BofA Power, Utilities & Clean Energy Conference March 5, 2024 8-K March 5, 20241

NorthWestern Energy 2 Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward- looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date of this document unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s 10-K and 10-Q along with other public filings with the SEC. NorthWestern Energy Group, Inc. dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com

Thank youOverview 3

NWE – An Investment for the Long Term 4 • Approved Montana electric & natural gas and South Dakota electric rate reviews aid earnings, cash flow, and balance sheet strength • History of consistent annual dividend growth • 100% pure electric & natural gas utility with over 100 years of operating history • Solid economic indicators in service territory • Diverse electric supply portfolio ~55% hydro, wind & solar Pure Electric & Gas Utility Solid Utility Foundation Earnings & Cash Flow Attractive Future Growth Prospects Financial Goals & Metrics Best Practices Corporate Governance • Residential electric & gas rates below national average • Solid system reliability • Low leaks per 100 miles of pipe • Solid JD Power Overall Customer Satisfaction scores • Disciplined maintenance capital investment program focus on reliability, capacity, asset life and compliance • Further opportunity for energy supply investment to meet significant capacity shortfalls • Target 4%-6% EPS growth plus dividend yield to provide competitive total return • Target dividend long-term payout ratio of 60%-70% • Target debt to capitalization ratio of 50%-55% with liquidity of $100 million or greater 5th Best Governance Score Recognized as one of America’s Greatest Workplaces

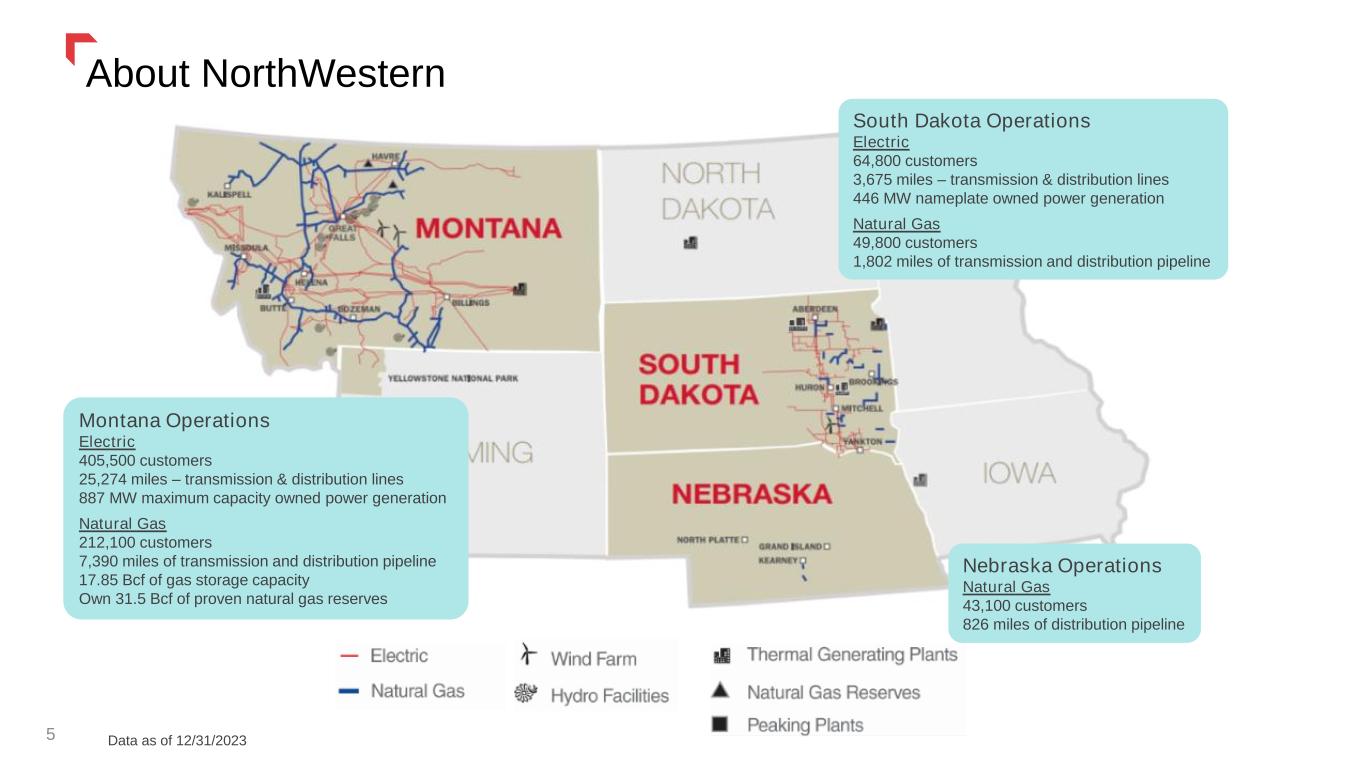

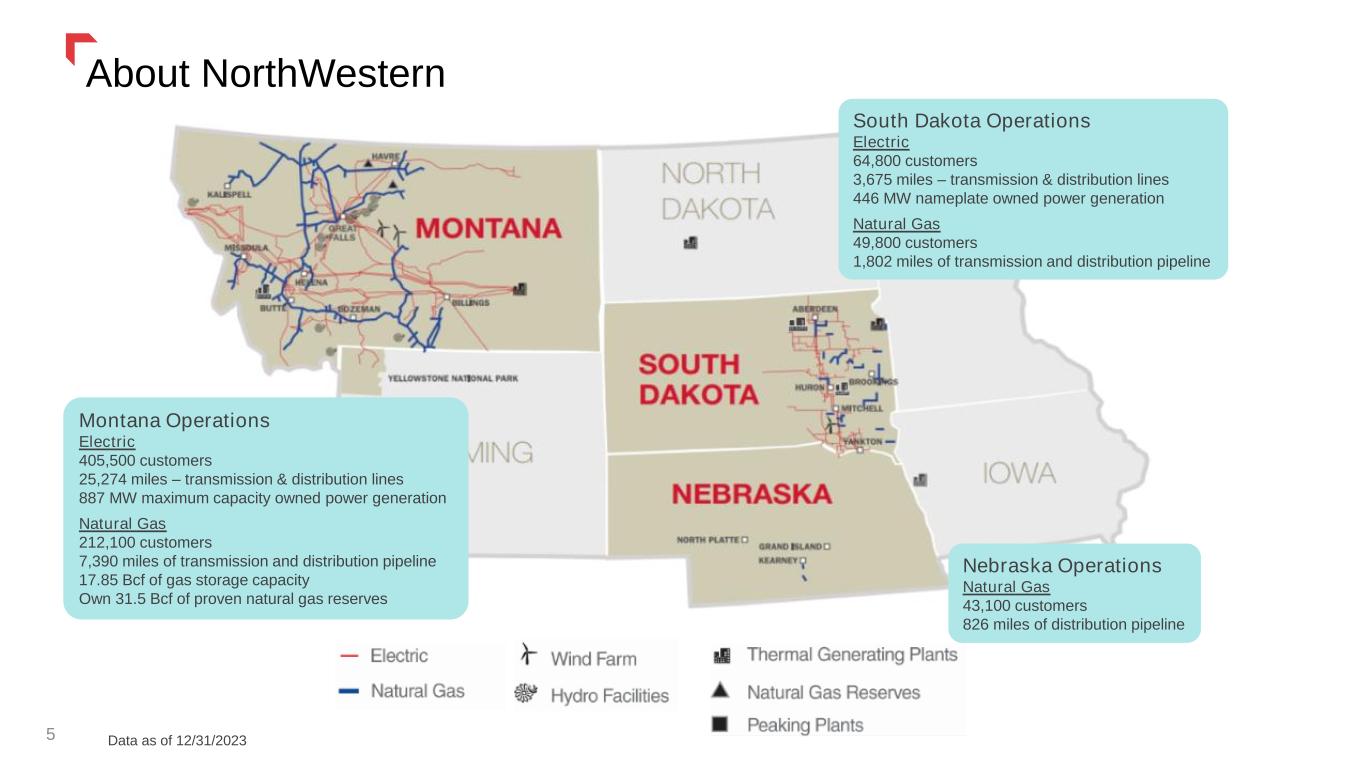

About NorthWestern 5 Montana Operations Electric 405,500 customers 25,274 miles – transmission & distribution lines 887 MW maximum capacity owned power generation Natural Gas 212,100 customers 7,390 miles of transmission and distribution pipeline 17.85 Bcf of gas storage capacity Own 31.5 Bcf of proven natural gas reserves Nebraska Operations Natural Gas 43,100 customers 826 miles of distribution pipeline Data as of 12/31/2023 South Dakota Operations Electric 64,800 customers 3,675 miles – transmission & distribution lines 446 MW nameplate owned power generation Natural Gas 49,800 customers 1,802 miles of transmission and distribution pipeline

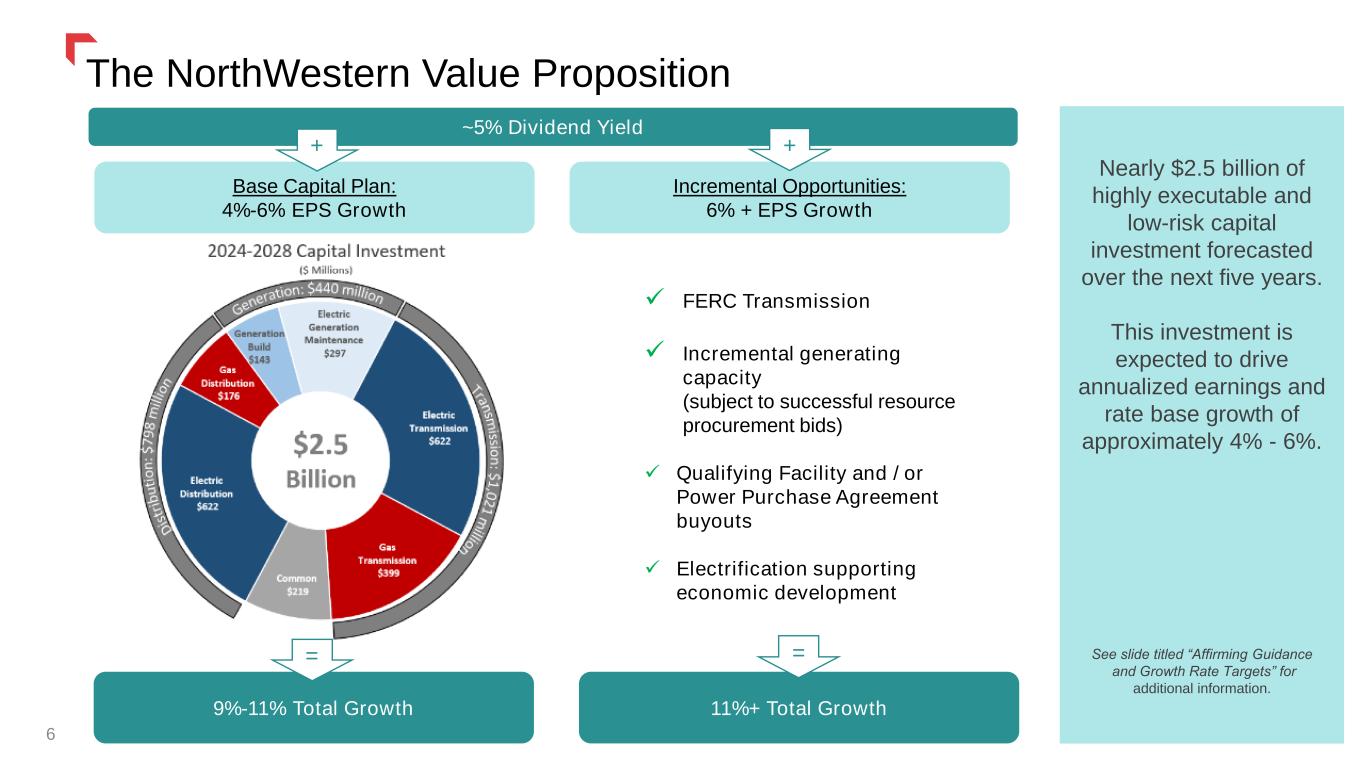

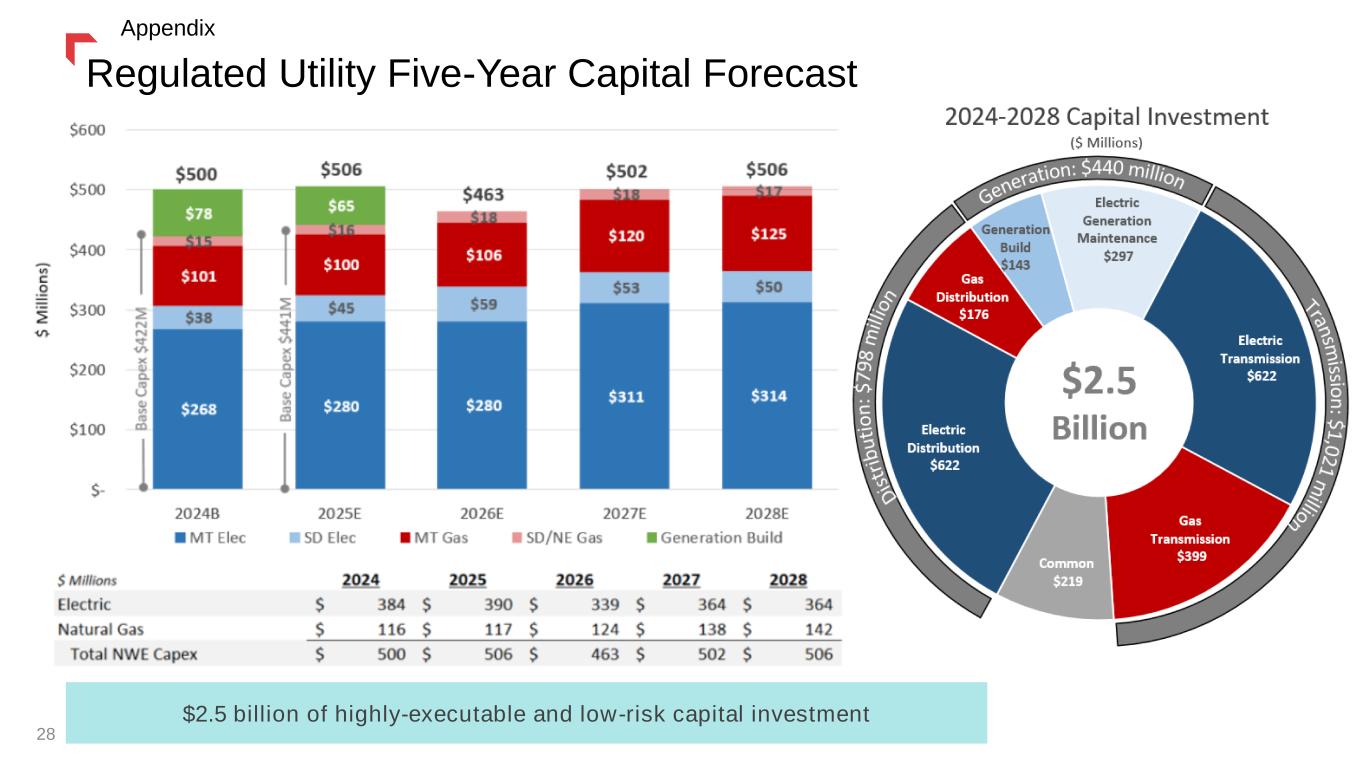

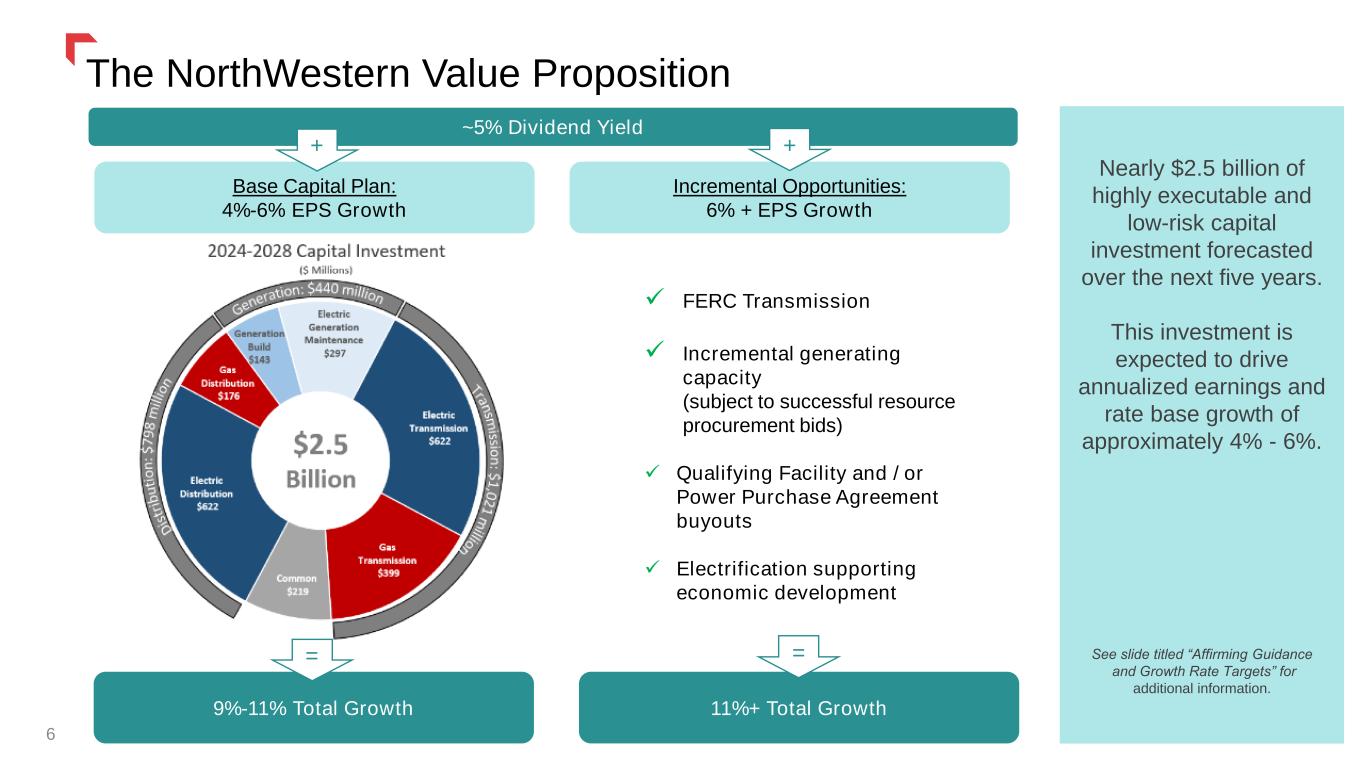

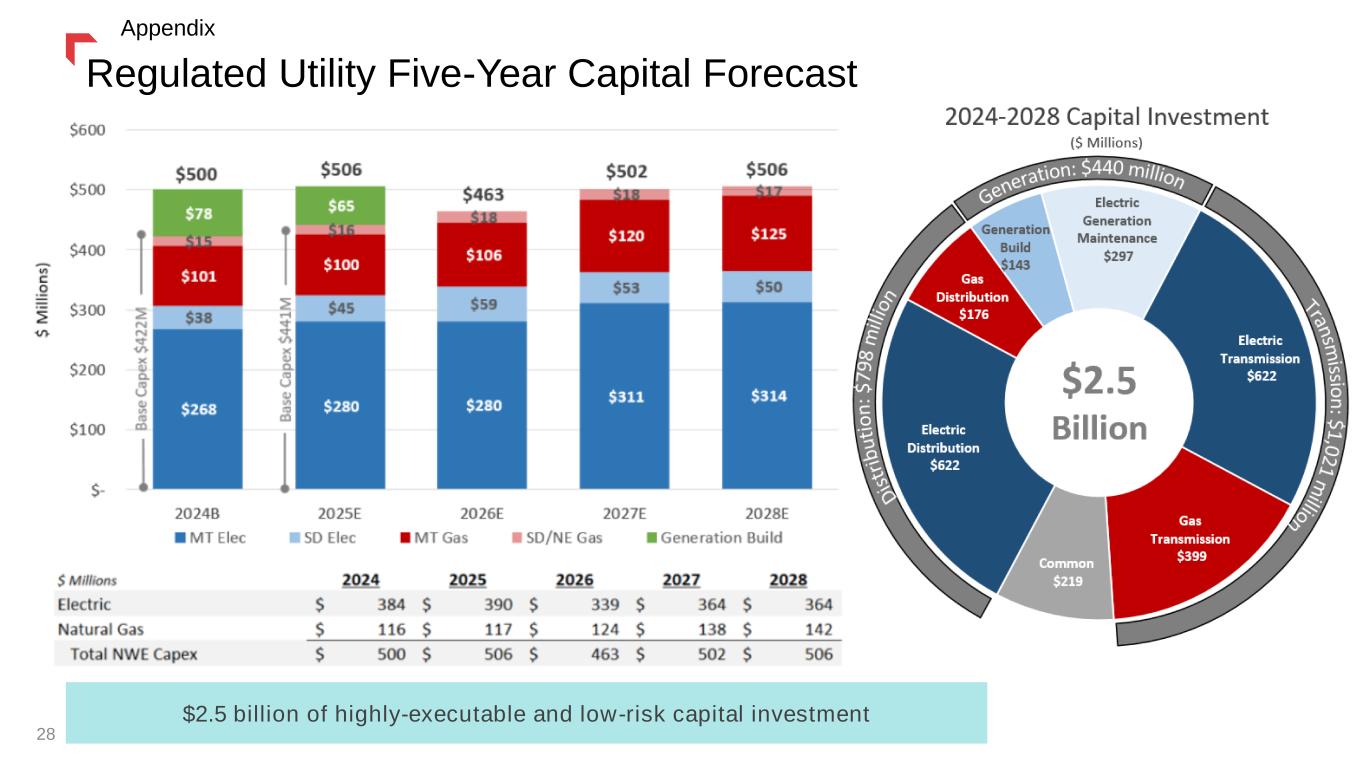

9%-11% Total Growth 11%+ Total Growth Incremental Opportunities: 6% + EPS Growth ~5% Dividend Yield Base Capital Plan: 4%-6% EPS Growth FERC Transmission Incremental generating capacity (subject to successful resource procurement bids) Qualifying Facility and / or Power Purchase Agreement buyouts Electrification supporting economic development Nearly $2.5 billion of highly executable and low-risk capital investment forecasted over the next five years. This investment is expected to drive annualized earnings and rate base growth of approximately 4% - 6%. See slide titled “Affirming Guidance and Growth Rate Targets” for additional information. + The NorthWestern Value Proposition + 6 = =

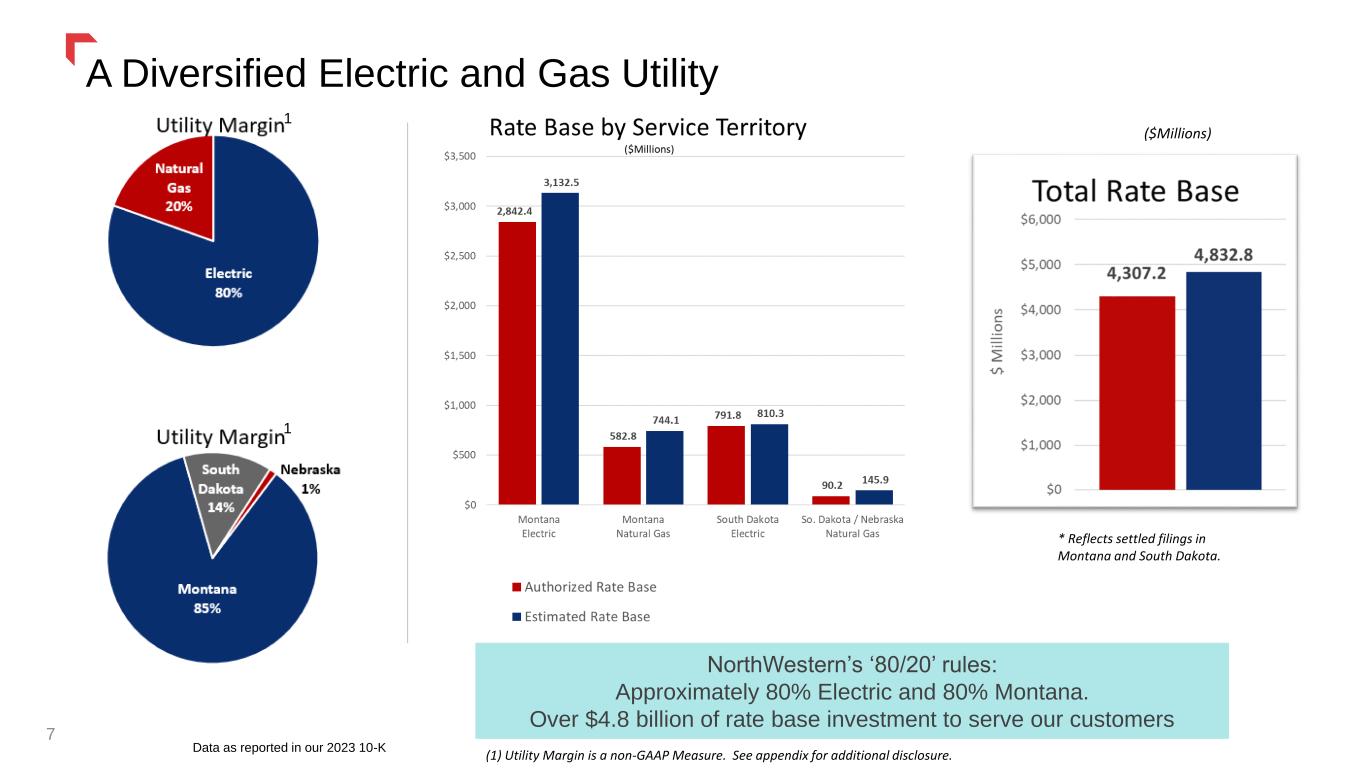

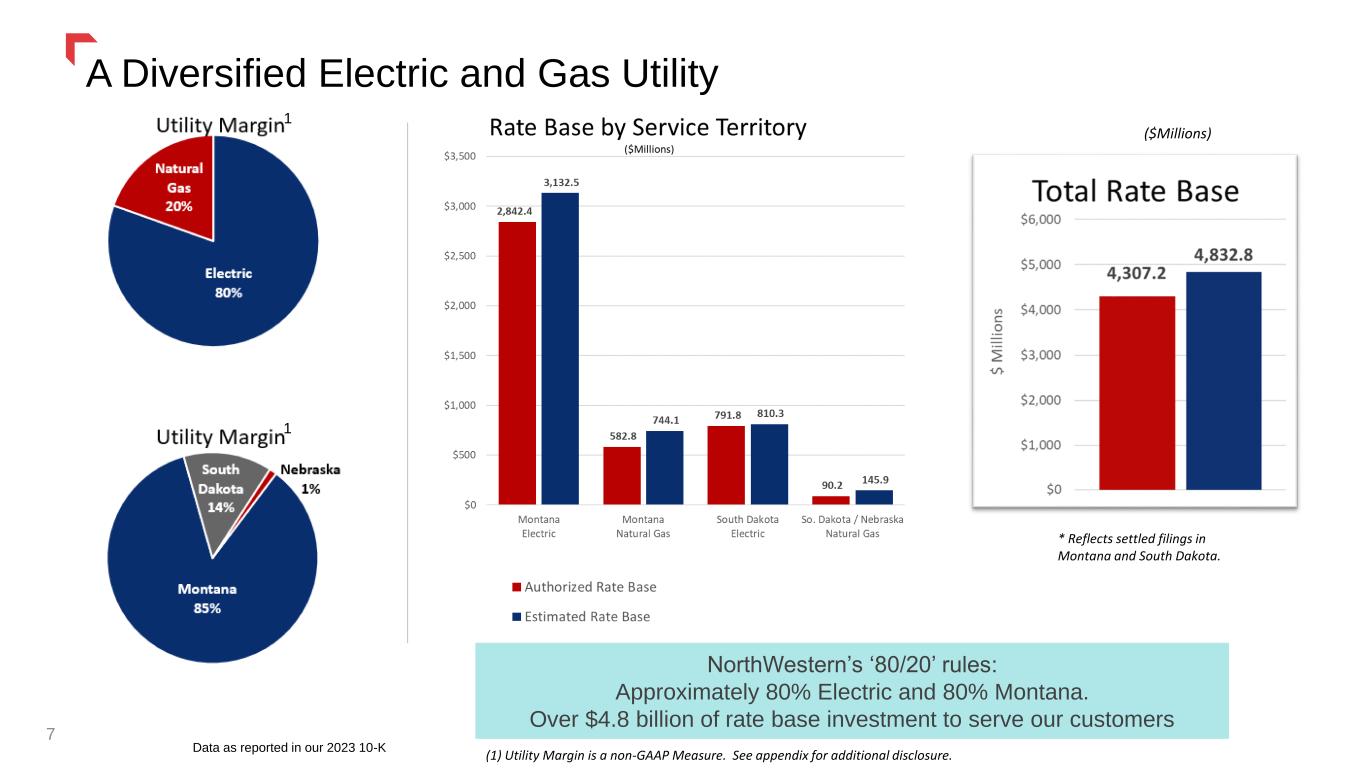

A Diversified Electric and Gas Utility 7 NorthWestern’s ‘80/20’ rules: Approximately 80% Electric and 80% Montana. Over $4.8 billion of rate base investment to serve our customers Data as reported in our 2023 10-K (1) Utility Margin is a non-GAAP Measure. See appendix for additional disclosure. * Reflects settled filings in Montana and South Dakota. ($Millions) 1 1

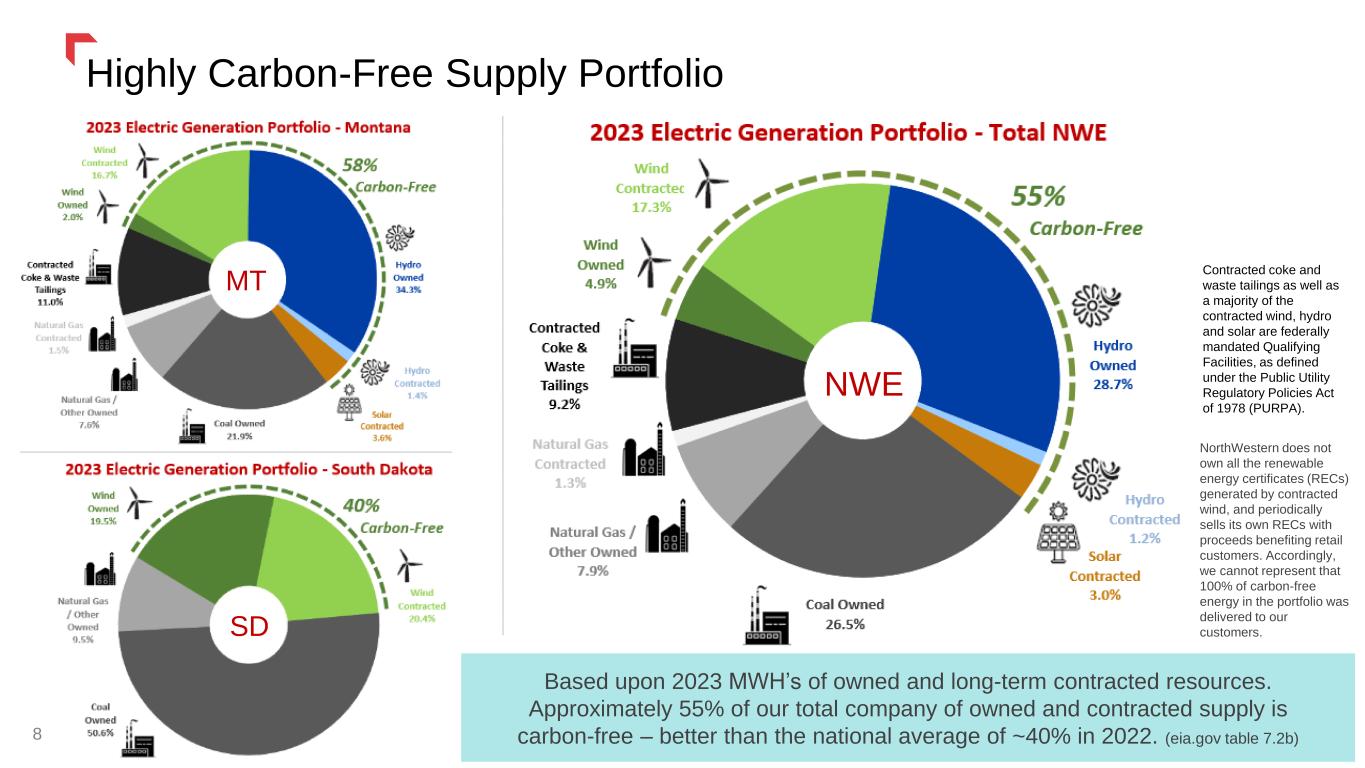

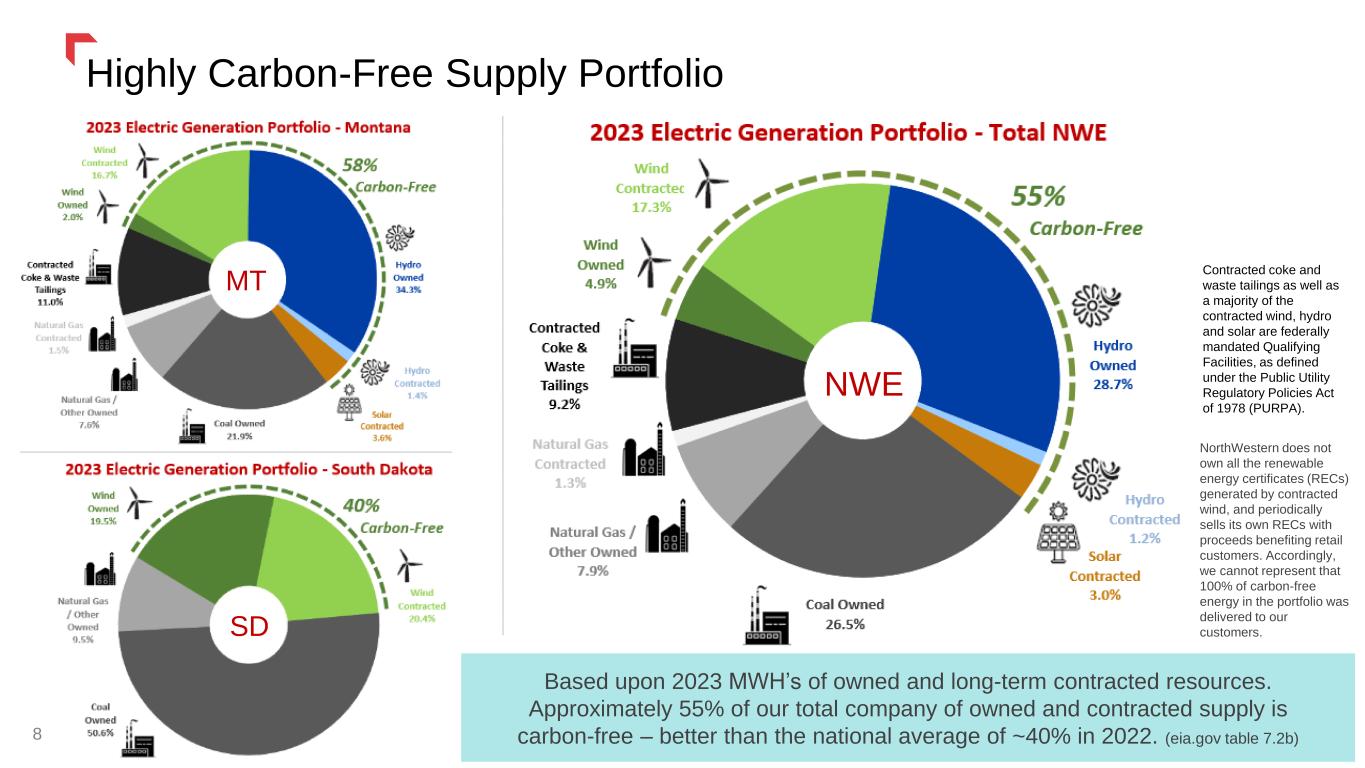

8 Highly Carbon-Free Supply Portfolio NorthWestern does not own all the renewable energy certificates (RECs) generated by contracted wind, and periodically sells its own RECs with proceeds benefiting retail customers. Accordingly, we cannot represent that 100% of carbon-free energy in the portfolio was delivered to our customers. Based upon 2023 MWH’s of owned and long-term contracted resources. Approximately 55% of our total company of owned and contracted supply is carbon-free – better than the national average of ~40% in 2022. (eia.gov table 7.2b) NWE Contracted coke and waste tailings as well as a majority of the contracted wind, hydro and solar are federally mandated Qualifying Facilities, as defined under the Public Utility Regulatory Policies Act of 1978 (PURPA). MT SD 8

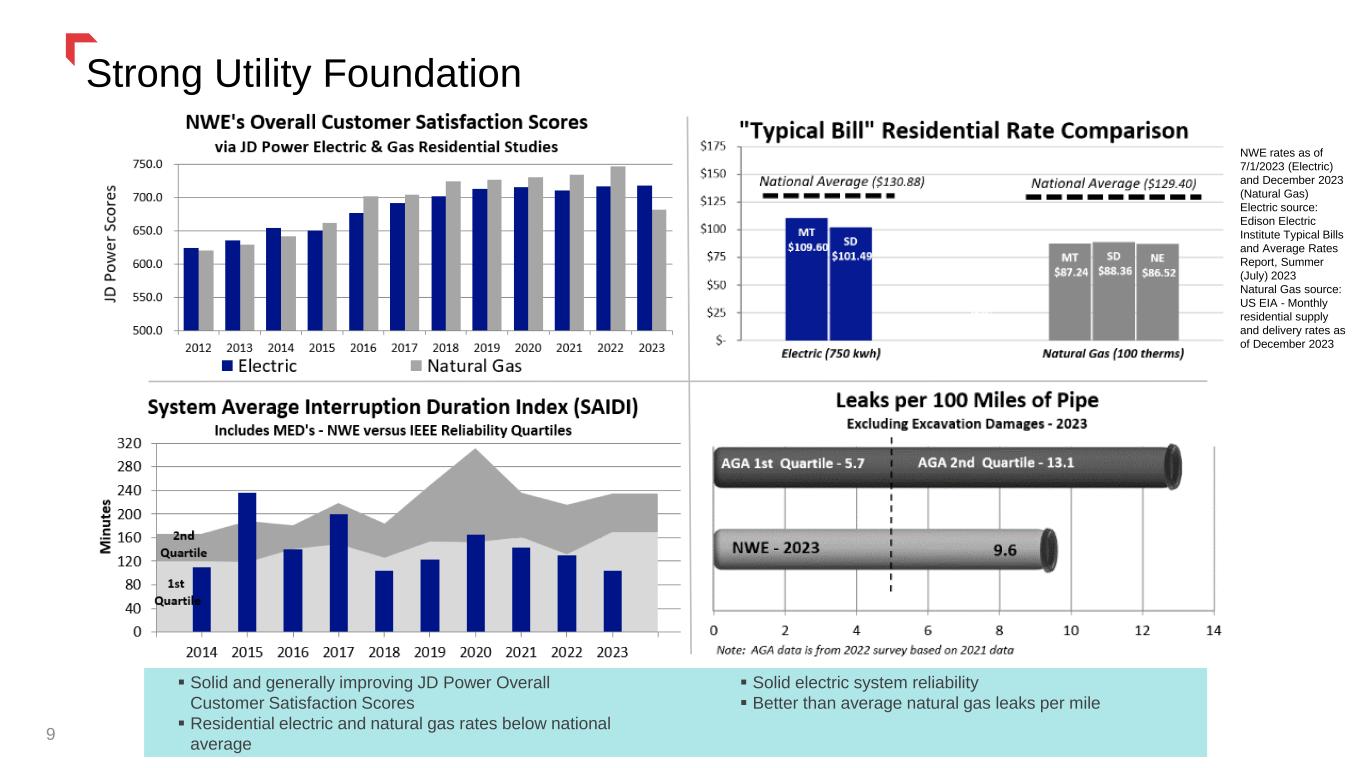

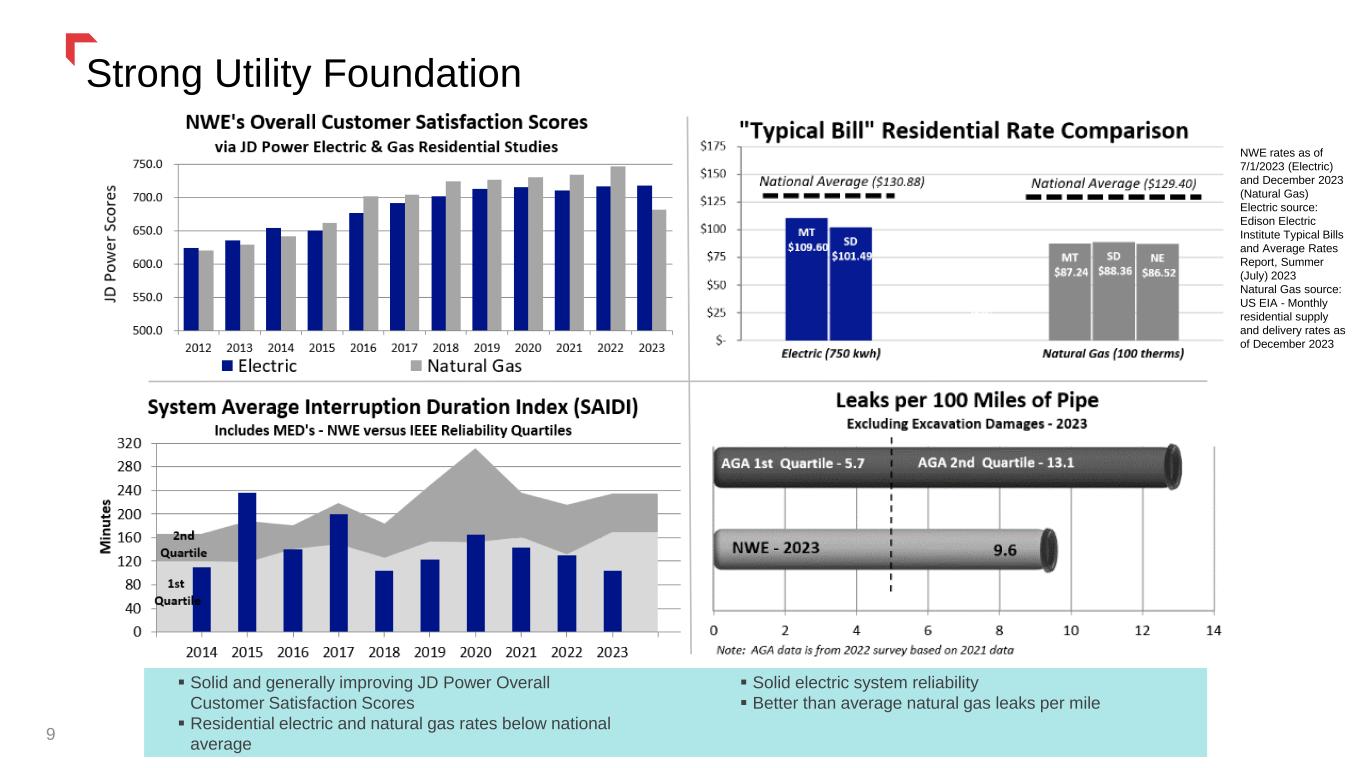

Strong Utility Foundation 9 Solid and generally improving JD Power Overall Customer Satisfaction Scores Residential electric and natural gas rates below national average Solid electric system reliability Better than average natural gas leaks per mile NWE rates as of 7/1/2023 (Electric) and December 2023 (Natural Gas) Electric source: Edison Electric Institute Typical Bills and Average Rates Report, Summer (July) 2023 Natural Gas source: US EIA - Monthly residential supply and delivery rates as of December 2023

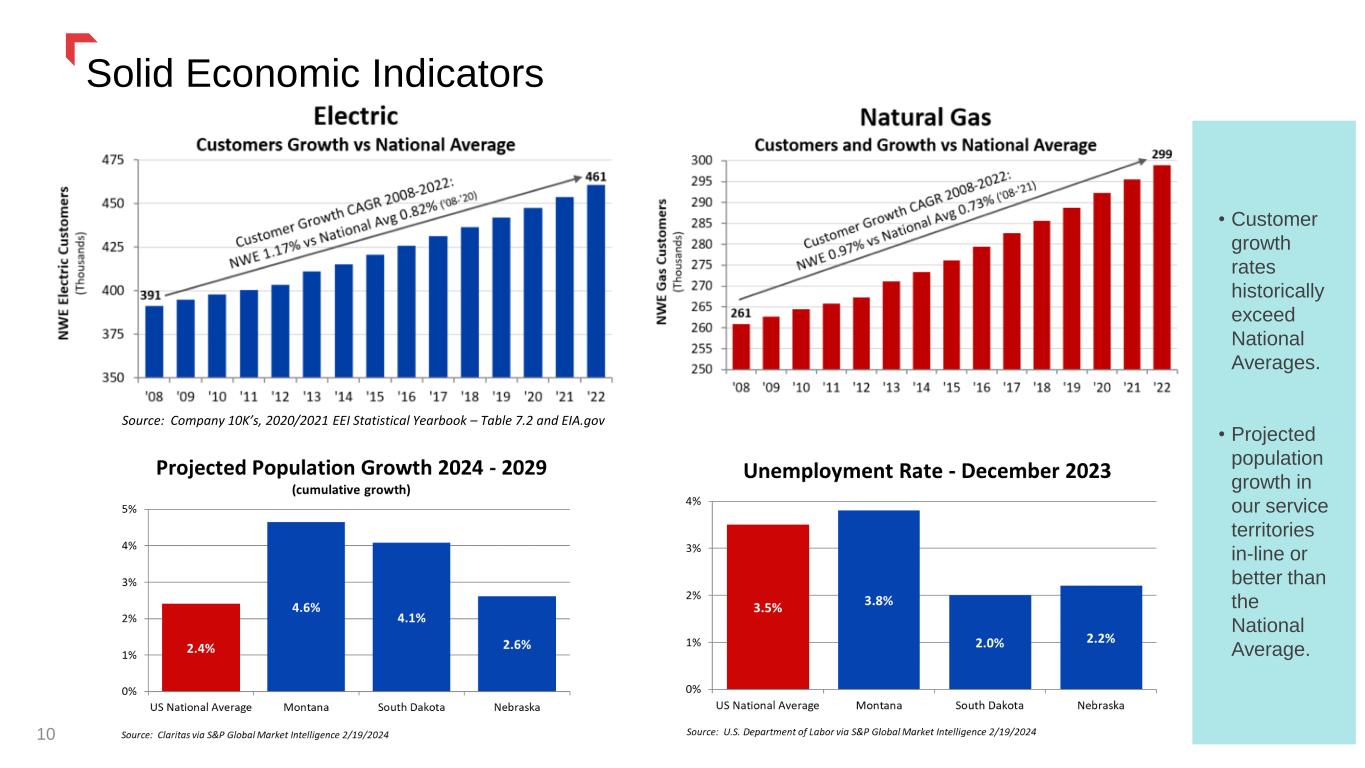

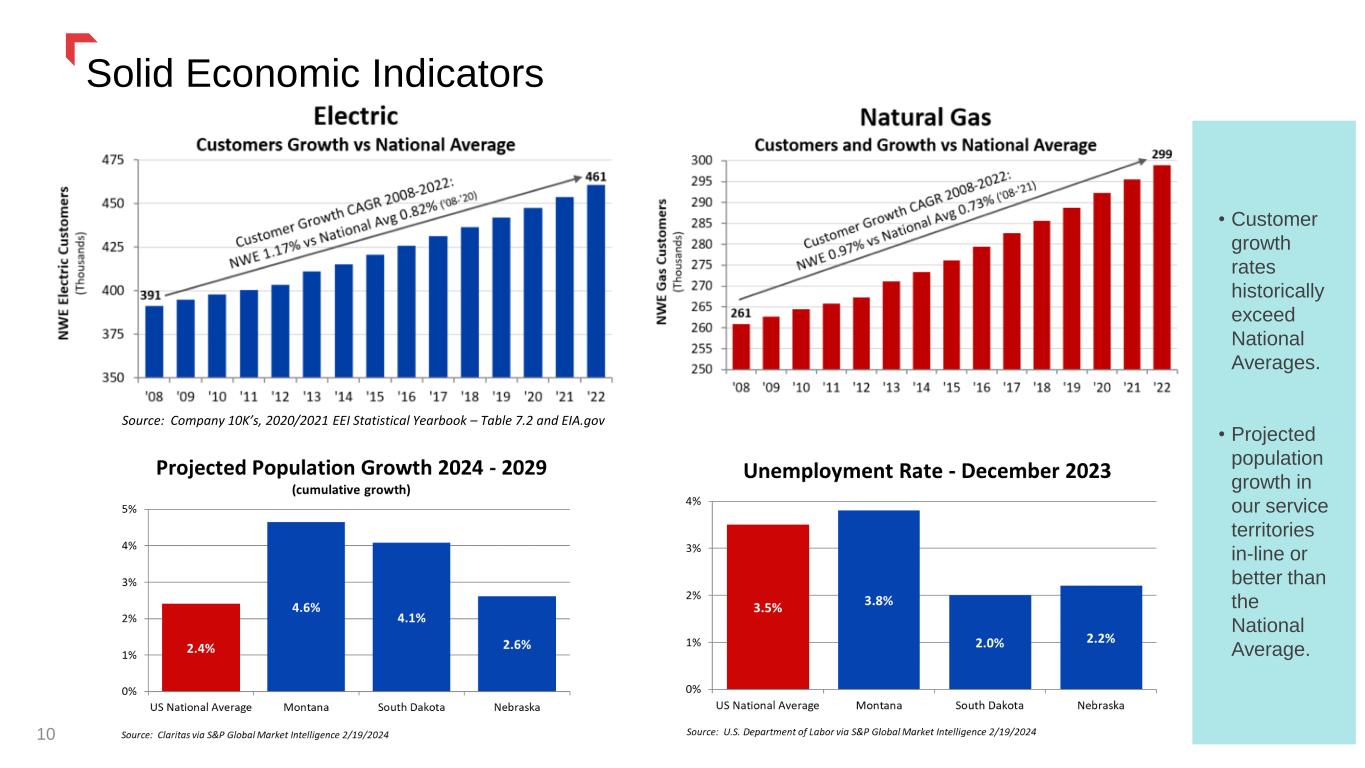

Solid Economic Indicators 10 • Customer growth rates historically exceed National Averages. • Projected population growth in our service territories in-line or better than the National Average. Source: Company 10K’s, 2020/2021 EEI Statistical Yearbook – Table 7.2 and EIA.gov

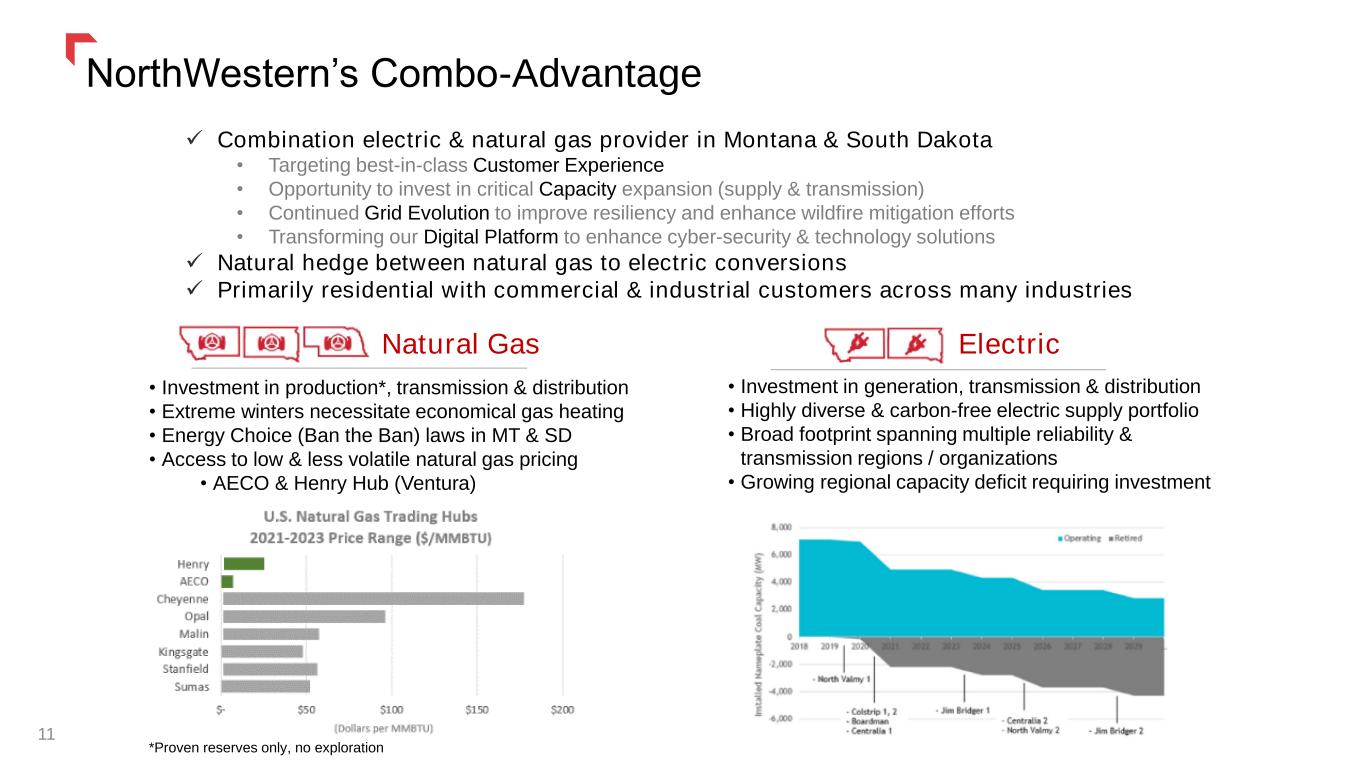

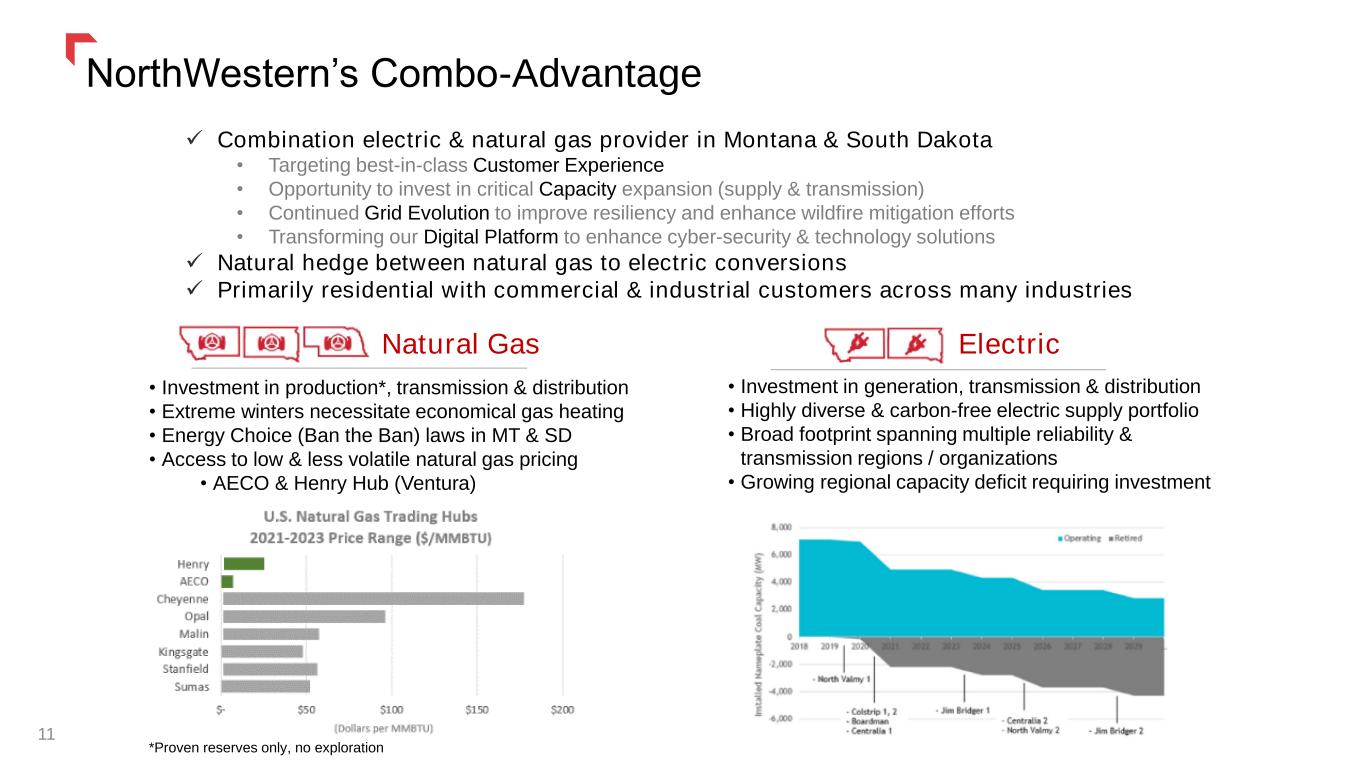

NorthWestern’s Combo-Advantage 11 Combination electric & natural gas provider in Montana & South Dakota • Targeting best-in-class Customer Experience • Opportunity to invest in critical Capacity expansion (supply & transmission) • Continued Grid Evolution to improve resiliency and enhance wildfire mitigation efforts • Transforming our Digital Platform to enhance cyber-security & technology solutions Natural hedge between natural gas to electric conversions Primarily residential with commercial & industrial customers across many industries • Investment in production*, transmission & distribution • Extreme winters necessitate economical gas heating • Energy Choice (Ban the Ban) laws in MT & SD • Access to low & less volatile natural gas pricing • AECO & Henry Hub (Ventura) *Proven reserves only, no exploration • Investment in generation, transmission & distribution • Highly diverse & carbon-free electric supply portfolio • Broad footprint spanning multiple reliability & transmission regions / organizations • Growing regional capacity deficit requiring investment ElectricNatural Gas

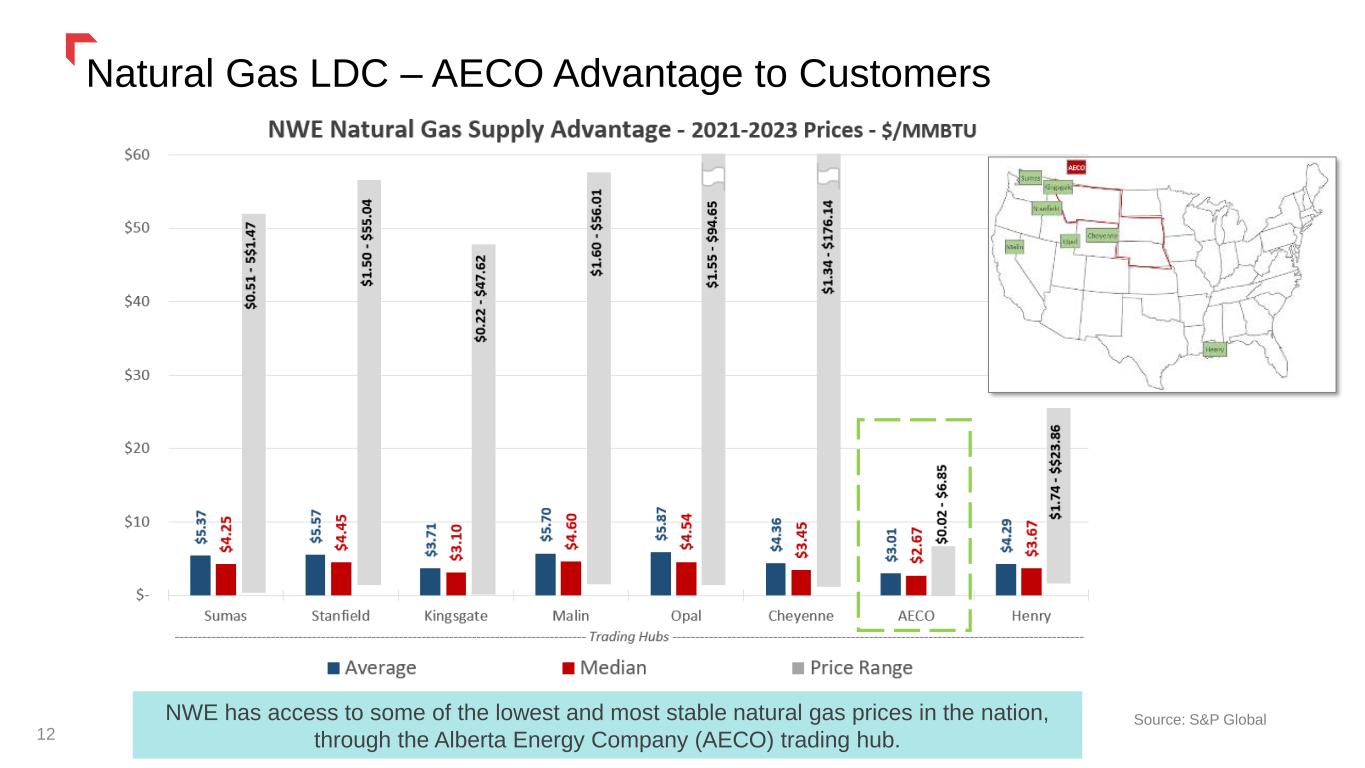

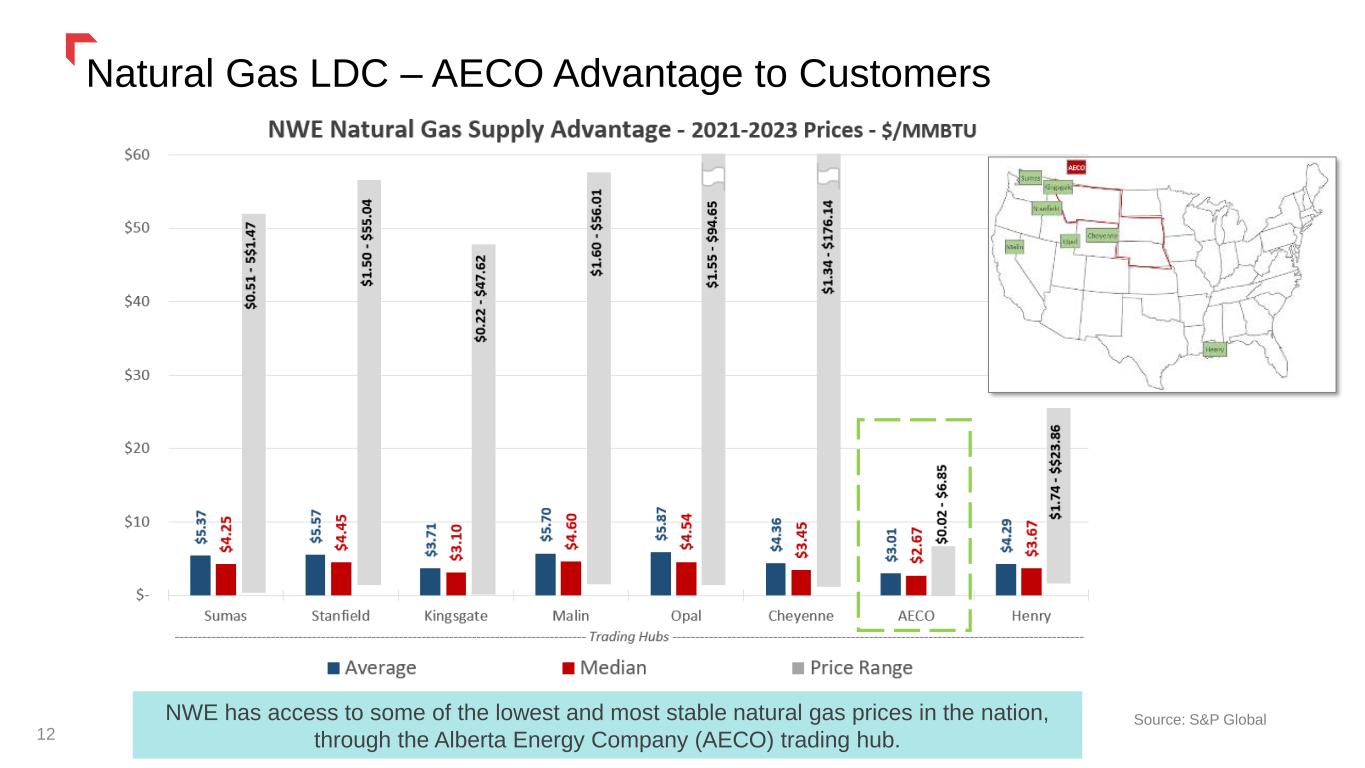

Natural Gas LDC – AECO Advantage to Customers 12 NWE has access to some of the lowest and most stable natural gas prices in the nation, through the Alberta Energy Company (AECO) trading hub. Source: S&P Global

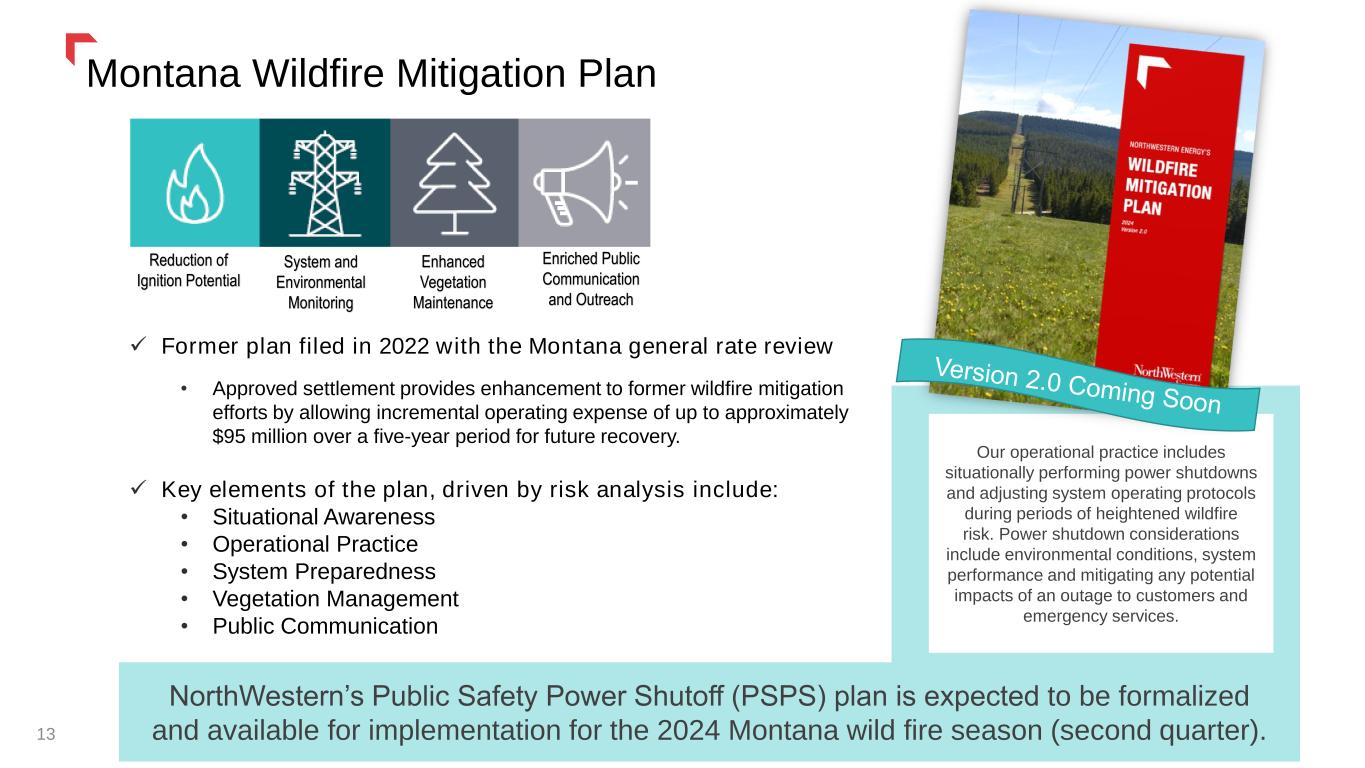

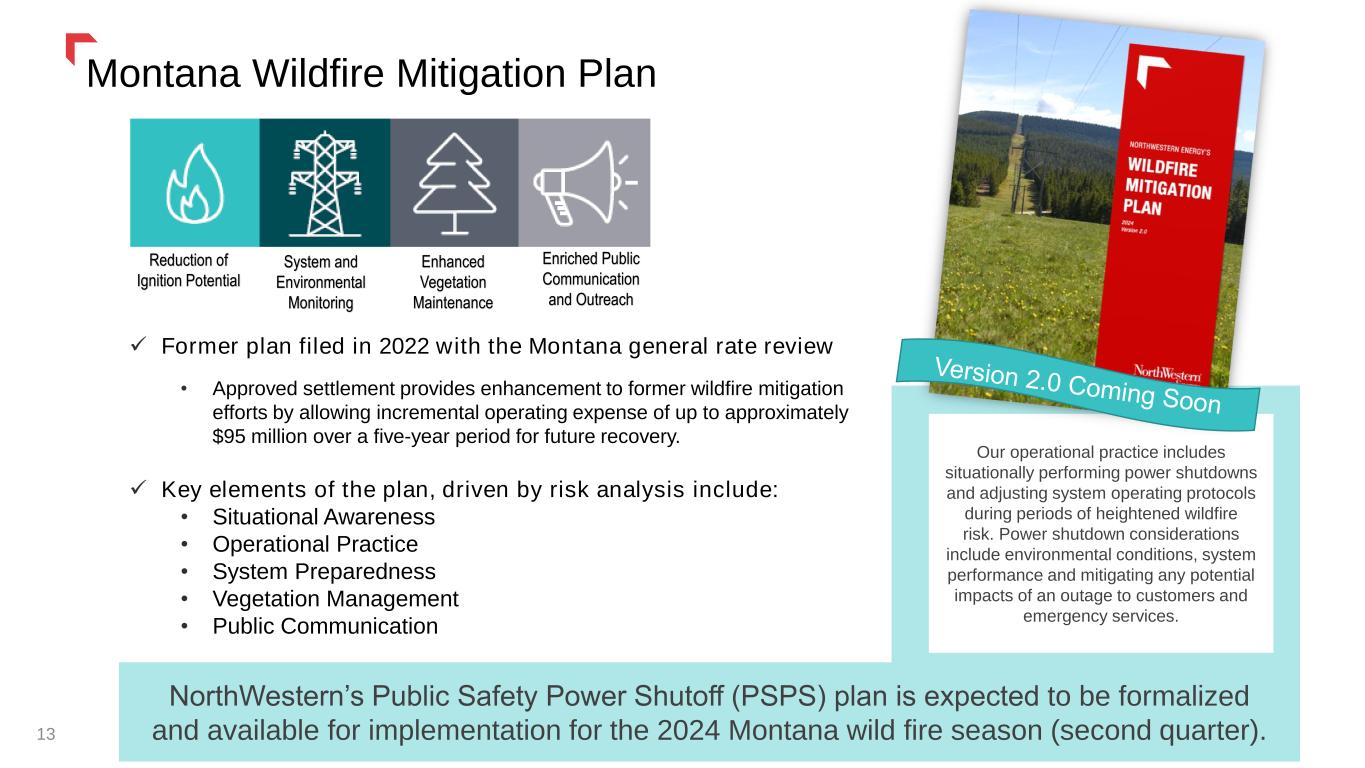

Montana Wildfire Mitigation Plan 13 Reduction of Ignition Potential System and Environmental Monitoring Enhanced Vegetation Maintenance Enriched Public Communication and Outreach Former plan filed in 2022 with the Montana general rate review • Approved settlement provides enhancement to former wildfire mitigation efforts by allowing incremental operating expense of up to approximately $95 million over a five-year period for future recovery. Key elements of the plan, driven by risk analysis include: • Situational Awareness • Operational Practice • System Preparedness • Vegetation Management • Public Communication NorthWestern’s Public Safety Power Shutoff (PSPS) plan is expected to be formalized and available for implementation for the 2024 Montana wild fire season (second quarter). Our operational practice includes situationally performing power shutdowns and adjusting system operating protocols during periods of heightened wildfire risk. Power shutdown considerations include environmental conditions, system performance and mitigating any potential impacts of an outage to customers and emergency services.

Corporate Sustainability 14 Environmental Social Governance These eight publications provide valuable insight into NorthWestern Energy’s Environmental, Social and Governance (ESG) Sustainability practices. Sustainability Report includes Sustainability Accounting Standards Board (SASB) and Task Force on Climate- Related Financial Disclosures (TCFD) aligned reporting.

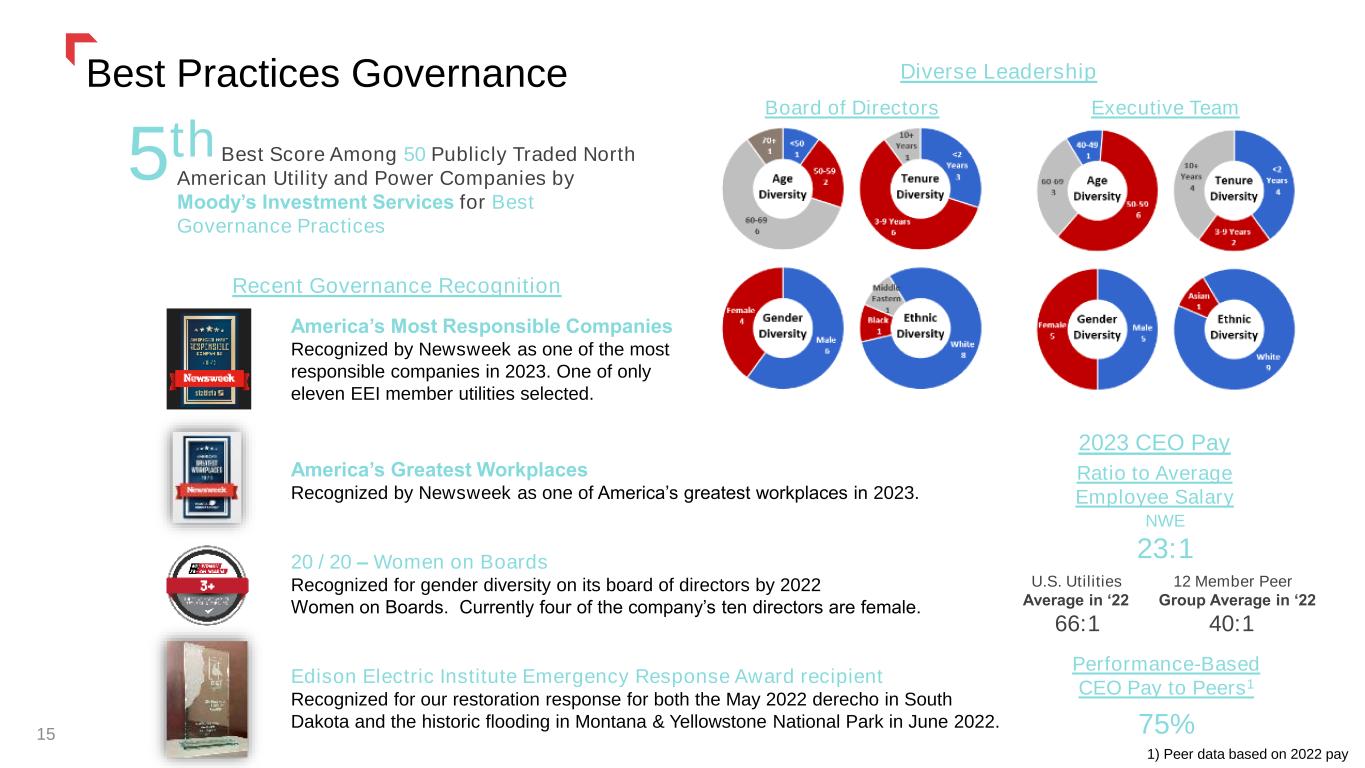

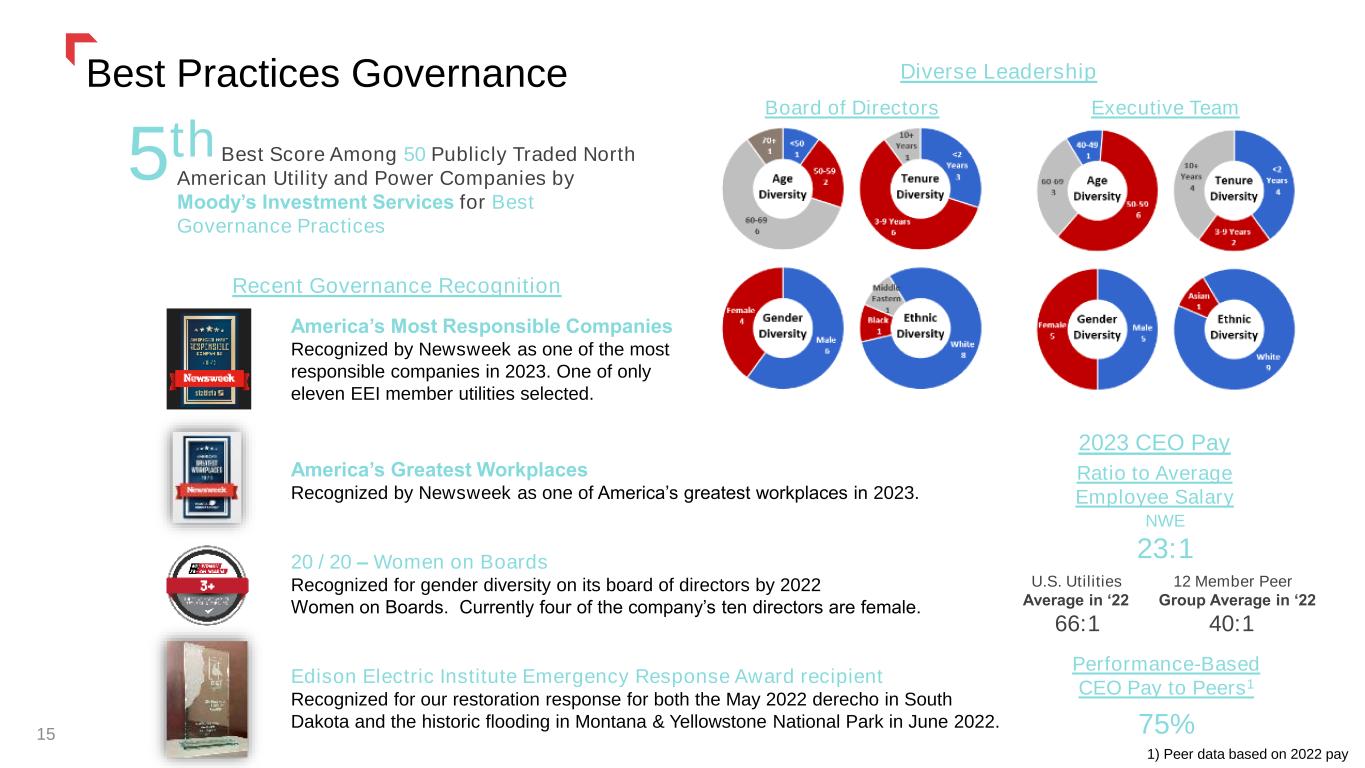

Best Practices Governance 15 America’s Most Responsible Companies Recognized by Newsweek as one of the most responsible companies in 2023. One of only eleven EEI member utilities selected. Board of Directors Executive Team 5thBest Score Among 50 Publicly Traded North American Utility and Power Companies by Moody’s Investment Services for Best Governance Practices Diverse Leadership 2023 CEO Pay Ratio to Average Employee Salary NWE 23:1 U.S. Utilities 12 Member Peer Average in ‘22 Group Average in ‘22 66:1 40:1 Performance-Based CEO Pay to Peers1 75% Recent Governance Recognition America’s Greatest Workplaces Recognized by Newsweek as one of America’s greatest workplaces in 2023. 20 / 20 – Women on Boards Recognized for gender diversity on its board of directors by 2022 Women on Boards. Currently four of the company’s ten directors are female. Edison Electric Institute Emergency Response Award recipient Recognized for our restoration response for both the May 2022 derecho in South Dakota and the historic flooding in Montana & Yellowstone National Park in June 2022. 1) Peer data based on 2022 pay

Thank youFinancial & Regulatory Update 16

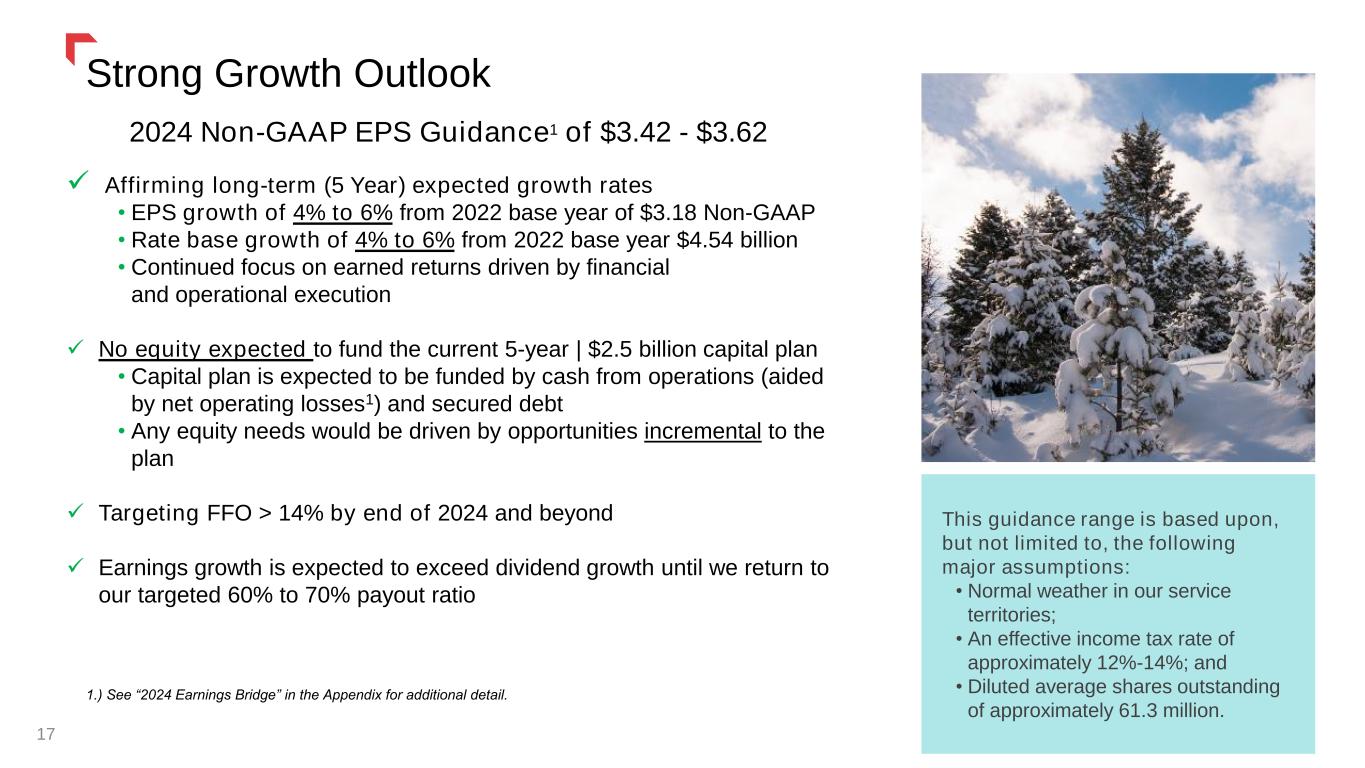

Strong Growth Outlook This guidance range is based upon, but not limited to, the following major assumptions: • Normal weather in our service territories; • An effective income tax rate of approximately 12%-14%; and • Diluted average shares outstanding of approximately 61.3 million. 2024 Non-GAAP EPS Guidance1 of $3.42 - $3.62 Affirming long-term (5 Year) expected growth rates • EPS growth of 4% to 6% from 2022 base year of $3.18 Non-GAAP • Rate base growth of 4% to 6% from 2022 base year $4.54 billion • Continued focus on earned returns driven by financial and operational execution No equity expected to fund the current 5-year | $2.5 billion capital plan • Capital plan is expected to be funded by cash from operations (aided by net operating losses1) and secured debt • Any equity needs would be driven by opportunities incremental to the plan Targeting FFO > 14% by end of 2024 and beyond Earnings growth is expected to exceed dividend growth until we return to our targeted 60% to 70% payout ratio 17 1.) See “2024 Earnings Bridge” in the Appendix for additional detail.

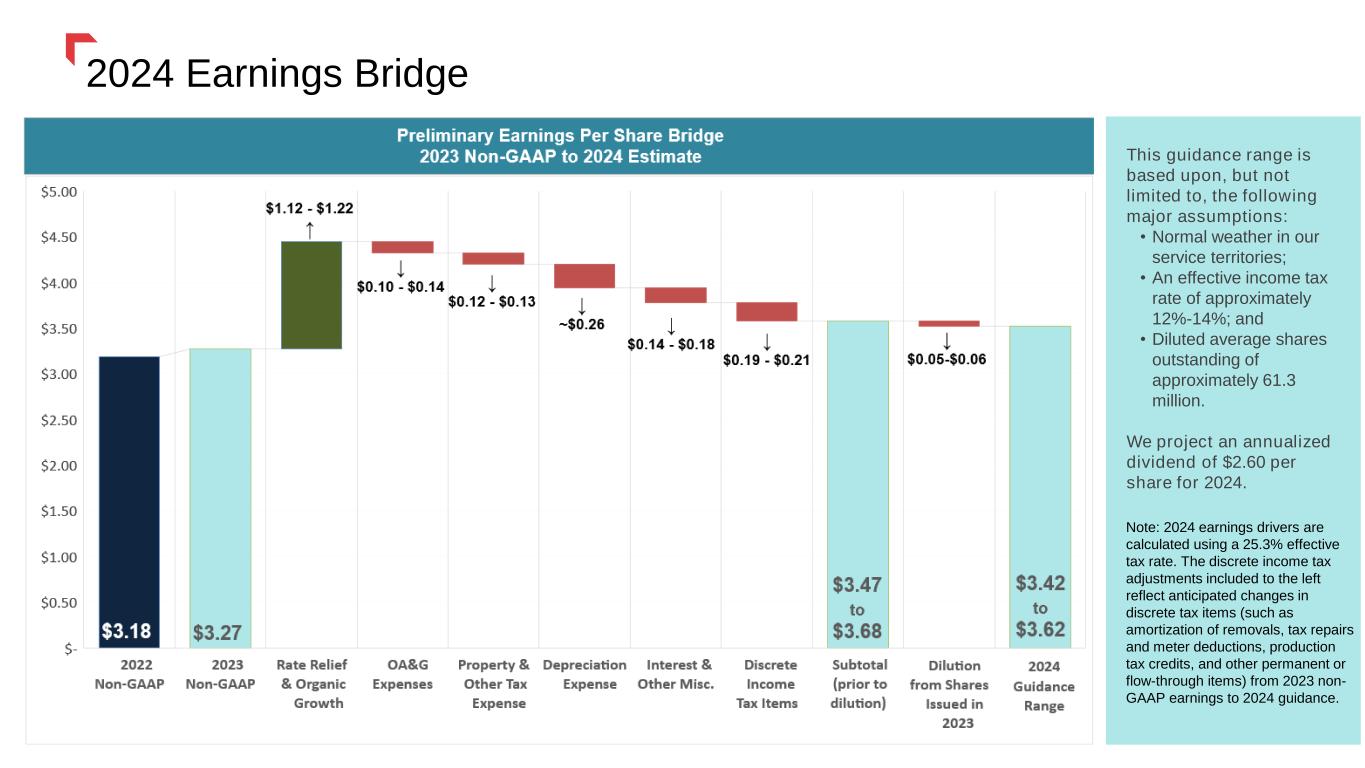

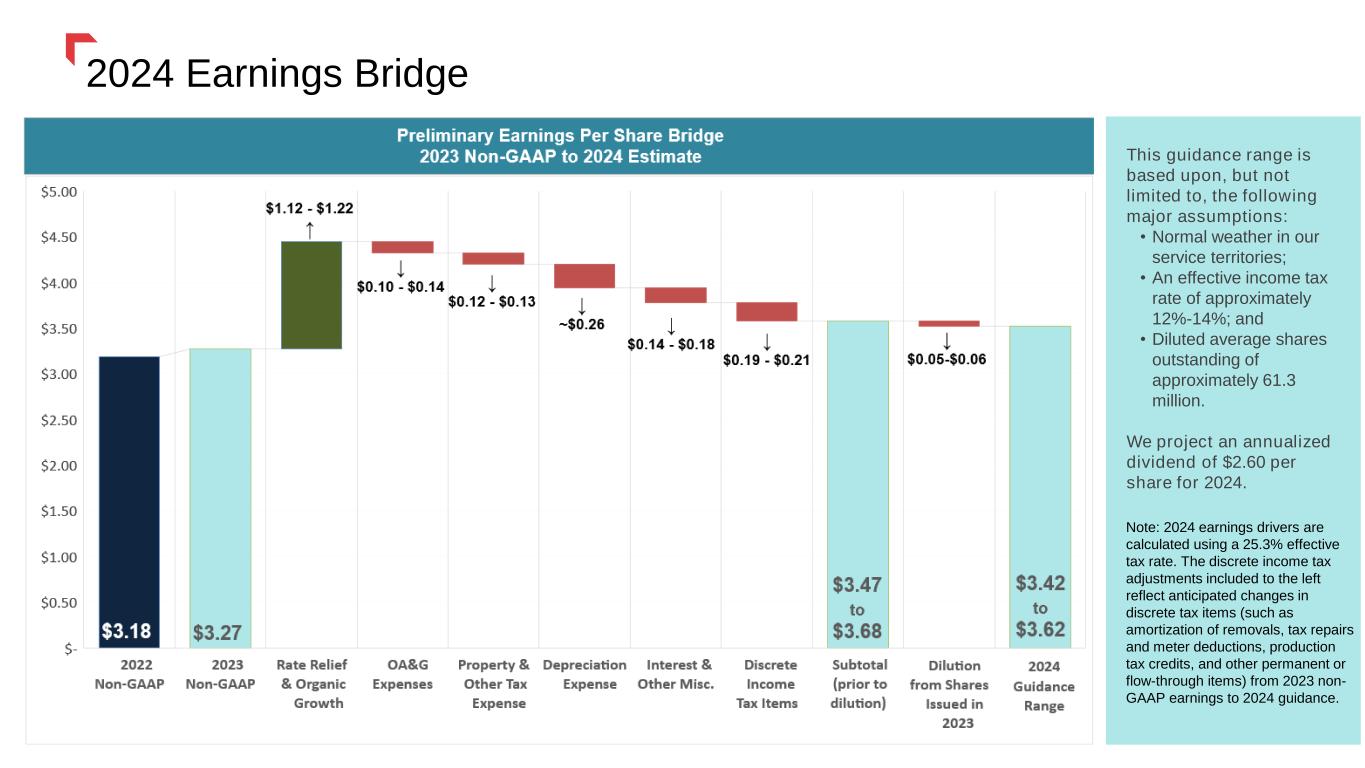

2024 Earnings Bridge This guidance range is based upon, but not limited to, the following major assumptions: • Normal weather in our service territories; • An effective income tax rate of approximately 12%-14%; and • Diluted average shares outstanding of approximately 61.3 million. We project an annualized dividend of $2.60 per share for 2024. 18 Note: 2024 earnings drivers are calculated using a 25.3% effective tax rate. The discrete income tax adjustments included to the left reflect anticipated changes in discrete tax items (such as amortization of removals, tax repairs and meter deductions, production tax credits, and other permanent or flow-through items) from 2023 non- GAAP earnings to 2024 guidance.

Track Record of Growing Capital Investment 19 2019-2023 Invested over the last 5 years* * Historical Capital Investment includes property, plant and equipment additions and AFUDC Credit, both from our cash flow statement, and change in capital expenditures included in accounts payable. ** See Regulated Utility Five-Year Capital Forecast slide in the appendix for additional detail. 2024-2028 Forecasted over the next 5 years** $2.3 Billion $2.5 Billion

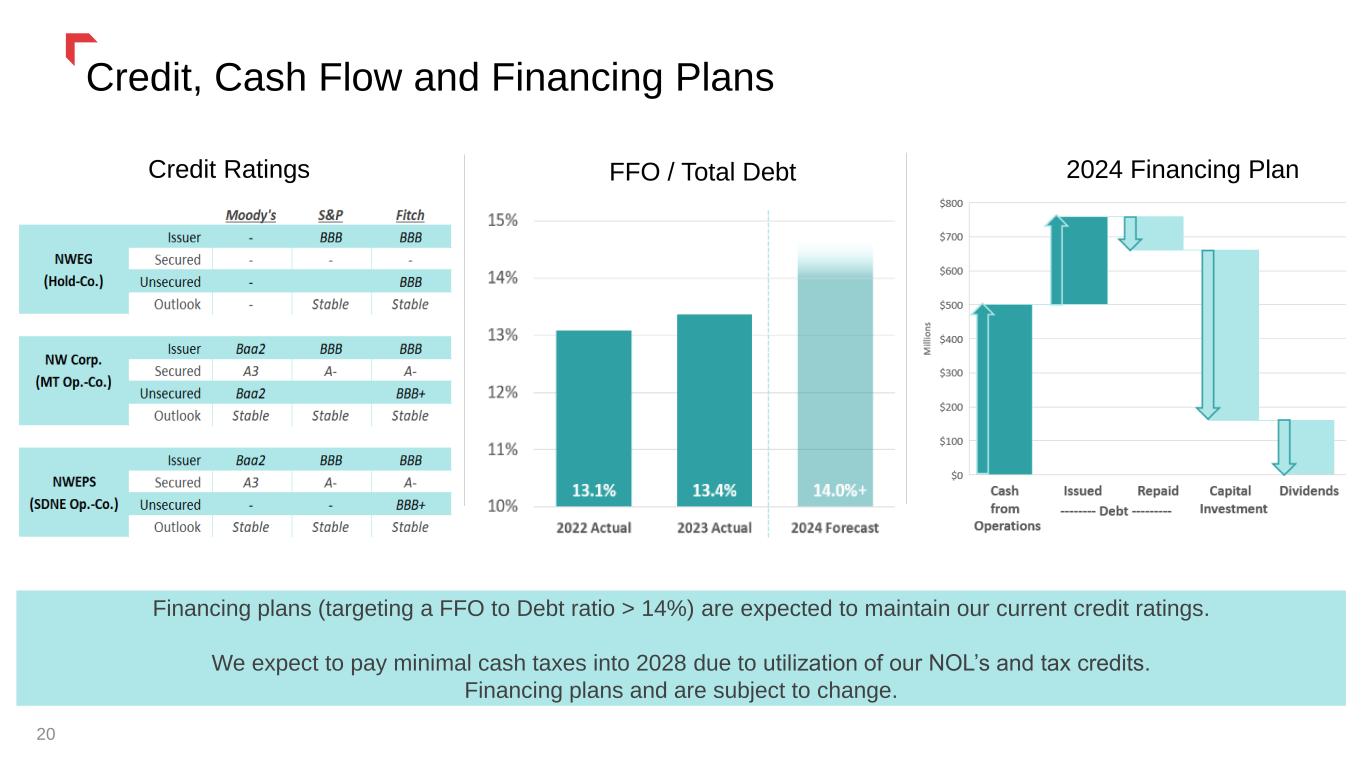

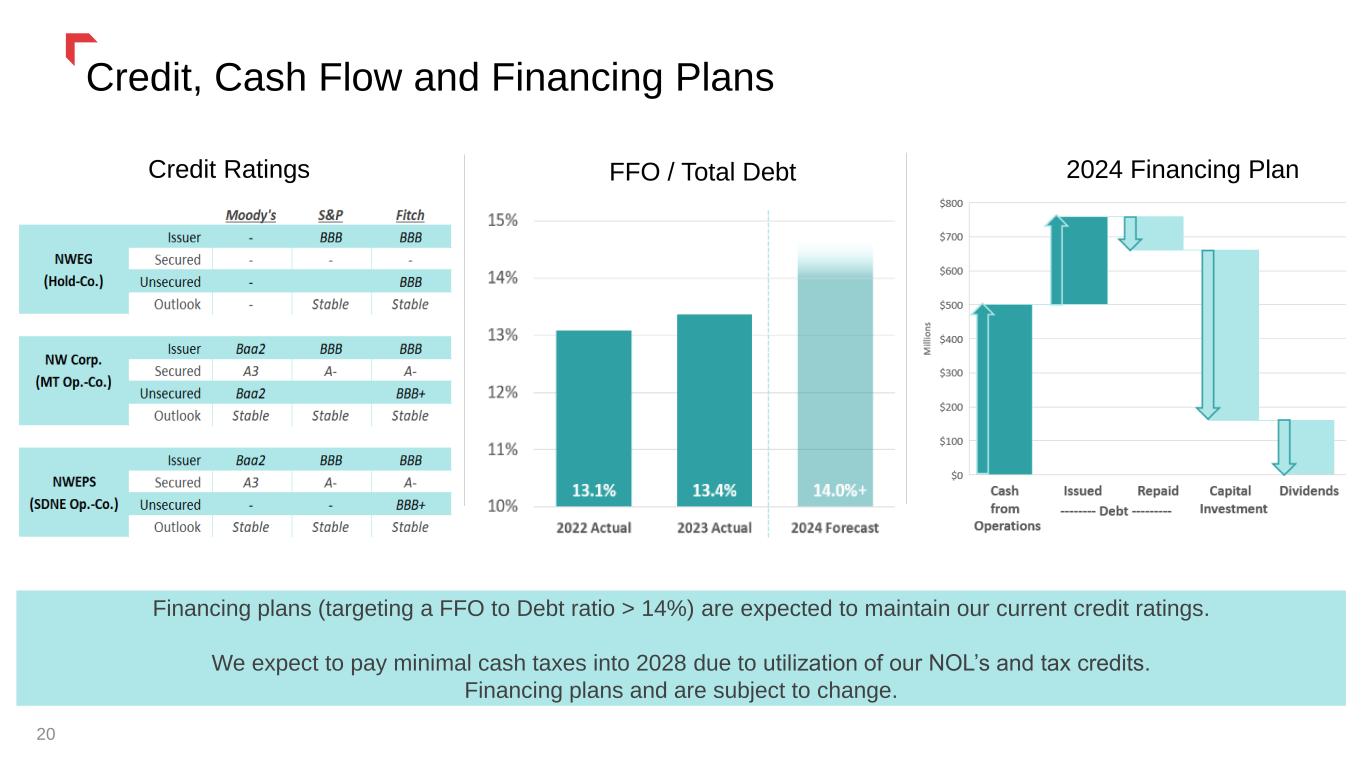

Credit, Cash Flow and Financing Plans 20 Credit Ratings 2024 Financing Plan Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings. We expect to pay minimal cash taxes into 2028 due to utilization of our NOL’s and tax credits. Financing plans and are subject to change. FFO / Total Debt

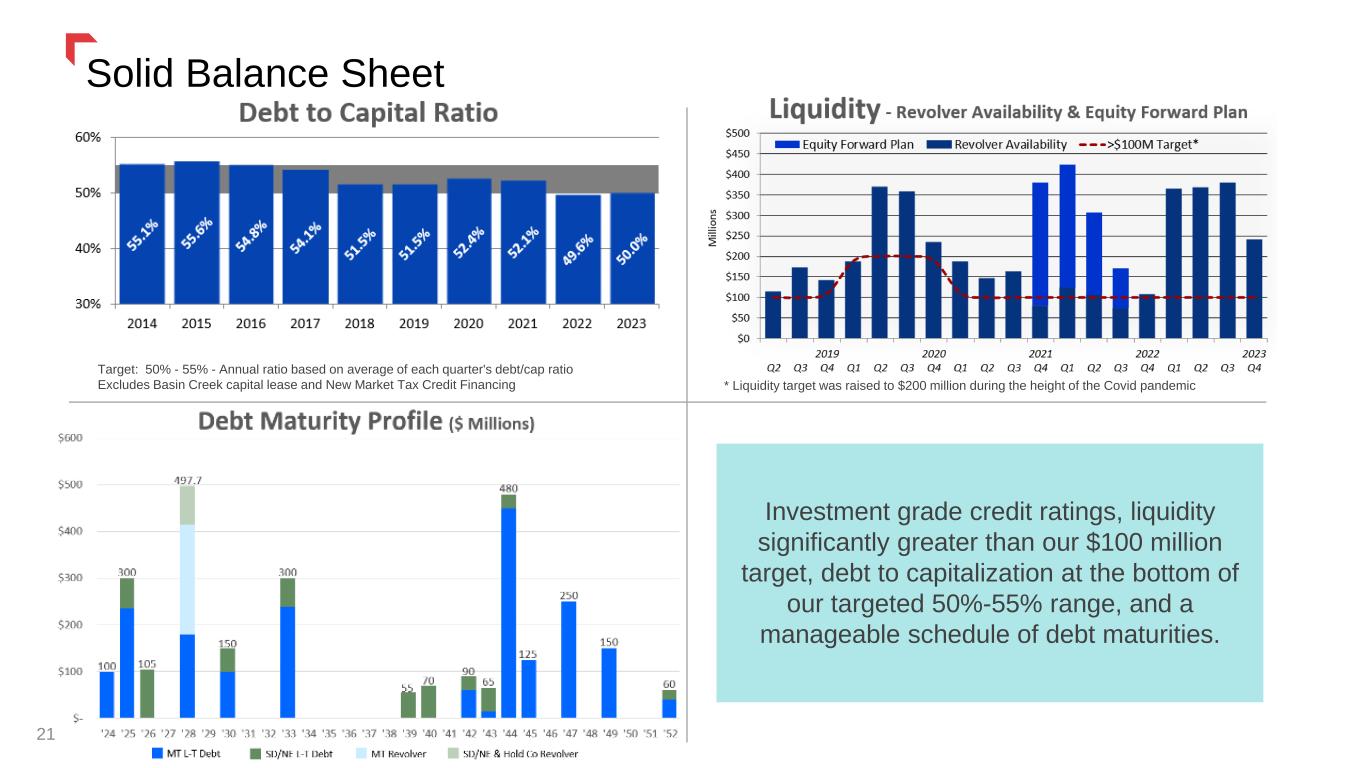

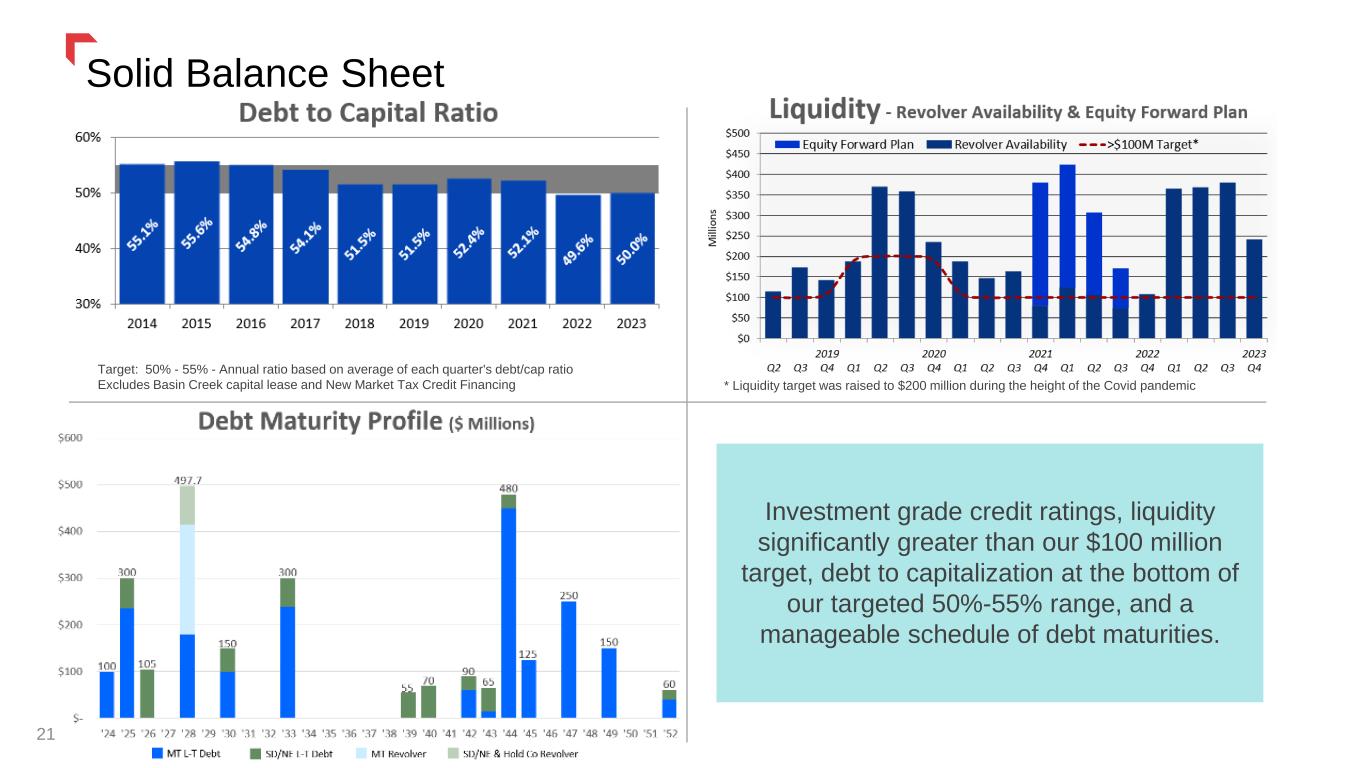

Solid Balance Sheet 21 Investment grade credit ratings, liquidity significantly greater than our $100 million target, debt to capitalization at the bottom of our targeted 50%-55% range, and a manageable schedule of debt maturities. * Liquidity target was raised to $200 million during the height of the Covid pandemic Target: 50% - 55% - Annual ratio based on average of each quarter's debt/cap ratio Excludes Basin Creek capital lease and New Market Tax Credit Financing

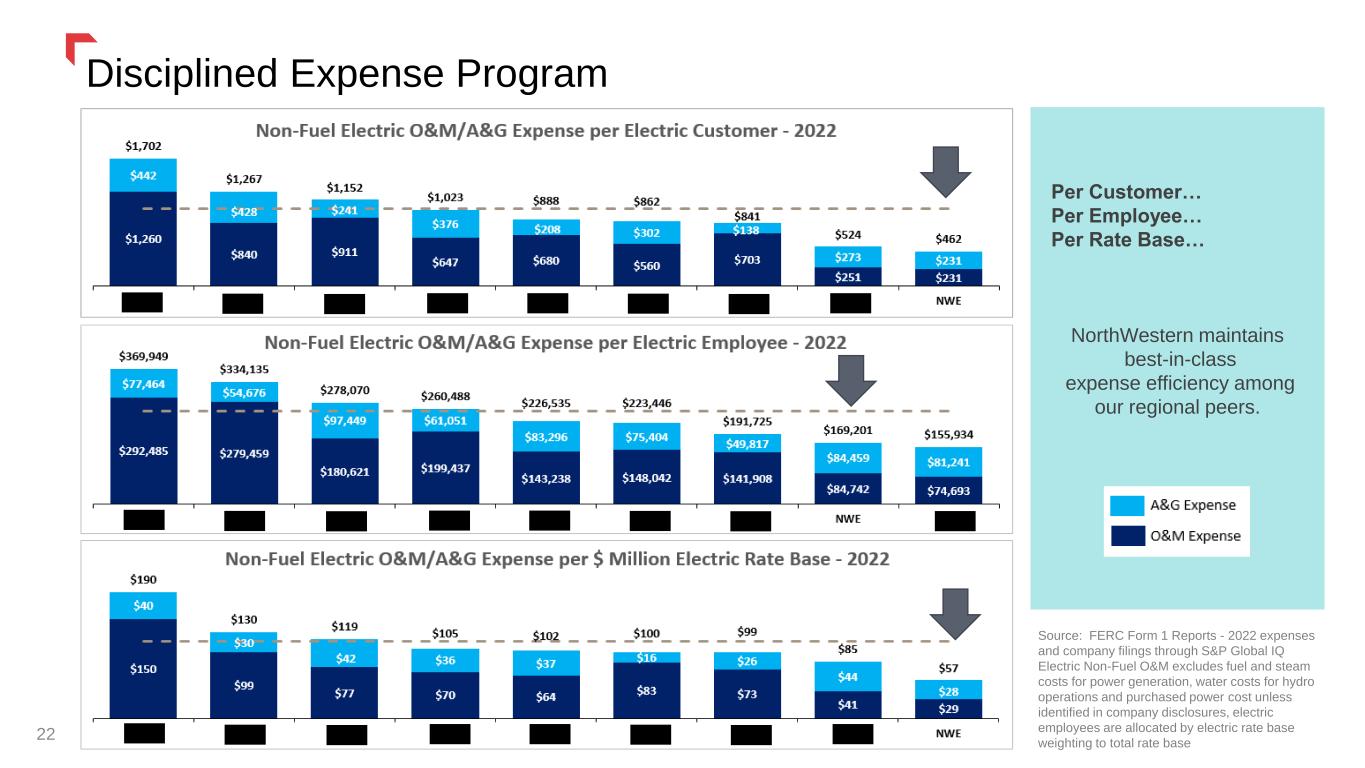

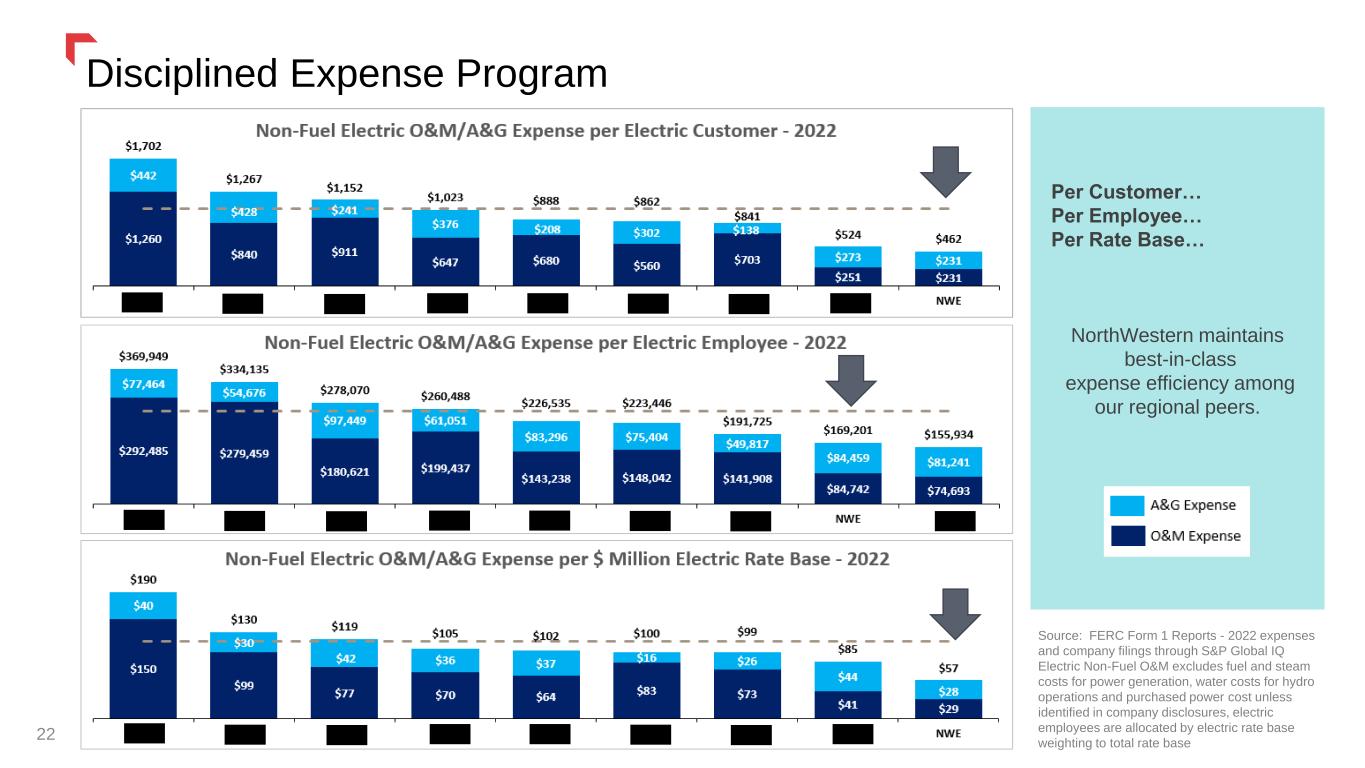

22 Disciplined Expense Program Source: FERC Form 1 Reports - 2022 expenses and company filings through S&P Global IQ Electric Non-Fuel O&M excludes fuel and steam costs for power generation, water costs for hydro operations and purchased power cost unless identified in company disclosures, electric employees are allocated by electric rate base weighting to total rate base Per Customer… Per Employee… Per Rate Base… NorthWestern maintains best-in-class expense efficiency among our regional peers.

South Dakota Electric Rate Review • First rate review since 2015 with base rate increase driven by more than $267 million invested in South Dakota critical electric infrastructure, while keeping operating costs below the rate of inflation, since our last electric rate review. • Received nearly 70% of our ask ($21.5M vs request of $30.9M) in base rates with 6.81% authorized rate of return vs 7.54% as requested. • Rates effective January 10, 2024 23 Category Pre-Filing Rates Requested Rates Final Rates Test Year (Trailing Twelve Months) Sep. 30, 2014 Dec. 31, 2022 Effective Jan. 10, 2024 Equity Ratio 50.50% 50.50% Return on Equity 10.70% Cost of Debt 4.32% Rate of Return 7.24% 7.54% 6.81% Authorized Rate Base $557.3M $787.3M $791.8M Rate Relief $30.9M $21.5M Unanimous approval from the South Dakota Public Utility Commission of a constructive settlement with the PUC staff in January 2024

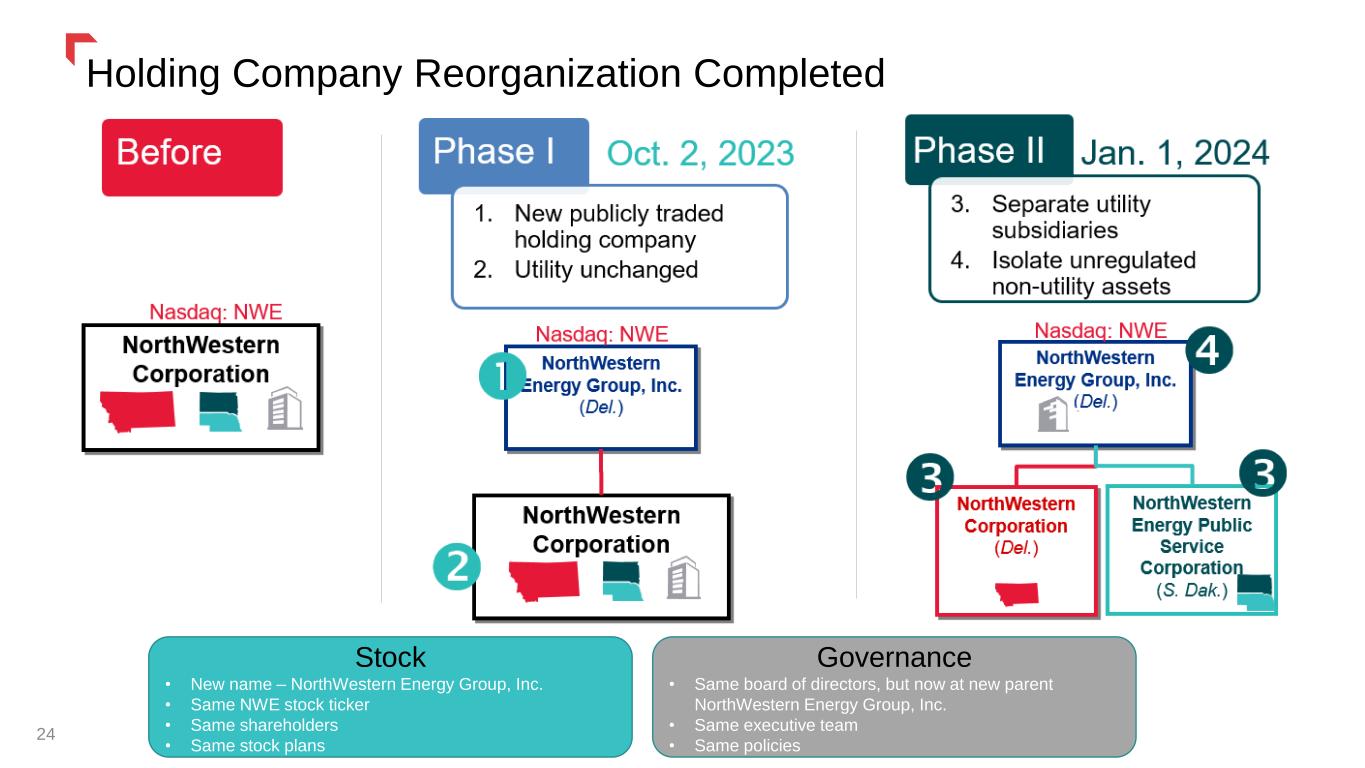

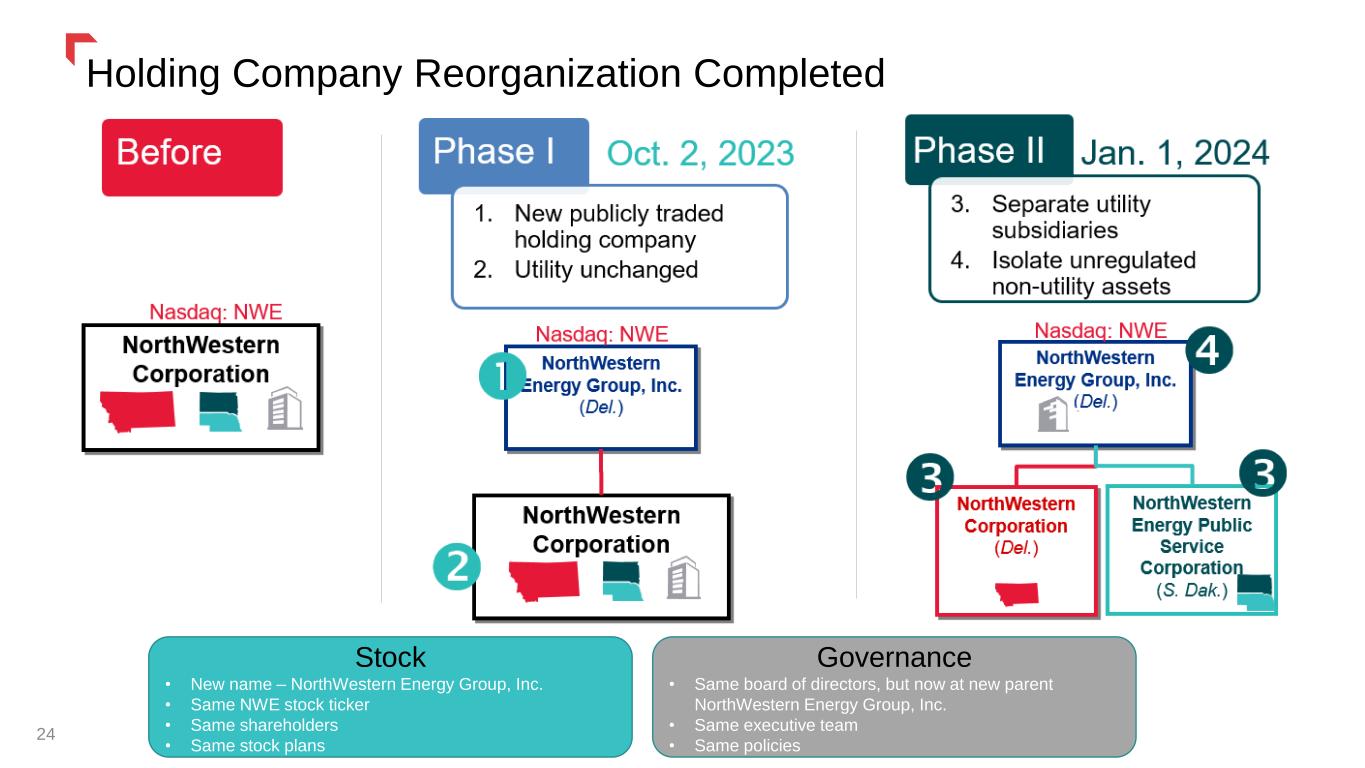

Holding Company Reorganization Completed 24 Stock • New name – NorthWestern Energy Group, Inc. • Same NWE stock ticker • Same shareholders • Same stock plans Governance • Same board of directors, but now at new parent NorthWestern Energy Group, Inc. • Same executive team • Same policies

Generation Investment 25 * See NorthWestern Energy Group’s 2023 10-K for additional detail associated with litigation challenging the Yellowstone County Generating Station air quality permit. This litigation could further delay the project and increase costs. Construction of our 175 MW Yellowstone County Generating Station Montana 175 MW Yellowstone County Generating Station natural gas fired facility • Construction started April 2022 • Total cost of $310-$320 million with $240M incurred thru 12/31/2023 • Scheduled to be online in Q3 of 2024* 222 MW of Colstrip from Avista • $0 purchase price • Avista retains pre-closing environmental and pension liabilities • Transfer effective 12/31/2025 Filed in April 2023, the plan evaluates alternatives to reliably and affordably to meet customer needs over a 20 year horizon. With the anticipated addition of YCGS and Avista’s transfer of Colstrip, the plan anticipates resource adequacy into 2029. South Dakota Capacity generation in Aberdeen, SD to replace aging generation resources • Construction to start in 2024 • Total cost of $70 million • Scheduled to be completed end of 2025 Filed in September 2022, the plan identifies 43 megawatts as retire and replace candidates. We anticipate filing the next IRP in the summer of 2024.

Conclusion Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows 26

Thank youAppendix 27

$2.5 billion of highly-executable and low-risk capital investment Regulated Utility Five-Year Capital Forecast 28 Appendix

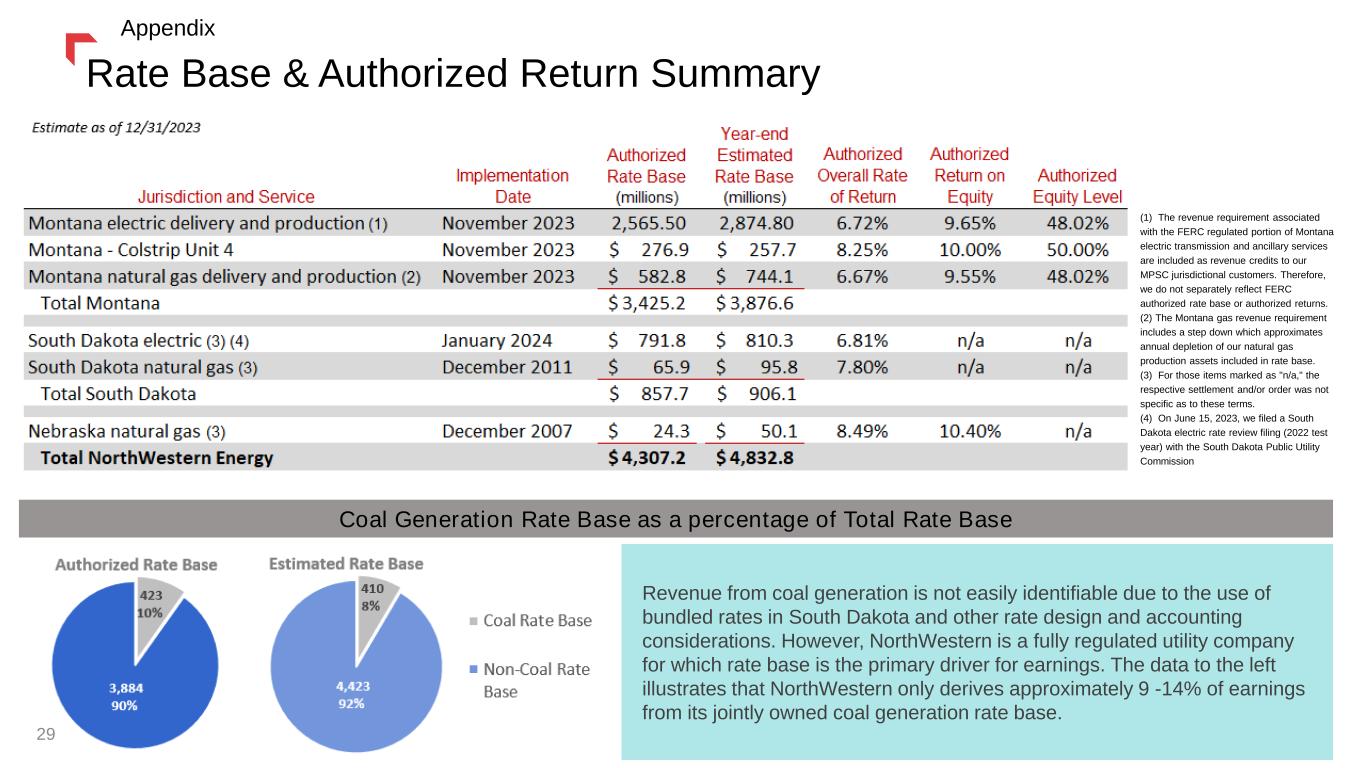

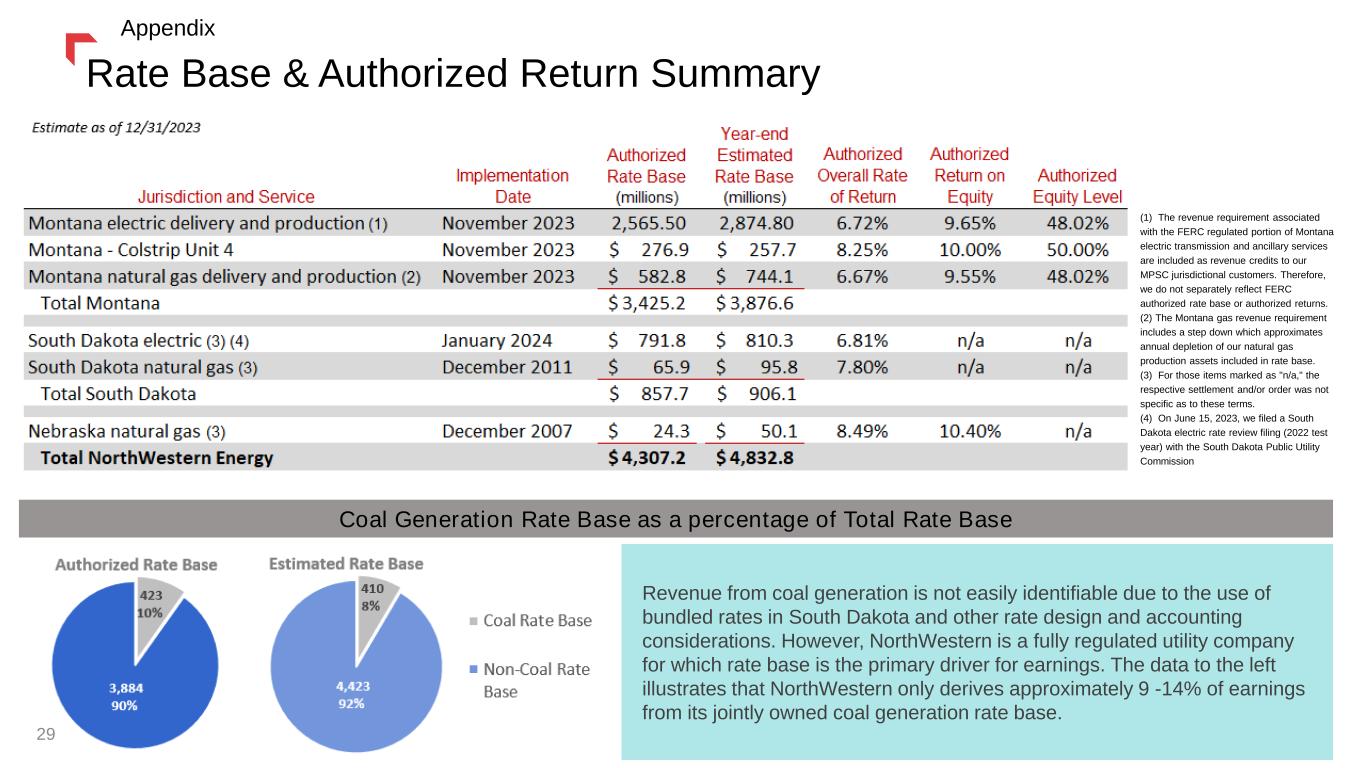

(1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) On June 15, 2023, we filed a South Dakota electric rate review filing (2022 test year) with the South Dakota Public Utility Commission Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 9 -14% of earnings from its jointly owned coal generation rate base. Rate Base & Authorized Return Summary Appendix 29

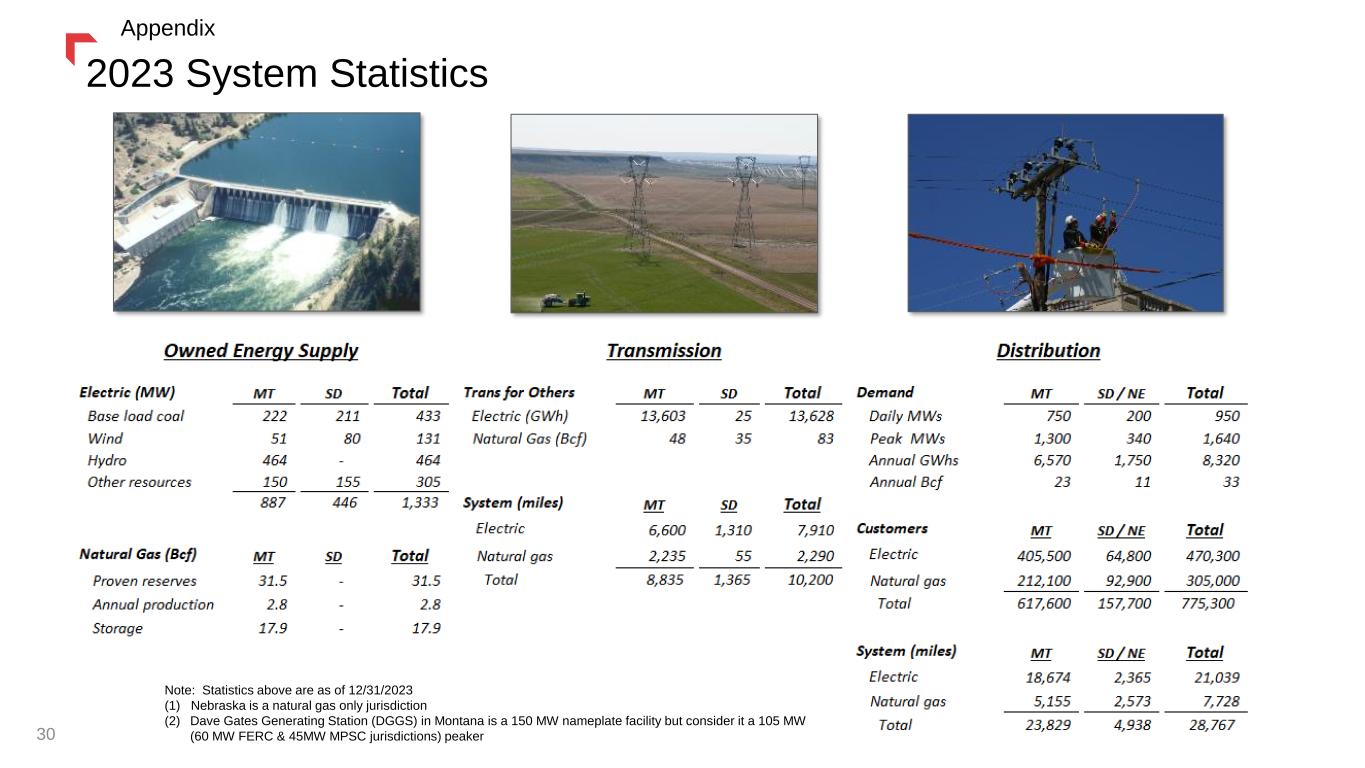

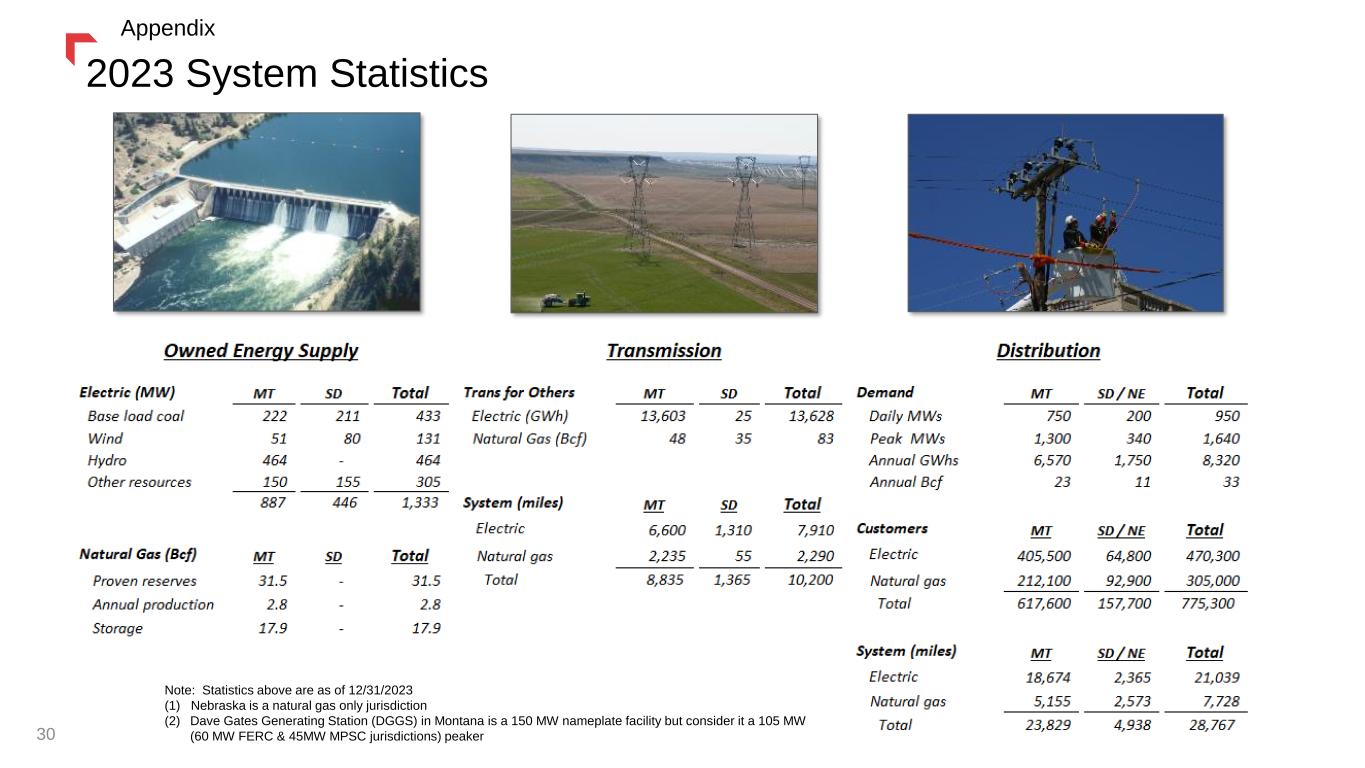

2023 System Statistics 30 Note: Statistics above are as of 12/31/2023 (1) Nebraska is a natural gas only jurisdiction (2) Dave Gates Generating Station (DGGS) in Montana is a 150 MW nameplate facility but consider it a 105 MW (60 MW FERC & 45MW MPSC jurisdictions) peaker Appendix

Thank youColstrip Transfer Agreement 31

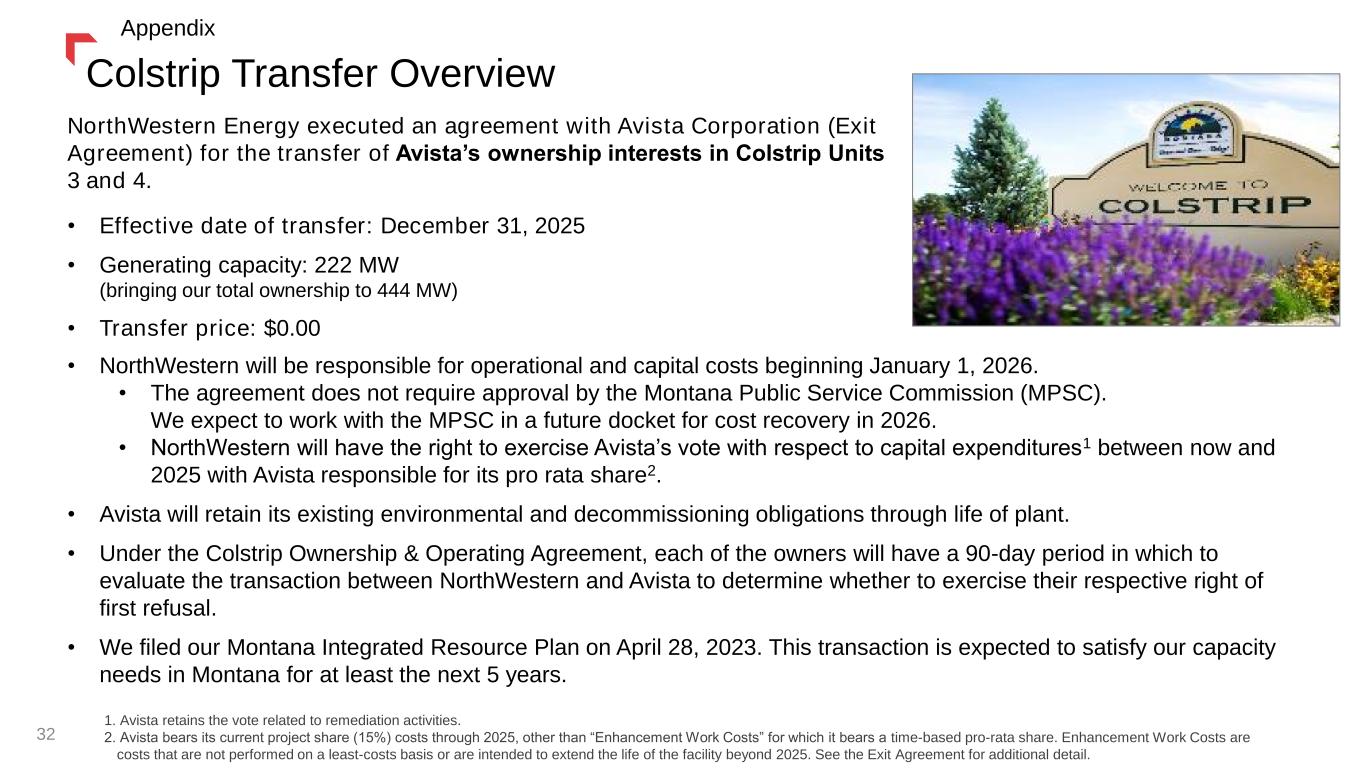

Colstrip Transfer Overview NorthWestern Energy executed an agreement with Avista Corporation (Exit Agreement) for the transfer of Avista’s ownership interests in Colstrip Units 3 and 4. • Effective date of transfer: December 31, 2025 • Generating capacity: 222 MW (bringing our total ownership to 444 MW) • Transfer price: $0.00 • NorthWestern will be responsible for operational and capital costs beginning January 1, 2026. • The agreement does not require approval by the Montana Public Service Commission (MPSC). We expect to work with the MPSC in a future docket for cost recovery in 2026. • NorthWestern will have the right to exercise Avista’s vote with respect to capital expenditures1 between now and 2025 with Avista responsible for its pro rata share2. • Avista will retain its existing environmental and decommissioning obligations through life of plant. • Under the Colstrip Ownership & Operating Agreement, each of the owners will have a 90-day period in which to evaluate the transaction between NorthWestern and Avista to determine whether to exercise their respective right of first refusal. • We filed our Montana Integrated Resource Plan on April 28, 2023. This transaction is expected to satisfy our capacity needs in Montana for at least the next 5 years. 1. Avista retains the vote related to remediation activities. 2. Avista bears its current project share (15%) costs through 2025, other than “Enhancement Work Costs” for which it bears a time-based pro-rata share. Enhancement Work Costs are costs that are not performed on a least-costs basis or are intended to extend the life of the facility beyond 2025. See the Exit Agreement for additional detail. 32 Appendix

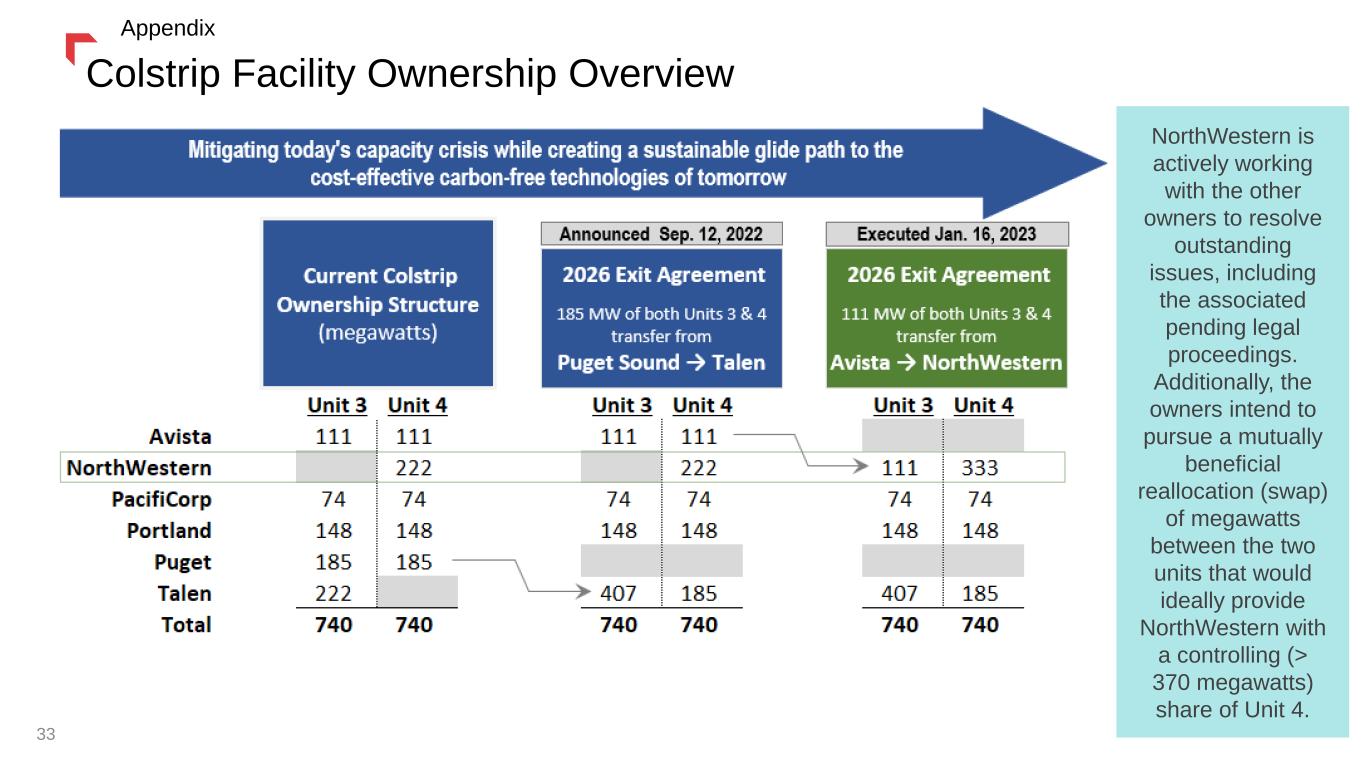

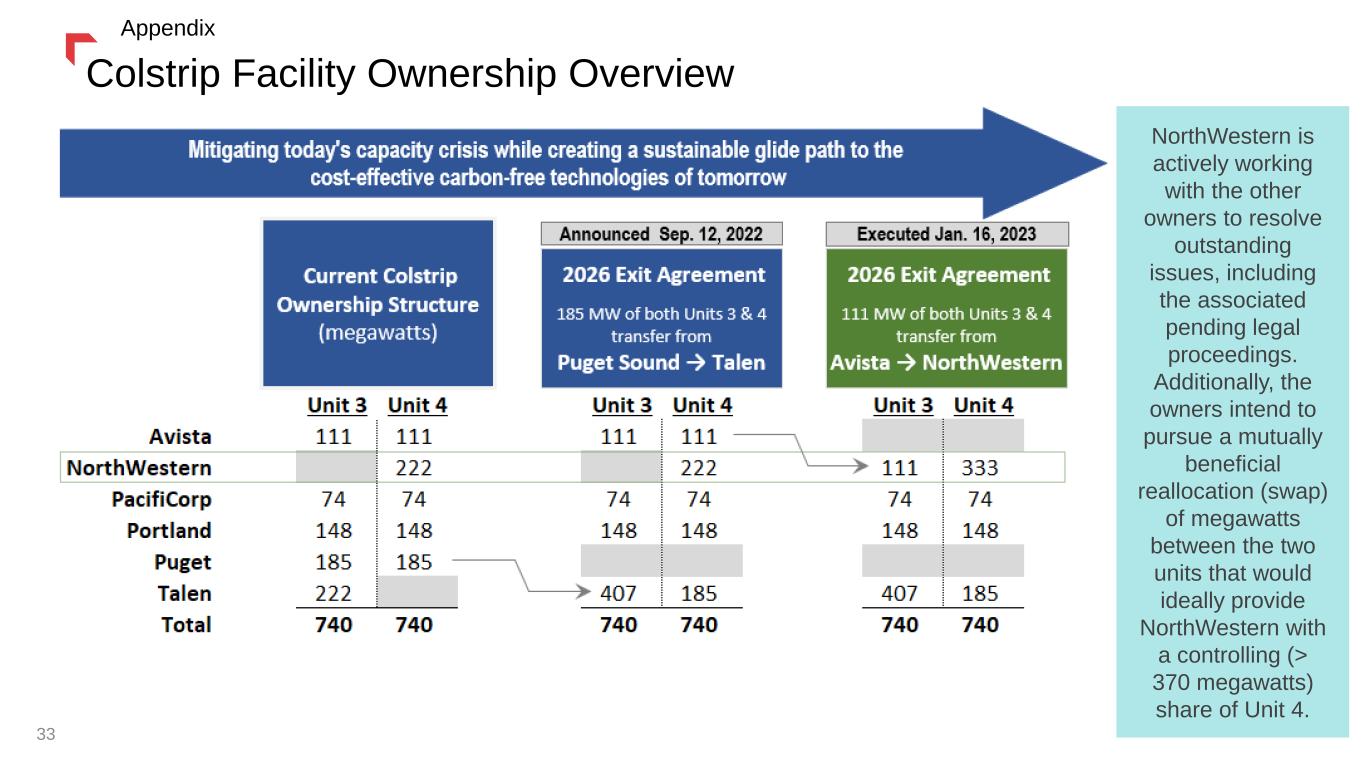

Colstrip Facility Ownership Overview NorthWestern is actively working with the other owners to resolve outstanding issues, including the associated pending legal proceedings. Additionally, the owners intend to pursue a mutually beneficial reallocation (swap) of megawatts between the two units that would ideally provide NorthWestern with a controlling (> 370 megawatts) share of Unit 4. 33 Appendix

Why Colstrip? Reliable Existing resource, ready to serve our Montana customers. Avoids lengthy planning, permitting and construction of a new facility that would stretch in-service beyond 2026. Reduces reliance on imported power and volatile markets, providing increased energy independence. In-state and on-system asset mitigating the transmission constraints we experience importing capacity. Adds critical long-duration, 24/7 on-demand generation necessary for balancing our existing portfolio. Affordable 222 MW of capacity with no upfront capital costs and stable operating costs going forward. o Equivalent new build would cost in excess of $500 million. o Incremental operating costs are known and reasonable. Resulting variable generation costs represent a 90%+ discount to market prices incurred during December’s polar vortex. In addition to no upfront capital, low and stably priced mine-mouth coal supply costs. Sustainable We remain committed to our net zero goal by 2050. This additional capacity, with a remaining life of up to 20 years, helps bridge the interim gap and will likely lead to less carbon post 2040. Yellowstone County Generating Station is potentially our last natural gas resource addition in Montana. Partners are committed to evaluate non-carbon long-duration alternative resources for the site. Keeps the existing plant open and retains its highly skilled jobs vital to the Colstrip community. Protects existing ownership interests with an ultimate goal of majority ownership of Unit 4. NorthWestern Energy executed an agreement with Avista Corporation for the transfer of Avista’s ownership interests in Colstrip Units 3 & 4. • Effective date of transfer: 12/31/2025 • Generating capacity: 222 MW • Transfer price: $0.00 34 Appendix

Why Colstrip? Reduces Risk We are in a supply capacity crisis due to lack of resource adequacy, with approx. 40% of our customers’ peak needs on the market. This transaction will reduce our need to import expensive capacity during critical times. Establishes clarity regarding operations past 2025 Washington state legislation deadline. Reduces PCCAM risk sharing for customers and shareholders. 35 Appendix Bill Headroom Stable pricing reduces impact of market volatility and high energy prices on customers. Aligned with ‘All of the Above’ energy transition in Montana Supports our generating portfolio that is nearly 60% carbon-free today. Provides future opportunity at the site while supporting economic development in Montana. Agreement considers the appropriate balance of reliability, affordability and sustainability.

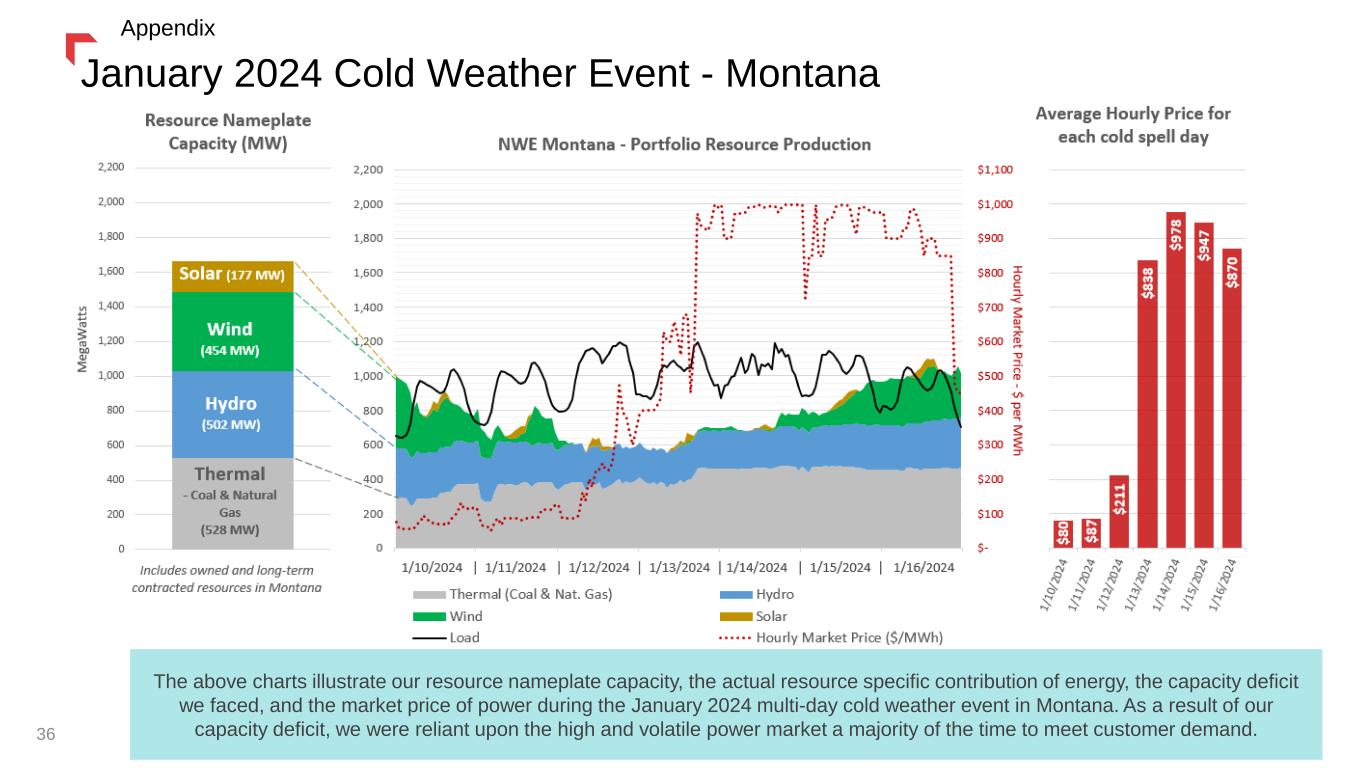

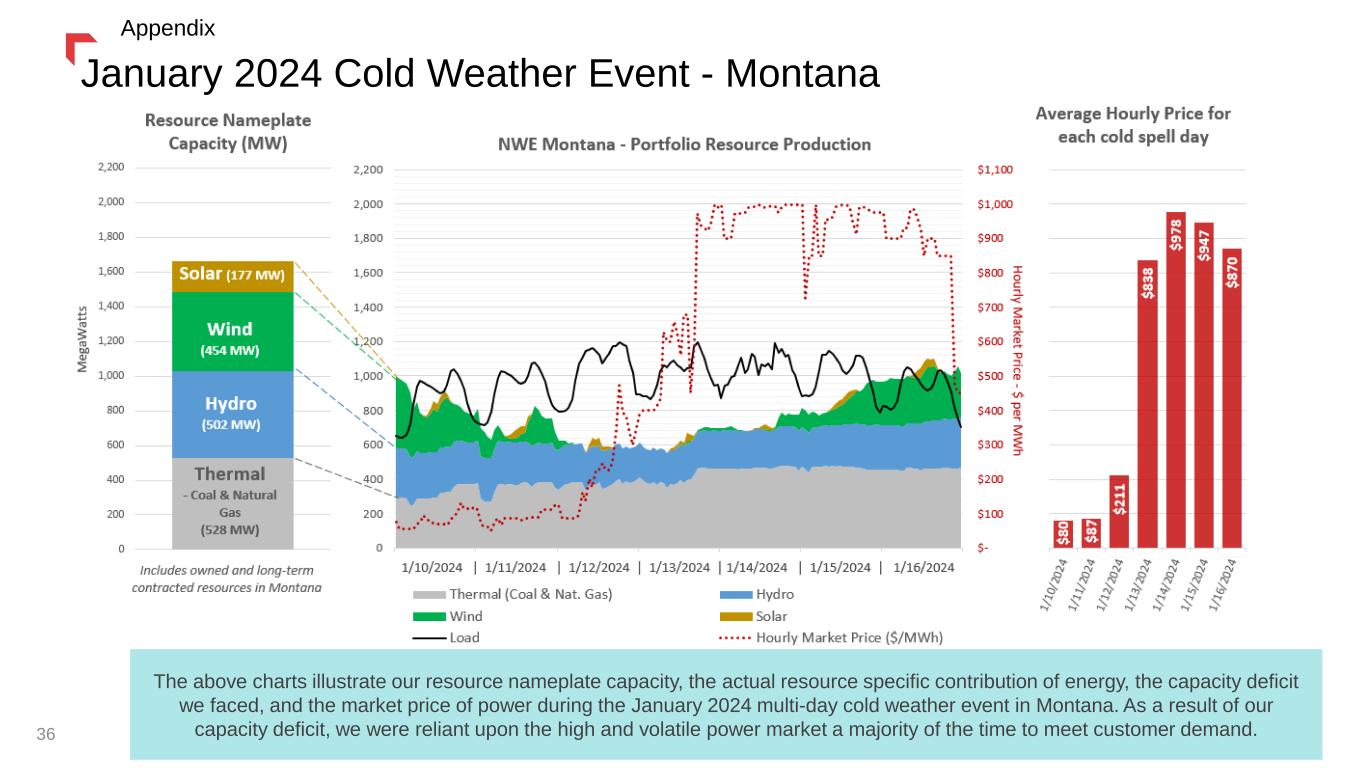

January 2024 Cold Weather Event - Montana 36 The above charts illustrate our resource nameplate capacity, the actual resource specific contribution of energy, the capacity deficit we faced, and the market price of power during the January 2024 multi-day cold weather event in Montana. As a result of our capacity deficit, we were reliant upon the high and volatile power market a majority of the time to meet customer demand. Appendix

Our Net-Zero Vision Over the past 100 years, NorthWestern Energy has maintained our commitment to provide customers with reliable and affordable electric and natural gas service while also being good stewards of the environment. We have responded to climate change, its implications and risks, by increasing our environmental sustainability efforts and our access to clean energy resources. But more must be done. We are committed to achieving net zero emissions by 2050. • Committed to achieving net-zero by 2050 for Scope 1 and 2 emissions • Must balance Affordability, Reliability and Sustainability in this transition • No new carbon emitting generation additions after 2035 • Pipeline modernization, enhanced leak detection and development of alternative fuels for natural gas business • Electrify fleet and add charging infrastructure • Carbon offsets likely needed to ultimately achieve net-zero • Please visit www.NorthWesternEnergy.com/NetZero to learn more about our Net Zero Vision. 37 Appendix

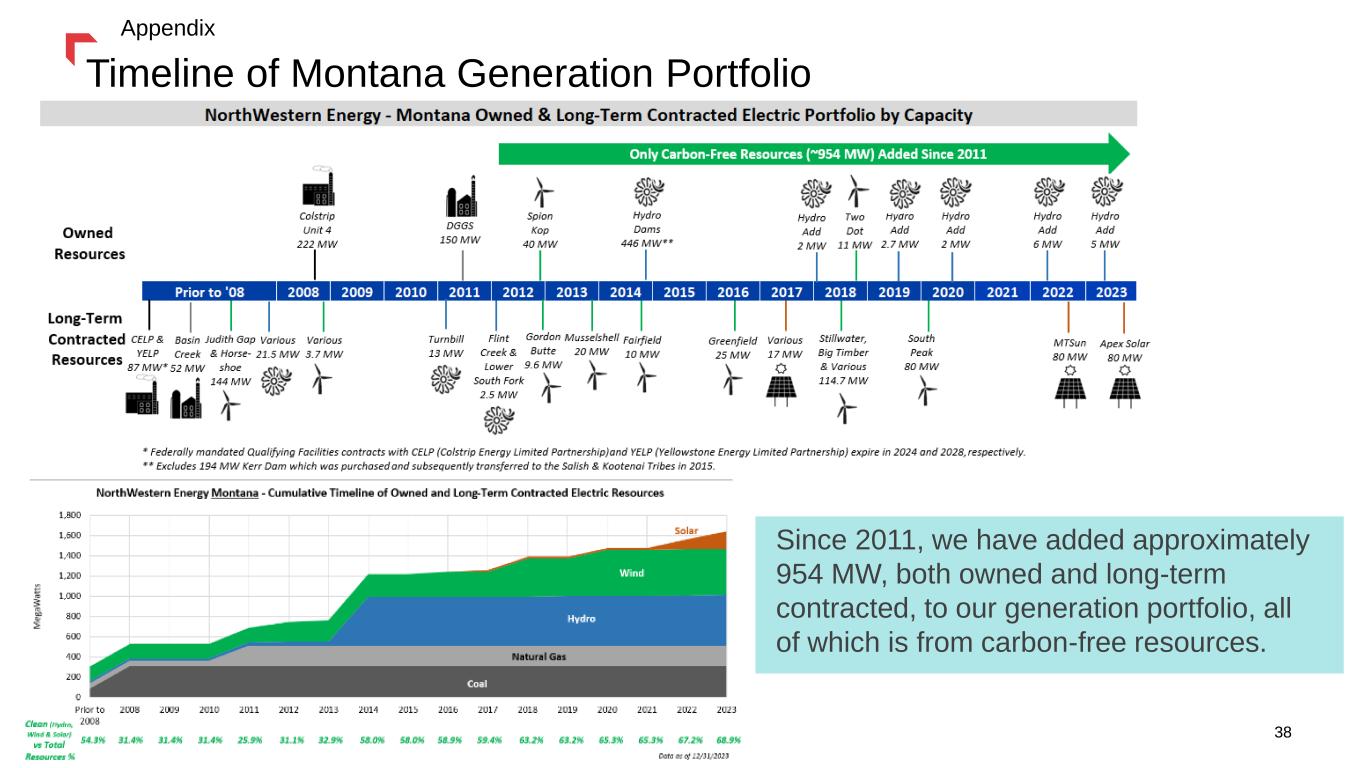

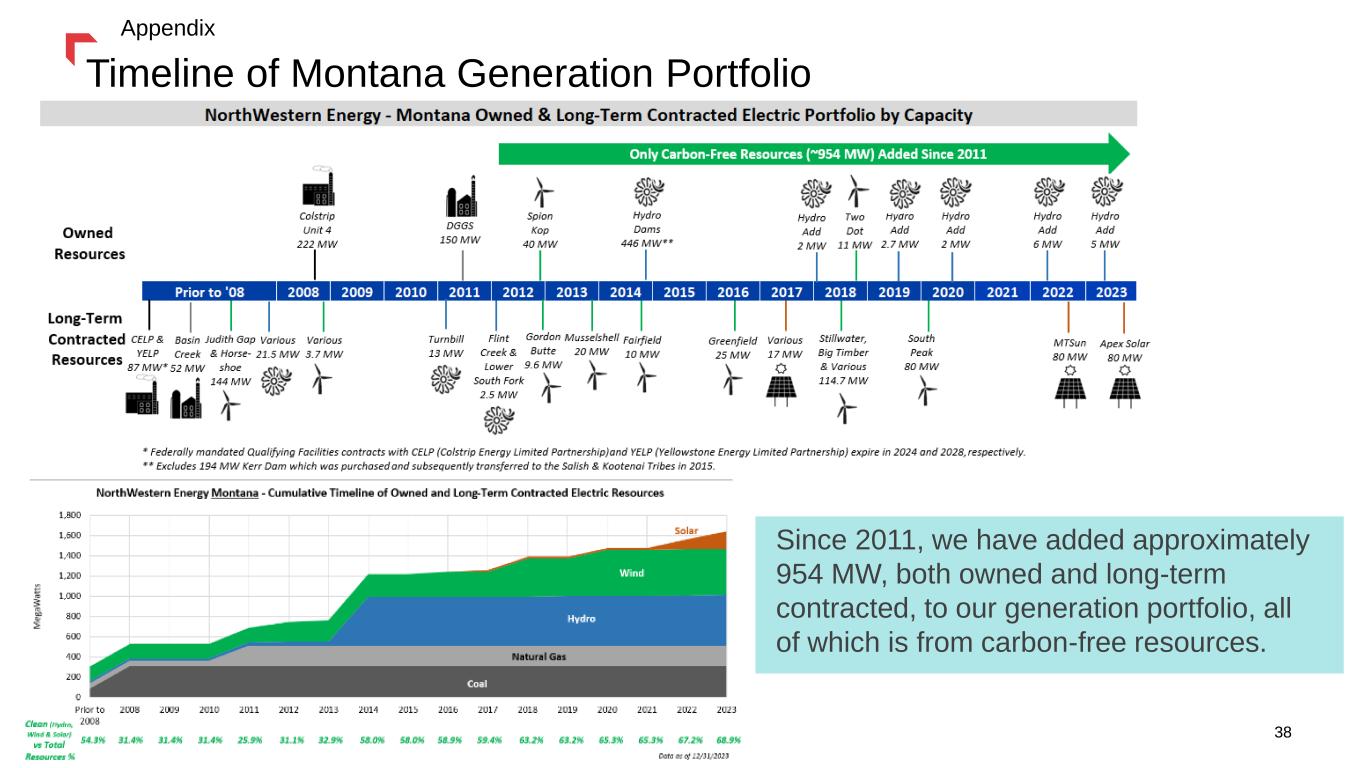

38 Timeline of Montana Generation Portfolio 38 Since 2011, we have added approximately 954 MW, both owned and long-term contracted, to our generation portfolio, all of which is from carbon-free resources. Appendix

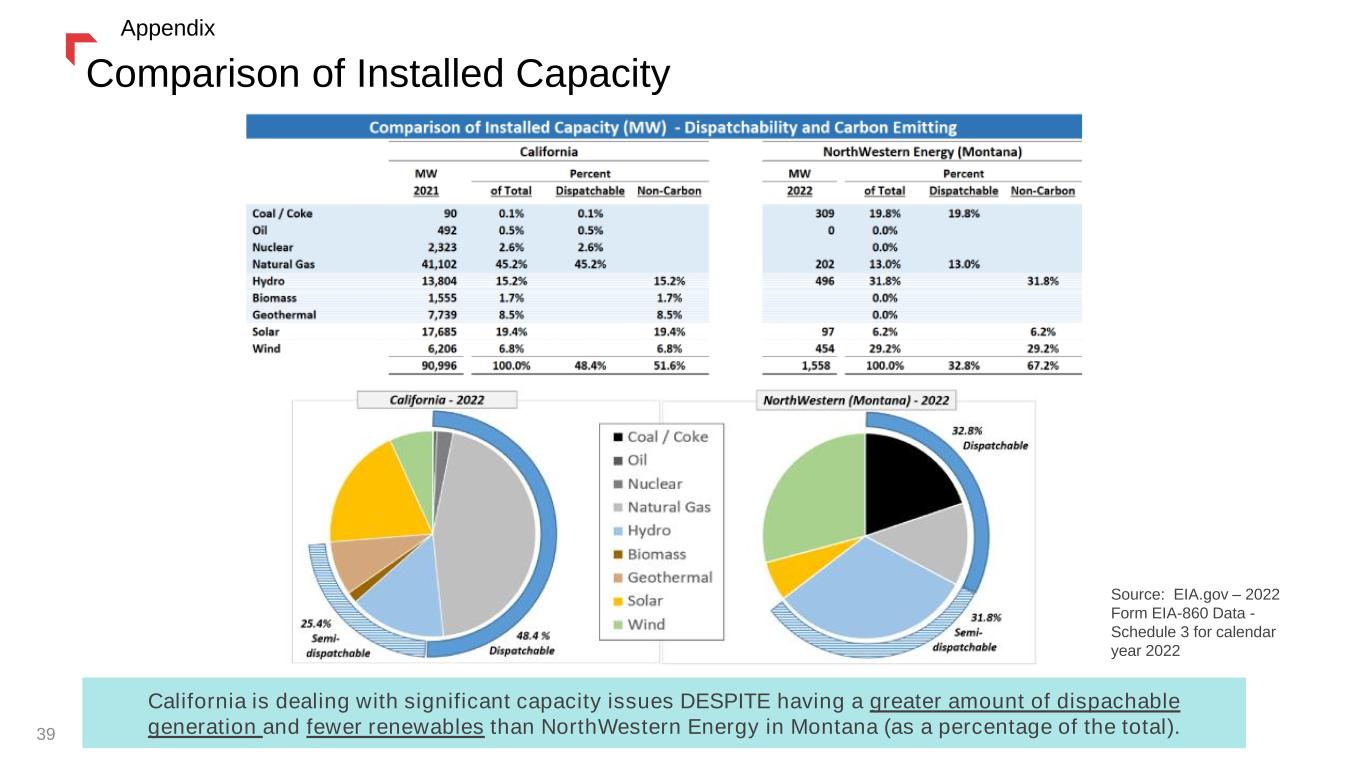

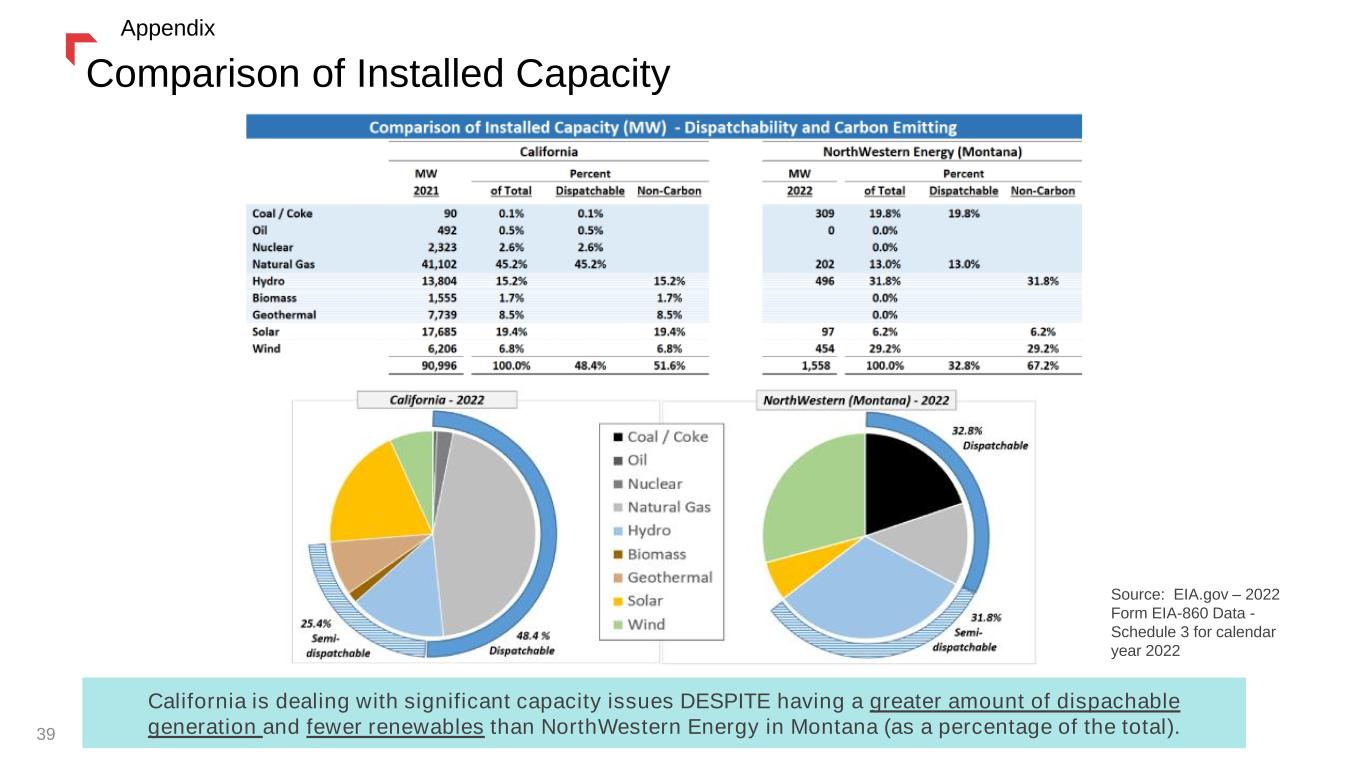

Comparison of Installed Capacity 39 California is dealing with significant capacity issues DESPITE having a greater amount of dispachable generation and fewer renewables than NorthWestern Energy in Montana (as a percentage of the total). Source: EIA.gov – 2022 Form EIA-860 Data - Schedule 3 for calendar year 2022 Appendix

Thank youEarnings and Other 40

EPS & Dividend History 41 2009-2023 CAGR’s: GAAP EPS: 3.4% Non-GAAP EPS: 3.5% Dividend: 4.7% See appendix for “Non- GAAP Financial Measures” Appendix

Full Year Financial Results 42 Decrease in revenues is primarily related to pass-through property tax and supply trackers and non-cash regulatory amortizations. 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. Appendix

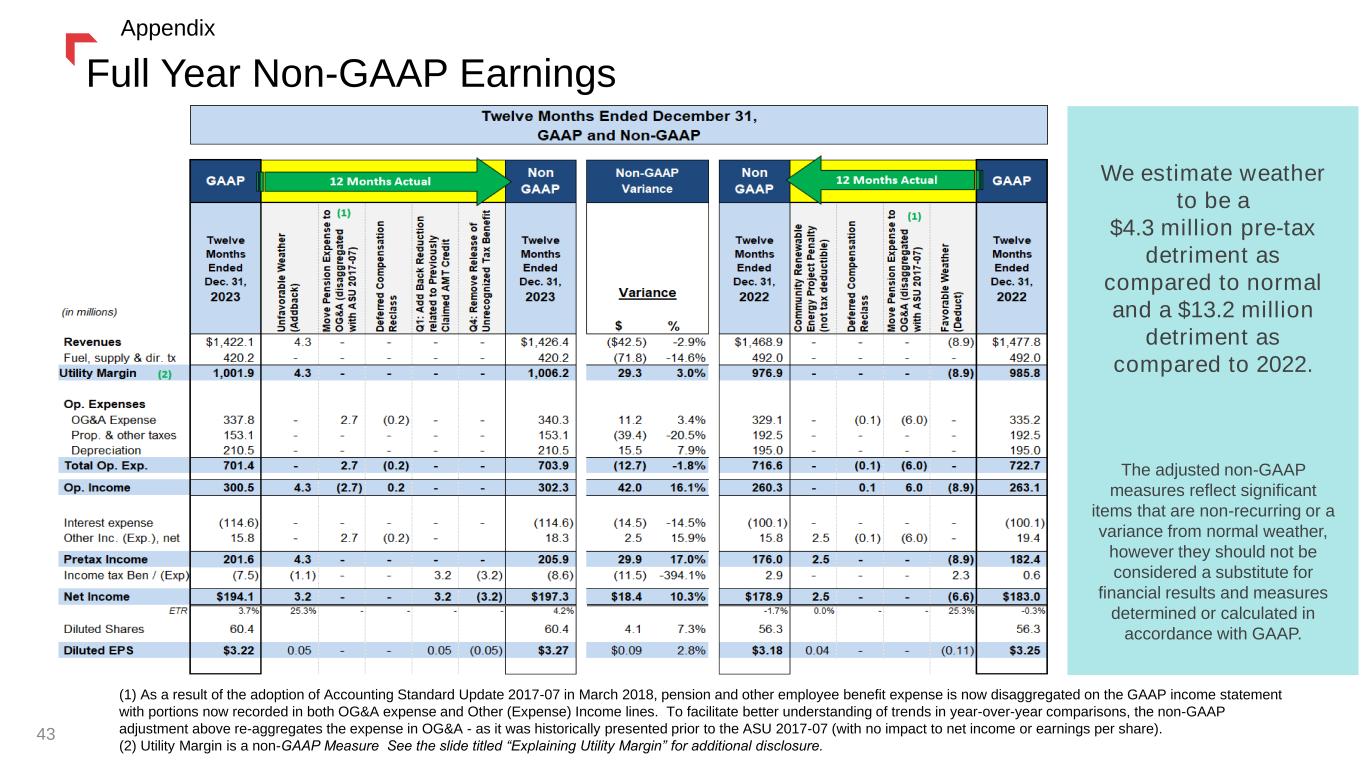

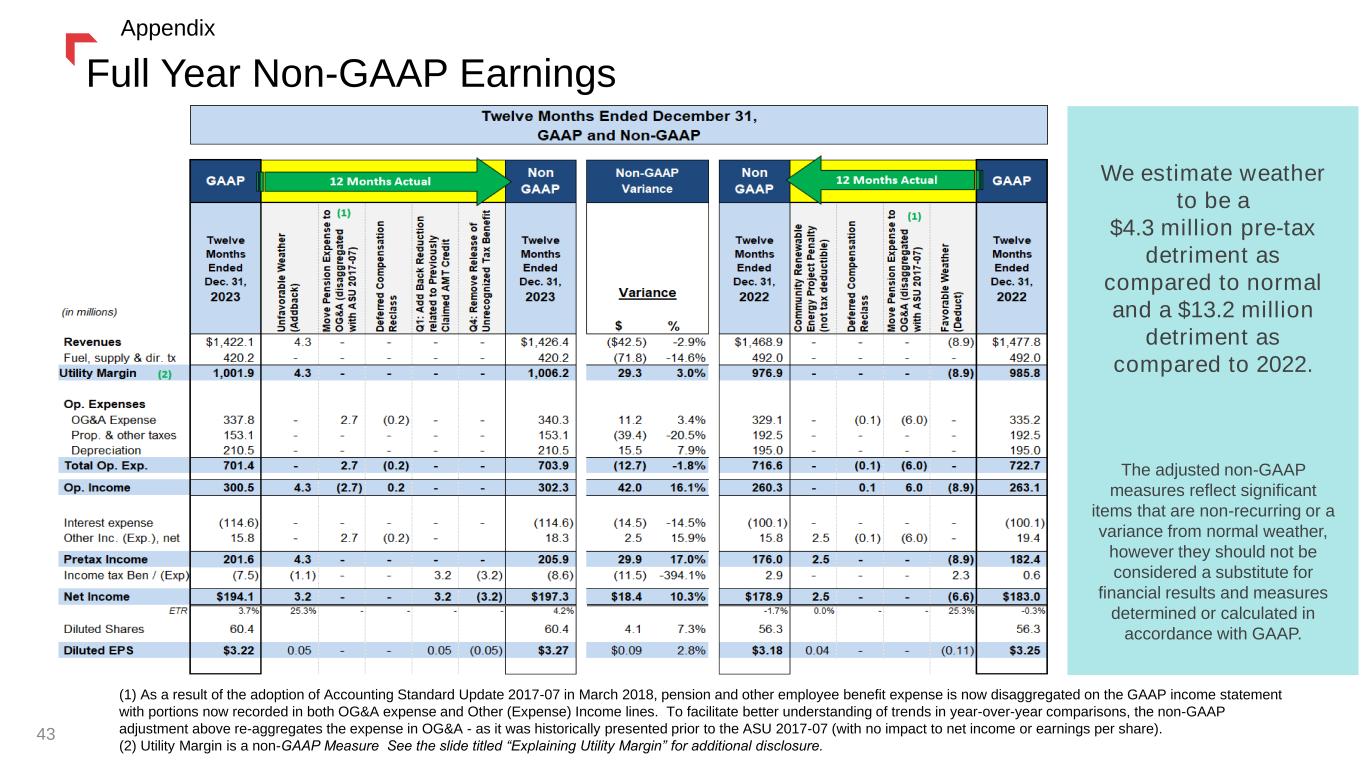

Full Year Non-GAAP Earnings We estimate weather to be a $4.3 million pre-tax detriment as compared to normal and a $13.2 million detriment as compared to 2022. The adjusted non-GAAP measures reflect significant items that are non-recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. 43 Appendix

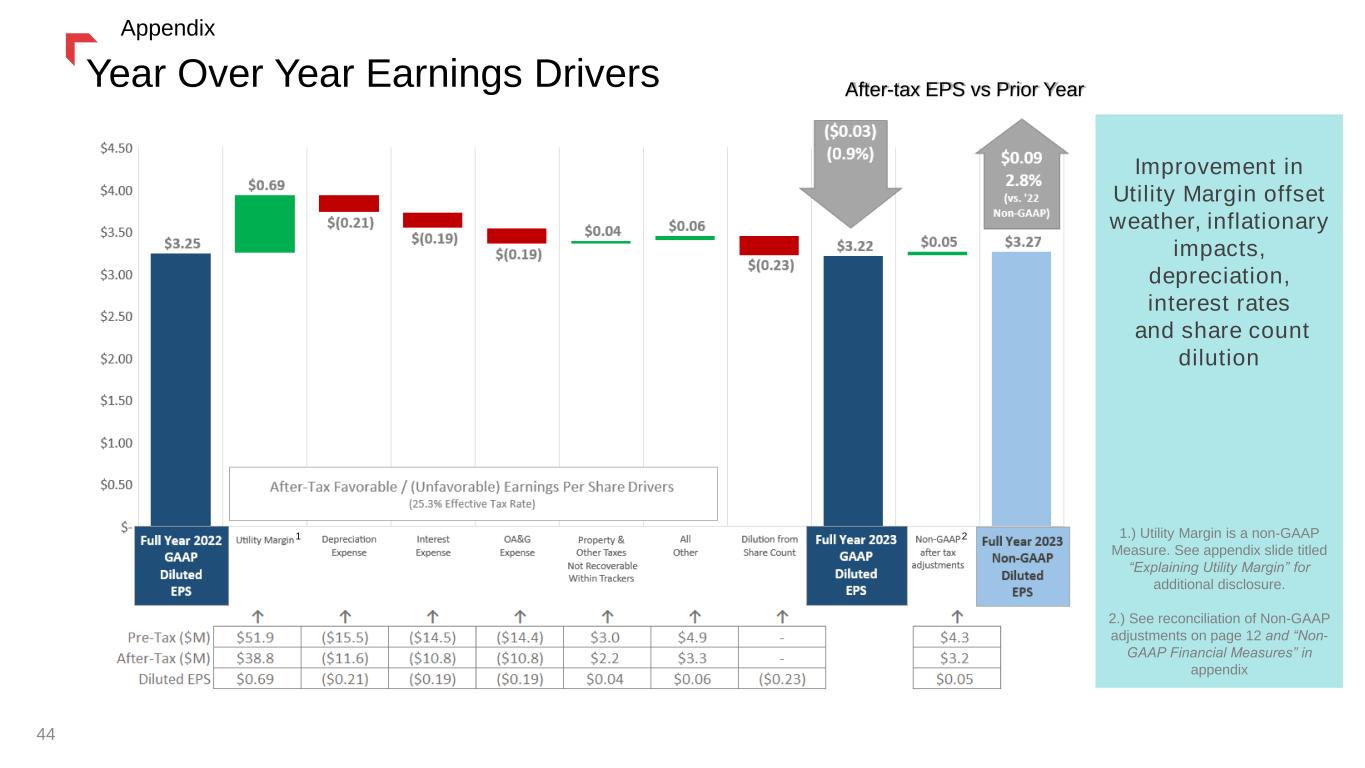

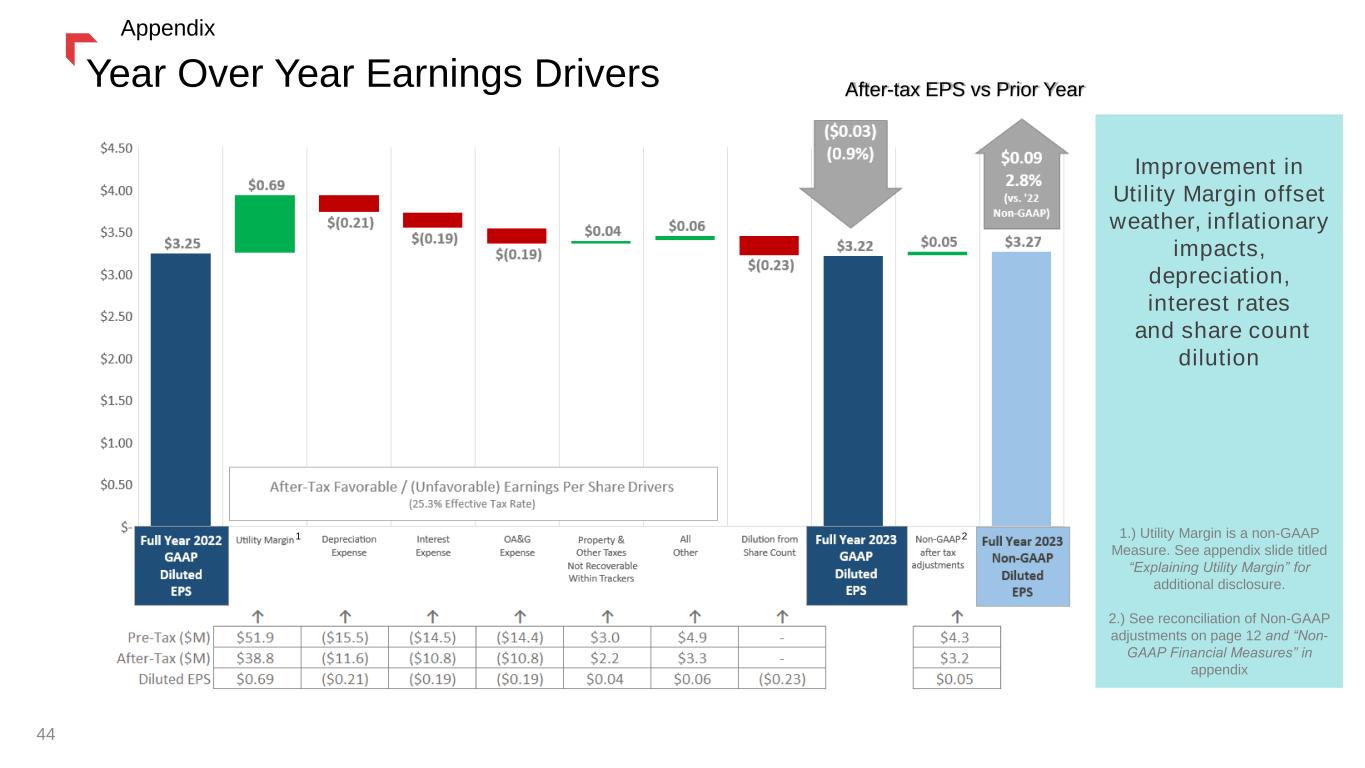

Improvement in Utility Margin offset weather, inflationary impacts, depreciation, interest rates and share count dilution 1.) Utility Margin is a non-GAAP Measure. See appendix slide titled “Explaining Utility Margin” for additional disclosure. 2.) See reconciliation of Non-GAAP adjustments on page 12 and “Non- GAAP Financial Measures” in appendix After-tax EPS vs Prior YearYear Over Year Earnings Drivers 44 1 2 Appendix

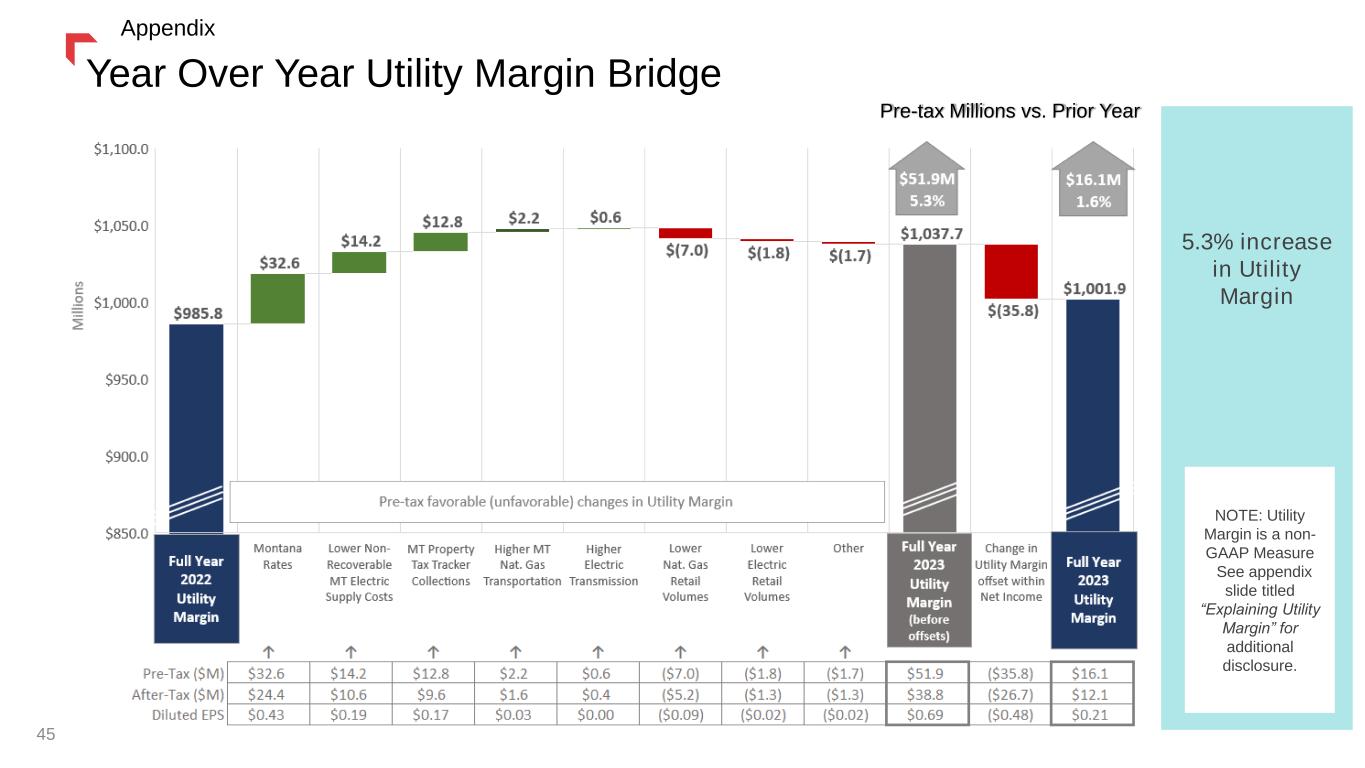

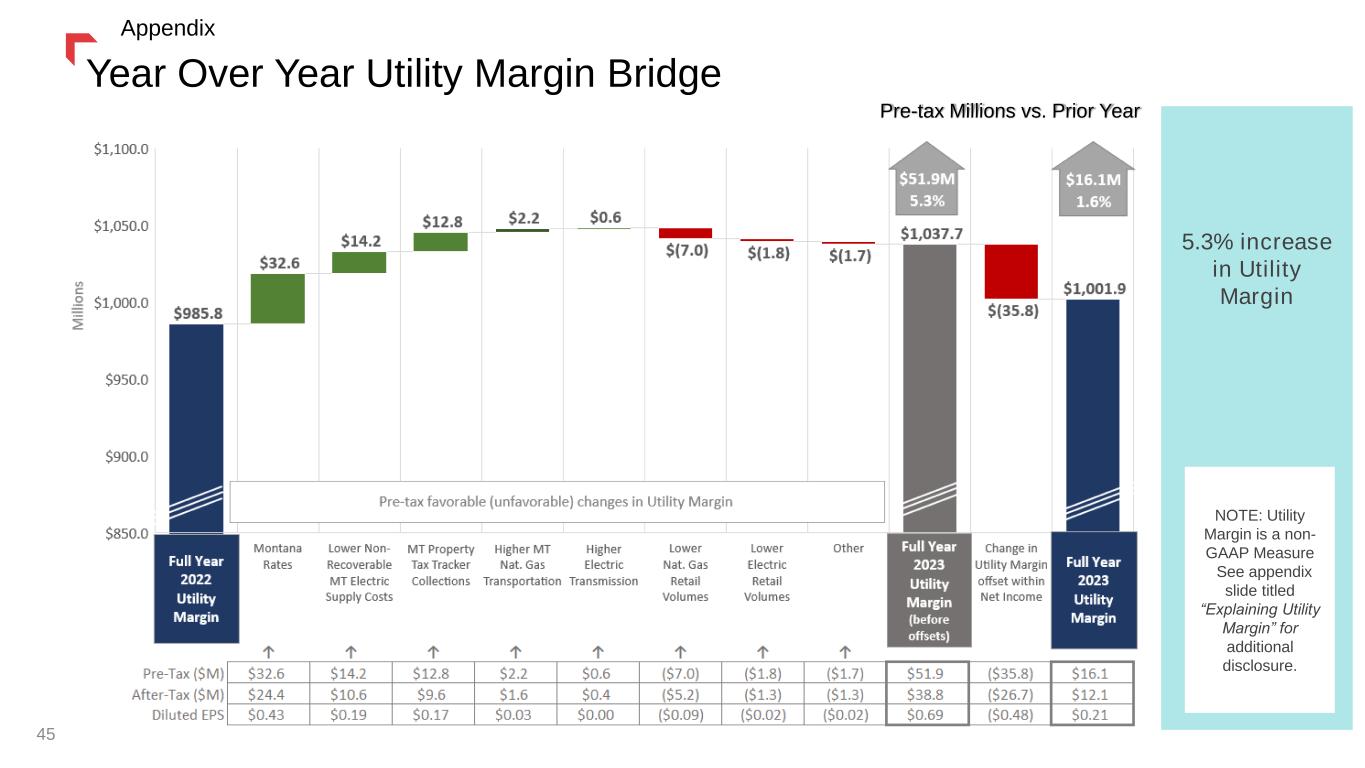

Year Over Year Utility Margin Bridge Pre-tax Millions vs. Prior Year 5.3% increase in Utility Margin NOTE: Utility Margin is a non- GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 45 Appendix

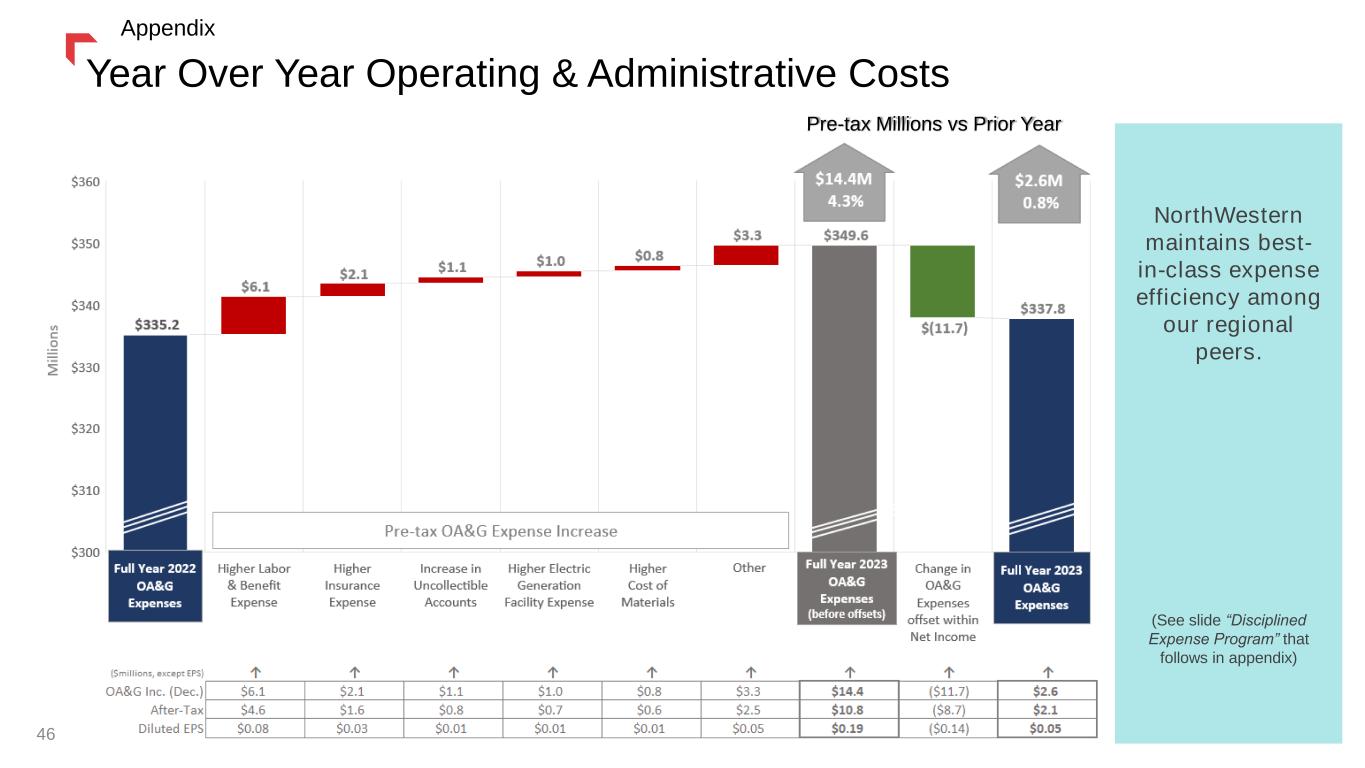

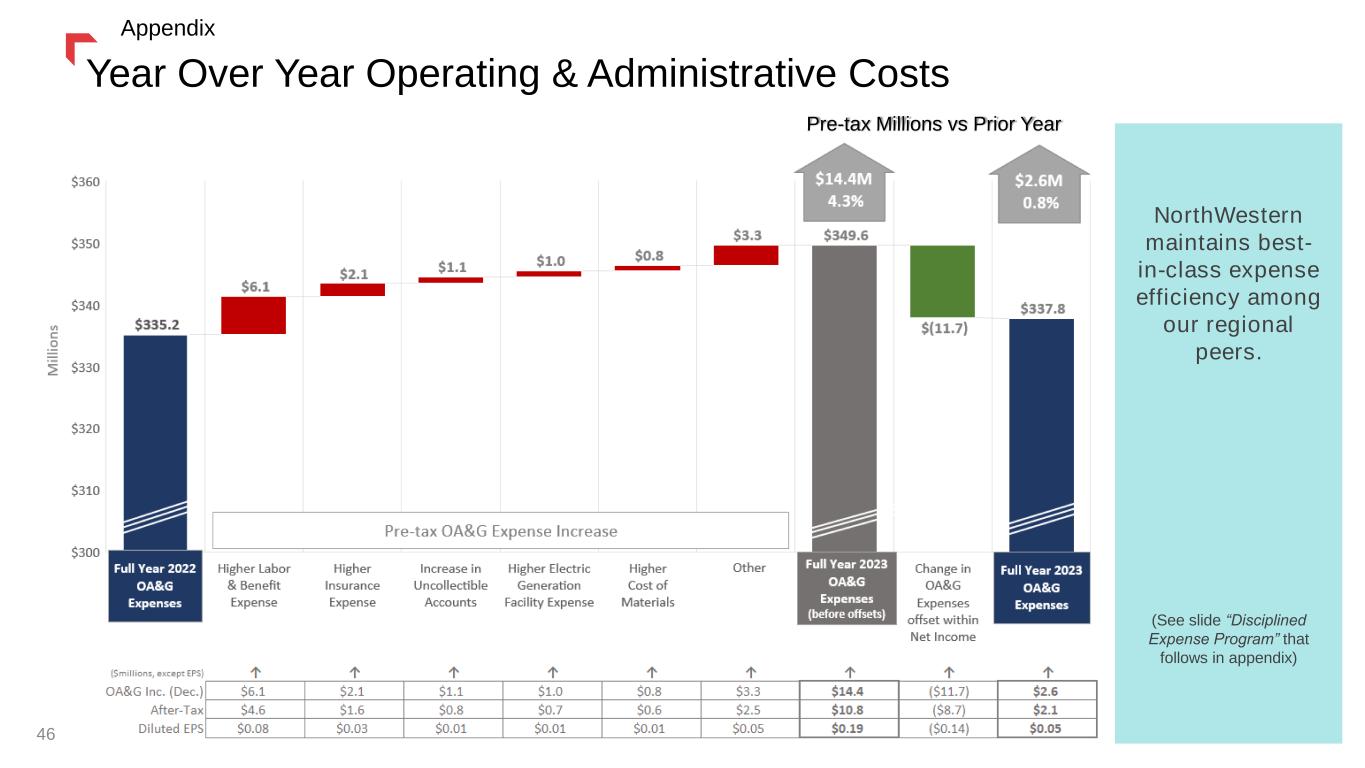

NorthWestern maintains best- in-class expense efficiency among our regional peers. (See slide “Disciplined Expense Program” that follows in appendix) Pre-tax Millions vs Prior Year Year Over Year Operating & Administrative Costs 46 Appendix

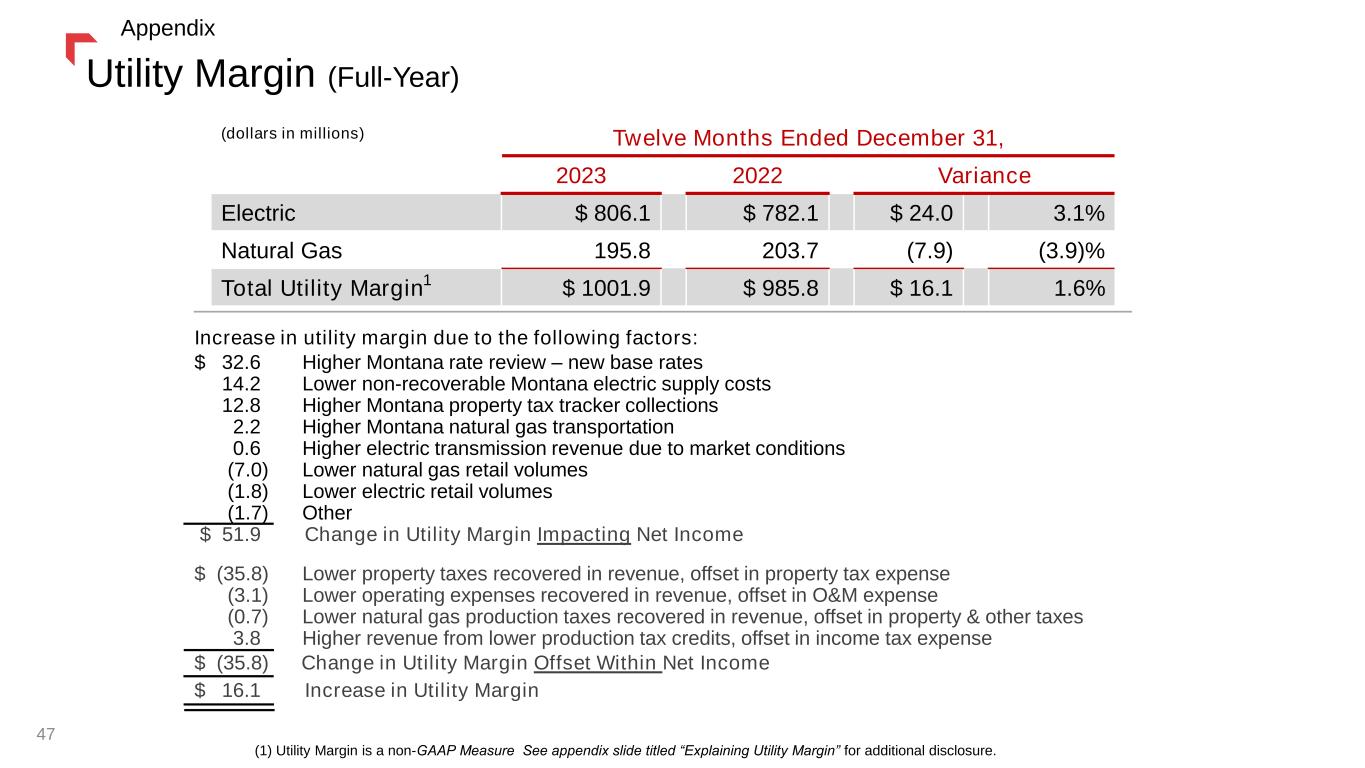

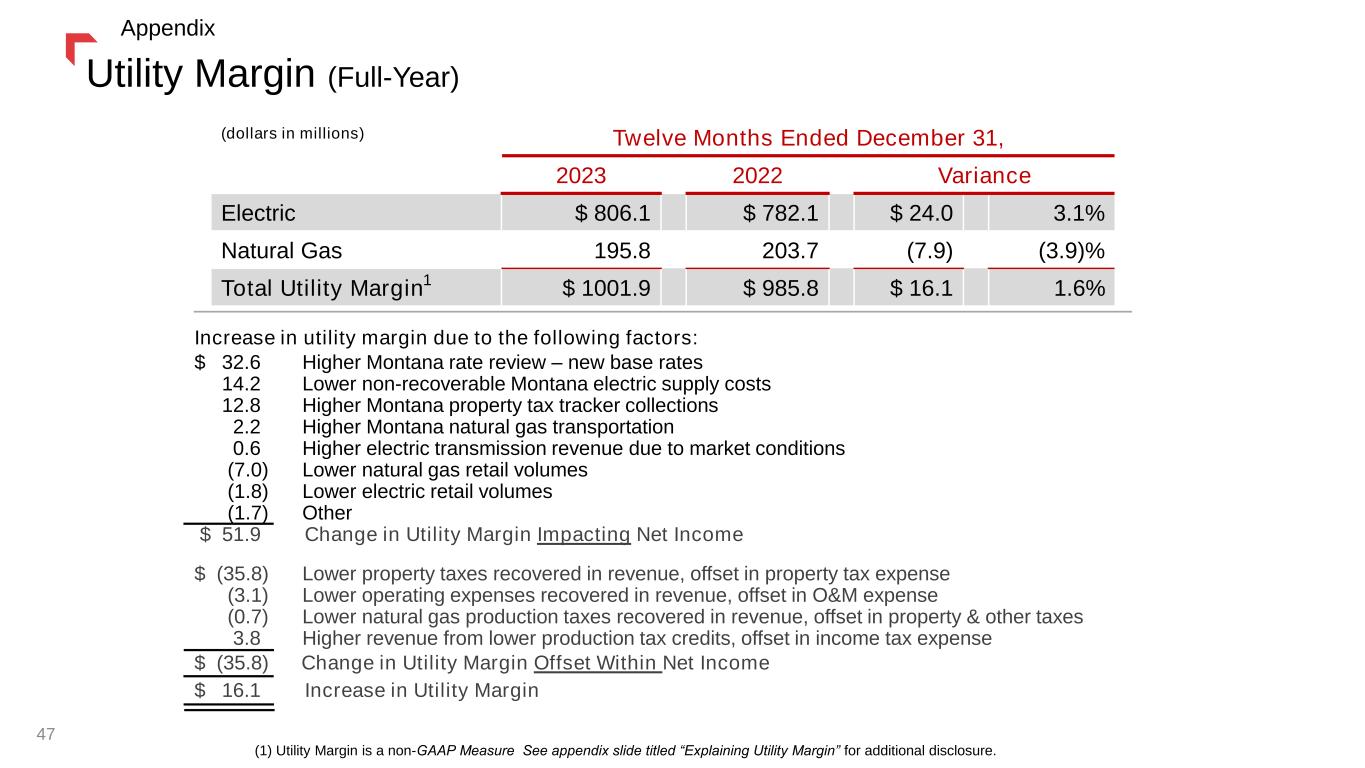

Utility Margin (Full-Year) Increase in utility margin due to the following factors: $ 32.6 Higher Montana rate review – new base rates 14.2 Lower non-recoverable Montana electric supply costs 12.8 Higher Montana property tax tracker collections 2.2 Higher Montana natural gas transportation 0.6 Higher electric transmission revenue due to market conditions (7.0) Lower natural gas retail volumes (1.8) Lower electric retail volumes (1.7) Other $ 51.9 Change in Utility Margin Impacting Net Income (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Electric $ 806.1 $ 782.1 $ 24.0 3.1% Natural Gas 195.8 203.7 (7.9) (3.9)% Total Utility Margin $ 1001.9 $ 985.8 $ 16.1 1.6% $ (35.8) Lower property taxes recovered in revenue, offset in property tax expense (3.1) Lower operating expenses recovered in revenue, offset in O&M expense (0.7) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 3.8 Higher revenue from lower production tax credits, offset in income tax expense $ (35.8) Change in Utility Margin Offset Within Net Income $ 16.1 Increase in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 47 Appendix 1

Operating Expenses (Full-Year) Decrease in operating expenses due to the following factors: $ 15.5 Higher depreciation due to plant additions 6.1 Higher labor and benefits expense(1) 2.1 Higher insurance expense 1.1 Increase in uncollectible accounts 1.0 Higher expenses at our electric generation facilities 0.8 Higher cost of materials (3.0) Lower property and other taxes not recoverable within trackers 3.3 Other $ 26.9 Change in Operating Expense Items Impacting Net Income (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Operating & maintenance $ 220.5 $ 221.4 $ (0.9) (0.4)% Administrative & general 117.3 113.8 3.5 3.1% Property and other taxes 153.1 192.5 (39.4) (20.5)% Depreciation and depletion 210.5 195.0 15.5 7.9% Operating Expenses $ 701.4 $ 722.7 $ (21.3) (2.9)% $ (35.8) Lower property and other taxes recovered in trackers, offset in revenue (8.7) Lower pension and other postretirement benefits, offset in other income(1) (3.1) Lower operating expenses recovered in trackers, offset in revenue (0.7) Lower natural gas production taxes recovered in trackers, offset in revenue (0.1) Higher deferred compensation, offset in other income $ (48.2) Change in Operating Expense Items Offset Within Net Income $ (21.3) Decrease in Operating Expenses (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses. 48 Appendix

Operating to Net Income (Full-Year) (dollars in millions) Twelve Months Ended December 31, 2023 2022 Variance Operating Income $ 300.5 $ 263.1 $ 37.4 14.2% Interest expense (114.6) (100.1) (14.5) (14.5)% Other income, net 15.8 19.4 (3.6) (18.6)% Income Before Taxes 201.6 182.4 19.2 10.5% Income tax (expense) / benefit (7.5) 0.6 (8.1) (1350)% Net Income $ 194.1 $ 183.0 $ 11.1 6.1% $14.5 million increase in interest expense was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of AFUDC. $3.6 million decrease in other income, net was primarily due to an increase in the non- service cost component of pension expense, partly offset by the prior year CREP penalty and higher capitalization of AFUDC. $8.1 million increase in income tax expense was primarily due to higher pre-tax income and lower permanent or flow through adjustments. 49 Appendix

Tax Reconciliation (Full-Year) 50 Appendix

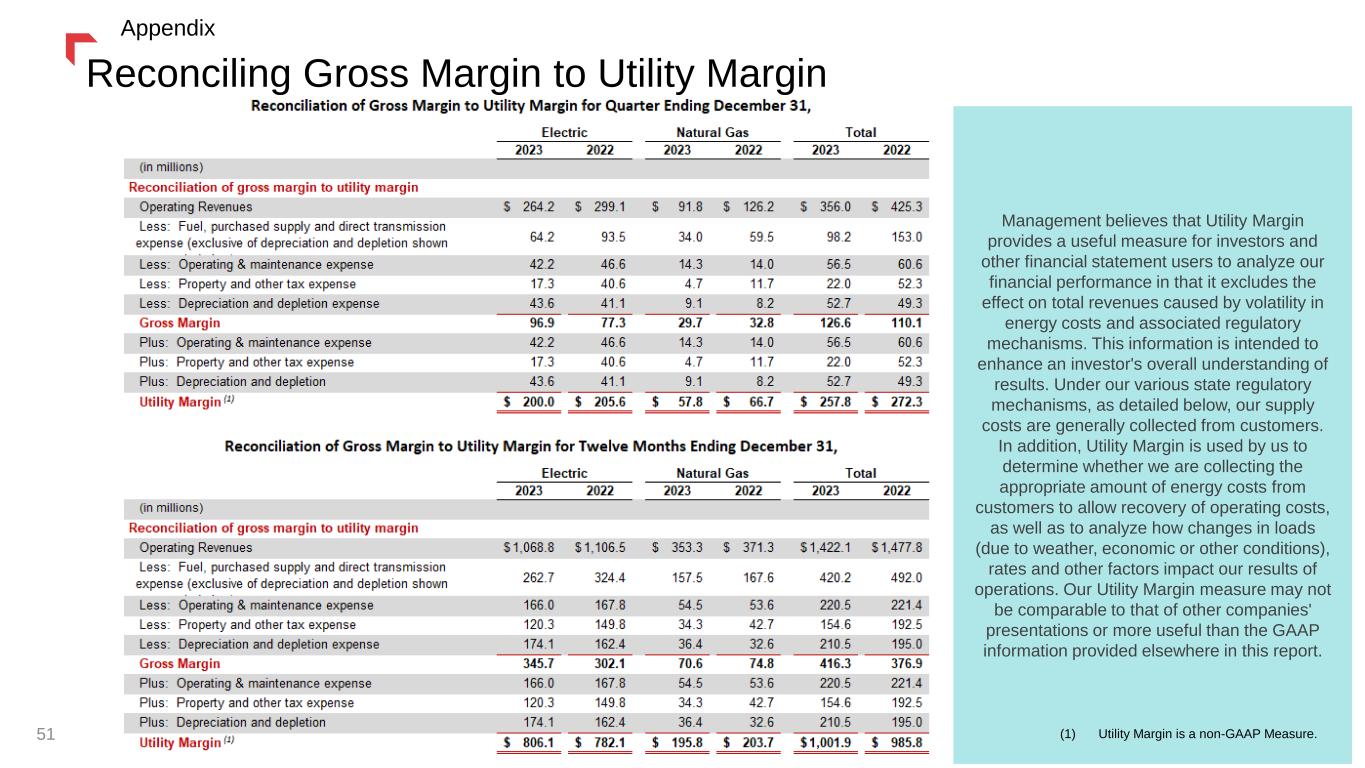

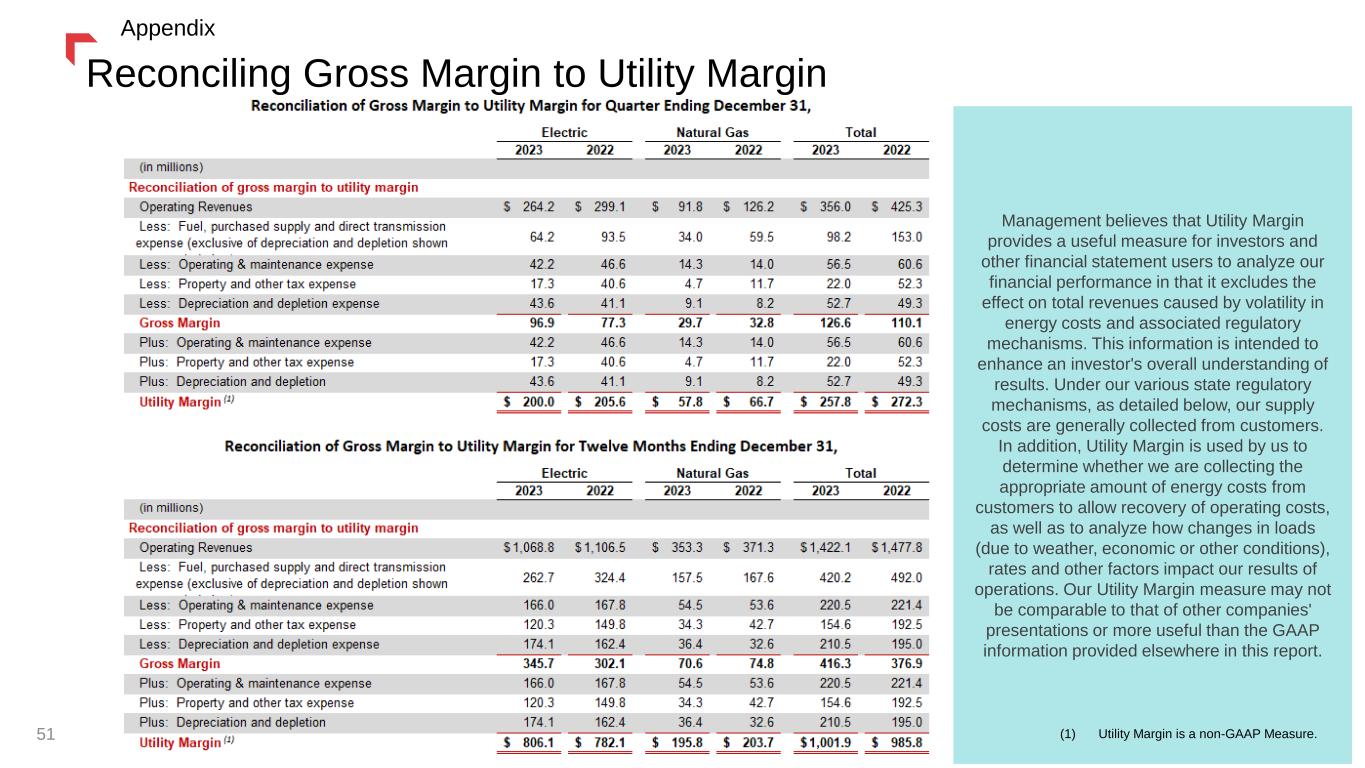

Reconciling Gross Margin to Utility Margin Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. (1) Utility Margin is a non-GAAP Measure. 51 Appendix

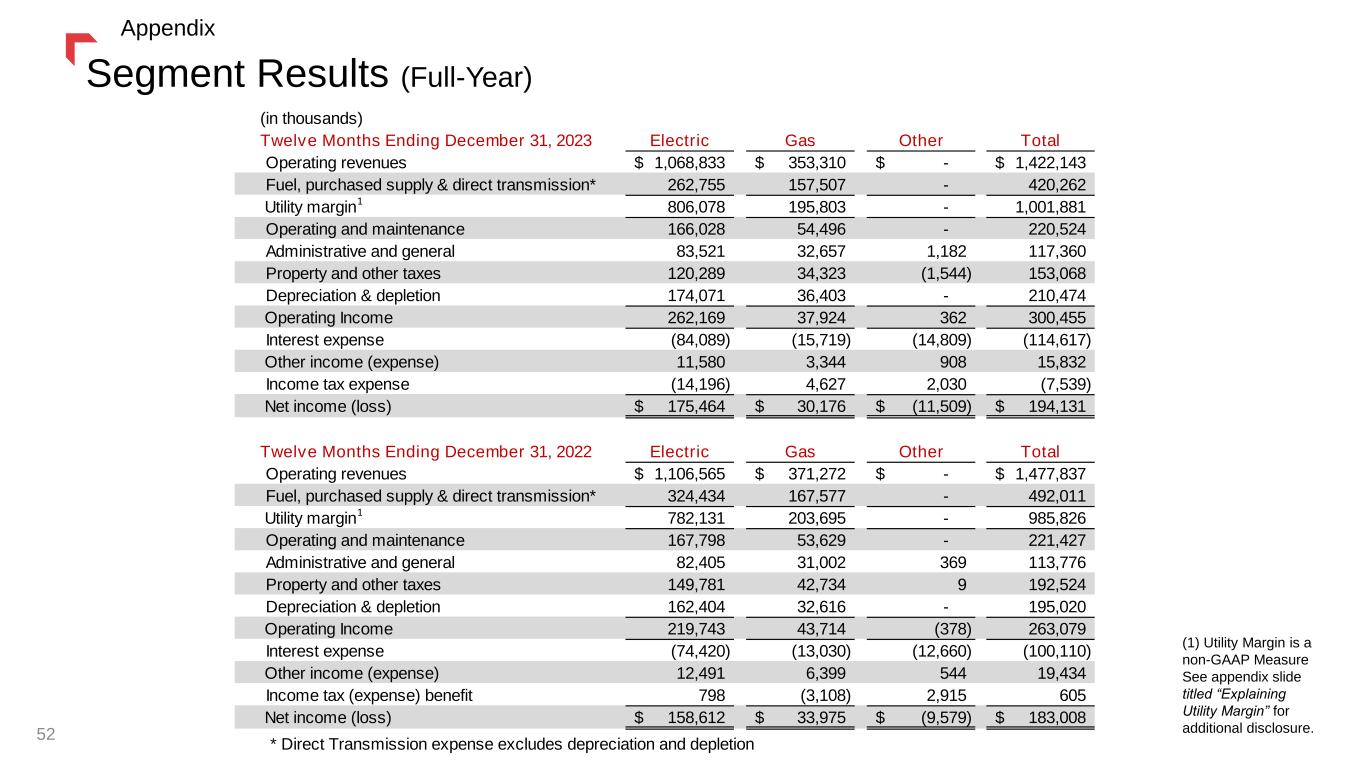

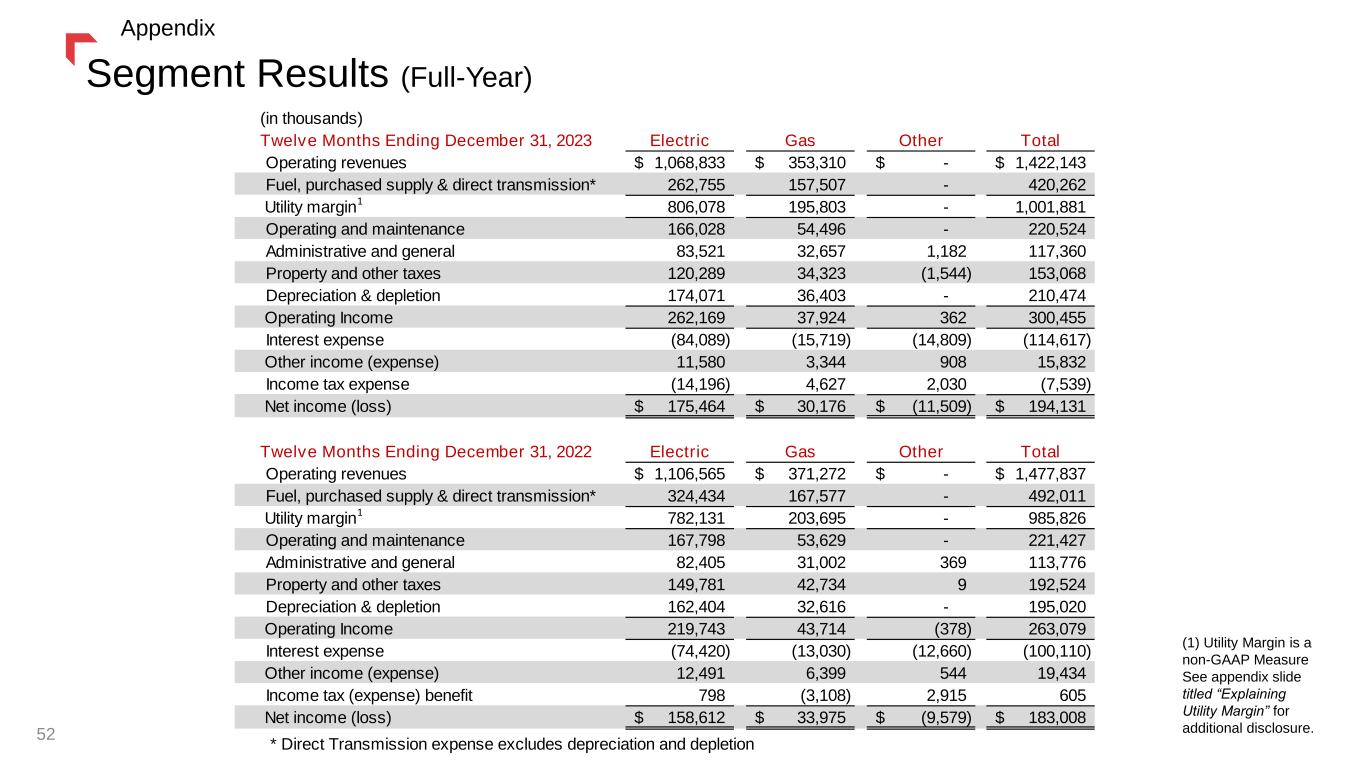

Twelve Months Ending December 31, 2023 Electric Gas Other Total Operating revenues 1,068,833$ 353,310$ -$ 1,422,143$ Fuel, purchased supply & direct transmission* 262,755 157,507 - 420,262 Utility margin 806,078 195,803 - 1,001,881 Operating and maintenance 166,028 54,496 - 220,524 Administrative and general 83,521 32,657 1,182 117,360 Property and other taxes 120,289 34,323 (1,544) 153,068 Depreciation & depletion 174,071 36,403 - 210,474 Operating Income 262,169 37,924 362 300,455 Interest expense (84,089) (15,719) (14,809) (114,617) Other income (expense) 11,580 3,344 908 15,832 Income tax expense (14,196) 4,627 2,030 (7,539) Net income (loss) 175,464$ 30,176$ (11,509)$ 194,131$ Twelve Months Ending December 31, 2022 Electric Gas Other Total Operating revenues 1,106,565$ 371,272$ -$ 1,477,837$ Fuel, purchased supply & direct transmission* 324,434 167,577 - 492,011 Utility margin 782,131 203,695 - 985,826 Operating and maintenance 167,798 53,629 - 221,427 Administrative and general 82,405 31,002 369 113,776 Property and other taxes 149,781 42,734 9 192,524 Depreciation & depletion 162,404 32,616 - 195,020 Operating Income 219,743 43,714 (378) 263,079 Interest expense (74,420) (13,030) (12,660) (100,110) Other income (expense) 12,491 6,399 544 19,434 Income tax (expense) benefit 798 (3,108) 2,915 605 Net income (loss) 158,612$ 33,975$ (9,579)$ 183,008$ * Direct Transmission expense excludes depreciation and depletion (in thousands) 1 1 52 Segment Results (Full-Year) Appendix (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

Electric Segment (Full-Year) 53 (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Appendix 2023 2022 $ % 2023 2022 2023 2022 Montana 408,341$ 357,384$ 50,957$ 14.3 % 2,795 2,868 322,489 316,968 South Dakota 67,888 69,809 (1,921) (2.8) % 603 596 51,261 51,069 Residential 476,229 427,193 49,036 11.5 % 3,398 3,464 373,750 368,037 Montana 431,357 368,634 62,723 17.0 % 3,238 3,237 74,438 73,093 South Dakota 103,194 108,202 (5,008) (4.6) % 1,101 1,114 12,973 12,897 Commercial 534,551 476,836 57,715 12.1 % 4,339 4,351 87,411 85,990 Industrial 45,958 39,773 6,185 15.6 % 2,660 2,590 79 76 Other 32,756 31,007 1,749 5.6 % 134 161 6,443 6,406 Total Retail Electric 1,089,494 974,809 114,685 11.8 % 10,531 10,566 467,683 460,509 Regulatory amortization (105,608) 46,382 (151,990) (327.7) % Transmission 78,436 77,791 645 0.8 % Wholesale and other 6,511 7,583 (1,072) (14.1) % Total Revenues 1,068,833 1,106,565 (37,732) (3.4) % Total fuel, purchased supply & direct transmission expense* 262,755 324,434 (61,679) (19.0) % Utility Margin 806,078$ 782,131$ 23,947$ 3.1 % * Direct transmission expense is exclusive of depreciation and depletion expense Megawatt Hours (MWH) Average Customer Counts Twelve Months Ended December 31, (in thousands) Revenues Change 1

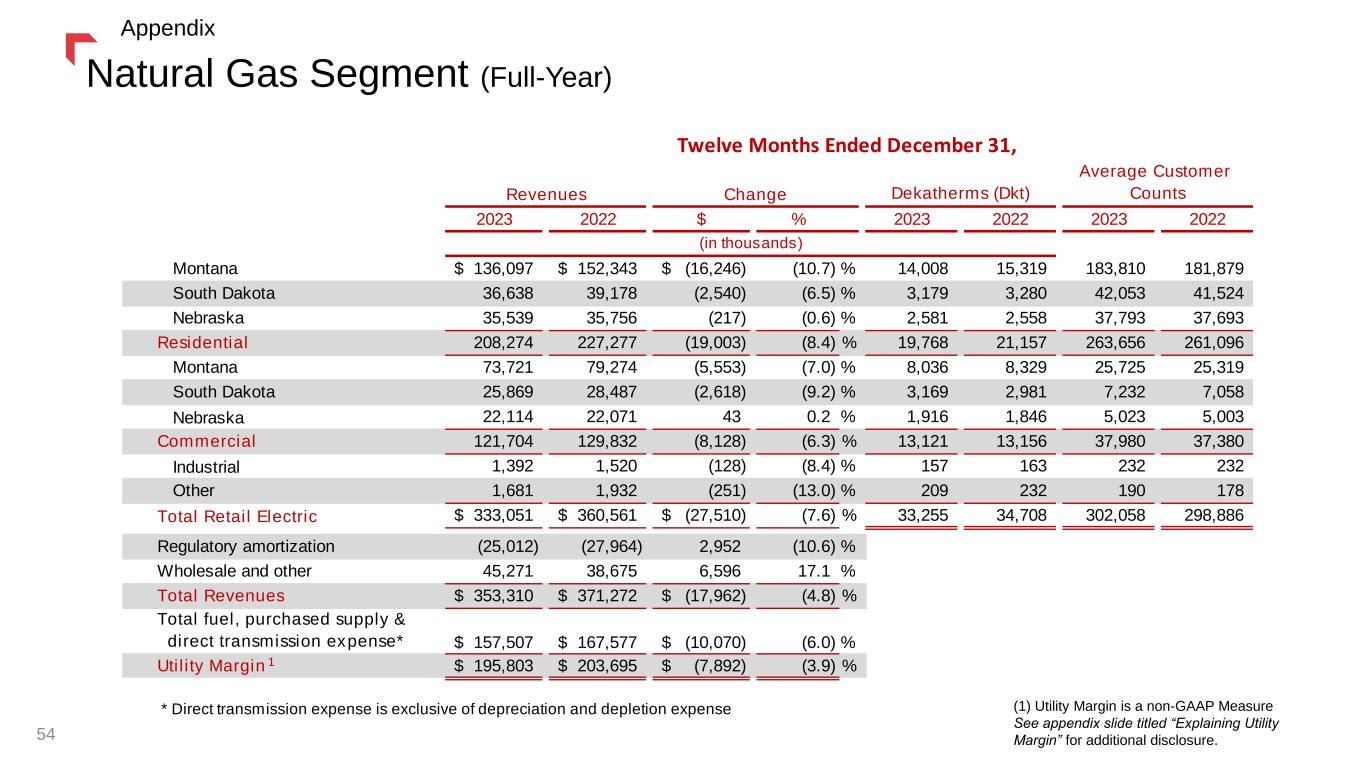

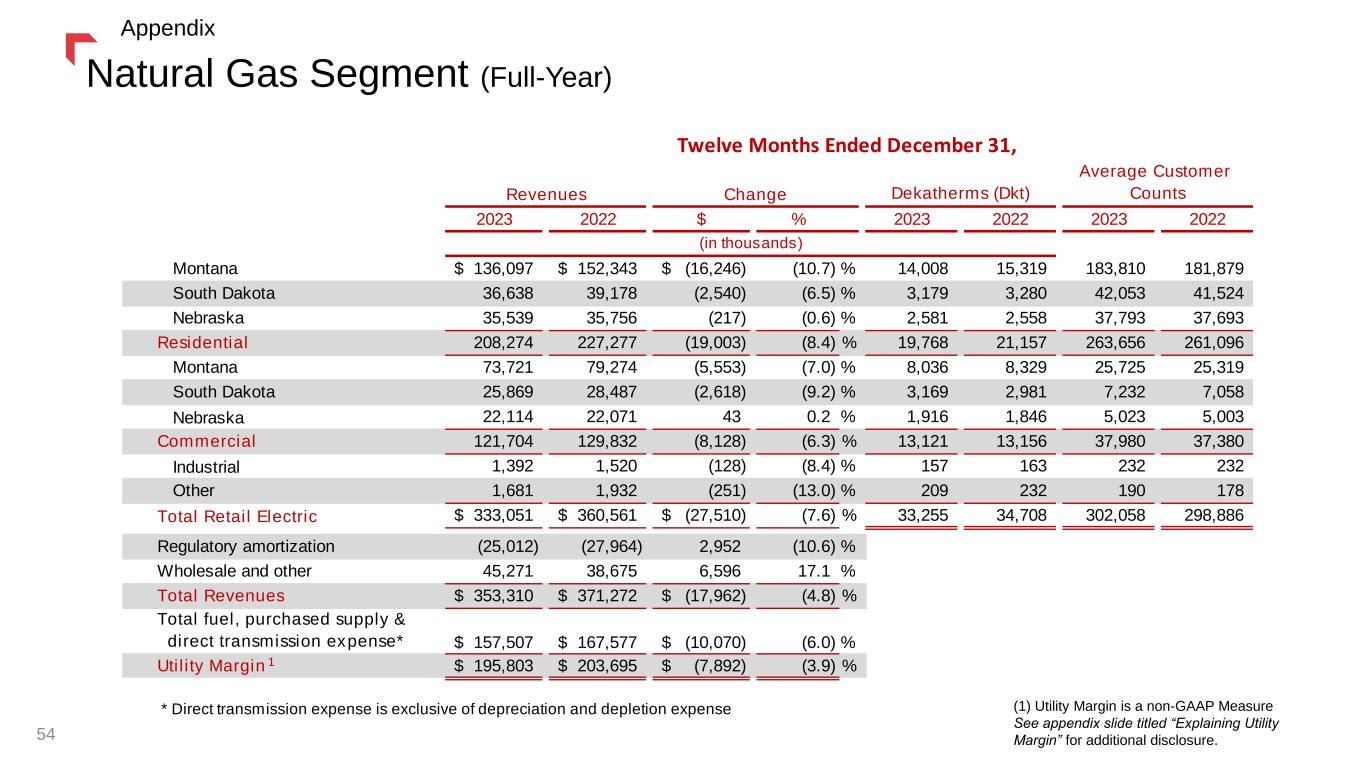

Natural Gas Segment (Full-Year) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. 54 Appendix 2023 2022 $ % 2023 2022 2023 2022 Montana 136,097$ 152,343$ (16,246)$ (10.7) % 14,008 15,319 183,810 181,879 South Dakota 36,638 39,178 (2,540) (6.5) % 3,179 3,280 42,053 41,524 Nebraska 35,539 35,756 (217) (0.6) % 2,581 2,558 37,793 37,693 Residential 208,274 227,277 (19,003) (8.4) % 19,768 21,157 263,656 261,096 Montana 73,721 79,274 (5,553) (7.0) % 8,036 8,329 25,725 25,319 South Dakota 25,869 28,487 (2,618) (9.2) % 3,169 2,981 7,232 7,058 Nebraska 22,114 22,071 43 0.2 % 1,916 1,846 5,023 5,003 Commercial 121,704 129,832 (8,128) (6.3) % 13,121 13,156 37,980 37,380 Industrial 1,392 1,520 (128) (8.4) % 157 163 232 232 Other 1,681 1,932 (251) (13.0) % 209 232 190 178 Total Retail Electric 333,051$ 360,561$ (27,510)$ (7.6) % 33,255 34,708 302,058 298,886 - Regulatory amortization (25,012) (27,964) 2,952 (10.6) % Wholesale and other 45,271 38,675 6,596 17.1 % Total Revenues 353,310$ 371,272$ (17,962)$ (4.8) % Total fuel, purchased supply & direct transmission expense* 157,507$ 167,577$ (10,070)$ (6.0) % Utility Margin 195,803$ 203,695$ (7,892)$ (3.9) % * Direct transmission expense is exclusive of depreciation and depletion expense (in thousands) Change Dekatherms (Dkt) Average Customer CountsRevenues Twelve Months Ended December 31, 1

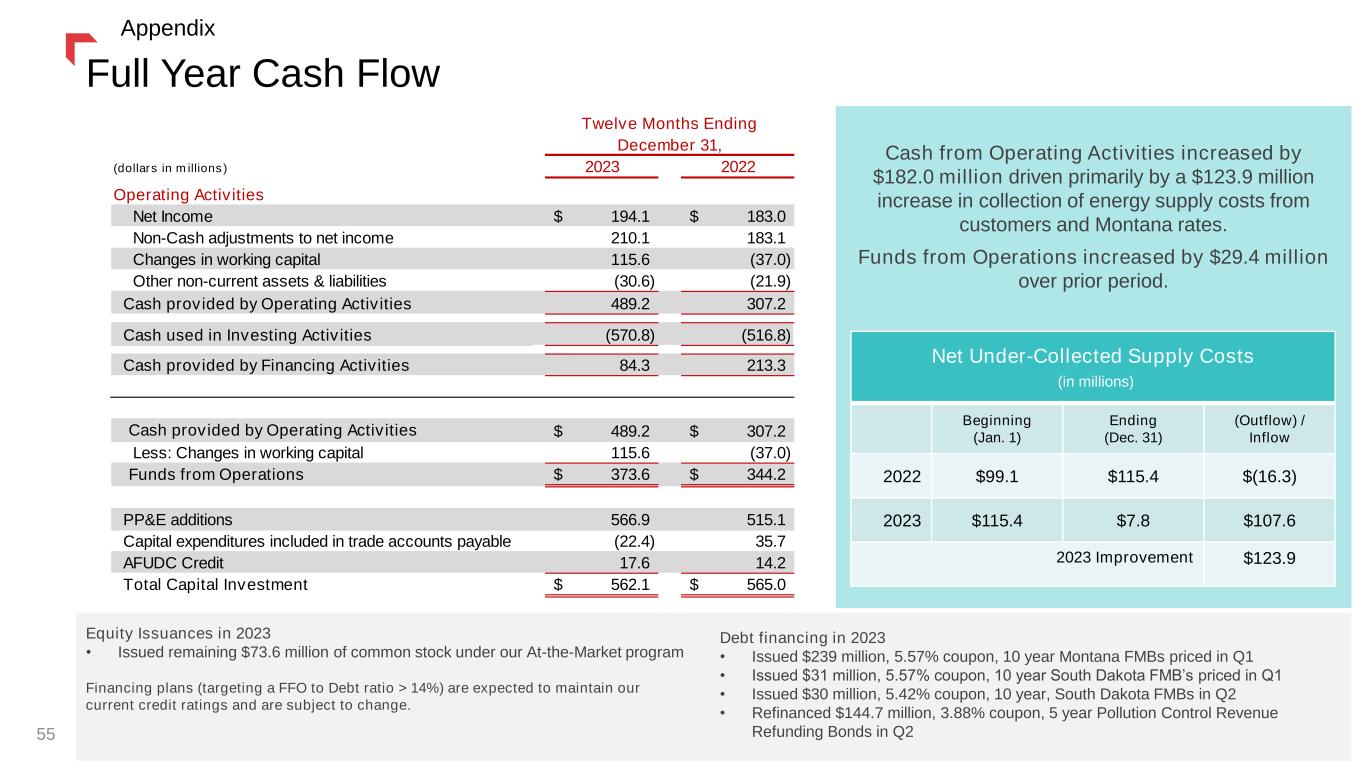

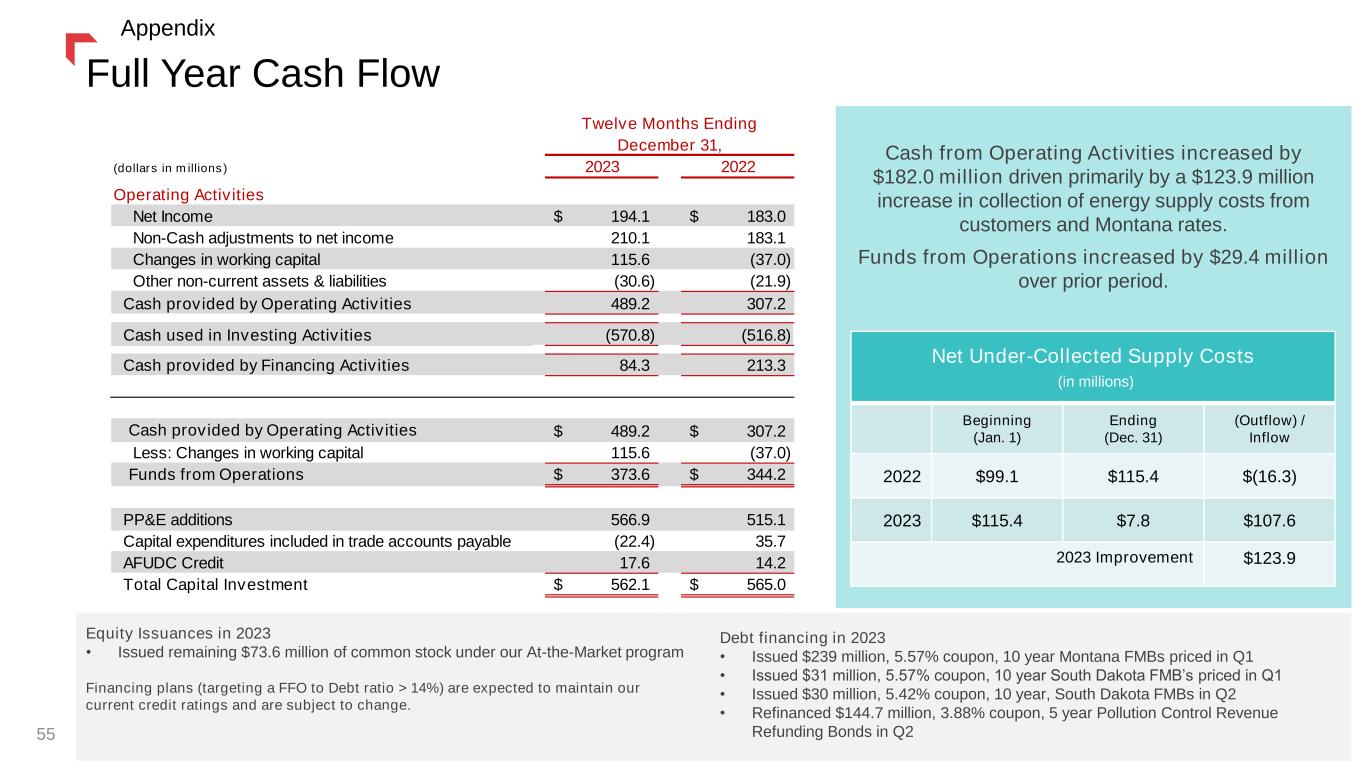

(dollars in millions) 2023 2022 Operating Activities Net Income 194.1$ 183.0$ Non-Cash adjustments to net income 210.1 183.1 Changes in working capital 115.6 (37.0) Other non-current assets & liabilities (30.6) (21.9) Cash provided by Operating Activities 489.2 307.2 Cash used in Investing Activities (570.8) (516.8) Cash provided by Financing Activities 84.3 213.3 Cash provided by Operating Activities 489.2$ 307.2$ Less: Changes in working capital 115.6 (37.0) Funds from Operations 373.6$ 344.2$ PP&E additions 566.9 515.1 Capital expenditures included in trade accounts payable (22.4) 35.7 AFUDC Credit 17.6 14.2 Total Capital Investment 562.1$ 565.0$ Twelve Months Ending December 31, Cash from Operating Activities increased by $182.0 million driven primarily by a $123.9 million increase in collection of energy supply costs from customers and Montana rates. Funds from Operations increased by $29.4 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Dec. 31) (Outflow) / Inflow 2022 $99.1 $115.4 $(16.3) 2023 $115.4 $7.8 $107.6 2023 Improvement $123.9 Equity Issuances in 2023 • Issued remaining $73.6 million of common stock under our At-the-Market program Financing plans (targeting a FFO to Debt ratio > 14%) are expected to maintain our current credit ratings and are subject to change. Debt financing in 2023 • Issued $239 million, 5.57% coupon, 10 year Montana FMBs priced in Q1 • Issued $31 million, 5.57% coupon, 10 year South Dakota FMB’s priced in Q1 • Issued $30 million, 5.42% coupon, 10 year, South Dakota FMBs in Q2 • Refinanced $144.7 million, 3.88% coupon, 5 year Pollution Control Revenue Refunding Bonds in Q2 Full Year Cash Flow 55 Appendix

Balance Sheet Debt to Total Capitalization remains at the bottom of our targeted 50% - 55% range. 56 Appendix

PCCAM Impact by Quarter 57 In 2017, the Montana legislature revised the statute regarding our recovery of electric supply costs. In response, the MPSC approved a new design for our electric tracker in 2018, effective July 1, 2017. The revised electric tracker, or PCCAM established a baseline of power supply costs and tracks the differences between the actual costs and revenues. Variances in supply costs above or below the baseline are allocated 90% to customers and 10% to shareholders, with an annual adjustment. From July 2017 to May 2019, the PCCAM also included a "deadband" which required us to absorb the variances within +/- $4.1 million from the base, with 90% of the variance above or below the deadband collected from or refunded to customers. In 2019, the Montana legislature revised the statute effective May 7, 2019, prohibiting a deadband, allowing 100% recovery of QF purchases, and maintaining the 90% / 10% sharing ratio for other purchases. In 2023, the PCCAM base increased from the Montana rate review, supporting a benefit in 2023 as compared to expense in 2021 & 2022. Appendix Pretax millions – shareholder (detriment) benefit

Qualified Facility Earnings Adjustment Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders. 58 Appendix

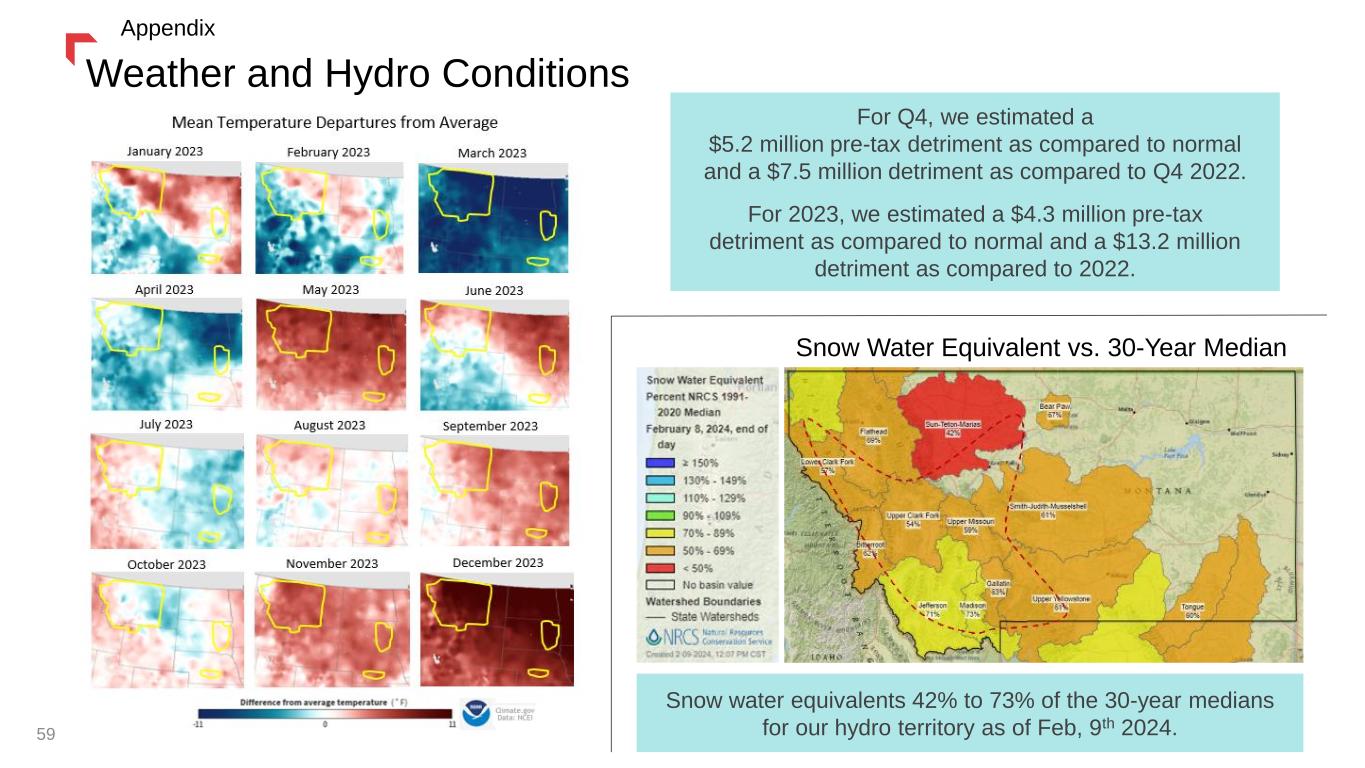

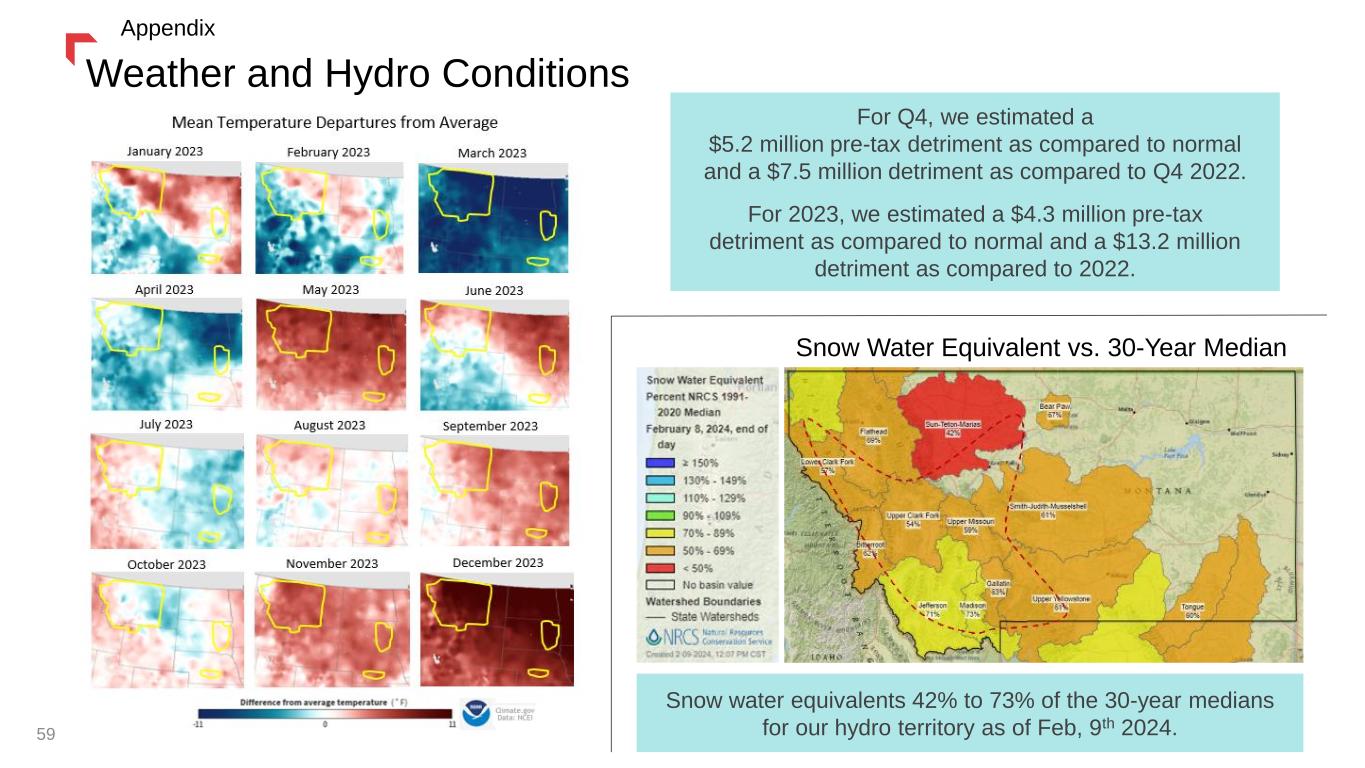

Weather and Hydro Conditions Snow water equivalents 42% to 73% of the 30-year medians for our hydro territory as of Feb, 9th 2024. For Q4, we estimated a $5.2 million pre-tax detriment as compared to normal and a $7.5 million detriment as compared to Q4 2022. For 2023, we estimated a $4.3 million pre-tax detriment as compared to normal and a $13.2 million detriment as compared to 2022. Snow Water Equivalent vs. 30-Year Median 59 Appendix

$2.3 billion invested into our operations over the last five years of which 65% was transmission and distribution. Historic 5-Year Capital Investment Appendix 60

Experienced & Engaged Board of Directors 61 Britt E. Ide • Nominating & Governance, HR • Independent • Since April 2017 Anthony T. Clark • Nominating & Governance., HR • Independent • Since Dec. 2016 Dana J. Dykhouse • Chairman • Independent • Since Jan. 2009 Jan R. Horsfall • SETO (chair), Audit • Independent • Since April 2015 Brian B. Bird • President & Chief Executive Officer • Non-independent • Since January 2023 Jeff W. Yingling • Nominating & Governance (Chair), Audit • Independent • Since October 2019 Linda G. Sullivan • Audit (Chair), SETO • Independent • Since April 2017 Mahvash Yazdi • HR (Chair), SETO • Independent • Since December 2019 Kent T. Larson • SETO, Audit • Independent • Since July 2022 Sherina M. Edwards • Nominating & Governance, HR • Independent • Since April 2023 Appendix

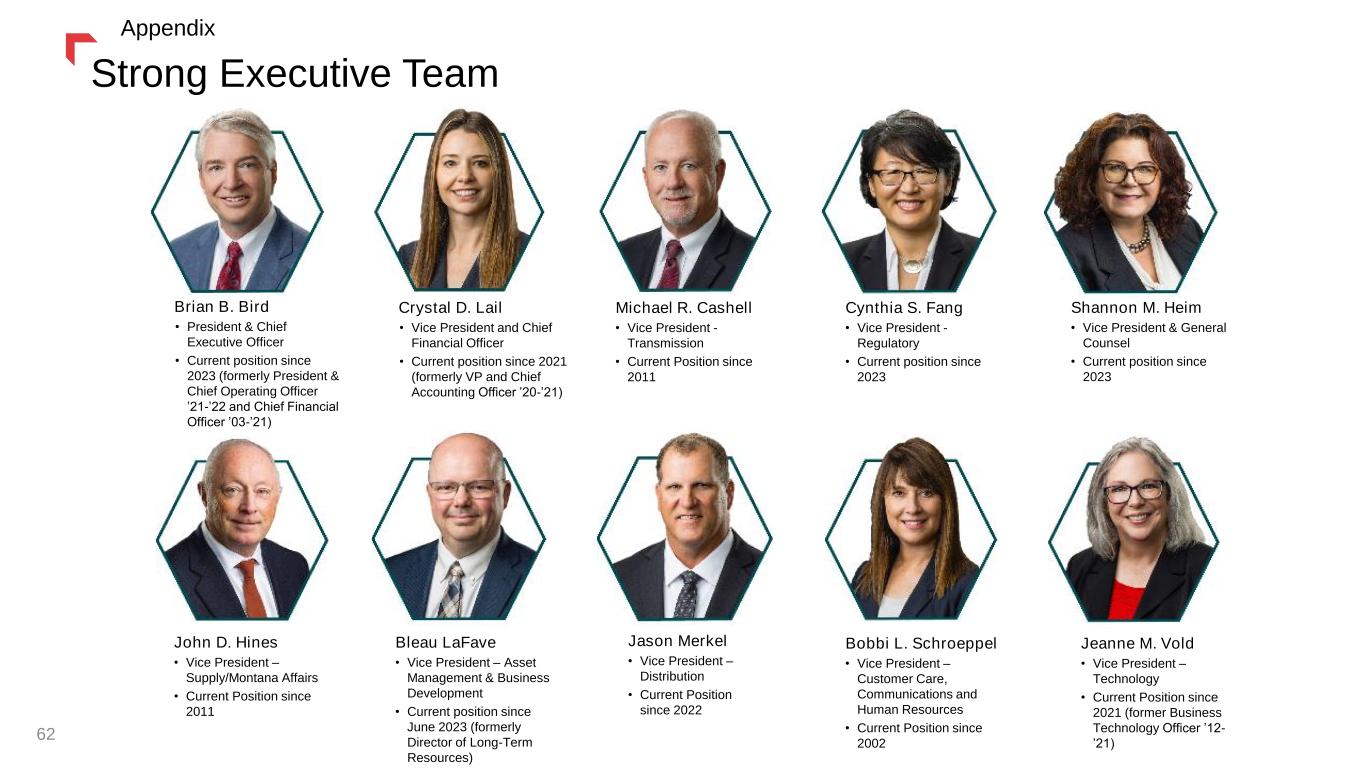

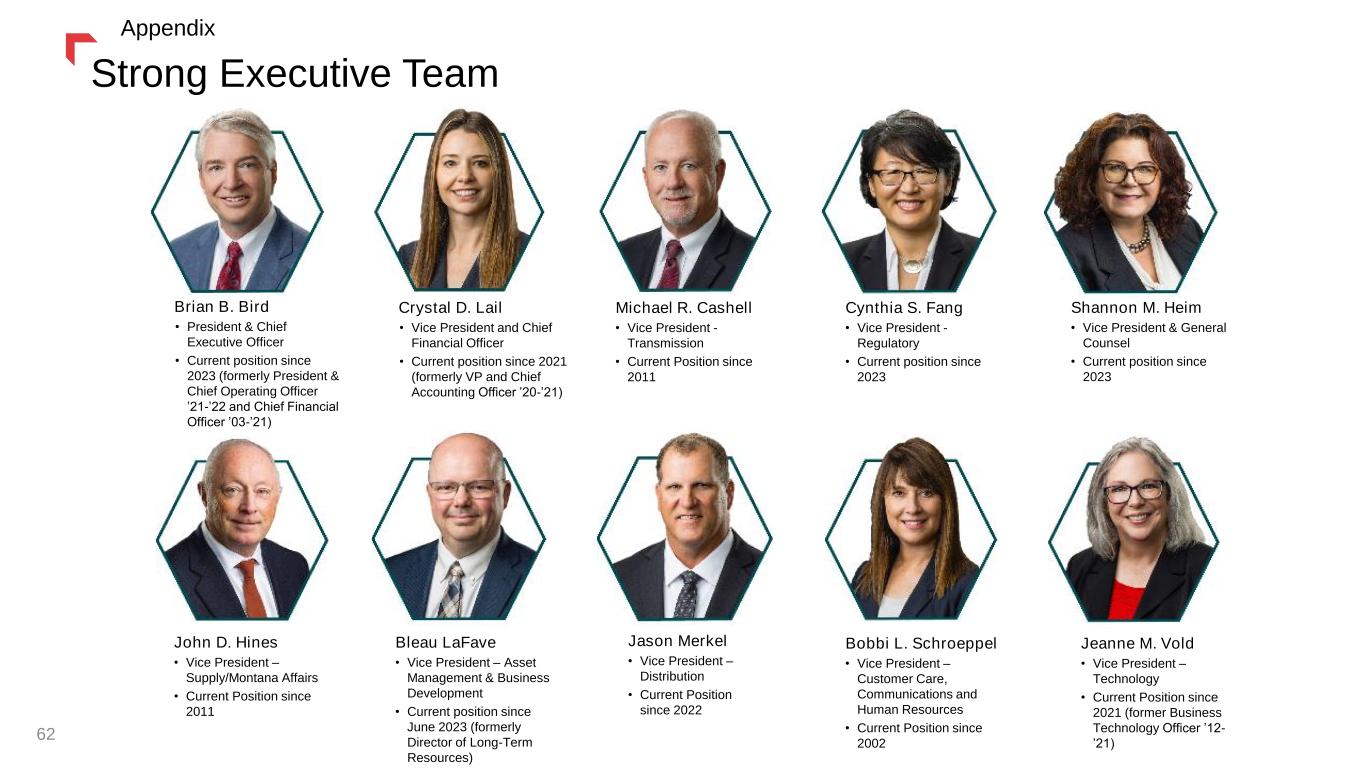

Strong Executive Team 62 Brian B. Bird • President & Chief Executive Officer • Current position since 2023 (formerly President & Chief Operating Officer ’21-’22 and Chief Financial Officer ’03-’21) Crystal D. Lail • Vice President and Chief Financial Officer • Current position since 2021 (formerly VP and Chief Accounting Officer ’20-’21) Michael R. Cashell • Vice President - Transmission • Current Position since 2011 Cynthia S. Fang • Vice President - Regulatory • Current position since 2023 Shannon M. Heim • Vice President & General Counsel • Current position since 2023 Bobbi L. Schroeppel • Vice President – Customer Care, Communications and Human Resources • Current Position since 2002 Bleau LaFave • Vice President – Asset Management & Business Development • Current position since June 2023 (formerly Director of Long-Term Resources) Jason Merkel • Vice President – Distribution • Current Position since 2022 John D. Hines • Vice President – Supply/Montana Affairs • Current Position since 2011 Jeanne M. Vold • Vice President – Technology • Current Position since 2021 (former Business Technology Officer ’12- ’21) Appendix

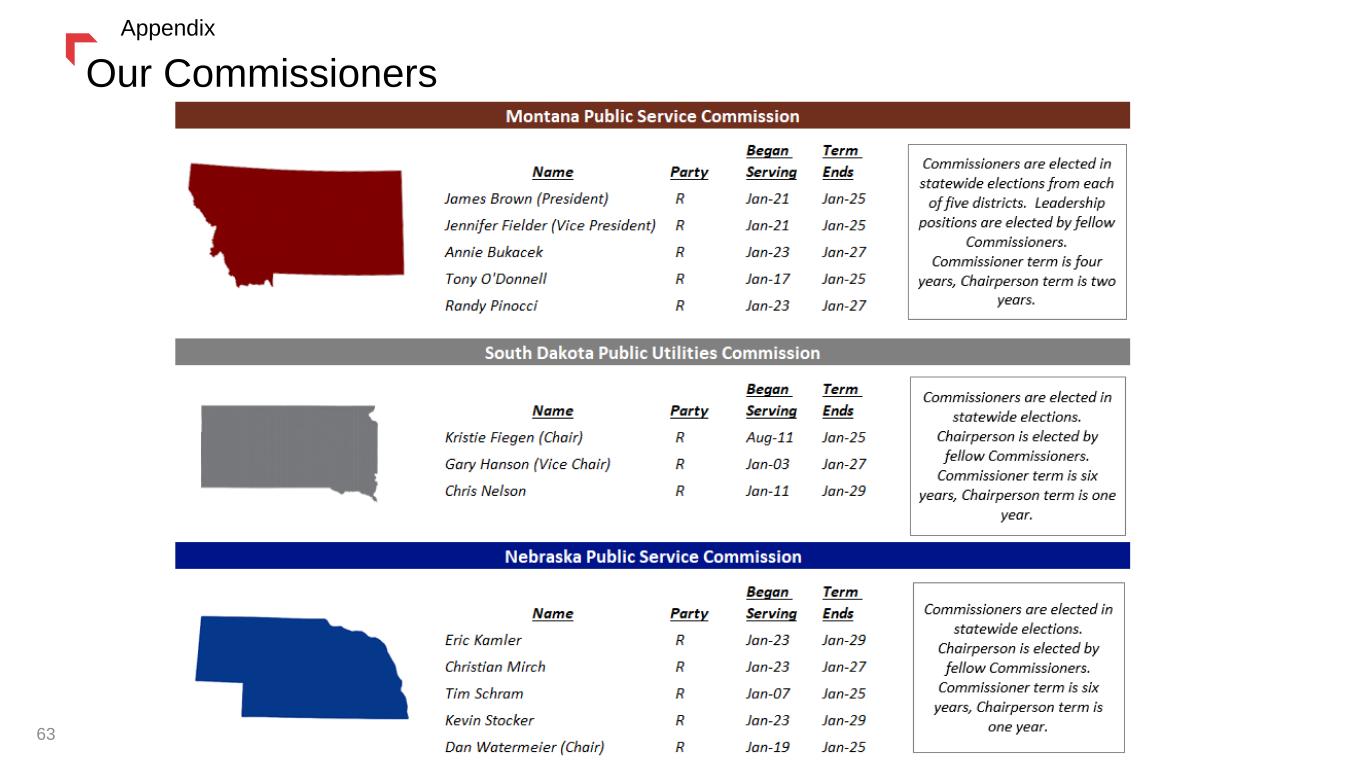

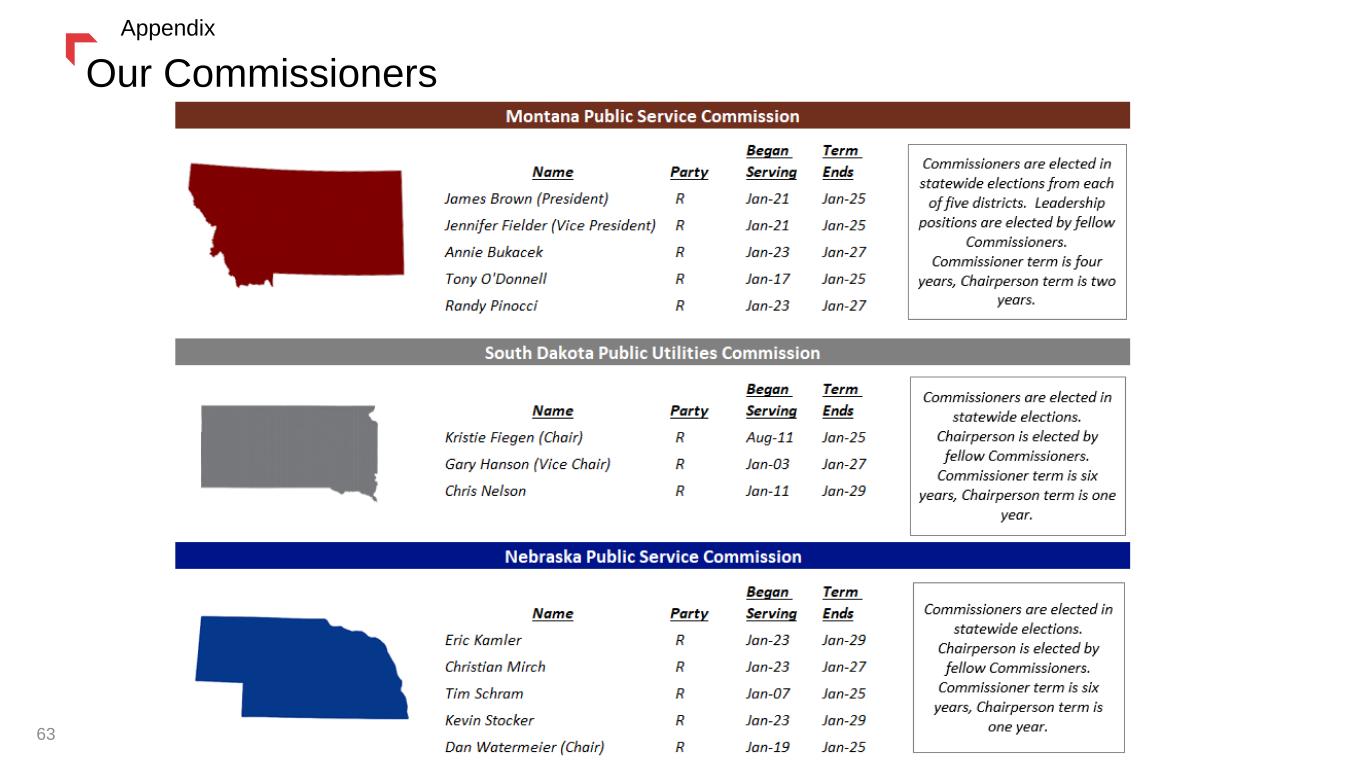

Our Commissioners 63 Appendix

Non-GAAP Financial Measures 64 Appendix

Non-GAAP Financial Measures This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. 65 Appendix

Thank youDelivering a bright future 66