0000831259false00008312592025-11-182025-11-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 18, 2025

Freeport-McMoRan Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

001-11307-01 |

74-2480931 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

| 333 North Central Avenue |

|

| Phoenix |

AZ |

85004 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (602) 366-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.10 per share |

FCX |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Freeport-McMoRan Inc. (FCX) issued a press release dated November 18, 2025, providing an update on restart plans for the Grasberg minerals district. A copy of the press release is furnished hereto as Exhibit 99.1.

The slides to be presented in connection with FCX’s previously announced conference call being webcast on the internet at 10:00 a.m. Eastern Time on November 18, 2025, are furnished hereto as Exhibit 99.2.

The information furnished pursuant to Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 8.01. Other Events.

FCX is providing the following risk factor in addition to the risk factors previously set forth in Part I, Item 1A. “Risk Factors” of FCX’s Annual Report on Form 10-K for the year ended December 31, 2024 (2024 Form 10-K). The below should be read in conjunction with the risk factors set forth in FCX’s 2024 Form 10-K.

The mud removal and other remediation activities, and the phased restart and ramp-up of the Grasberg Block Cave (GBC) underground mine following the September 2025 mud rush incident may not be achieved as planned which could adversely impact our results of operations and financial condition.

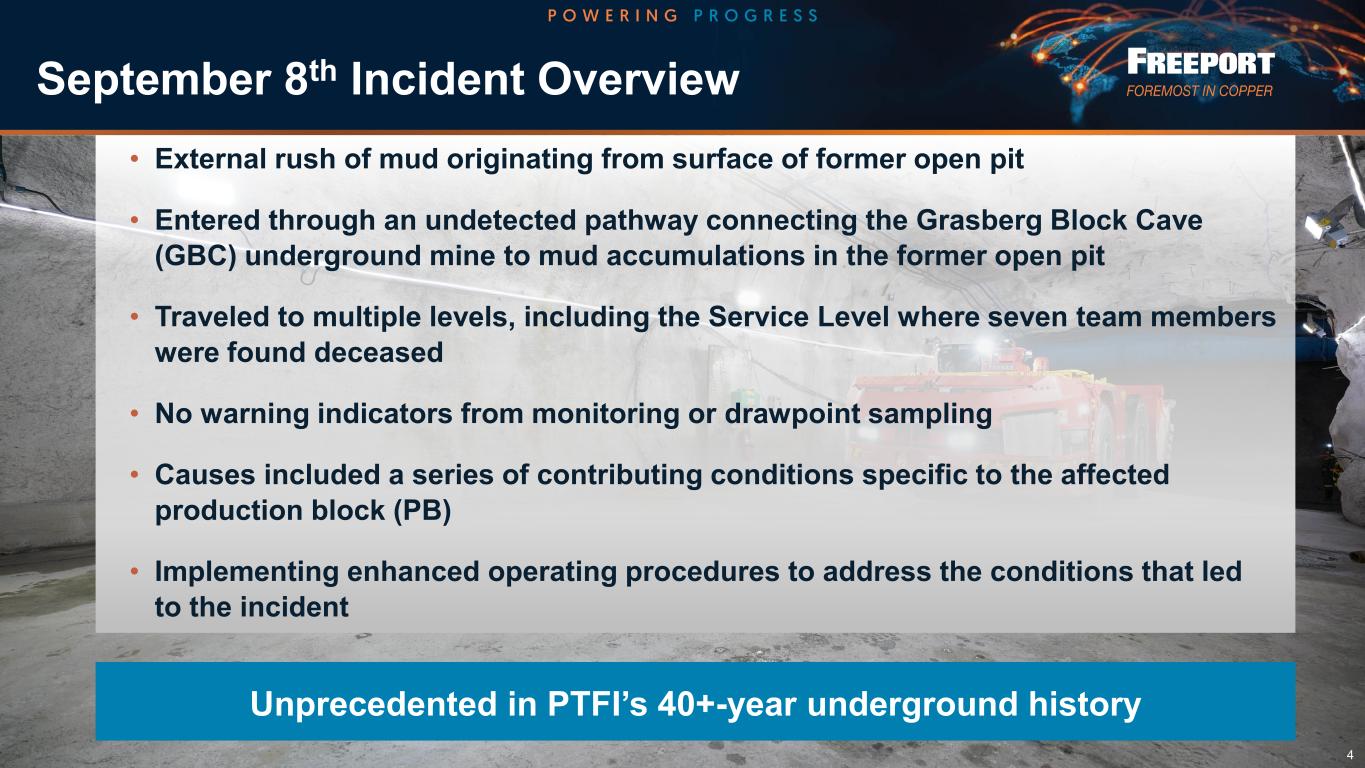

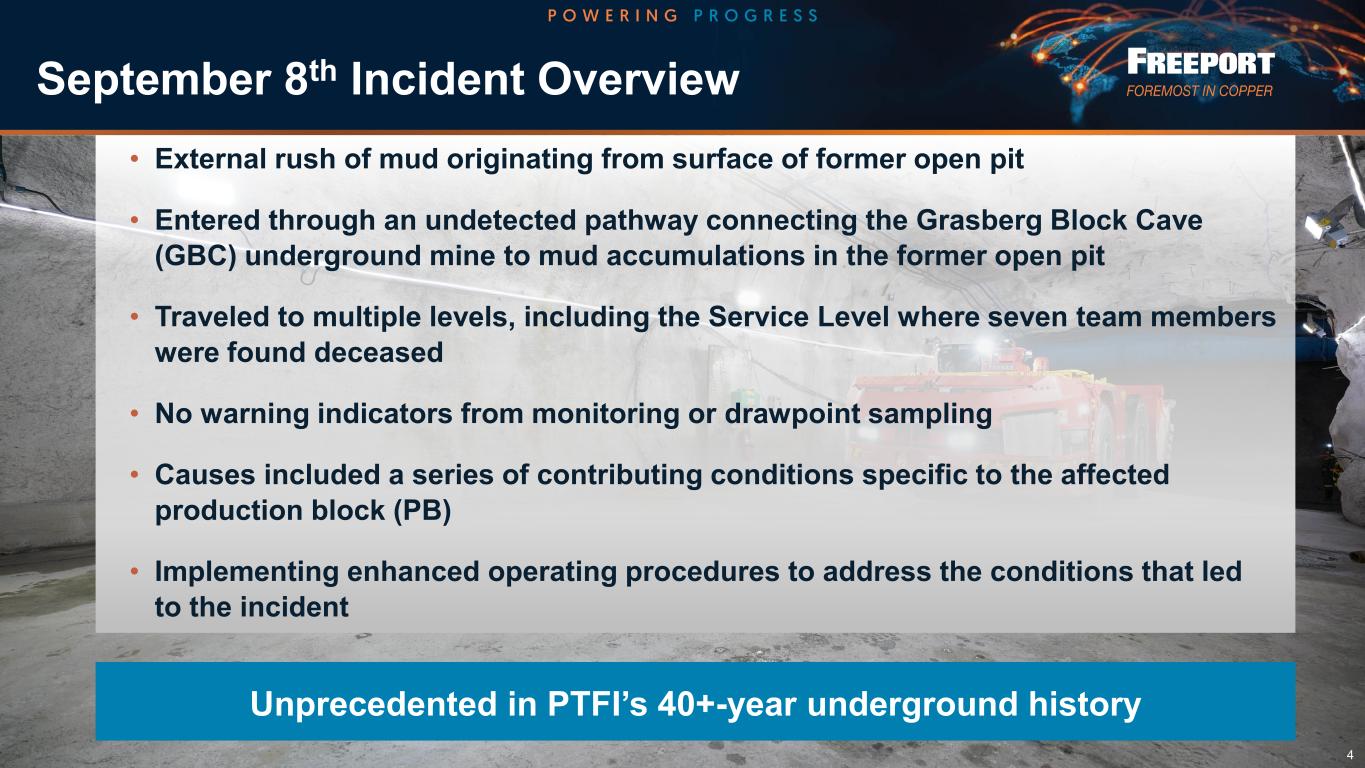

On September 8, 2025, PT Freeport Indonesia (PTFI) experienced an unprecedented mud rush incident, during which approximately 800,000 metric tons of wet material entered the GBC underground mine from the former Grasberg open pit and traveled rapidly to multiple levels of the mine, including a service level where seven team members were later found deceased.

Mining operations were temporarily suspended following the incident to prioritize the recovery of the seven team members fatally injured during the incident and to conduct an investigation into the root causes of the incident. In late October 2025, PTFI restarted operations at the unaffected Big Gossan and Deep Mill Level Zone underground mines. A phased restart and ramp-up of the GBC underground mine is anticipated to begin in second-quarter 2026. The incident impacted our third-quarter 2025 results, and we expect the incident to have a significant impact on our fourth-quarter 2025 and 2026 operating and financial results.

We plan to implement enhanced operating procedures to address the conditions that led to the incident and use information from this unprecedented incident to further enhance risk management processes. Material changes to our operating plans could affect our mineral reserves. In addition, there can be no assurance that other unforeseeable incidents will not occur in the future.

Mud removal is in process and other steps necessary for restart and ramp-up of operations, including implementation of enhanced operating procedures to address the conditions that led to the incident, development of updated cave management plans and draw protocols, and design, construction, repair and replacement of damaged infrastructure and equipment, are expected to begin in the near term. The timing of the phased restart and ramp-up of certain areas of the GBC underground mine could be impacted by any delay in the removal and remediation activities. Further, new or additional operational challenges could arise as we progress mud removal and other remediation activities and the phased restart and ramp-up of the GBC underground mine.

Damage assessments are being conducted in parallel with the ongoing mud removal activities. Upon completion of damage assessments and evaluation of the affected infrastructure, PTFI expects to write-off the carrying value of assets determined to be damaged beyond repair. If the damage assessments identify unexpected conditions, asset impairments could be significant. Further, we do not currently believe the incident indicates a broader impairment of PTFI’s long-lived mining assets based on PTFI’s reserve life, favorable market outlook for metal prices and the expected resumption of operations at the GBC underground mine; however, changes to our estimates of recoverable proven and probable mineral reserves or declines in the prices of commodities PTFI sells could have an impact on the recoverability assessment of PTFI’s long-lived mining assets.

PTFI has recorded charges and expects to incur additional costs related to the incident in the future. Any future costs, liabilities, fines, penalties and financial impacts resulting from the incident and any related investigations or claims may exceed our current expectations and any insurance recoveries. While PTFI intends to seek recovery of damages under its property and business interruption insurance policies, PTFI’s ability to recover damages under its insurance coverage with respect to the incident is subject to certain conditions, and the scope of insured losses, timing of recovery and potential disputes with insurers cannot be predicted. In addition, renewal of insurance policies following the incident could be subject to higher premiums, reduced coverage limits or exclusions for certain risks. To the extent insurance proceeds are delayed or disputed, we may be required to fund repairs and related costs from available cash flows or borrowings. Further, government agencies may impose changes to applicable laws, regulations or environmental requirements or new standards as a result of the incident. In addition, we may experience adverse indirect effects on our business, including negative publicity, damage to our reputation, increased scrutiny by regulators and investors, and reduced confidence from our workforce, local communities, customers and other stakeholders.

Smelting operations in Indonesia operated with limited availability since the incident, and both smelters are currently on stand-by status pending the delivery of copper concentrate. We expect higher variability between PTFI production and sales until PTFI’s downstream processing facilities achieve normalized operating rates, the timing of which could be impacted by any delay in the ramp-up of operations. As a result of the incident and impact on operations, PTFI notified certain commercial counterparties of a force majeure under its contracts, which may negatively impact PTFI’s relationships with such counterparties. Although the declaration of force majeure for certain PTFI contracts has not materially impacted PTFI’s contractual obligations to date, such obligations could be negatively impacted by the incident or any similar future incidents.

Any of the above could adversely affect our cash flows, access to capital, development projects, capital expenditures, results of operations and financial condition.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

| Exhibit Number |

Exhibit Title |

|

Press release dated November 18, 2025, titled “Freeport Provides Update on Restart Plans for Grasberg Minerals District.” |

|

|

|

Slides presented in connection with FCX’s conference call conducted via the internet on November 18, 2025. |

|

|

| 104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Freeport-McMoRan Inc.

By: /s/ Ellie L. Mikes

----------------------------------------

Ellie L. Mikes

Vice President and Chief Accounting Officer

(authorized signatory and

Principal Accounting Officer)

Date: November 18, 2025

EX-99.1

2

fcx_251118.htm

EX-99.1

fcx_251118

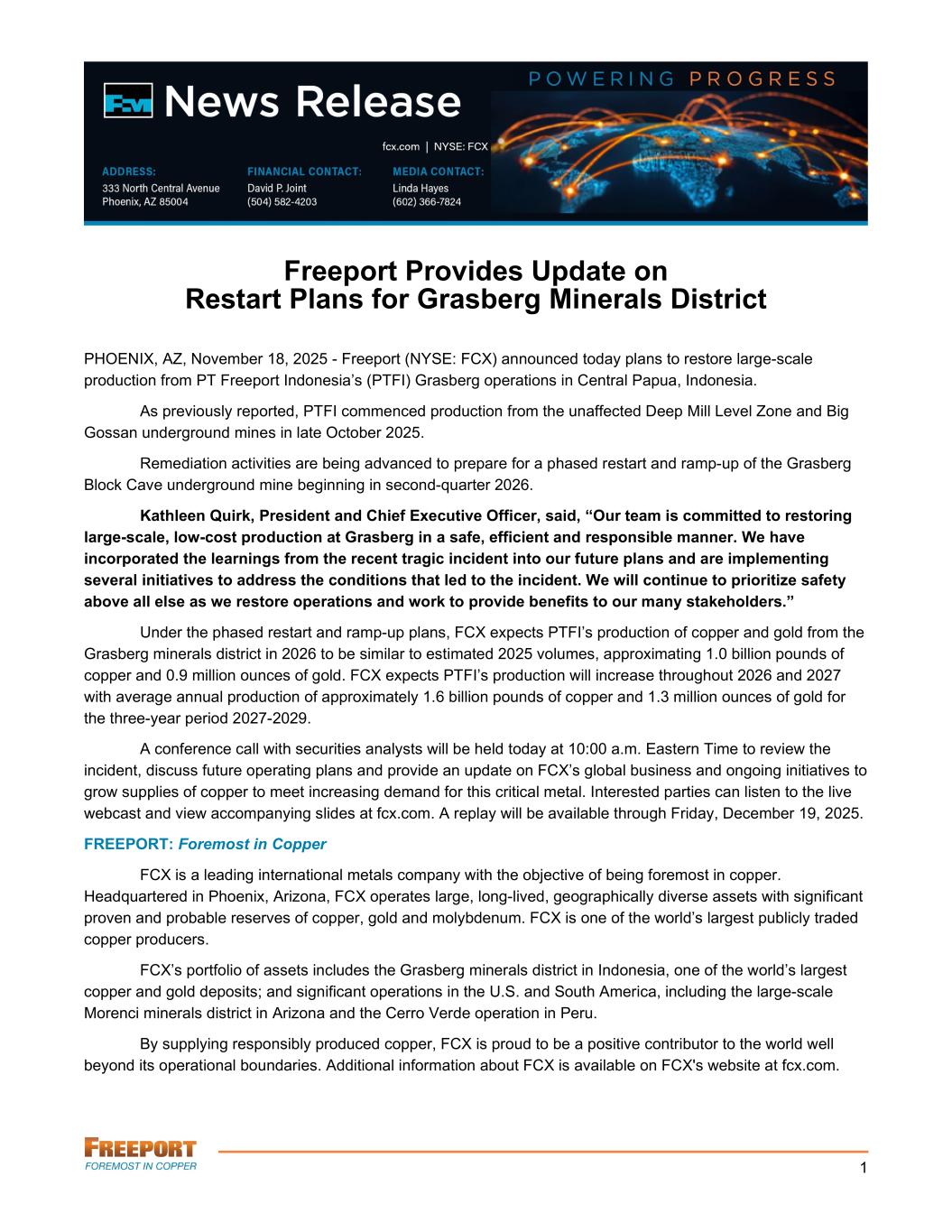

1 Freeport Provides Update on Restart Plans for Grasberg Minerals District PHOENIX, AZ, November 18, 2025 - Freeport (NYSE: FCX) announced today plans to restore large-scale production from PT Freeport Indonesia’s (PTFI) Grasberg operations in Central Papua, Indonesia. As previously reported, PTFI commenced production from the unaffected Deep Mill Level Zone and Big Gossan underground mines in late October 2025. Remediation activities are being advanced to prepare for a phased restart and ramp-up of the Grasberg Block Cave underground mine beginning in second-quarter 2026. Kathleen Quirk, President and Chief Executive Officer, said, “Our team is committed to restoring large-scale, low-cost production at Grasberg in a safe, efficient and responsible manner. We have incorporated the learnings from the recent tragic incident into our future plans and are implementing several initiatives to address the conditions that led to the incident. We will continue to prioritize safety above all else as we restore operations and work to provide benefits to our many stakeholders.” Under the phased restart and ramp-up plans, FCX expects PTFI’s production of copper and gold from the Grasberg minerals district in 2026 to be similar to estimated 2025 volumes, approximating 1.0 billion pounds of copper and 0.9 million ounces of gold. FCX expects PTFI’s production will increase throughout 2026 and 2027 with average annual production of approximately 1.6 billion pounds of copper and 1.3 million ounces of gold for the three-year period 2027-2029. A conference call with securities analysts will be held today at 10:00 a.m. Eastern Time to review the incident, discuss future operating plans and provide an update on FCX’s global business and ongoing initiatives to grow supplies of copper to meet increasing demand for this critical metal. Interested parties can listen to the live webcast and view accompanying slides at fcx.com. A replay will be available through Friday, December 19, 2025. FREEPORT: Foremost in Copper FCX is a leading international metals company with the objective of being foremost in copper. Headquartered in Phoenix, Arizona, FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold and molybdenum. FCX is one of the world’s largest publicly traded copper producers. FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant operations in the U.S. and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru. By supplying responsibly produced copper, FCX is proud to be a positive contributor to the world well beyond its operational boundaries. Additional information about FCX is available on FCX's website at fcx.com.

#110145784v1 2 Cautionary Statement: This press release contains forward-looking statements. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to the underlying assumptions and estimated impacts on FCX’s business and stakeholders related to the mud rush incident at PTFI’s Grasberg Block Cave underground mine; production and sales volumes; higher variability between PTFI production and sales; unit net cash costs (credits) and operating costs; capital expenditures; operating plans, including mine sequencing; cash flows; liquidity; investigations, remediation efforts and phased restart and ramp-up of production and downstream processing following the mud rush incident at PTFI’s Grasberg Block Cave underground mine and the anticipated impact on future production, sales, results of operations and operating plans, and recoveries under insurance policies; and the impact of copper, gold and molybdenum price changes. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward- looking statements. FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX’s actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper and gold; production rates; timing of shipments and sales; changes in cash requirements, financial position, financing or investment plans; changes in general market, economic, geopolitical, regulatory or industry conditions, including market volatility regarding trade policies and tariff uncertainty; reductions in liquidity and access to capital; PTFI’s ability to successfully complete remediation activities, implement any recommendations from the related investigation, safely restart, phase-in ramp- up and achieve full operating rates of production and downstream processing on the expected timeline and optimize production plans; recover amounts under insurance policies; resolve force majeure declarations and maintain relationships with commercial counterparties; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations, including the ability to smelt and refine or inventory; environmental risks; impacts, expenses or results from litigation or investigations; potential impairment of long-lived mining assets; and other factors described in more detail under the heading “Risk Factors” in FCX’s Annual Report on Form 10-K for the year ended December 31, 2024 and in FCX’s Current Report on Form 8- K dated November 18, 2025, each filed with the U.S. Securities and Exchange Commission. The forward-looking statements, including projections, in this press release are based on current market conditions and several assumptions, and are subject to significant risks and uncertainties. Projections are dependent on operational performance, the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident, weather-related conditions and other factors detailed herein. Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovations, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes. # # #

EX-99.2

3

fcxnov-18x2025cc_final.htm

EX-99.2

fcxnov-18x2025cc_final

fcx.com Freeport Update November 18, 2025

Cautionary Statement This presentation contains forward-looking statements in which FCX discusses its potential future performance, operations and projects. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to business outlook, strategy, goals or targets; the underlying assumptions and estimated impacts on FCX’s business and stakeholders related to the mud rush incident at PT Freeport Indonesia’s (PTFI) Grasberg Block Cave underground mine; global market conditions, including trade policies; ore grades and milling rates; production and sales volumes; higher variability between PTFI production and sales; unit net cash costs (credits) and operating costs; capital expenditures; operating plans, including mine sequencing; cash flows; liquidity; investigations, remediation efforts and phased restart and ramp-up of production and downstream processing following the mud rush incident at PTFI’s Grasberg Block Cave underground mine and the anticipated impact on future production, sales, results of operations and operating plans, and recoveries under insurance policies; potential extension of PTFI’s special mining business license (IUPK) beyond 2041; timing of shipments of inventoried production; FCX’s sustainability-related commitments and targets; FCX’s overarching commitment to deliver responsibly produced copper and molybdenum, including plans to implement, validate and maintain validation of its operating sites under specific frameworks; achievement of FCX’s 2030 climate targets and its 2050 net zero aspiration; improvements in operating procedures and technology innovations and applications; exploration efforts and results; development and production activities, rates and costs; future organic growth opportunities; tax rates; the impact of copper, gold and molybdenum price changes; the impact of deferred intercompany profits on earnings; mineral reserve and mineral resource estimates; final resolution of settlements associated with ongoing legal and environmental proceedings; debt repurchases; and the ongoing implementation of FCX’s financial policy and future returns to shareholders, including dividend payments (base or variable) and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration and payment of dividends (base or variable), and timing and amount of any share repurchases are at the discretion of the Board of Directors (Board) and management, respectively, and are subject to a number of factors, including not exceeding FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by the Board or management, as applicable. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion. FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX’s actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper and gold; changes in export duties and tariff rates; production rates; timing of shipments and sales; price and availability of consumables and components FCX purchases as well as constraints on supply and logistics, and transportation services; changes in cash requirements, financial position, financing or investment plans; changes in general market, economic, geopoli tical, regulatory or industry conditions, including market volatility regarding trade policies and tariff uncertainty; reductions in liquidity and access to capital; PTFI’s ability to successfully complete remediation activities, implement any recommendat ions from the related investigation, safely restart, phase-in ramp-up and achieve full operating rates of production and downstream processing on the expected timeline and optimize production plans; recover amounts under insurance policies; resolve force majeure declarations and maintain relationships with commercial counterparties; changes in tax laws and regulations; political and social risks, including the potential effects of violence in Indonesia, civil unrest in Peru, and relations with local communities and Indigenous Peoples; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations, including the ability to smelt and refine or inventory; results of technical, economic or feasibility studies; potential inventory adjustments; potential impairment of long-lived mining assets; satisfaction of requirements in accordance with PTFI’s IUPK to extend mining rights from 2031 through 2041; process relating to the extension of PTFI’s IUPK beyond 2041; cybersecurity risks; any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, including availability of secure water supplies; impacts, expenses or results from litigation or investigations; tailings management; FCX’s ability to comply with its responsible production commitments under specific frameworks and any changes to such frameworks and other factors described in more detail under the heading “Risk Factors” in FCX’s Annua l Report on Form 10-K for the year ended December 31, 2024 and in FCX’s Current Report on Form 8-K dated November 18, 2025, each filed with the U.S. Securities and Exchange Commission. The forward-looking statements, including projections, in this presentation are based on current market conditions and several assumptions, and are subject to significant risks and uncertainties. Projections are dependent on operational performance, the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident, weather-related conditions and other factors detailed herein. Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovations, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes. Estimates of mineral reserves and mineral resources are subject to considerable uncertainty. Such estimates are, to a large extent, based on metal prices for the commodities we produce and interpretations of geologic data, which may not necessarily be indicative of future results or quantities ultimately recovered. This presentation also includes forward-looking statements regarding mineral resources not included in proven and probable mineral reserves. A mineral resource, which includes measured, indicated and inferred mineral resources, is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. Such a deposit cannot qualify as recoverable proven and probable mineral reserves until legal and economic feasibility are confirmed based upon a comprehensive evaluation of development and operating costs, grades, recoveries and other material modifying factors. This presentation also includes forward-looking statements regarding mineral potential, which includes exploration targets and mineral resources but will not qualify as mineral reserves until comprehensive engineering studies establish legal and economic feasibility. Significant additional evaluation is required and no assurance can be given that the potential quantities of metal will be produced. Accordingly, no assurance can be given that estimated mineral resources or mineral potential will become proven and probable mineral reserves. This presentation also contains measures such as unit net cash costs (credits) per pound of copper and molybdenum, and EBITDA (earnings before interest, taxes, depreciation, amortization and accretion), which are not recognized under U.S. generally accepted accounting principles (GAAP). For FCX’s calculation and reconciliation of unit net cash costs (credits) per pound of copper and molybdenum to amounts reported in FCX’s consolidated financial statements refer to “Operations – Unit Net Cash Costs (Credits)” and to “Product Revenues and Production Costs” of FCX’s annual report on Form 10-K for the year ended December 31, 2024, which is available on FCX’s website, fcx.com. For forward-looking non-GAAP measures, FCX is unable to provide a reconciliation to the most comparable GAAP measure without unreasonable effort because estimating such GAAP measures and providing a meaningful reconciliation is extremely difficult and requires a level of precision that is unavailable for these future periods, and the information needed to reconcile these measures is dependent upon future events, many of which are outside of FCX’s control as described above. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions. 2

Honoring Our Team Members 3 * our prayers and condolences * “We mourn the loss of our seven co-workers and grieve with their families, friends and loved ones. Their memories will be forever present as we go forward. Our commitment to addressing all risks inherent in our business is unwavering and essential to protecting our most important asset – our people. The Freeport organization is united in prioritizing the safety of our people above all else.” - Richard Adkerson, Chairman of the Board - Kathleen Quirk, President and CEO

September 8th Incident Overview 4 • External rush of mud originating from surface of former open pit • Entered through an undetected pathway connecting the Grasberg Block Cave (GBC) underground mine to mud accumulations in the former open pit • Traveled to multiple levels, including the Service Level where seven team members were found deceased • No warning indicators from monitoring or drawpoint sampling • Causes included a series of contributing conditions specific to the affected production block (PB) • Implementing enhanced operating procedures to address the conditions that led to the incident Unprecedented in PTFI’s 40+-year underground history

Overview of Grasberg Minerals District 5 Map of Orebodies * Estimate of recoverable proven and probable consolidated mineral reserves using long-term average prices of $3.25/lb for copper and $1,600/oz for gold PTFI Year-end 2024 Reserves* thru 2041 PB1C represents ~2%-3% of PTFI’s Cu and Au Reserves Kucing Liar 26% DMLZ 16% Copper Gold Big GossanPB 2-7 41% 22 mm ozs 8% Grasberg Block Cave 50% 33% 4% 3% 6% 46% 28% 3% 2% 4% 22% 4% 27 bn lbs AB Adits 2004 Kucing Liar 2029 Grasberg Block Cave 2018 Grasberg Open Pit 1990-2019 Ertsberg Pit 1973-1989 Big Gossan 2007 Gunung Bijih Timur (GBT) 1981-1994 Intermediate Ore Zone (IOZ) 1994-2003 Deep Ore Zone (DOZ) 2000-2022 Deep Mill Level Zone (DMLZ) 2015 East Ertsberg Skarn System 4,300m 2,500m GBT DOZ DMLZ IOZ Grasberg Block Cave Big Gossan Kucing Liar N

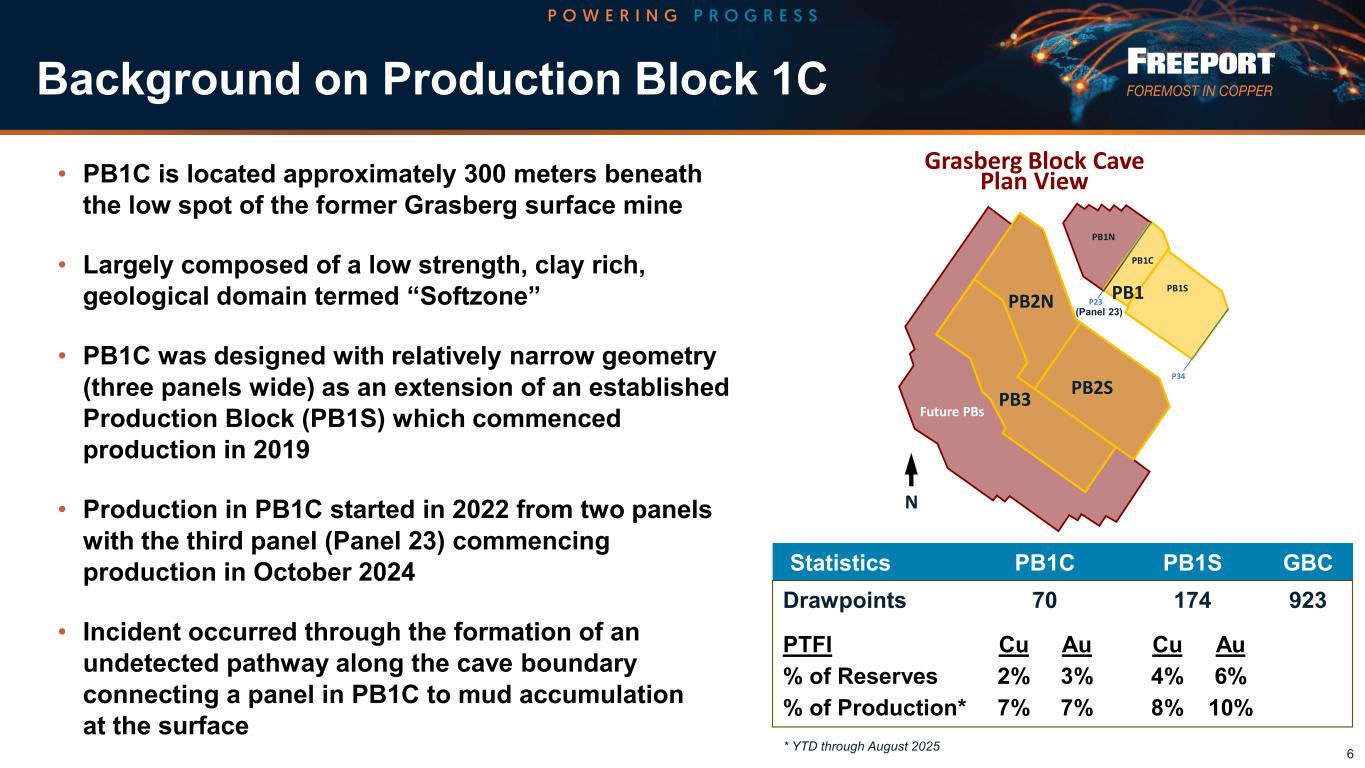

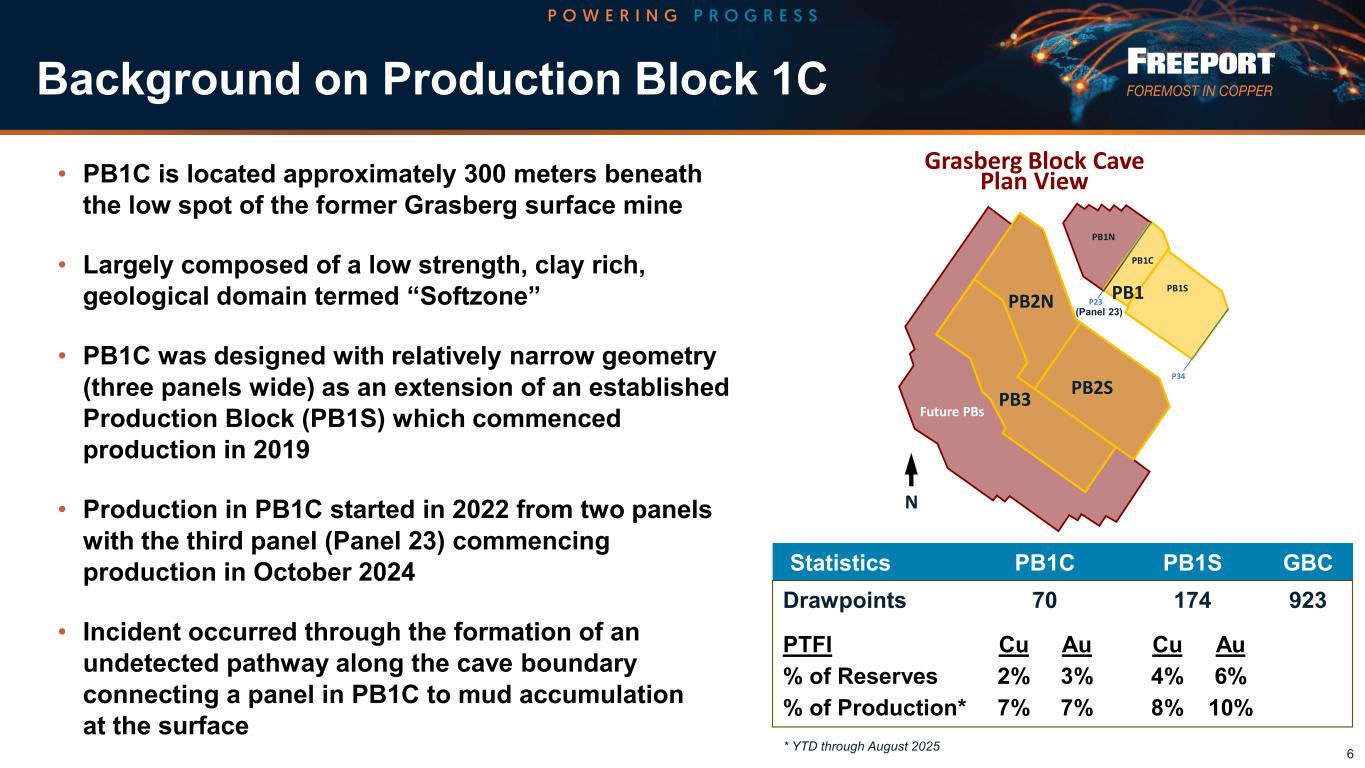

Background on Production Block 1C 6 • PB1C is located approximately 300 meters beneath the low spot of the former Grasberg surface mine • Largely composed of a low strength, clay rich, geological domain termed “Softzone” • PB1C was designed with relatively narrow geometry (three panels wide) as an extension of an established Production Block (PB1S) which commenced production in 2019 • Production in PB1C started in 2022 from two panels with the third panel (Panel 23) commencing production in October 2024 • Incident occurred through the formation of an undetected pathway along the cave boundary connecting a panel in PB1C to mud accumulation at the surface * YTD through August 2025 Statistics PB1C PB1S GBC Drawpoints 70 174 923 PTFI Cu Au Cu Au % of Reserves 2% 3% 4% 6% % of Production* 7% 7% 8% 10% Grasberg Block Cave Plan View Future PBs PB3 PB2N PB2S PB1 PB1N PB1C PB1S P23 P34 N (Panel 23)

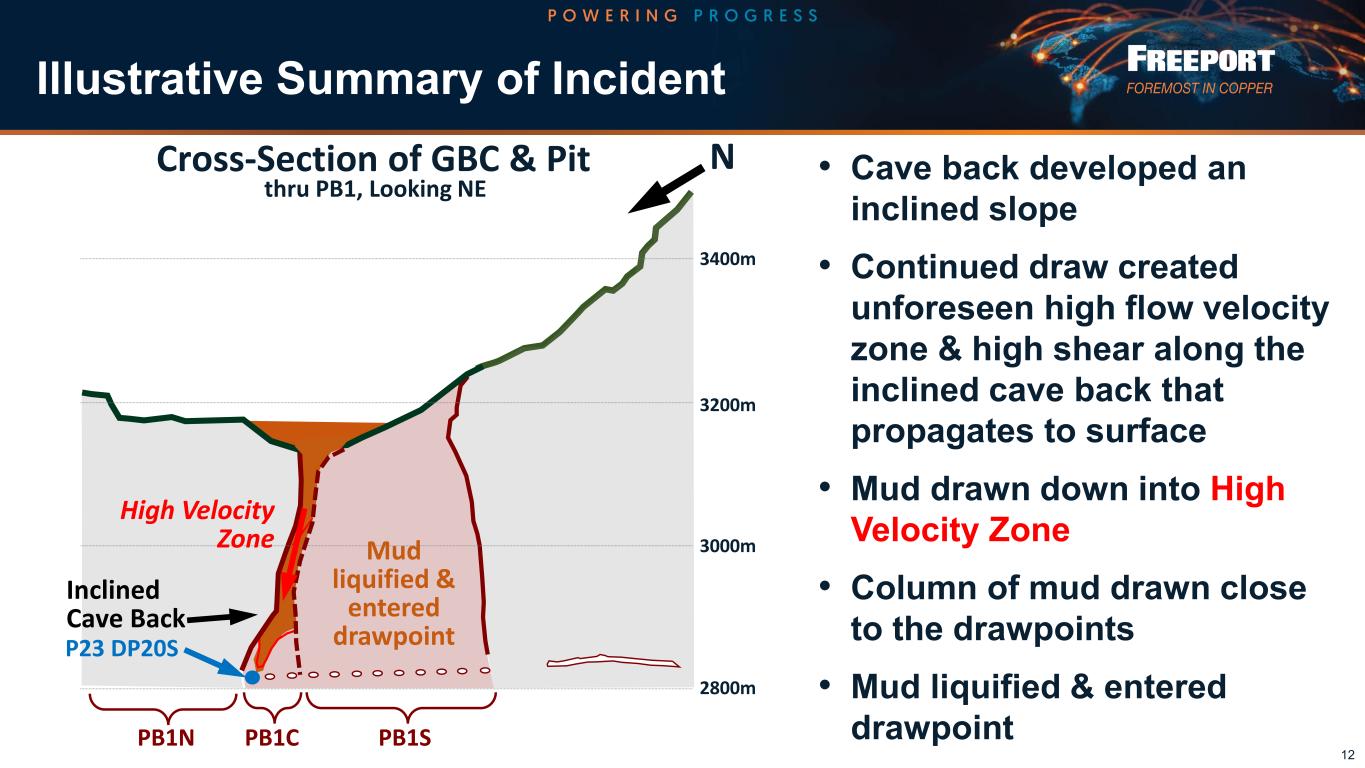

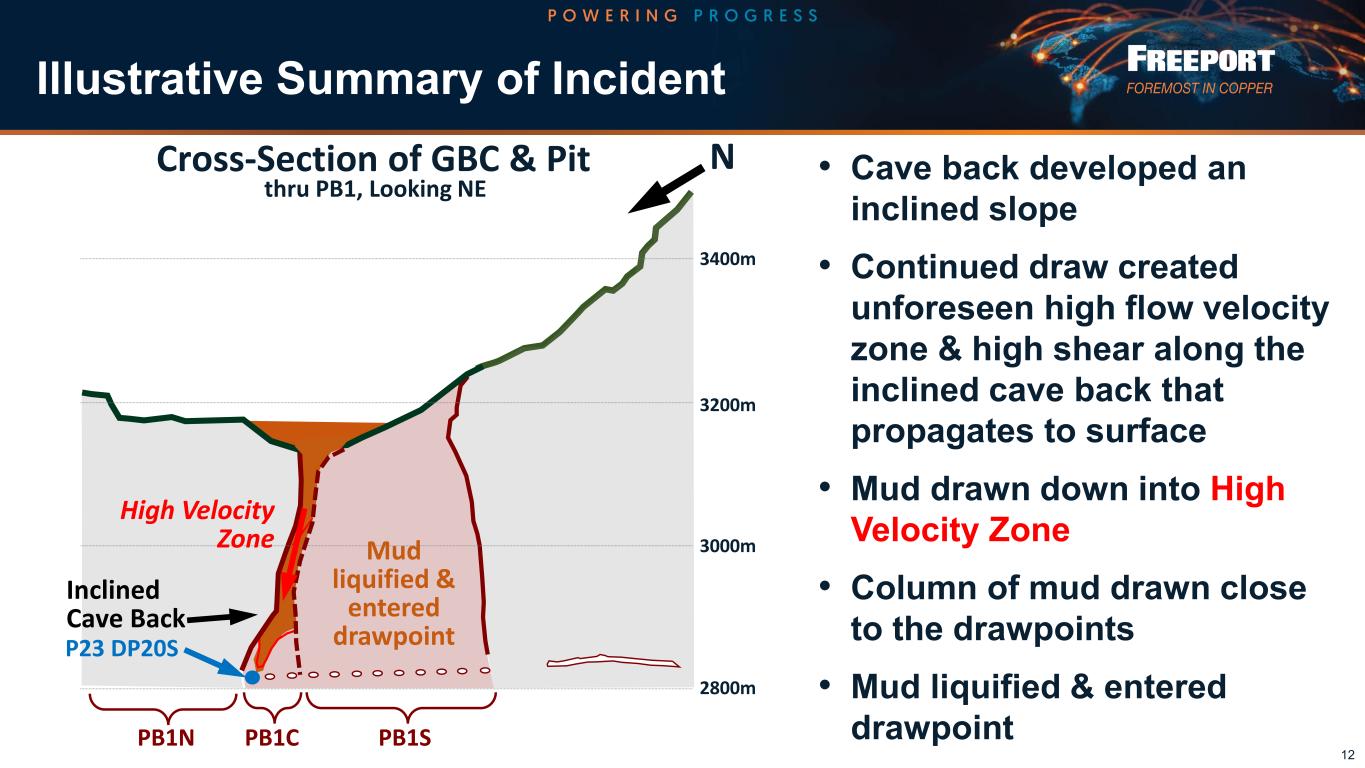

Contributing Conditions • Conditions in PB1C different than other Production Blocks • Partially unbroken, overhanging & inclined shape of the cave boundary adjacent to an established cave area in PB1S • Faster rate of production draw in PB1C in relation to the adjacent established cave area in PB1S o PB1C cave geometry resulted in production from multiple panels combining to draw in a narrow channel (“High Velocity Zone”) ▪ Magnified “effective draw” & velocity • Continued draw connected “High Velocity Zone” to the surface 7 Unique Characteristics 6 P23 DP20S 3400m 3200m 3000m 2800m PB1N PB1C PB1S High Velocity Zone NCross-Section of GBC & Pit Mud Pit Wall Inclined Cave Back Grasberg Block Cave thru PB1, Looking NE

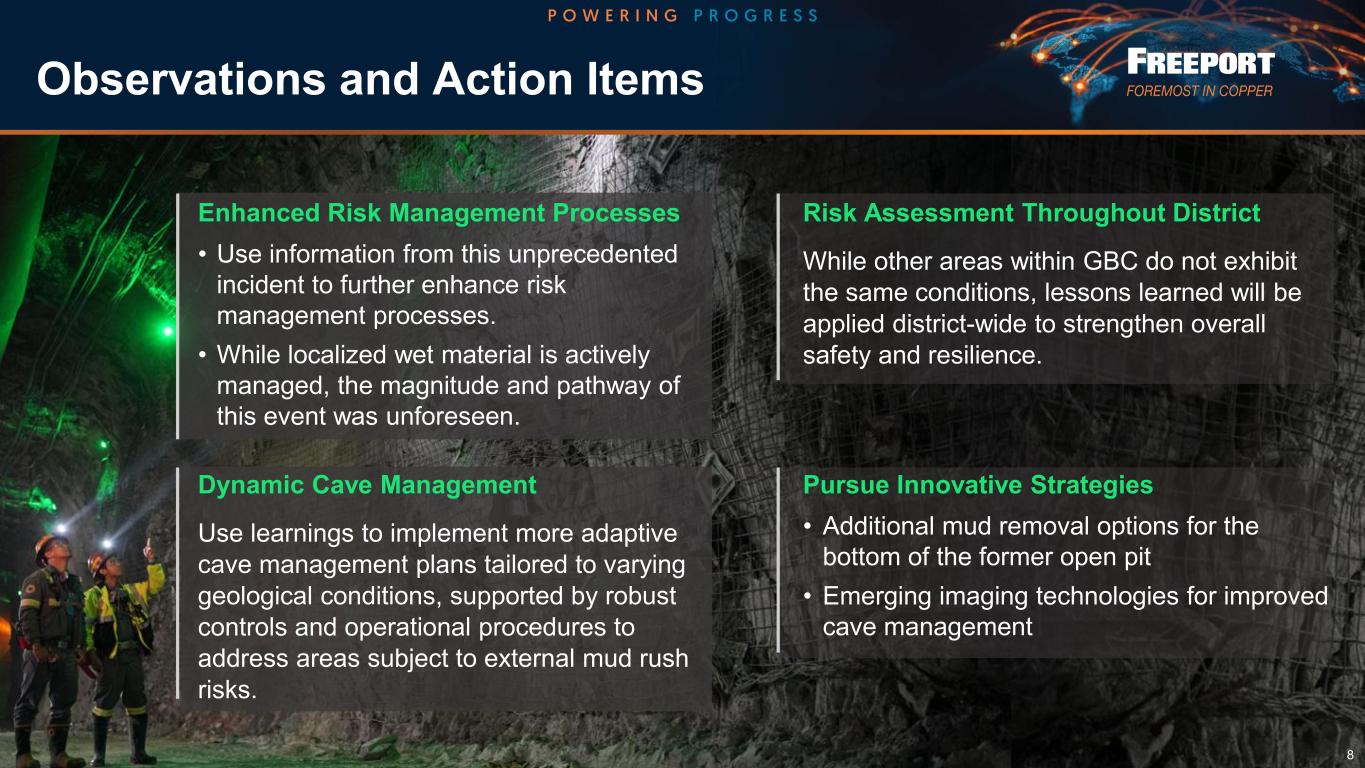

Observations and Action Items Dynamic Cave Management Use learnings to implement more adaptive cave management plans tailored to varying geological conditions, supported by robust controls and operational procedures to address areas subject to external mud rush risks. Risk Assessment Throughout District While other areas within GBC do not exhibit the same conditions, lessons learned will be applied district-wide to strengthen overall safety and resilience. Enhanced Risk Management Processes • Use information from this unprecedented incident to further enhance risk management processes. • While localized wet material is actively managed, the magnitude and pathway of this event was unforeseen. Pursue Innovative Strategies • Additional mud removal options for the bottom of the former open pit • Emerging imaging technologies for improved cave management 8

Path Forward • Restarted unaffected Big Gossan and Deep MLZ mines in late October 2025 • Prepare GBC for Restart of PB2/PB3 • Mud removal in mine workings • Re-establish services • Installation of cement plugs for panels in PB1C • PB1S Restart • Complete chute repairs • PB1C • Ongoing assessment and risk mitigation initiatives PB2 & PB3 Restart and ramp up beginning 2Q 2026 PB1S Restart mid-2027 PB1C Potential restart by YE 2027, pending further analysis and mud removal systems for former open pit 9

Grasberg Minerals District Mine Plan Metal Production, 2025e – 2029e 10 1.0 1.0 1.5 1.7 1.7 0.9 0.9 1.2 1.4 1.3 2025e 2026e 2027e 2028e 2029e | Copper 2025e – 2029e Total: 6.9 billion lbs copper Annual Average: ~1.4 billion lbs | Gold 2025e – 2029e Total: 5.7 million ozs gold Annual Average: ~1.14 million ozs Cu bn lbs Au mm ozs NOTE: Timing of annual production will depend on a number of factors including operational performance; the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident; weather-related conditions; and other factors. 2026e production expected to exceed sales and assumes deferrals of ~60 mm lbs of copper and ~150 k ozs of gold related to inventory held at PTFI’s smelting operations. FCX’s economic interest in PTFI is 48.76%. e = estimate.

Grasberg Surface Conditions 11 3400m 3200m 3000m 2800m NCross-Section of GBC & Pit PB1N PB1C PB1S Mud • Surface subsidence impacts pit walls as cave expands • Rain & runoff erode fines from slopes • Results in mud accumulation in the topographic low of the pit • Material dissipates over time in the caving process Pit Wall Topographic Low Grasberg Block Cave thru PB1, Looking NE

Illustrative Summary of Incident 12 P23 DP20S 3400m 3200m 3000m 2800m PB1N PB1C PB1S High Velocity Zone Mud liquified & entered drawpoint • Cave back developed an inclined slope • Continued draw created unforeseen high flow velocity zone & high shear along the inclined cave back that propagates to surface • Mud drawn down into High Velocity Zone • Column of mud drawn close to the drawpoints • Mud liquified & entered drawpoint NCross-Section of GBC & Pit thru PB1, Looking NE Inclined Cave Back

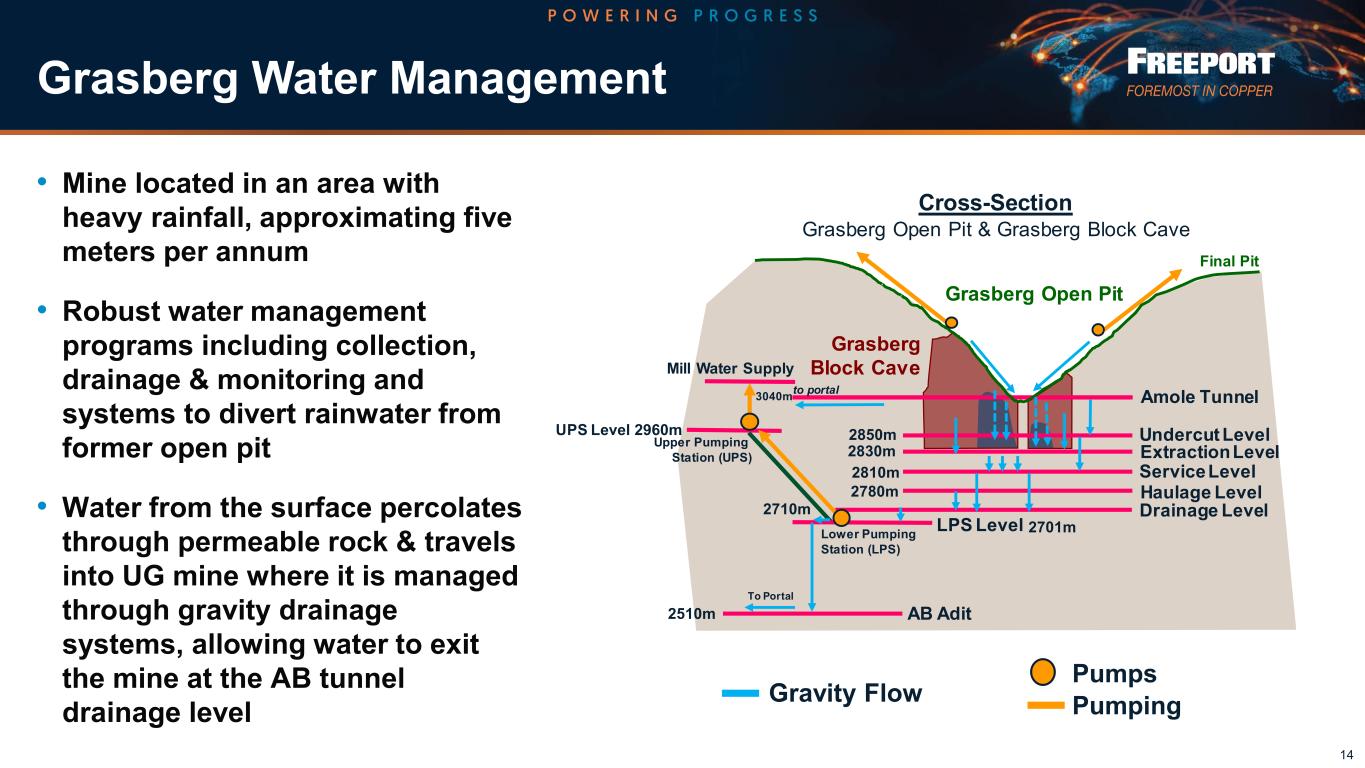

External Mud Rush v. Wet Muck Incidents 13 • Wet Muck Event ✓ Water from the surface percolates through permeable rock & travels into UG mine where it is managed through gravity drainage systems ✓ Some areas of the orebody generate fine material at the drawpoint ✓ When water moves down through broken rock in the cave & encounters fine material, wet muck spills are possible & generally limited to volume of the drawbell PTFI has safety controls & work practices to protect our people from the risk of localized wet muck flows • External Mud Rush Event ✓ Large volume of flowable mud traveling downward from the surface through vertical pathway Nature of the mud rush incident was unique in PTFI’s long underground history & different from wet muck incidents PTFI routinely manages Remote Loading on Extraction Level Remotely controlled Rock Breakers Autonomous Train Haulage Remote Train Loading Spillminator (wet muck control chute)

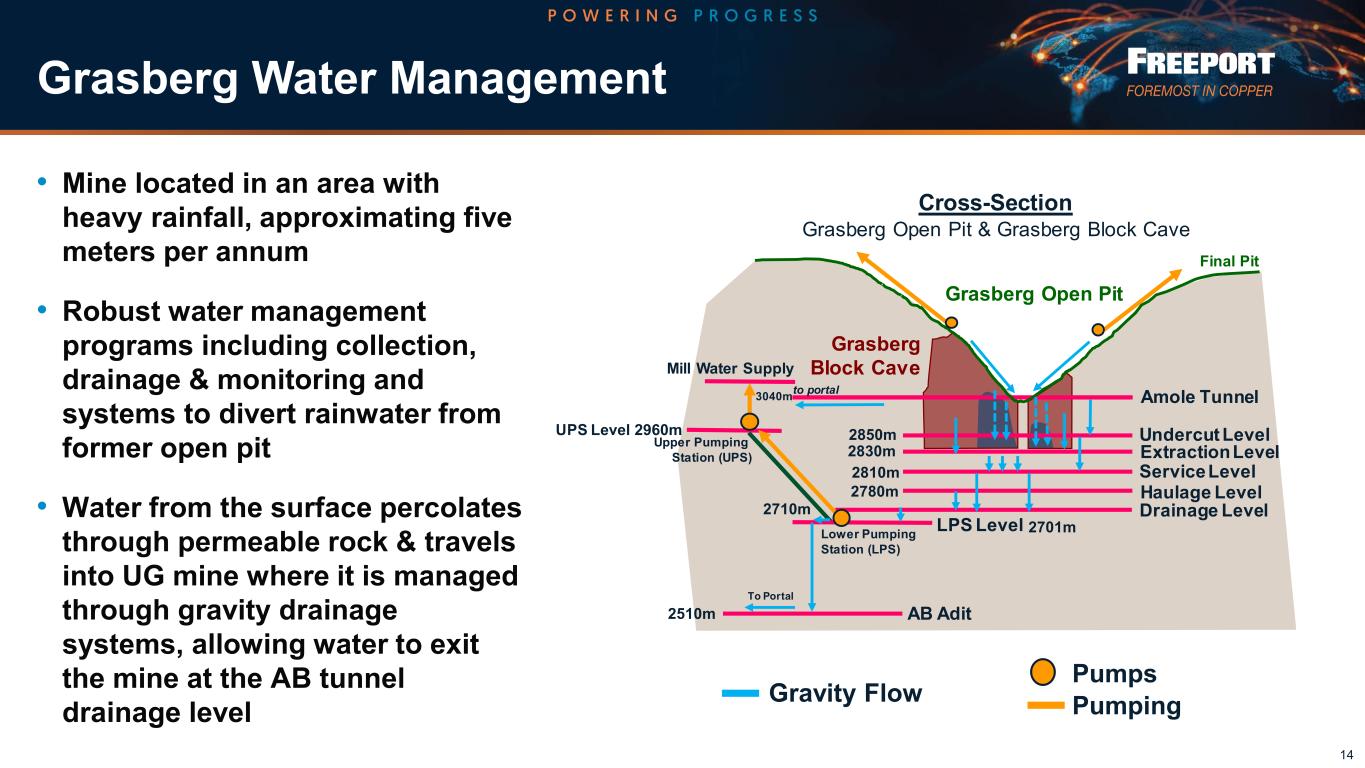

Amole Tunnel Undercut Level Extraction Level Service Level Haulage Level LPS Level AB Adit Grasberg Block Cave 3040m 2850m 2830m 2810m 2780m 2710m Drainage Level 2701m 2510m to portal Upper Pumping Station (UPS) UPS Level 2960m To Portal Mill Water Supply Lower Pumping Station (LPS) Final Pit Cross-Section Grasberg Open Pit & Grasberg Block Cave Grasberg Open Pit Grasberg Water Management 14 • Mine located in an area with heavy rainfall, approximating five meters per annum • Robust water management programs including collection, drainage & monitoring and systems to divert rainwater from former open pit • Water from the surface percolates through permeable rock & travels into UG mine where it is managed through gravity drainage systems, allowing water to exit the mine at the AB tunnel drainage level Gravity Flow Pumps Pumping

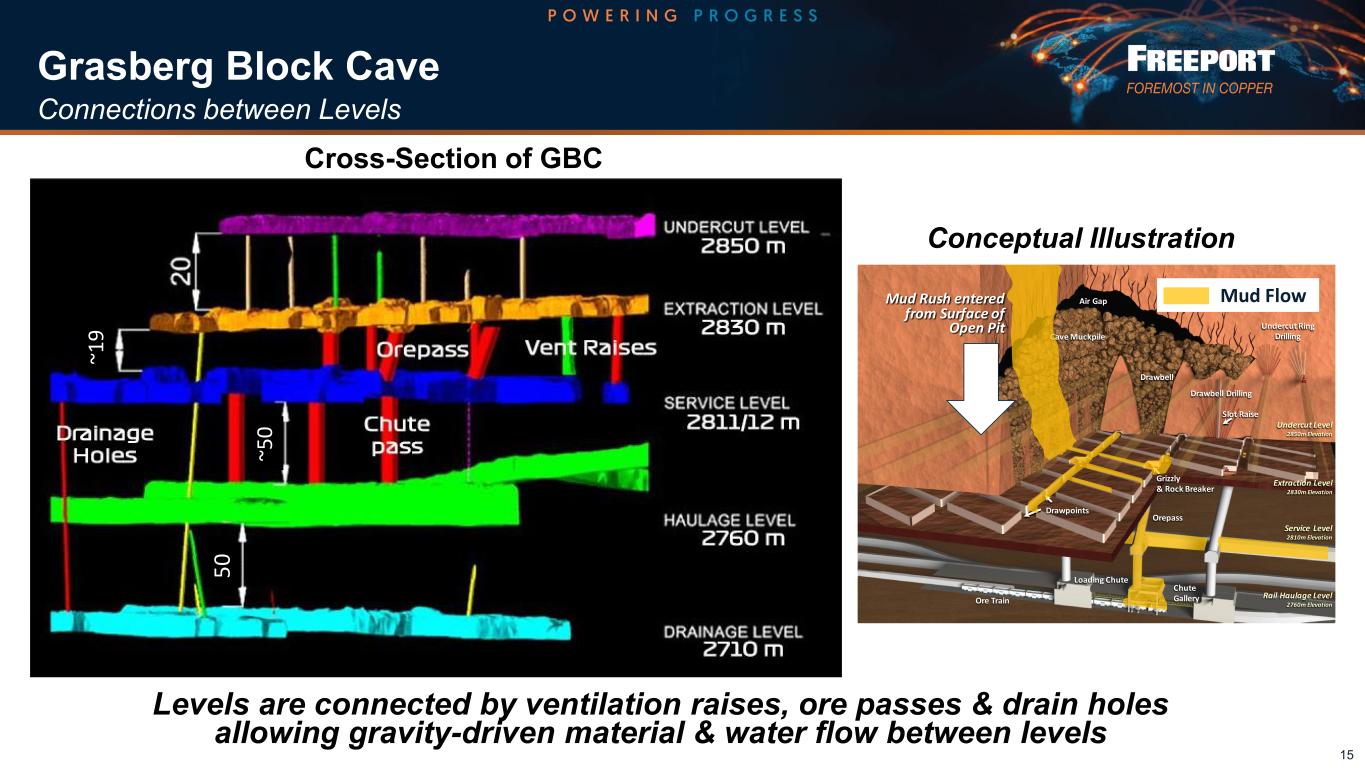

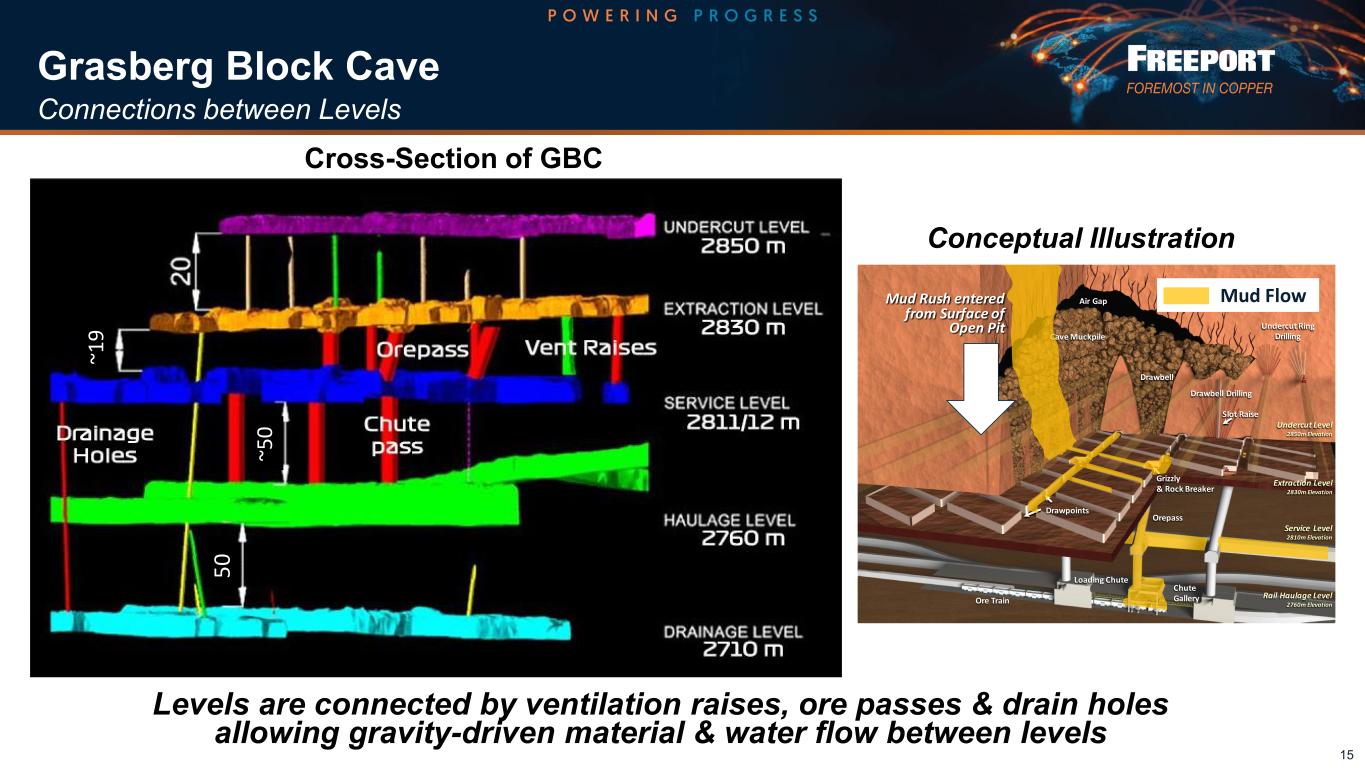

Grasberg Block Cave Levels are connected by ventilation raises, ore passes & drain holes allowing gravity-driven material & water flow between levels Cross-Section of GBC Drawbell Drilling Undercut Ring DrillingCave Muckpile Air Gap Undercut Level 2850m Elevation Extraction Level 2830m Elevation Service Level 2810m Elevation Rail Haulage Level 2760m Elevation Orepass Chute GalleryOre Train Slot Raise Grizzly & Rock Breaker Drawpoints Loading Chute Drawbell l i l i l i l i Mud FlowMud Rush entered from Surface of Open Pit 15 5 0 ~5 0 ~1 9 Conceptual Illustration Connections between Levels

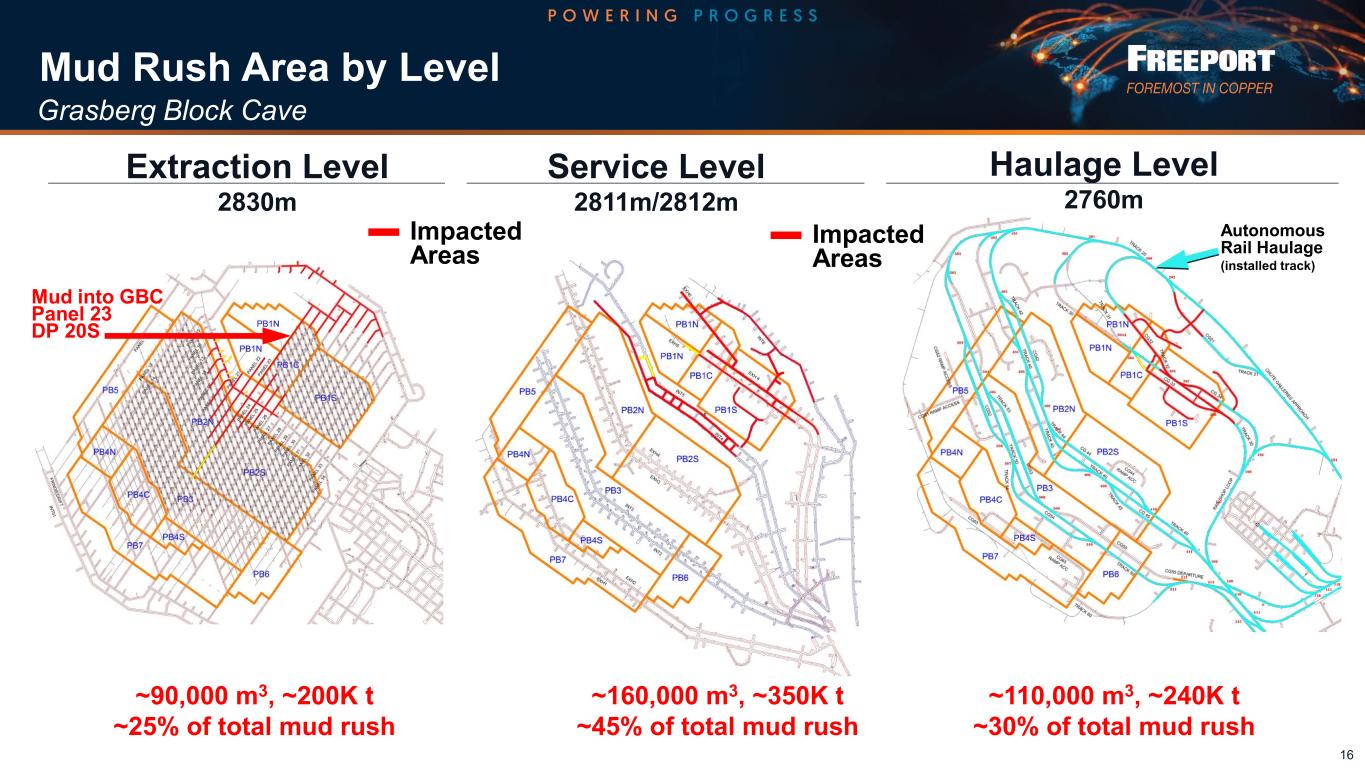

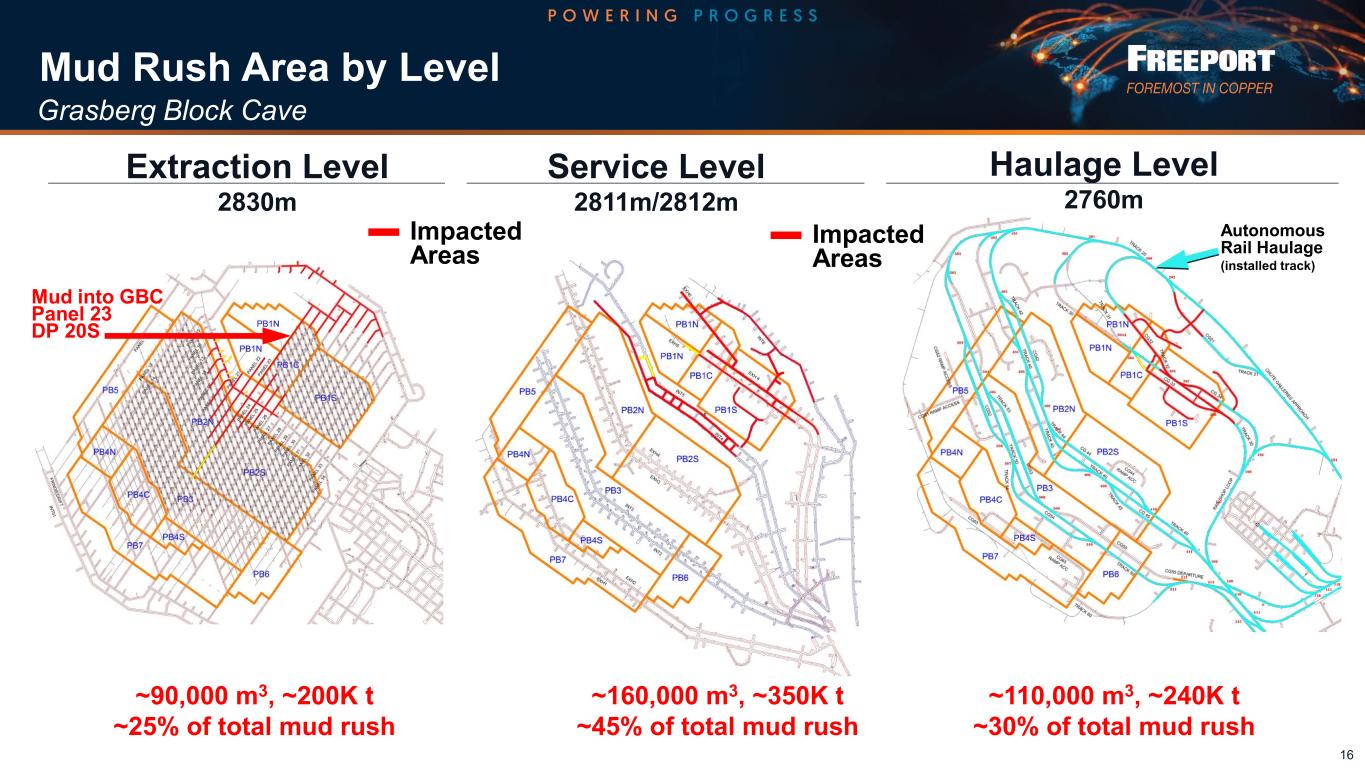

~90,000 m3, ~200K t ~25% of total mud rush ~160,000 m3, ~350K t ~45% of total mud rush ~110,000 m3, ~240K t ~30% of total mud rush Extraction Level 2830m Service Level 2811m/2812m Haulage Level 2760m 16 Impacted Areas Mud into GBC Panel 23 DP 20S Impacted Areas Autonomous Rail Haulage (installed track) Mud Rush Area by Level Grasberg Block Cave

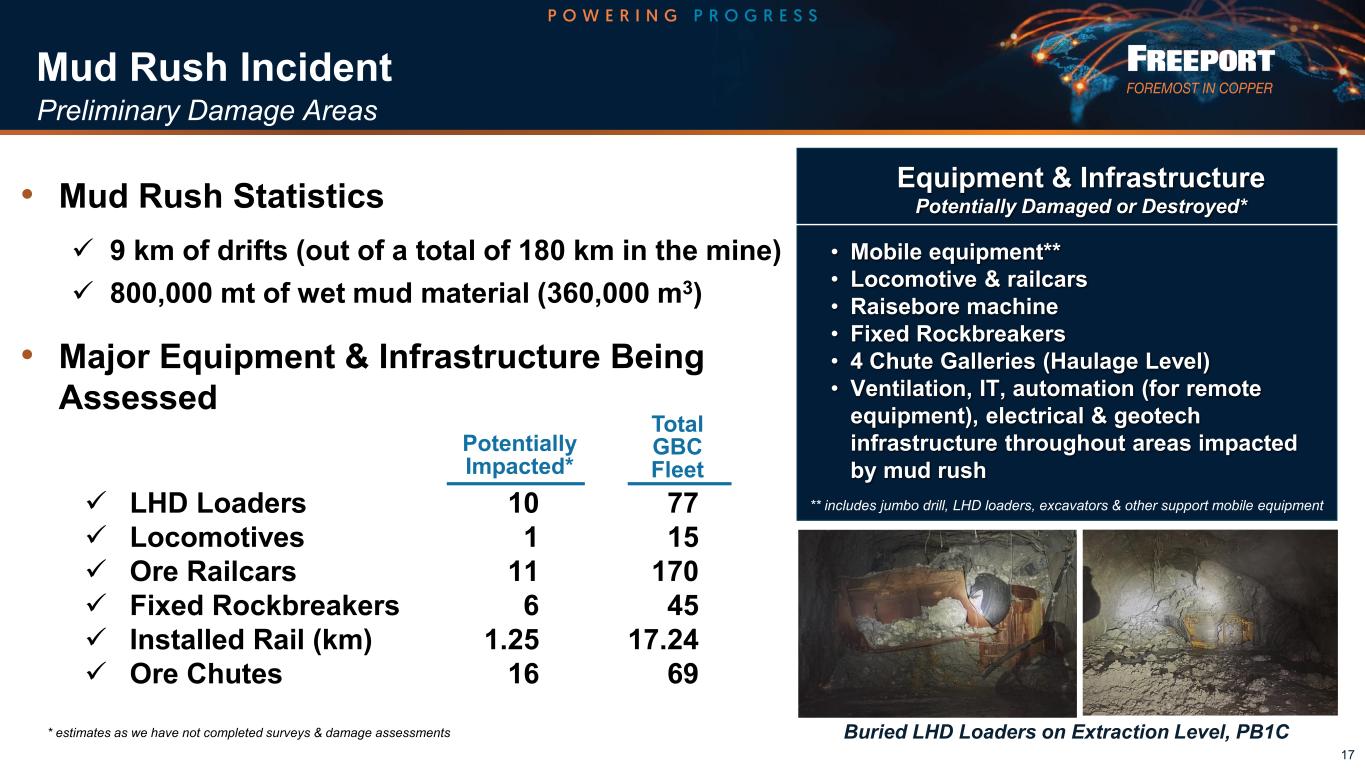

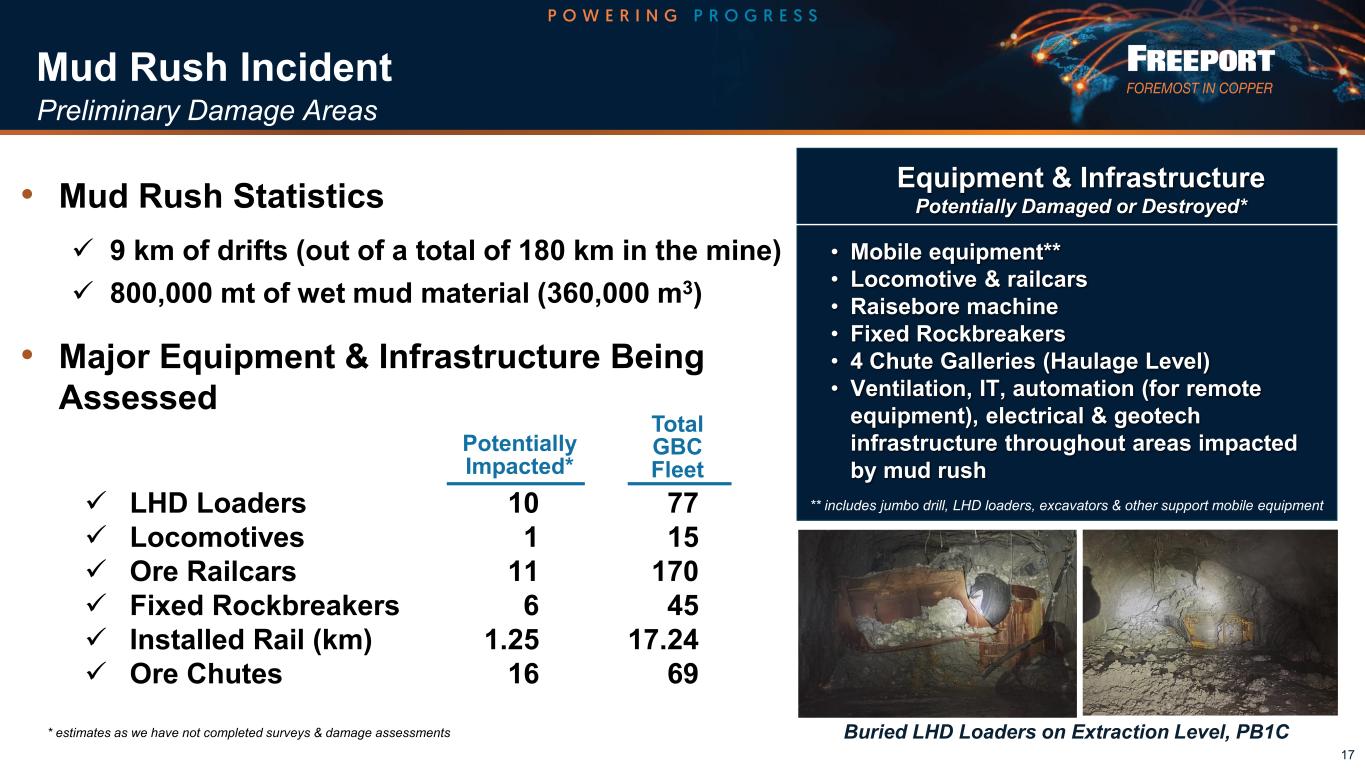

Mud Rush Incident • Mobile equipment** • Locomotive & railcars • Raisebore machine • Fixed Rockbreakers • 4 Chute Galleries (Haulage Level) • Ventilation, IT, automation (for remote equipment), electrical & geotech infrastructure throughout areas impacted by mud rush • Mud Rush Statistics ✓ 9 km of drifts (out of a total of 180 km in the mine) ✓ 800,000 mt of wet mud material (360,000 m3) • Major Equipment & Infrastructure Being Assessed ✓ LHD Loaders 10 77 ✓ Locomotives 1 15 ✓ Ore Railcars 11 170 ✓ Fixed Rockbreakers 6 45 ✓ Installed Rail (km) 1.25 17.24 ✓ Ore Chutes 16 69 Equipment & Infrastructure Potentially Damaged or Destroyed* * estimates as we have not completed surveys & damage assessments 17 Buried LHD Loaders on Extraction Level, PB1C Total GBC Fleet Potentially Impacted* ** includes jumbo drill, LHD loaders, excavators & other support mobile equipment Preliminary Damage Areas

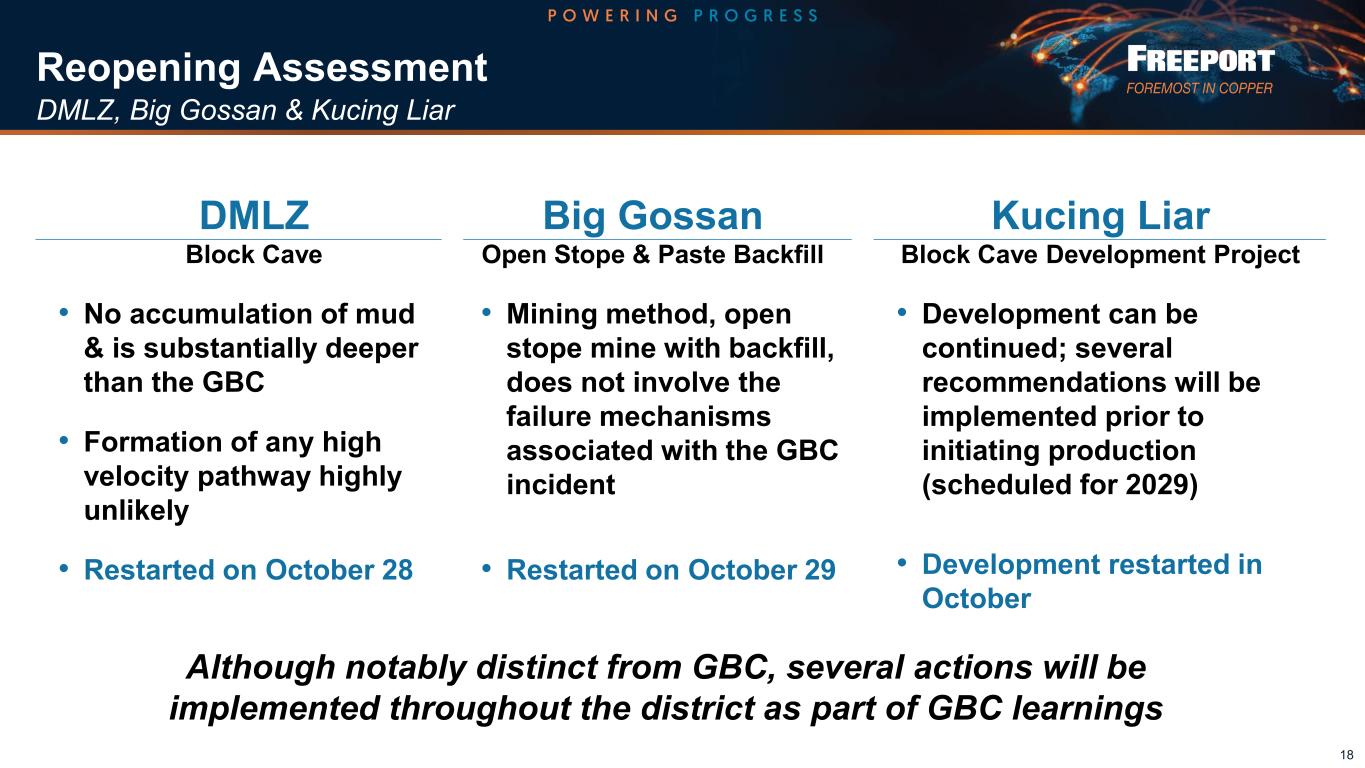

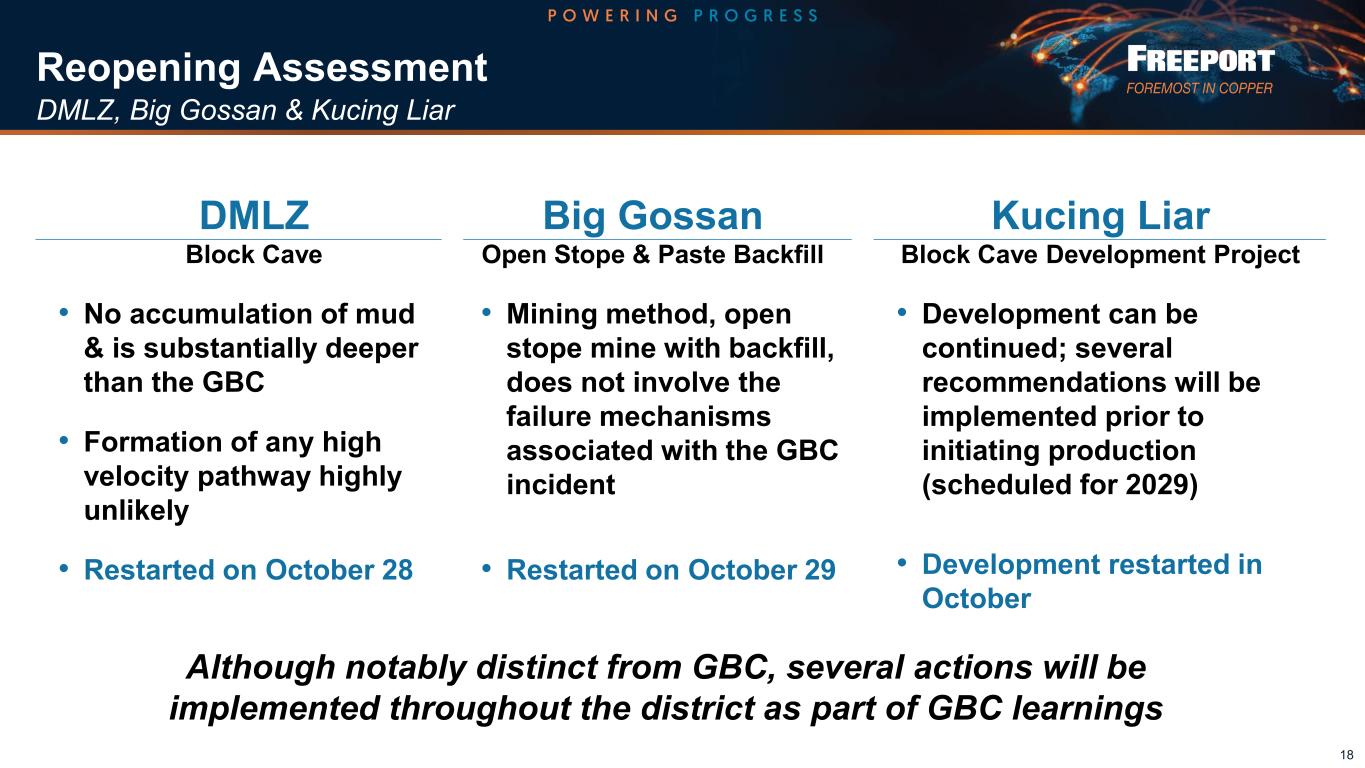

Reopening Assessment • Development can be continued; several recommendations will be implemented prior to initiating production (scheduled for 2029) • Development restarted in October 18 • Mining method, open stope mine with backfill, does not involve the failure mechanisms associated with the GBC incident • Restarted on October 29 • No accumulation of mud & is substantially deeper than the GBC • Formation of any high velocity pathway highly unlikely • Restarted on October 28 DMLZ Block Cave Big Gossan Open Stope & Paste Backfill Kucing Liar Block Cave Development Project Although notably distinct from GBC, several actions will be implemented throughout the district as part of GBC learnings DMLZ, Big Gossan & Kucing Liar

• Being isolated with cement plugs • Risk mitigation strategies being assessed for potential future restart 19 • Beneath the current accumulation of mud in the pit bottom but is fully broken through to surface with no inclined cave back • No overlying accumulation of mud • Draw management plan to take into account learnings from incident PB2/3 PB1S PB1C Reopening Assessment • Mud management of former open pit expected to provide a high-level of control & risk reduction Grasberg Block Cave

Key Recommendations • Update cave management plans & draw protocols • Establish Cave Management Committees • Enhance monitoring, reporting & audit protocols • Pursue mud removal options for the open pit • Trial advanced monitoring technologies & dewatering methods Recommendations focus on using learnings to strengthen cave management, operational safety & risk mitigation 20

Risk Management Diamond Drilling Sandvik DU311 Drill Cable-Suspended Slurry Pumping Conventional up-hole Coring for Slurry Pond Drainage Soft Zone Grasberg Pit Water-Driven In-the-Hole Hammer Drill Pit Bottom Drill Holes Pit Bottom Drainage Gallery Soft Zone Grasberg Pit Pit Bottom Cross-Section Plan View Grasberg Pit GBC Soft Zone New Drift for Drainage Gallery GBC New Drift for Drainage Gallery Pit Bottom Grasberg Pit Plan View 21 ~3,000 meters of new drift development Larger Diameter (5”) & Fast drilling (~200 meters/day) Small Diameter (<3”) & Slow drilling (~10 meters/day) Mud Removal Options for Former Open Pit

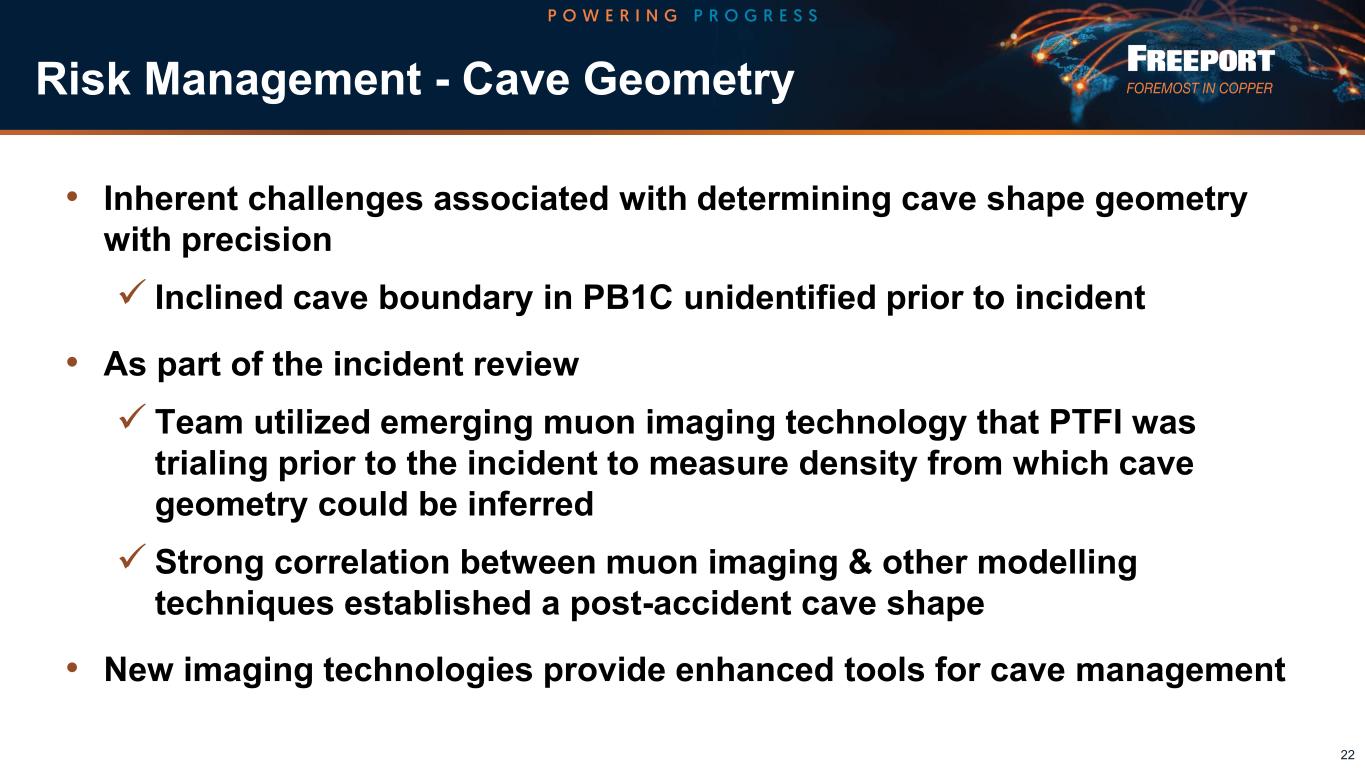

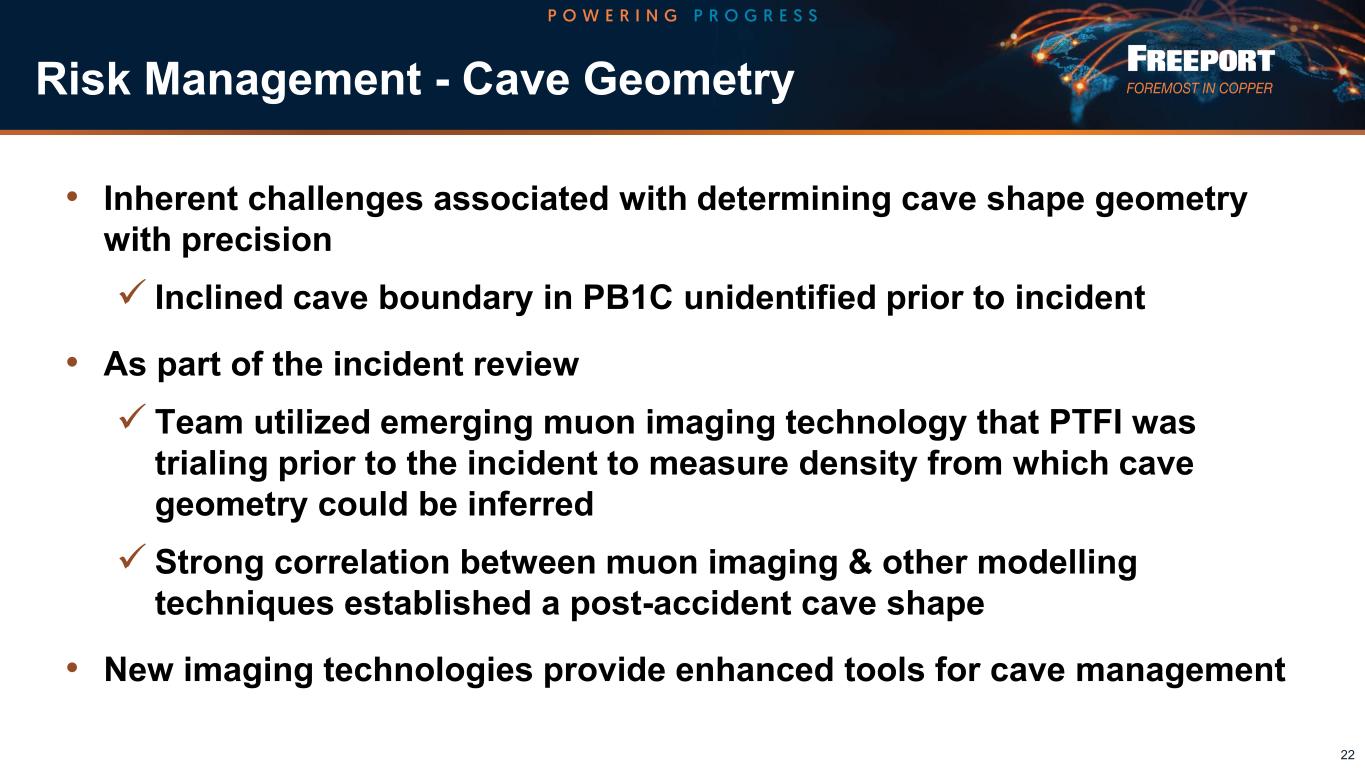

Risk Management - Cave Geometry • Inherent challenges associated with determining cave shape geometry with precision ✓ Inclined cave boundary in PB1C unidentified prior to incident • As part of the incident review ✓ Team utilized emerging muon imaging technology that PTFI was trialing prior to the incident to measure density from which cave geometry could be inferred ✓ Strong correlation between muon imaging & other modelling techniques established a post-accident cave shape • New imaging technologies provide enhanced tools for cave management 22

23 GBC Recovery Timeline 4Q25 1Q26 2Q26 20262025 Mud Removal in Extraction & Service Levels Service Level Rehab, Infrastructure & Services Updated PB2/3 CMP* PB2/3 Start-up Design & Construction of Plugs (PB1C) Haulage Level Mud Removal PB2/3 Restart * Cave Management Plan (CMP) Major Near-Term Milestones for PB2/3 Restart

PTFI Underground Operations 24 • State of the art monitoring system • Supported by industry experts • Mine-scale design upgrades to improve seismic conditions Seismic Monitoring & Management Cave Propagation & Flow Monitoring • In-cave marker monitoring system • Cutting edge cave propagation & in cave density using muon detection In-hole markers to detect cave advance & propagation In-cave beacons to track flow velocity & direction Detection of constantly occurring cosmic particles (muons) to measure the cave density above the footprint (emerging cave imaging technology)24/7 Monitoring Micro-seismic Monitoring System (deployed in all mining areas) Automation & Remote Operations Draw Control Management • Automated draw control management system (Phase 1 deployed in March 2025) • Automatic assignment of each bucket to operator based on compliance to plan, drawpoint availability & wet muck blending • Improved balance between cave health requirements & production targets Compliance View Tablet directing operator to the next drawpoint • Remote control systems & consoles so operators can operate equipment UG from safe location (ie, surface office) • Automated loading & hauling systems Remote Drilling Remote Loading Forefront of Technology & Risk Management

SUCCESSFUL 58-YEAR HISTORY PROVEN RESILIENCE UNITED TEAM PROMISING FUTURE

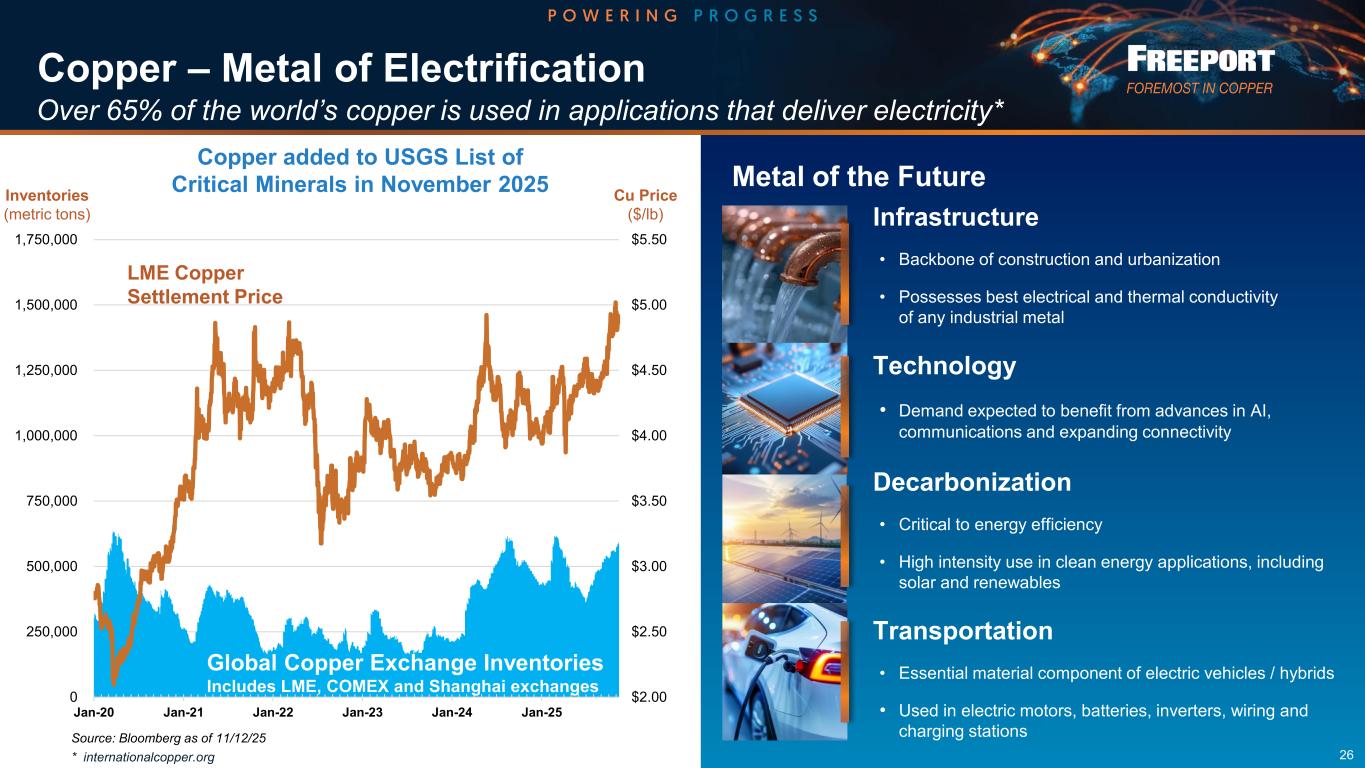

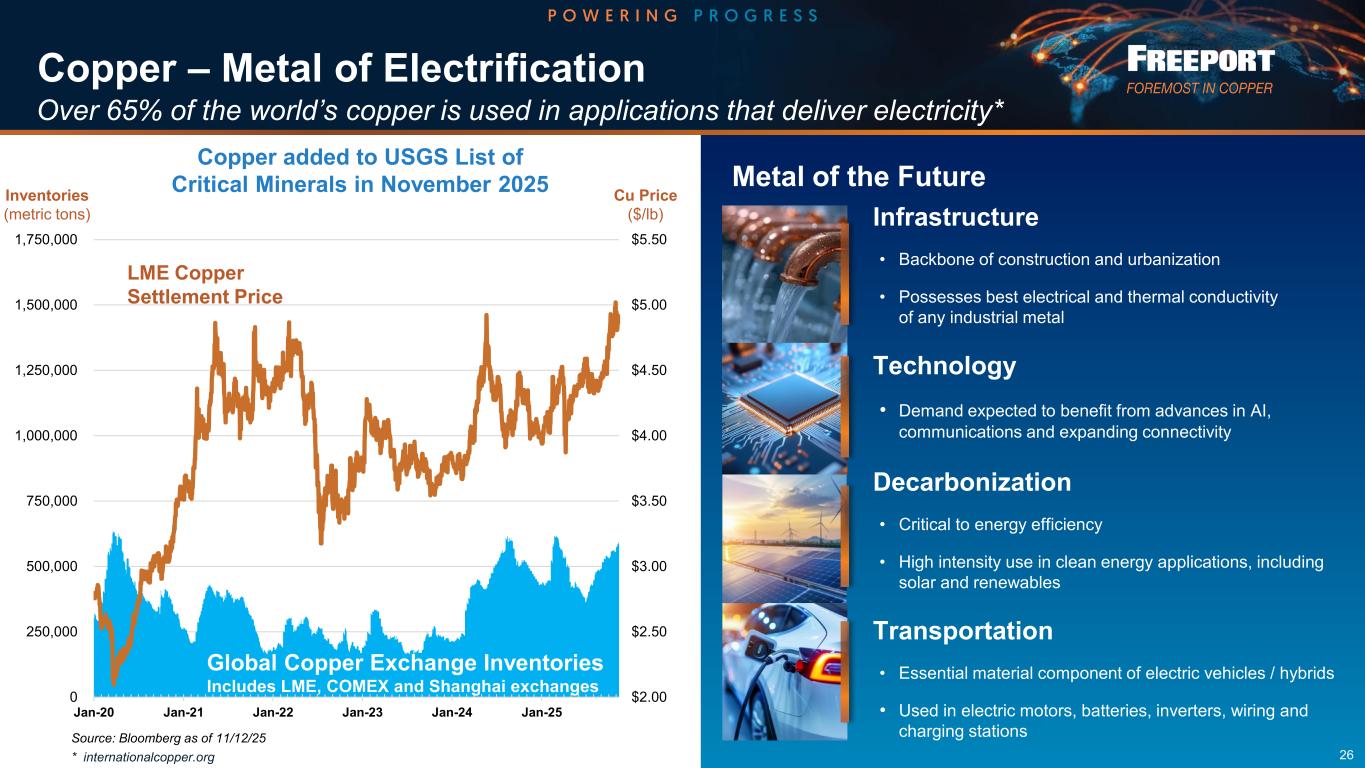

Copper – Metal of Electrification Over 65% of the world’s copper is used in applications that deliver electricity* Infrastructure • Backbone of construction and urbanization • Possesses best electrical and thermal conductivity of any industrial metal Technology • Demand expected to benefit from advances in AI, communications and expanding connectivity Decarbonization • Critical to energy efficiency • High intensity use in clean energy applications, including solar and renewables Transportation • Essential material component of electric vehicles / hybrids • Used in electric motors, batteries, inverters, wiring and charging stations 26 Metal of the Future $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 0 250,000 500,000 750,000 1,000,000 1,250,000 1,500,000 1,750,000 Jan-20 Jan-21 Jan-22 Jan-23 Jan-24 Jan-25 LME Copper Settlement Price Inventories (metric tons) Cu Price ($/lb) Global Copper Exchange Inventories Includes LME, COMEX and Shanghai exchanges Source: Bloomberg as of 11/12/25 Copper added to USGS List of Critical Minerals in November 2025 * internationalcopper.org

FCX Project Pipeline Update 27 El Abra Expansion Chile Lone Star/Safford Expansions Arizona Grasberg District Indonesia Bagdad Expansion Arizona New Leach Technologies Americas • Sustaining initial target of ~200 mm lbs/yr • Targeting increase to ~300 – 400 mm lbs/yr in 2026/2027 • Driving innovation toward 800 mm lbs/yr by 2030 • 200 – 250 mm incremental lbs/yr • Derisking in progress with autonomous conversion, tailings infrastructure investment and housing • 3-4 yr construction • Reviewing timing of investment decision • Advancing pre-feasibility study with expected completion in 2026 • Targeting incremental addition of 300 – 400 mm lbs/yr beginning in 2030s • Substantial resource • Kucing Liar project in development - Ramp-up to commence prior to 2030 - 560 mm lbs Cu & 520 k oz Au per annum reflected in base plan • Extension of mining rights beyond 2041 would create opportunities for future growth • Preparing EIS, targeting submission in 1Q 2026 • 3-yr permitting process • 4-yr construction • Potential start-up in 2033 timeframe • ~750 mm lbs/yr • Potential reserve adds: ~20 bn lbs <$1 billion Incremental investment $3.5 billion based on recent feasibility Incentive Price: <$4/lb Developing estimate ~$4 billion remaining for Kucing Liar $1.0 billion incurred to date ~$7.5 billion (under review) Excludes $2 billion for extension of leach operations Incentive Price: <$4/lb ANTICIPATED CAPITAL INVESTMENT

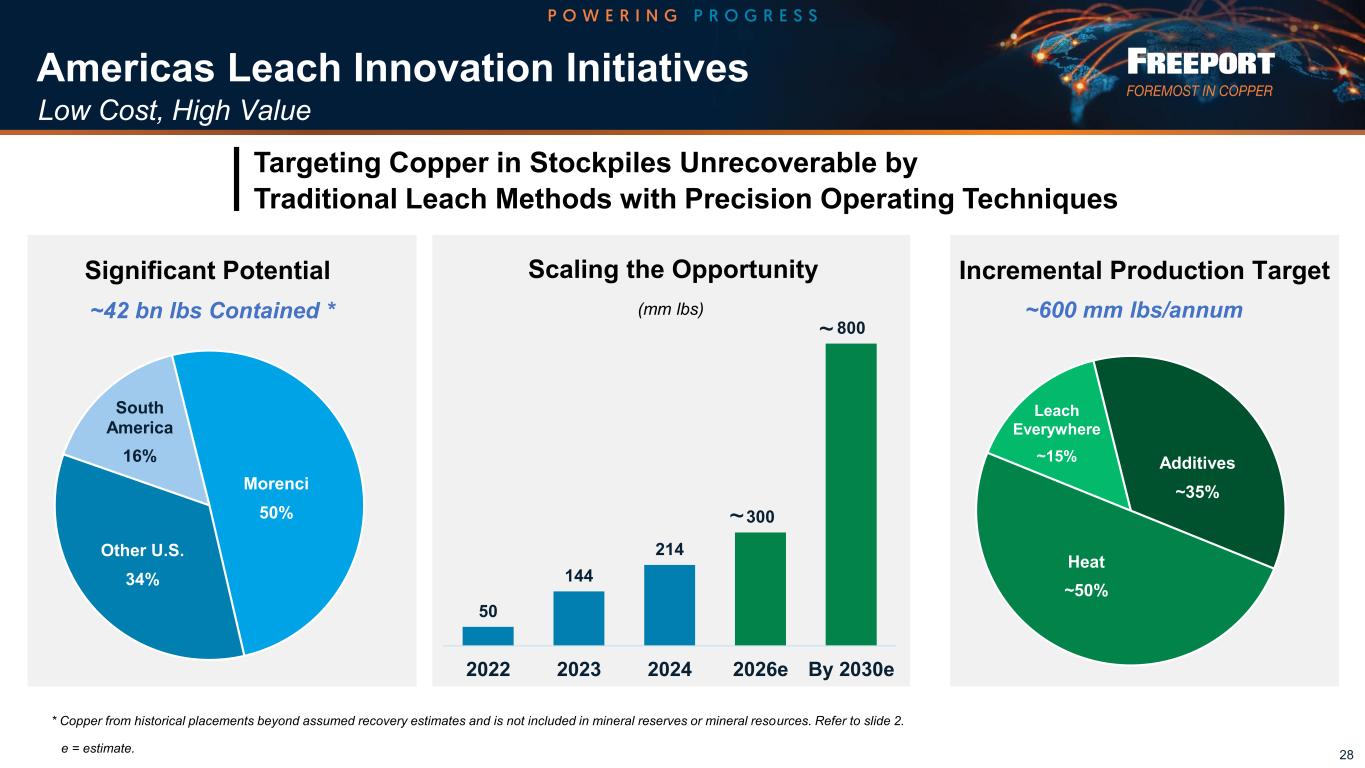

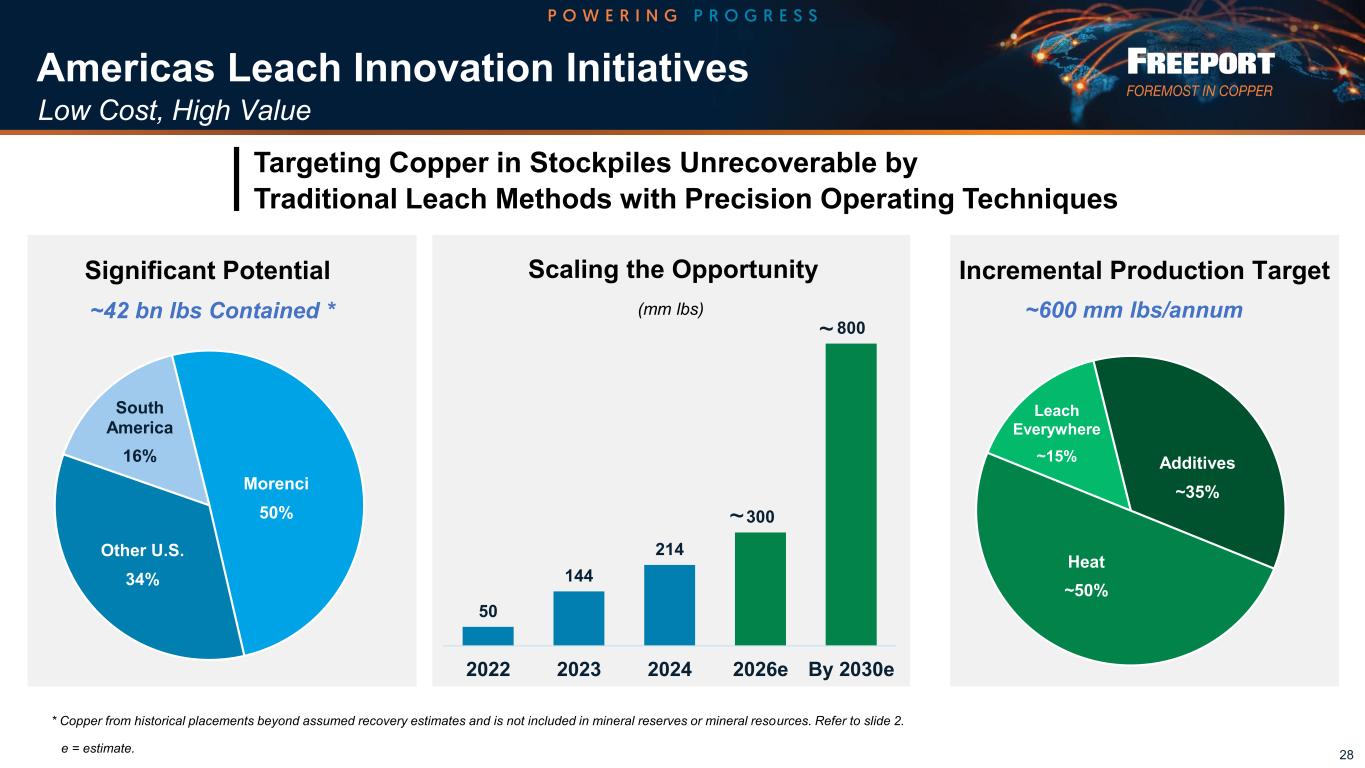

Americas Leach Innovation Initiatives Low Cost, High Value 28 * Copper from historical placements beyond assumed recovery estimates and is not included in mineral reserves or mineral resources. Refer to slide 2. South America 16% Other U.S. 34% Morenci 50% Significant Potential ~42 bn lbs Contained * Leach Everywhere ~15% Heat ~50% Additives ~35% ~600 mm lbs/annum Incremental Production Target | Targeting Copper in Stockpiles Unrecoverable by Traditional Leach Methods with Precision Operating Techniques 50 144 214 300 800 2022 2023 2024 2026e By 2030e Scaling the Opportunity (mm lbs) ~ ~ e = estimate.

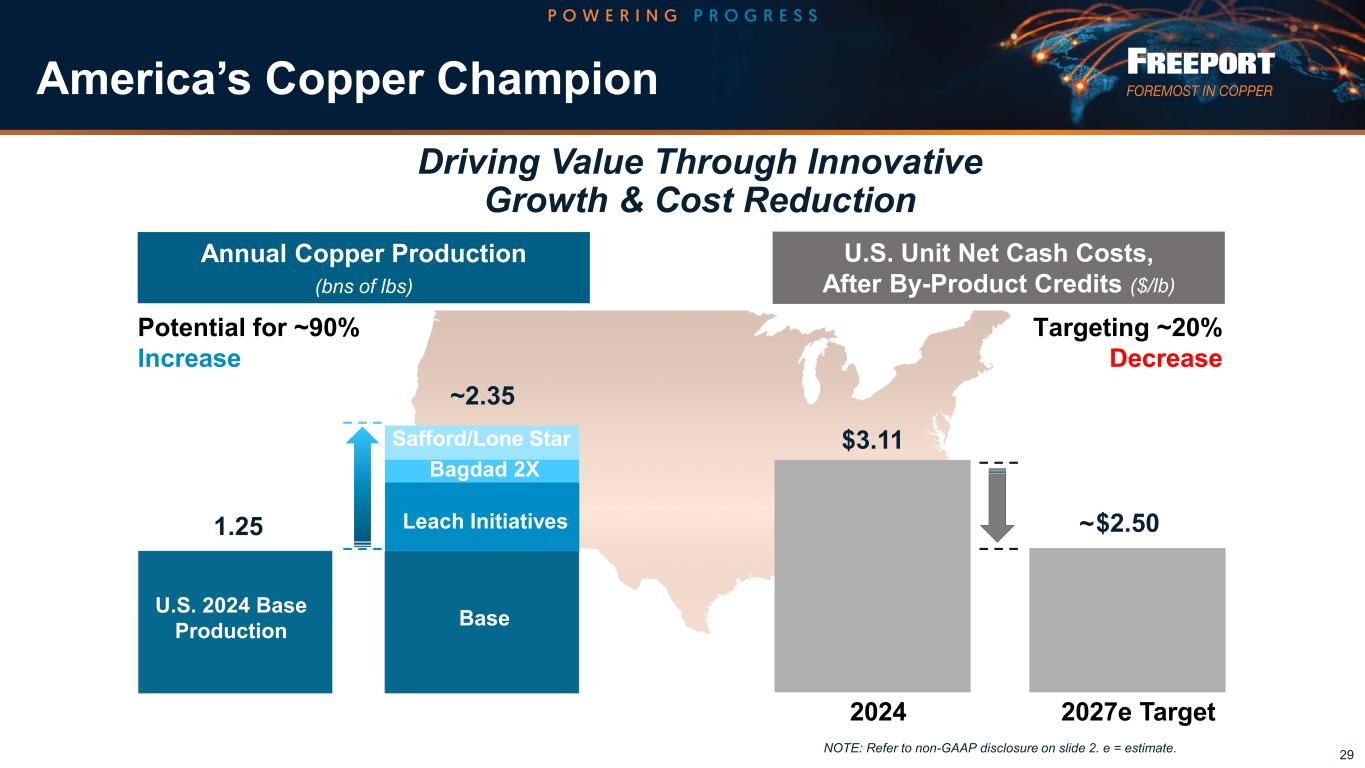

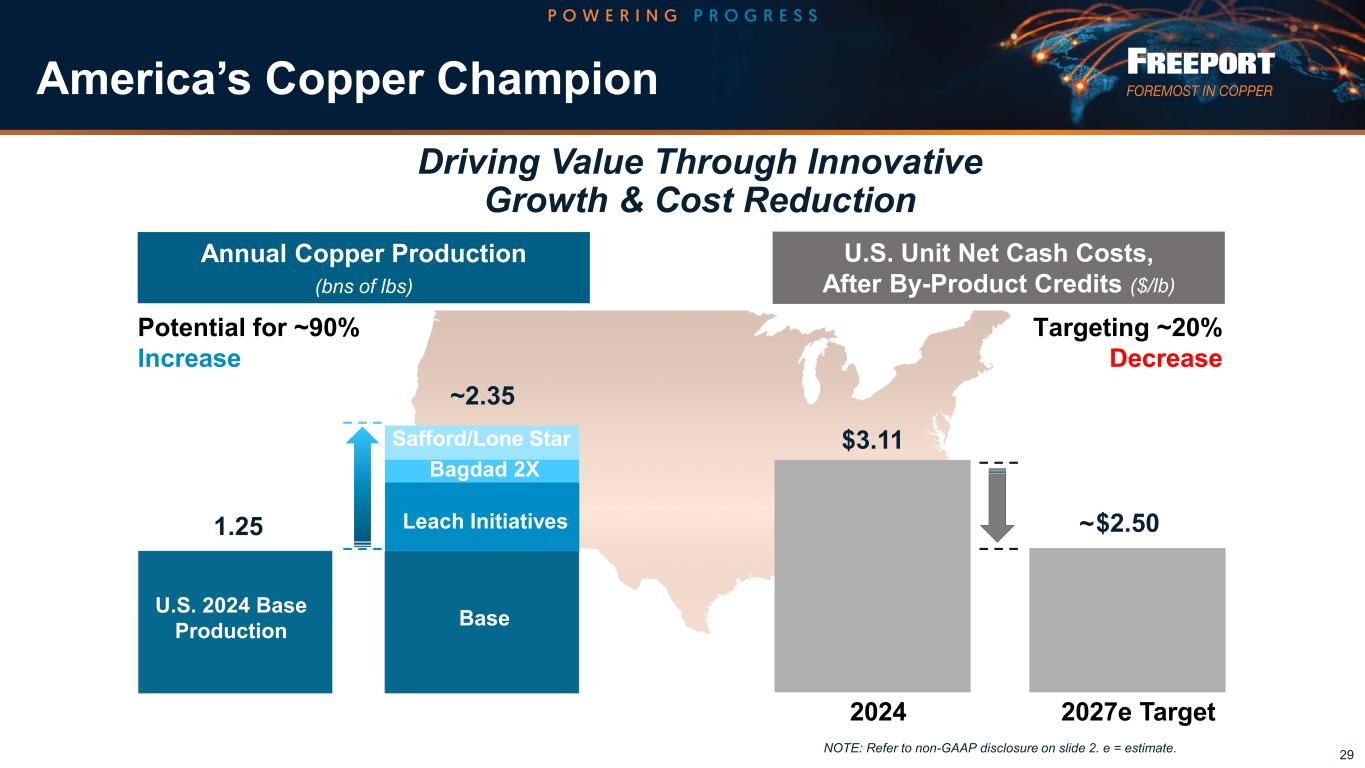

29 America’s Copper Champion $3.11 $2.50 2024 2027e Target ~ Annual Copper Production (bns of lbs) Targeting ~20% Decrease Potential for ~90% Increase ~2.35 1.25 U.S. 2024 Base Production Base Leach Initiatives Bagdad 2X U.S. Unit Net Cash Costs, After By-Product Credits ($/lb) Driving Value Through Innovative Growth & Cost Reduction Safford/Lone Star NOTE: Refer to non-GAAP disclosure on slide 2. e = estimate.

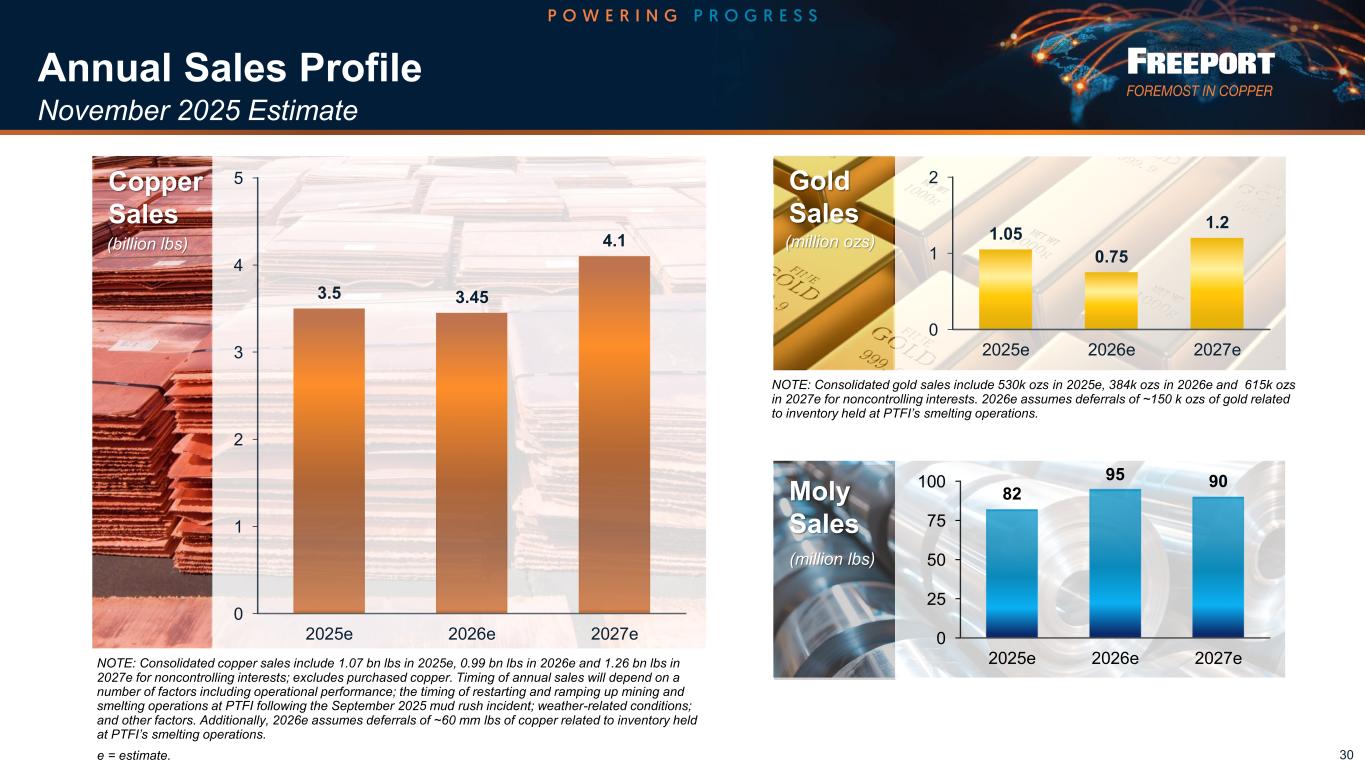

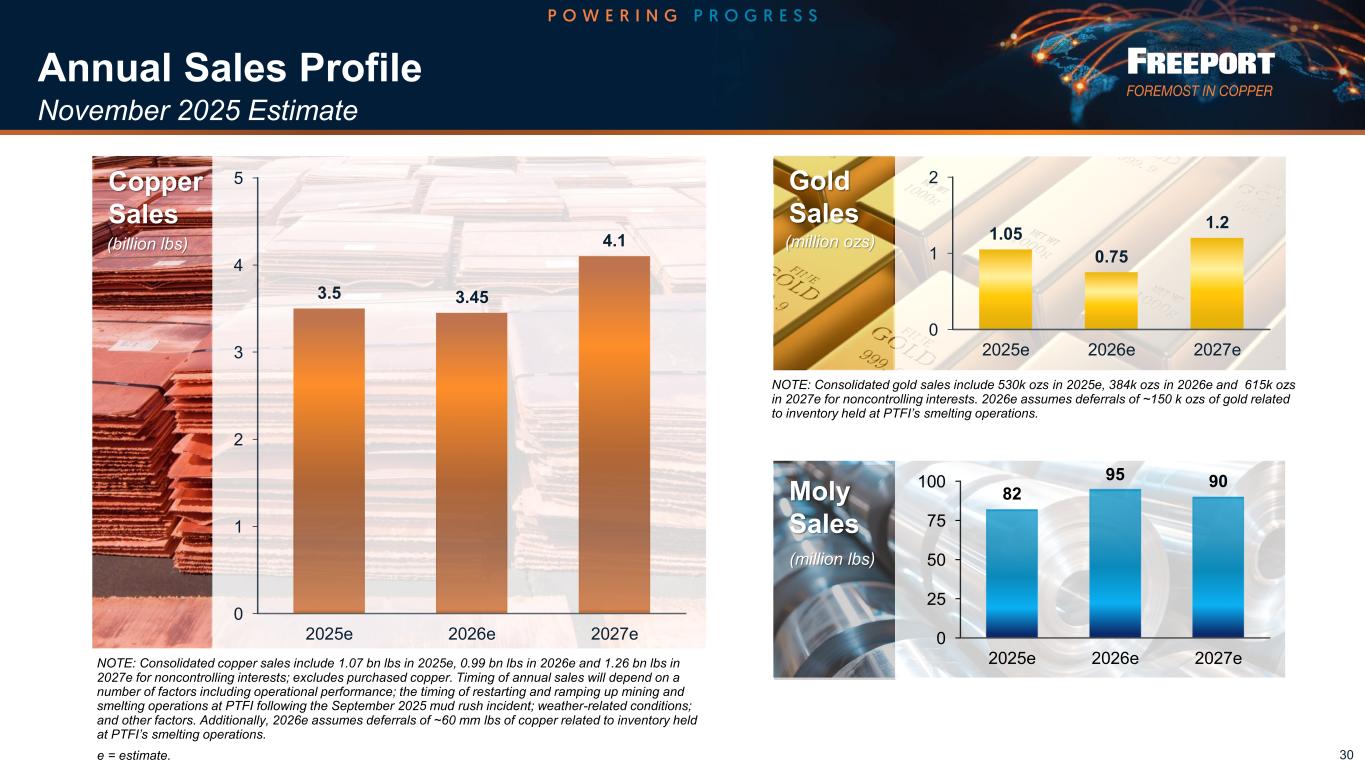

Annual Sales Profile November 2025 Estimate 30 NOTE: Consolidated copper sales include 1.07 bn lbs in 2025e, 0.99 bn lbs in 2026e and 1.26 bn lbs in 2027e for noncontrolling interests; excludes purchased copper. Timing of annual sales will depend on a number of factors including operational performance; the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident; weather-related conditions; and other factors. Additionally, 2026e assumes deferrals of ~60 mm lbs of copper related to inventory held at PTFI’s smelting operations. e = estimate. NOTE: Consolidated gold sales include 530k ozs in 2025e, 384k ozs in 2026e and 615k ozs in 2027e for noncontrolling interests. 2026e assumes deferrals of ~150 k ozs of gold related to inventory held at PTFI’s smelting operations. (million lbs) Moly Sales (billion lbs) Copper Sales 0 1 2 3 4 5 2025e 2026e 2027e 3.5 3.45 4.1 0 25 50 75 100 2025e 2026e 2027e 82 95 90 0 1 2 2025e 2026e 2027e 1.05 0.75 1.2 Gold Sales (million ozs)

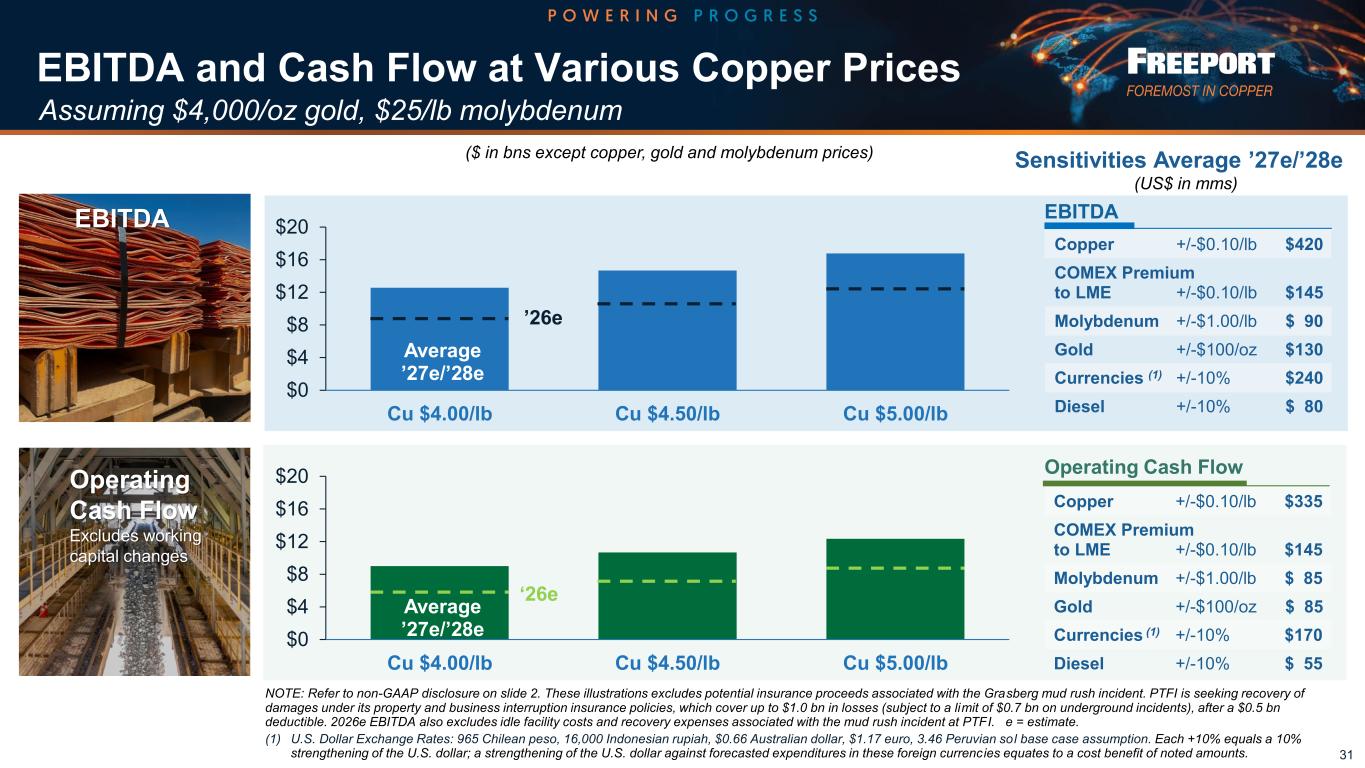

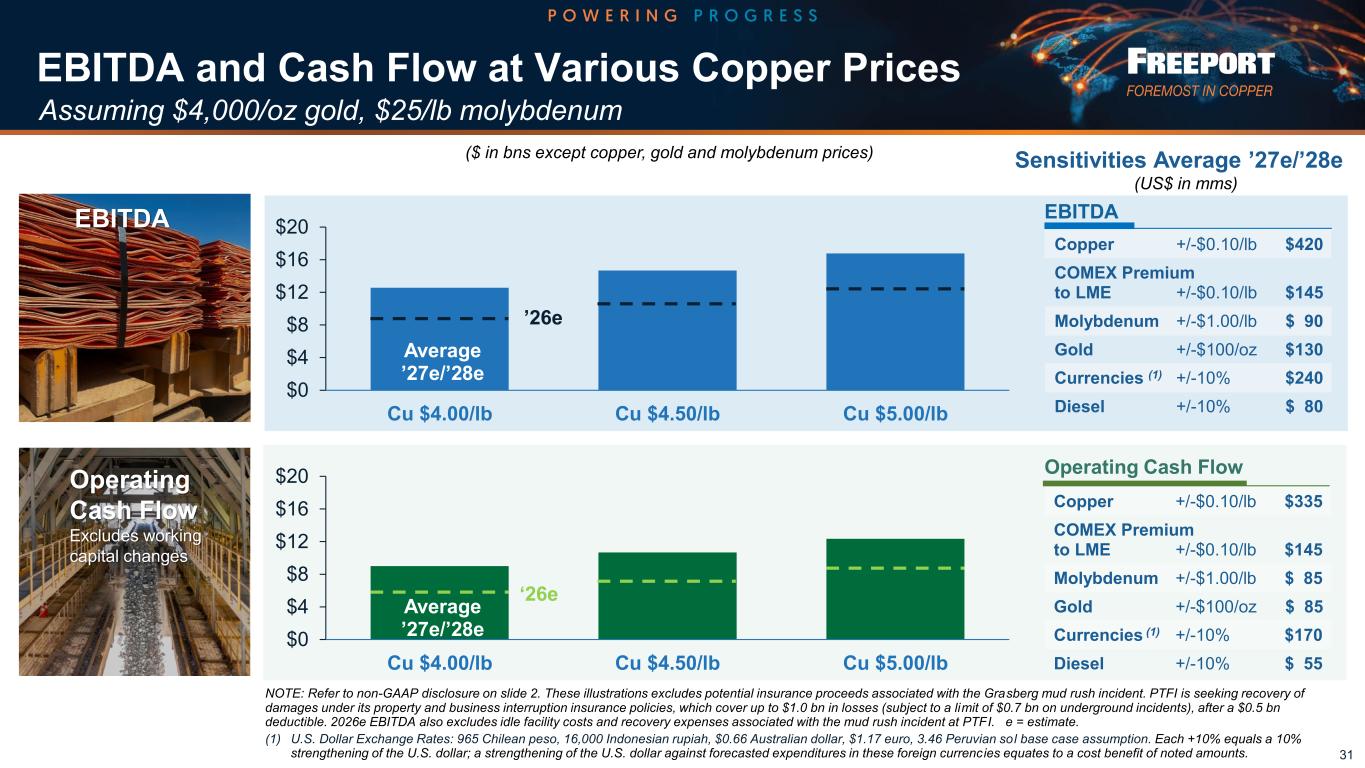

$0 $4 $8 $12 $16 $20 Cu $4.00/lb Cu $4.50/lb Cu $5.00/lb Average ’27e/’28e EBITDA and Cash Flow at Various Copper Prices Assuming $4,000/oz gold, $25/lb molybdenum 31 NOTE: Refer to non-GAAP disclosure on slide 2. These illustrations excludes potential insurance proceeds associated with the Grasberg mud rush incident. PTFI is seeking recovery of damages under its property and business interruption insurance policies, which cover up to $1.0 bn in losses (subject to a limit of $0.7 bn on underground incidents), after a $0.5 bn deductible. 2026e EBITDA also excludes idle facility costs and recovery expenses associated with the mud rush incident at PTFI. e = estimate. (1) U.S. Dollar Exchange Rates: 965 Chilean peso, 16,000 Indonesian rupiah, $0.66 Australian dollar, $1.17 euro, 3.46 Peruvian sol base case assumption. Each +10% equals a 10% strengthening of the U.S. dollar; a strengthening of the U.S. dollar against forecasted expenditures in these foreign currencies equates to a cost benefit of noted amounts. ($ in bns except copper, gold and molybdenum prices) Operating Cash Flow Excludes working capital changes EBITDA Sensitivities Average ’27e/’28e (US$ in mms) EBITDA Operating Cash Flow Copper +/-$0.10/lb $335 COMEX Premium to LME +/-$0.10/lb $145 Molybdenum +/-$1.00/lb $ 85 Gold +/-$100/oz $ 85 Currencies (1) +/-10% $170 Diesel +/-10% $ 55 Copper +/-$0.10/lb $420 COMEX Premium to LME +/-$0.10/lb $145 Molybdenum +/-$1.00/lb $ 90 Gold +/-$100/oz $130 Currencies (1) +/-10% $240 Diesel +/-10% $ 80 ’26e $0 $4 $8 $12 $16 $20 Cu $4.00/lb Cu $4.50/lb Cu $5.00/lb Average ’27e/’28e ‘26e

Consolidated Capital Expenditures Excluding Indonesia Downstream Projects CAPEX (1) 2024 2025e 2026e Major Projects (1) CAPEX for PTFI’s downstream processing facilities includes $1.2 bn in 2024 and $0.6 bn in 2025e. (2) Planned projects primarily include CAPEX associated with Grasberg underground development, supporting mill and power capital costs and a portion of spending on the new gas-fired combined cycle facility. NOTE: Amounts include capitalized interest. Discretionary CAPEX and spending on downstream processing facilities will be excluded from the free cash flow calculation for purposes of the performance- based payout framework. e= estimate. $1.6 $0.95 Planned (2) Discretionary Planned (2) Discretionary $1.35 $3.9 Other Other $1.5 $1.1 Planned (2) Discretionary $1.0 $3.6 Other $1.3 $1.3 $1.5 $4.1 41% 20% 12% 15% 12% Kucing Liar Bagdad Early Works Grasberg Energy Transition Atlantic Copper CirCular Other 2026e Projected Discretionary Spending by Project 2025e ($ in bns) 32 46% 39% 10% 5% Note: Other includes Grasberg Mill Recovery (2025), Safford 120k stacking and leach innovation spending.

33 Freeport – Store of Value Significant Gold Producer Organic Growth Pipeline Leadership Position in Critical Metal Large Scale Producer Strong Global Leader with Valuable U.S. Franchise

34 Reference Slides

Grasberg Block Cave Drawbell Drilling Undercut Ring DrillingCave Muckpile Air Gap Undercut Level 2850m Elevation Extraction Level 2830m Elevation Service Level 2810m Elevation Rail Haulage Level 2760m Elevation Orepass Chute GalleryOre Train Slot Raise Grizzly & Rock Breaker Drawpoints Loading Chute Drawbell Development Diagram • Undercut Level – initiates cave by removing rock beneath mining block • Extraction Level – active mining where broken rock gravitates through drawbells to drawpoints • Service Level – hosts ore passes, ventilation systems and other support infrastructure • Haulage Level – transports ore to primary crushers via rail systems • Drainage Level* – handles water discharge & dewatering operations Mining Levels 35 Development Overview * Drainage level (not shown at left) is located 50 meters below Haulage Level at 2710 m elevation

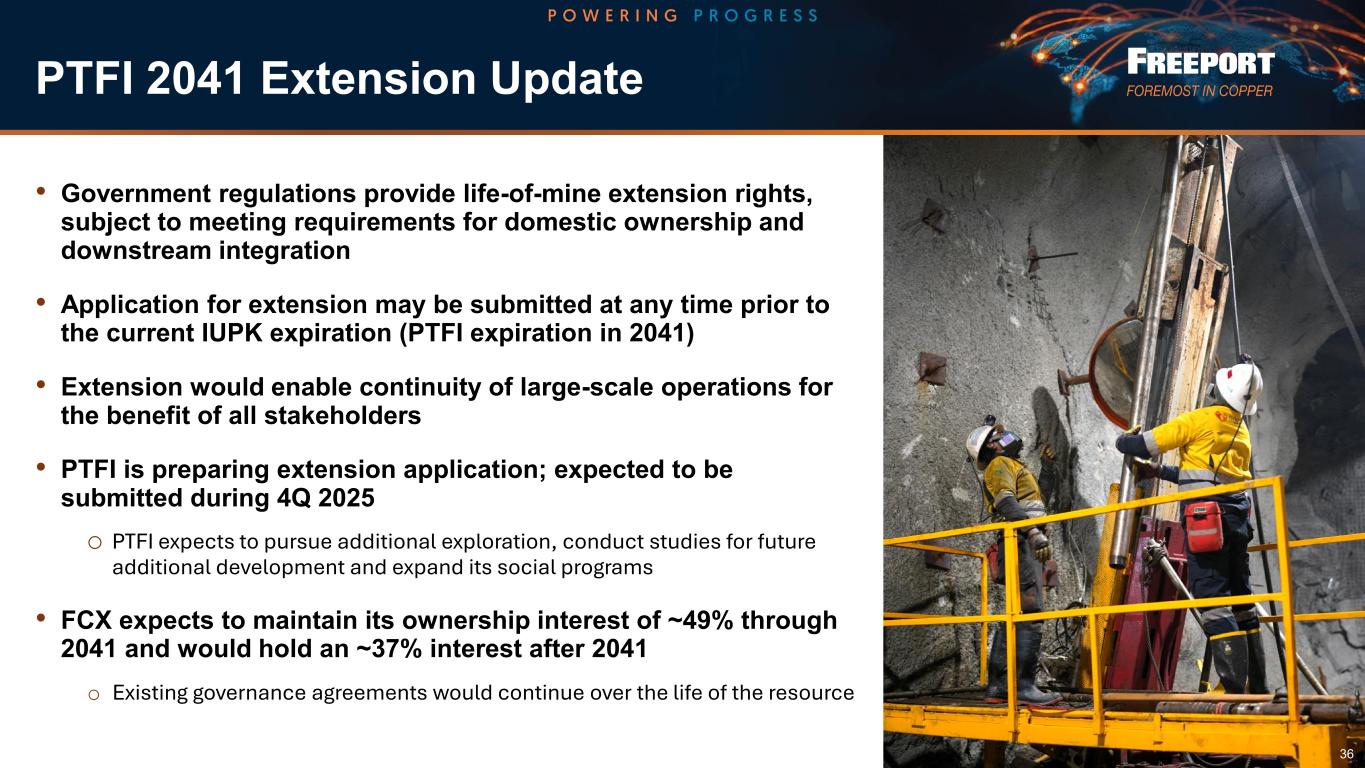

PTFI 2041 Extension Update • Government regulations provide life-of-mine extension rights, subject to meeting requirements for domestic ownership and downstream integration • Application for extension may be submitted at any time prior to the current IUPK expiration (PTFI expiration in 2041) • Extension would enable continuity of large-scale operations for the benefit of all stakeholders • PTFI is preparing extension application; expected to be submitted during 4Q 2025 o PTFI expects to pursue additional exploration, conduct studies for future additional development and expand its social programs • FCX expects to maintain its ownership interest of ~49% through 2041 and would hold an ~37% interest after 2041 o Existing governance agreements would continue over the life of the resource 36

Freeport ̶ America’s Copper Champion 37 • Strong U.S. franchise • Long-standing history in U.S. dating back to late 1800s • Dominant U.S. copper producer o Operations account for ~70% of total U.S. refined production o Integrated producer with smelter, refineries and rod mills • Proven track record of trust with communities • One of the largest U.S. copper resource positions • Uniquely positioned to increase U.S. copper production o Innovative leach opportunities o Portfolio of brownfield expansions • Employs over 39,000 workers in the U.S. (including 25,000 contractors) • U.S. represents approximately one-third of FCX’s copper production, 43% of reserves and 46% of copper resources Upstream copper mines with SX/EW facilities Downstream smelting and refining facilities EL PASO Copper Refinery and Rod Mill CHINO TYRONE MORENCI BAGDAD SAFFORD/LONE STAR SIERRITA MIAMI Mine, Copper Rod Plant & Smelter Fully integrated operations in Southwest U.S. ARIZONA NEW MEXICO TEXAS

2025e Outlook 38 (1) Excludes idle facility costs and recovery expenses associated with the mud rush incident at PTFI. (2) Assumes average prices of $4,000/oz gold and $25/lb molybdenum for 4Q25e. (3) 2025e consolidated unit net cash costs include 10¢/lb for PTFI export duties and exclude idle facility costs. (4) For 4Q25e each $100/oz change in gold is estimated to have an approximate $15 mm impact and each $2/lb change in molybdenum is estimated to have an approximate $30 mm impact. (5) Major projects CAPEX includes $0.95 bn for planned projects and $1.35 bn of discretionary projects. NOTE: Projected copper and gold sales and unit net cash costs are dependent on operational performance; the timing of restarting and ramping up mining and smelting operations at PTFI following the September 2025 mud rush incident; weather-related conditions; timing of shipments and other factors. e = estimate. Refer to non-GAAP disclosure on slide 2. • Copper: 3.5 billion lbs • Gold: 1.05 million ozs • Molybdenum: 82 million lbs | Sales Outlook • Site prod. & delivery(1) o 2025e: $2.77/lb o 4Q25e: $3.21/lb • After by-product credits(2) o 2025e: $1.68/lb(3) o 4Q25e: $2.47/lb | Unit Net Cash Cost of Copper • $3.9 billion (excluding PTFI’s downstream projects) o $2.3 billion for major projects(5) o $1.6 billion for other projects | Capital Expenditures • ~$5.5 billion @ $4.75/lb copper for 4Q25e • Each 10¢/lb change in copper for 4Q25e = $80 million impact | Operating Cash Flows (2,4)

2026 Sales Estimates South America 32% United States 40% Indonesia 28% 2H26e ~60% 1H26e ~40% 2H26e ~80% 1H26e ~20% Copper Sales Gold Sales By Region By Half 3.45 bn lbs 3.45 bn lbs 750k ozs e = estimate. 39 By Half

40