Document

REDWOOD TRUST REPORTS SECOND QUARTER 2025 FINANCIAL RESULTS AND ACCELERATES TRANSITION TO CORE OPERATING STRATEGY

INCREASES SHARE REPURCHASE AUTHORIZATION TO $150 MILLION

MILL VALLEY, CA – Redwood Trust, Inc. (NYSE:RWT; "Redwood", the "Company"), a leader in expanding access to housing for homebuyers and renters, today reported its financial results for the quarter ended June 30, 2025. The Company also announced an expedited transition to the scalable and simplified operating model initially described at its March 2024 Investor Day, as well as an increased share repurchase authorization.

Accelerated shift towards operating model and wind-down of legacy portfolio holdings

•Dispositions primarily focused on unsecuritized bridge loans and other non-core assets, now part of a new Legacy Investments(1) reporting segment

•Expected to generate up to $200-$250 million of incremental capital by year-end 2025 for efficient redeployment, complementing $302 million of unrestricted cash at June 30, 2025

Immediate avenues for capital redeployment to grow high-earning, core operating initiatives

•Mortgage banking platforms continue to profitably scale

◦Combined mortgage banking GAAP returns above 20% for four consecutive quarters

▪Capital allocated to mortgage banking has increased by $200 million since the second quarter 2024

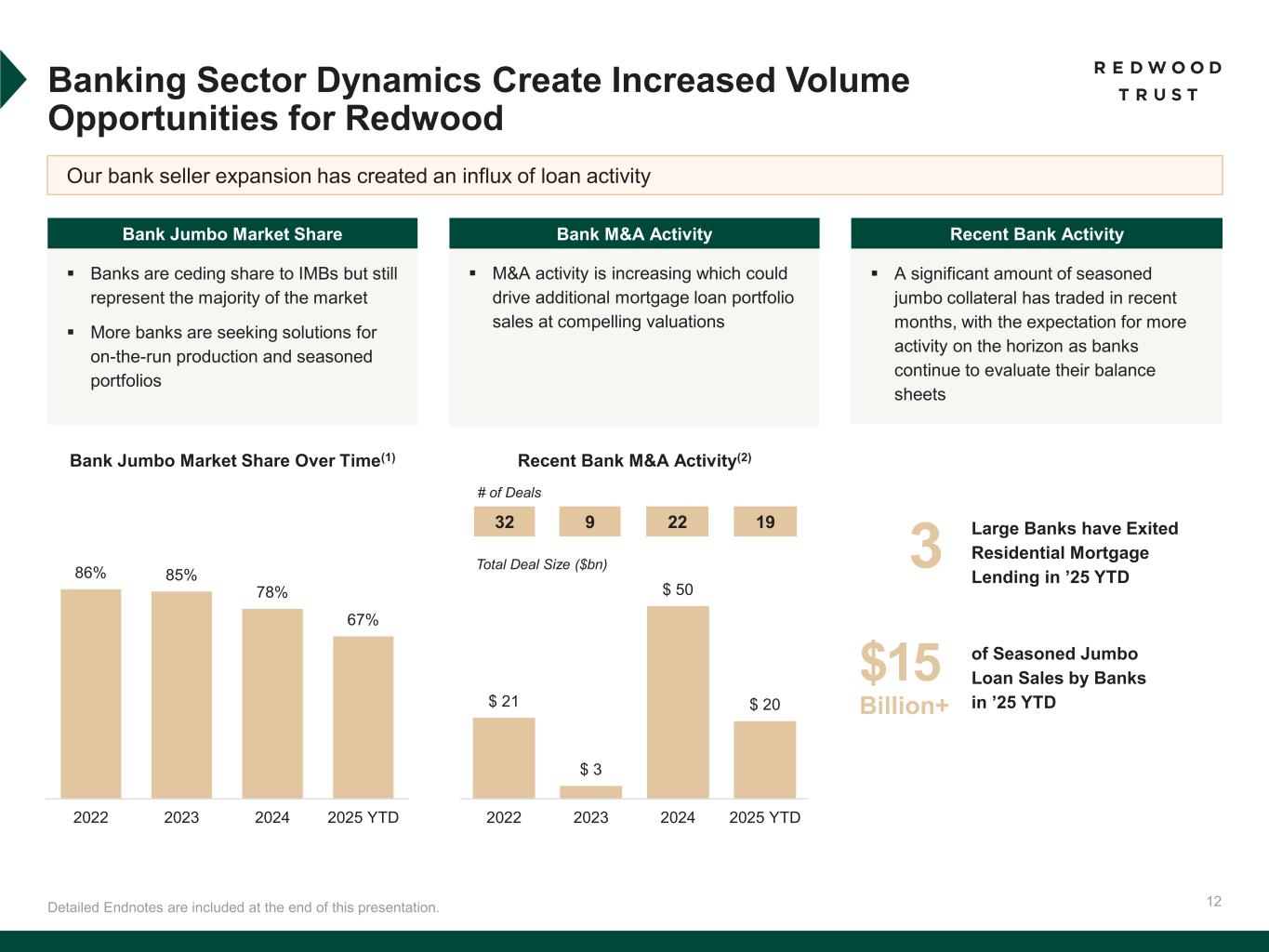

◦Company sees transformative growth opportunities through both ongoing strategic engagement with banks and unique positioning to benefit across a wide range of potential outcomes for housing finance reform

•Simplified revenue mix to enhance transparency of valuation and predictability of earnings

◦Mortgage banking activities – including upfront and recurring fee streams – and joint venture co-investments remain primary revenue drivers

Concurrent focus on return of capital to shareholders

•In tandem, the Company announced an upsized common stock repurchase authorization to $150 million, reflecting confidence in the go-forward value of the franchise

•The Company expects to expand upon the 2.4 million shares repurchased since June 2025

“This quarter marks a pivotal moment for Redwood as we further evolve toward a more scalable business underpinned by growing and durable fee streams,” said Christopher Abate, Chief Executive Officer of Redwood. “By proactively reallocating capital from legacy investments into our high-performing platforms, we’re enhancing our capacity to capitalize on growth opportunities in an evolving market landscape—unlocking greater long-term earnings potential while eliminating legacy overhangs that have impacted our current performance. Our strategic transition to a larger and simplified operating model includes an ongoing focus on partnerships with strategic capital providers—those looking both to acquire the assets our platforms originate and to invest directly in the expansion of our businesses.”

Continued Abate, “Our recent common stock repurchases and the refreshed buyback authorization reflect our strong conviction in the strategic direction of the business. We plan to expand our repurchase activity in the third quarter as we continue to execute on this strategy. We remain highly encouraged by our competitive positioning, sustained demand from loan sellers and private capital partners, and compelling opportunities to scale our business and enhance long-term shareholder value.”

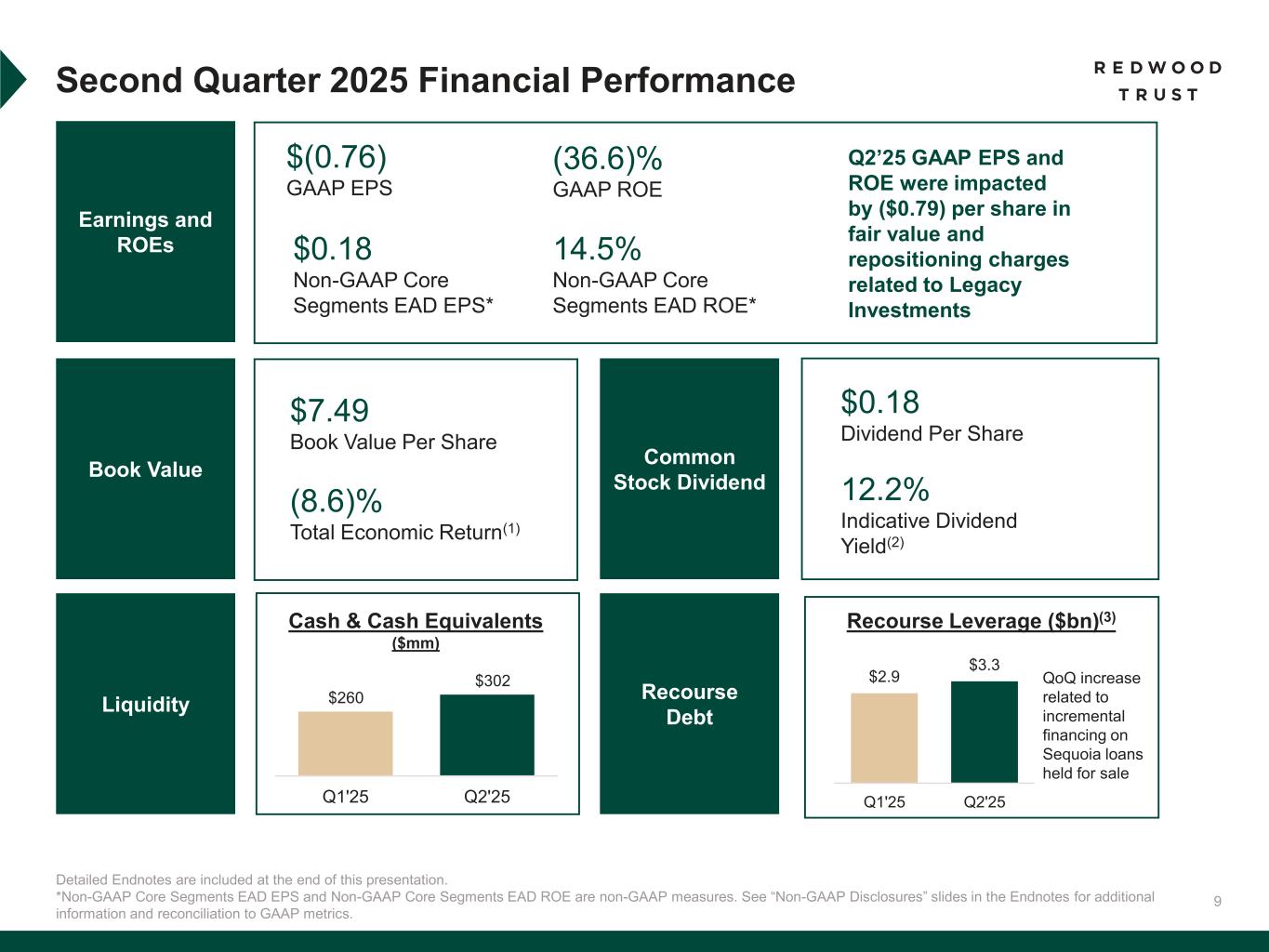

Key Q2 2025 Financial Results and Metrics

•GAAP book value per common share was $7.49 at June 30, 2025, relative to $8.39 per share at March 31, 2025

◦Economic return on book value of (8.6)% for the second quarter(2)

•GAAP net loss related to common stockholders of $(100.2) million or $(0.76) per basic and diluted common share, driven by Legacy Investments

•Non-GAAP Core Segments Earnings Available for Distribution ("Core Segments EAD") of $25.0 million or $0.18 per basic common share (refer to non-GAAP reconciliation under the section titled "Non-GAAP Disclosures")(3)

•Unrestricted cash and cash equivalents of $302 million

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share data) |

Three Months Ended |

|

|

|

|

6/30/2025 |

|

3/31/2025 |

|

|

|

| Financial Performance |

|

|

|

|

|

|

| Book Value per Common Share |

$ |

7.49 |

|

|

$ |

8.39 |

|

|

|

|

Economic Return on Book Value (2) |

(8.6) |

% |

|

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (Loss) Income per Basic Common Share |

$ |

(0.76) |

|

|

$ |

0.10 |

|

|

|

|

Non-GAAP Core Segments EAD per Basic Common Share (3) |

$ |

0.18 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends per Common Share |

$ |

0.18 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2025 Segment Highlights

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Segment Net (Loss) Income Results Summary |

| ($ in millions) |

|

Three Months Ended |

|

6/30/2025 |

|

3/31/2025 |

| Core Segments: |

|

|

|

| Sequoia Mortgage Banking |

$ |

22.2 |

|

|

$ |

25.8 |

|

| CoreVest Mortgage Banking |

6.1 |

|

|

3.0 |

|

| Redwood Investments |

11.9 |

|

|

25.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Core Segments |

$ |

40.2 |

|

|

$ |

53.8 |

|

| Total Legacy Investments Segment |

$ |

(104.0) |

|

|

$ |

(2.1) |

|

| Total Corporate/Other |

$ |

(36.4) |

|

|

$ |

(37.4) |

|

| GAAP Net (Loss) Income |

$ |

(100.2) |

|

|

$ |

14.3 |

|

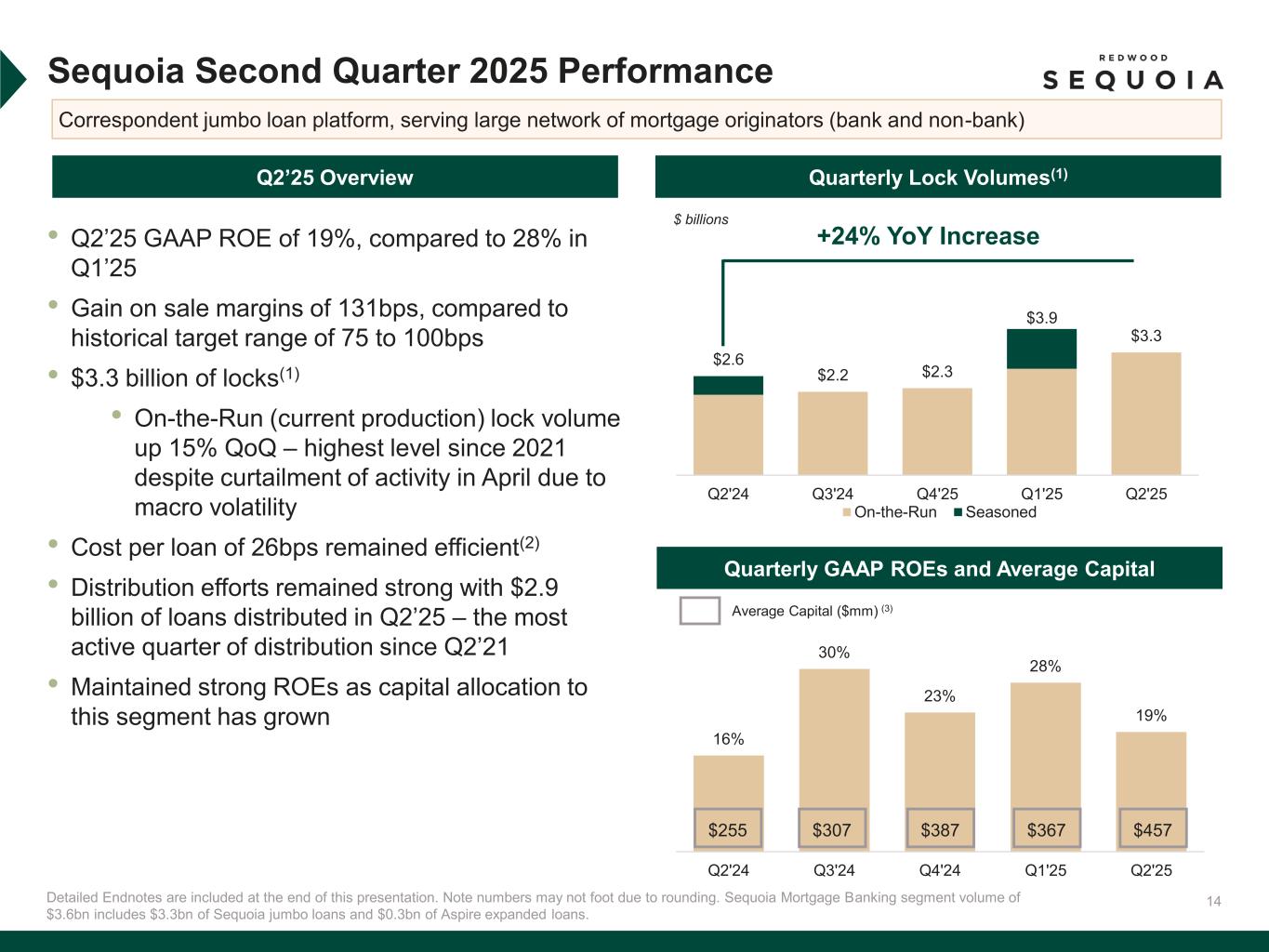

Sequoia Mortgage Banking

•Segment GAAP net income of $22.2 million

•Generated 19% annualized GAAP Return on Equity ("ROE") and non-GAAP EAD ROE(4)

•Gain on sale margin of 131 basis points, compared to historical target range of 75 to 100 basis points

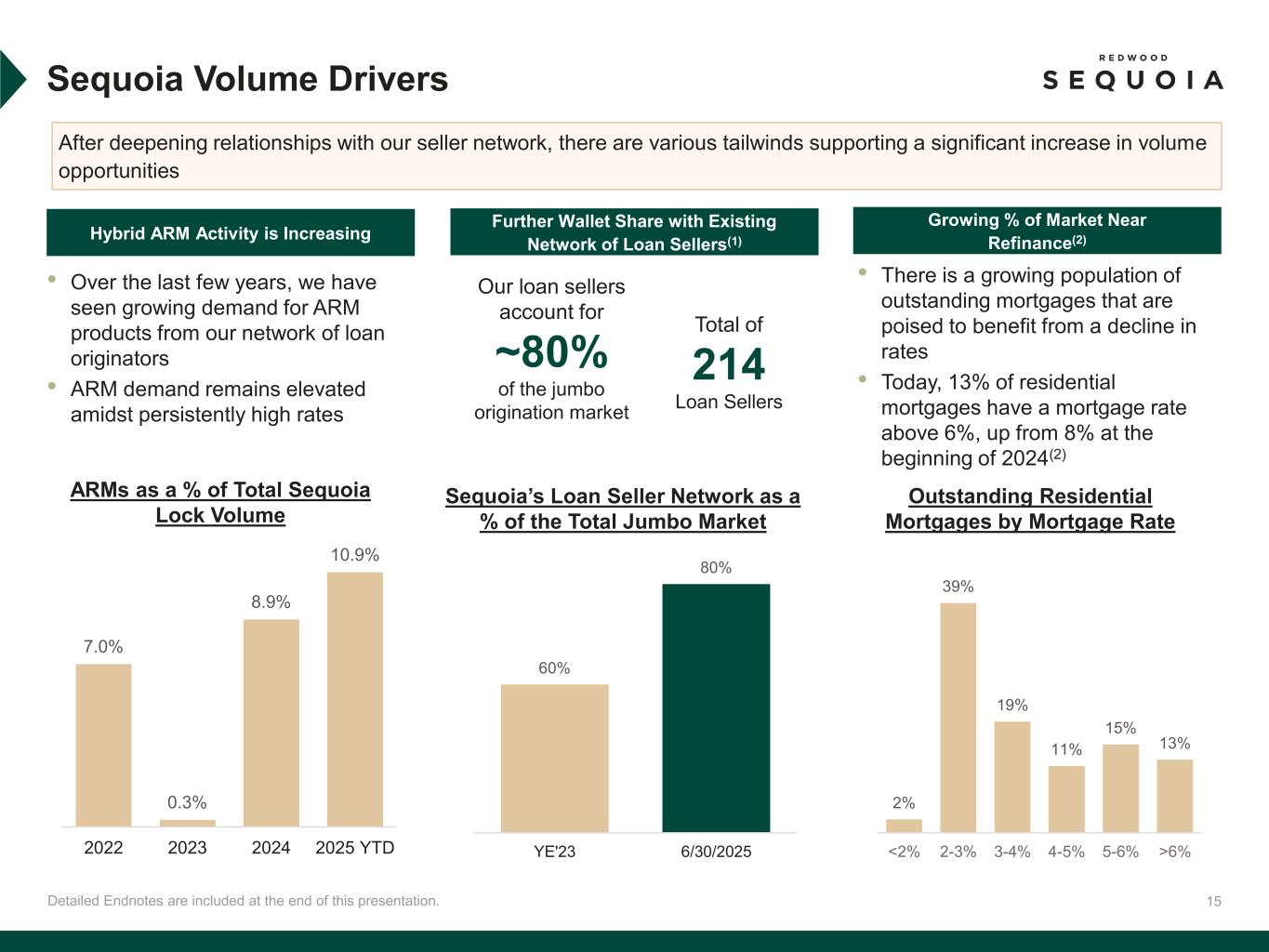

•Locked $3.6 billion of loans(5), down 10% from $4.0 billion in the first quarter 2025 (which included a $1.0 billion seasoned bulk pool) and up 35% from $2.7 billion in the second quarter 2024

◦On-the-run (current coupon) jumbo lock volume increased 15% from the first quarter 2025 to its highest level since 2021

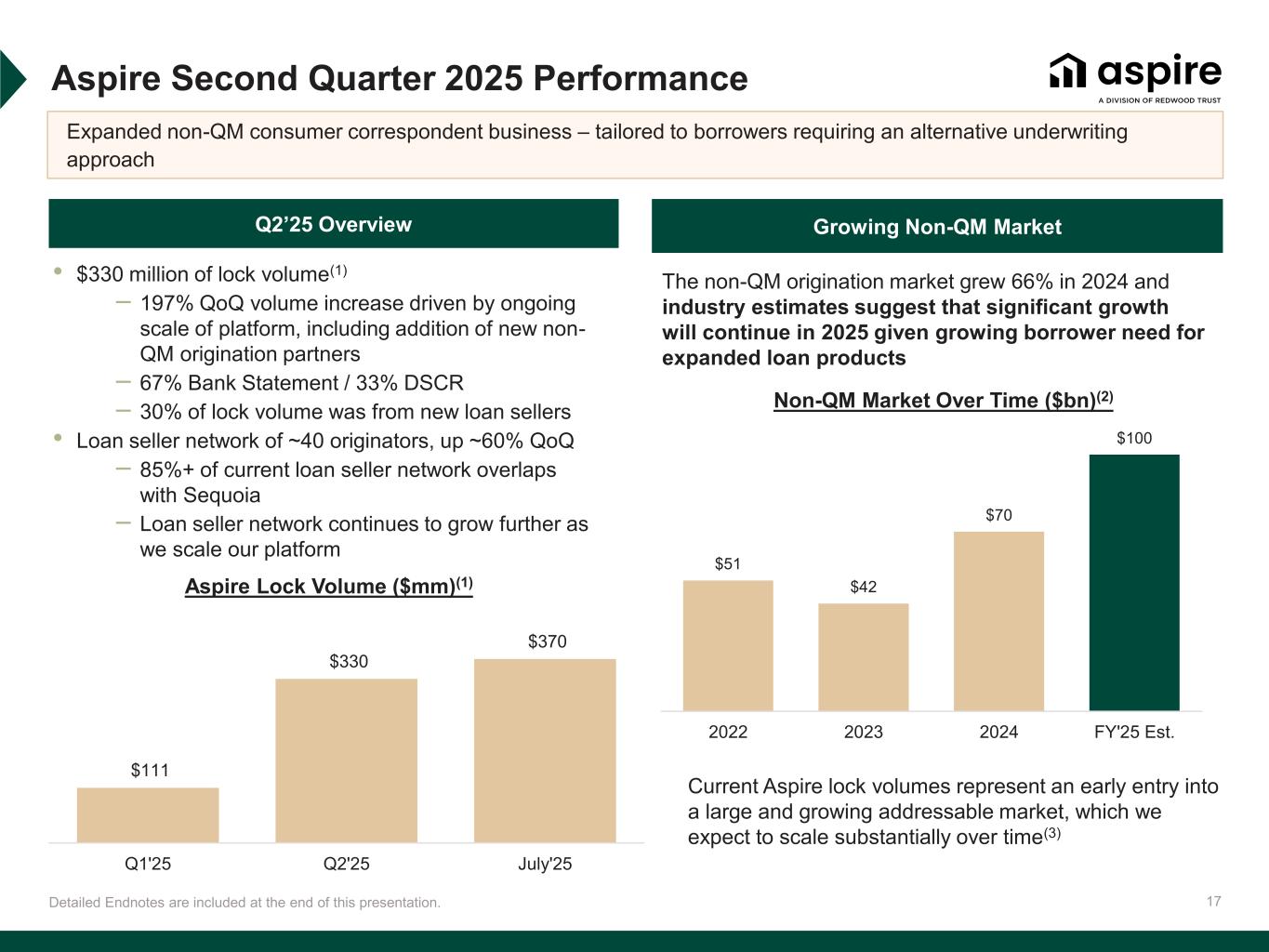

◦Lock volume includes $330 million of Aspire loans, a 197% increase from the first quarter 2025(6)

•Distributed $2.9 billion of loans through a combination of securitizations ($2.0 billion) and whole loan sales ($841 million), the most active quarter for distributions since 2021

CoreVest Mortgage Banking

•Segment GAAP net income of $6.1 million

•Generated 27% and 34% annualized GAAP ROE and non-GAAP EAD ROE, respectively(4)

•Funded $509 million of loans (55% bridge and 45% term), a 6% increase from $482 million in the first quarter 2025 and an 11% increase from $459 million in the second quarter 2024

•Distributed $583 million of loans through whole loan sales, securitizations and sales to joint ventures ("JVs"), the most active quarter of distributions in CoreVest's history

◦Distribution activities included completion of CoreVest's inaugural rated securitization backed by $284 million of bridge loans

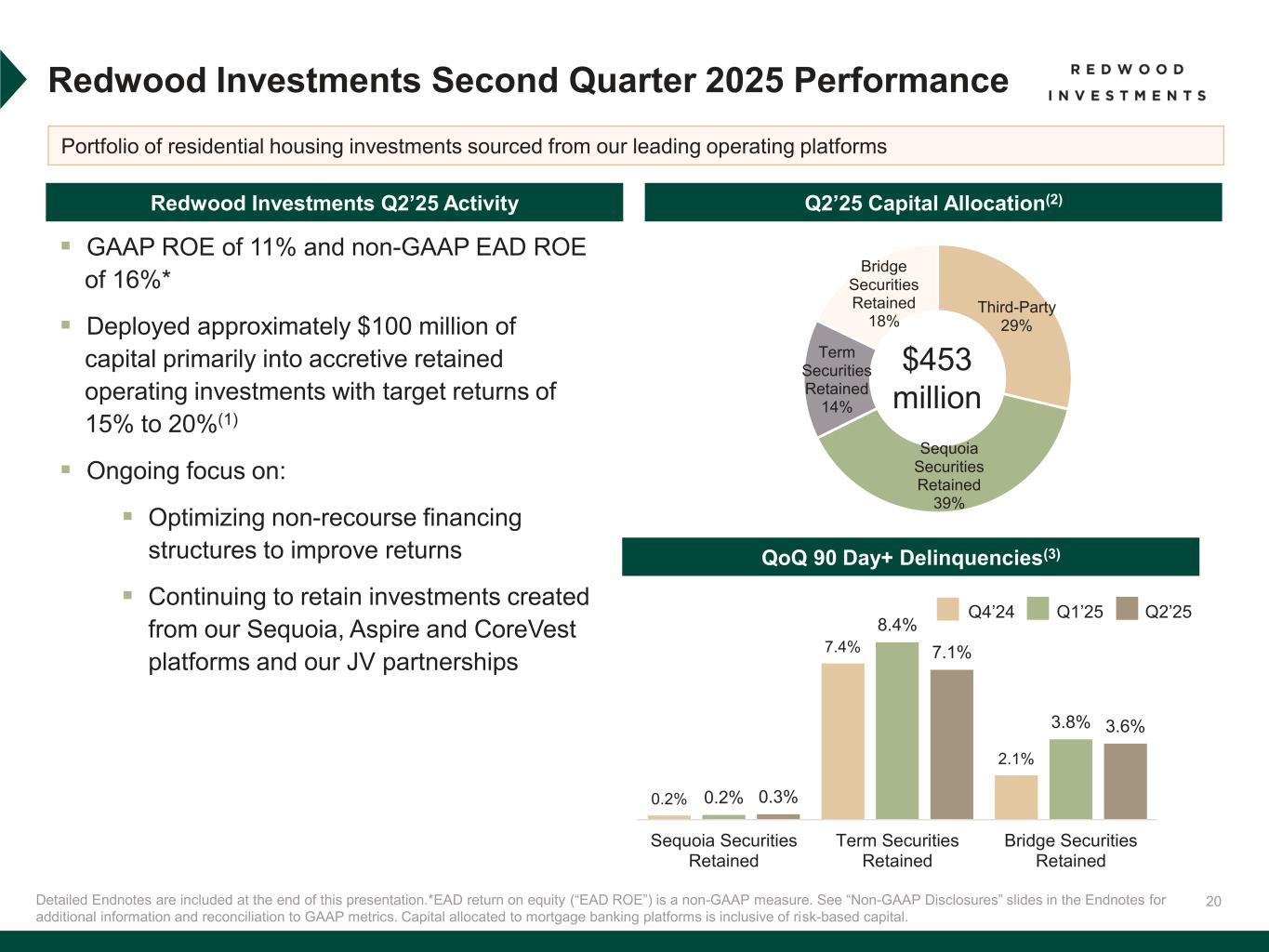

Redwood Investments(7)

•Segment GAAP net income of $11.9 million

◦Net income from Redwood Investments decreased in the second quarter 2025 relative to the first quarter 2025, largely driven by muted asset valuation gains relative to last quarter

•Accretively deployed approximately $100 million of capital into retained operating investments with mid-teens target returns(8)

•Redwood Investments recourse leverage ratio remained low at 1.1x at June 30, 2025(9)

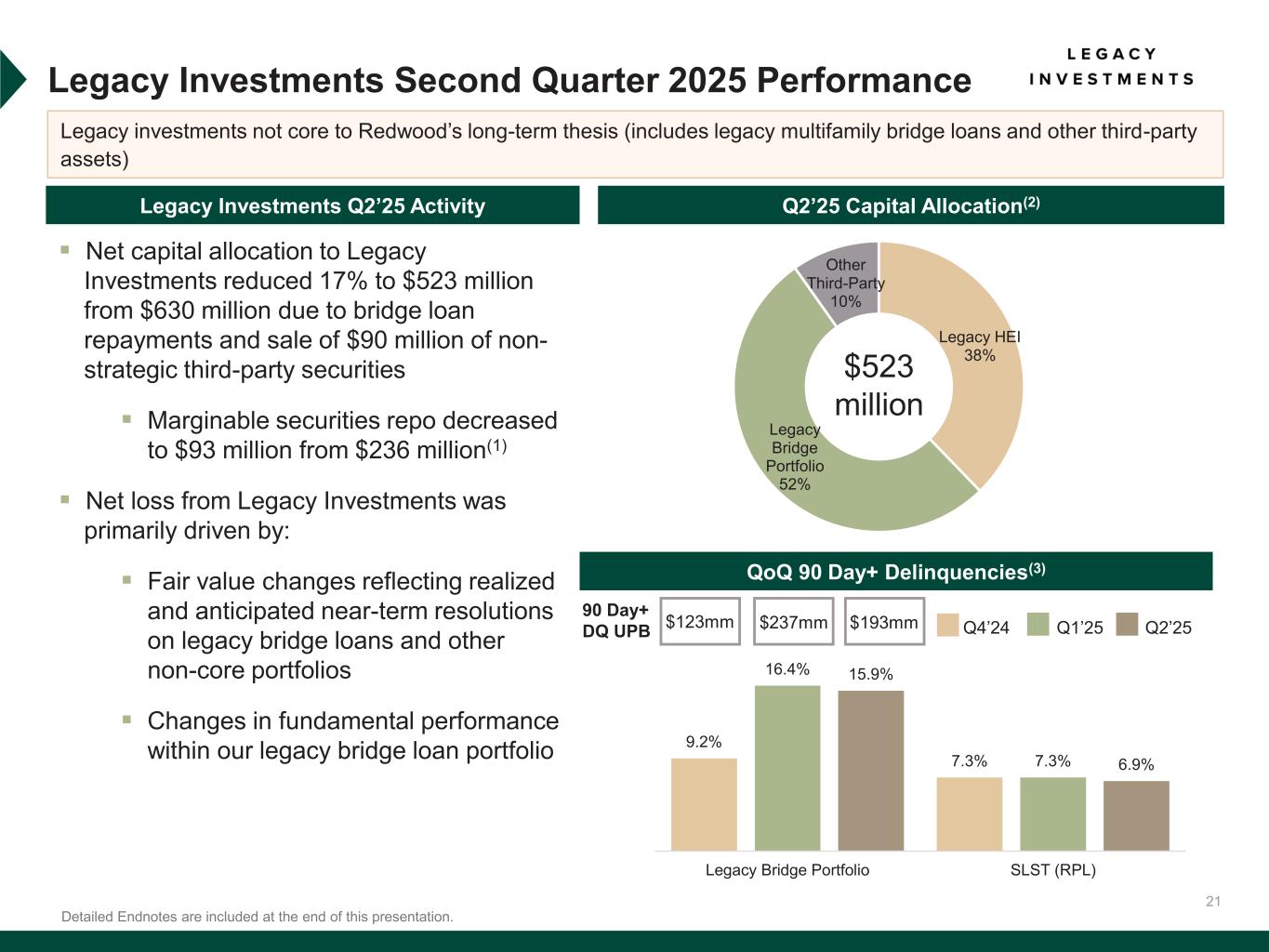

Legacy Investments(1)

•New reportable segment established in the second quarter 2025 to present financial results for assets not core to Redwood's long-term strategic objectives

◦These assets are generally in the process of active sale, run-off, or other disposition

◦Segment GAAP net loss of $(104.0) million

▪Net loss from Legacy Investments primarily driven by fair value adjustments, reflecting both realized and anticipated near-term resolutions on legacy bridge loans and other non-core assets, as well as changes in the underlying performance of certain legacy bridge loans

◦Capital allocated to Legacy Investments declined by $107 million or 17% at June 30, 2025 from March 31, 2025, largely due to paydowns, sales and fair value adjustments of our legacy bridge loans and the sale, or pending sale, of non-core third-party assets

•Legacy Investments recourse leverage ratio of 1.2x at June 30, 2025(10)

Capital and Financing

•Recourse debt of $3.3 billion at June 30, 2025 compared to $2.9 billion at March 31, 2025 (recourse leverage ratio of 3.2x at June 30, 2025, up from 2.5x at March 31, 2025)(11)

◦Quarter-over-quarter increase partially driven by increased warehouse utilization, reflecting the continued growth of our mortgage banking pipelines

•Marginable securities repo reduced to $93 million at June 30, 2025 from $236 million at March 31, 2025 from sale of third-party assets

Q3 2025 Highlights to Date(12)

•Locked or funded a combined $1.6 billion of loans across mortgage banking platforms

•Distributed approximately $0.7 billion of loans across mortgage banking platforms through securitizations, whole loans sales and sales to JVs(13)

•Repurchased 0.8 million shares of our common stock

•Increased common stock repurchase authorization to $150 million

_____________________

1.Legacy Investments consists of certain unsecuritized residential investor bridge loans (including multifamily loans), certain REO investments and other third-party originated investments.

2.Economic return on book value is based on the period change in GAAP book value per common share plus dividends declared per common share in the period.

3.Core Segments Earnings Available for Distribution ("Core Segments EAD") is a new non-GAAP measure established in the second quarter 2025 and is used to present management’s non-GAAP analysis of the combined performance the Company’s mortgage banking platforms and related investments (which consist of the Company’s Sequoia Mortgage Banking, CoreVest Mortgage Banking and Redwood Investments segments), inclusive of an allocated portion of the Company’s Corporate segment relating to those Core Segments. Core Segments EAD excludes the Company’s Legacy Investments segment and excludes an allocated portion of the Company’s Corporate segment relating to the Legacy Investments segment. Core Segments EAD per basic common share and Core Segments EAD ROE are also new non-GAAP measures established in the second quarter 2025 and are calculated using Core Segments EAD. See Non-GAAP Disclosures section that follows for additional information on these measures.

4.Earnings Available for Distribution (“EAD”) and EAD ROE are non-GAAP measures that the Company has historically reported and continue to be used to present management’s non-GAAP analysis of the performance of the Company’s different business segments, exclusive of any allocation of the Company’s Corporate segment. See Non-GAAP Disclosures section that follows for additional information on these measures.

5.Lock volume represents loans identified for purchase from loan sellers. Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process.

6.Aspire lock volume is included in the Sequoia Mortgage Banking business segment results.

7.Redwood Investments consists of retained operating investments sourced through our Sequoia securitizations and CoreVest term and bridge loan securitizations, some of which we consolidate for GAAP purposes, investments in joint ventures, and other third-party investments.

8.Represents management’s targets and actual results may differ materially.

9.Redwood Investments recourse leverage ratio is defined as recourse debt at Redwood Investments divided by capital invested. At June 30, 2025 recourse debt excludes $15.1 billion of consolidated securitization debt (ABS issued and servicer advance financing), other liabilities and other debt that is non-recourse to Redwood at Redwood Investments. Capital invested in our Redwood Investments segment at June 30, 2025 was $453 million.

10.Legacy Investments recourse leverage ratio is defined as recourse debt at Legacy Investments divided by capital invested. At June 30, 2025 recourse debt excludes $1.4 billion of consolidated securitization debt (ABS issued), other liabilities and other debt that is non-recourse to Redwood at Legacy Investments. Capital invested in our Legacy Investments segment at June 30, 2025 was $523 million.

11.Recourse leverage ratio is defined as recourse debt at Redwood divided by tangible stockholders' equity. At June 30, 2025, and March 31, 2025, recourse debt excluded $16.9 billion and $15.8 billion, respectively, of consolidated securitization debt (ABS issued and servicer advance financing), other liabilities and other debt that is non-recourse to Redwood, and tangible stockholders' equity excluded $38 million and $40 million, respectively, of goodwill and intangible assets.

12.Represents third quarter 2025 activity through July 29, 2025 unless otherwise noted.

13.Includes securitizations and sales that have priced but not yet closed as of July 29, 2025.

Second Quarter 2025 Redwood Review and Supplemental Tables Available Online

A further discussion of Redwood's business and financial results is included in the second quarter 2025 Shareholder Letter and Redwood Review which are available under "Financial Info" within the Investor Relations section of the Company’s website at redwoodtrust.com/investor-relations. Additional supplemental financial tables can also be found within this section of the Company's website.

Conference Call and Webcast

Redwood will host an earnings call today, July 30, 2025, at 8:00 a.m. Eastern Time / 5:00 a.m. Pacific Time to discuss its second quarter 2025 financial results. The number to dial in order to listen to the conference call is 1-877-423-9813 in the U.S. and Canada. International callers must dial 1-201-689-8573. A replay of the call will be available through midnight on Wednesday, August 13, 2025, and can be accessed by dialing 1-844-512-2921 in the U.S. and Canada or 1-412-317-6671 internationally and entering access code #13754528.

The conference call will be webcast live in listen-only mode through the News & Events section of Redwood’s Investor Relations website at https://www.redwoodtrust.com/investor-relations/news-events/events. To listen to the webcast, please go to Redwood's website at least 15 minutes before the call to register and to download and install any needed audio software. An audio replay of the call will also be available on Redwood's website following the call. Redwood plans to file its Quarterly Report on Form 10-Q with the Securities and Exchange Commission by Monday, August 11, 2025, and also make it available on Redwood’s website.

REDWOOD TRUST, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

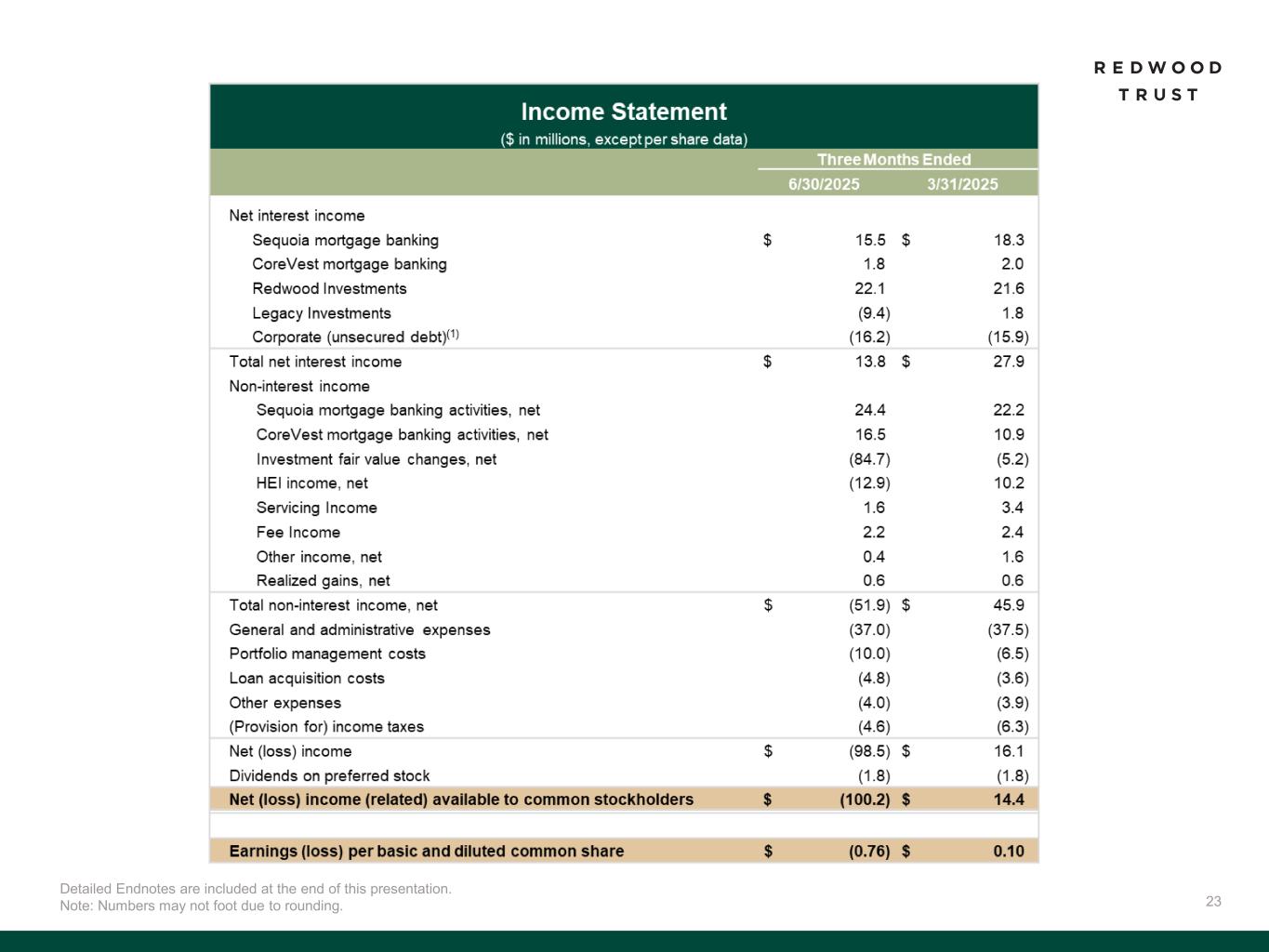

Consolidated Income Statements (1) |

|

Three Months Ended |

| ($ in millions, except share and per share data) |

|

6/30/25 |

|

3/31/25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Income from: |

|

|

|

|

|

|

|

|

|

|

| Sequoia mortgage banking |

|

$ |

15.5 |

|

|

$ |

18.3 |

|

|

|

|

|

|

|

| CoreVest mortgage banking |

|

1.8 |

|

|

2.0 |

|

|

|

|

|

|

|

| Redwood investments |

|

22.1 |

|

|

21.6 |

|

|

|

|

|

|

|

| Legacy investments |

|

(9.4) |

|

|

1.8 |

|

|

|

|

|

|

|

| Corporate/other |

|

(16.2) |

|

|

(15.9) |

|

|

|

|

|

|

|

| Net Interest Income |

|

$ |

13.8 |

|

|

$ |

27.9 |

|

|

|

|

|

|

|

| Non-interest income |

|

|

|

|

|

|

|

|

|

|

| Sequoia mortgage banking activities, net |

|

24.4 |

|

|

22.2 |

|

|

|

|

|

|

|

| CoreVest mortgage banking activities, net |

|

16.5 |

|

|

10.9 |

|

|

|

|

|

|

|

| Investment fair value changes, net |

|

(84.7) |

|

|

(5.2) |

|

|

|

|

|

|

|

| HEI income, net |

|

(12.9) |

|

|

10.2 |

|

|

|

|

|

|

|

| Servicing income, net |

|

1.6 |

|

|

3.4 |

|

|

|

|

|

|

|

| Fee income, net |

|

2.2 |

|

|

2.4 |

|

|

|

|

|

|

|

| Other income, net |

|

0.4 |

|

|

1.6 |

|

|

|

|

|

|

|

| Realized gains, net |

|

0.6 |

|

|

0.6 |

|

|

|

|

|

|

|

| Total non-interest income, net |

|

$ |

(51.9) |

|

|

$ |

45.9 |

|

|

|

|

|

|

|

| General and administrative expenses |

|

(37.0) |

|

|

(37.5) |

|

|

|

|

|

|

|

| Portfolio management costs |

|

(10.0) |

|

|

(6.5) |

|

|

|

|

|

|

|

| Loan acquisition costs |

|

(4.8) |

|

|

(3.6) |

|

|

|

|

|

|

|

| Other expenses |

|

(4.0) |

|

|

(3.9) |

|

|

|

|

|

|

|

| (Provision for) income taxes |

|

(4.6) |

|

|

(6.3) |

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(98.5) |

|

|

$ |

16.1 |

|

|

|

|

|

|

|

| Dividends on preferred stock |

|

(1.8) |

|

|

(1.8) |

|

|

|

|

|

|

|

| Net (loss) income (related) available to common stockholders |

|

$ |

(100.2) |

|

|

$ |

14.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average basic common shares (thousands) |

|

133,006 |

|

|

132,766 |

|

|

|

|

|

|

|

Weighted average diluted common shares (thousands) (2) |

|

133,006 |

|

|

132,766 |

|

|

|

|

|

|

|

| (Loss) earnings per basic common share |

|

$ |

(0.76) |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

| (Loss) earnings per diluted common share |

|

$ |

(0.76) |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

| Regular dividends declared per common share |

|

$ |

0.18 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Certain totals may not foot due to rounding.

(2)Actual shares outstanding (in thousands) at June 30, 2025 and March 31, 2025 were 131,680 and 133,005, respectively.

REDWOOD TRUST, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets (1) |

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except share and per share data) |

|

6/30/25 |

|

3/31/25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential consumer loans |

|

$ |

14,202 |

|

|

$ |

12,752 |

|

|

|

|

|

|

|

|

| Residential investor loans |

|

4,339 |

|

|

4,440 |

|

|

|

|

|

|

|

|

| Consolidated agency multifamily loans |

|

423 |

|

|

424 |

|

|

|

|

|

|

|

|

| Real estate securities |

|

265 |

|

|

376 |

|

|

|

|

|

|

|

|

| Home equity investments (HEI) |

|

588 |

|

|

600 |

|

|

|

|

|

|

|

|

| Servicing investments |

|

298 |

|

|

298 |

|

|

|

|

|

|

|

|

| Strategic investments |

|

78 |

|

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

302 |

|

|

260 |

|

|

|

|

|

|

|

|

| Other assets |

|

838 |

|

|

637 |

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

21,333 |

|

|

$ |

19,872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset-backed securities issued, net |

|

$ |

15,985 |

|

|

$ |

14,458 |

|

|

|

|

|

|

|

|

| Debt obligations, net |

|

3,745 |

|

|

3,761 |

|

|

|

|

|

|

|

|

| Other liabilities |

|

549 |

|

|

469 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

$ |

20,280 |

|

|

$ |

18,688 |

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

1,053 |

|

|

1,183 |

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

21,333 |

|

|

$ |

19,872 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding at period end (thousands) |

|

131,680 |

|

|

133,005 |

|

|

|

|

|

|

|

|

| GAAP book value per common share |

|

$ |

7.49 |

|

|

$ |

8.39 |

|

|

|

|

|

|

|

|

(1)Certain totals may not foot due to rounding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2025 |

| (In Millions) |

|

Sequoia Mortgage Banking |

|

CoreVest Mortgage Banking |

|

Redwood Investments |

|

Legacy Investments |

|

Corporate/

Other |

|

Total |

| Interest income |

|

$ |

37.0 |

|

|

$ |

3.7 |

|

|

$ |

219.7 |

|

|

$ |

23.4 |

|

|

$ |

0.4 |

|

|

$ |

284.3 |

|

| Interest expense |

|

(21.5) |

|

|

(1.9) |

|

|

(197.6) |

|

|

(32.9) |

|

|

(16.6) |

|

|

(270.5) |

|

| Net interest income (expense) |

|

15.5 |

|

|

1.8 |

|

|

22.1 |

|

|

(9.4) |

|

|

(16.2) |

|

|

13.8 |

|

| Non-interest income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage banking activities, net |

|

24.4 |

|

|

16.5 |

|

|

— |

|

|

— |

|

|

— |

|

|

40.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment fair value changes, net |

|

— |

|

|

— |

|

|

(9.0) |

|

|

(75.6) |

|

|

(0.1) |

|

|

(84.7) |

|

| HEI income, net |

|

— |

|

|

— |

|

|

0.1 |

|

|

(13.0) |

|

|

— |

|

|

(12.9) |

|

| Servicing Income, net |

|

— |

|

|

— |

|

|

1.6 |

|

|

— |

|

|

— |

|

|

1.6 |

|

| Fee Income, net |

|

— |

|

|

2.8 |

|

|

0.4 |

|

|

(1.0) |

|

|

— |

|

|

2.2 |

|

| Other income, net |

|

— |

|

|

0.7 |

|

|

0.4 |

|

|

— |

|

|

(0.8) |

|

|

0.4 |

|

| Realized gains, net |

|

— |

|

|

— |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

0.6 |

|

| Total non-interest income (loss), net |

|

24.4 |

|

|

20.0 |

|

|

(5.8) |

|

|

(89.6) |

|

|

(0.9) |

|

|

(51.9) |

|

| General and administrative expenses |

|

(7.2) |

|

|

(10.2) |

|

|

(1.5) |

|

|

(0.1) |

|

|

(18.0) |

|

|

(37.0) |

|

| Portfolio management costs |

|

— |

|

|

— |

|

|

(2.6) |

|

|

(7.4) |

|

|

— |

|

|

(10.0) |

|

| Loan acquisition costs |

|

(1.3) |

|

|

(3.5) |

|

|

— |

|

|

— |

|

|

— |

|

|

(4.8) |

|

| Other expenses |

|

— |

|

|

(2.2) |

|

|

(1.8) |

|

|

— |

|

|

— |

|

|

(4.0) |

|

| (Provision for) benefit from income taxes |

|

(9.3) |

|

|

0.3 |

|

|

1.6 |

|

|

2.5 |

|

|

0.3 |

|

|

(4.6) |

|

Net Income (Loss) (1) |

|

$ |

22.2 |

|

|

$ |

6.1 |

|

|

$ |

11.9 |

|

|

$ |

(104.0) |

|

|

$ |

(34.7) |

|

|

$ |

(98.5) |

|

| Total Assets |

|

$ |

1,689.1 |

|

|

$ |

338.0 |

|

|

$ |

15,982.4 |

|

|

$ |

2,917.4 |

|

|

$ |

406.2 |

|

|

$ |

21,333.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Net Income (Loss) by segment is also referred to as Segment Net Income (Loss).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Financial Information (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

| (In Millions) |

|

Sequoia Mortgage Banking |

|

CoreVest Mortgage Banking |

|

Redwood Investments |

|

Legacy Investments |

|

Corporate/

Other |

|

Total |

| Interest income |

|

$ |

31.7 |

|

|

$ |

4.4 |

|

|

$ |

201.6 |

|

|

$ |

34.2 |

|

|

$ |

0.3 |

|

|

$ |

272.1 |

|

| Interest expense |

|

(13.3) |

|

|

(2.4) |

|

|

(179.9) |

|

|

(32.3) |

|

|

(16.2) |

|

|

(244.2) |

|

| Net interest income (expense) |

|

18.3 |

|

|

2.0 |

|

|

21.7 |

|

|

1.8 |

|

|

(15.9) |

|

|

27.9 |

|

| Non-interest income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage banking activities, net |

|

22.2 |

|

|

10.9 |

|

|

— |

|

|

— |

|

|

— |

|

|

33.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment fair value changes, net |

|

— |

|

|

— |

|

|

3.6 |

|

|

(8.7) |

|

|

(0.1) |

|

|

(5.2) |

|

| HEI income, net |

|

— |

|

|

— |

|

|

0.1 |

|

|

10.1 |

|

|

— |

|

|

10.2 |

|

| Servicing Income, net |

|

— |

|

|

— |

|

|

3.4 |

|

|

— |

|

|

— |

|

|

3.4 |

|

| Fee Income, net |

|

— |

|

|

3.1 |

|

|

0.1 |

|

|

(0.9) |

|

|

— |

|

|

2.4 |

|

| Other income, net |

|

— |

|

|

1.7 |

|

|

0.4 |

|

|

— |

|

|

(0.5) |

|

|

1.6 |

|

| Realized gains, net |

|

— |

|

|

— |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

0.6 |

|

| Total non-interest income (loss), net |

|

22.2 |

|

|

15.7 |

|

|

8.2 |

|

|

0.5 |

|

|

(0.6) |

|

|

45.9 |

|

| General and administrative expenses |

|

(6.3) |

|

|

(10.6) |

|

|

(1.3) |

|

|

— |

|

|

(19.2) |

|

|

(37.5) |

|

| Portfolio management costs |

|

— |

|

|

— |

|

|

(2.1) |

|

|

(4.4) |

|

|

— |

|

|

(6.5) |

|

| Loan acquisition costs |

|

(1.1) |

|

|

(2.5) |

|

|

— |

|

|

— |

|

|

— |

|

|

(3.6) |

|

| Other expenses |

|

— |

|

|

(2.2) |

|

|

(1.7) |

|

|

— |

|

|

— |

|

|

(3.9) |

|

| (Provision for) benefit from income taxes |

|

(7.3) |

|

|

0.6 |

|

|

0.3 |

|

|

— |

|

|

— |

|

|

(6.3) |

|

Net Income (Loss) (1) |

|

$ |

25.8 |

|

|

$ |

3.0 |

|

|

$ |

25.0 |

|

|

$ |

(2.1) |

|

|

$ |

(35.6) |

|

|

$ |

16.1 |

|

| Total Assets |

|

$ |

1,559.1 |

|

|

$ |

344.0 |

|

|

$ |

14,514.7 |

|

|

$ |

3,087.2 |

|

|

$ |

366.7 |

|

|

$ |

19,871.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Net Income (Loss) by segment is also referred to as Segment Net Income (Loss).

Non-GAAP Disclosures

To supplement consolidated and segment financial information prepared and presented in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company also provides the following non-GAAP measures:

•Core Segments Earnings Available for Distribution (“Core Segments EAD”)

•Earnings Available for Distribution (“EAD”)

Management believes these non-GAAP measures provide supplemental information to assist management and investors in analyzing the Company’s results of operations and help facilitate comparisons to industry peers. Management also believes that these non-GAAP measures are metrics that can supplement its analysis of the Company’s ability to pay dividends, by providing an indication of the current income generating capacity of the Company's operating platforms as of the quarter being presented. In addition, management believes its new non-GAAP Core Segments EAD measure provide supplemental information to assist management and investors in analyzing the Company’s expedited transition to the scalable and simplified capital-efficient business model, which includes an accelerated wind-down of legacy portfolio holdings within its newly-established Legacy Investments segment.

These non-GAAP measures should not be utilized in isolation, nor should they be considered as an alternative to GAAP net income (loss) available (related) to common stockholders, GAAP ROE or other measurements of results of operations computed in accordance with GAAP or for federal income tax purposes.

Core Segments EAD. Core Segments EAD and Core Segments EAD ROE are new non-GAAP measures established in the second quarter 2025 and are used to present management’s non-GAAP analysis (based on its non-GAAP Earnings Available for Distribution (“EAD”) measure further described below) of the combined performance the Company’s mortgage banking platforms and related investments (which consist of the Company’s Sequoia Mortgage Banking, CoreVest Mortgage Banking and Redwood Investments segments and are defined as the Company’s “Core Segments”, inclusive of an allocated portion of the Company’s Corporate segment relating to those segments).

•Core Segments EAD excludes the Company’s Legacy Investments segment and excludes an allocated portion of the Company’s Corporate segment relating to the Legacy Investments segment.

•Core Segments EAD per basic common share and Core Segments EAD ROE are also new non-GAAP measures established in the second quarter 2025 and are calculated using Core Segments EAD.

•Core Segments EAD ROE is defined as Core Segments EAD divided by average capital attributable to Core Segments.

A further discussion of Core Segments EAD and a reconciliation of our non-GAAP Core Segments EAD measures to comparable GAAP measures is set forth below under the heading “Reconciliation of GAAP to non-GAAP Core Segments EAD”.

EAD. Earnings Available for Distribution (“EAD”) and EAD ROE are non-GAAP measures that the Company has historically reported and continue to be used to present management’s non-GAAP analysis of the performance of the Company’s different business segments, and that continue to be calculated exclusive of any allocation of the Company’s Corporate segment.

•Consistent with prior quarter disclosures, EAD and EAD ROE are non-GAAP measures derived from GAAP Net income (loss) available (related) to common stockholders and GAAP Return on common equity ("GAAP ROE" or "ROE"), respectively.

•Consistent with prior quarter disclosures, EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude investment fair value changes, net; (ii) exclude realized gains and losses; (iii) exclude acquisition related expenses; (iv) exclude certain organizational restructuring charges (as applicable); and (v) adjust for the hypothetical income taxes associated with these adjustments.

•Consistent with prior quarter disclosures, EAD ROE is defined as EAD divided by average capital utilized for each respective period.

A further discussion of EAD and a reconciliation of our non-GAAP EAD measures to comparable GAAP measures is set forth below under the heading “Reconciliation of GAAP to non-GAAP EAD”.

Supplemental Non-GAAP Table - Illustrating EAD With Allocated Corporate Segment.

Management is also presenting a supplemental non-GAAP table in this section under the heading “Supplemental Table - EAD With Allocated Corporate Segment” to clearly illustrate a key distinction between the methodology for calculating the two non-GAAP measures described above – namely, Core Segments EAD and EAD. That key distinction relates to whether or not the non-GAAP measure allocates the Company’s Corporate segment across its other reporting segments for purposes of calculating the non-GAAP measure of performance. Management believes this supplemental table assists management and investors in comparing the Company’s two distinct non-GAAP measures described above.

Non-GAAP Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to non-GAAP Core Segments EAD (1)(2) |

|

|

|

|

Three Months Ended |

| ($ in millions, except per share data) |

|

6/30/2025 |

|

3/31/25 |

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net (loss) income (related) available to common stockholders |

|

$ |

(100.2) |

|

|

$ |

14.4 |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to exclude Legacy Investments Segment: |

|

|

|

|

|

|

|

| GAAP net loss from Legacy Investments Segment |

|

104.0 |

|

|

2.1 |

|

|

|

|

Allocation of Corporate Segment relating to Legacy Investments Segment (3) |

|

13.4 |

|

|

14.8 |

|

|

|

|

| EAD adjustments relating to Core Segments and Corporate Segment: |

|

|

|

|

|

|

|

Investment fair value changes, net (4) |

|

9.0 |

|

|

(3.6) |

|

|

|

|

Realized (gains)/losses, net (5) |

|

(0.6) |

|

|

(0.6) |

|

|

|

|

Acquisition related expenses (6) |

|

2.2 |

|

|

2.2 |

|

|

|

|

Tax effect of adjustments (7) |

|

(2.8) |

|

|

(1.4) |

|

|

|

|

| Non-GAAP Core Segments EAD |

|

$ |

25.0 |

|

|

$ |

28.0 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net (Loss) Income per Basic Common Share (GAAP) |

|

$ |

(0.76) |

|

|

$ |

0.10 |

|

|

|

|

Non-GAAP Core Segments EAD per Basic Common Share (8) |

|

$ |

0.18 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Return on Equity ("ROE") (annualized) |

|

(36.6) |

% |

|

5.2 |

% |

|

|

|

Non-GAAP Core Segments EAD Return on Equity (annualized) ("Core Segments EAD ROE") (9) |

|

14.5 |

% |

|

16.7 |

% |

|

|

|

1.Certain totals may not foot due to rounding.

2.Core Segments EAD and Core Segments EAD ROE are new non-GAAP measures established in the second quarter 2025 and are used to present management’s non-GAAP analysis of the combined performance the Company’s mortgage banking platforms and related investments (which are defined as "Core Segments" and which consist of the Company’s Sequoia Mortgage Banking, CoreVest Mortgage Banking and Redwood Investments segments), inclusive of an allocated portion of the Company’s Corporate segment relating to those Core Segments. Core Segments EAD excludes the Company’s Legacy Investments segment and excludes an allocated portion of the Company’s Corporate segment relating to the Legacy Investments segment.

Core Segments EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude GAAP net loss from the Legacy Investments Segment, (ii) exclude the portion of the Corporate Segment allocation relating to the Legacy Investments segment, (iii) exclude investment fair value changes, net; (iv) exclude realized gains and losses; (v) exclude acquisition related expenses; (vi) exclude certain organizational restructuring charges (as applicable); and (vii) adjust for the hypothetical income taxes associated with these adjustments.

Refer to footnote 9 below for the definition of Core Segments EAD ROE.

3.Allocation of Corporate Segment relating to the Legacy Investments Segment is a non-GAAP adjustment based on average capital utilized by the Legacy Investments Segment of $576 million and $614 million for the three months ended June 30, 2025 and March 31, 2025, respectively.

4.Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income that are attributable to our Core Segments and Corporate segment, which primarily represents both realized and unrealized gains and losses on our investments held in our Core Segments and Corporate Segment and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net".

5.Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of (loss) income that are attributable to our Core Segments.

6.Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions.

7.Tax effect of adjustments represents the hypothetical income taxes associated with EAD adjustments used to calculate Core Segments EAD.

8.Core Segments EAD per basic common share is a new non-GAAP measure established in the second quarter 2025 and is defined as Core Segments EAD divided by basic weighted average common shares outstanding at the end of the period.

9.Core Segments EAD ROE is a new non-GAAP measure established in the second quarter 2025 and is defined as Core Segments EAD divided by average capital attributable to Core Segments of $689 million and $671 million for the three months ended June 30, 2025 and March 31, 2025, respectively.

Non-GAAP Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

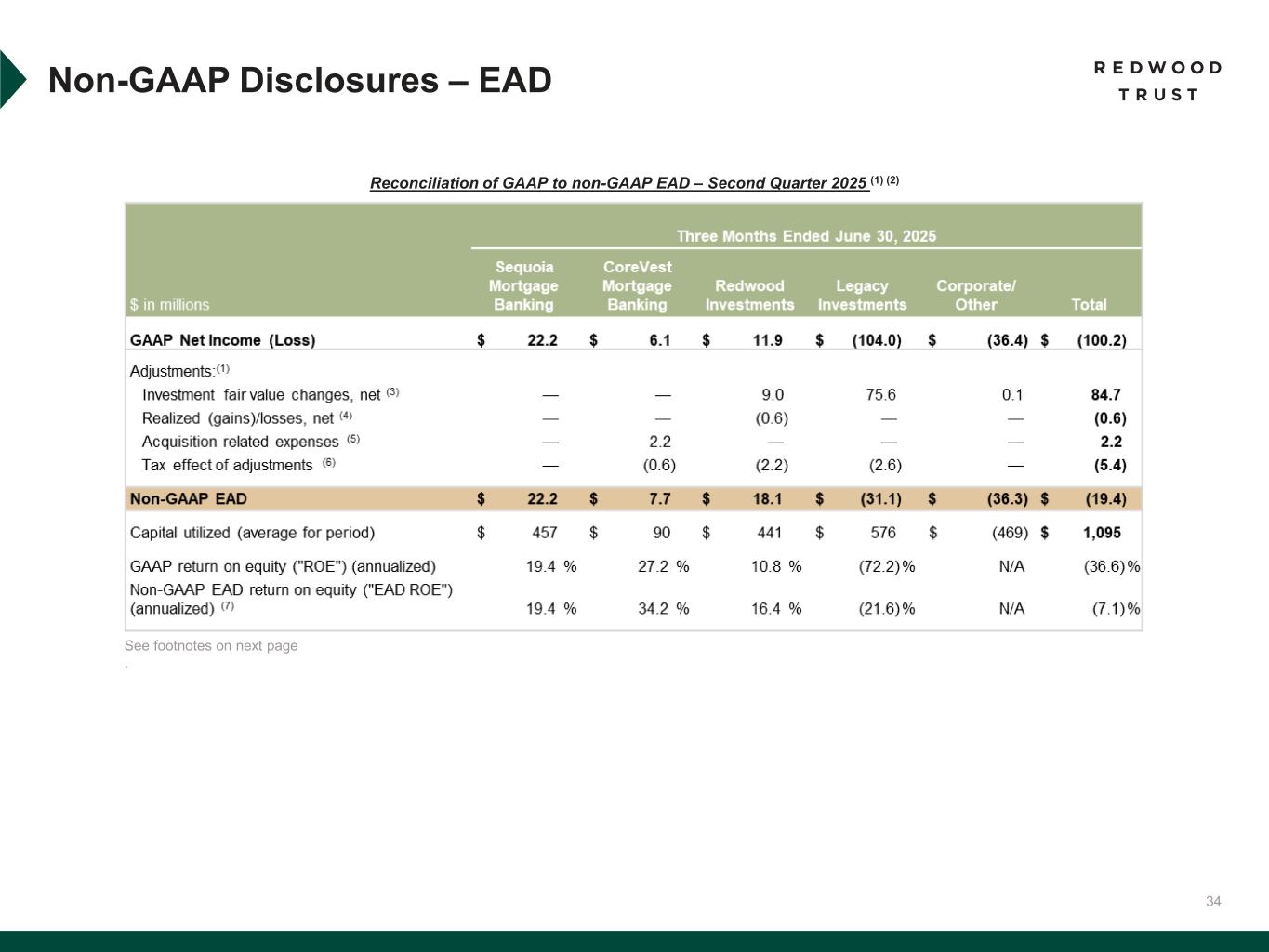

Reconciliation of GAAP to non-GAAP EAD - Second Quarter 2025 (1)(2) |

|

|

|

|

Three Months Ended June 30, 2025 |

| ($ in millions) |

Sequoia Mortgage Banking |

CoreVest Mortgage Banking |

Redwood Investments |

|

Legacy Investments |

Corporate/

Other |

Total |

| GAAP Net Income (Loss) |

$ |

22.2 |

|

$ |

6.1 |

|

$ |

11.9 |

|

|

$ |

(104.0) |

|

$ |

(36.4) |

|

$ |

(100.2) |

| EAD Adjustments: |

|

|

|

|

|

|

|

Investment fair value changes, net (3) |

— |

|

— |

|

9.0 |

|

|

75.6 |

|

0.1 |

|

84.7 |

Realized (gains)/losses, net (4) |

— |

|

— |

|

(0.6) |

|

|

— |

|

— |

|

(0.6) |

Acquisition related expenses (5) |

— |

|

2.2 |

|

— |

|

|

— |

|

— |

|

2.2 |

Tax effect of adjustments(6) |

— |

|

(0.6) |

|

(2.2) |

|

|

(2.6) |

|

— |

|

(5.4) |

| Non-GAAP EAD |

$ |

22.2 |

|

$ |

7.7 |

|

$ |

18.1 |

|

|

$ |

(31.1) |

|

$ |

(36.3) |

|

$ |

(19.4) |

|

|

|

|

|

|

|

|

| Capital utilized (average for period) |

$ |

457 |

|

$ |

90 |

|

$ |

441 |

|

|

$ |

576 |

|

$ |

(469) |

|

$ |

1,095 |

|

|

|

|

|

|

|

|

| GAAP Return on Equity ("ROE") (annualized) |

19.4 |

% |

27.2 |

% |

10.8 |

% |

|

(72.2) |

% |

N/A |

(36.6) |

% |

Non-GAAP EAD Return on Equity ("EAD ROE") (annualized) (7) |

19.4 |

% |

34.2 |

% |

16.4 |

% |

|

(21.6) |

% |

N/A |

(7.1) |

% |

See footnotes to table on next page

Non-GAAP Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

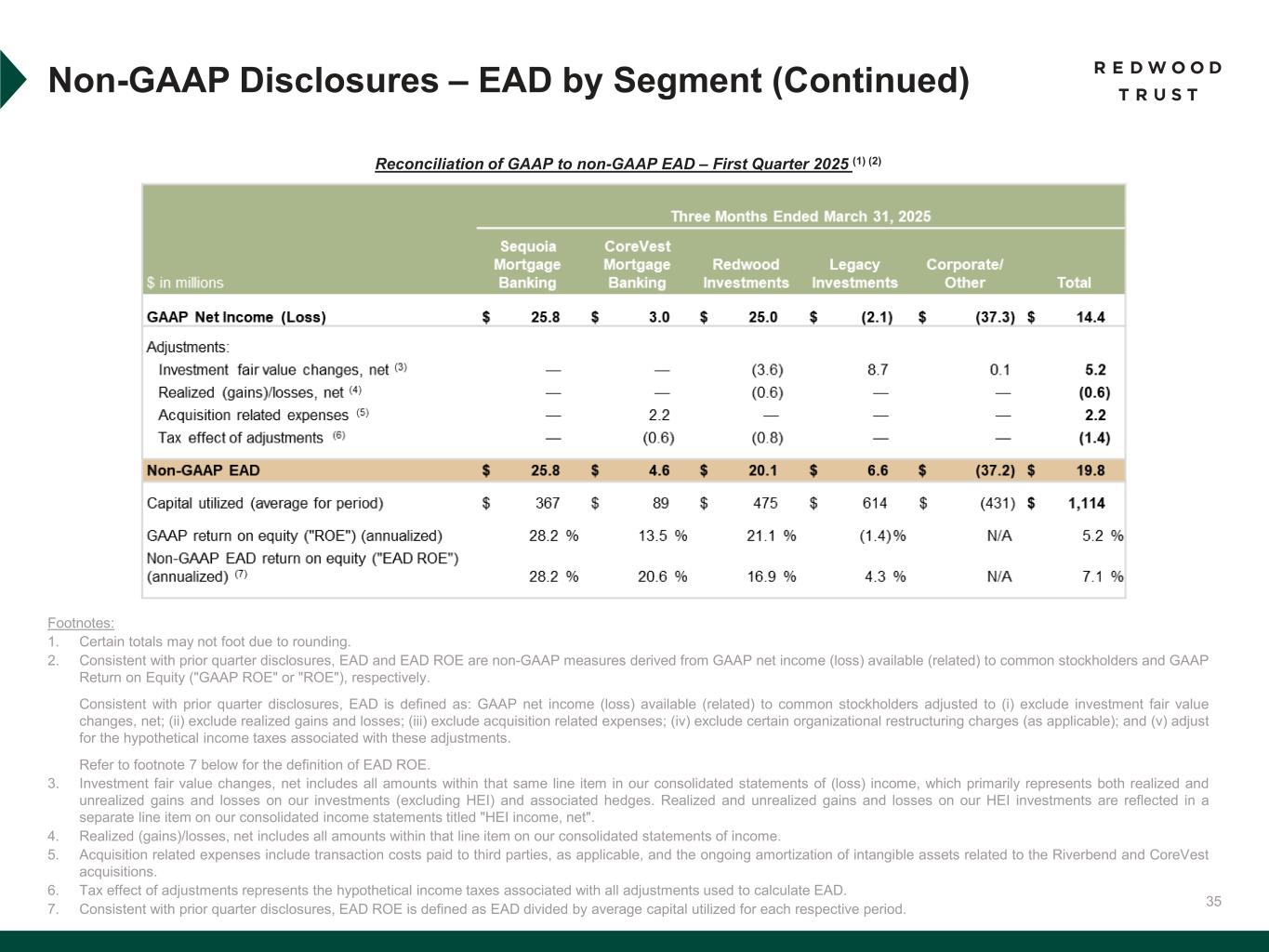

Reconciliation of GAAP to non-GAAP EAD - First Quarter 2025 (1)(2) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

| ($ in millions) |

Sequoia Mortgage Banking |

CoreVest Mortgage Banking |

Redwood Investments |

|

Legacy Investments |

Corporate/

Other |

Total |

| GAAP Net Income (Loss) |

$ |

25.8 |

|

$ |

3.0 |

|

$ |

25.0 |

|

|

$ |

(2.1) |

|

$ |

(37.3) |

|

$ |

14.4 |

| EAD Adjustments: |

|

|

|

|

|

|

|

Investment fair value changes, net (3) |

— |

|

— |

|

(3.6) |

|

|

8.7 |

|

0.1 |

|

5.2 |

Realized (gains)/losses, net (4) |

— |

|

— |

|

(0.6) |

|

|

— |

|

— |

|

(0.6) |

Acquisition related expenses (5) |

— |

|

2.2 |

|

— |

|

|

— |

|

— |

|

2.2 |

Tax effect of adjustments(6) |

— |

|

(0.6) |

|

(0.8) |

|

|

— |

|

— |

|

(1.4) |

| Non-GAAP EAD |

$ |

25.8 |

|

$ |

4.6 |

|

$ |

20.1 |

|

|

$ |

6.6 |

|

$ |

(37.2) |

|

$ |

19.8 |

|

|

|

|

|

|

|

|

| Capital utilized (average for period) |

$ |

367 |

|

$ |

89 |

|

$ |

475 |

|

|

$ |

614 |

|

$ |

(431) |

|

$ |

1,114 |

|

|

|

|

|

|

|

|

| GAAP Return on Equity ("ROE") (annualized) |

28.2 |

% |

13.5 |

% |

21.1 |

% |

|

(1.4) |

% |

N/A |

5.2 |

% |

Non-GAAP EAD Return on Equity ("EAD ROE") (annualized) (7) |

28.2 |

% |

20.6 |

% |

16.9 |

% |

|

4.3 |

% |

N/A |

7.1 |

% |

1.Certain totals may not foot due to rounding.

2.Consistent with prior quarter disclosures, EAD and EAD ROE are non-GAAP measures derived from GAAP net income (loss) available (related) to common stockholders and GAAP Return on Equity ("GAAP ROE" or "ROE"), respectively.

Consistent with prior quarter disclosures, EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude investment fair value changes, net; (ii) exclude realized gains and losses; (iii) exclude acquisition related expenses; (iv) exclude certain organizational restructuring charges (as applicable); and (v) adjust for the hypothetical income taxes associated with these adjustments.

Refer to footnote 7 below for the definition of EAD ROE.

3.Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income, which primarily represents both realized and unrealized gains and losses on our investments (excluding HEI) and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net".

4.Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income.

5.Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions.

6.Tax effect of adjustments represents the hypothetical income taxes associated with all adjustments used to calculate EAD.

7.Consistent with prior quarter disclosures, EAD ROE is defined as EAD divided by average capital utilized for each respective period.

Non-GAAP Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

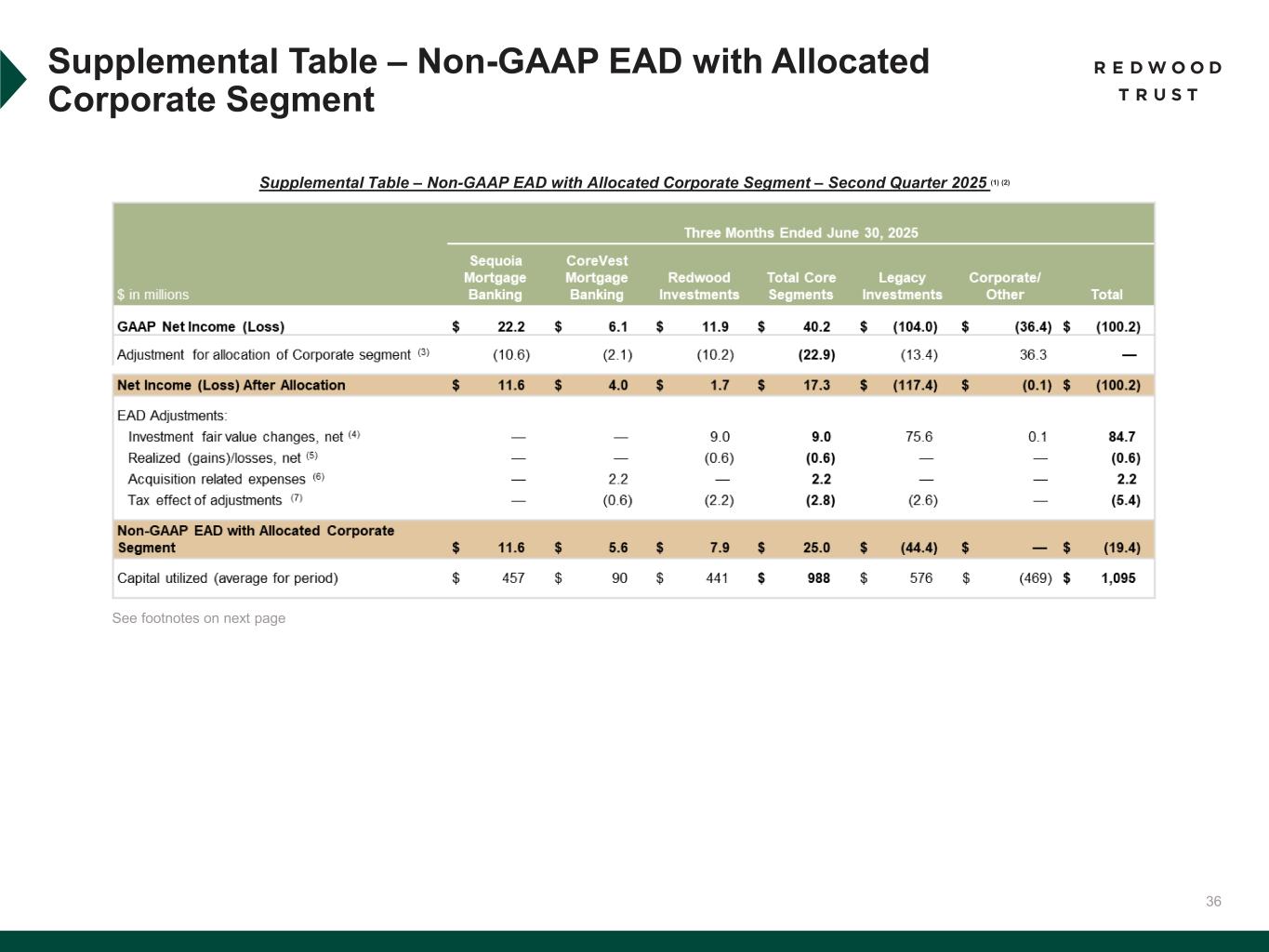

Supplemental Table - Non-GAAP EAD with Allocated Corporate Segment - Second Quarter 2025 (1)(2) |

|

|

|

|

Three Months Ended June 30, 2025 |

| ($ in millions) |

Sequoia Mortgage Banking |

CoreVest Mortgage Banking |

Redwood Investments |

Total Core Segments |

Legacy Investments |

Corporate/Other |

Total |

| GAAP Net Income (Loss) |

$ |

22.2 |

|

$ |

6.1 |

|

$ |

11.9 |

|

$ |

40.2 |

|

$ |

(104.0) |

|

$ |

(36.4) |

|

$ |

(100.2) |

Adjustment for allocation of Corporate segment (3) |

(10.6) |

|

(2.1) |

|

(10.2) |

|

(22.9) |

|

(13.4) |

|

36.3 |

|

— |

|

| Net Income (Loss) After Allocation |

$ |

11.6 |

|

$ |

4.0 |

|

$ |

1.7 |

|

$ |

17.3 |

|

$ |

(117.4) |

|

$ |

(0.1) |

|

$ |

(100.2) |

| EAD Adjustments: |

|

|

|

|

|

|

|

Investment fair value changes, net (4) |

— |

|

— |

|

9.0 |

|

9.0 |

|

75.6 |

|

0.1 |

|

84.7 |

Realized (gains)/losses, net (5) |

— |

|

— |

|

(0.6) |

|

(0.6) |

|

— |

|

— |

|

(0.6) |

Acquisition related expenses (6) |

— |

|

2.2 |

|

— |

|

2.2 |

|

— |

|

— |

|

2.2 |

Tax effect of adjustments(7) |

— |

|

(0.6) |

|

(2.2) |

|

(2.8) |

|

(2.6) |

|

— |

|

(5.4) |

| Non-GAAP EAD with Allocated Corporate Segment |

$ |

11.6 |

|

$ |

5.6 |

|

$ |

7.9 |

|

$ |

25.0 |

|

$ |

(44.4) |

|

$ |

— |

|

$ |

(19.4) |

|

|

|

|

|

|

|

|

|

| Capital utilized (average for period) |

$ |

457 |

|

$ |

90 |

|

$ |

441 |

|

$ |

988 |

|

$ |

576 |

|

$ |

(469) |

|

$ |

1,095 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See footnotes to table on next page

Non-GAAP Disclosures (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Table - Non-GAAP EAD with Allocated Corporate Segment - First Quarter 2025 (1)(2) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

| ($ in millions) |

Sequoia Mortgage Banking |

CoreVest Mortgage Banking |

Redwood Investments |

Total Core Segments |

Legacy Investments |

Corporate/Other |

Total |

| GAAP Net Income (Loss) |

$ |

25.8 |

|

$ |

3.0 |

|

$ |

25.0 |

|

$ |

53.8 |

|

$ |

(2.1) |

|

$ |

(37.3) |

|

$ |

14.4 |

Adjustment for allocation of Corporate segment (3) |

(8.8) |

|

(2.2) |

|

(11.4) |

|

(22.4) |

|

(14.8) |

|

37.2 |

|

— |

|

| Net Income (Loss) After Allocation |

$ |

17.0 |

|

$ |

0.8 |

|

$ |

13.6 |

|

$ |

31.4 |

|

$ |

(16.9) |

|

$ |

(0.1) |

|

$ |

14.4 |

| EAD Adjustments: |

|

|

|

|

|

|

|

Investment fair value changes, net (4) |

— |

|

— |

|

(3.6) |

|

(3.6) |

|

8.7 |

|

0.1 |

|

5.2 |

Realized (gains)/losses, net (5) |

— |

|

— |

|

(0.6) |

|

(0.6) |

|

— |

|

— |

|

(0.6) |

Acquisition related expenses (6) |

— |

|

2.2 |

|

— |

|

2.2 |

|

— |

|

— |

|

2.2 |

Tax effect of adjustments(7) |

— |

|

(0.6) |

|

(0.8) |

|

(1.4) |

|

— |

|

— |

|

(1.4) |

| Non-GAAP EAD with Allocated Corporate Segment |

$ |

17.0 |

|

$ |

2.4 |

|

$ |

8.6 |

|

$ |

28.0 |

|

$ |

(8.2) |

|

$ |

— |

|

$ |

19.8 |

|

|

|

|

|

|

|

|

|

| Capital utilized (average for period) |

$ |

367 |

|

$ |

89 |

|

$ |

475 |

|

$ |

931 |

|

$ |

614 |

|

$ |

(431) |

|

$ |

1,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.Certain totals may not foot due to rounding.

2.This supplemental measure is presented to clearly illustrate a key distinction between the methodology for calculating the two non-GAAP measures discussed in this earnings press release and detailed in the preceding tables - namely, Core Segments EAD and EAD. That key distinction relates to whether or not the non-GAAP measure allocates the Company’s Corporate segment across its other reporting segments for purposes of calculating the non-GAAP measure of performance.

In this supplemental non-GAAP table, GAAP Net Income by segment is adjusted to (i) include allocations of the Corporate Segment to each of our Mortgage Banking segments, as well as to our Redwood Investments and Legacy Investments segments, (ii) exclude investment fair value changes, net (as applicable); (iii) exclude realized gains and losses (as applicable); (iv) exclude acquisition related expenses; (v) exclude certain organizational restructuring charges (as applicable); and (vi) adjust for the hypothetical income taxes associated with these adjustments.

3.Allocation of Corporate Segment is a non-GAAP adjustment based on average capital utilized by each segment for the respective periods.

4.Investment fair value changes, net includes all amounts within that same line item in our consolidated statements of (loss) income, which primarily represents both realized and unrealized gains and losses on our investments (excluding HEI) and associated hedges. Realized and unrealized gains and losses on our HEI investments are reflected in a separate line item on our consolidated income statements titled "HEI income, net".

5.Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income.

6.Acquisition related expenses include transaction costs paid to third parties, as applicable, and the ongoing amortization of intangible assets related to the Riverbend and CoreVest acquisitions.

7.Tax effect of adjustments represents the hypothetical income taxes associated with all adjustments used to calculate EAD.

About Redwood

Redwood Trust, Inc. (NYSE: RWT) is a specialty finance company focused on several distinct areas of housing credit where we provide liquidity to growing segments of the U.S. housing market not well served by government programs. We deliver customized housing credit investments to a diverse mix of investors, through our best-in-class securitization platforms, whole-loan distribution activities, joint ventures and our publicly traded shares. We operate through three core residential housing-focused operating platforms — Sequoia, Aspire, and CoreVest — alongside our complementary Redwood Investments portfolio which is primarily composed of assets we source through these platforms. In addition, through RWT Horizons®, our venture investing initiative, we invest in early-stage companies that have a direct nexus to our operating platforms. Our goal is to provide attractive returns to shareholders through a stable and growing stream of earnings and dividends, capital appreciation, and a commitment to technological innovation that facilitates risk-minded scale. Redwood Trust is internally managed and structured as a real estate investment trust ("REIT") for tax purposes. For more information about Redwood, please visit our website at www.redwoodtrust.com or connect with us on LinkedIn.

Cautionary Statement; Forward-Looking Statements:

This press release and the related conference call contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements regarding our expectation to generate up to $200 - $250 million of capital by year-end 2025 in connection with the accelerated de-emphasis of capital-intensive investing activities, target returns we are seeking on portfolio investments, the anticipated expansion of our share repurchase activity, growth potential we see for our mortgage banking platforms in an evolving market landscape, anticipated sale or resolution of assets within our Legacy Investments segment, and the expected timing for the filing of Redwood's Quarterly Report on Form 10-Q. The timing and amount of stock repurchases made pursuant to the Redwood’s share repurchase authorization are at the Company’s discretion and subject to various factors, including the Company's capital position, liquidity, financial performance and alternative uses of capital, stock trading price, regulatory requirements and general market conditions. Redwood’s share repurchase authorization does not obligate the Company to acquire any specific number of shares or securities. Repurchases of shares or securities by the Company may be effected through open market purchases or privately negotiated transactions, including repurchase plans that satisfy the conditions of Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. Forward-looking statements involve numerous risks and uncertainties. Redwood's actual results may differ from Redwood's beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, opportunities, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2024 under the caption “Risk Factors”. Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q and 8-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

|

|

|

| CONTACTS |

| Investor Relations |

| Kaitlyn Mauritz |

| Head of Investor Relations |

| Phone: 866-269-4976 |

| Email: investorrelations@redwoodtrust.com |