Logistic Properties of the Americas Third Quarter 2025 Supplemental Information LPA Parque Logístico Calle 80 – Bogota, Colombia LPA Parque Logístico Calle 80 – Bogota, ColombiaLPA Parque ogístico San Jo é Verbena –San Jose, Costa Ric

Disclaimer This presentation (the “Presentation”) is provided for informational purposes only and has been prepared to provide interested parties with certain information about Logistic Properties of the Americas and its subsidiaries (collectively, “LPA”) and for no other purpose. This Presentation is not a prospectus, product disclosure statement or any other offering or disclosure document under any other law. The information contained herein is of a general background nature and does not purport to be exhaustive, all-inclusive or complete. This Presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase, any equity, debt or other financial instruments of LPA. No such offering of equity or debt securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom. No representations or warranties, express or implied are given in, or in respect of, the accuracy or completeness of this Presentation or any other information (whether written or oral) that has been or will be provided to you. To the fullest extent permitted by law, LPA disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or omitted from this Presentation and such liability is expressly disclaimed. The viewer of this Presentation agrees that it shall not seek to sue or otherwise hold LPA or any of its respective directors, officers, employees, affiliates, agents, advisors or representatives liable in any respect for the provision of this Presentation, the information contained in this Presentation, or the omission of any information from this Presentation. Viewers of this Presentation should each make their own evaluation of LPA and of the relevance and adequacy of the information provided in this Presentation and should make such other investigations as they deem necessary before making an investment decision. Nothing herein should be construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning anything described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Forward-Looking Statements This Presentation contains certain forward-looking information which may not be included in future public filings or investor guidance. The inclusion of forward-looking financial information or metrics in this Presentation should not be construed as a commitment by LPA to provide guidance on such information in the future. Certain statements in this Presentation may be considered forward-looking statements. Forward-looking statements include, without limitation, statements about future events or LPA’s future financial or operating performance. For example, statements regarding anticipated growth in the industry in which LPA operates and anticipated growth in demand for LPA’s products and solutions, the anticipated size of LPA’s addressable market and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. These forward-looking statements regarding future events and the future results of LPA are based on current expectations, estimates, forecasts, and projections about the industry in which LPA operates, as well as the beliefs and assumptions of LPA’s management. These forward-looking statements are only predictions and are subject to known and unknown risks, uncertainties, assumptions and other factors beyond LPA’s control that are difficult to predict because they relate to events and depend on circumstances that will occur in the future. They are neither statements of historical fact nor promises or guarantees of future performance. Therefore, LPA’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements and LPA therefore cautions against relying on any of these forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by LPA and its management, are inherently uncertain and are inherently subject to risks variability and contingencies, many of which are beyond LPA’s control. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the possibility of any economic slowdown or downturn in real estate asset values or leasing activity or in the geographic markets where LPA operates; (ii) LPA’s ability to manage growth; (iii) LPA’s ability to continue to comply with applicable listing standards of the New York Stock Exchange (“NYSE”); (iv) changes in applicable laws, regulations, political and economic developments; (v) the possibility that LPA may be adversely affected by other economic, business and/or competitive factors; (vi) LPA’s estimates of expenses and profitability; (vii) the outcome of any legal proceedings that may be instituted against LPA and (viii) other risks and uncertainties set forth in the filings by LPA with the U.S. Securities and Exchange Commission (the “SEC”). There may be additional risks that LPA does not presently know or that LPA currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Any forward-looking statements made by or on behalf of LPA speak only as of the date they are made. Except as otherwise required by applicable law, LPA disclaims any obligation to publicly update or revise any forward-looking statements to reflect any changes in their respective expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. Accordingly, you should not place undue reliance on forward- looking statements due to their inherent uncertainty. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Industry and Market Data This Presentation also contains estimates and other statistical data made by independent parties which they believe to be reliable and by LPA relating to market size and growth and other data about LPA’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the future performance of the markets in which LPA operates are necessarily subject to a high degree of uncertainty and risk. LPA has not independently verified the accuracy or completeness of the independent parties’ information. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of such independent information. Trademarks LPA owns or has rights to various trademarks, service marks and trade names used is connection with the operation of its business. This Presentation may also contain trademarks, service marks, trade names and copyrights of other companies or third parties, which are the property of their respective owners. LPA’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM or symbols, but LPA will assert, to the fullest extent under applicable law, the rights of the applicable owners to these trademarks, service marks, trade names and copyrights. Financial Measures Certain financial information contained herein is unaudited and is based on internal records and/or estimates. The Presentation also contains unaudited alternative financial measures that are measures of financial performance not calculated in accordance with generally accepted accounting principles in the United States (or international financial reporting standards (“IFRS”)) and should not be considered as replacements or alternatives to net income or loss, cash flow from operations or other measures of operating performance or liquidity of LPA. These alternative financial measures should be viewed in addition to, and not as a substitute for, analysis of LPA’s results reported in accordance with IFRS or otherwise. Notwithstanding these limitations, and in conjunction with other accounting and financial information available, LPA’s management considers the alternative financial measures contained in this presentation (including EBITDA, EBITDA margin, Net Debt, Net Operating Income (NOI), NOI margin, Cash NOI, Same-Property NOI, Same-Property Cash NOI, Net debt to NOI and net debt to EBITDA ratio, Equity Value, FFO, and AFFO reasonable indicators for comparisons between LPA and LPA’s principal competitors on the market. These alternative financial measures are used by market participants for comparative analysis, albeit with certain limitations as analytical tools, of the results of businesses in the sector and as indicators of LPA’s capacity to generate cash flows. Nevertheless, alternative financial measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other companies. You should review LPA’s financial statements and additional information included in its filings with the SEC.

3 Development and construction(2) of properties in the land bank DEVELOPER Asset ownership on a long-term basis OWNER Leasing and management(3) of assets MANAGER Logistic Properties of the Americas is a leading developer, owner, acquirer and manager of logistic and industrial real estate of international quality in America. LPA is one of the few, internally managed, vertically-integrated and institutional platforms operating across the region(1). Acquisition of stabilized assets ACQUIRER Notes: (1) The Company considers that most real estate companies and funds in México, Costa Rica, Perú and Colombia do not focus exclusively on the industrial segment; instead, they have investments across multiple sectors, including retail, hospitality, and others, and often lack a regional presence. (2) Construction is outsourced to construction companies; (3) Relationship with tenants and administration of logistics parks.

4 Content Highlights • Company Profile ## • Company Performance 6 • Financial Summary 7 Financial Information • Condensed Consolidated Interim Balance Sheet 8 • Condensed Consolidated Interim Statement of Profit or Loss and Other Comprehensive Income (Loss) 10 • Reconciliation for Adjusted EBITDA, Adjusted EBITDA margin, FFO, AFFO, NOI and NOI margin 11 Operations Overview • Total Portfolio GLA 13 • Operating Portfolio – Period end Occupancy 14 • Rental Revenues 15 • Net Operating Income 16 • Average Rent per Square Foot 17 • Same Property NOI Growth 18 • Other Non-IFRS Metrics 19 Operations • Customer Concentration and Lease Expiration Analysis 20 • Investment Properties Portfolio 21 Capital Deployment • Stabilized Properties ## • Development Portfolio 22 • Land Portfolio 23 Capitalization • Debt Summary and Metrics 24 Definitions • Definitions 25

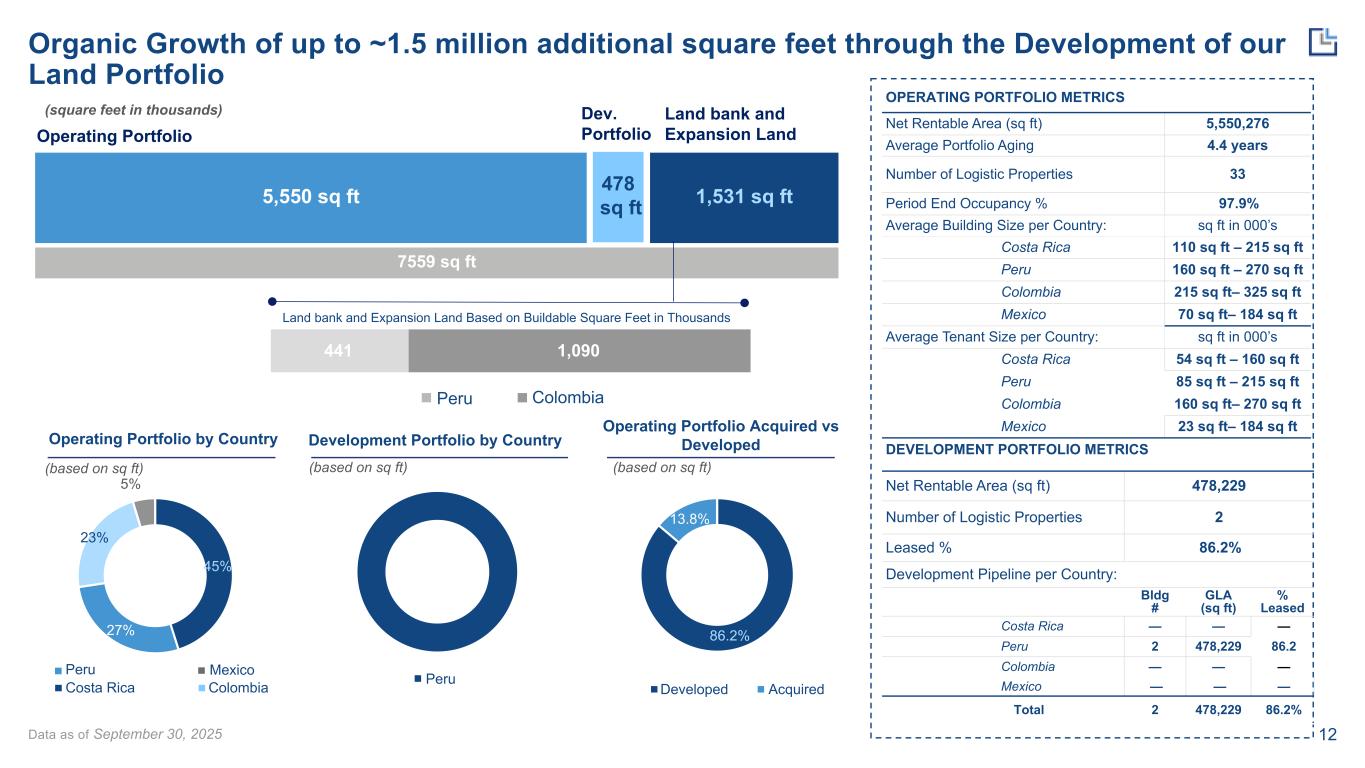

5 LIMA, PERU Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 1,521,047 478,229 19.0 BOGOTA, COLOMBIA Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 1,255,394 - 50.6 SAN JOSE, COSTA RICA Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 2,516,148 - - 7.6 mm sqft Gross Leasable Area(1) 80.5% US dollars-denominated Leases(3) 4.7 years Avg. remaining lease life(4) Current Operations Expansion Plans Logistic Park San Jose Verbena, Alajuelita, Costa Rica Logistic Park Callao, Callao, Peru Logistic Park Lurin I, Lima, Peru Highlights As of September 30, 2025 97.9% Occupancy(2) Example Properties Logistic Park Puebla MX, Puebla, Mexico US $38.3 mm Q3’25 LTM 2025 NOI (5) 9.0% Cash NOI Growth YTD 2025 – 2024 (1) Includes 6.0 million sq ft of GLA in our total portfolio and 1.5 million of potential new GLA to be built-out in our land portfolio. (2) Operating Portfolio period end occupancy. (3) Based on active leases as of September 30, 2025. (4) Weighted average remaining lease term/life by leased area (5) Includes NOI for the four-quarter period ended September 30, 2025. (6) Land reserve acres are adjusted for Floor Area Ratio (“FAR”). PUEBLA, MEXICO Operating GLA (sqft) Development GLA (sqft) Land Reserves (acres)(6) 257,688 - - Company Profile

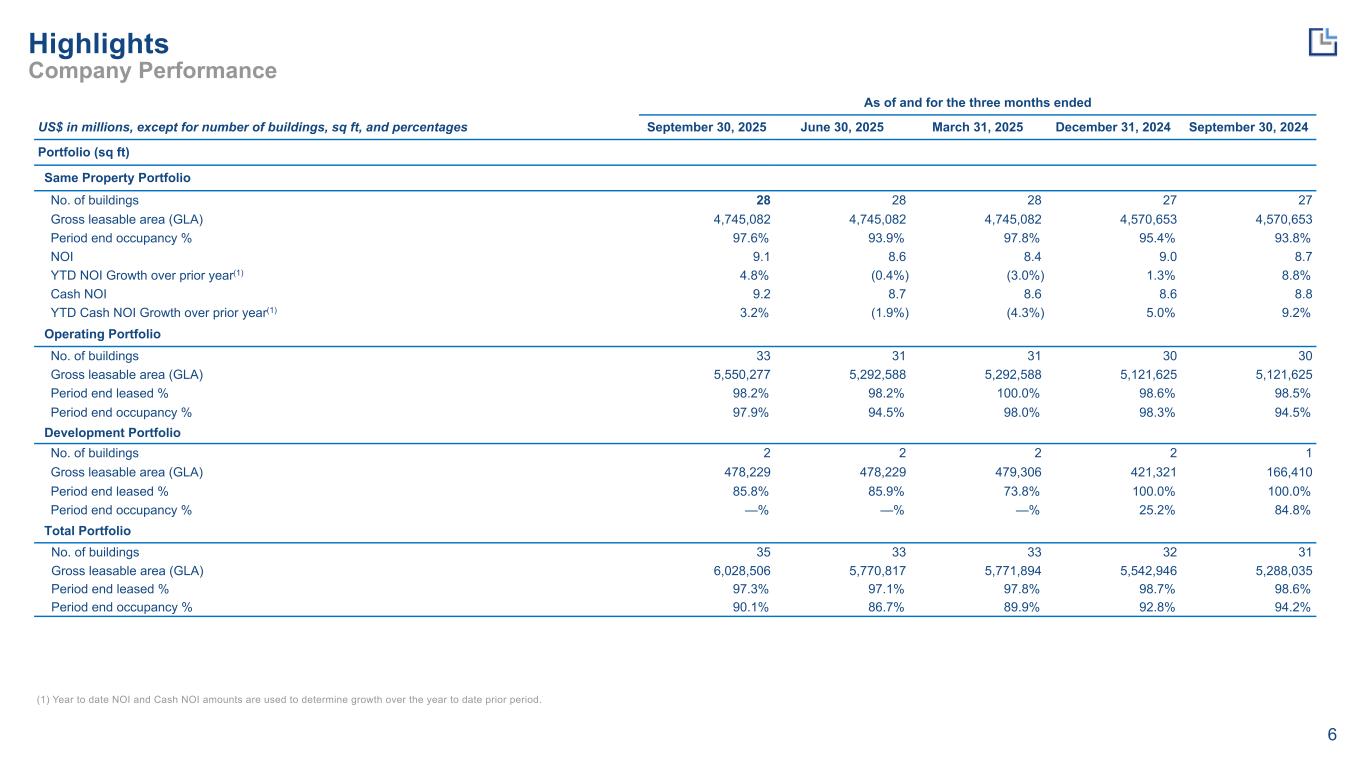

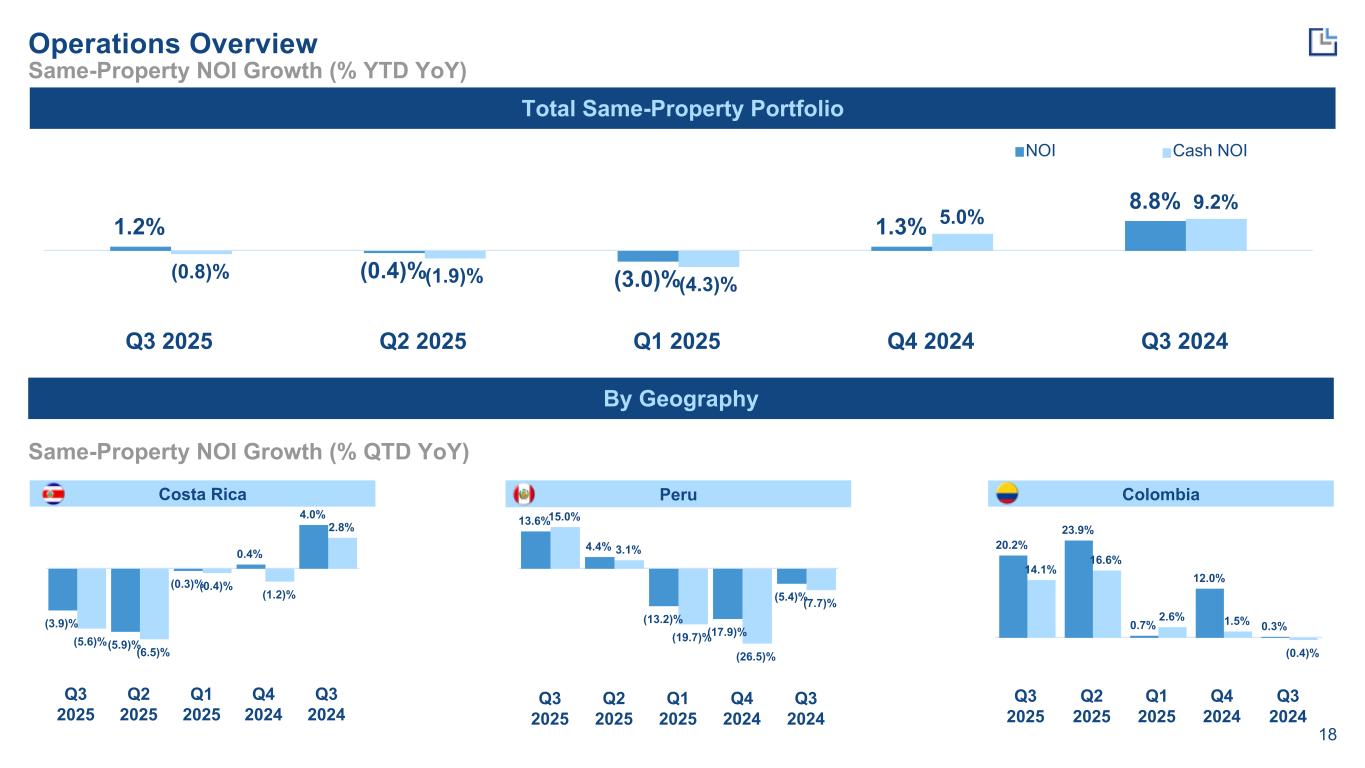

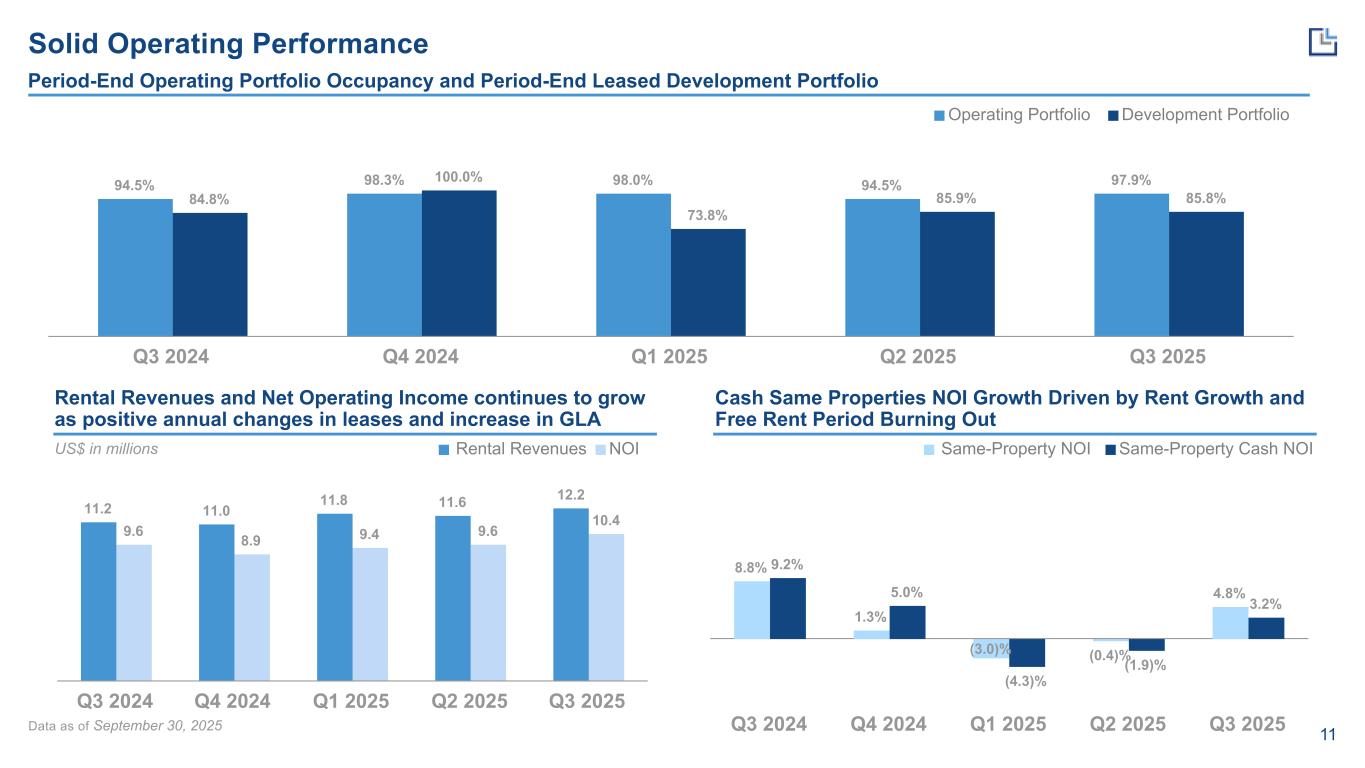

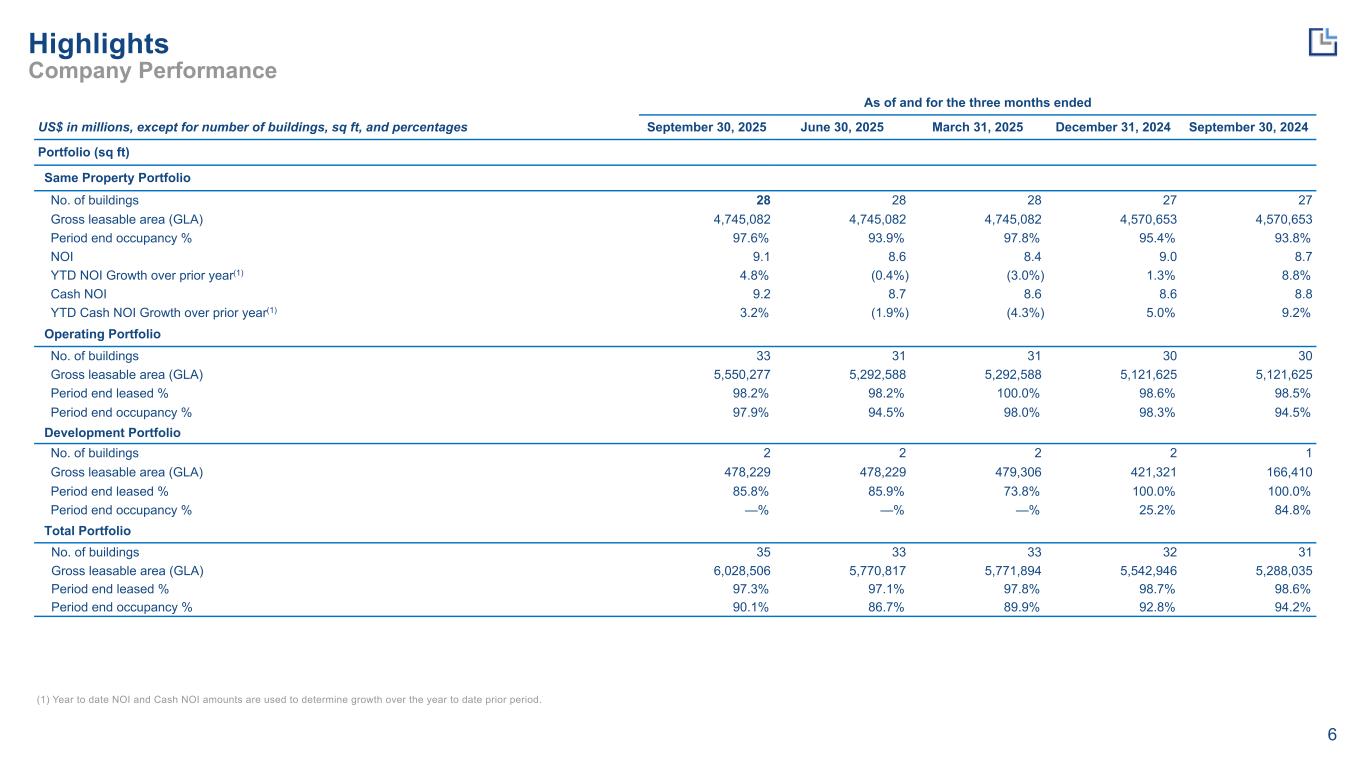

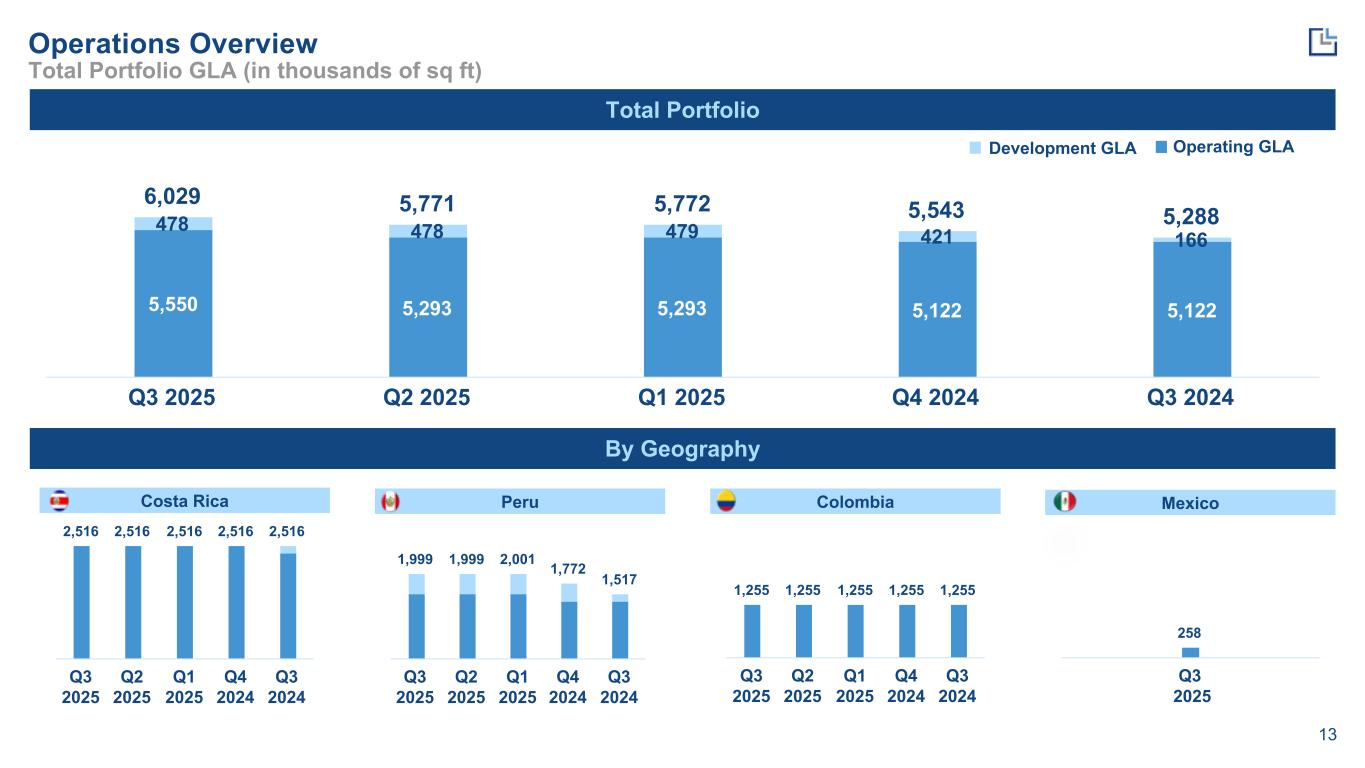

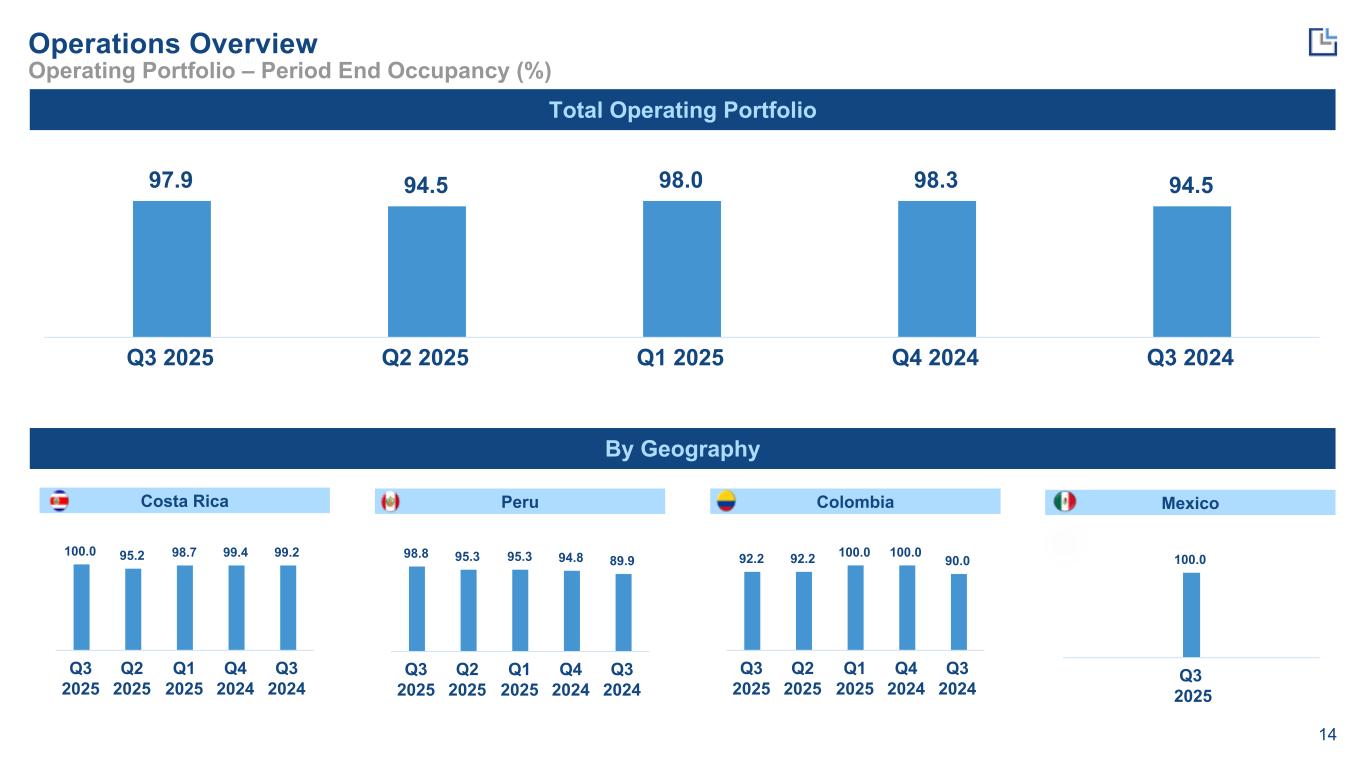

6 As of and for the three months ended US$ in millions, except for number of buildings, sq ft, and percentages September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Portfolio (sq ft) Same Property Portfolio No. of buildings 28 28 28 27 27 Gross leasable area (GLA) 4,745,082 4,745,082 4,745,082 4,570,653 4,570,653 Period end occupancy % 97.6% 93.9% 97.8% 95.4% 93.8% NOI 9.1 8.6 8.4 9.0 8.7 YTD NOI Growth over prior year(1) 4.8% (0.4%) (3.0%) 1.3% 8.8% Cash NOI 9.2 8.7 8.6 8.6 8.8 YTD Cash NOI Growth over prior year(1) 3.2% (1.9%) (4.3%) 5.0% 9.2% Operating Portfolio No. of buildings 33 31 31 30 30 Gross leasable area (GLA) 5,550,277 5,292,588 5,292,588 5,121,625 5,121,625 Period end leased % 98.2% 98.2% 100.0% 98.6% 98.5% Period end occupancy % 97.9% 94.5% 98.0% 98.3% 94.5% Development Portfolio No. of buildings 2 2 2 2 1 Gross leasable area (GLA) 478,229 478,229 479,306 421,321 166,410 Period end leased % 85.8% 85.9% 73.8% 100.0% 100.0% Period end occupancy % —% —% —% 25.2% 84.8% Total Portfolio No. of buildings 35 33 33 32 31 Gross leasable area (GLA) 6,028,506 5,770,817 5,771,894 5,542,946 5,288,035 Period end leased % 97.3% 97.1% 97.8% 98.7% 98.6% Period end occupancy % 90.1% 86.7% 89.9% 92.8% 94.2% Highlights Company Performance (1) Year to date NOI and Cash NOI amounts are used to determine growth over the year to date prior period.

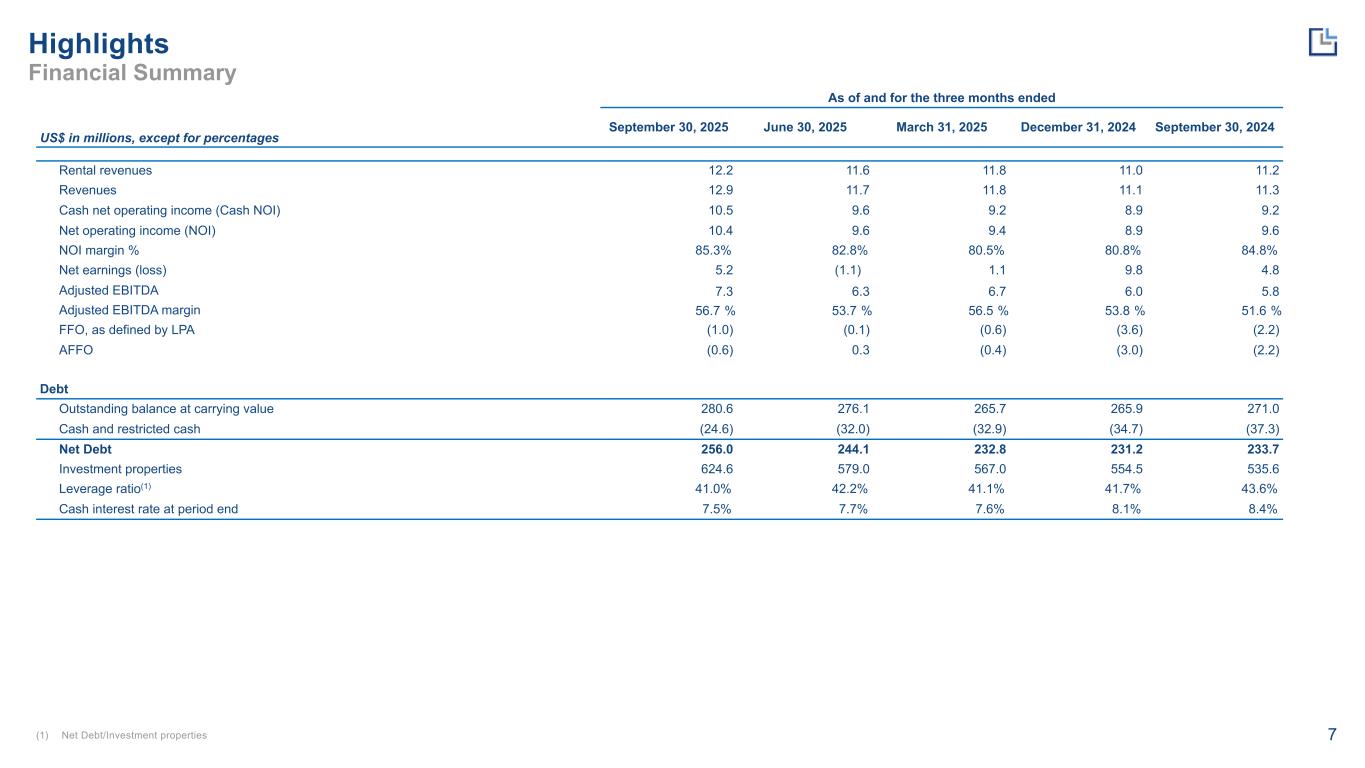

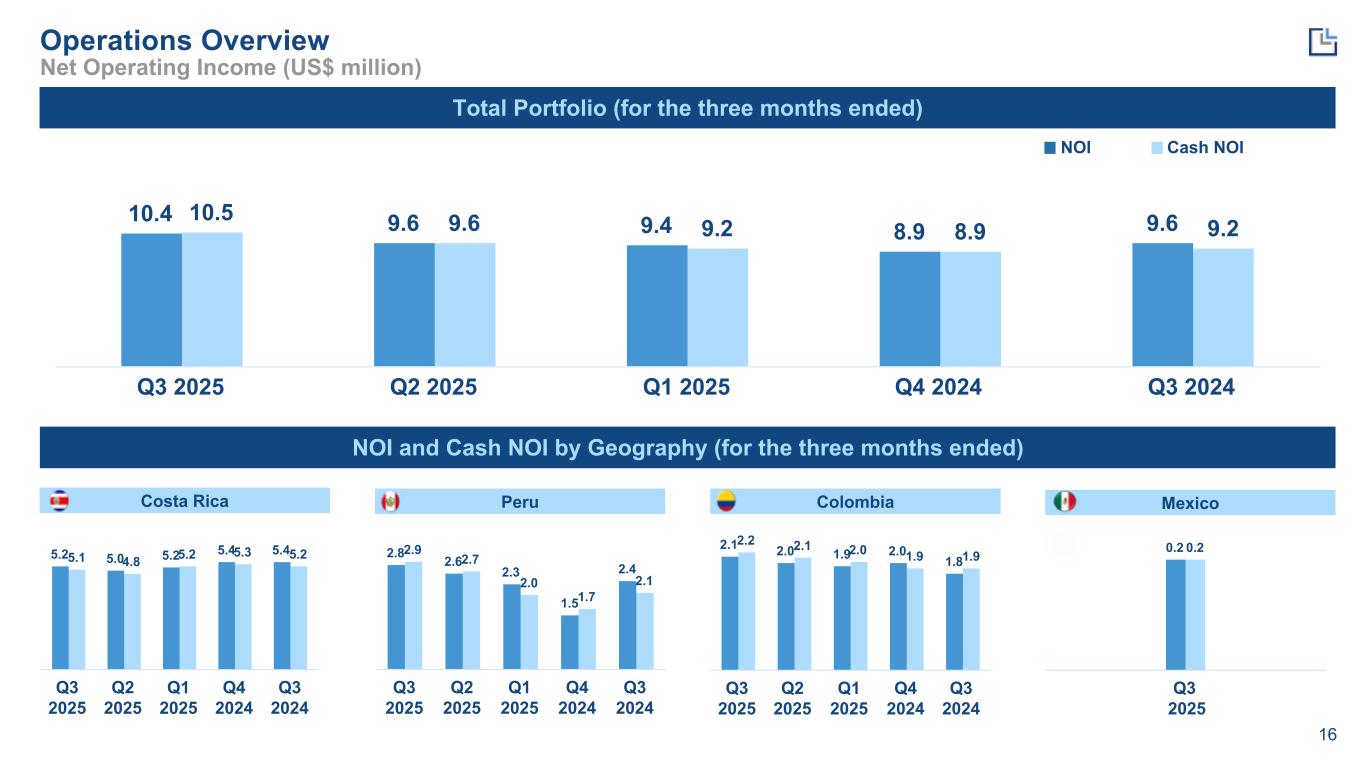

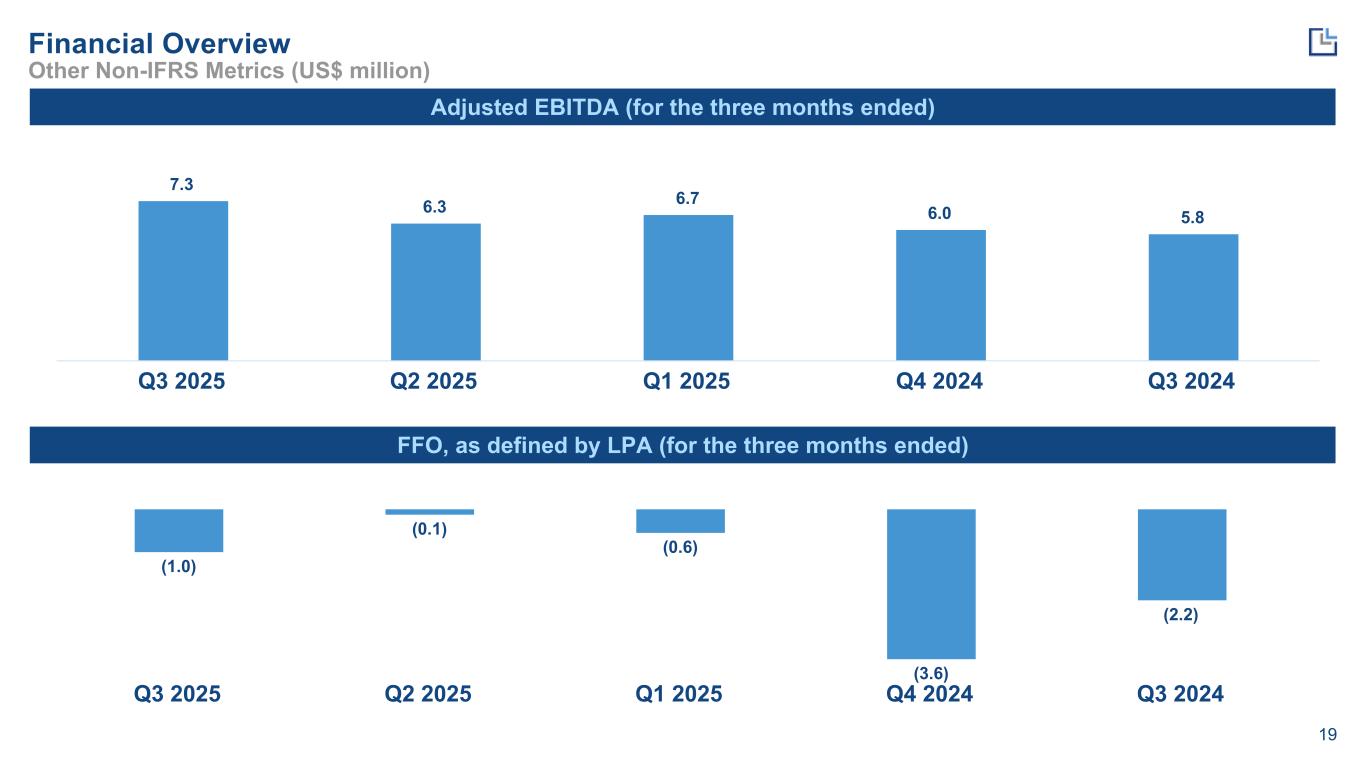

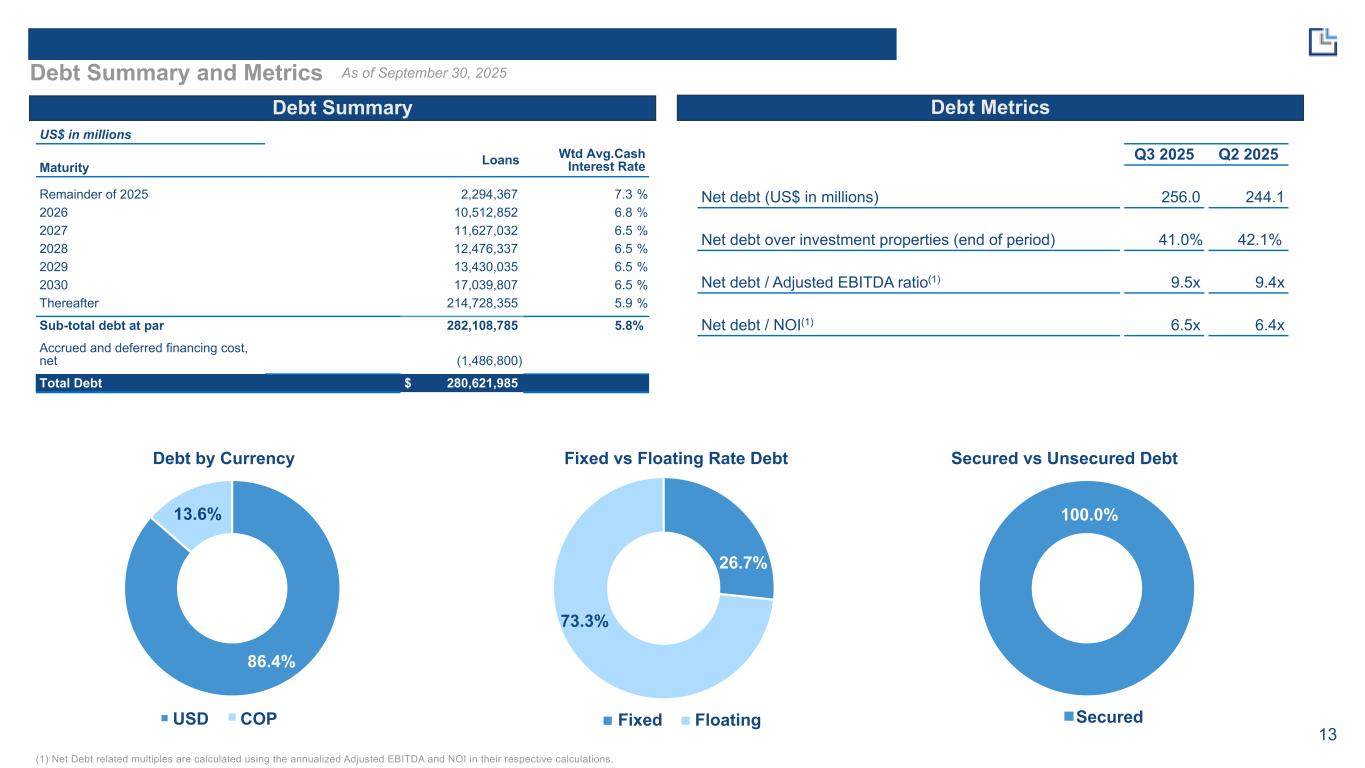

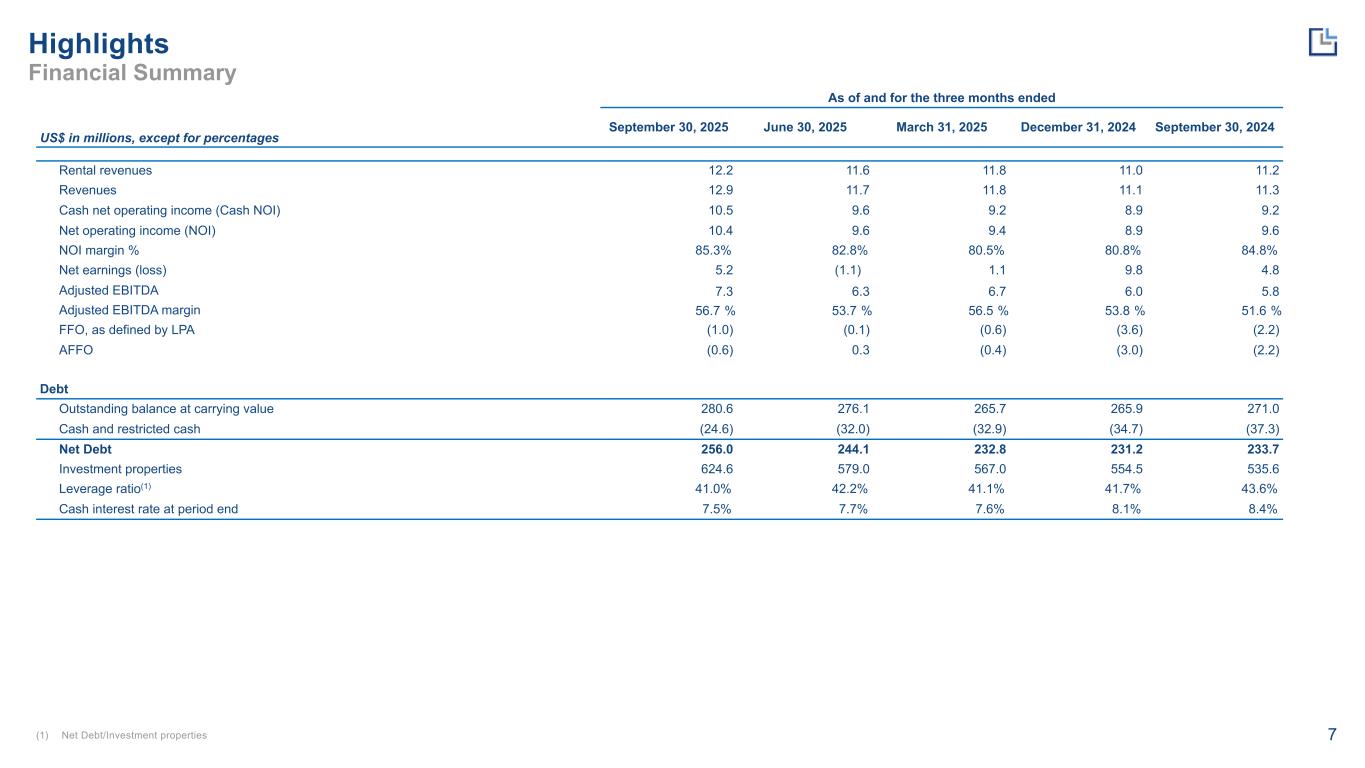

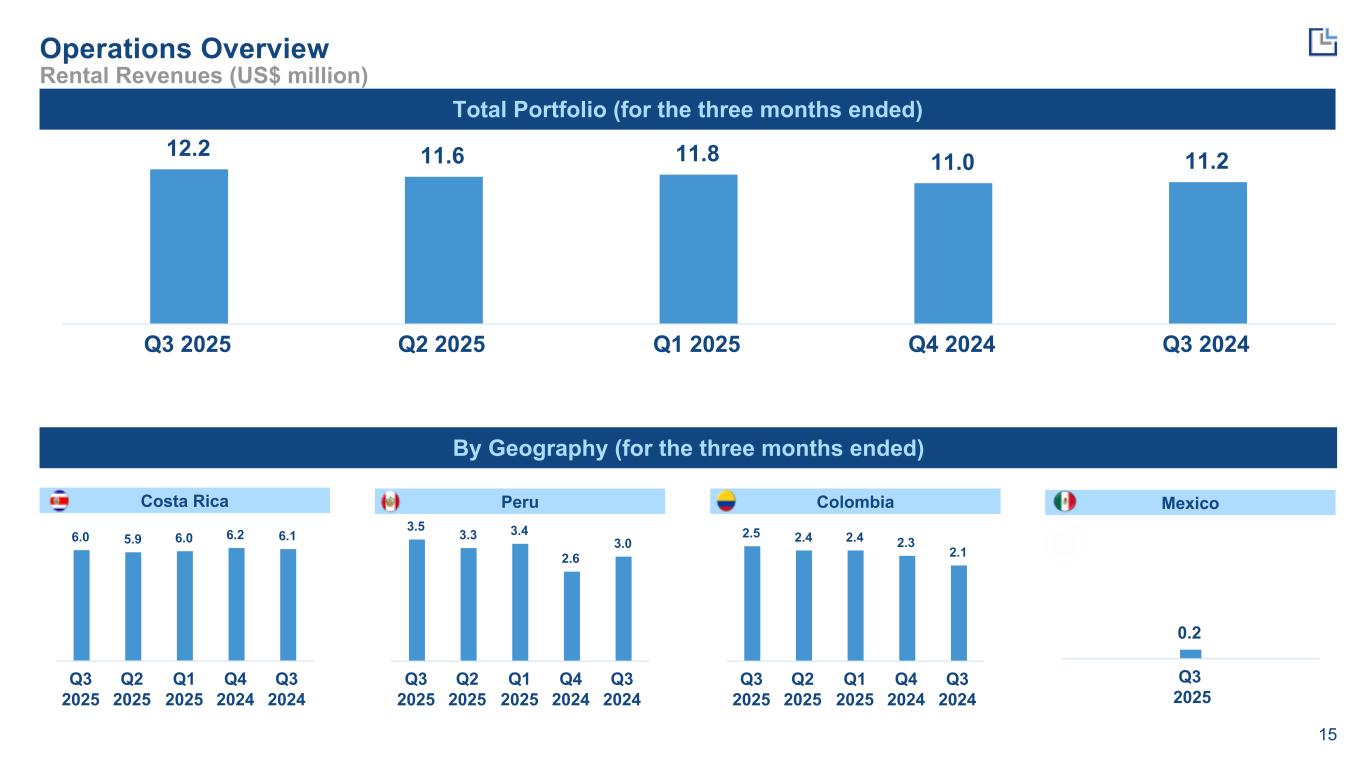

7 Highlights Financial Summary (1) Net Debt/Investment properties US$ in millions, except for percentages As of and for the three months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Rental revenues 12.2 11.6 11.8 11.0 11.2 Revenues 12.9 11.7 11.8 11.1 11.3 Cash net operating income (Cash NOI) 10.5 9.6 9.2 8.9 9.2 Net operating income (NOI) 10.4 9.6 9.4 8.9 9.6 NOI margin % 85.3% 82.8% 80.5% 80.8% 84.8% Net earnings (loss) 5.2 (1.1) 1.1 9.8 4.8 Adjusted EBITDA 7.3 6.3 6.7 6.0 5.8 Adjusted EBITDA margin 56.7 % 53.7 % 56.5 % 53.8 % 51.6 % FFO, as defined by LPA (1.0) (0.1) (0.6) (3.6) (2.2) AFFO (0.6) 0.3 (0.4) (3.0) (2.2) Debt Outstanding balance at carrying value 280.6 276.1 265.7 265.9 271.0 Cash and restricted cash (24.6) (32.0) (32.9) (34.7) (37.3) Net Debt 256.0 244.1 232.8 231.2 233.7 Investment properties 624.6 579.0 567.0 554.5 535.6 Leverage ratio(1) 41.0% 42.2% 41.1% 41.7% 43.6% Cash interest rate at period end 7.5% 7.7% 7.6% 8.1% 8.4%

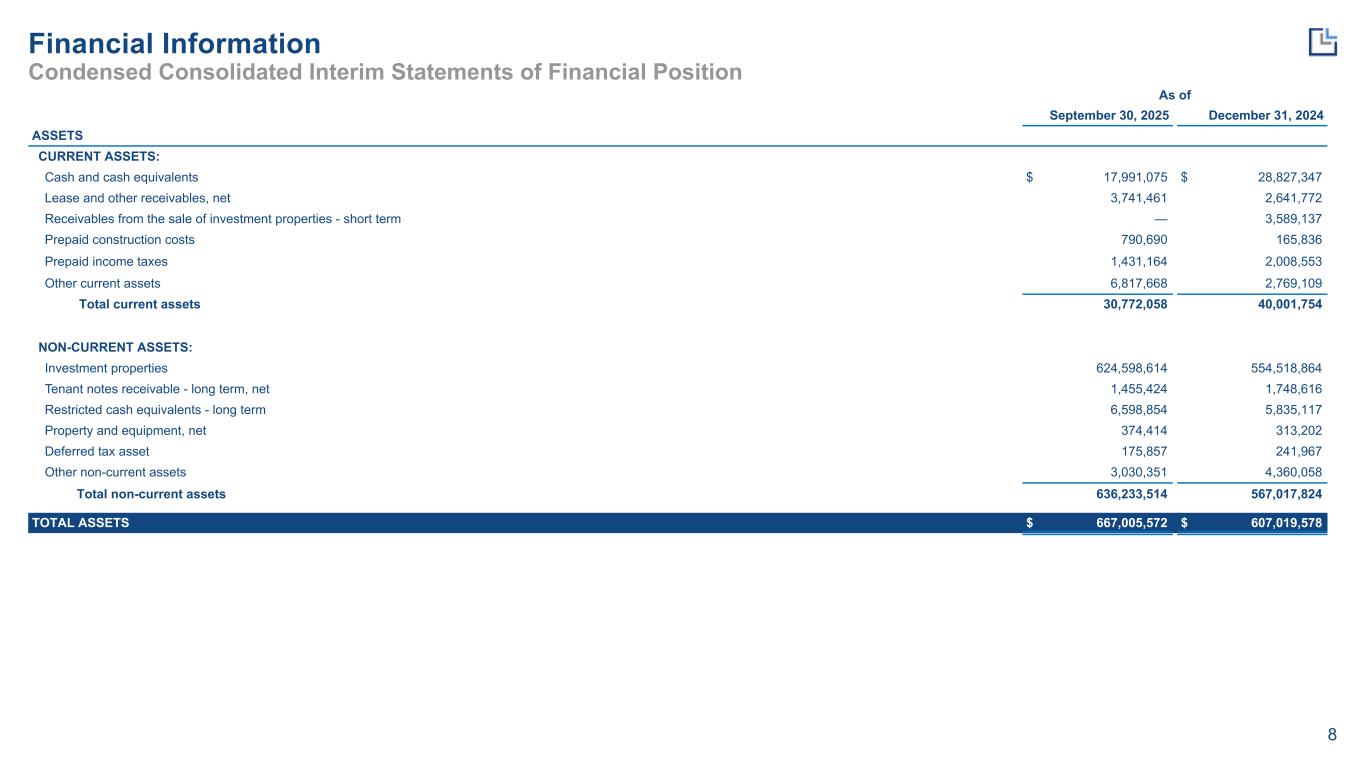

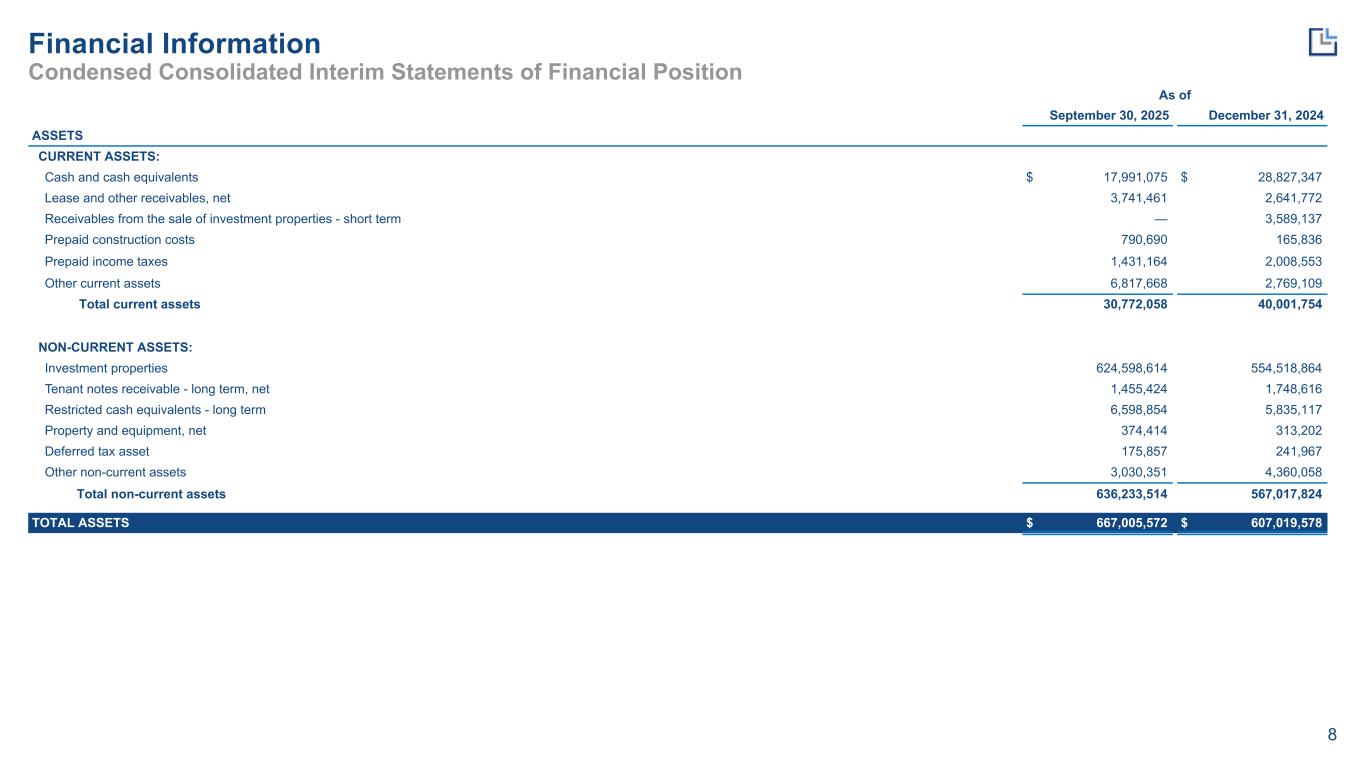

8 As of September 30, 2025 December 31, 2024 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 17,991,075 $ 28,827,347 Lease and other receivables, net 3,741,461 2,641,772 Receivables from the sale of investment properties - short term — 3,589,137 Prepaid construction costs 790,690 165,836 Prepaid income taxes 1,431,164 2,008,553 Other current assets 6,817,668 2,769,109 Total current assets 30,772,058 40,001,754 NON-CURRENT ASSETS: Investment properties 624,598,614 554,518,864 Tenant notes receivable - long term, net 1,455,424 1,748,616 Restricted cash equivalents - long term 6,598,854 5,835,117 Property and equipment, net 374,414 313,202 Deferred tax asset 175,857 241,967 Other non-current assets 3,030,351 4,360,058 Total non-current assets 636,233,514 567,017,824 TOTAL ASSETS $ 667,005,572 $ 607,019,578 Financial Information Condensed Consolidated Interim Statements of Financial Position

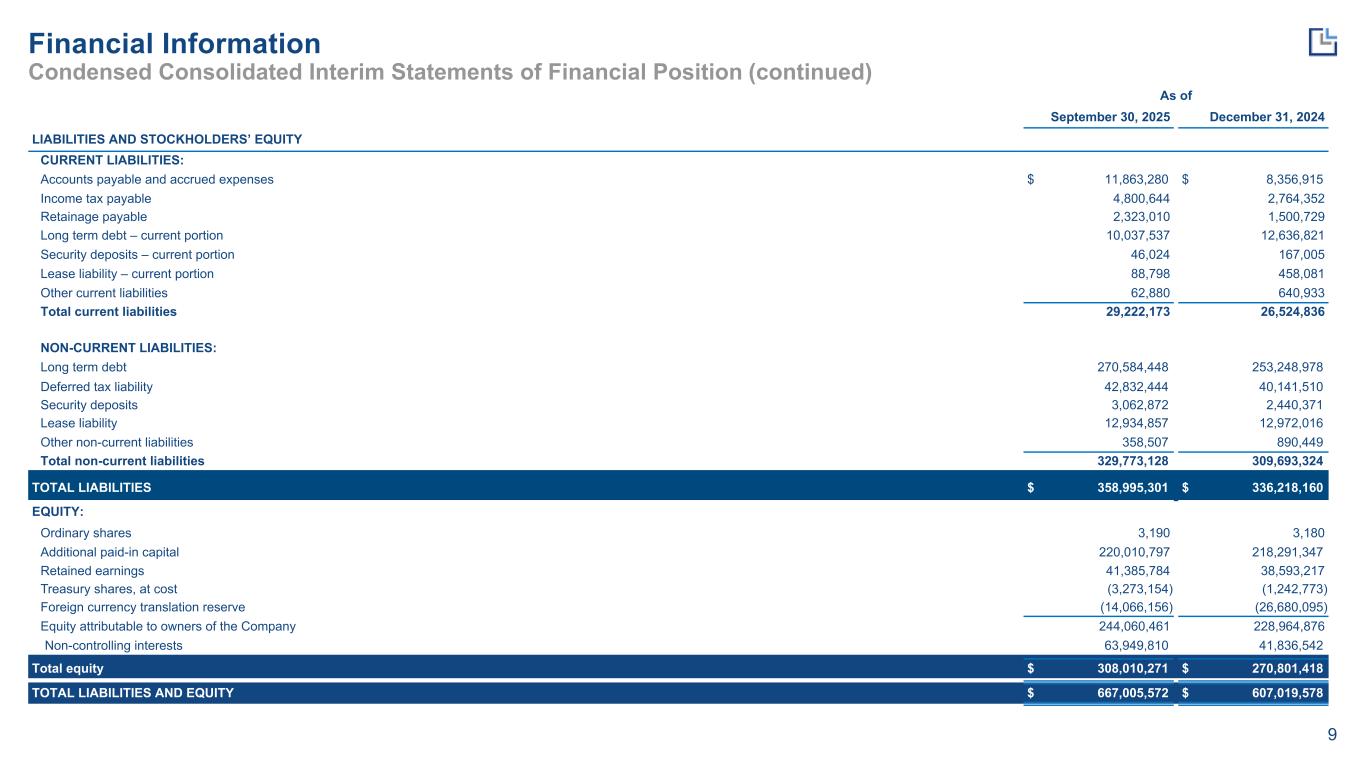

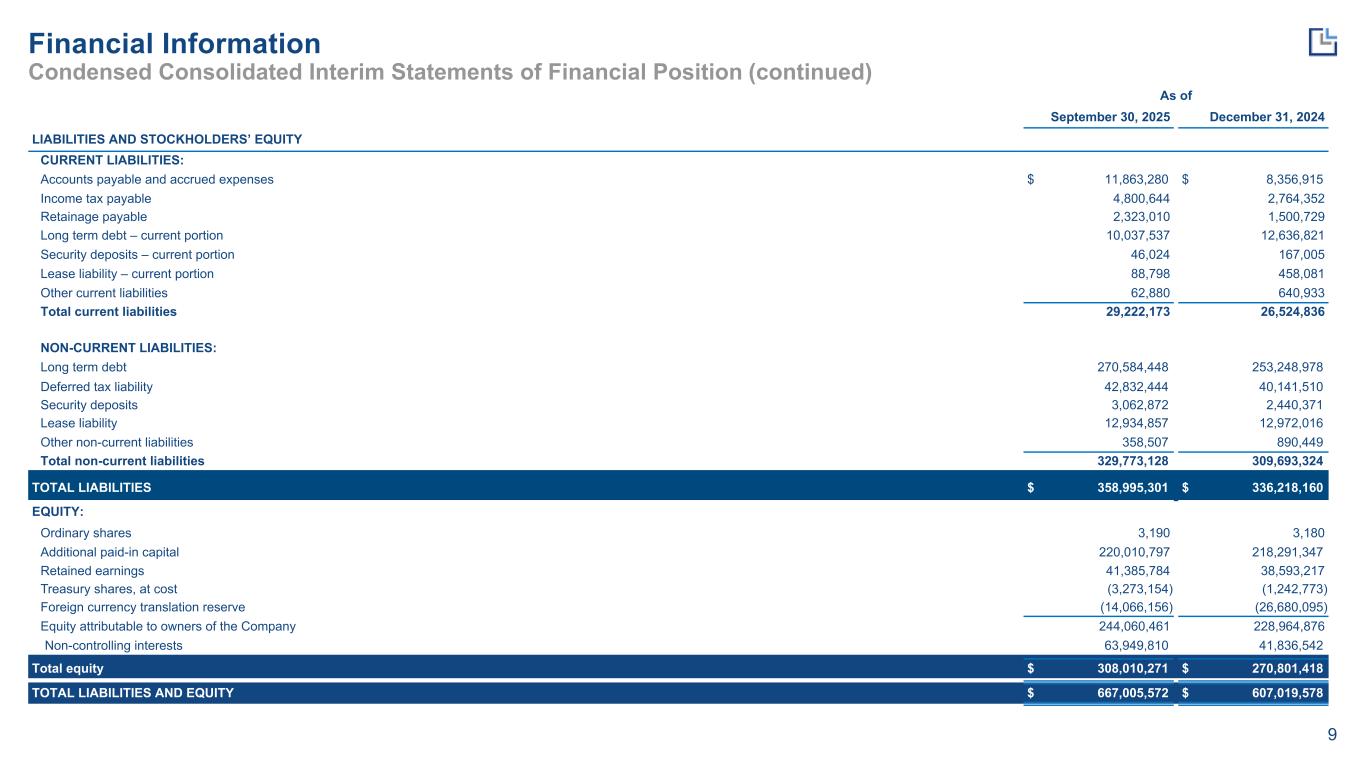

9 As of September 30, 2025 December 31, 2024 LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable and accrued expenses $ 11,863,280 $ 8,356,915 Income tax payable 4,800,644 2,764,352 Retainage payable 2,323,010 1,500,729 Long term debt – current portion 10,037,537 12,636,821 Security deposits – current portion 46,024 167,005 Lease liability – current portion 88,798 458,081 Other current liabilities 62,880 640,933 Total current liabilities 29,222,173 26,524,836 NON-CURRENT LIABILITIES: Long term debt 270,584,448 253,248,978 Deferred tax liability 42,832,444 40,141,510 Security deposits 3,062,872 2,440,371 Lease liability 12,934,857 12,972,016 Other non-current liabilities 358,507 890,449 Total non-current liabilities 329,773,128 309,693,324 TOTAL LIABILITIES $ 358,995,301 $ 336,218,160 EQUITY: Ordinary shares 3,190 3,180 Additional paid-in capital 220,010,797 218,291,347 Retained earnings 41,385,784 38,593,217 Treasury shares, at cost (3,273,154) (1,242,773) Foreign currency translation reserve (14,066,156) (26,680,095) Equity attributable to owners of the Company 244,060,461 228,964,876 Non-controlling interests 63,949,810 41,836,542 Total equity $ 308,010,271 $ 270,801,418 TOTAL LIABILITIES AND EQUITY $ 667,005,572 $ 607,019,578 Financial Information Condensed Consolidated Interim Statements of Financial Position (continued)

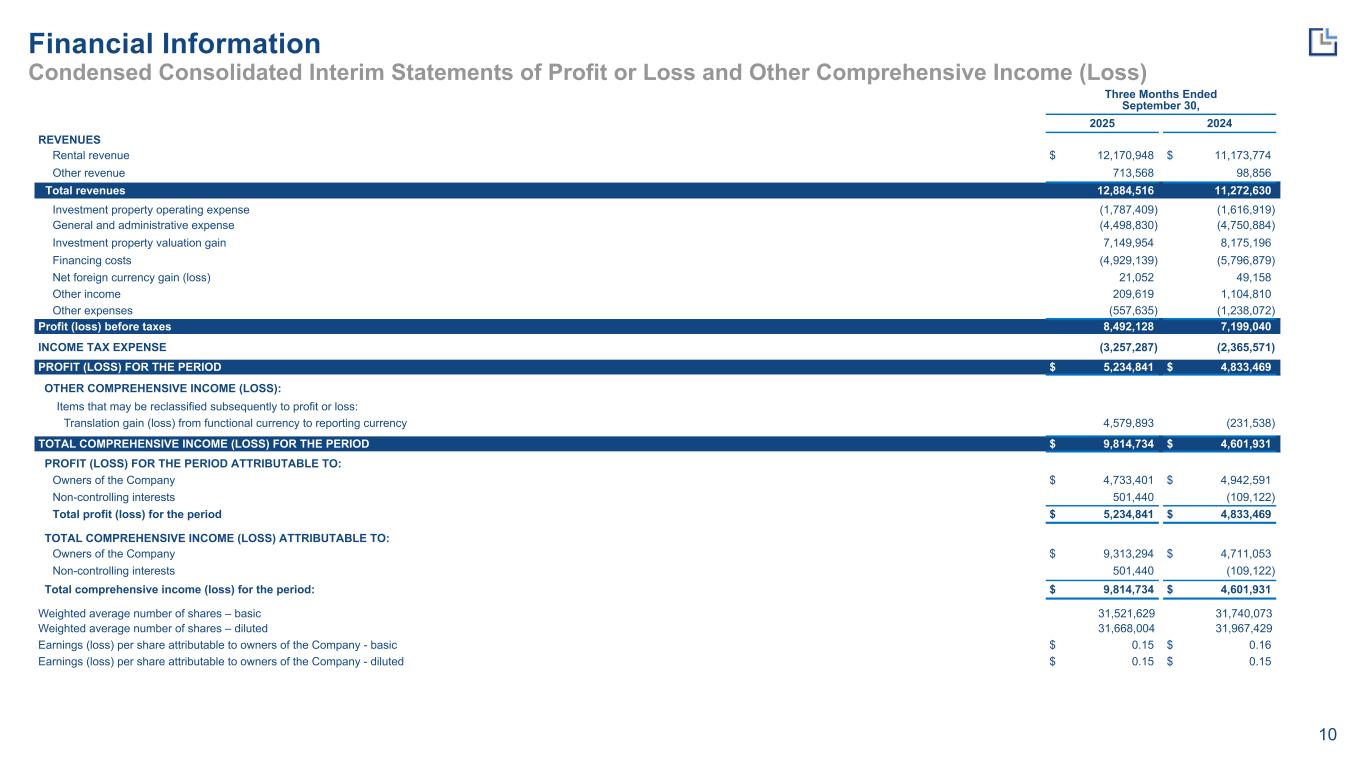

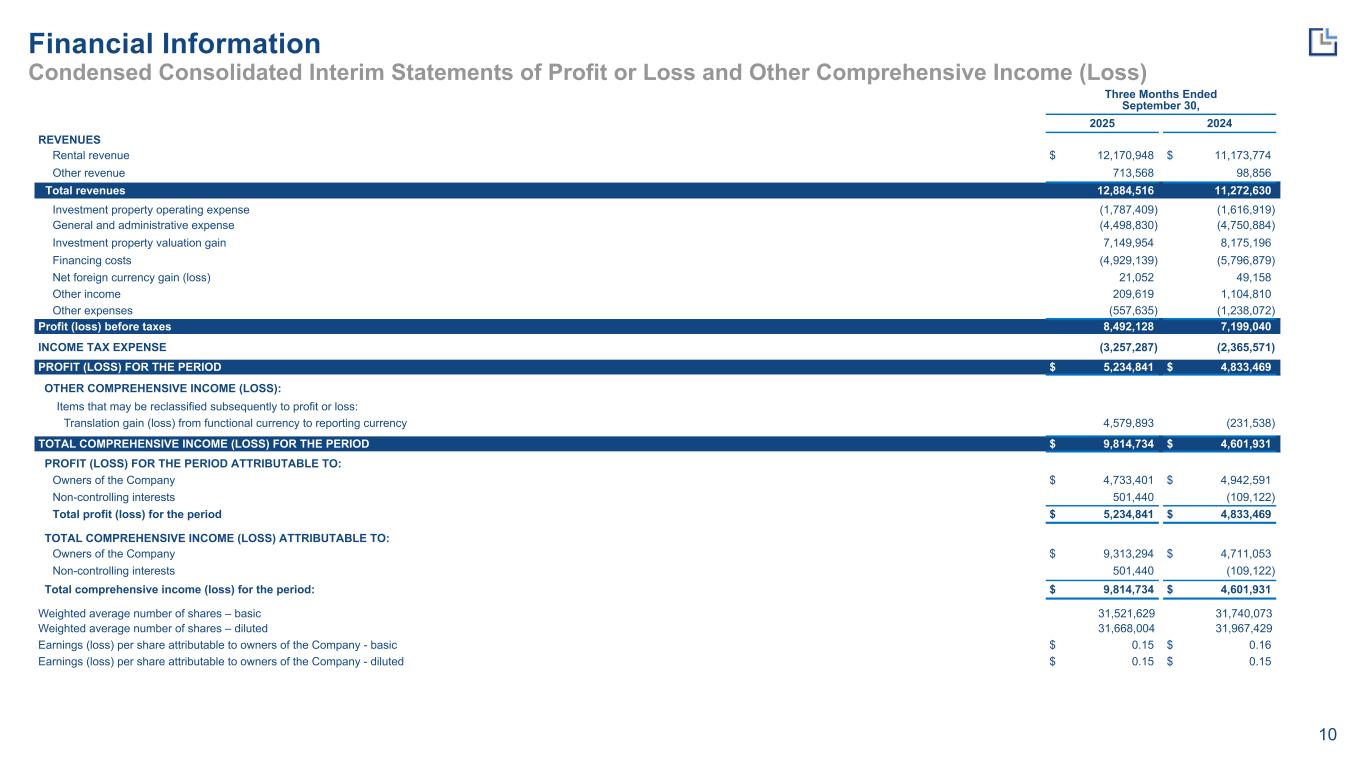

10 Financial Information Condensed Consolidated Interim Statements of Profit or Loss and Other Comprehensive Income (Loss) Three Months Ended September 30, 2025 2024 REVENUES Rental revenue $ 12,170,948 $ 11,173,774 Other revenue 713,568 98,856 Total revenues 12,884,516 11,272,630 Investment property operating expense (1,787,409) (1,616,919) General and administrative expense (4,498,830) (4,750,884) Investment property valuation gain 7,149,954 8,175,196 Financing costs (4,929,139) (5,796,879) Net foreign currency gain (loss) 21,052 49,158 Other income 209,619 1,104,810 Other expenses (557,635) (1,238,072) Profit (loss) before taxes 8,492,128 7,199,040 INCOME TAX EXPENSE (3,257,287) (2,365,571) PROFIT (LOSS) FOR THE PERIOD $ 5,234,841 $ 4,833,469 OTHER COMPREHENSIVE INCOME (LOSS): Items that may be reclassified subsequently to profit or loss: Translation gain (loss) from functional currency to reporting currency 4,579,893 (231,538) TOTAL COMPREHENSIVE INCOME (LOSS) FOR THE PERIOD $ 9,814,734 $ 4,601,931 PROFIT (LOSS) FOR THE PERIOD ATTRIBUTABLE TO: Owners of the Company $ 4,733,401 $ 4,942,591 Non-controlling interests 501,440 (109,122) Total profit (loss) for the period $ 5,234,841 $ 4,833,469 TOTAL COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO: Owners of the Company $ 9,313,294 $ 4,711,053 Non-controlling interests 501,440 (109,122) Total comprehensive income (loss) for the period: $ 9,814,734 $ 4,601,931 Weighted average number of shares – basic 31,521,629 31,740,073 Weighted average number of shares – diluted 31,668,004 31,967,429 Earnings (loss) per share attributable to owners of the Company - basic $ 0.15 $ 0.16 Earnings (loss) per share attributable to owners of the Company - diluted $ 0.15 $ 0.15

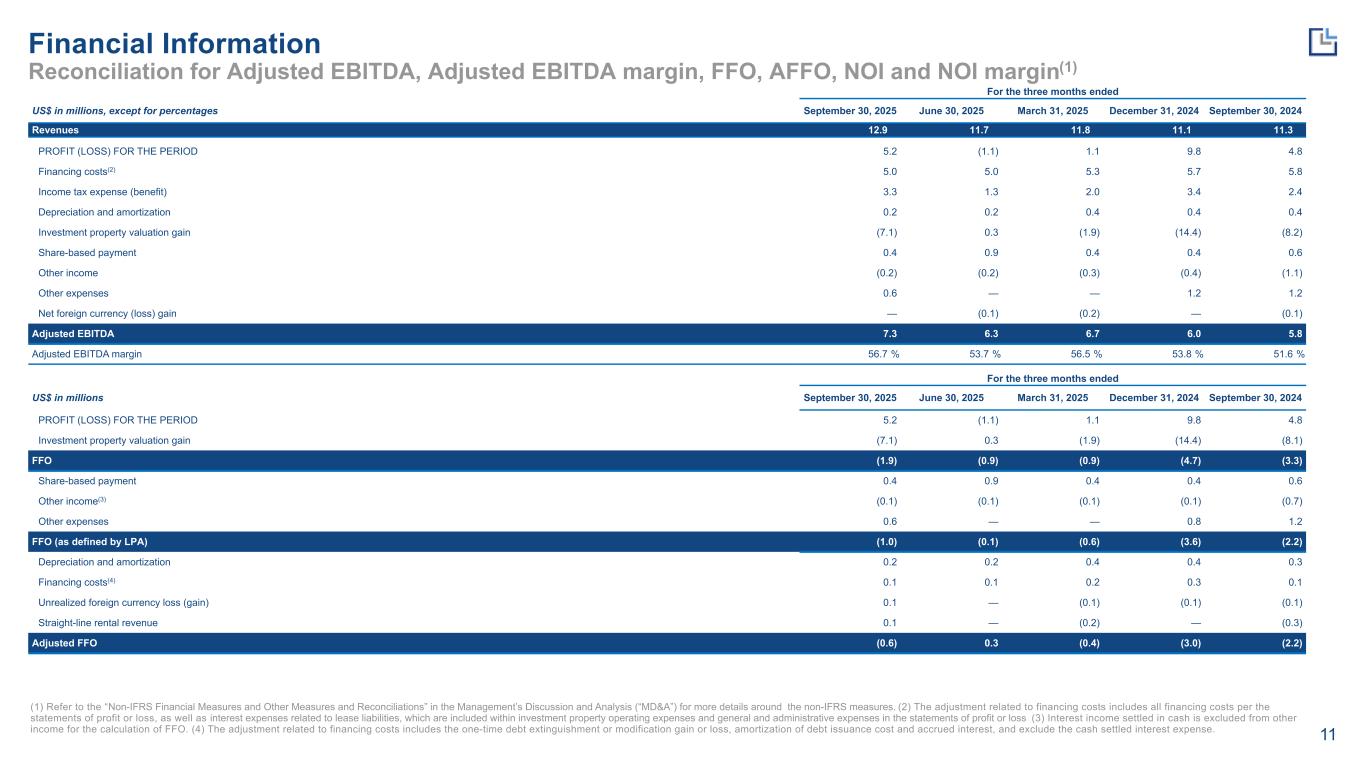

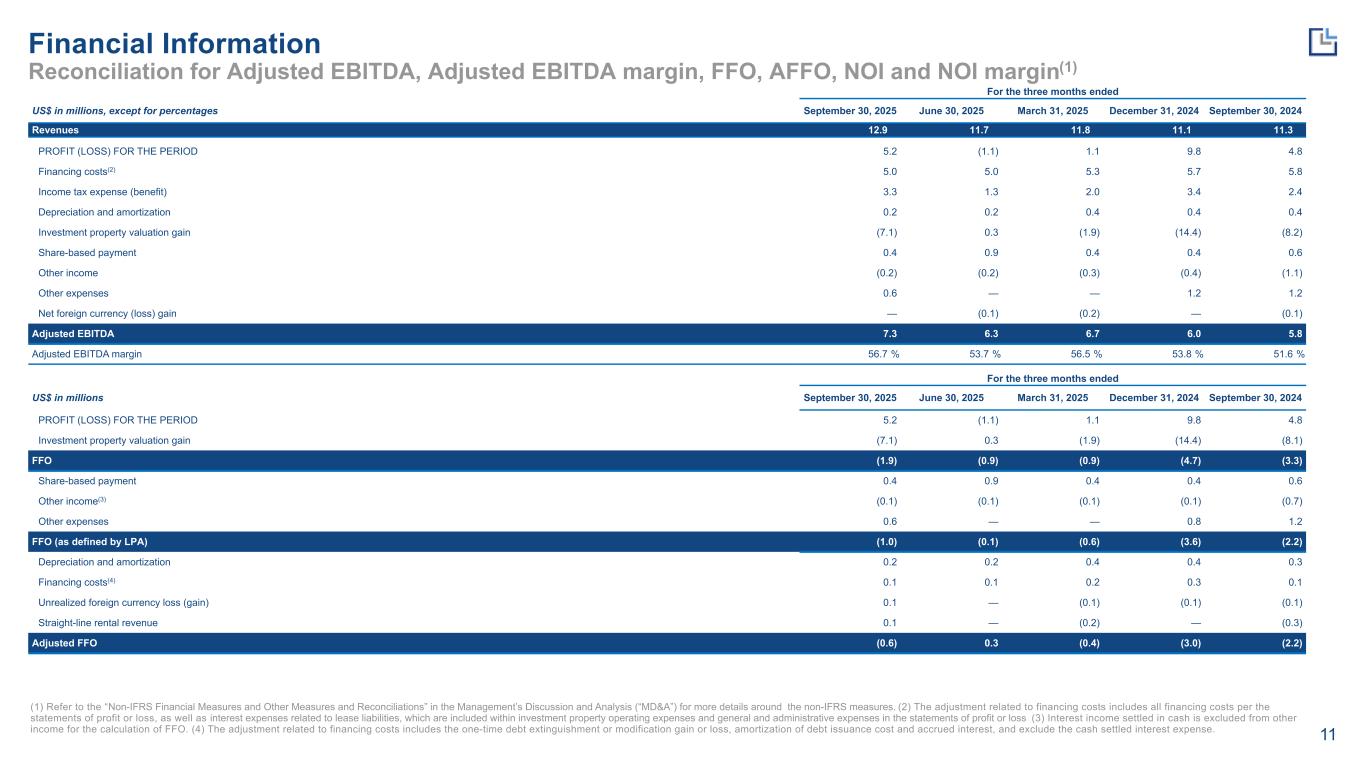

11 Financial Information Reconciliation for Adjusted EBITDA, Adjusted EBITDA margin, FFO, AFFO, NOI and NOI margin(1) (1) Refer to the “Non-IFRS Financial Measures and Other Measures and Reconciliations” in the Management’s Discussion and Analysis (“MD&A”) for more details around the non-IFRS measures. (2) The adjustment related to financing costs includes all financing costs per the statements of profit or loss, as well as interest expenses related to lease liabilities, which are included within investment property operating expenses and general and administrative expenses in the statements of profit or loss (3) Interest income settled in cash is excluded from other income for the calculation of FFO. (4) The adjustment related to financing costs includes the one-time debt extinguishment or modification gain or loss, amortization of debt issuance cost and accrued interest, and exclude the cash settled interest expense. For the three months ended US$ in millions, except for percentages September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Revenues 12.9 11.7 11.8 11.1 11.3 PROFIT (LOSS) FOR THE PERIOD 5.2 (1.1) 1.1 9.8 4.8 Financing costs(2) 5.0 5.0 5.3 5.7 5.8 Income tax expense (benefit) 3.3 1.3 2.0 3.4 2.4 Depreciation and amortization 0.2 0.2 0.4 0.4 0.4 Investment property valuation gain (7.1) 0.3 (1.9) (14.4) (8.2) Share-based payment 0.4 0.9 0.4 0.4 0.6 Other income (0.2) (0.2) (0.3) (0.4) (1.1) Other expenses 0.6 — — 1.2 1.2 Net foreign currency (loss) gain — (0.1) (0.2) — (0.1) Adjusted EBITDA 7.3 6.3 6.7 6.0 5.8 Adjusted EBITDA margin 56.7 % 53.7 % 56.5 % 53.8 % 51.6 % For the three months ended US$ in millions September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 PROFIT (LOSS) FOR THE PERIOD 5.2 (1.1) 1.1 9.8 4.8 Investment property valuation gain (7.1) 0.3 (1.9) (14.4) (8.1) FFO (1.9) (0.9) (0.9) (4.7) (3.3) Share-based payment 0.4 0.9 0.4 0.4 0.6 Other income(3) (0.1) (0.1) (0.1) (0.1) (0.7) Other expenses 0.6 — — 0.8 1.2 FFO (as defined by LPA) (1.0) (0.1) (0.6) (3.6) (2.2) Depreciation and amortization 0.2 0.2 0.4 0.4 0.3 Financing costs(4) 0.1 0.1 0.2 0.3 0.1 Unrealized foreign currency loss (gain) 0.1 — (0.1) (0.1) (0.1) Straight-line rental revenue 0.1 — (0.2) — (0.3) Adjusted FFO (0.6) 0.3 (0.4) (3.0) (2.2)

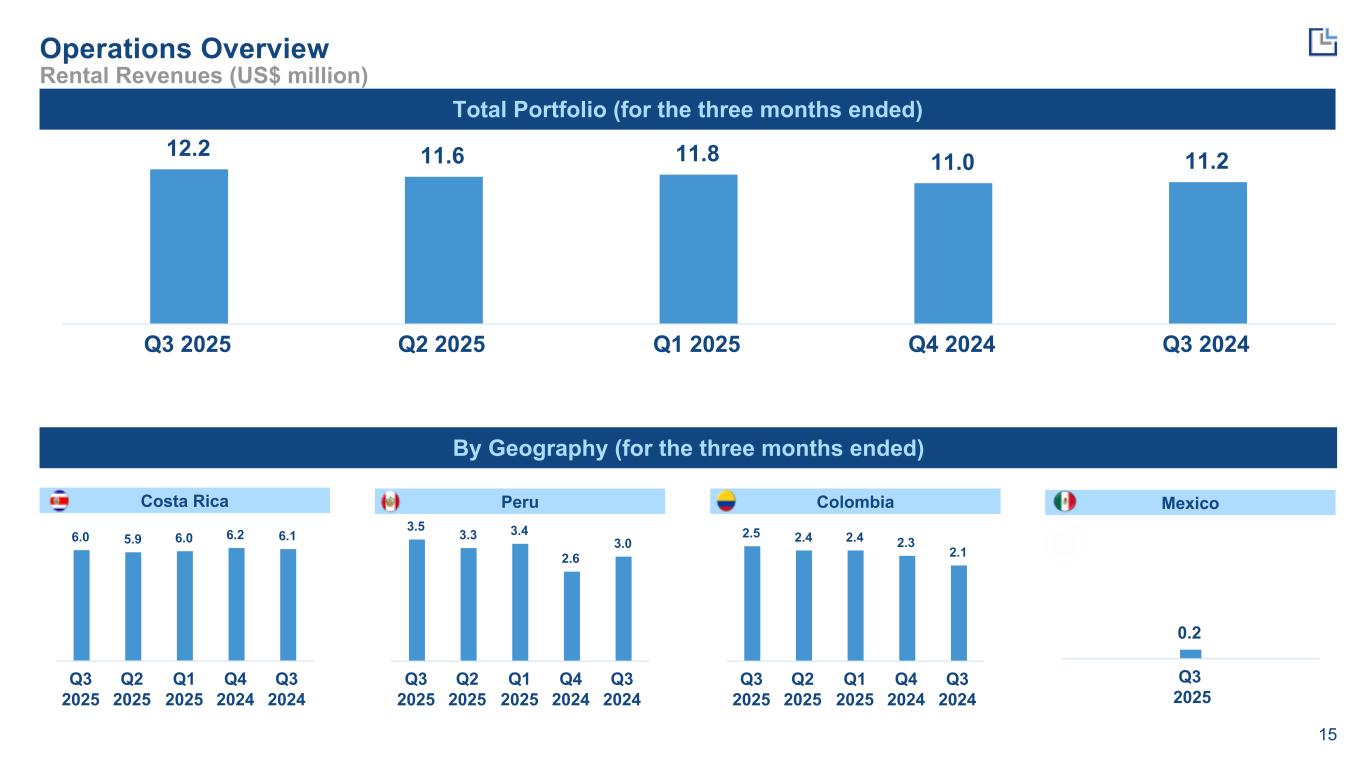

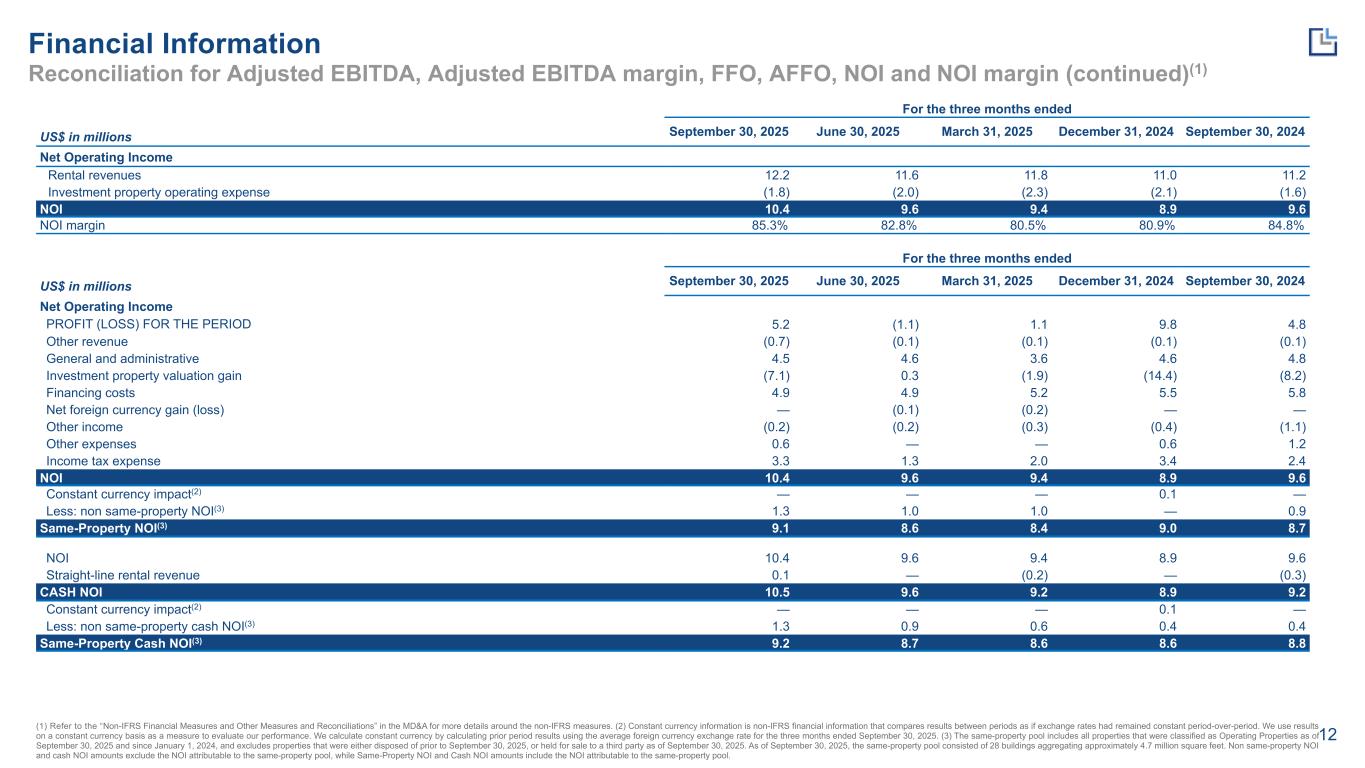

12 Financial Information Reconciliation for Adjusted EBITDA, Adjusted EBITDA margin, FFO, AFFO, NOI and NOI margin (continued)(1) For the three months ended US$ in millions September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net Operating Income Rental revenues 12.2 11.6 11.8 11.0 11.2 Investment property operating expense (1.8) (2.0) (2.3) (2.1) (1.6) NOI 10.4 9.6 9.4 8.9 9.6 NOI margin 85.3% 82.8% 80.5% 80.9% 84.8% For the three months ended US$ in millions September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net Operating Income PROFIT (LOSS) FOR THE PERIOD 5.2 (1.1) 1.1 9.8 4.8 Other revenue (0.7) (0.1) (0.1) (0.1) (0.1) General and administrative 4.5 4.6 3.6 4.6 4.8 Investment property valuation gain (7.1) 0.3 (1.9) (14.4) (8.2) Financing costs 4.9 4.9 5.2 5.5 5.8 Net foreign currency gain (loss) — (0.1) (0.2) — — Other income (0.2) (0.2) (0.3) (0.4) (1.1) Other expenses 0.6 — — 0.6 1.2 Income tax expense 3.3 1.3 2.0 3.4 2.4 NOI 10.4 9.6 9.4 8.9 9.6 Constant currency impact(2) — — — 0.1 — Less: non same-property NOI(3) 1.3 1.0 1.0 — 0.9 Same-Property NOI(3) 9.1 8.6 8.4 9.0 8.7 NOI 10.4 9.6 9.4 8.9 9.6 Straight-line rental revenue 0.1 — (0.2) — (0.3) CASH NOI 10.5 9.6 9.2 8.9 9.2 Constant currency impact(2) — — — 0.1 — Less: non same-property cash NOI(3) 1.3 0.9 0.6 0.4 0.4 Same-Property Cash NOI(3) 9.2 8.7 8.6 8.6 8.8 (1) Refer to the “Non-IFRS Financial Measures and Other Measures and Reconciliations” in the MD&A for more details around the non-IFRS measures. (2) Constant currency information is non-IFRS financial information that compares results between periods as if exchange rates had remained constant period-over-period. We use results on a constant currency basis as a measure to evaluate our performance. We calculate constant currency by calculating prior period results using the average foreign currency exchange rate for the three months ended September 30, 2025. (3) The same-property pool includes all properties that were classified as Operating Properties as of September 30, 2025 and since January 1, 2024, and excludes properties that were either disposed of prior to September 30, 2025, or held for sale to a third party as of September 30, 2025. As of September 30, 2025, the same-property pool consisted of 28 buildings aggregating approximately 4.7 million square feet. Non same-property NOI and cash NOI amounts exclude the NOI attributable to the same-property pool, while Same-Property NOI and Cash NOI amounts include the NOI attributable to the same-property pool.

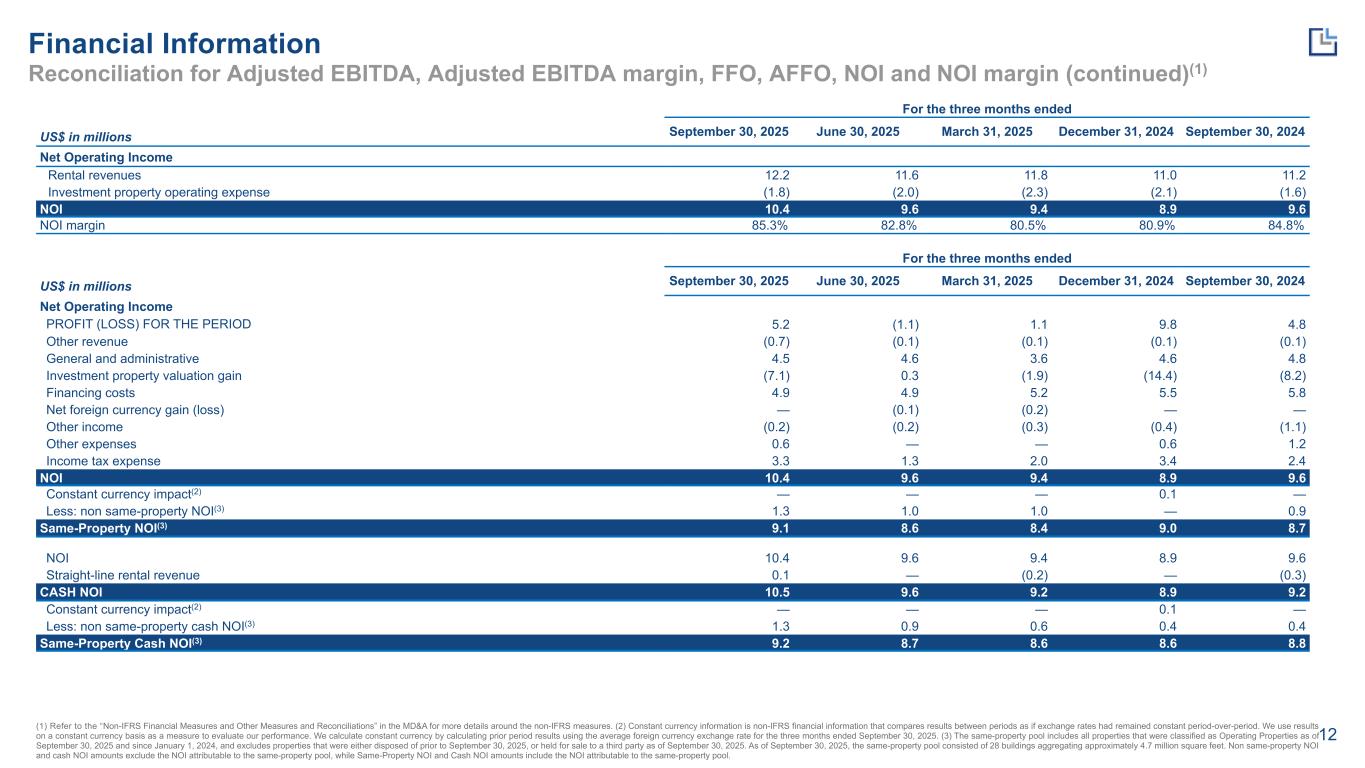

13 1,255 1,255 1,255 1,255 1,255 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Costa Rica Peru By Geography 6,029 5,771 5,772 5,543 5,288 5,550 5,293 5,293 5,122 5,122 478 478 479 421 166 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Development GLA Operating GLA 2,516 2,516 2,516 2,516 2,516 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 1,999 1,999 2,001 1,772 1,517 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Total Portfolio GLA (in thousands of sq ft) Total Portfolio 258 Q3 2025 MexicoColombia

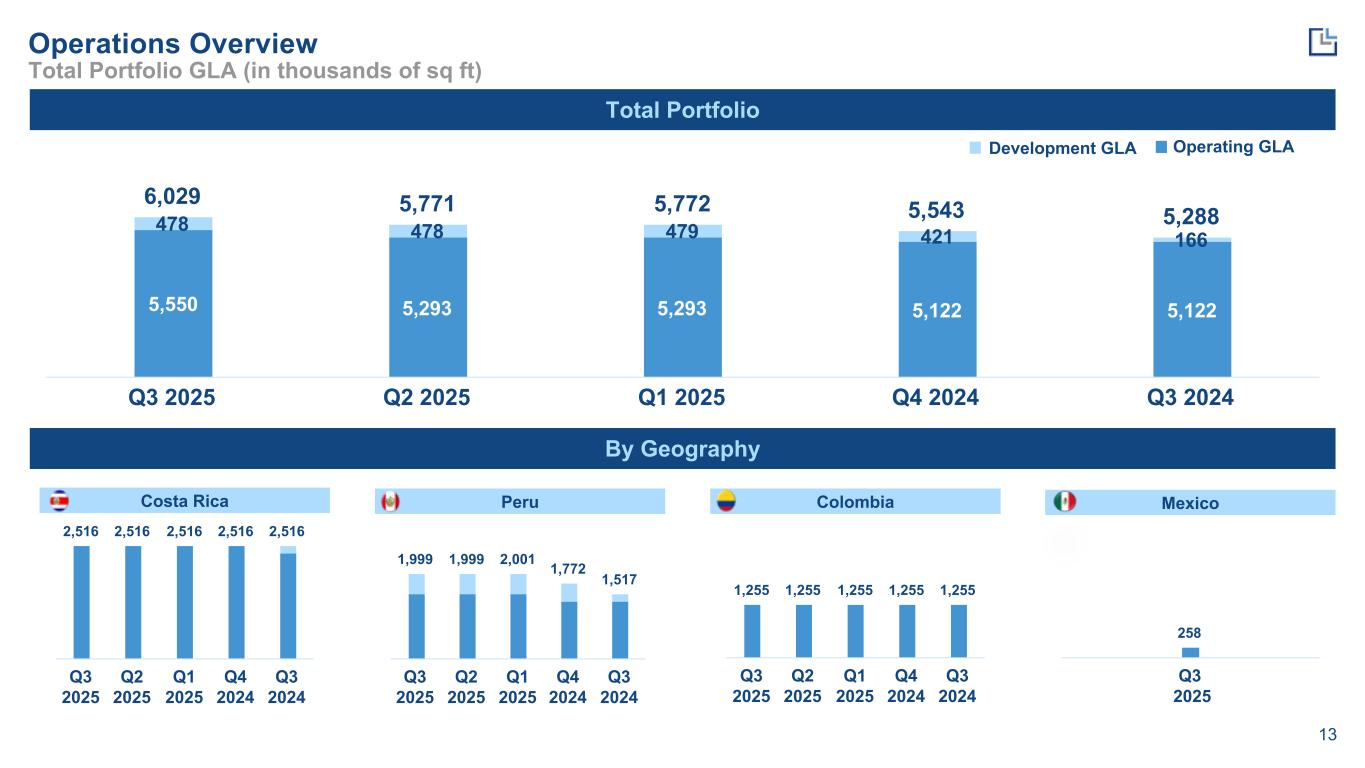

14 Total Operating Portfolio 92.2 92.2 100.0 100.0 90.0 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 98.8 95.3 95.3 94.8 89.9 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 100.0 95.2 98.7 99.4 99.2 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 97.9 94.5 98.0 98.3 94.5 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Operating Portfolio – Period End Occupancy (%) By Geography Costa Rica Peru MexicoColombia 100.0 Q3 2025

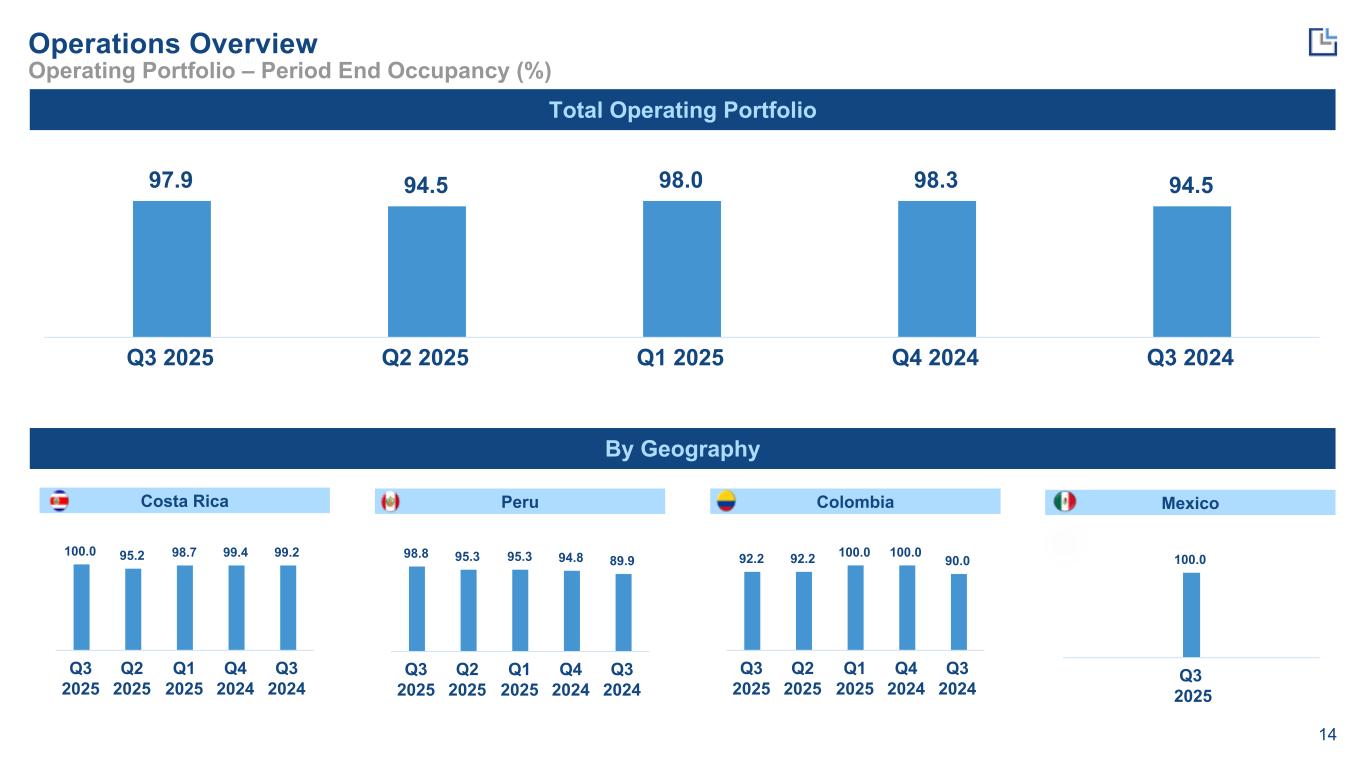

15 2.5 2.4 2.4 2.3 2.1 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 3.5 3.3 3.4 2.6 3.0 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 6.0 5.9 6.0 6.2 6.1 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 12.2 11.6 11.8 11.0 11.2 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Rental Revenues (US$ million) Total Portfolio (for the three months ended) By Geography (for the three months ended) 0.2 Q3 2025 Costa Rica Peru MexicoColombia

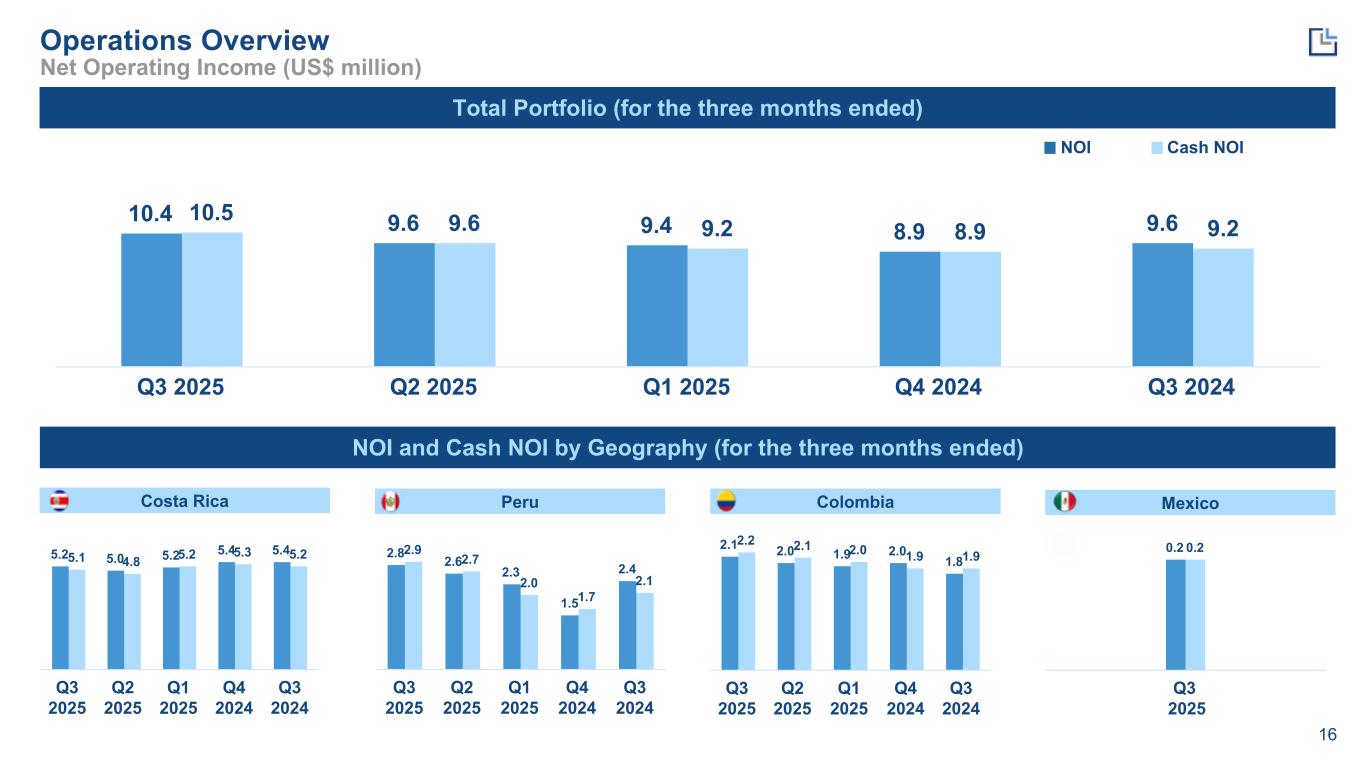

16 2.1 2.0 1.9 2.0 1.8 2.2 2.1 2.0 1.9 1.9 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 2.8 2.6 2.3 1.5 2.4 2.9 2.7 2.0 1.7 2.1 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 5.2 5.0 5.2 5.4 5.45.1 4.8 5.2 5.3 5.2 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 10.4 9.6 9.4 8.9 9.610.5 9.6 9.2 8.9 9.2 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Total Portfolio (for the three months ended) NOI and Cash NOI by Geography (for the three months ended) NOI Cash NOI Net Operating Income (US$ million) Costa Rica Peru MexicoColombia 0.2 0.2 Q3 2025

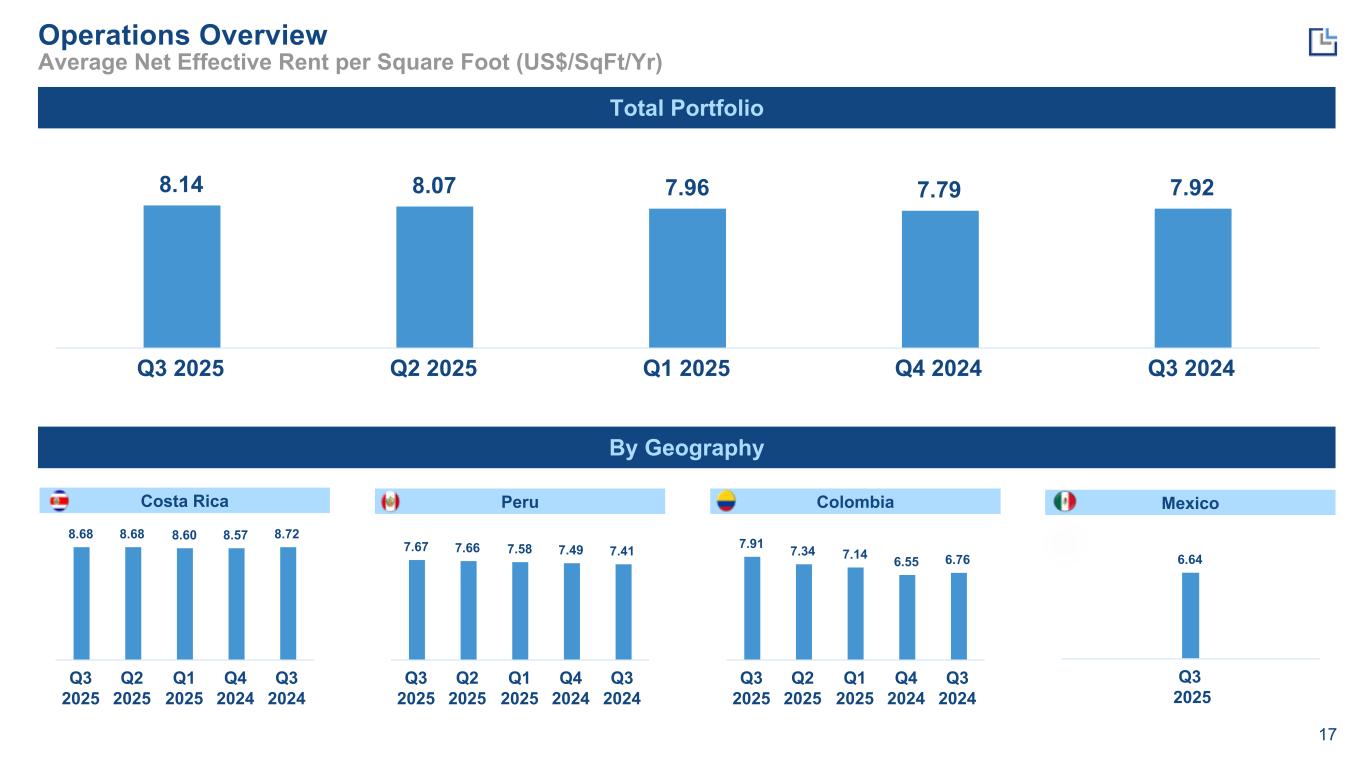

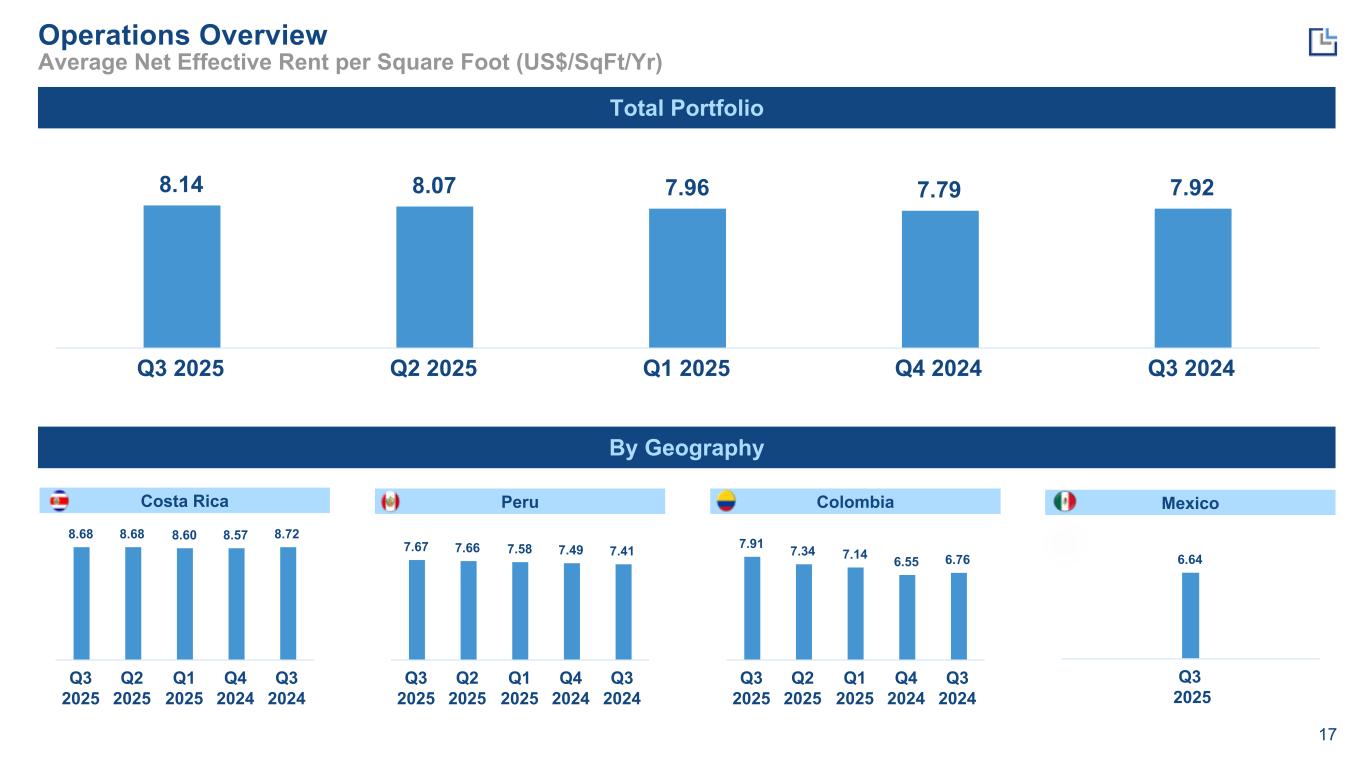

17 7.91 7.34 7.14 6.55 6.76 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 7.67 7.66 7.58 7.49 7.41 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 8.68 8.68 8.60 8.57 8.72 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 8.14 8.07 7.96 7.79 7.92 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Total Portfolio By Geography Average Net Effective Rent per Square Foot (US$/SqFt/Yr) Costa Rica Peru MexicoColombia 6.64 Q3 2025

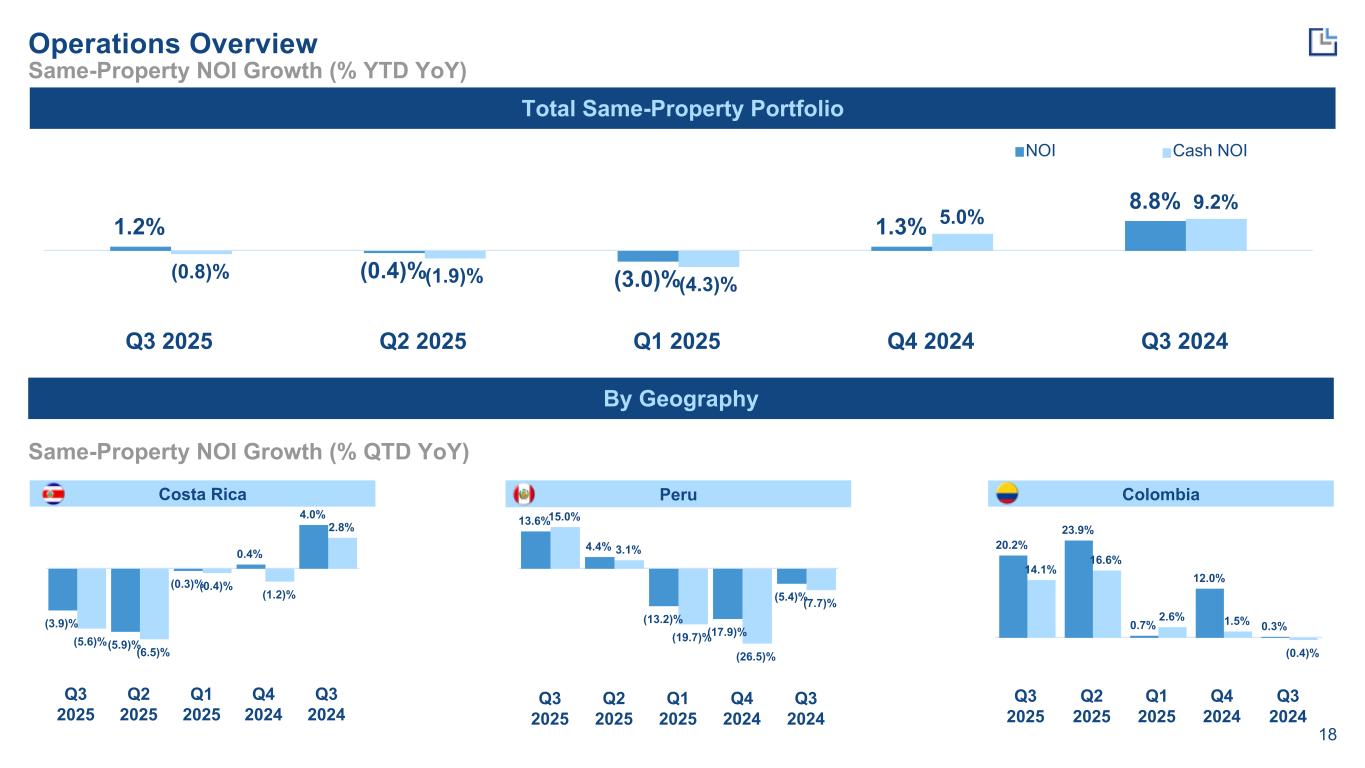

18 20.2% 23.9% 0.7% 12.0% 0.3% 14.1% 16.6% 2.6% 1.5% (0.4)% Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 13.6% 4.4% (13.2)% (17.9)% (5.4)% 15.0% 3.1% (19.7)% (26.5)% (7.7)% Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 (3.9)% (5.9)% (0.3)% 0.4% 4.0% (5.6)% (6.5)% (0.4)% (1.2)% 2.8% Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 1.2% (0.4)% (3.0)% 1.3% 8.8% (0.8)% (1.9)% (4.3)% 5.0% 9.2% Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Operations Overview Same-Property NOI Growth (% YTD YoY) Total Same-Property Portfolio By Geography NOI Cash NOI Same-Property NOI Growth (% QTD YoY) Costa Rica Peru Colombia

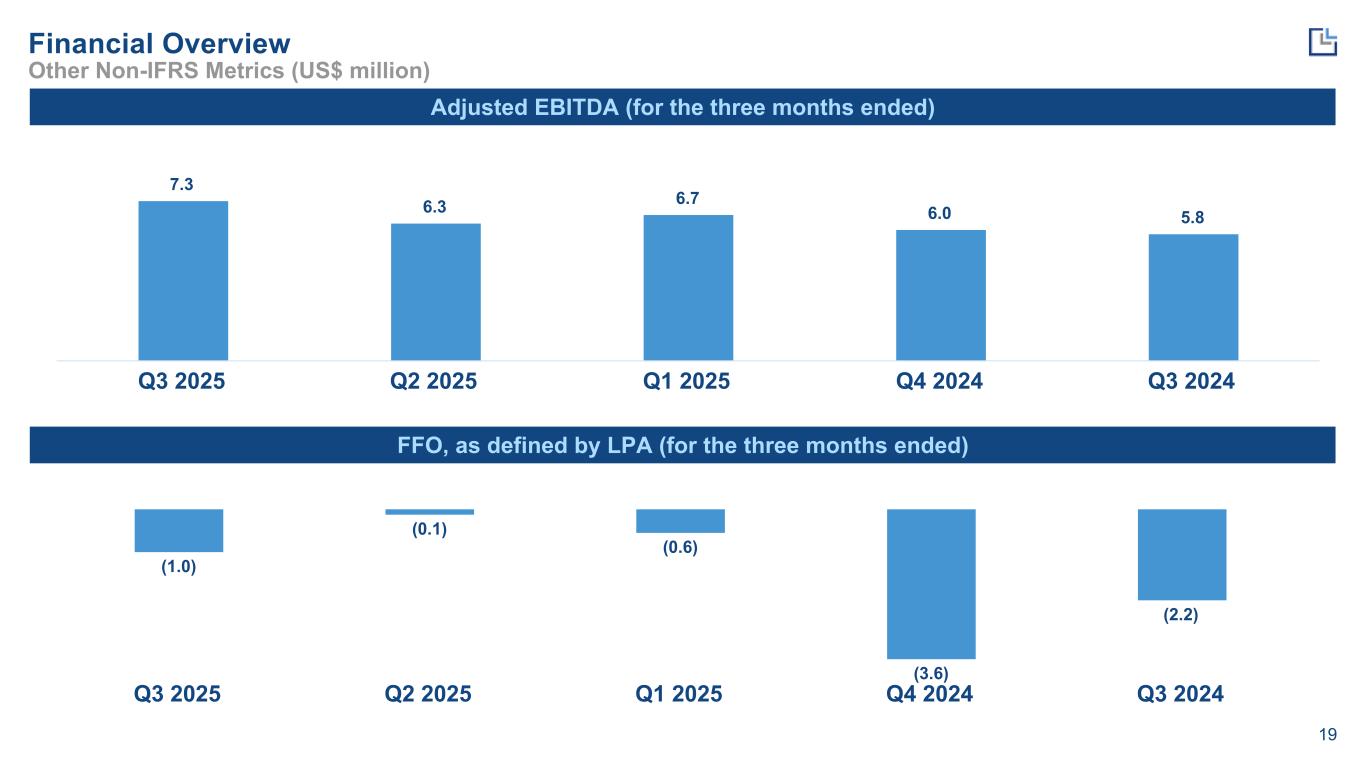

19 7.3 6.3 6.7 6.0 5.8 Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024 Financial Overview Other Non-IFRS Metrics (US$ million) Adjusted EBITDA (for the three months ended) FFO, as defined by LPA (for the three months ended) (1.0) (0.1) (0.6) (3.6) (2.2) Q3 2025 Q2 2025 Q1 2025 Q4 2024 Q3 2024

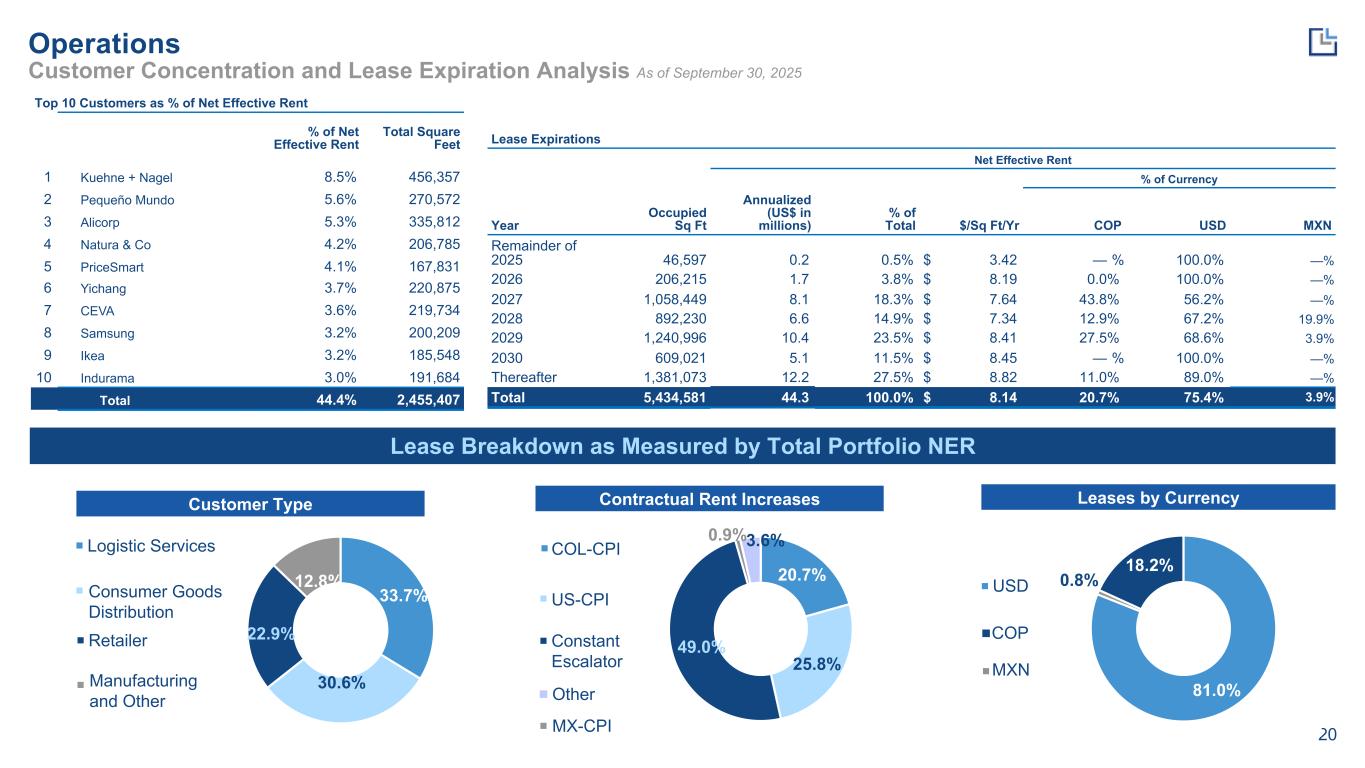

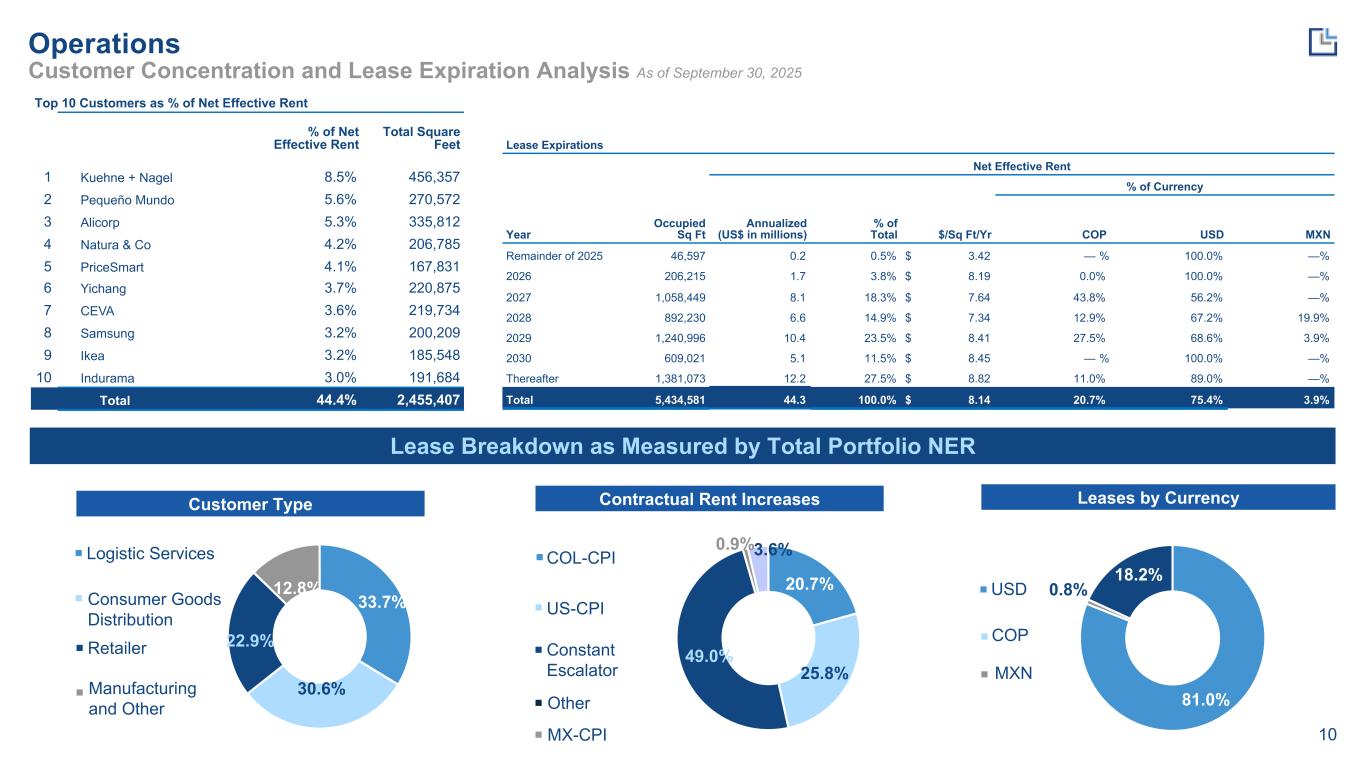

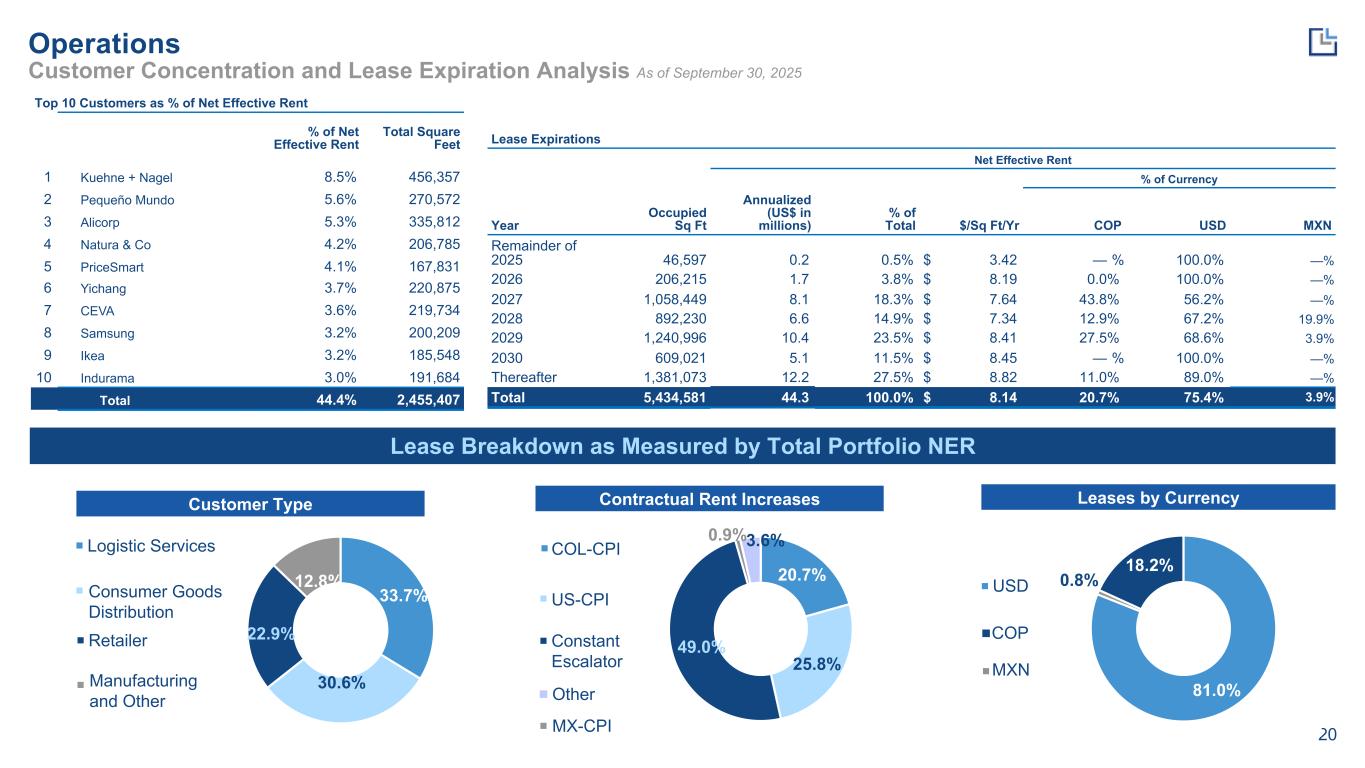

20 Operations Customer Concentration and Lease Expiration Analysis Lease Breakdown as Measured by Total Portfolio NER Customer Type Contractual Rent Increases Leases by Currency As of September 30, 2025 USD COP Top 10 Customers as % of Net Effective Rent % of Net Effective Rent Total Square Feet 1 Kuehne + Nagel 8.5% 456,357 2 Pequeño Mundo 5.6% 270,572 3 Alicorp 5.3% 335,812 4 Natura & Co 4.2% 206,785 5 PriceSmart 4.1% 167,831 6 Yichang 3.7% 220,875 7 CEVA 3.6% 219,734 8 Samsung 3.2% 200,209 9 Ikea 3.2% 185,548 10 Indurama 3.0% 191,684 Total 44.4% 2,455,407 Lease Expirations Net Effective Rent % of Currency Year Occupied Sq Ft Annualized (US$ in millions) % of Total $/Sq Ft/Yr COP USD MXN Remainder of 2025 46,597 0.2 0.5% $ 3.42 — % 100.0% — % 2026 206,215 1.7 3.8% $ 8.19 0.0% 100.0% — % 2027 1,058,449 8.1 18.3% $ 7.64 43.8% 56.2% — % 2028 892,230 6.6 14.9% $ 7.34 12.9% 67.2% 19.9 % 2029 1,240,996 10.4 23.5% $ 8.41 27.5% 68.6% 3.9 % 2030 609,021 5.1 11.5% $ 8.45 — % 100.0% — % Thereafter 1,381,073 12.2 27.5% $ 8.82 11.0% 89.0% — % Total 5,434,581 44.3 100.0% $ 8.14 20.7% 75.4% 3.9 % 81.0% 0.8% 18.2% MXN 33.7% 30.6% 22.9% 12.8% Logistic Services Consumer Goods Distribution Retailer Manufacturing and Other 20.7% 25.8% 49.0% 0.9%3.6%COL-CPI US-CPI Constant Escalator Other MX-CPI

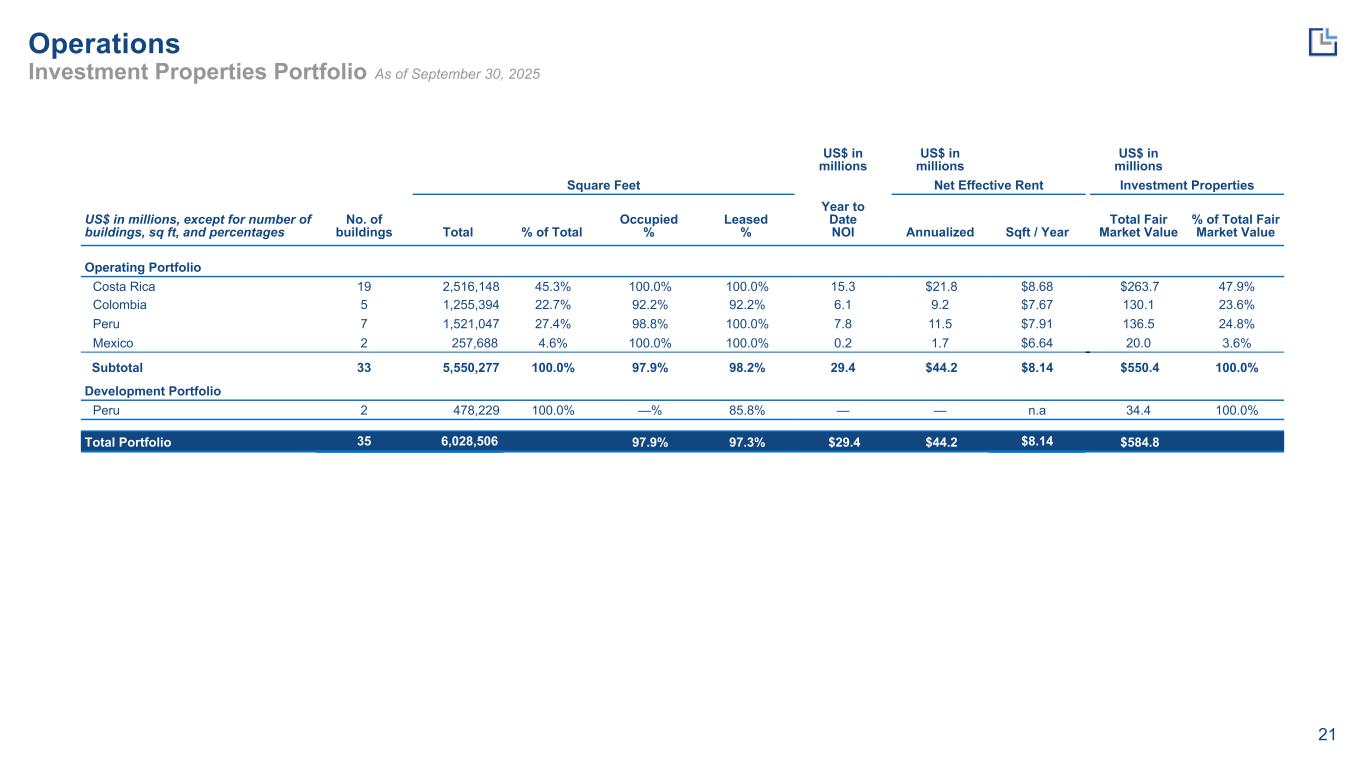

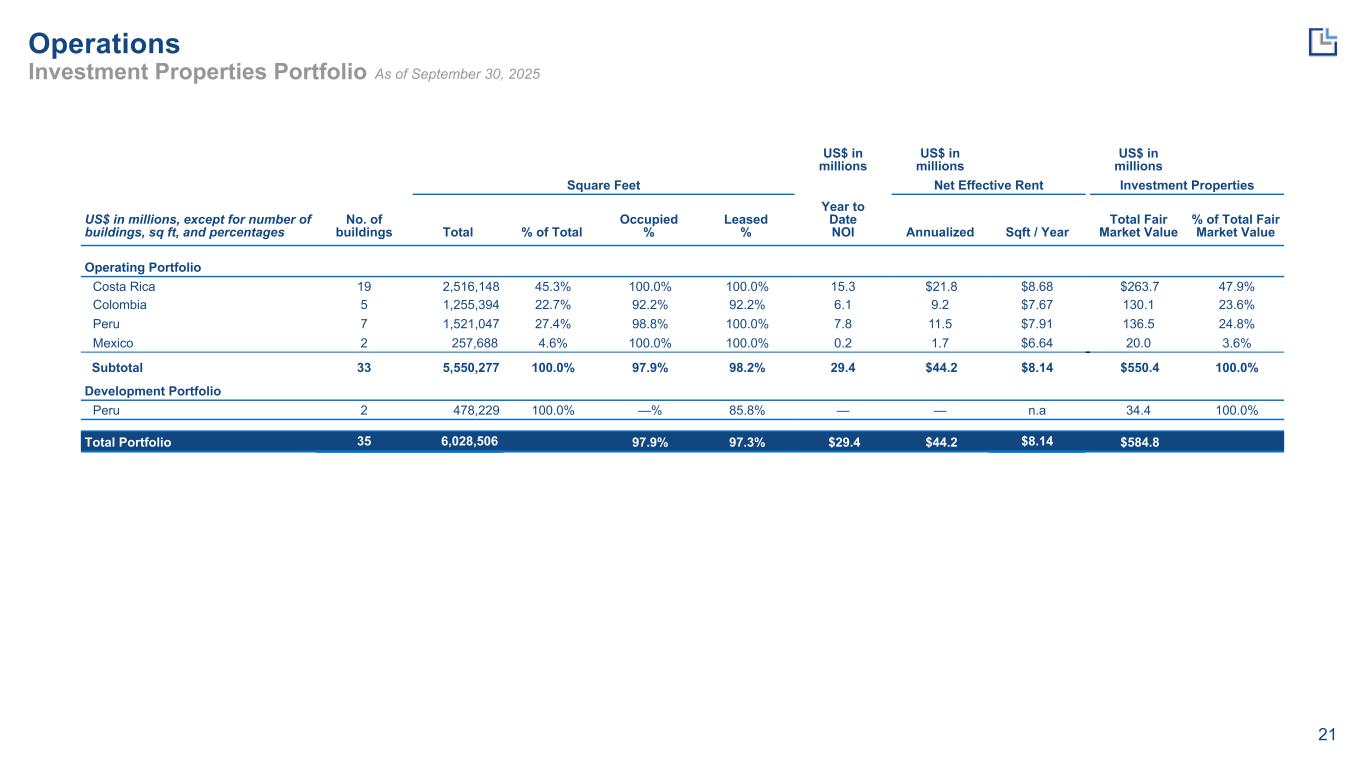

21 US$ in millions US$ in millions US$ in millions Square Feet Net Effective Rent Investment Properties US$ in millions, except for number of buildings, sq ft, and percentages No. of buildings Total % of Total Occupied % Leased % Year to Date NOI Annualized Sqft / Year Total Fair Market Value % of Total Fair Market Value Operating Portfolio Costa Rica 19 2,516,148 45.3% 100.0% 100.0% 15.3 $21.8 $8.68 $263.7 47.9% Colombia 5 1,255,394 22.7% 92.2% 92.2% 6.1 9.2 $7.67 130.1 23.6% Peru 7 1,521,047 27.4% 98.8% 100.0% 7.8 11.5 $7.91 136.5 24.8% Mexico 2 257,688 4.6% 100.0% 100.0% 0.2 1.7 $6.64 20.0 3.6% Subtotal 33 5,550,277 100.0% 97.9% 98.2% 29.4 $44.2 $8.14 $550.4 100.0% Development Portfolio Peru 2 478,229 100.0% —% 85.8% — — n.a 34.4 100.0% Total Portfolio 35 6,028,506 97.9% 97.3% $29.4 $44.2 $8.14 $584.8 Operations Investment Properties Portfolio As of September 30, 2025

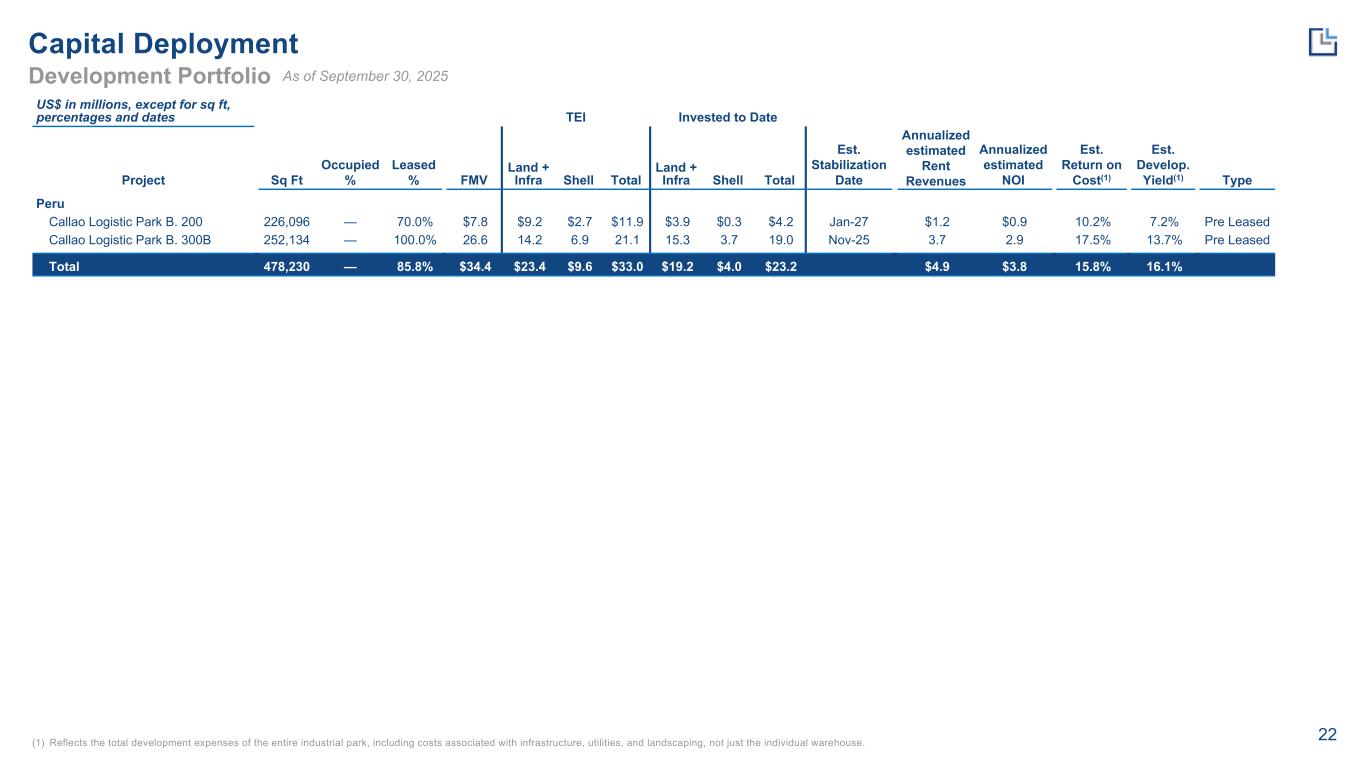

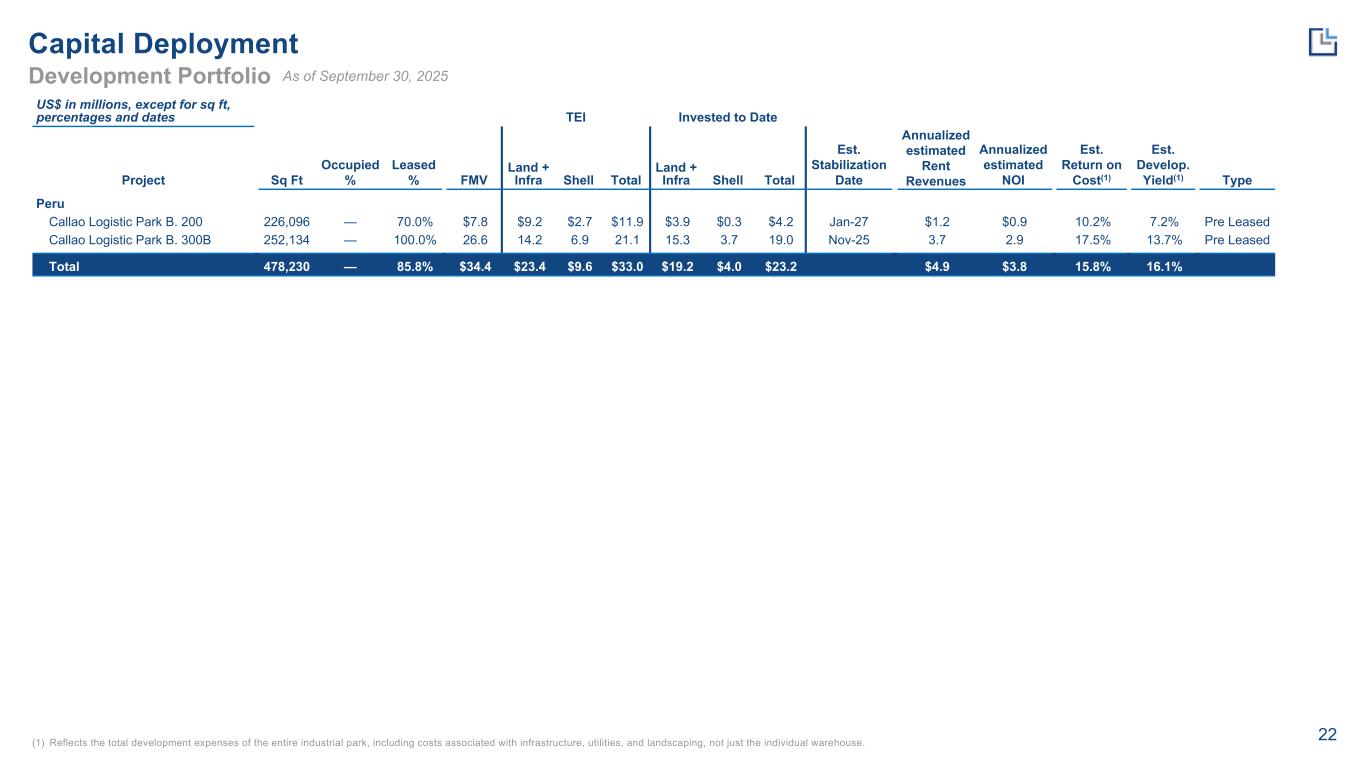

22 US$ in millions, except for sq ft, percentages and dates TEI Invested to Date Project Sq Ft Occupied % Leased % FMV Land + Infra Shell Total Land + Infra Shell Total Est. Stabilization Date Annualized estimated Rent Revenues Annualized estimated NOI Est. Return on Cost(1) Est. Develop. Yield(1) Type Peru Callao Logistic Park B. 200 226,096 — 70.0% $7.8 $9.2 $2.7 $11.9 $3.9 $0.3 $4.2 Jan-27 $1.2 $0.9 10.2% 7.2% Pre Leased Callao Logistic Park B. 300B 252,134 — 100.0% 26.6 14.2 6.9 21.1 15.3 3.7 19.0 Nov-25 3.7 2.9 17.5% 13.7% Pre Leased Total 478,230 — 85.8% $34.4 $23.4 $9.6 $33.0 $19.2 $4.0 $23.2 $4.9 $3.8 15.8% 16.1% Capital Deployment Development Portfolio (1) Reflects the total development expenses of the entire industrial park, including costs associated with infrastructure, utilities, and landscaping, not just the individual warehouse. As of September 30, 2025

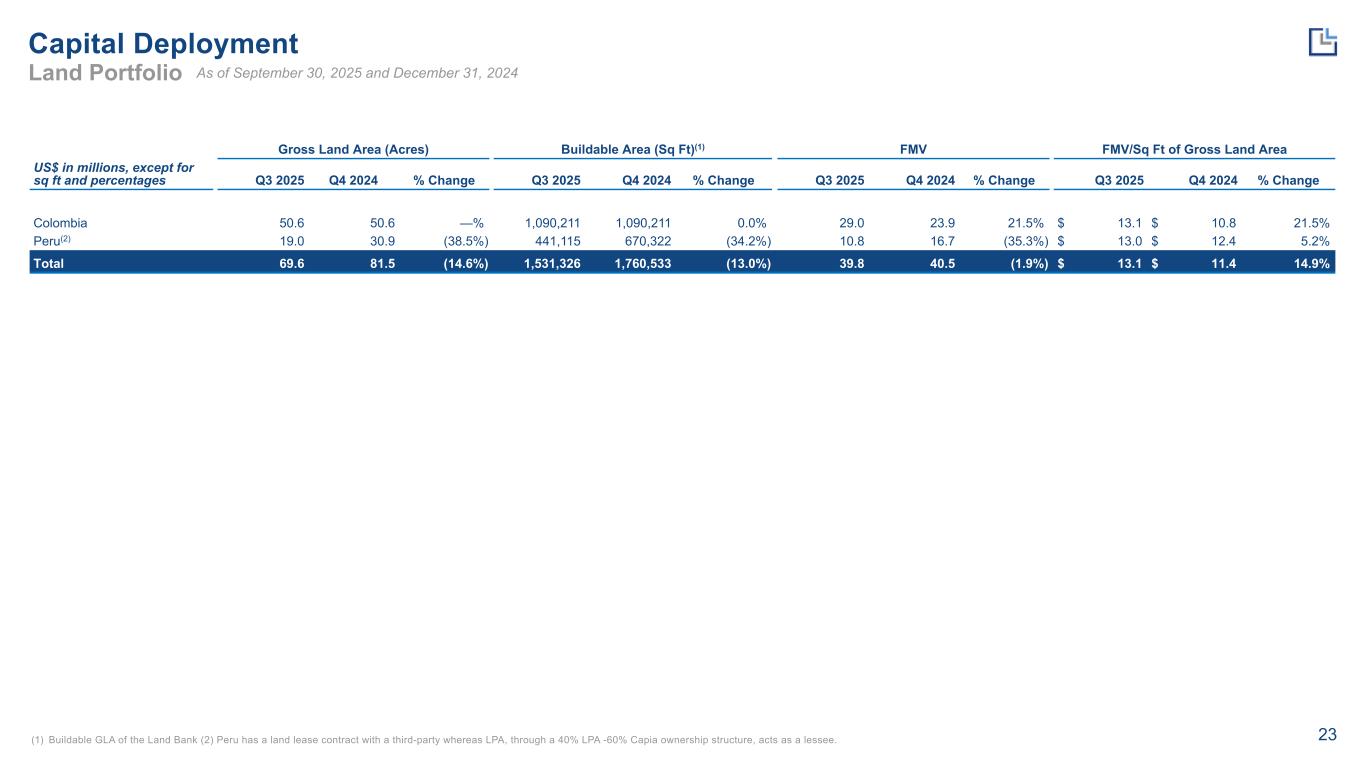

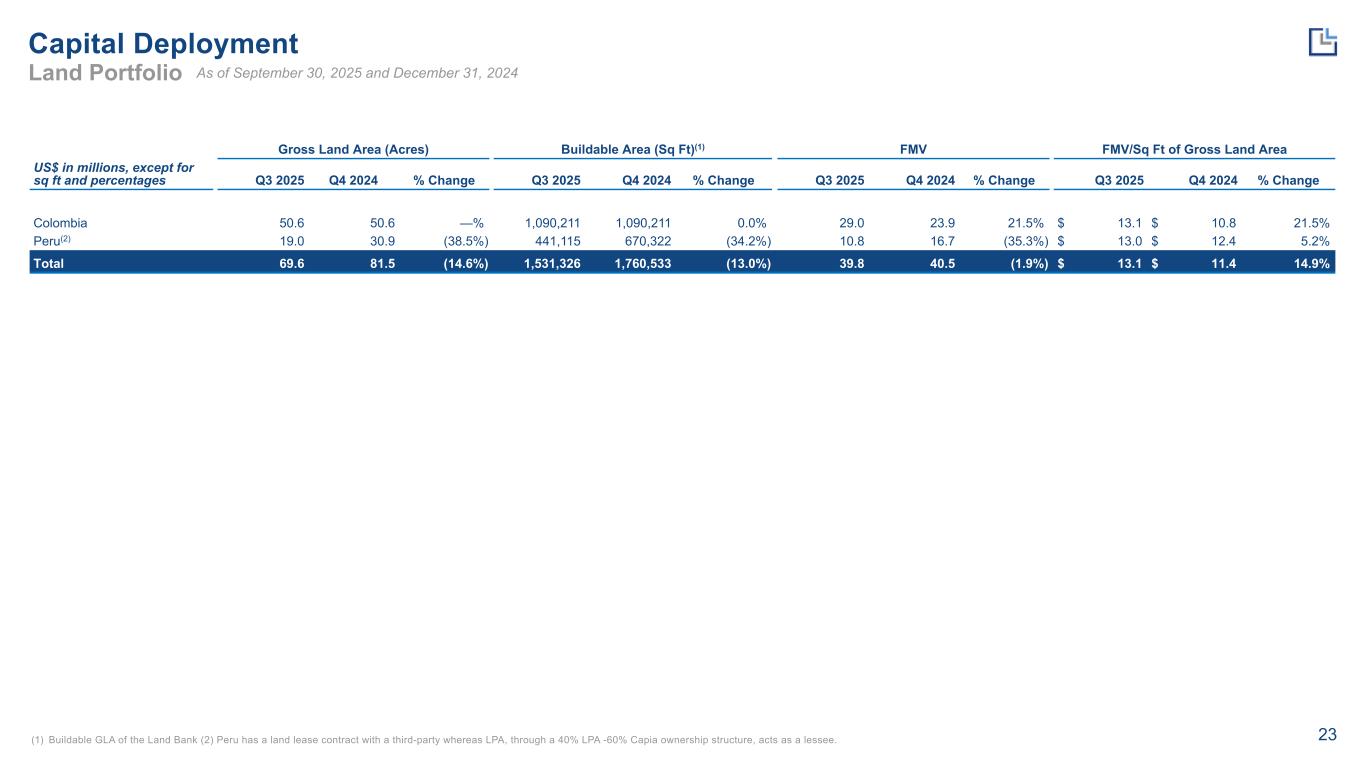

23 Gross Land Area (Acres) Buildable Area (Sq Ft)(1) FMV FMV/Sq Ft of Gross Land Area US$ in millions, except for sq ft and percentages Q3 2025 Q4 2024 % Change Q3 2025 Q4 2024 % Change Q3 2025 Q4 2024 % Change Q3 2025 Q4 2024 % Change Colombia 50.6 50.6 —% 1,090,211 1,090,211 0.0% 29.0 23.9 21.5% $ 13.1 $ 10.8 21.5% Peru(2) 19.0 30.9 (38.5%) 441,115 670,322 (34.2%) 10.8 16.7 (35.3%) $ 13.0 $ 12.4 5.2% Total 69.6 81.5 (14.6%) 1,531,326 1,760,533 (13.0%) 39.8 40.5 (1.9%) $ 13.1 $ 11.4 14.9% Capital Deployment Land Portfolio (1) Buildable GLA of the Land Bank (2) Peru has a land lease contract with a third-party whereas LPA, through a 40% LPA -60% Capia ownership structure, acts as a lessee. As of September 30, 2025 and December 31, 2024

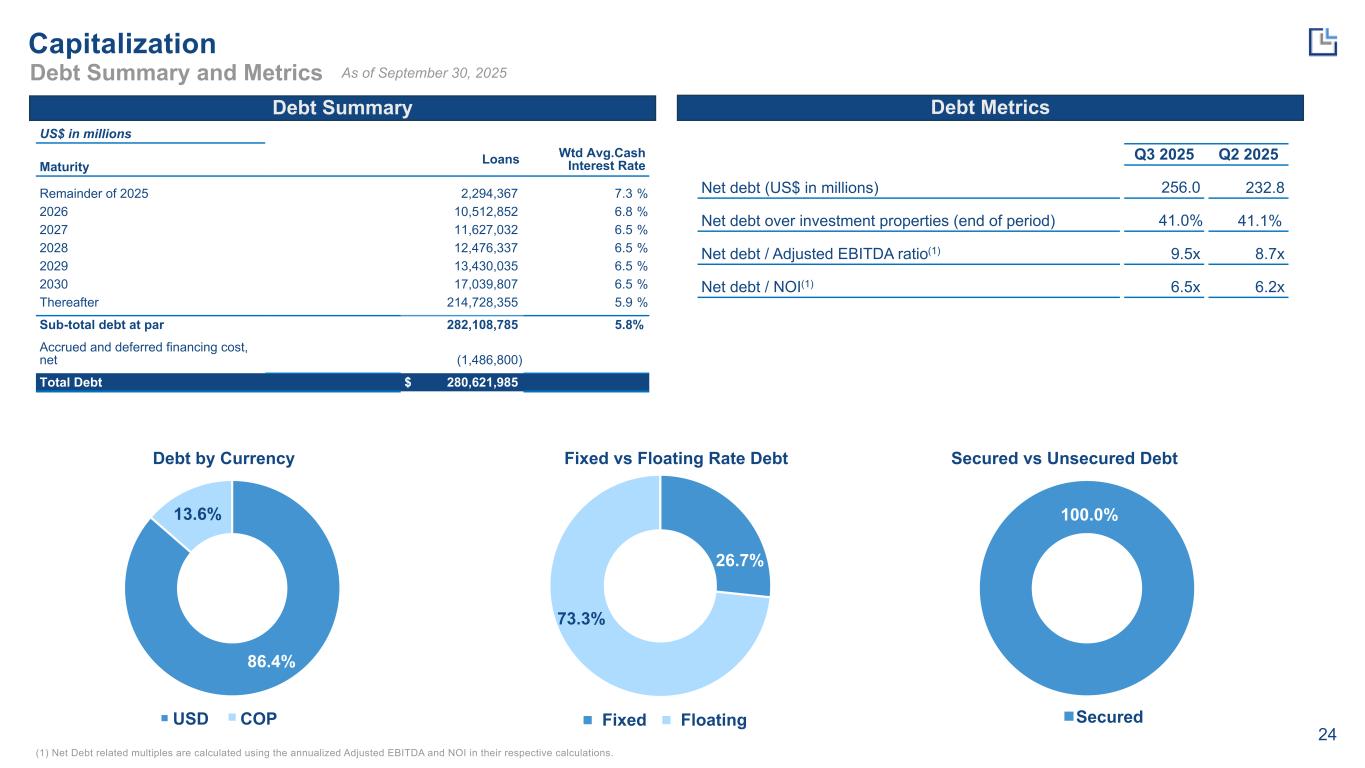

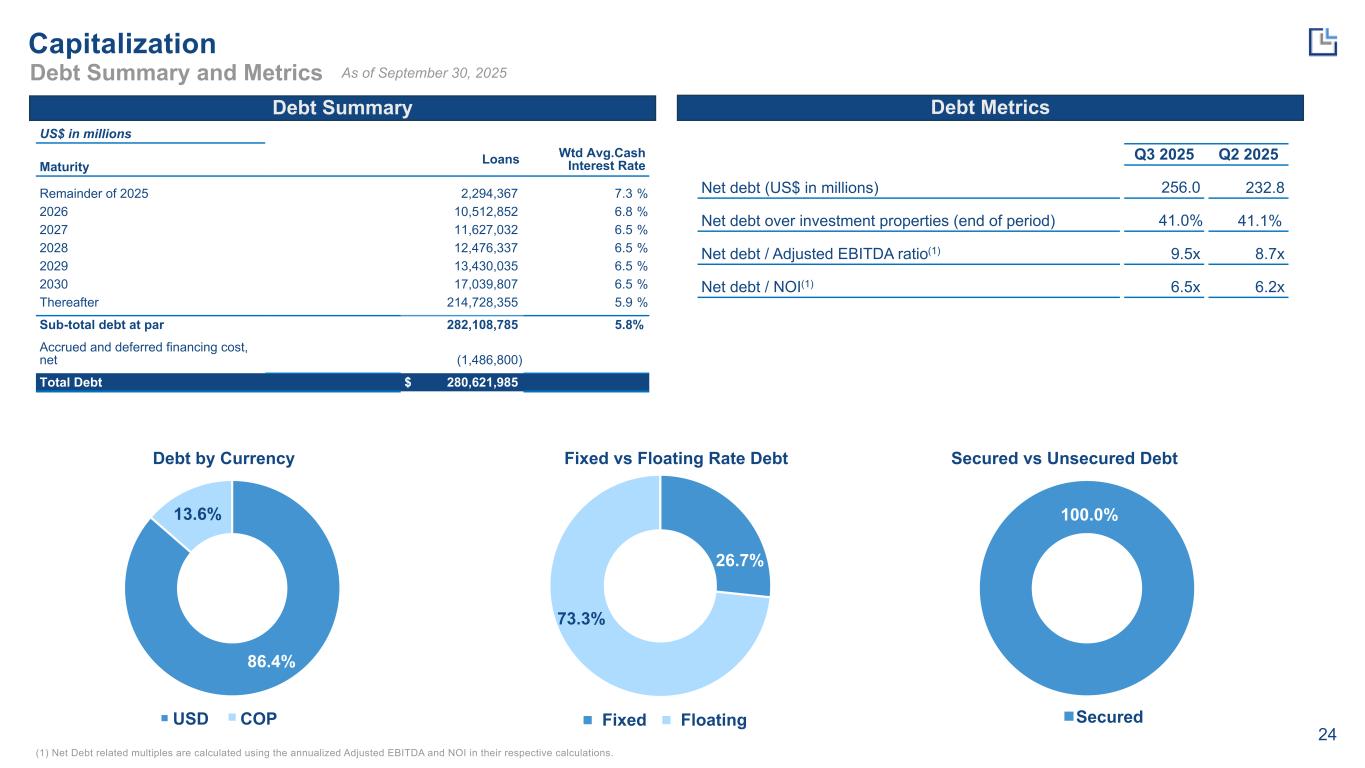

24 Q3 2025 Q2 2025 Net debt (US$ in millions) 256.0 232.8 Net debt over investment properties (end of period) 41.0 % 41.1% Net debt / Adjusted EBITDA ratio(1) 9.5x 8.7x Net debt / NOI(1) 6.5x 6.2x 26.7% 73.3% Fixed vs Floating Rate Debt 100.0% Secured vs Unsecured Debt 86.4% 13.6% Capitalization Debt Summary and Metrics Debt Summary Debt Metrics As of September 30, 2025 (1) Net Debt related multiples are calculated using the annualized Adjusted EBITDA and NOI in their respective calculations. Debt by Currency SecuredFixed FloatingUSD COP US$ in millions Maturity Loans Wtd Avg.Cash Interest Rate Remainder of 2025 2,294,367 7.3 % 2026 10,512,852 6.8 % 2027 11,627,032 6.5 % 2028 12,476,337 6.5 % 2029 13,430,035 6.5 % 2030 17,039,807 6.5 % Thereafter 214,728,355 5.9 % Sub-total debt at par 282,108,785 5.8% Accrued and deferred financing cost, net (1,486,800) Total Debt $ 280,621,985

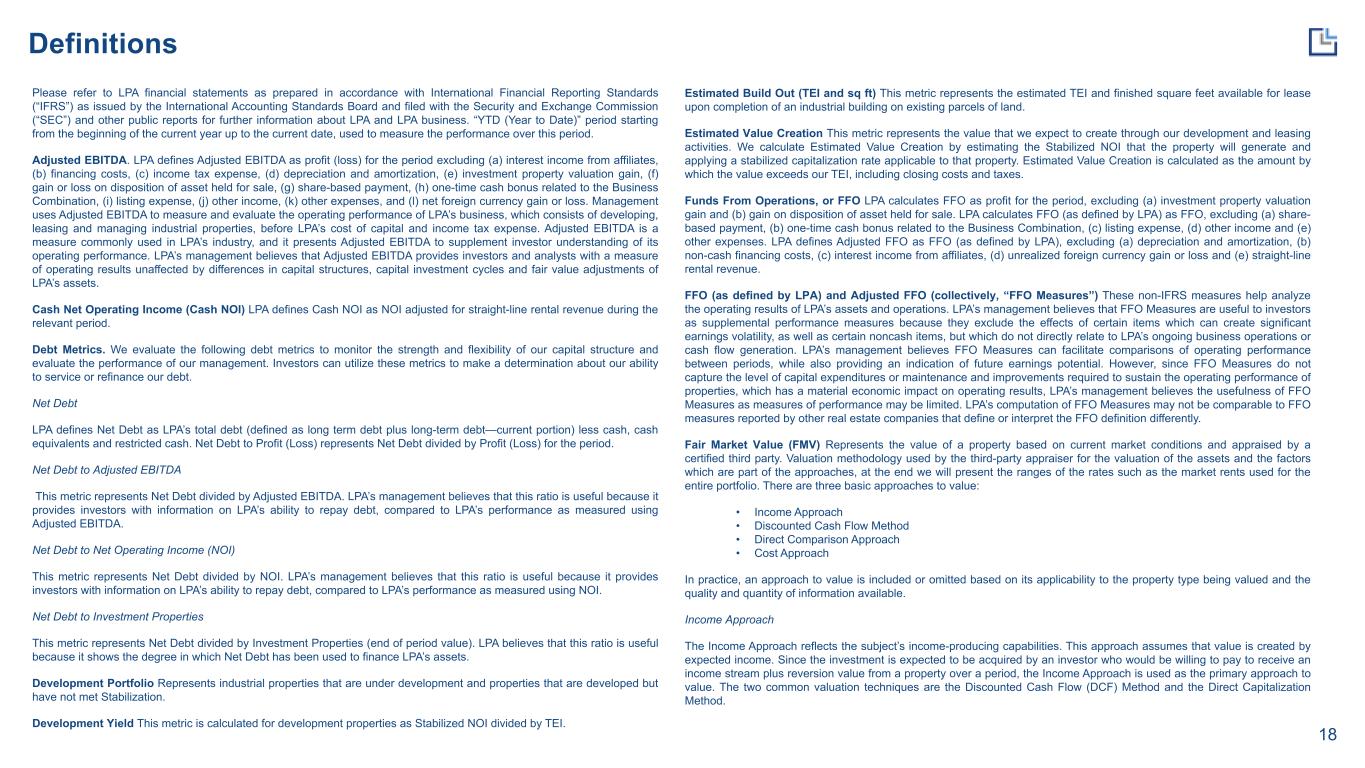

25 Definitions Please refer to LPA financial statements as prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and filed with the Security and Exchange Commission (“SEC”) and other public reports for further information about LPA and LPA business. “YTD (Year to Date)” period starting from the beginning of the current year up to the current date, used to measure the performance over this period. Adjusted EBITDA. LPA defines Adjusted EBITDA as profit (loss) for the period excluding (a) interest income from affiliates, (b) financing costs, (c) income tax expense, (d) depreciation and amortization, (e) investment property valuation gain, (f) gain or loss on disposition of asset held for sale, (g) share-based payment, (h) one-time cash bonus related to the Business Combination, (i) listing expense, (j) other income, (k) other expenses, and (l) net foreign currency gain or loss. Management uses Adjusted EBITDA to measure and evaluate the operating performance of LPA’s business, which consists of developing, leasing and managing industrial properties, before LPA’s cost of capital and income tax expense. Adjusted EBITDA is a measure commonly used in LPA’s industry, and it presents Adjusted EBITDA to supplement investor understanding of its operating performance. LPA’s management believes that Adjusted EBITDA provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and fair value adjustments of LPA’s assets. Cash Net Operating Income (Cash NOI) LPA defines Cash NOI as NOI adjusted for straight-line rental revenue during the relevant period. Debt Metrics. We evaluate the following debt metrics to monitor the strength and flexibility of our capital structure and evaluate the performance of our management. Investors can utilize these metrics to make a determination about our ability to service or refinance our debt. Net Debt LPA defines Net Debt as LPA’s total debt (defined as long term debt plus long-term debt—current portion) less cash, cash equivalents and restricted cash. Net Debt to Profit (Loss) represents Net Debt divided by Profit (Loss) for the period. Net Debt to Adjusted EBITDA This metric represents Net Debt divided by Adjusted EBITDA. LPA’s management believes that this ratio is useful because it provides investors with information on LPA’s ability to repay debt, compared to LPA’s performance as measured using Adjusted EBITDA. Net Debt to Net Operating Income (NOI) This metric represents Net Debt divided by NOI. LPA’s management believes that this ratio is useful because it provides investors with information on LPA’s ability to repay debt, compared to LPA’s performance as measured using NOI. Net Debt to Investment Properties This metric represents Net Debt divided by Investment Properties (end of period value). LPA believes that this ratio is useful because it shows the degree in which Net Debt has been used to finance LPA’s assets. Development Portfolio Represents industrial properties that are under development and properties that are developed but have not met Stabilization. Development Yield This metric is calculated for development properties as Stabilized NOI divided by TEI. Estimated Build Out (TEI and sq ft) This metric represents the estimated TEI and finished square feet available for lease upon completion of an industrial building on existing parcels of land. Estimated Value Creation This metric represents the value that we expect to create through our development and leasing activities. We calculate Estimated Value Creation by estimating the Stabilized NOI that the property will generate and applying a stabilized capitalization rate applicable to that property. Estimated Value Creation is calculated as the amount by which the value exceeds our TEI, including closing costs and taxes. Funds From Operations, or FFO LPA calculates FFO as profit for the period, excluding (a) investment property valuation gain and (b) gain on disposition of asset held for sale. LPA calculates FFO (as defined by LPA) as FFO, excluding (a) share- based payment, (b) one-time cash bonus related to the Business Combination, (c) listing expense, (d) other income and (e) other expenses. LPA defines Adjusted FFO as FFO (as defined by LPA), excluding (a) depreciation and amortization, (b) non-cash financing costs, (c) interest income from affiliates, (d) unrealized foreign currency gain or loss and (e) straight-line rental revenue. FFO (as defined by LPA) and Adjusted FFO (collectively, “FFO Measures”) These non-IFRS measures help analyze the operating results of LPA’s assets and operations. LPA’s management believes that FFO Measures are useful to investors as supplemental performance measures because they exclude the effects of certain items which can create significant earnings volatility, as well as certain noncash items, but which do not directly relate to LPA’s ongoing business operations or cash flow generation. LPA’s management believes FFO Measures can facilitate comparisons of operating performance between periods, while also providing an indication of future earnings potential. However, since FFO Measures do not capture the level of capital expenditures or maintenance and improvements required to sustain the operating performance of properties, which has a material economic impact on operating results, LPA’s management believes the usefulness of FFO Measures as measures of performance may be limited. LPA’s computation of FFO Measures may not be comparable to FFO measures reported by other real estate companies that define or interpret the FFO definition differently. Fair Market Value (FMV) Represents the value of a property based on current market conditions and appraised by a certified third party. Valuation methodology used by the third-party appraiser for the valuation of the assets and the factors which are part of the approaches, at the end we will present the ranges of the rates such as the market rents used for the entire portfolio. There are three basic approaches to value: • Income Approach • Discounted Cash Flow Method • Direct Comparison Approach • Cost Approach In practice, an approach to value is included or omitted based on its applicability to the property type being valued and the quality and quantity of information available. Income Approach The Income Approach reflects the subject’s income-producing capabilities. This approach assumes that value is created by expected income. Since the investment is expected to be acquired by an investor who would be willing to pay to receive an income stream plus reversion value from a property over a period, the Income Approach is used as the primary approach to value. The two common valuation techniques are the Discounted Cash Flow (DCF) Method and the Direct Capitalization Method.

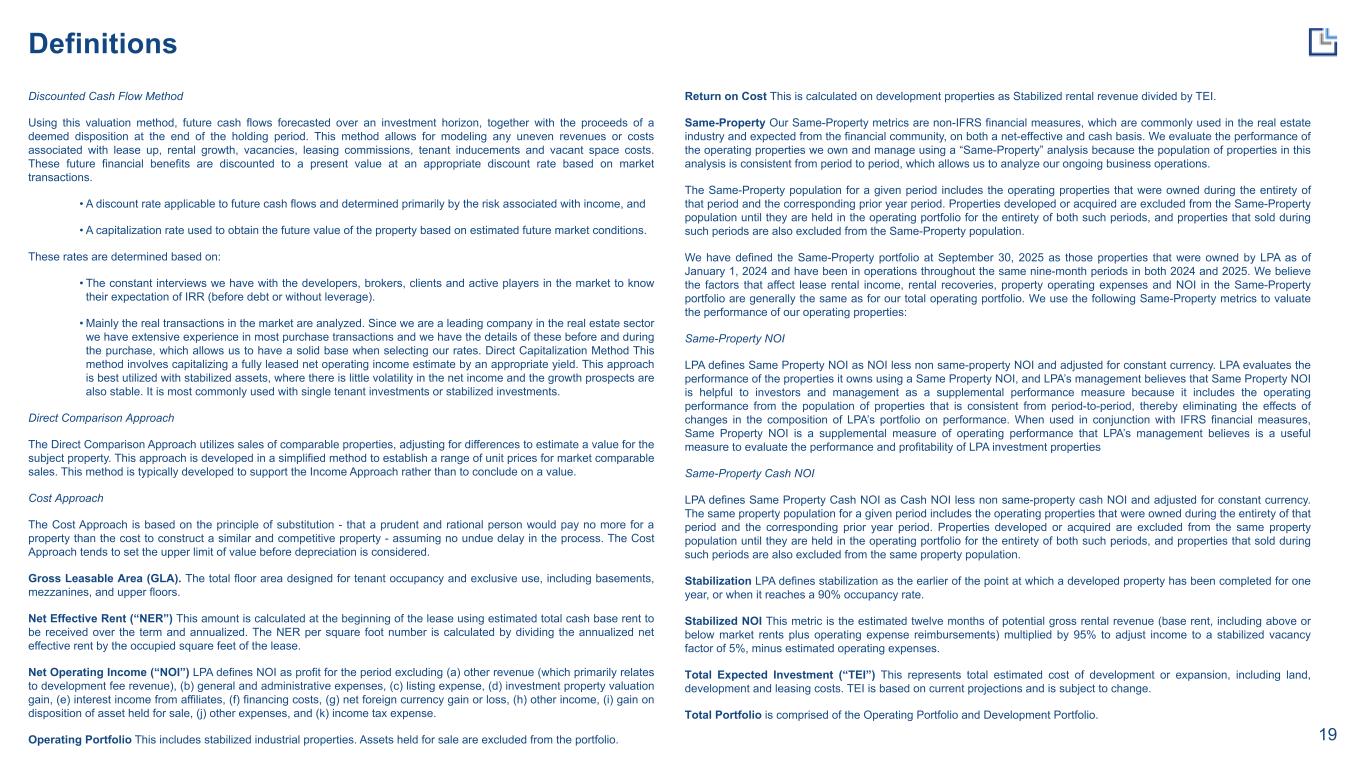

26 Definitions Return on Cost This is calculated on development properties as Stabilized rental revenue divided by TEI. Same-Property Our Same-Property metrics are non-IFRS financial measures, which are commonly used in the real estate industry and expected from the financial community, on both a net-effective and cash basis. We evaluate the performance of the operating properties we own and manage using a “Same-Property” analysis because the population of properties in this analysis is consistent from period to period, which allows us to analyze our ongoing business operations. The Same-Property population for a given period includes the operating properties that were owned during the entirety of that period and the corresponding prior year period. Properties developed or acquired are excluded from the Same- Property population until they are held in the operating portfolio for the entirety of both such periods, and properties that sold during such periods are also excluded from the Same-Property population. We have defined the Same-Property portfolio at September 30, 2025 as those properties that were owned by LPA as of January 1, 2024 and have been in operations throughout the same nine-month periods in both 2024 and 2025. We believe the factors that affect lease rental income, rental recoveries, property operating expenses and NOI in the Same-Property portfolio are generally the same as for our total operating portfolio. We use the following Same-Property metrics to valuate the performance of our operating properties: Same-Property NOI LPA defines Same Property NOI as NOI less non same-property NOI and adjusted for constant currency. LPA evaluates the performance of the properties it owns using a Same Property NOI, and LPA’s management believes that Same Property NOI is helpful to investors and management as a supplemental performance measure because it includes the operating performance from the population of properties that is consistent from period-to-period, thereby eliminating the effects of changes in the composition of LPA’s portfolio on performance. When used in conjunction with IFRS financial measures, Same Property NOI is a supplemental measure of operating performance that LPA’s management believes is a useful measure to evaluate the performance and profitability of LPA investment properties Same-Property Cash NOI LPA defines Same Property Cash NOI as Cash NOI less non same-property cash NOI and adjusted for constant currency. The same property population for a given period includes the operating properties that were owned during the entirety of that period and the corresponding prior year period. Properties developed or acquired are excluded from the same property population until they are held in the operating portfolio for the entirety of both such periods, and properties that sold during such periods are also excluded from the same property population. Stabilization LPA defines stabilization as the earlier of the point at which a developed property has been completed for one year, or when it reaches a 90% occupancy rate. Stabilized NOI This metric is the estimated twelve months of potential gross rental revenue (base rent, including above or below market rents plus operating expense reimbursements) multiplied by 95% to adjust income to a stabilized vacancy factor of 5%, minus estimated operating expenses. Total Expected Investment (“TEI”) This represents total estimated cost of development or expansion, including land, development and leasing costs. TEI is based on current projections and is subject to change. Total Portfolio is comprised of the Operating Portfolio and Development Portfolio. Discounted Cash Flow Method Using this valuation method, future cash flows forecasted over an investment horizon, together with the proceeds of a deemed disposition at the end of the holding period. This method allows for modeling any uneven revenues or costs associated with lease up, rental growth, vacancies, leasing commissions, tenant inducements and vacant space costs. These future financial benefits are discounted to a present value at an appropriate discount rate based on market transactions. • A discount rate applicable to future cash flows and determined primarily by the risk associated with income, and • A capitalization rate used to obtain the future value of the property based on estimated future market conditions. These rates are determined based on: • The constant interviews we have with the developers, brokers, clients and active players in the market to know their expectation of IRR (before debt or without leverage). • Mainly the real transactions in the market are analyzed. Since we are a leading company in the real estate sector, we have extensive experience in most purchase transactions and we have the details of these before and during the purchase, which allows us to have a solid base when selecting our rates. Direct Capitalization Method This method involves capitalizing a fully leased net operating income estimate by an appropriate yield. This approach is best utilized with stabilized assets, where there is little volatility in the net income and the growth prospects are also stable. It is most commonly used with single tenant investments or stabilized investments. Direct Comparison Approach The Direct Comparison Approach utilizes sales of comparable properties, adjusting for differences to estimate a value for the subject property. This approach is developed in a simplified method to establish a range of unit prices for market comparable sales. This method is typically developed to support the Income Approach rather than to conclude on a value. Cost Approach The Cost Approach is based on the principle of substitution - that a prudent and rational person would pay no more for a property than the cost to construct a similar and competitive property - assuming no undue delay in the process. The Cost Approach tends to set the upper limit of value before depreciation is considered. Gross Leasable Area (GLA). The total floor area designed for tenant occupancy and exclusive use, including basements, mezzanines, and upper floors. Net Effective Rent (“NER”) This amount is calculated at the beginning of the lease using estimated total cash base rent to be received over the term and annualized. The NER per square foot number is calculated by dividing the annualized net effective rent by the occupied square feet of the lease. Net Operating Income (“NOI”) LPA defines NOI as profit for the period excluding (a) other revenue (which primarily relates to development fee revenue), (b) general and administrative expenses, (c) listing expense, (d) investment property valuation gain, (e) interest income from affiliates, (f) financing costs, (g) net foreign currency gain or loss, (h) other income, (i) gain on disposition of asset held for sale, (j) other expenses, and (k) income tax expense. Operating Portfolio This includes stabilized industrial properties. Assets held for sale are excluded from the portfolio.

www.lpamericas.com