Document

Exhibit 99.1

FOR IMMEDIATE RELEASE

Nov. 7, 2023

Darling Ingredients Inc. Reports Third Quarter 2023 Results

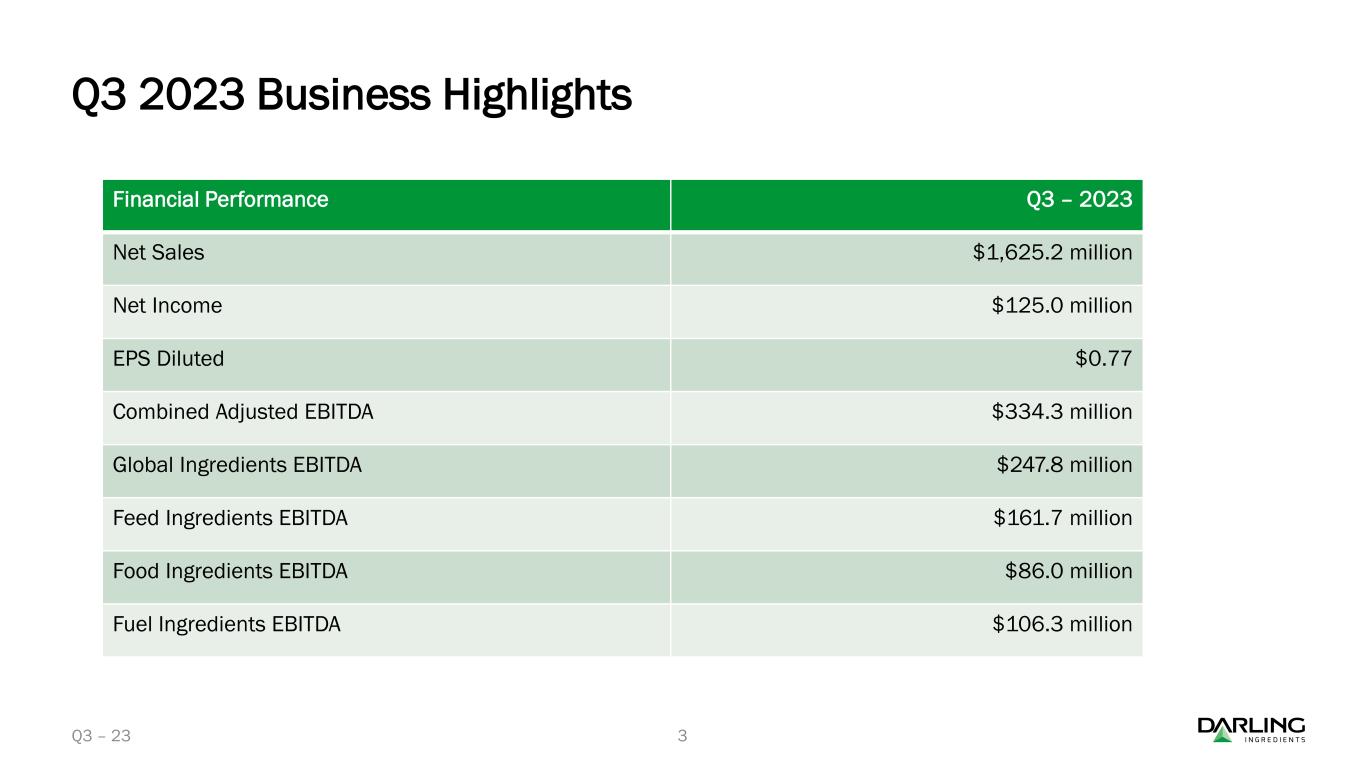

Third Quarter 2023

•Net income of $125.0 million, or $0.77 per GAAP diluted share

•Net sales of $1.6 billion

•Combined adjusted EBITDA of $334.3 million

•Global ingredients business EBITDA of $247.8 million

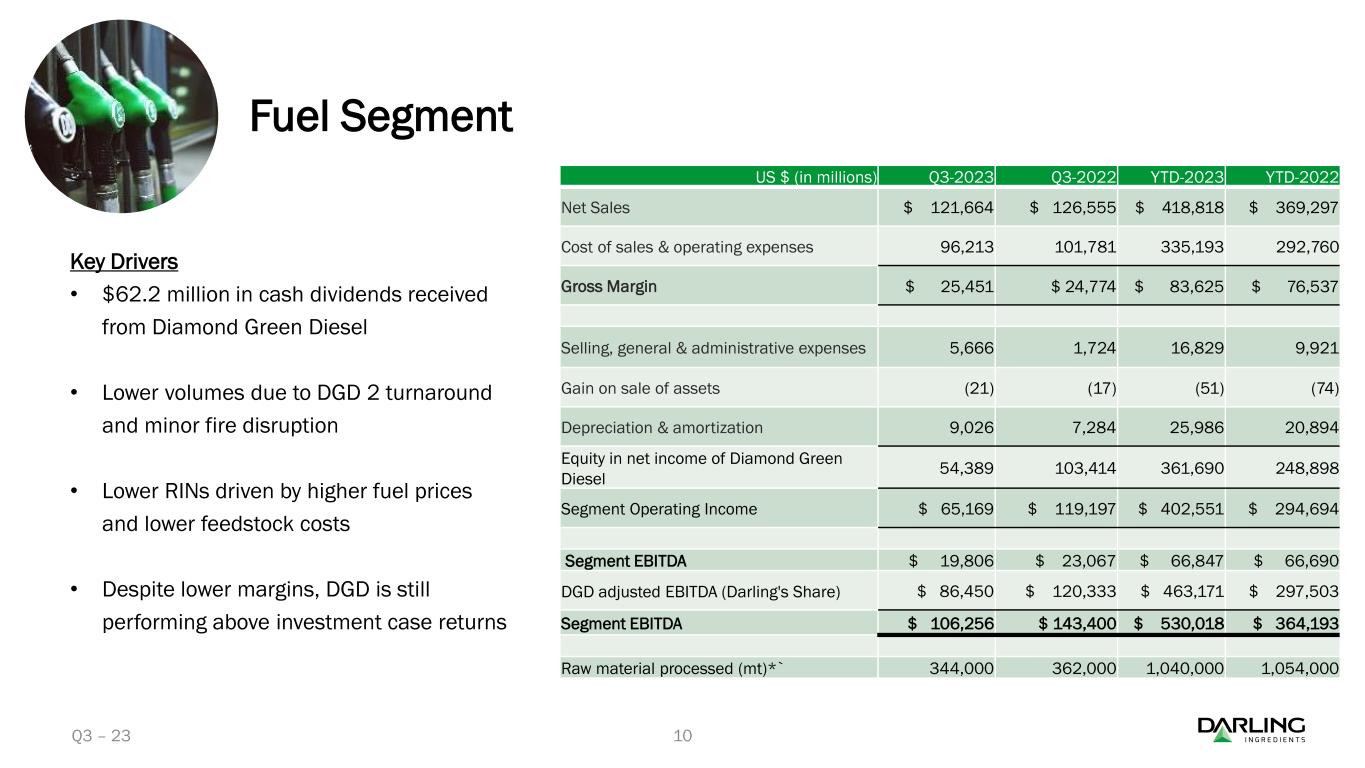

•Received $62.2 million in cash dividends from Diamond Green Diesel

IRVING, TEXAS - Darling Ingredients Inc.(NYSE: DAR) today reported net income of $125.0 million, or $0.77 per diluted share for third quarter of 2023, compared to net income of $191.1 million, or $1.17 per diluted share, for third quarter of 2022. The company also reported net sales of $1.6 billion for the third quarter of 2023, compared with net sales of $1.7 billion for the same period a year ago.

“Our core business continues to perform extremely well. We had seasonally strong performance during the third quarter and were able to return gross margins to pre-acquisition levels,” said Randall C. Stuewe, Darling Ingredients Chairman and Chief Executive Officer. “The company has good momentum as we close out the year and is well positioned heading into 2024.”

For the nine months ended Sept. 30, 2023, Darling Ingredients reported net sales of $5.2 billion, compared to net sales of $4.8 billion for the same period in 2022. Net income for the first nine months of 2023 was $563.2 million, or $3.47 per diluted share, as compared to net income of $581.1 million, or $3.54 per diluted share, for the first nine months of 2022.

Diamond Green Diesel (DGD) sold 266.8 million gallons of renewable diesel for the third quarter 2023 at an average of $0.65 per gallon EBITDA. Year-to-date, DGD has sold 910.0 million gallons of renewable diesel at an average of $1.02 per gallon EBITDA. During the third quarter, Darling Ingredients received $62.2 million in cash dividends from the joint venture, and $163.6 million in cash dividends year to date.

“Extreme volatility in the global petroleum market and swift declines in RINs and LCFS prices created headwinds in our Fuel business during 3Q,” Stuewe said. “A recent decline in fat prices have shown that new renewable diesel capacity is not coming on line as soon as projected. Despite these headwinds, DGD is still performing above investment case returns.”

Combined adjusted EBITDA for the third quarter 2023 was $334.3 million, compared to $394.7 million for the same period in 2022. On a year-to-date basis, combined adjusted EBITDA totaled $1.26 billion, as compared to $1.13 billion for the same period in 2022.

As of Sept. 30, 2023, Darling Ingredients had $119.0 million in cash and cash equivalents, and $1 billion available under its committed revolving credit agreement. Total debt outstanding as of Sept. 30, 2023, was $4.4 billion. The leverage ratio as measured by the company’s bank covenant was 3.25X as of Sept. 30, 2023. Capital expenditures were $146.2 million for the third quarter 2023, and $380.6 million for the first nine months ended Sept. 30, 2023.

The company guidance for fiscal year 2023 is $1.6 to $1.7 billion combined adjusted EBITDA.

Segment Financial Tables (in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed Ingredients |

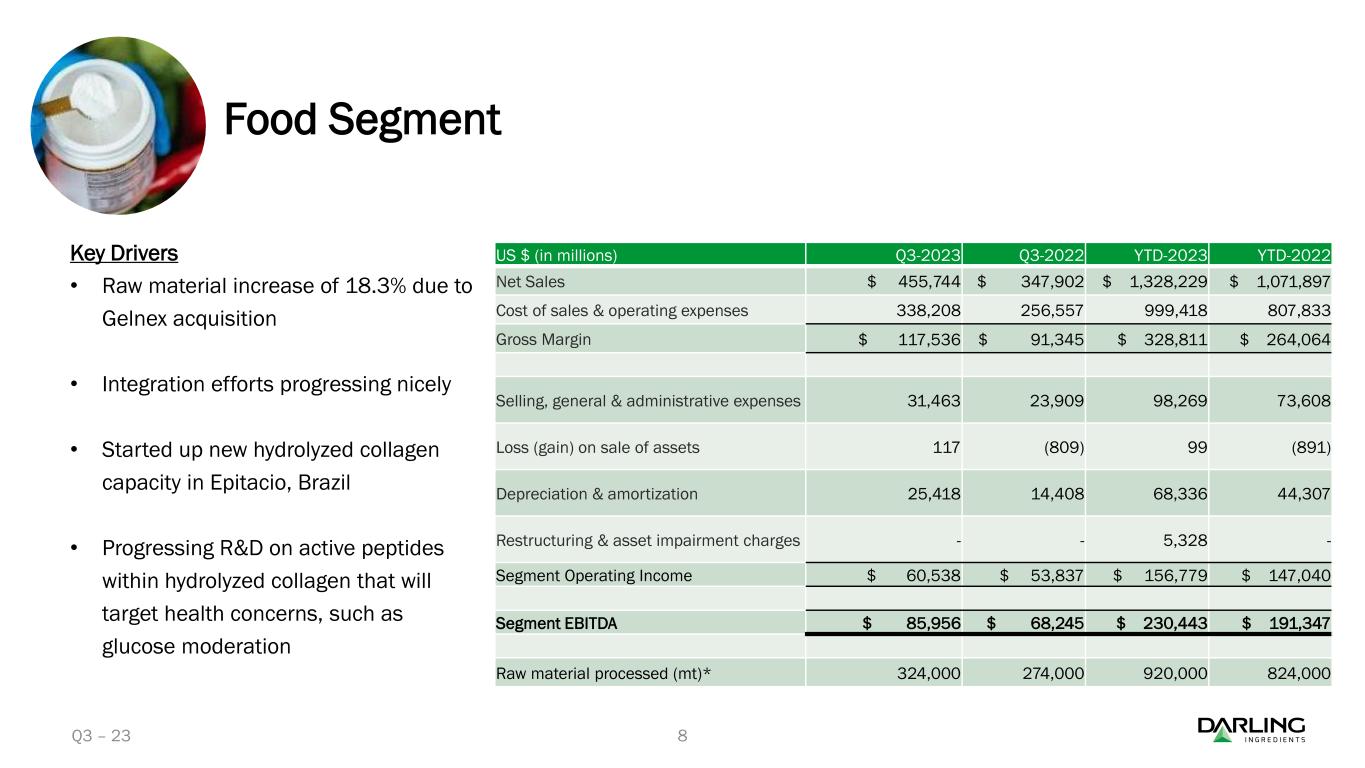

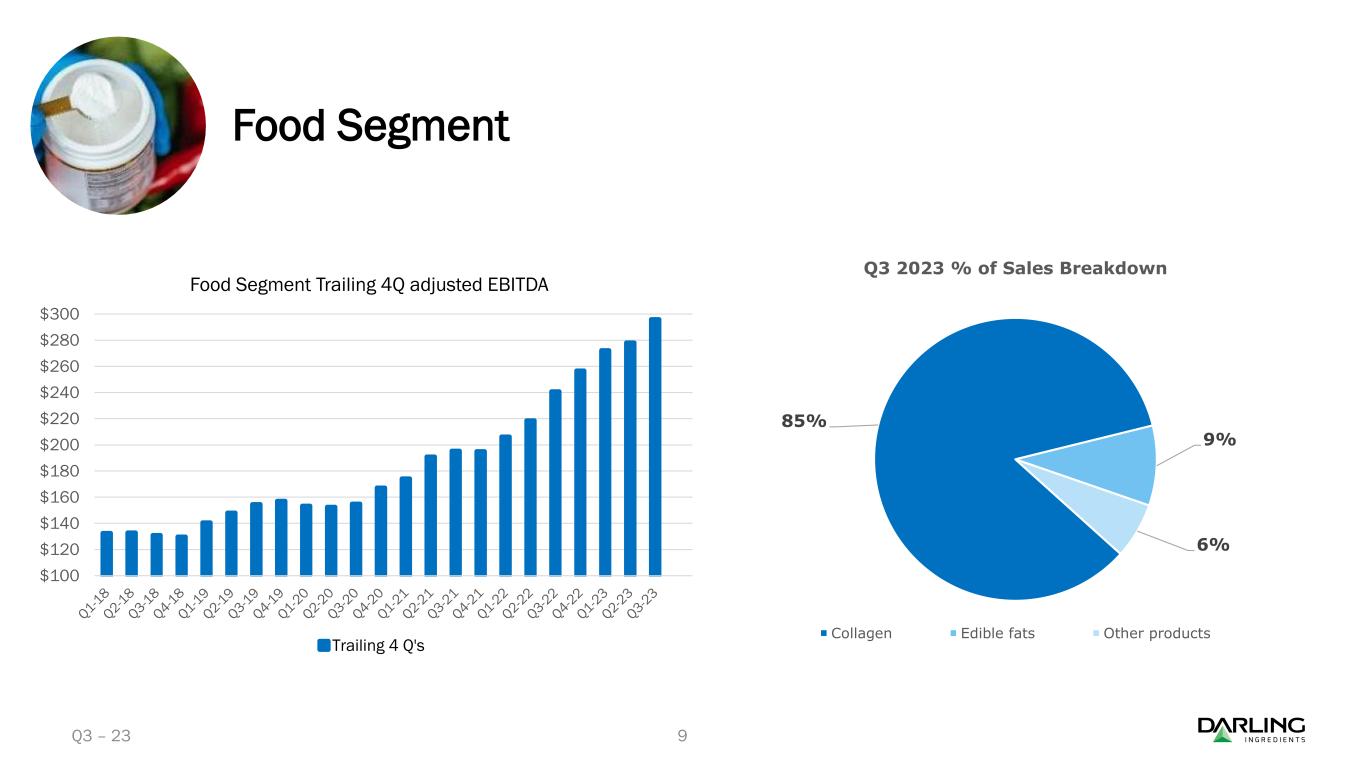

Food Ingredients |

Fuel Ingredients |

Corporate |

Total |

| Three Months Ended September 30, 2023 |

|

|

|

|

|

| Net sales |

$ |

1,047,796 |

|

$ |

455,744 |

|

$ |

121,664 |

|

$ |

— |

|

$ |

1,625,204 |

|

| Cost of sales and operating expenses |

804,312 |

|

338,208 |

|

96,213 |

|

— |

|

1,238,733 |

|

| Gross Margin |

$ |

243,484 |

|

$ |

117,536 |

|

$ |

25,451 |

|

$ |

— |

|

$ |

386,471 |

|

|

|

|

|

|

|

| Gross Margin % |

23.2 |

% |

25.8 |

% |

20.9 |

% |

— |

|

23.8 |

% |

|

|

|

|

|

|

| Loss/(gain) on sale of assets |

833 |

|

117 |

|

(21) |

|

— |

|

929 |

|

| Selling, general and administrative expenses |

80,985 |

|

31,463 |

|

5,666 |

|

19,583 |

|

137,697 |

|

|

|

|

|

|

|

| Acquisition and integration costs |

— |

|

— |

|

— |

|

3,430 |

|

3,430 |

|

| Change in fair value of contingent consideration |

(5,559) |

|

— |

|

— |

|

— |

|

(5,559) |

|

| Depreciation and amortization |

88,954 |

|

25,418 |

|

9,026 |

|

2,596 |

|

125,994 |

|

| Equity in net income of Diamond Green Diesel |

— |

|

— |

|

54,389 |

|

— |

|

54,389 |

|

| Segment Operating Income/(Loss) |

78,271 |

|

60,538 |

|

65,169 |

|

(25,609) |

|

178,369 |

|

|

|

|

|

|

|

| Equity in Net Income of Unconsolidated Subs |

1,534 |

|

— |

|

— |

|

— |

|

1,534 |

|

| Segment Income/(Loss) |

$ |

79,805 |

|

$ |

60,538 |

|

$ |

65,169 |

|

$ |

(25,609) |

|

$ |

179,903 |

|

|

|

|

|

|

|

| Segment EBITDA |

161,666 |

|

85,956 |

|

19,806 |

|

(19,583) |

|

247,845 |

|

| DGD Adjusted EBITDA (Darling's Share) |

— |

|

— |

|

86,450 |

|

— |

|

86,450 |

|

| Combined Adjusted EBITDA |

$ |

161,666 |

|

$ |

85,956 |

|

$ |

106,256 |

|

$ |

(19,583) |

|

$ |

334,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed Ingredients |

Food Ingredients |

Fuel Ingredients |

Corporate |

Total |

| Three Months Ended October 1, 2022 |

|

|

|

|

|

| Net sales |

$ |

1,273,142 |

|

$ |

347,902 |

|

$ |

126,555 |

|

$ |

— |

|

$ |

1,747,599 |

|

| Cost of sales and operating expenses |

1,012,899 |

|

256,557 |

|

101,781 |

|

— |

|

1,371,237 |

|

| Gross Margin |

$ |

260,243 |

|

$ |

91,345 |

|

$ |

24,774 |

|

$ |

— |

|

$ |

376,362 |

|

|

|

|

|

|

|

| Gross Margin % |

20.4 |

% |

26.3 |

% |

19.6 |

% |

— |

|

21.5 |

% |

|

|

|

|

|

|

| Gain on sale of assets |

(2,290) |

|

(809) |

|

(17) |

|

— |

|

(3,116) |

|

| Selling, general and administrative expenses |

63,973 |

|

23,909 |

|

1,724 |

|

15,474 |

|

105,080 |

|

|

|

|

|

|

|

| Acquisition and integration costs |

— |

|

— |

|

— |

|

4,503 |

|

4,503 |

|

| Depreciation and amortization |

80,679 |

|

14,408 |

|

7,284 |

|

2,607 |

|

104,978 |

|

| Equity in net income of Diamond Green Diesel |

— |

|

— |

|

103,414 |

|

— |

|

103,414 |

|

| Segment Operating Income/(Loss) |

117,881 |

|

53,837 |

|

119,197 |

|

(22,584) |

|

268,331 |

|

|

|

|

|

|

|

| Equity in Net Income of Unconsolidated Subs |

2,301 |

|

— |

|

— |

|

— |

|

2,301 |

|

| Segment Income/(Loss) |

$ |

120,182 |

|

$ |

53,837 |

|

$ |

119,197 |

|

$ |

(22,584) |

|

$ |

270,632 |

|

|

|

|

|

|

|

| Segment EBITDA |

198,560 |

|

68,245 |

|

23,067 |

|

(15,474) |

|

274,398 |

|

| DGD Adjusted EBITDA (Darling's Share) |

— |

|

— |

|

120,333 |

|

— |

|

120,333 |

|

| Combined Adjusted EBITDA |

$ |

198,560 |

|

$ |

68,245 |

|

$ |

143,400 |

|

$ |

(15,474) |

|

$ |

394,731 |

|

Segment Financial Tables (in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed Ingredients |

Food Ingredients |

Fuel Ingredients |

Corporate |

Total |

| Nine Months Ended September 30, 2023 |

|

|

|

|

|

| Net sales |

$ |

3,426,950 |

|

$ |

1,328,229 |

|

$ |

418,818 |

|

$ |

— |

|

$ |

5,173,997 |

|

| Cost of sales and operating expenses |

2,630,797 |

|

999,418 |

|

335,193 |

|

— |

|

3,965,408 |

|

| Gross Margin |

$ |

796,153 |

|

$ |

328,811 |

|

$ |

83,625 |

|

$ |

— |

|

$ |

1,208,589 |

|

|

|

|

|

|

|

| Gross Margin % |

23.2 |

% |

24.8 |

% |

20.0 |

% |

— |

|

23.4 |

% |

|

|

|

|

|

|

| Loss/(gain) on sale of assets |

813 |

|

99 |

|

(51) |

|

— |

|

861 |

|

| Selling, general and administrative expenses |

233,082 |

|

98,269 |

|

16,829 |

|

61,734 |

|

409,914 |

|

| Restructuring and asset impairment charges |

92 |

|

5,328 |

|

— |

|

— |

|

5,420 |

|

| Acquisition and integration costs |

— |

|

— |

|

— |

|

12,158 |

|

12,158 |

|

| Change in fair value of contingent consideration |

(13,058) |

|

— |

|

— |

|

— |

|

(13,058) |

|

| Depreciation and amortization |

261,849 |

|

68,336 |

|

25,986 |

|

7,915 |

|

364,086 |

|

| Equity in net income of Diamond Green Diesel |

— |

|

— |

|

361,690 |

|

— |

|

361,690 |

|

| Segment Operating Income/(Loss) |

313,375 |

|

156,779 |

|

402,551 |

|

(81,807) |

|

790,898 |

|

|

|

|

|

|

|

| Equity in Net Income of Unconsolidated Subs |

3,503 |

|

— |

|

— |

|

— |

|

3,503 |

|

| Segment Income/(Loss) |

$ |

316,878 |

|

$ |

156,779 |

|

$ |

402,551 |

|

$ |

(81,807) |

|

$ |

794,401 |

|

|

|

|

|

|

|

| Segment EBITDA |

562,258 |

|

230,443 |

|

66,847 |

|

(61,734) |

|

797,814 |

|

| DGD Adjusted EBITDA (Darling's Share) |

— |

|

— |

|

463,171 |

|

— |

|

463,171 |

|

| Combined Adjusted EBITDA |

$ |

562,258 |

|

$ |

230,443 |

|

$ |

530,018 |

|

$ |

(61,734) |

|

$ |

1,260,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed Ingredients |

Food Ingredients |

Fuel Ingredients |

Corporate |

Total |

| Nine Months Ended October 1, 2022 |

|

|

|

|

|

| Net sales |

$ |

3,322,927 |

|

$ |

1,071,897 |

|

$ |

369,297 |

|

$ |

— |

|

$ |

4,764,121 |

|

| Cost of sales and operating expenses |

2,522,728 |

|

807,833 |

|

292,760 |

|

— |

|

3,623,321 |

|

| Gross Margin |

$ |

800,199 |

|

$ |

264,064 |

|

$ |

76,537 |

|

$ |

— |

|

$ |

1,140,800 |

|

|

|

|

|

|

|

| Gross Margin % |

24.1 |

% |

24.6 |

% |

20.7 |

% |

— |

|

23.9 |

% |

|

|

|

|

|

|

| Gain on sale of assets |

(3,595) |

|

(891) |

|

(74) |

|

— |

|

(4,560) |

|

| Selling, general and administrative expenses |

185,045 |

|

73,608 |

|

9,921 |

|

46,314 |

|

314,888 |

|

| Restructuring and asset impairment charges |

8,557 |

|

— |

|

— |

|

— |

|

8,557 |

|

| Acquisition and integration costs |

— |

|

— |

|

— |

|

13,634 |

|

13,634 |

|

| Depreciation and amortization |

203,967 |

|

44,307 |

|

20,894 |

|

8,169 |

|

277,337 |

|

| Equity in net income of Diamond Green Diesel |

— |

|

— |

|

248,898 |

|

— |

|

248,898 |

|

| Segment Operating Income/(Loss) |

406,225 |

|

147,040 |

|

294,694 |

|

(68,117) |

|

779,842 |

|

|

|

|

|

|

|

| Equity in Net Income of Unconsolidated Subs |

5,933 |

|

— |

|

— |

|

— |

|

5,933 |

|

| Segment Income/(Loss) |

$ |

412,158 |

|

$ |

147,040 |

|

$ |

294,694 |

|

$ |

(68,117) |

|

$ |

785,775 |

|

|

|

|

|

|

|

| Segment EBITDA |

618,749 |

|

191,347 |

|

66,690 |

|

(46,314) |

|

830,472 |

|

| DGD Adjusted EBITDA (Darling's Share) |

— |

|

— |

|

297,503 |

|

— |

|

297,503 |

|

| Combined Adjusted EBITDA |

$ |

618,749 |

|

$ |

191,347 |

|

$ |

364,193 |

|

$ |

(46,314) |

|

$ |

1,127,975 |

|

Segment EBITDA consists of segment income (loss), less equity in net income/loss from unconsolidated subsidiaries, less equity in net income of Diamond Green Diesel, plus depreciation and amortization, acquisition and integration costs, restructuring and asset impairment charges, change in fair value of contingent consideration, plus Darling’s share of DGD Adjusted EBITDA.

Darling Ingredients Inc. and Subsidiaries

Consolidated Balance Sheets

September 30, 2023 and December 31, 2022

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

December 31, 2022 |

| ASSETS |

(unaudited) |

|

| Current assets: |

|

|

|

Cash and cash equivalents |

$ |

118,977 |

|

$ |

127,016 |

|

|

Restricted cash |

304 |

|

315 |

|

|

Accounts receivable, net |

735,582 |

|

676,573 |

|

|

Inventories |

822,765 |

|

673,621 |

|

|

Prepaid expenses |

101,559 |

|

85,665 |

|

|

Income taxes refundable |

25,689 |

|

18,583 |

|

|

Other current assets |

38,119 |

|

56,324 |

|

|

Total current assets |

1,842,995 |

|

1,638,097 |

|

|

|

|

| Property, plant and equipment, net |

2,798,727 |

|

2,462,082 |

|

| Intangible assets, net |

1,091,446 |

|

865,122 |

|

| Goodwill |

2,447,376 |

|

1,970,377 |

|

| Investment in unconsolidated subsidiaries |

2,164,182 |

|

1,926,395 |

|

| Operating lease right-of-use assets |

202,947 |

|

186,141 |

|

| Other assets |

238,053 |

|

136,268 |

|

| Deferred income taxes |

24,611 |

|

17,888 |

|

|

|

$ |

10,810,337 |

|

$ |

9,202,370 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

| Current liabilities: |

|

|

|

Current portion of long-term debt |

$ |

73,862 |

|

$ |

69,846 |

|

|

Accounts payable, principally trade |

394,748 |

|

472,491 |

|

|

Income taxes payable |

18,294 |

|

44,851 |

|

|

Current operating lease liabilities |

52,378 |

|

49,232 |

|

|

Accrued expenses |

494,421 |

|

432,023 |

|

|

Total current liabilities |

1,033,703 |

|

1,068,443 |

|

| Long-term debt, net of current portion |

4,338,126 |

|

3,314,969 |

|

| Long-term operating lease liabilities |

154,858 |

|

141,703 |

|

| Other non-current liabilities |

313,889 |

|

298,933 |

|

| Deferred income taxes |

502,779 |

|

481,832 |

|

|

Total liabilities |

6,343,355 |

|

5,305,880 |

|

| Commitments and contingencies |

|

|

| Stockholders' equity: |

|

|

|

Common stock, $0.01 par value; |

1,744 |

|

1,736 |

|

|

Additional paid-in capital |

1,691,636 |

|

1,660,084 |

|

|

Treasury stock, at cost |

(628,991) |

|

(554,451) |

|

|

Accumulated other comprehensive loss |

(332,413) |

|

(383,874) |

|

|

Retained earnings |

3,648,738 |

|

3,085,528 |

|

|

Total Darling's stockholders' equity |

4,380,714 |

|

3,809,023 |

|

| Noncontrolling interests |

86,268 |

|

87,467 |

|

| Total Stockholders' Equity |

4,466,982 |

|

3,896,490 |

|

|

|

$ |

10,810,337 |

|

$ |

9,202,370 |

|

Darling Ingredients Inc. and Subsidiaries

Consolidated Operating Results

For the Three and Nine Months Ended September 30, 2023 and October 1, 2022

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

(unaudited) |

|

$ Change |

|

(unaudited) |

|

$ Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

October 1, |

|

Favorable |

|

September 30, |

|

October 1, |

|

Favorable |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

(Unfavorable) |

|

2023 |

|

2022 |

|

(Unfavorable) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

1,625,204 |

|

|

$ |

1,747,599 |

|

|

$ |

(122,395) |

|

|

$ |

5,173,997 |

|

|

$ |

4,764,121 |

|

|

$ |

409,876 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales and operating expenses |

1,238,733 |

|

|

1,371,237 |

|

|

132,504 |

|

|

3,965,408 |

|

|

3,623,321 |

|

|

(342,087) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss/(gain) on sale of assets |

929 |

|

|

(3,116) |

|

|

(4,045) |

|

|

861 |

|

|

(4,560) |

|

|

(5,421) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

137,697 |

|

|

105,080 |

|

|

(32,617) |

|

|

409,914 |

|

|

314,888 |

|

|

(95,026) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring and asset impairment charges |

— |

|

|

— |

|

|

— |

|

|

5,420 |

|

|

8,557 |

|

|

3,137 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition and integration costs |

3,430 |

|

|

4,503 |

|

|

1,073 |

|

|

12,158 |

|

|

13,634 |

|

|

1,476 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of contingent consideration |

(5,559) |

|

|

— |

|

|

5,559 |

|

|

(13,058) |

|

|

— |

|

|

13,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

125,994 |

|

|

104,978 |

|

|

(21,016) |

|

|

364,086 |

|

|

277,337 |

|

|

(86,749) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

1,501,224 |

|

|

1,582,682 |

|

|

81,458 |

|

|

4,744,789 |

|

|

4,233,177 |

|

|

(511,612) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net income of Diamond Green Diesel |

54,389 |

|

|

103,414 |

|

|

(49,025) |

|

|

361,690 |

|

|

248,898 |

|

|

112,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

178,369 |

|

|

268,331 |

|

|

(89,962) |

|

|

790,898 |

|

|

779,842 |

|

|

11,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

(70,278) |

|

|

(39,816) |

|

|

(30,462) |

|

|

(190,770) |

|

|

(79,427) |

|

|

(111,343) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency gain/(loss) |

845 |

|

|

(493) |

|

|

1,338 |

|

|

8,339 |

|

|

(6,005) |

|

|

14,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income/(expense), net |

2,247 |

|

|

(2,807) |

|

|

5,054 |

|

|

13,485 |

|

|

(3,851) |

|

|

17,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

(67,186) |

|

|

(43,116) |

|

|

(24,070) |

|

|

(168,946) |

|

|

(89,283) |

|

|

(79,663) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net income of other unconsolidated subsidiaries |

1,534 |

|

|

2,301 |

|

|

(767) |

|

|

3,503 |

|

|

5,933 |

|

|

(2,430) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

112,717 |

|

|

227,516 |

|

|

(114,799) |

|

|

625,455 |

|

|

696,492 |

|

|

(71,037) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense/(benefit) |

(15,364) |

|

|

35,215 |

|

|

50,579 |

|

|

52,322 |

|

|

108,631 |

|

|

56,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

128,081 |

|

|

192,301 |

|

|

(64,220) |

|

|

573,133 |

|

|

587,861 |

|

|

(14,728) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interests |

(3,055) |

|

|

(1,220) |

|

|

(1,835) |

|

|

(9,923) |

|

|

(6,731) |

|

|

(3,192) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Darling |

$ |

125,026 |

|

|

$ |

191,081 |

|

|

$ |

(66,055) |

|

|

$ |

563,210 |

|

|

$ |

581,130 |

|

|

$ |

(17,920) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic income per share: |

$ |

0.78 |

|

|

$ |

1.19 |

|

|

$ |

(0.41) |

|

|

$ |

3.52 |

|

|

$ |

3.60 |

|

|

$ |

(0.08) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted income per share: |

$ |

0.77 |

|

|

$ |

1.17 |

|

|

$ |

(0.40) |

|

|

$ |

3.47 |

|

|

$ |

3.54 |

|

|

$ |

(0.07) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of diluted common shares: |

162,425 |

|

|

163,635 |

|

|

|

|

162,537 |

|

|

164,327 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Darling Ingredients Inc. and Subsidiaries

Consolidated Statement of Cash Flows

For the Nine Months Ended September 30, 2023 and October 1, 2022

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

September 30, |

|

October 1, |

| Cash flows from operating activities: |

2023 |

|

2022 |

| Net income |

$ |

573,133 |

|

|

$ |

587,861 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

364,086 |

|

|

277,337 |

|

| Loss/(gain) on sale of assets |

861 |

|

|

(4,560) |

|

|

|

|

|

|

|

|

|

| Asset Impairment |

— |

|

|

8,557 |

|

| Change in fair value of contingent consideration |

(13,058) |

|

|

— |

|

| Gain on insurance proceeds from insurance settlements |

(13,836) |

|

|

— |

|

| Deferred taxes |

(18,192) |

|

|

42,120 |

|

| Decrease in long-term pension liability |

809 |

|

|

(2,753) |

|

| Stock-based compensation expense |

27,046 |

|

|

18,884 |

|

|

|

|

|

| Deferred loan cost amortization |

4,674 |

|

|

3,552 |

|

| Equity in net income of Diamond Green Diesel and other unconsolidated subsidiaries |

(365,193) |

|

|

(254,831) |

|

| Distribution of earnings from Diamond Green Diesel and other unconsolidated subsidiaries |

168,277 |

|

|

95,546 |

|

| Changes in operating assets and liabilities, net of effects from acquisitions: |

|

|

|

| Accounts receivable |

25,731 |

|

|

(45,457) |

|

| Income taxes refundable/payable |

(39,123) |

|

|

(2,004) |

|

| Inventories and prepaid expenses |

(22,694) |

|

|

(140,971) |

|

| Accounts payable and accrued expenses |

(39,570) |

|

|

78,656 |

|

| Other |

29,337 |

|

|

(23,499) |

|

| Net cash provided by operating activities |

682,288 |

|

|

638,438 |

|

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(380,556) |

|

|

(257,120) |

|

| Acquisition, net of cash acquired |

(1,093,183) |

|

|

(1,760,139) |

|

| Investment in Diamond Green Diesel |

(75,000) |

|

|

(239,750) |

|

| Investment in other unconsolidated subsidiaries |

(27) |

|

|

— |

|

| Loan to Diamond Green Diesel |

— |

|

|

(25,000) |

|

| Loan repayment from Diamond Green Diesel |

25,000 |

|

|

50,000 |

|

|

|

|

|

| Gross proceeds from sale of property, plant and equipment and other assets |

4,817 |

|

|

9,430 |

|

| Proceeds from insurance settlement |

13,836 |

|

|

— |

|

| Payments related to routes and other intangibles |

(1,521) |

|

|

(179) |

|

| Net cash used in investing activities |

(1,506,634) |

|

|

(2,222,758) |

|

| Cash flows from financing activities: |

|

|

|

| Proceeds from long-term debt |

812,348 |

|

|

1,929,870 |

|

| Payments on long-term debt |

(102,463) |

|

|

(39,511) |

|

| Borrowings from revolving credit facility |

1,972,953 |

|

|

1,684,840 |

|

| Payments on revolving credit facility |

(1,707,840) |

|

|

(1,743,523) |

|

| Net cash overdraft financing |

6,008 |

|

|

21,090 |

|

| Deferred loan costs |

(9) |

|

|

(16,758) |

|

|

|

|

|

| Repurchase of common stock |

(52,941) |

|

|

(103,061) |

|

| Minimum withholding taxes paid on stock awards |

(17,278) |

|

|

(46,394) |

|

|

|

|

|

| Distributions to noncontrolling interests |

(8,628) |

|

|

(3,653) |

|

| Net cash provided by financing activities |

902,150 |

|

|

1,682,900 |

|

| Effect of exchange rate changes on cash flows |

25,559 |

|

|

(20,295) |

|

| Net increase in cash, cash equivalents and restricted cash |

103,363 |

|

|

78,285 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

150,168 |

|

|

69,072 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

253,531 |

|

|

$ |

147,357 |

|

Diamond Green Diesel Joint Venture

Condensed Consolidated Balance Sheets

September 30, 2023 and December 31, 2022

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

2023 |

|

2022 |

|

(unaudited) |

|

|

| Assets: |

|

|

|

| Total current assets |

$ |

1,641,934 |

|

|

$ |

1,304,805 |

|

| Property, plant and equipment, net |

3,831,367 |

|

|

3,866,854 |

|

| Other assets |

94,149 |

|

|

61,665 |

|

| Total assets |

$ |

5,567,450 |

|

|

$ |

5,233,324 |

|

|

|

|

|

| Liabilities and members' equity: |

|

|

|

| Total current portion of long term debt |

$ |

228,365 |

|

|

$ |

217,066 |

|

| Total other current liabilities |

391,027 |

|

|

515,023 |

|

| Total long term debt |

744,451 |

|

|

774,783 |

|

| Total other long term liabilities |

16,408 |

|

|

17,249 |

|

| Total members' equity |

4,187,199 |

|

|

3,709,203 |

|

| Total liabilities and members' equity |

$ |

5,567,450 |

|

|

$ |

5,233,324 |

|

Diamond Green Diesel Joint Venture

Operating Financial Results

For the Three and Nine Months Ended September 30, 2023 and September 30, 2022

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

(unaudited) |

|

$ Change |

|

(unaudited) |

|

$ Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

September 30, |

|

Favorable |

|

September 30, |

|

September 30, |

|

Favorable |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

(Unfavorable) |

|

2023 |

|

2022 |

|

(Unfavorable) |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues |

$ |

1,430,666 |

|

|

$ |

1,470,036 |

|

|

$ |

(39,370) |

|

|

$ |

5,356,827 |

|

|

$ |

3,906,614 |

|

|

$ |

1,450,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses less depreciation, amortization and accretion expense |

1,257,766 |

|

|

1,229,371 |

|

|

(28,395) |

|

|

4,430,485 |

|

|

3,311,608 |

|

|

(1,118,877) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization and accretion expense |

55,118 |

|

|

31,793 |

|

|

(23,325) |

|

|

172,040 |

|

|

89,602 |

|

|

(82,438) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

1,312,884 |

|

|

1,261,164 |

|

|

(51,720) |

|

|

4,602,525 |

|

|

3,401,210 |

|

|

(1,201,315) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

117,782 |

|

|

208,872 |

|

|

(91,090) |

|

|

754,302 |

|

|

505,404 |

|

|

248,898 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

2,701 |

|

|

1,215 |

|

|

1,486 |

|

|

6,863 |

|

|

1,926 |

|

|

4,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and debt expense, net |

(11,705) |

|

|

(3,259) |

|

|

(8,446) |

|

|

(37,785) |

|

|

(9,534) |

|

|

(28,251) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

108,778 |

|

|

$ |

206,828 |

|

|

$ |

(98,050) |

|

|

$ |

723,380 |

|

|

$ |

497,796 |

|

|

$ |

225,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Darling Ingredients Inc. reports Adjusted EBITDA results, which is a Non-GAAP financial measure, as a compliment to results provided in accordance with generally accepted accounting principles (GAAP) (for additional information, see “Use of Non-GAAP Financial Measures” included later in this media release). The Company believes that Adjusted EBITDA provides additional useful information to investors. Adjusted EBITDA, as the Company uses the term, is calculated below:

Reconciliation of Net Income to (Non-GAAP) Adjusted EBITDA and (Non-GAAP) Pro forma

Adjusted EBITDA to Foreign Currency

For the Three and Nine Months Ended September 30, 2023 and October 1, 2022

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

September 30, |

|

October 1, |

|

September 30, |

|

October 1, |

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Darling |

$ |

125,026 |

|

|

$ |

191,081 |

|

|

$ |

563,210 |

|

|

$ |

581,130 |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

125,994 |

|

|

104,978 |

|

|

364,086 |

|

|

277,337 |

|

|

|

|

|

|

|

|

|

| Interest expense |

70,278 |

|

|

39,816 |

|

|

190,770 |

|

|

79,427 |

|

|

|

|

|

|

|

|

|

| Income tax expense/(benefit) |

(15,364) |

|

|

35,215 |

|

|

52,322 |

|

|

108,631 |

|

|

|

|

|

|

|

|

|

| Restructuring and asset impairment charges |

— |

|

|

— |

|

|

5,420 |

|

|

8,557 |

|

|

|

|

|

|

|

|

|

| Acquisition and integration costs |

3,430 |

|

|

4,503 |

|

|

12,158 |

|

|

13,634 |

|

|

|

|

|

|

|

|

|

| Change in fair value of contingent consideration |

(5,559) |

|

|

— |

|

|

(13,058) |

|

|

— |

|

|

|

|

|

|

|

|

|

| Foreign currency loss/(gain) |

(845) |

|

|

493 |

|

|

(8,339) |

|

|

6,005 |

|

|

|

|

|

|

|

|

|

| Other expense/(income), net |

(2,247) |

|

|

2,807 |

|

|

(13,485) |

|

|

3,851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net income of Diamond Green Diesel |

(54,389) |

|

|

(103,414) |

|

|

(361,690) |

|

|

(248,898) |

|

|

|

|

|

|

|

|

|

| Equity in net income of other unconsolidated subsidiaries |

(1,534) |

|

|

(2,301) |

|

|

(3,503) |

|

|

(5,933) |

|

|

|

|

|

|

|

|

|

| Net income attributable to noncontrolling interests |

3,055 |

|

|

1,220 |

|

|

9,923 |

|

|

6,731 |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (Non-GAAP) |

$ |

247,845 |

|

|

$ |

274,398 |

|

|

$ |

797,814 |

|

|

$ |

830,472 |

|

|

|

|

|

|

|

|

|

| Foreign currency exchange impact |

(8,677) |

|

(1) |

|

|

(2,898) |

|

(2) |

|

|

|

|

|

|

|

|

|

| Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) |

$ |

239,168 |

|

|

$ |

274,398 |

|

|

$ |

794,916 |

|

|

$ |

830,472 |

|

|

|

|

|

|

|

|

|

| DGD Joint Venture Adjusted EBITDA (Darling's share) |

$ |

86,450 |

|

|

$ |

120,333 |

|

|

$ |

463,171 |

|

|

$ |

297,503 |

|

|

|

|

|

|

|

|

|

| Darling plus Darling's share of DGD Joint Venture Adjusted EBITDA |

$ |

334,295 |

|

|

$ |

394,731 |

|

|

$ |

1,260,985 |

|

|

$ |

1,127,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) The average rates for the three months ended September 30, 2023 were €1.00:$1.09, R$1.00:$0.21 and C$1.00:$0.75 as compared to the average rate for the three months ended October 1, 2022 of €1.00:$1.01, R$1.00:$0.19 and C$1.00:$0.77, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) The average rates for the nine months ended September 30, 2023 were €1.00:$1.08, R$1.00:$0.20 and C$1.00:$0.74 as compared to the average rate for the nine months ended October 1, 2022 of €1.00:$1.07, R$1.00:$0.19 and C$1.00:$0.78, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About Darling Ingredients

Darling Ingredients Inc. (NYSE: DAR) is the largest publicly traded company turning edible by-products and food waste into sustainable products and a leading producer of renewable energy. Recognized as a sustainability leader, the company operates more than 260 facilities in 17 countries and repurposes approximately 15% of the world's meat industry waste streams into value-added products, such as green energy, renewable diesel, collagen, fertilizer, animal proteins and meals, and pet food ingredients. To learn more, visit darlingii.com. Follow us on LinkedIn.

Darling Ingredients Inc. will host a conference call to discuss the Company’s third quarter 2023 financial results at 9 a.m. Eastern Time (8 a.m. Central Time) on Wednesday, Nov. 8, 2023.

To join the call as a participant to ask a question, please register in advance to receive a confirmation email with the dial-in number and PIN for immediate access on November 8, 2023, or call 844-868-8847 (United States) or 412-317-6593 (International) and ask for "The Darling Ingredients Call” that day.

A replay of the call will be available online via the webcast registration link and via phone at 877-344-7529 (United States), 855-669-9658 (Canada) or 412-317-0088 (International) using reference passcode 7150600. The phone replay will be available two hours after the call concludes through November 15, 2023.

Use of Non-GAAP Financial Measures:

Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity. It is presented here not as an alternative to net income, but rather as a measure of the Company's operating performance. Since EBITDA (generally, net income plus interest expense, taxes, depreciation and amortization) is not calculated identically by all companies, the presentation in this report may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated above and represents for any relevant period, net income/(loss) plus depreciation and amortization, restructuring, acquisition and integration costs, goodwill and long-lived asset impairment, change in fair value of contingent consideration, interest expense, income tax provision, other income/(expense) and equity in net (income)/loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company's operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance.

Pro forma Adjusted EBITDA to Foreign Currency is not a recognized accounting measurement under GAAP. The Company evaluates the impact of foreign currency on its adjusted EBITDA. DGD Joint Venture Adjusted EBITDA (Darling's share) is not reflected in the Adjusted EBITDA or the Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP).

The Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities, 6% Notes, 5.25% Notes and 3.625% Notes that were outstanding at September 30, 2023. However, the amounts shown below for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities, 6% Notes, 5.25% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other nonrecurring costs, non-cash charges and cash dividends from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization.

DGD Joint Venture Adjusted EBITDA (Darling’s share) is not a recognized accounting measure under GAAP; it should not be considered as an alternative to net income or equity in net income of Diamond Green Diesel, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. The Company calculates DGD Joint Venture Adjusted EBITDA (Darling’s share) by taking DGD’s operating income plus DGD’s depreciation, amortization and accretion expense and then multiplying by 50% to get Darling’s share of DGD’s EBITDA.

Information reconciling forward-looking combined adjusted EBITDA to net income is unavailable to the Company without unreasonable effort. The Company is not able to provide reconciliations of combined adjusted EBITDA to net income because certain items required for such reconciliations are outside of the Company’s control and/or cannot be reasonably predicted, such as the impact of volatile commodity prices on the Company’s operations, impact of foreign currency exchange fluctuations, depreciation and amortization and the provision for income taxes. Preparation of such reconciliations for Darling Ingredients Inc. and the Company’s joint venture, Diamond Green Diesel, would require a forward-looking balance sheet, statement of operations and statement of cash flows, prepared in accordance with GAAP for each entity, and such forward-looking financial statements are unavailable to the Company without unreasonable effort. The Company provides guidance for its combined adjusted EBITDA outlook that it believes will be achieved; however, it cannot accurately predict all the components of the combined adjusted EBITDA calculation.

EBITDA per gallon is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income or equity in income of Diamond Green Diesel, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. EBITDA per gallon is presented here not as an alternative to net income or equity in income of Diamond Green Diesel, but rather as a measure of Diamond Green Diesel's operating performance.

Since EBITDA per gallon (generally, net income plus interest expense, taxes, depreciation and amortization divided by total gallons sold) is not calculated identically by all companies, this presentation may not be comparable to EBITDA per gallon presentations disclosed by other companies. Management believes that EBITDA per gallon is useful in evaluating Diamond Green Diesel's operating performance compared to that of other companies in its industry because the calculation of EBITDA per gallon generally eliminates the effects of financing, income taxes and certain non-cash and other items presented on a per gallon basis that may vary for different companies for reasons unrelated to overall operating performance.

Cautionary Statements Regarding Forward-Looking Information:

This media release contains includes “forward-looking” statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. Statements that are not statements of historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “guidance,” “project,” “planned,” “contemplate,” “potential,” “possible,” “proposed,” “intend,” “believe,” “anticipate,” “expect,” “may,” “will,” “would,” “should,” “could,” and similar expressions are intended to identify forward-looking statements. All statements other than statements of historical facts included in this release are forward looking statements. Forward-looking statements are based on the Company's current expectations and assumptions regarding its business, the economy and other future conditions. The Company cautions readers that any such forward-looking statements it makes are not guarantees of future performance and that actual results may differ materially from anticipated results or expectations expressed in its forward-looking statements as a result of a variety of factors, including many that are beyond the Company's control. Important factors that could cause actual results to differ materially from the Company’s expectations include: existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas (“GHG”) emissions that adversely affect programs like the U.S. government's renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), severe acute respiratory syndrome (“SARS”), bovine spongiform encephalopathy (or “BSE”), porcine epidemic diarrhea (“PED”) or other diseases associated with animal origin in the United States or elsewhere, such as the outbreak of African Swine Fever in China and elsewhere; the occurrence of pandemics, epidemics or disease outbreaks, such as the COVID-19 outbreak; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, SARS, PED, BSE or ASF or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions, a decline in margins on the products produced by the DGD Joint Venture and issues relating to the announced SAF upgrade project; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; tax changes, such as the introduction of a global minimum tax; difficulties or a significant disruption in the Company's information systems or failure to implement new systems and software successfully; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere, including the Russia-Ukraine war and the Israel-Palestinian conflict; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, inflation rates, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, such as the recent turmoil in the world banking markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could cause actual results to vary materially from the forward-looking statements included in this report or negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. For more detailed discussion of these factors and other risks and uncertainties regarding the Company, its business and the industries in which it operates, see the Company’s filings with the SEC, including the Risk Factors discussion in Item 1A of Part I of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The Company cautions readers that all forward-looking statements speak only as of the date made, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of changes in circumstances, new events or otherwise.

# # #

Darling Ingredients Contacts

Investors: Suann Guthrie

Senior VP, Investor Relations, Sustainability & Communications

(469) 214-8202; suann.guthrie@darlingii.com

Media: Jillian Fleming

Director, Global Communications

(972) 541-7115; jillian.fleming@darlingii.com