| Delaware | 1-8923 | 34-1096634 | ||||||||||||||||||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||||||||||||||

| 4500 Dorr Street, | Toledo, | Ohio | 43615 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, $1.00 par value per share | WELL | New York Stock Exchange | ||||||||||||

| Guarantee of 4.800% Notes due 2028 issued by Welltower OP LLC | WELL/28 | New York Stock Exchange | ||||||||||||

| Guarantee of 4.500% Notes due 2034 issued by Welltower OP LLC | WELL/34 | New York Stock Exchange | ||||||||||||

| WELLTOWER INC. | |||||

| By: | /s/ Matthew McQueen | ||||

| Name: | Matthew McQueen | ||||

| Title: | Executive Vice President – General Counsel & Corporate Secretary | ||||

Page 1 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

Page 2 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

Page 3 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

Page 4 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

Page 5 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| Consolidated Balance Sheets (unaudited) | ||||||||||||||

| (in thousands) | ||||||||||||||

| December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| Assets | ||||||||||||||

| Real estate investments: | ||||||||||||||

| Land and land improvements | $ | 4,697,824 | $ | 4,249,834 | ||||||||||

| Buildings and improvements | 37,796,553 | 33,651,336 | ||||||||||||

| Acquired lease intangibles | 2,166,470 | 1,945,458 | ||||||||||||

| Real property held for sale, net of accumulated depreciation | 372,883 | 133,058 | ||||||||||||

| Construction in progress | 1,304,441 | 1,021,080 | ||||||||||||

| Less accumulated depreciation and intangible amortization | (9,274,814) | (8,075,733) | ||||||||||||

| Net real property owned | 37,063,357 | 32,925,033 | ||||||||||||

| Right of use assets, net | 350,969 | 323,942 | ||||||||||||

| Real estate loans receivable, net of credit allowance | 1,361,587 | 890,844 | ||||||||||||

| Net real estate investments | 38,775,913 | 34,139,819 | ||||||||||||

| Other assets: | ||||||||||||||

| Investments in unconsolidated entities | 1,636,531 | 1,499,790 | ||||||||||||

| Goodwill | 68,321 | 68,321 | ||||||||||||

| Cash and cash equivalents | 1,993,646 | 631,681 | ||||||||||||

| Restricted cash | 82,437 | 90,611 | ||||||||||||

| Straight-line rent receivable | 443,800 | 322,173 | ||||||||||||

| Receivables and other assets | 1,011,518 | 1,140,838 | ||||||||||||

| Total other assets | 5,236,253 | 3,753,414 | ||||||||||||

| Total assets | $ | 44,012,166 | $ | 37,893,233 | ||||||||||

| Liabilities and equity | ||||||||||||||

| Liabilities: | ||||||||||||||

| Unsecured credit facility and commercial paper | $ | — | $ | — | ||||||||||

| Senior unsecured notes | 13,552,222 | 12,437,273 | ||||||||||||

| Secured debt | 2,183,327 | 2,110,815 | ||||||||||||

| Lease liabilities | 383,230 | 415,824 | ||||||||||||

| Accrued expenses and other liabilities | 1,521,660 | 1,535,325 | ||||||||||||

| Total liabilities | 17,640,439 | 16,499,237 | ||||||||||||

| Redeemable noncontrolling interests | 290,605 | 384,443 | ||||||||||||

| Equity: | ||||||||||||||

| Common stock | 565,894 | 491,919 | ||||||||||||

| Capital in excess of par value | 32,741,949 | 26,742,750 | ||||||||||||

| Treasury stock | (111,578) | (111,001) | ||||||||||||

| Cumulative net income | 9,145,044 | 8,804,950 | ||||||||||||

| Cumulative dividends | (16,773,773) | (15,514,097) | ||||||||||||

| Accumulated other comprehensive income | (163,160) | (119,707) | ||||||||||||

| Total Welltower Inc. stockholders’ equity | 25,404,376 | 20,294,814 | ||||||||||||

| Noncontrolling interests | 676,746 | 714,739 | ||||||||||||

| Total equity | 26,081,122 | 21,009,553 | ||||||||||||

| Total liabilities and equity | $ | 44,012,166 | $ | 37,893,233 | ||||||||||

Page 6 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| Consolidated Statements of Income (unaudited) | ||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Resident fees and services | $ | 1,262,862 | $ | 1,100,671 | $ | 4,753,804 | $ | 4,173,711 | ||||||||||||||||||||||||

| Rental income | 404,068 | 372,002 | 1,556,073 | 1,451,786 | ||||||||||||||||||||||||||||

| Interest income | 51,019 | 36,646 | 168,354 | 150,571 | ||||||||||||||||||||||||||||

| Other income | 31,826 | 9,212 | 159,764 | 84,547 | ||||||||||||||||||||||||||||

| Total revenues | 1,749,775 | 1,518,531 | 6,637,995 | 5,860,615 | ||||||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

| Property operating expenses | 1,036,078 | 938,838 | 3,947,776 | 3,558,770 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 380,730 | 342,286 | 1,401,101 | 1,310,368 | ||||||||||||||||||||||||||||

| Interest expense | 154,574 | 140,391 | 607,846 | 529,519 | ||||||||||||||||||||||||||||

| General and administrative expenses | 44,327 | 41,319 | 179,091 | 150,390 | ||||||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (7,215) | 258 | (2,120) | 8,334 | ||||||||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | — | 87 | 7 | 680 | ||||||||||||||||||||||||||||

| Provision for loan losses, net | 2,517 | 10,469 | 9,809 | 10,320 | ||||||||||||||||||||||||||||

| Impairment of assets | 14,994 | 13,146 | 36,097 | 17,502 | ||||||||||||||||||||||||||||

| Other expenses | 36,307 | 24,954 | 108,341 | 101,670 | ||||||||||||||||||||||||||||

| Total expenses | 1,662,312 | 1,511,748 | 6,287,948 | 5,687,553 | ||||||||||||||||||||||||||||

| Income (loss) from continuing operations before income taxes | ||||||||||||||||||||||||||||||||

| and other items | 87,463 | 6,783 | 350,047 | 173,062 | ||||||||||||||||||||||||||||

| Income tax (expense) benefit | 4,768 | 4,088 | (6,364) | (7,247) | ||||||||||||||||||||||||||||

| Income (loss) from unconsolidated entities | (2,008) | (4,650) | (53,442) | (21,290) | ||||||||||||||||||||||||||||

| Gain (loss) on real estate dispositions, net | (1,783) | (4,423) | 67,898 | 16,043 | ||||||||||||||||||||||||||||

| Income (loss) from continuing operations | 88,440 | 1,798 | 358,139 | 160,568 | ||||||||||||||||||||||||||||

| Net income (loss) | 88,440 | 1,798 | 358,139 | 160,568 | ||||||||||||||||||||||||||||

| Less: | Net income (loss) attributable to noncontrolling interests (1) |

4,529 | 5,526 | 18,045 | 19,354 | |||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 83,911 | $ | (3,728) | $ | 340,094 | $ | 141,214 | ||||||||||||||||||||||||

| Average number of common shares outstanding: | ||||||||||||||||||||||||||||||||

| Basic | 548,892 | 483,305 | 515,629 | 462,185 | ||||||||||||||||||||||||||||

| Diluted | 552,380 | 483,305 | 518,701 | 465,158 | ||||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders per share: | ||||||||||||||||||||||||||||||||

| Basic | $ | 0.15 | $ | (0.01) | $ | 0.66 | $ | 0.31 | ||||||||||||||||||||||||

Diluted(2) |

$ | 0.15 | $ | (0.01) | $ | 0.66 | $ | 0.30 | ||||||||||||||||||||||||

| Common dividends per share | $ | 0.61 | $ | 0.61 | $ | 2.44 | $ | 2.44 | ||||||||||||||||||||||||

(1) Includes amounts attributable to redeemable noncontrolling interests. | ||||||||||||||||||||||||||||||||

(2) Includes adjustment to the numerator for income (loss) attributable to OP Units and DownREIT Units. | ||||||||||||||||||||||||||||||||

Page 7 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| FFO Reconciliations | Exhibit 1 | |||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 83,911 | $ | (3,728) | $ | 340,094 | $ | 141,214 | ||||||||||||||||||||||||||||||

| Depreciation and amortization | 380,730 | 342,286 | 1,401,101 | 1,310,368 | ||||||||||||||||||||||||||||||||||

| Impairments and losses (gains) on real estate dispositions, net | 16,777 | 17,569 | (31,801) | 1,459 | ||||||||||||||||||||||||||||||||||

Noncontrolling interests(1) |

(11,436) | (13,989) | (46,393) | (56,529) | ||||||||||||||||||||||||||||||||||

Unconsolidated entities(2) |

21,877 | 15,847 | 100,226 | 81,560 | ||||||||||||||||||||||||||||||||||

| NAREIT FFO attributable to common stockholders | 491,859 | 357,985 | 1,763,227 | 1,478,072 | ||||||||||||||||||||||||||||||||||

Normalizing items, net(3) |

37,760 | 46,247 | 122,317 | 80,198 | ||||||||||||||||||||||||||||||||||

| Normalized FFO attributable to common stockholders | $ | 529,619 | $ | 404,232 | $ | 1,885,544 | $ | 1,558,270 | ||||||||||||||||||||||||||||||

| Average diluted common shares outstanding | ||||||||||||||||||||||||||||||||||||||

| For net income (loss) purposes | 552,380 | 483,305 | 518,701 | 465,158 | ||||||||||||||||||||||||||||||||||

| For FFO purposes | 552,380 | 486,419 | 518,701 | 465,158 | ||||||||||||||||||||||||||||||||||

| Per diluted share data attributable to common stockholders: | ||||||||||||||||||||||||||||||||||||||

Net income (loss)(4) |

$ | 0.15 | $ | (0.01) | $ | 0.66 | $ | 0.30 | ||||||||||||||||||||||||||||||

| NAREIT FFO | $ | 0.89 | $ | 0.74 | $ | 3.40 | $ | 3.18 | ||||||||||||||||||||||||||||||

| Normalized FFO | $ | 0.96 | $ | 0.83 | $ | 3.64 | $ | 3.35 | ||||||||||||||||||||||||||||||

| Normalized FFO Payout Ratio: | ||||||||||||||||||||||||||||||||||||||

| Dividends per common share | $ | 0.61 | $ | 0.61 | $ | 2.44 | $ | 2.44 | ||||||||||||||||||||||||||||||

| Normalized FFO attributable to common stockholders per share | $ | 0.96 | $ | 0.83 | $ | 3.64 | $ | 3.35 | ||||||||||||||||||||||||||||||

| Normalized FFO payout ratio | 64% | 73% | 67% | 73% | ||||||||||||||||||||||||||||||||||

Other items:(5) |

||||||||||||||||||||||||||||||||||||||

Net straight-line rent and above/below market rent amortization(6) |

$ | (39,296) | $ | (26,539) | $ | (135,356) | $ | (106,496) | ||||||||||||||||||||||||||||||

Non-cash interest expenses(7) |

7,609 | 6,167 | 27,252 | 21,805 | ||||||||||||||||||||||||||||||||||

| Recurring cap-ex, tenant improvements, and lease commissions | (71,726) | (62,122) | (199,359) | (179,133) | ||||||||||||||||||||||||||||||||||

| Stock-based compensation | 8,418 | 6,569 | 36,611 | 26,027 | ||||||||||||||||||||||||||||||||||

| (1) Represents noncontrolling interests' share of net FFO adjustments. | ||||||||||||||||||||||||||||||||||||||

| (2) Represents Welltower's share of net FFO adjustments from unconsolidated entities. | ||||||||||||||||||||||||||||||||||||||

| (3) See Exhibit 2. | ||||||||||||||||||||||||||||||||||||||

| (4) Includes adjustment to the numerator for income (loss) attributable to OP Units and DownREIT Units. | ||||||||||||||||||||||||||||||||||||||

| (5) Amounts presented net of noncontrolling interests' share and including Welltower's share of unconsolidated entities. | ||||||||||||||||||||||||||||||||||||||

| (6) Excludes normalized other impairment (see Exhibit 2). | ||||||||||||||||||||||||||||||||||||||

| (7) Excludes normalized foreign currency loss (gain) (see Exhibit 2). | ||||||||||||||||||||||||||||||||||||||

Page 8 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| Normalizing Items | Exhibit 2 | ||||||||||||||||||||||||||||

| (in thousands, except per share data) | Three Months Ended | Twelve Months Ended | |||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | $ | (7,215) | (1) | $ | 258 | $ | (2,120) | $ | 8,334 | ||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | — | 87 | 7 | 680 | |||||||||||||||||||||||||

| Provision for loan losses, net | 2,517 | (2) | 10,469 | 9,809 | 10,320 | ||||||||||||||||||||||||

| Income tax benefits | (6,731) | (3) | (6,784) | (6,977) | (6,784) | ||||||||||||||||||||||||

| Other impairment | 4,333 | (4) | — | 16,642 | (620) | ||||||||||||||||||||||||

| Other expenses | 36,307 | (5) | 24,954 | 108,341 | 101,670 | ||||||||||||||||||||||||

| Leasehold interest termination | — | — | (65,485) | (64,854) | |||||||||||||||||||||||||

| Casualty losses, net of recoveries | 1,038 | (6) | 7,377 | 10,107 | 10,391 | ||||||||||||||||||||||||

| Foreign currency loss (gain) | (1,139) | (7) | (1,090) | (1,629) | 2,787 | ||||||||||||||||||||||||

| Normalizing items attributable to noncontrolling interests and unconsolidated entities, net | 8,650 | (8) | 10,976 | 53,622 | 18,274 | ||||||||||||||||||||||||

| Net normalizing items | $ | 37,760 | $ | 46,247 | $ | 122,317 | $ | 80,198 | |||||||||||||||||||||

| Average diluted common shares outstanding | 552,380 | 486,419 | 518,701 | 465,158 | |||||||||||||||||||||||||

| Net normalizing items per diluted share | $ | 0.07 | $ | 0.10 | $ | 0.24 | $ | 0.17 | |||||||||||||||||||||

| (1) Primarily related to mark-to-market of the equity warrants received as part of the Safanad/HC-One transactions. | |||||||||||||||||||||||||||||

| (2) Primarily related to reserves for loan losses under the current expected credit losses accounting standard. | |||||||||||||||||||||||||||||

| (3) Primarily related to the release of valuation allowances. | |||||||||||||||||||||||||||||

| (4) Represents the write off of straight-line rent receivable balances relating to leases placed on cash recognition. | |||||||||||||||||||||||||||||

| (5) Primarily related to non-capitalizable transaction costs and expenses associated with operator transitions. | |||||||||||||||||||||||||||||

| (6) Primarily relates to casualty losses net of any insurance recoveries. | |||||||||||||||||||||||||||||

| (7) Primarily relates to foreign currency gains and losses related to accrued interest on intercompany loans and third party debt denominated in a foreign currency. | |||||||||||||||||||||||||||||

| (8) Primarily related to hypothetical liquidation at book value adjustments related to in substance real estate investments. | |||||||||||||||||||||||||||||

| Outlook Reconciliation: Year Ending December 31, 2024 | Exhibit 3 | ||||||||||||||||

| (in millions, except per share data) | Current Outlook | ||||||||||||||||

| Low | High | ||||||||||||||||

| FFO Reconciliation: | |||||||||||||||||

| Net income attributable to common stockholders | $ | 694 | $ | 785 | |||||||||||||

Impairments and losses (gains) on real estate dispositions, net(1,2) |

(78) | (78) | |||||||||||||||

Depreciation and amortization(1) |

1,636 | 1,636 | |||||||||||||||

| NAREIT FFO and Normalized FFO attributable to common stockholders | 2,252 | 2,343 | |||||||||||||||

| Diluted per share data attributable to common stockholders: | |||||||||||||||||

| Net income | $ | 1.21 | $ | 1.37 | |||||||||||||

| NAREIT FFO and Normalized FFO | $ | 3.94 | $ | 4.10 | |||||||||||||

Other items:(1) |

|||||||||||||||||

| Net straight-line rent and above/below market rent amortization | $ | (138) | $ | (138) | |||||||||||||

| Non-cash interest expenses | 36 | 36 | |||||||||||||||

| Recurring cap-ex, tenant improvements, and lease commissions | (226) | (226) | |||||||||||||||

| Stock-based compensation | 39 | 39 | |||||||||||||||

| (1) Amounts presented net of noncontrolling interests' share and Welltower's share of unconsolidated entities. | |||||||||||||||||

| (2) Includes estimated gains on projected dispositions. | |||||||||||||||||

Page 9 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| SSNOI Reconciliations | Exhibit 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, | June 30, | September 30, | December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 28,635 | $ | 65,751 | $ | 106,342 | $ | 95,672 | $ | 134,722 | $ | (2,653) | $ | 88,440 | $ | 1,798 | ||||||||||||||||||||||||||||||||||||||||

| Loss (gain) on real estate dispositions, net | (747) | (22,934) | 2,168 | 3,532 | (71,102) | (1,064) | 1,783 | 4,423 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss (income) from unconsolidated entities | 7,071 | 2,884 | 40,332 | 7,058 | 4,031 | 6,698 | 2,008 | 4,650 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 3,045 | 5,013 | 3,503 | 3,065 | 4,584 | 3,257 | (4,768) | (4,088) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other expenses | 22,745 | 26,069 | 11,069 | 35,166 | 38,220 | 15,481 | 36,307 | 24,954 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment of assets | 12,629 | — | 1,086 | — | 7,388 | 4,356 | 14,994 | 13,146 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for loan losses, net | 777 | (804) | 2,456 | 165 | 4,059 | 490 | 2,517 | 10,469 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 5 | (12) | 1 | 603 | 1 | 2 | — | 87 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | 930 | 2,578 | 1,280 | (1,407) | 2,885 | 6,905 | (7,215) | 258 | ||||||||||||||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 44,371 | 37,706 | 44,287 | 36,554 | 46,106 | 34,811 | 44,327 | 41,319 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 339,112 | 304,088 | 341,945 | 310,295 | 339,314 | 353,699 | 380,730 | 342,286 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | 144,403 | 121,696 | 152,337 | 127,750 | 156,532 | 139,682 | 154,574 | 140,391 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated NOI | 602,976 | 542,035 | 706,806 | 618,453 | 666,740 | 561,664 | 713,697 | 579,693 | ||||||||||||||||||||||||||||||||||||||||||||||||

NOI attributable to unconsolidated investments(1) |

26,354 | 20,142 | 25,150 | 23,648 | 29,488 | 27,374 | 30,785 | 24,950 | ||||||||||||||||||||||||||||||||||||||||||||||||

NOI attributable to noncontrolling interests(2) |

(25,057) | (34,999) | (24,262) | (82,804) | (22,838) | (27,236) | (22,402) | (27,523) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Pro rata NOI | 604,273 | 527,178 | 707,694 | 559,297 | 673,390 | 561,802 | 722,080 | 577,120 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Non-cash NOI attributable to same store properties | (19,694) | (13,669) | (15,671) | (18,162) | (14,036) | (16,045) | (10,999) | (17,233) | ||||||||||||||||||||||||||||||||||||||||||||||||

| NOI attributable to non-same store properties | (144,558) | (106,506) | (242,710) | (133,593) | (190,461) | (134,532) | (243,171) | (148,387) | ||||||||||||||||||||||||||||||||||||||||||||||||

Currency and ownership(3) |

(576) | (4,787) | (1,738) | (1,713) | (1,513) | 2,746 | (992) | 4,456 | ||||||||||||||||||||||||||||||||||||||||||||||||

Other adjustments(4) |

4,558 | (2,123) | (3,378) | (11,603) | (1,489) | (5,758) | 458 | (362) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Same Store NOI (SSNOI) | $ | 444,003 | $ | 400,093 | $ | 444,197 | $ | 394,226 | $ | 465,891 | $ | 408,213 | $ | 467,376 | $ | 415,594 | ||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | $ | 216,304 | $ | 175,325 | $ | 217,863 | $ | 175,416 | $ | 238,882 | $ | 189,440 | $ | 237,948 | $ | 192,324 | ||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 94,408 | 94,203 | 93,575 | 90,740 | 89,929 | 86,573 | 90,599 | 88,689 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Outpatient Medical | 109,983 | 108,201 | 113,097 | 109,547 | 117,217 | 113,344 | 118,912 | 115,643 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 23,308 | 22,364 | 19,662 | 18,523 | 19,863 | 18,856 | 19,917 | 18,938 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total SSNOI | $ | 444,003 | $ | 400,093 | $ | 444,197 | $ | 394,226 | $ | 465,891 | $ | 408,213 | $ | 467,376 | $ | 415,594 | ||||||||||||||||||||||||||||||||||||||||

| Average | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 23.4 | % | 24.2 | % | 26.1 | % | 23.7 | % | 24.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 0.2 | % | 3.1 | % | 3.9 | % | 2.2 | % | 2.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Outpatient Medical | 1.6 | % | 3.2 | % | 3.4 | % | 2.8 | % | 2.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 4.2 | % | 6.1 | % | 5.3 | % | 5.2 | % | 5.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total SSNOI growth | 11.0 | % | 12.7 | % | 14.1 | % | 12.5 | % | 12.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Note: (1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Includes adjustments to reflect consistent property ownership percentages and foreign currency exchange rates for properties in the U.K. and Canada. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Includes other adjustments described in the accompanying Supplements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Page 10 of 11 |

||||||||

| 4Q23 | Earnings Release | February 13, 2024 | |||||||||

| Net Debt to Adjusted EBITDA Reconciliation | Exhibit 5 | |||||||||||||||||||||||||

| (in thousands) | Three Months Ended | |||||||||||||||||||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||

| Net income (loss) | $ | 88,440 | $ | 1,798 | ||||||||||||||||||||||

| Interest expense | 154,574 | 140,391 | ||||||||||||||||||||||||

| Income tax expense (benefit) | (4,768) | (4,088) | ||||||||||||||||||||||||

| Depreciation and amortization | 380,730 | 342,286 | ||||||||||||||||||||||||

| EBITDA | 618,976 | 480,387 | ||||||||||||||||||||||||

| Loss (income) from unconsolidated entities | 2,008 | 4,650 | ||||||||||||||||||||||||

| Stock-based compensation | 8,418 | 6,569 | ||||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | — | 87 | ||||||||||||||||||||||||

| Loss (gain) on real estate dispositions, net | 1,783 | 4,423 | ||||||||||||||||||||||||

| Impairment of assets | 14,994 | 13,146 | ||||||||||||||||||||||||

| Provision for loan losses, net | 2,517 | 10,469 | ||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (7,215) | 258 | ||||||||||||||||||||||||

| Other expenses | 36,307 | 24,954 | ||||||||||||||||||||||||

| Casualty losses, net of recoveries | 1,038 | 7,377 | ||||||||||||||||||||||||

Other impairment(1) |

4,333 | — | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 683,159 | $ | 552,320 | ||||||||||||||||||||||

Total debt(2) |

$ | 15,815,226 | $ | 14,661,552 | ||||||||||||||||||||||

| Cash and cash equivalents and restricted cash | (2,076,083) | (722,292) | ||||||||||||||||||||||||

| Net debt | $ | 13,739,143 | $ | 13,939,260 | ||||||||||||||||||||||

| Adjusted EBITDA annualized | $ | 2,732,636 | $ | 2,209,280 | ||||||||||||||||||||||

| Net debt to Adjusted EBITDA ratio | 5.03 | x | 6.31 | x | ||||||||||||||||||||||

| (1) Represents the write off of straight-line rent receivable balances for leases placed on cash recognition. | ||||||||||||||||||||||||||

(2) Amounts include unamortized premiums/discounts, other fair value adjustments and financing lease liabilities. Excludes operating lease liabilities related to ASC 842 of $303,553,000 and $302,360,000 for the three months ended December 31, 2023 and 2022, respectively. |

||||||||||||||||||||||||||

| Net Debt to Consolidated Enterprise Value | Exhibit 6 | |||||||||||||||||||

| (in thousands, except share price) | ||||||||||||||||||||

| December 31, 2023 | December 31, 2022 | |||||||||||||||||||

| Common shares outstanding | 564,241 | 490,509 | ||||||||||||||||||

| Period end share price | $ | 90.17 | $ | 65.55 | ||||||||||||||||

| Common equity market capitalization | $ | 50,877,611 | $ | 32,152,865 | ||||||||||||||||

| Net debt | $ | 13,739,143 | $ | 13,939,260 | ||||||||||||||||

Noncontrolling interests(1) |

967,351 | 1,099,182 | ||||||||||||||||||

| Consolidated enterprise value | $ | 65,584,105 | $ | 47,191,307 | ||||||||||||||||

| Net debt to consolidated enterprise value | 20.9 | % | 29.5 | % | ||||||||||||||||

| (1) Includes amounts attributable to both redeemable noncontrolling interests and noncontrolling interests as reflected on our consolidated balance sheets. | ||||||||||||||||||||

Page 11 of 11 |

||||||||

| Table of Contents | |||||

Overview |

|||||

Portfolio |

|||||

Investment |

|||||

Financial |

|||||

Glossary |

|||||

Supplemental Reporting Measures |

|||||

Forward Looking Statements and Risk Factors |

|||||

Overview |

|||||

| (dollars and occupancy at Welltower pro rata ownership; dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

Portfolio Composition(1) |

Beds/Unit Mix | ||||||||||||||||||||||||||||||||||||||||||||||

| Average Age | Properties | Total | Wellness Housing | Independent Living | Assisted Living | Memory Care | Long-Term/ Post-Acute Care | ||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 17 | 1,000 | 121,009 | 20,811 | 45,661 | 38,382 | 15,519 | 636 | |||||||||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 18 | 361 | 27,994 | — | 5,099 | 13,869 | 8,815 | 211 | |||||||||||||||||||||||||||||||||||||||

| Outpatient Medical | 19 | 447 | 26,548,070 | (2) | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 32 | 292 | 37,225 | — | — | 854 | — | 36,371 | |||||||||||||||||||||||||||||||||||||||

| Total | 20 | 2,100 | |||||||||||||||||||||||||||||||||||||||||||||

| NOI Performance | Same Store(3) |

In-Place Portfolio(4) |

||||||||||||||||||||||||||||||||||||||||||

| Properties | 4Q22 NOI | 4Q23 NOI | % Change | Properties | Annualized In-Place NOI |

% of Total | ||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 647 | $ | 192,324 | $ | 237,948 | 23.7 | % | 900 | $ | 1,219,612 | 49.6 | % | ||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 316 | 88,689 | 90,599 | 2.2 | % | 346 | 385,424 | 15.7 | % | |||||||||||||||||||||||||||||||||||

| Outpatient Medical | 377 | 115,643 | 118,912 | 2.8 | % | 423 | 523,108 | 21.3 | % | |||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 48 | 18,938 | 19,917 | 5.2 | % | 259 | 328,656 | 13.4 | % | |||||||||||||||||||||||||||||||||||

| Total | 1,388 | $ | 415,594 | $ | 467,376 | 12.5 | % | 1,928 | $ | 2,456,800 | 100.0 | % | ||||||||||||||||||||||||||||||||

| Portfolio Performance | Facility Revenue Mix | ||||||||||||||||||||||||||||||||||||||||

Stable Portfolio(5) |

Occupancy | EBITDAR Coverage(6) |

EBITDARM Coverage(6) |

Private Pay | Medicaid | Medicare | Other Government(7) |

||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 83.3 | % | n/a | n/a | 97.4 | % | 1.1 | % | 0.4 | % | 1.1 | % | |||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 82.4 | % | 0.95 | 1.15 | 88.5 | % | 4.4 | % | 0.5 | % | 6.6 | % | |||||||||||||||||||||||||||||

| Outpatient Medical | 94.5 | % | n/a | n/a | 100.0 | % | — | — | — | ||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 80.6 | % | 1.36 | 1.67 | 30.1 | % | 38.2 | % | 31.7 | % | — | % | |||||||||||||||||||||||||||||

| Total | 1.02 | 1.23 | 93.8 | % | 3.0 | % | 1.9 | % | 1.3 | % | |||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

In-Place NOI Diversification(1) | |||||||||||||||||||||||||||||||||||||||||

| By Partner: | Total Properties | Seniors Housing Operating | Seniors Housing Triple-net |

Outpatient Medical |

Long-Term/ Post-Acute Care | Total | % of Total | ||||||||||||||||||||||||||||||||||

| Integra Healthcare Properties | 147 | $ | — | $ | — | $ | — | $ | 152,088 | $ | 152,088 | 6.2 | % | ||||||||||||||||||||||||||||

| Avery Healthcare | 91 | 73,652 | 68,012 | — | — | 141,664 | 5.8 | % | |||||||||||||||||||||||||||||||||

| Cogir Management Corporation | 106 | 138,824 | — | — | — | 138,824 | 5.7 | % | |||||||||||||||||||||||||||||||||

| Sunrise Senior Living | 91 | 130,668 | — | — | — | 130,668 | 5.3 | % | |||||||||||||||||||||||||||||||||

| Oakmont Management Group | 63 | 101,624 | — | — | — | 101,624 | 4.1 | % | |||||||||||||||||||||||||||||||||

| Aspire | 53 | — | — | — | 86,524 | 86,524 | 3.5 | % | |||||||||||||||||||||||||||||||||

| Atria Senior Living | 91 | 83,828 | — | — | — | 83,828 | 3.4 | % | |||||||||||||||||||||||||||||||||

| Belmont Village | 21 | 80,628 | — | — | — | 80,628 | 3.3 | % | |||||||||||||||||||||||||||||||||

| Sagora Senior Living | 41 | 49,260 | 24,384 | — | — | 73,644 | 3.0 | % | |||||||||||||||||||||||||||||||||

| StoryPoint Senior Living | 81 | 39,844 | 25,156 | — | — | 65,000 | 2.6 | % | |||||||||||||||||||||||||||||||||

| Remaining | 1,143 | 521,284 | 267,872 | 523,108 | 90,044 | 1,402,308 | 57.1 | % | |||||||||||||||||||||||||||||||||

| Total | 1,928 | $ | 1,219,612 | $ | 385,424 | $ | 523,108 | $ | 328,656 | $ | 2,456,800 | 100.0 | % | ||||||||||||||||||||||||||||

| By Country: | |||||||||||||||||||||||||||||||||||||||||

| United States | 1,664 | $ | 950,536 | $ | 318,780 | $ | 523,108 | $ | 321,892 | $ | 2,114,316 | 86.1 | % | ||||||||||||||||||||||||||||

| United Kingdom | 129 | 112,268 | 63,196 | — | — | 175,464 | 7.1 | % | |||||||||||||||||||||||||||||||||

| Canada | 135 | 156,808 | 3,448 | — | 6,764 | 167,020 | 6.8 | % | |||||||||||||||||||||||||||||||||

| Total | 1,928 | $ | 1,219,612 | $ | 385,424 | $ | 523,108 | $ | 328,656 | $ | 2,456,800 | 100.0 | % | ||||||||||||||||||||||||||||

| By MSA: | |||||||||||||||||||||||||||||||||||||||||

| Los Angeles | 73 | $ | 81,612 | $ | 20,064 | $ | 41,332 | $ | — | $ | 143,008 | 5.8 | % | ||||||||||||||||||||||||||||

| New York / New Jersey | 76 | 54,216 | 13,340 | 37,648 | 3,512 | 108,716 | 4.4 | % | |||||||||||||||||||||||||||||||||

| Dallas | 69 | 53,060 | 6,592 | 29,020 | 4,436 | 93,108 | 3.8 | % | |||||||||||||||||||||||||||||||||

| Greater London | 49 | 69,092 | 16,924 | — | — | 86,016 | 3.5 | % | |||||||||||||||||||||||||||||||||

| Washington D.C. | 40 | 37,916 | 6,328 | 12,316 | 18,660 | 75,220 | 3.1 | % | |||||||||||||||||||||||||||||||||

| Montréal | 25 | 55,624 | — | — | — | 55,624 | 2.3 | % | |||||||||||||||||||||||||||||||||

| Houston | 37 | 9,496 | 3,436 | 40,576 | — | 53,508 | 2.2 | % | |||||||||||||||||||||||||||||||||

| Philadelphia | 45 | 5,972 | 5,232 | 16,700 | 25,520 | 53,424 | 2.2 | % | |||||||||||||||||||||||||||||||||

| Chicago | 49 | 30,272 | 6,120 | 9,004 | 5,784 | 51,180 | 2.1 | % | |||||||||||||||||||||||||||||||||

| Charlotte | 28 | 7,572 | 10,492 | 24,472 | — | 42,536 | 1.7 | % | |||||||||||||||||||||||||||||||||

| Raleigh | 13 | 8,744 | 29,524 | 3,144 | — | 41,412 | 1.7 | % | |||||||||||||||||||||||||||||||||

| San Diego | 17 | 19,000 | 7,096 | 11,848 | 3,000 | 40,944 | 1.7 | % | |||||||||||||||||||||||||||||||||

| Tampa | 37 | 304 | 4,472 | 5,956 | 28,400 | 39,132 | 1.6 | % | |||||||||||||||||||||||||||||||||

| San Francisco | 23 | 26,416 | 10,528 | 1,900 | — | 38,844 | 1.6 | % | |||||||||||||||||||||||||||||||||

| Seattle | 26 | 16,028 | 1,112 | 15,448 | 4,176 | 36,764 | 1.5 | % | |||||||||||||||||||||||||||||||||

| Pittsburgh | 27 | 17,500 | 4,588 | 4,532 | 7,964 | 34,584 | 1.4 | % | |||||||||||||||||||||||||||||||||

| Minneapolis | 21 | (28) | 17,812 | 13,432 | — | 31,216 | 1.3 | % | |||||||||||||||||||||||||||||||||

| Baltimore | 16 | 5,012 | 1,712 | 11,868 | 11,580 | 30,172 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Miami | 41 | (2,196) | 1,364 | 16,888 | 13,768 | 29,824 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Kansas City | 25 | 11,492 | 9,964 | 744 | 6,136 | 28,336 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Remaining | 1,191 | 712,508 | 208,724 | 226,280 | 195,720 | 1,343,232 | 54.5 | % | |||||||||||||||||||||||||||||||||

| Total | 1,928 | $ | 1,219,612 | $ | 385,424 | $ | 523,108 | $ | 328,656 | $ | 2,456,800 | 100.0 | % | ||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars, units and occupancy at Welltower pro rata ownership; dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | |||||||||||||||||||||||||||||||||||

Total Portfolio Performance(1) |

4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | ||||||||||||||||||||||||||||||

| Properties | 882 | 885 | 886 | 883 | 915 | ||||||||||||||||||||||||||||||

| Units | 88,783 | 89,240 | 89,932 | 90,953 | 99,387 | ||||||||||||||||||||||||||||||

| Total occupancy | 78.3 | % | 79.0 | % | 79.6 | % | 80.7 | % | 82.2 | % | |||||||||||||||||||||||||

| Total revenues | $ | 1,095,146 | $ | 1,143,744 | $ | 1,178,975 | $ | 1,221,753 | $ | 1,287,666 | |||||||||||||||||||||||||

| Operating expenses | 866,482 | 894,981 | 902,068 | 933,463 | 982,077 | ||||||||||||||||||||||||||||||

| NOI | $ | 228,664 | $ | 248,763 | $ | 276,907 | $ | 288,290 | $ | 305,589 | |||||||||||||||||||||||||

| NOI margin | 20.9 | % | 21.7 | % | 23.5 | % | 23.6 | % | 23.7 | % | |||||||||||||||||||||||||

| Recurring cap-ex | $ | 36,923 | $ | 26,848 | $ | 32,791 | $ | 31,685 | $ | 49,297 | |||||||||||||||||||||||||

| Other cap-ex | $ | 75,545 | $ | 45,557 | $ | 66,002 | $ | 68,281 | $ | 85,506 | |||||||||||||||||||||||||

Same Store Performance(2) |

4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | ||||||||||||||||||||||||||||||

| Properties | 647 | 647 | 647 | 647 | 647 | ||||||||||||||||||||||||||||||

| Units | 69,697 | 69,596 | 69,596 | 69,597 | 69,598 | ||||||||||||||||||||||||||||||

| Occupancy | 80.0 | % | 80.3 | % | 80.9 | % | 82.2 | % | 83.3 | % | |||||||||||||||||||||||||

| Same store revenues | $ | 868,488 | $ | 885,575 | $ | 910,059 | $ | 935,853 | $ | 952,508 | |||||||||||||||||||||||||

| Compensation | 392,440 | 394,200 | 399,147 | 406,780 | 415,781 | ||||||||||||||||||||||||||||||

| Utilities | 44,350 | 47,923 | 39,814 | 46,678 | 43,600 | ||||||||||||||||||||||||||||||

| Food | 36,887 | 34,692 | 36,284 | 36,933 | 38,652 | ||||||||||||||||||||||||||||||

| Repairs and maintenance | 25,861 | 25,783 | 27,033 | 28,577 | 28,249 | ||||||||||||||||||||||||||||||

| Property taxes | 32,266 | 35,968 | 35,423 | 35,328 | 34,496 | ||||||||||||||||||||||||||||||

| All other | 144,360 | 138,671 | 145,363 | 146,054 | 153,782 | ||||||||||||||||||||||||||||||

| Same store operating expenses | 676,164 | 677,237 | 683,064 | 700,350 | 714,560 | ||||||||||||||||||||||||||||||

| Same store NOI | $ | 192,324 | $ | 208,338 | $ | 226,995 | $ | 235,503 | $ | 237,948 | |||||||||||||||||||||||||

| Same store NOI margin % | 22.1 | % | 23.5 | % | 24.9 | % | 25.2 | % | 25.0 | % | |||||||||||||||||||||||||

| Year over year NOI growth rate | 23.7 | % | |||||||||||||||||||||||||||||||||

| Year over year revenue growth rate | 9.7 | % | |||||||||||||||||||||||||||||||||

Partners(3) |

Properties | Pro Rata Units | Welltower Ownership %(4) |

Top Markets | 4Q23 NOI | % of Total | ||||||||||||||||||||||||||||||||

| Cogir Management Corporation | 106 | 15,673 | 88.7 | % | Southern California | $ | 31,280 | 10.2 | % | |||||||||||||||||||||||||||||

| Sunrise Senior Living | 91 | 8,094 | 98.4 | % | Northern California | 18,904 | 6.2 | % | ||||||||||||||||||||||||||||||

| Oakmont Management Group | 63 | 6,557 | 100.0 | % | New York / New Jersey | 13,421 | 4.4 | % | ||||||||||||||||||||||||||||||

| Atria Senior Living | 91 | 10,728 | 100.0 | % | Greater London, UK | 17,273 | 5.7 | % | ||||||||||||||||||||||||||||||

| Belmont Village | 21 | 2,804 | 95.0 | % | Dallas | 13,080 | 4.3 | % | ||||||||||||||||||||||||||||||

| Avery Healthcare | 41 | 3,239 | 98.0 | % | Washington D.C. | 10,791 | 3.5 | % | ||||||||||||||||||||||||||||||

| Legend Senior Living | 40 | 3,208 | 93.9 | % | Montréal, QC | 15,143 | 5.0 | % | ||||||||||||||||||||||||||||||

| Sagora Senior Living | 19 | 3,010 | 99.5 | % | Toronto, ON | 7,815 | 2.6 | % | ||||||||||||||||||||||||||||||

| StoryPoint Senior Living | 60 | 6,954 | 100.0 | % | Chicago | 7,514 | 2.5 | % | ||||||||||||||||||||||||||||||

| Brandywine Living | 29 | 2,722 | 99.5 | % | Portland, OR | 5,688 | 1.9 | % | ||||||||||||||||||||||||||||||

| Clover | 36 | 3,950 | 90.4 | % | Top Markets | 140,909 | 46.3 | % | ||||||||||||||||||||||||||||||

| Care UK | 26 | 1,870 | 100.0 | % | All Other | 164,680 | 53.7 | % | ||||||||||||||||||||||||||||||

| Senior Resource Group | 12 | 1,258 | 47.2 | % | Total | $ | 305,589 | 100.0 | % | |||||||||||||||||||||||||||||

| Quality Senior Living | 12 | 1,277 | 100.0 | % | ||||||||||||||||||||||||||||||||||

| Remaining | 253 | 26,599 | ||||||||||||||||||||||||||||||||||||

| Total | 900 | 97,943 | ||||||||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||||||||

| Payment Coverage Stratification | |||||||||||||||||||||||||||||||||||||||||||||||

EBITDARM Coverage(1) |

EBITDAR Coverage(1) |

||||||||||||||||||||||||||||||||||||||||||||||

| % of In-Place NOI | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | |||||||||||||||||||||||||||||||||||||

| <.85x | 2.1 | % | — | % | 2.1 | % | 9 | 2 | 3.2 | % | — | % | 3.2 | % | 10 | 5 | |||||||||||||||||||||||||||||||

| .85x-.95x | 1.0 | % | — | % | 1.0 | % | 13 | 2 | 2.0 | % | 0.4 | % | 2.4 | % | 5 | 4 | |||||||||||||||||||||||||||||||

| .95x-1.05x | 1.3 | % | — | % | 1.3 | % | 7 | 1 | 2.3 | % | 0.9 | % | 3.2 | % | 11 | 3 | |||||||||||||||||||||||||||||||

| 1.05x-1.15x | 0.7 | % | 0.4 | % | 1.1 | % | 4 | 3 | 6.7 | % | — | % | 6.7 | % | 9 | 5 | |||||||||||||||||||||||||||||||

| 1.15x-1.25x | 1.4 | % | 0.9 | % | 2.3 | % | 9 | 2 | 0.2 | % | — | % | 0.2 | % | 13 | 2 | |||||||||||||||||||||||||||||||

| 1.25x-1.35x | 7.2 | % | — | % | 7.2 | % | 10 | 5 | — | % | — | % | — | % | 9 | 1 | |||||||||||||||||||||||||||||||

| >1.35 | 1.2 | % | 1.4 | % | 2.6 | % | 14 | 12 | 0.5 | % | 1.4 | % | 1.9 | % | 15 | 7 | |||||||||||||||||||||||||||||||

| Total | 14.9 | % | 2.7 | % | 17.6 | % | 10 | 27 | 14.9 | % | 2.7 | % | 17.6 | % | 10 | 27 | |||||||||||||||||||||||||||||||

Revenue and Lease Maturity(2) |

||||||||||||||||||||||||||||||||||||||

| Rental Income | ||||||||||||||||||||||||||||||||||||||

| Year | Seniors Housing Triple-net |

Outpatient Medical | Long-Term / Post-Acute Care | Interest Income |

Total Revenues |

% of Total | ||||||||||||||||||||||||||||||||

| 2024 | $ | 13,495 | $ | 64,497 | $ | — | $ | 36,835 | $ | 114,827 | 7.7 | % | ||||||||||||||||||||||||||

| 2025 | 5,667 | 40,473 | 720 | 12,023 | 58,883 | 4.0 | % | |||||||||||||||||||||||||||||||

| 2026 | 3,498 | 48,915 | 9,356 | 40,127 | 101,896 | 6.9 | % | |||||||||||||||||||||||||||||||

| 2027 | — | 39,958 | 1,232 | 11,884 | 53,074 | 3.6 | % | |||||||||||||||||||||||||||||||

| 2028 | — | 44,694 | 6,404 | 101,864 | 152,962 | 10.3 | % | |||||||||||||||||||||||||||||||

| 2029 | 1,035 | 38,491 | — | 451 | 39,977 | 2.7 | % | |||||||||||||||||||||||||||||||

| 2030 | 42,277 | 35,573 | 28,721 | 356 | 106,927 | 7.2 | % | |||||||||||||||||||||||||||||||

| 2031 | 6,390 | 50,215 | 4,372 | 233 | 61,210 | 4.1 | % | |||||||||||||||||||||||||||||||

| 2032 | 91,884 | 42,173 | — | 348 | 134,405 | 9.1 | % | |||||||||||||||||||||||||||||||

| 2033 | 54,813 | 31,710 | — | — | 86,523 | 5.8 | % | |||||||||||||||||||||||||||||||

| Thereafter | 163,561 | 130,082 | 277,236 | 1,937 | 572,816 | 38.6 | % | |||||||||||||||||||||||||||||||

| $ | 382,620 | $ | 566,781 | $ | 328,041 | $ | 206,058 | $ | 1,483,500 | 100.0 | % | |||||||||||||||||||||||||||

| Weighted Avg Maturity Years | 11 | 6 | 15 | 4 | 9 | |||||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars, square feet and occupancy at Welltower pro rata ownership; dollars in thousands except per square feet) | ||||||||||||||||||||||||||||||||

| Outpatient Medical | ||||||||||||||||||||||||||||||||

Total Portfolio Performance(1) |

4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |||||||||||||||||||||||||||

| Properties | 389 | 419 | 420 | 422 | 426 | |||||||||||||||||||||||||||

| Square feet | 18,844,516 | 20,188,159 | 20,236,315 | 20,748,969 | 21,043,557 | |||||||||||||||||||||||||||

| Occupancy | 94.2 | % | 94.0 | % | 94.4 | % | 94.5 | % | 94.5 | % | ||||||||||||||||||||||

| Total revenues | $ | 176,816 | $ | 185,190 | $ | 186,802 | $ | 195,136 | $ | 192,822 | ||||||||||||||||||||||

| Operating expenses | 53,259 | 58,977 | 59,358 | 63,831 | 55,060 | |||||||||||||||||||||||||||

| NOI | $ | 123,557 | $ | 126,213 | $ | 127,444 | $ | 131,305 | $ | 137,762 | ||||||||||||||||||||||

| NOI margin | 69.9 | % | 68.2 | % | 68.2 | % | 67.3 | % | 71.4 | % | ||||||||||||||||||||||

| Revenues per square foot | $ | 37.53 | $ | 36.69 | $ | 36.92 | $ | 37.62 | $ | 36.65 | ||||||||||||||||||||||

| NOI per square foot | $ | 26.23 | $ | 25.01 | $ | 25.19 | $ | 25.31 | $ | 26.19 | ||||||||||||||||||||||

| Recurring cap-ex | $ | 25,200 | $ | 10,666 | $ | 7,400 | $ | 18,340 | $ | 21,106 | ||||||||||||||||||||||

| Other cap-ex | $ | 5,633 | $ | 5,118 | $ | 4,397 | $ | 8,545 | $ | 10,151 | ||||||||||||||||||||||

Same Store Performance(2) |

4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | |||||||||||||||||||||||||||

| Properties | 377 | 377 | 377 | 377 | 377 | |||||||||||||||||||||||||||

| Occupancy | 95.0 | % | 94.8 | % | 95.0 | % | 95.1 | % | 94.9 | % | ||||||||||||||||||||||

| Same store revenues | $ | 167,023 | $ | 171,885 | $ | 170,589 | $ | 173,494 | $ | 166,567 | ||||||||||||||||||||||

| Same store operating expenses | 51,380 | 55,372 | 53,221 | 56,001 | 47,655 | |||||||||||||||||||||||||||

| Same store NOI | $ | 115,643 | $ | 116,513 | $ | 117,368 | $ | 117,493 | $ | 118,912 | ||||||||||||||||||||||

| NOI margin | 69.2 | % | 67.8 | % | 68.8 | % | 67.7 | % | 71.4 | % | ||||||||||||||||||||||

| Year over year NOI growth rate | 2.8 | % | ||||||||||||||||||||||||||||||

|

Portfolio Diversification

by Tenant(3)

|

Rental Income | % of Total | Quality Indicators | ||||||||||||||||||||

| Kelsey-Seybold | $ | 38,864 | 6.9 | % | Health system affiliated properties as % of NOI(3) |

87.7 | % | ||||||||||||||||

| United Health Care Services | 18,183 | 3.2 | % | Health system affiliated tenants as % of rental income(3) |

59.7 | % | |||||||||||||||||

| Common Spirit Health | 17,890 | 3.2 | % | Investment grade tenants as % of rental income | 55.2 | % | |||||||||||||||||

| Novant Health | 17,837 | 3.1 | % | Retention (trailing twelve months)(3) |

93.1 | % | |||||||||||||||||

| Providence Health & Services | 16,667 | 2.9 | % | In-house managed properties as % of square feet(3,4) |

85.9 | % | |||||||||||||||||

| Remaining portfolio | 457,340 | 80.7 | % | Average remaining lease term (years)(3) |

6.5 | ||||||||||||||||||

| Total | $ | 566,781 | 100.0 | % | Average building size (square feet)(3) |

58,591 | |||||||||||||||||

| Average age (years) | 19 | ||||||||||||||||||||||

Expirations(3) |

2024 | 2025 | 2026 | 2027 | 2028 | Thereafter | ||||||||||||||||||||||||||||||||

| Occupied square feet | 2,178,889 | 1,353,141 | 1,780,047 | 1,383,357 | 1,594,925 | 11,594,553 | ||||||||||||||||||||||||||||||||

| % of occupied square feet | 11.0 | % | 6.8 | % | 9.0 | % | 7.0 | % | 8.0 | % | 58.2 | % | ||||||||||||||||||||||||||

| Investment | |||||

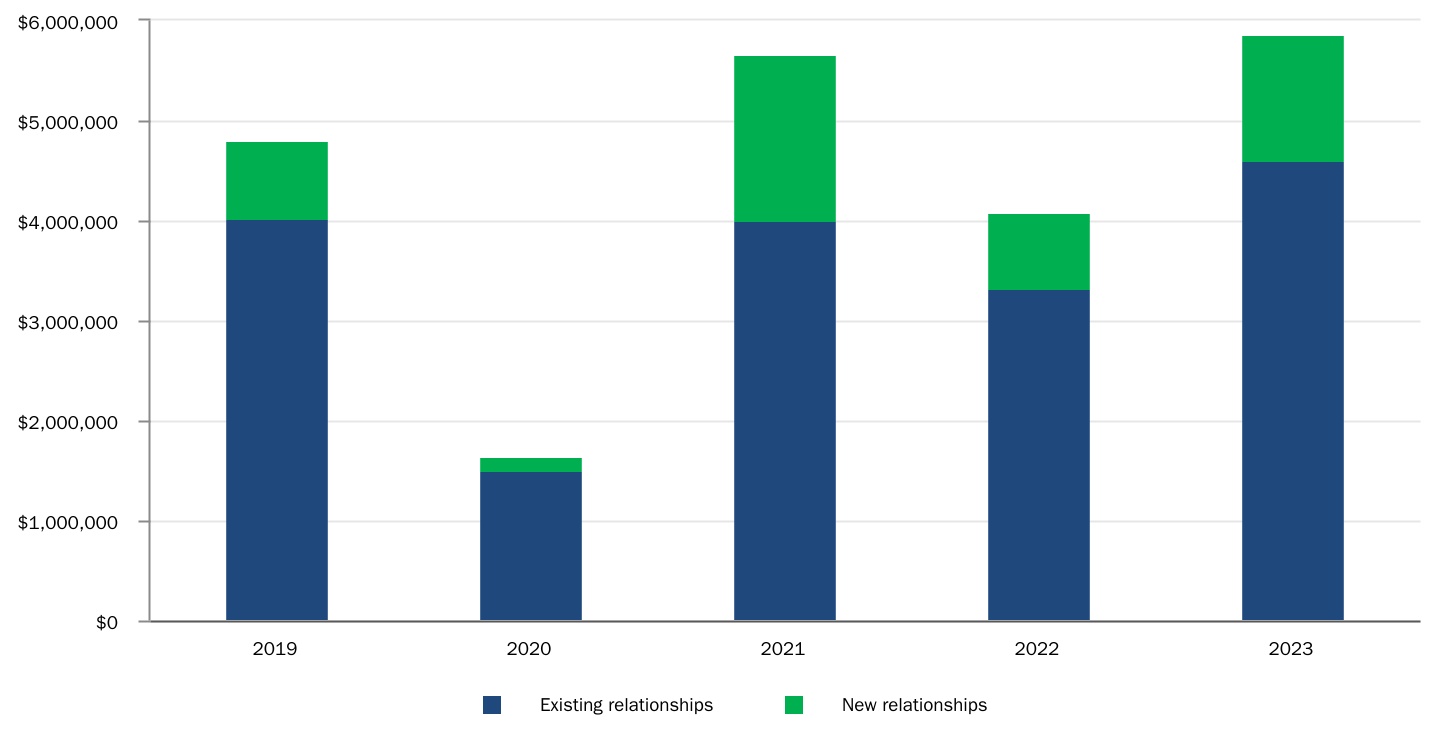

Detail of Acquisitions/JVs(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 19-23 Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| Count | 27 | 12 | 35 | 27 | 11 | 2 | 14 | 25 | 153 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 4,073,554 | $ | 910,217 | $ | 4,101,534 | $ | 2,785,739 | $ | 443,240 | $ | 145,094 | $ | 1,098,410 | $ | 2,535,962 | $ | 16,093,750 | ||||||||||||||||||||||||||||||||||||||

| Low | 7,550 | 6,201 | 5,000 | 6,485 | 19,967 | 34,532 | 2,950 | 5,015 | 2,950 | |||||||||||||||||||||||||||||||||||||||||||||||

| Median | 38,800 | 48,490 | 45,157 | 66,074 | 78,250 | 72,547 | 37,372 | 57,720 | 48,711 | |||||||||||||||||||||||||||||||||||||||||||||||

| High | 1,250,000 | 235,387 | 1,576,642 | 389,149 | 140,172 | 110,562 | 318,053 | 644,443 | 1,576,642 | |||||||||||||||||||||||||||||||||||||||||||||||

| Investment Timing | |||||||||||||||||||||||||||||

Acquisitions and Loan Funding(2) |

Yield | Construction Conversions(3) |

Year 1 Yield | Dispositions and Loan Payoffs | Yield | ||||||||||||||||||||||||

| October | $ | 930,527 | 7.1 | % | $ | 20,508 | -0.1 | % | $ | 29,293 | 6.5 | % | |||||||||||||||||

| November | 1,086,323 | 8.4 | % | 89,175 | 5.5 | % | 13,625 | 1.6 | % | ||||||||||||||||||||

| December | 735,081 | 6.4 | % | 224,841 | 1.8 | % | — | — | % | ||||||||||||||||||||

| Total | $ | 2,751,931 | 7.4 | % | $ | 334,524 | 2.7 | % | $ | 42,918 | 4.9 | % | |||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership, except per bed / unit / square foot) | ||||||||||||||||||||||||||||||||

| Gross Investment Activity | ||||||||||||||||||||||||||||||||

| Fourth Quarter 2023 | ||||||||||||||||||||||||||||||||

| Properties | Beds / Units / Square Feet | Investment Per Bed / Unit / SqFt |

Pro Rata Amount |

Yield | ||||||||||||||||||||||||||||

Acquisitions and Loan Funding(1) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 44 | 8,803 | units | $ | 222,286 | $ | 1,921,295 | |||||||||||||||||||||||||

| Outpatient Medical | 4 | 109,241 | sf | 345 | 37,547 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 34 | 4,202 | beds | 137,344 | 577,120 | |||||||||||||||||||||||||||

| Loan funding | 215,969 | |||||||||||||||||||||||||||||||

Total acquisitions and loan funding(2) |

82 | 2,751,931 | 7.4 | % | ||||||||||||||||||||||||||||

Development Funding(3) |

||||||||||||||||||||||||||||||||

| Development projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 34 | 6,242 | units | 163,339 | ||||||||||||||||||||||||||||

| Outpatient Medical | 12 | 1,105,788 | sf | 78,751 | ||||||||||||||||||||||||||||

| Total development projects | 46 | 242,090 | ||||||||||||||||||||||||||||||

| Redevelopment and expansion projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 1 | 271 | units | 11,164 | ||||||||||||||||||||||||||||

| Outpatient Medical | 4 | 229,294 | sf | 23,891 | ||||||||||||||||||||||||||||

| Total redevelopment and expansion projects | 5 | 35,055 | ||||||||||||||||||||||||||||||

| Total development funding | 51 | 277,145 | 7.0 | % | ||||||||||||||||||||||||||||

| Total gross investments | 3,029,076 | 7.4 | % | |||||||||||||||||||||||||||||

Dispositions and Loan Payoffs(4) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 2 | 209 | units | 65,191 | 13,625 | |||||||||||||||||||||||||||

| Loan payoffs | 29,293 | |||||||||||||||||||||||||||||||

Total dispositions and loan payoffs(5) |

2 | 42,918 | 4.9 | % | ||||||||||||||||||||||||||||

| Net investments (dispositions) | $ | 2,986,158 | ||||||||||||||||||||||||||||||

| Investment | |||||

| (dollars in thousands, except per bed / unit / square foot, at Welltower pro rata ownership) | ||||||||||||||||||||||||||||||||

| Gross Investment Activity | ||||||||||||||||||||||||||||||||

| Year-To-Date 2023 | ||||||||||||||||||||||||||||||||

| Properties | Beds / Units / Square Feet | Investment Per Bed / Unit / SqFt |

Pro Rata Amount |

Yield | ||||||||||||||||||||||||||||

Acquisitions and Loan Funding(1) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 52 | 9,702 | units | $ | 221,710 | $ | 2,543,439 | |||||||||||||||||||||||||

| Seniors Housing Triple-net | 8 | 612 | units | 122,217 | 74,797 | |||||||||||||||||||||||||||

| Outpatient Medical | 35 | 1,615,566 | sf | 286 | 621,770 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 58 | 7,099 | beds | 138,428 | 982,700 | |||||||||||||||||||||||||||

| Loan funding | 579,334 | |||||||||||||||||||||||||||||||

Total acquisitions and loan funding(2) |

153 | 4,802,040 | 7.2 | % | ||||||||||||||||||||||||||||

Development Funding(3) |

||||||||||||||||||||||||||||||||

| Development projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 44 | 7,435 | units | 614,262 | ||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 1 | 191 | units | 13,264 | ||||||||||||||||||||||||||||

| Outpatient Medical | 15 | 1,172,453 | sf | 275,043 | ||||||||||||||||||||||||||||

| Total development projects | 60 | 902,569 | ||||||||||||||||||||||||||||||

| Redevelopment and expansion projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 1 | 271 | units | 29,183 | ||||||||||||||||||||||||||||

| Outpatient Medical | 8 | 327,894 | sf | 122,376 | ||||||||||||||||||||||||||||

| Total redevelopment and expansion projects | 9 | 151,559 | ||||||||||||||||||||||||||||||

| Total development funding | 69 | 1,054,128 | 6.9 | % | ||||||||||||||||||||||||||||

| Total gross investments | 5,856,168 | 7.1 | % | |||||||||||||||||||||||||||||

Dispositions and Loan Payoffs(4) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 23 | 1,881 | units | 514,881 | 536,788 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | 2 | 141 | units | 46,348 | 6,535 | |||||||||||||||||||||||||||

| Outpatient Medical | 1 | 33,934 | sf | 97 | 492 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | — | — | beds | — | 74,279 | |||||||||||||||||||||||||||

| Loan payoffs | 92,823 | |||||||||||||||||||||||||||||||

| Leasehold termination | 7 | 1,112 | beds | 163,750 | 182,090 | |||||||||||||||||||||||||||

Total dispositions and loan payoffs(5) |

33 | 893,007 | 3.5 | % | ||||||||||||||||||||||||||||

| Net investments (dispositions) | $ | 4,963,161 | ||||||||||||||||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

Development Summary(1) |

|||||||||||||||||||||||||||||||||||||||||

| Unit Mix | |||||||||||||||||||||||||||||||||||||||||

| Facility MSA | Total | Wellness Housing | Independent Living | Assisted Living | Memory Care | Commitment Amount | Future Funding | Estimated Conversion(2) |

|||||||||||||||||||||||||||||||||

| Seniors Housing Operating | |||||||||||||||||||||||||||||||||||||||||

| Charlotte, NC | 328 | 328 | — | — | — | $ | 59,079 | $ | 1,420 | 1Q24 | |||||||||||||||||||||||||||||||

| Houston, TX | 130 | 130 | — | — | — | 34,216 | 2,006 | 3Q23 - 1Q24 | |||||||||||||||||||||||||||||||||

| Phoenix, AZ | 204 | 204 | — | — | — | 51,179 | 6,037 | 4Q23 - 2Q24 | |||||||||||||||||||||||||||||||||

| San Diego, CA | 96 | — | — | 56 | 40 | 42,340 | 3,970 | 2Q24 | |||||||||||||||||||||||||||||||||

| Hartford, CT | 128 | 128 | — | — | — | 22,005 | — | 2Q24 | |||||||||||||||||||||||||||||||||

| Hartford, CT | 122 | 122 | — | — | — | 20,616 | — | 2Q24 | |||||||||||||||||||||||||||||||||

| Dallas, TX | 72 | 72 | — | — | — | 20,378 | 4,658 | 3Q23 - 2Q24 | |||||||||||||||||||||||||||||||||

| Dallas, TX | 55 | 55 | — | — | — | 17,280 | 6,166 | 1Q24 - 2Q24 | |||||||||||||||||||||||||||||||||

| Cincinnati, OH | 122 | 122 | — | — | — | 15,602 | 2,586 | 2Q24 | |||||||||||||||||||||||||||||||||

| Washington D.C. | 302 | — | 190 | 89 | 23 | 157,660 | 25,040 | 3Q24 | |||||||||||||||||||||||||||||||||

| Vancouver, BC | 85 | — | — | 45 | 40 | 58,597 | 4,033 | 3Q24 | |||||||||||||||||||||||||||||||||

| Naples, FL | 188 | 188 | — | — | — | 52,568 | 23,161 | 3Q24 | |||||||||||||||||||||||||||||||||

| Phoenix, AZ | 199 | 199 | — | — | — | 51,794 | 4,936 | 1Q24 - 3Q24 | |||||||||||||||||||||||||||||||||

| Tampa, FL | 206 | 206 | — | — | — | 49,646 | 17,984 | 2Q24 - 3Q24 | |||||||||||||||||||||||||||||||||

| Norwich, UK | 80 | — | — | 52 | 28 | 9,669 | 4,161 | 3Q24 | |||||||||||||||||||||||||||||||||

| Boston, MA | 160 | — | 82 | 37 | 41 | 149,274 | 37,809 | 4Q24 | |||||||||||||||||||||||||||||||||

| Kansas City, MO | 265 | 265 | — | — | — | 70,864 | 51,501 | 4Q24 | |||||||||||||||||||||||||||||||||

| Miami, FL | 91 | — | — | 55 | 36 | 69,951 | 30,360 | 4Q24 | |||||||||||||||||||||||||||||||||

| Sacramento, CA | 100 | — | — | 70 | 30 | 43,815 | 21,844 | 4Q24 | |||||||||||||||||||||||||||||||||

| Phoenix, AZ | 110 | 110 | — | — | — | 40,195 | 23,947 | 2Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Kansas City, MO | 134 | 134 | — | — | — | 20,926 | — | 4Q24 | |||||||||||||||||||||||||||||||||

| Cambridge, UK | 70 | — | — | 45 | 25 | 10,284 | 5,597 | 4Q24 | |||||||||||||||||||||||||||||||||

| San Jose, CA | 685 | 509 | — | 143 | 33 | 175,381 | 4,242 | 1Q25 | |||||||||||||||||||||||||||||||||

| Washington D.C. | 137 | — | 53 | 47 | 37 | 120,793 | 45,135 | 1Q25 | |||||||||||||||||||||||||||||||||

| Chattanooga, TN | 243 | 243 | — | — | — | 62,116 | 50,005 | 3Q24 - 1Q25 | |||||||||||||||||||||||||||||||||

| San Jose, CA | 158 | — | — | 158 | — | 61,929 | 29,122 | 1Q25 | |||||||||||||||||||||||||||||||||

| Columbus, OH | 409 | 409 | — | — | — | 82,069 | 51,124 | 2Q25 | |||||||||||||||||||||||||||||||||

| Sherman, TX | 237 | 237 | — | — | — | 75,618 | 54,492 | 3Q24 - 2Q25 | |||||||||||||||||||||||||||||||||

| Killeen, TX | 256 | 256 | — | — | — | 68,505 | 52,000 | 4Q23 - 2Q25 | |||||||||||||||||||||||||||||||||

| Dallas, TX | 141 | 141 | — | — | — | 47,261 | 38,451 | 4Q24 - 3Q25 | |||||||||||||||||||||||||||||||||

| Little Rock, AR | 283 | 283 | — | — | — | 13,456 | 5,381 | 3Q25 | |||||||||||||||||||||||||||||||||

Various(3) |

271 | 75 | 196 | — | — | 29,076 | 15,842 | 1Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Subtotal | 6,067 | 4,416 | 521 | 797 | 333 | 1,804,142 | 623,010 | ||||||||||||||||||||||||||||||||||

| Outpatient Medical | Rentable Square Ft | Preleased % | Health System Affiliation | Commitment Amount | Future Funding | Estimated Conversion | |||||||||||||||||||||||||||||||||||

| Houston, TX | 121,368 | 100 | % | Yes | 74,842 | 9,852 | 4Q23 - 1Q24 | ||||||||||||||||||||||||||||||||||

| Oklahoma City, OK | 134,285 | 100 | % | Yes | 88,912 | 8,542 | 2Q24 | ||||||||||||||||||||||||||||||||||

| Santa Fe, NM | 90,000 | 100 | % | Yes | 45,977 | 21,087 | 3Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 51,134 | 100 | % | Yes | 28,723 | 21,958 | 3Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 135,255 | 100 | % | Yes | 86,559 | 63,959 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 111,803 | 100 | % | Yes | 78,282 | 62,140 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 36,248 | 100 | % | Yes | 32,991 | 22,252 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 50,323 | 100 | % | Yes | 30,156 | 23,464 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 116,000 | 100 | % | Yes | 76,800 | 71,116 | 1Q25 | ||||||||||||||||||||||||||||||||||

| Durango, CO | 33,290 | 100 | % | Yes | 24,112 | 22,547 | 1Q25 | ||||||||||||||||||||||||||||||||||

| Oklahoma City, OK | 47,636 | 100 | % | Yes | 40,543 | 35,042 | 2Q25 | ||||||||||||||||||||||||||||||||||

| Subtotal | 927,342 | 607,897 | 361,959 | ||||||||||||||||||||||||||||||||||||||

| Total Development Projects | $ | 2,412,039 | $ | 984,969 | |||||||||||||||||||||||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

Development Funding Projections(1) |

|||||||||||||||||||||||||||||||||||||||||

| Projected Future Funding | |||||||||||||||||||||||||||||||||||||||||

| Projects | Beds / Units / Square Feet | Stable Yields(2) |

2024 Funding | Funding Thereafter | Total Unfunded Commitments | Committed Balances | |||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 32 | 6,067 | 7.4 | % | $ | 504,855 | $ | 118,155 | $ | 623,010 | $ | 1,804,142 | |||||||||||||||||||||||||||||

| Outpatient Medical | 11 | 927,342 | 6.3 | % | 314,171 | 47,788 | 361,959 | 607,897 | |||||||||||||||||||||||||||||||||

| Total | 43 | 7.1 | % | $ | 819,026 | $ | 165,943 | $ | 984,969 | $ | 2,412,039 | ||||||||||||||||||||||||||||||

Development Project Conversion Estimates(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Conversions | Annual Conversions | |||||||||||||||||||||||||||||||||||||||||||

| Amount | Year 1 Yields(2) |

Stable Yields(2) |

Amount | Year 1 Yields(2) |

Stable Yields(2) |

|||||||||||||||||||||||||||||||||||||||

| 1Q23 actual | $ | 57,473 | 0.4 | % | 6.7 | % | 2023 actual | $ | 835,572 | 2.3 | % | 7.5 | % | |||||||||||||||||||||||||||||||

| 2Q23 actual | 315,262 | 3.0 | % | 8.2 | % | 2024 estimate | 1,563,456 | 1.8 | % | 7.1 | % | |||||||||||||||||||||||||||||||||

| 3Q23 actual | 137,270 | 0.9 | % | 7.2 | % | 2025 estimate | 848,583 | 3.3 | % | 7.1 | % | |||||||||||||||||||||||||||||||||

| 4Q23 actual | 325,567 | 2.6 | % | 7.0 | % | Total | $ | 3,247,611 | 2.3 | % | 7.2 | % | ||||||||||||||||||||||||||||||||

| 1Q24 estimate | 168,137 | 4.1 | % | 6.4 | % | |||||||||||||||||||||||||||||||||||||||

| 2Q24 estimate | 278,312 | 1.9 | % | 6.4 | % | |||||||||||||||||||||||||||||||||||||||

| 3Q24 estimate | 454,634 | 0.3 | % | 7.6 | % | |||||||||||||||||||||||||||||||||||||||

| 4Q24 estimate | 662,373 | 2.2 | % | 7.3 | % | |||||||||||||||||||||||||||||||||||||||

| 1Q25 estimate | 521,131 | 4.2 | % | 7.0 | % | |||||||||||||||||||||||||||||||||||||||

| 2Q25 estimate | 266,735 | 1.9 | % | 7.3 | % | |||||||||||||||||||||||||||||||||||||||

| 3Q25 estimate | 60,717 | 1.7 | % | 6.7 | % | |||||||||||||||||||||||||||||||||||||||

| Total | $ | 3,247,611 | 2.3 | % | 7.2 | % | ||||||||||||||||||||||||||||||||||||||

| Unstabilized Properties | ||||||||||||||||||||||||||||||||||||||

| 9/30/2023 Properties | Stabilizations | Construction Conversions(3) |

Acquisitions/ Dispositions | 12/31/2023 Properties | Beds / Units | |||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 41 | (3) | 3 | 3 | 44 | 6,338 | ||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 12 | — | — | (2) | 10 | 1,154 | ||||||||||||||||||||||||||||||||

| Total | 53 | (3) | 3 | 1 | 54 | 7,492 | ||||||||||||||||||||||||||||||||

| Occupancy | 9/30/2023 Properties | Stabilizations | Construction Conversions(3) |

Acquisitions/ Dispositions | Progressions | 12/31/2023 Properties | ||||||||||||||||||||||||||||||||

| 0% - 50% | 27 | — | 3 | — | (9) | 21 | ||||||||||||||||||||||||||||||||

| 50% - 70% | 17 | — | — | — | 4 | 21 | ||||||||||||||||||||||||||||||||

| 70% + | 9 | (3) | — | 1 | 5 | 12 | ||||||||||||||||||||||||||||||||

| Total | 53 | (3) | 3 | 1 | — | 54 | ||||||||||||||||||||||||||||||||

| Occupancy | 12/31/2023 Properties | Months In Operation | Revenues | % of Total Revenues(4) |

Gross Investment Balance | % of Total Gross Investment | ||||||||||||||||||||||||||||||||

| 0% - 50% | 21 | 9 | $ | 115,171 | 1.6 | % | $ | 1,148,018 | 2.4 | % | ||||||||||||||||||||||||||||

| 50% - 70% | 21 | 26 | 151,783 | 2.1 | % | 860,044 | 1.8 | % | ||||||||||||||||||||||||||||||

| 70% + | 12 | 33 | 144,034 | 2.0 | % | 460,467 | 1.0 | % | ||||||||||||||||||||||||||||||

| Total | 54 | 21 | $ | 410,988 | 5.7 | % | $ | 2,468,529 | 5.2 | % | ||||||||||||||||||||||||||||

| Financial | |||||

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

| Components of NAV | ||||||||||||||||||||

| Stabilized NOI | Pro rata beds/units/square feet | |||||||||||||||||||

Seniors Housing Operating(1) |

$ | 1,219,612 | 97,943 | units | ||||||||||||||||

| Seniors Housing Triple-net | 385,424 | 26,228 | units | |||||||||||||||||

| Outpatient Medical | 523,108 | 21,061,293 | square feet | |||||||||||||||||

| Long-Term/Post-Acute Care | 328,656 | 31,554 | beds | |||||||||||||||||

Total In-Place NOI(2) |

2,456,800 | |||||||||||||||||||

Incremental stabilized NOI(3) |

138,515 | |||||||||||||||||||

| Total stabilized NOI | $ | 2,595,315 | ||||||||||||||||||

| Obligations | ||||||||||||||||||||

Lines of credit and commercial paper(4) |

$ | — | ||||||||||||||||||

Senior unsecured notes(4) |

13,699,619 | |||||||||||||||||||

Secured debt(4) |

3,102,051 | |||||||||||||||||||

| Financing lease liabilities | 79,677 | |||||||||||||||||||

| Total debt | $ | 16,881,347 | ||||||||||||||||||

| Add (Subtract): | ||||||||||||||||||||

Other liabilities (assets), net(5) |

$ | 554,904 | ||||||||||||||||||

| Cash and cash equivalents and restricted cash | (2,076,083) | |||||||||||||||||||

| Net obligations | $ | 14,250,360 | ||||||||||||||||||

| Other Assets | ||||||||||||||||||||

Land parcels(6) |

$ | 375,851 | Effective Interest Rate(9) |

|||||||||||||||||

Real estate loans receivable(7) |

2,037,321 | 11.0% | ||||||||||||||||||

Non-real estate loans receivable(8) |

285,914 | 11.2% | ||||||||||||||||||

Joint venture real estate loans receivables(10) |

246,728 | 5.7% | ||||||||||||||||||

Property dispositions(11) |

949,662 | |||||||||||||||||||

Development properties:(12) |

||||||||||||||||||||

| Current balance | 1,372,689 | |||||||||||||||||||

| Unfunded commitments | 1,037,492 | |||||||||||||||||||

| Committed balances | $ | 2,410,181 | ||||||||||||||||||

| Projected yield | 7.1 | % | ||||||||||||||||||

| Projected NOI | $ | 171,123 | ||||||||||||||||||

Common Shares Outstanding(13) |

566,432 | |||||||||||||||||||

| Unearned revenues | $ | 374,545 | ||||||

| Below market tenant lease intangibles, net | 22,425 | |||||||

| Deferred taxes, net | (27,006) | |||||||

| Intangible assets, net | (150,727) | |||||||

| Other non-cash liabilities / (assets), net | 6,967 | |||||||

| Total non-cash liabilities/(assets), net | $ | 226,204 | ||||||

| Financial | |||||

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||||||||||||

Net Operating Income(1,2) |

||||||||||||||||||||||||||||||||

| 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 | ||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | ||||||||||||||||||||||||||||||||

| Resident fees and services | $ | 1,091,043 | $ | 1,138,916 | $ | 1,173,630 | $ | 1,216,368 | $ | 1,280,154 | ||||||||||||||||||||||

| Interest income | 2,388 | 2,318 | 1,850 | 1,928 | 2,968 | |||||||||||||||||||||||||||

| Other income | 1,715 | 2,510 | 3,495 | 3,457 | 4,544 | |||||||||||||||||||||||||||

| Total revenues | 1,095,146 | 1,143,744 | 1,178,975 | 1,221,753 | 1,287,666 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | ||||||||||||||||||||||||||||||||

| Rental income | 122,267 | 119,786 | 118,115 | 110,705 | 115,615 | |||||||||||||||||||||||||||

| Interest income | 31,837 | 31,540 | 32,657 | 33,523 | 36,150 | |||||||||||||||||||||||||||

| Other income | 1,361 | 1,675 | 1,202 | 1,168 | 924 | |||||||||||||||||||||||||||

| Total revenues | 155,465 | 153,001 | 151,974 | 145,396 | 152,689 | |||||||||||||||||||||||||||

| Outpatient Medical | ||||||||||||||||||||||||||||||||

| Rental income | 174,182 | 182,044 | 185,133 | 192,732 | 190,211 | |||||||||||||||||||||||||||

| Interest income | 86 | 91 | 95 | 98 | 382 | |||||||||||||||||||||||||||

| Other income | 2,548 | 3,055 | 1,574 | 2,306 | 2,229 | |||||||||||||||||||||||||||

| Total revenues | 176,816 | 185,190 | 186,802 | 195,136 | 192,822 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | ||||||||||||||||||||||||||||||||

| Rental income | 71,021 | 80,423 | 75,766 | 77,516 | 96,146 | |||||||||||||||||||||||||||

| Interest income | 5,982 | 6,367 | 8,264 | 10,981 | 15,784 | |||||||||||||||||||||||||||

| Other income | 153 | 193 | 65,490 | 315 | 6 | |||||||||||||||||||||||||||

| Total revenues | 77,156 | 86,983 | 149,520 | 88,812 | 111,936 | |||||||||||||||||||||||||||

| Corporate | ||||||||||||||||||||||||||||||||

| Other income | 7,714 | 5,147 | 16,807 | 33,802 | 30,021 | |||||||||||||||||||||||||||

| Total revenues | 7,714 | 5,147 | 16,807 | 33,802 | 30,021 | |||||||||||||||||||||||||||

| Total | ||||||||||||||||||||||||||||||||

| Rental income | 367,470 | 382,253 | 379,014 | 380,953 | 401,972 | |||||||||||||||||||||||||||

| Resident fees and services | 1,091,043 | 1,138,916 | 1,173,630 | 1,216,368 | 1,280,154 | |||||||||||||||||||||||||||

| Interest Income | 40,293 | 40,316 | 42,866 | 46,530 | 55,284 | |||||||||||||||||||||||||||

| Other Income | 13,491 | 12,580 | 88,568 | 41,048 | 37,724 | |||||||||||||||||||||||||||

| Total revenues | 1,512,297 | 1,574,065 | 1,684,078 | 1,684,899 | 1,775,134 | |||||||||||||||||||||||||||

| Property operating expenses: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 866,482 | 894,981 | 902,068 | 933,463 | 982,077 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | 6,924 | 7,917 | 7,996 | 7,849 | 6,662 | |||||||||||||||||||||||||||

| Outpatient Medical | 53,259 | 58,977 | 59,358 | 63,831 | 55,060 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 3,426 | 4,040 | 2,827 | 2,386 | 3,298 | |||||||||||||||||||||||||||

| Corporate | 5,086 | 3,877 | 4,135 | 3,980 | 5,957 | |||||||||||||||||||||||||||

| Total property operating expenses | 935,177 | 969,792 | 976,384 | 1,011,509 | 1,053,054 | |||||||||||||||||||||||||||

| Net operating income: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 228,664 | 248,763 | 276,907 | 288,290 | 305,589 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | 148,541 | 145,084 | 143,978 | 137,547 | 146,027 | |||||||||||||||||||||||||||

| Outpatient Medical | 123,557 | 126,213 | 127,444 | 131,305 | 137,762 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 73,730 | 82,943 | 146,693 | 86,426 | 108,638 | |||||||||||||||||||||||||||

| Corporate | 2,628 | 1,270 | 12,672 | 29,822 | 24,064 | |||||||||||||||||||||||||||

| Net operating income | $ | 577,120 | $ | 604,273 | $ | 707,694 | $ | 673,390 | $ | 722,080 | ||||||||||||||||||||||

| Financial | |||||

| (dollars in thousands) | ||||||||||||||

Leverage and EBITDA Reconciliations(1) |

||||||||||||||

| Twelve Months Ended | Three Months Ended | |||||||||||||

| December 31, 2023 | December 31, 2023 | |||||||||||||

| Net income (loss) | $ | 358,139 | $ | 88,440 | ||||||||||

| Interest expense | 607,846 | 154,574 | ||||||||||||

| Income tax expense (benefit) | 6,364 | (4,768) | ||||||||||||

| Depreciation and amortization | 1,401,101 | 380,730 | ||||||||||||

| EBITDA | 2,373,450 | 618,976 | ||||||||||||

| Loss (income) from unconsolidated entities | 53,442 | 2,008 | ||||||||||||

| Stock-based compensation | 36,611 | 8,418 | ||||||||||||

| Loss (gain) on extinguishment of debt, net | 7 | — | ||||||||||||

| Loss (gain) on real estate dispositions, net | (67,898) | 1,783 | ||||||||||||

| Impairment of assets | 36,097 | 14,994 | ||||||||||||

| Provision for loan losses, net | 9,809 | 2,517 | ||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (2,120) | (7,215) | ||||||||||||

| Other expenses | 108,341 | 36,307 | ||||||||||||

Leasehold interest termination(2) |

(65,485) | — | ||||||||||||

| Casualty losses, net of recoveries | 10,107 | 1,038 | ||||||||||||

Other impairment(3) |

16,642 | 4,333 | ||||||||||||

| Total adjustments | 135,553 | 64,183 | ||||||||||||

| Adjusted EBITDA | $ | 2,509,003 | $ | 683,159 | ||||||||||

| Interest Coverage Ratios | ||||||||||||||

| Interest expense | $ | 607,846 | $ | 154,574 | ||||||||||

| Capitalized interest | 50,699 | 14,547 | ||||||||||||

| Non-cash interest expense | (23,494) | (5,871) | ||||||||||||

| Total interest | $ | 635,051 | $ | 163,250 | ||||||||||

| EBITDA | $ | 2,373,450 | $ | 618,976 | ||||||||||

| Interest coverage ratio | 3.74 | x | 3.79 | x | ||||||||||

| Adjusted EBITDA | $ | 2,509,003 | $ | 683,159 | ||||||||||

| Adjusted Interest coverage ratio | 3.95 | x | 4.18 | x | ||||||||||

| Fixed Charge Coverage Ratios | ||||||||||||||

| Total interest | $ | 635,051 | $ | 163,250 | ||||||||||

| Secured debt principal amortization | 54,076 | 12,430 | ||||||||||||

| Total fixed charges | $ | 689,127 | $ | 175,680 | ||||||||||

| EBITDA | $ | 2,373,450 | $ | 618,976 | ||||||||||

| Fixed charge coverage ratio | 3.44 | x | 3.52 | x | ||||||||||

| Adjusted EBITDA | $ | 2,509,003 | $ | 683,159 | ||||||||||

| Adjusted Fixed charge coverage ratio | 3.64 | x | 3.89 | x | ||||||||||

| Net Debt to EBITDA Ratios | ||||||||||||||

Total debt(4) |

$ | 15,815,226 | ||||||||||||

| Less: cash and cash equivalents and restricted cash | (2,076,083) | |||||||||||||

| Net debt | $ | 13,739,143 | ||||||||||||

| EBITDA Annualized | $ | 2,475,904 | ||||||||||||

| Net debt to EBITDA ratio | 5.55 | x | ||||||||||||

| Adjusted EBITDA Annualized | $ | 2,732,636 | ||||||||||||

| Net debt to Adjusted EBITDA ratio | 5.03 | x | ||||||||||||

| Financial | |||||

| (in thousands except share price) | |||||||||||||||||

Leverage and Current Capitalization(1) | |||||||||||||||||

| % of Total | |||||||||||||||||

| Book capitalization | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | 0.00 | % | |||||||||||||

Long-term debt obligations(2)(3) |

15,815,226 | 39.43 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,076,083) | (5.18) | % | ||||||||||||||

| Net debt to consolidated book capitalization | $ | 13,739,143 | 34.25 | % | |||||||||||||

Total equity(4) |

26,371,727 | 65.75 | % | ||||||||||||||

| Consolidated book capitalization | $ | 40,110,870 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

879,606 | ||||||||||||||||

| Total book capitalization | $ | 40,990,476 | |||||||||||||||

| Undepreciated book capitalization | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | 0.00 | % | |||||||||||||

Long-term debt obligations(2)(3) |

15,815,226 | 32.02 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,076,083) | (4.20) | % | ||||||||||||||

| Net debt to consolidated undepreciated book capitalization | $ | 13,739,143 | 27.82 | % | |||||||||||||

| Accumulated depreciation and amortization | 9,274,814 | 18.78 | % | ||||||||||||||

Total equity(4) |

26,371,727 | 53.40 | % | ||||||||||||||

| Consolidated undepreciated book capitalization | $ | 49,385,684 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

879,606 | ||||||||||||||||

| Total undepreciated book capitalization | $ | 50,265,290 | |||||||||||||||

| Enterprise value | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | 0.00 | % | |||||||||||||

Long-term debt obligations(2)(3) |

15,815,226 | 24.12 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,076,083) | (3.17) | % | ||||||||||||||

| Net debt to consolidated enterprise value | $ | 13,739,143 | 20.95 | % | |||||||||||||

| Common shares outstanding | 564,241 | ||||||||||||||||

| Period end share price | 90.17 | ||||||||||||||||

| Common equity market capitalization | $ | 50,877,611 | 77.58 | % | |||||||||||||

Noncontrolling interests(4) |

967,351 | 1.47 | % | ||||||||||||||

| Consolidated enterprise value | $ | 65,584,105 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

879,606 | ||||||||||||||||

| Total enterprise value | $ | 66,463,711 | |||||||||||||||

| Secured debt as % of total assets | |||||||||||||||||

Secured debt(2) |

$ | 2,183,327 | 4.10 | % | |||||||||||||

Gross asset value(6) |

$ | 53,286,980 | |||||||||||||||

| Total debt as % of gross asset value | |||||||||||||||||

Total debt(2)(3) |

$ | 15,815,226 | 29.68 | % | |||||||||||||

Gross asset value(6) |

$ | 53,286,980 | |||||||||||||||

| Unsecured debt as % of unencumbered assets | |||||||||||||||||

Unsecured debt(2) |

$ | 13,552,222 | 28.44 | % | |||||||||||||

Unencumbered gross assets(7) |

$ | 47,647,177 | |||||||||||||||

| Financial | |||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Debt Maturities and Scheduled Principal Amortization(1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year | Lines of Credit and Commercial Paper(2) |

Senior Unsecured Notes(3,4,5,6,7) |

Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(8) |

% of Total | Wtd. Avg. Interest Rate (9) |

|||||||||||||||||||||||||||||||||||||||||||||

| 2024 | $ | — | $ | 1,350,000 | $ | 400,258 | $ | 229,175 | $ | (70,801) | $ | 1,908,632 | 11.36 | % | 4.21 | % | |||||||||||||||||||||||||||||||||||||

| 2025 | — | 1,260,000 | 428,821 | 508,473 | (48,882) | 2,148,412 | 12.79 | % | 4.08 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2026 | — | 700,000 | 155,500 | 49,248 | (20,647) | 884,101 | 5.26 | % | 4.02 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2027 | — | 1,916,604 | 210,091 | 113,121 | (33,986) | 2,205,830 | 13.13 | % | 4.57 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2028 | — | 2,485,865 | 107,546 | 26,719 | (15,397) | 2,604,733 | 15.50 | % | 3.79 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2029 | — | 1,050,000 | 318,275 | 36,701 | (1,179) | 1,403,797 | 8.36 | % | 3.81 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2030 | — | 750,000 | 57,130 | 35,197 | (127) | 842,200 | 5.01 | % | 3.13 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2031 | — | 1,350,000 | 7,044 | 34,214 | (133) | 1,391,125 | 8.28 | % | 2.77 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2032 | — | 1,050,000 | 48,021 | 3,971 | (139) | 1,101,853 | 6.56 | % | 4.97 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2033 | — | — | 395,574 | 7,353 | (35,364) | 367,563 | 2.19 | % | 4.88 | % | |||||||||||||||||||||||||||||||||||||||||||

| Thereafter | — | 1,787,150 | 94,185 | 67,044 | (4,955) | 1,943,424 | 11.56 | % | 5.04 | % | |||||||||||||||||||||||||||||||||||||||||||