Royal Sonesta Chase Park Plaza St. Louis, MO THIRD QUARTER 2022 Supplemental Operating and Financial Data ALL AMOUNTS IN THIS REPORT ARE UNAUDITED. Exhibit 99.2 Royal Sonesta Cambridge, MA

Supplemental Q3 2022 2 Table of Contents CORPORATE INFORMATION Company Profile ...................................................................................................................................................................................................................................... 3 Investor Information ................................................................................................................................................................................................................................ 4 Research Coverage ................................................................................................................................................................................................................................. 5 FINANCIALS Key Financial Data ................................................................................................................................................................................................................................... 6 Condensed Consolidated Balance Sheets ........................................................................................................................................................................................ 7 Condensed Consolidated Statements of Income (Loss) ................................................................................................................................................................. 8 Calculation of FFO and Normalized FFO ........................................................................................................................................................................................... 9 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre ............................................................................................................................................................ 10 Notes to Condensed Consolidated Statements of Income (Loss), and calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA ............................................................................................................................................................................................................ 11 Debt Summary ......................................................................................................................................................................................................................................... 12 Debt Maturity Schedule ......................................................................................................................................................................................................................... 13 Leverage Ratios, Coverage Ratios and Public Debt Covenants .................................................................................................................................................... 14 Capital Expenditures and Restricted Cash Activity .......................................................................................................................................................................... 15 Property Acquisitions and Dispositions Information Since January 1, 2022 ............................................................................................................................... 16 PORTFOLIO INFORMATION Portfolio Summary .................................................................................................................................................................................................................................. 17 Consolidated Portfolio Diversification by Industry ........................................................................................................................................................................... 18 Consolidated Portfolio Geographical Diversification ...................................................................................................................................................................... 19 Hotel Portfolio by Brand ........................................................................................................................................................................................................................ 20 Hotel Operating Statistics by Service Level - Comparable Hotels - three months ended September 30, 2022 ................................................................. 21 Hotel Operating Statistics by Service Level - Comparable Hotels - nine months ended September 30, 2022 ................................................................... 22 Hotel Operating Statistics by Service Level - All Hotels - three months ended September 30, 2022 ................................................................................... 23 Hotel Operating Statistics by Service Level - All Hotels - nine months ended September 30, 2022 ..................................................................................... 24 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels ...................................................................................................................................... 25 Calculation and Reconciliation of Hotel EBITDA - All Hotels .......................................................................................................................................................... 26 Net Lease Portfolio by Brand ................................................................................................................................................................................................................ 27 Net Lease Portfolio by Industry ............................................................................................................................................................................................................ 28 Net Lease Portfolio by Tenant (Top 10) .............................................................................................................................................................................................. 29 Net Lease Portfolio Expiration Schedule ............................................................................................................................................................................................ 30 Net Lease Portfolio Occupancy Summary .......................................................................................................................................................................................... 31 Non-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS .......................................................................................................................................................................... 32 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ............................................................................................................................................................................ 34 Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. SVC Nasdaq Listed

Supplemental Q3 2022 3 Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634 (t) (617) 964-8389 Stock Exchange Listing: Nasdaq Trading Symbol: Common Shares: SVC Key Data (as of and for the three months ended September 30, 2022): (dollars in 000s) Total properties: 1,011 Hotels 242 Net lease properties 769 Number of hotel rooms/suites 40,563 Total net lease square feet 13,412,371 Q3 2022 Total revenues $ 498,251 Q3 2022 Net income $ 7,500 Q3 2022 Normalized FFO $ 88,458 Q3 2022 Adjusted EBITDAre $ 173,455 The Company: Service Properties Trust, or SVC, we, our or us, is a real estate investment trust, or REIT, with over $11 billion invested in two asset categories: hotels and service-focused retail net lease properties. As of September 30, 2022, SVC owns 242 hotels with over 40,000 guest rooms throughout the United States and in Puerto Rico and Canada, the majority of which are extended stay and select service. As of September 30, 2022, SVC owns 769 retail service-focused net lease properties totaling over 13 million square feet throughout United States. SVC is included in 140 market indices and comprises more than 1% of the following indices as of September 30, 2022: Bloomberg Reit Hotels Index (BBREHOTL), Invesco S&P SmallCap Financials ETF INAV Index (PSCFIV), and Invesco S&P SmallCap 600 Equal Weight ETF INAV Index (EWSCIV). Management: SVC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of September 30, 2022, RMR had over $37 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion of annual revenues, 2,100 properties and over 38,000 employees. We believe that being managed by RMR is a competitive advantage for SVC because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self-managed. Company Profile RETURN TO TABLE OF CONTENTS

Supplemental Q3 2022 4 Board of Trustees Laurie B. Burns Robert E. Cramer Donna D. Fraiche Independent Trustee Independent Trustee Lead Independent Trustee John L. Harrington William A. Lamkin John G. Murray Independent Trustee Independent Trustee Managing Trustee Adam D. Portnoy Chair of the Board & Managing Trustee Senior Management Todd W. Hargreaves Brian E. Donley President and Chief Investment Officer Chief Financial Officer and Treasurer Contact Information Investor Relations Inquiries Service Properties Trust Financial, investor and media inquiries should be directed to: Two Newton Place Stephen Colbert, Director, Investor Relations at 255 Washington Street/Suite 300 (617) 231-3223, or scolbert@rmrgroup.com. Newton, MA 02458-1634 (t) (617) 964-8389 (email) info@svcreit.com (website) www.svcreit.com Investor Information RETURN TO TABLE OF CONTENTS Sonesta Resort Hilton Head, SC

Supplemental Q3 2022 5 Equity Research Coverage (1) B. Riley Securities, Inc. Oppenheimer & Co. Inc. Wells Fargo Securities Bryan Maher Tyler Batory Dori Kesten (646) 885-5423 (212) 667-7230 (617) 603-4233 bmaher@brileyfin.com tyler.batory@opco.com dori.kesten@wellsfargo.com Rating Agencies (1) Senior Unsecured Debt Ratings Moody’s Investors Service S&P Global Standard & Poor's: B+ (Outlook: Negative)/BB* Reed Valutas Alan Zigman Moody's: B1 (Outlook: Negative)/ Ba3* (212) 553-4169 (416) 507-2556 * BB/ Ba3 rating assigned to guaranteed Senior Unsecured Notes. reed.valutas@moodys.com alan.zigman@spglobal.com Research Coverage (1) SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. RETURN TO TABLE OF CONTENTS

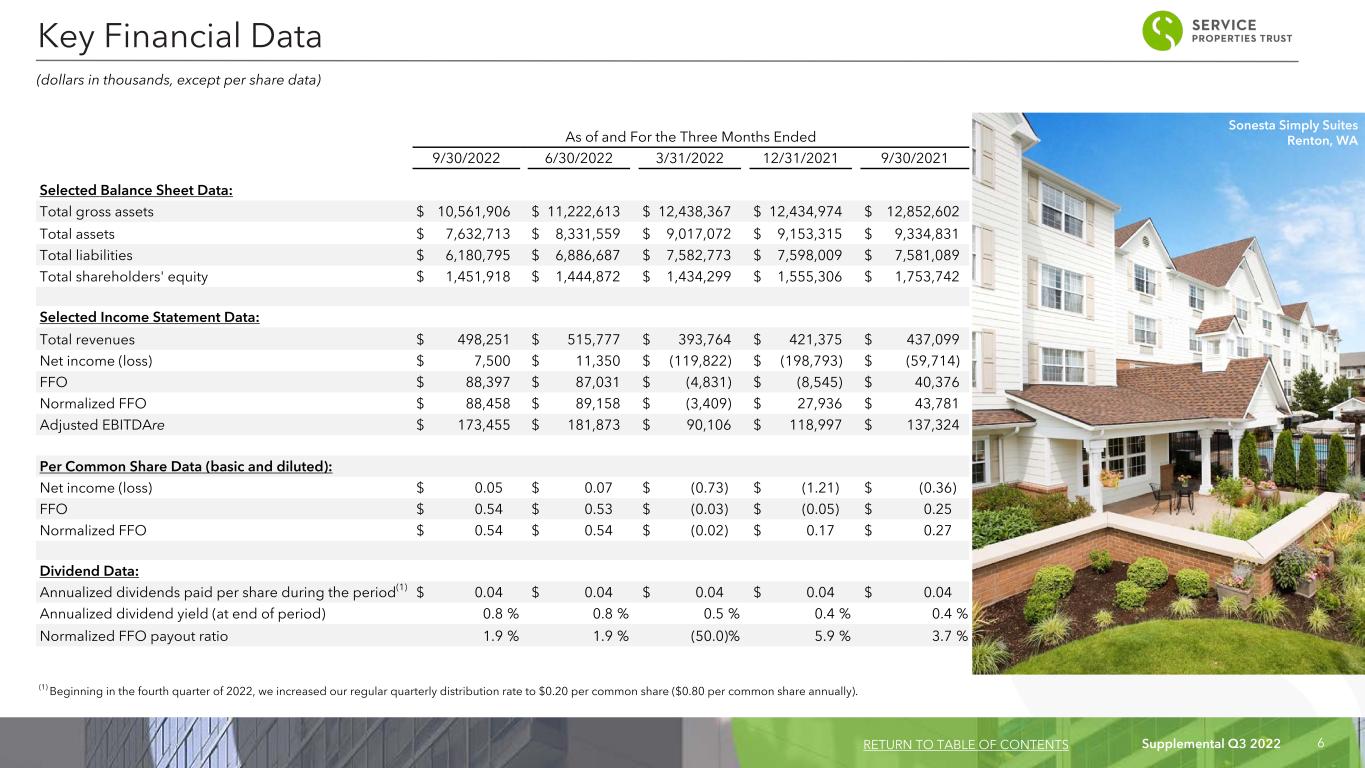

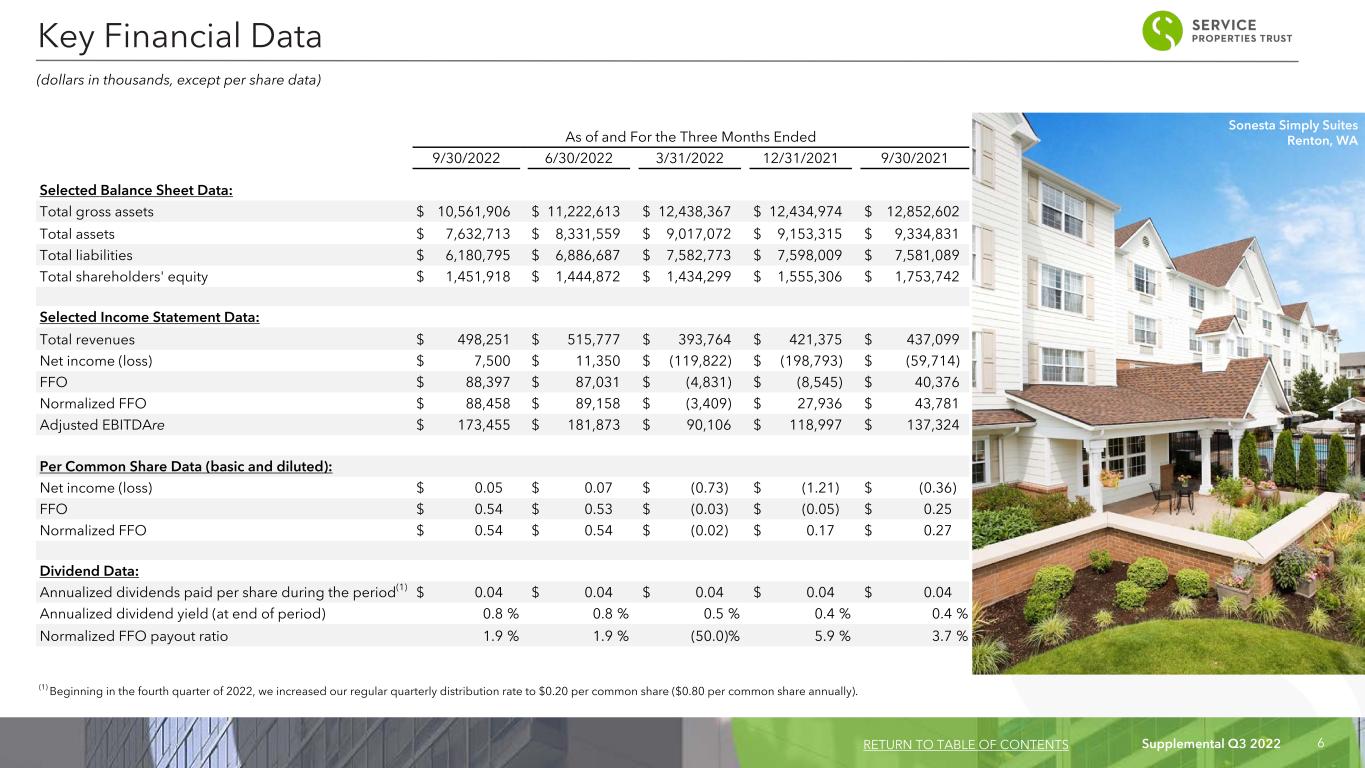

Supplemental Q3 2022 6 As of and For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Selected Balance Sheet Data: Total gross assets $ 10,561,906 $ 11,222,613 $ 12,438,367 $ 12,434,974 $ 12,852,602 Total assets $ 7,632,713 $ 8,331,559 $ 9,017,072 $ 9,153,315 $ 9,334,831 Total liabilities $ 6,180,795 $ 6,886,687 $ 7,582,773 $ 7,598,009 $ 7,581,089 Total shareholders' equity $ 1,451,918 $ 1,444,872 $ 1,434,299 $ 1,555,306 $ 1,753,742 Selected Income Statement Data: Total revenues $ 498,251 $ 515,777 $ 393,764 $ 421,375 $ 437,099 Net income (loss) $ 7,500 $ 11,350 $ (119,822) $ (198,793) $ (59,714) FFO $ 88,397 $ 87,031 $ (4,831) $ (8,545) $ 40,376 Normalized FFO $ 88,458 $ 89,158 $ (3,409) $ 27,936 $ 43,781 Adjusted EBITDAre $ 173,455 $ 181,873 $ 90,106 $ 118,997 $ 137,324 Per Common Share Data (basic and diluted): Net income (loss) $ 0.05 $ 0.07 $ (0.73) $ (1.21) $ (0.36) FFO $ 0.54 $ 0.53 $ (0.03) $ (0.05) $ 0.25 Normalized FFO $ 0.54 $ 0.54 $ (0.02) $ 0.17 $ 0.27 Dividend Data: Annualized dividends paid per share during the period(1) $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 0.04 Annualized dividend yield (at end of period) 0.8 % 0.8 % 0.5 % 0.4 % 0.4 % Normalized FFO payout ratio 1.9 % 1.9 % (50.0) % 5.9 % 3.7 % (dollars in thousands, except per share data) Key Financial Data RETURN TO TABLE OF CONTENTS Sonesta Simply Suites Renton, WA (1) Beginning in the fourth quarter of 2022, we increased our regular quarterly distribution rate to $0.20 per common share ($0.80 per common share annually).

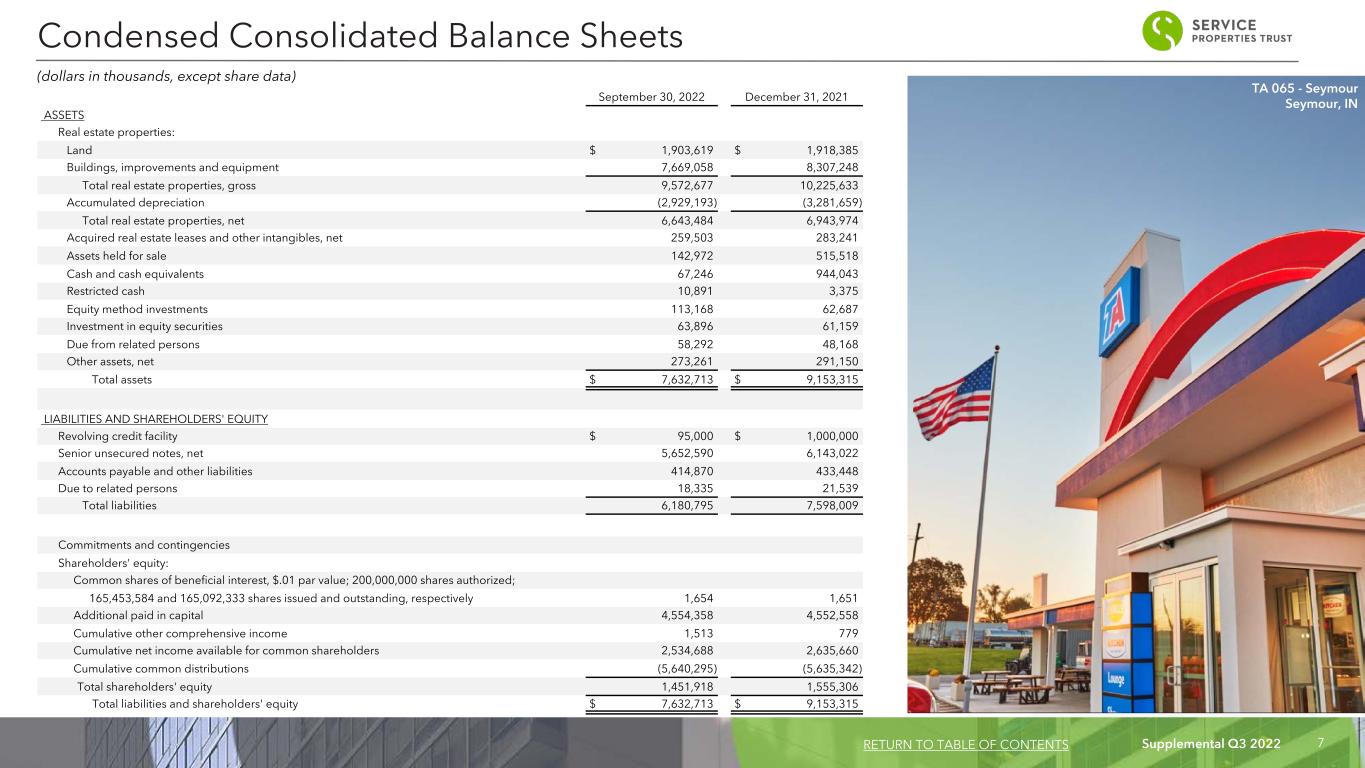

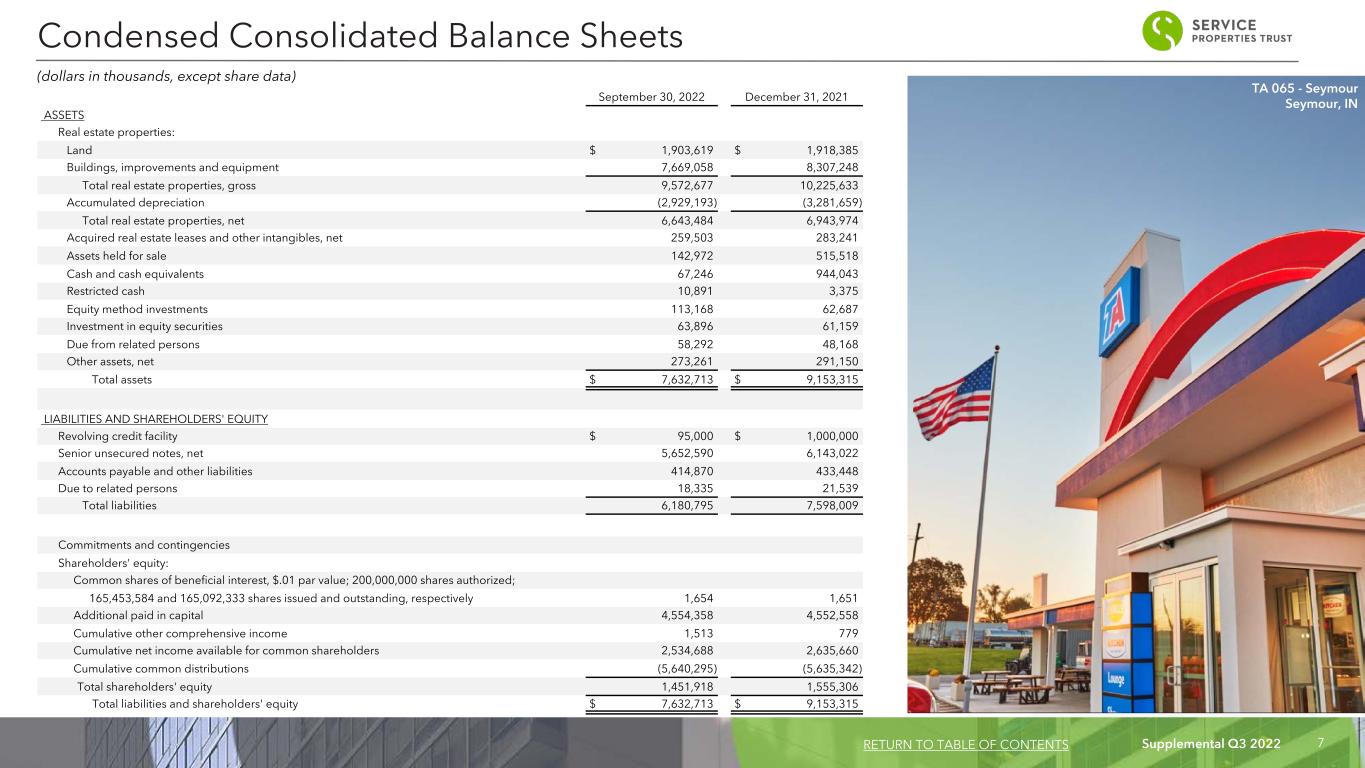

Supplemental Q3 2022 7 September 30, 2022 December 31, 2021 ASSETS Real estate properties: Land $ 1,903,619 $ 1,918,385 Buildings, improvements and equipment 7,669,058 8,307,248 Total real estate properties, gross 9,572,677 10,225,633 Accumulated depreciation (2,929,193) (3,281,659) Total real estate properties, net 6,643,484 6,943,974 Acquired real estate leases and other intangibles, net 259,503 283,241 Assets held for sale 142,972 515,518 Cash and cash equivalents 67,246 944,043 Restricted cash 10,891 3,375 Equity method investments 113,168 62,687 Investment in equity securities 63,896 61,159 Due from related persons 58,292 48,168 Other assets, net 273,261 291,150 Total assets $ 7,632,713 $ 9,153,315 LIABILITIES AND SHAREHOLDERS' EQUITY Revolving credit facility $ 95,000 $ 1,000,000 Senior unsecured notes, net 5,652,590 6,143,022 Accounts payable and other liabilities 414,870 433,448 Due to related persons 18,335 21,539 Total liabilities 6,180,795 7,598,009 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 165,453,584 and 165,092,333 shares issued and outstanding, respectively 1,654 1,651 Additional paid in capital 4,554,358 4,552,558 Cumulative other comprehensive income 1,513 779 Cumulative net income available for common shareholders 2,534,688 2,635,660 Cumulative common distributions (5,640,295) (5,635,342) Total shareholders' equity 1,451,918 1,555,306 Total liabilities and shareholders' equity $ 7,632,713 $ 9,153,315 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) RETURN TO TABLE OF CONTENTS TA 065 - Seymour Seymour, IN

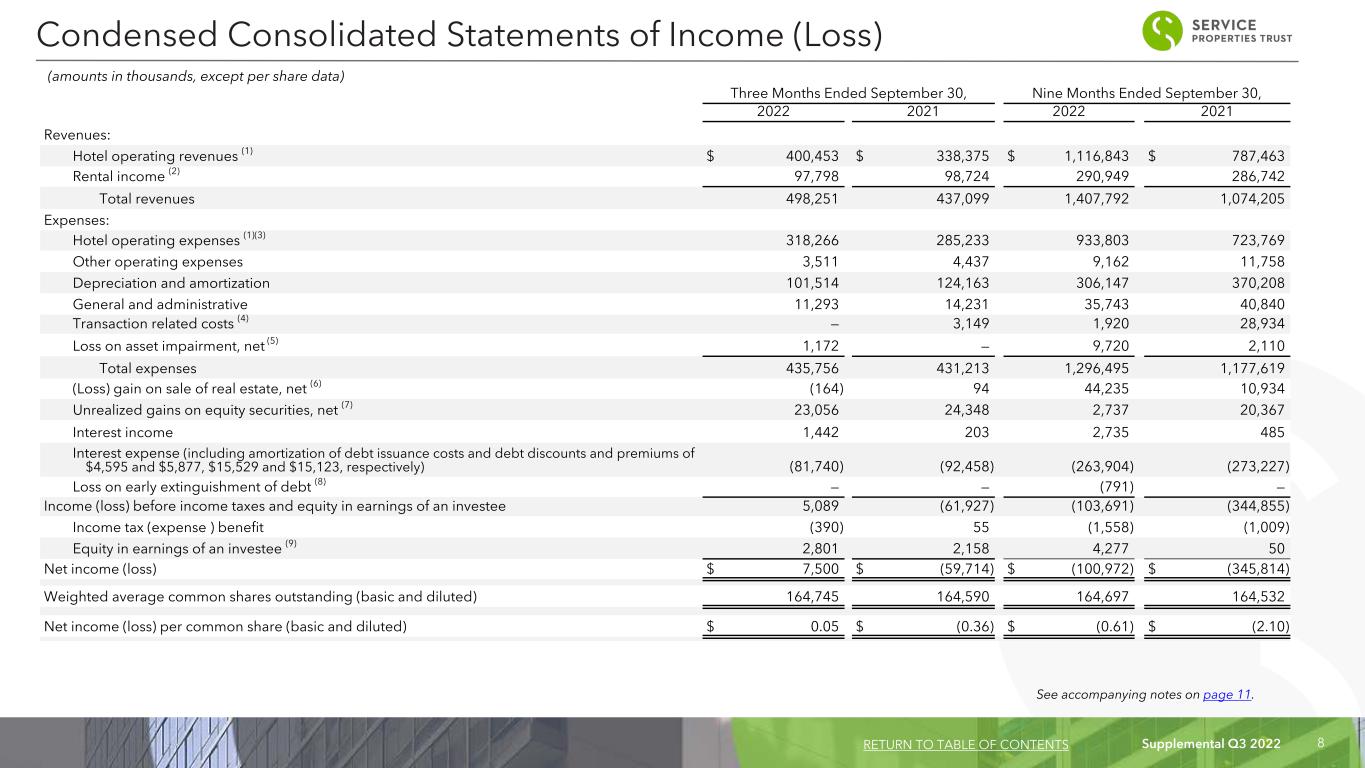

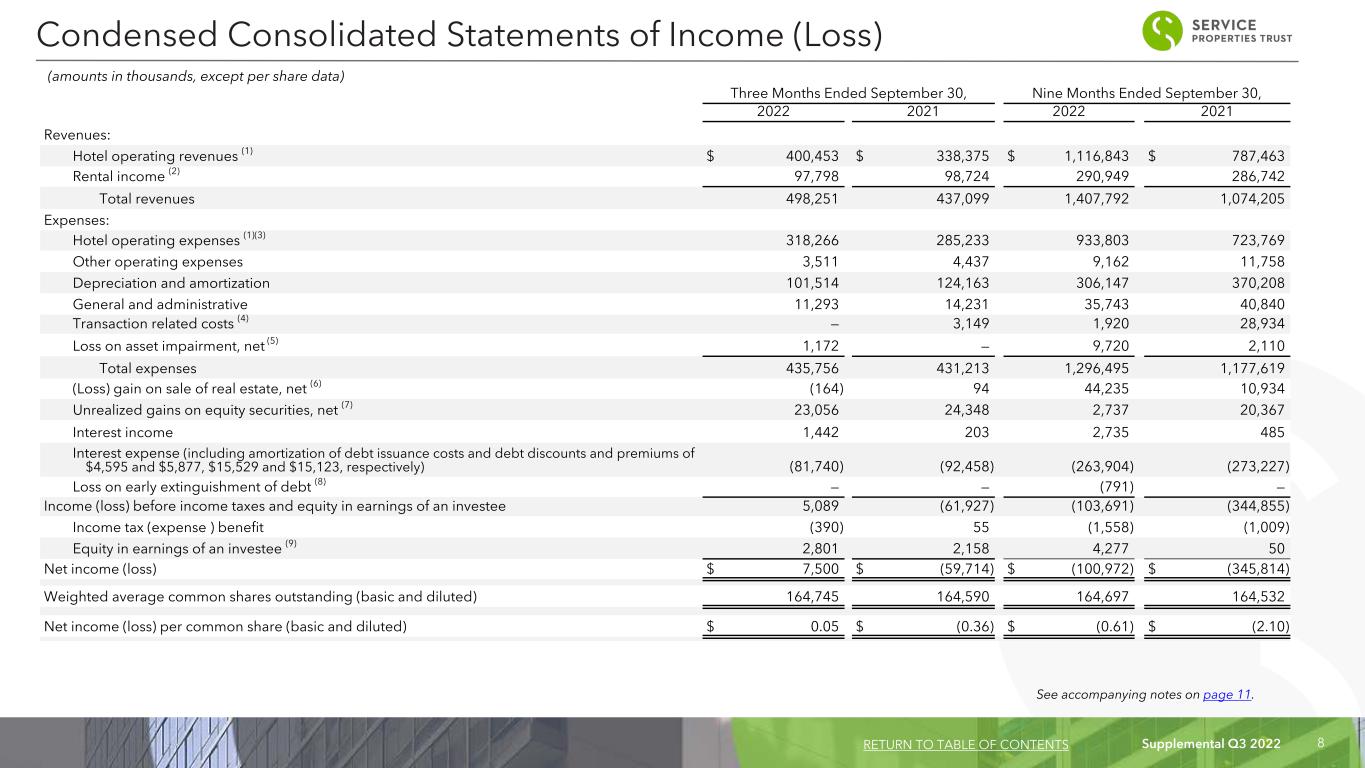

Supplemental Q3 2022 8 Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Revenues: Hotel operating revenues (1) $ 400,453 $ 338,375 $ 1,116,843 $ 787,463 Rental income (2) 97,798 98,724 290,949 286,742 Total revenues 498,251 437,099 1,407,792 1,074,205 Expenses: Hotel operating expenses (1)(3) 318,266 285,233 933,803 723,769 Other operating expenses 3,511 4,437 9,162 11,758 Depreciation and amortization 101,514 124,163 306,147 370,208 General and administrative 11,293 14,231 35,743 40,840 Transaction related costs (4) — 3,149 1,920 28,934 Loss on asset impairment, net (5) 1,172 — 9,720 2,110 Total expenses 435,756 431,213 1,296,495 1,177,619 (Loss) gain on sale of real estate, net (6) (164) 94 44,235 10,934 Unrealized gains on equity securities, net (7) 23,056 24,348 2,737 20,367 Interest income 1,442 203 2,735 485 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $4,595 and $5,877, $15,529 and $15,123, respectively) (81,740) (92,458) (263,904) (273,227) Loss on early extinguishment of debt (8) — — (791) — Income (loss) before income taxes and equity in earnings of an investee 5,089 (61,927) (103,691) (344,855) Income tax (expense ) benefit (390) 55 (1,558) (1,009) Equity in earnings of an investee (9) 2,801 2,158 4,277 50 Net income (loss) $ 7,500 $ (59,714) $ (100,972) $ (345,814) Weighted average common shares outstanding (basic and diluted) 164,745 164,590 164,697 164,532 Net income (loss) per common share (basic and diluted) $ 0.05 $ (0.36) $ (0.61) $ (2.10) (amounts in thousands, except per share data) Condensed Consolidated Statements of Income (Loss) RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

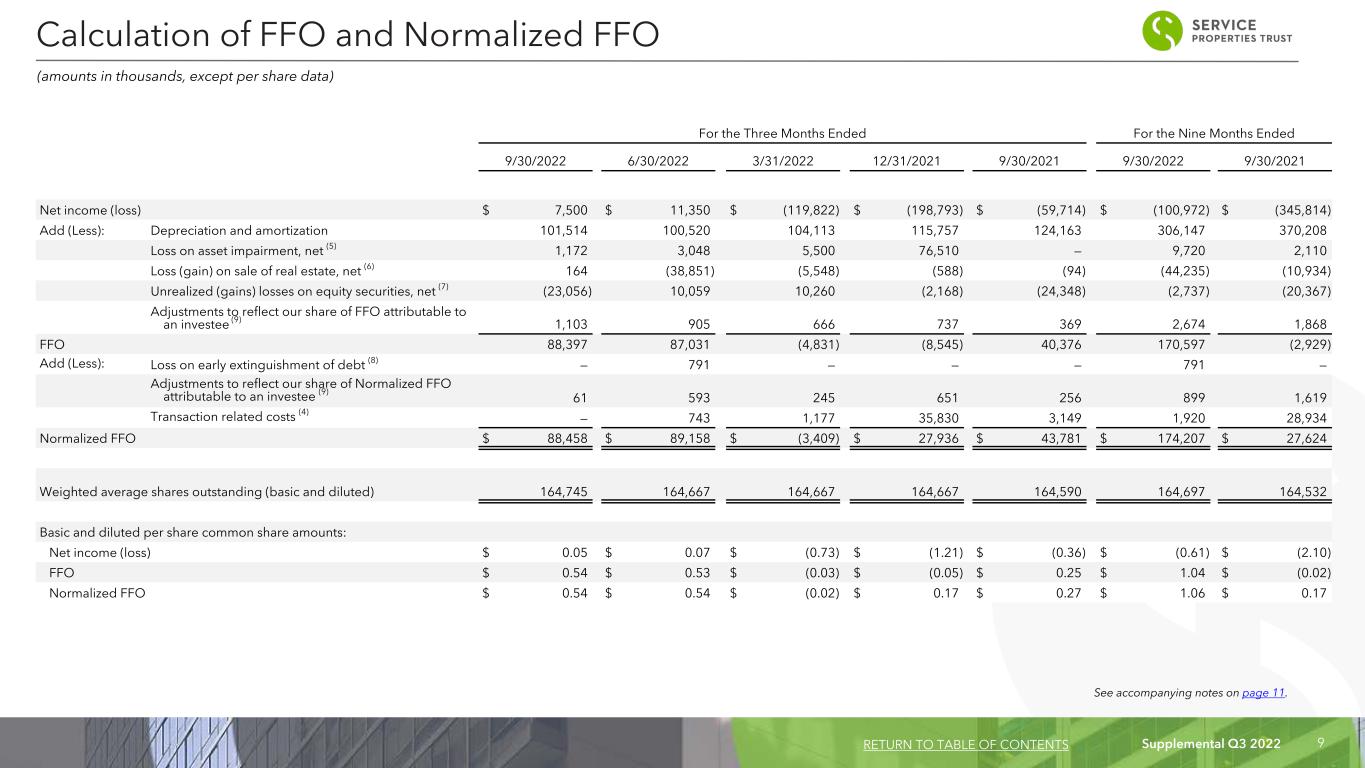

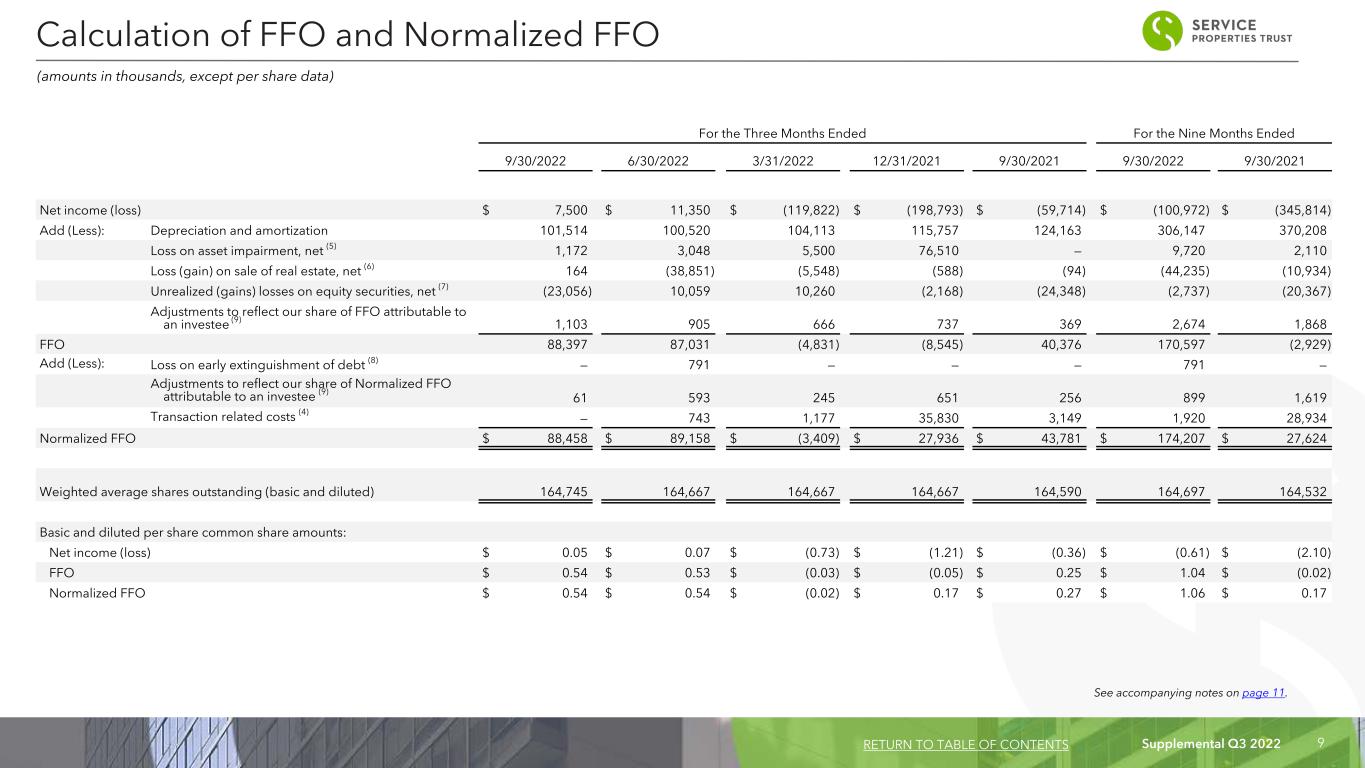

Supplemental Q3 2022 9 For the Three Months Ended For the Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Net income (loss) $ 7,500 $ 11,350 $ (119,822) $ (198,793) $ (59,714) $ (100,972) $ (345,814) Add (Less): Depreciation and amortization 101,514 100,520 104,113 115,757 124,163 306,147 370,208 Loss on asset impairment, net (5) 1,172 3,048 5,500 76,510 — 9,720 2,110 Loss (gain) on sale of real estate, net (6) 164 (38,851) (5,548) (588) (94) (44,235) (10,934) Unrealized (gains) losses on equity securities, net (7) (23,056) 10,059 10,260 (2,168) (24,348) (2,737) (20,367) Adjustments to reflect our share of FFO attributable to an investee (9) 1,103 905 666 737 369 2,674 1,868 FFO 88,397 87,031 (4,831) (8,545) 40,376 170,597 (2,929) Add (Less): Loss on early extinguishment of debt (8) — 791 — — — 791 — Adjustments to reflect our share of Normalized FFO attributable to an investee (9) 61 593 245 651 256 899 1,619 Transaction related costs (4) — 743 1,177 35,830 3,149 1,920 28,934 Normalized FFO $ 88,458 $ 89,158 $ (3,409) $ 27,936 $ 43,781 $ 174,207 $ 27,624 Weighted average shares outstanding (basic and diluted) 164,745 164,667 164,667 164,667 164,590 164,697 164,532 Basic and diluted per share common share amounts: Net income (loss) $ 0.05 $ 0.07 $ (0.73) $ (1.21) $ (0.36) $ (0.61) $ (2.10) FFO $ 0.54 $ 0.53 $ (0.03) $ (0.05) $ 0.25 $ 1.04 $ (0.02) Normalized FFO $ 0.54 $ 0.54 $ (0.02) $ 0.17 $ 0.27 $ 1.06 $ 0.17 Calculation of FFO and Normalized FFO (amounts in thousands, except per share data) RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

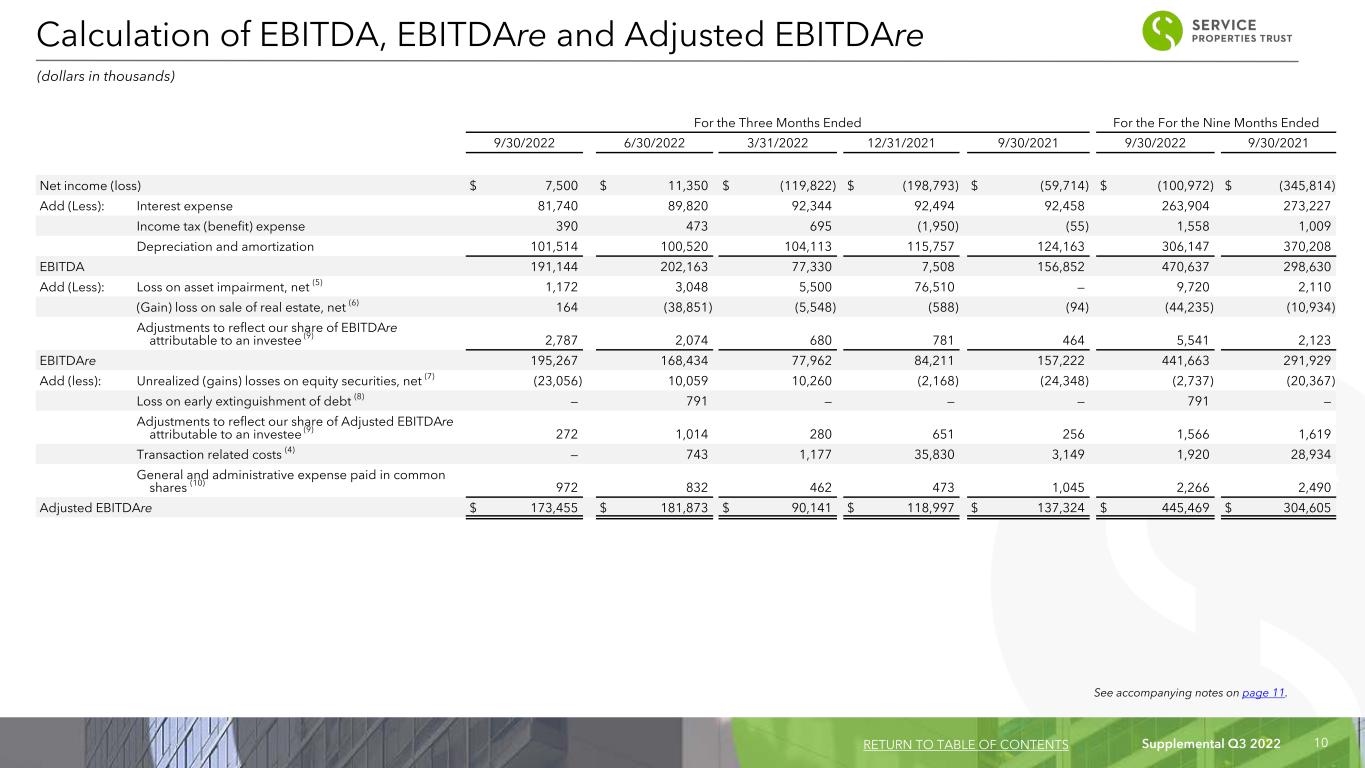

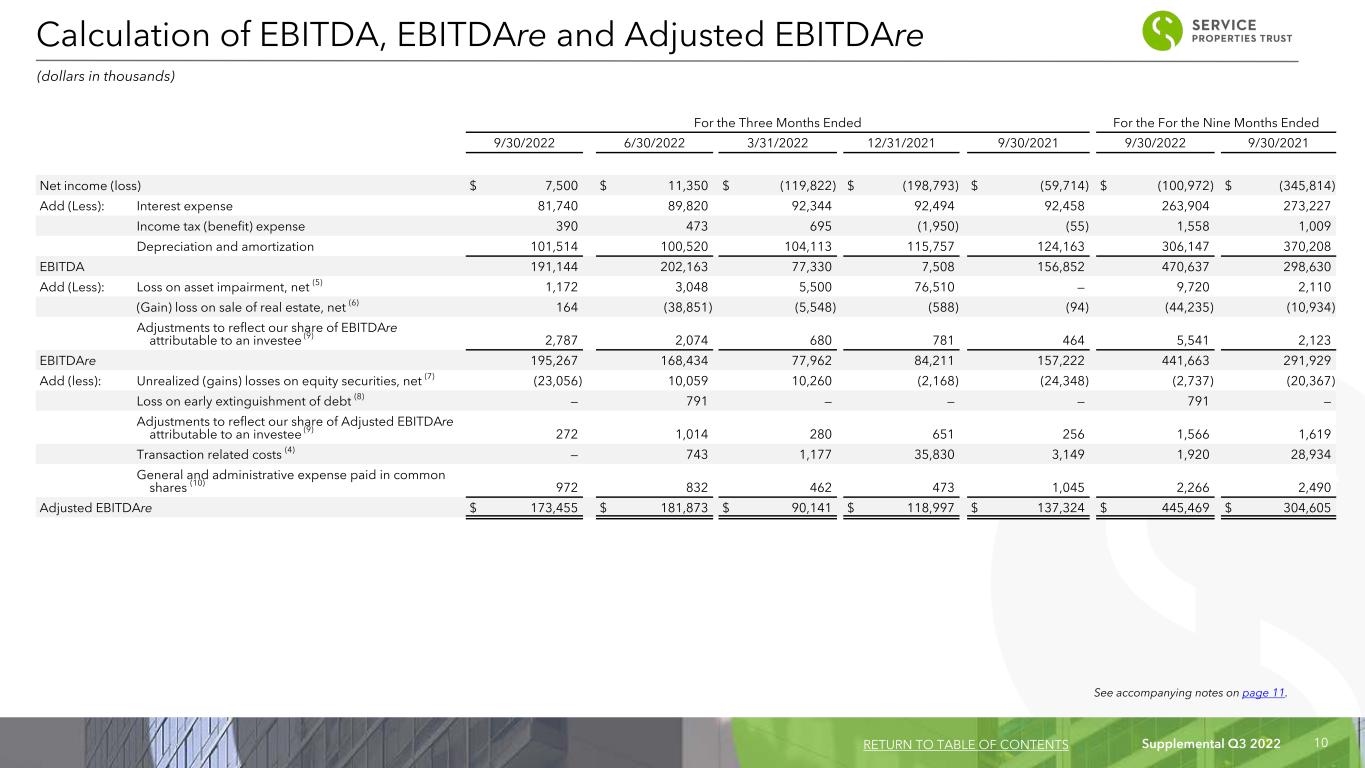

Supplemental Q3 2022 10 For the Three Months Ended For the For the Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Net income (loss) $ 7,500 $ 11,350 $ (119,822) $ (198,793) $ (59,714) $ (100,972) $ (345,814) Add (Less): Interest expense 81,740 89,820 92,344 92,494 92,458 263,904 273,227 Income tax (benefit) expense 390 473 695 (1,950) (55) 1,558 1,009 Depreciation and amortization 101,514 100,520 104,113 115,757 124,163 306,147 370,208 EBITDA 191,144 202,163 77,330 7,508 156,852 470,637 298,630 Add (Less): Loss on asset impairment, net (5) 1,172 3,048 5,500 76,510 — 9,720 2,110 (Gain) loss on sale of real estate, net (6) 164 (38,851) (5,548) (588) (94) (44,235) (10,934) Adjustments to reflect our share of EBITDAre attributable to an investee (9) 2,787 2,074 680 781 464 5,541 2,123 EBITDAre 195,267 168,434 77,962 84,211 157,222 441,663 291,929 Add (less): Unrealized (gains) losses on equity securities, net (7) (23,056) 10,059 10,260 (2,168) (24,348) (2,737) (20,367) Loss on early extinguishment of debt (8) — 791 — — — 791 — Adjustments to reflect our share of Adjusted EBITDAre attributable to an investee (9) 272 1,014 280 651 256 1,566 1,619 Transaction related costs (4) — 743 1,177 35,830 3,149 1,920 28,934 General and administrative expense paid in common shares (10) 972 832 462 473 1,045 2,266 2,490 Adjusted EBITDAre $ 173,455 $ 181,873 $ 90,141 $ 118,997 $ 137,324 $ 445,469 $ 304,605 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) See accompanying notes on page 11. RETURN TO TABLE OF CONTENTS

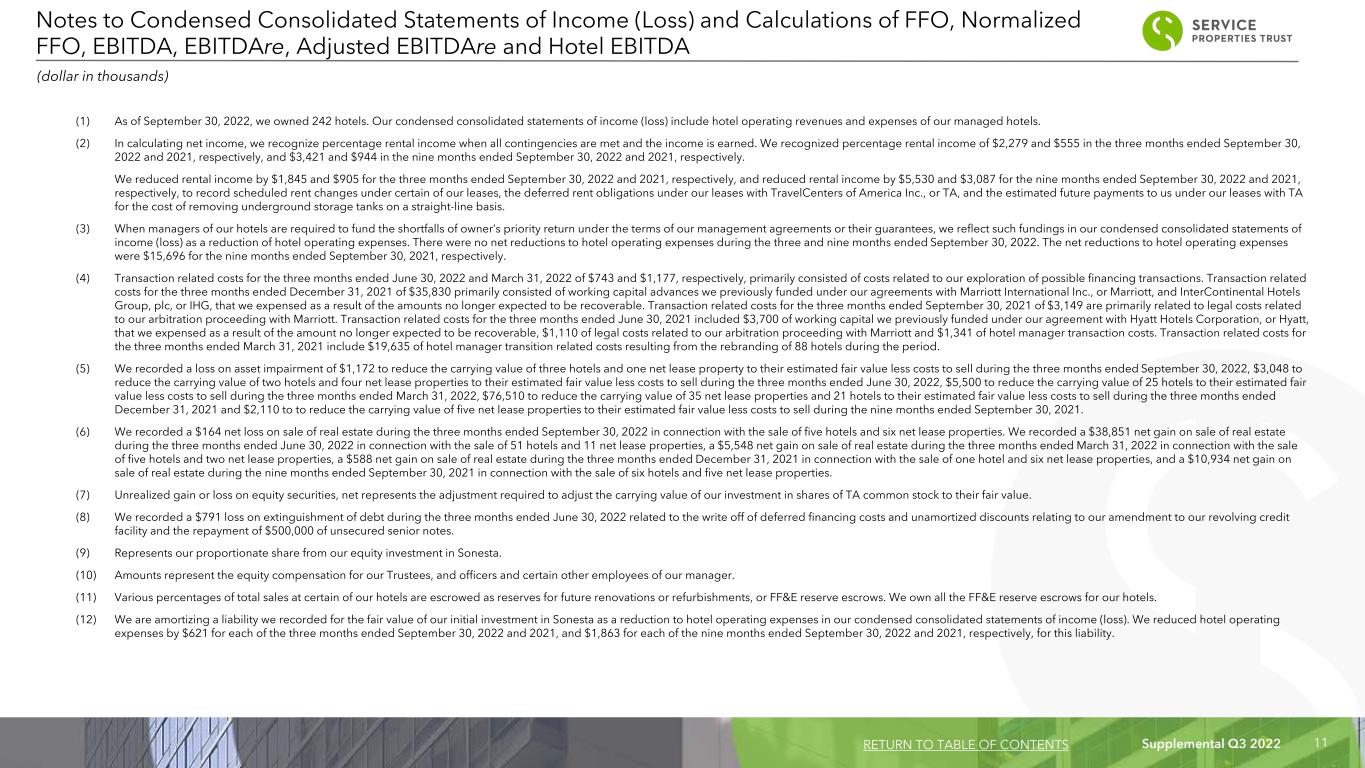

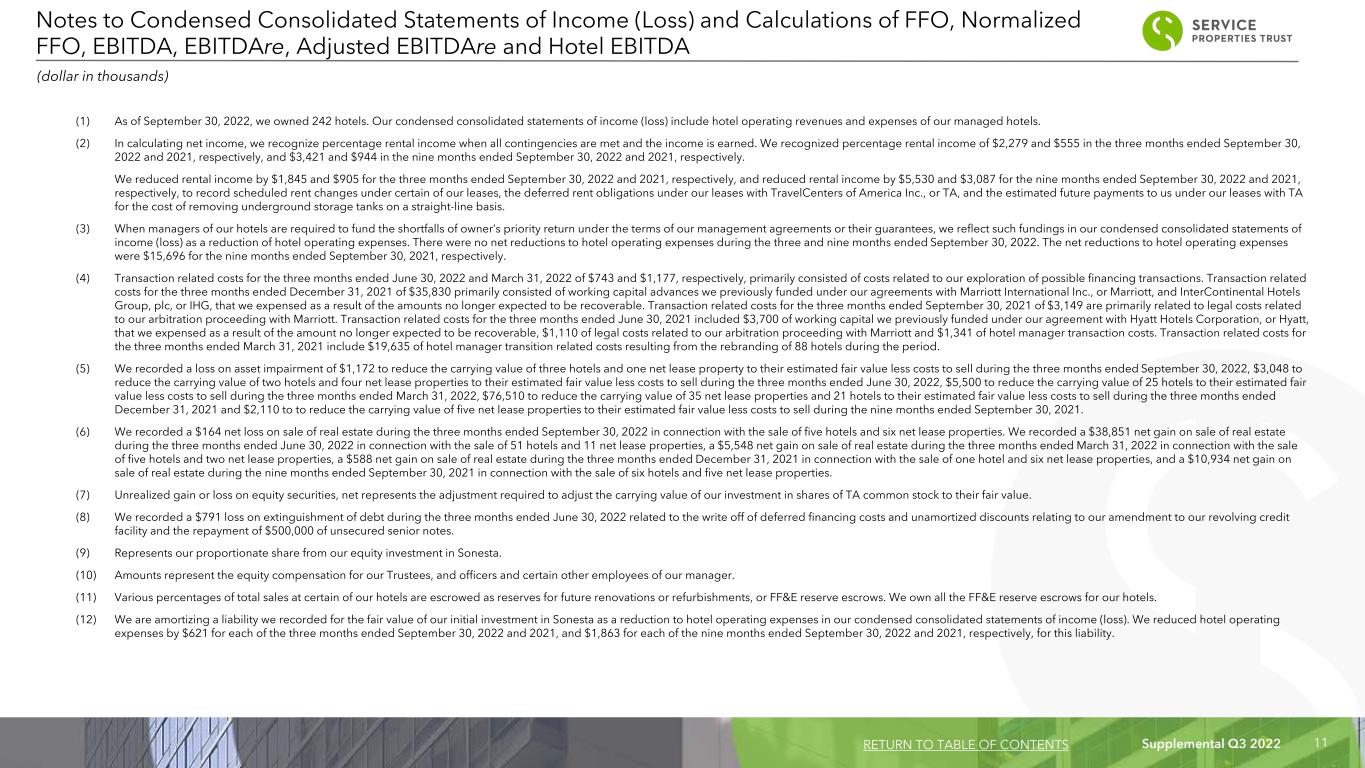

Supplemental Q3 2022 11 Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA (dollar in thousands) RETURN TO TABLE OF CONTENTS (1) As of September 30, 2022, we owned 242 hotels. Our condensed consolidated statements of income (loss) include hotel operating revenues and expenses of our managed hotels. (2) In calculating net income, we recognize percentage rental income when all contingencies are met and the income is earned. We recognized percentage rental income of $2,279 and $555 in the three months ended September 30, 2022 and 2021, respectively, and $3,421 and $944 in the nine months ended September 30, 2022 and 2021, respectively. We reduced rental income by $1,845 and $905 for the three months ended September 30, 2022 and 2021, respectively, and reduced rental income by $5,530 and $3,087 for the nine months ended September 30, 2022 and 2021, respectively, to record scheduled rent changes under certain of our leases, the deferred rent obligations under our leases with TravelCenters of America Inc., or TA, and the estimated future payments to us under our leases with TA for the cost of removing underground storage tanks on a straight-line basis. (3) When managers of our hotels are required to fund the shortfalls of owner’s priority return under the terms of our management agreements or their guarantees, we reflect such fundings in our condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. There were no net reductions to hotel operating expenses during the three and nine months ended September 30, 2022. The net reductions to hotel operating expenses were $15,696 for the nine months ended September 30, 2021, respectively. (4) Transaction related costs for the three months ended June 30, 2022 and March 31, 2022 of $743 and $1,177, respectively, primarily consisted of costs related to our exploration of possible financing transactions. Transaction related costs for the three months ended December 31, 2021 of $35,830 primarily consisted of working capital advances we previously funded under our agreements with Marriott International Inc., or Marriott, and InterContinental Hotels Group, plc, or IHG, that we expensed as a result of the amounts no longer expected to be recoverable. Transaction related costs for the three months ended September 30, 2021 of $3,149 are primarily related to legal costs related to our arbitration proceeding with Marriott. Transaction related costs for the three months ended June 30, 2021 included $3,700 of working capital we previously funded under our agreement with Hyatt Hotels Corporation, or Hyatt, that we expensed as a result of the amount no longer expected to be recoverable, $1,110 of legal costs related to our arbitration proceeding with Marriott and $1,341 of hotel manager transaction costs. Transaction related costs for the three months ended March 31, 2021 include $19,635 of hotel manager transition related costs resulting from the rebranding of 88 hotels during the period. (5) We recorded a loss on asset impairment of $1,172 to reduce the carrying value of three hotels and one net lease property to their estimated fair value less costs to sell during the three months ended September 30, 2022, $3,048 to reduce the carrying value of two hotels and four net lease properties to their estimated fair value less costs to sell during the three months ended June 30, 2022, $5,500 to reduce the carrying value of 25 hotels to their estimated fair value less costs to sell during the three months ended March 31, 2022, $76,510 to reduce the carrying value of 35 net lease properties and 21 hotels to their estimated fair value less costs to sell during the three months ended December 31, 2021 and $2,110 to to reduce the carrying value of five net lease properties to their estimated fair value less costs to sell during the nine months ended September 30, 2021. (6) We recorded a $164 net loss on sale of real estate during the three months ended September 30, 2022 in connection with the sale of five hotels and six net lease properties. We recorded a $38,851 net gain on sale of real estate during the three months ended June 30, 2022 in connection with the sale of 51 hotels and 11 net lease properties, a $5,548 net gain on sale of real estate during the three months ended March 31, 2022 in connection with the sale of five hotels and two net lease properties, a $588 net gain on sale of real estate during the three months ended December 31, 2021 in connection with the sale of one hotel and six net lease properties, and a $10,934 net gain on sale of real estate during the nine months ended September 30, 2021 in connection with the sale of six hotels and five net lease properties. (7) Unrealized gain or loss on equity securities, net represents the adjustment required to adjust the carrying value of our investment in shares of TA common stock to their fair value. (8) We recorded a $791 loss on extinguishment of debt during the three months ended June 30, 2022 related to the write off of deferred financing costs and unamortized discounts relating to our amendment to our revolving credit facility and the repayment of $500,000 of unsecured senior notes. (9) Represents our proportionate share from our equity investment in Sonesta. (10) Amounts represent the equity compensation for our Trustees, and officers and certain other employees of our manager. (11) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. (12) We are amortizing a liability we recorded for the fair value of our initial investment in Sonesta as a reduction to hotel operating expenses in our condensed consolidated statements of income (loss). We reduced hotel operating expenses by $621 for each of the three months ended September 30, 2022 and 2021, and $1,863 for each of the nine months ended September 30, 2022 and 2021, respectively, for this liability.

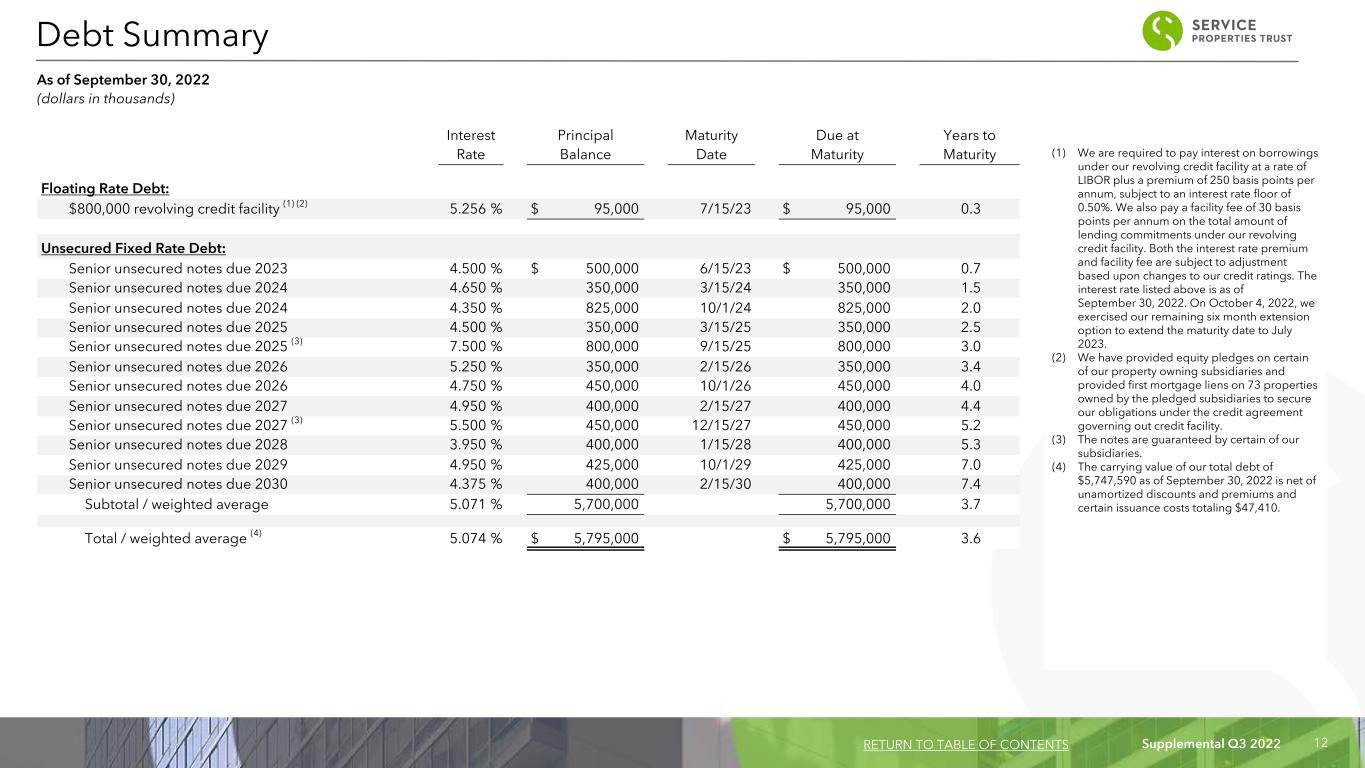

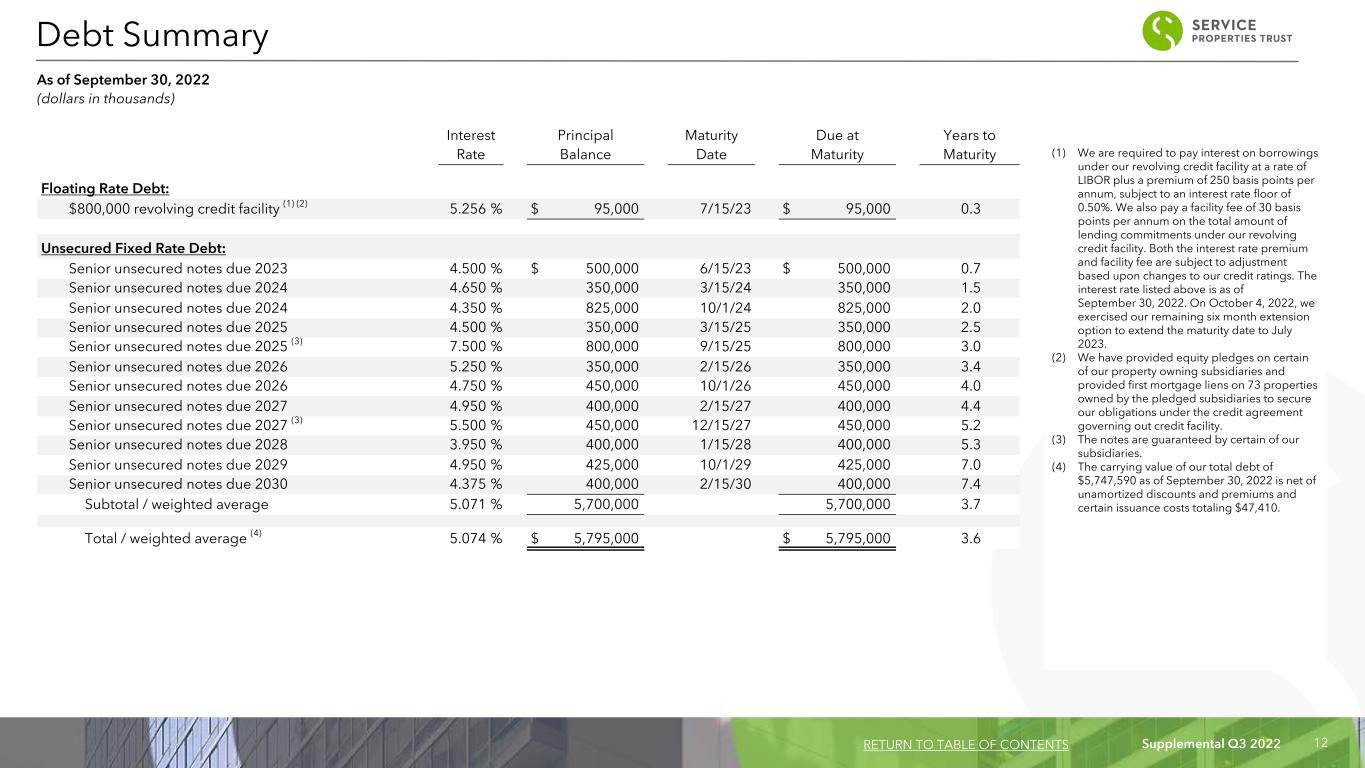

Supplemental Q3 2022 12 (1) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 250 basis points per annum, subject to an interest rate floor of 0.50%. We also pay a facility fee of 30 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed above is as of September 30, 2022. On October 4, 2022, we exercised our remaining six month extension option to extend the maturity date to July 2023. (2) We have provided equity pledges on certain of our property owning subsidiaries and provided first mortgage liens on 73 properties owned by the pledged subsidiaries to secure our obligations under the credit agreement governing out credit facility. (3) The notes are guaranteed by certain of our subsidiaries. (4) The carrying value of our total debt of $5,747,590 as of September 30, 2022 is net of unamortized discounts and premiums and certain issuance costs totaling $47,410. Interest Principal Maturity Due at Years to Rate Balance Date Maturity Maturity Floating Rate Debt: $800,000 revolving credit facility (1) (2) 5.256 % $ 95,000 7/15/23 $ 95,000 0.3 Unsecured Fixed Rate Debt: Senior unsecured notes due 2023 4.500 % $ 500,000 6/15/23 $ 500,000 0.7 Senior unsecured notes due 2024 4.650 % 350,000 3/15/24 350,000 1.5 Senior unsecured notes due 2024 4.350 % 825,000 10/1/24 825,000 2.0 Senior unsecured notes due 2025 4.500 % 350,000 3/15/25 350,000 2.5 Senior unsecured notes due 2025 (3) 7.500 % 800,000 9/15/25 800,000 3.0 Senior unsecured notes due 2026 5.250 % 350,000 2/15/26 350,000 3.4 Senior unsecured notes due 2026 4.750 % 450,000 10/1/26 450,000 4.0 Senior unsecured notes due 2027 4.950 % 400,000 2/15/27 400,000 4.4 Senior unsecured notes due 2027 (3) 5.500 % 450,000 12/15/27 450,000 5.2 Senior unsecured notes due 2028 3.950 % 400,000 1/15/28 400,000 5.3 Senior unsecured notes due 2029 4.950 % 425,000 10/1/29 425,000 7.0 Senior unsecured notes due 2030 4.375 % 400,000 2/15/30 400,000 7.4 Subtotal / weighted average 5.071 % 5,700,000 5,700,000 3.7 Total / weighted average (4) 5.074 % $ 5,795,000 $ 5,795,000 3.6 Debt Summary As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q3 2022 13 (1) Represents amounts outstanding under our revolving credit facility at September 30, 2022. $ (M ill io ns ) $0 $500 $1,175 $1,150 $800 $850 $400 $425 $400 $— $95 Fixed Rate Debt Revolving Credit Facility 2022 2023 2024 2025 2026 2027 2028 2029 2030 0 250 500 750 1,000 1,250 Debt Maturity Schedule As of September 30, 2022 RETURN TO TABLE OF CONTENTS (1) Sonesta ES Suites Carmel Mountain San Diego, CA

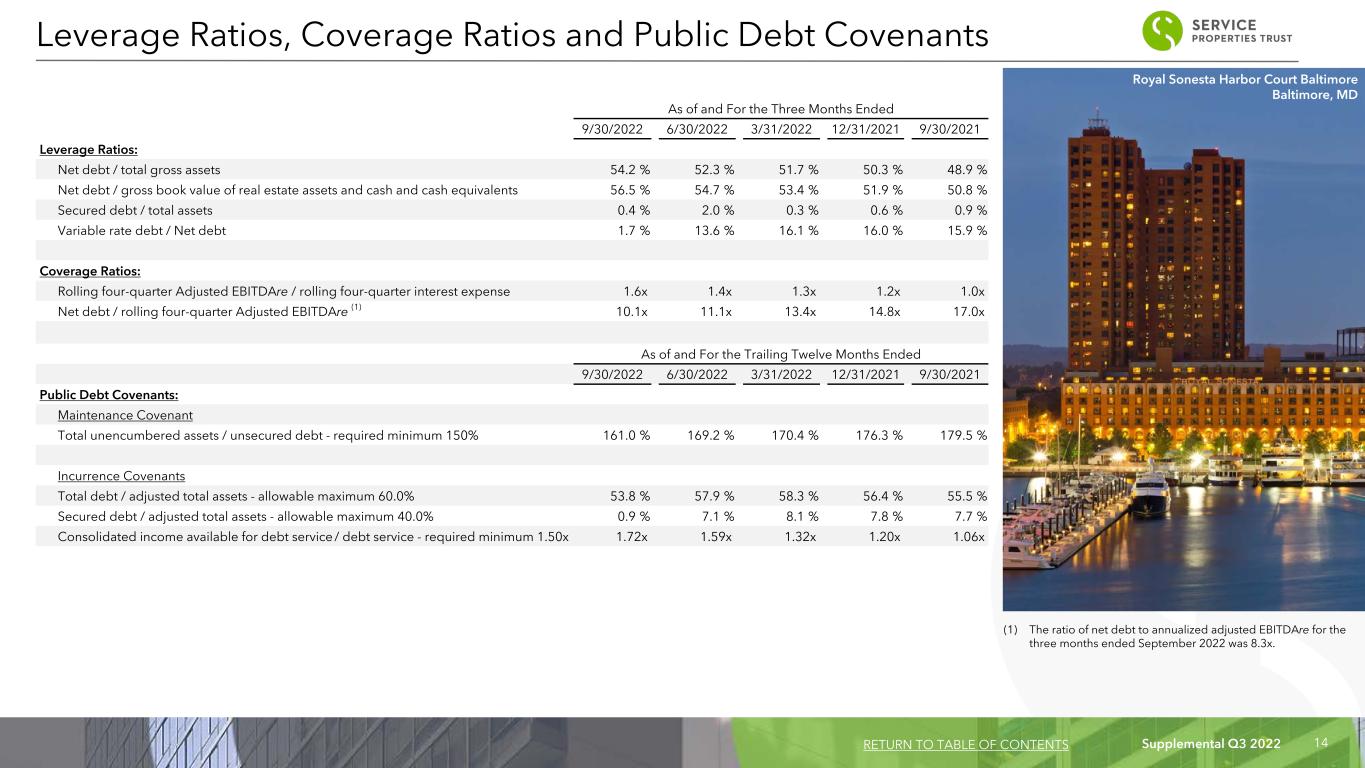

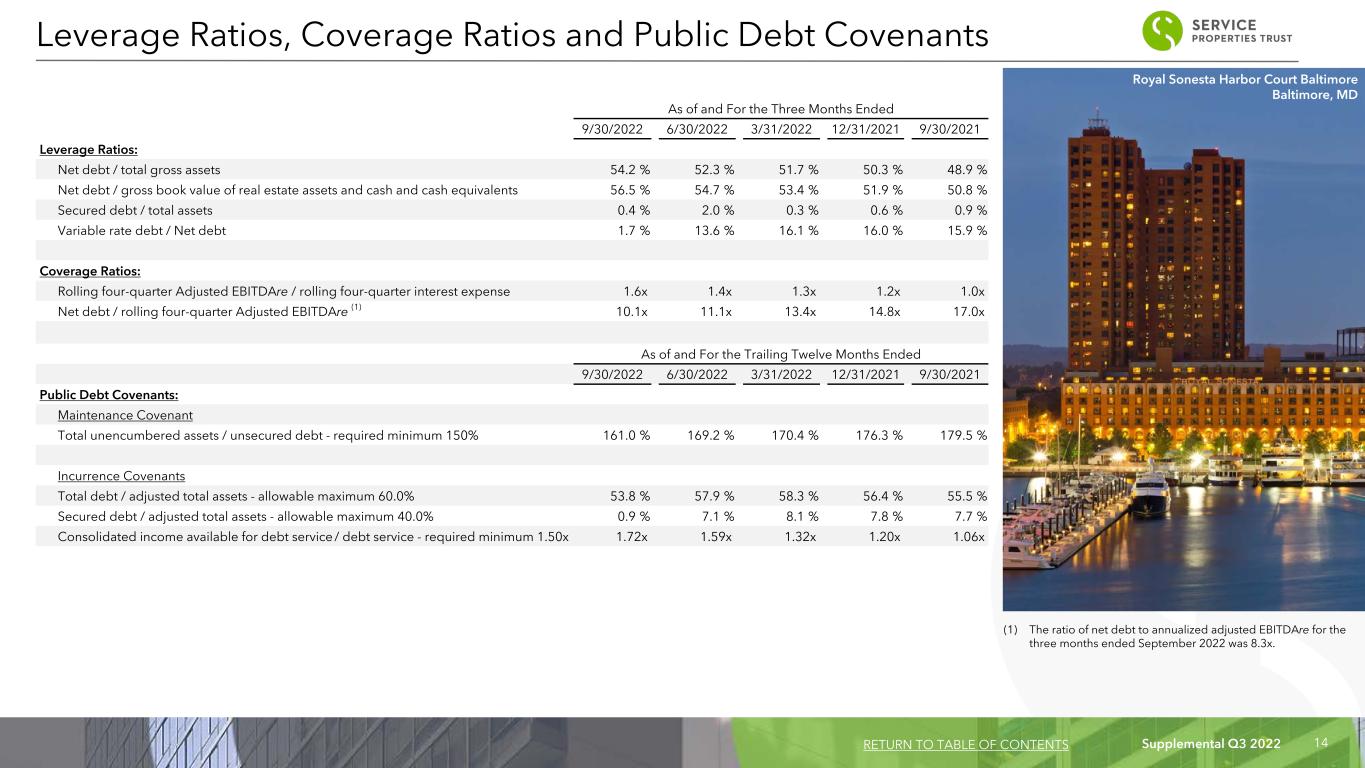

Supplemental Q3 2022 14 As of and For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Leverage Ratios: Net debt / total gross assets 54.2 % 52.3 % 51.7 % 50.3 % 48.9 % Net debt / gross book value of real estate assets and cash and cash equivalents 56.5 % 54.7 % 53.4 % 51.9 % 50.8 % Secured debt / total assets 0.4 % 2.0 % 0.3 % 0.6 % 0.9 % Variable rate debt / Net debt 1.7 % 13.6 % 16.1 % 16.0 % 15.9 % Coverage Ratios: Rolling four-quarter Adjusted EBITDAre / rolling four-quarter interest expense 1.6x 1.4x 1.3x 1.2x 1.0x Net debt / rolling four-quarter Adjusted EBITDAre (1) 10.1x 11.1x 13.4x 14.8x 17.0x As of and For the Trailing Twelve Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150% 161.0 % 169.2 % 170.4 % 176.3 % 179.5 % Incurrence Covenants Total debt / adjusted total assets - allowable maximum 60.0% 53.8 % 57.9 % 58.3 % 56.4 % 55.5 % Secured debt / adjusted total assets - allowable maximum 40.0% 0.9 % 7.1 % 8.1 % 7.8 % 7.7 % Consolidated income available for debt service / debt service - required minimum 1.50x 1.72x 1.59x 1.32x 1.20x 1.06x Leverage Ratios, Coverage Ratios and Public Debt Covenants RETURN TO TABLE OF CONTENTS (1) The ratio of net debt to annualized adjusted EBITDAre for the three months ended September 2022 was 8.3x. Royal Sonesta Harbor Court Baltimore Baltimore, MD

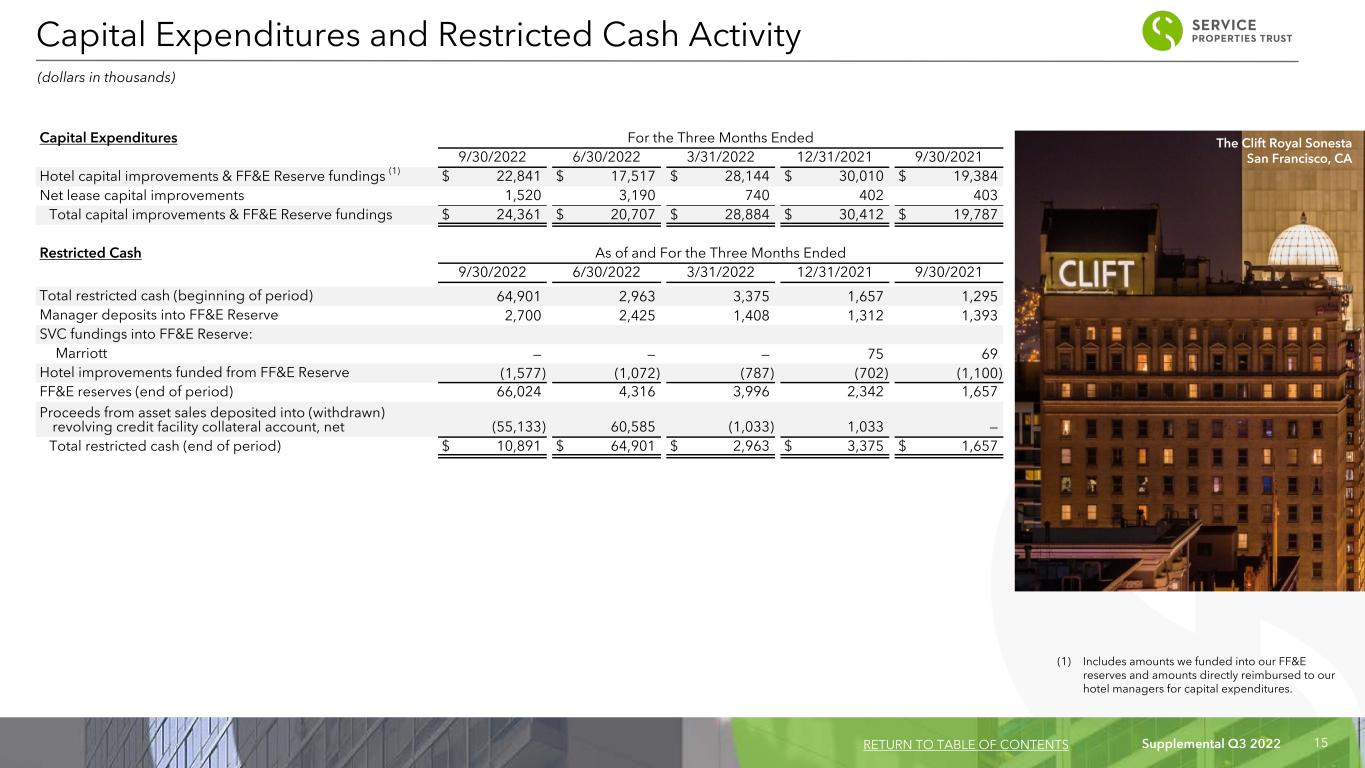

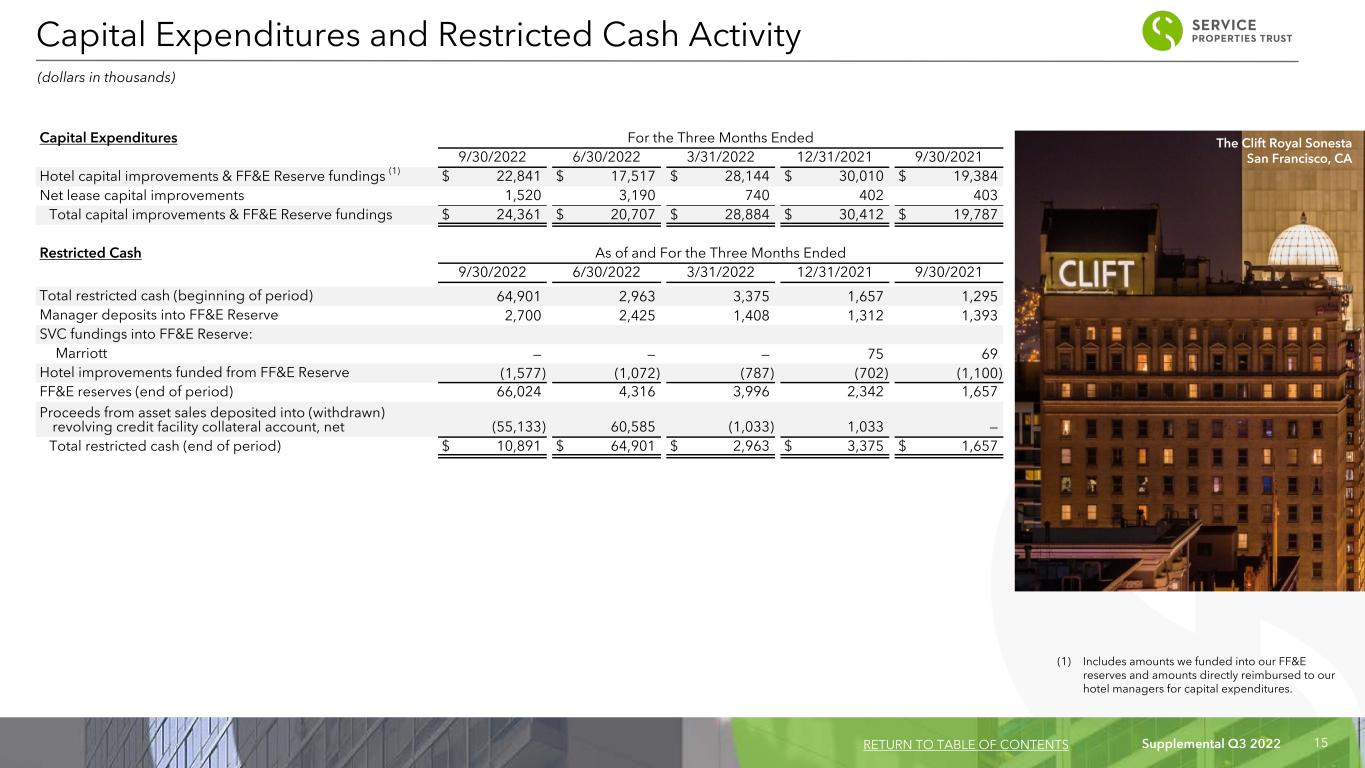

Supplemental Q3 2022 15 Capital Expenditures For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Hotel capital improvements & FF&E Reserve fundings (1) $ 22,841 $ 17,517 $ 28,144 $ 30,010 $ 19,384 Net lease capital improvements 1,520 3,190 740 402 403 Total capital improvements & FF&E Reserve fundings $ 24,361 $ 20,707 $ 28,884 $ 30,412 $ 19,787 Restricted Cash As of and For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Total restricted cash (beginning of period) 64,901 2,963 3,375 1,657 1,295 Manager deposits into FF&E Reserve 2,700 2,425 1,408 1,312 1,393 SVC fundings into FF&E Reserve: Marriott — — — 75 69 Hotel improvements funded from FF&E Reserve (1,577) (1,072) (787) (702) (1,100) FF&E reserves (end of period) 66,024 4,316 3,996 2,342 1,657 Proceeds from asset sales deposited into (withdrawn) revolving credit facility collateral account, net (55,133) 60,585 (1,033) 1,033 — Total restricted cash (end of period) $ 10,891 $ 64,901 $ 2,963 $ 3,375 $ 1,657 (1) Includes amounts we funded into our FF&E reserves and amounts directly reimbursed to our hotel managers for capital expenditures. (dollars in thousands) Capital Expenditures and Restricted Cash Activity RETURN TO TABLE OF CONTENTS The Clift Royal Sonesta San Francisco, CA

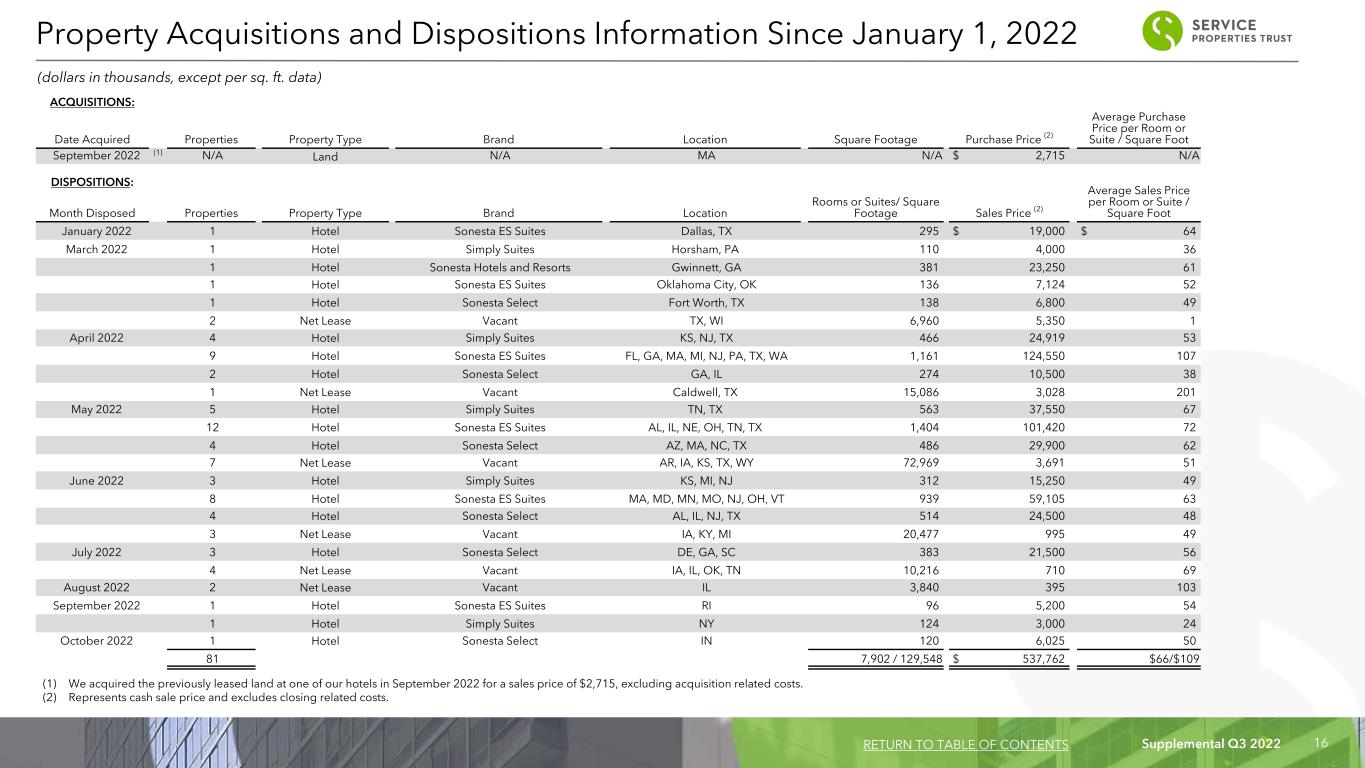

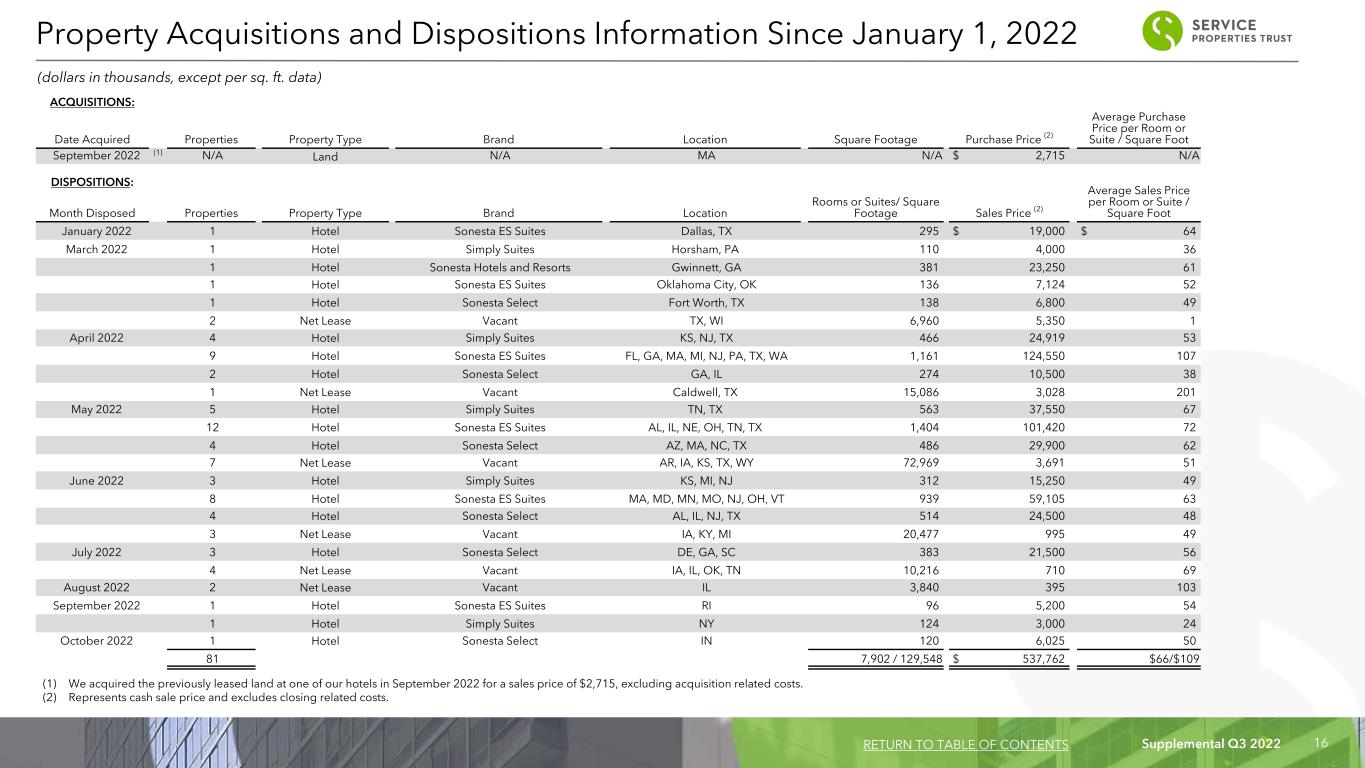

Supplemental Q3 2022 16 ACQUISITIONS: Square Footage Purchase Price (2) Average Purchase Price per Room or Suite / Square FootDate Acquired Properties Property Type Brand Location September 2022 (1) N/A Land N/A MA N/A $ 2,715 N/A DISPOSITIONS: Rooms or Suites/ Square Footage Average Sales Price per Room or Suite / Square FootMonth Disposed Properties Property Type Brand Location Sales Price (2) January 2022 1 Hotel Sonesta ES Suites Dallas, TX 295 $ 19,000 $ 64 March 2022 1 Hotel Simply Suites Horsham, PA 110 4,000 36 1 Hotel Sonesta Hotels and Resorts Gwinnett, GA 381 23,250 61 1 Hotel Sonesta ES Suites Oklahoma City, OK 136 7,124 52 1 Hotel Sonesta Select Fort Worth, TX 138 6,800 49 2 Net Lease Vacant TX, WI 6,960 5,350 1 April 2022 4 Hotel Simply Suites KS, NJ, TX 466 24,919 53 9 Hotel Sonesta ES Suites FL, GA, MA, MI, NJ, PA, TX, WA 1,161 124,550 107 2 Hotel Sonesta Select GA, IL 274 10,500 38 1 Net Lease Vacant Caldwell, TX 15,086 3,028 201 May 2022 5 Hotel Simply Suites TN, TX 563 37,550 67 12 Hotel Sonesta ES Suites AL, IL, NE, OH, TN, TX 1,404 101,420 72 4 Hotel Sonesta Select AZ, MA, NC, TX 486 29,900 62 7 Net Lease Vacant AR, IA, KS, TX, WY 72,969 3,691 51 June 2022 3 Hotel Simply Suites KS, MI, NJ 312 15,250 49 8 Hotel Sonesta ES Suites MA, MD, MN, MO, NJ, OH, VT 939 59,105 63 4 Hotel Sonesta Select AL, IL, NJ, TX 514 24,500 48 3 Net Lease Vacant IA, KY, MI 20,477 995 49 July 2022 3 Hotel Sonesta Select DE, GA, SC 383 21,500 56 4 Net Lease Vacant IA, IL, OK, TN 10,216 710 69 August 2022 2 Net Lease Vacant IL 3,840 395 103 September 2022 1 Hotel Sonesta ES Suites RI 96 5,200 54 1 Hotel Simply Suites NY 124 3,000 24 October 2022 1 Hotel Sonesta Select IN 120 6,025 50 81 7,902 / 129,548 $ 537,762 $66/$109 Property Acquisitions and Dispositions Information Since January 1, 2022 (dollars in thousands, except per sq. ft. data) (1) We acquired the previously leased land at one of our hotels in September 2022 for a sales price of $2,715, excluding acquisition related costs. (2) Represents cash sale price and excludes closing related costs. RETURN TO TABLE OF CONTENTS

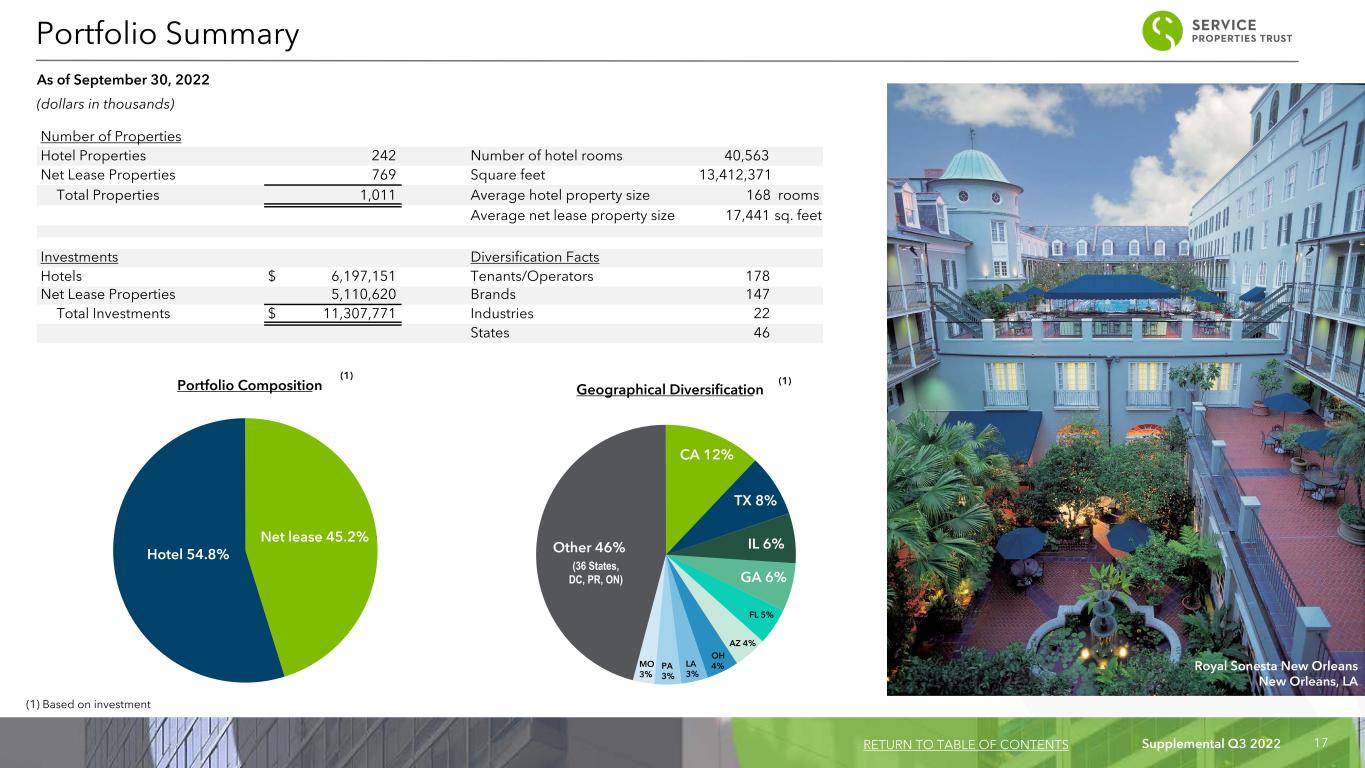

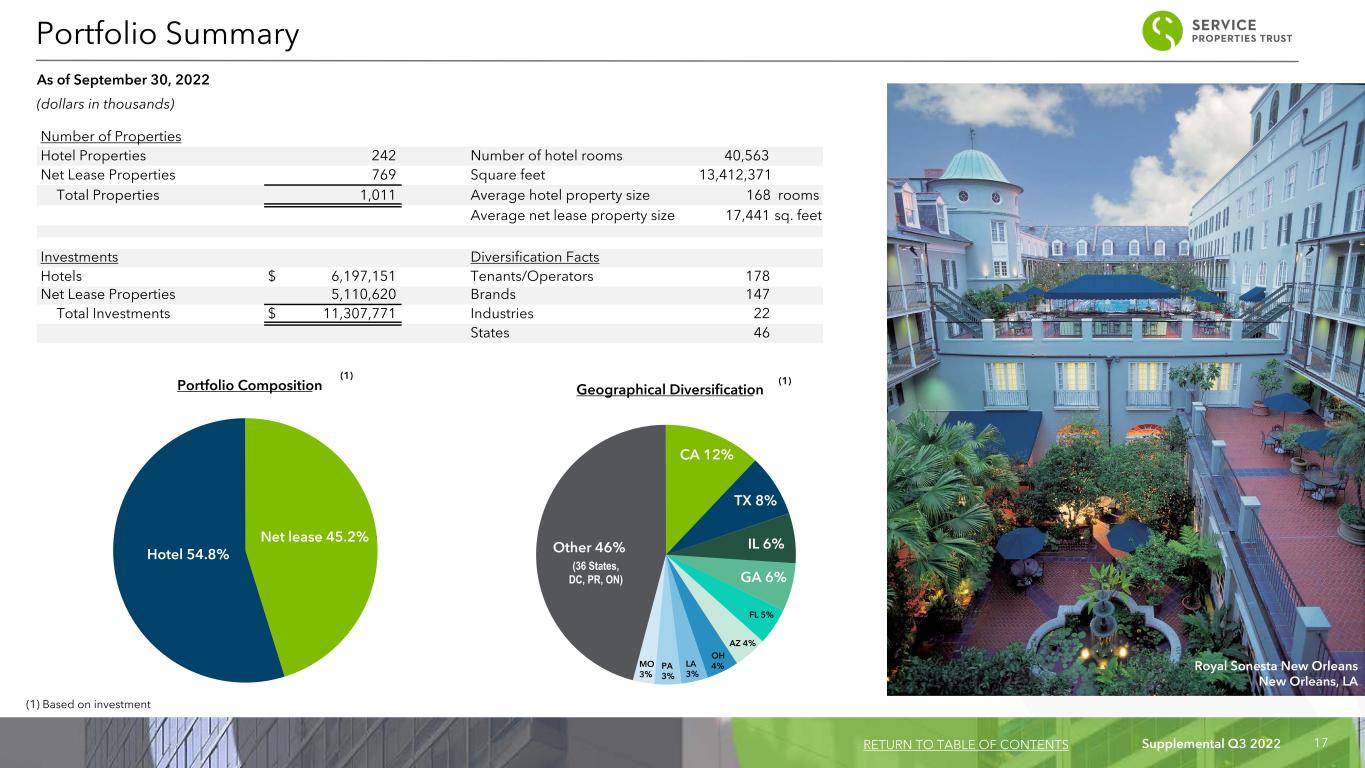

Supplemental Q3 2022 17 Portfolio Composition Net lease 45.2% Hotel 54.8% Number of Properties Hotel Properties 242 Number of hotel rooms 40,563 Net Lease Properties 769 Square feet 13,412,371 Total Properties 1,011 Average hotel property size 168 rooms Average net lease property size 17,441 sq. feet Investments Diversification Facts Hotels $ 6,197,151 Tenants/Operators 178 Net Lease Properties 5,110,620 Brands 147 Total Investments $ 11,307,771 Industries 22 States 46 Geographical Diversification CA 12% TX 8% IL 6% GA 6% FL 5% AZ 4% OH 4%LA 3% PA 3% MO 3% Other 46% (36 States, DC, PR, ON) Portfolio Summary As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS (1) Based on investment (1) (1) Royal Sonesta New Orleans New Orleans, LA

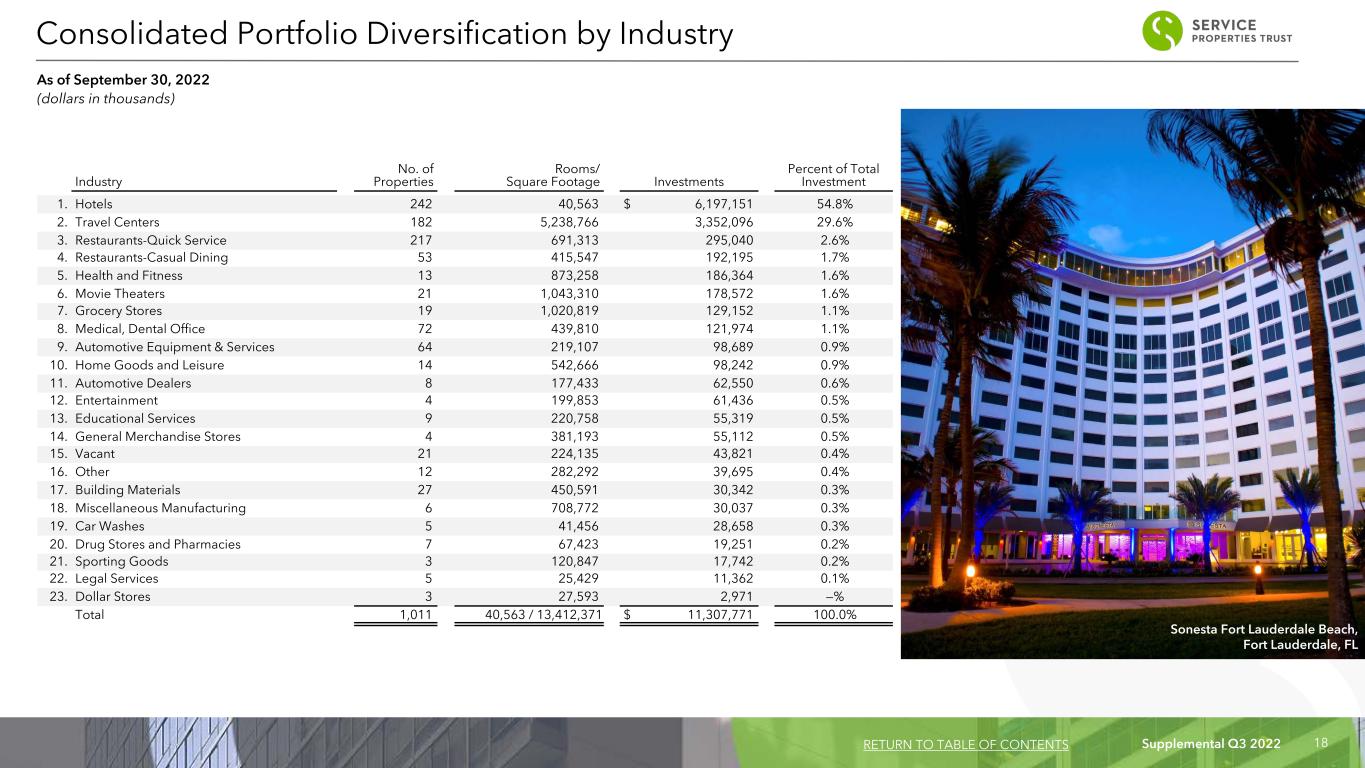

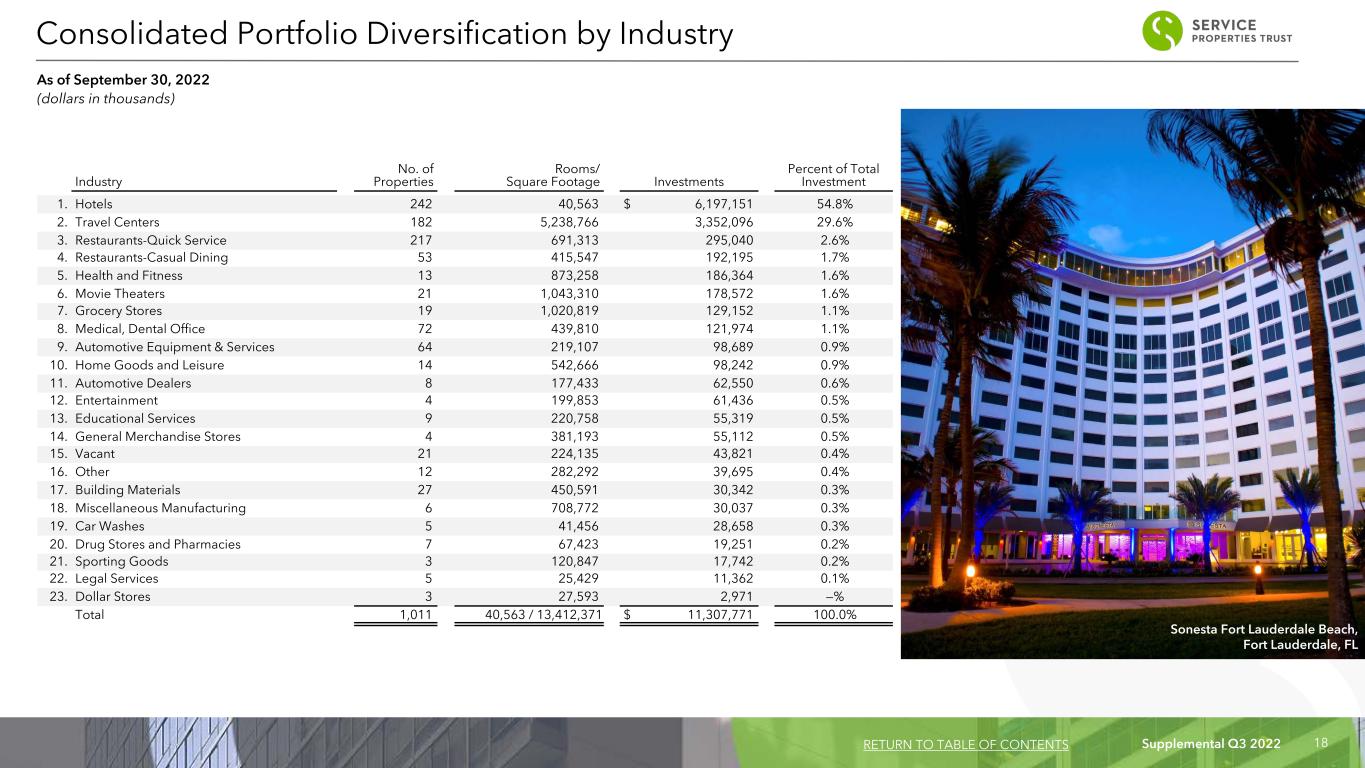

Supplemental Q3 2022 18 Industry No. of Properties Rooms/ Square Footage Investments Percent of Total Investment 1. Hotels 242 40,563 $ 6,197,151 54.8% 2. Travel Centers 182 5,238,766 3,352,096 29.6% 3. Restaurants-Quick Service 217 691,313 295,040 2.6% 4. Restaurants-Casual Dining 53 415,547 192,195 1.7% 5. Health and Fitness 13 873,258 186,364 1.6% 6. Movie Theaters 21 1,043,310 178,572 1.6% 7. Grocery Stores 19 1,020,819 129,152 1.1% 8. Medical, Dental Office 72 439,810 121,974 1.1% 9. Automotive Equipment & Services 64 219,107 98,689 0.9% 10. Home Goods and Leisure 14 542,666 98,242 0.9% 11. Automotive Dealers 8 177,433 62,550 0.6% 12. Entertainment 4 199,853 61,436 0.5% 13. Educational Services 9 220,758 55,319 0.5% 14. General Merchandise Stores 4 381,193 55,112 0.5% 15. Vacant 21 224,135 43,821 0.4% 16. Other 12 282,292 39,695 0.4% 17. Building Materials 27 450,591 30,342 0.3% 18. Miscellaneous Manufacturing 6 708,772 30,037 0.3% 19. Car Washes 5 41,456 28,658 0.3% 20. Drug Stores and Pharmacies 7 67,423 19,251 0.2% 21. Sporting Goods 3 120,847 17,742 0.2% 22. Legal Services 5 25,429 11,362 0.1% 23. Dollar Stores 3 27,593 2,971 —% Total 1,011 40,563 / 13,412,371 $ 11,307,771 100.0% Consolidated Portfolio Diversification by Industry As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS Sonesta Fort Lauderdale Beach, Fort Lauderdale, FL

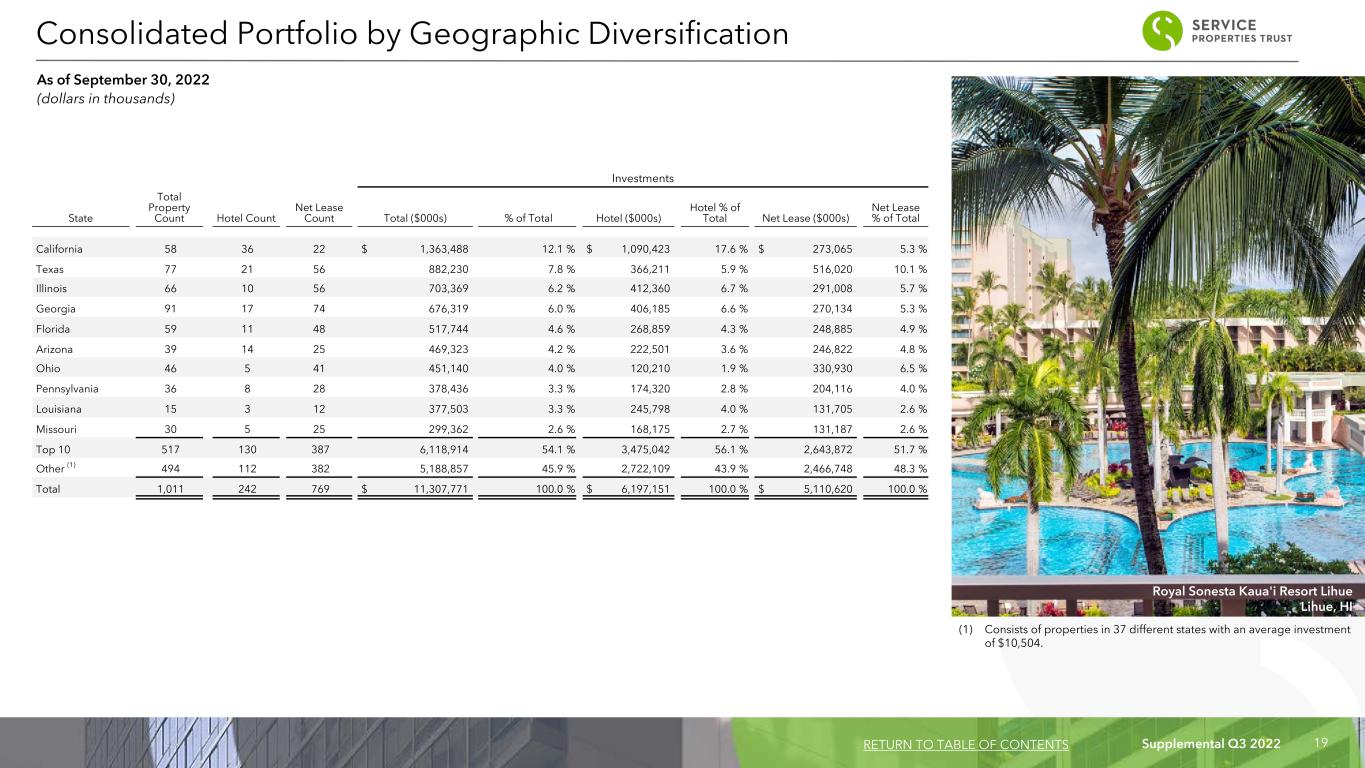

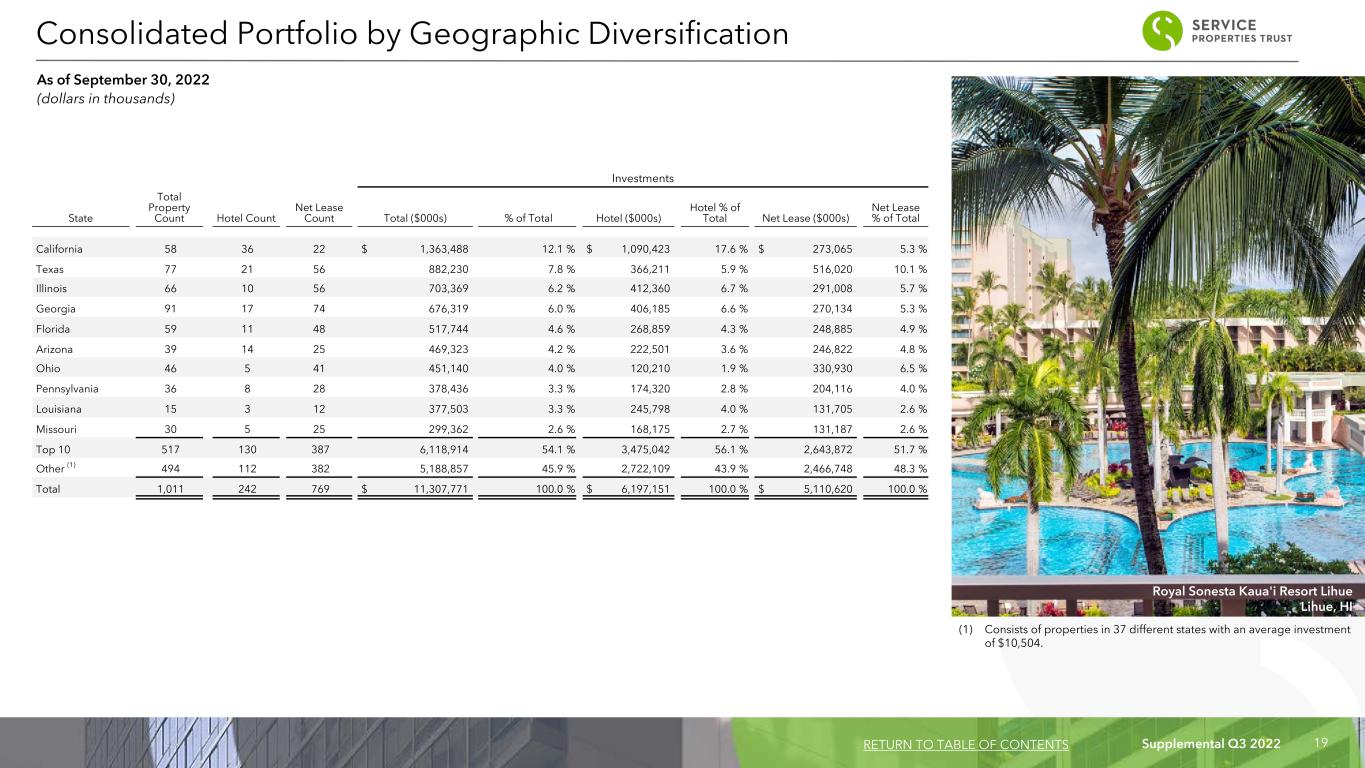

Supplemental Q3 2022 19 Investments State Total Property Count Hotel Count Net Lease Count Total ($000s) % of Total Hotel ($000s) Hotel % of Total Net Lease ($000s) Net Lease % of Total California 58 36 22 $ 1,363,488 12.1 % $ 1,090,423 17.6 % $ 273,065 5.3 % Texas 77 21 56 882,230 7.8 % 366,211 5.9 % 516,020 10.1 % Illinois 66 10 56 703,369 6.2 % 412,360 6.7 % 291,008 5.7 % Georgia 91 17 74 676,319 6.0 % 406,185 6.6 % 270,134 5.3 % Florida 59 11 48 517,744 4.6 % 268,859 4.3 % 248,885 4.9 % Arizona 39 14 25 469,323 4.2 % 222,501 3.6 % 246,822 4.8 % Ohio 46 5 41 451,140 4.0 % 120,210 1.9 % 330,930 6.5 % Pennsylvania 36 8 28 378,436 3.3 % 174,320 2.8 % 204,116 4.0 % Louisiana 15 3 12 377,503 3.3 % 245,798 4.0 % 131,705 2.6 % Missouri 30 5 25 299,362 2.6 % 168,175 2.7 % 131,187 2.6 % Top 10 517 130 387 6,118,914 54.1 % 3,475,042 56.1 % 2,643,872 51.7 % Other (1) 494 112 382 5,188,857 45.9 % 2,722,109 43.9 % 2,466,748 48.3 % Total 1,011 242 769 $ 11,307,771 100.0 % $ 6,197,151 100.0 % $ 5,110,620 100.0 % (1) Consists of properties in 37 different states with an average investment of $10,504. Consolidated Portfolio by Geographic Diversification As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS Royal Sonesta Kaua'i Resort Lihue Lihue, HI

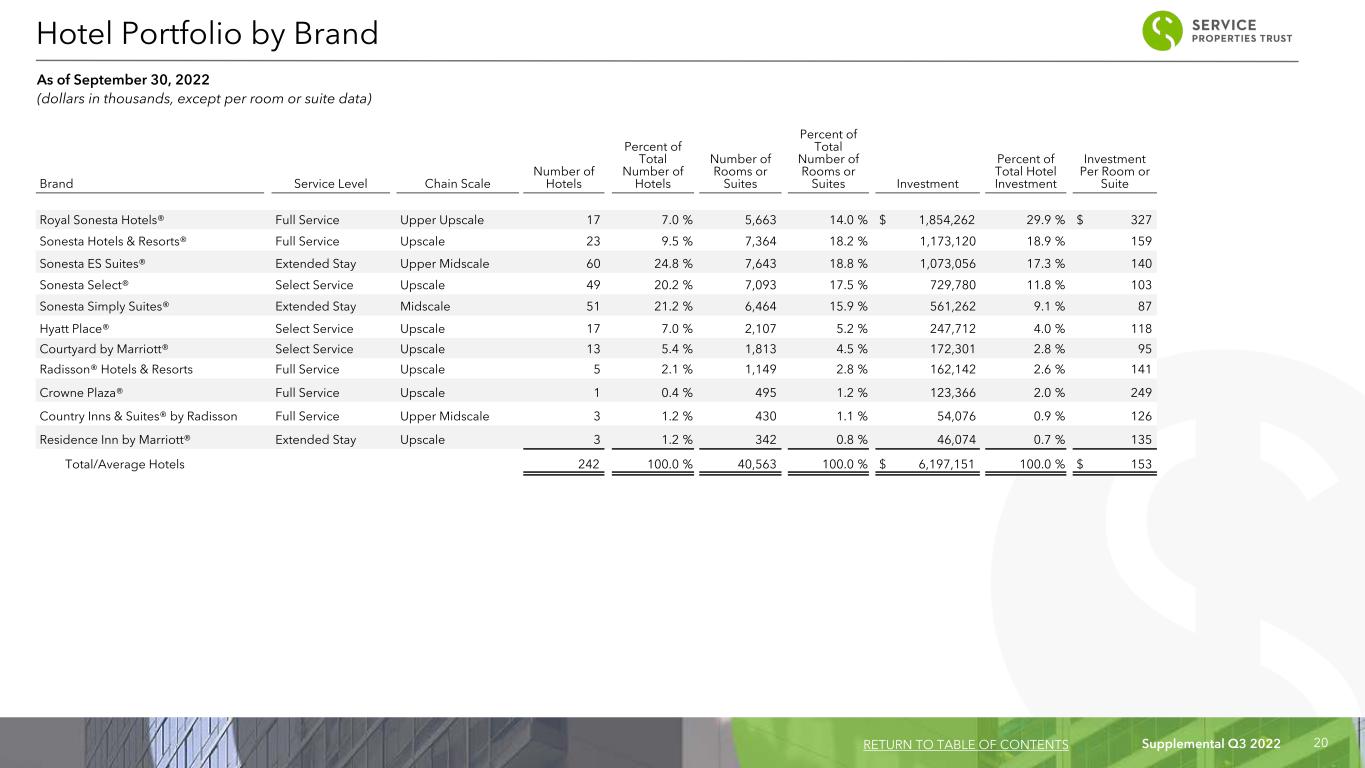

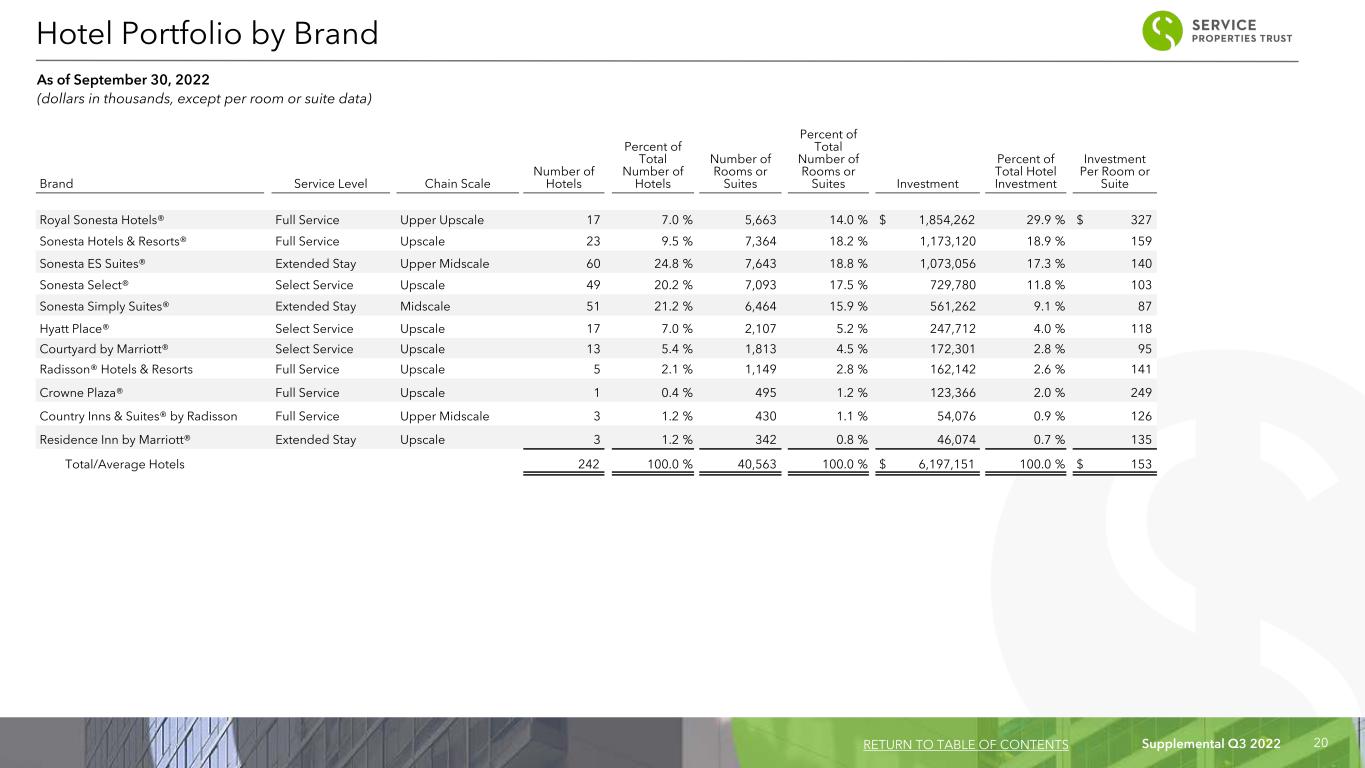

Supplemental Q3 2022 20 Brand Service Level Chain Scale Number of Hotels Percent of Total Number of Hotels Number of Rooms or Suites Percent of Total Number of Rooms or Suites Investment Percent of Total Hotel Investment Investment Per Room or Suite Royal Sonesta Hotels® Full Service Upper Upscale 17 7.0 % 5,663 14.0 % $ 1,854,262 29.9 % $ 327 Sonesta Hotels & Resorts® Full Service Upscale 23 9.5 % 7,364 18.2 % 1,173,120 18.9 % 159 Sonesta ES Suites® Extended Stay Upper Midscale 60 24.8 % 7,643 18.8 % 1,073,056 17.3 % 140 Sonesta Select® Select Service Upscale 49 20.2 % 7,093 17.5 % 729,780 11.8 % 103 Sonesta Simply Suites® Extended Stay Midscale 51 21.2 % 6,464 15.9 % 561,262 9.1 % 87 Hyatt Place® Select Service Upscale 17 7.0 % 2,107 5.2 % 247,712 4.0 % 118 Courtyard by Marriott® Select Service Upscale 13 5.4 % 1,813 4.5 % 172,301 2.8 % 95 Radisson® Hotels & Resorts Full Service Upscale 5 2.1 % 1,149 2.8 % 162,142 2.6 % 141 Crowne Plaza® Full Service Upscale 1 0.4 % 495 1.2 % 123,366 2.0 % 249 Country Inns & Suites® by Radisson Full Service Upper Midscale 3 1.2 % 430 1.1 % 54,076 0.9 % 126 Residence Inn by Marriott® Extended Stay Upscale 3 1.2 % 342 0.8 % 46,074 0.7 % 135 Total/Average Hotels 242 100.0 % 40,563 100.0 % $ 6,197,151 100.0 % $ 153 Hotel Portfolio by Brand As of September 30, 2022 (dollars in thousands, except per room or suite data) RETURN TO TABLE OF CONTENTS

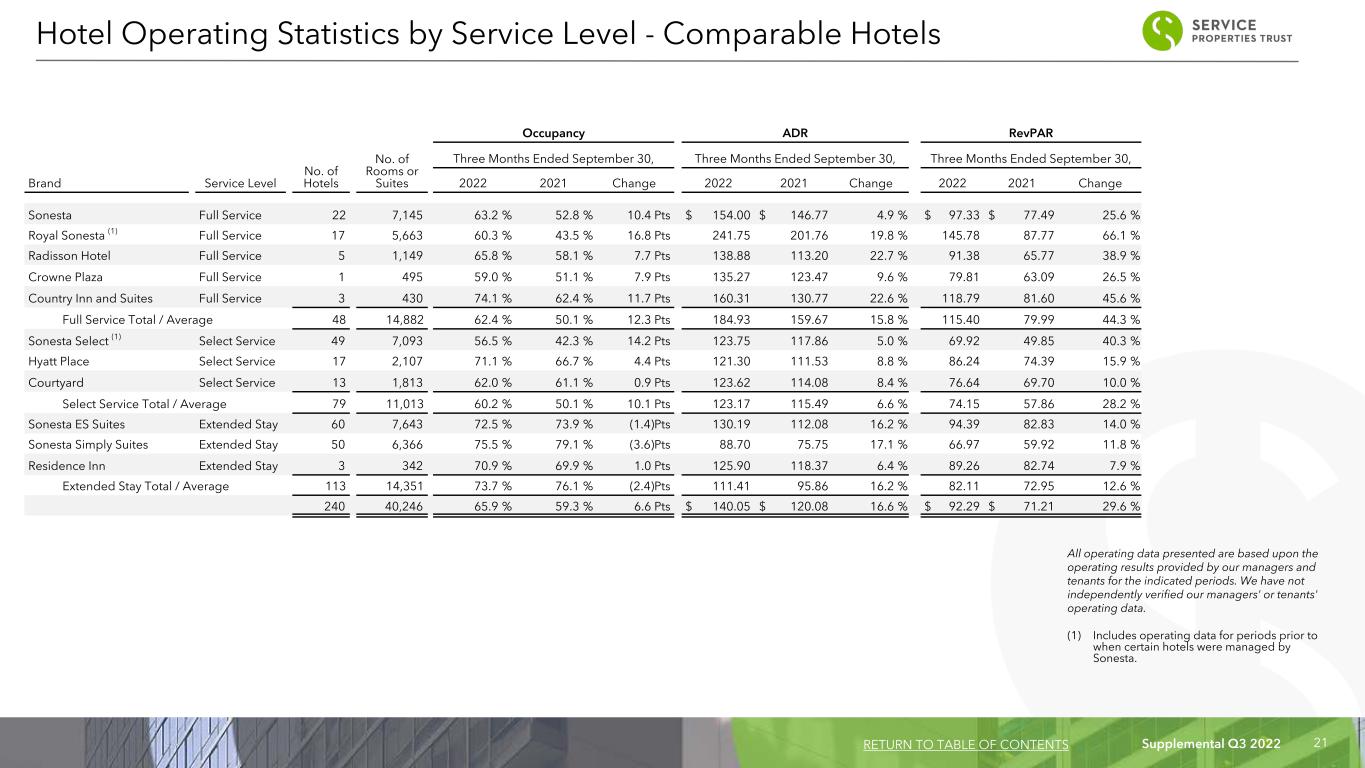

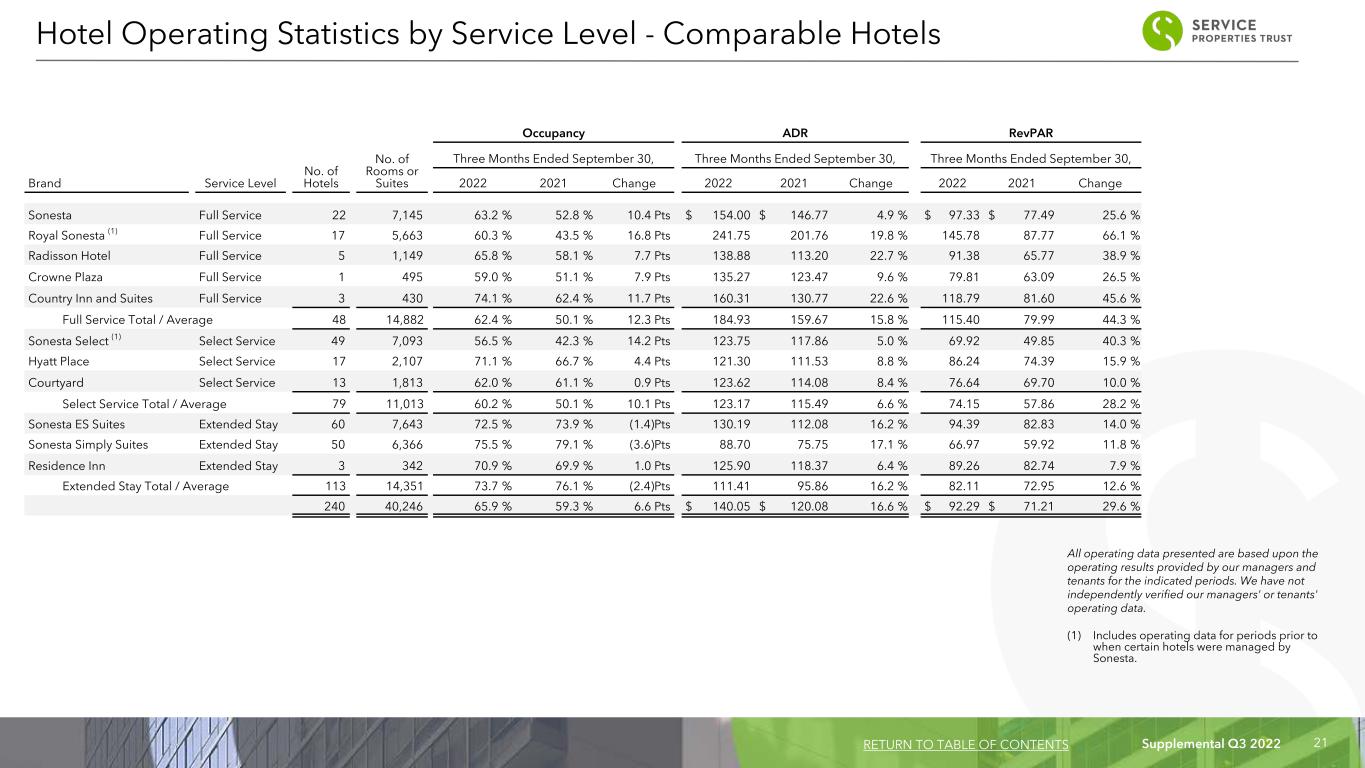

Supplemental Q3 2022 21 Occupancy ADR RevPAR No. of Hotels No. of Rooms or Suites Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Brand Service Level 2022 2021 Change 2022 2021 Change 2022 2021 Change Sonesta Full Service 22 7,145 63.2 % 52.8 % 10.4 Pts $ 154.00 $ 146.77 4.9 % $ 97.33 $ 77.49 25.6 % Royal Sonesta (1) Full Service 17 5,663 60.3 % 43.5 % 16.8 Pts 241.75 201.76 19.8 % 145.78 87.77 66.1 % Radisson Hotel Full Service 5 1,149 65.8 % 58.1 % 7.7 Pts 138.88 113.20 22.7 % 91.38 65.77 38.9 % Crowne Plaza Full Service 1 495 59.0 % 51.1 % 7.9 Pts 135.27 123.47 9.6 % 79.81 63.09 26.5 % Country Inn and Suites Full Service 3 430 74.1 % 62.4 % 11.7 Pts 160.31 130.77 22.6 % 118.79 81.60 45.6 % Full Service Total / Average 48 14,882 62.4 % 50.1 % 12.3 Pts 184.93 159.67 15.8 % 115.40 79.99 44.3 % Sonesta Select (1) Select Service 49 7,093 56.5 % 42.3 % 14.2 Pts 123.75 117.86 5.0 % 69.92 49.85 40.3 % Hyatt Place Select Service 17 2,107 71.1 % 66.7 % 4.4 Pts 121.30 111.53 8.8 % 86.24 74.39 15.9 % Courtyard Select Service 13 1,813 62.0 % 61.1 % 0.9 Pts 123.62 114.08 8.4 % 76.64 69.70 10.0 % Select Service Total / Average 79 11,013 60.2 % 50.1 % 10.1 Pts 123.17 115.49 6.6 % 74.15 57.86 28.2 % Sonesta ES Suites Extended Stay 60 7,643 72.5 % 73.9 % (1.4)Pts 130.19 112.08 16.2 % 94.39 82.83 14.0 % Sonesta Simply Suites Extended Stay 50 6,366 75.5 % 79.1 % (3.6)Pts 88.70 75.75 17.1 % 66.97 59.92 11.8 % Residence Inn Extended Stay 3 342 70.9 % 69.9 % 1.0 Pts 125.90 118.37 6.4 % 89.26 82.74 7.9 % Extended Stay Total / Average 113 14,351 73.7 % 76.1 % (2.4)Pts 111.41 95.86 16.2 % 82.11 72.95 12.6 % 240 40,246 65.9 % 59.3 % 6.6 Pts $ 140.05 $ 120.08 16.6 % $ 92.29 $ 71.21 29.6 % Hotel Operating Statistics by Service Level - Comparable Hotels RETURN TO TABLE OF CONTENTS All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Includes operating data for periods prior to when certain hotels were managed by Sonesta.

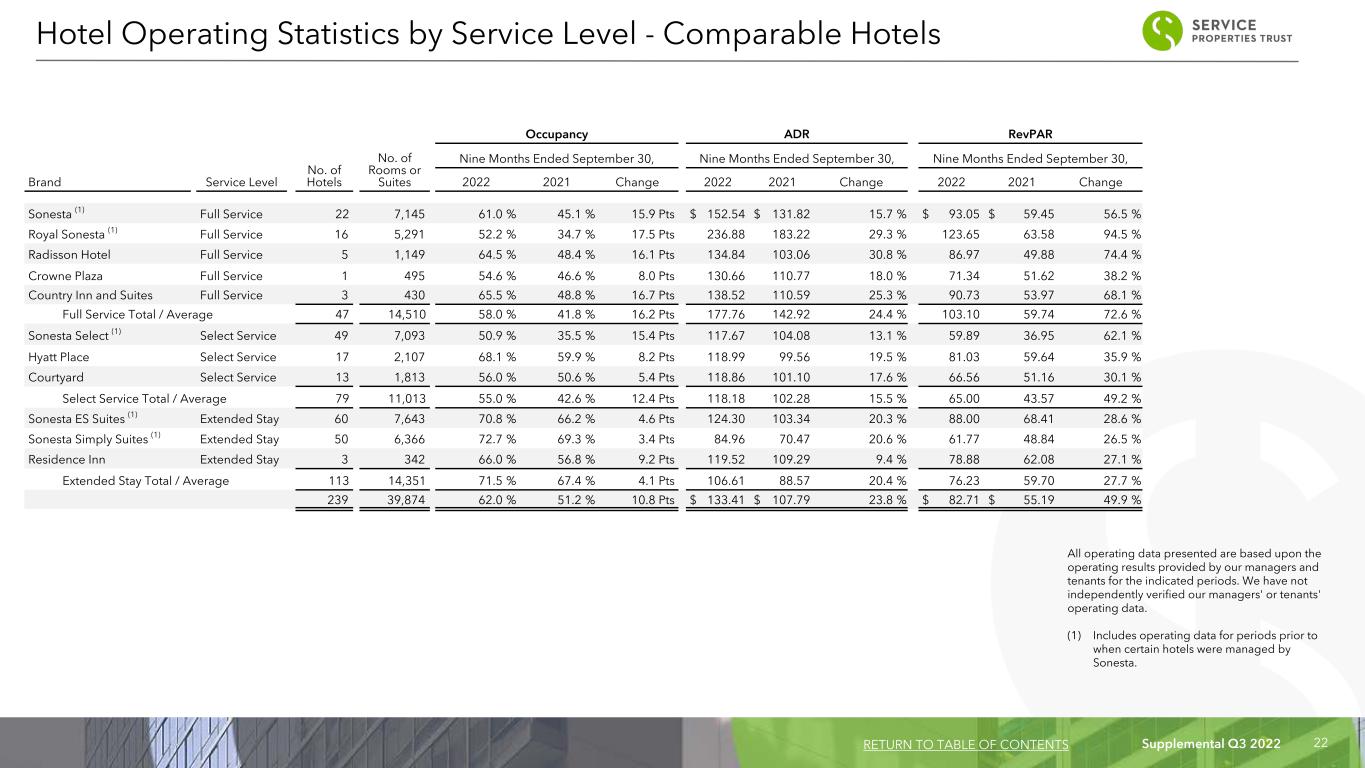

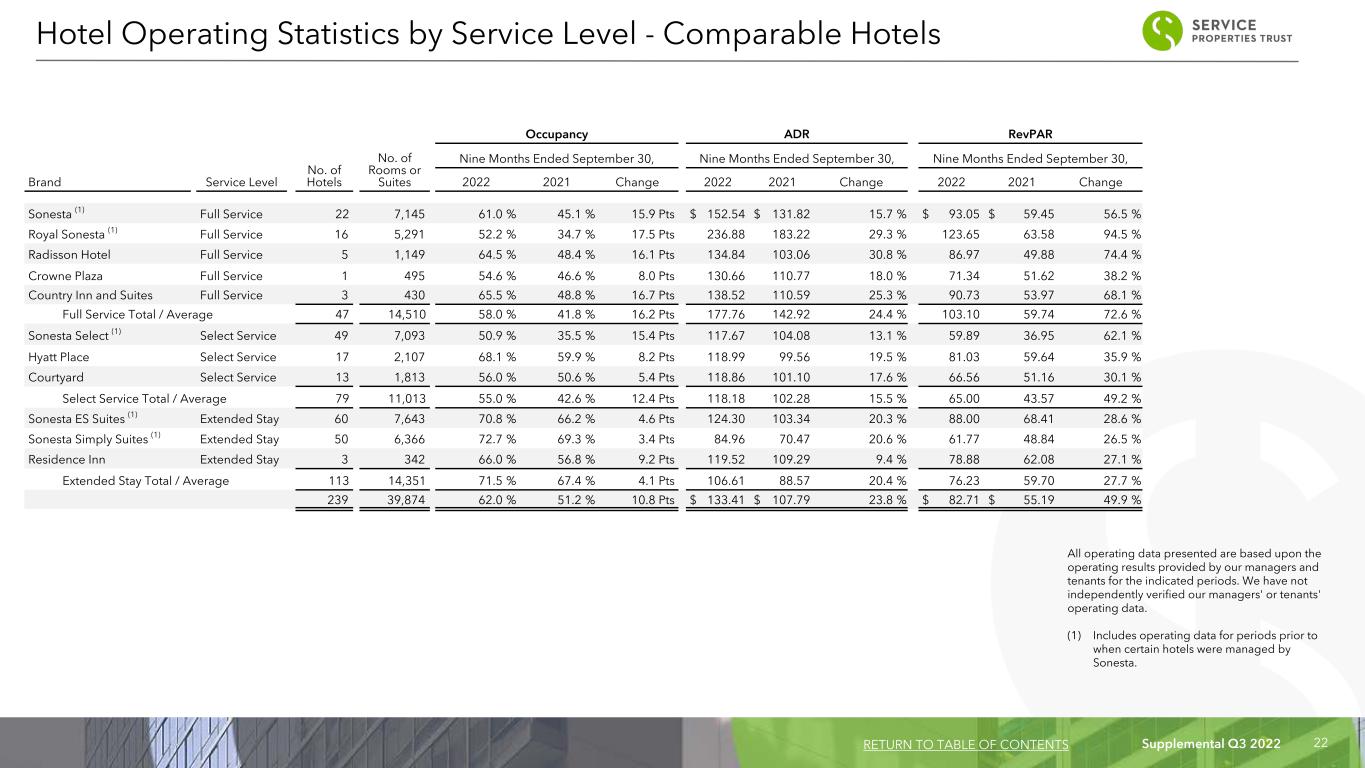

Supplemental Q3 2022 22 All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Includes operating data for periods prior to when certain hotels were managed by Sonesta. Occupancy ADR RevPAR No. of Hotels No. of Rooms or Suites Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Brand Service Level 2022 2021 Change 2022 2021 Change 2022 2021 Change Sonesta (1) Full Service 22 7,145 61.0 % 45.1 % 15.9 Pts $ 152.54 $ 131.82 15.7 % $ 93.05 $ 59.45 56.5 % Royal Sonesta (1) Full Service 16 5,291 52.2 % 34.7 % 17.5 Pts 236.88 183.22 29.3 % 123.65 63.58 94.5 % Radisson Hotel Full Service 5 1,149 64.5 % 48.4 % 16.1 Pts 134.84 103.06 30.8 % 86.97 49.88 74.4 % Crowne Plaza Full Service 1 495 54.6 % 46.6 % 8.0 Pts 130.66 110.77 18.0 % 71.34 51.62 38.2 % Country Inn and Suites Full Service 3 430 65.5 % 48.8 % 16.7 Pts 138.52 110.59 25.3 % 90.73 53.97 68.1 % Full Service Total / Average 47 14,510 58.0 % 41.8 % 16.2 Pts 177.76 142.92 24.4 % 103.10 59.74 72.6 % Sonesta Select (1) Select Service 49 7,093 50.9 % 35.5 % 15.4 Pts 117.67 104.08 13.1 % 59.89 36.95 62.1 % Hyatt Place Select Service 17 2,107 68.1 % 59.9 % 8.2 Pts 118.99 99.56 19.5 % 81.03 59.64 35.9 % Courtyard Select Service 13 1,813 56.0 % 50.6 % 5.4 Pts 118.86 101.10 17.6 % 66.56 51.16 30.1 % Select Service Total / Average 79 11,013 55.0 % 42.6 % 12.4 Pts 118.18 102.28 15.5 % 65.00 43.57 49.2 % Sonesta ES Suites (1) Extended Stay 60 7,643 70.8 % 66.2 % 4.6 Pts 124.30 103.34 20.3 % 88.00 68.41 28.6 % Sonesta Simply Suites (1) Extended Stay 50 6,366 72.7 % 69.3 % 3.4 Pts 84.96 70.47 20.6 % 61.77 48.84 26.5 % Residence Inn Extended Stay 3 342 66.0 % 56.8 % 9.2 Pts 119.52 109.29 9.4 % 78.88 62.08 27.1 % Extended Stay Total / Average 113 14,351 71.5 % 67.4 % 4.1 Pts 106.61 88.57 20.4 % 76.23 59.70 27.7 % 239 39,874 62.0 % 51.2 % 10.8 Pts $ 133.41 $ 107.79 23.8 % $ 82.71 $ 55.19 49.9 % Hotel Operating Statistics by Service Level - Comparable Hotels RETURN TO TABLE OF CONTENTS

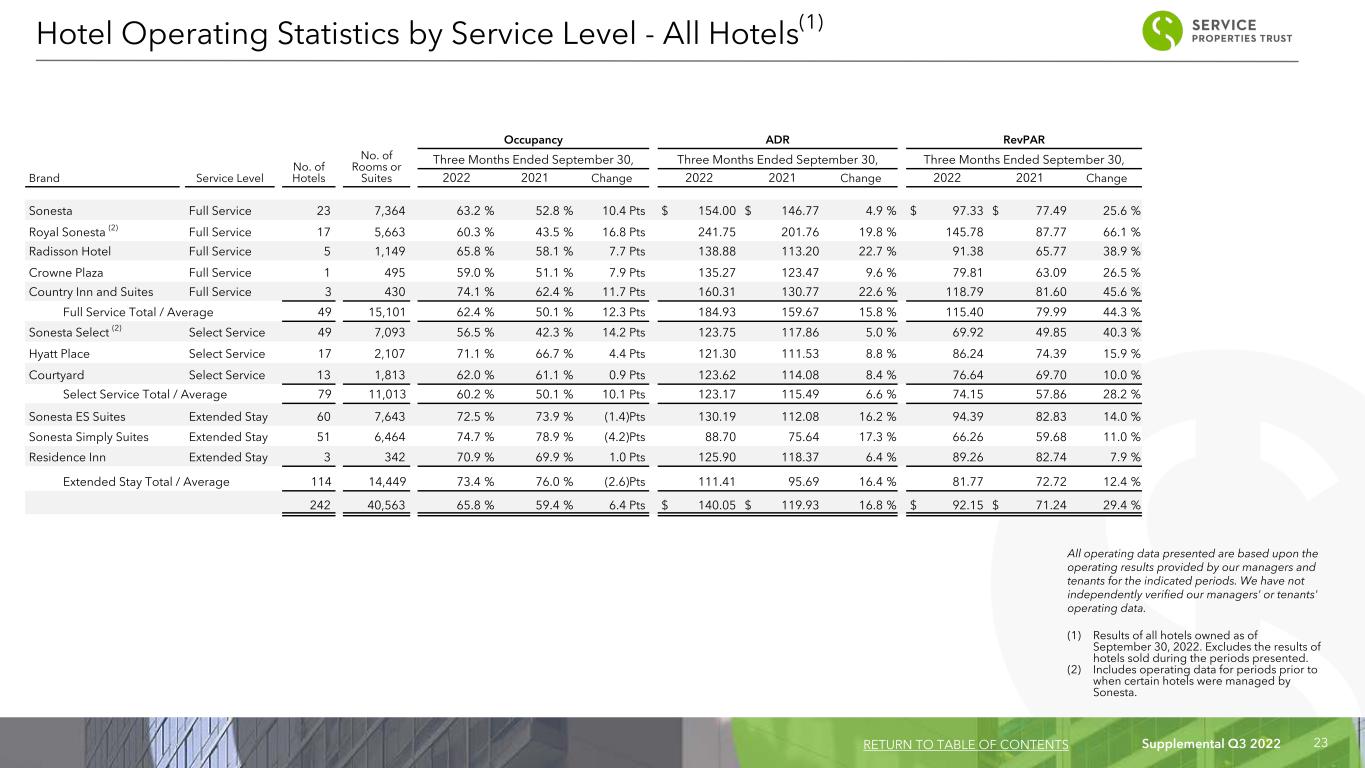

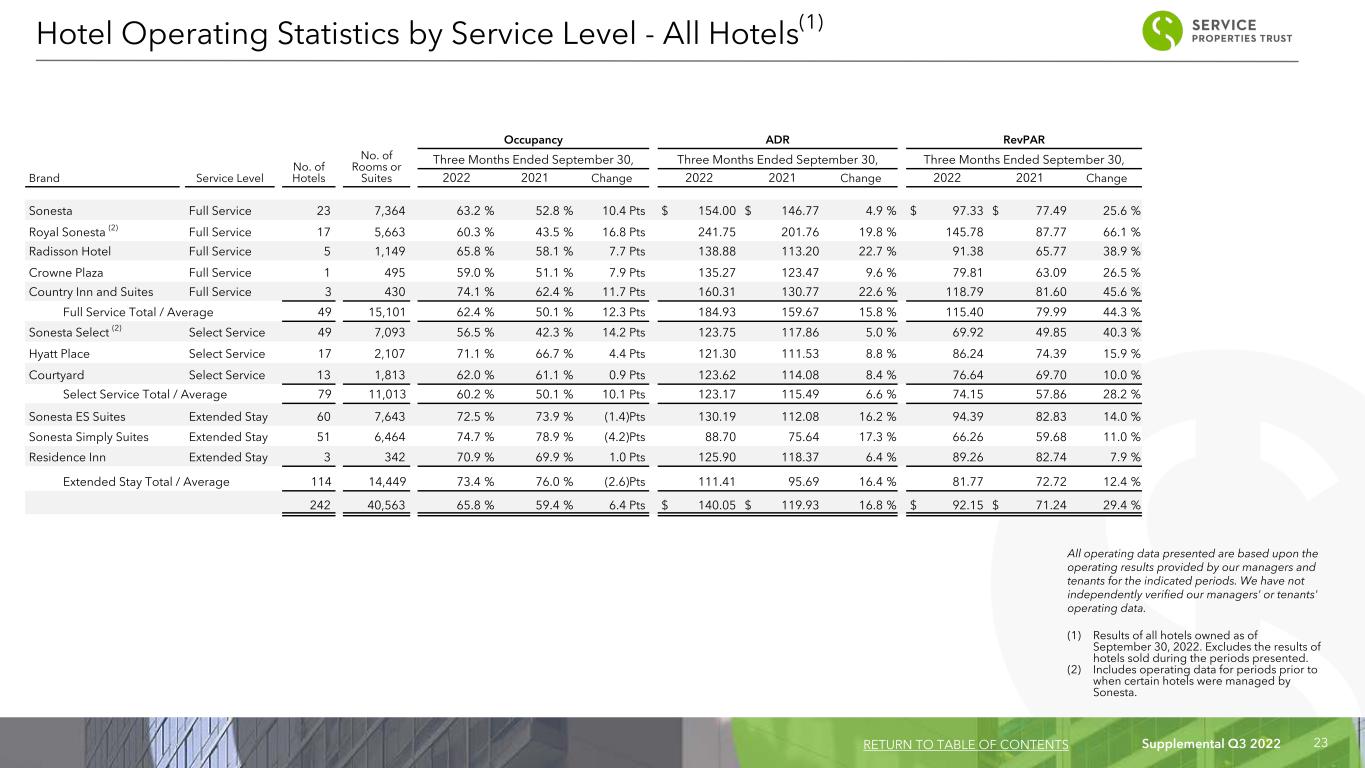

Supplemental Q3 2022 23 No. of Hotels No. of Rooms or Suites Occupancy ADR RevPAR Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Brand Service Level 2022 2021 Change 2022 2021 Change 2022 2021 Change Sonesta Full Service 23 7,364 63.2 % 52.8 % 10.4 Pts $ 154.00 $ 146.77 4.9 % $ 97.33 $ 77.49 25.6 % Royal Sonesta (2) Full Service 17 5,663 60.3 % 43.5 % 16.8 Pts 241.75 201.76 19.8 % 145.78 87.77 66.1 % Radisson Hotel Full Service 5 1,149 65.8 % 58.1 % 7.7 Pts 138.88 113.20 22.7 % 91.38 65.77 38.9 % Crowne Plaza Full Service 1 495 59.0 % 51.1 % 7.9 Pts 135.27 123.47 9.6 % 79.81 63.09 26.5 % Country Inn and Suites Full Service 3 430 74.1 % 62.4 % 11.7 Pts 160.31 130.77 22.6 % 118.79 81.60 45.6 % Full Service Total / Average 49 15,101 62.4 % 50.1 % 12.3 Pts 184.93 159.67 15.8 % 115.40 79.99 44.3 % Sonesta Select (2) Select Service 49 7,093 56.5 % 42.3 % 14.2 Pts 123.75 117.86 5.0 % 69.92 49.85 40.3 % Hyatt Place Select Service 17 2,107 71.1 % 66.7 % 4.4 Pts 121.30 111.53 8.8 % 86.24 74.39 15.9 % Courtyard Select Service 13 1,813 62.0 % 61.1 % 0.9 Pts 123.62 114.08 8.4 % 76.64 69.70 10.0 % Select Service Total / Average 79 11,013 60.2 % 50.1 % 10.1 Pts 123.17 115.49 6.6 % 74.15 57.86 28.2 % Sonesta ES Suites Extended Stay 60 7,643 72.5 % 73.9 % (1.4)Pts 130.19 112.08 16.2 % 94.39 82.83 14.0 % Sonesta Simply Suites Extended Stay 51 6,464 74.7 % 78.9 % (4.2)Pts 88.70 75.64 17.3 % 66.26 59.68 11.0 % Residence Inn Extended Stay 3 342 70.9 % 69.9 % 1.0 Pts 125.90 118.37 6.4 % 89.26 82.74 7.9 % Extended Stay Total / Average 114 14,449 73.4 % 76.0 % (2.6)Pts 111.41 95.69 16.4 % 81.77 72.72 12.4 % 242 40,563 65.8 % 59.4 % 6.4 Pts $ 140.05 $ 119.93 16.8 % $ 92.15 $ 71.24 29.4 % Hotel Operating Statistics by Service Level - All Hotels(1) RETURN TO TABLE OF CONTENTS All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Results of all hotels owned as of September 30, 2022. Excludes the results of hotels sold during the periods presented. (2) Includes operating data for periods prior to when certain hotels were managed by Sonesta.

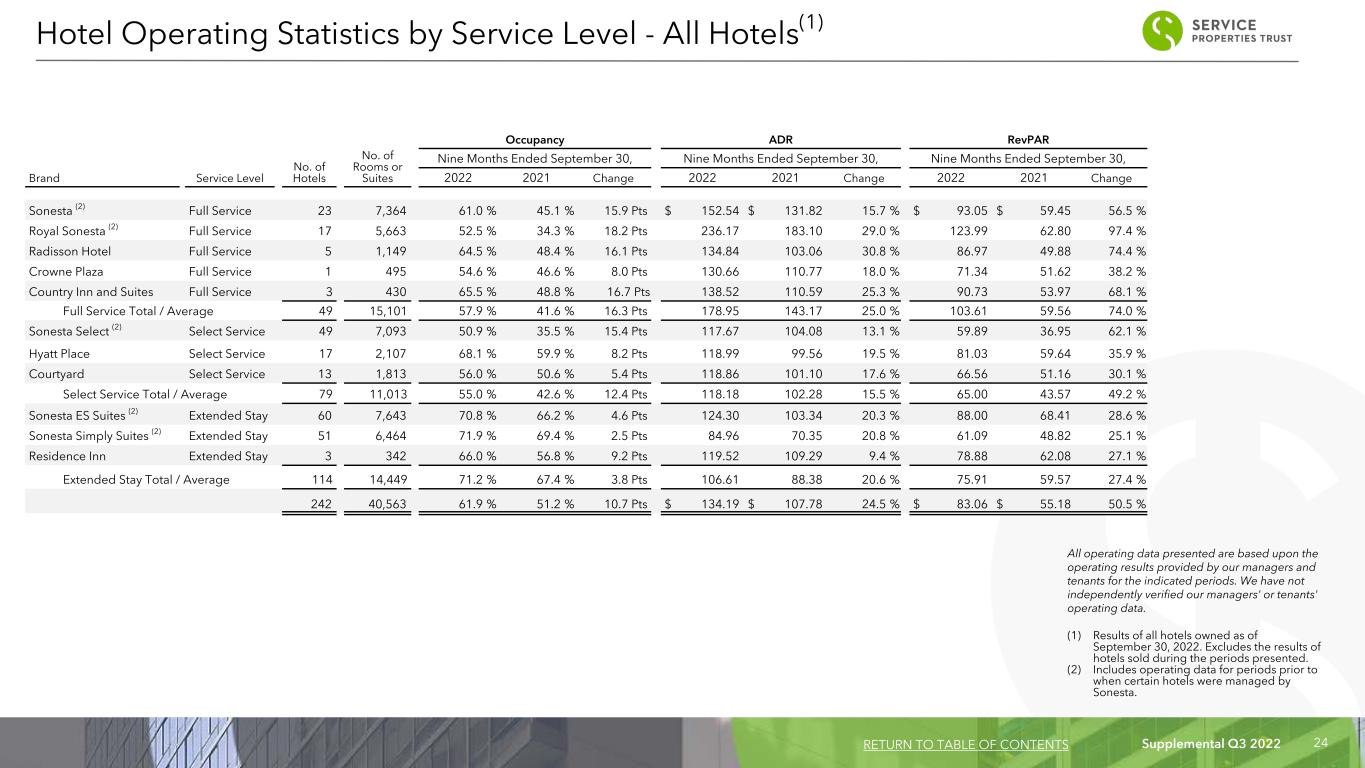

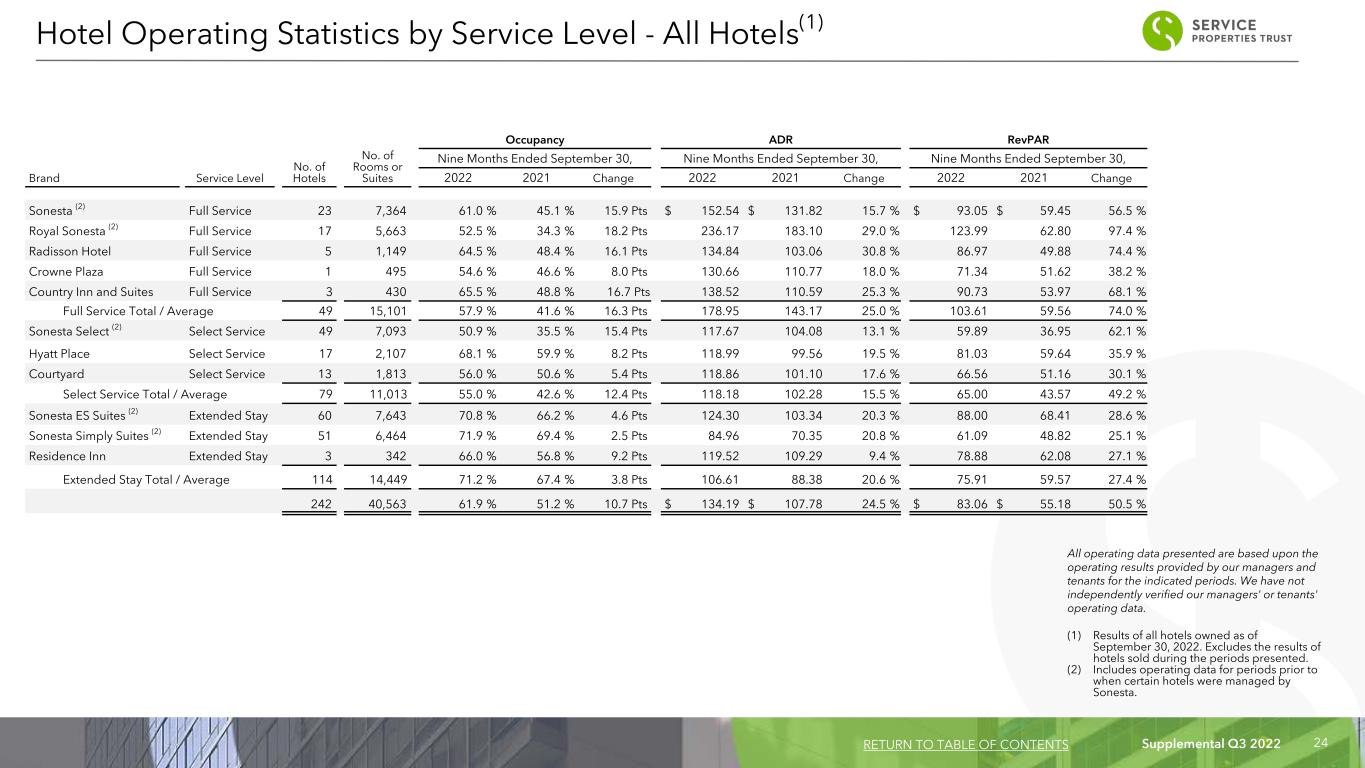

Supplemental Q3 2022 24 No. of Hotels No. of Rooms or Suites Occupancy ADR RevPAR Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Brand Service Level 2022 2021 Change 2022 2021 Change 2022 2021 Change Sonesta (2) Full Service 23 7,364 61.0 % 45.1 % 15.9 Pts $ 152.54 $ 131.82 15.7 % $ 93.05 $ 59.45 56.5 % Royal Sonesta (2) Full Service 17 5,663 52.5 % 34.3 % 18.2 Pts 236.17 183.10 29.0 % 123.99 62.80 97.4 % Radisson Hotel Full Service 5 1,149 64.5 % 48.4 % 16.1 Pts 134.84 103.06 30.8 % 86.97 49.88 74.4 % Crowne Plaza Full Service 1 495 54.6 % 46.6 % 8.0 Pts 130.66 110.77 18.0 % 71.34 51.62 38.2 % Country Inn and Suites Full Service 3 430 65.5 % 48.8 % 16.7 Pts 138.52 110.59 25.3 % 90.73 53.97 68.1 % Full Service Total / Average 49 15,101 57.9 % 41.6 % 16.3 Pts 178.95 143.17 25.0 % 103.61 59.56 74.0 % Sonesta Select (2) Select Service 49 7,093 50.9 % 35.5 % 15.4 Pts 117.67 104.08 13.1 % 59.89 36.95 62.1 % Hyatt Place Select Service 17 2,107 68.1 % 59.9 % 8.2 Pts 118.99 99.56 19.5 % 81.03 59.64 35.9 % Courtyard Select Service 13 1,813 56.0 % 50.6 % 5.4 Pts 118.86 101.10 17.6 % 66.56 51.16 30.1 % Select Service Total / Average 79 11,013 55.0 % 42.6 % 12.4 Pts 118.18 102.28 15.5 % 65.00 43.57 49.2 % Sonesta ES Suites (2) Extended Stay 60 7,643 70.8 % 66.2 % 4.6 Pts 124.30 103.34 20.3 % 88.00 68.41 28.6 % Sonesta Simply Suites (2) Extended Stay 51 6,464 71.9 % 69.4 % 2.5 Pts 84.96 70.35 20.8 % 61.09 48.82 25.1 % Residence Inn Extended Stay 3 342 66.0 % 56.8 % 9.2 Pts 119.52 109.29 9.4 % 78.88 62.08 27.1 % Extended Stay Total / Average 114 14,449 71.2 % 67.4 % 3.8 Pts 106.61 88.38 20.6 % 75.91 59.57 27.4 % 242 40,563 61.9 % 51.2 % 10.7 Pts $ 134.19 $ 107.78 24.5 % $ 83.06 $ 55.18 50.5 % Hotel Operating Statistics by Service Level - All Hotels(1) RETURN TO TABLE OF CONTENTS All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Results of all hotels owned as of September 30, 2022. Excludes the results of hotels sold during the periods presented. (2) Includes operating data for periods prior to when certain hotels were managed by Sonesta.

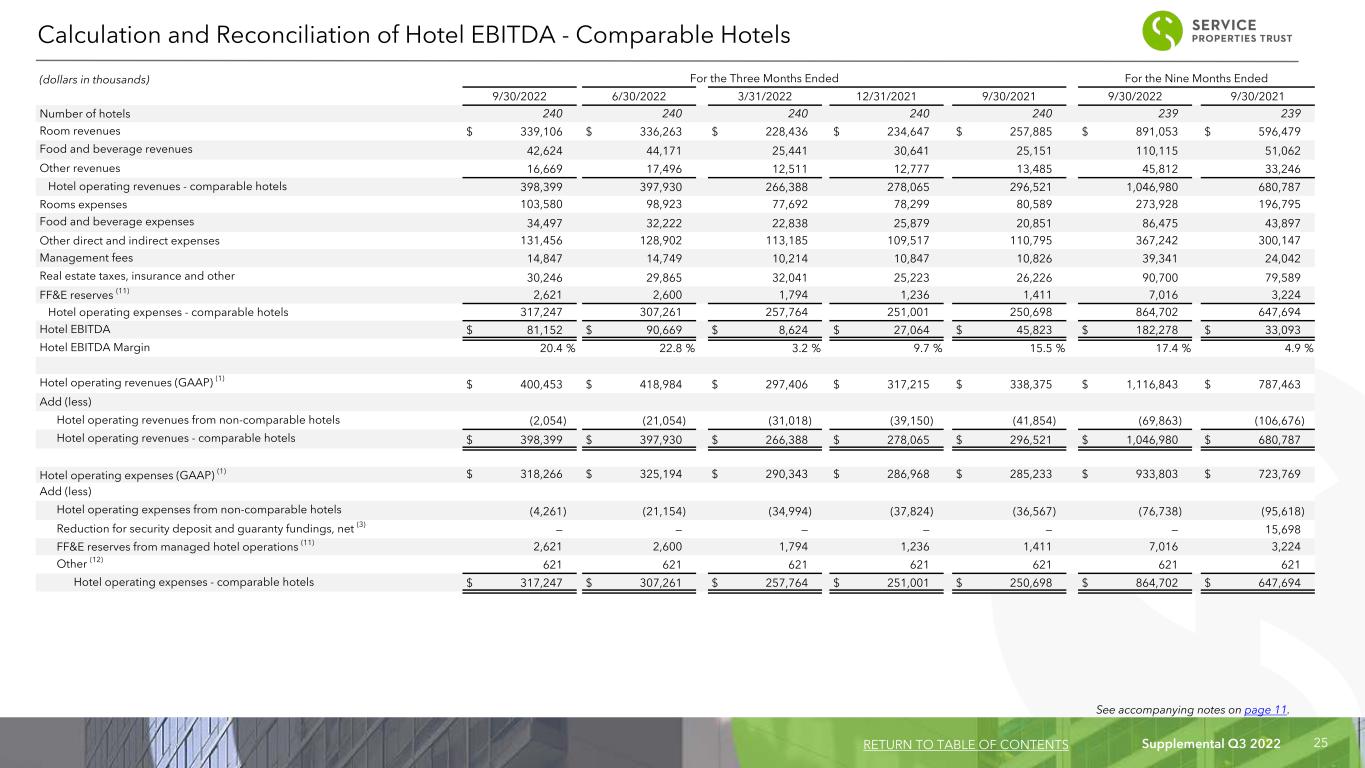

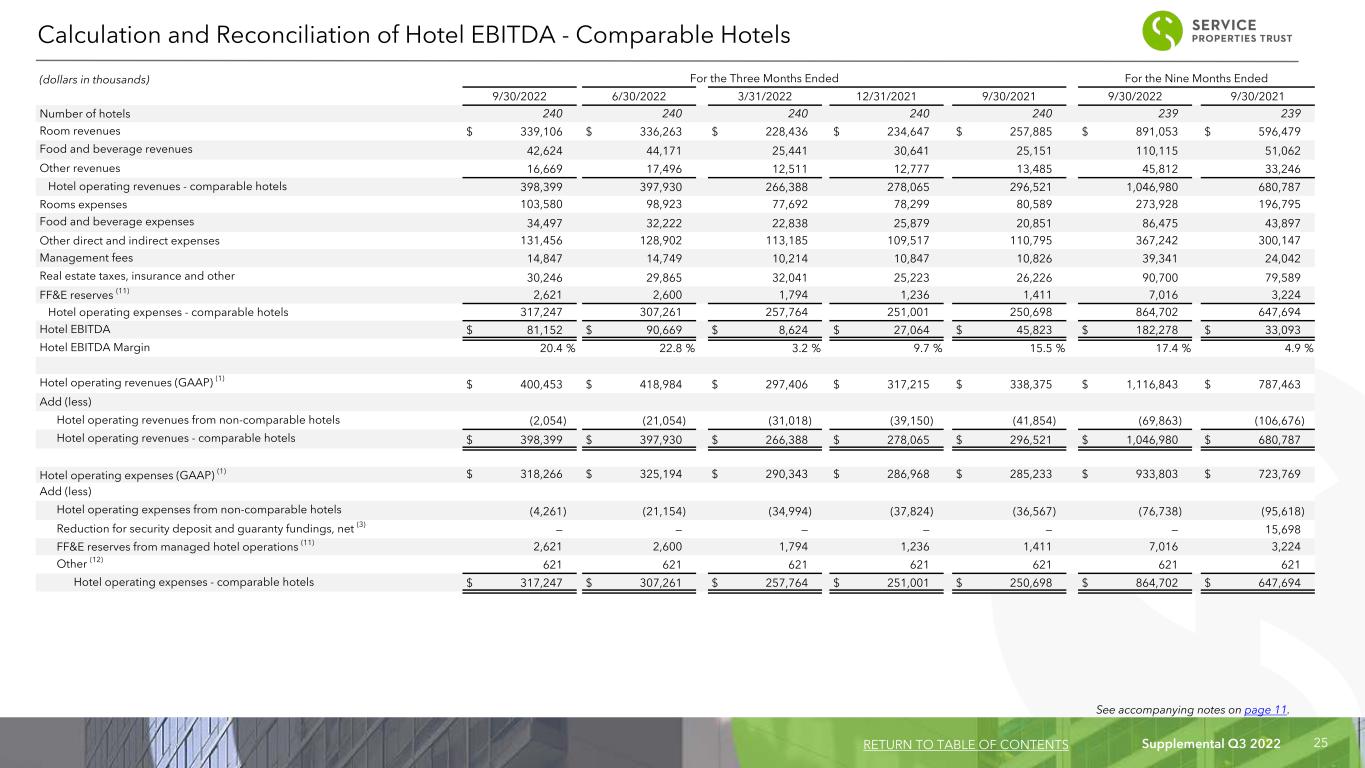

Supplemental Q3 2022 25 (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Number of hotels 240 240 240 240 240 239 239 Room revenues $ 339,106 $ 336,263 $ 228,436 $ 234,647 $ 257,885 $ 891,053 $ 596,479 Food and beverage revenues 42,624 44,171 25,441 30,641 25,151 110,115 51,062 Other revenues 16,669 17,496 12,511 12,777 13,485 45,812 33,246 Hotel operating revenues - comparable hotels 398,399 397,930 266,388 278,065 296,521 1,046,980 680,787 Rooms expenses 103,580 98,923 77,692 78,299 80,589 273,928 196,795 Food and beverage expenses 34,497 32,222 22,838 25,879 20,851 86,475 43,897 Other direct and indirect expenses 131,456 128,902 113,185 109,517 110,795 367,242 300,147 Management fees 14,847 14,749 10,214 10,847 10,826 39,341 24,042 Real estate taxes, insurance and other 30,246 29,865 32,041 25,223 26,226 90,700 79,589 FF&E reserves (11) 2,621 2,600 1,794 1,236 1,411 7,016 3,224 Hotel operating expenses - comparable hotels 317,247 307,261 257,764 251,001 250,698 864,702 647,694 Hotel EBITDA $ 81,152 $ 90,669 $ 8,624 $ 27,064 $ 45,823 $ 182,278 $ 33,093 Hotel EBITDA Margin 20.4 % 22.8 % 3.2 % 9.7 % 15.5 % 17.4 % 4.9 % Hotel operating revenues (GAAP) (1) $ 400,453 $ 418,984 $ 297,406 $ 317,215 $ 338,375 $ 1,116,843 $ 787,463 Add (less) Hotel operating revenues from non-comparable hotels (2,054) (21,054) (31,018) (39,150) (41,854) (69,863) (106,676) Hotel operating revenues - comparable hotels $ 398,399 $ 397,930 $ 266,388 $ 278,065 $ 296,521 $ 1,046,980 $ 680,787 Hotel operating expenses (GAAP) (1) $ 318,266 $ 325,194 $ 290,343 $ 286,968 $ 285,233 $ 933,803 $ 723,769 Add (less) Hotel operating expenses from non-comparable hotels (4,261) (21,154) (34,994) (37,824) (36,567) (76,738) (95,618) Reduction for security deposit and guaranty fundings, net (3) — — — — — — 15,698 FF&E reserves from managed hotel operations (11) 2,621 2,600 1,794 1,236 1,411 7,016 3,224 Other (12) 621 621 621 621 621 621 621 Hotel operating expenses - comparable hotels $ 317,247 $ 307,261 $ 257,764 $ 251,001 $ 250,698 $ 864,702 $ 647,694 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

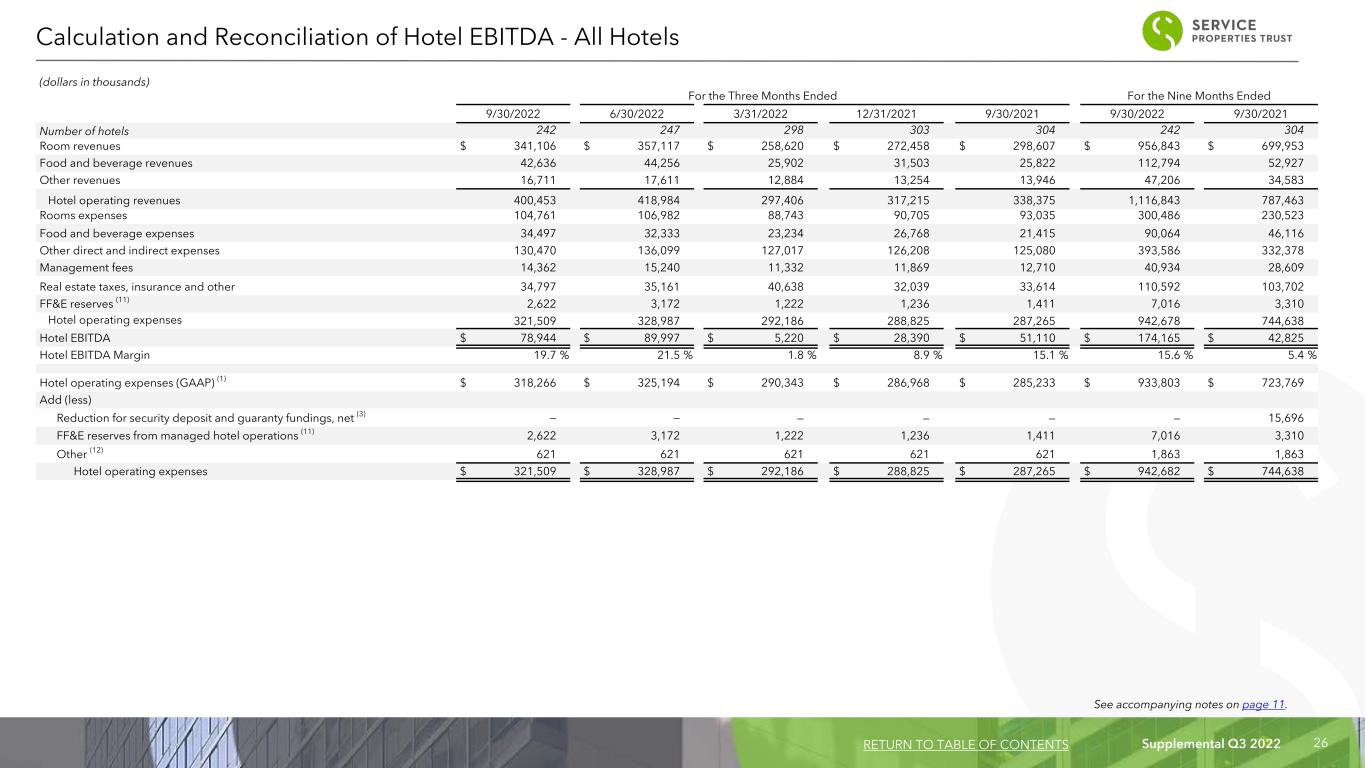

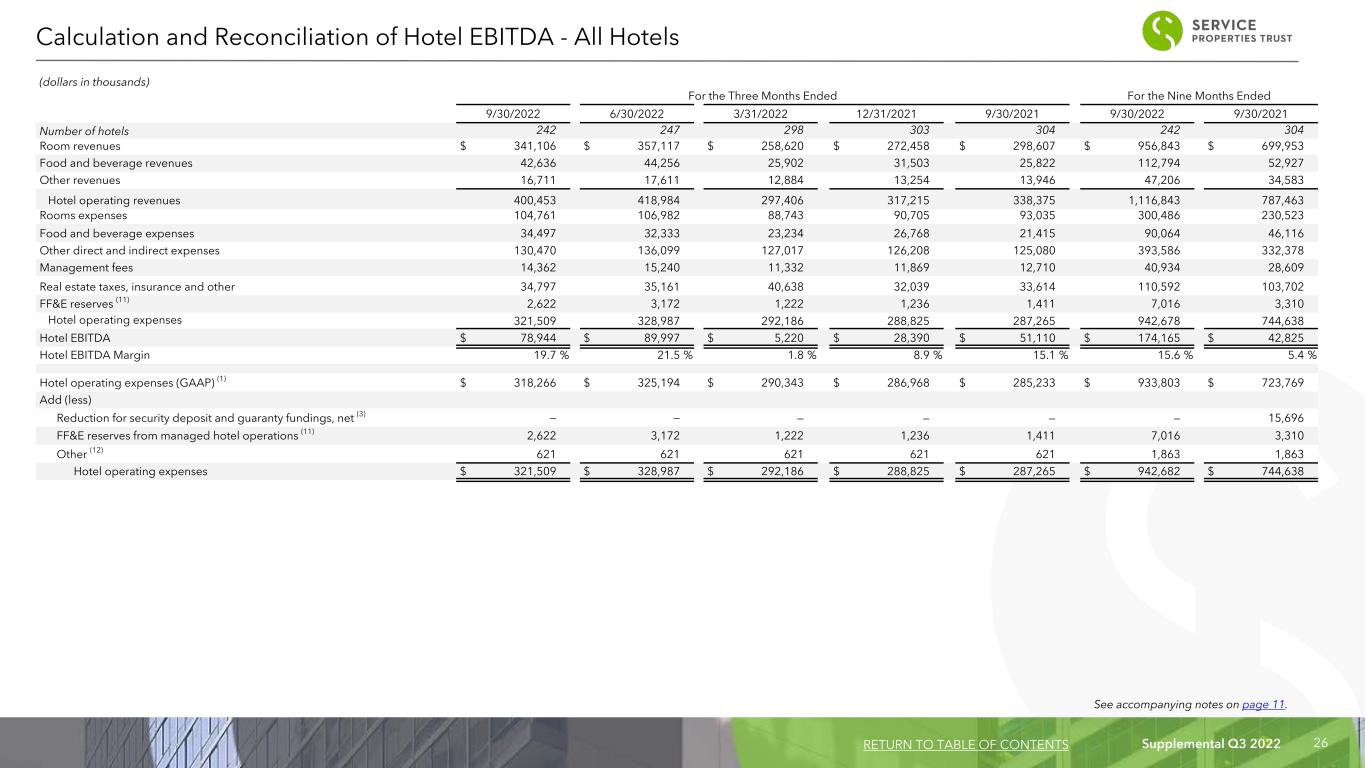

Supplemental Q3 2022 26 (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Number of hotels 242 247 298 303 304 242 304 Room revenues $ 341,106 $ 357,117 $ 258,620 $ 272,458 $ 298,607 $ 956,843 $ 699,953 Food and beverage revenues 42,636 44,256 25,902 31,503 25,822 112,794 52,927 Other revenues 16,711 17,611 12,884 13,254 13,946 47,206 34,583 Hotel operating revenues 400,453 418,984 297,406 317,215 338,375 1,116,843 787,463 Rooms expenses 104,761 106,982 88,743 90,705 93,035 300,486 230,523 Food and beverage expenses 34,497 32,333 23,234 26,768 21,415 90,064 46,116 Other direct and indirect expenses 130,470 136,099 127,017 126,208 125,080 393,586 332,378 Management fees 14,362 15,240 11,332 11,869 12,710 40,934 28,609 Real estate taxes, insurance and other 34,797 35,161 40,638 32,039 33,614 110,592 103,702 FF&E reserves (11) 2,622 3,172 1,222 1,236 1,411 7,016 3,310 Hotel operating expenses 321,509 328,987 292,186 288,825 287,265 942,678 744,638 Hotel EBITDA $ 78,944 $ 89,997 $ 5,220 $ 28,390 $ 51,110 $ 174,165 $ 42,825 Hotel EBITDA Margin 19.7 % 21.5 % 1.8 % 8.9 % 15.1 % 15.6 % 5.4 % Hotel operating expenses (GAAP) (1) $ 318,266 $ 325,194 $ 290,343 $ 286,968 $ 285,233 $ 933,803 $ 723,769 Add (less) Reduction for security deposit and guaranty fundings, net (3) — — — — — — 15,696 FF&E reserves from managed hotel operations (11) 2,622 3,172 1,222 1,236 1,411 7,016 3,310 Other (12) 621 621 621 621 621 1,863 1,863 Hotel operating expenses $ 321,509 $ 328,987 $ 292,186 $ 288,825 $ 287,265 $ 942,682 $ 744,638 Calculation and Reconciliation of Hotel EBITDA - All Hotels RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

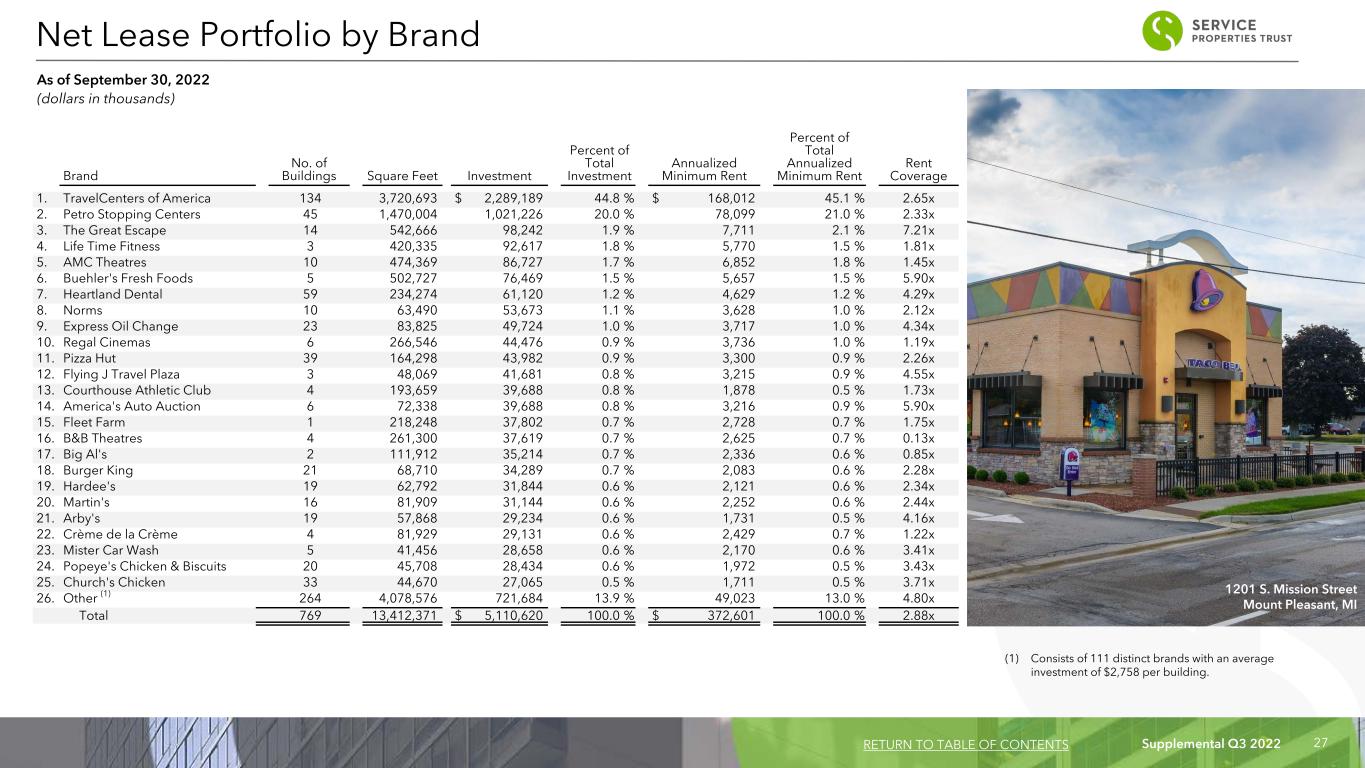

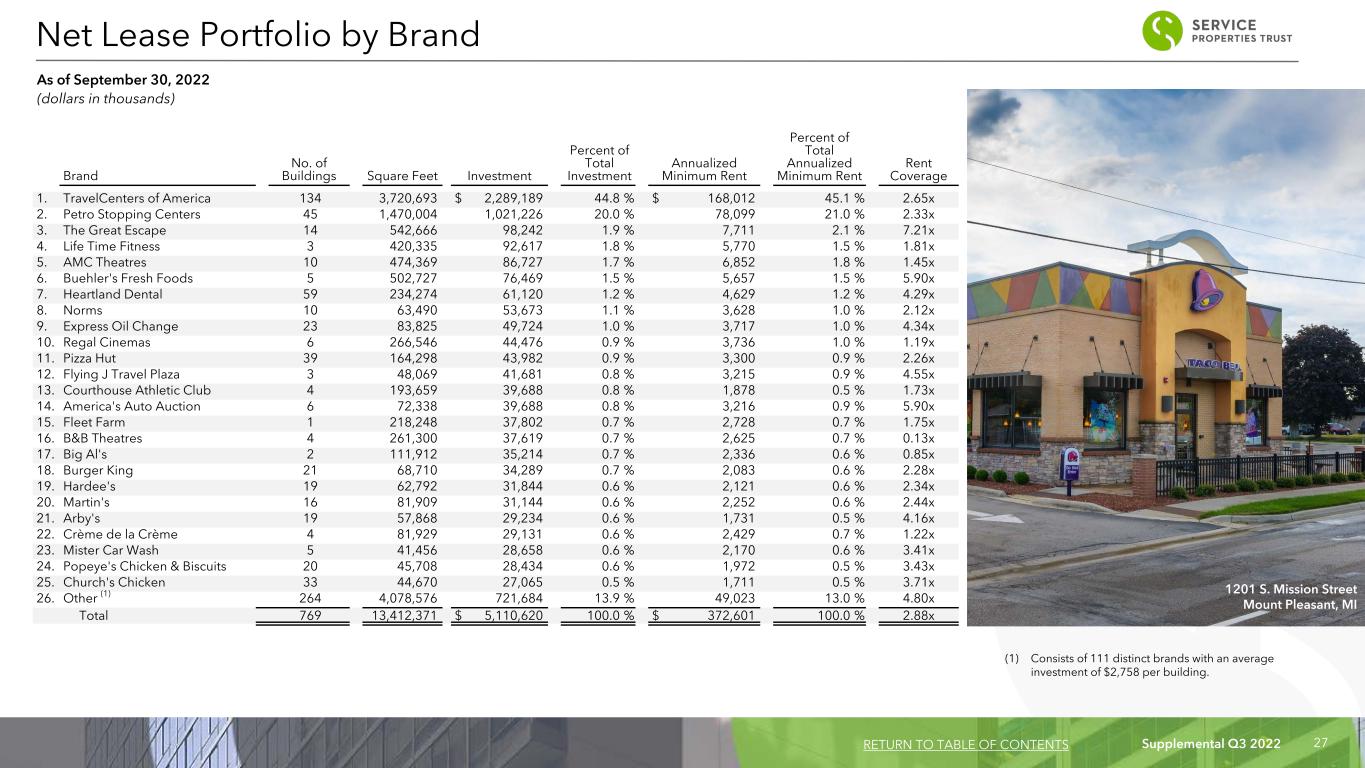

Supplemental Q3 2022 27 Brand No. of Buildings Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. TravelCenters of America 134 3,720,693 $ 2,289,189 44.8 % $ 168,012 45.1 % 2.65x 2. Petro Stopping Centers 45 1,470,004 1,021,226 20.0 % 78,099 21.0 % 2.33x 3. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 7.21x 4. Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 1.81x 5. AMC Theatres 10 474,369 86,727 1.7 % 6,852 1.8 % 1.45x 6. Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 5.90x 7. Heartland Dental 59 234,274 61,120 1.2 % 4,629 1.2 % 4.29x 8. Norms 10 63,490 53,673 1.1 % 3,628 1.0 % 2.12x 9. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 4.34x 10. Regal Cinemas 6 266,546 44,476 0.9 % 3,736 1.0 % 1.19x 11. Pizza Hut 39 164,298 43,982 0.9 % 3,300 0.9 % 2.26x 12. Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,215 0.9 % 4.55x 13. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,878 0.5 % 1.73x 14. America's Auto Auction 6 72,338 39,688 0.8 % 3,216 0.9 % 5.90x 15. Fleet Farm 1 218,248 37,802 0.7 % 2,728 0.7 % 1.75x 16. B&B Theatres 4 261,300 37,619 0.7 % 2,625 0.7 % 0.13x 17. Big Al's 2 111,912 35,214 0.7 % 2,336 0.6 % 0.85x 18. Burger King 21 68,710 34,289 0.7 % 2,083 0.6 % 2.28x 19. Hardee's 19 62,792 31,844 0.6 % 2,121 0.6 % 2.34x 20. Martin's 16 81,909 31,144 0.6 % 2,252 0.6 % 2.44x 21. Arby's 19 57,868 29,234 0.6 % 1,731 0.5 % 4.16x 22. Crème de la Crème 4 81,929 29,131 0.6 % 2,429 0.7 % 1.22x 23. Mister Car Wash 5 41,456 28,658 0.6 % 2,170 0.6 % 3.41x 24. Popeye's Chicken & Biscuits 20 45,708 28,434 0.6 % 1,972 0.5 % 3.43x 25. Church's Chicken 33 44,670 27,065 0.5 % 1,711 0.5 % 3.71x 26. Other (1) 264 4,078,576 721,684 13.9 % 49,023 13.0 % 4.80x Total 769 13,412,371 $ 5,110,620 100.0 % $ 372,601 100.0 % 2.88x (1) Consists of 111 distinct brands with an average investment of $2,758 per building. Net Lease Portfolio by Brand As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS 1201 S. Mission Street Mount Pleasant, MI

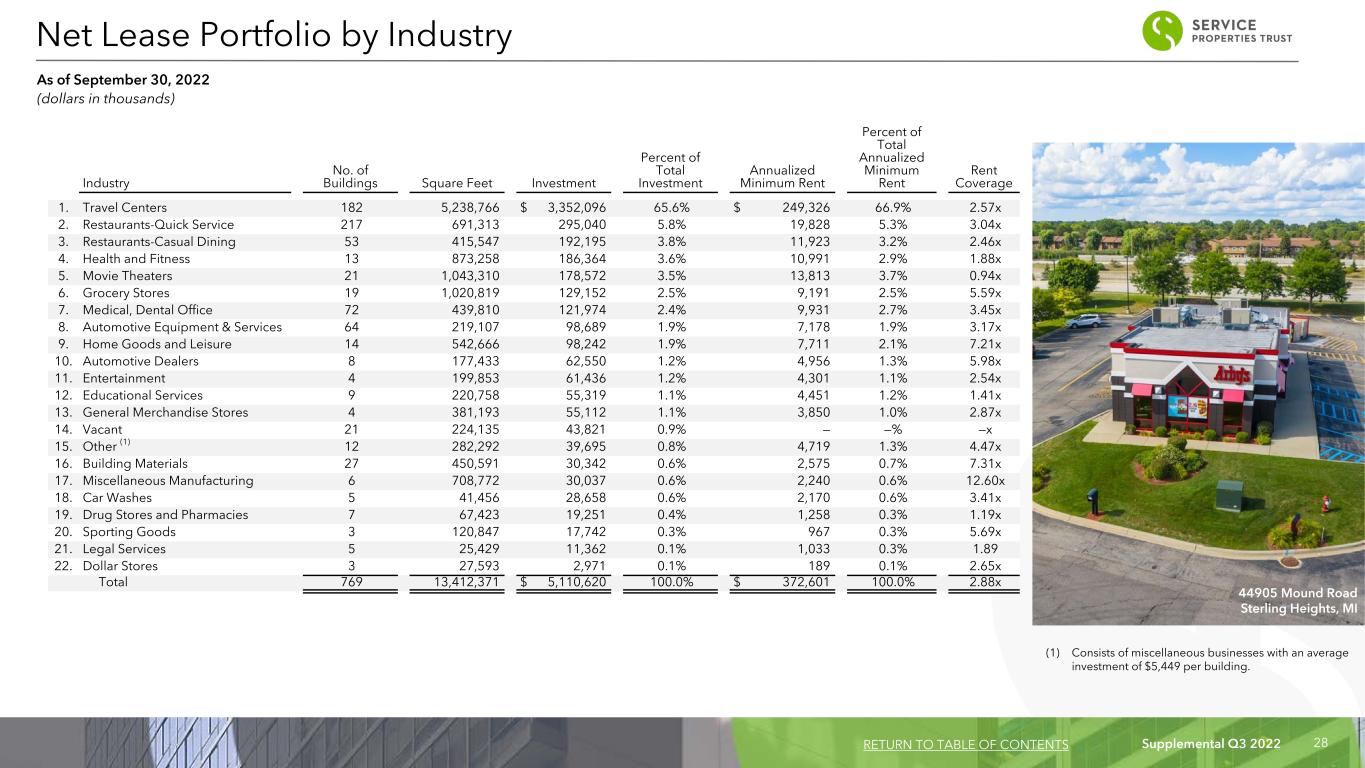

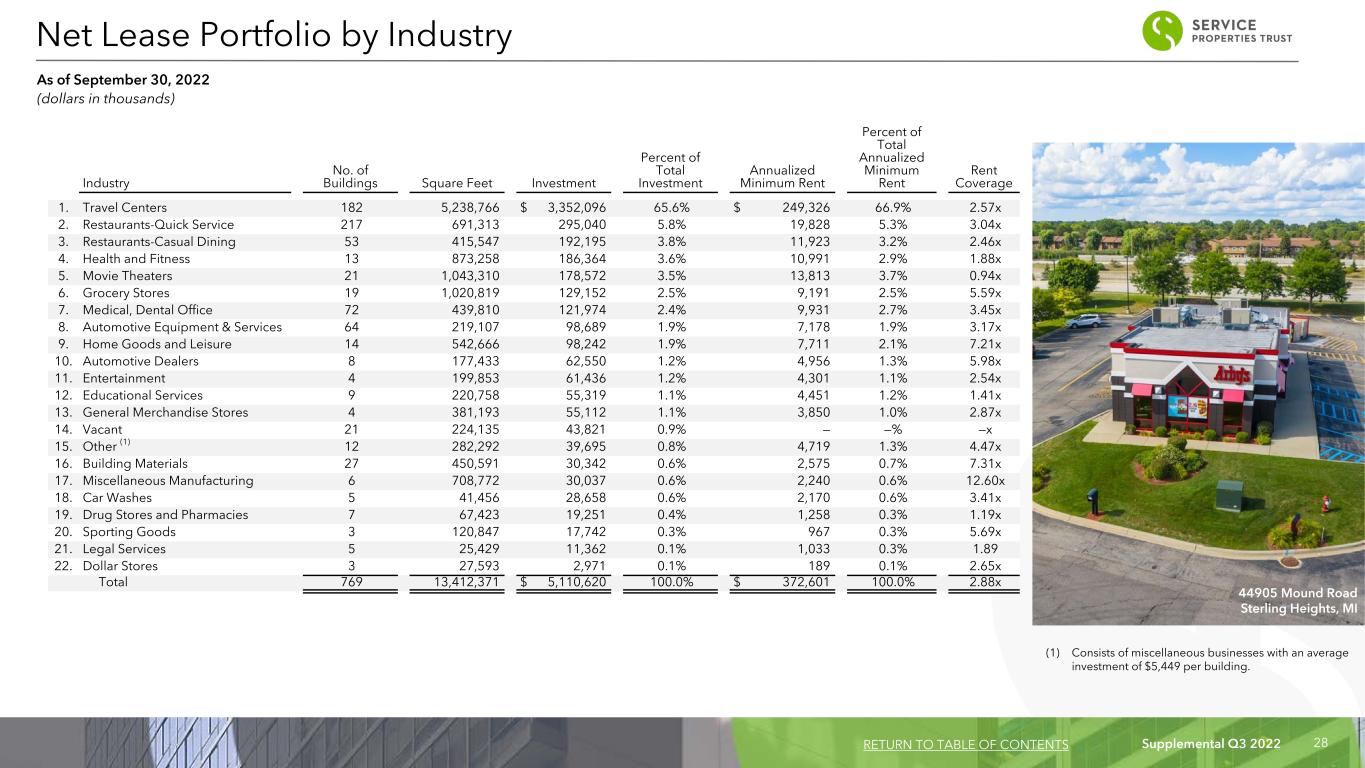

Supplemental Q3 2022 28 Industry No. of Buildings Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. Travel Centers 182 5,238,766 $ 3,352,096 65.6% $ 249,326 66.9% 2.57x 2. Restaurants-Quick Service 217 691,313 295,040 5.8% 19,828 5.3% 3.04x 3. Restaurants-Casual Dining 53 415,547 192,195 3.8% 11,923 3.2% 2.46x 4. Health and Fitness 13 873,258 186,364 3.6% 10,991 2.9% 1.88x 5. Movie Theaters 21 1,043,310 178,572 3.5% 13,813 3.7% 0.94x 6. Grocery Stores 19 1,020,819 129,152 2.5% 9,191 2.5% 5.59x 7. Medical, Dental Office 72 439,810 121,974 2.4% 9,931 2.7% 3.45x 8. Automotive Equipment & Services 64 219,107 98,689 1.9% 7,178 1.9% 3.17x 9. Home Goods and Leisure 14 542,666 98,242 1.9% 7,711 2.1% 7.21x 10. Automotive Dealers 8 177,433 62,550 1.2% 4,956 1.3% 5.98x 11. Entertainment 4 199,853 61,436 1.2% 4,301 1.1% 2.54x 12. Educational Services 9 220,758 55,319 1.1% 4,451 1.2% 1.41x 13. General Merchandise Stores 4 381,193 55,112 1.1% 3,850 1.0% 2.87x 14. Vacant 21 224,135 43,821 0.9% — —% —x 15. Other (1) 12 282,292 39,695 0.8% 4,719 1.3% 4.47x 16. Building Materials 27 450,591 30,342 0.6% 2,575 0.7% 7.31x 17. Miscellaneous Manufacturing 6 708,772 30,037 0.6% 2,240 0.6% 12.60x 18. Car Washes 5 41,456 28,658 0.6% 2,170 0.6% 3.41x 19. Drug Stores and Pharmacies 7 67,423 19,251 0.4% 1,258 0.3% 1.19x 20. Sporting Goods 3 120,847 17,742 0.3% 967 0.3% 5.69x 21. Legal Services 5 25,429 11,362 0.1% 1,033 0.3% 1.89 22. Dollar Stores 3 27,593 2,971 0.1% 189 0.1% 2.65x Total 769 13,412,371 $ 5,110,620 100.0% $ 372,601 100.0% 2.88x (1) Consists of miscellaneous businesses with an average investment of $5,449 per building. Net Lease Portfolio by Industry As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS 44905 Mound Road Sterling Heights, MI

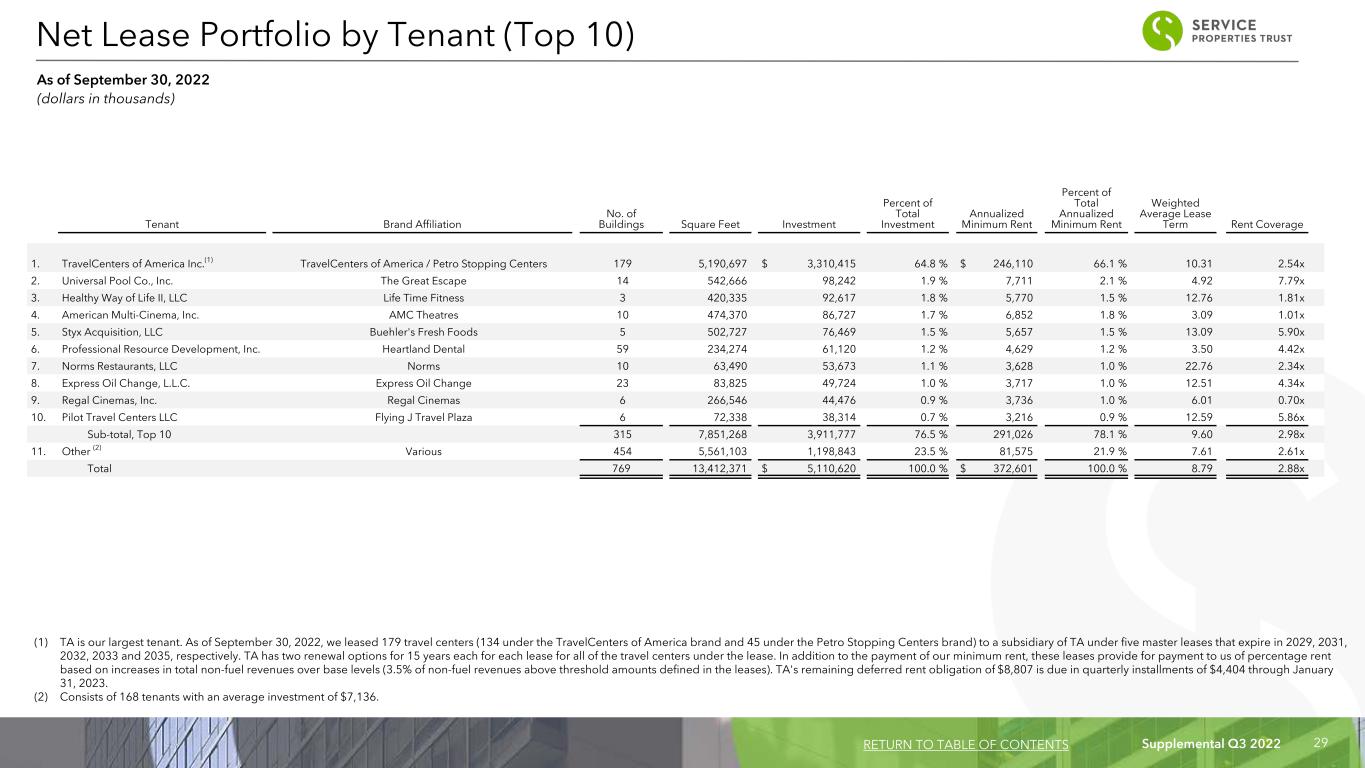

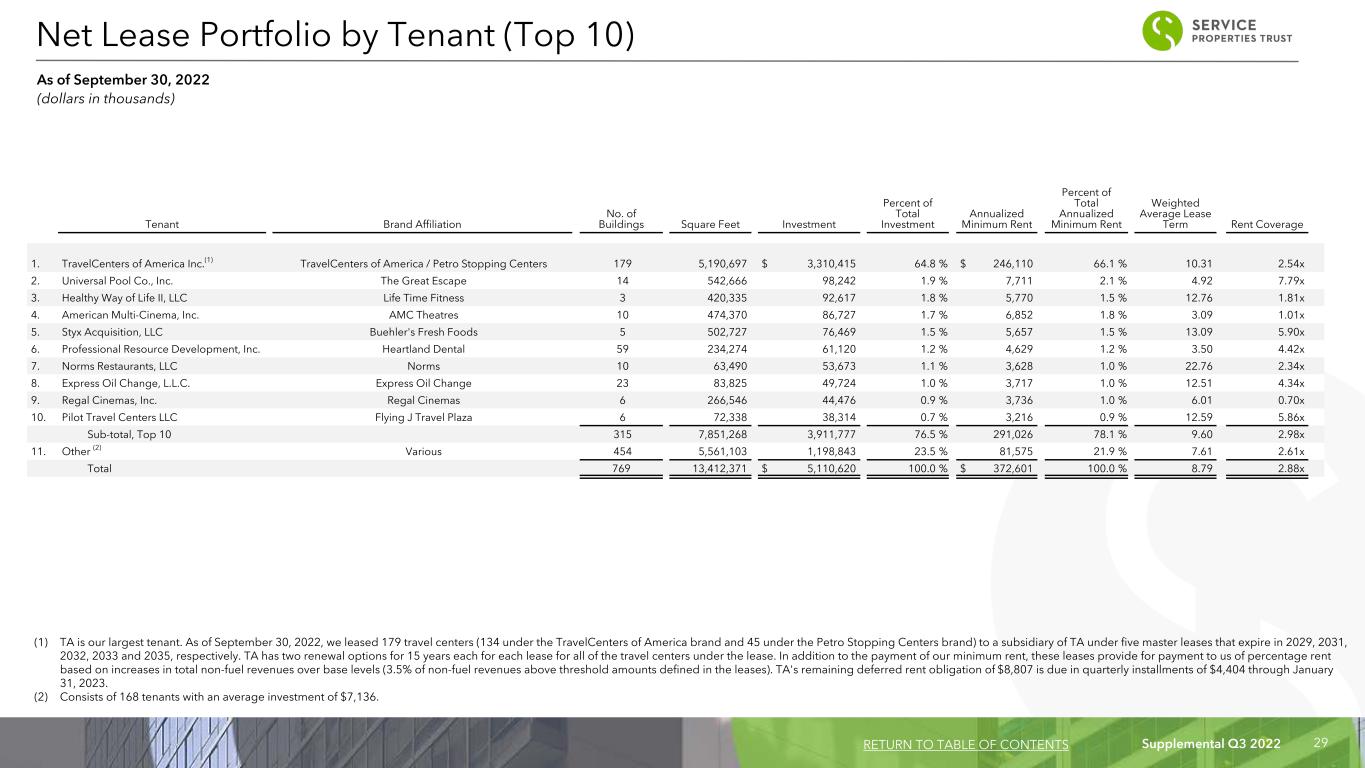

Supplemental Q3 2022 29 Tenant Brand Affiliation No. of Buildings Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Weighted Average Lease Term Rent Coverage 1. TravelCenters of America Inc.(1) TravelCenters of America / Petro Stopping Centers 179 5,190,697 $ 3,310,415 64.8 % $ 246,110 66.1 % 10.31 2.54x 2. Universal Pool Co., Inc. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 4.92 7.79x 3. Healthy Way of Life II, LLC Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 12.76 1.81x 4. American Multi-Cinema, Inc. AMC Theatres 10 474,370 86,727 1.7 % 6,852 1.8 % 3.09 1.01x 5. Styx Acquisition, LLC Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 13.09 5.90x 6. Professional Resource Development, Inc. Heartland Dental 59 234,274 61,120 1.2 % 4,629 1.2 % 3.50 4.42x 7. Norms Restaurants, LLC Norms 10 63,490 53,673 1.1 % 3,628 1.0 % 22.76 2.34x 8. Express Oil Change, L.L.C. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 12.51 4.34x 9. Regal Cinemas, Inc. Regal Cinemas 6 266,546 44,476 0.9 % 3,736 1.0 % 6.01 0.70x 10. Pilot Travel Centers LLC Flying J Travel Plaza 6 72,338 38,314 0.7 % 3,216 0.9 % 12.59 5.86x Sub-total, Top 10 315 7,851,268 3,911,777 76.5 % 291,026 78.1 % 9.60 2.98x 11. Other (2) Various 454 5,561,103 1,198,843 23.5 % 81,575 21.9 % 7.61 2.61x Total 769 13,412,371 $ 5,110,620 100.0 % $ 372,601 100.0 % 8.79 2.88x (1) TA is our largest tenant. As of September 30, 2022, we leased 179 travel centers (134 under the TravelCenters of America brand and 45 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2029, 2031, 2032, 2033 and 2035, respectively. TA has two renewal options for 15 years each for each lease for all of the travel centers under the lease. In addition to the payment of our minimum rent, these leases provide for payment to us of percentage rent based on increases in total non-fuel revenues over base levels (3.5% of non-fuel revenues above threshold amounts defined in the leases). TA's remaining deferred rent obligation of $8,807 is due in quarterly installments of $4,404 through January 31, 2023. (2) Consists of 168 tenants with an average investment of $7,136. Net Lease Portfolio by Tenant (Top 10) As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS

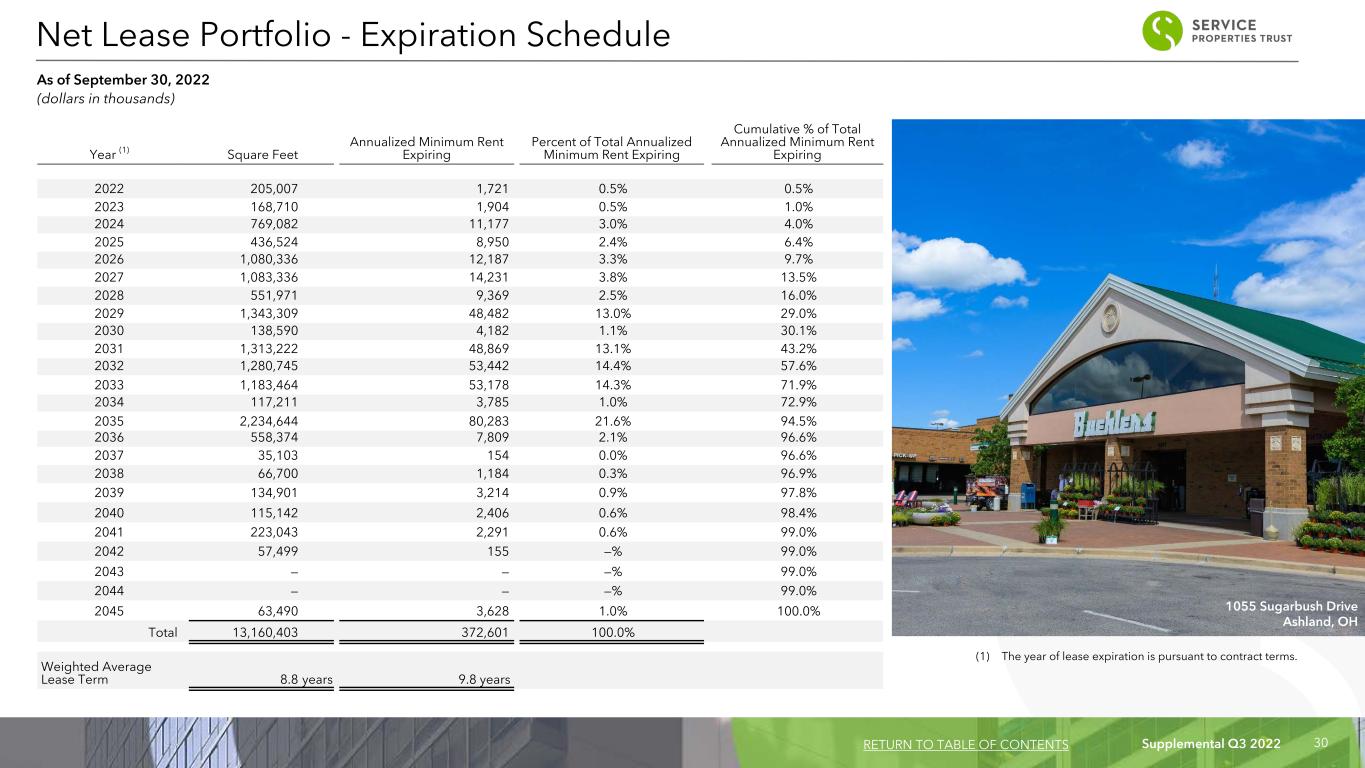

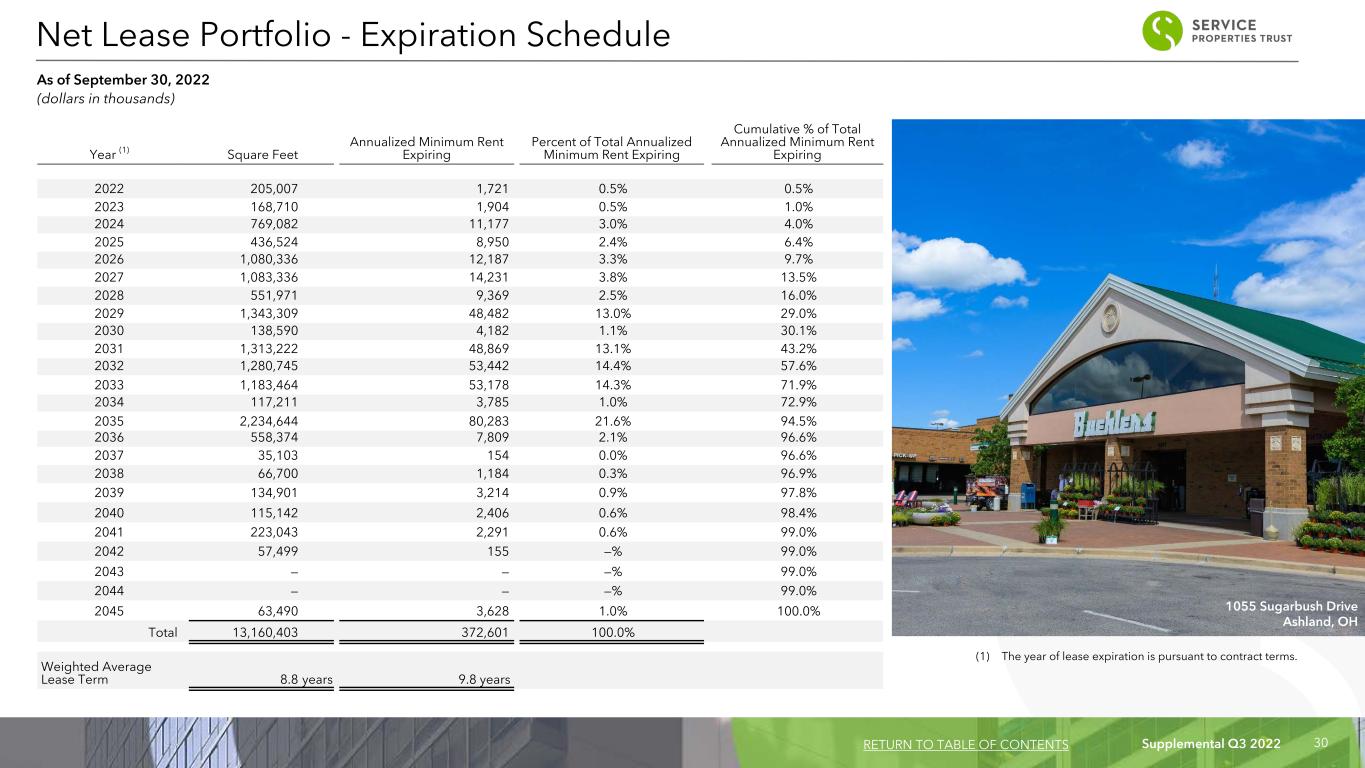

Supplemental Q3 2022 30 Year (1) Square Feet Annualized Minimum Rent Expiring Percent of Total Annualized Minimum Rent Expiring Cumulative % of Total Annualized Minimum Rent Expiring 2022 205,007 1,721 0.5% 0.5% 2023 168,710 1,904 0.5% 1.0% 2024 769,082 11,177 3.0% 4.0% 2025 436,524 8,950 2.4% 6.4% 2026 1,080,336 12,187 3.3% 9.7% 2027 1,083,336 14,231 3.8% 13.5% 2028 551,971 9,369 2.5% 16.0% 2029 1,343,309 48,482 13.0% 29.0% 2030 138,590 4,182 1.1% 30.1% 2031 1,313,222 48,869 13.1% 43.2% 2032 1,280,745 53,442 14.4% 57.6% 2033 1,183,464 53,178 14.3% 71.9% 2034 117,211 3,785 1.0% 72.9% 2035 2,234,644 80,283 21.6% 94.5% 2036 558,374 7,809 2.1% 96.6% 2037 35,103 154 0.0% 96.6% 2038 66,700 1,184 0.3% 96.9% 2039 134,901 3,214 0.9% 97.8% 2040 115,142 2,406 0.6% 98.4% 2041 223,043 2,291 0.6% 99.0% 2042 57,499 155 —% 99.0% 2043 — — —% 99.0% 2044 — — —% 99.0% 2045 63,490 3,628 1.0% 100.0% Total 13,160,403 372,601 100.0% Weighted Average Lease Term 8.8 years 9.8 years (1) The year of lease expiration is pursuant to contract terms. Net Lease Portfolio - Expiration Schedule As of September 30, 2022 (dollars in thousands) RETURN TO TABLE OF CONTENTS 1055 Sugarbush Drive Ashland, OH

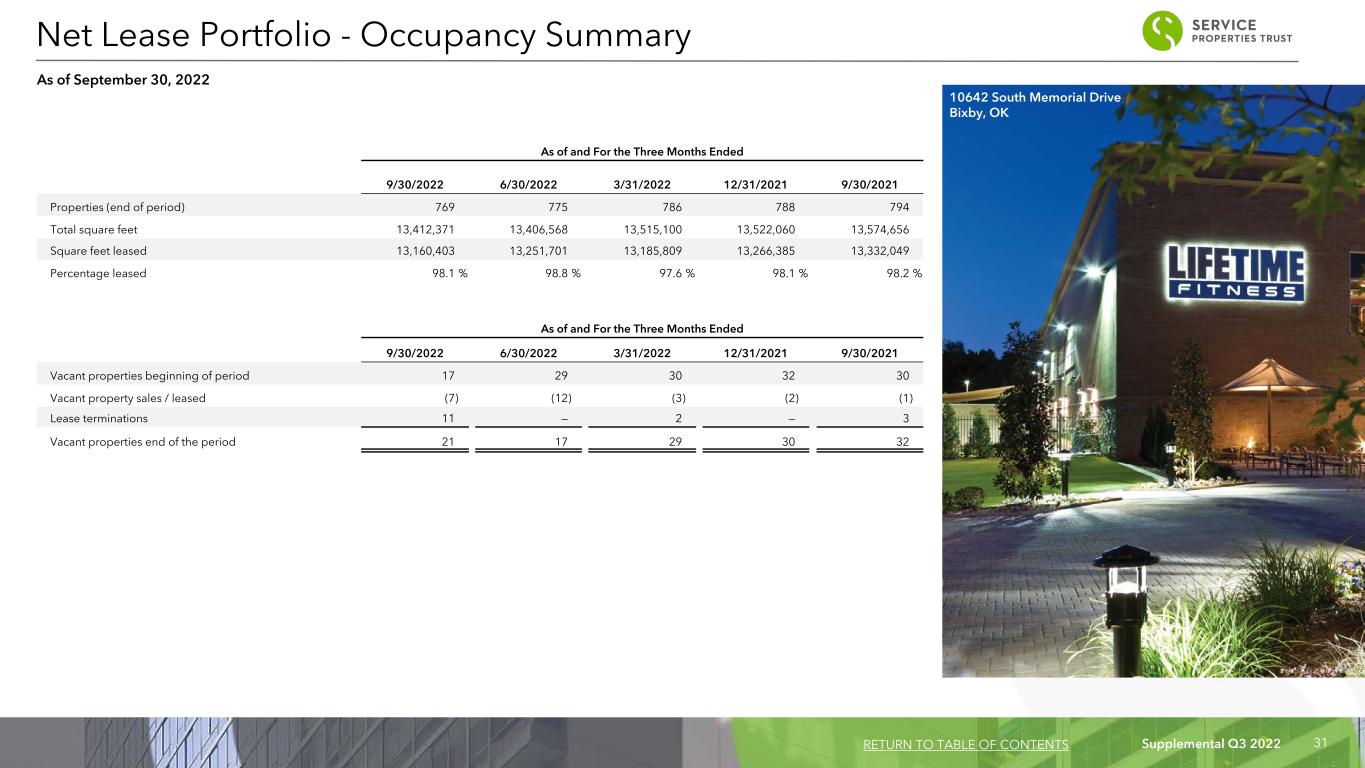

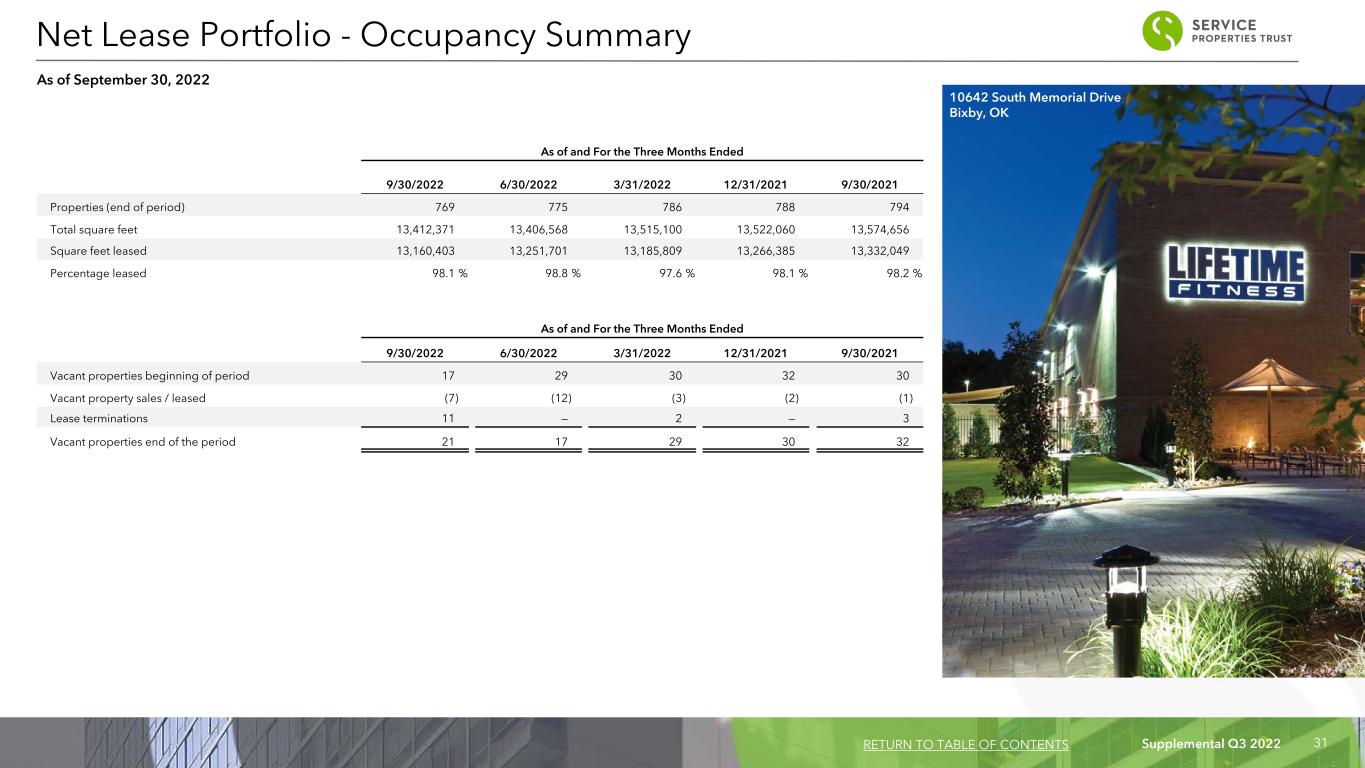

Supplemental Q3 2022 31 As of and For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Properties (end of period) 769 775 786 788 794 Total square feet 13,412,371 13,406,568 13,515,100 13,522,060 13,574,656 Square feet leased 13,160,403 13,251,701 13,185,809 13,266,385 13,332,049 Percentage leased 98.1 % 98.8 % 97.6 % 98.1 % 98.2 % As of and For the Three Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Vacant properties beginning of period 17 29 30 32 30 Vacant property sales / leased (7) (12) (3) (2) (1) Lease terminations 11 — 2 — 3 Vacant properties end of the period 21 17 29 30 32 Net Lease Portfolio - Occupancy Summary As of September 30, 2022 RETURN TO TABLE OF CONTENTS 10642 South Memorial Drive Bixby, OK

Supplemental Q3 2022 32 Non-GAAP Financial Measures We present certain “non-GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, Adjusted Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income (loss) as presented in our condensed consolidated statements of income (loss). We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of our operating performance between periods and with other REITs and, in the case of Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of our hotels. FFO and Normalized FFO: We calculate funds from operations, or FFO, and Normalized FFO as shown on page 9. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income (loss), calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any unrealized gains and losses on equity securities, as well as adjustments to reflect our share of FFO attributable to an investee and certain other adjustments currently not applicable to us. In calculating Normalized FFO, we adjust for the items shown on page 9. FFO and Normalized FFO are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to satisfy our REIT distribution requirements, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our distribution rate as a percentage of the trading price of our common shares, or dividend yield, and to the dividend yield of other REITs, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do. EBITDA, EBITDAre and Adjusted EBITDAre: We calculate earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 10. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect our share of EBITDAre attributable to an investee. In calculating Adjusted EBITDAre, we adjust for the items shown on page 10. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. Hotel EBITDA: We calculate Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in our condensed consolidated statements of income (loss) in accordance with GAAP. We believe that Hotel EBITDA provides useful information to management and investors as a key measure of the profitability of our hotel operations. Other Definitions Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment write-downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at our hotels and is a measure widely used in the hotel industry. Chain Scale: As characterized by STR, a data benchmark and analytics provider for the lodging industry. Comparable Hotels Data: We present RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. We generally define comparable hotels as those that we owned on September 30, 2022 and were open and operating since the beginning of the earliest period being compared. For the periods presented, our comparable results excluded three hotels that had suspended operations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in our debt agreements, is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. Non-GAAP Financial Measures and Certain Definitions RETURN TO TABLE OF CONTENTS

Supplemental Q3 2022 33 FF&E Reserve: Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for our hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such fundings, our contractual owner's priority returns or rents generally increase by a percentage of the amounts we fund. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel EBITDA Margin: Is Hotel EBITDA as a percentage of hotel operating revenues. Investment: We define hotel investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in owner's priority return or rents. We define net lease investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels. Occupancy is an important measure of the utilization rate and demand of our hotels. Owner's priority return: Each of our management agreements or leases with hotel operators provides for payment to us of an annual owner's priority return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees. In addition, certain of our hotel management agreements provide for payment to us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed. Each of our agreements with our net lease tenants provides for payment to us of minimum rent. Certain of these minimum payment amounts are secured by full or limited guarantees. Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to record scheduled rent changes under certain of our leases, the deferred rent obligations payable to us under our leases with TA and the estimated future payments to us under our TA leases for the cost of removing underground storage tanks at our travel centers on a straight line basis or any reimbursement of expenses paid by us. Rent Coverage: We define rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to us weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. EBITDAR amounts used to determine rent coverage are generally for the latest twelve-month period reported based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by us. Tenants that do not report operating information are excluded from the rent coverage calculations. In instances where we do not have financial information for the most recent quarter from our tenants, we have calculated an implied EBITDAR for the 2022 third quarter using industry benchmark data to reflect current operating trends. We believe using this industry benchmark data provides a reasonable estimate of recent operating results and rent coverage for those tenants. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure revenue performance over comparable periods. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation. Non-GAAP Financial Measures and Certain Definitions (Continued) RETURN TO TABLE OF CONTENTS

Supplemental Q3 2022 34 This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “will,” “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon our forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements RETURN TO TABLE OF CONTENTS