Q2 2023 Investor Presentation

Forward Looking Statements This presentation includes forward-looking statements. Each forward-looking statement contained in this presentation is based on current expectations and market outlook; and is subject to certain risks and uncertainties that may cause actual results to differ materially from those currently anticipated. More information about risks can be found in our filings with the Securities and Exchange Commission, including under the heading “Risk Factors” in our full year 2022 Form 10-K and our first and second quarter 2023 Forms 10-Q, which are available at sec.gov and at masterbrand.com. The forward-looking statements in this presentation speak only as of today, and the Company does not undertake any obligation to update or revise any of these statements, except as required by law. This presentations includes certain non-GAAP financial measures. Please refer to the reconciliation tables and definitions, which are in the appendix and are also available at sec.gov and at masterbrand.com. 2

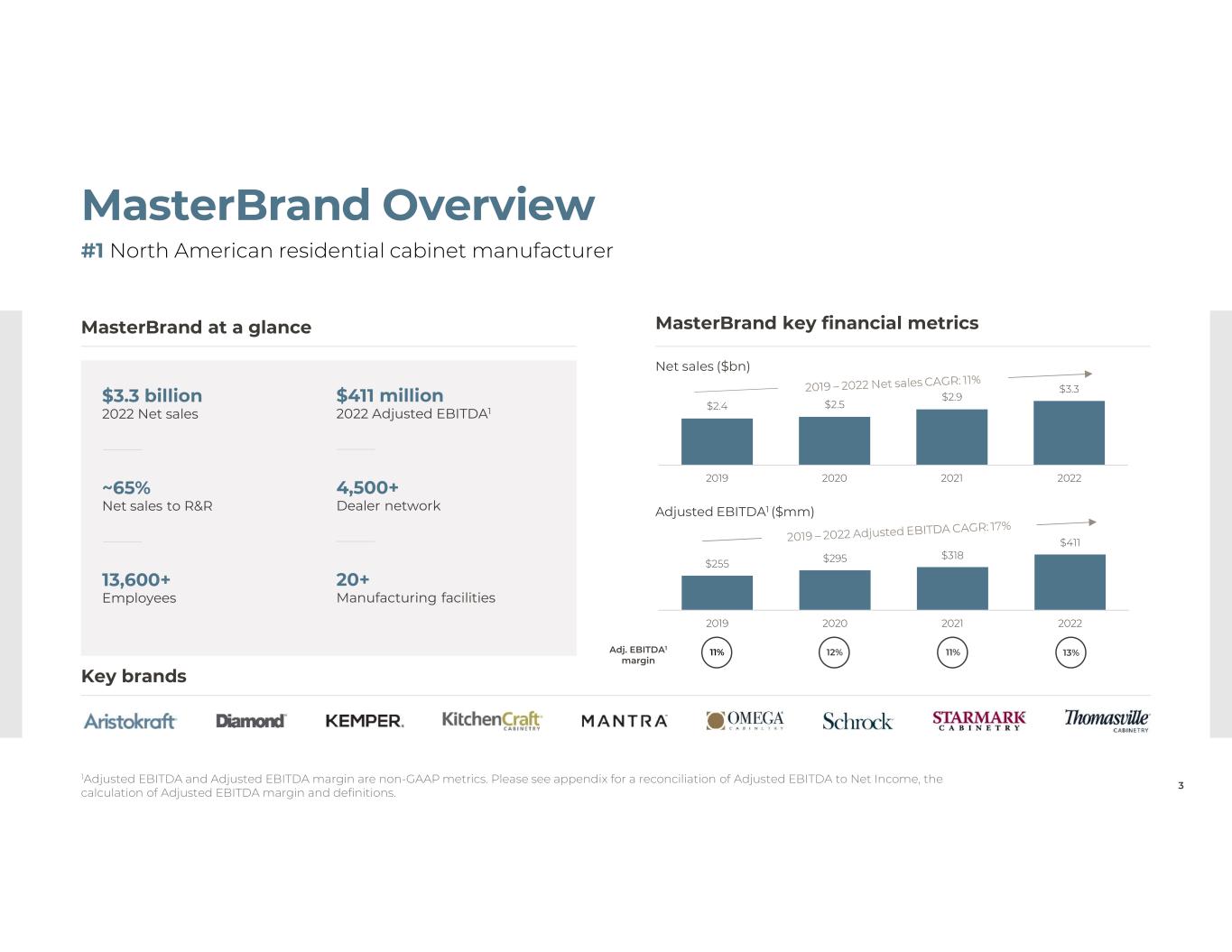

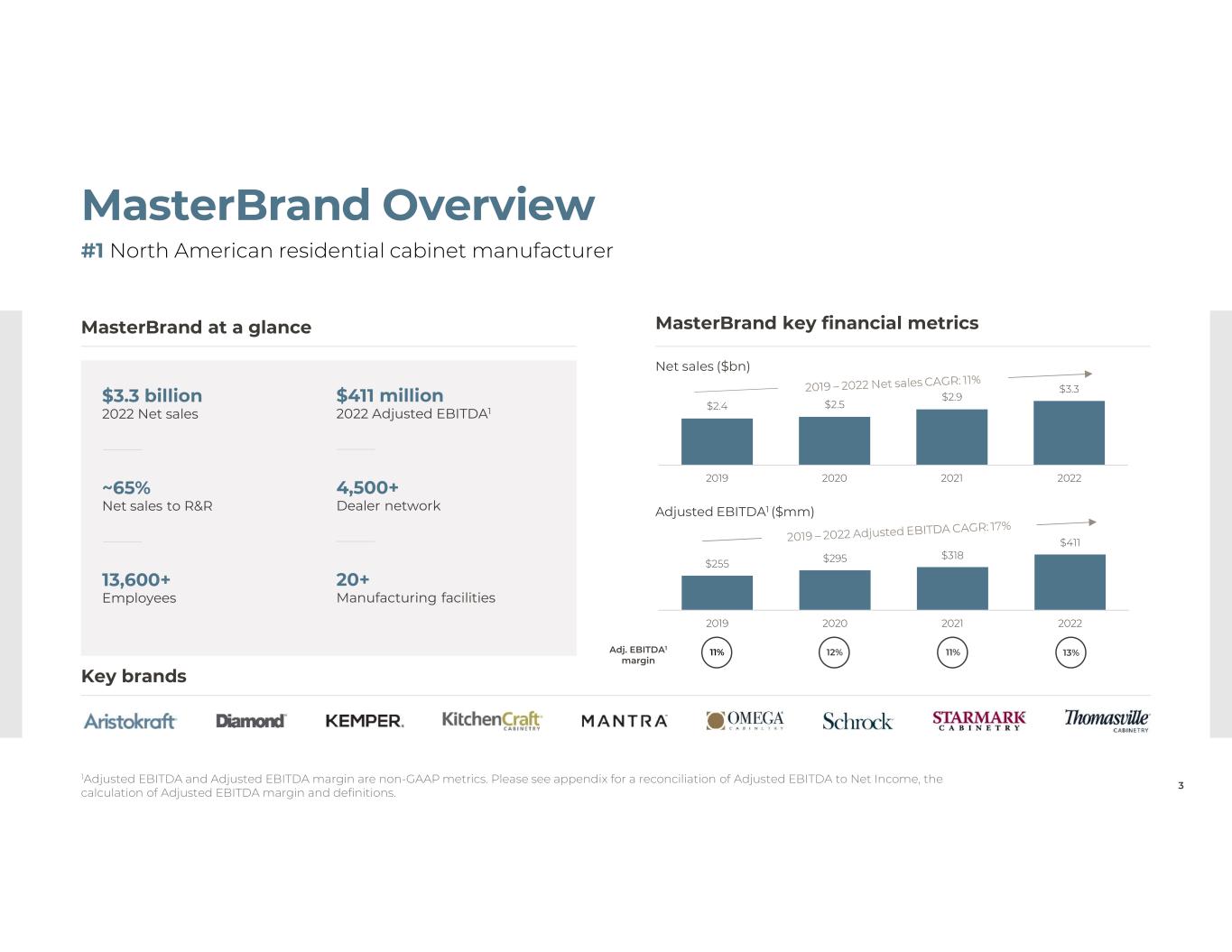

MasterBrand Overview #1 North American residential cabinet manufacturer Key brands 1Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP metrics. Please see appendix for a reconciliation of Adjusted EBITDA to Net Income, the calculation of Adjusted EBITDA margin and definitions. MasterBrand at a glance $3.3 billion 2022 Net sales ~65% Net sales to R&R 4,500+ Dealer network $411 million 2022 Adjusted EBITDA1 13,600+ Employees 20+ Manufacturing facilities MasterBrand key financial metrics 3 $255 $295 $318 $411 2019 2020 2021 2022 $2.4 $2.5 $2.9 $3.3 2019 2020 2021 2022 Net sales ($bn) Adjusted EBITDA1 ($mm) Adj. EBITDA1 margin 11% 12% 11% 13%

The MasterBrand Story Building great experiences together O U R P U R P O S E How? Tools that enable us to: Lead Through Lean Engage teams and foster problem-solving Align-to-Grow Deliver on the unique needs of each customer Tech Enabled Drive profitable growth and transform the way we work through digital, data, and analytics D E L I V E R E D T H R O U G H T H E M A S T E R B R A N D W A Y Build on our rich history by innovating how we work and what we offer to delight our customers O U R V I S I O N TEaM : Trust the tools, Empower the team, and Move forward O U R C U L T U R E 4 TODAY TOMORROW Industry Leader Largest distribution network Product & Brand Portfolio Unmatched by peers Operational Excellence At scale

2022 ESG REPORT HIGHLIGHTS INTRODUCING MASTERBRAND CREATING A POSITIVE IMPACT ENVIRONMENTAL SOCIAL GOVERNANCE At MasterBrand, we have built a foundation of best practices for doing what is right for people and the environment. We believe that the high standards by which we conduct our business will help us to build on our strengths and continually improve how we measure and monitor our progress on our ESG-related initiatives. We follow sustainable wood sourcing practices We are committed to building an inclusive and diverse workforce We have sustained an OSHA recordable rate close to 1, less than 1/3 industry average Over 80% of our board has prior board experience Our top leadership has comprehensive oversight of our organization The people of MasterBrand make a difference every day in meaningful ways. From caring about each other to bettering the communities in which we live, we are fostering a more sustainable world… The MasterBrand Way. At MasterBrand, we are proud of our 70-year heritage that has made us the number one North American residential cabinet manufacturer. We realize that with this status comes an even greater responsibility to do what is right for all stakeholders including customers, shareholders, dealers, supply chain partners, our team members and the communities in which we live and work. • We implement programs to recycle and repurpose our wood waste • 80% of our 2022 hardwood spend derived from supply originating in North America • We are a National Forest Foundation partner and Yellowstone Forever supporter • Our Always Aware safety program is focused on creating a Zero Injury culture • MasterBrand is a leader in employee safety • 44% female executive management team, 33% female board, and over 37% POC associates in the U.S. • We support employee resource groups, flexible work environments, DE&I training and robust wellness benefits • We incorporate a separate Chairman and CEO structure • We maintain a Code of Business Conduct and Ethics and Supplier Code of Conduct • We have established dedicated Nominating, Environmental, Social, and Governance Committees We follow comprehensive supplier audit process 5

Industry Leading Customer Base 6 55% 26% 10% 9% Dealer Retail: In Stock Retail: Semi-Custom Builder MasterBrand channel mix Dealer: provide customer education, service and design consultation 55% In-stock retail: standard products with little customization 26% Semi-custom retail: common box but offer some customization 10% Builder: sold directly and highly levered to single-family housing starts 9% MasterBrand has leadership in dealer channel... Source: Company estimates as of December 6, 2022 Overview of primary sales channels Builder ChannelRetailers / Home Center ChannelDealer Channel $1.0bn ~9% $3.7bn ~34% $6.3bn ~57% 2021 Channel Size % of total New Home Construction R&R R&R / New Home Construction Primary End Market Exposure Medium (Growing trend of National Homebuilder Consolidation) High (Top 3 represent ~60%) Low (25,000+ Nationally) Customer Concentration Fragmented network: Requires scale to address and allows a variety of consumer touch points Multi-brand strategy: Dealers offer multiple brands, enabling trade up and down to drive sales High switching costs: Physical showroom investments and sales training drive retention …and why it matters

7 Multi-Branded Strategy Across Price Points and Products ~50% ~40% ~100% ~35% ~60% ~15% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% MasterBrand Competitor A Competitor B Stock / In-Stock Semi-Custom Custom / Premium Price point (per cabinet) <$200 >$600 MasterBrand portfolio by type and key brands Stock /In-Stock Semi-Custom Custom/Premium Source: Company filings; Company estimates as of December 6, 2022 MasterBrand offers the most diverse product portfolio and covers the price spectrum

Integrated Manufacturing Network & Strong Track Record of Continuous Improvement 8 Footprint optimization Process improvement tools to simplify product portfolio MANTRA brand sales grew 115% CAGR from 2019 to 2022 Continuous improvement culture Facility improvements significantly reduced labor required to produce the same volume of cabinets Efficient capital spending profile Streamlined number of door styles and finishes offered, while retaining customization O L D M O D E L : 10+ product platform / plant silos N E W M O D E L : 4 construction-specific product platforms + + + Networked manufacturing footprint Capability duplication aligned to demand Aligned product continuum Assets Capabilities Product Specs MasterBrand’s strategic transformation initiatives have created >$40 million of cumulative annual savings to date

Plant C Plant D Plant E Plant F StockMTO 5 Networks PLANT NETWORKS 23 Independent Plants to MANUFACTURING FLEXIBILITY 1 Quarter facility transition from MTO to stock 1 Facility moved FACILITY RATIONALIZATION 2 Facilities closed Plant A Closed Apr-21 Plant B Closed Oct-22 Targeted manufacturing moved abroad Mar-22 A ch ie ve d In -p ro ce ssCOMMON CONSTRUCTION 9+ Platforms to 4 Platforms 57% Reduction in Doors 74% Reduction in Finishes 42% Reduction in Species Align to Grow 9 Stock MTO Framed Frameless Simplified manufacturing to fulfill market needs Reduced complexity enables improved services and quality Vanities

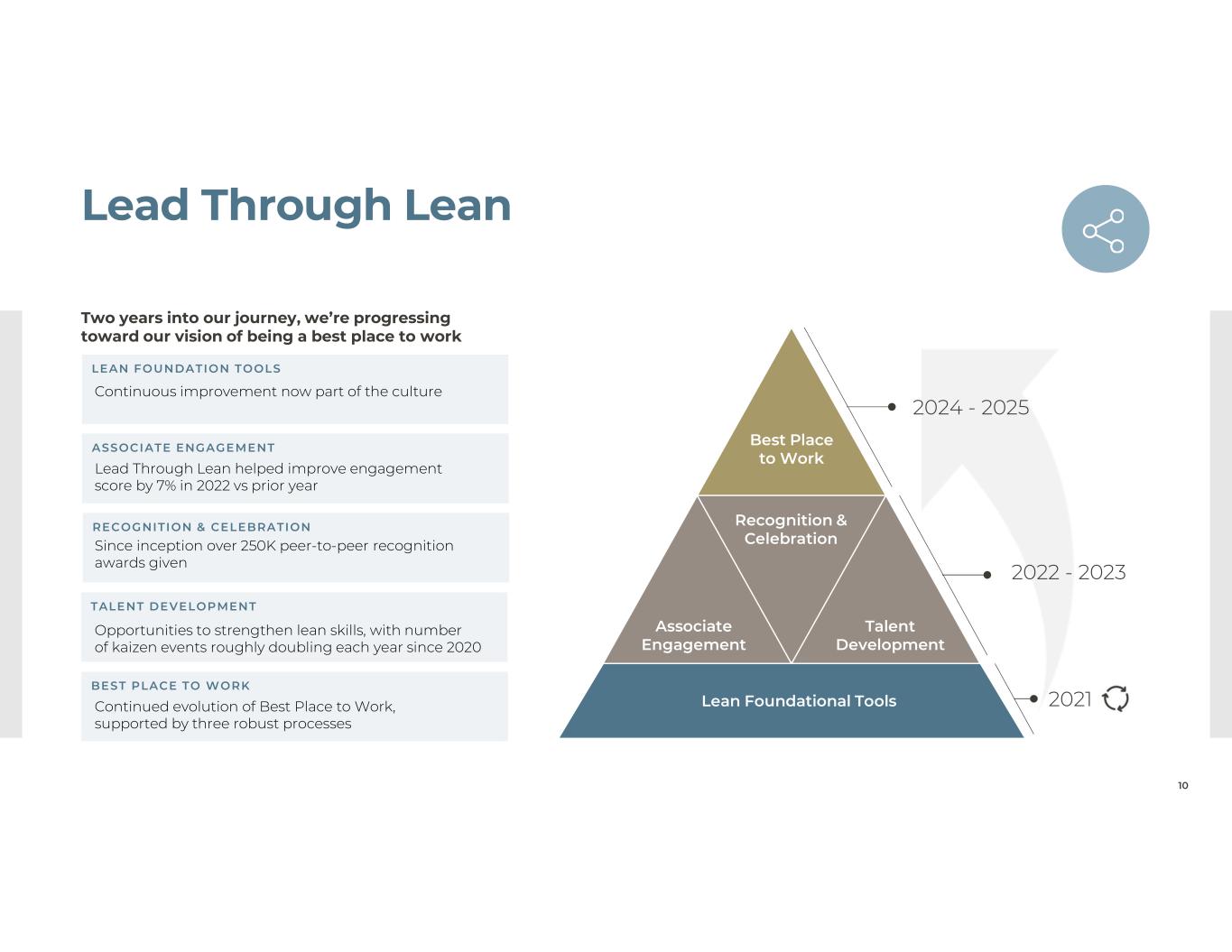

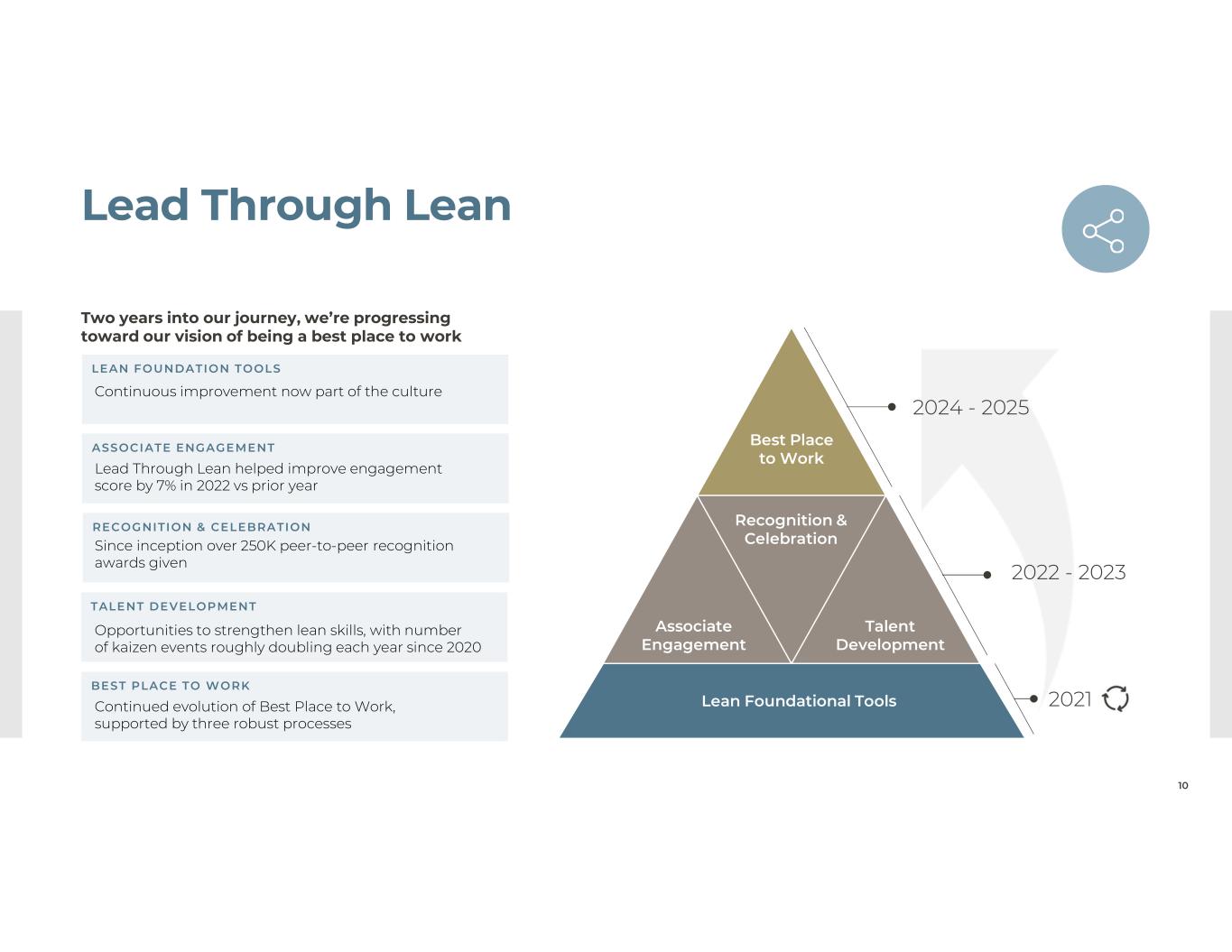

Lead Through Lean 10 2021 2022 - 2023 2024 - 2025 Best Place to Work Recognition & Celebration Talent Development Associate Engagement Lean Foundational Tools Two years into our journey, we’re progressing toward our vision of being a best place to work ASSOCIATE ENGAGEMENT RECOGNITION & CELEBRATION LEAN FOUNDATION TOOLS TALENT DEVELOPMENT BEST PLACE TO WORK Continuous improvement now part of the culture Continued evolution of Best Place to Work, supported by three robust processes Lead Through Lean helped improve engagement score by 7% in 2022 vs prior year Since inception over 250K peer-to-peer recognition awards given Opportunities to strengthen lean skills, with number of kaizen events roughly doubling each year since 2020

Simplify and Automate Backoffice Processes Enhance Customer Experience Digitize our Plants Leveraging Data and Analytics to Unlock Shareholder Value 11

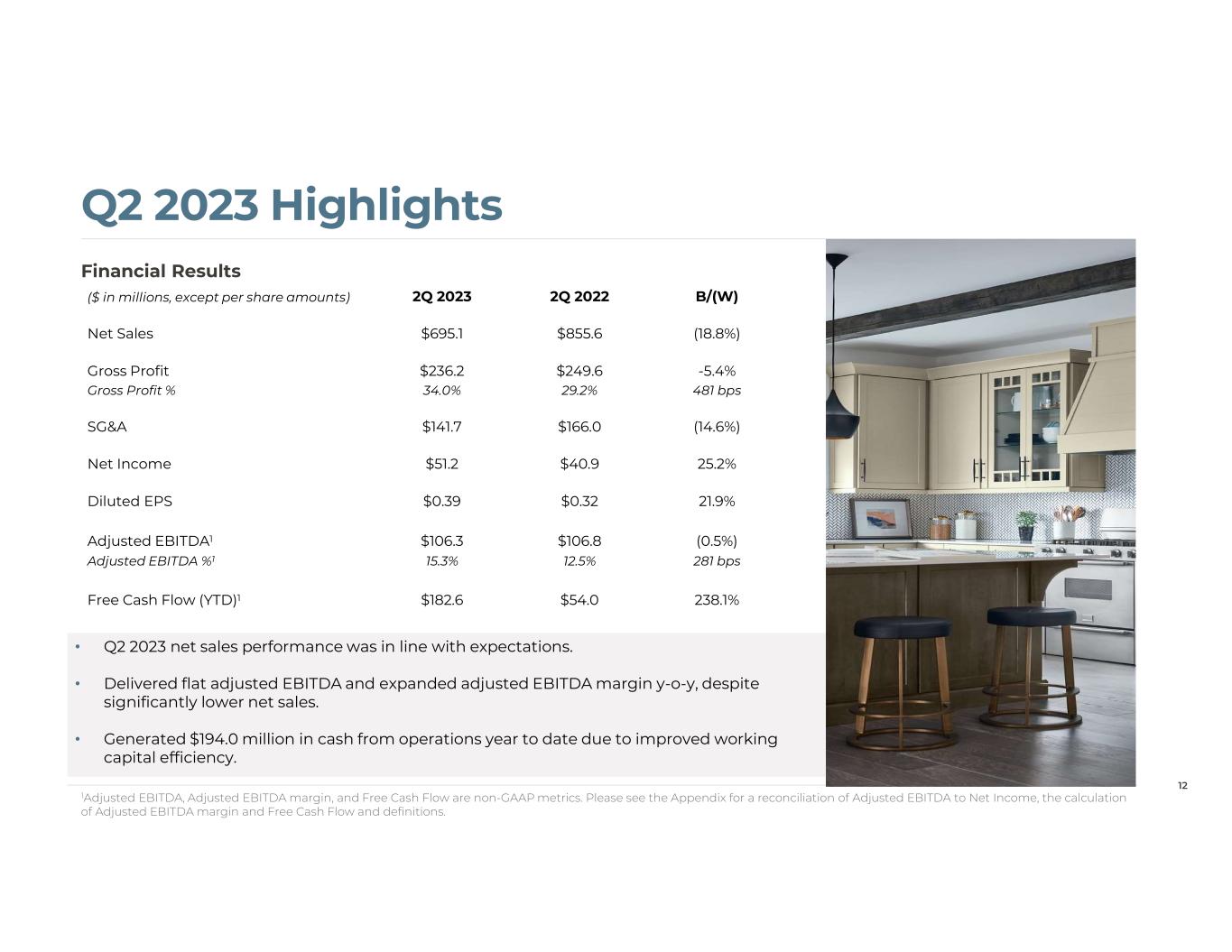

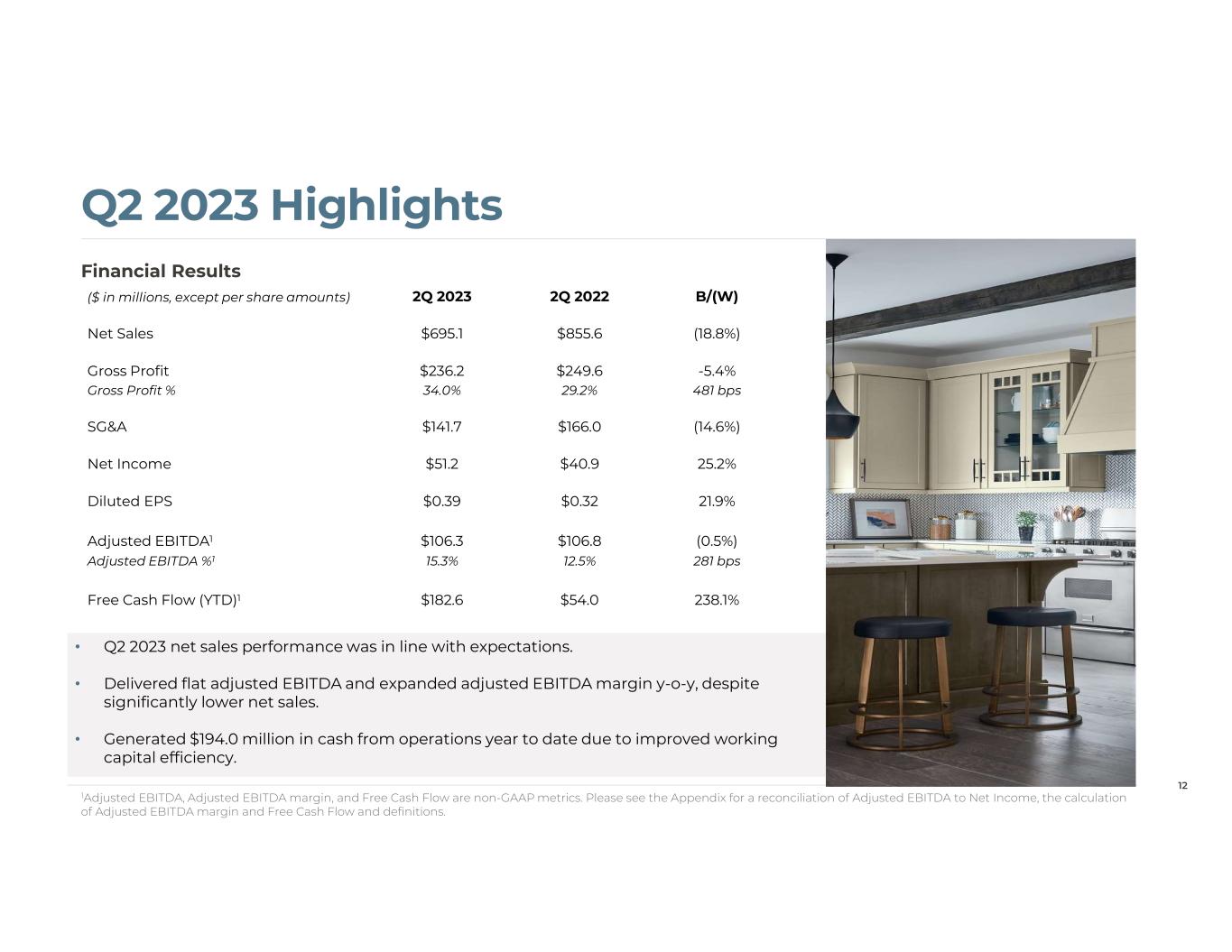

Q2 2023 Highlights 12 • Q2 2023 net sales performance was in line with expectations. • Delivered flat adjusted EBITDA and expanded adjusted EBITDA margin y-o-y, despite significantly lower net sales. • Generated $194.0 million in cash from operations year to date due to improved working capital efficiency. Financial Results 1Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow are non-GAAP metrics. Please see the Appendix for a reconciliation of Adjusted EBITDA to Net Income, the calculation of Adjusted EBITDA margin and Free Cash Flow and definitions. B/(W)2Q 20222Q 2023($ in millions, except per share amounts) (18.8%)$855.6$695.1Net Sales -5.4%$249.6$236.2Gross Profit 481 bps29.2%34.0%Gross Profit % (14.6%)$166.0 $141.7 SG&A 25.2%$40.9$51.2Net Income 21.9%$0.32$0.39Diluted EPS (0.5%)$106.8$106.3Adjusted EBITDA1 281 bps12.5%15.3%Adjusted EBITDA %1 238.1%$54.0$182.6Free Cash Flow (YTD)1

Long-Term Financial Targets Long Term Outlook1 1. Business and portfolio aligned with the customer 2. Operational Excellence will fuel margin growth 3. Flexible platform allows us to navigate any market condition Clear Path to Achieving Results 1This outlook information was presented by the Company at its Investor Day 2022 presentation on December 6, 2022, and it speaks only as of that date. Its inclusion in this presentation does not constitute a reaffirmation or update of such information as of the date hereof or any other date. 2Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP metrics. Please see appendix for definitions. Market Growth 3-5% CAGR North American Cabinets Market MasterBrand 4-6% CAGR Net Sales ~16%-18% FY Adj. EBITDA2 Margin 13 S T R O N G F O C U S O N M A R G I N E X P A N S I O N

MasterBrand: Investor Day 2022 Appendix

Non-GAAP Financial Measures To supplement the financial information presented in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”) in this presentation, certain non-GAAP financial measures as defined under SEC rules have been included. It is our intent to provide non-GAAP financial information to enhance understanding of our financial information as prepared in accordance with GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for, other financial measures prepared in accordance with GAAP. Our methods of determining these non-GAAP financial measures may differ from the methods used by other companies for these or similar non-GAAP financial measures. Accordingly, these non-GAAP financial measures may not be comparable to measures used by other companies. We use EBITDA, adjusted EBITDA, adjusted EBITDA margin, and free cash flow, which are all non-GAAP financial measures. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. We evaluate the performance of our business based on income before income taxes, but also look to EBITDA as a performance evaluation measure because interest expense is related to corporate functions, as opposed to operations. For that reason, we believe EBITDA is a useful metric to investors in evaluating our operating results. Adjusted EBITDA is calculated by removing the impact of non-operational results and special items from EBITDA. These non-GAAP measures are useful to investors as they are representative of our core operations and are used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. Free cash flow is defined as cash flow from operations less capital expenditures. We believe that free cash flow is a useful measure to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of our business strategy, and is used in the management of our business, including decisions concerning the allocation of resources and assessment of performance. As required by SEC rules, see the Appendix of this presentation for detailed reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure. We have not provided a reconciliation of our fiscal 2023 and long-term adjusted EBITDA and adjusted EBITDA margin guidance because the information needed to reconcile these measures is unavailable due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred, including the high variability and low visibility with respect to gains and losses associated with our defined benefit plans and restructuring and other charges, which are excluded from adjusted EBITDA and adjusted EBITDA margin. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future periods and cannot be accomplished without unreasonable effort. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions. 15

Full Year Non-GAAP Reconciliations 16 December 29, December 27, December 26, December 25, 2019 2020 2021 2022 100.7 145.7 182.6 155.4 (0.1) (2.4) (4.6) (12.9) - - - 2.2 34.5 50.5 55.7 58.0 44.3 48.0 44.4 47.3 17.8 17.8 17.8 17.2 197.2 259.6 295.9 267.2 5.8 14.4 14.3 44.4 - - - 15.4 10.2 6.1 4.2 25.1 0.5 5.3 3.7 12.7 41.5 9.5 - 46.4 - - - 0.2 255.2 294.9 318.1 411.4 2,388.7 2,469.3 2,855.3 3,275.5 11% 12% 11% 13% Income tax expense (In millions, except percentages) Reconciliation of Net Income to EBITDA to ADJUSTED Net income (GAAP) Related party interest income, net Interest expense Depreciation expense Amortization expense EBITDA (Non-GAAP Measure) [1] Net cost savings as standalone company [2] Separation costs [3] Restructuring charges [4] Restructuring-related items [5] Asset impairment charges [6] Recognition of actuarial gains Adjusted EBITDA (Non-GAAP Measure) Adjusted EBITDA Margin % 52 Weeks Ended NET SALES

Q2 2023 Non-GAAP Reconciliations 17 1. Reconciliation of Net Income to EBITDA to ADJUSTED EBITDA 13 Weeks Ended June 26,June 25, 20222023(In millions, except per share amounts and percentages) $ 40.9 $ 51.2 Net income (GAAP) (1.9)—Related party interest income, net —17.2Interest expense 13.118.5Income tax expense 10.711.7Depreciation expense 4.44.0Amortization expense $ 67.2 $ 102.6 EBITDA (Non-GAAP Measure) 9.9—[1] Net cost savings as standalone company 0.20.6[2] Separation costs 1.33.1[3] Restructuring charges 2.2—[4] Restructuring-related charges 26.0—[5] Asset impairment charge $ 106.8 $ 106.3 Adjusted EBITDA (Non-GAAP Measure) TICK LEGEND: [1] Prior to the separation from Fortune Brands in Q4 2022, our historical consolidated financial statements included expense allocations for certain corporate functions performed on our behalf by Fortune Brands, including information technology, finance, executive, human resources, supply chain, internal audit and legal services. As a standalone public company, we expect that the costs we incur on a standalone basis for such expenses previously allocated to us by Fortune Brands and new costs relating to our public company reporting and compliance obligations will be less than the expense allocations from Fortune Brands within our historical financial statements. The costs of MasterBrand we plan to incur are based on our expected organizational structure and expected cost structure as a standalone company. In order to determine the impact of the synergies and dissynergies, MasterBrand prepared a detailed assessment of personnel costs based on the estimated resources and associated costs required as a baseline to stand up MasterBrand as a standalone company. In addition to personnel costs, estimated nonpersonnel third party support costs in each function were considered, which included business support functions and corporate overhead charges previously shared with Fortune Brands. Estimated non personnel third party support costs were determined by estimating third party spend in each function, and include the costs associated with outside services supporting information technology, finance, executive, human resources, supply chain, internal audit and legal services. This process was used by all functions resulting in expected net cost savings when compared to the corporate allocations from Fortune Brands included in the historical financial statements. [2] Separation costs represent one-time costs incurred directly by MasterBrand related to the separation from Fortune Brands. [3] Restructuring charges are nonrecurring costs incurred to implement significant cost reduction initiatives and may consist of workforce reduction costs, facility closure costs, and other costs to maintain certain facilities where operations have ceased, but which we are still responsible for. The restructuring charges for the periods presented are comprised primarily of workforce reduction costs. [4] Restructuring-related charges are expenses directly related to restructuring initiatives that do not represent normal, recurring expenses necessary to operate the business, but cannot be reported as restructuring under GAAP. Such costs may include losses on disposal of inventories from exiting product lines, accelerated depreciation expense, and gains/losses on the sale of facilities closed as a result of restructuring actions. Restructuring-related adjustments are recoveries of previously recorded restructuring-related charges resulting from changes in estimates of accruals recorded in prior periods. Restructuring-related charges/(adjustments) for the periods presented are related primarily to the reserves for losses on disposal of inventories. [5] The thirteen and twenty-six weeks ended June 26, 2022, includes a $26.0 million pre-tax impairment charge related to the impairment of an indefinite lived trade name.

Q2 2023 Non-GAAP Reconciliations 18 June 25, June 26, (In millions) 2023 2022 Net income............................................................................................... $ 86.2 $ 87.9 NET CASH PROVIDED BY OPERATING ACTIVITIES................................ 194.0 76.1 Capital expenditures...................................................................... (11.4) (22.1) Proceeds from the disposition of assets.......................................... 0.2 — NET CASH USED IN INVESTING ACTIVITIES........................................... (11.2) (22.1) NET CASH USED IN FINANCING ACTIVITIES........................................... (172.0) (69.6) Effect of foreign exchange rate changes on cash and cash equivalents.......... (1.7) — NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS.......... $ 9.1 $ (15.6) Cash and cash equivalents at beginning of period........................................ $ 101.1 $ 141.4 Cash and cash equivalents at end of period................................................. $ 110.2 $ 125.8 Reconciliation of Free Cash Flow Net cash provided by operating activities..................................................... $ 194.0 $ 76.1 Less: Capital expenditures......................................................................... (11.4) (22.1) Free cash flow......................................................................................... $ 182.6 $ 54.0 26 Weeks Ended 2. Reconciliation of Free Cash Flow