Document

Burke & Herbert Financial Services Corp. Announces Second Quarter 2025 Results and Declares Common Stock Dividend

For Immediate Release

July 24, 2025

Alexandria, VA – Burke & Herbert Financial Services Corp. (the “Company” or “Burke & Herbert”) (Nasdaq: BHRB) reported financial results for the quarter year ended June 30, 2025, and disclosed that, at its meeting on July 24, 2025, the board of directors declared a $0.55 per share regular cash dividend to be paid on September 2, 2025, to shareholders of record as of the close of business on August 15, 2025.

Q2 2025 Highlights

•For the quarter, net income applicable to common shares totaled $29.7 million, and diluted earnings per common share (“EPS”) was $1.97. For the quarter ended March 31, 2025, net income applicable to common shares totaled $27.0 million, and diluted EPS was $1.80.

•For the quarter, the annualized return on average assets was 1.51% and the annualized return on average equity was 15.50%.

•Ending total gross loans were $5.6 billion and ending total deposits were $6.4 billion; ending loan-to-deposit ratio was 87.5%. The net interest margin (non-GAAP1) was 4.17% for the three months ended June 30, 2025.

•The balance sheet remains strong with ample liquidity. Total liquidity, including all available borrowing capacity with cash and cash equivalents, totaled $4.4 billion at the end of the second quarter.

•Asset quality metrics remain within the Company’s moderate risk profile with adequate reserve coverage.

•The Company continues to be well-capitalized, ending the quarter with 12.2%2 Common Equity Tier 1 capital to risk-weighted assets, 15.3%2 Total risk-based capital to risk-weighted assets, and a leverage ratio of 10.4%.2

From David P. Boyle, Company Chair and Chief Executive Officer

“I’m pleased with our first half 2025 results and how our balance sheet is positioned. We’re successfully replacing non-strategic loans with assets that meet our relationship-based approach and maintaining ample liquidity, solid capital ratios, and adequate loss reserves. Our provision for credit losses reflects the confidence we have in our ability to manage and maintain asset quality metrics within our moderate risk appetite. We’re keeping our focus on expense management while we continue to invest for the future, including our planned expansion in Bethesda, Maryland, and in Fredericksburg and Richmond, Virginia. We are looking forward to a strong second half of 2025 by continuing to be a trusted advisor to our customers and delivering our full suite of products and services across our footprint. Regardless of market developments, we are committed to delivering increased value for our customers, employees, communities and shareholders.”

Results of Operations

Second Quarter 2025 compared to First Quarter 2025

The Company reported second quarter 2025 net income applicable to common shares of $29.7 million, or $1.97 per diluted common share, compared to first quarter 2025 net income to applicable to common shares of $27.0 million, or $1.80 per diluted common share.

(1) Non-GAAP financial measures referenced in this release are used by management to measure performance in operating the business that management believes enhances investors’ ability to better understand the underlying business performance and trends related to core business activities. Reconciliations of non-GAAP operating measures to the most directly comparable GAAP financial measures are included in the non-GAAP reconciliation tables in this release. Non-GAAP measures should not be used as a substitute for the closest comparable GAAP measurements.

(2) Ratios as of June 30, 2025, are estimated.

1

•Period-end total gross loans were $5.6 billion at June 30, 2025, a decrease of $57.1 million from March 31, 2025, as the Company exited approximately $90.8 million of non-strategic loans while originating $200.0 million of new, relationship-based loans.

•Period-end total deposits were $6.4 billion at June 30, 2025, a decrease of $150.9 million from March 31, 2025, primarily due to a $114.8 million decrease in brokered deposits.

•Net interest income for the quarter was $74.2 million compared to $73.0 million in the prior quarter due to a decrease in interest expense of $0.2 million, combined with an increase in interest income of $1.1 million. Lower interest expense was primarily attributable to lower deposit costs, including lower interest expense resulting from calling brokered time deposits, and the increase in interest income was primarily due to higher security and other interest income, somewhat offset by lower loan interest income.

•Net interest margin on a fully taxable equivalent basis (non-GAAP1) decreased to 4.17% versus 4.18% in the first quarter of 2025, mainly attributable to a lower yield on the loan portfolio offset by an increase in yield on the securities portfolio and a decrease in yield on interest-bearing liabilities compared to the first quarter of 2025.

•Accretion income on loans during the quarter was $11.5 million, and the amortization expense impact on interest expense was $1.4 million, or 56.0 bps of net interest margin on an annualized basis in the second quarter of 2025. In the prior quarter, accretion income on loans during the quarter was $11.4 million, and the amortization expense impact on interest expense was $2.2 million, or 51.7 bps of net interest margin on an annualized basis.

•The cost of total deposits, including non-interest bearing deposits, was 1.90% in the second quarter of 2025, compared to 1.99% in the first quarter of 2025. The decrease in the cost of deposits was mostly due to a decrease in amortization of acquired time deposits of $0.8 million and a decrease in the rate paid on savings deposits and brokered time deposits compared to the first quarter of 2025.

•The Company recorded credit provision expense in the second quarter of 2025 of $624 thousand and the Company’s allowance for credit losses at June 30, 2025, was $67.3 million, or 1.2% of total loans.

•Total non-interest income for the second quarter of 2025 was $12.9 million compared to $10.0 million in the prior quarter, primarily due to collection of death proceeds from company-owned life insurance which increased non-interest income by $1.8 million, card network partnership income of $1.3 million, and additional swap income in the second quarter of 2025 compared to the first quarter of 2025.

•Non-interest expense for the second quarter of 2025 was $49.3 million compared to $49.7 million in the first quarter of 2025, primarily reflecting cost save realizations following the merger-related conversion that occurred in the fourth quarter of 2024.

Regulatory capital ratios2

The Company continues to be well-capitalized with capital ratios that are above regulatory requirements. As of June 30, 2025, our Common Equity Tier 1 capital to risk-weighted asset and Total risk-based capital to risk-weighted asset ratios were 12.2%2 and 15.3%2, respectively, and significantly above the well-capitalized requirements of 6.5% and 10%, respectively. The leverage ratio was 10.4%2 compared to a 5% level to be considered well-capitalized.

Burke & Herbert Bank & Trust Company (“the Bank”), the Company’s wholly-owned bank subsidiary, also continues to be well-capitalized with capital ratios that are above regulatory requirements. As of June 30, 2025, the Bank’s Common Equity Tier 1 capital to risk-weighted asset and Total risk-based capital to risk-weighted asset ratios were 14.0%2 and 15.1%,2 respectively, and significantly above the well-capitalized requirements. In addition, the Bank’s leverage ratio of 11.5%2 is considered to be well-capitalized.

For more information about the Company’s financial condition, including additional disclosures pertinent to recent events in the banking industry, please see our financial statements and supplemental information attached to this release.

About Burke & Herbert

Burke & Herbert Financial Services Corp. is the financial holding company for Burke & Herbert Bank & Trust Company. Burke & Herbert Bank & Trust Company is the oldest continuously operating bank under its original name headquartered in the greater Washington, D.C. metropolitan area. With over 75 branches across Delaware, Kentucky, Maryland, Virginia, and West Virginia, Burke & Herbert Bank & Trust Company offers a full range of business and personal financial solutions designed to meet customers’ banking, borrowing, and investment needs. Learn more at investor.burkeandherbertbank.com.

Cautionary Note Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the beliefs, goals, intentions, and expectations of the Company regarding revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of expected losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; and other statements that are not historical facts.

Forward–looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “will,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward–looking statements speak only as of the date they are made; the Company does not assume any duty, does not undertake, and specifically disclaims any obligation to update such forward–looking statements, whether written or oral, that may be made from time to time, whether because of new information, future events, or otherwise, except as required by law. Furthermore, because forward–looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in or implied by such forward-looking statements because of a variety of factors, many of which are beyond the control of the Company. Further, factors identified herein are not necessarily all of the factors that could cause the Company’s actual results, performance or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable factors, also could harm the Company. Accordingly, you should consider all of these risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made by the Company and not place undue reliance on forward-looking statements.

The risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to, the following: costs or difficulties associated with newly developed or acquired operations; changes in general economic, political, or market trends (either nationally or locally in the areas in which we conduct, or will conduct, business), including inflation, changes in interest rates, market volatility and monetary fluctuations, and changes in federal government policies and practices, as well as the impact from recently announced and future tariffs on the markets we serve; increased competition; changes in consumer confidence and demand for financial services, including changes in consumer borrowing, repayment, investment, and deposit practices; changes in asset quality and credit risk; our ability to control costs and expenses; adverse developments in borrower industries or declines in real estate values; changes in and compliance with federal and state laws and regulations that pertain to our business and capital levels; our ability to raise capital as needed; the impact, extent and timing of technological changes; the effects of any cybersecurity breaches; and the other factors discussed in the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” section of the Company's Annual Report on Form 10–K for the year ended December 31, 2024, the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and other reports the Company files with the SEC.

Burke & Herbert Financial Services Corp.

Consolidated Statements of Income (unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

March 31 |

|

June 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2025 |

|

2024 |

| Interest income |

|

|

|

|

|

|

|

|

|

|

| Taxable loans, including fees |

|

$ |

96,803 |

|

|

$ |

81,673 |

|

|

$ |

97,031 |

|

|

$ |

193,834 |

|

|

$ |

109,718 |

|

| Tax-exempt loans, including fees |

|

43 |

|

|

33 |

|

|

46 |

|

|

89 |

|

|

33 |

|

| Taxable securities |

|

9,303 |

|

|

10,930 |

|

|

9,487 |

|

|

18,790 |

|

|

19,873 |

|

| Tax-exempt securities |

|

3,939 |

|

|

2,556 |

|

|

3,267 |

|

|

7,206 |

|

|

3,917 |

|

| Other interest income |

|

1,770 |

|

|

905 |

|

|

955 |

|

|

2,725 |

|

|

1,301 |

|

| Total interest income |

|

111,858 |

|

|

96,097 |

|

|

110,786 |

|

|

222,644 |

|

|

134,842 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

30,431 |

|

|

30,373 |

|

|

31,851 |

|

|

62,282 |

|

|

43,304 |

|

| Short-term borrowings |

|

4,438 |

|

|

4,071 |

|

|

3,192 |

|

|

7,630 |

|

|

7,726 |

|

| Subordinated debt |

|

2,730 |

|

|

1,860 |

|

|

2,729 |

|

|

5,459 |

|

|

1,860 |

|

| Other interest expense |

|

26 |

|

|

28 |

|

|

27 |

|

|

53 |

|

|

56 |

|

| Total interest expense |

|

37,625 |

|

|

36,332 |

|

|

37,799 |

|

|

75,424 |

|

|

52,946 |

|

| Net interest income |

|

74,233 |

|

|

59,765 |

|

|

72,987 |

|

|

147,220 |

|

|

81,896 |

|

|

|

|

|

|

|

|

|

|

|

|

| Credit loss expense - loans and available-for-sale securities |

|

717 |

|

|

20,100 |

|

|

900 |

|

|

1,617 |

|

|

19,430 |

|

| Credit loss (recapture) - off-balance sheet credit exposures |

|

(93) |

|

|

3,810 |

|

|

(399) |

|

|

(492) |

|

|

3,810 |

|

| Total provision for credit losses |

|

624 |

|

|

23,910 |

|

|

501 |

|

|

1,125 |

|

|

23,240 |

|

| Net interest income after credit loss expense |

|

73,609 |

|

|

35,855 |

|

|

72,486 |

|

|

146,095 |

|

|

58,656 |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income |

|

|

|

|

|

|

|

|

|

|

| Fiduciary and wealth management |

|

2,425 |

|

|

2,211 |

|

|

2,443 |

|

|

4,868 |

|

|

3,630 |

|

| Service charges and fees |

|

2,036 |

|

|

1,813 |

|

|

2,089 |

|

|

4,125 |

|

|

2,470 |

|

| Net gains on securities |

|

38 |

|

|

613 |

|

|

1 |

|

|

39 |

|

|

613 |

|

| Income from company-owned life insurance |

|

2,982 |

|

|

922 |

|

|

1,193 |

|

|

4,175 |

|

|

1,469 |

|

| Bank debit and other card revenue |

|

3,024 |

|

|

2,457 |

|

|

2,884 |

|

|

5,908 |

|

|

3,588 |

|

| Other non-interest income |

|

2,372 |

|

|

1,489 |

|

|

1,413 |

|

|

3,785 |

|

|

1,989 |

|

| Total non-interest income |

|

12,877 |

|

|

9,505 |

|

|

10,023 |

|

|

22,900 |

|

|

13,759 |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense |

|

|

|

|

|

|

|

|

|

|

| Salaries and wages |

|

21,320 |

|

|

20,895 |

|

|

20,941 |

|

|

42,261 |

|

|

30,413 |

|

| Pensions and other employee benefits |

|

4,067 |

|

|

5,303 |

|

|

5,136 |

|

|

9,203 |

|

|

7,668 |

|

| Occupancy |

|

3,521 |

|

|

2,997 |

|

|

4,045 |

|

|

7,566 |

|

|

4,535 |

|

| Equipment rentals, depreciation and maintenance |

|

4,100 |

|

|

12,663 |

|

|

4,084 |

|

|

8,184 |

|

|

13,944 |

|

| Other operating |

|

16,297 |

|

|

22,574 |

|

|

15,458 |

|

|

31,755 |

|

|

29,037 |

|

| Total non-interest expense |

|

49,305 |

|

|

64,432 |

|

|

49,664 |

|

|

98,969 |

|

|

85,597 |

|

| Income (loss) before income taxes |

|

37,181 |

|

|

(19,072) |

|

|

32,845 |

|

|

70,026 |

|

|

(13,182) |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense (benefit) |

|

7,284 |

|

|

(2,153) |

|

|

5,644 |

|

|

12,928 |

|

|

(1,475) |

|

| Net income (loss) |

|

29,897 |

|

|

(16,919) |

|

|

27,201 |

|

|

57,098 |

|

|

(11,707) |

|

| Preferred stock dividends |

|

225 |

|

|

225 |

|

|

225 |

|

|

450 |

|

|

225 |

|

| Net income (loss) applicable to common shares |

|

$ |

29,672 |

|

|

$ |

(17,144) |

|

|

$ |

26,976 |

|

|

$ |

56,648 |

|

|

$ |

(11,932) |

|

Burke & Herbert Financial Services Corp.

Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

December 31, 2024 |

|

|

(Unaudited) |

|

(Audited) |

| Assets |

|

|

|

|

| Cash and due from banks |

|

$ |

65,173 |

|

|

$ |

35,554 |

|

| Interest-earning deposits with banks |

|

259,973 |

|

|

99,760 |

|

| Cash and cash equivalents |

|

325,146 |

|

|

135,314 |

|

| Securities available-for-sale, at fair value |

|

1,522,611 |

|

|

1,432,371 |

|

| Restricted stock, at cost |

|

42,189 |

|

|

33,559 |

|

| Loans held-for-sale, at fair value |

|

1,511 |

|

|

2,331 |

|

| Loans |

|

5,590,457 |

|

|

5,672,236 |

|

| Allowance for credit losses |

|

(67,256) |

|

|

(68,040) |

|

| Net loans |

|

5,523,201 |

|

|

5,604,196 |

|

| Premises and equipment, net |

|

133,997 |

|

|

132,270 |

|

| Other real estate owned |

|

2,742 |

|

|

2,783 |

|

| Accrued interest receivable |

|

35,453 |

|

|

34,454 |

|

| Intangible assets |

|

49,114 |

|

|

57,300 |

|

| Goodwill |

|

34,149 |

|

|

32,783 |

|

| Company-owned life insurance |

|

182,181 |

|

|

182,834 |

|

| Other assets |

|

205,687 |

|

|

161,990 |

|

Total Assets |

|

$ |

8,057,981 |

|

|

$ |

7,812,185 |

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

| Liabilities |

|

|

|

|

| Non-interest-bearing deposits |

|

$ |

1,363,617 |

|

|

$ |

1,379,940 |

|

| Interest-bearing deposits |

|

5,027,357 |

|

|

5,135,299 |

|

| Total deposits |

|

6,390,974 |

|

|

6,515,239 |

|

| Short-term borrowings |

|

650,000 |

|

|

365,000 |

|

| Subordinated debentures, net |

|

97,552 |

|

|

94,872 |

|

| Subordinated debentures owed to unconsolidated subsidiary trusts |

|

17,140 |

|

|

17,013 |

|

| Accrued interest and other liabilities |

|

122,297 |

|

|

89,904 |

|

| Total Liabilities |

|

7,277,963 |

|

|

7,082,028 |

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

| Preferred stock and surplus |

|

10,413 |

|

|

10,413 |

|

| Common stock |

|

7,790 |

|

|

7,770 |

|

| Common stock, additional paid-in capital |

|

403,234 |

|

|

401,172 |

|

| Retained earnings |

|

474,019 |

|

|

434,106 |

|

| Accumulated other comprehensive income (loss) |

|

(87,854) |

|

|

(95,720) |

|

| Treasury stock |

|

(27,584) |

|

|

(27,584) |

|

| Total Shareholders’ Equity |

|

780,018 |

|

|

730,157 |

|

| Total Liabilities and Shareholders’ Equity |

|

$ |

8,057,981 |

|

|

$ |

7,812,185 |

|

Burke & Herbert Financial Services Corp.

Details of Net Interest Margin (unaudited)

For the three months ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Details of Net Interest Margin - Yield Percentages |

|

|

|

|

|

|

|

|

|

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

Interest-earning assets: |

Loans: |

|

|

|

|

|

|

|

|

|

Taxable loans |

6.90 |

% |

|

6.96 |

% |

|

6.91 |

% |

|

7.34 |

% |

|

7.33 |

% |

Tax-exempt loans |

5.90 |

|

|

5.80 |

|

|

5.87 |

|

|

5.63 |

|

|

5.55 |

|

Total loans |

6.90 |

|

|

6.96 |

|

|

6.91 |

|

|

7.34 |

|

|

7.33 |

|

Interest-earning deposits and fed funds sold |

4.68 |

|

|

5.76 |

|

|

4.48 |

|

|

3.43 |

|

|

3.54 |

|

Securities: |

|

|

|

|

|

|

|

|

|

Taxable securities |

3.83 |

|

|

3.85 |

|

|

3.82 |

|

|

4.05 |

|

|

4.48 |

|

Tax-exempt securities |

4.20 |

|

|

3.85 |

|

|

3.55 |

|

|

3.58 |

|

|

3.05 |

|

Total securities |

3.95 |

|

|

3.85 |

|

|

3.75 |

|

|

3.91 |

|

|

4.05 |

|

| Total interest-earning assets |

6.25 |

% |

|

6.31 |

% |

|

6.22 |

% |

|

6.56 |

% |

|

6.49 |

% |

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

Deposits: |

|

|

|

|

|

|

|

|

|

Interest-bearing demand |

2.21 |

% |

|

2.16 |

% |

|

2.51 |

% |

|

3.19 |

% |

|

3.00 |

% |

Money market & savings |

2.01 |

|

|

2.02 |

|

|

1.60 |

|

|

1.43 |

|

|

1.53 |

|

Brokered CDs & time deposits |

3.37 |

|

|

3.85 |

|

|

4.55 |

|

|

4.82 |

|

|

4.55 |

|

Total interest-bearing deposits |

2.41 |

|

|

2.53 |

|

|

2.76 |

|

|

3.02 |

|

|

2.90 |

|

Borrowings: |

|

|

|

|

|

|

|

|

|

Short-term borrowings |

3.91 |

|

|

3.88 |

|

|

4.17 |

|

|

4.06 |

|

|

4.38 |

|

Subordinated debt borrowings and other |

9.62 |

|

|

9.85 |

|

|

9.87 |

|

|

10.16 |

|

|

10.30 |

|

Total interest-bearing liabilities |

2.68 |

% |

|

2.76 |

% |

|

2.98 |

% |

|

3.21 |

% |

|

3.14 |

% |

|

|

|

|

|

|

|

|

|

|

Taxable-equivalent net interest spread |

3.57 |

|

|

3.55 |

|

|

3.24 |

|

|

3.35 |

|

|

3.35 |

|

| Benefit from use of non-interest-bearing deposits |

0.60 |

|

|

0.63 |

|

|

0.67 |

|

|

0.72 |

|

|

0.71 |

|

Taxable-equivalent net interest margin (non-GAAP1) |

4.17 |

% |

|

4.18 |

% |

|

3.91 |

% |

|

4.07 |

% |

|

4.06 |

% |

Burke & Herbert Financial Services Corp.

Details of Net Interest Margin (unaudited)

For the three months ended

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of Net Interest Margin - Average Balances |

|

|

|

|

|

|

|

|

|

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

Interest-earning assets: |

Loans: |

|

|

|

|

|

|

|

|

|

Taxable loans |

$ |

5,627,236 |

|

|

$ |

5,651,937 |

|

|

$ |

5,634,157 |

|

|

$ |

5,621,531 |

|

|

$ |

4,481,993 |

|

Tax-exempt loans |

3,737 |

|

|

4,057 |

|

|

3,115 |

|

|

4,310 |

|

|

3,041 |

|

Total loans |

5,630,973 |

|

|

5,655,994 |

|

|

5,637,272 |

|

|

5,625,841 |

|

|

4,485,034 |

|

Interest-earning deposits and fed funds sold |

81,369 |

|

|

40,757 |

|

|

152,537 |

|

|

175,265 |

|

|

94,765 |

|

Securities: |

|

|

|

|

|

|

|

|

|

Taxable securities |

1,059,310 |

|

|

1,039,391 |

|

|

1,031,024 |

|

|

996,749 |

|

|

988,492 |

|

Tax-exempt securities |

476,586 |

|

|

435,789 |

|

|

452,937 |

|

|

440,781 |

|

|

426,092 |

|

Total securities |

1,535,896 |

|

|

1,475,180 |

|

|

1,483,961 |

|

|

1,437,530 |

|

|

1,414,584 |

|

| Total interest-earning assets |

$ |

7,248,238 |

|

|

$ |

7,171,931 |

|

|

$ |

7,273,770 |

|

|

$ |

7,238,636 |

|

|

$ |

5,994,383 |

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

Deposits: |

|

|

|

|

|

|

|

|

|

Interest-bearing demand |

$ |

2,239,100 |

|

|

$ |

2,216,243 |

|

|

$ |

2,560,445 |

|

|

$ |

2,144,567 |

|

|

$ |

1,587,914 |

|

Money market & savings |

1,648,338 |

|

|

1,633,307 |

|

|

1,366,276 |

|

|

1,725,387 |

|

|

1,480,985 |

|

Brokered CDs & time deposits |

1,173,213 |

|

|

1,253,841 |

|

|

1,247,900 |

|

|

1,328,076 |

|

|

1,141,758 |

|

Total interest-bearing deposits |

5,060,651 |

|

|

5,103,391 |

|

|

5,174,621 |

|

|

5,198,030 |

|

|

4,210,657 |

|

Borrowings: |

|

|

|

|

|

|

|

|

|

Short-term borrowings |

457,775 |

|

|

336,245 |

|

|

325,084 |

|

|

304,849 |

|

|

376,063 |

|

Subordinated debt borrowings and other |

113,813 |

|

|

112,383 |

|

|

111,021 |

|

|

109,557 |

|

|

72,643 |

|

Total interest-bearing liabilities |

$ |

5,632,239 |

|

|

$ |

5,552,019 |

|

|

$ |

5,610,726 |

|

|

$ |

5,612,436 |

|

|

$ |

4,659,363 |

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing deposits |

$ |

1,352,785 |

|

|

$ |

1,371,615 |

|

|

$ |

1,411,202 |

|

|

$ |

1,389,134 |

|

|

$ |

1,207,443 |

|

Burke & Herbert Financial Services Corp.

Supplemental Information (unaudited)

As of or for the three months ended

(In thousands, except ratios and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

| Per common share information |

Basic earnings (loss) |

$ |

1.98 |

|

|

$ |

1.80 |

|

|

$ |

1.31 |

|

|

$ |

1.83 |

|

|

$ |

(1.41) |

|

Diluted earnings (loss) |

1.97 |

|

|

1.80 |

|

|

1.30 |

|

|

1.82 |

|

|

(1.41) |

|

| Cash dividends |

0.55 |

|

|

0.55 |

|

|

0.55 |

|

|

0.53 |

|

|

0.53 |

|

| Book value |

51.28 |

|

|

49.90 |

|

|

48.08 |

|

|

48.63 |

|

|

45.72 |

|

Tangible book value (non-GAAP1) |

45.73 |

|

|

44.17 |

|

|

42.06 |

|

|

42.32 |

|

|

39.11 |

|

|

|

|

|

|

|

|

|

|

|

Balance sheet-related (at period end, unless otherwise indicated) |

| Assets |

$ |

8,057,981 |

|

|

$ |

7,838,090 |

|

|

$ |

7,812,185 |

|

|

$ |

7,864,913 |

|

|

$ |

7,810,193 |

|

Average interest-earning assets |

7,248,238 |

|

|

7,171,931 |

|

|

7,273,770 |

|

|

7,238,636 |

|

|

5,994,383 |

|

| Loans (gross) |

5,590,457 |

|

|

5,647,507 |

|

|

5,672,236 |

|

|

5,574,037 |

|

|

5,616,724 |

|

| Loans (net) |

5,523,201 |

|

|

5,579,754 |

|

|

5,604,196 |

|

|

5,506,220 |

|

|

5,548,707 |

|

| Securities, available-for-sale, at fair value |

1,522,611 |

|

|

1,436,869 |

|

|

1,432,371 |

|

|

1,436,431 |

|

|

1,414,870 |

|

| Intangible assets |

49,114 |

|

|

53,002 |

|

|

57,300 |

|

|

61,598 |

|

|

65,895 |

|

| Goodwill |

34,149 |

|

|

32,842 |

|

|

32,783 |

|

|

32,783 |

|

|

32,783 |

|

| Non-interest-bearing deposits |

1,363,617 |

|

|

1,382,427 |

|

|

1,379,940 |

|

|

1,392,123 |

|

|

1,397,030 |

|

| Interest-bearing deposits |

5,027,357 |

|

|

5,159,444 |

|

|

5,135,299 |

|

|

5,208,702 |

|

|

5,242,541 |

|

| Deposits, total |

6,390,974 |

|

|

6,541,871 |

|

|

6,515,239 |

|

|

6,600,825 |

|

|

6,639,571 |

|

| Brokered deposits |

132,098 |

|

|

246,902 |

|

|

244,802 |

|

|

345,328 |

|

|

403,668 |

|

| Uninsured deposits |

1,963,566 |

|

|

1,943,227 |

|

|

1,926,724 |

|

|

1,999,403 |

|

|

1,931,786 |

|

| Short-term borrowings |

650,000 |

|

|

300,000 |

|

|

365,000 |

|

|

320,163 |

|

|

285,161 |

|

| Subordinated debt, net |

114,692 |

|

|

113,289 |

|

|

111,885 |

|

|

110,482 |

|

|

109,064 |

|

Unused borrowing capacity3 |

4,075,313 |

|

|

4,082,879 |

|

|

4,092,378 |

|

|

2,353,963 |

|

|

2,162,112 |

|

| Total equity |

780,018 |

|

|

758,000 |

|

|

730,157 |

|

|

738,059 |

|

|

693,126 |

|

| Total common equity |

769,605 |

|

|

747,587 |

|

|

719,744 |

|

|

727,646 |

|

|

682,713 |

|

| Accumulated other comprehensive income (loss) |

(87,854) |

|

|

(88,024) |

|

|

(95,720) |

|

|

(75,758) |

|

|

(100,430) |

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality |

|

|

|

|

|

|

|

|

|

| Provision for credit losses |

$ |

624 |

|

|

$ |

501 |

|

|

$ |

833 |

|

|

$ |

147 |

|

|

$ |

23,910 |

|

| Net loan charge-offs |

1,214 |

|

|

1,187 |

|

|

737 |

|

|

285 |

|

|

599 |

|

| Allowance for credit losses |

67,256 |

|

|

67,753 |

|

|

68,040 |

|

|

67,817 |

|

|

68,017 |

|

Total delinquencies (4) |

29,056 |

|

|

86,223 |

|

|

38,213 |

|

|

12,486 |

|

|

16,334 |

|

Nonperforming loans (5) |

85,531 |

|

|

64,756 |

|

|

38,368 |

|

|

35,872 |

|

|

32,842 |

|

(3) Includes Federal Home Loan Bank, Borrower-in-Custody (BIC), and correspondent bank availability.

(4) Total delinquencies represent accruing loans 30 days or more past due.

(5) Includes non-accrual loans and loans 90 days past due and still accruing.

9

Burke & Herbert Financial Services Corp.

Supplemental Information (unaudited)

As of or for the three months ended

(In thousands, except ratios and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

| Income statement |

| Interest income |

$ |

111,858 |

|

|

$ |

110,786 |

|

|

$ |

112,793 |

|

|

$ |

118,526 |

|

|

$ |

96,097 |

|

| Interest expense |

37,625 |

|

|

37,799 |

|

|

42,083 |

|

|

45,347 |

|

|

36,332 |

|

| Non-interest income |

12,877 |

|

|

10,023 |

|

|

11,791 |

|

|

10,616 |

|

|

9,505 |

|

Total revenue (non-GAAP1) |

87,110 |

|

|

83,010 |

|

|

82,501 |

|

|

83,795 |

|

|

69,270 |

|

| Non-interest expense |

49,305 |

|

|

49,664 |

|

|

61,410 |

|

|

50,826 |

|

|

64,432 |

|

Pretax, pre-provision earnings (non-GAAP1) |

37,805 |

|

|

33,346 |

|

|

21,091 |

|

|

32,969 |

|

|

4,838 |

|

| Provision for (recapture of) credit losses |

624 |

|

|

501 |

|

|

833 |

|

|

147 |

|

|

23,910 |

|

Income (loss) before income taxes |

37,181 |

|

|

32,845 |

|

|

20,258 |

|

|

32,822 |

|

|

(19,072) |

|

Income tax expense (benefit) |

7,284 |

|

|

5,644 |

|

|

465 |

|

|

5,200 |

|

|

(2,153) |

|

| Net income (loss) |

29,897 |

|

|

27,201 |

|

|

19,793 |

|

|

27,622 |

|

|

(16,919) |

|

| Preferred stock dividends |

225 |

|

|

225 |

|

|

225 |

|

|

225 |

|

|

225 |

|

Net income (loss) applicable to common shares |

$ |

29,672 |

|

|

$ |

26,976 |

|

|

$ |

19,568 |

|

|

$ |

27,397 |

|

|

$ |

(17,144) |

|

|

|

|

|

|

|

|

|

|

|

| Ratios |

| Return on average assets (annualized) |

1.51 |

% |

|

1.41 |

% |

|

1.00 |

% |

|

1.40 |

% |

|

(1.06) |

% |

| Return on average equity (annualized) |

15.50 |

|

|

14.57 |

|

|

10.49 |

|

|

15.20 |

|

|

(12.44) |

|

Net interest margin (non-GAAP1) |

4.17 |

|

|

4.18 |

|

|

3.91 |

|

|

4.07 |

|

|

4.06 |

|

| Efficiency ratio |

56.60 |

|

|

59.83 |

|

|

74.44 |

|

|

60.66 |

|

|

93.02 |

|

| Loan-to-deposit ratio |

87.47 |

|

|

86.33 |

|

|

87.06 |

|

|

84.44 |

|

|

84.59 |

|

Consolidated Common Equity Tier 1 (CET1) capital ratio2 |

12.21 |

|

|

11.77 |

|

|

11.53 |

|

|

11.40 |

|

|

10.91 |

|

Consolidated Total risk-based capital ratio2 |

15.26 |

|

|

14.79 |

|

|

14.57 |

|

|

14.45 |

|

|

13.91 |

|

Consolidated Leverage ratio2 |

10.42 |

|

|

10.12 |

|

|

9.80 |

|

|

9.66 |

|

|

9.04 |

|

| Allowance coverage ratio |

1.20 |

|

|

1.20 |

|

|

1.20 |

|

|

1.22 |

|

|

1.21 |

|

| Allowance for credit losses as a percentage of non-performing loans |

78.63 |

|

|

104.63 |

|

|

177.34 |

|

|

189.05 |

|

|

207.10 |

|

| Non-performing loans as a percentage of total loans |

1.53 |

|

|

1.15 |

|

|

0.68 |

|

|

0.64 |

|

|

0.58 |

|

| Non-performing assets as a percentage of total assets |

1.10 |

|

|

0.86 |

|

|

0.53 |

|

|

0.49 |

|

|

0.46 |

|

Net charge-offs to average loans (annualized) |

8.6 bps |

|

8.5 bps |

|

5.2 bps |

|

2.0 bps |

|

5.4 bps |

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating net income, adjusted diluted EPS, and adjusted non-interest expense (non-GAAP1) |

|

|

For the three months ended |

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

| Net income (loss) applicable to common shares |

|

$ |

29,672 |

|

|

$ |

26,976 |

|

|

$ |

19,568 |

|

|

$ |

27,397 |

|

|

$ |

(17,144) |

|

| Add back significant items (tax effected): |

|

|

|

|

|

|

|

|

|

|

| Merger-related |

|

— |

|

|

— |

|

|

7,069 |

|

|

2,449 |

|

|

18,806 |

|

| Day 2 non-PCD Provision |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

23,305 |

|

| Total significant items |

|

— |

|

|

— |

|

|

7,069 |

|

|

2,449 |

|

|

42,111 |

|

| Operating net income |

|

$ |

29,672 |

|

|

$ |

26,976 |

|

|

$ |

26,637 |

|

|

$ |

29,846 |

|

|

$ |

24,967 |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average dilutive shares |

|

15,023,807 |

|

|

15,026,376 |

|

|

15,038,442 |

|

|

15,040,145 |

|

|

12,262,979 |

|

Adjusted diluted EPS 6 |

|

$ |

1.97 |

|

|

$ |

1.80 |

|

|

$ |

1.77 |

|

|

$ |

1.98 |

|

|

$ |

2.04 |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense |

|

$ |

49,305 |

|

|

$ |

49,664 |

|

|

$ |

61,410 |

|

|

$ |

50,826 |

|

|

$ |

64,432 |

|

| Remove significant items: |

|

|

|

|

|

|

|

|

|

|

| Merger-related |

|

— |

|

|

— |

|

|

8,948 |

|

|

3,101 |

|

|

23,805 |

|

| Total significant items |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

8,948 |

|

|

$ |

3,101 |

|

|

$ |

23,805 |

|

| Adjusted non-interest expense |

|

$ |

49,305 |

|

|

$ |

49,664 |

|

|

$ |

52,462 |

|

|

$ |

47,725 |

|

|

$ |

40,627 |

|

Operating net income is a non-GAAP measure that is derived from net income adjusted for significant items. The Company believes that operating net income is useful in periods with certain significant items such as merger-related expenses or Day 2 non-PCD provision. The operating net income is more reflective of management’s ability to grow the business and manage expenses. Adjusted non-interest expense also removes these significant items, such as merger-related expenses. Management believes it represents a more normalized non-interest expense total for periods with identified significant items.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue (non-GAAP1) |

|

|

For the three months ended |

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

| Interest income |

|

$ |

111,858 |

|

|

$ |

110,786 |

|

|

$ |

112,793 |

|

|

$ |

118,526 |

|

|

$ |

96,097 |

|

| Interest expense |

|

37,625 |

|

|

37,799 |

|

|

42,083 |

|

|

45,347 |

|

|

36,332 |

|

| Non-interest income |

|

12,877 |

|

|

10,023 |

|

|

11,791 |

|

|

10,616 |

|

|

9,505 |

|

Total revenue (non-GAAP1) |

|

$ |

87,110 |

|

|

$ |

83,010 |

|

|

$ |

82,501 |

|

|

$ |

83,795 |

|

|

$ |

69,270 |

|

|

|

|

|

|

|

|

|

|

|

|

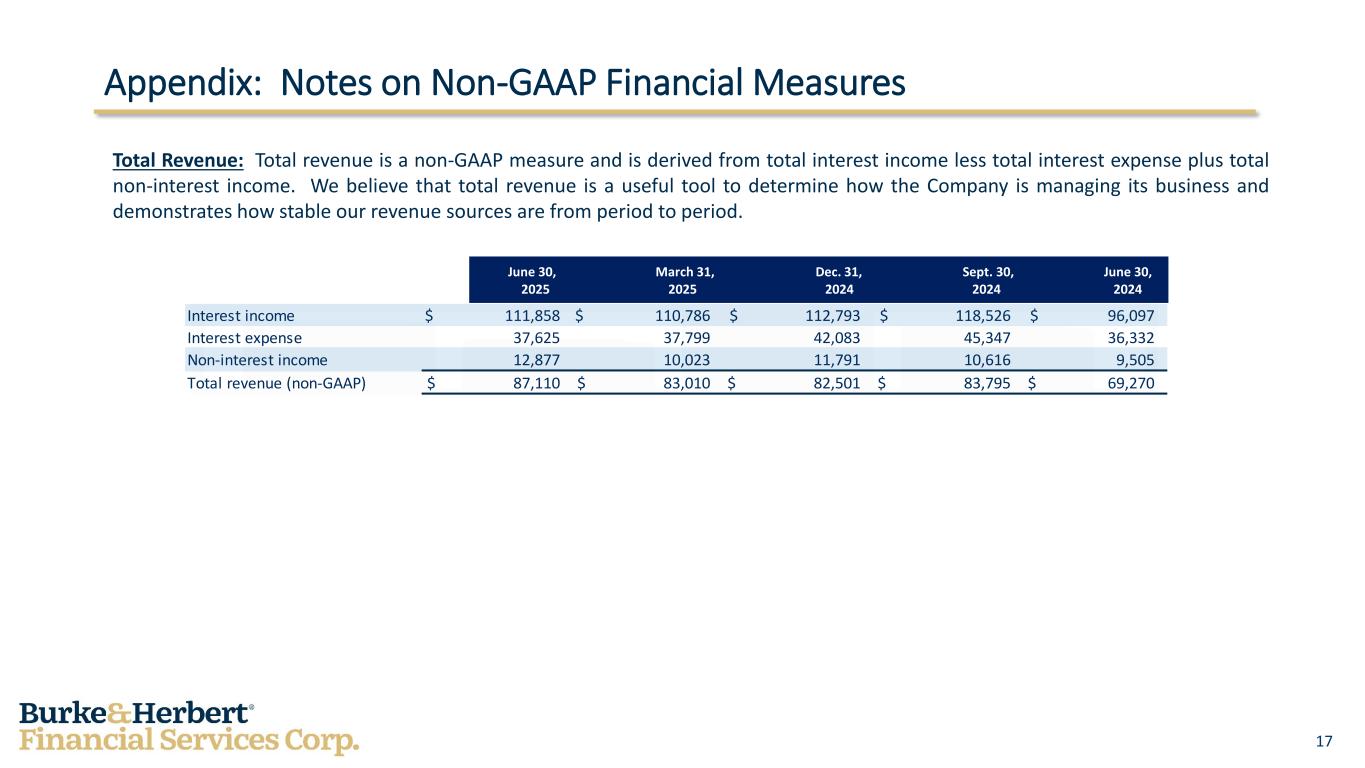

Total revenue is a non-GAAP measure and is derived from total interest income less total interest expense plus total non-interest income. We believe that total revenue is a useful tool to determine how the Company is managing its business and demonstrates how stable our revenue sources are from period to period.

(6) Weighted average diluted shares for Q2 2024 calculated only for computation of adjusted diluted EPS. Weighted average diluted shares for GAAP diluted EPS are the same as shares for calculating basic EPS due to the antidilutive effect of the diluted shares when considering the GAAP net loss for the quarter.

11

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax, Pre-Provision Earnings (non-GAAP1) |

|

|

|

|

For the three months ended |

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

Income (loss) before taxes |

|

$ |

37,181 |

|

|

$ |

32,845 |

|

|

$ |

20,258 |

|

|

$ |

32,822 |

|

|

$ |

(19,072) |

|

| Provision for (recapture of) credit losses |

|

624 |

|

|

501 |

|

|

833 |

|

|

147 |

|

|

23,910 |

|

Pretax, pre-provision earnings (non-GAAP1) |

|

$ |

37,805 |

|

|

$ |

33,346 |

|

|

$ |

21,091 |

|

|

$ |

32,969 |

|

|

$ |

4,838 |

|

|

|

|

|

|

|

|

|

|

|

|

Pretax, pre-provision earnings is a non-GAAP measure and is based on adjusting income before income taxes and to exclude provision for (recapture of) credit losses. We believe that pretax, pre-provision earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible Common Equity (non-GAAP1) |

|

|

|

|

For the three months ended |

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

| Common shareholders' equity |

|

$ |

769,605 |

|

|

$ |

747,587 |

|

|

$ |

719,744 |

|

|

$ |

727,646 |

|

|

$ |

682,713 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

| Intangible assets |

|

49,114 |

|

|

53,002 |

|

|

57,300 |

|

|

61,598 |

|

|

65,895 |

|

| Goodwill |

|

34,149 |

|

|

32,842 |

|

|

32,783 |

|

|

32,783 |

|

|

32,783 |

|

Tangible common equity (non-GAAP1) |

|

$ |

686,342 |

|

|

$ |

661,743 |

|

|

$ |

629,661 |

|

|

$ |

633,265 |

|

|

$ |

584,035 |

|

| Shares outstanding at end of period |

|

15,007,712 |

|

|

14,982,807 |

|

|

14,969,104 |

|

|

14,963,003 |

|

|

14,932,169 |

|

| Tangible book value per common share |

|

$ |

45.73 |

|

|

$ |

44.17 |

|

|

$ |

42.06 |

|

|

$ |

42.32 |

|

|

$ |

39.11 |

|

In management's view, tangible common equity measures are capital adequacy metrics that may be meaningful to the Company, as well as analysts and investors, in assessing the Company's use of equity and in facilitating comparisons with peers. These non-GAAP measures are valuable indicators of a financial institution's capital strength because they eliminate intangible assets from stockholders' equity and retain the effect of accumulated other comprehensive income/(loss) in stockholders' equity.

Burke & Herbert Financial Services Corp.

Non-GAAP Reconciliations (unaudited)

(In thousands, except ratios and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Margin & Taxable-Equivalent Net Interest Income (non-GAAP1) |

|

|

|

|

As of or for the three months ended |

|

|

June 30 |

|

March 31 |

|

December 31 |

|

September 30 |

|

June 30 |

|

|

2025 |

|

2025 |

|

2024 |

|

2024 |

|

2024 |

| Net interest income |

|

$ |

74,233 |

|

|

$ |

72,987 |

|

|

$ |

70,710 |

|

|

$ |

73,179 |

|

|

$ |

59,765 |

|

| Taxable-equivalent adjustments |

|

1,059 |

|

|

881 |

|

|

858 |

|

|

847 |

|

|

688 |

|

| Net interest income (Fully Taxable-Equivalent - FTE) |

|

$ |

75,292 |

|

|

$ |

73,868 |

|

|

$ |

71,568 |

|

|

$ |

74,026 |

|

|

$ |

60,453 |

|

|

|

|

|

|

|

|

|

|

|

|

Average interest-earning assets |

|

$ |

7,248,238 |

|

|

$ |

7,171,931 |

|

|

$ |

7,273,770 |

|

|

$ |

7,238,636 |

|

|

$ |

5,994,383 |

|

Net interest margin (non-GAAP1) |

|

4.17 |

% |

|

4.18 |

% |

|

3.91 |

% |

|

4.07 |

% |

|

4.06 |

% |

|

|

|

|

|

|

|

|

|

|

|

The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use net interest income on a fully taxable-equivalent (FTE) basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. FTE net interest income is calculated by adding the tax benefit on certain financial interest earning assets, whose interest is tax-exempt, to total interest income then subtracting total interest expense. Management believes FTE net interest income is a standard practice in the banking industry, and when net interest income is adjusted on an FTE basis, yields on taxable, nontaxable, and partially taxable assets are comparable; however, the adjustment to an FTE basis has no impact on net income and this adjustment is not permitted under GAAP. FTE net interest income is only used for calculating FTE net interest margin, which is calculated by annualizing FTE net interest income and then dividing by the average earning assets. The tax rate used for this adjustment is 21%. Net interest income shown elsewhere in this presentation is GAAP net interest income.