1 Investor Day May 20, 2025 Exhibit 99.1

Michael Russell, Corporate Director Investor Relations Introduction 2

Our Location Today 3 Hotel Breakers Cedar Point

Today’s Presenters 4 Richard A. Zimmerman President & Chief Executive Officer Brian Witherow Chief Financial Officer Christian Dieckmann Chief Commercial Officer

Investor Day Agenda 5 9:00 – 9:05 Introduction Michael Russell, Corporate Director, Investor Relations 9:05 – 9:30 The New Six Flags: Driving Profitable Growth Richard Zimmerman, CEO 9:30 – 9:55 The Path to Sustainable Revenue Growth Christian Dieckmann, CSO 9:55 – 10:25 Q&A 10:25 – 10:35 Break 10:35 – 11:00 Driving Sustainable Profitability and Higher Shareholder Returns Brian Witherow, CFO 11:00 – 11:45 Q&A 11:45 – 11:55 Close, Final Comments Richard Zimmerman, CEO

Safe Harbor 6 Some of the statements contained in this presentation that are not historical in nature are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements as to our expectations, beliefs, goals and strategies regarding the future. Words such as “anticipate,” “believe,” “create,” “expect,” “future,” “guidance,” “intend,” “plan,” “potential,” “seek,” “synergies,” “target,” “will,” “would,” similar expressions, and variations or negatives of these words identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. These forward-looking statements may involve current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct, or that our growth and operational strategies will achieve the target results. Important risks and uncertainties that may cause such a difference and could adversely affect attendance at our parks, our future financial performance, and/or our growth strategies, and could cause actual results to differ materially from our expectations or otherwise to fluctuate or decrease, include, but are not limited to: failure to realize the anticipated benefits of the Merger, including difficulty in integrating the businesses of legacy Six Flags and legacy Cedar Fair; failure to realize the expected amount and timing of cost savings and operating synergies related to the Merger; general economic, political and market conditions; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; adverse weather conditions; competition for consumer leisure time and spending or other changes in consumer behavior or sentiment for discretionary spending; unanticipated construction delays or increases in construction or supply costs; changes in capital investment plans and projects; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations; legislative, regulatory and economic developments and changes in laws, regulations, and policies affecting the combined company; acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances; and other risks and uncertainties we discuss under the heading “Risk Factors” within our Annual Report on Form 10-K and in the other filings we make from time to time with the Security and Exchange Commission. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this document and are based on information currently and reasonably known to us. We do not undertake any obligation to publicly update or revise any forward- looking statements to reflect future events, information or circumstances that arise after publication of this new release.

Richard Zimmerman, CEO The New Six Flags: Driving Profitable Growth 7

1. Integration Post-merger integration and synergy realization Issues We Know Are on the Minds of Investors 8 2. Growth Plans to drive attendance growth 3. Capital allocation Debt reduction plans and capital allocation priorities 4. Margin expansion Delivering significant margin expansion 5. Outlook Long-term outlook and key financial metrics

Why Six Flags is Different Now Proven Synergy Execution Underway ~$180M in synergies with tangible progress building confidence in execution. Real Attendance Recovery Potential ~10M visit recovery driven by new rides, better marketing, and unified season pass strategy. Reinvented Guest Experience Investing in guest-facing upgrades and new attractions—enhancing satisfaction and guest spend. Recurring, Resilient Business Model ~70% of attendance from advance purchase channels + broad geographic footprint limits volatility. Strong and Aligned Leadership Experienced executives with a proven track record now lead the combined company. Clear Deleveraging Path Targeting <4.0x net leverage by the end of 2026 while continuing to reinvest for sustainable growth. 9

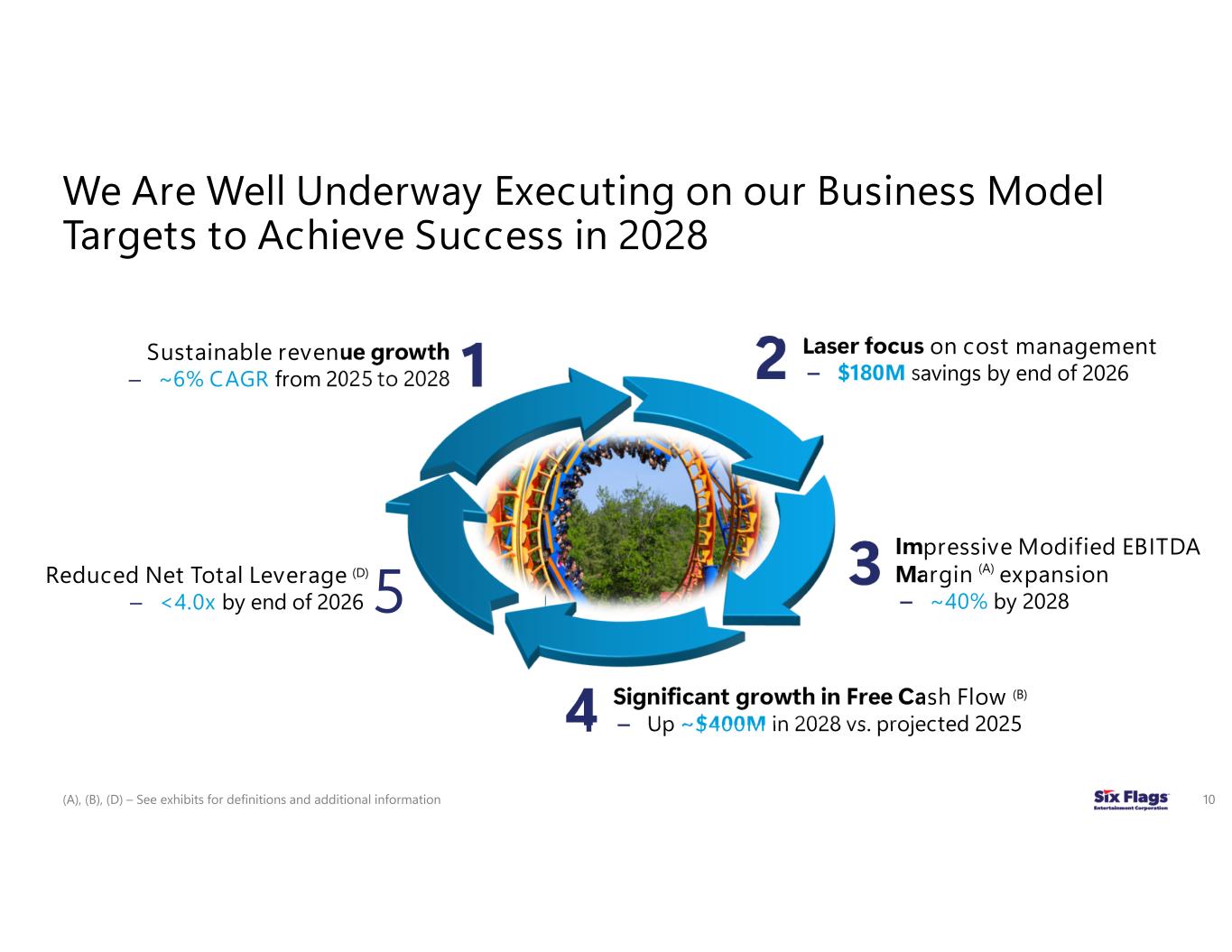

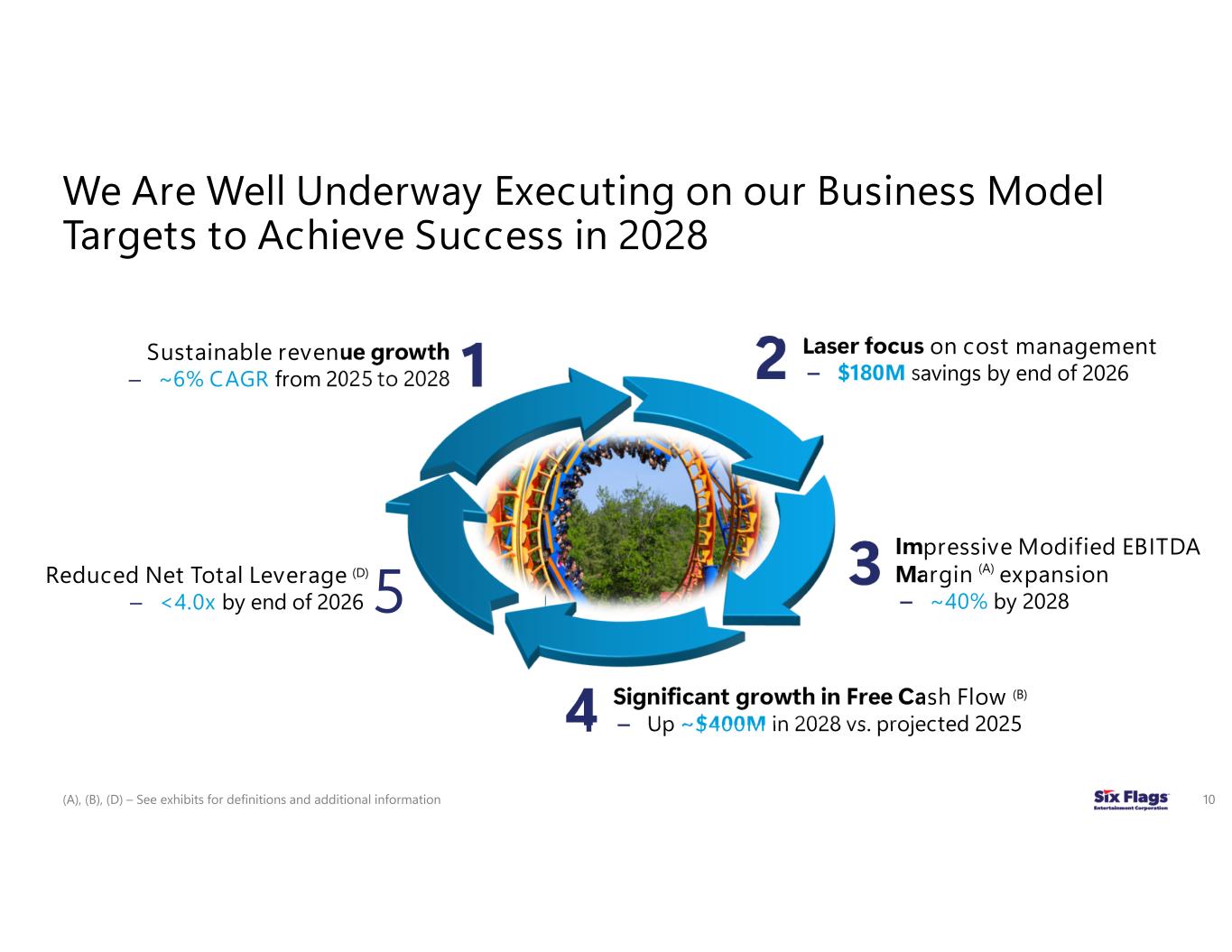

We Are Well Underway Executing on our Business Model Targets to Achieve Success in 2028 (A), (B), (D) – See exhibits for definitions and additional information 10 Laser focus on cost management ‒ $180M savings by end of 2026 2 3 Impressive Modified EBITDA Margin (A) expansion ‒ ~40% by 2028 1 Sustainable revenue growth ‒ ~6% CAGR from 2025 to 2028 4 Significant growth in Free Cash Flow (B) ‒ Up ~$400M in 2028 vs. projected 2025 Reduced Net Total Leverage (D) ‒ <4.0x by end of 2026 5

This is What Success Will Look Like…… (D), (E), (G) – See exhibits for definitions and additional information 11 2028 Net Revenue Cash Operating Costs (G) (2025-2028 CAGR) Net Total Leverage (D) (Year-end 2026) ~1-2% ~$1.5B <4.0X Adj EBITDA 2028 Attendance ~58M ~$3.8B 2028 Modified EBITDA (E)

Agenda: The New Six Flags – Leveraging Effective Strategies for Profitable Growth 12 Market leader with unique positioning Our strategy to drive sustained growth Building on a strong foundation Integration execution update

A T A G L A N C E : Six Flags Today – Market Leader with Growth Ahead #1 42 50M 250M Largest regional amusement park operator in North America Parks and 9 hotels / resort properties in 31 markets Guests entertained in 2024 on a Combined Basis (C) People live within 100 miles of our parks 13 (C) – See exhibits for definitions and additional information

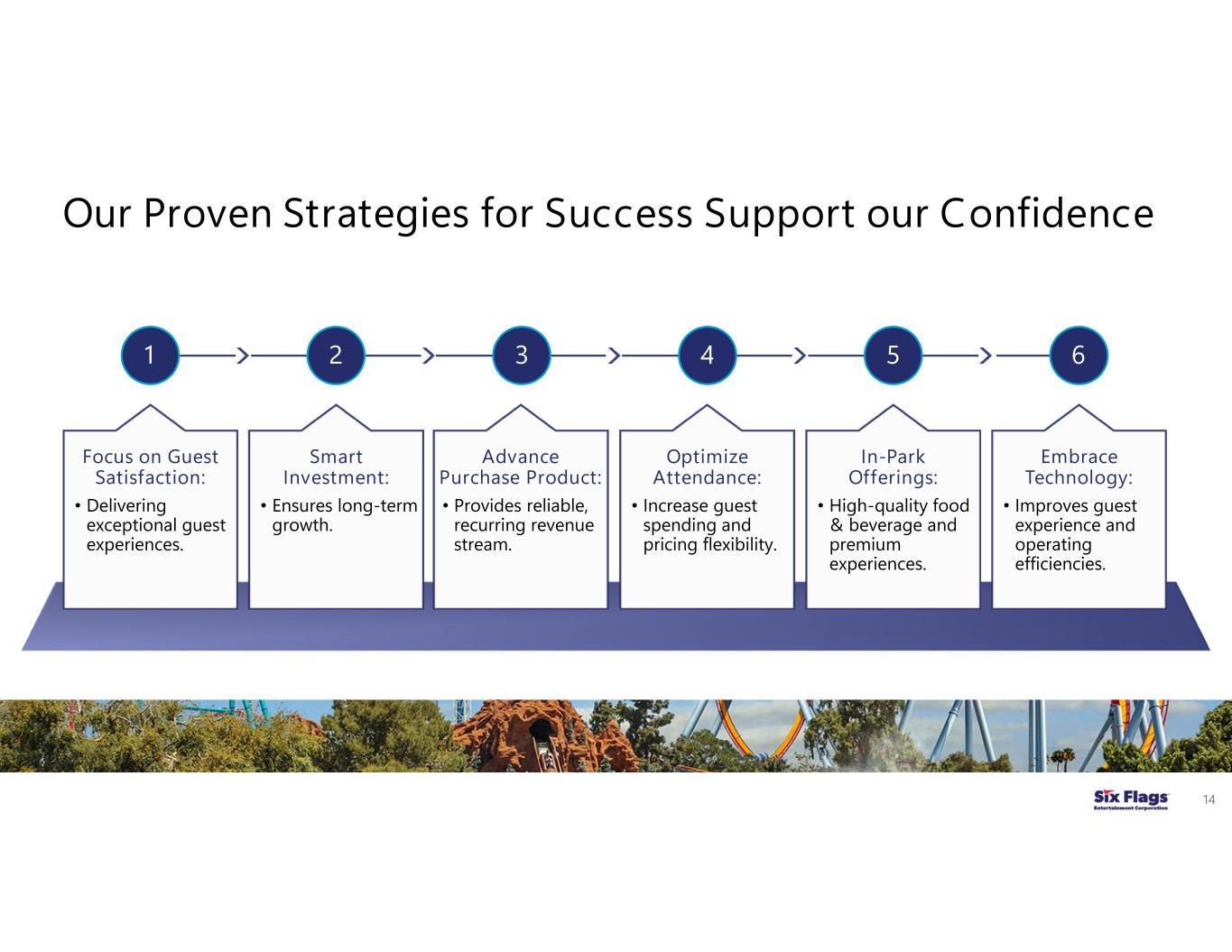

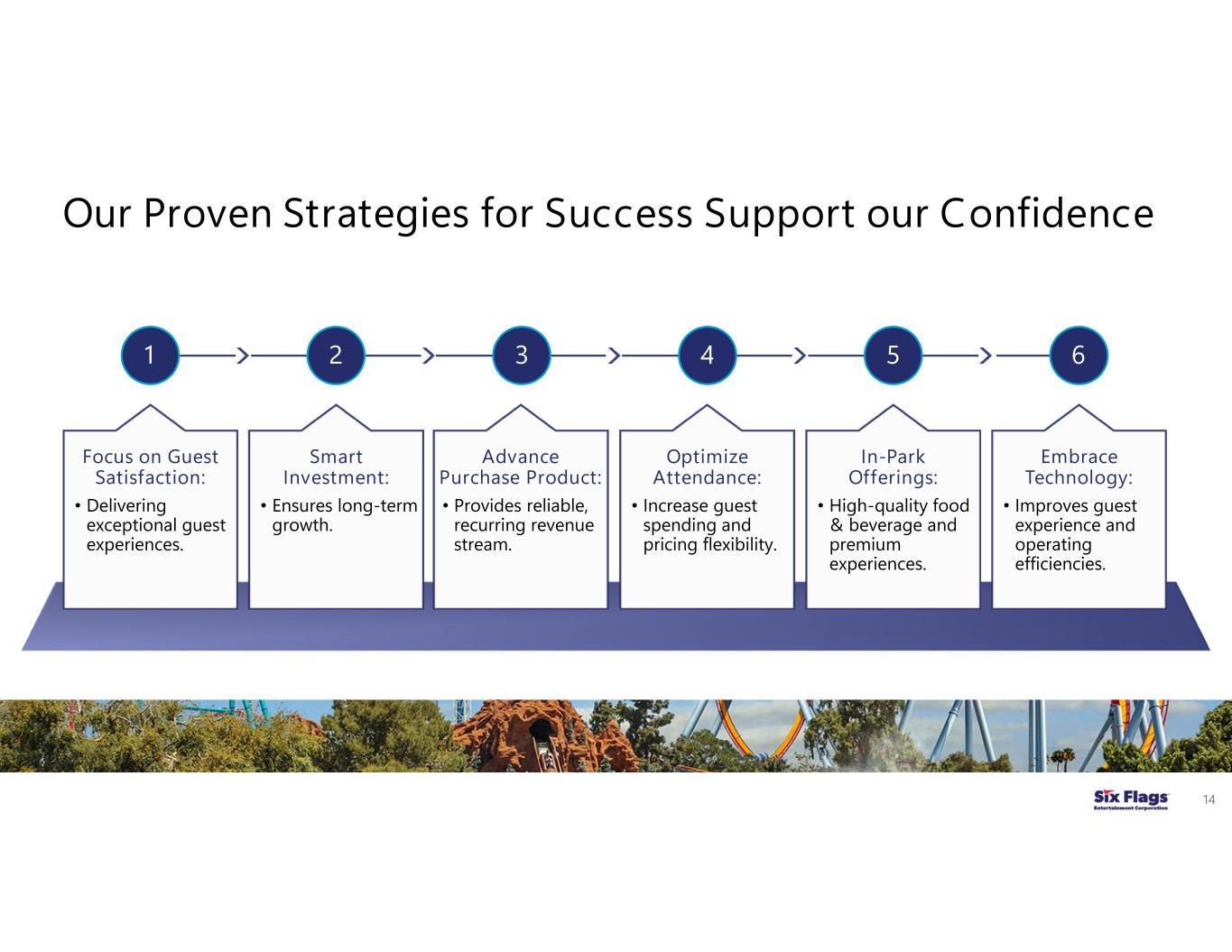

Our Proven Strategies for Success Support our Confidence 1 2 3 4 5 6 Focus on Guest Satisfaction: • Delivering exceptional guest experiences. Smart Investment: • Ensures long-term growth. Advance Purchase Product: • Provides reliable, recurring revenue stream. Optimize Attendance: • Increase guest spending and pricing flexibility. In-Park Offerings: • High-quality food & beverage and premium experiences. Embrace Technology: • Improves guest experience and operating efficiencies. 14

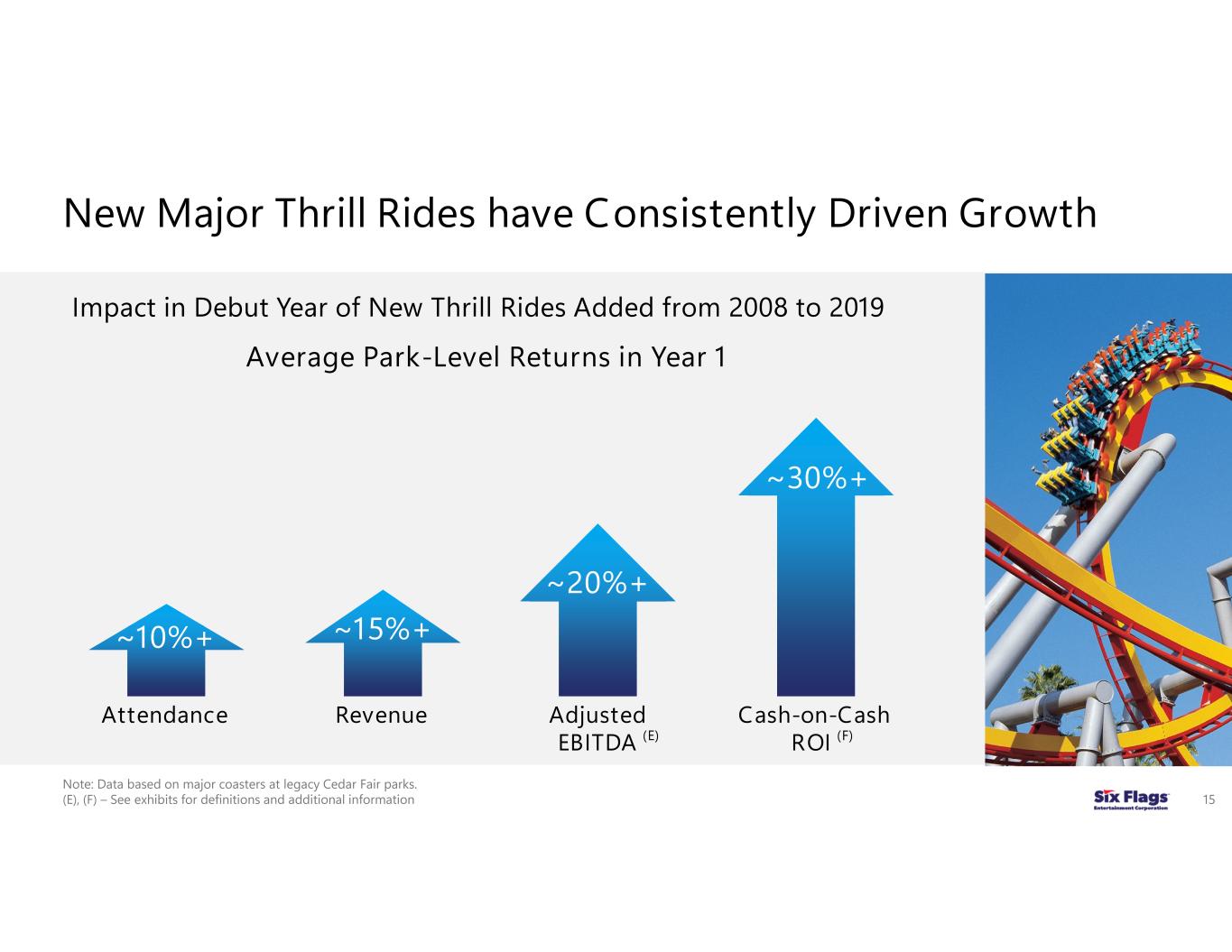

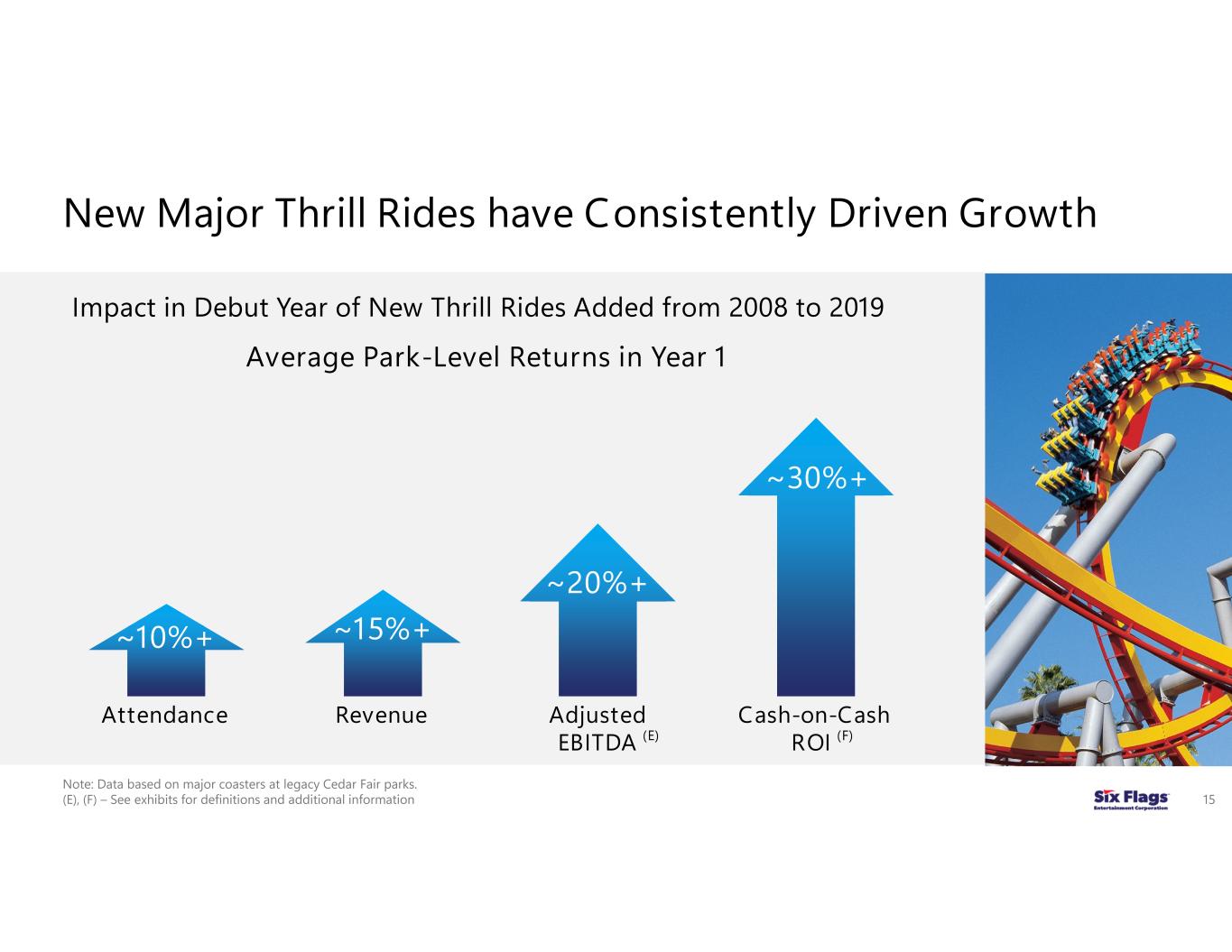

Attendance ~10%+ Adjusted EBITDA (E) ~20%+ Revenue ~15%+ Cash-on-Cash ROI (F) ~30%+ Impact in Debut Year of New Thrill Rides Added from 2008 to 2019 Average Park-Level Returns in Year 1 New Major Thrill Rides have Consistently Driven Growth Note: Data based on major coasters at legacy Cedar Fair parks. (E), (F) – See exhibits for definitions and additional information 15

Agenda: The New Six Flags – Leveraging Effective Strategies for Profitable Growth 16 Market leader with unique positioning Our strategy to drive sustained growth Building on a strong foundation Integration execution update

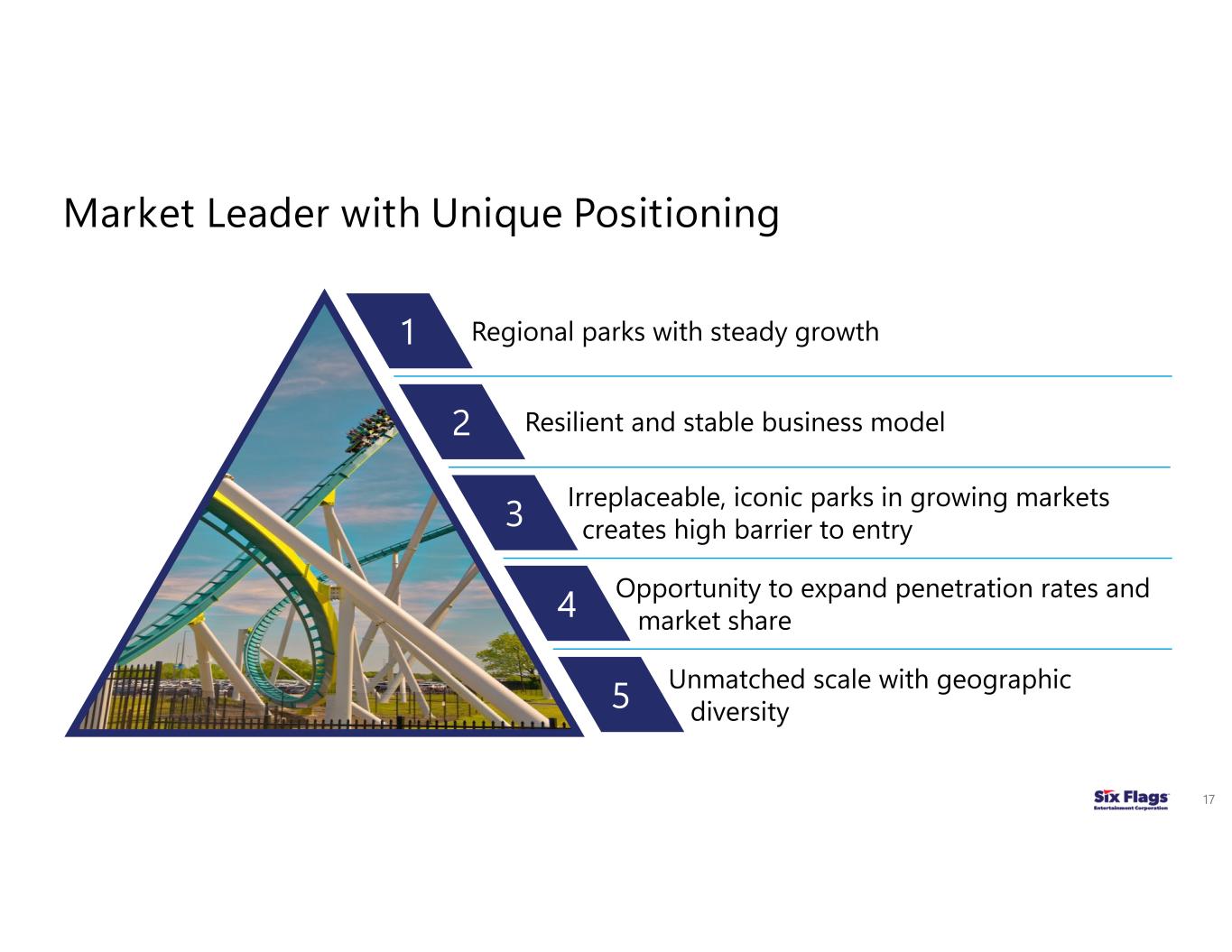

Market Leader with Unique Positioning 17 2 1 3 Unmatched scale with geographic diversity Opportunity to expand penetration rates and market share Resilient and stable business model Regional parks with steady growth Irreplaceable, iconic parks in growing markets creates high barrier to entry 3 4 5 2 1

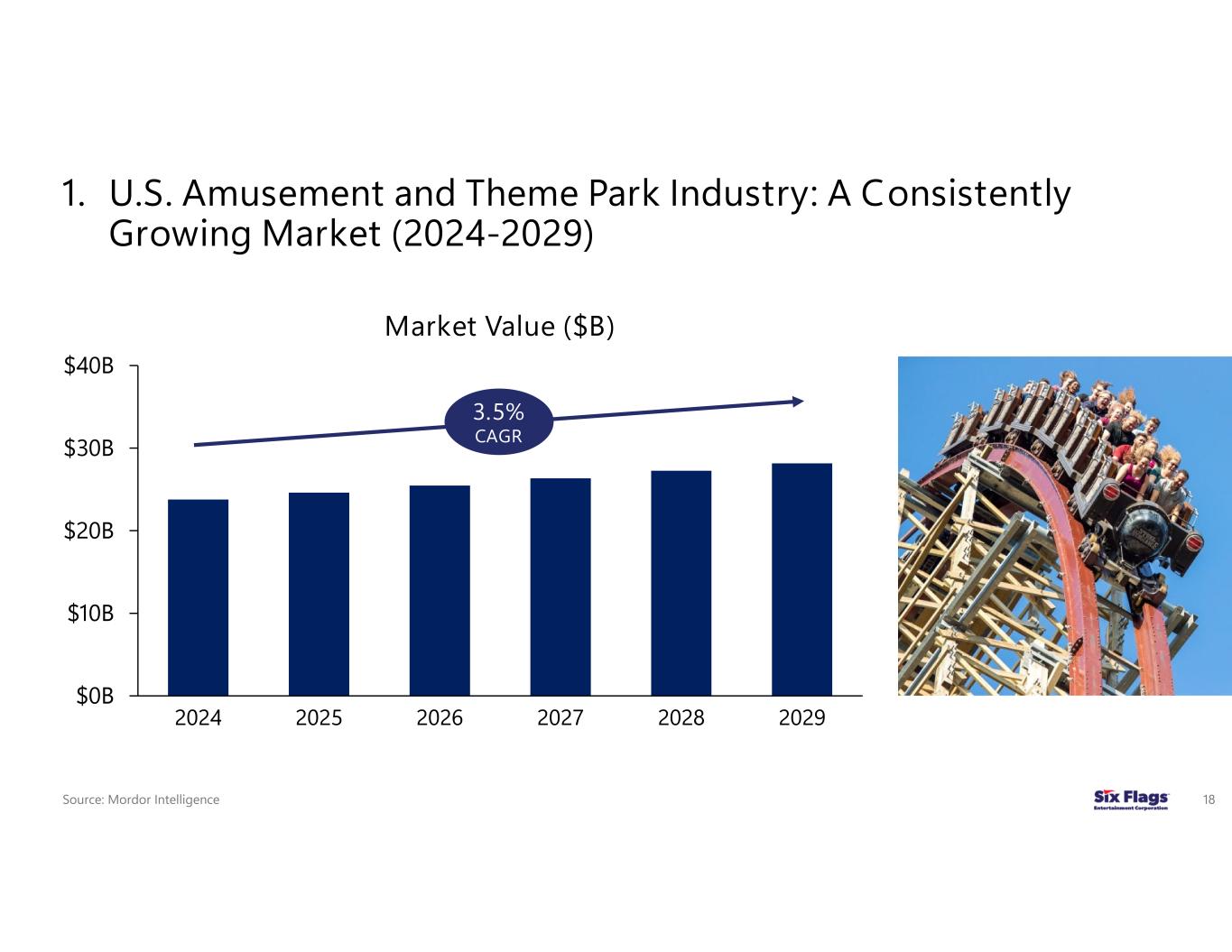

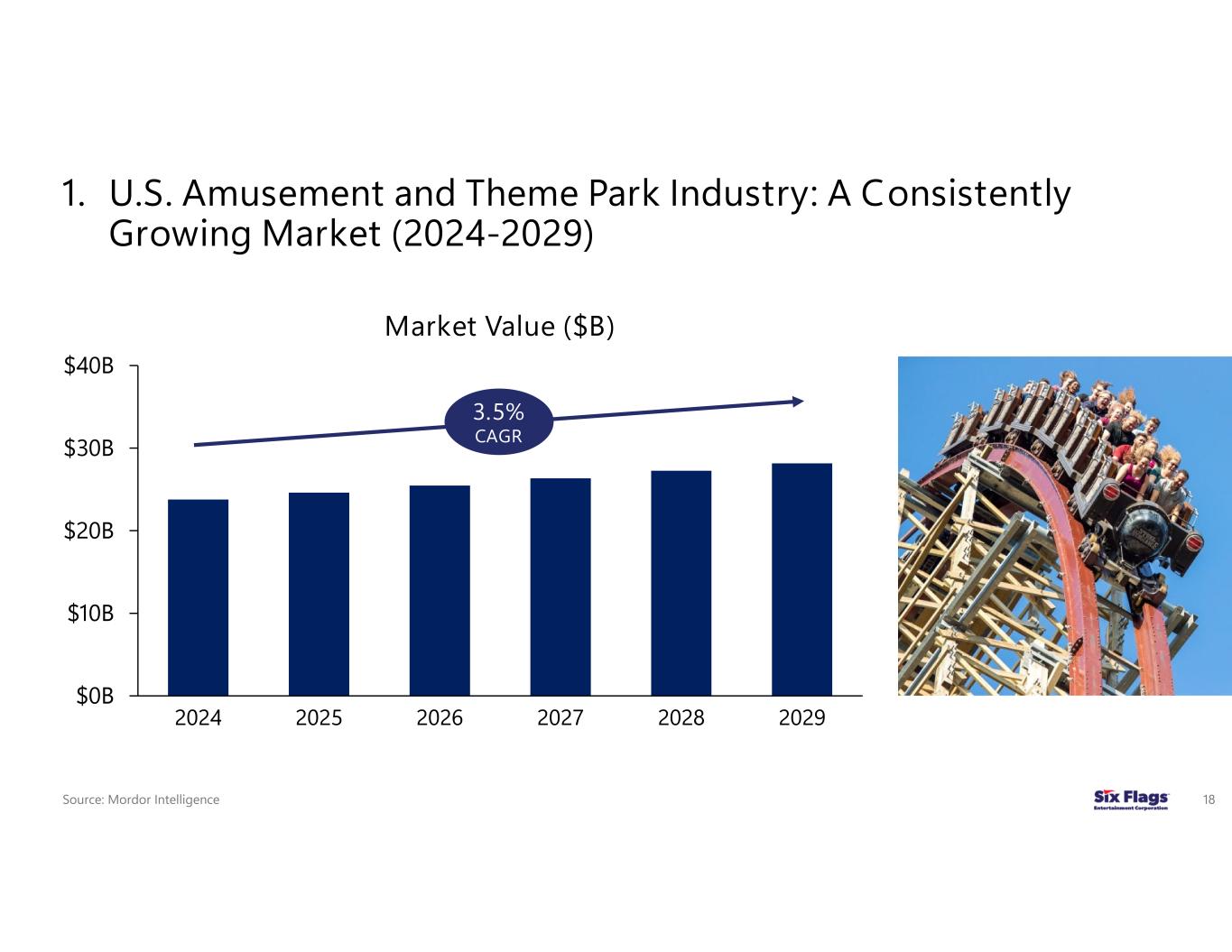

1. U.S. Amusement and Theme Park Industry: A Consistently Growing Market (2024-2029) Source: Mordor Intelligence 18 $0B $10B $20B $30B $40B 2024 2025 2026 2027 2028 2029 3.5% CAGR Market Value ($B)

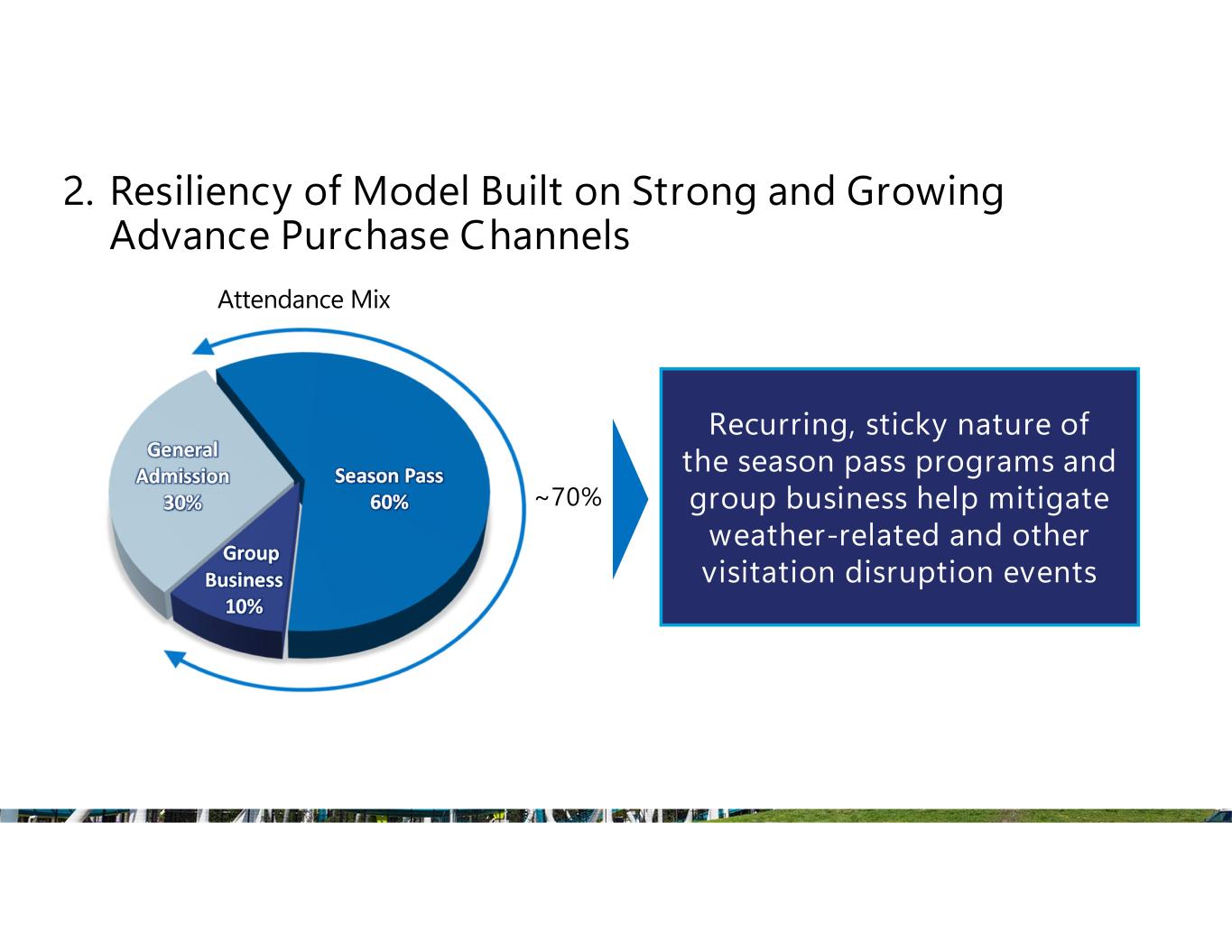

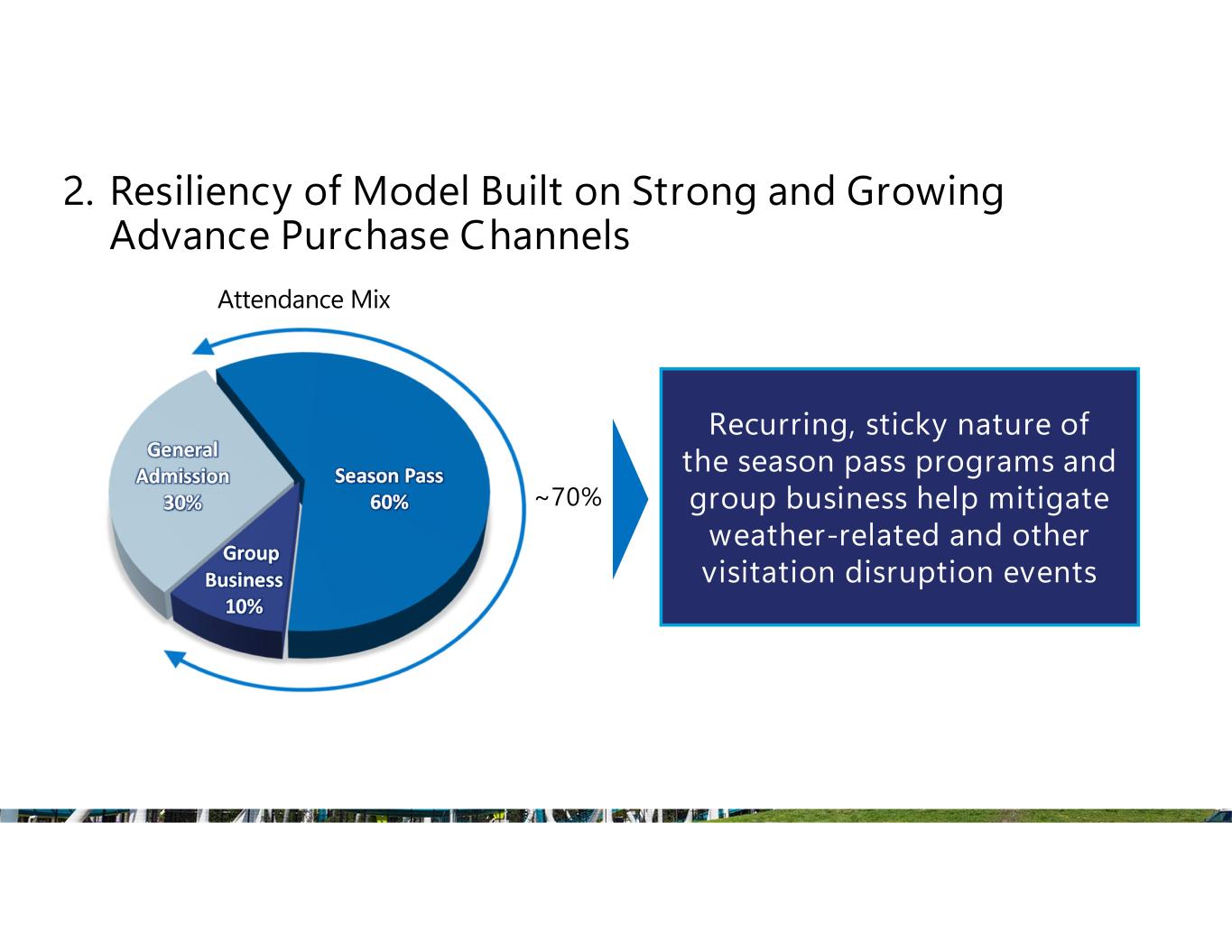

2. Resiliency of Model Built on Strong and Growing Advance Purchase Channels Recurring, sticky nature of the season pass programs and group business help mitigate weather-related and other visitation disruption events Season Pass 60% Group Business 10% General Admission 30% ~70% Attendance Mix 19

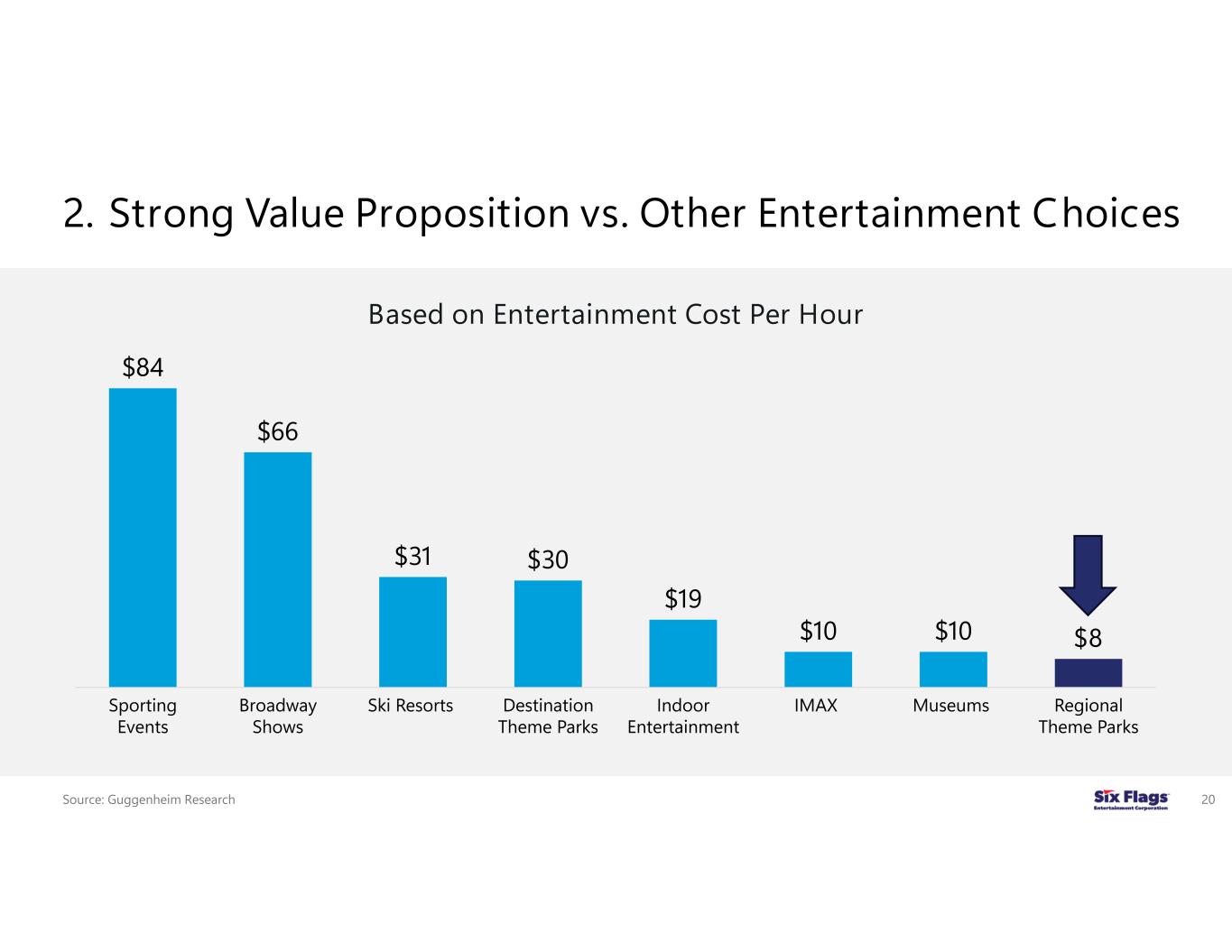

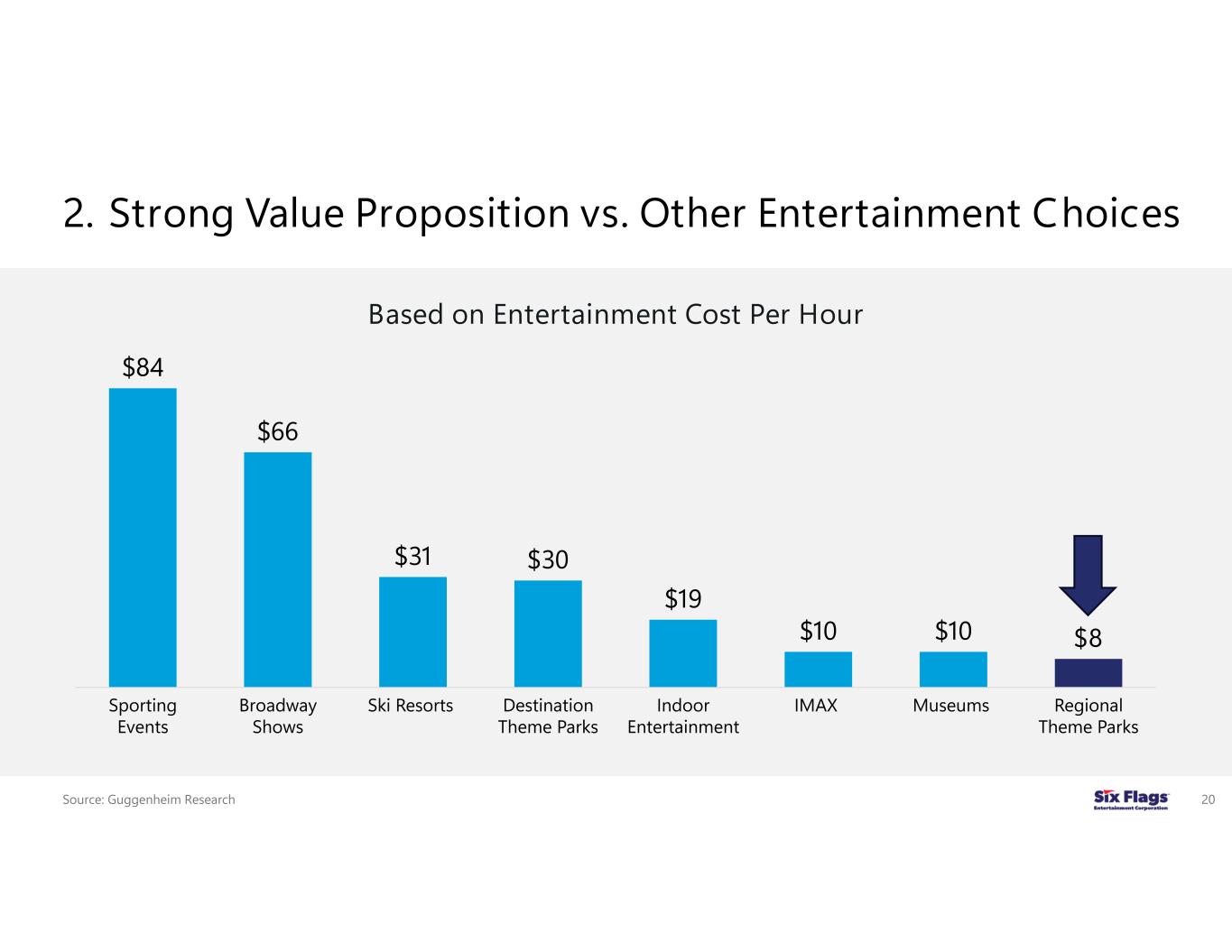

$84 $66 $31 $30 $19 $10 $10 $8 Sporting Events Broadway Shows Ski Resorts Destination Theme Parks Indoor Entertainment IMAX Museums Regional Theme Parks 2. Strong Value Proposition vs. Other Entertainment Choices Source: Guggenheim Research 20 Based on Entertainment Cost Per Hour

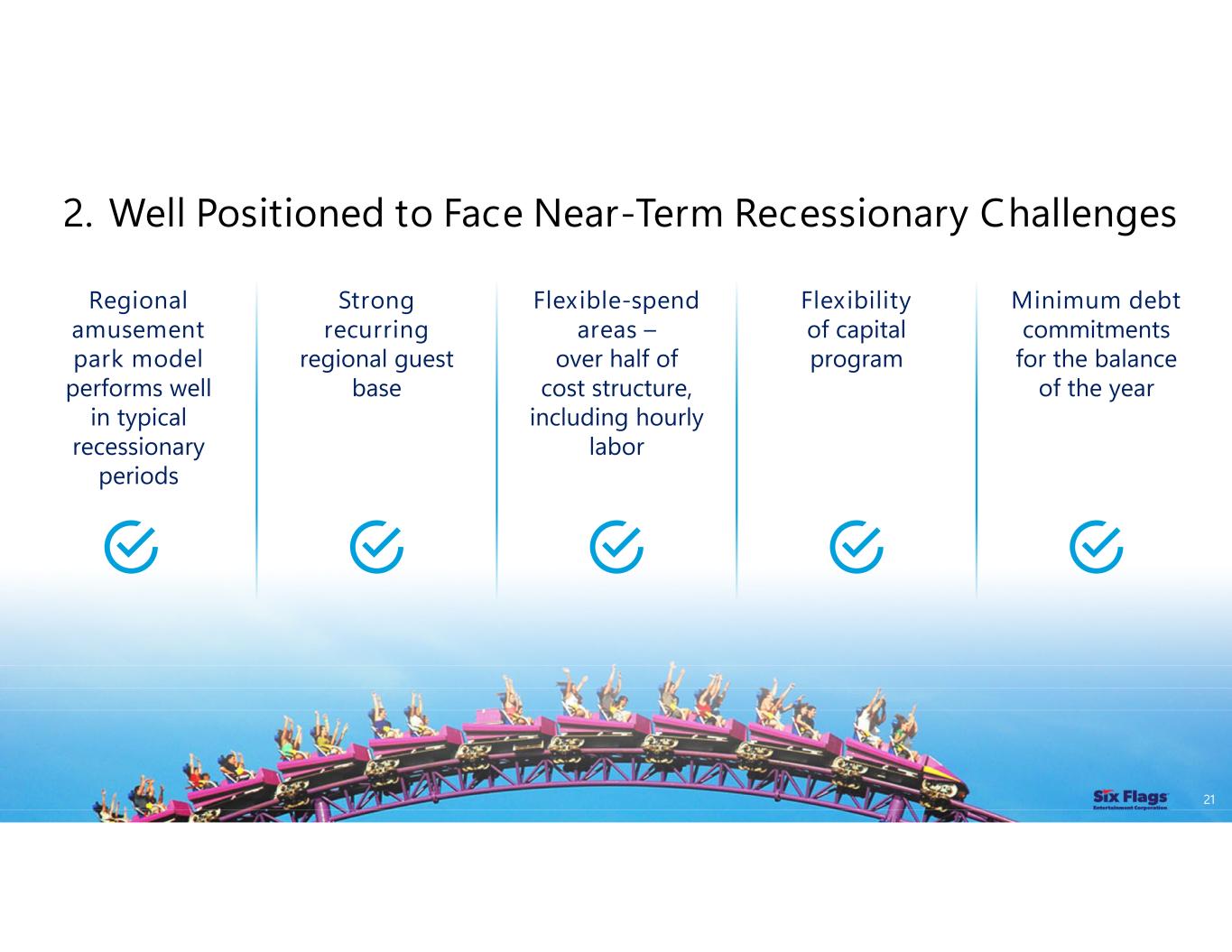

2. Well Positioned to Face Near-Term Recessionary Challenges 21 Regional amusement park model performs well in typical recessionary periods Strong recurring regional guest base Flexible-spend areas – over half of cost structure, including hourly labor Flexibility of capital program Minimum debt commitments for the balance of the year

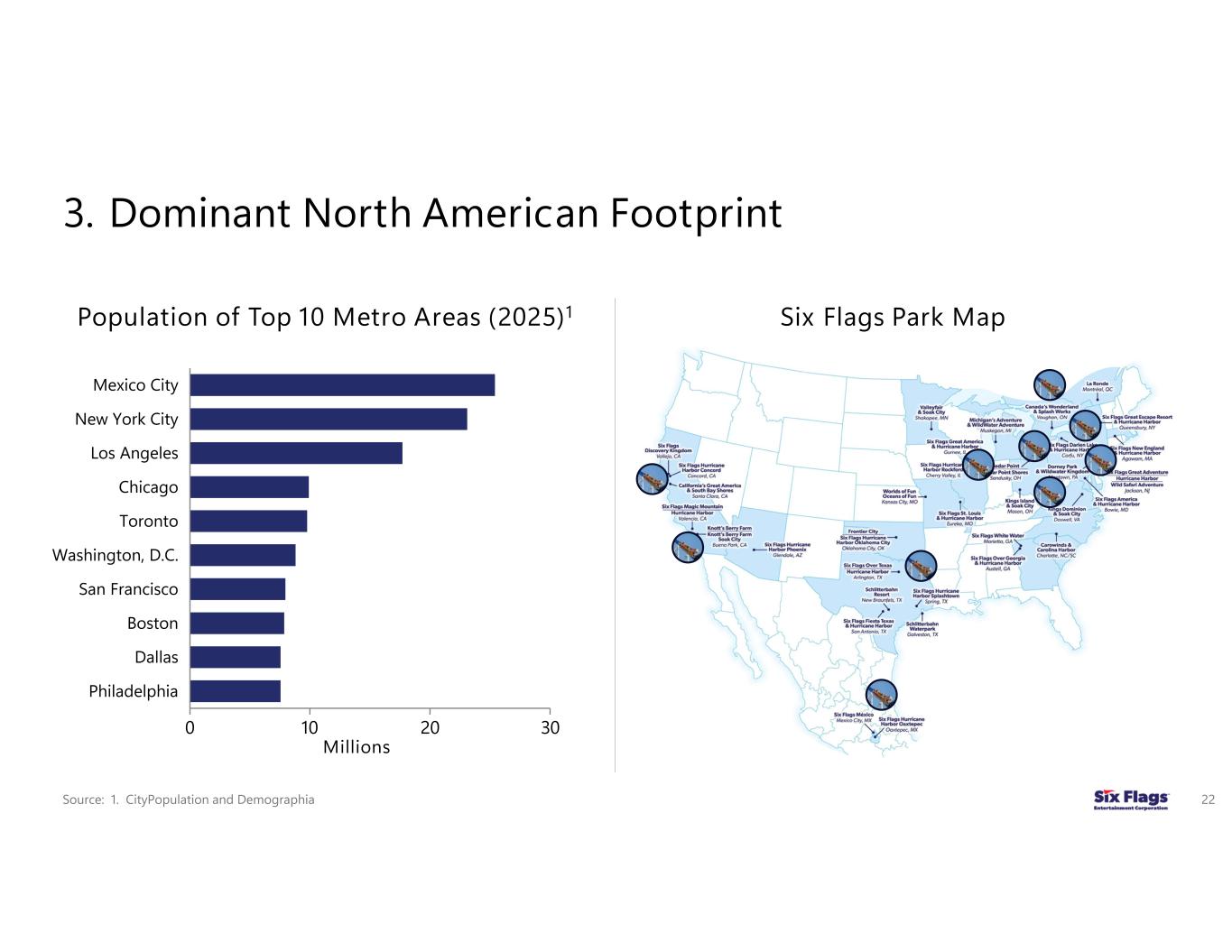

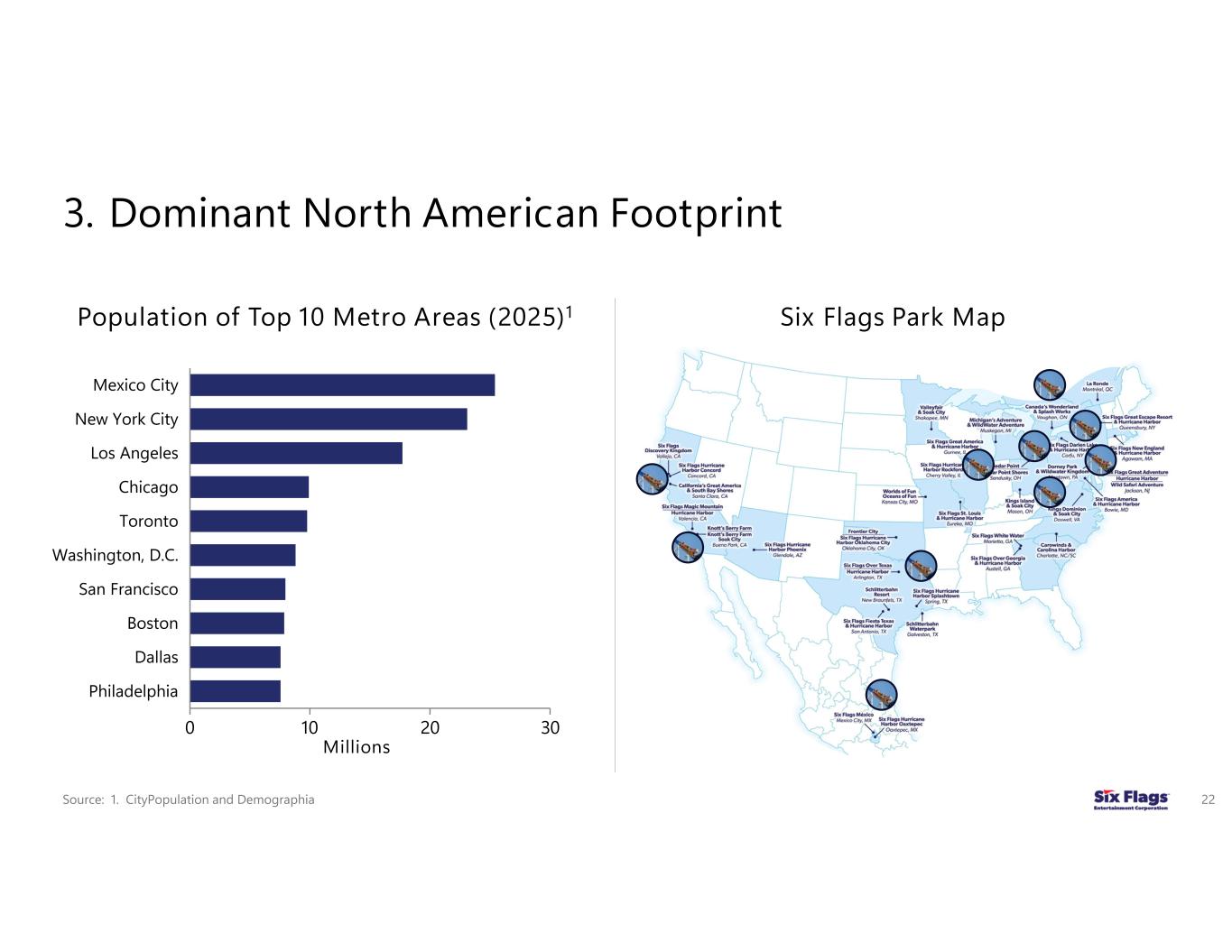

3. Dominant North American Footprint 22 0 10 20 30 Mexico City New York City Los Angeles Chicago Toronto Washington, D.C. San Francisco Boston Dallas Philadelphia Millions Population of Top 10 Metro Areas (2025)1 Six Flags Park Map Source: 1. CityPopulation and Demographia

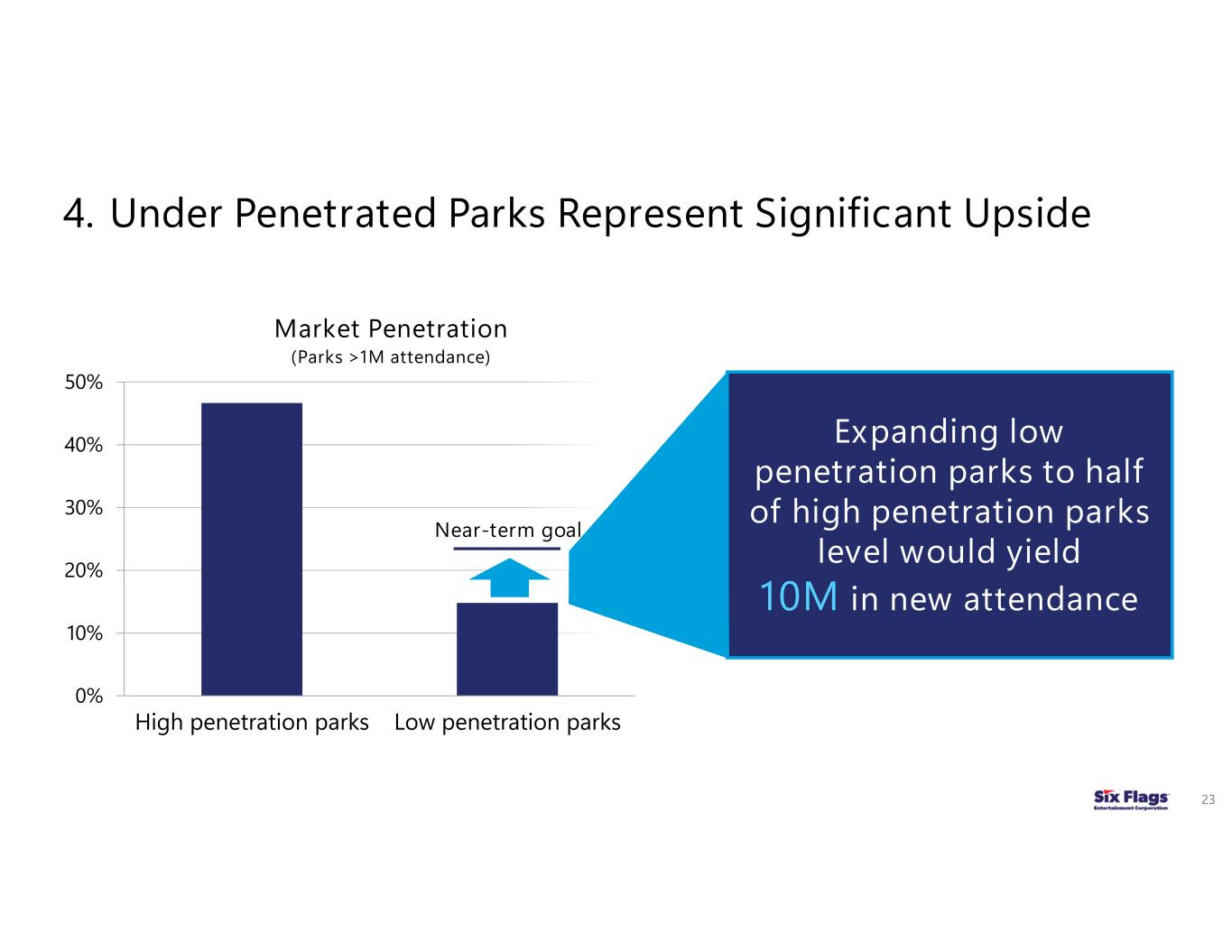

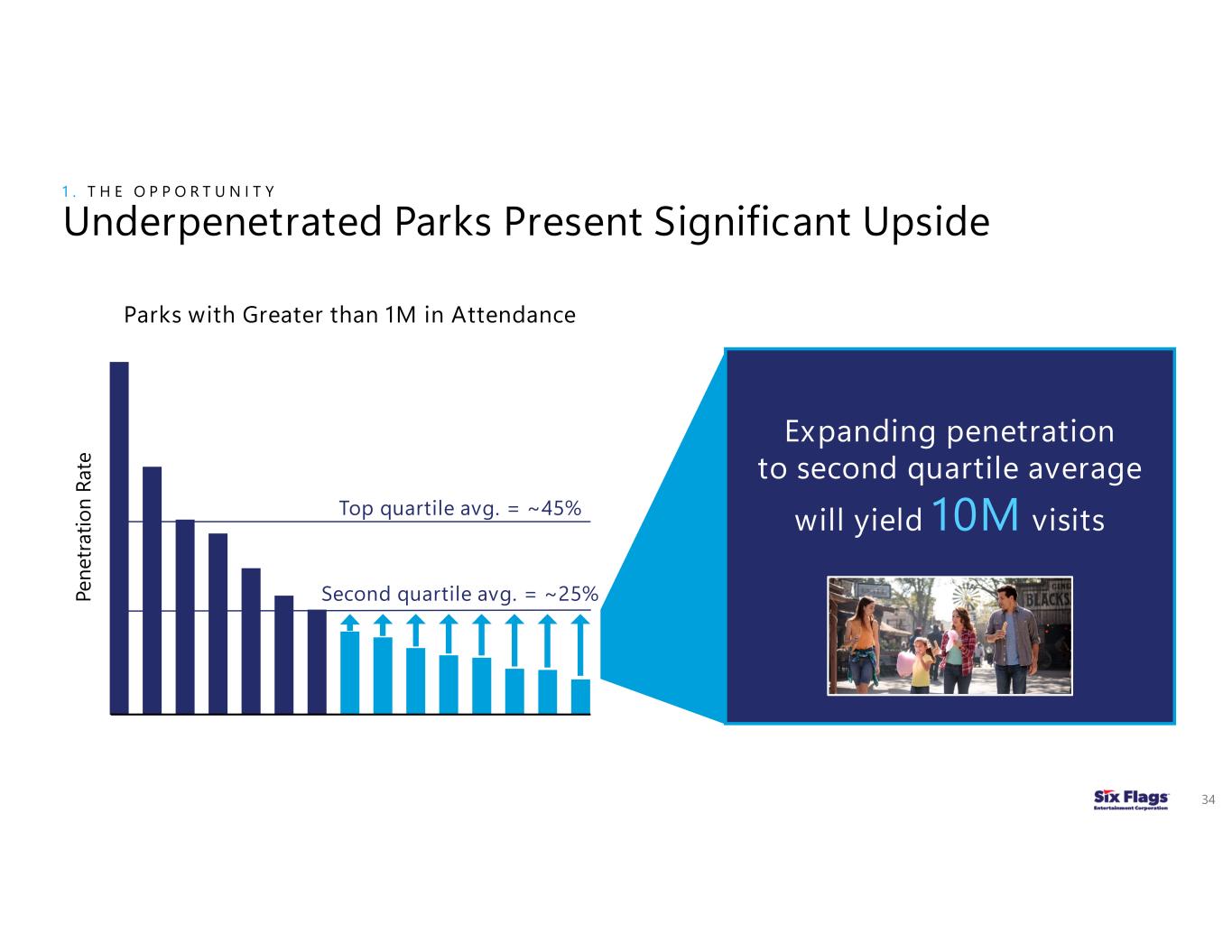

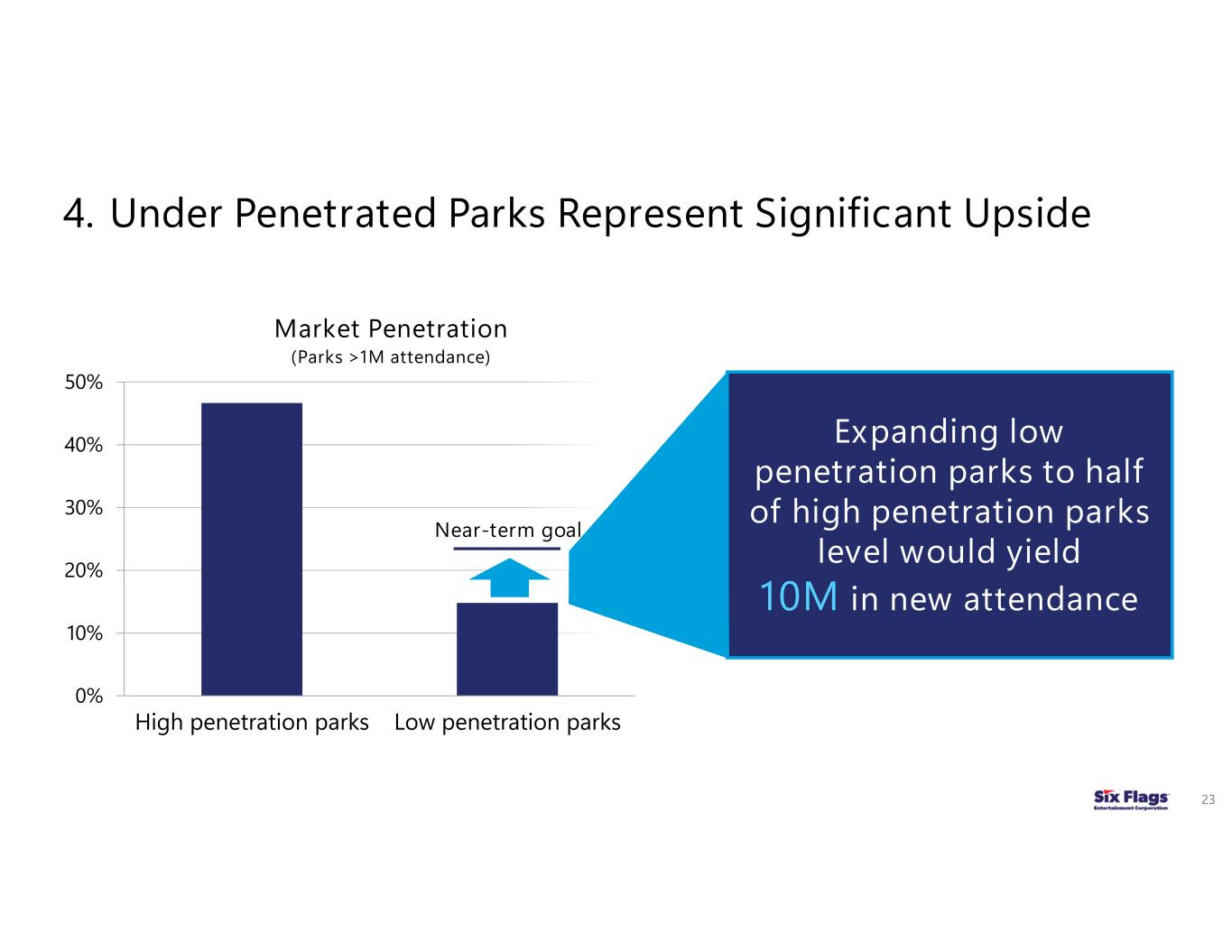

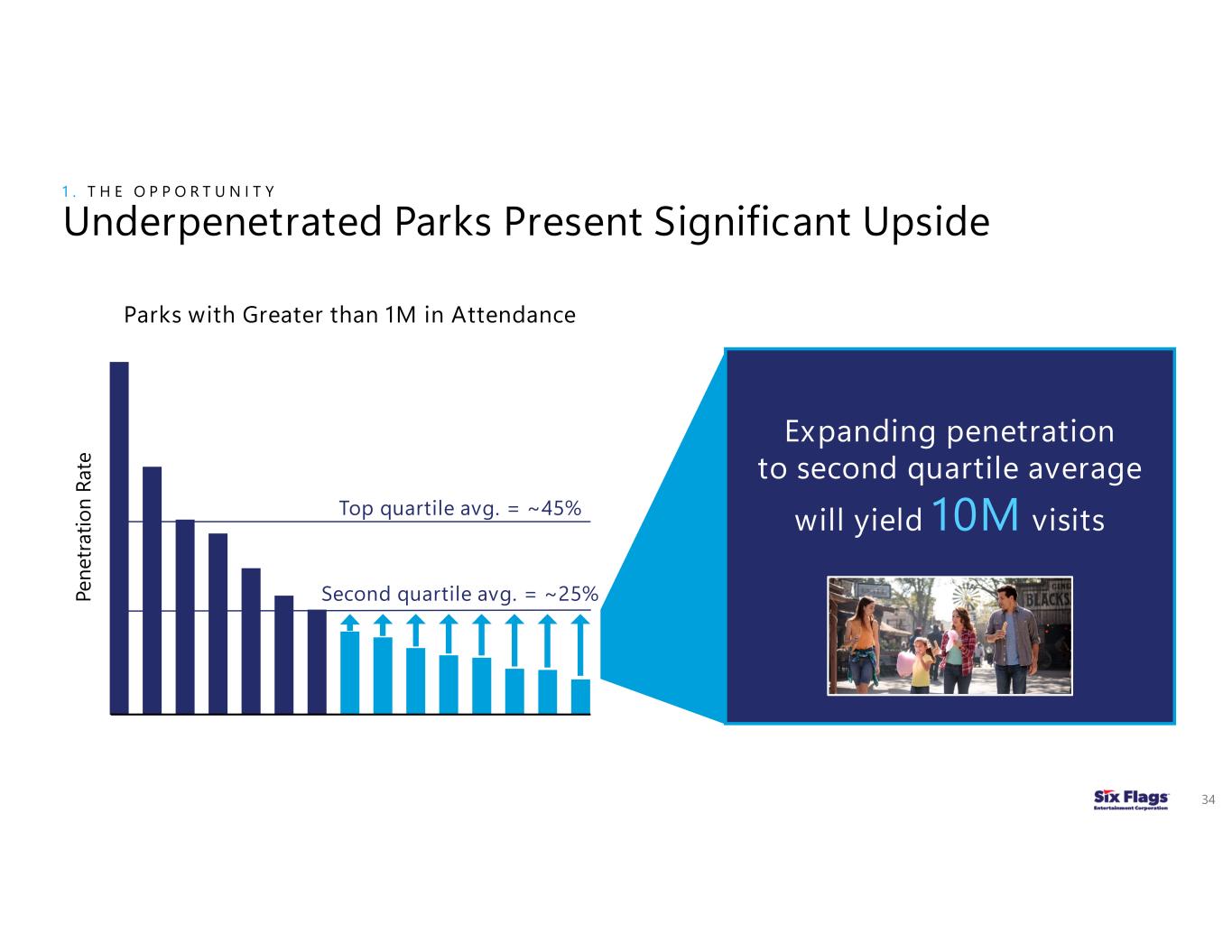

4. Under Penetrated Parks Represent Significant Upside 23 Expanding low penetration parks to half of high penetration parks level would yield 10M in new attendance 0% 10% 20% 30% 40% 50% High penetration parks Low penetration parks Market Penetration (Parks >1M attendance) Near-term goal

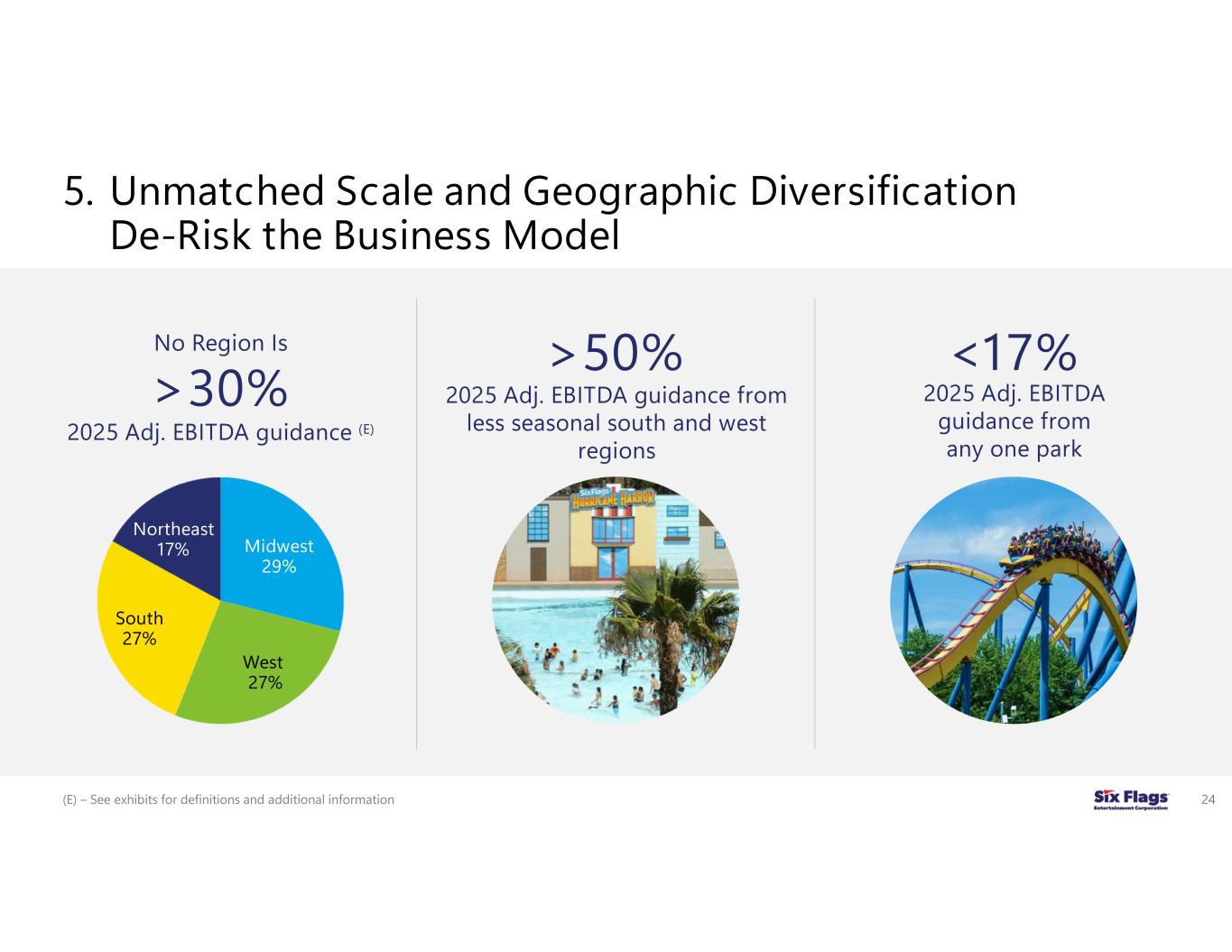

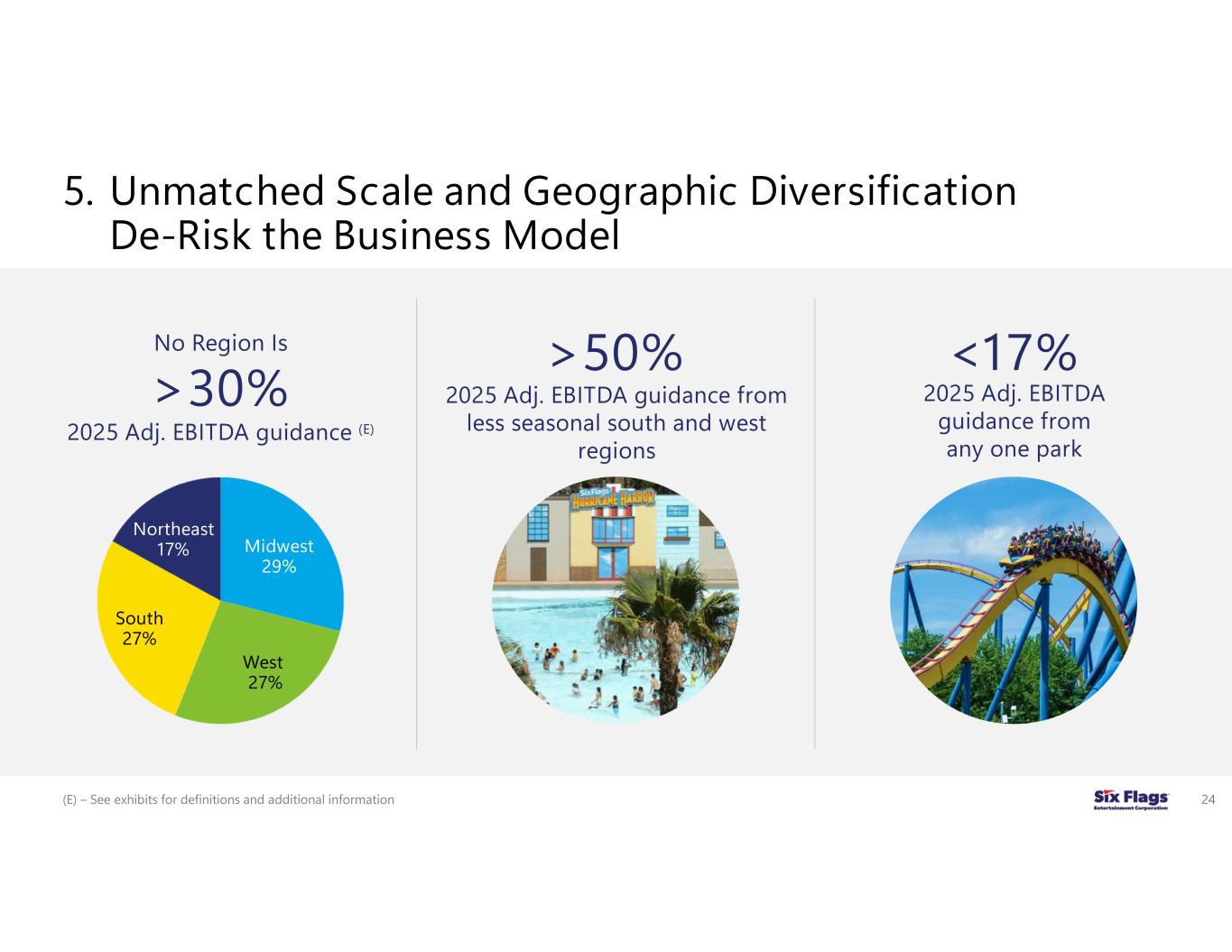

5. Unmatched Scale and Geographic Diversification De-Risk the Business Model 24 Midwest 29% West 27% South 27% Northeast 17% No Region Is >30% 2025 Adj. EBITDA guidance (E) >50% 2025 Adj. EBITDA guidance from less seasonal south and west regions <17% 2025 Adj. EBITDA guidance from any one park (E) – See exhibits for definitions and additional information

Agenda: The New Six Flags – Leveraging Effective Strategies for Profitable Growth 25 Market leader with unique positioning Our strategy to drive sustained growth Building on a strong foundation Integration execution update

Integration Efforts Delivering Solid Early Results Cost savings achieved – on track for more Guest satisfaction trending higher Attendance and guest spending improving Revenue strengthening Portfolio optimization progressing 26

Portfolio Optimization Supports Strategic Objectives Portfolio Optimization 27 1 Strengthen the business 2 Reduce portfolio risk 3 Simplify operations 4 Focus on high-growth parks

Agenda: The New Six Flags – Leveraging Effective Strategies for Profitable Growth 28 Market leader with unique positioning Our strategy to drive sustained growth Building on a strong foundation Integration execution update

Our Five Pillars for Profitable Growth 29 Drive demand higher 01 Leverage pricing power 02 Increase transaction counts and guest spending 03 Optimize cost structure 04 Maximize operating leverage and margins 05

Christian Dieckmann, Chief Commercial Officer The Path to Sustainable Revenue Growth 30

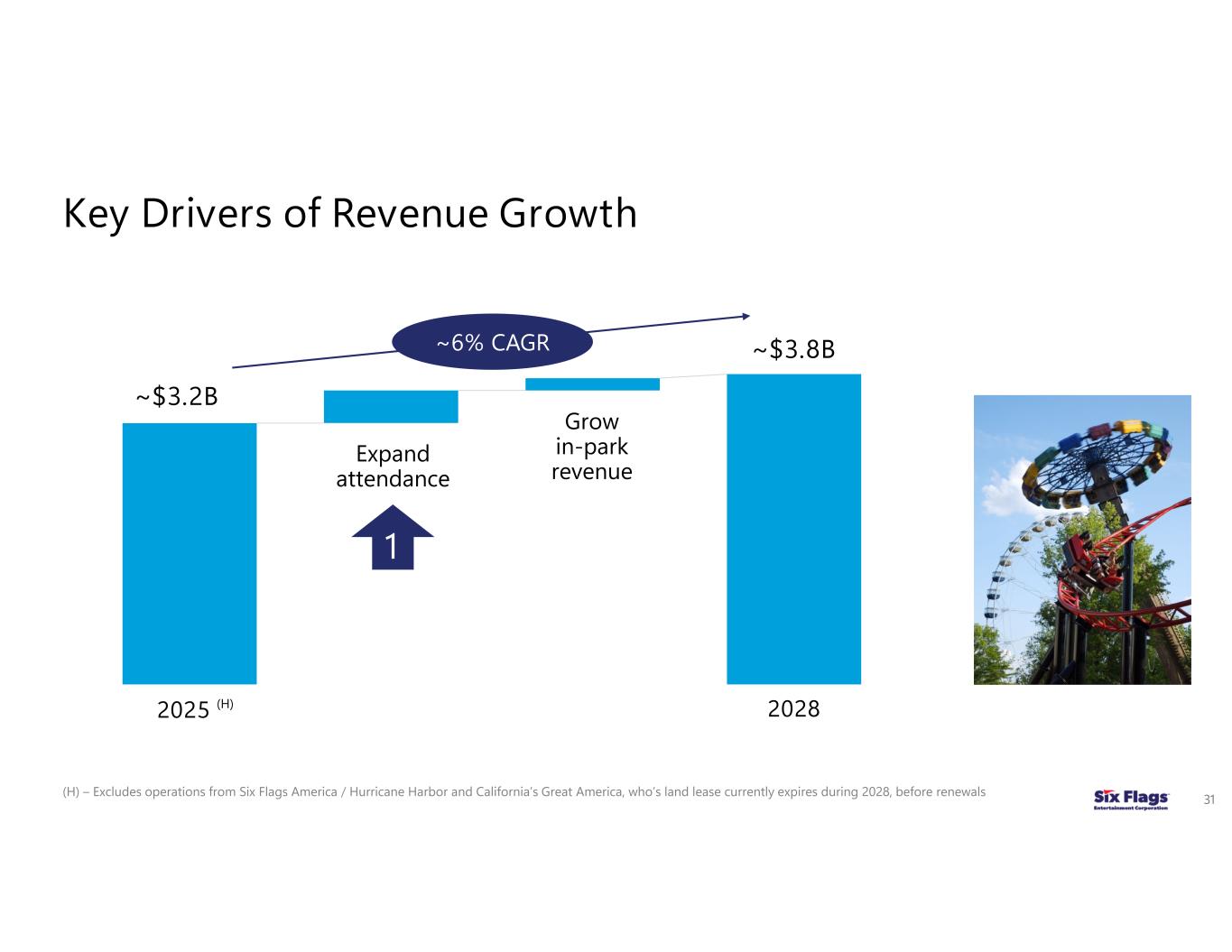

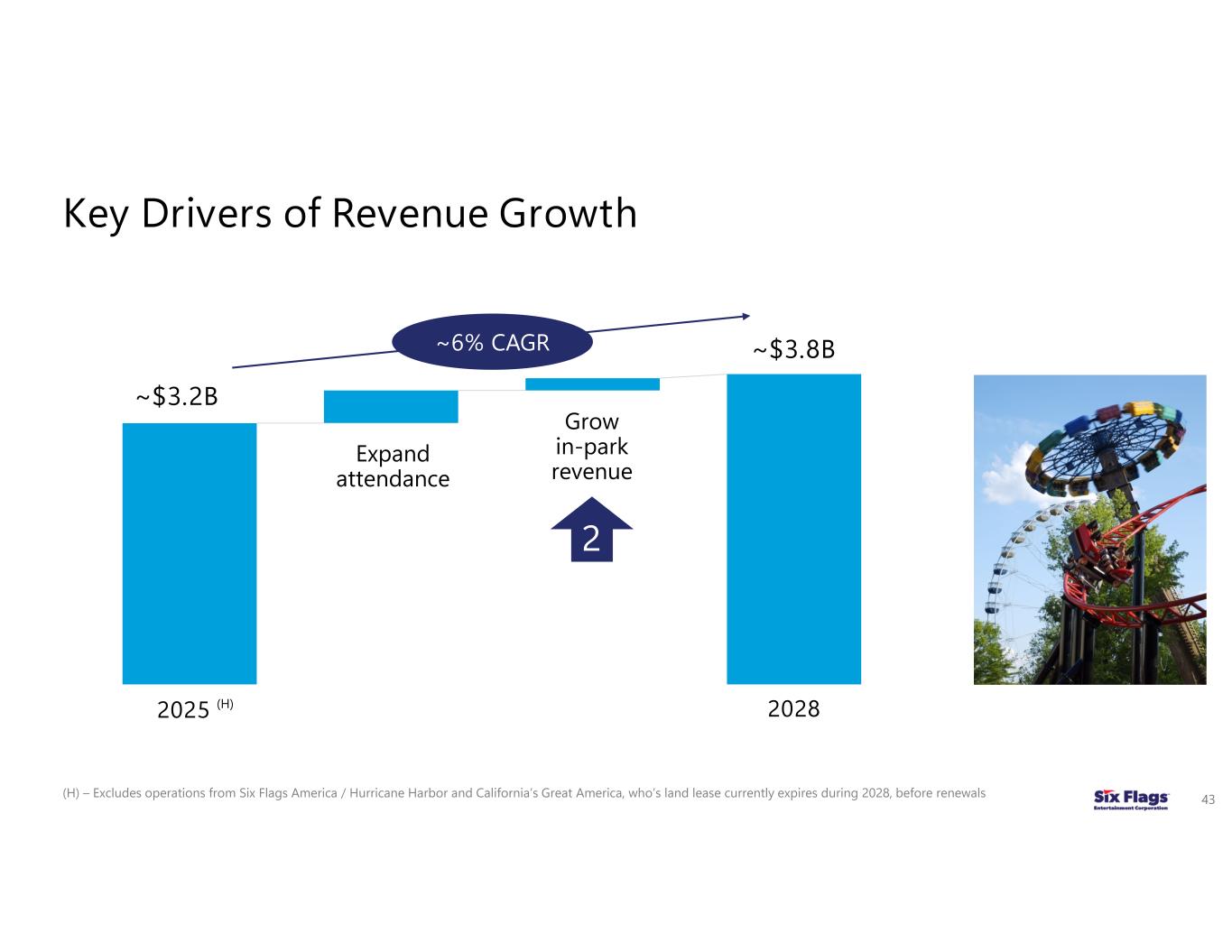

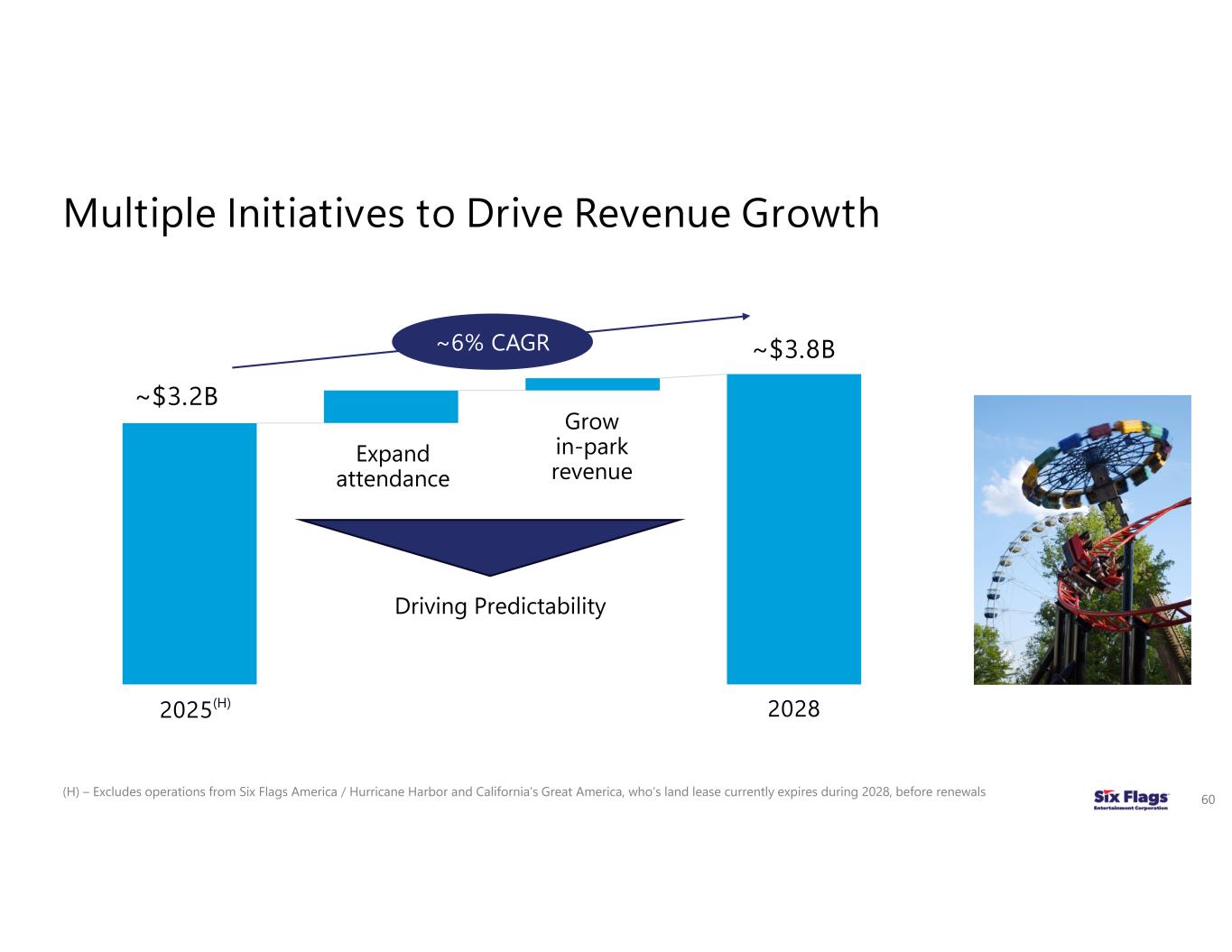

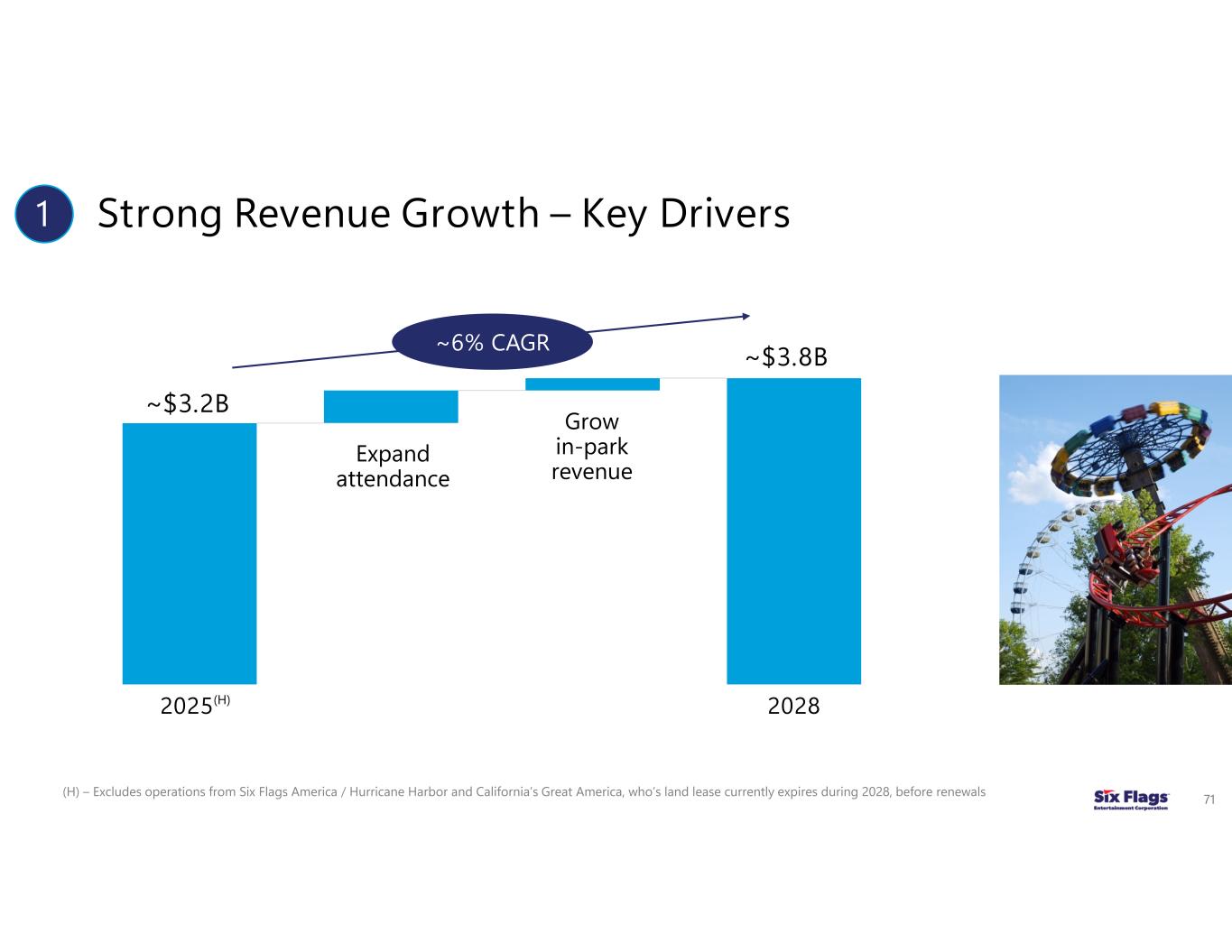

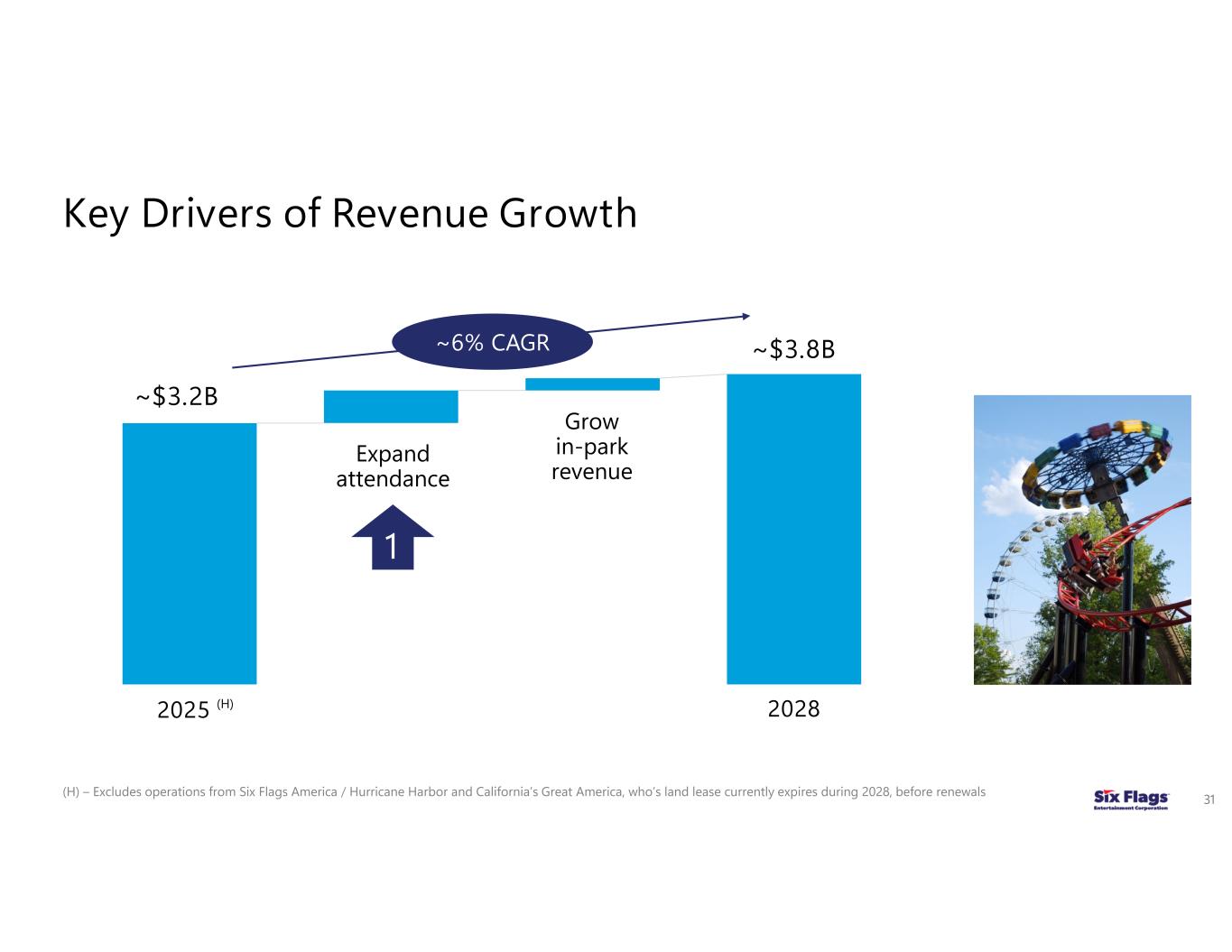

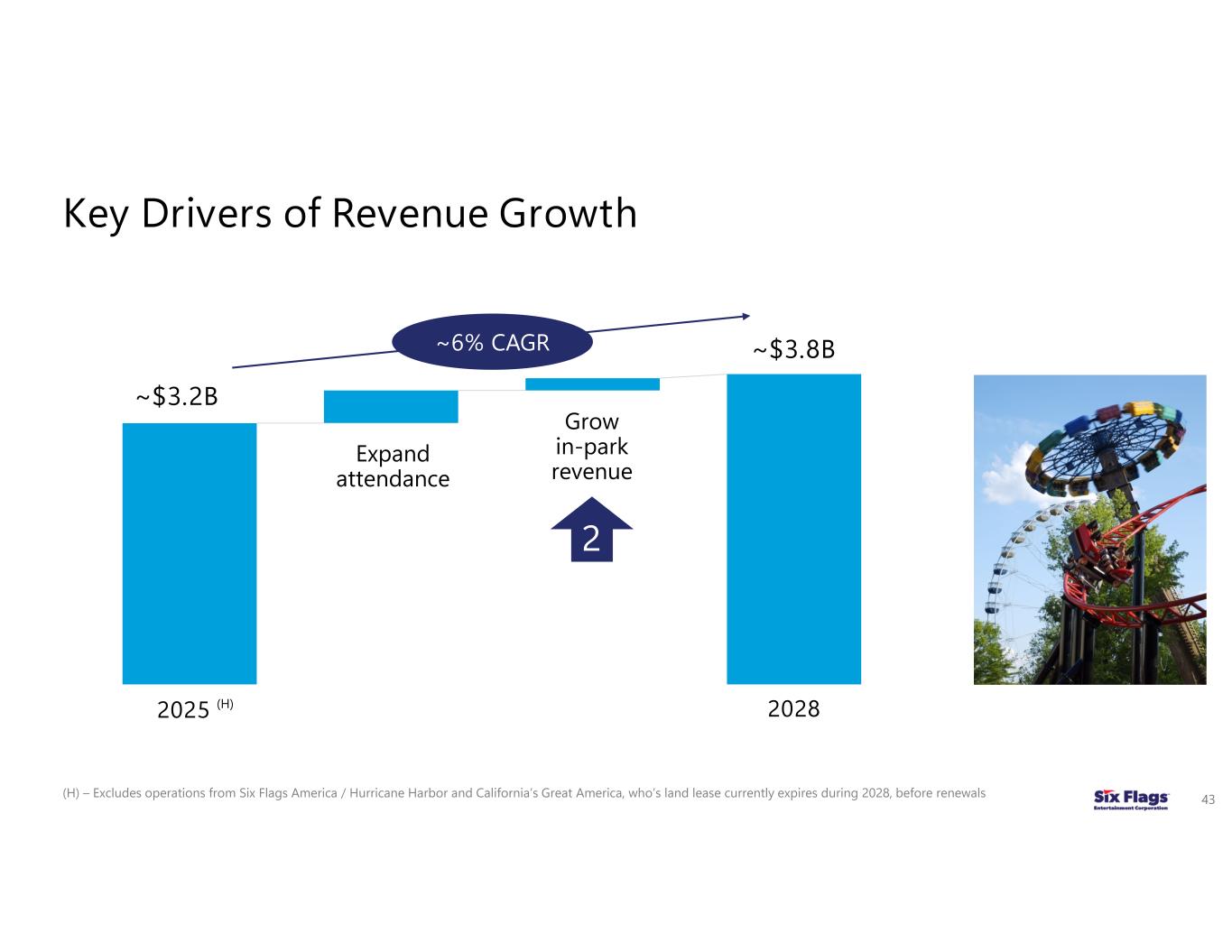

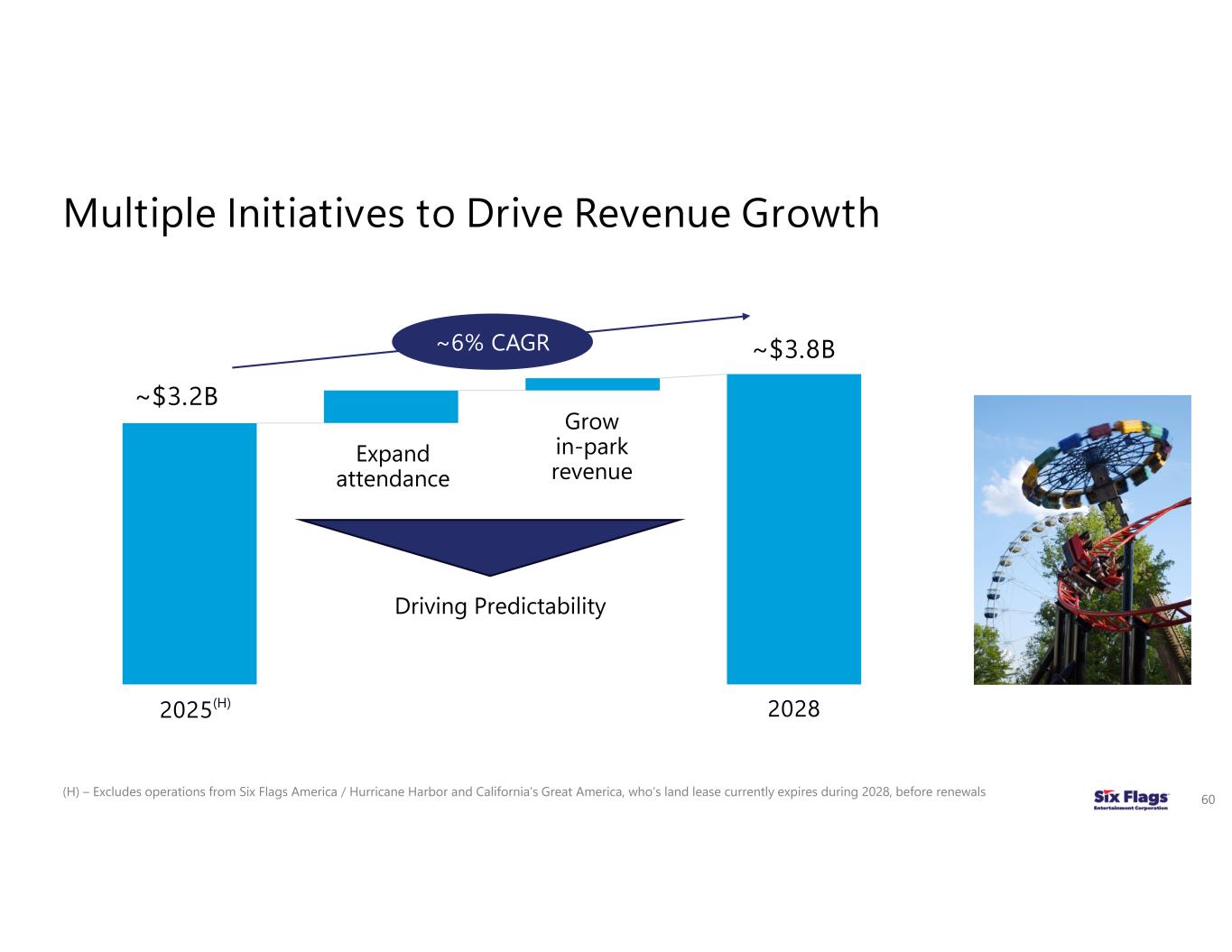

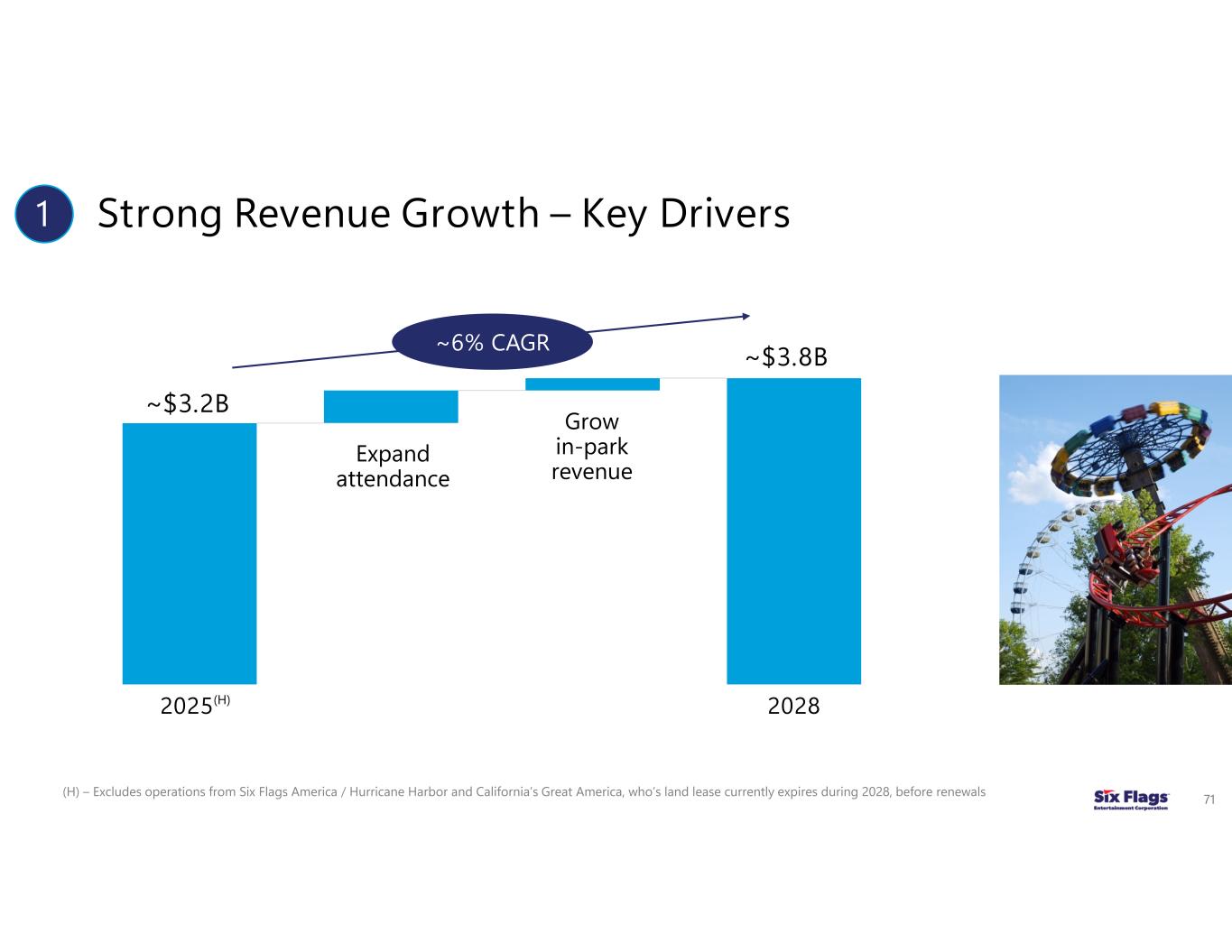

Key Drivers of Revenue Growth ~$3.2B ~$3.8B Expand attendance Grow in-park revenue ~6% CAGR 2025 (H) 2028 1 31 (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals

Expand Attendance 32 1. The opportunity 2. Proven strategies 3. Marketing & CRM 4. All-Park and Regional Passport 5. Compelling capital line-up

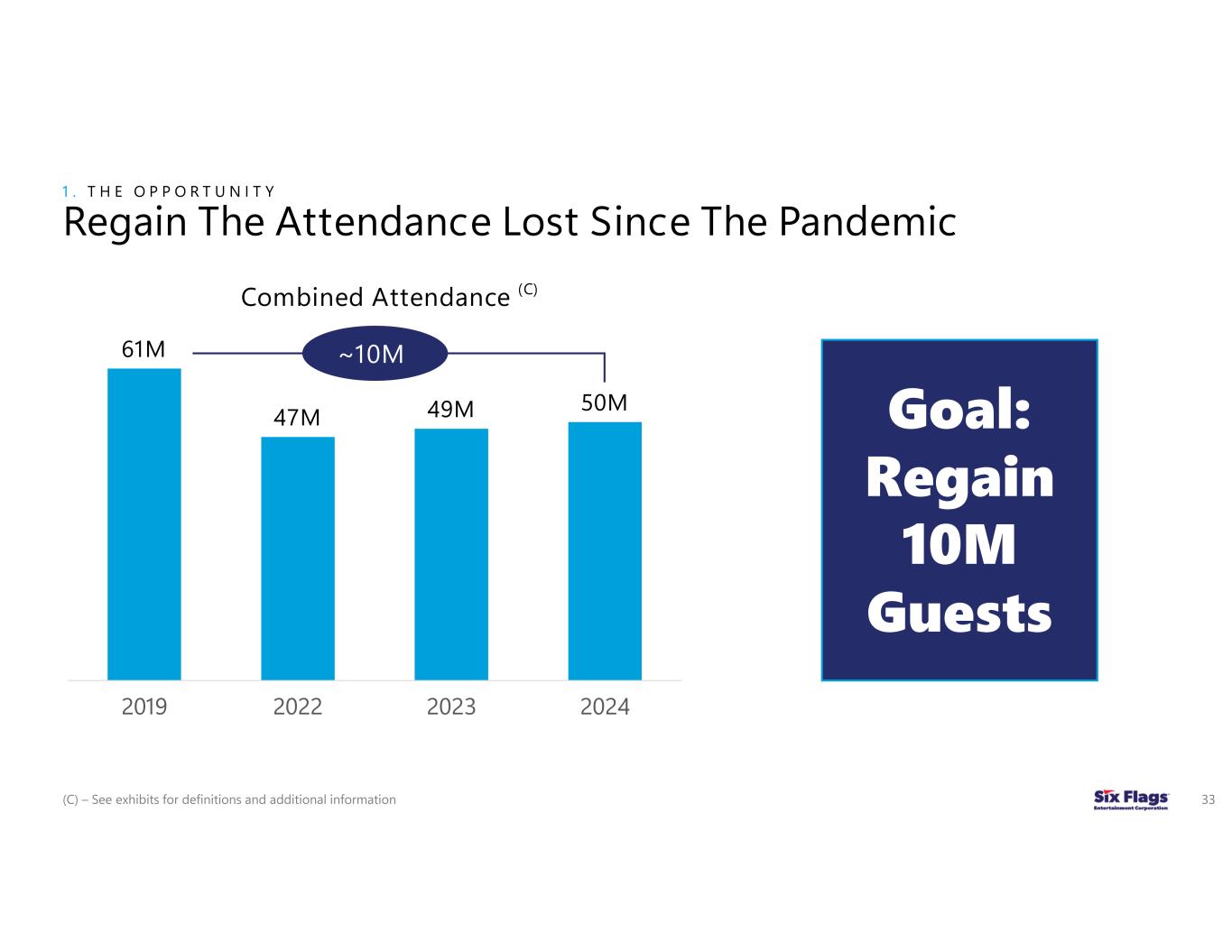

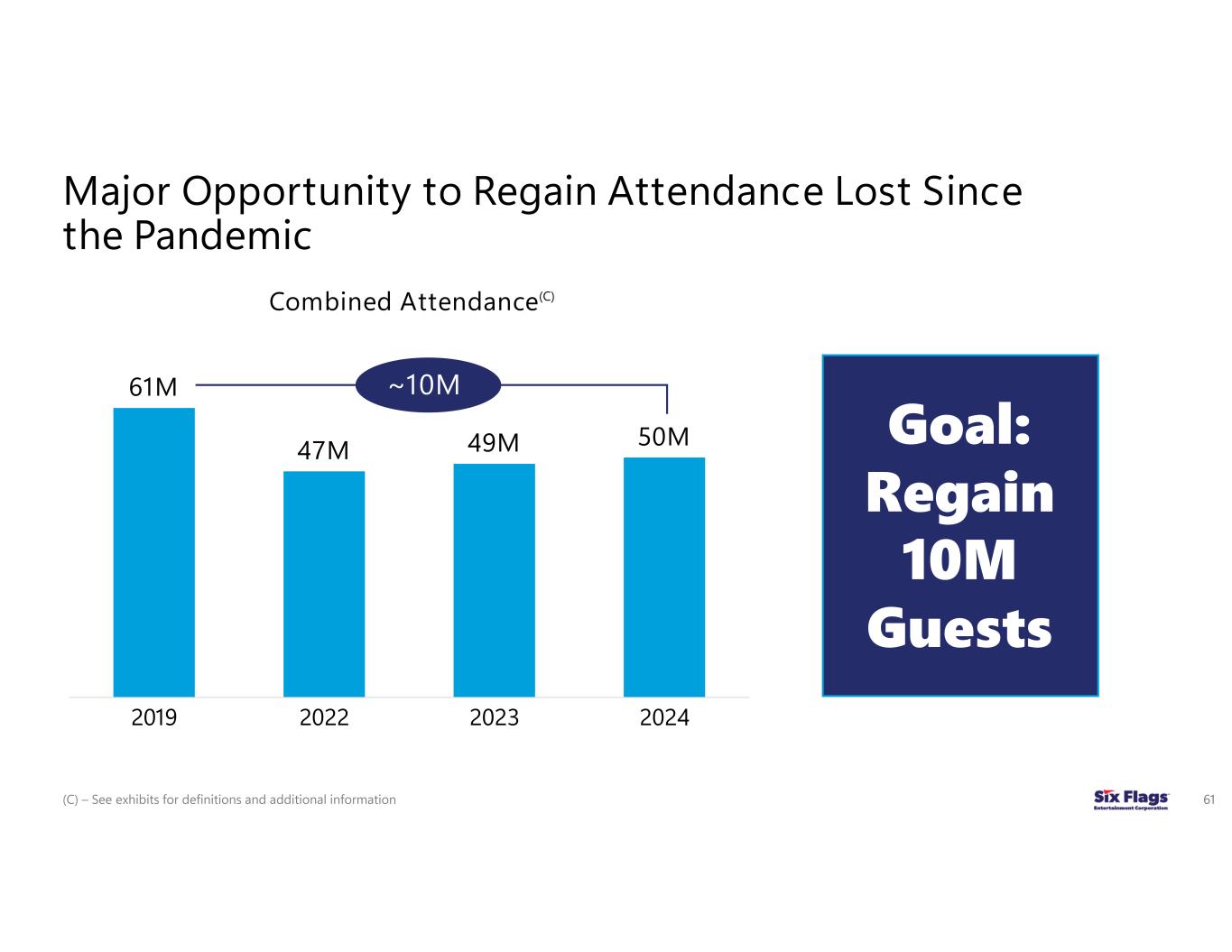

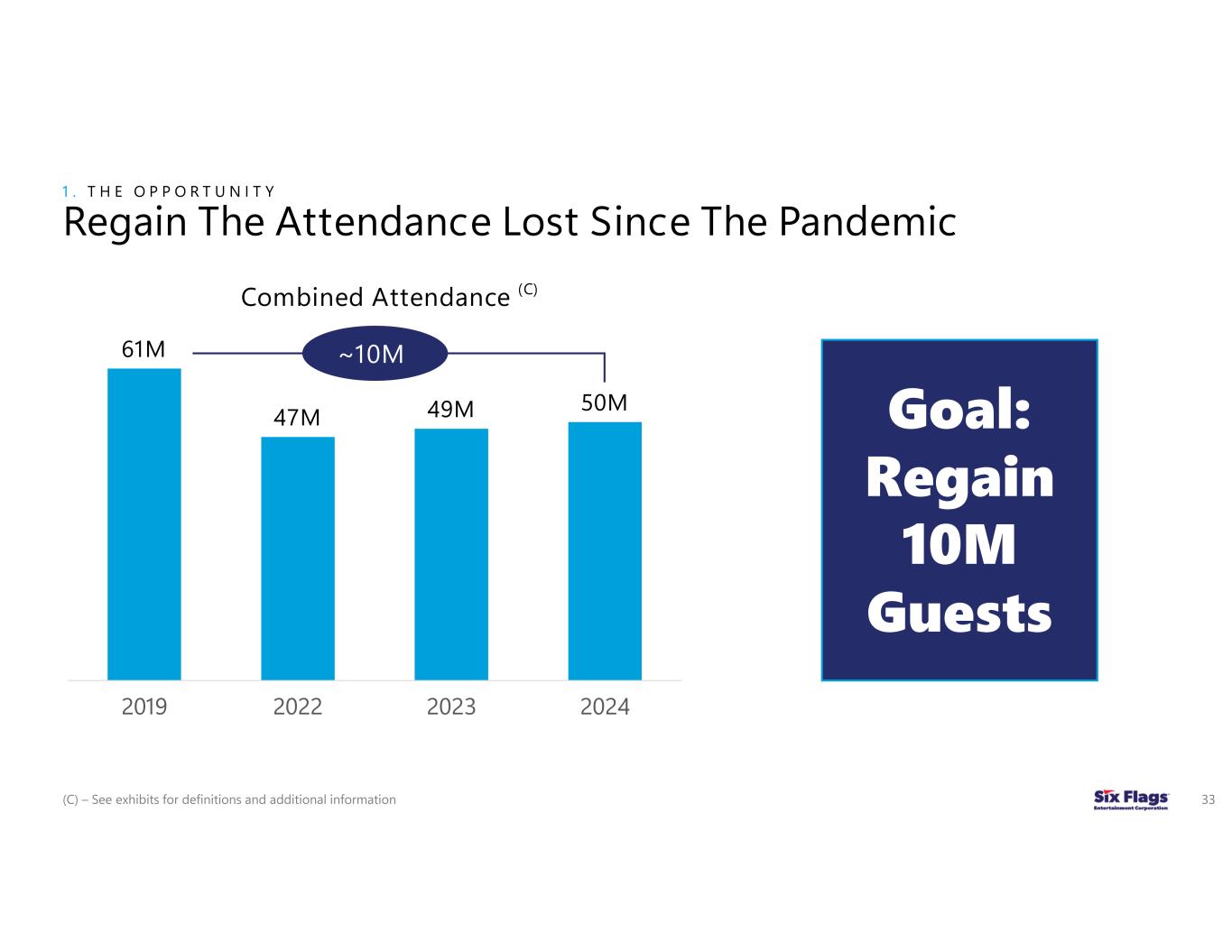

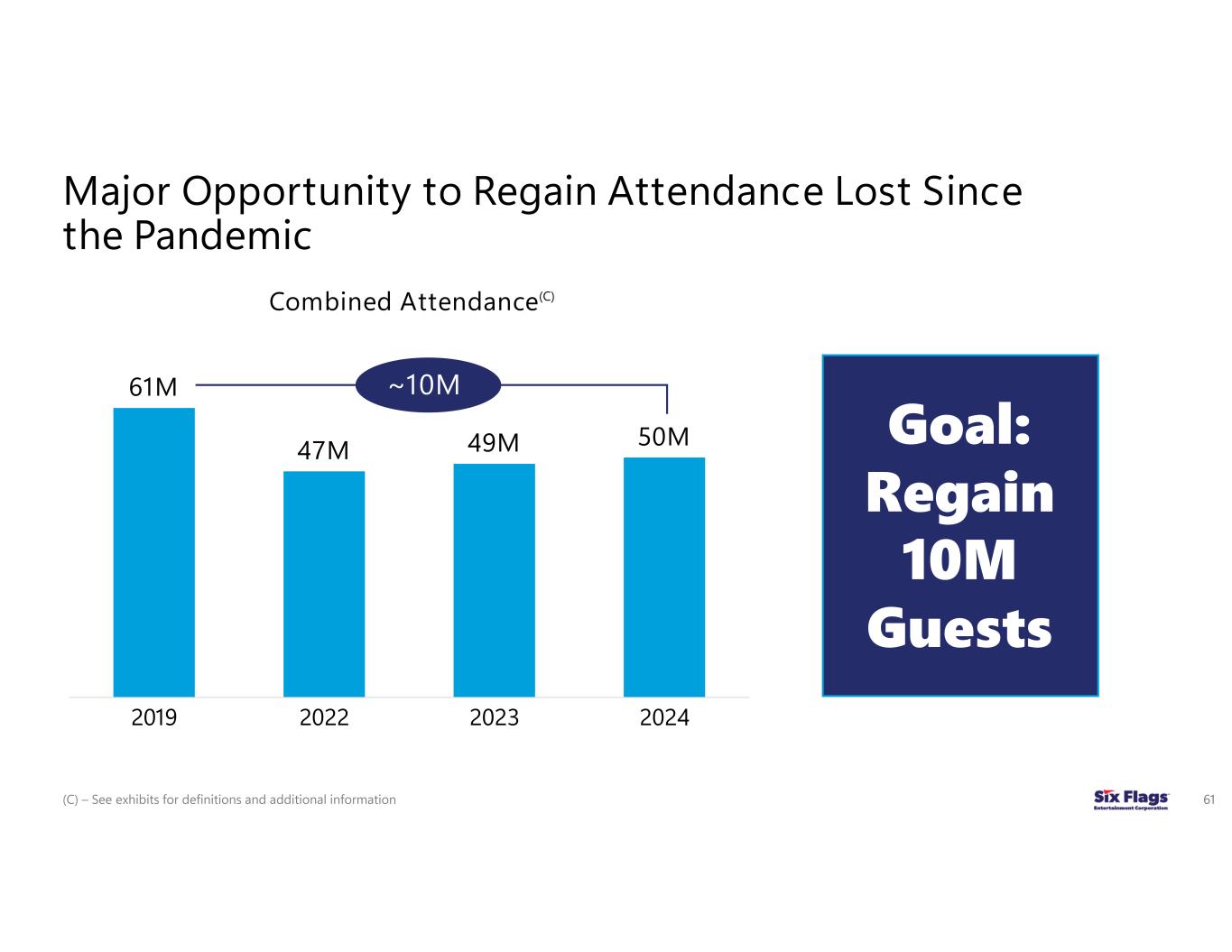

61M 47M 49M 50M 2019 2022 2023 2024 Goal: Regain 10M Guests Combined Attendance (C) ~10M 33 1 . T H E O P P O R T U N I T Y Regain The Attendance Lost Since The Pandemic (C) – See exhibits for definitions and additional information

34 Pe ne tr at io n Ra te Top quartile avg. = ~45% Second quartile avg. = ~25% Expanding penetration to second quartile average will yield 10M visits Parks with Greater than 1M in Attendance 1 . T H E O P P O R T U N I T Y Underpenetrated Parks Present Significant Upside

1 . T H E O P P O R T U N I T Y Improving Guest Experience will Drive Attendance at Underpenetrated Parks Market penetration rates highest at parks with the best guest satisfaction scores 2024 Penetration Rate Relative to Guest Satisfaction Scores (Bubble size = Relative Combined Attendance (C) ) Guest Satisfaction Score Pe ne tr at io n Ra te 35 (C) – See exhibits for definitions and additional information

• Expand rides per guest • Enhance quality and availability of in-park revenue offerings Guest Service Excellence • Thrill, family and water rotation • Area development • Family-friendly environment Compelling Capital • Evergreen annual events • Urgency driver • Season Pass value enhancer Seasons of FUN 2 . P R O V E N S T R A T E G I E S We Know How to Improve the Guest Experience 36

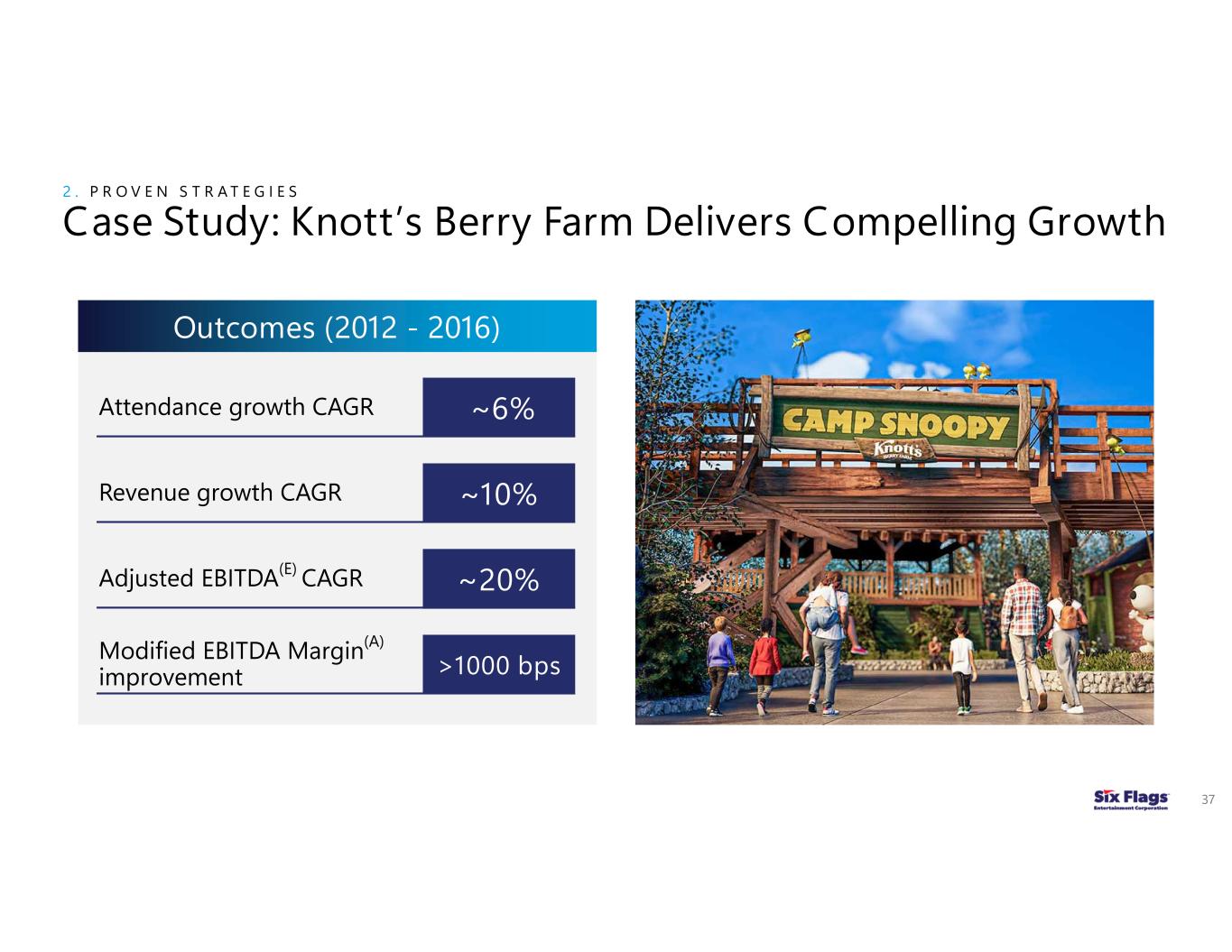

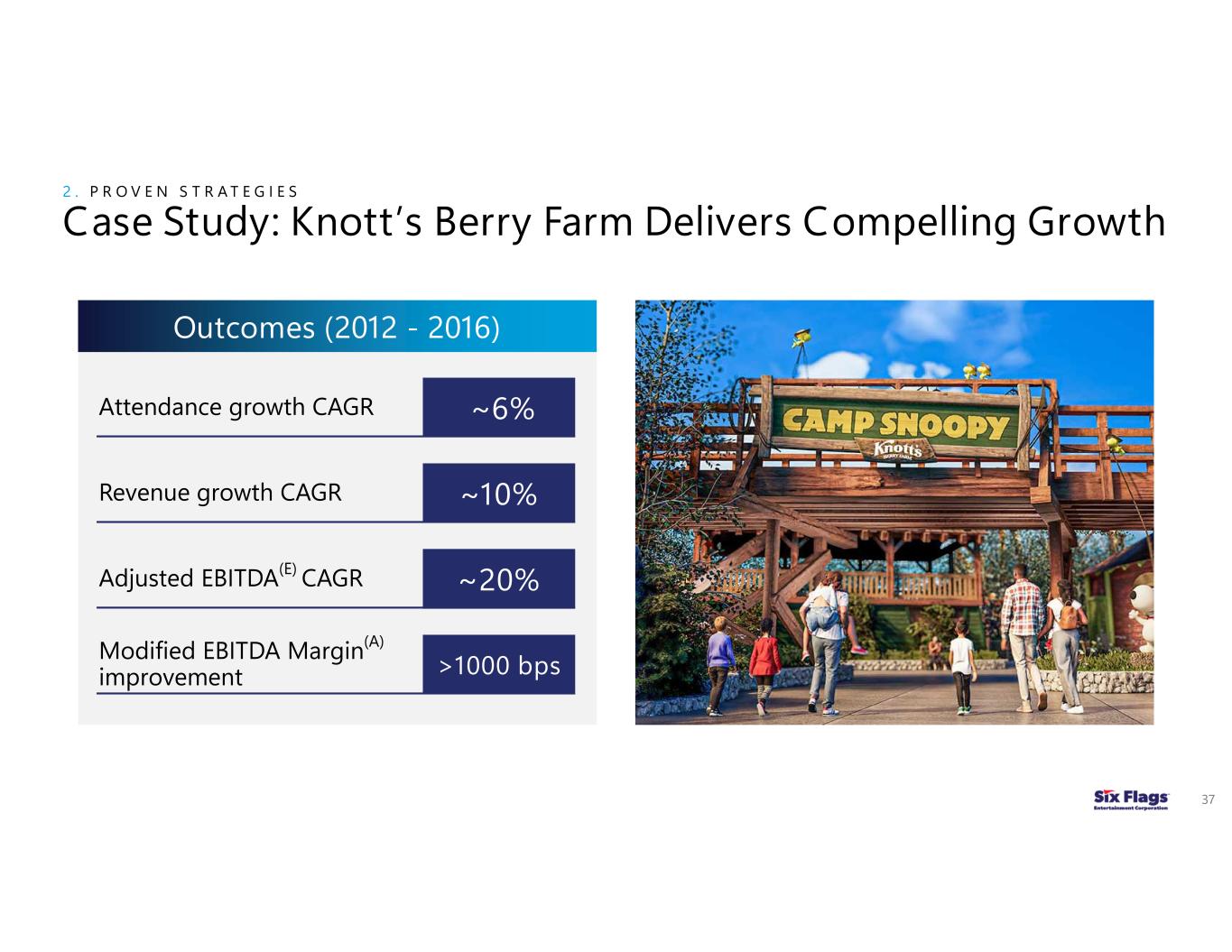

2 . P R O V E N S T R A T E G I E S Case Study: Knott’s Berry Farm Delivers Compelling Growth 37 Outcomes (2012 - 2016) Attendance growth CAGR ~6% ~10% Revenue growth CAGR ~20% Adjusted EBITDA(E) CAGR >1000 bps Modified EBITDA Margin(A) improvement

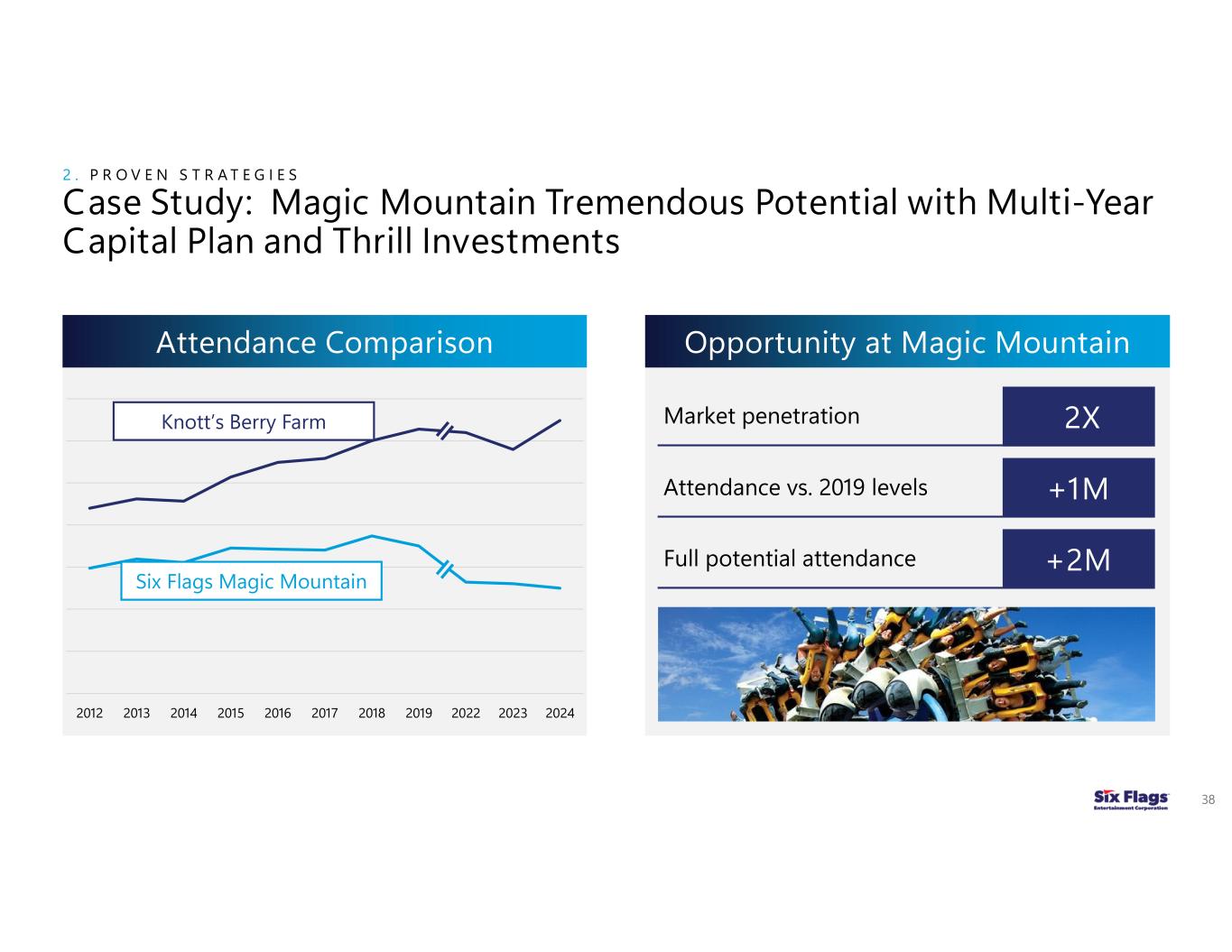

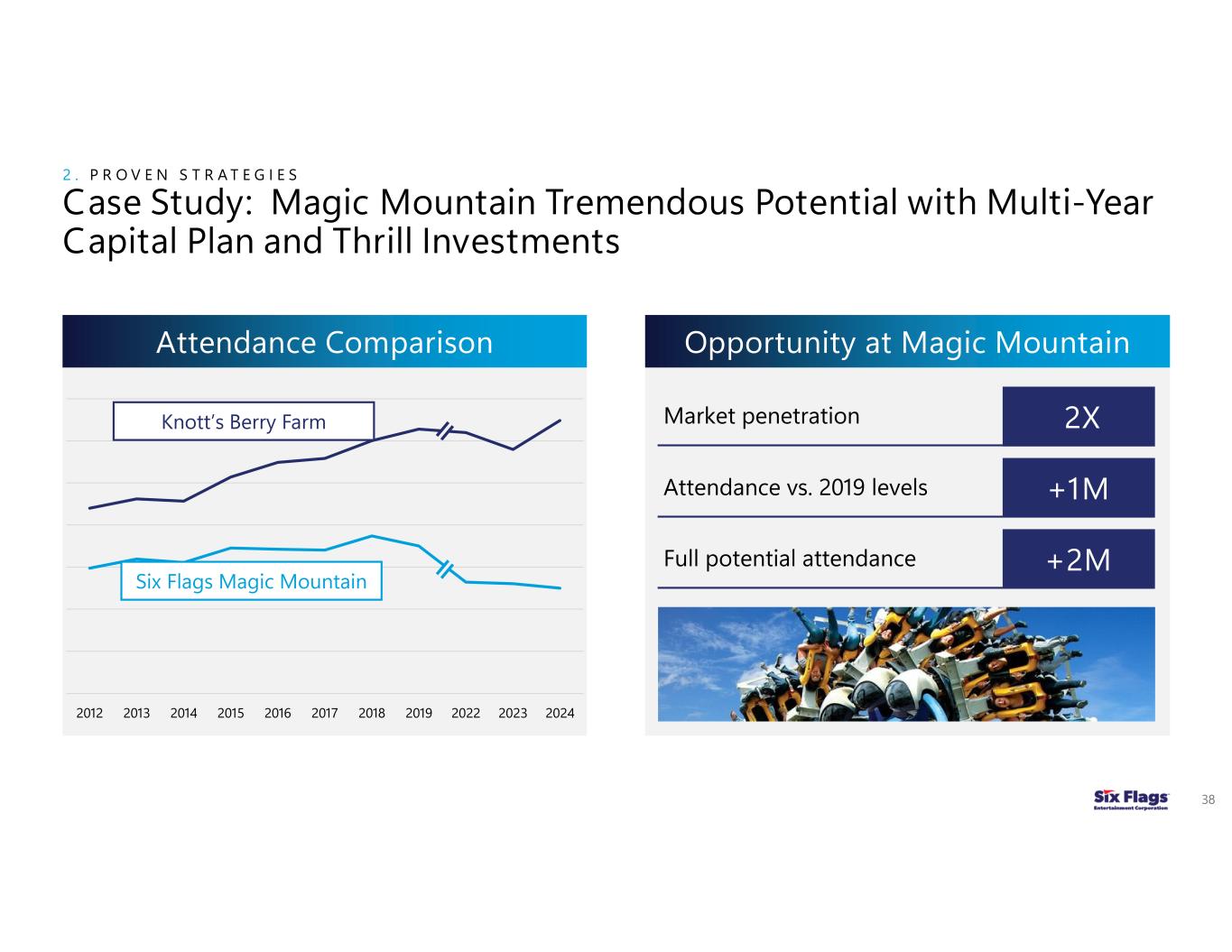

2 . P R O V E N S T R A T E G I E S Case Study: Magic Mountain Tremendous Potential with Multi-Year Capital Plan and Thrill Investments Opportunity at Magic Mountain 2X +1M +2M Attendance Comparison 2012 2013 2014 2015 2016 2017 2018 2019 2022 2023 2024 Knott’s Berry Farm Six Flags Magic Mountain Market penetration Attendance vs. 2019 levels Full potential attendance 38

Guest Satisfaction Scores 6.4 6.8 7.2 7.6 8.0 Pre-merger High penetration parks High opportunity parks Fall season Pre-merger Fall season 2 . P R O V E N S T R A T E G I E S Guest Satisfaction Scores Improving at High Opportunity Parks 39

40 Awareness Interest Action Loyalty Social + Paid Media E-mail, SMS, Push Mobile checkouts, promos Season Pass activation, renewal Impact • Deeper upsell penetration • Increases in visits per pass • Reduced discounting 3 . M A R K E T I N G & C R M Targeted Engagement Drives Visitation

41 Six Flags Discovery Kingdom, CA Six Flags Hurricane Harbor Concord, CA California’s Great America & South Bay Shores, CA Six Flags Magic Mountain Hurricane Harbor, CA Knott’s Berry Farm/Soak City, CA Six Flags Hurricane Harbor, Phoenix, AZ Frontier City Six Flags Hurricane Harbor, Oklahoma City, OK Six Flags Over Texas Hurricane Harbor, Arlington, TX Six Flags Hurricane Harbor Splashdown, Spring, TX Schlitterbahn Waterpark, Galveston TX Schlitterbahn Resort, New Braunfels, TX Six Flags Fiesta Texas & Hurricane Harbor San Antonio, TX Valleyfair & Soak City, MN Michigan’s Adventure & WildWater Adventure, MI Six Flags Great America & Hurricane Harbor, IL Six Flags Hurricane Harbor, Cherry Valley, IL World of Fun, Oceans of Fun, Kansas, MO Six Flags St. Louis & Hurricane Harbor, MO Canada’s Wonderland & Splash Works, Vaughan, ON La Ronde, Montréal QC Six Flags Great Escape Resort & Hurricane Harbor, NY Six Flags Darien Lake & Hurricane Harbor, NY Six Flags New England & Hurricane Harbor, MA Cedar Point Cedar Point Shores, Sandusky, OH Dorney Park & Wildwater Kingdom, Allentown, PA Six Flags Great Adventure, HH, Wild Safari, NJ Six Flags America & Hurricane Harbor, Bowie, MD Kings Dominion & Soak City, Doswell, VA Kings Island & Soak City, Mason, OH Six Flags White Water, GA Six Flags Over Georgia & Hurricane Harbor, GA Carowinds & Carolina Harbor, NC/SC Six Flags Mexico, Mexico City, MX Six Flags Hurricane Harbor Oaxtepec, MX 14 Pairs of FUN Parks Within Driving Distance of Each Other – Combined Map Park 4 . A L L - P A R K A N D R E G I O N A L P A S S P O R T National Footprint Offers Compelling Guest Value

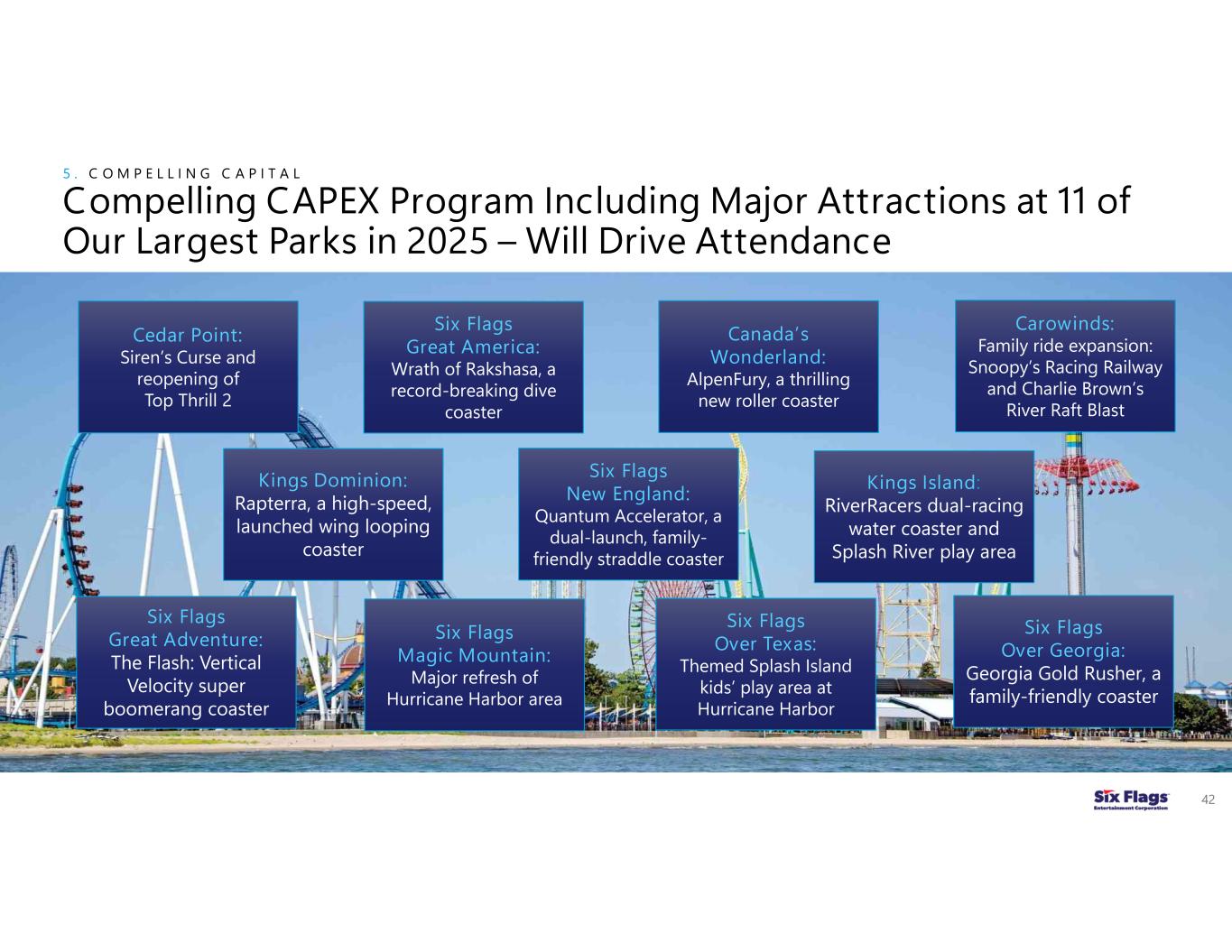

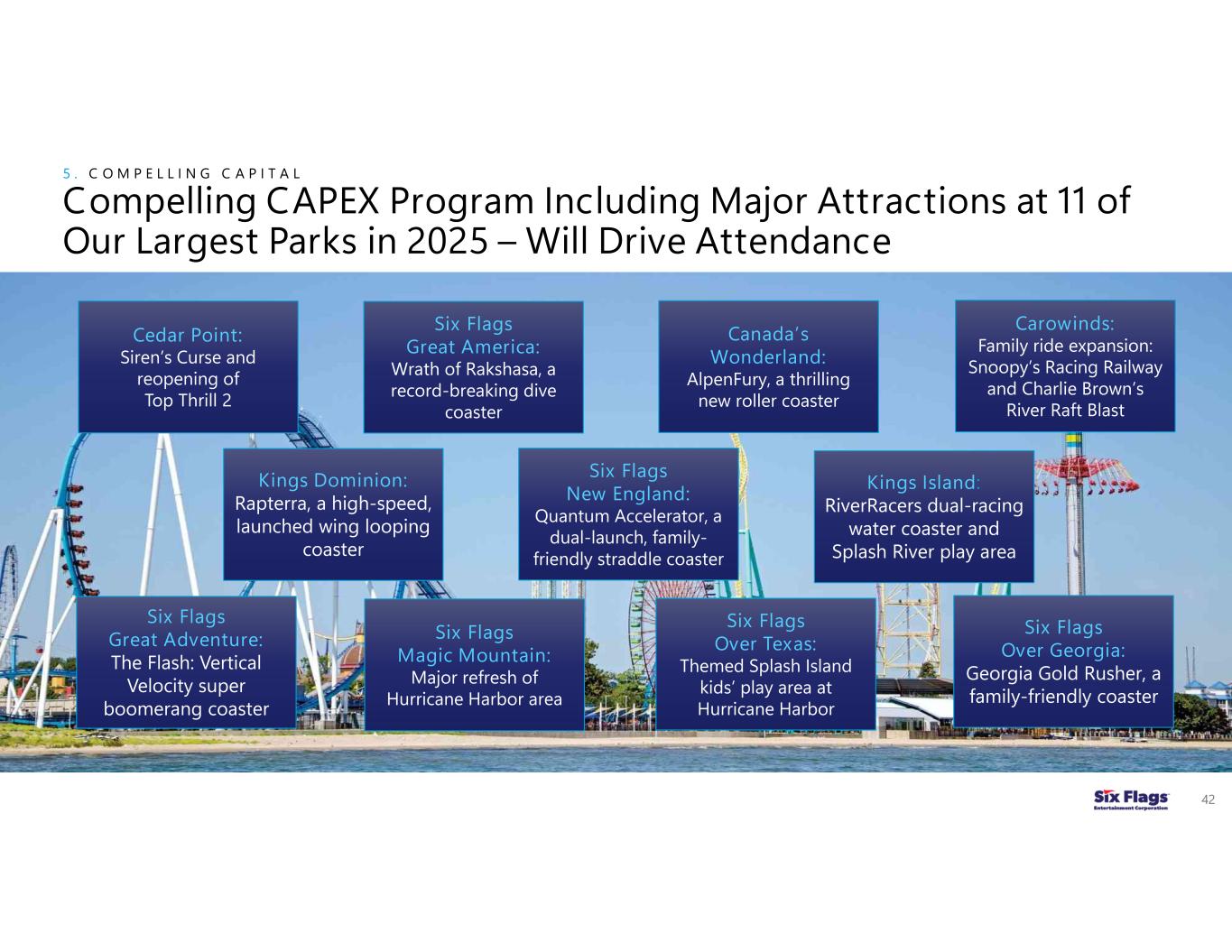

5 . C O M P E L L I N G C A P I T A L Compelling CAPEX Program Including Major Attractions at 11 of Our Largest Parks in 2025 – Will Drive Attendance 42 Cedar Point: Siren’s Curse and reopening of Top Thrill 2 Six Flags Great America: Wrath of Rakshasa, a record-breaking dive coaster Canada’s Wonderland: AlpenFury, a thrilling new roller coaster Six Flags New England: Quantum Accelerator, a dual-launch, family- friendly straddle coaster Carowinds: Family ride expansion: Snoopy’s Racing Railway and Charlie Brown’s River Raft Blast Kings Dominion: Rapterra, a high-speed, launched wing looping coaster Kings Island: RiverRacers dual-racing water coaster and Splash River play area Six Flags Magic Mountain: Major refresh of Hurricane Harbor area Six Flags Great Adventure: The Flash: Vertical Velocity super boomerang coaster Six Flags Over Texas: Themed Splash Island kids’ play area at Hurricane Harbor Six Flags Over Georgia: Georgia Gold Rusher, a family-friendly coaster

Key Drivers of Revenue Growth ~$3.2B ~$3.8B Expand attendance Grow in-park revenue ~6% CAGR 2025 (H) 2028 2 43 (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals

Food & Beverage (F&B) Improved quality, speed of service and convenience Merch., Games & Extra-charge Revitalized retail experiences and premium, VIP offerings Elevated In-Park Revenue Offerings Drive Revenue 44 1 2

Strategies • Raised the quality of the food • Increased efficiency so that guests can buy things easily • Increased the availability of adult beverages • Invested in capital to support the revenue Outcomes Achieved F&B Strategy Success At Legacy Cedar Fair Parks 45 1 • Guest satisfaction +10% +15% • Transactions per guest +40% • Avg. transaction value 7% CAGR • Accelerated F&B revenue growth Note: Outcomes achieved above are based on results from 2015 through 2024 at Legacy Cedar Fair parks.

Adult Beverages a Key Component of the F&B Growth Note: Outcomes achieved above are based on results from 2019 through 2024 at Legacy Cedar Fair parks. 46 Outcomes Achieved • Penetration over past five years Up ~2X • Growth in adult beverage revenue >100% • Incremental adult beverage revenue >$20M 1

Transactions per Guest Substantial Opportunity To Improve F&B Performance Goal Moving high opportunity parks to optimal penetration levels will drive transactions and revenue 2015 Optimized Parks High Opportunity Parks 2024 47 1

Six Flags Over Texas – JB’s Barbeque Top Performing Renovations F&B Renovations Offer Higher, More Labor-Efficient Revenue 48 2X Transactions growth +6% Average transaction value +800 bps Labor as percent revenue 1

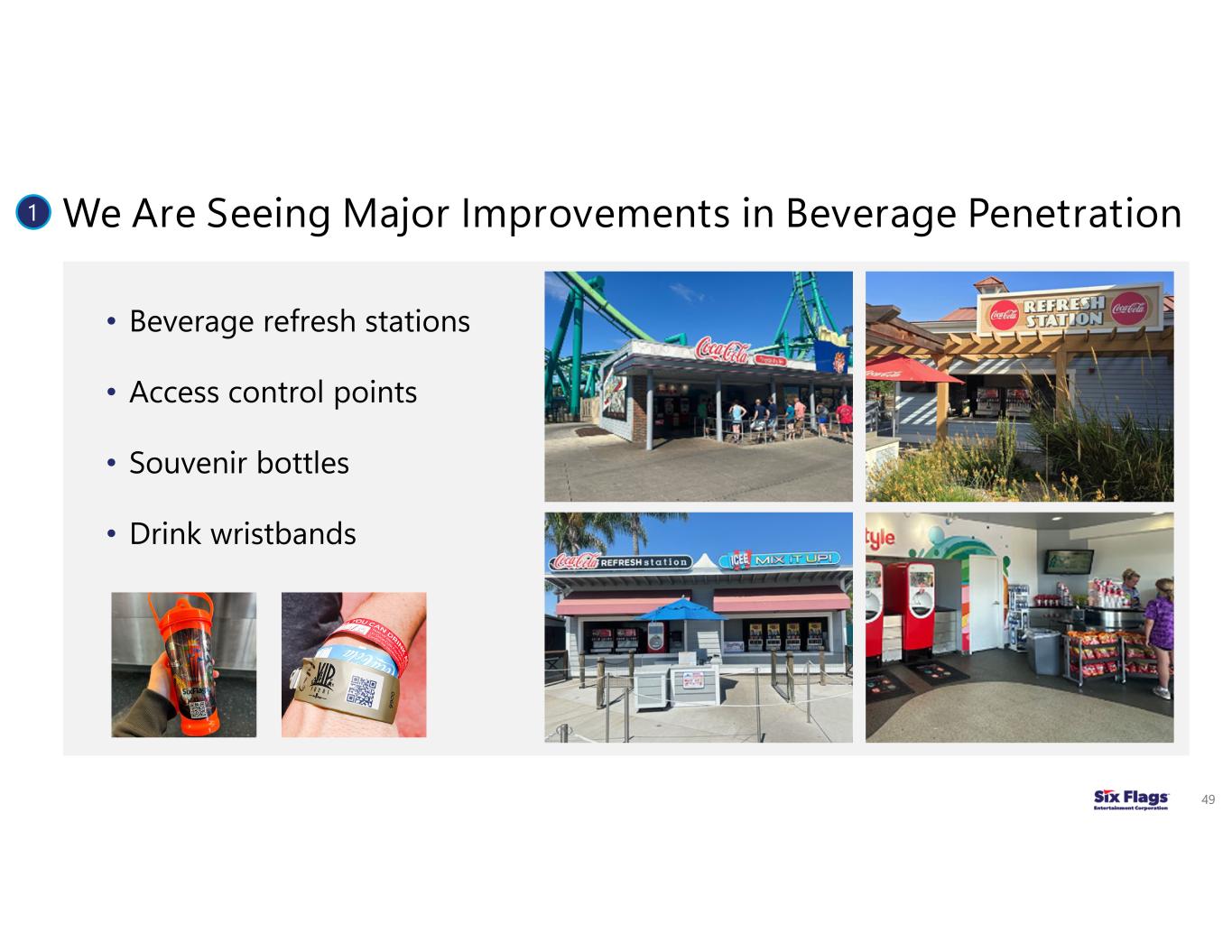

We Are Seeing Major Improvements in Beverage Penetration 49 • Beverage refresh stations • Access control points • Souvenir bottles • Drink wristbands 1

Food & Beverage (F&B) Improved quality, speed of service and convenience Merch., Games & Extra-charge Revitalized retail experiences and premium, VIP offerings Elevated In-Park Revenue Offerings Drive Revenue 50 1 2

We Are Raising the Bar on Experiential Retail 51 2 • Investment in retail locations • Centralized product development • Unique, park-specific merchandise • Merchandise bundles Merchandise and Games Drive transactions and average transaction value

Premium Products Deliver High Margin at a Compelling ROI 52 2 • Fast Lane / Flash Pass • Cabanas • VIP Lounges Extra-Charge Offerings Provide more value when the park is busy

I N S U M M A R Y : Here’s Why We’ll Win Activating centralized marketing, CRM and pricing Regaining 10M guests Elevating the in-park experience Capturing more value and high-margin revenue 53

Q&A 54

Brian Witherow, Chief Financial Officer Driving Sustainable Profitability and Higher Shareholder Returns 55

Agenda: Driving Sustainable Profitability and Higher Shareholder Returns 56 Proven business model Growing predictable attendance Focused on margin expansion Path to net leverage reduction Clear roadmap to value creation

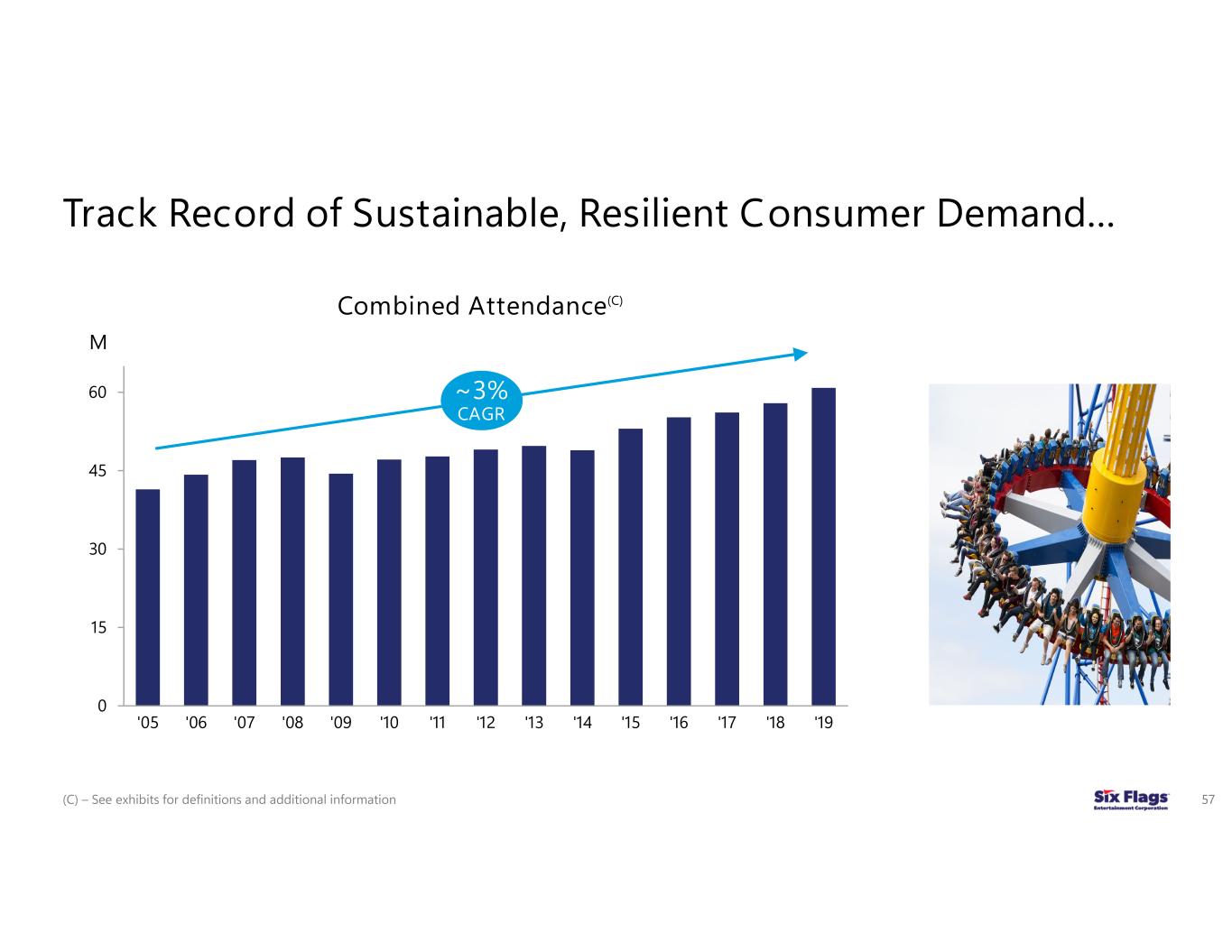

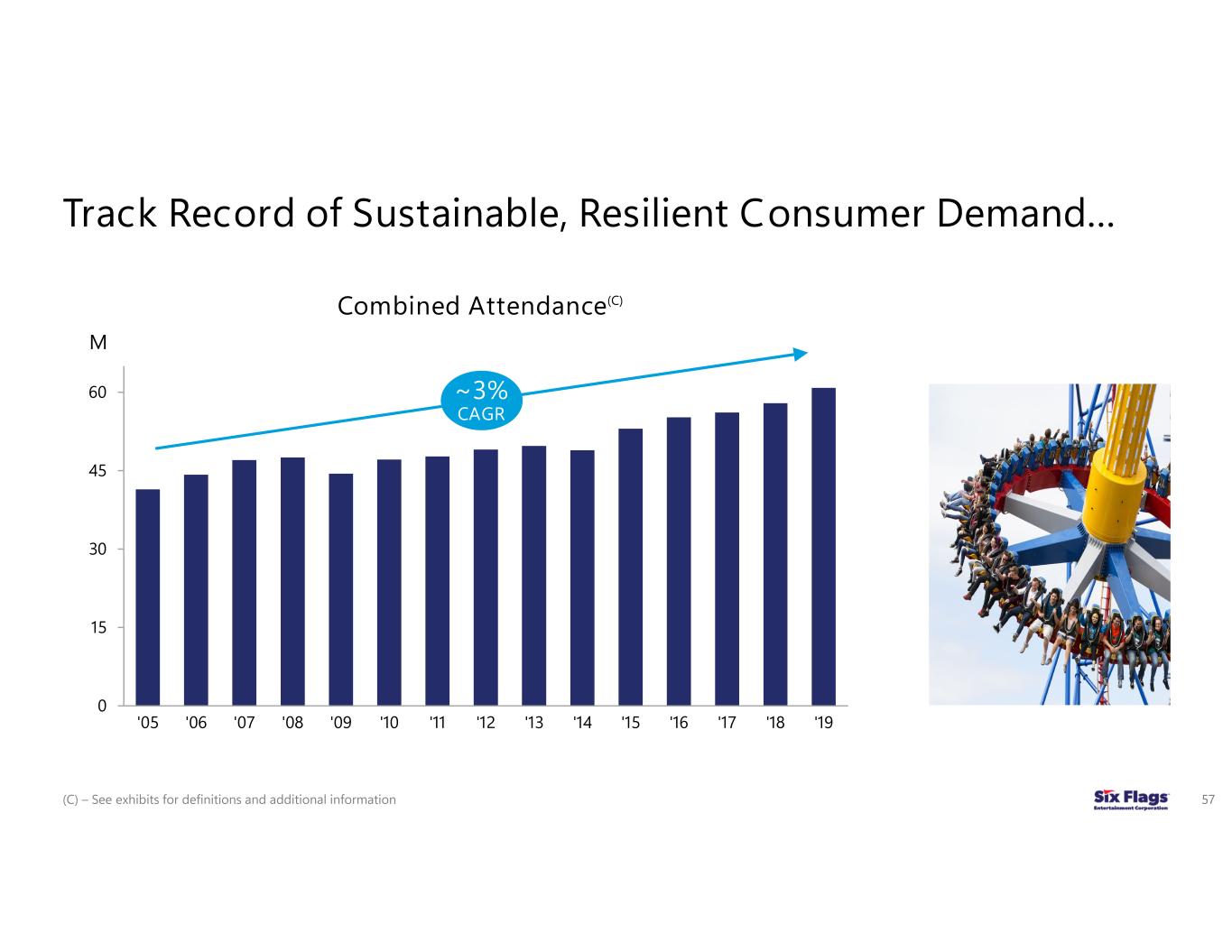

Track Record of Sustainable, Resilient Consumer Demand… 57 0 15 30 45 60 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 Combined Attendance(C) ~3% CAGR M (C) – See exhibits for definitions and additional information

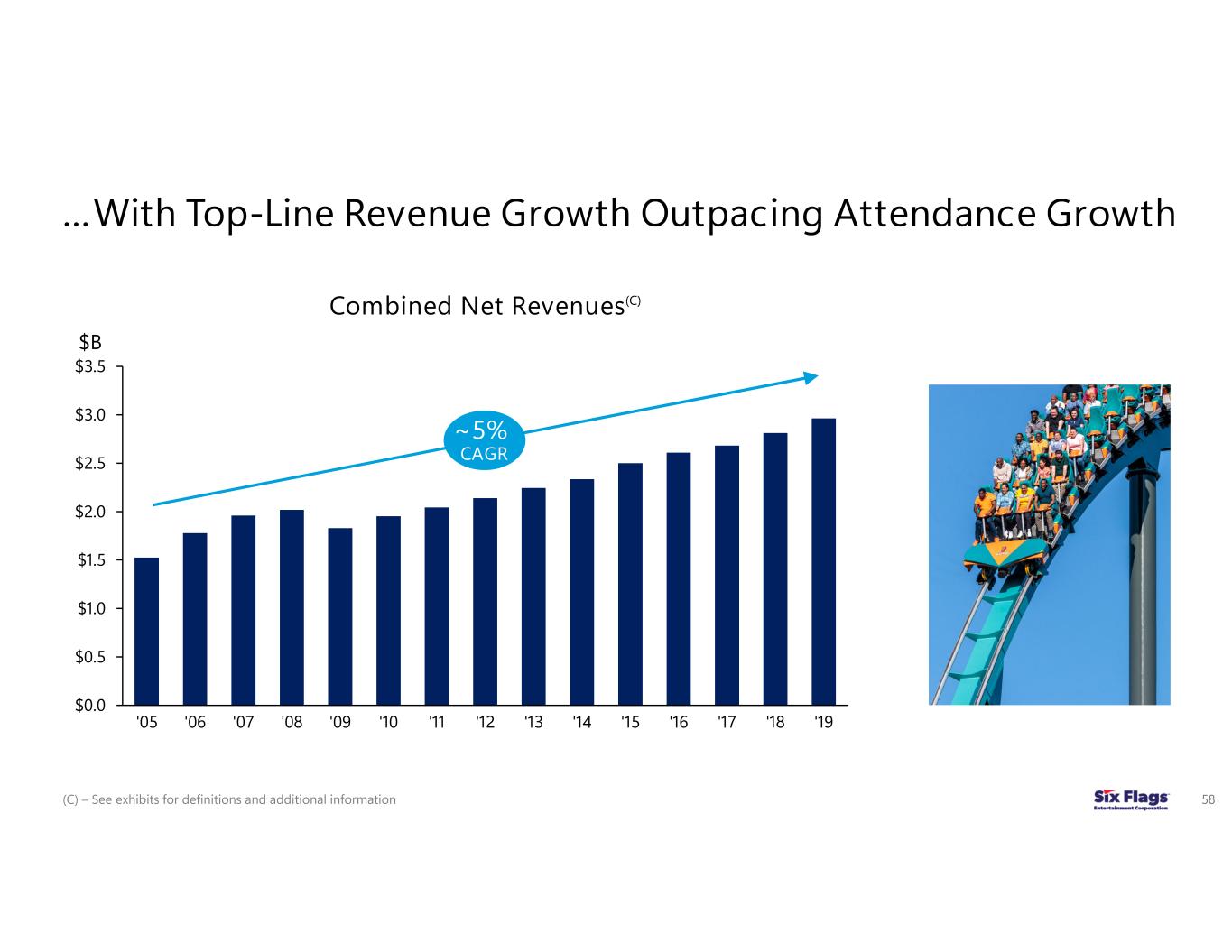

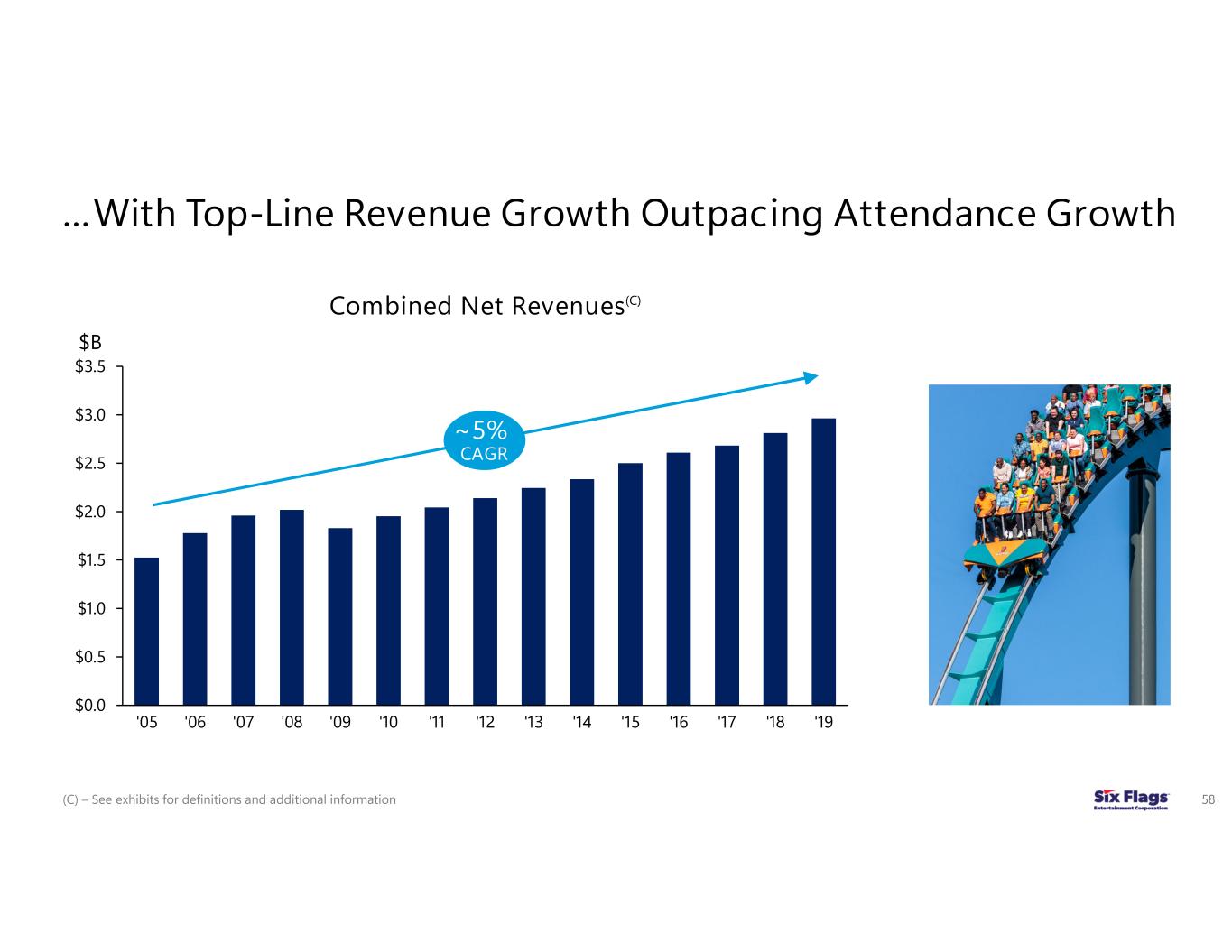

…With Top-Line Revenue Growth Outpacing Attendance Growth 58 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 Combined Net Revenues(C) ~5% CAGR $B (C) – See exhibits for definitions and additional information

Agenda: Driving Sustainable Profitability and Higher Shareholder Returns 59 Proven business model Growing predictable revenue Focused on margin expansion Path to net leverage reduction Clear roadmap to value creation

~$3.2B ~$3.8B Expand attendance Grow in-park revenue ~6% CAGR 2025(H) 2028 Multiple Initiatives to Drive Revenue Growth 60 Driving Predictability (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals

Major Opportunity to Regain Attendance Lost Since the Pandemic 61 61M 47M 49M 50M 2019 2022 2023 2024 Combined Attendance(C) ~10M Goal: Regain 10M Guests (C) – See exhibits for definitions and additional information

Focused on Shifting Attendance(C) to Advance Commitment Channels 62 50% 70% 50% 30% 2015 2024 Season Pass + Group General Admission Increase of 2000 bps since 2015 (C) – See exhibits for definitions and additional information

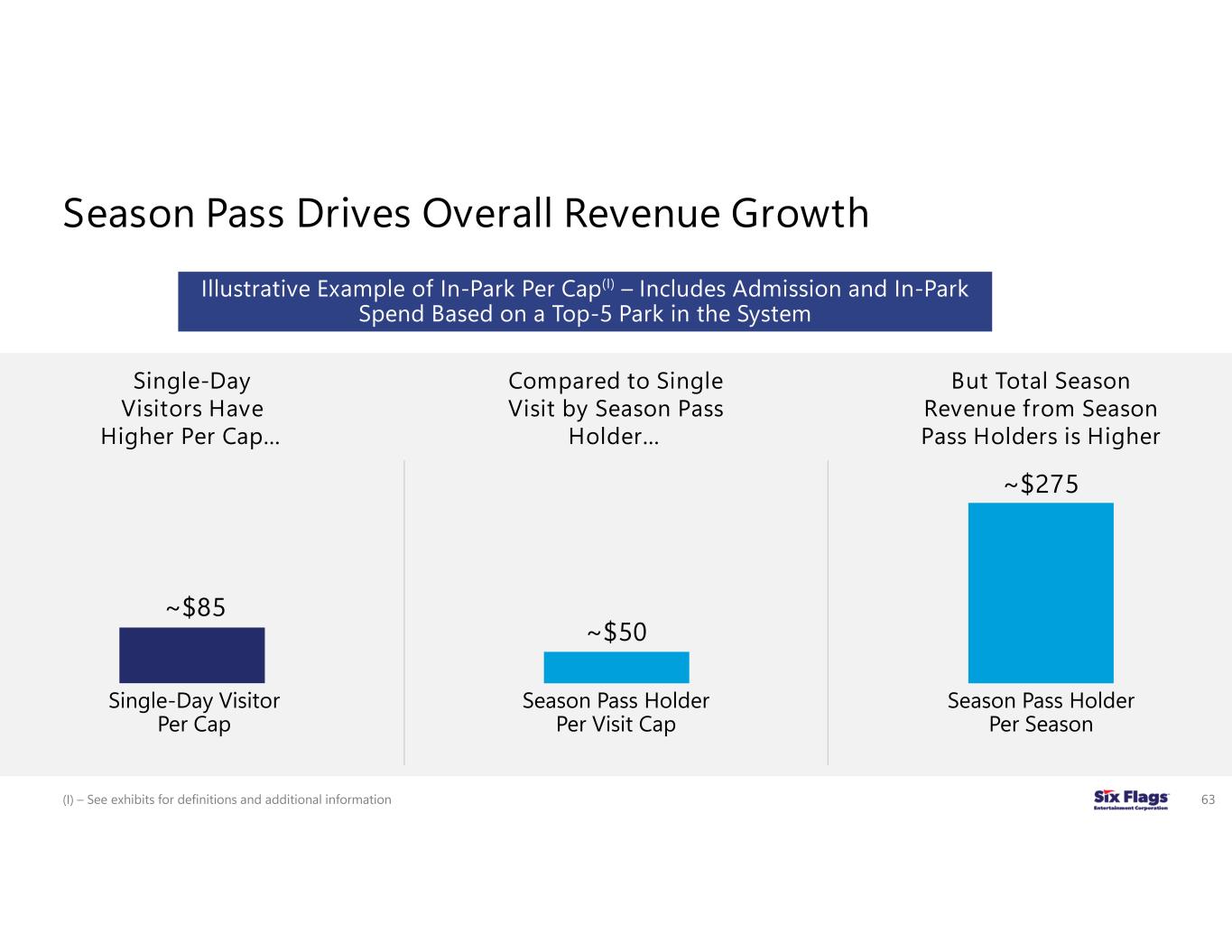

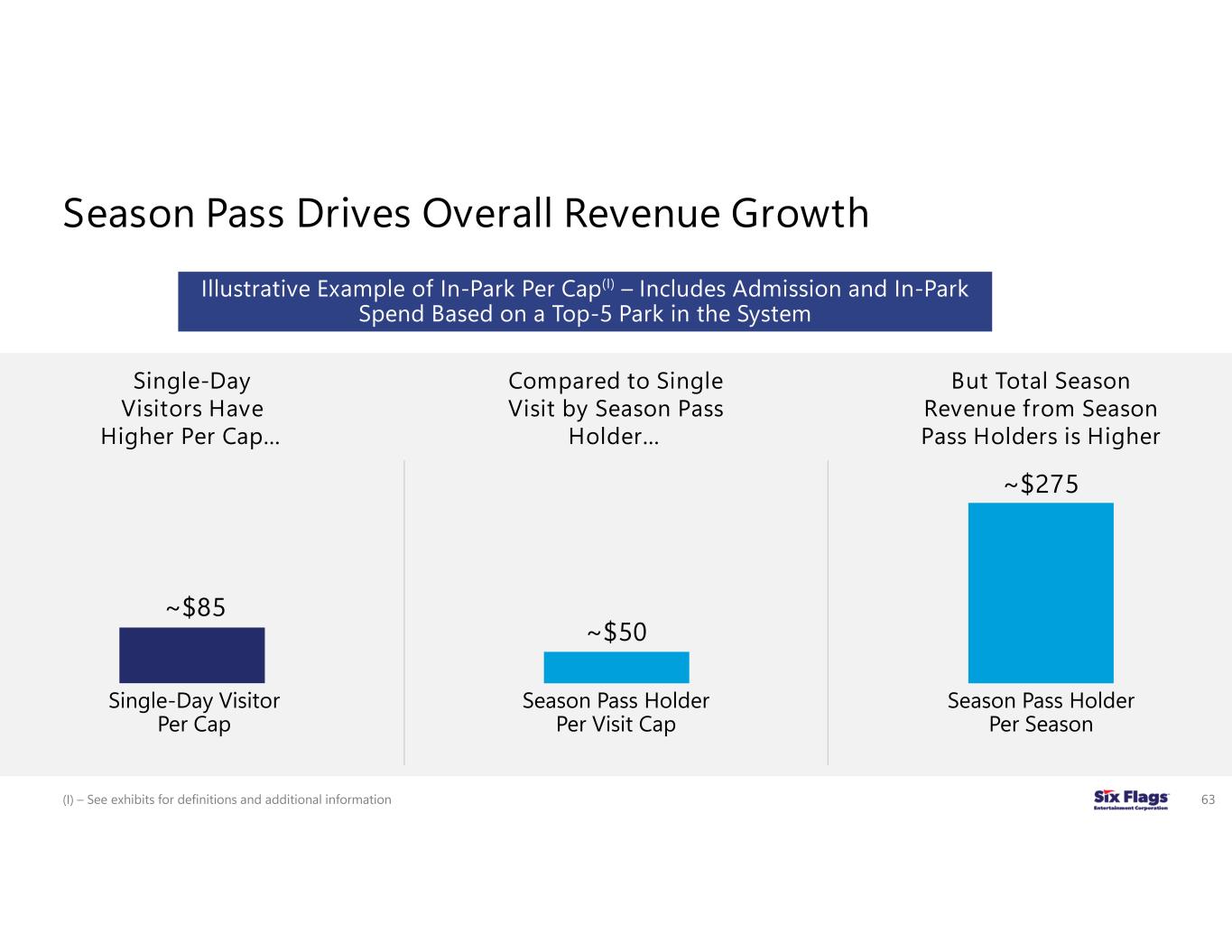

Season Pass Drives Overall Revenue Growth 63 Illustrative Example of In-Park Per Cap(I) – Includes Admission and In-Park Spend Based on a Top-5 Park in the System ~$85 ~$50 ~$275 Single-Day Visitor Per Cap Season Pass Holder Per Visit Cap Single-Day Visitors Have Higher Per Cap… Compared to Single Visit by Season Pass Holder… But Total Season Revenue from Season Pass Holders is Higher Season Pass Holder Per Season (I) – See exhibits for definitions and additional information

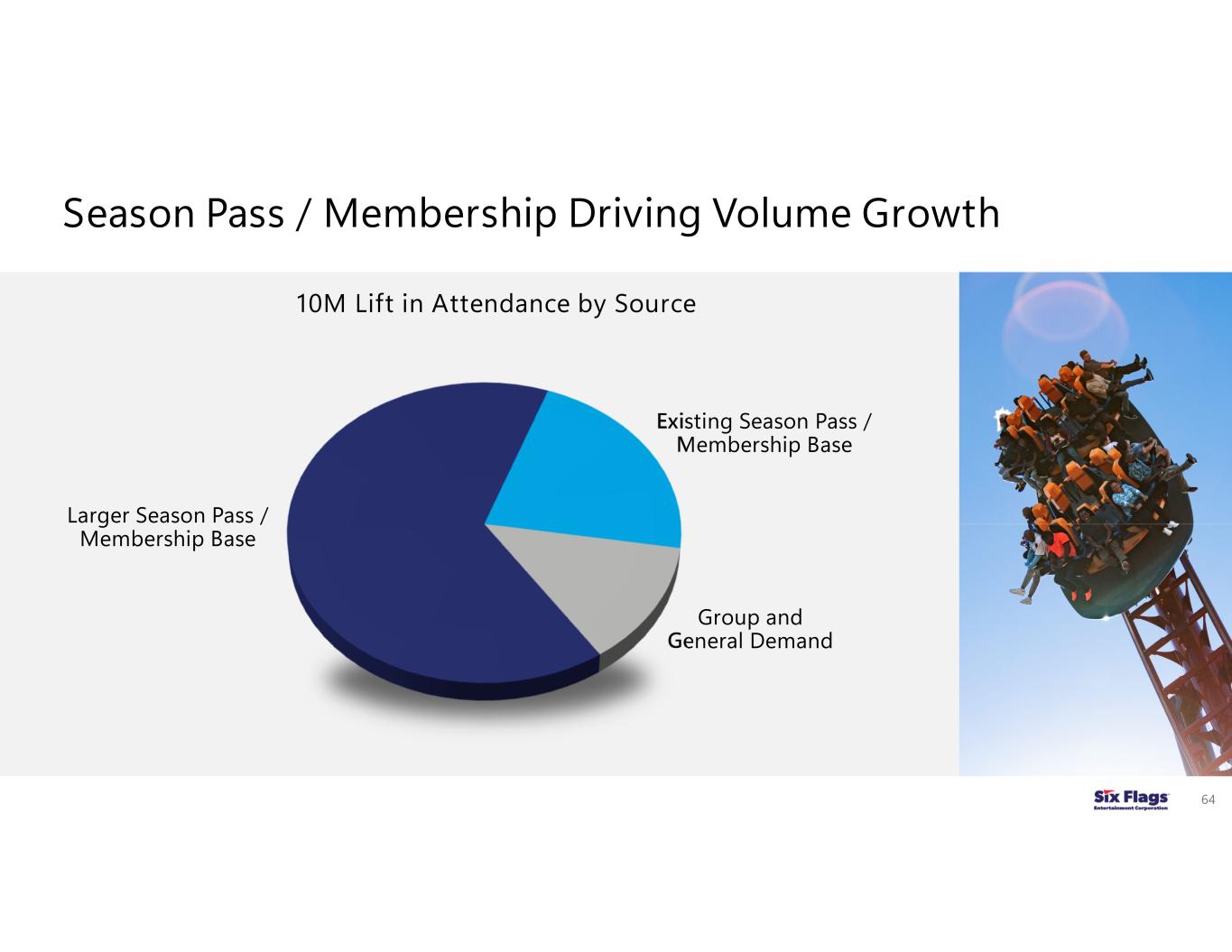

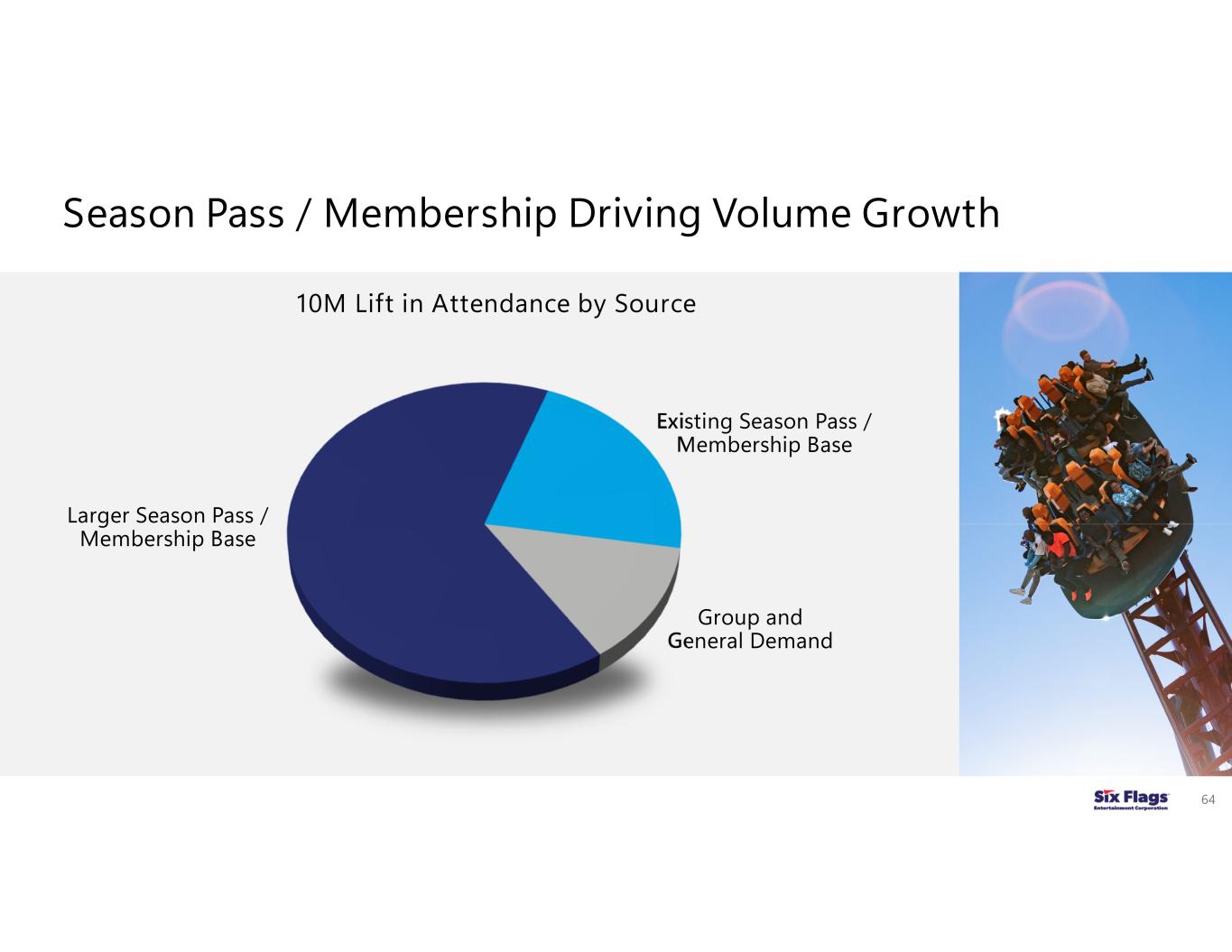

Season Pass / Membership Driving Volume Growth 64 10M Lift in Attendance by Source Group and General Demand Existing Season Pass / Membership Base Larger Season Pass / Membership Base

Agenda: Driving Sustainable Profitability and Higher Shareholder Returns 65 Proven business model Growing predictable revenue Focused on margin expansion Path to net leverage reduction Clear roadmap to value creation

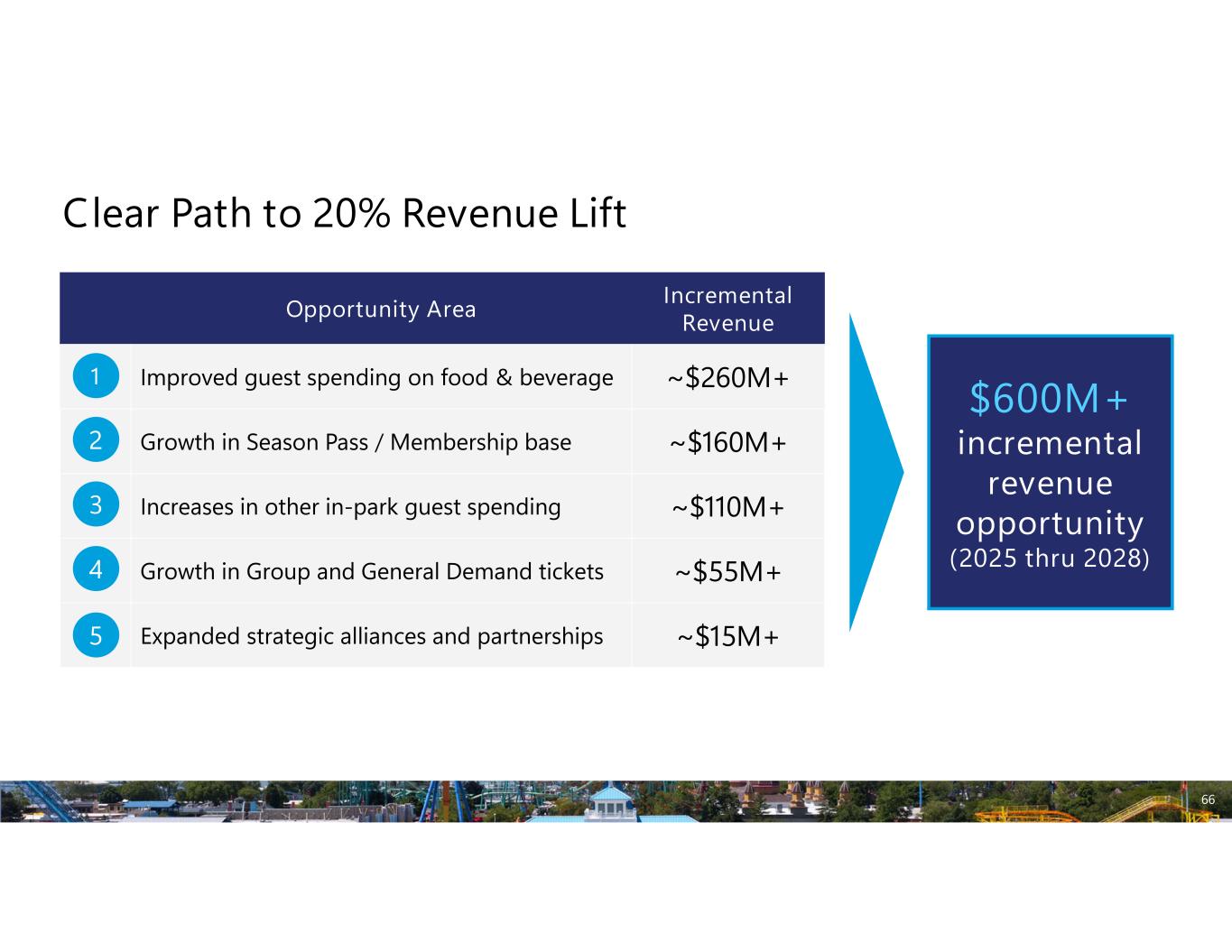

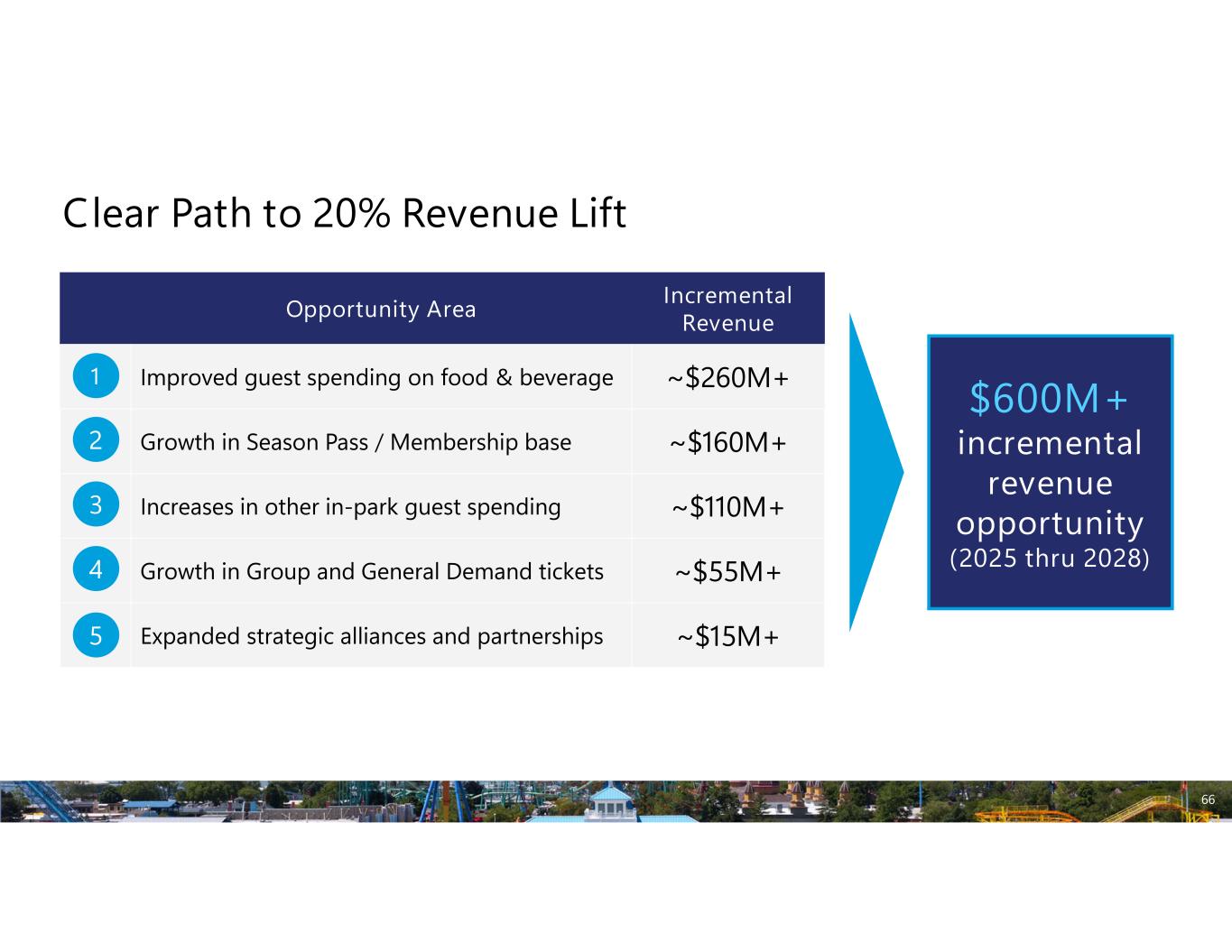

Clear Path to 20% Revenue Lift 66 Incremental Revenue Opportunity Area ~$260M+ Improved guest spending on food & beverage ~$160M+ Growth in Season Pass / Membership base ~$110M+ Increases in other in-park guest spending ~$55M+ Growth in Group and General Demand tickets ~$15M+ Expanded strategic alliances and partnerships 1 2 3 4 5 $600M+ incremental revenue opportunity (2025 thru 2028)

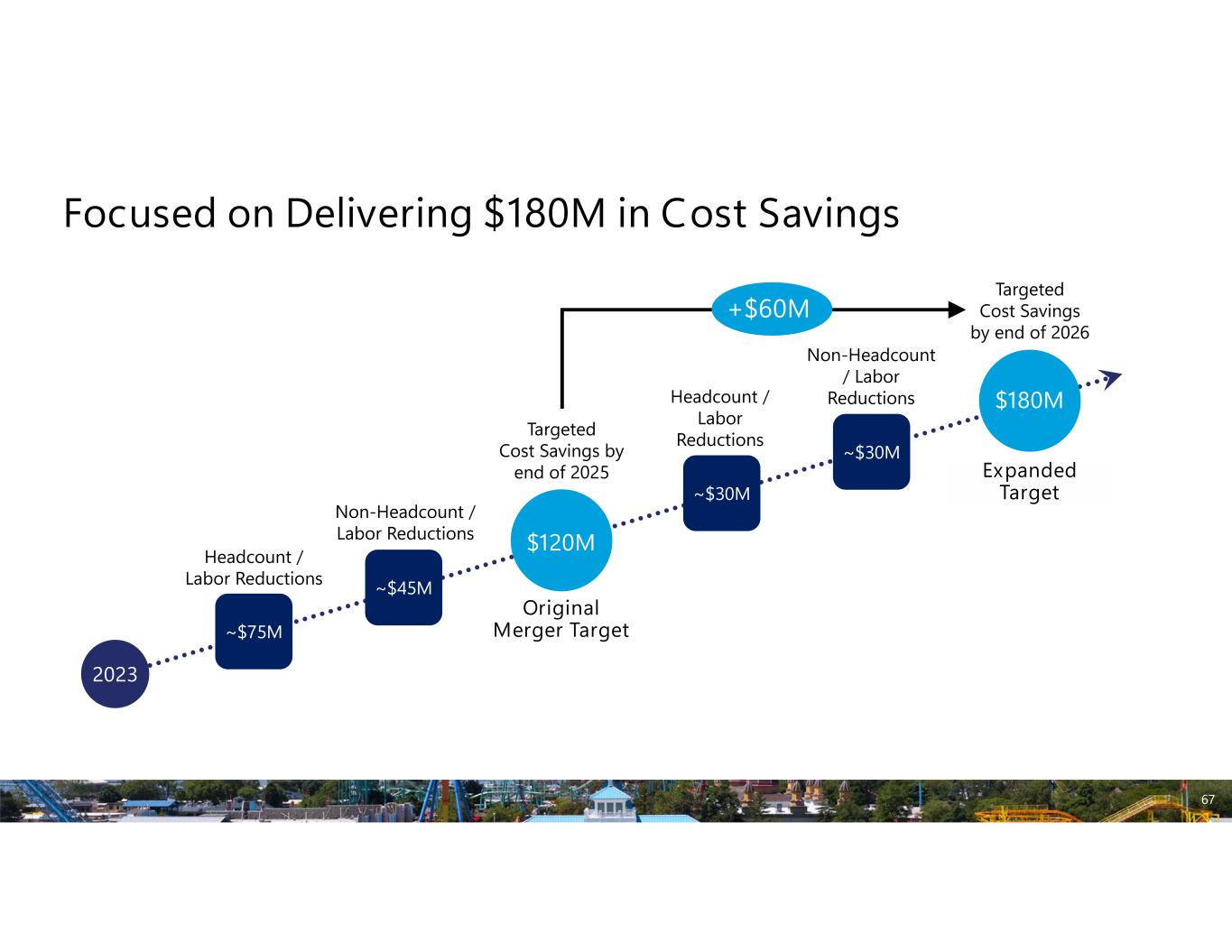

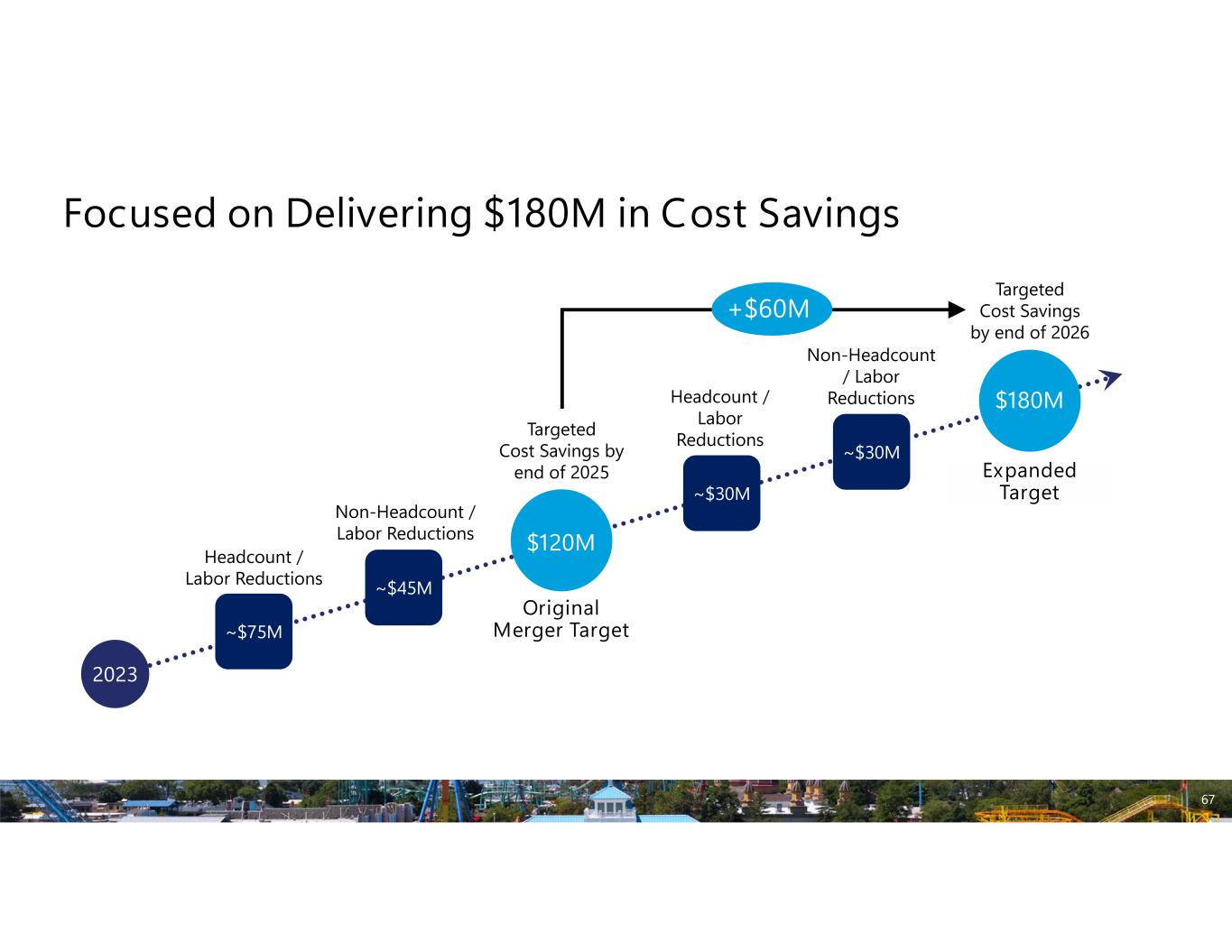

Focused on Delivering $180M in Cost Savings 67 Headcount / Labor Reductions $120M ~$45M Targeted Cost Savings by end of 2025 Non-Headcount / Labor Reductions ~$75M Headcount / Labor Reductions ~$30M Non-Headcount / Labor Reductions ~$30M $180M Original Merger Target Expanded Target Targeted Cost Savings by end of 2026 +$60M 2023

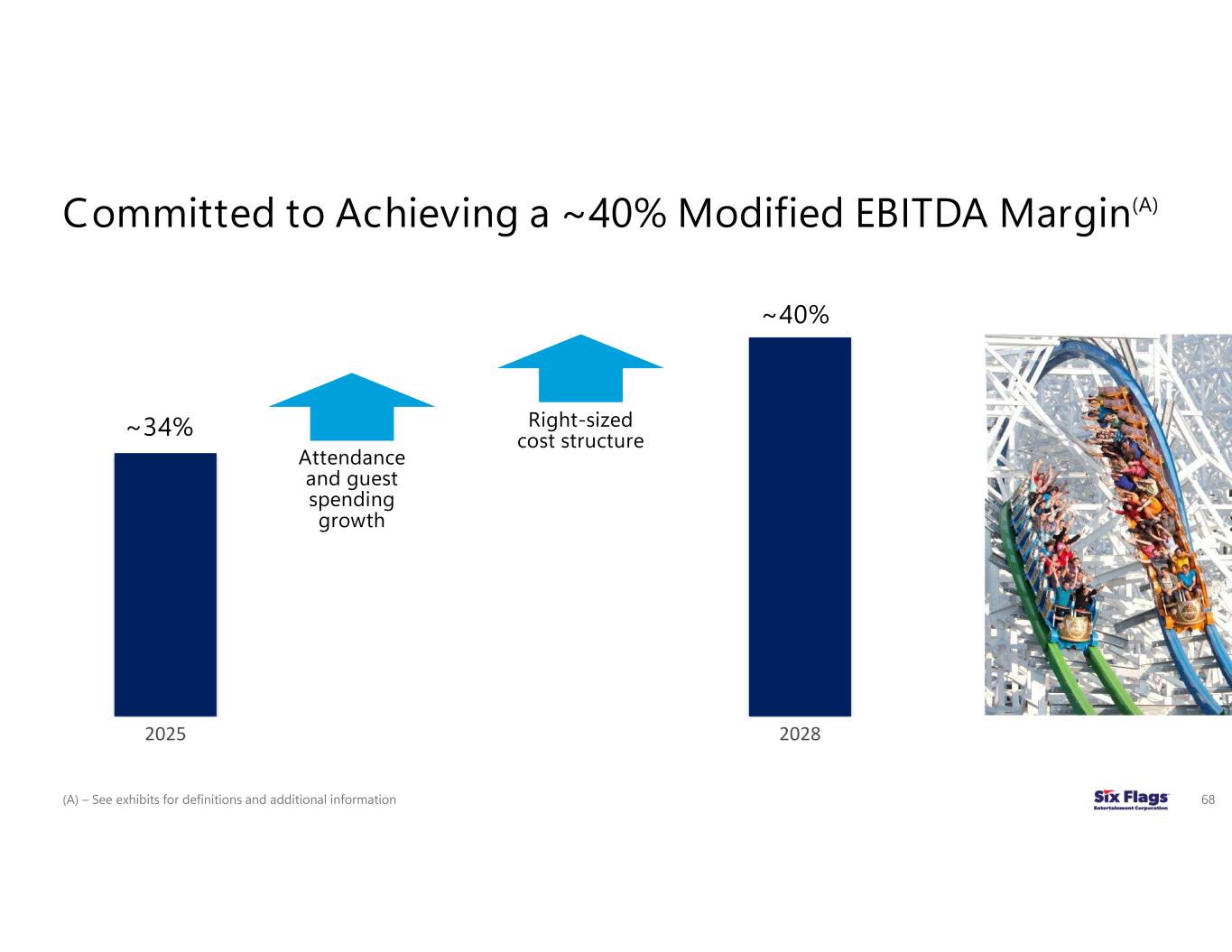

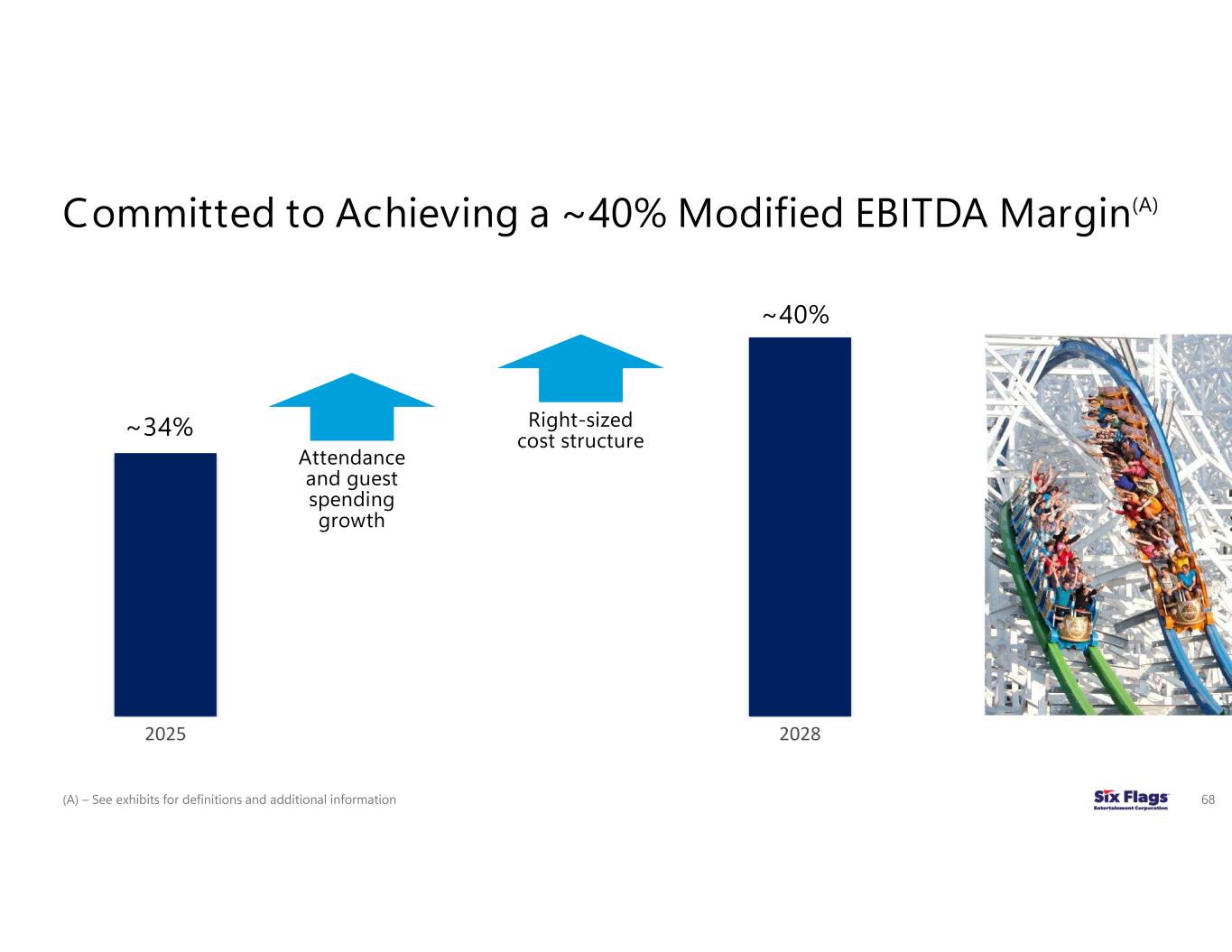

Committed to Achieving a ~40% Modified EBITDA Margin(A) (A) – See exhibits for definitions and additional information 68 2025 2028 ~40% ~34% Attendance and guest spending growth Right-sized cost structure

Agenda: Driving Sustainable Profitability and Higher Shareholder Returns 69 Proven business model Growing predictable revenue Focused on margin expansion Path to net leverage reduction Clear roadmap to value creation

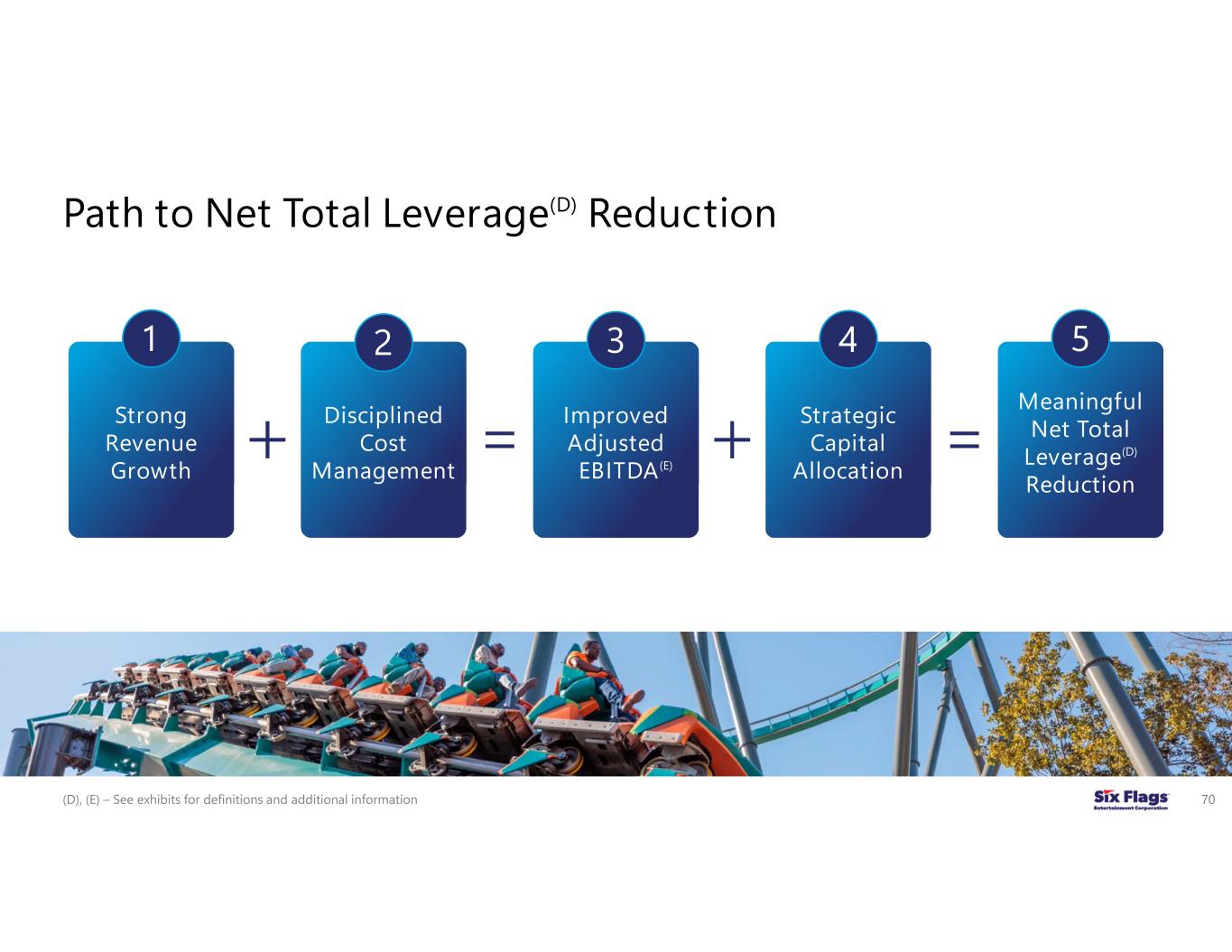

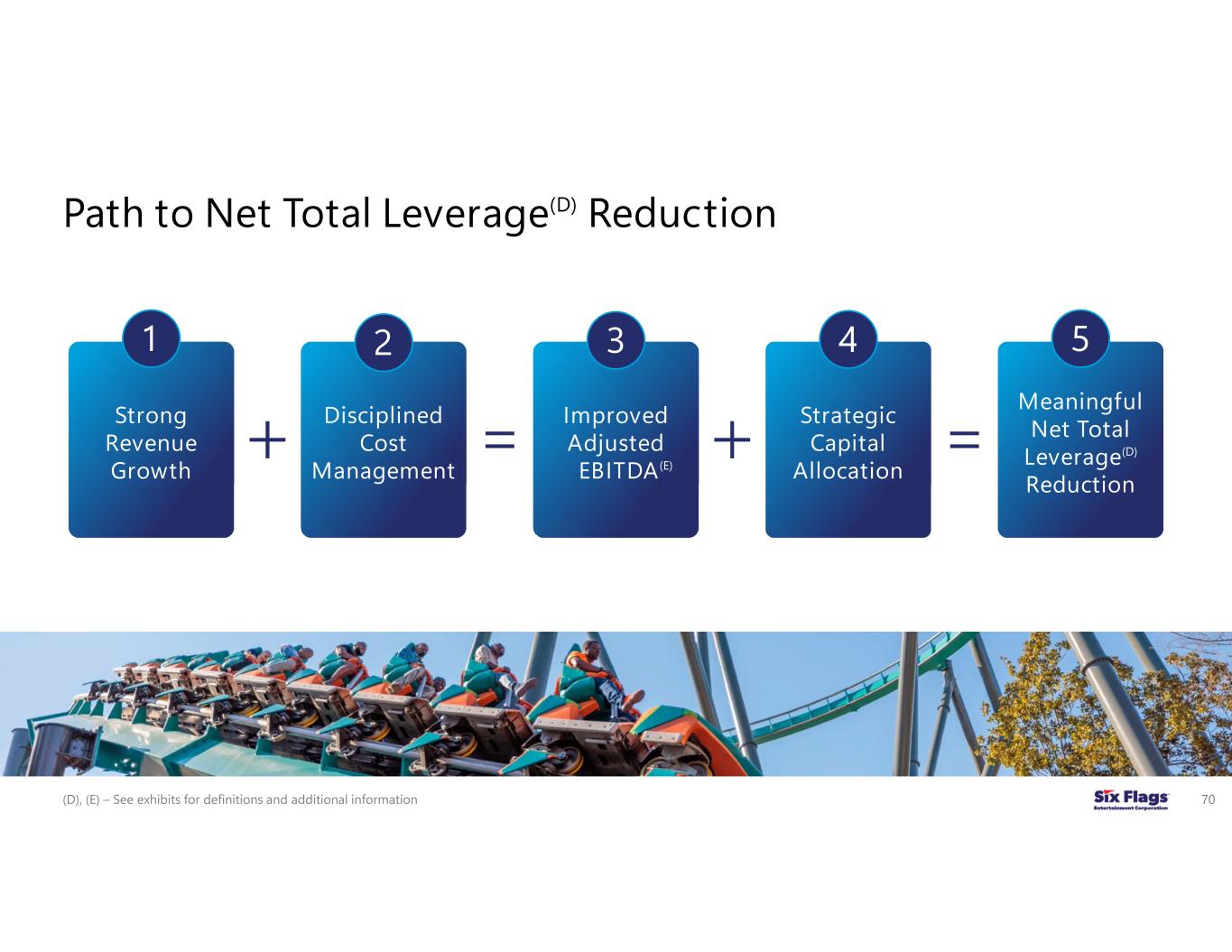

Path to Net Total Leverage(D) Reduction 70 Strong Revenue Growth Disciplined Cost Management Improved Adjusted EBITDA(E) Strategic Capital Allocation Meaningful Net Total Leverage(D) Reduction 1 2 4 5 3 (D), (E) – See exhibits for definitions and additional information

~$3.2B ~$3.8B Expand attendance Grow in-park revenue ~6% CAGR 2025(H) 2028 Strong Revenue Growth – Key Drivers 71 1 (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals

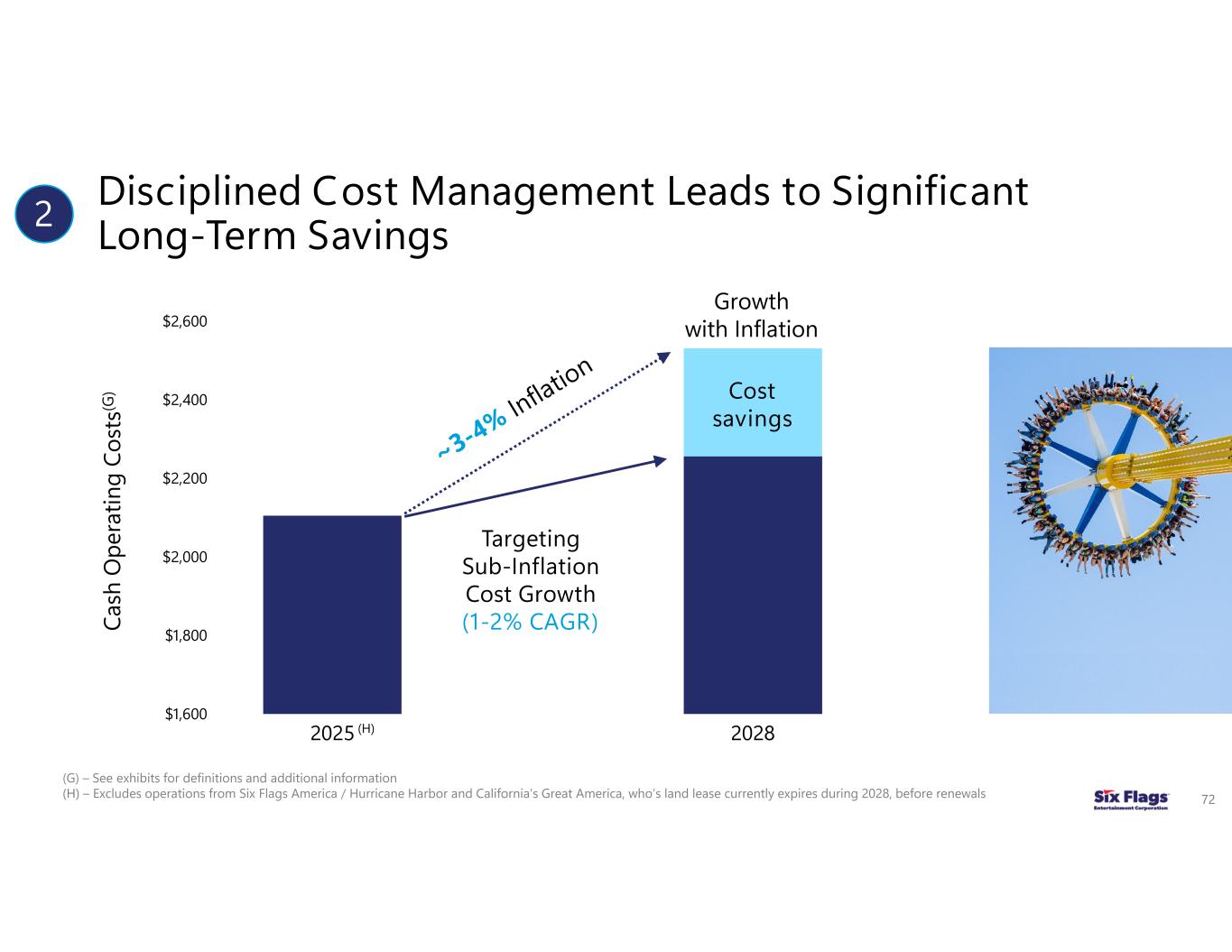

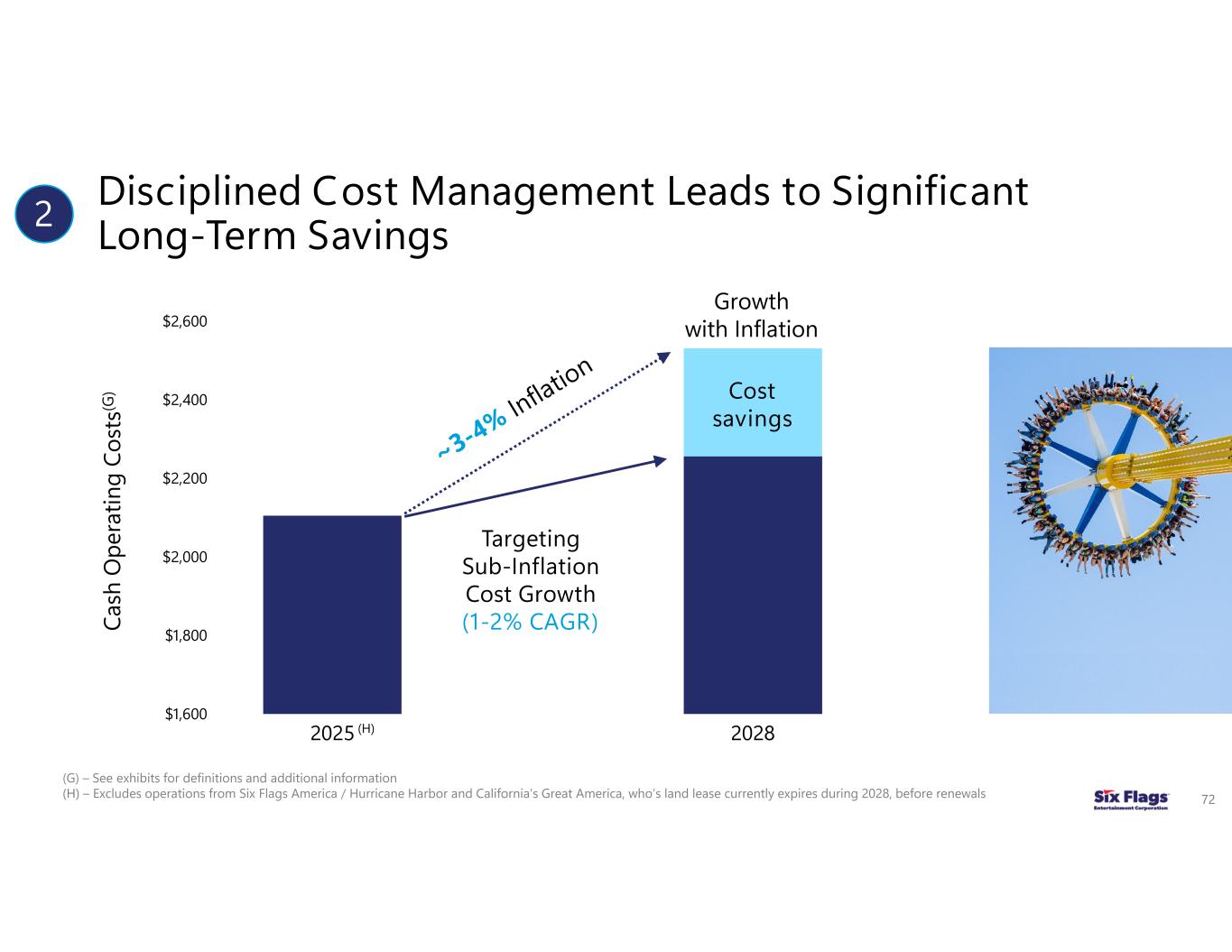

Disciplined Cost Management Leads to Significant Long-Term Savings (G) – See exhibits for definitions and additional information (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals 72 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 2025 2028 Targeting Sub-Inflation Cost Growth (1-2% CAGR) Growth with Inflation Cost savings (H) Ca sh O pe ra tin g Co st s(G ) 2

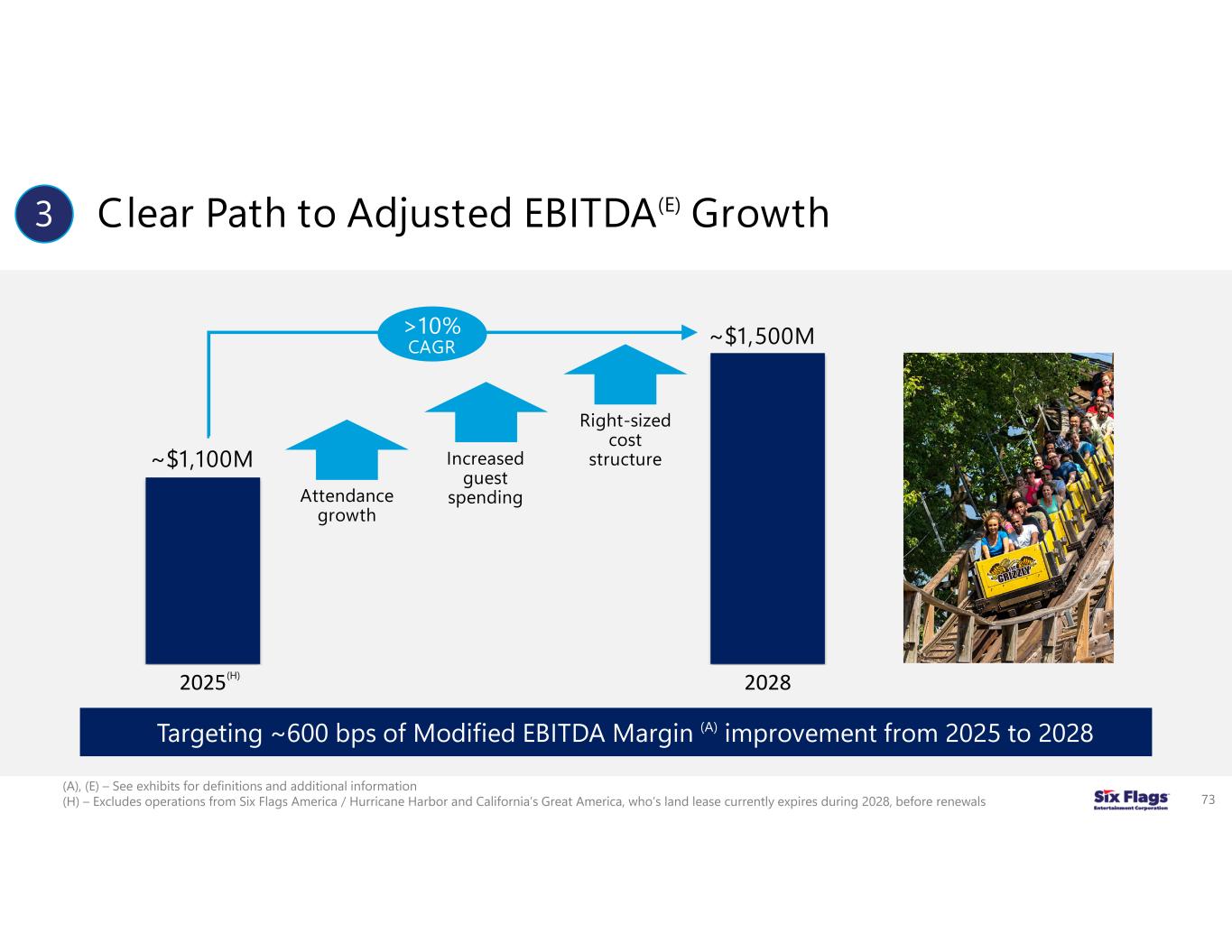

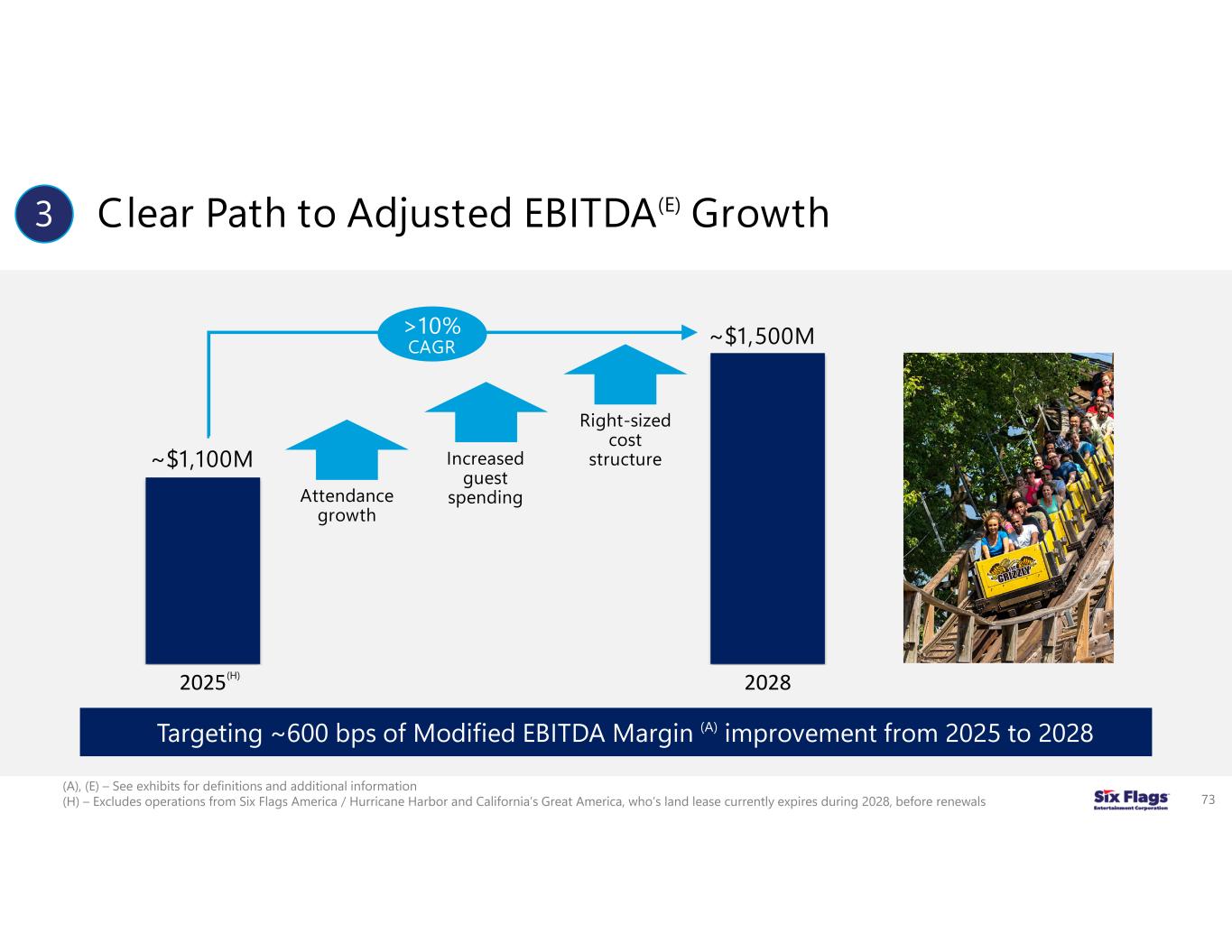

Clear Path to Adjusted EBITDA(E) Growth 73 2025 2028 ~$1,500M ~$1,100M Targeting ~600 bps of Modified EBITDA Margin (A) improvement from 2025 to 2028 Attendance growth Right-sized cost structure Increased guest spending >10% CAGR (H) (A), (E) – See exhibits for definitions and additional information (H) – Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals 3

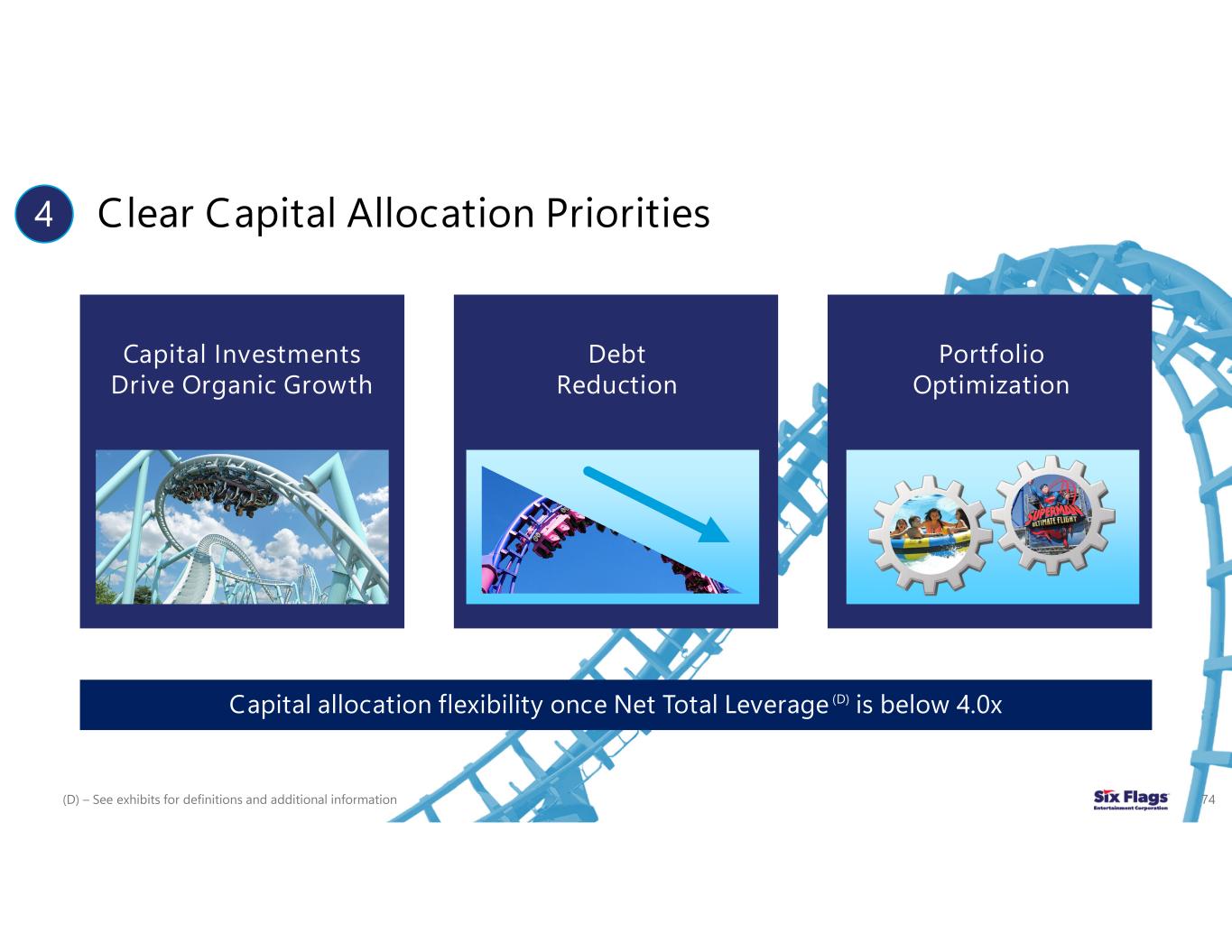

Clear Capital Allocation Priorities (D) – See exhibits for definitions and additional information 74 Capital Investments Drive Organic Growth Portfolio Optimization Debt Reduction Capital allocation flexibility once Net Total Leverage (D) is below 4.0x 4

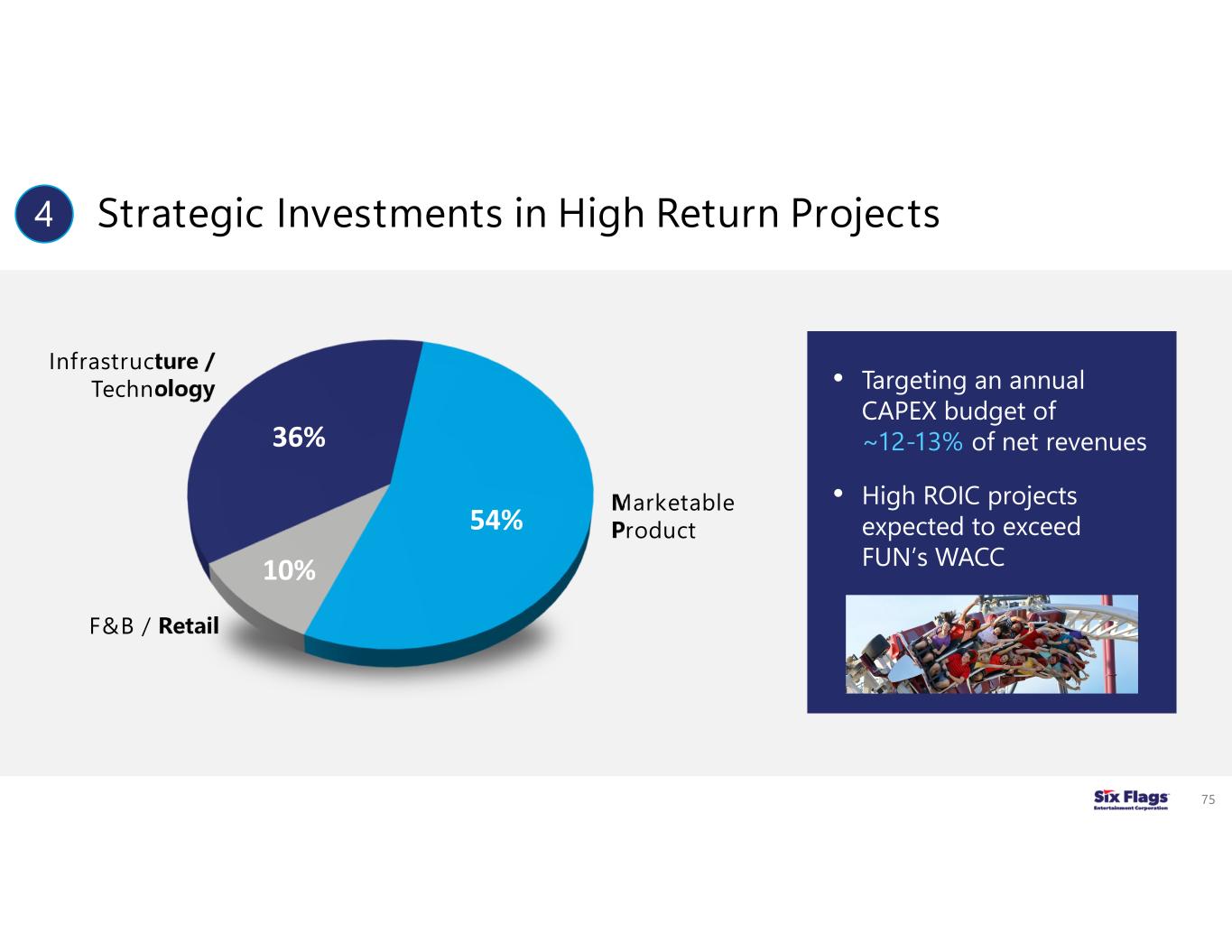

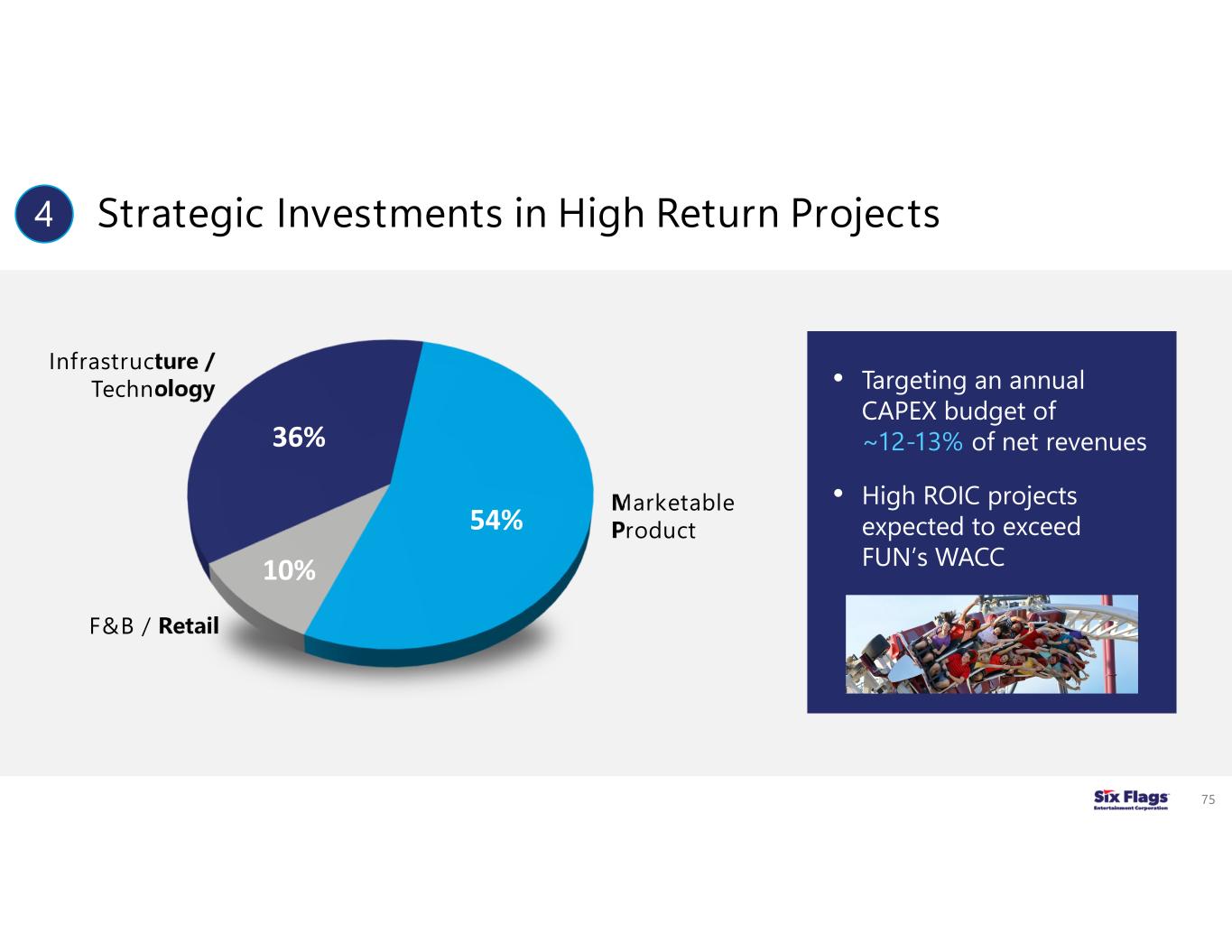

Strategic Investments in High Return Projects 75 Marketable Product Infrastructure / Technology F&B / Retail 54% 10% 36% • Targeting an annual CAPEX budget of ~12-13% of net revenues • High ROIC projects expected to exceed FUN’s WACC 4

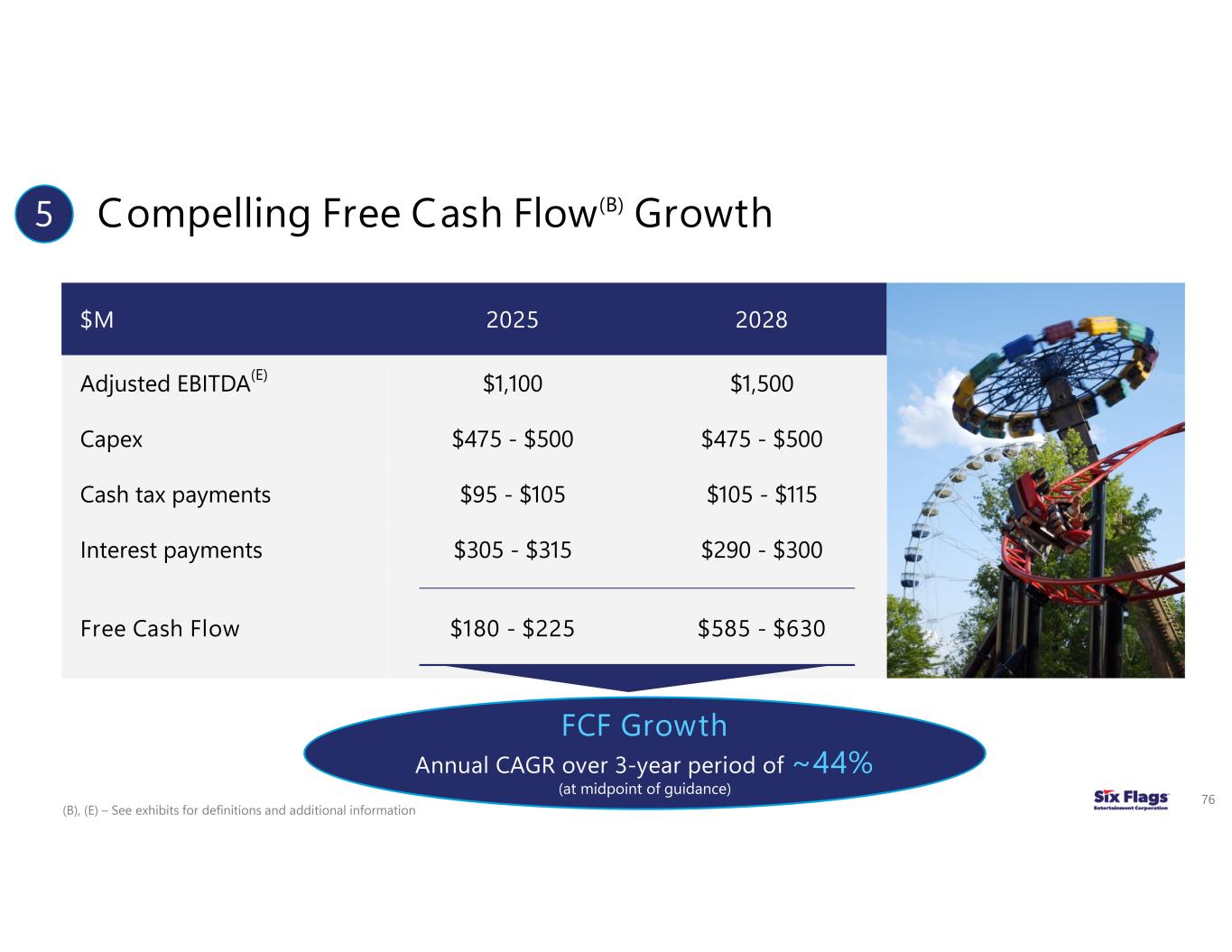

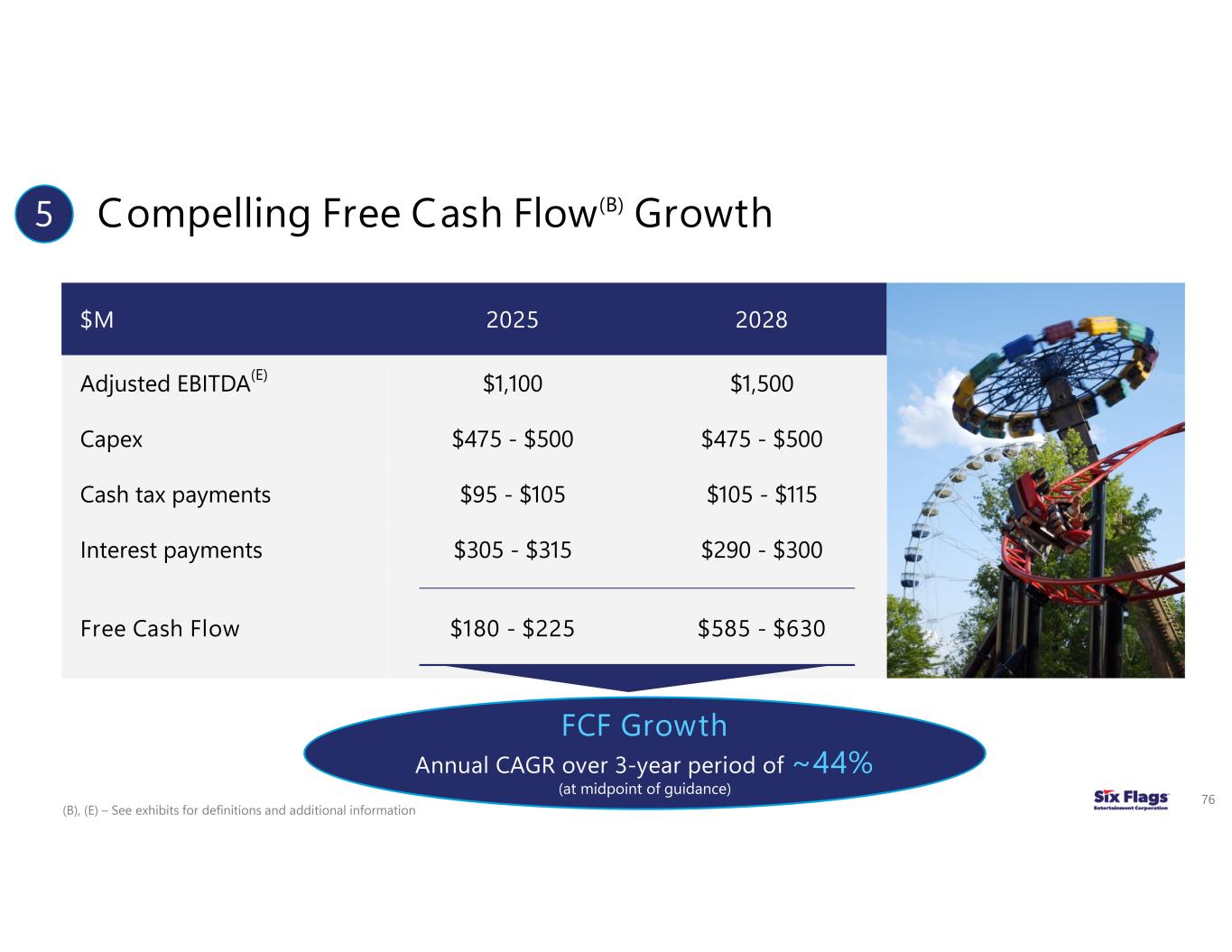

Compelling Free Cash Flow(B) Growth 76 2028 2025 $M $1,500 $1,100 Adjusted EBITDA(E) $475 - $500 $475 - $500 Capex $105 - $115 $95 - $105 Cash tax payments $290 - $300 $305 - $315 Interest payments $585 - $630 $180 - $225 Free Cash Flow 5 FCF Growth Annual CAGR over 3-year period of ~44% (at midpoint of guidance) (B), (E) – See exhibits for definitions and additional information

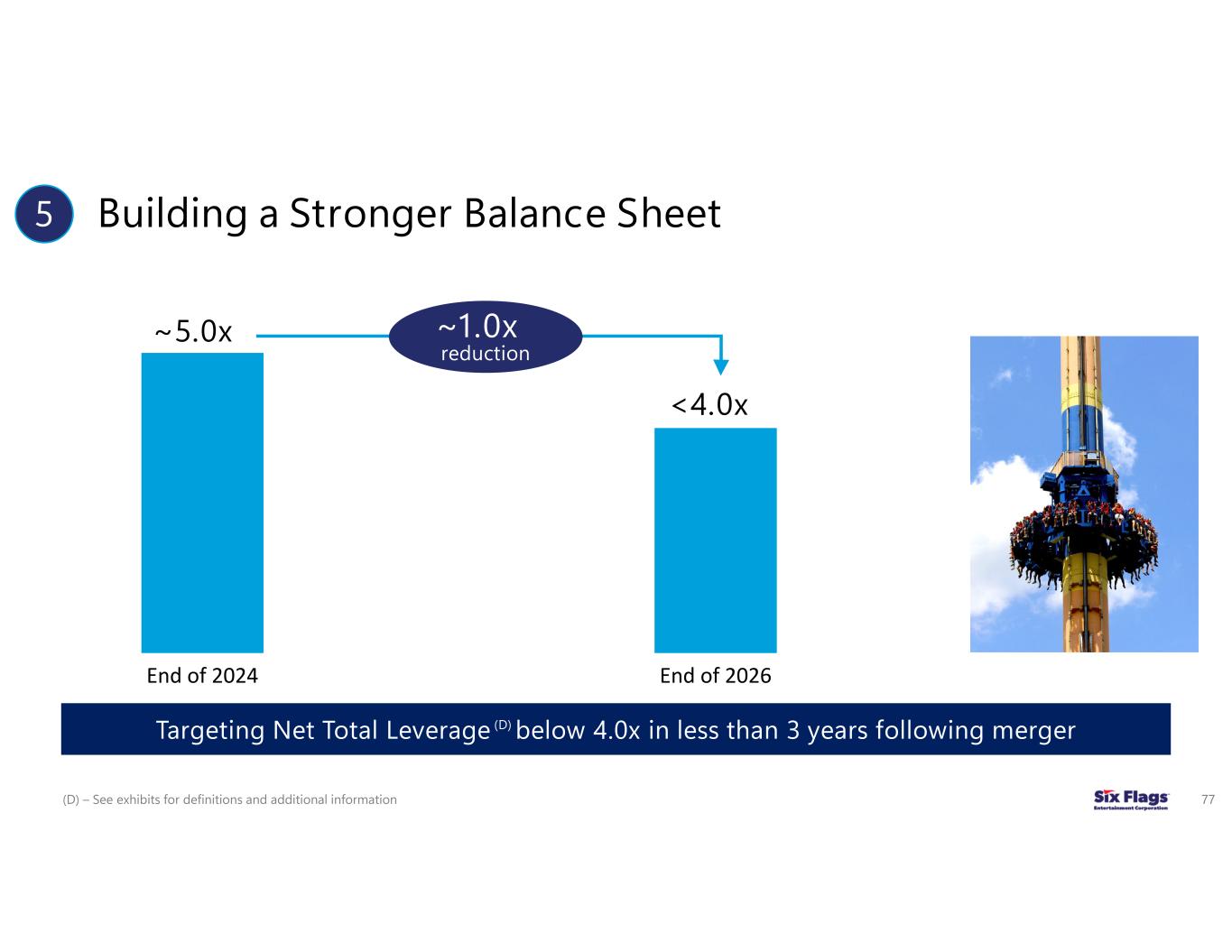

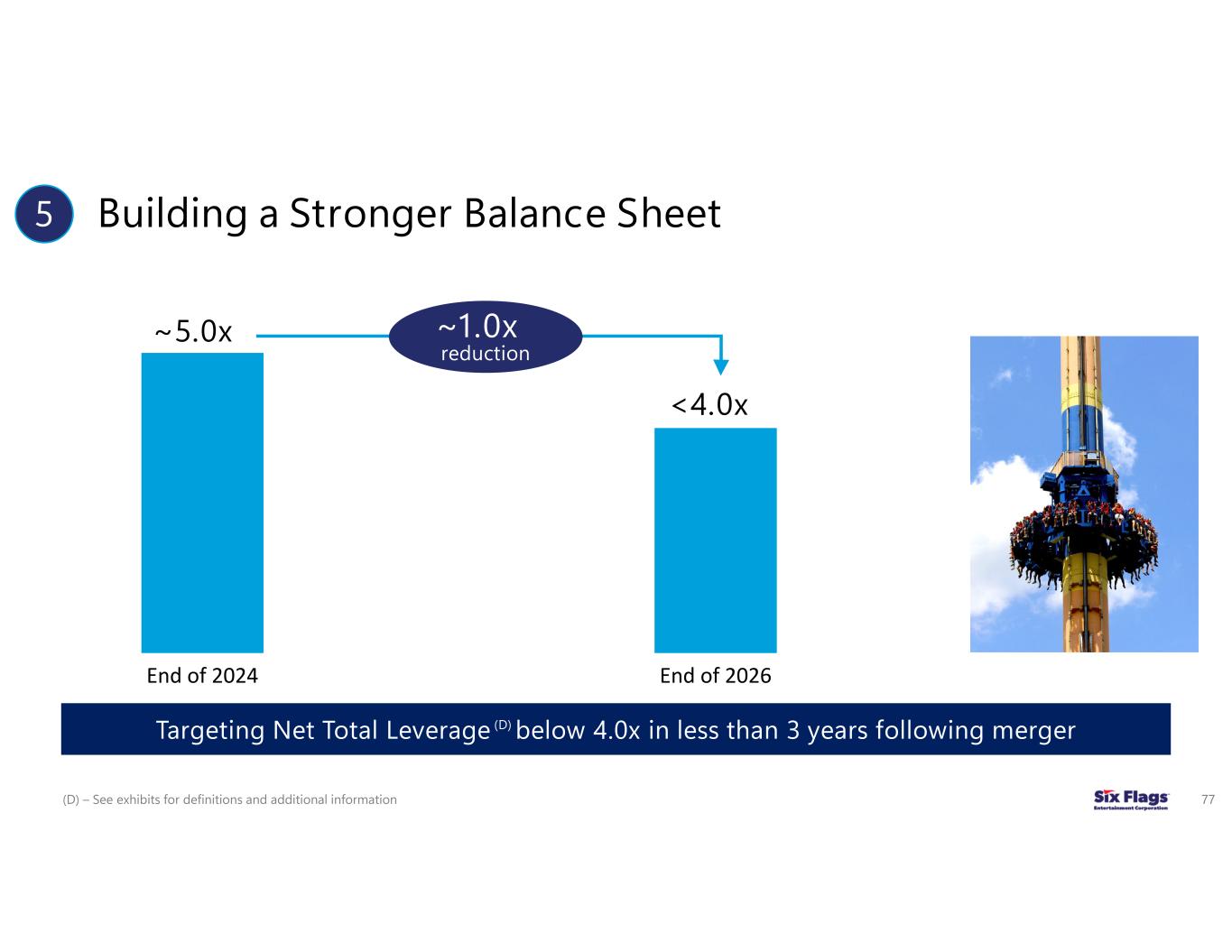

Building a Stronger Balance Sheet 77 End of 2024 End of 2026 ~5.0x <4.0x ~1.0x reduction Targeting Net Total Leverage (D) below 4.0x in less than 3 years following merger 5 (D) – See exhibits for definitions and additional information

Agenda: Driving Sustainable Profitability and Higher Shareholder Returns 78 Proven business model Growing predictable revenue Focused on margin expansion Path to net leverage reduction Clear roadmap to value creation

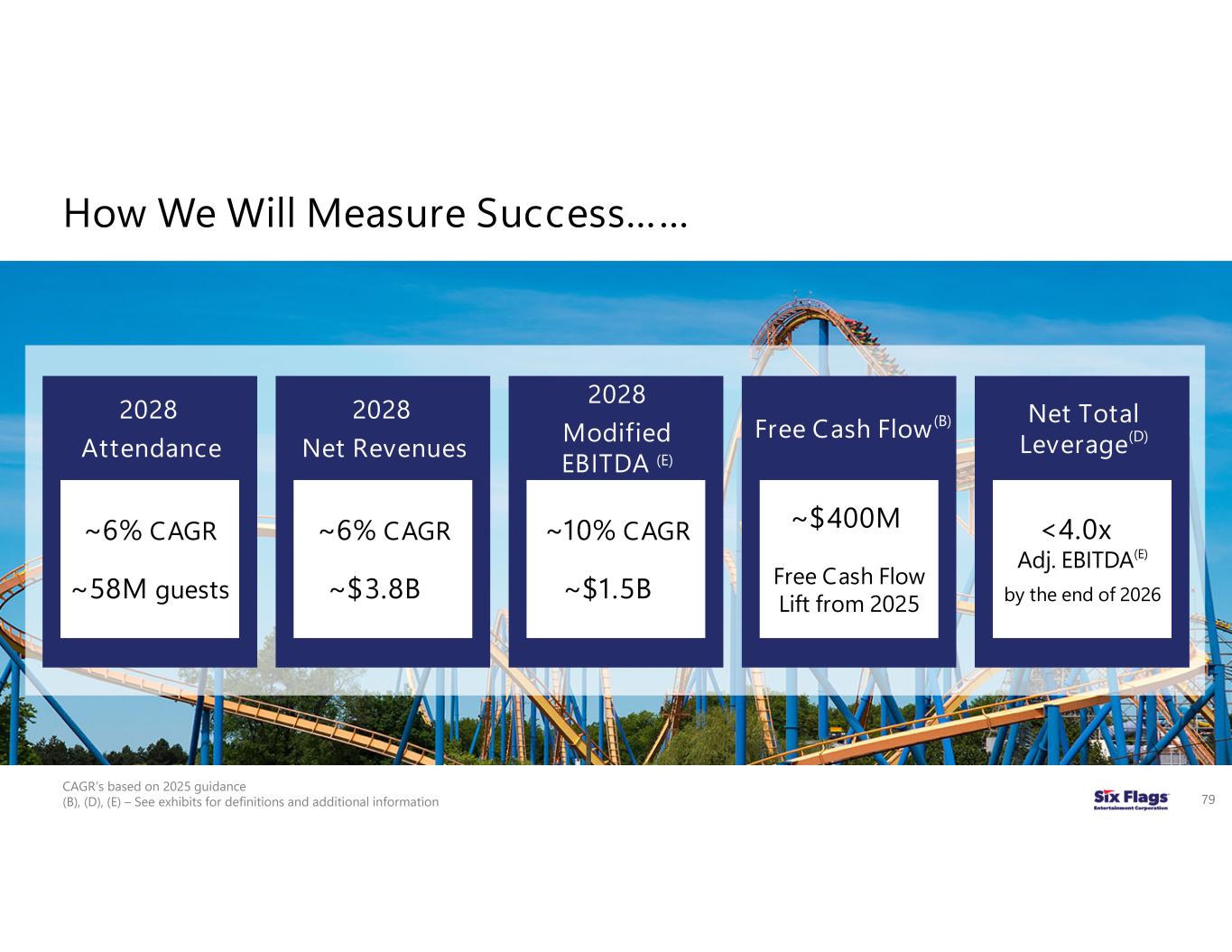

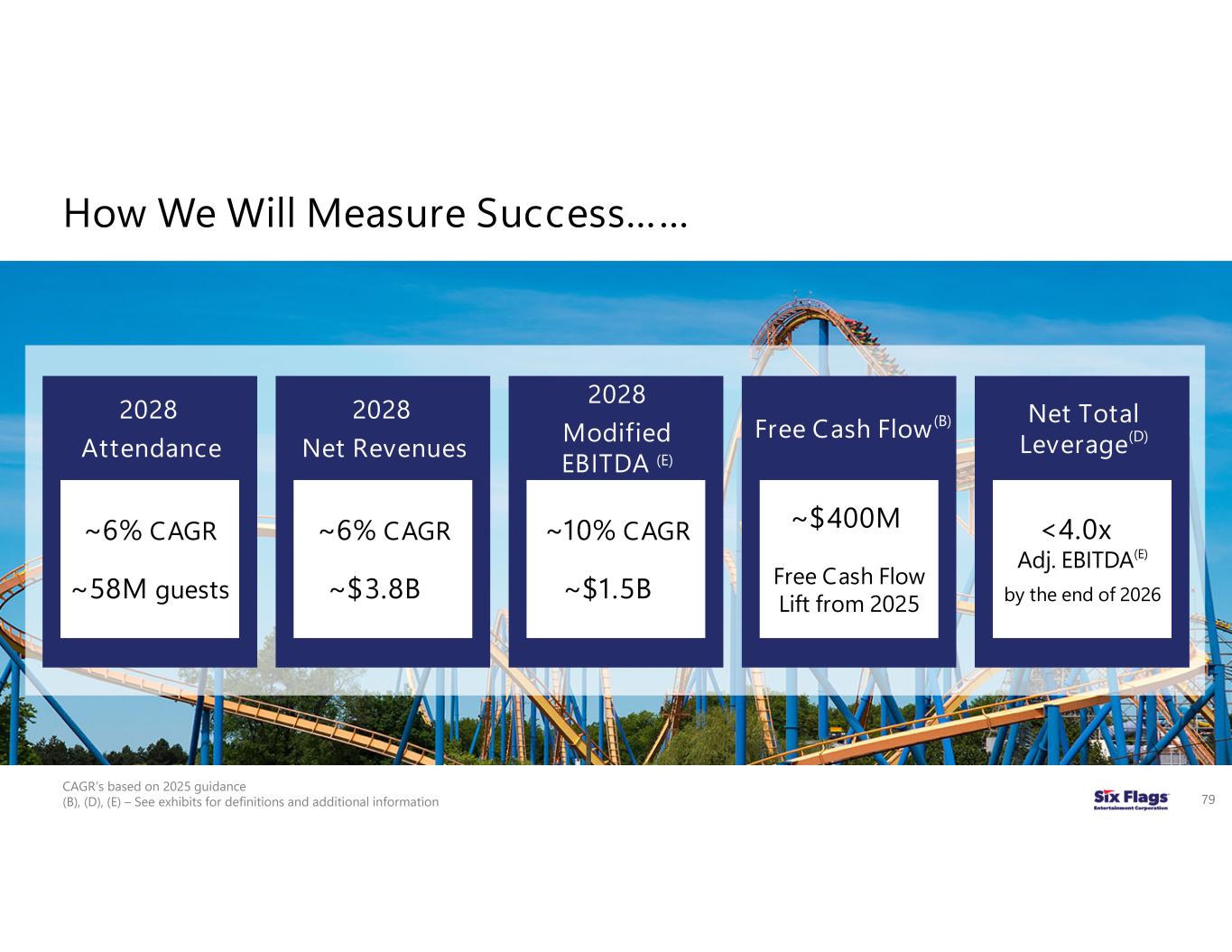

How We Will Measure Success…… 79 2028 Net Revenues 2028 Modified EBITDA (E) Free Cash Flow(B) Net Total Leverage(D) 2028 Attendance ~6% CAGR ~58M guests ~6% CAGR ~$3.8B ~10% CAGR ~$1.5B ~$400M Free Cash Flow Lift from 2025 <4.0x Adj. EBITDA(E) by the end of 2026 CAGR’s based on 2025 guidance (B), (D), (E) – See exhibits for definitions and additional information

I N S U M M A R Y : Here’s What Success Looks Like 80 Achieving 10M lift in annual attendance Leveraging demand to drive admissions pricing Growing in-park guest spending Capturing $180M in cost savings and flattening the cost curve Optimizing allocation of free cash flow to reduce net leverage

Q&A 81

Thank you for joining us for our 2025 Investor Day. We hope you found it informative. Your feedback is important to us, so we would appreciate it if you could fill out a quick survey - it should take only 2-3 minutes. The answers are all anonymous. This survey will be online for the next 5 days so we ask you to please complete it as soon as possible as we will then tabulate the results and share with our management team. Here is the link to the survey https://forms.office.com/Pages/ResponsePage.aspx?id=rWvxNGyyQ0iX-dYkZqj0wW_6ZFaq- IBAsfP9FsyV-4RUQzJNSVNMVzNZNDMzUDQ1MzBQRUdWSE02Mi4u Or use this QR code Thank you Feedback on Today’s Event 82

Richard Zimmerman, CEO Final Comments 83

I N S U M M A R Y : W H A T Y O U H A V E H E A R D T O D A Y What’s Different at Six Flags; Everything That Matters 1 Six Flags is Different Now 2 Strategies for Success 3 Unmatched growth opportunities, execution on track 4 Clear Roadmap Ahead Unlocking the Full Value of the New Six Flags 84 • World’s largest regional amusement park company • Clear path to 10M visit recovery • Reinventing guest satisfaction • Compelling CAPEX driving growth • $180M of cost savings by end of 2026 • Revenues strengthening • Robust 2028 targets set • Net Total Leverage priority <4.0x

Thank You 85

Exhibits 86 A. Modified EBITDA Margin is calculated as Modified EBITDA divided by net revenues. See Footnote E for additional information regarding Modified EBITDA, including how we define and use the measure. Modified EBITDA margin is not a measurement computed in accordance with generally accepted accounting principles ("GAAP") and may not be comparable to similarly titled measures of other companies. Modified EBITDA margin is provided because management believes the measure provides a meaningful metric of operating profitability. Modified EBITDA margin has been disclosed as opposed to Adjusted EBITDA margin because management believes Modified EBITDA margin more accurately reflects the park-level operations as it does not give effect to distributions to non-controlling interests. We are not providing a quantitative reconciliation of forward-looking Modified EBITDA Margin targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Modified EBITDA targets or guidance (a primary component of Modified EBITDA Margin) with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under our credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results. B. Free Cash Flow is calculated as Adjusted EBITDA less capital expenditures, cash payments for interest and cash payments for income taxes. See Footnote E for additional information regarding Adjusted EBITDA, including how we define and use the measure. Free Cash Flow is not a measurement computed in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Free Cash Flow is provided because management believes this measure provides a meaningful metric of liquidity. We are not providing a quantitative reconciliation of forward-looking Free Cash Flow targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Adjusted EBITDA targets or guidance (a primary component of Free Cash Flow) with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under our credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results. C. Combined Attendance and Combined Net Revenues are calculated as legacy Cedar Fair plus legacy Six Flags without adjustments for all periods prior to 2024. For 2024, Combined Attendance and Combined Net Revenues are calculated as legacy Six Flags without adjustments through June 30, 2024 plus our results as previously filed with the Securities and Exchange Commission ("SEC") from January 1, 2024 through December 31, 2024. The legacy Cedar Fair and legacy Six Flags financial information was prepared using the accounting policies, classifications and key performance metrics for the legacy companies and are not directly comparable. The Six Flags Merger was accounted for as a business combination under Accounting Standards Codification 805, Business Combinations, using the acquisition method of accounting, and Cedar Fair was determined to be the accounting acquirer and the predecessor for financial statement purposes. Accordingly, 2024 financial results and disclosures as previously filed with the SEC reflect combined operations for only July 1, 2024, through December 31, 2024, and include only Cedar Fair's results before giving effect to the Mergers for the first six months of 2024. Combined Attendance and Combined Net Revenues are for informational purposes only and are not necessarily indicative of the consolidated results of operations of the combined business had the merger between legacy Cedar Fair and legacy Six Flags actually occurred prior to the periods presented.

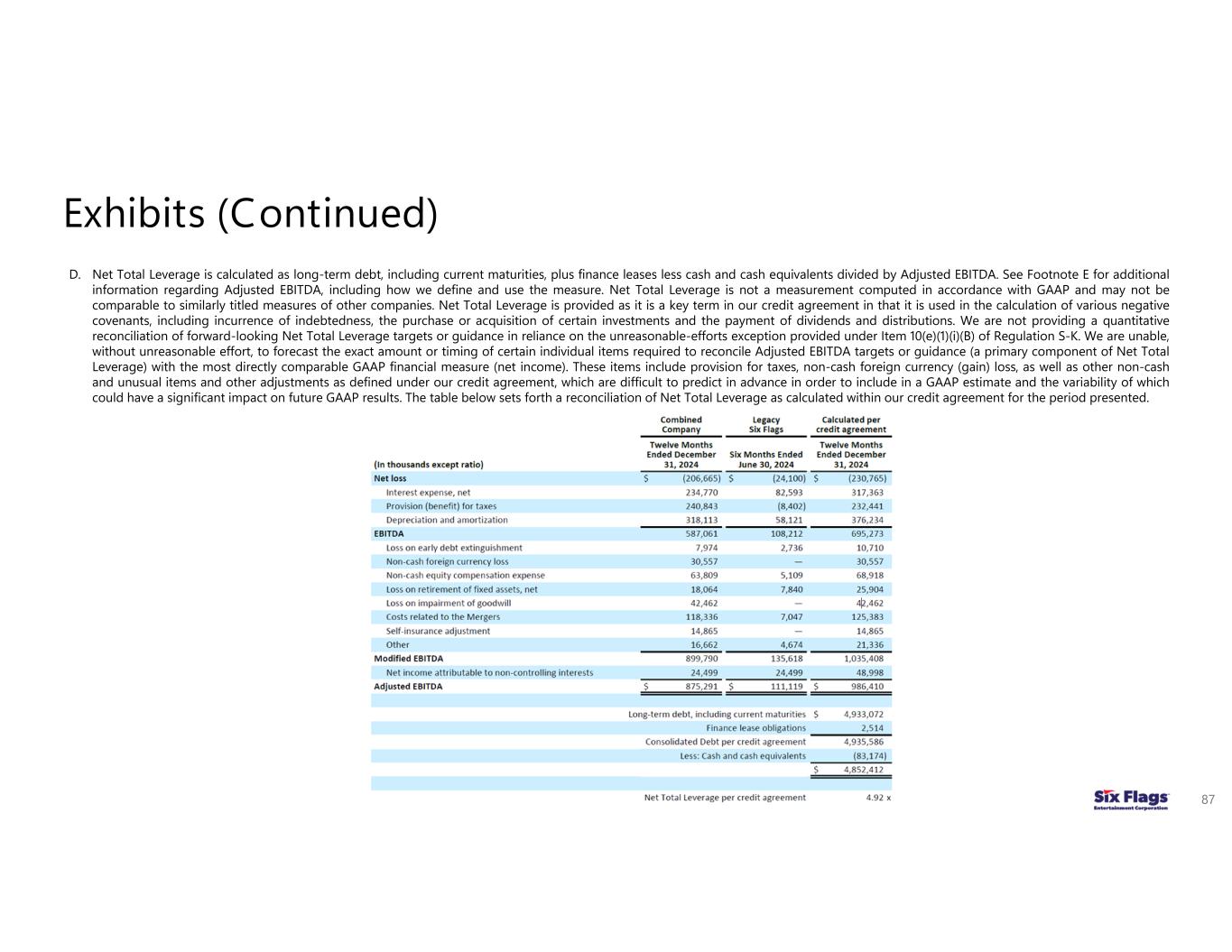

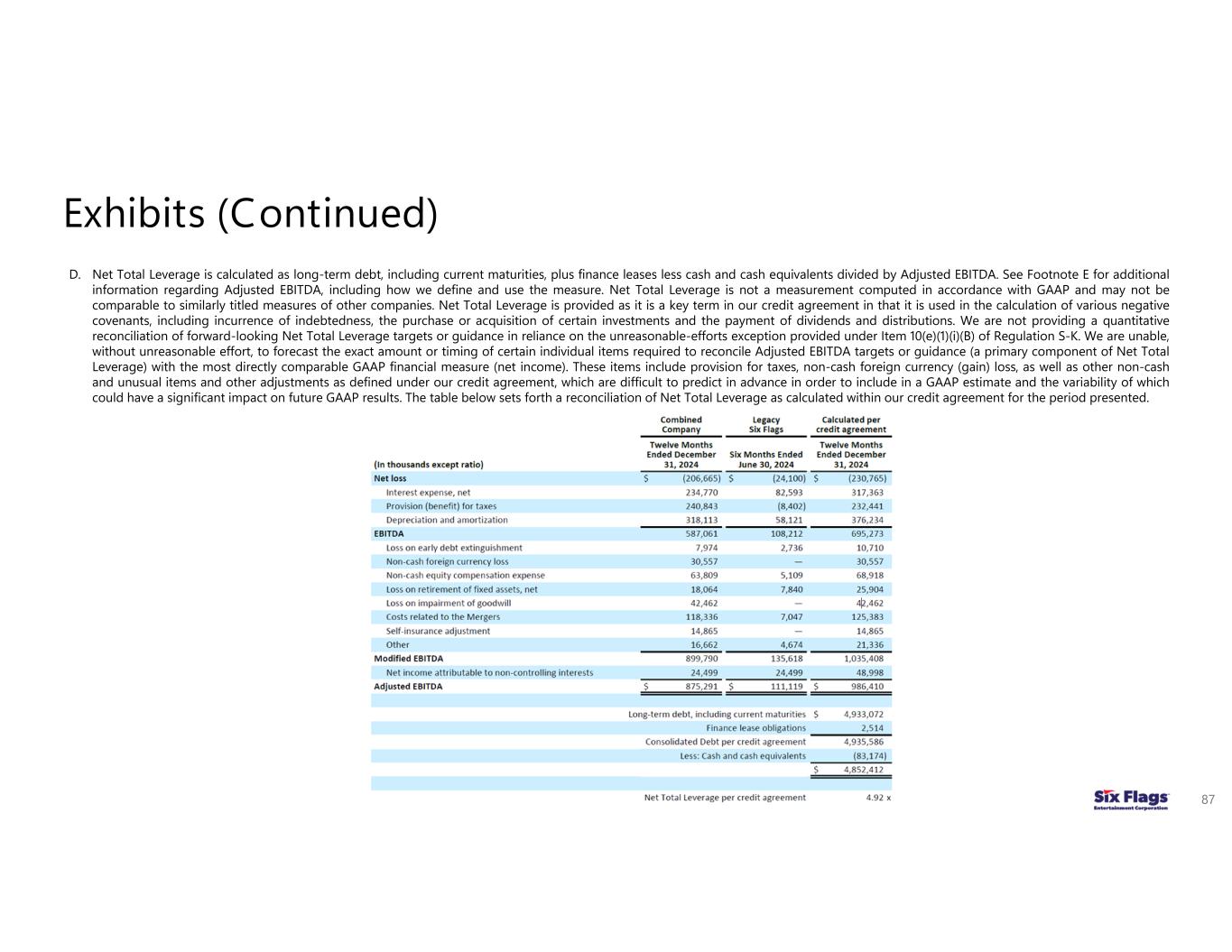

Exhibits (Continued) 87 D. Net Total Leverage is calculated as long-term debt, including current maturities, plus finance leases less cash and cash equivalents divided by Adjusted EBITDA. See Footnote E for additional information regarding Adjusted EBITDA, including how we define and use the measure. Net Total Leverage is not a measurement computed in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Net Total Leverage is provided as it is a key term in our credit agreement in that it is used in the calculation of various negative covenants, including incurrence of indebtedness, the purchase or acquisition of certain investments and the payment of dividends and distributions. We are not providing a quantitative reconciliation of forward-looking Net Total Leverage targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Adjusted EBITDA targets or guidance (a primary component of Net Total Leverage) with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under our credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results. The table below sets forth a reconciliation of Net Total Leverage as calculated within our credit agreement for the period presented.

Exhibits (Continued) 88 E. Modified EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in our credit agreement. Adjusted EBITDA represents Modified EBITDA less net income attributable to non-controlling interests. Adjusted EBITDA and Modified EBITDA are both included to disclose the effect of non-controlling interests. Prior to the Mergers, legacy Cedar Fair did not have net income attributable to non-controlling interests. Modified EBITDA and Adjusted EBITDA are not measurements of operating performance computed in accordance with GAAP and should not be considered as a substitute for operating income, net income or cash flows from operating activities computed in accordance with GAAP. Management believes Modified EBITDA and Adjusted EBITDA are meaningful measures of park-level operating profitability, and uses them for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA is widely used by analysts, investors and comparable companies in the industry to evaluate operating performance on a consistent basis, as well as more easily compare results with those of other companies in the industry. These measures are provided as supplemental measures of our operating results and may not be comparable to similarly titled measures of other companies. We are not providing a quantitative reconciliation of forward-looking Modified EBITDA and Adjusted EBITDA targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Modified EBITDA and Adjusted EBITDA targets or guidance with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under our credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results. F. Cash-on-cash ROI is calculated as the variance in Adjusted EBITDA attributable to a capital expenditure project divided by the cost of that capital expenditure project. See Footnote E for additional information regarding Adjusted EBITDA, including how we define and use the measure. Cash-on-cash ROI is not a measurement computed in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Cash-on-cash ROI is provided because management believes the measure provides a meaningful metric of cash flow generated by capital investments. G. Cash operating costs are calculated as net revenues less Adjusted EBITDA. See Footnote E for additional information regarding Adjusted EBITDA, including how we define and use the measure. Cash operating costs is not a measurement computed in accordance with GAAP and may not be comparable to similarly titled measures of other companies. Cash operating costs are provided because management believes the measure provides a meaningful metric of operating profitability. We are not providing a quantitative reconciliation of forward-looking cash operating cost targets or guidance in reliance on the unreasonable-efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. We are unable, without unreasonable effort, to forecast the exact amount or timing of certain individual items required to reconcile Adjusted EBITDA targets or guidance (a primary component of cash operating costs) with the most directly comparable GAAP financial measure (net income). These items include provision for taxes, non-cash foreign currency (gain) loss, as well as other non-cash and unusual items and other adjustments as defined under our credit agreement, which are difficult to predict in advance in order to include in a GAAP estimate and the variability of which could have a significant impact on future GAAP results. H. Excludes operations from Six Flags America / Hurricane Harbor and California’s Great America, who’s land lease currently expires during 2028, before renewals. I. In-park per capita spending is calculated as revenues generated within the amusement parks and separately gated outdoor water parks along with related parking revenues and online transaction fees charged to customers (in-park revenues), divided by total attendance. In-park revenues and in-park per capita spending are non-GAAP measures as they exclude concessionaire remittance. These metrics are used by management as major factors in significant operational decisions as they are primary drivers of financial and operational performance, measuring demand, pricing, and consumer behavior.