Document

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT: |

MARK J. GRESCOVICH, |

|

PRESIDENT & CEO |

|

ROBERT G. BUTTERFIELD, CFO |

|

(509) 527-3636 |

|

| NEWS RELEASE |

|

|

|

|

|

|

|

|

|

|

|

|

Banner Corporation Reports Net Income of $45.2 Million, or $1.30 Per Diluted Share, for Third Quarter 2024;

Declares Quarterly Cash Dividend of $0.48 Per Share

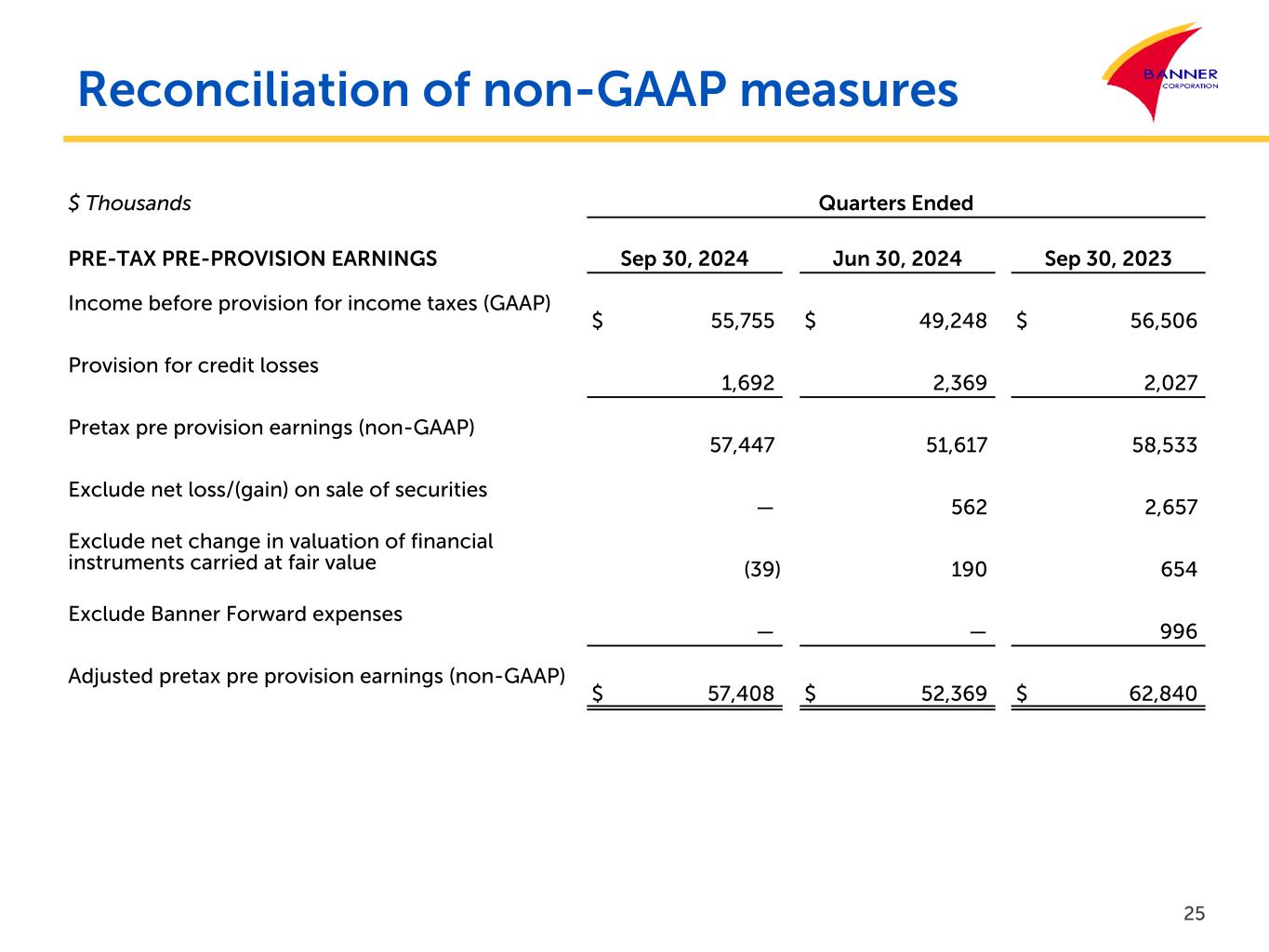

Walla Walla, WA - October 16, 2024 - Banner Corporation (NASDAQ GSM: BANR) (“Banner”), the parent company of Banner Bank, today reported net income of $45.2 million, or $1.30 per diluted share, for the third quarter of 2024, compared to $39.8 million, or $1.15 per diluted share, for the preceding quarter and $45.9 million, or $1.33 per diluted share, for the third quarter of 2023. Net interest income was $135.7 million in the third quarter of 2024, compared to $132.5 million in the preceding quarter and $141.8 million in the third quarter a year ago. The increase in net interest income compared to the preceding quarter reflects an increase in interest-earning assets and net interest margin. The decrease in net interest income compared to the prior year quarter reflects an increase in funding costs, partially offset by an increase in yields on earning assets. Banner’s results for the preceding quarter included a $562,000 net loss on the sale of securities and for the third quarter a year ago a $2.7 million net loss recorded on the sale of securities, compared to no gain or loss during the current quarter as no securities were sold during the third quarter of 2024. Third quarter 2024 results included a $1.7 million provision for credit losses, down from $2.4 million in the preceding quarter and $2.0 million in the third quarter of 2023.

Net income was $122.5 million, or $3.54 per diluted share, for the nine months ended September 30, 2024, compared to $141.0 million, or $4.09 per diluted share, for the nine months ended September 30, 2023. Results for the nine months ended September 30, 2024 included a $4.6 million provision for credit losses, a $5.5 million net loss on the sale of securities and a $1.1 million net decrease in the fair value adjustments on financial instruments carried at fair value, compared to an $8.3 million provision for credit losses, a $14.4 million net loss on the sale of securities and a $4.4 million net decrease in the fair value adjustments on financial instruments carried at fair value during the same period in 2023.

Banner announced that its Board of Directors declared a regular quarterly cash dividend of $0.48 per share payable November 15, 2024, to common shareholders of record on November 5, 2024.

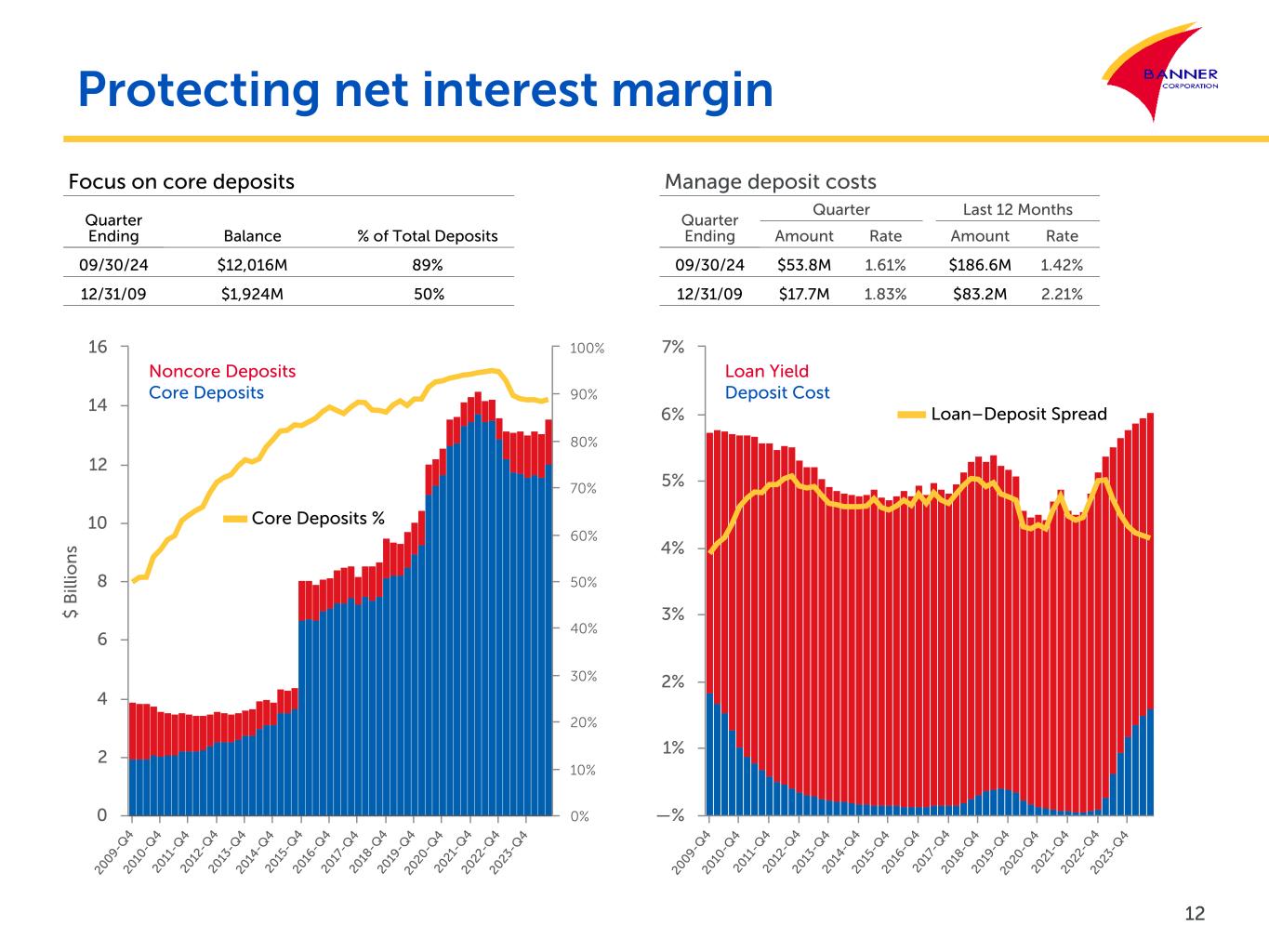

“Banner’s third quarter operating results reflect the continued successful execution of our super community bank strategy, which emphasizes growing new client relationships, maintaining our core funding position, promoting client loyalty and advocacy through our responsive service model, and sustaining a moderate risk profile,” said Mark Grescovich, President and CEO. “Our earnings for the third quarter of 2024 benefited from our solid year over year loan growth coupled with our expanded net interest margin. Additionally, Banner's credit metrics continue to be strong, our reserve for loan losses remained solid, and our capital base continues to be robust. We continue to benefit from a strong core deposit base that has been resilient in a highly competitive environment, with core deposits representing 89% of total deposits at quarter end. Banner has upheld its core values for the past 133 years, which are to do the right thing for our clients, communities, colleagues, company and shareholders; and to provide consistent and reliable strength through all economic cycles and change events.”

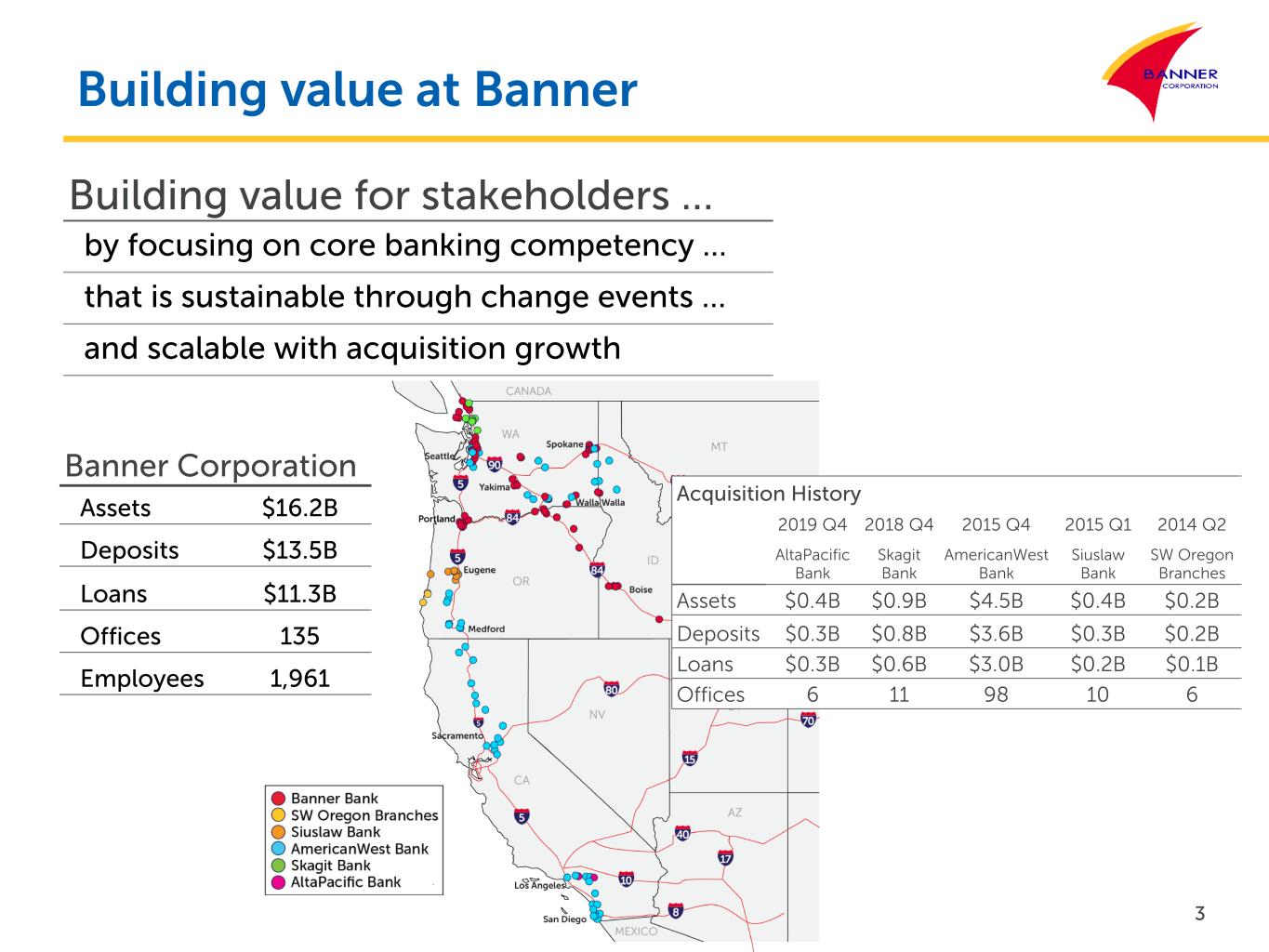

At September 30, 2024, Banner, on a consolidated basis, had $16.19 billion in assets, $11.07 billion in net loans and $13.54 billion in deposits. Banner operates 135 full-service branch offices, including branches located in eight of the top 20 largest western Metropolitan Statistical Areas by population.

BANR - Third Quarter 2024 Results

October 16, 2024

Page 2

Third Quarter 2024 Highlights

•Revenue was $153.7 million for the third quarter of 2024, compared to $149.7 million in the preceding quarter and $154.4 million in the third quarter a year ago.

•Adjusted revenue* (the total of net interest income and total non-interest income adjusted for the net gain or loss on the sale of securities and the net change in valuation of financial instruments) was $153.7 million in the third quarter of 2024, compared to $150.5 million in the preceding quarter and $157.7 million in the third quarter a year ago.

•Net interest income was $135.7 million in the third quarter of 2024, compared to $132.5 million in the preceding quarter and $141.8 million in the third quarter a year ago.

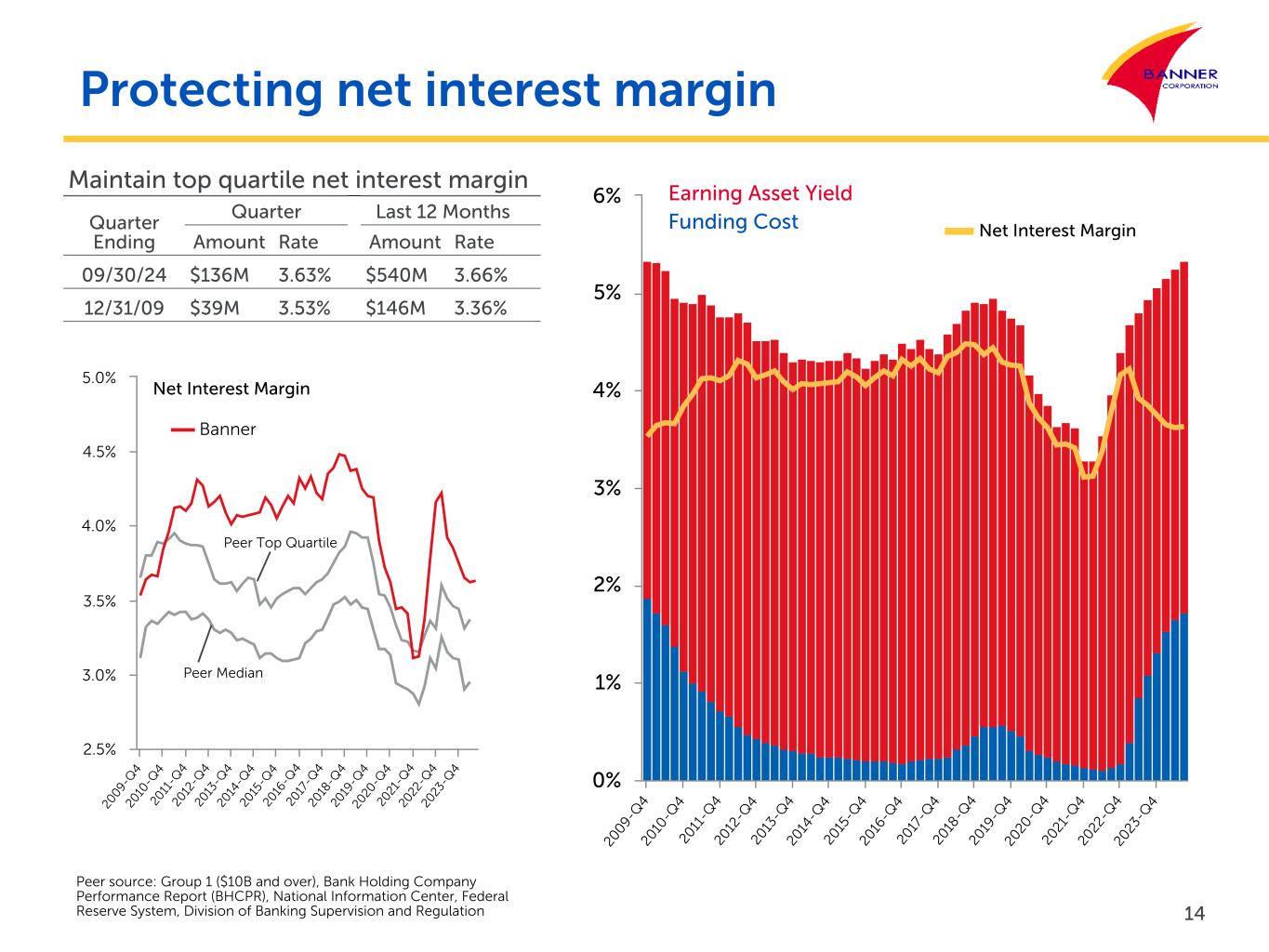

•Net interest margin, on a tax equivalent basis, was 3.72%, compared to 3.70% in the preceding quarter and 3.93% in the third quarter a year ago.

•Mortgage banking operations revenue was $3.2 million for the third quarter of 2024, compared to $3.0 million in the preceding quarter and $2.0 million in the third quarter a year ago.

•Return on average assets was 1.13%, compared to 1.02% in the preceding quarter and 1.17% in the third quarter a year ago.

•Net loans receivable increased 1% to $11.07 billion at September 30, 2024, compared to $10.99 billion at June 30, 2024, and increased 6% compared to $10.46 billion at September 30, 2023.

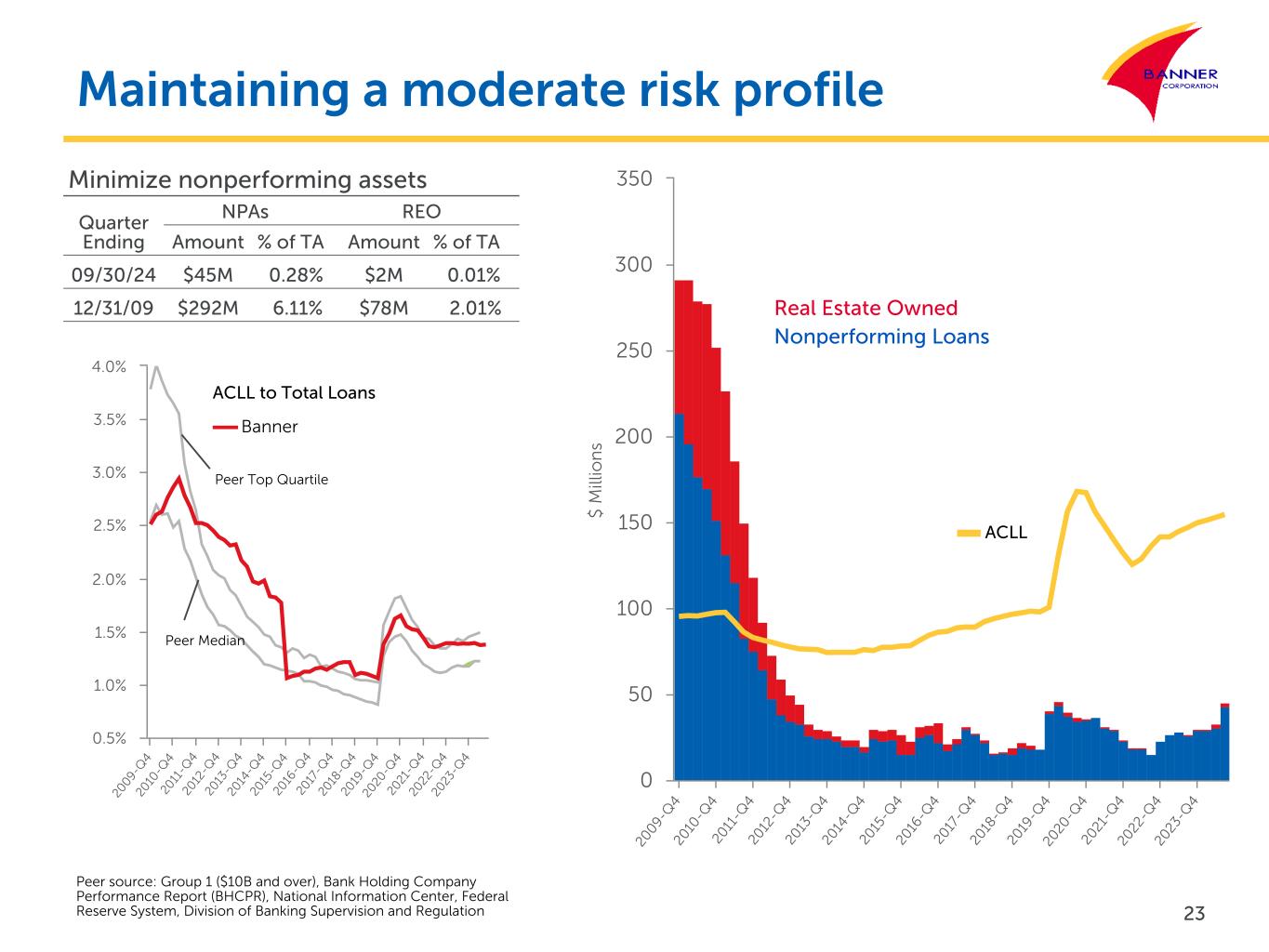

•Non-performing assets were $45.2 million, or 0.28% of total assets, at September 30, 2024, compared to $33.3 million, or 0.21% of total assets, at June 30, 2024 and $26.8 million, or 0.17% of total assets, at September 30, 2023.

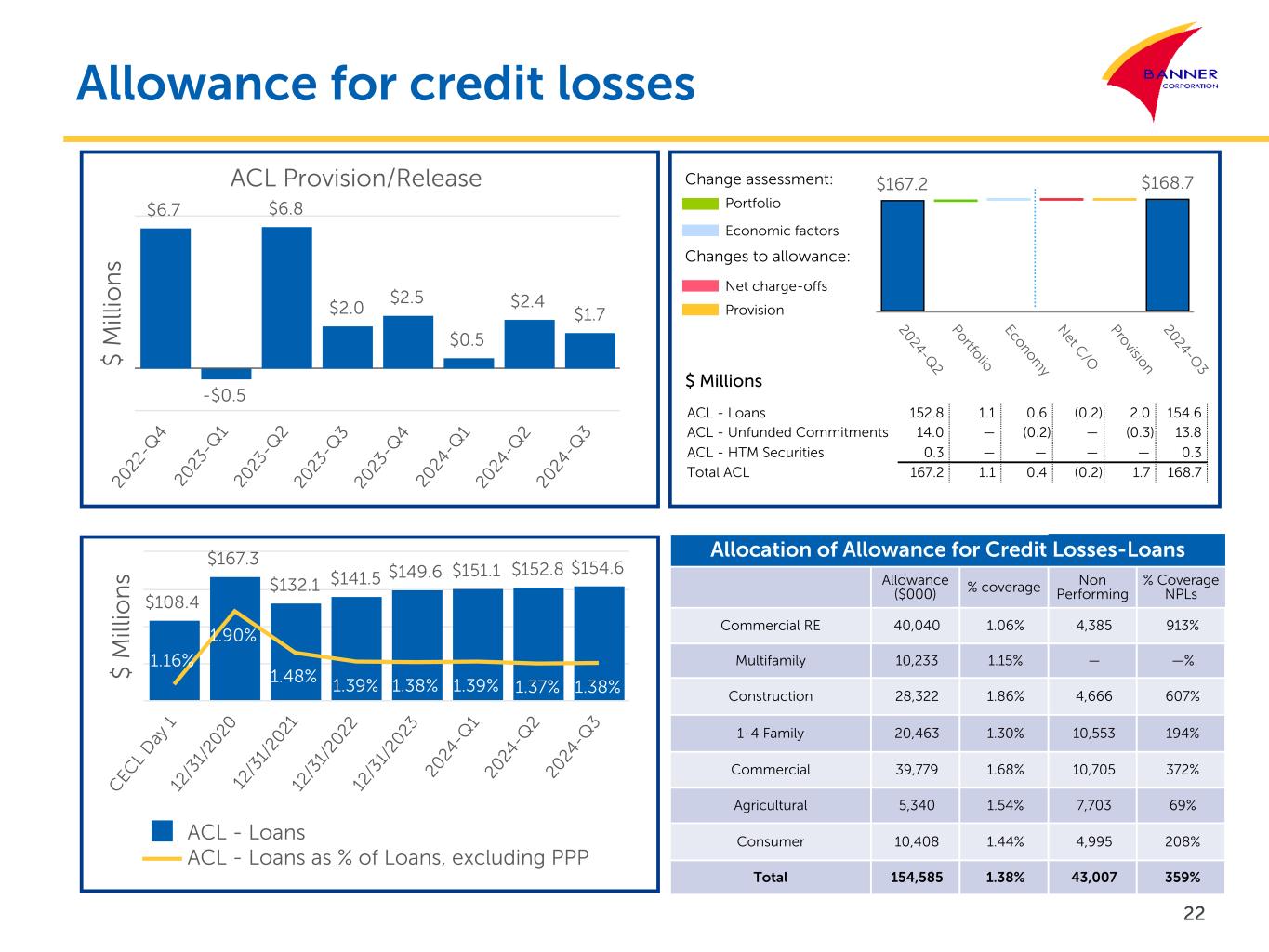

•The allowance for credit losses - loans was $154.6 million, or 1.38% of total loans receivable, as of September 30, 2024, compared to $152.8 million, or 1.37% of total loans receivable, as of June 30, 2024 and $147.0 million, or 1.38% of total loans receivable, as of September 30, 2023.

•Total deposits increased to $13.54 billion at September 30, 2024, compared to $13.08 billion at June 30, 2024 and $13.17 billion at September 30, 2023.

•Core deposits represented 89% of total deposits at September 30, 2024.

•Dividends paid to shareholders were $0.48 per share in the quarter ended September 30, 2024.

•Common shareholders’ equity per share increased 6% to $52.06 at September 30, 2024, compared to $49.07 at the preceding quarter end, and increased 18% from $44.27 at September 30, 2023.

•Tangible common shareholders’ equity per share* increased 8% to $41.12 at September 30, 2024, compared to $38.12 at the preceding quarter end, and increased 24% from $33.22 at September 30, 2023.

*Non-GAAP (Generally Accepted Accounting Principles) financial measure; See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

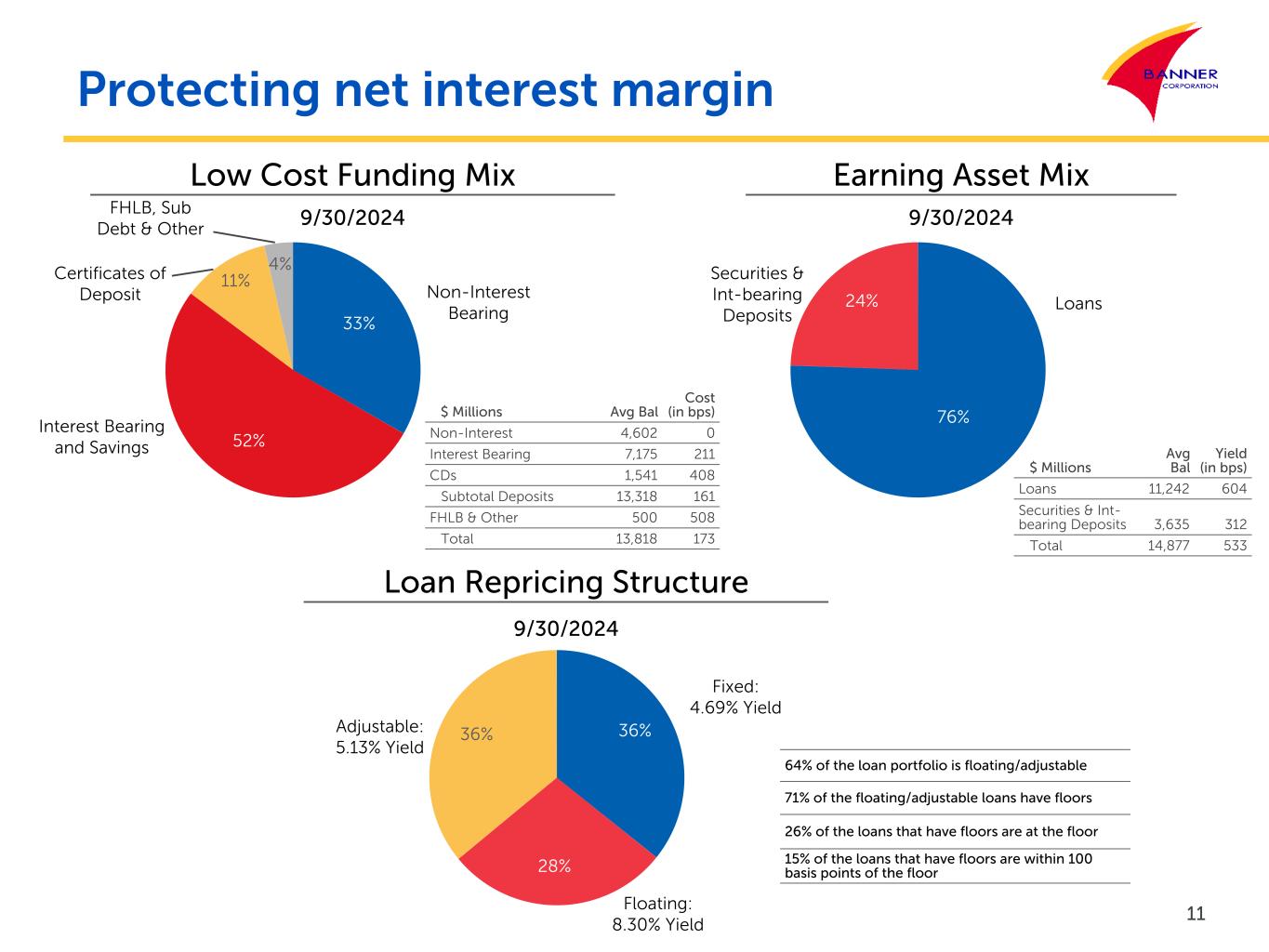

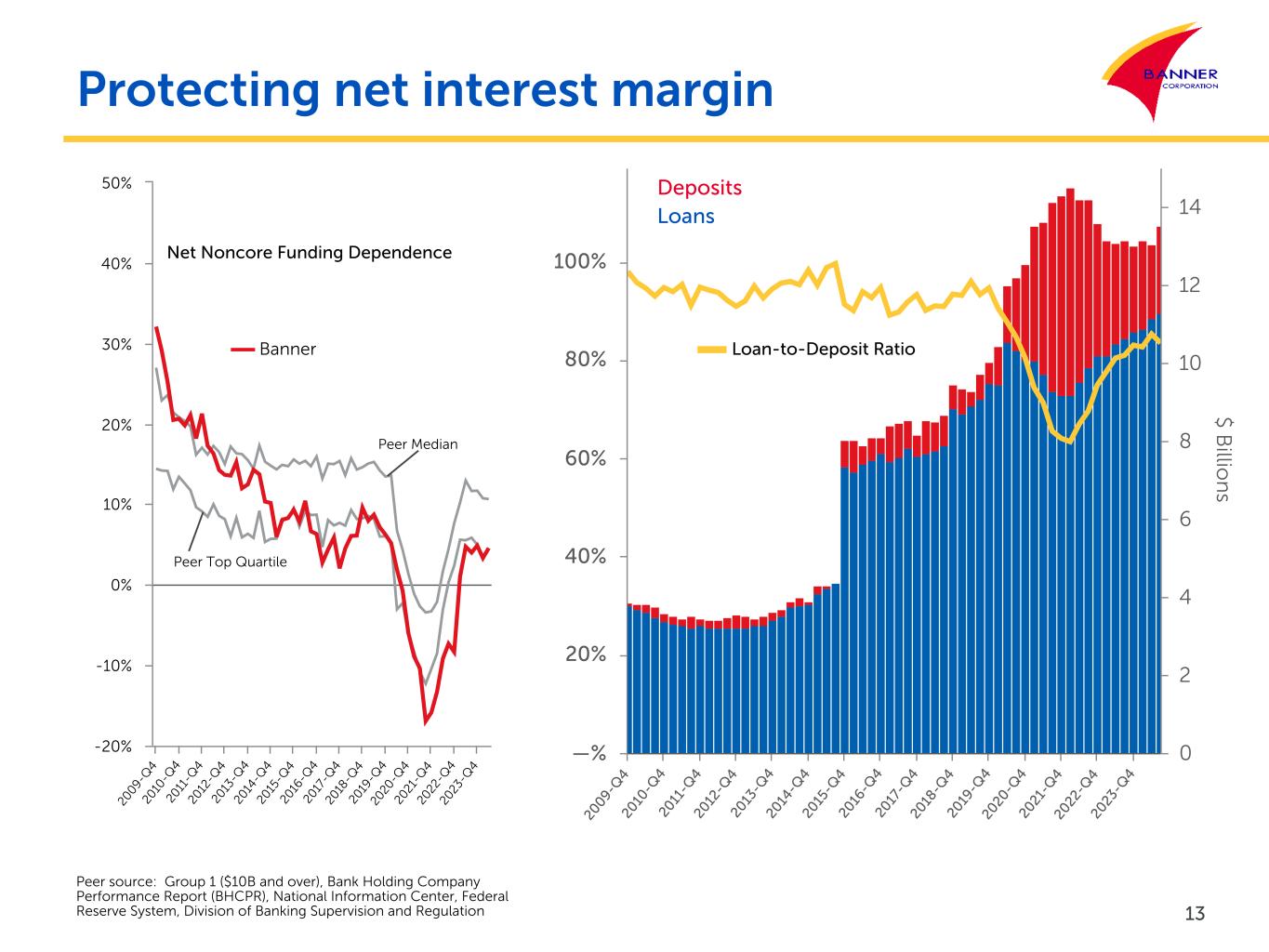

Income Statement Review

Net interest income was $135.7 million in the third quarter of 2024, compared to $132.5 million in the preceding quarter and $141.8 million in the third quarter a year ago. Net interest margin on a tax equivalent basis increased two basis points to 3.72% for the third quarter of 2024, compared to 3.70% in the preceding quarter, and decreased compared to 3.93% in the third quarter a year ago. Net interest margin for the current quarter benefited from increased yields on loans due to new loans being originated at higher interest rates and adjustable rate loans repricing higher, partially offset by increased funding costs. On September 18, 2024, the Federal Open Market Committee of the Federal Reserve System decreased the target range for the federal funds rate by 50 basis points, and as the change occurred late in the third quarter of 2024, it had minimal impact on our current quarter net interest margin.

Average yields on interest-earning assets increased eight basis points to 5.33% for the third quarter of 2024, compared to 5.25% for the preceding quarter, and increased compared to 4.94% in the third quarter a year ago. Average loan yields increased eight basis points to 6.04%, compared to 5.96% in the preceding quarter, and increased compared to 5.65% in the third quarter a year ago. The increase in average yields, especially loans, during the current quarter reflects the benefit of originating new loans at higher interest rates as well as adjustable rate loans repricing higher.

Total deposit costs increased 11 basis points to 1.61% in the third quarter of 2024, compared to 1.50% in the preceding quarter, and increased compared to 0.94% in the third quarter a year ago. The increase in deposit costs was due to a larger percentage of growth in higher costing deposits during the quarter. The average rate paid on borrowings increased one basis-point to 5.08% in the third quarter of 2024, compared to 5.07% in the preceding quarter, and increased compared to 4.64% in the third quarter a year ago. The total cost of funding liabilities increased seven basis points to 1.73% during the third quarter of 2024, compared to 1.66% in the preceding quarter, and increased compared to 1.08% in the third quarter a year ago.

A $1.7 million provision for credit losses was recorded in the current quarter (comprised of a $2.0 million provision for credit losses - loans, a $262,000 recapture of provision for credit losses - unfunded loan commitments and a $13,000 recapture of provision for credit losses - held-to-maturity debt securities). This compares to a $2.4 million provision for credit losses in the prior quarter (comprised of a $2.0 million provision for credit losses - loans, a $430,000 provision for credit losses - unfunded loan commitments and a $14,000 recapture of provision for credit losses - held-to-maturity debt securities) and a $2.0 million provision for credit losses in the third quarter a year ago (comprised of a $2.9 million provision for credit losses - loans, a $346,000 provision for credit losses - unfunded loan commitments, a $1.3 million recapture of provision for credit losses - available for sale securities and a $12,000 recapture of provision for credit losses - held-to-maturity debt securities). The provision for credit losses for the current quarter primarily reflected an increase in the reserve for non-performing collateral dependent loans.

BANR - Third Quarter 2024 Results

October 16, 2024

Page 3

Total non-interest income was $18.1 million in the third quarter of 2024, compared to $17.2 million in the preceding quarter and $12.7 million in the third quarter a year ago. The increase in non-interest income during the current quarter compared to the preceding quarter was primarily due to a $562,000 decrease in the net loss recognized on the sale of securities. The increase in non-interest income during the current quarter compared to the prior year quarter was primarily due to a $1.1 million increase in mortgage banking operations revenue, a $2.7 million decrease in the net loss recognized on the sale of securities and a $693,000 decrease in the net loss recognized for fair value adjustments on financial instruments carried at fair value. Total non-interest income was $46.9 million for the nine months ended September 30, 2024, compared to $30.4 million for the same period a year earlier.

Mortgage banking operations revenue was $3.2 million in the third quarter of 2024, compared to $3.0 million in the preceding quarter and $2.0 million in the third quarter a year ago. The volume of one- to four-family loans sold during the current quarter increased compared to the preceding and prior year quarters, although overall volumes remained low due to reduced refinancing and purchase activity in the current rate environment. The increase in mortgage banking operations revenue from the preceding quarter was also impacted by increases in the pricing on the one- to four-family loans sold during the current quarter. Home purchase activity accounted for 88% of one- to four-family mortgage loan originations in the third quarter of 2024, 89% in the preceding quarter and 90% in the third quarter of 2023.

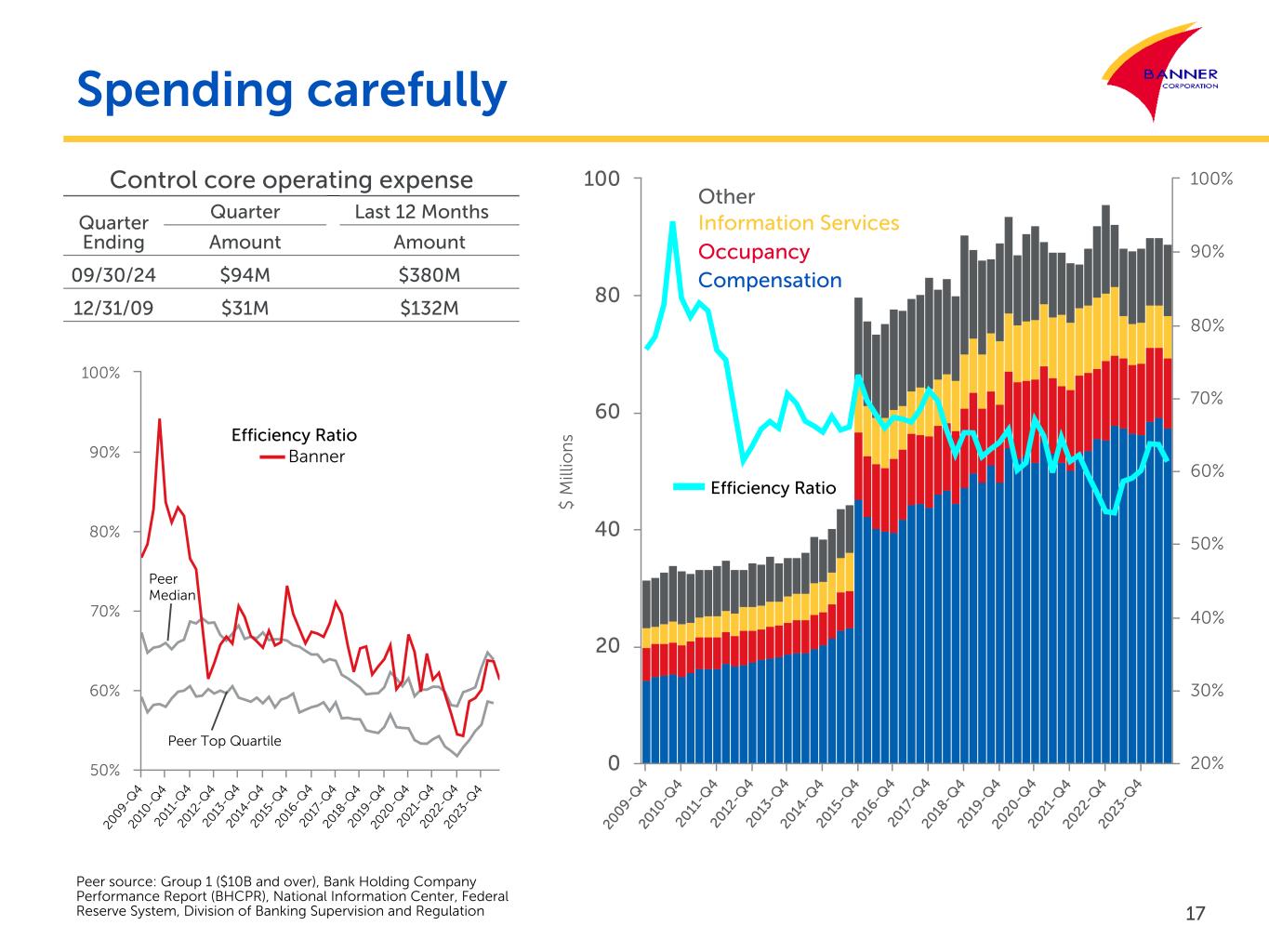

Total non-interest expense was $96.3 million in the third quarter of 2024, compared to $98.1 million in the preceding quarter and $95.9 million in the third quarter of 2023. The decrease in non-interest expense for the current quarter compared to the prior quarter reflects a $2.0 million decrease in salary and employee benefits, primarily resulting from decreased medical premiums expense and unemployment and workers compensation expense. The increase in non-interest expense for the current quarter compared to the same quarter a year ago primarily reflects increases in salary and employee benefits and real estate operations, net expenses, partially offset by a decrease in professional and legal expenses. For the nine months ended September 30, 2024, total non-interest expense was $292.1 million, compared to $285.9 million for the nine months ended September 30, 2023. Banner’s efficiency ratio was 62.63% for the third quarter of 2024, compared to 65.53% in the preceding quarter and 62.10% in the same quarter a year ago. Banner’s adjusted efficiency ratio, a non-GAAP financial measure, was 61.27% for the third quarter of 2024, compared to 63.60% in the preceding quarter and 59.00% in the year ago quarter. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a discussion and reconciliation of non-GAAP financial measures.

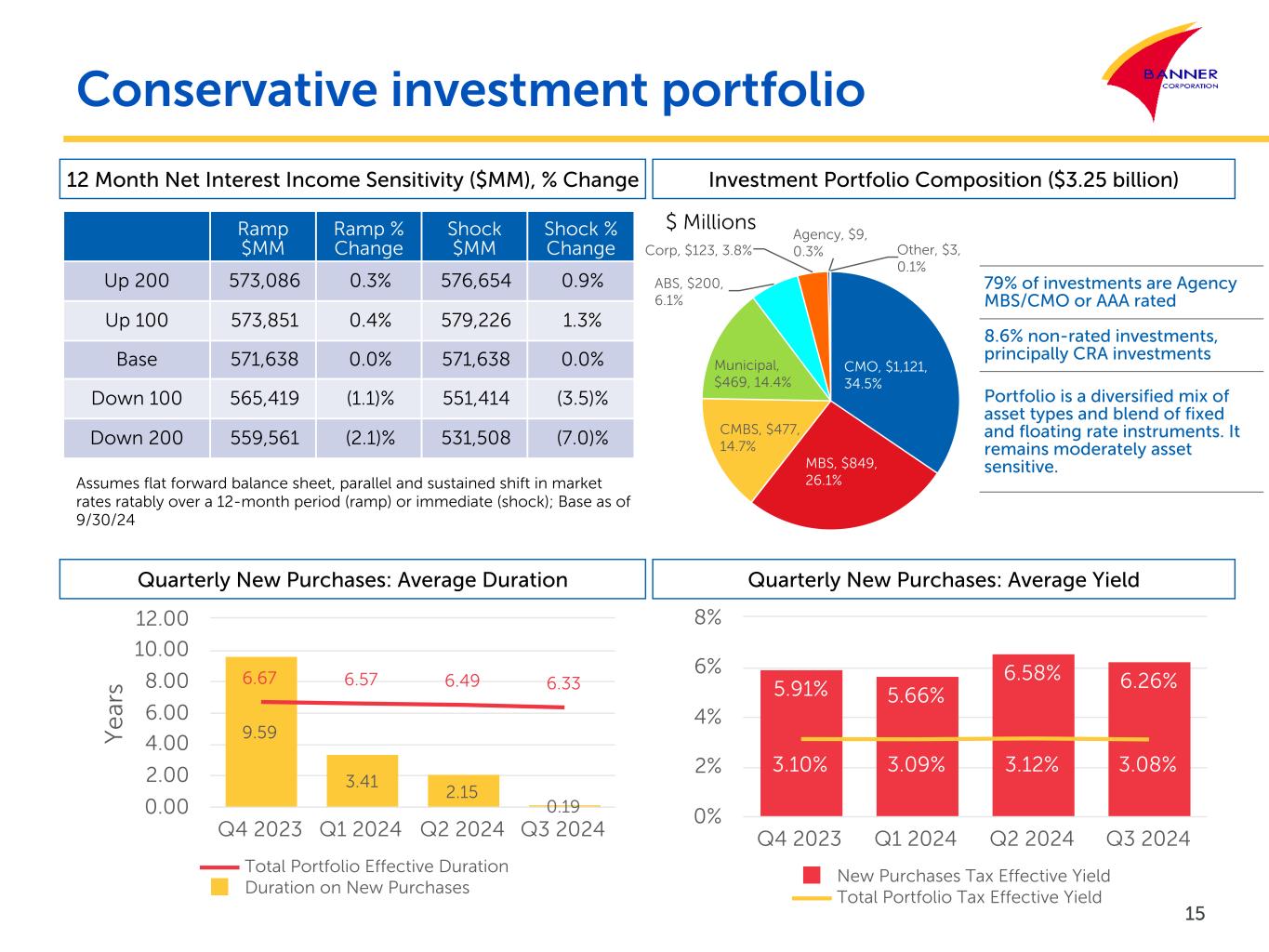

Balance Sheet Review

Total assets increased to $16.19 billion at September 30, 2024, compared to $15.82 billion at June 30, 2024, and $15.51 billion at September 30, 2023. Securities and interest-bearing deposits held at other banks totaled $3.50 billion at September 30, 2024, compared to $3.27 billion at June 30, 2024 and $3.44 billion at September 30, 2023. The increase compared to the prior quarter was primarily due to an increase in interest-bearing deposit balances. The average effective duration of the securities portfolio was approximately 6.3 years at September 30, 2024, compared to 6.8 years at September 30, 2023.

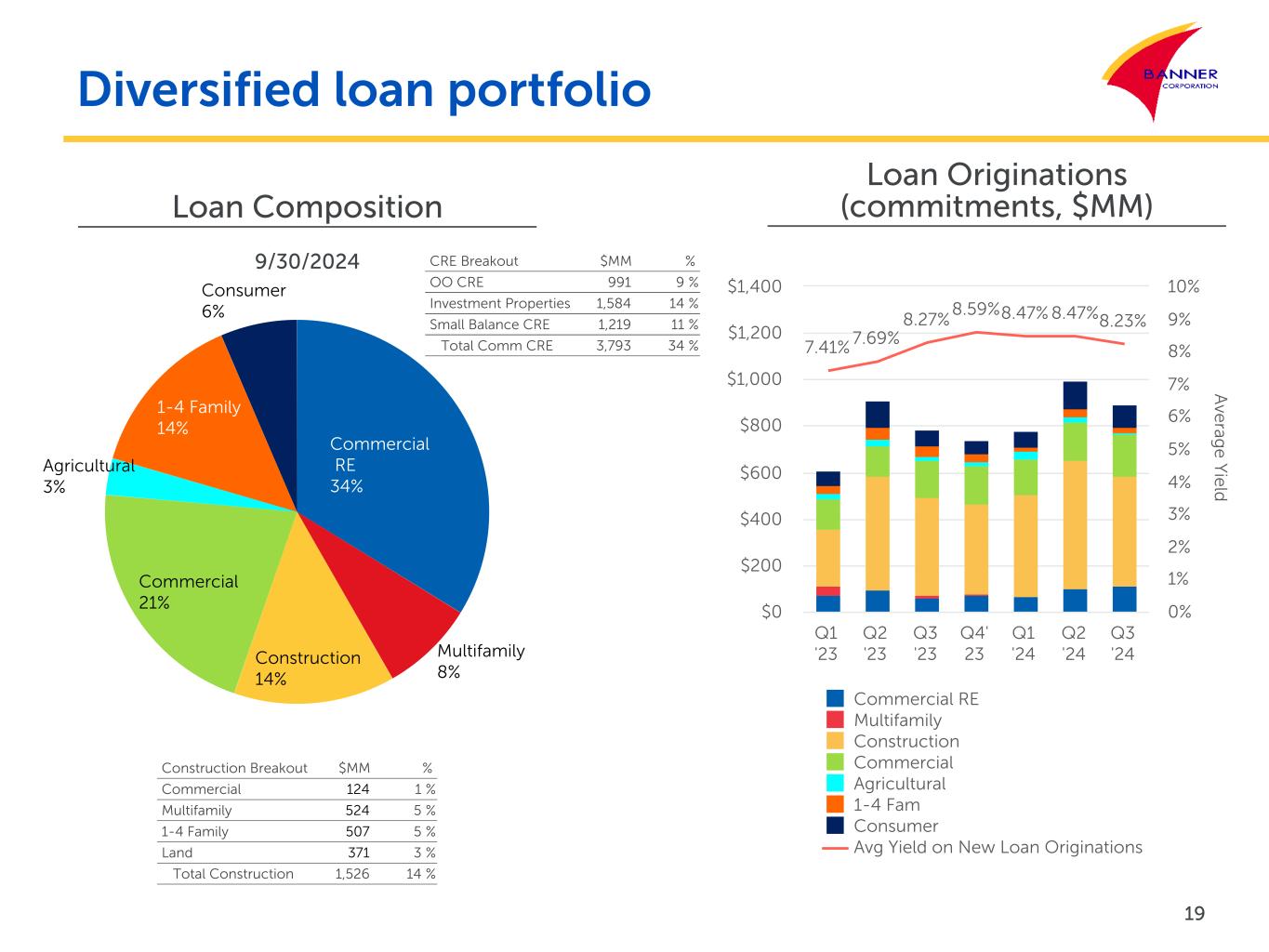

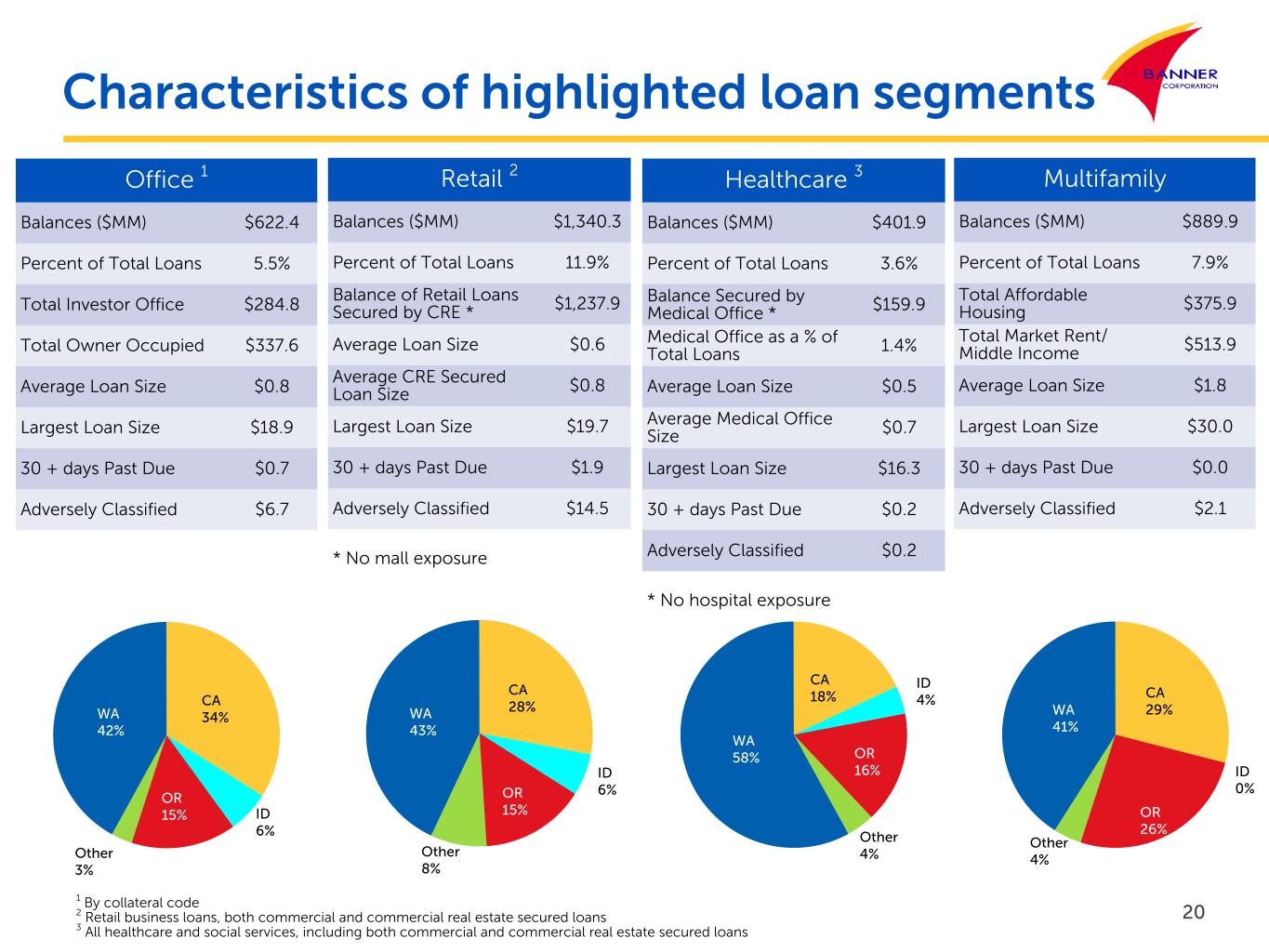

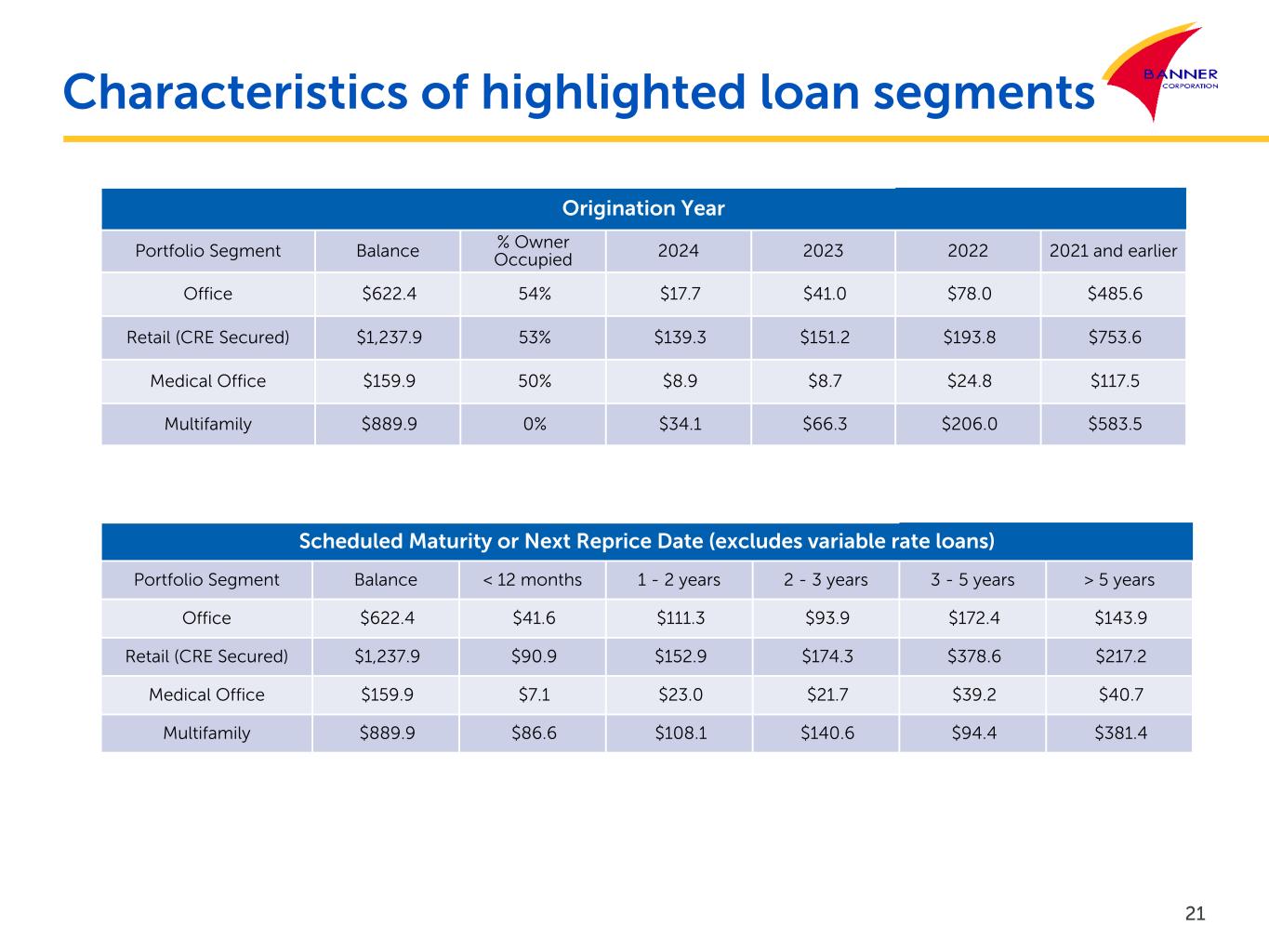

Total loans receivable increased to $11.22 billion at September 30, 2024, compared to $11.14 billion at June 30, 2024, and $10.61 billion at September 30, 2023. One- to four-family residential loans decreased 2% to $1.58 billion at September 30, 2024, compared to $1.60 billion at June 30, 2024, and increased 9% compared to $1.44 billion at September 30, 2023. The decrease in one- to four-family residential loans from the prior quarter was primarily the result of the transfer of $47.5 million of one- to four-family residential loans from portfolio to held for sale. The increase in one- to four-family residential loans from the prior year was primarily the result of one- to four-family construction loans converting to one- to four-family portfolio loans upon the completion of the construction phase and new loan production. Multifamily real estate loans increased 24% to $889.9 million at September 30, 2024, compared to $717.1 million at June 30, 2024, and increased 16% compared to $766.6 million at September 30, 2023. The increase in multifamily real estate loans from June 30, 2024 and September 30, 2023 was primarily the result of the conversion of multifamily construction loans to the multifamily portfolio upon the completion of the construction phase. The increase from the prior year also reflects the transfer of $43.5 million of multifamily loans held for sale to the held for investment loan portfolio in the fourth quarter of 2023, partially offset by the transfer of certain affordable housing loans to small balance commercial real estate loans. Construction, land and land development loans decreased 9% to $1.53 billion at September 30, 2024, compared to $1.68 billion at June 30, 2024, and increased 1% compared to $1.50 billion at September 30, 2023. The decrease in construction, land and land development loans was primarily the result of multifamily construction loans converting to multifamily portfolio loans upon the completion of the construction phase. Agricultural business loans increased 4% to $346.7 million at September 30, 2024, compared to $334.6 million at June 30, 2024 and increased 4% compared to $334.6 million at September 30, 2023, primarily due to advances on agricultural lines of credit.

Loans held for sale were $78.8 million at September 30, 2024, compared to $13.4 million at June 30, 2024 and $54.2 million at September 30, 2023. One- to four- family residential mortgage held for sale loans sold in the current quarter totaled $95.0 million, compared to $75.0 million in the preceding quarter and $87.3 million in the third quarter a year ago. The increase in loans held for sale was primarily the result of the transfer of $47.5 million of one- to four-family residential loans from portfolio to held for sale during the current quarter. The increase from the prior year was partially offset by the previously mentioned transfer of multifamily loans held for sale to the held for investment loan portfolio in the fourth quarter of 2023. There were no multifamily loans held for sale at September 30, 2024 or June 30, 2024.

Total deposits increased to $13.54 billion at September 30, 2024, compared to $13.08 billion at June 30, 2024 and $13.17 billion a year ago. Core deposits increased 4% to $12.02 billion at September 30, 2024, compared to $11.55 billion at June 30, 2024, and increased 3% compared to $11.72 billion at September 30, 2023. The increase in core deposits compared to the prior quarter primarily reflects normal seasonal increases primarily from agricultural clients. The increase in core deposits compared to the prior year quarter primarily reflects an increase in third-party insured sweep accounts. Core deposits were 89% of total deposits at September 30, 2024, compared to 88% of total deposits at June 30, 2024 and 89% of total deposits at September 30, 2023. Certificates of deposit decreased slightly to $1.52 billion at September 30, 2024, compared to $1.53 billion at June 30, 2024, and increased 4% compared to $1.46 billion a year earlier. The decrease in certificates of deposit during the current quarter compared to the preceding quarter was principally due to a $55.0 million decrease in brokered deposits. The increase in certificates of deposit during the current quarter compared to the third quarter a year ago was principally due to clients seeking higher yields moving funds from core deposit accounts to higher yielding certificates of deposits, partially offset by a $112.5 million decrease in brokered deposits.

BANR - Third Quarter 2024 Results

October 16, 2024

Page 4

FHLB advances were $230.0 million at September 30, 2024, compared to $398.0 million at June 30, 2024 and $140.0 million a year ago. At September 30, 2024, off-balance sheet liquidity included additional borrowing capacity of $3.23 billion at the FHLB and $1.53 billion at the Federal Reserve as well as federal funds line of credit agreements with other financial institutions of $125.0 million.

At September 30, 2024, total common shareholders’ equity was $1.79 billion, or 11.08% of total assets, compared to $1.69 billion or 10.69% of total assets at June 30, 2024, and $1.52 billion or 9.81% of total assets at September 30, 2023. The increase in total common shareholders’ equity at September 30, 2024 compared to June 30, 2024 was due to a $28.4 million increase in retained earnings as a result of $45.2 million in net income, partially offset by the accrual of $16.7 million of cash dividends during the third quarter of 2024, as well as a decrease in accumulated other comprehensive loss of $72.0 million as the result of an increase in the fair value of the security portfolio. At September 30, 2024, tangible common shareholders’ equity, a non-GAAP financial measure, was $1.42 billion, or 8.96% of tangible assets, compared to $1.31 billion, or 8.51% of tangible assets, at June 30, 2024, and $1.14 billion, or 7.54% of tangible assets, a year ago. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

Banner and Banner Bank continue to maintain capital levels in excess of the requirements to be categorized as “well-capitalized.” At September 30, 2024, Banner’s estimated common equity Tier 1 capital ratio was 12.30%, its estimated Tier 1 leverage capital to average assets ratio was 10.91%, and its estimated total capital to risk-weighted assets ratio was 14.92%. These regulatory capital ratios are estimates, pending completion and filing of Banner’s regulatory reports.

Credit Quality

The allowance for credit losses - loans was $154.6 million, or 1.38% of total loans receivable and 359% of non-performing loans, at September 30, 2024, compared to $152.8 million, or 1.37% of total loans receivable and 498% of non-performing loans, at June 30, 2024, and $147.0 million, or 1.38% of total loans receivable and 560% of non-performing loans, at September 30, 2023. In addition to the allowance for credit losses - loans, Banner maintains an allowance for credit losses - unfunded loan commitments, which was $13.8 million at September 30, 2024, compared to $14.0 million at June 30, 2024, and $15.0 million at September 30, 2023. Net loan charge-offs totaled $230,000 in the third quarter of 2024, compared to $245,000 in the preceding quarter and $663,000 in the third quarter a year ago. Non-performing loans were $43.0 million at September 30, 2024, compared to $30.7 million at June 30, 2024, and $26.3 million a year ago.

An increase in adversely classified loans, offset in part by payoffs and paydowns, resulted in total substandard loans of $150.1 million as of September 30, 2024. This compares to $122.0 million as of June 30, 2024 and $124.5 million a year ago.

Total non-performing assets were $45.2 million, or 0.28% of total assets, at September 30, 2024, compared to $33.3 million, or 0.21% of total assets, at June 30, 2024, and $26.8 million, or 0.17% of total assets, a year ago.

Conference Call

Banner will host a conference call on Thursday October 17, 2024, at 8:00 a.m. PDT, to discuss its third quarter results. Interested investors may listen to the call live at www.bannerbank.com. Investment professionals are invited to dial (833) 470-1428 using access code 433614 to participate in the call. A replay of the call will be available at www.bannerbank.com.

About the Company

Banner Corporation is a $16.19 billion bank holding company operating a commercial bank in four Western states through a network of branches offering a full range of deposit services and business, commercial real estate, construction, residential, agricultural and consumer loans. Visit Banner Bank on the Web at www.bannerbank.com.

BANR - Third Quarter 2024 Results

October 16, 2024

Page 5

Forward-Looking Statements

When used in this press release and in other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “may,” “believe,” “will,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” “potential,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date such statements are made and based only on information then actually known to Banner. Banner does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial information. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements and could negatively affect Banner’s operating and stock price performance.

Factors that could cause Banner’s actual results to differ materially from those described in the forward-looking statements, include but are not limited to, the following: (1) adverse impacts to economic conditions in our local market areas, other markets where the Company has lending relationships, or other aspects of the Company’s business operations or financial markets, including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a recession or slowed economic growth, or increased political instability due to acts of war; (2) changes in the interest rate environment, including increases or decreases in the Board of Governors of the Federal Reserve System (the “Federal Reserve”) benchmark rate and duration at which such interest rate levels are maintained, which could affect our revenues and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; (3) the impact of inflation and the current and future monetary policies of the Federal Reserve in response thereto; (4) the effects of any federal government shutdown; (5) the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment; (6) expectations regarding key growth initiatives and strategic priorities; (7) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses, which could necessitate additional provisions for credit losses, resulting both from loans originated and loans acquired from other financial institutions; (8) results of examinations by regulatory authorities, including the possibility that any such regulatory authority may, among other things, require increases in the allowance for credit losses or writing down of assets or impose restrictions or penalties with respect to Banner’s activities; (9) competitive pressures among depository institutions; (10) the effect of inflation on interest rate movements and their impact on client behavior and net interest margin; (11) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (12) fluctuations in real estate values; (13) the ability to adapt successfully to technological changes to meet clients’ needs and developments in the market place; (14) the ability to access cost-effective funding; (15) disruptions, security breaches or other adverse events, failures or interruptions in, or attacks on, information technology systems or on the third-party vendors who perform critical processing functions; (16) changes in financial markets; (17) changes in economic conditions in general and in Washington, Idaho, Oregon and California in particular; (18) the costs, effects and outcomes of litigation; (19) legislation or regulatory changes, including but not limited to changes in regulatory policies and principles, or the interpretation of regulatory capital or other rules, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (20) changes in accounting principles, policies or guidelines; (21) future acquisitions by Banner of other depository institutions or lines of business; (22) future goodwill impairment due to changes in Banner’s business or changes in market conditions; (23) effects of critical accounting policies and judgments, including the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; (24) environmental, social and governance goals and targets; (25) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services; and (26) other risks detailed from time to time in Banner’s other reports filed with and furnished to the Securities and Exchange Commission including Banner’s Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K.

BANR - Third Quarter 2024 Results

October 16, 2024

Page 6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RESULTS OF OPERATIONS |

|

Quarters Ended |

|

Nine Months Ended |

| (in thousands except shares and per share data) |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Sep 30, 2023 |

|

Sep 30, 2024 |

|

Sep 30, 2023 |

| INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

| Loans receivable |

|

$ |

168,338 |

|

|

$ |

161,191 |

|

|

$ |

149,254 |

|

|

$ |

486,004 |

|

|

$ |

423,359 |

|

| Mortgage-backed securities |

|

16,357 |

|

|

16,708 |

|

|

17,691 |

|

|

49,999 |

|

|

54,954 |

|

| Securities and cash equivalents |

|

11,146 |

|

|

11,239 |

|

|

12,119 |

|

|

33,664 |

|

|

39,521 |

|

| Total interest income |

|

195,841 |

|

|

189,138 |

|

|

179,064 |

|

|

569,667 |

|

|

517,834 |

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

53,785 |

|

|

48,850 |

|

|

31,001 |

|

|

147,248 |

|

|

60,784 |

|

| Federal Home Loan Bank (FHLB) advances |

|

2,263 |

|

|

3,621 |

|

|

2,233 |

|

|

8,856 |

|

|

8,654 |

|

| Other borrowings |

|

1,147 |

|

|

1,160 |

|

|

1,099 |

|

|

3,482 |

|

|

2,251 |

|

Subordinated debt |

|

2,971 |

|

|

2,961 |

|

|

2,965 |

|

|

8,901 |

|

|

8,549 |

|

| Total interest expense |

|

60,166 |

|

|

56,592 |

|

|

37,298 |

|

|

168,487 |

|

|

80,238 |

|

| Net interest income |

|

135,675 |

|

|

132,546 |

|

|

141,766 |

|

|

401,180 |

|

|

437,596 |

|

| PROVISION FOR CREDIT LOSSES |

|

1,692 |

|

|

2,369 |

|

|

2,027 |

|

|

4,581 |

|

|

8,267 |

|

| Net interest income after provision for credit losses |

|

133,983 |

|

|

130,177 |

|

|

139,739 |

|

|

396,599 |

|

|

429,329 |

|

| NON-INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

| Deposit fees and other service charges |

|

10,741 |

|

|

10,590 |

|

|

10,916 |

|

|

32,353 |

|

|

32,078 |

|

| Mortgage banking operations |

|

3,180 |

|

|

3,006 |

|

|

2,049 |

|

|

8,521 |

|

|

6,426 |

|

| Bank-owned life insurance |

|

2,445 |

|

|

2,367 |

|

|

2,062 |

|

|

7,049 |

|

|

6,636 |

|

| Miscellaneous |

|

1,658 |

|

|

1,988 |

|

|

942 |

|

|

5,538 |

|

|

4,010 |

|

| |

|

18,024 |

|

|

17,951 |

|

|

15,969 |

|

|

53,461 |

|

|

49,150 |

|

| Net loss on sale of securities |

|

— |

|

|

(562) |

|

|

(2,657) |

|

|

(5,465) |

|

|

(14,436) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in valuation of financial instruments carried at fair value |

|

39 |

|

|

(190) |

|

|

(654) |

|

|

(1,143) |

|

|

(4,357) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest income |

|

18,063 |

|

|

17,199 |

|

|

12,658 |

|

|

46,853 |

|

|

30,357 |

|

| NON-INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

| Salary and employee benefits |

|

61,832 |

|

|

63,831 |

|

|

61,091 |

|

|

188,032 |

|

|

184,452 |

|

| Less capitalized loan origination costs |

|

(4,354) |

|

|

(4,639) |

|

|

(4,498) |

|

|

(12,669) |

|

|

(12,386) |

|

| Occupancy and equipment |

|

12,040 |

|

|

12,128 |

|

|

11,722 |

|

|

36,630 |

|

|

35,686 |

|

| Information and computer data services |

|

7,134 |

|

|

7,240 |

|

|

7,118 |

|

|

21,694 |

|

|

21,347 |

|

| Payment and card processing services |

|

5,346 |

|

|

5,691 |

|

|

5,172 |

|

|

16,747 |

|

|

14,459 |

|

| Professional and legal expenses |

|

2,102 |

|

|

1,201 |

|

|

3,042 |

|

|

4,833 |

|

|

7,563 |

|

| Advertising and marketing |

|

1,161 |

|

|

1,198 |

|

|

1,362 |

|

|

3,438 |

|

|

3,108 |

|

| Deposit insurance |

|

2,874 |

|

|

2,858 |

|

|

2,874 |

|

|

8,541 |

|

|

7,603 |

|

| State and municipal business and use taxes |

|

1,432 |

|

|

1,394 |

|

|

1,359 |

|

|

4,130 |

|

|

3,888 |

|

| Real estate operations, net |

|

103 |

|

|

297 |

|

|

(383) |

|

|

180 |

|

|

(585) |

|

| Amortization of core deposit intangibles |

|

590 |

|

|

724 |

|

|

857 |

|

|

2,037 |

|

|

2,898 |

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous |

|

6,031 |

|

|

6,205 |

|

|

6,175 |

|

|

18,467 |

|

|

17,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest expense |

|

96,291 |

|

|

98,128 |

|

|

95,891 |

|

|

292,060 |

|

|

285,917 |

|

| Income before provision for income taxes |

|

55,755 |

|

|

49,248 |

|

|

56,506 |

|

|

151,392 |

|

|

173,769 |

|

| PROVISION FOR INCOME TAXES |

|

10,602 |

|

|

9,453 |

|

|

10,652 |

|

|

28,885 |

|

|

32,769 |

|

| NET INCOME |

|

$ |

45,153 |

|

|

$ |

39,795 |

|

|

$ |

45,854 |

|

|

$ |

122,507 |

|

|

$ |

141,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.31 |

|

|

$ |

1.15 |

|

|

$ |

1.33 |

|

|

$ |

3.56 |

|

|

$ |

4.11 |

|

| Diluted |

|

$ |

1.30 |

|

|

$ |

1.15 |

|

|

$ |

1.33 |

|

|

$ |

3.54 |

|

|

$ |

4.09 |

|

| Cumulative dividends declared per common share |

|

$ |

0.48 |

|

|

$ |

0.48 |

|

|

$ |

0.48 |

|

|

$ |

1.44 |

|

|

$ |

1.44 |

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

34,498,830 |

|

|

34,488,163 |

|

|

34,379,865 |

|

|

34,459,662 |

|

|

34,331,458 |

|

| Diluted |

|

34,650,322 |

|

|

34,537,012 |

|

|

34,429,726 |

|

|

34,575,498 |

|

|

34,439,214 |

|

| Increase in common shares outstanding |

|

936 |

|

|

60,531 |

|

|

1,322 |

|

|

108,319 |

|

|

151,931 |

|

BANR - Third Quarter 2024 Results

October 16, 2024

Page 7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL CONDITION |

|

|

|

|

|

|

|

|

|

Percentage Change |

| (in thousands except shares and per share data) |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

|

Prior Qtr |

|

Prior Yr Qtr |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

226,568 |

|

|

$ |

195,163 |

|

|

$ |

209,634 |

|

|

$ |

207,171 |

|

|

16 |

% |

|

9 |

% |

| Interest-bearing deposits |

|

252,227 |

|

|

52,295 |

|

|

44,830 |

|

|

44,535 |

|

|

382 |

% |

|

466 |

% |

Total cash and cash equivalents |

|

478,795 |

|

|

247,458 |

|

|

254,464 |

|

|

251,706 |

|

|

93 |

% |

|

90 |

% |

| Securities – trading |

|

— |

|

|

— |

|

|

— |

|

|

25,268 |

|

|

nm |

|

(100) |

% |

Securities - available for sale, amortized cost $2,523,968, $2,572,544, $2,729,980 and $2,774,972, respectively |

|

2,237,939 |

|

|

2,197,693 |

|

|

2,373,783 |

|

|

2,287,993 |

|

|

2 |

% |

|

(2) |

% |

Securities - held to maturity, fair value $879,278, $852,709, $907,514 and $853,653, respectively |

|

1,013,903 |

|

|

1,023,028 |

|

|

1,059,055 |

|

|

1,082,156 |

|

|

(1) |

% |

|

(6) |

% |

Total securities |

|

3,251,842 |

|

|

3,220,721 |

|

|

3,432,838 |

|

|

3,395,417 |

|

|

1 |

% |

|

(4) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FHLB stock |

|

19,751 |

|

|

27,311 |

|

|

24,028 |

|

|

15,600 |

|

|

(28) |

% |

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans held for sale |

|

78,841 |

|

|

13,421 |

|

|

11,170 |

|

|

54,158 |

|

|

487 |

% |

|

46 |

% |

| Loans receivable |

|

11,224,606 |

|

|

11,143,848 |

|

|

10,810,455 |

|

|

10,611,417 |

|

|

1 |

% |

|

6 |

% |

| Allowance for credit losses – loans |

|

(154,585) |

|

|

(152,848) |

|

|

(149,643) |

|

|

(146,960) |

|

|

1 |

% |

|

5 |

% |

Net loans receivable |

|

11,070,021 |

|

|

10,991,000 |

|

|

10,660,812 |

|

|

10,464,457 |

|

|

1 |

% |

|

6 |

% |

| Accrued interest receivable |

|

66,981 |

|

|

67,520 |

|

|

63,100 |

|

|

61,040 |

|

|

(1) |

% |

|

10 |

% |

| Property and equipment, net |

|

125,256 |

|

|

126,465 |

|

|

132,231 |

|

|

136,504 |

|

|

(1) |

% |

|

(8) |

% |

| Goodwill |

|

373,121 |

|

|

373,121 |

|

|

373,121 |

|

|

373,121 |

|

|

— |

% |

|

— |

% |

| Other intangibles, net |

|

3,647 |

|

|

4,237 |

|

|

5,684 |

|

|

6,542 |

|

|

(14) |

% |

|

(44) |

% |

| Bank-owned life insurance |

|

310,400 |

|

|

307,948 |

|

|

304,366 |

|

|

303,347 |

|

|

1 |

% |

|

2 |

% |

| Operating lease right-of-use assets |

|

38,192 |

|

|

39,628 |

|

|

43,731 |

|

|

43,447 |

|

|

(4) |

% |

|

(12) |

% |

| Other assets |

|

371,829 |

|

|

397,364 |

|

|

364,846 |

|

|

402,541 |

|

|

(6) |

% |

|

(8) |

% |

Total assets |

|

$ |

16,188,676 |

|

|

$ |

15,816,194 |

|

|

$ |

15,670,391 |

|

|

$ |

15,507,880 |

|

|

2 |

% |

|

4 |

% |

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest-bearing |

|

$ |

4,688,244 |

|

|

$ |

4,537,803 |

|

|

$ |

4,792,369 |

|

|

$ |

5,197,854 |

|

|

3 |

% |

|

(10) |

% |

| Interest-bearing transaction and savings accounts |

|

7,328,051 |

|

|

7,016,327 |

|

|

6,759,661 |

|

|

6,518,385 |

|

|

4 |

% |

|

12 |

% |

| Interest-bearing certificates |

|

1,521,853 |

|

|

1,525,133 |

|

|

1,477,467 |

|

|

1,458,313 |

|

|

— |

% |

|

4 |

% |

| Total deposits |

|

13,538,148 |

|

|

13,079,263 |

|

|

13,029,497 |

|

|

13,174,552 |

|

|

4 |

% |

|

3 |

% |

| Advances from FHLB |

|

230,000 |

|

|

398,000 |

|

|

323,000 |

|

|

140,000 |

|

|

(42) |

% |

|

64 |

% |

| Other borrowings |

|

154,533 |

|

|

165,956 |

|

|

182,877 |

|

|

188,440 |

|

|

(7) |

% |

|

(18) |

% |

| Subordinated notes, net |

|

80,170 |

|

|

89,561 |

|

|

92,851 |

|

|

92,748 |

|

|

(10) |

% |

|

(14) |

% |

| Junior subordinated debentures at fair value |

|

66,257 |

|

|

66,831 |

|

|

66,413 |

|

|

66,284 |

|

|

(1) |

% |

|

— |

% |

| Operating lease liabilities |

|

42,318 |

|

|

44,056 |

|

|

48,659 |

|

|

48,642 |

|

|

(4) |

% |

|

(13) |

% |

| Accrued expenses and other liabilities |

|

237,128 |

|

|

235,515 |

|

|

228,428 |

|

|

231,478 |

|

|

1 |

% |

|

2 |

% |

| Deferred compensation |

|

46,401 |

|

|

46,246 |

|

|

45,975 |

|

|

45,129 |

|

|

— |

% |

|

3 |

% |

| Total liabilities |

|

14,394,955 |

|

|

14,125,428 |

|

|

14,017,700 |

|

|

13,987,273 |

|

|

2 |

% |

|

3 |

% |

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

1,304,792 |

|

|

1,302,236 |

|

|

1,299,651 |

|

|

1,297,307 |

|

|

— |

% |

|

1 |

% |

| Retained earnings |

|

714,472 |

|

|

686,079 |

|

|

642,175 |

|

|

616,215 |

|

|

4 |

% |

|

16 |

% |

Accumulated other comprehensive loss |

|

(225,543) |

|

|

(297,549) |

|

|

(289,135) |

|

|

(392,915) |

|

|

(24) |

% |

|

(43) |

% |

| Total shareholders’ equity |

|

1,793,721 |

|

|

1,690,766 |

|

|

1,652,691 |

|

|

1,520,607 |

|

|

6 |

% |

|

18 |

% |

| Total liabilities and shareholders’ equity |

|

$ |

16,188,676 |

|

|

$ |

15,816,194 |

|

|

$ |

15,670,391 |

|

|

$ |

15,507,880 |

|

|

2 |

% |

|

4 |

% |

| Common Shares Issued: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares outstanding at end of period |

|

34,456,688 |

|

|

34,455,752 |

|

|

34,348,369 |

|

|

34,345,949 |

|

|

|

|

|

Common shareholders’ equity per share (1) |

|

$ |

52.06 |

|

|

$ |

49.07 |

|

|

$ |

48.12 |

|

|

$ |

44.27 |

|

|

|

|

|

Common shareholders’ tangible equity per share (1) (2) |

|

$ |

41.12 |

|

|

$ |

38.12 |

|

|

$ |

37.09 |

|

|

$ |

33.22 |

|

|

|

|

|

| Common shareholders’ equity to total assets |

|

11.08 |

% |

|

10.69 |

% |

|

10.55 |

% |

|

9.81 |

% |

|

|

|

|

Common shareholders’ tangible equity to tangible assets (2) |

|

8.96 |

% |

|

8.51 |

% |

|

8.33 |

% |

|

7.54 |

% |

|

|

|

|

| Consolidated Tier 1 leverage capital ratio |

|

10.91 |

% |

|

10.80 |

% |

|

10.56 |

% |

|

10.40 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| nm |

Not meaningful |

|

|

|

|

| (1) |

Calculation is based on number of common shares outstanding at the end of the period rather than weighted average shares outstanding. |

| (2) |

Common shareholders’ tangible equity and tangible assets exclude goodwill and other intangible assets. These ratios represent non-GAAP financial measures. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures. |

BANR - Third Quarter 2024 Results

October 16, 2024

Page 8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage Change |

| LOANS |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

|

Prior Qtr |

|

Prior Yr Qtr |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate (CRE): |

|

|

|

|

|

|

|

|

|

|

|

|

| Owner-occupied |

|

$ |

990,516 |

|

|

$ |

950,922 |

|

|

$ |

915,897 |

|

|

$ |

911,540 |

|

|

4 |

% |

|

9 |

% |

| Investment properties |

|

1,583,863 |

|

|

1,536,142 |

|

|

1,541,344 |

|

|

1,530,087 |

|

|

3 |

% |

|

4 |

% |

| Small balance CRE |

|

1,218,822 |

|

|

1,234,302 |

|

|

1,178,500 |

|

|

1,169,828 |

|

|

(1) |

% |

|

4 |

% |

| Multifamily real estate |

|

889,866 |

|

|

717,089 |

|

|

811,232 |

|

|

766,571 |

|

|

24 |

% |

|

16 |

% |

| Construction, land and land development: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial construction |

|

124,051 |

|

|

173,296 |

|

|

170,011 |

|

|

168,061 |

|

|

(28) |

% |

|

(26) |

% |

| Multifamily construction |

|

524,108 |

|

|

663,989 |

|

|

503,993 |

|

|

453,129 |

|

|

(21) |

% |

|

16 |

% |

| One- to four-family construction |

|

507,350 |

|

|

490,237 |

|

|

526,432 |

|

|

536,349 |

|

|

3 |

% |

|

(5) |

% |

| Land and land development |

|

370,690 |

|

|

352,184 |

|

|

336,639 |

|

|

346,362 |

|

|

5 |

% |

|

7 |

% |

| Commercial business: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial business |

|

1,281,615 |

|

|

1,298,134 |

|

|

1,255,734 |

|

|

1,263,747 |

|

|

(1) |

% |

|

1 |

% |

| Small business scored |

|

1,087,714 |

|

|

1,074,465 |

|

|

1,022,154 |

|

|

1,000,714 |

|

|

1 |

% |

|

9 |

% |

| Agricultural business, including secured by farmland: |

|

|

|

|

|

|

|

|

|

|

|

|

| Agricultural business, including secured by farmland |

|

346,686 |

|

|

334,583 |

|

|

331,089 |

|

|

334,626 |

|

|

4 |

% |

|

4 |

% |

| One- to four-family residential |

|

1,575,164 |

|

|

1,603,266 |

|

|

1,518,046 |

|

|

1,438,694 |

|

|

(2) |

% |

|

9 |

% |

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer—home equity revolving lines of credit |

|

622,615 |

|

|

611,739 |

|

|

588,703 |

|

|

579,836 |

|

|

2 |

% |

|

7 |

% |

| Consumer—other |

|

101,546 |

|

|

103,500 |

|

|

110,681 |

|

|

111,873 |

|

|

(2) |

% |

|

(9) |

% |

| Total loans receivable |

|

$ |

11,224,606 |

|

|

$ |

11,143,848 |

|

|

$ |

10,810,455 |

|

|

$ |

10,611,417 |

|

|

1 |

% |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans 30 - 89 days past due and on accrual |

|

$ |

13,030 |

|

|

$ |

11,850 |

|

|

$ |

19,744 |

|

|

$ |

6,108 |

|

|

|

|

|

| Total delinquent loans (including loans on non-accrual), net |

|

$ |

44,656 |

|

|

$ |

32,081 |

|

|

$ |

43,164 |

|

|

$ |

28,312 |

|

|

|

|

|

| Total delinquent loans / Total loans receivable |

|

0.40 |

% |

|

0.29 |

% |

|

0.40 |

% |

|

0.27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS BY GEOGRAPHIC LOCATION |

|

|

|

|

|

|

|

|

|

|

|

Percentage Change |

|

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

|

Prior Qtr |

|

Prior Yr Qtr |

|

|

Amount |

|

Percentage |

|

Amount |

|

Amount |

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Washington |

|

$ |

5,203,637 |

|

|

46 |

% |

|

$ |

5,182,378 |

|

|

$ |

5,095,602 |

|

|

$ |

5,046,028 |

|

|

— |

% |

|

3 |

% |

| California |

|

2,796,965 |

|

|

25 |

% |

|

2,787,190 |

|

|

2,670,923 |

|

|

2,570,175 |

|

|

— |

% |

|

9 |

% |

| Oregon |

|

2,108,229 |

|

|

19 |

% |

|

2,072,153 |

|

|

1,974,001 |

|

|

1,929,531 |

|

|

2 |

% |

|

9 |

% |

| Idaho |

|

652,148 |

|

|

6 |

% |

|

641,209 |

|

|

610,064 |

|

|

600,648 |

|

|

2 |

% |

|

9 |

% |

| Utah |

|

85,316 |

|

|

1 |

% |

|

80,295 |

|

|

68,931 |

|

|

57,711 |

|

|

6 |

% |

|

48 |

% |

| Other |

|

378,311 |

|

|

3 |

% |

|

380,623 |

|

|

390,934 |

|

|

407,324 |

|

|

(1) |

% |

|

(7) |

% |

| Total loans receivable |

|

$ |

11,224,606 |

|

|

100 |

% |

|

$ |

11,143,848 |

|

|

$ |

10,810,455 |

|

|

$ |

10,611,417 |

|

|

1 |

% |

|

6 |

% |

BANR - Third Quarter 2024 Results

October 16, 2024

Page 9

ADDITIONAL FINANCIAL INFORMATION

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOAN ORIGINATIONS |

Quarters Ended |

|

|

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Sep 30, 2023 |

|

|

|

|

| Commercial real estate |

$ |

114,372 |

|

|

$ |

102,258 |

|

|

$ |

62,337 |

|

|

|

|

|

| Multifamily real estate |

314 |

|

|

2,774 |

|

|

12,725 |

|

|

|

|

|

| Construction and land |

472,506 |

|

|

546,675 |

|

|

421,656 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial business |

179,871 |

|

|

167,168 |

|

|

157,833 |

|

|

|

|

|

| Agricultural business |

5,877 |

|

|

22,255 |

|

|

17,466 |

|

|

|

|

|

| One-to four-family residential |

24,488 |

|

|

34,498 |

|

|

43,622 |

|

|

|

|

|

| Consumer |

96,137 |

|

|

120,470 |

|

|

70,043 |

|

|

|

|

|

| Total loan originations (excluding loans held for sale) |

$ |

893,565 |

|

|

$ |

996,098 |

|

|

$ |

785,682 |

|

|

|

|

|

BANR - Third Quarter 2024 Results

October 16, 2024

Page 10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

Quarters Ended |

|

|

| CHANGE IN THE ALLOWANCE FOR CREDIT LOSSES – LOANS |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Sep 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, beginning of period |

|

$ |

152,848 |

|

|

$ |

151,140 |

|

|

$ |

144,680 |

|

|

|

|

|

| Provision for credit losses – loans |

|

1,967 |

|

|

1,953 |

|

|

2,943 |

|

|

|

|

|

| Recoveries of loans previously charged off: |

|

|

|

|

|

|

|

|

|

|

| Commercial real estate |

|

65 |

|

|

98 |

|

|

170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction and land |

|

— |

|

|

— |

|

|

29 |

|

|

|

|

|

| One- to four-family real estate |

|

14 |

|

|

17 |

|

|

59 |

|

|

|

|

|

| Commercial business |

|

613 |

|

|

324 |

|

|

403 |

|

|

|

|

|

| Agricultural business, including secured by farmland |

|

1 |

|

|

195 |

|

|

19 |

|

|

|

|

|

| Consumer |

|

41 |

|

|

112 |

|

|

126 |

|

|

|

|

|

| |

|

734 |

|

|

746 |

|

|

806 |

|

|

|

|

|

| Loans charged off: |

|

|

|

|

|

|

|

|

|

|

| Commercial real estate |

|

— |

|

|

(347) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction and land |

|

(145) |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial business |

|

(414) |

|

|

(137) |

|

|

(616) |

|

|

|

|

|

| Agricultural business, including secured by farmland |

|

— |

|

|

— |

|

|

(564) |

|

|

|

|

|

| Consumer |

|

(405) |

|

|

(507) |

|

|

(289) |

|

|

|

|

|

| |

|

(964) |

|

|

(991) |

|

|

(1,469) |

|

|

|

|

|

| Net charge-offs |

|

(230) |

|

|

(245) |

|

|

(663) |

|

|

|

|

|

| Balance, end of period |

|

$ |

154,585 |

|

|

$ |

152,848 |

|

|

$ |

146,960 |

|

|

|

|

|

| Net charge-offs / Average loans receivable |

|

(0.002) |

% |

|

(0.002) |

% |

|

(0.006) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALLOCATION OF ALLOWANCE FOR CREDIT LOSSES – LOANS |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

|

|

Sep 30, 2023 |

|

|

|

|

|

|

|

|

|

| Commercial real estate |

|

$ |

40,040 |

|

|

$ |

39,064 |

|

|

|

|

$ |

44,016 |

|

| Multifamily real estate |

|

10,233 |

|

|

8,253 |

|

|

|

|

8,804 |

|

| Construction and land |

|

28,322 |

|

|

31,597 |

|

|

|

|

29,389 |

|

| One- to four-family real estate |

|

20,463 |

|

|

20,906 |

|

|

|

|

17,925 |

|

| Commercial business |

|

39,779 |

|

|

38,835 |

|

|

|

|

34,065 |

|

| Agricultural business, including secured by farmland |

|

5,340 |

|

|

4,045 |

|

|

|

|

3,718 |

|

| Consumer |

|

10,408 |

|

|

10,148 |

|

|

|

|

9,043 |

|

| Total allowance for credit losses – loans |

|

$ |

154,585 |

|

|

$ |

152,848 |

|

|

|

|

$ |

146,960 |

|

| Allowance for credit losses - loans / Total loans receivable |

|

1.38 |

% |

|

1.37 |

% |

|

|

|

1.38 |

% |

| Allowance for credit losses - loans / Non-performing loans |

|

359 |

% |

|

498 |

% |

|

|

|

560 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarters Ended |

|

|

| CHANGE IN THE ALLOWANCE FOR CREDIT LOSSES - UNFUNDED LOAN COMMITMENTS |

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Sep 30, 2023 |

|

|

|

|

| Balance, beginning of period |

|

$ |

14,027 |

|

|

$ |

13,597 |

|

|

$ |

14,664 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Recapture) provision for credit losses - unfunded loan commitments |

|

(262) |

|

|

430 |

|

|

346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, end of period |

|

$ |

13,765 |

|

|

$ |

14,027 |

|

|

$ |

15,010 |

|

|

|

|

|

BANR - Third Quarter 2024 Results

October 16, 2024

Page 11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

| NON-PERFORMING ASSETS |

|

|

|

|

|

|

|

| |

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

| Loans on non-accrual status: |

|

|

|

|

|

|

|

| Secured by real estate: |

|

|

|

|

|

|

|

| Commercial |

$ |

2,127 |

|

|

$ |

2,326 |

|

|

$ |

2,677 |

|

|

$ |

1,365 |

|

|

|

|

|

|

|

|

|

| Construction and land |

4,286 |

|

|

3,999 |

|

|

3,105 |

|

|

5,538 |

|

| One- to four-family |

9,592 |

|

|

8,184 |

|

|

5,702 |

|

|

5,480 |

|

| Commercial business |

10,705 |

|

|

8,694 |

|

|

9,002 |

|

|

5,289 |

|

| Agricultural business, including secured by farmland |

7,703 |

|

|

1,586 |

|

|

3,167 |

|

|

3,170 |

|

| Consumer |

4,636 |

|

|

3,380 |

|

|

3,204 |

|

|

3,378 |

|

| |

39,049 |

|

|

28,169 |

|

|

26,857 |

|

|

24,220 |

|

| Loans more than 90 days delinquent, still on accrual: |

|

|

|

|

|

|

|

| Secured by real estate: |

|

|

|

|

|

|

|

| Commercial |

2,258 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

| Construction and land |

380 |

|

|

— |

|

|

1,138 |

|

|

— |

|

| One- to four-family |

961 |

|

|

1,861 |

|

|

1,205 |

|

|

1,799 |

|

| Commercial business |

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Consumer |

359 |

|

|

692 |

|

|

401 |

|

|

245 |

|

| |

3,958 |

|

|

2,553 |

|

|

2,745 |

|

|

2,044 |

|

| Total non-performing loans |

43,007 |

|

|

30,722 |

|

|

29,602 |

|

|

26,264 |

|

|

|

|

|

|

|

|

|

| REO |

2,221 |

|

|

2,564 |

|

|

526 |

|

|

546 |

|

|

|

|

|

|

|

|

|

| Total non-performing assets |

$ |

45,228 |

|

|

$ |

33,286 |

|

|

$ |

30,128 |

|

|

$ |

26,810 |

|

| Total non-performing assets to total assets |

0.28 |

% |

|

0.21 |

% |

|

0.19 |

% |

|

0.17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS BY CREDIT RISK RATING |

|

|

|

|

|

|

|

| |

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

| Pass |

$ |

11,022,014 |

|

|

$ |

10,971,850 |

|

|

$ |

10,671,281 |

|

|

$ |

10,467,498 |

|

| Special Mention |

52,497 |

|

|

50,027 |

|

|

13,732 |

|

|

19,394 |

|

| Substandard |

150,095 |

|

|

121,971 |

|

|

125,442 |

|

|

124,525 |

|

|

|

|

|

|

|

|

|

| Total |

$ |

11,224,606 |

|

|

$ |

11,143,848 |

|

|

$ |

10,810,455 |

|

|

$ |

10,611,417 |

|

BANR - Third Quarter 2024 Results

October 16, 2024

Page 12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DEPOSIT COMPOSITION |

|

|

|

|

|

|

|

|

|

Percentage Change |

|

|

Sep 30, 2024 |

|

Jun 30, 2024 |

|

Dec 31, 2023 |

|

Sep 30, 2023 |

|

Prior Qtr |

|

Prior Yr Qtr |

| Non-interest-bearing |

|

$ |

4,688,244 |

|

|

$ |

4,537,803 |

|

|

$ |

4,792,369 |

|

|

$ |

5,197,854 |

|

|

3 |

% |

|

(10) |

% |

| Interest-bearing checking |

|

2,344,561 |

|

|

2,208,742 |

|

|

2,098,526 |

|

|

2,006,866 |