Document

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

FIRST AMENDMENT TO

LOAN AND SECURITY AGREEMENT

This FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Agreement”) is entered into as of May 7, 2025 by and among (a) SILICON VALLEY BANK, A DIVISION OF FIRST-CITIZENS BANK & TRUST COMPANY (“Bank”), (b) MITEK SYSTEMS, INC., a Delaware corporation (“Parent”), (c) A2IA CORP., a Delaware corporation (“A2IA”), and (d) ID R&D, INC., a New York corporation (“ID R&D”; together with Parent and A2IA, jointly and severally, individually and collectively, “Borrower”).

RECITALS

A. Bank and Borrower have entered into that certain Loan and Security Agreement dated as of February 13, 2024 (as the same may from time to time be amended, modified, supplemented or restated, the “Loan Agreement”). Bank has extended credit to Borrower for the purposes permitted in the Loan Agreement.

B. Borrower has requested that Bank amend the Loan Agreement to (i) incorporate a new facility to draw Term Loan Advance(s) in an aggregate principal amount of up to Seventy-Five Million Dollars ($75,000,000), (ii) reduce the aggregate principal amount available under the Revolving Line to Twenty-Five Million Dollars ($25,000,000), (iii) adjust the financial covenant set forth in Section 5.10(a) of the Loan Agreement, (iv) extend the Revolving Line Maturity Date to May 1, 2030, (v) adjust the interest rate payable pursuant to Section 1.3(a) of the Loan Agreement, and (vi) make certain other revisions to the Loan Agreement as more fully set forth herein. Bank has agreed to so amend certain provisions of the Loan Agreement, but only to the extent, in accordance with the terms, subject to the conditions and in reliance upon the representations and warranties set forth below.

AGREEMENT

Now, Therefore, in consideration of the foregoing recitals and other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, and intending to be legally bound, the parties hereto agree as follows:

1.Definitions. Capitalized terms used but not defined in this Agreement shall have the meanings given to them in the Loan Agreement.

2.Amendments to Loan Agreement.

2.1Section 1.1.2 (Term Loan). The following new Section 1.1.2 hereby is added to the Loan Agreement to read as follows:

“Section 1.1.2 Term Loan.

(a) Availability. Subject to the terms and conditions of this Agreement, upon Borrower’s request, during the Draw Period, Bank shall make term loan advances to Borrower not exceeding the Term Loan Availability Amount (each such advance is referred to herein as a “Term Loan Advance” and, collectively, as the “Term Loan Advances”). Borrower may request Term Loan Advances as set forth on Schedule I hereto.

(b) Repayment. Borrower shall repay each Term Loan Advance as set forth in Schedule I hereto. All outstanding principal and accrued and unpaid interest under each Term Loan Advance, and all other outstanding Obligations with respect to such Term Loan Advance, are due and payable in full on the Term Loan Maturity Date.

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

(c) Permitted Prepayment. Borrower shall have the option to prepay all or any portion of the Term Loan Advances, provided Borrower (i) delivers written notice to Bank of its election to prepay the Term Loan Advances or portion thereof at least ten (10) days prior to such prepayment, which shall, among other things, specify the portion of the principal amount being prepaid, (ii) pays to Bank on the date of such prepayment (A) the outstanding principal being then prepaid plus accrued and unpaid interest with respect to the portion of the Term Loan Advances being prepaid, and (B) all other sums, if any, that shall have become due and payable with respect to the portion of the Term Loan Advances being prepaid, including Lenders’ Expenses and interest at the Default Rate with respect to any past due amounts, and (iii) the portion of the Term Loan Advances being prepaid shall be a minimum of Five Million Dollars ($5,000,000) and increments of One Million Dollars ($1,000,000) (or, if less, the total principal amount outstanding under the Term Loan Advances).

(d) Mandatory Prepayment Upon an Acceleration. If the Term Loan Advances are accelerated by Bank following the occurrence and during the continuance of an Event of Default, Borrower shall immediately pay to Bank an amount equal to the sum of (i) all outstanding principal plus accrued and unpaid interest with respect to the Term Loan Advances, and (ii) all other sums, if any, that shall have become due and payable with respect to the Term Loan Advances, including interest at the Default Rate with respect to any past due amounts.”

2.2Section 1.3 (Payment of Interest on the Credit Extensions). Subsections (a) and (b) of Section 1.3 of the Loan Agreement hereby are amended and restated in their entirety to read as follows:

“(a) Interest Payments.

(i) Advances. Interest on the principal amount of each Advance is payable as set forth on Schedule I hereto.

(ii) Term Loan Advances. Interest on the principal amount of each Term Loan Advance is payable as set forth on Schedule I hereto.

(b) Interest Rate.

(i) Advances. Subject to Section 1.3(c), the outstanding principal amount of any Advance shall accrue interest as set forth on Schedule I hereto.

(ii) Term Loan Advances. Subject to Section 1.3(c), the outstanding principal amount of any Term Loan Advance shall accrue interest as set forth on Schedule I hereto.

(iii) All-In Rate. Notwithstanding any terms in this Agreement to the contrary, if at any time the interest rate applicable to any Obligations is less than zero percent (0.0%), such interest rate shall be deemed to be zero percent (0.0%) for all purposes of this Agreement.”

2.3Section 1.4(b) (Unused Revolving Line Facility Fee). Section 1.4(b) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(b) Unused Revolving Line Facility Fee. Payable quarterly in arrears on the last calendar day of each calendar quarter occurring prior to the Revolving Line Maturity Date, and on the Revolving Line Maturity Date, a fee (the “Unused Revolving Line Facility Fee”) in an amount equal to one quarter of one percentage point (0.25%) per annum of the average unused portion of the Revolving Line, as determined by Bank, computed on the basis of a year with the applicable number of days as set forth in Section 1.3(e), which shall be fully earned and non-refundable as of such date. The unused portion of the Revolving Line, for purposes of this calculation, shall be calculated on a calendar year basis and shall equal the difference between (i) the Revolving Line, and (ii) the average for the period of the daily closing balance of the Revolving Line outstanding plus the sum of the aggregate Dollar Equivalent of the face amount of outstanding Letters of Credit (including drawn but unreimbursed Letters of Credit and any Letter of Credit Reserve);”

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

2.4Section 1.8 (Procedures for Borrowing). Section 1.8 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“1.8 Procedures for Borrowing.

(a) Advances. Subject to the prior satisfaction of all other applicable conditions to the making of an Advance set forth in this Agreement, to obtain an Advance, Borrower (via an individual duly authorized by an Administrator) shall notify Bank (which notice shall be irrevocable). Such notice shall be made through Bank’s online banking platform, by electronic mail or by telephone, in each case by an individual duly authorized by an Administrator. In connection with any such notification, Borrower shall deliver to Bank by electronic mail or through Bank’s online banking program such reports and information, including without limitation, sales journals, cash receipts journals, accounts receivable aging reports, as Bank may reasonably request. Together with any such electronic notification, Borrower shall deliver to Bank by electronic mail a completed Notice of Borrowing executed by an Authorized Signer or his or her designee. Bank shall have received satisfactory evidence that the Board has approved that such Authorized Signer may provide such notices and request Advances (which requirement may be deemed satisfied by the prior delivery of Borrowing Resolutions or a secretary’s certificate that certifies as to such Board approval). Such Notice of Borrowing must be received by Bank prior to 12:00 p.m. Pacific time, (a) at least three (3) U.S. Government Securities Business Days prior to the requested Funding Date, in the case of any SOFR Advance, and (b) one (1) Business Day prior to the requested Funding Date, in the case of a Prime Rate Advance, specifying: (i) the amount of the Advance; (ii) the requested Funding Date; (iii) whether the Advance is to be comprised of SOFR Advances or Prime Rate Advances; and (iv) the duration of the Interest Period applicable to any such SOFR Advances included in such notice. If no Interest Period is specified with respect to any requested SOFR Advance, Borrower shall be deemed to have selected an Interest Period of one month’s duration.

(b) Term Loan Advances. Subject to the prior satisfaction of all other applicable conditions to the making of a Term Loan Advance set forth in this Agreement (which must be satisfied no later than 12:00 p.m. Pacific time on the applicable Funding Date), to obtain a Term Loan Advance, Borrower shall notify Bank (which notice shall be irrevocable). Such notice shall be made through Bank’s online banking platform, by electronic mail or by telephone, in each case by an individual duly authorized by an Administrator. In connection with any such notification, Borrower shall deliver to Bank by electronic mail or through Bank’s online banking platform a completed Payment/Advance Form executed by an Authorized Signer and such other reports and information as Bank may reasonably request. Such Payment/Advance Form must be received by Bank prior to 12:00 p.m. Pacific time, (a) at least three (3) U.S. Government Securities Business Days prior to the requested Funding Date, in the case of any SOFR Advance, and (b) one (1) Business Day prior to the requested Funding Date, in the case of a Prime Rate Advance, specifying: (i) the amount of the Term Loan Advance; (ii) the requested Funding Date; (iii) whether the Term Loan Advance is to be comprised of SOFR Advances or Prime Rate Advances; and (iv) the duration of the Interest Period applicable to any such SOFR Advances included in such notice. If no Interest Period is specified with respect to any requested SOFR Advance, Borrower shall be deemed to have selected an Interest Period of one month’s duration.

(c) Bank shall credit proceeds of a Credit Extension to the Designated Deposit Account. Bank may make Advances and Term Loan Advances under this Agreement based on instructions from an Authorized Signer or without instructions if such Advances or Term Loan Advances are necessary to meet Obligations which have become due.”

2.5Section 2.2 (Conditions Precedent to all Credit Extensions). Section 2.2 of the Loan Agreement hereby is amended by (i) deleting the word “and” from the end of clause (b) therein, (ii) replacing the “.” with “; and” at the end of clause (c) therein, and (iii) adding new clause (d) to read as follows: “(d) with respect to any Term Loan Advance, evidence satisfactory to Bank that the proceeds of such Term Loan Advance have been disbursed directly in payment of amounts outstanding under the 2026 Convertible Senior Notes, or otherwise into a Deposit Account or Securities Account maintained by Borrower with Bank.”

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

2.6Section 2.4 (Conversion and Continuation Elections; Limitations on SOFR Tranches). Subsections (d) and (e) of Section 2.4 of the Loan Agreement hereby are amended and restated in their entirety to read as follows:

“(d) After the occurrence and during the continuance of an Event of Default, (i) Borrower may not elect to have an Advance or Term Loan Advance be made or continued as, or converted to, a SOFR Advance, after the expiration of any Interest Period then in effect for such Advance or Term Loan Advance, as applicable, and (ii), any Notice of Conversion/Continuation given by Borrower with respect to a requested conversion/continuation that has not yet occurred shall, at Bank’s option, be deemed to be rescinded by Borrower and be deemed a request to convert or continue Advances or Term Loan Advance, as applicable, referred to therein as Prime Rate Advances.

(e) Subject to the prior satisfaction of all other applicable conditions to the conversion or continuation of an Advance or Term Loan Advance, as applicable, set forth in this Agreement, a Notice of Conversion/Continuation of a SOFR Advance that requests a conversion of a Prime Rate Advance to a SOFR Advance, continuation of a SOFR Advance or conversion of a SOFR Advance to a Prime Rate Advance must specify: (i) the amount of the Advance or Term Loan Advance, as applicable, to be converted or continued; (ii) the requested conversion or continuation date; (iii) the nature of the proposed conversion or continuation; (iv) in the case of a continuation of a SOFR Advance or a conversion of a Prime Rate Advance to a SOFR Advance, the duration of the Interest Period applicable for such Advance or Term Loan Advance, as applicable; and (v) any other information requested on the form of Notice of Conversion/Continuation. In the case of a continuation of a SOFR Advance or a conversion of a Prime Rate Advance to a SOFR Advance, if no Interest Period is specified in such Notice of Conversion/Continuation, an Interest Period of one month’s duration shall be deemed to have been selected.”

2.7Section 2.5 (Special Provisions Governing SOFR Advances). Subsection (a) of Section 2.5 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(a) Inability to Determine Interest Rates. Subject to Section 2.5(b), as of any date,

(i) if Bank determines (which determination shall be conclusive and binding absent manifest error) that “Adjusted Term SOFR” cannot be determined pursuant to the definition thereof; or

(ii) Bank determines that for any reason in connection with any request for a SOFR Advance or a conversion thereto or a continuation thereof that “Adjusted Term SOFR” for any requested Interest Period with respect to a proposed SOFR Advance does not adequately and fairly reflect the cost to Bank of making and maintaining such Advance or Term Loan Advance, as applicable;

Bank will promptly so notify Borrower. Upon notice thereof by Bank to Borrower, any obligation of Bank to make and any right of Borrower to continue SOFR Advances or to convert Prime Rate Advances to SOFR Advances shall be suspended (to the extent of the affected Interest Periods) until Bank revokes such notice. Upon receipt of such notice, (x) Borrower may revoke any pending request for a borrowing of, conversion to or continuation of SOFR Advances (to the extent of the affected Interest Periods) or, failing that, Borrower will be deemed to have converted any such request into a request for an Advance or Term Loan Advance, as applicable, of or conversion to Prime Rate Advances in the amount specified therein and (y) any outstanding affected SOFR Advances will be deemed to have been converted into Prime Rate Advances at the end of the applicable Interest Period.

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

Upon any such conversion, Borrower shall also pay accrued interest on the amount so converted, together with any additional amounts required pursuant to Section 2.5(c).”

2.8Section 2.6 (Illegality). Section 2.6 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“2.6 Illegality. If Bank determines that any Requirement of Law has made it unlawful, or that any Governmental Authority has asserted that it is unlawful, for Bank or its applicable lending office to make, maintain or fund Advances or Term Loan Advances whose interest is determined by reference to SOFR, the Adjusted Term SOFR, Term SOFR or the Term SOFR Reference Rate, or to determine or charge interest rates based upon SOFR, the Adjusted Term SOFR or the Term SOFR Reference Rate, then, upon notice thereof by Bank to Borrower (an “Illegality Notice”), any obligation of Bank to make, and the right of Borrower to continue SOFR Advances or to convert Prime Rate Advances to SOFR Advances, shall be suspended until Bank notifies Borrower that the circumstances giving rise to such determination no longer exist. Upon receipt of an Illegality Notice, Borrower shall, if necessary to avoid such illegality, upon demand from Bank, prepay or, if applicable, convert all SOFR Advances to Prime Rate Advances on the last day of the Interest Period therefor, if Bank may lawfully continue to maintain such SOFR Advances to such day, or immediately, if Bank may not lawfully continue to maintain such SOFR Advances to such day. Upon any such prepayment or conversion, Borrower shall also pay accrued interest on the amount so prepaid or converted, together with any additional amounts required pursuant to Section 2.5(c).”

2.9Section 5.1 (Use of Proceeds). Section 5.1 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“5.1 Use of Proceeds. Cause the proceeds of (a) the Term Loan Advances to be used solely to pay amounts outstanding under the 2026 Convertible Senior Notes and customary fees and expenses in connection therewith, (b) the Advances to be used solely as working capital or to fund its general business purposes, and (c) the Credit Extensions to not be used in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any applicable anti-corruption law.”

2.10Section 5.10(a) (Maximum Net Leverage Ratio). Section 5.10(a) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(a) Maximum Net Leverage Ratio. A Maximum Net Leverage Ratio of no greater than 2.50 to 1.00; provided that, if one or more Permitted Acquisitions are consummated during the trailing twelve-month period ended on the applicable test date, the Maximum Net Leverage Ratio shall instead be no greater than 2.75 to 1.00 for such date; and”

2.11Section 6.3 (Mergers or Acquisitions). Section 6.3 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“6.3 Mergers or Acquisitions. Merge or consolidate, or permit any of its Subsidiaries to merge or consolidate, with any other Person, or acquire, or permit any of its Subsidiaries to acquire, all or substantially all of the stock, partnership, membership, or other ownership interest or other equity securities or property of another Person (including, without limitation, by the formation of any Subsidiary or pursuant to a Division); provided, however, that (i) any Subsidiary of Parent may merge with and into a Borrower, any Subsidiary that is not a Borrower may merge with any other Person so long as in connection with a Permitted Transfer or a Permitted Investment and (ii) Permitted Acquisitions shall not be prohibited by this Section 6.3.”

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

2.12 Section 6.7 (Distributions; Investments). Section 6.7 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“6.7 Distributions; Investments. (a) Pay any dividends or make any distribution or payment or redeem, retire or purchase any stock, partnership, membership, or other equity ownership interest or other equity securities provided that Borrower or any Subsidiary may (i) convert any of its convertible securities into other securities pursuant to the terms of such convertible securities or otherwise in exchange thereof; (ii) pay dividends solely in common stock; and (iii) repurchase equity interests of the Parent in accordance with any stock repurchase plan or similar arrangement approved by the Board of Directors of Parent so long as (A) Bank has received evidence that Borrower is in compliance with the financial covenants set forth in Section 5.10 on a pro forma basis before and immediately after giving effect to such repurchase, and (B) an Event of Default does not exist at the time of any such repurchase and would not exist after giving effect to any such repurchase or (b) directly or indirectly make any Investment (including, without limitation, by the formation of any Subsidiary) other than Permitted Investments, or permit any of its Subsidiaries to do so.”

2.13Section 6.11 (Term Loan Proceeds). The following new Section 6.11 hereby is added to the Loan Agreement to read as follows:

“6.11 Term Loan Proceeds. To the extent any Term Loan Advance has been funded into Deposit Account or Securities Account maintained by Borrower with Bank, disburse such proceeds for any purpose except in payment of amounts outstanding under the 2026 Convertible Senior Notes (as determined by Bank in its commercially reasonable discretion), either directly or to the trustee of the 2026 Convertible Senior Notes for the purpose of making such payment, and in payment of customary fees and expenses in connection therewith.”

2.14Section 7.1 (Payment Default). Section 7.1 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“7.1 Payment Default. Borrower fails to (a) make any payment of principal on any Credit Extension on its due date, or (b) pay any interest on any Credit Extension and any other Obligations within three (3) Business Days after such Obligations are due and payable (which three (3) Business Day cure period shall not apply to payments due on the Revolving Line Maturity Date or the Term Loan Maturity Date). During the cure period, the failure to make or pay any payment specified under clause (b) hereunder is not an Event of Default (but no Credit Extension will be made during the cure period);”

2.15Section 12.2 (Definitions). The following terms and their respective definitions hereby are added or amended and restated in their entirety in Section 12.2 of the Loan Agreement, as appropriate, to read as follows:

““Bank Services” are any products, credit services, and/or financial accommodations previously, now, or hereafter provided to Borrower or any of its Subsidiaries by Bank or any Bank Affiliate, including, without limitation, any letters of credit, cash management services (including, without limitation, merchant services, direct deposit of payroll, business credit cards, and check cashing services), Specified Swap Agreements, interest rate swap arrangements, and foreign exchange services as any such products or services may be identified in Bank’s various agreements related thereto (each, a “Bank Services Agreement”), and shall include, without limitation, any Letters of Credit pursuant to Section 1.1.1.

“Credit Extension” is any Advance, Overadvance, Letter of Credit, FX Contract, amount utilized for cash management services, Term Loan Advance, or any other extension of credit by Bank for Borrower’s benefit.

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

“First Amendment Effective Date” means May 7, 2025.

“Interest Period” means, (a) initially, the period commencing on the borrowing or conversion date, as the case may be, with respect to such SOFR Advance and ending on the numerically corresponding day in the month that is one, three or six months thereafter, as selected by Borrower in its Notice of Borrowing or Notice of Conversion/Continuation, as the case may be, given with respect thereto; and (b) thereafter, each period commencing on the last day of the next preceding Interest Period applicable to such SOFR Advance and ending on the numerically corresponding day in the month that is one, three or six months thereafter, as selected by Borrower in a Notice of Conversion/Continuation delivered to Bank not later than 12:00 p.m. Pacific time on the date that is three (3) U.S. Government Securities Business Days prior to the last day of the then current Interest Period with respect thereto; provided that all of the foregoing provisions relating to Interest Periods are subject to the following:

(i) if any Interest Period would otherwise end on a day that is not a Business Day, such Interest Period shall be extended to the next succeeding Business Day unless the result of such extension would be to carry such Interest Period into another calendar month in which event such Interest Period shall end on the immediately preceding Business Day;

(ii) Borrower may not select an Interest Period that would extend beyond the Revolving Termination Date (in the case of Advances) or beyond the Term Loan Maturity Date (in the case of Term Loan Advances);

(iii) any Interest Period that begins on the last Business Day of a calendar month (or on a day for which there is no numerically corresponding day in the calendar month at the end of such Interest Period) shall end on the last Business Day of the last calendar month of such Interest Period; and

(iv) no tenor that has been removed from this definition pursuant to Section 2.5(b) shall be available for specification in any Notice of Borrowing or Notice of Conversion/Continuation.

“Obligations” are Borrower’s obligations to pay when due any debts, principal, interest, fees, Bank Expenses, the Unused Revolving Line Facility Fee, and other amounts Borrower owes Bank (or in the case of any Specified Swap Agreement, a Qualified Counterparty) now or later, whether under this Agreement, the other Loan Documents, or otherwise, including, without limitation, all obligations relating to Bank Services and interest accruing after Insolvency Proceedings begin and debts, liabilities, or obligations of Borrower assigned to Bank, and to perform Borrower’s duties under the Loan Documents.

“Prime Rate Advance” means an Advance or Term Loan Advance the rate of interest applicable to which is based on upon the Prime Rate.

“Qualified Cash” means, at any time, the sum of the aggregate amount of Borrower’s and its Subsidiaries (a) unrestricted cash and Cash Equivalents held at such time in Deposit Accounts or Securities Accounts maintained with Bank, plus (b) unrestricted cash and Cash Equivalents held at such time at financial institutions other than Bank (subject at all times to a Control Agreement), which in no event shall the sum of (a) and (b) for the purposes of this defined term “Qualified Cash” exceed the aggregate Dollar Equivalent value of the Qualified Cash Percentage of all account balances of Borrower and its Subsidiaries maintained at all financial institutions globally.

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

“Qualified Cash Percentage” means, at any time, (a) if the 2026 Convertible Senior Notes remain outstanding, and a Term Loan Advance was funded at or before such time, seventy percent (70%), or (b) otherwise, fifty percent (50%).

“Qualified Counterparty” means with respect to any Specified Swap Agreement, any counterparty thereto that is Bank or a Bank Affiliate or, at the time such Specified Swap Agreement was entered into or as of the Closing Date, was Bank or a Bank Affiliate.

“SOFR Advance” means an Advance or Term Loan Advance the rate of interest applicable to which is based on the Term SOFR.

“SOFR Tranche” means the collective reference to SOFR Advances the then current Interest Periods with respect to all of which begin on the same date and end on the same later date (whether or not such Advances or Term Loan Advance, as applicable, shall originally have been made on the same day).

“Specified Swap Agreement” means any Swap Agreement entered into by Borrower and any Qualified Counterparty (or any Person who was a Qualified Counterparty as of the First Amendment Effective Date or as of the date such Swap Agreement was entered into).

“Swap Agreement” means any agreement with respect to any swap, hedge, forward, future or derivative transaction or option or similar agreement involving, or settled by reference to, one or more rates, currencies, commodities, equity or debt instruments or securities, or economic, financial or pricing indices or measures of economic, financial or pricing risk or value or any similar transaction or any combination of these transactions; provided that no phantom stock or similar plan providing for payments only on account of services provided by current or former directors, officers, employees or consultants of the Borrower and its Subsidiaries shall be deemed to be a “Swap Agreement”.

“Term Loan Advance” and “Term Loan Advances” are each defined in Section 1.1.2(a) of this Agreement.

“Term Loan Amortization Date” is set forth on Schedule I hereto.

“Term Loan Amount” means as of any date of determination, the aggregate principal amount of all outstanding Term Loan Advances.

“Term Loan Availability Amount” is set forth on Schedule I hereto.

“Term Loan Maturity Date” is set forth on Schedule I hereto.”

2.16Section 12.2 (Permitted Acquisition). Clause (d) of the definition of “Permitted Acquisition” and “Permitted Acquisitions” in Section 12.2 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(d) Bank has received evidence that Borrower is in compliance with the financial covenants set forth in Section 5.10 on a pro forma basis immediately after giving effect to such acquisition;”

2.17Section 12.2 (Permitted Indebtedness). The definition of “Permitted Indebtedness” in Section 12.2 of the Loan Agreement hereby is amended by (i) deleting the word “and” from the end of clause (o) therein, (ii) deleting clause (p) in its entirety, and (iii) adding new clauses (p), (q), (r) and (s) to read as follows: “(p) obligations (contingent or otherwise) of the Borrower or any of its Subsidiaries existing or arising under any Specified Swap Agreement, provided that such obligations are (or were) not entered into by such Person for purposes of speculation;

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

(q) Indebtedness of any Foreign Subsidiary (which is not a Borrower) owing to any other Foreign Subsidiary (which is not a Borrower);

(r) interest-free Indebtedness of any Foreign Subsidiary (which is not a Borrower) owed to the government of Spain and obtained in connection with research and development; and

(s) extensions, refinancings, modifications, amendments and restatements of any items of Permitted Indebtedness (a) through (r) above, provided that the principal amount thereof is not increased or the terms thereof are not modified to impose more burdensome terms upon Borrower or its Subsidiary, as the case may be.”

2.18Section 12.2 (Permitted Investments). Clause (h) of the definition of “Permitted Investments” in Section 12.2 of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(h) Investments (i) by Borrower in (A) Borrower or a Guarantor, (B) Foreign Subsidiaries in the aggregate in any fiscal year, not to exceed Five Million Dollars ($5,000,000) in the aggregate in any fiscal year, and (B) Domestic Subsidiaries that are not co-Borrowers or Guarantors of the Obligations not to exceed One Million Dollars ($1,000,000) in the aggregate in any fiscal year, and (ii) by Subsidiaries not a co-Borrower or a Guarantor (A) in other Subsidiaries not a co-Borrower or a Guarantor, or (B) in Borrower or a Guarantor;”

2.19Section 12.2 (Definitions). The following defined term and its respective definition hereby is deleted from Section 12.2 and the balance of the Loan Agreement in its entirety: “Term SOFR Adjustment”.

2.20Schedule I (LSA Provisions). The LSA Provisions set forth in Schedule I to the Loan Agreement hereby is replaced with Schedule I attached hereto.

2.21Exhibit A (Compliance Statement). The Compliance Statement set forth in Exhibit A to the Loan Agreement hereby is replaced with Exhibit A attached hereto.

2.22Exhibit B-1 (Form of Notice of Borrowing). The Notice of Borrowing set forth in Exhibit B-1 to the Loan Agreement hereby is replaced with Exhibit B-1 attached hereto.

2.23Exhibit B-2 (Form of Notice of Conversion/Continuation). The Notice of Conversion/ Continuation set forth in Exhibit B-2 to the Loan Agreement hereby is replaced with Exhibit B-2 attached hereto.

3.Limitation of Agreement.

3.1This Agreement is effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right or remedy which Bank may now have or may have in the future under or in connection with any Loan Document.

3.2This Agreement shall be construed in connection with and as part of the Loan Documents, and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents, except as herein amended, are hereby ratified and confirmed and shall remain in full force and effect.

4.Representations and Warranties. To induce Bank to enter into this Agreement, Borrower hereby represents and warrants to Bank as follows:

4.1Immediately after giving effect to this Agreement (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct as of such date), and (b) no Default or Event of Default has occurred and is continuing. Borrower understands and agrees that in modifying the existing Obligations, Bank is relying upon Borrower’s representations, warranties, and agreements, as set forth in the Loan Documents;

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

4.2Borrower has the power and authority to execute and deliver this Agreement and to perform its obligations under the Loan Agreement, as amended by this Agreement;

4.3The organizational documents of Borrower delivered to Bank on the Effective Date remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

4.4The execution and delivery by Borrower of this Agreement and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Agreement, have been duly authorized by all necessary action on the part of Borrower; and

4.5This Agreement has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

5.Updated Perfection Certificate. In connection with this Agreement, Borrower has delivered an updated Perfection Certificate (the “Updated Perfection Certificate”). Borrower and Bank acknowledge and agree that, from and after the date of this Agreement, each reference in the Loan Documents to the “Perfection Certificate” shall be deemed to be a reference to the Updated Perfection Certificate. Borrower acknowledges, confirms and agrees the disclosures and information Borrower provided to Bank in the Updated Perfection Certificate have not changed as of the date hereof.

6.Prior Agreement. The Loan Documents are hereby ratified and reaffirmed and shall remain in full force and effect. Borrower hereby ratifies, confirms, and reaffirms all terms and conditions of all security or other collateral granted to the Bank, and confirms that the indebtedness secured thereby includes, without limitation, the Obligations. This Agreement is not a novation and the terms and conditions of this Agreement shall be in addition to and supplemental to all terms and conditions set forth in the Loan Documents. In the event of any conflict or inconsistency between this Agreement and the terms of such documents, the terms of this Agreement shall be controlling, but such document shall not otherwise be affected or the rights therein impaired.

7.Integration. Except as expressly modified pursuant to this Agreement, the terms of the Loan Documents remain unchanged and in full force and effect. This Agreement and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements. All prior agreements, understandings, representations, warranties, and negotiations between the parties about the subject matter of this Agreement and the Loan Documents merge into this Agreement and the Loan Documents.

8.Fees and Expenses. Borrower shall pay to Bank on the date first listed above (a) all Bank Expenses due and owing as of the date hereof, provided that Borrower has been invoiced for such Bank Expenses, and (b) a commitment fee in an amount equal to One Hundred Twenty-Five Thousand Dollars ($125,000) (which fee shall be fully earned by Bank upon the execution and delivery of this Agreement by the parties hereto and non-refundable). The fees and expenses listed in the previous sentence may be debited from any of Borrower’s accounts at Bank.

9.Conditions to Effectiveness. The parties agree that the obligations of Bank herein shall be effective upon the satisfaction of each of the following conditions precedent, each in form and substance satisfactory to Bank in its sole discretion, on or prior to the date first listed above: (a) the due execution and delivery to Bank of (i) this Agreement by each party hereto, and (ii) the Updated Perfection Certificate, and (b) Bank’s receipt of (i) copies, certified in a certificate executed by a duly authorized officer of Borrower to be true and complete as of the date hereof, of each of (A) the governing documents of Borrower as in effect on the date hereof, (B) the resolutions of Borrower authorizing the execution and delivery of this Agreement, the other documents executed in connection herewith and Borrower’s performance of all of the transactions contemplated hereby, and (C) an incumbency certificate giving the name and bearing a specimen signature of each individual who shall be so authorized on behalf of Borrower, (ii) a good standing certificate of Borrower, certified by the Secretary of State of the state of incorporation of Borrower and each jurisdiction in which Borrower is qualified to do business, dated as of a date no earlier than thirty (30) days prior to the date hereof, (iii) certified copies, dated as of a recent date, of financing statement and other lien searches of Borrower, as Bank may request and which shall be obtained by Bank, accompanied by written evidence (including any UCC termination statements) that the Liens revealed in any such searched either (A) will be terminated prior to or in connection with the execution of this Agreement, or (B) in the sole discretion of Bank, will constitute Permitted Liens, (iv) a legal opinion of Borrower’s counsel dated as of the date of this Agreement, and (v) the payment of all fees and expenses owing by Borrower to Bank under Section 8 above.

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

10.Notices. Borrower hereby notifies Bank of its updated mailing and electronic mail address set forth below for delivery of notices pursuant to Section 9 of the Loan Agreement:

If to Borrower: MITEK SYSTEMS, INC., on behalf of each Borrower

770 First Street, Suite 425

San Diego, CA 92101

Attn: Andrea Williston, Head of Treasury

Email: awilliston@miteksystems.com

And: Jason Gray, Chief Legal Officer

Email: jgray@miteksystems.com

with a copy to (which shall not constitute notice):

Barnes & Thornburg LLP

1600 West End Avenue, Suite 800

Nashville, TN 37203

Attn: Vincent Lillegard

Email: vincent.lillegard@btlaw.com

11.Post-Closing Obligation. Borrower shall deliver to Bank, in form and substance satisfactory to Bank: (a) within thirty (30) days after the date of this Agreement (or such later date as Bank may approve in writing), evidence that the insurance policies required for Borrower are in full force and effect, together with appropriate evidence showing lender loss payable, notice of cancellation, and additional insured clauses or endorsements in favor of Bank; and (b) within sixty (60) days after the date of this Agreement (or such later date as Bank may approve in writing), evidence that any federal tax lien filed with the New York Department of State against ID R&D and outstanding on the date hereof has been released of record in full.

12.Miscellaneous.

12.1This Agreement shall constitute a Loan Document under the Loan Agreement; the failure to comply with the covenants contained herein shall constitute an Event of Default under the Loan Agreement; and all obligations included in this Agreement (including, without limitation, all obligations for the payment of principal, interest, fees, and other amounts and expenses) shall constitute obligations under the Loan Agreement and secured by the Collateral.

12.2Each provision of this Agreement is severable from every other provision in determining the enforceability of any provision.

12.3This Agreement may be executed in any number of counterparts and all of such counterparts taken together shall be deemed to constitute one and the same instrument.

12.4The Loan Documents are hereby amended wherever necessary to reflect the changes described above.

12.5Section 11.9 of the Loan Agreement applies to this Agreement.

12.6This Agreement and the rights and obligations of the parties hereto shall be governed by and construed in accordance with the laws of the State of California.

[Signature page follows.]

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

In Witness Whereof, the parties hereto have caused this Agreement to be duly executed and delivered as of the date first written above.

|

|

|

|

|

|

| BANK |

BORROWER |

|

FIRST-CITIZENS BANK & TRUST COMPANY

By: /s/ Kelly Schramm

Name: Kelly Schramm

Title: Managing Director

|

MITEK SYSTEMS, INC.

By: /s/ Jason Gray

Name: Jason Gray

Title: Secretary

A2IA CORP.

By: /s/ Jason Gray

Name: Jason Gray

Title: Secretary

ID R&D, INC.

By: /s/ Jason Gray

Name: Jason Gray

Title: Secretary

|

[Signature Page to First Amendment to Loan and Security Agreement]

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

SCHEDULE I

LSA PROVISIONS

|

|

|

|

|

|

| LSA Section |

LSA Provision |

1.1(a) – Revolving Line – Availability |

Amounts borrowed under the Revolving Line may be prepaid or repaid and, prior to the Revolving Line Maturity Date, reborrowed, subject to the applicable terms and conditions precedent herein. |

| 1.1.1(a) – Letter of Credit Sublimit |

The aggregate Dollar Equivalent of the face amount of outstanding Letters of Credit (including drawn but unreimbursed Letters of Credit and any Letter of Credit Reserve) may not exceed Five Million Dollars ($5,000,000). |

| 1.1.2(a) – Term Loan – Availability |

Each Term Loan Advance must be in an amount equal to at least Ten Million Dollars ($10,000,000) and increments of One Million Dollars ($1,000,000), or such lesser amount as remains available. After repayment, no Term Loan Advance (or any portion thereof) may be reborrowed. |

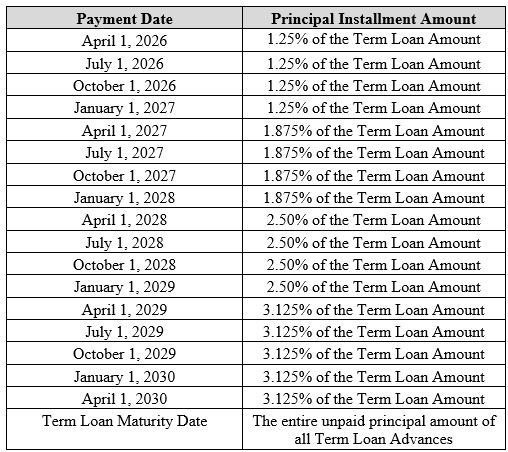

| 1.1.2(b) – Term Loan – Repayment |

Commencing on the Term Loan Amortization Date, Borrower shall repay the Term Loan Advances to Bank in (i) quarterly installments of principal set forth below in the column titled “Principal Installment Amount” on the date set forth immediately opposite thereto, plus (ii) payments of accrued interest at the rate set forth in Section 1.3(b)(ii):

|

1.3(a)(i) – Interest Payments – Advances |

Interest on the principal amount of each Advance is payable in arrears on each Payment Date. |

| 1.3(a)(ii) – Interest Payments – Term Loan Advances |

Interest on the principal amount of each Term Loan Advance is payable in arrears on each Payment Date commencing on the first Payment Date following the Funding Date of each such Term Loan Advance. |

1.3(b)(i) – Interest Rate – Advances |

The outstanding principal amount of any Advance shall accrue interest at, (a) with respect to any Advance that is a Prime Rate Advance, a floating rate per annum equal to the greater of (1) four and one half percent (4.50%), and (2) the Prime Rate minus the Prime Rate Margin, and (b) with respect to any Advance that is a SOFR Advance, a rate per annum equal to the greater of (1) one and one quarter percent (1.25%), and (2) Adjusted Term SOFR, plus the SOFR Rate Margin, which interest shall be payable in accordance with Section 1.3(a)(i). |

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

|

|

|

|

|

|

| LSA Section |

LSA Provision |

1.3(b)(ii) – Interest Rate – Term Loan Advances |

The outstanding principal amount of any Term Loan Advance shall accrue interest at, (a) with respect to any Term Loan Advance that is a Prime Rate Advance, a floating rate per annum equal to the greater of (1) four and one half percent (4.50%), and (2) the Prime Rate minus the Prime Rate Margin, and (b) with respect to any Term Loan Advance that is a SOFR Advance, rate per annum equal to the greater of (1) one and one quarter percent (1.25%), and (2) the Adjusted Term SOFR, plus the SOFR Rate Margin, which interest shall be payable in accordance with Section 1.3(a)(ii). |

1.3(e) – Interest Computation |

Interest shall be computed on the basis of the actual number of days elapsed and a 360-day year for any Credit Extension outstanding. |

1.4(a) – Revolving Line Commitment Fee |

A fully earned, non-refundable commitment fee of Eighty-Seven Thousand Five Hundred Dollars ($87,500), which was paid in full on the Effective Date. |

| 12.2 – “Adjusted Term SOFR” |

“Adjusted Term SOFR” means, for purposes of any calculation, the rate per annum equal to Term SOFR for such calculation. |

| 12.2 – “Draw Period” |

“Draw Period” is the period commencing on the First Amendment Effective Date and ending on the earlier to occur of (a) February 28, 2026 and (b) at the selection of Bank, an Event of Default that is continuing. |

12.2 – “Effective Date” |

“Effective Date” is February 13, 2024. |

12.2 – “Payment Date” |

“Payment Date” means (a) as to any Prime Rate Advance that is a Term Loan Advance, the first calendar day of each calendar month to occur while such Term Loan Advance is outstanding and the Term Loan Maturity Date and as to any Prime Rate Advance that is an Advance, the last calendar day of each calendar month to occur while such Advance is outstanding and the Revolving Line Maturity Date, (b) as to any SOFR Advance having an Interest Period of three (3) months or less, the last Business Day of such Interest Period and the final maturity date of such Advance or Term Loan Advance, as applicable, (c) as to any SOFR Advance having an Interest Period longer than three (3) months, each Business Day that is three (3) months after the first day of such Interest Period, the last Business Day of such Interest Period and the final maturity date of such Advance or Term Loan Advance, as applicable, and (d) as to any Advance and Term Loan Advance, the date of any repayment or prepayment made in respect thereof. |

12.2 – “Prime Rate” |

“Prime Rate” is the rate of interest per annum from time to time published in the money rates section of The Wall Street Journal or any successor publication thereto as the “prime rate” then in effect; provided that if such rate of interest, as set forth from time to time in the money rates section of The Wall Street Journal, becomes unavailable for any reason as determined by Bank, the “Prime Rate” shall mean the rate of interest per annum announced by Bank as its prime rate in effect at its principal office in the State of North Carolina (such Bank announced Prime Rate not being intended to be the lowest rate of interest charged by Bank in connection with extensions of credit to debtors). |

12.2 – “Prime Rate Margin” |

“Prime Rate Margin” is (a) if Borrower’s Maximum Net Leverage Ratio is less than 1.50 to 1.00, three-quarters of one percent (0.75%), (b) if Borrower’s Maximum Net Leverage Ratio is at least 1.50 to 1.00 but no greater than 2.25 to 1.00, one-half of one percent (0.50%), and (c) if Borrower’s Maximum Net Leverage Ratio is greater than 2.25 to 1.00, one-quarter of one percent (0.25%). |

12.2 – “Revolving Line” |

“Revolving Line” is an aggregate original principal amount equal to Twenty-Five Million Dollars ($25,000,000); provided, however, if Bank, in its sole and absolute discretion, grants any request by Borrower to make the Uncommitted Accordion available to Borrower, “Revolving Line” shall be updated to mean an aggregate original principal amount equal to Forty Million Dollars ($40,000,000). |

12.2 – “Revolving Line Maturity Date” |

“Revolving Line Maturity Date” is May 1, 3030. |

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

|

|

|

|

|

|

| LSA Section |

LSA Provision |

| 12.2 – “SOFR Rate Margin” |

“SOFR Rate Margin” is (a) if Borrower’s Maximum Net Leverage Ratio is less than 1.50 to 1.00, one and three-quarters of one percent (1.75%), (b) if Borrower’s Maximum Net Leverage Ratio is at least 1.50 to 1.00 but no greater than 2.25 to 1.00, two percent (2.00%), and (c) if Borrower’s Maximum Net Leverage Ratio is greater than 2.25 to 1.00, two and one-quarter of one percent (2.25%). |

| 12.2 – “Term Loan Amortization Date” |

“Term Loan Amortization Date” is April 1, 2026. |

| 12.2 – “Term Loan Availability Amount” |

“Term Loan Availability Amount” is an aggregate principal amount equal to Seventy-Five Million Dollars ($75,000,000). |

| 12.2 – “Term Loan Maturity Date” |

“Term Loan Maturity Date” is May 1, 3030. |

| 12.2 – “Term SOFR” |

“Term SOFR” is the Term SOFR Reference Rate for a tenor comparable to the applicable Interest Period on the day (such day, the “Periodic Term SOFR Determination Day”) that is two (2) U.S. Government Securities Business Days prior to the first day of such Interest Period, as such rate is published by the Term SOFR Administrator; provided, however, that if as of 5:00 p.m. (New York City time) on any Periodic Term SOFR Determination Day the Term SOFR Reference Rate for the applicable tenor has not been published by the Term SOFR Administrator and the Term SOFR Reference Rate has not been replaced as the benchmark rate, then Term SOFR will be the Term SOFR Reference Rate for such tenor as published by the Term SOFR Administrator on the first preceding U.S. Government Securities Business Day for which such Term SOFR Reference Rate for such tenor was published by the Term SOFR Administrator so long as such first preceding U.S. Government Securities Business Day is not more than three (3) U.S. Government Securities Business Days prior to such Periodic Term SOFR Determination Day. |

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

EXHIBIT A

COMPLIANCE STATEMENT

TO: SILICON VALLEY BANK, a division of First-Citizens Bank & Trust Company

FROM: MITEK SYSTEMS, INC., on behalf of each Borrower

Date:

Under the terms and conditions of the Loan and Security Agreement between Borrower and Bank (as amended, modified, supplemented and/or restated from time to time, the “Agreement”), Borrower is in complete compliance for the period ending _______________ with all required covenants except as noted below. Attached are the required documents evidencing such compliance, setting forth calculations prepared in accordance with GAAP consistently applied from one period to the next except as explained in an accompanying letter or footnotes. Capitalized terms used but not otherwise defined herein shall have the meanings given them in the Agreement.

|

|

|

|

|

|

|

|

|

| Please indicate compliance status by circling Yes/No under “Complies” column. |

| Reporting Covenants |

Required |

Complies |

|

|

|

|

Financial Statements with

Compliance Statement

|

Within the earlier of (i) quarterly within 45

days, and (ii) 5 Business Days of

filing/reporting of the same with the SEC

|

Yes No |

| Annual financial statements (CPA Audited) |

Within the earlier of (i) FYE within 120 days,

and (ii) 5 Business Days of

filing/reporting of the same with the SEC

|

Yes No |

| UBS Account Statements |

Quarterly within 45 days |

Yes No |

| 10-Q, 10-K and 8-K |

Within 5 Business Days after filing with SEC |

Yes No

N/A |

| Board approved projections |

FYE within 90 days and within 7 days of

any updates/amendments

|

Yes No |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Covenants |

Required |

Actual |

Complies |

| Maintain as indicated: |

|

|

|

| Maximum Net Leverage Ratio |

See Section 5.10(a) |

_________ |

Yes No |

| Minimum Fixed Charge Coverage Ratio |

1.35:1.00 |

_________ |

Yes No |

|

|

|

|

|

|

|

|

|

| Performance Pricing |

Applies |

|

Maximum Net Leverage Ratio

< 1.50:1.00

|

Prime – 0.75%

Adjusted Term SOFR + 1.75%

|

Yes No |

|

Maximum Net Leverage Ratio

≥ 1.50:1.00 and ≤ 2.25:1.00

|

Prime – 0.50%

Adjusted Term SOFR + 2.00%

|

Yes No |

|

Maximum Net Leverage Ratio

> 2.25:1.00

|

Prime – 0.25%

Adjusted Term SOFR + 2.25%

|

Yes No |

Other Matters

|

|

|

|

|

|

|

|

|

| Have there been any amendments of or other changes to the capitalization table of Borrower and to the Operating Documents of Borrower or any of its Subsidiaries? If yes, provide copies of any such amendments or changes with this Compliance Statement. |

Yes |

No |

The following financial covenant analyses and information set forth in Schedule 1 attached hereto are true and correct as of the date of this Compliance Statement.

The following are the exceptions with respect to the statements above: (If no exceptions exist, state “No exceptions to note.”)

-----------------------------------------------------------------------------------------------------------------------------------------------

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

Schedule 1 to Compliance Statement

Financial Covenants of Borrower

In the event of a conflict between this Schedule and the Agreement, the terms of the Agreement shall govern.

Dated: ____________________

I.Maximum Net Leverage Ratio (Section 5.10(a))

Required: A Maximum Net Leverage Ratio (subject to periodic reporting as of the last day of each calendar quarter) of no greater than 2.50 to 1.00; provided that, if one or more Permitted Acquisitions are consummated during the trailing twelve-month period ended on the applicable test date, the Maximum Net Leverage Ratio shall instead be no greater than 2.75 to 1.00 for such date only.

Actual: ______:1.00

|

|

|

|

|

|

|

|

|

| A. |

The aggregate value of all Obligations owing from Borrower to Bank |

$ |

| B. |

The aggregate value of all other Indebtedness owing by Borrower and its Subsidiaries (including, but not limited to Indebtedness owing in connection with the 2026 Convertible Senior Notes) |

$ |

|

|

|

| C. |

Funded Debt (the sum of lines A and B) |

$ |

| D. |

The aggregate value of Borrower’s and its Subsidiaries unrestricted cash and Cash Equivalents held at such time in Deposit Accounts or Securities Accounts maintained with Bank |

$ |

|

|

|

| E. |

The aggregate value of Borrower’s and its Subsidiaries unrestricted cash and Cash Equivalents held at such time at financial institutions other than Bank (subject at all times to a Control Agreement) |

$ |

|

|

|

| F. |

The aggregate value of Borrower’s and its Subsidiaries unrestricted cash and Cash Equivalents maintained at all financial institutions globally |

$ |

|

|

|

| G. |

Qualified Cash (the sum of lines D and E, minus line F) – note that this line G shall in no event exceed the aggregate Dollar Equivalent value of fifty percent (50%) (or if the 2026 Convertible Senior Notes remain outstanding, and a Term Loan Advance was funded at or before such time, seventy percent (70%)) of all account balances of Borrower and its Subsidiaries maintained at all financial institutions globally |

$ |

|

|

|

| H. |

Net Income |

$ |

| I. |

Interest Expense |

$ |

|

|

|

| J. |

Interest Income |

$ |

| K. |

To the extent deducted in the calculation of Net Income, depreciation expense and amortization expense |

$ |

| L. |

Income tax expense |

$ |

| M. |

Non-cash stock-based compensation expense |

$ |

| N. |

One-time extraordinary expenses that are approved by Bank in writing |

$______ |

|

|

|

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

|

|

|

|

|

|

|

|

|

| O. |

Adjusted EBITDA (the sum of lines H, I, K, L, M and N, minus line J) (measured on a trailing 12 month basis on a consolidated basis with respect to Borrower and its Subsidiaries) |

$ |

|

|

|

| P. |

Maximum Net Leverage Ratio (line C minus line G, divided by line O) |

________ |

Is line P less than or equal to 2.50 (or if applicable, 2.75) to 1.00 for the relevant measuring period?

No, not in compliance Yes, in compliance

II.Minimum Fixed Charge Coverage Ratio (Section 5.10(b))

Required: A minimum Fixed Charge Coverage Ratio (subject to periodic reporting as of the last day of each calendar quarter) of 1.35 to 1.00.

Actual: ______:1.00

|

|

|

|

|

|

|

|

|

| A. |

Adjusted EBITDA (value of line O in the section above) |

$ |

| B. |

Unfinanced capital expenditures (including capitalized software expenditures) actually made during such period

|

$ |

| C. |

Any cash distributions to stockholders (permitted under this Agreement) actually paid during such period |

$ |

| D. |

Federal and state taxes actually paid in cash during such period |

$ |

| E. |

Principal and interest payments on all Indebtedness owing by Borrower, excluding the principal portion only of the Indebtedness owing by Borrower in connection with the 2026 Convertible Senior Notes, measured on a trailing twelve (12) month basis |

$ |

| F. |

Fixed Charge Coverage Ratio: (line A minus lines B, C and D, divided by line E) |

________ |

Is line F at least 1.35 to 1.00 for the relevant measuring period?

No, not in compliance Yes, in compliance

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

EXHIBIT B-1

FORM OF NOTICE OF BORROWING

MITEK SYSTEMS, INC., on behalf of each borrower

Date: ______________

To: Silicon Valley Bank, a division of First-Citizens Bank & Trust Company

2625 Augustine Drive, Suite 301

Santa Clara, CA 95054

Attention: Kelly Schramm, Managing Director

Email: kschramm@svb.com

Re: Loan and Security Agreement dated as of February 13, 2024 (as amended, modified, supplemented or restated from time to time, the “Loan Agreement”), by and among MITEK SYSTEMS, INC., a Delaware corporation and IDCHECKER, INC., a Delaware limited liability company, A2IA CORP., a Delaware corporation, and ID R&D, INC., a New York corporation (individually and collectively, “Borrower”) and Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (the “Bank”); Loan Account # _________________

Ladies and Gentlemen:

The undersigned refers to the Loan Agreement, the terms defined therein and used herein as so defined, and hereby gives you notice irrevocably, pursuant to Section 1.8 of the Loan Agreement, of the borrowing of [an Advance][a Term Loan Advance][an Advance and Term Loan Advance].

1.The Funding Date, which shall be a Business Day, of the requested [Advance][Term Loan Advance][Advance and Term Loan Advance] is _______________.

2.[The aggregate amount of the requested Advance is $_____________.]

3.[The aggregate amount of the requested Term Loan Advance is $_____________.]

4.[The requested Advance shall consist of $___________ of Prime Rate Advances and $______ of SOFR Advances, bearing interest at Adjusted Term SOFR.]

5.[The requested Term Loan Advance shall consist of $___________ of Prime Rate Advances and $______ of SOFR Advances, bearing interest at Adjusted Term SOFR.]

6.[The duration of the Interest Period for the SOFR Advances bearing interest at Adjusted Term SOFR included in the requested Advance shall be __________ months.]

7.[The duration of the Interest Period for the SOFR Advances bearing interest at Adjusted Term SOFR included in the requested Term Loan Advance shall be __________ months.]

The undersigned hereby certifies that the following statements are true on the date hereof, and will be true on the date of the proposed [Advance][Term Loan Advance][Advance and Term Loan Advance] before and after giving effect thereto, and to the application of the proceeds therefrom, as applicable:

(a) all representations and warranties of Borrower contained in the Loan Agreement are true, accurate and complete in all material respects as of the date hereof; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof; and provided, further that those representations and warranties expressly referring to a specific date shall be true, accurate and complete in all material respects or all respects, as applicable, as of such date;

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

(b) no Event of Default has occurred and is continuing, or would result from such proposed [Advance][Term Loan Advance][Advance and Term Loan Advance];[ and

(c) immediately prior to making such Advance, the Availability Amount is greater than or equal to the amount of such requested Advance.][and

(d) annexed hereto is evidence that the proceeds of such Term Loan Advance have been disbursed [directly in payment of amounts outstanding under the 2026 Convertible Senior Notes][into a Deposit Account or Securities Account held by Borrower with Bank].]

Borrower MITEK SYSTEMS, INC.

By:

Name:

Title:

[For internal Bank use only]

|

|

|

|

|

|

|

|

|

|

|

|

| SOFR Pricing Date |

Term SOFR Reference Rate |

SOFR Variance |

Maturity Date |

|

|

____% |

|

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

EXHIBIT B-2

FORM OF NOTICE OF CONVERSION/CONTINUATION

MITEK SYSTEMS, INC., on behalf of each borrower

Date: ______________

To: Silicon Valley Bank, a division of First-Citizens Bank & Trust Company

2625 Augustine Drive, Suite 301

Santa Clara, CA 95054

Attention: Kelly Schramm, Managing Director

Email: kschramm@svb.com

Re: Loan and Security Agreement dated as of February 13, 2024 (as amended, modified, supplemented or restated from time to time, the “Loan Agreement”), by and among MITEK SYSTEMS, INC., a Delaware corporation and IDCHECKER, INC., a Delaware limited liability company, A2IA CORP., a Delaware corporation, and ID R&D, INC., a New York corporation (individually and collectively, “Borrower”) and Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (the “Bank”); Loan Account # _________________

Ladies and Gentlemen:

The undersigned refers to the Loan Agreement, the terms defined therein being used herein as therein defined, and hereby gives you notice irrevocably, pursuant to Section 2.4 of the Loan Agreement, of the [conversion] or [continuation] of the [Advance][Term Loan Advance][Advance and Term Loan Advance] specified herein, that::

1. The date of the [conversion] [continuation] is , 20___.

2. [The aggregate amount of the proposed Advances to be [converted] is

$ or [continued] is $ .]

3. [The aggregate amount of the proposed Term Loan Advances to be [converted] is

$ or [continued] is $ .]

4. [The Advances are to be [converted into] [continued as] [SOFR] [Prime Rate] Advances.]

5. [The Term Loan Advances are to be [converted into] [continued as] [SOFR] [Prime Rate] Advances.]

6. [The duration of the Interest Period for the Advances that are SOFR Advances included in the [conversion] [continuation] shall be months.]

7. [The duration of the Interest Period for the Term Loan Advances that are SOFR Advances included in the [conversion] [continuation] shall be months.]

The undersigned, on behalf of Borrower, hereby certifies that the following statements are true on the date hereof, and will be true on the date of the proposed [conversion] [continuation], before and after giving effect thereto and to the application of the proceeds therefrom:

(a) all representations and warranties of Borrower stated in the Loan Agreement are true, accurate and complete in all material respects as of the date hereof; provided, however, that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof; and provided, further that those representations and warranties expressly referring to a specific date shall be true, accurate and complete in all material respects or all respects, as applicable, as of such date; and

Docusign Envelope ID: 2CBBDCE1-9A80-41FE-932A-4D56838F0D57

(b) no Event of Default has occurred and is continuing, or would result from such proposed [conversion] [continuation].

Borrower MITEK SYSTEMS, INC.

By:

Name:

Title:

[For internal Bank use only]

|

|

|

|

|

|

|

|

|

|

|

|

| SOFR Pricing Date |

Term SOFR Reference Rate |

SOFR Variance |

Maturity Date |

|

|

____% |

|