Document

|

|

|

|

|

|

|

NorthWestern Energy Group, Inc.

d/b/a NorthWestern Energy

3010 W. 69th Street

Sioux Falls, SD 57108

www.northwesternenergy.com

|

FOR IMMEDIATE RELEASE

NorthWestern Reports Second Quarter 2025 Financial Results

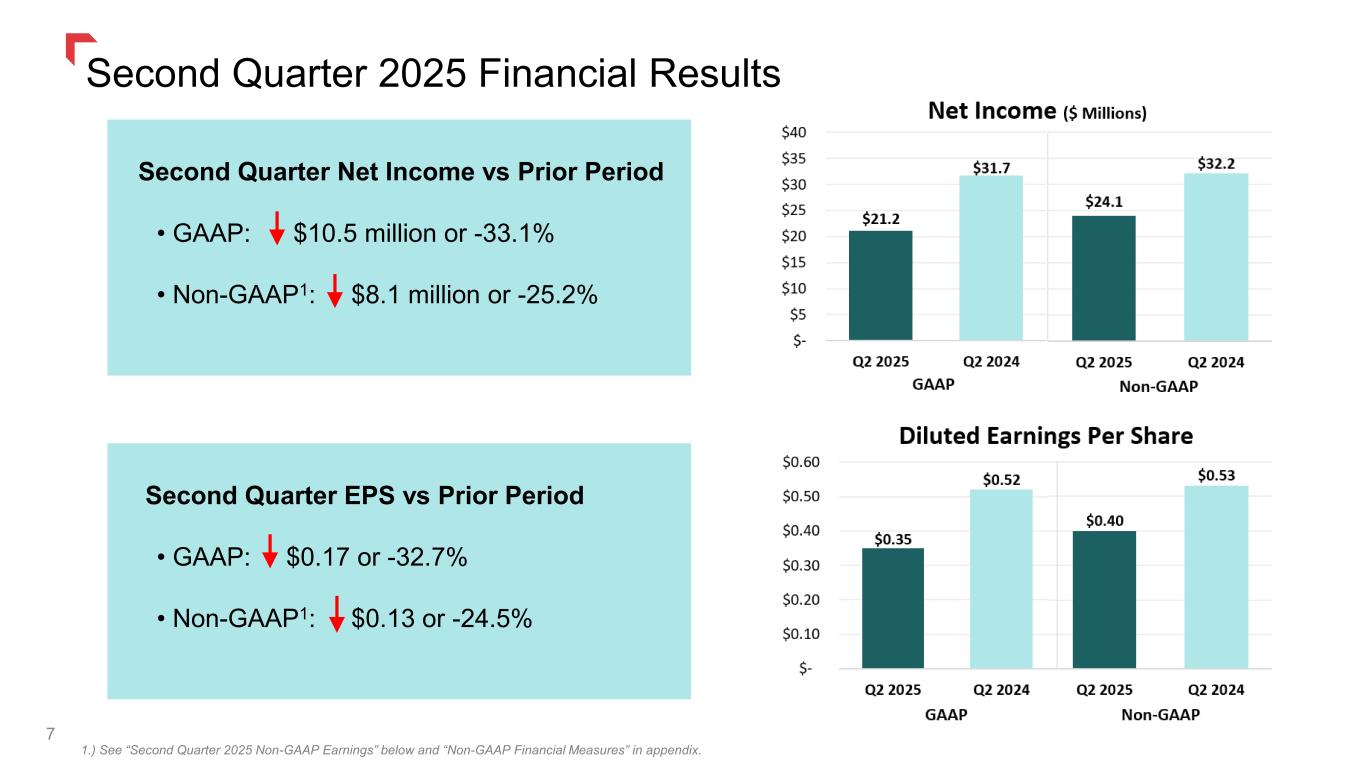

•Second Quarter 2025 Diluted GAAP EPS of $0.35, compared to $0.52 in 2024.

•Second Quarter 2025 Adjusted Diluted Non-GAAP EPS of $0.40, compared to $0.53 in 2024.

•Announces 2025 earnings guidance range of $3.53 to $3.65 per diluted share.

•Affirms $531 million capital plan for 2025 and 4% to 6% long-term EPS and rate base growth rate.

•Announces $0.66 per share quarterly dividend - payable September 30, 2025.

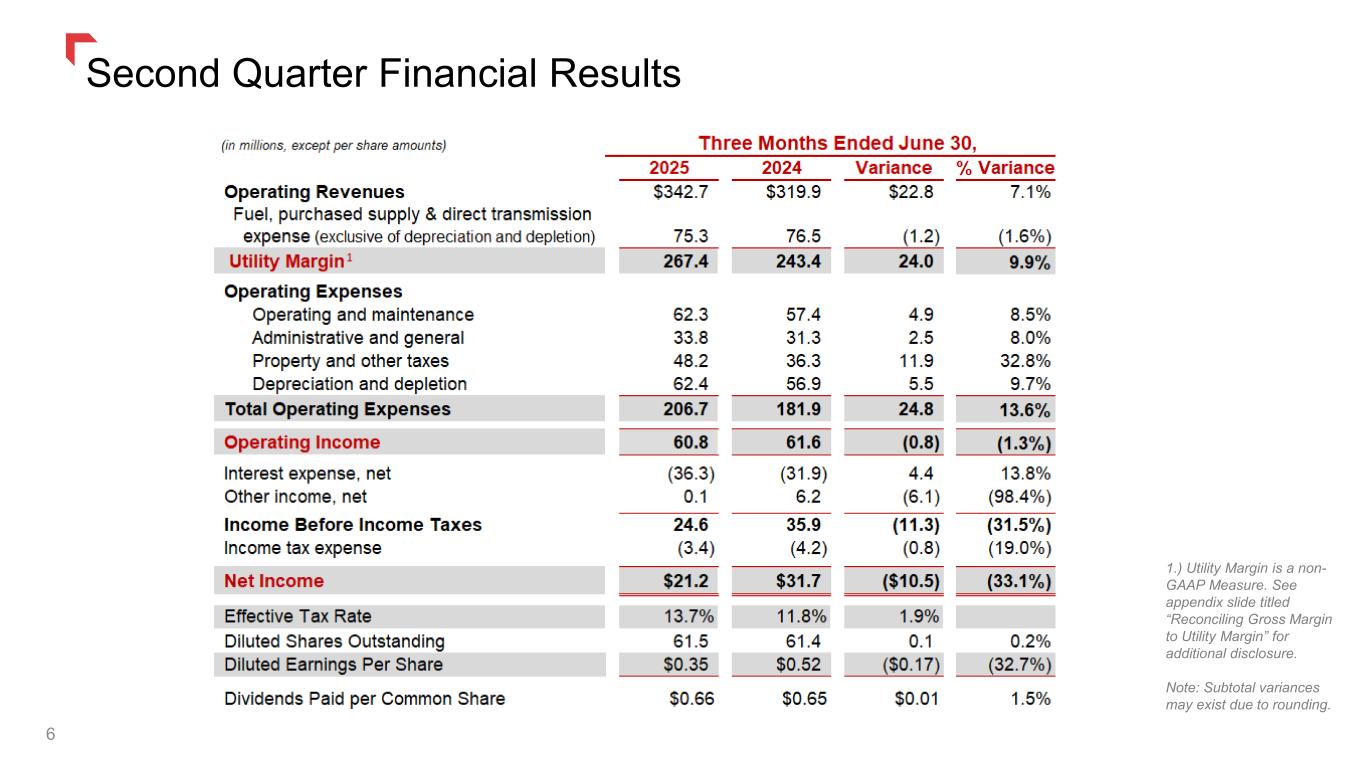

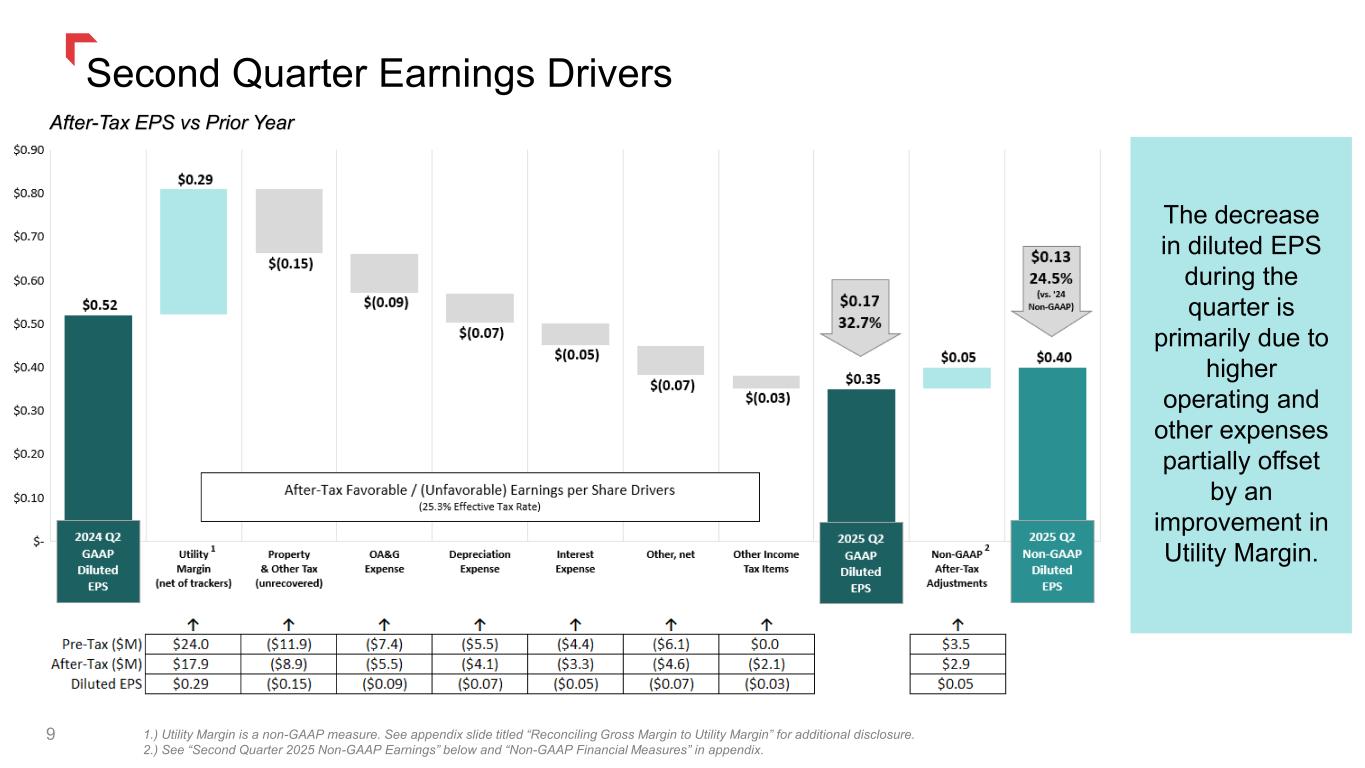

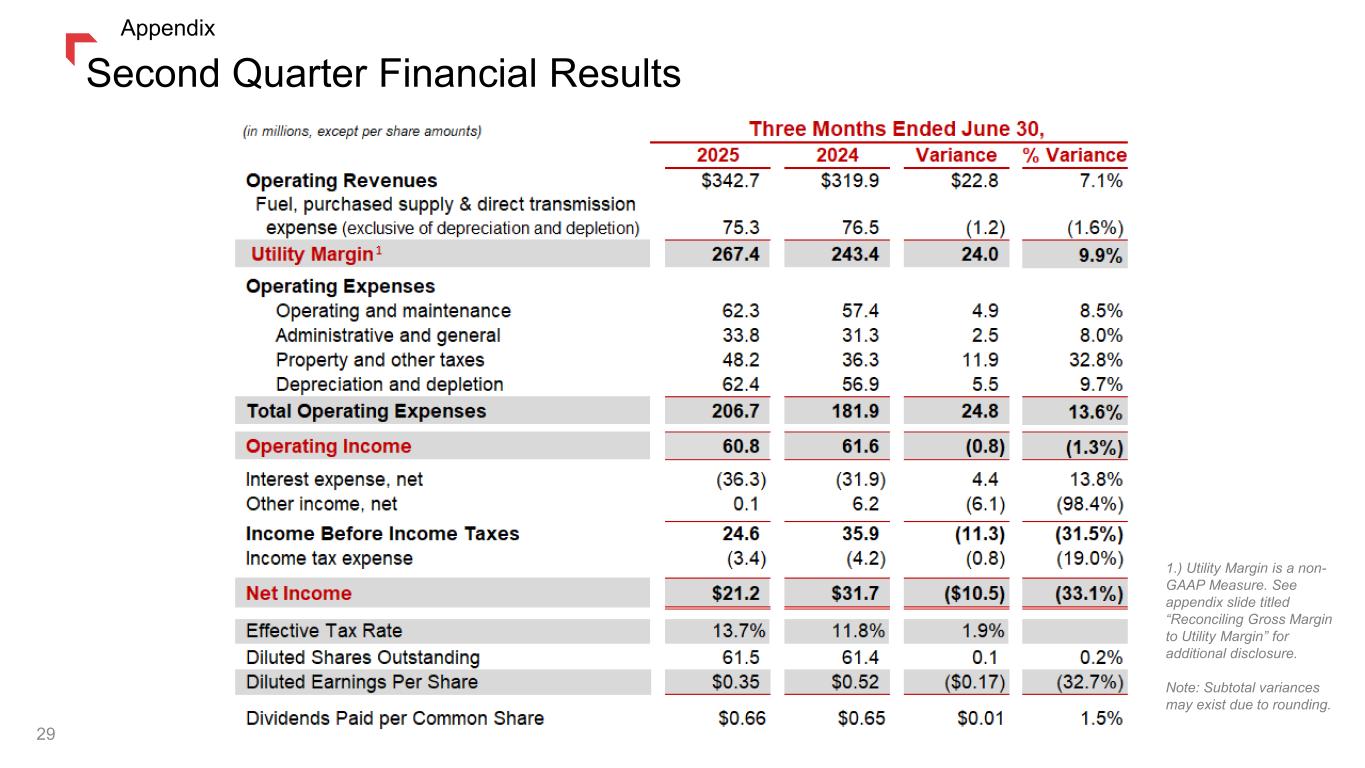

BUTTE, MT / SIOUX FALLS, SD - July 30, 2025 - NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy (Nasdaq: NWE) reported financial results for the second quarter of 2025. Net income for the period was $21.2 million, or $0.35 per diluted share, as compared with net income of $31.7 million, or $0.52 per diluted share, for the same period in 2024. This decrease was primarily due to lower retail natural gas and electric usage primarily driven by weather, Montana property tax tracker collections, non-recoverable Montana electric supply costs, depreciation, operating, administrative and general costs, and interest expense. These were partly offset by higher retail rates, higher electric transmission, and natural gas transportation revenues.

NorthWestern’s second quarter 2025 non-GAAP net income and earnings per share were $24.1 million and $0.40, respectively, compared to $32.2 million and $0.53 in 2024. See “Adjusted Non-GAAP Earnings” and “Non-GAAP Financial Measures” sections below for more information on these measures.

“We are pleased to report another quarter of strong operational performance, reinforcing our dedication to delivering safe, reliable, and affordable energy to our customers and communities. On July 1st, we successfully completed the acquisition of Energy West's natural gas distribution system in Montana, welcoming over 33,000 valued customers and 43 highly-skilled employees to our team. We also are happy to announce our third large-load letter of intent. We're actively working with an experienced developer, Quantica Infrastructure, to evaluate the transmission infrastructure and generation resources needed to support their proposed 500 megawatt project in Montana,” said Brian Bird, President and Chief Executive Officer.

“Earnings for the second quarter met our expectations, though they were lower than last year, primarily due to the delay in implementing updated interim rates in Montana. In late May, ahead of a productive public hearing, we implemented updated interim electric rates that more closely align with current service costs. An outcome in the rate review is expected early in the fourth quarter this year.” Mr. Bird continued, “The operational and financial progress this quarter continues to advance our strategic objectives that benefit our customers and investors."

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 2

FINANCIAL OUTLOOK

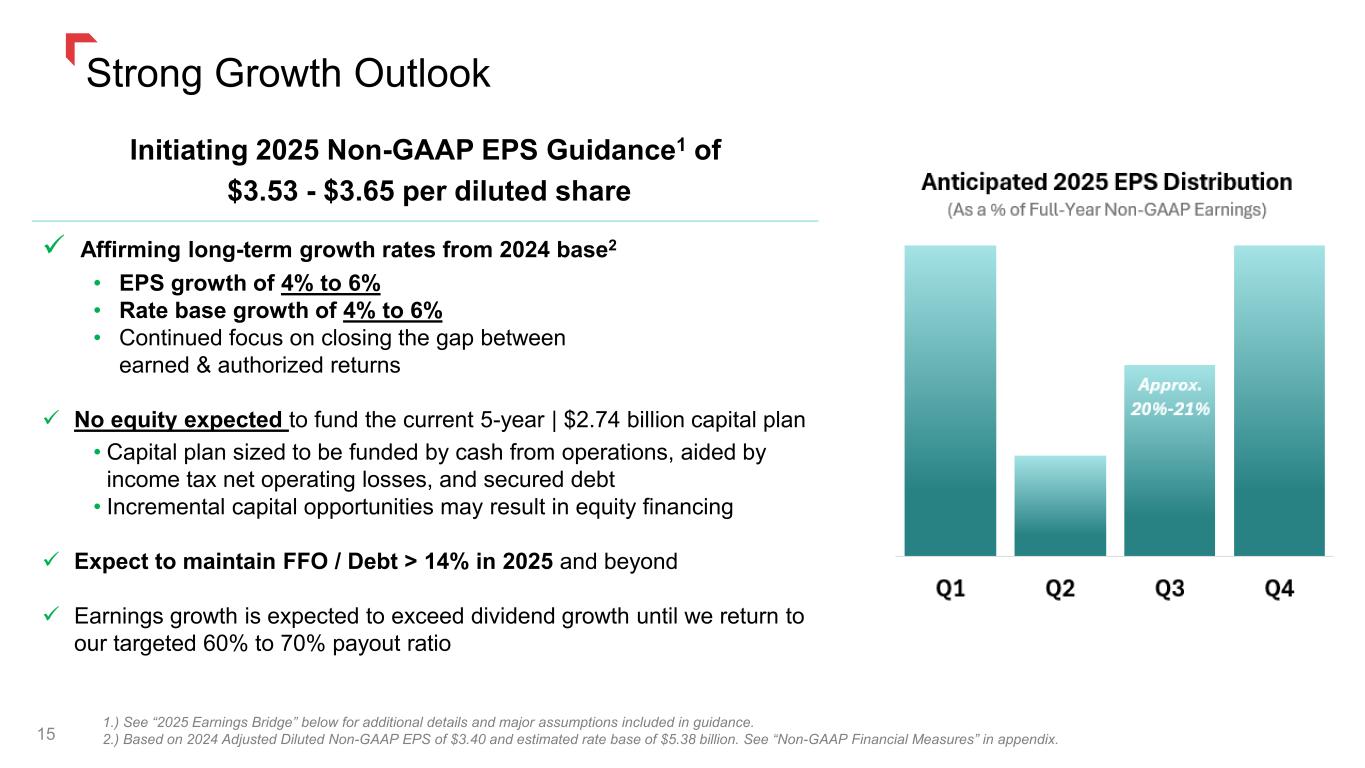

Initiating 2025 Guidance and Affirming Long-Term Growth Rates

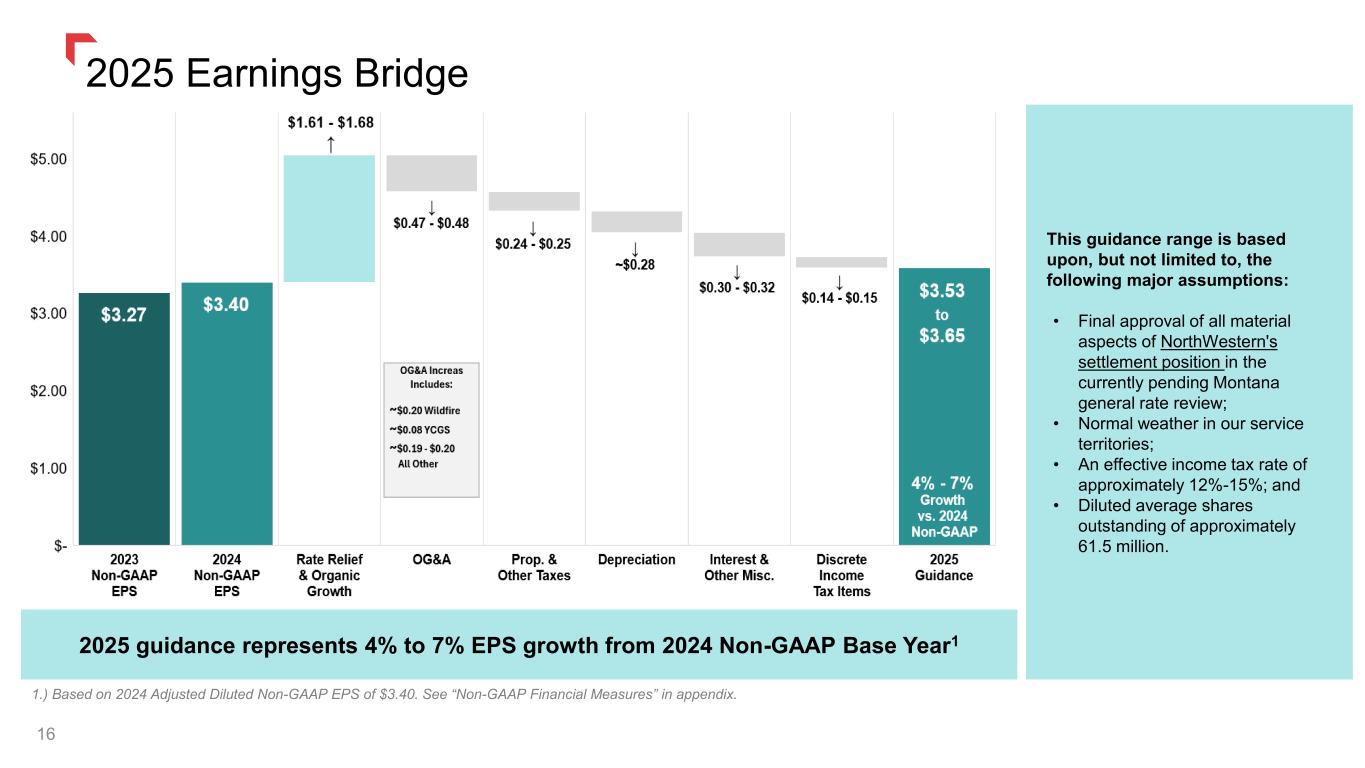

We are initiating 2025 non-GAAP earnings guidance of $3.53 - $3.65 per diluted share. This guidance is based upon, but not limited to, the following major assumptions:

• Final approval of all material aspects of NorthWestern's settlement position in the currently pending Montana general rate review;

• Normal weather in our service territories;

• An effective income tax rate of approximately 12%-15%; and

• Diluted average shares outstanding of approximately 61.5 million.

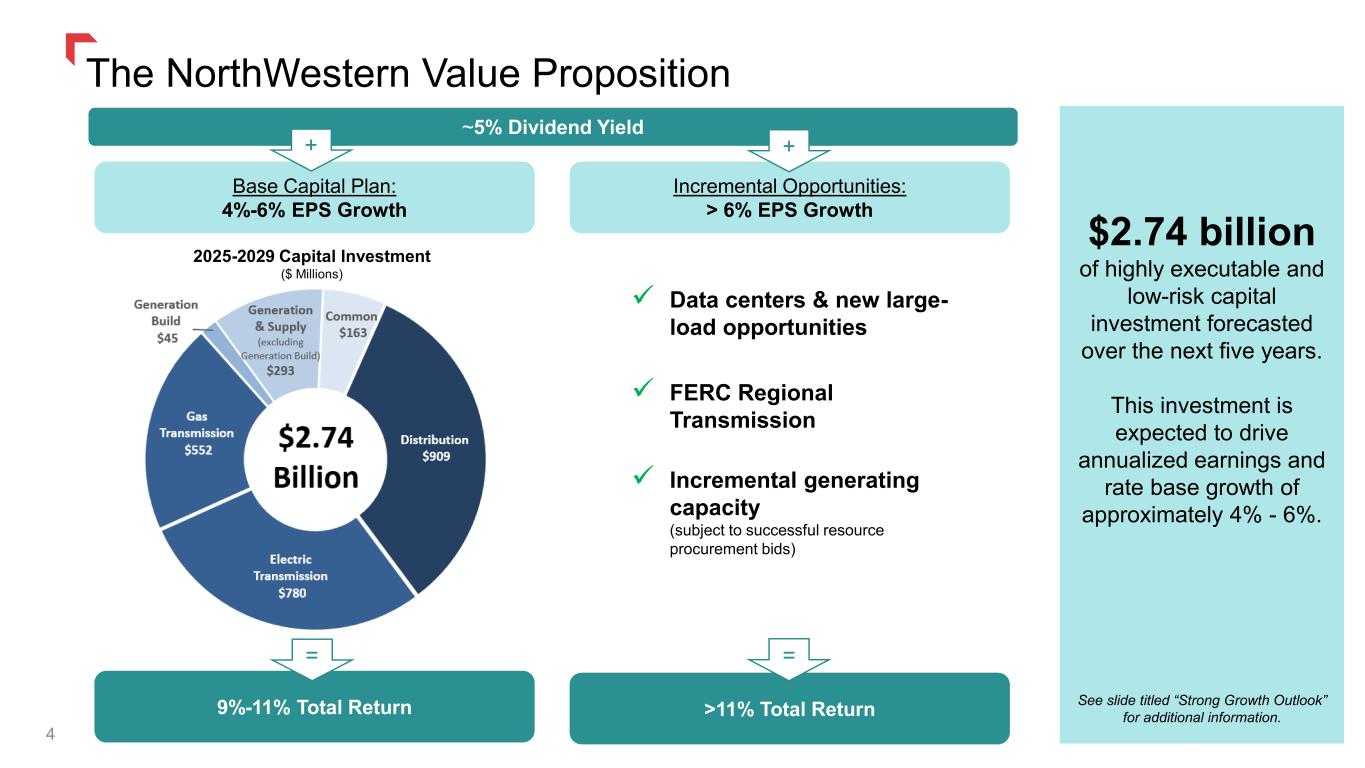

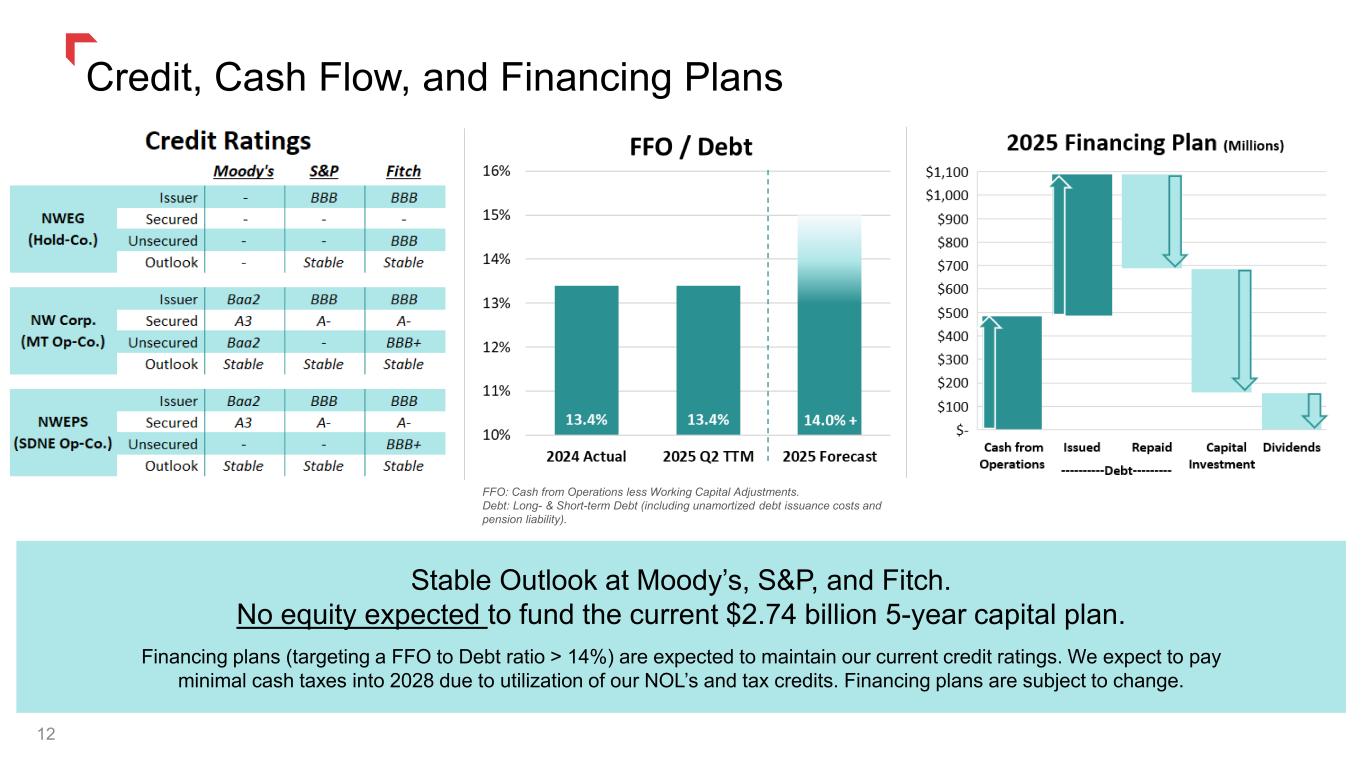

We are affirming our long-term (five-year) diluted earnings per share growth guidance of 4% to 6%, based on an updated 2024 adjusted diluted non-GAAP EPS baseline of $3.40.

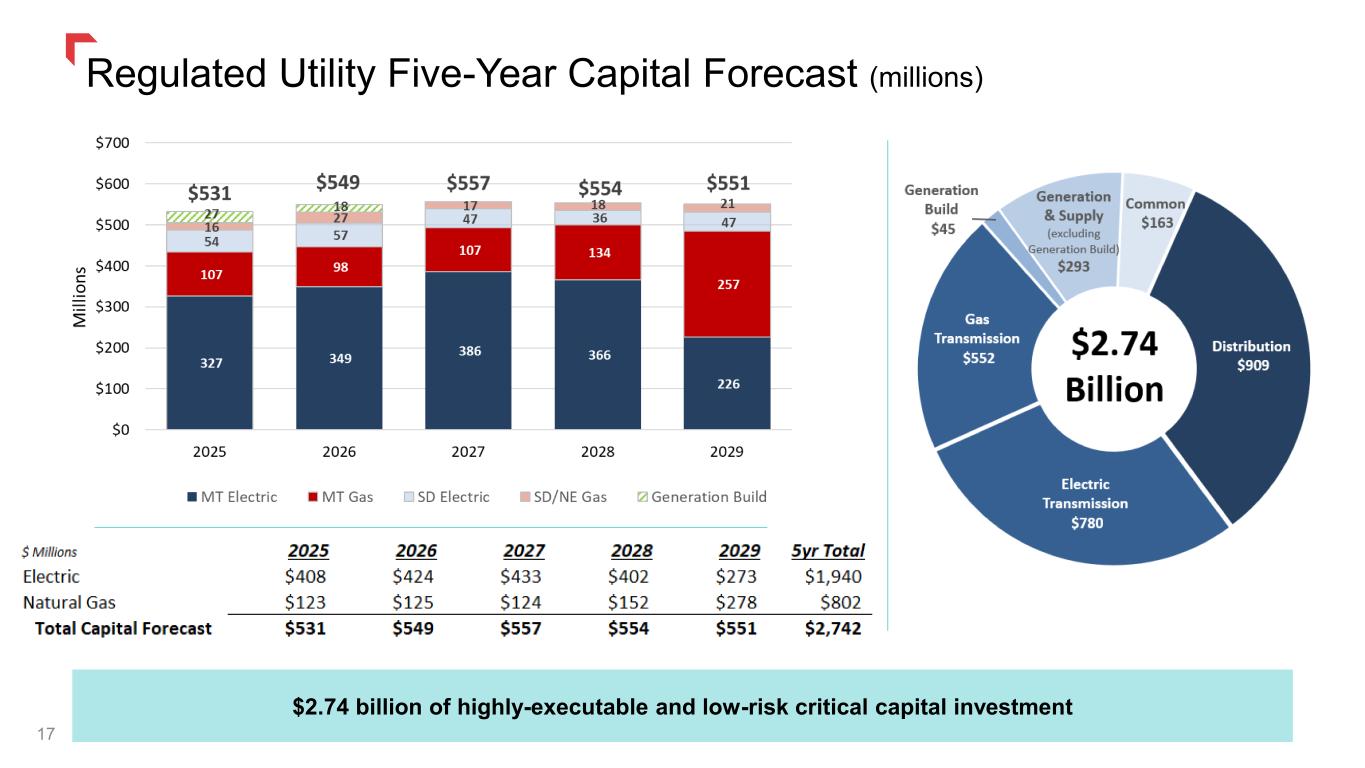

Additionally, we are affirming our $2.7 billion capital investment plan for 2025-2029, which is expected to support rate base growth of 4% to 6% from an updated 2024 base year of approximately $5.4 billion.

We plan to fund this capital program through a combination of cash from operations and secured debt issuances. Any incremental investments in generation, transmission, or other strategic growth opportunities may require equity financing.

Dividend Declared

NorthWestern Energy Group’s Board of Directors has declared a quarterly common stock dividend of $0.66 per share payable on September 30, 2025, to shareholders of record as of September 15, 2025.

Looking ahead, we remain committed to maintaining a dividend payout ratio within our targeted range of 60-70% over the long term.

Additional information regarding this release can be found in the earnings presentation at

https://www.northwesternenergy.com/investors/earnings.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 3

COMPANY UPDATES

Regulatory Update

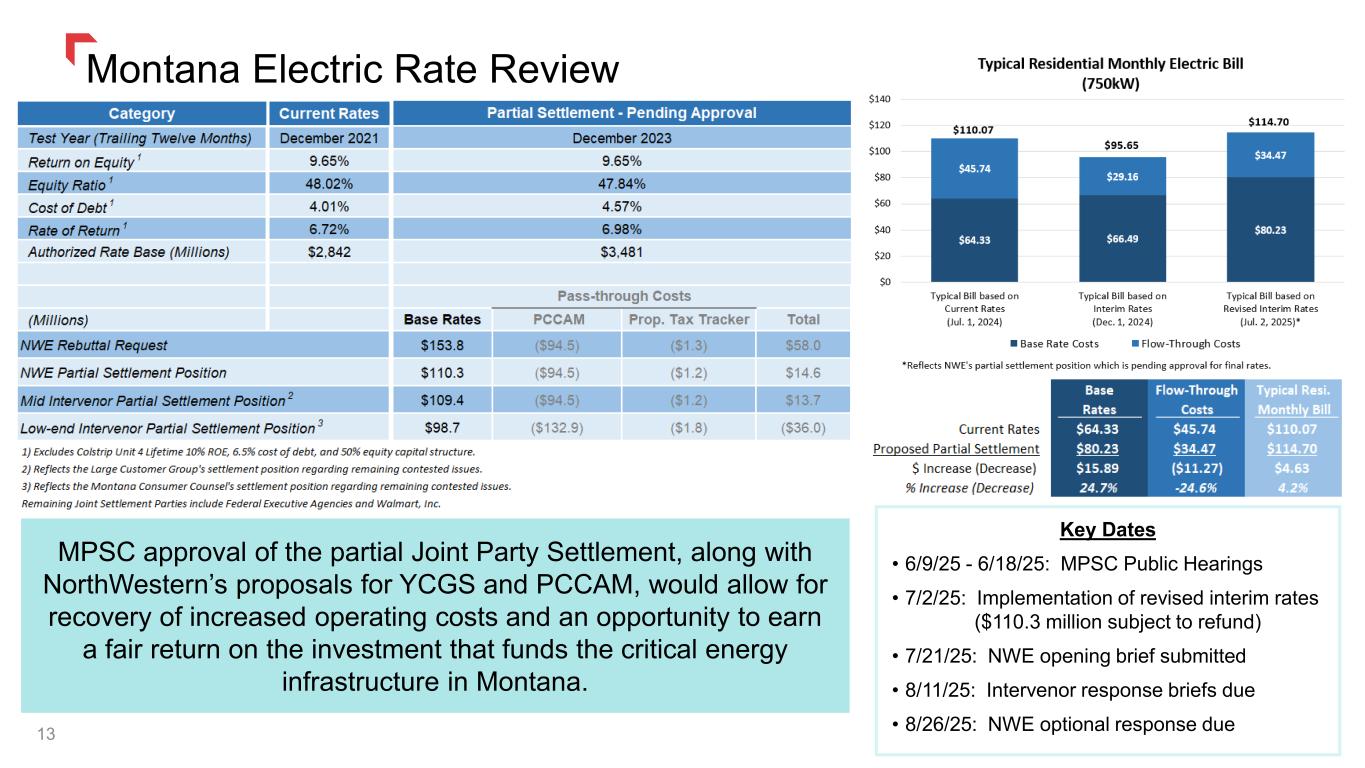

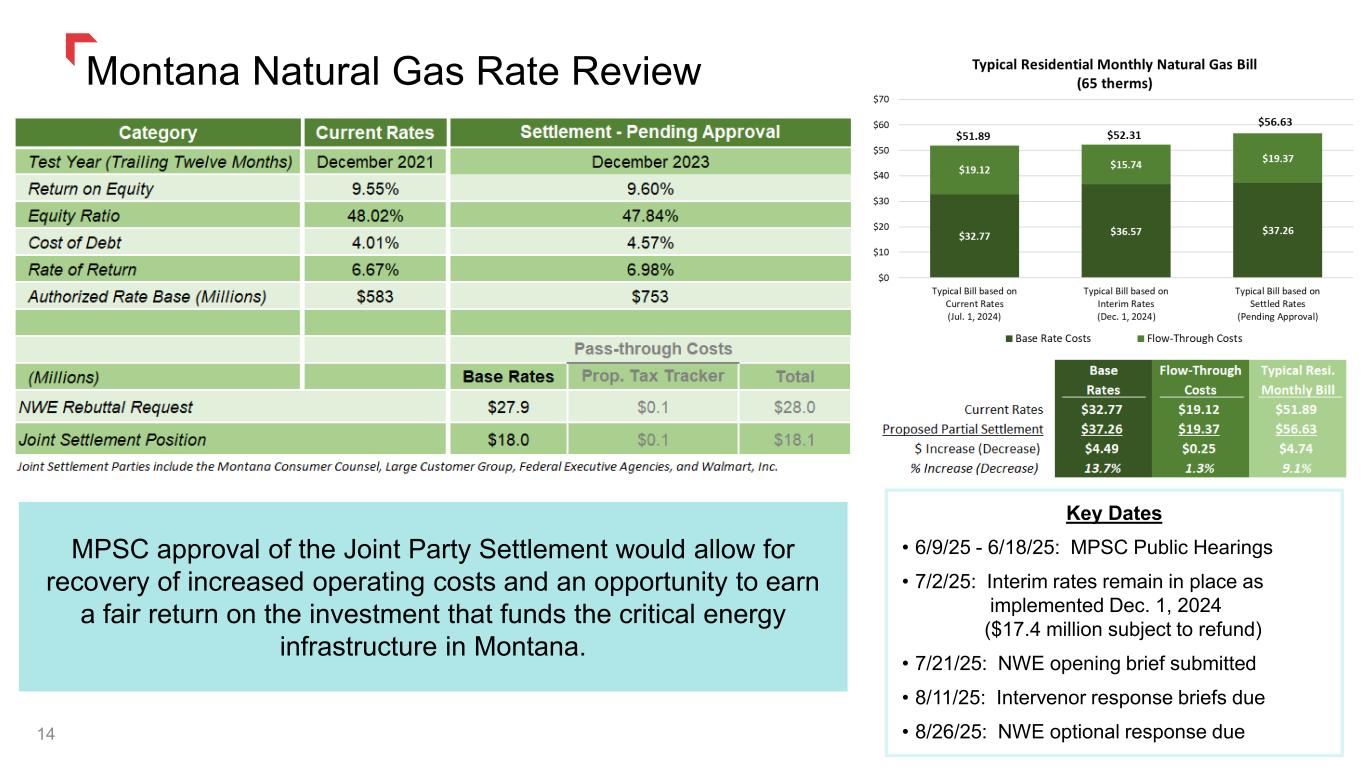

Montana Rate Review - In July 2024, we filed a Montana electric and natural gas rate review with the Montana Public Service Commission (MPSC). In November 2024, the MPSC partially approved our requested interim rates effective December 1, 2024, subject to refund. Subsequently, we modified our request through rebuttal testimony. In March 2025, we filed a natural gas settlement with certain parties. In April 2025, we filed a partial electric settlement with certain other parties. Both settlements are subject to approval by the MPSC.

The partial electric settlement includes, among other things, agreement on base revenue increases (excluding base revenues associated with Yellowstone County Generating Station (YCGS)), allocated cost of service, rate design, updates to the amount of revenues associated with property taxes (excluding property taxes associated with YCGS), regulatory policy issues related to requested changes in regulatory mechanisms, and agreement to support a separate motion for revised electric interim rates. The partial electric settlement provides for the deferral and annual recovery of incremental operating costs related to wildfire mitigation and insurance expenses through the Wildfire Mitigation Balancing Account.

The natural gas settlement includes, among other things, agreement on base revenues, allocated cost of service, rate design, updates to the amount of revenues associated with property taxes, and agreement to support a separate motion for revised natural gas interim rates.

The details of our filing request, as adjusted in rebuttal testimony are set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

| Requested Revenue Increase (Decrease) Through Rebuttal Testimony (in millions) |

|

Electric |

|

Natural Gas |

| Base Rates |

$ |

153.8 |

|

|

27.9 |

Power Cost and Credit Adjustment Mechanism (PCCAM)(1) |

(94.5) |

|

|

n/a |

Property Tax (tracker base adjustment)(1) |

(1.3) |

|

|

0.1 |

| Total Revenue Increase Requested through Rebuttal Testimony |

$ |

58.0 |

|

|

$ |

28.0 |

|

(1) These items are flow-through costs. PCCAM reflects our fuel and purchased power costs.

The details of our interim rates granted are set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

| Interim Revenue Increase (Decrease) Granted (in millions) |

|

Electric(1) |

|

Natural Gas(2) |

| Base Rates |

$ |

18.4 |

|

|

$ |

17.4 |

|

PCCAM(3) |

(88.0) |

|

|

n/a |

Property Tax (tracker base adjustment)(3)(4) |

7.4 |

|

0.2 |

| Total Interim Revenue Granted |

$ |

(62.2) |

|

|

$ |

17.6 |

|

(1) These electric interim rates were effective December 1, 2024, through May 22, 2025. See further discussion on revised electric interim rates below.

(2) These natural gas interim rates were effective December 1, 2024, and are expected to remain in effect until the MPSC final order rates are effective.

(3) These items are flow-through costs. PCCAM reflects our fuel and purchased power costs.

(4) Our requested interim property tax base increase went into effect on January 1, 2025, as part of our 2024 property tax tracker filing.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 4

The details of our settlement agreement are set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

Requested Revenue Increase (Decrease) through Settlement Agreements (in millions) |

|

Electric(1) |

|

Natural Gas |

Base Rates: |

|

|

|

Base Rates (Settled) |

$ |

66.4 |

|

|

$ |

18.0 |

|

Base Rates - YCGS (Non-settled)(2)(3) |

43.9 |

|

|

n/a |

Requested Base Rates |

110.3 |

|

|

18.0 |

|

|

|

|

|

Pass-through items: |

|

|

|

Property Tax (tracker base adjustment) (Settled)(4) |

(5.2) |

|

|

0.1 |

|

Property Tax (tracker base adjustment) - YCGS (Non-settled)(2)(4) |

4.0 |

|

|

n/a |

PCCAM (Non-settled)(2)(3)(4) |

(94.5) |

|

|

n/a |

Requested Pass-Through Rates |

(95.7) |

|

|

0.1 |

|

Total Requested Revenue Increase |

$ |

14.6 |

|

|

$ |

18.1 |

|

(1) We implemented these electric rates on July 2, 2025, on an interim basis, subject to refund.

(2) These items were not included within the partial electric settlement and will be contested items that are expected to be determined in the MPSC's final order.

(3) Intervenor positions on YCGS propose up to an $11.6 million reduction to the base rate revenue request and an additional $38.4 million decrease to the PCCAM base.

(4) These items are flow-through costs. PCCAM reflects our fuel and purchased power costs.

On May 23, 2025, as permitted by Montana statute, we implemented our initially requested electric rates, reflecting a base rate revenue increase of $156.5 million, on an interim basis, subject to refund with interest. Within our June 30, 2025 financial statements, we have deferred base rate revenues collected between May 23, 2025, and June 30, 2025, down to our requested revised electric interim rates of $110.3 million as shown within the above table. As of June 30, 2025, we have deferred approximately $3.5 million of base rate revenues collected. On June 20, 2025, we submitted the revised electric interim rates as shown within the above table to the MPSC for approval. The MPSC subsequently approved this request and the rates were implemented on July 2, 2025.

As discussed above, if the MPSC chooses to accept the intervenors positions on the remaining contested issues or does not accept the Settlement Agreements in its final order, losses related to excess interim revenues collected will be incurred. Additionally, any difference between interim and final approved rates will be refunded to customers with interest. However, if final approved rates are higher than interim rates, we will not recover the difference.

A hearing on the electric and natural gas rate review was held in June 2025, and final briefs are due in August 2025. Interim rates will remain in effect on a refundable basis, with interest, until the MPSC issues a final order.

Nebraska Natural Gas Rate Review - In June 2025, the Nebraska Public Service Commission approved a settlement agreement increasing base rate annual revenue by $2.4 million and final rates were implemented on July 1, 2025.

Environmental Protection Agency (EPA) Rules

In April 2024, the EPA released greenhouse gas (GHG) Rules for existing coal-fired facilities and new coal and natural gas-fired facilities as well as Mercury and Air Toxics Standards (MATS) Rules. Compliance with the rules would require expensive upgrades at Colstrip Units 3 and 4 with proposed compliance dates that may not be achievable and / or require technology that is unproven, resulting in significant impacts to costs of the facilities. The final MATS and GHG Rules require compliance as early as 2027 and 2032, respectively. On April 8, 2025, President Trump issued a proclamation, "Regulatory Relief for Certain Stationary Sources to Promote American Energy," exempting certain coal plants, including Colstrip Units 3 and 4, Big Stone Plant, and Coyote Plant, from compliance with the MATS Rule through July 8, 2029.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 5

On June 11, 2025, the EPA issued Notices of Proposed Rulemaking to, among other things, rescind the 2024 MATS Rule.

Acquisition of Energy West Montana Assets

In July 2024, NW Corp entered into an Asset Purchase Agreement with Hope Utilities to acquire its Energy West natural gas distribution and system operations serving approximately 33,000 customers located in Great Falls, Cut Bank, and West Yellowstone, Montana. In May 2025, the MPSC approved this acquisition and on July 1, 2025, NW Corp completed this acquisition for approximately $36.5 million in cash, which is subject to certain post-close working capital adjustments that we expect to finalize in the second half of 2025.

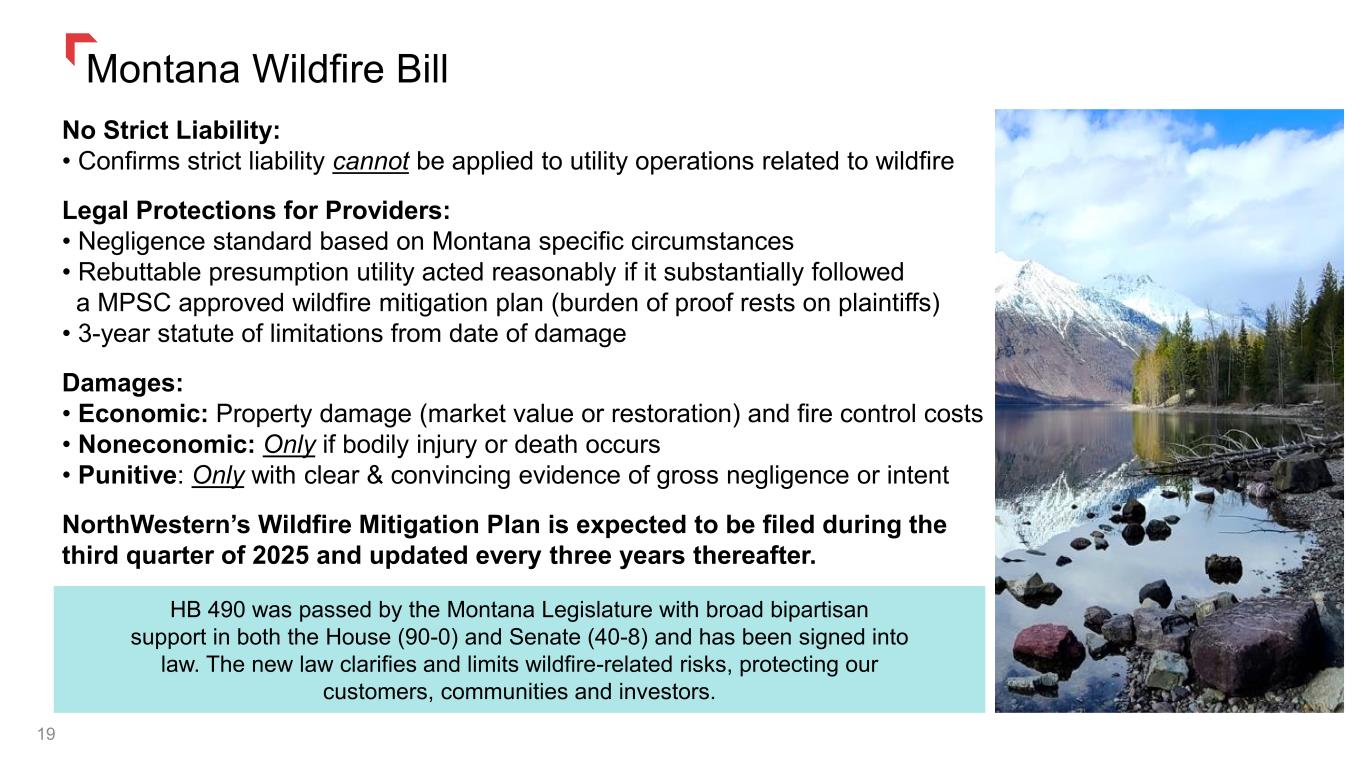

Montana Wildfire Risk Mitigation

The Montana Legislature approved House Bill 490 in April 2025, with broad bipartisan support in both the House (90-0) and Senate (40-8), and the Governor signed this bill into law in May 2025. This bill requires development, approval, and implementation of electric facilities providers' wildfire mitigation plans. Importantly, House Bill 490 helps address some preexisting liability risks facing electric facilities providers in Montana. It changes Montana law, recognizing utilities' obligation to provide a public service for customers that is different from typical businesses; circumscribes certain damages; and enacts liability protections related to wildfire and wildfire prevention efforts involving providers. More specifically, House Bill 490 precludes common law strict liability claims for damages related to wildfire and electric activities or wildfire mitigation activities; establishes a statutory standard of care, supplanting common law causes of action and other theories of recovery; and creates a rebuttable presumption that an electric facilities provider acted reasonably if it substantially followed an approved wildfire mitigation plan. The legislation also defines the availability of damages by allowing noneconomic personal injury damages only when there is bodily injury and punitive damages only when an injured party proves by clear and convincing evidence that an electric facilities provider's actions were grossly negligent or intentional. We expect to file our wildfire mitigation plan with the MPSC in the third quarter of 2025 for review and approval.

Montana Data Centers

In July 2025, we entered into a nonbinding letter of intent with Quantica Infrastructure to evaluate the transmission infrastructure and generation resources needed to support their proposed Phase 1 need of 5 megawatts in 2026 with growth up to 500 megawatts by 2030. This is our third signed letter of intent for data center load growth. In December 2024, we announced two separate nonbinding letters of intent to provide electric supply services for data centers being developed in Montana with a combined energy service requirement expected to be 75 megawatts beginning in early 2026 with growth of up to 400 megawatts or more by 2030. We anticipate that service could be provided through our regulated business, pending further evaluation and regulatory considerations.

Montana Electric Transmission Construction

In May 2025, Senate Bill 301 was passed by the Montana Legislature with unanimous bipartisan support and signed into law. The intention of this bill is to expedite and streamline the process for a public utility to construct electric transmission lines to serve the increasing demand for electricity, enhance grid reliability, and address current transmission congestion within Montana. This bill allows a public utility to request a Certificate of Public Convenience & Necessity for electric transmission lines rated higher than 69 kilovolts from the MPSC and also provides a process for a public utility to apply for advanced cost approval of electric transmission lines and related facilities before actual construction begins.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 6

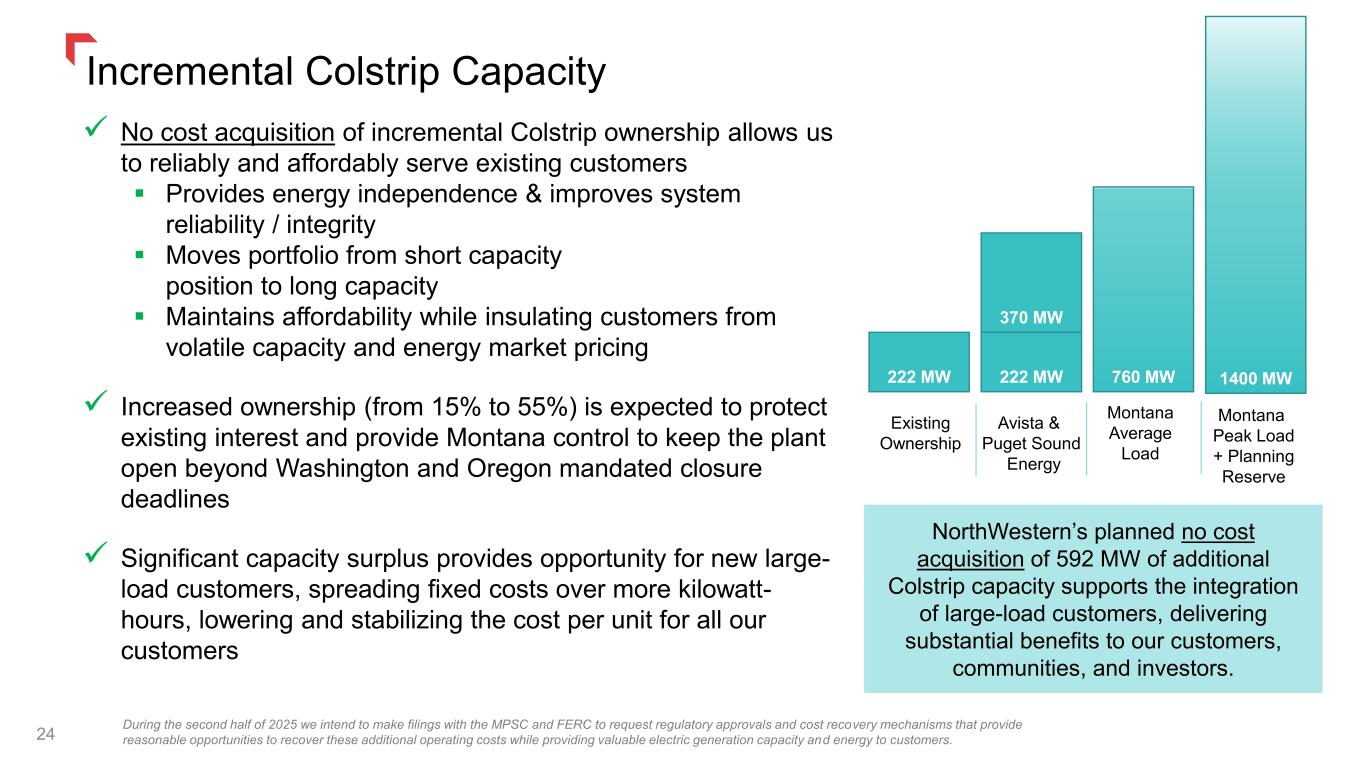

Colstrip Acquisitions and Requests for Cost Recovery

As previously disclosed, we entered into definitive agreements with Avista Corporation (Avista) and Puget Sound Energy (Puget) to acquire their respective interests in Colstrip Units 3 and 4 for $0 and expect to complete these acquisitions on December 31, 2025. Accordingly, we will be responsible for associated operating costs on January 1, 2026. Puget and Avista will remain responsible for their respective pre-closing share of environmental and pension liabilities attributed to events or conditions existing prior to the closing of the transaction and for any future decommissioning and demolition costs associated with the existing facilities that comprise their interests. During the second half of 2025 we intend to make filings with the MPSC and the Federal Energy Regulatory Commission (FERC) associated with these transactions, including recovery of incremental operating costs.

[The remainder of page is intentionally left blank]

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 7

CONSOLIDATED STATEMENT OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended

June 30, |

| ($ in millions, except per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues |

|

|

|

|

|

|

|

| Electric |

$ |

279.5 |

|

|

$ |

260.1 |

|

|

$ |

615.0 |

|

|

$ |

603.3 |

|

| Gas |

63.2 |

|

|

59.8 |

|

|

194.4 |

|

|

192.0 |

|

| Total Revenues |

342.7 |

|

|

319.9 |

|

|

809.3 |

|

|

795.3 |

|

| Operating expenses |

|

|

|

|

|

|

|

| Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) |

75.3 |

|

|

76.5 |

|

|

213.5 |

|

|

251.2 |

|

| Operating and maintenance |

62.3 |

|

|

57.4 |

|

|

119.0 |

|

|

111.5 |

|

| Administrative and general |

33.8 |

|

|

31.3 |

|

|

75.1 |

|

|

71.7 |

|

| Property and other taxes |

48.2 |

|

|

36.3 |

|

|

91.4 |

|

|

83.4 |

|

| Depreciation and depletion |

62.4 |

|

|

56.9 |

|

|

124.8 |

|

|

113.7 |

|

| Total Operating Expenses |

281.9 |

|

|

258.3 |

|

|

623.8 |

|

|

631.6 |

|

| Operating income |

60.8 |

|

|

61.6 |

|

|

185.5 |

|

|

163.7 |

|

| Interest expense, net |

(36.3) |

|

|

(31.9) |

|

|

(72.8) |

|

|

(62.9) |

|

| Other income, net |

0.1 |

|

|

6.2 |

|

|

4.0 |

|

|

10.5 |

|

| Income before income taxes |

24.6 |

|

|

35.9 |

|

|

116.8 |

|

|

111.3 |

|

| Income tax expense |

(3.4) |

|

|

(4.2) |

|

|

(18.6) |

|

|

(14.6) |

|

| Net Income |

$ |

21.2 |

|

|

$ |

31.7 |

|

|

$ |

98.2 |

|

|

$ |

96.7 |

|

|

|

|

|

|

|

|

|

| Average Common Shares Outstanding |

61.4 |

|

|

61.3 |

|

|

61.4 |

|

|

61.3 |

|

| Basic Earnings per Average Common Share |

$ |

0.35 |

|

|

$ |

0.52 |

|

|

$ |

1.60 |

|

|

$ |

1.58 |

|

| Diluted Earnings per Average Common Share |

$ |

0.35 |

|

|

$ |

0.52 |

|

|

$ |

1.60 |

|

|

$ |

1.58 |

|

|

|

|

|

|

|

|

|

| Dividends Declared per Common Share |

$ |

0.66 |

|

|

$ |

0.65 |

|

|

$ |

1.32 |

|

|

$ |

1.30 |

|

| Note: Subtotal variances may exist due to rounding. |

|

|

|

|

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 8

RECONCILIATION OF PRIMARY CHANGES DURING THE QUARTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, 2025 vs. 2024 |

| ($ in millions, except per share amounts) |

Pre-tax

Income |

|

Income Tax (Expense) Benefit (3) |

|

Net

Income |

|

Diluted

Earnings

Per Share |

|

|

|

|

|

|

|

|

| Second Quarter, 2024 |

$ |

35.9 |

|

|

$ |

(4.2) |

|

|

$ |

31.7 |

|

|

$ |

0.52 |

|

Variance in revenue and fuel, purchased supply, and direct transmission expense(1) items impacting net income: |

|

|

|

|

|

|

|

| Rates |

19.4 |

|

|

(4.9) |

|

|

14.5 |

|

|

0.23 |

|

Electric transmission revenue |

5.7 |

|

|

(1.4) |

|

|

4.3 |

|

|

0.07 |

|

| Natural gas transportation |

1.6 |

|

|

(0.4) |

|

|

1.2 |

|

|

0.02 |

|

Production tax credits, offset within income tax benefit |

1.2 |

|

|

(1.2) |

|

|

— |

|

|

— |

|

Natural gas retail volumes |

(4.0) |

|

|

1.0 |

|

|

(3.0) |

|

|

(0.05) |

|

| Montana property tax tracker collections |

(4.3) |

|

|

1.1 |

|

|

(3.2) |

|

|

(0.05) |

|

Electric retail volumes |

(2.9) |

|

|

0.7 |

|

|

(2.2) |

|

|

(0.04) |

|

Non-recoverable Montana electric supply costs |

(2.0) |

|

|

0.5 |

|

|

(1.5) |

|

|

(0.02) |

|

| Other |

(0.2) |

|

|

0.1 |

|

|

(0.1) |

|

|

— |

|

|

|

|

|

|

|

|

|

Variance in expense items(2) impacting net income: |

|

|

|

|

|

|

|

Depreciation |

(5.5) |

|

|

1.4 |

|

|

(4.1) |

|

|

(0.07) |

|

Interest expense |

(4.4) |

|

|

1.1 |

|

|

(3.3) |

|

|

(0.05) |

|

Operating, maintenance, and administrative |

(10.0) |

|

|

2.5 |

|

|

(7.5) |

|

|

(0.12) |

|

| Property and other taxes not recoverable within trackers |

(1.5) |

|

|

0.4 |

|

|

(1.1) |

|

|

(0.02) |

|

| Other |

(4.4) |

|

|

(0.1) |

|

|

(4.5) |

|

|

(0.07) |

|

| Dilution from higher share count |

|

|

|

|

|

|

— |

|

| Second Quarter, 2025 |

$ |

24.6 |

|

|

$ |

(3.4) |

|

|

$ |

21.2 |

|

|

$ |

0.35 |

|

| Change in Net Income |

|

|

|

|

$ |

(10.5) |

|

|

$ |

(0.17) |

|

|

(1) Exclusive of depreciation and depletion shown separately below

(2) Excluding fuel, purchased supply, and direct transmission expense

(3) Income Tax (Expense) Benefit calculation on reconciling items assumes blended federal plus state effective tax rate of 25.3%.

|

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 9

EXPLANATION OF CONSOLIDATED RESULTS

Three Months Ended June 30, 2025 Compared with the Three Months Ended June 30, 2024

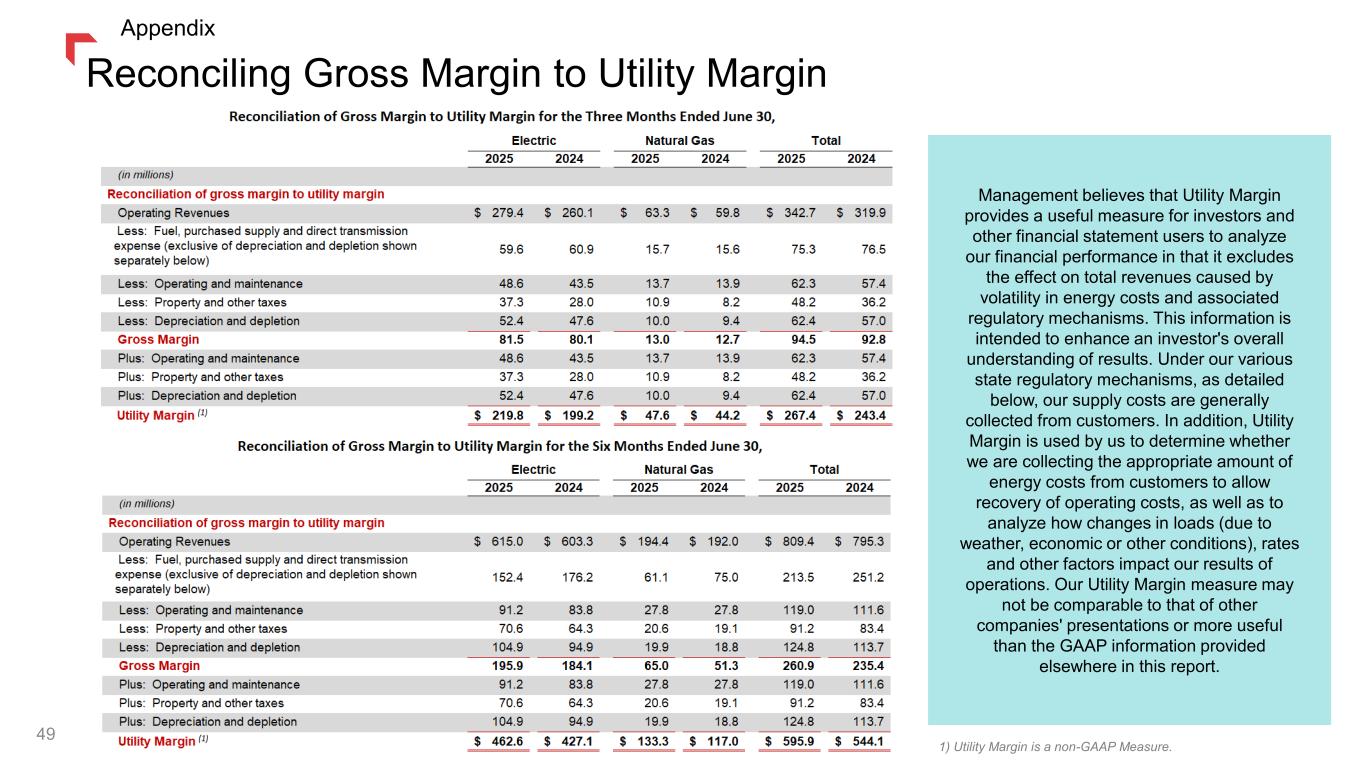

Consolidated gross margin for the three months ended June 30, 2025 was $94.5 million as compared with $92.8 million in 2024, an increase of $1.7 million, or 1.8 percent. This increase was primarily due to higher retail rates, higher electric transmission, and natural gas transportation revenues. These were partly offset by lower retail natural gas and electric usage primarily driven by weather, Montana property tax tracker collections, non-recoverable Montana electric supply costs, depreciation, and operating and maintenance costs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

|

Three Months Ended June 30, |

| Reconciliation of gross margin to utility margin: |

|

2025 |

|

2024 |

|

|

|

| Operating Revenues |

|

$ |

342.7 |

|

|

$ |

319.9 |

|

| Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) |

|

75.3 |

|

|

76.5 |

|

| Less: Operating and maintenance |

|

62.3 |

|

|

57.4 |

|

| Less: Property and other taxes |

|

48.2 |

|

|

36.2 |

|

| Less: Depreciation and depletion |

|

62.4 |

|

|

57.0 |

|

| Gross Margin |

|

94.5 |

|

|

92.8 |

|

|

|

|

|

|

| Operating and maintenance |

|

62.3 |

|

|

57.4 |

|

| Property and other taxes |

|

48.2 |

|

|

36.2 |

|

| Depreciation and depletion |

|

62.4 |

|

|

57.0 |

|

Utility Margin(1) |

|

$ |

267.4 |

|

|

$ |

243.4 |

|

| (1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

| ($ in millions) |

2025 |

|

2024 |

|

Change |

|

% Change |

| Utility Margin |

|

|

|

|

|

|

|

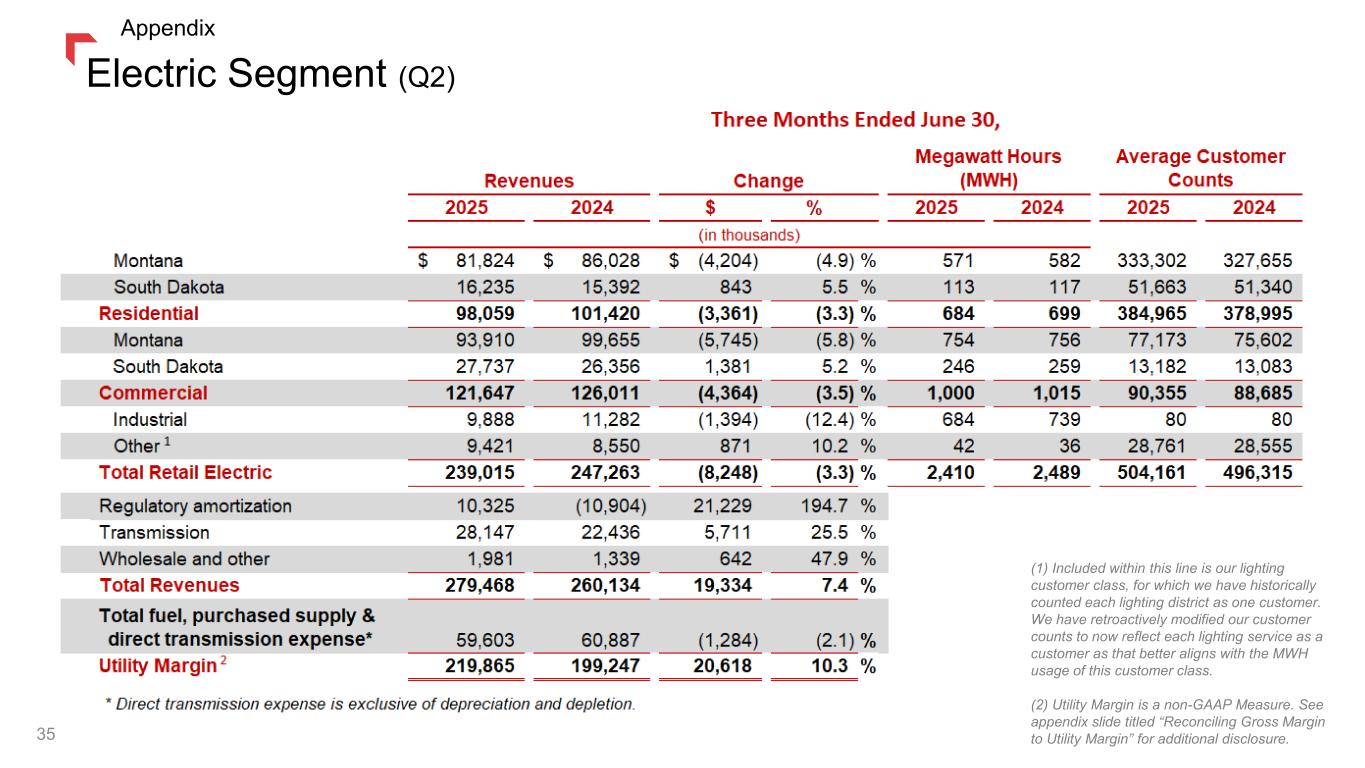

| Electric |

$ |

219.8 |

|

|

$ |

199.2 |

|

|

$ |

20.6 |

|

|

10.3 |

% |

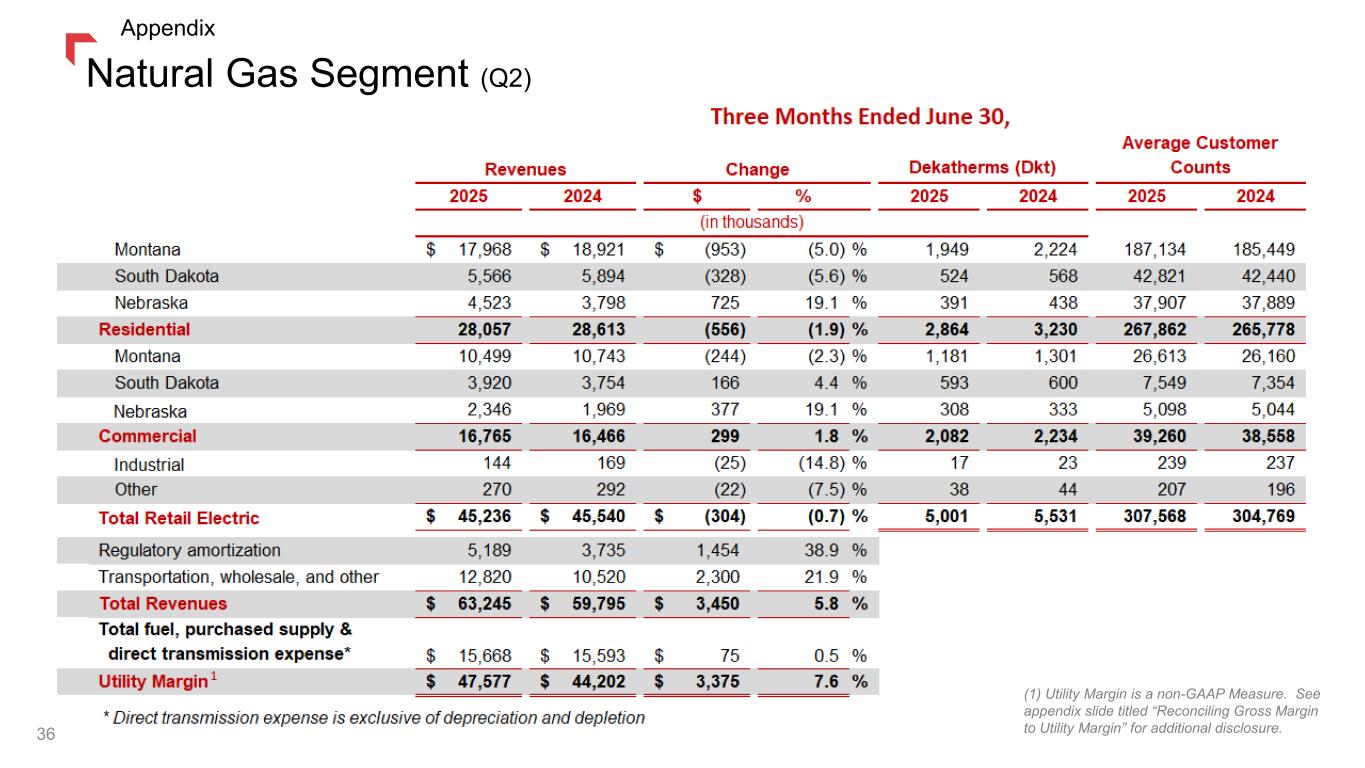

| Natural Gas |

47.6 |

|

|

44.2 |

|

|

3.4 |

|

|

7.7 |

|

Total Utility Margin(1) |

$ |

267.4 |

|

|

$ |

243.4 |

|

|

$ |

24.0 |

|

|

9.9 |

% |

(1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

|

|

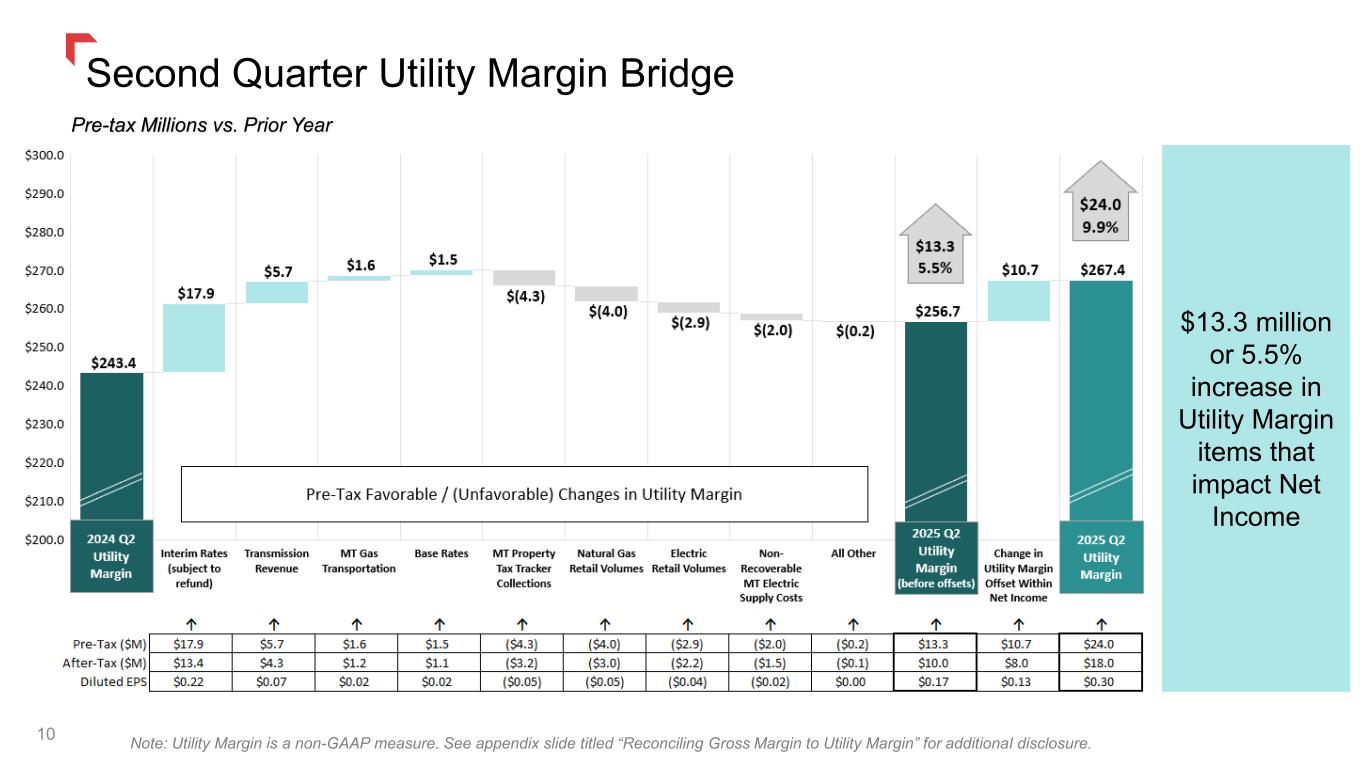

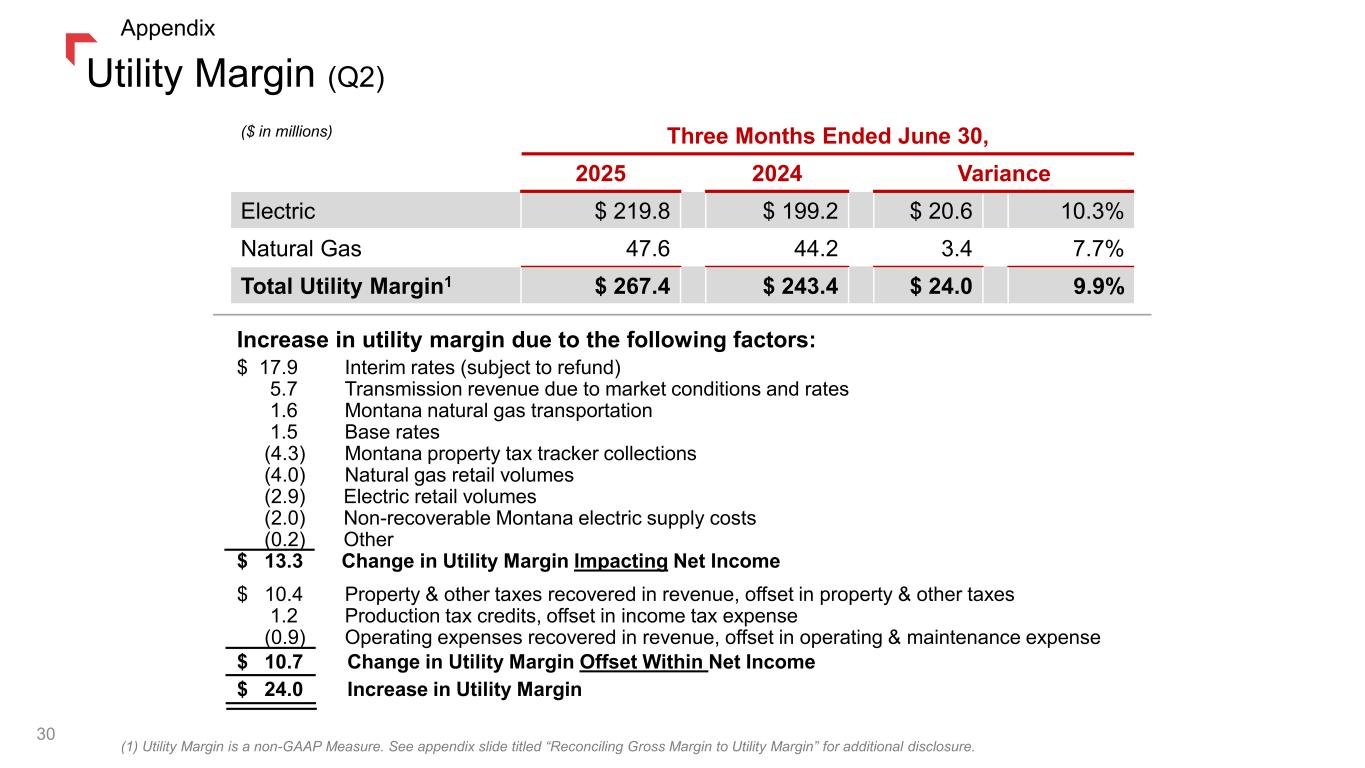

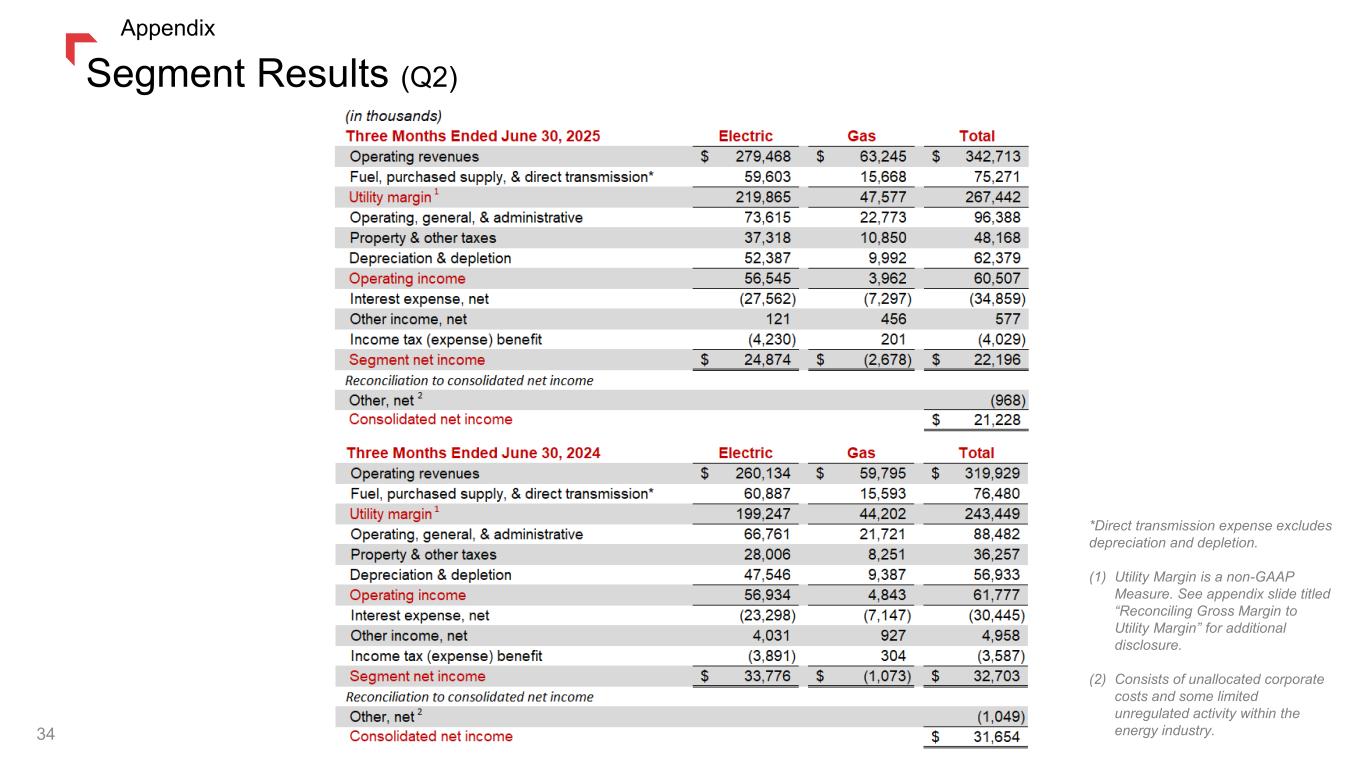

Consolidated utility margin for the three months ended June 30, 2025 was $267.4 million as compared with $243.4 million for the same period in 2024, an increase of $24.0 million, or 9.9 percent.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 10

Primary components of the change in utility margin include the following:

|

|

|

|

|

|

| ($ in millions) |

Utility Margin 2025 vs. 2024 |

| Utility Margin Items Impacting Net Income |

|

| Interim rates (subject to refund) |

$ |

17.9 |

|

Transmission revenue due to market conditions and rates |

5.7 |

|

Montana natural gas transportation |

1.6 |

|

Base rates |

1.5 |

|

| Montana property tax tracker collections |

(4.3) |

|

Natural gas retail volumes |

(4.0) |

|

Electric retail volumes |

(2.9) |

|

Non-recoverable Montana electric supply costs |

(2.0) |

|

| Other |

(0.2) |

|

| Change in Utility Margin Items Impacting Net Income |

13.3 |

|

| Utility Margin Items Offset Within Net Income |

|

Property and other taxes recovered in revenue, offset in property and other taxes |

10.4 |

|

Production tax credits, offset in income tax expense |

1.2 |

|

Operating expenses recovered in revenue, offset in operating and maintenance expense |

(0.9) |

|

| Change in Utility Margin Items Offset Within Net Income |

10.7 |

|

Increase in Consolidated Utility Margin(1) |

$ |

24.0 |

|

| (1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

Lower electric retail volumes were driven by unfavorable spring weather in all jurisdictions impacting residential demand, and lower commercial and industrial demand, partly offset by customer growth in all jurisdictions. Lower natural gas retail volumes were driven by unfavorable weather in all jurisdictions, partly offset by customer growth in all jurisdictions.

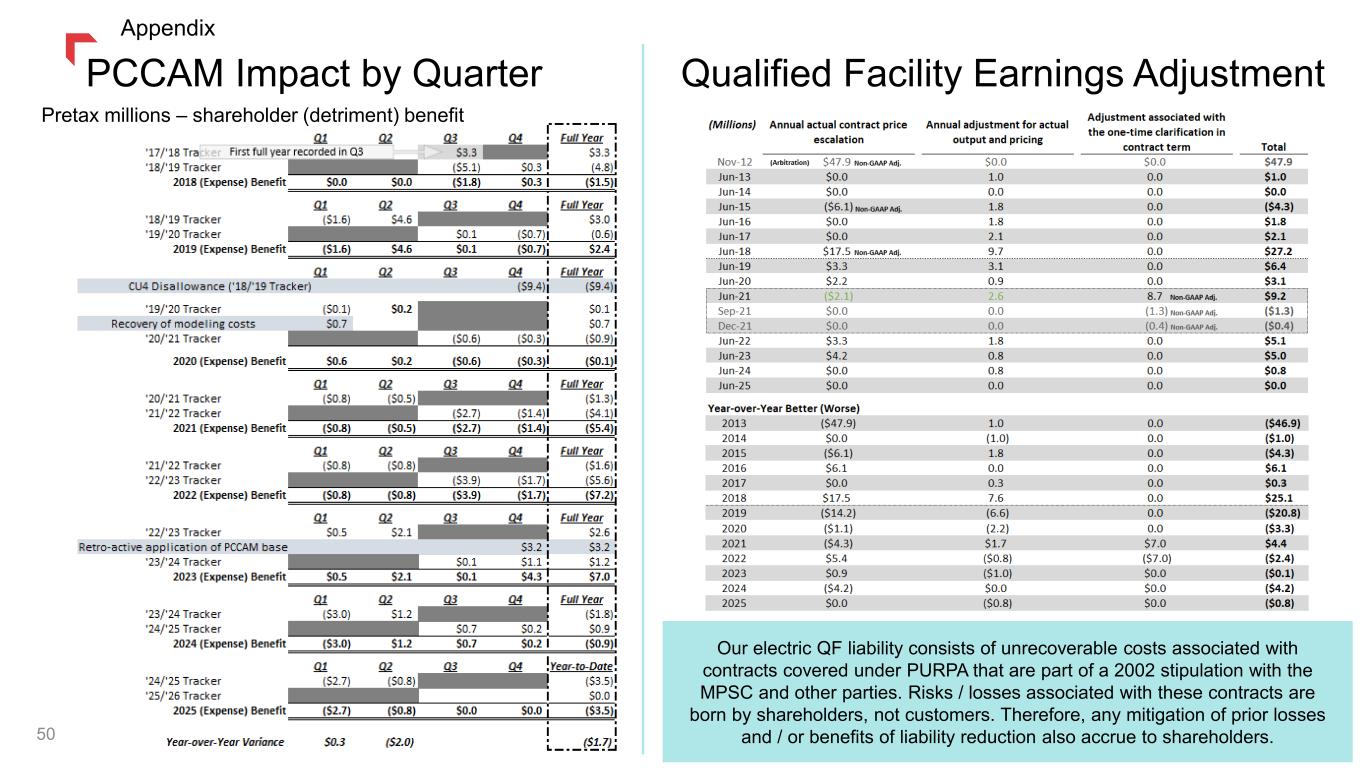

Under the PCCAM, net supply costs higher or lower than the PCCAM base rate (PCCAM Base) (excluding qualifying facility costs) are allocated 90 percent to Montana customers and 10 percent to shareholders. For the three months ended June 30, 2025, we under-collected supply costs of $7.6 million resulting in an increase to our under collection of costs, and recorded a decrease in pre-tax earnings of $0.8 million (10 percent of the PCCAM Base cost variance). For the three months ended June 30, 2024, we over-collected supply costs of $11.0 million resulting in a reduction to our under collection of costs, and recorded an increase in pre-tax earnings of $1.2 million (10 percent of the PCCAM Base cost variance).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

| ($ in millions) |

2025 |

|

2024 |

|

Change |

|

% Change |

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

|

|

|

|

|

|

|

| Operating and maintenance |

$ |

62.3 |

|

|

$ |

57.4 |

|

|

$ |

4.9 |

|

|

8.5 |

% |

| Administrative and general |

33.8 |

|

|

31.3 |

|

|

2.5 |

|

|

8.0 |

|

| Property and other taxes |

48.2 |

|

|

36.3 |

|

|

11.9 |

|

|

32.8 |

|

| Depreciation and depletion |

62.4 |

|

|

56.9 |

|

|

5.5 |

|

|

9.7 |

|

| Total Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

$ |

206.7 |

|

|

$ |

181.9 |

|

|

$ |

24.8 |

|

|

13.6 |

% |

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 11

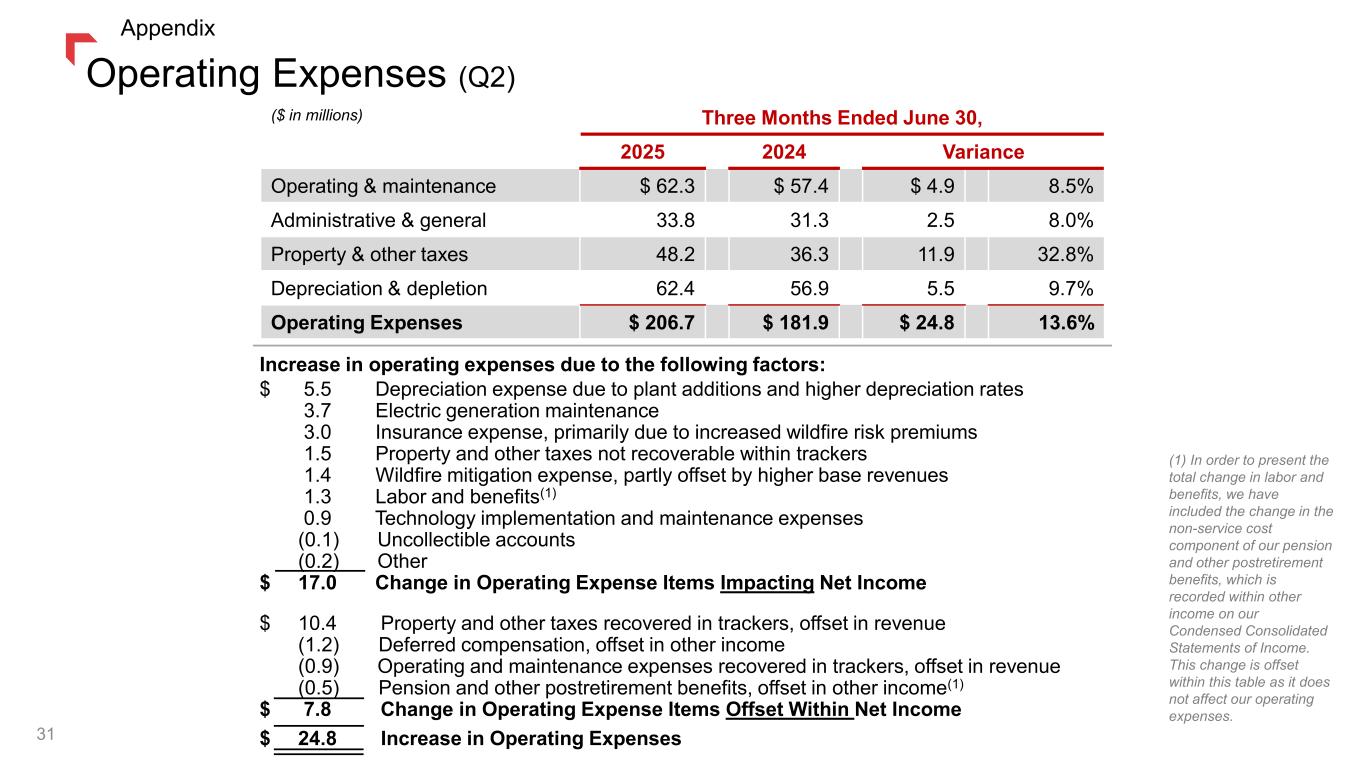

Consolidated operating expenses, excluding fuel, purchased supply and direct transmission expense, were $206.7 million for the three months ended June 30, 2025, as compared with $181.9 million for the three months ended June 30, 2024. Primary components of the change include the following:

|

|

|

|

|

|

|

Operating Expenses |

| ($ in millions) |

2025 vs. 2024 |

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) Impacting Net Income |

|

Depreciation expense due to plant additions and higher depreciation rates |

$ |

5.5 |

|

Electric generation maintenance |

3.7 |

|

Insurance expense, primarily due to increased wildfire risk premiums |

3.0 |

|

| Property and other taxes not recoverable within trackers |

1.5 |

|

| Wildfire mitigation expense, partly offset by higher base revenues |

1.4 |

|

Labor and benefits(1) |

1.3 |

|

Technology implementation and maintenance expenses |

0.9 |

|

Uncollectible accounts |

(0.1) |

|

| Other |

(0.2) |

|

| Change in Items Impacting Net Income |

17.0 |

|

|

|

| Operating Expenses Offset Within Net Income |

|

Property and other taxes recovered in trackers, offset in revenue |

10.4 |

|

Deferred compensation, offset in other income |

(1.2) |

|

| Operating and maintenance expenses recovered in trackers, offset in revenue |

(0.9) |

|

Pension and other postretirement benefits, offset in other income(1) |

(0.5) |

|

| Change in Items Offset Within Net Income |

7.8 |

|

| Increase in Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

$ |

24.8 |

|

| (1) In order to present the total change in labor and benefits, we have included the change in the non-service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. |

We estimate property taxes throughout each year, and update those estimates based on valuation reports received from the Montana Department of Revenue. Under Montana law, we are allowed to track the increases and decreases in the actual level of state and local taxes and fees and adjust our rates to recover the increase or decrease between rate cases less the amount allocated to FERC-jurisdictional customers and net of the associated income tax benefit.

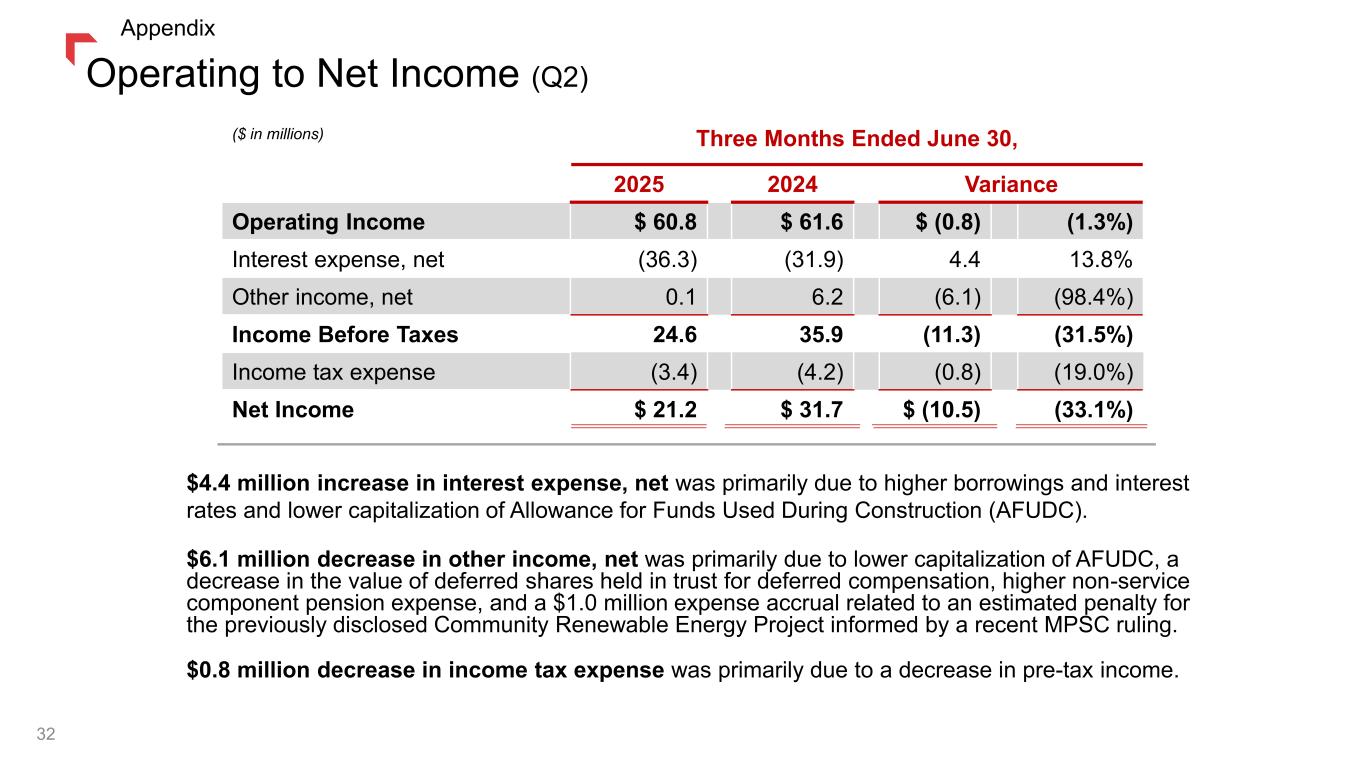

Consolidated operating income for the three months ended June 30, 2025 was $60.8 million as compared with $61.6 million in the same period of 2024. This decrease was primarily due to lower retail natural gas and electric usage primarily driven by weather, Montana property tax tracker collections, non-recoverable Montana electric supply costs, depreciation, and operating, administrative and general costs. These were partly offset by higher retail rates, higher electric transmission, and natural gas transportation revenues.

Consolidated interest expense was $36.3 million for the three months ended June 30, 2025 as compared with $31.9 million for the same period of 2024. This increase was due to higher borrowings and interest rates and lower capitalization of Allowance for Funds Used During Construction (AFUDC).

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 12

Consolidated other income was $0.1 million for the three months ended June 30, 2025 as compared with $6.2 million for the same period of 2024. This decrease was primarily due to lower capitalization of AFUDC, a decrease in the value of deferred shares held in trust for deferred compensation, higher non-service component pension expense, and a $1.0 million expense accrual related to an estimated penalty for the previously disclosed Community Renewable Energy Project informed by a recent MPSC ruling.

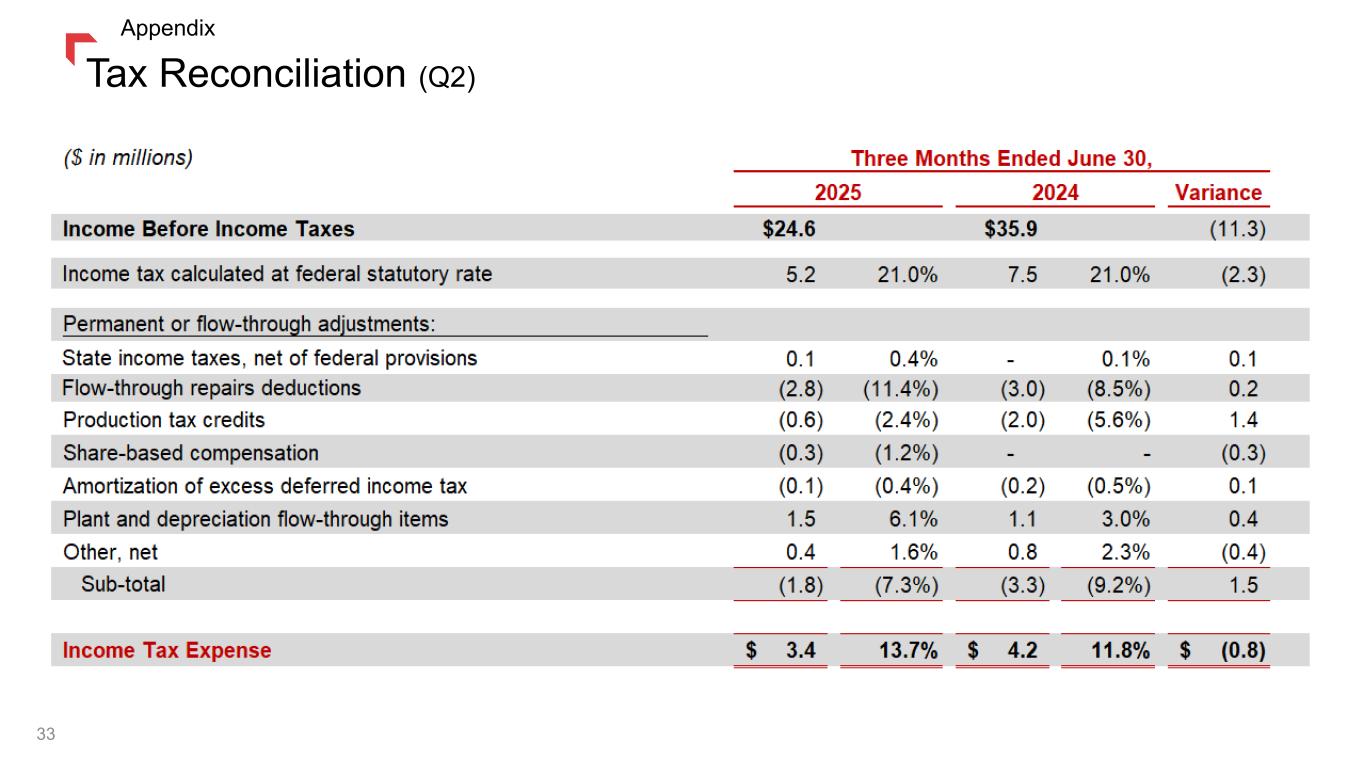

Consolidated income tax expense was $3.4 million for the three months ended June 30, 2025 as compared to $4.2 million for the same period of 2024. Our effective tax rate for the three months ended June 30, 2025 was 13.7% as compared with 11.8% for the same period in 2024.

The following table summarizes the differences between our effective tax rate and the federal statutory rate:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

| ($ in millions) |

2025 |

|

2024 |

| Income Before Income Taxes |

$ |

24.6 |

|

|

|

|

$ |

35.9 |

|

|

|

|

|

|

|

|

|

|

|

| Income tax calculated at federal statutory rate |

5.2 |

|

|

21.0 |

% |

|

7.5 |

|

|

21.0 |

% |

|

|

|

|

|

|

|

|

| Permanent or flow-through adjustments: |

|

|

|

|

|

|

|

| State income tax, net of federal provisions |

0.1 |

|

|

0.4 |

|

|

0.0 |

|

|

0.1 |

|

| Flow-through repairs deductions |

(2.8) |

|

|

(11.4) |

|

|

(3.0) |

|

|

(8.5) |

|

| Production tax credits |

(0.6) |

|

|

(2.4) |

|

|

(2.0) |

|

|

(5.6) |

|

| Share-based compensation |

(0.3) |

|

|

(1.2) |

|

|

0.0 |

|

|

0.0 |

|

| Amortization of excess deferred income tax |

(0.1) |

|

|

(0.4) |

|

|

(0.2) |

|

|

(0.5) |

|

| Plant and depreciation flow-through items |

1.5 |

|

|

6.1 |

|

|

1.1 |

|

|

3.0 |

|

| Other, net |

0.4 |

|

|

1.6 |

|

|

0.8 |

|

|

2.3 |

|

|

(1.8) |

|

|

(7.3) |

|

|

(3.3) |

|

|

(9.2) |

|

|

|

|

|

|

|

|

|

| Income tax expense |

$ |

3.4 |

|

|

13.7 |

% |

|

$ |

4.2 |

|

|

11.8 |

% |

|

|

|

|

|

|

|

|

We compute income tax expense for each quarter based on the estimated annual effective tax rate for the year, adjusted for certain discrete items. Our effective tax rate typically differs from the federal statutory tax rate primarily due to the regulatory impact of flowing through federal and state tax benefits of repairs deductions, state tax benefit of accelerated tax depreciation deductions (including bonus depreciation when applicable) and production tax credits.

LIQUIDITY AND OTHER CONSIDERATIONS

Liquidity and Capital Resources

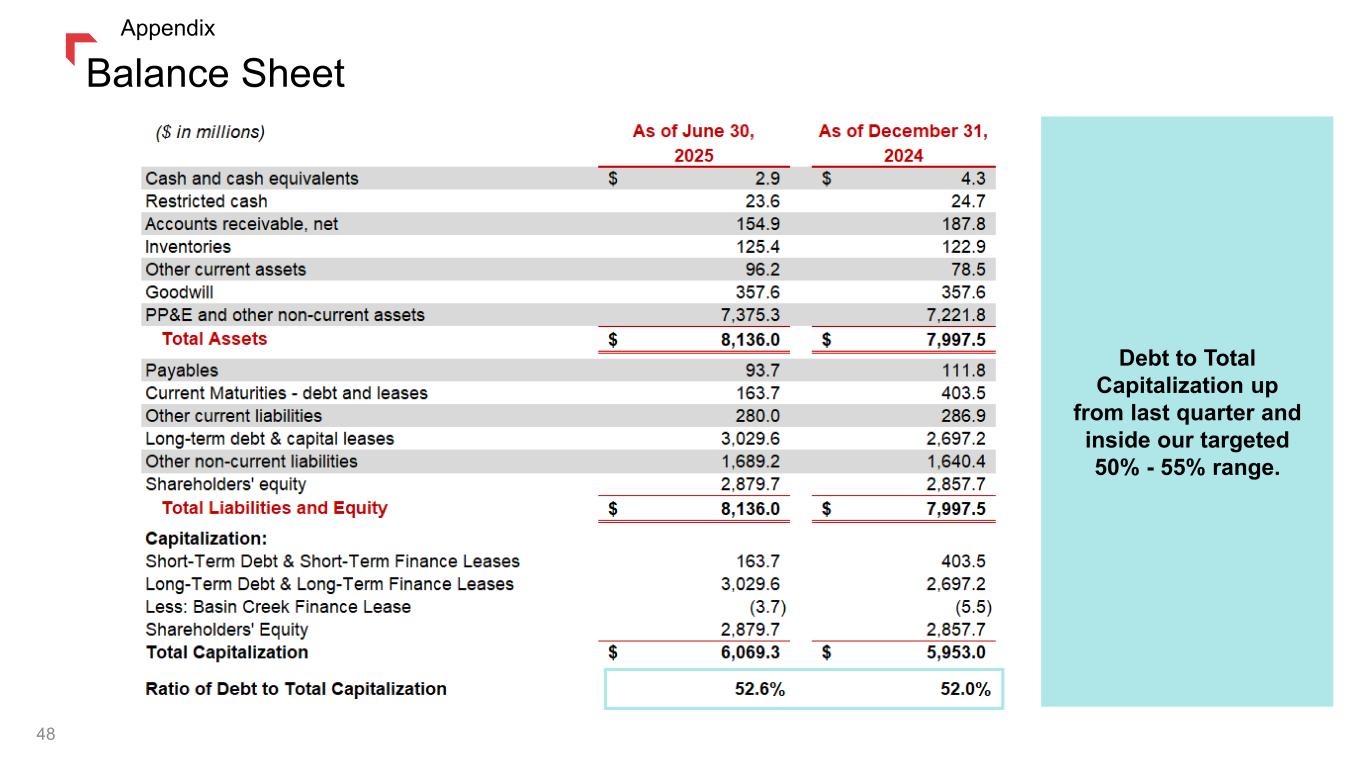

As of June 30, 2025, our total net liquidity was approximately $317.9 million, including $2.9 million of cash and $315.0 million of revolving credit facility availability with no letters of credit outstanding. This compares to total net liquidity one year ago at June 30, 2024 of $393.4 million.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 13

Earnings Per Share

Basic earnings per share are computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of common stock equivalent shares that could occur if unvested shares were to vest. Common stock equivalent shares are calculated using the treasury stock method, as applicable. The dilutive effect is computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding plus the effect of the outstanding unvested restricted stock and performance share awards. Average shares used in computing the basic and diluted earnings per share are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

June 30, 2025 |

|

June 30, 2024 |

| Basic computation |

61,380,777 |

|

|

61,288,870 |

|

| Dilutive effect of: |

|

|

|

Performance share awards(1) |

103,169 |

|

|

68,478 |

|

| Diluted computation |

61,483,946 |

|

|

61,357,348 |

|

(1) Performance share awards are included in diluted weighted average number of shares outstanding based upon what would be issued if the end of the most recent reporting period was the end of the term of the award. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

June 30, 2025 |

|

June 30, 2024 |

| Basic computation |

61,360,252 |

|

|

61,277,418 |

|

| Dilutive effect of: |

|

|

|

Performance share awards(1) |

95,733 |

|

|

56,065 |

|

| Diluted computation |

61,455,985 |

|

|

61,333,483 |

|

As of June 30, 2025, there were 68,107 shares from performance and restricted share awards which were antidilutive and excluded from the earnings per share calculations, compared to 35,933 shares as of June 30, 2024.

[The remainder of page is intentionally left blank]

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 14

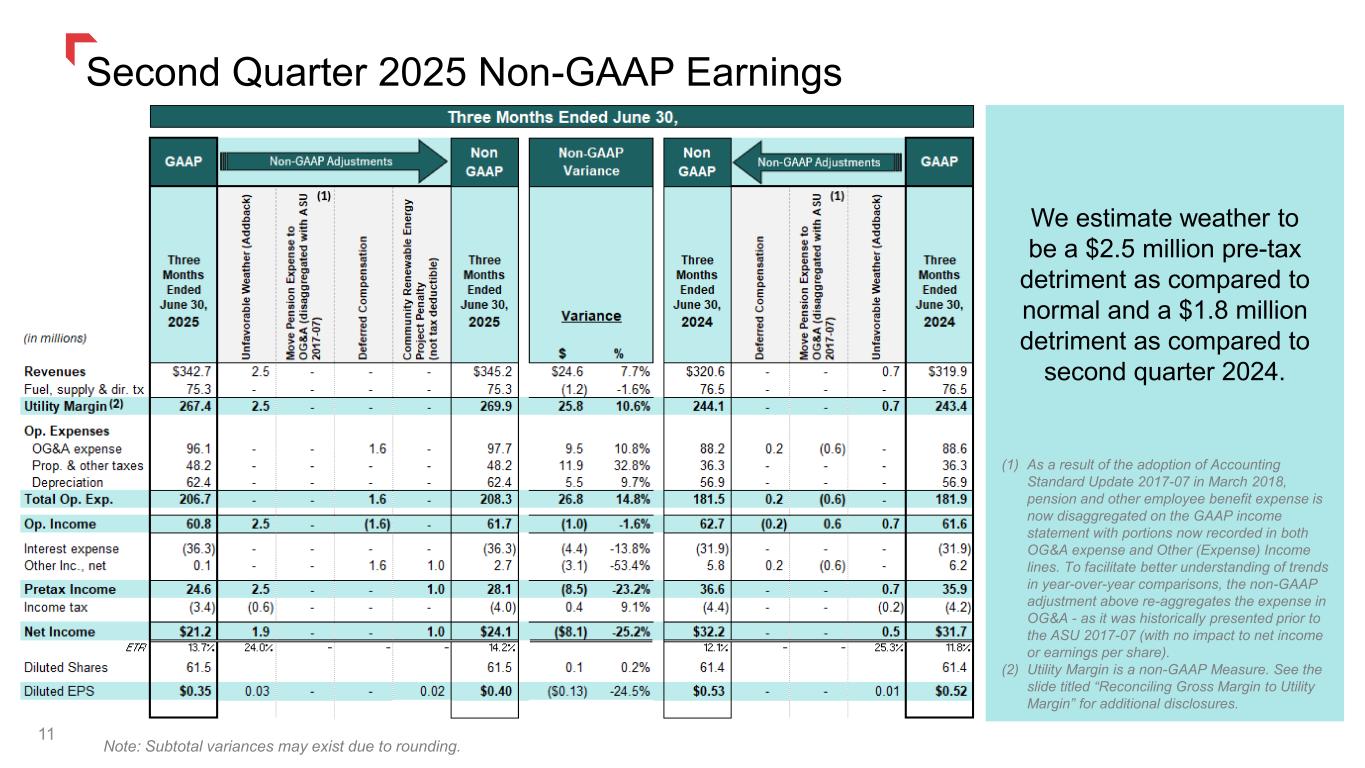

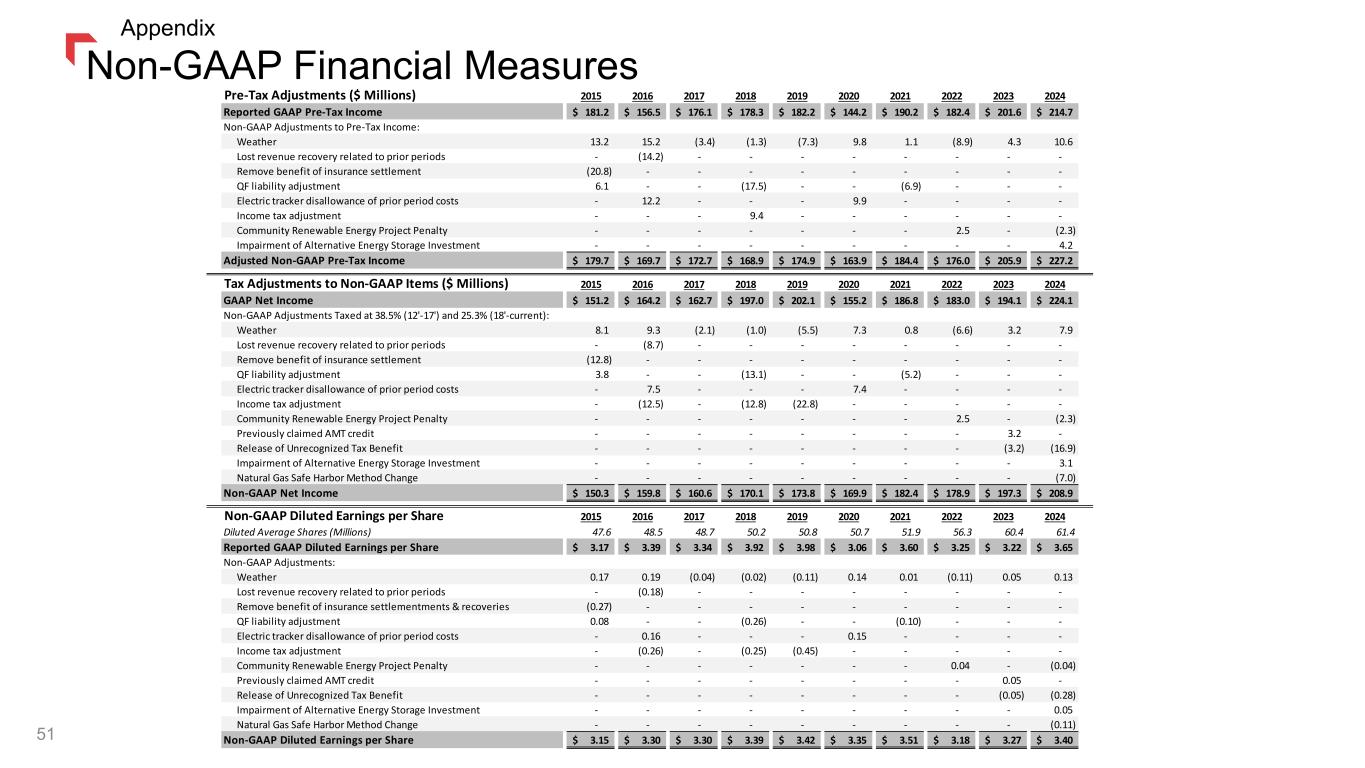

Adjusted Non-GAAP Earnings

We reported GAAP earnings of $0.35 per diluted share for the three months ended June 30, 2025 and $0.52 per diluted share for the same period in 2024. Adjusted Non-GAAP earnings per diluted share for the same periods are $0.40 and $0.53, respectively. A reconciliation of items factored into our Adjusted Non-GAAP diluted earnings are summarized below. The amount below represents a non-GAAP measure that may provide users of this data with additional meaningful information regarding the impact of certain items on our expected earnings. More information on this measure can be found in the "Non-GAAP Financial Measures" section below.

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except EPS) |

|

|

|

|

|

| Three Months Ended June 30, 2025 |

|

Pre-tax

Income |

Net(1)

Income |

Diluted

EPS |

| 2025 Reported GAAP |

$24.6 |

$21.2 |

$ |

0.35 |

|

|

|

|

|

| Non-GAAP Adjustments: |

Unfavorable weather as compared to normal |

2.5 |

|

1.9 |

|

0.03 |

|

Community Renewable Energy Project Penalty

(not tax deductible) |

1.0 |

|

1.0 |

|

0.02 |

|

|

|

|

|

| 2025 Adj. Non-GAAP |

$28.1 |

$24.1 |

$0.40 |

|

|

|

|

|

|

|

|

| Three Months Ended June 30, 2024 |

|

Pre-tax

Income |

Net(1)

Income |

Diluted

EPS |

| 2024 Reported GAAP |

$35.9 |

$31.7 |

$ |

0.52 |

|

|

|

|

|

| Non-GAAP Adjustments: |

Unfavorable weather as compared to normal |

0.7 |

|

0.5 |

|

0.01 |

|

|

|

|

|

| 2024 Adj. Non-GAAP |

$36.6 |

$32.2 |

$0.53 |

|

|

|

|

| (1) Income tax rate on reconciling items assumes blended federal plus state effective tax rate of 25.3%. |

Company Hosting Earnings Webinar

NorthWestern will host an investor earnings webinar on Thursday, July 31, 2025, at 3:30 p.m. Eastern time to review its financial results for the quarter ending June 30, 2025. To register for the webinar, please visit www.northwesternenergy.com/earnings-registration. Please go to the site at least 15 minutes in advance of

the webinar to register. An archived webinar will be available shortly after the event and remain active for one NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides essential energy infrastructure and valuable services that enrich lives and empower communities while serving as long-term partners to our customers and communities.

year.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 15

NorthWestern Energy - Delivering a Bright Future

We work to deliver safe, reliable, and innovative energy solutions that create value for customers, communities, employees, and investors. We do this by providing low-cost and reliable service performed by highly-adaptable and skilled employees. We provide electricity and / or natural gas to approximately 842,100 customers in Montana, South Dakota, Nebraska, and Yellowstone National Park. Our operations in Montana and Yellowstone National Park are conducted through our subsidiary, NW Corp, and our operations in South Dakota and Nebraska are conducted through our subsidiary, NWE Public Service. We have provided service in South Dakota and Nebraska since 1923 and in Montana since 2002.

Non-GAAP Financial Measures

This press release includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

We define Utility Margin as Operating Revenues less fuel, purchased supply, and direct transmission expense (exclusive of depreciation and depletion) as presented in our Condensed Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Condensed Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in the press release above.

Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow for recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report.

Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income, and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income, and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures.

NorthWestern Reports Second Quarter 2025 Financial Results

July 30, 2025

Page 16

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, the information under "Reconciliation of Non-GAAP Items." Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management's examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that we will achieve our projections. Factors that may cause such differences include, but are not limited to:

•adverse determinations by regulators, such as adverse outcomes from the denial of interim rates or final rates not consistent with a reasonable ability to earn our allowed returns, as well as potential adverse federal, state, or local legislation or regulation, including costs of compliance with existing and future environmental requirements, and wildfire damages in excess of liability insurance coverage, could have a material effect on our liquidity, results of operations and financial condition;

•the impact of extraordinary external events and natural disasters, such as a wide-spread or global pandemic, geopolitical events, earthquake, flood, drought, lightning, weather, wind, and fire, could have a material effect on our liquidity, results of operations and financial condition;

•acts of terrorism, cybersecurity attacks, data security breaches, or other malicious acts that cause damage to our generation, transmission, or distribution facilities, information technology systems, or result in the release of confidential customer, employee, or Company information;

•supply chain constraints, recent high levels of inflation for product, services and labor costs, and their impact on capital expenditures, operating activities, and/or our ability to safely and reliably serve our customers;

•changes in availability of trade credit, creditworthiness of counterparties, usage, commodity prices, fuel supply costs or availability due to higher demand, shortages, weather conditions, transportation problems or other developments, may reduce revenues or may increase operating costs, each of which could adversely affect our liquidity and results of operations;

•unscheduled generation outages or forced reductions in output, maintenance or repairs, which may reduce revenues and increase operating costs or may require additional capital expenditures or other increased operating costs; and

•adverse changes in general economic and competitive conditions in the U.S. financial markets and in our service territories.

Our 2024 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, reports on Form 8-K and other

Securities and Exchange Commission filings discuss some of the important risk factors that may affect our

business, results of operations and financial condition. We undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact: Media Contact:

Travis Meyer (605) 978-2967 Jo Dee Black (866) 622-8081

travis.meyer@northwestern.com jodee.black@northwestern.com