Document

NEWS RELEASE

|

|

|

|

|

|

|

|

|

|

|

|

| FOR IMMEDIATE RELEASE |

Investor Contact: Michael Russell, 419.627.2233 |

| https://investors.sixflags.com |

Media Contact: Gary Rhodes, 704.249.6119 |

SIX FLAGS ENTERTAINMENT CORPORATION REPORTS 2025 THIRD QUARTER RESULTS AND PROVIDES OCTOBER UPDATE

CHARLOTTE, N.C. (Nov. 7, 2025) -- Six Flags Entertainment Corporation (NYSE: FUN) (the “Company”, “Six Flags”, or the “Combined Company”), the largest regional amusement park operator in North America, today announced results for its 2025 third quarter ended Sept. 28, 2025. The Company is also providing a fourth quarter performance update through Nov. 2, 2025, and updating its previously provided full year Adjusted EBITDA(1) guidance.

Third Quarter 2025 Results

•Total operating days were 2,573 compared with 2,585 days in the third quarter of 2024.

•Net revenues totaled $1.32 billion, down $31 million or 2% compared with the third quarter of 2024.

•Net loss attributable to Six Flags Entertainment Corporation, which reflects a $1.5 billion non-cash impairment charge on goodwill and other intangibles, totaled $1.2 billion, compared with net income attributable to Six Flags Entertainment Corporation of $111 million in the prior year period.

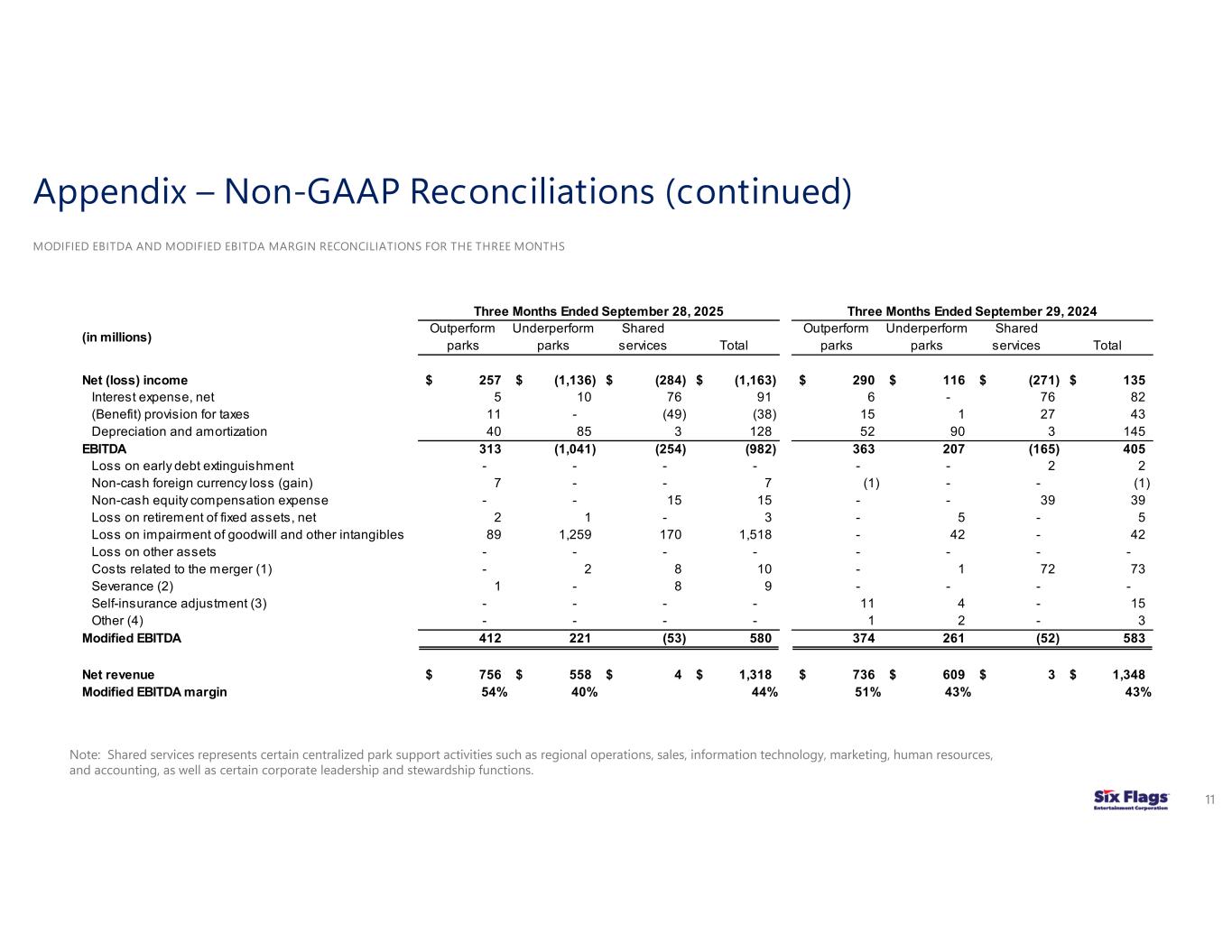

•Adjusted EBITDA(1) totaled $555 million, down $3 million compared with the third quarter of 2024.

•Attendance totaled 21.1 million guests, up 1% or approximately 138,000 visits compared with the third quarter of 2024.

•In-park per capita spending(2) was $59.08, down 4% compared with the third quarter of 2024.

•Out-of-park revenues(2) totaled $108 million, up 6% compared with the third quarter of 2024.

Management Commentary

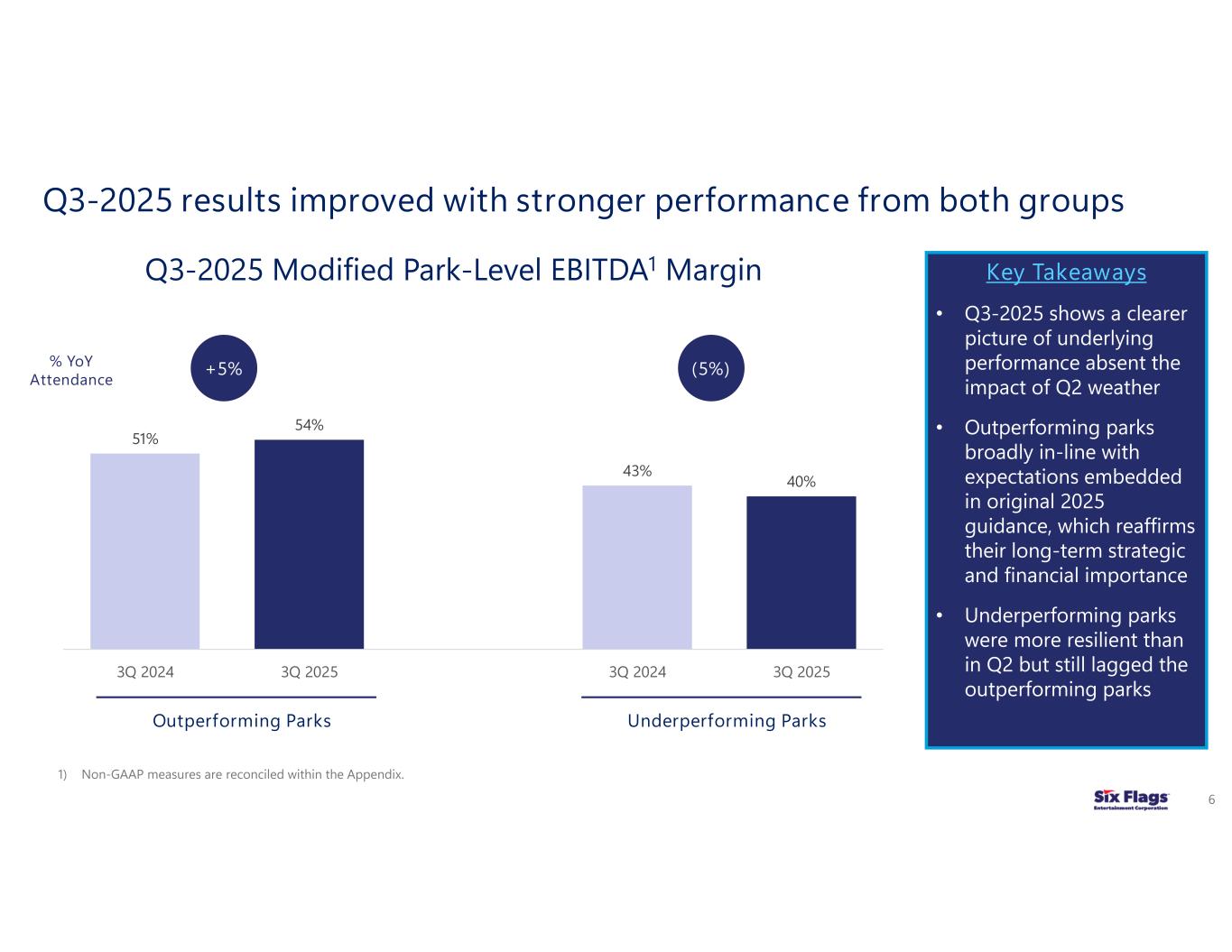

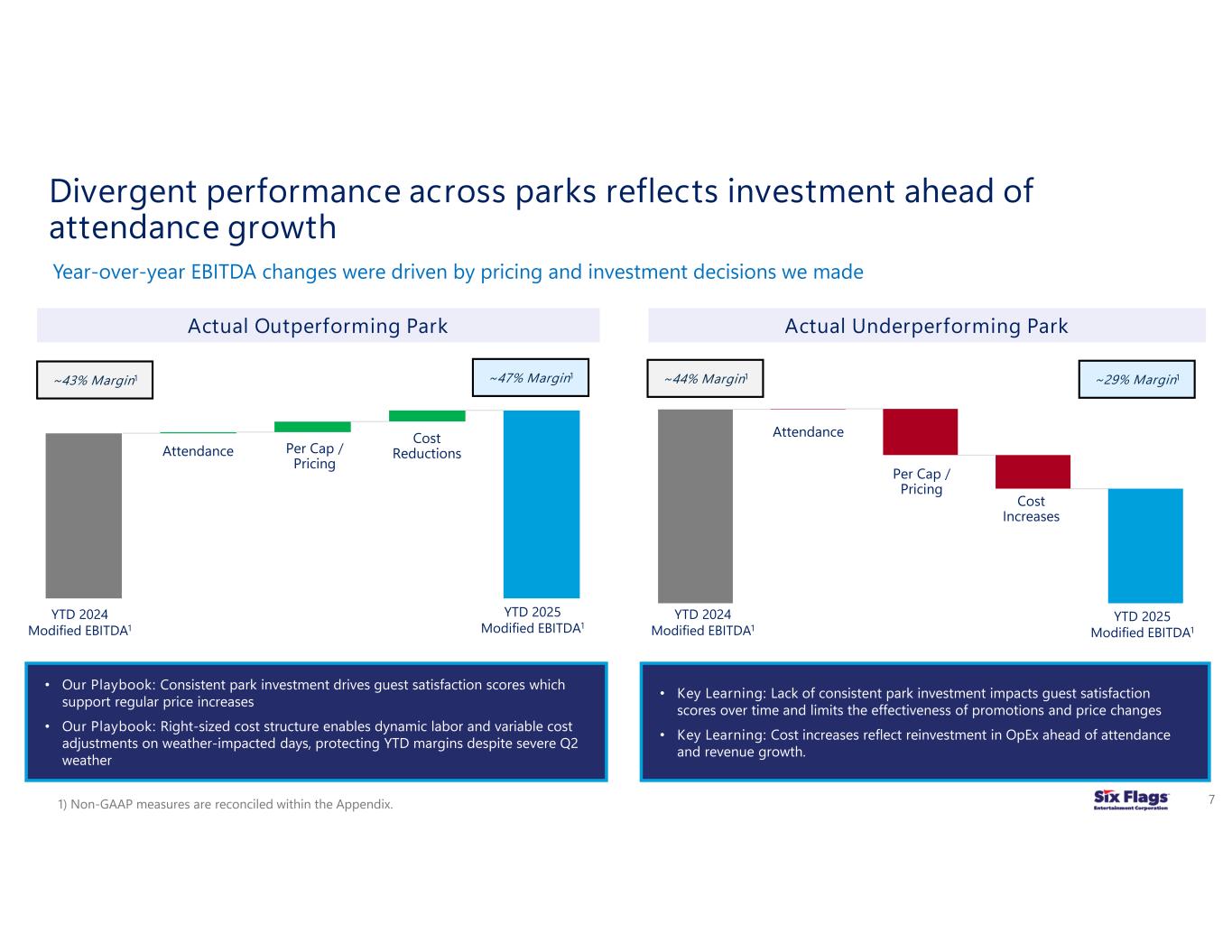

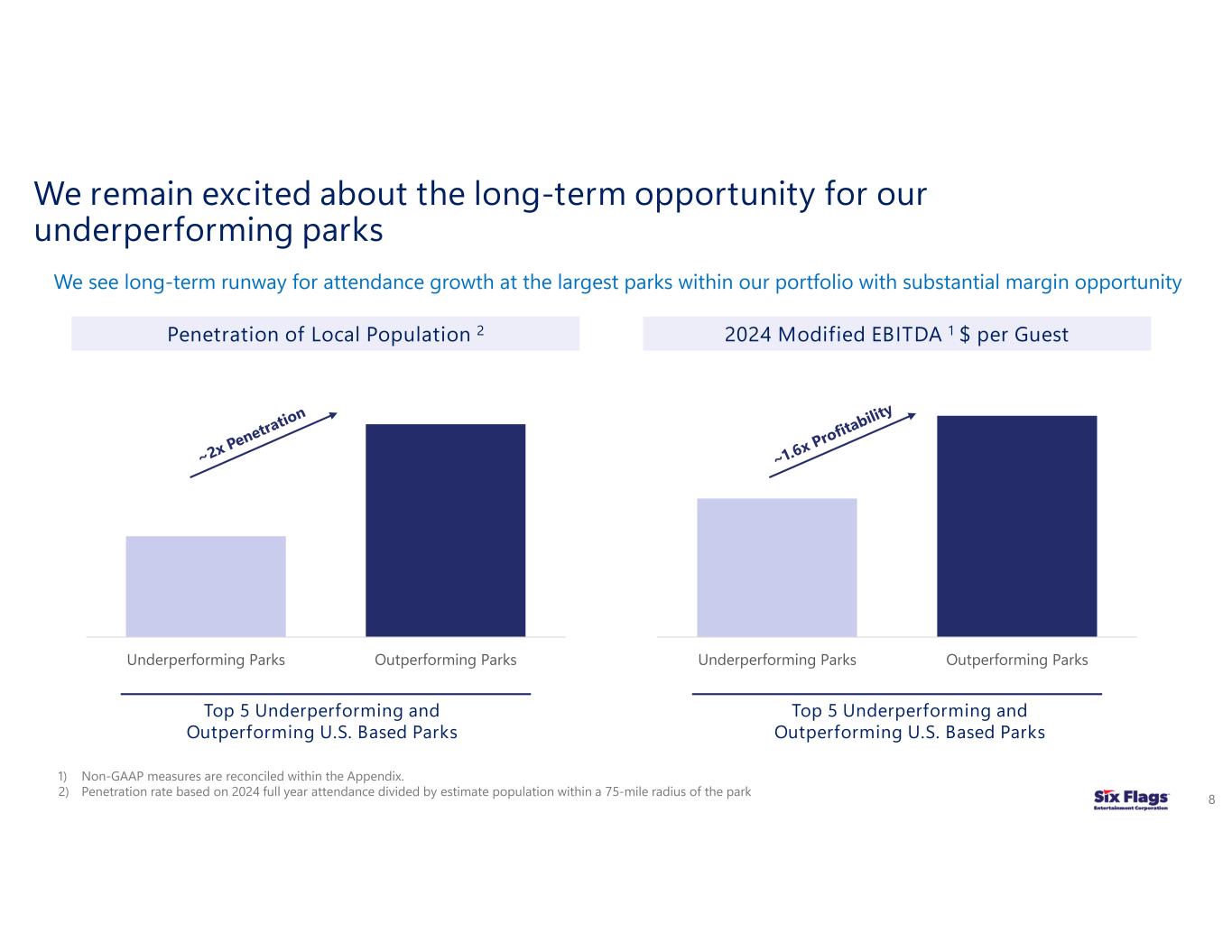

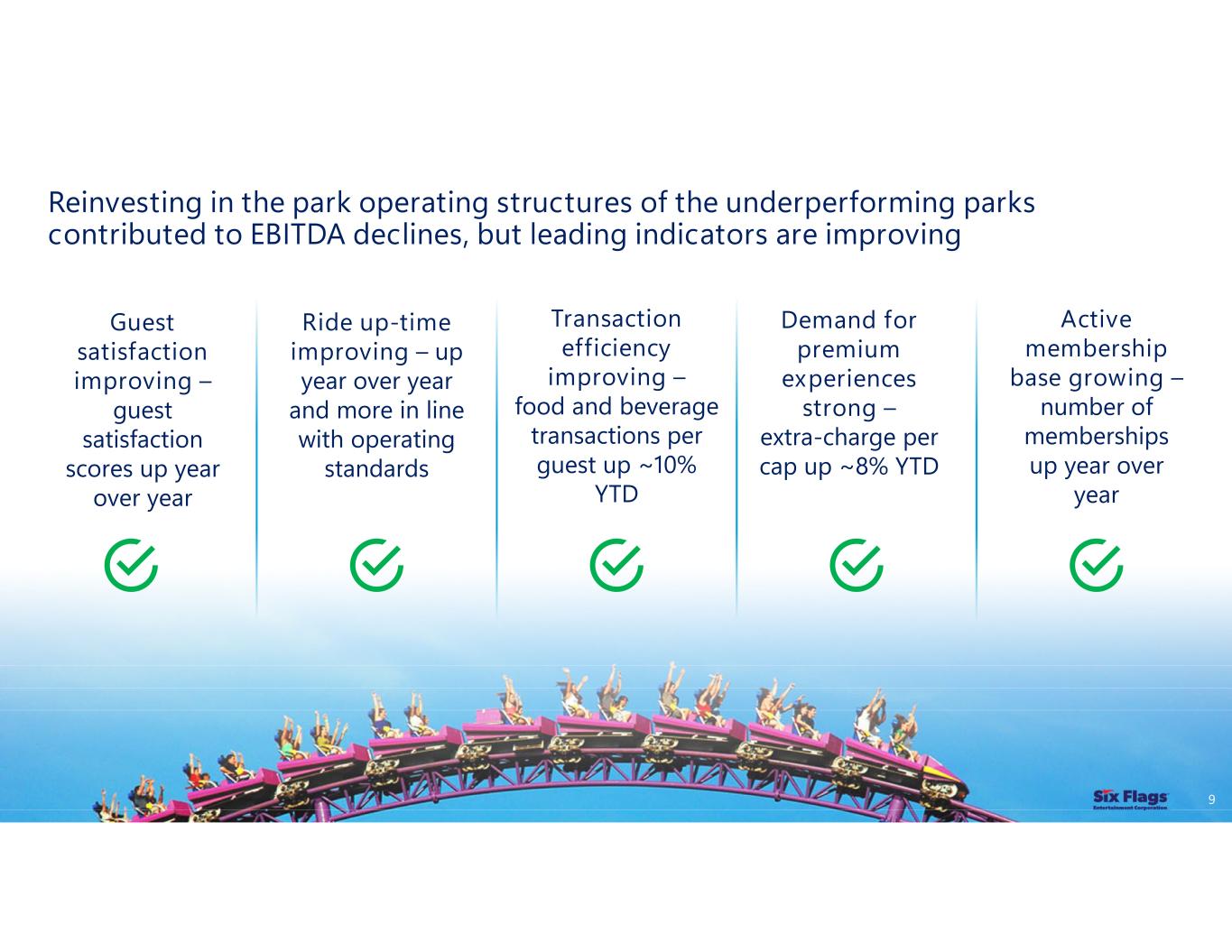

“Following strong performance in July and August, as discussed in our Labor Day update, attendance trends moderated in September,” said Six Flags President and CEO Richard Zimmerman. “Our efforts to stimulate demand did not achieve the desired returns and our decision to shift to more advertising spend earlier in the year in an effort to drive consumer awareness further impacted third quarter results, particularly at our underperforming parks. Our 2025 strategy has focused on investing ahead of attendance growth to lay the foundation for stronger guest satisfaction, which continues to improve across the portfolio.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 2

We are disciplined in our approach to capital allocation and prepared to prioritize investments in our highest return properties moving forward.

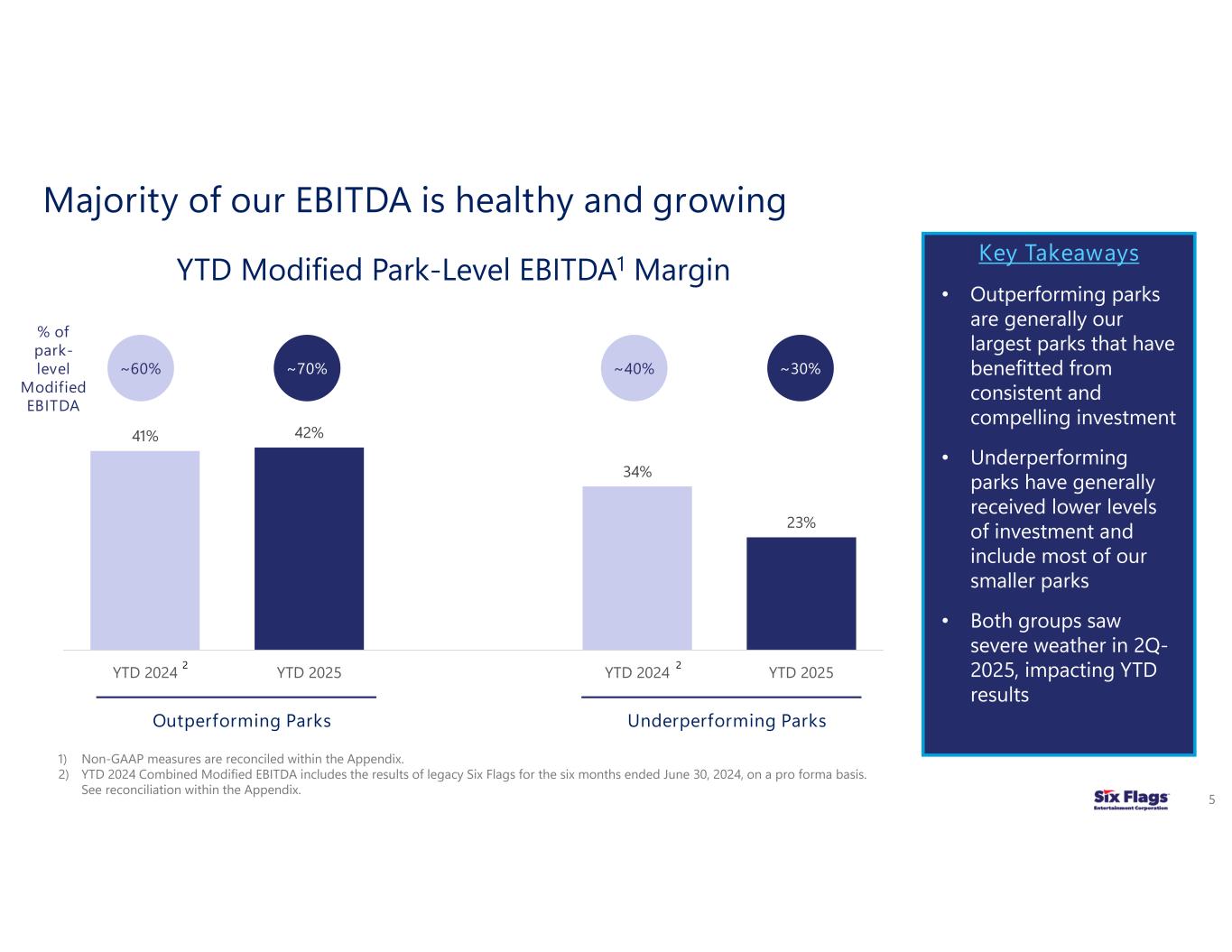

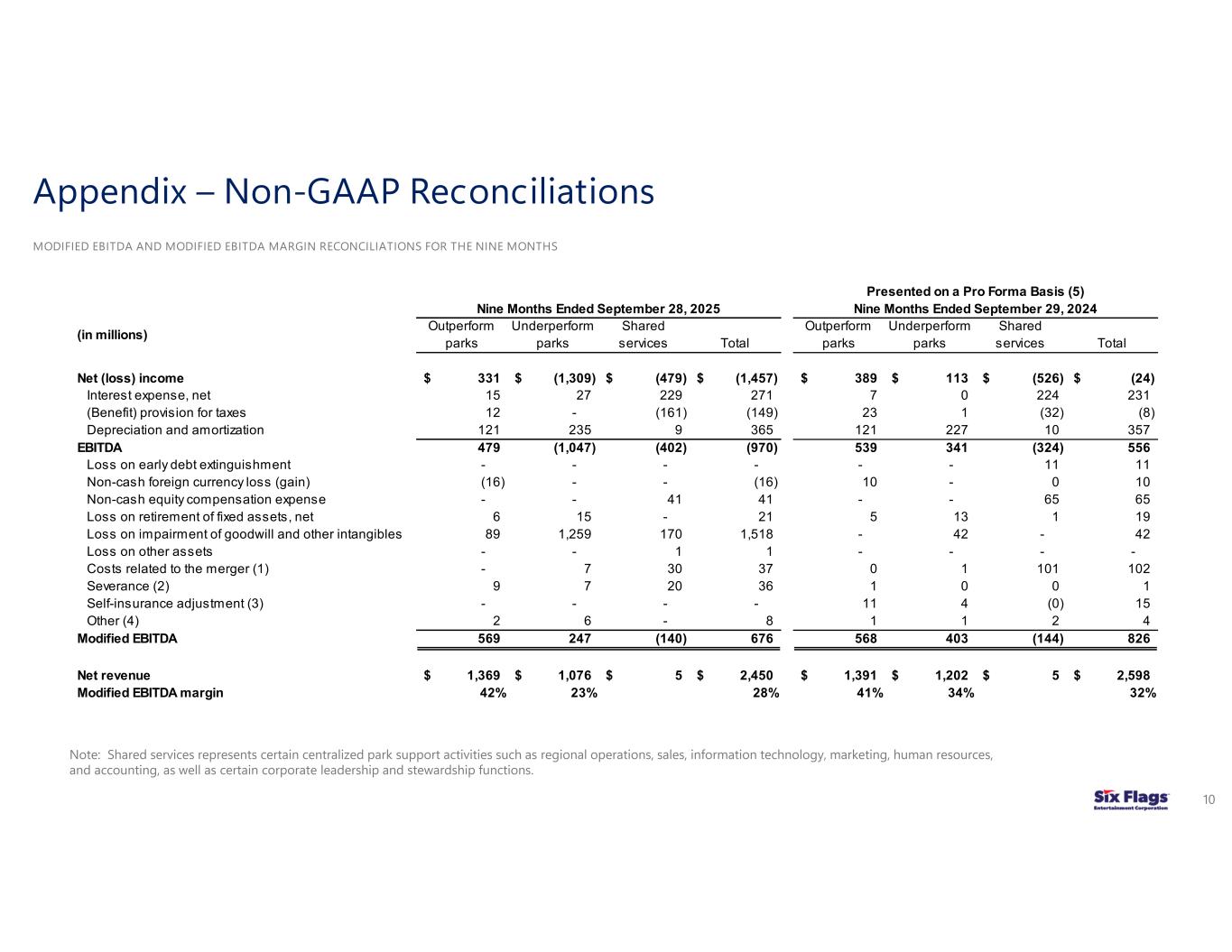

“We are very pleased that our largest and most established parks have continued to perform well during this challenging year,” continued Zimmerman. “This subset of Six Flags’ portfolio, which represents approximately 70% of park-level Modified EBITDA through the first nine months of 2025, has benefited from consistent investment in rides, attractions, and upgraded park facilities in recent years, all of which drive customer satisfaction and higher visitation. This year, several parks in this portfolio subset are on pace to deliver record or near-record results, validating our sound investments and strong consumer demand for the experiences our parks offer. Our teams remain focused on executing against our ongoing integration initiatives, sharpening our marketing messaging and strategies, and delivering an all-around better guest experience as we work to improve the value proposition of all our parks, and ensure we return to driving EBITDA growth across our portfolio.”

Commenting on recent shareholder engagement, Zimmerman added, “It was recently announced that a group led by JANA Partners, which includes NFL superstar Travis Kelce, has acquired a significant stake in Six Flags. We have been in active conversations with this group regarding our mutual goal of enhancing shareholder value. As part of these efforts, Six Flags is engaged with Kelce’s team to work together on a broader branding relationship, capitalizing on Kelce’s long history with our parks and his desire to help renew and enhance the fun and excitement he has enjoyed with us for future generations. These discussions come at an ideal time as we continue to invest across our business to modernize our brands, reinforce their longstanding cultural relevance, and build stronger connections with guests.”

Financial Results for the Third Quarter

Operating days – During the third quarter of 2025, operating days totaled 2,573 (net of 27 closed days) compared with 2,585 operating days (net of 29 closed days) in the third quarter of 2024. The minor variance reflects normal calendar differences and the removal of lower-volume operating days at certain parks.

Net revenues – For the quarter ended Sept. 28, 2025, net revenues totaled $1.32 billion, down $31 million (2%) versus the third quarter of 2024 ($1.35 billion). The decrease in revenues reflected:

• Attendance – up 1% (+138,000 visits) to 21.1 million guests, driven by the strong performance of parks representing the majority of park-level Modified EBITDA.

• In-park per capita spending – down 4% ($59.08 vs. $61.27 in Q3 2024), including admissions per capita spending(2) of $31.48 (down 8% from Q3 2024) and per capita spending on in-park products(2) of $27.60 (up 2% from Q3 2024). The decrease in admissions per capita spending reflects increased promotional activity during the quarter, including bring-a-friend offers, as well as the impact of a shift in attendance mix toward more season pass visitation and fewer higher-yielding single-day visitors. The increase in per capita spending on in-park products was driven by higher guest spending on food and beverage, and extra-charge products during the quarter. This reflects the success of continued investments to upgrade food and beverage offerings across the parks and higher demand for compelling premium experiences at higher attendance levels.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 3

• Out-of-park revenues – up 6% (+$6 million) to $108 million, driven in large part by increased sponsorship activity in Q3 2025.

Operating costs and expenses – In the third quarter of 2025, operating costs and expenses totaled $772 million, a decrease of $122 million compared to the third quarter of 2024. The decline in operating costs and expenses was driven by:

• Operating expenses – down $26 million from prior year due to reductions in full-time and seasonal wages ($19 million) and lower insurance costs ($15 million), offset by higher utility and maintenance costs.

• SG&A expenses – down $97 million, including a $56 million decrease in merger-related costs and a $20 million decrease in equity compensation expense. Excluding these factors, SG&A expenses in the third quarter decreased as a result of a planned reduction in advertising costs ($26 million) and lower full-time wages ($6 million), offset by higher technology costs, including merger-related integration costs.

• Cost of goods sold – up $1.3 million in the quarter due primarily to higher attendance. Additionally, cost of goods sold as a percentage of food, merchandise, and games revenue declined 10 basis points year over year due to menu mix and vendor sourcing efficiencies.

Depreciation and amortization – During the third quarter of 2025, depreciation and amortization expense totaled $128 million, a decrease of $17 million compared with the third quarter of 2024. The decrease was due to the impact of a higher fair value for legacy Six Flags property and equipment during the third quarter of 2024 and the impact of a change in interim depreciation method for legacy Cedar Fair. During the third quarter of 2025, the Company also recognized a $3 million loss on retirement of fixed assets in the normal course of business. By comparison, the Company recognized a $5 million loss on the retirement of fixed assets during the third quarter of 2024.

During the third quarter of 2025, the Company also recognized impairment charges totaling $1.5 billion to lower the carrying amount of goodwill and other intangible assets at certain reporting units. These are non-cash charges that do not impact cash flow, Adjusted EBITDA, or future park operations. The non-cash charges are the result of an internal impairment assessment triggered by the recent change in performance versus expectations, as well as a sustained lower share price. By comparison, the Company recorded a $42 million non-cash charge related to goodwill impairment during the third quarter of 2024.

Operating income – Following the items above, including the $1.5 billion non-cash impairment charge, operating loss for the three months ended Sept. 28, 2025, totaled $1.1 billion, compared with operating income of $263 million for the three months ended Sept. 29, 2024.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 4

Net interest expense – For the third quarter of 2025, net interest expense totaled $91 million, up $9 million compared to the prior year third quarter. The increase was primarily a result of interest accretion related to the Six Flags Over Georgia call option liability.

Taxes – During the three months ended Sept. 28, 2025, the Company recorded a benefit for income taxes of $38 million, compared with a $43 million provision recorded during the three months ended Sept. 29, 2024. The decrease in provision for income taxes was primarily attributable to a change in forecasted pre-tax book income.

Net income (loss) – After the items discussed above and income attributable to non-controlling interests, net loss attributable to the Company for the third quarter of 2025, totaled $1.2 billion, or a net loss of $11.77 per diluted share, compared with net income attributable to the Company of $111 million, or $1.10 per diluted share, for the third quarter of 2024.

Adjusted EBITDA – Management believes Adjusted EBITDA is a meaningful measure of park-level operating results. For the three months ended Sept. 28, 2025, Adjusted EBITDA totaled $555 million, reflecting a $3 million decline in Adjusted EBITDA compared to results for the three months ended Sept. 29, 2024. The variance in Adjusted EBITDA was entirely due to lower revenues during the quarter, driven by a decline in in-park per capita spending, offset in part by a reduction in operating expenses, particularly lower labor and advertising costs.

October Update

Operating days during the five-week periods ended Nov. 2, 2025, and Nov. 3, 2024, respectively, totaled 435 days (net of 5 closed days) and 451 days (with no closed days).

Based on preliminary operating results, attendance for the Combined Company over the five-week period ended Nov. 2, 2025, totaled 5.8 million guests, representing an 11% decrease in attendance compared to the same five-week period last year when October attendance was up approximately 20% due to exceptional weather. For an alternate comparison, our October 2025 attendance increased 7% compared to combined attendance for the two legacy companies during this same five-week period in 2023. Management believes this two-year comparison provides a more relevant indication of our growth trajectory.

Providing an update on long-lead indicators, the Company also noted that sales of 2026 season passes as of Nov. 2, 2025, were up approximately 3% compared to sales of 2025 season passes at this same time last year. The increase in sales reflects a 5% increase in the average season pass price, offset by a 3% decrease in the number of units sold to date.

Balance Sheet and Liquidity Highlights

As of Sept. 28, 2025, the Company reported the following:

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 5

Deferred revenues totaled $365 million compared with $359 million on Sept. 29, 2024. The $6 million increase in deferred revenues was primarily attributable to increased sales of 2026 season-long products, offset somewhat by the timing of sponsorship billings.

Total liquidity was $763 million, including cash and available borrowings under the Company’s revolving credit facility.

Net debt(3) totaled $4.98 billion, calculated as total debt of $5.03 billion (before debt issuance costs and acquisition fair value layers) less cash and cash equivalents of $71 million.

Updated Fiscal 2025 Outlook

Based on year-to-date results, combined with October’s preliminary results and the Company’s current expectations for the last two months of the year, the Company anticipates full year 2025 Adjusted EBITDA(1) of $780 million to $805 million.

Conference Call

As previously announced, Six Flags Entertainment Corporation will host a conference call with analysts starting at 8 a.m. ET today, Nov. 7, 2025, to discuss its recent financial results and the Company's business outlook. Participants on the call will include Six Flags President and CEO Richard Zimmerman and Executive Vice President and CFO Brian Witherow.

Investors and all other interested parties can access a live, listen-only audio webcast of the call on the Six Flags Investors website at https://investors.sixflags.com under the tabs Investor Information / Events & Presentations. Those unable to listen to the live webcast can access a recorded version of the call on the Six Flags Investors website at https://investors.sixflags.com under Investor Information / Events and Presentations, shortly after the live call’s conclusion.

A digital recording of the conference call will be available for replay by phone starting at approximately 1 p.m. ET on Friday Nov. 7, 2025, until 11:59 p.m. ET on Friday Nov. 14, 2025. To access the phone replay in North America please dial (800) 770-2030; from international locations please dial +1 (609) 800-9909, followed by Conference ID 3720518.

About Six Flags Entertainment Corporation

Six Flags Entertainment Corporation (NYSE: FUN) is North America’s largest regional amusement-resort operator with 26 amusement parks, 15 water parks and nine resort properties across 16 states in the U.S., Canada and Mexico. Focused on its purpose of making people happy, Six Flags provides fun, immersive and memorable experiences to millions of guests every year with world-class coasters, themed rides, thrilling water parks, resorts and a portfolio of beloved intellectual property such as Looney Tunes®, DC Comics® and PEANUTS®.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 6

Footnotes:

(1) Adjusted EBITDA, Modified EBITDA and Modified EBITDA margin are not measurements computed in accordance with GAAP. Management believes these are meaningful measures of park-level operating profitability and uses them for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. For additional information regarding these measures, including how the Company defines and uses these measures, see the attached reconciliation table and related footnotes. The Company is not providing a quantitative reconciliation of forward-looking Adjusted EBITDA targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. Management is unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Adjusted EBITDA targets or guidance with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under the Company's credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results.

(2) In-park per capita spending, admissions per capita spending, per capita spending on in-park products, and out-of-park revenues are non-GAAP financial measures. See the attached reconciliation table and related footnote for the calculation of these metrics. These metrics are used by management as major factors in significant operational decisions as they are primary drivers of financial and operational performance, measuring demand, pricing, and consumer behavior.

(3) Net debt is a non-GAAP financial measure. See the attached reconciliation table and related footnote for the calculation of net debt. Net debt is used by the Company and investors to monitor leverage, and management believes it is meaningful for this purpose.

Forward-Looking Statements

Some of the statements contained in this news release that are not historical in nature are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements as to our expectations, beliefs, goals and strategies regarding the future. Words such as “anticipate,” “believe,” “create,” “expect,” “future,” “guidance,” “intend,” “plan,” “potential,” “seek,” “synergies,” “target,” “objective,” “will,” “would,” similar expressions, and variations or negatives of these words identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. These forward-looking statements may involve current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct, or that our growth and operational strategies will achieve the target results.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 7

Important risks and uncertainties that may cause such a difference and could adversely affect attendance at our parks, our future financial performance, and/or our growth strategies, and could cause actual results to differ materially from our expectations or otherwise to fluctuate or decrease, include, but are not limited to: failure to realize the anticipated benefits of the merger, including difficulty in integrating the businesses of legacy Six Flags and legacy Cedar Fair; failure to realize the expected amount and timing of cost savings and operating synergies related to the merger; adverse weather conditions; general economic, political and market conditions; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; competition for consumer leisure time and spending or other changes in consumer behavior or sentiment for discretionary spending; unanticipated construction delays or increases in construction or supply costs; changes in capital investment plans and projects; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the Combined Company’s operations; legislative, regulatory and economic developments and changes in laws, regulations, and policies affecting the Combined Company; acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances; and other risks and uncertainties we discuss under the heading “Risk Factors” within our Annual Report on Form 10-K and in the other filings we make from time to time with the Securities and Exchange Commission. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this document and are based on information currently and reasonably known to us. We do not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information or circumstances that arise after publication of this news release.

This news release and prior releases are available under the News tab at https://investors.sixflags.com

- more -

(financial tables follow)

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 8

SIX FLAGS ENTERTAINMENT CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

Nine months ended |

| |

September 28, 2025 |

|

September 29, 2024 |

|

September 28, 2025 |

|

September 29, 2024 |

| Net revenues: |

|

|

|

|

|

|

|

| Admissions |

$ |

664,647 |

|

|

$ |

716,684 |

|

|

$ |

1,256,832 |

|

|

$ |

1,043,375 |

|

| Food, merchandise and games |

443,126 |

|

|

436,781 |

|

|

832,129 |

|

|

685,663 |

|

| Accommodations, extra-charge products and other |

209,980 |

|

|

194,920 |

|

|

361,239 |

|

|

292,578 |

|

|

1,317,753 |

|

|

1,348,385 |

|

|

2,450,200 |

|

|

2,021,616 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

| Cost of food, merchandise, and games revenues |

111,195 |

|

|

109,890 |

|

|

213,618 |

|

|

174,759 |

|

| Operating expenses |

549,340 |

|

|

575,032 |

|

|

1,348,940 |

|

|

999,159 |

|

| Selling, general and administrative |

111,834 |

|

|

209,260 |

|

|

332,441 |

|

|

322,518 |

|

| Depreciation and amortization |

128,053 |

|

|

144,560 |

|

|

365,011 |

|

|

211,887 |

|

| Loss on retirement of fixed assets, net |

2,797 |

|

|

4,671 |

|

|

21,413 |

|

|

11,406 |

|

| Loss on impairment of goodwill and other intangibles |

1,518,099 |

|

|

42,462 |

|

|

1,518,099 |

|

|

42,462 |

|

| Loss on other assets |

— |

|

|

— |

|

|

791 |

|

|

— |

|

|

2,421,318 |

|

|

1,085,875 |

|

|

3,800,313 |

|

|

1,762,191 |

|

| Operating (loss) income |

(1,103,565) |

|

|

262,510 |

|

|

(1,350,113) |

|

|

259,425 |

|

| Interest expense, net |

91,056 |

|

|

81,742 |

|

|

270,500 |

|

|

155,903 |

|

| Loss on early debt extinguishment |

— |

|

|

2,063 |

|

|

— |

|

|

7,974 |

|

| Other expense (income), net |

5,954 |

|

|

(101) |

|

|

(15,011) |

|

|

6,862 |

|

| (Loss) income before taxes |

(1,200,575) |

|

|

178,806 |

|

|

(1,605,602) |

|

|

88,686 |

|

| (Benefit) provision for taxes |

(38,043) |

|

|

43,341 |

|

|

(148,520) |

|

|

31,135 |

|

| Net (loss) income |

(1,162,532) |

|

|

135,465 |

|

|

(1,457,082) |

|

|

57,551 |

|

| Net (loss) income attributable to non-controlling interests |

24,816 |

|

|

24,499 |

|

|

49,632 |

|

|

24,499 |

|

| Net (loss) income attributable to Six Flags Entertainment Corporation |

$ |

(1,187,348) |

|

|

$ |

110,966 |

|

|

$ |

(1,506,714) |

|

|

$ |

33,052 |

|

| Net income margin (1) |

(88.2) |

% |

|

10.0 |

% |

|

(59.5) |

% |

|

2.8 |

% |

(1) Net income margin is calculated as net income divided by net revenues.

SIX FLAGS ENTERTAINMENT CORPORATION

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28, 2025 |

|

September 29, 2024 |

| Cash and cash equivalents |

$ |

70,683 |

|

|

$ |

89,705 |

|

| Total assets |

$ |

7,889,486 |

|

|

$ |

9,369,226 |

|

| Long-term debt, including current maturities: |

| Revolving credit loans |

$ |

97,361 |

|

|

$ |

139,080 |

|

| Term debt |

1,468,346 |

|

|

986,622 |

|

| Notes |

3,461,264 |

|

|

3,658,805 |

|

|

$ |

5,026,971 |

|

|

$ |

4,784,507 |

|

| Equity |

$ |

614,314 |

|

|

$ |

2,341,578 |

|

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 9

SIX FLAGS ENTERTAINMENT CORPORATION

RECONCILIATION OF MODIFIED EBITDA, ADJUSTED EBITDA AND MODIFIED EBITDA MARGIN

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

Nine months ended |

|

September 28, 2025 |

|

September 29, 2024 |

|

September 28, 2025 |

|

September 29, 2024 |

| Net (loss) income |

$ |

(1,162,532) |

|

|

$ |

135,465 |

|

|

$ |

(1,457,082) |

|

|

$ |

57,551 |

|

| Interest expense, net |

91,056 |

|

|

81,742 |

|

|

270,500 |

|

|

155,903 |

|

| (Benefit) provision for taxes |

(38,043) |

|

|

43,341 |

|

|

(148,520) |

|

|

31,135 |

|

| Depreciation and amortization |

128,053 |

|

|

144,560 |

|

|

365,011 |

|

|

211,887 |

|

| EBITDA |

(981,466) |

|

|

405,108 |

|

|

(970,091) |

|

|

456,476 |

|

| Loss on early debt extinguishment |

— |

|

|

2,063 |

|

|

— |

|

|

7,974 |

|

| Non-cash foreign currency loss (gain) |

6,625 |

|

|

(1,122) |

|

|

(15,575) |

|

|

5,880 |

|

| Non-cash equity compensation expense |

14,948 |

|

|

39,131 |

|

|

40,959 |

|

|

53,550 |

|

| Loss on retirement of fixed assets, net |

2,797 |

|

|

4,671 |

|

|

21,413 |

|

|

11,406 |

|

| Loss on impairment of goodwill and other intangibles |

1,518,099 |

|

|

42,462 |

|

|

1,518,099 |

|

|

42,462 |

|

| Loss on other assets |

— |

|

|

— |

|

|

791 |

|

|

— |

|

Costs related to the merger (1) |

10,486 |

|

|

73,335 |

|

|

37,156 |

|

|

94,610 |

|

Severance (2) |

8,592 |

|

|

126 |

|

|

35,792 |

|

|

676 |

|

| Self-insurance adjustment (3) |

— |

|

|

14,865 |

|

|

— |

|

|

14,865 |

|

Other (4) |

(577) |

|

|

1,893 |

|

|

7,604 |

|

|

2,917 |

|

Modified EBITDA (5) |

579,504 |

|

|

582,532 |

|

|

676,148 |

|

|

690,816 |

|

| Net income attributable to non-controlling interests |

24,816 |

|

|

24,499 |

|

|

49,632 |

|

|

24,499 |

|

Adjusted EBITDA (5) |

$ |

554,688 |

|

|

$ |

558,033 |

|

|

$ |

626,516 |

|

|

$ |

666,317 |

|

|

|

|

|

|

|

|

|

Modified EBITDA margin (6) |

44.0 |

% |

|

43.2 |

% |

|

27.6 |

% |

|

34.2 |

% |

(1) Consists of integration costs related to the merger, including third-party consulting costs, retention bonuses, integration team salaries and benefits, costs to integrate information technology systems, maintenance costs to update legacy Six Flags parks to legacy Cedar Fair standards and certain legal costs. Amounts in 2024 also include third-party legal and consulting transaction costs. These costs are added back to net (loss) income to calculate Modified EBITDA and Adjusted EBITDA as defined in the Combined Company's credit agreement.

(2) Consists of severance and related employer taxes and benefits. During 2025, certain employees, including certain executive level employees, were terminated as part of recent reorganization efforts.

(3) During the third quarter of 2024, an actuarial analysis of legacy Cedar Fair's self-insurance reserves resulted in a change in estimate that increased incurred but not reported reserves by $14.9 million. The increase was driven by an observed pattern of increasing litigation and settlement costs.

(4) Consists of certain costs as defined in the Combined Company's credit agreement. These costs are added back to net (loss) income to calculate Modified EBITDA and Adjusted EBITDA and include certain legal and consulting expenses unrelated to the merger, cost of goods sold recorded to align inventory standards following the merger, Mexican VAT taxes on intercompany activity, gains/losses related to the Partnership Parks and contract termination costs. This balance also includes unrealized gains and losses on pension assets and short-term investments.

(5) Modified EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in the Combined Company's credit agreement. Adjusted EBITDA represents Modified EBITDA less net (loss) income attributable to non-controlling interests. Management included both measures to disclose the effect of non-controlling interests. Prior to the merger, legacy Cedar Fair did not have net income attributable to non-controlling interests. Management believes Modified EBITDA and Adjusted EBITDA are meaningful measures of park-level operating profitability, and uses them for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA is widely used by analysts, investors and comparable companies in the industry to evaluate operating performance on a consistent basis, as well as more easily compare results with those of other companies in the industry. Modified EBITDA and Adjusted EBITDA are provided as supplemental measures of the Combined Company's operating results and are not intended to be a substitute for operating income, net income or cash flows from operating activities as defined under generally accepted accounting principles. In addition, Modified EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 10

(6) Modified EBITDA margin (Modified EBITDA divided by net revenues) is not a measurement computed in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Modified EBITDA margin is provided because management believes the measure provides a meaningful metric of operating profitability. Modified EBITDA margin has been disclosed as opposed to Adjusted EBITDA margin because management believes Modified EBITDA margin more accurately reflects the park-level operations of the Combined Company as it does not give effect to distributions to non-controlling interests.

SIX FLAGS ENTERTAINMENT CORPORATION

CALCULATION OF NET DEBT

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28, 2025 |

|

September 29, 2024 |

| Long-term debt, including current maturities |

$ |

5,026,971 |

|

|

$ |

4,784,507 |

|

| Plus: Debt issuance costs and original issue discount |

45,351 |

|

|

44,494 |

|

| Less: Acquisition fair value layers |

(21,582) |

|

|

(23,001) |

|

| Less: Cash and cash equivalents |

(70,683) |

|

|

(89,705) |

|

Net Debt (1) |

$ |

4,980,057 |

|

|

$ |

4,716,295 |

|

(1) Net Debt is a non-GAAP financial measure used by investors to monitor leverage. The measure may not be comparable to similarly titled measures of other companies.

SIX FLAGS ENTERTAINMENT CORPORATION

KEY OPERATIONAL MEASURES

(In thousands, except per capita and operating day amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

Nine months ended |

|

|

|

September 28, 2025 |

|

September 29, 2024 |

|

September 28, 2025 |

|

September 29, 2024 |

|

|

|

|

|

|

| Attendance |

21,109 |

|

|

20,971 |

|

|

38,118 |

|

|

30,955 |

|

|

|

|

|

|

|

In-park per capita spending (1) |

$ |

59.08 |

|

|

$ |

61.27 |

|

|

$ |

60.81 |

|

|

$ |

61.21 |

|

|

|

|

|

|

|

Admissions per capita spending (1) |

$ |

31.48 |

|

|

$ |

34.16 |

|

|

$ |

32.95 |

|

|

$ |

33.70 |

|

|

|

|

|

|

|

Per capita spending on in-park products (1) |

$ |

27.60 |

|

|

$ |

27.10 |

|

|

$ |

27.86 |

|

|

$ |

27.51 |

|

|

|

|

|

|

|

Out-of-park revenues (1) |

$ |

108,135 |

|

|

$ |

102,265 |

|

|

$ |

203,959 |

|

|

$ |

184,623 |

|

|

|

|

|

|

|

| Operating days |

2,573 |

|

|

2,585 |

|

|

4,959 |

|

|

3,491 |

|

|

|

|

|

|

|

(1) In-park per capita spending is calculated as revenues generated within the Combined Company's amusement parks and separately gated outdoor water parks along with related parking revenues and online transaction fees charged to customers (in-park revenues), divided by total attendance. Admissions per capita spending is calculated as revenues generated for admission to the Combined Company's amusement parks and separately gated water parks along with related parking revenues and online transaction fees charged to customers (in-park admissions revenues) divided by total attendance. Per capita spending on in-park products is calculated as all other revenues generated within the Combined Company's amusement parks and separately gated water parks, including food and beverage, merchandise, games and extra-charge offerings (in-park product revenues) divided by total attendance. Out-of-park revenues are defined as revenues from resorts, out-of-park food and merchandise locations, sponsorships, international agreements and all other out-of-park operations.

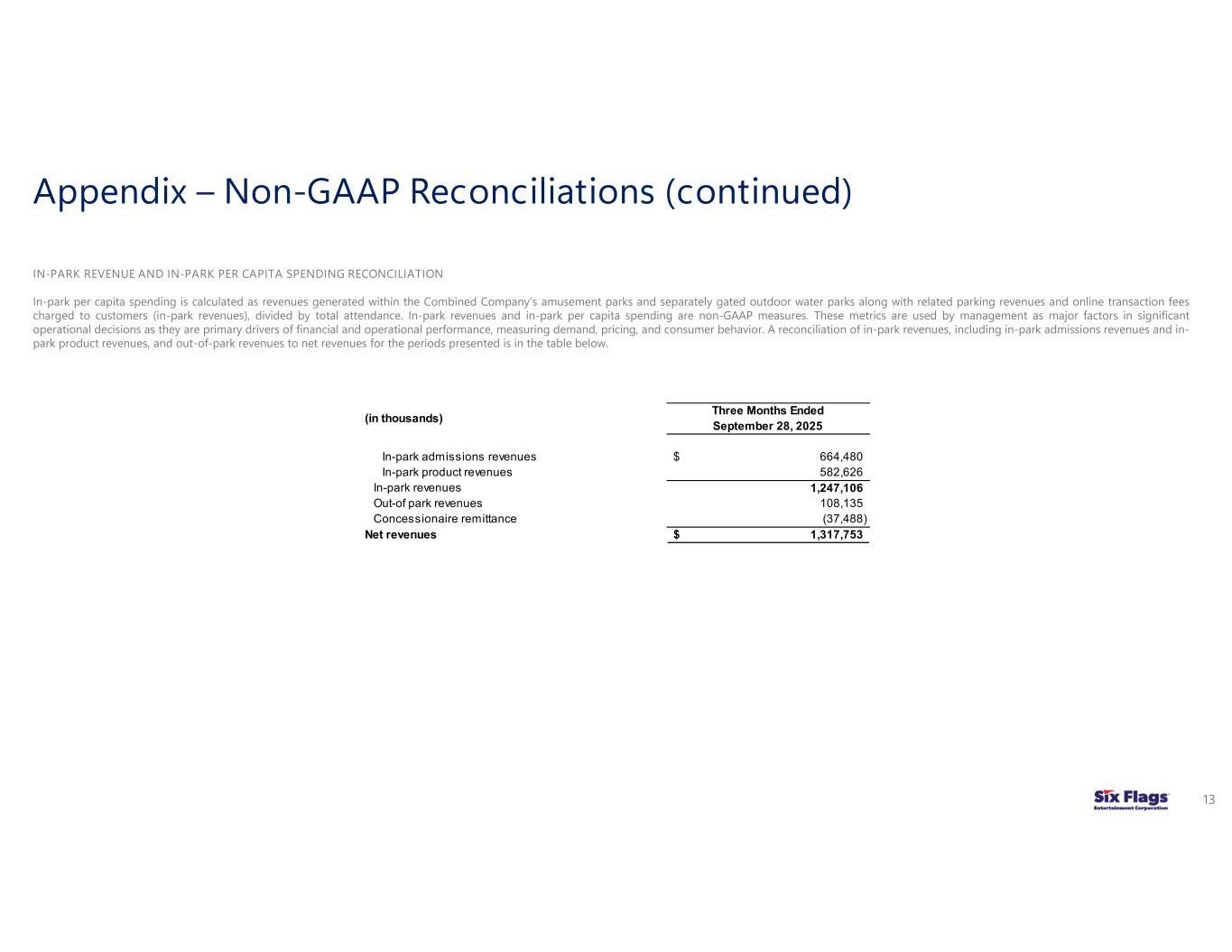

In-park revenues, in-park per capita spending, in-park admissions revenues, admissions per capita spending, in-park product revenues, per capita spending on in-park products, and out-of-park revenues are non-GAAP measures. These metrics are used by management as major factors in significant operational decisions as they are primary drivers of financial and operational performance, measuring demand, pricing, and consumer behavior. A reconciliation of in-park revenues, including in-park admissions revenues and in-park product revenues, and out-of-park revenues to net revenues for the periods presented is in the table below.

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700

SIX FLAGS REPORTS 2025 THIRD QUARTER RESULTS

Nov. 7, 2025

Page 11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

| (In thousands) |

September 28, 2025 |

|

September 29, 2024 |

|

September 28, 2025 |

|

September 29, 2024 |

|

|

|

|

|

|

| In-park admissions revenues |

$ |

664,480 |

|

|

$ |

716,483 |

|

|

1,255,968 |

|

|

1,043,172 |

|

|

|

|

|

|

|

| In-park product revenues |

582,626 |

|

|

568,392 |

|

|

1,061,873 |

|

|

851,594 |

|

|

|

|

|

|

|

| In-park revenues |

1,247,106 |

|

|

1,284,875 |

|

|

2,317,841 |

|

|

1,894,766 |

|

|

|

|

|

|

|

| Out-of-park revenues |

108,135 |

|

|

102,265 |

|

|

203,959 |

|

|

184,623 |

|

|

|

|

|

|

|

| Concessionaire remittance |

(37,488) |

|

|

(38,755) |

|

|

(71,600) |

|

|

(57,773) |

|

|

|

|

|

|

|

| Net revenues |

$ |

1,317,753 |

|

|

$ |

1,348,385 |

|

|

$ |

2,450,200 |

|

|

$ |

2,021,616 |

|

|

|

|

|

|

|

Six Flags Entertainment Corporation - 8701 Red Oak Boulevard, Charlotte, NC 28217 - Phone: 704.414.4700