Document

NORTHWESTERN ENERGY

2024 ANNUAL INCENTIVE PLAN

I. Introduction

NorthWestern Energy (NorthWestern) utilizes the 2024 Annual Incentive Plan (Plan) to reward non-represented employees for their contributions toward achieving desired business results.

II. Plan Objectives

This Plan is designed to achieve the following objectives:

Align the interests of shareholders, customers and employees.

Create incentives for employees to achieve financial and operating results.

Reward employees individually, and as a team, by providing compensation opportunities consistent with company financial and operating performance.

III. Plan Administration

The Plan is approved by NorthWestern's Board of Directors (Board) and administered by the NorthWestern Energy Incentive Plan Administration Committee (Administration Committee) consisting of the CEO and the CFO. The Administration Committee is responsible for all aspects of administration of the Plan and is responsible for resolving any conflicts or discrepancies that arise. The Administration Committee’s decision on any matter associated with this Plan is final, subject to approval by the Board's Human Resources Committee.

IV. Performance Period and Effective Date

The Plan becomes effective January 1, 2024, and will continue until December 31, 2024, which is the Performance Period. The Plan may be suspended and/or terminated by the Administration Committee, subject to approval by the Board, at any time, without prior notice and at its sole discretion.

V. Other Considerations

All awards are subject to income tax withholding and garnishment requirements. No right or interest in the Plan is transferable or assignable.

Distributions under the Plan are at the discretion of the Administration Committee, subject to approval of the Board's Human Resources Committee. Awards will not be made under the Plan if, in the sole and final judgment of the Board, the overall financial condition of the Company is insufficient to support awards.

NorthWestern Energy 2024 Annual Incentive Plan

Distributions from the Plan do not provide any rights to continued employment. A distribution from the Plan in any one performance period does not guarantee the participant a distribution, or the right to participate, in any subsequent performance period.

Employees have the right to report work-related injuries and illnesses. This Plan is not intended to interfere with that right and will not be applied in any manner that interferes with that right. NorthWestern Energy is prohibited from discharging or in any manner discriminating against employees for reporting work-related injuries or illnesses.

VI. Participation and Eligibility

All non-represented regular full-time, regular part-time, limited part-time and seasonal employees of NorthWestern, employed on the last business day of the plan year are eligible to receive payment under the Plan provided they are actively employed by NorthWestern for at least one full quarter of the Plan year. To participate in the Plan, employees must have written goals and objectives consistent with NorthWestern’s goals and objectives. These employee goals must target results that meet or exceed the normal requirements of the employee’s position, and that contribute to meeting the goals and objectives of NorthWestern. Goals and objectives can be based on individual and team performance.

An employee must meet acceptable performance standards, as defined and approved by the Administration Committee, to be eligible for an award. An employee who was under a formal disciplinary action during the Performance Period is not eligible for an award during the disciplinary period. An employee whose performance is rated “unsatisfactory” is not eligible for an award. An employee whose performance is rated “partially met expectations” may, at the discretion of their supervisor, be eligible for an award within established guidelines.

An employee is eligible for a prorated incentive award based upon the amount of time served in an eligible status with NorthWestern Energy during the Performance Period if they:

(1)Are classified as seasonal,

(2)Were under a formal disciplinary action for a portion of the Performance Period,

(3)Work on a part-time basis,

(4)Take unpaid leave, including military leave, that is nonmedical in nature and that exceeds 80 hours, or

(5)Retired, provided they worked at least one full quarter during the Performance Period, even though the retired employee was not employed on the last business day of the Plan year. For purposes of this incentive Plan, retirement shall mean the termination of an employee’s continuous service with NorthWestern after the employee has attained at least age 65 or attained at least age 55 with a minimum of 5 years of service. Retirement shall exclude any termination for cause.

NorthWestern Energy 2024 Annual Incentive Plan

Proration for retirement will be based on an employee’s last day actually worked, even though an employee may receive approval to extend their actual termination date by using accrued paid leave (i.e., PTO).

Temporary and summer employees, as well as independent contractors, are not eligible to participate in the Plan.

VII. Individual Awards

Awards to Plan participants from the Performance Pool (Section IX) will be determined based on individual performance ratings that evaluate achievement against established goals and objectives, as well as overall job performance. Supervisors will evaluate individual employee performance during the Performance Period covered by the Plan to determine individual awards.

VIII. Target Funding Level

Target funding level for each participating employee is set by position and will be expressed as a percentage of base salary. Each participant's target funding level is subject to approval by the Administration Committee and any changes will be communicated in writing to participants. The Board will approve senior executive target funding levels.

IX. Performance Pool

The Plan is funded through achievement of targeted results on key organizational performance objectives, inclusive of costs associated with the Plan. After implementation, the Plan will be reviewed periodically to ensure that the desired results are being achieved.

The Performance Pool will be created based on four factors: net income, system performance comprised of electric and natural gas service reliability, customer satisfaction, and employee safety. Each of these measures will be calculated at the conclusion of the Performance Period. Periodic accruals will be made to provide for the Performance Pool at year-end. The Performance Pool will be funded in accordance with Table 1 below; however,the Board has discretion to adjust any Performance Metric to address developments that (a) are extraordinary or unusual in nature or infrequent in occurrence and (b) impact the Performance Metric in a manner inconsistent with the intention of the Board with respect to this Plan. Officer awards will be modified based on each officer’s goal performance during the Performance Period.

NorthWestern Energy 2024 Annual Incentive Plan

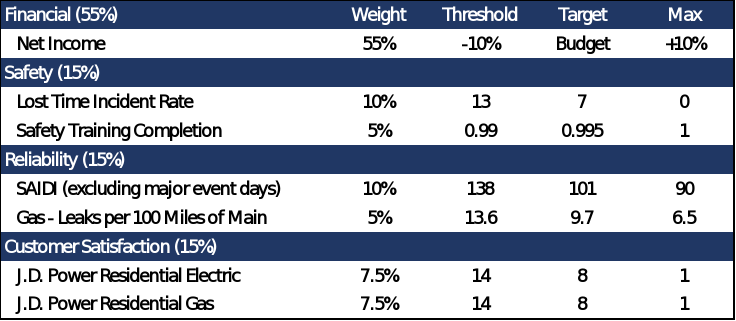

Table 1 – 2024 Plan Performance Metrics

Footnotes: 1) The net income financial target is based on Board-approved budget for 2024; 2) If a work-related fatality occurs, the lost time incident rate portion of the safety performance metric of the Annual Incentive Plan will be forfeited for all NorthWestern employees unless it is determined by the Board’s Human Resources Committee that no actions on the part of the employee or the Company contributed to the incident. 3) Any individual employee’s incentive will be reduced by the full Safety metric contribution to total if their individual safety and security training completion percentage is less than 100 percent. 4) The Reliability results will be adjusted for planned outages and catastrophic events. 5) Customer satisfaction results are based on independent JD Power residential electric and gas survey results.

Funding levels are computed by prorating if actual results lie between Threshold (0%) through Maximum (200%).

In calculating performance against target, adjustments may be made either positively or negatively for one-time events and extraordinary nonbudgeted items as approved by the Board. This plan is subject to the Company’s Erroneously Awarded Compensation Policy.

As soon as possible after the end of the Performance Period, NorthWestern will calculate the actual performance as compared against the established performance targets. Such calculations shall be finally determined at the sole discretion of the Board's Human Resources Committee or an appointed designee. Employees shall have no recourse, appeal or challenge available from this final determination. Summary results will be provided to employees.

X. Performance Pool Distribution and Incentive Pay Calculation

Individual employee performance is a key consideration in distributing incentive pay. The Performance Pool will be allocated to each officer using total target funding level at the end of the Performance Period for eligible employees in each functional unit, division or department, adjusted based on the performance funding level achieved. Each officer will then allocate the Performance Pool to the respective department supervisors, as appropriate, for further distribution based on attainment of either team or individual performance goals. Supervisors will submit recommended distributions to individual employees subject to the functional officer’s and Administration Committee approval.

NorthWestern Energy 2024 Annual Incentive Plan

In no case will the total payouts in a given Performance Pool exceed the total dollars available for that Performance Pool.

XI. Payment of Awards

Cash awards will be made in the same manner as each employee’s normal payroll processing, either in the form of Company check or direct deposit. Awards will be paid to employees in March 2025. Awards are considered ordinary income and subject to all applicable taxes.

NorthWestern Energy 2024 Annual Incentive Plan

NORTHWESTERN ENERGY

2024 ANNUAL INCENTIVE PLAN

ADDENDUM 1

UDefinitions

FINANCIAL

The Net Income target is based upon the Board approved budget for the plan year, and is determined by what is reported in the SEC Form 10k filed mid-February of the year following the plan year.

ELECTRIC SYSTEM RELIABILITY

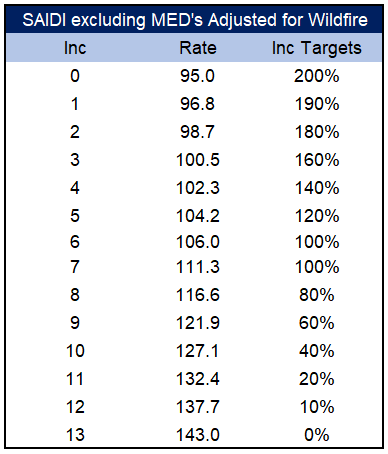

The overall objective is to maintain a high level of electric reliability. Targets for electric reliability are established using the System Average Interruption Duration Index (SAIDI) excluding MED’s adjusted to remove planned outages and catastrophic events - based on five year company averages and IEEE benchmark data..

SAIDI excluding MEDs:

System Average Interruption Duration Index (SAIDI) indicates, in minutes, the total duration of interruption for the average customer during a predefined period of time.

SAIDI = sum of the customer interruption durations

total number of customers served

Maximum Performance = 90 SAIDI minutes Maximum performance is an improvement of 1% over NWE’s best metric of the last five years. In 2018, the metric was 91 making the recommendation at 90 minutes.

Target Performance = 101 SAIDI minutes Target matches the five year average of NWE’s performance, which is 101 minutes.

Threshold Performance = 138 SAIDI minutes Threshold matches the IEEE 2nd quartile performance average of medium sized companies, which has a five year average of 138 minutes.

NorthWestern Energy 2024 Annual Incentive Plan

Major Event Days (MEDs) is defined as a day that SAIDI value exceeds a statistically derived threshold value (Tmed) that nominally represents “stresses beyond that normally expected (such as during severe weather).”

SAIDI targets reflect adjustments for the impact of wildfire operations. SAIDI results are adjusted to exclude planned outages, public safety power shutoff impacts and catastrophic events. A catastrophic event is defined as an event that has an overall impact of 7 times an MED.

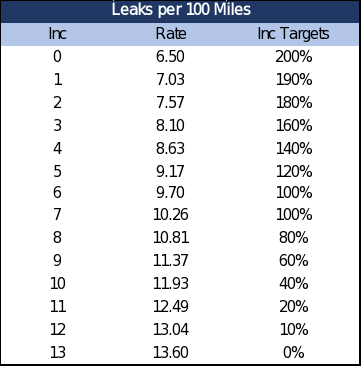

GAS SYSTEM RELIABILITY

The gas metric is gas leaks per 100 miles of distribution pipe and is established at target of a 4 year average performance.

Leaks per 100 miles of distribution pipe is calculated as the total number of leaks recorded on NorthWestern’s system caused by something other than 3rd party damage divided by the total miles of distribution pipe divided by 100.

Leaks per 100 miles of distribution pipe =

total leaks (other than 3rd party damages)

total miles of distribution pipe / 100

Maximum Performance = 6.5 Maximum performance is the AGA 1st quartile five year average of 6.5.

Target Performance = 9.7 Target the 4 year average for NorthWestern actuals at 9.7. This is in line with last year in that it uses an average of NWE actual figures since the major process change in 2019.

Threshold Performance = 13.6 Threshold is the AGA 2nd Quartile five year average at 13.6.

NorthWestern Energy 2024 Annual Incentive Plan

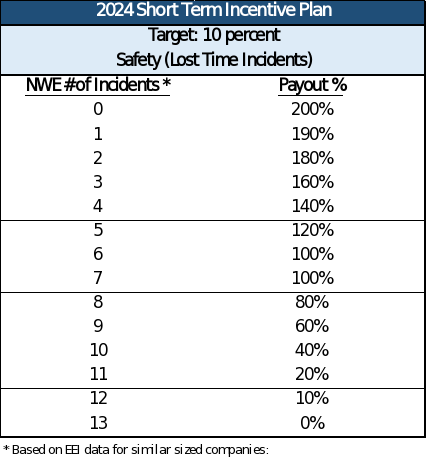

SAFETY

Safety performance is determined based on Lost Time Incidents. A Lost Time Incident is an incident in which an employee experiences a job-related injury that results in the employee missing work due to the injury. Determing when an incident is a Lost Time is based on OSHA standards. NorthWestern Energy utilizes EEI benchmarking to determine the payout matrix.

Lost time incident metrics are as follows:

Maximum Performance = 0 Lost time incidents

Target Performance = 7 Lost time incidents

NorthWestern Energy 2024 Annual Incentive Plan

Threshold Performance = 13 Lost time incidents Safety and Security training completion includes “completion” of assigned safety and security training for all Northwestern Energy employees through the learning management system by taking the total courses assigned less total courses overdue and dividing by the total courses assigned. The calculation shall exclude any courses that are assigned to be completed after the Performance Period, and a course that is assigned to be completed before the end of the Performance Period will be considered “overdue” if it is not completed by the end of the Performance Period.

Total % Completion = total courses assigned – total courses overdue

total courses assigned

*Calculation excludes inactive employees at year-end, such as those on disability or using accrued time off to retirement.

Maximum Performance = 100% safety training complete

Target Performance = 99.5% safety training complete

Threshold Performance = 99.0% safety training complete

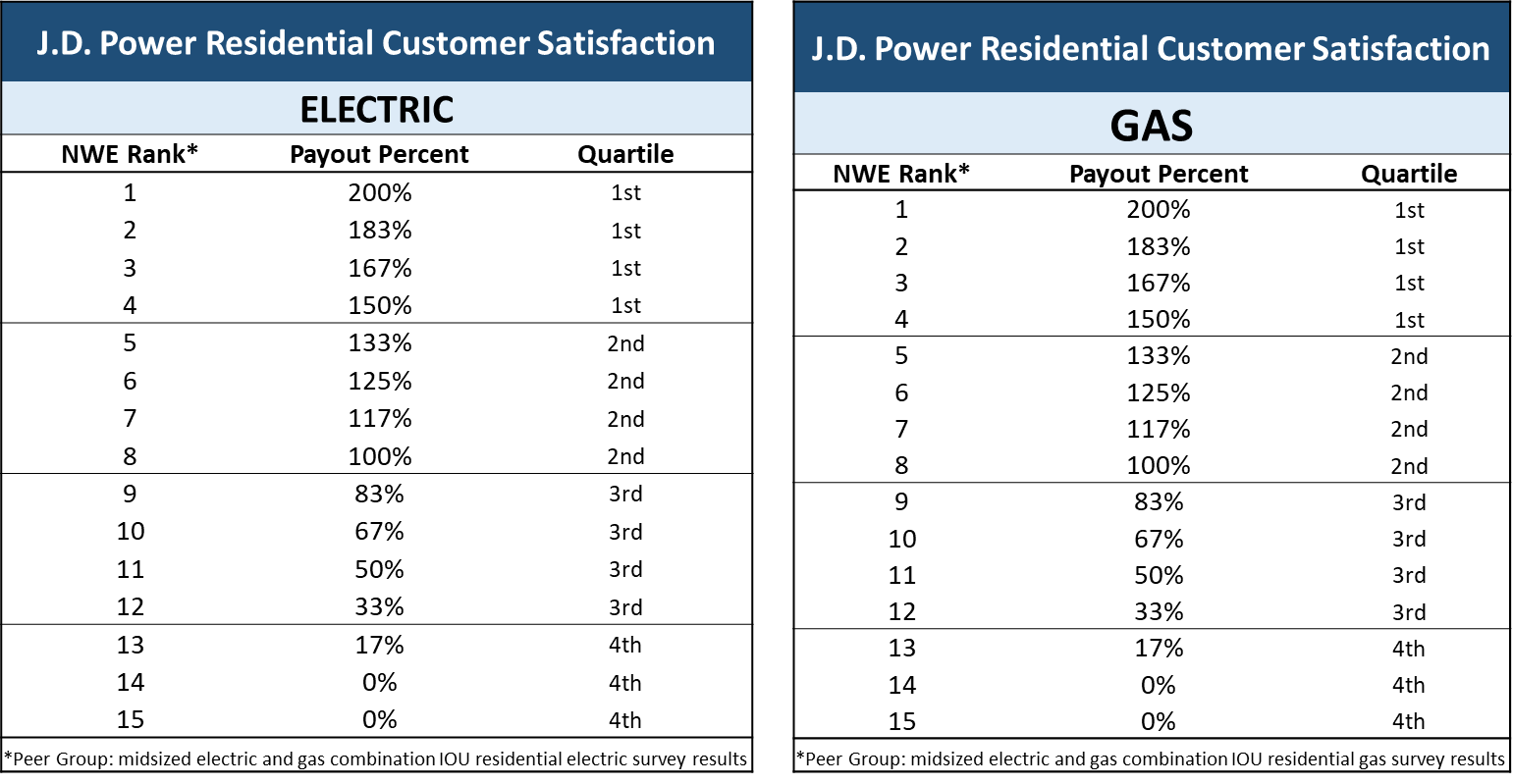

CUSTOMER SATISFACTION

Customer satisfaction is measured by the annual J.D. Power residential electric and gas survey.

J.D. Power is a global marketing information services company providing performance improvement, social media and customer satisfaction insights and solutions. J.D. Power results are measured against a peer group of mid-sized combination electric and gas utilities.

The J.D. Power model includes the following six components:

1.Communications

2.Corporate Citizenship

3.Billing and Payment

4.Price

5.Power Quality and Reliability (electric) or Field Services (gas)

6.Customer Service

J.D. Power metrics are established as follows:

Maximum Performance = rank vs. mid-sized IOU peers of 1

Target Performance = rank vs. mid-sized IOU peers of 8

Threshold Performance = rank vs. mid-sized IOU peers of 14

NorthWestern Energy 2024 Annual Incentive Plan