Document

Vestis Reports Third Quarter 2025 Results

ATLANTA, GA, August 5, 2025 – Vestis Corporation (NYSE: VSTS), a leading provider of uniforms and workplace supplies, today announced its results for the third quarter ended June 27, 2025.

Third Quarter 2025 Results

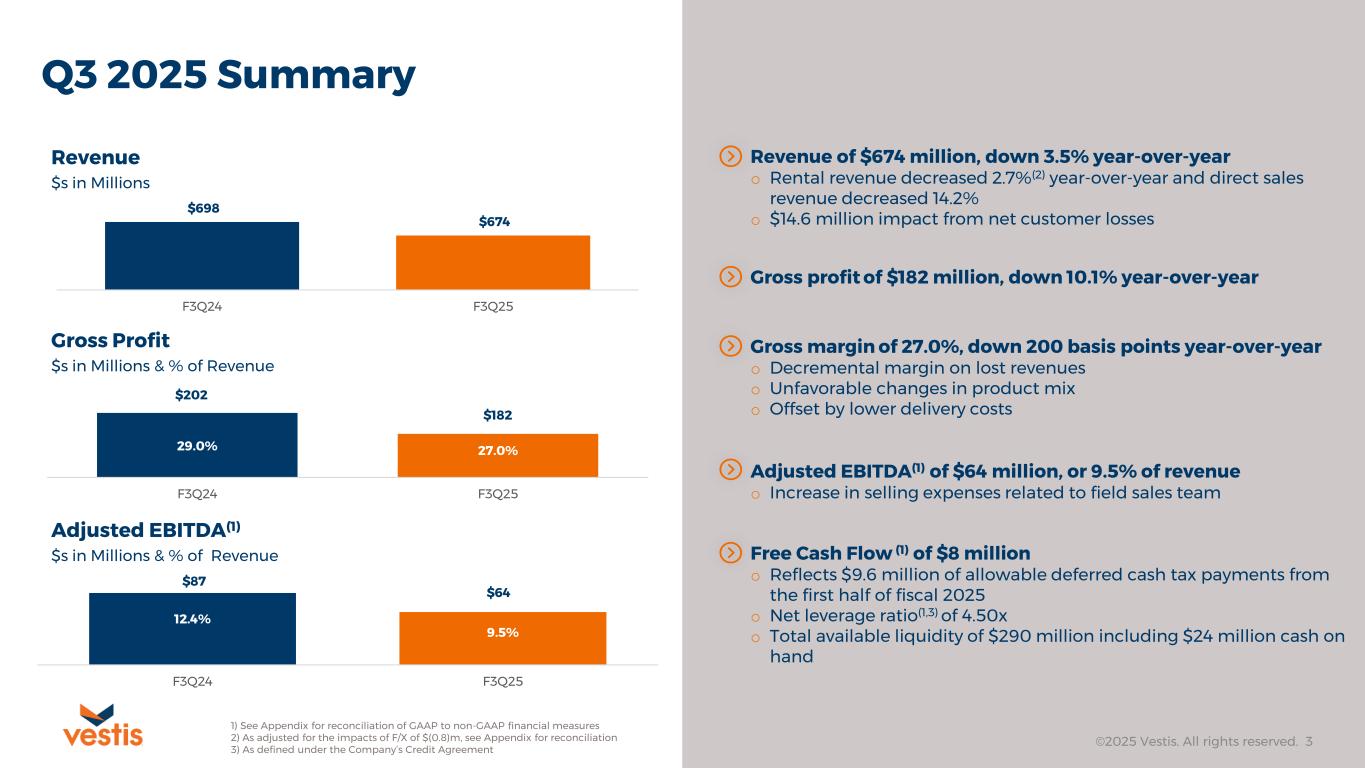

•Revenue of $674 million

•Operating Income of $25 million and Net Loss of $0.7 million

•Adjusted EBITDA* of $64 million

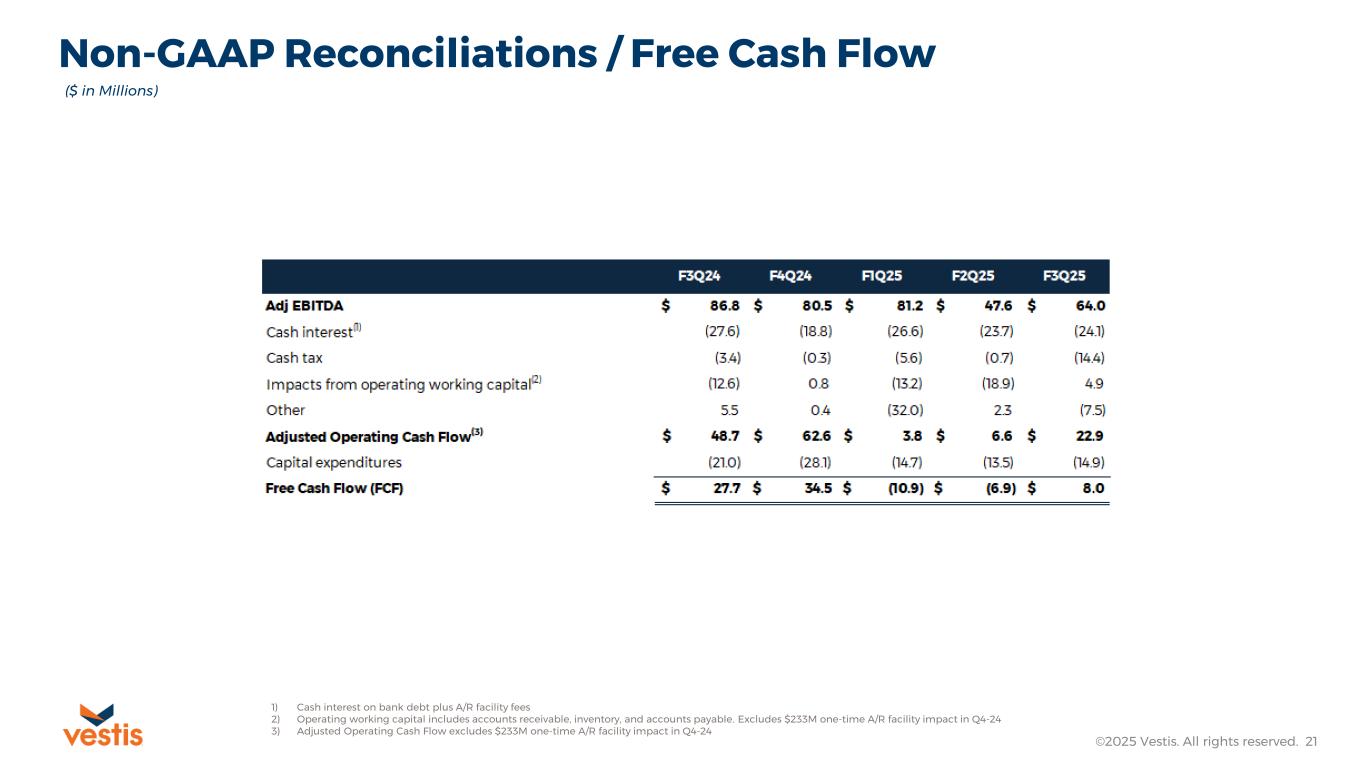

•Cash Flows Provided by Operating Activities of $23 million and Free Cash Flow* of $8 million

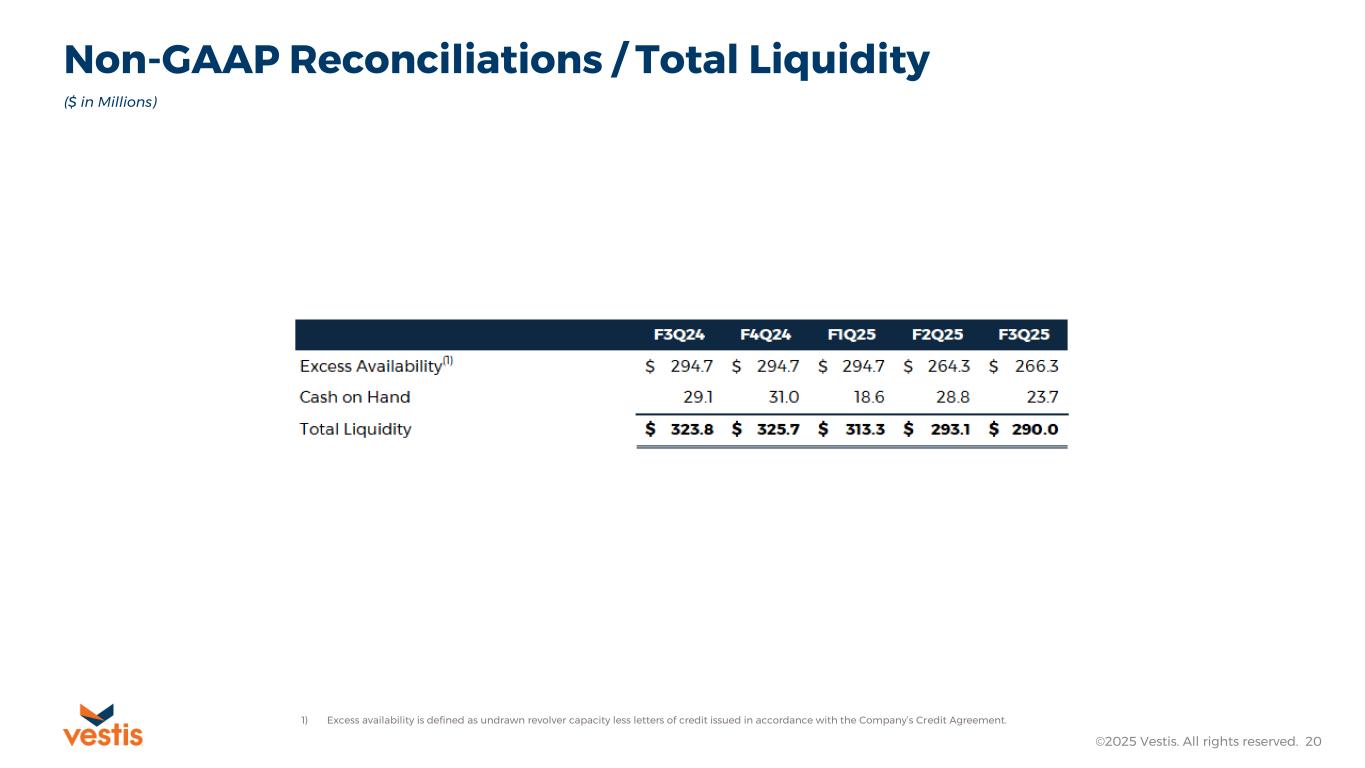

•Available liquidity of $290 million including $24 million cash and cash equivalents on hand

Management Commentary

“I’m pleased that our third quarter results were in line with our expectations and that we generated positive cash flow during the period,” said Jim Barber, President and CEO. “Our team has been focused on taking comprehensive actions designed to strengthen our overall results and create long-term shareholder value by unlocking operating leverage through commercial and operational excellence.”

“Since I joined the company as CEO two months ago, I have been focused on engaging in a thorough review of our business,” Mr. Barber continued. “Vestis has faced challenges, but I am optimistic about the road ahead and confident in the team’s ability to deliver for our key stakeholders. Our integrated network of assets gives us scale and reach in an attractive and growing industry.”

Third Quarter 2025 Financial Performance

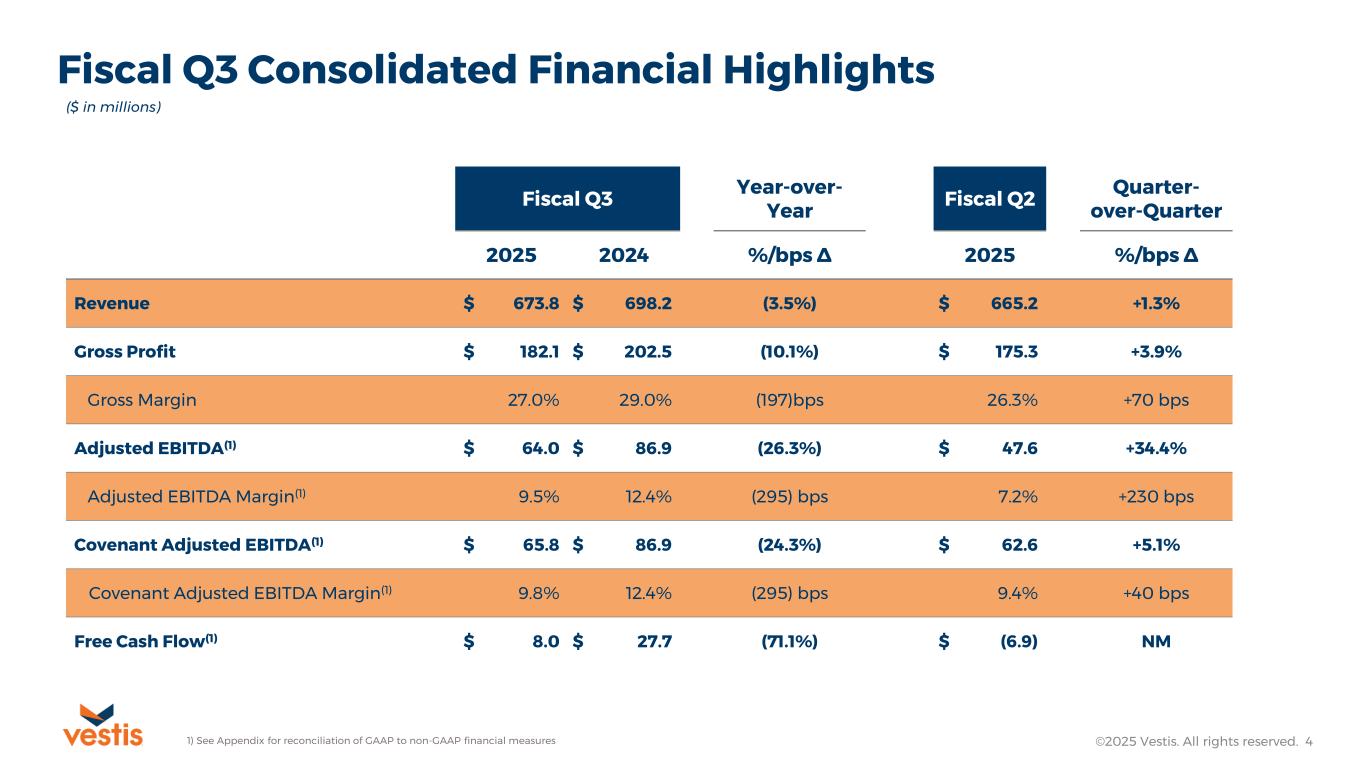

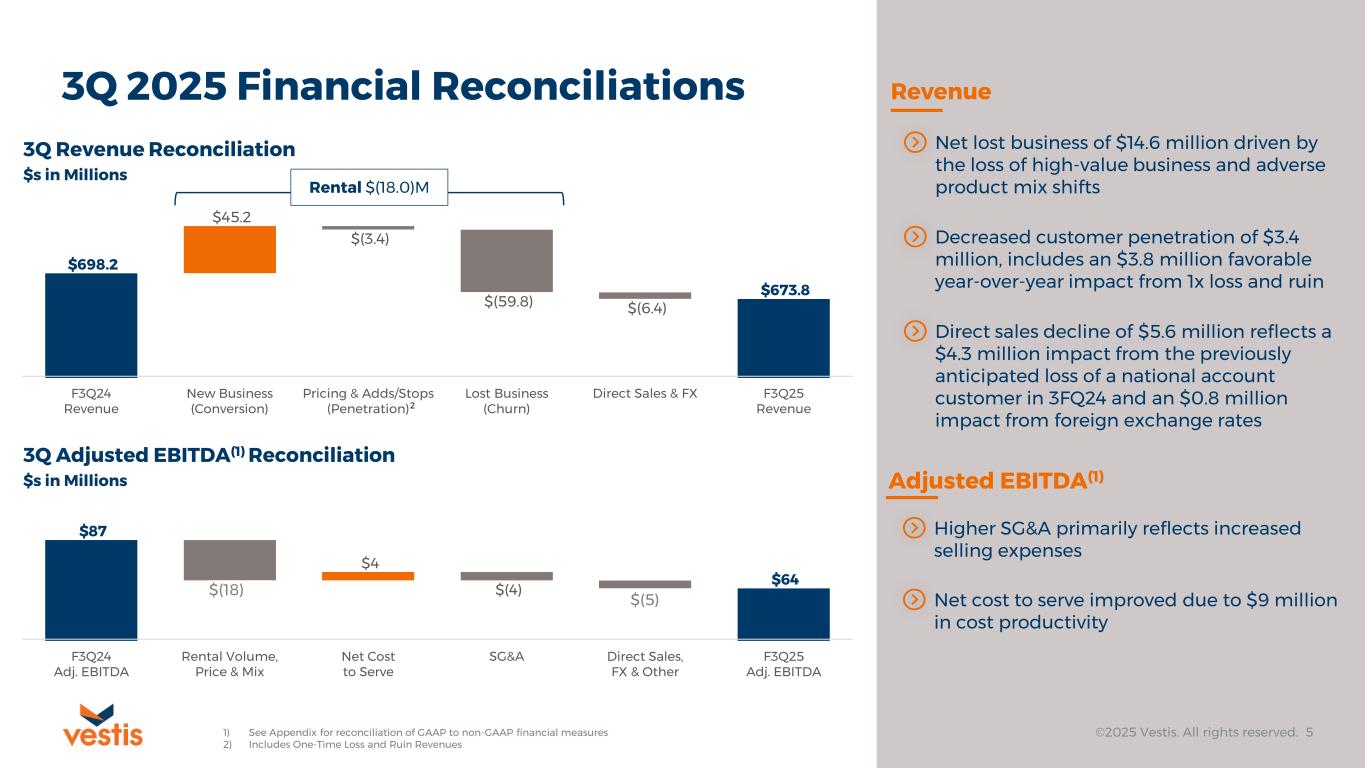

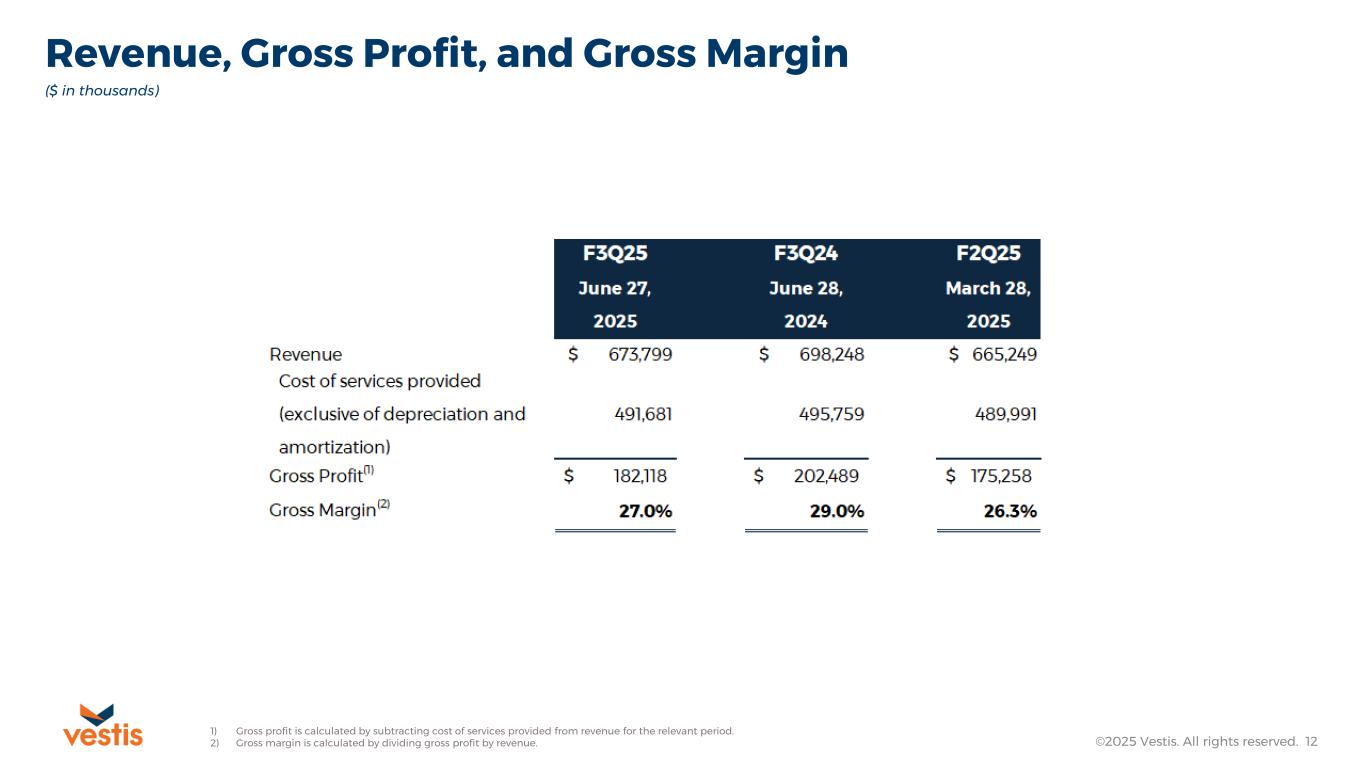

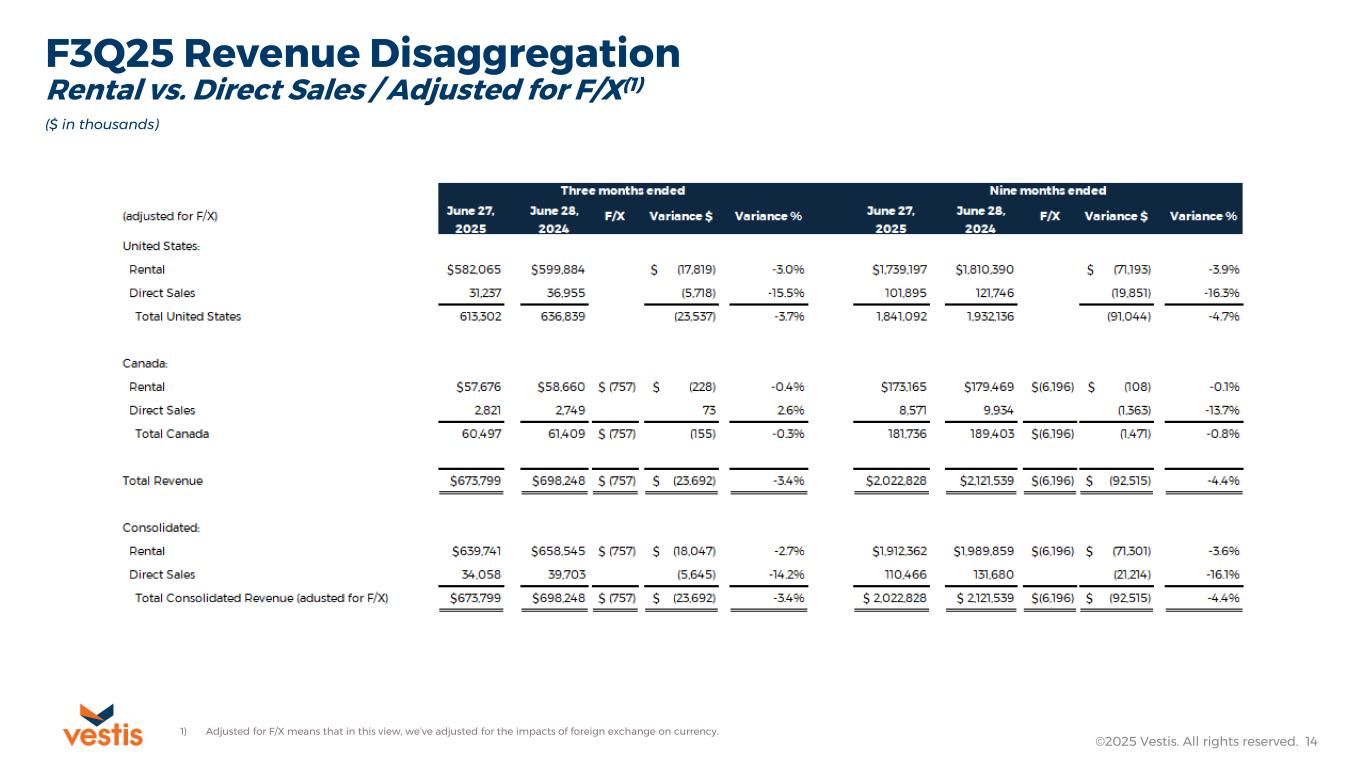

Third quarter fiscal 2025 revenue totaled $673.8 million, a decrease of $24.4 million year over year or 3.5%. The decline in revenue compared to the prior year reflects a $18.0 million decrease in rental revenue, a $5.6 million decline in direct sales revenue and a $0.8 million negative impact of foreign exchange on currency. The decrease in rental revenue was primarily due to a $14.6 million decline from lost business in excess of new business, and a $3.4 million decline in revenue related to existing business. The decline in direct sales revenue was primarily attributable to a $4.3 million unfavorable impact from the previously anticipated loss of a national account customer. Excluding that, direct sales decreased $1.3 million when compared to the prior year.

Gross profit for the third quarter of fiscal 2025 was $182.1 million, compared to $202.5 million in the third quarter of fiscal 2024, a decrease of 10.1%. The decrease in gross profit compared to the prior year period is primarily attributable to the decremental margin on lost revenues, unfavorable changes in product mix and increased merchandise amortization from new installations, which more than offset the incremental margin from new business and a decline in delivery costs.

Selling, general and administrative (“SG&A”) expenses were $122.3 million in the third quarter of fiscal 2025, which was $7.7 million lower than the same period in the prior year. The year-over-year decrease in SG&A was due primarily to a $6.0 million decline in share-based compensation, a $3.6 million decrease in separation related costs and a $2.6 million reduction in other administrative costs, offset by a $4.5 million increase in selling expenses related to additional field sales personnel.

*A non-GAAP measure, see accompanying non-GAAP measure explanations and reconciliations later in this release.

Interest expense was $22.5 million in the third quarter of fiscal 2025, compared to $29.9 million in the prior year period. The $7.4 million year-over-year decrease in interest expense reflects a decrease in net term loan borrowings resulting from the receipt of net proceeds from establishing the accounts receivable securitization facility during the fiscal fourth quarter of 2024.

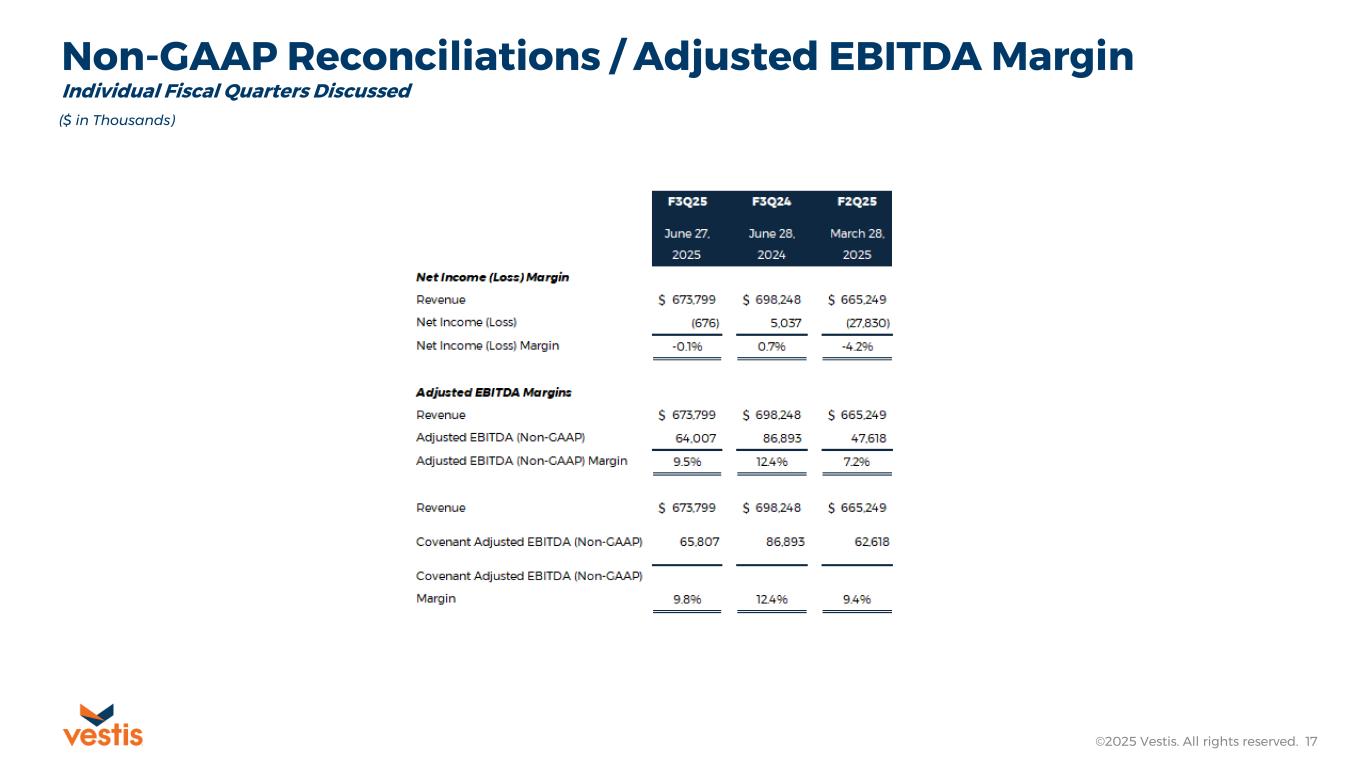

Net loss was $0.7 million or $(0.01) per diluted share, in the third quarter of fiscal 2025 versus net income of $5.0 million, or $0.04 per diluted share, in the prior year period and Adjusted EBITDA* was $64.0 million for the third quarter of 2025 as compared to $86.9 million in the third quarter of 2024.

Capital Allocation and Financial Position

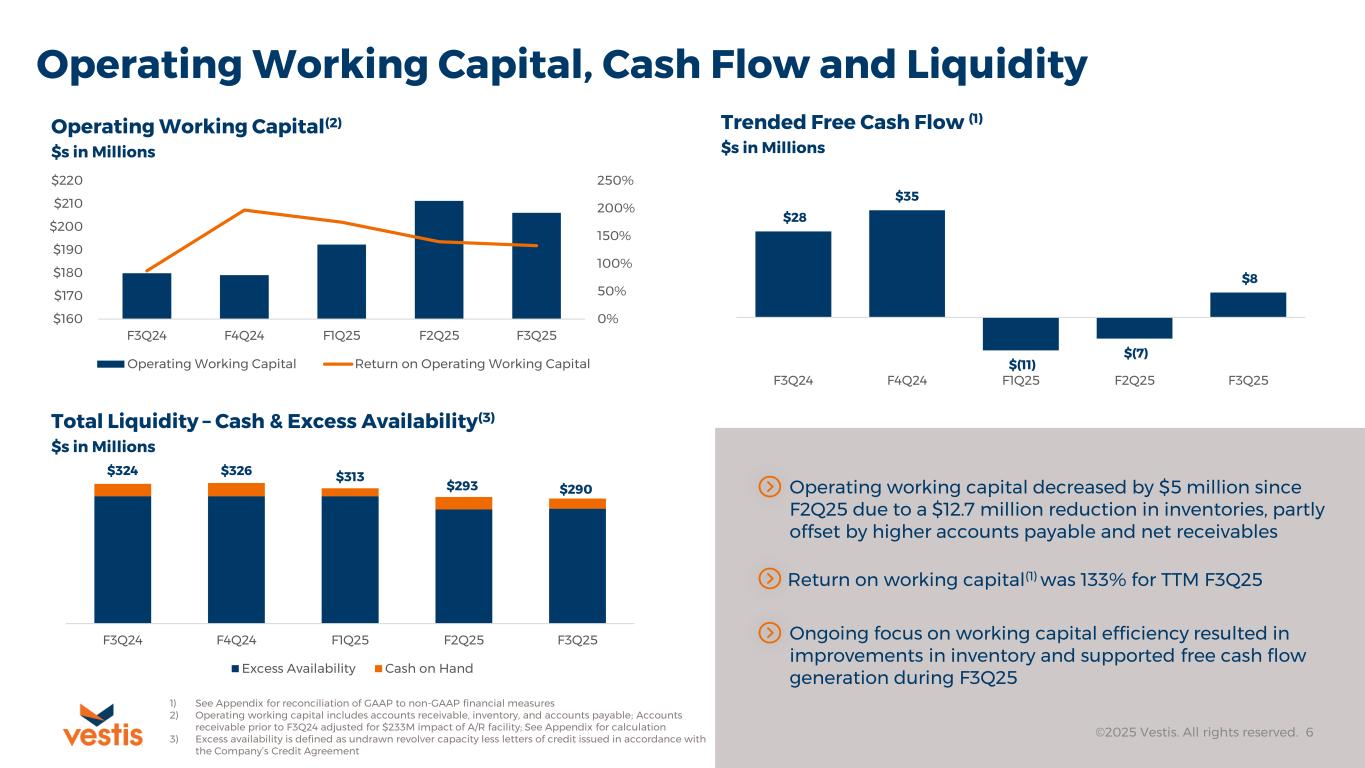

During the third quarter of 2025, we invested $14.9 million in property and equipment, the majority of which is related to market center facility improvements.

Net cash provided by operating activities was $22.9 million for the third quarter of 2025 and Free Cash Flow* was $8.0 million for the quarter, a decrease of $25.8 million and $19.7 million, respectively, from the comparative prior year periods. The reduction in cash flow was primarily due to the decrease in earnings and the current quarter includes the impact of allowable deferred cash tax payments from the first half of fiscal 2025 of $9.6 million.

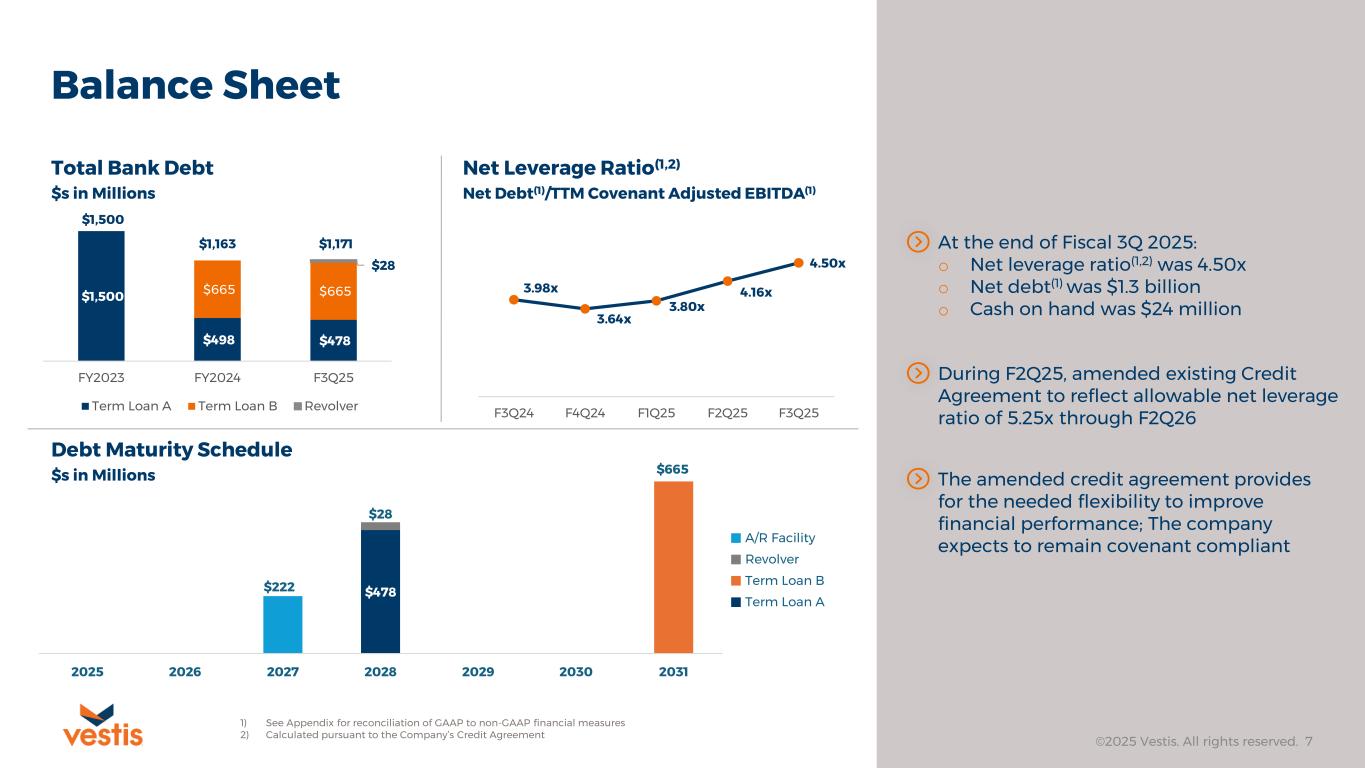

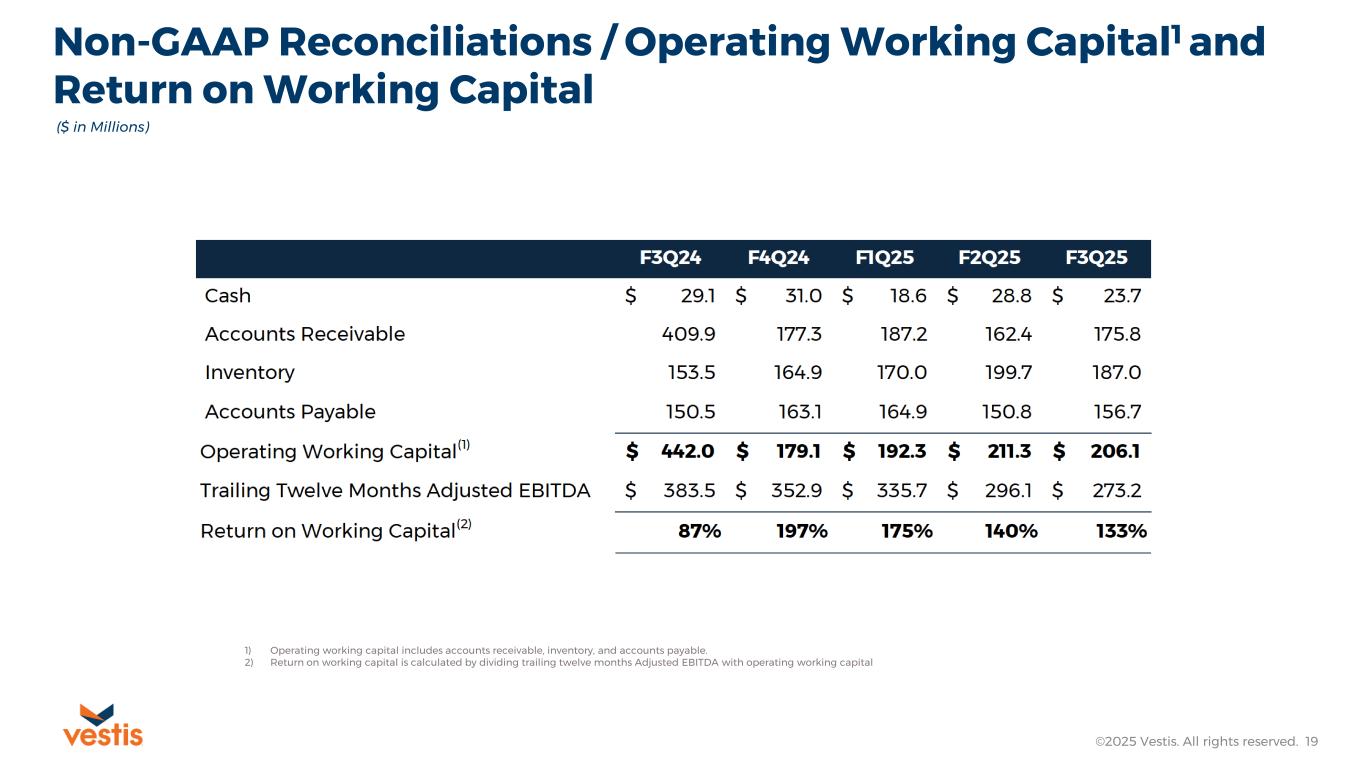

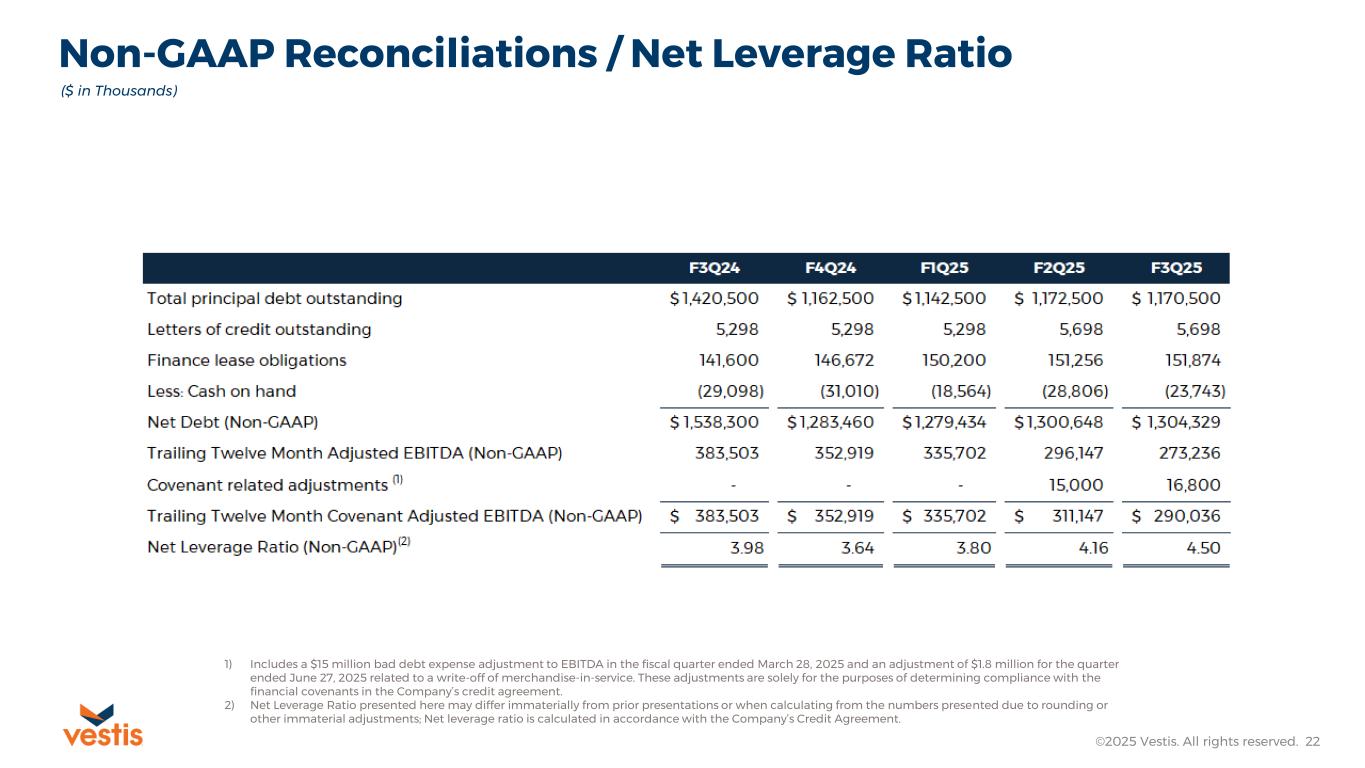

As of June 27, 2025, Vestis had total cash and excess availability under its revolving credit facility of $290 million as compared to $324 million at the end of the third quarter of 2024. Total debt outstanding at the end of the third quarter was $1.32 billion including principal bank debt outstanding of $1.17 billion. The Net Leverage Ratioa* was 4.50x at the end of the third quarter of fiscal 2025. Pursuant to the credit agreement, as amended, the Net Leverage Ratio cannot exceed 5.25x for any fiscal quarter ending prior to July 3, 2026.

Third Quarter 2025 Results Conference Call & Webcast

Vestis will host a conference call on Wednesday, August 6, 2025, at 8:30 a.m. Eastern Time to discuss its fiscal third quarter 2025 results.

For a live webcast of the conference call and to access the accompanying investor presentation, please visit the investor relations section of the Company’s website at www.vestis.com.

To participate in the live teleconference:

Unites States Live: 800-267-6316

International Live: 203-518-9783

Access Code: VSTSQ325

A replay of the live event will also be available on the Company’s website shortly after the conclusion of the call.

About Vestis™

Vestis is a leader in the B2B uniform and workplace supplies category. Vestis provides uniform services and workplace supplies to a broad range of North American customers from Fortune 500 companies to locally owned small businesses across a broad set of end sectors. The Company’s comprehensive service offering primarily includes a full-service uniform rental program, floor mats, towels, linens, managed restroom services, first aid supplies, and cleanroom and other specialty garment processing.

a The Company incurred a net loss during the third quarter of fiscal 2025, resulting in a negative debt to net income ratio, which is the most directly comparable GAAP measure to Net Leverage Ratio.

* A non-GAAP measure, see accompanying non-GAAP measure explanations and reconciliations later in this release.

Investor Contact

Stefan Neely or Bill Seymour

Vallum Advisors

615-844-6248

ir@vestis.com

Media

Danielle Holcomb

470-716-0917

danielle.holcomb@vestis.com

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the securities laws. All statements that reflect our expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts relating to discussions of future operations and financial performance and statements regarding our strategy for growth, future product development, regulatory approvals, competitive position and expenditures. In some cases, forward-looking statements can be identified by words such as “potential,” “outlook,” “guidance,” “anticipate,” “continue,” “estimate,” “expect,” “will,” and “believe,” and other words and terms of similar meaning or the negative versions of such words. Examples of forward-looking statements in this release include, but are not limited to, statements regarding: the potential effects of our comprehensive actions to enhance both our commercial and operational processes, and our expectations regarding our fourth quarter 2025 performance outlook. These forward-looking statements are subject to risks and uncertainties that may change at any time, and actual results or outcomes may differ materially from those that we expected. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict including, but not limited to: unfavorable macroeconomic conditions including inflationary pressures and higher interest rates; the failure to retain current customers, renew existing customer contracts and obtain new customer contracts, which could result in continued stock volatility and potential future goodwill impairment charges; competition in our industry; our ability to comply with certain financial ratios, tests and covenants in our credit agreement, including the Net Leverage Ratio; our significant indebtedness and ability to meet debt obligations and our reliance on an accounts receivable securitization facility; increases in fuel and energy costs and other supply chain challenges and disruptions, including as a result of ongoing military conflicts in Ukraine and the Middle East; implementation of new or increased tariffs and ongoing changes in U.S. and foreign government trade policies, including potential modifications to existing trade agreements and retaliatory measures by foreign governments; increased operating costs and obstacles to cost recovery due to the pricing and cancellation terms of our support services contracts; a determination by our customers to reduce their outsourcing or use of preferred vendors; the outcome of legal proceedings to which we are or may become subject; risks associated with suppliers from whom our products are sourced; challenge of contracts by our customers; currency risks and other risks associated with international operations, including compliance with a broad range of laws and regulations, including the United States Foreign Corrupt Practices Act; increases in labor costs or inability to hire and retain key or sufficient qualified personnel; continued or further unionization of our workforce; our expansion strategy and our ability to successfully integrate the businesses we acquire and costs and timing related thereto; natural disasters, global calamities, climate change, pandemics, and other adverse incidents; liability resulting from our participation in multiemployer-defined benefit pension plans; liability associated with noncompliance with applicable law or other governmental regulations; laws and governmental regulations including those relating to the environment, wage and hour and government contracting; unanticipated changes in tax law; new interpretations of or changes in the enforcement of the government regulatory framework; a cybersecurity incident or other disruptions in the availability of our computer systems or privacy breaches; stakeholder expectations relating to environmental, social and governance (“ESG”) considerations which may expose us to liabilities and other adverse effects on our business; any failure by Aramark to perform its obligations under the various separation agreements entered into in connection with the separation; and a determination by the IRS that the distribution or certain related transactions are taxable. The above list of factors is not exhaustive or necessarily in order of importance.

For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the Company’s filings with the Securities and Exchange Commission (“SEC”), including “Item 1A-Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in “Item 1A-Risk Factors” of Part II in subsequently-filed Quarterly Reports on Form 10-Q, which are available on the SEC’s website at www.sec.gov. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

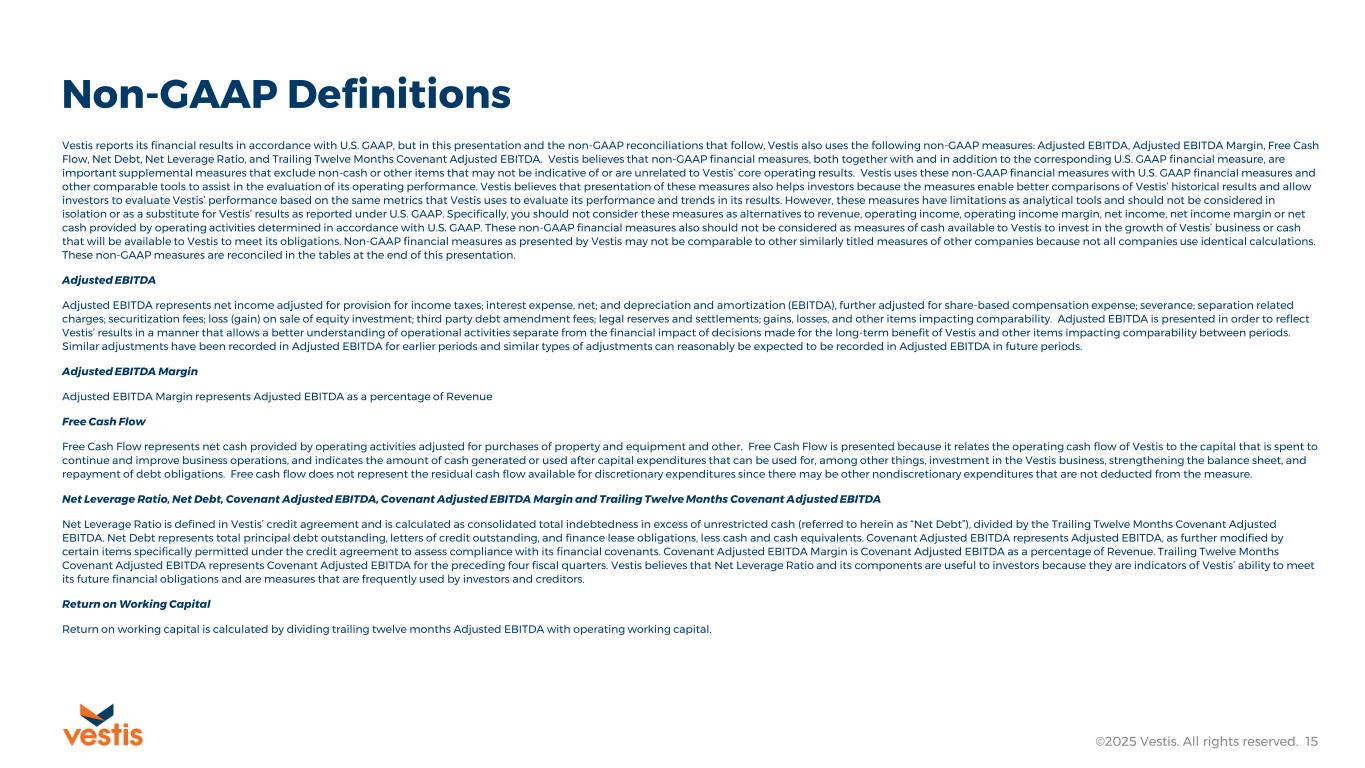

Non-GAAP Financial Measures

Vestis reports its financial results in accordance with U.S. GAAP, but in this release and the non-GAAP reconciliations that follow, Vestis also uses the following non-GAAP measures: Adjusted EBITDA, Free Cash Flow, Net Debt, Net Leverage Ratio, and Trailing Twelve Months Covenant Adjusted EBITDA. Vestis believes that non-GAAP financial measures, both together with and in addition to the corresponding U.S. GAAP financial measure, are important supplemental measures that exclude non-cash or other items that may not be indicative of or are unrelated to Vestis’ core operating results. Vestis uses these non-GAAP financial measures with U.S. GAAP financial measures and other comparable tools to assist in the evaluation of its operating performance. Vestis believes that presentation of these measures also helps investors because the measures enable better comparisons of Vestis’ historical results and allow investors to evaluate Vestis’ performance based on the same metrics that Vestis uses to evaluate its performance and trends in its results. However, these measures have limitations as analytical tools and should not be considered in isolation or as a substitute for Vestis’ results as reported under U.S. GAAP. Specifically, you should not consider these measures as alternatives to revenue, operating income, operating income margin, net income, net income margin or net cash provided by operating activities determined in accordance with U.S. GAAP. These non-GAAP financial measures also should not be considered as measures of cash available to Vestis to invest in the growth of Vestis’ business or cash that will be available to Vestis to meet its obligations. Non-GAAP financial measures as presented by Vestis may not be comparable to other similarly titled measures of other companies because not all companies use identical calculations. These non-GAAP measures are reconciled in the tables at the end of this release.

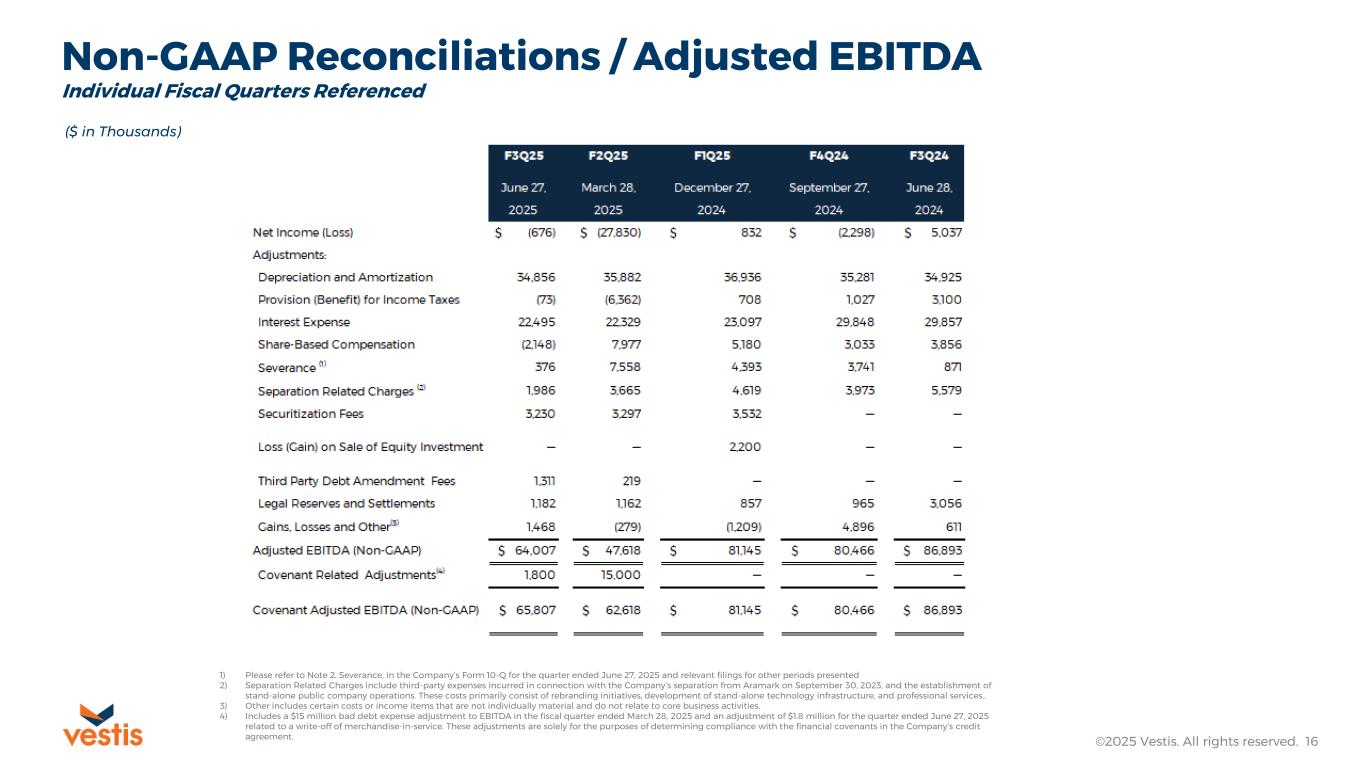

Adjusted EBITDA

Adjusted EBITDA represents net income adjusted for provision for income taxes; interest expense, net; and depreciation and amortization (EBITDA), further adjusted for share-based compensation expense; severance; separation related charges; securitization fees; loss (gain) on sale of equity investment; third party debt amendment fees; legal reserves and settlements; gains, losses, and other items impacting comparability. Adjusted EBITDA is presented in order to reflect Vestis’ results in a manner that allows a better understanding of operational activities separate from the financial impact of decisions made for the long-term benefit of Vestis and other items impacting comparability between periods. Similar adjustments have been recorded in Adjusted EBITDA for earlier periods and similar types of adjustments can reasonably be expected to be recorded in Adjusted EBITDA in future periods.

Free Cash Flow

Free Cash Flow represents net cash provided by operating activities adjusted for purchases of property and equipment and other. Free Cash Flow is presented because it relates the operating cash flow of Vestis to the capital that is spent to continue and improve business operations, and indicates the amount of cash generated or used after capital expenditures that can be used for, among other things, investment in the Vestis business, strengthening the balance sheet, and repayment of debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure.

Net Leverage Ratio, Net Debt, Covenant Adjusted EBITDA and Trailing Twelve Months Covenant Adjusted EBITDA

Net Leverage Ratio is defined in Vestis’ credit agreement and is calculated as consolidated total indebtedness in excess of unrestricted cash (referred to herein as “Net Debt”), divided by the Trailing Twelve Months Covenant Adjusted EBITDA. Net Debt represents total principal debt outstanding, letters of credit outstanding, and finance lease obligations, less cash and cash equivalents. Covenant Adjusted EBITDA represents Adjusted EBITDA, as further modified by certain items specifically permitted under the credit agreement to assess compliance with its financial covenants. Trailing Twelve Months Covenant Adjusted EBITDA represents Covenant Adjusted EBITDA for the preceding four fiscal quarters. Vestis believes that Net Leverage Ratio and its components are useful to investors because they are indicators of Vestis’ ability to meet its future financial obligations and are measures that are frequently used by investors and creditors.

VESTIS CORPORATION

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

June 27,

2025 |

|

June 28,

2024 |

|

June 27,

2025 |

|

June 28,

2024 |

| Revenue |

$ |

673,799 |

|

|

$ |

698,248 |

|

|

$ |

2,022,828 |

|

|

$ |

2,121,539 |

|

| Operating Expenses: |

|

|

|

|

|

|

|

| Cost of services provided (exclusive of depreciation and amortization) |

491,681 |

|

|

495,759 |

|

|

1,476,932 |

|

|

1,502,557 |

|

| Depreciation and amortization |

34,856 |

|

|

34,925 |

|

|

107,674 |

|

|

105,500 |

|

| Selling, general and administrative expenses |

122,301 |

|

|

130,041 |

|

|

391,432 |

|

|

385,307 |

|

| Total Operating Expenses |

648,838 |

|

|

660,725 |

|

|

1,976,038 |

|

|

1,993,364 |

|

Operating Income (Loss) |

24,961 |

|

|

37,523 |

|

|

46,790 |

|

|

128,175 |

|

| Interest Expense, net |

22,495 |

|

|

29,857 |

|

|

67,921 |

|

|

96,715 |

|

| Other Expense (Income), net |

3,215 |

|

|

(471) |

|

|

12,270 |

|

|

(1,841) |

|

Income (Loss) Before Income Taxes |

(749) |

|

|

8,137 |

|

|

(33,401) |

|

|

33,301 |

|

Provision (Benefit) for Income Taxes |

(73) |

|

|

3,100 |

|

|

(5,727) |

|

|

10,033 |

|

Net Income (Loss) |

$ |

(676) |

|

|

$ |

5,037 |

|

|

$ |

(27,674) |

|

|

$ |

23,268 |

|

|

|

|

|

|

|

|

|

Earnings (Loss) per share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.01) |

|

|

$ |

0.04 |

|

|

$ |

(0.21) |

|

|

$ |

0.18 |

|

| Diluted |

$ |

(0.01) |

|

|

$ |

0.04 |

|

|

$ |

(0.21) |

|

|

$ |

0.18 |

|

| Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

| Basic |

131,812 |

|

|

131,543 |

|

|

131,719 |

|

|

131,486 |

|

| Diluted |

131,812 |

|

|

131,833 |

|

|

131,719 |

|

|

131,785 |

|

VESTIS CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 27,

2025 |

|

September 27,

2024 |

| ASSETS |

|

|

|

| Current Assets: |

|

|

|

| Cash and cash equivalents |

$ |

23,743 |

|

|

$ |

31,010 |

|

| Receivables (net of allowances: $30,795 and $19,804, respectively) |

175,789 |

|

|

177,271 |

|

| Inventories, net |

186,992 |

|

|

164,913 |

|

| Rental merchandise in service, net |

400,374 |

|

|

396,094 |

|

| Other current assets |

33,704 |

|

|

18,101 |

|

| Total current assets |

820,602 |

|

|

787,389 |

|

| Property and Equipment, at cost: |

|

|

|

| Land, buildings and improvements |

574,174 |

|

|

590,972 |

|

| Equipment |

1,170,736 |

|

|

1,168,142 |

|

|

1,744,910 |

|

|

1,759,114 |

|

| Less - Accumulated depreciation |

(1,092,415) |

|

|

(1,088,256) |

|

| Total property and equipment, net |

652,495 |

|

|

670,858 |

|

| Goodwill |

963,027 |

|

|

963,844 |

|

| Other Intangible Assets, net |

196,370 |

|

|

212,773 |

|

| Operating Lease Right-of-use Assets |

86,539 |

|

|

73,530 |

|

| Other Assets |

189,058 |

|

|

223,993 |

|

| Total Assets |

$ |

2,908,091 |

|

|

$ |

2,932,387 |

|

| LIABILITIES AND EQUITY |

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

| Current maturities of financing lease obligations |

32,860 |

|

|

31,347 |

|

| Current operating lease liabilities |

20,576 |

|

|

19,886 |

|

| Accounts payable |

156,661 |

|

|

163,054 |

|

| Accrued payroll and related expenses |

97,329 |

|

|

96,768 |

|

| Accrued expenses and other current liabilities |

138,440 |

|

|

145,047 |

|

| Total current liabilities |

445,866 |

|

|

456,102 |

|

| Long-Term Borrowings |

1,156,457 |

|

|

1,147,733 |

|

| Noncurrent Financing Lease Obligations |

119,014 |

|

|

115,325 |

|

| Noncurrent Operating Lease Liabilities |

78,239 |

|

|

66,111 |

|

| Deferred Income Taxes |

175,069 |

|

|

191,465 |

|

| Other Noncurrent Liabilities |

51,218 |

|

|

52,600 |

|

| Total Liabilities |

2,025,863 |

|

|

2,029,336 |

|

| Commitments and Contingencies |

|

|

|

| Equity: |

|

|

|

| Common stock, par value $0.01 per share, 350,000,000 authorized, 131,836,607 and 131,481,967 issued and outstanding as of June 27, 2025 and September 27, 2024 ,respectively. |

1,318 |

|

|

1,315 |

|

| Additional paid-in capital |

937,051 |

|

|

928,082 |

|

| (Accumulated deficit) retained earnings |

(34,330) |

|

|

2,565 |

|

| Accumulated other comprehensive loss |

(21,811) |

|

|

(28,911) |

|

| Total Equity |

882,228 |

|

|

903,051 |

|

| Total Liabilities and Equity |

$ |

2,908,091 |

|

|

$ |

2,932,387 |

|

VESTIS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

June 27,

2025 |

|

June 28,

2024 |

|

June 27,

2025 |

|

June 28,

2024 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

Net Income (Loss) |

$ |

(676) |

|

|

$ |

5,037 |

|

|

$ |

(27,674) |

|

|

$ |

23,268 |

|

Adjustments to reconcile Net Income (Loss) to Net cash provided by operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization |

34,856 |

|

|

34,925 |

|

|

107,674 |

|

|

105,500 |

|

| Deferred income taxes |

(8,876) |

|

|

(4,431) |

|

|

(16,002) |

|

|

(10,166) |

|

| Share-based compensation expense |

(2,148) |

|

|

3,856 |

|

|

11,009 |

|

|

13,303 |

|

| Loss on sale of equity investment, net |

— |

|

|

— |

|

|

2,150 |

|

|

— |

|

| Asset write-down |

— |

|

|

208 |

|

|

189 |

|

|

980 |

|

| (Gain) Loss on disposals of property and equipment |

246 |

|

|

376 |

|

|

(726) |

|

|

618 |

|

| Amortization of debt issuance costs |

891 |

|

|

679 |

|

|

2,662 |

|

|

1,478 |

|

| Loss on extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

3,883 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

| Receivables, net |

(11,879) |

|

|

(4,307) |

|

|

1,063 |

|

|

(17,230) |

|

| Inventories, net |

13,091 |

|

|

(12,702) |

|

|

(21,487) |

|

|

21,136 |

|

| Rental merchandise in service, net |

(4,378) |

|

|

1,668 |

|

|

(4,708) |

|

|

178 |

|

| Other current assets |

(1,620) |

|

|

3,053 |

|

|

(11,888) |

|

|

(6,230) |

|

| Accounts payable |

3,664 |

|

|

2,137 |

|

|

(1,494) |

|

|

14,471 |

|

| Accrued expenses and other current liabilities |

8,130 |

|

|

29,269 |

|

|

19,203 |

|

|

54,511 |

|

| Changes in other noncurrent liabilities |

(7,794) |

|

|

(4,875) |

|

|

(22,718) |

|

|

(16,900) |

|

| Changes in other assets |

(1,368) |

|

|

(4,738) |

|

|

(3,879) |

|

|

(10,932) |

|

| Other operating activities |

725 |

|

|

(1,497) |

|

|

(72) |

|

|

(1,668) |

|

| Net cash provided by operating activities |

22,864 |

|

|

48,658 |

|

|

33,302 |

|

|

176,200 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Purchases of property and equipment and other |

(14,860) |

|

|

(20,962) |

|

|

(43,102) |

|

|

(50,787) |

|

| Proceeds from disposals of property and equipment |

167 |

|

|

— |

|

|

5,365 |

|

|

— |

|

| Proceeds from sale of equity investment |

— |

|

|

— |

|

|

36,792 |

|

|

— |

|

| Other investing activities |

(29) |

|

|

— |

|

|

(4,576) |

|

|

— |

|

Net cash provided by (used in) investing activities |

(14,722) |

|

|

(20,962) |

|

|

(5,521) |

|

|

(50,787) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Proceeds from long-term borrowings |

53,000 |

|

|

— |

|

|

93,000 |

|

|

798,000 |

|

| Payments of long-term borrowings |

(55,000) |

|

|

(17,000) |

|

|

(85,000) |

|

|

(879,500) |

|

| Payments of financing lease obligations |

(8,808) |

|

|

(7,424) |

|

|

(25,630) |

|

|

(22,572) |

|

| Net cash distributions to Parent |

— |

|

|

— |

|

|

— |

|

|

(6,051) |

|

| Dividend payments |

— |

|

|

(4,599) |

|

|

(13,822) |

|

|

(9,199) |

|

| Debt issuance costs |

(1,628) |

|

|

— |

|

|

(1,628) |

|

|

(11,134) |

|

| Other financing activities |

(242) |

|

|

(125) |

|

|

(2,037) |

|

|

(1,853) |

|

Net cash provided by (used in) financing activities |

(12,678) |

|

|

(29,148) |

|

|

(35,117) |

|

|

(132,309) |

|

| Effect of foreign exchange rates on cash and cash equivalents |

(527) |

|

|

(109) |

|

|

69 |

|

|

(57) |

|

Increase (decrease) in cash and cash equivalents |

(5,063) |

|

|

(1,561) |

|

|

(7,267) |

|

|

(6,953) |

|

| Cash and cash equivalents, beginning of period |

28,806 |

|

|

30,659 |

|

|

31,010 |

|

|

36,051 |

|

| Cash and cash equivalents, end of period |

$ |

23,743 |

|

|

$ |

29,098 |

|

|

$ |

23,743 |

|

|

$ |

29,098 |

|

VESTIS CORPORATION

RECONCILIATION OF NON-GAAP MEASURES

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

Consolidated |

|

Consolidated |

|

Three Months Ended |

|

Nine months ended |

|

Trailing Twelve Months Ended |

|

June 27, |

|

June 28, |

|

June 27, |

|

June 28, |

|

June 27, |

|

June 28, |

|

September 27, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

2024 |

| Net Income (Loss) |

$ |

(676) |

|

|

$ |

5,037 |

|

|

$ |

(27,674) |

|

|

$ |

23,268 |

|

|

$ |

(29,972) |

|

|

$ |

117,240 |

|

|

$ |

20,970 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and Amortization |

34,856 |

|

|

34,925 |

|

|

107,674 |

|

|

105,500 |

|

|

142,955 |

|

|

140,292 |

|

|

140,781 |

|

| Provision (Benefit) for Income Taxes |

(73) |

|

|

3,100 |

|

|

(5,727) |

|

|

10,033 |

|

|

(4,700) |

|

|

25,389 |

|

|

11,060 |

|

| Interest Expense |

22,495 |

|

|

29,857 |

|

|

67,921 |

|

|

96,715 |

|

|

97,769 |

|

|

97,501 |

|

|

126,563 |

|

| Share-Based Compensation |

(2,148) |

|

|

3,856 |

|

|

11,009 |

|

|

13,303 |

|

|

14,042 |

|

|

16,190 |

|

|

16,336 |

|

Severance (1) |

376 |

|

|

871 |

|

|

12,327 |

|

|

701 |

|

|

16,068 |

|

|

901 |

|

|

4,442 |

|

Separation Related Charges (2) |

1,986 |

|

|

5,579 |

|

|

10,270 |

|

|

18,629 |

|

|

14,244 |

|

|

36,849 |

|

|

22,602 |

|

| Securitization Fees |

3,230 |

|

|

— |

|

|

10,060 |

|

|

— |

|

|

10,060 |

|

|

— |

|

|

— |

|

| Loss (Gain) on Sale of Equity Investment |

— |

|

|

— |

|

|

2,200 |

|

|

— |

|

|

2,200 |

|

|

(51,863) |

|

|

— |

|

| Third Party Debt Amendment Charges |

1,311 |

|

|

— |

|

|

1,530 |

|

|

— |

|

|

1,530 |

|

|

— |

|

|

— |

|

| Legal Reserves and Settlements |

1,182 |

|

|

3,056 |

|

|

3,200 |

|

|

3,556 |

|

|

4,165 |

|

|

3,556 |

|

|

4,521 |

|

Gains, Losses and Other(3) |

1,468 |

|

|

611 |

|

|

(21) |

|

|

748 |

|

|

4,876 |

|

|

(2,551) |

|

|

5,644 |

|

| Adjusted EBITDA (Non-GAAP) |

$ |

64,007 |

|

|

$ |

86,893 |

|

|

$ |

192,769 |

|

|

$ |

272,452 |

|

|

$ |

273,236 |

|

|

$ |

383,503 |

|

|

$ |

352,919 |

|

Covenant Related Adjustments(4) |

1,800 |

|

|

— |

|

|

16,800 |

|

|

— |

|

|

16,800 |

|

|

— |

|

|

— |

|

| Covenant Adjusted EBITDA (Non-GAAP) |

$ |

65,807 |

|

|

$ |

86,893 |

|

|

$ |

209,569 |

|

|

$ |

272,452 |

|

|

$ |

290,036 |

|

|

$ |

383,503 |

|

|

$ |

352,919 |

|

(1) Please refer to Note 2. Severance, in the Company’s Form 10-Q for the quarter ended June 27, 2025.

(2) Separation Related Charges include third-party expenses incurred in connection with the Company’s separation from Aramark on September 30, 2023, and the establishment of stand-alone public company operations. These costs primarily consist of rebranding initiatives, development of stand-alone technology infrastructure, and professional services.

(3) Other includes certain costs or income items that are not individually material and do not relate to core business activities.

(4) Includes a $15 million bad debt expense adjustment to EBITDA in the fiscal quarter ended March 28, 2025 and an adjustment of $1.8 million for the quarter ended June 27, 2025 related to a write-off of merchandise-in-service. These adjustments are solely for the purposes of determining compliance with the financial covenants in the Company’s credit agreement.

VESTIS CORPORATION

RECONCILIATION OF NON-GAAP MEASURES

FREE CASH FLOW, NET DEBT, NET LEVERAGE RATIO, AND PRO FORMA NET LEVERAGE

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine Months Ended |

|

June 27, 2025 |

|

June 28, 2024 |

|

June 27, 2025 |

|

June 28, 2024 |

| Net cash provided by operating activities |

$ |

22,864 |

|

|

$ |

48,658 |

|

|

$ |

33,302 |

|

|

$ |

176,200 |

|

| Purchases of property and equipment and other |

(14,860) |

|

|

(20,962) |

|

|

(43,102) |

|

|

(50,787) |

|

| Free Cash Flow (Non-GAAP) |

$ |

8,004 |

|

|

$ |

27,696 |

|

|

$ |

(9,800) |

|

|

$ |

125,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

June 27, 2025 |

|

September 27, 2024 |

| Total principal debt outstanding |

$ |

1,170,500 |

|

|

$ |

1,162,500 |

|

| Letters of credit outstanding |

5,698 |

|

|

5,298 |

|

| Finance lease obligations |

151,874 |

|

|

146,672 |

|

| Less: Cash and cash equivalents |

(23,743) |

|

|

(31,010) |

|

| Net Debt (Non-GAAP) |

$ |

1,304,329 |

|

$ |

1,304,329 |

|

$ |

1,283,460 |

|

| Trailing Twelve Months Adjusted EBITDA (Non-GAAP) |

$ |

273,236 |

|

|

$ |

352,919 |

|

Covenant Related Adjustments (1) |

16,800 |

|

|

— |

|

| Trailing Twelve Months Covenant Adjusted EBITDA (Non-GAAP) |

$ |

290,036 |

|

|

$ |

352,919 |

|

Net Leverage Ratio (Non-GAAP) (1) |

4.50 |

|

|

3.64 |

|

(1) Includes a $15 million bad debt expense adjustment to EBITDA in the fiscal quarter ended March 28, 2025 and an adjustment of $1.8 million for the quarter ended June 27, 2025 related to a write-off of merchandise-in-service. These adjustments are solely for the purposes of determining compliance with the financial covenants in the Company’s credit agreement.