0001937926FALSE2024FYiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purebam:segmentbam:directoriso4217:CADxbrli:shares00019379262024-01-012024-12-3100019379262024-06-300001937926us-gaap:CommonClassAMember2025-03-070001937926us-gaap:CommonClassBMember2025-03-0700019379262024-12-3100019379262023-12-310001937926us-gaap:CommonClassAMember2024-12-310001937926us-gaap:CommonClassAMember2023-12-310001937926us-gaap:CommonClassBMember2024-12-310001937926us-gaap:CommonClassBMember2023-12-3100019379262023-01-012023-12-3100019379262022-07-042022-12-310001937926us-gaap:CommonClassAMember2024-01-012024-12-310001937926us-gaap:CommonClassAMember2023-01-012023-12-310001937926us-gaap:CommonClassAMember2022-07-042022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-030001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-030001937926us-gaap:CommonStockMember2022-07-030001937926us-gaap:TreasuryStockCommonMember2022-07-030001937926us-gaap:AdditionalPaidInCapitalMember2022-07-030001937926us-gaap:RetainedEarningsMember2022-07-030001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-030001937926us-gaap:NoncontrollingInterestMember2022-07-0300019379262022-07-030001937926us-gaap:RetainedEarningsMember2022-07-042022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-042022-12-310001937926us-gaap:CommonStockMember2022-07-042022-12-310001937926us-gaap:TreasuryStockCommonMember2022-07-042022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-042022-12-310001937926us-gaap:AdditionalPaidInCapitalMember2022-07-042022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001937926us-gaap:CommonStockMember2022-12-310001937926us-gaap:TreasuryStockCommonMember2022-12-310001937926us-gaap:AdditionalPaidInCapitalMember2022-12-310001937926us-gaap:RetainedEarningsMember2022-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001937926us-gaap:NoncontrollingInterestMember2022-12-3100019379262022-12-310001937926us-gaap:RetainedEarningsMember2023-01-012023-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001937926us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001937926us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001937926us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001937926us-gaap:CommonStockMember2023-01-012023-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001937926us-gaap:CommonStockMember2023-12-310001937926us-gaap:TreasuryStockCommonMember2023-12-310001937926us-gaap:AdditionalPaidInCapitalMember2023-12-310001937926us-gaap:RetainedEarningsMember2023-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001937926us-gaap:NoncontrollingInterestMember2023-12-310001937926us-gaap:RetainedEarningsMember2024-01-012024-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001937926us-gaap:CommonStockMember2024-01-012024-12-310001937926us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001937926us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001937926us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001937926us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310001937926us-gaap:CommonStockMember2024-12-310001937926us-gaap:TreasuryStockCommonMember2024-12-310001937926us-gaap:AdditionalPaidInCapitalMember2024-12-310001937926us-gaap:RetainedEarningsMember2024-12-310001937926us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001937926us-gaap:NoncontrollingInterestMember2024-12-310001937926bam:BrookfieldAssetManagementULCMember2022-12-090001937926bam:AmericanEquityInvestmentLifeHoldingCompanyMemberbam:BrookfieldCorporationMember2024-05-022024-05-020001937926bam:AmericanEquityInvestmentLifeHoldingCompanyMemberbam:BrookfieldCorporationMember2024-05-020001937926bam:AmericanEquityInvestmentLifeHoldingCompanyMember2024-05-020001937926bam:BrookfieldAssetManagementULCMember2024-05-010001937926bam:BrookfieldAssetManagementULCMember2024-05-020001937926bam:BrookfieldAssetManagementULCMember2024-12-310001937926bam:BrookfieldAssetManagementULCMember2023-12-310001937926bam:BrookfieldCorporationMember2024-01-012024-12-310001937926bam:BrookfieldAssetManagementULCMember2024-05-020001937926bam:BrookfieldAssetManagementULCMember2024-01-012024-12-310001937926bam:AssetManagementBusinessSubsidiaryMember2024-01-012024-12-310001937926bam:BrookfieldAssetManagementULCMember2024-12-310001937926bam:BrookfieldAssetManagementULCMember2023-12-310001937926bam:BrookfieldAssetManagementULCMember2024-01-012024-12-310001937926bam:BrookfieldAssetManagementULCMember2023-01-012023-12-310001937926bam:BrookfieldAssetManagementULCMember2022-07-042022-12-3100019379262022-12-092022-12-310001937926us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001937926us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001937926us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001937926us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926us-gaap:EmployeeStockOptionMember2024-12-310001937926us-gaap:EmployeeStockOptionMember2023-12-310001937926bam:EscrowedSharesMember2024-01-012024-12-310001937926bam:EscrowedSharesMember2023-01-012023-12-310001937926bam:EscrowedSharesMember2023-12-310001937926bam:EscrowedSharesMember2024-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2024-01-012024-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2023-01-012023-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2022-07-042022-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2024-01-012024-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2023-01-012023-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2022-07-042022-12-310001937926us-gaap:RestrictedStockMemberbam:RestrictedStockPlanMember2024-01-012024-12-310001937926us-gaap:RestrictedStockMemberbam:RestrictedStockPlanMember2023-01-012023-12-310001937926us-gaap:RestrictedStockMemberbam:RestrictedStockPlanMember2022-07-042022-12-310001937926bam:EquityAwardsMember2024-01-012024-12-310001937926bam:EquityAwardsMember2023-01-012023-12-310001937926bam:EquityAwardsMember2022-07-042022-12-310001937926bam:DeferredShareUnitMemberbam:DeferredShareUnitPlanMember2024-01-012024-12-310001937926bam:DeferredShareUnitMemberbam:DeferredShareUnitPlanMember2023-01-012023-12-310001937926bam:DeferredShareUnitMemberbam:DeferredShareUnitPlanMember2022-07-042022-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:RestrictedShareUnitPlanMember2024-01-012024-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:RestrictedShareUnitPlanMember2023-01-012023-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:RestrictedShareUnitPlanMember2022-07-042022-12-310001937926bam:CashSettledAwardsMember2024-01-012024-12-310001937926bam:CashSettledAwardsMember2023-01-012023-12-310001937926bam:CashSettledAwardsMember2022-07-042022-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2023-12-310001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2023-12-310001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2024-01-012024-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2024-12-310001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2024-12-310001937926us-gaap:ShareBasedPaymentArrangementEmployeeMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2024-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2022-12-310001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2022-12-310001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926us-gaap:ShareBasedPaymentArrangementEmployeeMemberbam:ManagementShareOptionPlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001937926us-gaap:EmployeeStockOptionMemberbam:ManagementShareOptionPlanMember2022-07-030001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2022-07-030001937926bam:ManagementShareOptionPlanMemberbam:BrookfieldCorporationMemberus-gaap:EmployeeStockOptionMember2022-07-042022-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2023-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldAssetManagementULCMemberbam:EscrowedSharesMember2023-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2023-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldAssetManagementULCMemberbam:EscrowedSharesMember2024-01-012024-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2024-01-012024-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2024-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldAssetManagementULCMemberbam:EscrowedSharesMember2024-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2024-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2022-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2022-12-310001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2023-01-012023-12-310001937926bam:EscrowedSharesMemberbam:EscrowedStockPlanMember2022-07-030001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2022-07-030001937926bam:EscrowedStockPlanMemberbam:BrookfieldCorporationMemberbam:EscrowedSharesMember2022-07-042022-12-310001937926bam:DeferredShareUnitMemberbam:DeferredShareUnitPlanMember2022-01-012022-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2023-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2023-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2023-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2024-01-012024-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2024-01-012024-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2024-01-012024-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2024-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2024-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2024-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2022-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2022-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2022-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2023-01-012023-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2023-01-012023-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2023-01-012023-12-310001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2022-07-030001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2022-07-030001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2022-07-030001937926bam:DeferredShareUnitsTrackingToBrookfieldAssetManagementLtdSharePriceMemberbam:BrookfieldCorporationMember2022-07-042022-12-310001937926bam:DeferredShareUnitsTrackingToBNSharePriceMemberbam:BrookfieldCorporationMember2022-07-042022-12-310001937926us-gaap:RestrictedStockUnitsRSUMemberbam:BrookfieldCorporationMember2022-07-042022-12-310001937926us-gaap:CommonClassBMember2024-01-012024-12-310001937926us-gaap:CommonClassBMember2023-01-012023-12-310001937926us-gaap:CommonClassBMember2022-07-042022-12-310001937926us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001937926us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001937926us-gaap:EmployeeStockOptionMember2022-07-042022-12-310001937926bam:EscrowSharesMember2024-01-012024-12-310001937926bam:EscrowSharesMember2023-01-012023-12-310001937926bam:EscrowSharesMember2022-07-042022-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001937926us-gaap:RestrictedStockUnitsRSUMember2022-07-042022-12-310001937926us-gaap:EquityMethodInvesteeMember2024-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2024-01-012024-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2023-01-012023-12-310001937926us-gaap:EquityMethodInvesteeMemberbam:AssetManagementServicesAgreementMember2022-01-012022-12-310001937926srt:AffiliatedEntityMemberbam:RelationshipAgreementMember2024-01-012024-12-310001937926srt:AffiliatedEntityMemberbam:RelationshipAgreementMember2023-01-012023-12-310001937926srt:AffiliatedEntityMemberbam:RelationshipAgreementMember2022-01-012022-12-310001937926srt:AffiliatedEntityMemberbam:TransitionalServicesAgreementMember2024-01-012024-12-310001937926srt:AffiliatedEntityMemberbam:TransitionalServicesAgreementMember2023-01-012023-12-310001937926srt:AffiliatedEntityMemberbam:TransitionalServicesAgreementMember2022-01-012022-12-310001937926srt:AffiliatedEntityMember2024-12-310001937926srt:AffiliatedEntityMember2023-12-310001937926us-gaap:SubsequentEventMember2025-02-110001937926bam:AssetManagementBusinessSubsidiaryMemberus-gaap:SubsequentEventMember2025-02-040001937926us-gaap:SubsequentEventMemberbam:BrookfieldCorporationMemberbam:AssetManagementCompanyMember2025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

|

|

|

|

|

|

|

|

|

| ☒ |

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024.

|

|

|

|

|

|

|

|

|

| ☐ |

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-41563

BROOKFIELD ASSET MANAGEMENT LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| British Columbia, Canada |

|

98-1702516 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Brookfield Place

250 Vesey Street, 15th Floor

New York, NY 10281-0221

(Address of principal executive offices)

(212) 417-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Limited Voting Shares |

|

BAM |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☒ No☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes☐ No☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

| Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the other registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes☐ No☒

As of June 30, 2024, the aggregate market value of the Class A Limited Voting Shares held by non-affiliates of the registrant was $16.0 billion.

As of March 7, 2025, the registrant had 1,637,295,707 Class A Limited Voting Shares and 21,280 Class B Limited Voting Shares outstanding.

EXPLANATORY NOTE

Brookfield Asset Management Ltd. (“BAM”) is a New York based asset manager, yet qualifies as an eligible Canadian issuer under the Multijurisdictional Disclosure System and as a “foreign private issuer” as such term is defined in Rule 405 under the U.S. Securities Act of 1933, as amended, and Rule 3b-4 under the U.S. Securities Exchange Act of 1934, as amended. Although, as a foreign private issuer, BAM is not required to do so, BAM intends to voluntarily file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K with the SEC instead of filing the reporting forms available to foreign private issuers.

BAM intends to prepare and file a management information circular and related materials under Canadian requirements that will not be filed pursuant to Regulation 14A.

BROOKFIELD ASSET MANAGEMENT LTD.

FORM 10-K

For the Year Ended December 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 1B. |

|

|

| Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

|

|

|

| Item 5. |

|

|

| Item 6. |

|

|

| Item 7. |

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Item 9C. |

|

|

|

|

|

| Item 10. |

|

|

| Item 11. |

|

|

| Item 12. |

|

|

| Item 13. |

|

|

| Item 14. |

|

|

|

|

|

| Item 15. |

|

|

| Item 16. |

|

|

|

|

|

|

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and forward-looking information within the meaning of other relevant securities legislation, including applicable securities laws in Canada, which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook”, “believe”, “think”, “expect”, “potential”, “continue”, “may”, “should”, “seek”, “approximately”, “predict”, “intend”, “will”, “plan”, “estimate”, “anticipate”, the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. These statements identify prospective information. Important factors could cause actual results to differ, possibly materially, from those indicated in these statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity.

We believe these factors include those described in the section entitled “Risk Factors” in this Annual Report on Form 10-K (our “Annual Report” or “report”). These factors should be read in conjunction with the other cautionary statements that are included in this report and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”). We do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

CERTAIN TERMS USED IN THIS REPORT

In this report, references to “BAM Ltd.” or “BAM” refer to Brookfield Asset Management Ltd. References to our “asset management business”, the “Asset Management Company”, “BAM ULC”, or the “Company” refer to Brookfield Asset Management ULC, and references to “we”, “us”, “our” means our asset management business and BAM, individually or collectively, where applicable. The term “BN” means Brookfield Corporation and its subsidiaries (including the perpetual affiliates (as defined below)) other than the Asset Management Company and its subsidiaries and does not, for greater certainty, include BAM, BWS (as defined below) or Oaktree (as defined below) and their affiliates. The term “Brookfield” means BAM, BN and the Asset Management Company, collectively.

Additional information about BAM is available on our website at https://bam.brookfield.com and on the EDGAR section of the SEC website at www.sec.gov. The information on our website is not, and shall not be deemed to be, a part of this report or incorporated by reference into any other filings we make with the SEC. Information is also available on the Canadian Securities Administrators’ (“CSA”) website at www.sedarplus.ca.

Unless the context suggests otherwise, references to:

•“2022 Arrangement” means the court approved plan of arrangement involving BN as a result of which (i) the shareholders of BN, while retaining their shares of BN, became shareholders of BAM, which acquired a 25% interest in our asset management business through common shares of the Asset Management Company, and (ii) BN changed its name from “Brookfield Asset Management Inc.” to “Brookfield Corporation”;

•“2025 Arrangement” has the meaning ascribed thereto on page

16;

•“2025 Plan of Arrangement” has the meaning ascribed thereto on page

16;

•“AEL” means American Equity Investment Life Holding Company;

•“AEL Mandate” means the May 2, 2024 acquisition of AEL by BWS through its subsidiary American National Group LLC. We manage AEL insurance capital under an investment management agreement with AEL operating companies;

•“AMSA” means the Asset Management Services Agreement dated December 9, 2022 between BAM and BAM ULC;

•“Asset Management Services Agreement” means the agreement dated November 8, 2022 between BAM and the Asset Management Company to govern the provision of services by BAM’s employees to the Asset Management Company on a cost recovery basis under a perpetual agreement, as further described in Note 1 “Organization” of the Consolidated Financial Statements of BAM;

•“Assets Under Management” or “AUM” has the meaning ascribed thereto under “Item 7 - Key Financial and Operating Measures”;

•“BAM Credit Facility” means the credit agreement dated November 8, 2022 between BAM and the Asset Management Company, pursuant to which the Asset Management Company has provided a five-year revolving $500 million credit facility to BAM, as further described under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources”;

•“BAM Partnership” means BAM Partners Trust;

•“BBU” means Brookfield Business Partners L.P., together with its subsidiaries including its paired corporation, Brookfield Business Corporation;

•“BCP” means Brookfield Capital Partners;

•“BEP” means Brookfield Renewable Partners L.P., together with its subsidiaries including its paired corporation, Brookfield Renewable Corporation;

•“BGTF” means Brookfield Global Transition Fund;

•“BIP” means Brookfield Infrastructure Partners L.P., together with its subsidiaries including its paired corporation, Brookfield Infrastructure Corporation;

•“BN” means Brookfield Corporation;

•“Board” means the board of directors of BAM;

•“BPG” means Brookfield Property Group, including Brookfield Property Partners L.P. and BN’s wholly-owned real estate directly held entities;

•“BPREP” means Brookfield Premier Real Estate Partners;

•“BPY” means Brookfield Property Partners, together with its subsidiaries;

•“Brookfield REIT” means Brookfield Real Estate Income Trust;

•“BSI” means Brookfield Special Investments;

•“BSIP” means Brookfield Super-Core Infrastructure Partners;

•“BSREP” means Brookfield Strategic Real Estate Partners;

•“BWS” means Brookfield Wealth Solutions Ltd., a paired entity to BN offering a range of retirement services, wealth protection products and tailored capital solutions;

•“Castlelake” means our 51% economic interest in Fee-Related Earnings, 7.5% interest in carried interest, 20% of returns from GP commitments of Castlelake, and 51% of GP commitments for in-market and future Castlelake funds acquired on September 16, 2024;

•“Class A Shares” means the class A limited voting shares in the capital of BAM;

•“Class B Shares” means the class B limited voting shares in the capital of BAM;

•“Code” means the U.S. Internal Revenue Code of 1986, as amended;

•“Code of Conduct” means the code of business conduct and ethics of BAM;

•“corporate liquidity” consists of cash, short-term financial assets, as well as the undrawn portions of the $300 million revolving credit facility established on November 8, 2022, with BN as lender, and a $750 million five-year revolving credit facility established on August 29, 2024, through bilateral agreements with a group of third party lenders;

•“CORRA” means the Canadian Overnight Repo Rate Average;

•“CRA” means the Canada Revenue Agency;

•“CTF” means Catalytic Transition Fund;

•“Distributable Earnings”, a non-GAAP measure, has the meaning ascribed thereto under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”;

•“Fee-Bearing Capital”, a non-GAAP measure, has the meaning ascribed thereto under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”;

•“Fee-Related Earnings”, a non-GAAP measure, has the meaning ascribed thereto under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”;

•“Fee Revenues”, a non-GAAP measure, has the meaning ascribed thereto under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”;

•“Investment Company Act” means the United States Investment Company Act of 1940, as amended;

•“IRS” means the United States Internal Revenue Service;

•“GEMS Education” means our warehoused investment in a Dubai-based international education provider, GEMS Education, acquired on July 12, 2024, as part of a Brookfield-led consortium of investors including the Asset Management Company, BSI, BWS, and certain co-investors;

•“Group deployable capital” consists of: (1) corporate liquidity of the Company and the perpetual affiliates, and (2) uncalled private fund commitments, which are third-party commitments available for drawdown in the private funds of our asset management business;

•“managed assets” means the businesses, operations and other assets managed by BN prior to completion of the 2022 Arrangement and to be managed by BAM and our asset management business following completion of the 2022 Arrangement;

•“mature fund” means a Brookfield fund which has already significantly deployed upon completion of the 2022 Arrangement;

•“new sponsored fund” or “new fund” means a Brookfield fund launched on or after the date of the 2022 Arrangement;

•“Oaktree” means Oaktree Capital Management, L.P., together with its affiliates, Oaktree Capital II, L.P. General (“OCM II General”), Oaktree Capital II, L.P. Manager (“OCM II Manager”), Oaktree Capital II, L.P New Fund (“OCM II New Fund”), Oaktree AIF Investments, L.P., Oaktree Capital Management (Cayman) L.P. and Oaktree Investment Holdings, L.P. and their consolidated subsidiaries;

•“perpetual affiliates” means BEP, BIP, BBU and BPG;

•“PFIC” means a passive foreign investment company for U.S. federal income tax purposes;

•“Pinegrove Ventures” means our acquisition of the investment platform business of SVB Financial Group, SVB Capital (rebranded to Pinegrove Ventures after acquisition), acquired on September 26, 2024 through Pinegrove Venture Partners (“Pinegrove”), our venture investment platform formed with Sequoia Heritage;

•“Pretium” means our 11% economic interest in Pretium acquired on June 29;

•“PVI” means Partners Value Investments L.P., a publicly-listed investment partnership whose principal business activity is owning equity interests in Brookfield for the long-term.

•“Relationship Agreement” means the agreement dated November 8, 2022 among BN, BAM and the Asset Management Company to govern aspects of their relationship following the 2022 Arrangement, as further described under Note 1 “Organization” of the Consolidated Financial Statements of BAM;

•“SOFR” means the Secured Overnight Financing Rate published by the Federal Reserve Bank of New York (or a successor administrator);

•“Tax Act” means the Income Tax Act (Canada);

•“Transitional Services Agreement” means the agreement dated November 8, 2022 among BN, BAM and the Asset Management Company described under Note 1 “Organization” of the Consolidated Financial Statements of BAM;

•“Trust Agreement” means the agreement dated December 9, 2022 among BAM, the BAM Partnership and Computershare Trust Company of Canada relating to the Class B Shares

•“Uncalled Fund Commitments”, a non-GAAP measure, has the meaning ascribed thereto under “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”;

•“U.S. Holder” is a beneficial owner of Class A Shares that for U.S. federal income tax purposes is: (1) an individual who is a citizen or resident of the United States, (2) a corporation (or other entity classified as a corporation for U.S. federal income tax purposes) created or organized in the United States, any state thereof, or the District of Columbia, (3) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (4) a trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (ii) the trust has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person for U.S. federal income tax purposes; and

•“Voting Agreement” means the agreement dated December 9, 2022 between BN and BAM providing for the election of directors of the Asset Management Company. The Voting Agreement was terminated on February 4, 2025 upon completion of the 2025 Arrangement.

BAM and the Asset Management Company prepare their financial statements in conformity with the accounting principles generally accepted in the United States of America (“U.S. GAAP”). This report discloses a number of non-GAAP financial and supplemental financial measures which are utilized in monitoring our asset management business, including for performance measurement, capital allocation and valuation purposes.

BAM believes that providing these performance measures is helpful to investors in assessing the overall performance of our asset management business. These non-GAAP financial measures should not be considered as the sole measure of BAM's or our asset management business’ performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in conformity with U.S. GAAP financial measures. These non-GAAP financial measures are not standardized financial measures and may not be comparable to similar financial measures used by other issuers. Non-GAAP measures include, but are not limited to: (i) distributable earnings (“Distributable Earnings”), (ii) fee revenues (“Fee Revenues”) and (iii) fee-related earnings (“Fee-Related Earnings” or “FRE”). Supplemental financial measures include assets under management (“AUM”), fee-bearing capital (“Fee-Bearing Capital”) and uncalled fund commitments (“Uncalled Fund Commitments”). The asset management business includes the asset management activities of Oaktree, an equity accounted affiliate, in its key financial and operating measures for the asset management business.

For more information on non-GAAP measures and other financial metrics, see “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures”. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP, where applicable, are included in “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of U.S. GAAP to Non-GAAP Measures” in this report.

The financial information contained in this report is presented in U.S. dollars and, unless otherwise indicated, all references to “$” are to U.S. dollars. All references to C$ are to Canadian dollars. All information in this report is presented as at December 31, 2024, unless otherwise noted.

SUMMARY RISK FACTORS

The following is a summary of the risk factors associated with investing in our securities. You should read this summary together with a more detailed description of these risks in the “Risk Factors” section of this report and in other filings that we make from time to time with the SEC.

We are subject to risks related to our business, including risks involving:

•volatility in the trading price of the Class A Shares;

•deficiencies in public company financial reporting and disclosures;

•the difficulty for investors to effect service of process and enforce judgments in various jurisdictions;

•being subjected to numerous laws, rules and regulatory requirements;

•the potential ineffectiveness of our policies to prevent violations of applicable law;

•foreign currency risk and exchange rate fluctuations;

•further increases in interest rates;

•political instability or changes in government;

•unfavorable economic conditions or changes in the industries in which we operate;

•inflationary pressures;

•catastrophic events, such as earthquakes, hurricanes, or pandemics/epidemics;

•ineffective management of sustainability considerations, and inadequate or ineffective health and safety programs;

•failure of our information technology systems;

•us and our managed assets becoming involved in legal disputes;

•losses not covered by insurance;

•inability to collect on amounts owing to us;

•operating and financial restrictions through covenants in our loan, debt and security agreements;

•the material assets of BAM consist solely of its interest in the common shares of the Asset Management Company; and

•our liability for our asset management business.

We are subject to risks related to our investment strategies, including risks involving:

•our ability to maintain our global reputation;

•risks related to our renewable power and transition, infrastructure, private equity, real estate, and credit strategies;

•the impact on growth in Fee-Bearing Capital of poor product development or marketing efforts;

•meeting our financial obligations due to our cash flow from our asset management business;

•our acquisitions;

•requirement of temporary investments and backstop commitments to support our asset management business;

•revenues impacted by a decline in the size or pace of investments made by our managed assets;

•our earnings growth can vary, which may affect our dividend and the trading price of the Class A Shares;

•exposed risk due to increased amount and type of investment products in our managed assets; and

•information barriers that may give rise to conflicts and risks.

We are subject to risks related to our organizational structure and ownership, including risks involving:

•BN exercising substantial influence over BAM;

•BN transferring the ownership of BAM to a third party;

•potential conflicts of interest with BN; and

•difficulty in maintaining our culture or managing our human capital.

We are subject to risks related to taxation, including risks involving:

•United States and Canadian taxation laws and changes thereto.

We caution that the foregoing list of important factors that may affect future results is not exhaustive and other factors could also adversely affect future results. Readers are urged to consider these risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements, which are based only on information available to us as of the date of this report and such other date specified herein.

Certain of the information contained herein is based on or derived from information provided by independent third-party sources. While BAM believes that such information is accurate as of the date it was produced and that the sources from which such information has been obtained are reliable, BAM makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information or the assumptions on which such information is based, contained herein, including but not limited to, information obtained from third parties.

PART I

ITEM 1. BUSINESS

Business Overview

We are a leading global alternative asset manager, headquartered in New York, NY, with over $1 trillion of Assets Under Management across renewable power and transition, infrastructure, private equity, real estate, and credit. Our objective is to generate attractive, long-term risk-adjusted returns for the benefit of our clients and shareholders.

We manage a range of public and private investment products and services for institutional and retail clients. We earn asset management income for doing so and ensure strong alignment of interests with our clients by investing Brookfield capital alongside them. Our access to large-scale capital enables us to make investments in sizeable, premier assets and businesses across geographies and asset classes that we believe few others can.

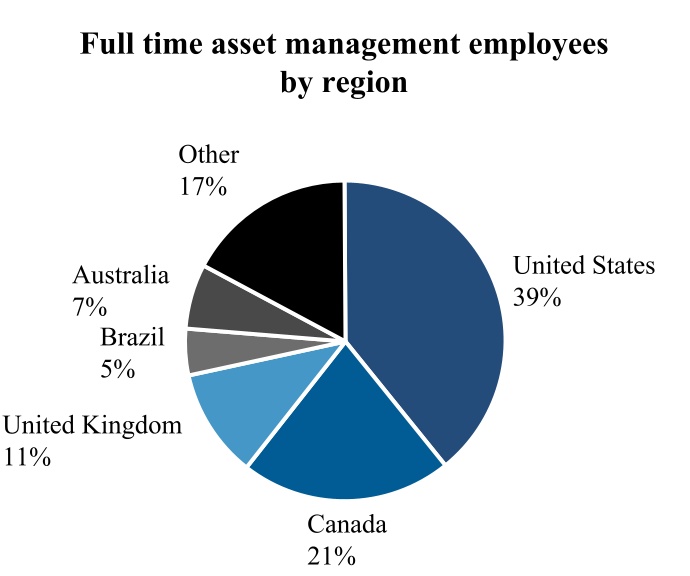

To do this, we leverage our team of over 2,500 investment and asset management professionals, our global reach, deep operating expertise, and access to large-scale capital to identify attractive investment opportunities and invest on a proprietary basis. Our investment approach and strong track record have been the foundation and driver of our growth.

We provide a highly diversified suite of alternative investment strategies to our clients and are constantly seeking to innovate new strategies to meet their needs. We have over 50 unique active strategies that span a wide range of risk-adjusted returns, including opportunistic, value-add, core, super-core, and credit. We evaluate the performance of these product offerings and our investment strategies using a number of non-GAAP measures. BAM utilizes Fee-Bearing Capital, Fee Revenues, Fee-Related Earnings and Distributable Earnings to assess the performance of our asset management business.

We are in a fortunate position to be trusted with our clients’ capital and our objective is to meet their financial goals and provide for a better financial future while providing market leading experience. Our team of over 300 client service professionals across 19 global offices are dedicated to ensuring that the business exceeds our clients’ service expectations.

We have over 2,300 clients, with some of our clients being among the world’s largest institutional investors, including sovereign wealth funds, pension plans, endowments, foundations, financial institutions, and insurance companies.

Our guiding principle is to operate our business and conduct our relationships with the highest level of integrity. Our emphasis on a culture of collaboration allows us to attract and retain top talent.

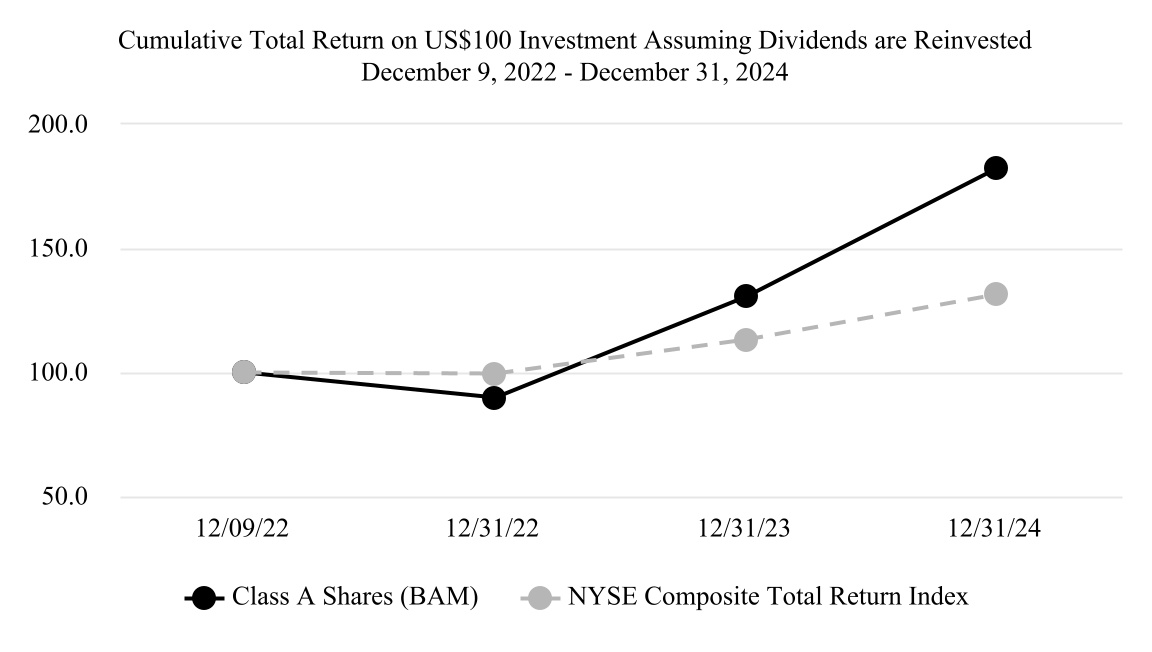

BAM's Class A Limited Voting Shares (the “Class A Shares”) are co-listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the symbol “BAM”.

Value Creation

We create shareholder value by increasing the earnings profile of our asset management business. Alternative asset management businesses such as ours are typically valued based on a multiple of their Fee-Related Earnings and performance income. Accordingly, we create value by increasing the amount and quality of Fee-Related Earnings and performance income, net of associated costs. We achieve this by raising more Fee-Bearing Capital and delivering strong investment performance, which enables us to generate performance income, such as carried interest, while maintaining efficient operating margins.

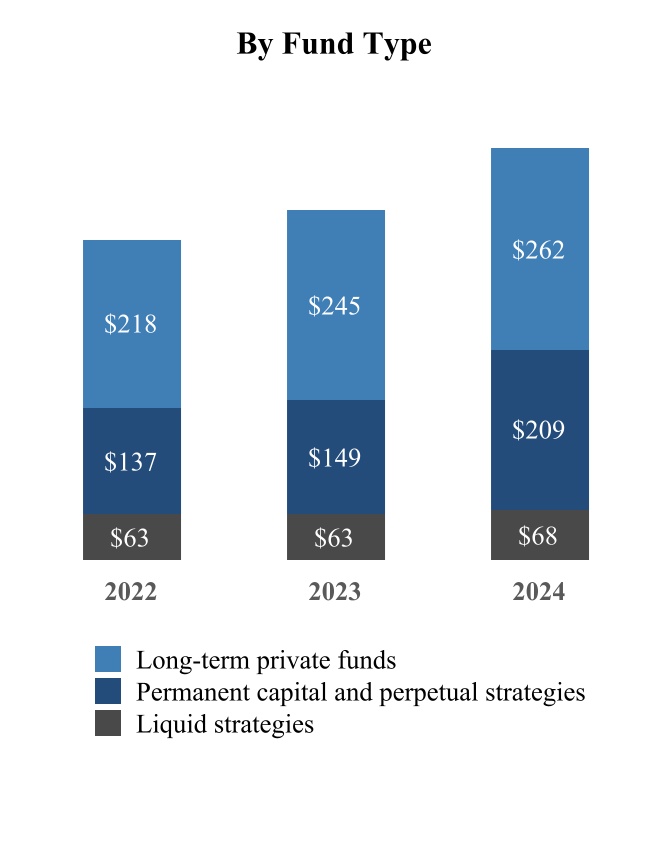

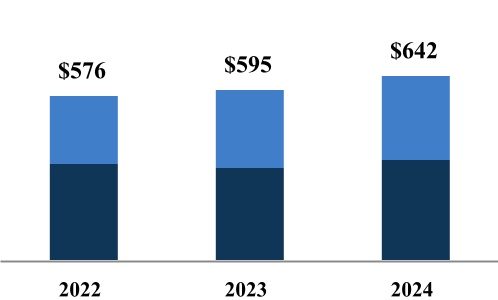

As at December 31, 2024, we had Fee-Bearing Capital of $539 billion, of which 87% is long-dated or perpetual in nature, providing significant stability to our earnings profile. We consider Fee-Bearing Capital that is long-dated or perpetual in nature to be Fee-Bearing Capital relating to our long-term private funds, which are typically committed for at least 10 years with two one-year extension options, and Fee-Bearing Capital relating to our perpetual strategies, which include our permanent capital vehicles as well as capital we manage in our perpetual private fund and private wealth strategies. We seek to increase our Fee-Bearing Capital by growing the size of our existing product offerings and developing new strategies that cater to our clients’ investment needs. We also aim to deepen our existing institutional relationships, develop new institutional relationships, and access new distribution channels, such as high net worth individuals and retail.

As of December 31, 2024, we had a diversified client base of over 2,300 clients, which continues to grow. Our private wealth channel also continues to grow and represents over 8% of capital raised. We have a dedicated team of over 150 people that are focused on distributing and developing catered products to the private wealth channel.

As we grow our Fee-Bearing Capital, we earn incremental base management fees. In order to support this growth, we have grown our team of investment and asset management professionals. Our costs are predominantly in the form of compensation for the over 2,500 professionals we employ globally.

When deploying our clients’ capital, we seek to leverage our competitive advantages to acquire high-quality real assets and essential service businesses that form the backbone of the global economy. We use our global reach and access to scale capital to source attractive investment opportunities and leverage our deep operating expertise to underwrite investments and create value through active asset management.

Our goal is to deliver superior investment returns to our clients and successfully doing so should result in the growth of realized carried interest over time.

We generate robust Distributable Earnings, which is a key measure of our financial performance. Distributable Earnings of BAM represent the Distributable Earnings from the Asset Management Company. BAM intends to pay out approximately 90% of its Distributable Earnings to shareholders quarterly and reinvest the balance back into the business, as discussed further in “Part II—Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operating Measures.”

We are actively progressing new organic growth strategies, including transition and secondaries. We are also pursuing strategic M&A opportunities that would expand our capabilities. These new initiatives, in addition to our existing strategies, are expected to have a very meaningful impact on our growth trajectory in the long term as BAM continues to be the partner of choice for investors. An example of such growth is the partnership we formed with Oaktree in 2019, which deepened the capabilities we offer our clients and better positions us across market cycles. Such acquisitions may occur from time to time should they be additive to our franchise, attractive to our clients, and accretive to our shareholders.

Competitive Advantages

We seek to harness the following four distinct competitive advantages that enable us to consistently identify and invest in high-quality assets and create significant value in the assets that we invest in and operate on behalf of our clients.

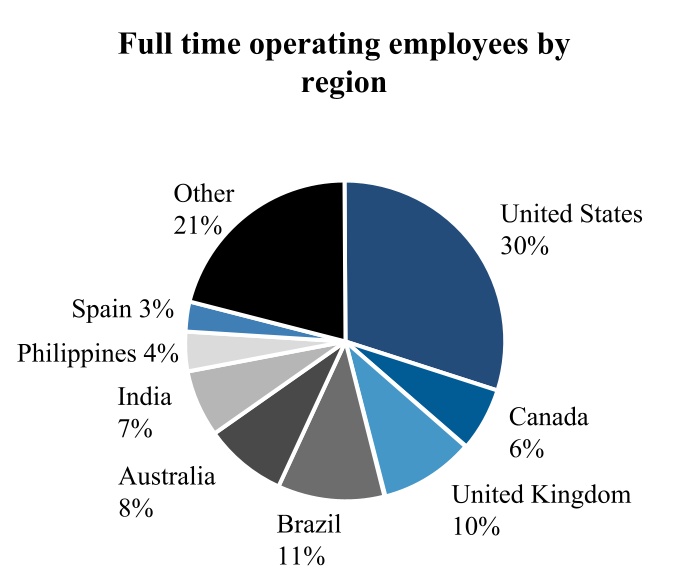

Operating Expertise

We are supported globally by approximately 250,000 operating employees of our managed businesses, who are instrumental in maximizing the value and cash flows of our managed assets. We believe that strong operating experience is essential in maximizing efficiency and productivity – and ultimately, returns. We do this by maintaining a culture of long-term focus, alignment of interest and collaboration through the people we hire, our compensation philosophy, and our operating philosophy. This operating expertise developed through our heritage as an owner-operator is invaluable in underwriting investments, conducting thorough due diligence, and executing value-creating development and capital projects.

Global Reach

We invest on behalf of our clients in more than 30 countries on five continents around the world. We believe that our global reach allows us to diversify and identify a broad range of opportunities. We can invest where capital is scarce, and we believe that our scale enables us to move quickly and pursue multiple opportunities across different markets. Our global reach also allows us to operate our assets more effectively: we believe that a strong on-the-ground presence is critical to operating successfully in many of our markets, and many of our businesses are truly local. Furthermore, the combination of our strong local presence and global reach enables us to bring relationships and operating practices to bear across markets to enhance returns.

Large Scale

We had over $1 trillion in Assets Under Management and $539 billion in Fee-Bearing Capital as of December 31, 2024. We offer our investors a large selection of private funds that have global mandates and diversified strategies. Our access to large-scale, flexible capital allows us to pursue transactions on a scale beyond the reach of many, delivering superior risk-adjusted returns.

Brookfield Ecosystem

The unique intelligence we generate from the ongoing interconnectivity between our over $1 trillion of Assets Under Management, our global partnerships and our visibility into global capital flows helps us identify themes and trends in investing, spot pockets of value and source attractive investment opportunities as BAM continues to be the partner of choice for investors. This competitive advantage has allowed us to build leading positions in assets classes that are most in favor among investors and deliver strong investment returns to our clients across multiple business cycles.

Investment Process

Our Investment Process Leads to Value Creation

Earning robust returns on the investments we make on behalf of our clients enhances our ability to increase our Fee-Bearing Capital and generates carried interest, both of which grow our cash flows and create value for our shareholders.

1. Raise Capital

As an asset manager, the starting point of the investment cycle is establishing new funds and other investment products for our clients. This in turn provides the capital to invest, from which we earn base management fees, incentive distributions and performance-based returns such as carried interest. Accordingly, we create value by increasing our amount of Fee-Bearing Capital and by achieving strong investment performance, which leads to growth in Fee-Bearing Capital and increased cash flows.

2. Identify and Invest in High-Quality Assets

We follow a value-based approach to investing and allocating capital. We believe that our disciplined approach, global reach and operating expertise afford us access to a wide range of potential opportunities and enable us to invest at attractive valuations and generate superior risk-adjusted returns for our clients. We also leverage our considerable expertise in executing recapitalizations, operational turnarounds and large development and capital projects, providing additional opportunities to deploy capital.

3. Secure Long-Term Financing

For our equity investments we finance the investments on behalf of our clients predominantly on a long-term investment-grade basis and asset-by-asset, which are primarily non-recourse. This financing approach provides us with considerable stability, improves our ability to withstand financial downturns and enables our asset management teams to focus on operations and other growth initiatives.

4. Enhance Value and Cash Flows Through Operating Expertise

We use our operating capabilities to increase the value of the assets within our product offerings and the cash flows they produce, and they help to protect our clients’ capital in adverse conditions. The combination of operating expertise, development capabilities and effective financing can help ensure that an investment’s full value creation potential is realized, which we believe is one of our most important competitive advantages.

5. Realize Capital from Asset Sales or Refinancing

We actively monitor opportunities to sell or refinance assets to generate proceeds for our investors. Capital generated in our limited life funds is returned to investors, and in the case of our perpetual funds, we then redeploy the capital to enhance returns. In many cases, returning capital from private funds completes the investment process, locks in investor returns and gives rise to performance income.

Products and Principal Strategies

Our products broadly fall into one of three categories: (i) long-term private funds, (ii) permanent capital vehicles and perpetual strategies, and (iii) liquid strategies. These are invested across five principal strategies: (i) renewable power and transition, (ii) infrastructure, (iii) real estate, (iv) private equity, and (v) credit.

Renewable Power and Transition

Overview

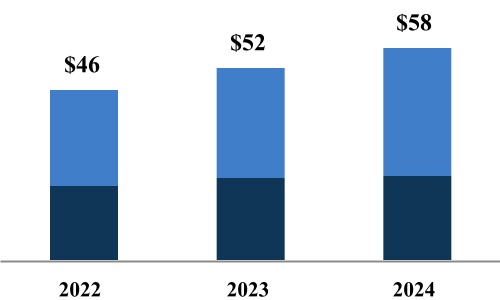

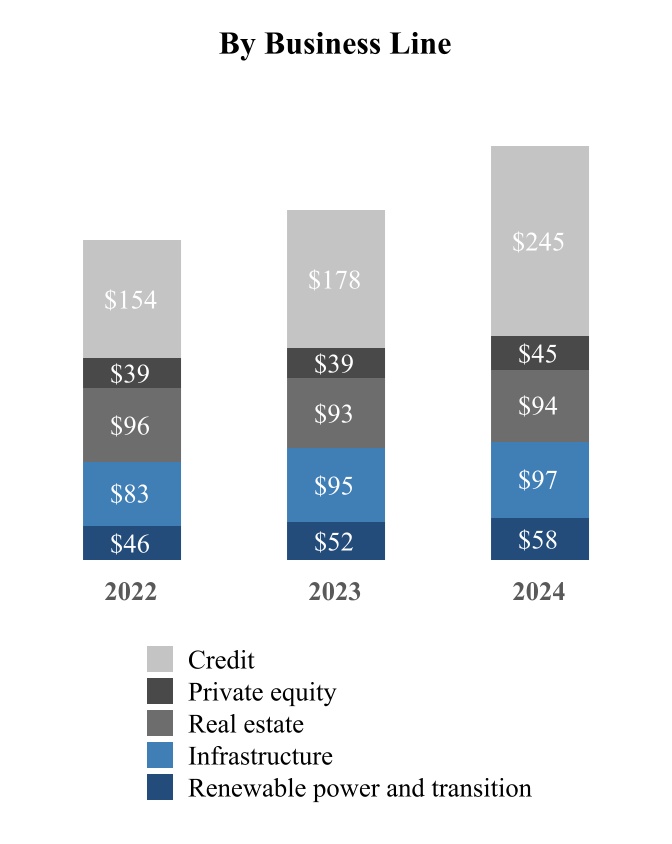

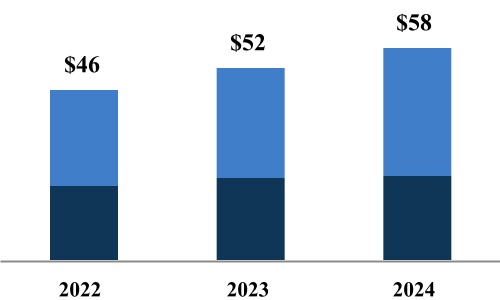

•We are one of the largest investors in renewable power and transition investments, with $126 billion of AUM and $58 billion of Fee-Bearing Capital as of December 31, 2024.

•We believe that the growing global demand for low-cost, low-carbon energy, especially amongst corporate off-takers, will lead to continued growth opportunities for us in the future. The investment environment for renewable power and transition remains favorable and we expect to continue to advance our substantial pipeline of renewable power and transition opportunities on behalf of our clients and managed assets.

•We have approximately 145 investment and asset management professionals globally that are focused on our renewable power and transition strategy, supported by approximately 17,800 operating employees in the renewable power and transition operating businesses that we manage. Our extensive experience and knowledge in this industry enable us to be a leader in all major technologies with deep operating and development capabilities.

Our Products

Long-term Private Funds

•Brookfield Global Transition Fund (“BGTF”) is our flagship transition fund series which is focused on investments aimed at accelerating the global transition to a net-zero carbon economy. The mandate of this product is to assist utility, energy and industrial businesses to reduce carbon dioxide emissions, expand low-carbon and renewable energy production and advance sustainable solutions.

•Our recently launched Catalytic Transition Fund (“CTF”) focuses on directing capital into clean energy and transition assets in emerging markets in South and Central America, South and Southeast Asia, the Middle East, and Eastern Europe. CTF will help drive clean energy investment in emerging markets.

Permanent Capital Vehicles and Perpetual Strategies

•We also manage Brookfield Renewable Partners L.P. (“BEP”), one of the world’s largest publicly traded renewable power platforms, which is listed on the NYSE and TSX and had a market capitalization of over $16.0 billion as of December 31, 2024.

Across our renewable power and transition products, we have invested on behalf of our clients in:

•Hydroelectric operations, through river systems and facilities that provide electricity and have grid stabilizing capabilities;

•Utility solar operations that harness energy from the sun to generate electricity;

•Distributed energy and storage which provides small-scale generation that can be locally installed, and pump storage facilities;

•Wind operations that use turbines to create electricity; and

•Sustainable solutions including renewable natural gas, carbon capture and storage, recycling, cogeneration biomass, nuclear services, and power transformation.

Infrastructure

Overview

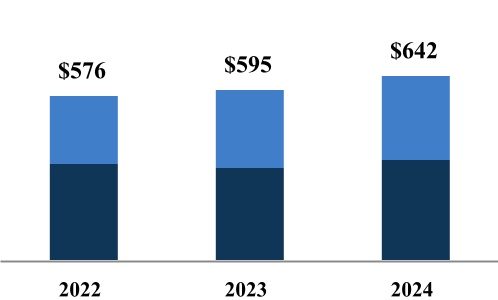

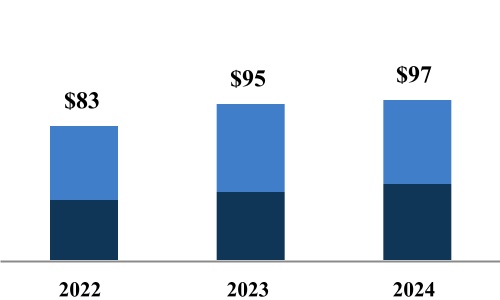

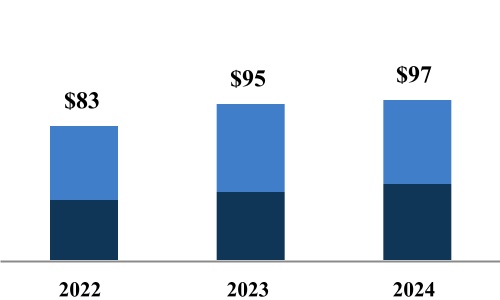

•We are one of the world’s largest investment managers in infrastructure, with $202 billion of AUM and $97 billion of Fee-Bearing Capital as of December 31, 2024.

•We focus on acquiring high-quality real assets and operating businesses on behalf of our clients that deliver essential goods and services, diversified across the utilities, transport, midstream and data infrastructure sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 220 investment and asset management professionals globally that are focused on our infrastructure strategy, supported by approximately 61,000 operating employees in the infrastructure operating businesses that we manage.

Our Products

Long-term Private Funds

•Brookfield Infrastructure Fund (“BIF”) is our flagship infrastructure fund series. In this product offering, we invest on behalf of our clients in high-quality infrastructure assets on a value basis and seek to add value through the investment life cycle by utilizing our operations-oriented approach.

•Brookfield Infrastructure Structured Solutions Fund (“BISS”) seeks to invest structured equity and non-control common equity in the infrastructure mid-market. The fund is focused on deploying our deep capabilities to partner with sponsors, developers, and corporates to access attractive development opportunities.

Permanent Capital Vehicles and Perpetual Strategies

•We manage Brookfield Infrastructure Partners L.P. (“BIP”), one of the largest, pure-play, publicly traded global infrastructure platforms, which is listed on the NYSE and TSX and had a market capitalization of $26.3 billion as of December 31, 2024.

•We manage Brookfield Super-Core Infrastructure Partners (“BSIP”), which is our perpetual infrastructure private fund strategy. In this product offering, we invest on behalf of our clients in core infrastructure assets in developed markets, with a focus on yield, diversification, and inflation-protection.

•We also manage Brookfield Infrastructure Income Fund, a semi-liquid infrastructure strategy, offering private wealth investors access to our best-in-class infrastructure platform.

The infrastructure investments that we manage provide a diversified exposure for our clients to scarce, high-quality businesses that benefit from significant barriers to entry and deliver essential goods and services to generate resilient and inflation-protected cash flow streams. Through the various products outlined, we have invested in:

•Regulated or contracted businesses that earn a return on an asset base, including electricity and gas connections, natural gas pipelines and electricity transmission lines;

•Systems involved in the movement of freight, commodities and passengers, including rail operations, toll roads, terminal and export facilities;

•Assets that handle the movement and storage of commodities from a source of supply to a demand center, including transmission pipelines, natural gas process plants and natural gas storage; and

•Businesses that provide essential services and critical infrastructure to transmit and store data globally, including telecom towers and active rooftop sites, fiber optic cable and data centers.

Real Estate

Overview

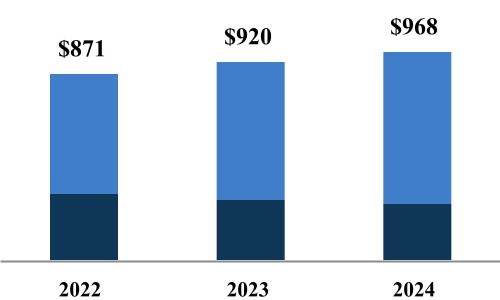

•We are one of the world’s largest investment managers in real estate, with over $271 billion of AUM and $94 billion of Fee-Bearing Capital as of December 31, 2024.

•We have invested, on behalf of clients, in iconic properties in the world’s most dynamic markets with the goal of generating stable and growing distributions for our investors while protecting them against downside risk.

•We have approximately 650 investment and asset management professionals that are focused on generating superior returns across our real estate strategies, supported by approximately 24,500 operating employees in the real estate operating businesses that we manage.

Our Products

Long-term Private Funds

•Our opportunistic real estate flagship fund series is Brookfield Strategic Real Estate Partners (“BSREP”). Through this product, we invest globally across various sectors and geographies on behalf of our clients in high-quality real estate with a focus on large, complex, distressed assets, turnarounds, and recapitalizations.

•We also manage a real estate secondaries strategy, Brookfield Real Estate Secondaries, with a focus on providing liquidity solutions for other real estate general partners.

Permanent Capital Vehicles and Perpetual Strategies

•We manage $17 billion of Fee-Bearing Capital in Brookfield Property Group (“BPG”) as of December 31, 2024, which we invest, on behalf of BN, directly in real estate assets. BPG owns, operates, and develops iconic properties in the world’s most dynamic markets with a global portfolio of office, retail, multifamily, logistics, hospitality, land and housing, triple net lease, manufactured housing, and student housing assets on five continents.

•We also manage capital in our perpetual private fund real estate strategy, Brookfield Premier Real Estate Partners (“BPREP”). This is a core plus strategy that invests in high-quality, stabilized real assets located primarily in the U.S. with a focus on office, retail, multifamily and logistics real estate assets. We also have two regional BPREP strategies that are dedicated specifically to investments in Australia and Europe.

•We also manage a non-traded REIT, Brookfield Real Estate Income Trust (“Brookfield REIT”), which is a semi-liquid strategy catering specifically to the private wealth channel. This product invests in high quality income-producing opportunities globally through equity or real estate-related debt.

Through the various products outlined, we have invested in multiple asset classes including:

•Office properties in key gateway cities in the U.S., Canada, the U.K., Germany, Australia, Brazil and India;

•High-quality retail destinations that are central gathering places for the communities they serve, combining shopping, dining, entertainment and other activities;

•Full-service hotels and leisure-style hospitality assets in high-barrier markets across North America, the U.K. and Australia; and

•High-quality assets with operational upside across multifamily, alternative living, life sciences and logistics sectors globally.

Private Equity

Overview

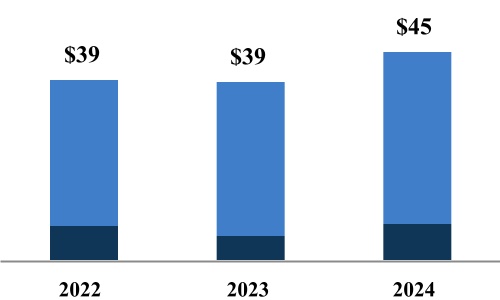

•We have one of the best long-term track records for investing in private equity with $145 billion of AUM and $45 billion of Fee-Bearing Capital as of December 31, 2024.

•We focus on high-quality businesses that provide essential products and services, diversified across business services and industrials sectors. We partner closely with management teams to enable long-term success through operational and other improvements.

•We have approximately 270 investment and asset management professionals globally that are focused on our private equity strategy, supported by approximately 142,900 operating employees in the businesses that we manage.

Our Products

Long-term Private Funds

•Our global opportunistic flagship fund series, Brookfield Capital Partners (“BCP”), is our leading private equity offering. The series of funds focuses on cash-flowing industrial and essential service businesses. We seek investments that benefit from high barriers to entry and enhance their cash flow capabilities by improving strategy and execution.

•Our special investments strategy, Brookfield Special Investments (“BSI”), is focused on structured, large-scale, non-control investments. This product capitalizes on transactions that do not fit our traditional control-oriented flagship private equity fund series. Situations may include recapitalization or strategic growth capital where we expect to generate equity-like returns while ensuring downside protection through contracted returns.

•Our thematic private equity strategy, Brookfield Financial Infrastructure Partners, focuses on investments in asset-light financial infrastructure companies that underpin the global financial system.

•Our regional private equity strategy, Brookfield Middle East Partners, is focused on opportunistically investing across sectors and countries in the Middle East by drawing on Brookfield’s global footprint and value-add as a strategic partner.

•Our venture capital strategy, Pinegrove Ventures, manages investments in the innovation economy and is uniquely positioned to access highly sought-after opportunities in high quality venture-backed companies and funds.

Permanent Capital Vehicles and Perpetual Strategies

•We manage Brookfield Business Partners L.P. (“BBU”), which is a publicly traded global business services and industrials company focused on owning and operating high-quality providers of essential products and services. BBU is listed on the NYSE and TSX and had a market capitalization of $5.2 billion as at December 31, 2024.

Our private equity vehicles acquire high-quality operations globally. The broad investment mandate provides us with the flexibility to invest on behalf of our clients across multiple industries through many forms. Through the various products outlined above, we have invested on behalf of our clients in:

•Leading service providers to large-scale infrastructure assets, including a leading provider of work access services, modular building leasing services, and a leading global provider of lottery services and technology solutions;

•Operationally intense industrial businesses that benefit from a strong competitive position, including a leading global provider of advanced automotive battery technology, a leading global aviation services and leasing business, and a leading manufacturer of engineered components for industrial trailers and other towable equipment providers, among others; and

•Essential services providers, including the largest private sector residential mortgage insurer in Canada, a leading value-add distributor of telecom equipment, a leading provider of software and technology services to automotive dealers, and one of the largest private school operators globally.

Credit

Overview

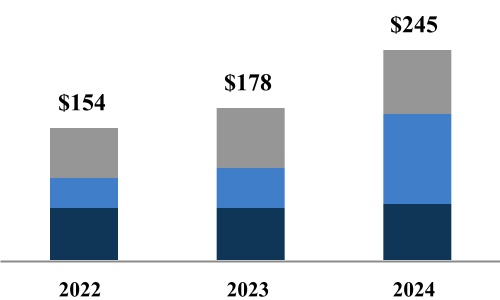

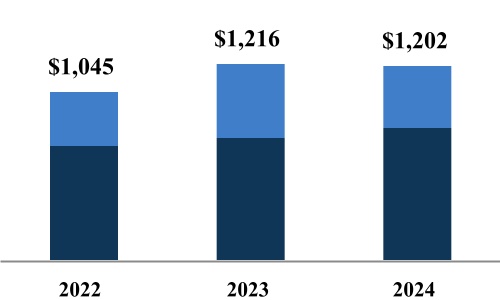

•We are one of the world’s largest and most experienced credit managers globally, with $317 billion of AUM and $245 billion of Fee-Bearing Capital as of December 31, 2024.

•We seek to provide flexible, specialized capital solutions to borrowers and deliver attractive risk-adjusted returns to our clients across a range of debt strategies, focusing on private credit and direct lending in areas in which we possess differentiated investment and operational capabilities.

•We have approximately 230 investment and asset management professionals globally that are focused on our credit strategies, investing across a broad spectrum of investments, leveraging the capabilities we have organically built in collaboration with the capabilities of leading credit managers with whom we partner.

Our Products

•Our flagship opportunistic credit strategy, Global Opportunities, seeks to generate current income and long-term capital appreciation by investing in private loans to large private-equity-owned companies with a focus on protecting against losses by buying claims on assets at discounted prices. We aim to achieve substantial gains by actively participating in restructurings to restore companies to financial viability and creating value at every stage of the investment process.

•Brookfield Infrastructure Debt is our infrastructure debt fund series, which invests on behalf of our clients in mezzanine debt investments in high-quality, infrastructure assets.

•Brookfield Real Estate Finance Fund is our commercial real estate debt fund series, which targets investments in transactions that are senior to traditional equity and subordinate to first mortgages or investment-grade corporate debt.

•In addition to several other credit strategies, we also provide tailored separately managed accounts for our clients, with private credit investment programs designed for each of our clients’ specific risk, return, and prudential requirements. Each client’s private credit investment portfolio can be customized across multiple dimensions, including asset class, credit quality, duration, sector, and geography, with proprietary access to our broad-based private credit origination capabilities.

The credit investments that we manage enable our clients to have exposure to a broad range of credit strategies, including:

•Private Credit strategies focusing on underwriting and managing directly sourced credit investments on behalf of our clients, across various sectors, including infrastructure, renewable energy, real estate, corporate credit, royalties, aviation, equipment finance, as well as consumer and SME credit;

•Opportunistic Credit strategies that are designed to capitalize on market dislocations and inefficiencies to generate high returns. These strategies typically involve investing in distressed or special situations where credit is undervalued or overlooked by traditional investors;

•Structured Credit strategies investing across structured and asset-backed finance opportunities in real estate, fund finance, aviation, consumer and corporate credit and more; and

•Liquid Credit strategies investing across a broad spectrum of public debt securities, from investment-grade to high-yield.

Development of the Business

Our asset management business is owned and operated through the Asset Management Company, which, as of February 4, 2025, is wholly-owned by BAM.

BAM is headquartered in New York, NY and was incorporated on July 4, 2022. BAM and the Asset Management Company were formed by BN to facilitate the 2022 Arrangement. The 2022 Arrangement, which closed on December 9, 2022, involved the division of Brookfield Asset Management Inc. into two publicly traded companies: BAM, a pure-play, leading global alternative asset management business; and BN, a leading global investment firm focused on building long-term wealth for institutions and individuals around the world.

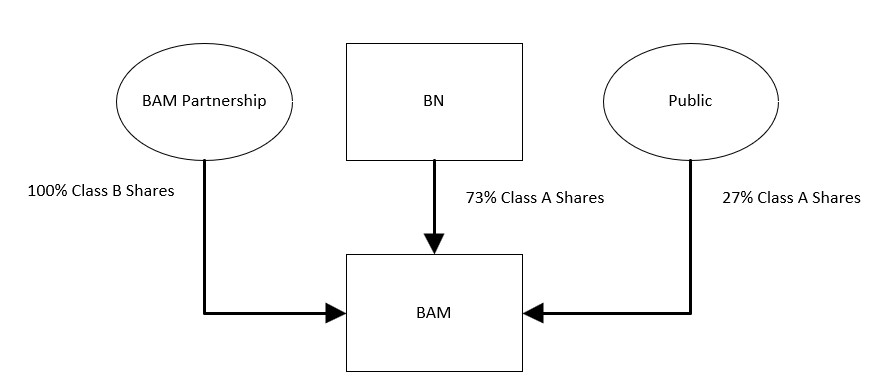

As at December 31, 2024, BAM owned approximately 27% of the Asset Management Company. On February 4, 2025, BAM completed a corporate restructuring with BN by way of a court-approved plan of arrangement (the “2025 Plan of Arrangement”), which was originally announced on October 31, 2024, whereby BN transferred its approximate 73% interest in the Asset Management Company to BAM in exchange for newly issued Class A Shares of BAM, on a one-for-one basis (the “2025 Arrangement”). After giving effect to the 2025 Arrangement, BAM owns 100% of the Asset Management Company, and BN owns approximately 73% of the Class A Shares. The 2025 Arrangement is expected to continue to broaden BAM’s shareholder base and simplify the structure of the Asset Management Company further by having its ownership consolidated under BAM, rather than being split between BN and BAM. The 2025 Arrangement also resulted in BAM’s market capitalization reflecting 100% of the value of the asset management business, which management believes will align BAM’s size and structure with its U.S.-based global alternative asset management business peers and position BAM for potential inclusion in some of the most widely followed global large cap stock indices, including in the U.S., in the future. As part of these efforts, a number of changes were made to BAM's board of directors. Please see “Part III—Item 10. Directors, Executive Officers and Corporate Governance—Directors and Executive Officers” on page

198 of this report.

The following is a summary of other recent developments affecting BAM and our asset management business since January 1, 2024.

Asset Management Business

2025 Activity

On February 10, 2025, BAM announced a €20 billion infrastructure investment program to support the deployment of artificial intelligence infrastructure in France. Brookfield's investment will be targeted across data centers and associated infrastructure sectors which are vital for the deployment of artificial intelligence. Up to €15 billion of data center investment will be led by a Brookfield portfolio company, Data4, one of Europe’s largest data center developers, headquartered in Paris. The investment of a further €5 billion is planned by Brookfield in France across associated artificial intelligence infrastructure such as data transfer, chip storage and energy generation. The total €20 billion investment is projected to be delivered by 2030.

On February 11, 2025, Oaktree announced the final close of Oaktree Opportunities Fund XII (“Opps XII”), with approximately $16 billion of commitments, including co-investment and affiliated vehicles. As of February 11, the Fund has more than $7 billion invested or committed for investment in businesses that are diversified across geographies, sectors, and asset classes.

On March 11, 2025, BAM announced the closing of its inaugural Brookfield Infrastructure Structured Solutions Fund (“BISS”), a middle-market infrastructure fund, achieving its fundraising target with over $1 billion of capital commitments. BISS is focused on deploying Brookfield’s capabilities as an owner and operator of global infrastructure assets to partner with sponsors, developers, and corporates in the mid-market. The strategy seeks to invest both structured and common equity.

2024 Activity

In 2024, our asset management business benefited from strong fundraising across our flagship and complementary fund offerings, with total fundraising of over $135 billion. The successful fundraising across our flagship series included the second vintage of our global transition fund of $4.6 billion, our fifth real estate flagship fund of $2.9 billion, and the twelfth vintage of our opportunistic credit fund of $5.2 billion. We expect to hold a final close for our second global transition flagship fund and fifth real estate flagship fund series in the first half of 2025.

We also raised approximately $103 billion of capital this year across more than a dozen credit strategies and under our mandate with BWS. This includes raising nearly $29 billion across our Oaktree franchise, including our aforementioned twelfth opportunities credit fund, $1.7 billion in the fourth vintage of our infrastructure debt fund, and $2.5 billion across our other partner managers. In addition, we raised a total of $67 billion from BWS including a $49 billion mandate following the May 2, 2024 acquisition of AEL and $17 billion from retail annuity sales, pension risk transfer inflows, and other reinsurance products.

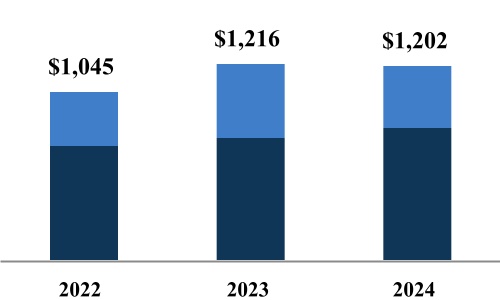

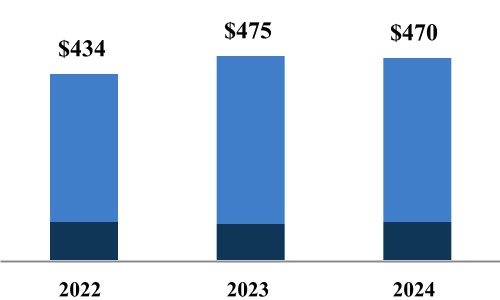

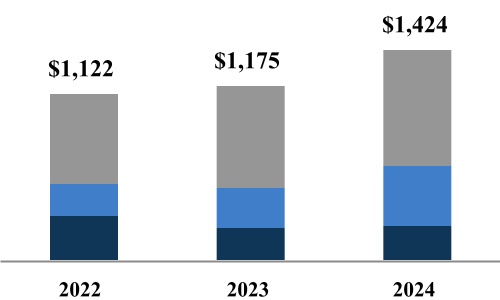

Our Fee-Bearing Capital represents the total capital managed by our asset management business for which we earn fee revenue. Fee-Bearing Capital of our asset management business increased by $82 billion, or 18% to $539 billion in 2024; of this, 87% is long-dated or perpetual in nature, providing resiliency and predictability to our revenues. Increases to Fee-Bearing Capital of $129 billion were largely attributable to fundraising during the year and the aforementioned AEL Mandate. These increases were partially offset by redemptions within our liquid and perpetual strategies and annuity-related outflows.

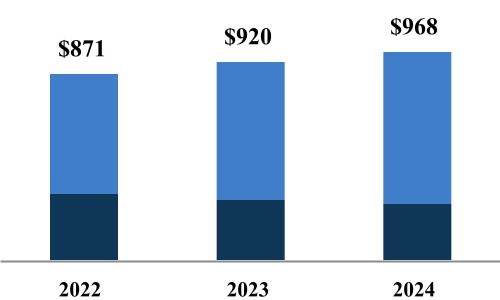

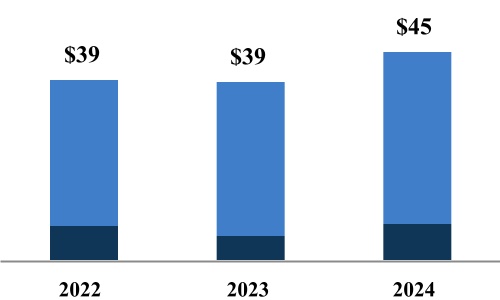

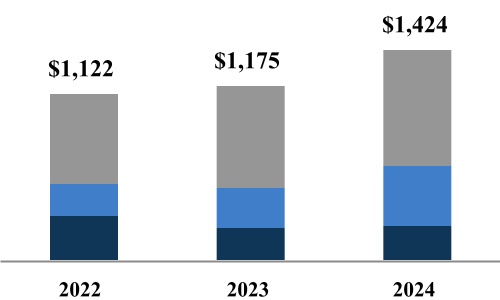

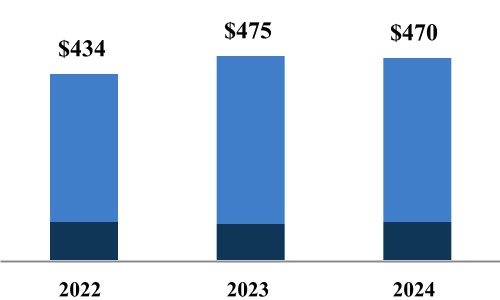

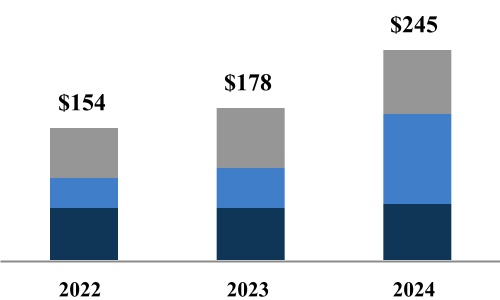

The increase in Fee-Bearing Capital contributed to Fee Revenues of $4.7 billion and Fee-Related Earnings of $2.5 billion for 2024, which increased by 7% and 10%, respectively, compared to 2023. The increase in Fee-Related Earnings was partially offset by higher cash taxes resulting in DE of $2.4 billion for 2024, or an increase of 5% compared to 2023.

During the year, our asset management business deployed $47.6 billion across the business groups, including $5.6 billion from renewable power and transition, $3.8 billion from infrastructure, $5.9 billion from private equity, $6.1 billion from real estate and $26.2 billion from credit.

As at December 31, 2024, the asset management business had total uncalled private fund commitments of $115 billion of which approximately $53 billion is committed across the business groups and is currently not earning fees, but will become fee-bearing once the capital is invested. Once invested, we expect these commitments will earn approximately $530 million of additional Fee Revenues.

Digitalization is being further propelled by significant increases in AI investment, increasing corporate clean energy demand, and the transformative role of private credit in the capital markets. In 2024, our investment strategies continued to focus on growing fundraising channels, direct credit lending, infrastructure, and transition and renewables. Some notable examples include:

•In February 2024, BAM announced that it raised $10 billion (inclusive of fund commitments and strategic capital from the investor base of our asset management business) in the first closing of the second vintage of Brookfield Global Transition Fund, our private fund dedicated to facilitating the global transition to a net-zero carbon economy. Total fundraising for the strategy this year was $5.2 billion.

•On May 2, 2024, BWS completed the acquisition of the remaining outstanding common stock of AEL that it did not already own. The acquisition by BWS from BN of the BAM Class A Shares required to satisfy the stock consideration pursuant to the AEL acquisition resulted in an increase to BAM's ownership in the Asset Management Company (after giving effect to the 2025 Arrangement, the non-controlling interest in BAM) from approximately 25% to approximately 27%. The AEL acquisition also resulted in the raising of $49 billion of fee-bearing capital to be managed by the asset management business.