Arm Holdings plc Annual Report and Consolidated Financial Statements For the year ended 31 March 2025 (Registered Number: 11299879) Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Page(s) Summary Information 1 Strategic Report 2 to 27 Directors' Report 28 to 32 Corporate Governance Report 33 to 44 Directors' Remuneration 45 to 56 Directors' Responsibilities Statement 57 to 58 Independent Auditor's Report to the Members of Arm Holdings plc 59 to 67 Consolidated Income Statement 68 Consolidated Statement of Comprehensive Income 69 Consolidated Balance Sheet 70 to 71 Consolidated Statement of Changes in Equity 72 to 73 Consolidated Statement of Cash Flows 74 Notes to the Consolidated Financial Statements 75 to 147 Company Balance Sheet 148 Company Statement of Changes in Equity 149 Notes to the Company Financial Statements 150 to 156 Arm Holdings plc Contents Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

About Us The future of computing is built on Arm. Arm is the industry leader in the design of CPUs and compute platforms for semiconductor chips. The CPU is the brain of the chip and we architect, develop, and licence high-performance, low-cost, and energy-efficient CPU products and related technology, on which many of the world’s leading semiconductor companies and OEMs rely to develop their products. Our compute platforms combine our CPU products and related technologies into a better starting point for our customers' chip designs. Our energy-efficient CPUs have enabled advanced computing in greater than 99% of the world’s smartphones that were sold in the fiscal year ended 31 March 2025 ('FYE25'). Cumulatively, our customers have now shipped more than 310 billion Arm-based chips, powering everything from the tiniest of sensors to the most powerful supercomputers. Today, any company can make a modern computer chip through the unique combination of our energy- efficient compute platforms, and our unmatched ecosystem of technology partners, and to do it cost effectively due to our flexible business model. Each CPU or compute platform can be licenced to multiple companies, leading to economies of scale that allow us to charge each licensee only a fraction of what it would cost them to develop internally, while minimising their risk and time-to-market. Our customers include some of the world’s largest companies including Advanced Micro Devices, Inc., Alphabet Inc., Amazon Web Services, Inc., Intel Corporation, MediaTek Inc., Microsoft Corporation, NVIDIA Corporation, Qualcomm Inc. and Samsung Electronics Co., Ltd. Our primary markets include smartphone applications processor and other chips used in mobile phones, consumer electronics, networking equipment, cloud and data centre servers, automotive applications, Internet of Things (IoT) and other embedded computing devices. In all of these devices, artificial intelligence ('AI') and machine learning are becoming increasingly important. In the data centre, companies like NVIDIA are deploying Arm-based chips to run complex generative AI algorithms. In mobile, companies such as MediaTek and Samsung have introduced new smartphone capabilities including live translation. We are also seeing AI being deployed to improve automotive applications such as spotting hazards, and in embedded applications such as electronic door-locks where an AI- enabled camera is used to identify known faces to unlock the door. All of these new capabilities are enabled by Arm technology. Arm Holdings plc Summary Information 1 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

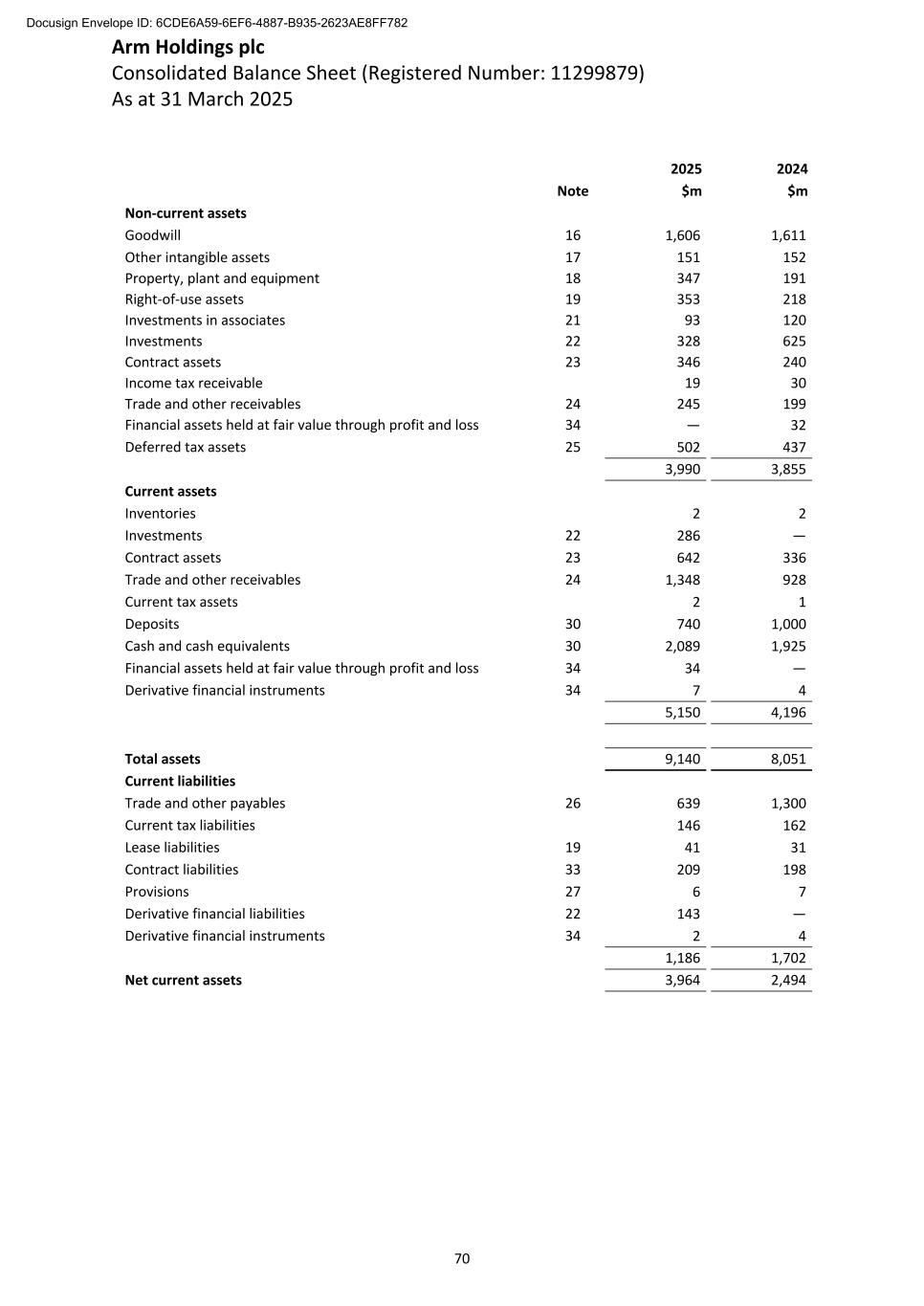

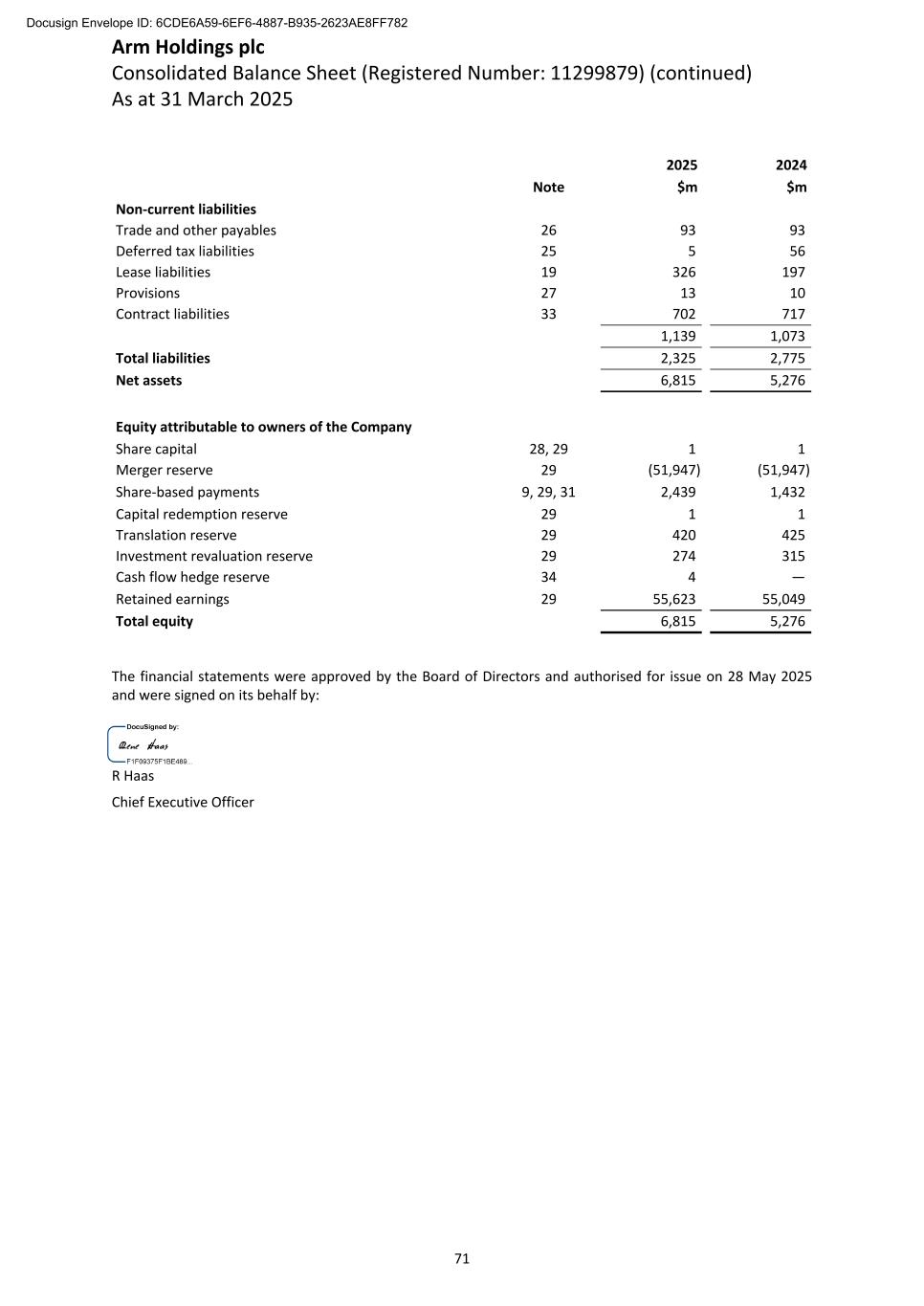

The directors present their Strategic Report for the Arm Holdings plc Group (‘the Group’, ‘Arm’) for the year ended 31 March 2025. The Group comprises Arm Holdings plc (‘the Company’) and its subsidiary undertakings. Financial and non-financial highlights The key financial and non-financial metrics, as presented in the sections of this report entitled Review of the business and Key performance indicators, are summarised alongside their comparatives below. 2025 2024 $m $m Group revenue 4,007 3,233 Total operating costs for the Group 3,076 2,882 Profit before tax for the Group 756 312 Net assets for the Group 6,815 5,276 2025 2024 Number of extant Arm Total Access licences 44 31 Number of extant Arm Flexible Access licences 314 222 Average employees for the Group 7,676 6,557 Review of the business The principal operations and activities of the Group are the licensing, marketing, research and development of CPU design intellectual property ('IP'), graphics processors, system IP, physical IP, market optimised platform IP, and associated software, tools and other related services. The Group’s revenues for the year ended 31 March 2025 were $4,007 million (2024: $3,233 million) comprising income from licensing Arm's technology designs, royalty fees on chips containing Arm's designs, and the sale of development tools and services. The increase in revenue is primarily due to new licensing agreements, renewals of existing license arrangements by customers to gain access to the latest versions of Arm's technology IP, higher chip shipments, and an improved mix of products with higher royalty rates per chip. Total operating costs for the year ended 31 March 2025 were $3,076 million (2024: $2,882 million). The following are key impacts for the year ended 31 March 2025 that, in combination, have resulted in a net increase in operating costs, in order of impact, highest first: • The increase in the number of employees for the Group, principally due to increased investment and demand for engineering; • The net cost increase to employee remuneration as a result of a new reward structure introduced at the beginning of the period; and • Increased information technology ('IT') expenses, primarily driven by continued engineering demand for cloud based services. Profit before tax for the year ended 31 March 2025 was $756 million (2024: $312 million). At 31 March 2025, the Group had total cash, short-term deposits and long-term deposits of $2,829 million (2024: $2,925 million) and total net assets of $6,815 million (2024: $5,276 million). The decrease in total cash and deposits is primarily driven by the timing of employment tax payments made in the current period and changes in working capital through the normal course of business. Arm Holdings plc Strategic Report 2 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Future developments The Group’s stated objective is to establish a global standard for its technology in the semiconductor industry. The directors believe that to achieve this goal it is important to expand the number and range of potential customers for its CPU and related products. The Group intends to enter into licence agreements with new customers and to increase the range of new products supplied to existing customers. The Group continues to evaluate opportunities, potential investments and technical partnerships to develop new technologies and advanced products, and thereby expand beyond individual design IP elements to providing a more complete system and custom chips for specific applications. Relationships will continue to be established with vendors of third-party tools, and software providers, to ensure that their products will operate with the Group’s products. Arm's long term strategy promotes multiple growth drivers: • Growth will be driven by royalty revenues. Demand for Arm-based compute is expected to continue across all market segments, especially as AI is deployed in all applications, from the most advanced data centres to the smallest edge devices. • Growth will be driven by the need for more energy-efficient compute and AI capability from the data centre to edge computers. As the amount of compute to run these complex AI workloads is increasing exponentially, so the amount of energy required will increase too. Arm's energy-efficient technology is being chosen by some cloud service providers to meet the demand for more compute whilst limiting the amount of additional electricity needed. • Growth will be driven by Compute Subsystems. Complex chips are becoming more difficult to develop leading to higher costs and longer design cycles. Arm is developing compute subsystems based on Arm's existing CPU and related technology that help to reduce that complexity, cost and time-to-market. • Growth will be driven by Arm’s unique ecosystem of software and design partners. Arm already has the world’s largest compute ecosystem with more than 22 million software developers and continues to increase investment across all market segments to accelerate software development on Arm. Key performance indicators For the purposes of this annual report, the key metrics disclosed under the Financial and non-financial highlights section above reflect the key performance indicators of the Group. Performance of these metrics is considered both in the Review of the business above and this section. The Group’s strategy enables key growth drivers that are measured on a regular basis. Building the base of licences that will drive future royalties: The Group mainly licences its products to semiconductor companies, original equipment manufacturers and other technology companies. Licence arrangements are typically multi-year and include obligations for the customer to pay Arm a royalty fee for every chip that contains Arm's products. During the year ended 31 March 2025, the Group saw strong demand for its technology. This demand was primarily due to new products introduced by Arm over recent years, the continued success of Arm's licensing model enabling more customers to access Arm technology, increased intensity of R&D investments from customers as they develop AI-enabled chips, and new customers licensing Arm technology for the first time. Arm considers the number of extant Arm Total Access and Arm Flexible Access licences as a key performance indicator as it represents the increasing collaboration between Arm and its customers, which could be a leading indicator to more chips being designed with Arm's products and, accordingly, more recurring royalty revenue in the future, improving long-term market share. As at 31 March 2025 the number of extant Arm Total Access licences were 44 (2024: 31) and extant Arm Flexible Access licences were 314 (2024: 222). Investing in the Group’s people and systems: the Group's people design and deliver Arm's products to its customers, and support the ecosystem of companies which brings that technology to market. Arm's goal is to attract talent from graduates to seasoned industry experts. Arm invests in its people, developing them and providing a supportive culture to maximise their capability and potential. During the year ended 31 March 2025, the Group had an average of 7,676 employees (2024: 6,557). The growth in employees from the prior year reflects the Group's continued investments in developing AI-capable CPUs and related products. Arm Holdings plc Strategic Report (continued) 3 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Impact of geopolitical events on Arm’s business performance Ongoing conflicts around the globe, such as the war in Ukraine, have had little direct impact on the business performance of the Group in the fiscal year ended 31 March 2025. The semiconductor industry can also be indirectly impacted through the disruption of global supply chains, increased cost of energy and raw materials, and the potential impact to consumer confidence around the world. During the fiscal year ended 31 March 2025, US trade restrictions on China had an isolated impact on Arm's direct and indirect licensing activities. Whilst licensing continued for the majority of customers in China, a small subset of customers faced limitations in their access to necessary technologies. Arm continues to monitor the long-term demand for its products and will adjust its strategy accordingly. Principal risks and uncertainties The Group’s robust risk management and internal control processes are in place to identify risks, assign ownership for each risk at a senior management level, identify both existing and planned management activities to mitigate each risk, assess the residual likelihood and impact of each risk, and ensure ongoing monitoring and reporting of each risk. These risk management and internal control processes have remained in place for the period under review including up until the approval of this report. The principal risks and uncertainties of the Group, which include those of the Company, are: A change in the industry business dynamic may lead to loss of market share and/or reduction in value of Intellectual Property, or a competitor’s product or technology may lead to loss of market share The Group’s technologies and services face significant competition. It is expected that competition will increase as current competitors expand their product offerings, improve their products or reduce the price of their products as part of a strategy to maintain existing business and customers or attract new business and customers, as new opportunities develop, and as new competitors enter the industry. Competition in the industry is affected by various factors that include, among others: original equipment manufacturer concentrations, vertical integration, changes in customer demand, consumption and competition in certain geographic regions, government intervention or support of national industries or competitors, evolving industry standards and business models, evolving nature of computing, the speed of technological change, value-added features that drive selling prices, and consumer demand for end-products. Arm’s development of compute subsystems (‘CSS’), chiplets, and complete end chip solutions as well as other more integrated compute products may subject Arm to new or enhanced risks To remain competitive, Arm must continue to innovate and develop new products and services, as well as enhancements to existing products and services, in response to expressed or anticipated customer demand and market opportunities. This has resulted in Arm allocating resources to, and exploring, new markets and/or different products and solutions for existing and prospective customers in various end markets. Any products or solutions that constitute an entry into new markets or offerings of different solutions may be unsuccessful for any number of reasons. As with any company entering a new market or offering new products or solutions, Arm will compete with companies that have a more established presence, long-standing customer relationships and established brand awareness or may have significantly greater resources dedicated to such markets and solutions than Arm. Further, Arm’s customers may prefer to continue integrating Arm’s IP components in their products and solutions, and, therefore, Arm’s more integrated compute products may not be adopted by customers on Arm’s expected timeline or at all. To the extent any such developments in Arm's product offerings, and other future changes to Arm's products and services, create real or perceived conflicts with companies that are important to Arm's business, such customers or partners may terminate or materially reduce their relationship with Arm and seek alternative architectures or products from competitors. Failure to adequately fund research and development efforts may materially impair Arm’s ability to compete effectively To remain competitive, Arm must continue to innovate and develop new products, applications and enhancements to existing products and services, particularly as next-generation technology is adopted by market participants. Arm Holdings plc Strategic Report (continued) 4 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Principal risks and uncertainties (continued) Allocating and maintaining adequate research and development resources, such as the appropriate personnel and development technology, to meet the evolving demands of the market is essential to Arm’s continued success. Significant concentration in customer base, such that the loss of a small number of key customers could significantly impact the Group’s growth In the year ended 31 March 2025, Arm derived approximately 56% of total net revenue from its top five customers (including Arm China) (2024: 54%). Arm expects customer concentration of revenue to continue for the foreseeable future. Arm continually assesses opportunities to broaden its customer base and to retain and increase penetration with existing customers through its innovative products, business model and customer support. The Group may have to assert IP rights against infringers or defend itself against third parties who claim that Arm has infringed their proprietary rights Arm’s success and ability to compete depend significantly on protecting its intellectual property. Litigation brought to protect and enforce Arm’s intellectual property rights could be costly, time-consuming, and distracting to the Group’s business operations and could result in the impairment or loss of portions of Arm’s intellectual property. Any allegations made in the course of regulatory or legal proceedings may also harm Arm's reputation, regardless of whether there is merit to such claims. The Group maintains and supports an active programme to protect its intellectual property, primarily through the filing of patent applications. The Group further may have to defend its products in litigations brought by third parties who claim that such products infringe third-party IP rights. From time to time, Arm is involved in various legal, administrative and regulatory proceedings, claims, demands and investigations relating to the business, which may include claims with respect to commercial, product liability, IP, cybersecurity, privacy, data protection, antitrust, breach of contract, labour and employment, whistleblower, mergers and acquisitions and other matters. Arm is involved in pending litigation, including, but not limited to, lawsuits with Qualcomm Inc. and Qualcomm Technologies, Inc. (together ‘Qualcomm’) and Nuvia, Inc. (‘Nuvia’). Arm cannot provide any assurances regarding how any such litigation will be resolved, what benefits Arm will obtain or what losses might be incurred. In August 2022, Arm sued Qualcomm and Nuvia, in the US, on the basis that Qualcomm and Nuvia: (i) breached the termination provisions of Nuvia’s Architecture License Agreement (the ‘Nuvia ALA’); and (ii) will infringe Arm’s trademarks if Qualcomm uses them in connection with the Nuvia technology which is subject to a destruction obligation under the Nuvia ALA. Qualcomm originally responded and brought a counterclaim against Arm seeking a declaratory judgment that after Qualcomm’s acquisition of Nuvia, Qualcomm’s proposed products are fully licensed under its separate license agreements with Arm and that it has complied with its contractual obligations to Arm and Nuvia did not breach the Nuvia ALA. On 6 March 2024, the Court denied-in-part Qualcomm’s motion to amend its counterclaims, but allowed Qualcomm to raise a new claim alleging that Arm breached the termination provisions of the Nuvia ALA by continuing to use Nuvia confidential information following termination. The original claims were narrowed by both parties to the contractual issues arising from the Nuvia ALA and the Qualcomm license and were tried to a jury in December 2024. The jury failed to reach a complete verdict on the three issues presented to it. The jury concluded that certain technology was licensed to Qualcomm under the Qualcomm license and that Qualcomm had not breached the Nuvia ALA but failed to reach a verdict on whether Nuvia breached the Nuvia ALA. Both parties have filed post-trial motions seeking judgment as a matter of law and/or a new trial on the issues that were tried. Those motions remain pending. In April 2024, Qualcomm brought a new action in Delaware against Arm asserting claims that were rejected for inclusion in the original action. In this new action, Qualcomm asserted that Arm failed to satisfy certain delivery obligations under the Qualcomm ALA. In December 2024, Qualcomm amended its complaint to add allegations relating to an Arm notice of breach of the Qualcomm ALA and related tort and anti-competition claims. In March 2025, Qualcomm indicated that it planned to seek leave to amend its complaint again to add claims relating to an alleged breach of the Qualcomm TLA. Arm Holdings plc Strategic Report (continued) 5 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Principal risks and uncertainties (continued) Arm disagrees with the assertions made by Qualcomm in this action and intends to vigorously defend against them. The case is currently set for trial in March 2026. Further, Arm is subject to antitrust laws and regulations in multiple jurisdictions, which could subject it to investigations by antitrust regulators. These matters will likely require significant legal expenditures going forward and may also require substantial time and attention from the Group's executives or employees, which could distract them from operating the business. In addition, Arm's involvement in such litigation or in any antitrust investigation could affect the Group’s relationship with or revenue from Qualcomm or could cause the Group to incur significant reputational damage in the industry or in its relationship with other third-party partners. The Group could become a victim of a cyber-attack or an online attempt to defraud the Group Security breaches, computer malware, phishing and cyber-attacks have become more prevalent and sophisticated in recent years, including targeted attacks driven by AI tools. These threats are constantly evolving, making it increasingly difficult to successfully defend against them or implement adequate preventative measures. These increasing threats are being driven by a variety of sources, including nation- state sponsored espionage and hacking activities, industrial espionage, organised crime, advanced persistent threat actors, and hacking by groups and individuals. Bad actors may penetrate security controls and misappropriate or compromise confidential information, including that of employees or third parties. These attacks may create system disruptions or cause shutdowns. These actors may also develop and deploy viruses, worms and other malicious software programs that attack or otherwise exploit security vulnerabilities in the Group’s products. For portions of Arm’s IT infrastructure, including business management and communication software products, the Group relies on products and services provided by third parties. These providers may also experience breaches and attacks to their products which may in turn impact Arm’s systems. Data security breaches may also result from non-technical means, such as actions by an employee with access to the Group’s systems. Actual or perceived breaches of security measures or the accidental loss, inadvertent disclosure or unapproved dissemination of proprietary information or sensitive or confidential data about Arm, its partners, customers or third parties could expose the Group and the parties affected to a risk of loss or misuse of this information, resulting in litigation and potential liability, paying damages, regulatory inquiries or actions, damage to brand and reputation or other harm to the business. In such scenarios, an inaccessibility to systems, disrupted access to key infrastructure and Arm's ability to recover critical data in a timely manner may have a significant and detrimental impact on Arm's operations. A risk to business continuity may therefore arise without mitigating measures in place. Arm has invested significant effort in its cyber security capability across prevention, detection and response capability in recent years to ensure Arm has appropriate cyber resilience. This commitment remains as Arm continuously reviews the threat and risk environment and makes decisions and investments to minimise the risk of a cyber-attack materialising. This includes, but is not limited to, ensuring Arm has a security aware colleague population, reviewing and improving security controls both from a governance and technology perspective, as well as partnering with industry leading partners for expert skills and capabilities. Arm recognises that the risk of a security breach or other cyber incident cannot be fully eliminated and therefore has 24/7 detect and response capabilities, should a cyber-attack materialise. This allows Arm to rapidly respond and minimise impact and disruption to the organisation. Furthermore, Arm simulates and stress-tests major cyber incidents to contribute towards its cyber readiness capability, the learnings of which are implemented as part of a continuous improvement programme. The Group may have difficulty in attracting and retaining quality engineering talent, which could limit the Group’s research and development capability Arm’s future success depends largely upon the continued service of key management and technical talent, and on the ability to continue to identify, attract, retain and motivate them. Implementing the Group’s business strategy requires specialised engineering and other talent, as Arm’s revenues are highly dependent on technological and product innovations. The market for talent in the industry is very competitive. A number of competitors for talent are significantly larger than the Group and may be able to offer compensation in excess of what Arm is able to offer. Arm Holdings plc Strategic Report (continued) 6 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Principal risks and uncertainties (continued) Further, existing immigration laws in certain countries can make it more difficult for the Group to recruit and retain highly skilled foreign nationals. Arm’s recruitment, compensation, talent development and performance assessment programmes are designed to help attract and retain quality talent across engineering and management teams. The Group could suffer a loss of revenue, or an increase in costs, as a result of the impact of geopolitical factors, such as international trade disputes, which limit the Group’s ability to transact with customers in certain jurisdictions Arm’s revenue is generated from customers located in several jurisdictions and a substantial portion of assets and employees are located in the UK and the US. Risks associated with international operations, any of which could have a material adverse effect on business, liquidity, financial condition and/or results of operations, include: • political instability and the possibility of a deteriorating relationship between the nations in which Arm does business; • the imposition of new or modified international trade restrictions, tariffs, import and excise duties or other taxes which may impact end customer demand or disrupt supply; • restrictions on foreign ownership and investments; • restrictions on repatriation of cash; • changes in local political, economic, social and labour conditions; • a less developed and less certain legal and regulatory environment in some countries, which, among other things, can create uncertainty regarding contract enforcement, IP rights and liability issues; and • inadequate levels of compliance with applicable anti-bribery laws, including the Foreign Corrupt Practices Act and the UK Bribery Act of 2010. Any changes to the international trading system, or the emergence of an international trade dispute, could significantly impact the Group’s business and have a negative impact on revenues. For example, the recent resurgence and escalation of trade conflicts between the US and China and other major US trade partners may cause decreased demand for products that include Arm’s technologies, which could have a material adverse effect on business, liquidity, financial condition and/or results of operations. Further, the US and UK have trade and national security policies regarding exports to China and certain countries that the US Government suspects are supplying the PRC of technology with potential advanced compute, AI, advanced node semiconductor applications, or military uses that would require Arm to obtain export licenses for certain processors, which can be difficult to obtain. Although Arm’s inability to sell such high-performance computing ('HPC') or advanced compute processors into China has not had a material impact on Arm’s business to date, future restrictions on sales of our products into China could have a material adverse impact on Arm’s business. Arm has installed a compliance program to ensure adherence to various trade laws. Combined with customer need for certainty, Arm has been able to address customer demand by licensing other CPU cores that do not exceed the HPC performance or advanced compute export control thresholds but yet still present a compelling solution. The Group’s business and operating results could be affected by global economic conditions Arm could be impacted by adverse changes in global economic conditions, including rising inflation and interest rates, stagflation, or recession. Due to economic uncertainties in many of Arm’s key markets, customers of Arm and their customers may delay, suspend or reduce their purchases and investments or delay payment to Arm. Economic conditions may continue to deteriorate in the future which could result in reduced demand for Arm’s products and decreased licensing fees and royalty revenue. Arm Holdings plc Strategic Report (continued) 7 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement In this section, the directors report on the way in which they have discharged their duties under Section 172(1) of the Companies Act 2006 ('CA 2006'). In particular, this section describes how, in having acted to promote the long-term success of the Company for the benefit of its members, they have had due regard to the factors (a) to (f) listed under Section 172(1) of the CA 2006 in their decision making during the financial year ended 31 March 2025. Throughout FYE25, the Board of Directors of the Company (the 'Board') has continually monitored and assessed the effectiveness of stakeholder engagement activities, as described in this Section 172(1) statement and in the Corporate Governance Report found at page 33. The Board regularly receives reports from internal committees and at Board meetings addressing the topic of stakeholder engagement, including in the form of corporate governance briefings with an emphasis on stakeholder engagement provided by the Chief Executive Officer, as detailed within the Corporate Governance Report. This consistent consideration of stakeholders in the context of current developments facilitates the directors' performance of their duties, in particular ensuring that the impact on stakeholders is duly weighed as part of decision making by the Board. Further details of the particular responsibilities of certain of the directors of the Company and their risk management through Committee involvement are provided within the Corporate Governance Report. Examples of the manner in which the Board had regard to the factors set out in section 172(1) of the CA 2006 are given below: s.172(1)(a) The likely consequences of any decision in the long term and (e) The desirability of the Company maintaining a reputation for high standards of business conduct Principal decisions: Business Conduct The Board developed and approved the Arm Group budget and operating plan (the 'Operating Plan') for FYE25, and oversaw compliance with that Operating Plan for the remainder of the year. The Board also discussed the long-term strategy of the Arm Group throughout the year noting the need for a strategic focus and a strong software strategy due to the increasing demands for, and acceleration of, AI. People Management changes During Q1, Arm reduced its layers of people management, in line with other technology companies, and in turn increased the scope of control of the remaining managers. As a result, 2,245 of Arm's people experienced a change in their line manager out of a total of 7,606 people at the end of Q1. These changes were implemented to speed up decision making and increase alignment. At the same time, many teams took the opportunity to reorganise their team structures to ensure alignment with Arm's strategic priorities. These included changes in grade, managing underperformance and a small number of exits. Customer Engagement Model During FYE25, Arm adapted its customer engagement model to better serve its customers, and implemented a new three-tier system to optimise customer interaction and deliver greater value. As part of this, Arm remodelled its dedicated customer teams to focus on building stronger alliances and deeper partner relationships. Approach to Stakeholder Engagement: Arm monitors oversight of the Company's stakeholder engagement through dedicated teams that manage relationships with customers, partners, investors, governments, communities, and Arm's people to ensure that their needs are consistently sought and addressed. Other stakeholder groups, such as local community leaders, are engaged on an issue-by-issue basis. Whilst the Board maintains oversight of the Company's wide- ranging stakeholder engagement activities, it has delegated day-to-day responsibility for this engagement to its Executive Committee. Arm Holdings plc Strategic Report (continued) 8 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) Arm's Executive Committee comprises of Arm’s Chief Executive Officer ('CEO') and members of senior management who are each appointed to the Executive Committee by the CEO. The CEO also serves as a Board member, thereby ensuring smooth communication between the Executive Committee and the Board in relation to the Company's stakeholder interactions. To allow the Board to monitor the Executive Committee's stakeholder activities, it also receives regular extensive updates in the form of Board 'pre-reads', which are discussed at Board meetings. Through these Board pre-reads and the CEO's briefings, the Board reviews stakeholder data and feedback at each scheduled Board meeting. The Company's key stakeholders include its shareholders, people, suppliers, customers, investors, partners, governments and the local communities in which it operates. Engaging actively and meaningfully with these groups, and genuinely caring about their interests and success, is at the heart of Arm’s culture and Core Beliefs, which remained in place throughout FYE25. Arm's Core Beliefs are anchored in the Company's Code of Conduct and are outlined in greater detail within the Corporate Governance Report. The required behaviours of the Core Beliefs were updated during FYE25 to better drive Arm’s strategy. They will be reviewed and evolve further in FYE26 to ensure they continue to create a high challenge, high support culture that reflects the organisation’s strategy whilst fostering an engaging work environment. Arm's business is stronger because its Board and management understand how Arm's strategy impacts stakeholders, and because these values are embedded across its global organisation. Key engagements with Arm's people in FYE25 included Arm's Quarterly Business updates where the CEO and Executive Committee updated the business on financial and business performance, strategic developments and other company news. There were also regular Q&A sessions led by members of Arm's Executive Committee (acting under their delegation from the Board). Supplier and partner engagement, guided by Arm's Supplier Code of Conduct, included regular review meetings with its partners, Arm's 'Tech Talks' series, continuous focus on Arm's 'Responsible Procurement strategy', and conversations with suppliers about their carbon footprint, as further detailed under s.172(1)(c). Arm, via its Board and Executive Committee, also continued to foster meaningful engagement with its shareholders through investor conferences, earnings and investor calls, and Arm's quarterly shareholder letter. Thereby, stakeholder interests and views are factored into the Board's decision-making when resolving strategic decisions and entering into material transactions. This multi-layered, regular engagement enables Arm to develop and deliver objectives, strategies, and initiatives that respond to those stakeholder needs. This is further elaborated within the Corporate Governance Report. Standards of Business Conduct: To maintain high standards of business conduct through the leadership and oversight of the Board, the Company maintains, reviews and monitors engagement with a number of compliance policies to ensure they remain relevant to Arm, its people, partners, and compliant with applicable legislation. These policies include the Code of Conduct, which underpins Arm's operation as an employer, partner, and as a business. Arm's Board has established the standards set forth in the Code of Conduct and, directly or through the Chief Compliance Officer, oversees and monitors its compliance. The Board has tasked the Executive Committee with ensuring that the Code and other corporate policies govern the Company’s activities, and has delegated day-to-day responsibility for administering and interpreting the Code to the Ethics and Compliance Team. In alignment with Arm’s update of its Core Beliefs, the Code of Conduct was also updated in FYE25 to align with these Core Beliefs and to ensure it accurately describes the risks applicable to Arm in its ever-changing risk environment. Further details on Arm's Code of Conduct and related policies such as Arm's Supplier Code of Conduct, Modern Slavery Statement and Environmental Policy Statement are provided within the Corporate Governance Report. The Board approves these frameworks and monitors compliance with relevant governance standards to ensure that high standards are maintained across Arm's business, its workforce and its business relationships. Arm Holdings plc Strategic Report (continued) 9 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) s.172(b) The interests of the Company's employees Culture, Core Beliefs and Feedback The Board recognises the crucial importance of the Company's workforce and their perspective, which the Company demonstrates through its Commitments to its people, particularly in relation to the Company strategy and Core Beliefs. Arm's Commitments are a set of key principles relating to the experience of working at Arm. These include commitments to ensure everyone's work is valued, ensuring a welcoming and inclusive culture that allows individuals to make a full contribution to the Company's success, rewarding individuals competitively and equitably, and fostering an environment which encourages career progression and development. In furtherance of this, in Q1, the CEO led a Strategy and Culture all-hands meeting for all of Arm outlining his vision and strategy for Arm’s future and the culture that is needed to ensure Arm's ambitions are met, with over 6,000 people joining. Arm also held several department specific global conferences to motivate Arm’s people within engineering and for graduates. Arm’s Commitments will also be reviewed and will evolve in FYE26 to ensure Arm continues to offer a meaningful and competitive experience for its people, aligned with the Company's evolving business environment. Arm's people are encouraged to report concerns and raise questions through multiple channels including via ongoing Q&A sessions with members of the Executive Committee, including with the CEO, and senior leadership as well as smaller 'breakfast with the Executive Committee' sessions. Arm holds quarterly company- wide Business Updates ('QBUs') which are typically attended by over 4,000 individuals from across the Arm Group. As an example, the QBU held in May 2024 was attended virtually by 4,084 people plus additional people attending in person. During these sessions, Arm's Executive Committee provides updates on business performance, strategy and important aspects of life at Arm such as reward, sustainability or Arm's culture. QBUs also include Q&As allowing people across Arm to hear directly from the Executive Committee and ask questions. The Executive Committee was keen to visit as many Arm offices as possible throughout the financial year. Offices visited by the Executive Committee in 2024 included: in EMEA; Cambridge, Lund, Trondheim, Budapest, Sophia, Munich, Grasbrunn, in APAC; Bangalore, Noida and Taipei, and in the US; Austin, Boston, Chandler, Raleigh and San Jose. Other channels for Arm's people to raise concerns or issues include reporting directly to their manager, the People Team via the People Hub, Arm's Office of Ethics and Compliance and through an anonymous, global Raise a Concern Helpline, available to everyone at Arm. Arm runs annual employee engagement surveys to identify areas to improve the experience of its people. This year, the Company's overall Sustainable Engagement score, which indicates the degree to which Arm's people are motivated, enabled, and energised to deliver their best work, was 84%. 95% of Arm's people reported they were proud to work for Arm, maintaining the very high score achieved last year. Additionally Arm was ranked number one Best Place to Work, out of a list of the UK’s largest companies (those with over 1,000 people). The Best Places to Work list is compiled annually by Glassdoor, based on reviews shared by current and former colleagues. It is a great recognition of the culture being built at Arm. These continuous engagements and interactions place Arm's people at the heart of its decision and policy- making. The Board acknowledges that meaningful and effective engagement is a key element of Arm's ability to create value, recognising that Arm relies on an innovative workforce of passionate people. The Board regularly and extensively monitors and considers its people’s views gathered through the workforce interactions described above. Performance Management In pursuit of Arm's commitment to its people's development, it introduced a new approach to performance management, 'myImpact', with a focus on driving high performance, individual goal setting in co-operation with managers and the increased provision and receipt of feedback. Following its introduction, the enhanced focus on the use of goals was very well received and helped drive greater company-wide alignment with business strategy; this was evidenced by nearly all people documenting their goals on the system. Following this, individuals had a myImpact conversation with their manager, focusing on the behaviours needed for high performance. These were supported by a Conversation Tool to drive meaningful conversations. Arm Holdings plc Strategic Report (continued) 10 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) Health and Wellbeing Arm is continuously looking to improve the health and wellbeing of its people. The safety and welfare of its people, contractors, and visitors remain key priorities and shared responsibilities across its global workspaces. Arm seeks to promote physical, mental and financial wellbeing by offering a wide range of in-person and virtual services. These include the Global Employee Assistance Program and Arm's Wellbeing Hub, which provides additional resources such as a partnership with Walking on Earth ('WONE') to support proactive mental wellbeing, which was expanded globally across Arm in FYE25. A range of other benefits designed to promote wellbeing are also tailored to the context of each region. Arm organises specialist trainings, a quarterly 'Day of Care', where everyone in Arm takes the same additional day off work to focus on their wellbeing, and mental and physical health awareness campaigns such as 'Movember', which continues to be supported by Arm's CFO. Details of the Company's wellbeing initiatives and campaigns were regularly provided to the Board, ensuring its continuous oversight of Arm's people engagement and allowing it to monitor progress made in improving workers' health across Arm's global organisation. People Management Changes As mentioned under s.172(1)(a) above, during Q1, Arm reduced its layers of people management, in line with other technology companies, and in turn increased the scope of control of the remaining people managers. These changes were implemented to speed up decision making and increase alignment. Equity and Inclusion Arm knows that diverse teams drive innovation and creativity, excel at solving complex problems and make better decisions. The Company and its Board, along with the Executive Committee, are committed to fostering a culture of inclusion at Arm in which representation matters, its people are valued, different perspectives are heard, and everyone’s skills are fully utilised. Further details of Arm's people initiatives are provided in section (d) impact of the Company's operations on the community and environment of this Section 172 statement. Remuneration The Company introduced its 'Employee Stock Purchase Plan 2024' in September 2024 providing another way to remunerate its people by providing those eligible with the opportunity to purchase shares or ADSs at a discounted price. In addition, the Board and Executive Committee updated the overall compensation structure for Arm's people and, effective in FYE25, cash bonuses were replaced by increasing base salaries and additional RSU awards. s.172(1)(c) The need to foster the Company's business relationships with suppliers, customers and others The Company has established or updated various group policies addressing Arm's practices and requirements with respect to environmental protection, responsible sourcing, human rights, labour standards and ethics, diversity, and compliance. These policies are further detailed in Arm's Code of Conduct for Suppliers and its Modern Slavery Statement for FYE24, as approved by the Board, which is available on Arm's website at arm.com/company/sustainability/read-our-reports. Further details of the various Arm policies are provided within the Corporate Governance Report. Engagement In FYE25, Arm continued to engage with its suppliers, customers and partners to ensure these values were embedded across its global organisation and the Arm ecosystem. Arm's active engagement with and feedback received from these critical stakeholders foster a continual process of improving Arm's product offerings and licensing model. This supports Arm's aim to realise its vision of building the future of computing on Arm. Together. For everyone. Arm Holdings plc Strategic Report (continued) 11 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) Partners and customers During FYE25, Arm recognised the importance of adapting its customer engagement model to better serve its customers, and implemented a new three-tier system to optimise interactions and value delivery. As part of this, Arm set up dedicated teams for a number of customers to focus on building stronger alliances and deepening partner relationships. The central focus for the new system is on tailoring support methods to the strategic needs of Arm's partners and, as a result, putting the needs of the partners first. Arm continues to offer regular, structured review meetings with its partners, including key customers, in the form of strategic management reviews and technical reviews, and regular calls with customer account teams. In August 2024, Arm hosted its Arm Partner Meeting as an opportunity to continue to build face-to-face connections with customers. Throughout the year, Arm organised a range of Tech Symposia events, with Executive Committee members and other senior managers attending, allowing customers, investors and other key industry players and experts to come together to foster meaningful partnerships. Details of the Executive Committee's engagements were provided to the Board to allow the Board to monitor continuous stakeholder engagement by the Arm Group. Further customer and stakeholder engagement is regularly enabled through Arm's 'Tech Talks' series, whereby leading Arm experts together with certain strategic customers of Arm jointly deliver panels, workshops and online sessions to share technological insights and best practice across Arm's ecosystem. In addition to events, the Company diligently monitors key performance metrics to drive continuous improvement of its partner experience. This involves a systematic analysis of customer feedback, support interactions, and product usage data to identify areas for enhancement. By measuring customer satisfaction scores, net promoter scores, and retention rates, Arm gains valuable insights into the customer journey. This data-driven approach allows Arm to make informed decisions, tailor its services to better meet customer needs, and implement changes that lead to higher quality standards. The results of such metrics are provided to, and discussed with, the Board. Suppliers Arm's Procurement Transformation programme was implemented during FYE25 with a focus on delivering increased controls and compliance and ensuring delivery of value throughout the supply chain. As part of this, Arm now has a full team of Procurement Business Partners working on demand planning, issue resolution and opportunity identification. In addition, during Q1, the transition from an outsourced model of procurement support to in-house began with the aim to reduce inefficiencies in the supply chain, and its launch was completed in Q2. Payment terms were also changed for a number of existing suppliers to align with new standard payment terms, including more favourable terms available to small businesses. As a technology leader, Arm's business practices reflect its core values of fairness, openness, and integrity. This is how Arm is governed, how its people are treated, how Arm engages with local communities, and how Arm transacts business across its value chain. The Company expects all of its suppliers to act with the same fairness, honesty and integrity in all aspects of their business. Therefore, the Arm Supplier Code of Conduct articulates the ethical, social, and environmental standard which the Company applies to itself and to all of Arm's suppliers globally. During FYE25, the Arm Supplier Code of Conduct was updated, with approval of the Board, to include more robust provisions on sustainability, ethics and compliance expectations. In a similar vein, the new Supply Risk Management Framework was implemented to assist suppliers that pose a higher risk to Arm's business with mitigation plans being developed in conjunction with such suppliers. Arm continues to apply mandatory third-party verified self-assessments against the Arm Supplier Code of Conduct for select suppliers providing certain types of products, goods and or services, or for specific spend thresholds. Arm also reserves the right to undertake audits of suppliers in accordance with the requirements of the Supplier Code of Conduct, including on-site visits. Where checks do not meet Arm’s requirements, the Company is committed to working with its suppliers to achieve sustainable improvements. Arm's Anti-Bribery & Anti-Corruption Policy details its approach and commitment to Anti-Bribery & Anti-Corruption standards and how the Company expects Arm's suppliers to act and ensure that its standards are continually achieved. Arm requires its suppliers to comply with all applicable legal and ethical standards. Arm Holdings plc Strategic Report (continued) 12 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) They must equally be committed to preventing bribery and corruption in any form, including, but not limited to facilitation of payments, extortion, money laundering and other illegal or unethical gratuities or payments. To foster transparency within Arm's ecosystem, Arm has developed a 'Responsible Procurement strategy' to support the UN Sustainable Development Goals by working with Arm's suppliers. This strategy is designed to enable Arm to purchase products, goods and/or services that are in compliance with applicable regulations, and which are transparent, fair, ethical, environmentally friendly and socially responsible. Arm also launched its first Supplier Newsletter focusing on the Responsible Procurement Strategy during FYE25. The emphasis on meaningful conversations with suppliers continued throughout FYE25. To minimise the Group's environmental impact, Arm has committed to a 42% absolute reduction in supply-chain carbon, which is supported by its work with the CDP (formerly the Carbon Disclosure Project) Supply Chain. Through the CDP Supply Chain questionnaire, which Arm issued to its top 500 suppliers, the Company has gathered carbon emissions data covering 71% of its annual spend in relation to FYE24; with data for FYE25 being collected. This allows Arm to start engaging in discussions with suppliers who contribute most to Arm’s Scope 3 carbon emissions to understand what they are doing themselves to reduce their own carbon footprint and to identify opportunities to work together to reduce those emissions. The Board oversees sustainability- related matters such as these and has delegated authority to Arm's Sustainability Committee to set sustainability targets and review Arm’s performance against them. Further details on Arm's climate and sustainability work are provided within the Climate-related Financial Disclosure and the Environment section below. s.172(1)(d) The impact of the Company's operations on the community and environment Community 'Team Arm' is the Company's community volunteering and giving program, designed for Arm's people to act on social and environmental causes, delivered in partnership with charitable organisations. Everyone at Arm can use half a day each month of company time to volunteer. In FYE25, 1,888 people (20.7% of eligible people at Arm, including contractors) recorded over 16,000 volunteering hours. People at Arm's combined giving through volunteering and donations supported more than 1,100 causes. Team Arm’s ongoing volunteering survey reported that 65.7% of colleagues who have volunteered "feel that Arm’s senior leadership encourages colleagues to volunteer" and 84.7% said volunteering “increased my sense of pride in Arm”. In Q2 FYE25, Team Arm launched a company-wide year-long campaign designed to boost the wellbeing of Arm's people, thus supporting productivity and helping to maintain Arm’s high-performance culture. The ‘One Million Minutes’ campaign challenged colleagues to collectively track one million minutes of volunteering time (which equates to 16,667 hours, or 2.1 hours per person) for Arm’s local communities. In the first seven months of the campaign, colleagues tracked over 737,800 minutes – an 81% increase on the same period in FYE24. The campaign is supported by delivery of local office volunteering activities, which are co-ordinated by a network of Team Arm Champions. Activities included volunteering for a homelessness charity in Chandler, local park maintenance in Galway, a beach clean-up in Japan and organising essential items for those facing food poverty in San Jose. Global activities included sponsorship of a 24-hour mapathon hosted by Humanitarian OpenStreetMap Team, in which approximately 100 colleagues contributed to mapping parts of the world where humanitarian organisations need improved data to respond to emergencies. The campaign has also included a regular cadence of communications such as volunteer interviews, spotlights on charity partners, and updates from executive sponsor Gary Campbell, EVP, Central Engineering. Team Arm has a strategic focus on supporting young people from underserved and underrepresented backgrounds to build their knowledge and enthusiasm for science, technology, engineering and maths ('STEM'). Partnerships supporting this goal in FYE25 included: FIRST (a global robotics charity), the Micro:bit Educational Foundation (a not-for-profit organisation supporting children to engage with digital technology), Uptree (a careers network for sixth-form students in the UK), Cambridge Science Centre and The Tech Museum in San Jose. In addition to the above, during FYE25, Arm's people were involved in a number of different community initiatives and events. Some of which were as follows: Arm Holdings plc Strategic Report (continued) 13 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) • Arm's Social Impact Team hosted an internal Sustainability Spotlight with partner Jangala, whose work focuses on enabling equal access to the internet. Over 100 colleagues joined this hybrid event. To highlight the importance of this partnership, Arm currently has two engineers carrying out part time assignments with Jangala; • In furtherance of World Refugee Day on 20 June 2024, a number of Arm's global offices raised awareness of refugees during a week-long campaign of volunteering activities including a donation drive and packing day for World Relief Texas in Austin, a Lunch & Learn with Borderlands in Bristol, and a fundraiser and donation drive for Gathering Humanity in Chandler; • Following the launch in FYE24 of volunteer opportunities with Carbon13, an Arm Sustainability Partner which supports start-ups developing climate change solutions, volunteer engagement continues to be managed through Team Arm in FYE25; • A mentoring relationship was established between Arm technical volunteers and junior engineers in Ghana working at social impact partner, Amplio. The Amplio Talking Book is an easy-to-use audio device that delivers hours of targeted, local language content to low-literate users in remote rural areas; and • A collaborative event with Arm’s Women’s Network in partnership with Uptree where 50 female UK- based students from state school backgrounds joined Arm for an online ‘Insight Day’ where they engaged with several Arm’s UK-based female colleagues to learn more about their career paths to Arm and their experiences in the technology industry. To maintain oversight of the Company's community engagement, the Board received regular updates on these activities as part of its corporate governance briefings, mentioned above. Arm Education The mission of Arm Education is to help close the education, skills and research gaps in Computer Engineering and STEM. To assist with this, Arm continued its Semiconductor Education Alliance following its announcement during FYE24, with support from partners including Arduino, Cadence, Cornell University, the Semiconductor Research Corporation, STMicroelectronics, Synopsys, Taiwan Semiconductor Research Institute, the All-India Council for Technical Education, and the University of Southampton. By bringing together stakeholders across industry, academia and government, the Semiconductor Education Alliance addresses the challenges of finding talent and upskilling the existing workforce by offering education programmes and initiatives, preparing competency frameworks, accelerated educational, training pathways, resources, and services to build and support future talent pools. Environment Arm recognises that its day-to-day activities have an impact on the environment and considers environmental management to be an integral part of good business practice. In response to the climate crisis, Arm has committed to cutting its absolute Greenhouse Gas ('GHG') emissions by 50% from a FYE20 baseline across all emissions sources (Scopes 1, 2, and the six categories of Scope 3 relevant to Arm) by FYE30 in line with a 1.5°C climate pathway and the Paris Agreement. Arm set individual targets, in FYE20, to deliver this carbon emissions reduction target by 2030, including: • Sourcing 100% of electricity consumption from renewable sources by the end of FYE23 to achieve Arm's RE100 commitment; and to maintain this position post FYE23 to FYE30. Since FYE23, 100% of Arm's electricity consumption has come from renewable sources; • Achieve a 7% absolute reduction in emissions from business travel by FYE30 against a FYE20 baseline; and • Achieve a 42% absolute reduction in its supply chain emissions by FYE30 against a FYE20 baseline. Arm publicly reports progress towards its carbon emissions reduction target each year in Arm's Sustainable Business Report. Arm Holdings plc Strategic Report (continued) 14 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Section 172(1) statement (continued) Arm's Sustainability Committee, with delegated authority from the Board, reviews Arm’s carbon and energy performance against its targets and considers future targets. The Committee meets bi-annually and is chaired by the Head of Sustainability, and reports into the Executive Committee via the Chief People Officer. As reported in Arm's Sustainable Business Report for FYE24, published in September 2024, the Company achieved a 77% reduction in emissions versus its 2020 baseline as well as a 100% usage of renewable electricity, thereby remaining on track to meet its 2030 target. Further details on Arm's climate-related financial disclosures are provided on page 16 of the Annual Report. To further support the achievement of these targets, Arm also delivers initiatives to empower its people and support its supply chain partners to make low-carbon, sustainable choices, and promotes innovation in tech- based carbon-removal solutions. Arm aims to engage with its stakeholders to help meet its targets by increasing awareness of its environmental policy with its people, contractors, external suppliers and customers to encourage their adoption of environmental best practices. These efforts are directed by the Company's Sustainability Committee, as further detailed within the Corporate Governance Report. Further details of some of Arm's sustainability initiatives including some environmental initiatives are provided in section (c) Company's business relationships with suppliers, customers and others of this Section 172 statement. s.172(f) the need to act fairly as between members of the Company Shareholder Engagement as a listed company The Company qualifies as a 'controlled company' under the Listing Rule 5615 of The Nasdaq Stock Market LLC (‘the Nasdaq’), with SoftBank Group Corp. ('SoftBank Group') being a controlling shareholder with an indirect shareholding of around 87% as at 31 March 2025. SoftBank Group has the right to designate a number of candidates for election to the Board depending on its and its controlled affiliates’ level of ownership from time to time. By virtue of such representation at the Board level, SoftBank Group benefits from direct interaction and engagement with the Board and the Executive Committee, ensuring that its views and interests are considered fairly during Board meetings. However, despite SoftBank Group's position as controlling shareholder, Arm is run for the benefit of all its shareholders. The Board embraces transparency and inclusivity in its decision-making and wider shareholder communication, and actively engages with the Company's collective investor base through various forums. Arm's Board is committed to maintaining regular shareholder interaction and communication to understand shareholders' interest and concerns. This allows the Company to align the strategic discussions of its Board and decisions on Arm's strategy, operations and policies with the expectations of its investors. In FYE25, Arm's discussions with its shareholders focused on increased licensing revenue driven by investment in AI and the increased demand for enhanced and energy-efficient cloud computing systems. Key engagements between the Board and Executive Committee with the Company's shareholders, potential investors and financial analysts included Board and senior management attendance at Arm's quarterly earnings calls as well as the provision of comprehensive investor information about Arm and relevant matters of interest on Arm's website, including quarterly results, Annual Reports, investor presentations and shareholder letters: investors.arm.com. Arm Holdings plc Strategic Report (continued) 15 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Climate-related Financial Disclosure Arm Group, incorporating its subsidiaries, ('Arm', 'the Group') has complied with requirements 'a' through to 'h' of the Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022. Arm recognises the identification, quantification and management of climate-related risks and opportunities is an iterative exercise and will continually evolve. During FYE25, Arm focused on the alignment and integration of climate risks in Arm's risk management framework and revalidating the assumptions used for climate scenario analysis in the context of Arm's business and operations. Arm is also working to reduce its own Greenhouse Gas ('GHG') emissions. Arm has committed to cutting its absolute GHG emissions by 50% from a FYE20 baseline across all emissions sources (Scopes 1, 2, and the six categories of Scope 3 relevant to Arm) by FYE30 in line with a 1.5°C climate pathway and the Paris Agreement. Governance The Arm Board has delegated authority for sustainability-related issues, including climate-related risks and opportunities, to two subsets of the Executive Committee; the Sustainability Committee and the Risk Review Committee. This is supported by a corporate governance framework including a subsidiary governance policy that ensures the wider Arm Group reports relevant issues, such as climate-related matters, to the Executive Committee. Further detail is contained within the Corporate Governance Report. The Sustainability Committee is composed of senior executives and other senior individuals representing sustainability, finance, legal, strategy, technology, and people (HR). Arm’s Sustainability Committee, chaired by the Head of Sustainability, meets bi-annually, and reports into the Executive Committee via the Chief People Officer. The Risk Review Committee is responsible for overseeing Arm's risk management framework. The most important risks and opportunities are monitored on a quarterly basis, with the other most critical risks reviewed annually. New and emerging risks, including climate risk, are considered quarterly. The Board Audit Committee receives a quarterly update on the work of the Risk Review Committee. Arm's Chief People Officer is the executive responsible for climate risk. The Sustainability Committee and the Risk Review Committee report to Arm's Board, via the Executive Committee and Audit Committee, respectively, as required throughout the year. Arm's Board retains ultimate responsibility for these matters and reviews the information in this climate-related disclosure, at a minimum, on an annual basis. Arm’s Board has reviewed and approved this climate-related disclosure, as part of its annual review and approval of Arm’s Annual Report and Accounts. Further information on how the Board interacts with the Executive Committee can be found within the Corporate Governance Report. Arm Holdings plc Strategic Report (continued) 16 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

Climate-related Financial Disclosure (continued) Risk Management As part of the identification and assessment process previously completed in FYE24, Arm considered its exposure to a range of climate-related risks and opportunities including: i) physical risks in its own operations and wider value chain, ii) existing and emerging regulations across the breadth of industries that its IP products serve, iii) changes to consumer preferences due to more climate conscious behaviour, and iv) technology changes to support the transition to a lower-carbon economy. To determine the potential materiality of these climate risks, the impact and likelihood of each risk and opportunity was assessed against Arm’s risk management framework to provide a final materiality score. Following this risk identification process in FYE24, a shortlist of seven climate-related risks and opportunities was identified, including two physical risks, four transition risks and one opportunity. Due to the nature of Arm’s business model as an IP company generating revenue through licence fees and royalties, most of the identified shortlisted risks and opportunities are indirect in nature. Any macroeconomic changes resulting from the global transition to a low carbon economy, response to climatic events or long-term shifts will likely have a direct impact lower down the value chain on Arm's customers and the products they produce and sell containing Arm IP, which in turn could indirectly affect Arm's costs and revenues, in either positive or negative directions. Climate risk, including both physical and transition risk, is incorporated into Arm's risk management framework. During FYE25, the risk management framework was reviewed and updated against the shortlist of seven climate-related risks and opportunities identified through the process outlined above. The shortlisted climate-related risks detailed in the risk tables below are included in the risk management framework. During FYE25, Arm also reviewed and updated the wider risk management framework and introduced a system of risk stratification based on factors such as potential impact to Arm, likelihood, and velocity. There are four classes of risk, with class 1 risks considered most significant to Arm. As a result of this review, climate change was categorised as a class 2 risk with the risk categorisation being approved by the Risk Review Committee. Going forward, the Committee will review risk categorisation regularly, or following any major business transformation. The risk likelihood will be considered on a quarterly basis as part of Arm's enterprise risk management process. Climate Scenario Analysis and Strategy Arm conducted climate scenario analysis on climate-related risks and opportunities for the first time in FYE24, focusing on risks and opportunities that could have a material financial impact on the business over the short, medium and long-term. During FYE25, Arm reviewed and revalidated the underlying data and assumptions used for the climate scenario analysis and materiality scoring. The scenario analysis model was updated with new internal (e.g. revenue, energy use, estate location, floor space) and external (e.g. climate, weather, global GDP) data sets and the underlying assumptions were revalidated. The methodology for two risk scenario calculations was also updated in FYE25; the split of gas and energy prices was added as an improvement to the physical risk model, and carbon price data was added to the transitional legal risk model to improve the accuracy of the estimated financial impacts. As a result of the refreshed climate scenario analysis, Arm continues to consider its business to be resilient to the physical and transition risks under different climate scenarios. Based on the results of the scenario analysis, none of the shortlisted climate-related risks and opportunities were determined to be material to the business having considered any mitigating actions available, including future business cycles, and the resulting impact on Arm. Principal risks arise where climate-related risks hold the potential to have a significant impact on Arm's business model or strategy and having identified no material risks, climate is not currently considered a principle risk for Arm. Arm will continue to review these risks, conduct scenario analysis and consider the mitigating actions it can take to manage climate-related risks. Arm has also considered the impact of its climate risks and opportunities upon its current financial results, including estimates, and does not currently consider there to be a material climate-related impact on its financial statements. Arm Holdings plc Strategic Report (continued) 17 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

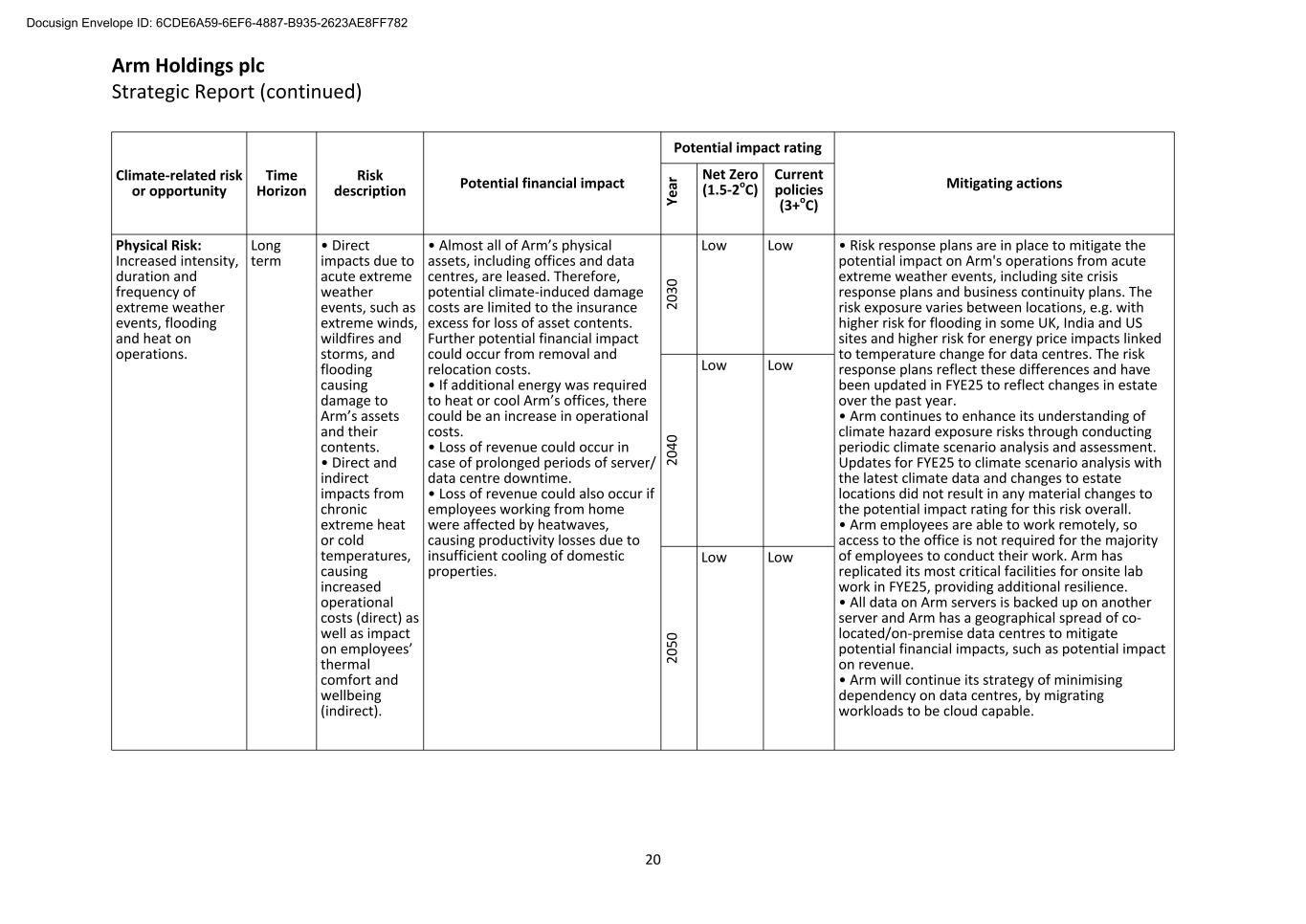

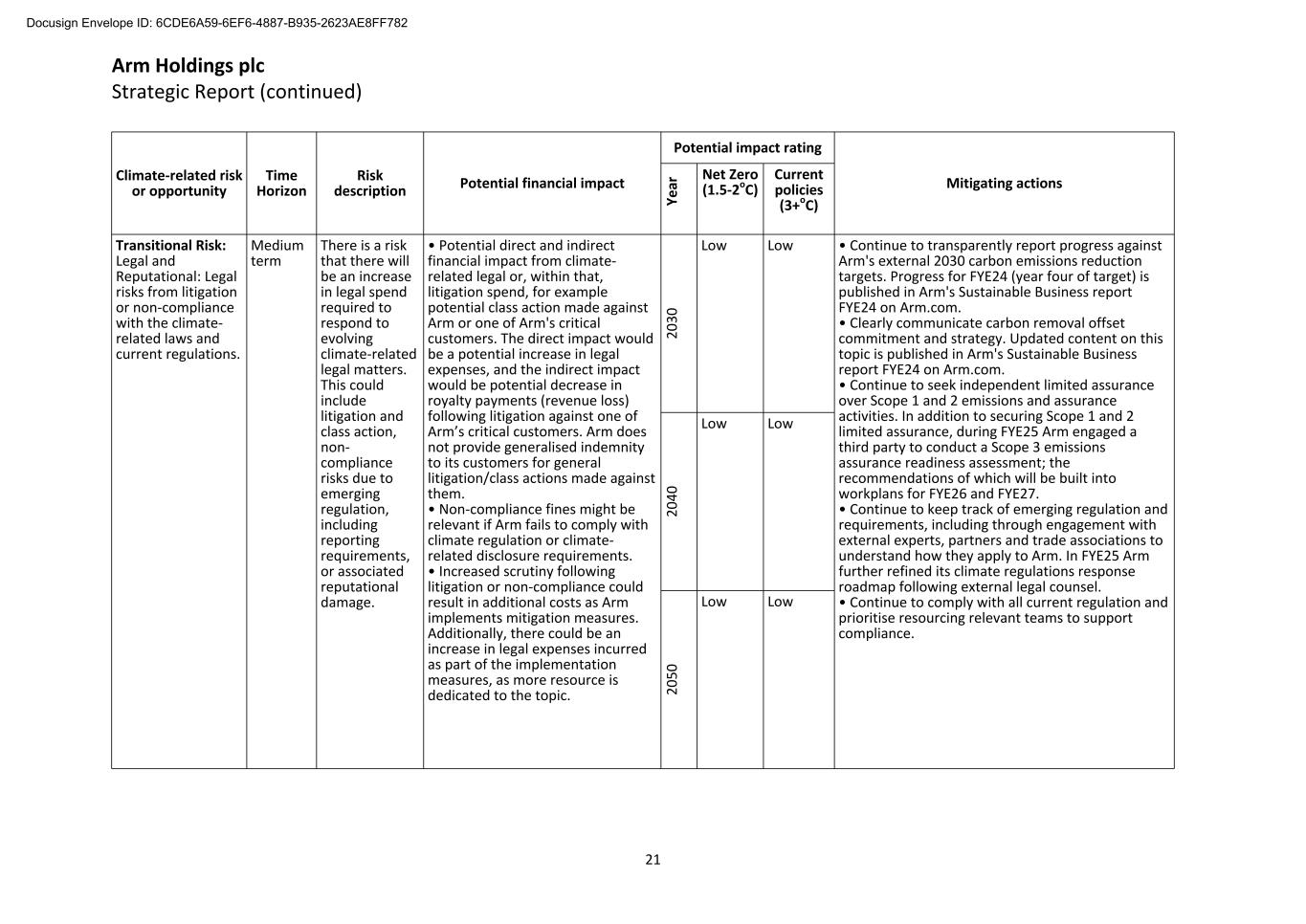

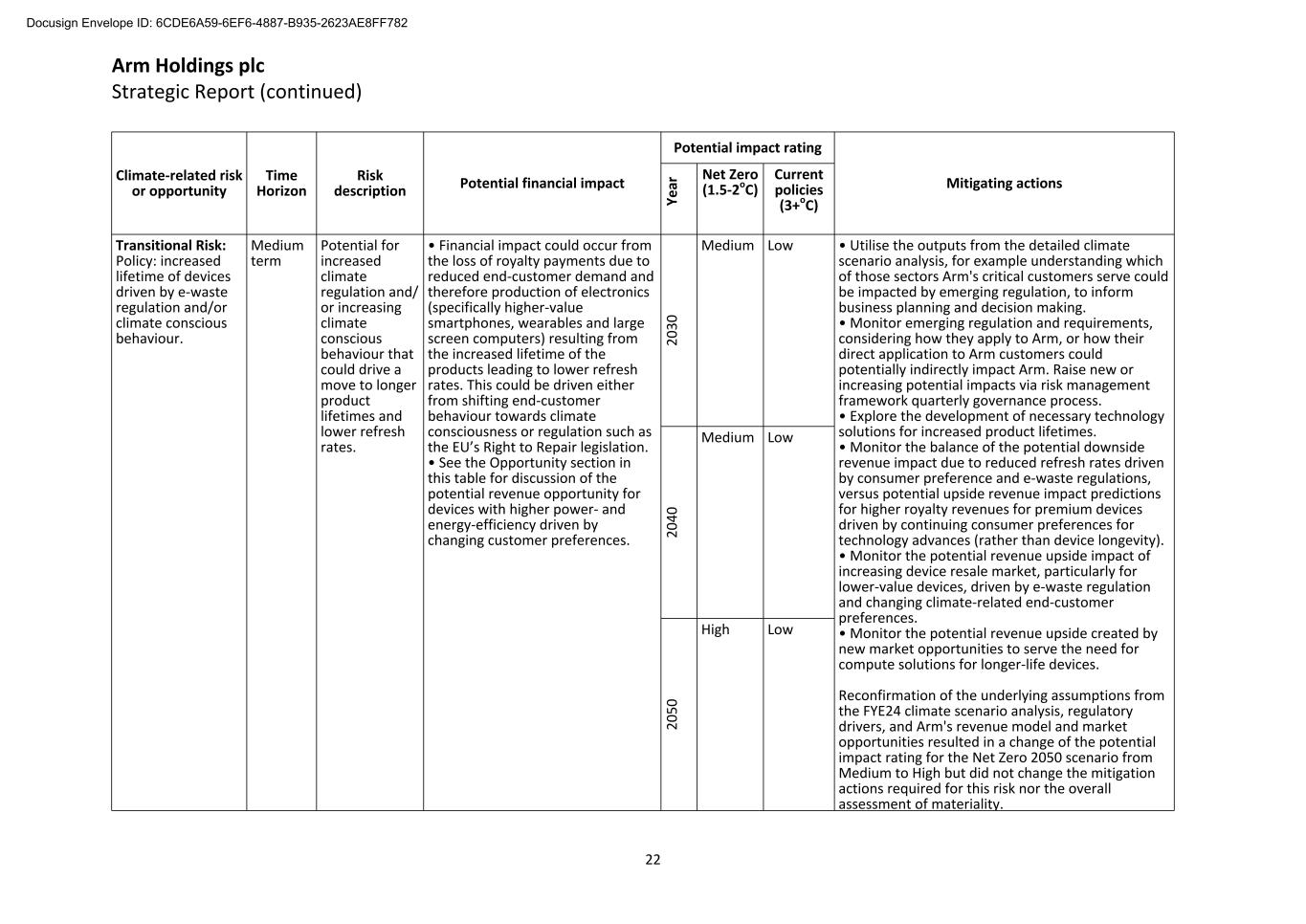

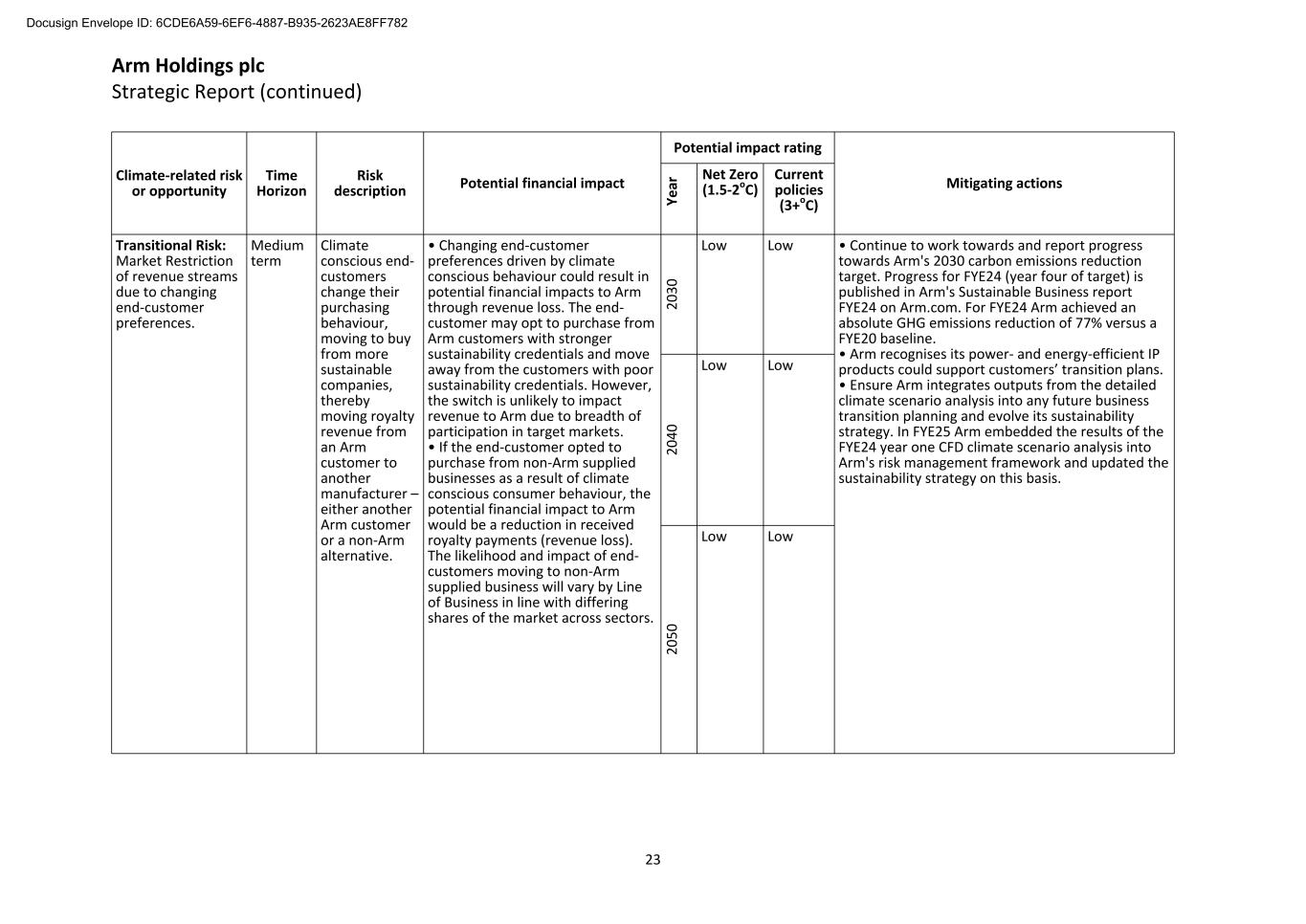

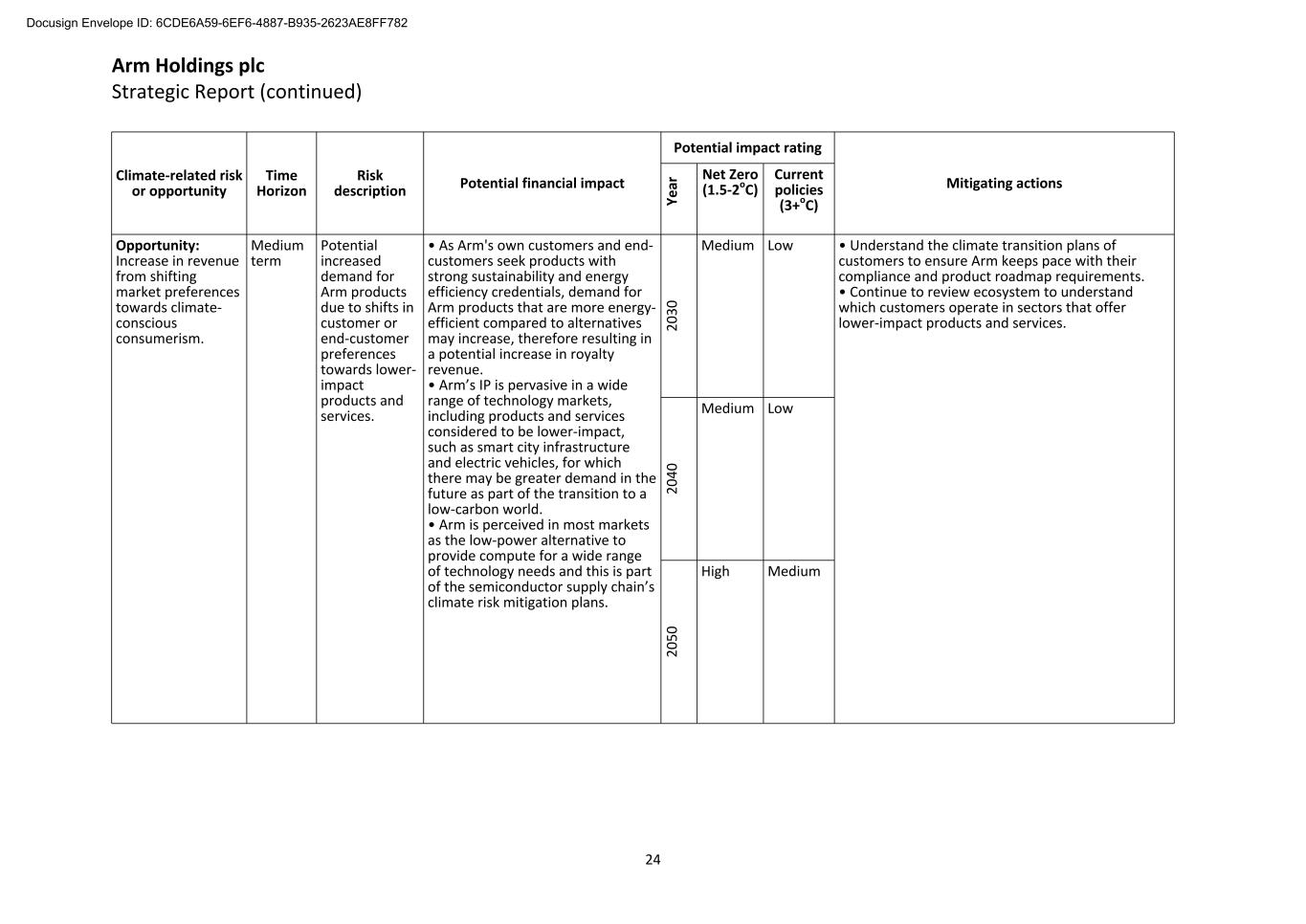

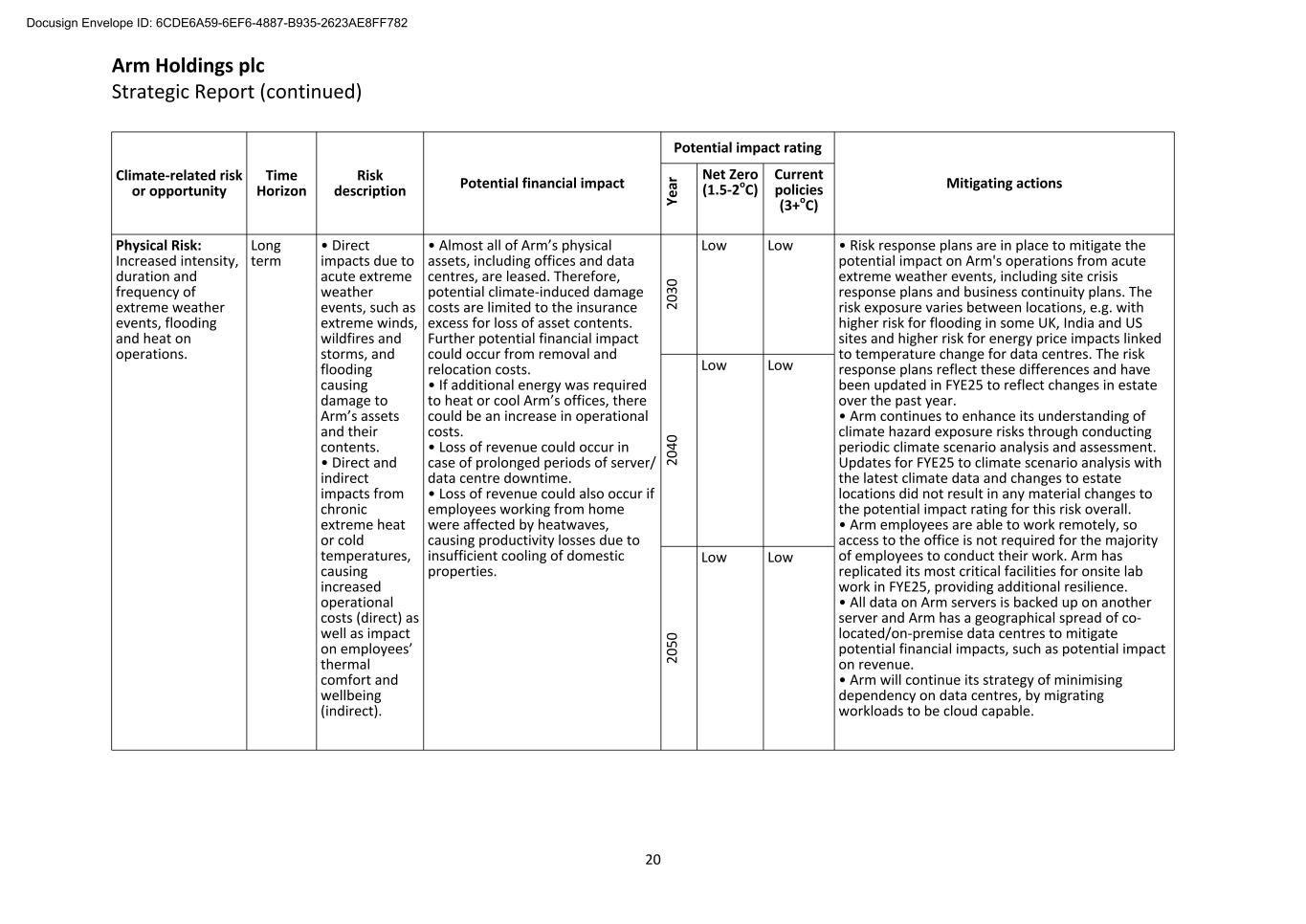

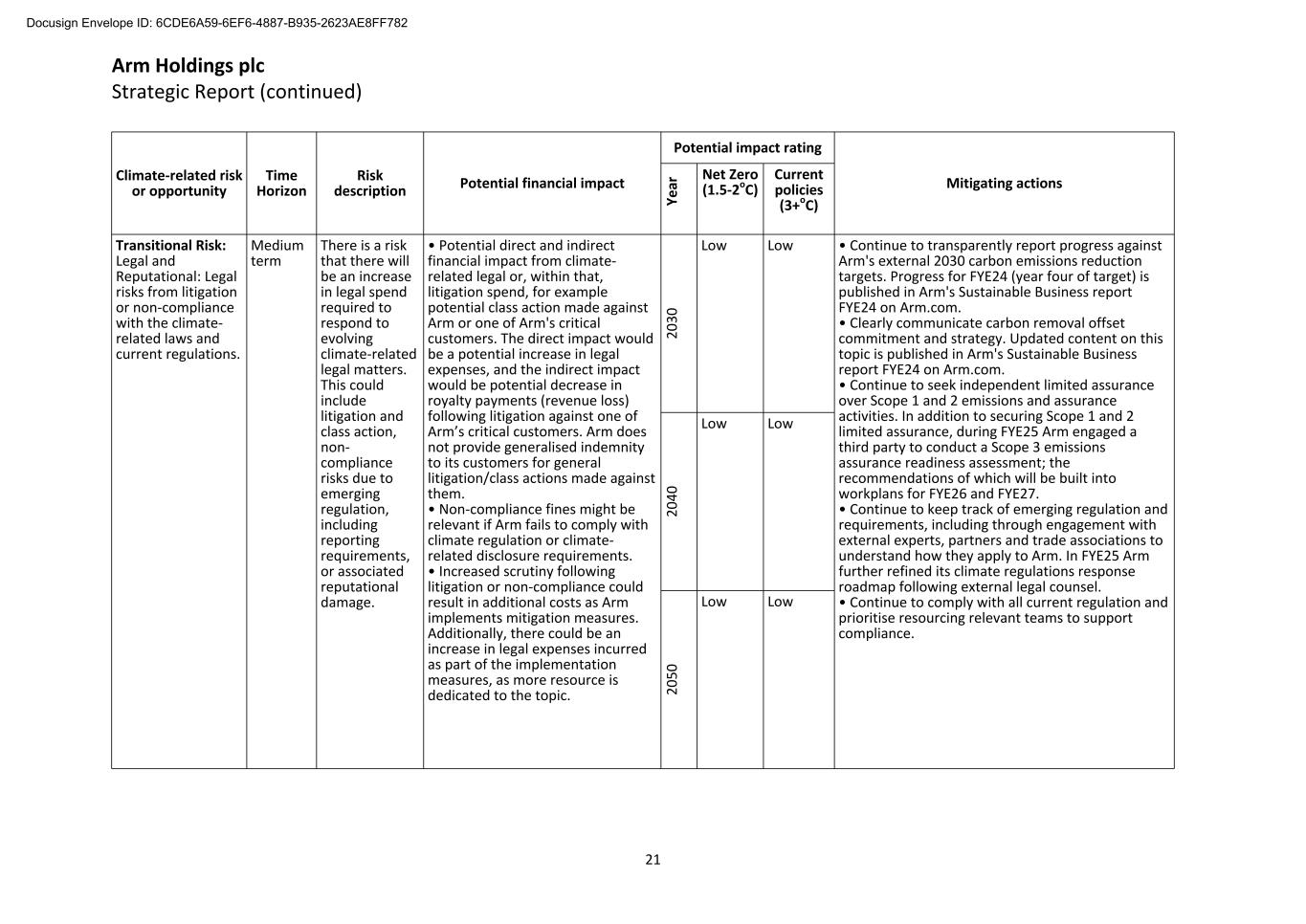

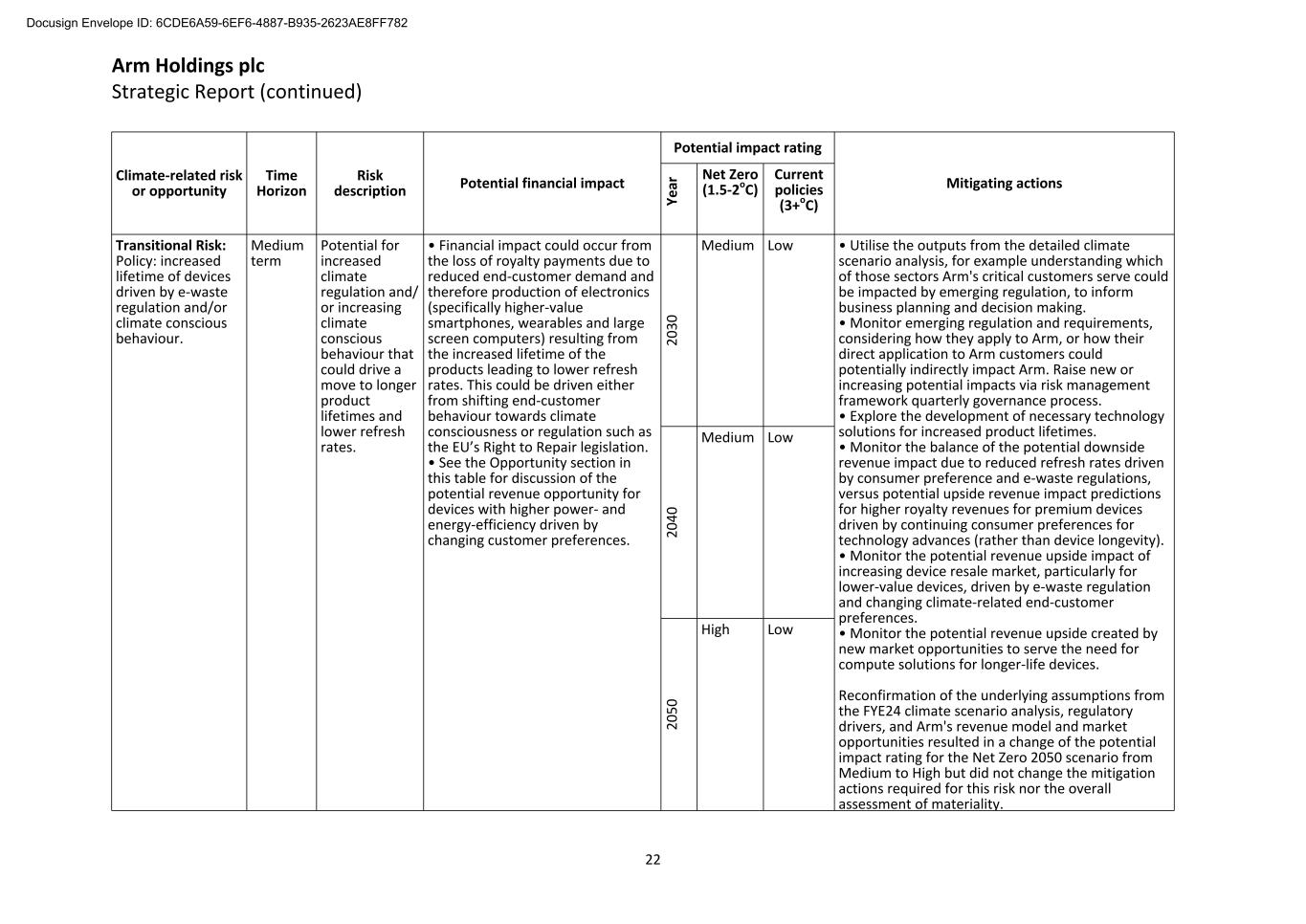

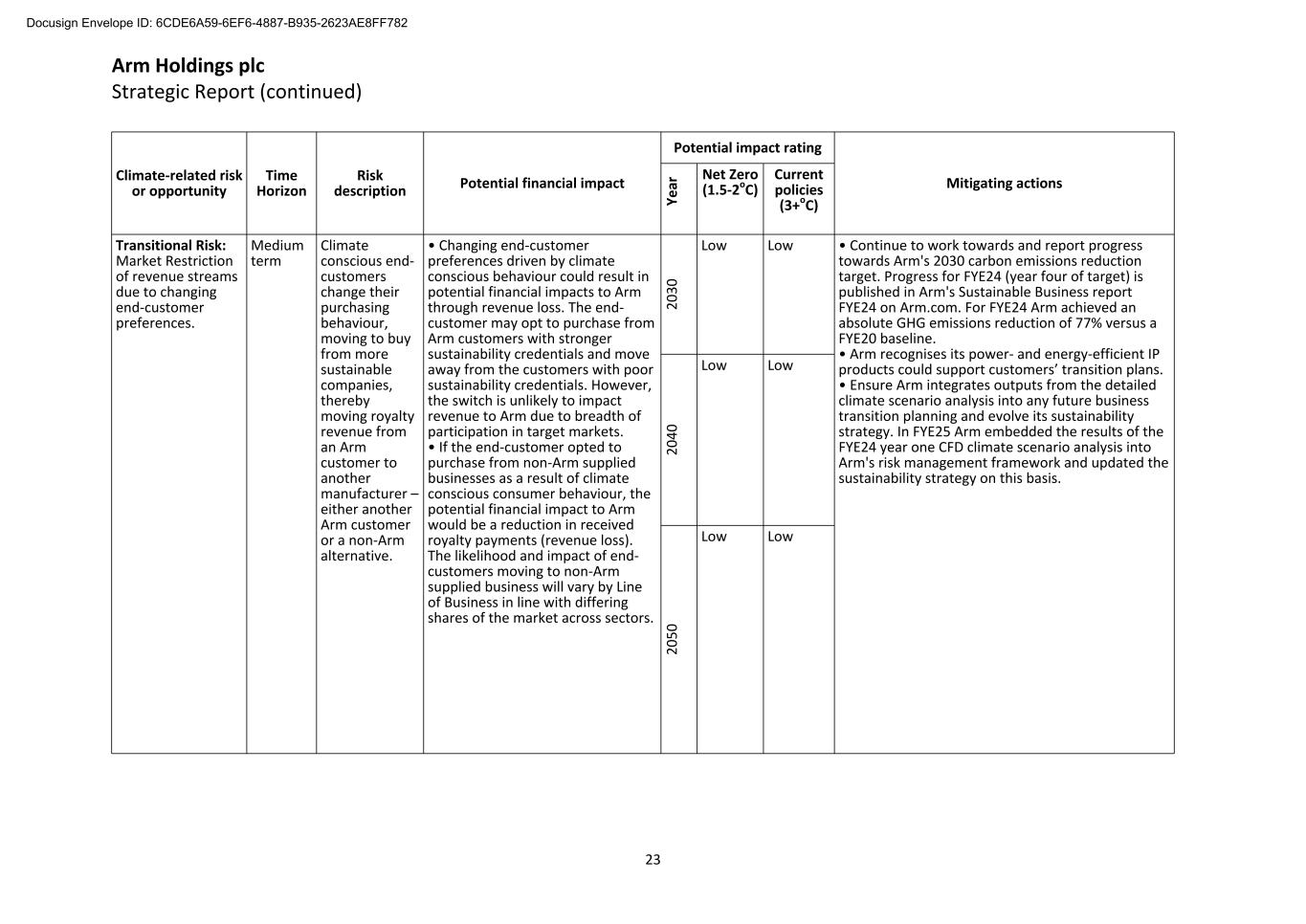

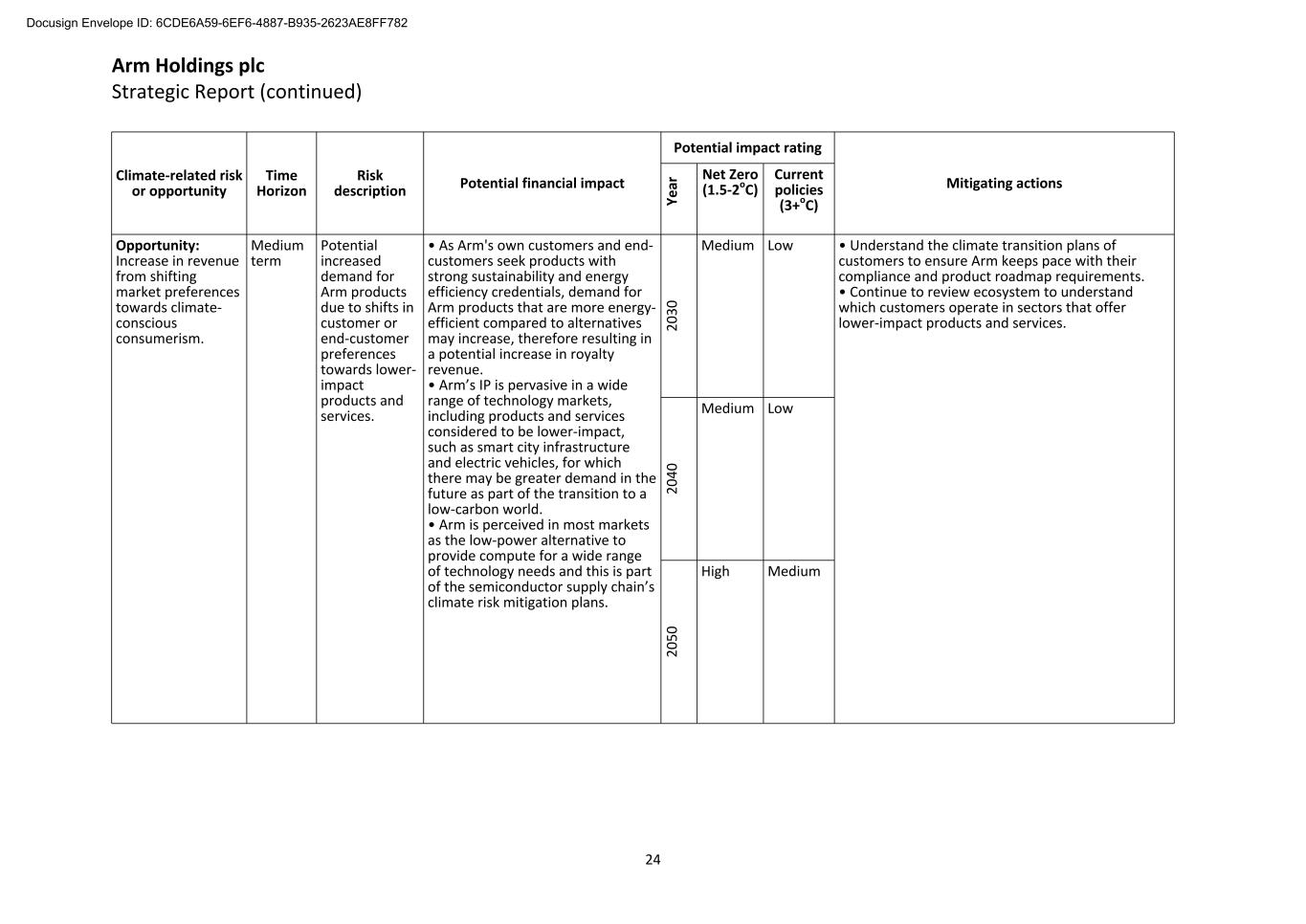

Climate-related Financial Disclosure (continued) Scenario analysis methodology A range of sources were used as part of the climate scenario analysis, including the Network for Greening the Financial System ('NGFS'), International Energy Agency ('IEA'), and the IPCC’s Representative Concentration Pathways ('RCPs') and Shared Socioeconomic Pathways ('SSPs'). These scenarios provide plausible projections of future macroeconomic and environmental states, based on key trends and inputs such as differing macroeconomic drivers and techno-economic outcomes and are not designed to deliver precise forecasts. In line with Arm’s context, the two extreme scenarios of optimistic 'net zero' and 'current policies' have been considered to allow for adequate testing of the resilience of Arm’s business and to capture the full range of potential impacts. With the support of an enlisted third party, the shortlist of seven prioritised climate-related risks and opportunities were assessed over short, medium and long-term horizons against the following scenarios: 1. Optimistic ‘net zero’ scenario: Associated with approximately 1.5 to 2°C global warming, which closely maps to the IPCC’s representative concentration pathway RCP2.6 and shared socioeconomic pathway SSP1. This scenario assumes all necessary climate policies are implemented sufficiently to achieve global net zero greenhouse gas emissions by 2050 and subsequently limit global warming to 1.5°C. This scenario expects transition risks, driven by changes in policy, markets and consumer behaviour, to have a much greater impact on society and business than physical risks; and 2. ‘Current policies’ scenario: Associated with 3°C+ global warming, which closely maps to the IPCC’s representative concentration pathway RCP8.5 and shared socioeconomic pathway SSP5. This scenario assumes that some climate policies are implemented, but some additional warming is still experienced. This scenario expects physical risks, driven by longer-term weather changes to have a greater impact on society and business than transition risks. In line with the CFD requirements and leading practice, the impact of these two climate scenarios on Arm's current business model and strategy was assessed. Due to the nature of Arm’s business model and the indirect impact climate change is expected to have on the Group, quantification of the financial impact of the climate risks and opportunities is limited in this second year of disclosure, and impact is instead described qualitatively where there have been constraints in data availability or uncertainty over causality and attribution. The financial impacts of the climate-related risks and opportunities have been assessed assuming that no actions or measures are taken by Arm to mitigate the risk. These scenarios have been considered over three defined time horizons: short-term (present to 2030s), medium-term (2040s) and long-term (2050s). These time horizons have been selected as most relevant to Arm and the markets in which it operates. The short-term 2030 horizon is critical as this aligns with Arm’s own 2030 carbon emissions reduction targets, as well as Arm’s financial planning cycle. The medium- to long-term time periods are outside of Arm’s typical planning cycles, but reflect the period in which climate risks and opportunities are expected to affect the business, including future legislative changes within key customer markets and are consistent with national and market net zero targets and commitments. The table below provides a description of the short-listed climate-related risks and opportunities for which financial quantification was conducted, along with an indication of the time horizon when the estimated full impact of each risk and opportunity is expected to occur. The table provides a summary of the potential financial impacts to Arm, as well as potential impact ratings reflecting the impact of the two different scenarios on Arm. These impact ratings are informed by both the quantitative and qualitative assessments of each potential financial impact to Arm under the current business model and strategy. Each risk and opportunity has been treated as a mutually exclusive event and the results are global in scope. Two further shortlisted climate- related risks and opportunities were identified for which financial quantification was not conducted. These risks and opportunities are discussed qualitatively below the table. Undertaking this detailed climate risk assessment has enabled Arm to understand its exposure and vulnerability to climate-related risks, and to identify potential mitigation measures. Arm Holdings plc Strategic Report (continued) 18 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782

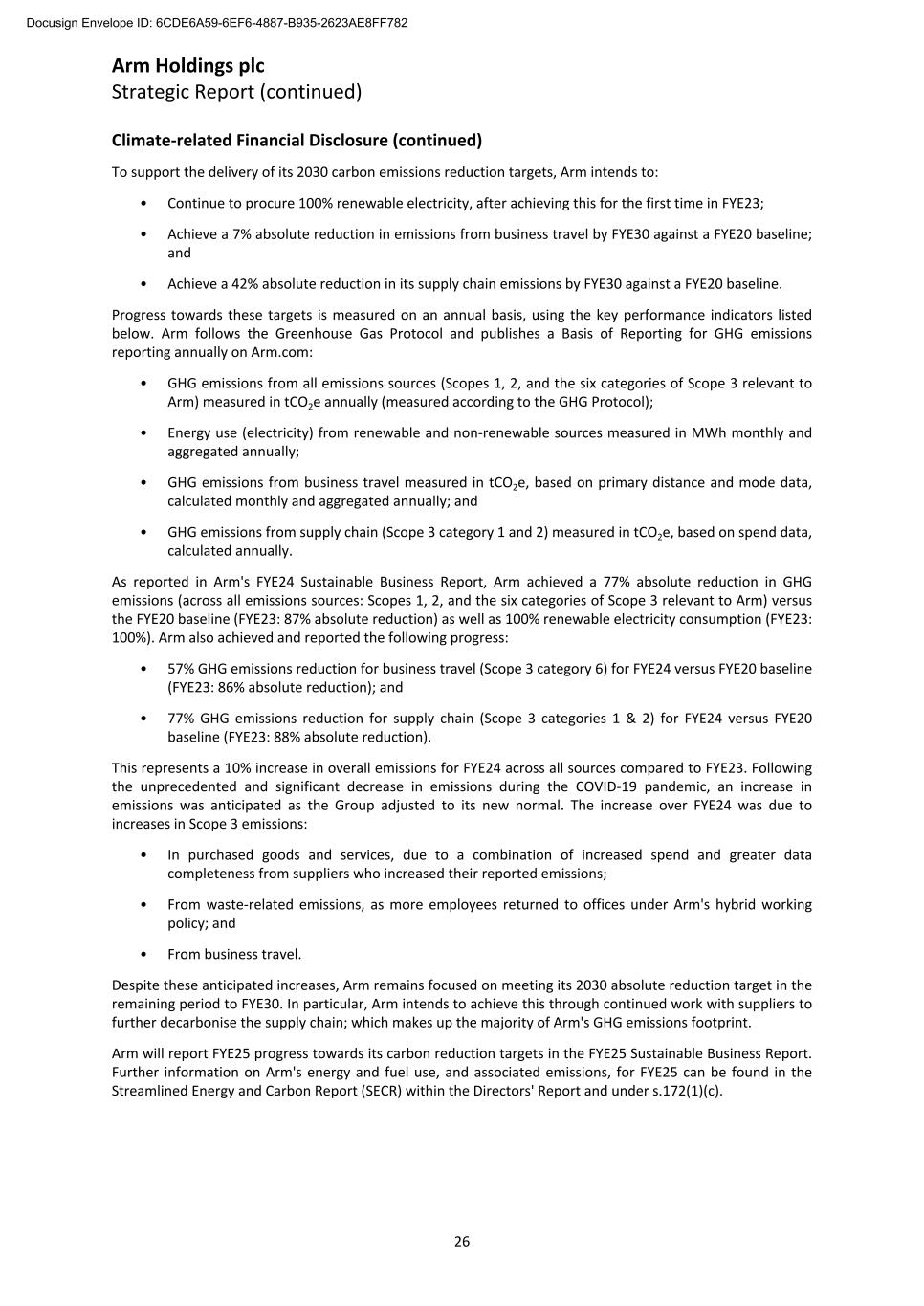

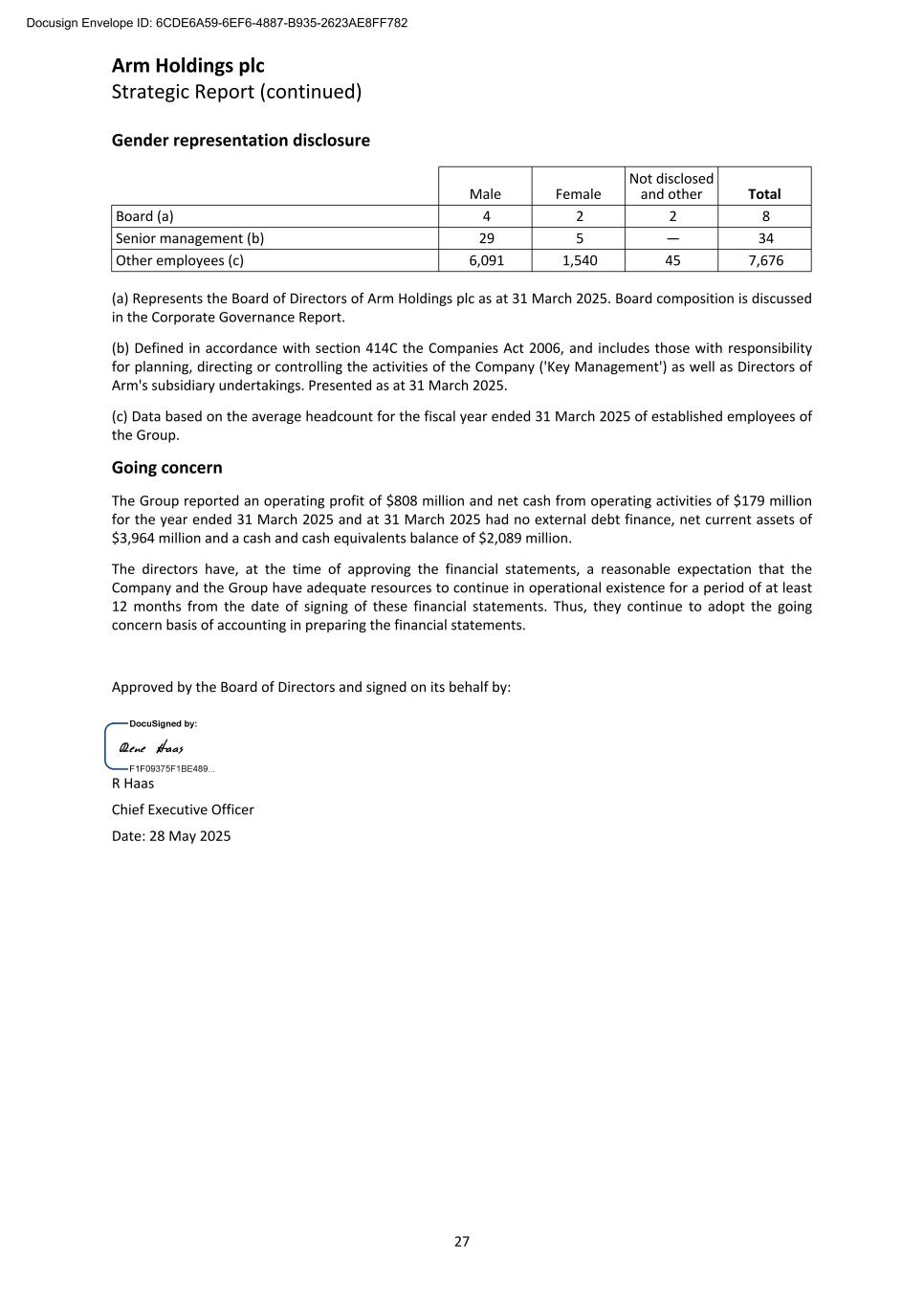

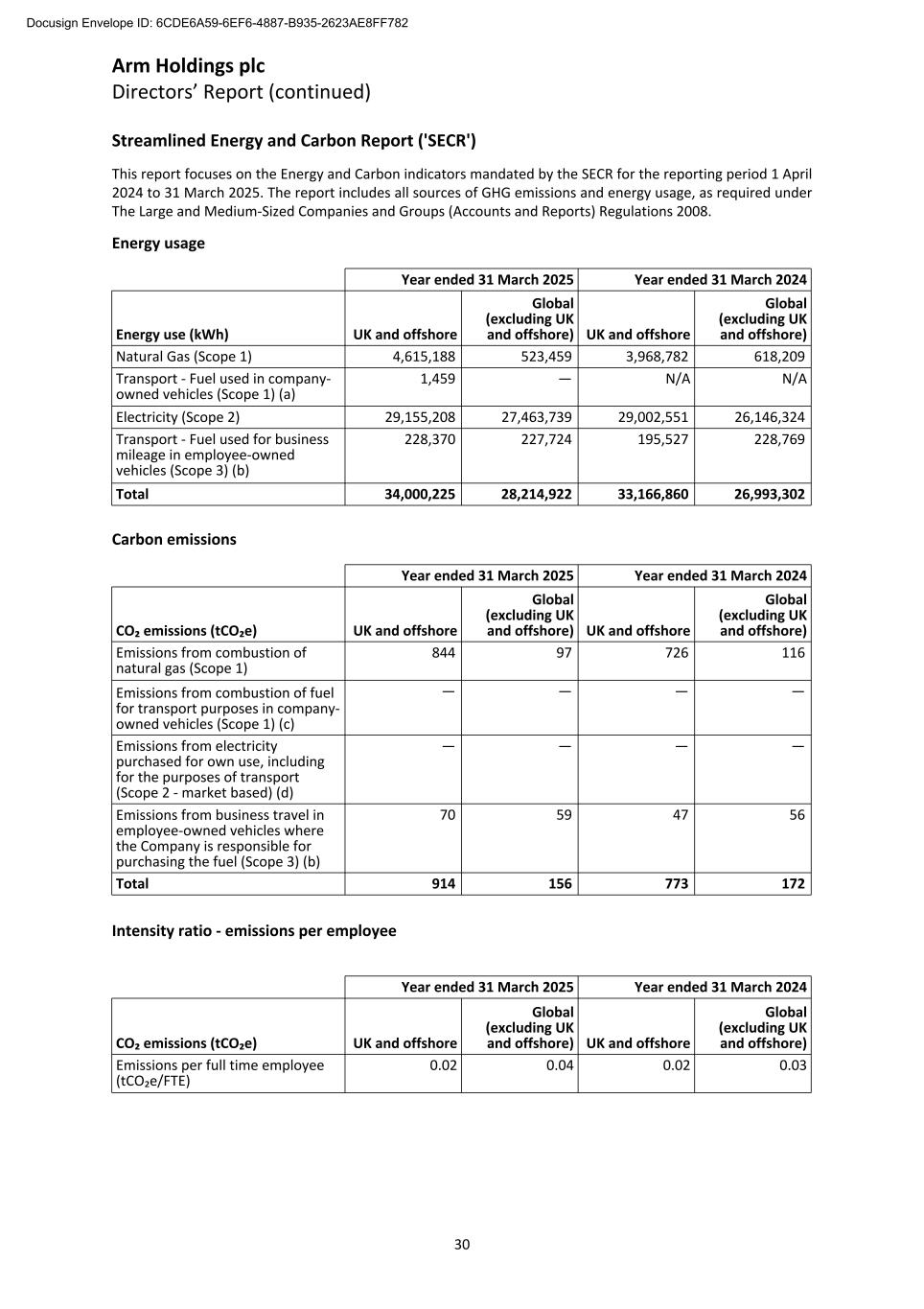

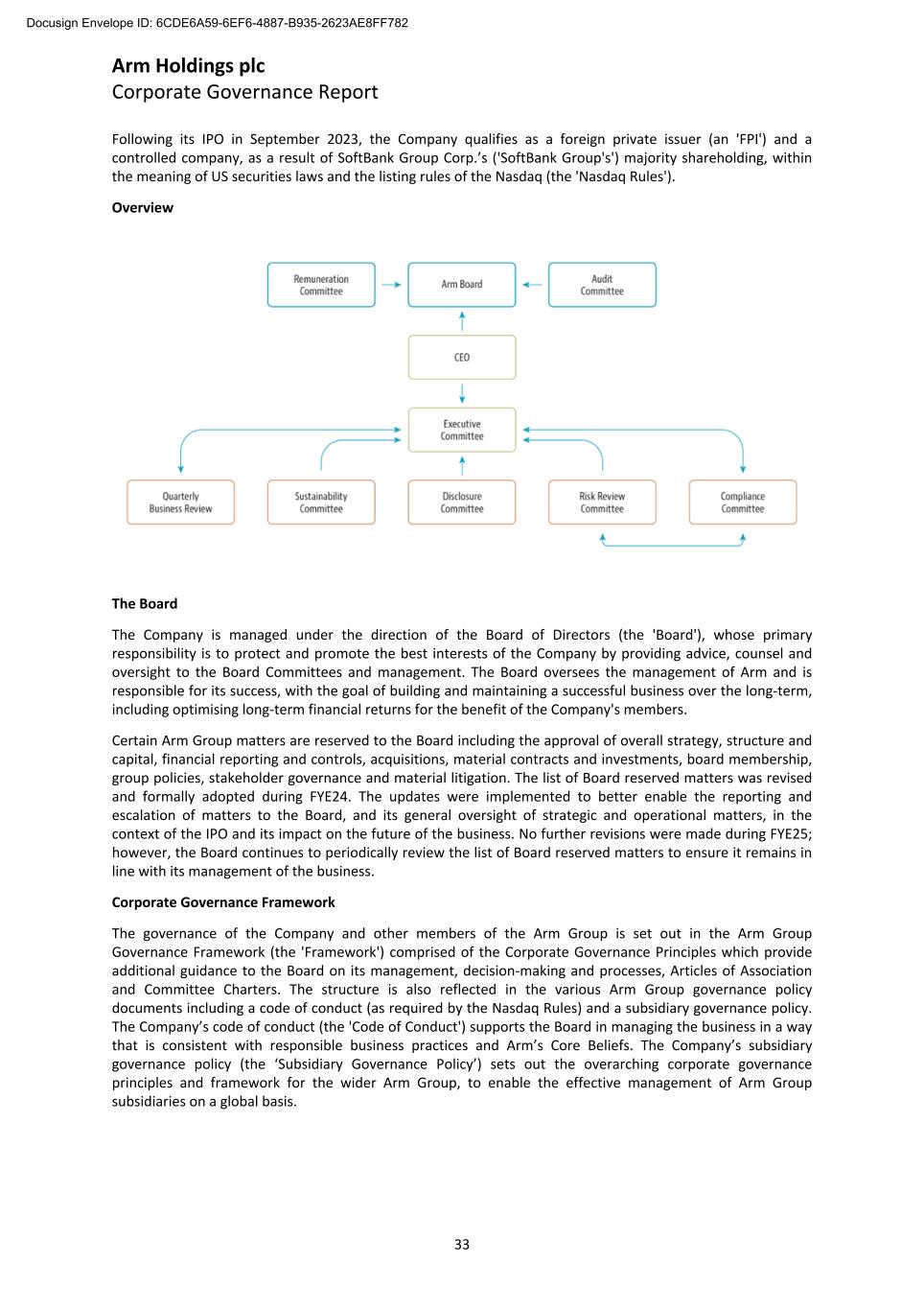

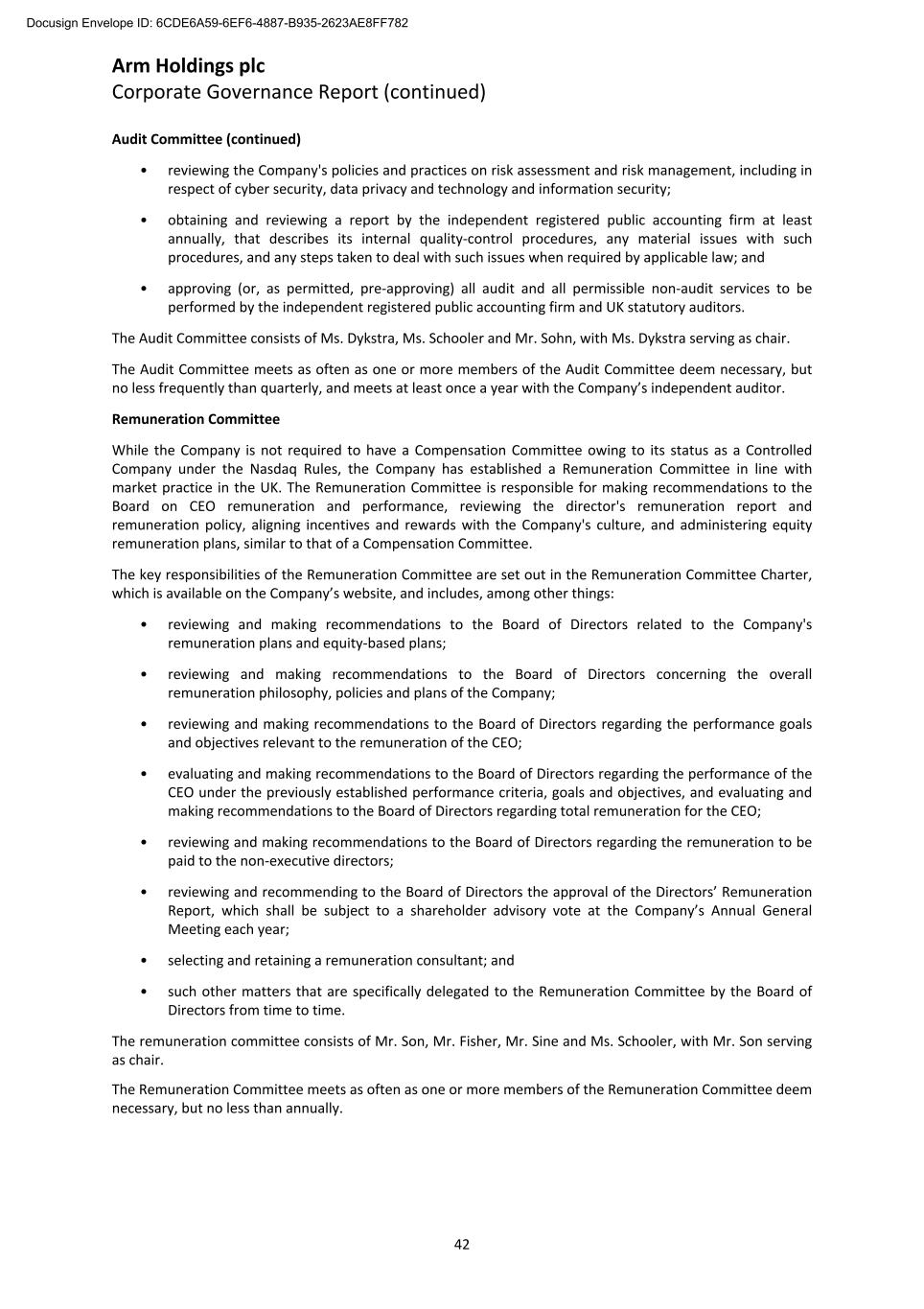

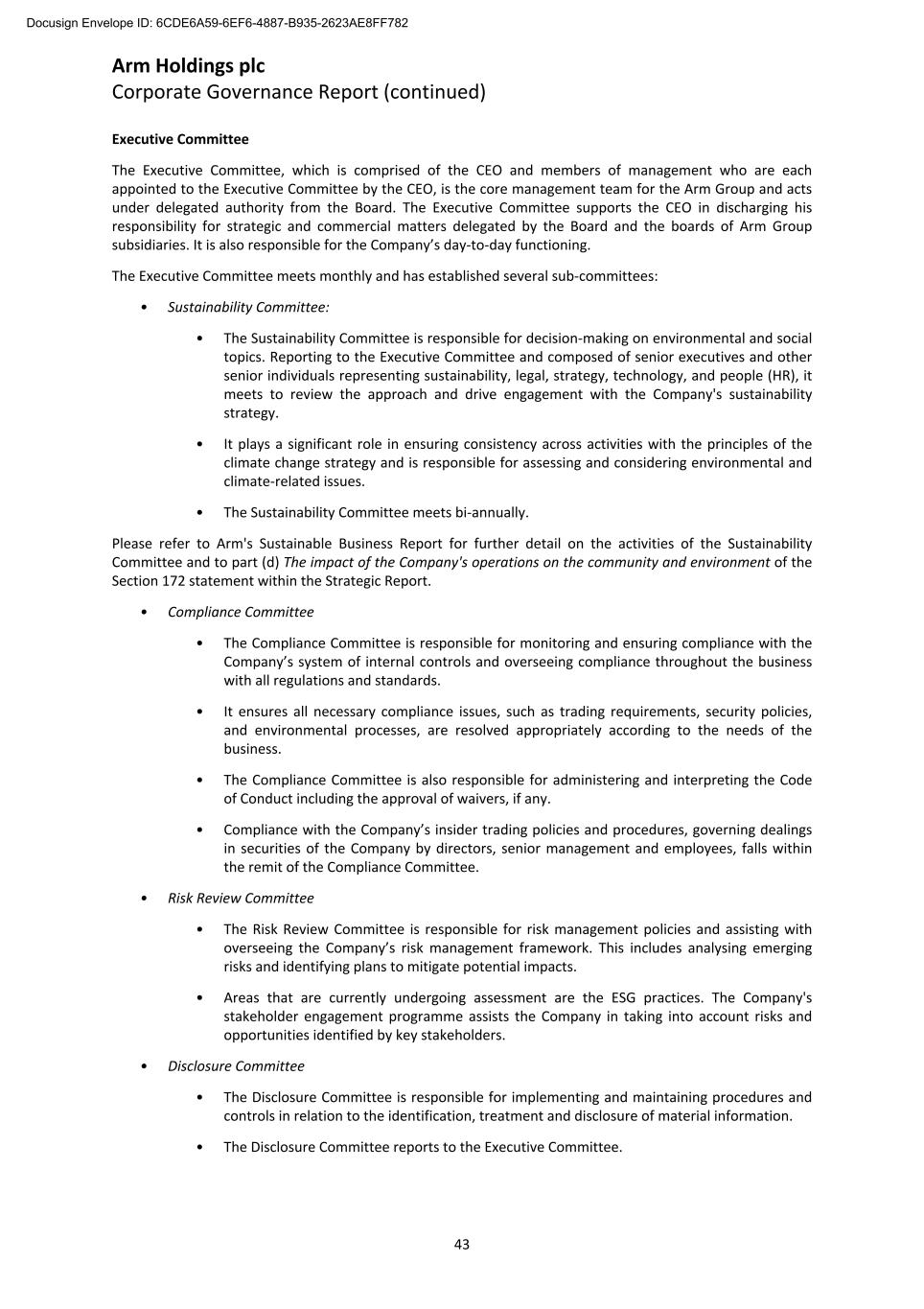

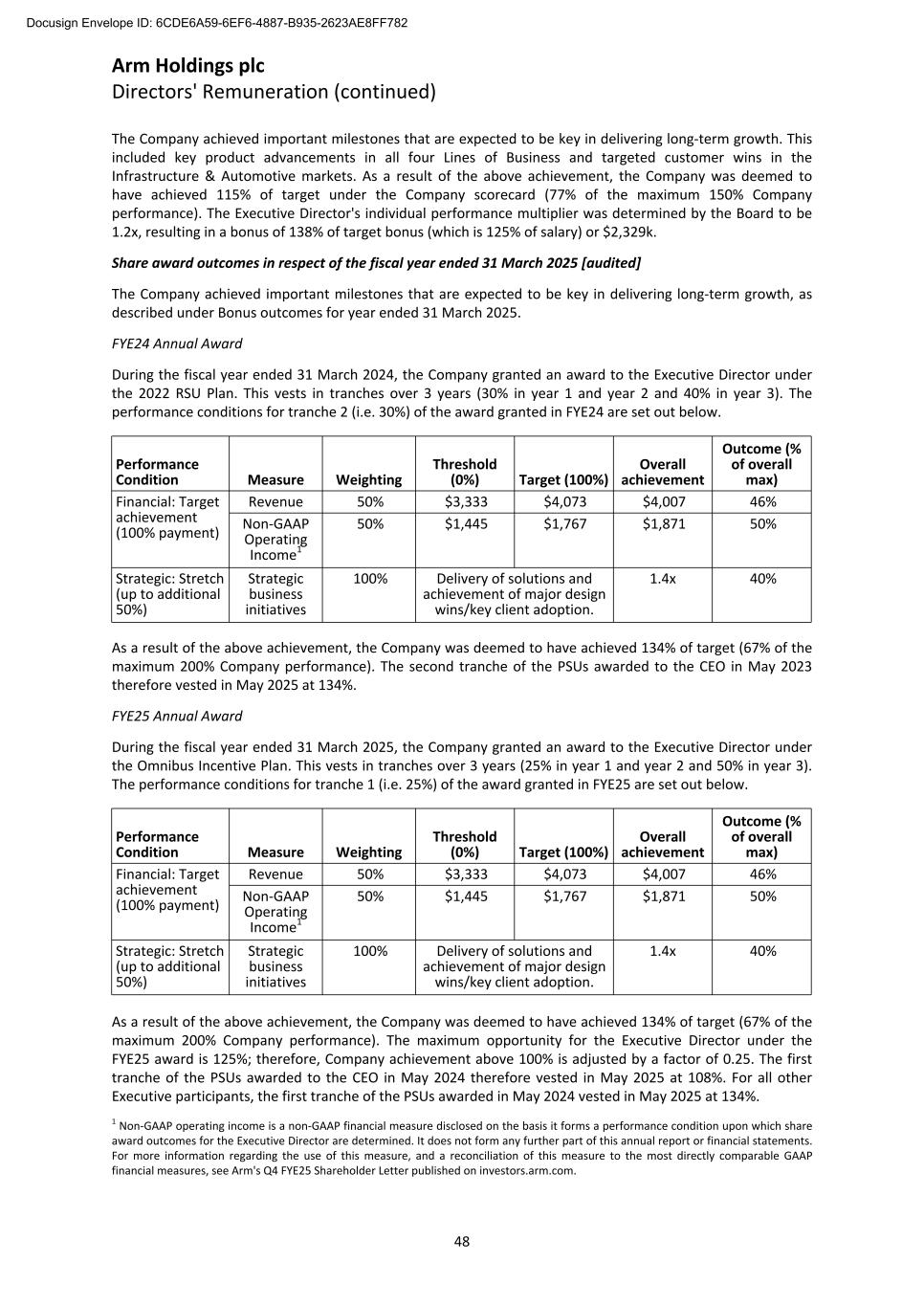

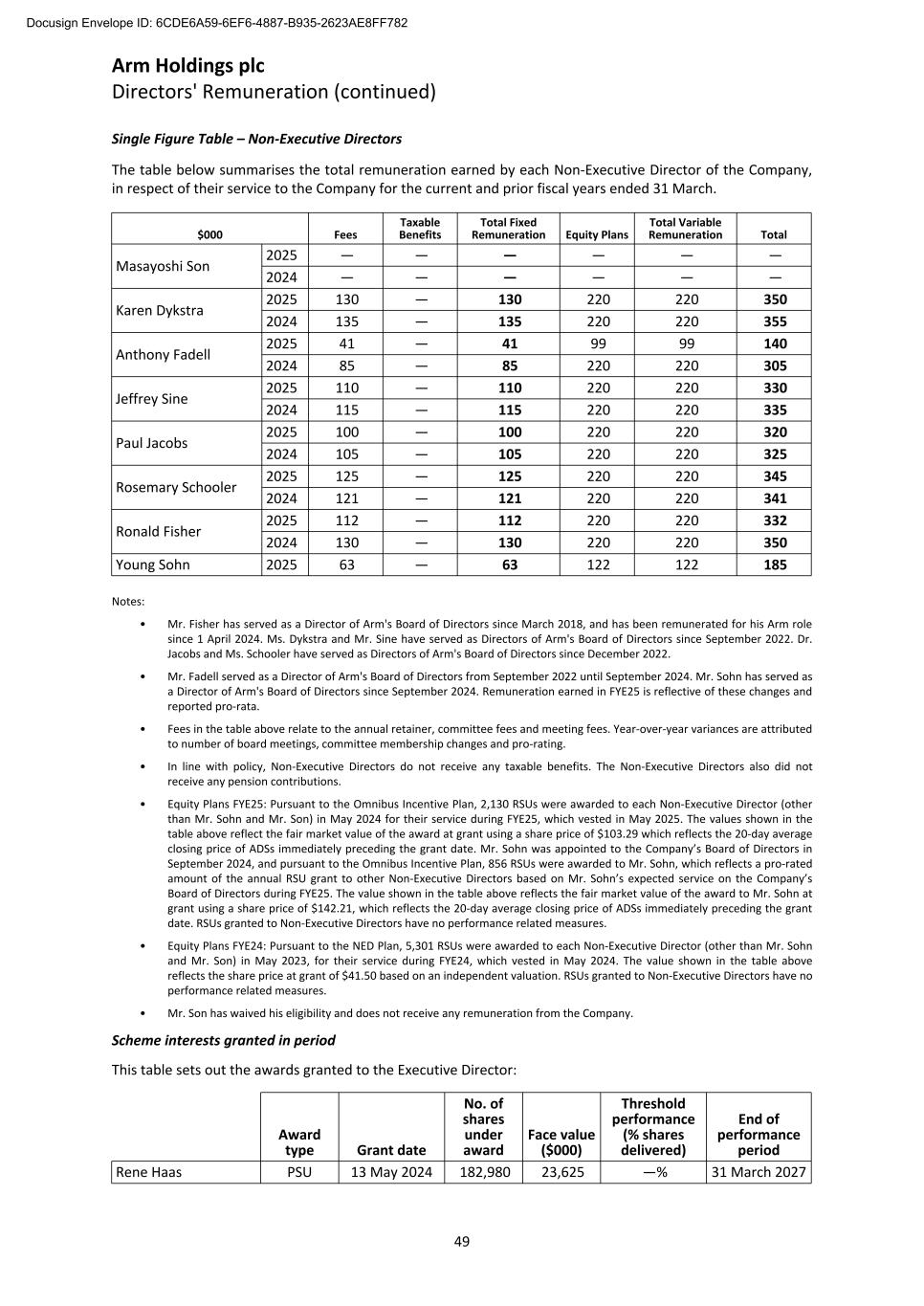

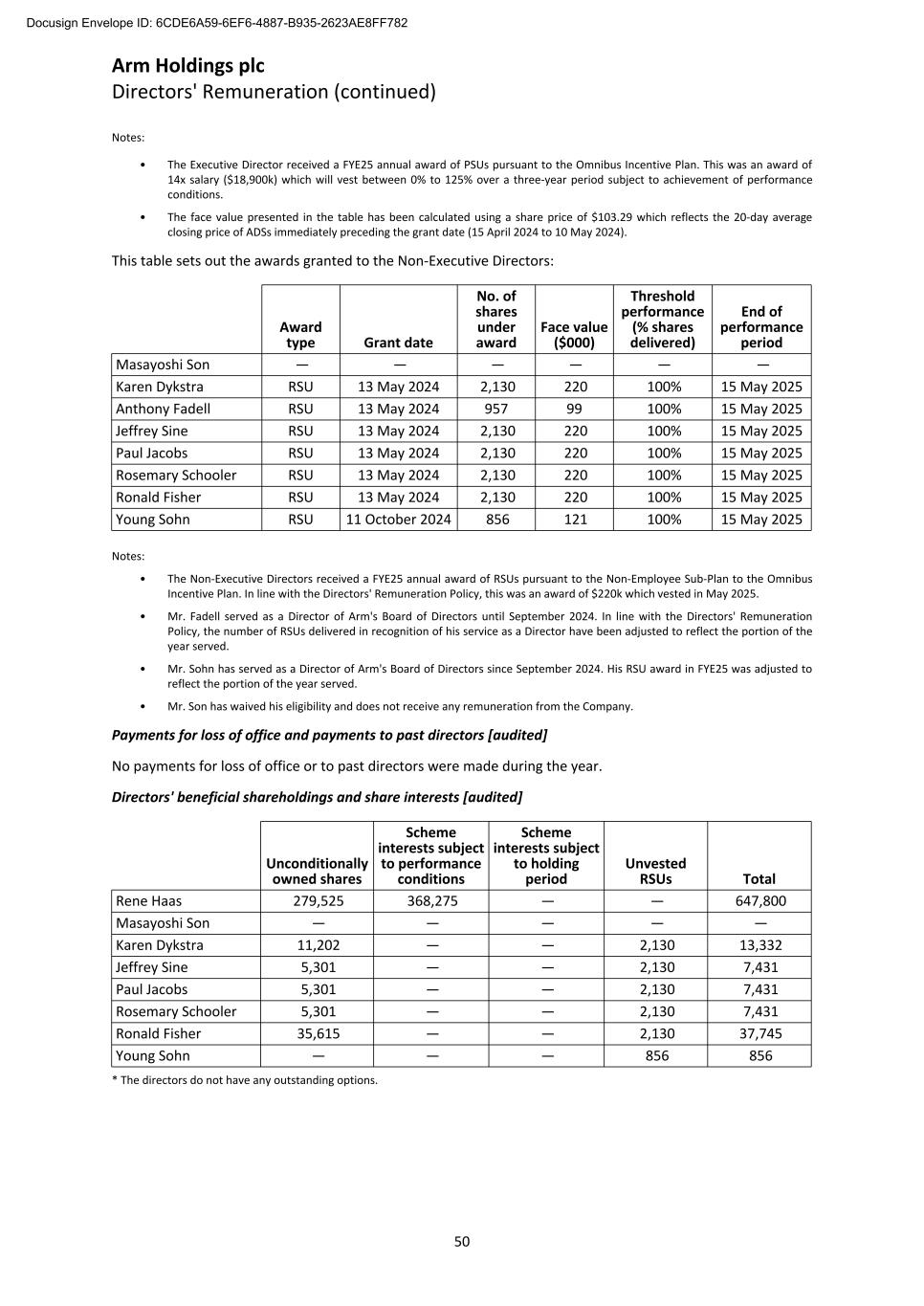

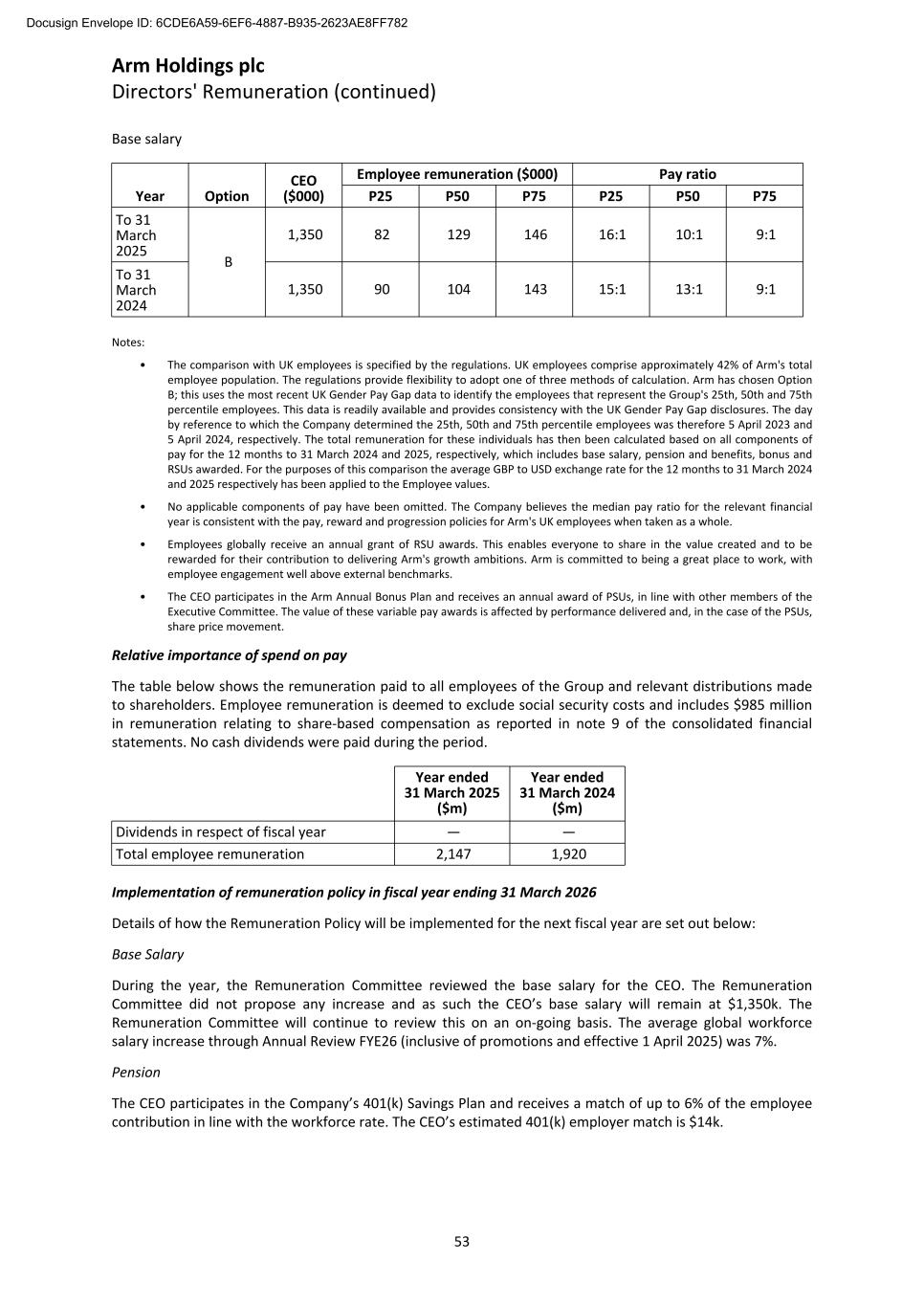

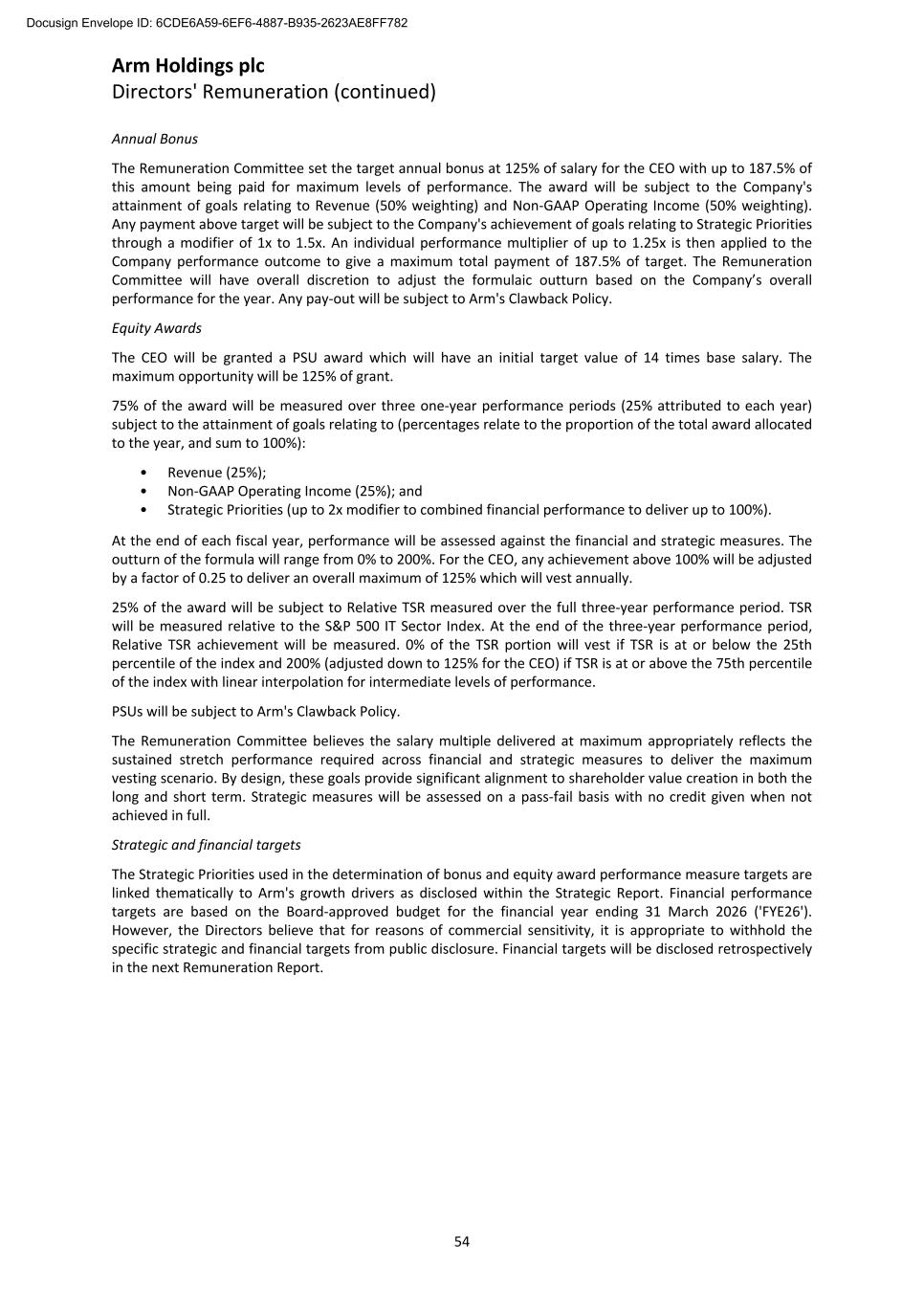

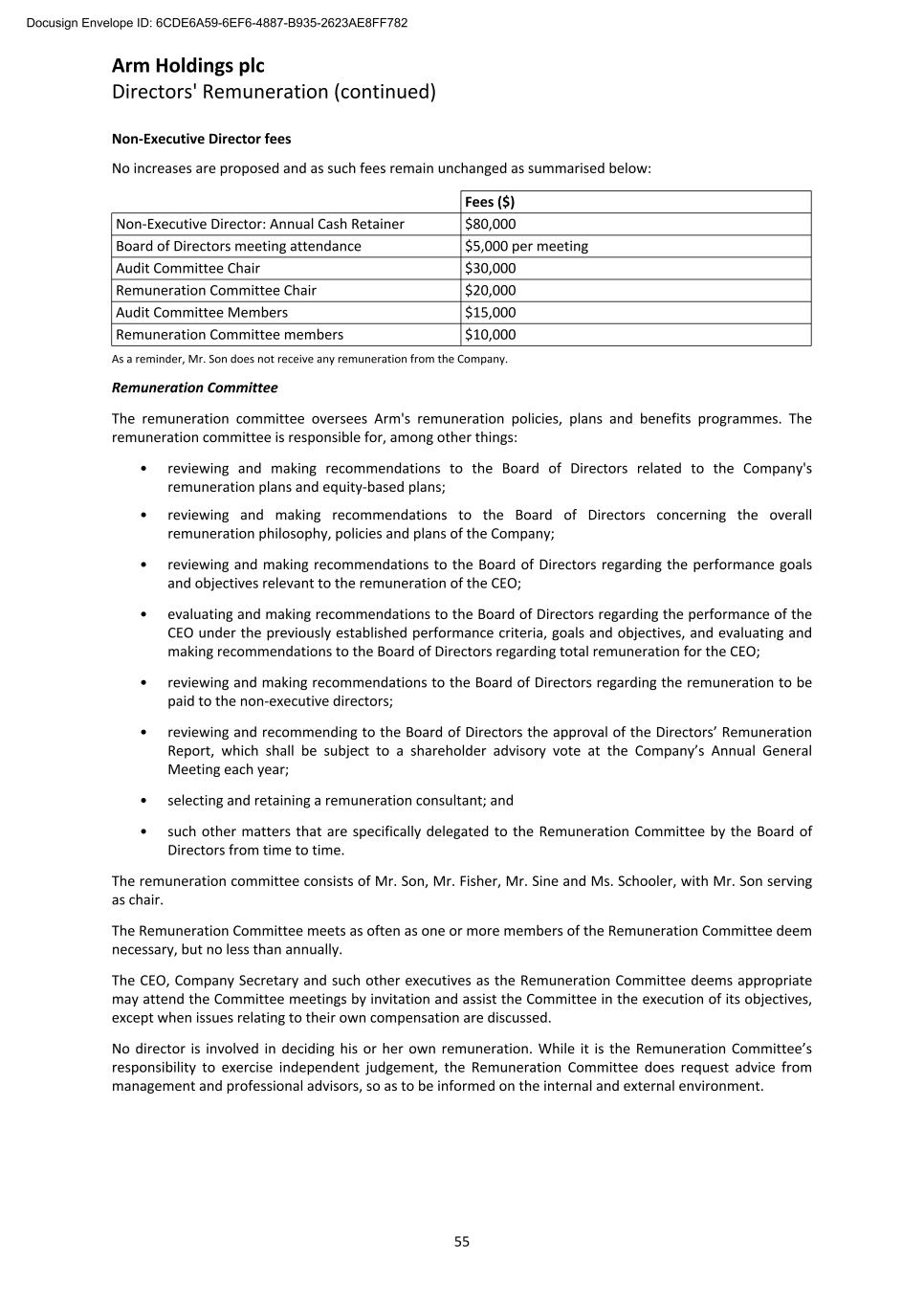

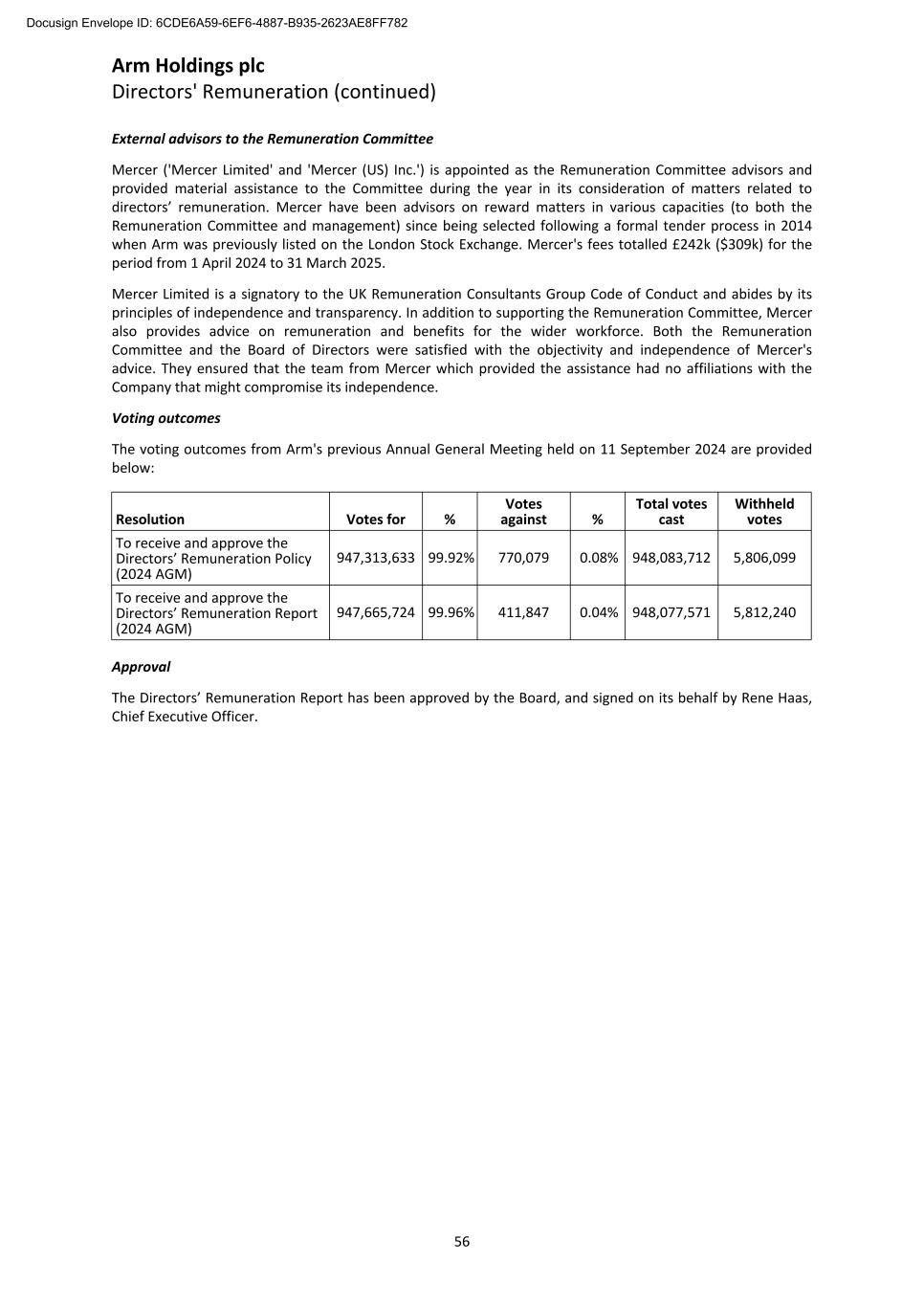

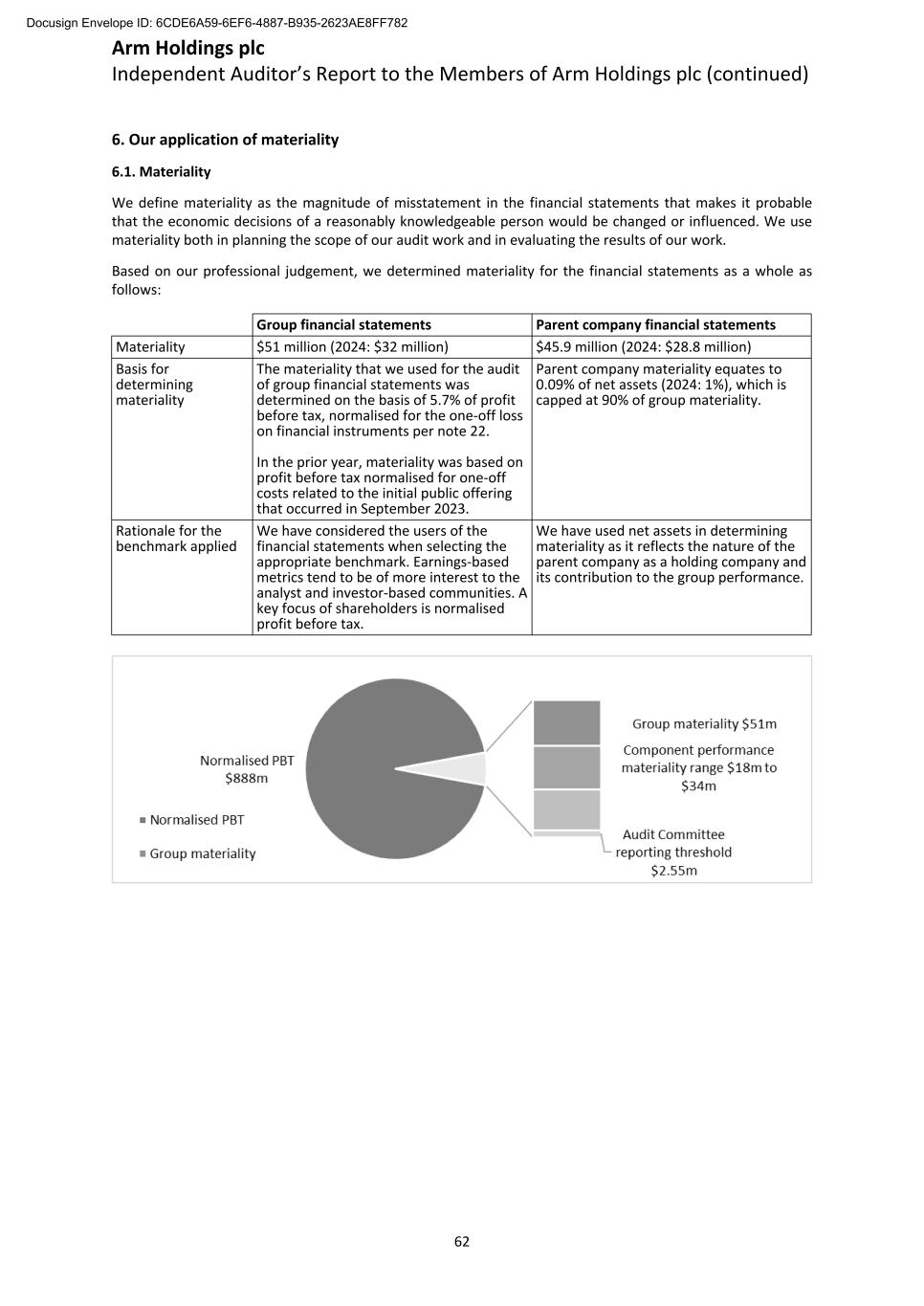

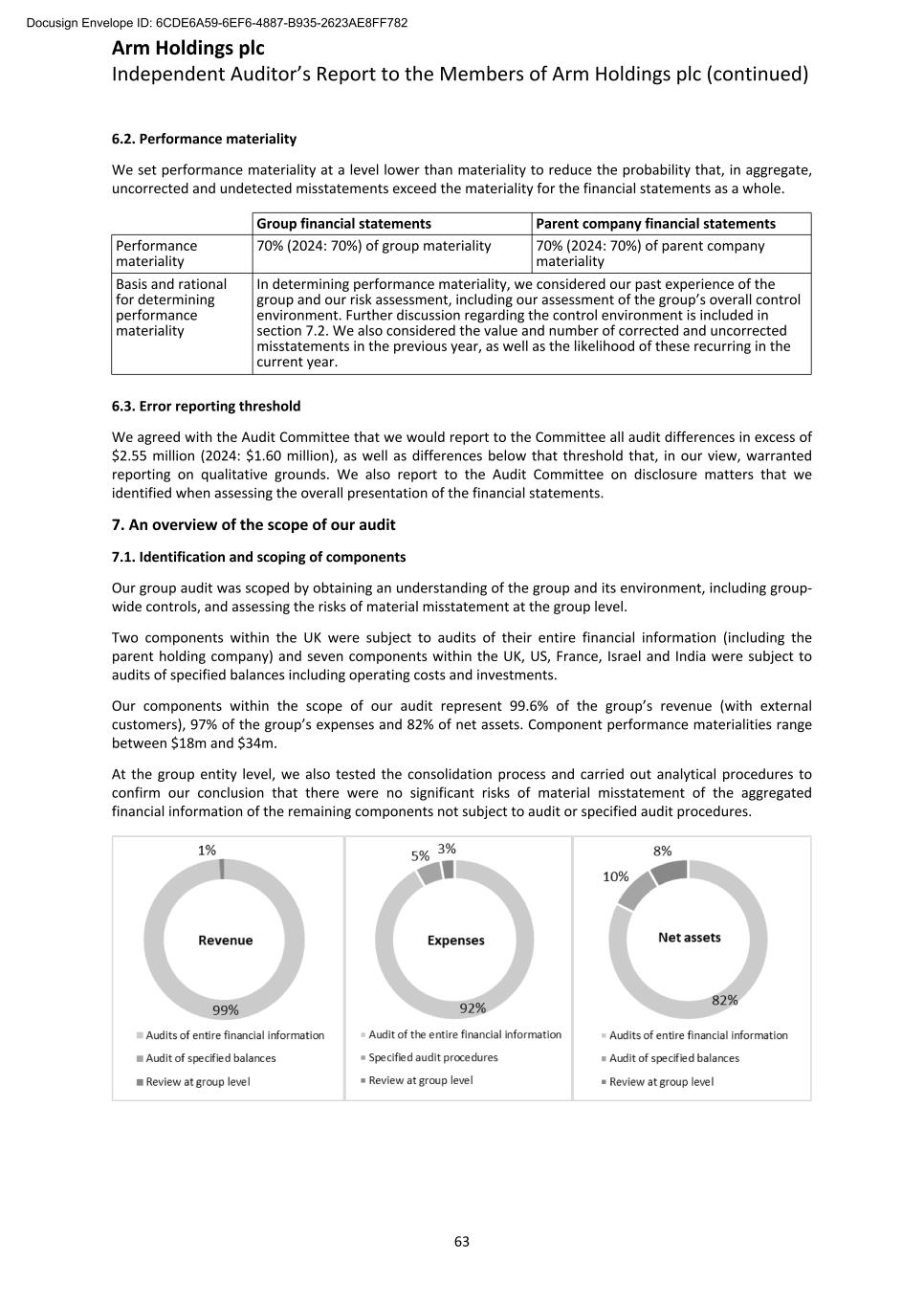

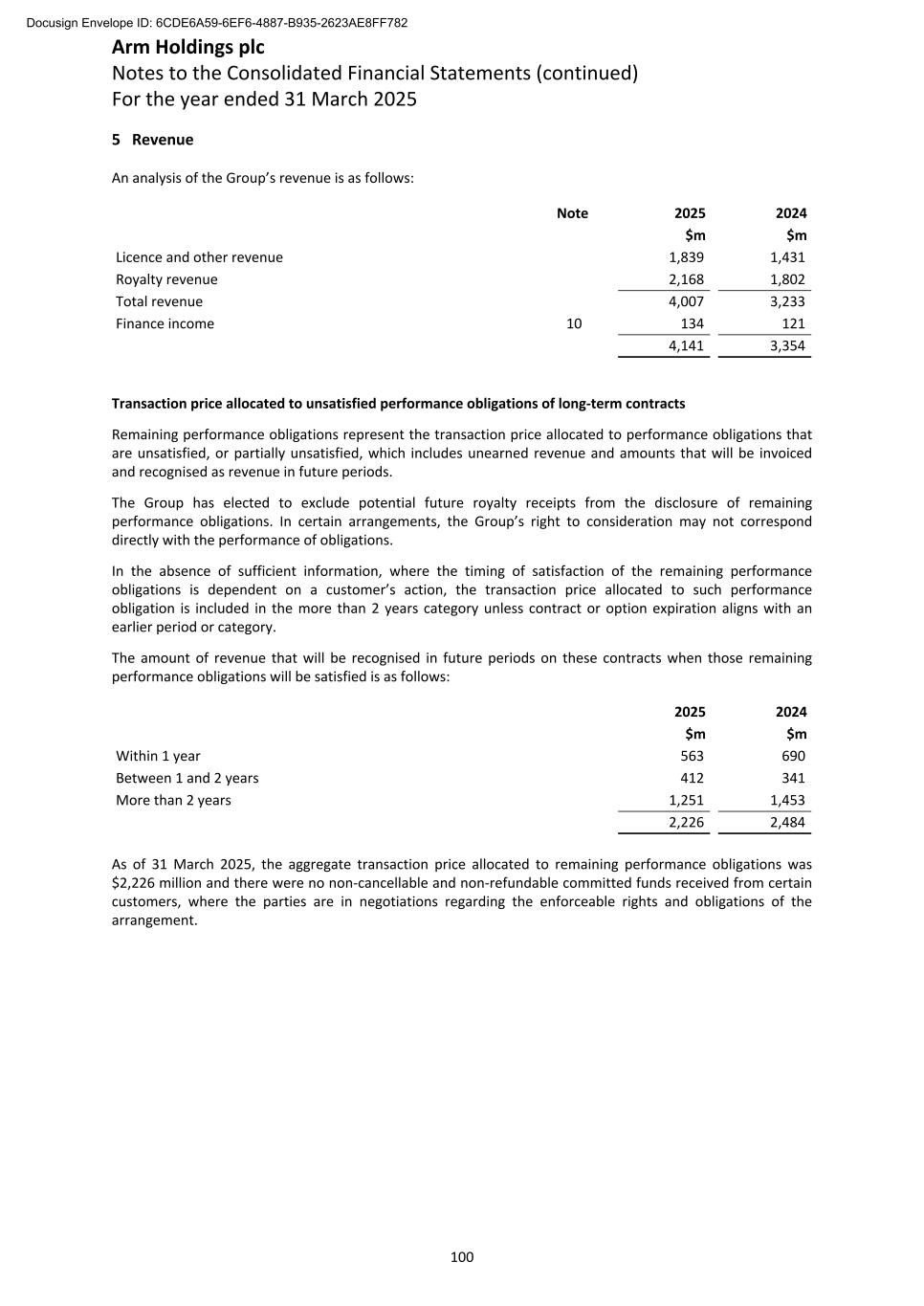

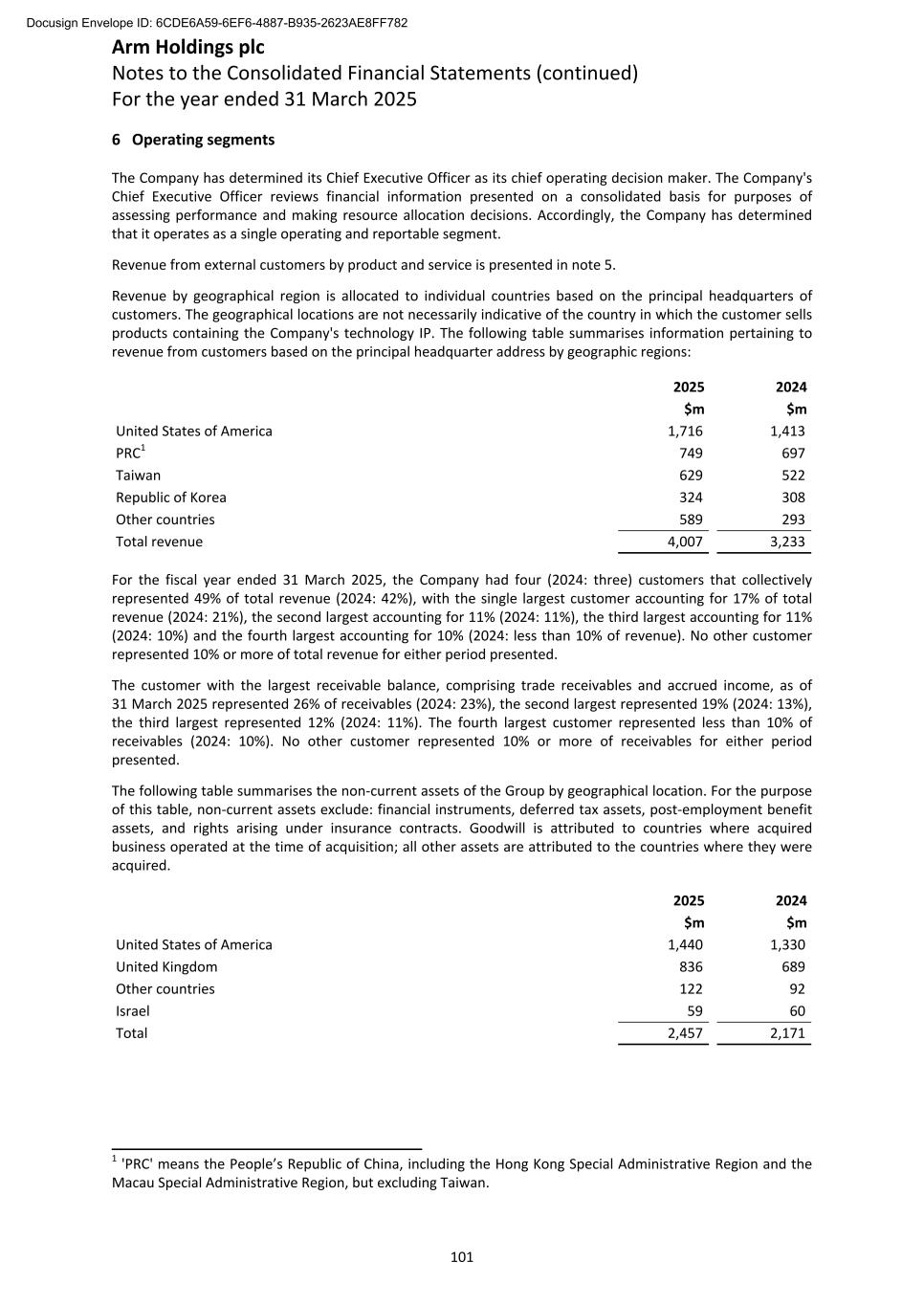

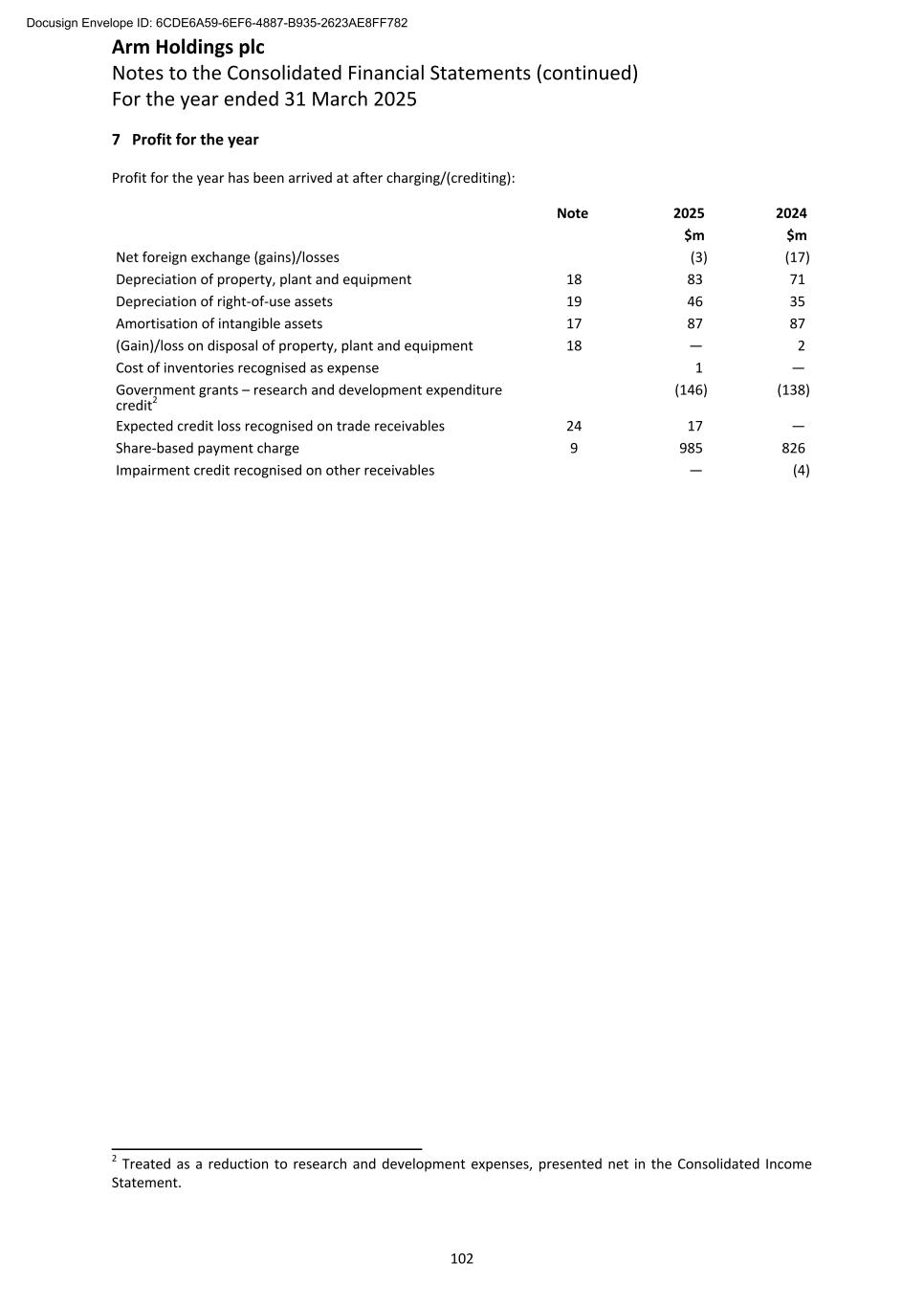

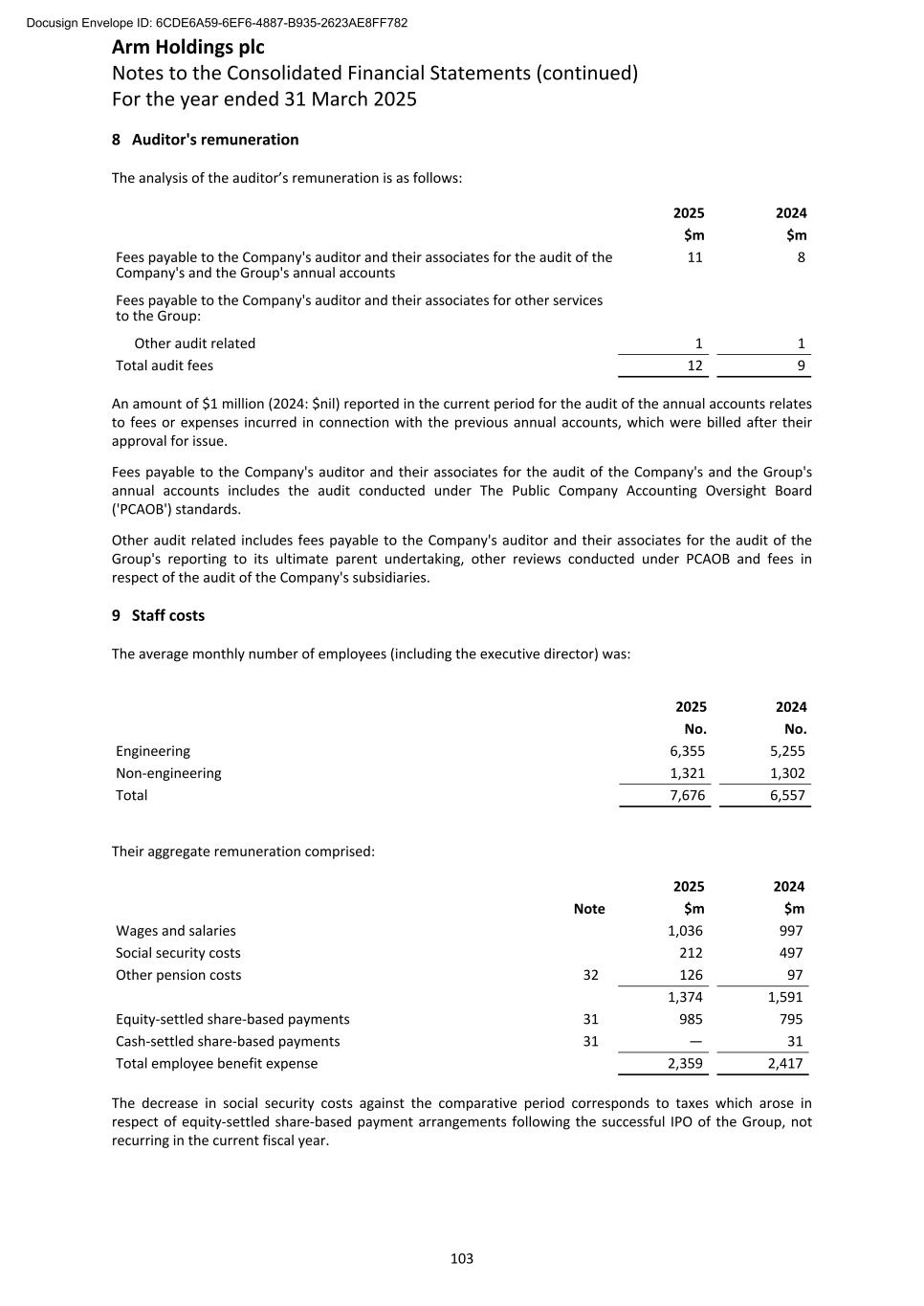

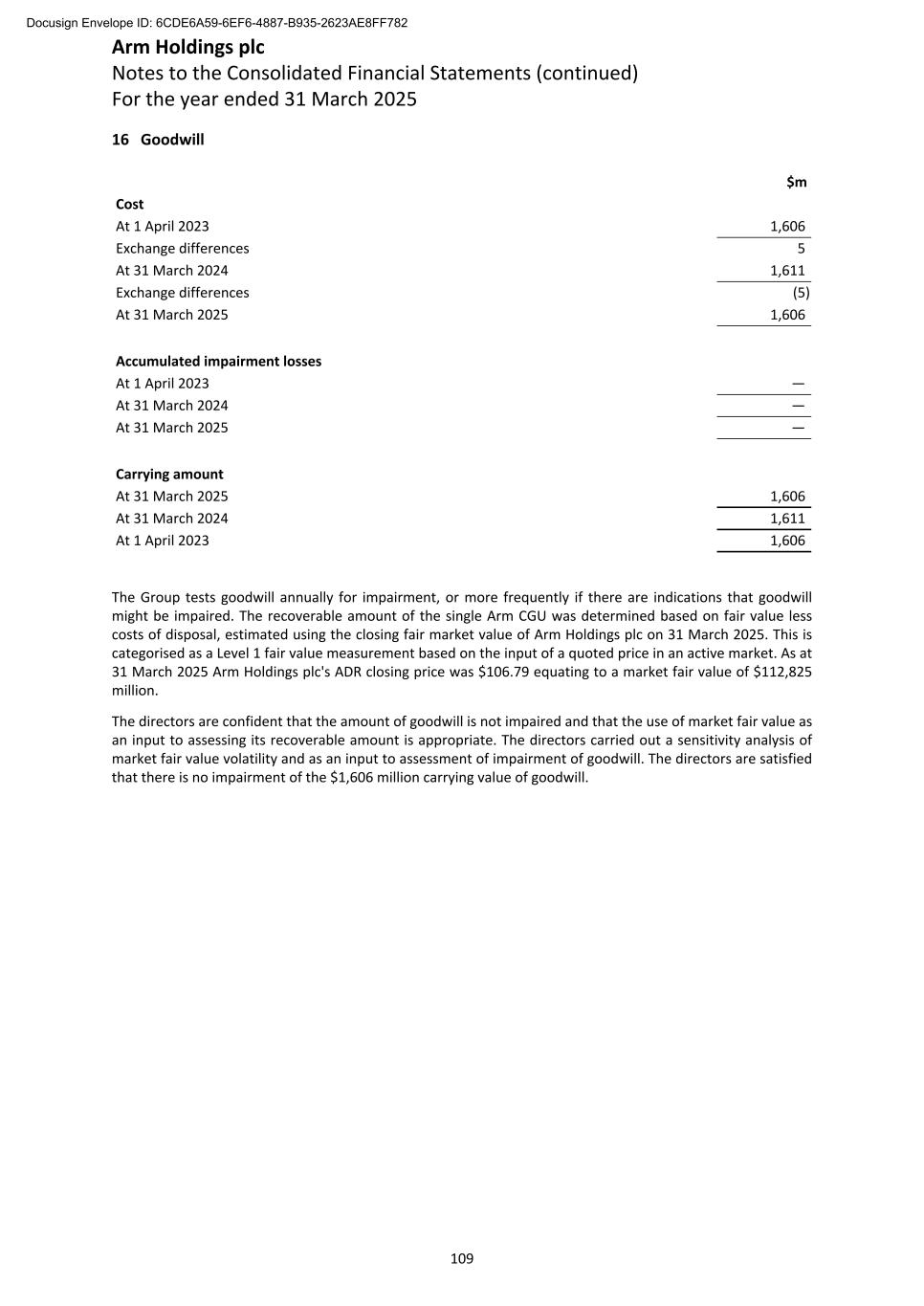

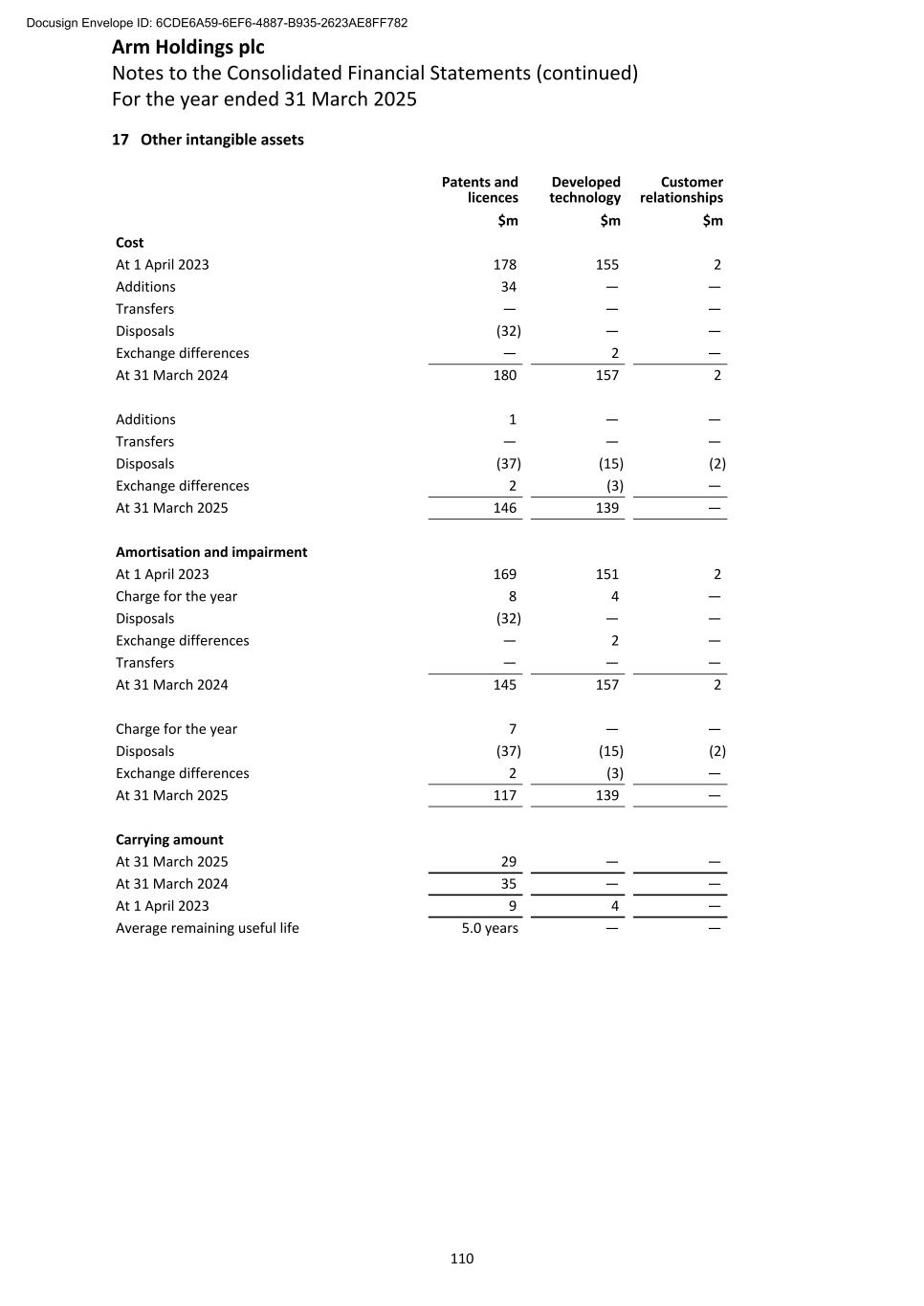

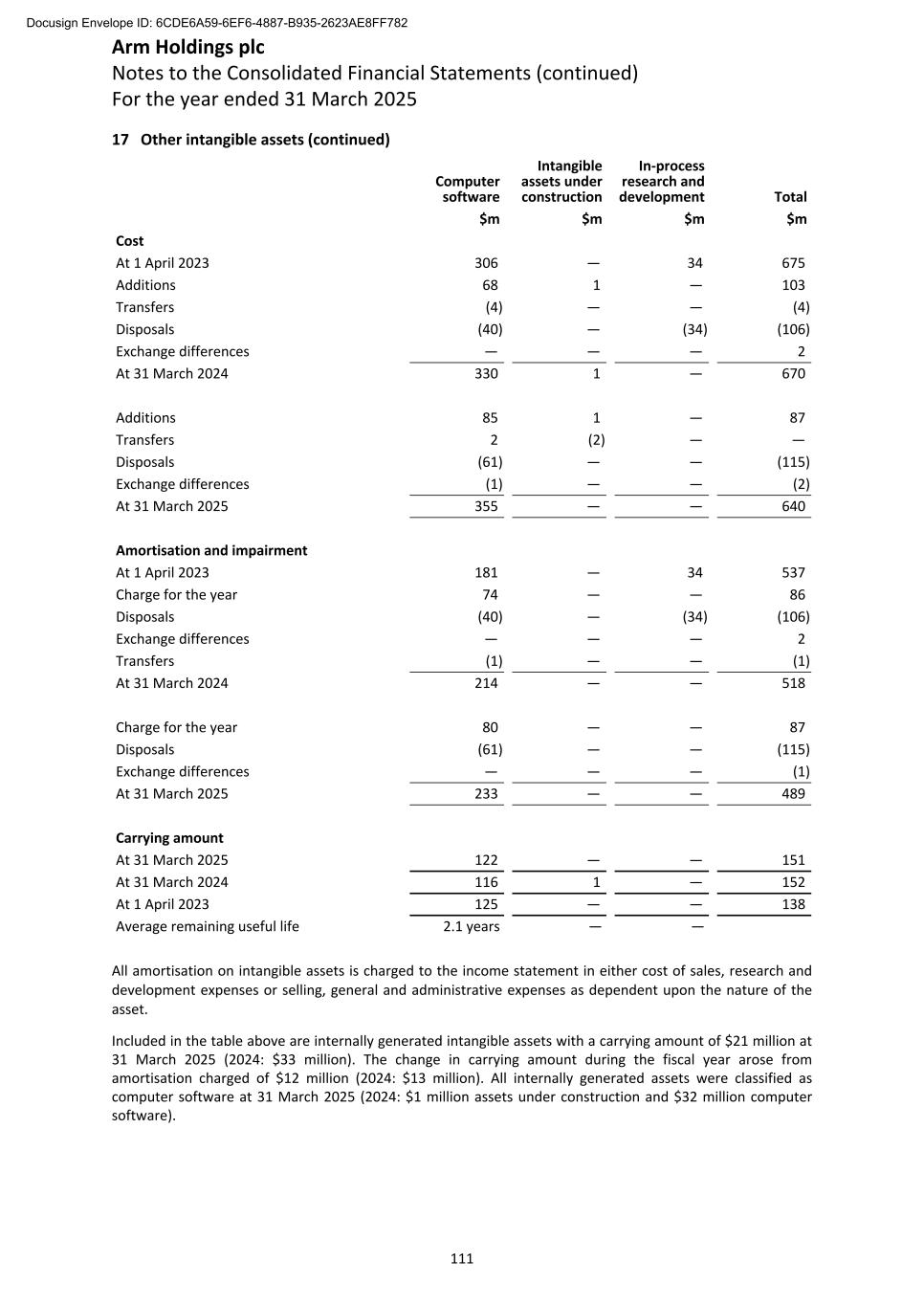

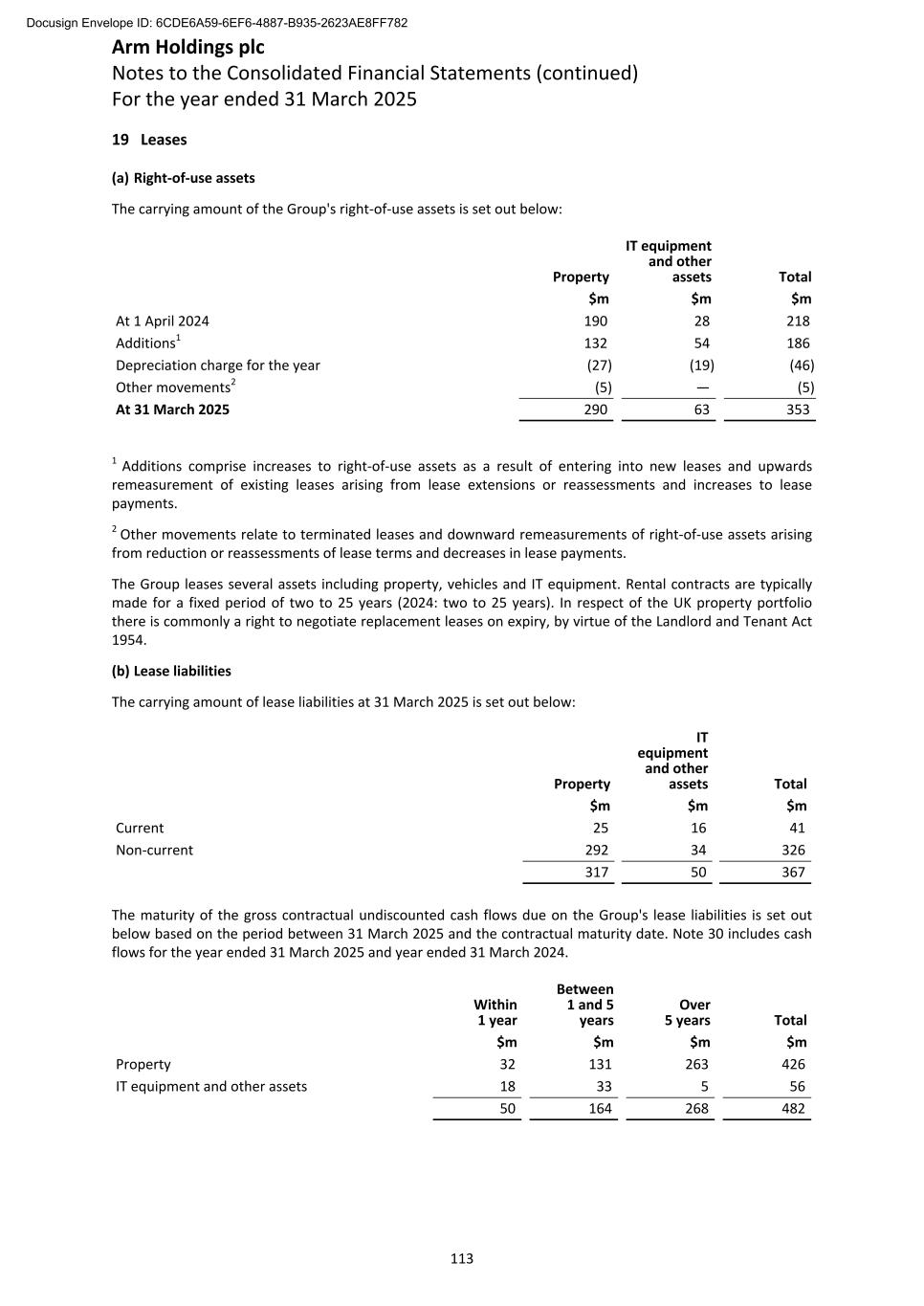

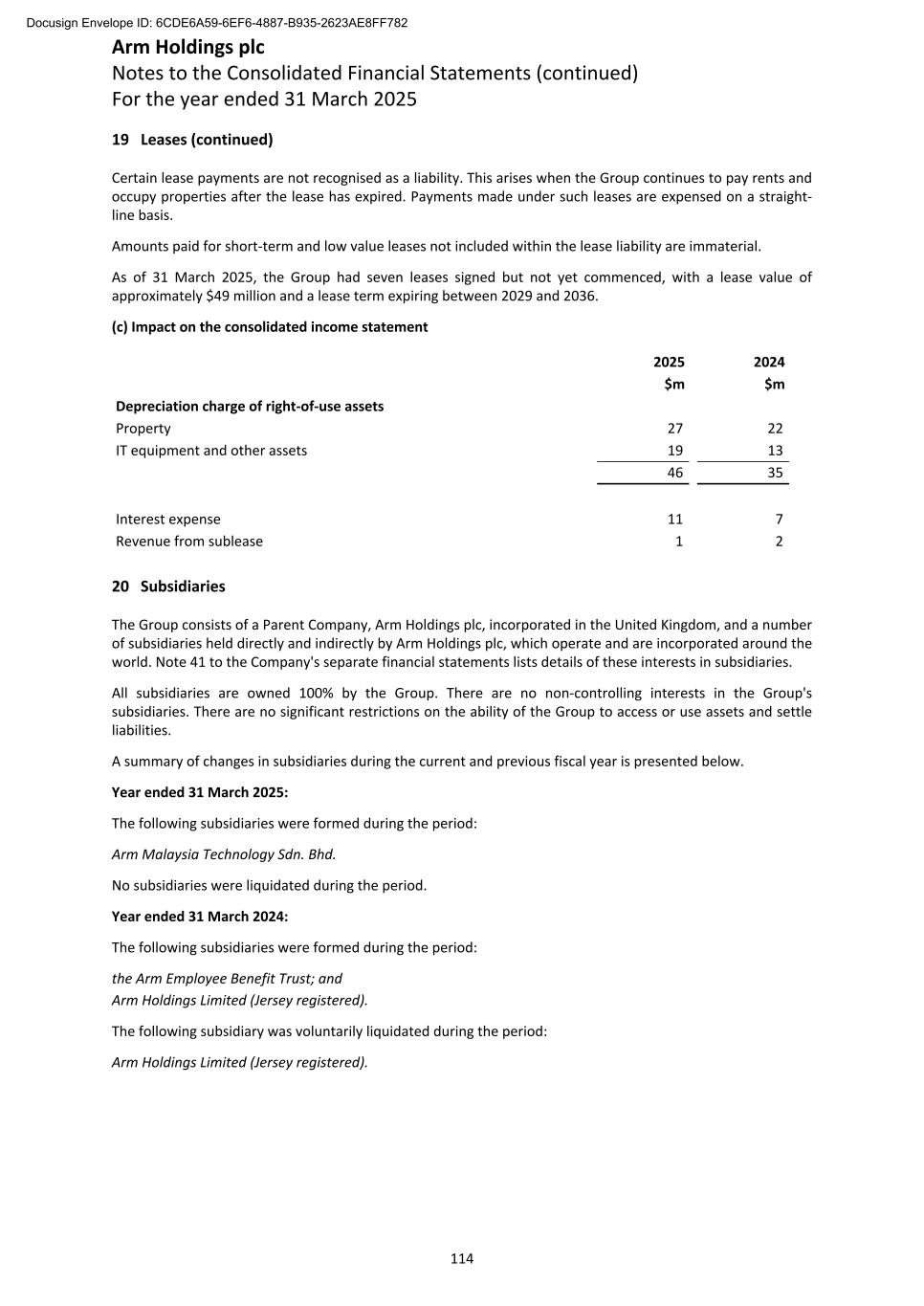

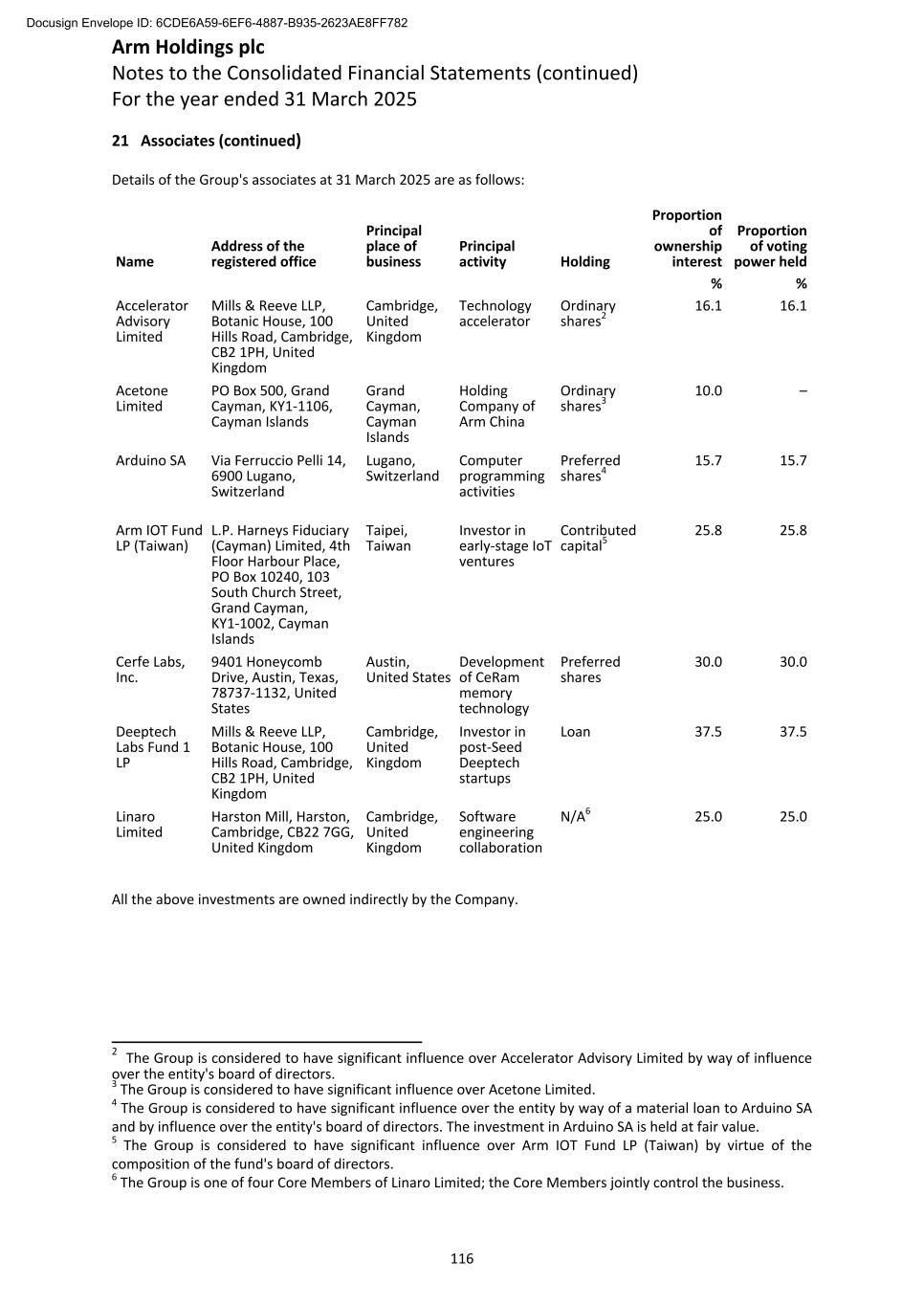

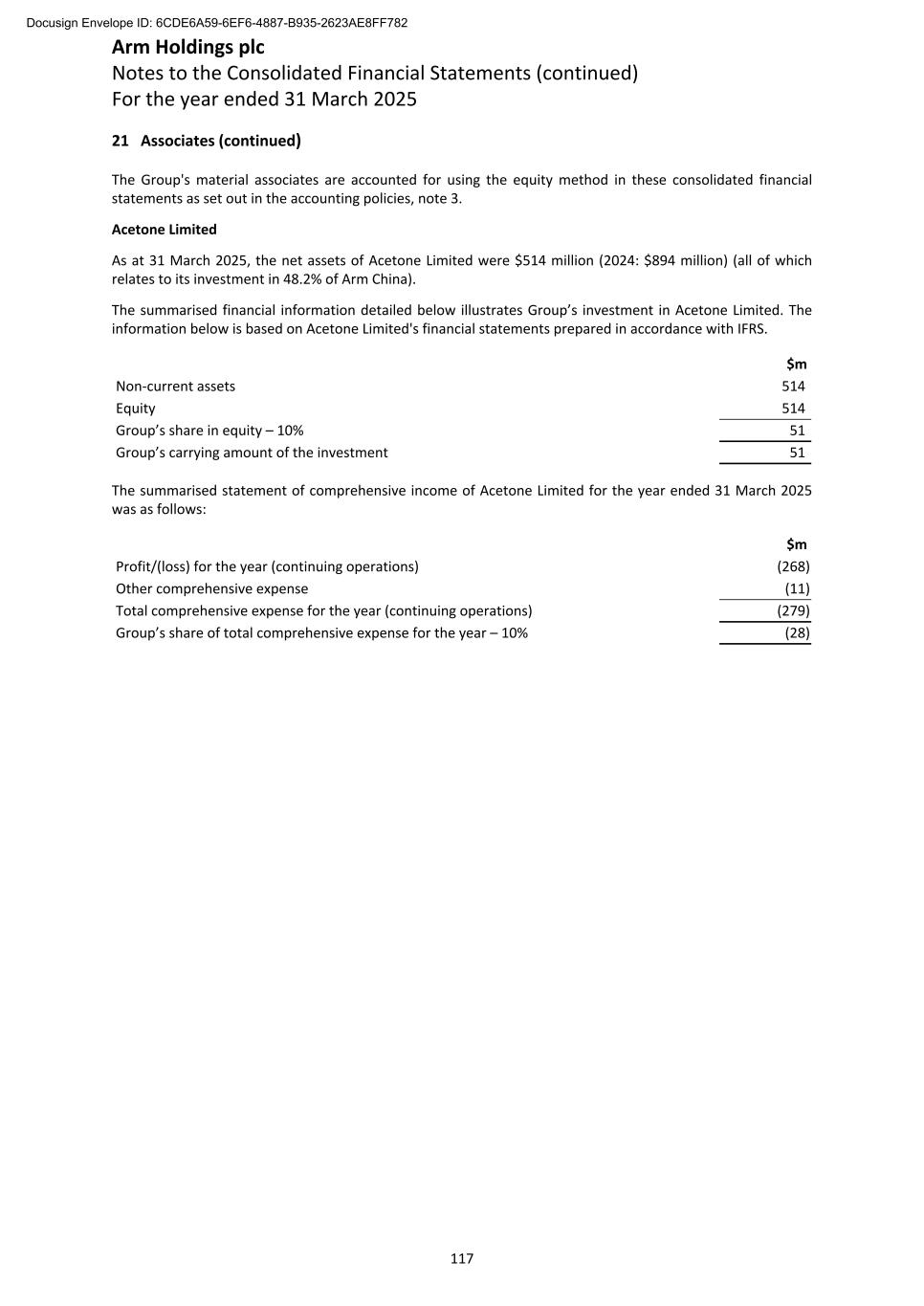

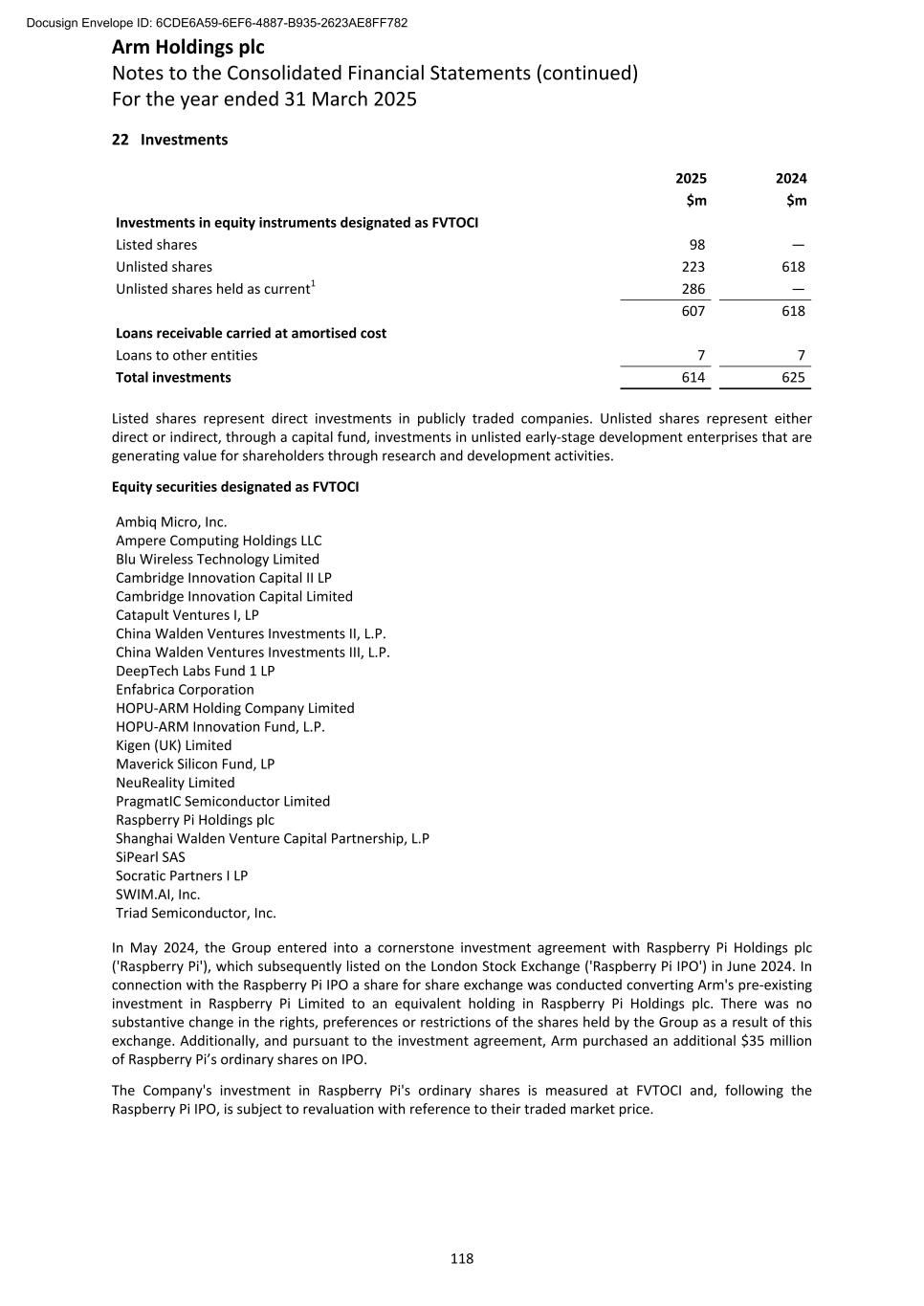

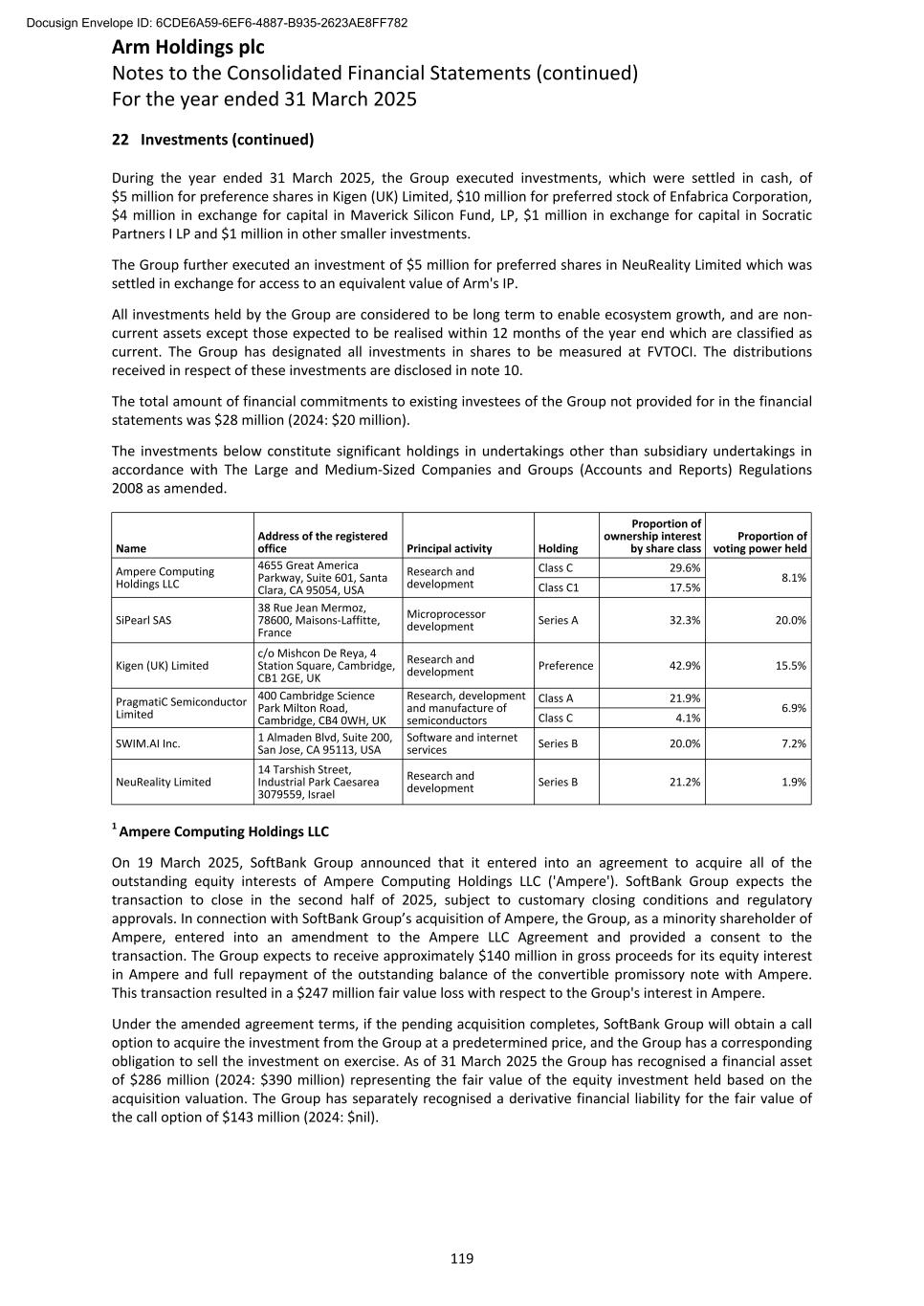

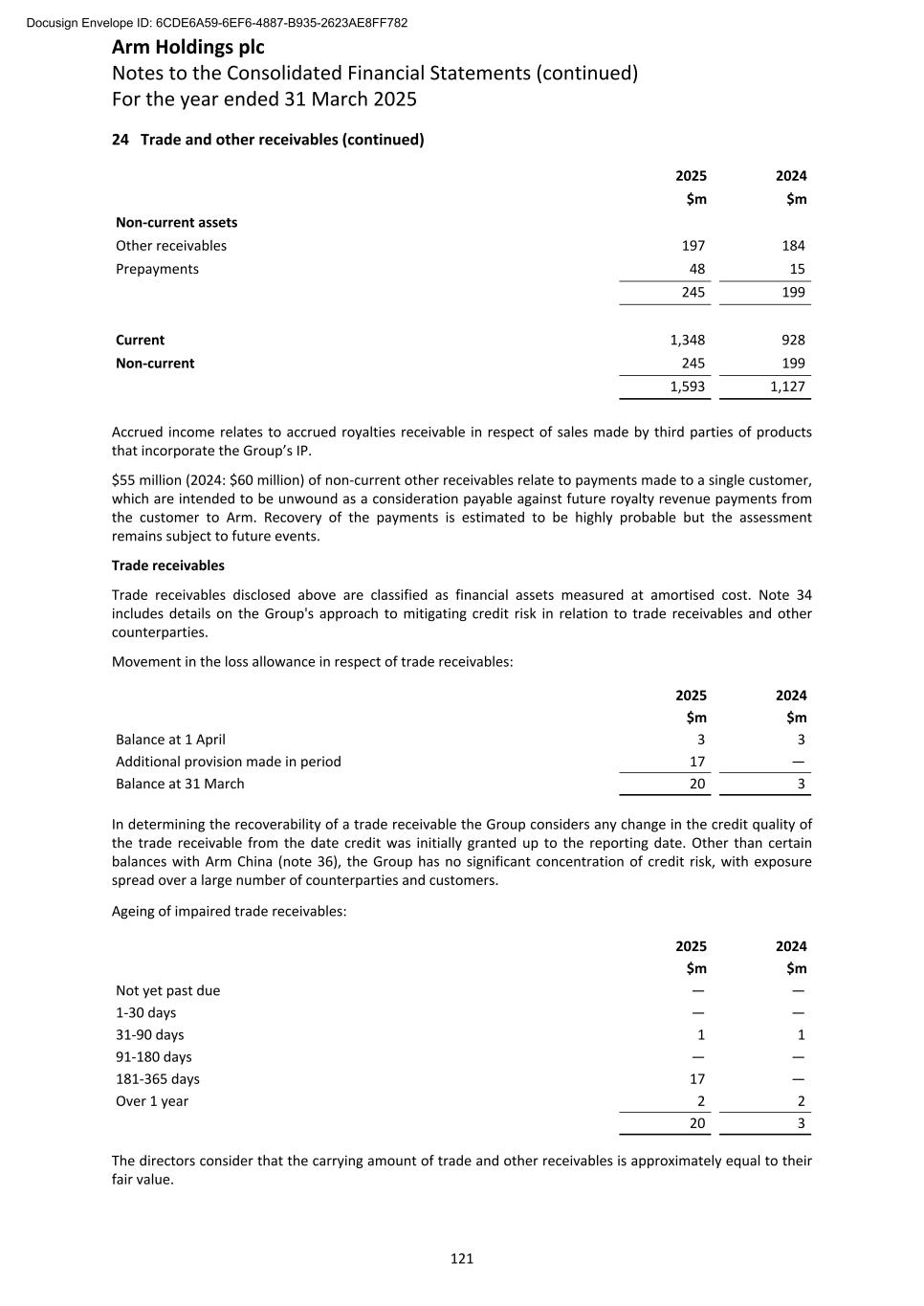

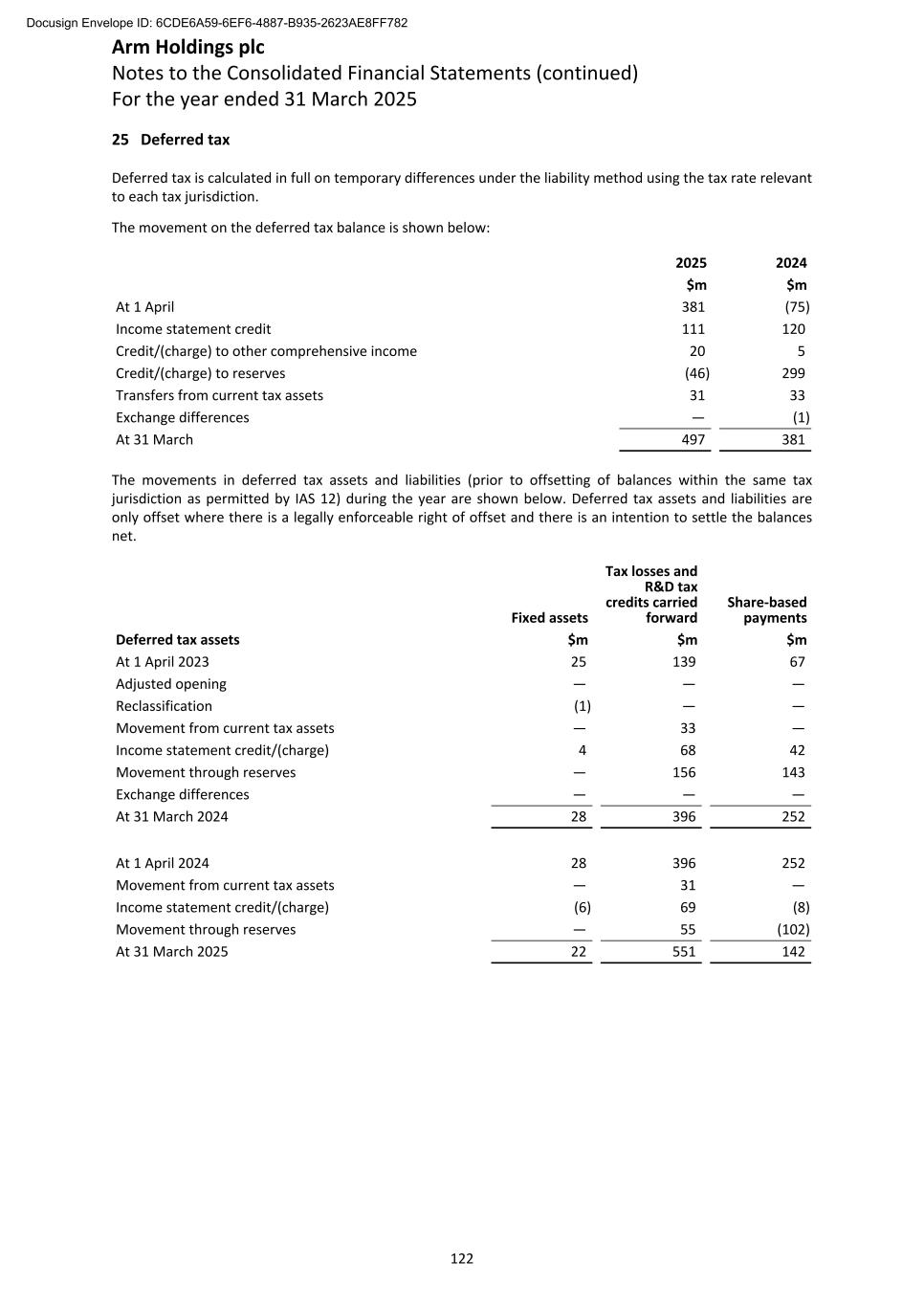

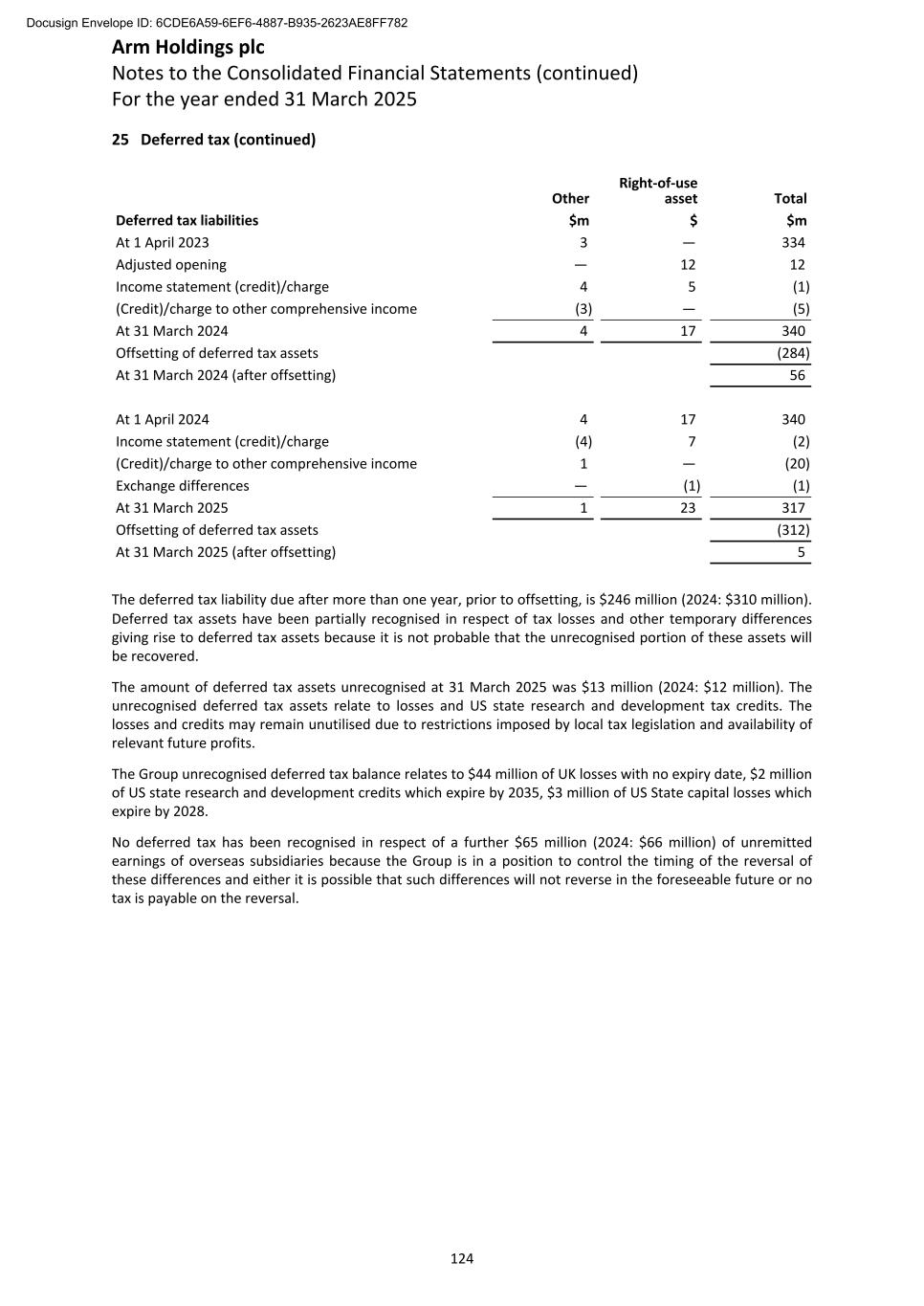

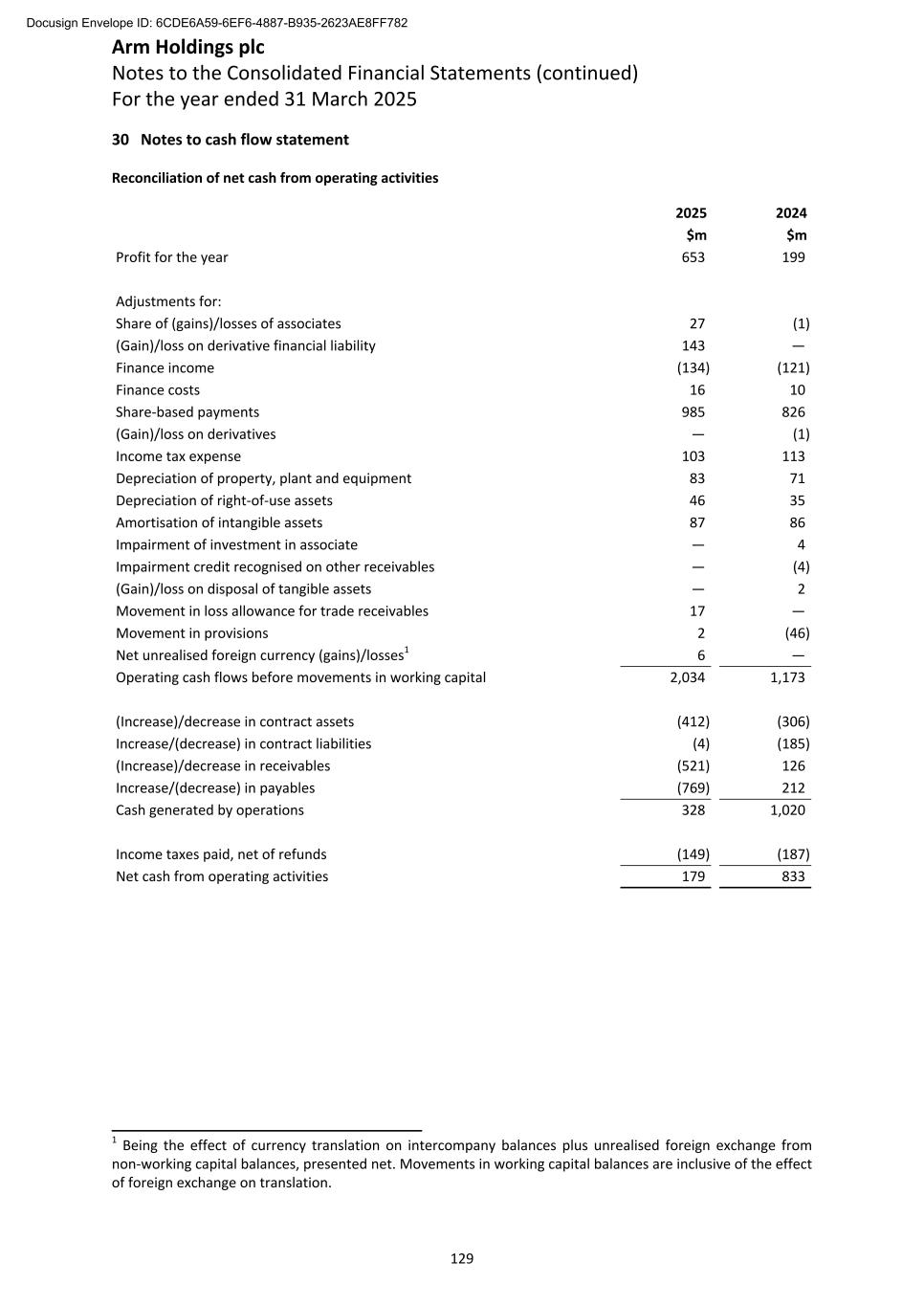

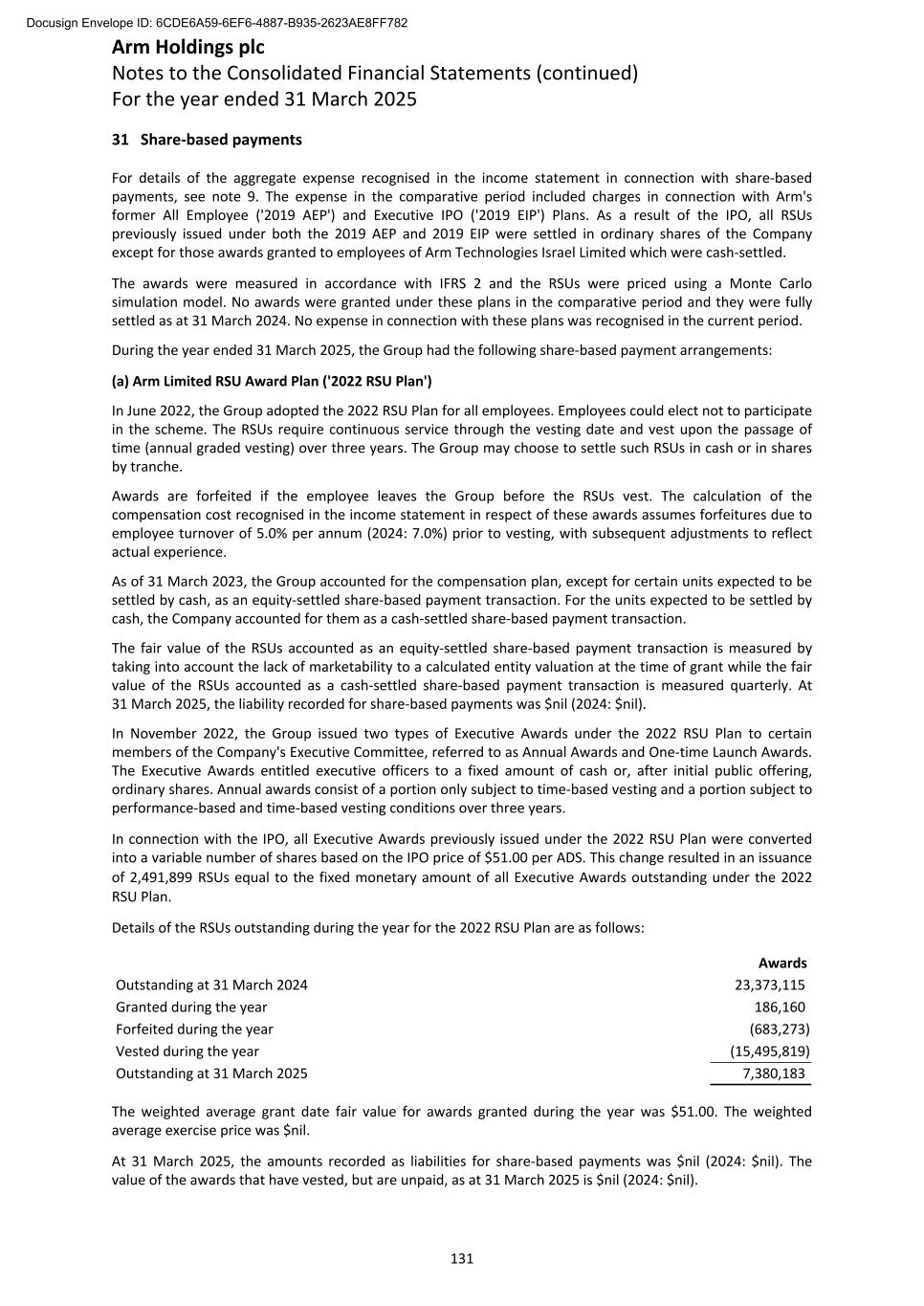

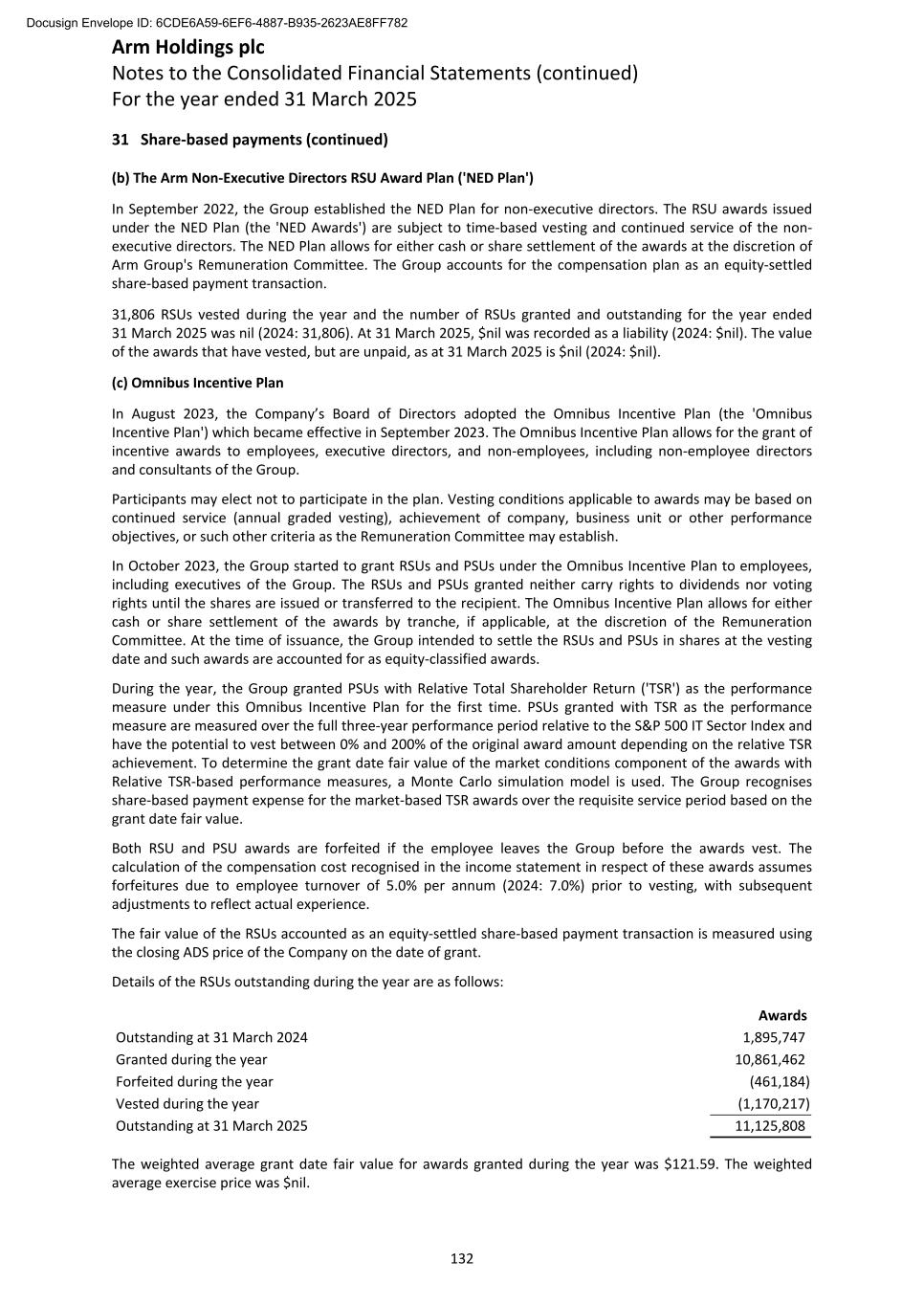

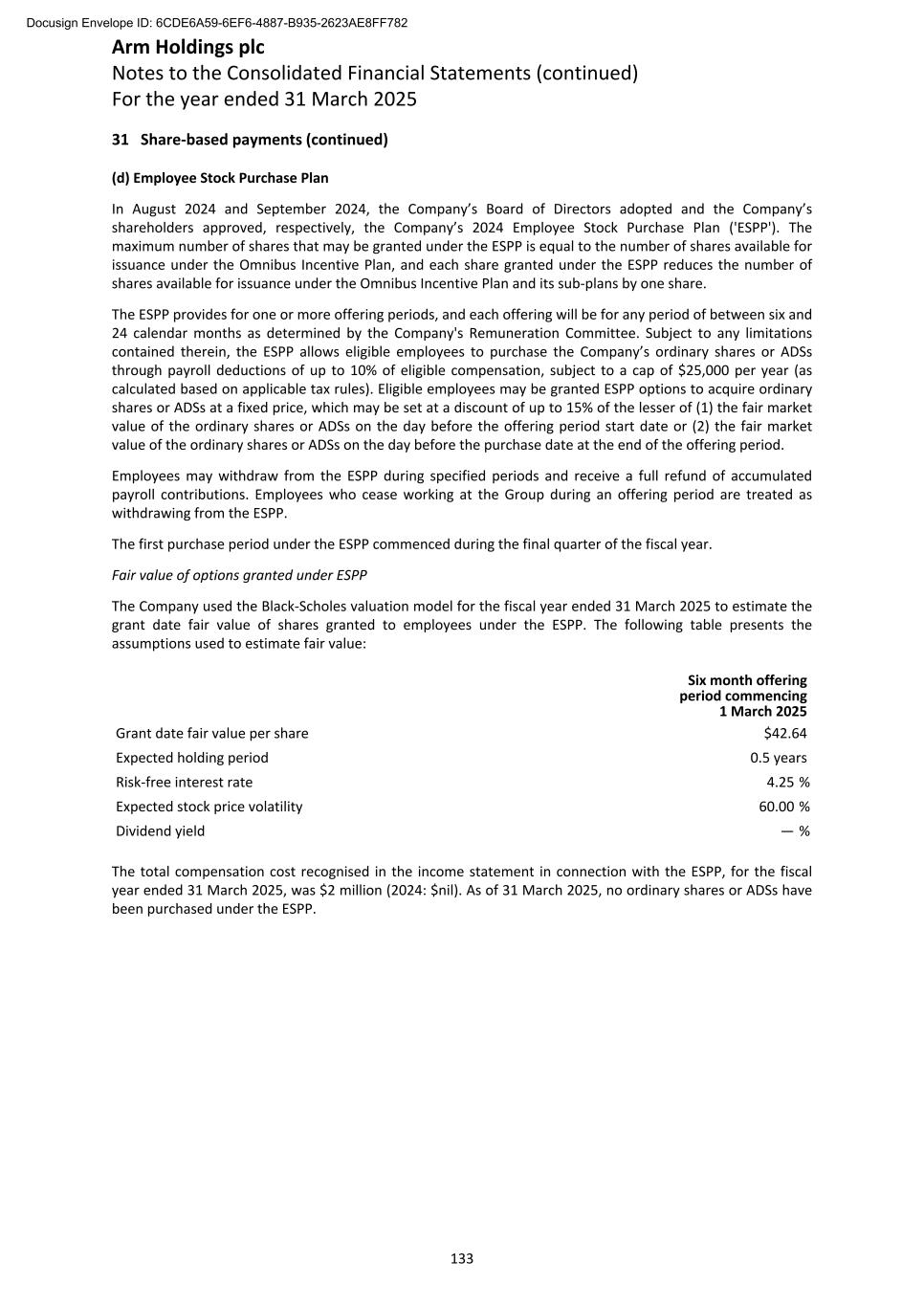

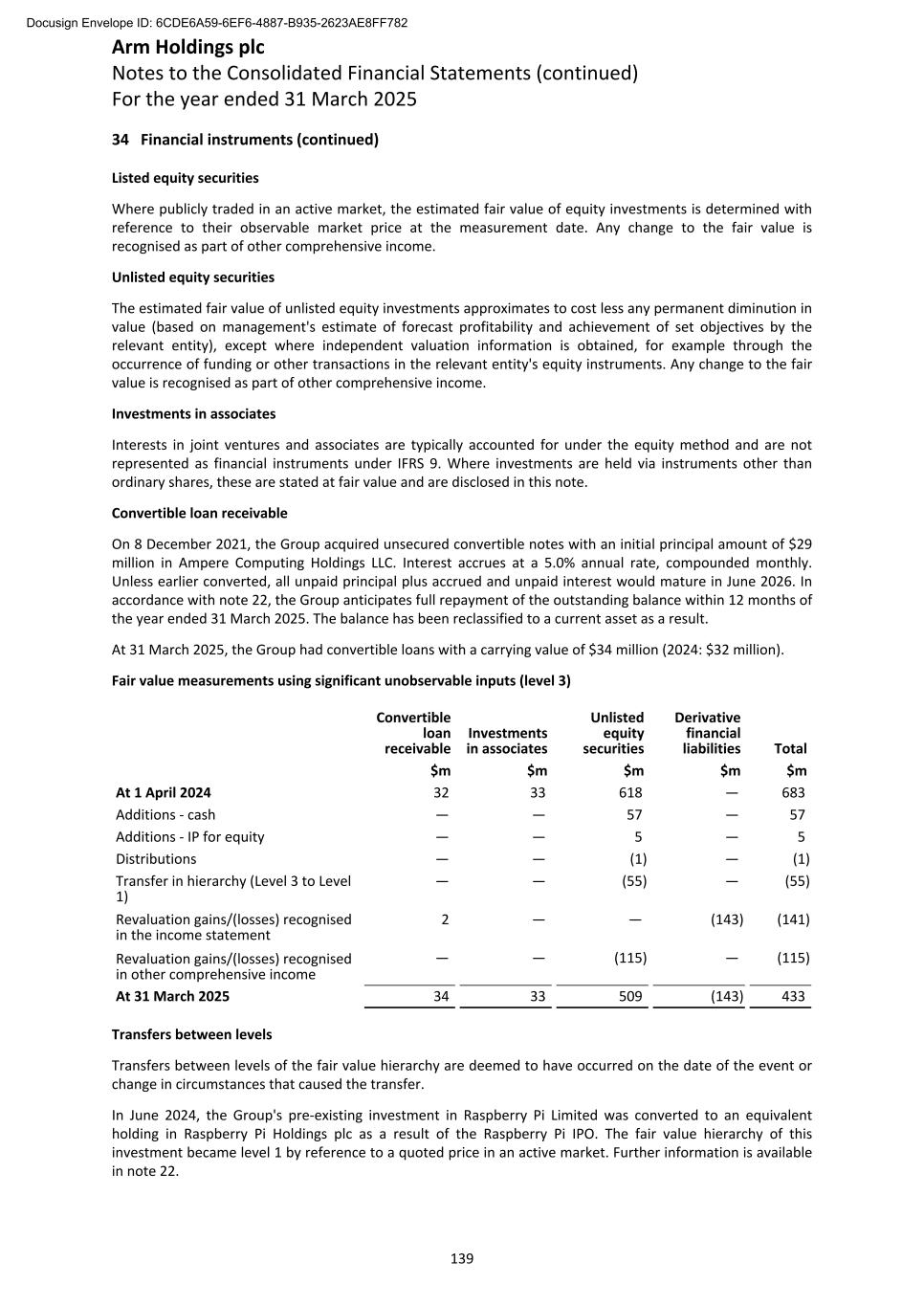

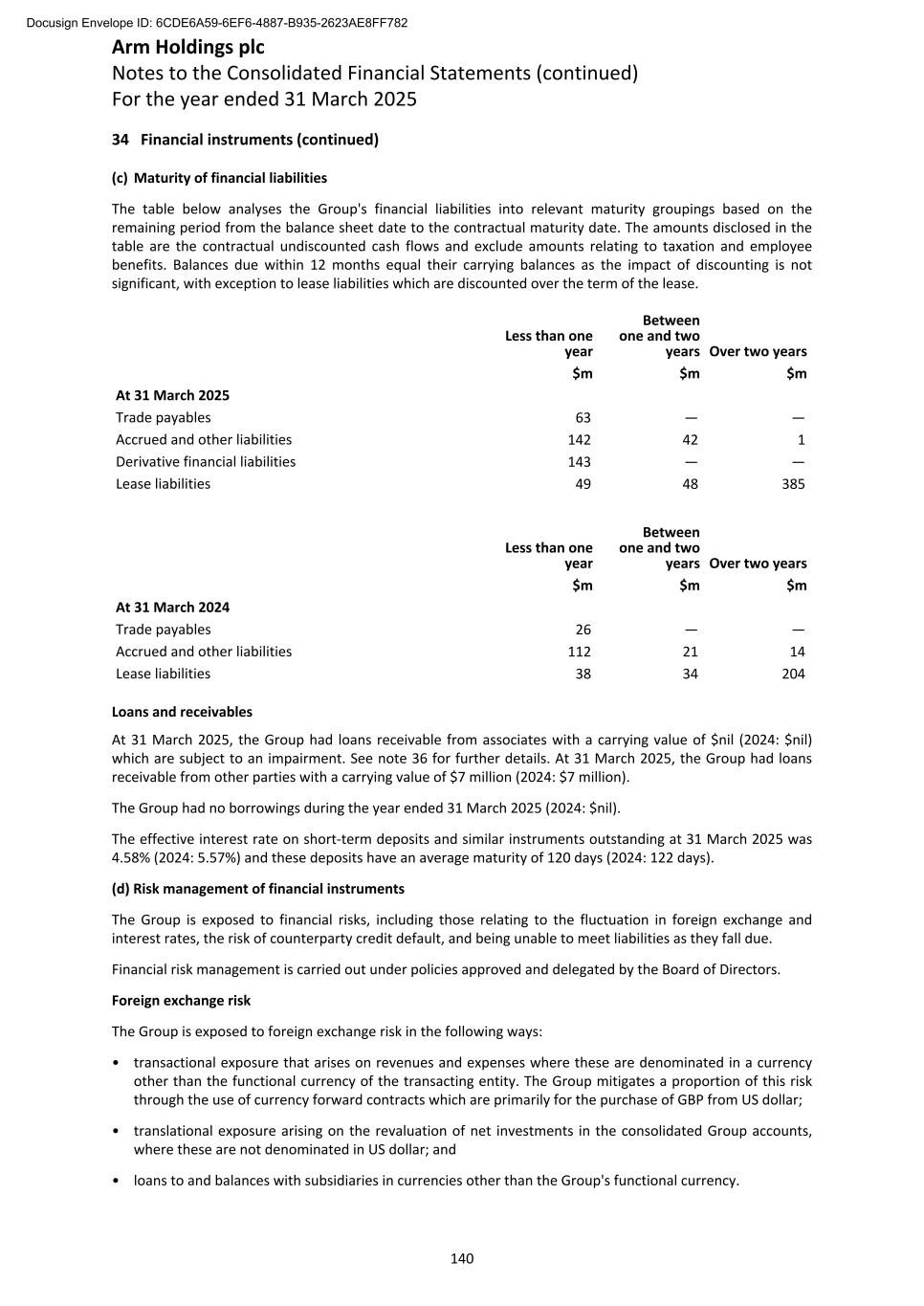

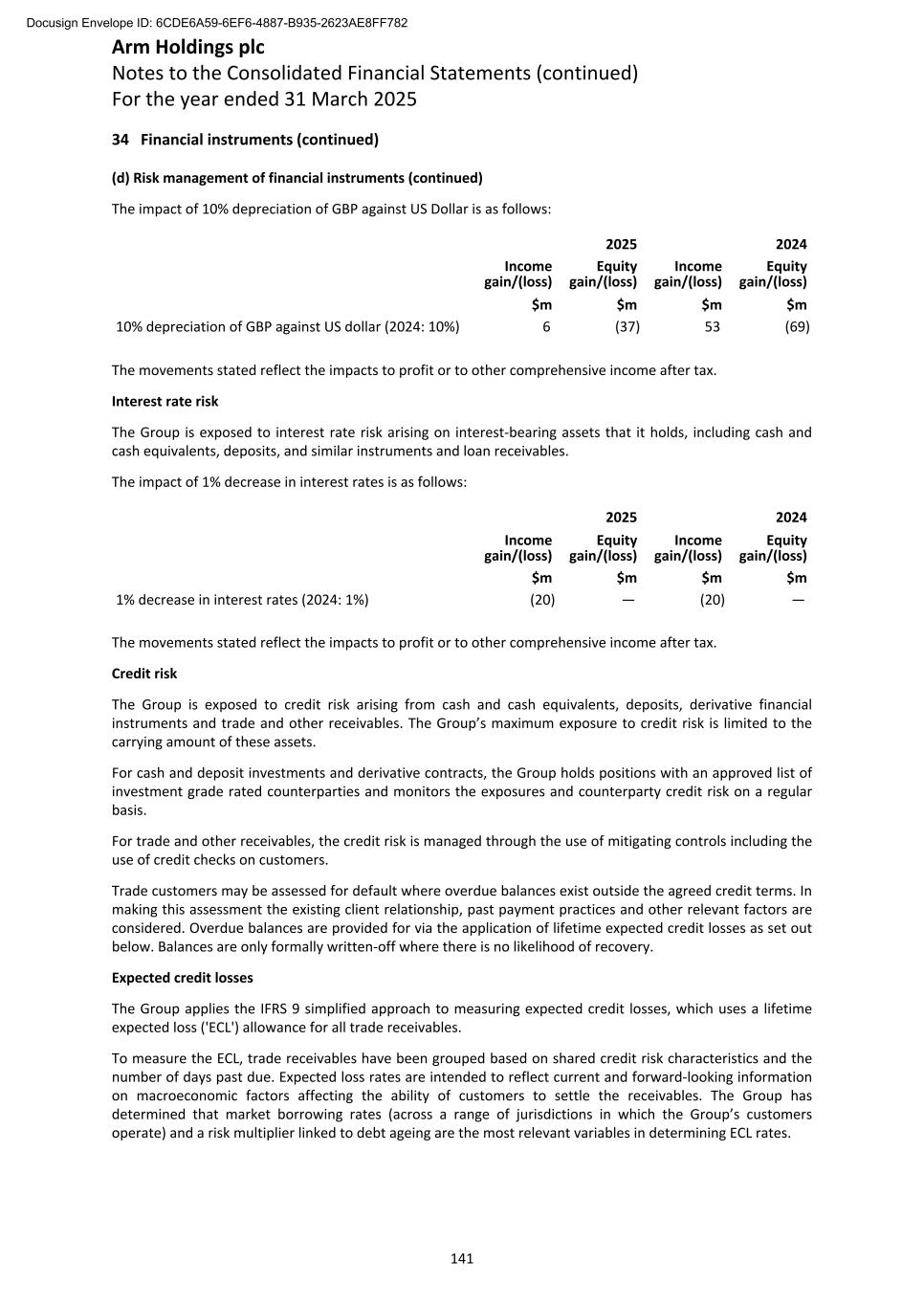

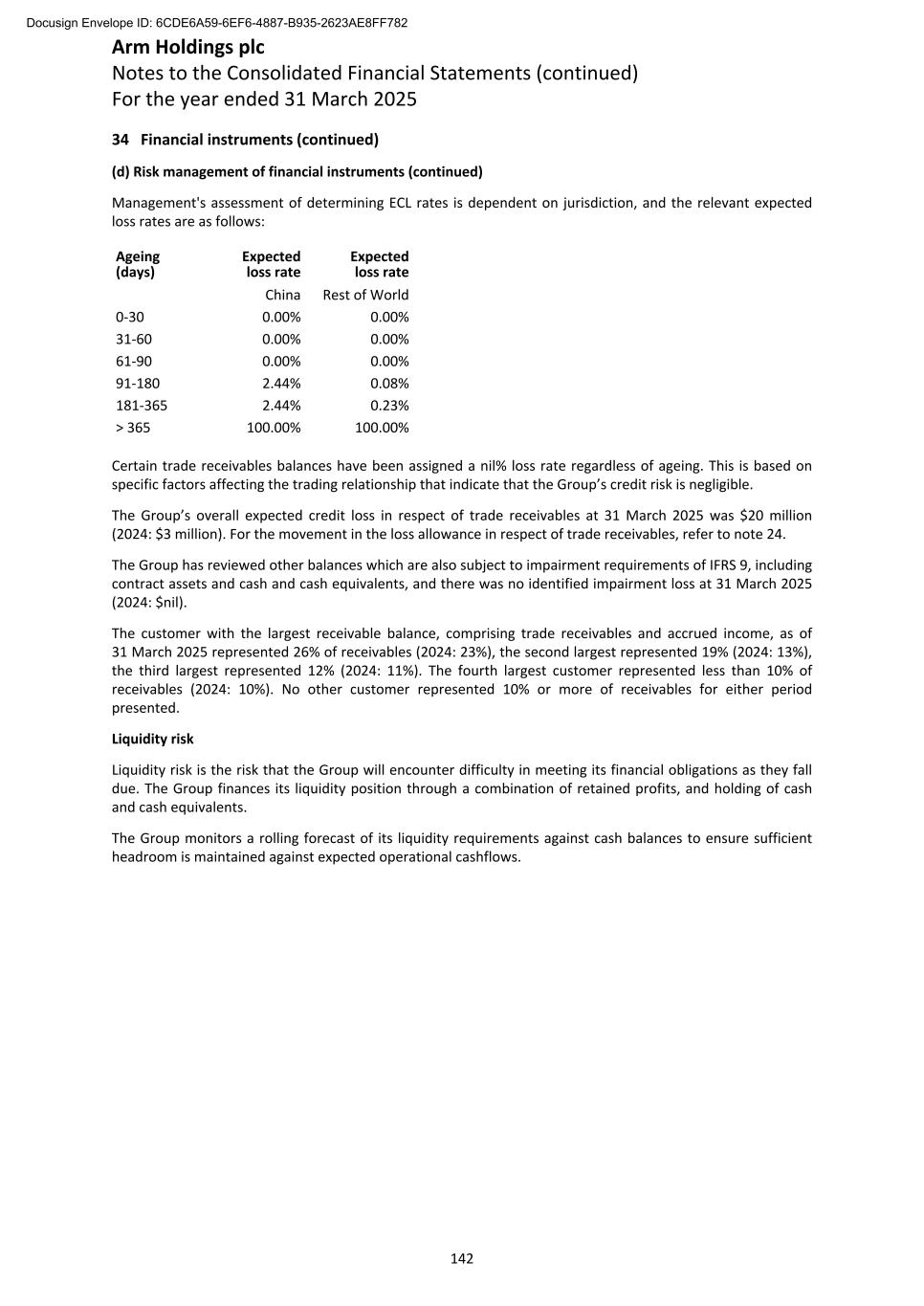

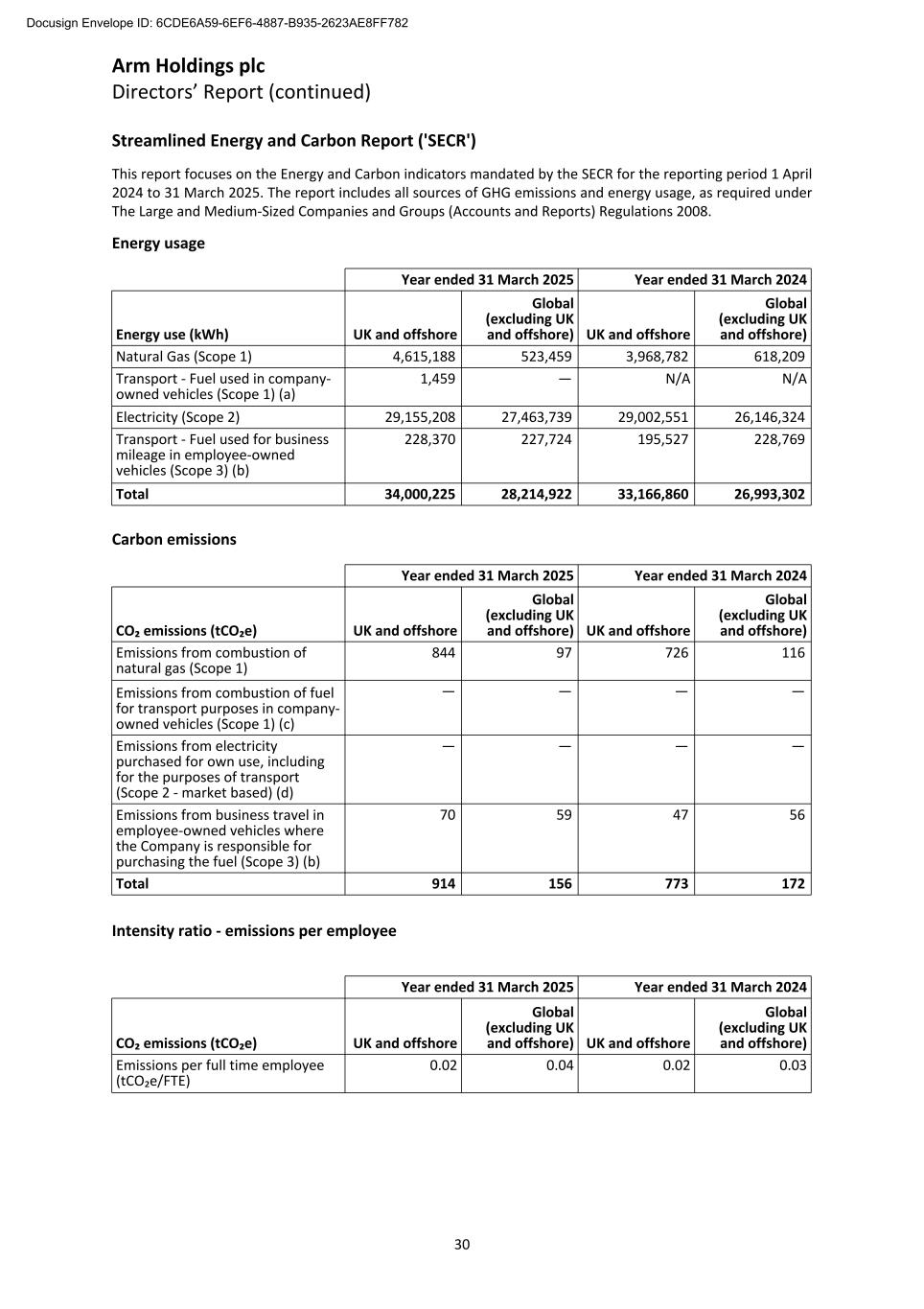

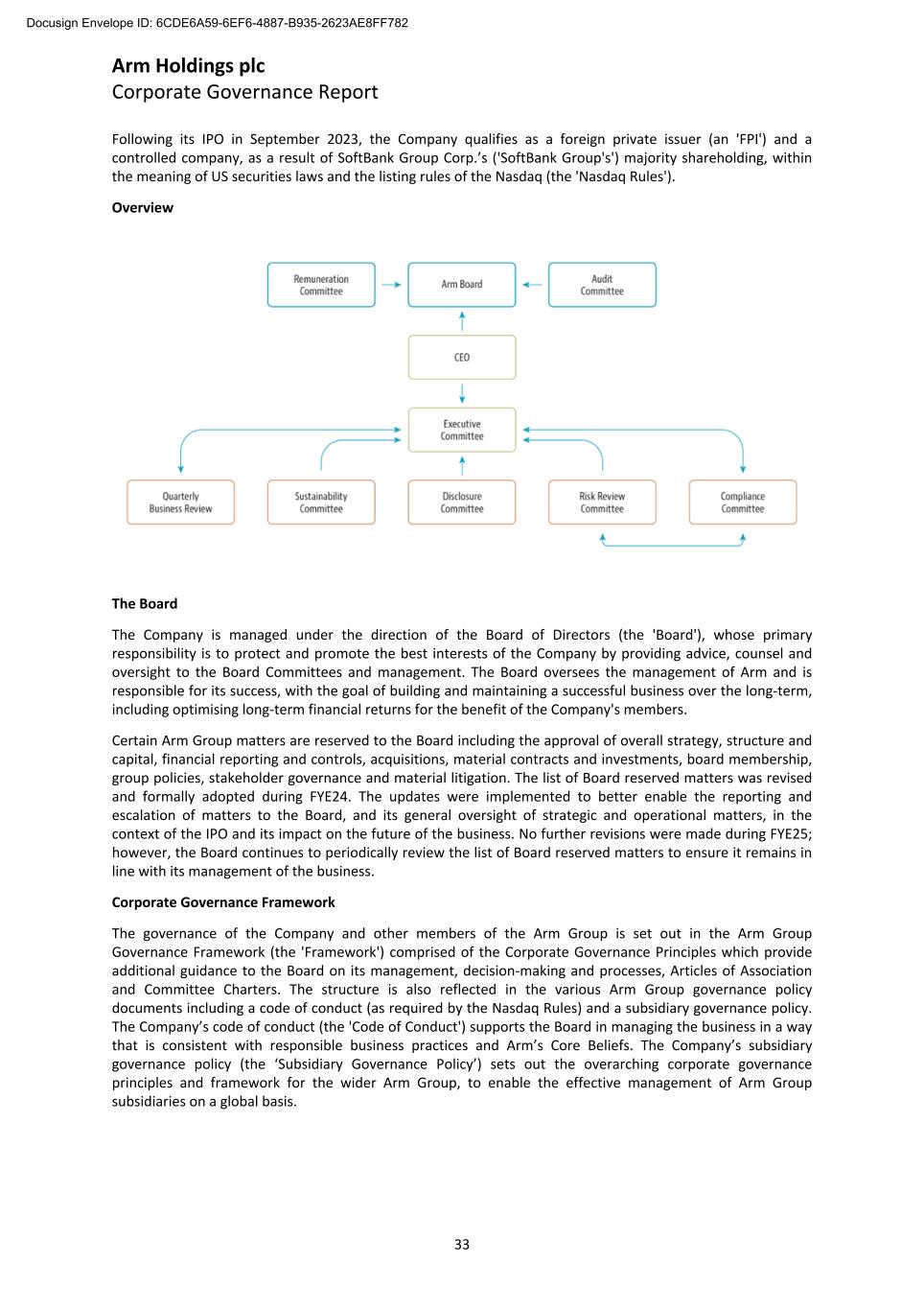

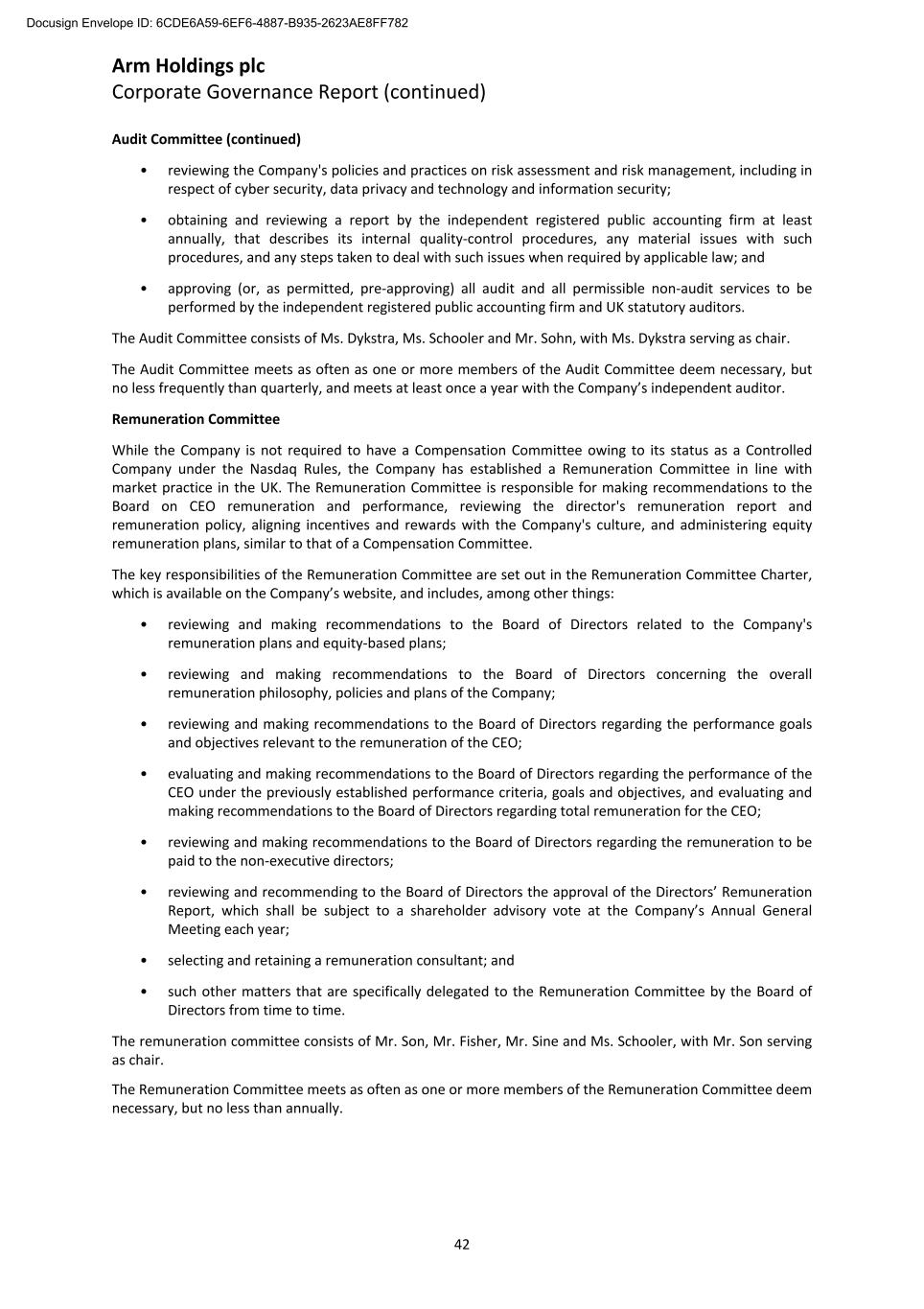

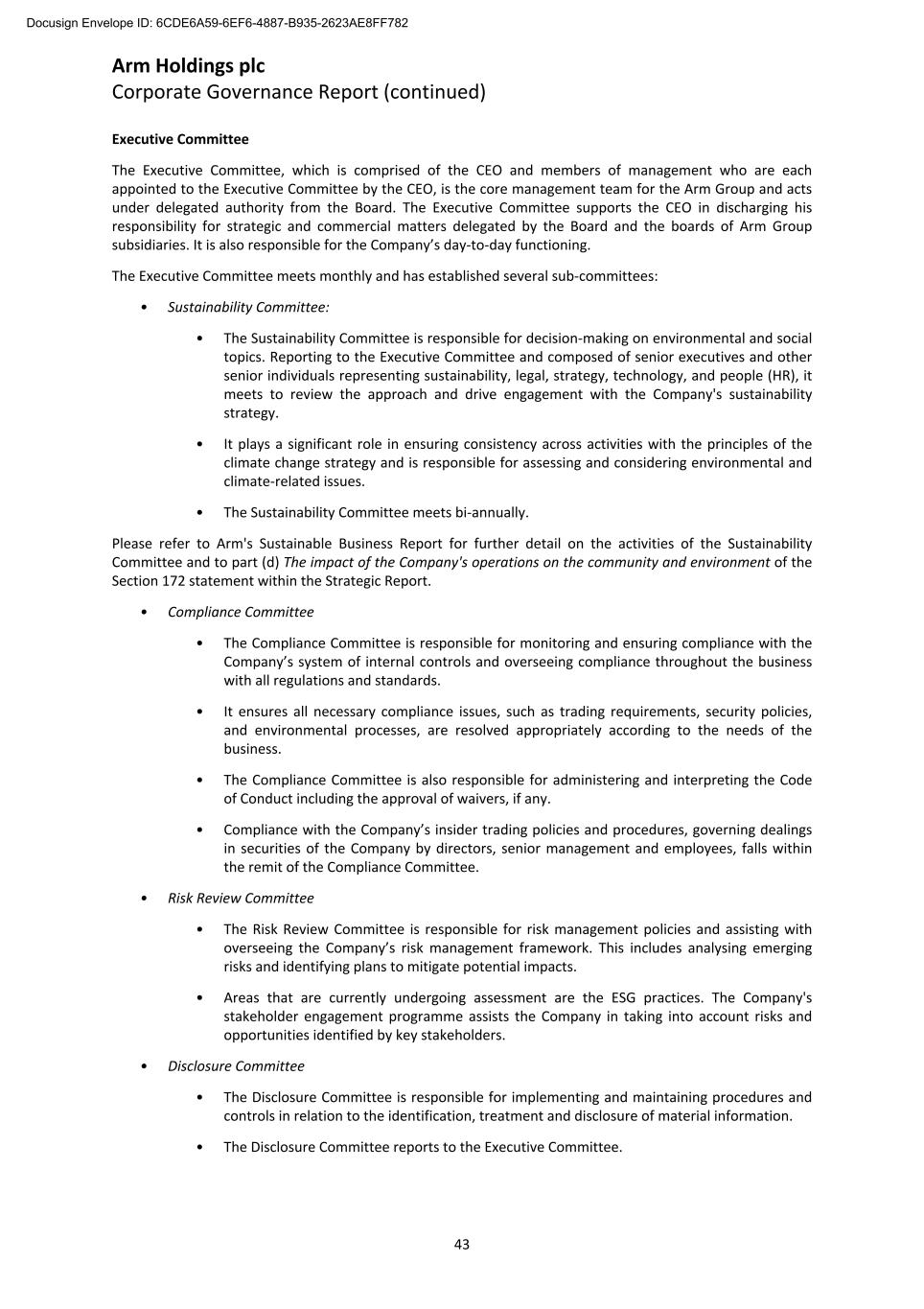

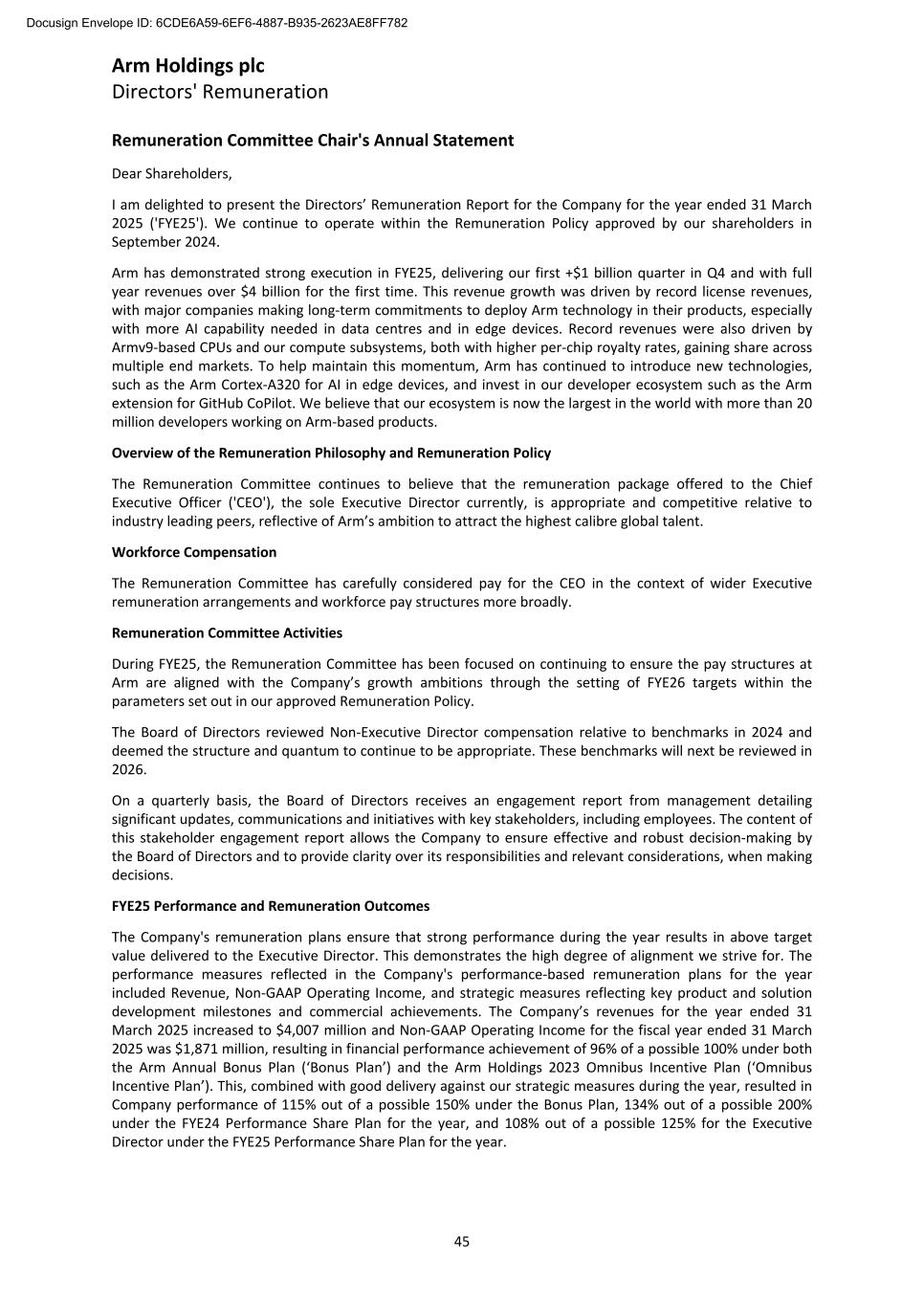

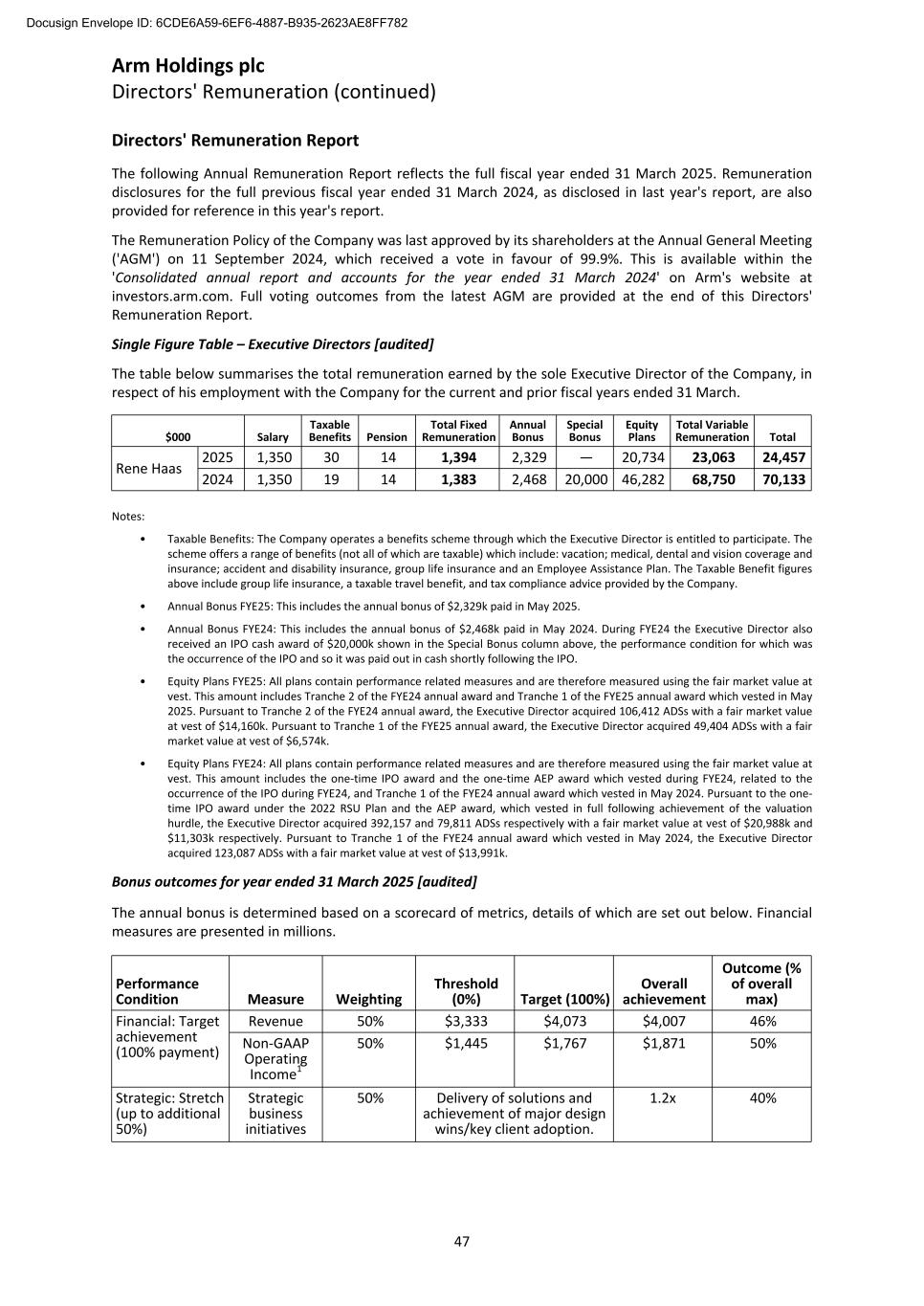

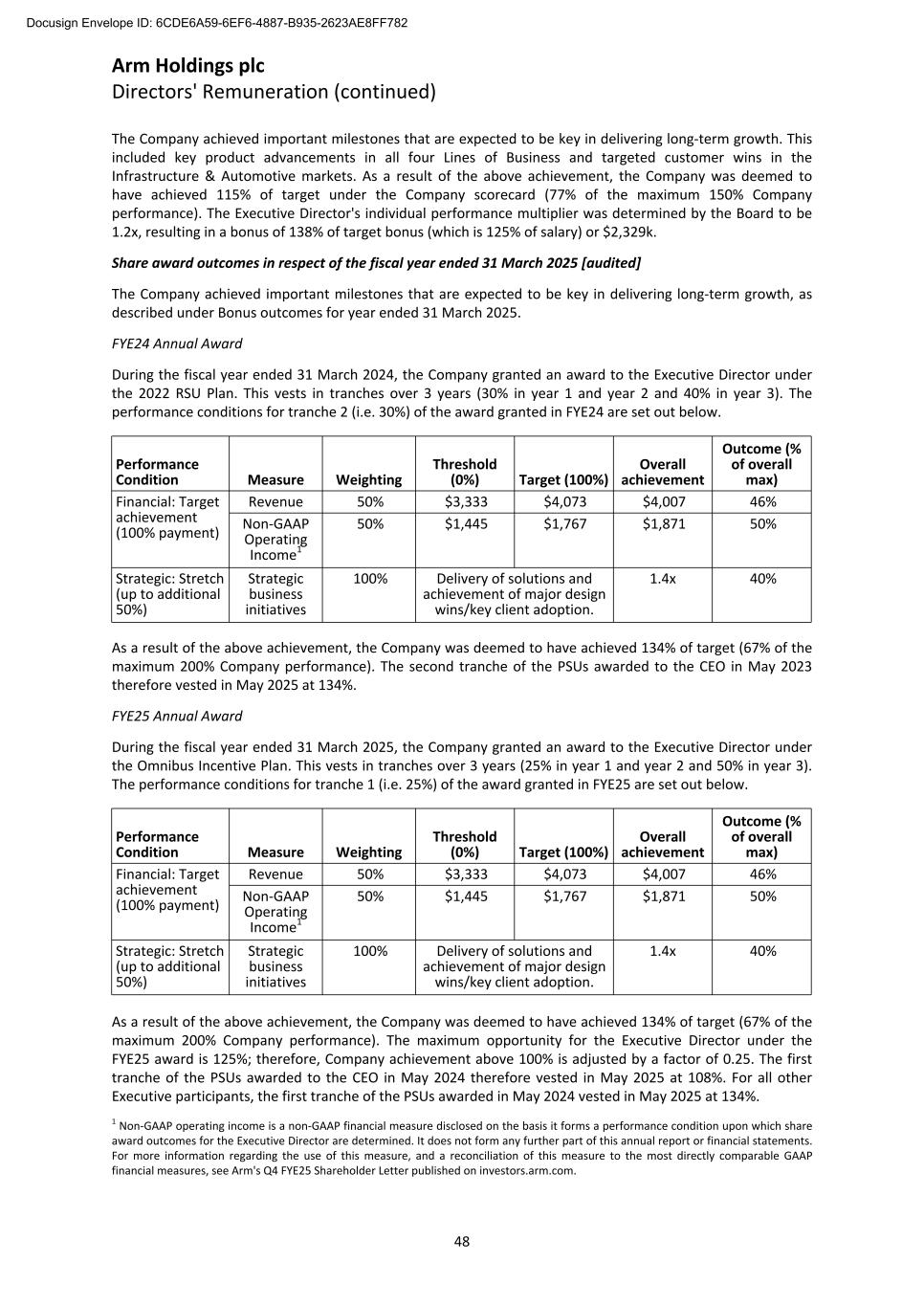

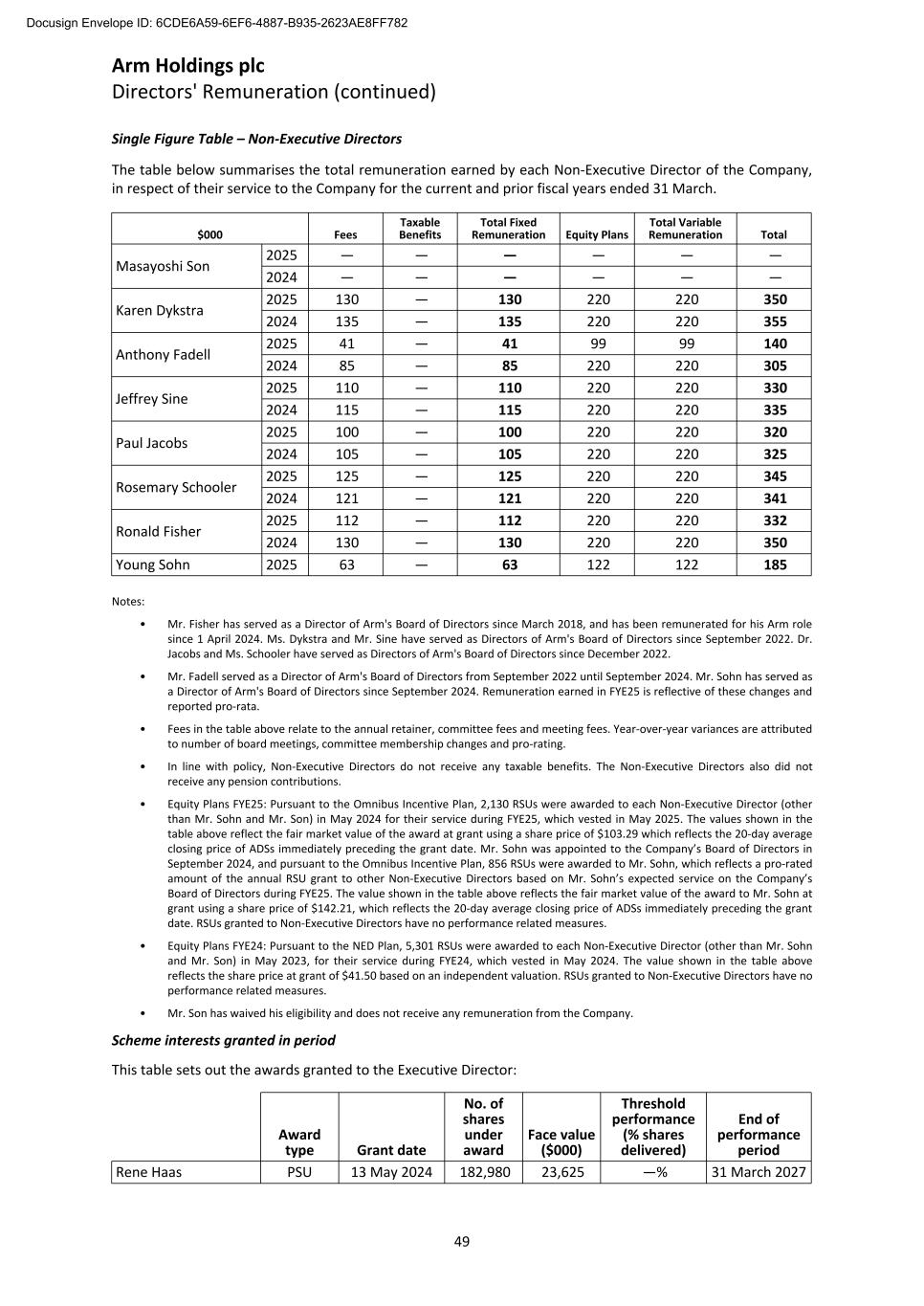

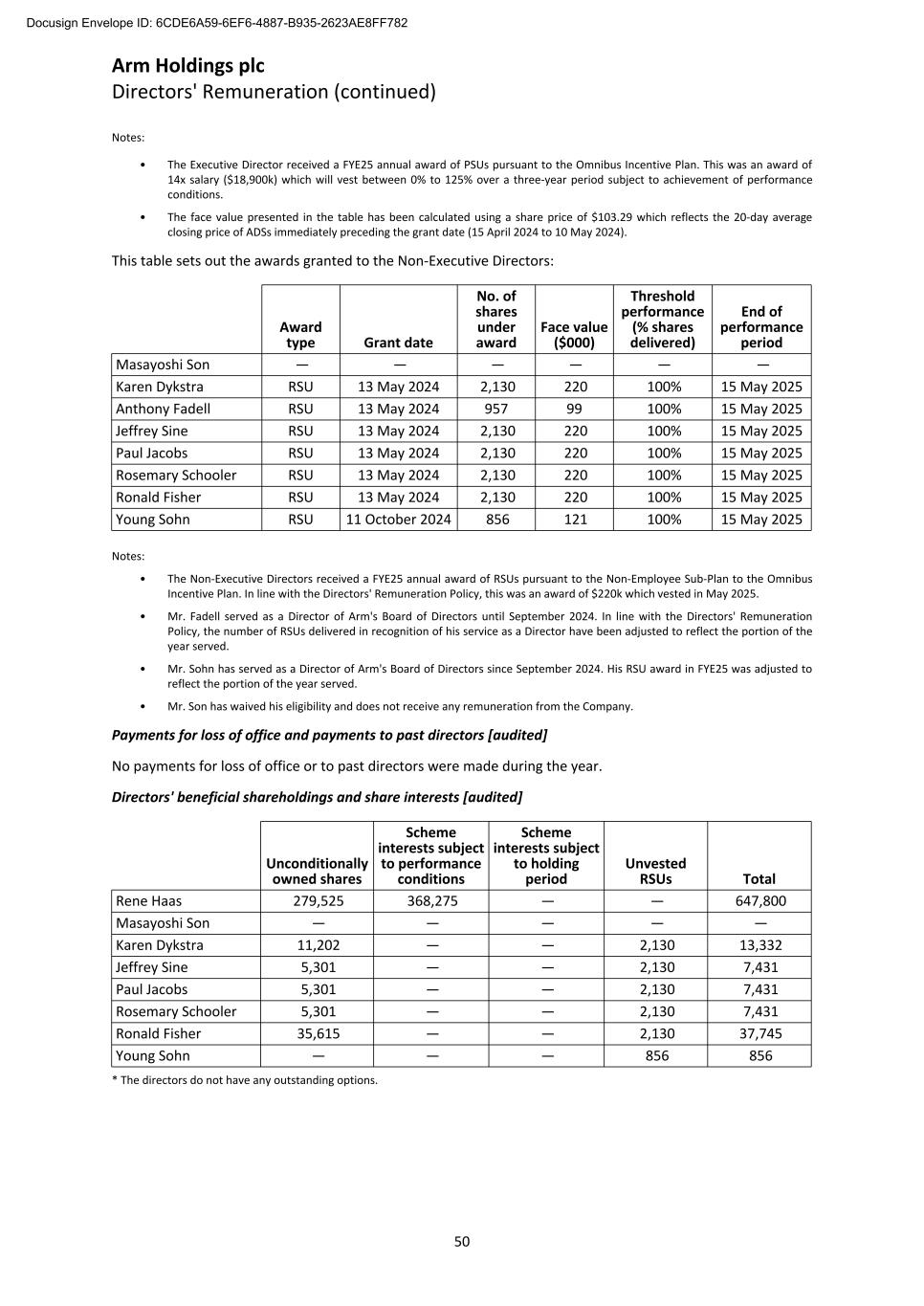

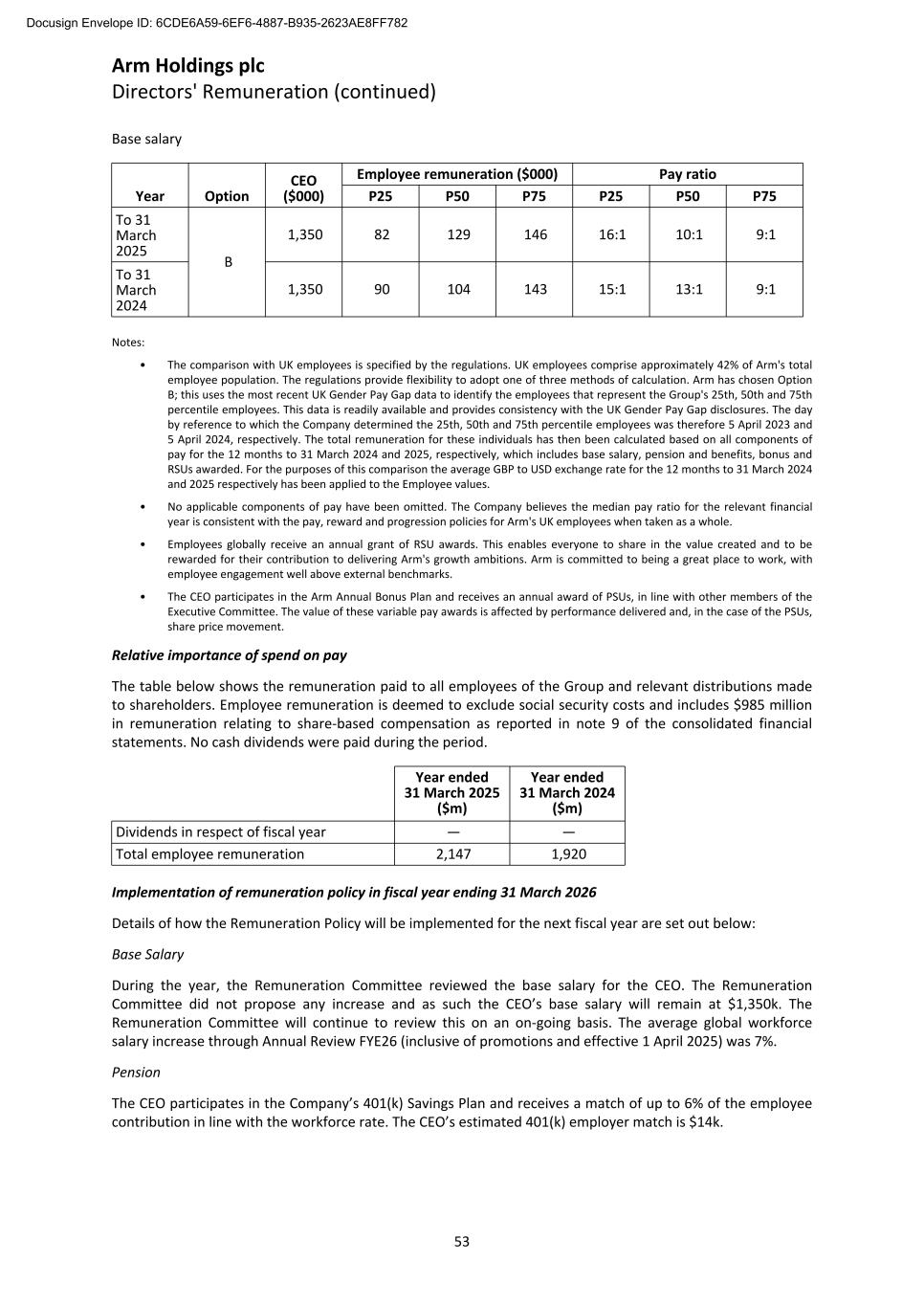

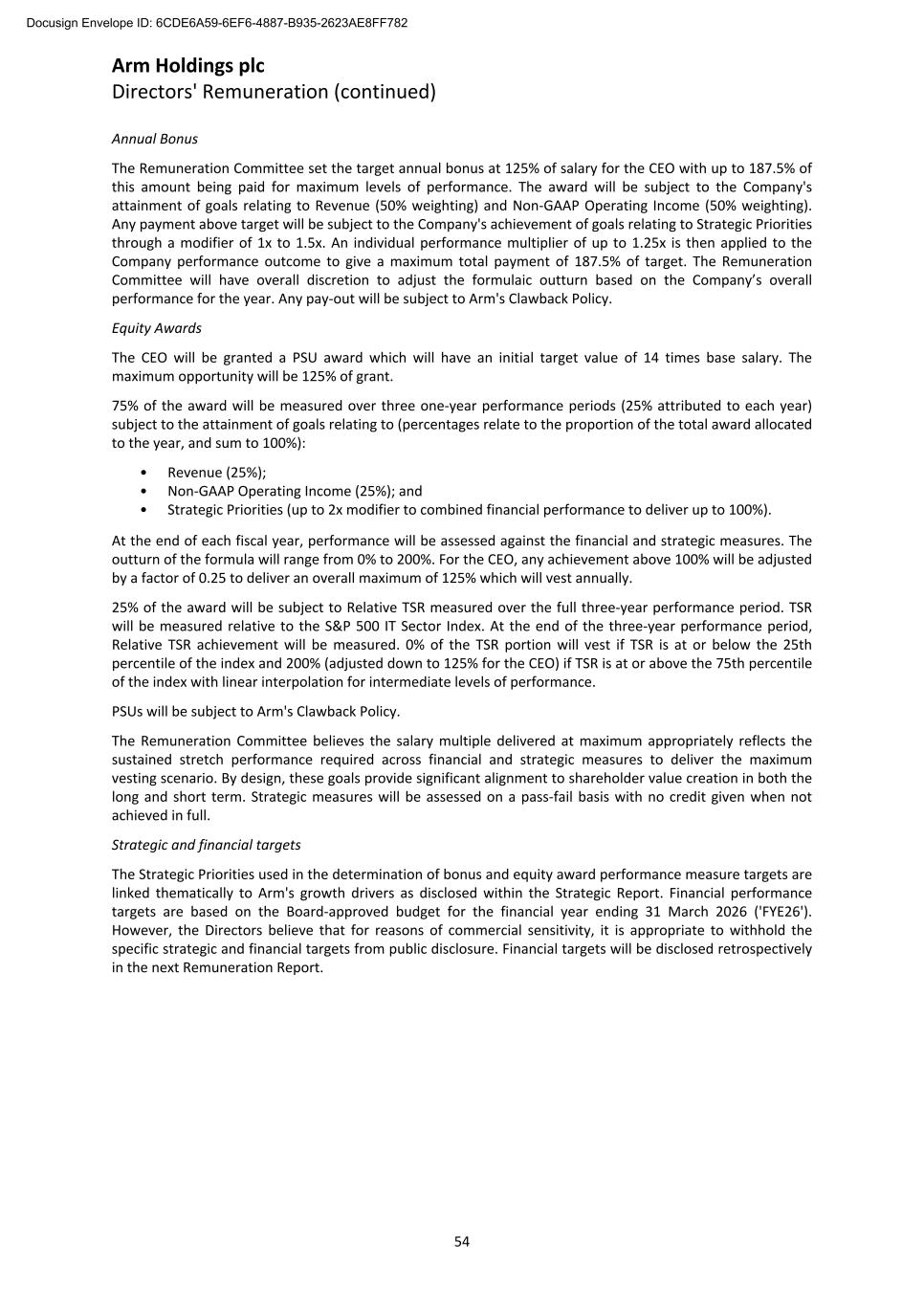

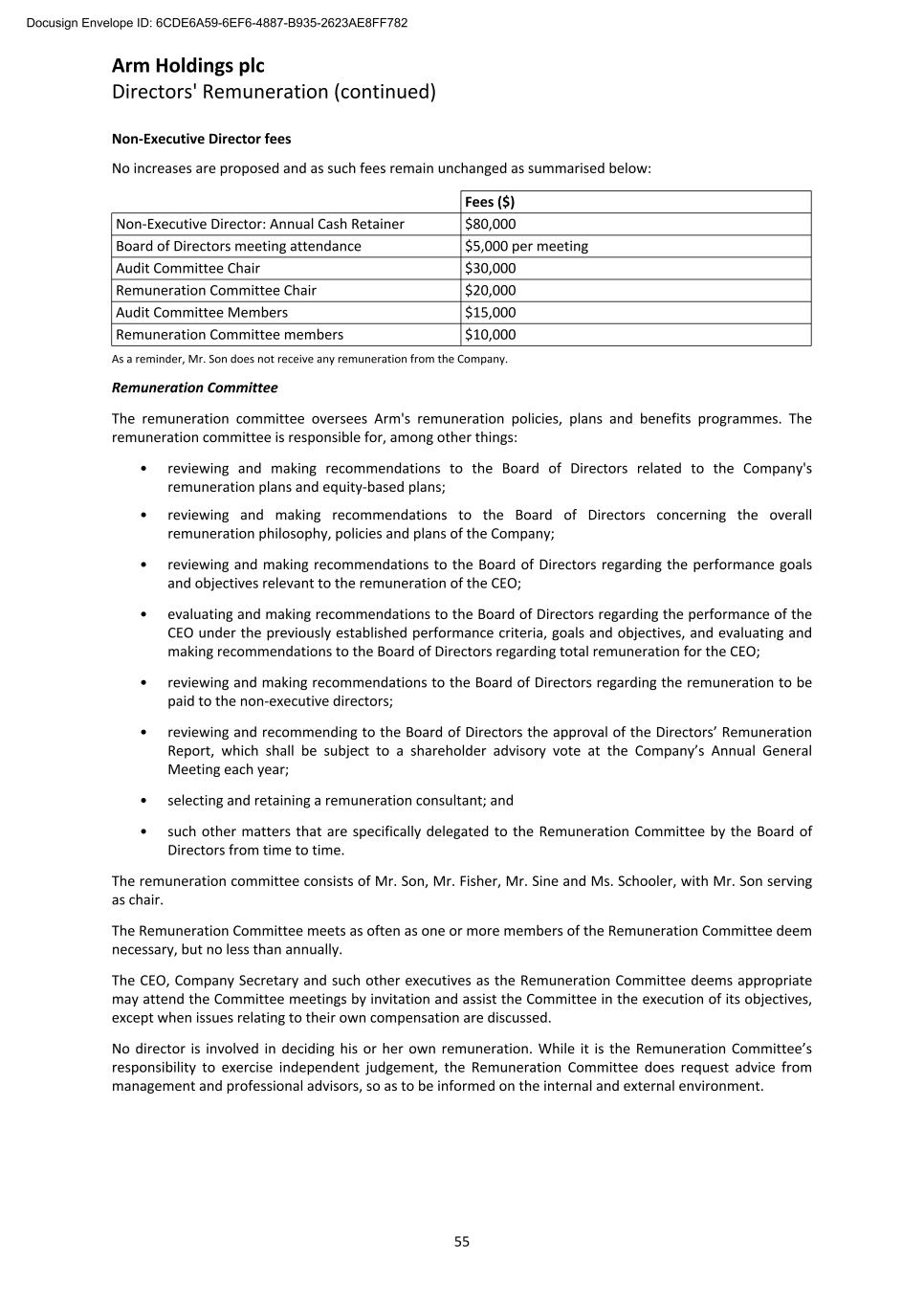

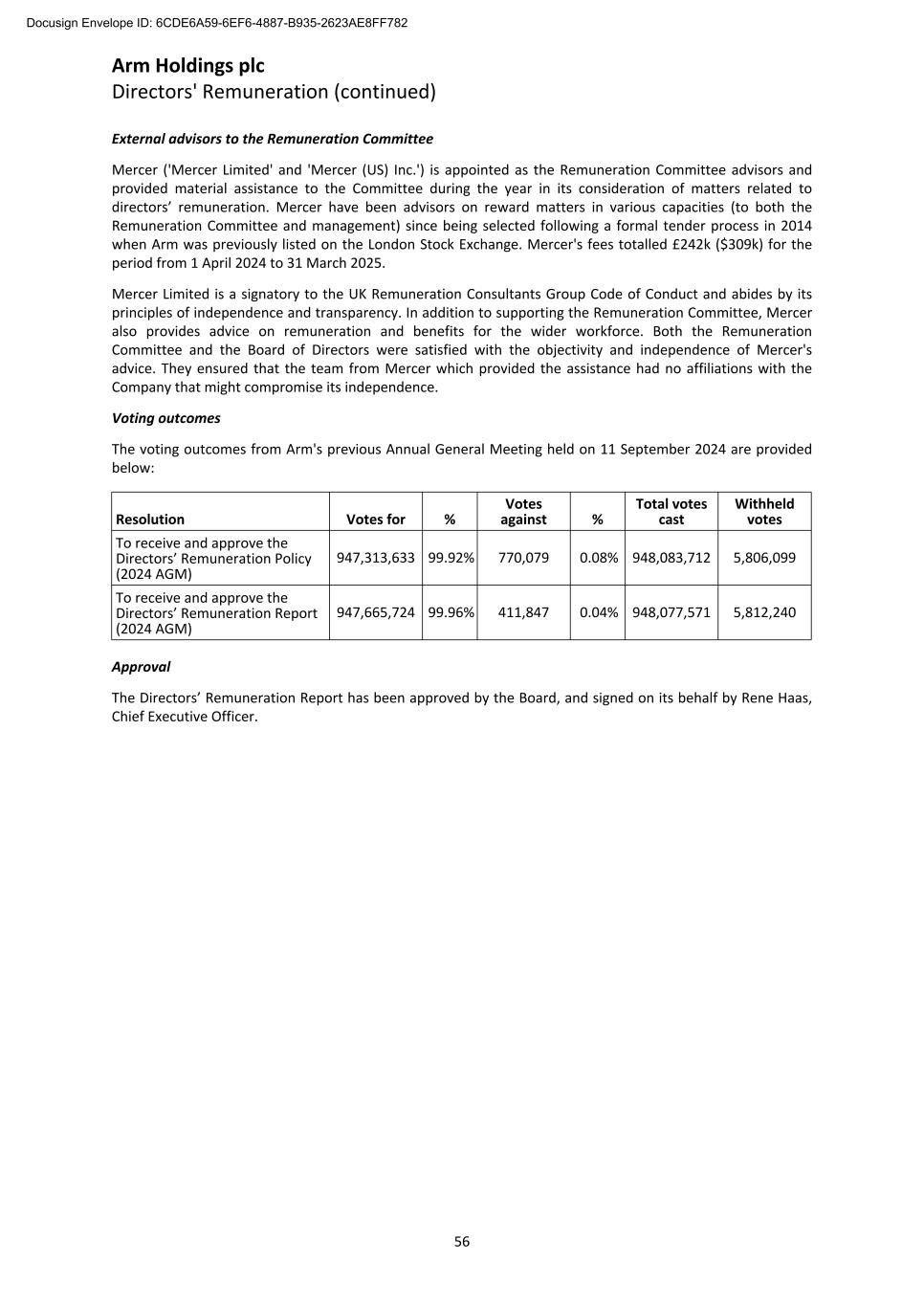

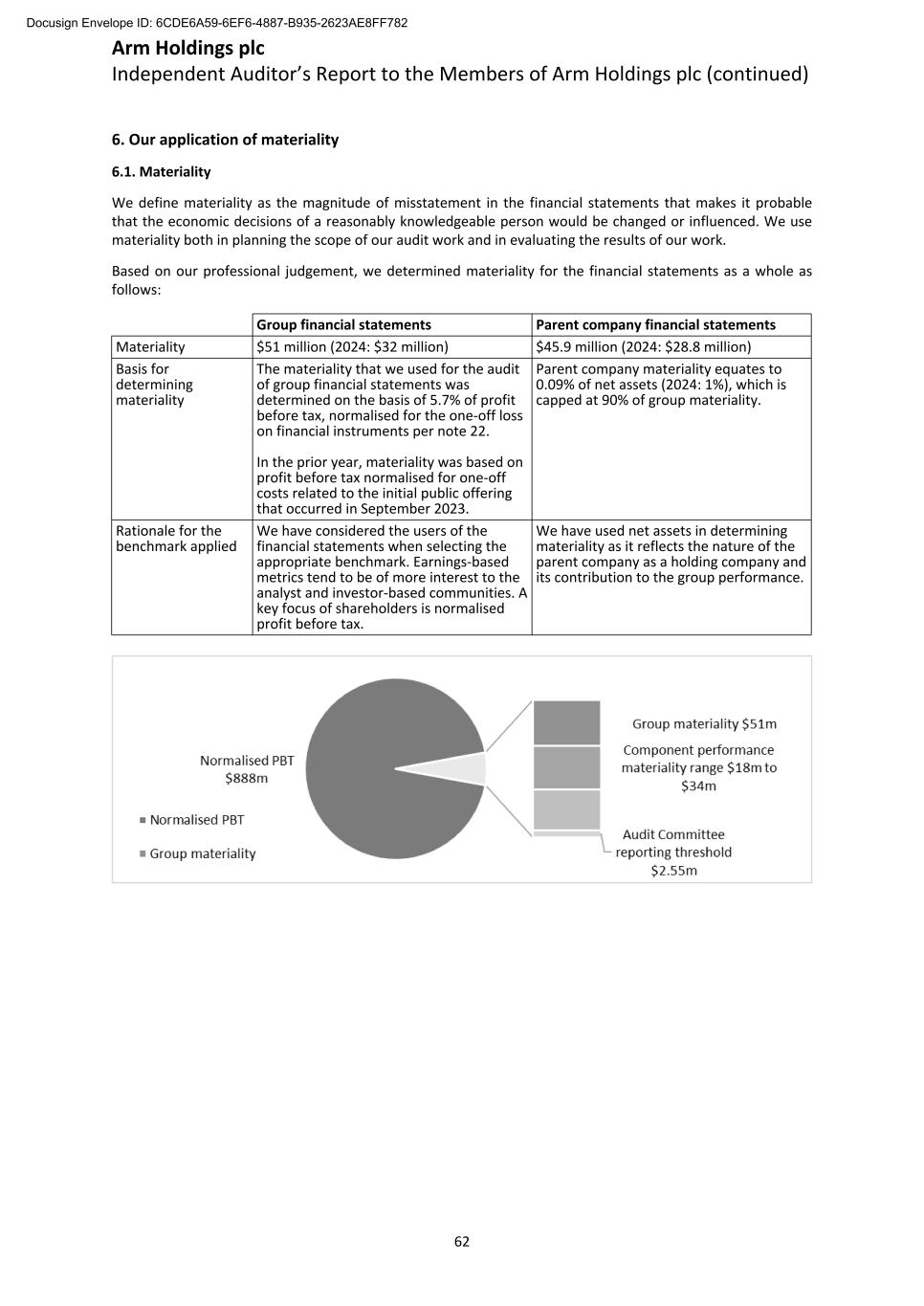

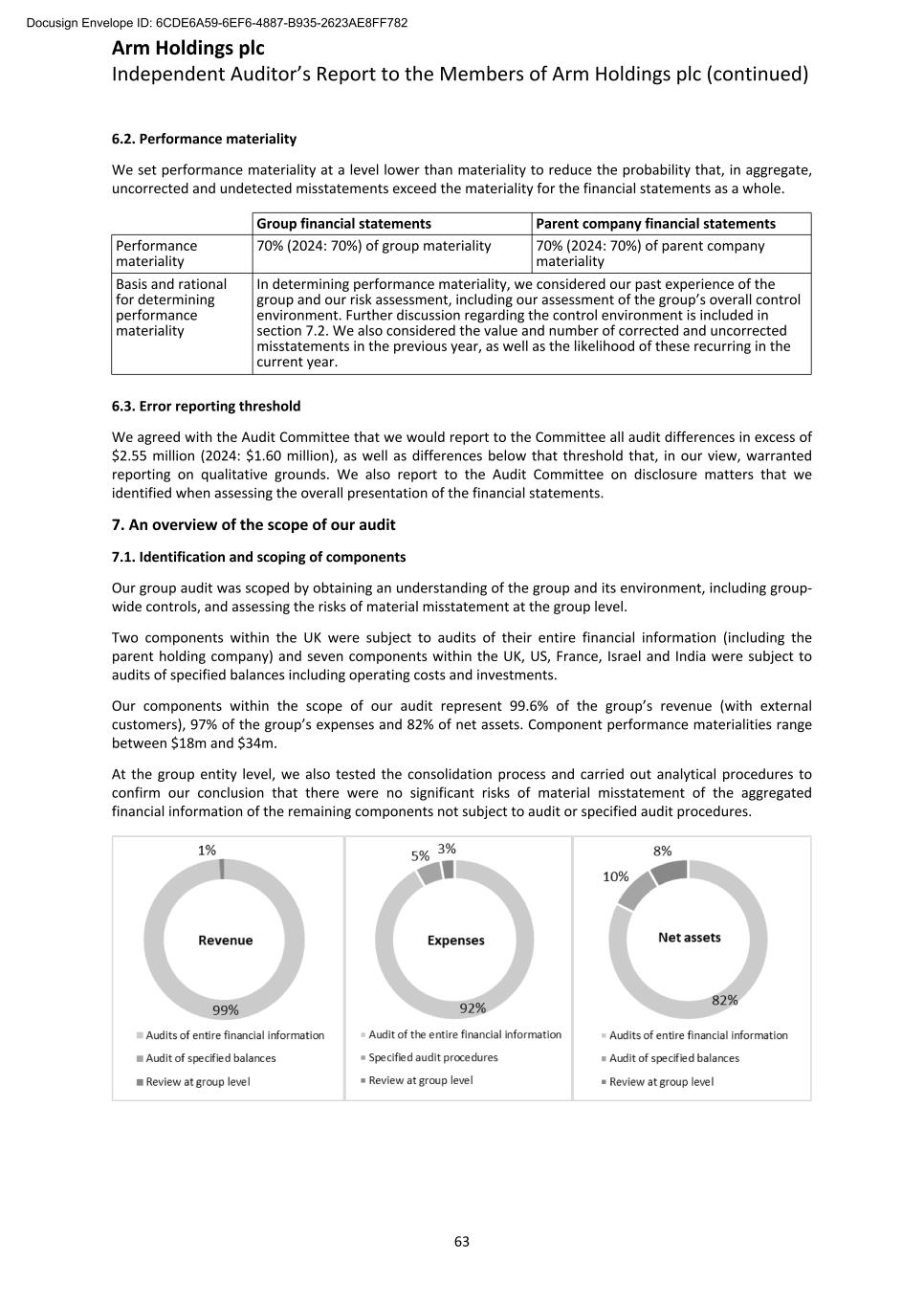

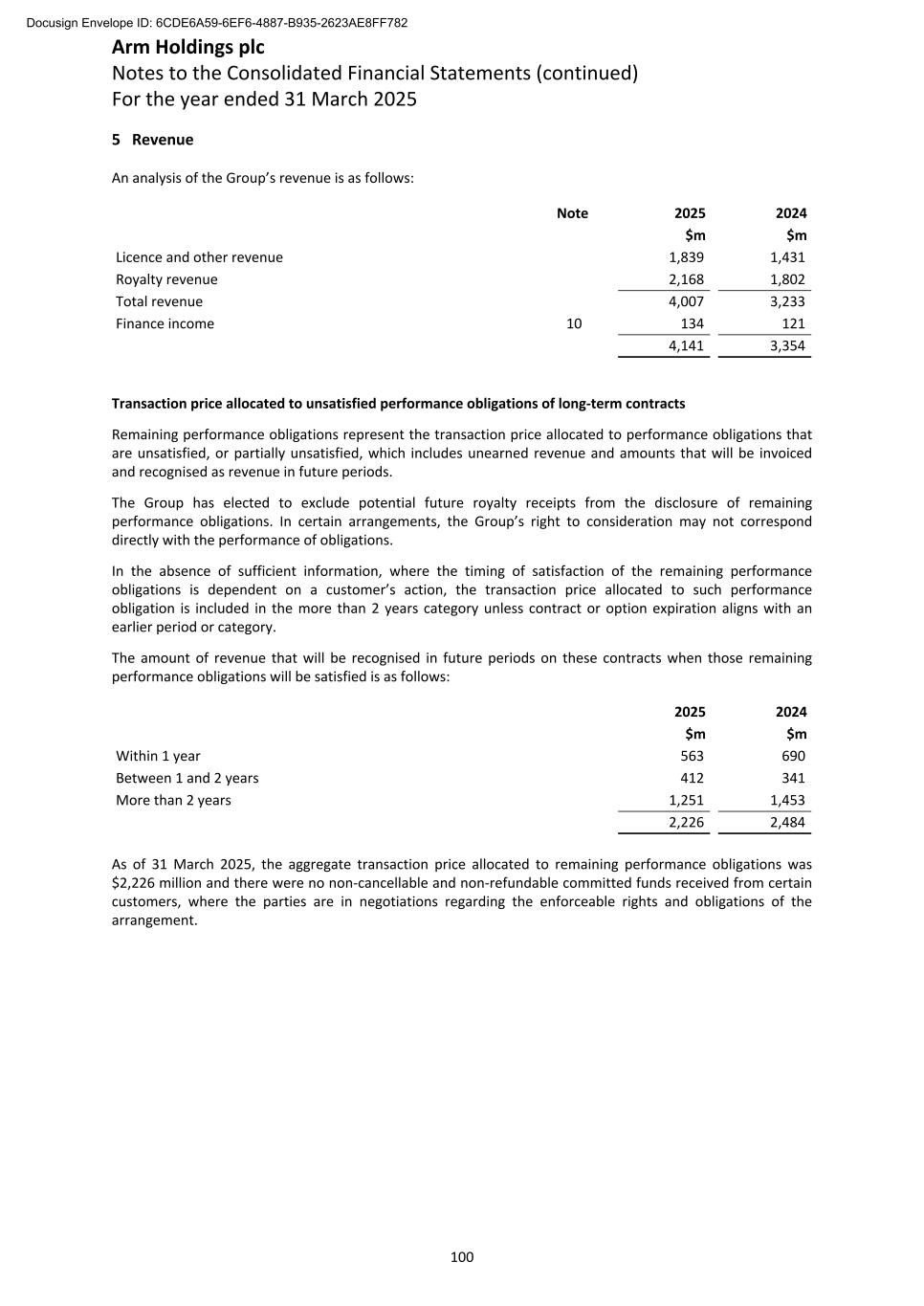

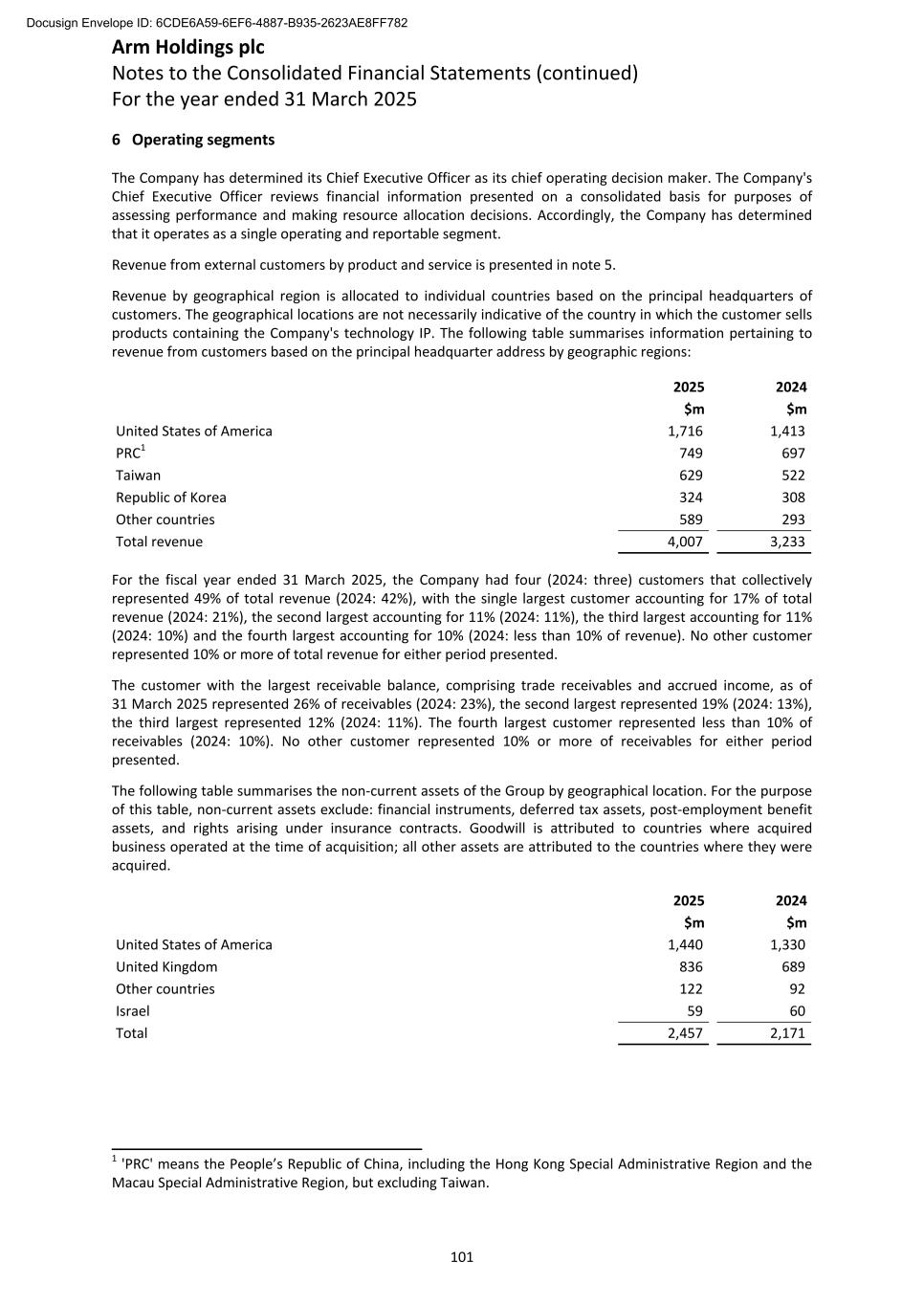

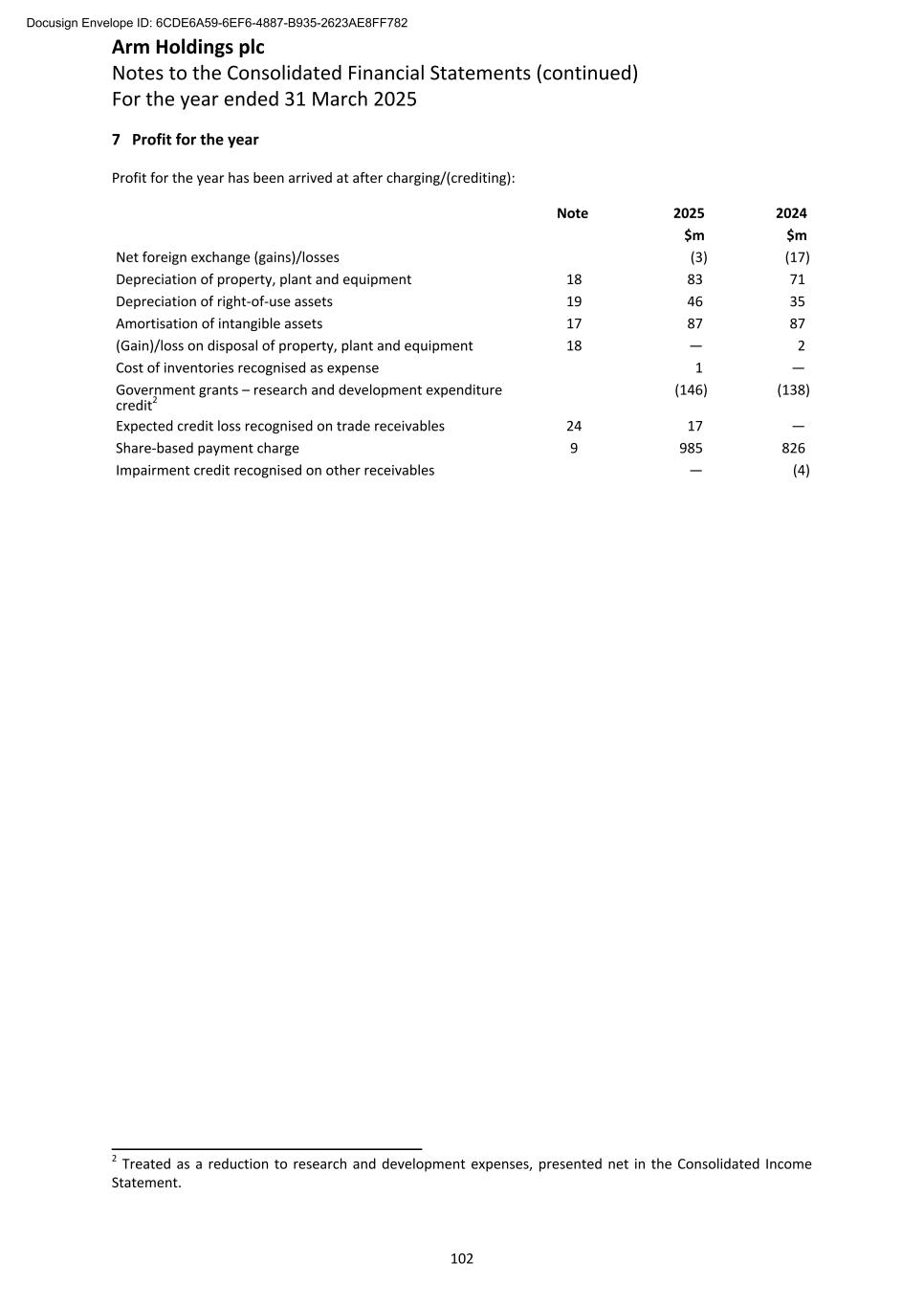

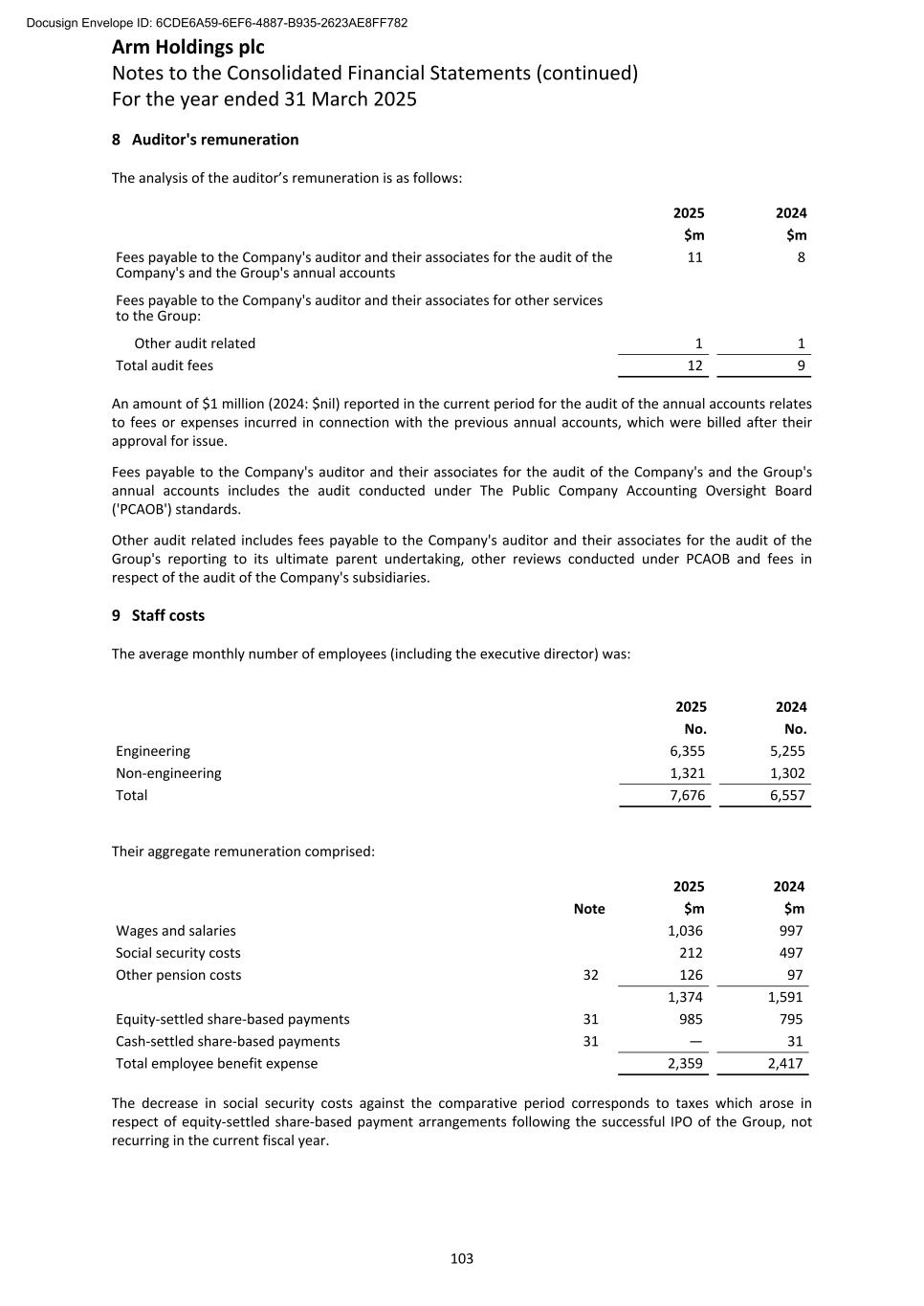

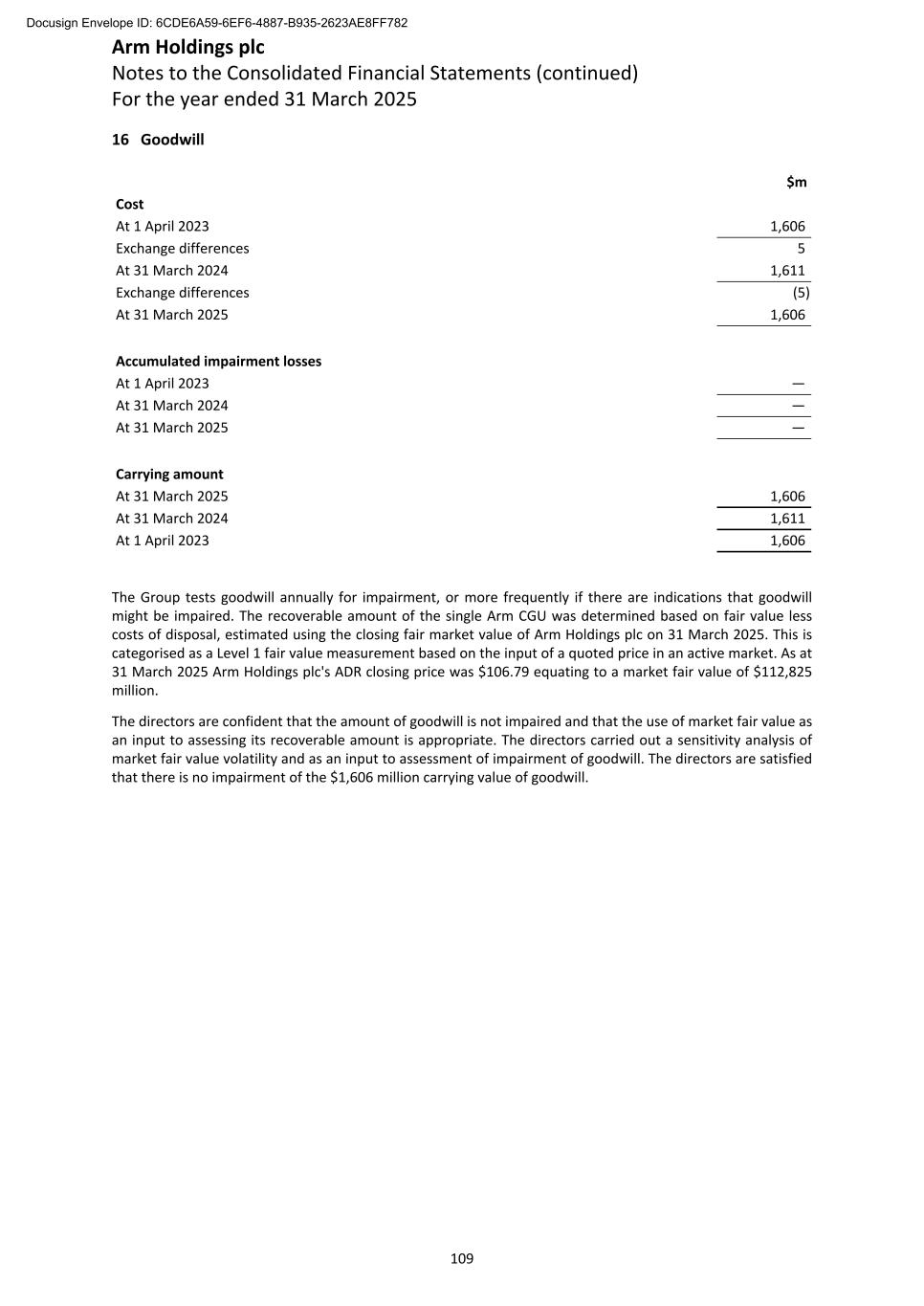

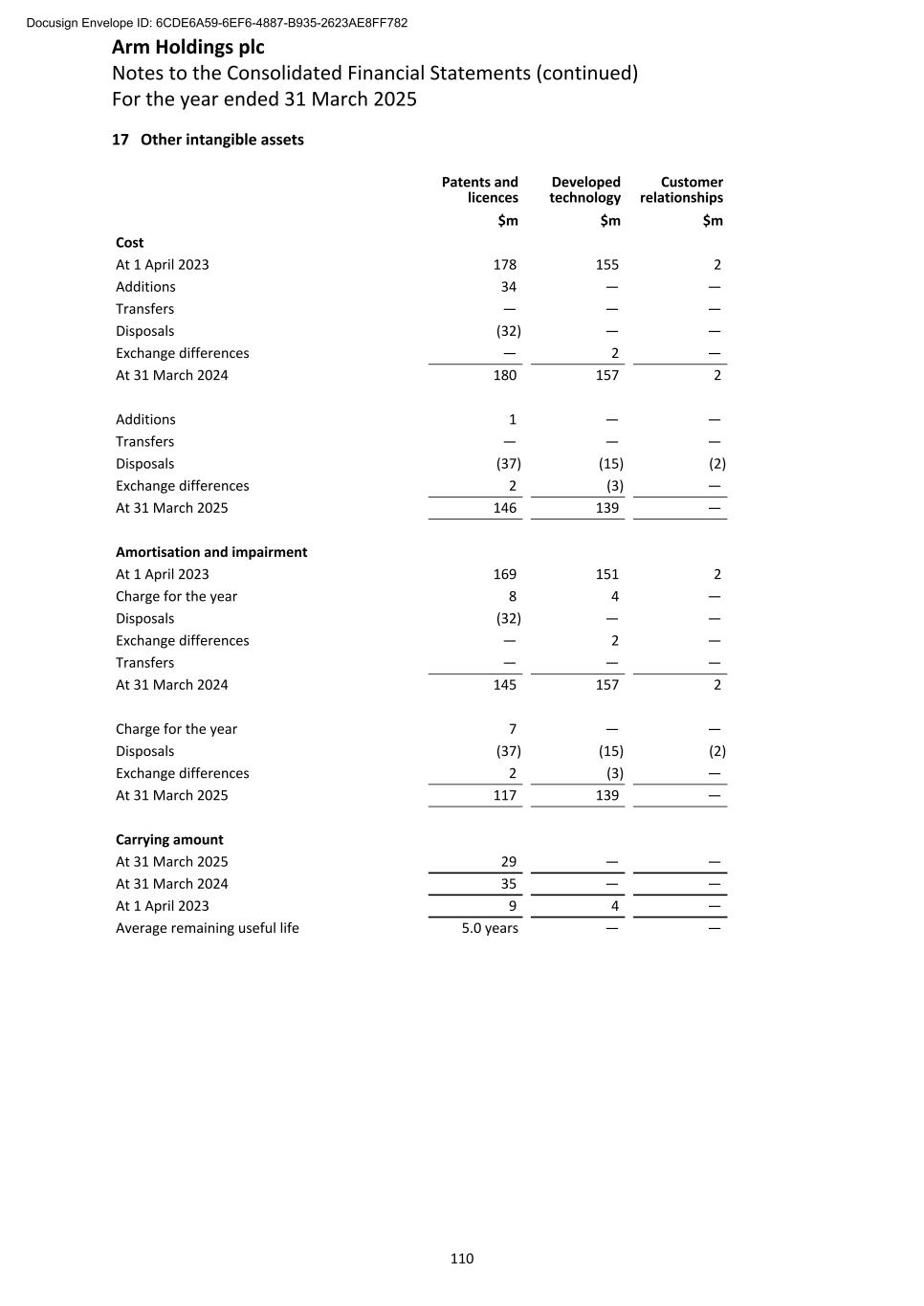

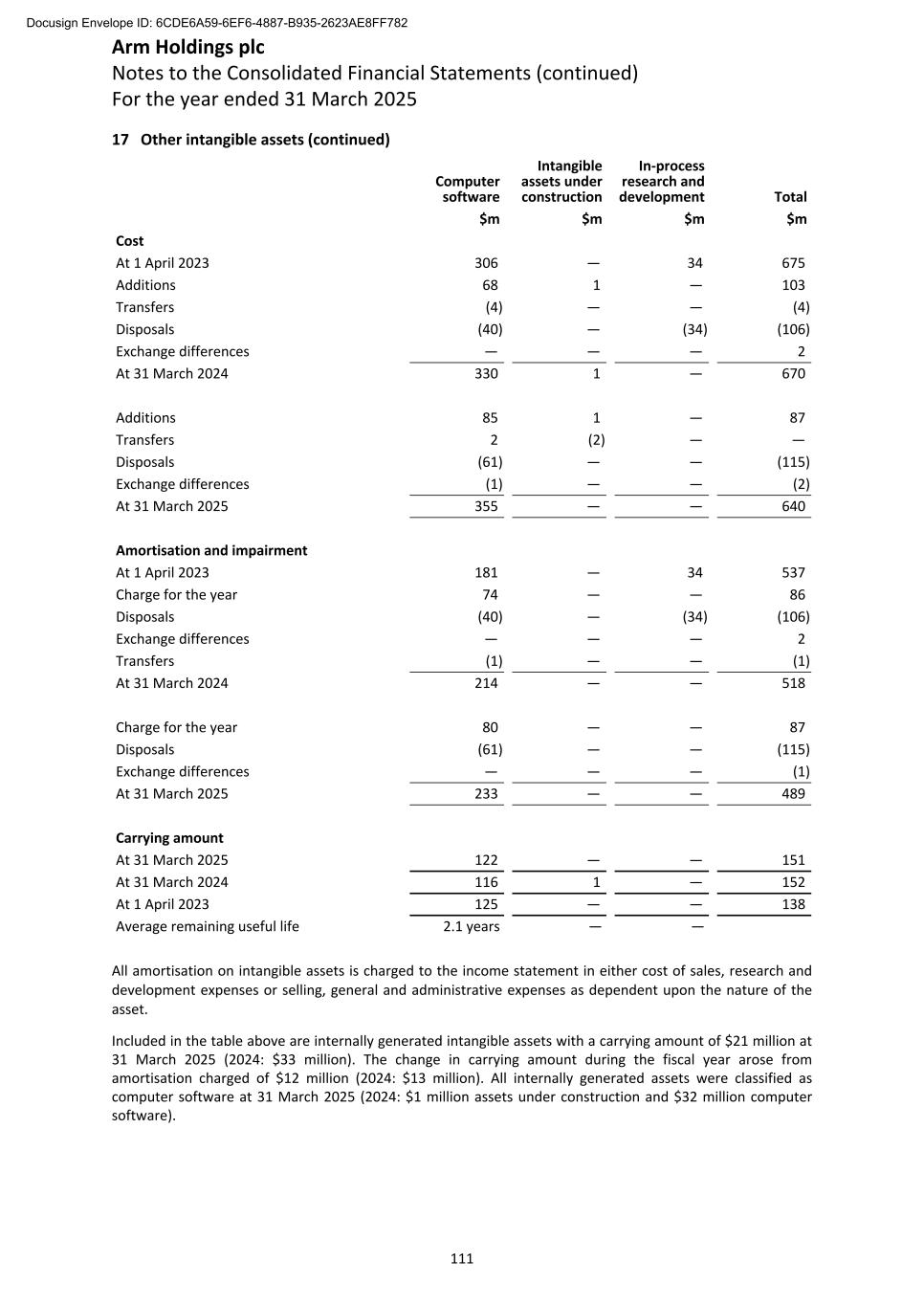

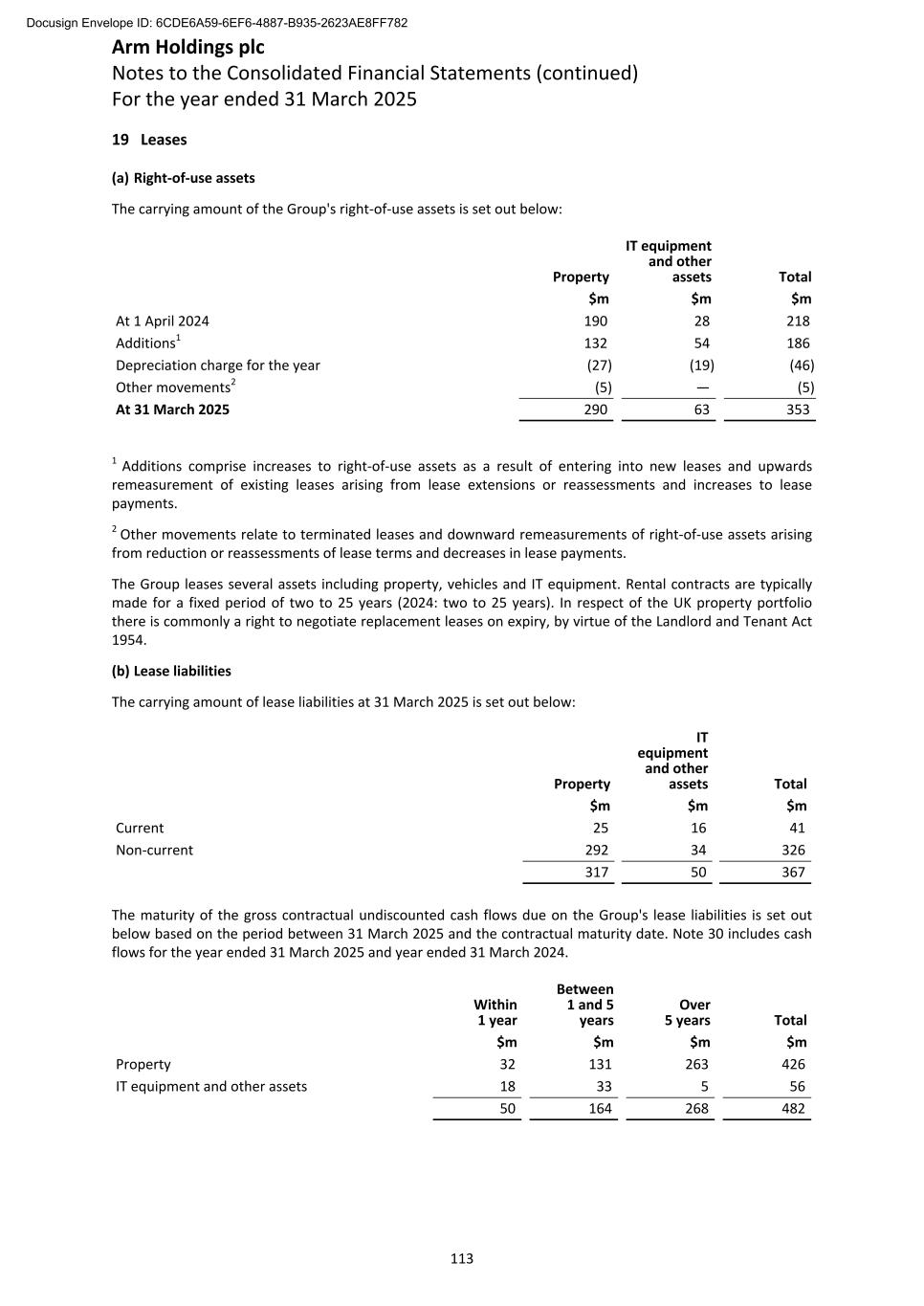

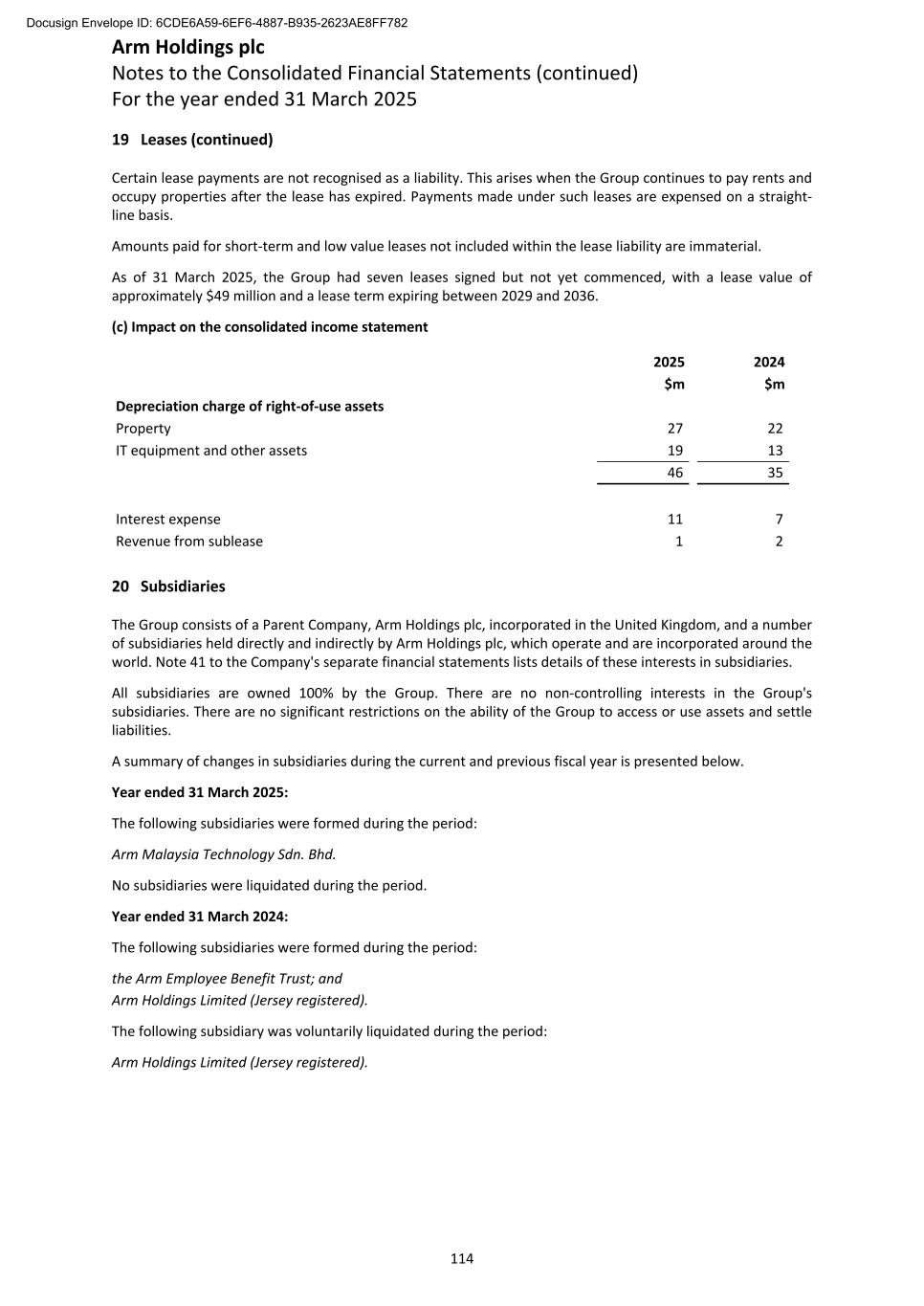

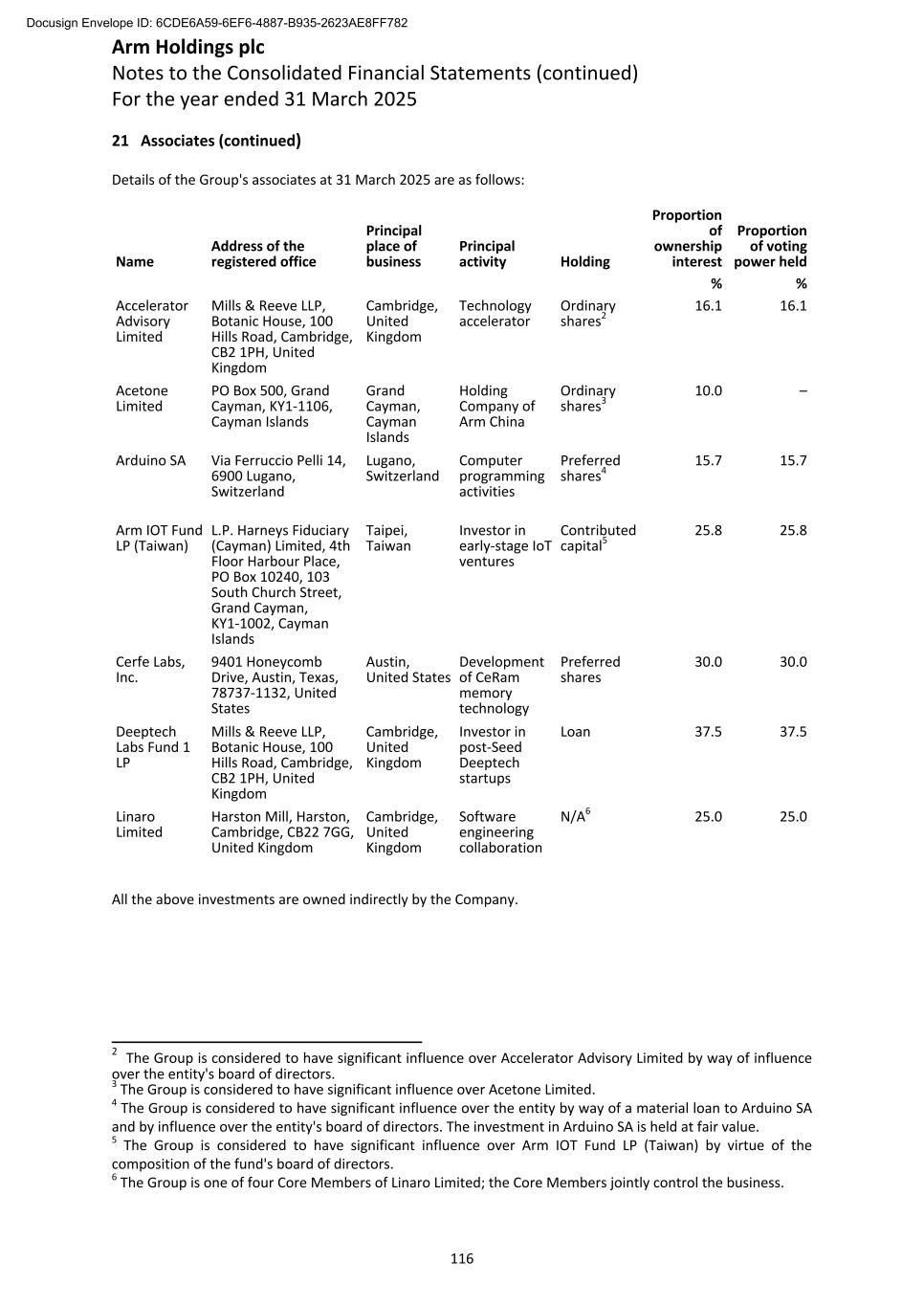

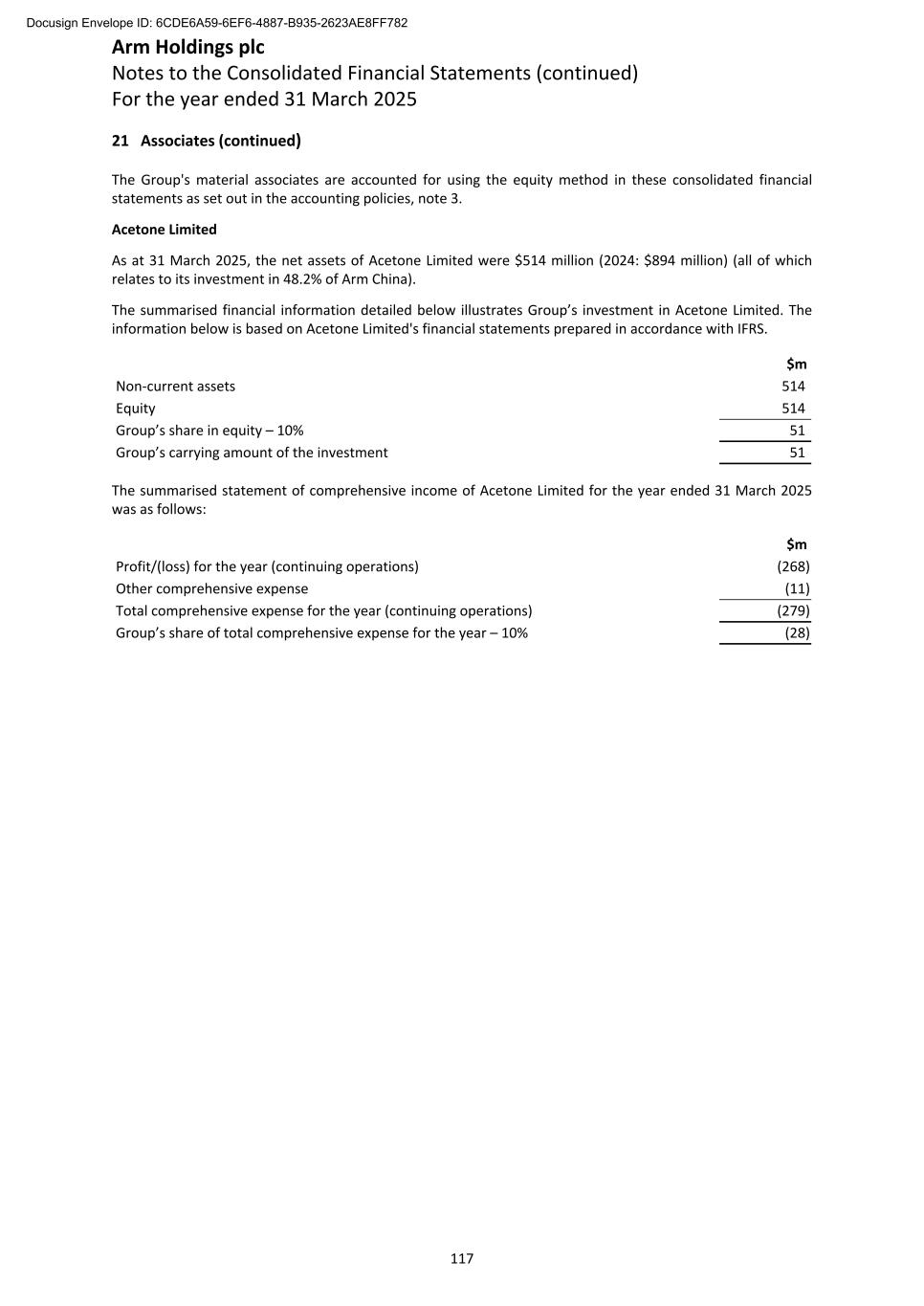

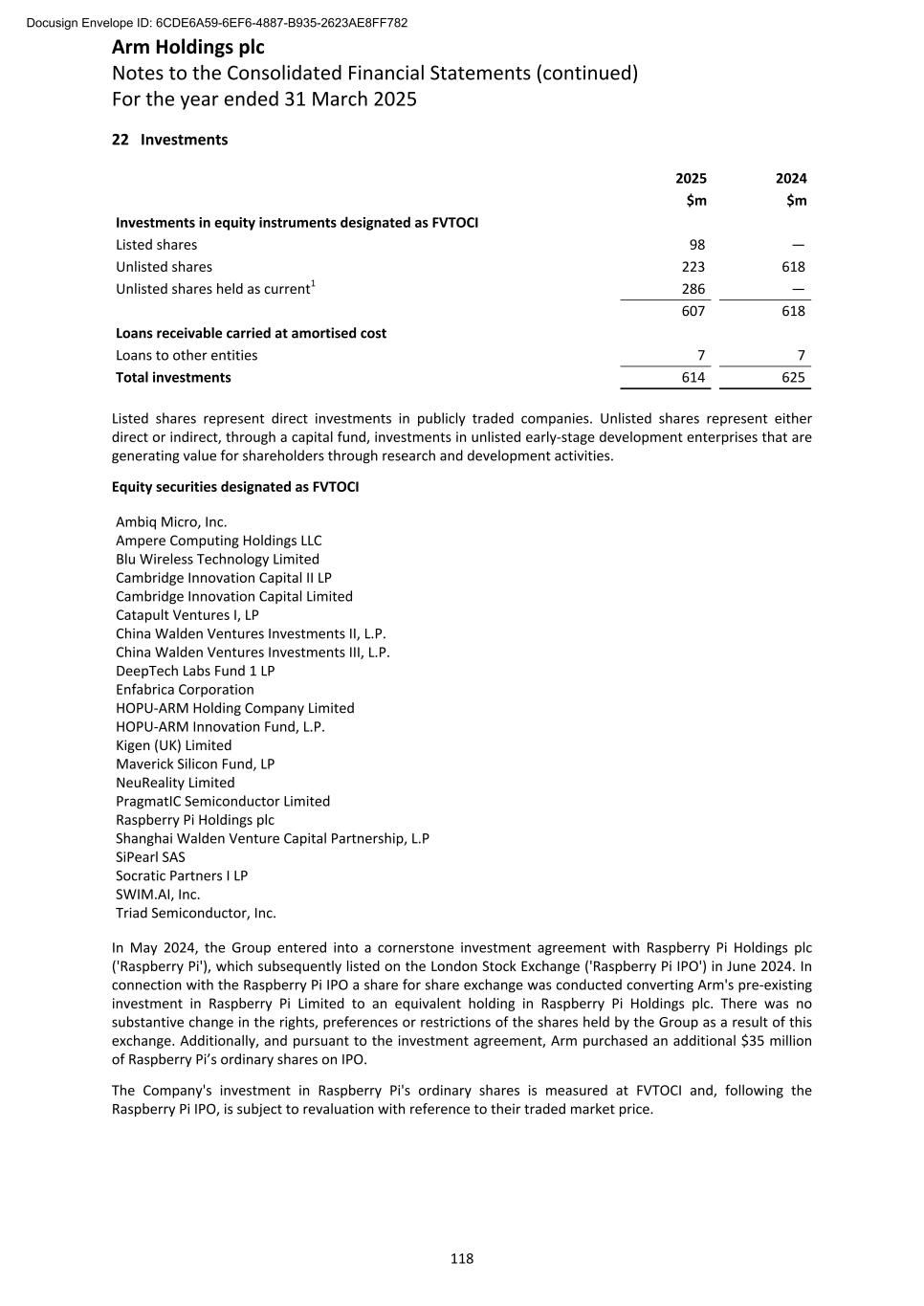

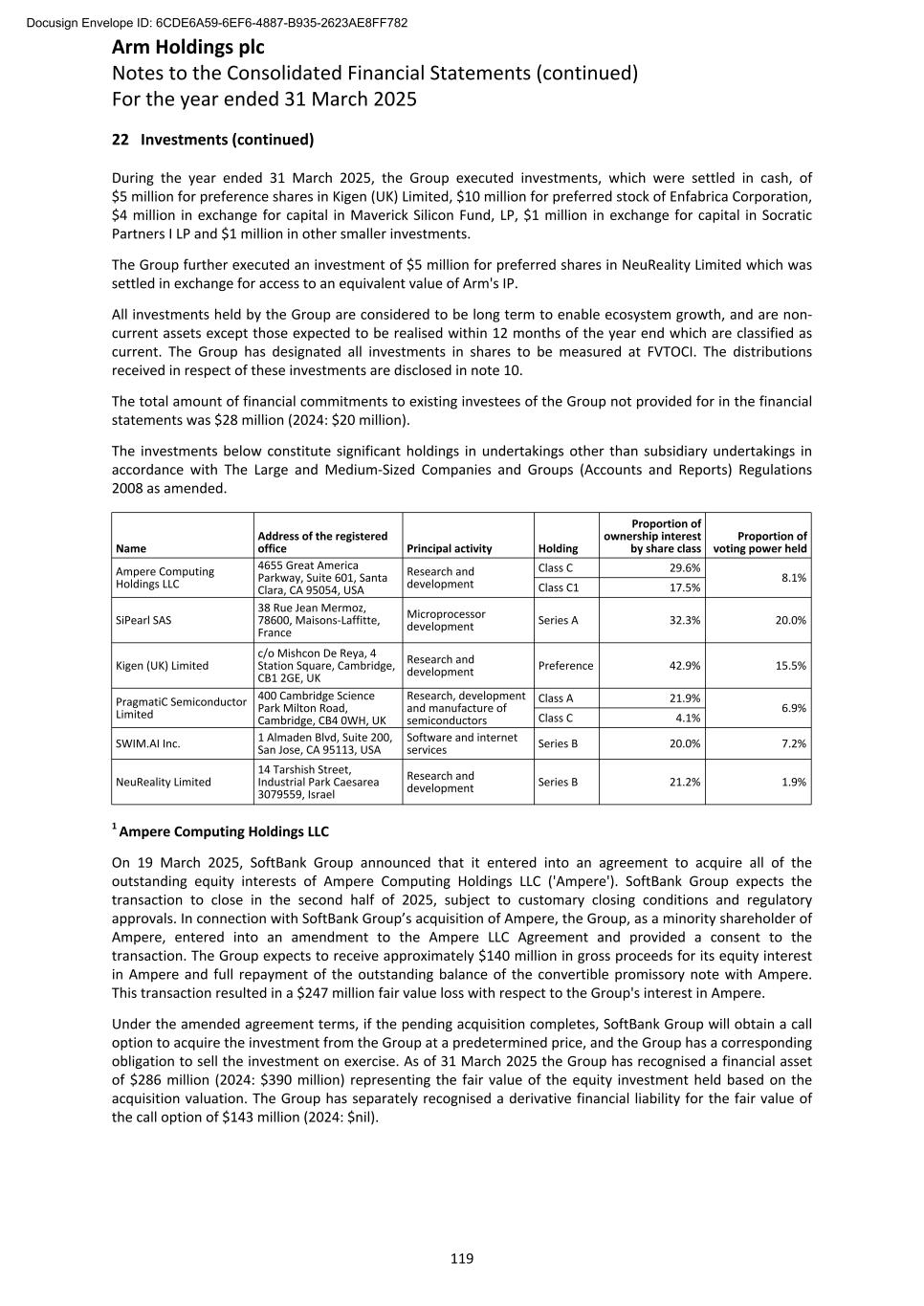

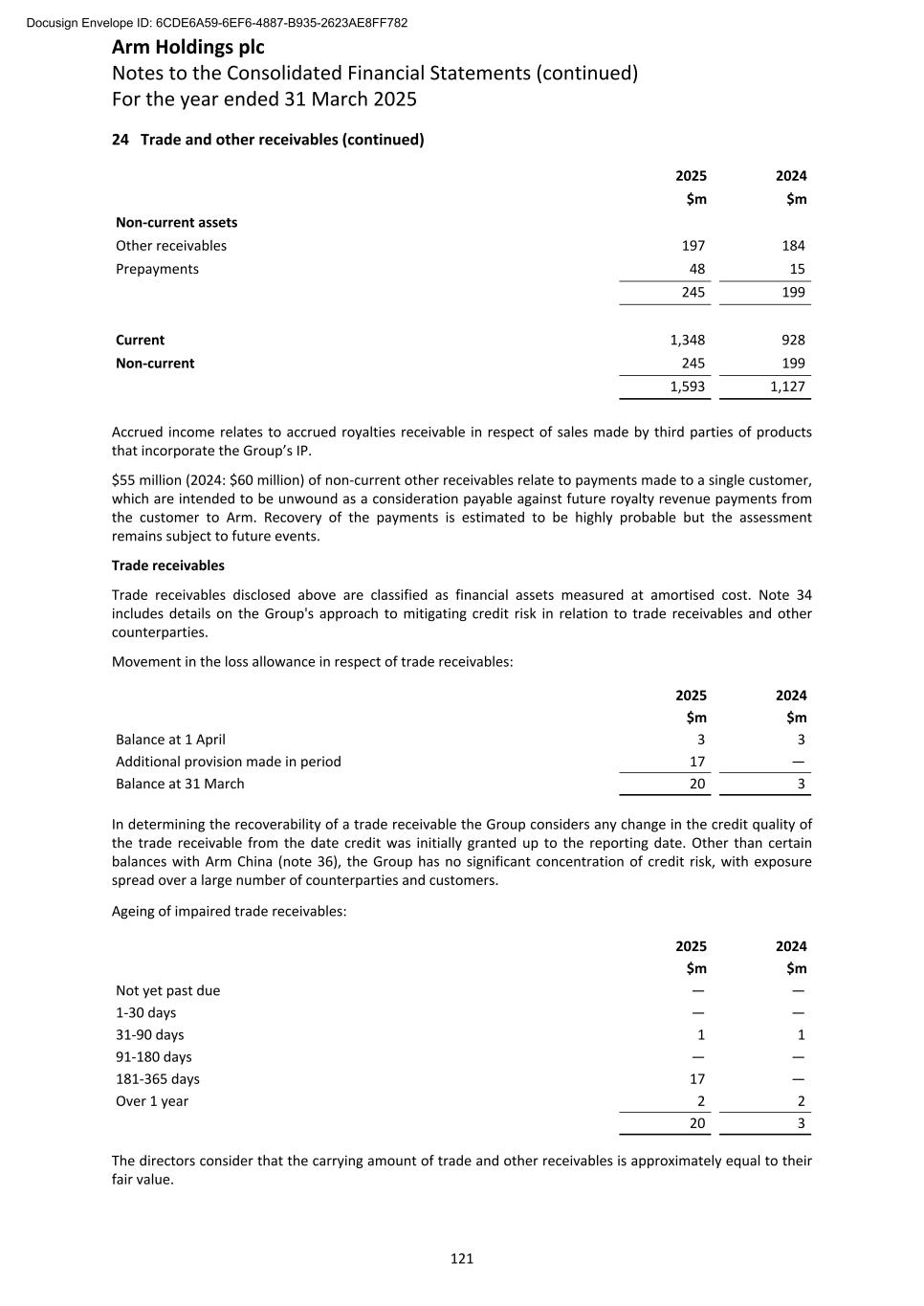

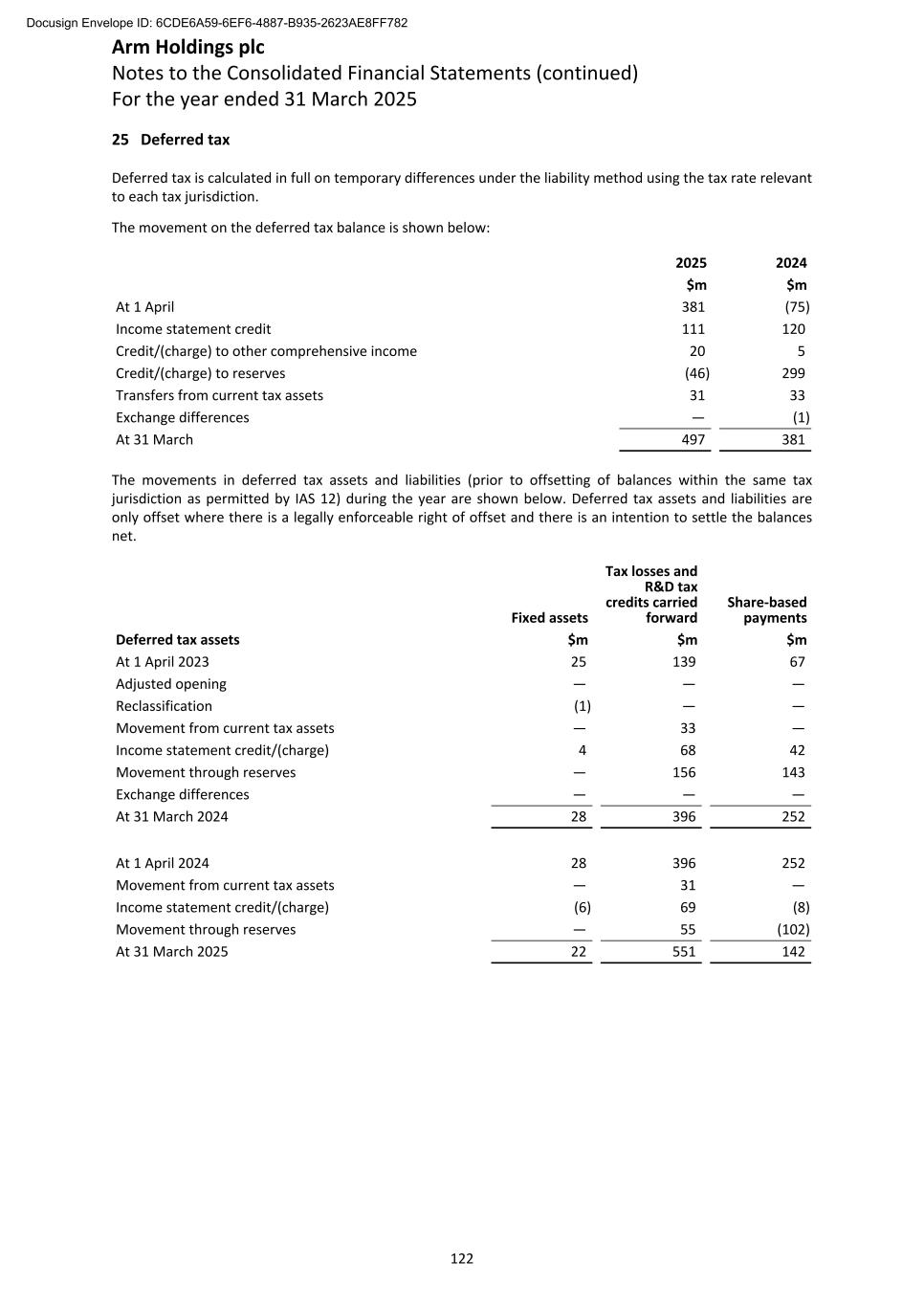

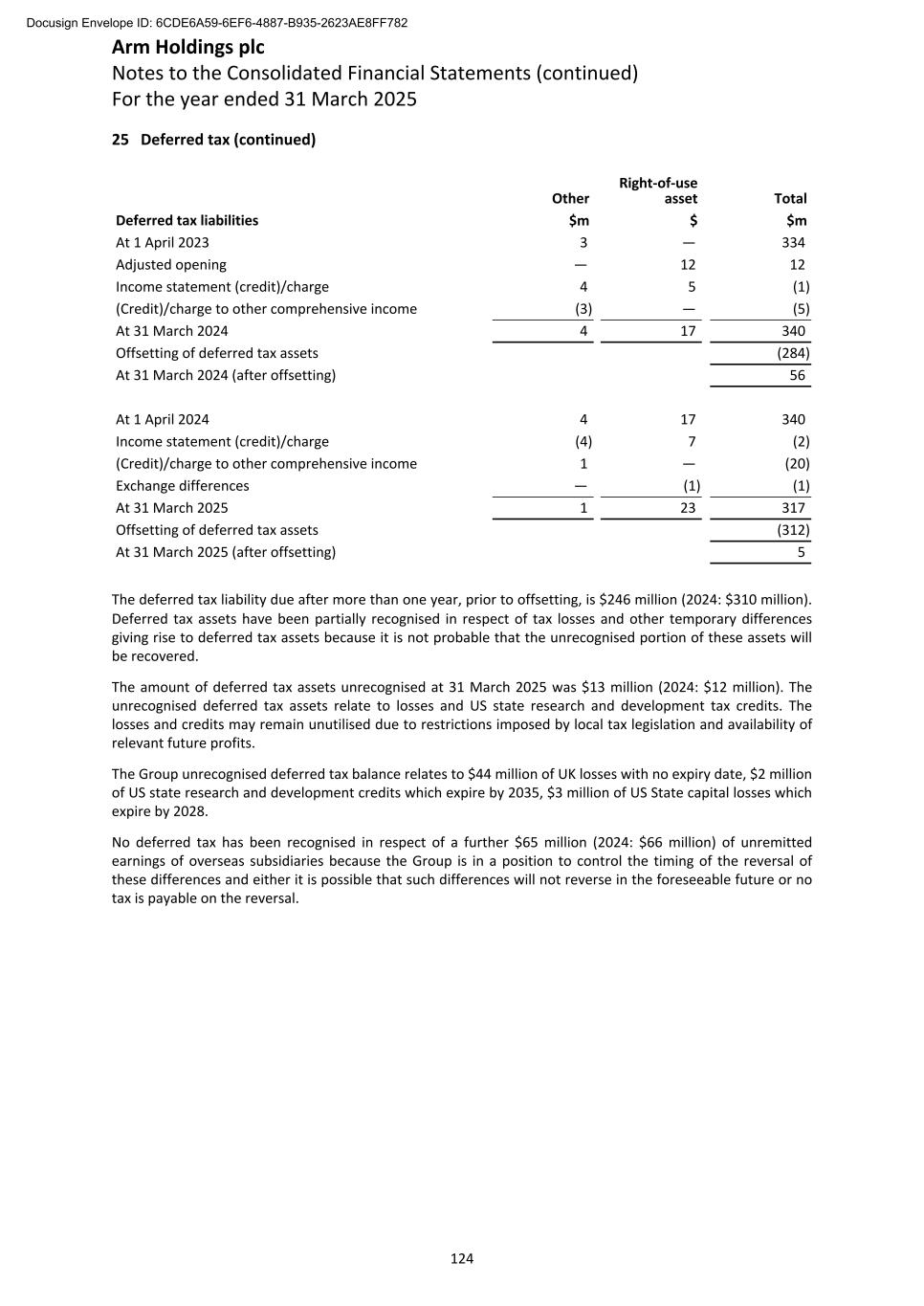

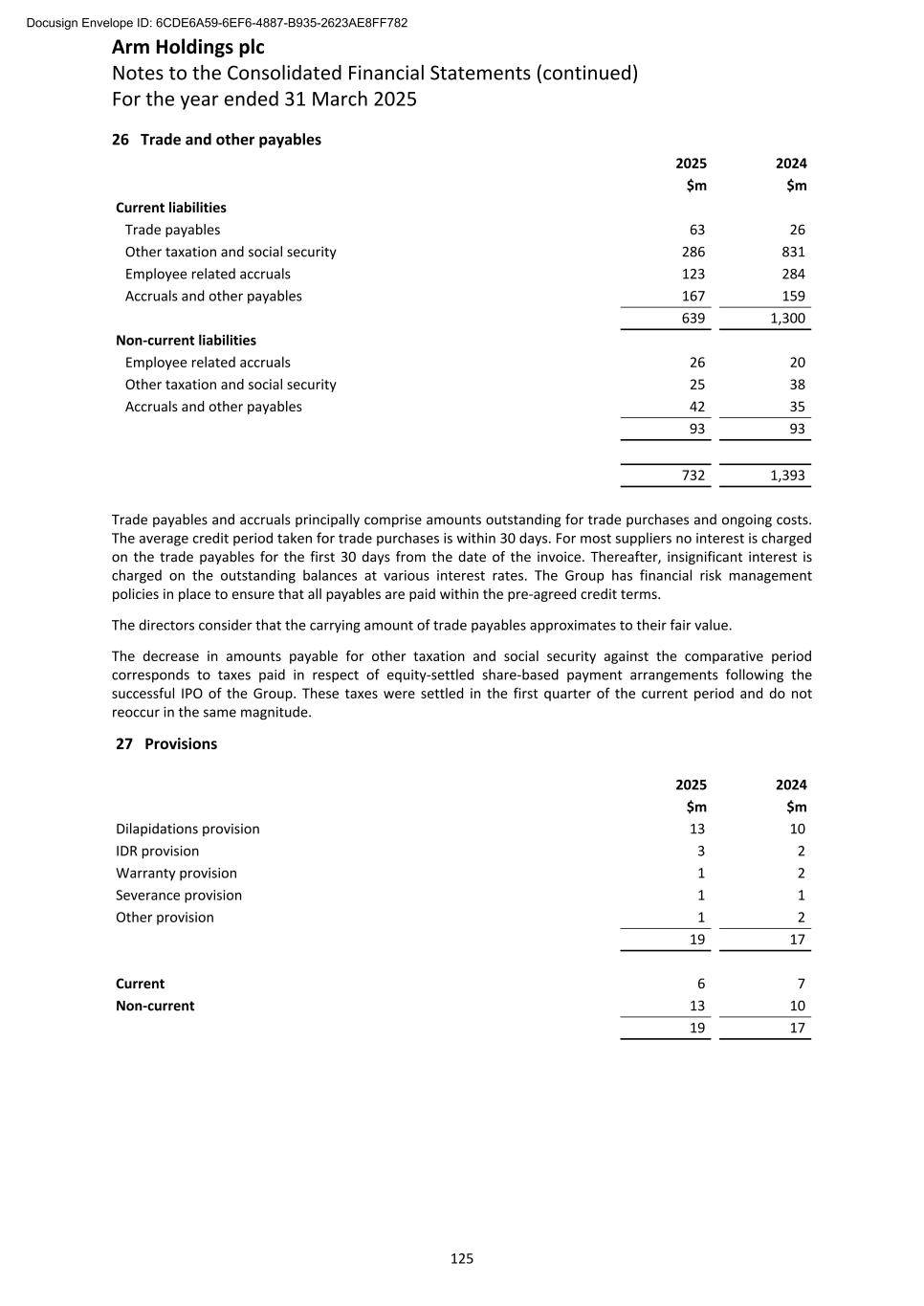

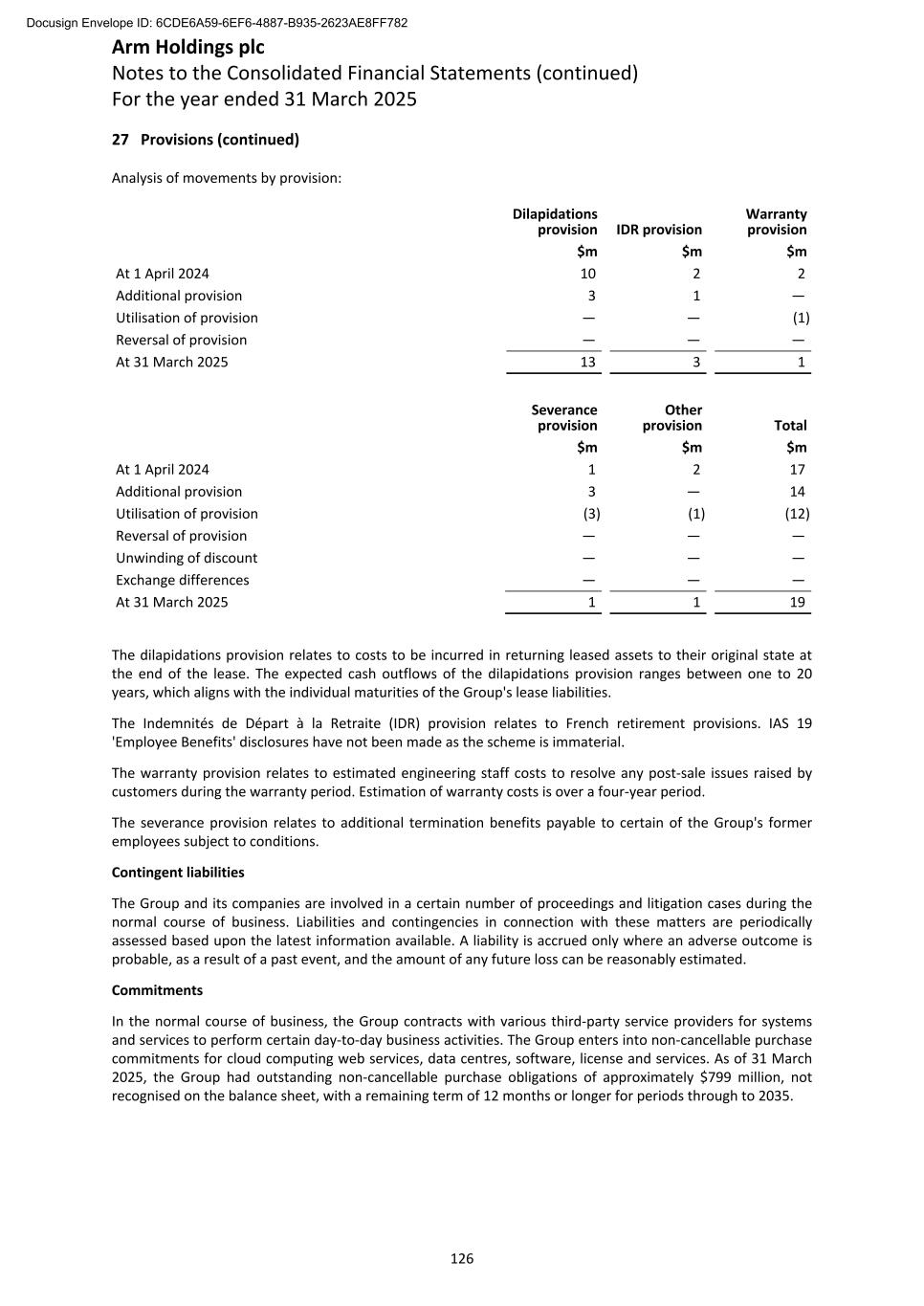

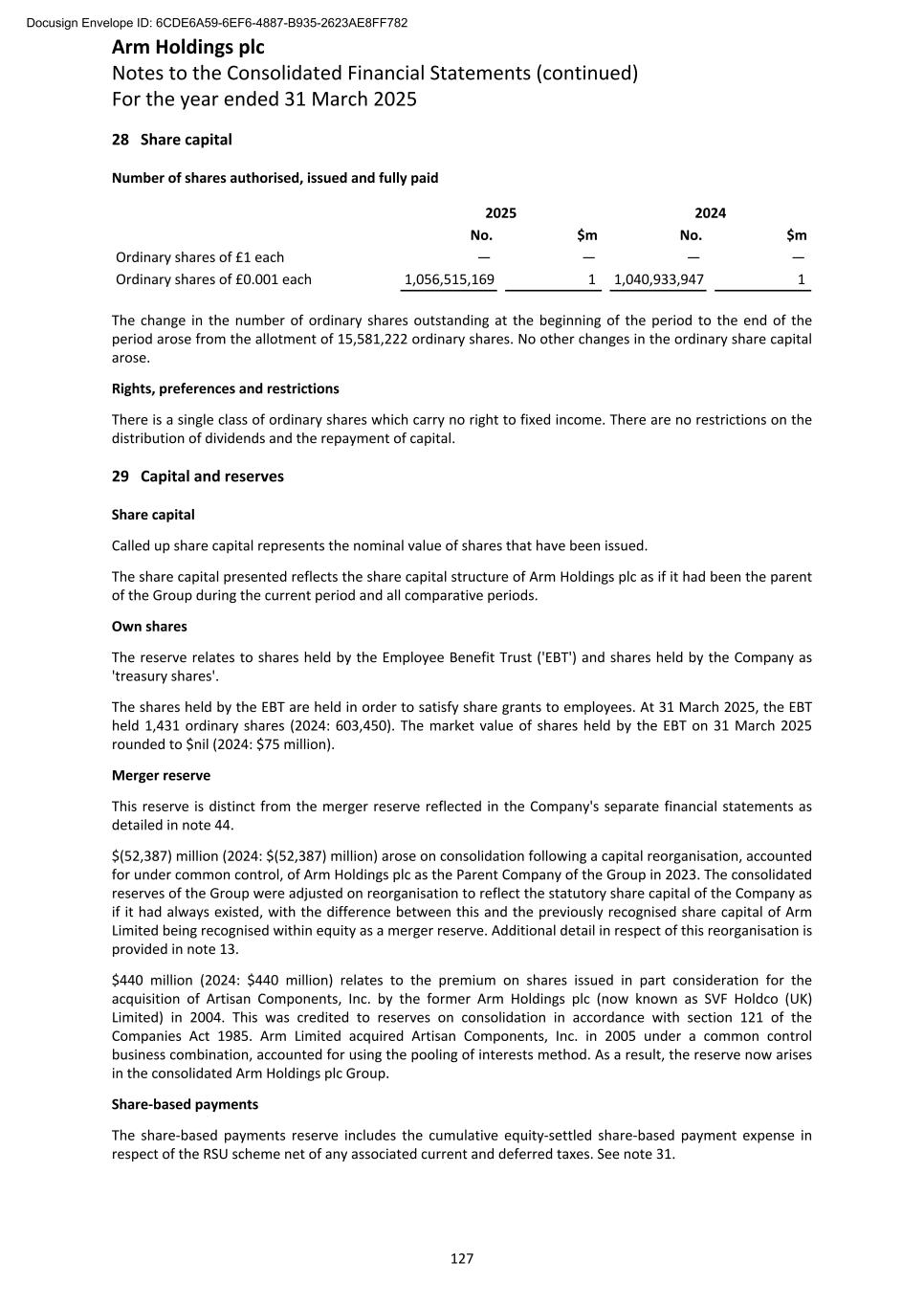

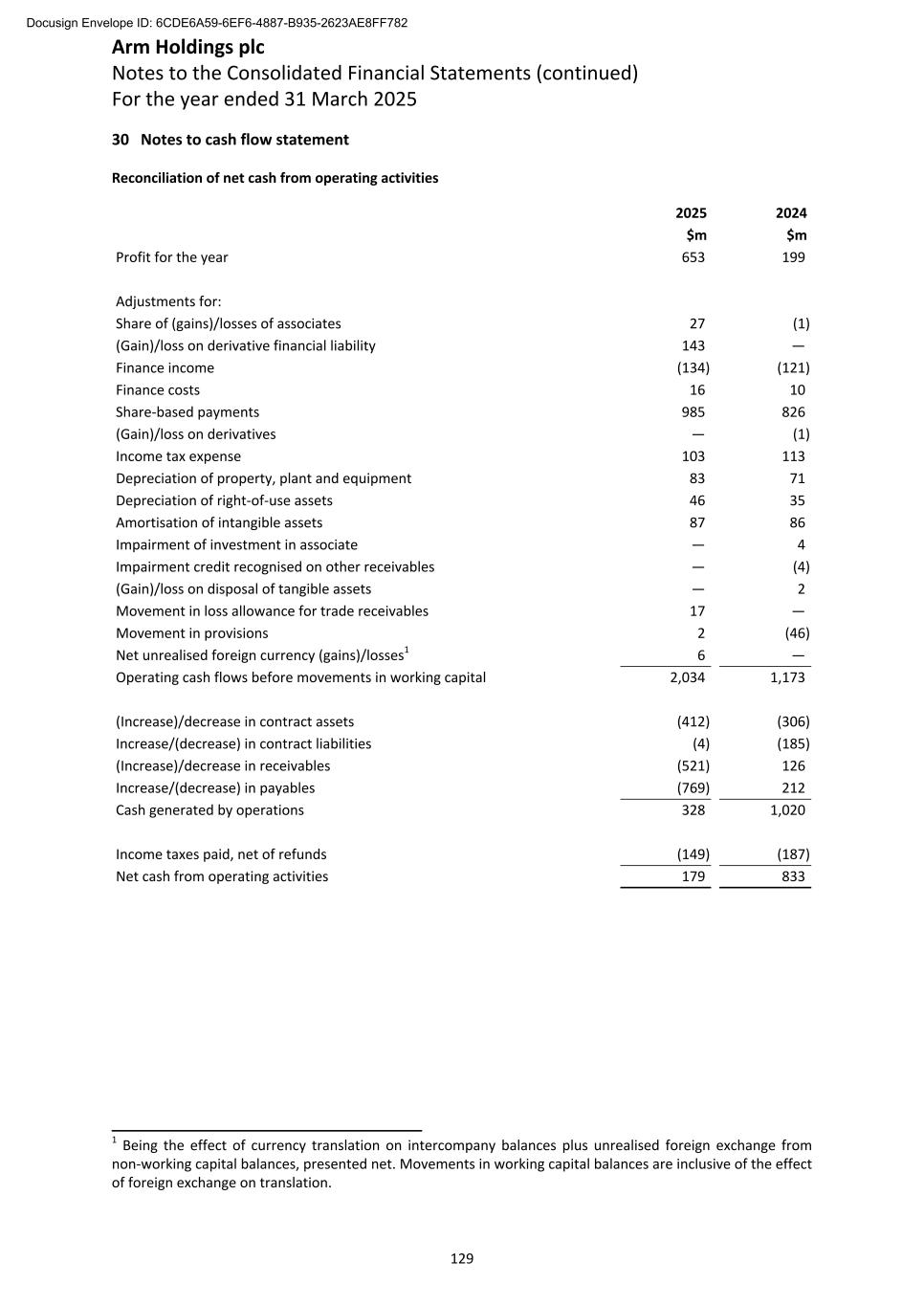

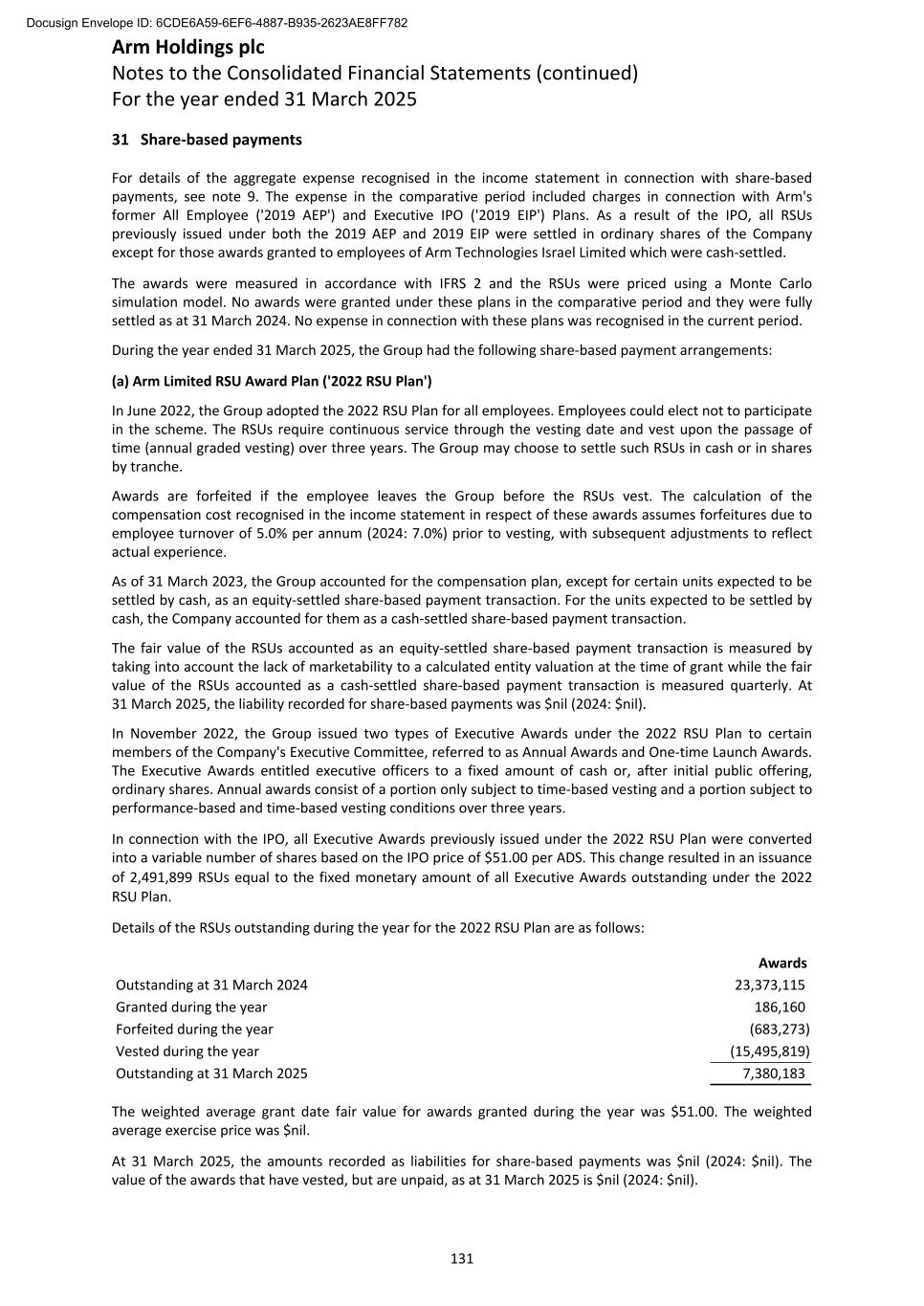

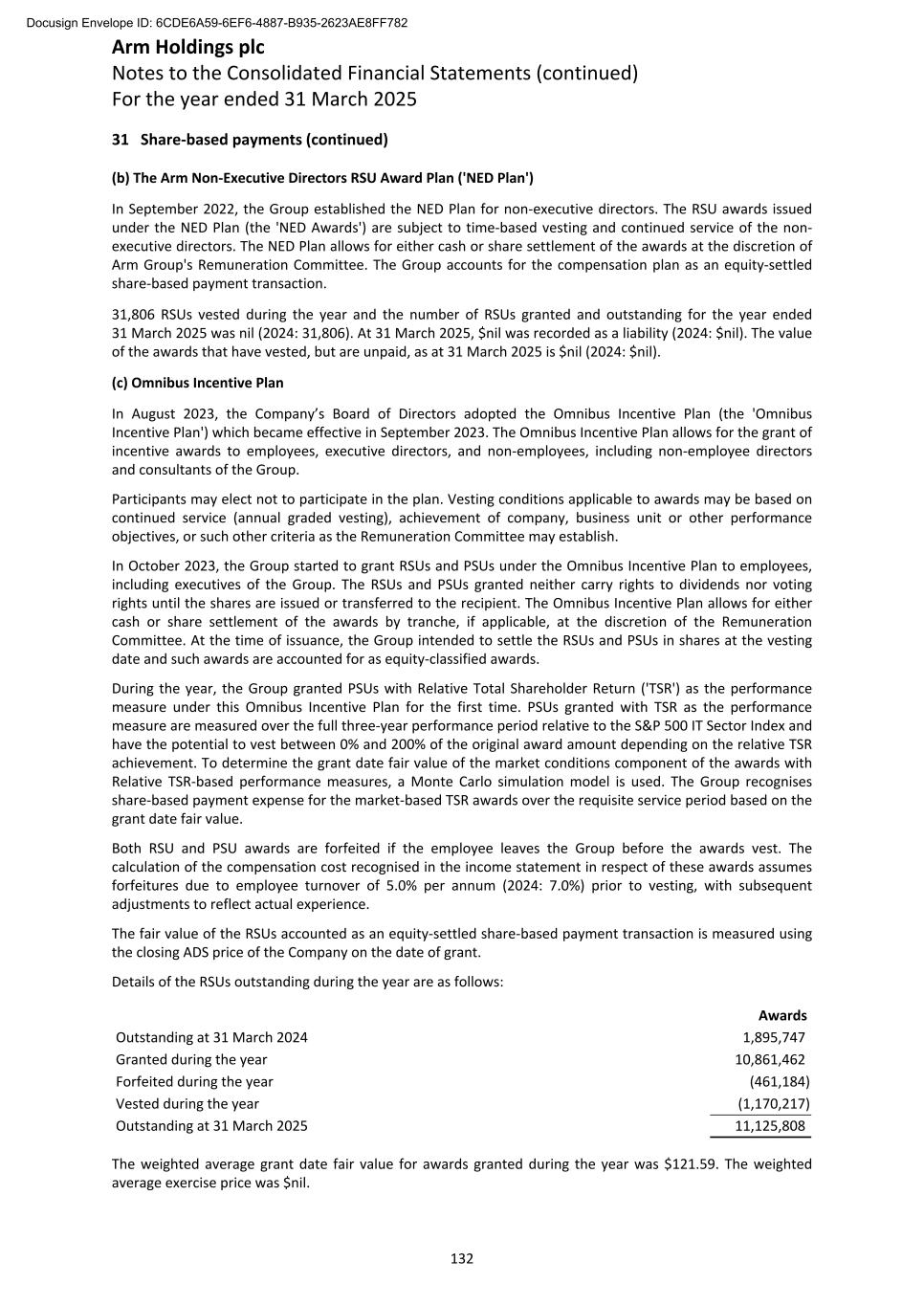

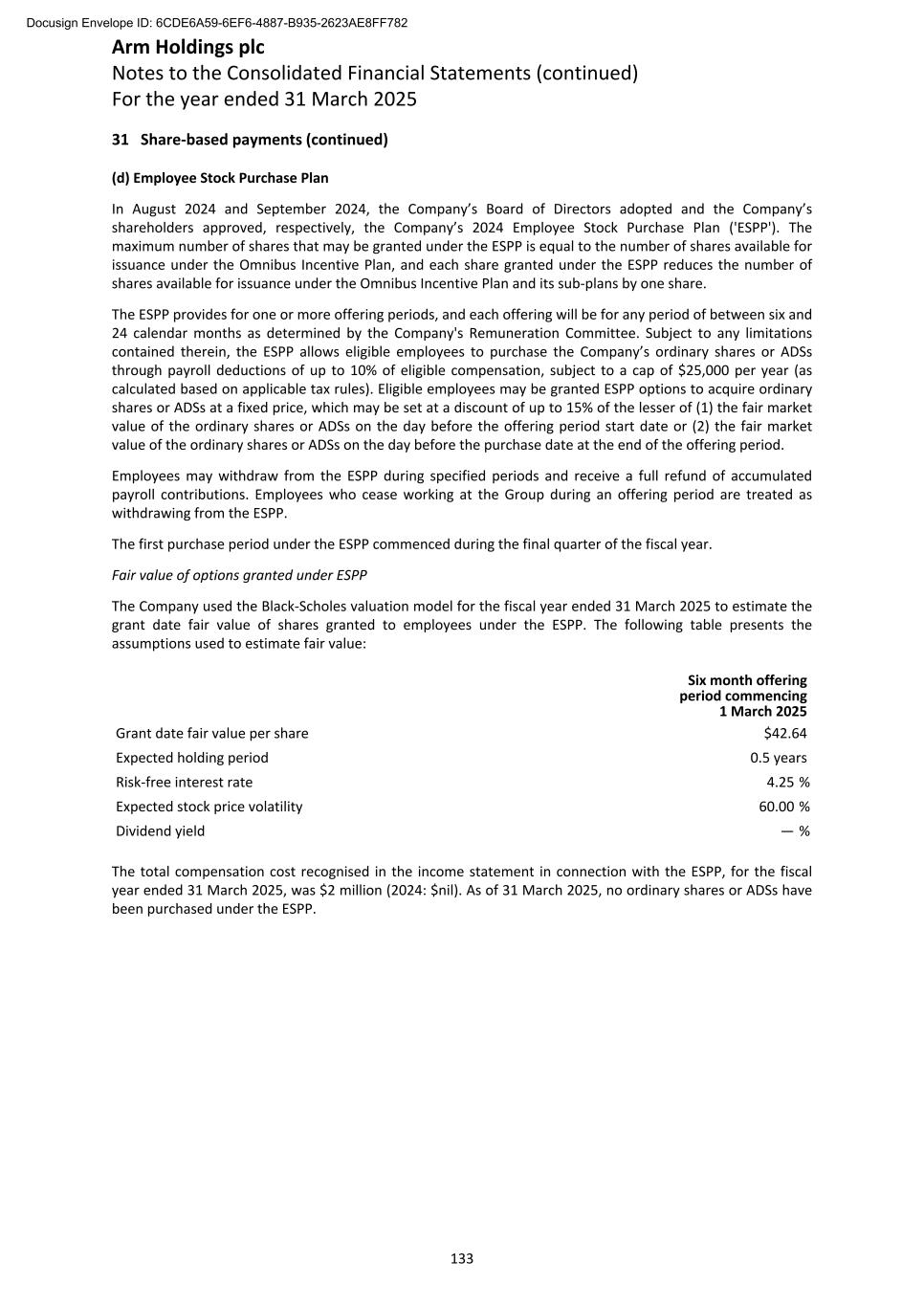

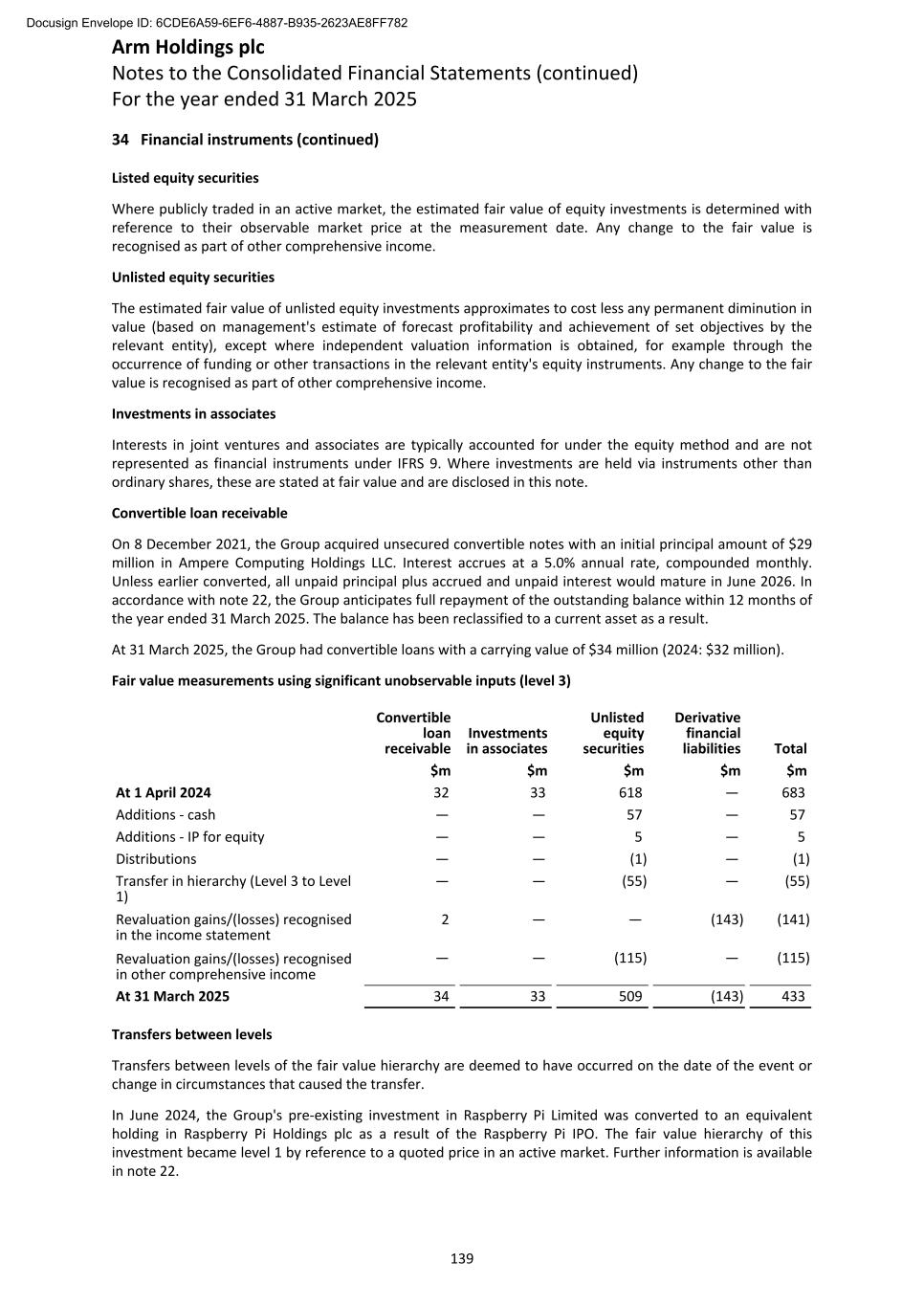

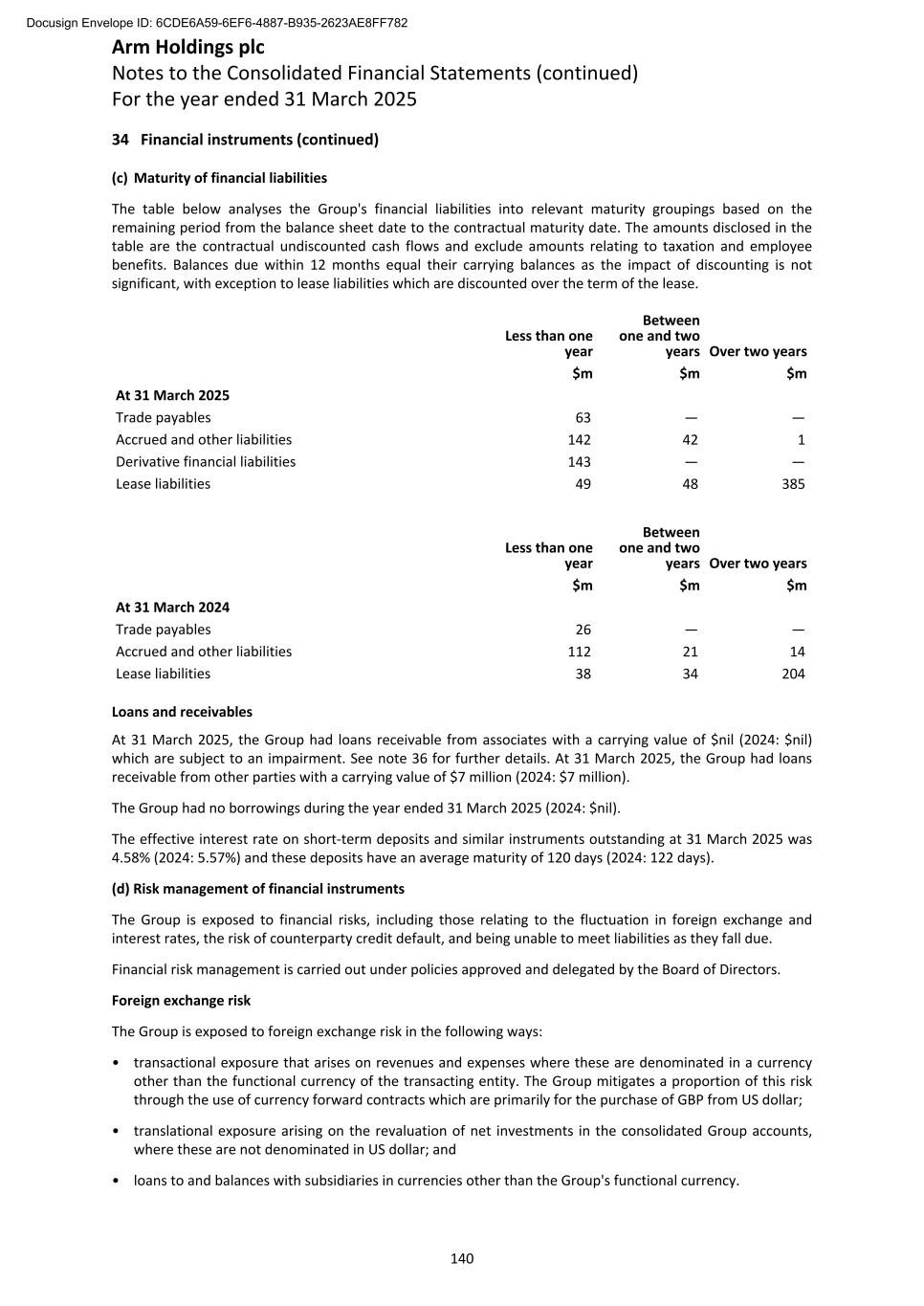

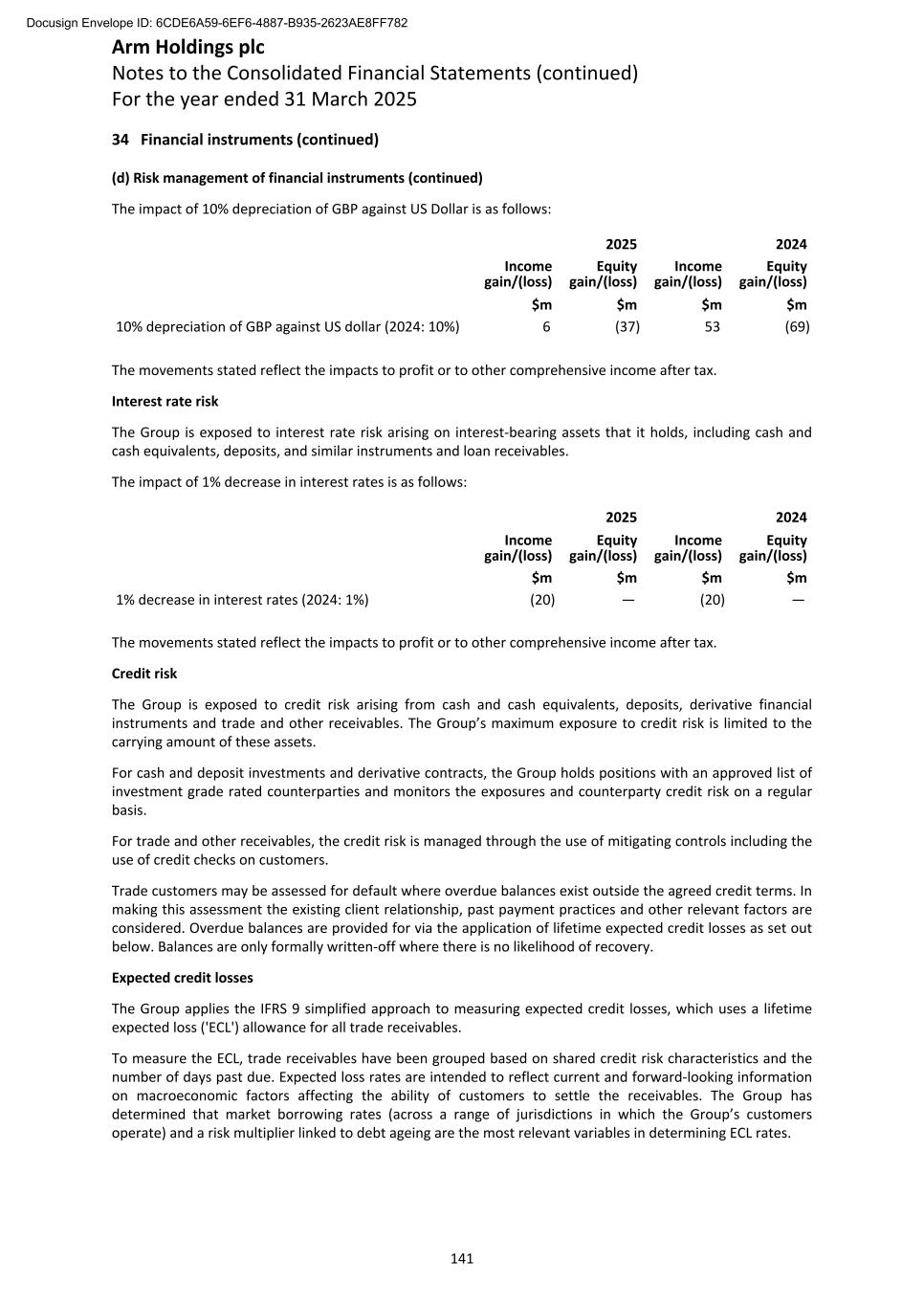

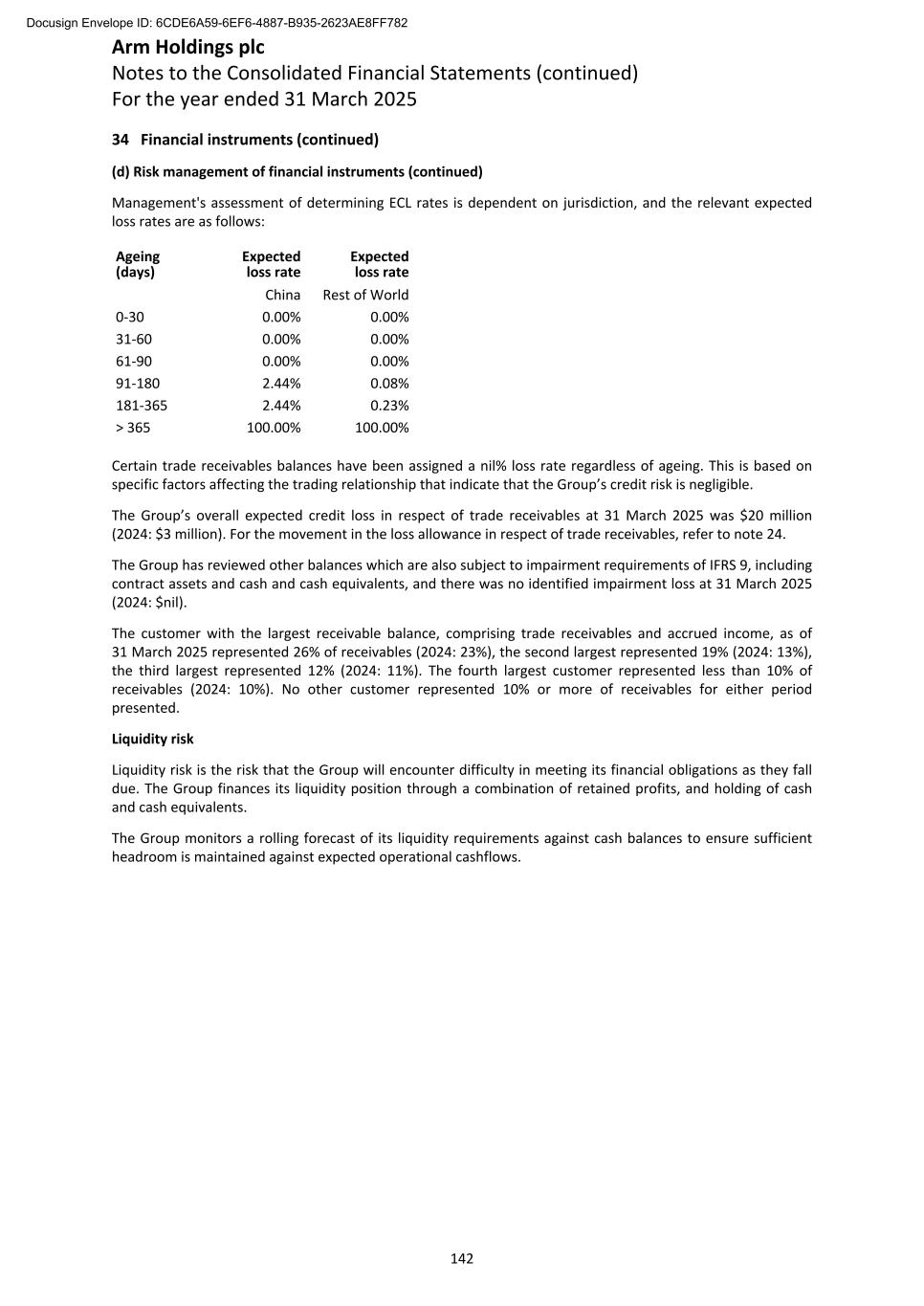

Climate-related Financial Disclosure (continued) The climate scenario analysis conducted is underpinned by the below key assumptions and estimates: • Conducting climate scenario analysis requires forecasting financial data, to do this the internal financial projections in the short- to medium-term, supplemented with GDP growth in the medium- to longer-term have been used; • The financial data used included operational costs and revenue from royalty payments. Revenue from licence fees was not considered as part of the analysis as these revenues are less directly impacted by the end consumer behaviour being modelled; • Climate-related risks and opportunities have been modelled as mutually exclusive to capture their individual impact; • Climate-related risks and opportunities have been modelled in nominal terms with no social discount factor applied; and • Arm's business model remains static. Recognising the assessment of climate risks and opportunities is an iterative process, Arm aims to take critical learnings from this exercise forward to enable more quantitative assessment and disclosure in the future. Arm continues to review the outputs of the climate scenario analysis to understand how best to integrate the outputs into its business decision making processes. Arm Holdings plc Strategic Report (continued) 19 Docusign Envelope ID: 6CDE6A59-6EF6-4887-B935-2623AE8FF782