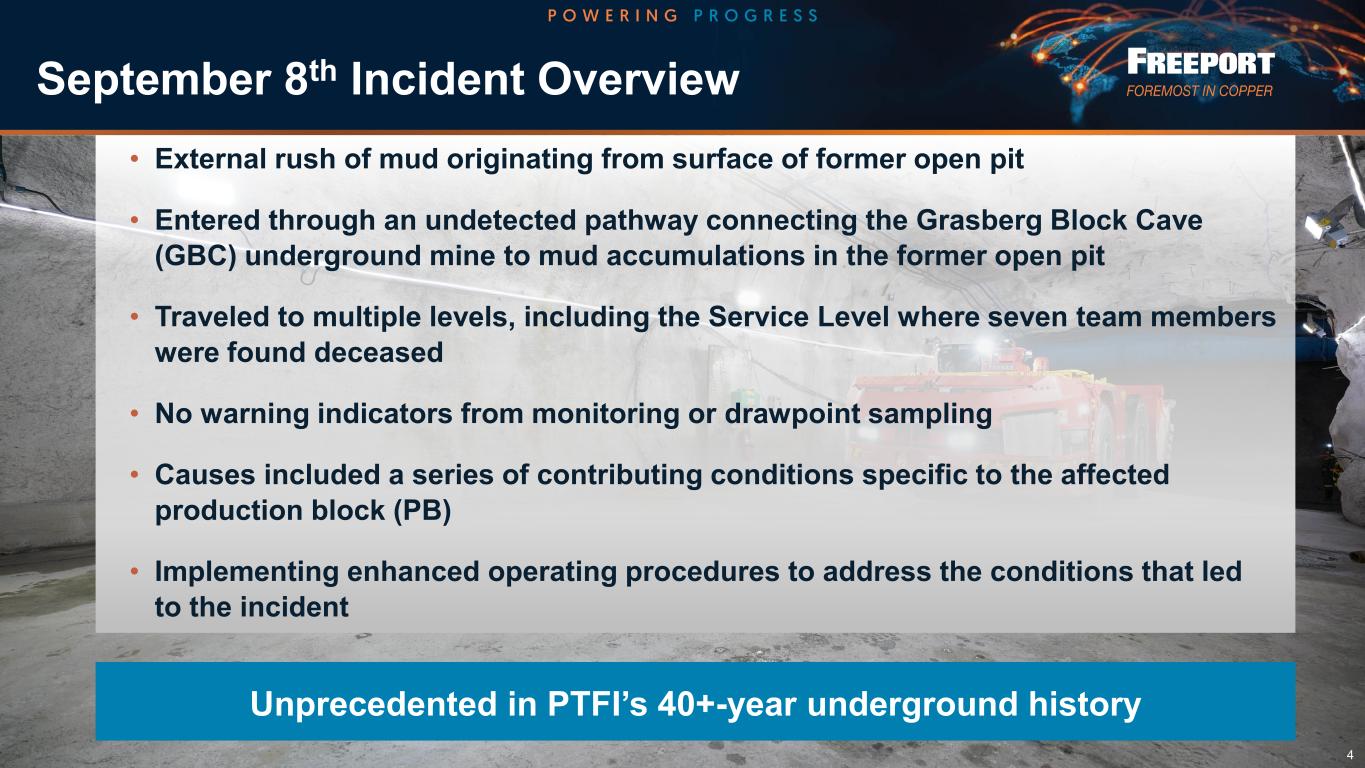

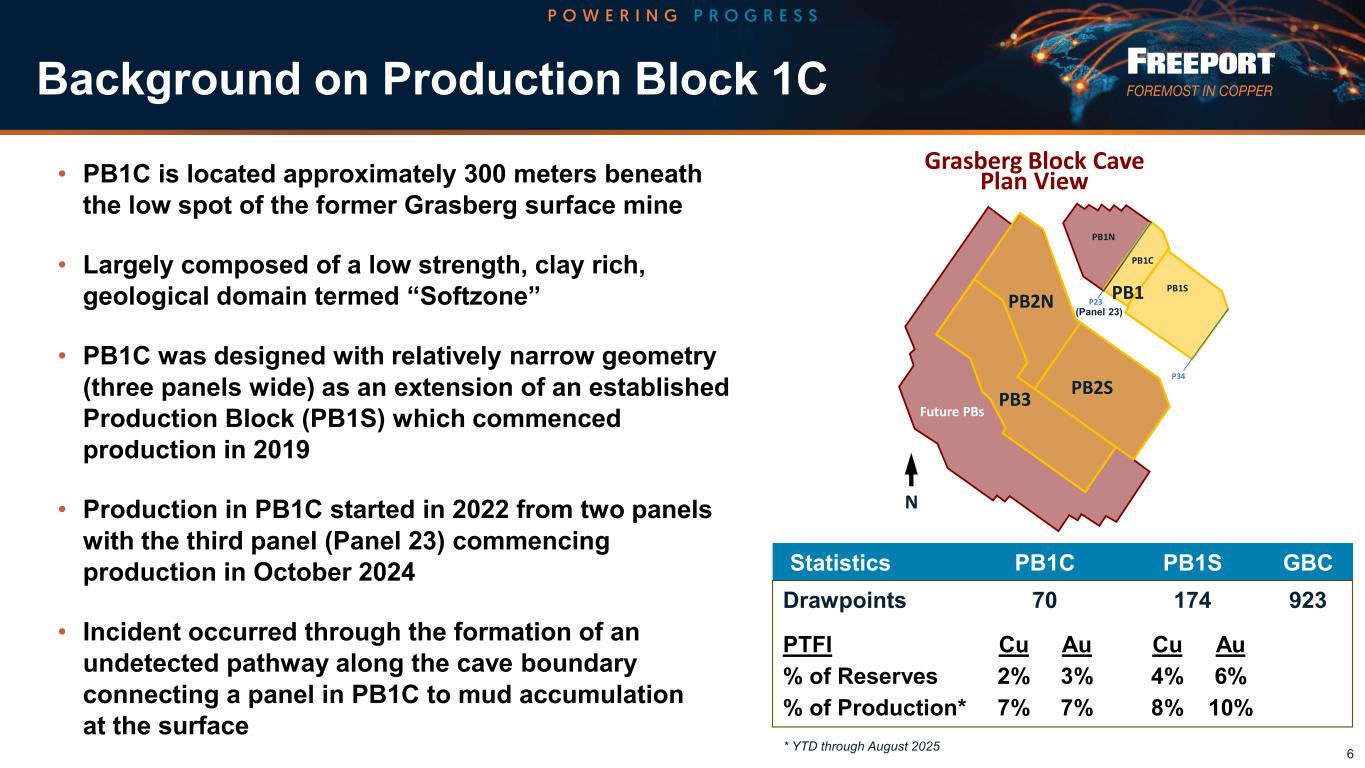

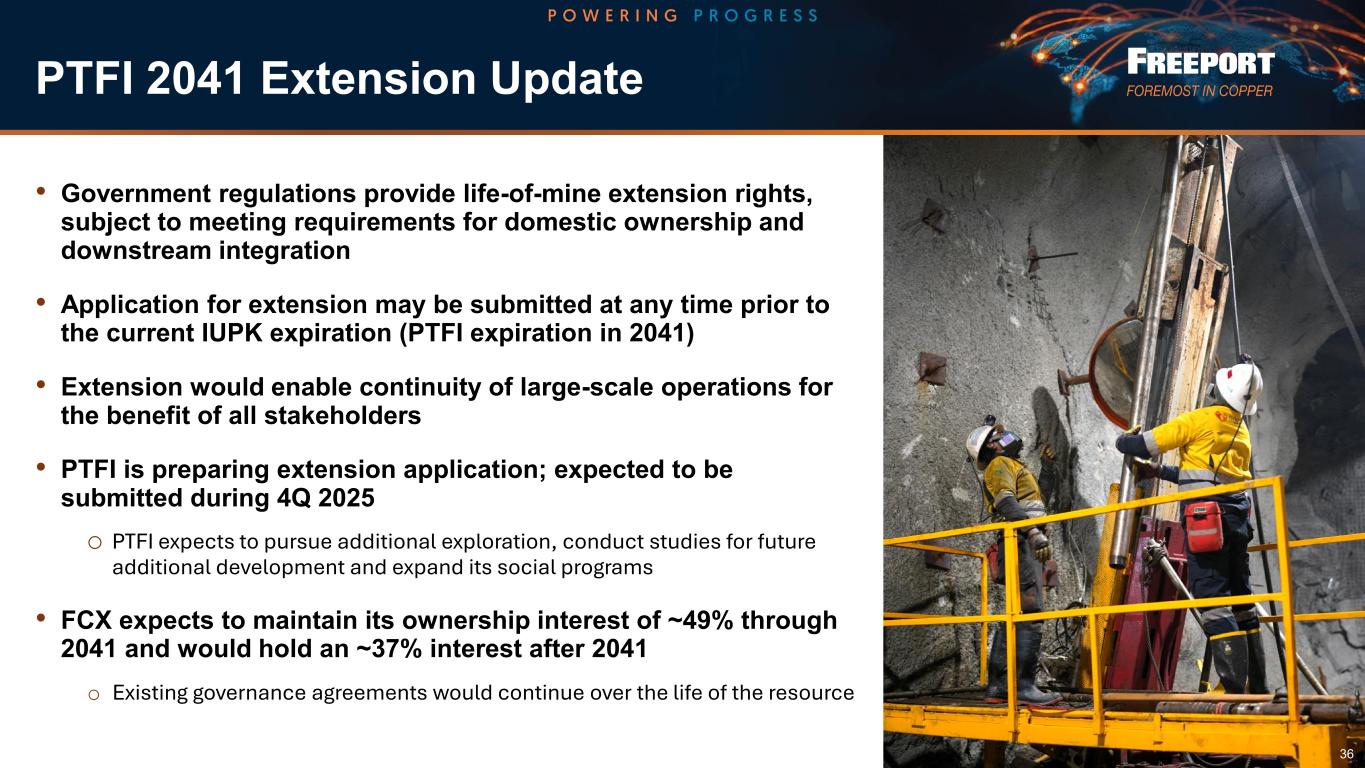

Cautionary Statement This presentation contains forward-looking statements in which FCX discusses its potential future performance, operations and projects. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to business outlook, strategy, goals or targets; the underlying assumptions and estimated impacts on FCX’s business and stakeholders related to the mud rush incident at PT Freeport Indonesia’s (PTFI) Grasberg Block Cave underground mine; global market conditions, including trade policies; ore grades and milling rates; production and sales volumes; higher variability between PTFI production and sales; unit net cash costs (credits) and operating costs; capital expenditures; operating plans, including mine sequencing; cash flows; liquidity; investigations, remediation efforts and phased restart and ramp-up of production and downstream processing following the mud rush incident at PTFI’s Grasberg Block Cave underground mine and the anticipated impact on future production, sales, results of operations and operating plans, and recoveries under insurance policies; potential extension of PTFI’s special mining business license (IUPK) beyond 2041; timing of shipments of inventoried production; FCX’s sustainability-related commitments and targets; FCX’s overarching commitment to deliver responsibly produced copper and molybdenum, including plans to implement, validate and maintain validation of its operating sites under specific frameworks; achievement of FCX’s 2030 climate targets and its 2050 net zero aspiration; improvements in operating procedures and technology innovations and applications; exploration efforts and results; development and production activities, rates and costs; future organic growth opportunities; tax rates; the impact of copper, gold and molybdenum price changes; the impact of deferred intercompany profits on earnings; mineral reserve and mineral resource estimates; final resolution of settlements associated with ongoing legal and environmental proceedings; debt repurchases; and the ongoing implementation of FCX’s financial policy and future returns to shareholders, including dividend payments (base or variable) and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration and payment of dividends (base or variable), and timing and amount of any share repurchases are at the discretion of the Board of Directors (Board) and management, respectively, and are subject to a number of factors, including not exceeding FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by the Board or management, as applicable. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion. FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX’s actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper and gold; changes in export duties and tariff rates; production rates; timing of shipments and sales; price and availability of consumables and components FCX purchases as well as constraints on supply and logistics, and transportation services; changes in cash requirements, financial position, financing or investment plans; changes in general market, economic, geopoli tical, regulatory or industry conditions, including market volatility regarding trade policies and tariff uncertainty; reductions in liquidity and access to capital; PTFI’s ability to successfully complete remediation activities, implement any recommendat ions from the related investigation, safely restart, phase-in ramp-up and achieve full operating rates of production and downstream processing on the expected timeline and optimize production plans; recover amounts under insurance policies; resolve force majeure declarations and maintain relationships with commercial counterparties; changes in tax laws and regulations; political and social risks, including the potential effects of violence in Indonesia, civil unrest in Peru, and relations with local communities and Indigenous Peoples; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations, including the ability to smelt and refine or inventory; results of technical, economic or feasibility studies; potential inventory adjustments; potential impairment of long-lived mining assets; satisfaction of requirements in accordance with PTFI’s IUPK to extend mining rights from 2031 through 2041; process relating to the extension of PTFI’s IUPK beyond 2041; cybersecurity risks; any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, including availability of secure water supplies; impacts, expenses or results from litigation or investigations; tailings management; FCX’s ability to comply with its responsible production commitments under specific frameworks and any changes to such frameworks and other factors described in more detail under the heading “Risk Factors” in FCX’s Annua l Report on Form 10-K for the year ended December 31, 2024 and in FCX’s Current Report on Form 8-K dated November 18, 2025, each filed with the U.S. Securities and Exchange Commission. The forward-looking statements, including projections, in this presentation are based on current market conditions and several assumptions, and are subject to significant risks and uncertainties. Projections are dependent on operational performance, the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident, weather-related conditions and other factors detailed herein. Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovations, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes. Estimates of mineral reserves and mineral resources are subject to considerable uncertainty. Such estimates are, to a large extent, based on metal prices for the commodities we produce and interpretations of geologic data, which may not necessarily be indicative of future results or quantities ultimately recovered. This presentation also includes forward-looking statements regarding mineral resources not included in proven and probable mineral reserves. A mineral resource, which includes measured, indicated and inferred mineral resources, is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. Such a deposit cannot qualify as recoverable proven and probable mineral reserves until legal and economic feasibility are confirmed based upon a comprehensive evaluation of development and operating costs, grades, recoveries and other material modifying factors. This presentation also includes forward-looking statements regarding mineral potential, which includes exploration targets and mineral resources but will not qualify as mineral reserves until comprehensive engineering studies establish legal and economic feasibility. Significant additional evaluation is required and no assurance can be given that the potential quantities of metal will be produced. Accordingly, no assurance can be given that estimated mineral resources or mineral potential will become proven and probable mineral reserves. This presentation also contains measures such as unit net cash costs (credits) per pound of copper and molybdenum, and EBITDA (earnings before interest, taxes, depreciation, amortization and accretion), which are not recognized under U.S. generally accepted accounting principles (GAAP). For FCX’s calculation and reconciliation of unit net cash costs (credits) per pound of copper and molybdenum to amounts reported in FCX’s consolidated financial statements refer to “Operations – Unit Net Cash Costs (Credits)” and to “Product Revenues and Production Costs” of FCX’s annual report on Form 10-K for the year ended December 31, 2024, which is available on FCX’s website, fcx.com. For forward-looking non-GAAP measures, FCX is unable to provide a reconciliation to the most comparable GAAP measure without unreasonable effort because estimating such GAAP measures and providing a meaningful reconciliation is extremely difficult and requires a level of precision that is unavailable for these future periods, and the information needed to reconcile these measures is dependent upon future events, many of which are outside of FCX’s control as described above. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions. 2

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン