Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our future operating results and financial position, including for the fiscal year 2025; anticipated future expenses and investments; our use of proceeds from the initial public offering; expectations relating to certain of our key financial and operating metrics; our business strategy and plans; expectations relating to legal and regulatory proceedings; expectations relating to our industry, the regulatory environment, market conditions, trends and growth; expectations relating to customer behaviors and preferences; our market position; potential market opportunities; and our objectives for future operations. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management’s expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including, among others: our ability to successfully execute our business and growth strategy and generate future profitability; market acceptance of our products and services; our ability to further penetrate our existing customer base and expand our customer base; our ability to develop new products and services; our ability to expand internationally; failure to obtain applicable regulatory approvals the success of any acquisitions or investments that we make; the effects of increased competition in our markets; our ability to stay in compliance with applicable laws and regulations; stock price fluctuations; market conditions across the cryptoeconomy, including crypto asset price volatility; and general market, political, and economic conditions, including interest rate fluctuations, inflation, tariffs, instability in the global banking system, economic downturns, and other global events, including regional wars and conflicts and government shutdowns. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, our actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are, or will be included, in our filings we make with the Securities and Exchange Commission from time to time, including our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

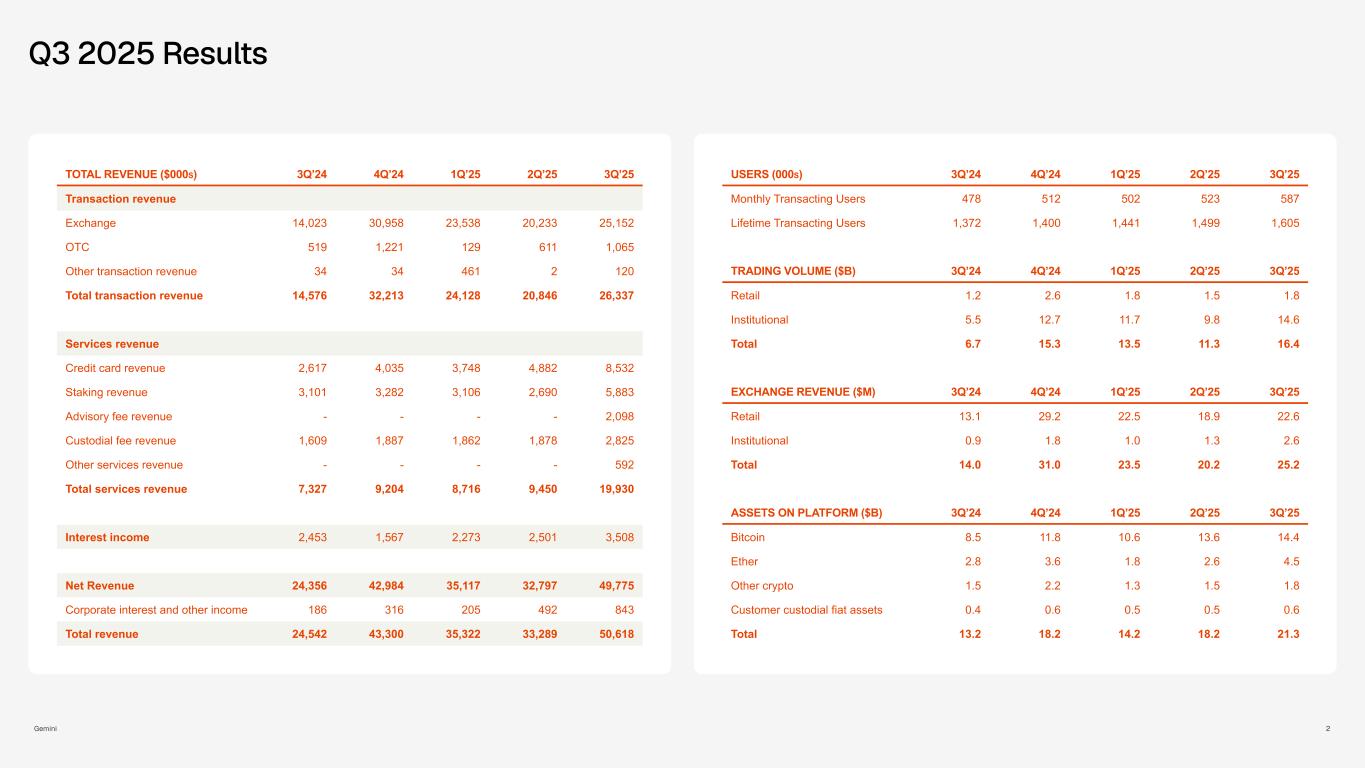

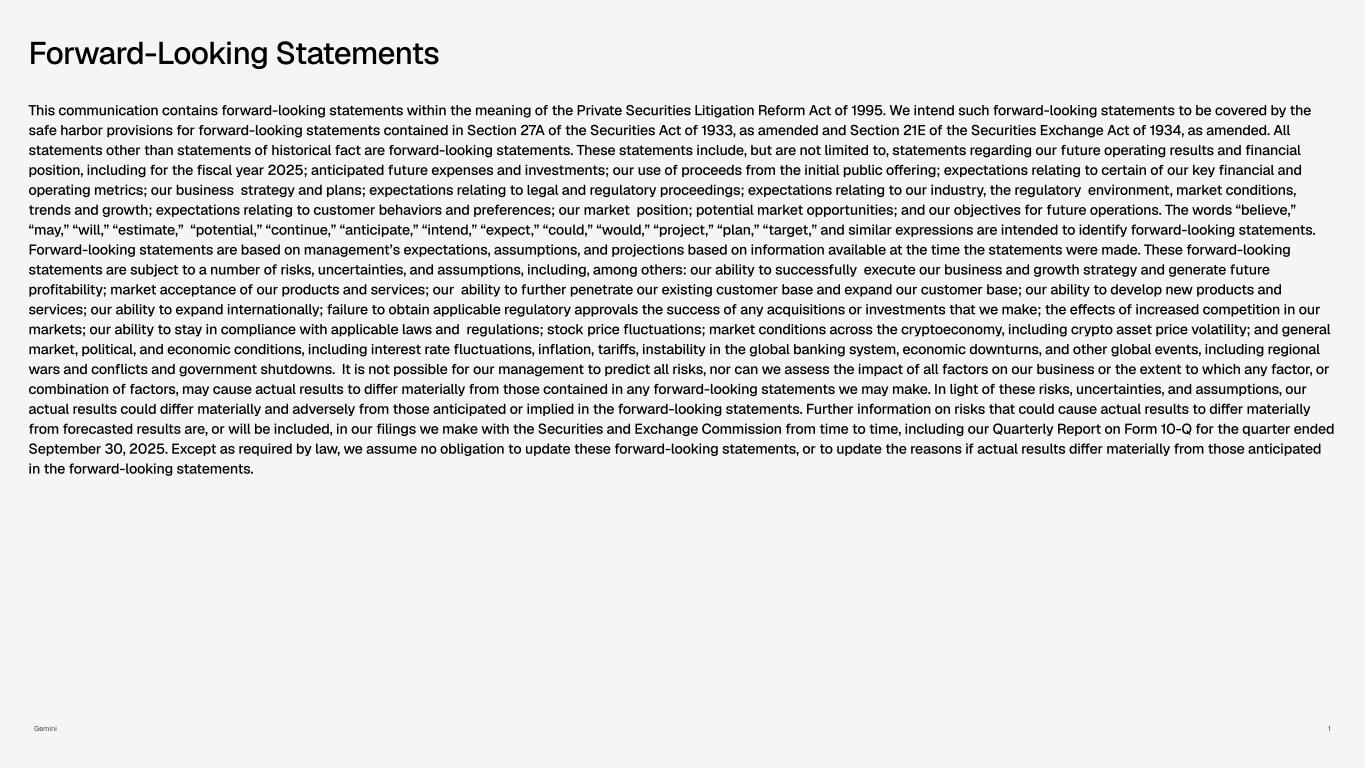

Total Revenue ($000S) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Transaction revenue Exchange 14,023 30,958 23,538 20,233 25,152 OTC 519 1,221 129 611 1,065 Other transaction revenue 34 34 461 2 120 Total transaction revenue 14,576 32,213 24,128 20,846 26,337 Services revenue Credit card revenue 2,617 4,035 3,748 4,882 8,532 Staking revenue 3,101 3,282 3,106 2,690 5,883 Advisory fee revenue - - - - 2,098 Custodial fee revenue 1,609 1,887 1,862 1,878 2,825 Other services revenue - - - - 592 Total services revenue 7,327 9,204 8,716 9,450 19,930 Interest income 2,453 1,567 2,273 2,501 3,508 Net Revenue 24,356 42,984 35,117 32,797 49,775 Corporate interest and other income 186 316 205 492 843 Total revenue 24,542 43,300 35,322 33,289 50,618 Users (000s) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Monthly Transacting Users 478 512 502 523 587 Lifetime Transacting Users 1,372 1,400 1,441 1,499 1,605 Trading volume ($B) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Retail 1.2 2.6 1.8 1.5 1.8 Institutional 5.5 12.7 11.7 9.8 14.6 Total 6.7 15.3 13.5 11.3 16.4 Exchange Revenue ($M) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Retail 13.1 29.2 22.5 18.9 22.6 Institutional 0.9 1.8 1.0 1.3 2.6 Total 14.0 31.0 23.5 20.2 25.2 Assets on platform ($B) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Bitcoin 8.5 11.8 10.6 13.6 14.4 Ether 2.8 3.6 1.8 2.6 4.5 Other crypto 1.5 2.2 1.3 1.5 1.8 Customer custodial fiat assets 0.4 0.6 0.5 0.5 0.6 Total 13.2 18.2 14.2 18.2 21.3 Q3 2025 Results

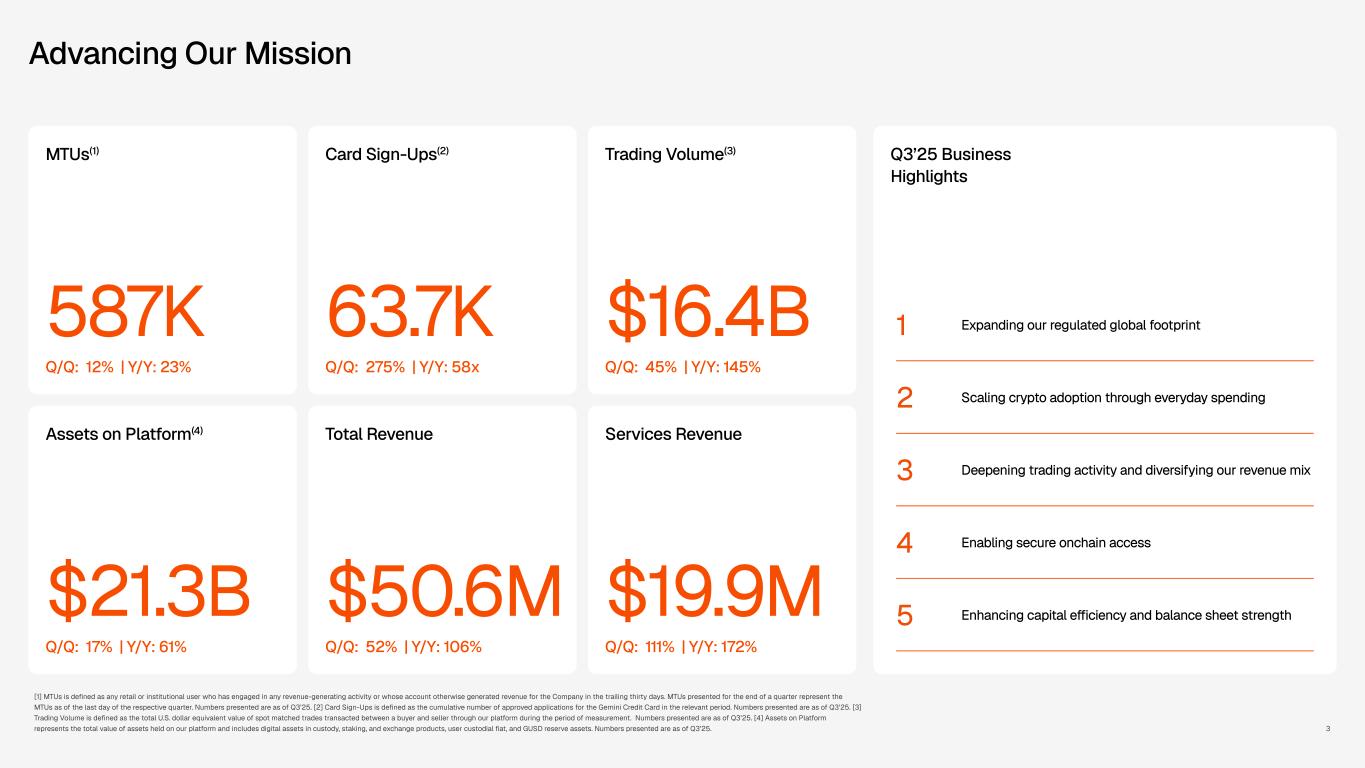

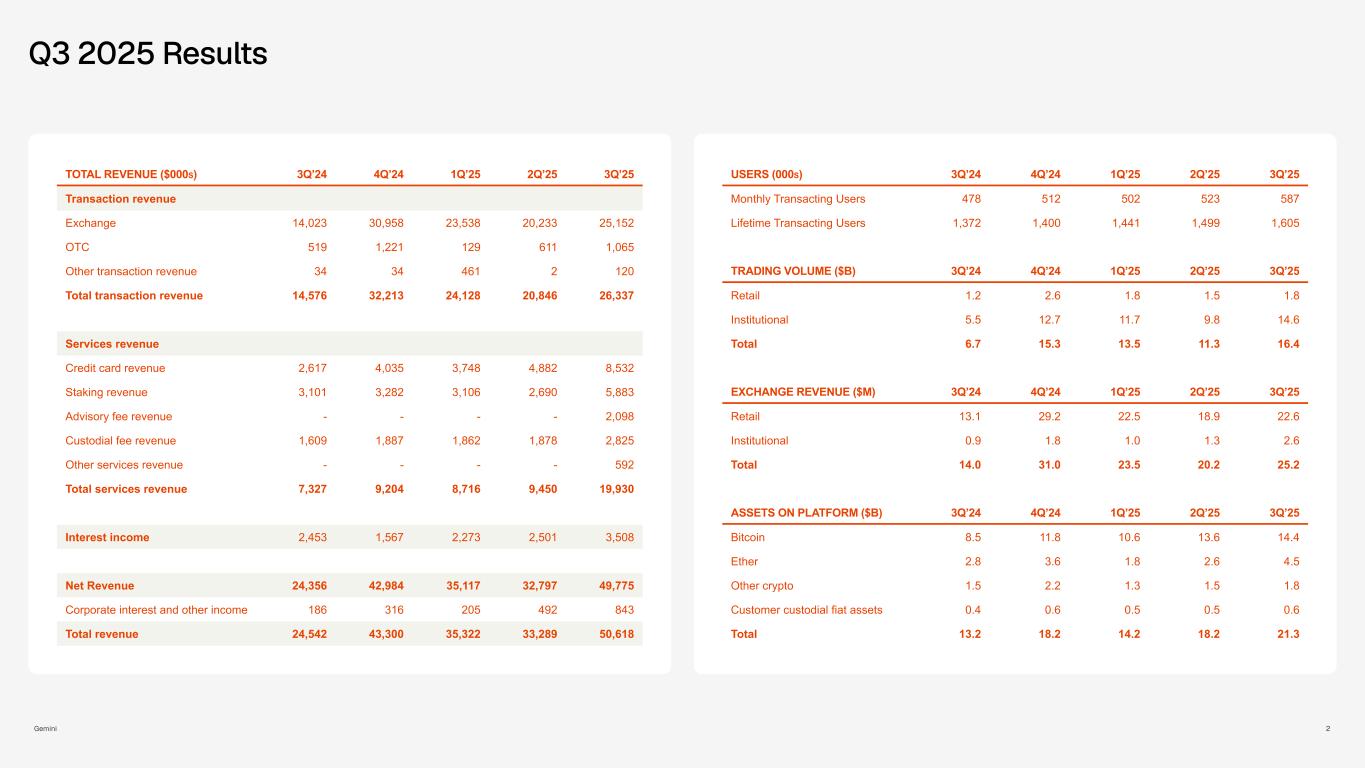

MTUs(1) 587K Q/Q: 12% | Y/Y: 23% Card Sign-Ups(2) 63.7K Q/Q: 275% | Y/Y: 58x Trading Volume(3) $16.4B Q/Q: 45% | Y/Y: 145% Assets on Platform(4) $21.3B Q/Q: 17% | Y/Y: 61% Total Revenue $50.6M Q/Q: 52% | Y/Y: 106% Services Revenue $19.9M Q/Q: 111% | Y/Y: 172% Q3’25 Business Highlights 1 Expanding our regulated global footprint 2 Scaling crypto adoption through everyday spending 3 Deepening trading activity and diversifying our revenue mix 4 Enabling secure onchain access 5 Enhancing capital efficiency and balance sheet strength Advancing Our Mission

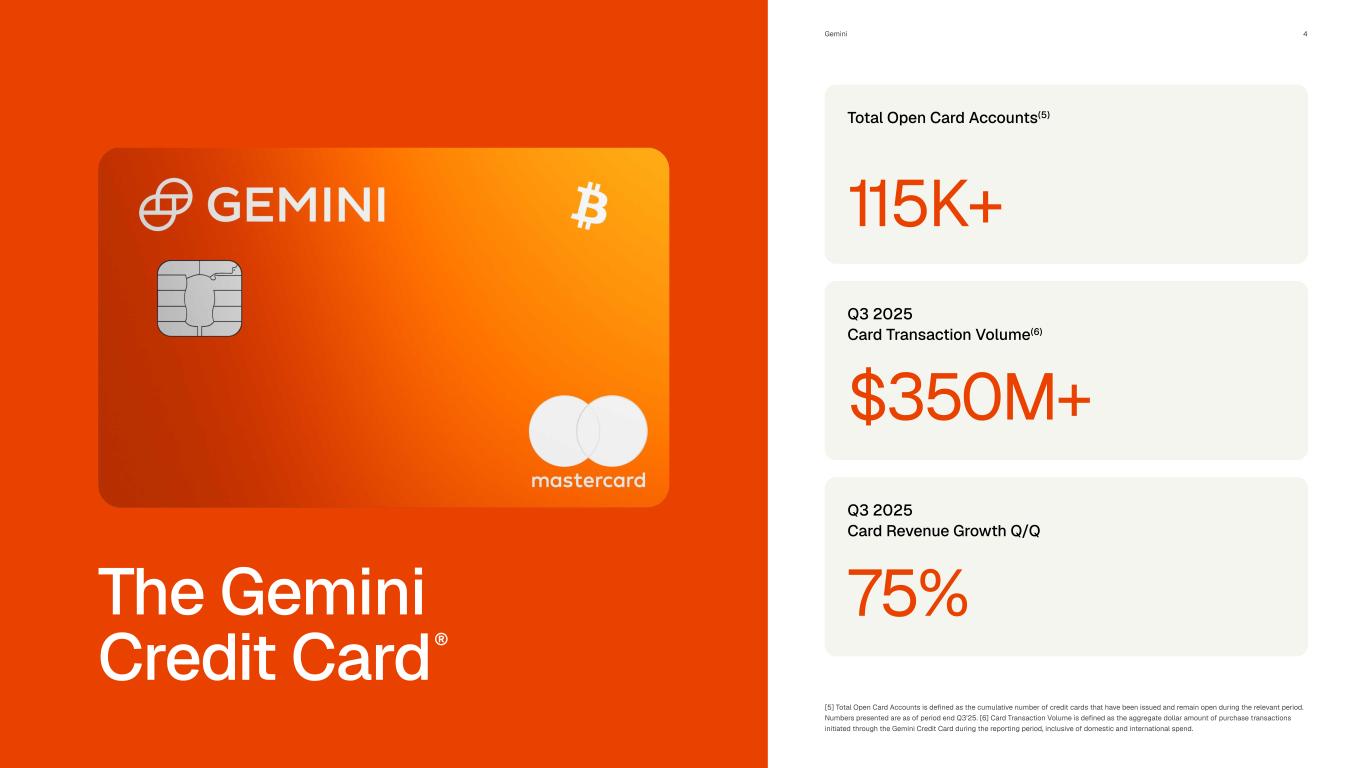

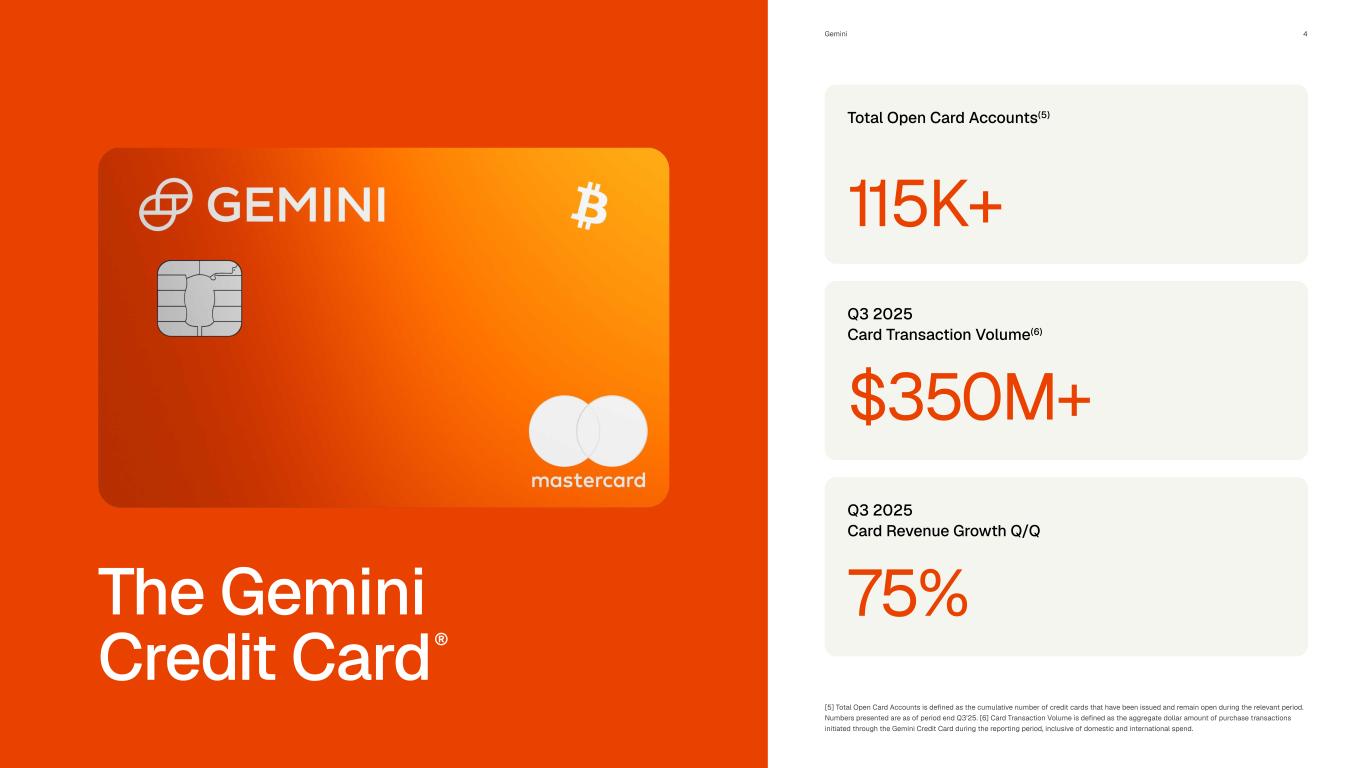

The Gemini

Credit Card® Total Open Card Accounts(5) 115K+ Q3 2025

Card Transaction Volume(6) $350M+ Q3 2025

Card Revenue Growth Q/Q 75%

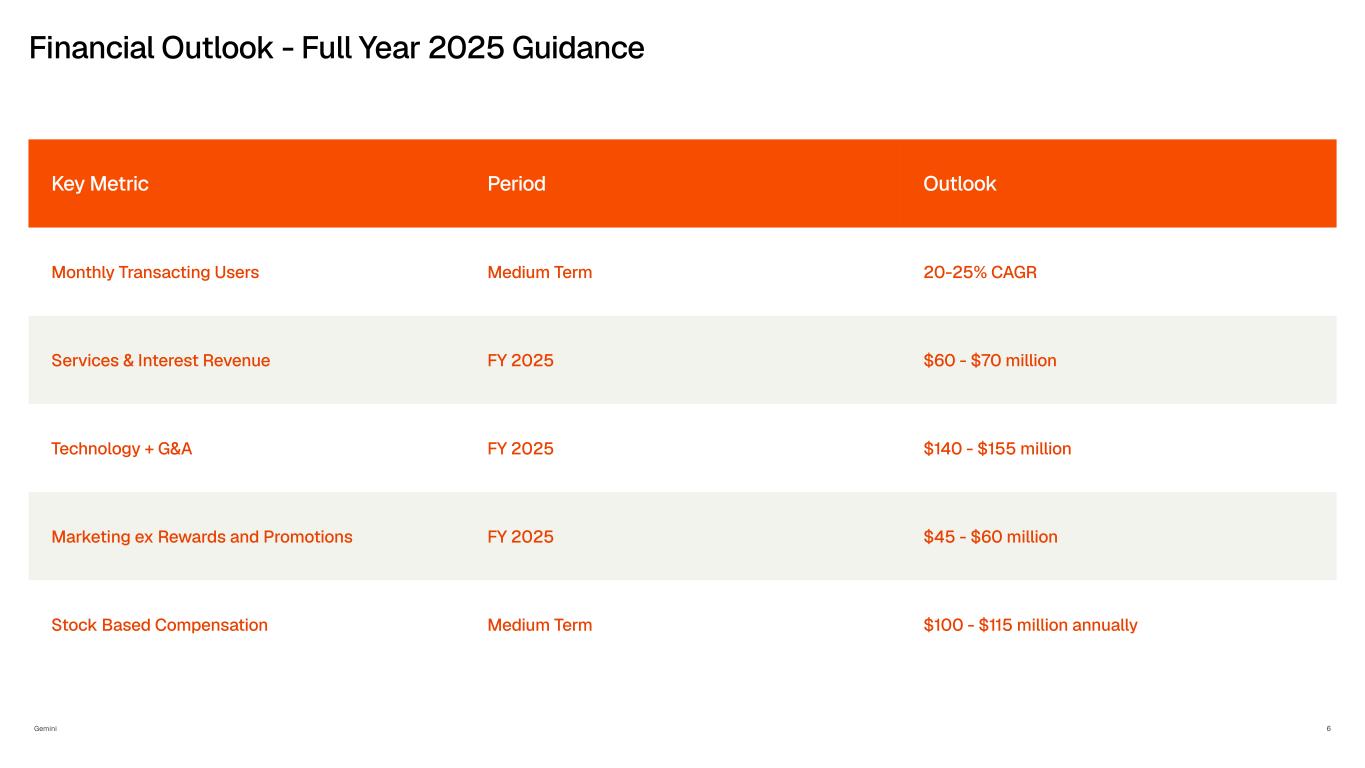

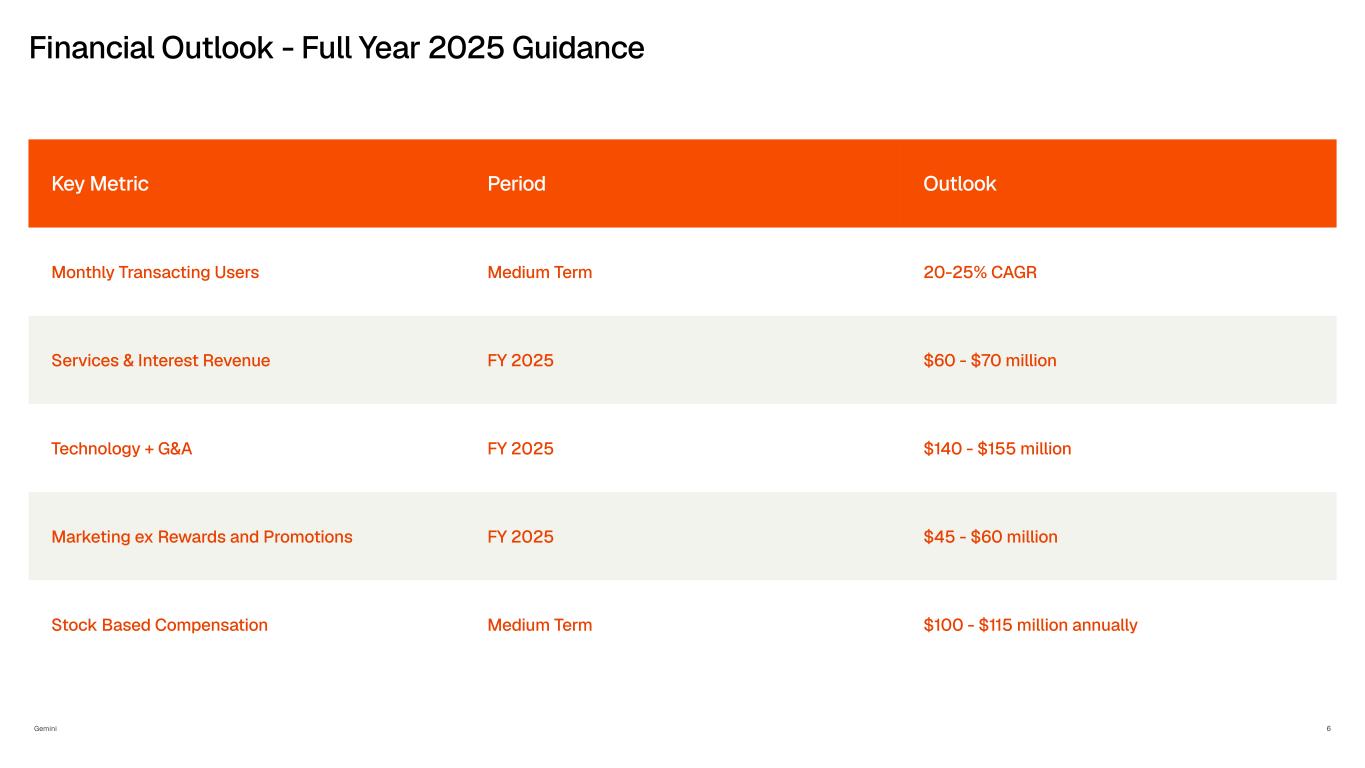

Key Metric Period Outlook Monthly Transacting Users Medium Term 20-25% CAGR Services & Interest Revenue FY 2025 $60 - $70 million Technology + G&A FY 2025 $140 - $155 million Marketing ex Rewards and Promotions FY 2025 $45 - $60 million Stock Based Compensation Medium Term $100 - $115 million annually Financial Outlook - Full Year 2025 Guidance

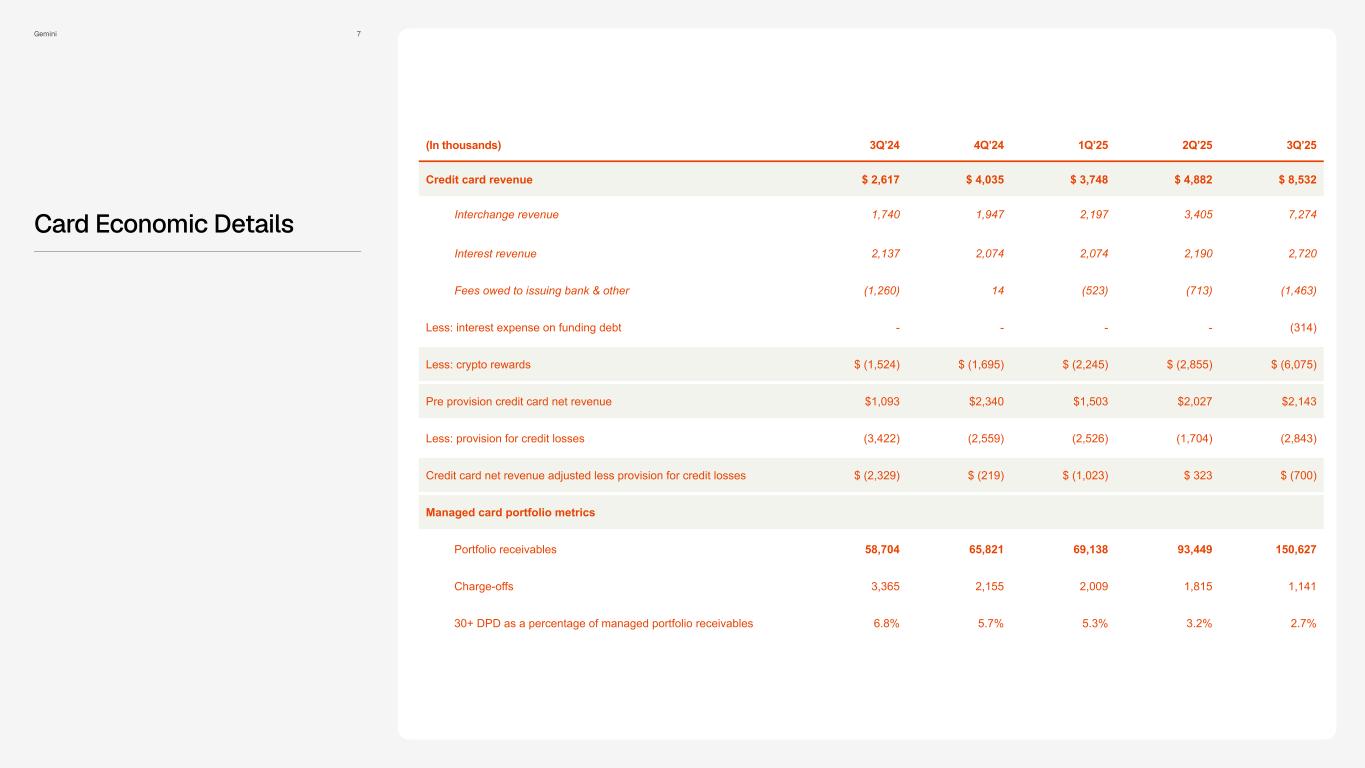

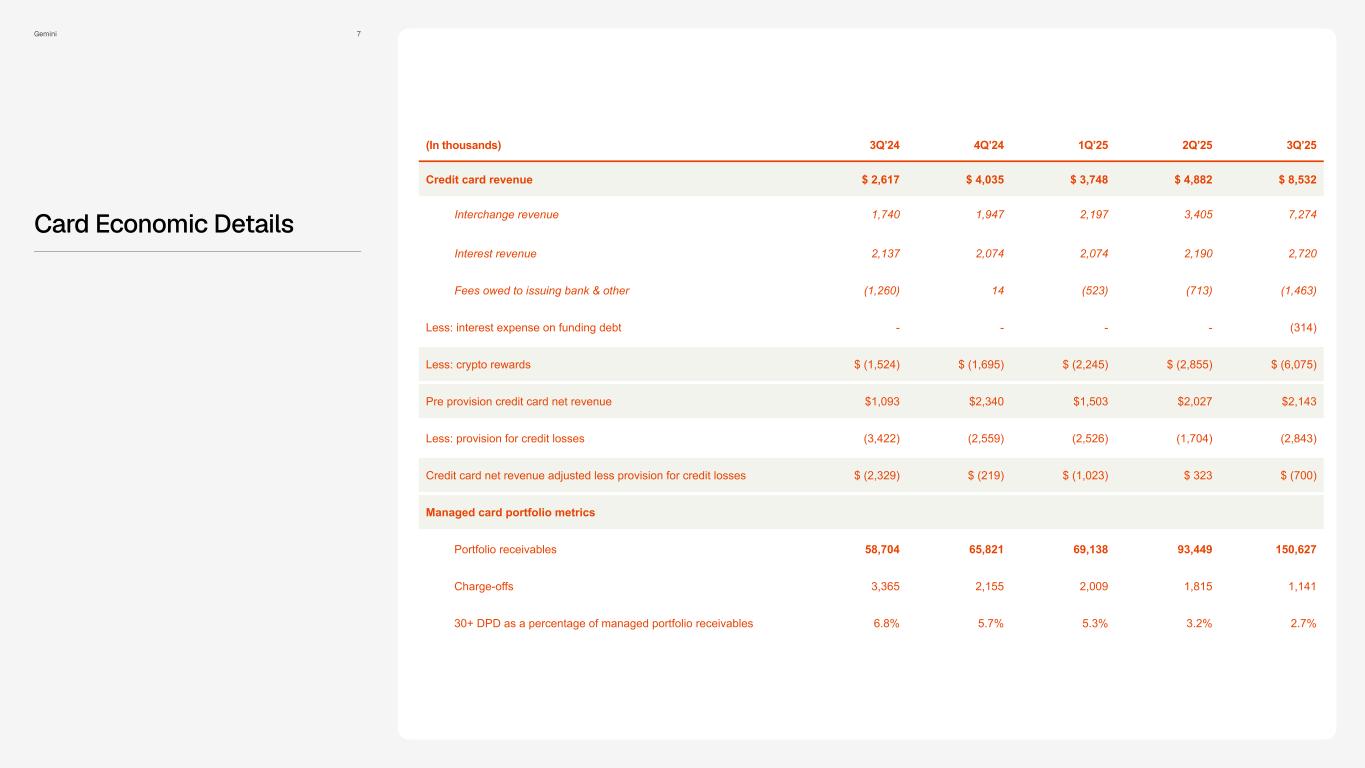

(In thousands) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Credit card revenue $ 2,617 $ 4,035 $ 3,748 $ 4,882 $ 8,532 Interchange revenue 1,740 1,947 2,197 3,405 7,274 Interest revenue 2,137 2,074 2,074 2,190 2,720 Fees owed to issuing bank & other (1,260) 14 (523) (713) (1,463) Less: interest expense on funding debt - - - - (314) Less: crypto rewards $ (1,524) $ (1,695) $ (2,245) $ (2,855) $ (6,075) Pre provision credit card net revenue $1,093 $2,340 $1,503 $2,027 $2,143 Less: provision for credit losses (3,422) (2,559) (2,526) (1,704) (2,843) Credit card net revenue adjusted less provision for credit losses $ (2,329) $ (219) $ (1,023) $ 323 $ (700) Managed card portfolio metrics Portfolio receivables 58,704 65,821 69,138 93,449 150,627 Charge-offs 3,365 2,155 2,009 1,815 1,141 30+ DPD as a percentage of managed portfolio receivables 6.8% 5.7% 5.3% 3.2% 2.7% Card Economic Details

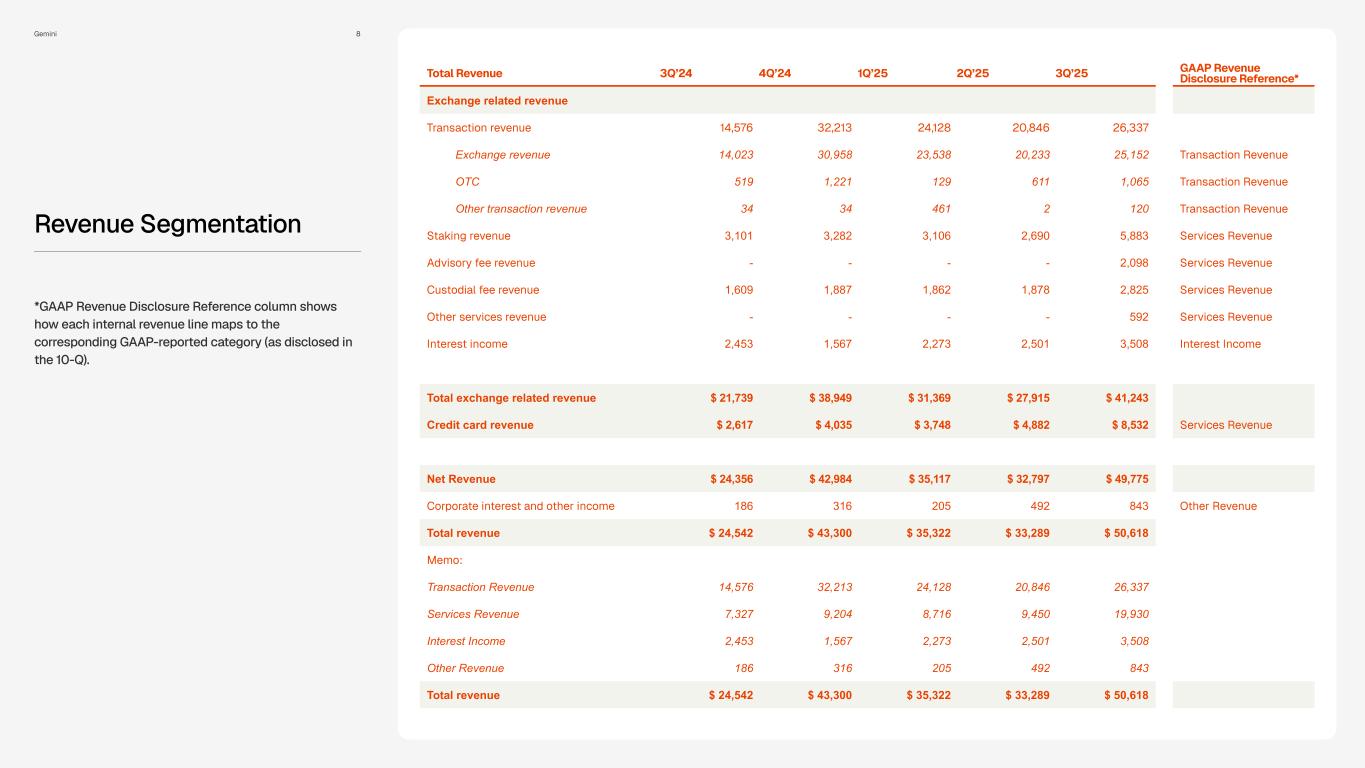

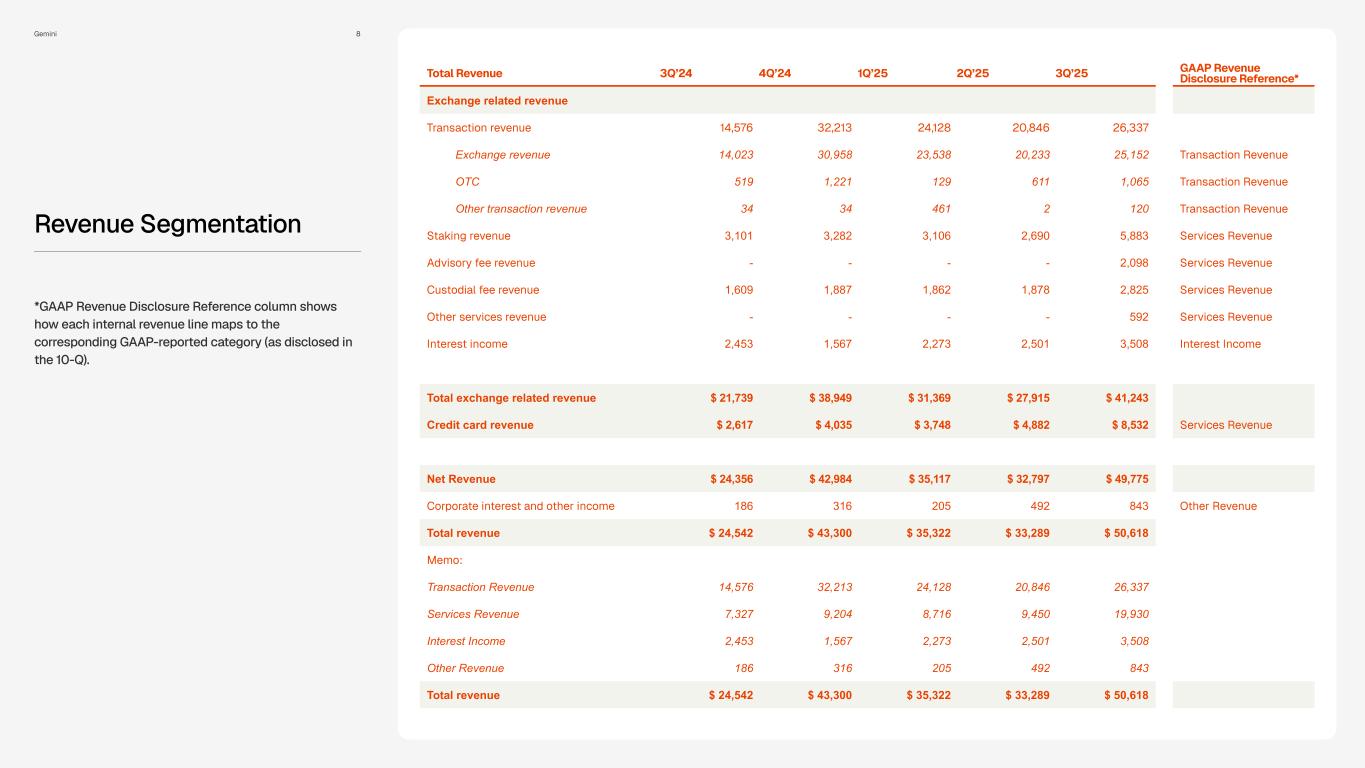

Total Revenue 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 Exchange related revenue Transaction revenue 14,576 32,213 24,128 20,846 26,337 Exchange revenue 14,023 30,958 23,538 20,233 25,152 OTC 519 1,221 129 611 1,065 Other transaction revenue 34 34 461 2 120 Staking revenue 3,101 3,282 3,106 2,690 5,883 Advisory fee revenue - - - - 2,098 Custodial fee revenue 1,609 1,887 1,862 1,878 2,825 Other services revenue - - - - 592 Interest income 2,453 1,567 2,273 2,501 3,508 Total exchange related revenue $ 21,739 $ 38,949 $ 31,369 $ 27,915 $ 41,243 Credit card revenue $ 2,617 $ 4,035 $ 3,748 $ 4,882 $ 8,532 Net Revenue $ 24,356 $ 42,984 $ 35,117 $ 32,797 $ 49,775 Corporate interest and other income 186 316 205 492 843 Total revenue $ 24,542 $ 43,300 $ 35,322 $ 33,289 $ 50,618 Memo: Transaction Revenue 14,576 32,213 24,128 20,846 26,337 Services Revenue 7,327 9,204 8,716 9,450 19,930 Interest Income 2,453 1,567 2,273 2,501 3,508 Other Revenue 186 316 205 492 843 Total revenue $ 24,542 $ 43,300 $ 35,322 $ 33,289 $ 50,618 GAAP Revenue Disclosure Reference* Transaction Revenue Transaction Revenue Transaction Revenue Services Revenue Services Revenue Services Revenue Services Revenue Interest Income Services Revenue Other Revenue Revenue Segmentation

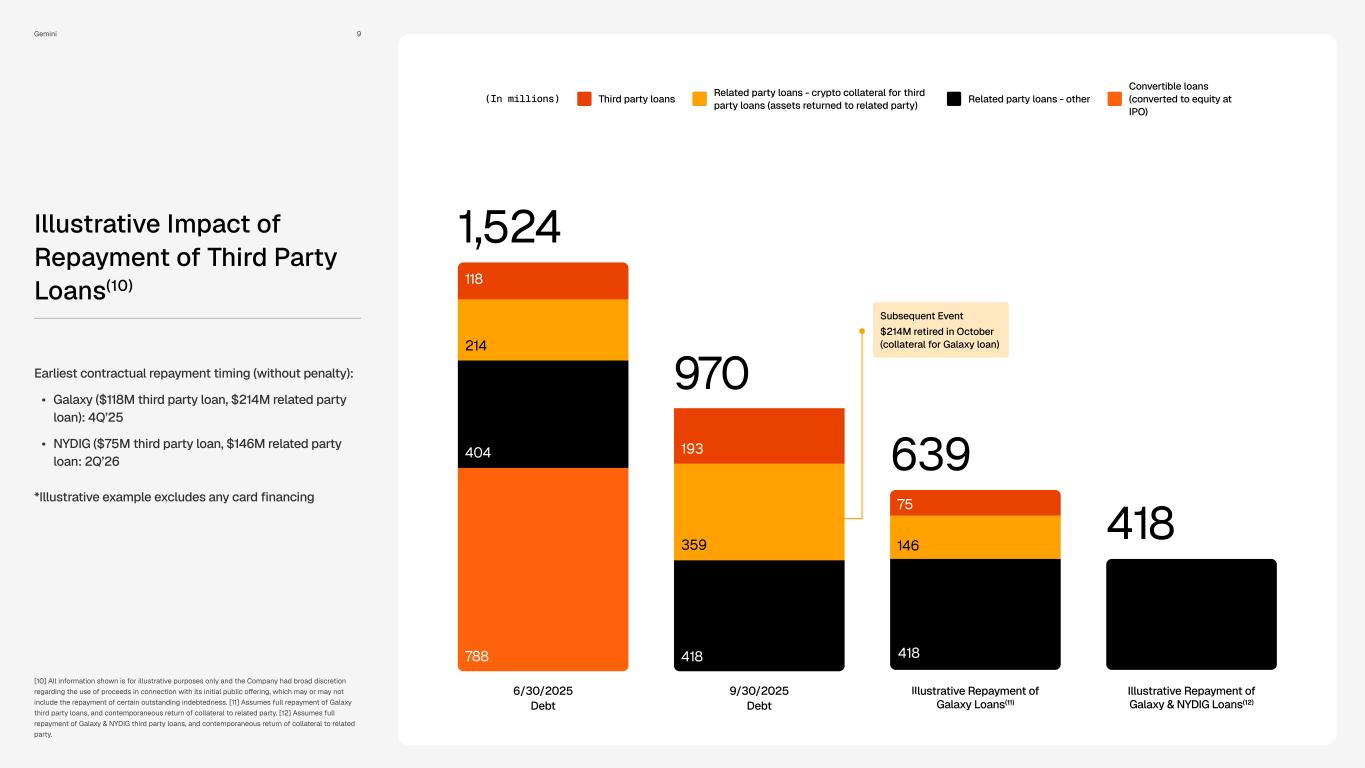

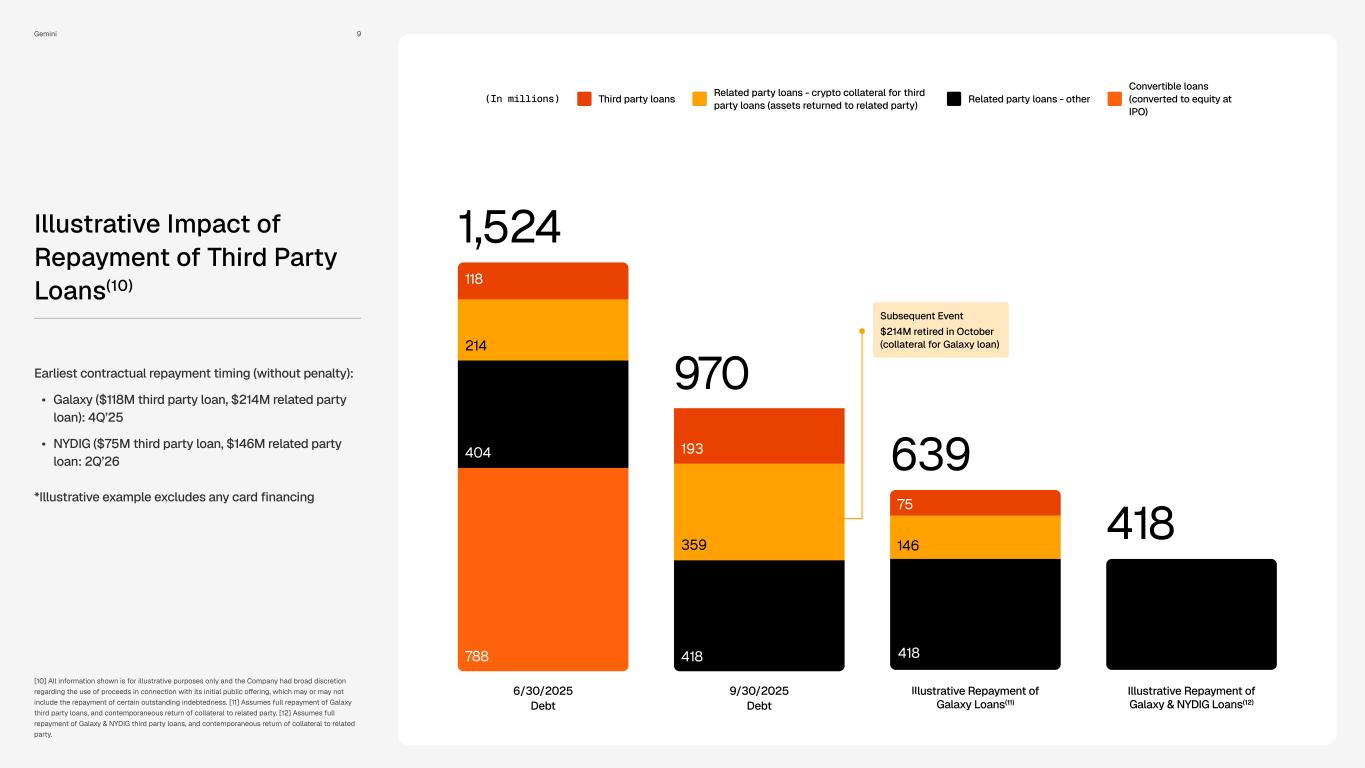

1,524 118 404 214 788 6/30/2025 Debt 970 418 359 193 9/30/2025 Debt 639 418 146 146 75 Illustrative Repayment of

Galaxy Loans(11)418 418 49 Illustrative Repayment of Galaxy & NYDIG Loans(12) (In millions) Third party loans Related party loans - crypto collateral for third party loans (assets returned to related party) Related party loans - other Convertible loans (converted to equity at IPO) Subsequent Event $214M retired in October (collateral for Galaxy loan) Illustrative Impact of Repayment of Third Party Loans(10)

Footnotes [1] MTUs is defined as any retail or institutional user who has engaged in any revenue-generating activity or whose account otherwise generated revenue for the Company in the trailing thirty days. MTUs presented for the end of a quarter represent the MTUs as of the last day of the respective quarter. Numbers presented are as of Q3’25.

[2] Card Sign-Ups is defined as the cumulative number of approved applications for the Gemini Credit Card in the relevant period. Numbers presented are as of Q3’25.

[3] Trading Volume is defined as the total U.S. dollar equivalent value of spot matched trades transacted between a buyer and seller through our platform during the period of measurement. Numbers presented are as of Q3’25.

[4] Assets on Platform represents the total value of assets held on our platform and includes digital assets in custody, staking, and exchange products, user custodial fiat, and GUSD reserve assets. Numbers presented are as of Q3’25.

[5] Total Open Card Accounts is defined as the cumulative number of credit cards that have been issued and remain open during the relevant period. Numbers presented are as of period end Q3’25.

[6] Card Transaction Volume is defined as the aggregate dollar amount of purchase transactions initiated through the Gemini Credit Card during the reporting period, inclusive of domestic and international spend.

[7] Cardholders is defined as an open credit card account that have been issued and remain open, while non-card users are all other users on our exchange that do not have an open card account. Balances on platform looks at the average balances on platform per number of users in each cohort, with the cardholder cohort being an active card account whose first card transaction is at least three months before period end. Participation in more product lines measures the average number of products used in a thirty-day period for both cardholders and non-cardholders. ARPU looks at the average revenue per user for cardholders vs. non-cardholders as of June 30, 2025. [8] The percentage looks at the aggregate total number of US acquired transacting users in the quarter that first applied for the card (accepted or denied), before transacting on the exchange or card, versus the total number of US acquired transacting users that had either an exchange or card first transaction. [9] The percentage looks at the total number of active card users at period end, defined as either transacting on the card or carrying a revolving balance in the prior thirty day period, versus the total number of open card accounts at period end. [10] All information shown is for illustrative purposes only and the Company had broad discretion regarding the use of proceeds in connection with its initial public offering, which may or may not include the repayment of certain outstanding indebtedness. [11] Assumes full repayment of Galaxy third party loans, and contemporaneous return of collateral to related party.

[12] Assumes full repayment of Galaxy & NYDIG third party loans, and contemporaneous return of collateral to related party.