| Delaware | 41-0255900 | ||||

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification Number) | ||||

| Title of each class |

Trading

symbol

|

Name of each exchange

on which registered

|

||||||

| Common Stock, $.01 par value per share | USB | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/100th interest in a share of Series A Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrA | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/1,000th interest in a share of Series B Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrH | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/1,000th interest in a share of Series K Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrP | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/1,000th interest in a share of Series L Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrQ | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/1,000th interest in a share of Series M Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrR | New York Stock Exchange | ||||||

| Depositary Shares (each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock, par value $1.00) | USB PrS | New York Stock Exchange | ||||||

| 0.850% Medium-Term Notes, Series X (Senior), due June 7, 2024 | USB/24B | New York Stock Exchange | ||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| U.S. BANCORP | ||

| By /s/ Lisa R. Stark | ||

| Lisa R. Stark | ||

|

Executive Vice President and

Controller

| ||

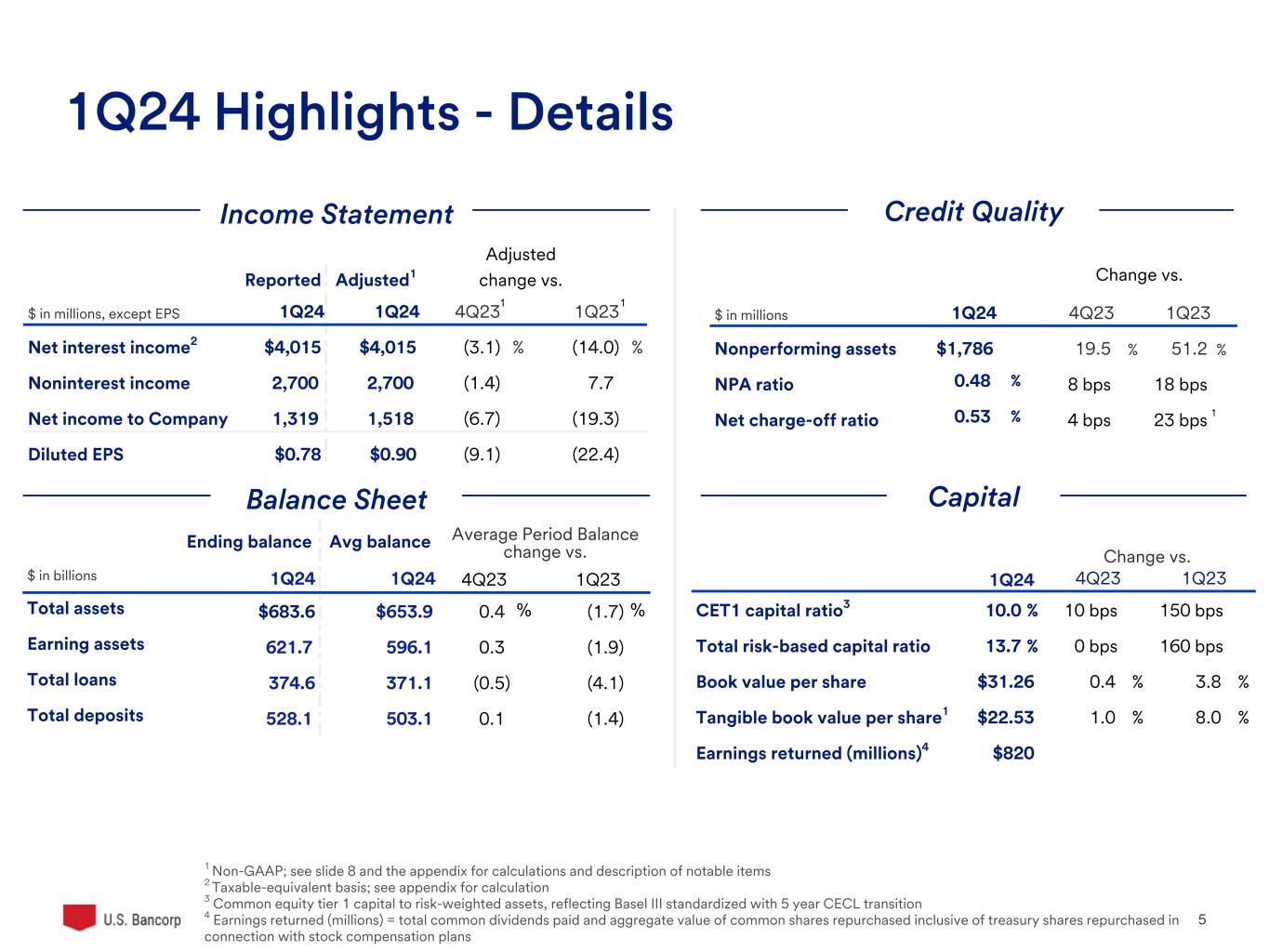

1Q24 Key Financial Data |

1Q24 Highlights |

|||||||||||||||||||

| PROFITABILITY METRICS | 1Q24 | 4Q23 | 1Q23 |

•Net income of $1,518 million and diluted earnings per common share of $0.90, as adjusted for notable items

•Net revenue of $6,715 million, including $4,015 million of net interest income on a taxable-equivalent basis

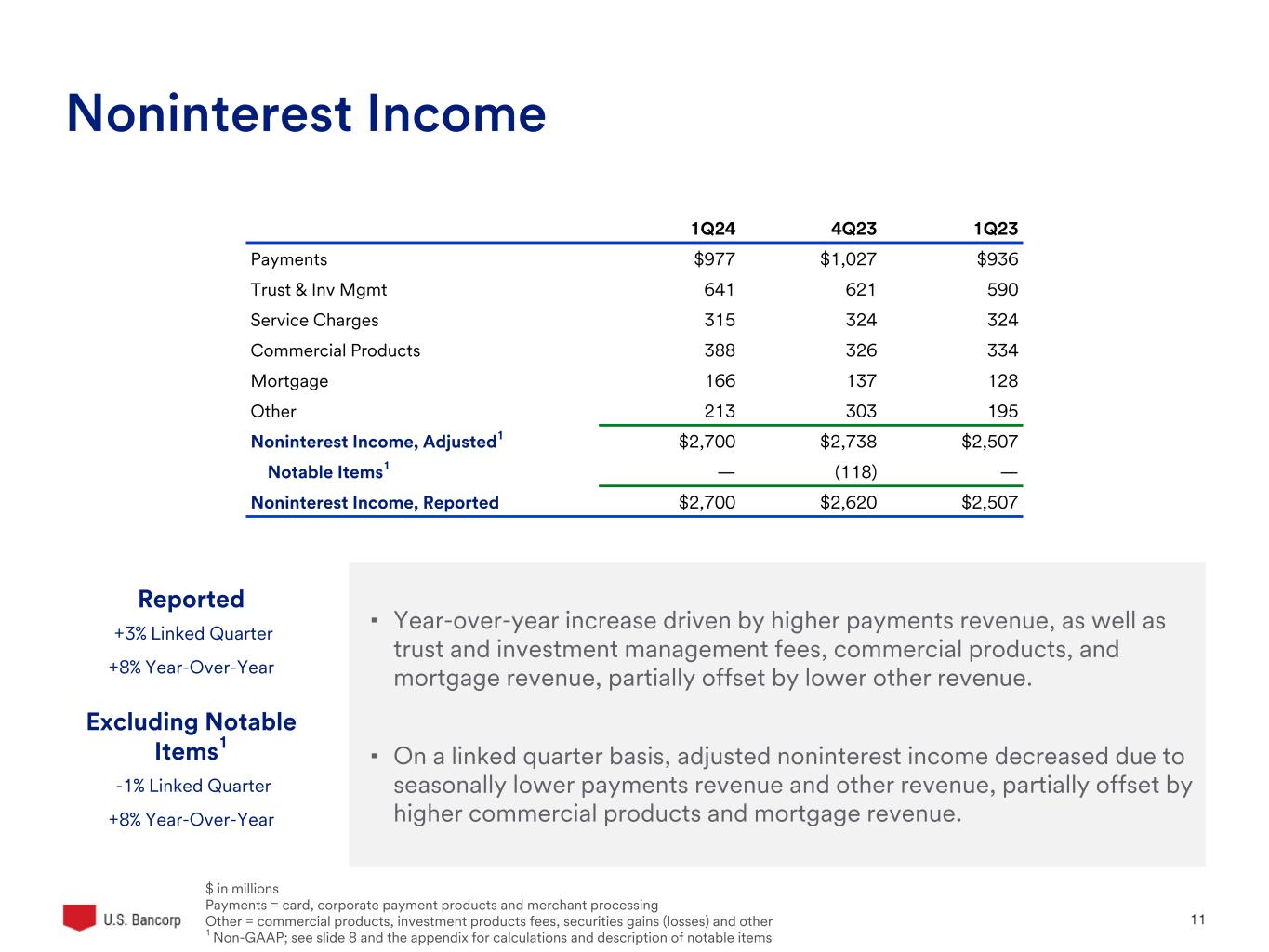

•Noninterest income increased 7.7% year-over-year and decreased 1.4% on a linked quarter basis, as adjusted for notable items

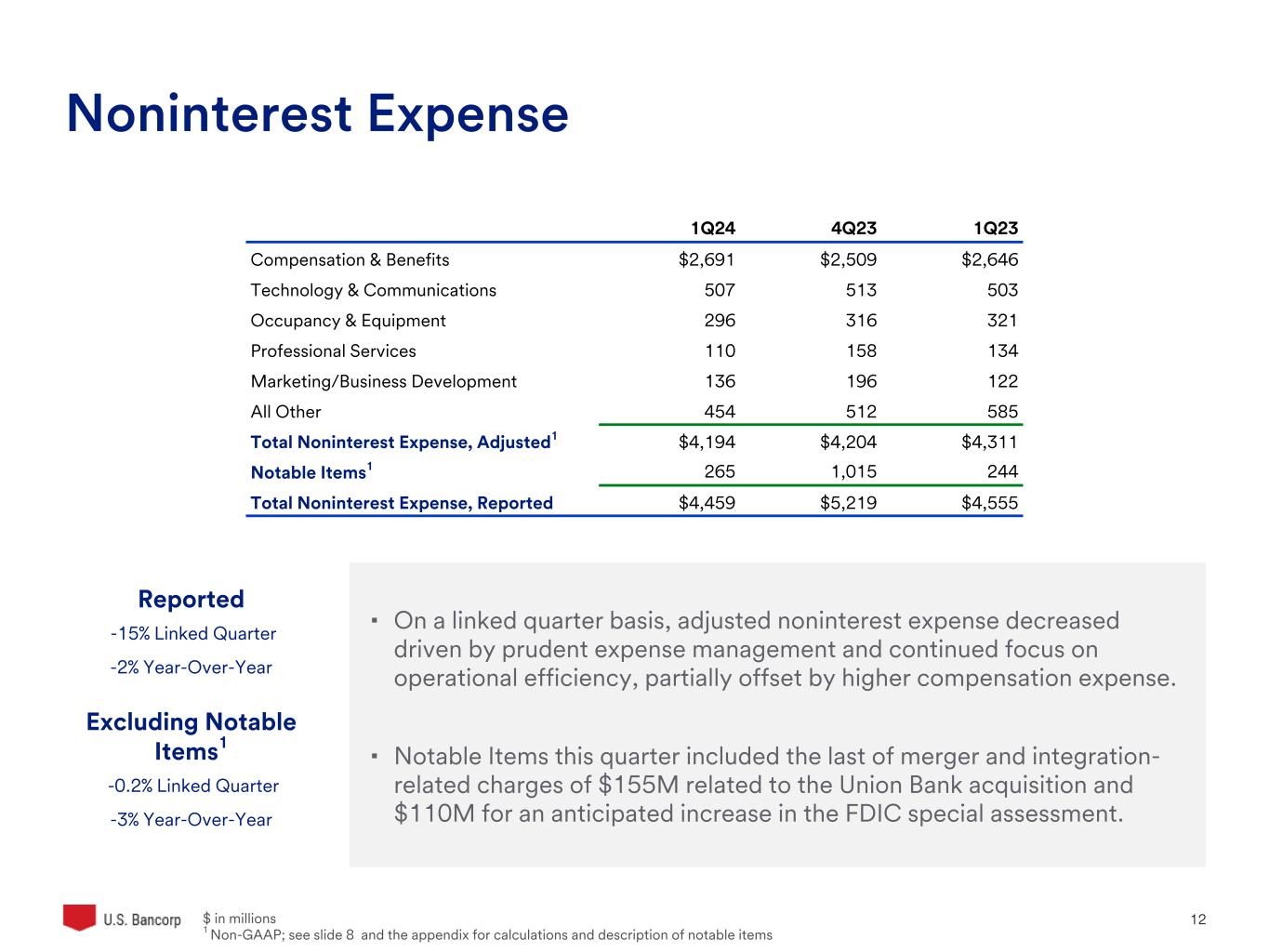

•Noninterest expense decreased 2.7% year-over-year and 0.2% on a linked quarter basis, as adjusted for notable items

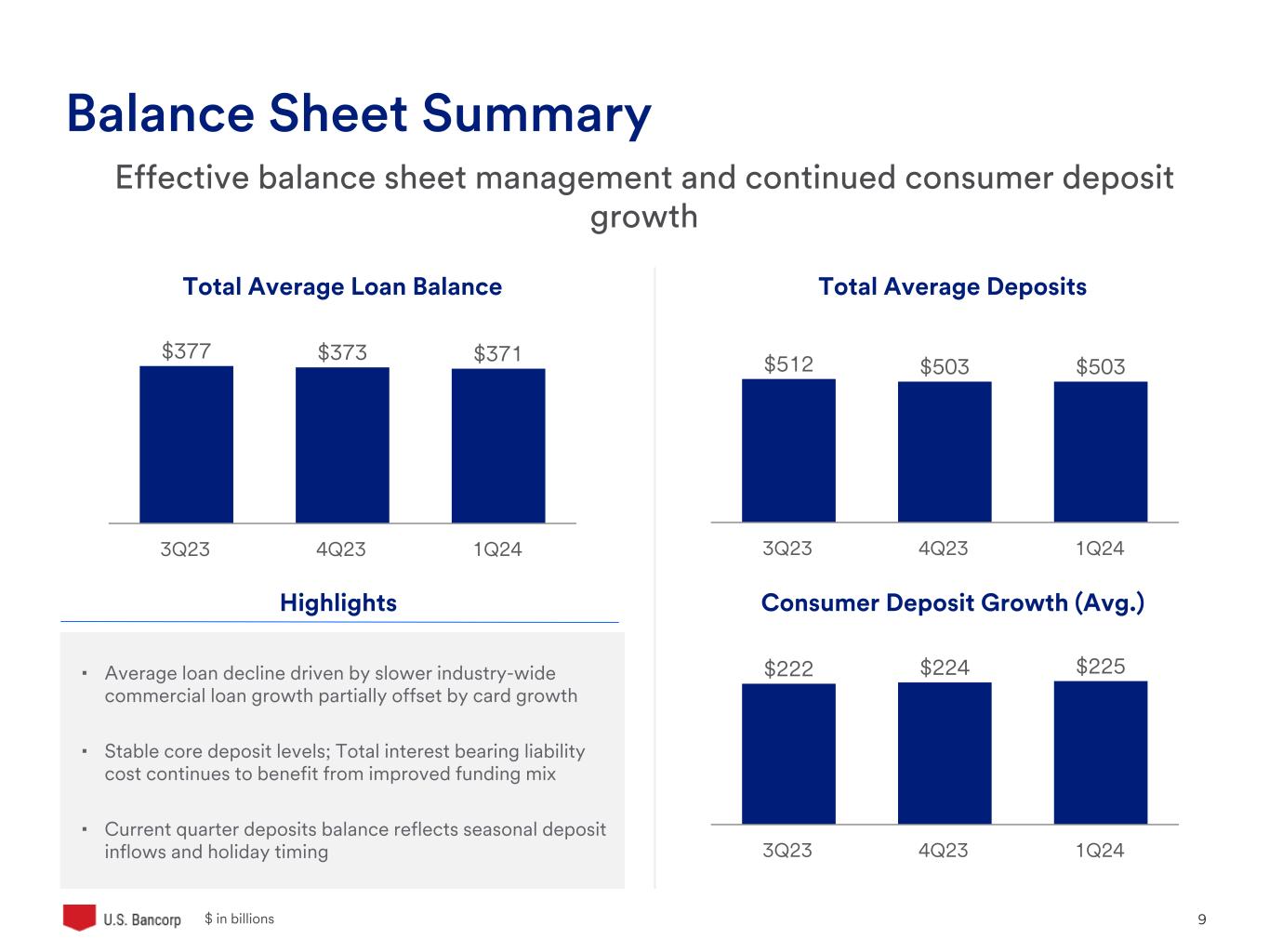

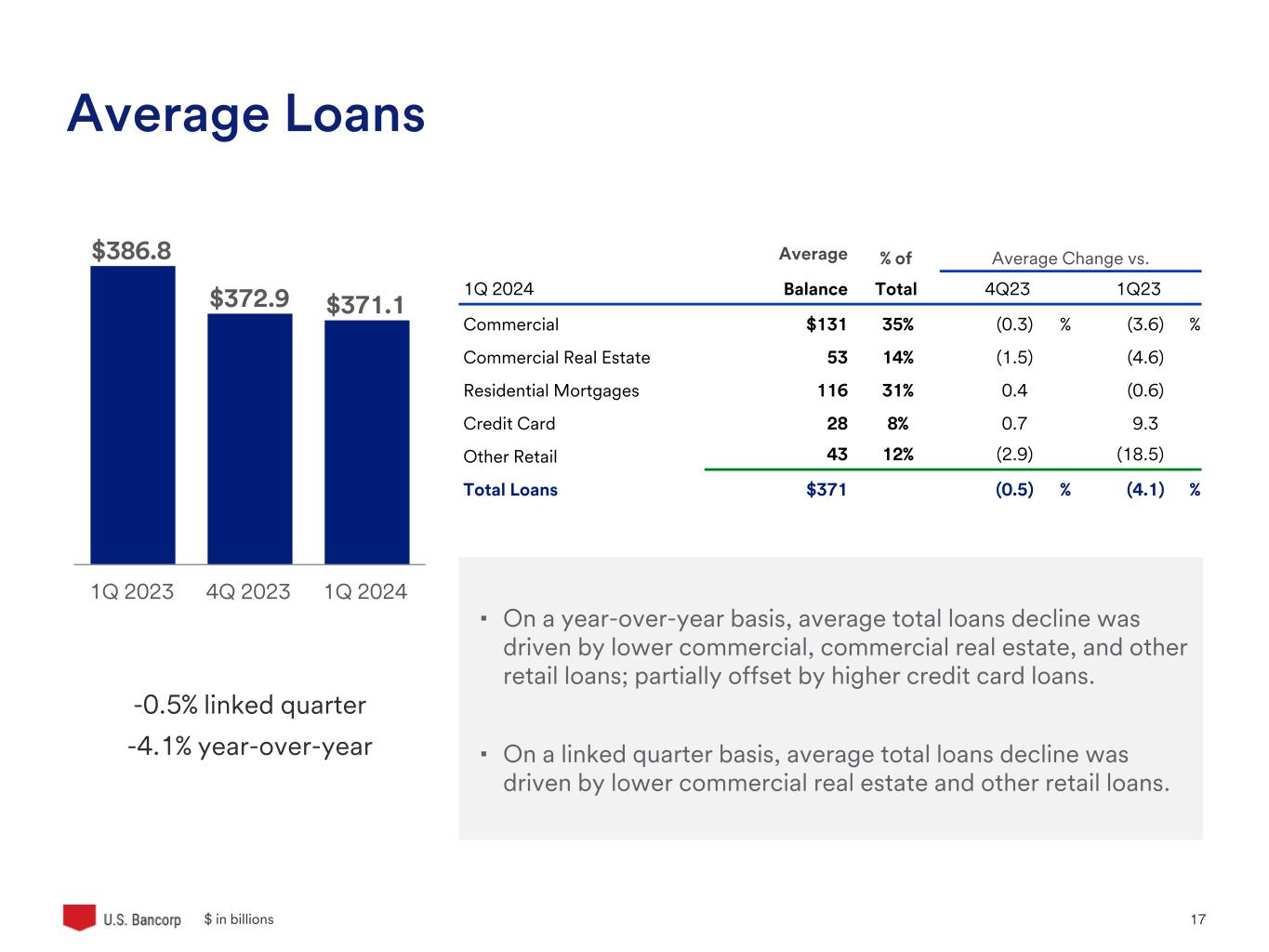

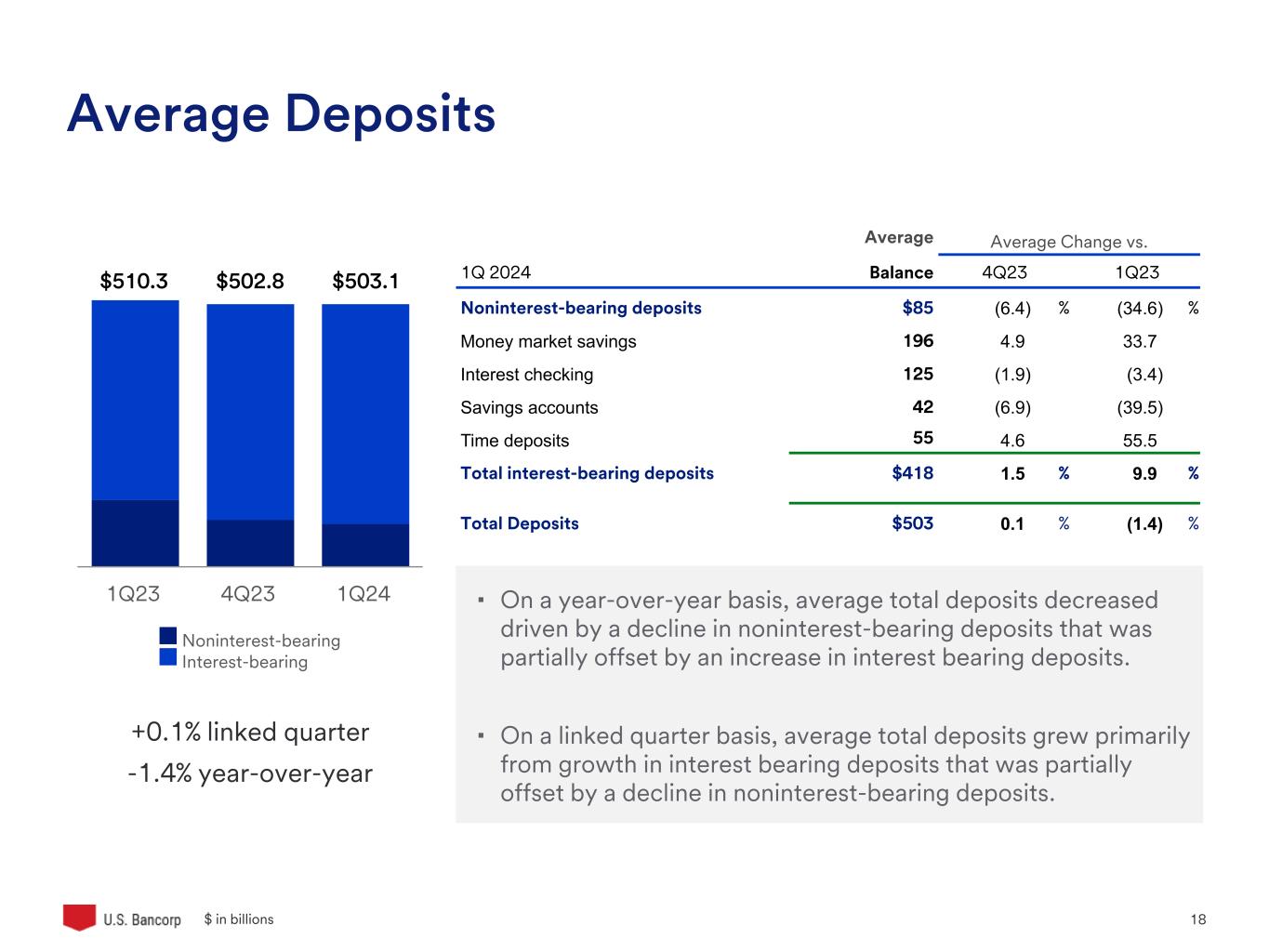

•Average total loans decreased 0.5% and average total deposits increased 0.1% on a linked quarter basis

•Return on tangible common equity of 17.4%, return on average assets of 0.93%, and efficiency ratio of 62.5%, as adjusted for notable items

•CET1 capital ratio of 10.0% at March 31, 2024, compared with 9.9% at December 31, 2023

•Notable items for the quarter, on a pretax basis, consisted of $155 million of merger and integration-related charges related to the acquisition of MUFG Union Bank ("MUB") and a $110 million charge for the increase in the Federal Deposit Insurance Corporation ("FDIC") special assessment

|

||||||||||||||||

| Return on average assets (%) | .81 | .52 | 1.03 | |||||||||||||||||

| Return on average common equity (%) | 10.0 | 6.4 | 14.1 | |||||||||||||||||

| Return on tangible common equity (%) (a) | 15.1 | 10.5 | 22.0 | |||||||||||||||||

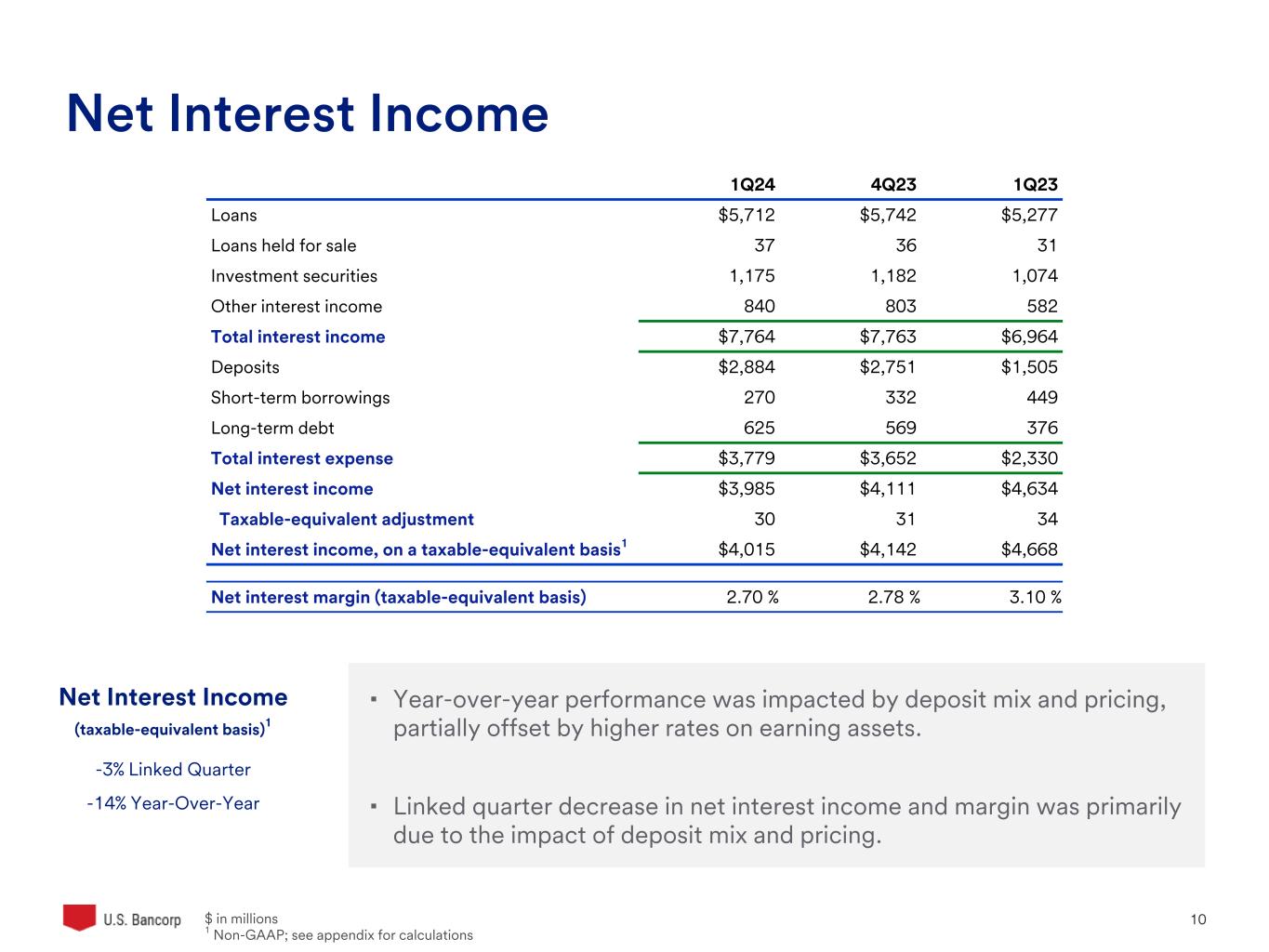

| Net interest margin (%) | 2.70 | 2.78 | 3.10 | |||||||||||||||||

| Efficiency ratio (%) (a) | 66.4 | 75.9 | 63.2 | |||||||||||||||||

| Tangible efficiency ratio (%) (a) | 64.2 | 73.6 | 61.0 | |||||||||||||||||

| INCOME STATEMENT (b) | 1Q24 | 4Q23 | 1Q23 | |||||||||||||||||

| Net interest income (taxable-equivalent basis) | $4,015 | $4,142 | $4,668 | |||||||||||||||||

| Noninterest income | $2,700 | $2,620 | $2,507 | |||||||||||||||||

| Net income attributable to U.S. Bancorp | $1,319 | $847 | $1,698 | |||||||||||||||||

| Diluted earnings per common share | $.78 | $.49 | $1.04 | |||||||||||||||||

| Dividends declared per common share | $.49 | $.49 | $.48 | |||||||||||||||||

| BALANCE SHEET (b) | 1Q24 | 4Q23 | 1Q23 | |||||||||||||||||

| Average total loans | $371,070 | $372,856 | $386,750 | |||||||||||||||||

| Average total deposits | $503,061 | $502,782 | $510,324 | |||||||||||||||||

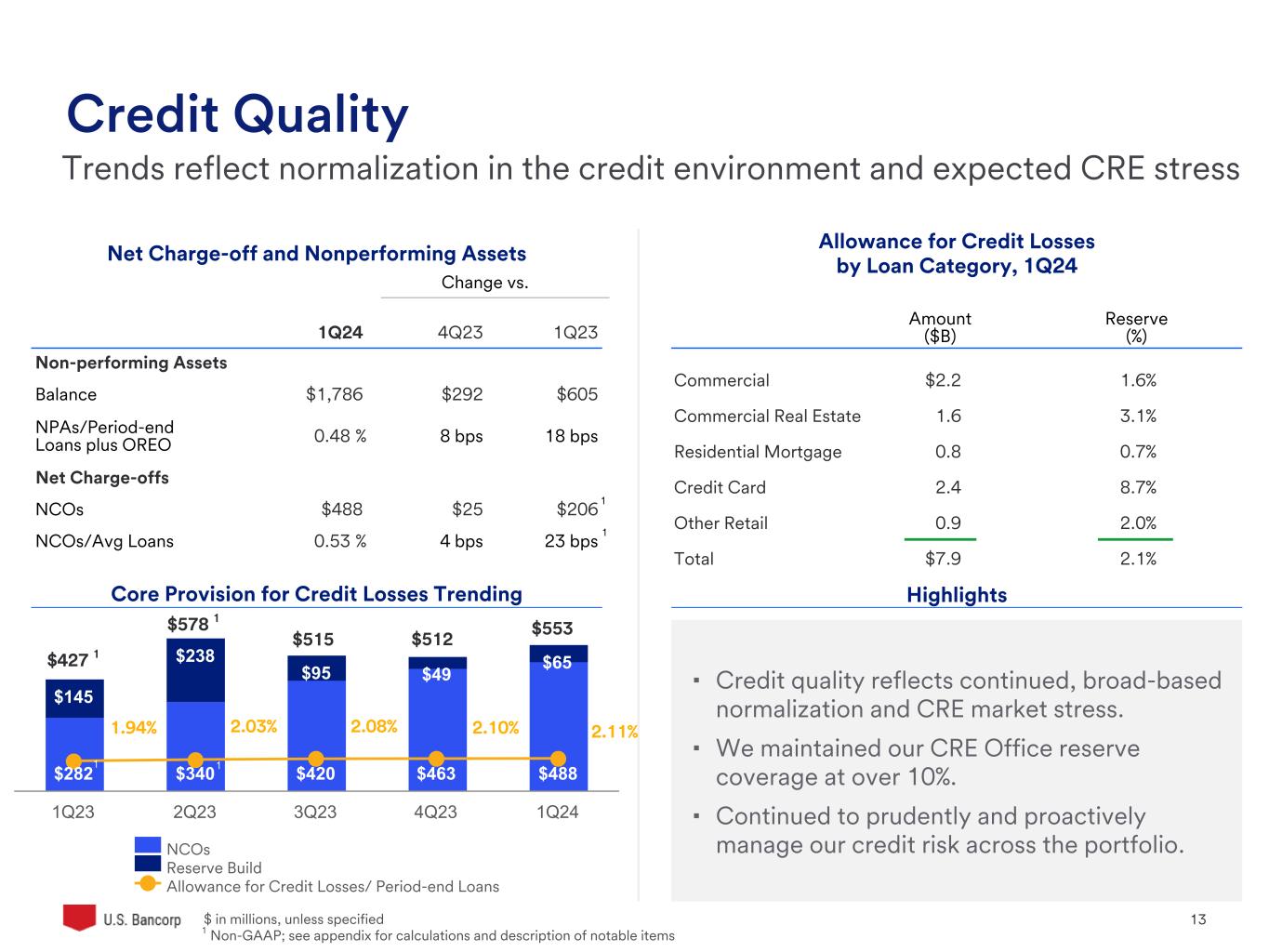

| Net charge-off ratio (%) | .53 | .49 | .39 | |||||||||||||||||

| Book value per common share (period end) | $31.26 | $31.13 | $30.12 | |||||||||||||||||

| Basel III standardized CET1 (%) (c) | 10.0 | 9.9 | 8.5 | |||||||||||||||||

|

(a) See Non-GAAP Financial Measures reconciliation on page 18

(b) Dollars in millions, except per share data

(c) CET1 = Common equity tier 1 capital ratio

|

||||||||||||||||||||

| CEO Commentary | ||

| Business and Other Highlights | ||

|

Notable Item Impacts 1Q24

($ in million, except per share data)

|

Income Before Taxes | Net Income Attributable to U.S. Bancorp | Diluted Earnings Per Common Share |

||||||||

| Reported | $1,703 | $1,319 | $.78 | ||||||||

| Notable items | 265 | 199 | .12 | ||||||||

| Adjusted | $1,968 | $1,518 | $.90 | ||||||||

| Notable Items | |||||||||||

| ($ in millions) | 1Q24 | 4Q23 | 1Q23 | ||||||||

| Balance sheet optimization | $— | $118 | $— | ||||||||

| Merger and integration charges | 155 | 171 | 244 | ||||||||

| FDIC special assessment | 110 | 734 | — | ||||||||

| Foundation contribution | — | 110 | — | ||||||||

| Notable items | 265 | 1,133 | 244 | ||||||||

| Tax expense (a) | (66) | (353) | (61) | ||||||||

| Notable items, net of tax expense | $199 | $780 | $183 | ||||||||

| (a) 4Q23 includes $70 million of favorable discrete tax settlements | |||||||||||

Investor contact: George Andersen, 612.303.3620 | Media contact: Jeff Shelman, 612.303.9933 | ||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| INCOME STATEMENT HIGHLIGHTS | ||||||||||||||||||||||||||||||||||||||

| ($ in millions, except per share data) | ADJUSTED (a) (b) | |||||||||||||||||||||||||||||||||||||

| Percent Change | Percent Change | |||||||||||||||||||||||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||||||||||||||||||

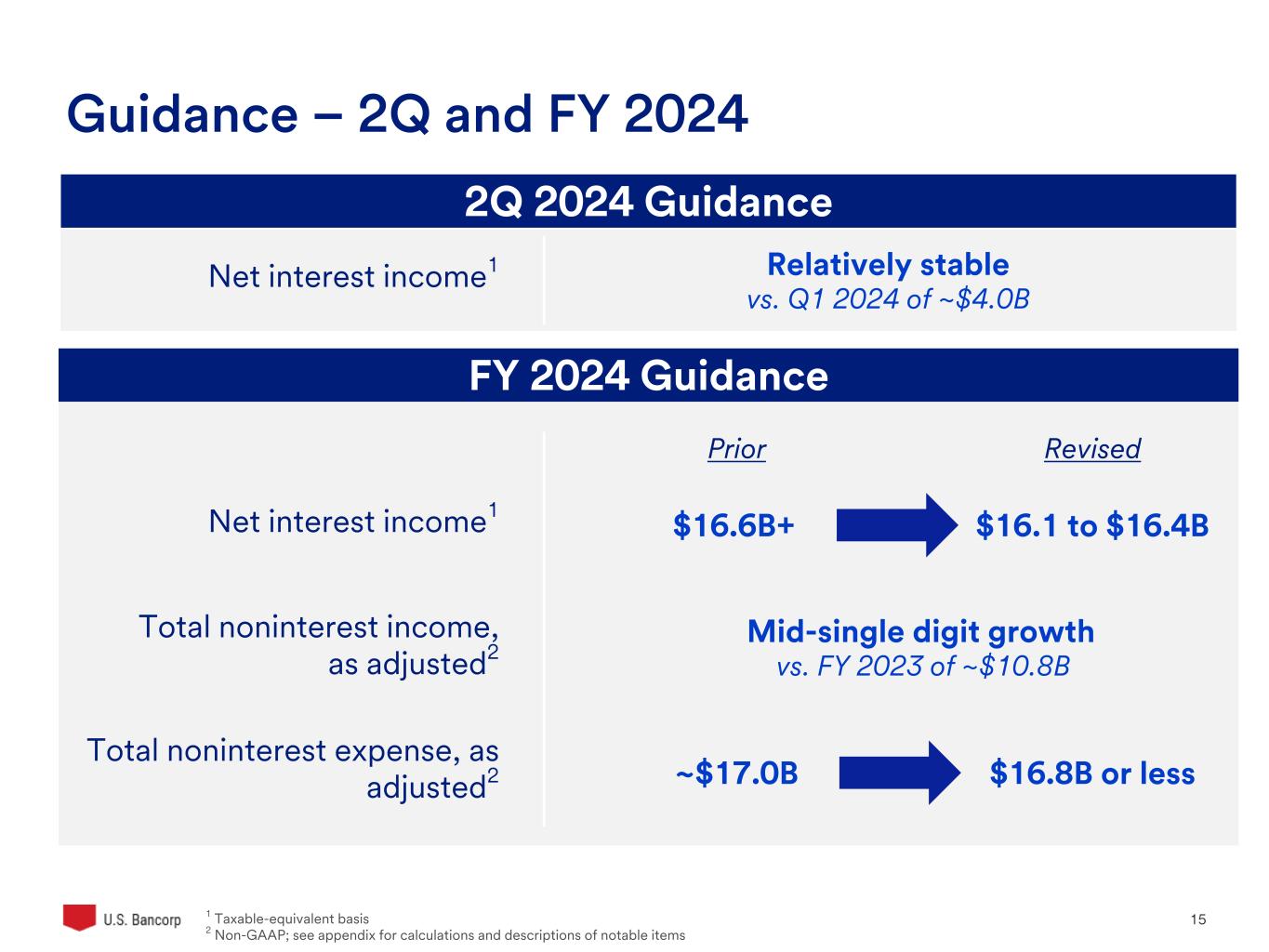

| Net interest income | $3,985 | $4,111 | $4,634 | (3.1) | (14.0) | $3,985 | $4,111 | $4,634 | (3.1) | (14.0) | ||||||||||||||||||||||||||||

| Taxable-equivalent adjustment | 30 | 31 | 34 | (3.2) | (11.8) | 30 | 31 | 34 | (3.2) | (11.8) | ||||||||||||||||||||||||||||

| Net interest income (taxable-equivalent basis) | 4,015 | 4,142 | 4,668 | (3.1) | (14.0) | 4,015 | 4,142 | 4,668 | (3.1) | (14.0) | ||||||||||||||||||||||||||||

| Noninterest income | 2,700 | 2,620 | 2,507 | 3.1 | 7.7 | 2,700 | 2,738 | 2,507 | (1.4) | 7.7 | ||||||||||||||||||||||||||||

| Total net revenue | 6,715 | 6,762 | 7,175 | (.7) | (6.4) | 6,715 | 6,880 | 7,175 | (2.4) | (6.4) | ||||||||||||||||||||||||||||

| Noninterest expense | 4,459 | 5,219 | 4,555 | (14.6) | (2.1) | 4,194 | 4,204 | 4,311 | (.2) | (2.7) | ||||||||||||||||||||||||||||

| Income before provision and income taxes | 2,256 | 1,543 | 2,620 | 46.2 | (13.9) | 2,521 | 2,676 | 2,864 | (5.8) | (12.0) | ||||||||||||||||||||||||||||

| Provision for credit losses | 553 | 512 | 427 | 8.0 | 29.5 | 553 | 512 | 427 | 8.0 | 29.5 | ||||||||||||||||||||||||||||

| Income before taxes | 1,703 | 1,031 | 2,193 | 65.2 | (22.3) | 1,968 | 2,164 | 2,437 | (9.1) | (19.2) | ||||||||||||||||||||||||||||

| Income taxes and taxable-equivalent adjustment | 377 | 170 | 489 | nm | (22.9) | 443 | 523 | 550 | (15.3) | (19.5) | ||||||||||||||||||||||||||||

| Net income | 1,326 | 861 | 1,704 | 54.0 | (22.2) | 1,525 | 1,641 | 1,887 | (7.1) | (19.2) | ||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (7) | (14) | (6) | 50.0 | (16.7) | (7) | (14) | (6) | 50.0 | (16.7) | ||||||||||||||||||||||||||||

| Net income attributable to U.S. Bancorp | $1,319 | $847 | $1,698 | 55.7 | (22.3) | $1,518 | $1,627 | $1,881 | (6.7) | (19.3) | ||||||||||||||||||||||||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | $766 | $1,592 | 57.8 | (24.1) | $1,407 | $1,541 | $1,773 | (8.7) | (20.6) | ||||||||||||||||||||||||||||

| Diluted earnings per common share | $.78 | $.49 | $1.04 | 59.2 | (25.0) | $.90 | $.99 | $1.16 | (9.1) | (22.4) | ||||||||||||||||||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| NET INTEREST INCOME | ||||||||||||||||||||||||||||||||

| (Taxable-equivalent basis; $ in millions) | Change | |||||||||||||||||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | ||||||||||||||||||||||||||||

| Components of net interest income | ||||||||||||||||||||||||||||||||

| Income on earning assets | $ | 7,795 | $ | 7,795 | $ | 6,999 | $ | — | $ | 796 | ||||||||||||||||||||||

| Expense on interest-bearing liabilities | 3,780 | 3,653 | 2,331 | 127 | 1,449 | |||||||||||||||||||||||||||

| Net interest income | $ | 4,015 | $ | 4,142 | $ | 4,668 | $ | (127) | $ | (653) | ||||||||||||||||||||||

| Average yields and rates paid | ||||||||||||||||||||||||||||||||

| Earning assets yield | 5.25 | % | 5.22 | % | 4.65 | % | .03 | % | .60 | % | ||||||||||||||||||||||

| Rate paid on interest-bearing liabilities | 3.12 | 3.02 | 2.06 | .10 | 1.06 | |||||||||||||||||||||||||||

| Gross interest margin | 2.13 | % | 2.20 | % | 2.59 | % | (.07) | % | (.46) | % | ||||||||||||||||||||||

| Net interest margin | 2.70 | % | 2.78 | % | 3.10 | % | (.08) | % | (.40) | % | ||||||||||||||||||||||

| Average balances | ||||||||||||||||||||||||||||||||

| Investment securities (a) | $161,236 | $ | 161,885 | $ | 166,125 | $ | (649) | $ | (4,889) | |||||||||||||||||||||||

| Loans | 371,070 | 372,856 | 386,750 | (1,786) | (15,680) | |||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 50,903 | 47,532 | 43,305 | 3,371 | 7,598 | |||||||||||||||||||||||||||

| Earning assets | 596,135 | 594,244 | 607,614 | 1,891 | (11,479) | |||||||||||||||||||||||||||

| Interest-bearing liabilities | 487,351 | 479,700 | 458,074 | 7,651 | 29,277 | |||||||||||||||||||||||||||

| (a) Excludes unrealized gain (loss) | ||||||||||||||||||||||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| AVERAGE LOANS | |||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Commercial | $126,602 | $126,884 | $131,227 | (.2) | % | (3.5) | % | ||||||||||

| Lease financing | 4,165 | 4,212 | 4,456 | (1.1) | (6.5) | ||||||||||||

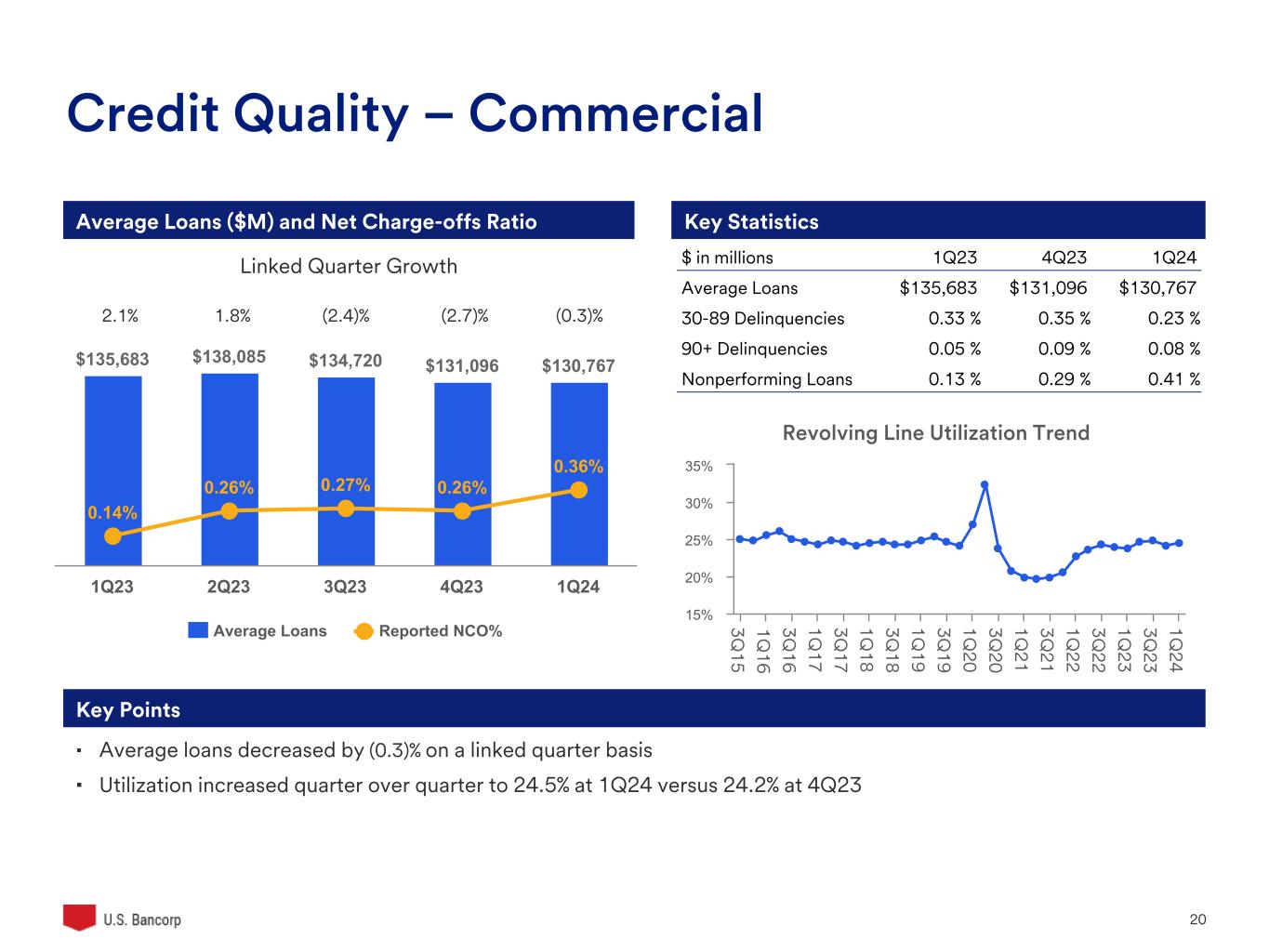

| Total commercial | 130,767 | 131,096 | 135,683 | (.3) | (3.6) | ||||||||||||

| Commercial mortgages | 41,545 | 42,089 | 43,627 | (1.3) | (4.8) | ||||||||||||

| Construction and development | 11,492 | 11,736 | 11,968 | (2.1) | (4.0) | ||||||||||||

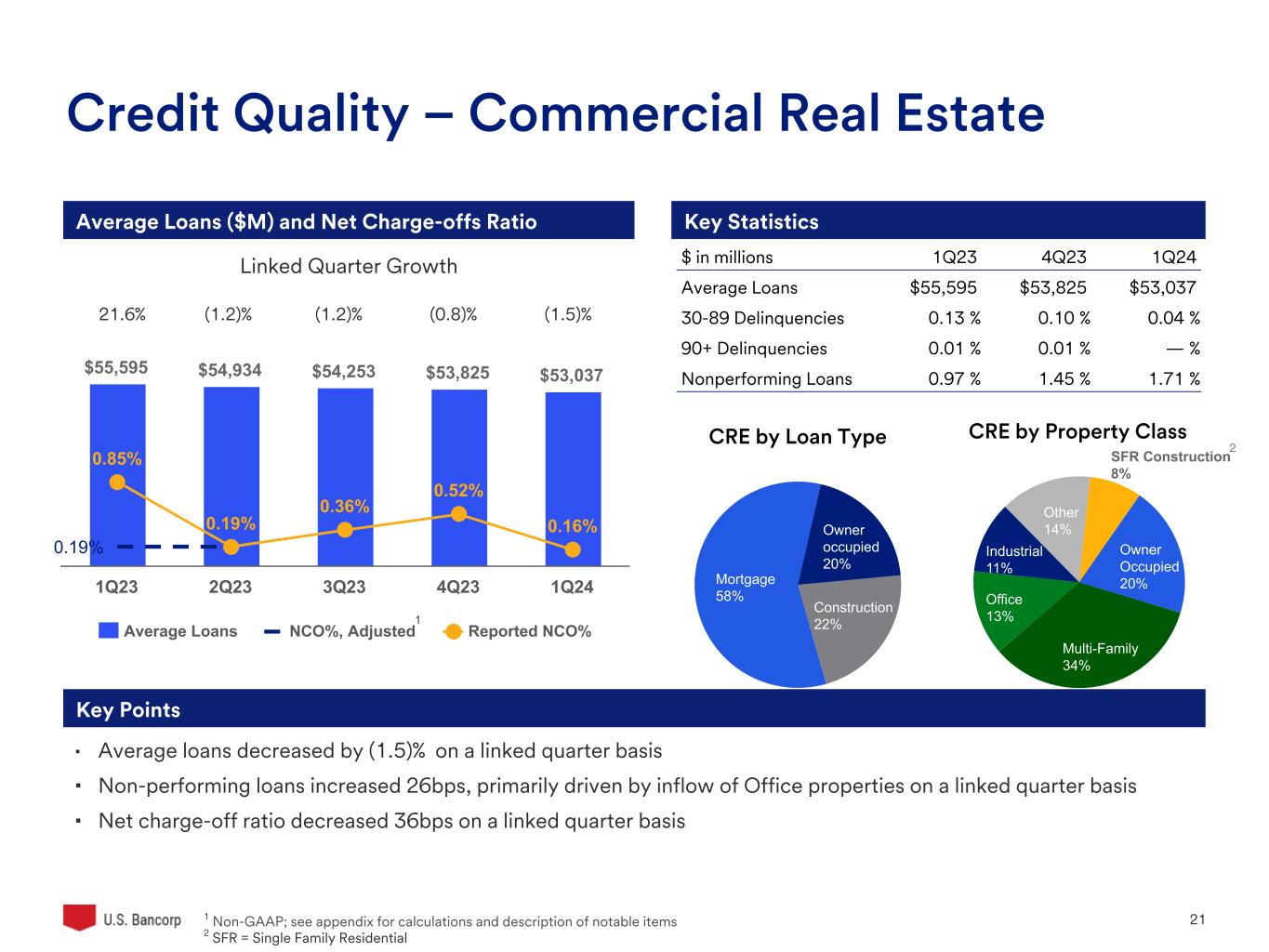

| Total commercial real estate | 53,037 | 53,825 | 55,595 | (1.5) | (4.6) | ||||||||||||

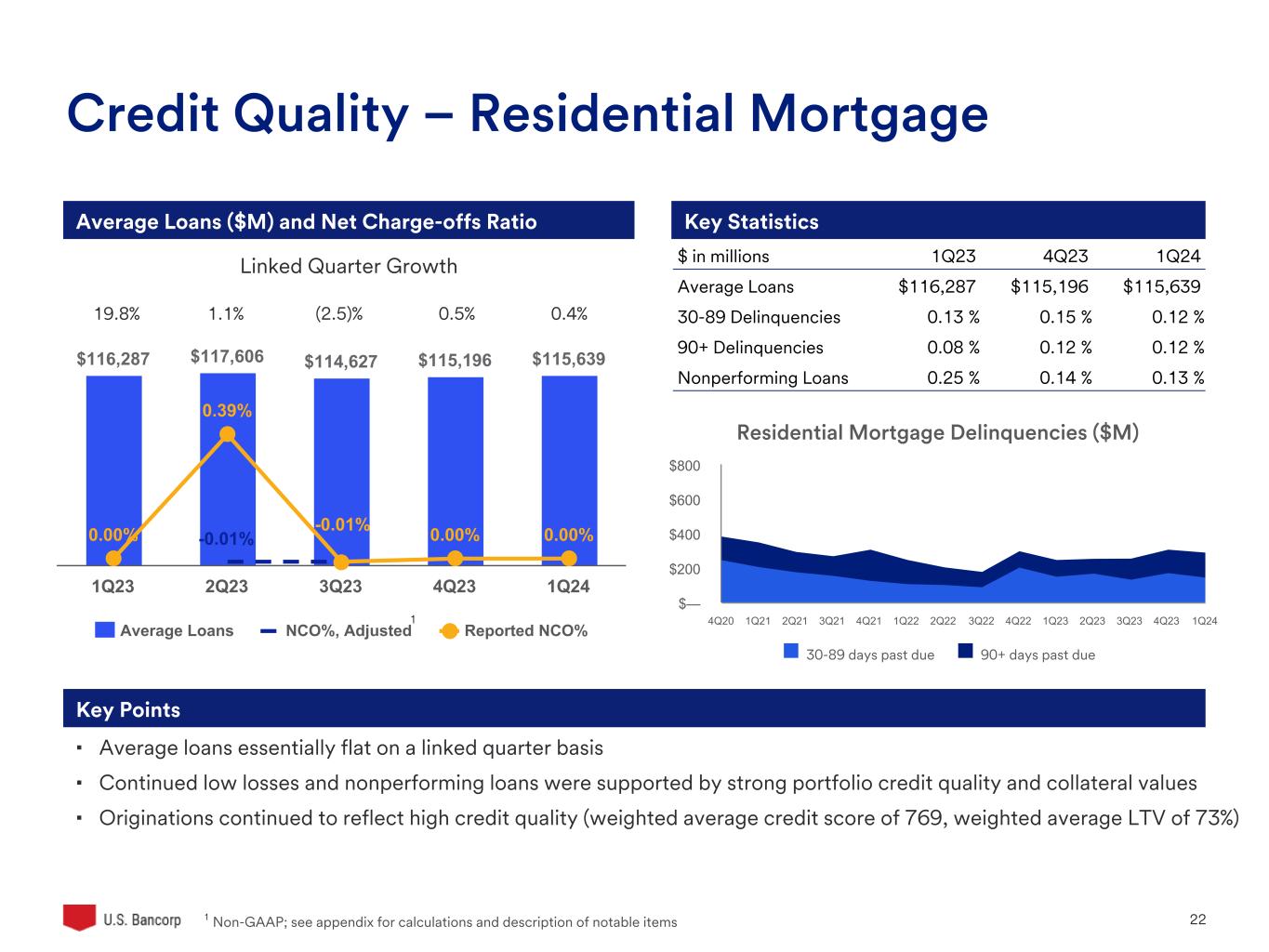

| Residential mortgages | 115,639 | 115,196 | 116,287 | .4 | (.6) | ||||||||||||

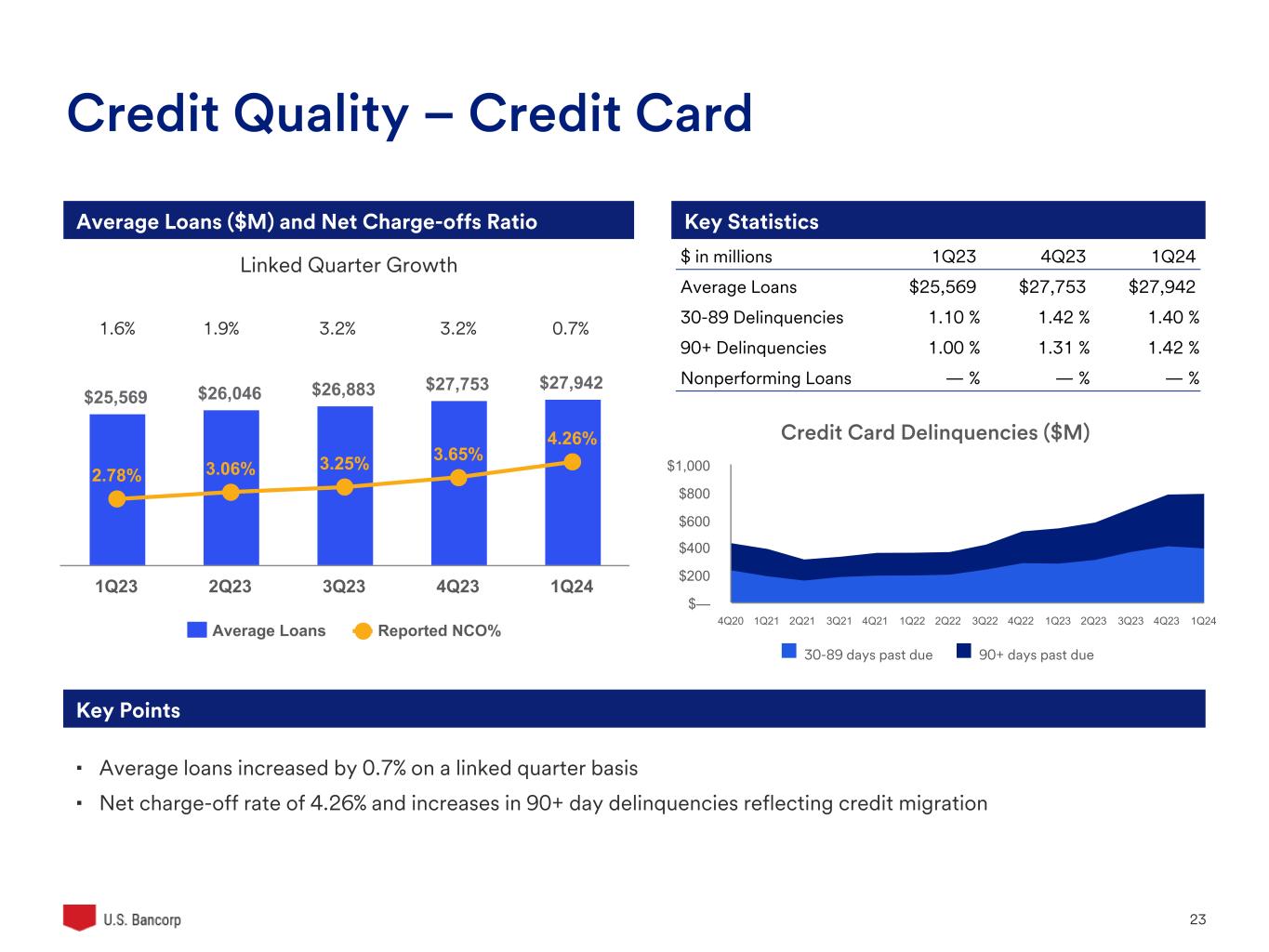

| Credit card | 27,942 | 27,753 | 25,569 | .7 | 9.3 | ||||||||||||

| Retail leasing | 4,082 | 4,167 | 5,241 | (2.0) | (22.1) | ||||||||||||

| Home equity and second mortgages | 12,983 | 12,977 | 12,774 | — | 1.6 | ||||||||||||

| Other | 26,620 | 27,842 | 35,601 | (4.4) | (25.2) | ||||||||||||

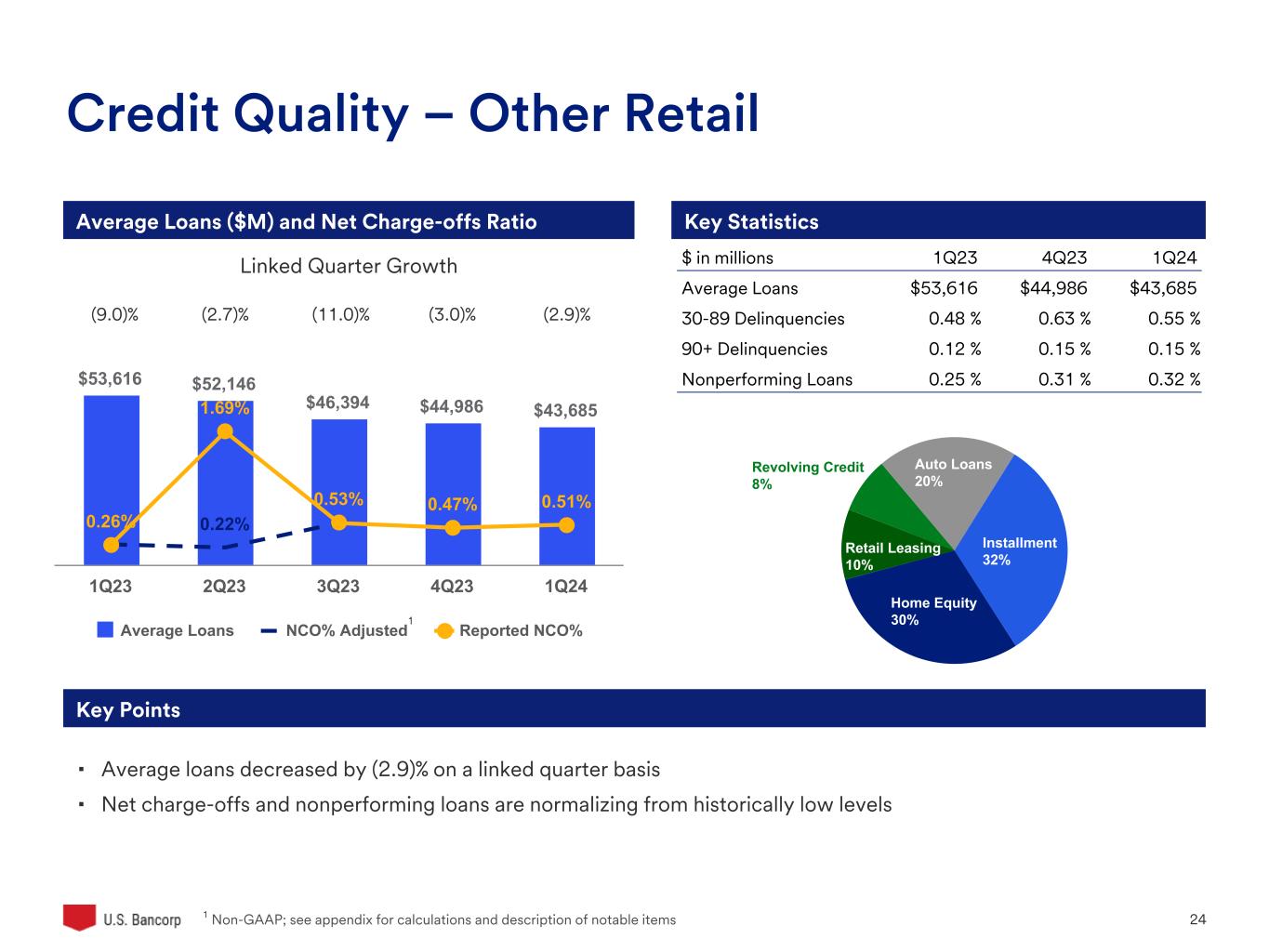

| Total other retail | 43,685 | 44,986 | 53,616 | (2.9) | (18.5) | ||||||||||||

| Total loans | $371,070 | $372,856 | $386,750 | (.5) | (4.1) | ||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| AVERAGE DEPOSITS | |||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Noninterest-bearing deposits | $84,787 | $90,590 | $129,741 | (6.4) | % | (34.6) | % | ||||||||||

| Interest-bearing savings deposits | |||||||||||||||||

| Interest checking | 125,011 | 127,445 | 129,350 | (1.9) | (3.4) | ||||||||||||

| Money market savings | 196,502 | 187,322 | 146,970 | 4.9 | 33.7 | ||||||||||||

| Savings accounts | 41,645 | 44,728 | 68,827 | (6.9) | (39.5) | ||||||||||||

| Total savings deposits | 363,158 | 359,495 | 345,147 | 1.0 | 5.2 | ||||||||||||

| Time deposits | 55,116 | 52,697 | 35,436 | 4.6 | 55.5 | ||||||||||||

| Total interest-bearing deposits | 418,274 | 412,192 | 380,583 | 1.5 | 9.9 | ||||||||||||

| Total deposits | $503,061 | $502,782 | $510,324 | .1 | (1.4) | ||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| NONINTEREST INCOME | |||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Card revenue | $392 | $436 | $360 | (10.1) | 8.9 | ||||||||||||

| Corporate payment products revenue | 184 | 182 | 189 | 1.1 | (2.6) | ||||||||||||

| Merchant processing services | 401 | 409 | 387 | (2.0) | 3.6 | ||||||||||||

| Trust and investment management fees | 641 | 621 | 590 | 3.2 | 8.6 | ||||||||||||

| Service charges | 315 | 324 | 324 | (2.8) | (2.8) | ||||||||||||

| Commercial products revenue | 388 | 326 | 334 | 19.0 | 16.2 | ||||||||||||

| Mortgage banking revenue | 166 | 137 | 128 | 21.2 | 29.7 | ||||||||||||

| Investment products fees | 77 | 73 | 68 | 5.5 | 13.2 | ||||||||||||

| Securities gains (losses), net | 2 | 2 | (32) | — | nm | ||||||||||||

| Other | 134 | 228 | 159 | (41.2) | (15.7) | ||||||||||||

| Total before balance sheet optimization | 2,700 | 2,738 | 2,507 | (1.4) | 7.7 | ||||||||||||

| Balance sheet optimization | — | (118) | — | nm | nm | ||||||||||||

| Total noninterest income | $2,700 | $2,620 | $2,507 | 3.1 | 7.7 | ||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| NONINTEREST EXPENSE | |||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 | 4Q 2023 | 1Q 2023 | 1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Compensation and employee benefits | $2,691 | $2,509 | $2,646 | 7.3 | 1.7 | ||||||||||||

| Net occupancy and equipment | 296 | 316 | 321 | (6.3) | (7.8) | ||||||||||||

| Professional services | 110 | 158 | 134 | (30.4) | (17.9) | ||||||||||||

| Marketing and business development | 136 | 196 | 122 | (30.6) | 11.5 | ||||||||||||

| Technology and communications | 507 | 513 | 503 | (1.2) | .8 | ||||||||||||

| Other intangibles | 146 | 156 | 160 | (6.4) | (8.8) | ||||||||||||

| Other | 308 | 356 | 425 | (13.5) | (27.5) | ||||||||||||

| Total before notable items | 4,194 | 4,204 | 4,311 | (.2) | (2.7) | ||||||||||||

| Notable items | 265 | 1,015 | 244 | (73.9) | 8.6 | ||||||||||||

| Total noninterest expense | $4,459 | $5,219 | $4,555 | (14.6) | (2.1) | ||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||

| ($ in millions) | 1Q 2024 | % (a) | 4Q 2023 | % (a) | 3Q 2023 | % (a) | 2Q 2023 | % (a) | 1Q 2023 | % (a) | ||||||||||||||||||||||

| Balance, beginning of period | $7,839 | $7,790 | $7,695 | $7,523 | $7,404 | |||||||||||||||||||||||||||

| Change in accounting principle (b) | — | — | — | — | (62) | |||||||||||||||||||||||||||

| Allowance for acquired credit losses (c) | — | — | — | — | 127 | |||||||||||||||||||||||||||

| Net charge-offs | ||||||||||||||||||||||||||||||||

| Total excluding acquisition and optimization impacts | 488 | .53 | 463 | .49 | 420 | .44 | 340 | .35 | 282 | .30 | ||||||||||||||||||||||

| Balance sheet optimization impact | — | — | — | 309 | — | |||||||||||||||||||||||||||

| Acquisition impact | — | — | — | — | 91 | |||||||||||||||||||||||||||

| Total net charge-offs | 488 | .53 | 463 | .49 | 420 | .44 | 649 | .67 | 373 | .39 | ||||||||||||||||||||||

| Provision for credit losses | ||||||||||||||||||||||||||||||||

| Total excluding acquisition and optimization impacts | 553 | 512 | 515 | 578 | 427 | |||||||||||||||||||||||||||

| Balance sheet optimization impact | — | — | — | 243 | — | |||||||||||||||||||||||||||

| Total provision for credit losses | 553 | 512 | 515 | 821 | 427 | |||||||||||||||||||||||||||

| Balance, end of period | $7,904 | $7,839 | $7,790 | $7,695 | $7,523 | |||||||||||||||||||||||||||

| Components | ||||||||||||||||||||||||||||||||

| Allowance for loan losses | $7,514 | $7,379 | $7,218 | $7,164 | $7,020 | |||||||||||||||||||||||||||

| Liability for unfunded | ||||||||||||||||||||||||||||||||

| credit commitments | 390 | 460 | 572 | 531 | 503 | |||||||||||||||||||||||||||

| Total allowance for credit losses | $7,904 | $7,839 | $7,790 | $7,695 | $7,523 | |||||||||||||||||||||||||||

| Allowance for credit losses as a percentage of | ||||||||||||||||||||||||||||||||

| Period-end loans (%) | 2.11 | 2.10 | 2.08 | 2.03 | 1.94 | |||||||||||||||||||||||||||

| Nonperforming loans (%) | 454 | 541 | 615 | 739 | 660 | |||||||||||||||||||||||||||

| Nonperforming assets (%) | 443 | 525 | 595 | 709 | 637 | |||||||||||||||||||||||||||

|

(a)Annualized and calculated on average loan balances

(b)Effective January 1, 2023, the Company adopted accounting guidance which removed the separate recognition and measurement of troubled debt restructurings

(c)Allowance for purchased credit deteriorated and charged-off loans acquired from MUB

| ||||||||||||||||||||||||||||||||

| SUMMARY OF NET CHARGE-OFFS | ||||||||||||||||||||||||||||||||

| ($ in millions) | 1Q 2024 | % (a) | 4Q 2023 | % (a) | 3Q 2023 | % (a) | 2Q 2023 | % (a) | 1Q 2023 | % (a) | ||||||||||||||||||||||

| Net charge-offs | ||||||||||||||||||||||||||||||||

| Commercial | $109 | .35 | $78 | .24 | $86 | .26 | $87 | .26 | $42 | .13 | ||||||||||||||||||||||

| Lease financing | 7 | .68 | 7 | .66 | 6 | .55 | 3 | .27 | 5 | .46 | ||||||||||||||||||||||

| Total commercial | 116 | .36 | 85 | .26 | 92 | .27 | 90 | .26 | 47 | .14 | ||||||||||||||||||||||

| Commercial mortgages | 15 | .15 | 75 | .71 | 49 | .46 | 26 | .24 | 115 | 1.07 | ||||||||||||||||||||||

| Construction and development | 6 | .21 | (4) | (.14) | — | — | — | — | 2 | .07 | ||||||||||||||||||||||

| Total commercial real estate | 21 | .16 | 71 | .52 | 49 | .36 | 26 | .19 | 117 | .85 | ||||||||||||||||||||||

| Residential mortgages | — | — | (1) | — | (3) | (.01) | 114 | .39 | (1) | — | ||||||||||||||||||||||

| Credit card | 296 | 4.26 | 255 | 3.65 | 220 | 3.25 | 199 | 3.06 | 175 | 2.78 | ||||||||||||||||||||||

| Retail leasing | 5 | .49 | 2 | .19 | 2 | .18 | 1 | .08 | 1 | .08 | ||||||||||||||||||||||

| Home equity and second mortgages | — | — | (1) | (.03) | 1 | .03 | (1) | (.03) | (1) | (.03) | ||||||||||||||||||||||

| Other | 50 | .76 | 52 | .74 | 59 | .80 | 220 | 2.55 | 35 | .40 | ||||||||||||||||||||||

| Total other retail | 55 | .51 | 53 | .47 | 62 | .53 | 220 | 1.69 | 35 | .26 | ||||||||||||||||||||||

| Total net charge-offs | $488 | .53 | $463 | .49 | $420 | .44 | $649 | .67 | $373 | .39 | ||||||||||||||||||||||

| Gross charge-offs | $595 | $559 | $508 | $755 | $469 | |||||||||||||||||||||||||||

| Gross recoveries | $107 | $96 | $88 | $106 | $96 | |||||||||||||||||||||||||||

| (a) Annualized and calculated on average loan balances | ||||||||||||||||||||||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN BALANCES | |||||||||||||||||

| (Percent) | Mar 31 2024 | Dec 31 2023 | Sep 30 2023 | Jun 30 2023 | Mar 31 2023 | ||||||||||||

| Delinquent loan ratios - 90 days or more past due | |||||||||||||||||

| Commercial | .08 | .09 | .05 | .04 | .05 | ||||||||||||

| Commercial real estate | — | .01 | — | — | .01 | ||||||||||||

| Residential mortgages | .12 | .12 | .11 | .08 | .08 | ||||||||||||

| Credit card | 1.42 | 1.31 | 1.17 | 1.02 | 1.00 | ||||||||||||

| Other retail | .15 | .15 | .13 | .12 | .12 | ||||||||||||

| Total loans | .19 | .19 | .15 | .12 | .13 | ||||||||||||

| Delinquent loan ratios - 90 days or more past due and nonperforming loans | |||||||||||||||||

| Commercial | .49 | .37 | .24 | .21 | .18 | ||||||||||||

| Commercial real estate | 1.71 | 1.46 | 1.33 | .87 | .98 | ||||||||||||

| Residential mortgages | .26 | .25 | .25 | .26 | .33 | ||||||||||||

| Credit card | 1.42 | 1.31 | 1.17 | 1.02 | 1.01 | ||||||||||||

| Other retail | .47 | .46 | .41 | .39 | .37 | ||||||||||||

| Total loans | .66 | .57 | .49 | .40 | .42 | ||||||||||||

| ASSET QUALITY (a) | |||||||||||||||||

| ($ in millions) | |||||||||||||||||

| Mar 31 2024 | Dec 31 2023 | Sep 30 2023 | Jun 30 2023 | Mar 31 2023 | |||||||||||||

| Nonperforming loans | |||||||||||||||||

| Commercial | $522 | $349 | $231 | $204 | $150 | ||||||||||||

| Lease financing | 27 | 27 | 25 | 27 | 28 | ||||||||||||

| Total commercial | 549 | 376 | 256 | 231 | 178 | ||||||||||||

| Commercial mortgages | 755 | 675 | 566 | 361 | 432 | ||||||||||||

| Construction and development | 145 | 102 | 155 | 113 | 103 | ||||||||||||

| Total commercial real estate | 900 | 777 | 721 | 474 | 535 | ||||||||||||

| Residential mortgages | 155 | 158 | 161 | 207 | 292 | ||||||||||||

| Credit card | — | — | — | — | 1 | ||||||||||||

| Other retail | 137 | 138 | 129 | 129 | 133 | ||||||||||||

| Total nonperforming loans | 1,741 | 1,449 | 1,267 | 1,041 | 1,139 | ||||||||||||

| Other real estate | 25 | 26 | 25 | 25 | 23 | ||||||||||||

| Other nonperforming assets | 20 | 19 | 18 | 19 | 19 | ||||||||||||

| Total nonperforming assets | $1,786 | $1,494 | $1,310 | $1,085 | $1,181 | ||||||||||||

| Accruing loans 90 days or more past due | $714 | $698 | $569 | $474 | $494 | ||||||||||||

| Nonperforming assets to loans plus ORE (%) | .48 | .40 | .35 | .29 | .30 | ||||||||||||

| (a) Throughout this document, nonperforming assets and related ratios do not include accruing loans 90 days or more past due | |||||||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| COMMON SHARES | |||||||||||||||||

| (Millions) | 1Q 2024 | 4Q 2023 | 3Q 2023 | 2Q 2023 | 1Q 2023 | ||||||||||||

| Beginning shares outstanding | 1,558 | 1,557 | 1,533 | 1,533 | 1,531 | ||||||||||||

| Shares issued for stock incentive plans, | |||||||||||||||||

| acquisitions and other corporate purposes | 3 | 1 | 24 | — | 3 | ||||||||||||

| Shares repurchased | (1) | — | — | — | (1) | ||||||||||||

| Ending shares outstanding | 1,560 | 1,558 | 1,557 | 1,533 | 1,533 | ||||||||||||

| CAPITAL POSITION | Preliminary Data | |||||||||||||||||||||||||||||||

| ($ in millions) | Mar 31 2024 | Dec 31 2023 | Sep 30 2023 | Jun 30 2023 | Mar 31 2023 | |||||||||||||||||||||||||||

| Total U.S. Bancorp shareholders' equity | $55,568 | $55,306 | $53,113 | $53,019 | $52,989 | |||||||||||||||||||||||||||

| Basel III Standardized Approach (a) | ||||||||||||||||||||||||||||||||

| Common equity tier 1 capital | $45,239 | $44,947 | $44,655 | $42,944 | $42,027 | |||||||||||||||||||||||||||

| Tier 1 capital | 52,491 | 52,199 | 51,906 | 50,187 | 49,278 | |||||||||||||||||||||||||||

| Total risk-based capital | 62,203 | 61,921 | 61,737 | 60,334 | 59,920 | |||||||||||||||||||||||||||

| Common equity tier 1 capital ratio | 10.0 | % | 9.9 | % | 9.7 | % | 9.1 | % | 8.5 | % | ||||||||||||||||||||||

| Tier 1 capital ratio | 11.6 | 11.5 | 11.2 | 10.6 | 10.0 | |||||||||||||||||||||||||||

| Total risk-based capital ratio | 13.7 | 13.7 | 13.4 | 12.7 | 12.1 | |||||||||||||||||||||||||||

| Leverage ratio | 8.1 | 8.1 | 7.9 | 7.5 | 7.5 | |||||||||||||||||||||||||||

| Tangible common equity to tangible assets (b) | 5.2 | 5.3 | 5.0 | 4.8 | 4.8 | |||||||||||||||||||||||||||

| Tangible common equity to risk-weighted assets (b) | 7.8 | 7.7 | 7.0 | 6.8 | 6.5 | |||||||||||||||||||||||||||

| Common equity tier 1 capital to risk-weighted assets, reflecting the full implementation of the current expected credit losses methodology (b) | 9.9 | 9.7 | 9.5 | 8.9 | 8.3 | |||||||||||||||||||||||||||

|

(a) Amounts and ratios calculated in accordance with transitional regulatory requirements related to the current expected credit losses methodology

(b) See Non-GAAP Financial Measures reconciliation on page 18

| ||||||||||||||||||||||||||||||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| Investor Conference Call | ||

| About U.S. Bancorp | ||

| Forward-looking Statements | ||

|

U.S. Bancorp First Quarter 2024 Results |

||||

|

U.S. Bancorp First Quarter 2024 Results |

||||

| Non-GAAP Financial Measures | ||

| CONSOLIDATED STATEMENT OF INCOME | ||||||||

| (Dollars and Shares in Millions, Except Per Share Data) | Three Months Ended March 31, | |||||||

| (Unaudited) | 2024 | 2023 | ||||||

| Interest Income | ||||||||

| Loans | $5,712 | $5,277 | ||||||

| Loans held for sale | 37 | 31 | ||||||

| Investment securities | 1,175 | 1,074 | ||||||

| Other interest income | 840 | 582 | ||||||

| Total interest income | 7,764 | 6,964 | ||||||

| Interest Expense | ||||||||

| Deposits | 2,884 | 1,505 | ||||||

| Short-term borrowings | 270 | 449 | ||||||

| Long-term debt | 625 | 376 | ||||||

| Total interest expense | 3,779 | 2,330 | ||||||

| Net interest income | 3,985 | 4,634 | ||||||

| Provision for credit losses | 553 | 427 | ||||||

| Net interest income after provision for credit losses | 3,432 | 4,207 | ||||||

| Noninterest Income | ||||||||

| Card revenue | 392 | 360 | ||||||

| Corporate payment products revenue | 184 | 189 | ||||||

| Merchant processing services | 401 | 387 | ||||||

| Trust and investment management fees | 641 | 590 | ||||||

| Service charges | 315 | 324 | ||||||

| Commercial products revenue | 388 | 334 | ||||||

| Mortgage banking revenue | 166 | 128 | ||||||

| Investment products fees | 77 | 68 | ||||||

| Securities gains (losses), net | 2 | (32) | ||||||

| Other | 134 | 159 | ||||||

| Total noninterest income | 2,700 | 2,507 | ||||||

| Noninterest Expense | ||||||||

| Compensation and employee benefits | 2,691 | 2,646 | ||||||

| Net occupancy and equipment | 296 | 321 | ||||||

| Professional services | 110 | 134 | ||||||

| Marketing and business development | 136 | 122 | ||||||

| Technology and communications | 507 | 503 | ||||||

| Other intangibles | 146 | 160 | ||||||

| Merger and integration charges | 155 | 244 | ||||||

| Other | 418 | 425 | ||||||

| Total noninterest expense | 4,459 | 4,555 | ||||||

| Income before income taxes | 1,673 | 2,159 | ||||||

| Applicable income taxes | 347 | 455 | ||||||

| Net income | 1,326 | 1,704 | ||||||

| Net (income) loss attributable to noncontrolling interests | (7) | (6) | ||||||

| Net income attributable to U.S. Bancorp | $1,319 | $1,698 | ||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | $1,592 | ||||||

| Earnings per common share | $.78 | $1.04 | ||||||

| Diluted earnings per common share | $.78 | $1.04 | ||||||

| Dividends declared per common share | $.49 | $.48 | ||||||

| Average common shares outstanding | 1,559 | 1,532 | ||||||

| Average diluted common shares outstanding | 1,559 | 1,532 | ||||||

| CONSOLIDATED ENDING BALANCE SHEET | |||||||||||

| (Dollars in Millions) | March 31, 2024 | December 31, 2023 | March 31, 2023 | ||||||||

| Assets | (Unaudited) | (Unaudited) | |||||||||

| Cash and due from banks | $76,985 | $61,192 | $67,228 | ||||||||

| Investment securities | |||||||||||

| Held-to-maturity | 82,948 | 84,045 | 88,462 | ||||||||

| Available-for-sale | 72,426 | 69,706 | 65,491 | ||||||||

| Loans held for sale | 2,080 | 2,201 | 2,381 | ||||||||

| Loans | |||||||||||

| Commercial | 134,726 | 131,881 | 137,326 | ||||||||

| Commercial real estate | 52,677 | 53,455 | 55,158 | ||||||||

| Residential mortgages | 116,079 | 115,530 | 116,948 | ||||||||

| Credit card | 27,844 | 28,560 | 25,489 | ||||||||

| Other retail | 43,262 | 44,409 | 52,945 | ||||||||

| Total loans | 374,588 | 373,835 | 387,866 | ||||||||

| Less allowance for loan losses | (7,514) | (7,379) | (7,020) | ||||||||

| Net loans | 367,074 | 366,456 | 380,846 | ||||||||

| Premises and equipment | 3,537 | 3,623 | 3,735 | ||||||||

| Goodwill | 12,479 | 12,489 | 12,560 | ||||||||

| Other intangible assets | 6,031 | 6,084 | 6,883 | ||||||||

| Other assets | 60,046 | 57,695 | 54,791 | ||||||||

| Total assets | $683,606 | $663,491 | $682,377 | ||||||||

| Liabilities and Shareholders' Equity | |||||||||||

| Deposits | |||||||||||

| Noninterest-bearing | $91,220 | $89,989 | $124,595 | ||||||||

| Interest-bearing | 436,843 | 422,323 | 380,744 | ||||||||

| Total deposits | 528,063 | 512,312 | 505,339 | ||||||||

| Short-term borrowings | 17,102 | 15,279 | 56,875 | ||||||||

| Long-term debt | 52,693 | 51,480 | 42,045 | ||||||||

| Other liabilities | 29,715 | 28,649 | 24,664 | ||||||||

| Total liabilities | 627,573 | 607,720 | 628,923 | ||||||||

| Shareholders' equity | |||||||||||

| Preferred stock | 6,808 | 6,808 | 6,808 | ||||||||

| Common stock | 21 | 21 | 21 | ||||||||

| Capital surplus | 8,642 | 8,673 | 8,699 | ||||||||

| Retained earnings | 74,473 | 74,026 | 72,807 | ||||||||

| Less treasury stock | (24,023) | (24,126) | (25,193) | ||||||||

| Accumulated other comprehensive income (loss) | (10,353) | (10,096) | (10,153) | ||||||||

| Total U.S. Bancorp shareholders' equity | 55,568 | 55,306 | 52,989 | ||||||||

| Noncontrolling interests | 465 | 465 | 465 | ||||||||

| Total equity | 56,033 | 55,771 | 53,454 | ||||||||

| Total liabilities and equity | $683,606 | $663,491 | $682,377 | ||||||||

| NON-GAAP FINANCIAL MEASURES | ||||||||||||||||||||

| (Dollars in Millions, Unaudited) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||

| Total equity | $56,033 | $55,771 | $53,578 | $53,484 | $53,454 | |||||||||||||||

| Preferred stock | (6,808) | (6,808) | (6,808) | (6,808) | (6,808) | |||||||||||||||

| Noncontrolling interests | (465) | (465) | (465) | (465) | (465) | |||||||||||||||

Goodwill (net of deferred tax liability) (1) |

(11,459) | (11,480) | (11,470) | (11,493) | (11,575) | |||||||||||||||

| Intangible assets (net of deferred tax liability), other than mortgage servicing rights | (2,158) | (2,278) | (2,370) | (2,490) | (2,611) | |||||||||||||||

Tangible common equity (a) |

35,143 | 34,740 | 32,465 | 32,228 | 31,995 | |||||||||||||||

|

Common equity tier 1 capital, determined in accordance with transitional regulatory

capital requirements related to the current expected credit losses methodology implementation

|

45,239 | 44,947 | 44,655 | 42,944 | 42,027 | |||||||||||||||

Adjustments (2) |

(433) | (866) | (867) | (866) | (866) | |||||||||||||||

| Common equity tier 1 capital, reflecting the full implementation | ||||||||||||||||||||

of the current expected credit losses methodology (b) |

44,806 | 44,081 | 43,788 | 42,078 | 41,161 | |||||||||||||||

| Total assets | 683,606 | 663,491 | 668,039 | 680,825 | 682,377 | |||||||||||||||

Goodwill (net of deferred tax liability) (1) |

(11,459) | (11,480) | (11,470) | (11,493) | (11,575) | |||||||||||||||

| Intangible assets (net of deferred tax liability), other than mortgage servicing rights | (2,158) | (2,278) | (2,370) | (2,490) | (2,611) | |||||||||||||||

Tangible assets (c) |

669,989 | 649,733 | 654,199 | 666,842 | 668,191 | |||||||||||||||

|

Risk-weighted assets, determined in accordance with transitional regulatory capital

requirements related to the current expected credit losses methodology

implementation (d)

|

452,831 | * | 453,390 | 462,250 | 473,393 | 494,048 | ||||||||||||||

Adjustments (3) |

(368) | * | (736) | (736) | (735) | (735) | ||||||||||||||

|

Risk-weighted assets, reflecting the full implementation of the current expected

credit losses methodology (e)

|

452,463 | * | 452,654 | 461,514 | 472,658 | 493,313 | ||||||||||||||

| Ratios * | ||||||||||||||||||||

Tangible common equity to tangible assets (a)/(c) |

5.2 | % | 5.3 | % | 5.0 | % | 4.8 | % | 4.8 | % | ||||||||||

Tangible common equity to risk-weighted assets (a)/(d) |

7.8 | 7.7 | 7.0 | 6.8 | 6.5 | |||||||||||||||

|

Common equity tier 1 capital to risk-weighted assets, reflecting the full

implementation of the current expected credit losses methodology (b)/(e)

|

9.9 | 9.7 | 9.5 | 8.9 | 8.3 | |||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | $766 | $1,412 | $1,281 | $1,592 | |||||||||||||||

| Intangibles amortization (net-of-tax) | 115 | 123 | 127 | 126 | 126 | |||||||||||||||

|

Net income applicable to U.S. Bancorp common shareholders, excluding

intangibles amortization

|

1,324 | 889 | 1,539 | 1,407 | 1,718 | |||||||||||||||

|

Annualized net income applicable to U.S. Bancorp common shareholders,

excluding intangible amortization (f)

|

5,325 | 3,527 | 6,106 | 5,643 | 6,967 | |||||||||||||||

| Average total equity | 56,131 | 54,779 | 54,283 | 54,287 | 53,132 | |||||||||||||||

| Average preferred stock | (6,808) | (6,808) | (6,808) | (6,808) | (6,808) | |||||||||||||||

| Average noncontrolling interests | (464) | (465) | (466) | (465) | (465) | |||||||||||||||

Average goodwill (net of deferred tax liability) (1) |

(11,473) | (11,475) | (11,493) | (11,527) | (11,444) | |||||||||||||||

|

Average intangible assets (net of deferred tax liability), other than mortgage

servicing rights

|

(2,208) | (2,295) | (2,418) | (2,530) | (2,681) | |||||||||||||||

Average tangible common equity (g) |

35,178 | 33,736 | 33,098 | 32,957 | 31,734 | |||||||||||||||

Return on tangible common equity (f)/(g) |

15.1 | % | 10.5 | % | 18.4 | % | 17.1 | % | 22.0 | % | ||||||||||

| Net interest income | $3,985 | $4,111 | $4,236 | $4,415 | $4,634 | |||||||||||||||

Taxable-equivalent adjustment (4) |

30 | 31 | 32 | 34 | 34 | |||||||||||||||

| Net interest income, on a taxable-equivalent basis | 4,015 | 4,142 | 4,268 | 4,449 | 4,668 | |||||||||||||||

| Net interest income, on a taxable-equivalent basis (as calculated above) | 4,015 | 4,142 | 4,268 | 4,449 | 4,668 | |||||||||||||||

| Noninterest income | 2,700 | 2,620 | 2,764 | 2,726 | 2,507 | |||||||||||||||

| Less: Securities gains (losses), net | 2 | (116) | — | 3 | (32) | |||||||||||||||

Total net revenue, excluding net securities gains (losses) (h) |

6,713 | 6,878 | 7,032 | 7,172 | 7,207 | |||||||||||||||

Noninterest expense (i) |

4,459 | 5,219 | 4,530 | 4,569 | 4,555 | |||||||||||||||

| Less: Intangible amortization | 146 | 156 | 161 | 159 | 160 | |||||||||||||||

Noninterest expense, excluding intangible amortization (j) |

4,313 | 5,063 | 4,369 | 4,410 | 4,395 | |||||||||||||||

Efficiency ratio (i)/(h) |

66.4 | % | 75.9 | % | 64.4 | % | 63.7 | % | 63.2 | % | ||||||||||

Tangible efficiency ratio (j)/(h) |

64.2 | 73.6 | 62.1 | 61.5 | 61.0 | |||||||||||||||

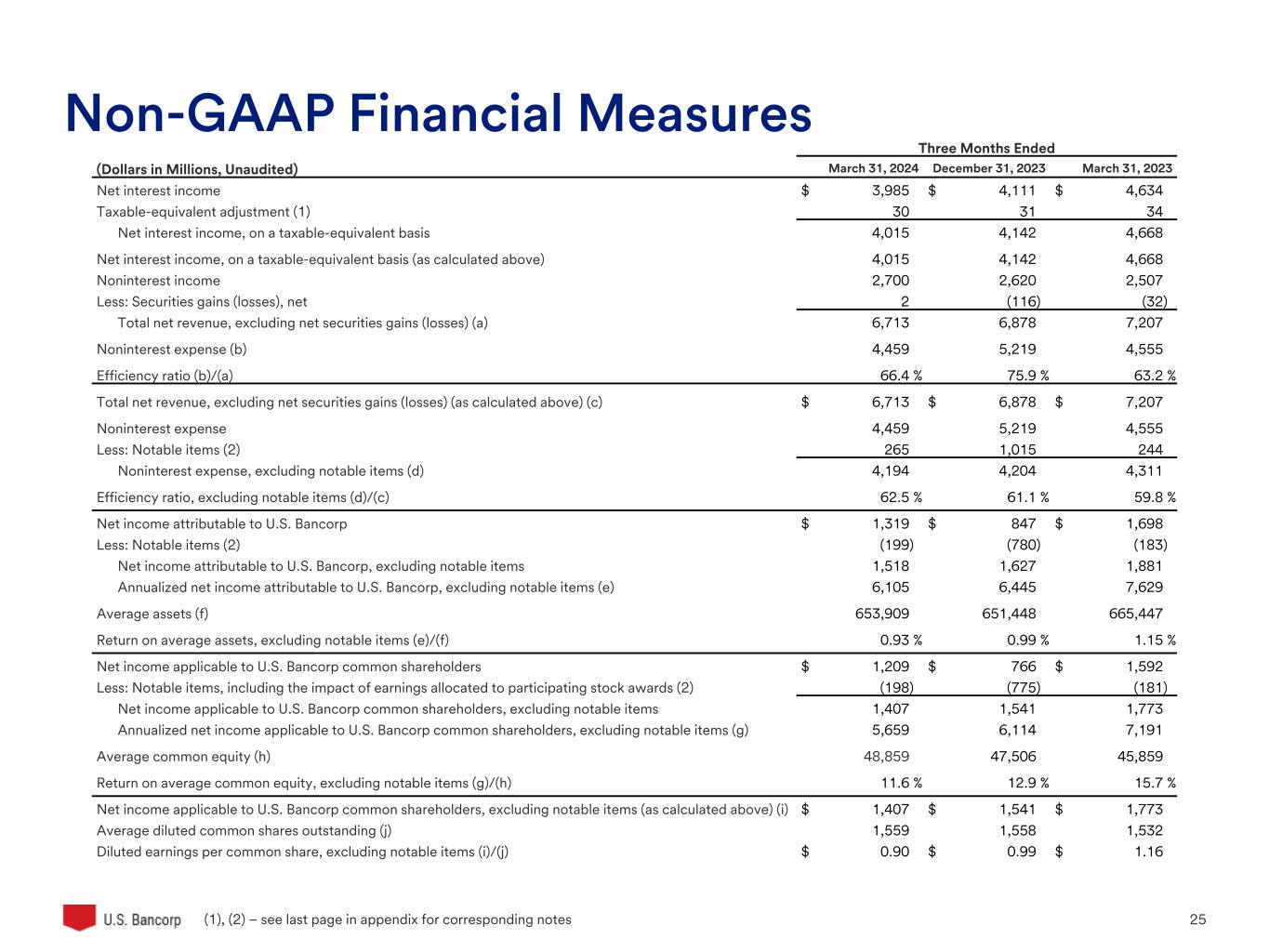

| NON-GAAP FINANCIAL MEASURES | |||||||||||

| Three Months Ended | |||||||||||

| (Dollars and Shares in Millions, Except Per Share Data, Unaudited) | March 31, 2024 |

December 31, 2023 |

March 31, 2023 |

||||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | $766 | $1,592 | ||||||||

Less: Notable items, including the impact of earnings allocated to participating stock awards (1) |

(198) | (775) | (181) | ||||||||

Net income applicable to U.S. Bancorp common shareholders, excluding notable items (a) |

1,407 | 1,541 | 1,773 | ||||||||

Average diluted common shares outstanding (b) |

1,559 | 1,558 | 1,532 | ||||||||

Diluted earnings per common share, excluding notable items (a)/(b) |

$.90 | $.99 | $1.16 | ||||||||

| Income before taxes | 1,673 | 1,000 | 2,159 | ||||||||

Taxable-equivalent adjustment (2) |

30 | 31 | 34 | ||||||||

Less: Notable items (1) |

(265) | (1,133) | (244) | ||||||||

Income before taxes (taxable-equivalent basis), excluding notable items (c) |

1,968 | 2,164 | 2,437 | ||||||||

| Income taxes | 347 | 139 | 455 | ||||||||

Taxable-equivalent adjustment (2) |

30 | 31 | 34 | ||||||||

Less: Notable items (1) |

(66) | (353) | (61) | ||||||||

Income taxes and tax-equivalent adjustment, excluding notable items (d) |

443 | 523 | 550 | ||||||||

Income tax rate (taxable-equivalent basis), excluding notable items (d)/(c) |

22.5 | % | 24.2 | % | 22.6 | % | |||||

| Net income attributable to U.S. Bancorp | $1,319 | ||||||||||

Less: Notable items (1) |

(199) | ||||||||||

| Net income attributable to U.S. Bancorp, excluding notable items | 1,518 | ||||||||||

Annualized net income attributable to U.S. Bancorp, excluding notable items (e) |

6,105 | ||||||||||

Average assets (f) |

653,909 | ||||||||||

Return on average assets, excluding notable items (e)/(f) |

.93 | % | |||||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | ||||||||||

| Intangibles amortization (net-of-tax) | 115 | ||||||||||

Less: Notable items, including the impact of earnings allocated to participating stock awards (1) |

(198) | ||||||||||

| Net income applicable to U.S. Bancorp common shareholders, excluding intangibles amortization and notable items | 1,522 | ||||||||||

|

Annualized net income applicable to U.S. Bancorp common shareholders, excluding intangible amortization and

notable items (g)

|

6,121 | ||||||||||

| Average total equity | $56,131 | ||||||||||

| Average preferred stock | (6,808) | ||||||||||

| Average noncontrolling interests | (464) | ||||||||||

Average goodwill (net of deferred tax liability) (3) |

(11,473) | ||||||||||

| Average intangible assets (net of deferred tax liability), other than mortgage servicing rights | (2,208) | ||||||||||

| Average tangible common equity (h) | 35,178 | ||||||||||

| Return on tangible common equity, excluding notable items (g)/(h) | 17.4 | % | |||||||||

| Net interest income | $3,985 | ||||||||||

Taxable-equivalent adjustment (2) |

30 | ||||||||||

| Net interest income, on a taxable-equivalent basis | 4,015 | ||||||||||

| Net interest income, on a taxable-equivalent basis (as calculated above) | 4,015 | ||||||||||

| Noninterest income | 2,700 | ||||||||||

| Less: Securities gains (losses), net | 2 | ||||||||||

Total net revenue, excluding net securities gains (losses) (i) |

6,713 | ||||||||||

| Noninterest expense | 4,459 | ||||||||||

Less: Notable items (1) |

265 | ||||||||||

Noninterest expense, excluding notable items (j) |

4,194 | ||||||||||

Efficiency ratio, excluding notable items (j)/(i) |

62.5 | % | |||||||||

| Three Months Ended | |||||||||||

| June 30, 2023 |

March 31, 2023 |

||||||||||

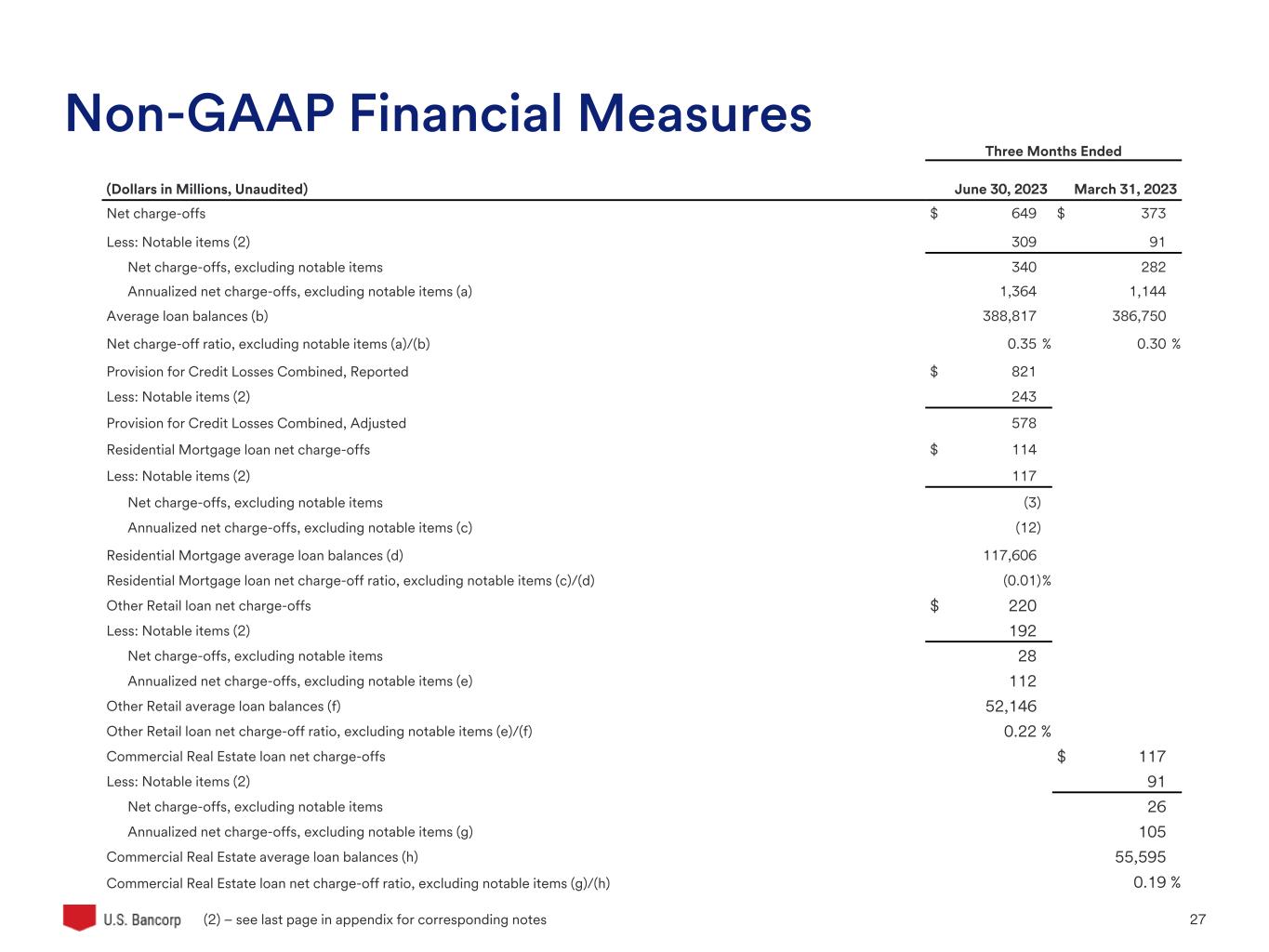

| Net charge-offs | $649 | $373 | |||||||||

Less: Notable items (4) |

309 | 91 | |||||||||

| Net charge-offs, excluding notable items | 340 | 282 | |||||||||

Annualized net charge-offs, excluding notable items (k) |

1,364 | 1,144 | |||||||||

Average loan balances (l) |

388,817 | 386,750 | |||||||||

Net charge-off ratio, excluding notable items (k)/(l) |

.35 | % | .30 | % | |||||||

|

Business Line Schedules

First Quarter 2024

| ||

|

WEALTH, CORPORATE, COMMERCIAL AND

INSTITUTIONAL BANKING

CONSUMER AND BUSINESS BANKING

PAYMENT SERVICES

TREASURY AND CORPORATE SUPPORT

| ||

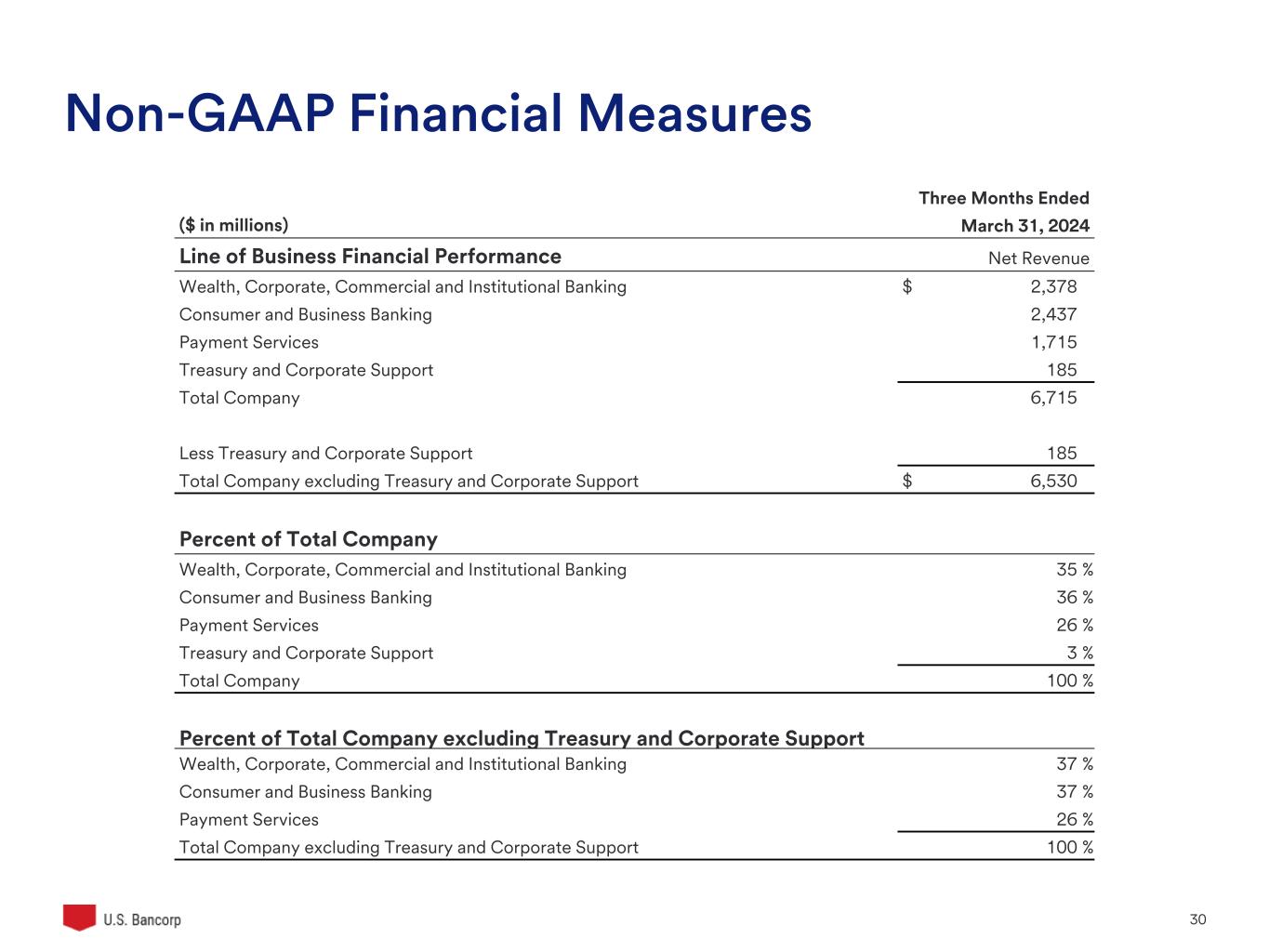

| LINE OF BUSINESS FINANCIAL PERFORMANCE | Preliminary data | |||||||||||||||||||

| ($ in millions) | Net Income Attributable to U.S. Bancorp |

Percent Change | ||||||||||||||||||

| Business Line | 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||||

| Wealth, Corporate, Commercial and Institutional Banking | $651 | $687 | $942 | (5.2) | (30.9) | |||||||||||||||

| Consumer and Business Banking | 601 | 616 | 770 | (2.4) | (21.9) | |||||||||||||||

| Payment Services | 248 | 183 | 310 | 35.5 | (20.0) | |||||||||||||||

| Treasury and Corporate Support | (181) | (639) | (324) | 71.7 | 44.1 | |||||||||||||||

| Consolidated Company | $1,319 | $847 | $1,698 | 55.7 | (22.3) | |||||||||||||||

| Income Before Provision and Taxes |

Percent Change | |||||||||||||||||||

| 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | ||||||||||||||||

| Wealth, Corporate, Commercial and Institutional Banking | $1,006 | $986 | $1,230 | 2.0 | (18.2) | |||||||||||||||

| Consumer and Business Banking | 857 | 871 | 1,035 | (1.6) | (17.2) | |||||||||||||||

| Payment Services | 690 | 705 | 633 | (2.1) | 9.0 | |||||||||||||||

| Treasury and Corporate Support | (297) | (1,019) | (278) | 70.9 | (6.8) | |||||||||||||||

| Consolidated Company | $2,256 | $1,543 | $2,620 | 46.2 | (13.9) | |||||||||||||||

|

|||||

| WEALTH, CORPORATE, COMMERCIAL AND INSTITUTIONAL BANKING | Preliminary data | ||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Condensed Income Statement | |||||||||||||||||

| Net interest income (taxable-equivalent basis) | $1,265 | $1,304 | $1,550 | (3.0) | (18.4) | ||||||||||||

| Noninterest income | 1,113 | 1,024 | 1,020 | 8.7 | 9.1 | ||||||||||||

| Securities gains (losses), net | — | — | — | — | — | ||||||||||||

| Total net revenue | 2,378 | 2,328 | 2,570 | 2.1 | (7.5) | ||||||||||||

| Noninterest expense | 1,320 | 1,287 | 1,279 | 2.6 | 3.2 | ||||||||||||

| Other intangibles | 52 | 55 | 61 | (5.5) | (14.8) | ||||||||||||

| Total noninterest expense | 1,372 | 1,342 | 1,340 | 2.2 | 2.4 | ||||||||||||

| Income before provision and taxes | 1,006 | 986 | 1,230 | 2.0 | (18.2) | ||||||||||||

| Provision for credit losses | 138 | 70 | (26) | 97.1 | nm | ||||||||||||

| Income before income taxes | 868 | 916 | 1,256 | (5.2) | (30.9) | ||||||||||||

| Income taxes and taxable-equivalent adjustment | 217 | 229 | 314 | (5.2) | (30.9) | ||||||||||||

| Net income | 651 | 687 | 942 | (5.2) | (30.9) | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | — | — | — | — | — | ||||||||||||

| Net income attributable to U.S. Bancorp | $651 | $687 | $942 | (5.2) | (30.9) | ||||||||||||

| Average Balance Sheet Data | |||||||||||||||||

| Loans | $170,965 | $171,761 | $177,011 | (.5) | (3.4) | ||||||||||||

| Other earning assets | 8,740 | 7,288 | 6,027 | 19.9 | 45.0 | ||||||||||||

| Goodwill | 4,825 | 4,825 | 4,614 | — | 4.6 | ||||||||||||

| Other intangible assets | 1,059 | 1,112 | 1,034 | (4.8) | 2.4 | ||||||||||||

| Assets | 199,085 | 200,354 | 201,182 | (.6) | (1.0) | ||||||||||||

| Noninterest-bearing deposits | 58,446 | 62,057 | 82,403 | (5.8) | (29.1) | ||||||||||||

| Interest-bearing deposits | 203,980 | 202,663 | 196,843 | .6 | 3.6 | ||||||||||||

| Total deposits | 262,426 | 264,720 | 279,246 | (.9) | (6.0) | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 21,749 | 22,699 | 21,536 | (4.2) | 1.0 | ||||||||||||

|

|||||

| CONSUMER AND BUSINESS BANKING | Preliminary data | ||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Condensed Income Statement | |||||||||||||||||

| Net interest income (taxable-equivalent basis) | $2,014 | $2,095 | $2,341 | (3.9) | (14.0) | ||||||||||||

| Noninterest income | 423 | 410 | 401 | 3.2 | 5.5 | ||||||||||||

| Securities gains (losses), net | — | — | — | — | — | ||||||||||||

| Total net revenue | 2,437 | 2,505 | 2,742 | (2.7) | (11.1) | ||||||||||||

| Noninterest expense | 1,513 | 1,562 | 1,636 | (3.1) | (7.5) | ||||||||||||

| Other intangibles | 67 | 72 | 71 | (6.9) | (5.6) | ||||||||||||

| Total noninterest expense | 1,580 | 1,634 | 1,707 | (3.3) | (7.4) | ||||||||||||

| Income before provision and taxes | 857 | 871 | 1,035 | (1.6) | (17.2) | ||||||||||||

| Provision for credit losses | 55 | 49 | 7 | 12.2 | nm | ||||||||||||

| Income before income taxes | 802 | 822 | 1,028 | (2.4) | (22.0) | ||||||||||||

| Income taxes and taxable-equivalent adjustment | 201 | 206 | 258 | (2.4) | (22.1) | ||||||||||||

| Net income | 601 | 616 | 770 | (2.4) | (21.9) | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | — | — | — | — | — | ||||||||||||

| Net income attributable to U.S. Bancorp | $601 | $616 | $770 | (2.4) | (21.9) | ||||||||||||

| Average Balance Sheet Data | |||||||||||||||||

| Loans | $154,933 | $155,900 | $167,409 | (.6) | (7.5) | ||||||||||||

| Other earning assets | 1,879 | 2,170 | 2,179 | (13.4) | (13.8) | ||||||||||||

| Goodwill | 4,325 | 4,328 | 4,493 | (.1) | (3.7) | ||||||||||||

| Other intangible assets | 4,696 | 4,926 | 5,594 | (4.7) | (16.1) | ||||||||||||

| Assets | 169,177 | 171,810 | 185,245 | (1.5) | (8.7) | ||||||||||||

| Noninterest-bearing deposits | 21,500 | 23,481 | 41,269 | (8.4) | (47.9) | ||||||||||||

| Interest-bearing deposits | 203,343 | 200,266 | 176,797 | 1.5 | 15.0 | ||||||||||||

| Total deposits | 224,843 | 223,747 | 218,066 | .5 | 3.1 | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 14,848 | 15,368 | 16,565 | (3.4) | (10.4) | ||||||||||||

|

|||||

| PAYMENT SERVICES | Preliminary data | ||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Condensed Income Statement | |||||||||||||||||

| Net interest income (taxable-equivalent basis) | $735 | $709 | $655 | 3.7 | 12.2 | ||||||||||||

| Noninterest income | 980 | 1,029 | 937 | (4.8) | 4.6 | ||||||||||||

| Securities gains (losses), net | — | — | — | — | — | ||||||||||||

| Total net revenue | 1,715 | 1,738 | 1,592 | (1.3) | 7.7 | ||||||||||||

| Noninterest expense | 998 | 1,004 | 931 | (.6) | 7.2 | ||||||||||||

| Other intangibles | 27 | 29 | 28 | (6.9) | (3.6) | ||||||||||||

| Total noninterest expense | 1,025 | 1,033 | 959 | (.8) | 6.9 | ||||||||||||

| Income before provision and taxes | 690 | 705 | 633 | (2.1) | 9.0 | ||||||||||||

| Provision for credit losses | 359 | 461 | 220 | (22.1) | 63.2 | ||||||||||||

| Income before income taxes | 331 | 244 | 413 | 35.7 | (19.9) | ||||||||||||

| Income taxes and taxable-equivalent adjustment | 83 | 61 | 103 | 36.1 | (19.4) | ||||||||||||

| Net income | 248 | 183 | 310 | 35.5 | (20.0) | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | — | — | — | — | — | ||||||||||||

| Net income attributable to U.S. Bancorp | $248 | $183 | $310 | 35.5 | (20.0) | ||||||||||||

| Average Balance Sheet Data | |||||||||||||||||

| Loans | $39,803 | $40,039 | $36,935 | (.6) | 7.8 | ||||||||||||

| Other earning assets | 153 | 10 | 302 | nm | (49.3) | ||||||||||||

| Goodwill | 3,332 | 3,325 | 3,315 | .2 | .5 | ||||||||||||

| Other intangible assets | 300 | 319 | 385 | (6.0) | (22.1) | ||||||||||||

| Assets | 46,816 | 45,373 | 42,858 | 3.2 | 9.2 | ||||||||||||

| Noninterest-bearing deposits | 2,791 | 2,772 | 3,184 | .7 | (12.3) | ||||||||||||

| Interest-bearing deposits | 97 | 99 | 108 | (2.0) | (10.2) | ||||||||||||

| Total deposits | 2,888 | 2,871 | 3,292 | .6 | (12.3) | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 9,965 | 9,695 | 8,968 | 2.8 | 11.1 | ||||||||||||

|

|||||

| TREASURY AND CORPORATE SUPPORT | Preliminary data | ||||||||||||||||

| ($ in millions) | Percent Change | ||||||||||||||||

| 1Q 2024 |

4Q 2023 |

1Q 2023 |

1Q24 vs 4Q23 | 1Q24 vs 1Q23 | |||||||||||||

| Condensed Income Statement | |||||||||||||||||

| Net interest income (taxable-equivalent basis) | $1 | $34 | $122 | (97.1) | (99.2) | ||||||||||||

| Noninterest income | 182 | 273 | 181 | (33.3) | .6 | ||||||||||||

| Securities gains (losses), net | 2 | (116) | (32) | nm | nm | ||||||||||||

| Total net revenue | 185 | 191 | 271 | (3.1) | (31.7) | ||||||||||||

| Noninterest expense | 482 | 1,210 | 549 | (60.2) | (12.2) | ||||||||||||

| Other intangibles | — | — | — | — | — | ||||||||||||

| Total noninterest expense | 482 | 1,210 | 549 | (60.2) | (12.2) | ||||||||||||

| Income (loss) before provision and taxes | (297) | (1,019) | (278) | 70.9 | (6.8) | ||||||||||||

| Provision for credit losses | 1 | (68) | 226 | nm | (99.6) | ||||||||||||

| Income (loss) before income taxes | (298) | (951) | (504) | 68.7 | 40.9 | ||||||||||||

| Income taxes and taxable-equivalent adjustment | (124) | (326) | (186) | 62.0 | 33.3 | ||||||||||||

| Net income (loss) | (174) | (625) | (318) | 72.2 | 45.3 | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | (7) | (14) | (6) | 50.0 | (16.7) | ||||||||||||

| Net income (loss) attributable to U.S. Bancorp | ($181) | ($639) | ($324) | 71.7 | 44.1 | ||||||||||||

| Average Balance Sheet Data | |||||||||||||||||

| Loans | $5,369 | $5,156 | $5,395 | 4.1 | (.5) | ||||||||||||

| Other earning assets | 214,293 | 211,920 | 212,356 | 1.1 | .9 | ||||||||||||

| Goodwill | — | — | — | — | — | ||||||||||||

| Other intangible assets | 10 | 10 | 36 | — | (72.2) | ||||||||||||

| Assets | 238,831 | 233,911 | 236,162 | 2.1 | 1.1 | ||||||||||||

| Noninterest-bearing deposits | 2,050 | 2,280 | 2,885 | (10.1) | (28.9) | ||||||||||||

| Interest-bearing deposits | 10,854 | 9,164 | 6,835 | 18.4 | 58.8 | ||||||||||||

| Total deposits | 12,904 | 11,444 | 9,720 | 12.8 | 32.8 | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 9,105 | 6,552 | 5,598 | 39.0 | 62.6 | ||||||||||||

|

|||||

|

Supplemental Consolidated Schedules

First Quarter 2024

| ||

|

|||||

| QUARTERLY CONSOLIDATED STATEMENT OF INCOME | |||||||||||||||||

| (Dollars and Shares in Millions, Except Per Share Data) (Unaudited) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Interest Income | |||||||||||||||||

| Loans | $5,712 | $5,742 | $5,700 | $5,605 | $5,277 | ||||||||||||

| Loans held for sale | 37 | 36 | 42 | 38 | 31 | ||||||||||||

| Investment securities | 1,175 | 1,182 | 1,152 | 1,077 | 1,074 | ||||||||||||

| Other interest income | 840 | 803 | 860 | 806 | 582 | ||||||||||||

| Total interest income | 7,764 | 7,763 | 7,754 | 7,526 | 6,964 | ||||||||||||

| Interest Expense | |||||||||||||||||

| Deposits | 2,884 | 2,751 | 2,580 | 1,939 | 1,505 | ||||||||||||

| Short-term borrowings | 270 | 332 | 450 | 740 | 449 | ||||||||||||

| Long-term debt | 625 | 569 | 488 | 432 | 376 | ||||||||||||

| Total interest expense | 3,779 | 3,652 | 3,518 | 3,111 | 2,330 | ||||||||||||

| Net interest income | 3,985 | 4,111 | 4,236 | 4,415 | 4,634 | ||||||||||||

| Provision for credit losses | 553 | 512 | 515 | 821 | 427 | ||||||||||||

| Net interest income after provision for credit losses | 3,432 | 3,599 | 3,721 | 3,594 | 4,207 | ||||||||||||

| Noninterest Income | |||||||||||||||||

| Card revenue | 392 | 436 | 412 | 422 | 360 | ||||||||||||

| Corporate payment products revenue | 184 | 182 | 198 | 190 | 189 | ||||||||||||

| Merchant processing services | 401 | 409 | 427 | 436 | 387 | ||||||||||||

| Trust and investment management fees | 641 | 621 | 627 | 621 | 590 | ||||||||||||

| Service charges | 315 | 324 | 334 | 324 | 324 | ||||||||||||

| Commercial products revenue | 388 | 326 | 354 | 358 | 334 | ||||||||||||

| Mortgage banking revenue | 166 | 137 | 144 | 131 | 128 | ||||||||||||

| Investment products fees | 77 | 73 | 70 | 68 | 68 | ||||||||||||

| Securities gains (losses), net | 2 | (116) | — | 3 | (32) | ||||||||||||

| Other | 134 | 228 | 198 | 173 | 159 | ||||||||||||

| Total noninterest income | 2,700 | 2,620 | 2,764 | 2,726 | 2,507 | ||||||||||||

| Noninterest Expense | |||||||||||||||||

| Compensation and employee benefits | 2,691 | 2,509 | 2,615 | 2,646 | 2,646 | ||||||||||||

| Net occupancy and equipment | 296 | 316 | 313 | 316 | 321 | ||||||||||||

| Professional services | 110 | 158 | 127 | 141 | 134 | ||||||||||||

| Marketing and business development | 136 | 306 | 176 | 122 | 122 | ||||||||||||

| Technology and communications | 507 | 513 | 511 | 522 | 503 | ||||||||||||

| Other intangibles | 146 | 156 | 161 | 159 | 160 | ||||||||||||

| Merger and integration charges | 155 | 171 | 284 | 310 | 244 | ||||||||||||

| Other | 418 | 1,090 | 343 | 353 | 425 | ||||||||||||

| Total noninterest expense | 4,459 | 5,219 | 4,530 | 4,569 | 4,555 | ||||||||||||

| Income before income taxes | 1,673 | 1,000 | 1,955 | 1,751 | 2,159 | ||||||||||||

| Applicable income taxes | 347 | 139 | 431 | 382 | 455 | ||||||||||||

| Net income | 1,326 | 861 | 1,524 | 1,369 | 1,704 | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | (7) | (14) | (1) | (8) | (6) | ||||||||||||

| Net income attributable to U.S. Bancorp | $1,319 | $847 | $1,523 | $1,361 | $1,698 | ||||||||||||

| Net income applicable to U.S. Bancorp common shareholders | $1,209 | $766 | $1,412 | $1,281 | $1,592 | ||||||||||||

| Earnings per common share | $.78 | $.49 | $.91 | $.84 | $1.04 | ||||||||||||

| Diluted earnings per common share | $.78 | $.49 | $.91 | $.84 | $1.04 | ||||||||||||

| Dividends declared per common share | $.49 | $.49 | $.48 | $.48 | $.48 | ||||||||||||

| Average common shares outstanding | 1,559 | 1,557 | 1,548 | 1,533 | 1,532 | ||||||||||||

| Average diluted common shares outstanding | 1,559 | 1,558 | 1,549 | 1,533 | 1,532 | ||||||||||||

| Financial Ratios (%) | |||||||||||||||||

| Net interest margin (taxable-equivalent basis) | 2.70 | 2.78 | 2.81 | 2.90 | 3.10 | ||||||||||||

| Return on average assets | .81 | .52 | .91 | .81 | 1.03 | ||||||||||||

| Return on average common equity | 10.0 | 6.4 | 11.9 | 10.9 | 14.1 | ||||||||||||

| Efficiency ratio | 66.4 | 75.9 | 64.4 | 63.7 | 63.2 | ||||||||||||

|

|||||

| CONSOLIDATED ENDING BALANCE SHEET | |||||||||||||||||

| (Dollars in Millions) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Assets | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Cash and due from banks | $76,985 | $61,192 | $64,354 | $70,642 | $67,228 | ||||||||||||

| Investment securities | |||||||||||||||||

| Held-to-maturity | 82,948 | 84,045 | 85,342 | 86,938 | 88,462 | ||||||||||||

| Available-for-sale | 72,426 | 69,706 | 67,207 | 69,221 | 65,491 | ||||||||||||

| Loans held for sale | 2,080 | 2,201 | 2,336 | 2,361 | 2,381 | ||||||||||||

| Loans | |||||||||||||||||

| Commercial | 134,726 | 131,881 | 133,319 | 136,775 | 137,326 | ||||||||||||

| Commercial real estate | 52,677 | 53,455 | 54,131 | 54,357 | 55,158 | ||||||||||||

| Residential mortgages | 116,079 | 115,530 | 115,055 | 114,449 | 116,948 | ||||||||||||

| Credit card | 27,844 | 28,560 | 27,080 | 26,626 | 25,489 | ||||||||||||

| Other retail | 43,262 | 44,409 | 45,649 | 47,221 | 52,945 | ||||||||||||

| Total loans | 374,588 | 373,835 | 375,234 | 379,428 | 387,866 | ||||||||||||

| Less allowance for loan losses | (7,514) | (7,379) | (7,218) | (7,164) | (7,020) | ||||||||||||

| Net loans | 367,074 | 366,456 | 368,016 | 372,264 | 380,846 | ||||||||||||

| Premises and equipment | 3,537 | 3,623 | 3,616 | 3,695 | 3,735 | ||||||||||||

| Goodwill | 12,479 | 12,489 | 12,472 | 12,486 | 12,560 | ||||||||||||

| Other intangible assets | 6,031 | 6,084 | 6,435 | 6,634 | 6,883 | ||||||||||||

| Other assets | 60,046 | 57,695 | 58,261 | 56,584 | 54,791 | ||||||||||||

| Total assets | $683,606 | $663,491 | $668,039 | $680,825 | $682,377 | ||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||

| Deposits | |||||||||||||||||

| Noninterest-bearing | $91,220 | $89,989 | $98,006 | $104,996 | $124,595 | ||||||||||||

| Interest-bearing | 436,843 | 422,323 | 420,352 | 416,604 | 380,744 | ||||||||||||

| Total deposits | 528,063 | 512,312 | 518,358 | 521,600 | 505,339 | ||||||||||||

| Short-term borrowings | 17,102 | 15,279 | 21,900 | 32,334 | 56,875 | ||||||||||||

| Long-term debt | 52,693 | 51,480 | 43,074 | 45,283 | 42,045 | ||||||||||||

| Other liabilities | 29,715 | 28,649 | 31,129 | 28,124 | 24,664 | ||||||||||||

| Total liabilities | 627,573 | 607,720 | 614,461 | 627,341 | 628,923 | ||||||||||||

| Shareholders' equity | |||||||||||||||||

| Preferred stock | 6,808 | 6,808 | 6,808 | 6,808 | 6,808 | ||||||||||||

| Common stock | 21 | 21 | 21 | 21 | 21 | ||||||||||||

| Capital surplus | 8,642 | 8,673 | 8,684 | 8,742 | 8,699 | ||||||||||||

| Retained earnings | 74,473 | 74,026 | 74,023 | 73,355 | 72,807 | ||||||||||||

| Less treasury stock | (24,023) | (24,126) | (24,168) | (25,189) | (25,193) | ||||||||||||

| Accumulated other comprehensive income (loss) | (10,353) | (10,096) | (12,255) | (10,718) | (10,153) | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 55,568 | 55,306 | 53,113 | 53,019 | 52,989 | ||||||||||||

| Noncontrolling interests | 465 | 465 | 465 | 465 | 465 | ||||||||||||

| Total equity | 56,033 | 55,771 | 53,578 | 53,484 | 53,454 | ||||||||||||

| Total liabilities and equity | $683,606 | $663,491 | $668,039 | $680,825 | $682,377 | ||||||||||||

|

|||||

| CONSOLIDATED QUARTERLY AVERAGE BALANCE SHEET | |||||||||||||||||

| (Dollars in Millions, Unaudited) | March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| Assets | |||||||||||||||||

| Investment securities | $161,236 | $161,885 | $163,236 | $159,824 | $166,125 | ||||||||||||

| Loans held for sale | 2,002 | 2,154 | 2,661 | 2,569 | 2,461 | ||||||||||||

| Loans | |||||||||||||||||

| Commercial | |||||||||||||||||

| Commercial | 126,602 | 126,884 | 130,415 | 133,697 | 131,227 | ||||||||||||

| Lease financing | 4,165 | 4,212 | 4,305 | 4,388 | 4,456 | ||||||||||||

| Total commercial | 130,767 | 131,096 | 134,720 | 138,085 | 135,683 | ||||||||||||

| Commercial real estate | |||||||||||||||||

| Commercial mortgages | 41,545 | 42,089 | 42,665 | 43,214 | 43,627 | ||||||||||||

| Construction and development | 11,492 | 11,736 | 11,588 | 11,720 | 11,968 | ||||||||||||

| Total commercial real estate | 53,037 | 53,825 | 54,253 | 54,934 | 55,595 | ||||||||||||

| Residential mortgages | 115,639 | 115,196 | 114,627 | 117,606 | 116,287 | ||||||||||||

| Credit card | 27,942 | 27,753 | 26,883 | 26,046 | 25,569 | ||||||||||||

| Other retail | |||||||||||||||||

| Retail leasing | 4,082 | 4,167 | 4,436 | 4,829 | 5,241 | ||||||||||||

| Home equity and second mortgages | 12,983 | 12,977 | 12,809 | 12,753 | 12,774 | ||||||||||||

| Other | 26,620 | 27,842 | 29,149 | 34,564 | 35,601 | ||||||||||||

| Total other retail | 43,685 | 44,986 | 46,394 | 52,146 | 53,616 | ||||||||||||

| Total loans | 371,070 | 372,856 | 376,877 | 388,817 | 386,750 | ||||||||||||

| Interest-bearing deposits with banks | 50,903 | 47,532 | 53,100 | 51,972 | 43,305 | ||||||||||||

| Other earning assets | 10,924 | 9,817 | 9,371 | 10,657 | 8,973 | ||||||||||||

| Total earning assets | 596,135 | 594,244 | 605,245 | 613,839 | 607,614 | ||||||||||||

| Allowance for loan losses | (7,438) | (7,270) | (7,266) | (7,068) | (6,944) | ||||||||||||

| Unrealized gain (loss) on investment securities | (7,121) | (8,806) | (8,241) | (7,356) | (7,519) | ||||||||||||

| Other assets | 72,333 | 73,280 | 74,261 | 73,597 | 72,296 | ||||||||||||

| Total assets | $653,909 | $651,448 | $663,999 | $673,012 | $665,447 | ||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||

| Noninterest-bearing deposits | $84,787 | $90,590 | $97,524 | $113,758 | $129,741 | ||||||||||||

| Interest-bearing deposits | |||||||||||||||||

| Interest checking | 125,011 | 127,445 | 132,560 | 127,994 | 129,350 | ||||||||||||

| Money market savings | 196,502 | 187,322 | 177,340 | 152,893 | 146,970 | ||||||||||||

| Savings accounts | 41,645 | 44,728 | 50,138 | 58,993 | 68,827 | ||||||||||||

| Time deposits | 55,116 | 52,697 | 54,729 | 43,627 | 35,436 | ||||||||||||

| Total interest-bearing deposits | 418,274 | 412,192 | 414,767 | 383,507 | 380,583 | ||||||||||||

| Short-term borrowings | 16,364 | 18,645 | 27,550 | 54,172 | 36,467 | ||||||||||||

| Long-term debt | 52,713 | 48,863 | 43,826 | 42,771 | 41,024 | ||||||||||||

| Total interest-bearing liabilities | 487,351 | 479,700 | 486,143 | 480,450 | 458,074 | ||||||||||||

| Other liabilities | 25,640 | 26,379 | 26,049 | 24,517 | 24,500 | ||||||||||||

| Shareholders' equity | |||||||||||||||||

| Preferred equity | 6,808 | 6,808 | 6,808 | 6,808 | 6,808 | ||||||||||||

| Common equity | 48,859 | 47,506 | 47,009 | 47,014 | 45,859 | ||||||||||||

| Total U.S. Bancorp shareholders' equity | 55,667 | 54,314 | 53,817 | 53,822 | 52,667 | ||||||||||||

| Noncontrolling interests | 464 | 465 | 466 | 465 | 465 | ||||||||||||

| Total equity | 56,131 | 54,779 | 54,283 | 54,287 | 53,132 | ||||||||||||

| Total liabilities and equity | $653,909 | $651,448 | $663,999 | $673,012 | $665,447 | ||||||||||||

|

|||||

| CONSOLIDATED DAILY AVERAGE BALANCE SHEET AND RELATED YIELDS AND RATES (a) | ||||||||||||||||||||||||||

| For the Three Months Ended March 31, | ||||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||||

| (Dollars in Millions) (Unaudited) |

Average Balances |

Interest | Yields and Rates |

Average Balances |

Interest | Yields and Rates |

% Change Average Balances |

|||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Investment securities | $161,236 | $1,194 | 2.96 | % | $166,125 | $1,094 | 2.64 | % | (2.9) | % | ||||||||||||||||

| Loans held for sale | 2,002 | 37 | 7.32 | 2,461 | 31 | 5.10 | (18.7) | |||||||||||||||||||

| Loans (b) | ||||||||||||||||||||||||||

| Commercial | 130,767 | 2,180 | 6.70 | 135,683 | 1,997 | 5.96 | (3.6) | |||||||||||||||||||

| Commercial real estate | 53,037 | 854 | 6.48 | 55,595 | 803 | 5.86 | (4.6) | |||||||||||||||||||

| Residential mortgages | 115,639 | 1,107 | 3.83 | 116,287 | 1,050 | 3.62 | (.6) | |||||||||||||||||||

| Credit card | 27,942 | 940 | 13.53 | 25,569 | 800 | 12.69 | 9.3 | |||||||||||||||||||

| Other retail | 43,685 | 642 | 5.91 | 53,616 | 642 | 4.86 | (18.5) | |||||||||||||||||||

| Total loans | 371,070 | 5,723 | 6.20 | 386,750 | 5,292 | 5.53 | (4.1) | |||||||||||||||||||

| Interest-bearing deposits with banks | 50,903 | 704 | 5.56 | 43,305 | 488 | 4.57 | 17.5 | |||||||||||||||||||

| Other earning assets | 10,924 | 137 | 5.05 | 8,973 | 94 | 4.23 | 21.7 | |||||||||||||||||||

| Total earning assets | 596,135 | 7,795 | 5.25 | 607,614 | 6,999 | 4.65 | (1.9) | |||||||||||||||||||

| Allowance for loan losses | (7,438) | (6,944) | (7.1) | |||||||||||||||||||||||

| Unrealized gain (loss) on investment securities | (7,121) | (7,519) | 5.3 | |||||||||||||||||||||||

| Other assets | 72,333 | 72,296 | .1 | |||||||||||||||||||||||

| Total assets | $653,909 | $665,447 | (1.7) | |||||||||||||||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | $84,787 | $129,741 | (34.6) | % | ||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||

| Interest checking | 125,011 | 362 | 1.17 | 129,350 | 283 | .89 | (3.4) | |||||||||||||||||||

| Money market savings | 196,502 | 1,914 | 3.92 | 146,970 | 979 | 2.70 | 33.7 | |||||||||||||||||||

| Savings accounts | 41,645 | 26 | .25 | 68,827 | 13 | .07 | (39.5) | |||||||||||||||||||

| Time deposits | 55,116 | 582 | 4.25 | 35,436 | 230 | 2.64 | 55.5 | |||||||||||||||||||

| Total interest-bearing deposits | 418,274 | 2,884 | 2.77 | 380,583 | 1,505 | 1.60 | 9.9 | |||||||||||||||||||

| Short-term borrowings | 16,364 | 271 | 6.66 | 36,467 | 450 | 5.01 | (55.1) | |||||||||||||||||||

| Long-term debt | 52,713 | 625 | 4.76 | 41,024 | 376 | 3.71 | 28.5 | |||||||||||||||||||

| Total interest-bearing liabilities | 487,351 | 3,780 | 3.12 | 458,074 | 2,331 | 2.06 | 6.4 | |||||||||||||||||||

| Other liabilities | 25,640 | 24,500 | 4.7 | |||||||||||||||||||||||

| Shareholders' equity | ||||||||||||||||||||||||||

| Preferred equity | 6,808 | 6,808 | — | |||||||||||||||||||||||

| Common equity | 48,859 | 45,859 | 6.5 | |||||||||||||||||||||||

| Total U.S. Bancorp shareholders' equity | 55,667 | 52,667 | 5.7 | |||||||||||||||||||||||

| Noncontrolling interests | 464 | 465 | (.2) | |||||||||||||||||||||||

| Total equity | 56,131 | 53,132 | 5.6 | |||||||||||||||||||||||

| Total liabilities and equity | $653,909 | $665,447 | (1.7) | |||||||||||||||||||||||

| Net interest income | $4,015 | $4,668 | ||||||||||||||||||||||||

| Gross interest margin | 2.13 | % | 2.59 | % | ||||||||||||||||||||||

| Gross interest margin without taxable-equivalent increments | 2.11 | 2.57 | ||||||||||||||||||||||||

| Percent of Earning Assets | ||||||||||||||||||||||||||

| Interest income | 5.25 | % | 4.65 | % | ||||||||||||||||||||||

| Interest expense | 2.55 | 1.55 | ||||||||||||||||||||||||

| Net interest margin | 2.70 | % | 3.10 | % | ||||||||||||||||||||||

| Net interest margin without taxable-equivalent increments | 2.68 | % | 3.08 | % | ||||||||||||||||||||||

|

(a)Interest and rates are presented on a fully taxable-equivalent basis based on a federal income tax rate of 21 percent.

(b)Interest income and rates on loans include loan fees. Nonaccrual loans are included in average loan balances.

| ||||||||||||||||||||||||||

|

|||||

| CONSOLIDATED DAILY AVERAGE BALANCE SHEET AND RELATED YIELDS AND RATES (a) | ||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||

| (Dollars in Millions) (Unaudited) |

Average Balances |

Interest | Yields and Rates |

Average Balances |

Interest | Yields and Rates |

% Change Average Balances |

|||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Investment securities | $161,236 | $1,194 | 2.96 | % | $161,885 | $1,202 | 2.97 | % | (.4) | % | ||||||||||||||||

| Loans held for sale | 2,002 | 37 | 7.32 | 2,154 | 36 | 6.69 | (7.1) | |||||||||||||||||||

| Loans (b) | ||||||||||||||||||||||||||

| Commercial | 130,767 | 2,180 | 6.70 | 131,096 | 2,210 | 6.69 | (.3) | |||||||||||||||||||

| Commercial real estate | 53,037 | 854 | 6.48 | 53,825 | 880 | 6.49 | (1.5) | |||||||||||||||||||

| Residential mortgages | 115,639 | 1,107 | 3.83 | 115,196 | 1,090 | 3.78 | .4 | |||||||||||||||||||

| Credit card | 27,942 | 940 | 13.53 | 27,753 | 921 | 13.17 | .7 | |||||||||||||||||||

| Other retail | 43,685 | 642 | 5.91 | 44,986 | 652 | 5.75 | (2.9) | |||||||||||||||||||

| Total loans | 371,070 | 5,723 | 6.20 | 372,856 | 5,753 | 6.13 | (.5) | |||||||||||||||||||

| Interest-bearing deposits with banks | 50,903 | 704 | 5.56 | 47,532 | 677 | 5.65 | 7.1 | |||||||||||||||||||

| Other earning assets | 10,924 | 137 | 5.05 | 9,817 | 127 | 5.12 | 11.3 | |||||||||||||||||||

| Total earning assets | 596,135 | 7,795 | 5.25 | 594,244 | 7,795 | 5.22 | .3 | |||||||||||||||||||

| Allowance for loan losses | (7,438) | (7,270) | (2.3) | |||||||||||||||||||||||

| Unrealized gain (loss) on investment securities | (7,121) | (8,806) | 19.1 | |||||||||||||||||||||||

| Other assets | 72,333 | 73,280 | (1.3) | |||||||||||||||||||||||

| Total assets | $653,909 | $651,448 | .4 | |||||||||||||||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | $84,787 | $90,590 | (6.4) | % | ||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||

| Interest checking | 125,011 | 362 | 1.17 | 127,445 | 369 | 1.15 | (1.9) | |||||||||||||||||||

| Money market savings | 196,502 | 1,914 | 3.92 | 187,322 | 1,813 | 3.84 | 4.9 | |||||||||||||||||||

| Savings accounts | 41,645 | 26 | .25 | 44,728 | 29 | .26 | (6.9) | |||||||||||||||||||

| Time deposits | 55,116 | 582 | 4.25 | 52,697 | 540 | 4.06 | 4.6 | |||||||||||||||||||

| Total interest-bearing deposits | 418,274 | 2,884 | 2.77 | 412,192 | 2,751 | 2.65 | 1.5 | |||||||||||||||||||

| Short-term borrowings | 16,364 | 271 | 6.66 | 18,645 | 333 | 7.09 | (12.2) | |||||||||||||||||||

| Long-term debt | 52,713 | 625 | 4.76 | 48,863 | 569 | 4.62 | 7.9 | |||||||||||||||||||

| Total interest-bearing liabilities | 487,351 | 3,780 | 3.12 | 479,700 | 3,653 | 3.02 | 1.6 | |||||||||||||||||||

| Other liabilities | 25,640 | 26,379 | (2.8) | |||||||||||||||||||||||

| Shareholders' equity | ||||||||||||||||||||||||||

| Preferred equity | 6,808 | 6,808 | — | |||||||||||||||||||||||

| Common equity | 48,859 | 47,506 | 2.8 | |||||||||||||||||||||||

| Total U.S. Bancorp shareholders' equity | 55,667 | 54,314 | 2.5 | |||||||||||||||||||||||

| Noncontrolling interests | 464 | 465 | (.2) | |||||||||||||||||||||||

| Total equity | 56,131 | 54,779 | 2.5 | |||||||||||||||||||||||

| Total liabilities and equity | $653,909 | $651,448 | .4 | |||||||||||||||||||||||

| Net interest income | $4,015 | $4,142 | ||||||||||||||||||||||||

| Gross interest margin | 2.13 | % | 2.20 | % | ||||||||||||||||||||||

| Gross interest margin without taxable-equivalent increments | 2.11 | 2.18 | ||||||||||||||||||||||||

| Percent of Earning Assets | ||||||||||||||||||||||||||

| Interest income | 5.25 | % | 5.22 | % | ||||||||||||||||||||||

| Interest expense | 2.55 | 2.44 | ||||||||||||||||||||||||

| Net interest margin | 2.70 | % | 2.78 | % | ||||||||||||||||||||||

| Net interest margin without taxable-equivalent increments | 2.68 | % | 2.76 | % | ||||||||||||||||||||||

|

(a)Interest and rates are presented on a fully taxable-equivalent basis based on a federal income tax rate of 21 percent.

(b)Interest income and rates on loans include loan fees. Nonaccrual loans are included in average loan balances.

| ||||||||||||||||||||||||||

|

|||||

| LOAN PORTFOLIO | ||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | ||||||||||||||||||||||||||||

| (Dollars in Millions) (Unaudited) |

Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

Amount | Percent of Total |

||||||||||||||||||||||

| Commercial | ||||||||||||||||||||||||||||||||

| Commercial | $130,530 | 34.8 | $127,676 | 34.2 | $129,040 | 34.4 | $132,374 | 34.9 | $132,894 | 34.3 | ||||||||||||||||||||||

| Lease financing | 4,196 | 1.2 | 4,205 | 1.1 | 4,279 | 1.1 | 4,401 | 1.2 | 4,432 | 1.1 | ||||||||||||||||||||||

| Total commercial | 134,726 | 36.0 | 131,881 | 35.3 | 133,319 | 35.5 | 136,775 | 36.1 | 137,326 | 35.4 | ||||||||||||||||||||||

| Commercial real estate | ||||||||||||||||||||||||||||||||

| Commercial mortgages | 41,157 | 11.0 | 41,934 | 11.2 | 42,473 | 11.3 | 42,775 | 11.3 | 43,549 | 11.2 | ||||||||||||||||||||||

| Construction and | ||||||||||||||||||||||||||||||||

| development | 11,520 | 3.1 | 11,521 | 3.1 | 11,658 | 3.1 | 11,582 | 3.0 | 11,609 | 3.0 | ||||||||||||||||||||||

| Total commercial | ||||||||||||||||||||||||||||||||

| real estate | 52,677 | 14.1 | 53,455 | 14.3 | 54,131 | 14.4 | 54,357 | 14.3 | 55,158 | 14.2 | ||||||||||||||||||||||

| Residential mortgages | ||||||||||||||||||||||||||||||||

| Residential mortgages | 109,396 | 29.2 | 108,605 | 29.0 | 107,875 | 28.8 | 107,017 | 28.2 | 109,246 | 28.2 | ||||||||||||||||||||||

| Home equity loans, first | ||||||||||||||||||||||||||||||||

| liens | 6,683 | 1.8 | 6,925 | 1.9 | 7,180 | 1.9 | 7,432 | 2.0 | 7,702 | 2.0 | ||||||||||||||||||||||

| Total residential | ||||||||||||||||||||||||||||||||

| mortgages | 116,079 | 31.0 | 115,530 | 30.9 | 115,055 | 30.7 | 114,449 | 30.2 | 116,948 | 30.2 | ||||||||||||||||||||||

| Credit card | 27,844 | 7.4 | 28,560 | 7.6 | 27,080 | 7.2 | 26,626 | 7.0 | 25,489 | 6.6 | ||||||||||||||||||||||

| Other retail | ||||||||||||||||||||||||||||||||

| Retail leasing | 4,137 | 1.1 | 4,135 | 1.1 | 4,271 | 1.2 | 4,637 | 1.2 | 5,017 | 1.3 | ||||||||||||||||||||||

| Home equity and second | ||||||||||||||||||||||||||||||||

| mortgages | 12,932 | 3.5 | 13,056 | 3.5 | 12,879 | 3.4 | 12,799 | 3.4 | 12,720 | 3.3 | ||||||||||||||||||||||

| Revolving credit | 3,473 | .9 | 3,668 | 1.0 | 3,766 | 1.0 | 3,797 | 1.0 | 3,720 | .9 | ||||||||||||||||||||||

| Installment | 13,921 | 3.7 | 13,889 | 3.7 | 14,145 | 3.8 | 14,452 | 3.8 | 14,357 | 3.7 | ||||||||||||||||||||||

| Automobile | 8,799 | 2.3 | 9,661 | 2.6 | 10,588 | 2.8 | 11,536 | 3.0 | 17,131 | 4.4 | ||||||||||||||||||||||

| Total other retail | 43,262 | 11.5 | 44,409 | 11.9 | 45,649 | 12.2 | 47,221 | 12.4 | 52,945 | 13.6 | ||||||||||||||||||||||

| Total loans | $374,588 | 100.0 | $373,835 | 100.0 | $375,234 | 100.0 | $379,428 | 100.0 | $387,866 | 100.0 | ||||||||||||||||||||||

|

|||||

|

Supplemental Business Line Schedules

First Quarter 2024

| ||

|

WEALTH, CORPORATE, COMMERCIAL AND

INSTITUTIONAL BANKING

CONSUMER AND BUSINESS BANKING

PAYMENT SERVICES

TREASURY AND CORPORATE SUPPORT

| ||

| WEALTH, CORPORATE, COMMERCIAL AND INSTITUTIONAL BANKING | Preliminary data | ||||||||||||||||

| Three Months Ended | |||||||||||||||||

| (Dollars in Millions) (Unaudited) |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

||||||||||||

| INCOME STATEMENT | |||||||||||||||||

| Net Interest Income (taxable-equivalent basis) | $1,265 | $1,304 | $1,343 | $1,427 | $1,550 | ||||||||||||

| Noninterest Income | |||||||||||||||||

| Card revenue | — | — | — | — | — | ||||||||||||

| Corporate payment products revenue | — | — | — | — | — | ||||||||||||

| Merchant processing services | — | — | — | — | — | ||||||||||||

| Trust and investment management fees | 640 | 620 | 627 | 621 | 590 | ||||||||||||

| Service charges | 135 | 128 | 129 | 135 | 129 | ||||||||||||

| Commercial products revenue | 208 | 152 | 154 | 203 | 185 | ||||||||||||

| Mortgage banking revenue | — | — | — | — | — | ||||||||||||

| Investment products fees | 77 | 73 | 70 | 68 | 68 | ||||||||||||

| Securities gains (losses), net | — | — | — | — | — | ||||||||||||

| Other | 53 | 51 | 54 | 48 | 48 | ||||||||||||

| Total noninterest income | 1,113 | 1,024 | 1,034 | 1,075 | 1,020 | ||||||||||||

| Total net revenue | 2,378 | 2,328 | 2,377 | 2,502 | 2,570 | ||||||||||||

| Noninterest Expense | |||||||||||||||||

| Compensation and employee benefits | 567 | 534 | 543 | 544 | 532 | ||||||||||||

| Net occupancy and equipment | 39 | 37 | 37 | 38 | 37 | ||||||||||||

| Other intangibles | 52 | 55 | 57 | 57 | 61 | ||||||||||||

| Net shared services | 513 | 491 | 495 | 549 | 516 | ||||||||||||

| Other | 201 | 225 | 183 | 179 | 194 | ||||||||||||