|

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| ||

Ohio |

001-11302 |

34-6542451 |

||||||||||||

| State or other jurisdiction of incorporation or organization: | Commission File Number | I.R.S. Employer Identification Number: | ||||||||||||

127 Public Square, |

Cleveland, |

Ohio |

44114-1306 |

|||||||||||

| Address of principal executive offices: | Zip Code: | |||||||||||||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | |||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Common Shares, $1 par value |

KEY |

New York Stock Exchange |

||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Stock, Series E) |

KEY PrI |

New York Stock Exchange |

||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed Rate Perpetual Non-Cumulative Preferred Stock, Series F) |

KEY PrJ |

New York Stock Exchange |

||||||

Depositary Shares (each representing a 1/40th interest in a share of Fixed Rate Perpetual Non-Cumulative Preferred Stock, Series G) |

KEY PrK |

New York Stock Exchange |

||||||

| SIGNATURE | ||||||||

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | ||||||||

| KEYCORP | ||||||||

| (Registrant) | ||||||||

| Date: July 20, 2022 | /s/ Douglas M. Schosser | |||||||

| By: Douglas M. Schosser | ||||||||

| Chief Accounting Officer | ||||||||

| Selected Financial Highlights | |||||||||||||||||||||||

| Dollars in millions, except per share data | Change 2Q22 vs. | ||||||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | |||||||||||||||||||

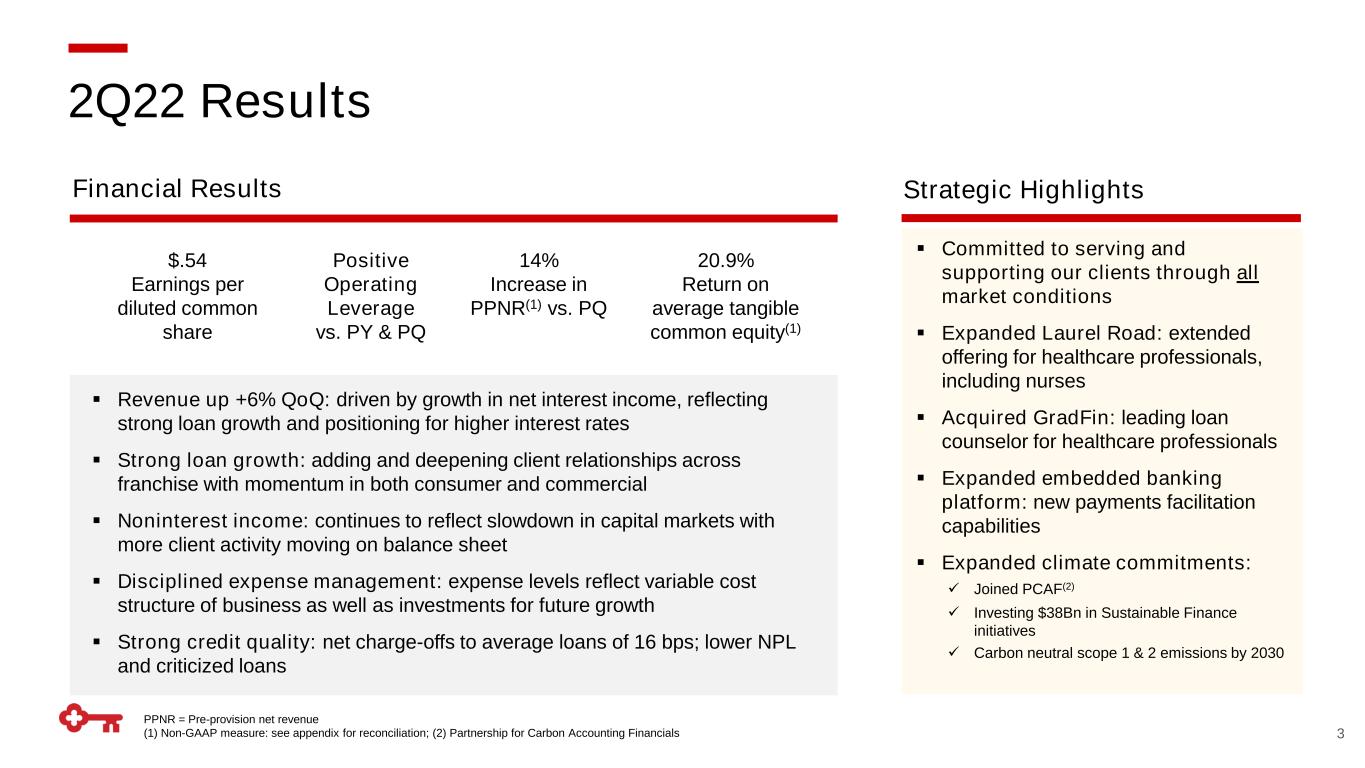

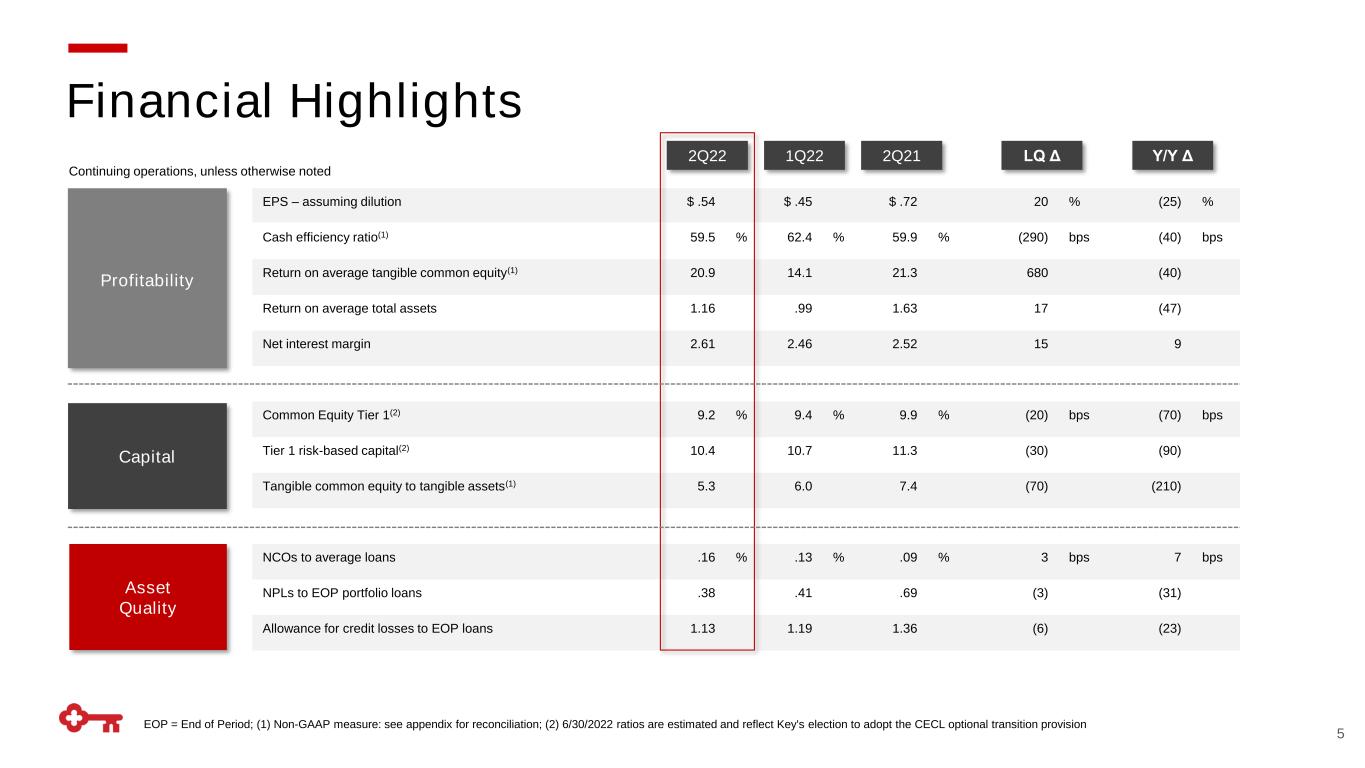

| Income (loss) from continuing operations attributable to Key common shareholders | $ | 504 | $ | 420 | $ | 698 | 20.0 | % | (27.8) | % | |||||||||||||

Income (loss) from continuing operations attributable to Key common shareholders per common share — assuming dilution |

.54 | .45 | .72 | 20.0 | (25.0) | ||||||||||||||||||

Return on average tangible common equity from continuing operations (a) |

20.90 | % | 14.12 | % | 21.34 | % | N/A | N/A | |||||||||||||||

| Return on average total assets from continuing operations | 1.16 | .99 | 1.63 | N/A | N/A | ||||||||||||||||||

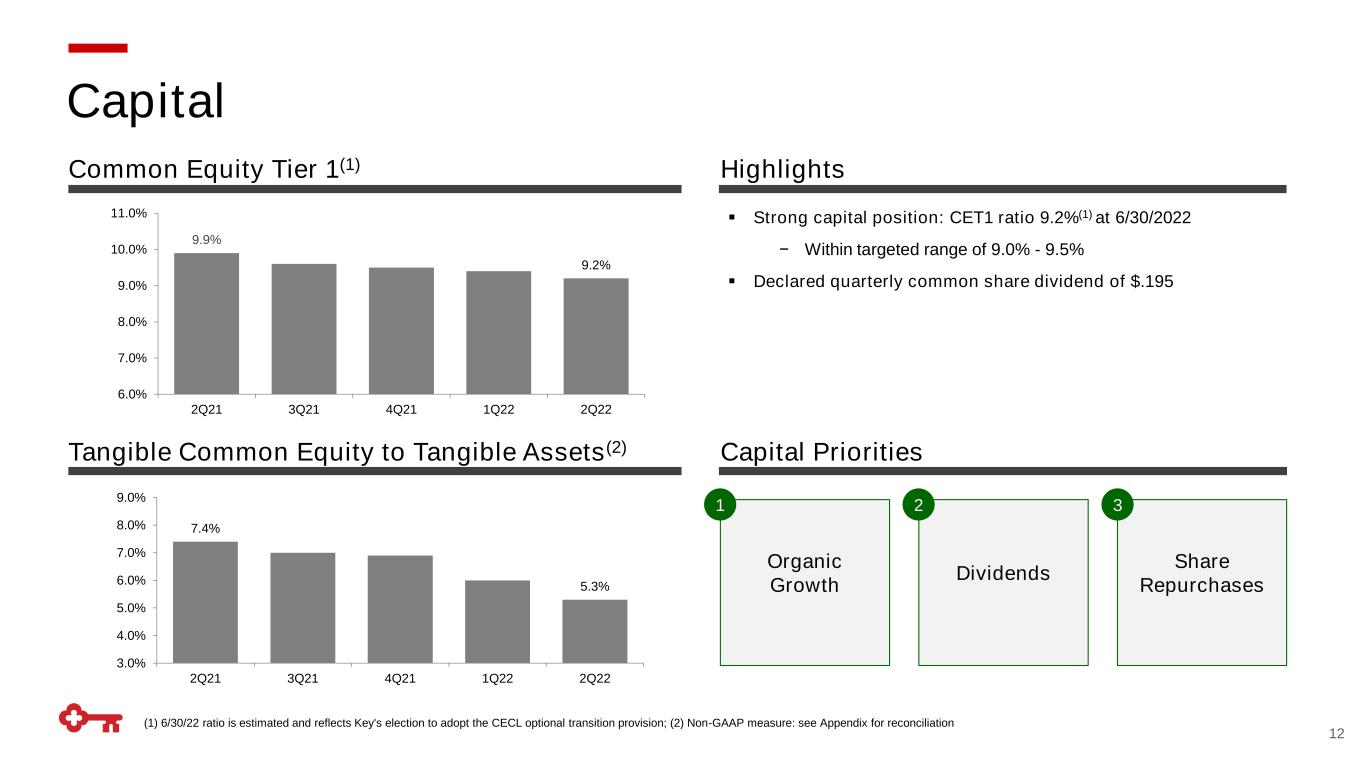

Common Equity Tier 1 ratio (b) |

9.2 | 9.4 | 9.9 | N/A | N/A | ||||||||||||||||||

| Book value at period end | $ | 13.48 | $ | 14.43 | $ | 16.75 | (6.6) | (19.5) | |||||||||||||||

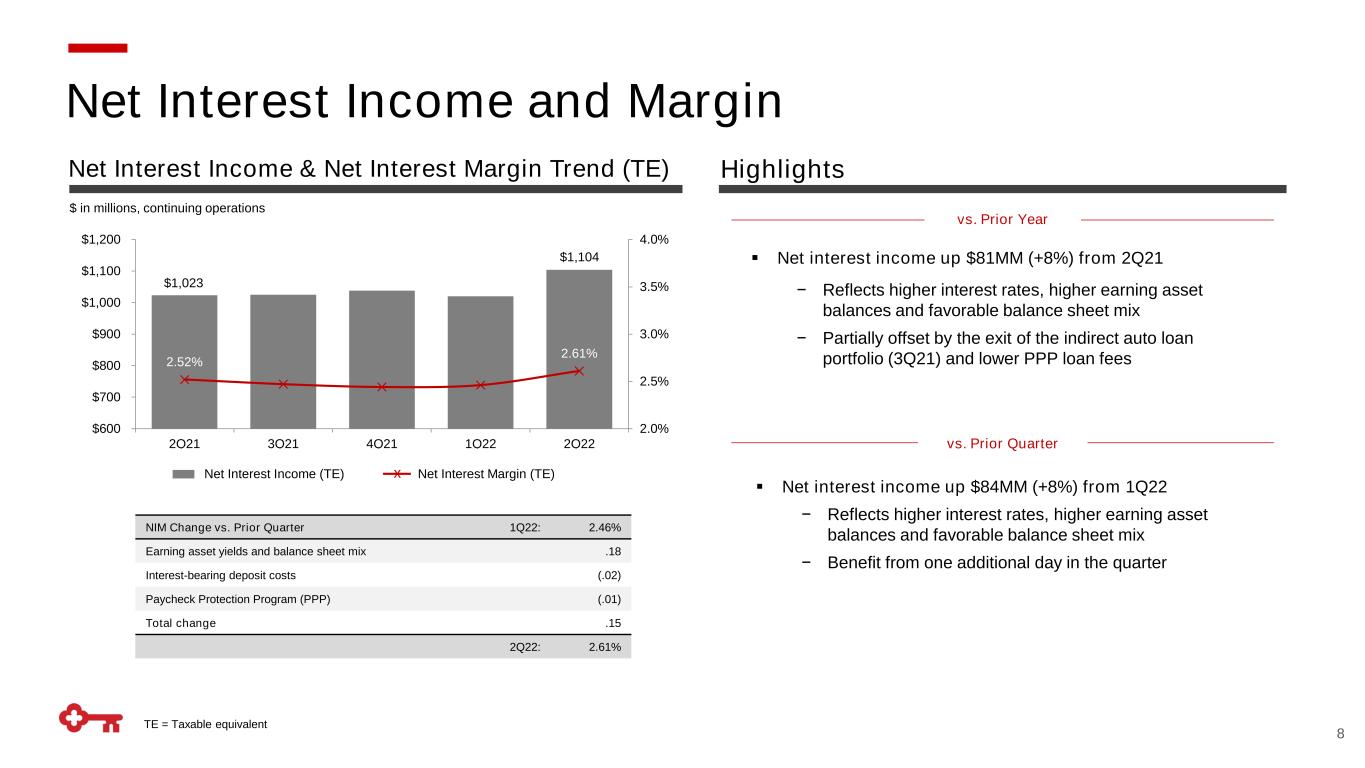

| Net interest margin (TE) from continuing operations | 2.61 | % | 2.46 | % | 2.52 | % | N/A | N/A | |||||||||||||||

| INCOME STATEMENT HIGHLIGHTS | ||||||||||||||||||||

| Revenue | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Net interest income (TE) | $ | 1,104 | $ | 1,020 | $ | 1,023 | 8.2 | % | 7.9 | % | ||||||||||

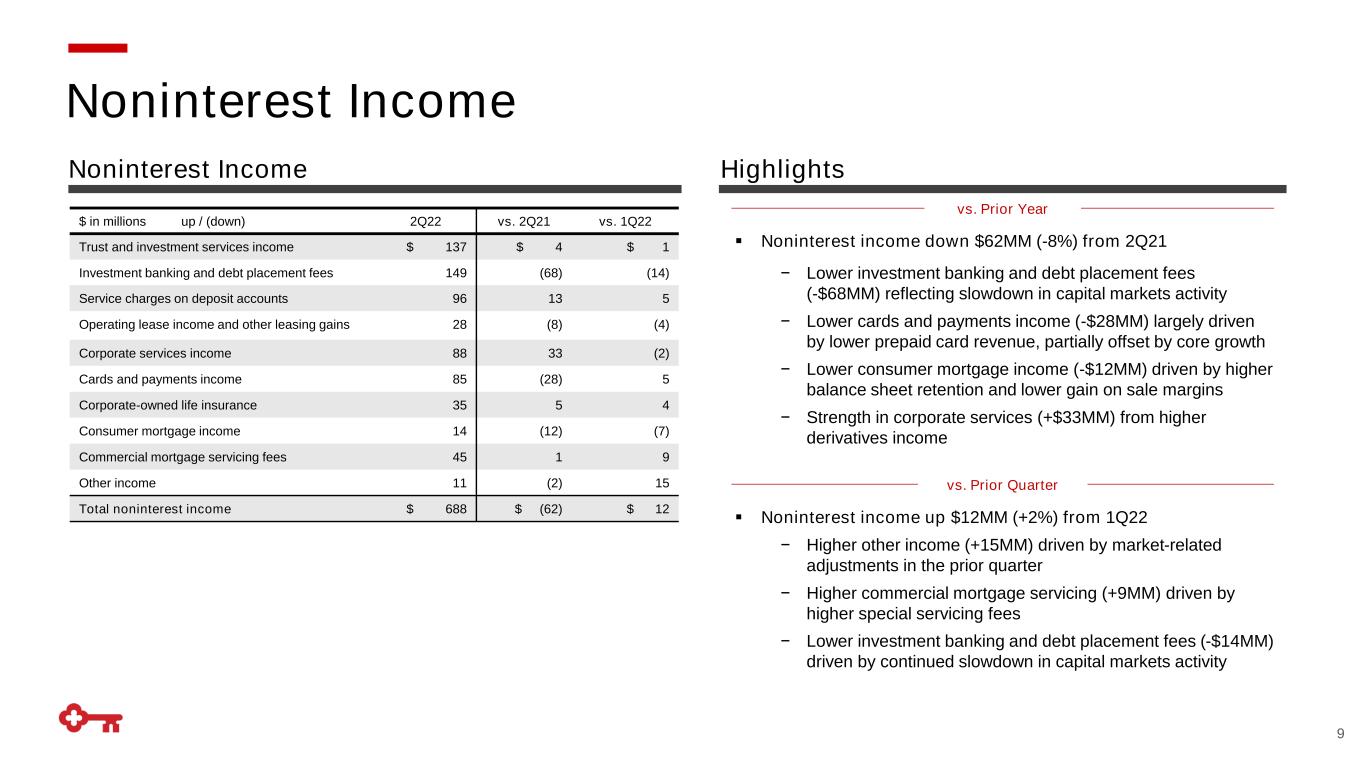

| Noninterest income | 688 | 676 | 750 | 1.8 | (8.3) | |||||||||||||||

| Total revenue | $ | 1,792 | $ | 1,696 | $ | 1,773 | 5.7 | % | 1.1 | % | ||||||||||

| Noninterest Income | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Trust and investment services income | $ | 137 | $ | 136 | $ | 133 | .7 | % | 3.0 | % | ||||||||||

| Investment banking and debt placement fees | 149 | 163 | 217 | (8.6) | (31.3) | |||||||||||||||

| Service charges on deposit accounts | 96 | 91 | 83 | 5.5 | 15.7 | |||||||||||||||

| Operating lease income and other leasing gains | 28 | 32 | 36 | (12.5) | (22.2) | |||||||||||||||

| Corporate services income | 88 | 90 | 55 | (2.2) | 60.0 | |||||||||||||||

| Cards and payments income | 85 | 80 | 113 | 6.3 | (24.8) | |||||||||||||||

| Corporate-owned life insurance income | 35 | 31 | 30 | 12.9 | 16.7 | |||||||||||||||

| Consumer mortgage income | 14 | 21 | 26 | (33.3) | (46.2) | |||||||||||||||

| Commercial mortgage servicing fees | 45 | 36 | 44 | 25.0 | 2.3 | |||||||||||||||

| Other income | 11 | (4) | 13 | 375.0 | (15.4) | |||||||||||||||

| Total noninterest income | $ | 688 | $ | 676 | $ | 750 | 1.8 | % | (8.3) | % | ||||||||||

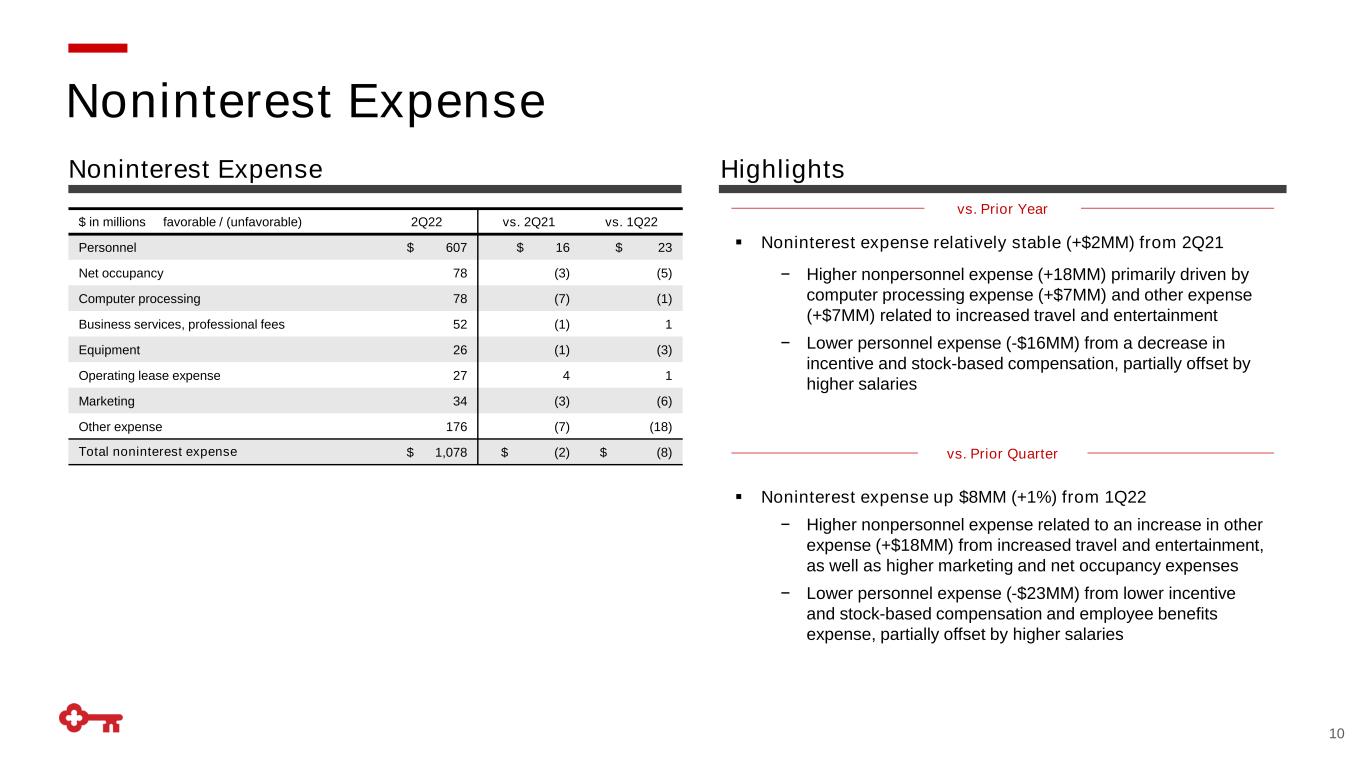

| Noninterest Expense | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Personnel expense | $ | 607 | $ | 630 | $ | 623 | (3.7) | % | (2.6) | % | ||||||||||

| Nonpersonnel expense | 471 | 440 | 453 | 7.0 | 4.0 | |||||||||||||||

| Total noninterest expense | $ | 1,078 | $ | 1,070 | 1,076 | .7 | % | .2 | % | |||||||||||

| BALANCE SHEET HIGHLIGHTS | ||||||||||||||||||||

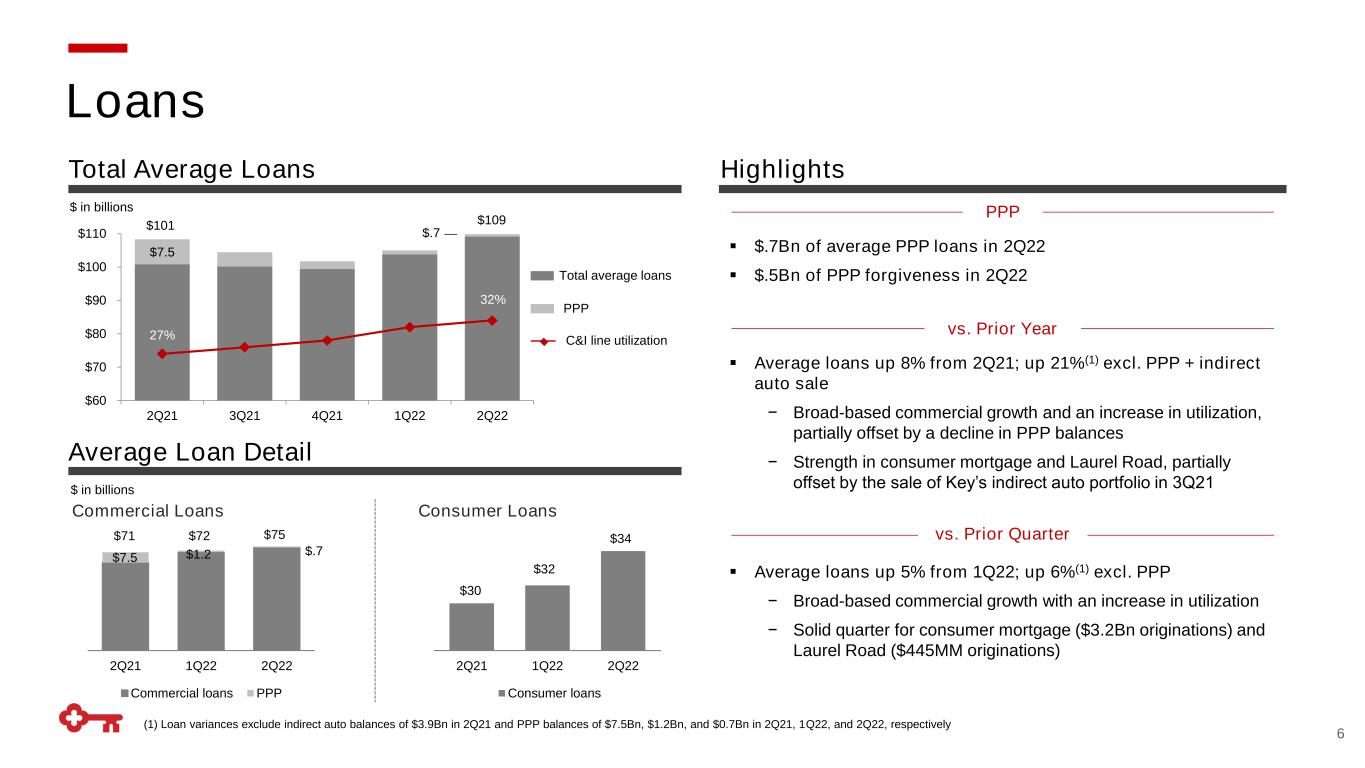

| Average Loans | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

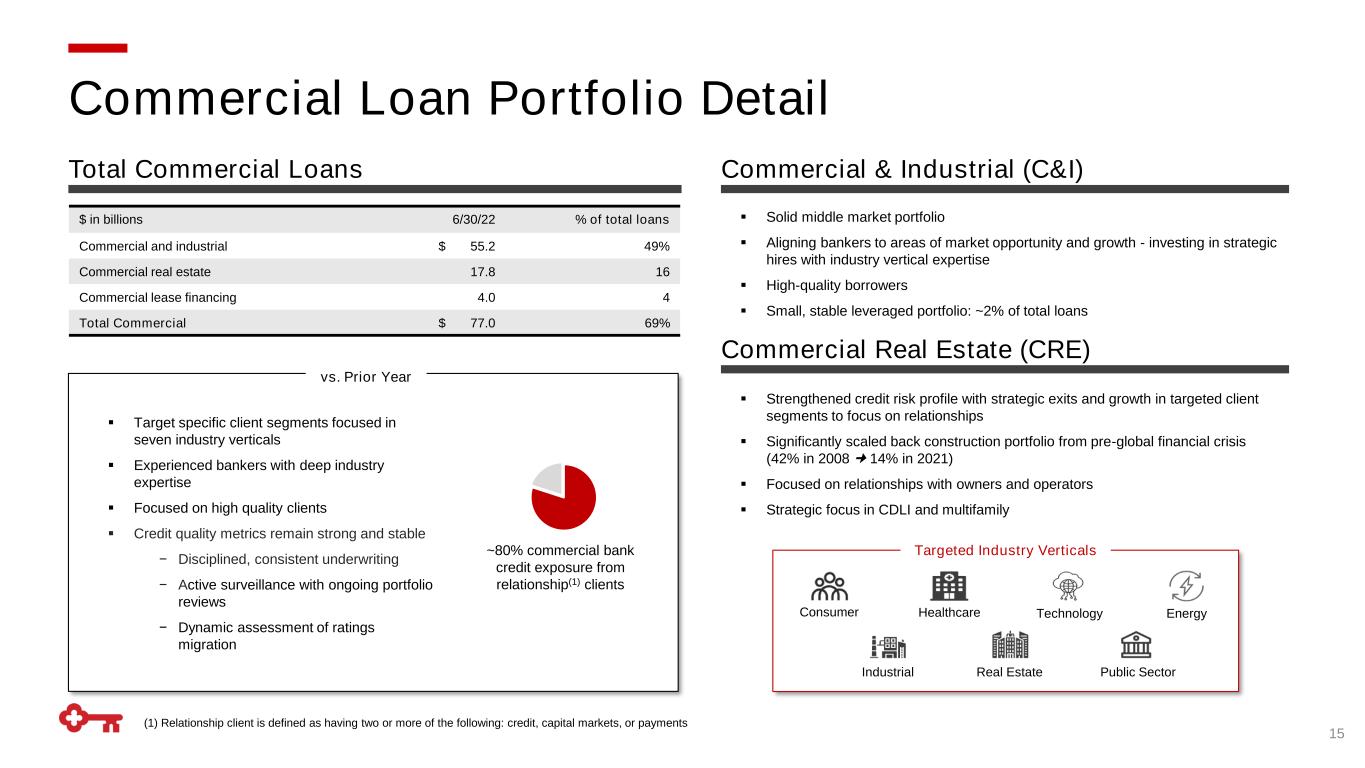

Commercial and industrial (a) |

$ | 53,858 | $ | 51,574 | $ | 51,808 | 4.4 | % | 4.0 | % | ||||||||||

| Other commercial loans | 21,173 | 20,556 | 19,034 | 3.0 | 11.2 | |||||||||||||||

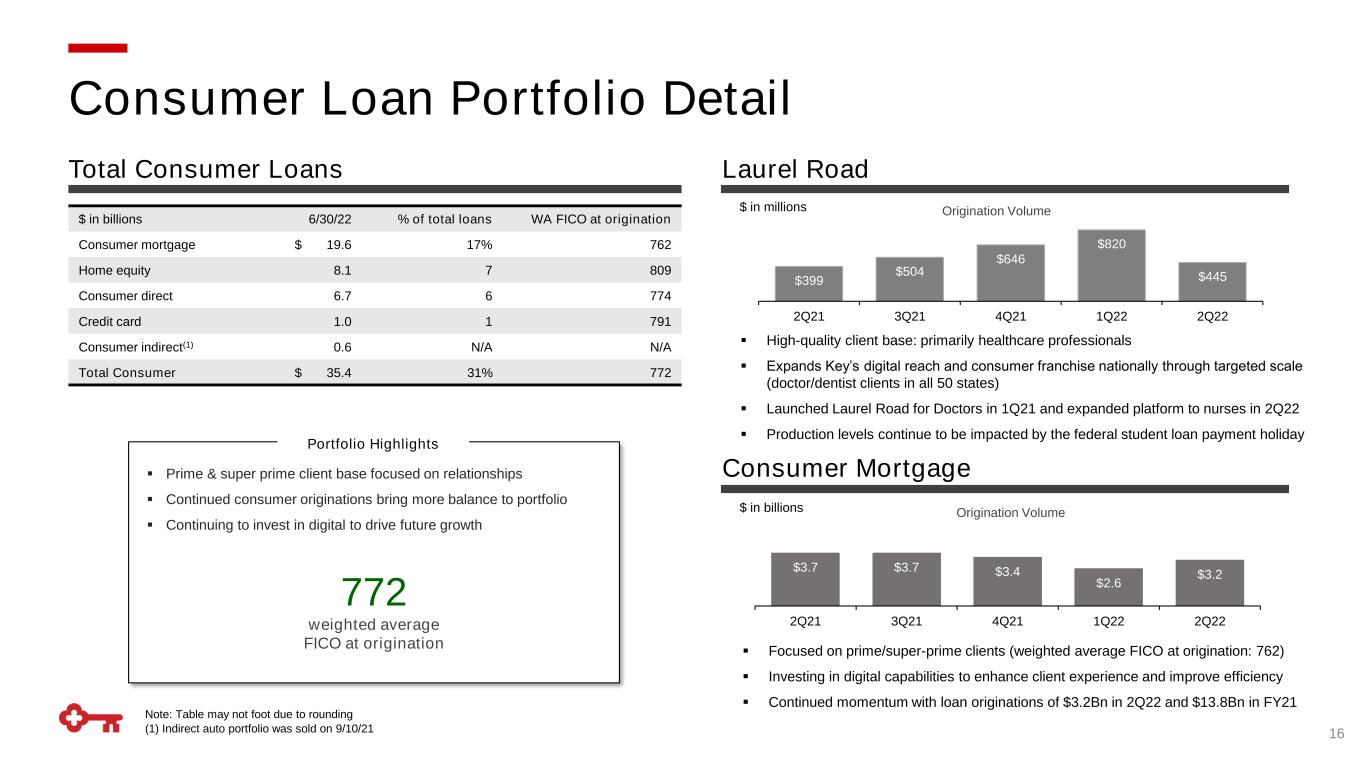

| Total consumer loans | 34,107 | 31,632 | 29,972 | 7.8 | 13.8 | |||||||||||||||

| Total loans | $ | 109,138 | $ | 103,762 | $ | 100,814 | 5.2 | % | 8.3 | % | ||||||||||

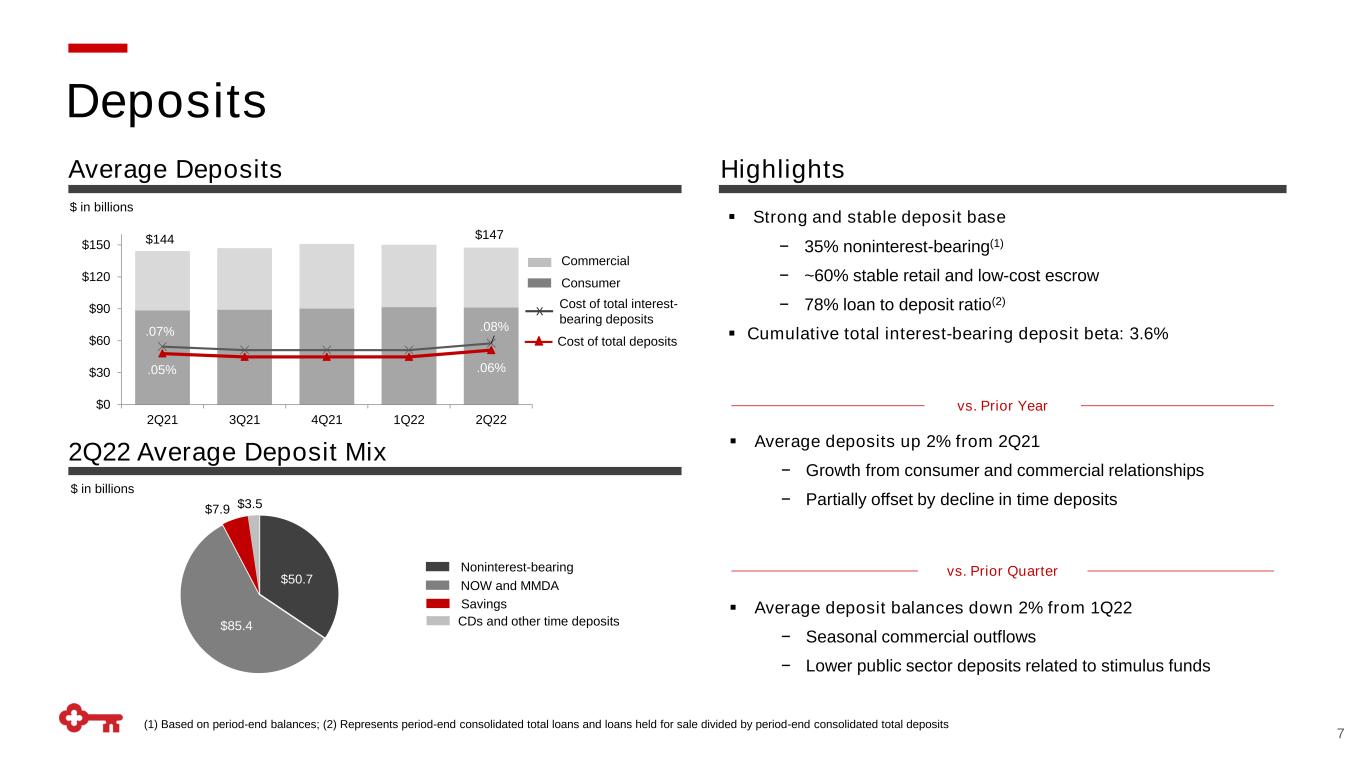

| Average Deposits | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Non-time deposits | $ | 144,012 | $ | 146,426 | $ | 139,480 | (1.6) | % | 3.2 | % | ||||||||||

| Certificates of deposit ($100,000 or more) | 1,487 | 1,639 | 2,212 | (9.3) | (32.8) | |||||||||||||||

| Other time deposits | 1,972 | 2,098 | 2,630 | (6.0) | (25.0) | |||||||||||||||

| Total deposits | $ | 147,471 | $ | 150,163 | $ | 144,322 | (1.8) | % | 2.2 | % | ||||||||||

| Cost of total deposits | .06 | % | .04 | % | .05 | % | N/A | N/A | ||||||||||||

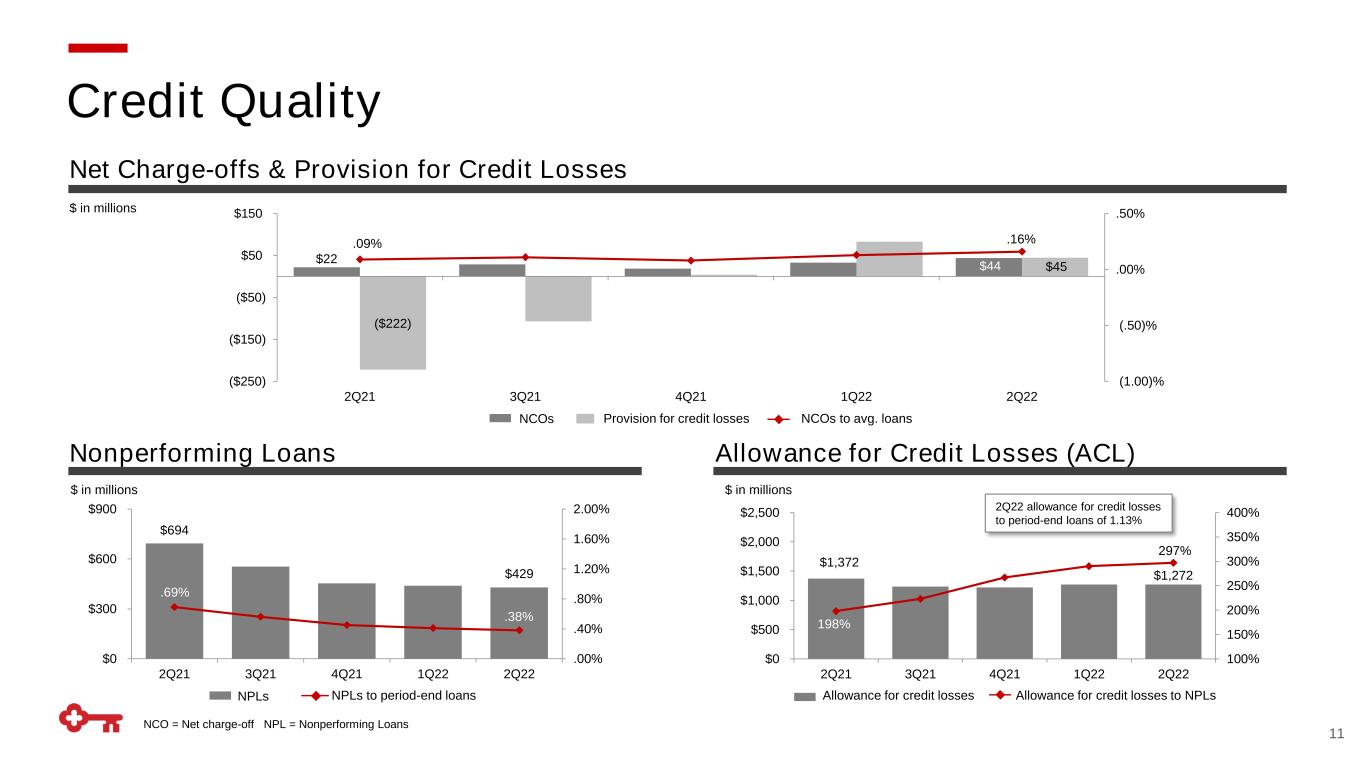

| ASSET QUALITY | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Net loan charge-offs | $ | 44 | $ | 33 | $ | 22 | 33.3 | % | 100.0 | % | ||||||||||

| Net loan charge-offs to average total loans | .16 | % | .13 | % | .09 | % | N/A | N/A | ||||||||||||

| Nonperforming loans at period end | $ | 429 | $ | 439 | $ | 694 | (2.3) | (38.2) | ||||||||||||

| Nonperforming assets at period end | 463 | 467 | 738 | (0.9) | (37.3) | |||||||||||||||

| Allowance for loan and lease losses | 1,099 | 1,105 | 1,220 | (0.5) | (9.9) | |||||||||||||||

| Allowance for credit losses | 1,272 | 1,271 | 1,372 | 0.1 | (7.3) | |||||||||||||||

| Provision for credit losses | 45 | 83 | (222) | (45.8) | 120.3 | |||||||||||||||

| Allowance for loan and lease losses to nonperforming loans | 256.2 | % | 251.7 | % | 175.8 | % | N/A | N/A | ||||||||||||

| Allowance for credit losses to nonperforming loans | 296.5 | 289.5 | 197.7 | N/A | N/A | |||||||||||||||

| Capital Ratios | |||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | |||||||||

Common Equity Tier 1 (a) |

9.2 | % | 9.4 | % | 9.9 | % | |||||

Tier 1 risk-based capital (a) |

10.4 | 10.7 | 11.3 | ||||||||

Total risk based capital (a) |

12.0 | 12.4 | 13.2 | ||||||||

Tangible common equity to tangible assets (b) |

5.3 | 6.0 | 7.4 | ||||||||

Leverage (a) |

8.8 | 8.6 | 8.7 | ||||||||

| Summary of Changes in Common Shares Outstanding | |||||||||||||||||||||||

| In thousands | Change 2Q22 vs. | ||||||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | |||||||||||||||||||

| Shares outstanding at beginning of period | 932,398 | 928,850 | 972,587 | .4 | % | (4.1) | % | ||||||||||||||||

| Open market repurchases, repurchases under the accelerated repurchase program, and return of shares under employee compensation plans | (24) | (1,707) | (13,304) | (98.6) | (99.8) | ||||||||||||||||||

| Shares issued under employee compensation plans (net of cancellations) | 269 | 5,255 | 993 | (94.9) | (72.9) | ||||||||||||||||||

| Shares outstanding at end of period | 932,643 | 932,398 | 960,276 | — | % | (2.9) | % | ||||||||||||||||

| Major Business Segments | |||||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | ||||||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | |||||||||||||||||||

| Revenue from continuing operations (TE) | |||||||||||||||||||||||

| Consumer Bank | $ | 824 | $ | 799 | $ | 852 | 3.1 | % | (3.3) | % | |||||||||||||

| Commercial Bank | 844 | 810 | 871 | 4.2 | (3.1) | ||||||||||||||||||

Other (a) |

124 | 87 | 50 | 42.5 | 148.0 | ||||||||||||||||||

| Total | $ | 1,792 | $ | 1,696 | $ | 1,773 | 5.7 | % | 1.1 | % | |||||||||||||

| Income (loss) from continuing operations attributable to Key | |||||||||||||||||||||||

| Consumer Bank | $ | 107 | $ | 70 | $ | 257 | 52.9 | % | (58.4) | % | |||||||||||||

| Commercial Bank | 315 | 283 | 432 | 11.3 | (27.1) | ||||||||||||||||||

Other (a) |

108 | 94 | 35 | 14.9 | 208.6 | ||||||||||||||||||

| Total | $ | 530 | $ | 447 | $ | 724 | 18.6 | % | (26.8) | % | |||||||||||||

| Consumer Bank | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Summary of operations | ||||||||||||||||||||

| Net interest income (TE) | $ | 570 | $ | 543 | $ | 599 | 5.0 | % | (4.8) | % | ||||||||||

| Noninterest income | 254 | 256 | 253 | (.8) | .4 | |||||||||||||||

| Total revenue (TE) | 824 | 799 | 852 | 3.1 | (3.3) | |||||||||||||||

| Provision for credit losses | 8 | 43 | (70) | (81.4) | 111.4 | |||||||||||||||

| Noninterest expense | 676 | 663 | 584 | 2.0 | 15.8 | |||||||||||||||

| Income (loss) before income taxes (TE) | 140 | 93 | 338 | 50.5 | (58.6) | |||||||||||||||

| Allocated income taxes (benefit) and TE adjustments | 33 | 23 | 81 | 43.5 | (59.3) | |||||||||||||||

| Net income (loss) attributable to Key | $ | 107 | $ | 70 | $ | 257 | 52.9 | % | (58.4) | % | ||||||||||

| Average balances | ||||||||||||||||||||

| Loans and leases | $ | 40,818 | $ | 38,637 | $ | 40,598 | 5.6 | % | .5 | % | ||||||||||

| Total assets | 43,868 | 41,814 | 43,818 | 4.9 | .1 | |||||||||||||||

| Deposits | 91,256 | 91,468 | 88,412 | (.2) | 3.2 | |||||||||||||||

| Assets under management at period end | $ | 49,003 | $ | 53,707 | $ | 51,013 | (8.8) | % | (3.9) | % | ||||||||||

| Additional Consumer Bank Data | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Noninterest income | ||||||||||||||||||||

| Trust and investment services income | $ | 104 | $ | 106 | $ | 104 | (1.9) | % | — | % | ||||||||||

| Service charges on deposit accounts | 59 | 54 | 48 | 9.3 | 22.9 | |||||||||||||||

| Cards and payments income | 62 | 57 | 62 | 8.8 | — | |||||||||||||||

| Consumer mortgage income | 14 | 21 | 26 | (33.3) | (46.2) | |||||||||||||||

| Other noninterest income | 15 | 18 | 13 | (16.7) | 15.4 | |||||||||||||||

| Total noninterest income | $ | 254 | $ | 256 | $ | 253 | (.8) | % | .4 | % | ||||||||||

| Average deposit balances | ||||||||||||||||||||

| NOW and money market deposit accounts | $ | 57,884 | $ | 58,625 | $ | 56,038 | (1.3) | % | 3.3 | % | ||||||||||

| Savings deposits | 7,515 | 7,233 | 6,523 | 3.9 | 15.2 | |||||||||||||||

| Certificates of deposit ($100,000 or more) | 1,375 | 1,520 | 2,083 | (9.5) | (34.0) | |||||||||||||||

| Other time deposits | 1,966 | 2,090 | 2,616 | (5.9) | (24.8) | |||||||||||||||

| Noninterest-bearing deposits | 22,516 | 22,000 | 21,152 | 2.3 | 6.4 | |||||||||||||||

| Total deposits | $ | 91,256 | $ | 91,468 | $ | 88,412 | (.2) | % | 3.2 | % | ||||||||||

| Other data | ||||||||||||||||||||

| Branches | 978 | 993 | 1,014 | |||||||||||||||||

| Automated teller machines | 1,284 | 1,308 | 1,329 | |||||||||||||||||

| Commercial Bank | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Summary of operations | ||||||||||||||||||||

| Net interest income (TE) | $ | 440 | $ | 415 | $ | 417 | 6.0 | % | 5.5 | % | ||||||||||

| Noninterest income | 404 | 395 | 454 | 2.3 | (11.0) | |||||||||||||||

| Total revenue (TE) | 844 | 810 | 871 | 4.2 | (3.1) | |||||||||||||||

| Provision for credit losses | 37 | 41 | (131) | 9.8 | 128.2 | |||||||||||||||

| Noninterest expense | 414 | 417 | 451 | (.7) | (8.2) | |||||||||||||||

| Income (loss) before income taxes (TE) | 393 | 352 | 551 | 11.6 | (28.7) | |||||||||||||||

| Allocated income taxes and TE adjustments | 78 | 69 | 119 | 13.0 | (34.5) | |||||||||||||||

| Net income (loss) attributable to Key | $ | 315 | $ | 283 | $ | 432 | 11.3 | % | (27.1) | % | ||||||||||

| Average balances | ||||||||||||||||||||

| Loans and leases | $ | 67,834 | $ | 64,701 | $ | 59,953 | 4.8 | % | 13.1 | % | ||||||||||

| Loans held for sale | 1,016 | 1,323 | 1,341 | (23.2) | (24.2) | |||||||||||||||

| Total assets | 78,824 | 74,860 | 69,101 | 5.3 | 14.1 | |||||||||||||||

| Deposits | 54,864 | 57,289 | 54,814 | (4.2) | % | 0.1 | % | |||||||||||||

| Additional Commercial Bank Data | ||||||||||||||||||||

| Dollars in millions | Change 2Q22 vs. | |||||||||||||||||||

| 2Q22 | 1Q22 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||

| Noninterest income | ||||||||||||||||||||

| Trust and investment services income | $ | 33 | $ | 30 | $ | 27 | 10.0 | % | 22.2 | % | ||||||||||

| Investment banking and debt placement fees | 149 | 163 | 215 | (8.6) | (30.7) | |||||||||||||||

| Operating lease income and other leasing gains | 27 | 32 | 35 | (15.6) | (22.9) | |||||||||||||||

| Corporate services income | 80 | 82 | 47 | (2.4) | 70.2 | |||||||||||||||

| Service charges on deposit accounts | 36 | 36 | 34 | — | 5.9 | |||||||||||||||

| Cards and payments income | 23 | 22 | 49 | 4.5 | (53.1) | |||||||||||||||

| Payments and services income | 139 | 140 | 130 | (0.7) | 6.9 | |||||||||||||||

| Commercial mortgage servicing fees | 45 | 36 | 44 | 25.0 | 2.3 | |||||||||||||||

| Other noninterest income | 11 | (6) | 3 | 283.3 | 266.7 | |||||||||||||||

| Total noninterest income | $ | 404 | $ | 395 | $ | 454 | 2.3 | % | (11.0) | % | ||||||||||

| CONTACTS: | |||||

| ANALYSTS | MEDIA | ||||

| Vernon L. Patterson | Susan Donlan | ||||

| 216.689.0520 | 216.471.3133 | ||||

| Vernon_Patterson@KeyBank.com | Susan_E_Donlan@KeyBank.com | ||||

| Melanie S. Kaiser | Beth Strauss | ||||

| 216.689.4545 | 216.471.2787 | ||||

| Melanie_S_Kaiser@KeyBank.com | Beth_A_Strauss@KeyBank.com | ||||

| Halle A. Nichols | Twitter: @keybank | ||||

| 216.471.2184 | |||||

| Halle_A_Nichols@KeyBank.com | |||||

| INVESTOR RELATIONS: | KEY MEDIA NEWSROOM: | ||||

| www.key.com/ir | www.key.com/newsroom | ||||

| This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements do not relate strictly to historical or current facts. Forward-looking statements usually can be identified by the use of words such as “goal,” “objective,” “plan,” “expect,” “assume,” “anticipate,” “intend,” “project,” “believe,” “estimate,” or other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results, or aspirations. Forward-looking statements, by their nature, are subject to assumptions, risks and uncertainties, many of which are outside of our control. Our actual results may differ materially from those set forth in our forward-looking statements. There is no assurance that any list of risks and uncertainties or risk factors is complete. Factors that could cause Key’s actual results to differ from those described in the forward-looking statements can be found in KeyCorp’s Form 10-K for the year ended December 31, 2021, as well as in KeyCorp’s subsequent SEC filings, all of which have been or will be filed with the Securities and Exchange Commission (the “SEC”) and are or will be available on Key’s website (www.key.com/ir) and on the SEC’s website (www.sec.gov). These factors may include, among others, deterioration of commercial real estate market fundamentals, adverse changes in credit quality trends, declining asset prices, a worsening of the U.S. economy due to financial, political, or other shocks, the extensive regulation of the U.S. financial services industry, and the impact of the COVID-19 global pandemic on us, our clients, our third-party service providers, and the markets. Any forward-looking statements made by us or on our behalf speak only as of the date they are made and we do not undertake any obligation to update any forward-looking statement to reflect the impact of subsequent events or circumstances. | ||

| Page | |||||

| Financial Highlights | |||||

| GAAP to Non-GAAP Reconciliation | |||||

| Consolidated Balance Sheets | |||||

| Consolidated Statements of Income | |||||

| Consolidated Average Balance Sheets, and Net Interest Income and Yields/Rates From Continuing Operations | |||||

| Noninterest Expense | |||||

| Personnel Expense | |||||

| Loan Composition | |||||

| Loans Held for Sale Composition | |||||

| Summary of Changes in Loans Held for Sale | |||||

| Summary of Loan and Lease Loss Experience From Continuing Operations | |||||

| Asset Quality Statistics From Continuing Operations | |||||

| Summary of Nonperforming Assets and Past Due Loans From Continuing Operations | |||||

| Summary of Changes in Nonperforming Loans From Continuing Operations | |||||

| Line of Business Results | |||||

| Financial Highlights | |||||||||||||||||

| (Dollars in millions, except per share amounts) | |||||||||||||||||

| Three months ended | |||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | |||||||||||||||

| Summary of operations | |||||||||||||||||

| Net interest income (TE) | $ | 1,104 | $ | 1,020 | $ | 1,023 | |||||||||||

| Noninterest income | 688 | 676 | 750 | ||||||||||||||

Total revenue (TE) |

1,792 | 1,696 | 1,773 | ||||||||||||||

| Provision for credit losses | 45 | 83 | (222) | ||||||||||||||

| Noninterest expense | 1,078 | 1,070 | 1,076 | ||||||||||||||

| Income (loss) from continuing operations attributable to Key | 530 | 447 | 724 | ||||||||||||||

| Income (loss) from discontinued operations, net of taxes | 3 | 1 | 5 | ||||||||||||||

| Net income (loss) attributable to Key | 533 | 448 | 729 | ||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | 504 | 420 | 698 | ||||||||||||||

| Income (loss) from discontinued operations, net of taxes | 3 | 1 | 5 | ||||||||||||||

| Net income (loss) attributable to Key common shareholders | 507 | 421 | 703 | ||||||||||||||

| Per common share | |||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | .54 | $ | .45 | $ | .73 | |||||||||||

| Income (loss) from discontinued operations, net of taxes | — | — | — | ||||||||||||||

Net income (loss) attributable to Key common shareholders (a) |

.55 | .46 | .73 | ||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders — assuming dilution | .54 | .45 | .72 | ||||||||||||||

| Income (loss) from discontinued operations, net of taxes — assuming dilution | — | — | — | ||||||||||||||

Net income (loss) attributable to Key common shareholders — assuming dilution (a) |

.54 | .45 | .73 | ||||||||||||||

| Cash dividends declared | .195 | .195 | .185 | ||||||||||||||

| Book value at period end | 13.48 | 14.43 | 16.75 | ||||||||||||||

| Tangible book value at period end | 10.40 | 11.41 | 13.81 | ||||||||||||||

| Market price at period end | 17.23 | 22.38 | 20.65 | ||||||||||||||

| Performance ratios | |||||||||||||||||

| From continuing operations: | |||||||||||||||||

| Return on average total assets | 1.16 | % | .99 | % | 1.63 | % | |||||||||||

| Return on average common equity | 16.17 | 11.45 | 17.54 | ||||||||||||||

Return on average tangible common equity (b) |

20.90 | 14.12 | 21.34 | ||||||||||||||

| Net interest margin (TE) | 2.61 | 2.46 | 2.52 | ||||||||||||||

Cash efficiency ratio (b) |

59.5 | 62.4 | 59.9 | ||||||||||||||

| From consolidated operations: | |||||||||||||||||

| Return on average total assets | 1.16 | % | .99 | % | 1.64 | % | |||||||||||

| Return on average common equity | 16.27 | 11.47 | 17.67 | ||||||||||||||

Return on average tangible common equity (b) |

21.03 | 14.15 | 21.49 | ||||||||||||||

| Net interest margin (TE) | 2.60 | 2.46 | 2.55 | ||||||||||||||

Loan to deposit (c) |

78.3 | 72.9 | 70.4 | ||||||||||||||

| Capital ratios at period end | |||||||||||||||||

| Key shareholders’ equity to assets | 7.7 | % | 8.5 | % | 9.9 | % | |||||||||||

| Key common shareholders’ equity to assets | 6.7 | 7.4 | 8.9 | ||||||||||||||

Tangible common equity to tangible assets (b) |

5.3 | 6.0 | 7.4 | ||||||||||||||

Common Equity Tier 1 (d) |

9.2 | 9.4 | 9.9 | ||||||||||||||

Tier 1 risk-based capital (d) |

10.4 | 10.7 | 11.3 | ||||||||||||||

Total risk-based capital (d) |

12.0 | 12.4 | 13.2 | ||||||||||||||

Leverage (d) |

8.8 | 8.6 | 8.7 | ||||||||||||||

Asset quality — from continuing operations |

|||||||||||||||||

Net loan charge-offs |

$ | 44 | $ | 33 | $ | 22 | |||||||||||

Net loan charge-offs to average loans |

.16 | % | .13 | % | .09 | % | |||||||||||

Allowance for loan and lease losses |

$ | 1,099 | $ | 1,105 | $ | 1,220 | |||||||||||

Allowance for credit losses |

1,272 | 1,271 | 1,372 | ||||||||||||||

Allowance for loan and lease losses to period-end loans |

.98 | % | 1.04 | % | 1.21 | % | |||||||||||

Allowance for credit losses to period-end loans |

1.13 | 1.19 | 1.36 | ||||||||||||||

| Allowance for loan and lease losses to nonperforming loans | 256.2 | 251.7 | 175.8 | ||||||||||||||

| Allowance for credit losses to nonperforming loans | 296.5 | 289.5 | 197.7 | ||||||||||||||

| Nonperforming loans at period-end | $ | 429 | $ | 439 | $ | 694 | |||||||||||

| Nonperforming assets at period-end | 463 | 467 | 738 | ||||||||||||||

| Nonperforming loans to period-end portfolio loans | .38 | % | .41 | % | .69 | % | |||||||||||

| Nonperforming assets to period-end portfolio loans plus OREO and other nonperforming assets | .41 | .44 | .73 | ||||||||||||||

Trust assets |

|||||||||||||||||

| Assets under management | $ | 49,003 | $ | 53,707 | $ | 51,013 | |||||||||||

Other data |

|||||||||||||||||

Average full-time equivalent employees |

17,414 | 17,110 | 17,003 | ||||||||||||||

Branches |

978 | 993 | 1,014 | ||||||||||||||

Taxable-equivalent adjustment |

$ | 7 | $ | 6 | $ | 6 | |||||||||||

| Financial Highlights (continued) | |||||||||||

| (Dollars in millions, except per share amounts) | |||||||||||

| Six months ended | |||||||||||

| 6/30/2022 | 6/30/2021 | ||||||||||

| Summary of operations | |||||||||||

| Net interest income (TE) | $ | 2,124 | $ | 2,035 | |||||||

| Noninterest income | 1,364 | 1,488 | |||||||||

| Total revenue (TE) | 3,488 | 3,523 | |||||||||

| Provision for credit losses | 128 | (315) | |||||||||

| Noninterest expense | 2,148 | 2,147 | |||||||||

| Income (loss) from continuing operations attributable to Key | 977 | 1,342 | |||||||||

| Income (loss) from discontinued operations, net of taxes | 4 | 9 | |||||||||

| Net income (loss) attributable to Key | 981 | 1,351 | |||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | 924 | 1,289 | |||||||||

| Income (loss) from discontinued operations, net of taxes | 4 | 9 | |||||||||

| Net income (loss) attributable to Key common shareholders | 928 | 1,298 | |||||||||

| Per common share | |||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | 1.00 | $ | 1.34 | |||||||

| Income (loss) from discontinued operations, net of taxes | — | .01 | |||||||||

Net income (loss) attributable to Key common shareholders (a) |

1.00 | 1.35 | |||||||||

| Income (loss) from continuing operations attributable to Key common shareholders — assuming dilution | .99 | 1.33 | |||||||||

| Income (loss) from discontinued operations, net of taxes — assuming dilution | — | .01 | |||||||||

Net income (loss) attributable to Key common shareholders — assuming dilution (a) |

1.00 | 1.34 | |||||||||

| Cash dividends paid | .39 | .37 | |||||||||

| Performance ratios | |||||||||||

| From continuing operations: | |||||||||||

| Return on average total assets | 1.08 | % | 1.55 | % | |||||||

| Return on average common equity | 13.62 | 16.33 | |||||||||

Return on average tangible common equity (b) |

17.15 | 19.88 | |||||||||

| Net interest margin (TE) | 2.53 | 2.56 | |||||||||

Cash efficiency ratio (b) |

60.9 | 60.1 | |||||||||

| From consolidated operations: | |||||||||||

| Return on average total assets | 1.08 | % | 1.55 | % | |||||||

| Return on average common equity | 13.68 | 16.45 | |||||||||

Return on average tangible common equity (b) |

17.23 | 20.02 | |||||||||

| Net interest margin (TE) | 2.53 | 2.57 | |||||||||

| Asset quality — from continuing operations | |||||||||||

| Net loan charge-offs | $ | 77 | $ | 136 | |||||||

| Net loan charge-offs to average total loans | .15 | % | .27 | % | |||||||

| Other data | |||||||||||

| Average full-time equivalent employees | 17,262 | 17,046 | |||||||||

| Taxable-equivalent adjustment | 13 | 13 | |||||||||

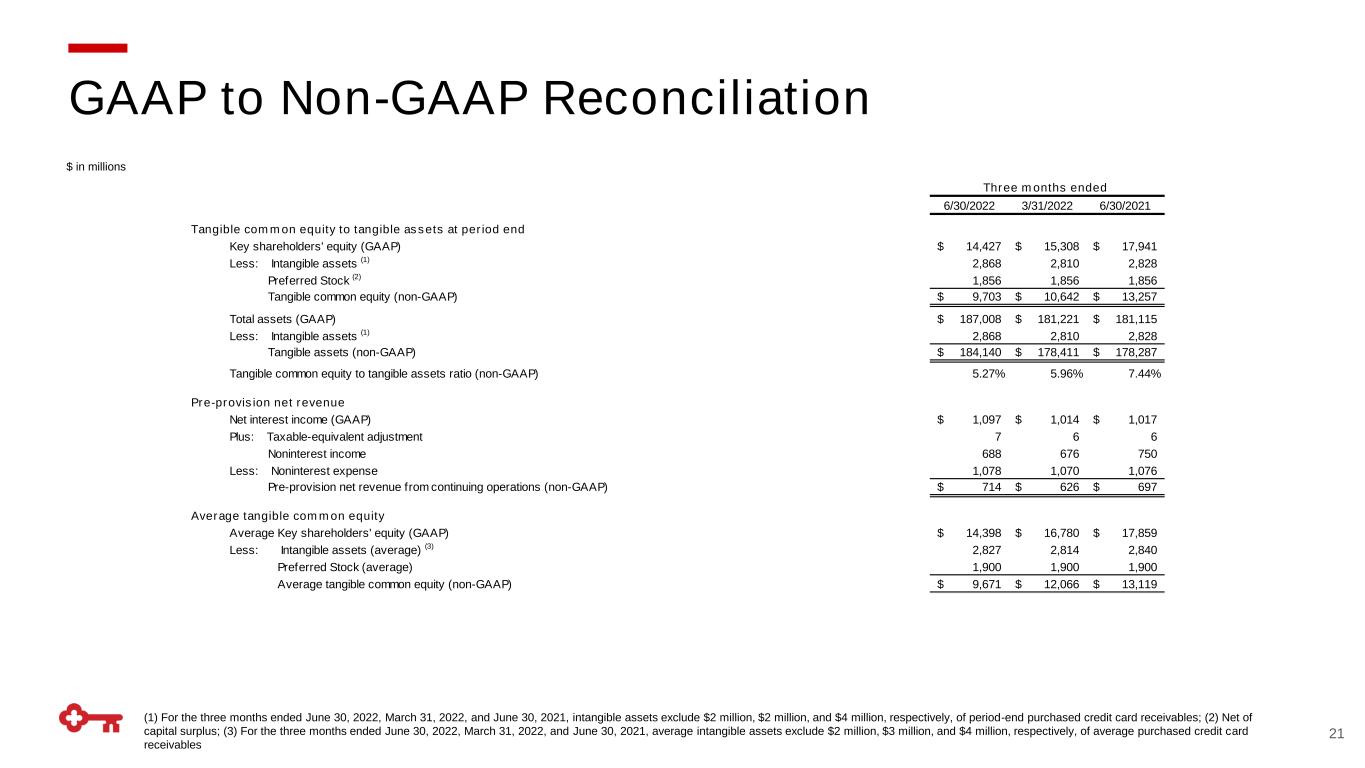

| Three months ended | Six months ended | |||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||

| Tangible common equity to tangible assets at period-end | ||||||||||||||||||||

| Key shareholders’ equity (GAAP) | $ | 14,427 | $ | 15,308 | $ | 17,941 | ||||||||||||||

Less: Intangible assets (a) |

2,868 | 2,810 | 2,828 | |||||||||||||||||

Preferred Stock (b) |

1,856 | 1,856 | 1,856 | |||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 9,703 | $ | 10,642 | $ | 13,257 | ||||||||||||||

| Total assets (GAAP) | $ | 187,008 | $ | 181,221 | $ | 181,115 | ||||||||||||||

Less: Intangible assets (a) |

2,868 | 2,810 | 2,828 | |||||||||||||||||

| Tangible assets (non-GAAP) | $ | 184,140 | $ | 178,411 | $ | 178,287 | ||||||||||||||

| Tangible common equity to tangible assets ratio (non-GAAP) | 5.27 | % | 5.96 | % | 7.44 | % | ||||||||||||||

| Pre-provision net revenue | ||||||||||||||||||||

| Net interest income (GAAP) | $ | 1,097 | $ | 1,014 | $ | 1,017 | $ | 2,111 | $ | 2,022 | ||||||||||

| Plus: Taxable-equivalent adjustment | 7 | 6 | 6 | 13 | 13 | |||||||||||||||

| Noninterest income | 688 | 676 | 750 | 1,364 | 1,488 | |||||||||||||||

| Less: Noninterest expense | 1,078 | 1,070 | 1,076 | 2,148 | 2,147 | |||||||||||||||

| Pre-provision net revenue from continuing operations (non-GAAP) | $ | 714 | $ | 626 | $ | 697 | $ | 1,340 | $ | 1,376 | ||||||||||

| Average tangible common equity | ||||||||||||||||||||

| Average Key shareholders' equity (GAAP) | $ | 14,398 | $ | 16,780 | $ | 17,859 | $ | 15,583 | $ | 17,814 | ||||||||||

Less: Intangible assets (average) (c) |

2,827 | 2,814 | 2,840 | 2,821 | 2,840 | |||||||||||||||

| Preferred stock (average) | 1,900 | 1,900 | 1,900 | 1,900 | 1,900 | |||||||||||||||

| Average tangible common equity (non-GAAP) | $ | 9,671 | $ | 12,066 | $ | 13,119 | $ | 10,862 | $ | 13,074 | ||||||||||

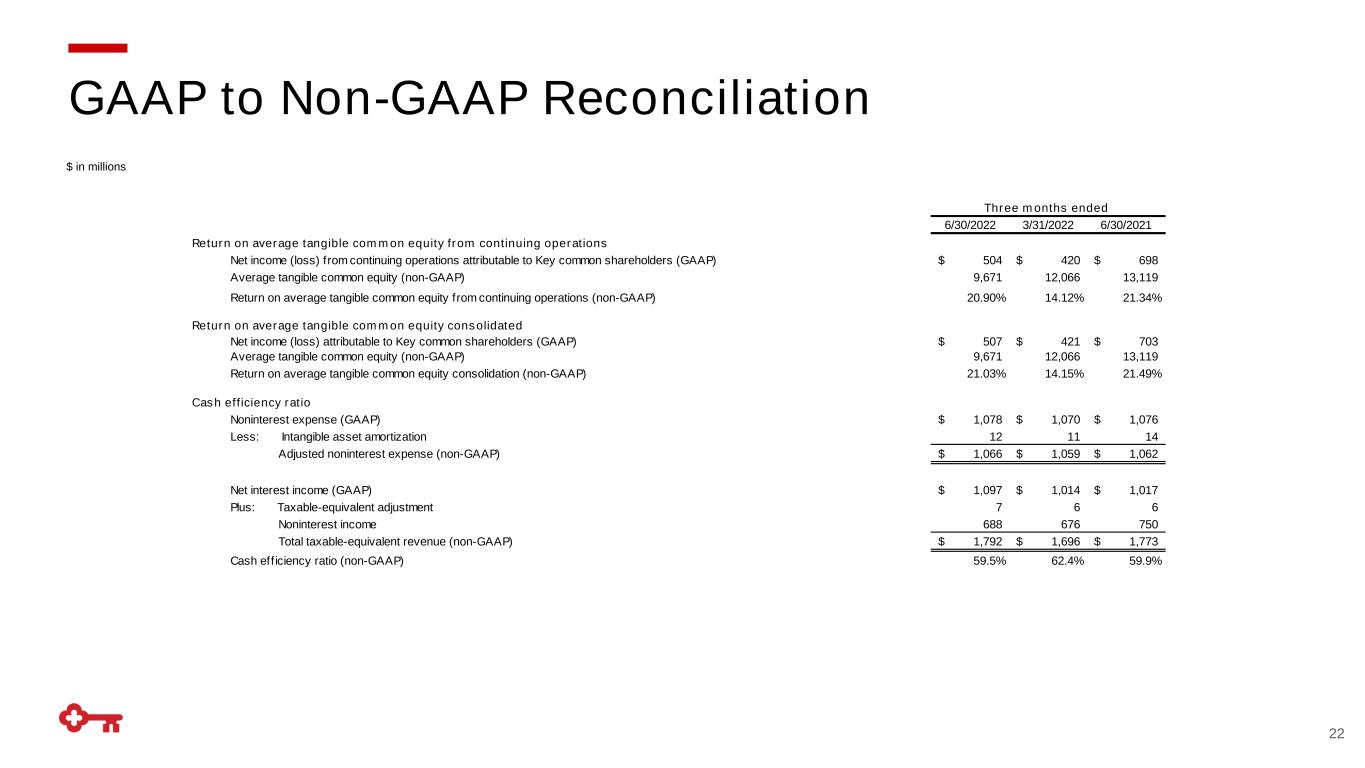

| Return on average tangible common equity from continuing operations | ||||||||||||||||||||

| Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) | $ | 504 | $ | 420 | $ | 698 | $ | 924 | $ | 1,289 | ||||||||||

| Average tangible common equity (non-GAAP) | 9,671 | 12,066 | 13,119 | 10,862 | 13,074 | |||||||||||||||

| Return on average tangible common equity from continuing operations (non-GAAP) | 20.90 | % | 14.12 | % | 21.34 | % | 17.15 | % | 19.88 | % | ||||||||||

| Return on average tangible common equity consolidated | ||||||||||||||||||||

| Net income (loss) attributable to Key common shareholders (GAAP) | $ | 507 | $ | 421 | $ | 703 | $ | 928 | $ | 1,298 | ||||||||||

| Average tangible common equity (non-GAAP) | 9,671 | 12,066 | 13,119 | 10,862 | 13,074 | |||||||||||||||

| Return on average tangible common equity consolidated (non-GAAP) | 21.03 | % | 14.15 | % | 21.49 | % | 17.23 | % | 20.02 | % | ||||||||||

| GAAP to Non-GAAP Reconciliations (continued) | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||

| Cash efficiency ratio | ||||||||||||||||||||

| Noninterest expense (GAAP) | $ | 1,078 | $ | 1,070 | $ | 1,076 | $ | 2,148 | $ | 2,147 | ||||||||||

| Less: Intangible asset amortization | 12 | 11 | 14 | 23 | 29 | |||||||||||||||

| Adjusted noninterest expense (non-GAAP) | $ | 1,066 | $ | 1,059 | $ | 1,062 | $ | 2,125 | $ | 2,118 | ||||||||||

| Net interest income (GAAP) | $ | 1,097 | $ | 1,014 | $ | 1,017 | $ | 2,111 | $ | 2,022 | ||||||||||

| Plus: Taxable-equivalent adjustment | 7 | 6 | 6 | 13 | 13 | |||||||||||||||

| Noninterest income | 688 | 676 | 750 | 1,364 | 1,488 | |||||||||||||||

| Total taxable-equivalent revenue (non-GAAP) | $ | 1,792 | $ | 1,696 | $ | 1,773 | $ | 3,488 | $ | 3,523 | ||||||||||

| Cash efficiency ratio (non-GAAP) | 59.5 | % | 62.4 | % | 59.9 | % | 60.9 | % | 60.1 | % | ||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | |||||||||||||||

| Assets | |||||||||||||||||

| Loans | $ | 112,390 | $ | 106,600 | $ | 100,730 | |||||||||||

| Loans held for sale | 1,306 | 1,170 | 1,537 | ||||||||||||||

| Securities available for sale | 42,437 | 43,681 | 34,638 | ||||||||||||||

| Held-to-maturity securities | 8,186 | 6,871 | 6,175 | ||||||||||||||

| Trading account assets | 809 | 848 | 851 | ||||||||||||||

| Short-term investments | 2,456 | 3,881 | 20,460 | ||||||||||||||

| Other investments | 969 | 722 | 635 | ||||||||||||||

| Total earning assets | 168,553 | 163,773 | 165,026 | ||||||||||||||

| Allowance for loan and lease losses | (1,099) | (1,105) | (1,220) | ||||||||||||||

| Cash and due from banks | 678 | 684 | 792 | ||||||||||||||

| Premises and equipment | 638 | 647 | 785 | ||||||||||||||

| Goodwill | 2,752 | 2,694 | 2,673 | ||||||||||||||

| Other intangible assets | 118 | 118 | 159 | ||||||||||||||

| Corporate-owned life insurance | 4,343 | 4,340 | 4,304 | ||||||||||||||

| Accrued income and other assets | 10,529 | 9,544 | 7,966 | ||||||||||||||

| Discontinued assets | 496 | 526 | 630 | ||||||||||||||

| Total assets | $ | 187,008 | $ | 181,221 | $ | 181,115 | |||||||||||

| Liabilities | |||||||||||||||||

| Deposits in domestic offices: | |||||||||||||||||

| NOW and money market deposit accounts | $ | 83,628 | $ | 86,829 | $ | 85,242 | |||||||||||

| Savings deposits | 7,934 | 7,840 | 6,993 | ||||||||||||||

| Certificates of deposit ($100,000 or more) | 1,421 | 1,533 | 2,064 | ||||||||||||||

| Other time deposits | 1,909 | 2,037 | 2,493 | ||||||||||||||

| Total interest-bearing deposits | 94,892 | 98,239 | 96,792 | ||||||||||||||

| Noninterest-bearing deposits | 50,973 | 50,424 | 49,280 | ||||||||||||||

| Total deposits | 145,865 | 148,663 | 146,072 | ||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 3,234 | 599 | 211 | ||||||||||||||

| Bank notes and other short-term borrowings | 2,809 | 2,222 | 723 | ||||||||||||||

| Accrued expense and other liabilities | 4,056 | 3,615 | 2,957 | ||||||||||||||

| Long-term debt | 16,617 | 10,814 | 13,211 | ||||||||||||||

| Total liabilities | 172,581 | 165,913 | 163,174 | ||||||||||||||

| Equity | |||||||||||||||||

| Preferred stock | 1,900 | 1,900 | 1,900 | ||||||||||||||

| Common shares | 1,257 | 1,257 | 1,257 | ||||||||||||||

| Capital surplus | 6,241 | 6,214 | 6,232 | ||||||||||||||

| Retained earnings | 15,118 | 14,793 | 13,689 | ||||||||||||||

| Treasury stock, at cost | (5,923) | (5,927) | (5,287) | ||||||||||||||

| Accumulated other comprehensive income (loss) | (4,166) | (2,929) | 150 | ||||||||||||||

| Key shareholders’ equity | 14,427 | 15,308 | 17,941 | ||||||||||||||

| Total liabilities and equity | $ | 187,008 | $ | 181,221 | $ | 181,115 | |||||||||||

| Common shares outstanding (000) | 932,643 | 932,398 | 960,276 | ||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts) | ||||||||||||||||||||||||||

Three months ended |

Six months ended | |||||||||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||||

| Loans | $ | 923 | $ | 837 | $ | 888 | $ | 1,760 | $ | 1,777 | ||||||||||||||||

| Loans held for sale | 10 | 12 | 11 | 22 | 22 | |||||||||||||||||||||

| Securities available for sale | 188 | 173 | 133 | 361 | 263 | |||||||||||||||||||||

| Held-to-maturity securities | 48 | 46 | 45 | 94 | 90 | |||||||||||||||||||||

| Trading account assets | 7 | 6 | 5 | 13 | 10 | |||||||||||||||||||||

| Short-term investments | 13 | 4 | 6 | 17 | 11 | |||||||||||||||||||||

| Other investments | 4 | 2 | 2 | 6 | 4 | |||||||||||||||||||||

| Total interest income | 1,193 | 1,080 | 1,090 | 2,273 | 2,177 | |||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||

| Deposits | 20 | 14 | 16 | 34 | 37 | |||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 6 | — | — | 6 | — | |||||||||||||||||||||

| Bank notes and other short-term borrowings | 9 | 3 | 3 | 12 | 4 | |||||||||||||||||||||

| Long-term debt | 61 | 49 | 54 | 110 | 114 | |||||||||||||||||||||

| Total interest expense | 96 | 66 | 73 | 162 | 155 | |||||||||||||||||||||

| Net interest income | 1,097 | 1,014 | 1,017 | 2,111 | 2,022 | |||||||||||||||||||||

| Provision for credit losses | 45 | 83 | (222) | 128 | (315) | |||||||||||||||||||||

| Net interest income after provision for credit losses | 1,052 | 931 | 1,239 | 1,983 | 2,337 | |||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||

| Trust and investment services income | 137 | 136 | 133 | 273 | 266 | |||||||||||||||||||||

| Investment banking and debt placement fees | 149 | 163 | 217 | 312 | 379 | |||||||||||||||||||||

| Service charges on deposit accounts | 96 | 91 | 83 | 187 | 156 | |||||||||||||||||||||

| Operating lease income and other leasing gains | 28 | 32 | 36 | 60 | 74 | |||||||||||||||||||||

| Corporate services income | 88 | 90 | 55 | 178 | 119 | |||||||||||||||||||||

| Cards and payments income | 85 | 80 | 113 | 165 | 218 | |||||||||||||||||||||

| Corporate-owned life insurance income | 35 | 31 | 30 | 66 | 61 | |||||||||||||||||||||

| Consumer mortgage income | 14 | 21 | 26 | 35 | 73 | |||||||||||||||||||||

| Commercial mortgage servicing fees | 45 | 36 | 44 | 81 | 78 | |||||||||||||||||||||

| Other income | 11 | (4) | 13 | 7 | 64 | |||||||||||||||||||||

| Total noninterest income | 688 | 676 | 750 | 1,364 | 1,488 | |||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||

| Personnel | 607 | 630 | 623 | 1,237 | 1,247 | |||||||||||||||||||||

| Net occupancy | 78 | 73 | 75 | 151 | 151 | |||||||||||||||||||||

| Computer processing | 78 | 77 | 71 | 155 | 144 | |||||||||||||||||||||

| Business services and professional fees | 52 | 53 | 51 | 105 | 101 | |||||||||||||||||||||

| Equipment | 26 | 23 | 25 | 49 | 50 | |||||||||||||||||||||

| Operating lease expense | 27 | 28 | 31 | 55 | 65 | |||||||||||||||||||||

| Marketing | 34 | 28 | 31 | 62 | 57 | |||||||||||||||||||||

| Other expense | 176 | 158 | 169 | 334 | 332 | |||||||||||||||||||||

| Total noninterest expense | 1,078 | 1,070 | 1,076 | 2,148 | 2,147 | |||||||||||||||||||||

| Income (loss) from continuing operations before income taxes | 662 | 537 | 913 | 1,199 | 1,678 | |||||||||||||||||||||

| Income taxes | 132 | 90 | 189 | 222 | 336 | |||||||||||||||||||||

| Income (loss) from continuing operations | 530 | 447 | 724 | 977 | 1,342 | |||||||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | 3 | 1 | 5 | 4 | 9 | |||||||||||||||||||||

| Net income (loss) | 533 | 448 | 729 | 981 | 1,351 | |||||||||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests | — | — | — | — | — | |||||||||||||||||||||

| Net income (loss) attributable to Key | $ | 533 | $ | 448 | $ | 729 | $ | 981 | 1,351 | |||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | 504 | $ | 420 | $ | 698 | $ | 924 | $ | 1,289 | ||||||||||||||||

| Net income (loss) attributable to Key common shareholders | 507 | 421 | 703 | 928 | 1,298 | |||||||||||||||||||||

| Per common share | ||||||||||||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | .54 | $ | .45 | $ | .73 | $ | 1.00 | $ | 1.34 | ||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | — | — | — | — | .01 | |||||||||||||||||||||

Net income (loss) attributable to Key common shareholders (a) |

.55 | .46 | .73 | 1.00 | 1.35 | |||||||||||||||||||||

| Per common share — assuming dilution | ||||||||||||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | .54 | $ | .45 | $ | .72 | $ | .99 | $ | 1.33 | ||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | — | — | — | — | .01 | |||||||||||||||||||||

Net income (loss) attributable to Key common shareholders (a) |

.54 | .45 | .73 | 1.00 | 1.34 | |||||||||||||||||||||

| Cash dividends declared per common share | $ | .195 | $ | .195 | $ | .185 | $ | .390 | $ | .370 | ||||||||||||||||

| Weighted-average common shares outstanding (000) | 924,302 | 922,941 | 957,423 | 923,717 | 961,292 | |||||||||||||||||||||

| Effect of common share options and other stock awards | 7,506 | 10,692 | 9,740 | 9,087 | 9,514 | |||||||||||||||||||||

Weighted-average common shares and potential common shares outstanding (000) (b) |

931,808 | 933,634 | 967,163 | 932,805 | 970,806 | |||||||||||||||||||||

| Consolidated Average Balance Sheets, and Net Interest Income and Yields/Rates From Continuing Operations | ||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||

| Second Quarter 2022 | First Quarter 2022 | Second Quarter 2021 | ||||||||||||||||||||||||||||||||||||

| Average | Yield/ | Average | Yield/ | Average | Yield/ | |||||||||||||||||||||||||||||||||

| Balance | Interest (a) |

Rate (a) |

Balance | Interest (a) |

Rate (a) |

Balance | Interest (a) |

Rate (a) |

||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

Loans: (b), (c) |

||||||||||||||||||||||||||||||||||||||

Commercial and industrial (d) |

$ | 53,858 | $ | 449 | 3.34 | % | $ | 51,574 | $ | 410 | 3.22 | % | $ | 51,808 | $ | 450 | 3.48 | % | ||||||||||||||||||||

| Real estate — commercial mortgage | 15,231 | 136 | 3.58 | 14,587 | 121 | 3.37 | 12,825 | 117 | 3.67 | |||||||||||||||||||||||||||||

| Real estate — construction | 2,125 | 20 | 3.81 | 2,027 | 17 | 3.37 | 2,149 | 20 | 3.68 | |||||||||||||||||||||||||||||

| Commercial lease financing | 3,817 | 24 | 2.47 | 3,942 | 24 | 2.41 | 4,060 | 30 | 2.98 | |||||||||||||||||||||||||||||

| Total commercial loans | 75,031 | 629 | 3.36 | 72,130 | 572 | 3.21 | 70,842 | 617 | 3.49 | |||||||||||||||||||||||||||||

| Real estate — residential mortgage | 18,383 | 131 | 2.85 | 16,309 | 112 | 2.75 | 11,055 | 81 | 2.92 | |||||||||||||||||||||||||||||

| Home equity loans | 8,208 | 78 | 3.83 | 8,345 | 74 | 3.61 | 9,089 | 85 | 3.76 | |||||||||||||||||||||||||||||

| Consumer direct loans | 6,514 | 68 | 4.19 | 5,954 | 61 | 4.16 | 4,910 | 57 | 4.69 | |||||||||||||||||||||||||||||

| Credit cards | 943 | 24 | 10.20 | 932 | 24 | 10.36 | 908 | 22 | 9.79 | |||||||||||||||||||||||||||||

| Consumer indirect loans | 59 | — | — | 92 | — | — | 4,010 | 32 | 3.19 | |||||||||||||||||||||||||||||

| Total consumer loans | 34,107 | 301 | 3.53 | 31,632 | 271 | 3.45 | 29,972 | 277 | 3.71 | |||||||||||||||||||||||||||||

| Total loans | 109,138 | 930 | 3.41 | 103,762 | 843 | 3.28 | 100,814 | 894 | 3.56 | |||||||||||||||||||||||||||||

| Loans held for sale | 1,107 | 10 | 3.49 | 1,485 | 12 | 3.32 | 1,616 | 11 | 2.60 | |||||||||||||||||||||||||||||

Securities available for sale (b), (e) |

43,023 | 188 | 1.60 | 44,923 | 173 | 1.50 | 33,623 | 133 | 1.57 | |||||||||||||||||||||||||||||

Held-to-maturity securities (b) |

7,291 | 48 | 2.65 | 7,188 | 46 | 2.54 | 6,452 | 45 | 2.75 | |||||||||||||||||||||||||||||

| Trading account assets | 854 | 7 | 3.45 | 842 | 6 | 2.74 | 837 | 5 | 2.56 | |||||||||||||||||||||||||||||

| Short-term investments | 3,591 | 13 | 1.45 | 7,323 | 4 | .25 | 18,817 | 6 | .13 | |||||||||||||||||||||||||||||

Other investments (e) |

800 | 4 | 2.27 | 651 | 2 | 1.26 | 622 | 2 | 1.02 | |||||||||||||||||||||||||||||

| Total earning assets | 165,804 | 1,200 | 2.83 | 166,174 | 1,086 | 2.62 | 162,781 | 1,096 | 2.70 | |||||||||||||||||||||||||||||

| Allowance for loan and lease losses | (1,103) | (1,056) | (1,442) | |||||||||||||||||||||||||||||||||||

| Accrued income and other assets | 18,826 | 17,471 | 16,531 | |||||||||||||||||||||||||||||||||||

| Discontinued assets | 505 | 539 | 650 | |||||||||||||||||||||||||||||||||||

| Total assets | $ | 184,032 | $ | 183,128 | $ | 178,520 | ||||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||

| NOW and money market deposit accounts | $ | 85,389 | $ | 18 | .08 | $ | 88,515 | $ | 11 | .05 | $ | 83,981 | $ | 9 | .05 | |||||||||||||||||||||||

| Savings deposits | 7,891 | — | .01 | 7,599 | — | .01 | 6,859 | 1 | .03 | |||||||||||||||||||||||||||||

| Certificates of deposit ($100,000 or more) | 1,487 | 1 | .44 | 1,639 | 2 | .44 | 2,212 | 4 | .72 | |||||||||||||||||||||||||||||

| Other time deposits | 1,972 | 1 | .13 | 2,098 | 1 | .15 | 2,630 | 2 | .38 | |||||||||||||||||||||||||||||

| Total interest-bearing deposits | 96,739 | 20 | .08 | 99,851 | 14 | .06 | 95,682 | 16 | .07 | |||||||||||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 2,792 | 6 | .88 | 287 | — | .13 | 251 | — | .02 | |||||||||||||||||||||||||||||

| Bank notes and other short-term borrowings | 1,943 | 9 | 1.77 | 705 | 3 | 1.94 | 744 | 3 | 1.19 | |||||||||||||||||||||||||||||

Long-term debt (f), (g) |

12,662 | 61 | 1.92 | 10,830 | 49 | 1.79 | 11,978 | 54 | 1.79 | |||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 114,136 | 96 | .34 | 111,673 | 66 | .24 | 108,655 | 73 | .27 | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 50,732 | 50,312 | 48,640 | |||||||||||||||||||||||||||||||||||

| Accrued expense and other liabilities | 4,261 | 3,824 | 2,716 | |||||||||||||||||||||||||||||||||||

Discontinued liabilities (g) |

505 | 539 | 650 | |||||||||||||||||||||||||||||||||||

| Total liabilities | $ | 169,634 | $ | 166,348 | $ | 160,661 | ||||||||||||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||||||||||||||

| Key shareholders’ equity | $ | 14,398 | $ | 16,780 | $ | 17,859 | ||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | |||||||||||||||||||||||||||||||||||

| Total equity | 14,398 | 16,780 | 17,859 | |||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 184,032 | $ | 183,128 | $ | 178,520 | ||||||||||||||||||||||||||||||||

| Interest rate spread (TE) | 2.50 | % | 2.38 | % | 2.43 | % | ||||||||||||||||||||||||||||||||

| Net interest income (TE) and net interest margin (TE) | $ | 1,104 | 2.61 | % | $ | 1,020 | 2.46 | % | $ | 1,023 | 2.52 | % | ||||||||||||||||||||||||||

TE adjustment (b) |

7 | 6 | 6 | |||||||||||||||||||||||||||||||||||

| Net interest income, GAAP basis | $ | 1,097 | $ | 1,014 | $ | 1,017 | ||||||||||||||||||||||||||||||||

| Consolidated Average Balance Sheets, and Net Interest Income and Yields/Rates From Continuing Operations | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| Six months ended June 30, 2022 | Six months ended June 30, 2021 | ||||||||||||||||||||||||||||

| Average | Yield/ | Average | Yield/ | ||||||||||||||||||||||||||

| Balance | Interest (a) | Rate (a) | Balance | Interest (a) | Rate (a) | ||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

Loans: (b), (c) |

|||||||||||||||||||||||||||||

Commercial and industrial (d) |

$ | 52,723 | $ | 858 | 3.28 | % | $ | 52,194 | $ | 902 | 3.49 | % | |||||||||||||||||

| Real estate — commercial mortgage | 14,910 | 257 | 3.48 | 12,742 | 232 | 3.67 | |||||||||||||||||||||||

| Real estate — construction | 2,076 | 37 | 3.60 | 2,099 | 39 | 3.71 | |||||||||||||||||||||||

| Commercial lease financing | 3,879 | 48 | 2.44 | 4,101 | 61 | 2.99 | |||||||||||||||||||||||

| Total commercial loans | 73,588 | 1,200 | 3.28 | 71,136 | 1,234 | 3.49 | |||||||||||||||||||||||

| Real estate — residential mortgage | 17,352 | 243 | 2.80 | 10,380 | 154 | 2.97 | |||||||||||||||||||||||

| Home equity loans | 8,276 | 153 | 3.72 | 9,189 | 173 | 3.79 | |||||||||||||||||||||||

| Consumer direct loans | 6,236 | 129 | 4.18 | 4,864 | 113 | 4.70 | |||||||||||||||||||||||

| Credit cards | 938 | 48 | 10.28 | 920 | 46 | 10.12 | |||||||||||||||||||||||

| Consumer indirect loans | 75 | — | — | 4,288 | 69 | 3.25 | |||||||||||||||||||||||

| Total consumer loans | 32,877 | 573 | 3.49 | 29,641 | 555 | 3.77 | |||||||||||||||||||||||

| Total loans | 106,465 | 1,773 | 3.35 | 100,777 | 1,789 | 3.58 | |||||||||||||||||||||||

| Loans held for sale | 1,295 | 22 | 3.40 | 1,574 | 22 | 2.74 | |||||||||||||||||||||||

Securities available for sale (b), (e) |

43,968 | 361 | 1.55 | 31,841 | 263 | 1.66 | |||||||||||||||||||||||

Held-to-maturity securities (b) |

7,239 | 94 | 2.59 | 6,818 | 90 | 2.63 | |||||||||||||||||||||||

| Trading account assets | 848 | 13 | 3.10 | 842 | 10 | 2.35 | |||||||||||||||||||||||

| Short-term investments | 5,447 | 17 | .65 | 17,670 | 11 | .13 | |||||||||||||||||||||||

Other investments (e) |

726 | 6 | 1.82 | 618 | 4 | 1.21 | |||||||||||||||||||||||

| Total earning assets | 165,988 | 2,286 | 2.72 | 160,140 | 2,189 | 2.75 | |||||||||||||||||||||||

| Allowance for loan and lease losses | (1,080) | (1,532) | |||||||||||||||||||||||||||

| Accrued income and other assets | 18,152 | 16,463 | |||||||||||||||||||||||||||

| Discontinued assets | 522 | 668 | |||||||||||||||||||||||||||

| Total assets | $ | 183,582 | $ | 175,739 | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| NOW and money market deposit accounts | $ | 86,943 | $ | 29 | .07 | $ | 82,717 | $ | 20 | .05 | |||||||||||||||||||

| Savings deposits | 7,746 | 1 | .01 | 6,533 | 1 | .03 | |||||||||||||||||||||||

| Certificates of deposit ($100,000 or more) | 1,562 | 3 | .44 | 2,390 | 10 | .85 | |||||||||||||||||||||||

| Other time deposits | 2,035 | 1 | .14 | 2,766 | 6 | .48 | |||||||||||||||||||||||

| Total interest-bearing deposits | 98,286 | 34 | .07 | 94,406 | 37 | .08 | |||||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 1,547 | 6 | .81 | 247 | — | .03 | |||||||||||||||||||||||

| Bank notes and other short-term borrowings | 1,327 | 12 | 1.82 | 811 | 4 | .89 | |||||||||||||||||||||||

Long-term debt (f), (g) |

11,751 | 110 | 1.86 | 12,402 | 114 | 1.85 | |||||||||||||||||||||||

| Total interest-bearing liabilities | 112,911 | 162 | .29 | 107,866 | 155 | .29 | |||||||||||||||||||||||

| Noninterest-bearing deposits | 50,523 | 46,638 | |||||||||||||||||||||||||||

| Accrued expense and other liabilities | 4,043 | 2,753 | |||||||||||||||||||||||||||

Discontinued liabilities (g) |

522 | 668 | |||||||||||||||||||||||||||

| Total liabilities | $ | 167,999 | $ | 157,925 | |||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Key shareholders’ equity | $ | 15,583 | $ | 17,814 | |||||||||||||||||||||||||

| Noncontrolling interests | — | — | |||||||||||||||||||||||||||

| Total equity | 15,583 | 17,814 | |||||||||||||||||||||||||||

| Total liabilities and equity | $ | 183,582 | $ | 175,739 | |||||||||||||||||||||||||

| Interest rate spread (TE) | 2.44 | % | 2.46 | % | |||||||||||||||||||||||||

| Net interest income (TE) and net interest margin (TE) | $ | 2,124 | 2.53 | % | $ | 2,035 | 2.56 | % | |||||||||||||||||||||

TE adjustment (b) |

13 | 13 | |||||||||||||||||||||||||||

| Net interest income, GAAP basis | $ | 2,111 | $ | 2,022 | |||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||

Personnel (a) |

$ | 607 | $ | 630 | $ | 623 | $ | 1,237 | $ | 1,247 | ||||||||||

| Net occupancy | 78 | 73 | 75 | 151 | 151 | |||||||||||||||

| Computer processing | 78 | 77 | 71 | 155 | 144 | |||||||||||||||

| Business services and professional fees | 52 | 53 | 51 | 105 | 101 | |||||||||||||||

| Equipment | 26 | 23 | 25 | 49 | 50 | |||||||||||||||

| Operating lease expense | 27 | 28 | 31 | 55 | 65 | |||||||||||||||

| Marketing | 34 | 28 | 31 | 62 | 57 | |||||||||||||||

| Other expense | 176 | 158 | 169 | 334 | 332 | |||||||||||||||

| Total noninterest expense | $ | 1,078 | $ | 1,070 | $ | 1,076 | $ | 2,148 | $ | 2,147 | ||||||||||

Average full-time equivalent employees (b) |

17,414 | 17,110 | 17,003 | 17,262 | 17,046 | |||||||||||||||

| Personnel Expense | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||

| Salaries and contract labor | $ | 357 | $ | 348 | $ | 321 | $ | 705 | $ | 641 | ||||||||||

| Incentive and stock-based compensation | 163 | 183 | 210 | 346 | 406 | |||||||||||||||

| Employee benefits | 83 | 97 | 92 | 180 | 199 | |||||||||||||||

| Severance | 4 | 2 | — | 6 | 1 | |||||||||||||||

| Total personnel expense | $ | 607 | $ | 630 | $ | 623 | $ | 1,237 | $ | 1,247 | ||||||||||

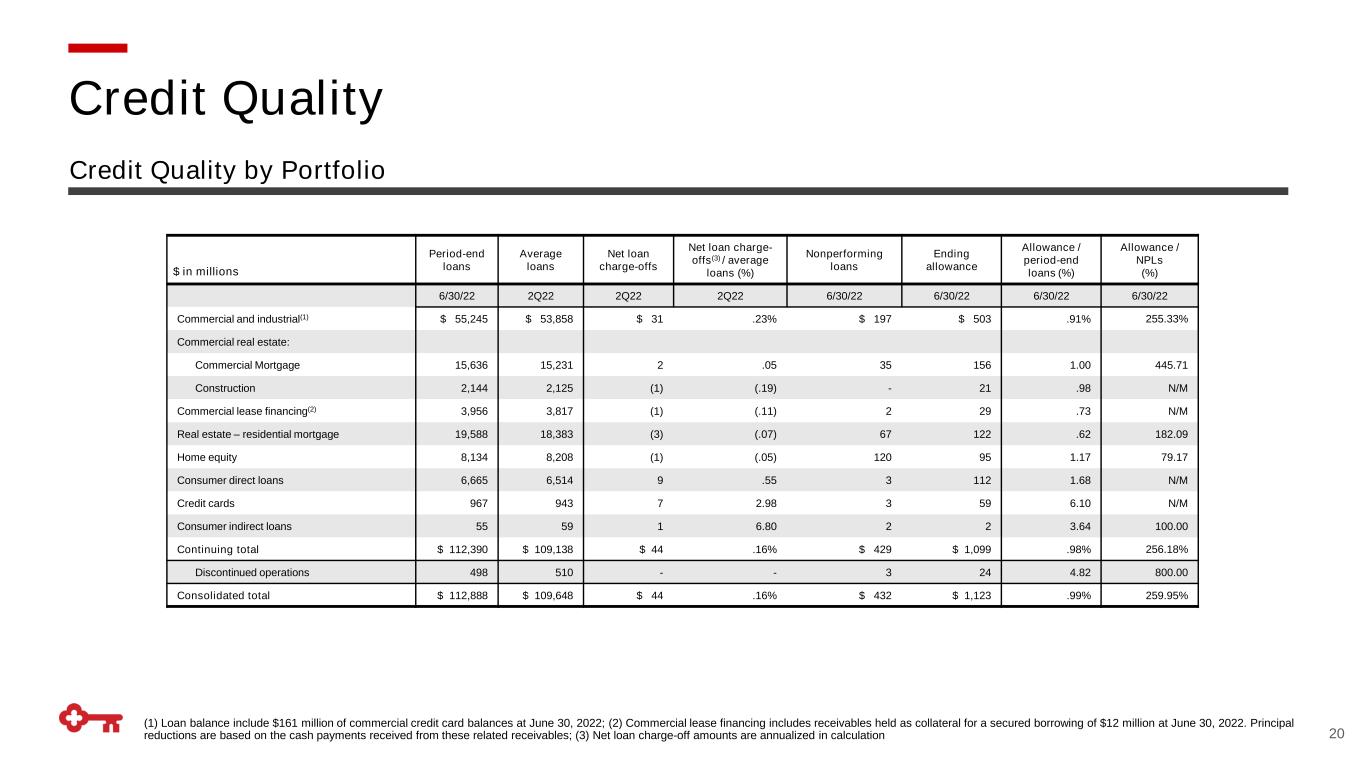

| Loan Composition | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Change 6/30/2022 vs | ||||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 3/31/2022 | 6/30/2021 | ||||||||||||||||

Commercial and industrial (a) |

$ | 55,245 | $ | 52,815 | $ | 50,672 | 4.6 | % | 9.0 | % | ||||||||||

| Commercial real estate: | ||||||||||||||||||||

| Commercial mortgage | 15,636 | 15,124 | 12,965 | 3.4 | 20.6 | |||||||||||||||

| Construction | 2,144 | 2,065 | 2,132 | 3.8 | .6 | |||||||||||||||

| Total commercial real estate loans | 17,780 | 17,189 | 15,097 | 3.4 | 17.8 | |||||||||||||||

Commercial lease financing (b) |

3,956 | 3,916 | 4,061 | 1.0 | (2.6) | |||||||||||||||

| Total commercial loans | 76,981 | 73,920 | 69,830 | 4.1 | 10.2 | |||||||||||||||

| Residential — prime loans: | ||||||||||||||||||||

| Real estate — residential mortgage | 19,588 | 17,181 | 12,131 | 14.0 | 61.5 | |||||||||||||||

| Home equity loans | 8,134 | 8,258 | 9,047 | (1.5) | (10.1) | |||||||||||||||

| Total residential — prime loans | 27,722 | 25,439 | 21,178 | 9.0 | 30.9 | |||||||||||||||

| Consumer direct loans | 6,665 | 6,249 | 5,049 | 6.7 | 32.0 | |||||||||||||||

| Credit cards | 967 | 930 | 923 | 4.0 | 4.8 | |||||||||||||||

| Consumer indirect loans | 55 | 62 | 3,750 | (11.3) | (98.5) | |||||||||||||||

| Total consumer loans | 35,409 | 32,680 | 30,900 | 8.4 | 14.6 | |||||||||||||||

Total loans (c), (d) |

$ | 112,390 | $ | 106,600 | $ | 100,730 | 5.4 | % | 11.6 | % | ||||||||||

| Loans Held for Sale Composition | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Change 6/30/2022 vs | ||||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 3/31/2022 | 6/30/2021 | ||||||||||||||||

| Commercial and industrial | $ | 213 | $ | 216 | $ | 233 | (1.4) | % | (8.6) | % | ||||||||||

| Real estate — commercial mortgage | 1,004 | 819 | 1,073 | 22.6 | (6.4) | |||||||||||||||

| Real estate — construction | 6 | 21 | — | (71.4) | % | N/M | ||||||||||||||

| Real estate — residential mortgage | 83 | 114 | 231 | (27.2) | (64.1) | |||||||||||||||

| Total loans held for sale | $ | 1,306 | $ | 1,170 | $ | 1,537 | 11.6 | % | (15.0) | % | ||||||||||

| Summary of Changes in Loans Held for Sale | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | |||||||||||||

| Balance at beginning of period | $ | 1,170 | $ | 2,729 | $ | 1,805 | $ | 1,537 | $ | 2,296 | |||||||

| New originations | 2,837 | 2,724 | 5,704 | 3,328 | 3,573 | ||||||||||||

| Transfers from (to) held to maturity, net | (57) | — | (1) | 3,305 | (71) | ||||||||||||

| Loan sales | (2,506) | (4,269) | (4,742) | (6,405) | (4,195) | ||||||||||||

| Loan draws (payments), net | (133) | (12) | (12) | 8 | (27) | ||||||||||||

| Valuation and other adjustments | (5) | (2) | (25) | 32 | (39) | ||||||||||||

| Balance at end of period | $ | 1,306 | $ | 1,170 | $ | 2,729 | $ | 1,805 | $ | 1,537 | |||||||

| Summary of Loan and Lease Loss Experience From Continuing Operations | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||

| Average loans outstanding | $ | 109,138 | $ | 103,762 | $ | 100,814 | $ | 106,465 | $ | 100,777 | ||||||||||

| Allowance for loan and lease losses at the beginning of the period | 1,105 | 1,061 | 1,438 | 1,061 | 1,626 | |||||||||||||||

| Loans charged off: | ||||||||||||||||||||

| Commercial and industrial | 39 | 30 | 41 | 69 | 114 | |||||||||||||||

| Real estate — commercial mortgage | 3 | 4 | 4 | 7 | 39 | |||||||||||||||

| Real estate — construction | — | — | — | — | — | |||||||||||||||

| Total commercial real estate loans | 3 | 4 | 4 | 7 | 39 | |||||||||||||||

| Commercial lease financing | — | 2 | — | 2 | 4 | |||||||||||||||

| Total commercial loans | 42 | 36 | 45 | 78 | 157 | |||||||||||||||

| Real estate — residential mortgage | (2) | (1) | 1 | (3) | 1 | |||||||||||||||

| Home equity loans | — | 1 | 4 | 1 | 6 | |||||||||||||||

| Consumer direct loans | 10 | 7 | 7 | 17 | 15 | |||||||||||||||

| Credit cards | 8 | 7 | 9 | 15 | 15 | |||||||||||||||

| Consumer indirect loans | 1 | 1 | 5 | 2 | 12 | |||||||||||||||

| Total consumer loans | 17 | 15 | 26 | 32 | 49 | |||||||||||||||

| Total loans charged off | 59 | 51 | 71 | 110 | 206 | |||||||||||||||

| Recoveries: | ||||||||||||||||||||

| Commercial and industrial | 8 | 11 | 32 | 19 | 40 | |||||||||||||||

| Real estate — commercial mortgage | 1 | 1 | 6 | 2 | 7 | |||||||||||||||

| Real estate — construction | 1 | — | — | 1 | — | |||||||||||||||

| Total commercial real estate loans | 2 | 1 | 6 | 3 | 7 | |||||||||||||||

| Commercial lease financing | 1 | — | — | 1 | 1 | |||||||||||||||

| Total commercial loans | 11 | 12 | 38 | 23 | 48 | |||||||||||||||

| Real estate — residential mortgage | 1 | — | — | 1 | 1 | |||||||||||||||

| Home equity loans | 1 | 1 | 1 | 2 | 2 | |||||||||||||||

| Consumer direct loans | 1 | 2 | 2 | 3 | 4 | |||||||||||||||

| Credit cards | 1 | 2 | 3 | 3 | 5 | |||||||||||||||

| Consumer indirect loans | — | 1 | 5 | 1 | 10 | |||||||||||||||

| Total consumer loans | 4 | 6 | 11 | 10 | 22 | |||||||||||||||

| Total recoveries | 15 | 18 | 49 | 33 | 70 | |||||||||||||||

| Net loan charge-offs | (44) | (33) | (22) | (77) | (136) | |||||||||||||||

| Provision (credit) for loan and lease losses | 38 | 77 | (196) | 115 | (270) | |||||||||||||||

| Allowance for loan and lease losses at end of period | $ | 1,099 | $ | 1,105 | $ | 1,220 | $ | 1,099 | $ | 1,220 | ||||||||||

| Liability for credit losses on lending-related commitments at beginning of period | 166 | 160 | 178 | 160 | 197 | |||||||||||||||

| Provision (credit) for losses on lending-related commitments | 7 | 6 | (26) | 13 | (45) | |||||||||||||||

Liability for credit losses on lending-related commitments at end of period (a) |

$ | 173 | $ | 166 | $ | 152 | $ | 173 | $ | 152 | ||||||||||

| Total allowance for credit losses at end of period | $ | 1,272 | $ | 1,271 | $ | 1,372 | $ | 1,272 | $ | 1,372 | ||||||||||

| Net loan charge-offs to average total loans | .16 | % | .13 | % | .09 | % | .15 | % | .27 | % | ||||||||||

| Allowance for loan and lease losses to period-end loans | .98 | 1.04 | 1.21 | .98 | 1.21 | |||||||||||||||

| Allowance for credit losses to period-end loans | 1.13 | 1.19 | 1.36 | 1.13 | 1.36 | |||||||||||||||

| Allowance for loan and lease losses to nonperforming loans | 256.2 | 251.7 | 175.8 | 256.2 | 175.8 | |||||||||||||||

| Allowance for credit losses to nonperforming loans | 296.5 | 289.5 | 197.7 | 296.5 | 197.7 | |||||||||||||||

| Discontinued operations — education lending business: | ||||||||||||||||||||

| Loans charged off | $ | 1 | 2 | $ | 1 | $ | 3 | $ | 2 | |||||||||||

| Recoveries | 1 | — | — | 1 | 1 | |||||||||||||||

| Net loan charge-offs | $ | — | $ | (2) | $ | (1) | $ | (2) | $ | (1) | ||||||||||

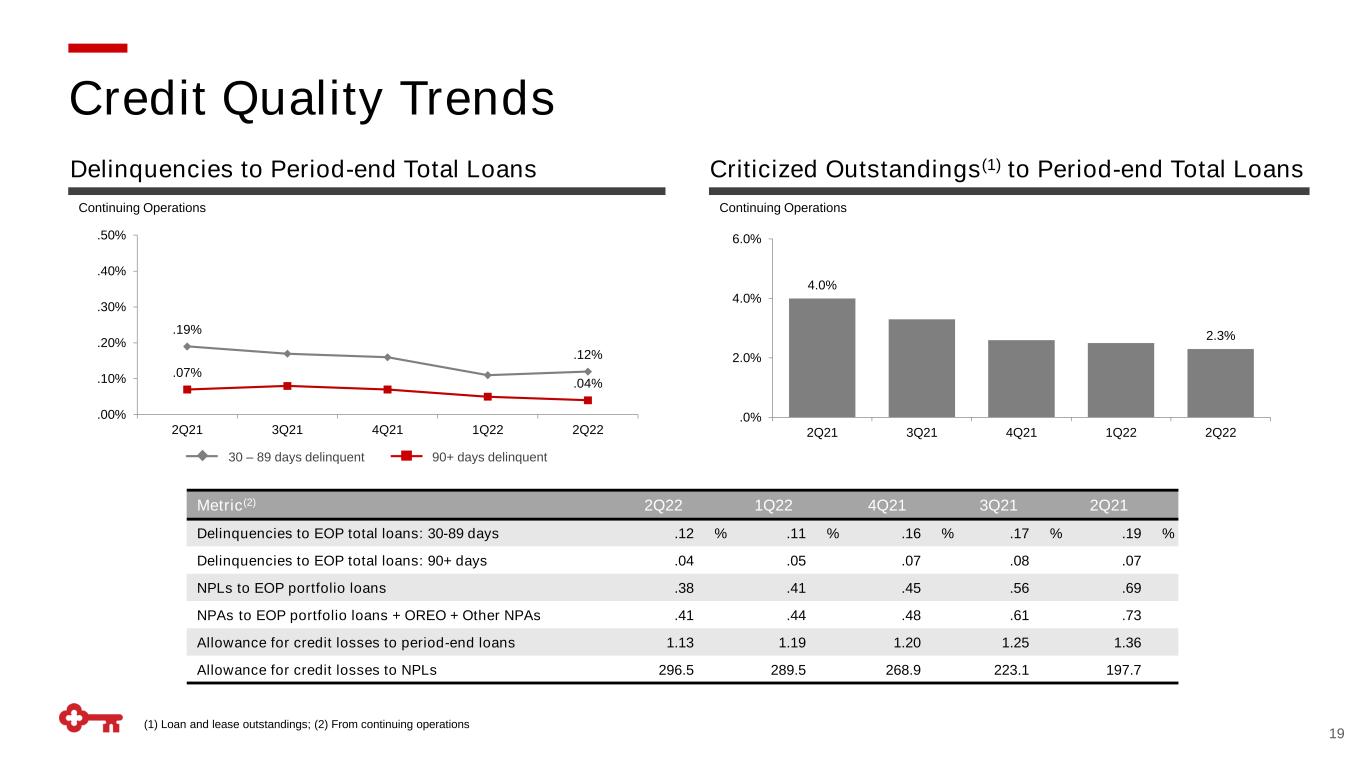

| Asset Quality Statistics From Continuing Operations | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | |||||||||||||

| Net loan charge-offs | $ | 44 | $ | 33 | $ | 19 | $ | 29 | $ | 22 | |||||||

| Net loan charge-offs to average total loans | .16 | % | .13 | % | .08 | % | .11 | % | .09 | % | |||||||

| Allowance for loan and lease losses | $ | 1,099 | $ | 1,105 | $ | 1,061 | $ | 1,084 | $ | 1,220 | |||||||

Allowance for credit losses (a) |

1,272 | 1,271 | 1,221 | 1,236 | 1,372 | ||||||||||||

| Allowance for loan and lease losses to period-end loans | .98 | % | 1.04 | % | 1.04 | % | 1.10 | % | 1.21 | % | |||||||

| Allowance for credit losses to period-end loans | 1.13 | 1.19 | 1.20 | 1.25 | 1.36 | ||||||||||||

| Allowance for loan and lease losses to nonperforming loans | 256.2 | 251.7 | 233.7 | 195.7 | 175.8 | ||||||||||||

| Allowance for credit losses to nonperforming loans | 296.5 | 289.5 | 268.9 | 223.1 | 197.7 | ||||||||||||

| Nonperforming loans at period end | $ | 429 | $ | 439 | $ | 454 | $ | 554 | $ | 694 | |||||||

| Nonperforming assets at period end | 463 | 467 | 489 | 599 | 738 | ||||||||||||

| Nonperforming loans to period-end portfolio loans | .38 | % | .41 | % | .45 | % | .56 | % | .69 | % | |||||||

Nonperforming assets to period-end portfolio loans plus OREO and other nonperforming assets |

.41 | .44 | .48 | .61 | .73 | ||||||||||||

| Summary of Nonperforming Assets and Past Due Loans From Continuing Operations | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| 6/30/2022 | 3/31/2022 | 12/31/2021 | 9/30/2021 | 6/30/2021 | |||||||||||||

| Commercial and industrial | $ | 197 | $ | 186 | $ | 191 | $ | 253 | $ | 355 | |||||||

| Real estate — commercial mortgage | 35 | 40 | 44 | 49 | 66 | ||||||||||||

| Real estate — construction | — | — | — | — | — | ||||||||||||

| Total commercial real estate loans | 35 | 40 | 44 | 49 | 66 | ||||||||||||

| Commercial lease financing | 2 | 3 | 4 | 5 | 7 | ||||||||||||

| Total commercial loans | 234 | 229 | 239 | 307 | 428 | ||||||||||||

| Real estate — residential mortgage | 67 | 73 | 72 | 93 | 99 | ||||||||||||

| Home equity loans | 120 | 129 | 135 | 146 | 146 | ||||||||||||

| Consumer direct loans | 3 | 4 | 4 | 4 | 4 | ||||||||||||

| Credit cards | 3 | 3 | 3 | 3 | 3 | ||||||||||||

| Consumer indirect loans | 2 | 1 | 1 | 1 | 14 | ||||||||||||

| Total consumer loans | 195 | 210 | 215 | 247 | 266 | ||||||||||||

| Total nonperforming loans | 429 | 439 | 454 | 554 | 694 | ||||||||||||

| OREO | 9 | 8 | 8 | 8 | 9 | ||||||||||||

| Nonperforming loans held for sale | 25 | 20 | 24 | 35 | 32 | ||||||||||||

| Other nonperforming assets | — | — | 3 | 2 | 3 | ||||||||||||

| Total nonperforming assets | $ | 463 | $ | 467 | $ | 489 | $ | 599 | $ | 738 | |||||||

| Accruing loans past due 90 days or more | 41 | 55 | 68 | 82 | 74 | ||||||||||||

| Accruing loans past due 30 through 89 days | 137 | 122 | 165 | 164 | 190 | ||||||||||||

Restructured loans — accruing and nonaccruing (a) |

216 | 219 | 220 | 270 | 334 | ||||||||||||

Restructured loans included in nonperforming loans (a) |

94 | 98 | 99 | 146 | 177 | ||||||||||||

| Nonperforming assets from discontinued operations — education lending business | 3 | 4 | 4 | 4 | 5 | ||||||||||||

| Nonperforming loans to period-end portfolio loans | .38 | % | .41 | % | .45 | % | .56 | % | .69 | % | |||||||

Nonperforming assets to period-end portfolio loans plus OREO and other nonperforming assets |

.41 | .44 | .48 | .61 | .73 | ||||||||||||

| Summary of Changes in Nonperforming Loans From Continuing Operations | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | |||||||||||||

| Balance at beginning of period | $ | 439 | $ | 454 | $ | 554 | $ | 694 | $ | 728 | |||||||

| Loans placed on nonaccrual status | 118 | 87 | 116 | 116 | 186 | ||||||||||||

| Charge-offs | (59) | (50) | (51) | (66) | (74) | ||||||||||||

| Loans sold | (8) | — | (38) | (17) | (10) | ||||||||||||

| Payments | (35) | (27) | (68) | (136) | (92) | ||||||||||||

| Transfers to OREO | (2) | (1) | (1) | (1) | — | ||||||||||||

| Loans returned to accrual status | (24) | (24) | (58) | (36) | (44) | ||||||||||||

| Balance at end of period | $ | 429 | $ | 439 | $ | 454 | $ | 554 | $ | 694 | |||||||

| Line of Business Results | ||||||||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||||||||

| Change 2Q22 vs. | ||||||||||||||||||||||||||

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q22 | 2Q21 | ||||||||||||||||||||

| Consumer Bank | ||||||||||||||||||||||||||

| Summary of operations | ||||||||||||||||||||||||||

| Total revenue (TE) | $ | 824 | $ | 799 | $ | 839 | $ | 870 | $ | 852 | 3.1 | % | (3.3) | % | ||||||||||||

| Provision for credit losses | 8 | 43 | 14 | (38) | (70) | (81.4) | 111.4 | |||||||||||||||||||

| Noninterest expense | 676 | 663 | 613 | 591 | 584 | 2.0 | 15.8 | |||||||||||||||||||

| Net income (loss) attributable to Key | 107 | 70 | 161 | 241 | 257 | 52.9 | (58.4) | |||||||||||||||||||

| Average loans and leases | 40,818 | 38,637 | 37,792 | 39,796 | 40,598 | 5.6 | .5 | |||||||||||||||||||

| Average deposits | 91,256 | 91,468 | 90,271 | 89,156 | 88,412 | (.2) | 3.2 | |||||||||||||||||||

| Net loan charge-offs | 23 | 22 | 22 | 35 | 34 | 4.5 | (32.4) | |||||||||||||||||||

| Net loan charge-offs to average total loans | .23 | % | .23 | % | .23 | % | .35 | % | .34 | % | — | (32.4) | ||||||||||||||

| Nonperforming assets at period end | $ | 203 | $ | 217 | $ | 222 | $ | 254 | $ | 274 | (6.5) | (25.9) | ||||||||||||||

| Return on average allocated equity | 11.66 | % | 7.91 | % | 18.05 | % | 25.81 | % | 28.53 | % | 47.4 | (59.1) | ||||||||||||||

| Commercial Bank | ||||||||||||||||||||||||||

| Summary of operations | ||||||||||||||||||||||||||

| Total revenue (TE) | $ | 844 | $ | 810 | $ | 1,028 | $ | 886 | $ | 871 | 4.2 | % | (3.1) | % | ||||||||||||

| Provision for credit losses | 37 | 41 | (12) | (69) | (131) | (9.8) | 128.2 | |||||||||||||||||||

| Noninterest expense | 414 | 417 | 501 | 470 | 451 | (.7) | (8.2) | |||||||||||||||||||

| Net income (loss) attributable to Key | 315 | 283 | 449 | 381 | 432 | 11.3 | (27.1) | |||||||||||||||||||

| Average loans and leases | 67,834 | 64,701 | 61,127 | 59,914 | 59,953 | 4.8 | 13.1 | |||||||||||||||||||

| Average loans held for sale | 1,016 | 1,323 | 1,962 | 1,190 | 1,341 | (23.2) | (24.2) | |||||||||||||||||||

| Average deposits | 54,864 | 57,289 | 59,537 | 56,522 | 54,814 | (4.2) | .1 | |||||||||||||||||||

| Net loan charge-offs | 21 | 11 | — | (6) | 9 | 90.9 | 133.3 | |||||||||||||||||||

| Net loan charge-offs to average total loans | .12 | % | .07 | % | — | % | (.04) | % | .06 | % | 71.4 | 100.0 | ||||||||||||||

| Nonperforming assets at period end | $ | 260 | $ | 250 | $ | 267 | $ | 345 | $ | 464 | 4.0 | (44.0) | ||||||||||||||

| Return on average allocated equity | 14.16 | % | 13.21 | % | 21.54 | % | 18.54 | % | 20.69 | % | 7.2 | (31.6) | ||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| (dollars in millions) | |||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | |||||||||||||||

| Assets | |||||||||||||||||

| Loans | $ | 112,390 | $ | 106,600 | $ | 100,730 | |||||||||||

| Loans held for sale | 1,306 | 1,170 | 1,537 | ||||||||||||||

| Securities available for sale | 42,437 | 43,681 | 34,638 | ||||||||||||||

| Held-to-maturity securities | 8,186 | 6,871 | 6,175 | ||||||||||||||

| Trading account assets | 809 | 848 | 851 | ||||||||||||||

| Short-term investments | 2,456 | 3,881 | 20,460 | ||||||||||||||

| Other investments | 969 | 722 | 635 | ||||||||||||||

| Total earning assets | 168,553 | 163,773 | 165,026 | ||||||||||||||

| Allowance for loan and lease losses | (1,099) | (1,105) | (1,220) | ||||||||||||||

| Cash and due from banks | 678 | 684 | 792 | ||||||||||||||

| Premises and equipment | 638 | 647 | 785 | ||||||||||||||

| Goodwill | 2,752 | 2,694 | 2,673 | ||||||||||||||

| Other intangible assets | 118 | 118 | 159 | ||||||||||||||

| Corporate-owned life insurance | 4,343 | 4,340 | 4,304 | ||||||||||||||

| Accrued income and other assets | 10,529 | 9,544 | 7,966 | ||||||||||||||

| Discontinued assets | 496 | 526 | 630 | ||||||||||||||

| Total assets | $ | 187,008 | $ | 181,221 | $ | 181,115 | |||||||||||

| Liabilities | |||||||||||||||||

| Deposits in domestic offices: | |||||||||||||||||

| NOW and money market deposit accounts | $ | 83,628 | $ | 86,829 | $ | 85,242 | |||||||||||

| Savings deposits | 7,934 | 7,840 | 6,993 | ||||||||||||||

| Certificates of deposit ($100,000 or more) | 1,421 | 1,533 | 2,064 | ||||||||||||||

| Other time deposits | 1,909 | 2,037 | 2,493 | ||||||||||||||

| Total interest-bearing deposits | 94,892 | 98,239 | 96,792 | ||||||||||||||

| Noninterest-bearing deposits | 50,973 | 50,424 | 49,280 | ||||||||||||||

| Total deposits | 145,865 | 148,663 | 146,072 | ||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 3,234 | 599 | 211 | ||||||||||||||

| Bank notes and other short-term borrowings | 2,809 | 2,222 | 723 | ||||||||||||||

| Accrued expense and other liabilities | 4,056 | 3,615 | 2,957 | ||||||||||||||

| Long-term debt | 16,617 | 10,814 | 13,211 | ||||||||||||||

| Total liabilities | 172,581 | 165,913 | 163,174 | ||||||||||||||

| Equity | |||||||||||||||||

| Preferred stock | 1,900 | 1,900 | 1,900 | ||||||||||||||

| Common shares | 1,257 | 1,257 | 1,257 | ||||||||||||||

| Capital surplus | 6,241 | 6,214 | 6,232 | ||||||||||||||

| Retained earnings | 15,118 | 14,793 | 13,689 | ||||||||||||||

| Treasury stock, at cost | (5,923) | (5,927) | (5,287) | ||||||||||||||

| Accumulated other comprehensive income (loss) | (4,166) | (2,929) | 150 | ||||||||||||||

| Key shareholders’ equity | 14,427 | 15,308 | 17,941 | ||||||||||||||

| Noncontrolling interests | — | — | — | ||||||||||||||

| Total equity | 14,427 | 15,308 | 17,941 | ||||||||||||||

| Total liabilities and equity | $ | 187,008 | $ | 181,221 | $ | 181,115 | |||||||||||

| Common shares outstanding (000) | 932,643 | 932,398 | 960,276 | ||||||||||||||

| Consolidated Statements of Income | ||||||||||||||||||||||||||

| (dollars in millions, except per share amounts) | ||||||||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||||||||

| 6/30/2022 | 3/31/2022 | 6/30/2021 | 6/30/2022 | 6/30/2021 | ||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||||

| Loans | $ | 923 | $ | 837 | $ | 888 | $ | 1,760 | $ | 1,777 | ||||||||||||||||

| Loans held for sale | 10 | 12 | 11 | 22 | 22 | |||||||||||||||||||||

| Securities available for sale | 188 | 173 | 133 | 361 | 263 | |||||||||||||||||||||

| Held-to-maturity securities | 48 | 46 | 45 | 94 | 90 | |||||||||||||||||||||

| Trading account assets | 7 | 6 | 5 | 13 | 10 | |||||||||||||||||||||

| Short-term investments | 13 | 4 | 6 | 17 | 11 | |||||||||||||||||||||

| Other investments | 4 | 2 | 2 | 6 | 4 | |||||||||||||||||||||

| Total interest income | 1,193 | 1,080 | 1,090 | 2,273 | 2,177 | |||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||

| Deposits | 20 | 14 | 16 | 34 | 37 | |||||||||||||||||||||

| Federal funds purchased and securities sold under repurchase agreements | 6 | — | — | 6 | — | |||||||||||||||||||||

| Bank notes and other short-term borrowings | 9 | 3 | 3 | 12 | 4 | |||||||||||||||||||||

| Long-term debt | 61 | 49 | 54 | 110 | 114 | |||||||||||||||||||||

| Total interest expense | 96 | 66 | 73 | 162 | 155 | |||||||||||||||||||||

| Net interest income | 1,097 | 1,014 | 1,017 | 2,111 | 2,022 | |||||||||||||||||||||

| Provision for credit losses | 45 | 83 | (222) | 128 | (315) | |||||||||||||||||||||

| Net interest income after provision for credit losses | 1,052 | 931 | 1,239 | 1,983 | 2,337 | |||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||

| Trust and investment services income | 137 | 136 | 133 | 273 | 266 | |||||||||||||||||||||

| Investment banking and debt placement fees | 149 | 163 | 217 | 312 | 379 | |||||||||||||||||||||

| Service charges on deposit accounts | 96 | 91 | 83 | 187 | 156 | |||||||||||||||||||||

| Operating lease income and other leasing gains | 28 | 32 | 36 | 60 | 74 | |||||||||||||||||||||

| Corporate services income | 88 | 90 | 55 | 178 | 119 | |||||||||||||||||||||

| Cards and payments income | 85 | 80 | 113 | 165 | 218 | |||||||||||||||||||||

| Corporate-owned life insurance income | 35 | 31 | 30 | 66 | 61 | |||||||||||||||||||||

| Consumer mortgage income | 14 | 21 | 26 | 35 | 73 | |||||||||||||||||||||

| Commercial mortgage servicing fees | 45 | 36 | 44 | 81 | 78 | |||||||||||||||||||||

| Other income | 11 | (4) | 13 | 7 | 64 | |||||||||||||||||||||

| Total noninterest income | 688 | 676 | 750 | 1,364 | 1,488 | |||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||

| Personnel | 607 | 630 | 623 | 1,237 | 1,247 | |||||||||||||||||||||

| Net occupancy | 78 | 73 | 75 | 151 | 151 | |||||||||||||||||||||

| Computer processing | 78 | 77 | 71 | 155 | 144 | |||||||||||||||||||||

| Business services and professional fees | 52 | 53 | 51 | 105 | 101 | |||||||||||||||||||||

| Equipment | 26 | 23 | 25 | 49 | 50 | |||||||||||||||||||||

| Operating lease expense | 27 | 28 | 31 | 55 | 65 | |||||||||||||||||||||

| Marketing | 34 | 28 | 31 | 62 | 57 | |||||||||||||||||||||

| Intangible asset amortization | — | — | — | — | — | |||||||||||||||||||||

| Other expense | 176 | 158 | 169 | 334 | 332 | |||||||||||||||||||||

| Total noninterest expense | 1,078 | 1,070 | 1,076 | 2,148 | 2,147 | |||||||||||||||||||||

| Income (loss) from continuing operations before income taxes | 662 | 537 | 913 | 1,199 | 1,678 | |||||||||||||||||||||

| Income taxes | 132 | 90 | 189 | 222 | 336 | |||||||||||||||||||||

| Income (loss) from continuing operations | 530 | 447 | 724 | 977 | 1,342 | |||||||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | 3 | 1 | 5 | 4 | 9 | |||||||||||||||||||||

| Net income (loss) | 533 | 448 | 729 | 981 | 1,351 | |||||||||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests | — | — | — | — | — | |||||||||||||||||||||

| Net income (loss) attributable to Key | $ | 533 | $ | 448 | $ | 729 | $ | 981 | $ | 1,351 | ||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | 504 | $ | 420 | $ | 698 | $ | 924 | $ | 1,289 | ||||||||||||||||

| Net income (loss) attributable to Key common shareholders | 507 | 421 | 703 | 928 | 1,298 | |||||||||||||||||||||

| Per common share | ||||||||||||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | .54 | $ | .45 | $ | .73 | $ | 1 | $ | 1.34 | ||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | — | — | — | — | .01 | |||||||||||||||||||||

Net income (loss) attributable to Key common shareholders (a) |

.55 | .46 | .73 | 1 | 1.35 | |||||||||||||||||||||

| Per common share — assuming dilution | ||||||||||||||||||||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | .54 | $ | .45 | $ | .72 | $ | .99 | $ | 1.33 | ||||||||||||||||

| Income (loss) from discontinued operations, net of taxes | — | — | — | — | .01 | |||||||||||||||||||||

Net income (loss) attributable to Key common shareholders (a) |

.54 | .45 | $ | .73 | 1.00 | 1.34 | ||||||||||||||||||||

| Cash dividends declared per common share | $ | .195 | $ | .195 | $ | .185 | $ | .39 | $ | .37 | ||||||||||||||||

| Weighted-average common shares outstanding (000) | 924,302 | 922,941 | 957,423 | 923,717 | 961,292 | |||||||||||||||||||||

| Effect of common share options and other stock awards | 7,506 | 10,692 | 9,740 | 9,087 | 9,514 | |||||||||||||||||||||

Weighted-average common shares and potential common shares outstanding (000) (b) |

931,808 | 933,634 | 967,163 | 932,805 | 970,806 | |||||||||||||||||||||