2025Q3FALSE000206495312/31.25P1Y0.252xbrli:sharesiso4217:USDxbrli:puresols:joint_venturesols:lawsuitsols:segment00020649532025-01-012025-09-3000020649532025-11-070002064953us-gaap:ProductMember2025-07-012025-09-300002064953us-gaap:ProductMember2024-07-012024-09-300002064953us-gaap:ProductMember2025-01-012025-09-300002064953us-gaap:ProductMember2024-01-012024-09-300002064953us-gaap:ServiceMember2025-07-012025-09-300002064953us-gaap:ServiceMember2024-07-012024-09-300002064953us-gaap:ServiceMember2025-01-012025-09-300002064953us-gaap:ServiceMember2024-01-012024-09-3000020649532025-07-012025-09-3000020649532024-07-012024-09-3000020649532024-01-012024-09-300002064953us-gaap:ProductMemberus-gaap:RelatedPartyMember2025-07-012025-09-300002064953us-gaap:ProductMemberus-gaap:RelatedPartyMember2024-07-012024-09-300002064953us-gaap:ProductMemberus-gaap:RelatedPartyMember2025-01-012025-09-300002064953us-gaap:ProductMemberus-gaap:RelatedPartyMember2024-01-012024-09-300002064953us-gaap:ServiceMemberus-gaap:RelatedPartyMember2024-07-012024-09-300002064953us-gaap:ServiceMemberus-gaap:RelatedPartyMember2025-07-012025-09-300002064953us-gaap:ServiceMemberus-gaap:RelatedPartyMember2025-01-012025-09-300002064953us-gaap:ServiceMemberus-gaap:RelatedPartyMember2024-01-012024-09-3000020649532025-09-3000020649532024-12-310002064953us-gaap:RelatedPartyMember2025-09-300002064953us-gaap:RelatedPartyMember2024-12-3100020649532023-12-3100020649532024-09-300002064953us-gaap:RelatedPartyMember2025-01-012025-09-300002064953us-gaap:RelatedPartyMember2024-01-012024-09-300002064953sols:NetParentInvestmentMember2025-06-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300002064953us-gaap:NoncontrollingInterestMember2025-06-3000020649532025-06-300002064953sols:NetParentInvestmentMember2025-07-012025-09-300002064953us-gaap:NoncontrollingInterestMember2025-07-012025-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300002064953sols:NetParentInvestmentMember2025-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300002064953us-gaap:NoncontrollingInterestMember2025-09-300002064953sols:NetParentInvestmentMember2024-06-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300002064953us-gaap:NoncontrollingInterestMember2024-06-3000020649532024-06-300002064953sols:NetParentInvestmentMember2024-07-012024-09-300002064953us-gaap:NoncontrollingInterestMember2024-07-012024-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300002064953sols:NetParentInvestmentMember2024-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300002064953us-gaap:NoncontrollingInterestMember2024-09-300002064953sols:NetParentInvestmentMember2024-12-310002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310002064953us-gaap:NoncontrollingInterestMember2024-12-310002064953sols:NetParentInvestmentMember2025-01-012025-09-300002064953us-gaap:NoncontrollingInterestMember2025-01-012025-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-09-300002064953sols:NetParentInvestmentMember2023-12-310002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310002064953us-gaap:NoncontrollingInterestMember2023-12-310002064953sols:NetParentInvestmentMember2024-01-012024-09-300002064953us-gaap:NoncontrollingInterestMember2024-01-012024-09-300002064953us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300002064953us-gaap:SubsequentEventMember2025-10-300002064953sols:HoneywellMemberus-gaap:SpinoffMemberus-gaap:SubsequentEventMember2025-10-300002064953sols:SuppliersUtilizingThirdPartyServicesSoldThroughToFinancialInstitutionsMember2025-09-300002064953sols:SuppliersUtilizingThirdPartyServicesSoldThroughToFinancialInstitutionsMember2024-12-310002064953sols:ManagementCostAndCorporateSupportServicesMemberus-gaap:RelatedPartyMember2025-07-012025-09-300002064953sols:ManagementCostAndCorporateSupportServicesMemberus-gaap:RelatedPartyMember2025-01-012025-09-300002064953sols:ManagementCostAndCorporateSupportServicesMemberus-gaap:RelatedPartyMember2024-07-012024-09-300002064953sols:ManagementCostAndCorporateSupportServicesMemberus-gaap:RelatedPartyMember2024-01-012024-09-300002064953us-gaap:RelatedPartyMember2025-07-012025-09-300002064953us-gaap:RelatedPartyMember2024-07-012024-09-300002064953srt:AffiliatedEntityMember2025-07-012025-09-300002064953srt:AffiliatedEntityMember2025-01-012025-09-300002064953srt:AffiliatedEntityMember2024-07-012024-09-300002064953srt:AffiliatedEntityMember2024-01-012024-09-300002064953srt:AffiliatedEntityMember2025-09-300002064953srt:AffiliatedEntityMember2024-12-310002064953sols:ConverDynMembersrt:AffiliatedEntityMember2025-09-300002064953sols:ConverDynMembersrt:AffiliatedEntityMember2024-12-310002064953us-gaap:ServiceMembersrt:AffiliatedEntityMembersols:ConverDynMember2025-07-012025-09-300002064953us-gaap:ServiceMembersrt:AffiliatedEntityMembersols:ConverDynMember2025-01-012025-09-300002064953us-gaap:ServiceMembersrt:AffiliatedEntityMembersols:ConverDynMember2024-07-012024-09-300002064953us-gaap:ServiceMembersrt:AffiliatedEntityMembersols:ConverDynMember2024-01-012024-09-300002064953sols:RefrigerantsMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953sols:RefrigerantsMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953sols:RefrigerantsMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953sols:RefrigerantsMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953sols:BuildingSolutionsAndIntermediatesMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953sols:BuildingSolutionsAndIntermediatesMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953sols:BuildingSolutionsAndIntermediatesMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953sols:BuildingSolutionsAndIntermediatesMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953sols:AlternativeEnergyServicesMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953sols:AlternativeEnergyServicesMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953sols:AlternativeEnergyServicesMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953sols:AlternativeEnergyServicesMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953sols:HealthcarePackagingMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953sols:HealthcarePackagingMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953sols:HealthcarePackagingMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953sols:HealthcarePackagingMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953sols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953sols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953sols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953sols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953sols:ResearchAndPerformanceChemicalsMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953sols:ResearchAndPerformanceChemicalsMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953sols:ResearchAndPerformanceChemicalsMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953sols:ResearchAndPerformanceChemicalsMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953sols:ElectronicMaterialsMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953sols:ElectronicMaterialsMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953sols:ElectronicMaterialsMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953sols:ElectronicMaterialsMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953sols:SafetyAndDefenseSolutionsMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953sols:SafetyAndDefenseSolutionsMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953sols:SafetyAndDefenseSolutionsMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953sols:SafetyAndDefenseSolutionsMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953sols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953sols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953sols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953sols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953sols:WithinOneYearMember2025-09-300002064953sols:GreaterThanOneYearMember2025-09-300002064953sols:RefrigerantsAppliedSolutionsMember2024-12-310002064953sols:RefrigerantsAppliedSolutionsMember2025-09-300002064953sols:ElectronicSpecialtyMaterialsMember2024-12-310002064953sols:ElectronicSpecialtyMaterialsMember2025-09-300002064953us-gaap:CustomerRelationshipsMember2025-09-300002064953us-gaap:CustomerRelationshipsMember2024-12-310002064953sols:PatentsAndTechnologiesMember2025-09-300002064953sols:PatentsAndTechnologiesMember2024-12-310002064953us-gaap:TrademarksMember2025-09-300002064953us-gaap:TrademarksMember2024-12-310002064953srt:MinimumMember2025-09-300002064953srt:MaximumMember2025-09-300002064953sols:SeniorNotesDueSeptember2033Memberus-gaap:SeniorNotesMember2025-09-300002064953us-gaap:SecuredDebtMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-290002064953us-gaap:RevolvingCreditFacilityMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:RevolvingCreditFacilityMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-290002064953us-gaap:LetterOfCreditMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-290002064953sols:FederalFundsRateMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:SecuredOvernightFinancingRateSofrMembersols:SeniorCreditFacilitiesMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMemberus-gaap:BaseRateMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMembersrt:MinimumMember2025-10-292025-10-290002064953us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMembersrt:MaximumMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMemberus-gaap:BaseRateMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMembersrt:MinimumMember2025-10-292025-10-290002064953us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMembersrt:MaximumMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953sols:SeniorCreditFacilitiesMembersrt:MinimumMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:RevolvingCreditFacilityMembersols:SeniorCreditFacilitiesMembersrt:MaximumMemberus-gaap:SubsequentEventMember2025-10-292025-10-290002064953us-gaap:SecuredDebtMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMember2025-10-290002064953us-gaap:RevolvingCreditFacilityMembersols:SeniorCreditFacilitiesMemberus-gaap:SubsequentEventMember2025-10-290002064953sols:SidecarLCFacilitiesMembersrt:MinimumMemberus-gaap:SubsequentEventMember2025-10-300002064953sols:SidecarLCFacilitiesMembersrt:MaximumMemberus-gaap:SubsequentEventMember2025-10-300002064953us-gaap:FairValueInputsLevel2Member2025-09-300002064953us-gaap:FairValueInputsLevel2Member2024-12-310002064953us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310002064953us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-09-300002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-09-300002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-01-012025-09-300002064953us-gaap:AccumulatedTranslationAdjustmentMember2025-09-300002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-09-300002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2025-09-300002064953us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310002064953us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-09-300002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-09-300002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-09-300002064953us-gaap:AccumulatedTranslationAdjustmentMember2024-09-300002064953us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-09-300002064953us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-09-300002064953sols:AsahiSchwebelJVMember2025-09-300002064953sols:QuimobasicosS.A.DeC.v.Member2025-09-300002064953sols:SinochemLantianNewMaterialsCo.Ltd.Member2025-09-300002064953sols:SinochemLantianNewMaterialsCo.Ltd.Member2024-12-310002064953sols:ConverDynMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2025-01-012025-09-300002064953sols:ConverDynMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2025-09-300002064953sols:ConverDynMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-12-3100020649532024-01-012024-12-310002064953srt:MaximumMember2025-01-012025-09-300002064953srt:MinimumMember2025-01-012025-09-300002064953sols:AESFacilityMember2024-01-012024-12-310002064953sols:PersonalInjuryCaseMember2025-09-300002064953us-gaap:ProductMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953us-gaap:ProductMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953us-gaap:ProductMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953us-gaap:ProductMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953us-gaap:ServiceMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953us-gaap:ServiceMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953us-gaap:ServiceMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953us-gaap:ServiceMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953us-gaap:ProductMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953us-gaap:ProductMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953us-gaap:ProductMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953us-gaap:ProductMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953us-gaap:ServiceMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953us-gaap:ServiceMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953us-gaap:ServiceMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953us-gaap:ServiceMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2025-07-012025-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2024-07-012024-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2025-01-012025-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2024-01-012024-09-300002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2025-07-012025-09-300002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2024-07-012024-09-300002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2025-01-012025-09-300002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2024-01-012024-09-300002064953us-gaap:OperatingSegmentsMember2025-07-012025-09-300002064953us-gaap:OperatingSegmentsMember2024-07-012024-09-300002064953us-gaap:OperatingSegmentsMember2025-01-012025-09-300002064953us-gaap:OperatingSegmentsMember2024-01-012024-09-300002064953us-gaap:CorporateNonSegmentMember2025-07-012025-09-300002064953us-gaap:CorporateNonSegmentMember2024-07-012024-09-300002064953us-gaap:CorporateNonSegmentMember2025-01-012025-09-300002064953us-gaap:CorporateNonSegmentMember2024-01-012024-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2025-09-300002064953us-gaap:OperatingSegmentsMembersols:RefrigerantsAppliedSolutionsMember2024-12-310002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2025-09-300002064953us-gaap:OperatingSegmentsMembersols:ElectronicSpecialtyMaterialsMember2024-12-310002064953us-gaap:CorporateNonSegmentMember2025-09-300002064953us-gaap:CorporateNonSegmentMember2024-12-310002064953us-gaap:SpinoffMembersrt:MaximumMemberus-gaap:SubsequentEventMember2025-10-300002064953sols:A1234yfDIYMemberus-gaap:SpinoffMemberus-gaap:SubsequentEventMember2025-10-300002064953us-gaap:SpinoffMemberus-gaap:SubsequentEventMember2025-10-300002064953sols:RefrigerantProductsMemberus-gaap:SpinoffMemberus-gaap:SubsequentEventMember2025-10-300002064953us-gaap:SpinoffMemberus-gaap:SubsequentEventMember2025-10-302025-10-300002064953us-gaap:SpinoffMembersrt:MinimumMemberus-gaap:SubsequentEventMember2025-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

__________________

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___to __

Commission file number 001-42812

Solstice Advanced Materials Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

|

33-2919563 |

|

(State or other jurisdiction of |

|

|

(I.R.S. Employer |

|

incorporation or organization) |

|

|

Identification No.) |

|

115 Tabor Rd |

|

|

|

|

Morris Plains, NJ |

|

|

07950-2546 |

(Address of principal executive offices) |

|

|

(Zip Code) |

|

|

|

(973) 370-8188 |

|

|

(Registrant’s telephone number, including area code) |

| Securities registered pursuant to Section 12(b) of the Act: |

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

SOLS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

x |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 158,727,456 of common shares outstanding at November 7, 2025.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

Cautionary Statement about Forward-Looking Statements |

|

| Part I |

Financial Information |

|

| Item 1 |

Financial Statements (Unaudited) |

|

|

CONDENSED COMBINED STATEMENTS OF OPERATIONS (Unaudited) |

|

|

CONDENSED COMBINED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited) |

|

|

CONDENSED COMBINED BALANCE SHEETS (Unaudited) |

|

|

CONDENSED COMBINED STATEMENTS OF CASH FLOWS (Unaudited) |

|

|

CONDENSED COMBINED STATEMENTS OF EQUITY (Unaudited) |

|

|

NOTES TO THE CONDENSED COMBINED FINANCIAL STATEMENTS (Unaudited) |

|

|

Note 1. Business Overview and Basis of Presentation |

|

|

Note 2. Summary of Significant Accounting Policies |

|

|

Note 3. Related Party Transactions |

|

|

Note 4. Revenue Recognition and Contracts with Customers |

|

|

Note 5. Income Taxes |

|

|

Note 6. Inventories |

|

|

Note 7. Goodwill and Other Intangible Assets – Net |

|

|

Note 8. Debt and Credit Agreements |

|

|

Note 9. Fair Value Measurements |

|

|

|

|

|

Note 10. Accumulated Other Comprehensive Loss |

|

|

Note 11. Investments |

|

|

Note 12. Commitments and Contingencies |

|

|

Note 13. Segment Financial Data |

|

|

Note 14. Subsequent Events |

|

| Item 2 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 3 |

Quantitative and Qualitative Disclosures About Market Risk |

|

| Item 4 |

Controls and Procedures |

|

|

|

|

| Part II |

Other Information |

|

| Item 1 |

Legal Proceedings |

|

| Item 1A |

Risk Factors |

|

| Item 2 |

Unregistered Sales of Equity Securities and Use of Proceeds |

|

| Item 3 |

Defaults Upon Senior Securities |

|

| Item 4 |

Mine Safety Disclosures |

|

| Item 5 |

Other Information |

|

| Item 6 |

Exhibits |

|

|

Signatures |

|

|

|

|

Cautionary Statement About Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the federal securities laws made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 about us and our industry that involve substantial risks and uncertainties. These statements can be identified by the fact that they do not relate strictly to historical or current facts, but rather are based on current expectations, estimates, assumptions and projections about our industry and our business and financial results. Forward-looking statements often include words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts,” “intends,” “plans,” “continues,” “believes,” “may,” “will,” “goals” and words and terms of similar substance in connection with discussions of future operating or financial performance. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. Our actual results may vary materially from those expressed or implied in our forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by us or on our behalf. Although we believe that the forward-looking statements contained in this report are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including, but not limited to:

•our lack of operating history as an independent, publicly traded company and unreliability of historical combined financial information as an indicator of our future results;

•our ability to successfully develop new technologies and introduce new products;

•changes in the price and availability of raw materials that we use to produce our products;

•our ability to comply with complex government regulations and the impact of changes in such regulations;

•global climate change and related regulations and changes in customer demand;

•the public and political perceptions of nuclear energy and radioactive materials;

•economic, political, regulatory, foreign exchange and other risks of international operations;

•the impact of tariffs or other restrictions on foreign imports;

•our ability to borrow funds and access capital markets and any limitations in the terms of our indebtedness;

•our ability to compete successfully in the markets in which we operate;

•the effect on our revenue and cash flow from seasonal fluctuations and cyclical market conditions;

•concentrations of our credit, counterparty and market risk;

•our ability to successfully execute or effectively integrate acquisitions;

•our joint ventures and strategic co-development partnerships;

•our ability to recruit and retain qualified personnel;

•potential material environmental liabilities;

•the hazardous nature of chemical manufacturing;

•decommissioning and remediation expenses and regulatory requirements;

•potential material litigation matters, including disputes related to the Spin-off (as defined herein);

•the impact of potential cybersecurity attacks, data privacy breaches and other operational disruptions;

•increasing stakeholder interest in public company performance, disclosure, and goal-setting with respect to environmental, social and governance matters;

•failure to maintain, protect and enforce our intellectual property or to be successful in litigation related to our intellectual property or the intellectual property of others, or competitors developing similar or superior intellectual property or technology;

•unforeseen U.S. federal income tax and foreign tax liabilities and our ability to achieve anticipated tax treatments in connection with the Spin-off;

•U.S. federal income tax reform;

•our ability to operate as an independent, publicly traded company without certain benefits available to us as a part of Honeywell, including managing the increased costs following the Spin-off (as defined herein);

•our ability to achieve some or all of the benefits that we expect to achieve from the Spin-off;

•our inability to maintain intellectual property agreements;

•potential timing, declaration, amount and payment of any dividend program;

•potential cash contributions to benefit pension plans; and

•our ability to maintain proper and effective internal controls.

These and other factors are more fully discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and elsewhere in this report and included in our final Information Statement, dated as of October 17, 2025 (the “Information Statement”), attached as Exhibit 99.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on October 17, 2025, as may be updated from time to time in our other SEC filings. These risks could cause actual results to differ materially from those implied by forward-looking statements in this report. Even if our results of operations, financial condition and liquidity and the development of the industry in which we operate are consistent with the forward-looking statements contained in this report, those results or developments may not be indicative of results or developments in subsequent periods.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

SOLSTICE ADVANCED MATERIALS INC.

CONDENSED COMBINED STATEMENTS OF OPERATIONS (Unaudited)

(Dollars in millions, except per share amount)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended September 30, |

|

For The Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Product sales1 |

$ |

905 |

|

|

$ |

843 |

|

|

$ |

2,687 |

|

|

$ |

2,621 |

|

Service sales2 |

64 |

|

|

64 |

|

|

212 |

|

|

236 |

|

Net sales |

969 |

|

|

907 |

|

|

2,899 |

|

|

2,857 |

|

Costs, expenses and other |

|

|

|

|

|

|

|

Cost of products sold3 |

613 |

|

|

528 |

|

|

1,745 |

|

|

1,674 |

|

Cost of services sold |

46 |

|

|

47 |

|

|

162 |

|

|

182 |

|

Total cost of products and services sold |

659 |

|

|

575 |

|

|

1,907 |

|

|

1,856 |

|

Research and development expenses |

26 |

|

|

21 |

|

|

70 |

|

|

62 |

|

Selling, general and administrative expenses |

113 |

|

|

107 |

|

|

309 |

|

|

303 |

|

| Transaction-related costs |

32 |

|

|

3 |

|

|

90 |

|

|

6 |

|

Other expense (income) |

(36) |

|

|

1 |

|

|

(43) |

|

|

(2) |

|

Interest and other financial charges |

2 |

|

|

3 |

|

|

5 |

|

|

11 |

|

Total costs, expenses and other |

796 |

|

|

710 |

|

|

2,338 |

|

|

2,236 |

|

Income before taxes |

173 |

|

|

197 |

|

|

561 |

|

|

621 |

|

Income tax expense |

182 |

|

|

49 |

|

|

330 |

|

|

150 |

|

Net (loss) income |

(9) |

|

|

148 |

|

|

231 |

|

|

471 |

|

Less: Net income (loss) attributable to noncontrolling interest |

26 |

|

|

(4) |

|

|

35 |

|

|

10 |

|

Net (loss) income attributable to Solstice Advanced Materials |

$ |

(35) |

|

|

$ |

152 |

|

|

$ |

196 |

|

|

$ |

461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

1.Product sales include related party product sales of $22 million and $31 million for the three months and $60 million and $65 million, for the nine months ended September 30, 2025 and 2024, respectively.

2.Service sales include related party service sales of $0 million for the three months and $0 million and $29 million, for the nine months ended September 30, 2025 and 2024, respectively.

3.Cost of products sold include related party cost of products sold of $6 million and $2 million for the three months and $14 million and $13 million, for the nine months ended September 30, 2025 and 2024, respectively.

The Notes to the Condensed Combined Financial Statements are an integral part of this statement.

SOLSTICE ADVANCED MATERIALS INC.

CONDENSED COMBINED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited)

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended September 30, |

|

For The Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Net (loss) income |

$ |

(9) |

|

|

$ |

148 |

|

|

$ |

231 |

|

|

$ |

471 |

|

Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

Foreign exchange translation adjustment |

(5) |

|

|

50 |

|

|

83 |

|

|

12 |

|

Pension and other postretirement benefit adjustments |

(1) |

|

|

(1) |

|

|

(3) |

|

|

(2) |

|

Cash flow hedges recognized in other comprehensive income |

6 |

|

|

(2) |

|

|

(31) |

|

|

2 |

|

Less: Reclassification adjustment for gains (losses) included in net income |

10 |

|

|

(6) |

|

|

10 |

|

|

(10) |

|

Changes in fair value of cash flow hedges |

16 |

|

|

(8) |

|

|

(21) |

|

|

(8) |

|

Total other comprehensive (loss) income, net of tax |

10 |

|

|

41 |

|

|

59 |

|

|

2 |

|

Comprehensive (loss) income |

$ |

1 |

|

|

$ |

189 |

|

|

$ |

290 |

|

|

$ |

473 |

|

The Notes to the Condensed Combined Financial Statements are an integral part of this statement.

SOLSTICE ADVANCED MATERIALS INC.

CONDENSED COMBINED BALANCE SHEETS (Unaudited)

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

September 30, 2025 |

|

December 31, 2024 |

ASSETS |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

417 |

|

|

$ |

661 |

|

Accounts receivable, less allowances of $6 and $7, respectively1 |

635 |

|

|

569 |

|

Inventories |

732 |

|

|

558 |

|

Other current assets |

94 |

|

|

73 |

|

Total current assets |

1,878 |

|

|

1,861 |

|

Property, plant and equipment – net |

1,947 |

|

|

1,746 |

|

Goodwill |

820 |

|

|

806 |

|

Intangible assets – net |

39 |

|

|

35 |

|

Deferred income taxes |

2 |

|

|

3 |

|

Product loans receivable2 |

274 |

|

|

264 |

|

| Investments |

159 |

|

|

146 |

|

Other assets3 |

128 |

|

|

142 |

|

Total assets |

$ |

5,247 |

|

|

$ |

5,004 |

|

LIABILITIES |

|

|

|

Current liabilities: |

|

|

|

Accounts payable4 |

$ |

872 |

|

|

$ |

778 |

|

| Finance lease liability, current |

13 |

|

|

22 |

|

Accrued liabilities5 |

341 |

|

|

283 |

|

Total current liabilities |

1,226 |

|

|

1,083 |

|

Deferred income taxes |

174 |

|

|

179 |

|

Product loans payable |

311 |

|

|

293 |

|

| Finance lease liability, non-current |

108 |

|

|

37 |

|

Other noncurrent liabilities |

247 |

|

|

230 |

|

Total liabilities |

2,066 |

|

|

1,822 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

EQUITY |

|

|

|

Net Parent investment |

3,382 |

|

|

3,471 |

|

Accumulated other comprehensive loss |

(154) |

|

|

(213) |

|

Total Net Parent investment |

3,228 |

|

|

3,258 |

|

Noncontrolling interest |

(47) |

|

|

(76) |

|

Total equity |

3,181 |

|

|

3,182 |

|

Total liabilities and equity |

$ |

5,247 |

|

|

$ |

5,004 |

|

__________________

1.Accounts receivable include related party receivables of $31 million and $40 million, as of September 30, 2025 and December 31, 2024, respectively.

2.Product loans receivable include related party loans receivables of $162 million and $156 million as of September 30, 2025 and December 31, 2024, respectively.

3.Other assets include related party long-term receivables of $0 million and $7 million as of September 30, 2025 and December 31, 2024, respectively.

4.Accounts payable include related party accounts payables of $3 million and $3 million as of September 30, 2025 and December 31, 2024, respectively.

5.Accrued liabilities include related party payables of $66 million and $60 million as of September 30, 2025 and December 31, 2024, respectively.

The Notes to the Condensed Combined Financial Statements are an integral part of this statement.

SOLSTICE ADVANCED MATERIALS INC.

CONDENSED COMBINED STATEMENTS OF CASH FLOWS (Unaudited)

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Nine Months Ended September 30, |

|

2025 |

|

2024 |

Cash flows from operating activities: |

|

|

|

Net income |

$ |

231 |

|

|

$ |

471 |

|

Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

Depreciation |

151 |

|

|

126 |

|

Amortization |

15 |

|

|

35 |

|

Equity income of affiliated companies |

(15) |

|

|

(15) |

|

Gain on sale of fixed assets |

(15) |

|

|

— |

|

Stock compensation expense |

19 |

|

|

13 |

|

Deferred income taxes |

(6) |

|

|

(5) |

|

Other |

1 |

|

|

2 |

|

Changes in assets and liabilities |

|

|

|

Accounts receivable1 |

(46) |

|

|

18 |

|

Inventories |

(150) |

|

|

4 |

|

Other current assets |

(24) |

|

|

(13) |

|

Accounts payable2 |

82 |

|

|

(35) |

|

Deferred income and customer advances |

2 |

|

|

(43) |

|

Accrued liabilities3 |

26 |

|

|

45 |

|

Other changes in assets and liabilities4 |

18 |

|

|

(36) |

|

Net cash provided by operating activities |

289 |

|

|

567 |

|

Cash flows from investing activities: |

|

|

|

Capital expenditures |

(248) |

|

|

(201) |

|

Cash paid for long-life catalysts and deferred maintenance |

(1) |

|

|

(1) |

|

Proceeds from disposals of property, plant, and equipment |

23 |

|

|

— |

|

Other |

(2) |

|

|

(2) |

|

Net cash used for investing activities |

(228) |

|

|

(204) |

|

Cash flows from financing activities: |

|

|

|

Net transfers to Parent |

(310) |

|

|

(297) |

|

Finance lease payments |

(18) |

|

|

(28) |

|

Net cash used for financing activities |

(328) |

|

|

(325) |

|

Effect of foreign exchange rate changes on cash and cash equivalents |

23 |

|

|

1 |

|

Net increase in cash and cash equivalents |

(244) |

|

|

39 |

|

Cash and cash equivalents at beginning of period |

661 |

|

|

606 |

|

Cash and cash equivalents at end of period |

$ |

417 |

|

|

$ |

645 |

|

__________________

1.Includes decrease in related party receivables of $9 million and $5 million for the nine months ended September 30, 2025 and 2024, respectively.

2.Includes increase/(decrease) in related party accounts payables of $1 million and $(5) million for the nine months ended September 30, 2025 and 2024, respectively.

3.Includes increase in related party accrued liabilities of $5 million and $5 million for the nine months ended September 30, 2025 and 2024, respectively.

4.Includes decrease/(increase) in related party long-term receivable of $7 million and $(7) million for the nine months ended September 30, 2025 and 2024, respectively.

The Notes to the Condensed Combined Financial Statements are an integral part of this statement.

SOLSTICE ADVANCED MATERIALS INC.

CONDENSED COMBINED STATEMENTS OF EQUITY (Unaudited)

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Parent Investment |

|

Accumulated Other Comprehensive Loss |

|

Noncontrolling Interest |

|

Total Equity |

Balance as of June 30, 2025 |

$ |

3,706 |

|

|

$ |

(164) |

|

|

$ |

(69) |

|

|

$ |

3,473 |

|

Net (loss) income |

(35) |

|

|

— |

|

|

26 |

|

|

(9) |

|

Foreign exchange translation adjustment |

— |

|

|

(5) |

|

|

— |

|

|

(5) |

|

Pension and other postretirement benefit adjustments |

— |

|

|

(1) |

|

|

— |

|

|

(1) |

|

Changes in fair value of cash flow hedges |

— |

|

|

16 |

|

|

— |

|

|

16 |

|

| Noncontrolling interest |

— |

|

|

— |

|

|

(4) |

|

|

(4) |

|

Net transfers to Parent |

(289) |

|

|

— |

|

|

— |

|

|

(289) |

|

Balance as of September 30, 2025 |

$ |

3,382 |

|

|

$ |

(154) |

|

|

$ |

(47) |

|

|

$ |

3,181 |

|

Balance as of June 30, 2024 |

$ |

3,404 |

|

|

$ |

(197) |

|

|

$ |

(73) |

|

|

$ |

3,134 |

|

Net income (loss) |

152 |

|

|

— |

|

|

(4) |

|

|

148 |

|

Foreign exchange translation adjustment |

— |

|

|

50 |

|

|

— |

|

|

50 |

|

Pension and other postretirement benefit adjustments |

— |

|

|

(1) |

|

|

— |

|

|

(1) |

|

Changes in fair value of cash flow hedges |

— |

|

|

(8) |

|

|

— |

|

|

(8) |

|

Net transfers to Parent |

(106) |

|

|

— |

|

|

— |

|

|

(106) |

|

Balance as of September 30, 2024 |

$ |

3,450 |

|

|

$ |

(156) |

|

|

$ |

(77) |

|

|

$ |

3,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Parent Investment |

|

Accumulated Other Comprehensive Loss |

|

Noncontrolling Interest |

|

Total Equity |

Balance as of December 31, 2024 |

$ |

3,471 |

|

|

$ |

(213) |

|

|

$ |

(76) |

|

|

$ |

3,182 |

|

Net income |

196 |

|

|

— |

|

|

35 |

|

|

231 |

|

Foreign exchange translation adjustment |

— |

|

|

83 |

|

|

— |

|

|

83 |

|

Pension and other postretirement benefit adjustments |

— |

|

|

(3) |

|

|

— |

|

|

(3) |

|

Changes in fair value of cash flow hedges |

— |

|

|

(21) |

|

|

— |

|

|

(21) |

|

| Noncontrolling interest |

— |

|

|

— |

|

|

(6) |

|

|

(6) |

|

Net transfers to Parent |

(285) |

|

|

— |

|

|

— |

|

|

(285) |

|

Balance as of September 30, 2025 |

$ |

3,382 |

|

|

$ |

(154) |

|

|

$ |

(47) |

|

|

$ |

3,181 |

|

Balance as of December 31, 2023 |

$ |

3,269 |

|

|

$ |

(158) |

|

|

$ |

(83) |

|

|

$ |

3,028 |

|

Net income |

461 |

|

|

— |

|

|

10 |

|

|

471 |

|

Foreign exchange translation adjustment |

— |

|

|

12 |

|

|

— |

|

|

12 |

|

Pension and other postretirement benefit adjustments |

— |

|

|

(2) |

|

|

— |

|

|

(2) |

|

Changes in fair value of cash flow hedges |

— |

|

|

(8) |

|

|

— |

|

|

(8) |

|

| Noncontrolling interest |

— |

|

|

— |

|

|

(4) |

|

|

(4) |

|

Net transfers to Parent |

(280) |

|

|

— |

|

|

— |

|

|

(280) |

|

Balance as of September 30, 2024 |

$ |

3,450 |

|

|

$ |

(156) |

|

|

$ |

(77) |

|

|

$ |

3,217 |

|

The Notes to the Condensed Combined Financial Statements are an integral part of this statement.

SOLSTICE ADVANCED MATERIALS INC.

NOTES TO THE CONDENSED COMBINED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions, unless otherwise noted)

Note 1. Business Overview and Basis of Presentation

The accompanying Condensed Combined Financial Statements and notes present the combined results of operations, financial position and cash flows of the Solstice Advanced Materials business (“Solstice Advanced Materials”, “Solstice”, the “Business” or the “Company”) of Honeywell International Inc. (“Honeywell” or “Parent”). The Company is a global specialty chemicals and advanced materials company with positions in refrigerants, semiconductor materials, protective fibers, and healthcare packaging.

On October 8, 2024, Honeywell announced its plan to spin off its Advanced Materials business into an independent, U.S. publicly traded company through a pro rata distribution of all of the outstanding common shares of Solstice Advanced Materials to Honeywell shareholders (the “Spin-off”) that is tax-free for U.S. federal tax purposes. On October 30, 2025, the Spin-off was consummated by means of a tax-free pro-rata distribution (the “Distribution”) of all of the issued and outstanding Solstice Advanced Materials common shares to Honeywell’s shareholders of record as of October 17, 2025 (the “Record Date”), at which time each holder of Honeywell's common shares received one Solstice Advanced Materials common share for every four Honeywell common shares held as of the close of business on the Record Date, resulting in the Distribution of 158,727,456 of the Company’s common shares to Honeywell shareholders. Upon completion of the Distribution, on October 30, 2025, the Company commenced “regular way” trading as an independent public company under the ticker symbol “SOLS” on The Nasdaq Stock Market (“Nasdaq”). Following the Distribution, Honeywell does not beneficially own any Solstice Advanced Materials common shares and will no longer consolidate Solstice Advanced Materials with Honeywell’s financial results. See Note 8, “Long-Term Debt” and Note 14, “Subsequent Events,” for additional information on the Spin-off and related transactions.

For the periods prior to the Spin-off, including those presented in these Condensed Combined Financial Statements, the Business historically operated as part of Honeywell’s Energy and Sustainability Solutions reportable business segment; consequently, separate financial statements have not historically been prepared for the Business. The Condensed Combined Financial Statements have been derived from Honeywell’s historical accounting records as if the operations of the Business had been conducted independently from Honeywell and were prepared on a stand-alone basis in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) and, in the opinion of management, include all adjustments (consisting of normal, recurring adjustments, unless otherwise disclosed) necessary for a fair statement of the condensed combined results of operations, financial position, and cash flows for each period presented.

The combined results for the interim periods are not necessarily indicative of results to be expected for the full year. The 2024 year-end Combined Financial Statements were derived from Honeywell’s audited financial statements. These financial statements should be read in conjunction with the audited Combined Financial Statements included in our final Information Statement, dated as of October 17, 2025 (the “Information Statement”).

The Condensed Combined Financial Statements include all revenues and costs directly attributable to the Business and an allocation of expenses related to certain Honeywell corporate functions (refer to Note 3. – “Related Party Transactions”). These expenses are allocated to the Business based on a proportion of net sales. The Business and Honeywell consider these allocations to be a reasonable reflection of the utilization of services or the benefits received. However, the allocations may not be indicative of the actual expenses that would have been incurred had the Business operated as an independent, stand-alone entity, nor are they indicative of future expenses of the Business.

The Condensed Combined Financial Statements include assets and liabilities specifically attributable to the Business and certain assets and liabilities held by Honeywell that are specifically identifiable or otherwise attributable to the Business. For the periods prior to the Spin-off, including those presented in these Condensed Combined Financial Statements, Honeywell used a centralized approach to cash management and financing of its operations.

Accordingly, a substantial portion of the Business’ cash accounts were regularly cleared to the Parent at Honeywell’s discretion and Honeywell funded the Business’s operating and investing activities as needed. Transfers of cash between Honeywell and the Business are included within Net transfers to Parent on the Condensed Combined Statements of Cash Flows and the Condensed Combined Statements of Equity. Cash and cash equivalents in the Condensed Combined Financial Statements represent cash and cash equivalents held by, or amounts otherwise attributable to, the Business. Honeywell’s long-term debt and related interest expense are not attributed to the Business for any of the periods presented as the Business is not the legal obligor of such borrowings and Honeywell’s borrowings are not directly attributable to the Business. This arrangement is not reflective of the debt costs the Business would have incurred had it been a stand-alone business separate from Honeywell during the periods presented.

All intercompany transactions and balances within the Business have been eliminated. Transactions between the Business and Honeywell are deemed to have been settled immediately through Net Parent investment. The net effect of the deemed settled transactions is reflected in the Condensed Combined Statements of Cash Flows as Net transfers to Parent within financing activities and in the Condensed Combined Balance Sheets as Net Parent investment. Within the financial statements and tables presented, certain columns and rows may not add due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. Certain items have been recast to conform to current-period presentation.

Solstice Advanced Materials historically reports its quarterly financial information using a calendar convention; the first, second, and third quarters are consistently reported as ended on March 31, June 30, and September 30, respectively. It is Solstice Advanced Materials’ practice to establish actual quarterly closing dates using a predetermined fiscal calendar, which requires Solstice Advanced Materials’ businesses to close their books on a Saturday in order to minimize the potentially disruptive effects of quarterly closing on the Company’s business processes. The effects of this practice are generally not significant to reported results for any quarter and only exist within a reporting year. In the event differences in actual closing dates are material to year-over-year comparisons of quarterly or year-to-date results, Solstice Advanced Materials will provide appropriate disclosures. Solstice Advanced Materials’ actual closing dates for the nine months ended September 30, 2025, and 2024, were September 27, 2025, and September 28, 2024, respectively.

Note 2. Summary of Significant Accounting Policies

The significant accounting policies of the Company are set forth in Note 2. – “Summary of Significant Accounting Policies” within the Company’s audited Combined Financial Statements as of December 31, 2024 and 2023, and for the years ended December 31, 2024, 2023, and 2022, which can be found in the Information Statement. The Company includes herein certain updates to those policies.

Supply Chain Financing

Amounts outstanding related to supply chain financing programs are included in Accounts payable in the Condensed Combined Balance Sheet. Accounts payable included approximately $111 million and $96 million as of September 30, 2025 and December 31, 2024, respectively, related to supply chain financing programs.

Transaction-related costs

The Company classifies certain expenses related to the Spin-off, acquisitions and divestitures as Transaction-related costs in the Condensed Combined Income Statement. The Transaction-related costs include one-time and non-recurring expenses associated with the separation and stand-up of functions required to operate as a standalone public entity. These non-recurring costs primarily relate to legal, accounting, consulting and other professional service fees, system implementation costs, business and facilities separation, development of our brand and other matters.

Recent Accounting Pronouncements

The Company considers the applicability and impact of all Accounting Standards Updates (“ASUs”) issued by the Financial Accounting Standards Board (“FASB”). ASUs not listed below were assessed and determined to be either not applicable or are expected to have minimal impact on the Company's Condensed Combined Financial Statements.

In September 2025, the FASB issued ASU 2025-06, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Targeted Improvements to the Accounting for Internal-Use Software, which modernizes the accounting for internal-use software costs by removing all references to prescriptive and sequential software development stages. The new standard requires entities to consider whether significant development uncertainty has been resolved before starting to capitalize software costs and aligns disclosure requirements with Accounting Standards Codification (“ASC”) 360, Property, Plant, and Equipment. The ASU is effective for annual and interim reporting periods beginning after December 15, 2027, and can be applied prospectively, retrospectively, or using a modified transition method, with early adoption permitted. The Company is currently evaluating the impact of this guidance on the Company's Condensed Combined Financial Statements.

In November 2024, the FASB issued ASU 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses, which requires companies to disclose additional information about the types of expenses in commonly presented expense captions. The new standard requires tabular disclosure of specified natural expenses in certain expense captions, a qualitative description of amounts that are not separately disaggregated, and disclosure of the Company's definition and total amount of selling expenses. The ASU should be applied prospectively for annual reporting periods beginning after December 15, 2026, with retrospective application and early adoption permitted. The Company is currently evaluating the impact of this guidance on the Company's Condensed Combined Financial Statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Taxes Disclosures, which requires greater disaggregation of income tax disclosures. The new standard requires additional information to be disclosed annually with respect to the income tax rate reconciliation and income taxes paid disaggregated by jurisdiction. This ASU should be applied prospectively for fiscal years beginning after December 15, 2024, with retrospective application permitted. The Company is currently evaluating the impact of this guidance on the Company’s Condensed Combined Financial Statements.

Note 3. Related Party Transactions

Corporate Allocations

Prior to the Spin-off, the Company operated as a part of Honeywell’s Energy and Sustainability Solutions reporting segment. The Condensed Combined Financial Statements reflect allocations of certain expenses from Honeywell including, but not limited to, legal, accounting, information technology, human resources and other infrastructure support. The allocation method used was a pro rata basis of net sales, utilizing the Company’s proportion of total Honeywell revenue in each respective year, relative to the Honeywell expense cost pool. Allocations for management costs and corporate support services provided to the Company totaled $56 million and $171 million for the three and nine months ended September 30, 2025, respectively, and totaled $51 million and $157 million for the three and nine months ended September 30, 2024, respectively, and such amounts are included within Selling, general and administrative expenses in the Condensed Combined Statements of Operations. These corporate allocations include stock-based compensation expense allocated to the Company for corporate and shared employees of $4 million and $12 million and U.S. pension service costs of $1 million and $2 million for the three and nine months ended September 30, 2025, respectively, and $3 million and $9 million and U.S. pension service costs of $1 million and $2 million for the three and nine months ended September 30, 2024, respectively.

Related Party Sales and Purchases

Product sales to affiliates

Product and service sales in the Condensed Combined Statements of Operations include sales to Honeywell or its affiliates of $22 million and $60 million for the three and nine months ended September 30, 2025, respectively, and $31 million and $94 million for the three and nine months ended September 30, 2024, respectively.

These product sales are reflected on the Condensed Combined Balance Sheets. Accounts receivable – net includes $31 million and $40 million of these transactions as of September 30, 2025 and December 31, 2024, respectively.

Purchases from affiliates

Purchases made by the Company from Honeywell or its affiliates were $6 million and $14 million for the three and nine months ended September 30, 2025, respectively, and $2 million and $13 million for the three and nine months ended September 30, 2024, respectively.

Accounts payable includes $3 million and $3 million as of September 30, 2025 and December 31, 2024, respectively, related to such transactions.

In addition to normal recurring purchases, ConverDyn, the Company’s joint venture with General Atomics, holds accrued liabilities of $66 million and $60 million as of September 30, 2025 and December 31, 2024, respectively. These liabilities are due to an affiliate of General Atomics relating to payments owed by ConverDyn for the standby costs of maintaining a uranium conversion facility owned by such affiliate of General Atomics. These payments cannot be paid by ConverDyn until ConverDyn fully pays to the Company the costs of operating the Alternative Energy Services Facility (“AES Facility”). Until repaid, these obligations to the affiliate General Atomics accrue interest at the U.S. prime rate plus two percent.

Product loans

During 2024, ConverDyn entered into an arrangement to borrow certain products from a customer of ConverDyn and loan such products to an affiliate of General Atomics until December 31, 2026, in exchange for a fixed fee billed annually. Service net sales within the Condensed Combined Statements of Operations includes $0 million for the three and nine months ended September 30, 2025, respectively and $0 million and $29 million for the three and nine months ended September 30, 2024, respectively, related to this arrangement. As of September 30, 2025 and December 31, 2024, the Condensed Combined Balance Sheets includes unbilled Accounts receivable of approximately $7 million and $18 million, and Product loans receivable of approximately $162 million and $156 million, related to the loan fees receivable and the uranium ore Product loans receivable, respectively. Related to this matter, as of September 30, 2025, the Combined Balance Sheet included short-term and long-term payables and obligations in respect of loan fees payable and loans payable from ConverDyn to such customer of approximately $1 million and approximately $162 million, respectively, resulting in a net position of approximately $6 million loan fees receivable and approximately $0 million loans payable/receivable for ConverDyn related to these arrangements.

Cash Management and Net Parent Investment

For the periods prior to the Spin-off, including those presented in these Condensed Combined Financial Statements, Honeywell used a centralized approach for the purpose of cash management and financing of its operations. The Company’s excess cash was transferred to Honeywell daily, and Honeywell funded the Company’s operating and investing activities as needed. The Company operates a centralized non-interest-bearing cash pool in the U.S. and regional interest-bearing cash pools outside of the U.S. The total net effect of the settlement of these intercompany transactions is reflected in the Condensed Combined Statements of Cash Flows as a financing activity and in the Condensed Combined Balance Sheets as Net Parent investment.

Parent Company Credit Support

Honeywell provided the Company with Parent credit support in certain jurisdictions. To support the Company in selling products and services globally, Honeywell often entered into contracts on behalf of the Company or issued Parent guarantees.

Honeywell provided similar credit support for some non-customer related activities of the Company, including Parent guarantees for the decommissioning of nuclear facilities required by the Nuclear Regulatory Commission as well as environmental remediation of certain sites (refer to Note 12. - “Commitments and Contingencies” for further details). There are no instances under the Company’s existing customer contracts requiring payments or performance under Parent company guarantees. As such, the Company recorded no amounts related to Parent company guarantees in the Condensed Combined Financial Statements as of or for the three and nine months ended September 30, 2025 and 2024, respectively.

Note 4. Revenue Recognition and Contracts with Customers

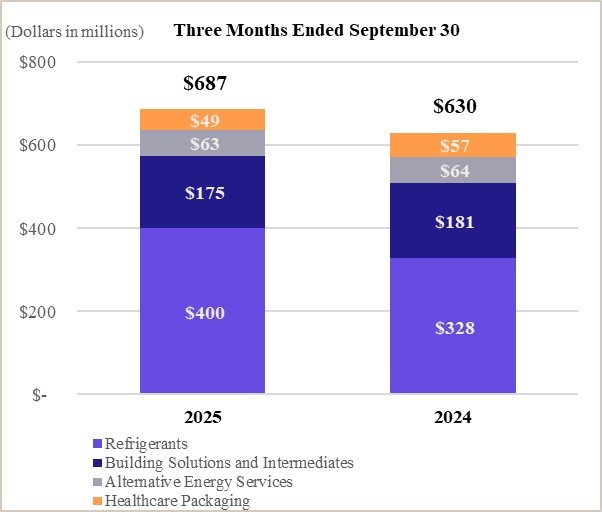

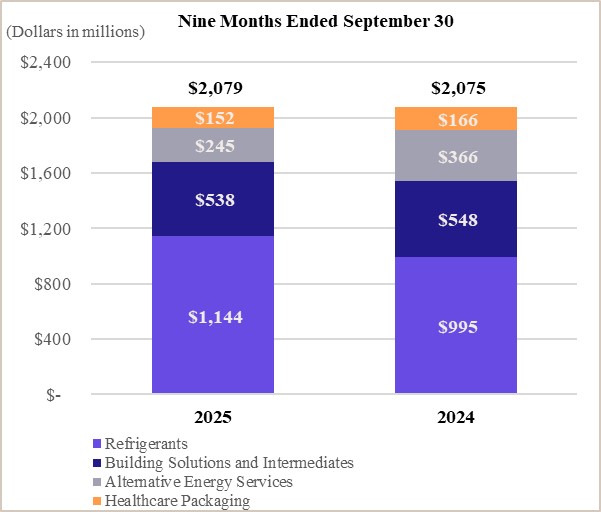

The Company has a comprehensive offering of products and services sold to a variety of customers in multiple end markets. See the following disaggregated revenue table and related discussions by reportable business segment for details:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Refrigerants & Applied Solutions |

|

|

|

|

|

|

|

Refrigerants |

$ |

400 |

|

|

$ |

328 |

|

|

$ |

1,144 |

|

|

$ |

995 |

|

Building Solutions and Intermediates |

175 |

|

|

181 |

|

|

538 |

|

|

548 |

|

Alternative Energy Services |

63 |

|

|

64 |

|

|

245 |

|

|

366 |

|

Healthcare Packaging |

49 |

|

|

57 |

|

|

152 |

|

|

166 |

|

Net Refrigerants & Applied Solutions |

687 |

|

|

630 |

|

|

2,079 |

|

|

2,075 |

|

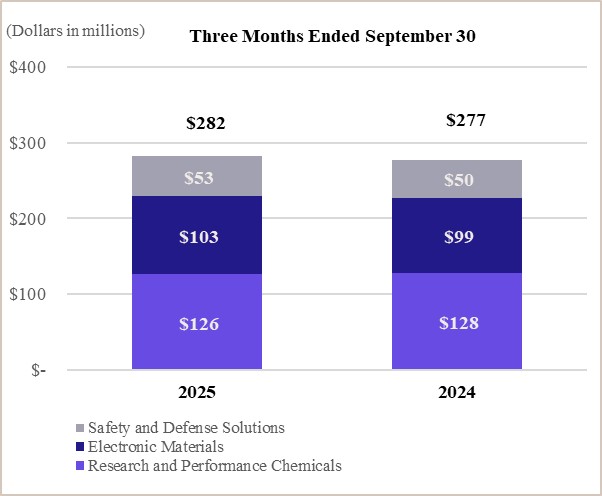

Electronic & Specialty Materials |

|

|

|

|

|

|

|

Research and Performance Chemicals |

126 |

|

|

128 |

|

|

379 |

|

|

357 |

|

Electronic Materials |

103 |

|

|

99 |

|

|

297 |

|

|

287 |

|

Safety and Defense Solutions |

53 |

|

|

50 |

|

|

144 |

|

|

138 |

|

Net Electronic & Specialty Materials |

282 |

|

|

277 |

|

|

820 |

|

|

782 |

|

Net sales |

$ |

969 |

|

|

$ |

907 |

|

|

$ |

2,899 |

|

|

$ |

2,857 |

|

Contract Balances

The Company tracks progress on satisfying performance obligations under contracts with customers and records the related billings and cash collections on the Condensed Combined Balance Sheets in Accounts receivable – net. Unbilled receivables (contract assets) arise when the revenue associated with the contract is recognized prior to billing and derecognized when billed in accordance with the terms of the contract. Deferred revenue (contract liabilities) arise when customers remit contractual cash payments in advance of the Company satisfying performance obligations under contractual arrangements. Contract liabilities are derecognized when revenue is recorded.

Contract balances are classified as assets or liabilities on a contract-by-contract basis at the end of each reporting period. The following table summarizes the Company’s contract assets and liabilities balances:

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

2024 |

Contract assets - January 1 |

$ |

51 |

|

|

$ |

26 |

|

Contract assets – September 30 |

38 |

|

|

55 |

|

Change in contract assets - (decrease) increase |

(13) |

|

|

29 |

|

Contract liabilities - January 1 |

(39) |

|

|

(59) |

|

Contract liabilities – September 30 |

(41) |

|

|

(15) |

|

Change in contract liabilities - decrease (increase) |

(2) |

|

|

43 |

|

Net change |

$ |

(15) |

|

|

$ |

72 |

|

When contracts are modified to account for changes in contract specifications and requirements, the Company considers whether the modification either creates new or changes the existing enforceable rights and obligations.

When the modifications include additional performance obligations that are distinct and at stand-alone selling price, they are accounted for as a new contract and performance obligations, which are recognized prospectively. The effect of a contract modification on the transaction price and the Company’s measure of progress for the performance obligation to which it relates is recognized as an adjustment to revenue (either as an increase in or a reduction of revenue) on a cumulative catch-up basis. For the nine months ended September 30, 2025 and 2024, the Company recognized revenue of $0 million and $39 million, respectively, that was previously included in the beginning balance of contract liabilities.

Performance Obligations

A performance obligation is a promise in a contract to transfer a distinct good or service to the customer and is defined as the unit of account. The Company allocates a contract’s transaction price to each distinct performance obligation and recognizes revenue when, or as, the performance obligation is satisfied. When contracts with customers require highly complex integration or manufacturing services not separately identifiable from other promises in the contracts and, therefore, not distinct, then the entire contract is accounted for as a single performance obligation. For contracts with multiple performance obligations, the Company allocates the contract’s transaction price to each performance obligation based on the estimated relative stand-alone selling price of each distinct good or service in the contract. For product sales, each product sold to a customer typically represents a distinct performance obligation. In such cases, the observable stand-alone sales are used to determine the stand-alone selling price.

Performance obligations satisfied as of a point in time are supported by contracts with customers, providing a framework for the nature of the distinct goods, services or bundle of goods and services. The timing of satisfying the performance obligation is typically indicated by the terms of the contract. Substantially all of the Company’s revenue relates to transfer of control of products at a point in time.

As of September 30, 2025, the Company’s remaining performance obligations (“RPO”), which is the aggregate amount of total contract transaction price that is unsatisfied or partially unsatisfied was approximately $2,866 million. RPO as of September 30, 2025 will be satisfied over the course of future periods. The Company’s disclosure of the timing for satisfying the performance obligation is based on the requirements of contracts with customers. The timing of satisfaction of the Company’s performance obligations does not significantly vary from the typical timing of payment. However, from time to time, these contracts may be subject to modifications, impacting the timing of satisfying the performance obligations. Performance obligations expected to be satisfied within one year and greater than one year are 36% and 64%, respectively.

Note 5. Income Taxes

The effective tax rate in 2025 was higher than the U.S. federal statutory rate of 21% and increased during 2025 compared to 2024 as a result of discrete tax adjustments related to restructuring in advance of the Spin-off from Honeywell.

On July 4, 2025, H.R.1, commonly referred to as the One Big Beautiful Bill Act (“OBBBA”) was enacted. The OBBBA includes a broad range of tax reform provisions affecting businesses, including extending and modifying certain key Tax Cuts & Jobs Act provisions (both domestic and international), expanding certain Inflation Reduction Act incentives, and accelerating the phase-out of or repealing others.

Note 6. Inventories

The following table presents the balances of inventories by type:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

Raw materials |

$ |

78 |

|

|

$ |

67 |

|

Work in process |

220 |

|

|

193 |

|

Finished products |

434 |

|

|

298 |

|

Total Inventories |

$ |

732 |

|

|

$ |

558 |

|

Note 7. Goodwill and Other Intangible Assets – Net

The below table summarizes the change in goodwill, for the nine months ended September 30, 2025, by segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

Currency Translation Adjustment |

|

September 30, 2025 |

Refrigerants & Applied Solutions |

$ |

613 |

|

|

$ |

11 |

|

|

$ |

624 |

|

Electronic & Specialty Materials |

193 |

|

|

3 |

|

|

196 |

|

Total Goodwill |

$ |

806 |

|

|

$ |

14 |

|

|

$ |

820 |

|

Other intangible assets are comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

|

Gross Carrying Amount |

|

Accumulated Amortization |

|

Net Carrying Amount |

|

Gross Carrying Amount |

|

Accumulated Amortization |

|

Net Carrying Amount |

Definite-life intangibles |

|

|

|

|

|

|

|

|

|

|

|

Customer relationships |

$ |

35 |

|

|

$ |

(29) |

|

|

$ |

6 |

|

|

$ |

34 |

|

|

$ |

(27) |

|

|

$ |

7 |

|

Patents and technologies |

12 |

|

|

(7) |

|

|

5 |

|

|

9 |

|

|

(6) |

|

|

3 |

|

Total definite-life intangibles – net |

47 |

|

|

(36) |

|

|

11 |

|

|

43 |

|

|

(33) |

|

|

10 |

|

Indefinite-life intangibles |

|

|

|

|

|

|

|

|

|

|