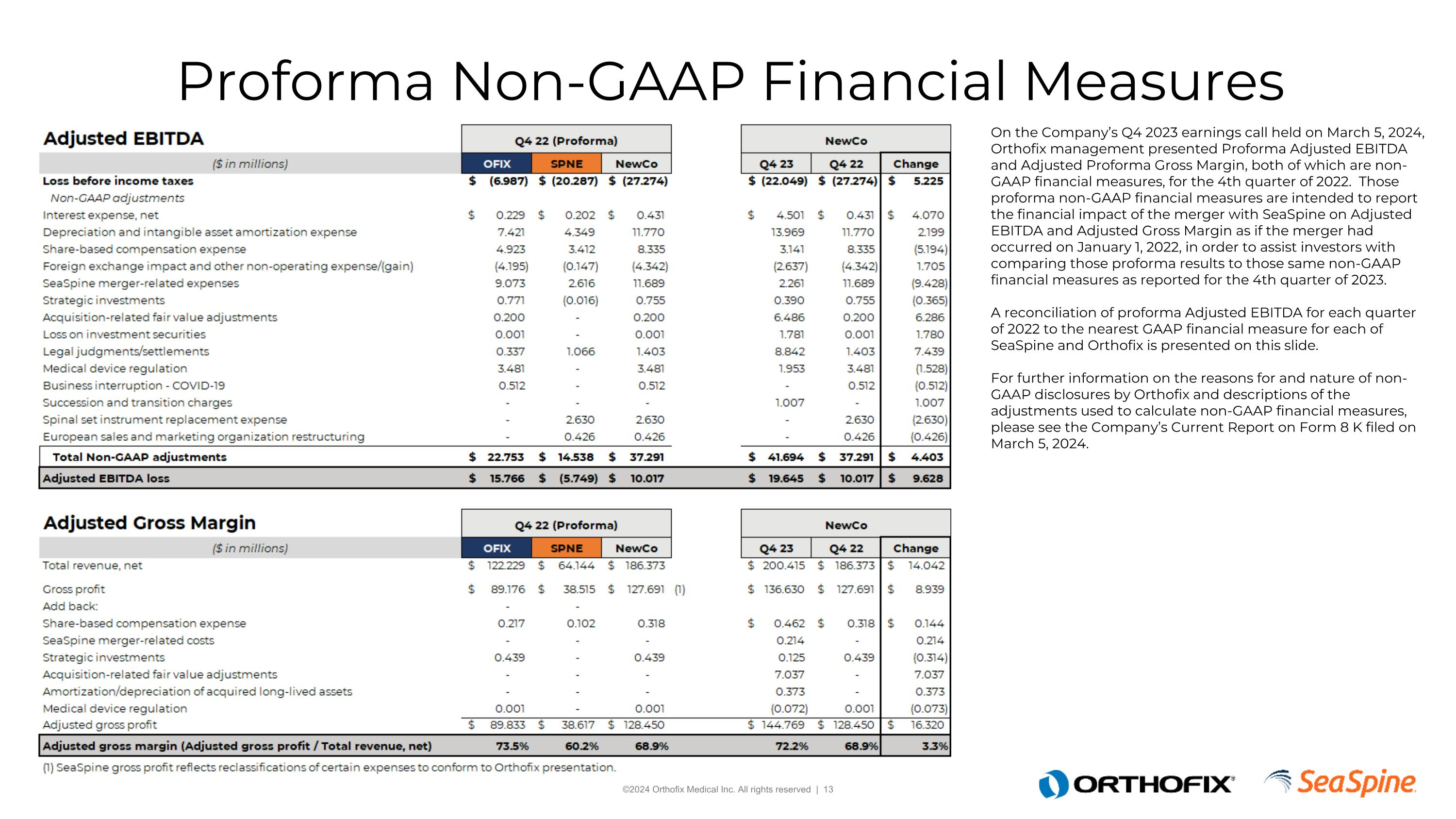

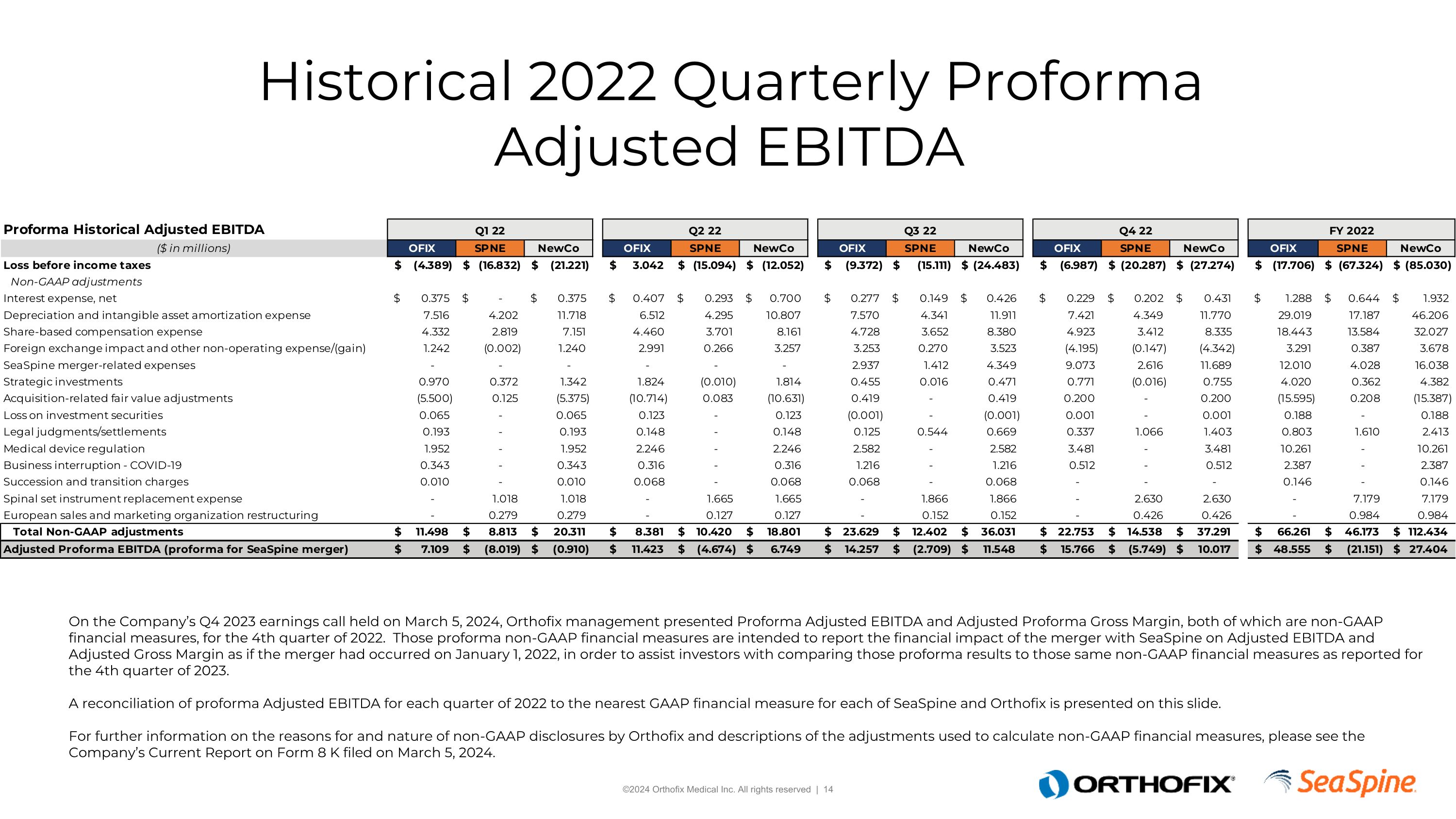

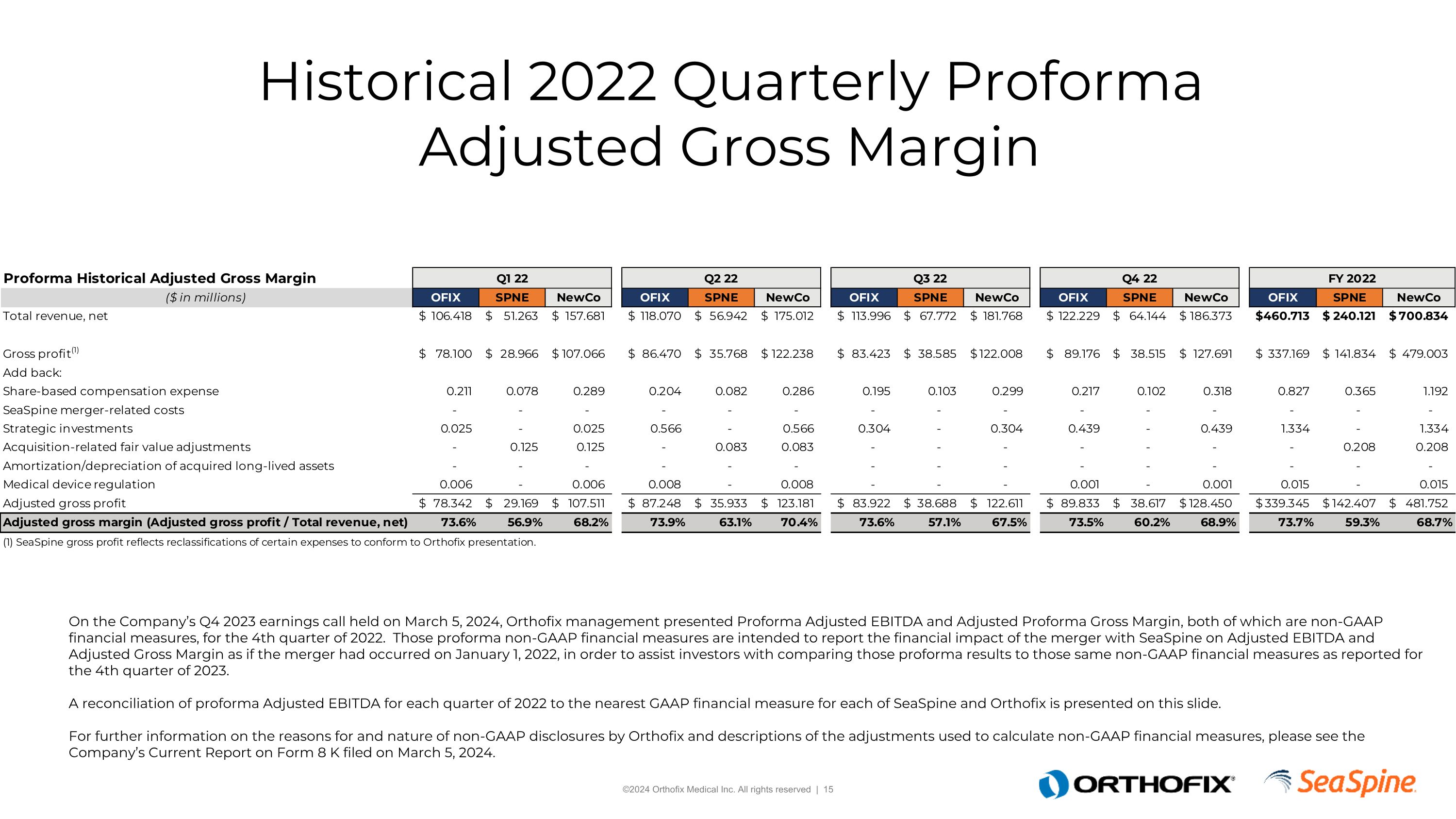

Proforma Non-GAAP Financial Measures On the Company’s Q4 2023 earnings call held on March 5, 2024, Orthofix management presented Proforma Adjusted EBITDA and Adjusted Proforma Gross Margin, both of which are non-GAAP financial measures, for the 4th quarter of 2022. Those proforma non-GAAP financial measures are intended to report the financial impact of the merger with SeaSpine on Adjusted EBITDA and Adjusted Gross Margin as if the merger had occurred on January 1, 2022, in order to assist investors with comparing those proforma results to those same non-GAAP financial measures as reported for the 4th quarter of 2023. A reconciliation of proforma Adjusted EBITDA for each quarter of 2022 to the nearest GAAP financial measure for each of SeaSpine and Orthofix is presented on this slide.For further information on the reasons for and nature of non-GAAP disclosures by Orthofix and descriptions of the adjustments used to calculate non-GAAP financial measures, please see the Company’s Current Report on Form 8 K filed on March 5, 2024.

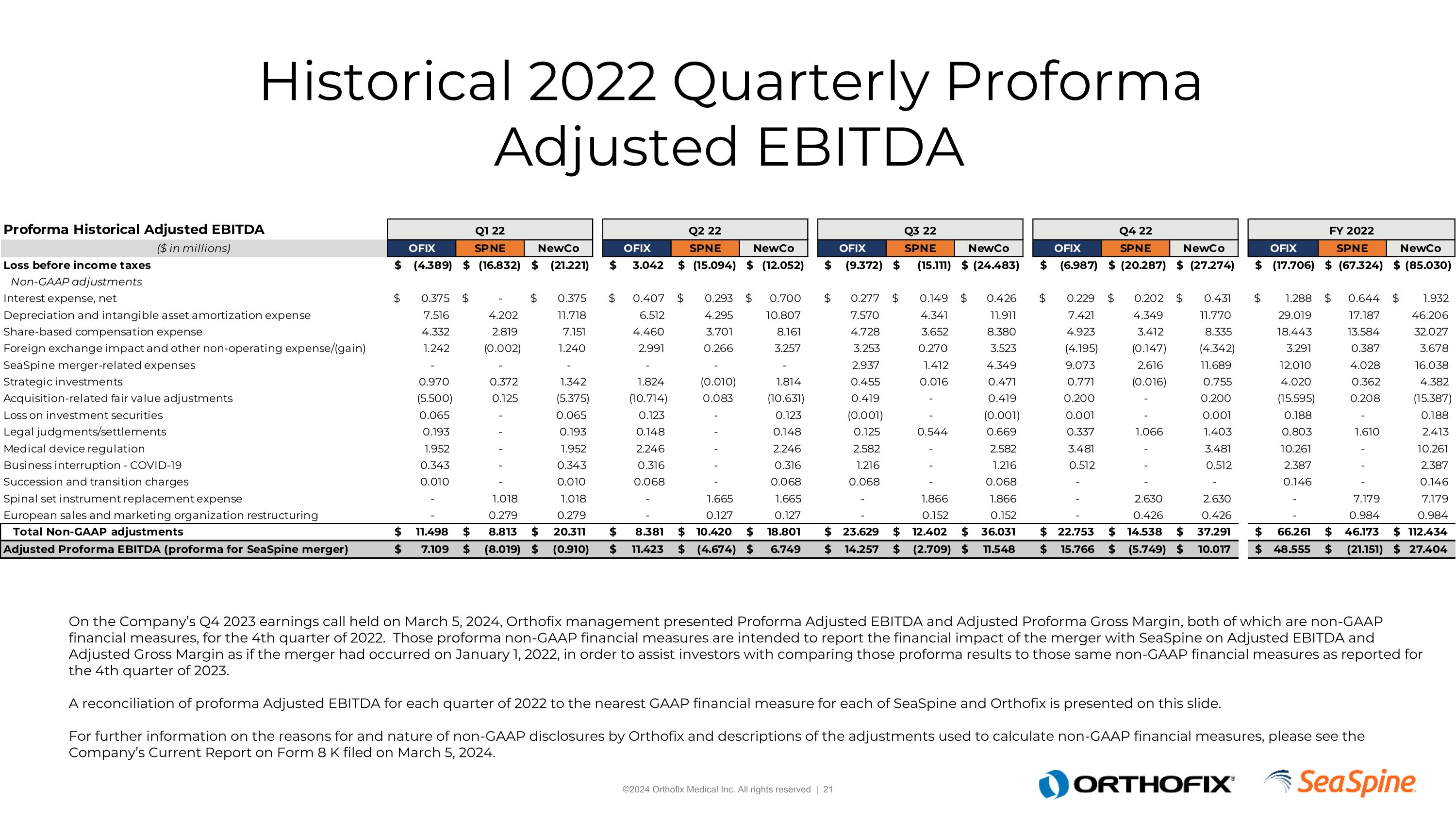

Historical 2022 Quarterly Proforma Adjusted EBITDA On the Company’s Q4 2023 earnings call held on March 5, 2024, Orthofix management presented Proforma Adjusted EBITDA and Adjusted Proforma Gross Margin, both of which are non-GAAP financial measures, for the 4th quarter of 2022. Those proforma non-GAAP financial measures are intended to report the financial impact of the merger with SeaSpine on Adjusted EBITDA and Adjusted Gross Margin as if the merger had occurred on January 1, 2022, in order to assist investors with comparing those proforma results to those same non-GAAP financial measures as reported for the 4th quarter of 2023. A reconciliation of proforma Adjusted EBITDA for each quarter of 2022 to the nearest GAAP financial measure for each of SeaSpine and Orthofix is presented on this slide.For further information on the reasons for and nature of non-GAAP disclosures by Orthofix and descriptions of the adjustments used to calculate non-GAAP financial measures, please see the Company’s Current Report on Form 8 K filed on March 5, 2024.

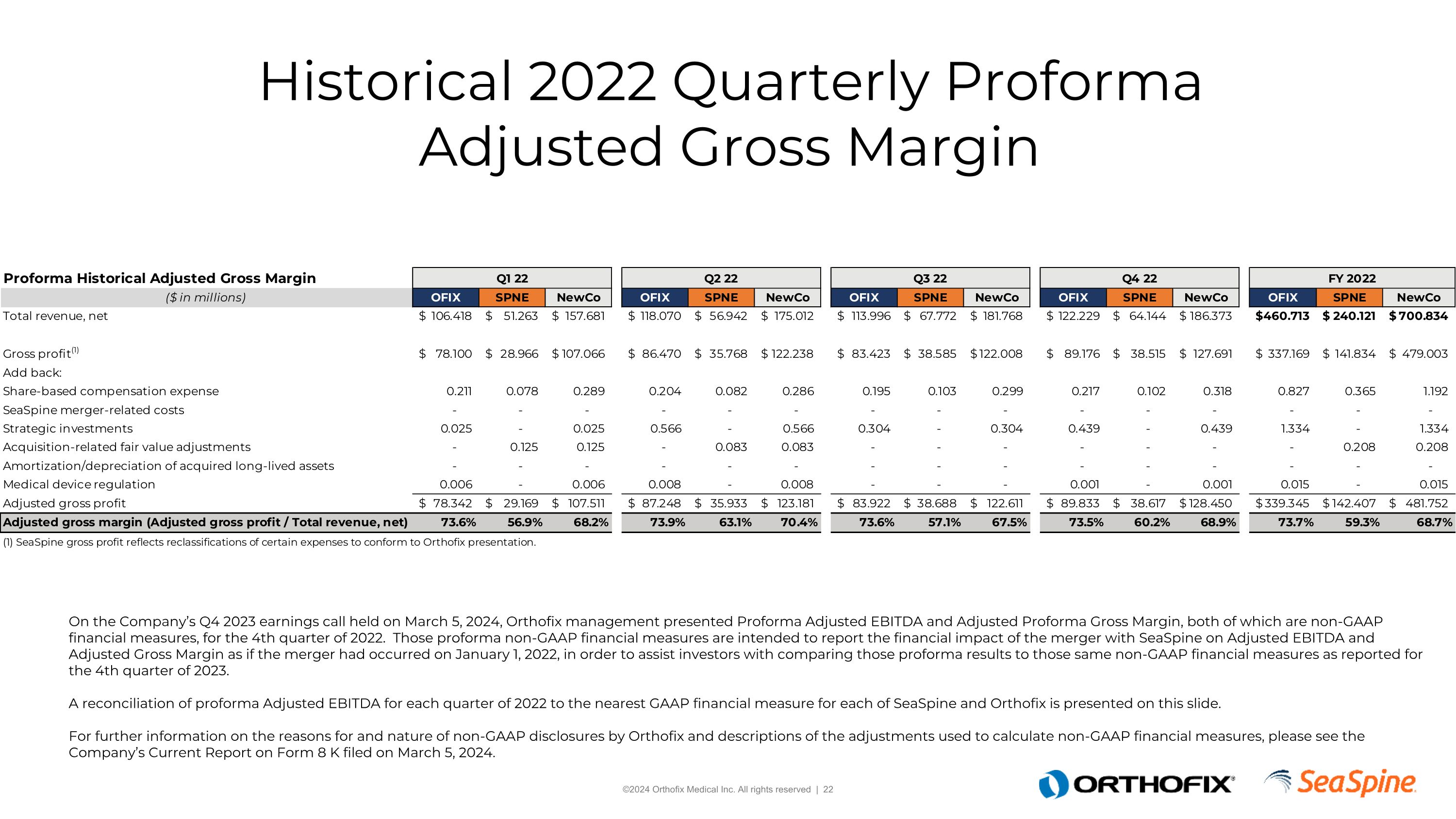

Historical 2022 Quarterly Proforma Adjusted Gross Margin On the Company’s Q4 2023 earnings call held on March 5, 2024, Orthofix management presented Proforma Adjusted EBITDA and Adjusted Proforma Gross Margin, both of which are non-GAAP financial measures, for the 4th quarter of 2022. Those proforma non-GAAP financial measures are intended to report the financial impact of the merger with SeaSpine on Adjusted EBITDA and Adjusted Gross Margin as if the merger had occurred on January 1, 2022, in order to assist investors with comparing those proforma results to those same non-GAAP financial measures as reported for the 4th quarter of 2023. A reconciliation of proforma Adjusted EBITDA for each quarter of 2022 to the nearest GAAP financial measure for each of SeaSpine and Orthofix is presented on this slide.For further information on the reasons for and nature of non-GAAP disclosures by Orthofix and descriptions of the adjustments used to calculate non-GAAP financial measures, please see the Company’s Current Report on Form 8 K filed on March 5, 2024.

Supplemental Financials 4Q23 and FY23 Earnings March 5, 2024

Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” or “continue” or other comparable terminology. Forward-looking statements in this communication include the Company's expectations regarding net sales and adjusted EBITDA for the year ended December 31, 2024. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K. Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii) risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to recruit and retain management and key personnel, (vii) global economic instability and potential supply chain disruption caused by Russia’s invasion of Ukraine and resulting sanctions, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements. This list of risks, uncertainties, and other factors is not complete. We discuss some of these matters more fully, as well as certain risk factors that could affect our business, financial condition, results of operations, and prospects, in reports we file from time-to-time with the SEC, which are available to read at www.sec.gov. Any or all forward-looking statements that we make may turn out to be wrong (due to inaccurate assumptions that we make or otherwise), and our actual outcomes and results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any of these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. We undertake no obligation to update, and expressly disclaim any duty to update, our forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law. The Company is unable to provide expectations of GAAP income (loss) before income taxes, the closest comparable GAAP measures to Adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict without unreasonable efforts the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating Adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

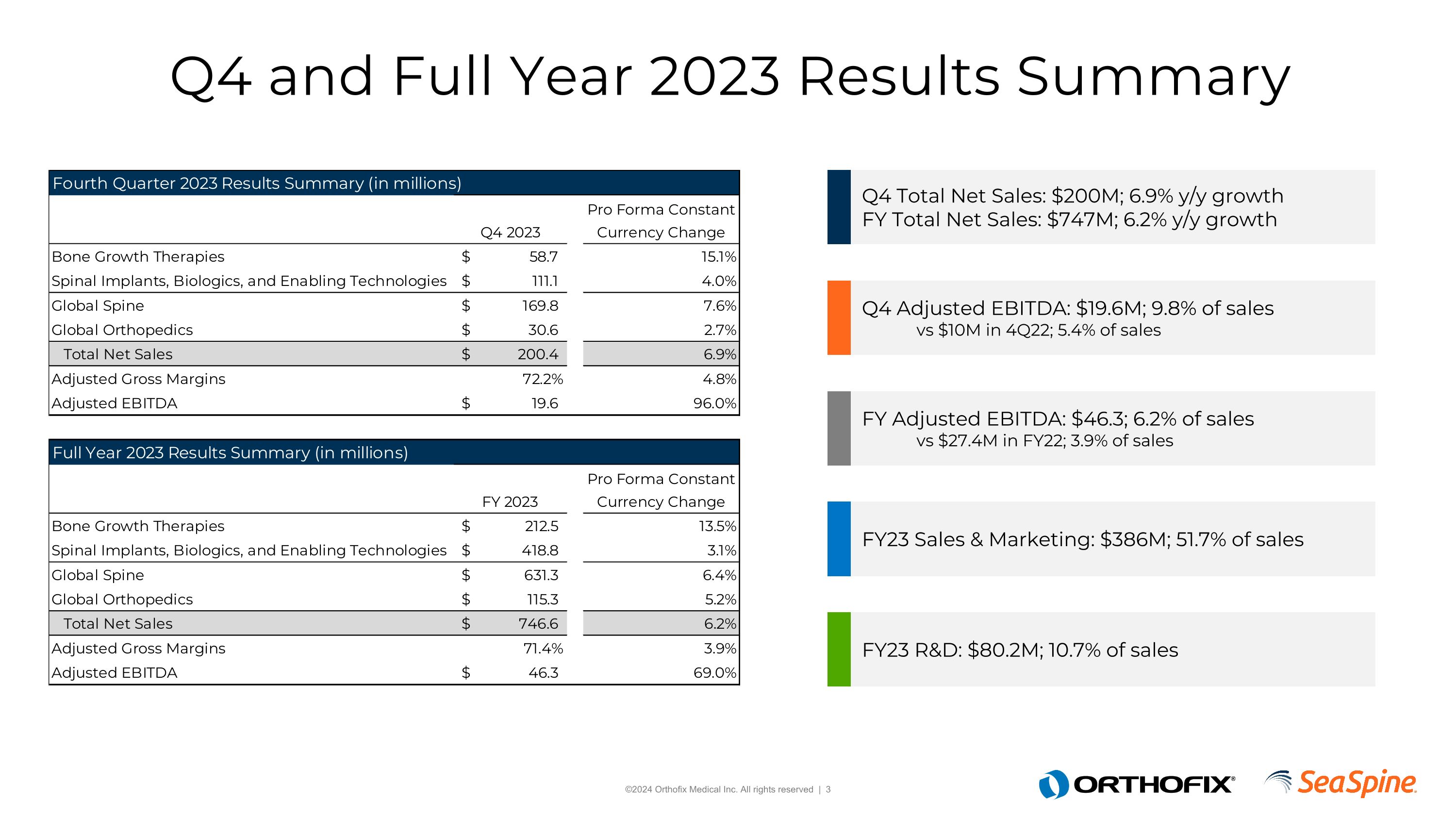

Q4 and Full Year 2023 Results Summary Q4 Total Net Sales: $200M; 6.9% y/y growth FY Total Net Sales: $747M; 6.2% y/y growth Q4 Adjusted EBITDA: $19.6M; 9.8% of sales vs $10M in 4Q22; 5.4% of sales FY Adjusted EBITDA: $46.3; 6.2% of sales vs $27.4M in FY22; 3.9% of sales FY23 Sales & Marketing: $386M; 51.7% of sales FY23 R&D: $80.2M; 10.7% of sales

Q4 2023 Key Messages Strong fundamentals with compelling growth opportunity and value proposition across diverse portfolio Merger thesis remains intact Capitalizing on market disruption through expansion of distributor network Commitment to profitable growth Solid operational execution with sequential gains in Adjusted EBITDA and gross margin

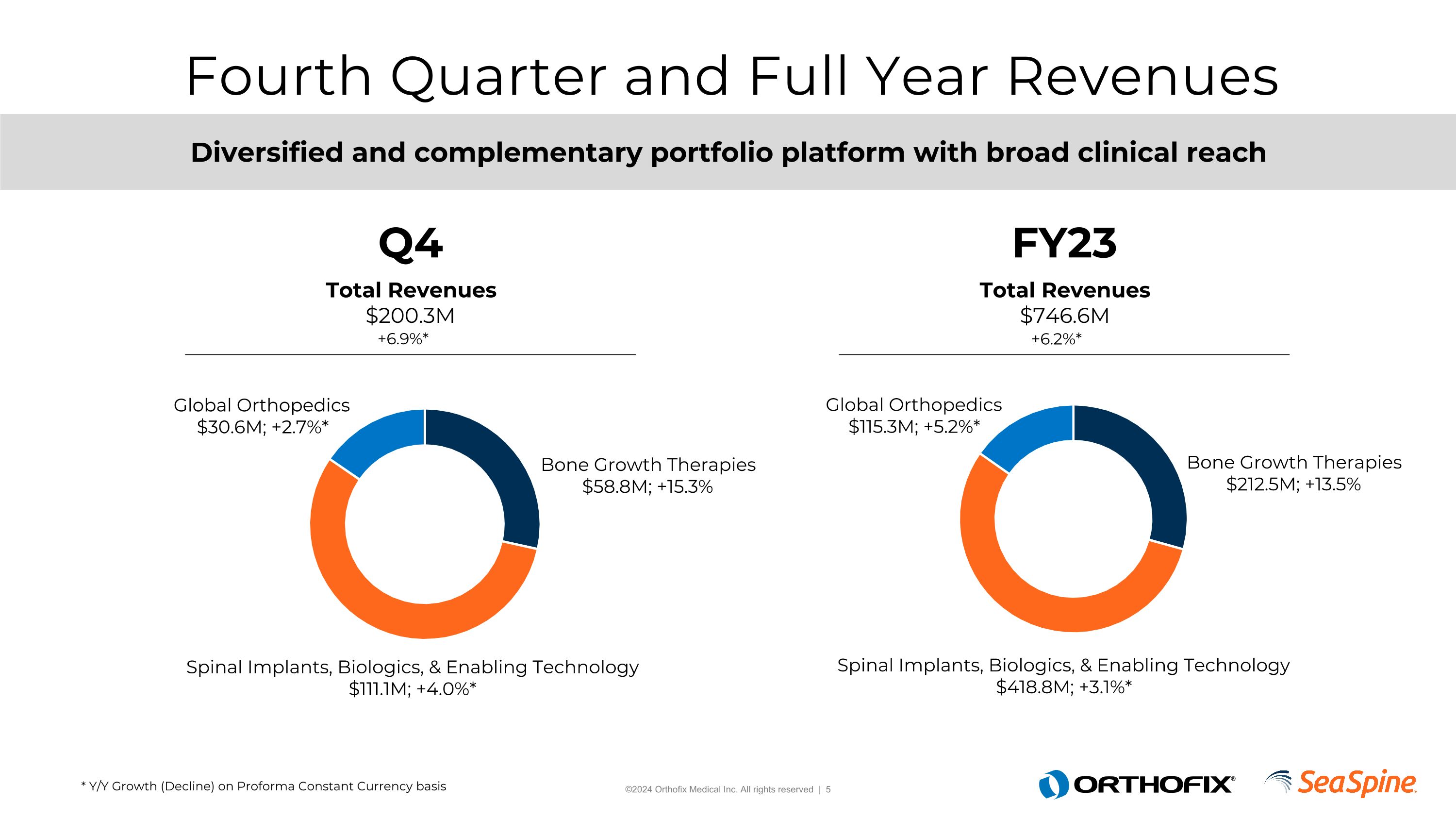

Fourth Quarter and Full Year Revenues Q4 FY23 * Y/Y Growth (Decline) on Proforma Constant Currency basis Total Revenues $200.3M Total Revenues $746.6M +6.2%* +6.9%* Diversified and complementary portfolio platform with broad clinical reach Bone Growth Therapies $58.8M; +15.3% Bone Growth Therapies $212.5M; +13.5% Global Orthopedics $30.6M; +2.7%* Global Orthopedics $115.3M; +5.2%* Spinal Implants, Biologics, & Enabling Technology $418.8M; +3.1%* Spinal Implants, Biologics, & Enabling Technology $111.1M; +4.0%*

Complementary High Growth Portfolio SmartTRAK® 2022 – 2026 U.S. Estimates*Focused growth segments include Enabling Technologies, Motion Preservation, Interbody, DBM, LLIF/OLIF, MIS and Long Bone Stimulation $7B of Focused High-Growth Market Segments* | 6.1% CAGR Motion Preservation Spinal Fixation Spinal Implants Limb Reconstruction Deformity Correction Orthopedics Cellular Allograft Demineralized Bone Matrices Synthetic Bone Grafts Biologics Machine-vision 7D FLASH™ Navigation Enabling Technologies Bone Growth Stimulation Non-Surgical Alternative Regenerative Technology Bone Growth Therapies Synergistic Product Platform

2024 Full Year Guidance* $785 – 795M Revenue $62 – 67M Adjusted EBITDA Revenue ranges above represent 5% to 7% year-over-year growth Guidance information is as of March 5, 2024, based on guidance provided by Orthofix leadership on that date. Inclusion of this information in this presentation is not a confirmation or an update of, and should not be construed or otherwise assumed to reflect ay confirmation or update of, that guidance by Orthofix leadership as of any date other than March 5, 2024. *As of the Company’s Q4 2023 Earnings Call hosted on March 5, 2024 Cash Flow Positive Exiting Q4 2024

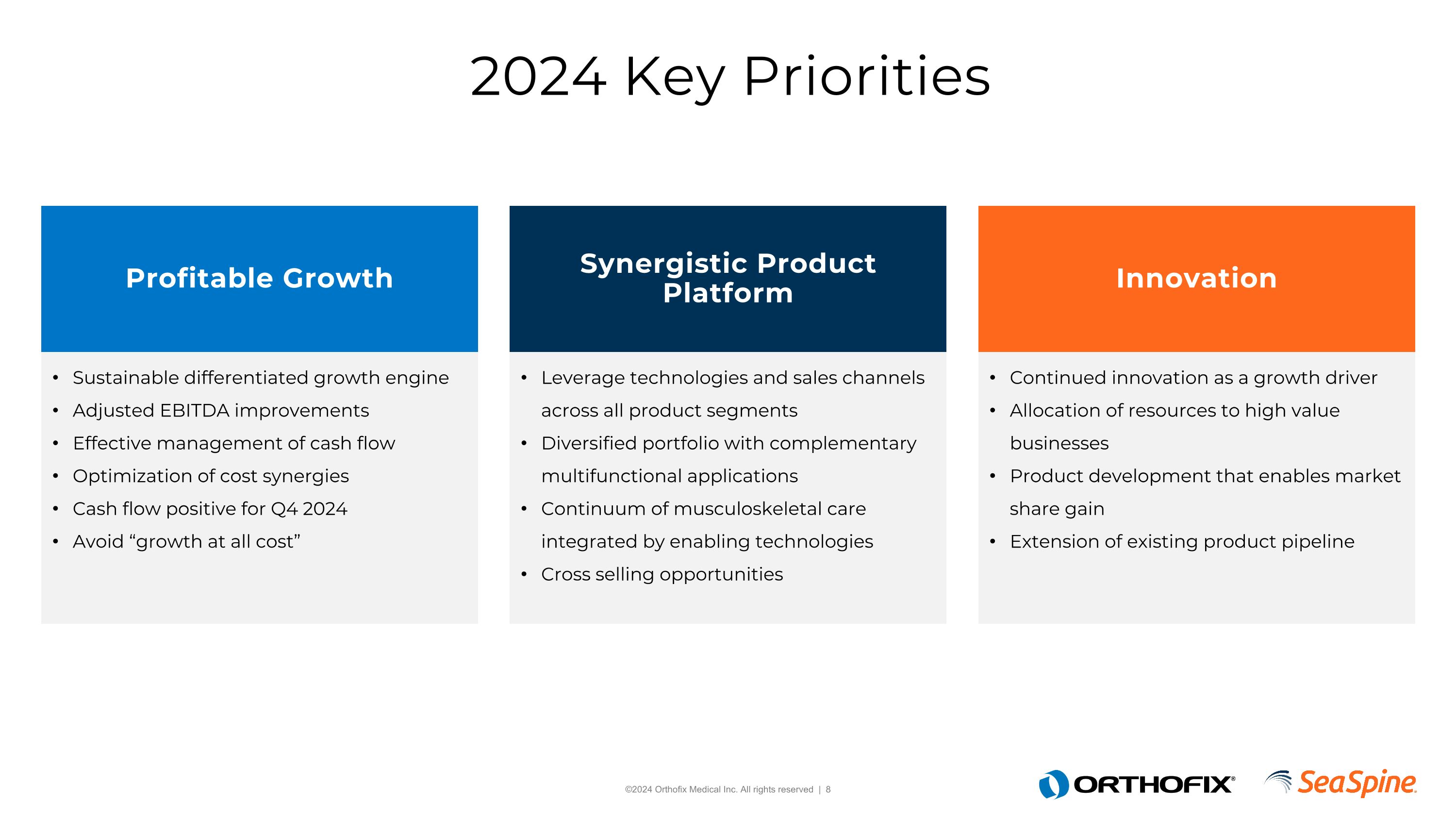

2024 Key Priorities Profitable Growth Synergistic Product Platform Innovation Sustainable differentiated growth engine Adjusted EBITDA improvements Effective management of cash flow Optimization of cost synergies Cash flow positive for Q4 2024 Avoid “growth at all cost” Leverage technologies and sales channels across all product segments Diversified portfolio with complementary multifunctional applications Continuum of musculoskeletal care integrated by enabling technologies Cross selling opportunities Continued innovation as a growth driver Allocation of resources to high value businesses Product development that enables market share gain Extension of existing product pipeline

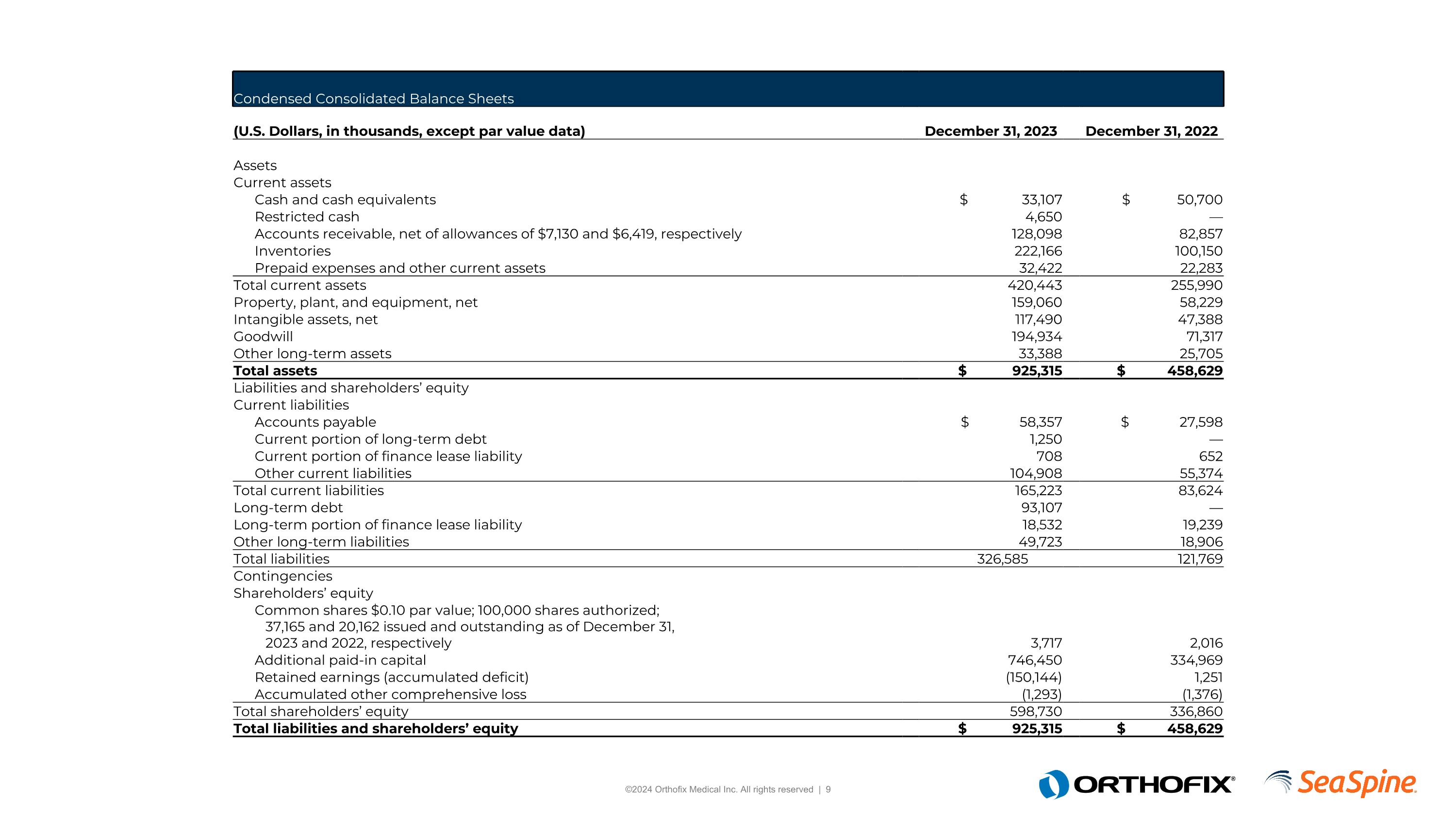

Condensed Consolidated Balance Sheets (U.S. Dollars, in thousands, except par value data) December 31, 2023 December 31, 2022 Assets Current assets Cash and cash equivalents $ 33,107 $ 50,700 Restricted cash 4,650 — Accounts receivable, net of allowances of $7,130 and $6,419, respectively 128,098 82,857 Inventories 222,166 100,150 Prepaid expenses and other current assets 32,422 22,283 Total current assets 420,443 255,990 Property, plant, and equipment, net 159,060 58,229 Intangible assets, net 117,490 47,388 Goodwill 194,934 71,317 Other long-term assets 33,388 25,705 Total assets $ 925,315 $ 458,629 Liabilities and shareholders’ equity Current liabilities Accounts payable $ 58,357 $ 27,598 Current portion of long-term debt 1,250 — Current portion of finance lease liability 708 652 Other current liabilities 104,908 55,374 Total current liabilities 165,223 83,624 Long-term debt 93,107 — Long-term portion of finance lease liability 18,532 19,239 Other long-term liabilities 49,723 18,906 Total liabilities 326,585 121,769 Contingencies Shareholders’ equity Common shares $0.10 par value; 100,000 shares authorized; 37,165 and 20,162 issued and outstanding as of December 31, 2023 and 2022, respectively 3,717 2,016 Additional paid-in capital 746,450 334,969 Retained earnings (accumulated deficit) (150,144) 1,251 Accumulated other comprehensive loss (1,293) (1,376) Total shareholders’ equity 598,730 336,860 Total liabilities and shareholders’ equity $ 925,315 $ 458,629

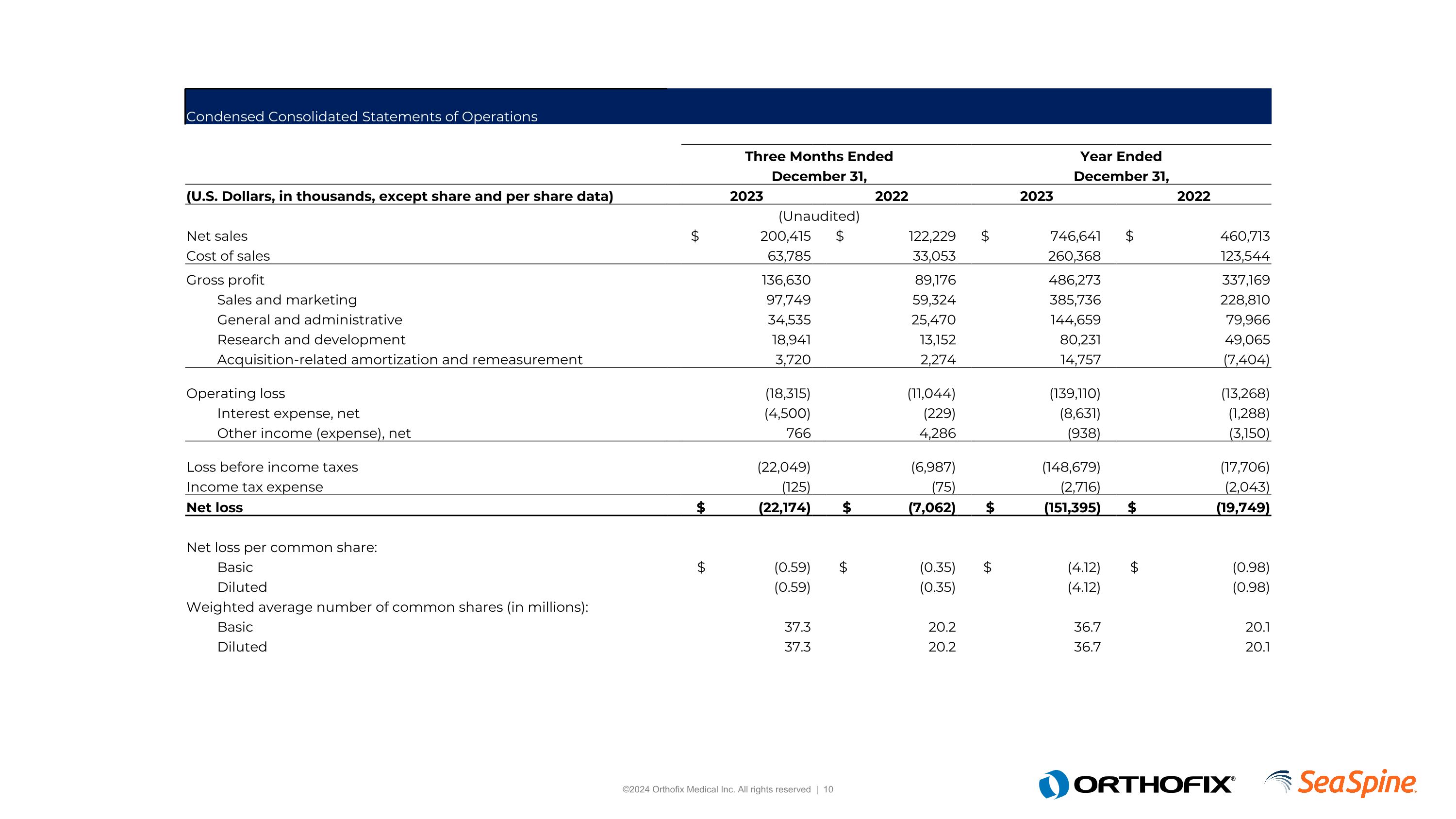

Condensed Consolidated Statements of Operations Three Months Ended Year Ended December 31, December 31, (U.S. Dollars, in thousands, except share and per share data) 2023 2022 2023 2022 (Unaudited) Net sales $ 200,415 $ 122,229 $ 746,641 $ 460,713 Cost of sales 63,785 33,053 260,368 123,544 Gross profit 136,630 89,176 486,273 337,169 Sales and marketing 97,749 59,324 385,736 228,810 General and administrative 34,535 25,470 144,659 79,966 Research and development 18,941 13,152 80,231 49,065 Acquisition-related amortization and remeasurement 3,720 2,274 14,757 (7,404) Operating loss (18,315) (11,044) (139,110) (13,268) Interest expense, net (4,500) (229) (8,631) (1,288) Other income (expense), net 766 4,286 (938) (3,150) Loss before income taxes (22,049) (6,987) (148,679) (17,706) Income tax expense (125) (75) (2,716) (2,043) Net loss $ (22,174) $ (7,062) $ (151,395) $ (19,749) Net loss per common share: Basic $ (0.59) $ (0.35) $ (4.12) $ (0.98) Diluted (0.59) (0.35) (4.12) (0.98) Weighted average number of common shares (in millions): Basic 37.3 20.2 36.7 20.1 Diluted 37.3 20.2 36.7 20.1

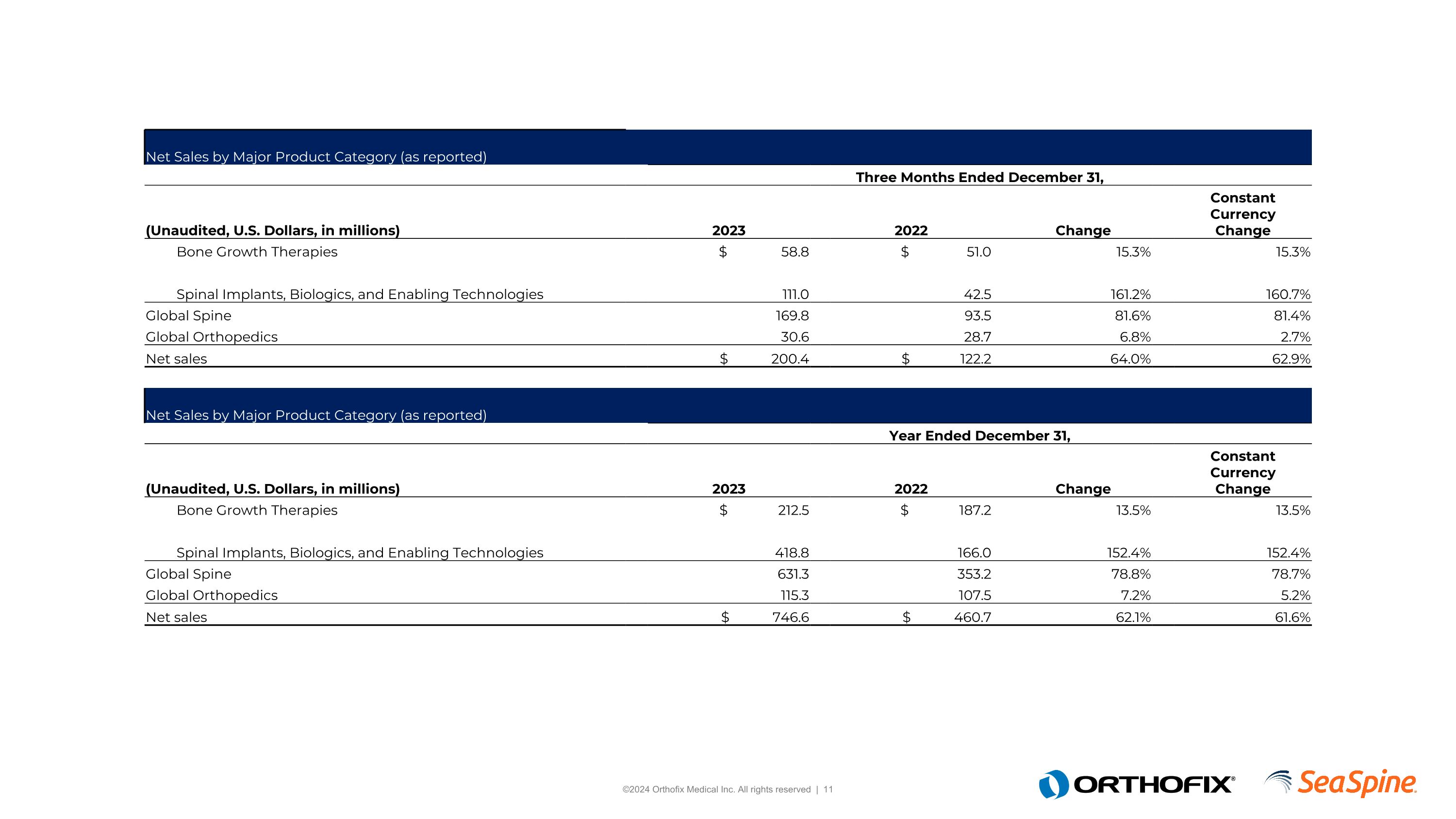

Net Sales by Major Product Category (as reported) Three Months Ended December 31, (Unaudited, U.S. Dollars, in millions) 2023 2022 Change ConstantCurrencyChange Bone Growth Therapies $ 58.8 $ 51.0 15.3% 15.3% Spinal Implants, Biologics, and Enabling Technologies 111.0 42.5 161.2% 160.7% Global Spine 169.8 93.5 81.6% 81.4% Global Orthopedics 30.6 28.7 6.8% 2.7% Net sales $ 200.4 $ 122.2 64.0% 62.9% Net Sales by Major Product Category (as reported) Year Ended December 31, (Unaudited, U.S. Dollars, in millions) 2023 2022 Change ConstantCurrencyChange Bone Growth Therapies $ 212.5 $ 187.2 13.5% 13.5% Spinal Implants, Biologics, and Enabling Technologies 418.8 166.0 152.4% 152.4% Global Spine 631.3 353.2 78.8% 78.7% Global Orthopedics 115.3 107.5 7.2% 5.2% Net sales $ 746.6 $ 460.7 62.1% 61.6%