| Form 20-F | X | Form 40-F | ||||||||||||

| EXHIBIT | |||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| Lavoro Limited | |||||||||||||||||

| By: | /s/ Ruy Cunha | ||||||||||||||||

| Name: | Ruy Cunha | ||||||||||||||||

| Title: | Chief Executive Officer | ||||||||||||||||

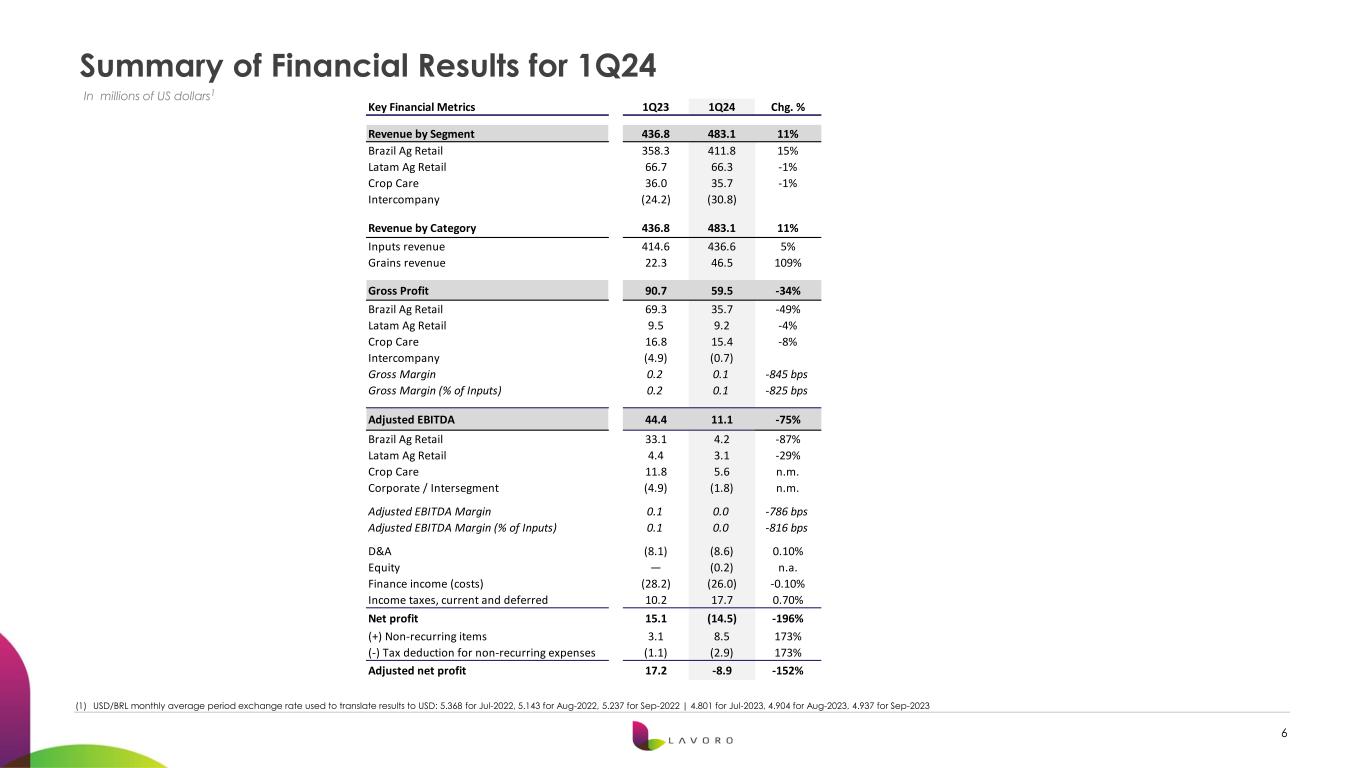

| Key Financial Metrics | 1Q23 | 1Q24 | Chg. % | |||||||||||

| (in millions of US dollars) | ||||||||||||||

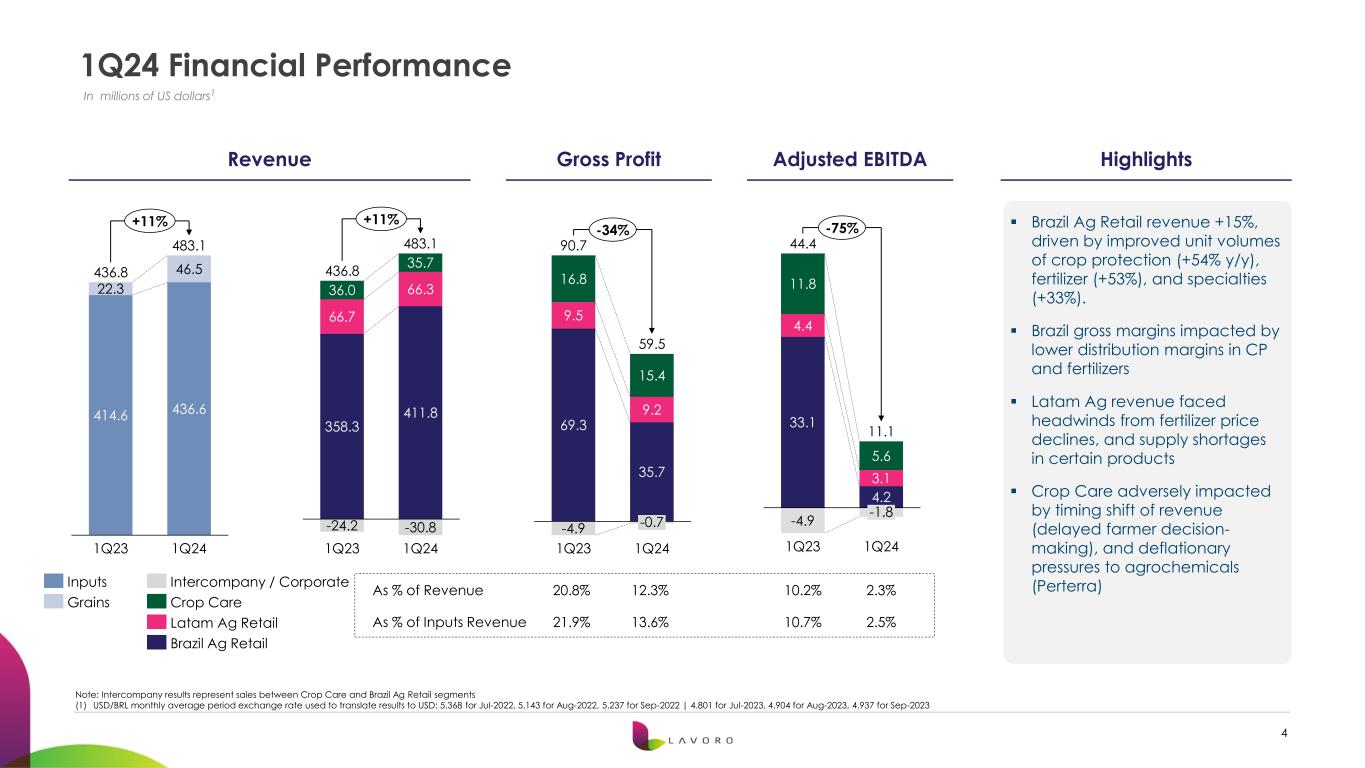

| Revenue by Segment | 436.8 | 483.1 | 11 | % | ||||||||||

| Brazil Ag Retail | 358.3 | 411.8 | 15 | % | ||||||||||

| Latam Ag Retail | 66.7 | 66.3 | -1 | % | ||||||||||

| Crop Care | 36.0 | 35.7 | -1 | % | ||||||||||

| Intercompany | (24.2) | (30.8) | ||||||||||||

| Revenue by Category | 436.8 | 483.1 | 11 | % | ||||||||||

| Inputs revenue | 414.6 | 436.6 | 5 | % | ||||||||||

| Grains revenue | 22.3 | 46.5 | 109 | % | ||||||||||

| Gross Profit | 90.7 | 59.5 | -34 | % | ||||||||||

| Brazil Ag Retail | 69.3 | 35.7 | -49 | % | ||||||||||

| Latam Ag Retail | 9.5 | 9.2 | -4 | % | ||||||||||

| Crop Care | 16.8 | 15.4 | -8 | % | ||||||||||

| Intercompany | (4.9) | (0.7) | ||||||||||||

| Gross Margin | 20.8 | % | 12.3 | % | -845 bps | |||||||||

| Gross Margin (% of Inputs) | 21.9 | % | 13.6 | % | -825 bps | |||||||||

| Adjusted EBITDA | 44.4 | 11.1 | (75) | % | ||||||||||

| Brazil Ag Retail | 33.1 | 4.2 | (87) | % | ||||||||||

| Latam Ag Retail | 4.4 | 3.1 | (29) | % | ||||||||||

| Crop Care | 11.8 | 5.6 | n.m. | |||||||||||

| Corporate / Intersegment2 | (4.9) | (1.8) | n.m. | |||||||||||

| Adjusted EBITDA Margin | 10.2 | % | 2.3 | % | -786 bps | |||||||||

| Adjusted EBITDA Margin (% of Inputs) | 10.7 | % | 2.5 | % | -816 bps | |||||||||

| D&A | (8.1) | (8.6) | 0.1% | |||||||||||

| Equity | — | (0.2) | n.a. | |||||||||||

| Finance income (costs) | (28.2) | (26.0) | -0.1% | |||||||||||

| Income taxes, current and deferred | 10.2 | 17.7 | 0.7% | |||||||||||

| Net profit | 15.1 | (14.5) | -196 | % | ||||||||||

| (+) Non-recurring items | 3.1 | 8.5 | 173 | % | ||||||||||

| (-) Tax deduction for non-recurring expenses | (1.1) | (2.9) | 173 | % | ||||||||||

| Adjusted net profit | 17.2 | (8.9) | -152 | % | ||||||||||

| Brazil Ag Retail | 1Q23 | 1Q24 | Chg. % | |||||||||||

| (in millions of US dollars) | ||||||||||||||

| Inputs revenue | 341.3 | 371.6 | 9 | % | ||||||||||

| Grains revenue | 17.0 | 40.2 | 136 | % | ||||||||||

| Revenue | 358.3 | 411.8 | 15 | % | ||||||||||

| Gross Profit | 69.3 | 35.7 | -49 | % | ||||||||||

| Gross Margin | 19.4 | % | 8.7 | % | -1069 bps | |||||||||

| Gross Margin (% of Inputs) | 20.3 | % | 9.6 | % | -1072 bps | |||||||||

| Adjusted EBITDA | 33.1 | 4.2 | -87 | % | ||||||||||

| Adjusted EBITDA margin | 9.2 | % | 1.0 | % | -823 bps | |||||||||

| Adjusted EBITDA margin (% of Inputs) | 9.7 | % | 1.1 | % | -858 bps | |||||||||

| Latam Ag Retail | 1Q23 | 1Q24 | Chg. % | |||||||||||

| (in millions of US dollars) | ||||||||||||||

| Inputs revenue | 61.4 | 60.1 | -2 | % | ||||||||||

| Grains revenue | 5.3 | 6.2 | 18 | % | ||||||||||

| Revenue | 66.7 | 66.3 | -1 | % | ||||||||||

| Gross Profit | 9.5 | 9.2 | -4 | % | ||||||||||

| Gross Margin | 14.3 | % | 13.8 | % | -48 bps | |||||||||

| Gross Margin (% of Inputs) | 15.5 | % | 15.2 | % | -27 bps | |||||||||

| Adjusted EBITDA | 4.4 | 3.1 | -29 | % | ||||||||||

| Adjusted EBITDA margin | 6.6 | % | 4.7 | % | -188 bps | |||||||||

| Adjusted EBITDA margin (% of Inputs) | 7.2 | % | 5.2 | % | -196 bps | |||||||||

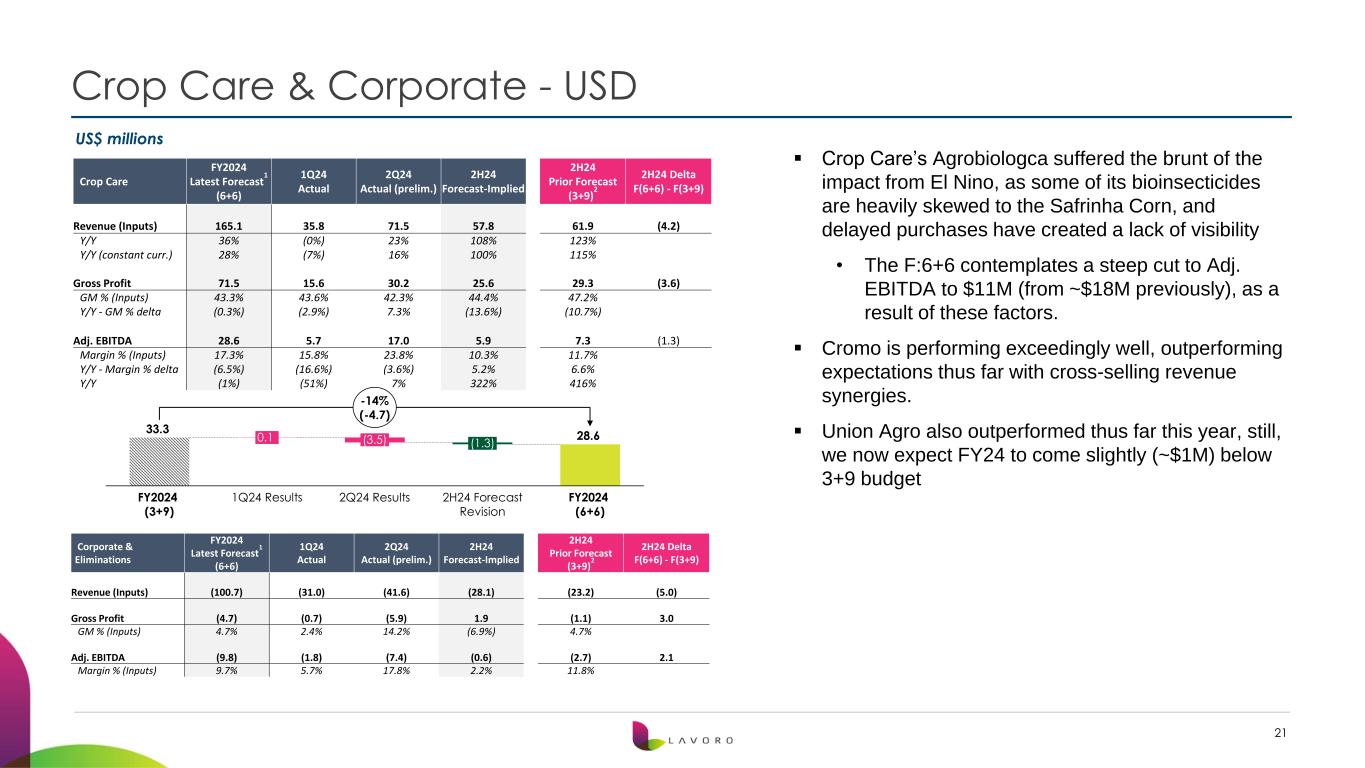

| Crop Care | 1Q23 | 1Q24 | Chg. % | |||||||||||

| (in millions of US dollars) | ||||||||||||||

| Revenue | 36.0 | 35.7 | -1 | % | ||||||||||

| Gross Profit | 16.8 | 15.4 | 22 | % | ||||||||||

| Gross Margin | 46.6 | % | 43.3 | % | -331 bps | |||||||||

| Adjusted EBITDA | 11.8 | 5.6 | -53 | % | ||||||||||

| Adjusted EBITDA margin | 32.6 | % | 15.6 | % | -1,703 bps | |||||||||

| Previous FY2024 Guidance | Revised FY2024 Guidance | |||||||||||||||||||

| Consolidated Financials Outlook | Low | High | Low | High | ||||||||||||||||

| (in millions of US dollars) | ||||||||||||||||||||

| Revenue | 2,000 | 2,300 | 2,000 | 2,300 | ||||||||||||||||

| Inputs revenue | 1,700 | 2,000 | 1,700 | 2,000 | ||||||||||||||||

| Adjusted EBITDA | 135 | 165 | 80 | 110 | ||||||||||||||||

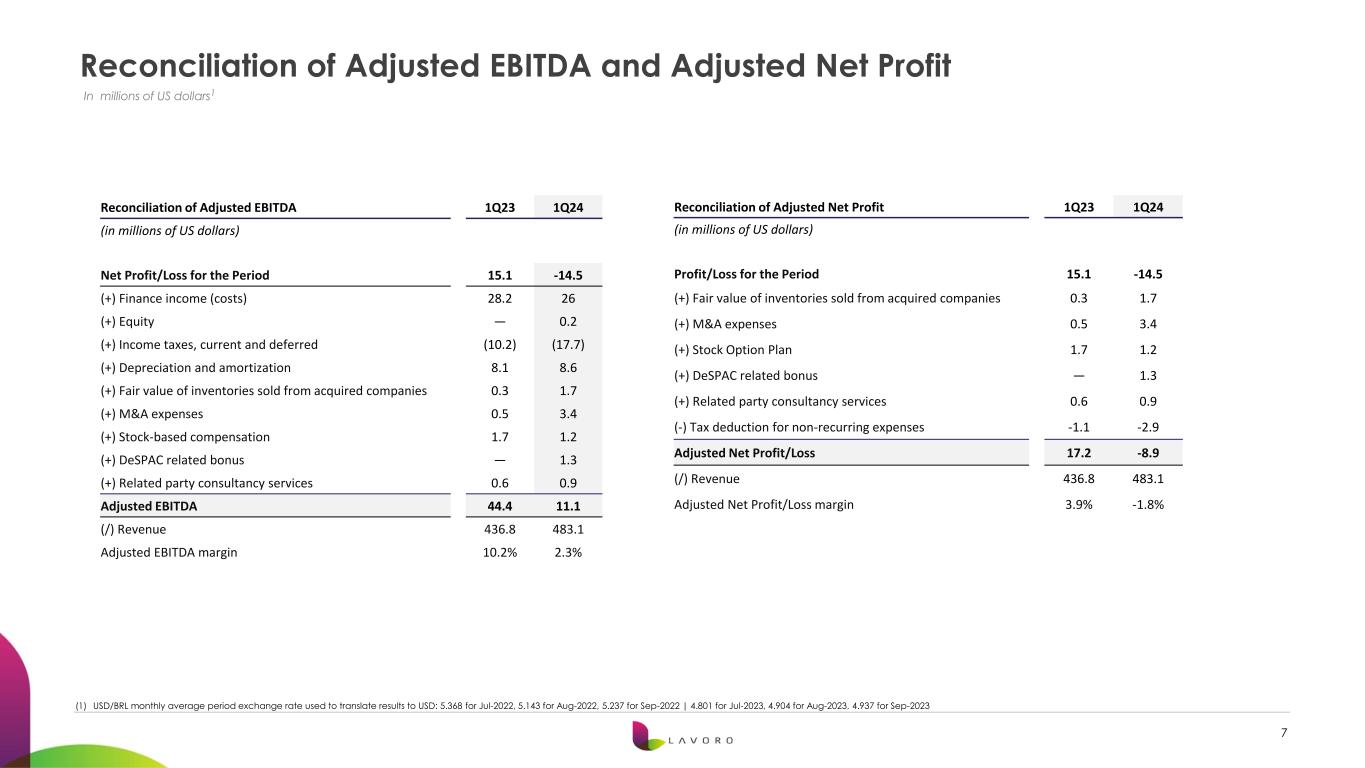

| Reconciliation of Adjusted EBITDA | 1Q23 | 1Q24 | |||||||||

| (in millions of US dollars) | |||||||||||

| Net Profit/Loss for the Period | 15.1 | (14.5) | |||||||||

| (+) Finance income (costs) | 28.2 | 26.0 | |||||||||

| (+) Equity | — | 0.2 | |||||||||

| (+) Income taxes, current and deferred | (10.2) | (17.7) | |||||||||

| (+) Depreciation and amortization | 8.1 | 8.6 | |||||||||

| (+) Fair value of inventories sold from acquired companies | 0.3 | 1.7 | |||||||||

| (+) M&A expenses | 0.5 | 3.4 | |||||||||

| (+) Stock-based compensation | 1.7 | 1.2 | |||||||||

| (+) DeSPAC related bonus | — | 1.3 | |||||||||

| (+) Related party consultancy services | 0.6 | 0.9 | |||||||||

| Adjusted EBITDA | 44.4 | 11.1 | |||||||||

| (/) Revenue | 436.8 | 483.1 | |||||||||

| Adjusted EBITDA margin | 10.2 | % | 2.3 | % | |||||||

| Reconciliation of Adjusted Net Profit | 1Q23 | 1Q24 | |||||||||

| (in millions of US dollars) | |||||||||||

| Profit/Loss for the Period | 15.1 | (14.5) | |||||||||

| (+) Fair value of inventories sold from acquired companies | 0.3 | 1.7 | |||||||||

| (+) M&A expenses | 0.5 | 3.4 | |||||||||

| (+) Stock Option Plan | 1.7 | 1.2 | |||||||||

| (+) DeSPAC related bonus | — | 1.3 | |||||||||

| (+) Related party consultancy services | 0.6 | 0.9 | |||||||||

| (-) Tax deduction for non-recurring expenses | (1.1) | (2.9) | |||||||||

| Adjusted Net Profit/Loss | 17.2 | (8.9) | |||||||||

| (/) Revenue | 436.8 | 483.1 | |||||||||

| Adjusted Net Profit/Loss margin | 3.9 | % | -1.8 | % | |||||||

|

Interim condensed consolidated statement of financial position

As of September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Unaudited interim condensed consolidated financial statements | |||||

| Interim condensed consolidated statement of financial position | |||||

| Interim condensed consolidated statement of profit or loss | |||||

| Interim condensed consolidated statement of comprehensive income or loss | |||||

| Interim condensed consolidated statement of changes in equity | |||||

| Interim condensed consolidated statement of cash flows | |||||

| ||

|

Interim condensed consolidated statement of financial position

As of September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Notes | September 30, 2023 |

June, 30 2023 | |||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash equivalents | 4 | 564,312 | 564,294 | ||||||||

| Trade receivables | 5 | 3,070,618 | 2,667,057 | ||||||||

| Inventories | 8 | 2,556,598 | 1,868,204 | ||||||||

| Taxes recoverable | 9 | 73,781 | 57,001 | ||||||||

| Derivative financial instruments | 7 | 39,145 | 40,410 | ||||||||

| Commodity forward contracts | 10 | 92,779 | 114,861 | ||||||||

| Advances to suppliers | 679,772 | 192,119 | |||||||||

| Other assets | 27,783 | 32,701 | |||||||||

| Total current assets | 7,104,788 | 5,536,647 | |||||||||

| Non-current assets | |||||||||||

| Restricted cash | 19 | 147,917 | 139,202 | ||||||||

| Trade receivables | 5 | 31,559 | 41,483 | ||||||||

| Other assets | 20,870 | 8,390 | |||||||||

| Judicial deposits | 24,246 | 8,820 | |||||||||

| Right-of-use assets | 12 | 171,332 | 173,679 | ||||||||

| Taxes recoverable | 9 | 330,979 | 282,903 | ||||||||

| Deferred tax assets | 20 | 382,383 | 329,082 | ||||||||

| Investments | 2,376 | - | |||||||||

| Property, plant and equipment | 12 | 203,395 | 196,588 | ||||||||

| Intangible assets | 13 | 941,152 | 807,192 | ||||||||

| Total non-current assets | 2,256,209 | 1,987,339 | |||||||||

| Total assets | 9,360,997 | 7,523,984 | |||||||||

| ||

|

Interim condensed consolidated statement of financial position

As of September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Notes | September 30, 2023 |

June 30, 2023 | |||||||||

| Liabilities | |||||||||||

| Current liabilities | |||||||||||

| Trade payables | 14 | 3,620,208 | 2,575,701 | ||||||||

| Trade payables – Supplier finance | 14(c) | - | 26,157 | ||||||||

| Lease liabilities | 11 | 82,306 | 85,865 | ||||||||

| Borrowings | 15 | 1,700,925 | 922,636 | ||||||||

| Obligations to FIAGRO quota holders | 16 | 160,249 | 150,018 | ||||||||

| Payables for the acquisition of subsidiaries | 17 | 236,783 | 221,509 | ||||||||

| Derivative financial instruments | 7 | 46,281 | 44,008 | ||||||||

| Commodity forward contracts | 10 | 82,538 | 207,067 | ||||||||

| Salaries and social charges | 201,246 | 223,376 | |||||||||

| Taxes payable | 49,381 | 37,105 | |||||||||

| Dividends payable | 1,324 | 1,619 | |||||||||

| Warrant liabilities | 19 | 37,866 | 36,446 | ||||||||

| Advances from customers | 22 | 630,301 | 488,578 | ||||||||

| Other liabilities | 90,788 | 34,388 | |||||||||

| Total current liabilities | 6,940,196 | 5,054,473 | |||||||||

| Non-current liabilities | |||||||||||

| Trade payables | 14 | 333 | 2,547 | ||||||||

| Lease liabilities | 11 | 100,616 | 98,554 | ||||||||

| Borrowings | 15 | 37,484 | 42,839 | ||||||||

| Payables for the acquisition of subsidiaries | 17 | 31,632 | 53,700 | ||||||||

| Provision for contingencies | 21 | 12,729 | 8,845 | ||||||||

| Liability for FPA Shares | 19 | 144,572 | 139,133 | ||||||||

| Other liabilities | 181 | 223 | |||||||||

| Taxes payable | 16,100 | 963 | |||||||||

| Deferred tax liabilities | 20 | 18,499 | 12,351 | ||||||||

| Total non-current liabilities | 362,146 | 359,155 | |||||||||

| Equity | 24 | ||||||||||

| Share Capital | 591 | 591 | |||||||||

| Additional Paid-in Capital | 2,127,299 | 2,134,339 | |||||||||

| Capital reserve | 20,497 | 14,533 | |||||||||

| Other comprehensive loss | (14,440) | (28,634) | |||||||||

| Accumulated losses | (327,247) | (260,710) | |||||||||

| Equity attributable to shareholders of the Parent Company | 1,806,700 | 1,860,119 | |||||||||

| Non-controlling interests | 251,955 | 250,238 | |||||||||

| ||

|

Interim condensed consolidated statement of financial position

As of September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Total equity | 2,058,655 | 2,110,357 | |||||||||

| Total liabilities and equity | 9,360,997 | 7,523,984 | |||||||||

| ||

|

Interim condensed consolidated statement of profit or loss

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Notes | September 30, 2023 |

September 30, 2022 |

|||||||||

| Revenue | 25 | 2,365,956 | 2,285,964 | ||||||||

| Cost of goods sold | 26 | (2,072,671) | (1,811,756) | ||||||||

| Gross profit | 293,285 | 474,208 | |||||||||

| Operating expenses | |||||||||||

| Sales, general and administrative expenses | 26 | (320,238) | (315,425) | ||||||||

| Other operating (expenses) income, net | 352 | 13,617 | |||||||||

| Share of profit of an associate | (967) | - | |||||||||

| Operating profit | (27,568) | 172,400 | |||||||||

| Finance Income (costs) | |||||||||||

| Finance income | 27 | 85,899 | 88,819 | ||||||||

| Finance costs | 27 | (235,987) | (227,420) | ||||||||

| Other financial income (costs) | 27 | 21,136 | (9,219) | ||||||||

| Profit (loss) before income taxes | (156,520) | 24,580 | |||||||||

| Income taxes | |||||||||||

| Current | 20 | 38,493 | 16,232 | ||||||||

| Deferred | 20 | 47,030 | 37,267 | ||||||||

| Profit (loss) for the year | (70,997) | 78,079 | |||||||||

| Attributable to: | |||||||||||

| Net investment of the parent/ Equity holders of the parent | (66,537) | 59,615 | |||||||||

| Non-controlling interests | (4,460) | 18,464 | |||||||||

| Earnings (loss) per share | |||||||||||

| Basic, profit (loss) for the period attributable to net investment of the parent/ equity holders of the parent | 24 | (0.59) | 0.52 | ||||||||

| Diluted, profit (loss) for the period attributable to net investment of the parent/ equity holders of the parent | 24 | (0.59) | 0.52 | ||||||||

| ||

|

Interim consolidated statement of comprehensive income or loss

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| September 30, 2023 | September 30, 2022 | |||||||

| Profit (loss) for the period | (70,997) | 78,079 | ||||||

| Items that may be reclassified to profit or loss in subsequent periods | ||||||||

| Exchange differences on translation of foreign operations | 14,194 | 61,024 | ||||||

| Total comprehensive (loss) income for the year | (56,803) | 139,103 | ||||||

| Attributable to: | ||||||||

| Net investment of the parent/ equity holders of the parent | (52,343) | 120,639 | ||||||

| Non-controlling interests | (4,460) | 18,464 | ||||||

| ||

|

Interim condensed consolidated statement of changes in equity

For the three-month period ended September 30, 2023 and 2022

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Notes | Net investment of the Parent | Share Capital | Additional Paid-in Capital |

Share-Based Compensation reserve | Acumulated gain/losses | Foreign currency translation reserve |

Total | Non-controlling interest | Total Equity/ Net Investment |

|||||||||||||||||||||||

| At June 30, 2022 | 1,451,647 | - | - | - | - | - | 1,451,647 | 218,080 | 1,669,727 | |||||||||||||||||||||||

| Exchange differences on translation of foreign operations | (1,374) | - | - | - | - | - | (1,374) | - | (1,374) | |||||||||||||||||||||||

| Share-based payment | 8,912 | - | - | - | - | - | 8,912 | - | 8,912 | |||||||||||||||||||||||

| Acquisition of non-controlling interests | (8,058) | - | - | - | - | - | (8,058) | - | (8,058) | |||||||||||||||||||||||

| Acquisition of subsidiaries | - | - | - | - | - | - | - | (4,597) | (4,597) | |||||||||||||||||||||||

| Other | - | - | - | - | - | - | - | (8,109) | (8,109) | |||||||||||||||||||||||

| Profit for the period | 59,615 | - | - | - | - | - | 59,615 | 18,464 | 78,079 | |||||||||||||||||||||||

| At September 30, 2022 | 1,510,742 | - | - | - | - | - | 1,510,742 | 223,838 | 1,734,580 | |||||||||||||||||||||||

| At June 30, 2023 | - | 591 | 2,134,339 | 14,533 | (260,710) | (28,634) | 1,860,119 | 250,238 | 2,110,357 | |||||||||||||||||||||||

| Exchange differences on translation of foreign operations | - | - | - | - | - | 14,194 | 14,194 | - | 14,194 | |||||||||||||||||||||||

| Share-based payment | 24 | - | - | - | 5,964 | - | - | 5,964 | - | 5,964 | ||||||||||||||||||||||

| Acquisition of subsidiaries | 18 | - | - | - | - | - | - | - | 2,118 | 2,118 | ||||||||||||||||||||||

| Other | - | - | (7,040) | - | - | - | (7,040) | 4,059 | (2,981) | |||||||||||||||||||||||

| Loss for the period | - | - | - | - | (66,537) | - | (66,537) | (4,460) | (70,997) | |||||||||||||||||||||||

| At September 30, 2023 | — | 591 | 2,127,299 | 20,497 | (327,247) | (14,440) | 1,806,700 | 251,955 | 2,058,655 | |||||||||||||||||||||||

|

8 |

||||

|

Interim condensed consolidated statement of cash flows

For the three-month period ended September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Notes | September 30, 2023 |

September 30, 2022 |

|||||||||

| Operating activities: | |||||||||||

| Profit (loss) before income taxes | (156,520) | 24,580 | |||||||||

| Adjustments to reconcile profit (loss) for the period to net cash flow: | |||||||||||

| Allowance for expected credit losses | 26 | 26,496 | 12,061 | ||||||||

| Foreign exchange diferences | 27 | 4,862 | 11,889 | ||||||||

| Accrued interest expenses | 27 | 80,143 | 53,265 | ||||||||

| Interest arising from revenue contracts | 27 | (65,647) | (65,129) | ||||||||

| Interest on trade payables | 27 | 142,360 | 148,911 | ||||||||

| Loss (gain) on derivatives | 27 | (26,281) | 450 | ||||||||

| Interest from tax benefits | 27 | (10,465) | (7,407) | ||||||||

| Fair value on commodity forward contracts | 27 | 284 | (3,121) | ||||||||

| Gain on changes in fair value of warrants | 1,420 | - | |||||||||

| Amortization of intangibles | 26 | 18,376 | 24,350 | ||||||||

| Amortization of right-of-use assets | 26 | 19,441 | 16,613 | ||||||||

| Depreciation | 26 | 4,515 | 3,578 | ||||||||

| Losses and damages of inventories | 26 | 1,565 | 4,209 | ||||||||

| Provisions for contingencies | 3,884 | 8,313 | |||||||||

| Share-based payment | 24 | 5,964 | 8,911 | ||||||||

| Share of profit of an associate | 967 | - | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Assets | |||||||||||

| Trade receivables | (446,075) | (715,626) | |||||||||

| Inventories | (643,982) | (897,943) | |||||||||

| Advances to suppliers | (480,712) | (499,853) | |||||||||

| Derivative financial instruments | 29,819 | (1,106) | |||||||||

| Taxes recoverable | (15,651) | (19,360) | |||||||||

| Other receivables | (122,747) | 13,987 | |||||||||

| Liabilities | |||||||||||

| Trade payables | 1,057,664 | 1,081,930 | |||||||||

| Advances from customers | 138,212 | 473,146 | |||||||||

| Salaries and social charges | (23,781) | (25,143) | |||||||||

| Taxes payable | 23,719 | 36,057 | |||||||||

| Other payables | 72,283 | 152,902 | |||||||||

|

9 |

||||

|

Interim condensed consolidated statement of cash flows

For the three-month period ended September 30, 2023

(In thousands of Brazilian reais - R$, except if otherwise indicated)

|

|

||||

| Interest paid on borrowings and FIAGRO quota holders | (84,501) | (45,644) | |||||||||

| Interest paid on acquisitions of subsidiary | (4,461) | (2,652) | |||||||||

| Interest paid on trade payables and lease liabilities | (234,048) | (307,574) | |||||||||

| Interest received from revenue contracts | 86,825 | 122,981 | |||||||||

| Income taxes paid/received | 5,578 | (40,004) | |||||||||

| Net cash flows from (used in) operating activities | (590,494) | (432,429) | |||||||||

| Investing activities: | |||||||||||

| Acquisition of subsidiary, net of cash acquired | (109,724) | (91,773) | |||||||||

| Additions to property, plant and equipment and intangible assets | (23,896) | (57,201) | |||||||||

| Proceeds from the sale of property, plant and equipment | 3,720 | 32 | |||||||||

| Net cash flows used in investing activities | (129,900) | (148,942) | |||||||||

| Financing activities: | |||||||||||

| Proceeds from borrowings | 15 | 1,218,074 | 731,007 | ||||||||

| Repayment of borrowings | 15 | (481,957) | (156,751) | ||||||||

| Payment of principal portion of lease liabilities | 11 | (18,787) | (15,171) | ||||||||

| Proceeds from FIAGRO quota holders, net of transaction costs | 16 | 137,496 | 141,645 | ||||||||

| Repayment of FIAGRO quota holders | 16 | (117,297) | (6,632) | ||||||||

| Trade payables – Supplier finance | 14(c) | (26,157) | - | ||||||||

| Acquisition of non-controlling interests | - | (31,500) | |||||||||

| Dividend payments | (295) | - | |||||||||

| Net cash flows provided by financing activities | 711,077 | 662,598 | |||||||||

| Net increase (decrease) in cash equivalents | (9,317) | 81,228 | |||||||||

| Net foreign exchange difference | 9,335 | - | |||||||||

| Cash equivalents at beginning of year | 564,294 | 254,413 | |||||||||

| Cash equivalents at end of year | 564,312 | 335,641 | |||||||||

|

10 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

11 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Equity interest | ||||||||||||||

| Name | Core activities | Location | September 30, 2023 | June 30, 2023 | ||||||||||

| Corporate: | ||||||||||||||

|

12 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Lavoro Agro Limited | Holding | George Town – Cayman Island | 100% | 100% | ||||||||||

| Lavoro America Inc. | Holding | California - USA | 100% | 100% | ||||||||||

| Lavoro Merger Sub II Limited (i) | Holding | George Town – Cayman Island | 100% | 100% | ||||||||||

| Lavoro Agro Cayman II | Holding | George Town – Cayman Island | 100% | 100% | ||||||||||

| Lavoro Latam SL | Holding | Madrid - Spain | 100% | 100% | ||||||||||

| Lavoro Uruguay S.A. (formerly Malinas SA) | Holding | Montevideu – Uruguay | 100% | 100% | ||||||||||

| Lavoro Brazil: | ||||||||||||||

| Lavoro Agro Holding S.A. | Holding | São Paulo – Brazil | 100% | 100% | ||||||||||

| Lavoro Agrocomercial S.A. | Distributor of agricultural inputs | Rondonópolis – Brazil | 97.42% | 97.42% | ||||||||||

| Agrocontato Comércio e Representações de Produtos Agropecuários S.A. | Distributor of agricultural inputs | Sinop – Brazil | 97.42% | 97.42% | ||||||||||

| PCO Comércio, Importação, Exportação e Agropecuária Ltda. | Distributor of agricultural inputs | Campo Verde – Brazil | 97.42% | 97.42% | ||||||||||

| Agrovenci Distribuidora de Insumos Agrícolas Ltda. (MS) | Distributor of agricultural inputs | Chapadão do Sul – Brazil | 93.11% | 93.11% | ||||||||||

| Produtiva Agronegócios Comércio e Representação Ltda. | Distributor of agricultural inputs | Paracatu – Brazil | 87.40% | 87.40% | ||||||||||

| Facirolli Comércio e Representação S.A. (Agrozap) | Distributor of agricultural inputs | Uberaba – Brazil | 62.61%- | 62.61%- | ||||||||||

| Agrovenci Comércio, Importação, Exportação e Agropecuária Ltda. | Distributor of agricultural inputs | Campo Verde – Brazil | 97.42% | 97.42% | ||||||||||

| Central Agrícola Rural Distribuidora de Defensivos Ltda. | Distributor of agricultural inputs | Vilhena – Brazil | 97.42% | 97.42% | ||||||||||

| Distribuidora Pitangueiras de Produtos Agropecuários S.A. | Distributor of agricultural inputs | Ponta Grossa – Brazil | 93.11% | 93.11% | ||||||||||

| Produtec Comércio e Representações S.A. | Distributor of agricultural inputs | Cristalina – Brazil | 87.4% | 87.4% | ||||||||||

|

13 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Qualiciclo Agrícola S.A. | Distributor of agricultural inputs | Limeira – Brazil | 66.75% | 66.75% | ||||||||||

| Desempar Participações Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Denorpi Distribuidora de Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Deragro Distribuidora de Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Desempar Tecnologia Ltda. | Holding | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Futuragro Distribuidora de Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Plenafértil Distribuidora de Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Realce Distribuidora de Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Palmeira – Brazil | 93.11% | 93.11% | ||||||||||

| Cultivar Agrícola Comércio, Importação e Exportação S.A. | Distributor of agricultural inputs | Chapadão do Sul – Brazil | 93.11% | 93.11% | ||||||||||

| Nova Geração. | Distributor of agricultural inputs | Pinhalzinho – Brazil | 66.75% | 66.75% | ||||||||||

| Floema Soluções Nutricionais de Cultivos Ltda. | Distributor of agricultural inputs | Uberaba – Brazil | 62.61% | 62.61% | ||||||||||

| Casa Trevo Participações S.A. | Holding | Nova Prata – Brazil | 79.14% | 79.14% | ||||||||||

| Casa Trevo Comercial Agrícola LTDA. | Distributor of agricultural inputs | Nova Prata – Brazil | 79.14% | 79.14% | ||||||||||

| CATR Comercial Agrícola LTDA | Distributor of agricultural inputs | Nova Prata – Brazil | 79.14% | 79.14% | ||||||||||

| Sollo Sul Insumos Agrícolas Ltda | Distributor of agricultural inputs | Pato Branco – Brazil | 93.11% | 93.11% | ||||||||||

|

14 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Dissul Insumos Agrícolas Ltda. | Distributor of agricultural inputs | Pato Branco – Brazil | 93.11% | 93.11% | ||||||||||

| Referência Agroinsumos LTDA. (i) | Distributor of agricultural inputs | Dom Pedrito - Brazil | 65,18% | - | ||||||||||

| Perterra Trading S.A. (ii) | Private label products | Montevideu - Uruguay | 100% | 100% | ||||||||||

| Lavoro Agro Fundo de Investimento nas Cadeias Produtivas Agroindustriais | FIAGRO | São Paulo – Brazil | 5% | 5% | ||||||||||

| Lavoro Colômbia: | ||||||||||||||

| Lavoro Colombia S.A.S. | Holding | Bogota – Colombia | 94.90% | 94.90% | ||||||||||

| Crop Care Colombia | Distributor of agricultural inputs | Bogota - Colombia | 94.90% | 94.90% | ||||||||||

| Agricultura y Servicios S.A.S. | Distributor of agricultural inputs | Ginebra - Colombia | 94.90% | 94.90% | ||||||||||

| Grupo Cenagro S.A.S. | Distributor of agricultural inputs | Yumbo – Colombia | 94.90% | 94.90% | ||||||||||

| Cenagral S.A.S | Distributor of agricultural inputs | Yumbo – Colombia | 94.90% | 94.90% | ||||||||||

| Grupo Gral S.A.S. | Distributor of agricultural inputs | Bogota - Colombia | 94.90% | 94.90% | ||||||||||

| Agrointegral Andina S.A.S. | Distributor of agricultural inputs | Bogota – Colombia | 94.90% | 94.90% | ||||||||||

| Servigral Praderas S.A.S. | Distributor of agricultural inputs | Bogota – Colombia | 94.90% | 94.90% | ||||||||||

| Agroquímicos para la Agricultura Colombiana S.A.S. | Distributor of agricultural inputs | Bogota – Colombia | 94.90% | 94.90% | ||||||||||

| Provecampo S.A.S. | Distributor of agricultural inputs | Envigado – Colombia | 94.90% | 94.90% | ||||||||||

| Crop Care: | ||||||||||||||

| Crop Care Holding S.A. | Holding | São Paulo – Brazil | 100% | 100% | ||||||||||

|

15 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Perterra Insumos Agropecuários S.A. | Private label products | São Paulo – Brazil | 100% | 100% | ||||||||||

| Araci Administradora de Bens S.A. | Private label products | São Paulo – Brazil | 100% | 100% | ||||||||||

| Union Agro S.A. | Private label products | Pederneiras – Brazil | 73% | 73% | ||||||||||

| Agrobiológica Sustentabilidade S.A. | Private label products | São Paulo – Brazil | 65.13% | 65.13% | ||||||||||

| Agrobiológica Soluções Naturais Ltda. | Private label products | Leme – Brazil | 65.13% | 65.13% | ||||||||||

| Cromo Indústria Química LTDA. | Private label products | Estrela - Brasil | 70% | 70% | ||||||||||

| Equity interest | ||||||||||||||

| Name | Core activities | Location | September 30, 2023 | June 30, 2023 | ||||||||||

| Gestão e Transformação Consultoria S.A. | Consulting | São Paulo – Brazil | 40% | 40% | ||||||||||

|

16 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Description | Brazil | LATAM | Crop Care | Total reportable segments | Corporate (i) | Eliminations between segments (ii) | Consolidated | ||||||||||||||||

| Certain assets | |||||||||||||||||||||||

| Cash equivalents | 266,605 | 19,305 | 86,349 | 372,259 | 192,053 | - | 564,312 | ||||||||||||||||

| Trade receivables | 2,502,896 | 395,801 | 309,279 | 3,207,976 | - | (105,799) | 3,102,177 | ||||||||||||||||

| Inventories | 2,153,485 | 234,117 | 205,305 | 2,592,907 | - | (36,309) | 2,556,598 | ||||||||||||||||

| Advances to suppliers | 654,137 | 2,516 | 23,231 | 679,884 | - | (112) | 679,772 | ||||||||||||||||

| Total assets | 7,664,723 | 781,697 | 818,210 | 9,264,630 | 2,030,669 | (1,934,302) | 9,360,997 | ||||||||||||||||

| Certain liabilities | |||||||||||||||||||||||

| Trade payables | 3,224,160 | 358,974 | 142,376 | 3,725,510 | 830 | (105,799) | 3,620,541 | ||||||||||||||||

| Borrowings | 1,532,322 | 92,055 | 114,032 | 1,738,409 | - | - | 1,738,409 | ||||||||||||||||

| Advances from customers | 625,153 | 480 | 4,780 | 630,413 | - | (112) | 630,301 | ||||||||||||||||

| Total liabilities and equity | 7,664,723 | 781,697 | 818,210 | 9,264,630 | 2,030,669 | (1,934,302) | 9,360,997 | ||||||||||||||||

|

17 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Description | Brazil | LATAM | Crop Care | Total reportable segments | Corporate (i) | Eliminations between segments (ii) | Consolidated | ||||||||||||||||

| Revenue | 2,017,918 | 324,161 | 175,045 | 2,517,124 | - | (151,168) | 2,365,956 | ||||||||||||||||

| Cost of goods sold | (1,841,573) | (279,486) | (99,179) | (2,220,238) | - | 147,567 | (2,072,671) | ||||||||||||||||

| Sales, general and administrative expenses (iii) | (230,637) | (31,091) | (56,207) | (317,935) | (2,303) | - | (320,238) | ||||||||||||||||

| Equity results and other results from subsidiaries | (1,459) | - | 492 | (967) | (57,391) | 57,391 | (967) | ||||||||||||||||

| Other operating income, net | 17,653 | (1,147) | 1,519 | 18,025 | (17,673) | - | 352 | ||||||||||||||||

| Financial (costs) income | (121,849) | (5,376) | (12,557) | (139,782) | 10,830 | - | (128,952) | ||||||||||||||||

| Income taxes | 85,958 | (2,251) | 592 | 84,299 | - | 1,224 | 85,523 | ||||||||||||||||

| Profit (loss) for the year | (73,989) | 4,810 | 9,705 | (59,474) | (66,537) | 55,014 | (70,997) | ||||||||||||||||

| Depreciation and amortization | (41,570) | (2,810) | (5,342) | (49,722) | - | - | (49,722) | ||||||||||||||||

|

18 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Description | Brazil | LATAM | Crop Care | Total reportable segments | Corporate (i) | Eliminations between segments (ii) | Consolidated | ||||||||||||||||

| Certain assets | |||||||||||||||||||||||

| Cash equivalents | 207,744 | 22,003 | 95,585 | 325,332 | 238,962 | - | 564,294 | ||||||||||||||||

| Trade receivables | 2,194,853 | 343,745 | 242,391 | 2,780,989 | - | (72,449) | 2,708,540 | ||||||||||||||||

| Inventories | 1,547,384 | 202,239 | 151,289 | 1,900,912 | - | (32,708) | 1,868,204 | ||||||||||||||||

| Advances to suppliers | 176,831 | 2,266 | 13,088 | 192,185 | - | (66) | 192,119 | ||||||||||||||||

| Total assets | 5,926,380 | 683,894 | 680,294 | 7,290,568 | 449,779 | (216,363) | 7,523,984 | ||||||||||||||||

| Certain liabilities | |||||||||||||||||||||||

| Trade payables | 2,304,043 | 309,828 | 46,506 | 2,660,377 | 455 | (56,427) | 2,604,405 | ||||||||||||||||

| Borrowings | 824,868 | 71,562 | 69,045 | 965,475 | - | - | 965,475 | ||||||||||||||||

| Advances from customers | 478,313 | 7,020 | 3,245 | 488,578 | - | - | 488,578 | ||||||||||||||||

| Total liabilities and equity | 5,926,380 | 683,894 | 680,294 | 7,290,568 | 449,779 | (216,361) | 7,523,984 | ||||||||||||||||

|

19 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Description | Brazil | LATAM | Crop Care | Total reportable segments | Corporate (i) | Eliminations between segments (i) | Combined | ||||||||||||||||

| Revenue | 1,874,853 | 349,364 | 187,962 | 2,412,179 | (126,215) | 2,285,964 | |||||||||||||||||

| Cost of goods sold | (1,512,328) | (299,405) | (100,537) | (1,912,270) | - | 100,514 | (1,811,756) | ||||||||||||||||

| Sales, general and administrative expenses (ii) | (251,998) | (28,071) | (35,356) | (315,425) | - | - | (315,425) | ||||||||||||||||

| Other operating income, net | 9,841 | (2,404) | 6,180 | 13,617 | - | - | 13,617 | ||||||||||||||||

| Financial (costs) income | (138,352) | (2,934) | (6,533) | (147,819) | - | (147,819) | |||||||||||||||||

| Income taxes | 64,525 | (6,598) | (13,166) | 44,761 | 8,738 | 53,499 | |||||||||||||||||

| Profit for the year | 46,541 | 9,952 | 38,550 | 95,043 | - | (16,963) | 78,080 | ||||||||||||||||

| Depreciation and amortization | (38,452) | (3,617) | (2,229) | (44,298) | (44,298) | ||||||||||||||||||

| Annual yield | September, 30 2023 | June, 30 2023 | |||||||||

| Cash equivalents (R$) | 75% CDI (i) | 352,954 | 304,292 | ||||||||

| Cash equivalents (COP) | 13.77% DTF(ii) | 19,305 | 22,003 | ||||||||

| Cash equivalents (US$) | 3.65% a year(iii) | 192,053 | 237,999 | ||||||||

| Total cash equivalents | 564,312 | 564,294 | |||||||||

|

20 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September, 30 2023 | June, 30 2023 | |||||||

| Trade receivables (Brazil) | 2,877,760 | 2,525,845 | ||||||

| Trade receivables (Colombia) | 424,875 | 370,767 | ||||||

| (-) Allowance for expected credit losses | (200,458) | (188,072) | ||||||

| Total | 3,102,177 | 2,708,540 | ||||||

| Current | 3,070,618 | 2,667,057 | ||||||

| Non-current | 31,559 | 41,483 | ||||||

| September, 30 2023 | September, 30 2022 | |||||||

| Opening balance | (188,072) | (151,114) | ||||||

| Increase in allowance | (26,496) | (12,061) | ||||||

| Allowance for credit losses from acquisitions | (9,642) | (714) | ||||||

| Trade receivables write-off | 25,554 | 5,108 | ||||||

| Exchange rate translation adjustment | (1,802) | (1,905) | ||||||

| Ending balance (i) | (200,458) | (160,686) | ||||||

|

21 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September, 30 2023 | June, 30 2023 | |||||||

| Not past due | 2,373,773 | 2,089,543 | ||||||

| Overdue | ||||||||

| 1 to 60 days | 393,983 | 169,556 | ||||||

| 61 to 180 days | 249,062 | 359,958 | ||||||

| 181 to 365 days | 70,270 | 90,734 | ||||||

| Over 365 days | 215,547 | 186,821 | ||||||

| Allowance for expected credit losses | (200,458) | (188,072) | ||||||

| 3,102,177 | 2,708,540 | |||||||

|

22 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September, 30 2023 | ||||||||

| Amortized cost | Fair value through profit or loss | |||||||

| Assets: | ||||||||

| Trade receivables | 3,102,177 | - | ||||||

| Commodity forward contracts | - | 92,779 | ||||||

| Derivative financial instruments | - | 39,145 | ||||||

| Restricted cash | 147,917 | - | ||||||

| Total | 3,250,094 | 131,924 | ||||||

| Liabilities: | ||||||||

| Trade payables | 3,620,541 | - | ||||||

| Lease liabilities | 182,922 | - | ||||||

| Borrowings | 1,738,409 | - | ||||||

| Obligations to FIAGRO quota holders | 160,249 | - | ||||||

| Payables for the acquisition of subsidiaries | 268,415 | - | ||||||

| Derivative financial instruments | - | 46,281 | ||||||

| Salaries and social charges | 201,246 | - | ||||||

| Commodity forward contracts | - | 82,538 | ||||||

| Dividends payable | 1,324 | - | ||||||

| Warrant liabilities | - | 37,866 | ||||||

| Liability for FPA Shares | 144,572 | - | ||||||

| Total | 6,317,678 | 166,685 | ||||||

|

23 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| June, 30 2023 | ||||||||

| Amortized cost | Fair value through profit or loss | |||||||

| Assets: | ||||||||

| Trade receivables | 2,708,540 | - | ||||||

| Commodity forward contracts | - | 114,861 | ||||||

| Derivative financial instruments | - | 40,410 | ||||||

| Restricted cash | 139,202 | - | ||||||

| Total | 2,847,742 | 155,271 | ||||||

| Liabilities: | ||||||||

| Trade payables | 2,578,248 | - | ||||||

| Lease liabilities | 184,419 | - | ||||||

| Borrowings | 965,475 | - | ||||||

| Obligations to FIAGRO quota holders | 150,018 | - | ||||||

| Payables for the acquisition of subsidiaries | 275,209 | - | ||||||

| Derivative financial instruments | - | 44,008 | ||||||

| Salaries and social charges | 223,376 | - | ||||||

| Commodity forward contracts | - | 207,067 | ||||||

| Dividends payable | 1,619 | - | ||||||

| Warrant liabilities | - | 36,446 | ||||||

| Liability for FPA Shares | 139,133 | - | ||||||

| Total | 4,517,497 | 287,521 | ||||||

|

24 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

25 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

26 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| % Of guarantees required on sales | ||||||||||||||

| Credit rating | % Customers | Risk classification | Medium-sized farmers (i) | Other | ||||||||||

| AA & A | 18% | Very small | 80-90% |

0% | ||||||||||

| B | 49% | Medium | 100% | 30% | ||||||||||

| C & D | 15% | High | 100% | 60% | ||||||||||

| Simplified | 18% | Small farmers | N/A | N/A | ||||||||||

| September 30, 2023 | June 30, 2023 | |||||||

| Trade receivables (current and non-current) | 3,102,177 | 2,708,539 | ||||||

| Advances to suppliers | 679,772 | 192,119 | ||||||

| 3,781,949 | 2,900,658 | |||||||

|

27 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September, 30 2023 | |||||||||||

| Up to 1 year | From 1 to 5 years | Total | |||||||||

| Trade payables | 3,861,655 | 333 | 3,861,988 | ||||||||

| Lease liabilities | 87,759 | 107,281 | 195,040 | ||||||||

| Borrowings | 1,813,611 | 39,967 | 1,853,578 | ||||||||

| Obligations to FIAGRO quota holders | 170,865 | - | 170,865 | ||||||||

| Payables for the acquisition of subsidiaries | 237,411 | 31,716 | 269,127 | ||||||||

| Commodity forward contracts | 82,757 | - | 82,757 | ||||||||

| Derivative financial instruments | 46,404 | - | 46,404 | ||||||||

| Salaries and social charges | 201,780 | - | 201,780 | ||||||||

| Dividends payable | 1,327 | - | 1,327 | ||||||||

| Warrant liabilities | 37,866 | - | 37,866 | ||||||||

| Liability for FPA Shares | - | 144,956 | 144,956 | ||||||||

| 6,541,435 | 324,253 | 6,865,688 | |||||||||

|

28 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| June, 30 2023 | |||||||||||

| Up to 1 year | From 1 to 5 years | Total | |||||||||

| Trade payables | 2,765,354 | 2,547 | 2,767,901 | ||||||||

| Lease liabilities | 91,419 | 111,304 | 202,723 | ||||||||

| Borrowings | 982,318 | 48,382 | 1,030,700 | ||||||||

| Obligations to FIAGRO quota holders | 159,722 | - | 159,722 | ||||||||

| Payables for the acquisition of subsidiaries | 224,689 | 55,242 | 279,931 | ||||||||

| Commodity forward contracts | 210,040 | - | 210,040 | ||||||||

| Derivative financial instruments | 44,639 | - | 44,639 | ||||||||

| Salaries and social charges | 226,583 | - | 226,583 | ||||||||

| Dividends payable | 1,642 | - | 1,642 | ||||||||

| Warrant liabilities | 36,446 | - | 36,446 | ||||||||

| Liability for FPA Shares | - | 139,133 | 139,133 | ||||||||

| 4,742,852 | 356,608 | 5,099,460 | |||||||||

|

29 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September, 30 2023 | ||||||||||||||

| Expense on profit or loss | ||||||||||||||

| Current Index | Scenario 1 | Scenario 2 | Scenario 3 | |||||||||||

| Floating rate borrowings in Brazil | CDI Rate (12,65%) | 277,693 | 325,644 | 373,594 | ||||||||||

| Floating rate borrowings in Colombia | IBR Rate (12,75%) | 17,185 | 20,207 | 23,230 | ||||||||||

| 294,878 | 345,851 | 396,824 | ||||||||||||

|

30 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | ||||||||||||||

| Effect on profit or loss | ||||||||||||||

| Current Index | Scenario 1 | Scenario 2 | Scenario 3 | |||||||||||

| Cash equivalents in U.S. Dollars | 4.9397 | (2,565) | 44,079 | 90,724 | ||||||||||

| Trade receivables in U.S. Dollars | 4.9397 | (1,023) | 17,577 | 36,177 | ||||||||||

| Trade payables in U.S. Dollars | 4.9397 | 4,635 | (79,668) | (163,971) | ||||||||||

| Borrowings in U.S. Dollars | 4.9397 | 6,314 | (108,529) | (223,372) | ||||||||||

| Net impacts on commercial operations | 7,361 | (126,541) | (260,442) | |||||||||||

| Derivative financial instruments | 4.9397 | (6,136) | 105,465 | 217,067 | ||||||||||

| Total impact, net of derivatives | 1,225 | (21,076) | (43,375) | |||||||||||

|

31 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Tons | Position | Current Risk | Average of contract prices | Current Market (R$/bag) | +25% current | +50% current | |||||||||||||||||||||||

| Position | Market | Impact | Market | Impact | |||||||||||||||||||||||||

| Soybean 2024 | 555,257 | Purchased | (8,272) | 128 | 127 | 159 | (2,068) | 191 | (4,136) | ||||||||||||||||||||

| Soybean 2024 | (174,338) | Sold | 3,232 | 149 | 148 | 185 | 808 | 222 | 1,616 | ||||||||||||||||||||

| Corn 2024 | 95,141 | Purchased | (5,642) | 48 | 44 | 56 | (1,411) | 67 | (2,821) | ||||||||||||||||||||

| Corn 2024 | (50,355) | Sold | (1,543) | 41 | 43 | 54 | (386) | 65 | (771) | ||||||||||||||||||||

| Soybean 2025 | 59,627 | Purchased | 22,703 | 107 | 130 | 162 | 5,676 | 195 | 11,351 | ||||||||||||||||||||

| Net exposure on grain contracts | 485,332 | Net purchased | 10,478 | 2,619 | 5,239 | ||||||||||||||||||||||||

| Soybean 2024 | (412,777) | Sold on derivatives | 7,255 | 151 | 150 | 187 | 1,814 | 224 | 3,627 | ||||||||||||||||||||

| Corn 2024 | (8,480) | Sold on derivatives | 3,224 | 86 | 63 | 79 | 806 | 95 | 1,612 | ||||||||||||||||||||

| Soybean 2025 | (59,447) | Sold on derivatives | (23,000) | 125 | 148 | 185 | (5,750) | 222 | (11,500) | ||||||||||||||||||||

| Net exposure on derivatives | (480,704) | (12,521) | (3,130) | (6,261) | |||||||||||||||||||||||||

| Net exposure | 4,628 | (2,043) | (511) | (1,022) | |||||||||||||||||||||||||

|

32 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Options (put/call of commodities) | 8,343 | (513) | ||||||

| Forwards (R$/US$) (i) | (12,250) | 8,837 | ||||||

| Swap (R$/US$) | (3,229) | (11,922) | ||||||

| Derivative financial instruments, net | (7,136) | (3,598) | ||||||

| September 30, 2023 | June 30, 2023 | |||||||

| Goods for resale | 2,576,140 | 1,885,941 | ||||||

| (-) Allowance for inventory losses | (19,542) | (17,737) | ||||||

| Total | 2,556,598 | 1,868,204 | ||||||

| September 30, 2023 | September 30, 2022 | |||||||

| Opening balance | (17,737) | (10,186) | ||||||

| Increase in allowance | (1,565) | (4,209) | ||||||

| Exchange rate translation adjustment | (240) | 246 | ||||||

| Ending balance | (19,542) | (14,149) | ||||||

|

33 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| State VAT (“ICMS”) (i) | 80,136 | 78,805 | ||||||

| Brazilian federal contributions (ii) | 295,480 | 239,815 | ||||||

| Colombian federal contributions | 29,144 | 21,284 | ||||||

| Total | 404,760 | 339,904 | ||||||

| Current | 73,781 | 57,001 | ||||||

| Non-current | 330,979 | 282,903 | ||||||

|

34 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Fair value of commodity forward contracts: | ||||||||

| Assets | ||||||||

| Purchase contracts | 85,666 | 53,695 | ||||||

| Sale contracts | 7,113 | 61,166 | ||||||

| 92,779 | 114,861 | |||||||

| Liabilities | ||||||||

| Purchase contracts | (77,114) | (206,881) | ||||||

| Sale contracts | (5,424) | (186) | ||||||

| (82,538) | (207,067) | |||||||

|

35 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Outstanding Volume (tons) | Average of contract prices R$/Bag | Average Market Prices (Corn R$/bag (ii); Soybean US$/bu(i)) | Soybean market premium (US$/bu) | Freight (R$/ton) | |||||||||||||

| Purchase Contracts | |||||||||||||||||

| Soybean | |||||||||||||||||

| As of June 30, 2023 | 449,847 | 127.95 | 13.16 | (0,3) | 294.65 | ||||||||||||

| As of September 30, 2023 | 614,885 | 125.91 | 13.16 | (0,3) | 317.58 | ||||||||||||

| Corn | |||||||||||||||||

| As of June 30, 2023 | 303,432 | 65.25 | 56.04 | N/A | 282.23 | ||||||||||||

| As of September 30, 2023 | 95,141 | 48.21 | 63.30 | N/A | 310.86 | ||||||||||||

| Selling Contracts | |||||||||||||||||

| Soybean | |||||||||||||||||

| As of June 30, 2023 | 145,915 | 145.71 | 13.16 | 0,0 | 0,0 | ||||||||||||

| As of September 30, 2023 | (174,338) | 148.87 | 13.19 | 0,0 | 0,0 | ||||||||||||

| Corn | |||||||||||||||||

| As of June 30, 2023 | 255,499 | 48.36 | 56.04 | N/A | 284.59 | ||||||||||||

| As of September 30, 2023 | 50,355 | 41.49 | 63.30 | N/A | 333.82 | ||||||||||||

|

36 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Vehicles | Buildings | Machinery and equipment | Total | |||||||||||

| Cost | 120,052 | 141,915 | 73,236 | 335,203 | ||||||||||

| Accumulated depreciation | (54,560) | (77,732) | (29,232) | (161,524) | ||||||||||

| Balance at June 30, 2023 | 65,492 | 64,183 | 44,004 | 173,679 | ||||||||||

| Cost | 125,055 | 147,117 | 71,030 | 343,202 | ||||||||||

| Accumulated depreciation | (56,658) | (85,764) | (29,448) | (171,870) | ||||||||||

| Balance at September 30, 2023 | 68,397 | 61,353 | 41,582 | 171,332 | ||||||||||

| September, 30 2023 | June, 30 2023 | |||||||

| Vehicles | 73,484 | 68,420 | ||||||

| Buildings | 82,242 | 85,839 | ||||||

| Machinery and equipment | 27,196 | 30,160 | ||||||

| Total | 182,922 | 184,419 | ||||||

| Current | 82,306 | 85,865 | ||||||

| Non-current | 100,616 | 98,554 | ||||||

|

37 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Vehicles | Lands, buildings and improvements | Machines, equipment and facilities | Furniture and fixtures | Computer equipment | Total | |||||||||||||||

| Cost | 40,851 | 142,561 | 75,134 | 15,610 | 10,015 | 284,171 | ||||||||||||||

| Accumulated depreciation | (31,349) | (14,698) | (26,817) | (7,198) | (7,521) | (87,583) | ||||||||||||||

| Balance at June 30, 2023 | 9,502 | 127,863 | 48,317 | 8,412 | 2,494 | 196,588 | ||||||||||||||

| Cost | 42,050 | 151,347 | 76,338 | 16,073 | 10,775 | 296,583 | ||||||||||||||

| Accumulated depreciation | (33,235) | (16,945) | (27,105) | (7,621) | (8,282) | (93,188) | ||||||||||||||

| Balance at September 30, 2023 | 8,815 | 134,402 | 49,233 | 8,452 | 2,493 | 203,395 | ||||||||||||||

|

38 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Goodwill | Customer relationship | Purchase contracts and brands | Software and other | Total | |||||||||||||

| Cost: | |||||||||||||||||

| At June 30, 2022 | 451,974 | 301,477 | 21,846 | 56,373 | 831,670 | ||||||||||||

| Additions | - | - | - | 5,025 | 5,025 | ||||||||||||

| Business combinations (i) | 98,890 | 50,600 | 1,207 | — | 150,698 | ||||||||||||

| Other (ii) | (3,201) | — | — | — | (3,201) | ||||||||||||

| Translation adjustment | (998) | (666) | (48) | (10) | (1,722) | ||||||||||||

| At June 30, 2023 | 546,665 | 351,411 | 23,005 | 61,388 | 982,470 | ||||||||||||

| Additions | - | - | - | 6,520 | 6,520 | ||||||||||||

| Business combinations (i) | 97,169 | 44,244 | - | - | 141,413 | ||||||||||||

| Other (iii) | 2,748 | — | - | - | 2,748 | ||||||||||||

| Translation adjustment | 1,440 | 137 | 335 | - | 1,912 | ||||||||||||

| At September 30, 2023 | 648,022 | 395,793 | 23,340 | 67,650 | 1,134,805 | ||||||||||||

| Amortization: | |||||||||||||||||

| At June 30, 2022 | - | 89,502 | 6,929 | 10,918 | 107,349 | ||||||||||||

| Amortization for the period | - | 50,263 | 8,983 | 8,682 | 67,928 | ||||||||||||

| At June 30, 2023 | - | 139,765 | 15,912 | 19,600 | 175,277 | ||||||||||||

| Amortization for the period | - | 13,641 | 1,919 | 2,816 | 18,376 | ||||||||||||

| At September 30, 2023 | - | 153,406 | 17,831 | 22,416 | 193,653 | ||||||||||||

| At June 30, 2023 | 546,665 | 211,646 | 7,093 | 41,788 | 807,192 | ||||||||||||

| At September 30, 2023 | 648,022 | 242,387 | 5,509 | 45,234 | 941,152 | ||||||||||||

|

39 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

40 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Trade payables – Brazil | 3,210,155 | 2,268,420 | ||||||

| Trade payables – Colombia | 410,386 | 309,828 | ||||||

| Total | 3,620,541 | 2,578,248 | ||||||

| Current | 3,620,208 | 2,575,701 | ||||||

| Non-current | 333 | 2,547 | ||||||

|

41 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Borrowing in Colombia | 92,055 | 71,562 | ||||||

| Borrowings in Brazil | 1,646,354 | 893,913 | ||||||

| Total borrowings | 1,738,409 | 965,475 | ||||||

| Average interest rate September 30,2023 (i) | September 30, 2023 | Average interest rate June 30, 2023 (i) | June 30, 2023 | |||||||||||

| Debt contracts in Brazil in: | ||||||||||||||

| R$, indexed to CDI (ii) | 15.76 | % | 1,149,975 | 16.62 | % | 725,563 | ||||||||

| R$, with fixed interest | 9.73 | % | 7,010 | 8.76 | % | 8,590 | ||||||||

| U.S. Dollars, with fixed interest | 2.71 | % | 489,368 | 4.03 | % | 159,760 | ||||||||

| Debt contracts in Colombia in: | ||||||||||||||

| COP, indexed to IBR (iii) | 17.19 | % | 82,328 | 15.43 | % | 69,862 | ||||||||

| COP, with fixed interest | 16.75 | % | 9,728 | 15.72 | % | 1,700 | ||||||||

| Total | 1,738,409 | 965,475 | ||||||||||||

| Current | 1,700,925 | 922,636 | ||||||||||||

| Non-current | 37,484 | 42,839 | ||||||||||||

|

42 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| At June 30, 2022 | 710,552 | ||||

| Proceeds from borrowings | 731,007 | ||||

| Repayment of principal amount | (156,751) | ||||

| Accrued interest | 36,303 | ||||

| Exchange rate translation | (5,574) | ||||

| Interest payment | (24,342) | ||||

| At September 30, 2022 | 1,291,195 | ||||

| At June 30, 2023 | 965,475 | ||||

| Proceeds from borrowings | 1,218,074 | ||||

| Repayment of principal amount | (481,957) | ||||

| Accrued interest | 61,268 | ||||

| Borrowings from acquired companies | 32,429 | ||||

| Foreign exchange differences | 8,735 | ||||

| Exchange rate translation | 3,921 | ||||

| Interest payment | (69,536) | ||||

| At September 30, 2023 | 1,738,409 | ||||

| September 30, 2023 | June 30, 2023 | |||||||

| 2024 | 4,751 | 726 | ||||||

| 2025 | 12,312 | 15,452 | ||||||

| 2026 | 11,274 | 1,376 | ||||||

| 2027 | 6,634 | 25,285 | ||||||

| 2028 | 2,513 | - | ||||||

| Total | 37,484 | 42,839 | ||||||

|

43 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

44 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

45 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Fair value as of the acquisition date | |||||

| Assets | Referência Agroinsumos (a) | ||||

| Cash equivalents | 8,135 | ||||

| Trade receivables | 31,464 | ||||

| Inventories | 43,680 | ||||

| Other assets | 11,473 | ||||

| Property, plant and equipment | 1,556 | ||||

| Intangible assets | 44,244 | ||||

| 140,552 | |||||

| Liabilities | |||||

| Trade payables | 56,137 | ||||

| Borrowings | 32,429 | ||||

| Advances from customers | 40,757 | ||||

| Other liabilities | 4,168 | ||||

| 133,491 | |||||

| Total identifiable net assets at fair value | 7,061 | ||||

| Non-controlling interests (i) | (2,118) | ||||

| Goodwill arising on acquisition | 97,169 | ||||

| Consideration transferred | 102,112 | ||||

| Cash paid | 67,112 | ||||

| Payable in installments | 35,000 | ||||

|

46 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Fair value as of the acquisition date | ||||||||||||||||||||

| Assets | Floema (b) |

Casa Trevo (c) | Provecampo (d) | Sollo Sul and Dissul (e) | Cromo (f) | Total | ||||||||||||||

| Cash equivalents | 24,167 | 12,306 | 10,479 | 16,307 | 8,735 | 71,994 | ||||||||||||||

| Trade receivables | 19,892 | 32,106 | 7,499 | 132,467 | 11,907 | 203,871 | ||||||||||||||

| Inventories | 52,133 | 61,734 | 11,320 | 84,226 | 5,311 | 214,724 | ||||||||||||||

| Other assets | 11,739 | 4,750 | 23 | 46,663 | 664 | 63,839 | ||||||||||||||

| Property, plant and equipment | 1,152 | 867 | 983 | 2,372 | 3,151 | 8,525 | ||||||||||||||

| Intangible assets | 14,879 | 1,676 | 12,117 | 2,083 | 2,722 | 33,477 | ||||||||||||||

| 123,962 | 113,439 | 42,421 | 284,118 | 32,490 | 596,430 | |||||||||||||||

| Liabilities | ||||||||||||||||||||

| Trade payables | 88,902 | 48,070 | 10,980 | 80,811 | 1,200 | 229,963 | ||||||||||||||

| Borrowings | - | - | - | 25,756 | - | 25,756 | ||||||||||||||

| Provision for contingencies | - | 10,245 | - | - | - | 10,245 | ||||||||||||||

| Other liabilities | 1,543 | 13,659 | 6,910 | 87,921 | 4,056 | 114,089 | ||||||||||||||

| 90,445 | 71,974 | 17,890 | 194,488 | 5,256 | 380,053 | |||||||||||||||

| Total identifiable net assets at fair value | 33,517 | 41,465 | 24,531 | 89,630 | 27,234 | 216,376 | ||||||||||||||

| Non-controlling interests (1) | (6,220) | - | - | (8,169) | (14,389) | |||||||||||||||

| Goodwill arising on acquisition | 25,796 | 9,625 | 2,010 | 57,719 | 5,331 | 100,481 | ||||||||||||||

| Consideration transferred | 59,313 | 44,870 | 26,541 | 147,349 | 24,395 | 302,468 | ||||||||||||||

| Cash paid | 25,294 | 23,619 | 17,682 | 52,832 | 8,120 | 127,547 | ||||||||||||||

| Shares issued (1) | 12,296 | - | - | - | - | 12,296 | ||||||||||||||

| Payable in installments | 21,723 | 21,251 | 8,859 | 94,517 | 16,275 | 162,625 | ||||||||||||||

|

47 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Item | September 30, 2023 | June 30, 2023 | Nature | Valuation method | ||||||||||

| Customer relationship | 34,731 | 33,477 | A loyal relationship between the acquirees and its customers, which translates into recurring purchases of products and services | Multi Period Excess Earnings Method (MPEEM) | ||||||||||

| Inventories | — | 214,724 | Inventories | Selling price less all expenses related to the distribution of that good | ||||||||||

| Purchase Contracts | - | - | Favorable purchase contract with suppliers | Multi Period Excess Earnings Method (MPEEM) | ||||||||||

| Total | 34,731 | 248,201 | ||||||||||||

|

48 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2023 | |||||||

| Revenues | 45,670 | 2,405,360 | ||||||

| Profit (loss) for the year | (14,090) | 86,491 | ||||||

|

49 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Revenues | Profit (loss) | Period from | |||||||||

| Referência Agroinsumos | 39,114 | (696) | July 2023 | ||||||||

| Total | 39,114 | (696) | |||||||||

| Revenues | Profit (loss) | Period from | |||||||||

| Provecampo | 37,291 | 1,656 | August 2022 | ||||||||

| Floema | 205,451 | 12,628 | August 2022 | ||||||||

| Casa Trevo | 136,003 | 20,787 | September 2022 | ||||||||

| Total | 378,745 | 35,071 | |||||||||

|

50 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

51 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2022 | |||||||

| Profit (loss) before income taxes | (156,520) | 24,581 | ||||||

| Statutory rate (i) | 34% | 34% | ||||||

| Income taxes at statutory rate | 53,217 | (8,358) | ||||||

| Unrecognized deferred tax asset (ii) | (21,964) | (3,143) | ||||||

| Difference from income taxes calculation based on taxable profit computed as a percentage of gross revenue | (21) | (23) | ||||||

| Deferred income taxes over goodwill tax recoverable | (845) | (619) | ||||||

| Tax benefit (iii) | 52,613 | 66,561 | ||||||

| Other | 2,523 | (919) | ||||||

| Income tax expense | 85,523 | 53,499 | ||||||

| Income tax and social contribution effective rate | -55% | 218% | ||||||

| Current income taxes | 38,493 | 16,232 | ||||||

| Deferred income taxes | 47,030 | 37,267 | ||||||

|

52 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Deferred assets and liabilities: | ||||||||

| Amortization of fair value adjustment | 69,195 | 66,065 | ||||||

| Tax losses | 150,716 | 123,072 | ||||||

| Allowance for expected credit losses | 47,729 | 49,026 | ||||||

| Adjustment to present value | 10,147 | 14,222 | ||||||

| Provision for management bonuses | 17,341 | 22,182 | ||||||

| Allowance for inventory losses | 9,491 | 3,841 | ||||||

| Financial effect on derivatives | 1,937 | (1,468) | ||||||

| Fair value of commodity forward contracts | (48) | 31,343 | ||||||

| Unrealized exchange gains or losses | 439 | (7,618) | ||||||

| Unrealized profit in Inventories | 12,345 | (11,121) | ||||||

| Amortized right-of-use assets | 6,706 | 6,273 | ||||||

| Deferred tax on goodwill | (3,290) | (2,067) | ||||||

| Other provisions | 41,178 | 22,981 | ||||||

| Deferred income tax assets, net | 382,383 | 329,082 | ||||||

| Deferred income tax liabilities, net | (18,499) | (12,351) | ||||||

| Deferred income tax assets, net | 363,884 | 316,731 | ||||||

| Deferred income tax and social contribution | |||||

| At June 30, 2022 | 193,495 | ||||

| Recognized in the statement of profit or loss | 128,362 | ||||

| Deferred tax from acquired companies | (5,126) | ||||

| At June 30, 2023 | 316,731 | ||||

| Recognized in the statement of profit or loss | 41,951 | ||||

| At September 30, 2023 | 358,682 | ||||

|

53 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Up to 1 year | 211,256 | 185,123 | ||||||

| Over 1 year | 147,426 | 131,608 | ||||||

| Total | 358,682 | 316,731 | ||||||

| September 30, 2023 | June 30, 2023 | |||||||

| Balance as of the beginning of the year | 488,578 | 320,560 | ||||||

| Revenue recognized that was included in the contract liability balance at the beginning of the year | (488,578) | (320,560) | ||||||

| Increase in advances | 626,790 | 427,463 | ||||||

| Advances from acquired companies | 3,511 | 61,115 | ||||||

| Balance at the end of the year | 630,301 | 488,578 | ||||||

|

54 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | June 30, 2023 | |||||||

| Assets | ||||||||

| Trade receivables (i) | 21,626 | 24,487 | ||||||

| Total assets | 21,626 | 24,487 | ||||||

| Liabilities | ||||||||

| Trade payables (i) | 1,467 | 1,675 | ||||||

| Payables for the acquisition of subsidiaries (ii) | 159,387 | 100,287 | ||||||

| Total liabilities | 160,854 | 101,962 | ||||||

| September 30, 2023 | September 30, 2022 | |||||||

| Revenue from sales of products (i) | 3,601 | 9,927 | ||||||

| Monitoring expenses (ii) | (7,026) | (4,967) | ||||||

| Interest on payables for the acquisition of subsidiaries | (4,461) | (2,652) | ||||||

| Other expenses | (450) | (516) | ||||||

| Total | (8,336) | 1,792 | ||||||

|

55 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2022 | |||||||

| Wages | 3,606 | 5,268 | ||||||

| Direct and indirect benefits | 485 | 413 | ||||||

| Variable compensation (bonuses) | - | 7,421 | ||||||

| Short-term benefits | 4,091 | 13,102 | ||||||

| Share-based payment benefits | 5,964 | 8,912 | ||||||

| Total | 10,055 | 22,014 | ||||||

| Ordinary authorized and issued shares | Number of shares |

Share capital |

||||||

| Shares issued to the shareholders of Lavoro Agro Limited | 98,726,401 | 514 | ||||||

| Shares issued to the shareholders of TPB Acquisition Corp | 14,875,879 | 77 | ||||||

| As of September 30, 2023 | 113,602,280 | 591 | ||||||

|

56 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

57 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| Other capital reserves |

|||||

| At June 30, 2022 | - | ||||

| Share-based payments expense during the year | 14,533 | ||||

| At June 30, 2023 | 14,533 | ||||

| Share-based payments expense during the year | (336) | ||||

| At September 30, 2023 | 14,197 | ||||

| Options granted | |||||

| At June 30, 2022 | - | ||||

| Granted options | 49,518,732 | ||||

| Canceled | (3,800,000) | ||||

| At June 30, 2023 | 45,718,732 | ||||

| Canceled | (1,724,990) | ||||

| At September 30, 2023 | 43,993,742 | ||||

|

58 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| RSUs granted | |||||

| At June 30, 2023 | - | ||||

| Granted options | 1,597,076 | ||||

| Canceled | - | ||||

| At September 30, 2023 | 1,597,076 | ||||

|

59 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| 2023 | 2022 | |||||||

| Weighted average ordinary shares of Lavoro | 113,602 | 113,602 | ||||||

| Effects of dilution from: | ||||||||

| Share-based payment (i) | 2,248 | 1,638 | ||||||

| Restricted stock unit plan (ii) | 1,003 | - | ||||||

| Number of ordinary shares adjusted for the effect of dilution | 116,853 | 115,210 | ||||||

| Profit (loss) for the period attributable to net investment of the parent/equity holders of the parent | (66,537) | 59,615 | ||||||

| Basic earnings (loss) per share | (0.59) | 0.52 | ||||||

| Diluted earnings (loss) per share | (0.59) | 0.52 | ||||||

|

60 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2022 | |||||||

| Inputs Retails sales | ||||||||

| Brazil | 1,679,850 | 1,726,013 | ||||||

| Colombia | 265,609 | 305,229 | ||||||

| Private Label products | ||||||||

| Crop Care | 166,557 | 121,521 | ||||||

| Grains (i) | ||||||||

| Brazil | 195,386 | 89,065 | ||||||

| Colombia | 30,616 | 27,524 | ||||||

| Services | ||||||||

| Colombia | 27,938 | 16,612 | ||||||

| Total Revenues | 2,365,956 | 2,285,964 | ||||||

| Summarized by region | ||||||||

| Brazil | 2,041,793 | 1,936,599 | ||||||

| Colombia | 324,163 | 349,365 | ||||||

|

61 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2022 | |||||||

| Cost of inventory (i) | 2,043,280 | 1,794,563 | ||||||

| Personnel expenses | 123,447 | 146,916 | ||||||

| Maintenance of the units | 11,946 | 7,443 | ||||||

| Consulting, legal and other services | 30,453 | 23,831 | ||||||

| Freight on sales | 26,821 | 15,993 | ||||||

| Commissions | 22,119 | 18,629 | ||||||

| Storage | 6,323 | 2,280 | ||||||

| Travel | 8,556 | 7,812 | ||||||

| Depreciation | 4,515 | 3,578 | ||||||

| Amortization of intangibles | 18,376 | 22,837 | ||||||

| Amortization of right-of-use assets | 19,441 | 16,613 | ||||||

| Taxes and fees | 9,556 | 8,774 | ||||||

| Short term rentals | 3,025 | 4,276 | ||||||

| Business events | 3,888 | 3,870 | ||||||

| Marketing and advertising | 4,267 | 2,336 | ||||||

| Insurance | 3,643 | 1,884 | ||||||

| Utilities | 3,124 | 2,443 | ||||||

| Allowance for expected credit losses | 26,496 | 12,061 | ||||||

| Losses and damage of inventories | 1,565 | 4,209 | ||||||

| Fuels and lubricants | 6,953 | 6,256 | ||||||

| Other administrative expenditures | 15,115 | 20,577 | ||||||

| Total | 2,392,909 | 2,127,181 | ||||||

| Classified as: | ||||||||

| Cost of goods sold | 2,072,671 | 1,811,756 | ||||||

| Sales, general and administrative expenses | 320,238 | 315,425 | ||||||

|

62 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

| September 30, 2023 | September 30, 2022 | |||||||

| Finance income | ||||||||

| Interest from cash equivalents | 6,806 | 1,450 | ||||||

| Interest arising from revenue contracts | 65,647 | 65,129 | ||||||

| Interest from tax benefit (see note 20) | 10,465 | 7,407 | ||||||

| Other | 2,981 | 14,833 | ||||||

| Total | 85,899 | 88,819 | ||||||

| Finance costs | ||||||||

| Interest on borrowings | (62,370) | (36,303) | ||||||

| Interest on acquisitions of subsidiary | (3,636) | 602 | ||||||

| Interest on FIAGRO | (9,880) | (13,625) | ||||||

| Interest on leases | (4,258) | (3,939) | ||||||

| Interest on trade payables | (142,360) | (148,911) | ||||||

| Gain on changes in fair value of warrants | (1,420) | - | ||||||

| Other | (12,063) | (25,244) | ||||||

| Total | (235,987) | (227,420) | ||||||

| Other Finance Income (Cost) | ||||||||

| Gain on changes in fair value of derivative instruments | 26,281 | - | ||||||

| Loss on changes in fair value of derivative instruments | - | (450) | ||||||

| Gain on fair value of commodity forward contracts | — | 3,121 | ||||||

| Loss on fair value of commodity forward contracts | (284) | - | ||||||

| Foreign exchange differences on cash equivalents | 9,335 | - | ||||||

| Foreign exchange differences on trade receivables and trade payables, net | (5,446) | (11,890) | ||||||

| Foreign exchange differences on borrowings | (8,750) | - | ||||||

| Total | 21,136 | (9,219) | ||||||

| Finance costs, net | (128,952) | (147,820) | ||||||

|

63 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

64 |

||||

|

|||||

|

Notes to the interim condensed consolidated financial statements

(In thousands of Brazilian reais - R$, except if otherwise indicated)

| |||||

|

65 |

||||