Document

Patrick Industries, Inc. Reports Third Quarter 2023 Financial Results

Third Quarter 2023 Highlights (compared to Third Quarter 2022 unless otherwise noted)

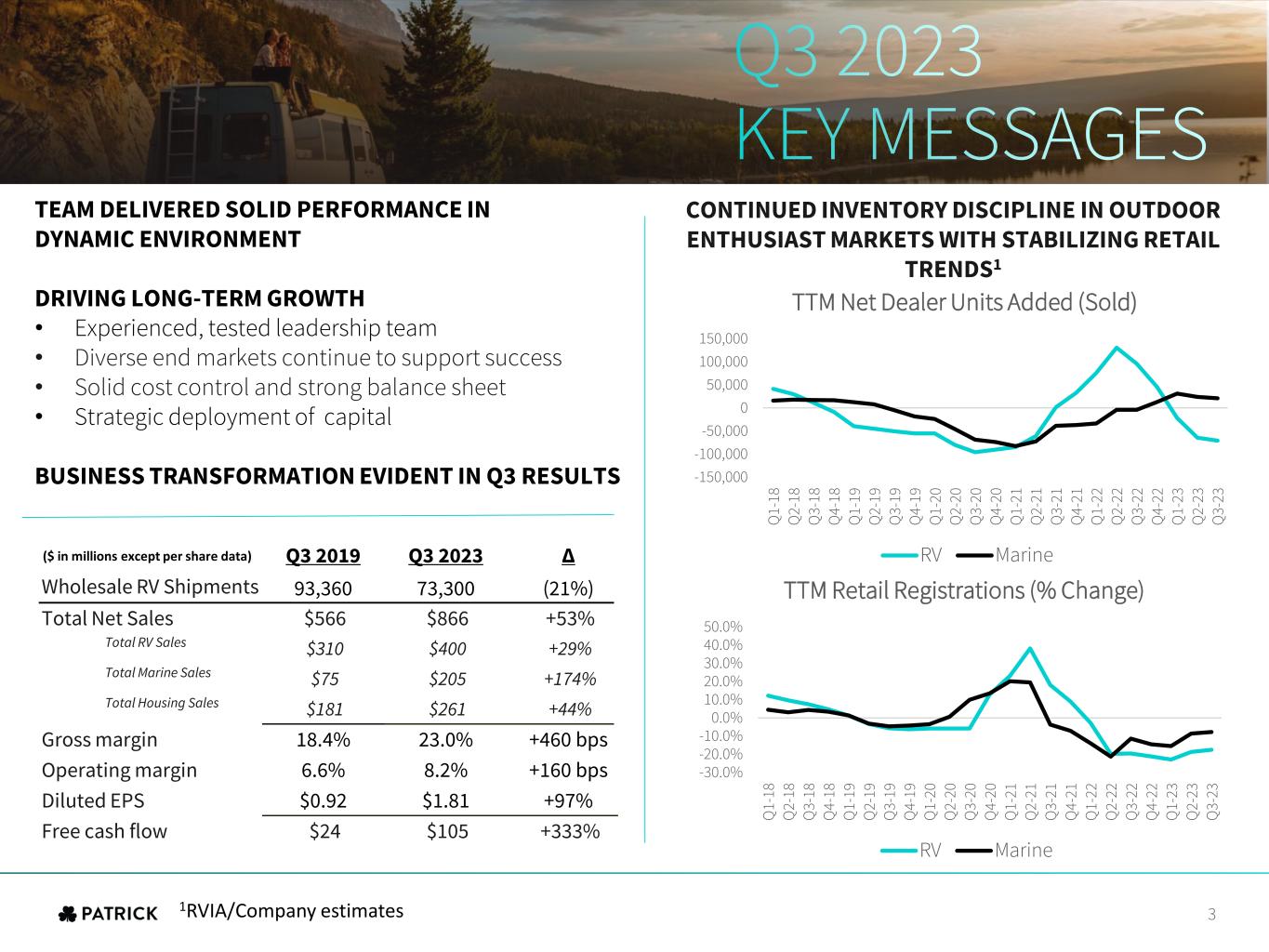

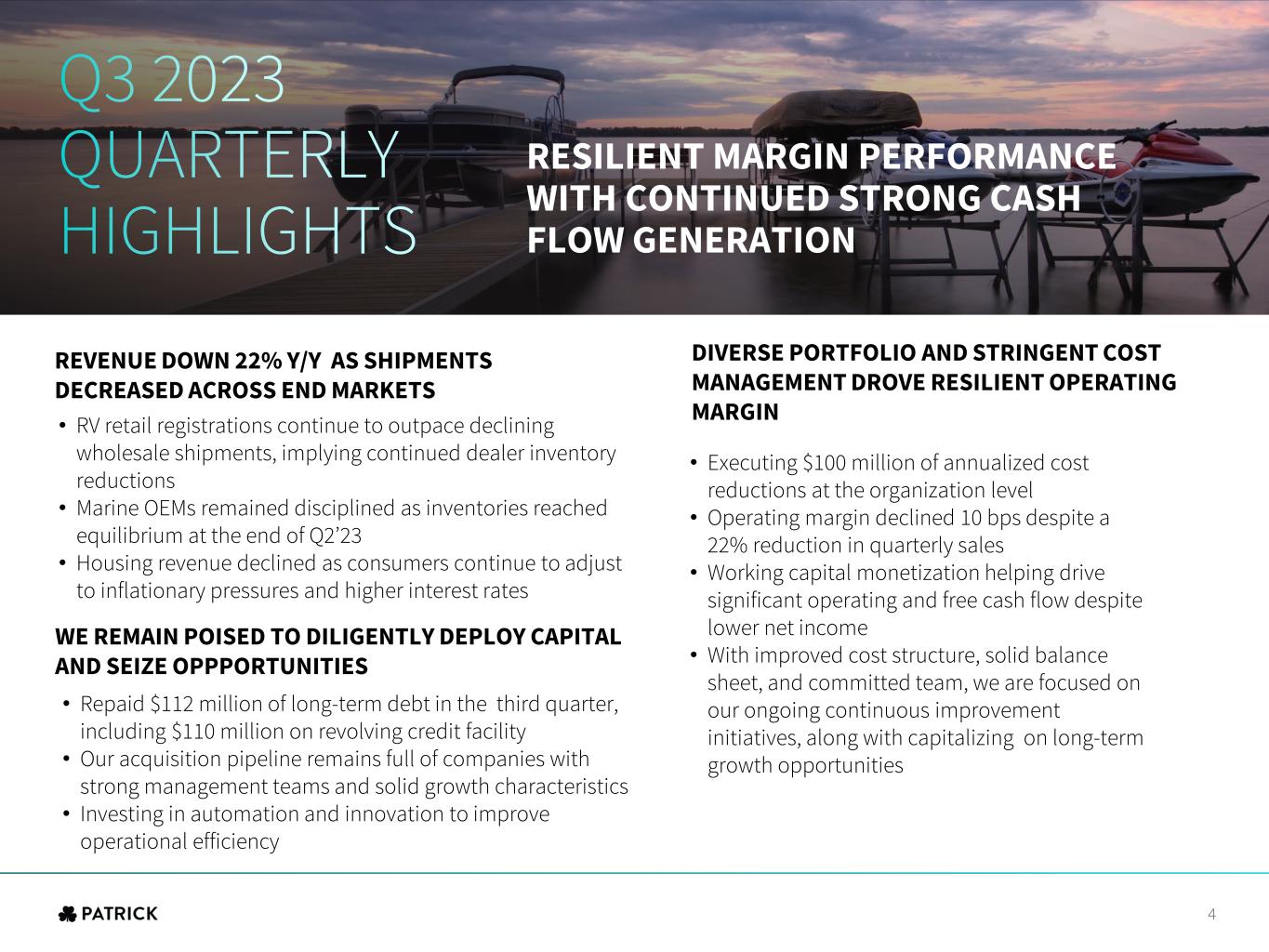

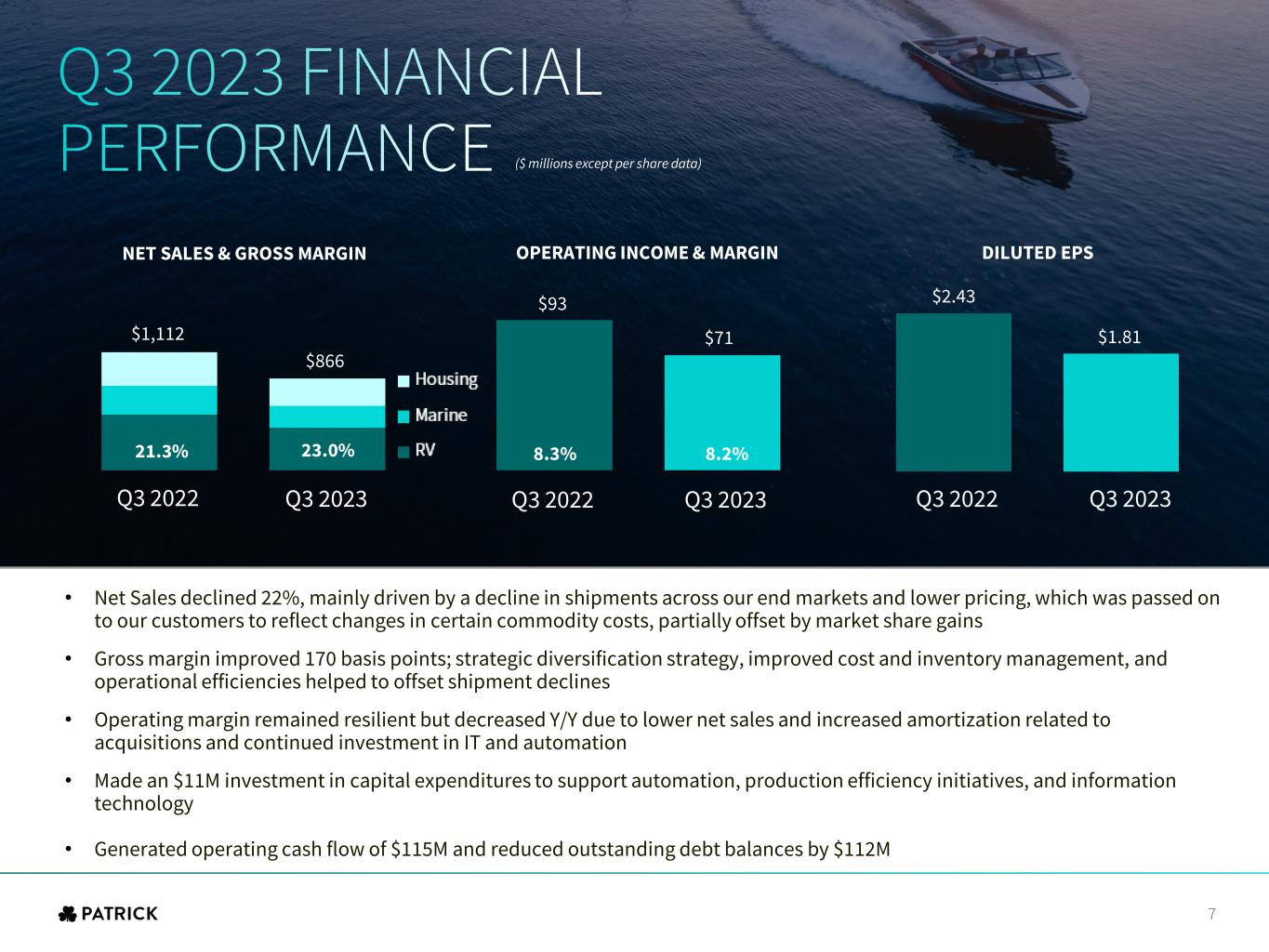

•Net sales of $866 million decreased 22% as a result of lower wholesale unit shipments in our end markets and lower pricing passed on to our customers to reflect changes in certain commodity costs, partially offset by market share gains.

•Diversification strategy, acquisitions, successful labor management and cost control, continuous improvement and automation initiatives resulted in operating margin resilience despite the sales decline, with operating margin declining 10 basis points to 8.2% during the quarter.

•Adjusted EBITDA of $113 million decreased 14%; adjusted EBITDA margin increased 130 basis points to 13.1%.

•Inventory reduction of $150 million from year-end 2022 and $216 million from the end of the third quarter of 2022; cash provided by operations for the first nine months of 2023 was $294 million versus $230 million for the same period last year.

•On a trailing twelve-month basis, free cash flow through the third quarter of 2023 was $412 million, an increase of 64% compared to $250 million through the third quarter of 2022.

•Strong cash flow and solid balance sheet and liquidity position us favorably and help enable us to continue to opportunistically deploy capital and flex our operations, to reflect current market conditions.

ELKHART, IN - October 26, 2023 - Patrick Industries, Inc. (NASDAQ: PATK) ("Patrick" or the "Company"), a leading component solutions provider for the Outdoor Enthusiast and Housing markets, today reported financial results for the third quarter ended October 1, 2023.

Net sales were $866 million, a decrease of $246 million, or 22% from $1.11 billion in the third quarter of 2022. The decline in sales was primarily driven by a decrease in unit shipments across our end markets and lower pricing passed on to our customers to reflect changes in certain commodity costs, partially offset by market share gains.

Operating income of $71 million in the third quarter of 2023 decreased $22 million from $93 million in the third quarter of 2022. Operating margin of 8.2% decreased 10 basis points compared to 8.3% in the same period a year ago, primarily due to the impact of lower net sales, absorption on certain fixed distribution expenses, and an increase in non-cash amortization due to acquisitions.

Net income decreased 33% to $40 million from $59 million in the third quarter of 2022. Diluted earnings per share of $1.81 decreased 26% compared to $2.43 for the third quarter of 2022.

“Our operating results for the third quarter of 2023 are a reflection of our team’s thoughtful discipline to manage our business and drive resilient operating margins in a very dynamic environment, despite the continued reduction in shipments across our end markets,” said Andy Nemeth, Chief Executive Officer. “We have reduced our overall cost structure and reduced our inventory by $150 million from year-end 2022. Our team’s focus on labor management, automation and continuous improvement has helped enable us to dynamically adjust our business to current market demand and industry trends, while remaining opportunistically nimble and poised, ready to pivot when opportunity presents itself or upon an uptick in our markets.”

Jeff Rodino, President, said, “We continue to strategically deploy capital and reinvest in the business with the goal of achieving our long-term growth objectives and operational excellence. This focus is also reflected in our repayment of $112 million of long-term debt during the quarter, demonstrating our commitment to maintaining our solid financial foundation and bolstering our ability to seize upon both organic and strategic opportunities. Our acquisition pipeline remains full of potential targets to continue to enhance our outdoor enthusiast platform.”

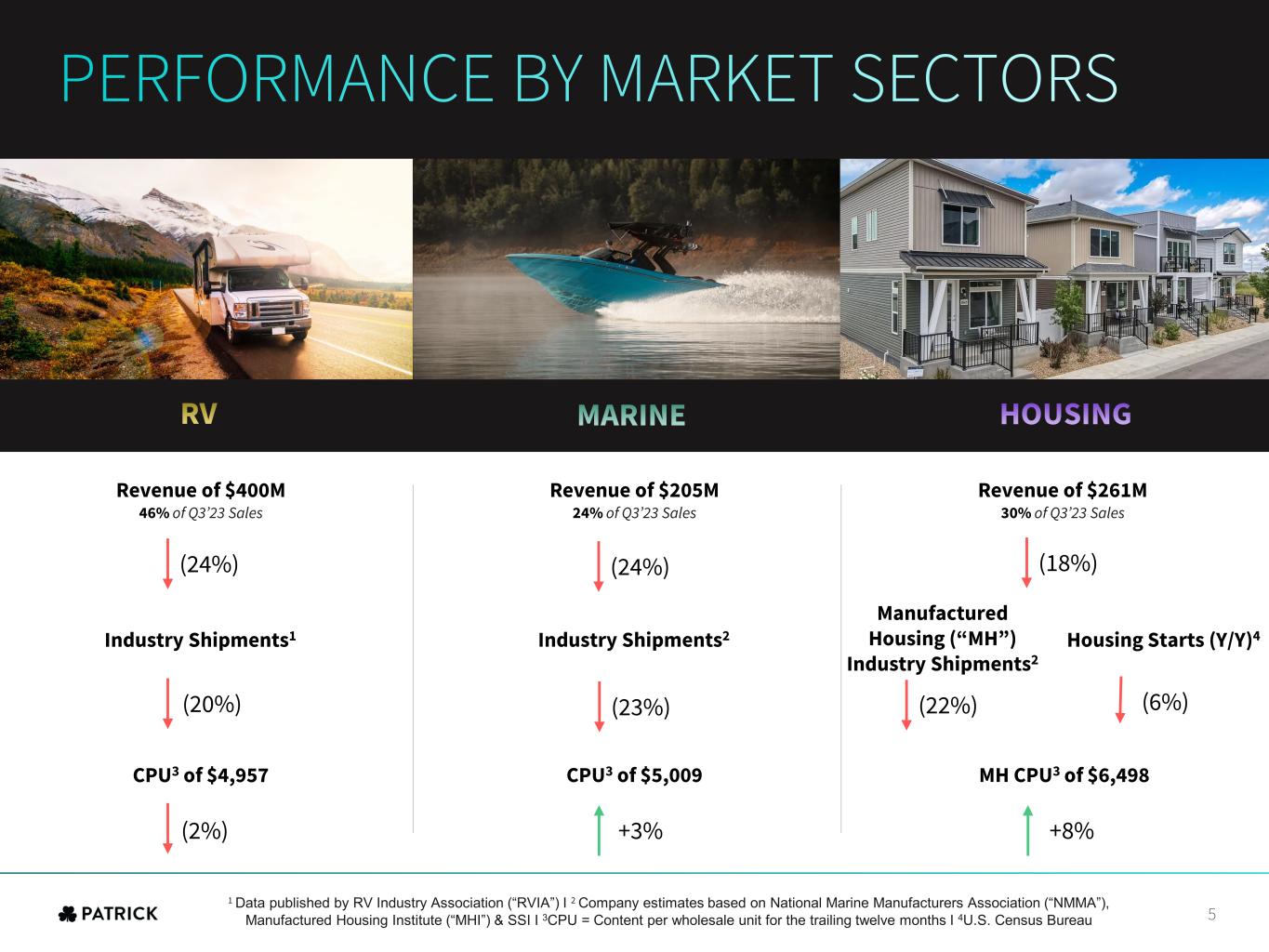

Third Quarter 2023 Revenue by Market Sector (compared to Third Quarter 2022 unless otherwise noted)

RV (46% of Revenue)

•Revenue of $400 million decreased 24% while wholesale RV industry unit shipments declined 20%.

•Content per wholesale RV unit (on a trailing twelve-month basis) decreased 2% to $4,957.

Marine (24% of Revenue)

•Revenue of $205 million decreased 24% while estimated wholesale powerboat industry unit shipments decreased 23%.

•Estimated content per wholesale powerboat unit (on a trailing twelve-month basis) increased 3% to $5,009.

Housing (30% of Revenue, comprised of Manufactured Housing ("MH") and Industrial)

•Revenue of $261 million decreased 18%; estimated wholesale MH industry unit shipments decreased 22%; total housing starts decreased 6%, with single-family housing starts increasing 7% and multifamily housing starts decreasing 28%.

•Estimated MH content per wholesale MH unit (on a trailing twelve-month basis) increased 8% to $6,498.

Balance Sheet, Cash Flow and Capital Allocation

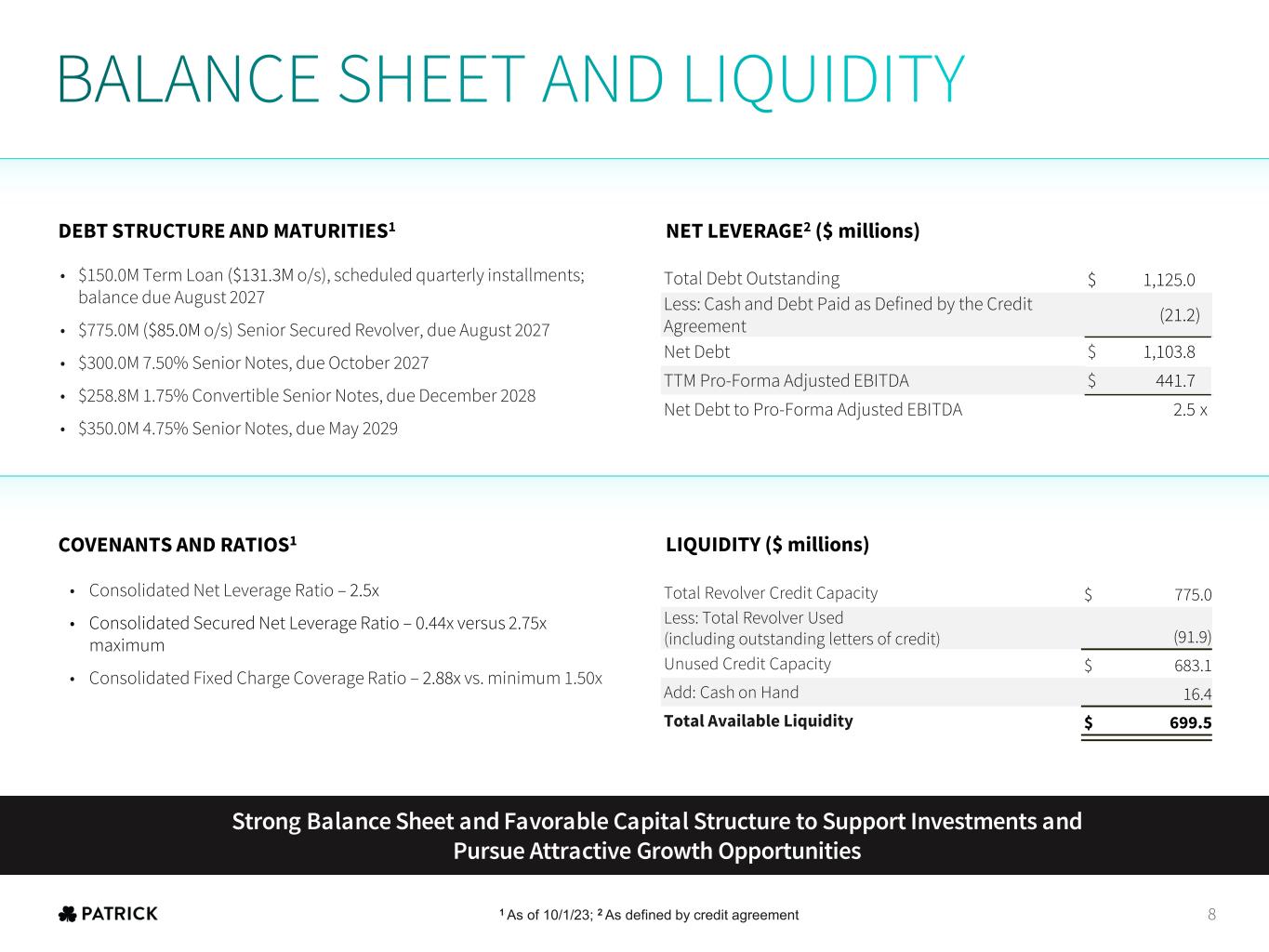

Cash provided by operations of $294 million in the first nine months of 2023 increased by $64 million from $230 million in the first nine months of 2022 due to an improvement of $227 million in working capital monetization, partially offset by a $176 million reduction in net income. Capital expenditures totaled $11 million in the third quarter of 2023, reflecting continued investments in alignment with our automation and technology initiatives. On a trailing twelve-month basis, free cash flow through the third quarter of 2023 was $412 million, an increase of 64% compared to $250 million through the third quarter of 2022. Our long-term debt decreased approximately $112 million during the third quarter of 2023, principally due to net repayments on our revolving credit facility.

We remained disciplined in allocating and deploying capital, returning approximately $10 million to shareholders in the third quarter of 2023 through dividends.

Our total debt at the end of the third quarter was approximately $1.13 billion, resulting in a total net leverage ratio of 2.5x (as calculated in accordance with our credit agreement). Available net liquidity, comprised of borrowing availability under our credit facility and cash on hand, was approximately $700 million.

Business Outlook and Summary

“We remain confident in our ability to navigate the current macroeconomic environment while continuing to reinvest in our business thanks to our solid balance sheet and liquidity position and our team’s dedication to operational excellence and customer service at the highest level,” continued Mr. Nemeth. “We believe RV OEM production is calibrated with retail unit shipments as a result of disciplined business management by dealers and OEMs alike resulting in lower dealer inventory relative to historical levels, and a healthier mix of product by model year. As we anticipate a potential recovery in RV production next year, we expect improving industry wholesale shipments to offset the financial impact of continued restricted production from marine OEMs and inventory discipline from dealers. More importantly, long-term demand for the outdoor enthusiast lifestyle is supported by positive demographic trends and consumers' affinity for outdoor living and innovative lifestyle product enhancements. Affordable housing continues to be in short supply and we remain optimistic about the long-term opportunity this presents as home buyers adjust to higher interest rates. We like our position in the markets we serve and are confident that our diverse portfolio and flexible operating model will help continue to enable us to deliver value to our stakeholders." Patrick Industries will host an online webcast of its third quarter 2023 earnings conference call that can be accessed on the Company’s website, www.patrickind.com, under “For Investors,” on Thursday, October 26, 2023 at 10:00 a.m. Eastern Time. In addition, a supplemental earnings presentation can be accessed on the Company’s website, www.patrickind.com under “For Investors.”

Conference Call Webcast

About Patrick Industries, Inc.

Patrick Industries (NASDAQ: PATK) is a leading component solutions provider for the RV, Marine and Housing markets. Founded in 1959, Patrick is based in Elkhart, Indiana, employing approximately 10,000 team members throughout the United States.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: the effects of external macroeconomic factors, including adverse developments in world financial markets, disruptions related to tariffs and other trade issues, and global supply chain interruptions; adverse economic and business conditions, including inflationary pressures, cyclicality and seasonality in the industries we sell our products; the effects of interest rate changes and other monetary and market fluctuations; the deterioration of the financial condition of our customers or suppliers; the ability to adjust our production schedules up or down quickly in response to rapid changes in demand; the loss of a significant customer; changes in consumer preferences; pricing pressures due to competition; conditions in the credit market limiting the ability of consumers and wholesale customers to obtain retail and wholesale financing for RVs, manufactured homes, and marine products; public health emergencies or pandemics, such as the COVID-19 pandemic; the imposition of, or changes in, restrictions and taxes on imports of raw materials and components used in our products; information technology performance and security to include our ability to deter cyberattacks or other information security incidents; any increased cost or limited availability of certain raw materials; the impact of governmental and environmental regulations, and our inability to comply with them; our level of indebtedness; the ability to remain in compliance with our credit agreement covenants; the availability and costs of labor and production facilities and the impact of labor shortages; inventory levels of retailers and manufacturers; the ability to manage working capital, including inventory and inventory obsolescence; the ability to generate cash flow or obtain financing to fund growth; future growth rates in the Company's core businesses; realization and impact of efficiency improvements and cost reductions; the successful integration of acquisitions and other growth initiatives; increases in interest rates and oil and gasoline prices; the ability to retain key executive and management personnel; the impact on our business resulting from wars and military conflicts such as war in Ukraine and evolving conflict in Israel, Gaza and Syria, and throughout the Middle East; natural disasters or other unforeseen events, and adverse weather conditions.

There can be no assurance that any forward-looking statement will be realized or that actual results will not be significantly different from that set forth in such forward-looking statement. Information about certain risks that could affect our business and cause actual results to differ from those expressed or implied in the forward-looking statements are contained in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company's Forms 10-Q for subsequent quarterly periods, which are filed with the Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of this press release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

Contact:

Steve O'Hara

Vice President of Investor Relations

oharas@patrickind.com

574.294.7511

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter Ended |

|

Nine Months Ended |

|

|

| ($ in thousands except per share data) |

|

October 1, 2023 |

|

September 25, 2022 |

|

October 1, 2023 |

|

September 25, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET SALES |

|

$ |

866,073 |

|

|

$ |

1,112,089 |

|

|

$ |

2,686,858 |

|

|

$ |

3,929,957 |

|

|

|

|

|

| Cost of goods sold |

|

666,954 |

|

|

875,638 |

|

|

2,083,527 |

|

|

3,071,057 |

|

|

|

|

|

| GROSS PROFIT |

|

199,119 |

|

|

236,451 |

|

|

603,331 |

|

|

858,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Warehouse and delivery |

|

37,664 |

|

|

39,997 |

|

|

109,540 |

|

|

125,213 |

|

|

|

|

|

| Selling, general and administrative |

|

70,873 |

|

|

84,924 |

|

|

231,814 |

|

|

250,969 |

|

|

|

|

|

| Amortization of intangible assets |

|

19,507 |

|

|

18,769 |

|

|

59,093 |

|

|

54,175 |

|

|

|

|

|

| Total operating expenses |

|

128,044 |

|

|

143,690 |

|

|

400,447 |

|

|

430,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

71,075 |

|

|

92,761 |

|

|

202,884 |

|

|

428,543 |

|

|

|

|

|

| Interest expense, net |

|

16,879 |

|

|

15,302 |

|

|

53,623 |

|

|

44,990 |

|

|

|

|

|

| Income before income taxes |

|

54,196 |

|

|

77,459 |

|

|

149,261 |

|

|

383,553 |

|

|

|

|

|

| Income taxes |

|

14,646 |

|

|

18,640 |

|

|

37,181 |

|

|

95,537 |

|

|

|

|

|

| NET INCOME |

|

$ |

39,550 |

|

|

$ |

58,819 |

|

|

$ |

112,080 |

|

|

$ |

288,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS PER COMMON SHARE |

|

$ |

1.84 |

|

|

$ |

2.66 |

|

|

$ |

5.20 |

|

|

$ |

12.93 |

|

|

|

|

|

| DILUTED EARNINGS PER COMMON SHARE |

|

$ |

1.81 |

|

|

$ |

2.43 |

|

|

$ |

5.09 |

|

|

$ |

11.78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding - Basic |

|

21,511 |

|

|

22,087 |

|

|

21,541 |

|

|

22,274 |

|

|

|

|

|

| Weighted average shares outstanding - Diluted |

|

21,884 |

|

|

24,413 |

|

|

22,063 |

|

|

24,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PATRICK INDUSTRIES, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

As of |

| ($ in thousands) |

|

October 1, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

|

| Current Assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

16,450 |

|

|

$ |

22,847 |

|

| Trade receivables, net |

|

240,850 |

|

|

172,890 |

|

| Inventories |

|

517,657 |

|

|

667,841 |

|

| Prepaid expenses and other |

|

36,296 |

|

|

46,326 |

|

| Total current assets |

|

811,253 |

|

|

909,904 |

|

| Property, plant and equipment, net |

|

358,266 |

|

|

350,572 |

|

| Operating lease right-of-use assets |

|

170,128 |

|

|

163,674 |

|

| Goodwill and intangible assets, net |

|

1,308,156 |

|

|

1,349,493 |

|

| Other non-current assets |

|

8,140 |

|

|

8,828 |

|

| TOTAL ASSETS |

|

$ |

2,655,943 |

|

|

$ |

2,782,471 |

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current Liabilities |

|

|

|

|

| Current maturities of long-term debt |

|

$ |

7,500 |

|

|

$ |

7,500 |

|

| Current operating lease liabilities |

|

47,262 |

|

|

44,235 |

|

| Accounts payable |

|

148,239 |

|

|

142,910 |

|

| Accrued liabilities |

|

132,813 |

|

|

172,595 |

|

| Total current liabilities |

|

335,814 |

|

|

367,240 |

|

| Long-term debt, less current maturities, net |

|

1,104,618 |

|

|

1,276,149 |

|

| Long-term operating lease liabilities |

|

126,231 |

|

|

122,471 |

|

| Deferred tax liabilities, net |

|

47,390 |

|

|

48,392 |

|

| Other long-term liabilities |

|

10,587 |

|

|

13,050 |

|

| TOTAL LIABILITIES |

|

1,624,640 |

|

|

1,827,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SHAREHOLDERS’ EQUITY |

|

1,031,303 |

|

|

955,169 |

|

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

2,655,943 |

|

|

$ |

2,782,471 |

|

PATRICK INDUSTRIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

| ($ in thousands) |

|

|

|

|

| |

|

October 1, 2023 |

|

September 25, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

| Net income |

|

$ |

112,080 |

|

|

$ |

288,016 |

|

| Depreciation and amortization |

|

107,976 |

|

|

96,256 |

|

| Stock-based compensation expense |

|

13,675 |

|

|

15,596 |

|

| Amortization of convertible notes debt discount |

|

823 |

|

|

1,399 |

|

| Other adjustments to reconcile net income to net cash provided by operating activities |

|

3,201 |

|

|

(664) |

|

| Change in operating assets and liabilities, net of acquisitions of businesses |

|

56,075 |

|

|

(170,795) |

|

| Net cash provided by operating activities |

|

293,830 |

|

|

229,808 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

| Purchases of property, plant and equipment |

|

(47,430) |

|

|

(63,437) |

|

| Business acquisitions and other investing activities |

|

(28,033) |

|

|

(145,447) |

|

| Net cash used in investing activities |

|

(75,463) |

|

|

(208,884) |

|

| NET CASH FLOWS USED IN FINANCING ACTIVITIES |

|

(224,764) |

|

|

(90,504) |

|

| Decrease in cash and cash equivalents |

|

(6,397) |

|

|

(69,580) |

|

| Cash and cash equivalents at beginning of year |

|

22,847 |

|

|

122,849 |

|

| Cash and cash equivalents at end of period |

|

$ |

16,450 |

|

|

$ |

53,269 |

|

PATRICK INDUSTRIES, INC.

Earnings Per Common Share

The table below illustrates the calculation for diluted share count which shows the dilutive impact of the adoption of ASU 2020-06 on our 1.00% Convertible Senior Notes due 2023, which were paid off in full at maturity in February 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Third Quarter Ended |

|

Nine Months Ended |

|

| ($ in thousands except per share data) |

|

October 1, 2023 |

|

September 25, 2022 |

|

October 1, 2023 |

|

September 25, 2022 |

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings for basic earnings per common share calculation |

|

$ |

39,550 |

|

|

$ |

58,819 |

|

|

$ |

112,080 |

|

|

$ |

288,016 |

|

|

|

|

|

| Effect of interest on potentially dilutive convertible notes, net of tax |

|

— |

|

|

478 |

|

|

162 |

|

|

1,417 |

|

|

|

|

|

| Earnings for diluted earnings per common share calculation |

|

$ |

39,550 |

|

|

$ |

59,297 |

|

|

$ |

112,242 |

|

|

$ |

289,433 |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic |

|

21,511 |

|

22,087 |

|

21,541 |

|

22,274 |

|

|

|

|

| Weighted average impact of potentially dilutive convertible notes |

|

— |

|

2,064 |

|

221 |

|

2,053 |

|

|

|

|

| Weighted average impact of potentially dilutive securities |

|

373 |

|

262 |

|

301 |

|

246 |

|

|

|

|

| Weighted average common shares outstanding - diluted |

|

21,884 |

|

24,413 |

|

22,063 |

|

24,573 |

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

1.84 |

|

|

$ |

2.66 |

|

|

$ |

5.20 |

|

|

$ |

12.93 |

|

|

|

|

|

| Diluted earnings per common share |

|

$ |

1.81 |

|

|

$ |

2.43 |

|

|

$ |

5.09 |

|

|

$ |

11.78 |

|

|

|

|

|

PATRICK INDUSTRIES, INC.

Non-GAAP Reconciliation (Unaudited)

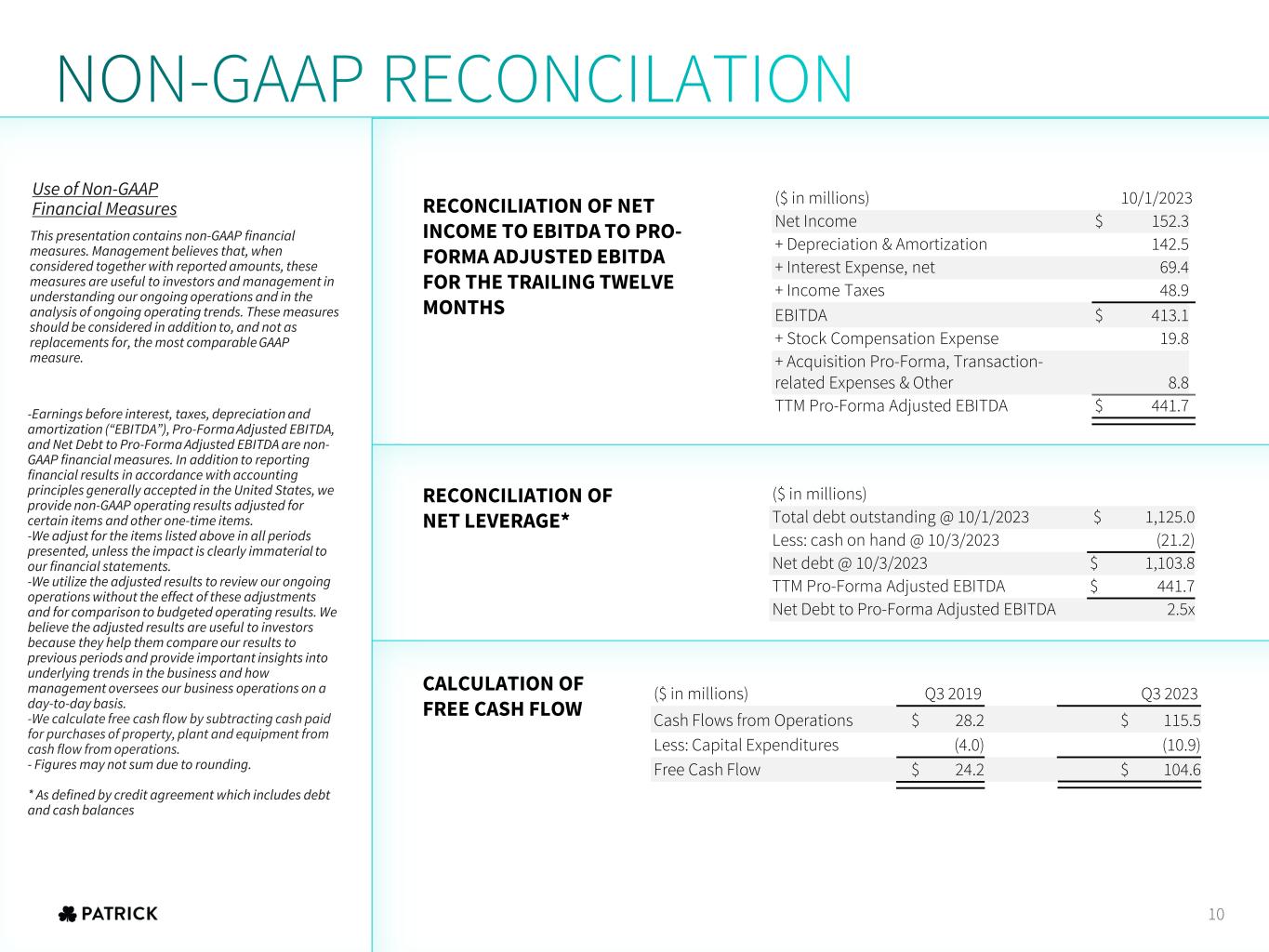

Use of Non-GAAP Financial Metrics

In addition to reporting financial results in accordance with U.S. GAAP, the Company also provides financial metrics, such as net leverage ratio, content per unit, net debt, free cash flow, earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted EBITDA, and available liquidity, which we believe are important measures of the Company's business performance. These metrics should not be considered alternatives to U.S. GAAP. Our computations of net leverage ratio, content per unit, net debt, free cash flow, EBITDA, adjusted EBITDA, and available liquidity may differ from similarly titled measures used by others. We calculate net debt by subtracting cash and cash equivalents from the gross value of debt outstanding. We calculate EBITDA by adding back depreciation and amortization, net interest expense, and income tax expense to net income. We calculate adjusted EBITDA by taking EBITDA and adding back stock-based compensation and loss on sale of property, plant and equipment and subtracting out gain on sale of property, plant and equipment. We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. RV wholesale unit shipments are provided by the RV Industry Association. Marine wholesale unit shipments are Company estimates based on data provided by the National Marine Manufacturers Association. MH wholesale unit shipments are provided by the Manufactured Housing Institute. Housing starts are provided by the U.S. Census Bureau. You should not consider these metrics in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP.

The following table reconciles net income to EBITDA and adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Third Quarter Ended |

|

Nine Months Ended |

| ($ in thousands) |

|

October 1, 2023 |

|

September 25, 2022 |

|

October 1, 2023 |

|

September 25, 2022 |

| Net income |

|

$ |

39,550 |

|

|

$ |

58,819 |

|

|

$ |

112,080 |

|

|

$ |

288,016 |

|

| + Depreciation & amortization |

|

36,484 |

|

|

33,281 |

|

|

107,976 |

|

|

96,256 |

|

| + Interest expense, net |

|

16,879 |

|

|

15,302 |

|

|

53,623 |

|

|

44,990 |

|

| + Income taxes |

|

14,646 |

|

|

18,640 |

|

|

37,181 |

|

|

95,537 |

|

| EBITDA |

|

107,559 |

|

|

126,042 |

|

|

310,860 |

|

|

524,799 |

|

| + Stock-based compensation |

|

5,729 |

|

|

5,352 |

|

|

13,675 |

|

|

15,596 |

|

| + Loss (Gain) on sale of property, plant and equipment |

|

142 |

|

|

(165) |

|

|

242 |

|

|

(5,713) |

|

| Adjusted EBITDA |

|

$ |

113,430 |

|

|

$ |

131,229 |

|

|

$ |

324,777 |

|

|

$ |

534,682 |

|

The following table reconciles cash flow from operations to free cash flow on a trailing twelve-month basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Trailing Twelve Months Ended |

| ($ in thousands) |

|

October 1, 2023 |

|

September 25, 2022 |

| Cash flow from operations |

|

$ |

475,760 |

|

|

$ |

334,521 |

|

| Less: purchases of property, plant and equipment |

|

(63,876) |

|

|

(84,086) |

|

| Free cash flow |

|

$ |

411,884 |

|

|

$ |

250,435 |

|