| Oklahoma | 73-1373454 | ||||||||||

| (State or other jurisdiction of Incorporation or Organization) |

(IRS Employer Identification No.) |

||||||||||

| Bank of Oklahoma Tower | |||||||||||

| Boston Avenue at Second Street | |||||||||||

| Tulsa, | Oklahoma | 74192 | |||||||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.00006 per share | BOKF | Nasdaq Stock Market | ||||||||||||

| CEO Commentary | ||

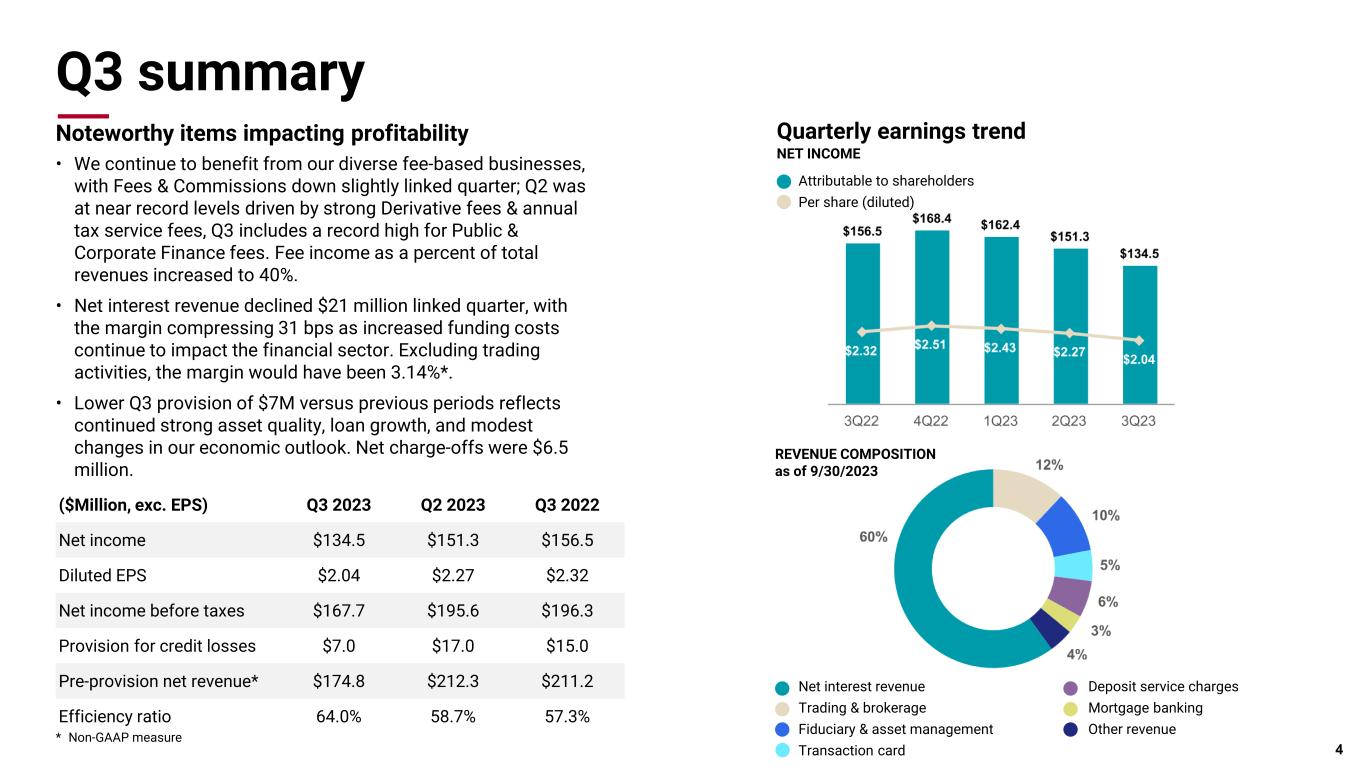

Stacy Kymes, president and chief executive officer, stated, "We recognized another solid quarter of earnings driven by our diverse business model, which prudently balances interest revenue with non-interest revenues and allows us to perform well in a multitude of business climates. Non-interest revenues now represent 40% of our total revenues. In addition, we continue to focus on opportunities for growth given the economic vitality of our core geographic footprint as we take advantage of our capital and liquidity strengths. We have increased loans almost 9% over the previous year and our core commercial and industrial loans are up 8% from last year. We’re focused on investing in growth initiatives like our San Antonio expansion, which will drive long-term shareholder value. We have consistently proven that our business diversification coupled with our outstanding team outperforms against strong headwinds." | ||

| Third Quarter 2023 Financial Highlights | ||||||||||||||

| (Unless indicated otherwise, all comparisons are to the prior quarter) | ||||||||||||||

| Third Quarter 2023 Segment Highlights | ||||||||||||||

| Net Interest Revenue | ||||||||||||||

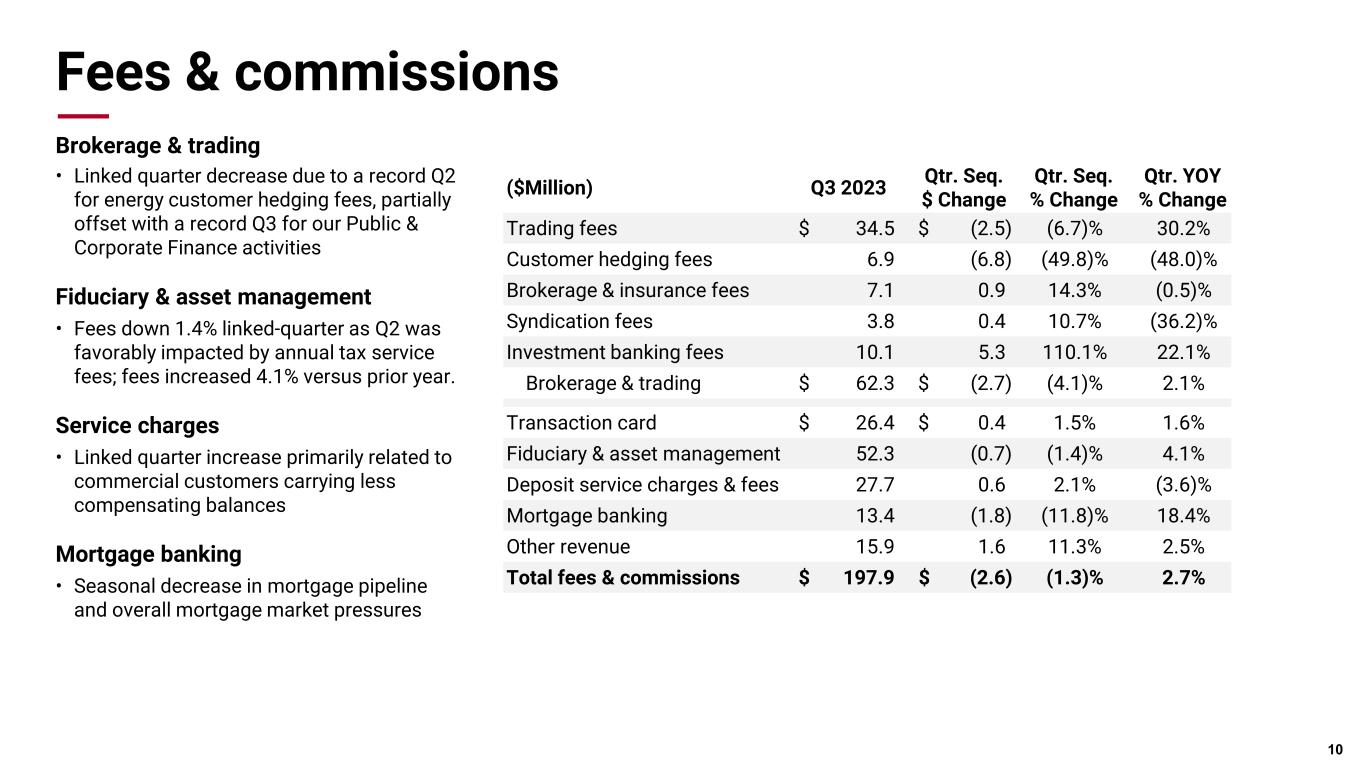

| Fees and Commissions Revenue | ||||||||||||||

| Operating Expense | ||||||||||||||

| Loans, Deposits and Capital | ||||||||||||||

| Credit Quality | ||||||||||||||

| Securities and Derivatives | ||||||||||||||

| Conference Call and Webcast | ||||||||||||||

| About BOK Financial Corporation | ||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | ||||||||||

| ASSETS | |||||||||||

| Cash and due from banks | $ | 854,161 | $ | 875,714 | |||||||

| Interest-bearing cash and cash equivalents | 520,774 | 571,616 | |||||||||

| Trading securities | 4,748,101 | 5,442,364 | |||||||||

| Investment securities, net of allowance | 2,298,418 | 2,374,071 | |||||||||

| Available for sale securities | 11,906,647 | 11,938,523 | |||||||||

| Fair value option securities | 20,215 | 212,321 | |||||||||

| Restricted equity securities | 435,112 | 330,086 | |||||||||

| Residential mortgage loans held for sale | 72,489 | 94,820 | |||||||||

| Loans: | |||||||||||

| Commercial | 14,719,839 | 14,534,516 | |||||||||

| Commercial real estate | 5,241,300 | 4,970,801 | |||||||||

| Loans to individuals | 3,762,879 | 3,732,342 | |||||||||

| Total loans | 23,724,018 | 23,237,659 | |||||||||

| Allowance for loan losses | (272,114) | (262,714) | |||||||||

| Loans, net of allowance | 23,451,904 | 22,974,945 | |||||||||

| Premises and equipment, net | 616,439 | 617,918 | |||||||||

| Receivables | 255,164 | 263,915 | |||||||||

| Goodwill | 1,044,749 | 1,044,749 | |||||||||

| Intangible assets, net | 65,804 | 69,246 | |||||||||

| Mortgage servicing rights | 311,382 | 304,722 | |||||||||

| Real estate and other repossessed assets, net | 3,753 | 4,227 | |||||||||

| Derivative contracts, net | 546,109 | 353,037 | |||||||||

| Cash surrender value of bank-owned life insurance | 406,623 | 411,084 | |||||||||

| Receivable on unsettled securities sales | 28,707 | 133,909 | |||||||||

| Other assets | 1,344,846 | 1,220,653 | |||||||||

| TOTAL ASSETS | $ | 48,931,397 | $ | 49,237,920 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Deposits: | |||||||||||

| Demand | $ | 9,974,223 | $ | 10,782,548 | |||||||

| Interest-bearing transaction | 19,897,179 | 18,907,981 | |||||||||

| Savings | 853,933 | 897,937 | |||||||||

| Time | 2,927,217 | 2,706,377 | |||||||||

| Total deposits | 33,652,552 | 33,294,843 | |||||||||

| Funds purchased and repurchase agreements | 2,722,998 | 5,446,864 | |||||||||

| Other borrowings | 6,201,644 | 3,777,056 | |||||||||

| Subordinated debentures | 131,152 | 131,154 | |||||||||

| Accrued interest, taxes and expense | 244,105 | 228,797 | |||||||||

| Due on unsettled securities purchases | 235,473 | 400,430 | |||||||||

| Derivative contracts, net | 403,947 | 550,653 | |||||||||

| Other liabilities | 522,318 | 540,726 | |||||||||

| TOTAL LIABILITIES | 44,114,189 | 44,370,523 | |||||||||

| Shareholders' equity: | |||||||||||

| Capital, surplus and retained earnings | 5,743,004 | 5,700,526 | |||||||||

| Accumulated other comprehensive loss | (928,985) | (836,672) | |||||||||

| TOTAL SHAREHOLDERS' EQUITY | 4,814,019 | 4,863,854 | |||||||||

| Non-controlling interests | 3,189 | 3,543 | |||||||||

| TOTAL EQUITY | 4,817,208 | 4,867,397 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 48,931,397 | $ | 49,237,920 | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Interest-bearing cash and cash equivalents | $ | 598,734 | $ | 708,475 | $ | 616,596 | $ | 568,307 | $ | 748,263 | |||||||||||||||||||

| Trading securities | 5,444,587 | 4,274,803 | 3,031,969 | 3,086,985 | 3,178,068 | ||||||||||||||||||||||||

| Investment securities, net of allowance | 2,331,595 | 2,408,122 | 2,473,796 | 2,535,305 | 2,593,989 | ||||||||||||||||||||||||

| Available for sale securities | 11,925,800 | 12,033,597 | 11,738,693 | 10,953,851 | 10,306,257 | ||||||||||||||||||||||||

| Fair value option securities | 41,741 | 245,469 | 300,372 | 92,012 | 36,846 | ||||||||||||||||||||||||

| Restricted equity securities | 445,532 | 351,944 | 316,724 | 216,673 | 173,656 | ||||||||||||||||||||||||

| Residential mortgage loans held for sale | 77,208 | 72,959 | 65,769 | 98,613 | 132,685 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Commercial | 14,527,676 | 14,316,474 | 14,046,237 | 13,846,339 | 13,508,325 | ||||||||||||||||||||||||

| Commercial real estate | 5,172,876 | 4,896,230 | 4,757,362 | 4,488,091 | 4,434,650 | ||||||||||||||||||||||||

| Loans to individuals | 3,713,756 | 3,676,350 | 3,672,648 | 3,641,574 | 3,656,257 | ||||||||||||||||||||||||

| Total loans | 23,414,308 | 22,889,054 | 22,476,247 | 21,976,004 | 21,599,232 | ||||||||||||||||||||||||

| Allowance for loan losses | (267,205) | (252,890) | (238,909) | (242,450) | (241,136) | ||||||||||||||||||||||||

| Loans, net of allowance | 23,147,103 | 22,636,164 | 22,237,338 | 21,733,554 | 21,358,096 | ||||||||||||||||||||||||

| Total earning assets | 44,012,300 | 42,731,533 | 40,781,257 | 39,285,300 | 38,527,860 | ||||||||||||||||||||||||

| Cash and due from banks | 799,291 | 875,280 | 857,771 | 865,796 | 821,801 | ||||||||||||||||||||||||

Derivative contracts, net |

412,707 | 410,793 | 546,018 | 1,239,717 | 2,019,905 | ||||||||||||||||||||||||

Cash surrender value of bank-owned life insurance |

408,295 | 409,313 | 408,124 | 406,826 | 410,667 | ||||||||||||||||||||||||

| Receivable on unsettled securities sales | 268,344 | 163,903 | 177,312 | 194,996 | 219,113 | ||||||||||||||||||||||||

| Other assets | 3,418,615 | 3,317,285 | 3,211,986 | 3,216,983 | 3,119,856 | ||||||||||||||||||||||||

| TOTAL ASSETS | $ | 49,319,552 | $ | 47,908,107 | $ | 45,982,468 | $ | 45,209,618 | $ | 45,119,202 | |||||||||||||||||||

| LIABILITIES AND EQUITY | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Demand | $ | 10,157,821 | $ | 10,998,201 | $ | 12,406,408 | $ | 14,176,189 | $ | 15,105,305 | |||||||||||||||||||

| Interest-bearing transaction | 19,415,599 | 18,368,592 | 18,639,900 | 18,898,315 | 19,556,806 | ||||||||||||||||||||||||

| Savings | 874,530 | 926,882 | 958,443 | 969,275 | 978,596 | ||||||||||||||||||||||||

| Time | 2,839,947 | 2,076,037 | 1,477,720 | 1,417,606 | 1,409,069 | ||||||||||||||||||||||||

| Total deposits | 33,287,897 | 32,369,712 | 33,482,471 | 35,461,385 | 37,049,776 | ||||||||||||||||||||||||

Funds purchased and repurchase agreements |

2,699,027 | 3,670,994 | 1,759,237 | 1,046,447 | 800,759 | ||||||||||||||||||||||||

| Other borrowings | 6,968,309 | 5,275,291 | 4,512,280 | 2,523,195 | 1,528,887 | ||||||||||||||||||||||||

| Subordinated debentures | 131,151 | 131,153 | 131,166 | 131,180 | 131,199 | ||||||||||||||||||||||||

| Derivative contracts, net | 429,989 | 576,558 | 428,023 | 445,105 | 105,221 | ||||||||||||||||||||||||

| Due on unsettled securities purchases | 435,927 | 436,353 | 316,738 | 575,957 | 331,428 | ||||||||||||||||||||||||

| Other liabilities | 461,686 | 503,134 | 511,530 | 408,029 | 396,510 | ||||||||||||||||||||||||

| TOTAL LIABILITIES | 44,413,986 | 42,963,195 | 41,141,445 | 40,591,298 | 40,343,780 | ||||||||||||||||||||||||

| Total equity | 4,905,566 | 4,944,912 | 4,841,023 | 4,618,320 | 4,775,422 | ||||||||||||||||||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 49,319,552 | $ | 47,908,107 | $ | 45,982,468 | $ | 45,209,618 | $ | 45,119,202 | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| September 30, | September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Interest revenue | $ | 617,044 | $ | 363,150 | $ | 1,704,140 | $ | 940,496 | |||||||||||||||

| Interest expense | 316,148 | 46,825 | 728,635 | 81,742 | |||||||||||||||||||

| Net interest revenue | 300,896 | 316,325 | 975,505 | 858,754 | |||||||||||||||||||

| Provision for credit losses | 7,000 | 15,000 | 40,000 | 15,000 | |||||||||||||||||||

Net interest revenue after provision for credit losses |

293,896 | 301,325 | 935,505 | 843,754 | |||||||||||||||||||

| Other operating revenue: | |||||||||||||||||||||||

| Brokerage and trading revenue | 62,312 | 61,006 | 179,714 | 77,970 | |||||||||||||||||||

| Transaction card revenue | 26,387 | 25,974 | 78,011 | 77,130 | |||||||||||||||||||

| Fiduciary and asset management revenue | 52,256 | 50,190 | 155,910 | 146,427 | |||||||||||||||||||

| Deposit service charges and fees | 27,676 | 28,703 | 80,744 | 84,207 | |||||||||||||||||||

| Mortgage banking revenue | 13,356 | 11,282 | 42,864 | 39,300 | |||||||||||||||||||

| Other revenue | 15,865 | 15,479 | 47,085 | 38,608 | |||||||||||||||||||

| Total fees and commissions | 197,852 | 192,634 | 584,328 | 463,642 | |||||||||||||||||||

| Other gains (losses), net | 1,474 | 979 | 16,343 | (8,304) | |||||||||||||||||||

| Loss on derivatives, net | (9,010) | (17,009) | (18,513) | (77,559) | |||||||||||||||||||

| Loss on fair value option securities, net | (203) | (4,368) | (5,323) | (17,790) | |||||||||||||||||||

| Change in fair value of mortgage servicing rights | 8,039 | 16,570 | 11,241 | 83,165 | |||||||||||||||||||

| Gain (loss) on available for sale securities, net | — | 892 | (3,010) | 3,017 | |||||||||||||||||||

| Total other operating revenue | 198,152 | 189,698 | 585,066 | 446,171 | |||||||||||||||||||

| Other operating expense: | |||||||||||||||||||||||

| Personnel | 190,791 | 170,348 | 563,588 | 484,499 | |||||||||||||||||||

| Business promotion | 6,958 | 6,127 | 23,167 | 18,965 | |||||||||||||||||||

| Charitable contributions to BOKF Foundation | 23 | — | 1,165 | — | |||||||||||||||||||

| Professional fees and services | 13,224 | 14,089 | 39,049 | 37,977 | |||||||||||||||||||

| Net occupancy and equipment | 32,583 | 29,296 | 91,147 | 87,640 | |||||||||||||||||||

| Insurance | 7,996 | 4,306 | 22,285 | 13,317 | |||||||||||||||||||

| Data processing and communications | 45,672 | 41,743 | 135,781 | 122,859 | |||||||||||||||||||

| Printing, postage and supplies | 3,760 | 4,349 | 11,381 | 11,967 | |||||||||||||||||||

| Amortization of intangible assets | 3,474 | 3,943 | 10,339 | 11,956 | |||||||||||||||||||

| Mortgage banking costs | 8,357 | 9,504 | 22,439 | 26,818 | |||||||||||||||||||

| Other expense | 11,475 | 11,046 | 28,457 | 30,026 | |||||||||||||||||||

| Total other operating expense | 324,313 | 294,751 | 948,798 | 846,024 | |||||||||||||||||||

| Net income before taxes | 167,735 | 196,272 | 571,773 | 443,901 | |||||||||||||||||||

| Federal and state income taxes | 33,256 | 39,681 | 123,162 | 92,000 | |||||||||||||||||||

| Net income | 134,479 | 156,591 | 448,611 | 351,901 | |||||||||||||||||||

| Net income (loss) attributable to non-controlling interests | (16) | 81 | 440 | 57 | |||||||||||||||||||

Net income attributable to BOK Financial Corporation shareholders |

$ | 134,495 | $ | 156,510 | $ | 448,171 | $ | 351,844 | |||||||||||||||

| Average shares outstanding: | |||||||||||||||||||||||

| Basic | 65,548,307 | 67,003,199 | 65,955,294 | 67,409,789 | |||||||||||||||||||

| Diluted | 65,548,307 | 67,004,623 | 65,955,294 | 67,411,222 | |||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||

| Basic | $ | 2.04 | $ | 2.32 | $ | 6.74 | $ | 5.18 | |||||||||||||||

| Diluted | $ | 2.04 | $ | 2.32 | $ | 6.74 | $ | 5.18 | |||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Interest revenue | $ | 617,044 | $ | 570,367 | $ | 516,729 | $ | 451,606 | $ | 363,150 | |||||||||||||||||||

| Interest expense | 316,148 | 248,106 | 164,381 | 98,980 | 46,825 | ||||||||||||||||||||||||

| Net interest revenue | 300,896 | 322,261 | 352,348 | 352,626 | 316,325 | ||||||||||||||||||||||||

| Provision for credit losses | 7,000 | 17,000 | 16,000 | 15,000 | 15,000 | ||||||||||||||||||||||||

Net interest revenue after provision for credit losses |

293,896 | 305,261 | 336,348 | 337,626 | 301,325 | ||||||||||||||||||||||||

| Other operating revenue: | |||||||||||||||||||||||||||||

| Brokerage and trading revenue | 62,312 | 65,006 | 52,396 | 63,008 | 61,006 | ||||||||||||||||||||||||

| Transaction card revenue | 26,387 | 26,003 | 25,621 | 27,136 | 25,974 | ||||||||||||||||||||||||

| Fiduciary and asset management revenue | 52,256 | 52,997 | 50,657 | 49,899 | 50,190 | ||||||||||||||||||||||||

| Deposit service charges and fees | 27,676 | 27,100 | 25,968 | 26,429 | 28,703 | ||||||||||||||||||||||||

| Mortgage banking revenue | 13,356 | 15,141 | 14,367 | 10,065 | 11,282 | ||||||||||||||||||||||||

| Other revenue | 15,865 | 14,250 | 16,970 | 17,034 | 15,479 | ||||||||||||||||||||||||

| Total fees and commissions | 197,852 | 200,497 | 185,979 | 193,571 | 192,634 | ||||||||||||||||||||||||

| Other gains (losses), net | 1,474 | 12,618 | 2,251 | 8,427 | 979 | ||||||||||||||||||||||||

| Gain (loss) on derivatives, net | (9,010) | (8,159) | (1,344) | 4,548 | (17,009) | ||||||||||||||||||||||||

| Loss on fair value option securities, net | (203) | (2,158) | (2,962) | (2,568) | (4,368) | ||||||||||||||||||||||||

Change in fair value of mortgage servicing rights |

8,039 | 9,261 | (6,059) | (2,904) | 16,570 | ||||||||||||||||||||||||

| Gain (loss) on available for sale securities, net | — | (3,010) | — | (3,988) | 892 | ||||||||||||||||||||||||

| Total other operating revenue | 198,152 | 209,049 | 177,865 | 197,086 | 189,698 | ||||||||||||||||||||||||

| Other operating expense: | |||||||||||||||||||||||||||||

| Personnel | 190,791 | 190,652 | 182,145 | 186,419 | 170,348 | ||||||||||||||||||||||||

| Business promotion | 6,958 | 7,640 | 8,569 | 7,470 | 6,127 | ||||||||||||||||||||||||

Charitable contributions to BOKF Foundation |

23 | 1,142 | — | 2,500 | — | ||||||||||||||||||||||||

| Professional fees and services | 13,224 | 12,777 | 13,048 | 18,365 | 14,089 | ||||||||||||||||||||||||

| Net occupancy and equipment | 32,583 | 30,105 | 28,459 | 29,227 | 29,296 | ||||||||||||||||||||||||

| Insurance | 7,996 | 6,974 | 7,315 | 4,677 | 4,306 | ||||||||||||||||||||||||

Data processing and communications |

45,672 | 45,307 | 44,802 | 43,048 | 41,743 | ||||||||||||||||||||||||

| Printing, postage and supplies | 3,760 | 3,728 | 3,893 | 3,890 | 4,349 | ||||||||||||||||||||||||

Amortization of intangible assets |

3,474 | 3,474 | 3,391 | 3,736 | 3,943 | ||||||||||||||||||||||||

| Mortgage banking costs | 8,357 | 8,300 | 5,782 | 9,016 | 9,504 | ||||||||||||||||||||||||

| Other expense | 11,475 | 8,574 | 8,408 | 10,108 | 11,046 | ||||||||||||||||||||||||

| Total other operating expense | 324,313 | 318,673 | 305,812 | 318,456 | 294,751 | ||||||||||||||||||||||||

| Net income before taxes | 167,735 | 195,637 | 208,401 | 216,256 | 196,272 | ||||||||||||||||||||||||

| Federal and state income taxes | 33,256 | 44,001 | 45,905 | 47,864 | 39,681 | ||||||||||||||||||||||||

| Net income | 134,479 | 151,636 | 162,496 | 168,392 | 156,591 | ||||||||||||||||||||||||

Net income (loss) attributable to non-controlling interests |

(16) | 328 | 128 | (37) | 81 | ||||||||||||||||||||||||

Net income attributable to BOK Financial Corporation shareholders |

$ | 134,495 | $ | 151,308 | $ | 162,368 | $ | 168,429 | $ | 156,510 | |||||||||||||||||||

| Average shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 65,548,307 | 65,994,132 | 66,331,775 | 66,627,955 | 67,003,199 | ||||||||||||||||||||||||

| Diluted | 65,548,307 | 65,994,132 | 66,331,775 | 66,627,955 | 67,004,623 | ||||||||||||||||||||||||

| Net income per share: | |||||||||||||||||||||||||||||

| Basic | $ | 2.04 | $ | 2.27 | $ | 2.43 | $ | 2.51 | $ | 2.32 | |||||||||||||||||||

| Diluted | $ | 2.04 | $ | 2.27 | $ | 2.43 | $ | 2.51 | $ | 2.32 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Capital: | |||||||||||||||||||||||||||||

| Period-end shareholders' equity | $ | 4,814,019 | $ | 4,863,854 | $ | 4,874,786 | $ | 4,682,649 | $ | 4,509,934 | |||||||||||||||||||

| Risk weighted assets | $ | 38,791,023 | $ | 38,218,164 | $ | 37,192,197 | $ | 38,142,231 | $ | 36,866,994 | |||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||

| Common equity tier 1 | 12.06 | % | 12.13 | % | 12.19 | % | 11.69 | % | 11.80 | % | |||||||||||||||||||

| Tier 1 | 12.07 | % | 12.13 | % | 12.20 | % | 11.71 | % | 11.82 | % | |||||||||||||||||||

| Total capital | 13.16 | % | 13.24 | % | 13.21 | % | 12.67 | % | 12.81 | % | |||||||||||||||||||

| Leverage ratio | 9.52 | % | 9.75 | % | 9.94 | % | 9.91 | % | 9.76 | % | |||||||||||||||||||

Tangible common equity ratio1 |

7.74 | % | 7.79 | % | 8.46 | % | 7.63 | % | 7.96 | % | |||||||||||||||||||

Adjusted tangible common equity ratio1 |

7.35 | % | 7.49 | % | 8.22 | % | 7.36 | % | 7.66 | % | |||||||||||||||||||

| Common stock: | |||||||||||||||||||||||||||||

| Book value per share | $ | 73.31 | $ | 73.28 | $ | 73.19 | $ | 69.93 | $ | 67.06 | |||||||||||||||||||

| Tangible book value per share | $ | 56.40 | $ | 56.50 | $ | 56.42 | $ | 53.19 | $ | 50.34 | |||||||||||||||||||

| Market value per share: | |||||||||||||||||||||||||||||

| High | $ | 92.41 | $ | 90.91 | $ | 106.47 | $ | 110.28 | $ | 95.51 | |||||||||||||||||||

| Low | $ | 77.61 | $ | 74.40 | $ | 80.00 | $ | 88.46 | $ | 69.82 | |||||||||||||||||||

| Cash dividends paid | $ | 35,655 | $ | 35,879 | $ | 36,006 | $ | 36,188 | $ | 35,661 | |||||||||||||||||||

| Dividend payout ratio | 26.51 | % | 23.71 | % | 22.18 | % | 21.49 | % | 22.79 | % | |||||||||||||||||||

| Shares outstanding, net | 65,664,840 | 66,369,208 | 66,600,833 | 66,958,634 | 67,254,383 | ||||||||||||||||||||||||

| Stock buy-back program: | |||||||||||||||||||||||||||||

| Shares repurchased | 700,500 | 266,000 | 447,071 | 314,406 | 548,034 | ||||||||||||||||||||||||

| Amount | $ | 58,961 | $ | 22,366 | $ | 44,100 | $ | 32,429 | $ | 49,980 | |||||||||||||||||||

Average price paid per share2 |

$ | 84.17 | $ | 84.08 | $ | 98.64 | $ | 103.14 | $ | 91.20 | |||||||||||||||||||

Performance ratios (quarter annualized): | |||||||||||||||||||||||||||||

| Return on average assets | 1.08 | % | 1.27 | % | 1.43 | % | 1.48 | % | 1.38 | % | |||||||||||||||||||

| Return on average equity | 10.88 | % | 12.28 | % | 13.61 | % | 14.48 | % | 13.01 | % | |||||||||||||||||||

Return on average tangible common equity1 |

14.08 | % | 15.86 | % | 17.71 | % | 19.14 | % | 17.04 | % | |||||||||||||||||||

| Net interest margin | 2.69 | % | 3.00 | % | 3.45 | % | 3.54 | % | 3.24 | % | |||||||||||||||||||

Efficiency ratio1,3 |

64.01 | % | 58.75 | % | 56.79 | % | 56.61 | % | 57.33 | % | |||||||||||||||||||

| Other data: | |||||||||||||||||||||||||||||

| Tax equivalent interest | $ | 2,214 | $ | 2,200 | $ | 2,285 | $ | 2,287 | $ | 2,163 | |||||||||||||||||||

| Net unrealized loss on available for sale securities | $ | (1,034,520) | $ | (898,906) | $ | (741,508) | $ | (865,553) | $ | (935,788) | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Mortgage banking: | |||||||||||||||||||||||||||||

| Mortgage production revenue | $ | (1,887) | $ | (284) | $ | (633) | $ | (3,983) | $ | (2,406) | |||||||||||||||||||

| Mortgage loans funded for sale | $ | 173,727 | $ | 214,785 | $ | 138,624 | $ | 141,090 | $ | 260,210 | |||||||||||||||||||

Add: current period-end outstanding commitments |

49,284 | 55,031 | 71,693 | 45,492 | 75,779 | ||||||||||||||||||||||||

Less: prior period end outstanding commitments |

55,031 | 71,693 | 45,492 | 75,779 | 106,004 | ||||||||||||||||||||||||

Total mortgage production volume |

$ | 167,980 | $ | 198,123 | $ | 164,825 | $ | 110,803 | $ | 229,985 | |||||||||||||||||||

Mortgage loan refinances to mortgage loans funded for sale |

9 | % | 8 | % | 9 | % | 10 | % | 10 | % | |||||||||||||||||||

| Realized margin on funded mortgage loans | (0.94) | % | (0.14) | % | (1.25) | % | (1.10) | % | (0.41) | % | |||||||||||||||||||

| Production revenue as a percentage of production volume | (1.12) | % | (0.14) | % | (0.38) | % | (3.59) | % | (1.05) | % | |||||||||||||||||||

| Mortgage servicing revenue | $ | 15,243 | $ | 15,425 | $ | 15,000 | $ | 14,048 | $ | 13,688 | |||||||||||||||||||

Average outstanding principal balance of mortgage loans serviced for others |

20,719,116 | 20,807,044 | 21,121,319 | 18,923,078 | 19,070,221 | ||||||||||||||||||||||||

| Average mortgage servicing revenue rates | 0.29 | % | 0.30 | % | 0.29 | % | 0.29 | % | 0.28 | % | |||||||||||||||||||

Gain (loss) on mortgage servicing rights, net of economic hedge: | |||||||||||||||||||||||||||||

Gain (loss) on mortgage hedge derivative contracts, net |

$ | (8,980) | $ | (8,099) | $ | (1,711) | $ | 4,373 | $ | (17,027) | |||||||||||||||||||

| Loss on fair value option securities, net | (203) | (2,158) | (2,962) | (2,568) | (4,368) | ||||||||||||||||||||||||

| Gain (loss) on economic hedge of mortgage servicing rights | (9,183) | (10,257) | (4,673) | 1,805 | (21,395) | ||||||||||||||||||||||||

| Gain (loss) on changes in fair value of mortgage servicing rights | 8,039 | 9,261 | (6,059) | (2,904) | 16,570 | ||||||||||||||||||||||||

| Gain (loss) on changes in fair value of mortgage servicing rights, net of economic hedges, included in other operating revenue | (1,144) | (996) | (10,732) | (1,099) | (4,825) | ||||||||||||||||||||||||

Net interest revenue (expense) on fair value option securities4 |

(112) | (232) | 187 | (118) | 29 | ||||||||||||||||||||||||

| Total economic benefit (cost) of changes in the fair value of mortgage servicing rights, net of economic hedges | $ | (1,256) | $ | (1,228) | $ | (10,545) | $ | (1,217) | $ | (4,796) | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

Reconciliation of tangible common equity ratio and adjusted tangible common equity ratio: | |||||||||||||||||||||||||||||

| Total shareholders' equity | $ | 4,814,019 | $ | 4,863,854 | $ | 4,874,786 | $ | 4,682,649 | $ | 4,509,934 | |||||||||||||||||||

Less: Goodwill and intangible assets, net |

1,110,553 | 1,113,995 | 1,117,438 | 1,120,880 | 1,124,582 | ||||||||||||||||||||||||

| Tangible common equity | 3,703,466 | 3,749,859 | 3,757,348 | 3,561,769 | 3,385,352 | ||||||||||||||||||||||||

| Add: Unrealized gain (loss) on investment securities, net | (246,395) | (189,152) | (140,947) | (167,477) | (165,206) | ||||||||||||||||||||||||

| Add: Tax effect on unrealized gain (loss) on investment securities, net | 57,949 | 44,486 | 33,149 | 39,196 | 38,665 | ||||||||||||||||||||||||

| Adjusted tangible common equity | $ | 3,515,020 | $ | 3,605,193 | $ | 3,649,550 | $ | 3,433,488 | $ | 3,258,811 | |||||||||||||||||||

| Total assets | $ | 48,931,397 | $ | 49,237,920 | $ | 45,524,122 | $ | 47,790,642 | $ | 43,645,446 | |||||||||||||||||||

Less: Goodwill and intangible assets, net |

1,110,553 | 1,113,995 | 1,117,438 | 1,120,880 | 1,124,582 | ||||||||||||||||||||||||

| Tangible assets | $ | 47,820,844 | $ | 48,123,925 | $ | 44,406,684 | $ | 46,669,762 | $ | 42,520,864 | |||||||||||||||||||

| Tangible common equity ratio | 7.74 | % | 7.79 | % | 8.46 | % | 7.63 | % | 7.96 | % | |||||||||||||||||||

| Adjusted tangible common equity ratio | 7.35 | % | 7.49 | % | 8.22 | % | 7.36 | % | 7.66 | % | |||||||||||||||||||

Reconciliation of return on average tangible common equity: | |||||||||||||||||||||||||||||

| Total average shareholders' equity | $ | 4,902,119 | $ | 4,941,352 | $ | 4,837,567 | $ | 4,613,929 | $ | 4,771,123 | |||||||||||||||||||

| Less: Average goodwill and intangible assets, net | 1,112,217 | 1,115,652 | 1,119,123 | 1,122,680 | 1,126,440 | ||||||||||||||||||||||||

| Average tangible common equity | $ | 3,789,902 | $ | 3,825,700 | $ | 3,718,444 | $ | 3,491,249 | $ | 3,644,683 | |||||||||||||||||||

| Net Income | 134,495 | 151,308 | 162,368 | 168,429 | 156,510 | ||||||||||||||||||||||||

| Return on average tangible common equity | 14.08 | % | 15.86 | % | 17.71 | % | 19.14 | % | 17.04 | % | |||||||||||||||||||

| Reconciliation of pre-provision net revenue: | |||||||||||||||||||||||||||||

| Net income before taxes | $ | 167,735 | $ | 195,637 | $ | 208,401 | $ | 216,256 | $ | 196,272 | |||||||||||||||||||

| Provision for expected credit losses | 7,000 | 17,000 | 16,000 | 15,000 | 15,000 | ||||||||||||||||||||||||

| Net income (loss) attributable to non-controlling interests | (16) | 328 | 128 | (37) | 81 | ||||||||||||||||||||||||

| Pre-provision net revenue | $ | 174,751 | $ | 212,309 | $ | 224,273 | $ | 231,293 | $ | 211,191 | |||||||||||||||||||

| Calculation of efficiency ratio: | |||||||||||||||||||||||||||||

| Total other operating expense | $ | 324,313 | $ | 318,673 | $ | 305,812 | $ | 318,456 | $ | 294,751 | |||||||||||||||||||

| Less: Amortization of intangible assets | 3,474 | 3,474 | 3,391 | 3,736 | 3,943 | ||||||||||||||||||||||||

| Adjusted total other operating expense | $ | 320,839 | $ | 315,199 | $ | 302,421 | $ | 314,720 | $ | 290,808 | |||||||||||||||||||

| Net interest revenue | $ | 300,896 | $ | 322,261 | $ | 352,348 | $ | 352,626 | $ | 316,325 | |||||||||||||||||||

| Tax-equivalent adjustment | 2,214 | 2,200 | 2,285 | 2,287 | 2,163 | ||||||||||||||||||||||||

| Tax-equivalent net interest revenue | 303,110 | 324,461 | 354,633 | 354,913 | 318,488 | ||||||||||||||||||||||||

| Total other operating revenue | 198,152 | 209,049 | 177,865 | 197,086 | 189,698 | ||||||||||||||||||||||||

| Less: Gain (loss) on available for sale securities, net | — | (3,010) | — | (3,988) | 892 | ||||||||||||||||||||||||

| Adjusted revenue | $ | 501,262 | $ | 536,520 | $ | 532,498 | $ | 555,987 | $ | 507,294 | |||||||||||||||||||

| Efficiency ratio | 64.01 | % | 58.75 | % | 56.79 | % | 56.61 | % | 57.33 | % | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Information on net interest revenue and net interest margin excluding trading activities: | |||||||||||||||||||||||||||||

| Net interest revenue | $ | 300,896 | $ | 322,261 | $ | 352,348 | $ | 352,626 | $ | 316,325 | |||||||||||||||||||

| Less: Trading activities net interest revenue | (7,343) | (3,461) | 70 | (860) | 4,478 | ||||||||||||||||||||||||

| Net interest revenue excluding trading activities | 308,239 | 325,722 | 352,278 | 353,486 | 311,847 | ||||||||||||||||||||||||

| Tax-equivalent adjustment | 2,214 | 2,200 | 2,285 | 2,287 | 2,163 | ||||||||||||||||||||||||

| Tax-equivalent net interest revenue excluding trading activities | $ | 310,453 | $ | 327,922 | $ | 354,563 | $ | 355,773 | $ | 314,010 | |||||||||||||||||||

| Average total earning assets | $ | 44,012,300 | $ | 42,731,533 | $ | 40,781,257 | $ | 39,285,300 | $ | 38,527,860 | |||||||||||||||||||

| Less: Average trading activities interest-earning assets | 5,444,587 | 4,274,803 | 3,031,969 | 3,086,985 | 3,178,068 | ||||||||||||||||||||||||

| Average interest-earning assets excluding trading activities | $ | 38,567,713 | $ | 38,456,730 | $ | 37,749,288 | $ | 36,198,315 | $ | 35,349,792 | |||||||||||||||||||

| Net interest margin on average interest-earning assets | 2.69 | % | 3.00 | % | 3.45 | % | 3.54 | % | 3.24 | % | |||||||||||||||||||

| Net interest margin on average trading activities interest-earning assets | (0.49) | % | (0.34) | % | — | % | (0.12) | % | 0.53 | % | |||||||||||||||||||

| Net interest margin on average interest-earning assets excluding trading activities | 3.14 | % | 3.36 | % | 3.72 | % | 3.84 | % | 3.49 | % | |||||||||||||||||||

| Explanation of Non-GAAP Measures | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | ||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||

| Healthcare | $ | 4,083,134 | $ | 3,991,387 | $ | 3,899,341 | $ | 3,845,017 | $ | 3,826,623 | ||||||||||||||||||||||

| Services | 3,566,361 | 3,585,169 | 3,563,702 | 3,431,521 | 3,280,925 | |||||||||||||||||||||||||||

| Energy | 3,490,602 | 3,508,752 | 3,398,057 | 3,424,790 | 3,371,588 | |||||||||||||||||||||||||||

| General business | 3,579,742 | 3,449,208 | 3,356,249 | 3,511,171 | 3,148,783 | |||||||||||||||||||||||||||

| Total commercial | 14,719,839 | 14,534,516 | 14,217,349 | 14,212,499 | 13,627,919 | |||||||||||||||||||||||||||

| Commercial real estate: | ||||||||||||||||||||||||||||||||

| Multifamily | 1,734,688 | 1,502,971 | 1,363,881 | 1,212,883 | 1,126,700 | |||||||||||||||||||||||||||

| Industrial | 1,432,629 | 1,349,709 | 1,309,435 | 1,221,501 | 1,103,905 | |||||||||||||||||||||||||||

| Office | 981,876 | 1,005,660 | 1,045,700 | 1,053,331 | 1,086,615 | |||||||||||||||||||||||||||

| Retail | 608,073 | 617,886 | 618,264 | 620,518 | 635,021 | |||||||||||||||||||||||||||

Residential construction and land development |

100,465 | 106,370 | 102,828 | 95,684 | 91,690 | |||||||||||||||||||||||||||

| Other commercial real estate | 383,569 | 388,205 | 375,208 | 402,860 | 429,980 | |||||||||||||||||||||||||||

| Total commercial real estate | 5,241,300 | 4,970,801 | 4,815,316 | 4,606,777 | 4,473,911 | |||||||||||||||||||||||||||

| Loans to individuals: | ||||||||||||||||||||||||||||||||

| Residential mortgage | 2,090,992 | 1,993,690 | 1,926,027 | 1,890,784 | 1,851,836 | |||||||||||||||||||||||||||

| Residential mortgages guaranteed by U.S. government agencies | 161,092 | 186,170 | 224,753 | 245,940 | 262,466 | |||||||||||||||||||||||||||

| Personal | 1,510,795 | 1,552,482 | 1,566,608 | 1,601,150 | 1,574,325 | |||||||||||||||||||||||||||

| Total loans to individuals | 3,762,879 | 3,732,342 | 3,717,388 | 3,737,874 | 3,688,627 | |||||||||||||||||||||||||||

| Total | $ | 23,724,018 | $ | 23,237,659 | $ | 22,750,053 | $ | 22,557,150 | $ | 21,790,457 | ||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Texas: | |||||||||||||||||||||||||||||

| Commercial | $ | 7,249,963 | $ | 7,223,820 | $ | 7,103,166 | $ | 6,878,618 | $ | 6,644,890 | |||||||||||||||||||

| Commercial real estate | 1,873,477 | 1,748,796 | 1,675,831 | 1,555,508 | 1,448,590 | ||||||||||||||||||||||||

| Loans to individuals | 961,299 | 974,911 | 992,343 | 982,700 | 970,459 | ||||||||||||||||||||||||

| Total Texas | 10,084,739 | 9,947,527 | 9,771,340 | 9,416,826 | 9,063,939 | ||||||||||||||||||||||||

| Oklahoma: | |||||||||||||||||||||||||||||

| Commercial | 3,384,627 | 3,251,547 | 3,178,934 | 3,382,577 | 3,108,608 | ||||||||||||||||||||||||

| Commercial real estate | 601,087 | 573,559 | 574,708 | 582,109 | 608,856 | ||||||||||||||||||||||||

| Loans to individuals | 2,100,974 | 2,079,311 | 2,049,472 | 2,077,124 | 2,054,362 | ||||||||||||||||||||||||

| Total Oklahoma | 6,086,688 | 5,904,417 | 5,803,114 | 6,041,810 | 5,771,826 | ||||||||||||||||||||||||

| Colorado: | |||||||||||||||||||||||||||||

| Commercial | 2,219,460 | 2,179,473 | 2,148,066 | 2,149,199 | 2,117,181 | ||||||||||||||||||||||||

| Commercial real estate | 710,552 | 683,973 | 646,537 | 613,912 | 565,057 | ||||||||||||||||||||||||

| Loans to individuals | 227,569 | 223,200 | 231,368 | 241,902 | 237,981 | ||||||||||||||||||||||||

| Total Colorado | 3,157,581 | 3,086,646 | 3,025,971 | 3,005,013 | 2,920,219 | ||||||||||||||||||||||||

| Arizona: | |||||||||||||||||||||||||||||

| Commercial | 1,173,491 | 1,177,778 | 1,115,973 | 1,124,289 | 1,103,000 | ||||||||||||||||||||||||

| Commercial real estate | 1,014,151 | 926,750 | 881,465 | 860,947 | 850,319 | ||||||||||||||||||||||||

| Loans to individuals | 260,282 | 242,102 | 240,556 | 229,872 | 225,981 | ||||||||||||||||||||||||

| Total Arizona | 2,447,924 | 2,346,630 | 2,237,994 | 2,215,108 | 2,179,300 | ||||||||||||||||||||||||

| Kansas/Missouri: | |||||||||||||||||||||||||||||

| Commercial | 307,725 | 309,148 | 318,782 | 310,715 | 307,456 | ||||||||||||||||||||||||

| Commercial real estate | 547,708 | 516,299 | 489,951 | 479,968 | 466,955 | ||||||||||||||||||||||||

| Loans to individuals | 132,137 | 138,960 | 129,580 | 131,307 | 125,039 | ||||||||||||||||||||||||

| Total Kansas/Missouri | 987,570 | 964,407 | 938,313 | 921,990 | 899,450 | ||||||||||||||||||||||||

| New Mexico: | |||||||||||||||||||||||||||||

| Commercial | 297,714 | 287,443 | 280,945 | 263,349 | 258,754 | ||||||||||||||||||||||||

| Commercial real estate | 405,989 | 425,472 | 449,715 | 417,008 | 426,367 | ||||||||||||||||||||||||

| Loans to individuals | 69,418 | 64,803 | 65,770 | 67,163 | 68,095 | ||||||||||||||||||||||||

| Total New Mexico | 773,121 | 777,718 | 796,430 | 747,520 | 753,216 | ||||||||||||||||||||||||

| Arkansas: | |||||||||||||||||||||||||||||

| Commercial | 86,859 | 105,307 | 71,483 | 103,752 | 88,030 | ||||||||||||||||||||||||

| Commercial real estate | 88,336 | 95,952 | 97,109 | 97,325 | 107,767 | ||||||||||||||||||||||||

| Loans to individuals | 11,200 | 9,055 | 8,299 | 7,806 | 6,710 | ||||||||||||||||||||||||

| Total Arkansas | 186,395 | 210,314 | 176,891 | 208,883 | 202,507 | ||||||||||||||||||||||||

| TOTAL BOK FINANCIAL | $ | 23,724,018 | $ | 23,237,659 | $ | 22,750,053 | $ | 22,557,150 | $ | 21,790,457 | |||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Oklahoma: | |||||||||||||||||||||||||||||

| Demand | $ | 4,019,019 | $ | 4,273,136 | $ | 4,369,944 | $ | 4,585,963 | $ | 5,143,405 | |||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 9,970,955 | 9,979,534 | 9,468,100 | 9,475,528 | 9,619,419 | ||||||||||||||||||||||||

| Savings | 508,619 | 531,536 | 564,829 | 555,407 | 558,256 | ||||||||||||||||||||||||

| Time | 2,019,749 | 1,945,916 | 942,787 | 794,002 | 776,306 | ||||||||||||||||||||||||

| Total interest-bearing | 12,499,323 | 12,456,986 | 10,975,716 | 10,824,937 | 10,953,981 | ||||||||||||||||||||||||

| Total Oklahoma | 16,518,342 | 16,730,122 | 15,345,660 | 15,410,900 | 16,097,386 | ||||||||||||||||||||||||

| Texas: | |||||||||||||||||||||||||||||

| Demand | 2,599,998 | 2,876,568 | 3,154,789 | 3,873,759 | 4,609,255 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 5,046,288 | 4,532,093 | 4,366,932 | 4,878,482 | 4,781,920 | ||||||||||||||||||||||||

| Savings | 154,863 | 162,704 | 175,012 | 178,356 | 179,049 | ||||||||||||||||||||||||

| Time | 436,218 | 377,424 | 321,774 | 356,538 | 343,015 | ||||||||||||||||||||||||

| Total interest-bearing | 5,637,369 | 5,072,221 | 4,863,718 | 5,413,376 | 5,303,984 | ||||||||||||||||||||||||

| Total Texas | 8,237,367 | 7,948,789 | 8,018,507 | 9,287,135 | 9,913,239 | ||||||||||||||||||||||||

| Colorado: | |||||||||||||||||||||||||||||

| Demand | 1,598,622 | 1,726,130 | 1,869,194 | 2,462,891 | 2,510,179 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 1,888,026 | 1,825,295 | 2,126,435 | 2,123,218 | 2,221,796 | ||||||||||||||||||||||||

| Savings | 63,129 | 66,968 | 72,548 | 77,961 | 80,542 | ||||||||||||||||||||||||

| Time | 185,030 | 148,840 | 128,583 | 135,043 | 151,064 | ||||||||||||||||||||||||

| Total interest-bearing | 2,136,185 | 2,041,103 | 2,327,566 | 2,336,222 | 2,453,402 | ||||||||||||||||||||||||

| Total Colorado | 3,734,807 | 3,767,233 | 4,196,760 | 4,799,113 | 4,963,581 | ||||||||||||||||||||||||

| New Mexico: | |||||||||||||||||||||||||||||

| Demand | 853,571 | 912,218 | 997,364 | 1,141,958 | 1,296,410 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 1,049,903 | 712,541 | 674,328 | 691,915 | 717,492 | ||||||||||||||||||||||||

| Savings | 97,753 | 102,729 | 111,771 | 112,430 | 113,056 | ||||||||||||||||||||||||

| Time | 217,535 | 179,548 | 137,875 | 133,625 | 142,856 | ||||||||||||||||||||||||

| Total interest-bearing | 1,365,191 | 994,818 | 923,974 | 937,970 | 973,404 | ||||||||||||||||||||||||

| Total New Mexico | 2,218,762 | 1,907,036 | 1,921,338 | 2,079,928 | 2,269,814 | ||||||||||||||||||||||||

| Arizona: | |||||||||||||||||||||||||||||

| Demand | 522,142 | 592,144 | 780,051 | 844,327 | 903,296 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 903,535 | 800,970 | 687,527 | 739,628 | 788,142 | ||||||||||||||||||||||||

| Savings | 12,340 | 14,489 | 16,993 | 16,496 | 18,258 | ||||||||||||||||||||||||

| Time | 36,689 | 31,248 | 27,755 | 24,846 | 26,704 | ||||||||||||||||||||||||

| Total interest-bearing | 952,564 | 846,707 | 732,275 | 780,970 | 833,104 | ||||||||||||||||||||||||

| Total Arizona | 1,474,706 | 1,438,851 | 1,512,326 | 1,625,297 | 1,736,400 | ||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Kansas/Missouri: | |||||||||||||||||||||||||||||

| Demand | 351,236 | 363,534 | 393,321 | 436,259 | 479,459 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 981,091 | 1,014,247 | 1,040,009 | 694,163 | 747,981 | ||||||||||||||||||||||||

| Savings | 14,331 | 16,316 | 18,292 | 20,678 | 19,375 | ||||||||||||||||||||||||

| Time | 22,437 | 16,176 | 13,061 | 12,963 | 13,258 | ||||||||||||||||||||||||

| Total interest-bearing | 1,017,859 | 1,046,739 | 1,071,362 | 727,804 | 780,614 | ||||||||||||||||||||||||

| Total Kansas/Missouri | 1,369,095 | 1,410,273 | 1,464,683 | 1,164,063 | 1,260,073 | ||||||||||||||||||||||||

| Arkansas: | |||||||||||||||||||||||||||||

| Demand | 29,635 | 38,818 | 42,312 | 50,180 | 43,111 | ||||||||||||||||||||||||

| Interest-bearing: | |||||||||||||||||||||||||||||

| Transaction | 57,381 | 43,301 | 71,158 | 56,181 | 123,273 | ||||||||||||||||||||||||

| Savings | 2,898 | 3,195 | 3,228 | 3,083 | 3,098 | ||||||||||||||||||||||||

| Time | 9,559 | 7,225 | 4,775 | 4,825 | 5,940 | ||||||||||||||||||||||||

| Total interest-bearing | 69,838 | 53,721 | 79,161 | 64,089 | 132,311 | ||||||||||||||||||||||||

| Total Arkansas | 99,473 | 92,539 | 121,473 | 114,269 | 175,422 | ||||||||||||||||||||||||

| TOTAL BOK FINANCIAL | $ | 33,652,552 | $ | 33,294,843 | $ | 32,580,747 | $ | 34,480,705 | $ | 36,415,915 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| TAX-EQUIVALENT ASSETS YIELDS | |||||||||||||||||||||||||||||

| Interest-bearing cash and cash equivalents | 5.43 | % | 5.41 | % | 4.28 | % | 4.06 | % | 1.87 | % | |||||||||||||||||||

| Trading securities | 4.76 | % | 4.50 | % | 4.52 | % | 3.70 | % | 2.72 | % | |||||||||||||||||||

| Investment securities, net of allowance | 1.43 | % | 1.44 | % | 1.46 | % | 1.46 | % | 1.42 | % | |||||||||||||||||||

| Available for sale securities | 3.11 | % | 3.00 | % | 2.87 | % | 2.54 | % | 2.21 | % | |||||||||||||||||||

| Fair value option securities | 4.61 | % | 5.07 | % | 5.17 | % | 4.40 | % | 2.98 | % | |||||||||||||||||||

| Restricted equity securities | 7.88 | % | 7.31 | % | 7.34 | % | 5.70 | % | 6.23 | % | |||||||||||||||||||

| Residential mortgage loans held for sale | 6.27 | % | 5.85 | % | 5.79 | % | 5.56 | % | 5.05 | % | |||||||||||||||||||

| Loans | 7.25 | % | 7.03 | % | 6.67 | % | 5.99 | % | 4.89 | % | |||||||||||||||||||

| Allowance for loan losses | |||||||||||||||||||||||||||||

| Loans, net of allowance | 7.33 | % | 7.10 | % | 6.74 | % | 6.06 | % | 4.94 | % | |||||||||||||||||||

| Total tax-equivalent yield on earning assets | 5.49 | % | 5.29 | % | 5.06 | % | 4.53 | % | 3.71 | % | |||||||||||||||||||

| COST OF INTEREST-BEARING LIABILITIES | |||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||

| Interest-bearing transaction | 3.18 | % | 2.60 | % | 1.91 | % | 1.28 | % | 0.63 | % | |||||||||||||||||||

| Savings | 0.47 | % | 0.21 | % | 0.10 | % | 0.08 | % | 0.05 | % | |||||||||||||||||||

| Time | 3.96 | % | 3.27 | % | 1.95 | % | 1.25 | % | 0.93 | % | |||||||||||||||||||

| Total interest-bearing deposits | 3.17 | % | 2.56 | % | 1.83 | % | 1.22 | % | 0.63 | % | |||||||||||||||||||

| Funds purchased and repurchase agreements | 4.81 | % | 4.58 | % | 3.33 | % | 2.05 | % | 0.72 | % | |||||||||||||||||||

| Other borrowings | 5.48 | % | 5.12 | % | 4.73 | % | 4.08 | % | 2.33 | % | |||||||||||||||||||

| Subordinated debt | 7.02 | % | 6.79 | % | 6.40 | % | 6.16 | % | 5.07 | % | |||||||||||||||||||

| Total cost of interest-bearing liabilities | 3.81 | % | 3.27 | % | 2.43 | % | 1.57 | % | 0.76 | % | |||||||||||||||||||

| Tax-equivalent net interest revenue spread | 1.68 | % | 2.02 | % | 2.63 | % | 2.96 | % | 2.95 | % | |||||||||||||||||||

Effect of noninterest-bearing funding sources and other |

1.01 | % | 0.98 | % | 0.82 | % | 0.58 | % | 0.29 | % | |||||||||||||||||||

| Tax-equivalent net interest margin | 2.69 | % | 3.00 | % | 3.45 | % | 3.54 | % | 3.24 | % | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

| Nonperforming assets: | |||||||||||||||||||||||||||||

| Nonaccruing loans: | |||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Healthcare | $ | 41,836 | $ | 36,753 | $ | 37,247 | $ | 41,034 | $ | 41,438 | |||||||||||||||||||

| Energy | 19,559 | 20,037 | 127 | 1,399 | 4,164 | ||||||||||||||||||||||||

| Services | 2,820 | 4,541 | 8,097 | 16,228 | 27,315 | ||||||||||||||||||||||||

| General business | 6,483 | 11,946 | 8,961 | 1,636 | 2,753 | ||||||||||||||||||||||||

| Total commercial | 70,698 | 73,277 | 54,432 | 60,297 | 75,670 | ||||||||||||||||||||||||

| Commercial real estate | 7,418 | 17,395 | 21,668 | 16,570 | 7,971 | ||||||||||||||||||||||||

| Loans to individuals: | |||||||||||||||||||||||||||||

| Permanent mortgage | 30,954 | 29,973 | 29,693 | 29,791 | 30,066 | ||||||||||||||||||||||||

Permanent mortgage guaranteed by U.S. government agencies |

10,436 | 11,473 | 14,302 | 15,005 | 16,957 | ||||||||||||||||||||||||

| Personal | 79 | 133 | 200 | 134 | 136 | ||||||||||||||||||||||||

| Total loans to individuals | 41,469 | 41,579 | 44,195 | 44,930 | 47,159 | ||||||||||||||||||||||||

| Total nonaccruing loans | $ | 119,585 | $ | 132,251 | $ | 120,295 | $ | 121,797 | $ | 130,800 | |||||||||||||||||||

Accruing renegotiated loans guaranteed by U.S. government agencies1 |

— | — | — | 163,535 | 176,022 | ||||||||||||||||||||||||

| Real estate and other repossessed assets | 3,753 | 4,227 | 12,651 | 14,304 | 29,676 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 123,338 | $ | 136,478 | $ | 132,946 | $ | 299,636 | $ | 336,498 | |||||||||||||||||||

Total nonperforming assets excluding those guaranteed by U.S. government agencies |

$ | 112,902 | $ | 125,005 | $ | 118,644 | $ | 121,096 | $ | 143,519 | |||||||||||||||||||

Accruing loans 90 days past due2 |

$ | 64 | $ | 220 | $ | 76 | $ | 510 | $ | 120 | |||||||||||||||||||

| Gross charge-offs | $ | 10,593 | $ | 8,049 | $ | 3,667 | $ | 17,807 | $ | 1,766 | |||||||||||||||||||

| Recoveries | (4,062) | (1,346) | (2,898) | (2,301) | (1,309) | ||||||||||||||||||||||||

| Net charge-offs (recoveries) | $ | 6,531 | $ | 6,703 | $ | 769 | $ | 15,506 | $ | 457 | |||||||||||||||||||

Provision for loan losses |

$ | 15,931 | $ | 19,957 | $ | 14,525 | $ | 9,442 | $ | 1,111 | |||||||||||||||||||

Provision for credit losses from off-balance sheet unfunded loan commitments |

(7,336) | (3,003) | 2,024 | 4,609 | 14,060 | ||||||||||||||||||||||||

| Provision for expected credit losses from mortgage banking activities | (1,474) | 78 | (488) | 1,003 | (66) | ||||||||||||||||||||||||

| Provision for credit losses related to held-to maturity (investment) securities portfolio | (121) | (32) | (61) | (54) | (105) | ||||||||||||||||||||||||

| Total provision for credit losses | $ | 7,000 | $ | 17,000 | $ | 16,000 | $ | 15,000 | $ | 15,000 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Mar. 31, 2023 | Dec. 31, 2022 | Sep. 30, 2022 | |||||||||||||||||||||||||

Allowance for loan losses to period end loans |

1.15 | % | 1.13 | % | 1.10 | % | 1.04 | % | 1.11 | % | |||||||||||||||||||

Combined allowance for loan losses and accrual for off-balance sheet credit risk from unfunded loan commitments to period end loans |

1.37 | % | 1.39 | % | 1.37 | % | 1.31 | % | 1.37 | % | |||||||||||||||||||

Nonperforming assets to period end loans and repossessed assets |

0.52 | % | 0.59 | % | 0.58 | % | 1.33 | % | 1.54 | % | |||||||||||||||||||

Net charge-offs (annualized) to average loans |

0.11 | % | 0.12 | % | 0.01 | % | 0.28 | % | 0.01 | % | |||||||||||||||||||

Allowance for loan losses to nonaccruing loans2 |

249.31 | % | 217.52 | % | 235.36 | % | 220.71 | % | 212.37 | % | |||||||||||||||||||

Combined allowance for loan losses and accrual for off-balance sheet credit risk from unfunded loan commitments to nonaccruing loans2 |

297.50 | % | 267.15 | % | 294.74 | % | 277.76 | % | 261.83 | % | |||||||||||||||||||

| Three Months Ended | 3Q23 vs 2Q23 |

3Q23 vs 3Q22 |

||||||||||||||||||||||||||||||||||||||||||

| Sep. 30, 2023 | June 30, 2023 | Sep. 30, 2022 | $ change | % change | $ change | % change | ||||||||||||||||||||||||||||||||||||||

| Commercial Banking | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest revenue | $ | 254,464 | $ | 260,099 | $ | 208,065 | $ | (5,635) | (2.2) | % | $ | 46,399 | 22.3 | % | ||||||||||||||||||||||||||||||

| Fees and commissions revenue | 57,858 | 59,704 | 58,147 | (1,846) | (3.1) | % | (289) | (0.5) | % | |||||||||||||||||||||||||||||||||||

| Combined net interest and fee revenue | 312,322 | 319,803 | 266,212 | (7,481) | (2.3) | % | 46,110 | 17.3 | % | |||||||||||||||||||||||||||||||||||

| Other operating expense | 81,751 | 77,479 | 75,490 | 4,272 | 5.5 | % | 6,261 | 8.3 | % | |||||||||||||||||||||||||||||||||||

| Corporate expense allocations | 17,834 | 21,404 | 16,438 | (3,570) | (16.7) | % | 1,396 | 8.5 | % | |||||||||||||||||||||||||||||||||||

| Net income | 157,930 | 170,179 | 134,134 | (12,249) | (7.2) | % | 23,796 | 17.7 | % | |||||||||||||||||||||||||||||||||||

| Average assets | 28,849,597 | 28,170,869 | 28,890,429 | 678,728 | 2.4 | % | (40,832) | (0.1) | % | |||||||||||||||||||||||||||||||||||

| Average loans | 19,645,259 | 19,158,984 | 17,904,779 | 486,275 | 2.5 | % | 1,740,480 | 9.7 | % | |||||||||||||||||||||||||||||||||||

| Average deposits | 15,098,038 | 14,822,093 | 17,966,661 | 275,945 | 1.9 | % | (2,868,623) | (16.0) | % | |||||||||||||||||||||||||||||||||||

| Consumer Banking | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest revenue | $ | 112,608 | $ | 113,391 | $ | 43,951 | $ | (783) | (0.7) | % | $ | 68,657 | 156.2 | % | ||||||||||||||||||||||||||||||

| Fees and commissions revenue | 30,715 | 32,361 | 30,230 | (1,646) | (5.1) | % | 485 | 1.6 | % | |||||||||||||||||||||||||||||||||||

| Combined net interest and fee revenue | 143,323 | 145,752 | 74,181 | (2,429) | (1.7) | % | 69,142 | 93.2 | % | |||||||||||||||||||||||||||||||||||

| Other operating expense | 54,497 | 52,340 | 53,236 | 2,157 | 4.1 | % | 1,261 | 2.4 | % | |||||||||||||||||||||||||||||||||||

| Corporate expense allocations | 11,920 | 12,318 | 10,792 | (398) | (3.2) | % | 1,128 | 10.5 | % | |||||||||||||||||||||||||||||||||||

| Net income | 58,009 | 60,332 | 2,970 | (2,323) | (3.9) | % | 55,039 | 1,853.2 | % | |||||||||||||||||||||||||||||||||||

| Average assets | 9,379,478 | 9,597,723 | 10,233,401 | (218,245) | (2.3) | % | (853,923) | (8.3) | % | |||||||||||||||||||||||||||||||||||

| Average loans | 1,812,606 | 1,762,568 | 1,686,498 | 50,038 | 2.8 | % | 126,108 | 7.5 | % | |||||||||||||||||||||||||||||||||||

| Average deposits | 7,936,186 | 7,986,674 | 8,812,884 | (50,488) | (0.6) | % | (876,698) | (9.9) | % | |||||||||||||||||||||||||||||||||||

| Wealth Management | ||||||||||||||||||||||||||||||||||||||||||||

| Net interest revenue | $ | 36,437 | $ | 49,352 | $ | 33,584 | $ | (12,915) | (26.2) | % | $ | 2,853 | 8.5 | % | ||||||||||||||||||||||||||||||

| Fees and commissions revenue | 123,614 | 123,050 | 113,113 | 564 | 0.5 | % | 10,501 | 9.3 | % | |||||||||||||||||||||||||||||||||||

| Combined net interest and fee revenue | 160,051 | 172,402 | 146,697 | (12,351) | (7.2) | % | 13,354 | 9.1 | % | |||||||||||||||||||||||||||||||||||

| Other operating expense | 89,367 | 84,859 | 79,151 | 4,508 | 5.3 | % | 10,216 | 12.9 | % | |||||||||||||||||||||||||||||||||||

| Corporate expense allocations | 14,331 | 12,574 | 12,934 | 1,757 | 14.0 | % | 1,397 | 10.8 | % | |||||||||||||||||||||||||||||||||||

| Net income | 43,029 | 57,317 | 41,808 | (14,288) | (24.9) | % | 1,221 | 2.9 | % | |||||||||||||||||||||||||||||||||||

| Average assets | 14,740,641 | 12,949,258 | 13,818,299 | 1,791,383 | 13.8 | % | 922,342 | 6.7 | % | |||||||||||||||||||||||||||||||||||

| Average loans | 2,219,829 | 2,230,906 | 2,163,975 | (11,077) | (0.5) | % | 55,854 | 2.6 | % | |||||||||||||||||||||||||||||||||||

| Average deposits | 7,886,962 | 7,544,143 | 7,999,074 | 342,819 | 4.5 | % | (112,112) | (1.4) | % | |||||||||||||||||||||||||||||||||||

| Fiduciary assets | 56,380,009 | 57,873,868 | 54,714,705 | (1,493,859) | (2.6) | % | 1,665,304 | 3.0 | % | |||||||||||||||||||||||||||||||||||

| Assets under management or administration | 99,004,179 | 103,618,940 | 95,401,638 | (4,614,761) | (4.5) | % | 3,602,541 | 3.8 | % | |||||||||||||||||||||||||||||||||||