| North Carolina | 1-10853 | 56-0939887 | ||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||

214 North Tryon Street |

||||||||

Charlotte, |

North Carolina |

28202 |

||||||

(Address of principal executive offices) |

(Zip Code) |

|||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $5 par value | TFC | New York Stock Exchange | ||||||

| Depositary Shares each representing 1/4,000th interest in a share of Series I Perpetual Preferred Stock | TFC.PI | New York Stock Exchange | ||||||

| 5.853% Fixed-to-Floating Rate Normal Preferred Purchase Securities each representing 1/100th interest in a share of Series J Perpetual Preferred Stock | TFC.PJ | New York Stock Exchange | ||||||

| Depositary Shares each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock | TFC.PO | New York Stock Exchange | ||||||

| Depositary Shares each representing 1/1,000th interest in a share of Series R Non-Cumulative Perpetual Preferred Stock | TFC.PR | New York Stock Exchange | ||||||

| Exhibit No. | Description of Exhibit | |||||||

| Earnings Release issued January 17, 2025. | ||||||||

| Quarterly Performance Summary issued January 17, 2025. | ||||||||

| Earnings Release Presentation issued January 17, 2025. | ||||||||

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |||||||

TRUIST FINANCIAL CORPORATION |

||||||||

(Registrant) |

||||||||

| By: | /s/ Cynthia B. Powell | |||||||

Cynthia B. Powell |

||||||||

Executive Vice President and Corporate Controller |

||||||||

(Principal Accounting Officer) |

||||||||

|

News Release | ||||||||||

Truist reports fourth quarter 2024 results | |||||||||||

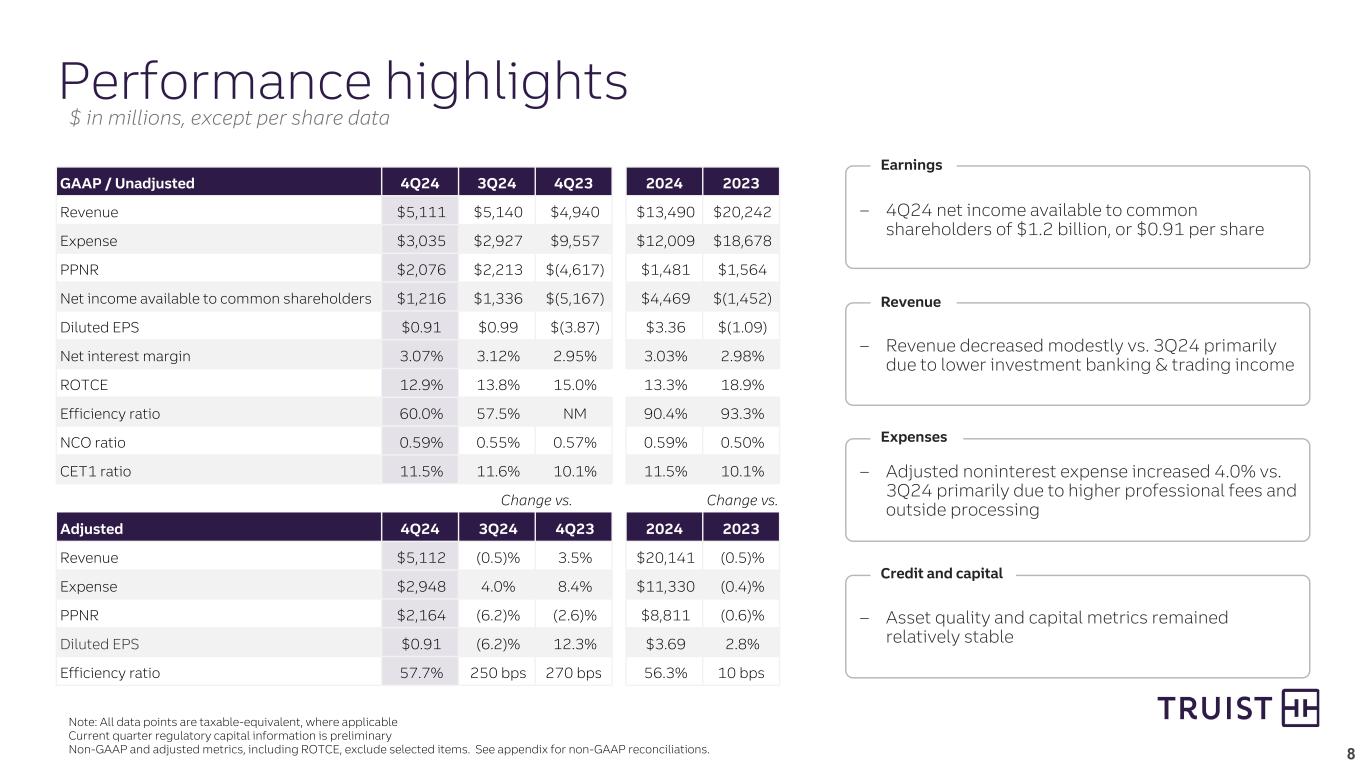

Net income available to common shareholders of $1.2 billion, or $0.91 per share |

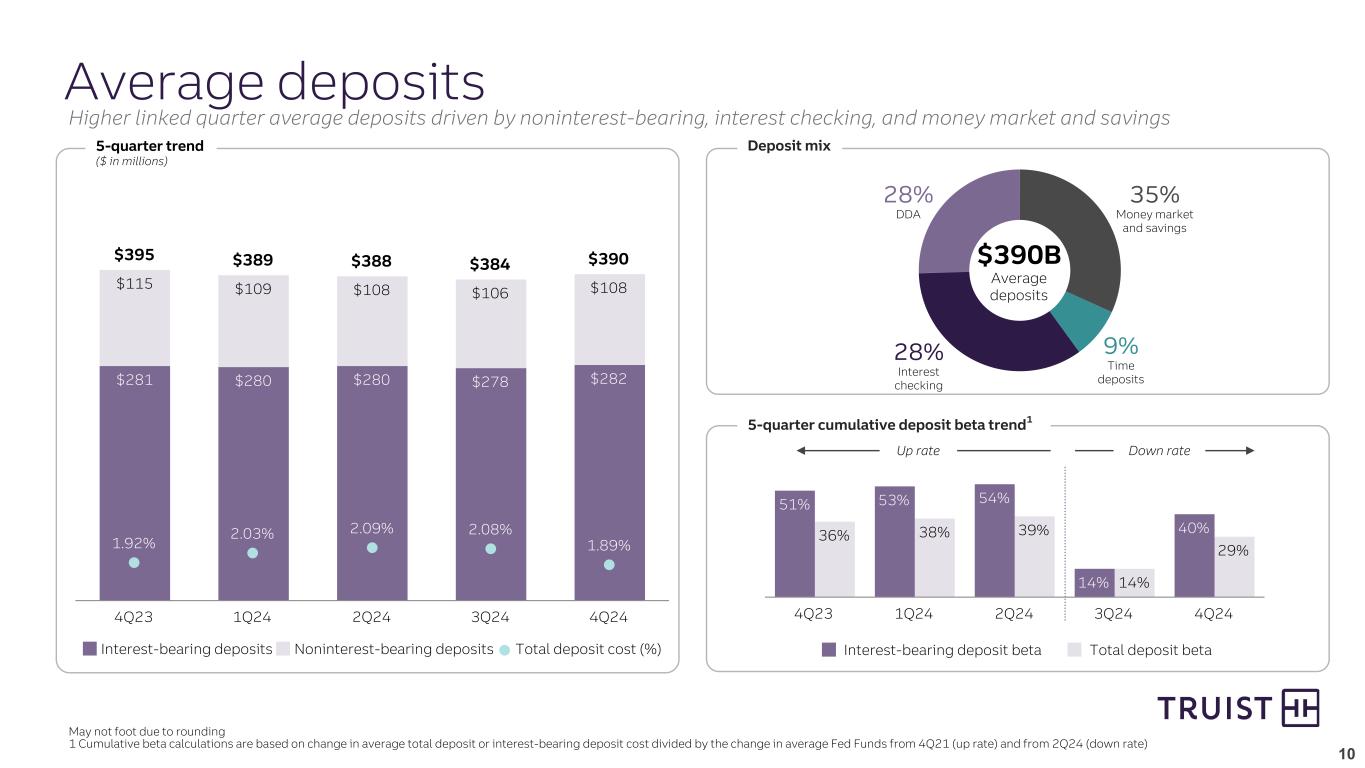

Average deposits increased $5.7 billion while total deposit costs were down 19 basis points |

Repurchased $500 million in common shares;

Dividend and total payout ratios of 57% and 98%

|

|||||||||

4Q24 Key Financial Data |

4Q24 and 2024 Performance Highlights(4) |

||||||||||

| (Dollars in billions, except per share data) | 4Q24 | 3Q24 | 4Q23 | FY2024 | FY2023 | ||||||||||||

| Summary Income Statement | |||||||||||||||||

| Net interest income - TE | $ | 3.64 | $ | 3.66 | $ | 3.58 | $ | 14.30 | $ | 14.74 | |||||||

| Noninterest income | 1.47 | 1.48 | 1.36 | (0.81) | 5.50 | ||||||||||||

| Total revenue - TE | 5.11 | 5.14 | 4.94 | 13.49 | 20.24 | ||||||||||||

| Noninterest expense | 3.04 | 2.93 | 9.56 | 12.01 | 18.68 | ||||||||||||

| Net income (loss) from continuing operations | 1.29 | 1.44 | (5.19) | (0.05) | (1.50) | ||||||||||||

| Net income from discontinued operations | (0.01) | 0.00 | 0.10 | 4.89 | 0.46 | ||||||||||||

| Net income | 1.28 | 1.44 | (5.09) | 4.84 | (1.05) | ||||||||||||

| Net income available to common shareholders | 1.22 | 1.34 | (5.17) | 4.47 | (1.45) | ||||||||||||

Adjusted net income available to common shareholders(1) |

1.21 | 1.31 | 1.09 | 4.97 | 4.81 | ||||||||||||

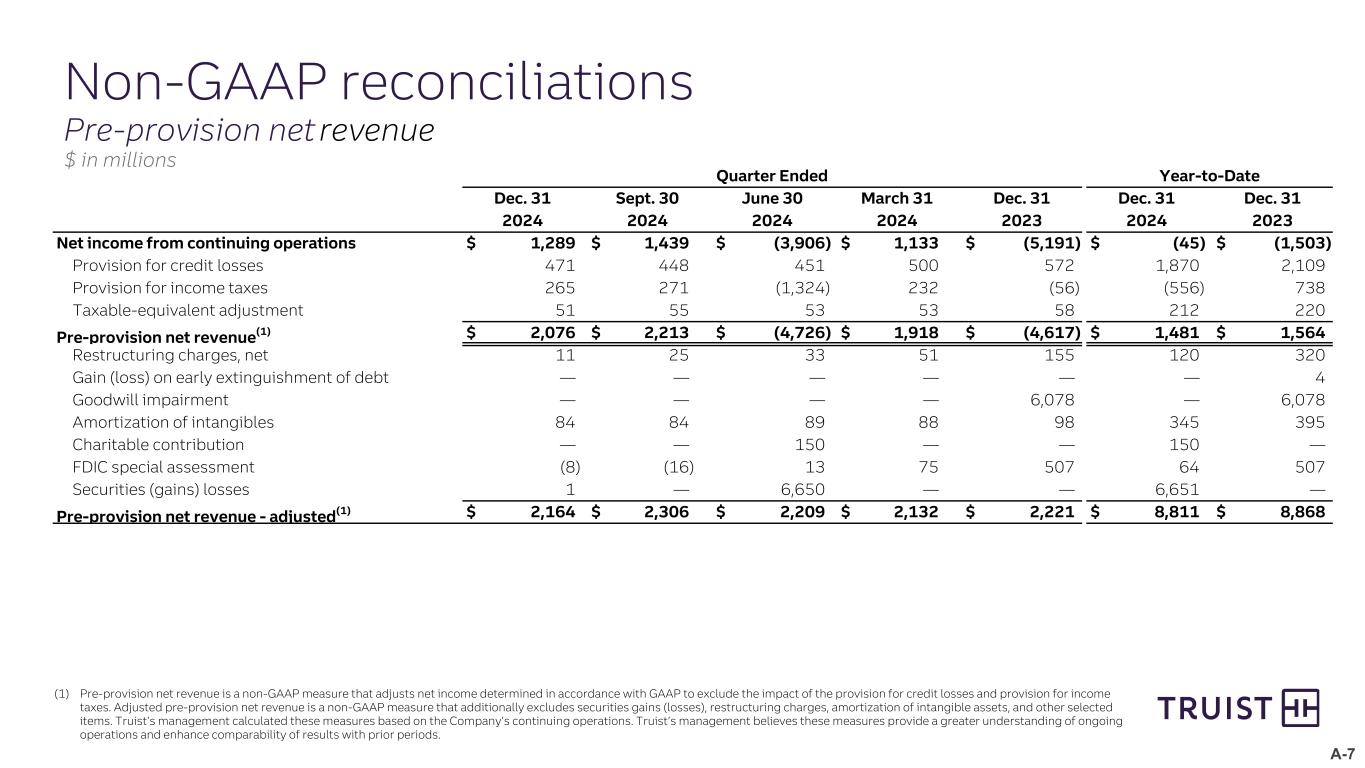

PPNR - unadjusted(1)(2) |

2.08 | 2.21 | (4.62) | 1.48 | 1.56 | ||||||||||||

PPNR - adjusted(1)(2) |

2.16 | 2.31 | 2.22 | 8.81 | 8.87 | ||||||||||||

| Key Metrics | |||||||||||||||||

| Diluted EPS | $ | 0.91 | $ | 0.99 | $ | (3.87) | $ | 3.36 | $ | (1.09) | |||||||

Adjusted diluted EPS(1) |

0.91 | 0.97 | 0.81 | 3.69 | 3.59 | ||||||||||||

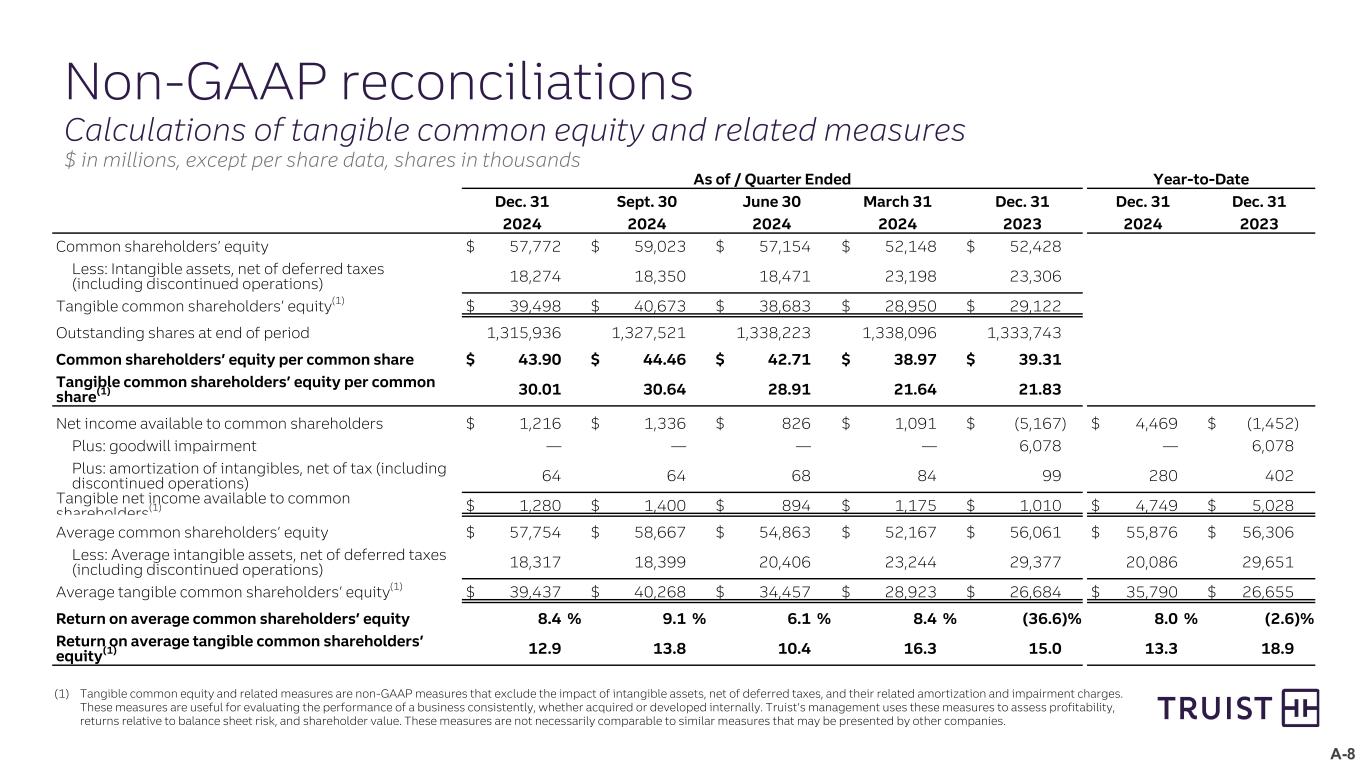

| BVPS | 43.90 | 44.46 | 39.31 | ||||||||||||||

TBVPS(1) |

30.01 | 30.64 | 21.83 | ||||||||||||||

| ROCE | 8.4 | % | 9.1 | % | (36.6) | % | 8.0 | % | (2.6) | % | |||||||

ROTCE(1) |

12.9 | 13.8 | 15.0 | 13.3 | 18.9 | ||||||||||||

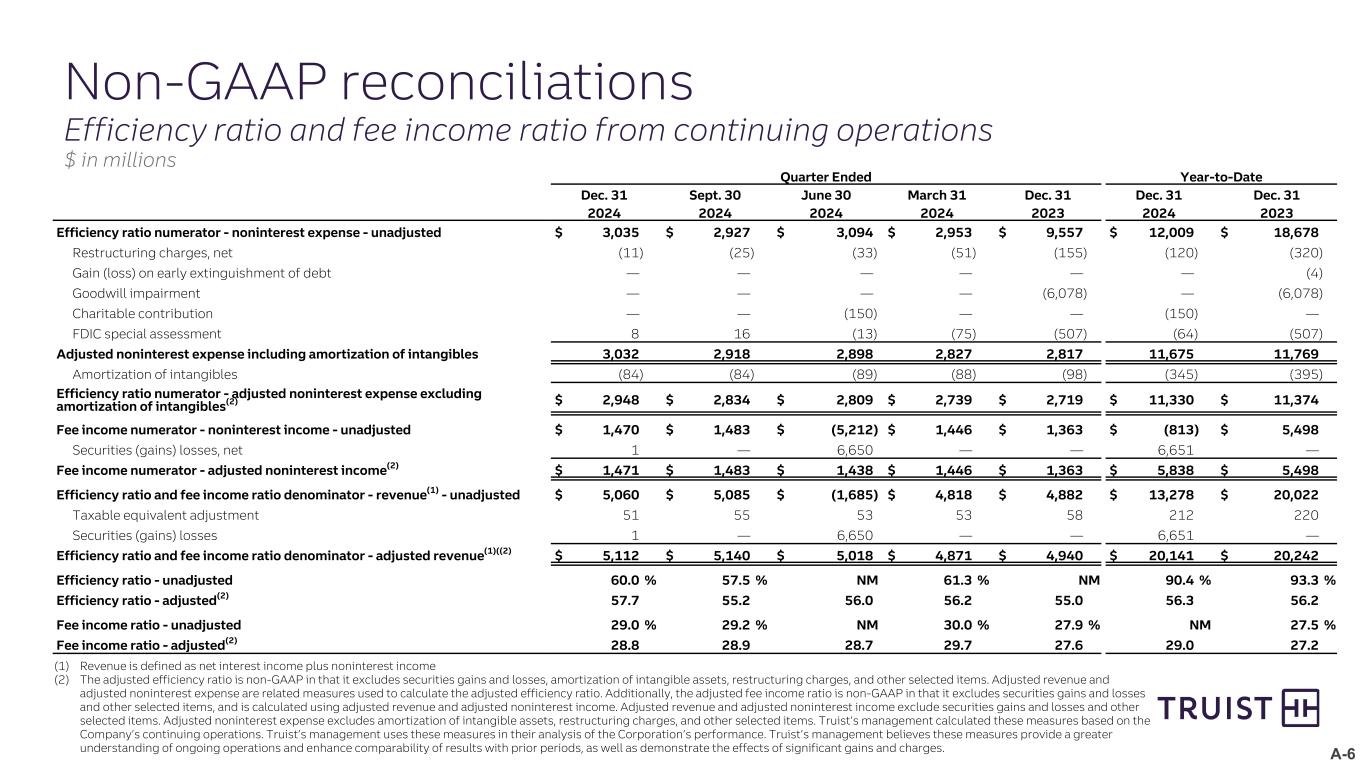

Efficiency ratio - unadjusted(2) |

60.0 | 57.5 | NM | 90.4 | 93.3 | ||||||||||||

Efficiency ratio - adjusted(1)(2) |

57.7 | 55.2 | 55.0 | 56.3 | 56.2 | ||||||||||||

Fee income ratio - unadjusted(2) |

29.0 | 29.2 | 27.9 | NM | 27.5 | ||||||||||||

Fee income ratio - adjusted(1)(2) |

28.8 | 28.9 | 27.6 | 29.0 | 27.2 | ||||||||||||

NIM - TE(2) |

3.07 | 3.12 | 2.95 | 3.03 | 2.98 | ||||||||||||

| NCO ratio | 0.59 | 0.55 | 0.57 | 0.59 | 0.50 | ||||||||||||

| ALLL ratio | 1.59 | 1.60 | 1.54 | ||||||||||||||

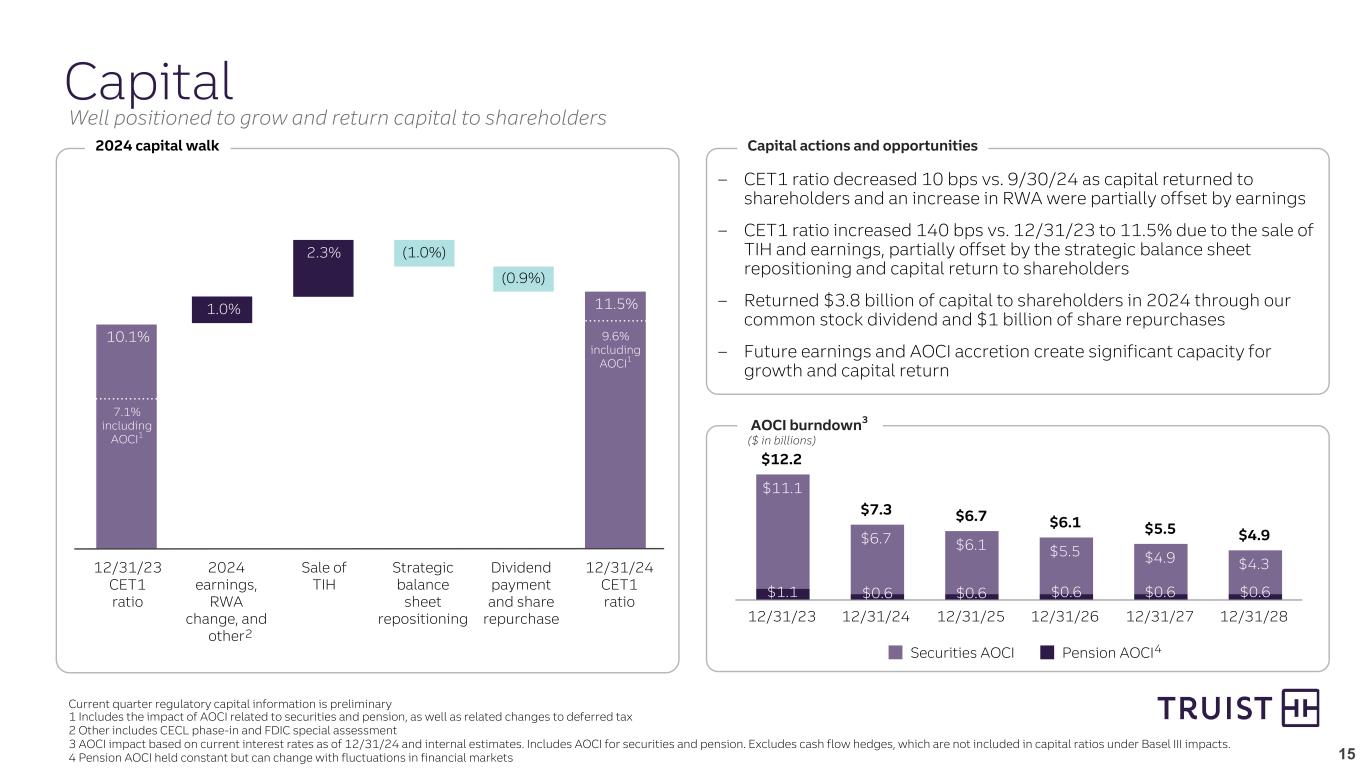

CET1 ratio(3) |

11.5 | 11.6 | 10.1 | ||||||||||||||

| Average Balances | |||||||||||||||||

| Assets | $ | 527 | $ | 519 | $ | 540 | $ | 526 | $ | 553 | |||||||

| Securities | 125 | 117 | 134 | 124 | 138 | ||||||||||||

| Loans and leases | 305 | 305 | 314 | 307 | 322 | ||||||||||||

| Deposits | 390 | 384 | 395 | 388 | 401 | ||||||||||||

| CEO Commentary | ||

| Contact: | ||||||||

| Investors: | Brad Milsaps | 770.352.5347 | investors@truist.com | ||||||

| Media: | Shelley Miller | 704.692.1518 | media@truist.com | ||||||

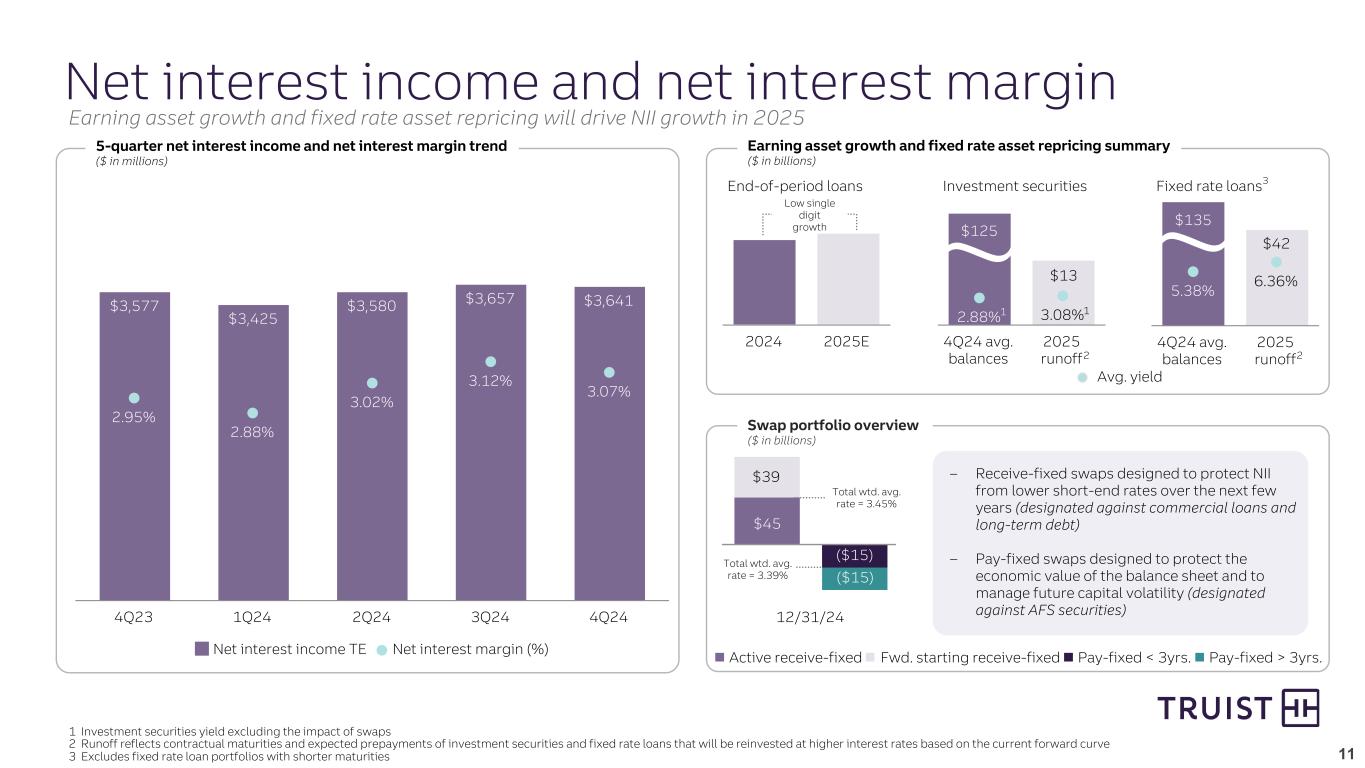

| Net Interest Income, Net Interest Margin, and Average Balances | |||||||||||||||||||||||||||||

| Quarter Ended | Change | ||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 4Q23 | Link | Like | ||||||||||||||||||||||||

Interest income(1) |

$ | 6,230 | $ | 6,407 | $ | 6,324 | $ | (177) | (2.8) | % | $ | (94) | (1.5) | % | |||||||||||||||

| Interest expense | 2,589 | 2,750 | 2,747 | (161) | (5.9) | (158) | (5.8) | ||||||||||||||||||||||

Net interest income(1) |

$ | 3,641 | $ | 3,657 | $ | 3,577 | $ | (16) | (0.4) | $ | 64 | 1.8 | |||||||||||||||||

Net interest margin(1) |

3.07 | % | 3.12 | % | 2.95 | % | (5) bps | 12 bps | |||||||||||||||||||||

Average Balances(2) |

|||||||||||||||||||||||||||||

| Total earning assets | $ | 472,639 | $ | 466,137 | $ | 481,538 | $ | 6,502 | 1.4 | % | $ | (8,899) | (1.8) | % | |||||||||||||||

| Total interest-bearing liabilities | 341,213 | 334,363 | 346,554 | 6,850 | 2.0 | (5,341) | (1.5) | ||||||||||||||||||||||

Yields / Rates(1) |

|||||||||||||||||||||||||||||

| Total earning assets | 5.25 | % | 5.47 | % | 5.22 | % | (22) bps | 3 bps | |||||||||||||||||||||

| Total interest-bearing liabilities | 3.02 | 3.27 | 3.15 | (25) bps | (13) bps | ||||||||||||||||||||||||

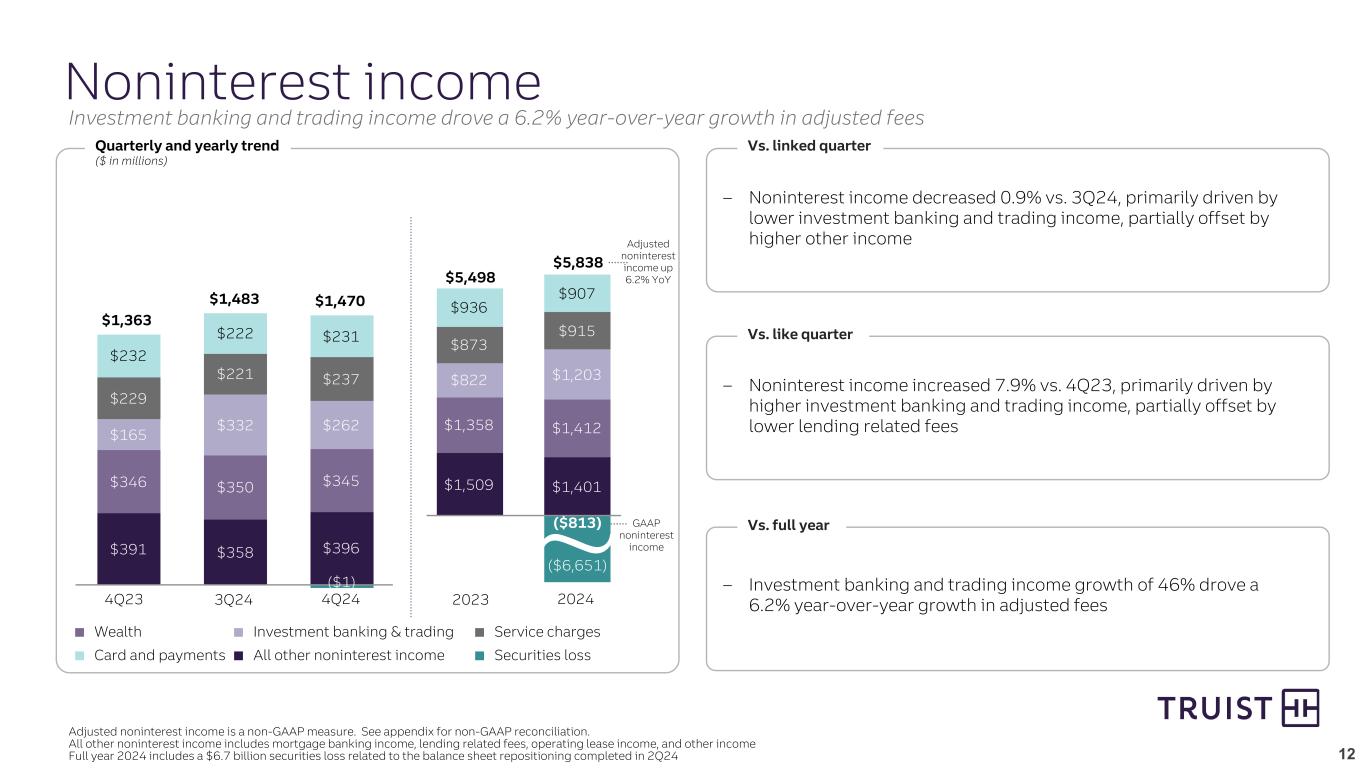

| Noninterest Income | |||||||||||||||||||||||||||||

| Quarter Ended | Change | ||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 4Q23 | Link | Like | ||||||||||||||||||||||||

| Wealth management income | $ | 345 | $ | 350 | $ | 346 | $ | (5) | (1.4) | % | $ | (1) | (0.3) | % | |||||||||||||||

| Investment banking and trading income | 262 | 332 | 165 | (70) | (21.1) | 97 | 58.8 | ||||||||||||||||||||||

| Card and payment related fees | 231 | 222 | 232 | 9 | 4.1 | (1) | (0.4) | ||||||||||||||||||||||

| Service charges on deposits | 237 | 221 | 229 | 16 | 7.2 | 8 | 3.5 | ||||||||||||||||||||||

| Mortgage banking income | 117 | 106 | 94 | 11 | 10.4 | 23 | 24.5 | ||||||||||||||||||||||

| Lending related fees | 93 | 88 | 153 | 5 | 5.7 | (60) | (39.2) | ||||||||||||||||||||||

| Operating lease income | 47 | 49 | 60 | (2) | (4.1) | (13) | (21.7) | ||||||||||||||||||||||

| Securities gains (losses) | (1) | — | — | (1) | NM | (1) | NM | ||||||||||||||||||||||

| Other income | 139 | 115 | 84 | 24 | 20.9 | 55 | 65.5 | ||||||||||||||||||||||

| Total noninterest income | $ | 1,470 | $ | 1,483 | $ | 1,363 | $ | (13) | (0.9) | $ | 107 | 7.9 | |||||||||||||||||

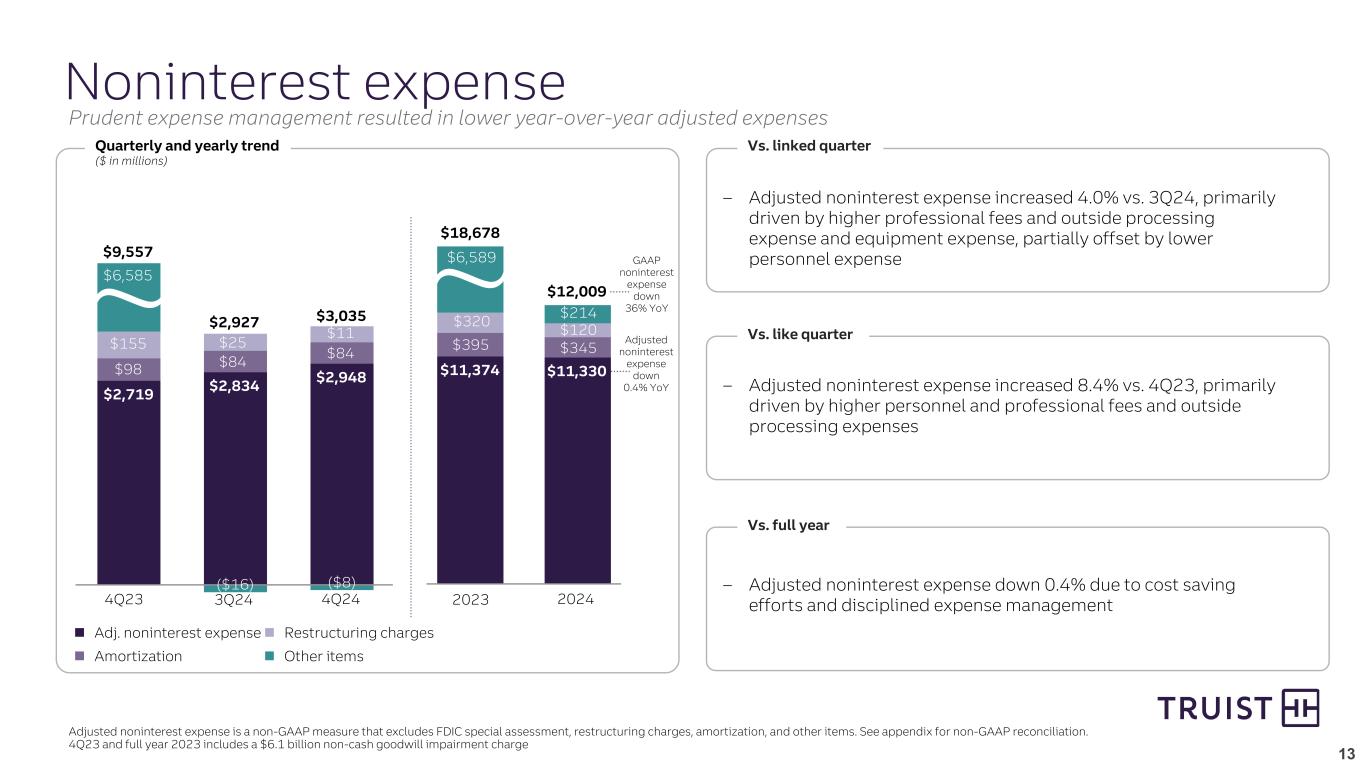

Noninterest Expense | |||||||||||||||||||||||||||||

| Quarter Ended | Change | ||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 4Q23 | Link | Like | ||||||||||||||||||||||||

| Personnel expense | $ | 1,587 | $ | 1,628 | $ | 1,474 | $ | (41) | (2.5) | % | $ | 113 | 7.7 | % | |||||||||||||||

| Professional fees and outside processing | 415 | 336 | 305 | 79 | 23.5 | 110 | 36.1 | ||||||||||||||||||||||

| Software expense | 232 | 222 | 223 | 10 | 4.5 | 9 | 4.0 | ||||||||||||||||||||||

| Net occupancy expense | 179 | 157 | 159 | 22 | 14.0 | 20 | 12.6 | ||||||||||||||||||||||

| Equipment expense | 112 | 84 | 103 | 28 | 33.3 | 9 | 8.7 | ||||||||||||||||||||||

| Amortization of intangibles | 84 | 84 | 98 | — | — | (14) | (14.3) | ||||||||||||||||||||||

| Marketing and customer development | 74 | 75 | 53 | (1) | (1.3) | 21 | 39.6 | ||||||||||||||||||||||

| Operating lease depreciation | 36 | 34 | 42 | 2 | 5.9 | (6) | (14.3) | ||||||||||||||||||||||

| Regulatory costs | 56 | 51 | 599 | 5 | 9.8 | (543) | (90.7) | ||||||||||||||||||||||

| Restructuring charges | 11 | 25 | 155 | (14) | (56.0) | (144) | (92.9) | ||||||||||||||||||||||

| Goodwill impairment | — | — | 6,078 | — | — | (6,078) | (100.0) | ||||||||||||||||||||||

| Other expense | 249 | 231 | 268 | 18 | 7.8 | (19) | (7.1) | ||||||||||||||||||||||

| Total noninterest expense | $ | 3,035 | $ | 2,927 | $ | 9,557 | $ | 108 | 3.7 | $ | (6,522) | (68.2) | |||||||||||||||||

| Provision for Income Taxes | |||||||||||||||||||||||||||||

| Quarter Ended | Change | ||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 4Q23 | Link | Like | ||||||||||||||||||||||||

| Provision (benefit) for income taxes | $ | 265 | $ | 271 | $ | (56) | $ | (6) | (2.2)% | $ | 321 | NM | |||||||||||||||||

| Effective tax rate | 17.1 | % | 15.8 | % | 1.1 | % | 130 bps | NM | |||||||||||||||||||||

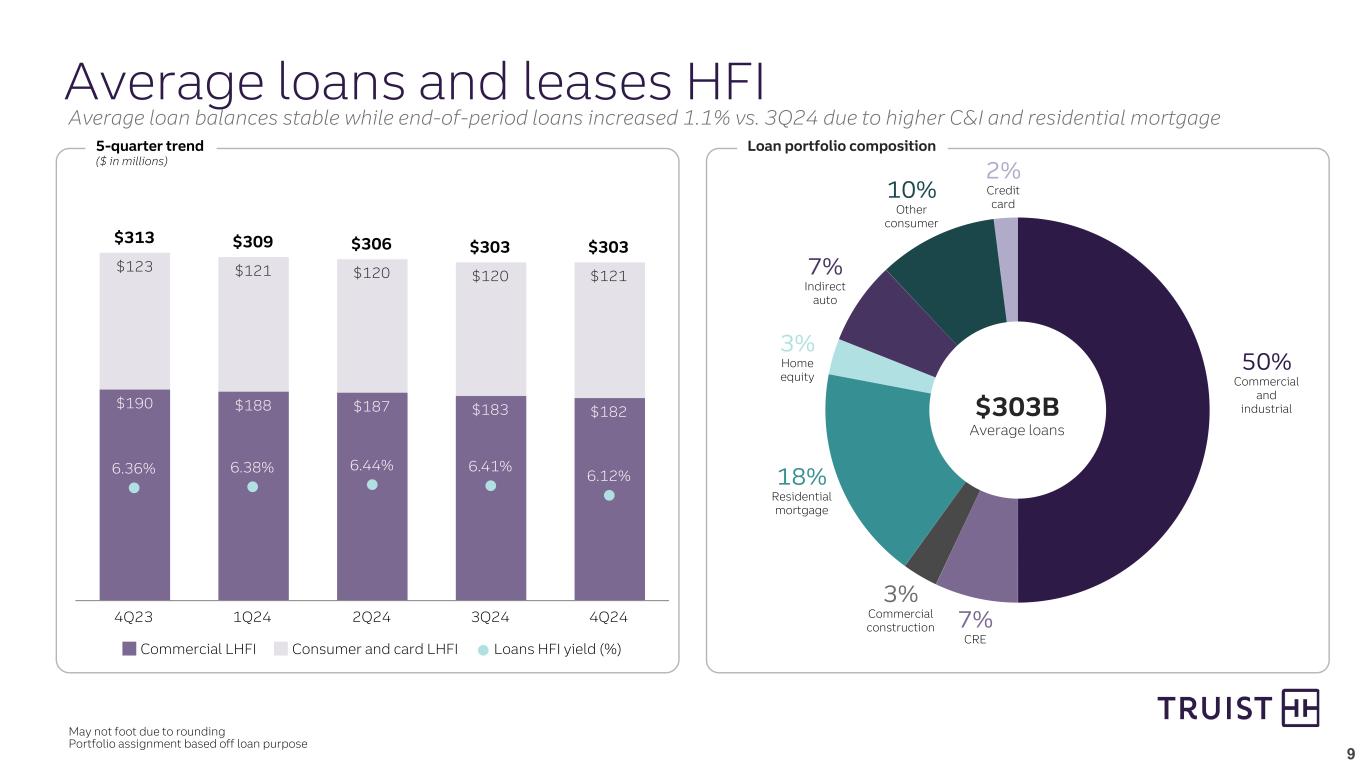

Average Loans and Leases | |||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | Change | % Change | |||||||||||||||||||

| Commercial: | |||||||||||||||||||||||

| Commercial and industrial | $ | 153,209 | $ | 154,102 | $ | (893) | (0.6) | % | |||||||||||||||

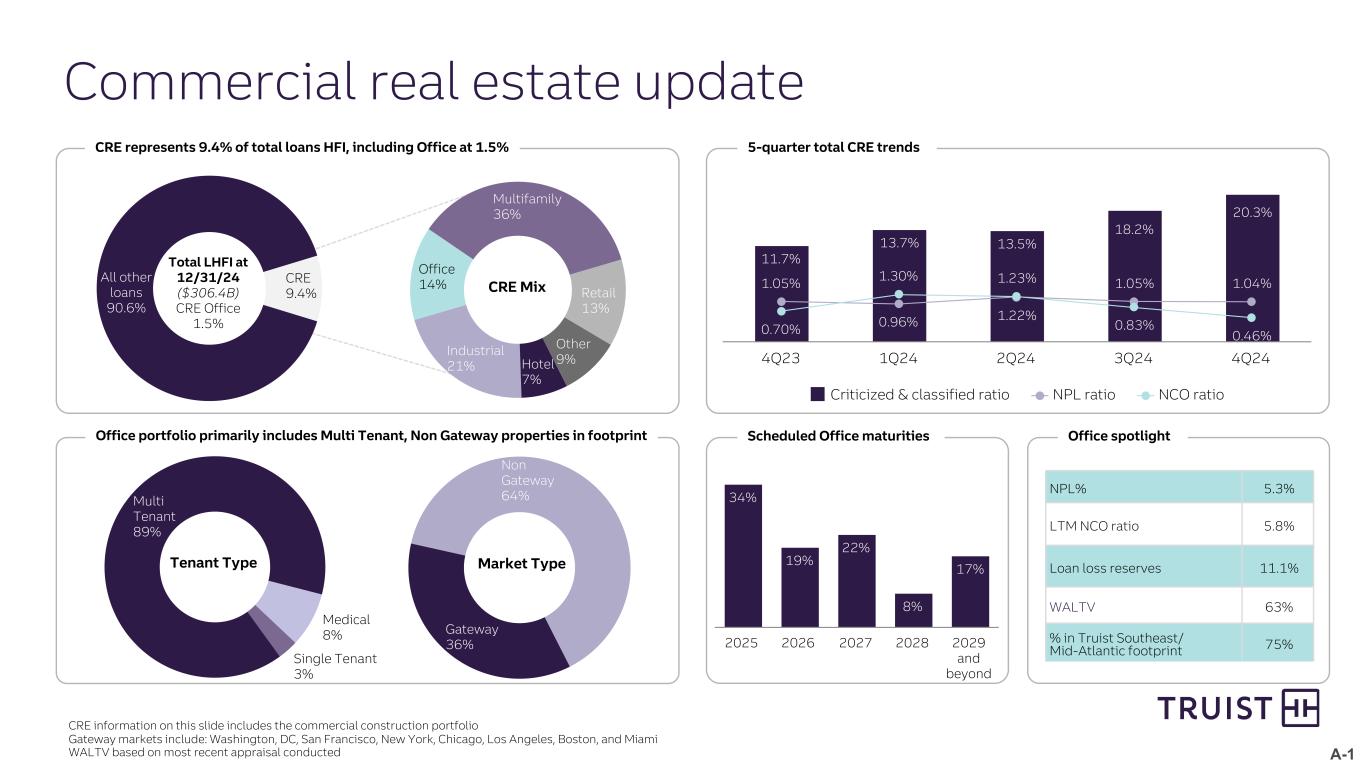

| CRE | 20,504 | 21,481 | (977) | (4.5) | |||||||||||||||||||

| Commercial construction | 8,261 | 7,870 | 391 | 5.0 | |||||||||||||||||||

| Total commercial | 181,974 | 183,453 | (1,479) | (0.8) | |||||||||||||||||||

| Consumer: | |||||||||||||||||||||||

| Residential mortgage | 54,390 | 53,999 | 391 | 0.7 | |||||||||||||||||||

| Home equity | 9,675 | 9,703 | (28) | (0.3) | |||||||||||||||||||

| Indirect auto | 22,790 | 22,121 | 669 | 3.0 | |||||||||||||||||||

| Other consumer | 29,355 | 29,015 | 340 | 1.2 | |||||||||||||||||||

| Total consumer | 116,210 | 114,838 | 1,372 | 1.2 | |||||||||||||||||||

| Credit card | 4,926 | 4,874 | 52 | 1.1 | |||||||||||||||||||

| Total loans and leases held for investment | $ | 303,110 | $ | 303,165 | $ | (55) | — | ||||||||||||||||

| Average Deposits | |||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | Change | % Change | |||||||||||||||||||

| Noninterest-bearing deposits | $ | 107,968 | $ | 106,080 | $ | 1,888 | 1.8 | % | |||||||||||||||

| Interest checking | 107,075 | 103,899 | 3,176 | 3.1 | |||||||||||||||||||

| Money market and savings | 138,242 | 136,639 | 1,603 | 1.2 | |||||||||||||||||||

| Time deposits | 36,757 | 37,726 | (969) | (2.6) | |||||||||||||||||||

| Total deposits | $ | 390,042 | $ | 384,344 | $ | 5,698 | 1.5 | ||||||||||||||||

Capital Ratios | |||||||||||||||||||||||||||||

| 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | |||||||||||||||||||||||||

| Risk-based: | (preliminary) | ||||||||||||||||||||||||||||

| CET1 | 11.5 | % | 11.6 | % | 11.6 | % | 10.1 | % | 10.1 | % | |||||||||||||||||||

| Tier 1 | 12.9 | 13.2 | 13.2 | 11.7 | 11.6 | ||||||||||||||||||||||||

| Total | 14.9 | 15.3 | 15.4 | 13.9 | 13.7 | ||||||||||||||||||||||||

| Leverage | 10.5 | 10.8 | 10.5 | 9.5 | 9.3 | ||||||||||||||||||||||||

| Supplementary leverage | 8.8 | 9.1 | 8.9 | 8.0 | 7.9 | ||||||||||||||||||||||||

| Asset Quality | |||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 1,477 | $ | 1,528 | $ | 1,476 | $ | 1,476 | $ | 1,488 | |||||||||||||||||||

| Total loans 90 days past due and still accruing | 587 | 518 | 489 | 538 | 534 | ||||||||||||||||||||||||

| Total loans 30-89 days past due and still accruing | 1,949 | 1,769 | 1,791 | 1,716 | 1,971 | ||||||||||||||||||||||||

Nonperforming loans and leases as a percentage of loans and leases held for investment |

0.47 | % | 0.48 | % | 0.46 | % | 0.45 | % | 0.44 | % | |||||||||||||||||||

| Loans 30-89 days past due and still accruing as a percentage of loans and leases | 0.64 | 0.58 | 0.59 | 0.56 | 0.63 | ||||||||||||||||||||||||

| Loans 90 days or more past due and still accruing as a percentage of loans and leases | 0.19 | 0.17 | 0.16 | 0.18 | 0.17 | ||||||||||||||||||||||||

| Loans 90 days or more past due and still accruing as a percentage of loans and leases, excluding government guaranteed | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | ||||||||||||||||||||||||

Allowance for loan and lease losses as a percentage of loans and leases held for investment |

1.59 | 1.60 | 1.57 | 1.56 | 1.54 | ||||||||||||||||||||||||

Ratio of allowance for loan and lease losses to net charge-offs |

2.7x | 2.9x | 2.7x | 2.4x | 2.7x | ||||||||||||||||||||||||

Ratio of allowance for loan and lease losses to nonperforming loans and leases held for investment |

3.4x | 3.3x | 3.4x | 3.4x | 3.5x | ||||||||||||||||||||||||

Provision for Credit Losses | |||||||||||||||||||||||||||||

| Quarter Ended | Change | ||||||||||||||||||||||||||||

| (Dollars in millions) | 4Q24 | 3Q24 | 4Q23 | Link | Like | ||||||||||||||||||||||||

| Provision for credit losses | $ | 471 | $ | 448 | $ | 572 | $ | 23 | 5.1 | % | $ | (101) | (17.7) | % | |||||||||||||||

| Net charge-offs | 453 | 418 | 453 | 35 | 8.4 | — | — | ||||||||||||||||||||||

Net charge-offs as a percentage of average loans and leases |

0.59 | % | 0.55 | % | 0.57 | % | 4 bps | 2 bps | |||||||||||||||||||||

Earnings Presentation and Quarterly Performance Summary | ||

About Truist | ||

| Glossary of Defined Terms | |||||

| Term | Definition | ||||

ALLL |

Allowance for loan and lease losses |

||||

| BVPS | Book value (common equity) per share | ||||

| CEO | Chief Executive Officer | ||||

CET1 |

Common equity tier 1 |

||||

| CRE | Commercial real estate | ||||

| FDIC | Federal Deposit Insurance Corporation | ||||

| GAAP | Accounting principles generally accepted in the United States of America | ||||

| HFI | Held for investment | ||||

| LCR | Liquidity Coverage Ratio | ||||

| Like | Compared to fourth quarter of 2023 |

||||

| Link | Compared to third quarter of 2024 |

||||

NCO |

Net charge-offs |

||||

| NIM | Net interest margin, computed on a TE basis | ||||

| NM | Not meaningful | ||||

| PPNR | Pre-provision net revenue | ||||

| ROCE | Return on average common equity | ||||

ROTCE |

Return on average tangible common equity |

||||

TBVPS |

Tangible book value per common share | ||||

| TE | Taxable-equivalent | ||||

| TIH | Truist Insurance Holdings | ||||

| Non-GAAP Financial Information | ||

| Forward Looking Statements | ||

| Table of Contents | ||||||||

| Quarterly Performance Summary | ||||||||

| Truist Financial Corporation | ||||||||

| Page | ||||||||

| Financial Highlights | ||||||||

| Consolidated Statements of Income | ||||||||

| Consolidated Ending Balance Sheets | ||||||||

| Average Balances and Rates - Quarters | ||||||||

| Average Balances and Rates - Year-To-Date | ||||||||

| Credit Quality | ||||||||

| Segment Financial Performance | ||||||||

| Capital Information | ||||||||

| Selected Mortgage Banking Information & Additional Information | ||||||||

| Selected Items | ||||||||

| Quarter Ended | Year-to-Date | ||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share data, shares in thousands) | Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | Dec. 31 | Dec. 31 | ||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| Summary Income Statement | |||||||||||||||||||||||||||||||||||||||||

| Interest income - taxable equivalent | $ | 6,230 | $ | 6,407 | $ | 6,404 | $ | 6,237 | $ | 6,324 | $ | 25,278 | $ | 24,672 | |||||||||||||||||||||||||||

| Interest expense | 2,589 | 2,750 | 2,824 | 2,812 | 2,747 | 10,975 | 9,928 | ||||||||||||||||||||||||||||||||||

| Net interest income - taxable equivalent | 3,641 | 3,657 | 3,580 | 3,425 | 3,577 | 14,303 | 14,744 | ||||||||||||||||||||||||||||||||||

| Less: Taxable-equivalent adjustment | 51 | 55 | 53 | 53 | 58 | 212 | 220 | ||||||||||||||||||||||||||||||||||

| Net interest income | 3,590 | 3,602 | 3,527 | 3,372 | 3,519 | 14,091 | 14,524 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 471 | 448 | 451 | 500 | 572 | 1,870 | 2,109 | ||||||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 3,119 | 3,154 | 3,076 | 2,872 | 2,947 | 12,221 | 12,415 | ||||||||||||||||||||||||||||||||||

| Noninterest income | 1,470 | 1,483 | (5,212) | 1,446 | 1,363 | (813) | 5,498 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | 3,035 | 2,927 | 3,094 | 2,953 | 9,557 | 12,009 | 18,678 | ||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 1,554 | 1,710 | (5,230) | 1,365 | (5,247) | (601) | (765) | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 265 | 271 | (1,324) | 232 | (56) | (556) | 738 | ||||||||||||||||||||||||||||||||||

Net income (loss) from continuing operations(1) |

1,289 | 1,439 | (3,906) | 1,133 | (5,191) | (45) | (1,503) | ||||||||||||||||||||||||||||||||||

Net income (loss) from discontinued operations(1) |

(13) | 3 | 4,828 | 67 | 101 | 4,885 | 456 | ||||||||||||||||||||||||||||||||||

| Net income (loss) | 1,276 | 1,442 | 922 | 1,200 | (5,090) | 4,840 | (1,047) | ||||||||||||||||||||||||||||||||||

Noncontrolling interests from discontinued operations(1) |

— | — | 19 | 3 | — | 22 | 44 | ||||||||||||||||||||||||||||||||||

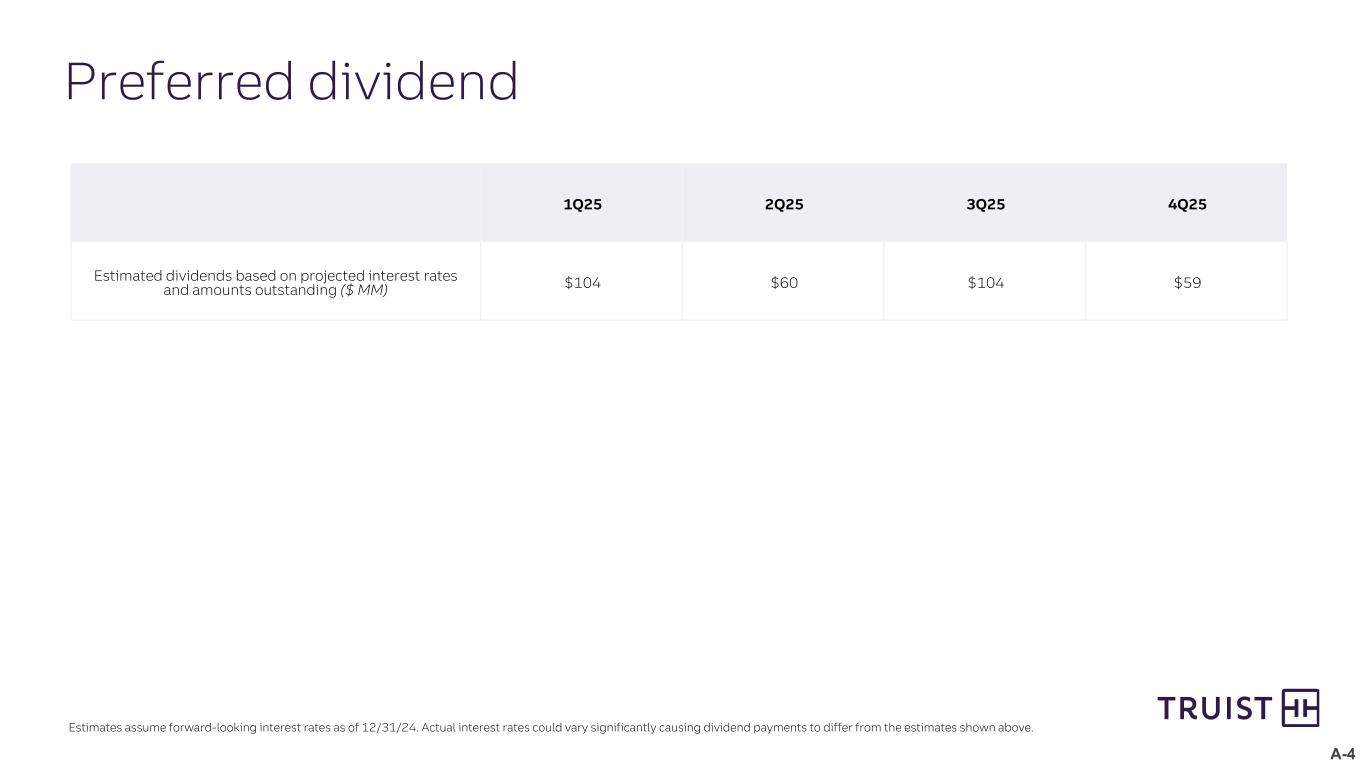

| Preferred stock dividends and other | 60 | 106 | 77 | 106 | 77 | 349 | 361 | ||||||||||||||||||||||||||||||||||

| Net income (loss) available to common shareholders | 1,216 | 1,336 | 826 | 1,091 | (5,167) | 4,469 | (1,452) | ||||||||||||||||||||||||||||||||||

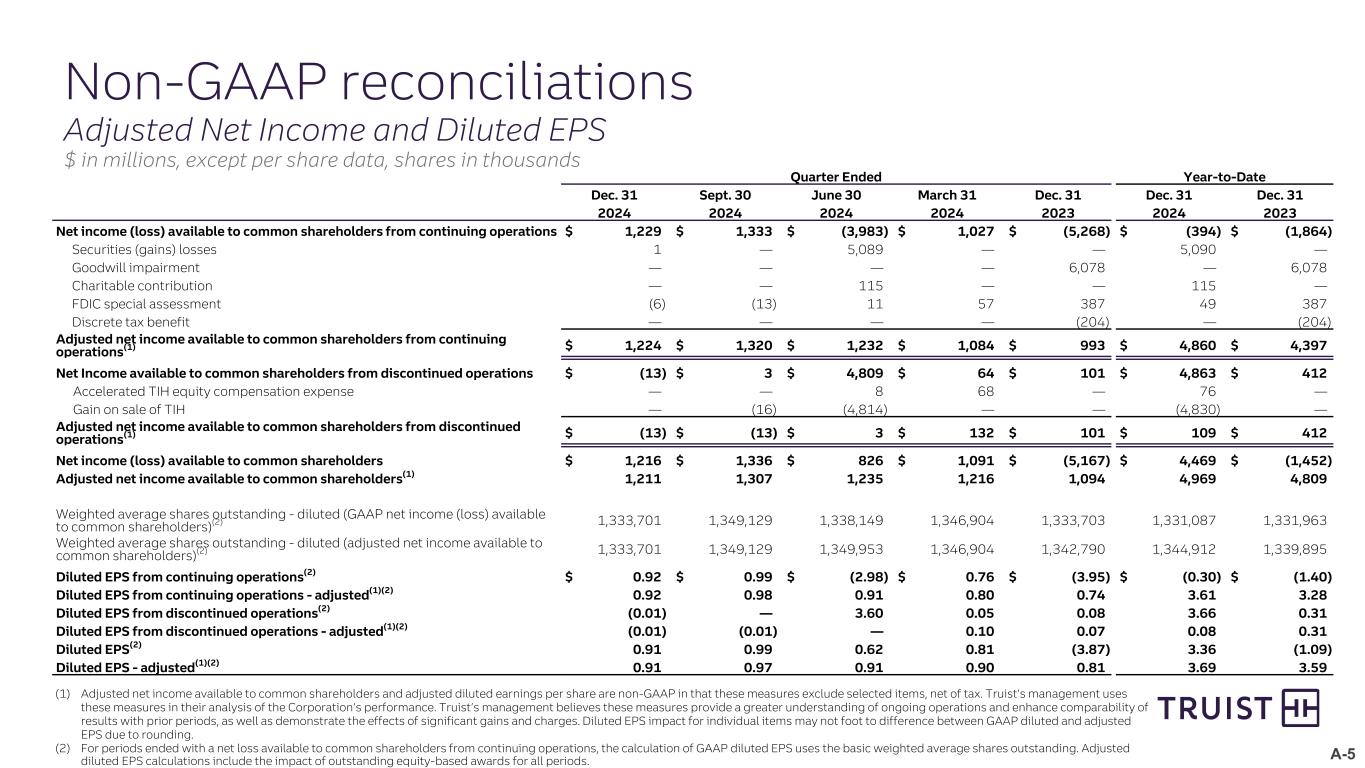

Net income available to common shareholders - adjusted(2) |

1,211 | 1,307 | 1,235 | 1,216 | 1,094 | 4,969 | 4,809 | ||||||||||||||||||||||||||||||||||

| Additional Income Statement Information | |||||||||||||||||||||||||||||||||||||||||

| Revenue - taxable equivalent | 5,111 | 5,140 | (1,632) | 4,871 | 4,940 | 13,490 | 20,242 | ||||||||||||||||||||||||||||||||||

Pre-provision net revenue - unadjusted(2) |

2,076 | 2,213 | (4,726) | 1,918 | (4,617) | 1,481 | 1,564 | ||||||||||||||||||||||||||||||||||

Pre-provision net revenue - adjusted(2) |

2,164 | 2,306 | 2,209 | 2,132 | 2,221 | 8,811 | 8,868 | ||||||||||||||||||||||||||||||||||

| Key Metrics | |||||||||||||||||||||||||||||||||||||||||

| Earnings: | |||||||||||||||||||||||||||||||||||||||||

Earnings per share-basic from continuing operations(1)(3) |

$ | 0.93 | $ | 1.00 | $ | (2.98) | $ | 0.77 | $ | (3.95) | $ | (0.30) | $ | (1.40) | |||||||||||||||||||||||||||

| Earnings per share-basic | 0.92 | 1.00 | 0.62 | 0.82 | (3.87) | $ | 3.36 | $ | (1.09) | ||||||||||||||||||||||||||||||||

Earnings per share-diluted from continuing operations(1)(3) |

0.92 | 0.99 | (2.98) | 0.76 | (3.95) | (0.30) | (1.40) | ||||||||||||||||||||||||||||||||||

| Earnings per share-diluted | 0.91 | 0.99 | 0.62 | 0.81 | (3.87) | 3.36 | (1.09) | ||||||||||||||||||||||||||||||||||

Earnings per share-adjusted diluted(2) |

0.91 | 0.97 | 0.91 | 0.90 | 0.81 | 3.69 | 3.59 | ||||||||||||||||||||||||||||||||||

| Cash dividends declared per share | 0.52 | 0.52 | 0.52 | 0.52 | 0.52 | 2.08 | 2.08 | ||||||||||||||||||||||||||||||||||

| Common shareholders’ equity per share | 43.90 | 44.46 | 42.71 | 38.97 | 39.31 | ||||||||||||||||||||||||||||||||||||

Tangible common shareholders’ equity per share(2) |

30.01 | 30.64 | 28.91 | 21.64 | 21.83 | ||||||||||||||||||||||||||||||||||||

| End of period shares outstanding | 1,315,936 | 1,327,521 | 1,338,223 | 1,338,096 | 1,333,743 | ||||||||||||||||||||||||||||||||||||

| Weighted average shares outstanding-basic | 1,317,017 | 1,334,212 | 1,338,149 | 1,335,091 | 1,333,703 | 1,331,087 | 1,331,963 | ||||||||||||||||||||||||||||||||||

| Weighted average shares outstanding-diluted | 1,333,701 | 1,349,129 | 1,338,149 | 1,346,904 | 1,333,703 | 1,331,087 | 1,331,963 | ||||||||||||||||||||||||||||||||||

| Return on average assets | 0.96 | % | 1.10 | % | 0.70 | % | 0.91 | % | (3.74) | % | 0.92 | % | (0.19) | % | |||||||||||||||||||||||||||

| Return on average common shareholders’ equity | 8.4 | 9.1 | 6.1 | 8.4 | (36.6) | 8.0 | (2.6) | ||||||||||||||||||||||||||||||||||

Return on average tangible common shareholders’ equity(2) |

12.9 | 13.8 | 10.4 | 16.3 | 15.0 | 13.3 | 18.9 | ||||||||||||||||||||||||||||||||||

Net interest margin - taxable equivalent(3) |

3.07 | 3.12 | 3.02 | 2.88 | 2.95 | 3.03 | 2.98 | ||||||||||||||||||||||||||||||||||

Efficiency ratio-unadjusted(3) |

60.0 | 57.5 | NM | 61.3 | NM | 90.4 | 93.3 | ||||||||||||||||||||||||||||||||||

Efficiency ratio-adjusted(2)(3) |

57.7 | 55.2 | 56.0 | 56.2 | 55.0 | 56.3 | 56.2 | ||||||||||||||||||||||||||||||||||

Fee income ratio-unadjusted(3) |

29.0 | 29.2 | NM | 30.0 | 27.9 | NM | 27.5 | ||||||||||||||||||||||||||||||||||

Fee income ratio-adjusted(2)(3) |

28.8 | 28.9 | 28.7 | 29.7 | 27.6 | 29.0 | 27.2 | ||||||||||||||||||||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans and leases as a percentage of LHFI | 0.47 | % | 0.48 | % | 0.46 | % | 0.45 | % | 0.44 | % | |||||||||||||||||||||||||||||||

| Net charge-offs as a percentage of average LHFI | 0.59 | 0.55 | 0.58 | 0.64 | 0.57 | 0.59 | % | 0.50 | % | ||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses as a percentage of LHFI | 1.59 | 1.60 | 1.57 | 1.56 | 1.54 | ||||||||||||||||||||||||||||||||||||

| Ratio of allowance for loan and lease losses to nonperforming LHFI | 3.4x | 3.3x | 3.4x | 3.4x | 3.5x | ||||||||||||||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||||||||||||||

| Assets | $ | 527,013 | $ | 519,415 | $ | 526,894 | $ | 531,002 | $ | 539,656 | $ | 526,065 | $ | 553,132 | |||||||||||||||||||||||||||

Securities(4) |

124,871 | 117,172 | 121,796 | 131,659 | 134,070 | 123,858 | 137,552 | ||||||||||||||||||||||||||||||||||

| Loans and leases | 304,609 | 304,578 | 307,583 | 309,426 | 313,832 | 306,538 | 322,335 | ||||||||||||||||||||||||||||||||||

| Deposits | 390,042 | 384,344 | 388,042 | 389,058 | 395,333 | 387,868 | 401,127 | ||||||||||||||||||||||||||||||||||

| Common shareholders’ equity | 57,754 | 58,667 | 54,863 | 52,167 | 56,061 | 55,876 | 56,306 | ||||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 64,295 | 65,341 | 61,677 | 59,011 | 62,896 | 62,593 | 63,099 | ||||||||||||||||||||||||||||||||||

| Period-End Balances | |||||||||||||||||||||||||||||||||||||||||

| Assets | $ | 531,176 | $ | 523,434 | $ | 519,853 | $ | 534,959 | $ | 535,349 | |||||||||||||||||||||||||||||||

Securities(4) |

118,104 | 115,606 | 108,416 | 119,419 | 121,473 | ||||||||||||||||||||||||||||||||||||

| Loans and leases | 307,771 | 304,362 | 307,149 | 308,477 | 313,341 | ||||||||||||||||||||||||||||||||||||

| Deposits | 390,524 | 387,778 | 385,411 | 394,265 | 395,865 | ||||||||||||||||||||||||||||||||||||

| Common shareholders’ equity | 57,772 | 59,023 | 57,154 | 52,148 | 52,428 | ||||||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 63,679 | 65,696 | 63,827 | 59,053 | 59,253 | ||||||||||||||||||||||||||||||||||||

| Capital and Liquidity Ratios | (preliminary) | ||||||||||||||||||||||||||||||||||||||||

| Common equity tier 1 | 11.5 | % | 11.6 | % | 11.6 | % | 10.1 | % | 10.1 | % | |||||||||||||||||||||||||||||||

| Tier 1 | 12.9 | 13.2 | 13.2 | 11.7 | 11.6 | ||||||||||||||||||||||||||||||||||||

| Total | 14.9 | 15.3 | 15.4 | 13.9 | 13.7 | ||||||||||||||||||||||||||||||||||||

| Leverage | 10.5 | 10.8 | 10.5 | 9.5 | 9.3 | ||||||||||||||||||||||||||||||||||||

| Supplementary leverage | 8.8 | 9.1 | 8.9 | 8.0 | 7.9 | ||||||||||||||||||||||||||||||||||||

| Liquidity coverage ratio | 109 | 112 | 110 | 115 | 112 | ||||||||||||||||||||||||||||||||||||

| Quarter Ended | Year-to-Date | ||||||||||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | Dec. 31 | Dec. 31 | |||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share data, shares in thousands) | 2024 | 2024 | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans and leases | $ | 4,634 | $ | 4,852 | $ | 4,879 | $ | 4,865 | $ | 4,971 | $ | 19,230 | $ | 19,518 | |||||||||||||||||||||||||||

| Interest on securities | 994 | 869 | 838 | 805 | 802 | 3,506 | 3,066 | ||||||||||||||||||||||||||||||||||

| Interest on other earning assets | 551 | 631 | 634 | 514 | 493 | 2,330 | 1,868 | ||||||||||||||||||||||||||||||||||

| Total interest income | 6,179 | 6,352 | 6,351 | 6,184 | 6,266 | 25,066 | 24,452 | ||||||||||||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 1,855 | 2,014 | 2,016 | 1,964 | 1,917 | 7,849 | 6,427 | ||||||||||||||||||||||||||||||||||

| Interest on long-term debt | 431 | 454 | 446 | 482 | 476 | 1,813 | 2,215 | ||||||||||||||||||||||||||||||||||

| Interest on other borrowings | 303 | 282 | 362 | 366 | 354 | 1,313 | 1,286 | ||||||||||||||||||||||||||||||||||

| Total interest expense | 2,589 | 2,750 | 2,824 | 2,812 | 2,747 | 10,975 | 9,928 | ||||||||||||||||||||||||||||||||||

| Net Interest Income | 3,590 | 3,602 | 3,527 | 3,372 | 3,519 | 14,091 | 14,524 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 471 | 448 | 451 | 500 | 572 | 1,870 | 2,109 | ||||||||||||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 3,119 | 3,154 | 3,076 | 2,872 | 2,947 | 12,221 | 12,415 | ||||||||||||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||||||||||||||

| Wealth management income | 345 | 350 | 361 | 356 | 346 | 1,412 | 1,358 | ||||||||||||||||||||||||||||||||||

| Investment banking and trading income | 262 | 332 | 286 | 323 | 165 | 1,203 | 822 | ||||||||||||||||||||||||||||||||||

| Card and payment related fees | 231 | 222 | 230 | 224 | 232 | 907 | 936 | ||||||||||||||||||||||||||||||||||

| Service charges on deposits | 237 | 221 | 232 | 225 | 229 | 915 | 873 | ||||||||||||||||||||||||||||||||||

| Mortgage banking income | 117 | 106 | 112 | 97 | 94 | 432 | 437 | ||||||||||||||||||||||||||||||||||

| Lending related fees | 93 | 88 | 89 | 96 | 153 | 366 | 447 | ||||||||||||||||||||||||||||||||||

| Operating lease income | 47 | 49 | 50 | 59 | 60 | 205 | 254 | ||||||||||||||||||||||||||||||||||

| Securities gains (losses) | (1) | — | (6,650) | — | — | (6,651) | — | ||||||||||||||||||||||||||||||||||

| Other income | 139 | 115 | 78 | 66 | 84 | 398 | 371 | ||||||||||||||||||||||||||||||||||

| Total noninterest income | 1,470 | 1,483 | (5,212) | 1,446 | 1,363 | (813) | 5,498 | ||||||||||||||||||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||||||||||||||||||||

| Personnel expense | 1,587 | 1,628 | 1,661 | 1,630 | 1,474 | 6,506 | 6,516 | ||||||||||||||||||||||||||||||||||

| Professional fees and outside processing | 415 | 336 | 308 | 278 | 305 | 1,337 | 1,192 | ||||||||||||||||||||||||||||||||||

| Software expense | 232 | 222 | 218 | 224 | 223 | 896 | 868 | ||||||||||||||||||||||||||||||||||

| Net occupancy expense | 179 | 157 | 160 | 160 | 159 | 656 | 658 | ||||||||||||||||||||||||||||||||||

| Equipment expense | 112 | 84 | 89 | 88 | 103 | 373 | 381 | ||||||||||||||||||||||||||||||||||

| Amortization of intangibles | 84 | 84 | 89 | 88 | 98 | 345 | 395 | ||||||||||||||||||||||||||||||||||

| Marketing and customer development | 74 | 75 | 63 | 56 | 53 | 268 | 260 | ||||||||||||||||||||||||||||||||||

| Operating lease depreciation | 36 | 34 | 34 | 40 | 42 | 144 | 175 | ||||||||||||||||||||||||||||||||||

| Regulatory costs | 56 | 51 | 85 | 152 | 599 | 344 | 824 | ||||||||||||||||||||||||||||||||||

| Restructuring charges | 11 | 25 | 33 | 51 | 155 | 120 | 320 | ||||||||||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | 6,078 | — | 6,078 | ||||||||||||||||||||||||||||||||||

| Other expense | 249 | 231 | 354 | 186 | 268 | 1,020 | 1,011 | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | 3,035 | 2,927 | 3,094 | 2,953 | 9,557 | 12,009 | 18,678 | ||||||||||||||||||||||||||||||||||

| Earnings | |||||||||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 1,554 | 1,710 | (5,230) | 1,365 | (5,247) | (601) | (765) | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 265 | 271 | (1,324) | 232 | (56) | (556) | 738 | ||||||||||||||||||||||||||||||||||

Net income (loss) from continuing operations(1) |

1,289 | 1,439 | (3,906) | 1,133 | (5,191) | (45) | (1,503) | ||||||||||||||||||||||||||||||||||

Net income from discontinued operations(1) |

(13) | 3 | 4,828 | 67 | 101 | 4,885 | 456 | ||||||||||||||||||||||||||||||||||

| Net income (loss) | 1,276 | 1,442 | 922 | 1,200 | (5,090) | 4,840 | (1,047) | ||||||||||||||||||||||||||||||||||

Noncontrolling interests from discontinuing operations(1) |

— | — | 19 | 3 | — | 22 | 44 | ||||||||||||||||||||||||||||||||||

| Preferred stock dividends and other | 60 | 106 | 77 | 106 | 77 | 349 | 361 | ||||||||||||||||||||||||||||||||||

| Net income (loss) available to common shareholders | $ | 1,216 | $ | 1,336 | $ | 826 | $ | 1,091 | $ | (5,167) | $ | 4,469 | $ | (1,452) | |||||||||||||||||||||||||||

| Earnings Per Common Share | |||||||||||||||||||||||||||||||||||||||||

Basic earnings from continuing operations(1) |

$ | 0.93 | $ | 1.00 | $ | (2.98) | $ | 0.77 | $ | (3.95) | $ | (0.30) | $ | (1.40) | |||||||||||||||||||||||||||

| Basic earnings | 0.92 | 1.00 | 0.62 | 0.82 | (3.87) | $ | 3.36 | (1.09) | |||||||||||||||||||||||||||||||||

Diluted earnings from continuing operations(1) |

0.92 | 0.99 | (2.98) | 0.76 | (3.95) | (0.30) | (1.40) | ||||||||||||||||||||||||||||||||||

| Diluted earnings | 0.91 | 0.99 | 0.62 | 0.81 | (3.87) | 3.36 | (1.09) | ||||||||||||||||||||||||||||||||||

| Weighted Average Shares Outstanding | |||||||||||||||||||||||||||||||||||||||||

| Basic | 1,317,017 | 1,334,212 | 1,338,149 | 1,335,091 | 1,333,703 | 1,331,087 | 1,331,963 | ||||||||||||||||||||||||||||||||||

| Diluted | 1,333,701 | 1,349,129 | 1,338,149 | 1,346,904 | 1,333,703 | 1,331,087 | 1,331,963 | ||||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | |||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2024 | 2024 | 2023 | ||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 5,793 | $ | 5,229 | $ | 5,204 | $ | 5,040 | $ | 5,000 | |||||||||||||||||||

| Interest-bearing deposits with banks | 33,975 | 34,411 | 35,675 | 29,510 | 25,230 | ||||||||||||||||||||||||

| Securities borrowed or purchased under resale agreements | 2,550 | 2,973 | 2,338 | 2,091 | 2,378 | ||||||||||||||||||||||||

| Trading assets at fair value | 5,100 | 5,209 | 5,558 | 5,268 | 4,332 | ||||||||||||||||||||||||

| Securities available for sale at fair value | 67,464 | 64,111 | 55,969 | 66,050 | 67,366 | ||||||||||||||||||||||||

| Securities held to maturity at amortized cost | 50,640 | 51,495 | 52,447 | 53,369 | 54,107 | ||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial and industrial | 154,848 | 153,925 | 156,400 | 157,669 | 160,788 | ||||||||||||||||||||||||

| CRE | 20,363 | 20,912 | 21,730 | 22,142 | 22,570 | ||||||||||||||||||||||||

| Commercial construction | 8,520 | 7,980 | 7,787 | 7,472 | 6,683 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Residential mortgage | 55,599 | 53,963 | 54,344 | 54,886 | 55,492 | ||||||||||||||||||||||||

| Home equity | 9,642 | 9,680 | 9,772 | 9,825 | 10,053 | ||||||||||||||||||||||||

| Indirect auto | 23,089 | 22,508 | 21,994 | 22,145 | 22,727 | ||||||||||||||||||||||||

| Other consumer | 29,395 | 29,282 | 28,677 | 28,096 | 28,647 | ||||||||||||||||||||||||

| Credit card | 4,927 | 4,834 | 4,988 | 4,989 | 5,101 | ||||||||||||||||||||||||

| Total loans and leases held for investment | 306,383 | 303,084 | 305,692 | 307,224 | 312,061 | ||||||||||||||||||||||||

| Loans held for sale | 1,388 | 1,278 | 1,457 | 1,253 | 1,280 | ||||||||||||||||||||||||

| Total loans and leases | 307,771 | 304,362 | 307,149 | 308,477 | 313,341 | ||||||||||||||||||||||||

| Allowance for loan and lease losses | (4,857) | (4,842) | (4,808) | (4,803) | (4,798) | ||||||||||||||||||||||||

| Premises and equipment | 3,225 | 3,251 | 3,244 | 3,274 | 3,298 | ||||||||||||||||||||||||

| Goodwill | 17,125 | 17,125 | 17,157 | 17,157 | 17,156 | ||||||||||||||||||||||||

| Core deposit and other intangible assets | 1,550 | 1,635 | 1,729 | 1,816 | 1,909 | ||||||||||||||||||||||||

| Loan servicing rights at fair value | 3,708 | 3,499 | 3,410 | 3,417 | 3,378 | ||||||||||||||||||||||||

| Other assets | 37,132 | 34,976 | 34,781 | 36,521 | 34,997 | ||||||||||||||||||||||||

Assets of discontinued operations(1) |

— | — | — | 7,772 | 7,655 | ||||||||||||||||||||||||

| Total assets | $ | 531,176 | $ | 523,434 | $ | 519,853 | $ | 534,959 | $ | 535,349 | |||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 107,451 | $ | 105,984 | $ | 107,310 | $ | 110,901 | $ | 111,624 | |||||||||||||||||||

| Interest checking | 109,042 | 109,493 | 102,654 | 108,329 | 104,757 | ||||||||||||||||||||||||

| Money market and savings | 137,307 | 134,349 | 136,989 | 133,176 | 135,923 | ||||||||||||||||||||||||

| Time deposits | 36,724 | 37,952 | 38,458 | 41,859 | 43,561 | ||||||||||||||||||||||||

| Total deposits | 390,524 | 387,778 | 385,411 | 394,265 | 395,865 | ||||||||||||||||||||||||

| Short-term borrowings | 29,205 | 20,859 | 22,816 | 26,329 | 24,828 | ||||||||||||||||||||||||

| Long-term debt | 34,956 | 36,770 | 34,616 | 39,071 | 38,918 | ||||||||||||||||||||||||

| Other liabilities | 12,812 | 12,331 | 13,183 | 13,119 | 12,946 | ||||||||||||||||||||||||

| Liabilities of discontinued operations | — | — | — | 3,122 | 3,539 | ||||||||||||||||||||||||

| Total liabilities | 467,497 | 457,738 | 456,026 | 475,906 | 476,096 | ||||||||||||||||||||||||

| Shareholders’ Equity: | |||||||||||||||||||||||||||||

| Preferred stock | 5,907 | 6,673 | 6,673 | 6,673 | 6,673 | ||||||||||||||||||||||||

| Common stock | 6,580 | 6,638 | 6,691 | 6,690 | 6,669 | ||||||||||||||||||||||||

| Additional paid-in capital | 35,628 | 36,020 | 36,364 | 36,197 | 36,177 | ||||||||||||||||||||||||

| Retained earnings | 23,777 | 23,248 | 22,603 | 22,483 | 22,088 | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (8,213) | (6,883) | (8,504) | (13,222) | (12,506) | ||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | 232 | 152 | ||||||||||||||||||||||||

| Total shareholders’ equity | 63,679 | 65,696 | 63,827 | 59,053 | 59,253 | ||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 531,176 | $ | 523,434 | $ | 519,853 | $ | 534,959 | $ | 535,349 | |||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Average Balances(1) |

Income/ Expense(2) |

Yields/ Rates(2) |

Average Balances(1) |

Income/ Expense(2) |

Yields/ Rates(2) |

Average Balances(1) |

Income/ Expense(2) |

Yields/ Rates(2) |

Average Balances(1) |

Income/ Expense(2) |

Yields/ Rates(2) |

Average Balances(1) |

Income/ Expense(2) |

Yields/ Rates(2) |

||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AFS and HTM securities at amortized cost: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury | $ | 14,387 | $ | 196 | 5.40 | % | $ | 12,986 | $ | 151 | 4.65 | % | $ | 11,138 | $ | 101 | 3.66 | % | $ | 9,853 | $ | 37 | 1.49 | % | $ | 10,967 | $ | 38 | 1.37 | % | |||||||||||||||||||||||||||||

| U.S. government-sponsored entities (GSE) | 412 | 3 | 3.42 | 377 | 4 | 3.41 | 382 | 3 | 3.27 | 389 | 3 | 3.40 | 389 | 2 | 3.23 | ||||||||||||||||||||||||||||||||||||||||||||

| Mortgage-backed securities issued by GSE | 109,644 | 792 | 2.89 | 103,374 | 711 | 2.75 | 108,358 | 720 | 2.66 | 117,301 | 735 | 2.51 | 118,548 | 736 | 2.48 | ||||||||||||||||||||||||||||||||||||||||||||

| States and political subdivisions | 411 | 5 | 4.14 | 417 | 3 | 4.14 | 420 | 5 | 4.14 | 421 | 4 | 4.15 | 421 | 5 | 4.16 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-agency mortgage-backed | — | — | — | — | — | — | 1,480 | 10 | 2.56 | 3,676 | 27 | 2.95 | 3,725 | 22 | 2.37 | ||||||||||||||||||||||||||||||||||||||||||||

| Other | 17 | — | 5.16 | 18 | 1 | 5.18 | 18 | — | 5.29 | 19 | — | 5.35 | 20 | — | 5.47 | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | 124,871 | 996 | 3.19 | 117,172 | 870 | 2.97 | 121,796 | 839 | 2.76 | 131,659 | 806 | 2.45 | 134,070 | 803 | 2.39 | ||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 153,209 | 2,293 | 5.95 | 154,102 | 2,482 | 6.41 | 157,043 | 2,550 | 6.53 | 158,385 | 2,572 | 6.53 | 160,278 | 2,657 | 6.58 | ||||||||||||||||||||||||||||||||||||||||||||

| CRE | 20,504 | 337 | 6.47 | 21,481 | 373 | 6.88 | 21,969 | 381 | 6.93 | 22,400 | 389 | 6.95 | 22,755 | 400 | 6.94 | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | 8,261 | 147 | 7.26 | 7,870 | 152 | 7.79 | 7,645 | 147 | 7.85 | 7,134 | 137 | 7.83 | 6,515 | 127 | 7.84 | ||||||||||||||||||||||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 54,390 | 536 | 3.94 | 53,999 | 525 | 3.89 | 54,490 | 525 | 3.86 | 55,070 | 528 | 3.84 | 55,658 | 532 | 3.83 | ||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 9,675 | 189 | 7.78 | 9,703 | 196 | 8.04 | 9,805 | 195 | 8.02 | 9,930 | 196 | 7.92 | 10,104 | 199 | 7.80 | ||||||||||||||||||||||||||||||||||||||||||||

| Indirect auto | 22,790 | 411 | 7.19 | 22,121 | 399 | 7.18 | 22,016 | 381 | 6.95 | 22,374 | 372 | 6.69 | 23,368 | 381 | 6.46 | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer | 29,355 | 606 | 8.21 | 29,015 | 603 | 8.26 | 28,326 | 581 | 8.25 | 28,285 | 561 | 7.98 | 28,913 | 561 | 7.69 | ||||||||||||||||||||||||||||||||||||||||||||

| Credit card | 4,926 | 143 | 11.54 | 4,874 | 150 | 12.20 | 4,905 | 148 | 12.14 | 4,923 | 146 | 11.96 | 4,996 | 149 | 11.84 | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases held for investment | 303,110 | 4,662 | 6.12 | 303,165 | 4,880 | 6.41 | 306,199 | 4,908 | 6.44 | 308,501 | 4,901 | 6.38 | 312,587 | 5,006 | 6.36 | ||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 1,499 | 21 | 5.87 | 1,413 | 24 | 6.49 | 1,384 | 22 | 6.56 | 925 | 15 | 6.38 | 1,245 | 21 | 6.82 | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | 304,609 | 4,683 | 6.12 | 304,578 | 4,904 | 6.41 | 307,583 | 4,930 | 6.44 | 309,426 | 4,916 | 6.38 | 313,832 | 5,027 | 6.36 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest earning trading assets | 5,462 | 79 | 5.86 | 5,454 | 84 | 6.05 | 5,515 | 84 | 6.11 | 4,845 | 79 | 6.50 | 4,680 | 80 | 6.92 | ||||||||||||||||||||||||||||||||||||||||||||

Other earning assets(3) |

37,697 | 472 | 4.91 | 38,933 | 549 | 5.54 | 39,250 | 551 | 5.56 | 30,567 | 436 | 5.74 | 28,956 | 414 | 5.65 | ||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 472,639 | 6,230 | 5.25 | 466,137 | 6,407 | 5.47 | 474,144 | 6,404 | 5.42 | 476,497 | 6,237 | 5.25 | 481,538 | 6,324 | 5.22 | ||||||||||||||||||||||||||||||||||||||||||||

| Nonearning assets | 54,374 | 53,278 | 50,109 | 46,921 | 50,485 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets of discontinued operations | — | — | 2,641 | 7,584 | 7,633 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 527,013 | $ | 519,415 | $ | 526,894 | $ | 531,002 | $ | 539,656 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest checking | $ | 107,075 | 679 | 2.52 | $ | 103,899 | 732 | 2.80 | $ | 103,894 | 707 | 2.74 | $ | 103,537 | 684 | 2.65 | $ | 101,722 | 635 | 2.48 | |||||||||||||||||||||||||||||||||||||||

| Money market and savings | 138,242 | 838 | 2.41 | 136,639 | 914 | 2.66 | 135,264 | 873 | 2.60 | 134,696 | 832 | 2.49 | 137,464 | 843 | 2.43 | ||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 36,757 | 338 | 3.66 | 37,726 | 368 | 3.88 | 41,250 | 436 | 4.24 | 41,937 | 448 | 4.30 | 41,592 | 439 | 4.19 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 282,074 | 1,855 | 2.62 | 278,264 | 2,014 | 2.88 | 280,408 | 2,016 | 2.89 | 280,170 | 1,964 | 2.82 | 280,778 | 1,917 | 2.71 | ||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 25,006 | 303 | 4.81 | 20,781 | 282 | 5.41 | 26,016 | 362 | 5.58 | 26,230 | 366 | 5.62 | 24,958 | 354 | 5.62 | ||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 34,133 | 431 | 5.06 | 35,318 | 454 | 5.13 | 36,721 | 446 | 4.87 | 40,721 | 482 | 4.74 | 40,818 | 476 | 4.67 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 341,213 | 2,589 | 3.02 | 334,363 | 2,750 | 3.27 | 343,145 | 2,824 | 3.31 | 347,121 | 2,812 | 3.26 | 346,554 | 2,747 | 3.15 | ||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 107,968 | 106,080 | 107,634 | 108,888 | 114,555 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 13,537 | 13,631 | 13,318 | 12,885 | 12,433 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities of discontinued operations | — | — | 1,120 | 3,097 | 3,218 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 64,295 | 65,341 | 61,677 | 59,011 | 62,896 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 527,013 | $ | 519,415 | $ | 526,894 | $ | 531,002 | $ | 539,656 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Average interest-rate spread | 2.23 | 2.20 | 2.11 | 1.99 | 2.07 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/ net interest margin | $ | 3,641 | 3.07 | % | $ | 3,657 | 3.12 | % | $ | 3,580 | 3.02 | % | $ | 3,425 | 2.88 | % | $ | 3,577 | 2.95 | % | |||||||||||||||||||||||||||||||||||||||

| Taxable-equivalent adjustment | 51 | 55 | 53 | 53 | 58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Memo: Total deposits | $ | 390,042 | 1,855 | 1.89 | % | $ | 384,344 | 2,014 | 2.08 | % | $ | 388,042 | 2,016 | 2.09 | % | $ | 389,058 | 1,964 | 2.03 | % | $ | 395,333 | 1,917 | 1.92 | % | ||||||||||||||||||||||||||||||||||

| Year-to-Date | ||||||||||||||||||||||||||||||||||||||

| December 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | Average Balances(1) |

Income/Expense(2) |

Yields/ Rates(2) |

Average Balances(1) |

Income/Expense(2) |

Yields/ Rates(2) |

||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| AFS and HTM securities at amortized cost: | ||||||||||||||||||||||||||||||||||||||

| U.S. Treasury | $ | 12,100 | $ | 485 | 4.01 | % | $ | 11,021 | $ | 132 | 1.20 | % | ||||||||||||||||||||||||||

| U.S. government-sponsored entities (GSE) | 390 | 13 | 3.38 | 348 | 10 | 2.94 | ||||||||||||||||||||||||||||||||

| Mortgage-backed securities issued by GSE | 109,652 | 2,958 | 2.70 | 121,923 | 2,821 | 2.31 | ||||||||||||||||||||||||||||||||

| States and political subdivisions | 417 | 17 | 4.14 | 424 | 18 | 4.13 | ||||||||||||||||||||||||||||||||

| Non-agency mortgage-backed | 1,282 | 37 | 2.85 | 3,816 | 89 | 2.34 | ||||||||||||||||||||||||||||||||

| Other | 17 | 1 | 5.25 | 20 | 1 | 5.37 | ||||||||||||||||||||||||||||||||

| Total securities | 123,858 | 3,511 | 2.83 | 137,552 | 3,071 | 2.23 | ||||||||||||||||||||||||||||||||

| Loans and leases: | ||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 155,674 | 9,897 | 6.36 | 163,983 | 10,389 | 6.34 | ||||||||||||||||||||||||||||||||

| CRE | 21,585 | 1,480 | 6.81 | 22,741 | 1,535 | 6.71 | ||||||||||||||||||||||||||||||||

| Commercial construction | 7,729 | 583 | 7.67 | 6,125 | 459 | 7.62 | ||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 54,486 | 2,114 | 3.88 | 56,131 | 2,121 | 3.78 | ||||||||||||||||||||||||||||||||

| Home equity | 9,778 | 776 | 7.94 | 10,388 | 765 | 7.36 | ||||||||||||||||||||||||||||||||

| Indirect auto | 22,326 | 1,563 | 7.00 | 25,621 | 1,563 | 6.10 | ||||||||||||||||||||||||||||||||

| Other consumer | 28,748 | 2,351 | 8.18 | 28,412 | 2,061 | 7.25 | ||||||||||||||||||||||||||||||||

| Student | — | — | — | 2,453 | 170 | 6.91 | ||||||||||||||||||||||||||||||||

| Credit card | 4,907 | 587 | 11.96 | 4,876 | 565 | 11.59 | ||||||||||||||||||||||||||||||||

| Total loans and leases held for investment | 305,233 | 19,351 | 6.34 | 320,730 | 19,628 | 6.12 | ||||||||||||||||||||||||||||||||

| Loans held for sale | 1,305 | 82 | 6.31 | 1,605 | 102 | 6.37 | ||||||||||||||||||||||||||||||||

| Total loans and leases | 306,538 | 19,433 | 6.34 | 322,335 | 19,730 | 6.12 | ||||||||||||||||||||||||||||||||

| Interest earning trading assets | 5,320 | 326 | 6.12 | 4,739 | 314 | 6.64 | ||||||||||||||||||||||||||||||||

Other earning assets(3) |

36,622 | 2,008 | 5.48 | 29,335 | 1,557 | 5.31 | ||||||||||||||||||||||||||||||||

| Total earning assets | 472,338 | 25,278 | 5.35 | 493,961 | 24,672 | 4.99 | ||||||||||||||||||||||||||||||||

| Nonearning assets | 51,185 | 51,554 | ||||||||||||||||||||||||||||||||||||

| Assets of discontinued operations | 2,542 | 7,617 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 526,065 | $ | 553,132 | ||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest checking | $ | 104,606 | 2,802 | 2.68 | $ | 103,465 | 2,184 | 2.11 | ||||||||||||||||||||||||||||||

| Money market and savings | 136,217 | 3,457 | 2.54 | 138,841 | 2,834 | 2.04 | ||||||||||||||||||||||||||||||||

| Time deposits | 39,406 | 1,590 | 4.04 | 36,803 | 1,409 | 3.83 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 280,229 | 7,849 | 2.80 | 279,109 | 6,427 | 2.30 | ||||||||||||||||||||||||||||||||

| Short-term borrowings | 24,499 | 1,313 | 5.36 | 24,478 | 1,286 | 5.25 | ||||||||||||||||||||||||||||||||

| Long-term debt | 36,713 | 1,813 | 4.94 | 49,678 | 2,215 | 4.46 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 341,441 | 10,975 | 3.21 | 353,265 | 9,928 | 2.81 | ||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 107,639 | 122,018 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 13,343 | 11,560 | ||||||||||||||||||||||||||||||||||||

| Liabilities of discontinued operations | 1,049 | 3,190 | ||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 62,593 | 63,099 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 526,065 | $ | 553,132 | ||||||||||||||||||||||||||||||||||

| Average interest-rate spread | 2.14 | 2.18 | ||||||||||||||||||||||||||||||||||||

| Net interest income/ net interest margin | $ | 14,303 | 3.03 | % | $ | 14,744 | 2.98 | % | ||||||||||||||||||||||||||||||

| Taxable-equivalent adjustment | 212 | 220 | ||||||||||||||||||||||||||||||||||||

| Memo: Total deposits | $ | 387,868 | 7,849 | 2.02 | % | $ | 401,127 | 6,427 | 1.60 | % | ||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2024 | 2024 | 2023 | |||||||||||||||||||||||||||

| Nonperforming Assets | ||||||||||||||||||||||||||||||||

| Nonaccrual loans and leases: | ||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 521 | $ | 575 | $ | 459 | $ | 512 | $ | 470 | ||||||||||||||||||||||

| CRE | 298 | 302 | 360 | 261 | 284 | |||||||||||||||||||||||||||

| Commercial construction | 3 | 1 | — | 23 | 24 | |||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||

| Residential mortgage | 166 | 156 | 161 | 151 | 153 | |||||||||||||||||||||||||||

| Home equity | 116 | 118 | 123 | 130 | 122 | |||||||||||||||||||||||||||

| Indirect auto | 259 | 252 | 244 | 256 | 268 | |||||||||||||||||||||||||||

| Other consumer | 66 | 63 | 64 | 61 | 59 | |||||||||||||||||||||||||||

| Total nonaccrual loans and leases held for investment | 1,429 | 1,467 | 1,411 | 1,394 | 1,380 | |||||||||||||||||||||||||||

| Loans held for sale | — | 5 | 9 | 22 | 51 | |||||||||||||||||||||||||||

| Total nonaccrual loans and leases | 1,429 | 1,472 | 1,420 | 1,416 | 1,431 | |||||||||||||||||||||||||||

| Foreclosed real estate | 3 | 3 | 5 | 4 | 3 | |||||||||||||||||||||||||||

| Other foreclosed property | 45 | 53 | 51 | 56 | 54 | |||||||||||||||||||||||||||

| Total nonperforming assets | $ | 1,477 | $ | 1,528 | $ | 1,476 | $ | 1,476 | $ | 1,488 | ||||||||||||||||||||||

| Loans 90 Days or More Past Due and Still Accruing | ||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 19 | $ | 5 | $ | 8 | $ | 12 | $ | 7 | ||||||||||||||||||||||

| CRE | 1 | — | — | — | — | |||||||||||||||||||||||||||

| Commercial construction | — | — | 1 | — | 1 | |||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||

| Residential mortgage - government guaranteed | 430 | 394 | 375 | 408 | 418 | |||||||||||||||||||||||||||

| Residential mortgage - nonguaranteed | 51 | 39 | 27 | 33 | 21 | |||||||||||||||||||||||||||

| Home equity | 9 | 7 | 7 | 10 | 11 | |||||||||||||||||||||||||||

| Indirect auto | — | — | 1 | 1 | 2 | |||||||||||||||||||||||||||

| Other consumer | 23 | 22 | 19 | 18 | 21 | |||||||||||||||||||||||||||

| Credit card | 54 | 51 | 51 | 56 | 53 | |||||||||||||||||||||||||||

| Total loans 90 days past due and still accruing | $ | 587 | $ | 518 | $ | 489 | $ | 538 | $ | 534 | ||||||||||||||||||||||

| Loans 30-89 Days Past Due | ||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 168 | $ | 116 | $ | 109 | $ | 158 | $ | 230 | ||||||||||||||||||||||

| CRE | 60 | 10 | 8 | 21 | 5 | |||||||||||||||||||||||||||

| Commercial construction | 3 | 4 | — | — | — | |||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||

| Residential mortgage - government guaranteed | 318 | 305 | 340 | 286 | 326 | |||||||||||||||||||||||||||

| Residential mortgage - nonguaranteed | 401 | 366 | 392 | 352 | 313 | |||||||||||||||||||||||||||

| Home equity | 60 | 63 | 58 | 59 | 70 | |||||||||||||||||||||||||||

| Indirect auto | 622 | 596 | 592 | 540 | 669 | |||||||||||||||||||||||||||

| Other consumer | 236 | 233 | 214 | 226 | 271 | |||||||||||||||||||||||||||

| Credit card | 81 | 76 | 78 | 74 | 87 | |||||||||||||||||||||||||||

| Total loans 30-89 days past due | $ | 1,949 | $ | 1,769 | $ | 1,791 | $ | 1,716 | $ | 1,971 | ||||||||||||||||||||||

| As of/For the Quarter Ended | ||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2023 | ||||||||||||||||||||||||||||

| Asset Quality Ratios | ||||||||||||||||||||||||||||||||

| Loans 30-89 days past due and still accruing as a percentage of loans and leases | 0.64 | % | 0.58 | % | 0.59 | % | 0.56 | % | 0.63 | % | ||||||||||||||||||||||

| Loans 90 days or more past due and still accruing as a percentage of loans and leases | 0.19 | 0.17 | 0.16 | 0.18 | 0.17 | |||||||||||||||||||||||||||

| Nonperforming loans and leases as a percentage of loans and leases held for investment | 0.47 | 0.48 | 0.46 | 0.45 | 0.44 | |||||||||||||||||||||||||||

Nonperforming loans and leases as a percentage of loans and leases(1) |

0.46 | 0.48 | 0.46 | 0.46 | 0.46 | |||||||||||||||||||||||||||

| Nonperforming assets as a percentage of: | ||||||||||||||||||||||||||||||||

Total assets(1) |

0.28 | 0.29 | 0.28 | 0.28 | 0.28 | |||||||||||||||||||||||||||

| Loans and leases plus foreclosed property | 0.48 | 0.50 | 0.48 | 0.47 | 0.46 | |||||||||||||||||||||||||||

| Net charge-offs as a percentage of average loans and leases | 0.59 | 0.55 | 0.58 | 0.64 | 0.57 | |||||||||||||||||||||||||||

| Allowance for loan and lease losses as a percentage of loans and leases | 1.59 | 1.60 | 1.57 | 1.56 | 1.54 | |||||||||||||||||||||||||||

| Ratio of allowance for loan and lease losses to: | ||||||||||||||||||||||||||||||||

| Net charge-offs | 2.7X | 2.9X | 2.7X | 2.4X | 2.7X | |||||||||||||||||||||||||||

| Nonperforming loans and leases | 3.4X | 3.3X | 3.4X | 3.4X | 3.5X | |||||||||||||||||||||||||||

| Asset Quality Ratios (Excluding Government Guaranteed) | ||||||||||||||||||||||||||||||||

| Loans 90 days or more past due and still accruing as a percentage of loans and leases | 0.05 | % | 0.04 | % | 0.04 | % | 0.04 | % | 0.04 | % | ||||||||||||||||||||||

| Applicable ratios are annualized. | ||||||||||||||||||||||||||||||||

(1)Includes loans held for sale. |

||||||||||||||||||||||||||||||||

| As of/For the Year-to-Date | ||||||||||||||||||||||||||||||||

| Period Ended Dec. 31 | ||||||||||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||||||||||

| Asset Quality Ratios | ||||||||||||||||||||||||||||||||

| Net charge-offs as a percentage of average loans and leases | 0.59 | % | 0.50 | % | ||||||||||||||||||||||||||||

| Ratio of allowance for loan and lease losses to net charge-offs | 2.7X | 3.0X | ||||||||||||||||||||||||||||||

| As of/For the Quarter Ended | As of/For the Year-to-Date | |||||||||||||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | Period Ended Dec. 31 | |||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||||

| Allowance for Credit Losses | ||||||||||||||||||||||||||||||||||||||||||||

| Beginning balance | $ | 5,140 | $ | 5,110 | $ | 5,100 | $ | 5,093 | $ | 4,970 | $ | 5,093 | $ | 4,649 | ||||||||||||||||||||||||||||||

| Provision for credit losses | 471 | 448 | 451 | 500 | 572 | 1,870 | 2,109 | |||||||||||||||||||||||||||||||||||||

| Charge-offs: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | (119) | (96) | (83) | (97) | (110) | (395) | (390) | |||||||||||||||||||||||||||||||||||||

| CRE | (51) | (65) | (97) | (103) | (48) | (316) | (166) | |||||||||||||||||||||||||||||||||||||

| Commercial construction | — | — | — | — | (5) | — | (5) | |||||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | (1) | — | (1) | (1) | — | (3) | (10) | |||||||||||||||||||||||||||||||||||||

| Home equity | (2) | (1) | (3) | (3) | (2) | (9) | (10) | |||||||||||||||||||||||||||||||||||||

| Indirect auto | (158) | (143) | (136) | (154) | (154) | (591) | (531) | |||||||||||||||||||||||||||||||||||||

| Other consumer | (148) | (152) | (141) | (165) | (148) | (606) | (477) | |||||||||||||||||||||||||||||||||||||

| Student | — | — | — | — | — | — | (108) | |||||||||||||||||||||||||||||||||||||

| Credit card | (74) | (71) | (74) | (77) | (64) | (296) | (223) | |||||||||||||||||||||||||||||||||||||

| Total charge-offs | (553) | (528) | (535) | (600) | (531) | (2,216) | (1,920) | |||||||||||||||||||||||||||||||||||||

| Recoveries: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 15 | 26 | 14 | 32 | 16 | 87 | 70 | |||||||||||||||||||||||||||||||||||||

| CRE | 17 | 5 | 5 | 7 | — | 34 | 3 | |||||||||||||||||||||||||||||||||||||

| Commercial construction | — | 1 | 1 | — | 2 | 2 | 3 | |||||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 2 | 1 | 2 | 1 | 1 | 6 | 6 | |||||||||||||||||||||||||||||||||||||

| Home equity | 3 | 4 | 4 | 5 | 5 | 16 | 23 | |||||||||||||||||||||||||||||||||||||

| Indirect auto | 24 | 38 | 30 | 28 | 25 | 120 | 107 | |||||||||||||||||||||||||||||||||||||

| Other consumer | 28 | 26 | 28 | 28 | 21 | 110 | 78 | |||||||||||||||||||||||||||||||||||||

| Credit card | 11 | 9 | 9 | 9 | 8 | 38 | 35 | |||||||||||||||||||||||||||||||||||||

| Total recoveries | 100 | 110 | 93 | 110 | 78 | 413 | 325 | |||||||||||||||||||||||||||||||||||||

| Net charge-offs | (453) | (418) | (442) | (490) | (453) | (1,803) | (1,595) | |||||||||||||||||||||||||||||||||||||

Other(1) |

3 | — | 1 | (3) | 4 | 1 | (70) | |||||||||||||||||||||||||||||||||||||

| Ending balance | $ | 5,161 | $ | 5,140 | $ | 5,110 | $ | 5,100 | $ | 5,093 | $ | 5,161 | $ | 5,093 | ||||||||||||||||||||||||||||||

| Allowance for Credit Losses: | ||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan and lease losses | $ | 4,857 | $ | 4,842 | $ | 4,808 | $ | 4,803 | $ | 4,798 | ||||||||||||||||||||||||||||||||||

| Reserve for unfunded lending commitments (RUFC) | 304 | 298 | 302 | 297 | 295 | |||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | $ | 5,161 | $ | 5,140 | $ | 5,110 | $ | 5,100 | $ | 5,093 | ||||||||||||||||||||||||||||||||||

| Quarter Ended | As of/For the Year-to-Date | |||||||||||||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | Period Ended Dec. 31 | |||||||||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||

| Net Charge-offs as a Percentage of Average Loans and Leases: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 0.27 | % | 0.18 | % | 0.18 | % | 0.17 | % | 0.23 | % | 0.20 | % | 0.20 | % | ||||||||||||||||||||||||||||||

| CRE | 0.66 | 1.12 | 1.67 | 1.73 | 0.83 | 1.31 | 0.71 | |||||||||||||||||||||||||||||||||||||

| Commercial construction | (0.02) | (0.01) | (0.05) | (0.02) | 0.22 | (0.03) | 0.04 | |||||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | (0.01) | (0.01) | (0.01) | — | (0.01) | (0.01) | 0.01 | |||||||||||||||||||||||||||||||||||||

| Home equity | (0.07) | (0.11) | (0.03) | (0.08) | (0.12) | (0.07) | (0.12) | |||||||||||||||||||||||||||||||||||||

| Indirect auto | 2.33 | 1.89 | 1.94 | 2.26 | 2.19 | 2.11 | 1.66 | |||||||||||||||||||||||||||||||||||||

| Other consumer | 1.63 | 1.73 | 1.60 | 1.96 | 1.74 | 1.73 | 1.40 | |||||||||||||||||||||||||||||||||||||

| Student | — | — | — | — | — | — | 4.39 | |||||||||||||||||||||||||||||||||||||

| Credit card | 5.10 | 5.04 | 5.33 | 5.54 | 4.38 | 5.26 | 3.85 | |||||||||||||||||||||||||||||||||||||

| Total loans and leases | 0.59 | 0.55 | 0.58 | 0.64 | 0.57 | 0.59 | 0.50 | |||||||||||||||||||||||||||||||||||||

| Applicable ratios are annualized. | ||||||||||||||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2024 | 2024 | 2023 | |||||||||||||||||||||||||||

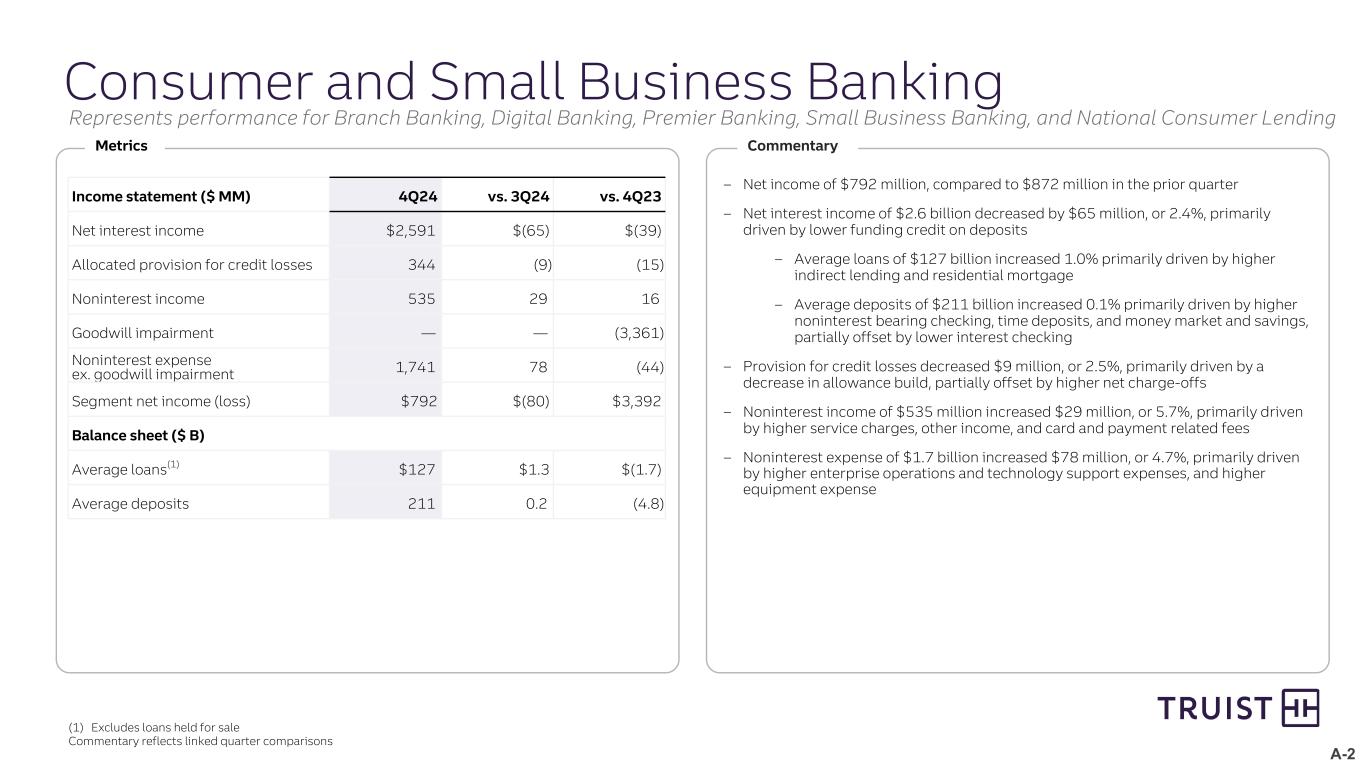

| Consumer and Small Business Banking | ||||||||||||||||||||||||||||||||

| Net interest income (expense) | $ | 1,388 | $ | 1,345 | $ | 1,289 | $ | 1,266 | $ | 1,342 | ||||||||||||||||||||||

| Net intersegment interest income (expense) | 1,203 | 1,311 | 1,354 | 1,352 | 1,288 | |||||||||||||||||||||||||||

| Segment net interest income (expense) | 2,591 | 2,656 | 2,643 | 2,618 | 2,630 | |||||||||||||||||||||||||||

| Allocated provision for credit losses | 344 | 353 | 308 | 303 | 359 | |||||||||||||||||||||||||||

| Noninterest income | 535 | 506 | 503 | 497 | 519 | |||||||||||||||||||||||||||

| Personnel expense | 406 | 399 | 417 | 405 | 416 | |||||||||||||||||||||||||||

| Amortization of intangibles | 45 | 45 | 45 | 46 | 52 | |||||||||||||||||||||||||||

| Restructuring charges | 1 | 1 | 1 | 1 | 33 | |||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | 3,361 | |||||||||||||||||||||||||||

| Other direct noninterest expense | 308 | 298 | 265 | 244 | 303 | |||||||||||||||||||||||||||

| Direct noninterest expense | 760 | 743 | 728 | 696 | 4,165 | |||||||||||||||||||||||||||

| Expense allocations | 981 | 920 | 934 | 890 | 981 | |||||||||||||||||||||||||||

Total noninterest expense(3) |

1,741 | 1,663 | 1,662 | 1,586 | 5,146 | |||||||||||||||||||||||||||

| Income (loss) before income taxes | 1,041 | 1,146 | 1,176 | 1,226 | (2,356) | |||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 249 | 274 | 282 | 294 | 244 | |||||||||||||||||||||||||||

| Segment net income (loss) | $ | 792 | $ | 872 | $ | 894 | $ | 932 | $ | (2,600) | ||||||||||||||||||||||

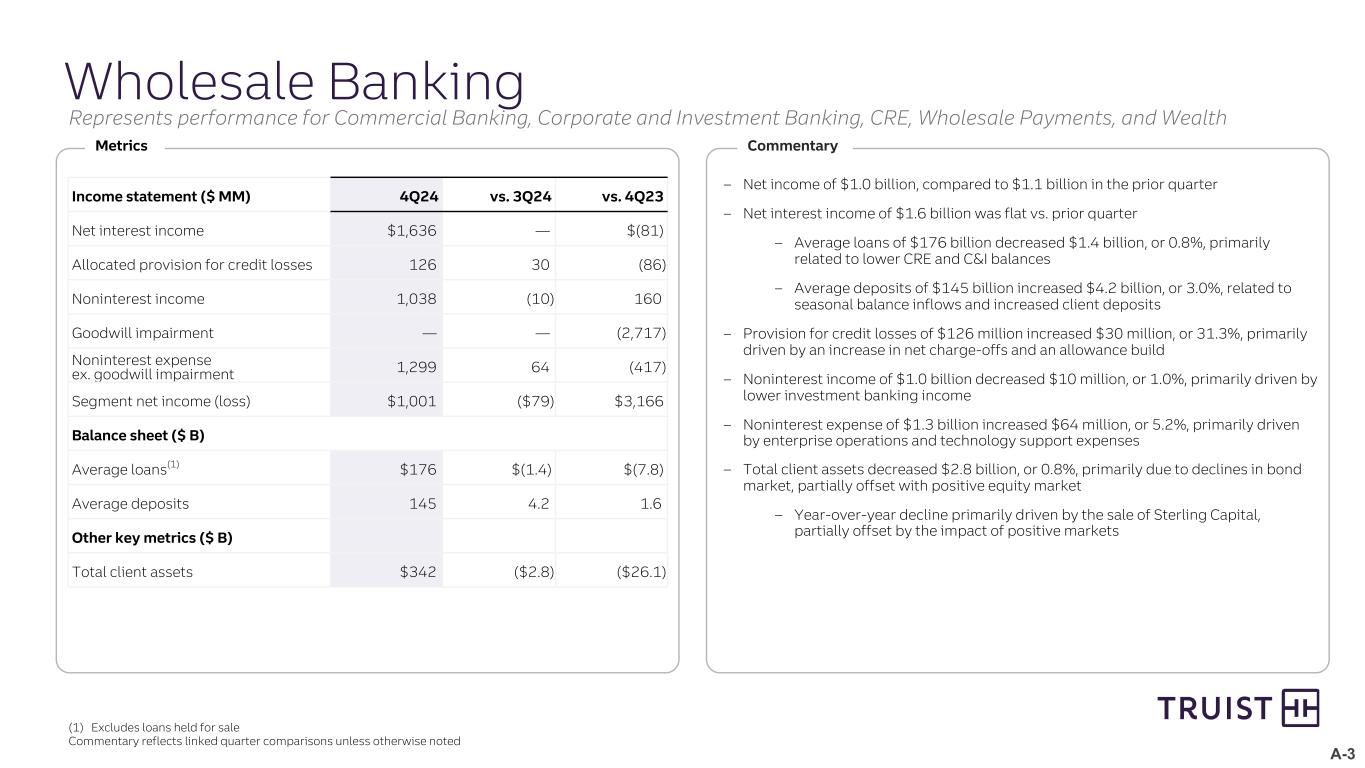

| Wholesale Banking | ||||||||||||||||||||||||||||||||

| Net interest income (expense) | $ | 1,978 | $ | 2,105 | $ | 2,184 | $ | 2,232 | $ | 2,297 | ||||||||||||||||||||||

| Net intersegment interest income (expense) | (342) | (469) | (507) | (559) | (580) | |||||||||||||||||||||||||||

| Segment net interest income (expense) | 1,636 | 1,636 | 1,677 | 1,673 | 1,717 | |||||||||||||||||||||||||||

| Allocated provision for credit losses | 126 | 96 | 142 | 198 | 212 | |||||||||||||||||||||||||||

| Noninterest income | 1,038 | 1,048 | 987 | 980 | 878 | |||||||||||||||||||||||||||

| Personnel expense | 553 | 569 | 586 | 580 | 515 | |||||||||||||||||||||||||||

| Amortization of intangibles | 39 | 39 | 41 | 42 | 46 | |||||||||||||||||||||||||||

| Restructuring charges | 4 | 9 | 9 | 7 | 47 | |||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | 2,717 | |||||||||||||||||||||||||||

| Other direct noninterest expense | 206 | 182 | 186 | 176 | 210 | |||||||||||||||||||||||||||

| Direct noninterest expense | 802 | 799 | 822 | 805 | 3,535 | |||||||||||||||||||||||||||

| Expense allocations | 497 | 436 | 447 | 528 | 898 | |||||||||||||||||||||||||||

Total noninterest expense(3) |

1,299 | 1,235 | 1,269 | 1,333 | 4,433 | |||||||||||||||||||||||||||

| Income (loss) before income taxes | 1,249 | 1,353 | 1,253 | 1,122 | (2,050) | |||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 248 | 273 | 252 | 220 | 115 | |||||||||||||||||||||||||||

| Segment net income (loss) | $ | 1,001 | $ | 1,080 | $ | 1,001 | $ | 902 | $ | (2,165) | ||||||||||||||||||||||

Other, Treasury & Corporate(4) |

||||||||||||||||||||||||||||||||

| Net interest income (expense) | $ | 224 | $ | 152 | $ | 54 | $ | (126) | $ | (120) | ||||||||||||||||||||||

| Net intersegment interest income (expense) | (861) | (842) | (847) | (793) | (708) | |||||||||||||||||||||||||||

| Segment net interest income (expense) | (637) | (690) | (793) | (919) | (828) | |||||||||||||||||||||||||||

| Allocated provision for credit losses | 1 | (1) | 1 | (1) | 1 | |||||||||||||||||||||||||||

| Noninterest income | (103) | (71) | (6,702) | (31) | (34) | |||||||||||||||||||||||||||

| Personnel expense | 628 | 660 | 658 | 645 | 543 | |||||||||||||||||||||||||||

| Amortization of intangibles | — | — | 3 | — | — | |||||||||||||||||||||||||||

| Restructuring charges | 6 | 15 | 23 | 43 | 75 | |||||||||||||||||||||||||||

| Other direct noninterest expense | 839 | 710 | 860 | 764 | 1,239 | |||||||||||||||||||||||||||

| Direct Noninterest Expense | 1,473 | 1,385 | 1,544 | 1,452 | 1,857 | |||||||||||||||||||||||||||

| Expense Allocations | (1,478) | (1,356) | (1,381) | (1,418) | (1,879) | |||||||||||||||||||||||||||

Total noninterest expense(3) |

(5) | 29 | 163 | 34 | (22) | |||||||||||||||||||||||||||

| Income (loss) before income taxes | (736) | (789) | (7,659) | (983) | (841) | |||||||||||||||||||||||||||

| Provision (benefit) for income taxes | (232) | (276) | (1,858) | (282) | (415) | |||||||||||||||||||||||||||

| Segment net income (loss) | $ | (504) | $ | (513) | $ | (5,801) | $ | (701) | $ | (426) | ||||||||||||||||||||||

| Total Truist Financial Corporation | ||||||||||||||||||||||||||||||||

| Net interest income (expense) | $ | 3,590 | $ | 3,602 | $ | 3,527 | $ | 3,372 | $ | 3,519 | ||||||||||||||||||||||

| Net intersegment interest income (expense) | — | — | — | — | — | |||||||||||||||||||||||||||

| Segment net interest income (expense) | 3,590 | 3,602 | 3,527 | 3,372 | 3,519 | |||||||||||||||||||||||||||

| Allocated provision for credit losses | 471 | 448 | 451 | 500 | 572 | |||||||||||||||||||||||||||

| Noninterest income | 1,470 | 1,483 | (5,212) | 1,446 | 1,363 | |||||||||||||||||||||||||||

| Personnel expense | 1,587 | 1,628 | 1,661 | 1,630 | 1,474 | |||||||||||||||||||||||||||

| Amortization of intangibles | 84 | 84 | 89 | 88 | 98 | |||||||||||||||||||||||||||

| Restructuring charges | 11 | 25 | 33 | 51 | 155 | |||||||||||||||||||||||||||

| Goodwill impairment | — | — | — | — | 6,078 | |||||||||||||||||||||||||||

| Other direct noninterest expense | 1,353 | 1,190 | 1,311 | 1,184 | 1,752 | |||||||||||||||||||||||||||

| Direct Noninterest Expense | 3,035 | 2,927 | 3,094 | 2,953 | 9,557 | |||||||||||||||||||||||||||

| Expense Allocations | — | — | — | — | — | |||||||||||||||||||||||||||

| Total noninterest expense | 3,035 | 2,927 | 3,094 | 2,953 | 9,557 | |||||||||||||||||||||||||||

| Income (loss) before income taxes | 1,554 | 1,710 | (5,230) | 1,365 | (5,247) | |||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 265 | 271 | (1,324) | 232 | (56) | |||||||||||||||||||||||||||

| Net income (loss) from continuing operations | $ | 1,289 | $ | 1,439 | $ | (3,906) | $ | 1,133 | $ | (5,191) | ||||||||||||||||||||||

| As of/For the Quarter Ended | ||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| (Dollars in millions, except per share data, shares in thousands) | 2024 | 2024 | 2024 | 2024 | 2023 | |||||||||||||||||||||||||||

| Selected Capital Information | (preliminary) | |||||||||||||||||||||||||||||||

| Risk-based capital: | ||||||||||||||||||||||||||||||||

| Common equity tier 1 | $ | 48,223 | $ | 48,076 | $ | 47,706 | $ | 42,691 | $ | 42,671 | ||||||||||||||||||||||

| Tier 1 | 54,127 | 54,746 | 54,376 | 49,361 | 49,341 | |||||||||||||||||||||||||||

| Total | 62,583 | 63,349 | 63,345 | 58,548 | 58,063 | |||||||||||||||||||||||||||

| Risk-weighted assets | 419,329 | 414,828 | 412,607 | 421,680 | 423,705 | |||||||||||||||||||||||||||

| Average quarterly assets for leverage ratio | 515,831 | 508,280 | 519,467 | 522,095 | 533,084 | |||||||||||||||||||||||||||

| Average quarterly assets for supplementary leverage ratio | 612,289 | 600,000 | 608,627 | 614,238 | 624,591 | |||||||||||||||||||||||||||

| Risk-based capital ratios: | ||||||||||||||||||||||||||||||||

| Common equity tier 1 | 11.5 | % | 11.6 | % | 11.6 | % | 10.1 | % | 10.1 | % | ||||||||||||||||||||||

| Tier 1 | 12.9 | 13.2 | 13.2 | 11.7 | 11.6 | |||||||||||||||||||||||||||

| Total | 14.9 | 15.3 | 15.4 | 13.9 | 13.7 | |||||||||||||||||||||||||||

| Leverage capital ratio | 10.5 | 10.8 | 10.5 | 9.5 | 9.3 | |||||||||||||||||||||||||||

| Supplementary leverage | 8.8 | 9.1 | 8.9 | 8.0 | 7.9 | |||||||||||||||||||||||||||

| Common equity per common share | $ | 43.90 | $ | 44.46 | $ | 42.71 | $ | 38.97 | $ | 39.31 | ||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| (Dollars in millions, except per share data, shares in thousands) | 2024 | 2024 | 2024 | 2024 | 2023 | |||||||||||||||||||||||||||

Calculations of Tangible Common Equity and Related Measures:(1) |

||||||||||||||||||||||||||||||||

| Total shareholders’ equity | $ | 63,679 | $ | 65,696 | $ | 63,827 | $ | 59,053 | $ | 59,253 | ||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||

| Preferred stock | 5,907 | 6,673 | 6,673 | 6,673 | 6,673 | |||||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | 232 | 152 | |||||||||||||||||||||||||||

| Intangible assets, net of deferred taxes (including discontinued operations) | 18,274 | 18,350 | 18,471 | 23,198 | 23,306 | |||||||||||||||||||||||||||

| Tangible common equity | $ | 39,498 | $ | 40,673 | $ | 38,683 | $ | 28,950 | $ | 29,122 | ||||||||||||||||||||||

| Outstanding shares at end of period (in thousands) | 1,315,936 | 1,327,521 | 1,338,223 | 1,338,096 | 1,333,743 | |||||||||||||||||||||||||||

| Tangible common equity per common share | $ | 30.01 | $ | 30.64 | $ | 28.91 | $ | 21.64 | $ | 21.83 | ||||||||||||||||||||||

| Total assets | $ | 531,176 | $ | 523,434 | $ | 519,853 | $ | 534,959 | $ | 535,349 | ||||||||||||||||||||||

| Less: Intangible assets, net of deferred taxes (including discontinued operations prior to the sale of TIH) | 18,274 | 18,350 | 18,471 | 23,198 | 23,306 | |||||||||||||||||||||||||||

| Tangible assets | $ | 512,902 | $ | 505,084 | $ | 501,382 | $ | 511,761 | $ | 512,043 | ||||||||||||||||||||||

| Equity as a percentage of total assets | 12.0 | % | 12.6 | % | 12.3 | % | 11.0 | % | 11.1 | % | ||||||||||||||||||||||

| Tangible common equity as a percentage of tangible assets | 7.7 | 8.1 | 7.7 | 5.7 | 5.7 | |||||||||||||||||||||||||||

| As of/For the Quarter Ended | ||||||||||||||||||||||||||||||||

| Dec. 31 | Sept. 30 | June 30 | March 31 | Dec. 31 | ||||||||||||||||||||||||||||

| (Dollars in millions, except per share data) | 2024 | 2024 | 2024 | 2024 | 2023 | |||||||||||||||||||||||||||

| Mortgage Banking Income | ||||||||||||||||||||||||||||||||

| Residential mortgage income: | ||||||||||||||||||||||||||||||||

| Residential mortgage production revenue | $ | 25 | $ | 25 | $ | 24 | $ | 17 | $ | 14 | ||||||||||||||||||||||

| Residential mortgage servicing income: | ||||||||||||||||||||||||||||||||

| Residential mortgage servicing income before MSR valuation | 83 | 80 | 72 | 88 | 85 | |||||||||||||||||||||||||||

| Net MSRs valuation | (5) | (7) | (12) | (15) | (13) | |||||||||||||||||||||||||||

| Total residential mortgage servicing income | 78 | 73 | 60 | 73 | 72 | |||||||||||||||||||||||||||

| Total residential mortgage income | 103 | 98 | 84 | 90 | 86 | |||||||||||||||||||||||||||

| Commercial mortgage income: | ||||||||||||||||||||||||||||||||

| Commercial mortgage production revenue | 12 | 6 | 4 | 5 | 5 | |||||||||||||||||||||||||||

| Commercial mortgage servicing income: | ||||||||||||||||||||||||||||||||

| Commercial mortgage servicing income before MSR valuation | 4 | 3 | 7 | 3 | 3 | |||||||||||||||||||||||||||

| Net MSRs valuation | (2) | (1) | 17 | (1) | — | |||||||||||||||||||||||||||

| Total commercial mortgage servicing income | 2 | 2 | 24 | 2 | 3 | |||||||||||||||||||||||||||

| Total commercial mortgage income | 14 | 8 | 28 | 7 | 8 | |||||||||||||||||||||||||||

| Total mortgage banking income | $ | 117 | $ | 106 | $ | 112 | $ | 97 | $ | 94 | ||||||||||||||||||||||

Other Mortgage Banking Information |

||||||||||||||||||||||||||||||||

| Residential mortgage loan originations | $ | 4,745 | $ | 3,726 | $ | 3,881 | $ | 2,412 | $ | 3,027 | ||||||||||||||||||||||

Residential mortgage servicing portfolio:(1) |

||||||||||||||||||||||||||||||||

| Loans serviced for others | 218,475 | 221,143 | 208,270 | 210,635 | 213,399 | |||||||||||||||||||||||||||

| Bank-owned loans serviced | 54,937 | 54,281 | 54,903 | 55,255 | 55,669 | |||||||||||||||||||||||||||

| Total servicing portfolio | 273,412 | 275,424 | 263,173 | 265,890 | 269,068 | |||||||||||||||||||||||||||

| Weighted-average coupon rate on mortgage loans serviced for others | 3.65 | % | 3.62 | % | 3.63 | % | 3.59 | % | 3.56 | % | ||||||||||||||||||||||

| Weighted-average servicing fee on mortgage loans serviced for others | 0.28 | 0.28 | 0.28 | 0.28 | 0.27 | |||||||||||||||||||||||||||

| Additional Information | ||||||||||||||||||||||||||||||||

Brokered deposits(2) |

$ | 28,085 | $ | 27,671 | $ | 27,384 | $ | 30,650 | $ | 31,260 | ||||||||||||||||||||||

NQDCP income (expense):(3) |

||||||||||||||||||||||||||||||||

| Interest income | $ | 4 | $ | 1 | $ | — | $ | 1 | $ | 2 | ||||||||||||||||||||||

| Other income | (2) | 12 | 4 | 15 | 17 | |||||||||||||||||||||||||||

| Personnel expense | (2) | (13) | (4) | (16) | (19) | |||||||||||||||||||||||||||

| Total NQDCP income (expense) | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| Common stock prices: | ||||||||||||||||||||||||||||||||

| High | $ | 49.06 | $ | 45.31 | $ | 40.51 | $ | 39.29 | $ | 37.83 | ||||||||||||||||||||||

| Low | 41.08 | 37.85 | 35.09 | 34.23 | 26.57 | |||||||||||||||||||||||||||

| End of period | 43.38 | 42.77 | 38.85 | 38.98 | 36.92 | |||||||||||||||||||||||||||

| Banking offices | 1,928 | 1,930 | 1,930 | 1,930 | 2,001 | |||||||||||||||||||||||||||

| ATMs | 2,901 | 2,928 | 2,942 | 2,947 | 3,031 | |||||||||||||||||||||||||||

FTEs(4) |

37,661 | 37,867 | 41,368 | 49,218 | 50,905 | |||||||||||||||||||||||||||

FTEs - continuing operations(4) |

37,661 | 37,867 | 38,140 | 39,417 | 40,997 | |||||||||||||||||||||||||||

| Favorable (Unfavorable) | |||||||||||||||||

| (Dollars in millions, except per share data) Description |

Pre-Tax | After-Tax at Marginal Rate | Impact to Diluted EPS(2) |

||||||||||||||

| Selected Items | |||||||||||||||||

| Fourth Quarter 2024 | |||||||||||||||||

| Restructuring charges | $ | (11) | $ | (9) | $ | (0.01) | |||||||||||

| FDIC special assessment (regulatory costs) | 8 | 6 | — | ||||||||||||||

| Third Quarter 2024 | |||||||||||||||||

| Gain on sale of TIH (net income from discontinued operations) | $ | 36 | $ | 16 | $ | 0.01 | |||||||||||

| Restructuring charges | (25) | (19) | (0.01) | ||||||||||||||

| FDIC special assessment (regulatory costs) | 16 | 13 | 0.01 | ||||||||||||||

| Second Quarter 2024 | |||||||||||||||||

| Gain on sale of TIH (net income from discontinued operations) | $ | 6,903 | $ | 4,814 | $ | 3.60 | |||||||||||

| Loss on sale of securities (securities gains (losses)) | (6,650) | (5,089) | (3.80) | ||||||||||||||

| Charitable contribution (other expense) | (150) | (115) | (0.09) | ||||||||||||||

| Restructuring charges ($33 million in restructuring charges and $63 million in net income from discontinued operations) | (96) | (73) | (0.05) | ||||||||||||||

| FDIC special assessment (regulatory costs) | (13) | (11) | (0.01) | ||||||||||||||

Accelerated recognition of TIH equity compensation expense (net income from discontinued operations) |

(10) | (8) | (0.01) | ||||||||||||||

| First Quarter 2024 | |||||||||||||||||

Accelerated recognition of TIH equity compensation expense (net income from discontinued operations) |