| Delaware | 001-36636 | 05-0412693 | |||||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

|||||||||

| One Citizens Plaza | |||||||||||

| Providence, | RI | 02903 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, $0.01 par value per share | CFG | New York Stock Exchange | ||||||

| Depositary Shares, each representing a 1/40th interest in a share of 6.350% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series D | CFG PrD | New York Stock Exchange | ||||||

| Depositary Shares, each representing a 1/40th interest in a share of 5.000% Fixed-Rate Non-Cumulative Perpetual Preferred Stock, Series E | CFG PrE | New York Stock Exchange | ||||||

| Exhibit Number | Description | ||||||||||

| (d) | Exhibit 99.1 | ||||||||||

| Exhibit 99.2 | |||||||||||

| Exhibit 99.3 | |||||||||||

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||||||||

| CITIZENS FINANCIAL GROUP, INC. | ||||||||

| By: | /s/ John F. Woods | |||||||

| John F. Woods | ||||||||

| Vice Chair and Chief Financial Officer | ||||||||

| Key Financial Data | 4Q23 | 3Q23 | 4Q22 | Fourth Quarter 2023 Highlights |

||||||||||||||||||||||

| Income Statement |

($s in millions) |

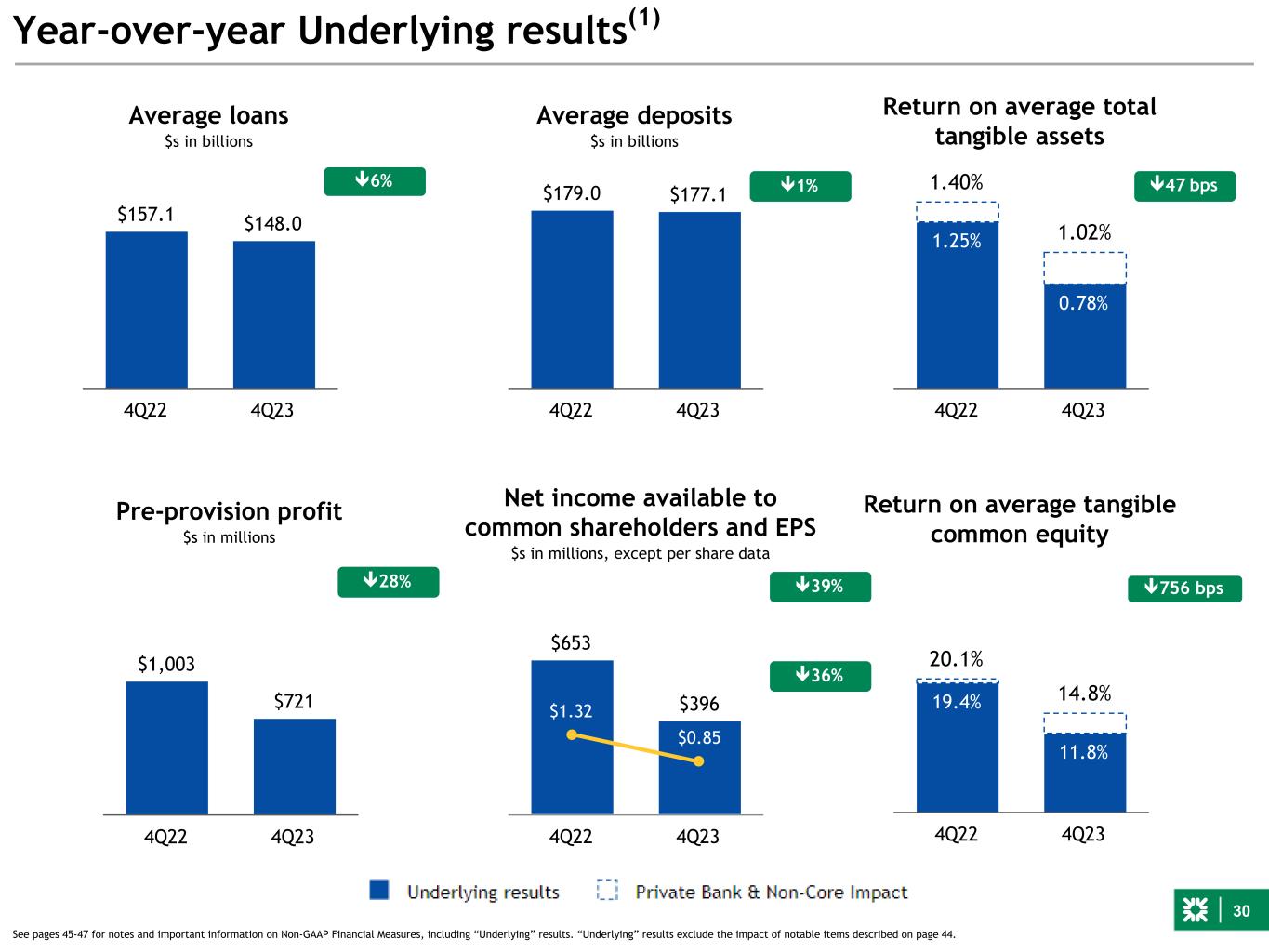

■Underlying EPS of $0.85 and ROTCE of 11.8%

■Underlying PPNR of $721 million

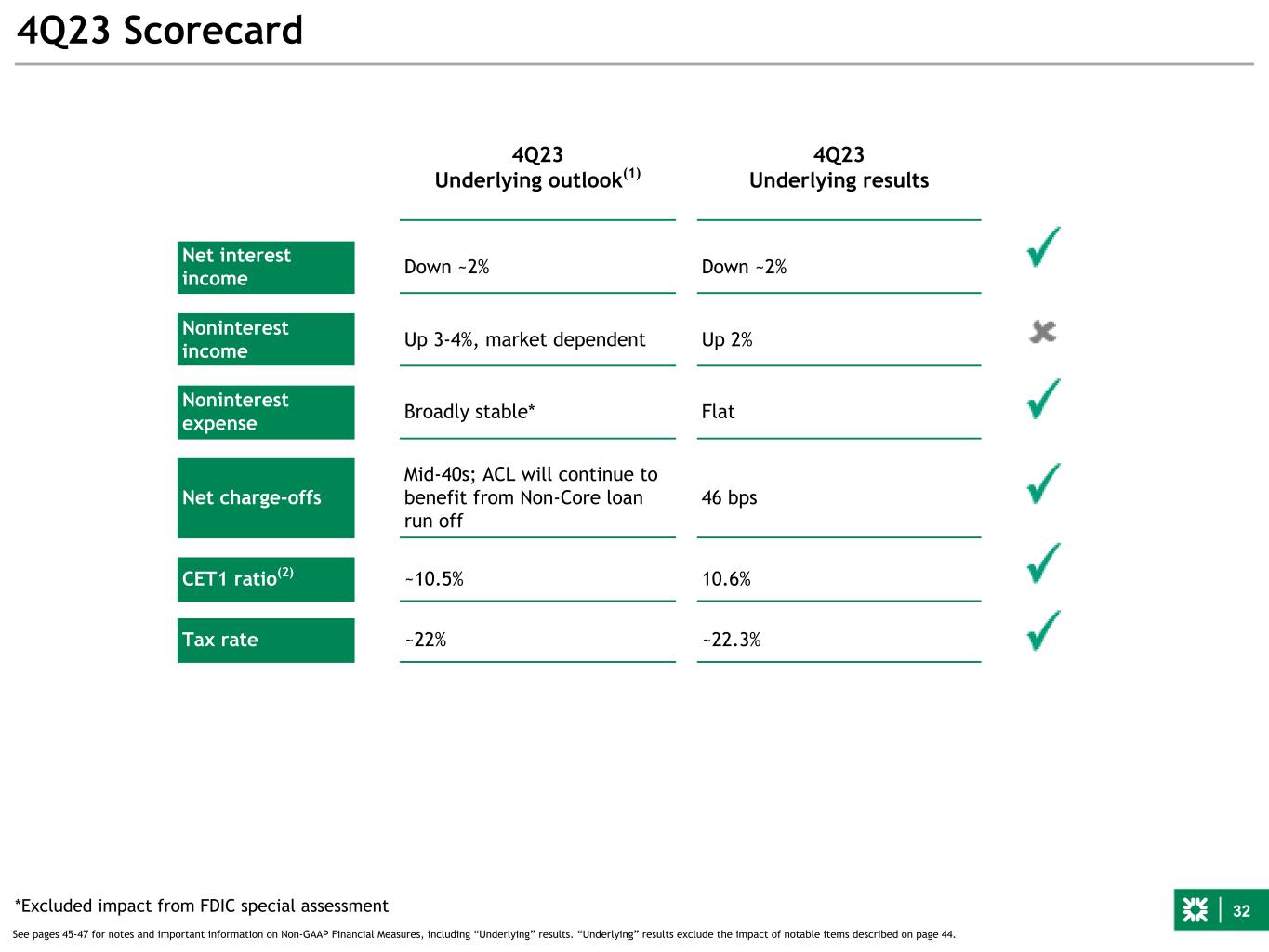

–NII down 2% QoQ given lower NIM, partly offset by a modest increase in interest-earning assets

–Fees up 2% QoQ with improved Capital Markets and Wealth, partly offset by lower Mortgage Banking

–Expenses stable QoQ including the Private Bank start-up investment

■Underlying efficiency ratio of 63.8%, or 61.9% excluding Private Bank start-up investment

■Provision for credit losses of $171 million; ACL/loans ratio up 4 bps QoQ to 1.59%

■Period-end loans down 3% and average loans down 2% QoQ given balance sheet optimization, including Non-Core portfolio run off

■Period-end and average deposits broadly stable

–Total deposit costs up 16 bps QoQ

■Period-end LDR improved to 82%

■Strong CET1 ratio of 10.6%; TCE ratio of 6.7%

■TBV/share of $30.91, up 11% QoQ

|

||||||||||||||||||||||||

| Total revenue | $ | 1,988 | $ | 2,014 | $ | 2,200 | ||||||||||||||||||||

| Pre-provision profit | 376 | 721 | 960 | |||||||||||||||||||||||

| Underlying pre-provision profit | 721 | 743 | 1,003 | |||||||||||||||||||||||

| Provision for credit losses | 171 | 172 | 132 | |||||||||||||||||||||||

| Net income | 189 | 430 | 653 | |||||||||||||||||||||||

| Underlying net income | 426 | 448 | 685 | |||||||||||||||||||||||

| Balance Sheet & Credit Quality |

($s in billions) | |||||||||||||||||||||||||

| Period-end loans and leases | $ | 146.0 | $ | 149.7 | $ | 156.7 | ||||||||||||||||||||

| Average loans and leases | 148.0 | 150.8 | 157.1 | |||||||||||||||||||||||

| Period-end deposits | 177.3 | 178.2 | 180.7 | |||||||||||||||||||||||

| Average deposits | 177.1 | 176.5 | 179.0 | |||||||||||||||||||||||

Period-end loan-to-deposit ratio |

82.3 | % | 84.0 | % | 86.7 | % | ||||||||||||||||||||

| NCO ratio | 0.46 | % | 0.40 | % | 0.22 | % | ||||||||||||||||||||

| Financial Metrics | Diluted EPS | $ | 0.34 | $ | 0.85 | $ | 1.25 | |||||||||||||||||||

| Underlying EPS | 0.85 | 0.89 | 1.32 | |||||||||||||||||||||||

| ROTCE | 4.7 | % | 12.0 | % | 18.5 | % | ||||||||||||||||||||

| Underlying ROTCE | 11.8 | 12.5 | 19.4 | |||||||||||||||||||||||

| Net interest margin, FTE | 2.91 | 3.03 | 3.30 | |||||||||||||||||||||||

| Efficiency ratio | 81.1 | 64.2 | 56.4 | |||||||||||||||||||||||

| Underlying efficiency ratio | 63.8 | 63.1 | 54.4 | |||||||||||||||||||||||

| CET1 | 10.6 | % | 10.4 | % | 10.0 | % | ||||||||||||||||||||

| TBV/Share | $ | 30.91 | $ | 27.73 | $ | 27.88 | ||||||||||||||||||||

| Notable Items | 4Q23 | ||||||||||||||||

| ($s in millions except per share data) | Pre-tax $ | EPS | |||||||||||||||

| Integration related | $ | (5) | $ | (0.01) | |||||||||||||

| TOP and Other items | (115) | (0.15) | |||||||||||||||

FDIC special assessment |

(225) | (0.35) | |||||||||||||||

| Total: | $ | (345) | $ | (0.51) | |||||||||||||

| Comments from Chairman and CEO Bruce Van Saun | ||||||||

| Quarterly Trends | Full Year | |||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 change from | 2023 change from 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | |||||||||||||||||||||||||||||||||||||||||||

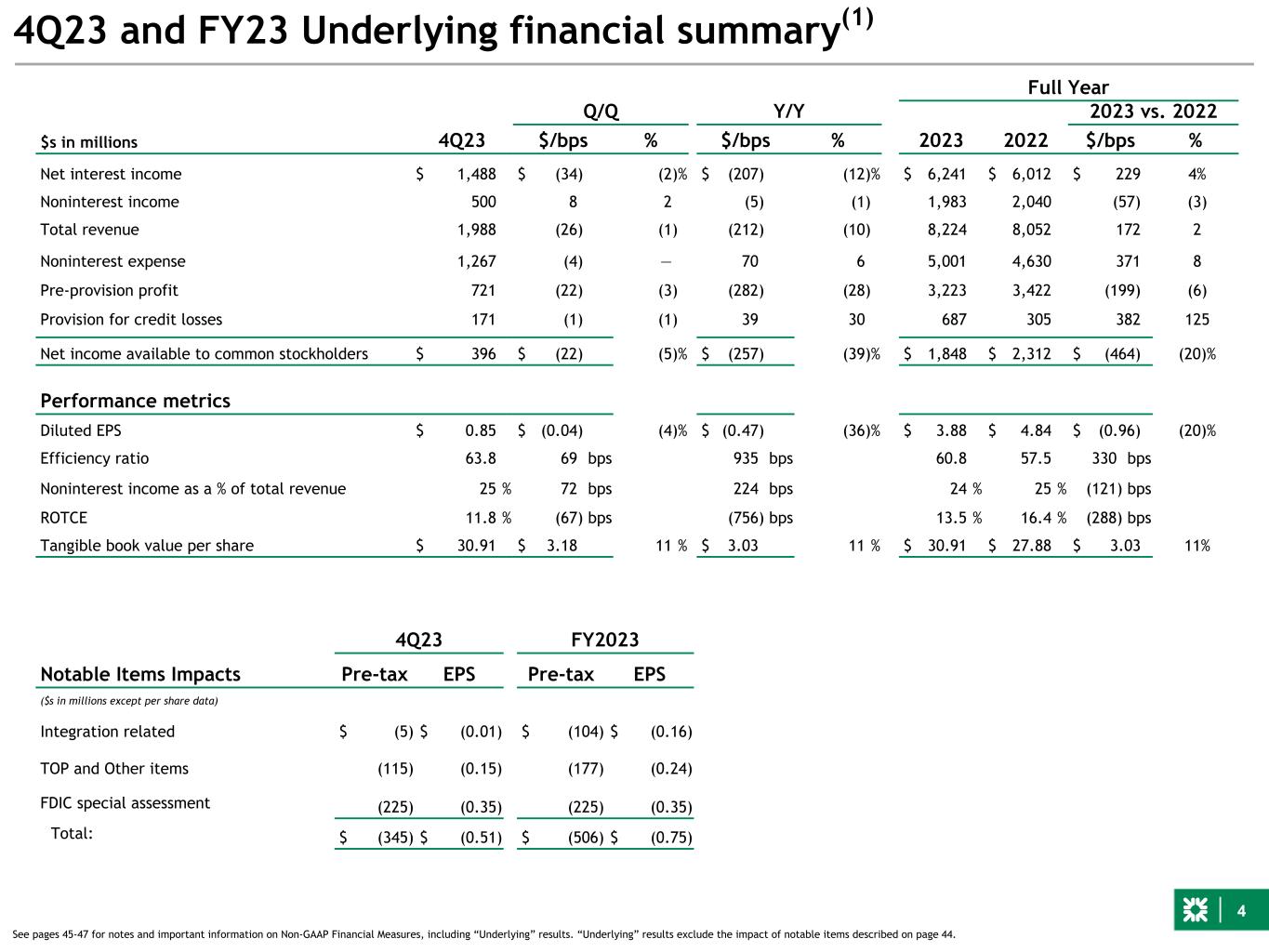

| Earnings | $/bps | % | $/bps | % | $ | $ | $/bps | |||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 1,488 | $ | 1,522 | $ | 1,695 | $ | (34) | (2) | % | $ | (207) | (12) | % | $ | 6,241 | $ | 6,012 | $ | 229 | ||||||||||||||||||||||||||||||

| Noninterest income | 500 | 492 | 505 | 8 | 2 | (5) | (1) | 1,983 | 2,009 | (26) | ||||||||||||||||||||||||||||||||||||||||

| Total revenue | 1,988 | 2,014 | 2,200 | (26) | (1) | (212) | (10) | 8,224 | 8,021 | 203 | ||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,612 | 1,293 | 1,240 | 319 | 25 | 372 | 30 | 5,507 | 4,892 | 615 | ||||||||||||||||||||||||||||||||||||||||

| Pre-provision profit | 376 | 721 | 960 | (345) | (48) | (584) | (61) | 2,717 | 3,129 | (412) | ||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 171 | 172 | 132 | (1) | (1) | 39 | 30 | 687 | 474 | 213 | ||||||||||||||||||||||||||||||||||||||||

| Net income | 189 | 430 | 653 | (241) | (56) | (464) | (71) | 1,608 | 2,073 | (465) | ||||||||||||||||||||||||||||||||||||||||

| Preferred dividends | 30 | 30 | 32 | — | — | (2) | (6) | 117 | 113 | 4 | ||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 159 | $ | 400 | $ | 621 | $ | (241) | (60) | % | $ | (462) | (74) | % | $ | 1,491 | $ | 1,960 | $ | (469) | ||||||||||||||||||||||||||||||

| After-tax notable Items | 237 | 18 | 32 | 219 | NM | 205 | NM | 357 | 352 | 5 | ||||||||||||||||||||||||||||||||||||||||

| Underlying net income | $ | 426 | $ | 448 | $ | 685 | $ | (22) | (5) | % | $ | (259) | (38) | % | $ | 1,965 | $ | 2,425 | $ | (460) | ||||||||||||||||||||||||||||||

| Underlying net income available to common stockholders | 396 | 418 | 653 | (22) | (5) | (257) | (39) | $ | 1,848 | $ | 2,312 | $ | (464) | |||||||||||||||||||||||||||||||||||||

| Average common shares outstanding | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic (in millions) | 466.2 | 469.5 | 493.3 | (3.2) | (1) | (27.1) | (5) | 475.1 | 476.0 | (0.9) | ||||||||||||||||||||||||||||||||||||||||

| Diluted (in millions) | 468.2 | 471.2 | 495.5 | (3.0) | (1) | (27.3) | (6) | 476.7 | 477.8 | (1.1) | ||||||||||||||||||||||||||||||||||||||||

| Diluted earnings per share | $ | 0.34 | $ | 0.85 | $ | 1.25 | $ | (0.51) | (60) | % | $ | (0.91) | (73) | % | $ | 3.13 | $ | 4.10 | $ | (0.97) | ||||||||||||||||||||||||||||||

| Underlying diluted earnings per share | 0.85 | 0.89 | 1.32 | (0.04) | (4) | (0.47) | (36) | $ | 3.88 | $ | 4.84 | $ | (0.96) | |||||||||||||||||||||||||||||||||||||

| Performance metrics | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.90 | % | 3.03 | % | 3.29 | % | (13) | bps | (39) | bps | 3.09 | % | 3.10 | % | (1) | bps | ||||||||||||||||||||||||||||||||||

| Net interest margin, FTE | 2.91 | 3.03 | 3.30 | (12) | (39) | 3.10 | 3.10 | — | ||||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 7.6 | 21.5 | 21.2 | (1,392) | (1,357) | 20.8 | 21.9 | (117) | ||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 81.1 | 64.2 | 56.4 | 1,692 | 2,477 | 67.0 | 61.0 | 598 | ||||||||||||||||||||||||||||||||||||||||||

| Underlying efficiency ratio | 63.8 | 63.1 | 54.4 | 69 | 935 | 60.8 | 57.5 | 330 | ||||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | 4.7 | 12.0 | 18.5 | (728) | (1,374) | 10.9 | 13.9 | (299) | ||||||||||||||||||||||||||||||||||||||||||

| Underlying return on average tangible common equity | 11.8 | 12.5 | 19.4 | (67) | (756) | 13.5 | 16.4 | (288) | ||||||||||||||||||||||||||||||||||||||||||

| Return on average total tangible assets | 0.35 | 0.81 | 1.19 | (46) | (84) | 0.75 | 1.00 | (25) | ||||||||||||||||||||||||||||||||||||||||||

| Underlying return on average total tangible assets | 0.78 | % | 0.84 | % | 1.25 | % | (6) | bps | (47) | bps | 0.92 | % | 1.17 | % | (25) | bps | ||||||||||||||||||||||||||||||||||

Capital adequacy(2,3) |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Common equity tier 1 capital ratio | 10.6 | % | 10.4 | % | 10.0 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total capital ratio | 13.7 | 13.4 | 12.8 | |||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 9.3 | 9.4 | 9.3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Tangible common equity ratio | 6.7 | 5.9 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to loans and leases | 1.59 | % | 1.55 | % | 1.43 | % | 4 | bps | 16 | bps | ||||||||||||||||||||||||||||||||||||||||

Asset quality(3) |

||||||||||||||||||||||||||||||||||||||||||||||||||

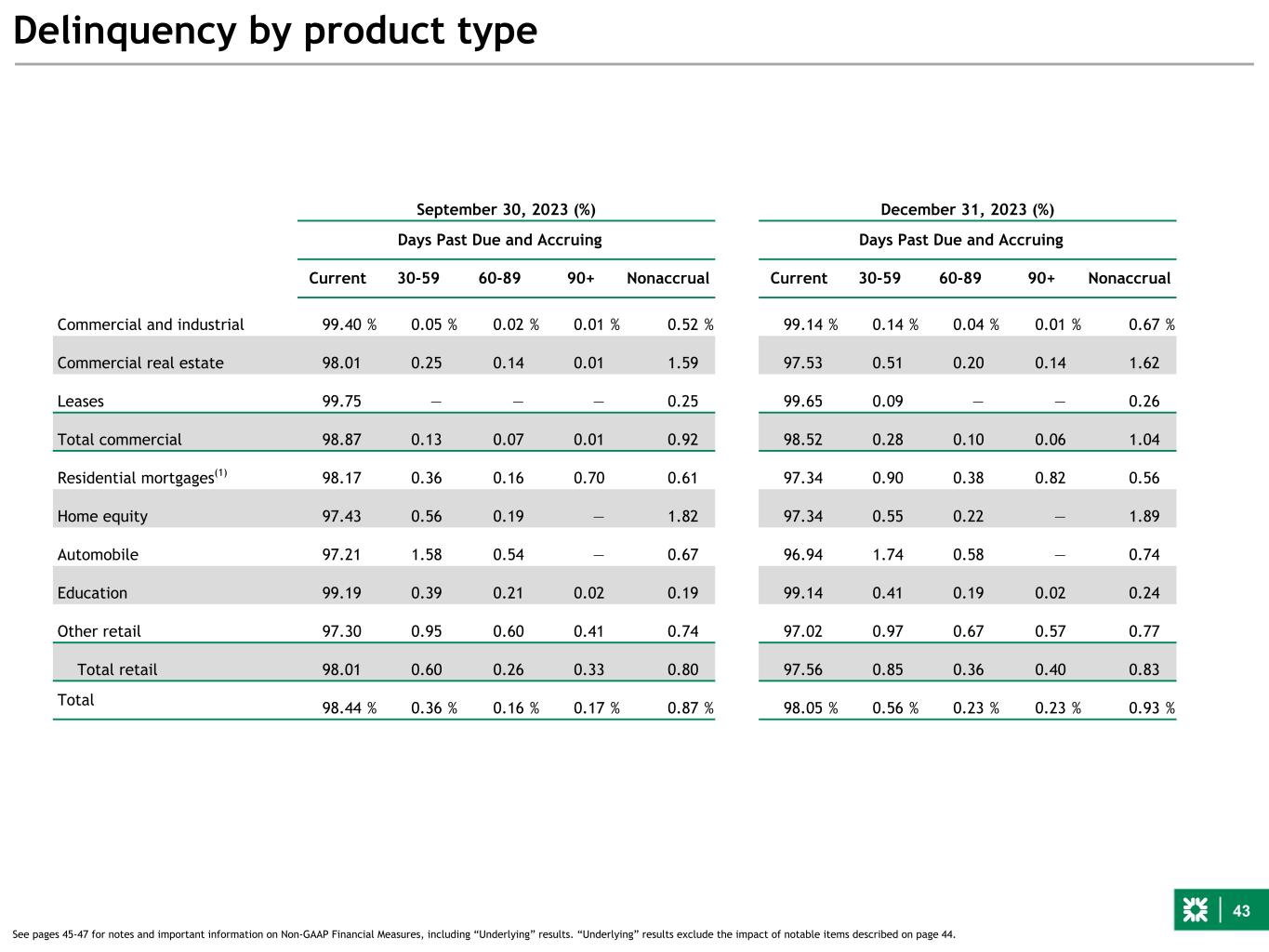

| Nonaccrual loans and leases to loans and leases | 0.93 | % | 0.87 | % | 0.60 | % | 6 | bps | 33 | bps | ||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to nonaccrual loans and leases | 170 | 179 | 237 | (9) | (67) | |||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs as a % of average loans and leases | 0.46 | % | 0.40 | % | 0.22 | % | 6 | bps | 24 | bps | 0.40 | % | 0.18 | % | 22 | bps | ||||||||||||||||||||||||||||||||||

| Quarterly Trends | Full Year | ||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 change from | 2023 Change | ||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | from 2022 | |||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | % | |||||||||||||||||||||||||||||||||||||||||||

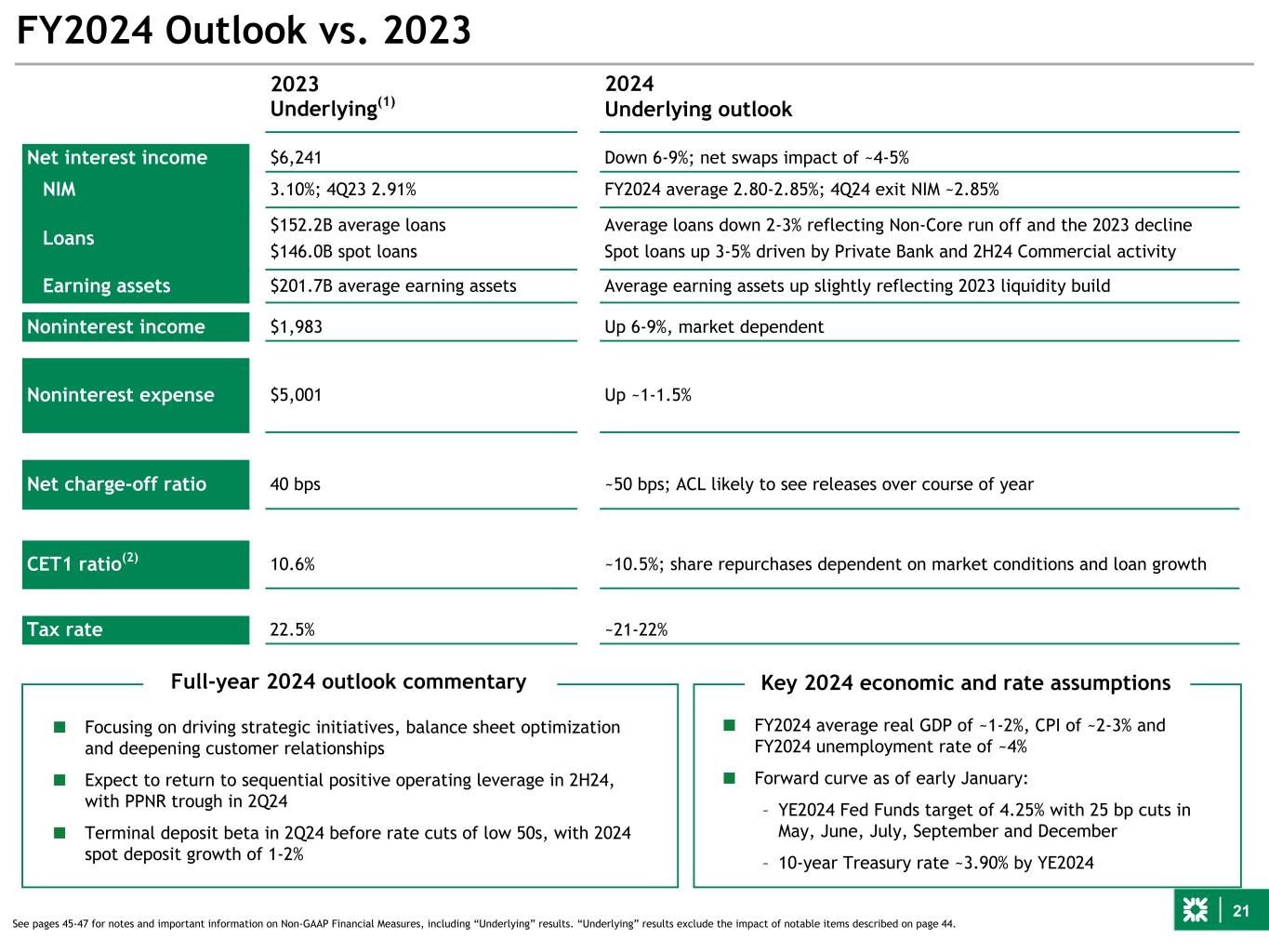

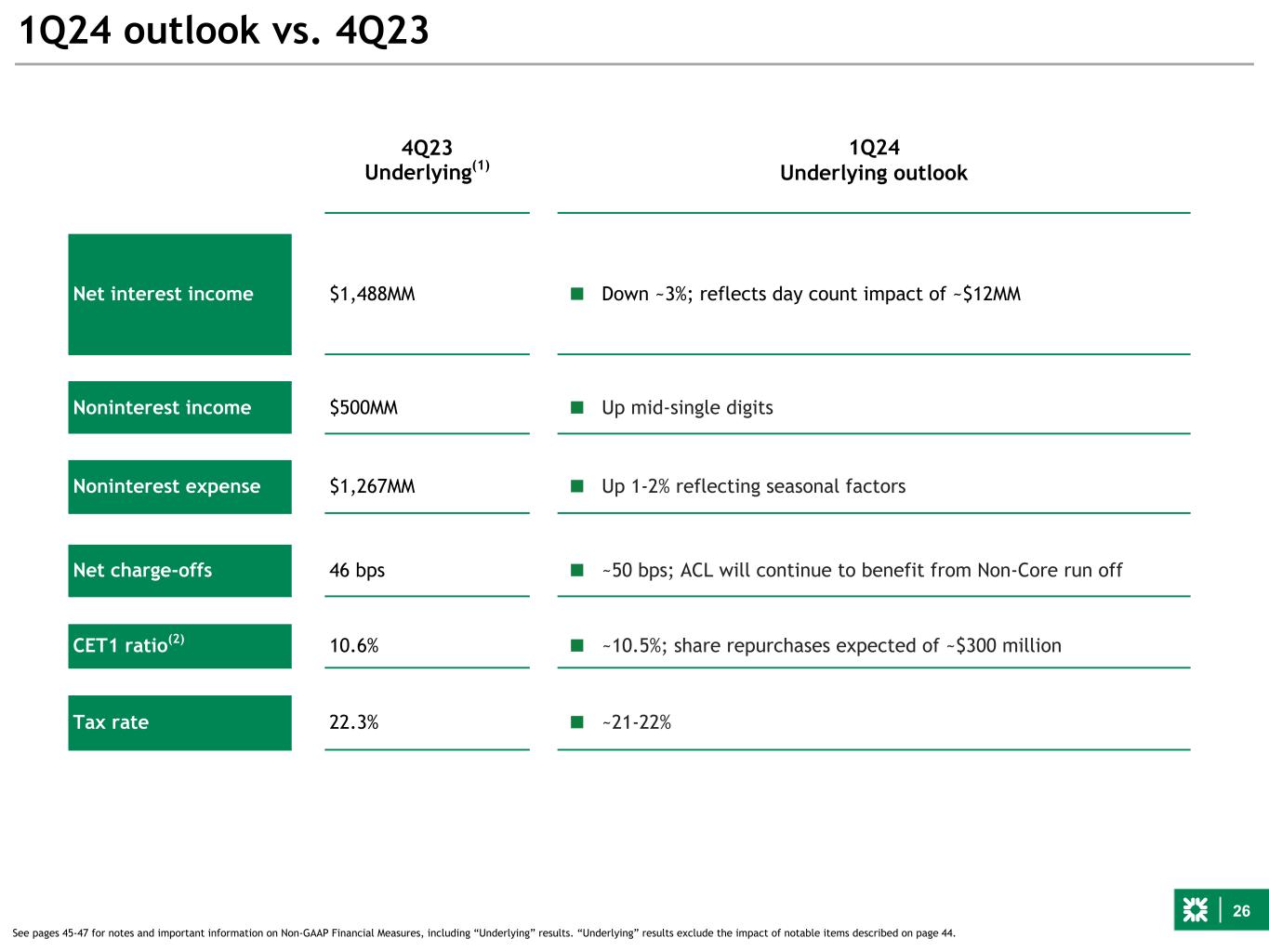

| Net interest income | $ | 1,488 | $ | 1,522 | $ | 1,695 | $ | (34) | (2) | % | $ | (207) | (12) | % | $ | 6,241 | $ | 6,012 | 4 | % | |||||||||||||||||||||||||||

| Noninterest income | 500 | 492 | 505 | 8 | 2 | (5) | (1) | 1,983 | 2,040 | (3) | |||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 1,988 | $ | 2,014 | $ | 2,200 | $ | (26) | (1) | % | $ | (212) | (10) | % | $ | 8,224 | $ | 8,052 | 2 | % | |||||||||||||||||||||||||||

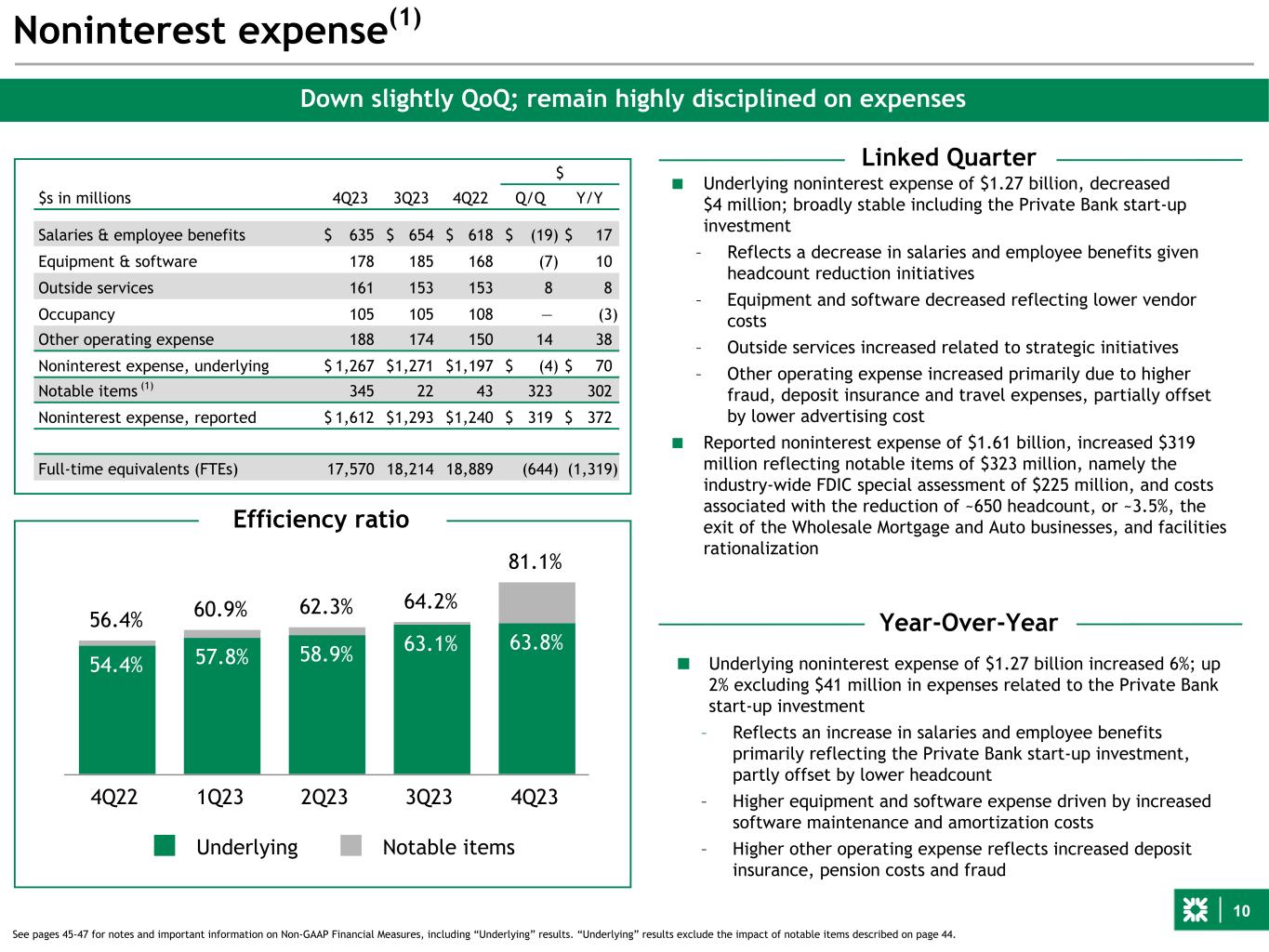

| Noninterest expense | $ | 1,267 | $ | 1,271 | $ | 1,197 | $ | (4) | — | % | $ | 70 | 6 | % | $ | 5,001 | $ | 4,630 | 8 | % | |||||||||||||||||||||||||||

| Provision for credit losses | 171 | 172 | 132 | (1) | (1) | 39 | 30 | 687 | 305 | 125 | |||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 396 | $ | 418 | $ | 653 | $ | (22) | (5) | % | $ | (257) | (39) | % | $ | 1,848 | $ | 2,312 | (20) | % | |||||||||||||||||||||||||||

| Performance metrics | |||||||||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.85 | $ | 0.89 | $ | 1.32 | $ | (0.04) | (4) | % | $ | (0.47) | (36) | % | $ | 3.88 | $ | 4.84 | (20) | % | |||||||||||||||||||||||||||

| Efficiency ratio | 63.8 | % | 63.1 | % | 54.4 | % | 69 | bps | 935 | bps | 60.8 | 57.5 | 330 | ||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | 11.8 | % | 12.5 | % | 19.4 | % | (67) | bps | (756) | bps | 13.5 | % | 16.4 | % | (288) | bps | |||||||||||||||||||||||||||||||

| 4Q23 change from | ||||||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | |||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||

| Total assets | $ | 221,964 | $ | 225,270 | $ | 226,733 | $ | (3,306) | (1) | % | $ | (4,769) | (2) | % | ||||||||||||||||||||||||

| Total loans and leases | 145,959 | 149,746 | 156,662 | (3,787) | (3) | (10,703) | (7) | |||||||||||||||||||||||||||||||

| Total loans held for sale | 779 | 848 | 982 | (69) | (8) | (203) | (21) | |||||||||||||||||||||||||||||||

| Deposits | 177,342 | 178,197 | 180,724 | (855) | — | (3,382) | (2) | |||||||||||||||||||||||||||||||

| Stockholders' equity | 24,342 | 22,878 | 23,690 | 1,464 | 6 | 652 | 3 | |||||||||||||||||||||||||||||||

| Stockholders' common equity | 22,329 | 20,864 | 21,676 | 1,465 | 7 | 653 | 3 | |||||||||||||||||||||||||||||||

| Tangible common equity | $ | 14,417 | $ | 12,930 | $ | 13,728 | $ | 1,487 | 12 | % | $ | 689 | 5 | % | ||||||||||||||||||||||||

Loan-to-deposit ratio (period-end)(2) |

82.3 | % | 84.0 | % | 86.7 | % | (173) | bps | (439) | bps | ||||||||||||||||||||||||||||

Loan-to-deposit ratio (average)(2) |

83.5 | % | 85.5 | % | 87.7 | % | (192) | bps | (420) | bps | ||||||||||||||||||||||||||||

| 1) Represents period-end unless otherwise noted. | ||||||||||||||||||||||||||||||||||||||

| 2) Excludes loans held for sale. | ||||||||||||||||||||||||||||||||||||||

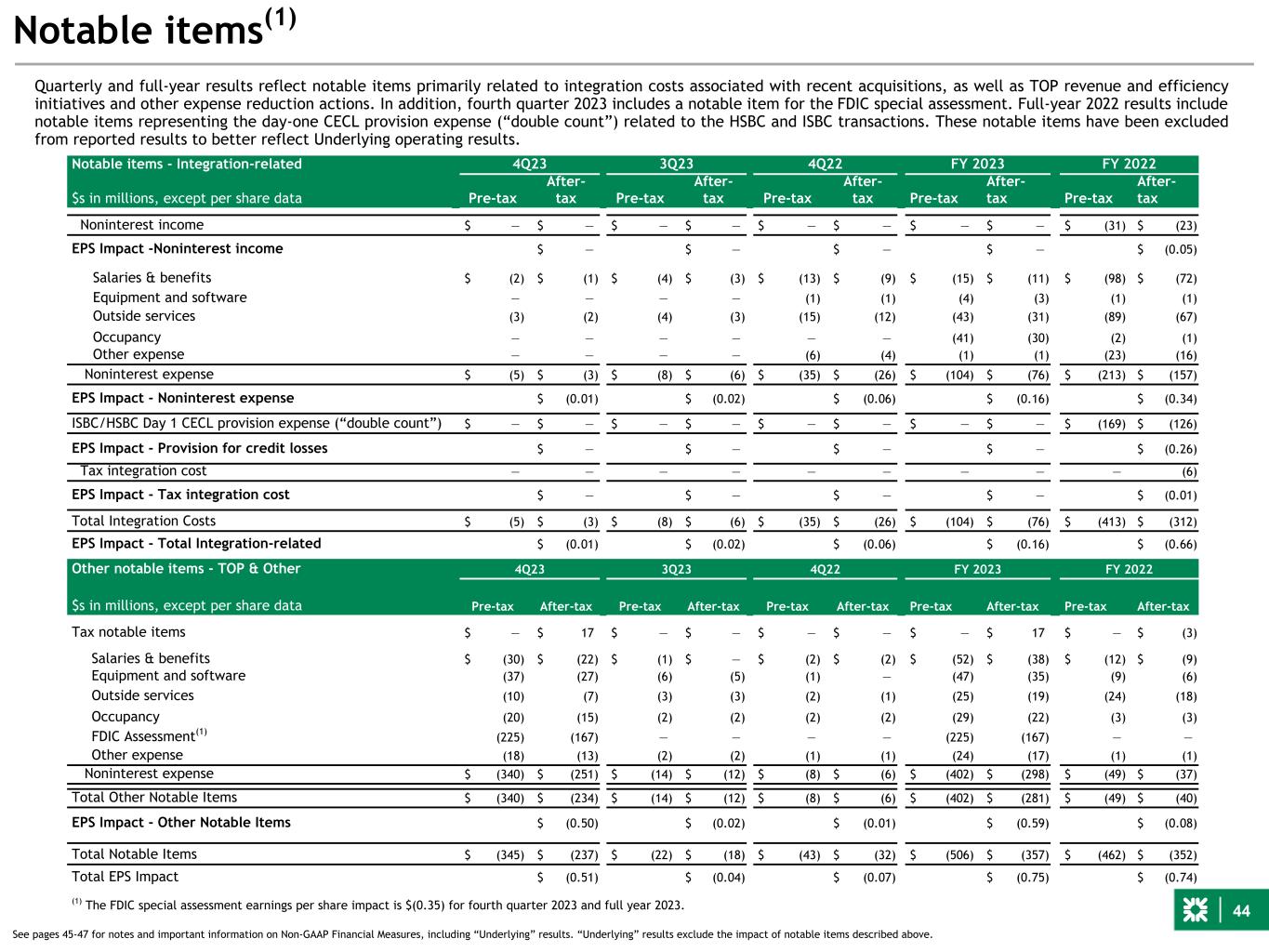

Notable items - Integration-related |

4Q23 | 3Q23 | 4Q22 | FY 2023 | FY 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (31) | $ | (23) | ||||||||||||||||||||||||||||||||||||||||||

| EPS Impact - Noninterest income | $ | — | $ | — | $ | — | $ | — | $ | (0.05) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries & benefits | $ | (2) | $ | (1) | $ | (4) | $ | (3) | $ | (13) | $ | (9) | $ | (15) | $ | (11) | $ | (98) | $ | (72) | ||||||||||||||||||||||||||||||||||||||||||

| Equipment and software | — | — | — | — | (1) | (1) | (4) | (3) | (1) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | (3) | (2) | (4) | (3) | (15) | (12) | (43) | (31) | (89) | (67) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | — | — | — | — | — | — | (41) | (30) | (2) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other expense | — | — | — | — | (6) | (4) | (1) | (1) | (23) | (16) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | $ | (5) | $ | (3) | $ | (8) | $ | (6) | $ | (35) | $ | (26) | $ | (104) | $ | (76) | $ | (213) | $ | (157) | ||||||||||||||||||||||||||||||||||||||||||

| EPS Impact - Noninterest expense | $ | (0.01) | $ | (0.02) | $ | (0.06) | $ | (0.16) | $ | (0.34) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISBC/HSBC Day 1 CECL provision expense (“double count”) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (169) | $ | (126) | ||||||||||||||||||||||||||||||||||||||||||

| EPS Impact - Provision for credit losses | $ | — | $ | — | $ | — | $ | — | $ | (0.26) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax integration cost | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | (6) | ||||||||||||||||||||||||||||||||||||||||||

| EPS Impact - Tax integration cost | $ | — | $ | — | $ | — | $ | — | $ | (0.01) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total integration related | $ | (5) | $ | (3) | $ | (8) | $ | (6) | $ | (35) | $ | (26) | $ | (104) | $ | (76) | $ | (413) | $ | (312) | ||||||||||||||||||||||||||||||||||||||||||

EPS Impact - Total Integration-related |

$ | (0.01) | $ | (0.02) | $ | (0.06) | $ | (0.16) | $ | (0.66) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Other notable items - TOP & Other |

4Q23 | 3Q23 | 4Q22 | FY 2023 | FY 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($s in millions, except per share data) | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | Pre-tax | After-tax | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax notable items | $ | — | $ | 17 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 17 | $ | — | $ | (3) | ||||||||||||||||||||||||||||||||||||||||||

| Salaries & benefits | (30) | (22) | (1) | — | (2) | (2) | (52) | (38) | (12) | (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment and software | (37) | (27) | (6) | (5) | (1) | — | (47) | (35) | (9) | (6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | (10) | (7) | (3) | (3) | (2) | (1) | (25) | (19) | (24) | (18) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | (20) | (15) | (2) | (2) | (2) | (2) | (29) | (22) | (3) | (3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

FDIC special assessment(1) |

(225) | (167) | — | — | — | — | (225) | (167) | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other expense | (18) | (13) | (2) | (2) | (1) | (1) | (24) | (17) | (1) | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | $ | (340) | $ | (251) | $ | (14) | $ | (12) | $ | (8) | $ | (6) | $ | (402) | $ | (298) | $ | (49) | $ | (37) | ||||||||||||||||||||||||||||||||||||||||||

| Total Other Notable Items | $ | (340) | $ | (234) | $ | (14) | $ | (12) | $ | (8) | $ | (6) | $ | (402) | $ | (281) | $ | (49) | $ | (40) | ||||||||||||||||||||||||||||||||||||||||||

| EPS Impact - Other Notable Items | $ | (0.50) | $ | (0.02) | $ | (0.01) | $ | (0.59) | $ | (0.08) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Notable Items | $ | (345) | $ | (237) | $ | (22) | $ | (18) | $ | (43) | $ | (32) | $ | (506) | $ | (357) | $ | (462) | $ | (352) | ||||||||||||||||||||||||||||||||||||||||||

| Total EPS Impact | $ | (0.51) | $ | (0.04) | $ | (0.07) | $ | (0.75) | $ | (0.74) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) The FDIC special assessment earnings per share impact is $(0.35) for fourth quarter 2023 and full year 2023. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 4Q23 change from | |||||||||||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | |||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans and leases and loans held for sale | $ | 2,166 | $ | 2,194 | $ | 1,919 | $ | (28) | (1) | % | $ | 247 | 13 | % | ||||||||||||||||||||||||||||||

| Investment securities | 339 | 290 | 258 | 49 | 17 | 81 | 31 | |||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits in banks | 171 | 111 | 75 | 60 | 54 | 96 | 128 | |||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 2,676 | $ | 2,595 | $ | 2,252 | $ | 81 | 3 | % | $ | 424 | 19 | % | ||||||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||||||||||||||

| Deposits | $ | 974 | $ | 898 | $ | 396 | $ | 76 | 8 | % | $ | 578 | 146 | % | ||||||||||||||||||||||||||||||

| Short-term borrowed funds | 7 | 8 | 2 | (1) | (13) | 5 | 250 | |||||||||||||||||||||||||||||||||||||

| Long-term borrowed funds | 207 | 167 | 159 | 40 | 24 | 48 | 30 | |||||||||||||||||||||||||||||||||||||

| Total interest expense | $ | 1,188 | $ | 1,073 | $ | 557 | $ | 115 | 11 | % | $ | 631 | 113 | % | ||||||||||||||||||||||||||||||

| Net interest income | $ | 1,488 | $ | 1,522 | $ | 1,695 | $ | (34) | (2) | % | $ | (207) | (12) | % | ||||||||||||||||||||||||||||||

| Net interest margin, FTE | 2.91 | % | 3.03 | % | 3.30 | % | (12) | bps | (39) | bps | ||||||||||||||||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Noninterest Income | 4Q23 change from | |||||||||||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | |||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | $ | 104 | $ | 105 | $ | 105 | $ | (1) | (1) | % | $ | (1) | (1) | % | ||||||||||||||||||||||||||||||

| Capital markets fees | 87 | 67 | 98 | 20 | 30 | (11) | (11) | |||||||||||||||||||||||||||||||||||||

| Card fees | 70 | 74 | 71 | (4) | (5) | (1) | (1) | |||||||||||||||||||||||||||||||||||||

| Trust and investment services fees | 68 | 63 | 61 | 5 | 8 | 7 | 11 | |||||||||||||||||||||||||||||||||||||

| Mortgage banking fees | 57 | 69 | 54 | (12) | (17) | 3 | 6 | |||||||||||||||||||||||||||||||||||||

| Foreign exchange and derivative products | 43 | 48 | 35 | (5) | (10) | 8 | 23 | |||||||||||||||||||||||||||||||||||||

| Letter of credit and loan fees | 42 | 43 | 41 | (1) | (2) | 1 | 2 | |||||||||||||||||||||||||||||||||||||

| Securities gains, net | 9 | 5 | 4 | 4 | 80 | 5 | 125 | |||||||||||||||||||||||||||||||||||||

Other income(1) |

20 | 18 | 36 | 2 | 11 | (16) | (44) | |||||||||||||||||||||||||||||||||||||

| Noninterest income | $ | 500 | $ | 492 | $ | 505 | $ | 8 | 2 | % | $ | (5) | (1) | % | ||||||||||||||||||||||||||||||

| 1) Includes bank-owned life insurance income and other miscellaneous income for all periods presented. | ||||||||||||||||||||||||||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Noninterest Expense | 4Q23 change from | |||||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | |||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 667 | $ | 659 | $ | 633 | $ | 8 | 1 | % | $ | 34 | 5 | % | ||||||||||||||||||||||||

| Equipment and software | 215 | 191 | 170 | 24 | 13 | 45 | 26 | |||||||||||||||||||||||||||||||

| Outside services | 174 | 160 | 170 | 14 | 9 | 4 | 2 | |||||||||||||||||||||||||||||||

| Occupancy | 125 | 107 | 110 | 18 | 17 | 15 | 14 | |||||||||||||||||||||||||||||||

| Other operating expense | 431 | 176 | 157 | 255 | 145 | 274 | 175 | |||||||||||||||||||||||||||||||

| Noninterest expense | $ | 1,612 | $ | 1,293 | $ | 1,240 | $ | 319 | 25 | % | $ | 372 | 30 | % | ||||||||||||||||||||||||

| Notable items | $ | 345 | $ | 22 | $ | 43 | $ | 323 | NM | $ | 302 | NM | ||||||||||||||||||||||||||

| Underlying, as applicable | ||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 635 | $ | 654 | $ | 618 | $ | (19) | (3) | % | $ | 17 | 3 | % | ||||||||||||||||||||||||

| Equipment and software | 178 | 185 | 168 | (7) | (4) | 10 | 6 | |||||||||||||||||||||||||||||||

| Outside services | 161 | 153 | 153 | 8 | 5 | 8 | 5 | |||||||||||||||||||||||||||||||

| Occupancy | 105 | 105 | 108 | — | — | (3) | (3) | |||||||||||||||||||||||||||||||

| Other operating expense | 188 | 174 | 150 | 14 | 8 | 38 | 25 | |||||||||||||||||||||||||||||||

| Underlying noninterest expense | $ | 1,267 | $ | 1,271 | $ | 1,197 | $ | (4) | — | % | $ | 70 | 6 | % | ||||||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Interest-earning assets | 4Q23 change from | ||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | ||||||||||||||||||||||||||||||

| Period-end interest-earning assets | $ | % | $ | % | |||||||||||||||||||||||||||||||

| Investments | $ | 40,003 | $ | 35,547 | $ | 35,052 | $ | 4,456 | 13 | % | $ | 4,951 | 14 | % | |||||||||||||||||||||

| Interest-bearing deposits in banks | 10,239 | 14,329 | 9,361 | (4,090) | (29) | 878 | 9 | ||||||||||||||||||||||||||||

| Commercial loans and leases | 74,445 | 77,457 | 82,180 | (3,012) | (4) | (7,735) | (9) | ||||||||||||||||||||||||||||

| Retail loans | 71,514 | 72,289 | 74,482 | (775) | (1) | (2,968) | (4) | ||||||||||||||||||||||||||||

| Total loans and leases | 145,959 | 149,746 | 156,662 | (3,787) | (3) | (10,703) | (7) | ||||||||||||||||||||||||||||

| Loans held for sale, at fair value | 676 | 749 | 774 | (73) | (10) | (98) | (13) | ||||||||||||||||||||||||||||

| Other loans held for sale | 103 | 99 | 208 | 4 | 4 | (105) | (50) | ||||||||||||||||||||||||||||

| Total loans and leases and loans held for sale | 146,738 | 150,594 | 157,644 | (3,856) | (3) | (10,906) | (7) | ||||||||||||||||||||||||||||

| Total period-end interest-earning assets | $ | 196,980 | $ | 200,470 | $ | 202,057 | $ | (3,490) | (2) | % | $ | (5,077) | (3) | % | |||||||||||||||||||||

Average interest-earning assets |

|||||||||||||||||||||||||||||||||||

| Investments | $ | 41,499 | $ | 39,273 | $ | 38,772 | $ | 2,226 | 6 | % | $ | 2,727 | 7 | % | |||||||||||||||||||||

| Interest-bearing deposits in banks | 12,387 | 8,005 | 6,915 | 4,382 | 55 | 5,472 | 79 | ||||||||||||||||||||||||||||

| Commercial loans and leases | 76,078 | 78,261 | 82,468 | (2,183) | (3) | (6,390) | (8) | ||||||||||||||||||||||||||||

| Retail loans | 71,891 | 72,530 | 74,631 | (639) | (1) | (2,740) | (4) | ||||||||||||||||||||||||||||

| Total loans and leases | 147,969 | 150,791 | 157,099 | (2,822) | (2) | (9,130) | (6) | ||||||||||||||||||||||||||||

| Loans held for sale, at fair value | 1,047 | 1,204 | 1,179 | (157) | (13) | (132) | (11) | ||||||||||||||||||||||||||||

| Other loans held for sale | 219 | 321 | 557 | (102) | (32) | (338) | (61) | ||||||||||||||||||||||||||||

| Total loans and leases and loans held for sale | 149,235 | 152,316 | 158,835 | (3,081) | (2) | (9,600) | (6) | ||||||||||||||||||||||||||||

| Total average interest-earning assets | $ | 203,121 | $ | 199,594 | $ | 204,522 | $ | 3,527 | 2 | % | $ | (1,401) | (1) | % | |||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Deposits | 4Q23 change from | ||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | ||||||||||||||||||||||||||||||

| Period-end deposits | $ | % | $ | % | |||||||||||||||||||||||||||||||

Demand |

$ | 37,107 | $ | 38,561 | $ | 49,283 | $ | (1,454) | (4) | % | $ | (12,176) | (25) | % | |||||||||||||||||||||

| Money market | 53,812 | 53,517 | 49,905 | 295 | 1 | 3,907 | 8 | ||||||||||||||||||||||||||||

| Checking with interest | 31,876 | 33,355 | 39,721 | (1,479) | (4) | (7,845) | (20) | ||||||||||||||||||||||||||||

| Savings | 27,983 | 29,139 | 29,805 | (1,156) | (4) | (1,822) | (6) | ||||||||||||||||||||||||||||

| Term | 26,564 | 23,625 | 12,010 | 2,939 | 12 | 14,554 | 121 | ||||||||||||||||||||||||||||

| Total period-end deposits | $ | 177,342 | $ | 178,197 | $ | 180,724 | $ | (855) | — | % | $ | (3,382) | (2) | % | |||||||||||||||||||||

| Average deposits | |||||||||||||||||||||||||||||||||||

Demand |

$ | 38,390 | $ | 39,728 | $ | 50,706 | $ | (1,338) | (3) | % | $ | (12,316) | (24) | % | |||||||||||||||||||||

| Money market | 53,003 | 52,057 | 50,228 | 946 | 2 | 2,775 | 6 | ||||||||||||||||||||||||||||

| Checking with interest | 31,788 | 33,545 | 36,952 | (1,757) | (5) | (5,164) | (14) | ||||||||||||||||||||||||||||

| Savings | 28,455 | 29,516 | 29,780 | (1,061) | (4) | (1,325) | (4) | ||||||||||||||||||||||||||||

| Term | 25,492 | 21,604 | 11,378 | 3,888 | 18 | 14,114 | 124 | ||||||||||||||||||||||||||||

| Total average deposits | $ | 177,128 | $ | 176,450 | $ | 179,044 | $ | 678 | — | % | $ | (1,916) | (1) | % | |||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Borrowed Funds | 4Q23 change from | ||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | ||||||||||||||||||||||||||||||

| Period-end borrowed funds | $ | % | $ | % | |||||||||||||||||||||||||||||||

| Short-term borrowed funds | $ | 505 | $ | 232 | $ | 3 | $ | 273 | 118 % | $ | 502 | NM | |||||||||||||||||||||||

| Long-term borrowed funds | |||||||||||||||||||||||||||||||||||

| FHLB advances | 3,786 | 7,036 | 8,519 | (3,250) | (46) | (4,733) | (56) | ||||||||||||||||||||||||||||

| Senior debt | 5,170 | 5,258 | 5,555 | (88) | (2) | (385) | (7) | ||||||||||||||||||||||||||||

| Subordinated debt and other debt | 1,819 | 1,815 | 1,813 | 4 | — | 6 | — | ||||||||||||||||||||||||||||

| Auto collateralized borrowings | 2,692 | 3,245 | — | (553) | (17) | 2,692 | 100 | ||||||||||||||||||||||||||||

| Total borrowed funds | $ | 13,972 | $ | 17,586 | $ | 15,890 | $ | (3,614) | (21) | % | $ | (1,918) | (12) | % | |||||||||||||||||||||

| Average borrowed funds | |||||||||||||||||||||||||||||||||||

| Short-term borrowed funds | $ | 491 | $ | 506 | $ | 262 | $ | (15) | (3) % | $ | 229 | 87 | % | ||||||||||||||||||||||

| Long-term borrowed funds | |||||||||||||||||||||||||||||||||||

| FHLB advances | 5,751 | 4,023 | 8,818 | 1,728 | 43 | (3,067) | (35) | ||||||||||||||||||||||||||||

| Senior debt | 5,217 | 5,259 | 5,397 | (42) | (1) | (180) | (3) | ||||||||||||||||||||||||||||

| Subordinated debt and other debt | 1,816 | 1,814 | 1,812 | 2 | — | 4 | — | ||||||||||||||||||||||||||||

| Auto collateralized borrowings | 2,904 | 2,106 | — | 798 | 38 | 2,904 | 100 | ||||||||||||||||||||||||||||

| Total average borrowed funds | $ | 16,179 | $ | 13,708 | $ | 16,289 | $ | 2,471 | 18 | % | $ | (110) | (1) | % | |||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| Capital | 4Q23 change from | ||||||||||||||||||||||||||||||||||

| ($s and shares in millions, except per share data) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | ||||||||||||||||||||||||||||||

| Period-end capital | $ | % | $ | % | |||||||||||||||||||||||||||||||

| Stockholders' equity | $ | 24,342 | $ | 22,878 | $ | 23,690 | $ | 1,464 | 6 | % | $ | 652 | 3 | % | |||||||||||||||||||||

| Stockholders' common equity | 22,329 | 20,864 | 21,676 | 1,465 | 7 | 653 | 3 | ||||||||||||||||||||||||||||

| Tangible common equity | 14,417 | 12,930 | 13,728 | 1,487 | 12 | 689 | 5 | ||||||||||||||||||||||||||||

| Tangible book value per common share | $ | 30.91 | $ | 27.73 | $ | 27.88 | $ | 3.18 | 11 | % | $ | 3.03 | 11 | % | |||||||||||||||||||||

| Common shares - at end of period | 466.4 | 466.2 | 492.3 | 0.2 | — | (25.9) | (5) | ||||||||||||||||||||||||||||

| Common shares - average (diluted) | 468.2 | 471.2 | 495.5 | (3.0) | (1) | % | (27.3) | (6) | % | ||||||||||||||||||||||||||

Common equity tier 1 capital ratio(1) |

10.6 | % | 10.4 | % | 10.0 | % | |||||||||||||||||||||||||||||

Total capital ratio(1) |

13.7 | 13.4 | 12.8 | ||||||||||||||||||||||||||||||||

| Tangible common equity ratio | 6.7 | 5.9 | 6.3 | ||||||||||||||||||||||||||||||||

Tier 1 leverage ratio(1) |

9.3 | 9.4 | 9.3 | ||||||||||||||||||||||||||||||||

| 1) Current reporting-period regulatory capital ratios are preliminary. | |||||||||||||||||||||||||||||||||||

| Fourth quarter 2023 | ||

| Credit quality review | 4Q23 change from | |||||||||||||||||||||||||||||||||||||||||||

| ($s in millions) | 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | |||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||

Nonaccrual loans and leases(1) |

$ | 1,364 | $ | 1,296 | $ | 944 | $ | 68 | 5 | % | $ | 420 | 44 | % | ||||||||||||||||||||||||||||||

90+ days past due and accruing(2) |

333 | 248 | 367 | 85 | 34 | (34) | (9) | |||||||||||||||||||||||||||||||||||||

| Net charge-offs | 171 | 153 | 88 | 18 | 12 | 83 | 94 | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 171 | 172 | 132 | (1) | (1) | 39 | 30 | |||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | $ | 2,318 | $ | 2,318 | $ | 2,240 | $ | — | — | % | $ | 78 | 3 | % | ||||||||||||||||||||||||||||||

| Nonaccrual loans and leases to loans and leases | 0.93 | % | 0.87 | % | 0.60 | % | 6 | bps | 33 | |||||||||||||||||||||||||||||||||||

| Net charge-offs as a % of total loans and leases | 0.46 | 0.40 | 0.22 | 6 | 24 | |||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to loans and leases | 1.59 | 1.55 | 1.43 | 4 | 16 | |||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to nonaccrual loans and leases | 170 | % | 179 | % | 237 | % | (9) | bps | (67) | bps | ||||||||||||||||||||||||||||||||||

1) Loans fully or partially guaranteed by the FHA, VA and USDA are classified as accruing. | ||||||||||||||||||||||||||||||||||||||||||||

2) 90+ days past due and accruing includes $243 million, $216 million, and $316 million of loans fully or partially guaranteed by the FHA, VA, and USDA for December 31, 2023, September 30, 2023, and December 31, 2022, respectively. | ||||||||||||||||||||||||||||||||||||||||||||

| Fourth quarter 2023 | vs. | third quarter 2023 | ||||||

| Fourth quarter 2023 | vs. | fourth quarter 2022 | ||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income (GAAP) | $500 | $492 | $505 | $8 | 2 | % | ($5) | (1 | %) | $1,983 | $2,009 | ($26) | (1 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | — | — | — | — | — | — | — | — | (31) | 31 | 100 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income, Underlying (non-GAAP) | $500 | $492 | $505 | $8 | 2 | % | ($5) | (1 | %) | $1,983 | $2,040 | ($57) | (3 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue (GAAP) | A | $1,988 | $2,014 | $2,200 | ($26) | (1 | %) | ($212) | (10 | %) | $8,224 | $8,021 | $203 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | — | — | — | — | — | — | — | — | (31) | 31 | 100 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue, Underlying (non-GAAP) | B | $1,988 | $2,014 | $2,200 | ($26) | (1 | %) | ($212) | (10 | %) | $8,224 | $8,052 | $172 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense (GAAP) | C | $1,612 | $1,293 | $1,240 | $319 | 25 | % | $372 | 30 | % | $5,507 | $4,892 | $615 | 13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 345 | 22 | 43 | 323 | NM | 302 | NM | 506 | 262 | 244 | 93 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense, Underlying (non-GAAP) | D | $1,267 | $1,271 | $1,197 | ($4) | — | % | $70 | 6 | % | $5,001 | $4,630 | $371 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-provision profit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue (GAAP) | A | $1,988 | $2,014 | $2,200 | ($26) | (1 | %) | ($212) | (10 | %) | $8,224 | $8,021 | $203 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Noninterest expense (GAAP) | C | 1,612 | 1,293 | 1,240 | 319 | 25 | 372 | 30 | 5,507 | 4,892 | 615 | 13 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-provision profit (GAAP) | $376 | $721 | $960 | ($345) | (48 | %) | ($584) | (61 | %) | $2,717 | $3,129 | ($412) | (13 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-provision profit, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue, Underlying (non-GAAP) | B | $1,988 | $2,014 | $2,200 | ($26) | (1 | %) | ($212) | (10 | %) | $8,224 | $8,052 | $172 | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Noninterest expense, Underlying (non-GAAP) | D | 1,267 | 1,271 | 1,197 | (4) | — | 70 | 6 | 5,001 | 4,630 | 371 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-provision profit, Underlying (non-GAAP) | $721 | $743 | $1,003 | ($22) | (3 | %) | ($282) | (28 | %) | $3,223 | $3,422 | ($199) | (6 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses (GAAP) | $171 | $172 | $132 | ($1) | (1%) | $39 | 30% | $687 | $474 | $213 | 45 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | — | — | — | — | — | — | — | — | 169 | (169) | (100) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses, Underlying (non-GAAP) | $171 | $172 | $132 | ($1) | (1%) | $39 | 30 | % | $687 | $305 | $382 | 125 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense (GAAP) | E | $205 | $549 | $828 | ($344) | (63 | %) | ($623) | (75 | %) | $2,030 | $2,655 | ($625) | (24 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Income (expense) before income tax expense (benefit) related to notable items | (345) | (22) | (43) | (323) | NM | (302) | NM | (506) | (462) | (44) | (10) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense, Underlying (non-GAAP) | F | $550 | $571 | $871 | ($21) | (4 | %) | ($321) | (37 | %) | $2,536 | $3,117 | ($581) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense (GAAP) | G | $16 | $119 | $175 | ($103) | (87 | %) | ($159) | (91 | %) | $422 | $582 | ($160) | (27 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Income tax expense (benefit) related to notable items | (108) | (4) | (11) | (104) | NM | (97) | NM | (149) | (110) | (39) | (35) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense, Underlying (non-GAAP) | H | $124 | $123 | $186 | $1 | 1 | % | ($62) | (33 | %) | $571 | $692 | ($121) | (17 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (GAAP) | I | $189 | $430 | $653 | ($241) | (56 | %) | ($464) | (71 | %) | $1,608 | $2,073 | ($465) | (22 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Notable items, net of income tax benefit | 237 | 18 | 32 | 219 | NM | 205 | NM | 357 | 352 | 5 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income, Underlying (non-GAAP) | J | $426 | $448 | $685 | ($22) | (5 | %) | ($259) | (38 | %) | $1,965 | $2,425 | ($460) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders (GAAP) | K | $159 | $400 | $621 | ($241) | (60 | %) | ($462) | (74 | %) | $1,491 | $1,960 | ($469) | (24 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Notable items, net of income tax benefit | 237 | 18 | 32 | 219 | NM | 205 | NM | 357 | 352 | 5 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders, Underlying (non-GAAP) | L | $396 | $418 | $653 | ($22) | (5 | %) | ($257) | (39 | %) | $1,848 | $2,312 | ($464) | (20 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating leverage: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue (GAAP) | A | $1,988 | $2,014 | $2,200 | ($26) | (1.39 | %) | ($212) | (9.70 | %) | $8,224 | $8,021 | $203 | 2.53 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Noninterest expense (GAAP) | C | 1,612 | 1,293 | 1,240 | 319 | 24.60 | 372 | 30.00 | 5,507 | 4,892 | 615 | 12.58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating leverage | (25.99 | %) | (39.70 | %) | (10.05 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating leverage, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue, Underlying (non-GAAP) | B | $1,988 | $2,014 | $2,200 | ($26) | (1.39 | %) | ($212) | (9.70 | %) | $8,224 | $8,052 | $172 | 2.13 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Noninterest expense, Underlying (non-GAAP) | D | 1,267 | 1,271 | 1,197 | (4) | (0.30) | 70 | 5.82 | 5,001 | 4,630 | 371 | 8.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating leverage, Underlying (non-GAAP) | (1.09 | %) | (15.52 | %) | (5.87 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio and efficiency ratio, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | C/A | 81.13 | % | 64.21 | % | 56.36 | % | 1,692 | bps | 2,477 | bps | 66.97 | % | 60.99 | % | 598 | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio, Underlying (non-GAAP) | D/B | 63.77 | 63.08 | 54.42 | 69 | bps | 935 | bps | 60.81 | 57.51 | 330 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate and effective income tax rate, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | G/E | 7.59 | % | 21.51 | % | 21.16 | % | (1,392) | bps | (1,357) | bps | 20.76 | % | 21.93 | % | (117) | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate, Underlying (non-GAAP) | H/F | 22.25 | 21.69 | 21.37 | 56 | bps | 88 | bps | 22.48 | 22.19 | 29 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

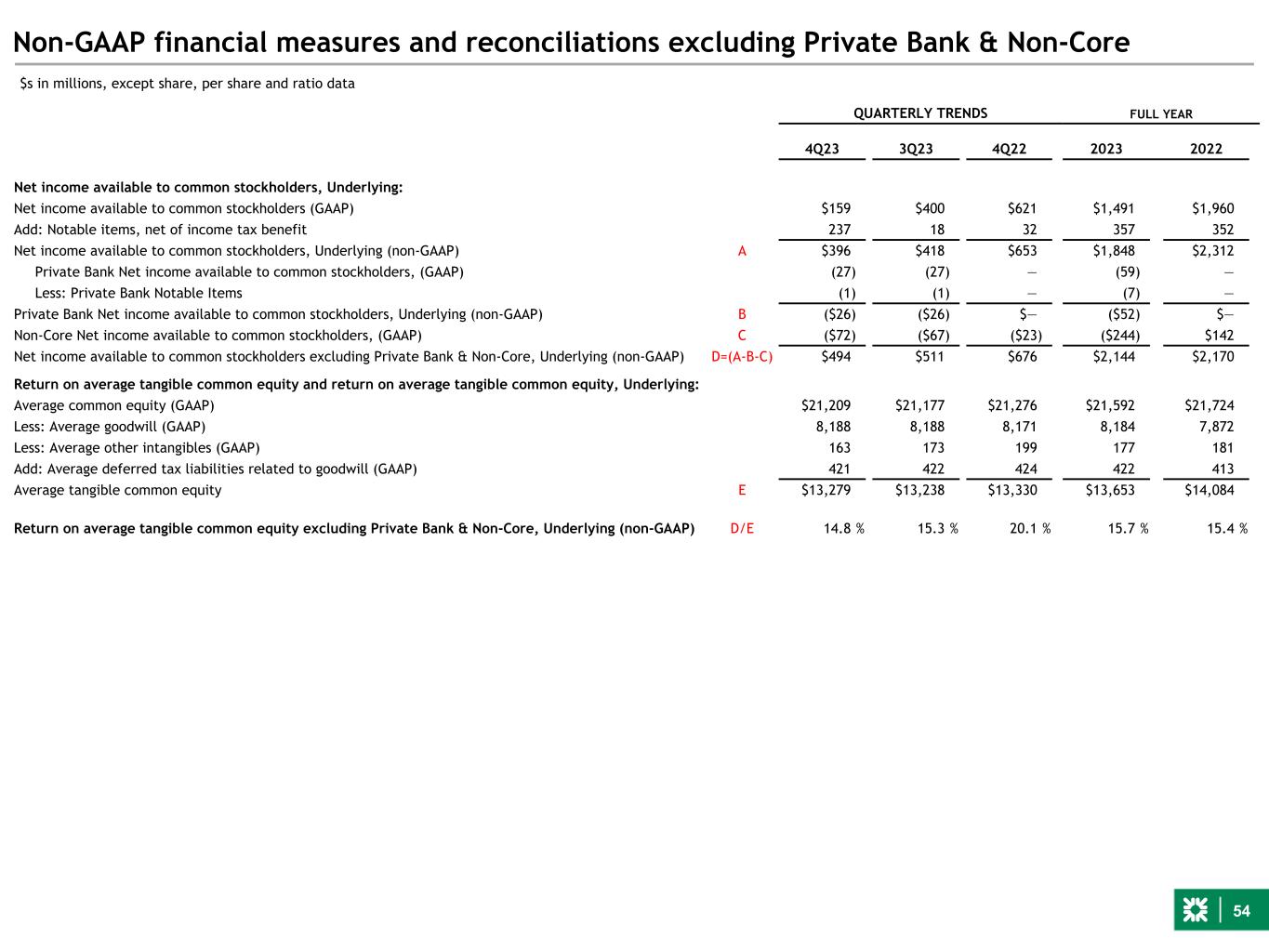

| Return on average tangible common equity and return on average tangible common equity, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common equity (GAAP) | M | $21,209 | $21,177 | $21,276 | $32 | — | % | ($67) | — | % | $21,592 | $21,724 | ($132) | (1 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Average goodwill (GAAP) | 8,188 | 8,188 | 8,171 | — | — | 17 | — | 8,184 | 7,872 | 312 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Average other intangibles (GAAP) | 163 | 173 | 199 | (10) | (6) | (36) | (18) | 177 | 181 | (4) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Average deferred tax liabilities related to goodwill and other intangible assets (GAAP) | 421 | 422 | 424 | (1) | — | (3) | (1) | 422 | 413 | 9 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average tangible common equity | N | $13,279 | $13,238 | $13,330 | $41 | — | % | ($51) | — | % | $13,653 | $14,084 | ($431) | (3 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | K/N | 4.72 | % | 12.00 | % | 18.46 | % | (728) | bps | (1,374) | bps | 10.92 | % | 13.91 | % | (299) | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity, Underlying (non-GAAP) | L/N | 11.84 | 12.51 | 19.40 | (67) | bps | (756) | bps | 13.53 | 16.41 | (288) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average total tangible assets and return on average total tangible assets, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average total assets (GAAP) | O | $223,653 | $220,162 | $224,970 | $3,491 | 2 | % | ($1,317) | (1 | %) | $222,221 | $215,061 | $7,160 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Average goodwill (GAAP) | 8,188 | 8,188 | 8,171 | — | — | 17 | — | 8,184 | 7,872 | 312 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Average other intangibles (GAAP) | 163 | 173 | 199 | (10) | (6) | (36) | (18) | 177 | 181 | (4) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Average deferred tax liabilities related to goodwill and other intangible assets (GAAP) | 421 | 422 | 424 | (1) | — | (3) | (1) | 422 | 413 | 9 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average tangible assets | P | $215,723 | $212,223 | $217,024 | $3,500 | 2 | % | ($1,301) | (1 | %) | $214,282 | $207,421 | $6,861 | 3 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average total tangible assets | I/P | 0.35 | % | 0.81 | % | 1.19 | % | (46) | bps | (84) | bps | 0.75 | % | 1.00 | % | (25) | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average total tangible assets, Underlying (non-GAAP) | J/P | 0.78 | 0.84 | 1.25 | (6) | bps | (47) | bps | 0.92 | 1.17 | (25) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible book value per common share: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares - at period-end (GAAP) | Q | 466,418,055 | 466,221,795 | 492,282,158 | 196,260 | — | % | (25,864,103) | (5 | %) | 466,418,055 | 492,282,158 | (25,864,103) | (5 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stockholders' equity (GAAP) | $22,329 | $20,864 | $21,676 | $1,465 | 7 | $653 | 3 | $22,329 | $21,676 | $653 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Goodwill (GAAP) | 8,188 | 8,188 | 8,173 | — | — | 15 | — | 8,188 | 8,173 | 15 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Other intangible assets (GAAP) | 157 | 167 | 197 | (10) | (6) | (40) | (20) | 157 | 197 | (40) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Add: Deferred tax liabilities related to goodwill and other intangible assets (GAAP) | 433 | 421 | 422 | 12 | 3 | 11 | 3 | 433 | 422 | 11 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible common equity | R | $14,417 | $12,930 | $13,728 | $1,487 | 12 | % | $689 | 5 | % | $14,417 | $13,728 | $689 | 5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible book value per common share | R/Q | $30.91 | $27.73 | $27.88 | $3.18 | 11 | % | $3.03 | 11 | % | $30.91 | $27.88 | $3.03 | 11 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income per average common share - basic and diluted and net income per average common share - basic and diluted, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding - basic (GAAP) | S | 466,234,324 | 469,481,085 | 493,293,981 | (3,246,761) | (1 | %) | (27,059,657) | (5 | %) | 475,089,384 | 475,959,815 | (870,431) | — | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average common shares outstanding - diluted (GAAP) | T | 468,159,167 | 471,183,719 | 495,478,398 | (3,024,552) | (1) | (27,319,231) | (6) | 476,693,148 | 477,803,142 | (1,109,994) | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income per average common share - basic (GAAP) | K/S | $0.34 | $0.85 | $1.26 | ($0.51) | (60) | ($0.92) | (73) | $3.14 | $4.12 | ($0.98) | (24) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income per average common share - diluted (GAAP) | K/T | 0.34 | 0.85 | 1.25 | (0.51) | (60) | (0.91) | (73) | 3.13 | 4.10 | (0.97) | (24) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income per average common share - basic, Underlying (non-GAAP) | L/S | 0.85 | 0.89 | 1.32 | (0.04) | (4) | (0.47) | (36) | 3.89 | 4.86 | (0.97) | (20) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income per average common share - diluted, Underlying (non-GAAP) | L/T | 0.85 | 0.89 | 1.32 | (0.04) | (4) | (0.47) | (36) | 3.88 | 4.84 | (0.96) | (20) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other income, Underlying: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other income (GAAP) | $20 | $18 | $36 | $2 | 11 | ($16) | (44%) | $78 | $82 | ($4) | (5 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | — | — | — | — | — | — | — | — | (31) | 31 | 100 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other income, Underlying (non-GAAP) | $20 | $18 | $36 | $2 | 11 | ($16) | (44 | %) | $78 | $113 | ($35) | (31 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits (GAAP) | $667 | $659 | $633 | $8 | 1 | % | $34 | 5 | % | $2,599 | $2,549 | $50 | — | 2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 32 | 5 | 15 | 27 | NM | 17 | 113 | 67 | 110 | (43) | (39) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits, Underlying (non-GAAP) | $635 | $654 | $618 | ($19) | (3 | %) | $17 | 3 | % | $2,532 | $2,439 | $93 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment and software, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Equipment and software (GAAP) |

$215 | $191 | $170 | $24 | 13 | % | $45 | 26 | % | $756 | $648 | $108 | 17 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 37 | 6 | 2 | 31 | NM | 35 | NM | 51 | 10 | 41 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment and software, Underlying (non-GAAP) | $178 | $185 | $168 | ($7) | (4 | %) | $10 | 6 | % | $705 | $638 | $67 | 11 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services (GAAP) | $174 | $160 | $170 | $14 | 9 | % | $4 | 2 | % | $687 | $700 | ($13) | — | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 13 | 7 | 17 | 6 | 86 | (4) | (24) | 68 | 113 | (45) | (40) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services, Underlying (non-GAAP) | $161 | $153 | $153 | $8 | 5 | % | $8 | 5 | % | $619 | $587 | $32 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy (GAAP) | $125 | $107 | $110 | $18 | 17 | % | $15 | 14 | % | $492 | $410 | $82 | 20 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 20 | 2 | 2 | 18 | NM | 18 | NM | 70 | 5 | 65 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy, Underlying (non-GAAP) | $105 | $105 | $108 | $— | — | % | ($3) | (3 | %) | $422 | $405 | $17 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating expense, Underlying: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating expense (GAAP) | $431 | $176 | $157 | $255 | 145 | % | $274 | 175 | % | $973 | $585 | $388 | — | 66 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Notable items | 243 | 2 | 7 | 241 | NM | 236 | NM | 250 | 24 | 226 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating expense, Underlying (non-GAAP) | $188 | $174 | $150 | $14 | 8 | % | $38 | 25 | % | $723 | $561 | $162 | 29 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | ||||||||

| Total revenue, Underlying excluding Private Bank: | ||||||||

| Total revenue (GAAP) | $1,988 | |||||||

| Less: Notable items | — | |||||||

| Less: Private Bank Total revenue (GAAP) | 5 | |||||||

| Total revenue, Underlying excluding Private Bank (non-GAAP) | A | $1,983 | ||||||

| Noninterest expense, Underlying excluding Private Bank: | ||||||||

| Noninterest expense (GAAP) | $1,612 | |||||||

| Less: Notable items | 345 | |||||||

| Noninterest expense, Underlying (non-GAAP) | B | $1,267 | ||||||

| Private Bank Noninterest expense (GAAP) | $42 | |||||||

| Less: Private Bank Notable Items | 2 | |||||||

| Noninterest expense, Underlying Private Bank (non-GAAP) | C | $40 | ||||||

| Noninterest expense, Underlying excluding Private Bank (non-GAAP) | B-C | $1,227 | ||||||

| Efficiency ratio, Underlying excluding Private Bank: | ||||||||

| Efficiency ratio, excluding Private Bank (non-GAAP) | (B-C)/A | 61.9 | % | |||||

| Table of Contents | Page | |||||||

Credit-Related Information: |

||||||||

The information in this Financial Supplement is preliminary and based on company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying pages. The Company does not undertake an obligation to, and disclaims any duty to, update any of the information provided. Any forward-looking statements in this Financial Supplement are subject to the forward-looking statements language contained in the Company’s reports filed with the SEC pursuant to the Securities Exchange Act of 1934, which can be found on the SEC’s website (www.sec.gov) or on the Company’s website (www.citizensbank.com). The Company’s future financial performance is subject to the risks and uncertainties described in its SEC filings. | ||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED OPERATING DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | $1,988 | $2,014 | $2,094 | $2,128 | $2,200 | ($26) | (1 | %) | ($212) | (10 | %) | $8,224 | $8,021 | $203 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 1,612 | 1,293 | 1,306 | 1,296 | 1,240 | 319 | 25 | 372 | 30 | 5,507 | 4,892 | 615 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit before provision (benefit) for credit losses | 376 | 721 | 788 | 832 | 960 | (345) | (48) | (584) | (61) | 2,717 | 3,129 | (412) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision (benefit) for credit losses | 171 | 172 | 176 | 168 | 132 | (1) | (1) | 39 | 30 | 687 | 474 | 213 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NET INCOME | 189 | 430 | 478 | 511 | 653 | (241) | (56) | (464) | (71) | 1,608 | 2,073 | (465) | (22) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income, Underlying1 |

426 | 448 | 531 | 560 | 685 | (22) | (5) | (259) | (38) | 1,965 | 2,425 | (460) | (19) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders | 159 | 400 | 444 | 488 | 621 | (241) | (60) | (462) | (74) | 1,491 | 1,960 | (469) | (24) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income available to common stockholders, Underlying1 |

396 | 418 | 497 | 537 | 653 | (22) | (5) | (257) | (39) | 1,848 | 2,312 | (464) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PER COMMON SHARE DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic earnings | $0.34 | $0.85 | $0.93 | $1.00 | $1.26 | ($0.51) | (60 | %) | ($0.92) | (73 | %) | $3.14 | $4.12 | ($0.98) | (24 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted earnings | 0.34 | 0.85 | 0.92 | 1.00 | 1.25 | (0.51) | (60) | (0.91) | (73) | 3.13 | 4.10 | (0.97) | (24) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Basic earnings, Underlying1 |

0.85 | 0.89 | 1.04 | 1.10 | 1.32 | (0.04) | (4) | (0.47) | (36) | 3.89 | 4.86 | (0.97) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Diluted earnings, Underlying1 |

0.85 | 0.89 | 1.04 | 1.10 | 1.32 | (0.04) | (4) | (0.47) | (36) | 3.88 | 4.84 | (0.96) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared and paid per common share | 0.42 | 0.42 | 0.42 | 0.42 | 0.42 | — | — | — | — | 1.68 | 1.62 | 0.06 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Book value per common share | 47.87 | 44.75 | 45.44 | 45.84 | 44.03 | 3.12 | 7 | 3.84 | 9 | 47.87 | 44.03 | 3.84 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible book value per common share | 30.91 | 27.73 | 28.72 | 29.44 | 27.88 | 3.18 | 11 | 3.03 | 11 | 30.91 | 27.88 | 3.03 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dividend payout ratio | 124 | % | 49 | % | 45 | % | 42 | % | 33 | % | 7,412 | bps | 9,053 | bps | 54 | % | 39 | % | 1,450 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividend payout ratio, Underlying1 |

49 | 47 | 40 | 38 | 32 | 200 | bps | 1,700 | bps | 43 | 33 | 1,000 | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMMON SHARES OUTSTANDING | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average: Basic | 466,234,324 | 469,481,085 | 479,470,543 | 485,444,313 | 493,293,981 | (3,246,761) | (1 | %) | (27,059,657) | (5 | %) | 475,089,384 | 475,959,815 | (870,431) | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted | 468,159,167 | 471,183,719 | 480,975,281 | 487,712,146 | 495,478,398 | (3,024,552) | (1) | (27,319,231) | (6) | 476,693,148 | 477,803,142 | (1,109,994) | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common shares at period-end | 466,418,055 | 466,221,795 | 474,682,759 | 483,982,264 | 492,282,158 | 196,260 | — | (25,864,103) | (5) | 466,418,055 | 492,282,158 | (25,864,103) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $/bps | % | $/bps | % | $/bps | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL RATIOS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 2.90 | % | 3.03 | % | 3.16 | % | 3.29 | % | 3.29 | % | (13) bps | (39) bps | 3.09 | % | 3.10 | % | (1) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin, FTE1 |

2.91 | 3.03 | 3.17 | 3.30 | 3.30 | (12) | (39) | 3.10 | 3.10 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average common equity | 2.96 | 7.50 | 8.00 | 9.11 | 11.56 | (454) | (860) | 6.90 | 9.02 | (212) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average common equity, Underlying2 |

7.41 | 7.82 | 8.97 | 10.01 | 12.15 | (41) | (474) | 8.56 | 10.64 | (208) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average tangible common equity | 4.72 | 12.00 | 12.42 | 14.38 | 18.46 | (728) | (1,374) | 10.92 | 13.91 | (299) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity, Underlying2 |

11.84 | 12.51 | 13.93 | 15.80 | 19.40 | (67) | (756) | 13.53 | 16.41 | (288) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average total assets | 0.33 | 0.78 | 0.86 | 0.93 | 1.15 | (45) | (82) | 0.72 | 0.96 | (24) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average total assets, Underlying2 |

0.76 | 0.81 | 0.96 | 1.02 | 1.21 | (5) | (45) | 0.88 | 1.13 | (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average total tangible assets | 0.35 | 0.81 | 0.89 | 0.97 | 1.19 | (46) | (84) | 0.75 | 1.00 | (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Return on average total tangible assets, Underlying2 |

0.78 | 0.84 | 0.99 | 1.06 | 1.25 | (6) | (47) | 0.92 | 1.17 | (25) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Effective income tax rate | 7.59 | 21.51 | 22.09 | 22.97 | 21.16 | (1,392) | (1,357) | 20.76 | 21.93 | (117) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Effective income tax rate, Underlying2 |

22.25 | 21.69 | 22.51 | 23.25 | 21.37 | 56 | 88 | 22.48 | 22.19 | 29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 81.13 | 64.21 | 62.34 | 60.90 | 56.36 | 1,692 | 2,477 | 66.97 | 60.99 | 598 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Efficiency ratio, Underlying2 |

63.77 | 63.08 | 58.86 | 57.84 | 54.42 | 69 | 935 | 60.81 | 57.51 | 330 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income as a % of total revenue | 25.16 | 24.44 | 24.14 | 22.81 | 22.92 | 72 | 224 | 24.12 | 25.04 | (92) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Noninterest income as a % of total revenue, Underlying2 |

25.16 | 24.44 | 24.14 | 22.81 | 22.92 | 72 | 224 | 24.12 | 25.33 | (121) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CAPITAL RATIOS - PERIOD-END (PRELIMINARY) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CET1 capital ratio | 10.6 | % | 10.4 | % | 10.3 | % | 10.0 | % | 10.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 capital ratio | 11.8 | 11.5 | 11.4 | 11.1 | 11.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total capital ratio | 13.7 | 13.4 | 13.3 | 12.9 | 12.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tier 1 leverage ratio | 9.3 | 9.4 | 9.4 | 9.4 | 9.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tangible common equity ratio | 6.7 | 5.9 | 6.3 | 6.6 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SELECTED BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan-to-deposit ratio (period-end balances) | 82.30 | % | 84.03 | % | 85.17 | % | 89.83 | % | 86.69 | % | (173) | bps | (439) | bps | 82.30 | % | 86.69 | % | (439) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan-to-deposit ratio (average balances) | 83.54 | 85.46 | 88.73 | 89.76 | 87.74 | (192) | bps | (420) | bps | 86.83 | 86.77 | 6 | bps | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-time equivalent colleagues (period-end) | 17,570 | 18,214 | 18,468 | 18,547 | 18,889 | (644) | (4) | (1,319) | (7) | 17,570 | 18,889 | (1,319) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QUARTERLY TRENDS | FULL YEAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 Change | 2023 Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q23 | 4Q22 | 2023 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INTEREST INCOME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans and leases | $2,144 | $2,166 | $2,132 | $2,047 | $1,893 | ($22) | (1 | %) | $251 | 13 | % | $8,489 | $5,968 | $2,521 | 42 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans held for sale | 18 | 20 | 20 | 15 | 16 | (2) | (10) | 2 | 13 | 73 | 67 | 6 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest and fees on other loans held for sale | 4 | 8 | 12 | 5 | 10 | (4) | (50) | (6) | (60) | 29 | 57 | (28) | (49) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 339 | 290 | 267 | 266 | 258 | 49 | 17 | 81 | 31 | 1,162 | 840 | 322 | 38 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits in banks | 171 | 111 | 100 | 69 | 75 | 60 | 54 | 96 | 128 | 451 | 128 | 323 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest income | 2,676 | 2,595 | 2,531 | 2,402 | 2,252 | 81 | 3 | 424 | 19 | 10,204 | 7,060 | 3,144 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 974 | 898 | 723 | 550 | 396 | 76 | 8 | 578 | 146 | 3,145 | 651 | 2,494 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowed funds | 7 | 8 | 22 | 6 | 2 | (1) | (13) | 5 | 250 | 43 | 23 | 20 | 87 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term borrowed funds | 207 | 167 | 198 | 203 | 159 | 40 | 24 | 48 | 30 | 775 | 374 | 401 | 107 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest expense | 1,188 | 1,073 | 943 | 759 | 557 | 115 | 11 | 631 | 113 | 3,963 | 1,048 | 2,915 | NM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 1,488 | 1,522 | 1,588 | 1,643 | 1,695 | (34) | (2) | (207) | (12) | 6,241 | 6,012 | 229 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONINTEREST INCOME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service charges and fees | 104 | 105 | 101 | 100 | 105 | (1) | (1) | (1) | (1) | 410 | 420 | (10) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital markets fees | 87 | 67 | 82 | 83 | 98 | 20 | 30 | (11) | (11) | 319 | 368 | (49) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Card fees | 70 | 74 | 80 | 72 | 71 | (4) | (5) | (1) | (1) | 296 | 273 | 23 | 8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trust and investment services fees | 68 | 63 | 65 | 63 | 61 | 5 | 8 | 7 | 11 | 259 | 249 | 10 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage banking fees | 57 | 69 | 59 | 57 | 54 | (12) | (17) | 3 | 6 | 242 | 261 | (19) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange and derivative products | 43 | 48 | 44 | 48 | 35 | (5) | (10) | 8 | 23 | 183 | 188 | (5) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Letter of credit and loan fees | 42 | 43 | 43 | 40 | 41 | (1) | (2) | 1 | 2 | 168 | 159 | 9 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities gains, net | 9 | 5 | 9 | 5 | 4 | 4 | 80 | 5 | 125 | 28 | 9 | 19 | 211 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other income | 20 | 18 | 23 | 17 | 36 | 2 | 11 | (16) | (44) | 78 | 82 | (4) | (5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 500 | 492 | 506 | 485 | 505 | 8 | 2 | (5) | (1) | 1,983 | 2,009 | (26) | (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL REVENUE | 1,988 | 2,014 | 2,094 | 2,128 | 2,200 | (26) | (1) | (212) | (10) | 8,224 | 8,021 | 203 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision (benefit) for credit losses | 171 | 172 | 176 | 168 | 132 | (1) | (1) | 39 | 30 | 687 | 474 | 213 | 45 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NONINTEREST EXPENSE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 667 | 659 | 615 | 658 | 633 | 8 | 1 | 34 | 5 | 2,599 | 2,549 | 50 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment and software | 215 | 191 | 181 | 169 | 170 | 24 | 13 | 45 | 26 | 756 | 648 | 108 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside services | 174 | 160 | 177 | 176 | 170 | 14 | 9 | 4 | 2 | 687 | 700 | (13) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Occupancy | 125 | 107 | 136 | 124 | 110 | 18 | 17 | 15 | 14 | 492 | 410 | 82 | 20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other operating expense | 431 | 176 | 197 | 169 | 157 | 255 | 145 | 274 | 175 | 973 | 585 | 388 | 66 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 1,612 | 1,293 | 1,306 | 1,296 | 1,240 | 319 | 25 | 372 | 30 | 5,507 | 4,892 | 615 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 205 | 549 | 612 | 664 | 828 | (344) | (63) | (623) | (75) | 2,030 | 2,655 | (625) | (24) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 16 | 119 | 134 | 153 | 175 | (103) | (87) | (159) | (91) | 422 | 582 | (160) | (27) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | $189 | $430 | $478 | $511 | $653 | ($241) | (56 | %) | ($464) | (71 | %) | $1,608 | $2,073 | ($465) | (22 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income, Underlying1 |

$426 | $448 | $531 | $560 | $685 | ($22) | (5 | %) | ($259) | (38 | %) | $1,965 | $2,425 | ($460) | (19 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common stockholders | $159 | $400 | $444 | $488 | $621 | ($241) | (60 | %) | ($462) | (74 | %) | $1,491 | $1,960 | ($469) | (24 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income available to common stockholders, Underlying1 |

$396 | $418 | $497 | $537 | $653 | ($22) | (5 | %) | ($257) | (39 | %) | $1,848 | $2,312 | ($464) | (20 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PERIOD-END BALANCES | AS OF | DECEMBER 31, 2023 CHANGE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dec 31, 2023 | Sept 30, 2023 | June 30, 2023 | Mar 31, 2023 | Dec 31, 2022 | September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | % | $ | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | $1,794 | $1,395 | $1,689 | $1,283 | $1,489 | $399 | 29 | % | $305 | 20 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing cash and due from banks | 9,834 | 14,005 | 9,878 | 6,691 | 9,058 | (4,171) | (30) | 776 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits in banks | 405 | 324 | 284 | 320 | 303 | 81 | 25 | 102 | 34 | |||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities available for sale, at fair value | 29,777 | 25,069 | 24,755 | 23,845 | 24,007 | 4,708 | 19 | 5,770 | 24 | |||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities held to maturity | 9,184 | 9,320 | 9,520 | 9,677 | 9,834 | (136) | (1) | (650) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale, at fair value | 676 | 749 | 1,225 | 855 | 774 | (73) | (10) | (98) | (13) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other loans held for sale | 103 | 99 | 196 | 1,000 | 208 | 4 | 4 | (105) | (50) | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases | 145,959 | 149,746 | 151,320 | 154,688 | 156,662 | (3,787) | (3) | (10,703) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Less: Allowance for loan and lease losses | (2,098) | (2,080) | (2,044) | (2,017) | (1,983) | (18) | 1 | (115) | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net loans and leases | 143,861 | 147,666 | 149,276 | 152,671 | 154,679 | (3,805) | (3) | (10,818) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Derivative assets | 440 | 522 | 719 | 569 | 842 | (82) | (16) | (402) | (48) | |||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment | 895 | 878 | 876 | 866 | 844 | 17 | 2 | 51 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 3,291 | 3,275 | 3,263 | 3,244 | 3,236 | 16 | — | 55 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 8,188 | 8,188 | 8,188 | 8,177 | 8,173 | — | — | 15 | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Other intangible assets | 157 | 167 | 175 | 185 | 197 | (10) | (6) | (40) | (20) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 13,359 | 13,613 | 13,022 | 12,873 | 13,089 | (254) | (2) | 270 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL ASSETS | $221,964 | $225,270 | $223,066 | $222,256 | $226,733 | ($3,306) | (1 | %) | ($4,769) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing | $37,107 | $38,561 | $40,286 | $44,326 | $49,283 | ($1,454) | (4 | %) | ($12,176) | (25 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing | 140,235 | 139,636 | 137,381 | 127,868 | 131,441 | 599 | — | 8,794 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | 177,342 | 178,197 | 177,667 | 172,194 | 180,724 | (855) | — | (3,382) | (2) | |||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowed funds | 505 | 232 | 1,099 | 1,018 | 3 | 273 | 118 | 502 | NM | |||||||||||||||||||||||||||||||||||||||||||||||

| Derivative liabilities | 1,562 | 2,109 | 2,270 | 1,704 | 1,909 | (547) | (26) | (347) | (18) | |||||||||||||||||||||||||||||||||||||||||||||||

| Long-term borrowed funds: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 3,786 | 7,036 | 5,029 | 11,779 | 8,519 | (3,250) | (46) | (4,733) | (56) | |||||||||||||||||||||||||||||||||||||||||||||||

| Senior debt | 5,170 | 5,258 | 5,258 | 5,263 | 5,555 | (88) | (2) | (385) | (7) | |||||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debt and other debt | 4,511 | 5,060 | 3,813 | 1,813 | 1,813 | (549) | (11) | 2,698 | 149 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total long-term borrowed funds | 13,467 | 17,354 | 14,100 | 18,855 | 15,887 | (3,887) | (22) | (2,420) | (15) | |||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 4,746 | 4,500 | 4,345 | 4,284 | 4,520 | 246 | 5 | 226 | 5 | |||||||||||||||||||||||||||||||||||||||||||||||