Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Condensed Consolidated Interim Financial Statements for the six- and three months periods ended June 30, 2025, and 2024 (unaudited)

Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Condensed Consolidated Interim Financial Statements for six and three-month periods ended June 30, 2025, and 2024 (unaudited) Table of contents Page Unaudited Condensed Consolidated Interim Statements of Financial Position 1 Unaudited Condensed Consolidated Interim Statements of Profit and Other Comprehensive Income 2 Unaudited Condensed Consolidated Interim Statements of Changes in Stockholders’ Equity 3 Unaudited Condensed Consolidated Interim Statements of Cash Flows 4 Notes to Unaudited Condensed Consolidated Interim Financial Statements 6

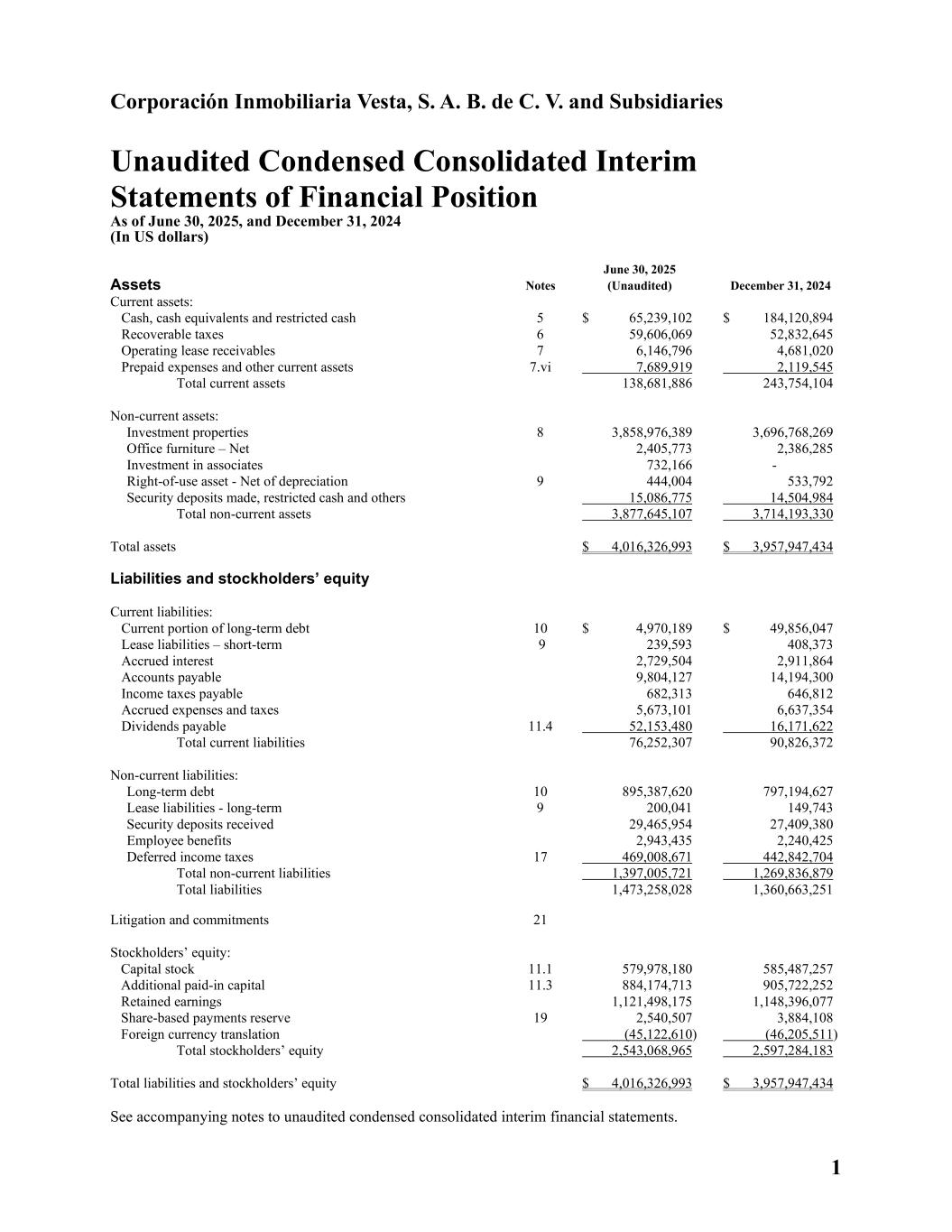

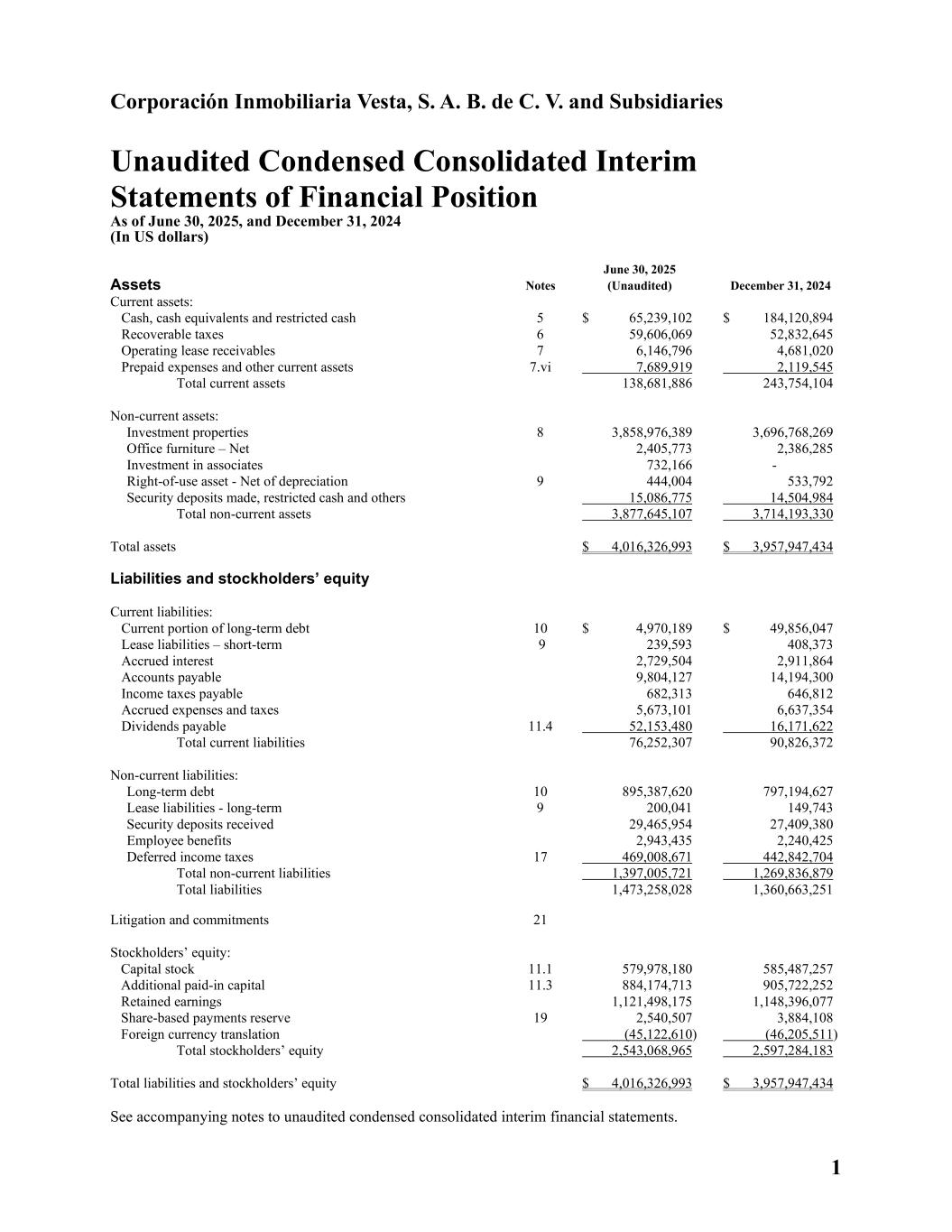

1 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Condensed Consolidated Interim Statements of Financial Position As of June 30, 2025, and December 31, 2024 (In US dollars) Assets Notes June 30, 2025 (Unaudited) December 31, 2024 Current assets: Cash, cash equivalents and restricted cash 5 $ 65,239,102 $ 184,120,894 Recoverable taxes 6 59,606,069 52,832,645 Operating lease receivables 7 6,146,796 4,681,020 Prepaid expenses and other current assets 7.vi 7,689,919 2,119,545 Total current assets 138,681,886 243,754,104 Non-current assets: Investment properties 8 3,858,976,389 3,696,768,269 Office furniture – Net 2,405,773 2,386,285 Investment in associates 732,166 - Right-of-use asset - Net of depreciation 9 444,004 533,792 Security deposits made, restricted cash and others 15,086,775 14,504,984 Total non-current assets 3,877,645,107 3,714,193,330 Total assets $ 4,016,326,993 $ 3,957,947,434 Liabilities and stockholders’ equity Current liabilities: Current portion of long-term debt 10 $ 4,970,189 $ 49,856,047 Lease liabilities – short-term 9 239,593 408,373 Accrued interest 2,729,504 2,911,864 Accounts payable 9,804,127 14,194,300 Income taxes payable 682,313 646,812 Accrued expenses and taxes 5,673,101 6,637,354 Dividends payable 11.4 52,153,480 16,171,622 Total current liabilities 76,252,307 90,826,372 Non-current liabilities: Long-term debt 10 895,387,620 797,194,627 Lease liabilities - long-term 9 200,041 149,743 Security deposits received 29,465,954 27,409,380 Employee benefits 2,943,435 2,240,425 Deferred income taxes 17 469,008,671 442,842,704 Total non-current liabilities 1,397,005,721 1,269,836,879 Total liabilities 1,473,258,028 1,360,663,251 Litigation and commitments 21 Stockholders’ equity: Capital stock 11.1 579,978,180 585,487,257 Additional paid-in capital 11.3 884,174,713 905,722,252 Retained earnings 1,121,498,175 1,148,396,077 Share-based payments reserve 19 2,540,507 3,884,108 Foreign currency translation (45,122,610) (46,205,511) Total stockholders’ equity 2,543,068,965 2,597,284,183 Total liabilities and stockholders’ equity $ 4,016,326,993 $ 3,957,947,434 See accompanying notes to unaudited condensed consolidated interim financial statements.

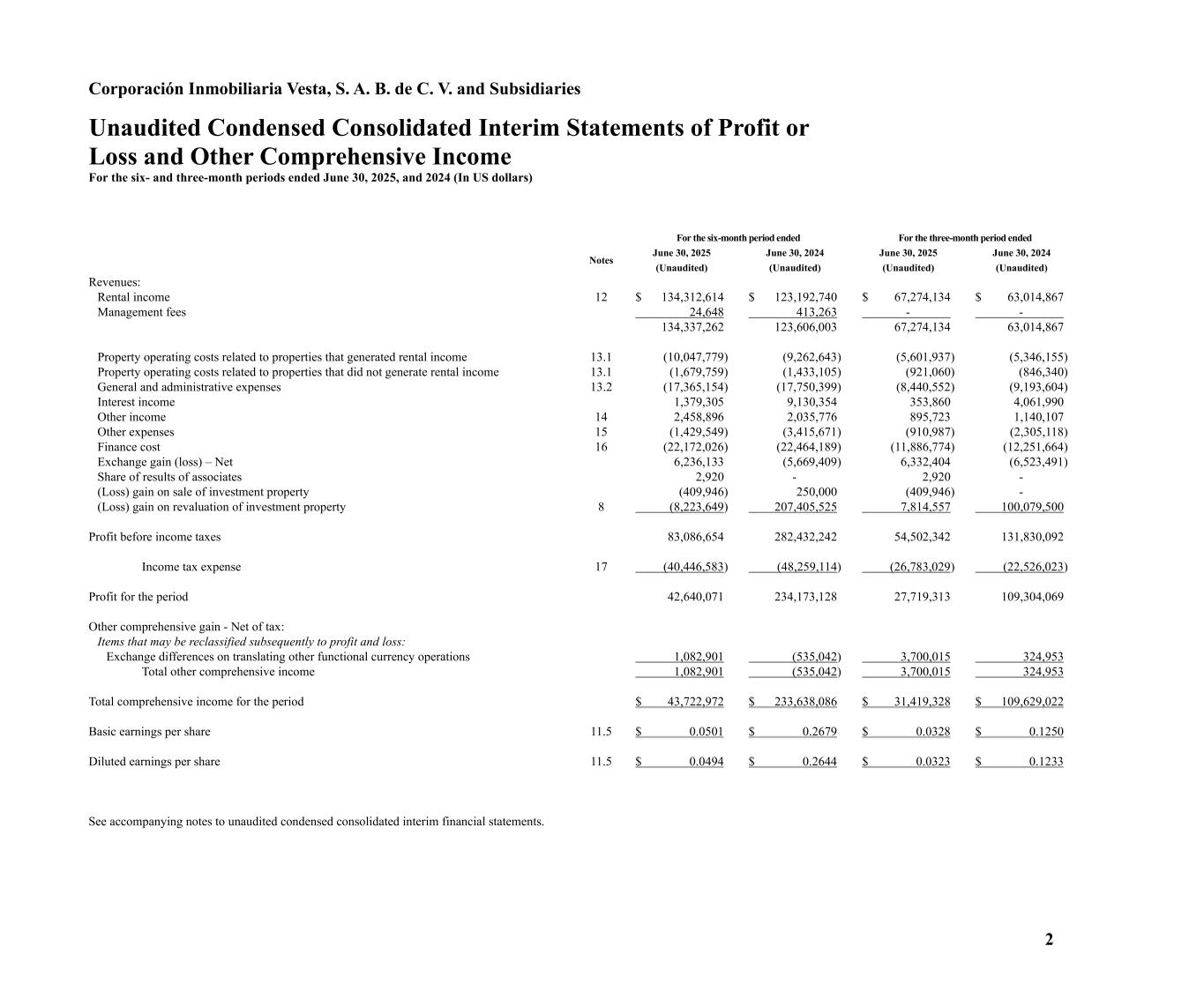

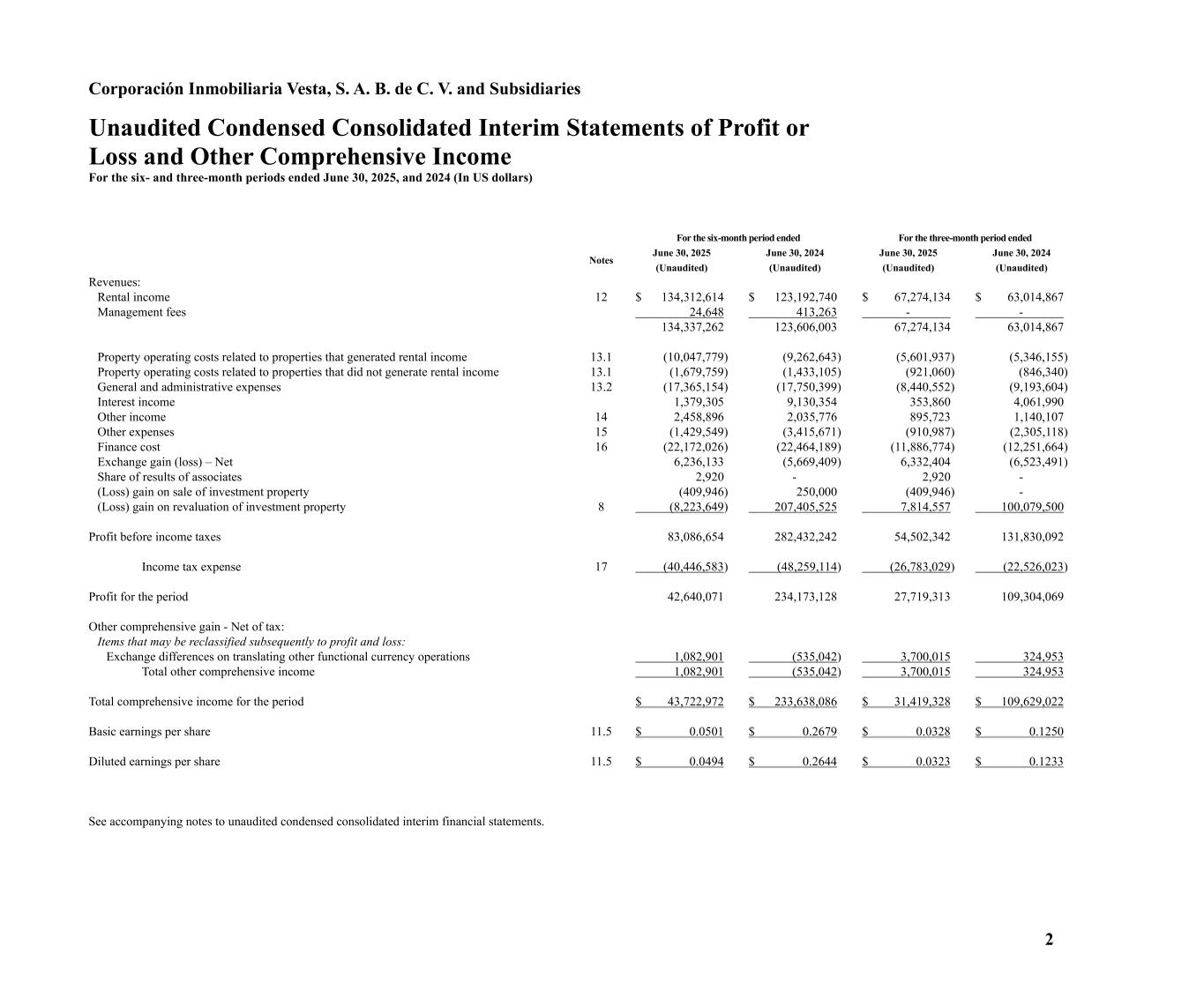

2 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Condensed Consolidated Interim Statements of Profit or Loss and Other Comprehensive Income For the six- and three-month periods ended June 30, 2025, and 2024 (In US dollars) For the six-month period ended For the three-month period ended Notes June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Revenues: Rental income 12 $ 134,312,614 $ 123,192,740 $ 67,274,134 $ 63,014,867 Management fees 24,648 413,263 - - 134,337,262 123,606,003 67,274,134 63,014,867 Property operating costs related to properties that generated rental income 13.1 (10,047,779) (9,262,643) (5,601,937) (5,346,155) Property operating costs related to properties that did not generate rental income 13.1 (1,679,759) (1,433,105) (921,060) (846,340) General and administrative expenses 13.2 (17,365,154) (17,750,399) (8,440,552) (9,193,604) Interest income 1,379,305 9,130,354 353,860 4,061,990 Other income 14 2,458,896 2,035,776 895,723 1,140,107 Other expenses 15 (1,429,549) (3,415,671) (910,987) (2,305,118) Finance cost 16 (22,172,026) (22,464,189) (11,886,774) (12,251,664) Exchange gain (loss) – Net 6,236,133 (5,669,409) 6,332,404 (6,523,491) Share of results of associates 2,920 - 2,920 - (Loss) gain on sale of investment property (409,946) 250,000 (409,946) - (Loss) gain on revaluation of investment property 8 (8,223,649) 207,405,525 7,814,557 100,079,500 Profit before income taxes 83,086,654 282,432,242 54,502,342 131,830,092 Income tax expense 17 (40,446,583) (48,259,114) (26,783,029) (22,526,023) Profit for the period 42,640,071 234,173,128 27,719,313 109,304,069 Other comprehensive gain - Net of tax: Items that may be reclassified subsequently to profit and loss: Exchange differences on translating other functional currency operations 1,082,901 (535,042) 3,700,015 324,953 Total other comprehensive income 1,082,901 (535,042) 3,700,015 324,953 Total comprehensive income for the period $ 43,722,972 $ 233,638,086 $ 31,419,328 $ 109,629,022 Basic earnings per share 11.5 $ 0.0501 $ 0.2679 $ 0.0328 $ 0.1250 Diluted earnings per share 11.5 $ 0.0494 $ 0.2644 $ 0.0323 $ 0.1233 See accompanying notes to unaudited condensed consolidated interim financial statements.

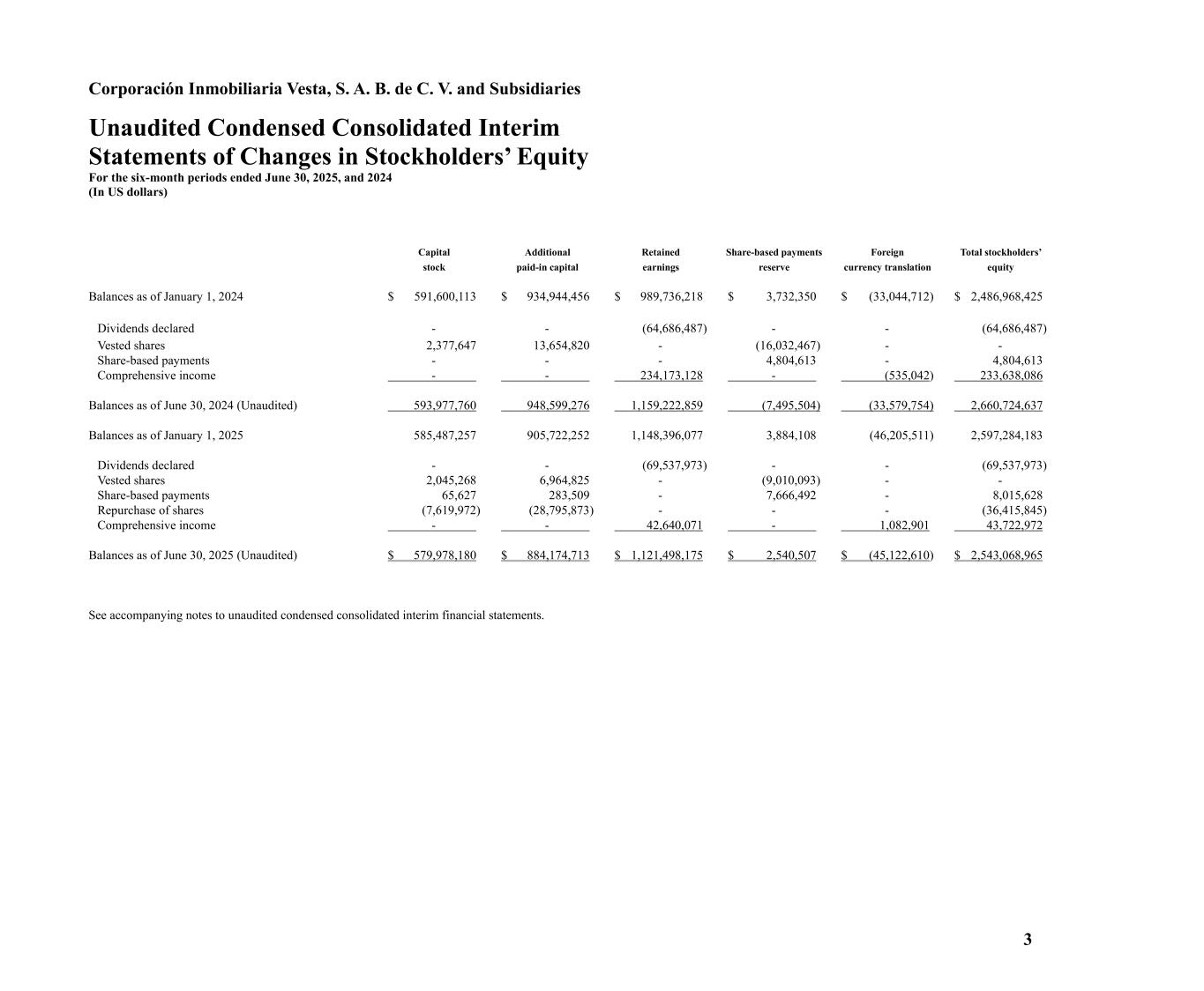

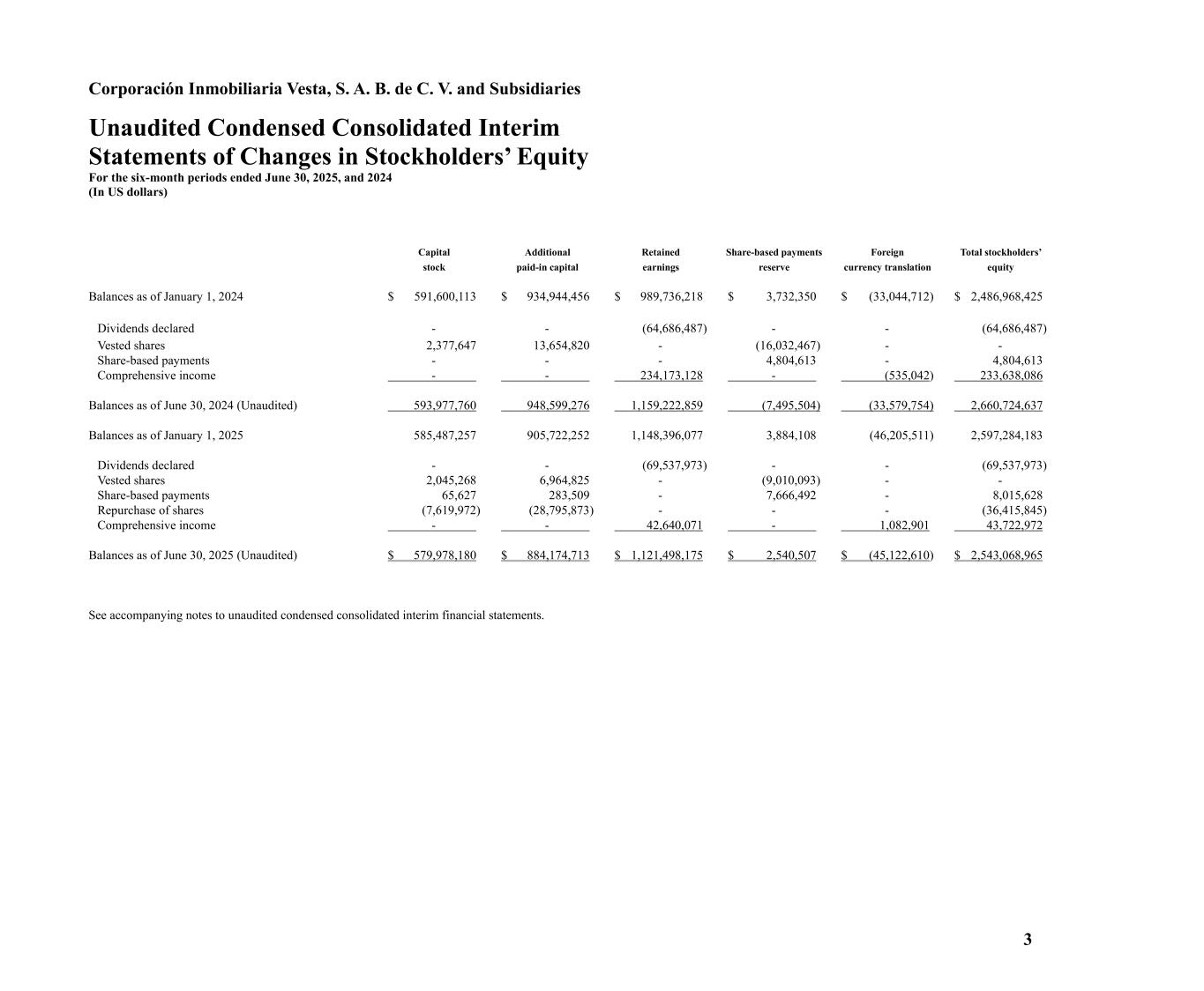

3 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Condensed Consolidated Interim Statements of Changes in Stockholders’ Equity For the six-month periods ended June 30, 2025, and 2024 (In US dollars) Capital stock Additional paid-in capital Retained earnings Share-based payments reserve Foreign currency translation Total stockholders’ equity Balances as of January 1, 2024 $ 591,600,113 $ 934,944,456 $ 989,736,218 $ 3,732,350 $ (33,044,712) $ 2,486,968,425 Dividends declared - - (64,686,487) - - (64,686,487) Vested shares 2,377,647 13,654,820 - (16,032,467) - - Share-based payments - - - 4,804,613 - 4,804,613 Comprehensive income - - 234,173,128 - (535,042) 233,638,086 Balances as of June 30, 2024 (Unaudited) 593,977,760 948,599,276 1,159,222,859 (7,495,504) (33,579,754) 2,660,724,637 Balances as of January 1, 2025 585,487,257 905,722,252 1,148,396,077 3,884,108 (46,205,511) 2,597,284,183 Dividends declared - - (69,537,973) - - (69,537,973) Vested shares 2,045,268 6,964,825 - (9,010,093) - - Share-based payments 65,627 283,509 - 7,666,492 - 8,015,628 Repurchase of shares (7,619,972) (28,795,873) - - - (36,415,845) Comprehensive income - - 42,640,071 - 1,082,901 43,722,972 Balances as of June 30, 2025 (Unaudited) $ 579,978,180 $ 884,174,713 $ 1,121,498,175 $ 2,540,507 $ (45,122,610) $ 2,543,068,965 See accompanying notes to unaudited condensed consolidated interim financial statements.

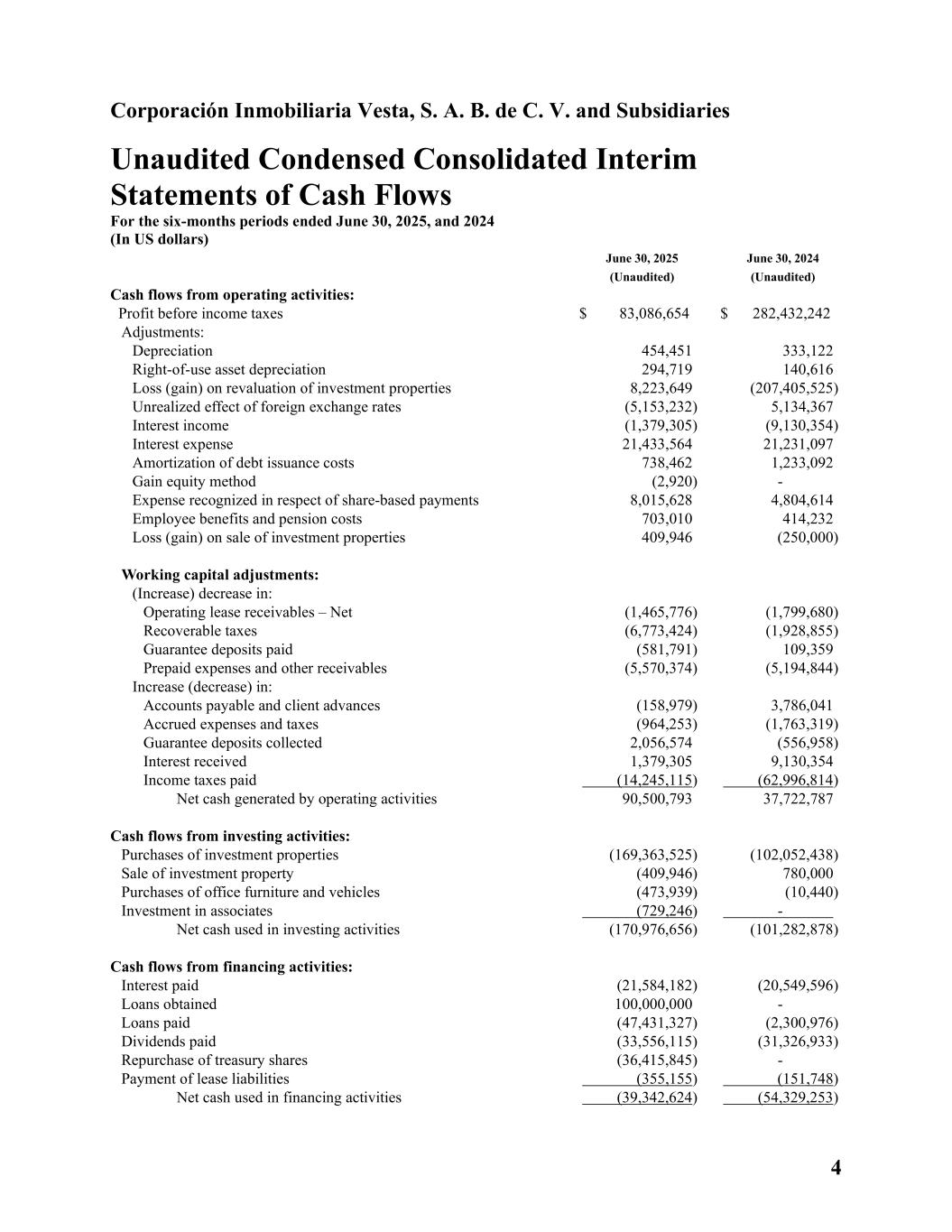

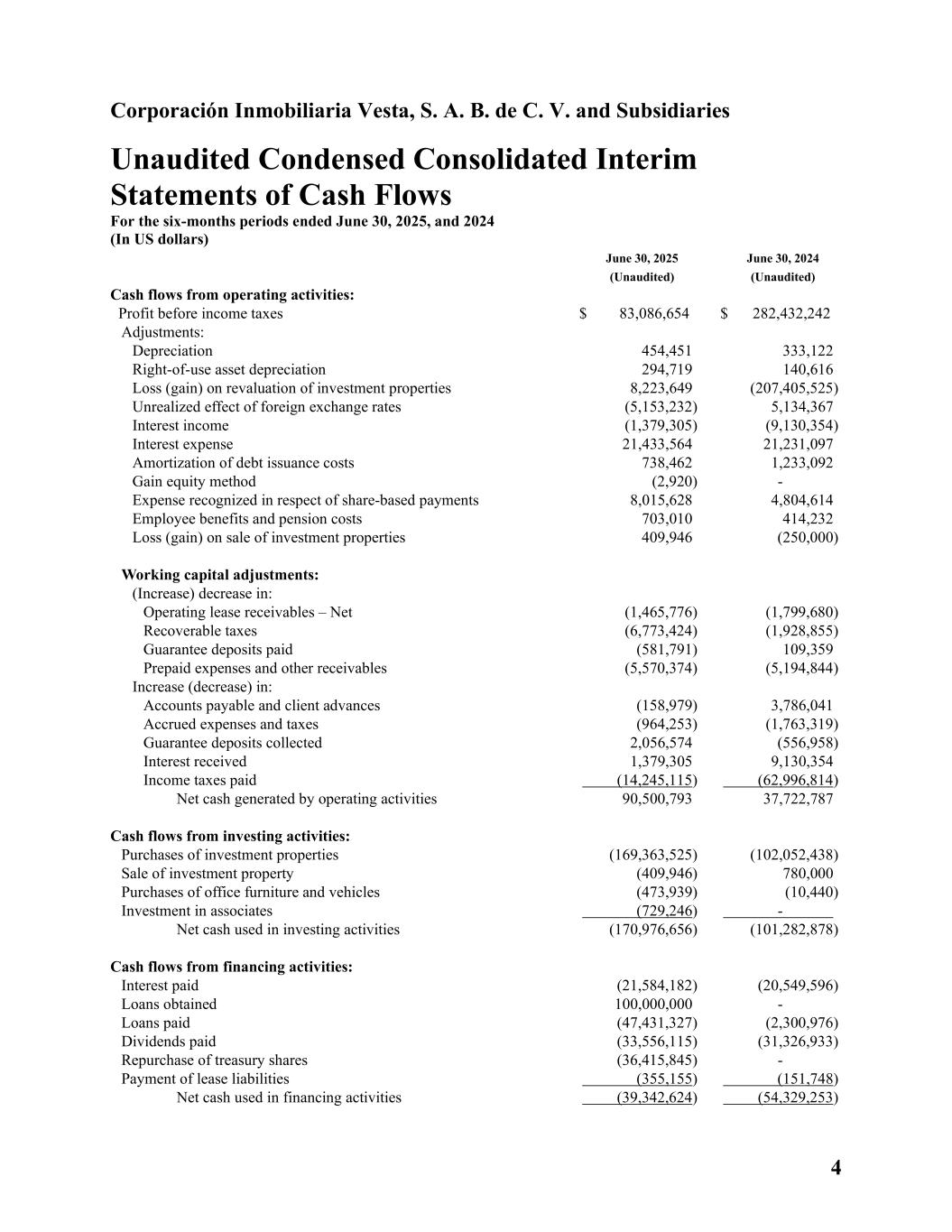

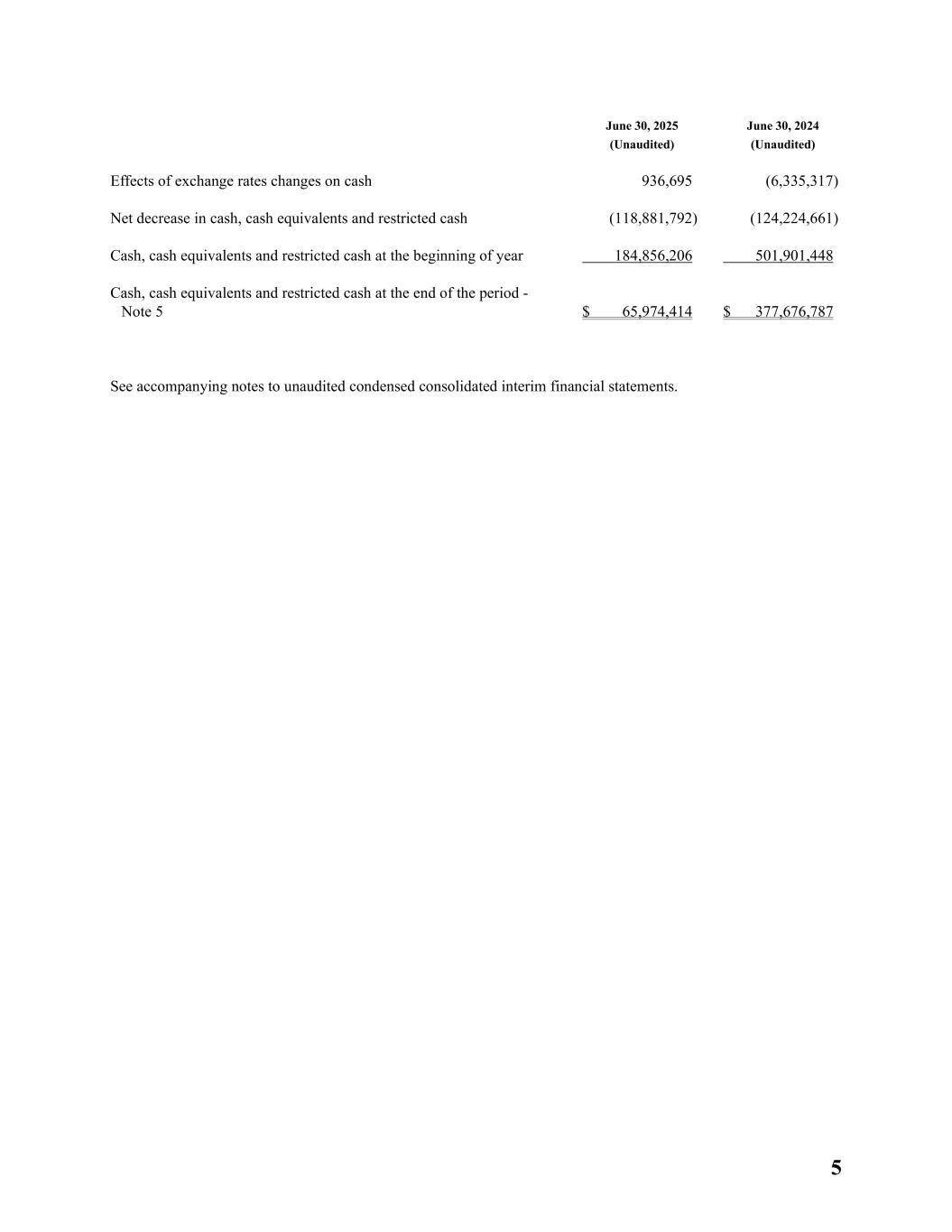

4 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Condensed Consolidated Interim Statements of Cash Flows For the six-months periods ended June 30, 2025, and 2024 (In US dollars) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Cash flows from operating activities: Profit before income taxes $ 83,086,654 $ 282,432,242 Adjustments: Depreciation 454,451 333,122 Right-of-use asset depreciation 294,719 140,616 Loss (gain) on revaluation of investment properties 8,223,649 (207,405,525) Unrealized effect of foreign exchange rates (5,153,232) 5,134,367 Interest income (1,379,305) (9,130,354) Interest expense 21,433,564 21,231,097 Amortization of debt issuance costs 738,462 1,233,092 Gain equity method (2,920) - Expense recognized in respect of share-based payments 8,015,628 4,804,614 Employee benefits and pension costs 703,010 414,232 Loss (gain) on sale of investment properties 409,946 (250,000) Working capital adjustments: (Increase) decrease in: Operating lease receivables – Net (1,465,776) (1,799,680) Recoverable taxes (6,773,424) (1,928,855) Guarantee deposits paid (581,791) 109,359 Prepaid expenses and other receivables (5,570,374) (5,194,844) Increase (decrease) in: Accounts payable and client advances (158,979) 3,786,041 Accrued expenses and taxes (964,253) (1,763,319) Guarantee deposits collected 2,056,574 (556,958) Interest received 1,379,305 9,130,354 Income taxes paid (14,245,115) (62,996,814) Net cash generated by operating activities 90,500,793 37,722,787 Cash flows from investing activities: Purchases of investment properties (169,363,525) (102,052,438) Sale of investment property (409,946) 780,000 Purchases of office furniture and vehicles (473,939) (10,440) Investment in associates (729,246) - Net cash used in investing activities (170,976,656) (101,282,878) Cash flows from financing activities: Interest paid (21,584,182) (20,549,596) Loans obtained 100,000,000 - Loans paid (47,431,327) (2,300,976) Dividends paid (33,556,115) (31,326,933) Repurchase of treasury shares (36,415,845) - Payment of lease liabilities (355,155) (151,748) Net cash used in financing activities (39,342,624) (54,329,253)

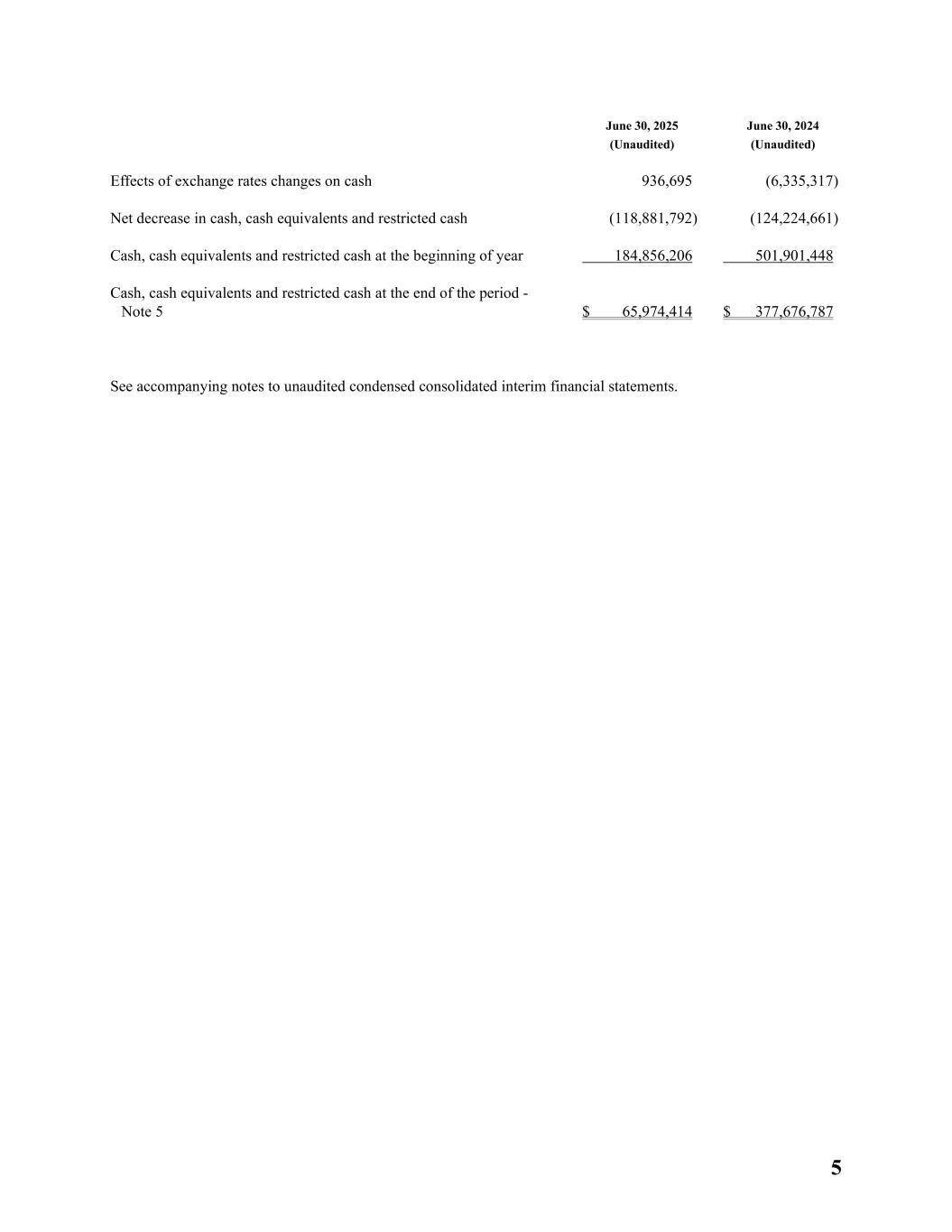

5 June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Effects of exchange rates changes on cash 936,695 (6,335,317) Net decrease in cash, cash equivalents and restricted cash (118,881,792) (124,224,661) Cash, cash equivalents and restricted cash at the beginning of year 184,856,206 501,901,448 Cash, cash equivalents and restricted cash at the end of the period - Note 5 $ 65,974,414 $ 377,676,787 See accompanying notes to unaudited condensed consolidated interim financial statements.

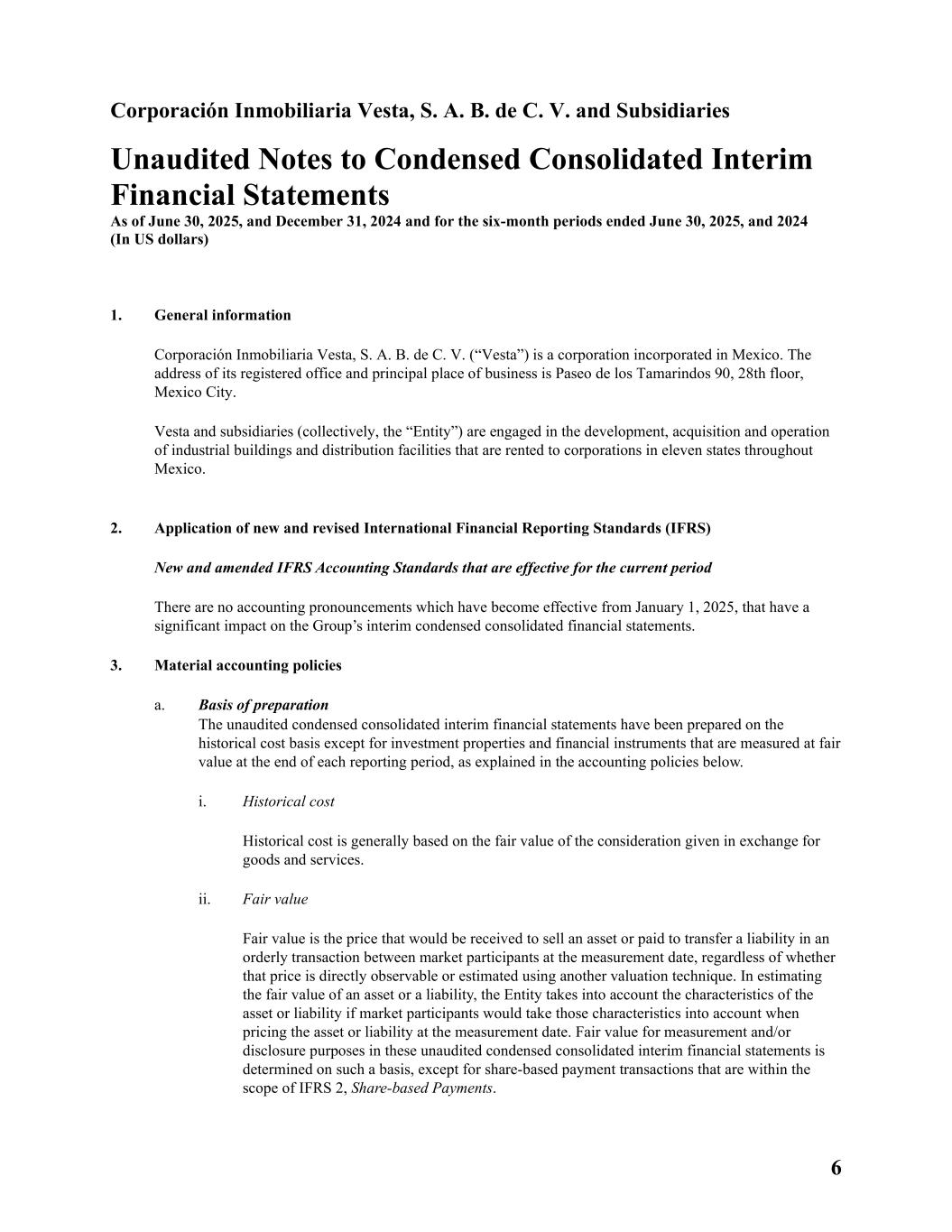

6 Corporación Inmobiliaria Vesta, S. A. B. de C. V. and Subsidiaries Unaudited Notes to Condensed Consolidated Interim Financial Statements As of June 30, 2025, and December 31, 2024 and for the six-month periods ended June 30, 2025, and 2024 (In US dollars) 1. General information Corporación Inmobiliaria Vesta, S. A. B. de C. V. (“Vesta”) is a corporation incorporated in Mexico. The address of its registered office and principal place of business is Paseo de los Tamarindos 90, 28th floor, Mexico City. Vesta and subsidiaries (collectively, the “Entity”) are engaged in the development, acquisition and operation of industrial buildings and distribution facilities that are rented to corporations in eleven states throughout Mexico. 2. Application of new and revised International Financial Reporting Standards (IFRS) New and amended IFRS Accounting Standards that are effective for the current period There are no accounting pronouncements which have become effective from January 1, 2025, that have a significant impact on the Group’s interim condensed consolidated financial statements. 3. Material accounting policies a. Basis of preparation The unaudited condensed consolidated interim financial statements have been prepared on the historical cost basis except for investment properties and financial instruments that are measured at fair value at the end of each reporting period, as explained in the accounting policies below. i. Historical cost Historical cost is generally based on the fair value of the consideration given in exchange for goods and services. ii. Fair value Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Entity takes into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure purposes in these unaudited condensed consolidated interim financial statements is determined on such a basis, except for share-based payment transactions that are within the scope of IFRS 2, Share-based Payments.

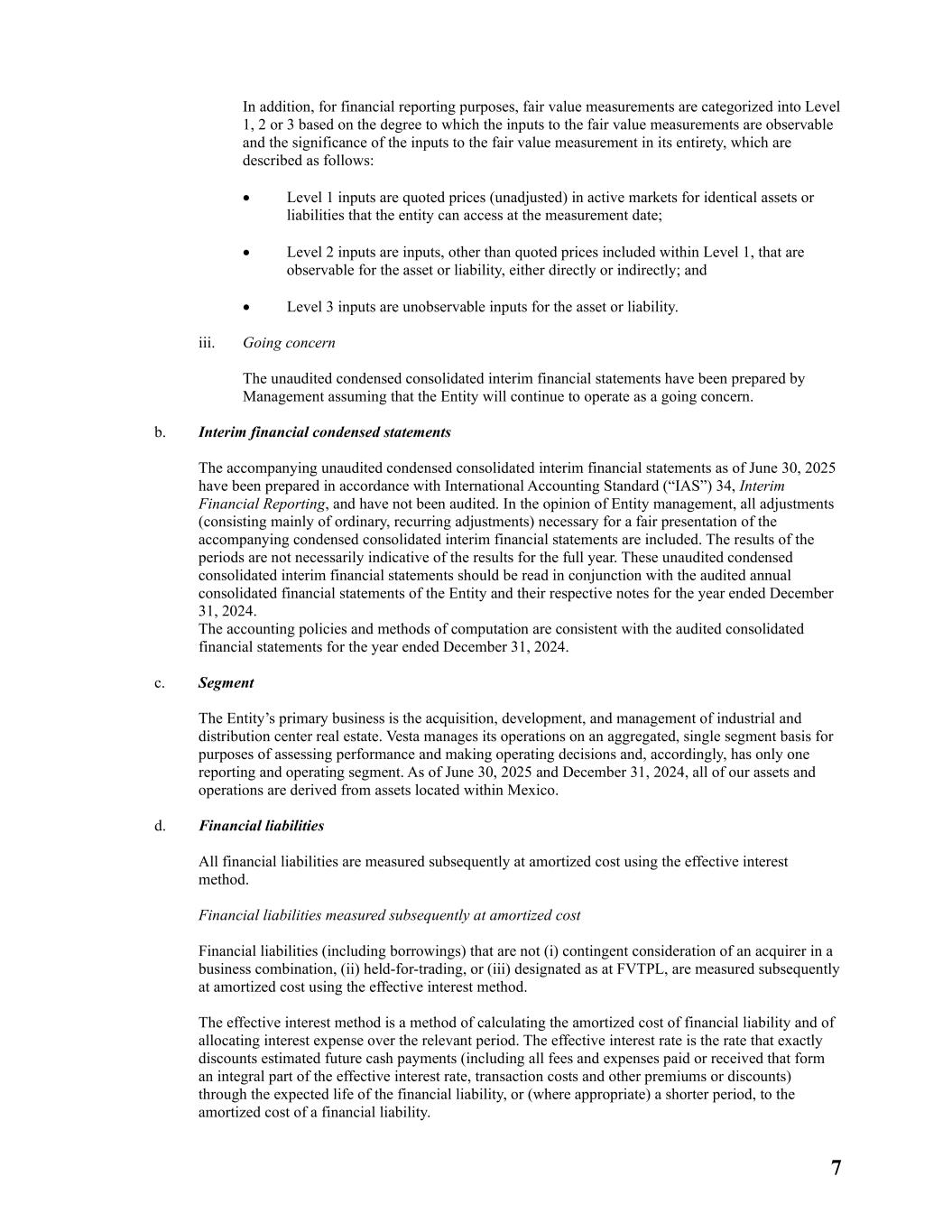

7 In addition, for financial reporting purposes, fair value measurements are categorized into Level 1, 2 or 3 based on the degree to which the inputs to the fair value measurements are observable and the significance of the inputs to the fair value measurement in its entirety, which are described as follows: • Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date; • Level 2 inputs are inputs, other than quoted prices included within Level 1, that are observable for the asset or liability, either directly or indirectly; and • Level 3 inputs are unobservable inputs for the asset or liability. iii. Going concern The unaudited condensed consolidated interim financial statements have been prepared by Management assuming that the Entity will continue to operate as a going concern. b. Interim financial condensed statements The accompanying unaudited condensed consolidated interim financial statements as of June 30, 2025 have been prepared in accordance with International Accounting Standard (“IAS”) 34, Interim Financial Reporting, and have not been audited. In the opinion of Entity management, all adjustments (consisting mainly of ordinary, recurring adjustments) necessary for a fair presentation of the accompanying condensed consolidated interim financial statements are included. The results of the periods are not necessarily indicative of the results for the full year. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited annual consolidated financial statements of the Entity and their respective notes for the year ended December 31, 2024. The accounting policies and methods of computation are consistent with the audited consolidated financial statements for the year ended December 31, 2024. c. Segment The Entity’s primary business is the acquisition, development, and management of industrial and distribution center real estate. Vesta manages its operations on an aggregated, single segment basis for purposes of assessing performance and making operating decisions and, accordingly, has only one reporting and operating segment. As of June 30, 2025 and December 31, 2024, all of our assets and operations are derived from assets located within Mexico. d. Financial liabilities All financial liabilities are measured subsequently at amortized cost using the effective interest method. Financial liabilities measured subsequently at amortized cost Financial liabilities (including borrowings) that are not (i) contingent consideration of an acquirer in a business combination, (ii) held-for-trading, or (iii) designated as at FVTPL, are measured subsequently at amortized cost using the effective interest method. The effective interest method is a method of calculating the amortized cost of financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments (including all fees and expenses paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) through the expected life of the financial liability, or (where appropriate) a shorter period, to the amortized cost of a financial liability.

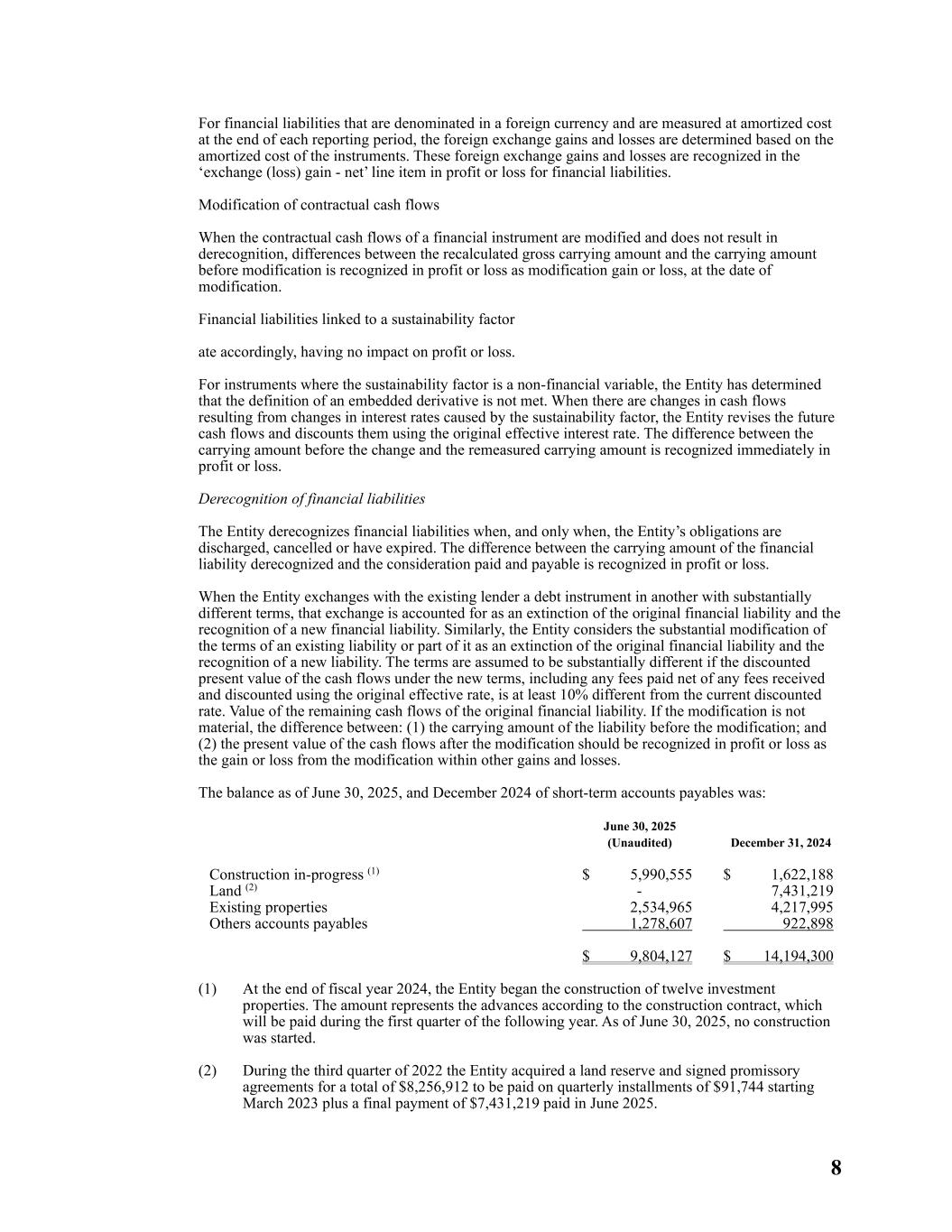

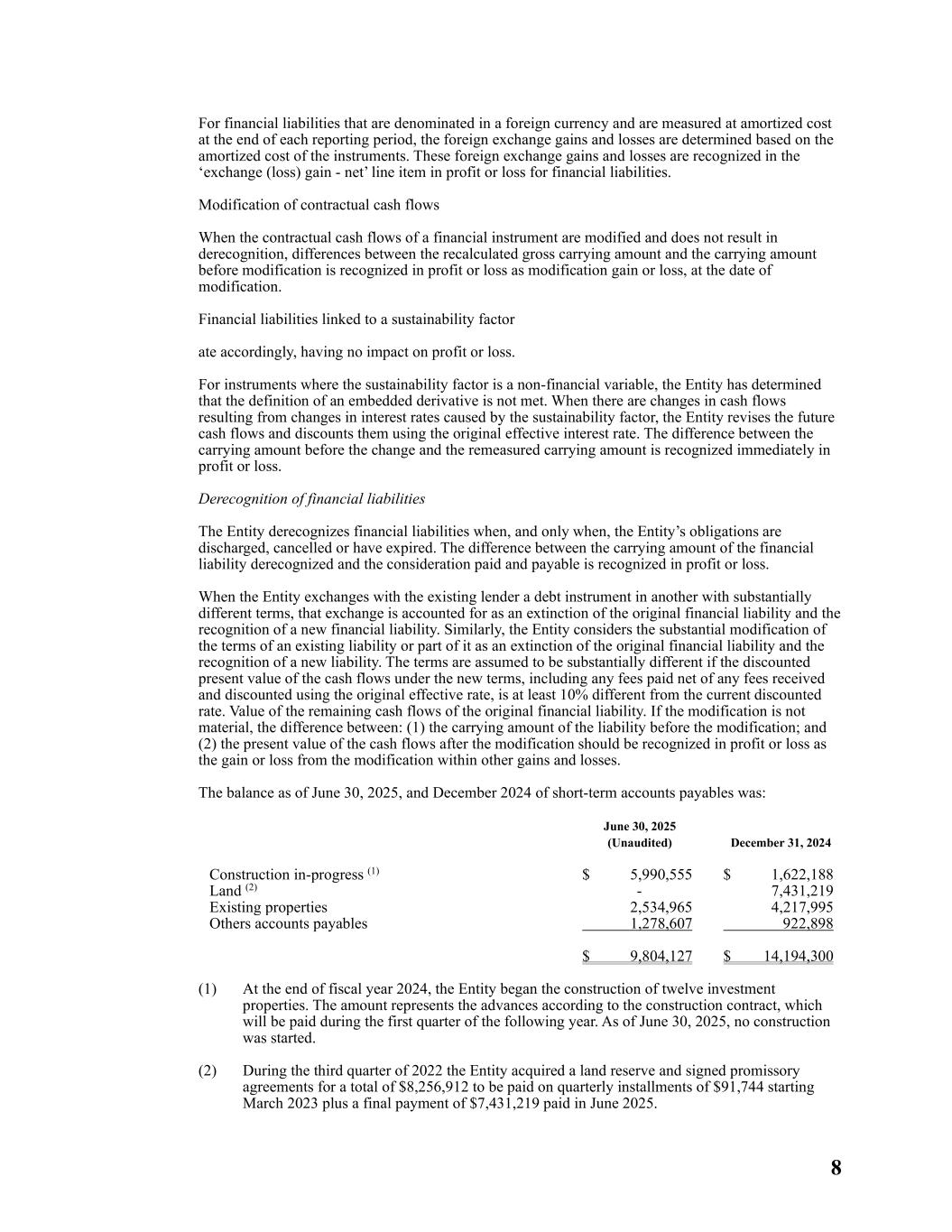

8 For financial liabilities that are denominated in a foreign currency and are measured at amortized cost at the end of each reporting period, the foreign exchange gains and losses are determined based on the amortized cost of the instruments. These foreign exchange gains and losses are recognized in the ‘exchange (loss) gain - net’ line item in profit or loss for financial liabilities. Modification of contractual cash flows When the contractual cash flows of a financial instrument are modified and does not result in derecognition, differences between the recalculated gross carrying amount and the carrying amount before modification is recognized in profit or loss as modification gain or loss, at the date of modification. Financial liabilities linked to a sustainability factor ate accordingly, having no impact on profit or loss. For instruments where the sustainability factor is a non-financial variable, the Entity has determined that the definition of an embedded derivative is not met. When there are changes in cash flows resulting from changes in interest rates caused by the sustainability factor, the Entity revises the future cash flows and discounts them using the original effective interest rate. The difference between the carrying amount before the change and the remeasured carrying amount is recognized immediately in profit or loss. Derecognition of financial liabilities The Entity derecognizes financial liabilities when, and only when, the Entity’s obligations are discharged, cancelled or have expired. The difference between the carrying amount of the financial liability derecognized and the consideration paid and payable is recognized in profit or loss. When the Entity exchanges with the existing lender a debt instrument in another with substantially different terms, that exchange is accounted for as an extinction of the original financial liability and the recognition of a new financial liability. Similarly, the Entity considers the substantial modification of the terms of an existing liability or part of it as an extinction of the original financial liability and the recognition of a new liability. The terms are assumed to be substantially different if the discounted present value of the cash flows under the new terms, including any fees paid net of any fees received and discounted using the original effective rate, is at least 10% different from the current discounted rate. Value of the remaining cash flows of the original financial liability. If the modification is not material, the difference between: (1) the carrying amount of the liability before the modification; and (2) the present value of the cash flows after the modification should be recognized in profit or loss as the gain or loss from the modification within other gains and losses. The balance as of June 30, 2025, and December 2024 of short-term accounts payables was: June 30, 2025 (Unaudited) December 31, 2024 Construction in-progress (1) $ 5,990,555 $ 1,622,188 Land (2) - 7,431,219 Existing properties 2,534,965 4,217,995 Others accounts payables 1,278,607 922,898 $ 9,804,127 $ 14,194,300 (1) At the end of fiscal year 2024, the Entity began the construction of twelve investment properties. The amount represents the advances according to the construction contract, which will be paid during the first quarter of the following year. As of June 30, 2025, no construction was started. (2) During the third quarter of 2022 the Entity acquired a land reserve and signed promissory agreements for a total of $8,256,912 to be paid on quarterly installments of $91,744 starting March 2023 plus a final payment of $7,431,219 paid in June 2025.

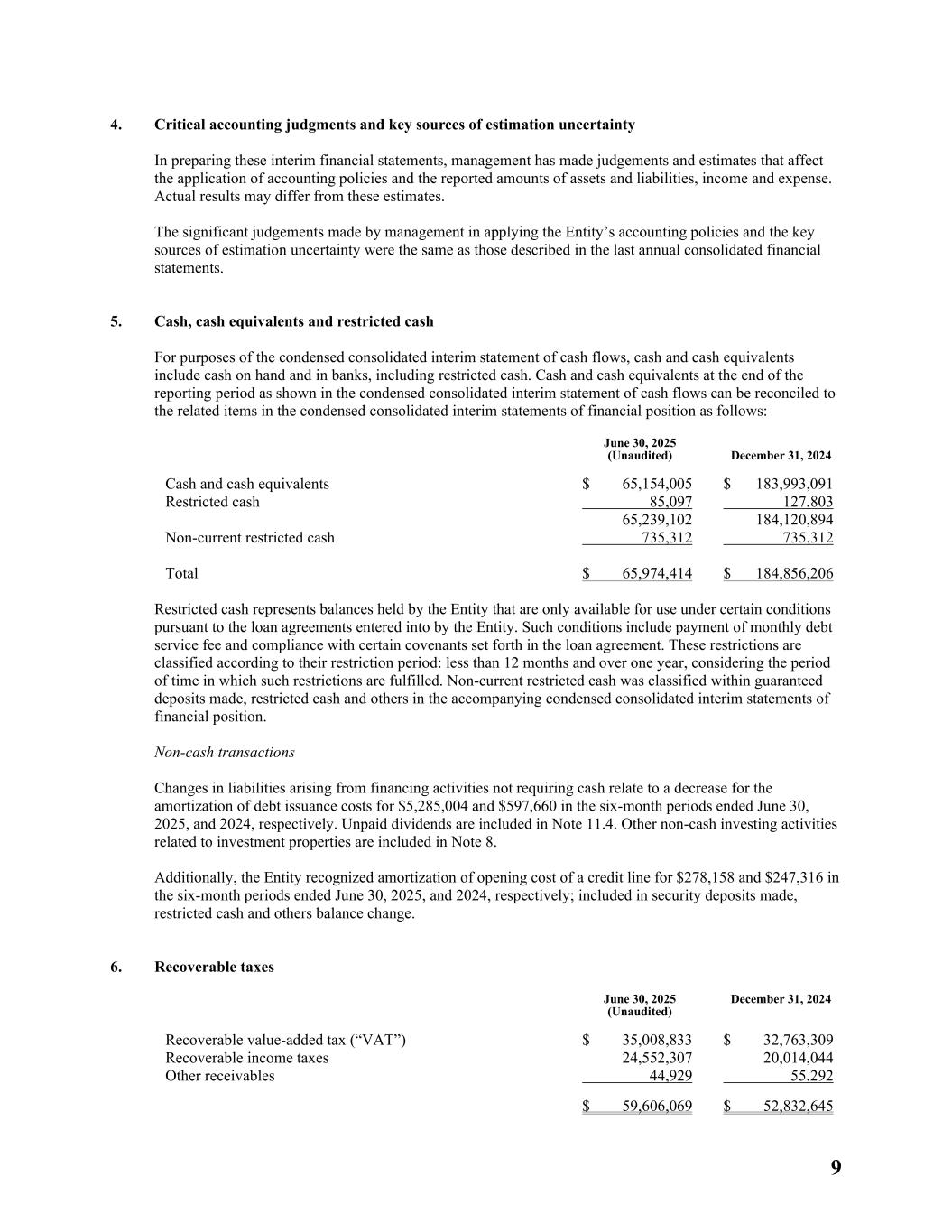

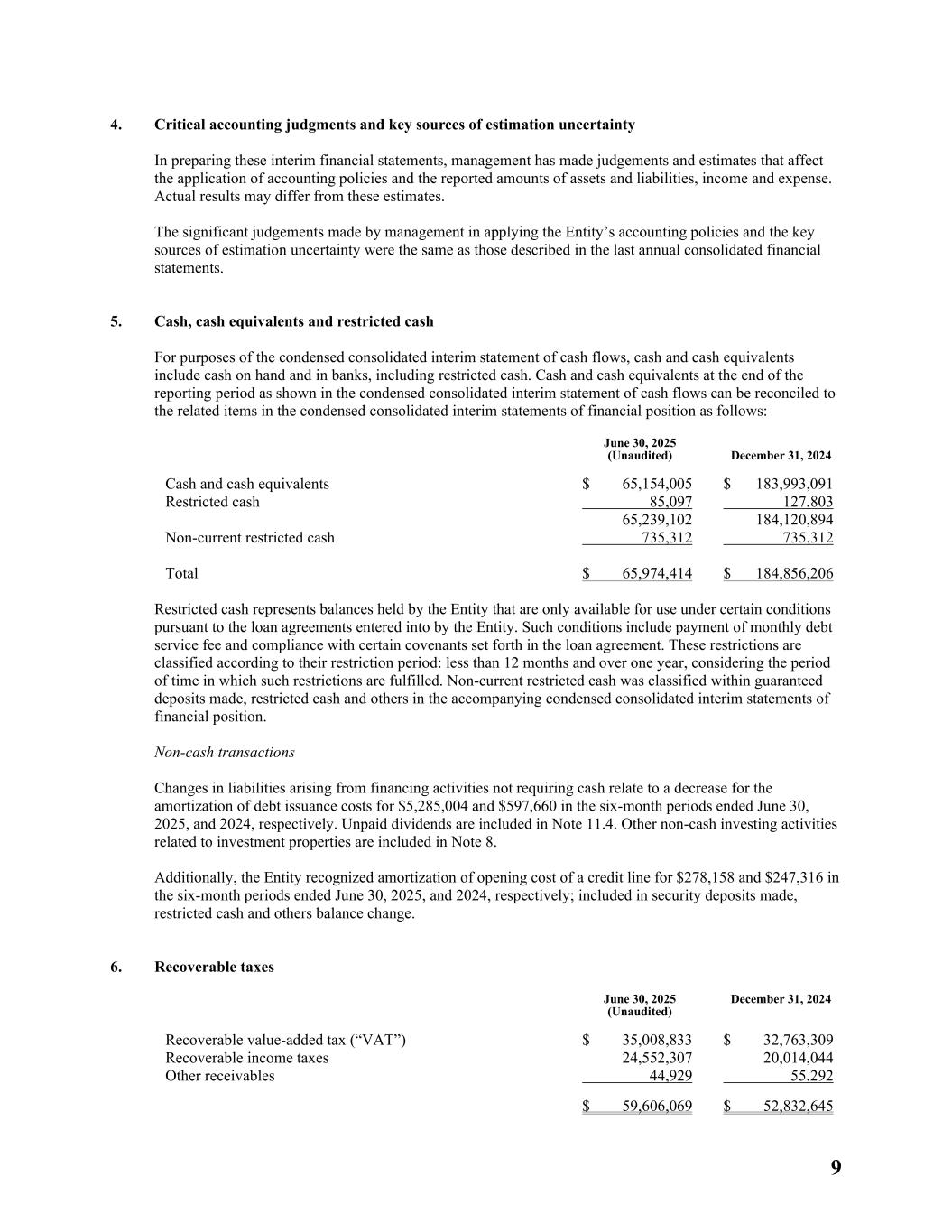

9 4. Critical accounting judgments and key sources of estimation uncertainty In preparing these interim financial statements, management has made judgements and estimates that affect the application of accounting policies and the reported amounts of assets and liabilities, income and expense. Actual results may differ from these estimates. The significant judgements made by management in applying the Entity’s accounting policies and the key sources of estimation uncertainty were the same as those described in the last annual consolidated financial statements. 5. Cash, cash equivalents and restricted cash For purposes of the condensed consolidated interim statement of cash flows, cash and cash equivalents include cash on hand and in banks, including restricted cash. Cash and cash equivalents at the end of the reporting period as shown in the condensed consolidated interim statement of cash flows can be reconciled to the related items in the condensed consolidated interim statements of financial position as follows: June 30, 2025 (Unaudited) December 31, 2024 Cash and cash equivalents $ 65,154,005 $ 183,993,091 Restricted cash 85,097 127,803 65,239,102 184,120,894 Non-current restricted cash 735,312 735,312 Total $ 65,974,414 $ 184,856,206 Restricted cash represents balances held by the Entity that are only available for use under certain conditions pursuant to the loan agreements entered into by the Entity. Such conditions include payment of monthly debt service fee and compliance with certain covenants set forth in the loan agreement. These restrictions are classified according to their restriction period: less than 12 months and over one year, considering the period of time in which such restrictions are fulfilled. Non-current restricted cash was classified within guaranteed deposits made, restricted cash and others in the accompanying condensed consolidated interim statements of financial position. Non‑cash transactions Changes in liabilities arising from financing activities not requiring cash relate to a decrease for the amortization of debt issuance costs for $5,285,004 and $597,660 in the six-month periods ended June 30, 2025, and 2024, respectively. Unpaid dividends are included in Note 11.4. Other non-cash investing activities related to investment properties are included in Note 8. Additionally, the Entity recognized amortization of opening cost of a credit line for $278,158 and $247,316 in the six-month periods ended June 30, 2025, and 2024, respectively; included in security deposits made, restricted cash and others balance change. 6. Recoverable taxes June 30, 2025 (Unaudited) December 31, 2024 Recoverable value-added tax (“VAT”) $ 35,008,833 $ 32,763,309 Recoverable income taxes 24,552,307 20,014,044 Other receivables 44,929 55,292 $ 59,606,069 $ 52,832,645

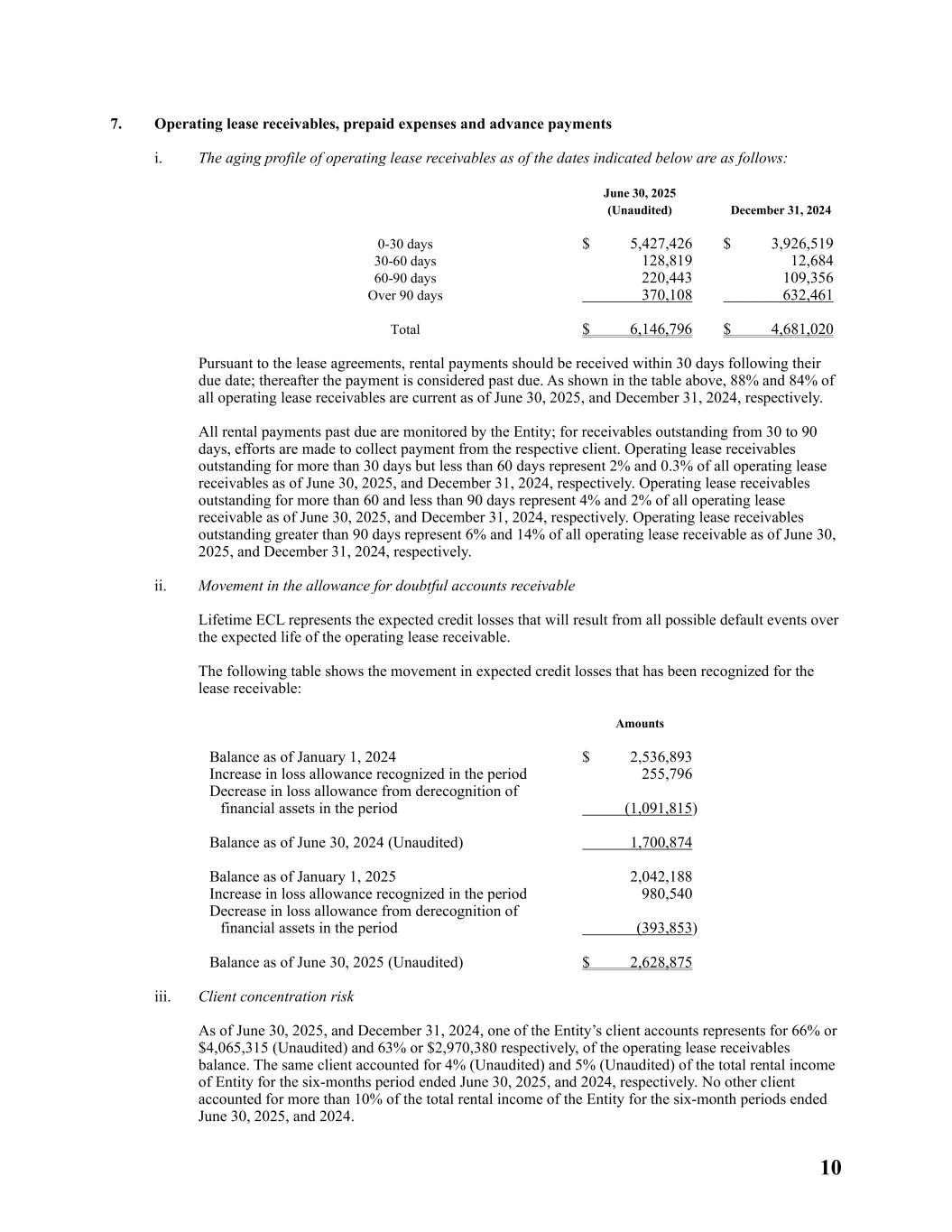

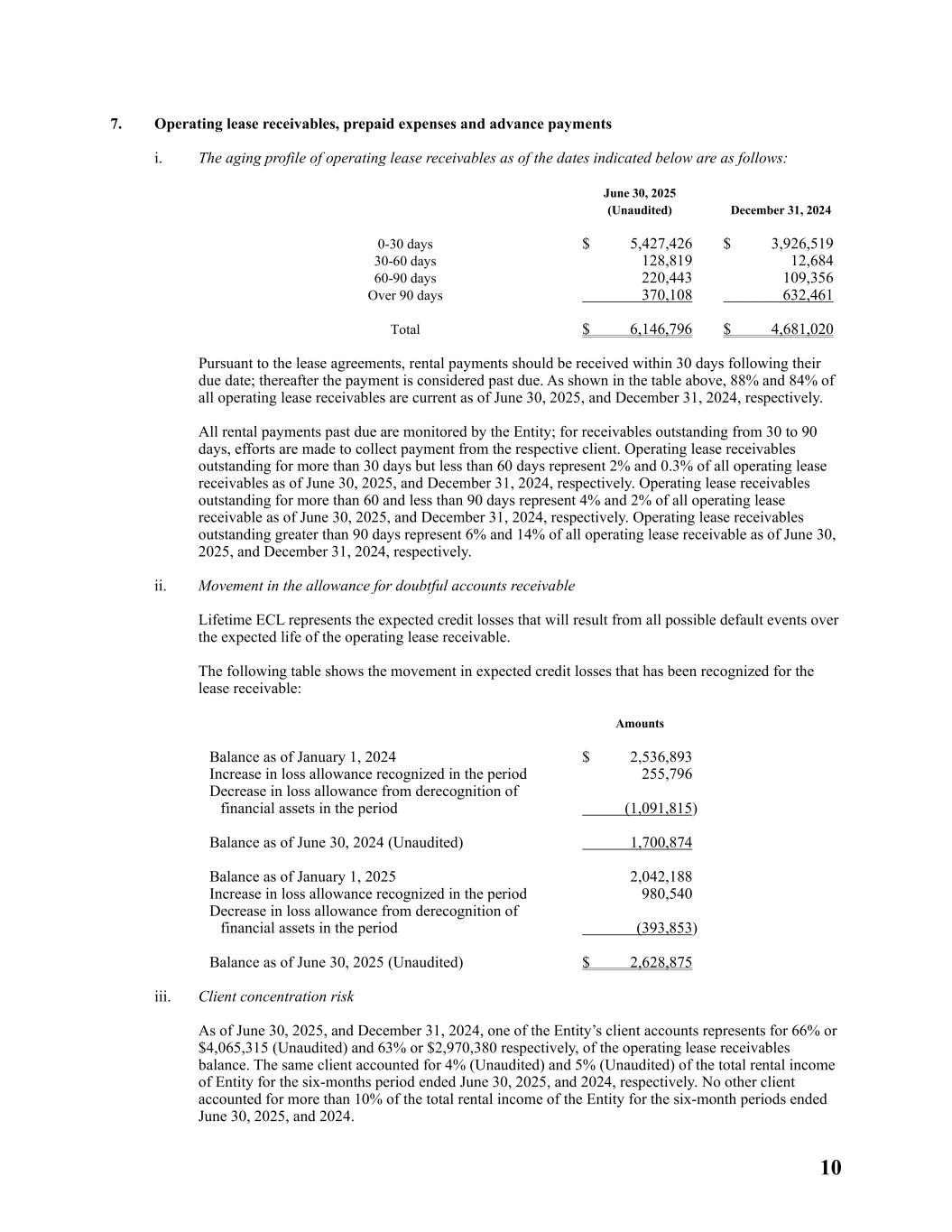

10 7. Operating lease receivables, prepaid expenses and advance payments i. The aging profile of operating lease receivables as of the dates indicated below are as follows: June 30, 2025 (Unaudited) December 31, 2024 0-30 days $ 5,427,426 $ 3,926,519 30-60 days 128,819 12,684 60-90 days 220,443 109,356 Over 90 days 370,108 632,461 Total $ 6,146,796 $ 4,681,020 Pursuant to the lease agreements, rental payments should be received within 30 days following their due date; thereafter the payment is considered past due. As shown in the table above, 88% and 84% of all operating lease receivables are current as of June 30, 2025, and December 31, 2024, respectively. All rental payments past due are monitored by the Entity; for receivables outstanding from 30 to 90 days, efforts are made to collect payment from the respective client. Operating lease receivables outstanding for more than 30 days but less than 60 days represent 2% and 0.3% of all operating lease receivables as of June 30, 2025, and December 31, 2024, respectively. Operating lease receivables outstanding for more than 60 and less than 90 days represent 4% and 2% of all operating lease receivable as of June 30, 2025, and December 31, 2024, respectively. Operating lease receivables outstanding greater than 90 days represent 6% and 14% of all operating lease receivable as of June 30, 2025, and December 31, 2024, respectively. ii. Movement in the allowance for doubtful accounts receivable Lifetime ECL represents the expected credit losses that will result from all possible default events over the expected life of the operating lease receivable. The following table shows the movement in expected credit losses that has been recognized for the lease receivable: Amounts Balance as of January 1, 2024 $ 2,536,893 Increase in loss allowance recognized in the period 255,796 Decrease in loss allowance from derecognition of financial assets in the period (1,091,815) Balance as of June 30, 2024 (Unaudited) 1,700,874 Balance as of January 1, 2025 2,042,188 Increase in loss allowance recognized in the period 980,540 Decrease in loss allowance from derecognition of financial assets in the period (393,853) Balance as of June 30, 2025 (Unaudited) $ 2,628,875 iii. Client concentration risk As of June 30, 2025, and December 31, 2024, one of the Entity’s client accounts represents for 66% or $4,065,315 (Unaudited) and 63% or $2,970,380 respectively, of the operating lease receivables balance. The same client accounted for 4% (Unaudited) and 5% (Unaudited) of the total rental income of Entity for the six-months period ended June 30, 2025, and 2024, respectively. No other client accounted for more than 10% of the total rental income of the Entity for the six-month periods ended June 30, 2025, and 2024.

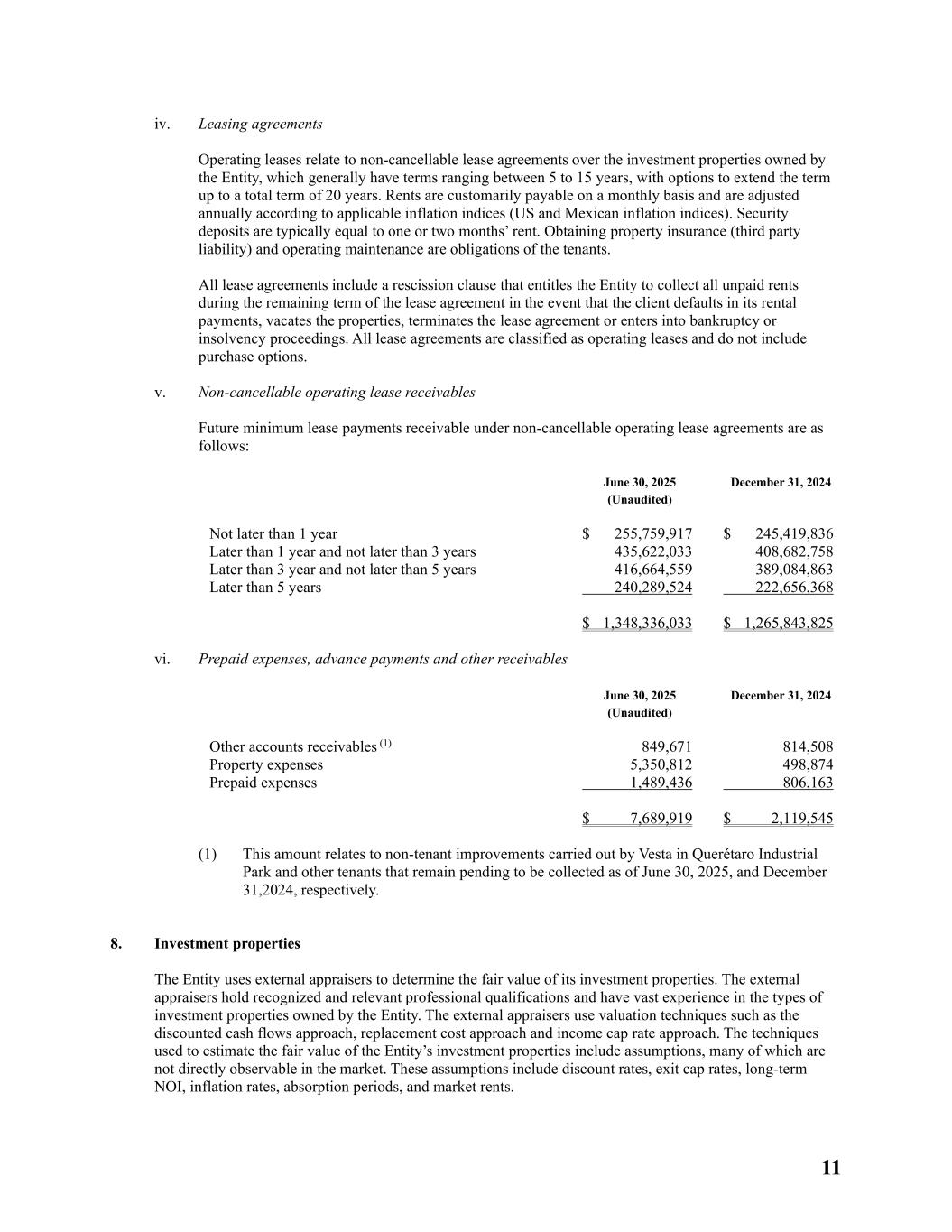

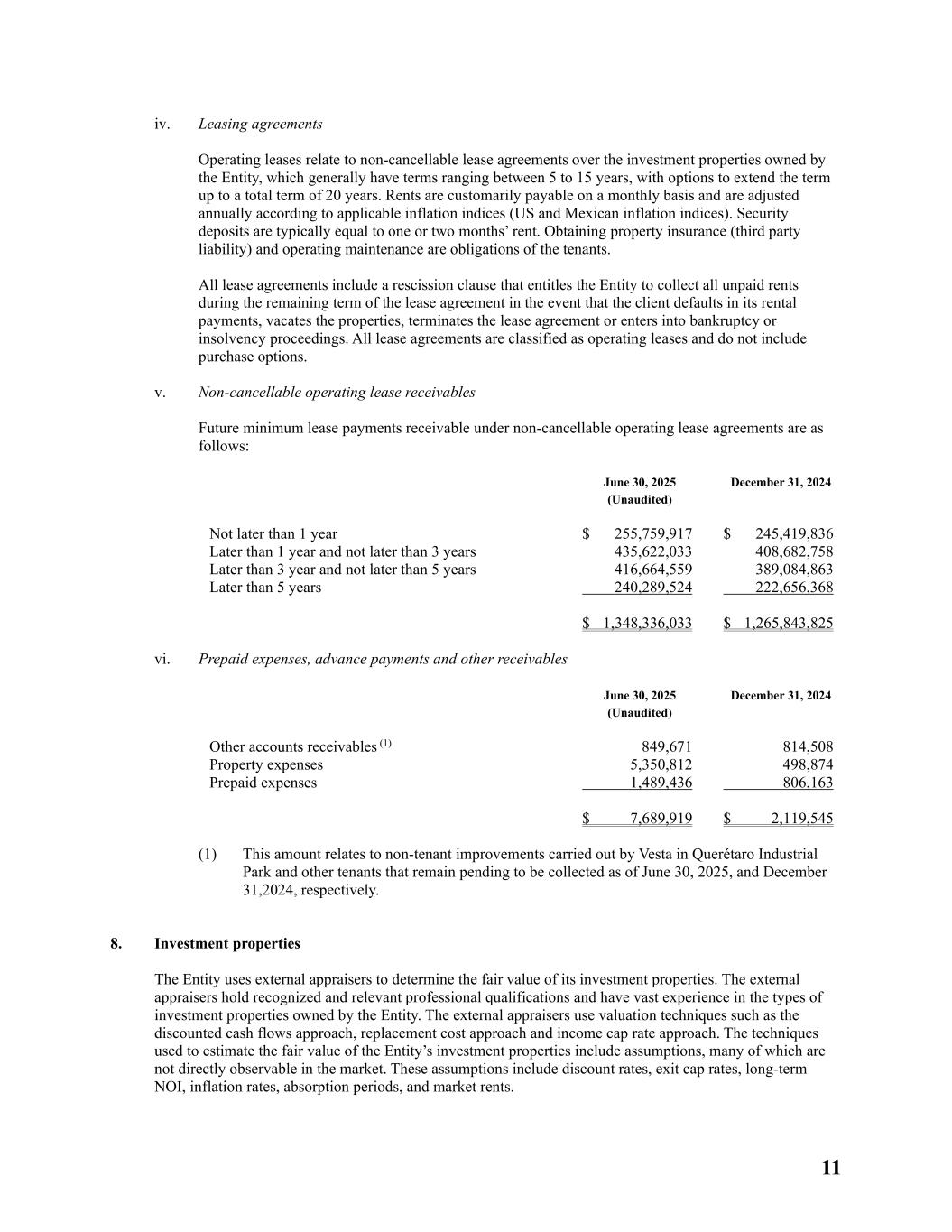

11 iv. Leasing agreements Operating leases relate to non-cancellable lease agreements over the investment properties owned by the Entity, which generally have terms ranging between 5 to 15 years, with options to extend the term up to a total term of 20 years. Rents are customarily payable on a monthly basis and are adjusted annually according to applicable inflation indices (US and Mexican inflation indices). Security deposits are typically equal to one or two months’ rent. Obtaining property insurance (third party liability) and operating maintenance are obligations of the tenants. All lease agreements include a rescission clause that entitles the Entity to collect all unpaid rents during the remaining term of the lease agreement in the event that the client defaults in its rental payments, vacates the properties, terminates the lease agreement or enters into bankruptcy or insolvency proceedings. All lease agreements are classified as operating leases and do not include purchase options. v. Non-cancellable operating lease receivables Future minimum lease payments receivable under non-cancellable operating lease agreements are as follows: June 30, 2025 (Unaudited) December 31, 2024 Not later than 1 year $ 255,759,917 $ 245,419,836 Later than 1 year and not later than 3 years 435,622,033 408,682,758 Later than 3 year and not later than 5 years 416,664,559 389,084,863 Later than 5 years 240,289,524 222,656,368 $ 1,348,336,033 $ 1,265,843,825 vi. Prepaid expenses, advance payments and other receivables June 30, 2025 (Unaudited) December 31, 2024 Other accounts receivables (1) 849,671 814,508 Property expenses 5,350,812 498,874 Prepaid expenses 1,489,436 806,163 $ 7,689,919 $ 2,119,545 (1) This amount relates to non-tenant improvements carried out by Vesta in Querétaro Industrial Park and other tenants that remain pending to be collected as of June 30, 2025, and December 31,2024, respectively. 8. Investment properties The Entity uses external appraisers to determine the fair value of its investment properties. The external appraisers hold recognized and relevant professional qualifications and have vast experience in the types of investment properties owned by the Entity. The external appraisers use valuation techniques such as the discounted cash flows approach, replacement cost approach and income cap rate approach. The techniques used to estimate the fair value of the Entity’s investment properties include assumptions, many of which are not directly observable in the market. These assumptions include discount rates, exit cap rates, long-term NOI, inflation rates, absorption periods, and market rents.

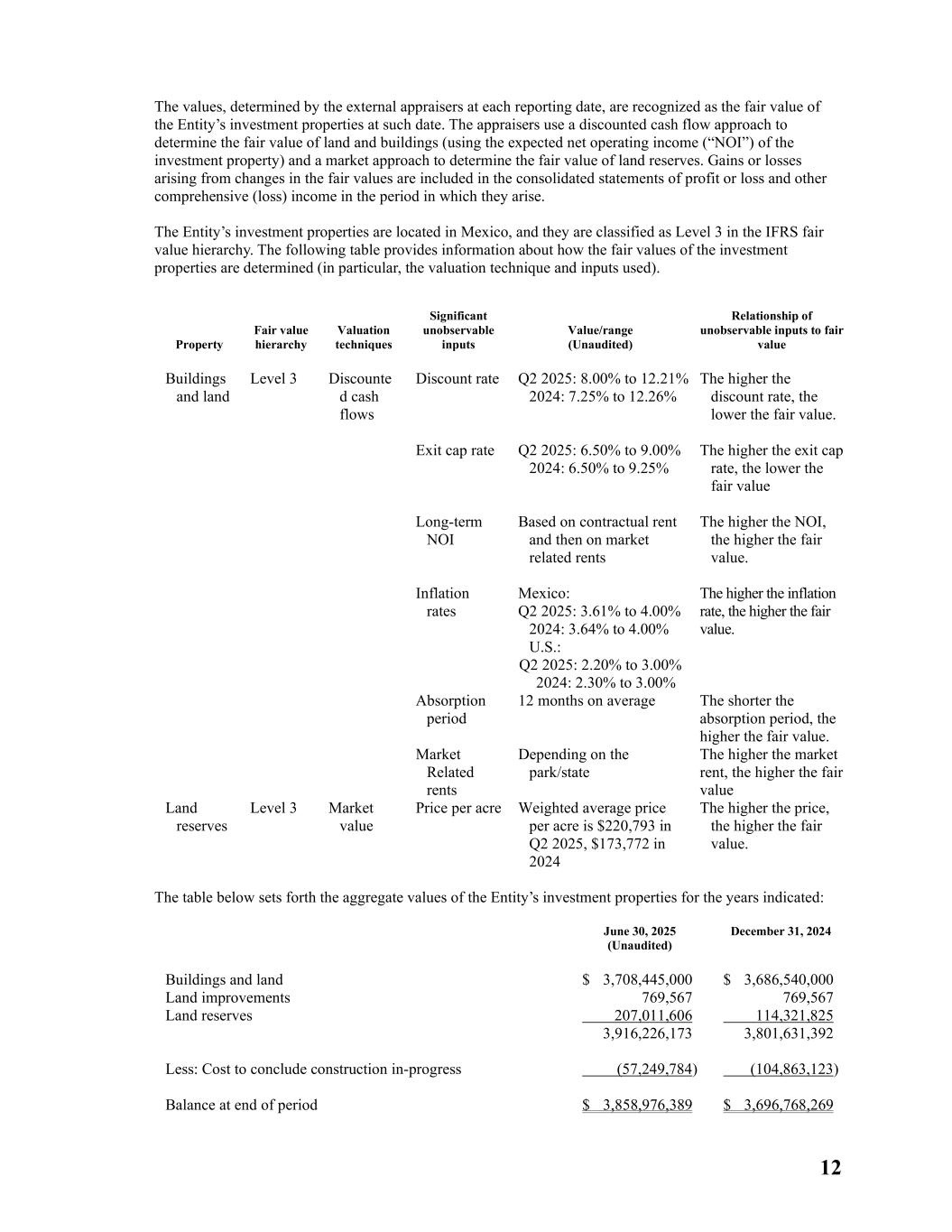

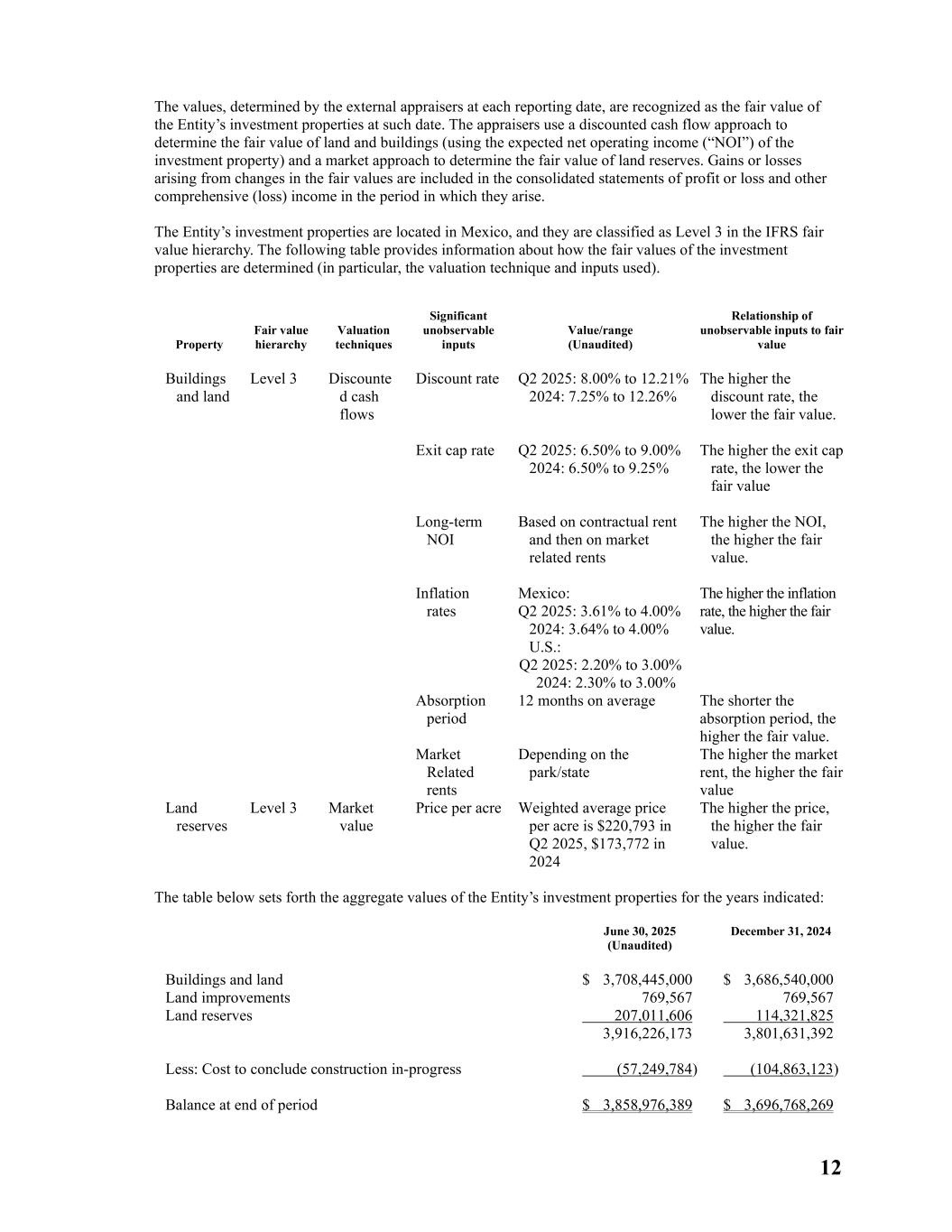

12 The values, determined by the external appraisers at each reporting date, are recognized as the fair value of the Entity’s investment properties at such date. The appraisers use a discounted cash flow approach to determine the fair value of land and buildings (using the expected net operating income (“NOI”) of the investment property) and a market approach to determine the fair value of land reserves. Gains or losses arising from changes in the fair values are included in the consolidated statements of profit or loss and other comprehensive (loss) income in the period in which they arise. The Entity’s investment properties are located in Mexico, and they are classified as Level 3 in the IFRS fair value hierarchy. The following table provides information about how the fair values of the investment properties are determined (in particular, the valuation technique and inputs used). Property Fair value hierarchy Valuation techniques Significant unobservable inputs Value/range (Unaudited) Relationship of unobservable inputs to fair value Buildings and land Level 3 Discounte d cash flows Discount rate Q2 2025: 8.00% to 12.21% 2024: 7.25% to 12.26% The higher the discount rate, the lower the fair value. Exit cap rate Q2 2025: 6.50% to 9.00% 2024: 6.50% to 9.25% The higher the exit cap rate, the lower the fair value Long-term NOI Based on contractual rent and then on market related rents The higher the NOI, the higher the fair value. Inflation rates Mexico: Q2 2025: 3.61% to 4.00% 2024: 3.64% to 4.00% U.S.: Q2 2025: 2.20% to 3.00% 2024: 2.30% to 3.00% The higher the inflation rate, the higher the fair value. Absorption period 12 months on average The shorter the absorption period, the higher the fair value. Market Related rents Depending on the park/state The higher the market rent, the higher the fair value Land reserves Level 3 Market value Price per acre Weighted average price per acre is $220,793 in Q2 2025, $173,772 in 2024 The higher the price, the higher the fair value. The table below sets forth the aggregate values of the Entity’s investment properties for the years indicated: June 30, 2025 (Unaudited) December 31, 2024 Buildings and land $ 3,708,445,000 $ 3,686,540,000 Land improvements 769,567 769,567 Land reserves 207,011,606 114,321,825 3,916,226,173 3,801,631,392 Less: Cost to conclude construction in-progress (57,249,784) (104,863,123) Balance at end of period $ 3,858,976,389 $ 3,696,768,269

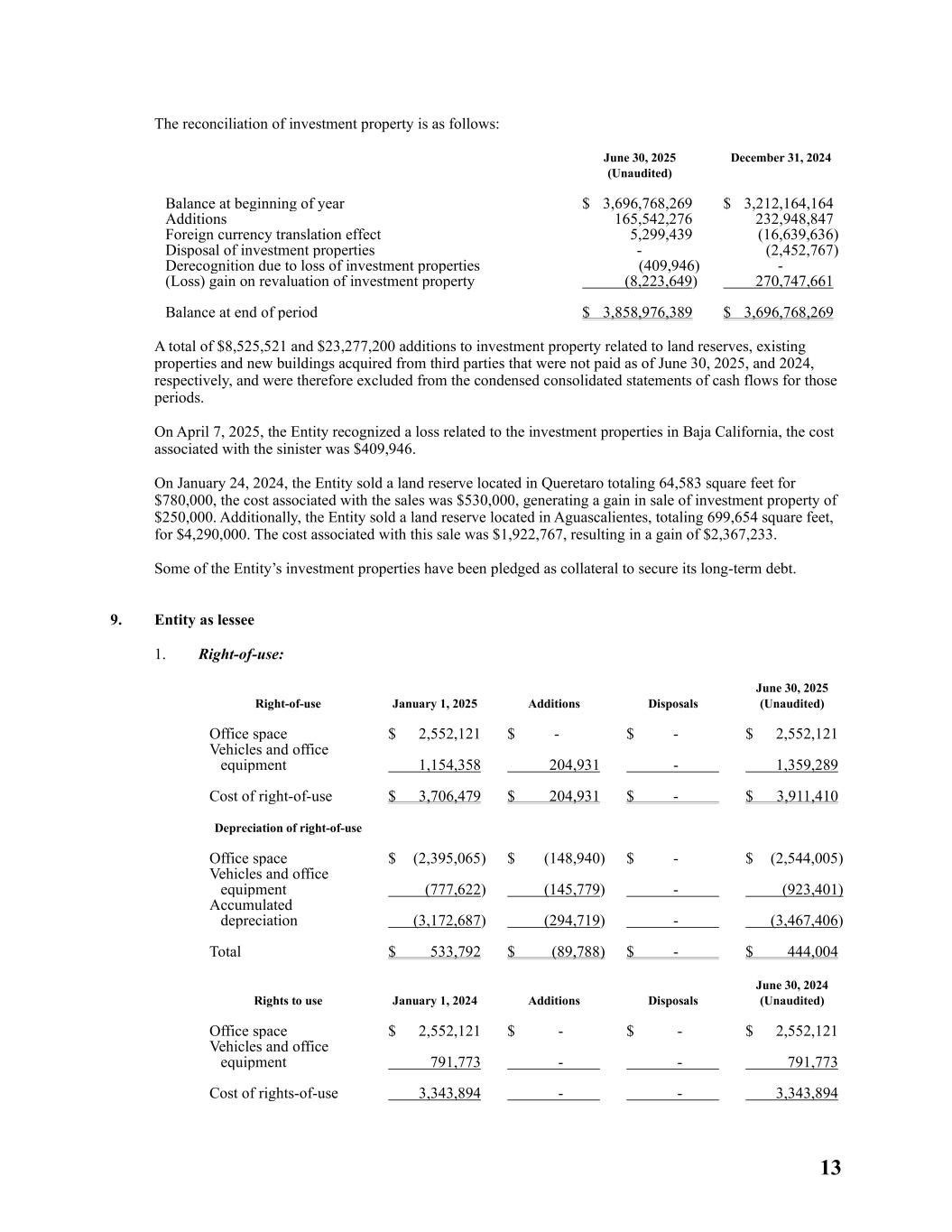

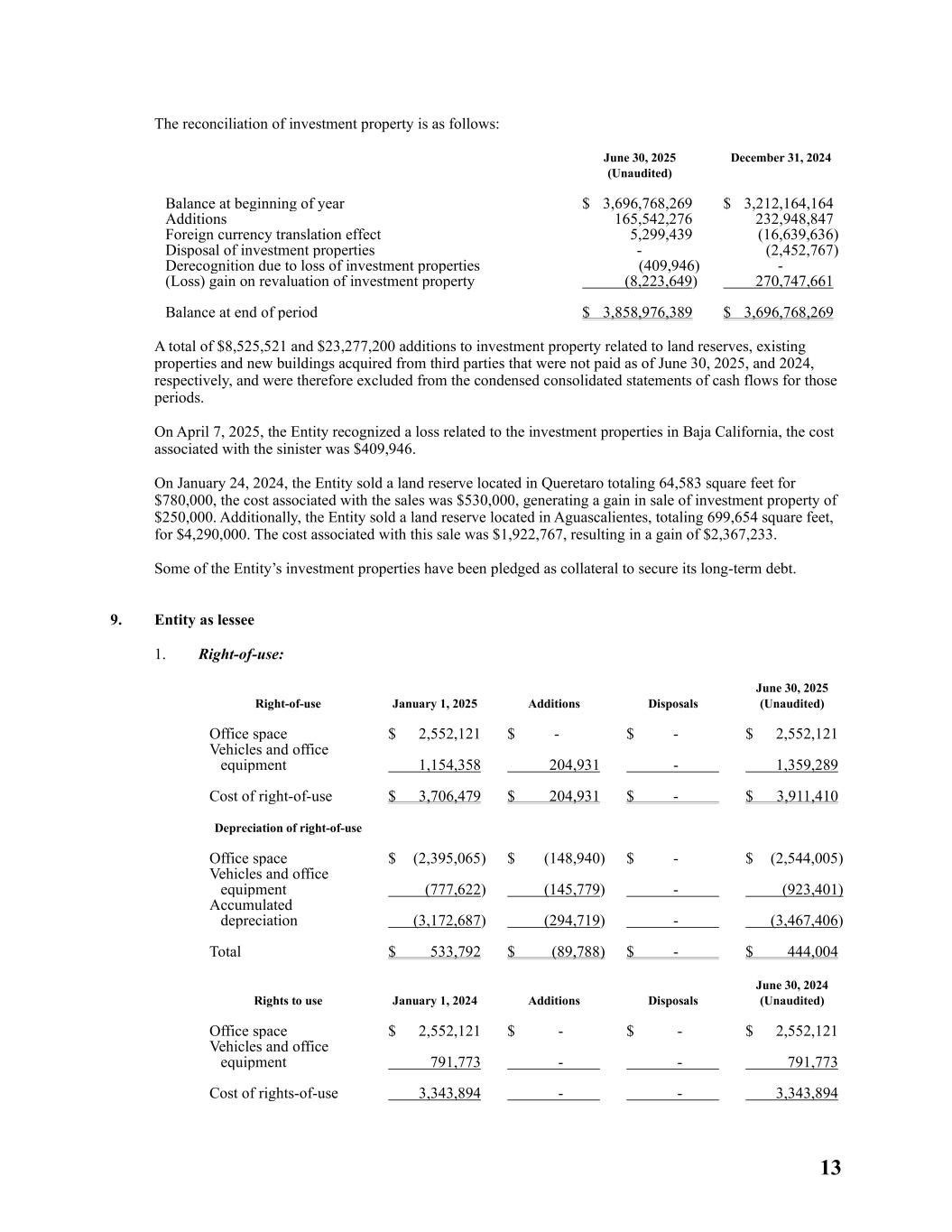

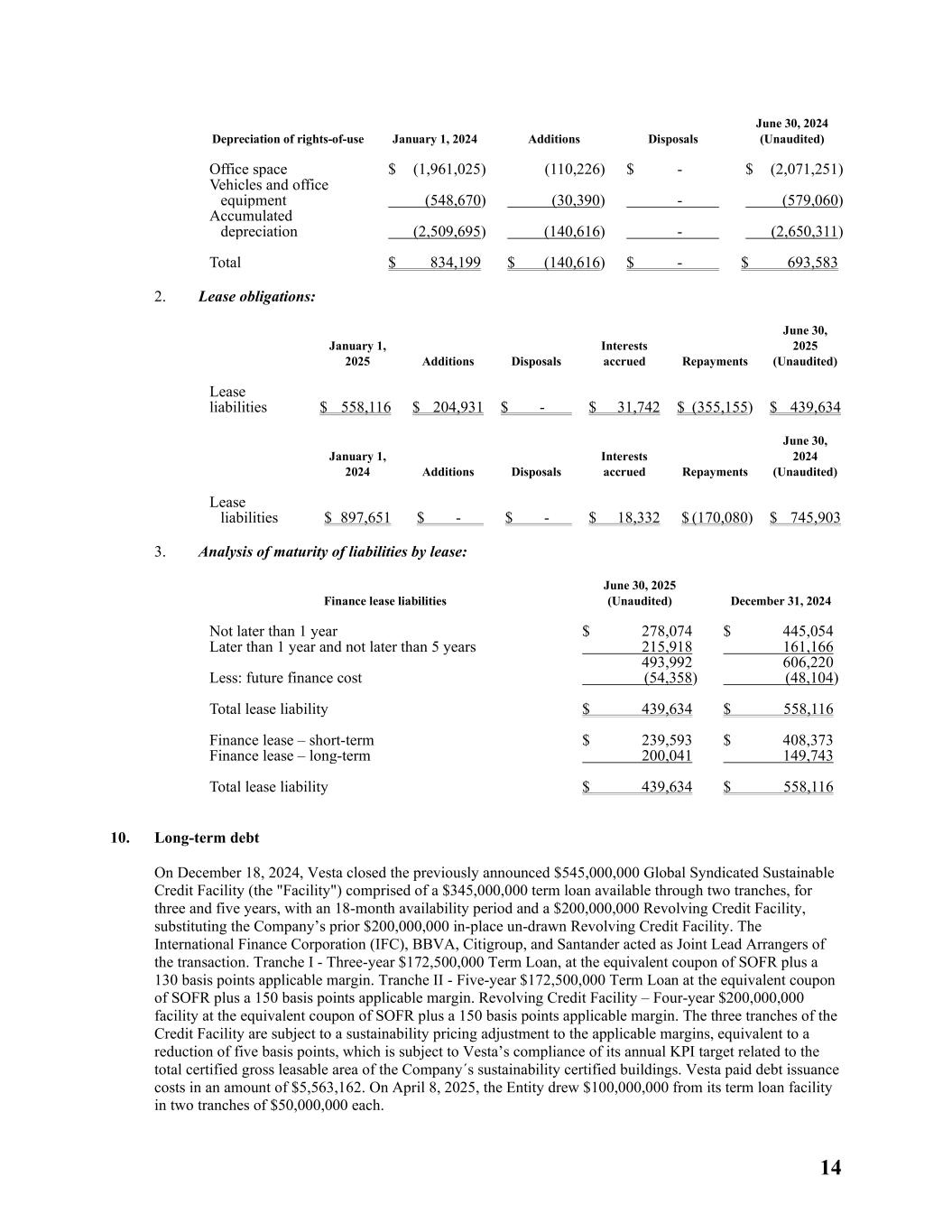

13 The reconciliation of investment property is as follows: June 30, 2025 (Unaudited) December 31, 2024 Balance at beginning of year $ 3,696,768,269 $ 3,212,164,164 Additions 165,542,276 232,948,847 Foreign currency translation effect 5,299,439 (16,639,636) Disposal of investment properties - (2,452,767) Derecognition due to loss of investment properties (409,946) - (Loss) gain on revaluation of investment property (8,223,649) 270,747,661 Balance at end of period $ 3,858,976,389 $ 3,696,768,269 A total of $8,525,521 and $23,277,200 additions to investment property related to land reserves, existing properties and new buildings acquired from third parties that were not paid as of June 30, 2025, and 2024, respectively, and were therefore excluded from the condensed consolidated statements of cash flows for those periods. On April 7, 2025, the Entity recognized a loss related to the investment properties in Baja California, the cost associated with the sinister was $409,946. On January 24, 2024, the Entity sold a land reserve located in Queretaro totaling 64,583 square feet for $780,000, the cost associated with the sales was $530,000, generating a gain in sale of investment property of $250,000. Additionally, the Entity sold a land reserve located in Aguascalientes, totaling 699,654 square feet, for $4,290,000. The cost associated with this sale was $1,922,767, resulting in a gain of $2,367,233. Some of the Entity’s investment properties have been pledged as collateral to secure its long-term debt. 9. Entity as lessee 1. Right-of-use: Right-of-use January 1, 2025 Additions Disposals June 30, 2025 (Unaudited) Office space $ 2,552,121 $ - $ - $ 2,552,121 Vehicles and office equipment 1,154,358 204,931 - 1,359,289 Cost of right-of-use $ 3,706,479 $ 204,931 $ - $ 3,911,410 Depreciation of right-of-use Office space $ (2,395,065) $ (148,940) $ - $ (2,544,005) Vehicles and office equipment (777,622) (145,779) - (923,401) Accumulated depreciation (3,172,687) (294,719) - (3,467,406) Total $ 533,792 $ (89,788) $ - $ 444,004 Rights to use January 1, 2024 Additions Disposals June 30, 2024 (Unaudited) Office space $ 2,552,121 $ - $ - $ 2,552,121 Vehicles and office equipment 791,773 - - 791,773 Cost of rights-of-use 3,343,894 - - 3,343,894

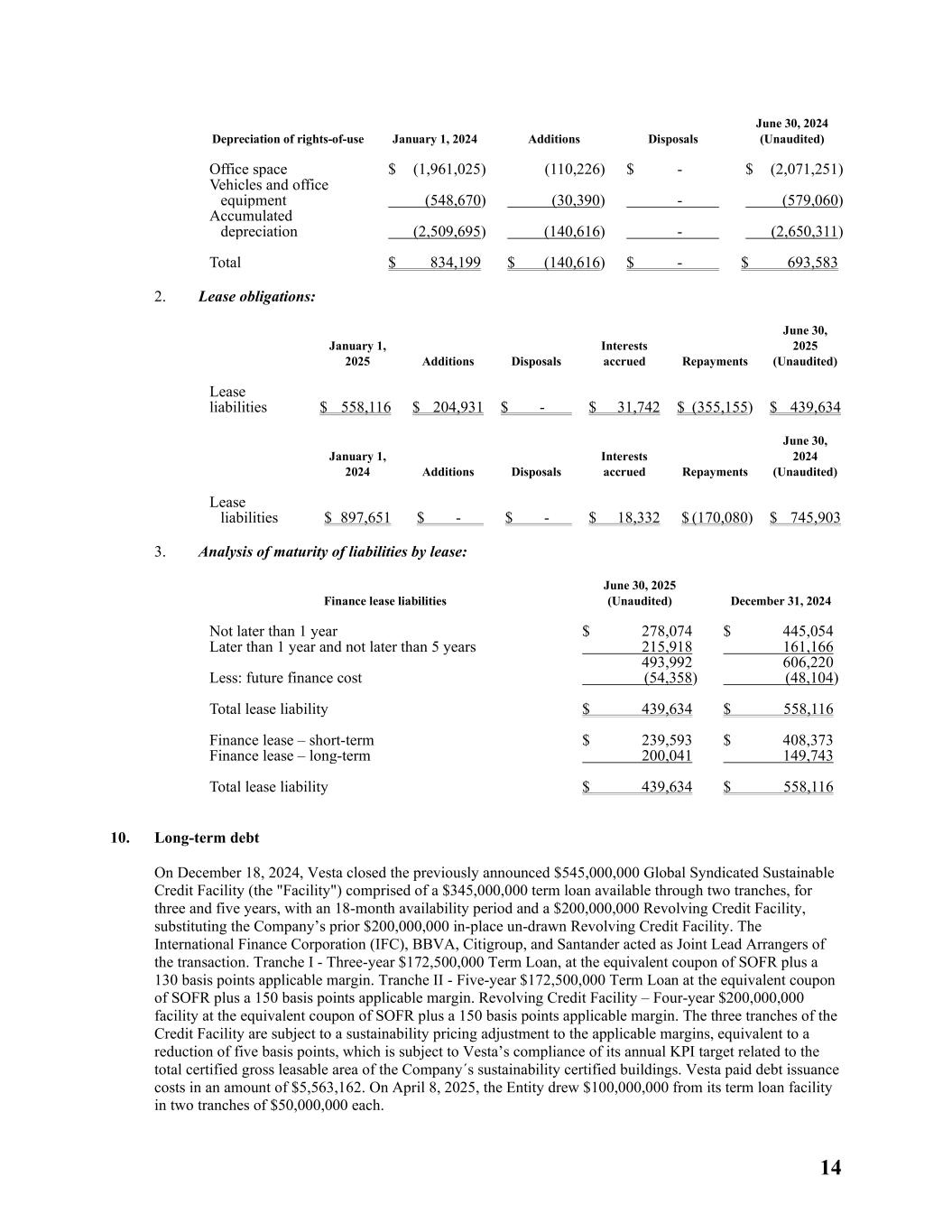

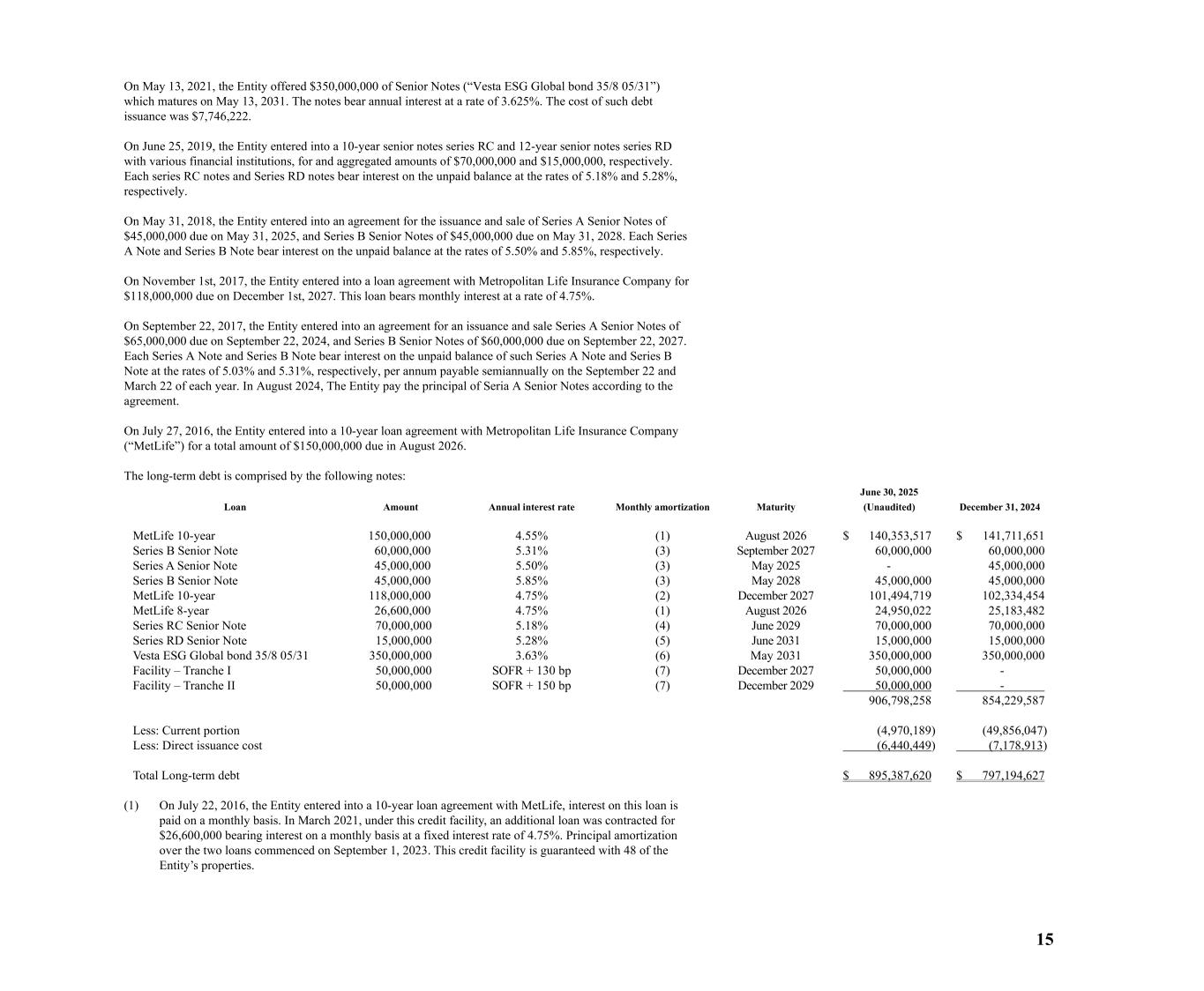

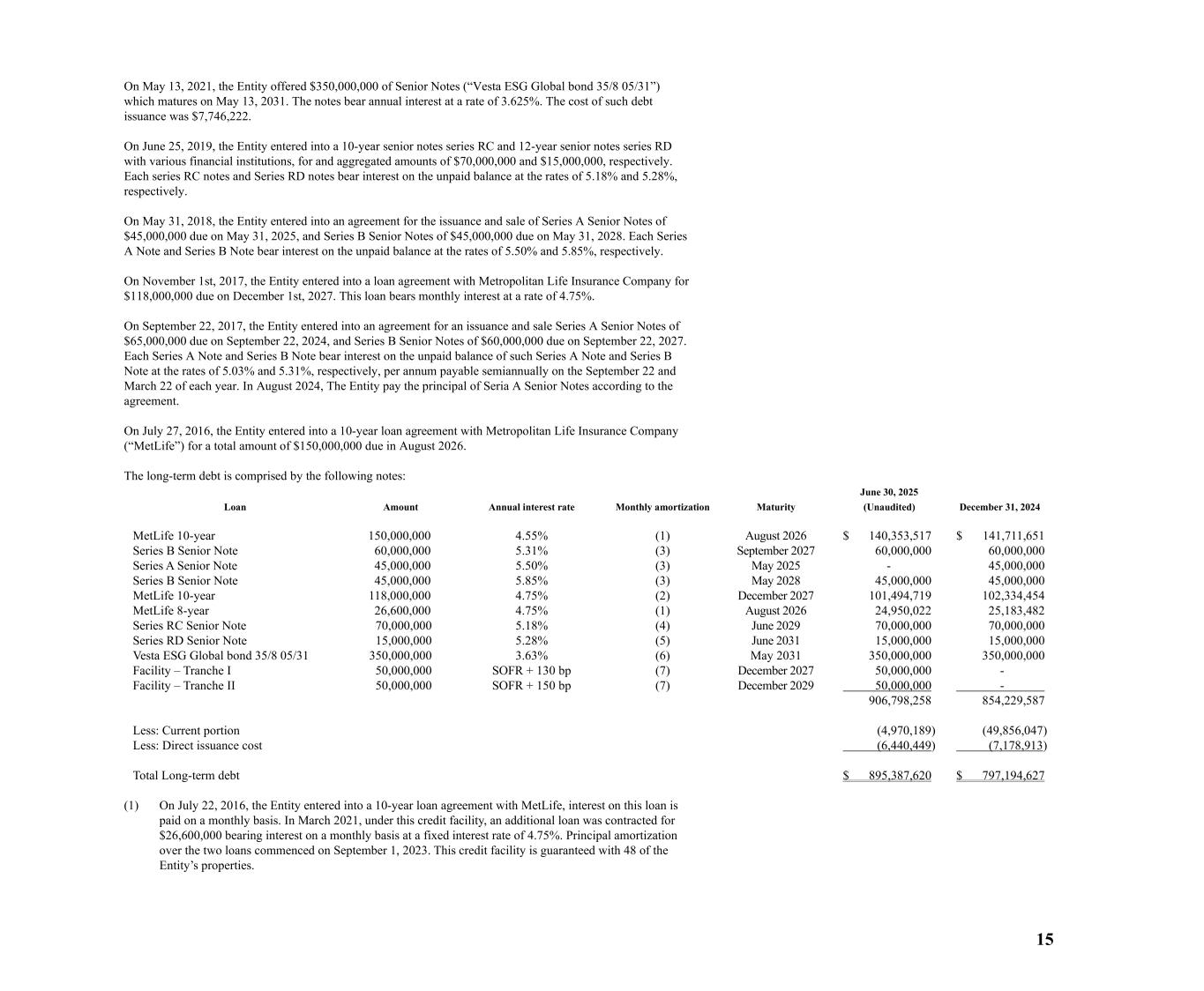

14 Depreciation of rights-of-use January 1, 2024 Additions Disposals June 30, 2024 (Unaudited) Office space $ (1,961,025) (110,226) $ - $ (2,071,251) Vehicles and office equipment (548,670) (30,390) - (579,060) Accumulated depreciation (2,509,695) (140,616) - (2,650,311) Total $ 834,199 $ (140,616) $ - $ 693,583 2. Lease obligations: January 1, 2025 Additions Disposals Interests accrued Repayments June 30, 2025 (Unaudited) Lease liabilities $ 558,116 $ 204,931 $ - $ 31,742 $ (355,155) $ 439,634 January 1, 2024 Additions Disposals Interests accrued Repayments June 30, 2024 (Unaudited) Lease liabilities $ 897,651 $ - $ - $ 18,332 $ (170,080) $ 745,903 3. Analysis of maturity of liabilities by lease: Finance lease liabilities June 30, 2025 (Unaudited) December 31, 2024 Not later than 1 year $ 278,074 $ 445,054 Later than 1 year and not later than 5 years 215,918 161,166 493,992 606,220 Less: future finance cost (54,358) (48,104) Total lease liability $ 439,634 $ 558,116 Finance lease – short-term $ 239,593 $ 408,373 Finance lease – long-term 200,041 149,743 Total lease liability $ 439,634 $ 558,116 10. Long-term debt On December 18, 2024, Vesta closed the previously announced $545,000,000 Global Syndicated Sustainable Credit Facility (the "Facility") comprised of a $345,000,000 term loan available through two tranches, for three and five years, with an 18-month availability period and a $200,000,000 Revolving Credit Facility, substituting the Company’s prior $200,000,000 in-place un-drawn Revolving Credit Facility. The International Finance Corporation (IFC), BBVA, Citigroup, and Santander acted as Joint Lead Arrangers of the transaction. Tranche I - Three-year $172,500,000 Term Loan, at the equivalent coupon of SOFR plus a 130 basis points applicable margin. Tranche II - Five-year $172,500,000 Term Loan at the equivalent coupon of SOFR plus a 150 basis points applicable margin. Revolving Credit Facility – Four-year $200,000,000 facility at the equivalent coupon of SOFR plus a 150 basis points applicable margin. The three tranches of the Credit Facility are subject to a sustainability pricing adjustment to the applicable margins, equivalent to a reduction of five basis points, which is subject to Vesta’s compliance of its annual KPI target related to the total certified gross leasable area of the Company´s sustainability certified buildings. Vesta paid debt issuance costs in an amount of $5,563,162. On April 8, 2025, the Entity drew $100,000,000 from its term loan facility in two tranches of $50,000,000 each.

15 On May 13, 2021, the Entity offered $350,000,000 of Senior Notes (“Vesta ESG Global bond 35/8 05/31”) which matures on May 13, 2031. The notes bear annual interest at a rate of 3.625%. The cost of such debt issuance was $7,746,222. On June 25, 2019, the Entity entered into a 10-year senior notes series RC and 12-year senior notes series RD with various financial institutions, for and aggregated amounts of $70,000,000 and $15,000,000, respectively. Each series RC notes and Series RD notes bear interest on the unpaid balance at the rates of 5.18% and 5.28%, respectively. On May 31, 2018, the Entity entered into an agreement for the issuance and sale of Series A Senior Notes of $45,000,000 due on May 31, 2025, and Series B Senior Notes of $45,000,000 due on May 31, 2028. Each Series A Note and Series B Note bear interest on the unpaid balance at the rates of 5.50% and 5.85%, respectively. On November 1st, 2017, the Entity entered into a loan agreement with Metropolitan Life Insurance Company for $118,000,000 due on December 1st, 2027. This loan bears monthly interest at a rate of 4.75%. On September 22, 2017, the Entity entered into an agreement for an issuance and sale Series A Senior Notes of $65,000,000 due on September 22, 2024, and Series B Senior Notes of $60,000,000 due on September 22, 2027. Each Series A Note and Series B Note bear interest on the unpaid balance of such Series A Note and Series B Note at the rates of 5.03% and 5.31%, respectively, per annum payable semiannually on the September 22 and March 22 of each year. In August 2024, The Entity pay the principal of Seria A Senior Notes according to the agreement. On July 27, 2016, the Entity entered into a 10-year loan agreement with Metropolitan Life Insurance Company (“MetLife”) for a total amount of $150,000,000 due in August 2026. The long-term debt is comprised by the following notes: Loan Amount Annual interest rate Monthly amortization Maturity June 30, 2025 (Unaudited) December 31, 2024 MetLife 10-year 150,000,000 4.55% (1) August 2026 $ 140,353,517 $ 141,711,651 Series B Senior Note 60,000,000 5.31% (3) September 2027 60,000,000 60,000,000 Series A Senior Note 45,000,000 5.50% (3) May 2025 - 45,000,000 Series B Senior Note 45,000,000 5.85% (3) May 2028 45,000,000 45,000,000 MetLife 10-year 118,000,000 4.75% (2) December 2027 101,494,719 102,334,454 MetLife 8-year 26,600,000 4.75% (1) August 2026 24,950,022 25,183,482 Series RC Senior Note 70,000,000 5.18% (4) June 2029 70,000,000 70,000,000 Series RD Senior Note 15,000,000 5.28% (5) June 2031 15,000,000 15,000,000 Vesta ESG Global bond 35/8 05/31 350,000,000 3.63% (6) May 2031 350,000,000 350,000,000 Facility – Tranche I 50,000,000 SOFR + 130 bp (7) December 2027 50,000,000 - Facility – Tranche II 50,000,000 SOFR + 150 bp (7) December 2029 50,000,000 - 906,798,258 854,229,587 Less: Current portion (4,970,189) (49,856,047) Less: Direct issuance cost (6,440,449) (7,178,913) Total Long-term debt $ 895,387,620 $ 797,194,627 (1) On July 22, 2016, the Entity entered into a 10-year loan agreement with MetLife, interest on this loan is paid on a monthly basis. In March 2021, under this credit facility, an additional loan was contracted for $26,600,000 bearing interest on a monthly basis at a fixed interest rate of 4.75%. Principal amortization over the two loans commenced on September 1, 2023. This credit facility is guaranteed with 48 of the Entity’s properties.

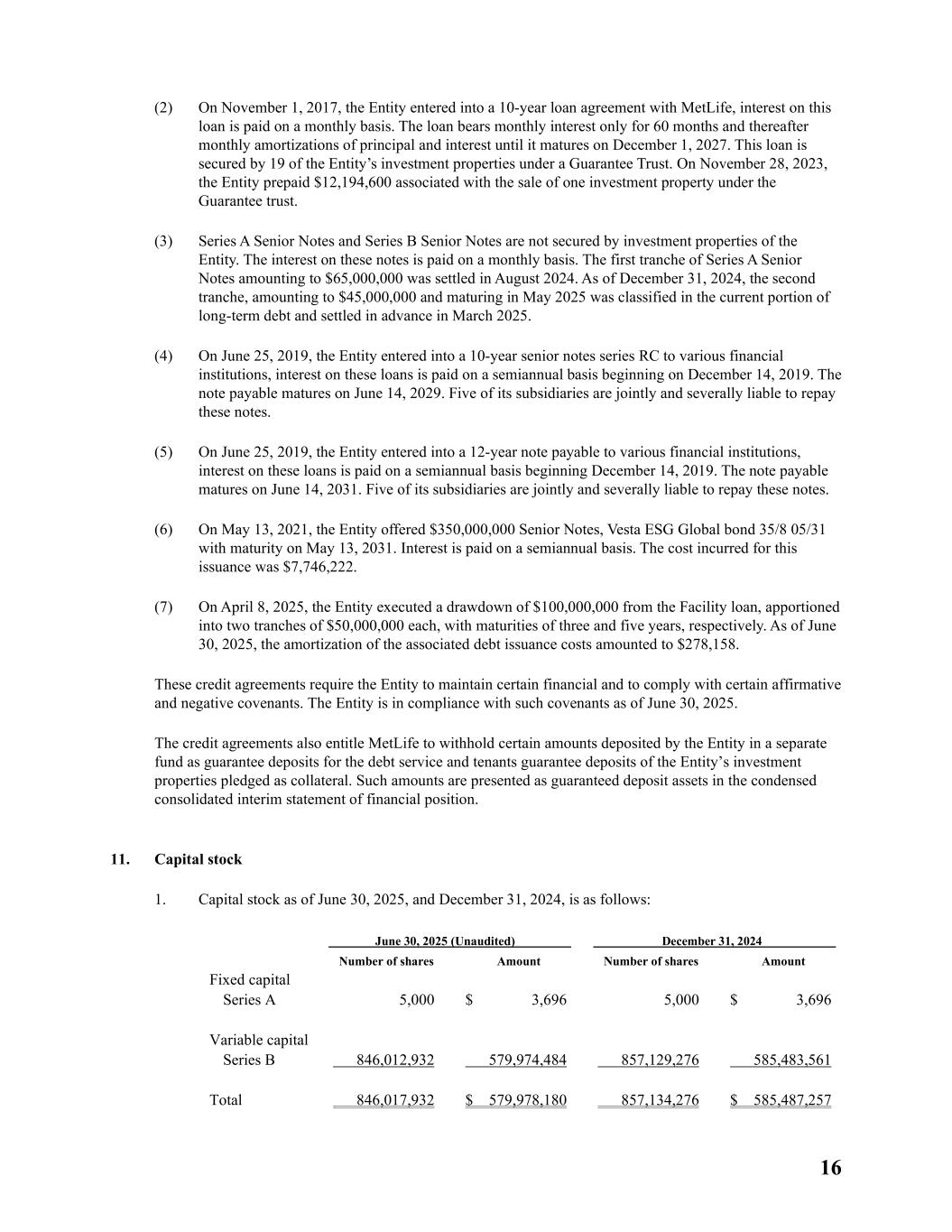

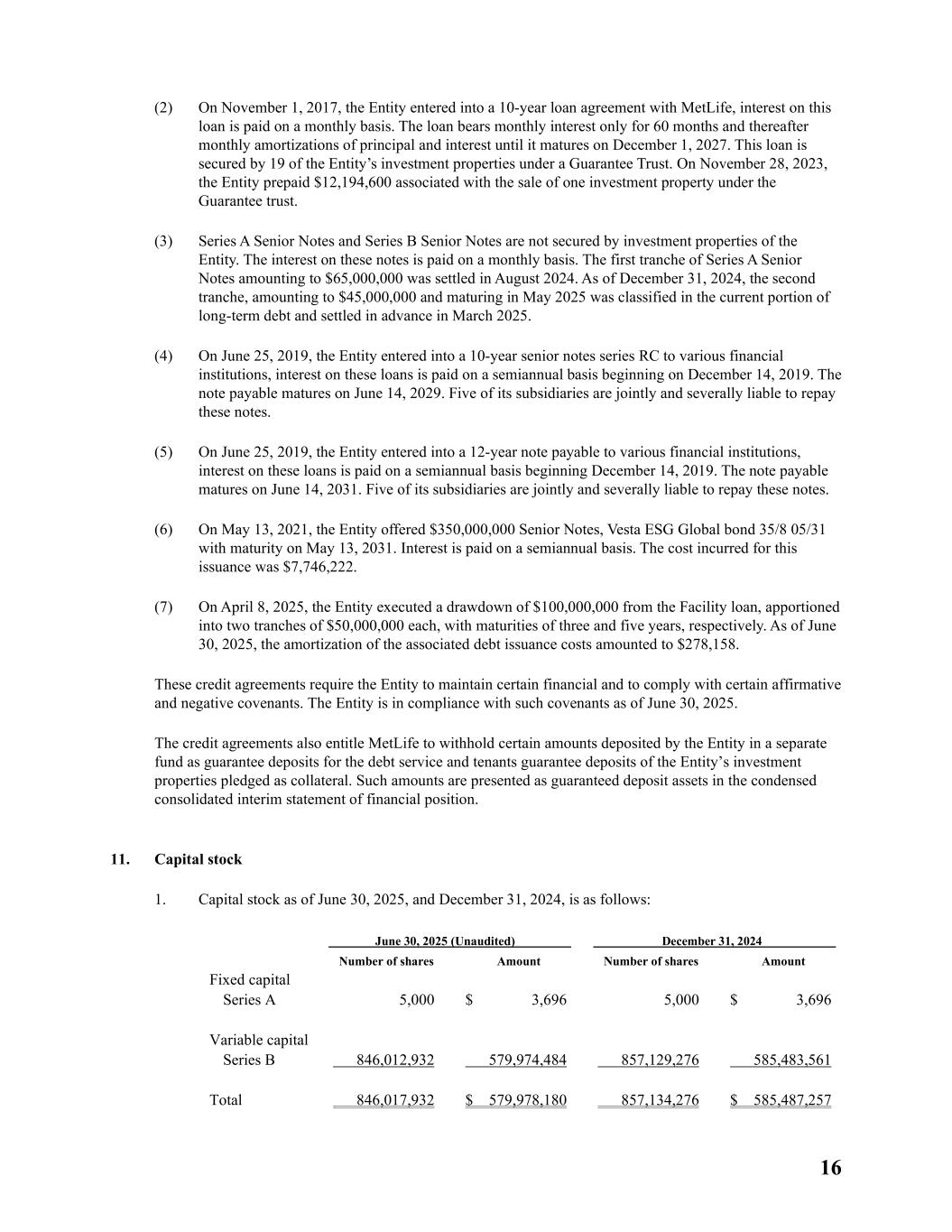

16 (2) On November 1, 2017, the Entity entered into a 10-year loan agreement with MetLife, interest on this loan is paid on a monthly basis. The loan bears monthly interest only for 60 months and thereafter monthly amortizations of principal and interest until it matures on December 1, 2027. This loan is secured by 19 of the Entity’s investment properties under a Guarantee Trust. On November 28, 2023, the Entity prepaid $12,194,600 associated with the sale of one investment property under the Guarantee trust. (3) Series A Senior Notes and Series B Senior Notes are not secured by investment properties of the Entity. The interest on these notes is paid on a monthly basis. The first tranche of Series A Senior Notes amounting to $65,000,000 was settled in August 2024. As of December 31, 2024, the second tranche, amounting to $45,000,000 and maturing in May 2025 was classified in the current portion of long-term debt and settled in advance in March 2025. (4) On June 25, 2019, the Entity entered into a 10-year senior notes series RC to various financial institutions, interest on these loans is paid on a semiannual basis beginning on December 14, 2019. The note payable matures on June 14, 2029. Five of its subsidiaries are jointly and severally liable to repay these notes. (5) On June 25, 2019, the Entity entered into a 12-year note payable to various financial institutions, interest on these loans is paid on a semiannual basis beginning December 14, 2019. The note payable matures on June 14, 2031. Five of its subsidiaries are jointly and severally liable to repay these notes. (6) On May 13, 2021, the Entity offered $350,000,000 Senior Notes, Vesta ESG Global bond 35/8 05/31 with maturity on May 13, 2031. Interest is paid on a semiannual basis. The cost incurred for this issuance was $7,746,222. (7) On April 8, 2025, the Entity executed a drawdown of $100,000,000 from the Facility loan, apportioned into two tranches of $50,000,000 each, with maturities of three and five years, respectively. As of June 30, 2025, the amortization of the associated debt issuance costs amounted to $278,158. These credit agreements require the Entity to maintain certain financial and to comply with certain affirmative and negative covenants. The Entity is in compliance with such covenants as of June 30, 2025. The credit agreements also entitle MetLife to withhold certain amounts deposited by the Entity in a separate fund as guarantee deposits for the debt service and tenants guarantee deposits of the Entity’s investment properties pledged as collateral. Such amounts are presented as guaranteed deposit assets in the condensed consolidated interim statement of financial position. 11. Capital stock 1. Capital stock as of June 30, 2025, and December 31, 2024, is as follows: June 30, 2025 (Unaudited) December 31, 2024 Number of shares Amount Number of shares Amount Fixed capital Series A 5,000 $ 3,696 5,000 $ 3,696 Variable capital Series B 846,012,932 579,974,484 857,129,276 585,483,561 Total 846,017,932 $ 579,978,180 857,134,276 $ 585,487,257

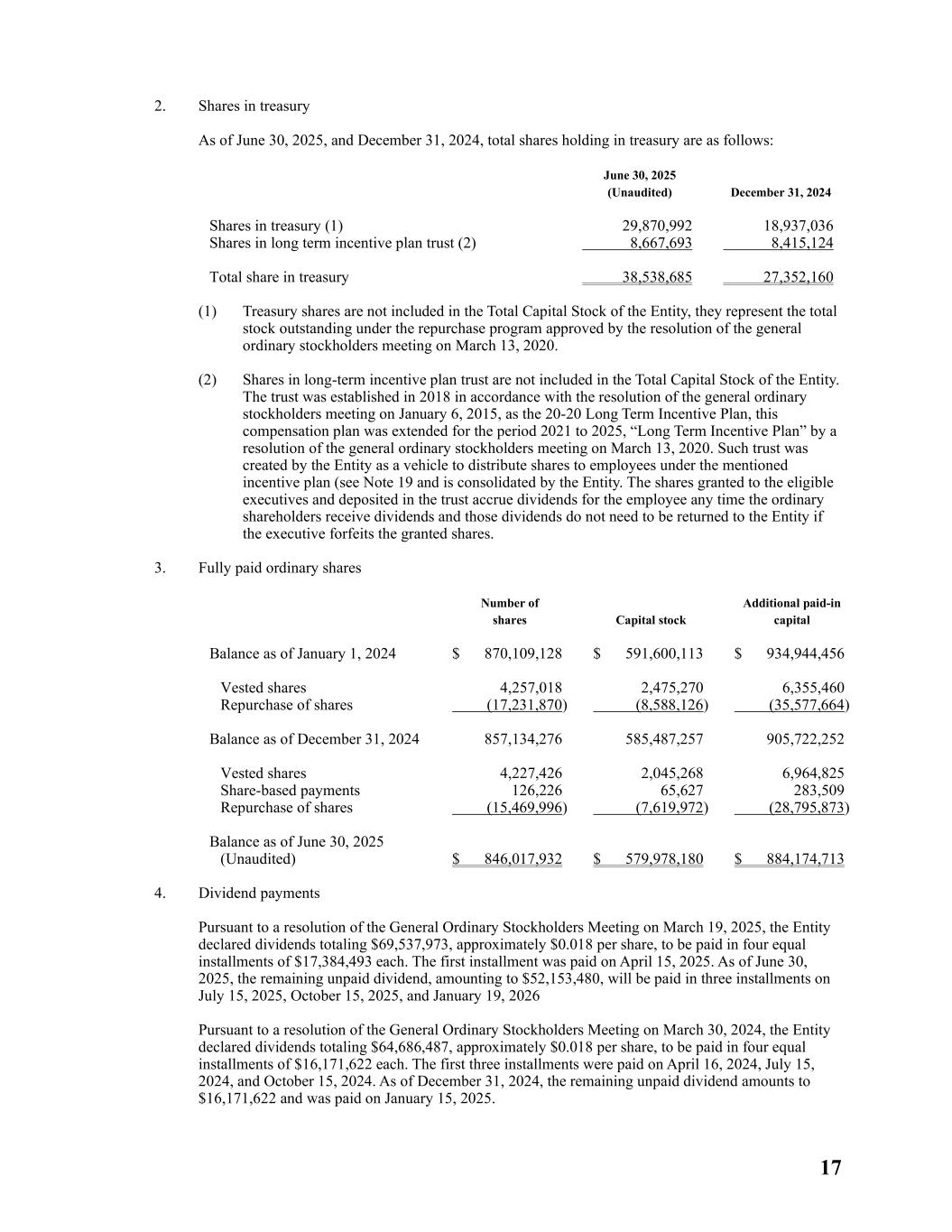

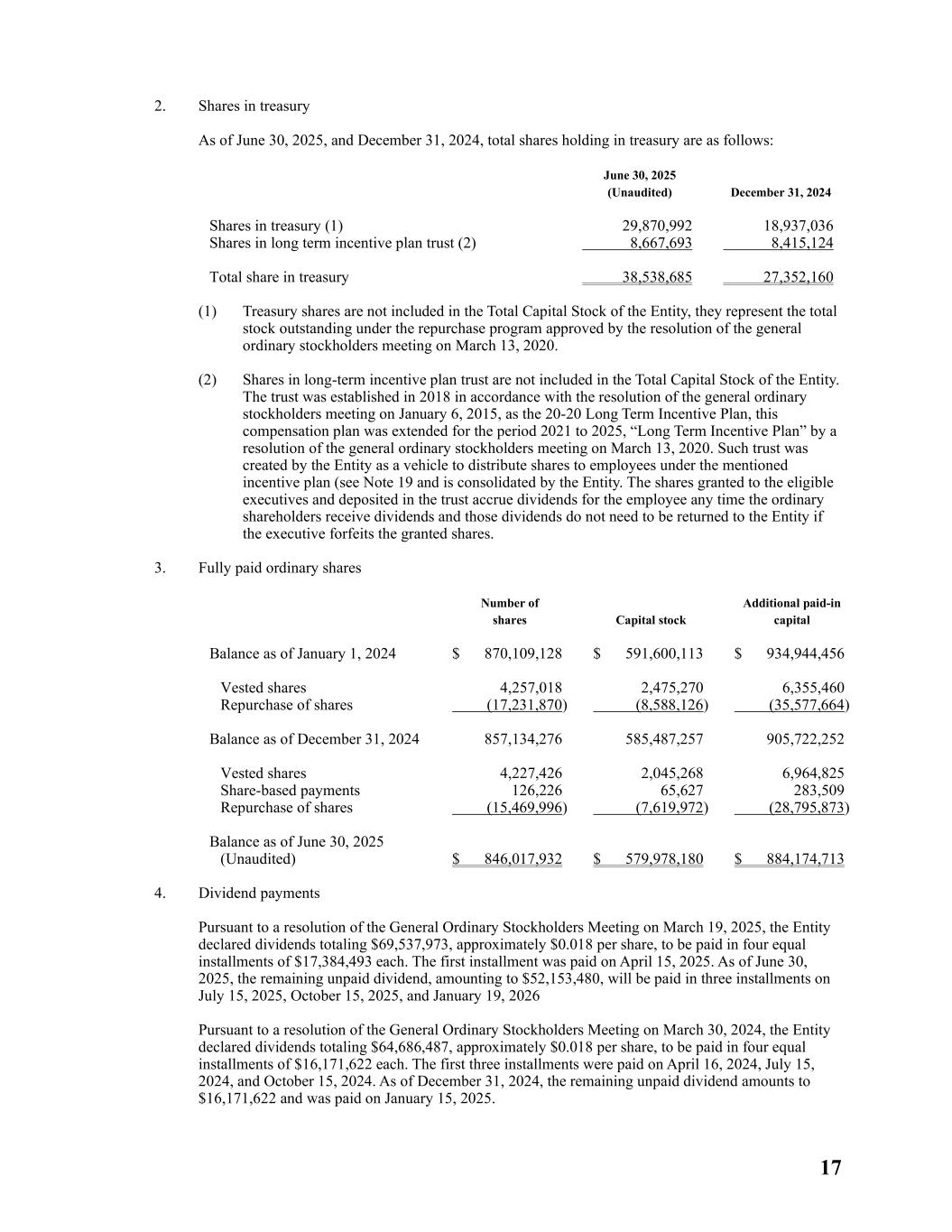

17 2. Shares in treasury As of June 30, 2025, and December 31, 2024, total shares holding in treasury are as follows: June 30, 2025 (Unaudited) December 31, 2024 Shares in treasury (1) 29,870,992 18,937,036 Shares in long term incentive plan trust (2) 8,667,693 8,415,124 Total share in treasury 38,538,685 27,352,160 (1) Treasury shares are not included in the Total Capital Stock of the Entity, they represent the total stock outstanding under the repurchase program approved by the resolution of the general ordinary stockholders meeting on March 13, 2020. (2) Shares in long-term incentive plan trust are not included in the Total Capital Stock of the Entity. The trust was established in 2018 in accordance with the resolution of the general ordinary stockholders meeting on January 6, 2015, as the 20-20 Long Term Incentive Plan, this compensation plan was extended for the period 2021 to 2025, “Long Term Incentive Plan” by a resolution of the general ordinary stockholders meeting on March 13, 2020. Such trust was created by the Entity as a vehicle to distribute shares to employees under the mentioned incentive plan (see Note 19 and is consolidated by the Entity. The shares granted to the eligible executives and deposited in the trust accrue dividends for the employee any time the ordinary shareholders receive dividends and those dividends do not need to be returned to the Entity if the executive forfeits the granted shares. 3. Fully paid ordinary shares Number of shares Capital stock Additional paid-in capital Balance as of January 1, 2024 $ 870,109,128 $ 591,600,113 $ 934,944,456 Vested shares 4,257,018 2,475,270 6,355,460 Repurchase of shares (17,231,870) (8,588,126) (35,577,664) Balance as of December 31, 2024 857,134,276 585,487,257 905,722,252 Vested shares 4,227,426 2,045,268 6,964,825 Share-based payments 126,226 65,627 283,509 Repurchase of shares (15,469,996) (7,619,972) (28,795,873) Balance as of June 30, 2025 (Unaudited) $ 846,017,932 $ 579,978,180 $ 884,174,713 4. Dividend payments Pursuant to a resolution of the General Ordinary Stockholders Meeting on March 19, 2025, the Entity declared dividends totaling $69,537,973, approximately $0.018 per share, to be paid in four equal installments of $17,384,493 each. The first installment was paid on April 15, 2025. As of June 30, 2025, the remaining unpaid dividend, amounting to $52,153,480, will be paid in three installments on July 15, 2025, October 15, 2025, and January 19, 2026 Pursuant to a resolution of the General Ordinary Stockholders Meeting on March 30, 2024, the Entity declared dividends totaling $64,686,487, approximately $0.018 per share, to be paid in four equal installments of $16,171,622 each. The first three installments were paid on April 16, 2024, July 15, 2024, and October 15, 2024. As of December 31, 2024, the remaining unpaid dividend amounts to $16,171,622 and was paid on January 15, 2025.

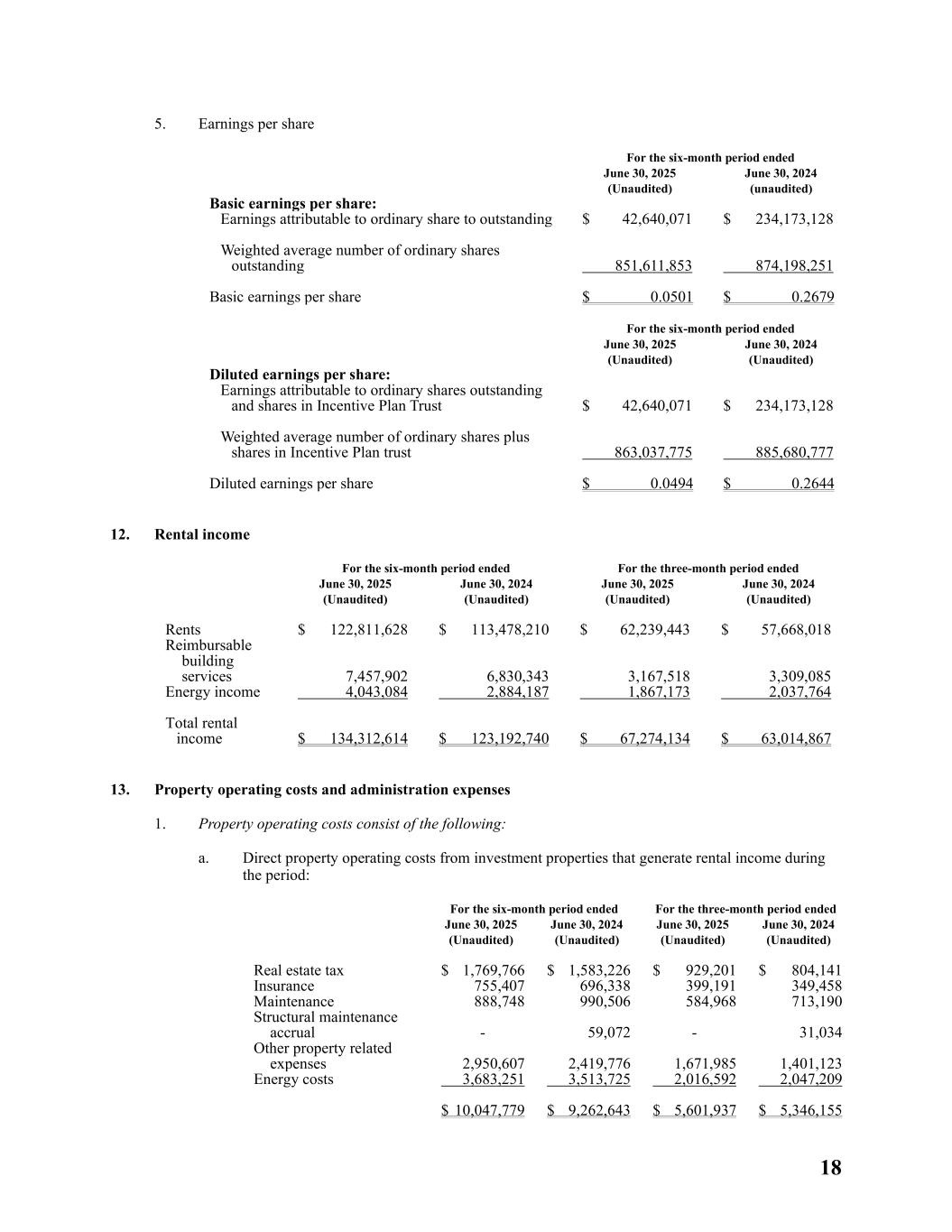

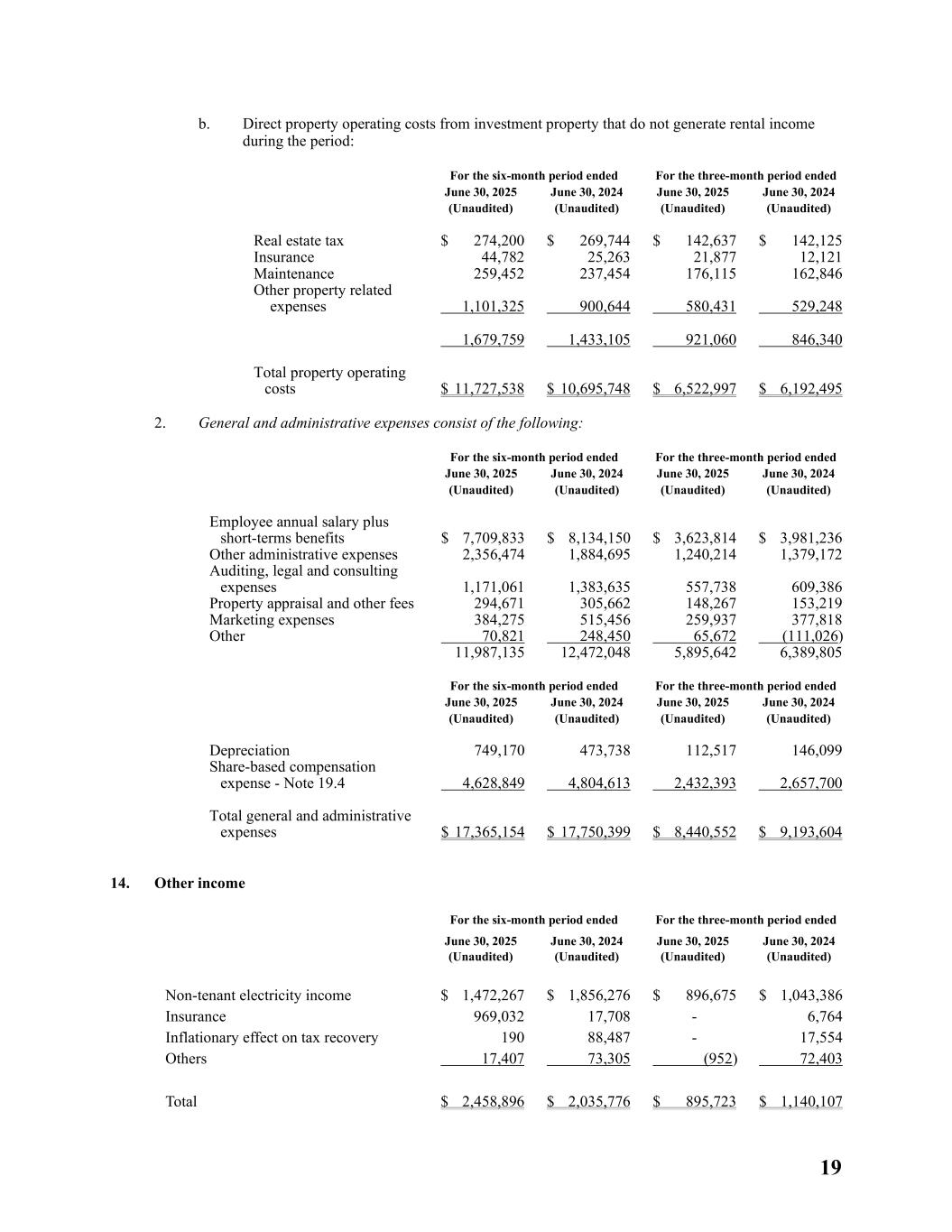

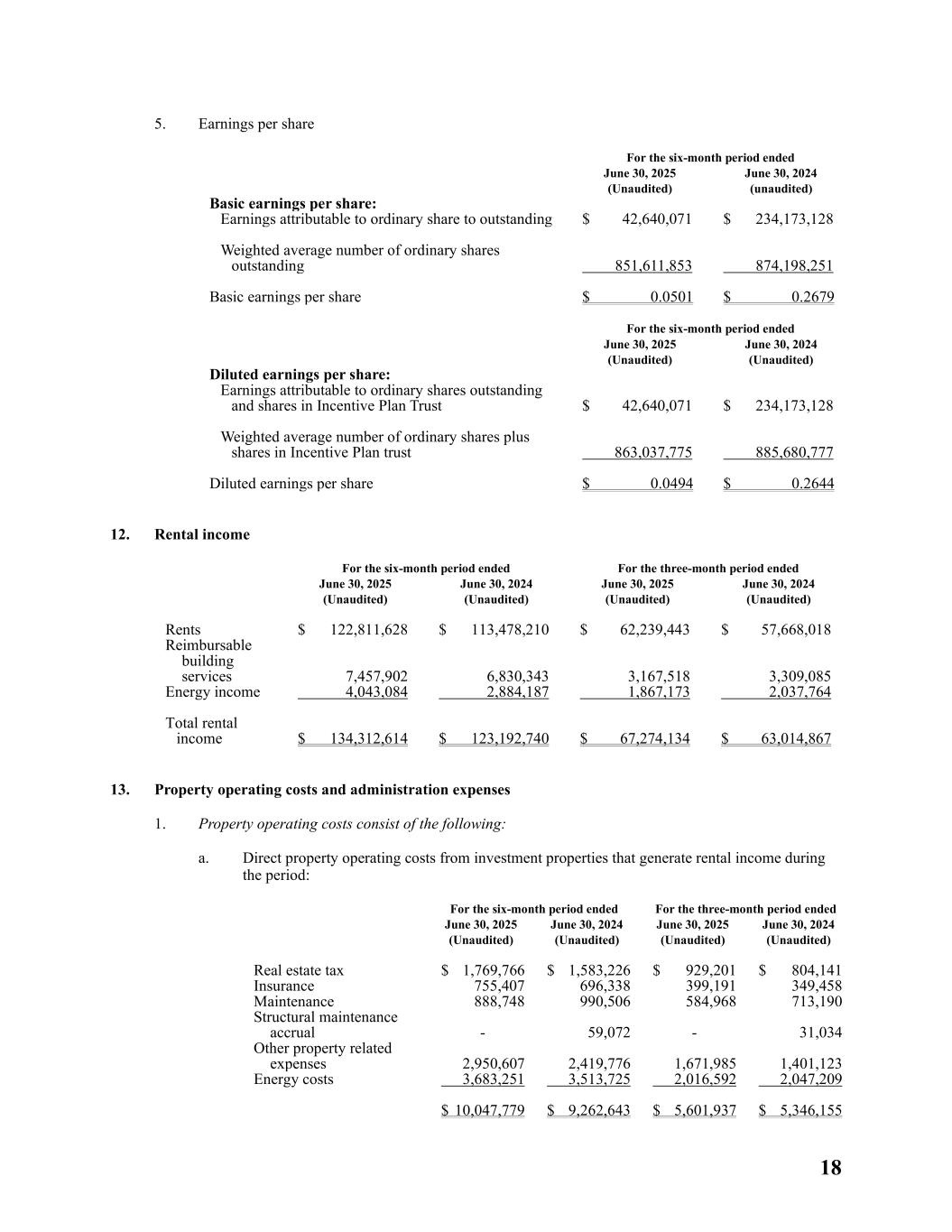

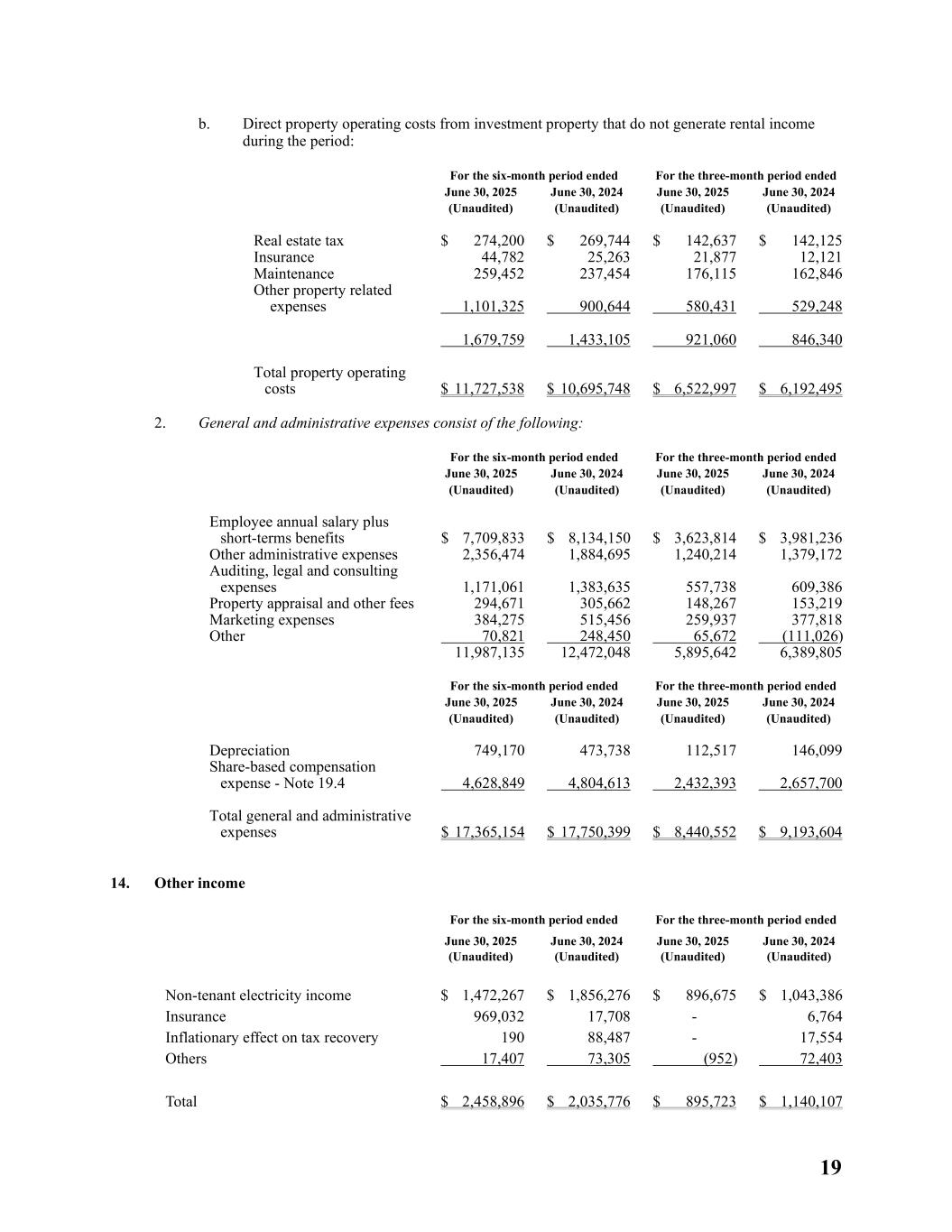

18 5. Earnings per share For the six-month period ended June 30, 2025 (Unaudited) June 30, 2024 (unaudited) Basic earnings per share: Earnings attributable to ordinary share to outstanding $ 42,640,071 $ 234,173,128 Weighted average number of ordinary shares outstanding 851,611,853 874,198,251 Basic earnings per share $ 0.0501 $ 0.2679 For the six-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Diluted earnings per share: Earnings attributable to ordinary shares outstanding and shares in Incentive Plan Trust $ 42,640,071 $ 234,173,128 Weighted average number of ordinary shares plus shares in Incentive Plan trust 863,037,775 885,680,777 Diluted earnings per share $ 0.0494 $ 0.2644 12. Rental income For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Rents $ 122,811,628 $ 113,478,210 $ 62,239,443 $ 57,668,018 Reimbursable building services 7,457,902 6,830,343 3,167,518 3,309,085 Energy income 4,043,084 2,884,187 1,867,173 2,037,764 Total rental income $ 134,312,614 $ 123,192,740 $ 67,274,134 $ 63,014,867 13. Property operating costs and administration expenses 1. Property operating costs consist of the following: a. Direct property operating costs from investment properties that generate rental income during the period: For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Real estate tax $ 1,769,766 $ 1,583,226 $ 929,201 $ 804,141 Insurance 755,407 696,338 399,191 349,458 Maintenance 888,748 990,506 584,968 713,190 Structural maintenance accrual - 59,072 - 31,034 Other property related expenses 2,950,607 2,419,776 1,671,985 1,401,123 Energy costs 3,683,251 3,513,725 2,016,592 2,047,209 $ 10,047,779 $ 9,262,643 $ 5,601,937 $ 5,346,155

19 b. Direct property operating costs from investment property that do not generate rental income during the period: For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Real estate tax $ 274,200 $ 269,744 $ 142,637 $ 142,125 Insurance 44,782 25,263 21,877 12,121 Maintenance 259,452 237,454 176,115 162,846 Other property related expenses 1,101,325 900,644 580,431 529,248 1,679,759 1,433,105 921,060 846,340 Total property operating costs $ 11,727,538 $ 10,695,748 $ 6,522,997 $ 6,192,495 2. General and administrative expenses consist of the following: For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Employee annual salary plus short-terms benefits $ 7,709,833 $ 8,134,150 $ 3,623,814 $ 3,981,236 Other administrative expenses 2,356,474 1,884,695 1,240,214 1,379,172 Auditing, legal and consulting expenses 1,171,061 1,383,635 557,738 609,386 Property appraisal and other fees 294,671 305,662 148,267 153,219 Marketing expenses 384,275 515,456 259,937 377,818 Other 70,821 248,450 65,672 (111,026) 11,987,135 12,472,048 5,895,642 6,389,805 For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Depreciation 749,170 473,738 112,517 146,099 Share-based compensation expense - Note 19.4 4,628,849 4,804,613 2,432,393 2,657,700 Total general and administrative expenses $ 17,365,154 $ 17,750,399 $ 8,440,552 $ 9,193,604 14. Other income For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Non-tenant electricity income $ 1,472,267 $ 1,856,276 $ 896,675 $ 1,043,386 Insurance 969,032 17,708 - 6,764 Inflationary effect on tax recovery 190 88,487 - 17,554 Others 17,407 73,305 (952) 72,403 Total $ 2,458,896 $ 2,035,776 $ 895,723 $ 1,140,107

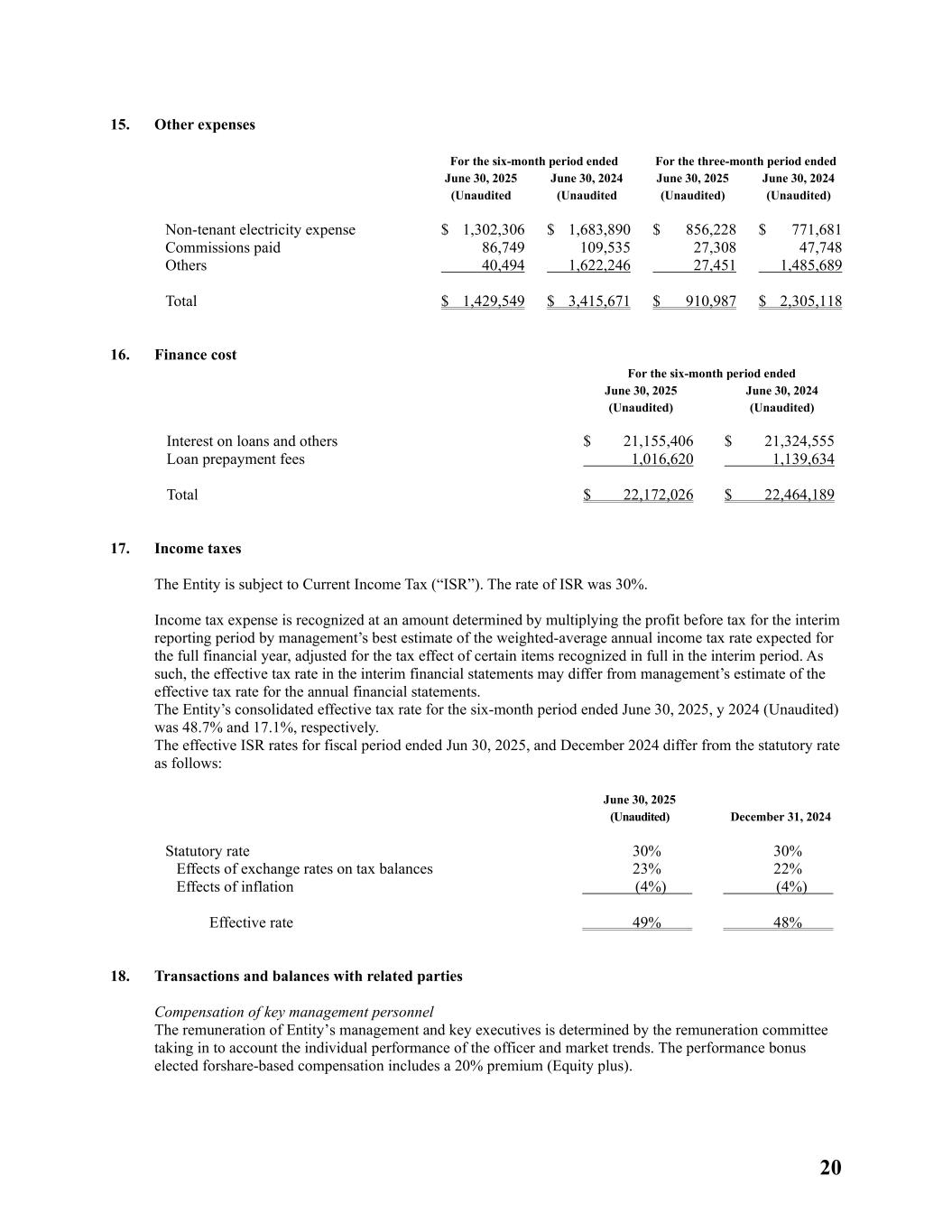

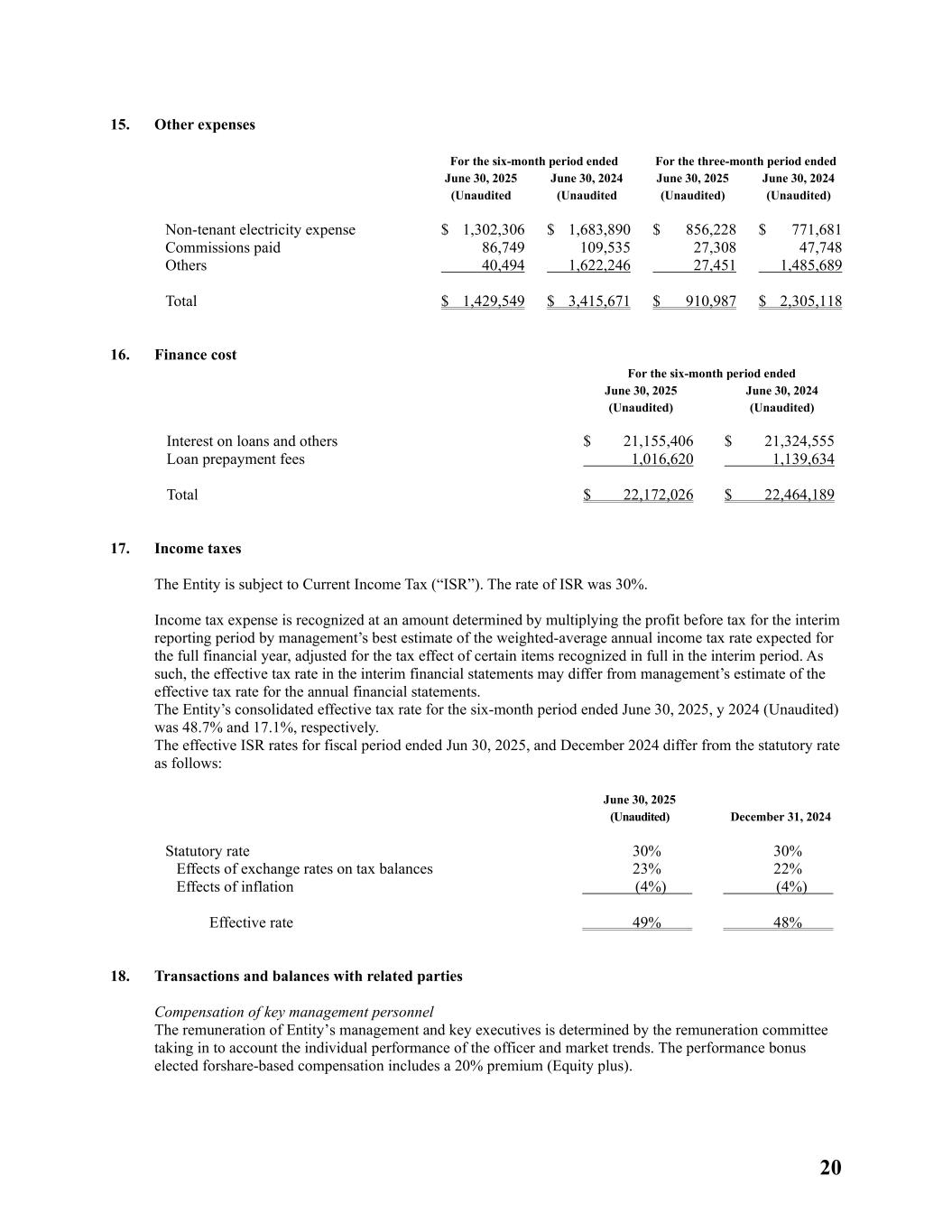

20 15. Other expenses For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited June 30, 2024 (Unaudited June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Non-tenant electricity expense $ 1,302,306 $ 1,683,890 $ 856,228 $ 771,681 Commissions paid 86,749 109,535 27,308 47,748 Others 40,494 1,622,246 27,451 1,485,689 Total $ 1,429,549 $ 3,415,671 $ 910,987 $ 2,305,118 16. Finance cost For the six-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Interest on loans and others $ 21,155,406 $ 21,324,555 Loan prepayment fees 1,016,620 1,139,634 Total $ 22,172,026 $ 22,464,189 17. Income taxes The Entity is subject to Current Income Tax (“ISR”). The rate of ISR was 30%. Income tax expense is recognized at an amount determined by multiplying the profit before tax for the interim reporting period by management’s best estimate of the weighted-average annual income tax rate expected for the full financial year, adjusted for the tax effect of certain items recognized in full in the interim period. As such, the effective tax rate in the interim financial statements may differ from management’s estimate of the effective tax rate for the annual financial statements. The Entity’s consolidated effective tax rate for the six-month period ended June 30, 2025, y 2024 (Unaudited) was 48.7% and 17.1%, respectively. The effective ISR rates for fiscal period ended Jun 30, 2025, and December 2024 differ from the statutory rate as follows: June 30, 2025 (Unaudited) December 31, 2024 Statutory rate 30% 30% Effects of exchange rates on tax balances 23% 22% Effects of inflation (4%) (4%) Effective rate 49% 48% 18. Transactions and balances with related parties Compensation of key management personnel The remuneration of Entity’s management and key executives is determined by the remuneration committee taking in to account the individual performance of the officer and market trends. The performance bonus elected forshare-based compensation includes a 20% premium (Equity plus).

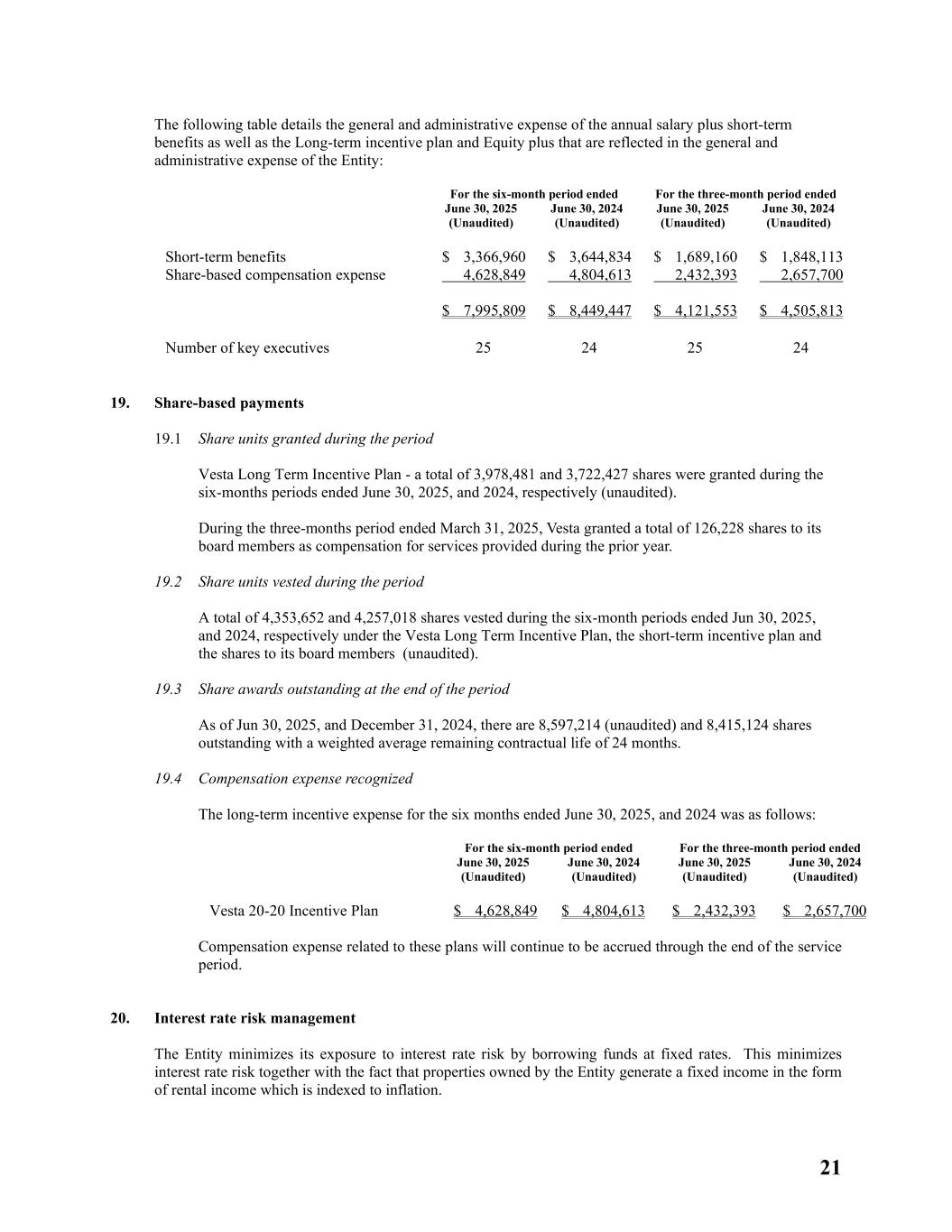

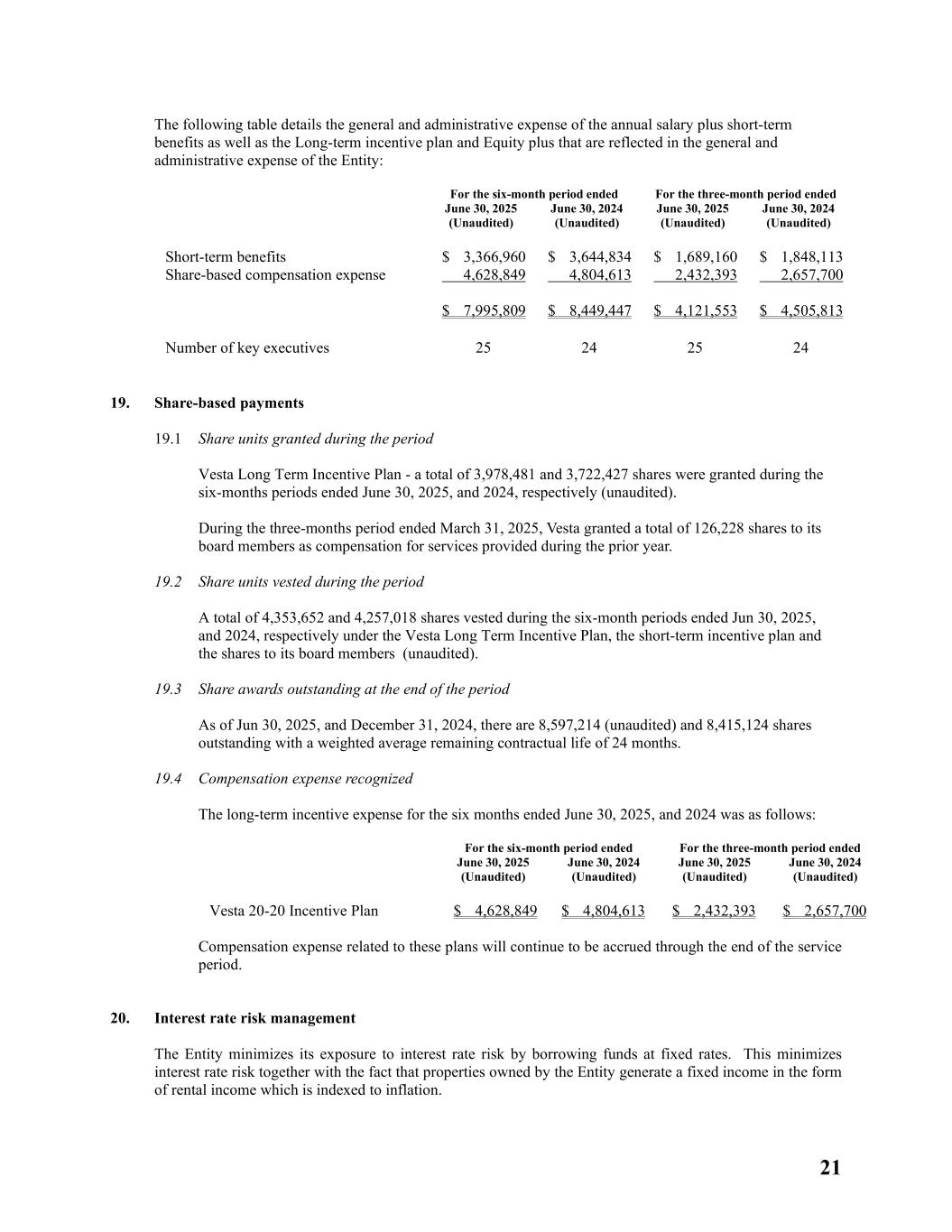

21 The following table details the general and administrative expense of the annual salary plus short-term benefits as well as the Long-term incentive plan and Equity plus that are reflected in the general and administrative expense of the Entity: For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Short-term benefits $ 3,366,960 $ 3,644,834 $ 1,689,160 $ 1,848,113 Share-based compensation expense 4,628,849 4,804,613 2,432,393 2,657,700 $ 7,995,809 $ 8,449,447 $ 4,121,553 $ 4,505,813 Number of key executives 25 24 25 24 19. Share-based payments 19.1 Share units granted during the period Vesta Long Term Incentive Plan - a total of 3,978,481 and 3,722,427 shares were granted during the six-months periods ended June 30, 2025, and 2024, respectively (unaudited). During the three-months period ended March 31, 2025, Vesta granted a total of 126,228 shares to its board members as compensation for services provided during the prior year. 19.2 Share units vested during the period A total of 4,353,652 and 4,257,018 shares vested during the six-month periods ended Jun 30, 2025, and 2024, respectively under the Vesta Long Term Incentive Plan, the short-term incentive plan and the shares to its board members (unaudited). 19.3 Share awards outstanding at the end of the period As of Jun 30, 2025, and December 31, 2024, there are 8,597,214 (unaudited) and 8,415,124 shares outstanding with a weighted average remaining contractual life of 24 months. 19.4 Compensation expense recognized The long-term incentive expense for the six months ended June 30, 2025, and 2024 was as follows: For the six-month period ended For the three-month period ended June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) June 30, 2025 (Unaudited) June 30, 2024 (Unaudited) Vesta 20-20 Incentive Plan $ 4,628,849 $ 4,804,613 $ 2,432,393 $ 2,657,700 Compensation expense related to these plans will continue to be accrued through the end of the service period. 20. Interest rate risk management The Entity minimizes its exposure to interest rate risk by borrowing funds at fixed rates. This minimizes interest rate risk together with the fact that properties owned by the Entity generate a fixed income in the form of rental income which is indexed to inflation.

22 21. Litigation and commitments Litigation In the ordinary course of business, the Entity is party to various legal proceedings. The Entity is not involved in any litigation or arbitration proceeding for which the Entity believes it is not adequately insured or indemnified, or which, if determined adversely, would have a material adverse effect on the Entity or its financial position, results of operations or cash flows. Commitments All rights to construction, improvements and infrastructure built by the Entity in the Queretaro Aerospace Park and in the DSP Park automatically revert back to the government of the State of Queretaro and to Nissan at the end of the concessions, which is approximately in 40 and 33 years, respectively. 22. Events after the reporting period The second installment of the 2025 declared dividends was paid on July 15, 2025, by approximately $0.0814 per share, for a total dividend of $17,384,493. The Entity invest in an associate company approximately $732,166 on April 2025, for development and management energy assets. 23. Condensed consolidated interim financial statements issuance authorization The accompanying condensed consolidated interim financial statements were approved by the Board of Directors on July 24, 2025. * * * * *