Document

Exhibit 10.1

[WEC ENERGY GROUP LETTERHEAD]

March 7, 2024

Michael Hooper

[ADDRESS]

[ADDRESS]

Dear Mike:

On behalf of WEC Energy Group, we are pleased to confirm the offer of employment we have extended to you for the position of President Wisconsin Utilities. You will report to the President and Chief Executive Officer. Your start date is anticipated to be no later than April 1, 2024. Details regarding this employment offer are outlined below.

Base Salary

The annual base salary offered for this position is $650,000 payable in accordance with the Company’s regular payroll practices. Other compensation and benefits associated with this offer are outlined below.

Annual Incentive Plan

In addition to your base salary, you will participate in the Short-Term Performance Plan. Under this plan, your target award level is 80 percent of base salary. Payment is earned when you and the Company meet pre-established performance targets based on WEC financial performance and results against certain operational targets. Since the plan has an upside potential of 210 percent of the target award, payments may range from 0 percent to 168 percent of your base salary based on the degree to which the performance goals are met. Participation in this plan is reviewed annually. Your 2024 award will be prorated to reflect partial year participation.

Long-Term Incentive Awards

You will participate in the long-term incentive plan with a target compensation level of 170 percent of base salary. Awards may be in the form of stock options, restricted stock, performance units or such other form as approved by the Compensation Committee each year. The current practice is to award 65 percent of the target compensation level in the form of performance units, 20 percent in restricted stock, and 15 percent in stock options. These weightings and the forms of awards are subject to annual review. Annual awards have historically been made in early January.

For 2024, you will receive long-term awards with a target compensation level of 170 percent of base salary effective as of the date you begin employment. The weightings of performance units, restricted stock and stock options will be consistent with those applied in January 2024 for other plan participants, which are referenced in the preceding paragraph. Standard terms, conditions and restrictions will apply, including the performance period for the 2024 performance unit awards.

Acceptance of the standard written terms shall be a condition to the foregoing grants.

Relocation

You will be eligible for comprehensive relocation benefits commensurate with those provided to senior executives of the company to assist you with your relocation. As a condition of your employment, you will be expected to establish your principal residence in the Milwaukee area within six months of your start date.

401(k) Plan

You will be eligible to participate in the company’s 401(k) plan. The company matches 100 percent of the first one percent of participant contributions and 50 percent of the next 6 percent of participant contributions, resulting in a 4 percent match on participant contributions of 7 percent.

Deferred Compensation

At the next annual enrollment period, you will be eligible to participate in the Executive Deferred Compensation Plan (EDCP), which allows deferral of a portion of base salary and incentive awards into a nonqualified account. You will have the opportunity to select among two investment alternatives for any amounts you elect to defer. One alternative tracks the value of WEC common stock including reinvestment of common dividends and the other credits your balance at the then current prime rate of interest. The company matches amounts you defer to the plan consistent with the matching formula applied to the 401(k).

In addition, as soon as practicable, the Company will begin crediting $300,000 annually to the EDCP. The annual company credit will be invested in the account that tracks WEC common stock performance in accordance with plan provisions. The Company will make a total of five annual contributions to the plan with each subsequent contribution occurring on the anniversary of the date your employment commences. The balance will vest on your fifth anniversary with the company or in the event of your death or disability. The balance at separation after vesting, including any reinvested dividends and earnings or losses, will be distributed in a form elected by you at the time you commence employment. Administration of this benefit will comply with Section 409A of the Internal Revenue Code.

Retirement Savings Benefit

The company offers a defined contribution retirement savings plan with an annual contribution of 6 percent of base salary and annual incentive. Earnings on the account will be determined by performance of the investment funds you elect. Retirement income benefits are provided through both a tax-qualified and nonqualified plan to ensure that IRS limits on compensation recognized by the qualified plan do not impact the overall benefit. Tax-qualified contributions are made to the 401(k) and have the same investment options available as employee contributions to the plan. Nonqualified investment options are limited to the prime rate and WEC stock fund options referenced above.

Medical and Dental Benefits

You will be eligible to participate in the medical and dental benefit plans available to other management employees of the company. The company offers a consumer-driven health plan with an HSA savings option.

The plan is administered through United Healthcare. Coverage begins on your first day of employment. Dental benefits are available at a subsidized cost through a dental maintenance organization or through a comprehensive plan.

Life Insurance

You will be eligible for group term life insurance at two times your base salary at no cost. The company also offers an opportunity to purchase voluntary life insurance.

In addition, you will have an opportunity to participate in an Executive Life Insurance Benefit, which provides a benefit of three times your then current base salary to your beneficiary if you should die while employed with the company.

Long-term Disability

After six months of employment, you will be eligible for long-term disability benefits, which would begin on the 181st day after you become disabled. The company provides 60 percent base salary replacement at no cost to you. You will have the option to increase the benefit to 66.67 percent of salary, with the premium being paid by you.

Vacation & Holidays

You will be credited with 25 days of vacation. For purposes of future vacation accrual, you will be treated as if your employment had commenced in 2004, which provides you with 20 years of recognized service under the plan. The vacation schedule provides an increase to 27 days of vacation in the year you reach 25 years of credited service under the plan. Your allocation will be increased at that time and will follow the schedule for management employees from that point forward. Vacation eligibility for 2024 will be pro-rated based on your date of hire. In addition, the company currently provides 10 paid holidays.

Financial Planning

You will be credited with an annual financial planning benefit of $18,000. You will have discretion to choose the provider.

Executive Physical Program

The company provides supplemental payment for some preventative screenings if the cost is not covered under the company’s medical plan. You may utilize your primary care physician or another medical provider of your choice. Expenses incurred through the Program are first submitted to insurance, and the remaining balance is considered under this benefit.

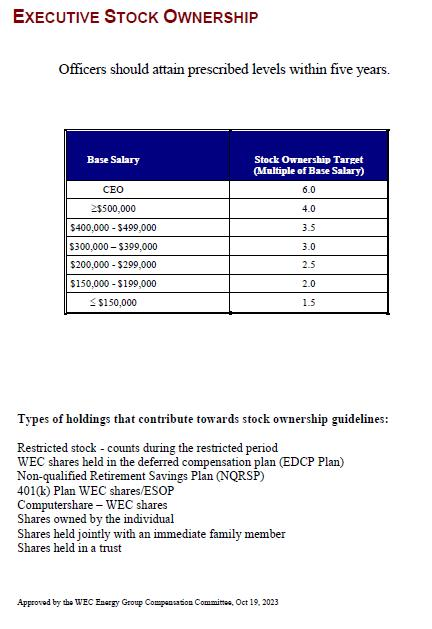

Stock Ownership Requirement Attached is a copy of the company’s current stock ownership requirements. At your level you will be required to hold four times your annual salary in WEC stock within five years of your effective employment date. There are a wide range of holdings that contribute toward the guideline, including the restricted stock granted by the company as a part of the long term incentive awards and amounts held in the EDCP WEC common stock fund described above. Plan Documents and Future Changes All benefits described above which are further defined in plan documents are subject to all of the terms in those documents which supersede any other description.

Management reserves the right in its discretion to change or terminate all current benefit plans or practices and other policies and procedures. Other Terms This offer is contingent upon the successful outcome of a criminal background investigation and a pre-employment drug screen. The pre-employment drug screen timing will be communicated to you at a later date and you will be expected to comply with the screening requirement within 24 hours of notification. In addition, your employment would be considered at-will; that is, you could be discharged for any reason or no reason at all, at any time and without notice, and likewise, you may resign at any time and without notice.

Please acknowledge the details of this offer and your acceptance on the line below and return it to me. If you have any questions regarding the details of this offer, please feel free to contact me or Lisa George directly.

Sincerely,

/s/ Scott J. Lauber

Scott J. Lauber

President and Chief Executive Officer

__________________________________

I have reviewed and accept this offer of employment.

Signature: /s/ Michael Hooper Date: 03/07/2024