Quarterly Financial Supplement ——————————— Third Quarter 2025 The financial statements and financial exhibits included herein are unaudited. These financial statements and exhibits should be read in conjunction with the Company's periodic reports on Form 10-K, Form 10-Q and Form 8-K as applicable. All dollar amounts are presented in millions except for per share amounts. Exhibit 99.2

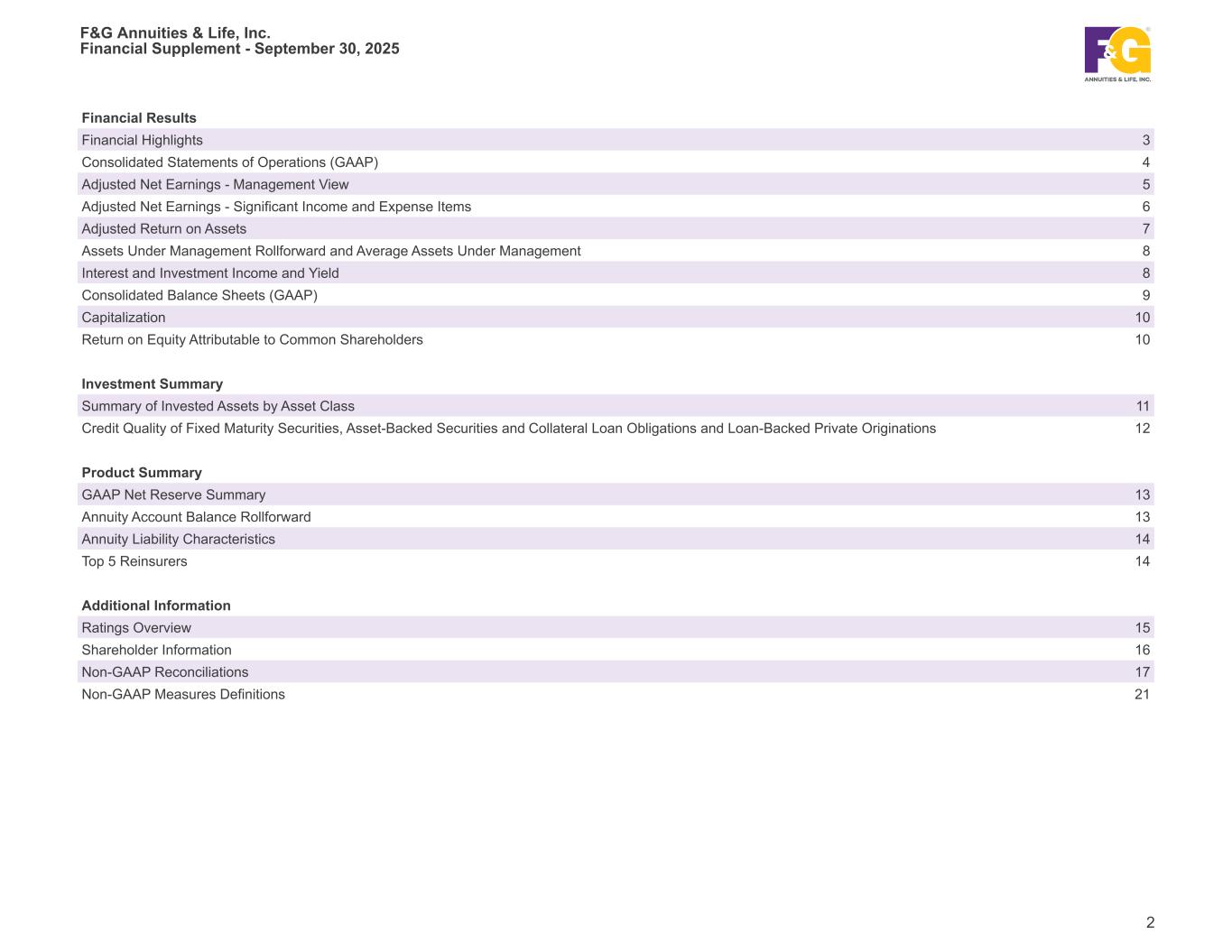

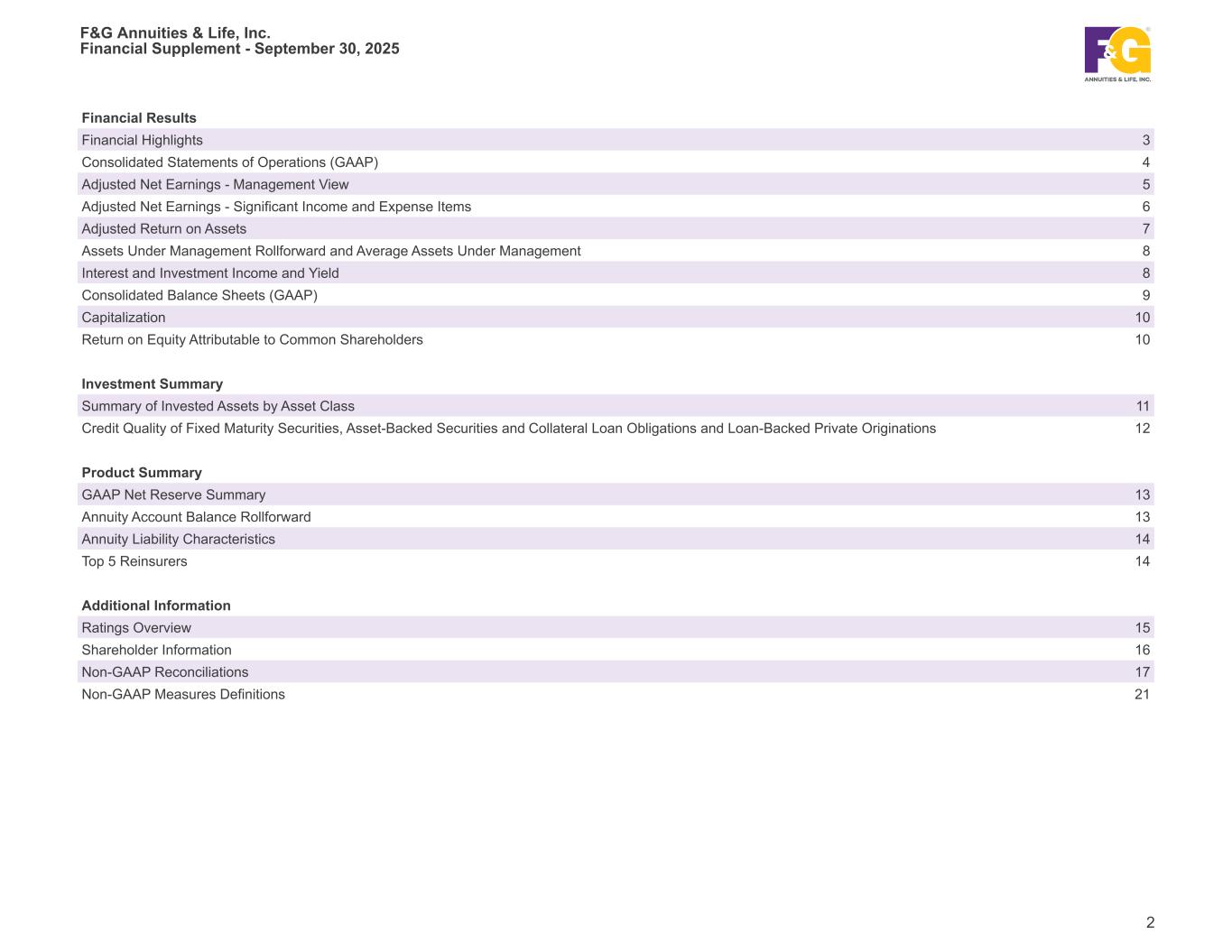

Financial Results Financial Highlights 3 Consolidated Statements of Operations (GAAP) 4 Adjusted Net Earnings - Management View 5 Adjusted Net Earnings - Significant Income and Expense Items 6 Adjusted Return on Assets 7 Assets Under Management Rollforward and Average Assets Under Management 8 Interest and Investment Income and Yield 8 Consolidated Balance Sheets (GAAP) 9 Capitalization 10 Return on Equity Attributable to Common Shareholders 10 Investment Summary Summary of Invested Assets by Asset Class 11 Credit Quality of Fixed Maturity Securities, Asset-Backed Securities and Collateral Loan Obligations and Loan-Backed Private Originations 12 Product Summary GAAP Net Reserve Summary 13 Annuity Account Balance Rollforward 13 Annuity Liability Characteristics 14 Top 5 Reinsurers 14 Additional Information Ratings Overview 15 Shareholder Information 16 Non-GAAP Reconciliations 17 Non-GAAP Measures Definitions 21 F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 2

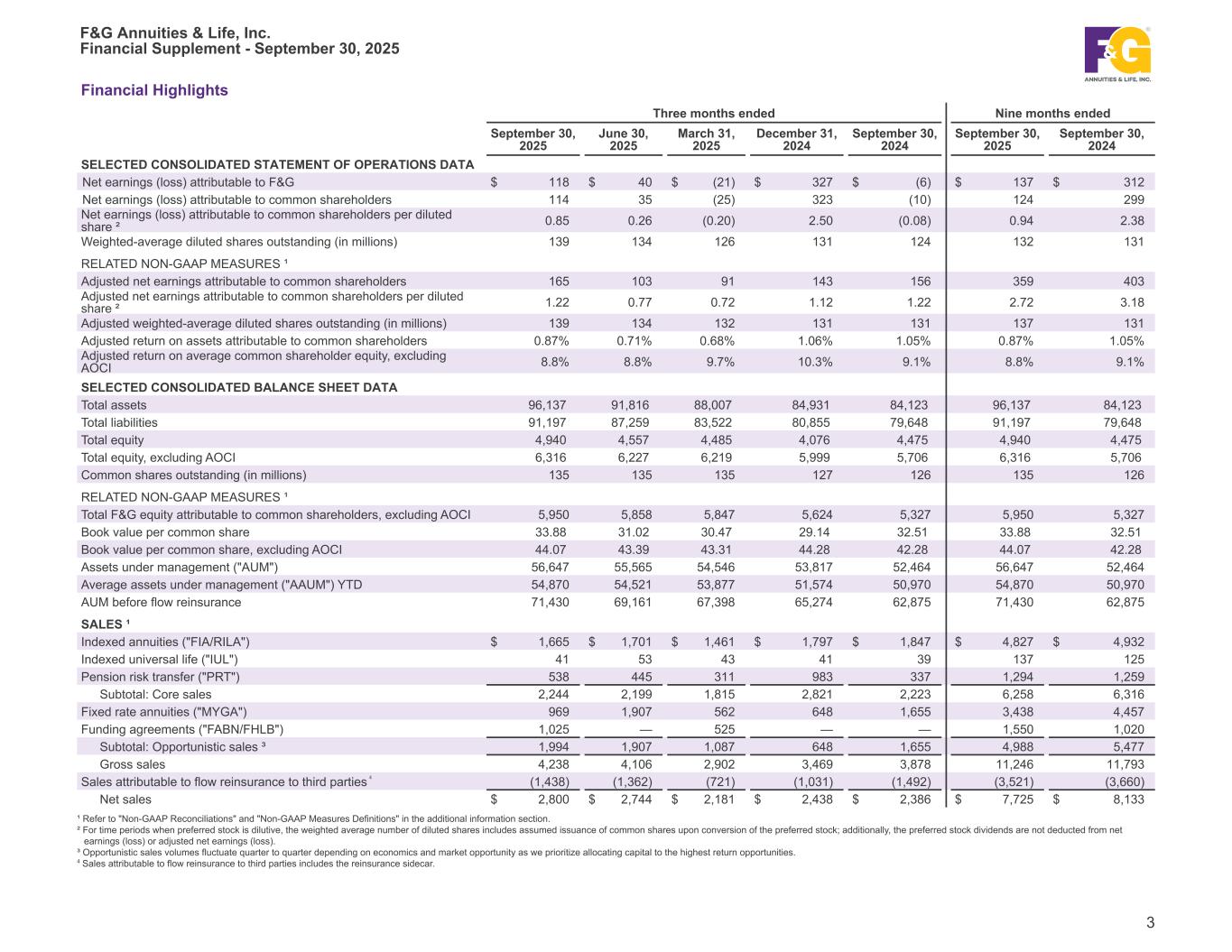

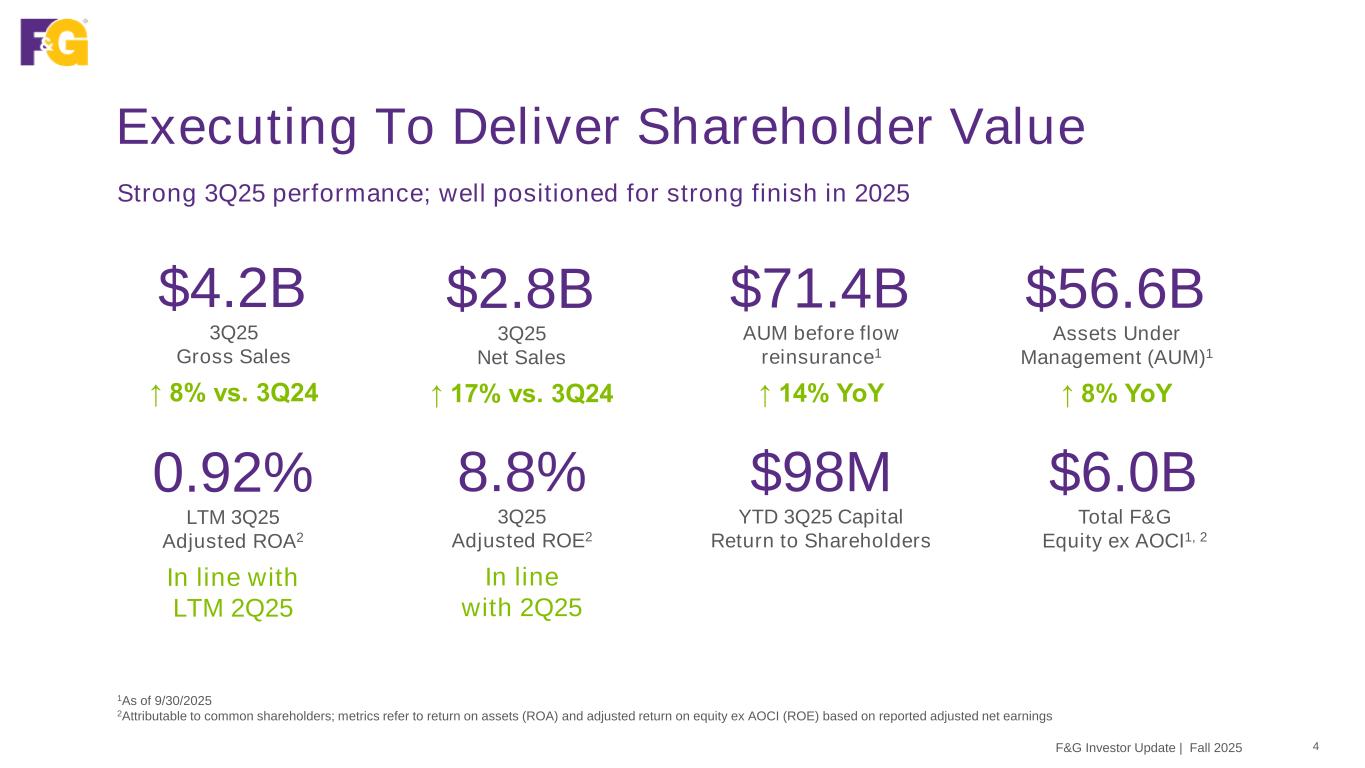

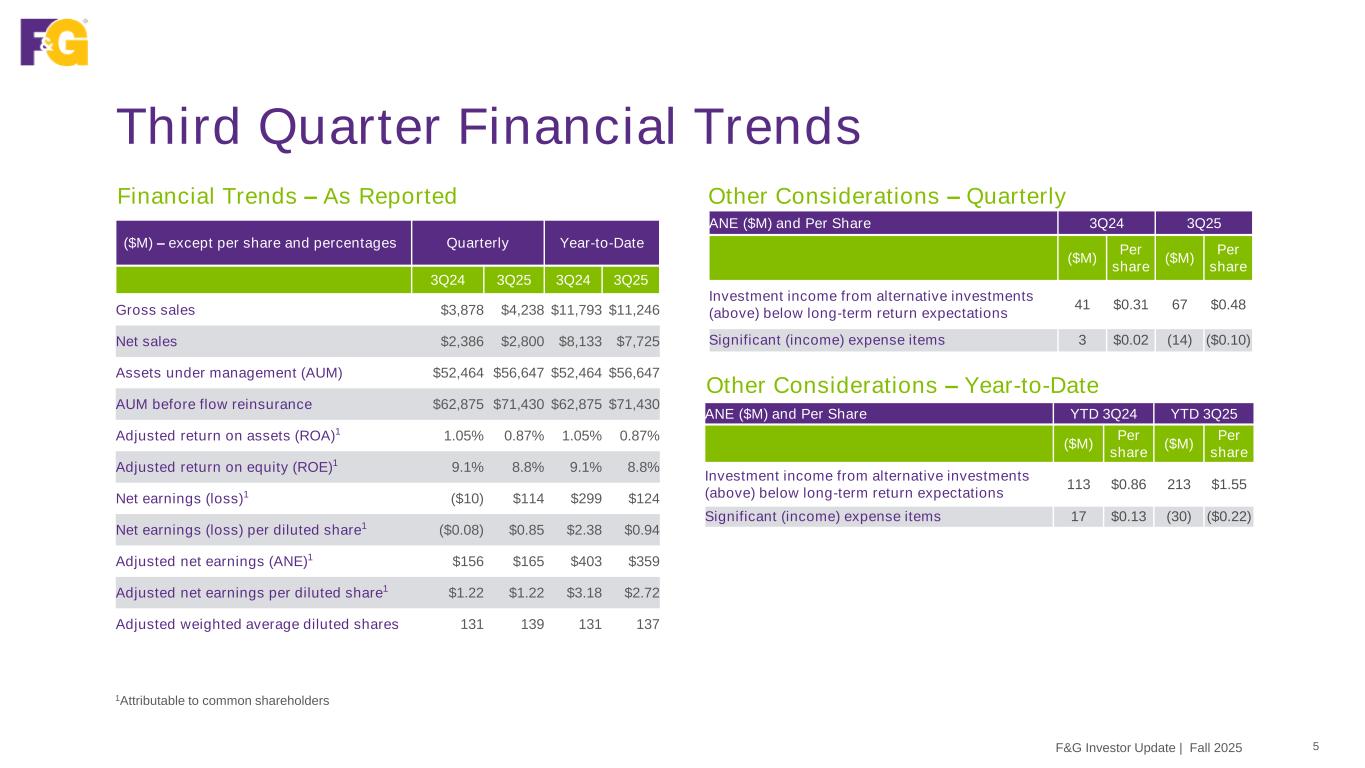

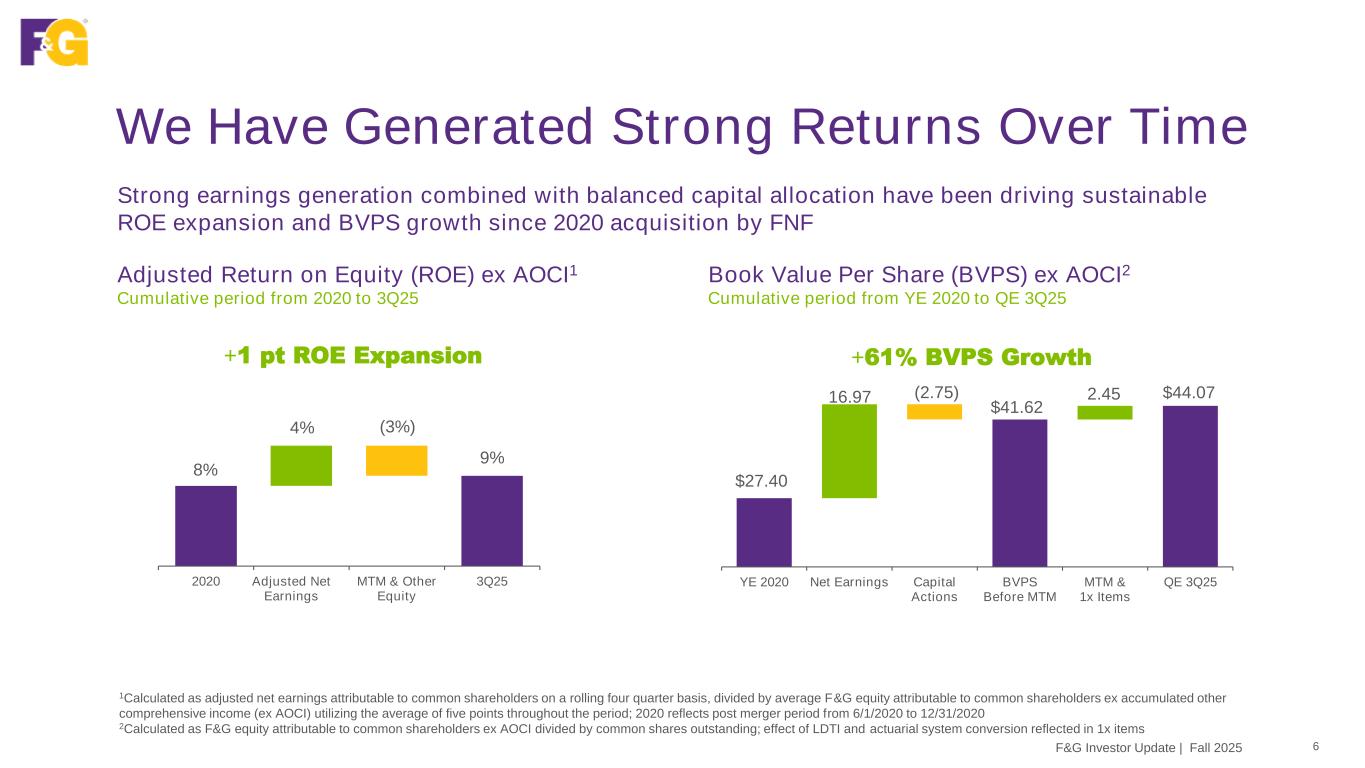

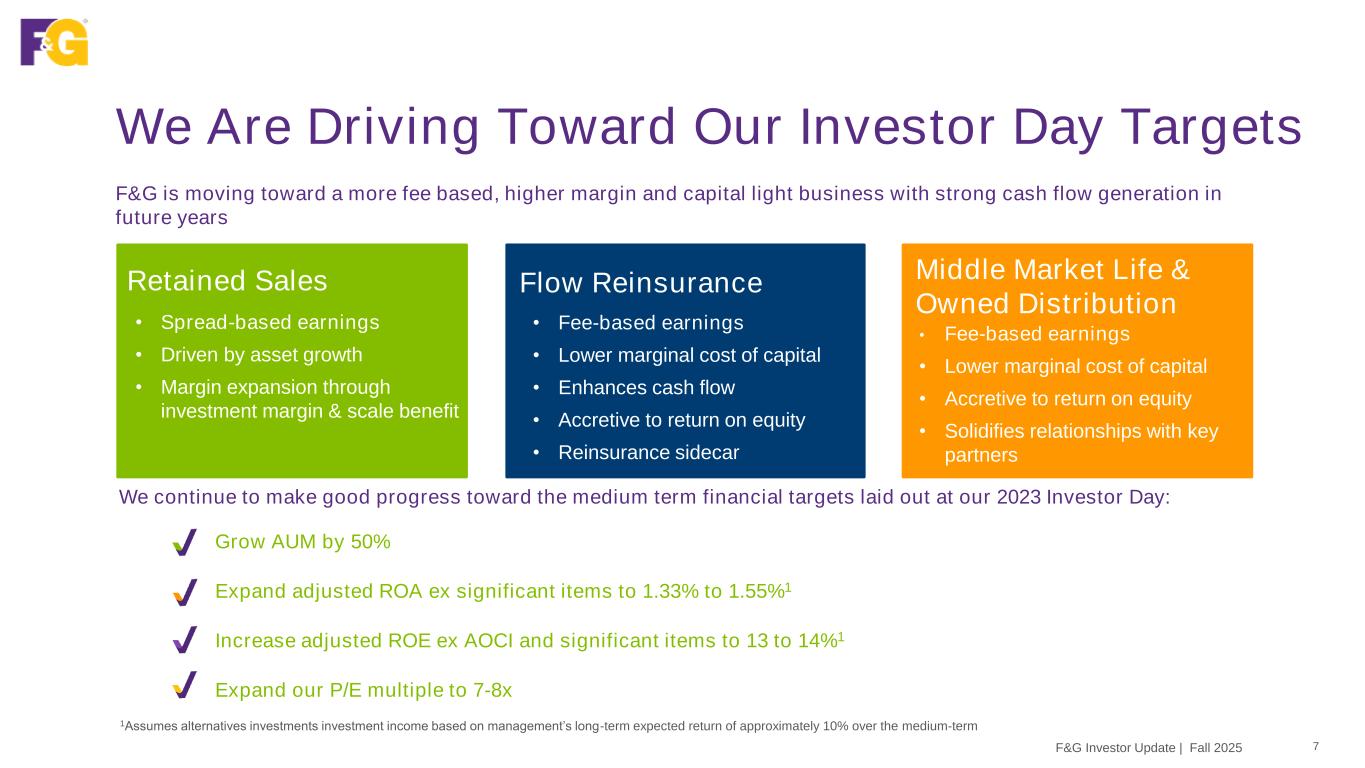

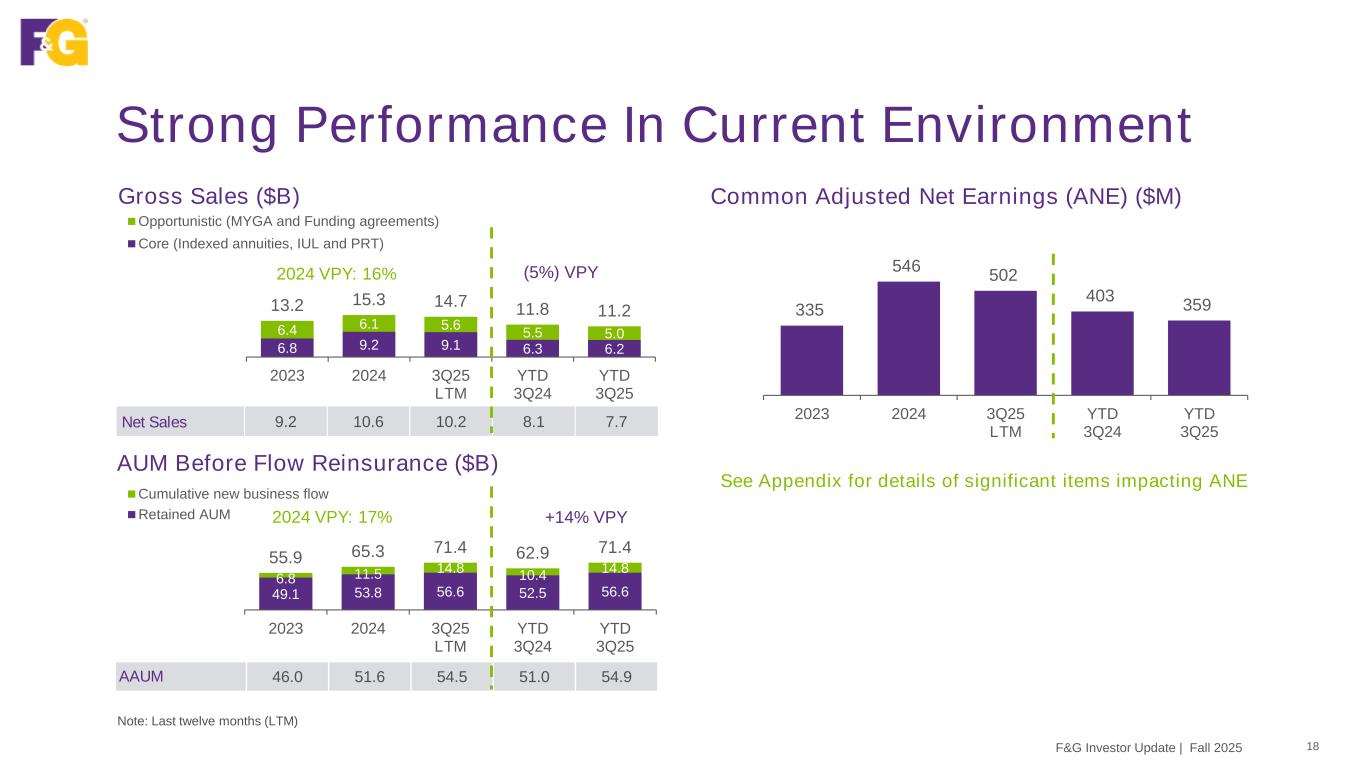

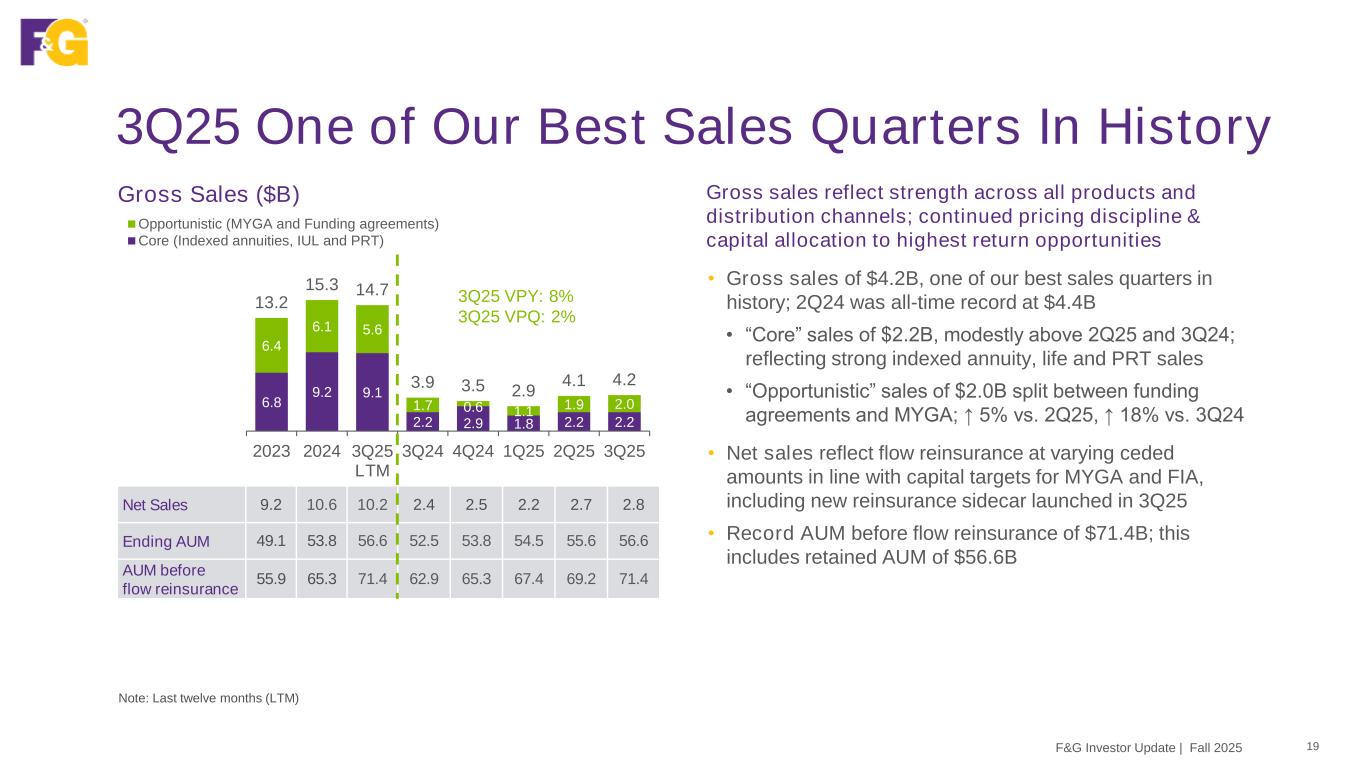

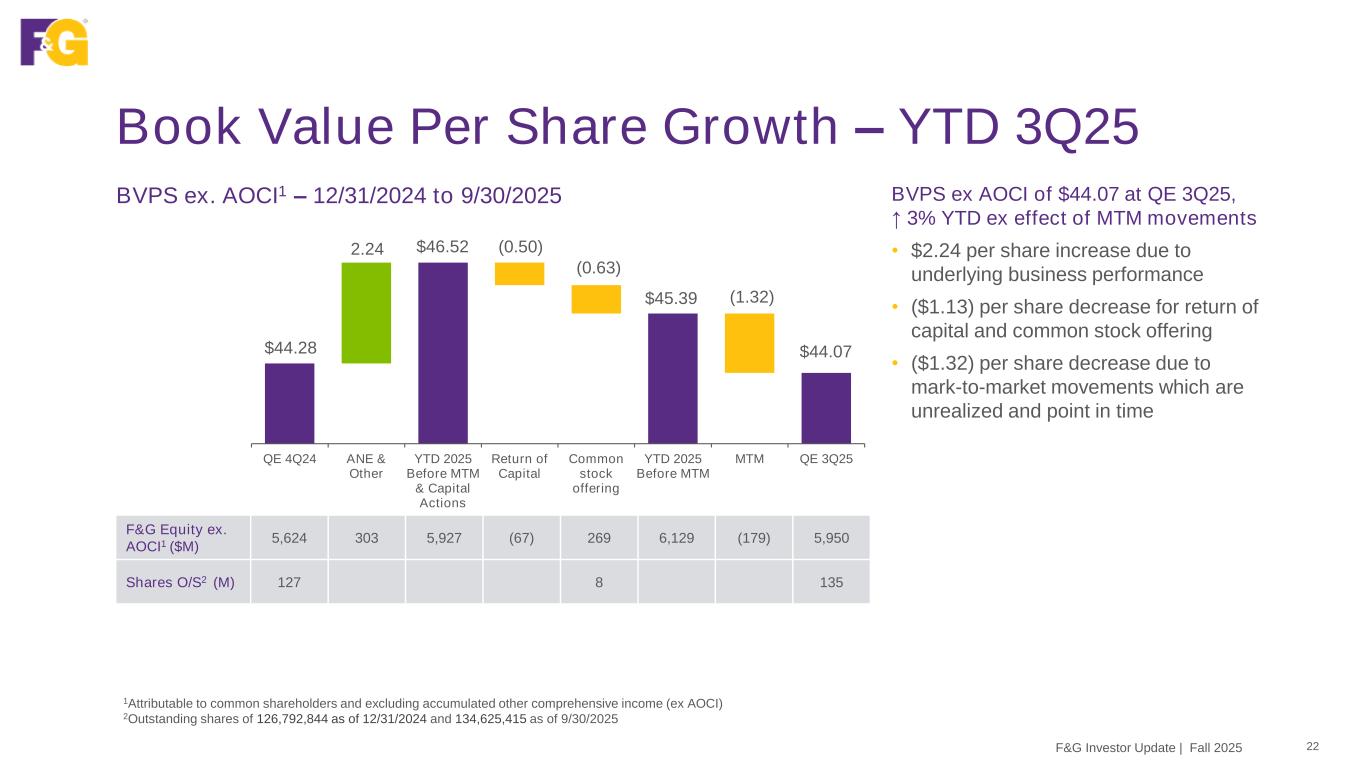

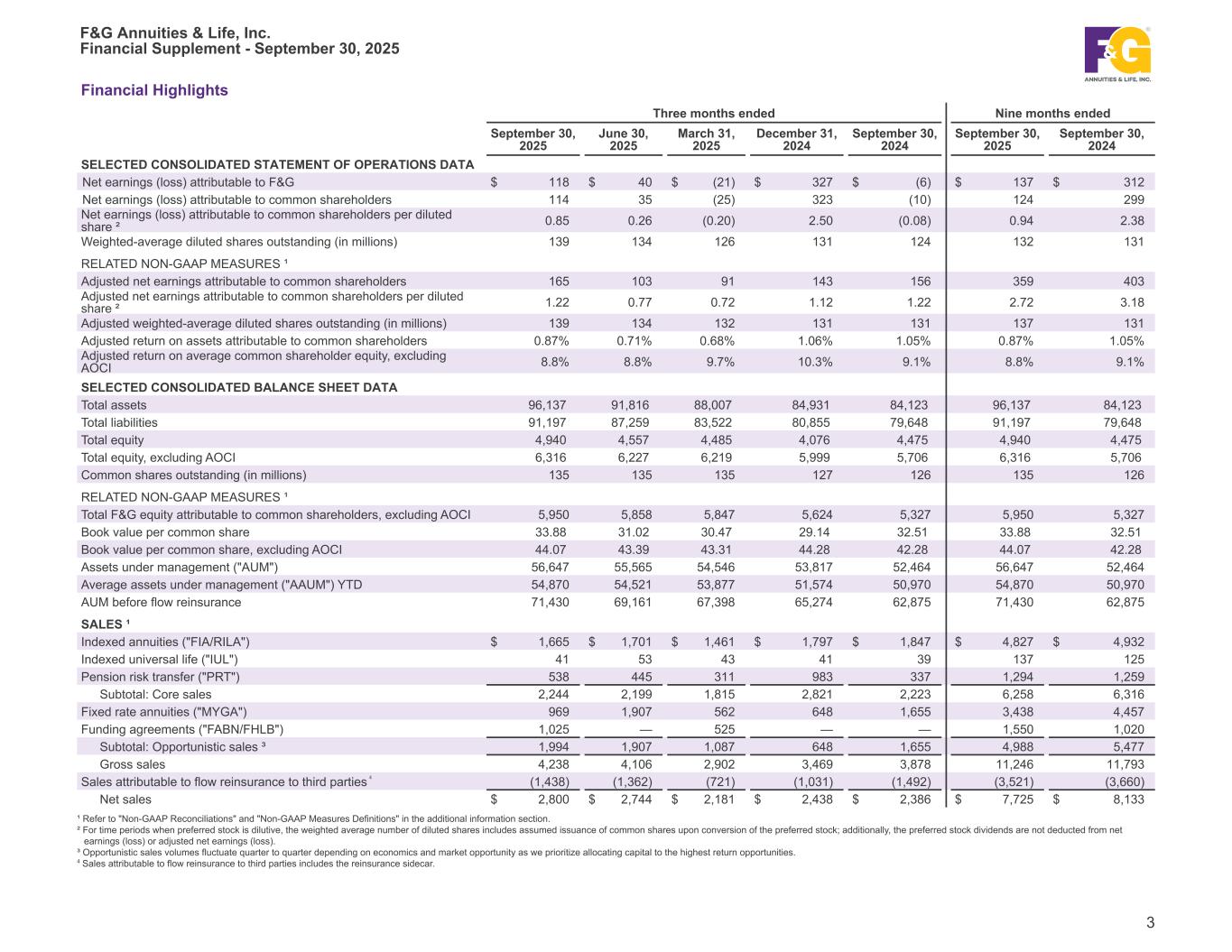

Financial Highlights Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 SELECTED CONSOLIDATED STATEMENT OF OPERATIONS DATA Net earnings (loss) attributable to F&G $ 118 $ 40 $ (21) $ 327 $ (6) $ 137 $ 312 Net earnings (loss) attributable to common shareholders 114 35 (25) 323 (10) 124 299 Net earnings (loss) attributable to common shareholders per diluted share ² 0.85 0.26 (0.20) 2.50 (0.08) 0.94 2.38 Weighted-average diluted shares outstanding (in millions) 139 134 126 131 124 132 131 RELATED NON-GAAP MEASURES ¹ Adjusted net earnings attributable to common shareholders 165 103 91 143 156 359 403 Adjusted net earnings attributable to common shareholders per diluted share ² 1.22 0.77 0.72 1.12 1.22 2.72 3.18 Adjusted weighted-average diluted shares outstanding (in millions) 139 134 132 131 131 137 131 Adjusted return on assets attributable to common shareholders 0.87 % 0.71 % 0.68 % 1.06 % 1.05 % 0.87 % 1.05 % Adjusted return on average common shareholder equity, excluding AOCI 8.8 % 8.8 % 9.7 % 10.3 % 9.1 % 8.8 % 9.1 % SELECTED CONSOLIDATED BALANCE SHEET DATA Total assets 96,137 91,816 88,007 84,931 84,123 96,137 84,123 Total liabilities 91,197 87,259 83,522 80,855 79,648 91,197 79,648 Total equity 4,940 4,557 4,485 4,076 4,475 4,940 4,475 Total equity, excluding AOCI 6,316 6,227 6,219 5,999 5,706 6,316 5,706 Common shares outstanding (in millions) 135 135 135 127 126 135 126 RELATED NON-GAAP MEASURES ¹ Total F&G equity attributable to common shareholders, excluding AOCI 5,950 5,858 5,847 5,624 5,327 5,950 5,327 Book value per common share 33.88 31.02 30.47 29.14 32.51 33.88 32.51 Book value per common share, excluding AOCI 44.07 43.39 43.31 44.28 42.28 44.07 42.28 Assets under management ("AUM") 56,647 55,565 54,546 53,817 52,464 56,647 52,464 Average assets under management ("AAUM") YTD 54,870 54,521 53,877 51,574 50,970 54,870 50,970 AUM before flow reinsurance 71,430 69,161 67,398 65,274 62,875 71,430 62,875 SALES ¹ Indexed annuities ("FIA/RILA") $ 1,665 $ 1,701 $ 1,461 $ 1,797 $ 1,847 $ 4,827 $ 4,932 Indexed universal life ("IUL") 41 53 43 41 39 137 125 Pension risk transfer ("PRT") 538 445 311 983 337 1,294 1,259 Subtotal: Core sales 2,244 2,199 1,815 2,821 2,223 6,258 6,316 Fixed rate annuities ("MYGA") 969 1,907 562 648 1,655 3,438 4,457 Funding agreements ("FABN/FHLB") 1,025 — 525 — — 1,550 1,020 Subtotal: Opportunistic sales ³ 1,994 1,907 1,087 648 1,655 4,988 5,477 Gross sales 4,238 4,106 2,902 3,469 3,878 11,246 11,793 Sales attributable to flow reinsurance to third parties ⁴ (1,438) (1,362) (721) (1,031) (1,492) (3,521) (3,660) Net sales $ 2,800 $ 2,744 $ 2,181 $ 2,438 $ 2,386 $ 7,725 $ 8,133 ¹ Refer to "Non-GAAP Reconciliations" and "Non-GAAP Measures Definitions" in the additional information section. ² For time periods when preferred stock is dilutive, the weighted average number of diluted shares includes assumed issuance of common shares upon conversion of the preferred stock; additionally, the preferred stock dividends are not deducted from net earnings (loss) or adjusted net earnings (loss). ³ Opportunistic sales volumes fluctuate quarter to quarter depending on economics and market opportunity as we prioritize allocating capital to the highest return opportunities. ⁴ Sales attributable to flow reinsurance to third parties includes the reinsurance sidecar. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 3

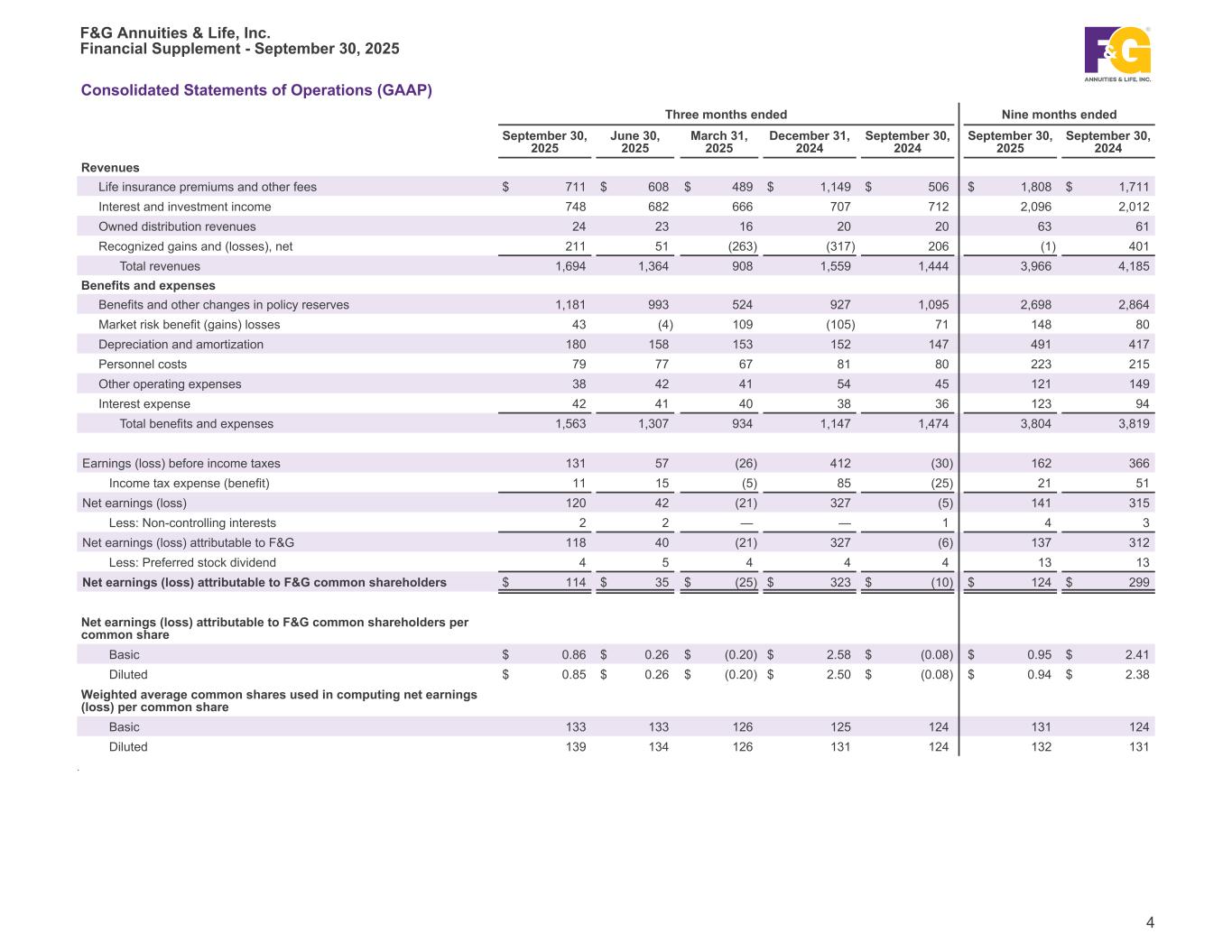

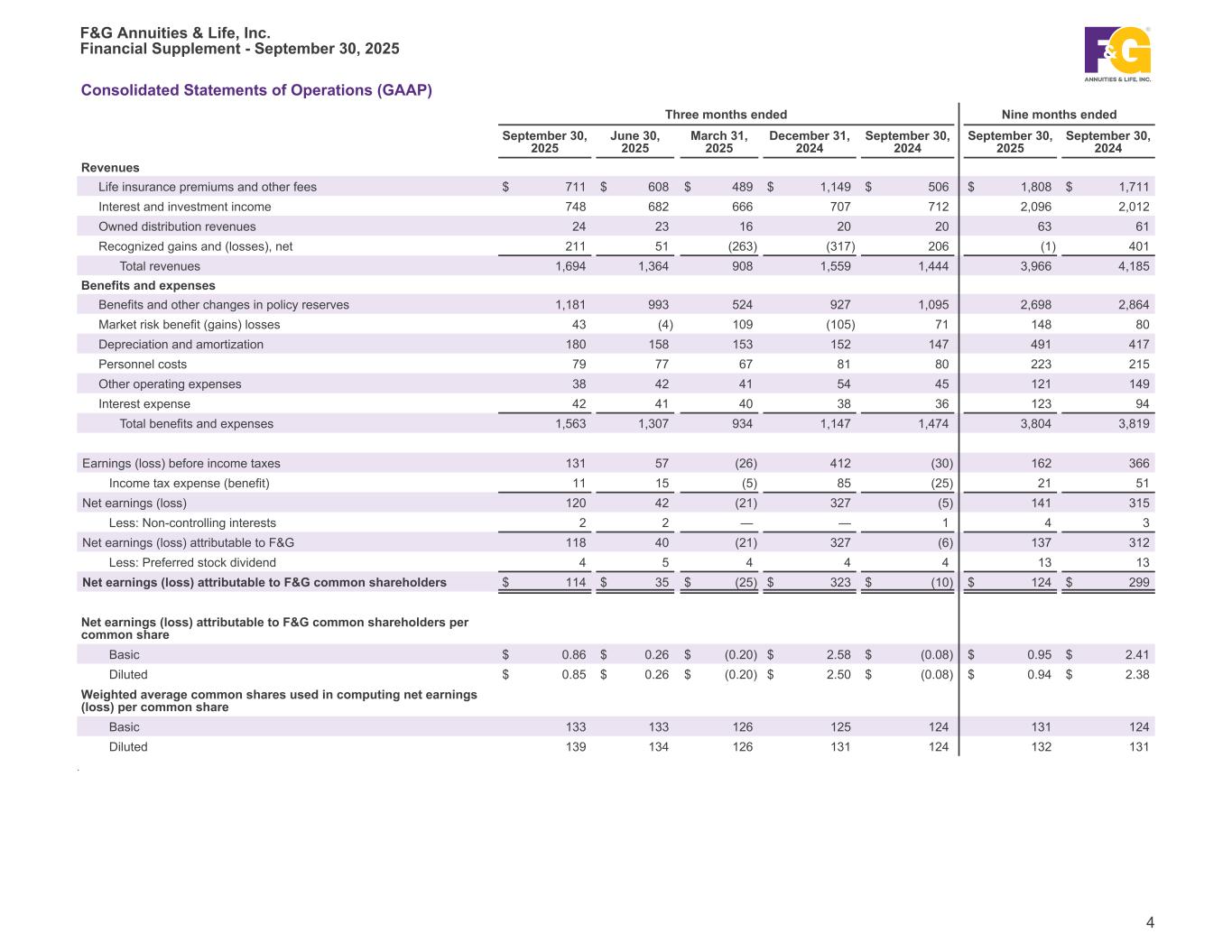

Consolidated Statements of Operations (GAAP) Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Revenues Life insurance premiums and other fees $ 711 $ 608 $ 489 $ 1,149 $ 506 $ 1,808 $ 1,711 Interest and investment income 748 682 666 707 712 2,096 2,012 Owned distribution revenues 24 23 16 20 20 63 61 Recognized gains and (losses), net 211 51 (263) (317) 206 (1) 401 Total revenues 1,694 1,364 908 1,559 1,444 3,966 4,185 Benefits and expenses Benefits and other changes in policy reserves 1,181 993 524 927 1,095 2,698 2,864 Market risk benefit (gains) losses 43 (4) 109 (105) 71 148 80 Depreciation and amortization 180 158 153 152 147 491 417 Personnel costs 79 77 67 81 80 223 215 Other operating expenses 38 42 41 54 45 121 149 Interest expense 42 41 40 38 36 123 94 Total benefits and expenses 1,563 1,307 934 1,147 1,474 3,804 3,819 Earnings (loss) before income taxes 131 57 (26) 412 (30) 162 366 Income tax expense (benefit) 11 15 (5) 85 (25) 21 51 Net earnings (loss) 120 42 (21) 327 (5) 141 315 Less: Non-controlling interests 2 2 — — 1 4 3 Net earnings (loss) attributable to F&G 118 40 (21) 327 (6) 137 312 Less: Preferred stock dividend 4 5 4 4 4 13 13 Net earnings (loss) attributable to F&G common shareholders $ 114 $ 35 $ (25) $ 323 $ (10) $ 124 $ 299 Net earnings (loss) attributable to F&G common shareholders per common share Basic $ 0.86 $ 0.26 $ (0.20) $ 2.58 $ (0.08) $ 0.95 $ 2.41 Diluted $ 0.85 $ 0.26 $ (0.20) $ 2.50 $ (0.08) $ 0.94 $ 2.38 Weighted average common shares used in computing net earnings (loss) per common share Basic 133 133 126 125 124 131 124 Diluted 139 134 126 131 124 132 131 . F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 4

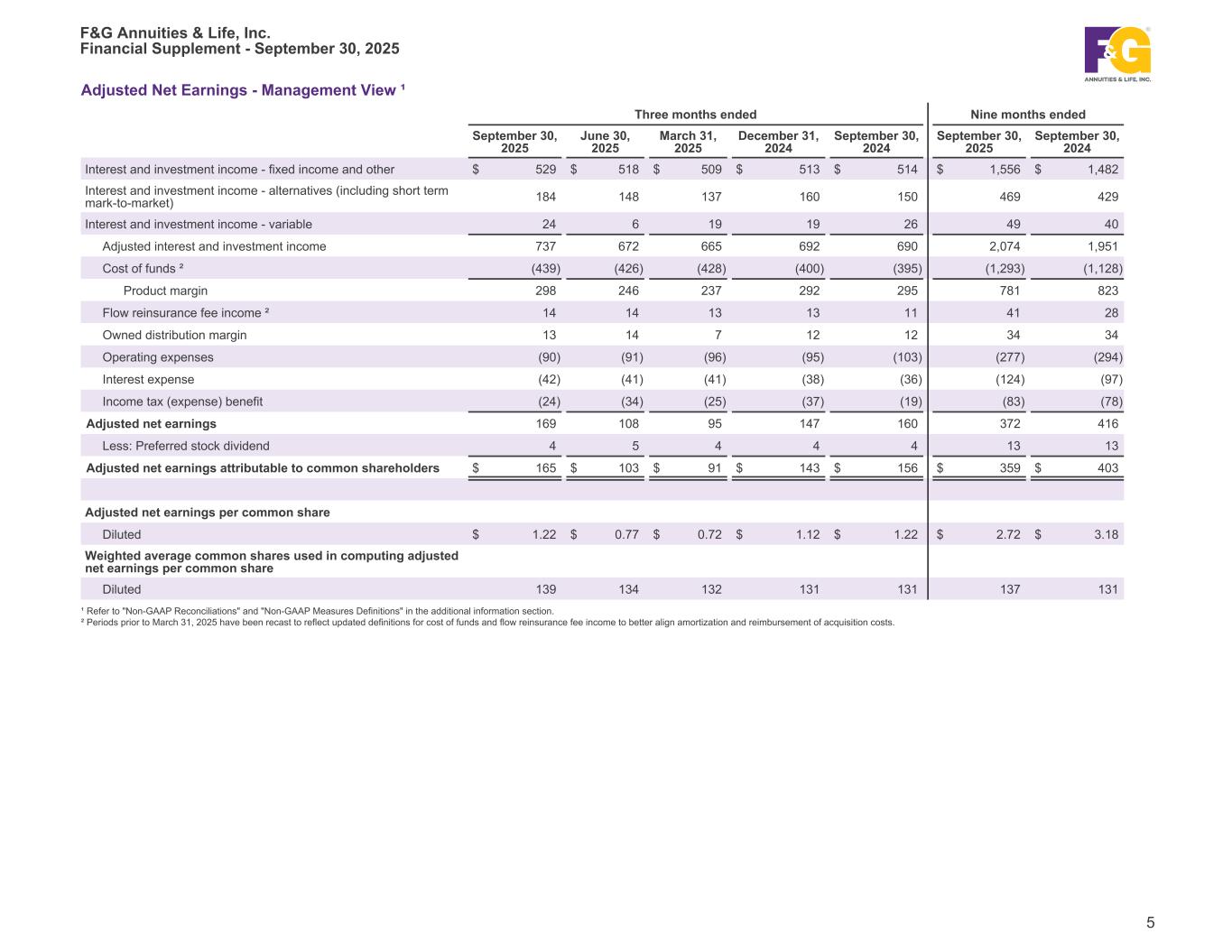

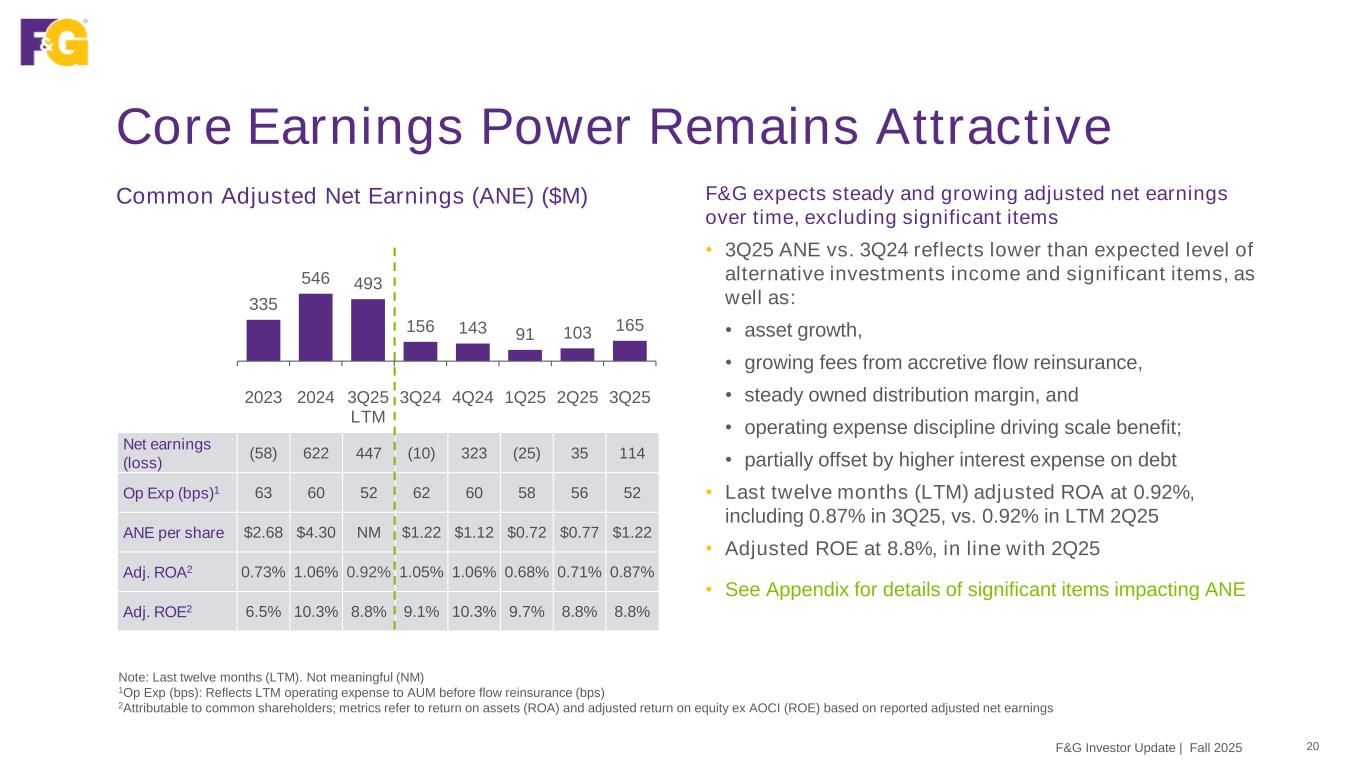

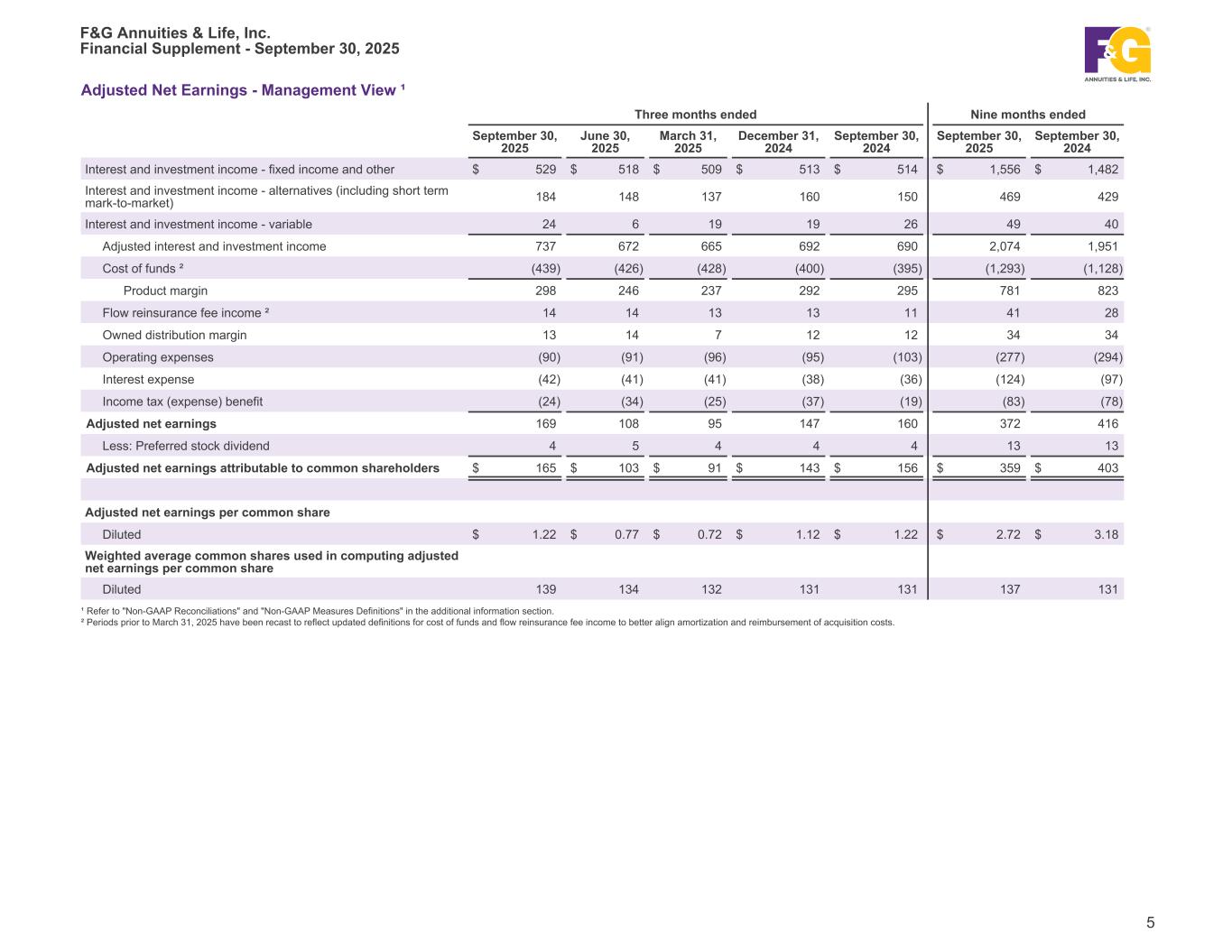

Adjusted Net Earnings - Management View ¹ Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Interest and investment income - fixed income and other $ 529 $ 518 $ 509 $ 513 $ 514 $ 1,556 $ 1,482 Interest and investment income - alternatives (including short term mark-to-market) 184 148 137 160 150 469 429 Interest and investment income - variable 24 6 19 19 26 49 40 Adjusted interest and investment income 737 672 665 692 690 2,074 1,951 Cost of funds ² (439) (426) (428) (400) (395) (1,293) (1,128) Product margin 298 246 237 292 295 781 823 Flow reinsurance fee income ² 14 14 13 13 11 41 28 Owned distribution margin 13 14 7 12 12 34 34 Operating expenses (90) (91) (96) (95) (103) (277) (294) Interest expense (42) (41) (41) (38) (36) (124) (97) Income tax (expense) benefit (24) (34) (25) (37) (19) (83) (78) Adjusted net earnings 169 108 95 147 160 372 416 Less: Preferred stock dividend 4 5 4 4 4 13 13 Adjusted net earnings attributable to common shareholders $ 165 $ 103 $ 91 $ 143 $ 156 $ 359 $ 403 Adjusted net earnings per common share Diluted $ 1.22 $ 0.77 $ 0.72 $ 1.12 $ 1.22 $ 2.72 $ 3.18 Weighted average common shares used in computing adjusted net earnings per common share Diluted 139 134 132 131 131 137 131 ¹ Refer to "Non-GAAP Reconciliations" and "Non-GAAP Measures Definitions" in the additional information section. ² Periods prior to March 31, 2025 have been recast to reflect updated definitions for cost of funds and flow reinsurance fee income to better align amortization and reimbursement of acquisition costs. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 5

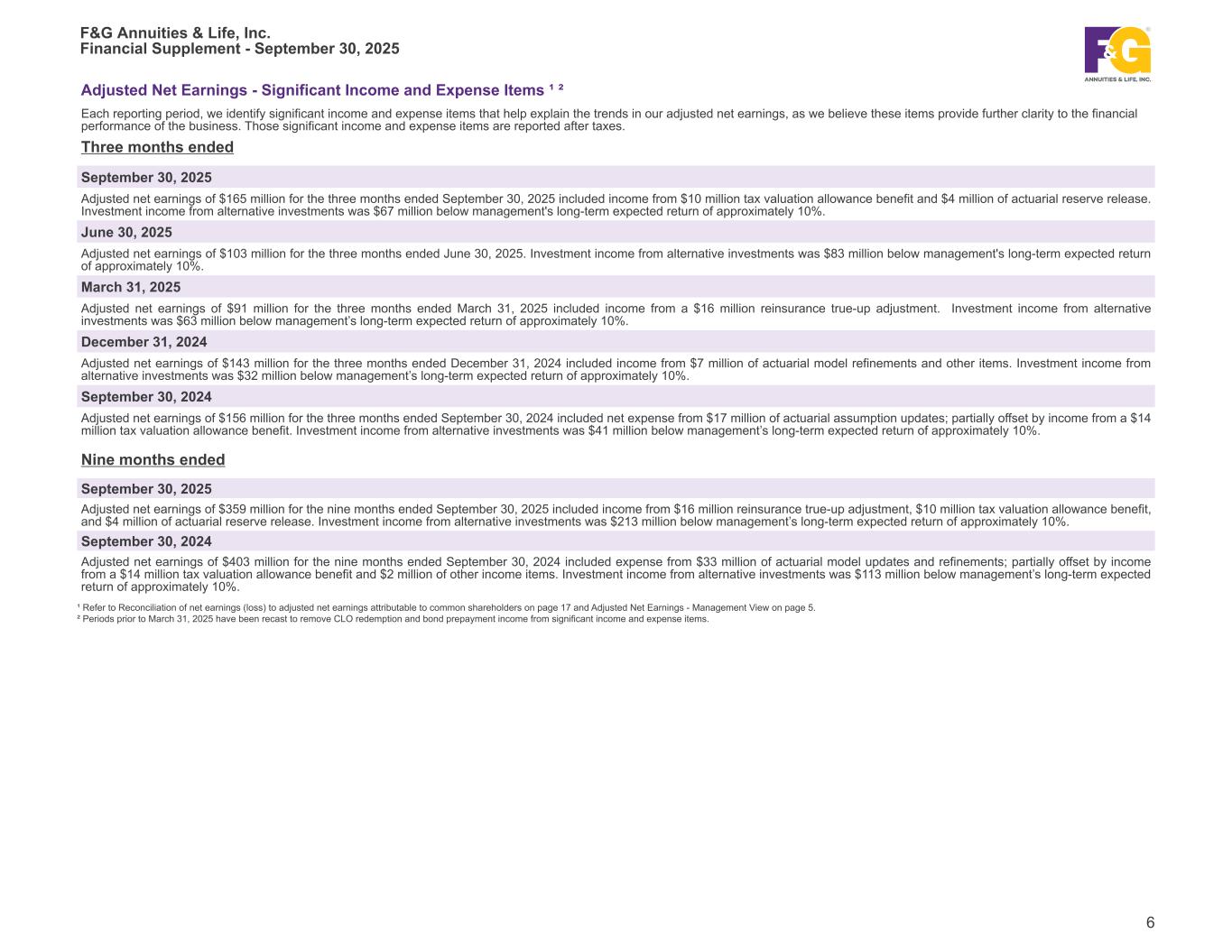

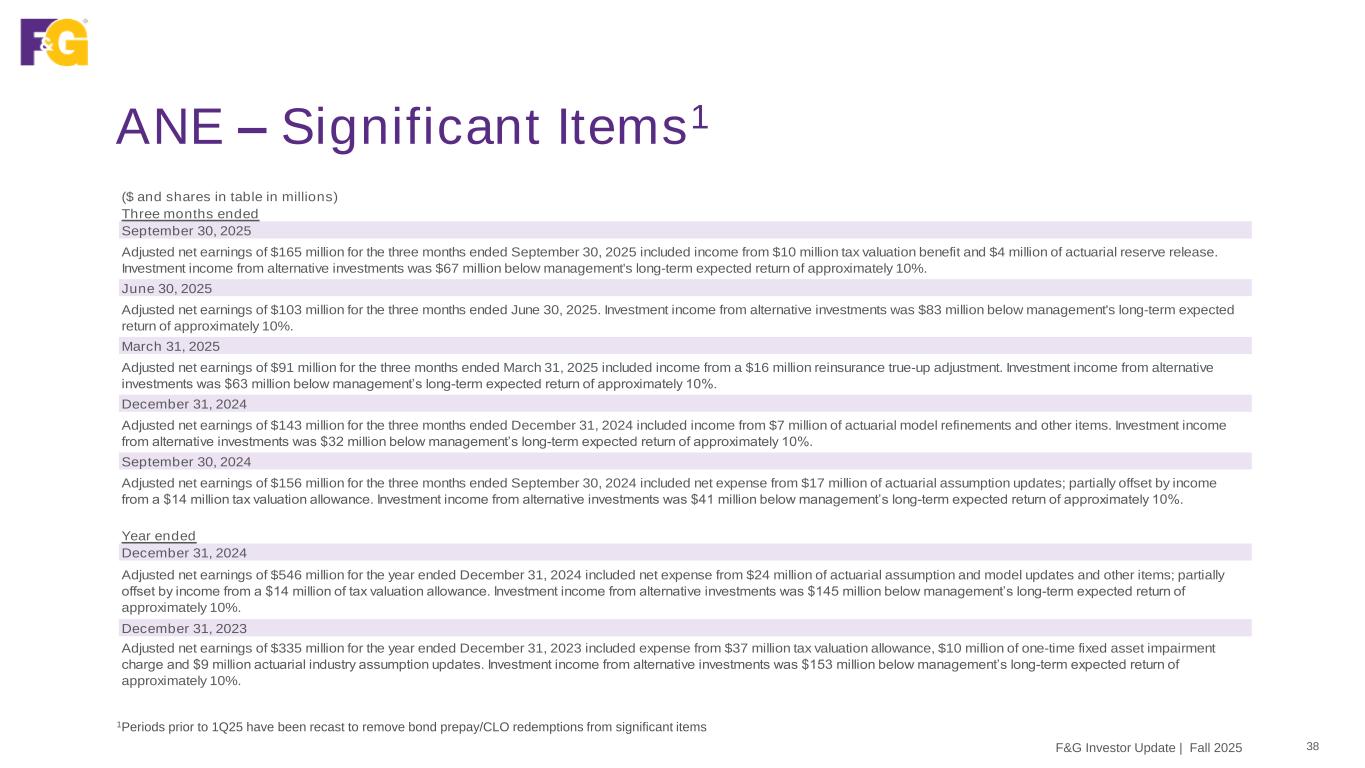

Adjusted Net Earnings - Significant Income and Expense Items ¹ ² Each reporting period, we identify significant income and expense items that help explain the trends in our adjusted net earnings, as we believe these items provide further clarity to the financial performance of the business. Those significant income and expense items are reported after taxes. Three months ended September 30, 2025 Adjusted net earnings of $165 million for the three months ended September 30, 2025 included income from $10 million tax valuation allowance benefit and $4 million of actuarial reserve release. Investment income from alternative investments was $67 million below management's long-term expected return of approximately 10%. June 30, 2025 Adjusted net earnings of $103 million for the three months ended June 30, 2025. Investment income from alternative investments was $83 million below management's long-term expected return of approximately 10%. March 31, 2025 Adjusted net earnings of $91 million for the three months ended March 31, 2025 included income from a $16 million reinsurance true-up adjustment. Investment income from alternative investments was $63 million below management’s long-term expected return of approximately 10%. December 31, 2024 Adjusted net earnings of $143 million for the three months ended December 31, 2024 included income from $7 million of actuarial model refinements and other items. Investment income from alternative investments was $32 million below management’s long-term expected return of approximately 10%. September 30, 2024 Adjusted net earnings of $156 million for the three months ended September 30, 2024 included net expense from $17 million of actuarial assumption updates; partially offset by income from a $14 million tax valuation allowance benefit. Investment income from alternative investments was $41 million below management’s long-term expected return of approximately 10%. Nine months ended September 30, 2025 Adjusted net earnings of $359 million for the nine months ended September 30, 2025 included income from $16 million reinsurance true-up adjustment, $10 million tax valuation allowance benefit, and $4 million of actuarial reserve release. Investment income from alternative investments was $213 million below management’s long-term expected return of approximately 10%. September 30, 2024 Adjusted net earnings of $403 million for the nine months ended September 30, 2024 included expense from $33 million of actuarial model updates and refinements; partially offset by income from a $14 million tax valuation allowance benefit and $2 million of other income items. Investment income from alternative investments was $113 million below management’s long-term expected return of approximately 10%. ¹ Refer to Reconciliation of net earnings (loss) to adjusted net earnings attributable to common shareholders on page 17 and Adjusted Net Earnings - Management View on page 5. ² Periods prior to March 31, 2025 have been recast to remove CLO redemption and bond prepayment income from significant income and expense items. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 6

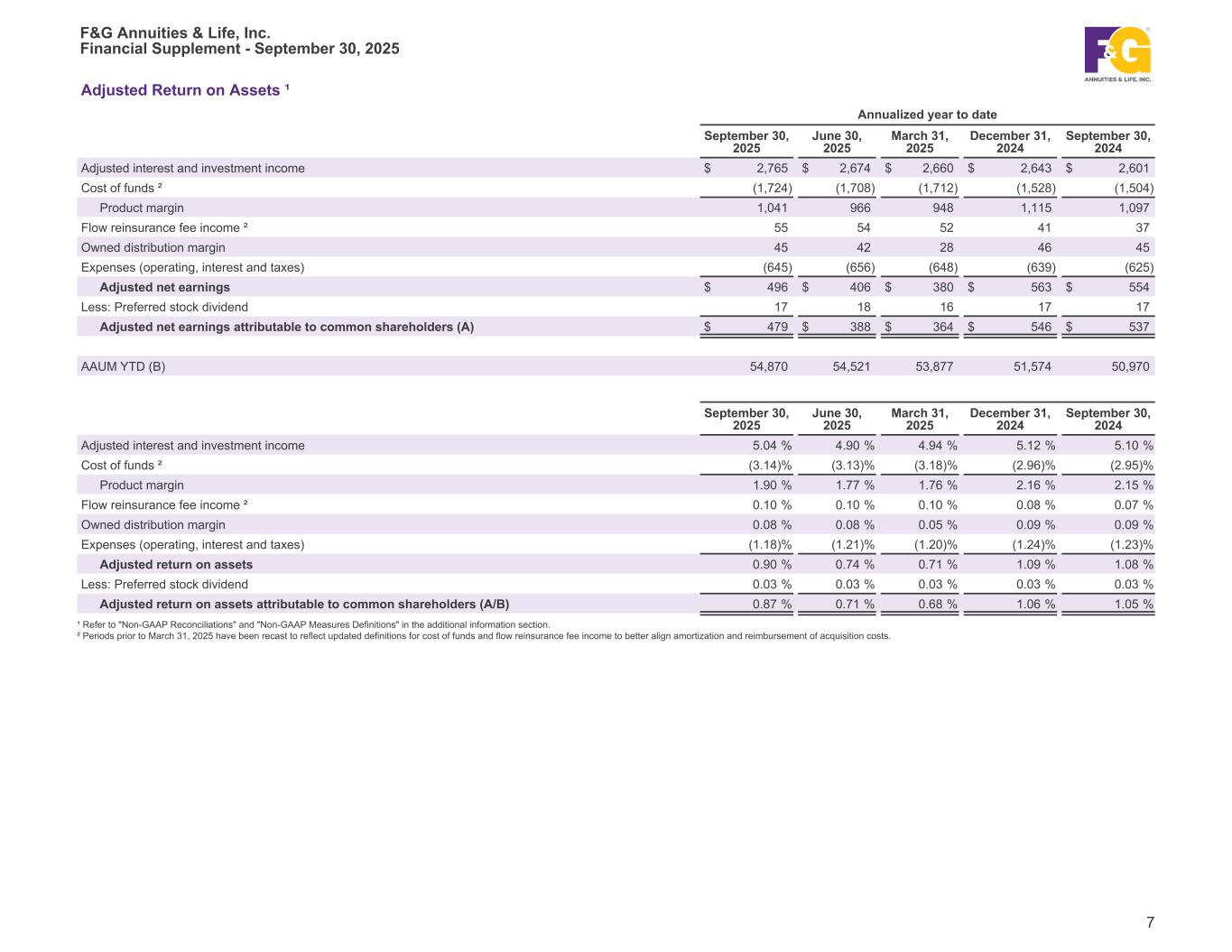

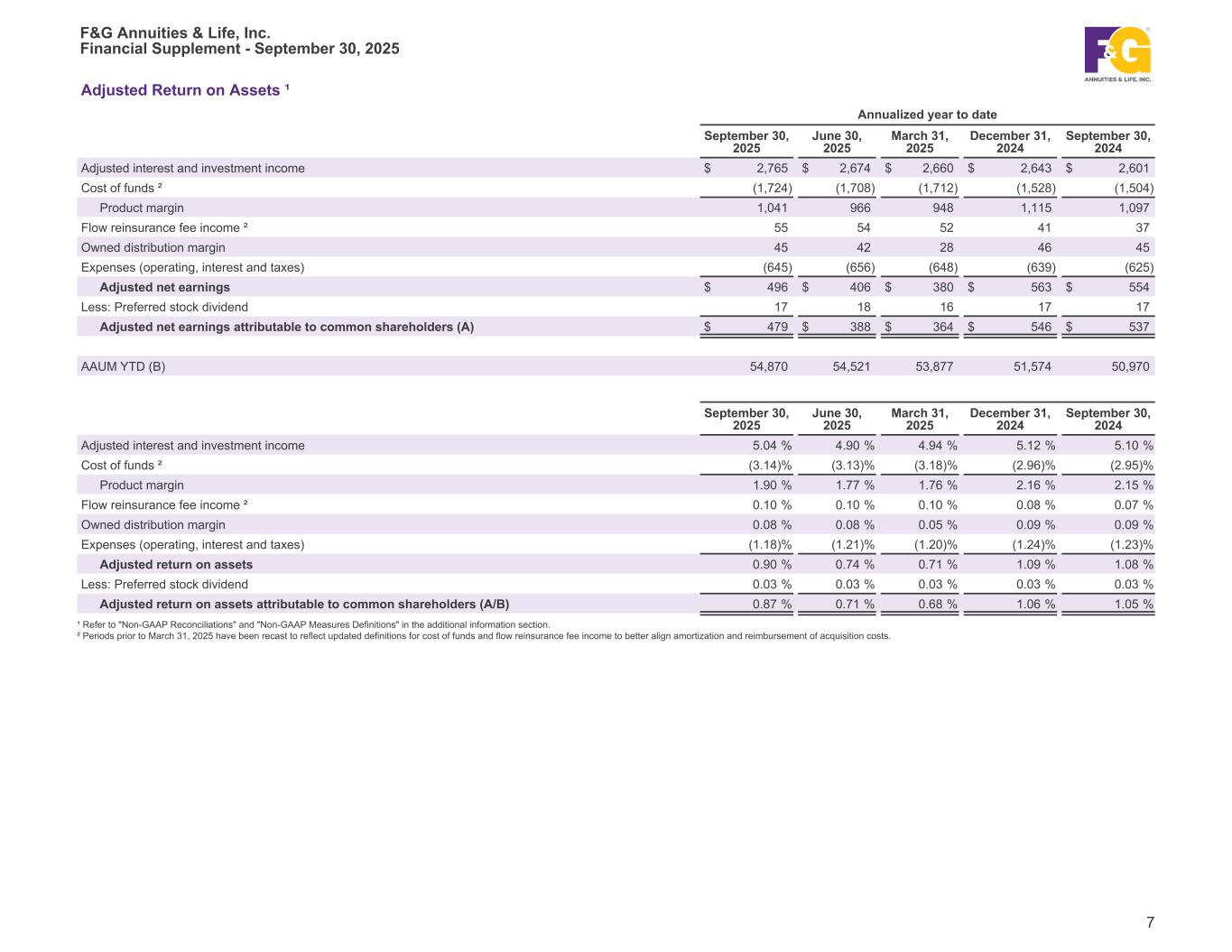

Adjusted Return on Assets ¹ Annualized year to date September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Adjusted interest and investment income $ 2,765 $ 2,674 $ 2,660 $ 2,643 $ 2,601 Cost of funds ² (1,724) (1,708) (1,712) (1,528) (1,504) Product margin 1,041 966 948 1,115 1,097 Flow reinsurance fee income ² 55 54 52 41 37 Owned distribution margin 45 42 28 46 45 Expenses (operating, interest and taxes) (645) (656) (648) (639) (625) Adjusted net earnings $ 496 $ 406 $ 380 $ 563 $ 554 Less: Preferred stock dividend 17 18 16 17 17 Adjusted net earnings attributable to common shareholders (A) $ 479 $ 388 $ 364 $ 546 $ 537 AAUM YTD (B) 54,870 54,521 53,877 51,574 50,970 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Adjusted interest and investment income 5.04 % 4.90 % 4.94 % 5.12 % 5.10 % Cost of funds ² (3.14) % (3.13) % (3.18) % (2.96) % (2.95) % Product margin 1.90 % 1.77 % 1.76 % 2.16 % 2.15 % Flow reinsurance fee income ² 0.10 % 0.10 % 0.10 % 0.08 % 0.07 % Owned distribution margin 0.08 % 0.08 % 0.05 % 0.09 % 0.09 % Expenses (operating, interest and taxes) (1.18) % (1.21) % (1.20) % (1.24) % (1.23) % Adjusted return on assets 0.90 % 0.74 % 0.71 % 1.09 % 1.08 % Less: Preferred stock dividend 0.03 % 0.03 % 0.03 % 0.03 % 0.03 % Adjusted return on assets attributable to common shareholders (A/B) 0.87 % 0.71 % 0.68 % 1.06 % 1.05 % ¹ Refer to "Non-GAAP Reconciliations" and "Non-GAAP Measures Definitions" in the additional information section. ² Periods prior to March 31, 2025 have been recast to reflect updated definitions for cost of funds and flow reinsurance fee income to better align amortization and reimbursement of acquisition costs. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 7

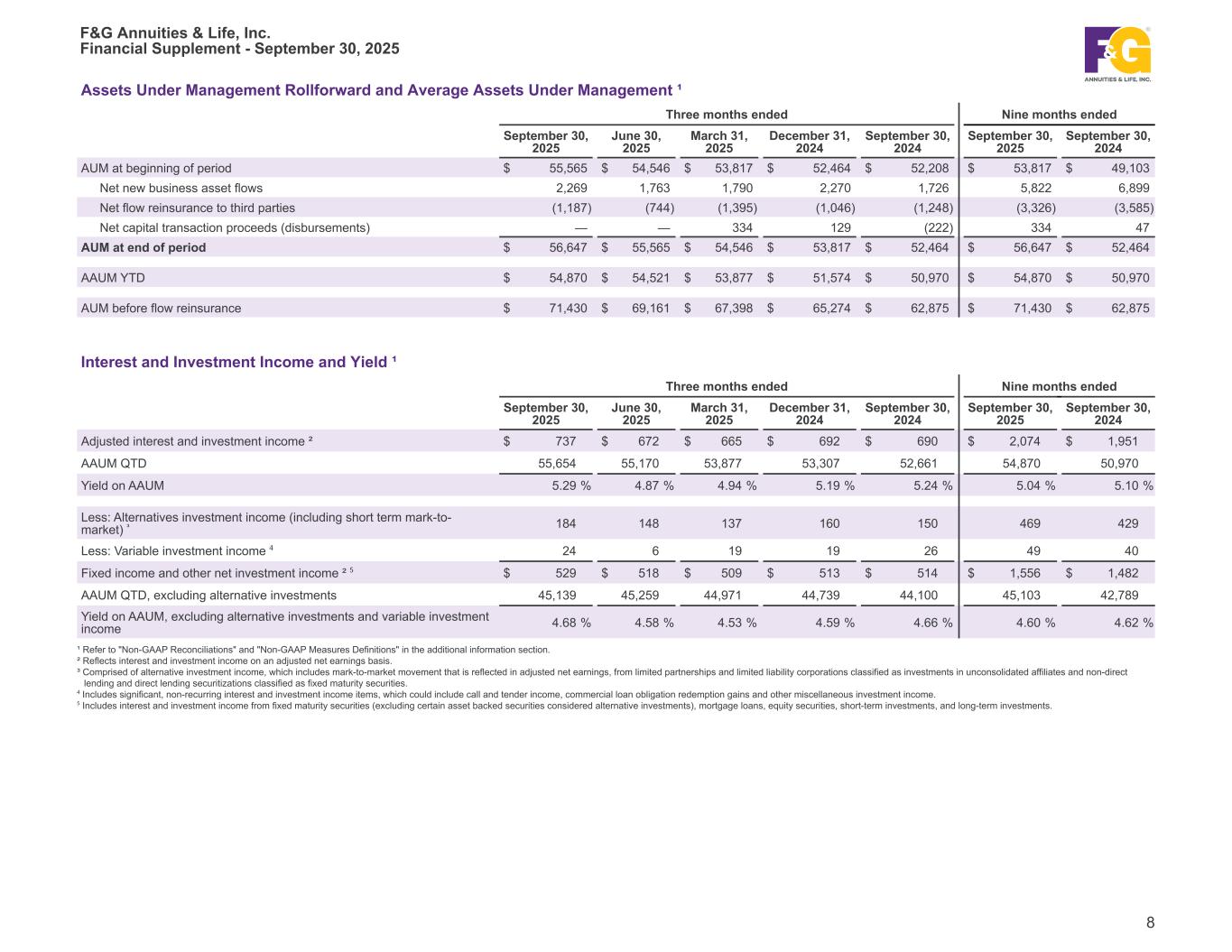

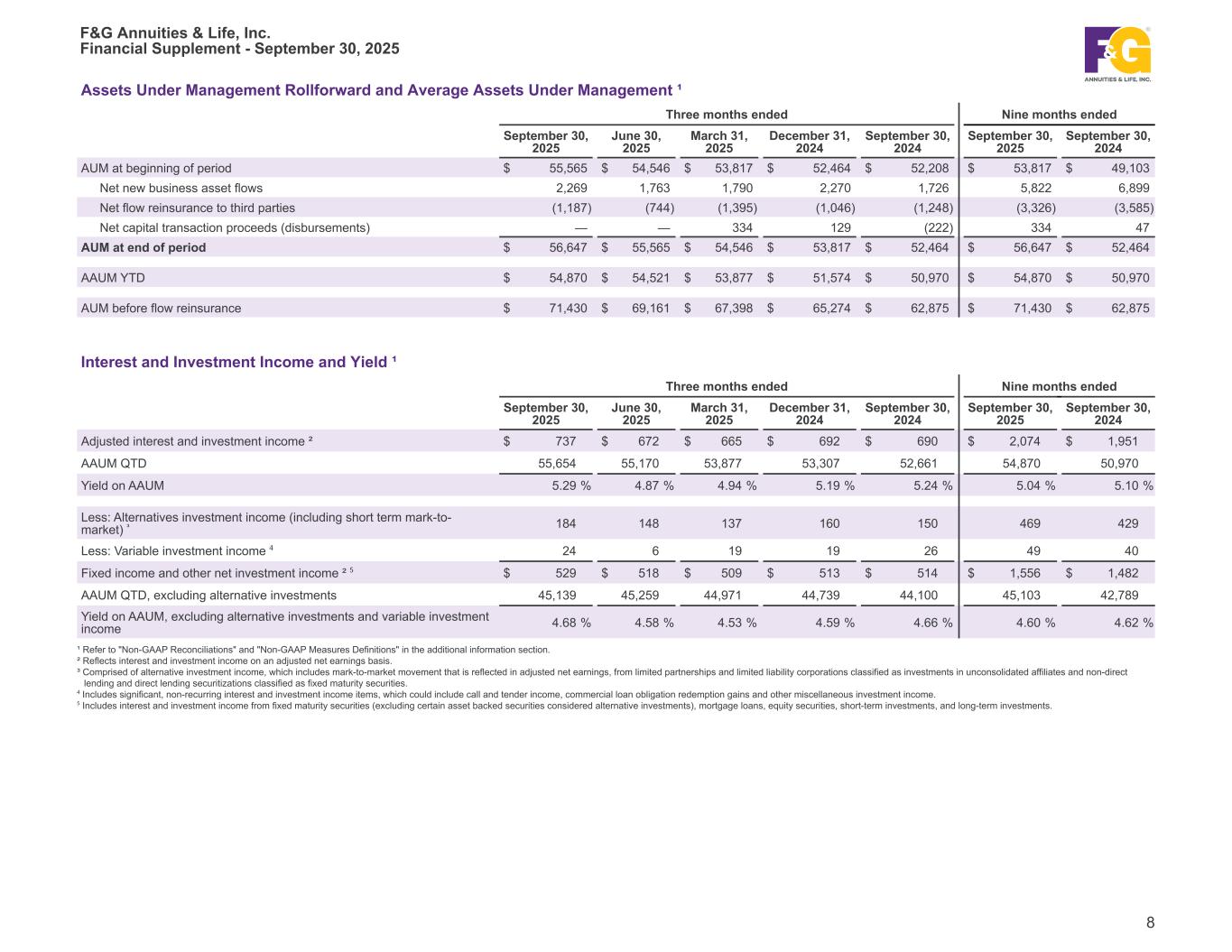

Assets Under Management Rollforward and Average Assets Under Management ¹ Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 AUM at beginning of period $ 55,565 $ 54,546 $ 53,817 $ 52,464 $ 52,208 $ 53,817 $ 49,103 Net new business asset flows 2,269 1,763 1,790 2,270 1,726 5,822 6,899 Net flow reinsurance to third parties (1,187) (744) (1,395) (1,046) (1,248) (3,326) (3,585) Net capital transaction proceeds (disbursements) — — 334 129 (222) 334 47 AUM at end of period $ 56,647 $ 55,565 $ 54,546 $ 53,817 $ 52,464 $ 56,647 $ 52,464 AAUM YTD $ 54,870 $ 54,521 $ 53,877 $ 51,574 $ 50,970 $ 54,870 $ 50,970 AUM before flow reinsurance $ 71,430 $ 69,161 $ 67,398 $ 65,274 $ 62,875 $ 71,430 $ 62,875 Interest and Investment Income and Yield ¹ Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Adjusted interest and investment income ² $ 737 $ 672 $ 665 $ 692 $ 690 $ 2,074 $ 1,951 AAUM QTD 55,654 55,170 53,877 53,307 52,661 54,870 50,970 Yield on AAUM 5.29 % 4.87 % 4.94 % 5.19 % 5.24 % 5.04 % 5.10 % Less: Alternatives investment income (including short term mark-to- market) ³ 184 148 137 160 150 469 429 Less: Variable investment income ⁴ 24 6 19 19 26 49 40 Fixed income and other net investment income ² ⁵ $ 529 $ 518 $ 509 $ 513 $ 514 $ 1,556 $ 1,482 AAUM QTD, excluding alternative investments 45,139 45,259 44,971 44,739 44,100 45,103 42,789 Yield on AAUM, excluding alternative investments and variable investment income 4.68 % 4.58 % 4.53 % 4.59 % 4.66 % 4.60 % 4.62 % ¹ Refer to "Non-GAAP Reconciliations" and "Non-GAAP Measures Definitions" in the additional information section. ² Reflects interest and investment income on an adjusted net earnings basis. ³ Comprised of alternative investment income, which includes mark-to-market movement that is reflected in adjusted net earnings, from limited partnerships and limited liability corporations classified as investments in unconsolidated affiliates and non-direct lending and direct lending securitizations classified as fixed maturity securities. ⁴ Includes significant, non-recurring interest and investment income items, which could include call and tender income, commercial loan obligation redemption gains and other miscellaneous investment income. ⁵ Includes interest and investment income from fixed maturity securities (excluding certain asset backed securities considered alternative investments), mortgage loans, equity securities, short-term investments, and long-term investments. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 8

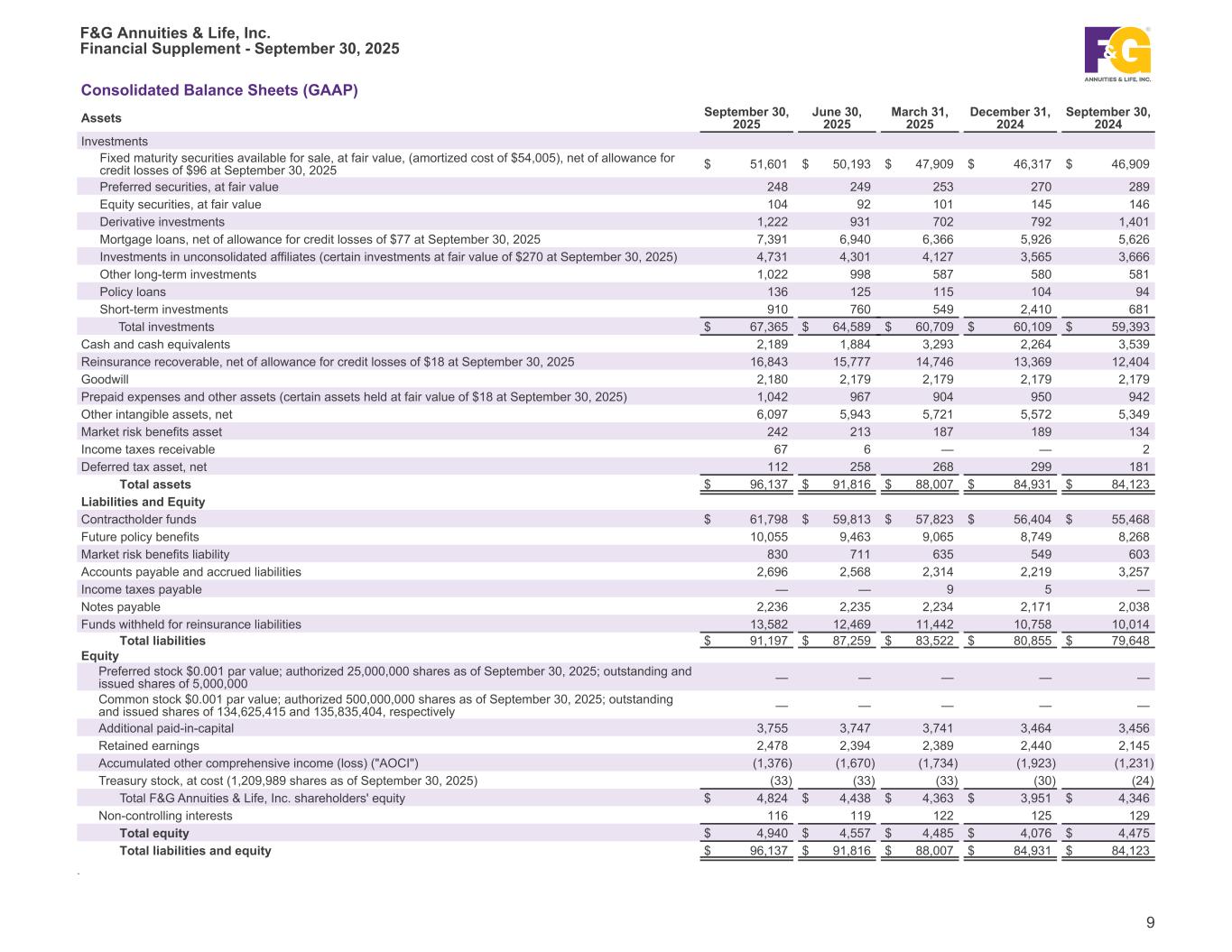

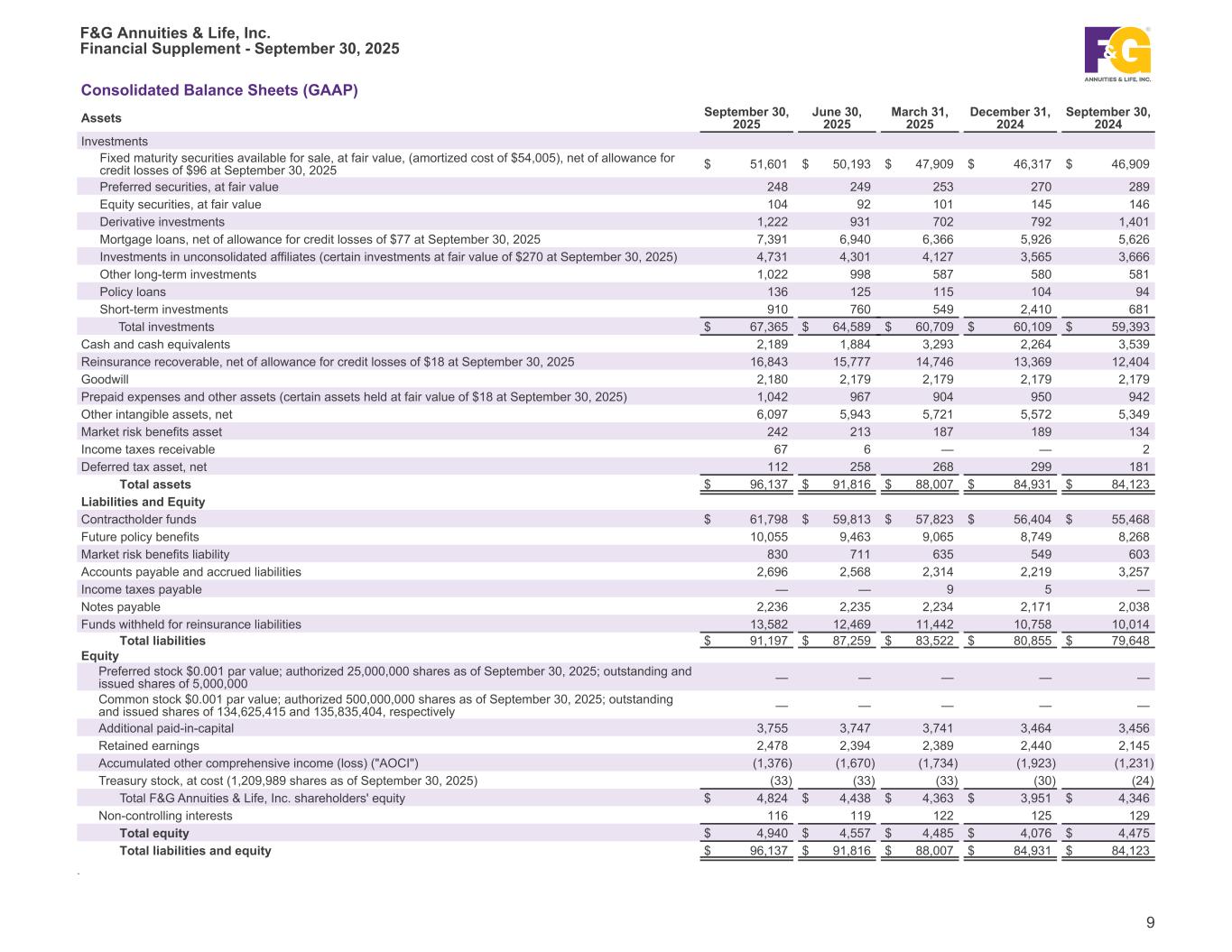

Consolidated Balance Sheets (GAAP) Assets September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Investments Fixed maturity securities available for sale, at fair value, (amortized cost of $54,005), net of allowance for credit losses of $96 at September 30, 2025 $ 51,601 $ 50,193 $ 47,909 $ 46,317 $ 46,909 Preferred securities, at fair value 248 249 253 270 289 Equity securities, at fair value 104 92 101 145 146 Derivative investments 1,222 931 702 792 1,401 Mortgage loans, net of allowance for credit losses of $77 at September 30, 2025 7,391 6,940 6,366 5,926 5,626 Investments in unconsolidated affiliates (certain investments at fair value of $270 at September 30, 2025) 4,731 4,301 4,127 3,565 3,666 Other long-term investments 1,022 998 587 580 581 Policy loans 136 125 115 104 94 Short-term investments 910 760 549 2,410 681 Total investments $ 67,365 $ 64,589 $ 60,709 $ 60,109 $ 59,393 Cash and cash equivalents 2,189 1,884 3,293 2,264 3,539 Reinsurance recoverable, net of allowance for credit losses of $18 at September 30, 2025 16,843 15,777 14,746 13,369 12,404 Goodwill 2,180 2,179 2,179 2,179 2,179 Prepaid expenses and other assets (certain assets held at fair value of $18 at September 30, 2025) 1,042 967 904 950 942 Other intangible assets, net 6,097 5,943 5,721 5,572 5,349 Market risk benefits asset 242 213 187 189 134 Income taxes receivable 67 6 — — 2 Deferred tax asset, net 112 258 268 299 181 Total assets $ 96,137 $ 91,816 $ 88,007 $ 84,931 $ 84,123 Liabilities and Equity Contractholder funds $ 61,798 $ 59,813 $ 57,823 $ 56,404 $ 55,468 Future policy benefits 10,055 9,463 9,065 8,749 8,268 Market risk benefits liability 830 711 635 549 603 Accounts payable and accrued liabilities 2,696 2,568 2,314 2,219 3,257 Income taxes payable — — 9 5 — Notes payable 2,236 2,235 2,234 2,171 2,038 Funds withheld for reinsurance liabilities 13,582 12,469 11,442 10,758 10,014 Total liabilities $ 91,197 $ 87,259 $ 83,522 $ 80,855 $ 79,648 Equity Preferred stock $0.001 par value; authorized 25,000,000 shares as of September 30, 2025; outstanding and issued shares of 5,000,000 — — — — — Common stock $0.001 par value; authorized 500,000,000 shares as of September 30, 2025; outstanding and issued shares of 134,625,415 and 135,835,404, respectively — — — — — Additional paid-in-capital 3,755 3,747 3,741 3,464 3,456 Retained earnings 2,478 2,394 2,389 2,440 2,145 Accumulated other comprehensive income (loss) ("AOCI") (1,376) (1,670) (1,734) (1,923) (1,231) Treasury stock, at cost (1,209,989 shares as of September 30, 2025) (33) (33) (33) (30) (24) Total F&G Annuities & Life, Inc. shareholders' equity $ 4,824 $ 4,438 $ 4,363 $ 3,951 $ 4,346 Non-controlling interests 116 119 122 125 129 Total equity $ 4,940 $ 4,557 $ 4,485 $ 4,076 $ 4,475 Total liabilities and equity $ 96,137 $ 91,816 $ — $ 88,007 $ 84,931 $ 84,123 . F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 9

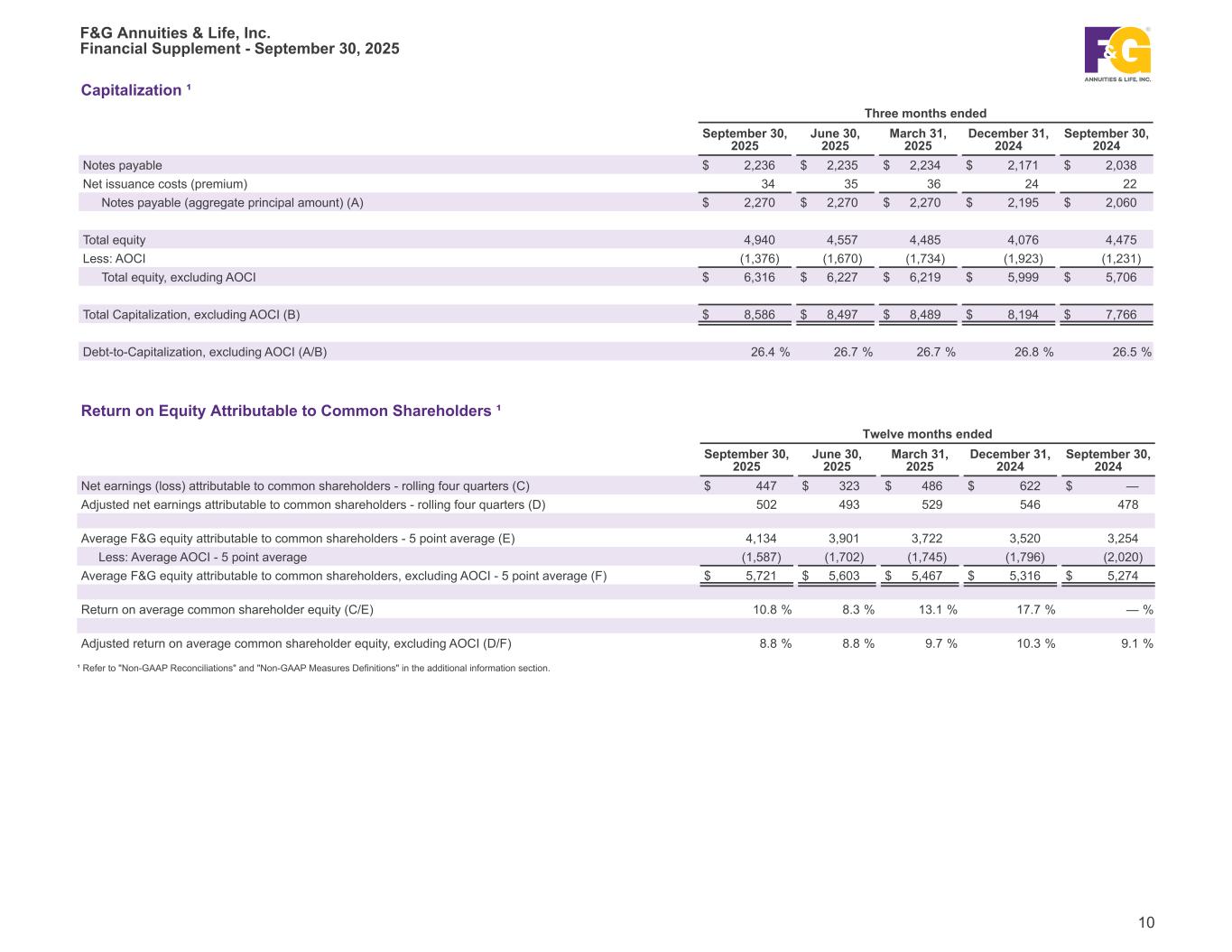

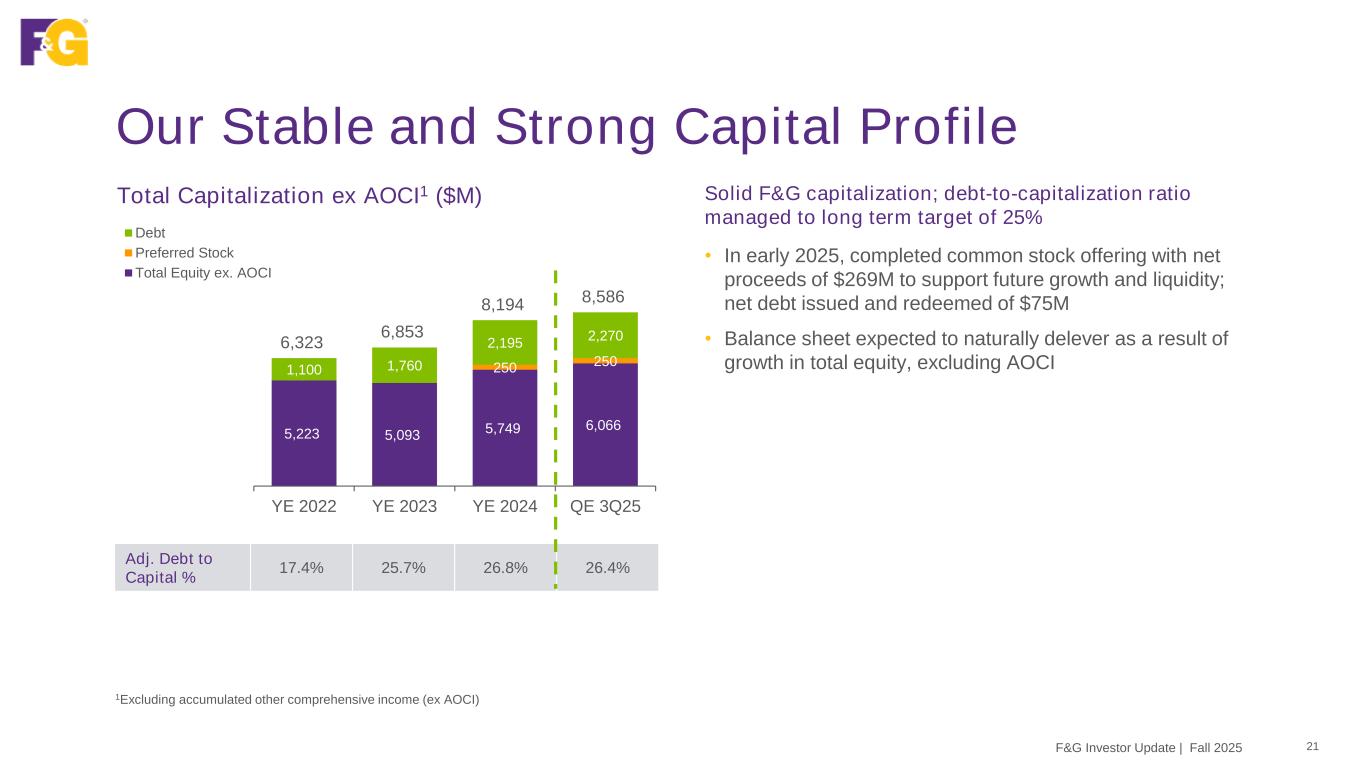

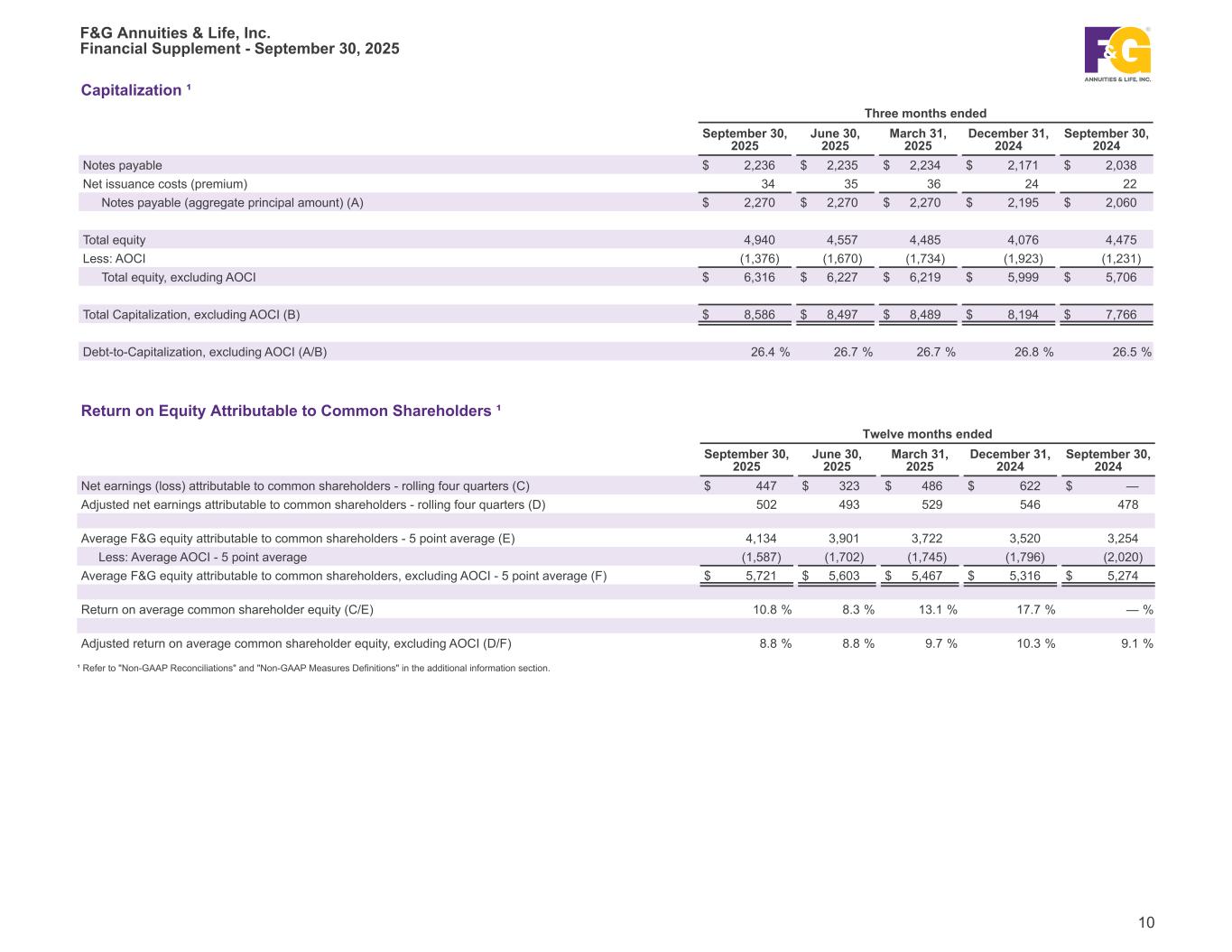

Capitalization ¹ Three months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Notes payable $ 2,236 $ 2,235 $ 2,234 $ 2,171 $ 2,038 Net issuance costs (premium) 34 35 36 24 22 Notes payable (aggregate principal amount) (A) $ 2,270 $ 2,270 $ 2,270 $ 2,195 $ 2,060 Total equity 4,940 4,557 4,485 4,076 4,475 Less: AOCI (1,376) (1,670) (1,734) (1,923) (1,231) Total equity, excluding AOCI $ 6,316 $ 6,227 $ 6,219 $ 5,999 $ 5,706 Total Capitalization, excluding AOCI (B) $ 8,586 $ 8,497 $ 8,489 $ 8,194 $ 7,766 Debt-to-Capitalization, excluding AOCI (A/B) 26.4 % 26.7 % 26.7 % 26.8 % 26.5 % Return on Equity Attributable to Common Shareholders ¹ Twelve months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net earnings (loss) attributable to common shareholders - rolling four quarters (C) $ 447 $ 323 $ 486 $ 622 $ — Adjusted net earnings attributable to common shareholders - rolling four quarters (D) 502 493 529 546 478 Average F&G equity attributable to common shareholders - 5 point average (E) 4,134 3,901 3,722 3,520 3,254 Less: Average AOCI - 5 point average (1,587) (1,702) (1,745) (1,796) (2,020) Average F&G equity attributable to common shareholders, excluding AOCI - 5 point average (F) $ 5,721 $ 5,603 $ 5,467 $ 5,316 $ 5,274 Return on average common shareholder equity (C/E) 10.8 % 8.3 % 13.1 % 17.7 % — % Adjusted return on average common shareholder equity, excluding AOCI (D/F) 8.8 % 8.8 % 9.7 % 10.3 % 9.1 % ¹ Refer to "Non-GAAP Reconciliations" and "Non-GAAP Measures Definitions" in the additional information section. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 10

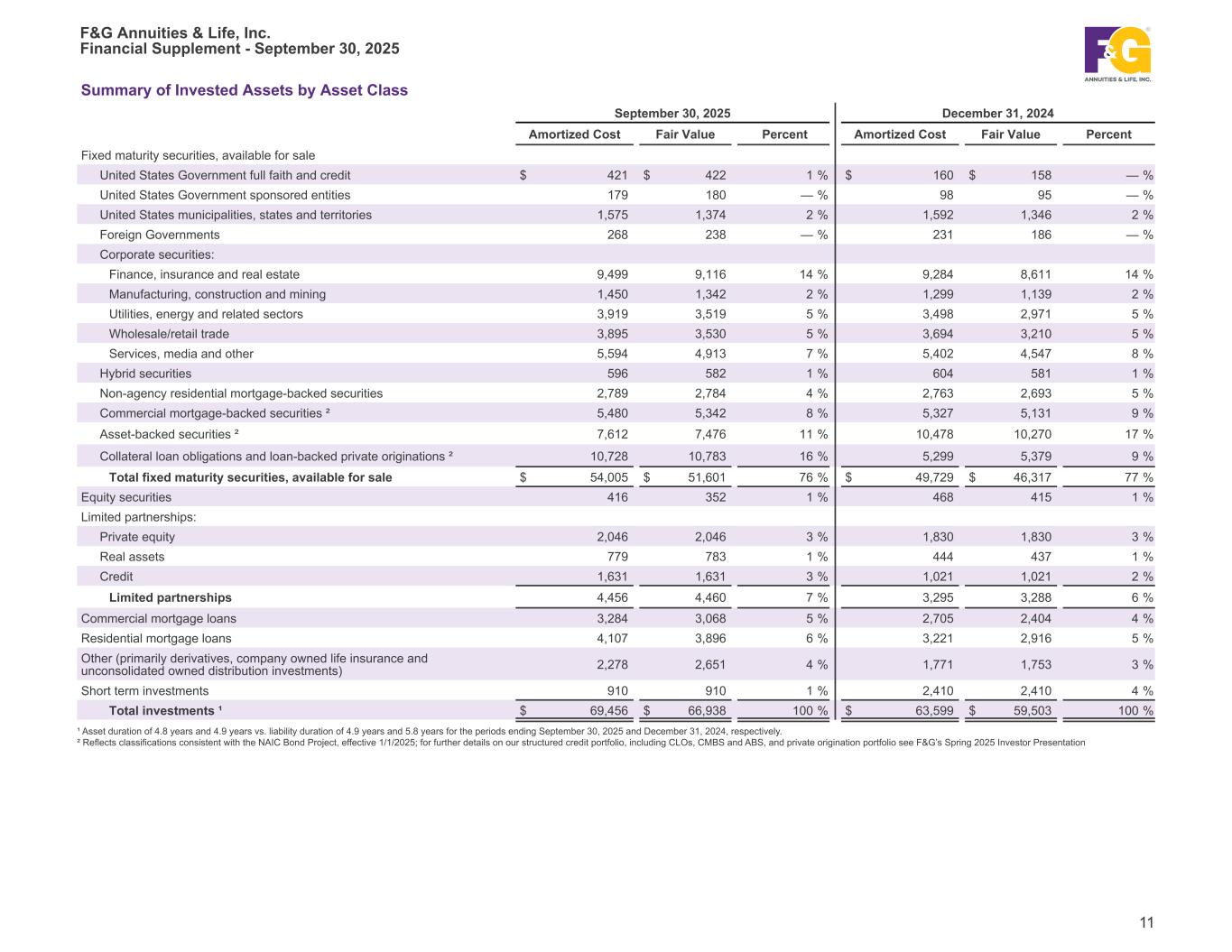

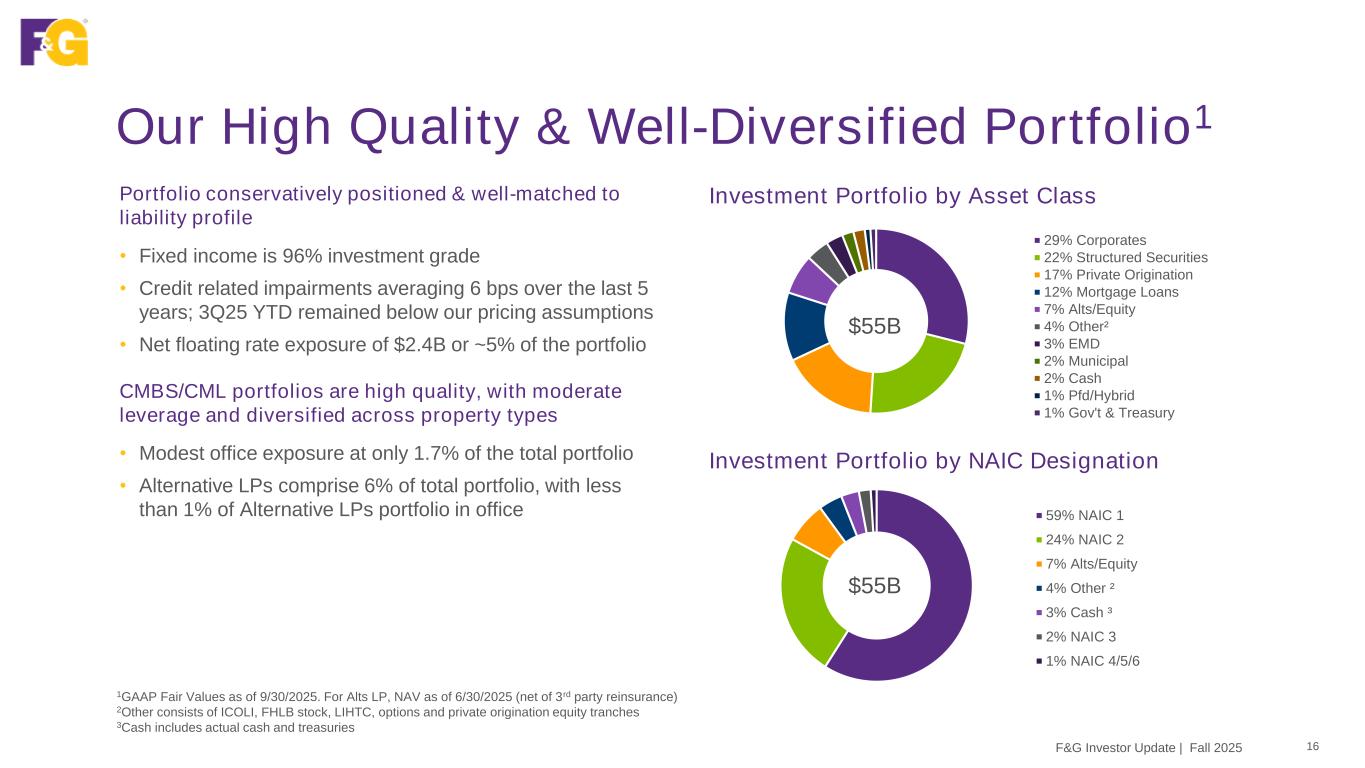

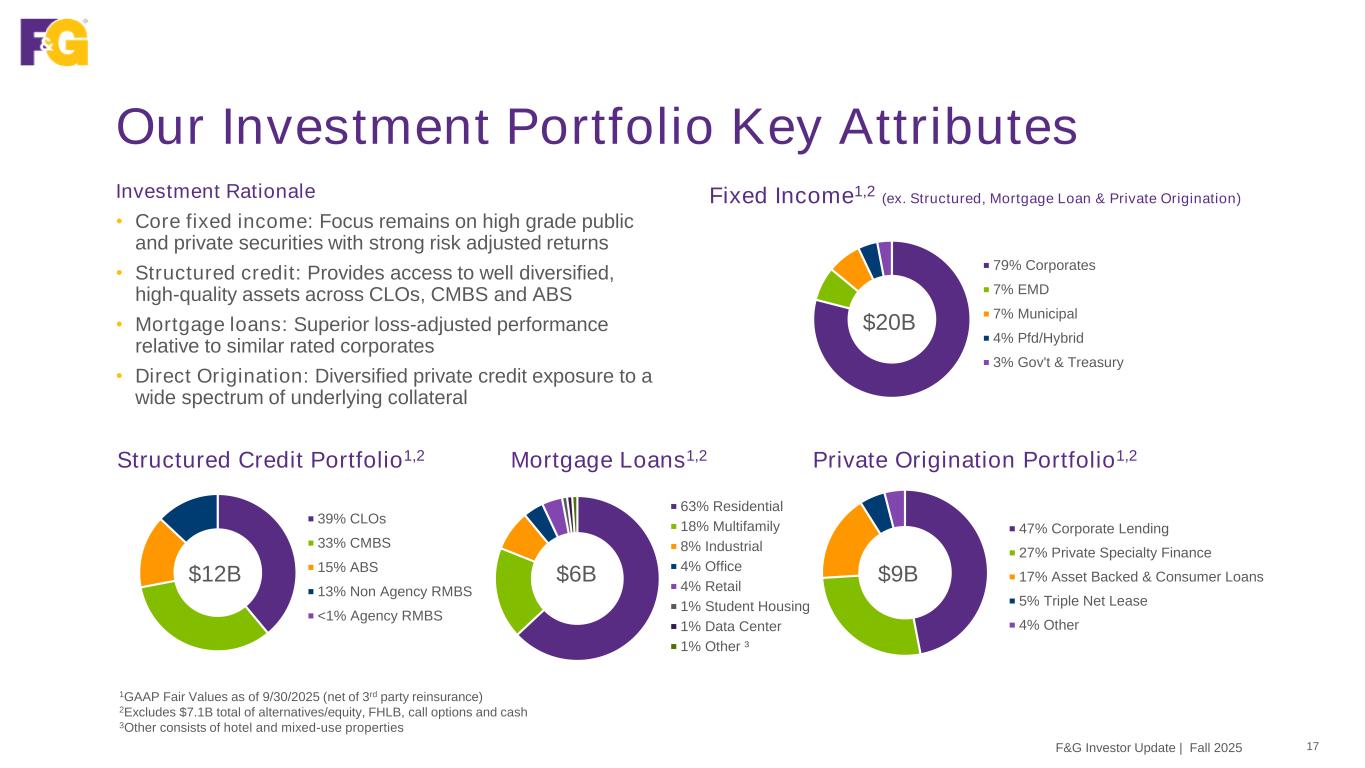

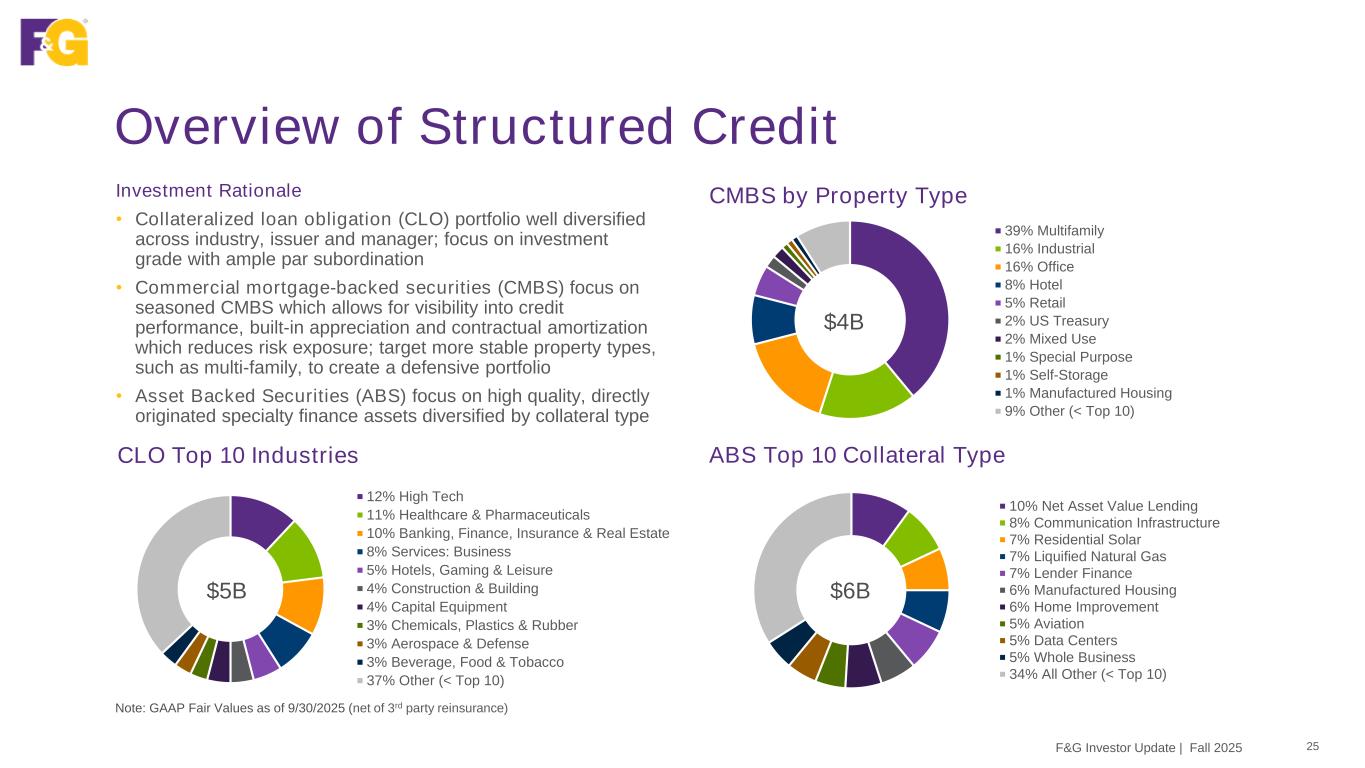

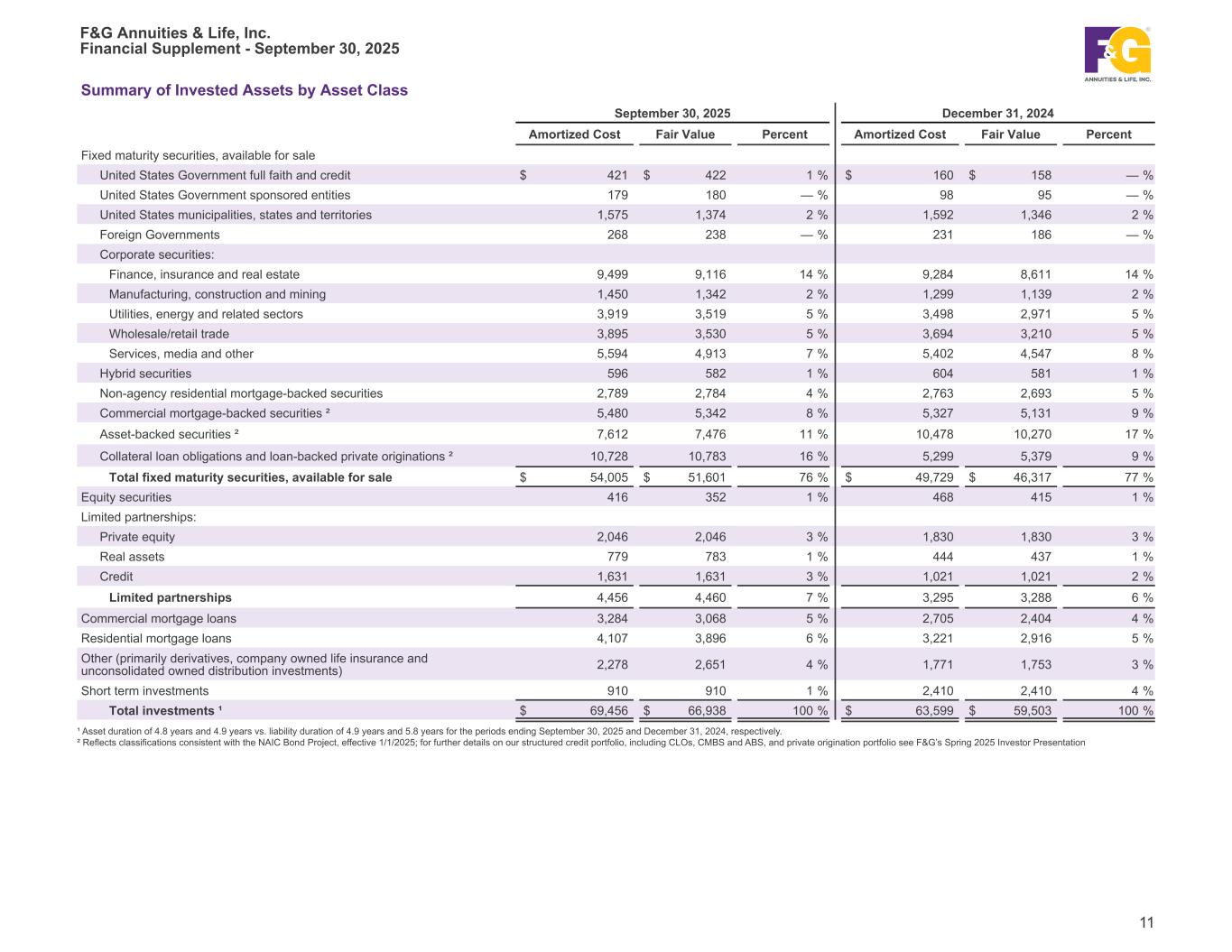

Summary of Invested Assets by Asset Class September 30, 2025 December 31, 2024 Amortized Cost Fair Value Percent Amortized Cost Fair Value Percent Fixed maturity securities, available for sale United States Government full faith and credit $ 421 $ 422 1 % $ 160 $ 158 — % United States Government sponsored entities 179 180 — % 98 95 — % United States municipalities, states and territories 1,575 1,374 2 % 1,592 1,346 2 % Foreign Governments 268 238 — % 231 186 — % Corporate securities: Finance, insurance and real estate 9,499 9,116 14 % 9,284 8,611 14 % Manufacturing, construction and mining 1,450 1,342 2 % 1,299 1,139 2 % Utilities, energy and related sectors 3,919 3,519 5 % 3,498 2,971 5 % Wholesale/retail trade 3,895 3,530 5 % 3,694 3,210 5 % Services, media and other 5,594 4,913 7 % 5,402 4,547 8 % Hybrid securities 596 582 1 % 604 581 1 % Non-agency residential mortgage-backed securities 2,789 2,784 4 % 2,763 2,693 5 % Commercial mortgage-backed securities ² 5,480 5,342 8 % 5,327 5,131 9 % Asset-backed securities ² 7,612 7,476 11 % 10,478 10,270 17 % Collateral loan obligations and loan-backed private originations ² 10,728 10,783 16 % 5,299 5,379 9 % Total fixed maturity securities, available for sale $ 54,005 $ 51,601 76 % $ 49,729 $ 46,317 77 % Equity securities 416 352 1 % 468 415 1 % Limited partnerships: Private equity 2,046 2,046 3 % 1,830 1,830 3 % Real assets 779 783 1 % 444 437 1 % Credit 1,631 1,631 3 % 1,021 1,021 2 % Limited partnerships 4,456 4,460 7 % 3,295 3,288 6 % Commercial mortgage loans 3,284 3,068 5 % 2,705 2,404 4 % Residential mortgage loans 4,107 3,896 6 % 3,221 2,916 5 % Other (primarily derivatives, company owned life insurance and unconsolidated owned distribution investments) 2,278 2,651 4 % 1,771 1,753 3 % Short term investments 910 910 1 % 2,410 2,410 4 % Total investments ¹ $ 69,456 $ 66,938 100 % $ 63,599 $ 59,503 100 % ¹ Asset duration of 4.8 years and 4.9 years vs. liability duration of 4.9 years and 5.8 years for the periods ending September 30, 2025 and December 31, 2024, respectively. ² Reflects classifications consistent with the NAIC Bond Project, effective 1/1/2025; for further details on our structured credit portfolio, including CLOs, CMBS and ABS, and private origination portfolio see F&G’s Spring 2025 Investor Presentation F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 11

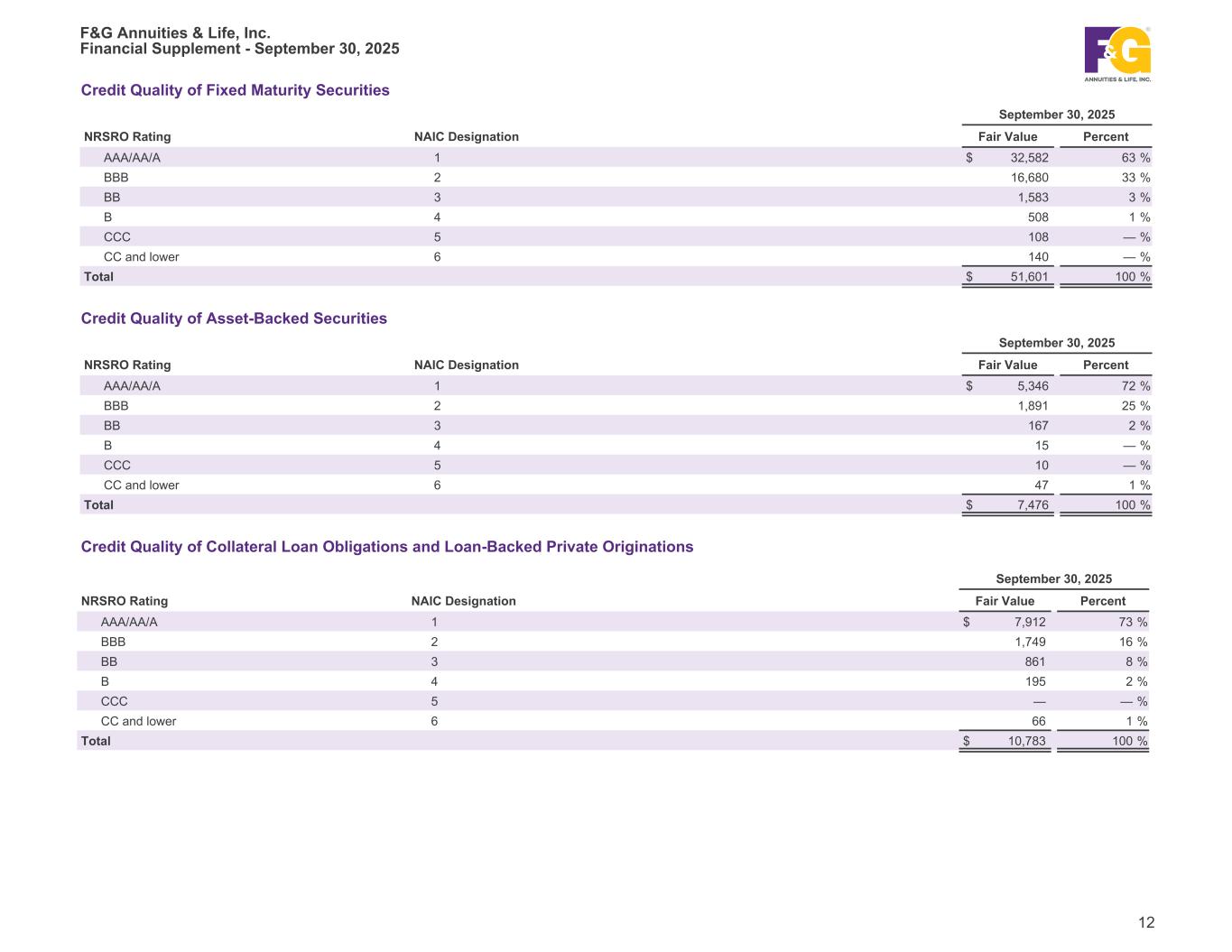

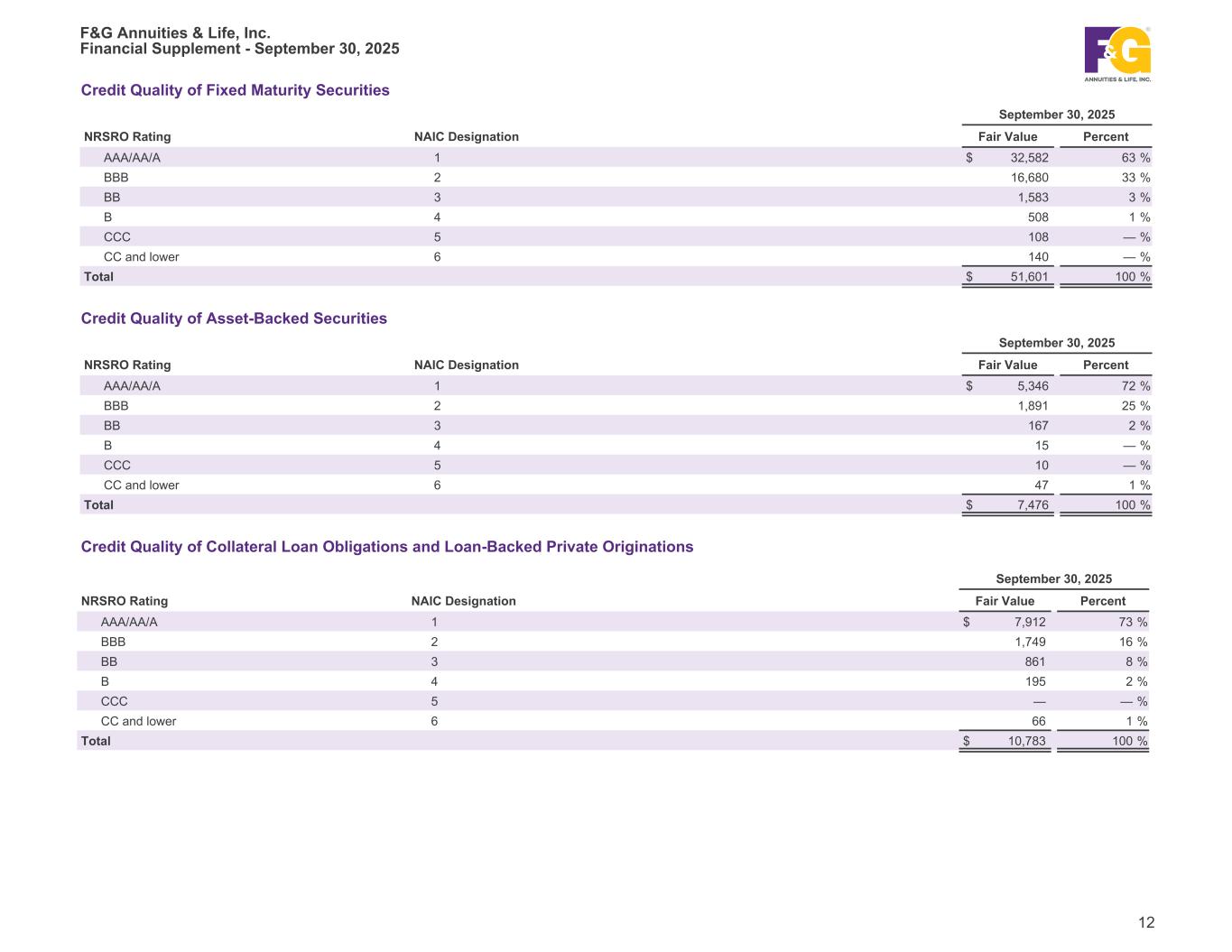

Credit Quality of Fixed Maturity Securities September 30, 2025 NRSRO Rating NAIC Designation Fair Value Percent AAA/AA/A 1 $ 32,582 63 % BBB 2 16,680 33 % BB 3 1,583 3 % B 4 508 1 % CCC 5 108 — % CC and lower 6 140 — % Total $ 51,601 100 % Credit Quality of Asset-Backed Securities September 30, 2025 NRSRO Rating NAIC Designation Fair Value Percent AAA/AA/A 1 $ 5,346 72 % BBB 2 1,891 25 % BB 3 167 2 % B 4 15 — % CCC 5 10 — % CC and lower 6 47 1 % Total $ 7,476 100 % Credit Quality of Collateral Loan Obligations and Loan-Backed Private Originations September 30, 2025 NRSRO Rating NAIC Designation Fair Value Percent AAA/AA/A 1 $ 7,912 73 % BBB 2 1,749 16 % BB 3 861 8 % B 4 195 2 % CCC 5 — — % CC and lower 6 66 1 % Total $ 10,783 100 % F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 12

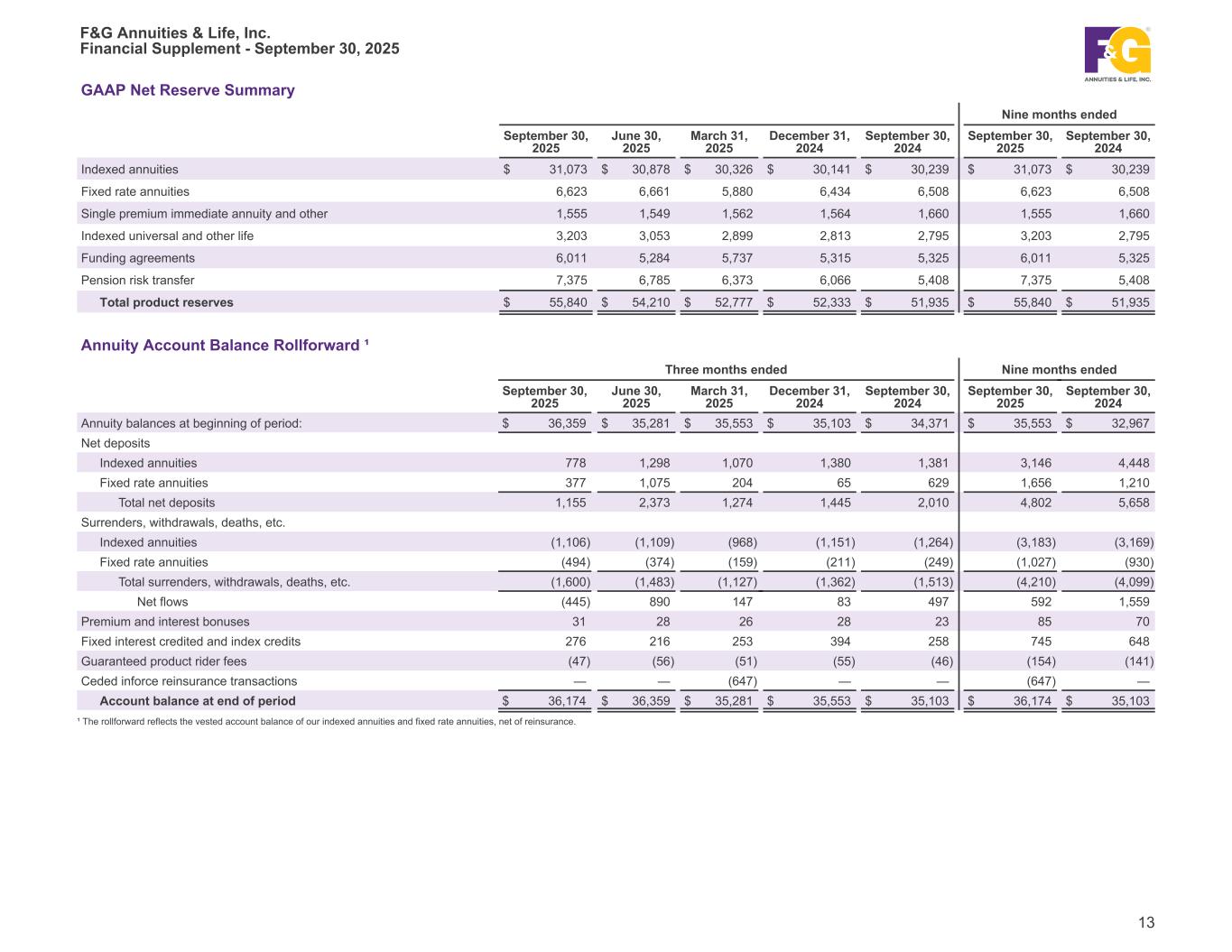

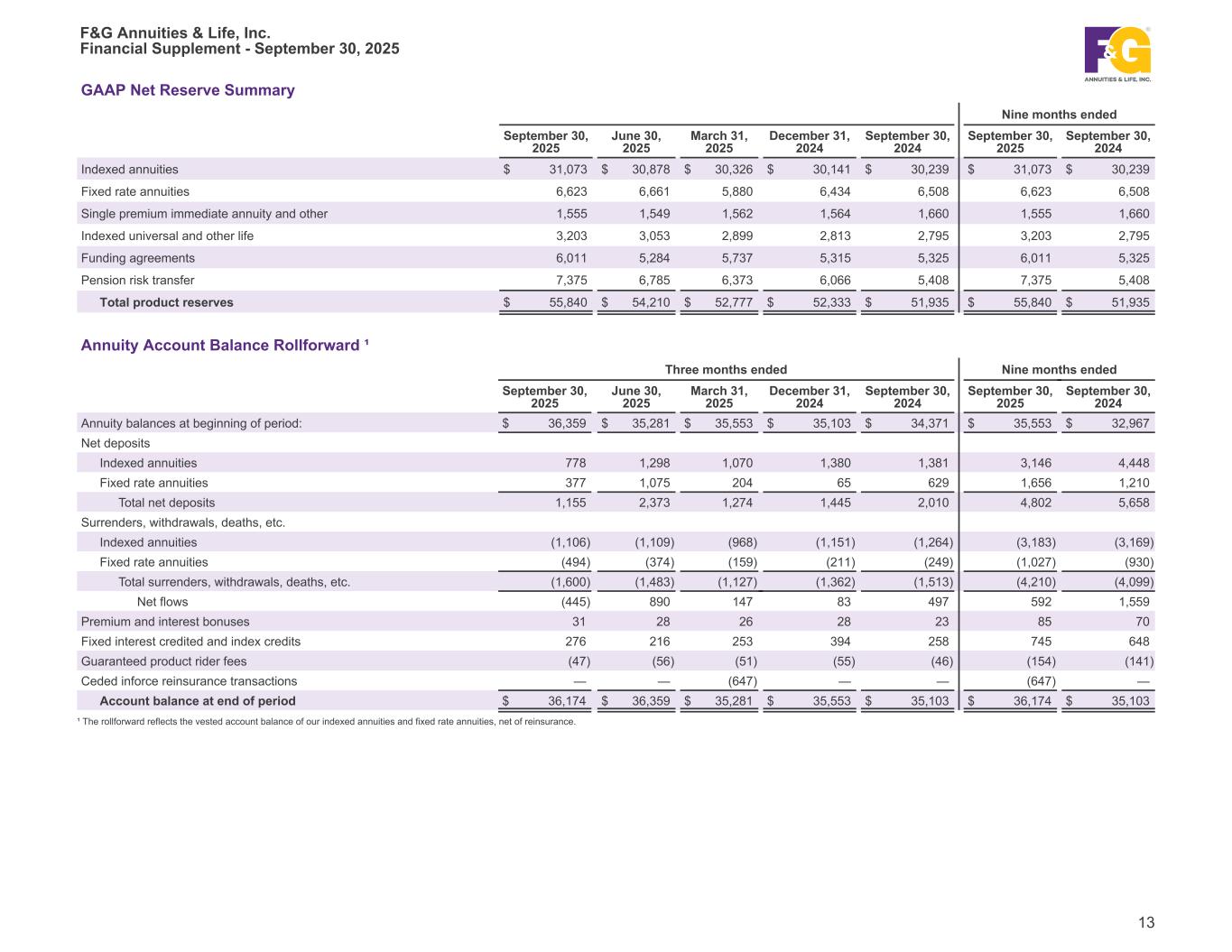

GAAP Net Reserve Summary Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Indexed annuities $ 31,073 $ 30,878 $ 30,326 $ 30,141 $ 30,239 $ 31,073 $ 30,239 Fixed rate annuities 6,623 6,661 5,880 6,434 6,508 6,623 6,508 Single premium immediate annuity and other 1,555 1,549 1,562 1,564 1,660 1,555 1,660 Indexed universal and other life 3,203 3,053 2,899 2,813 2,795 3,203 2,795 Funding agreements 6,011 5,284 5,737 5,315 5,325 6,011 5,325 Pension risk transfer 7,375 6,785 6,373 6,066 5,408 7,375 5,408 Total product reserves $ 55,840 $ 54,210 $ 52,777 $ 52,333 $ 51,935 $ 55,840 $ 51,935 Annuity Account Balance Rollforward ¹ Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Annuity balances at beginning of period: $ 36,359 $ 35,281 $ 35,553 $ 35,103 $ 34,371 $ 35,553 $ 32,967 Net deposits Indexed annuities 778 1,298 1,070 1,380 1,381 3,146 4,448 Fixed rate annuities 377 1,075 204 65 629 1,656 1,210 Total net deposits 1,155 2,373 1,274 1,445 2,010 4,802 5,658 Surrenders, withdrawals, deaths, etc. Indexed annuities (1,106) (1,109) (968) (1,151) (1,264) (3,183) (3,169) Fixed rate annuities (494) (374) (159) (211) (249) (1,027) (930) Total surrenders, withdrawals, deaths, etc. (1,600) (1,483) (1,127) (1,362) (1,513) (4,210) (4,099) Net flows (445) 890 147 83 497 592 1,559 Premium and interest bonuses 31 28 26 28 23 85 70 Fixed interest credited and index credits 276 216 253 394 258 745 648 Guaranteed product rider fees (47) (56) (51) (55) (46) (154) (141) Ceded inforce reinsurance transactions — — (647) — — (647) — Account balance at end of period $ 36,174 $ 36,359 $ 35,281 $ 35,553 $ 35,103 $ 36,174 $ 35,103 ¹ The rollforward reflects the vested account balance of our indexed annuities and fixed rate annuities, net of reinsurance. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 13

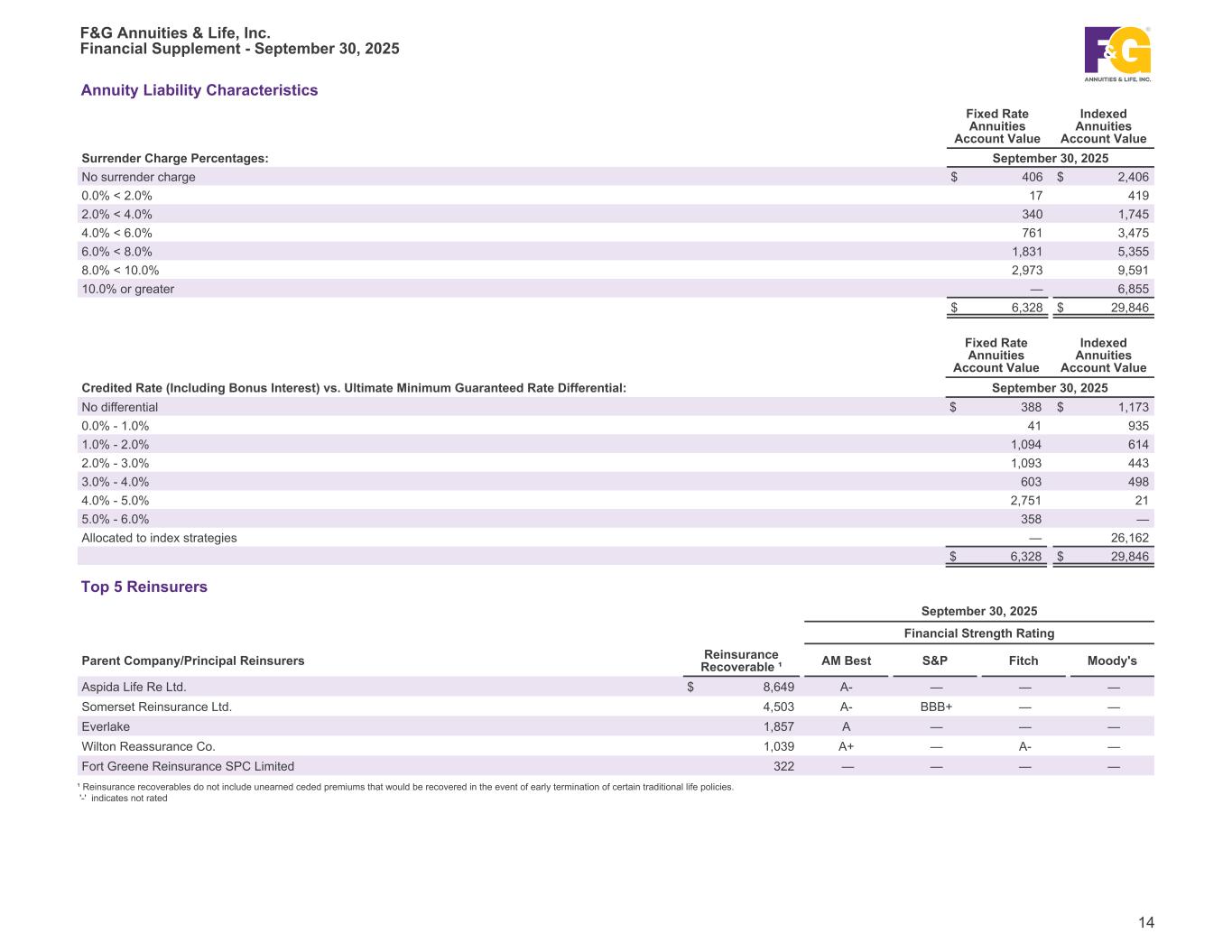

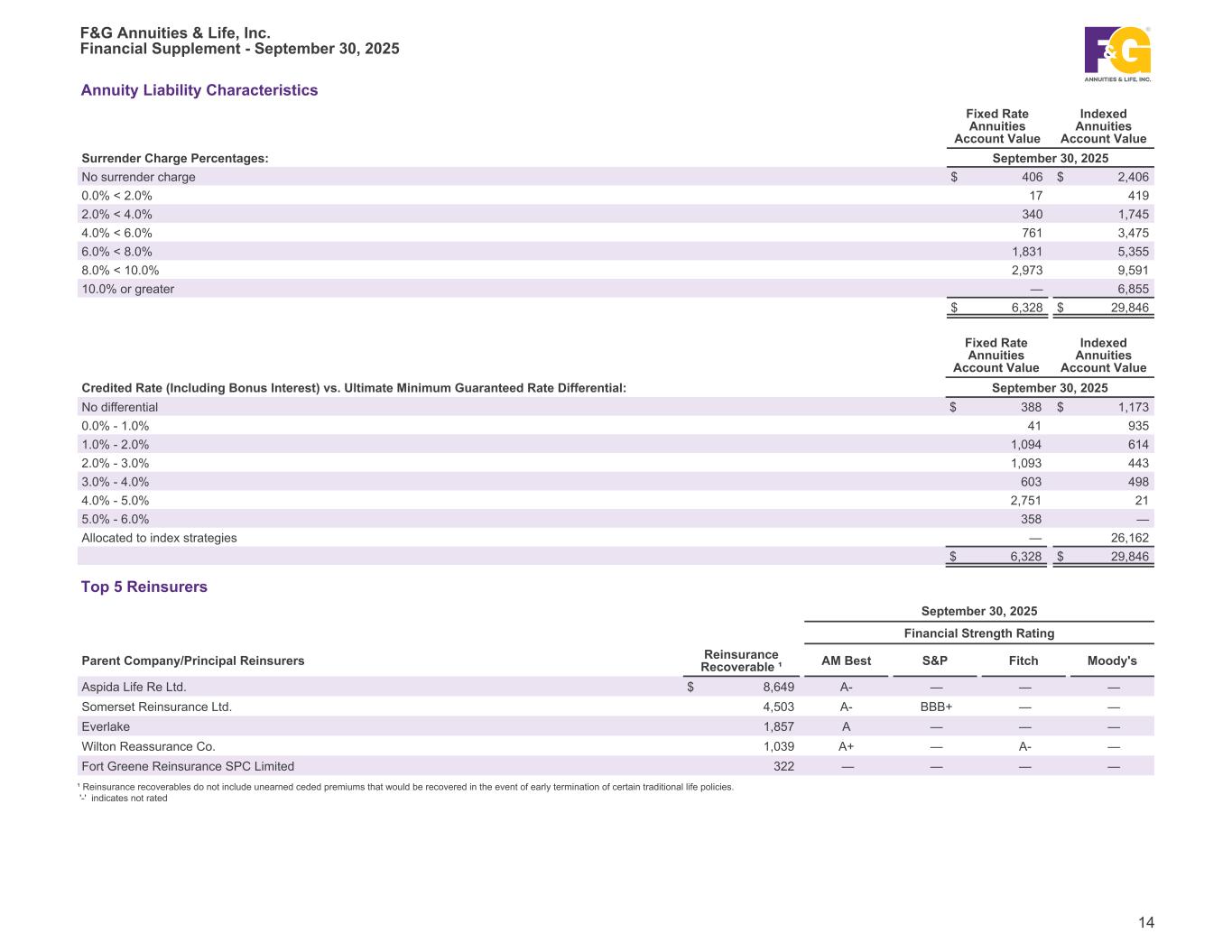

Annuity Liability Characteristics Fixed Rate Annuities Account Value Indexed Annuities Account Value Surrender Charge Percentages: September 30, 2025 No surrender charge $ 406 $ 2,406 0.0% < 2.0% 17 419 2.0% < 4.0% 340 1,745 4.0% < 6.0% 761 3,475 6.0% < 8.0% 1,831 5,355 8.0% < 10.0% 2,973 9,591 10.0% or greater — 6,855 $ 6,328 $ 29,846 Fixed Rate Annuities Account Value Indexed Annuities Account Value Credited Rate (Including Bonus Interest) vs. Ultimate Minimum Guaranteed Rate Differential: September 30, 2025 No differential $ 388 $ 1,173 0.0% - 1.0% 41 935 1.0% - 2.0% 1,094 614 2.0% - 3.0% 1,093 443 3.0% - 4.0% 603 498 4.0% - 5.0% 2,751 21 5.0% - 6.0% 358 — Allocated to index strategies — 26,162 $ 6,328 $ 29,846 Top 5 Reinsurers September 30, 2025 Financial Strength Rating Parent Company/Principal Reinsurers Reinsurance Recoverable ¹ AM Best S&P Fitch Moody's Aspida Life Re Ltd. $ 8,649 A- — — — Somerset Reinsurance Ltd. 4,503 A- BBB+ — — Everlake 1,857 A — — — Wilton Reassurance Co. 1,039 A+ — A- — Fort Greene Reinsurance SPC Limited 322 — — — — ¹ Reinsurance recoverables do not include unearned ceded premiums that would be recovered in the event of early termination of certain traditional life policies. '-' indicates not rated F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 14

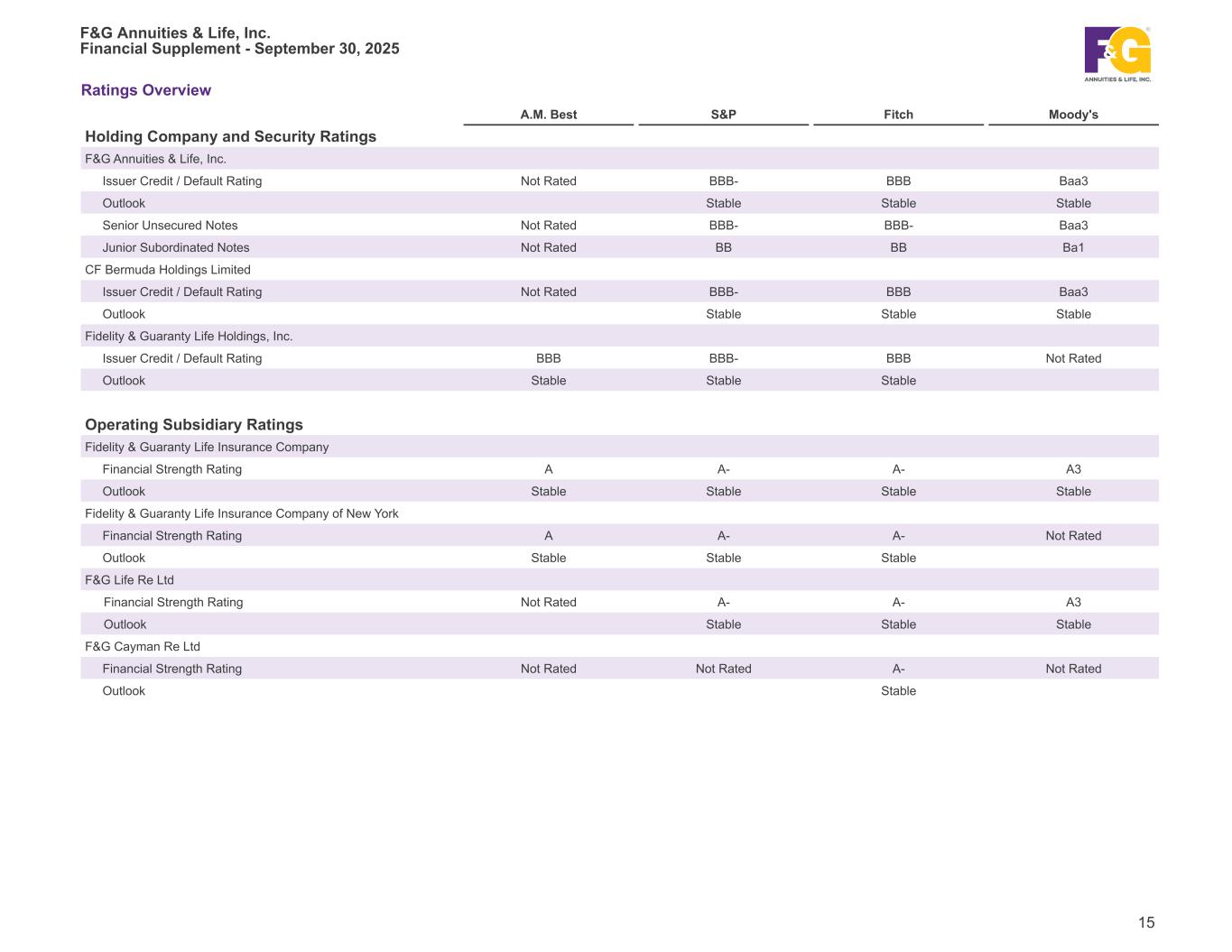

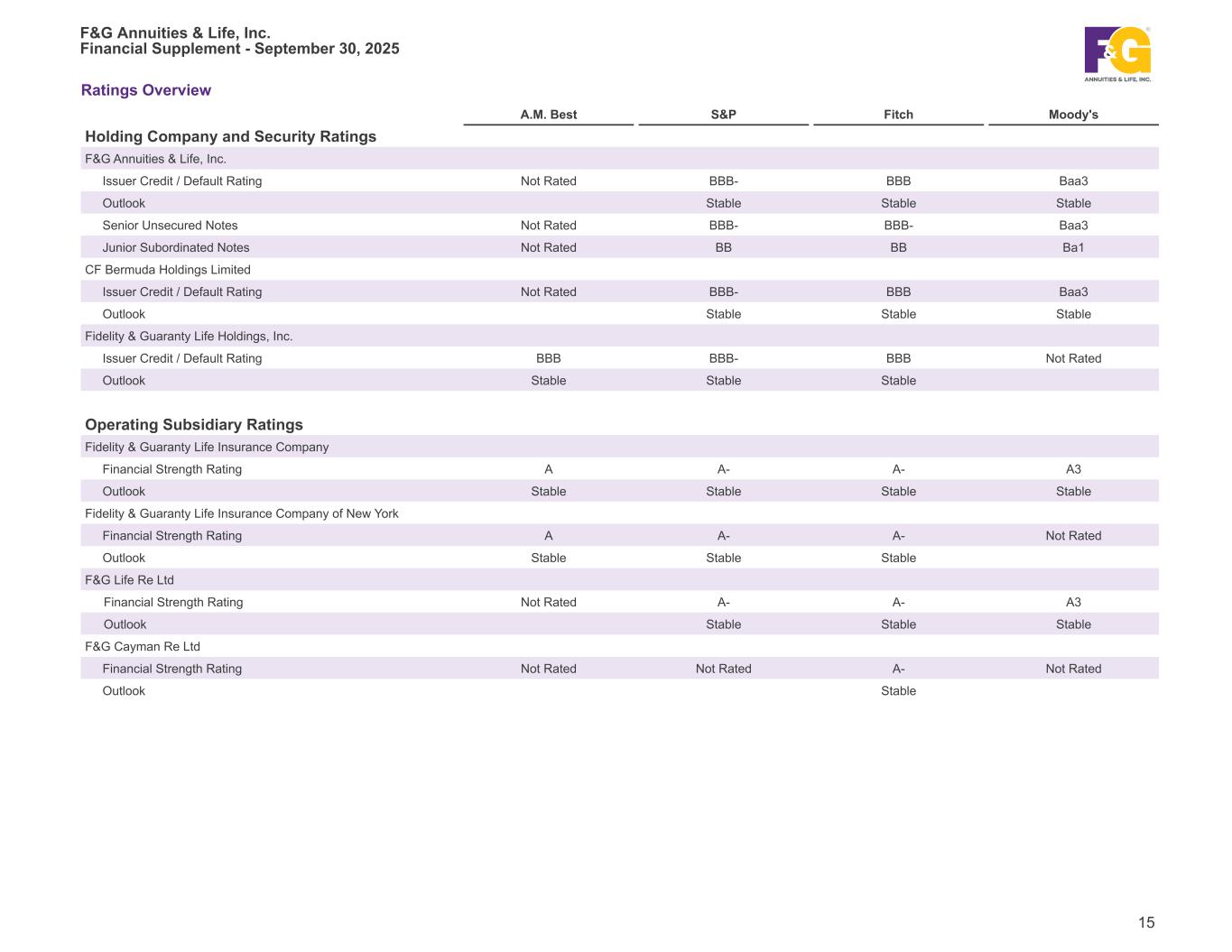

Ratings Overview A.M. Best S&P Fitch Moody's Holding Company and Security Ratings F&G Annuities & Life, Inc. Issuer Credit / Default Rating Not Rated BBB- BBB Baa3 Outlook Stable Stable Stable Senior Unsecured Notes Not Rated BBB- BBB- Baa3 Junior Subordinated Notes Not Rated BB BB Ba1 CF Bermuda Holdings Limited Issuer Credit / Default Rating Not Rated BBB- BBB Baa3 Outlook Stable Stable Stable Fidelity & Guaranty Life Holdings, Inc. Issuer Credit / Default Rating BBB BBB- BBB Not Rated Outlook Stable Stable Stable Operating Subsidiary Ratings Fidelity & Guaranty Life Insurance Company Financial Strength Rating A A- A- A3 Outlook Stable Stable Stable Stable Fidelity & Guaranty Life Insurance Company of New York Financial Strength Rating A A- A- Not Rated Outlook Stable Stable Stable F&G Life Re Ltd Financial Strength Rating Not Rated A- A- A3 Outlook Stable Stable Stable F&G Cayman Re Ltd Financial Strength Rating Not Rated Not Rated A- Not Rated Outlook Stable F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 15

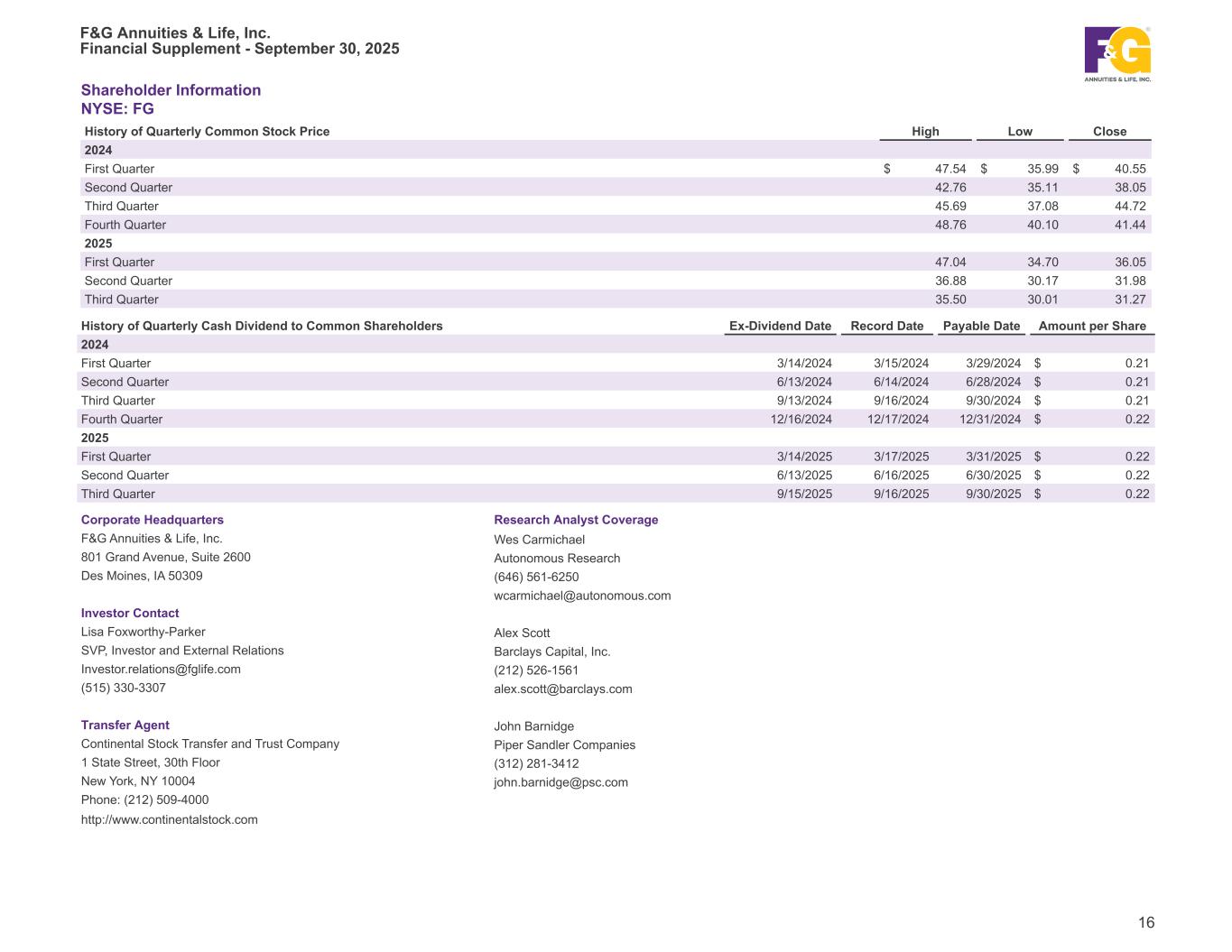

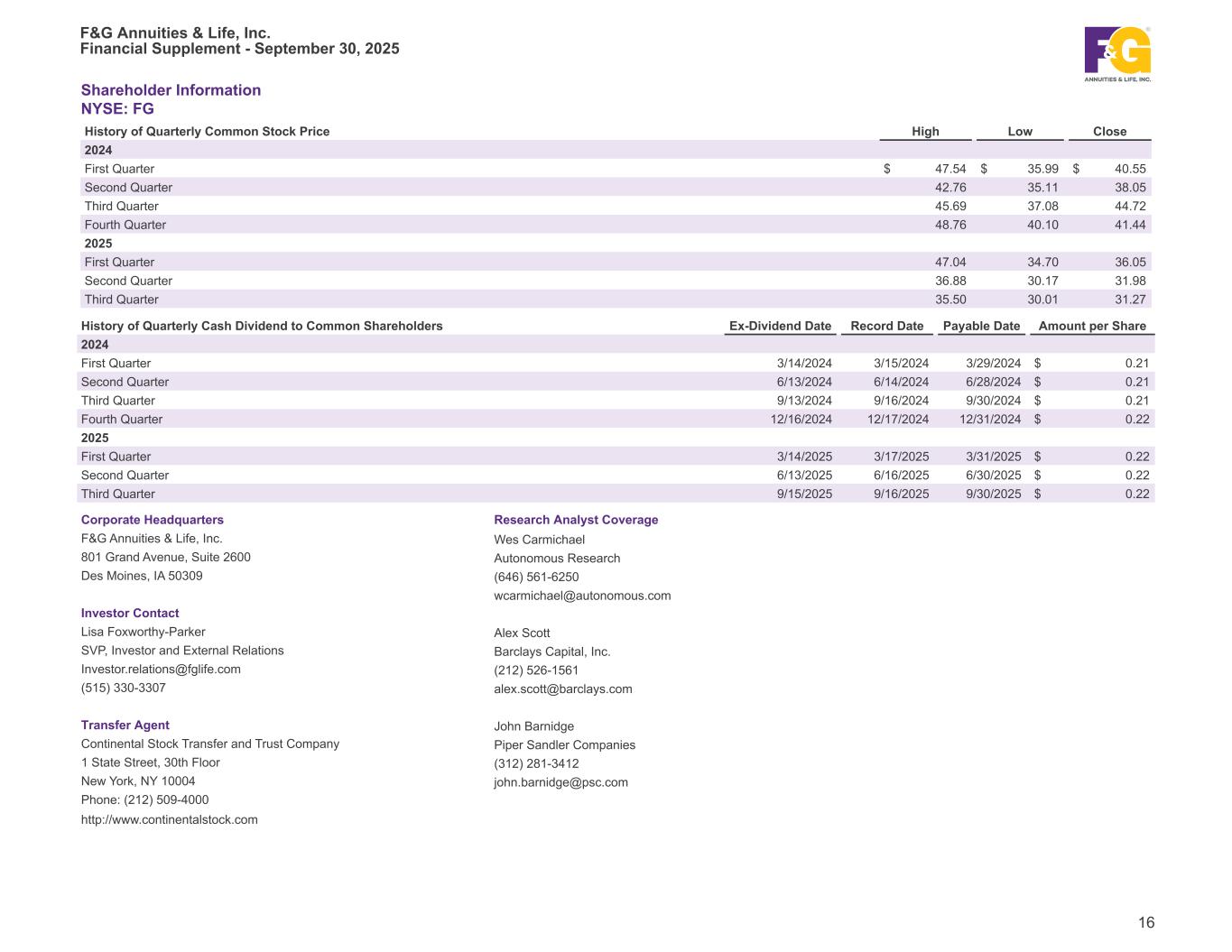

Shareholder Information NYSE: FG History of Quarterly Common Stock Price High Low Close 2024 First Quarter $ 47.54 $ 35.99 $ 40.55 Second Quarter 42.76 35.11 38.05 Third Quarter 45.69 37.08 44.72 Fourth Quarter 48.76 40.10 41.44 2025 First Quarter 47.04 34.70 36.05 Second Quarter 36.88 30.17 31.98 Third Quarter 35.50 30.01 31.27 History of Quarterly Cash Dividend to Common Shareholders Ex-Dividend Date Record Date Payable Date Amount per Share 2024 First Quarter 3/14/2024 3/15/2024 3/29/2024 $ 0.21 Second Quarter 6/13/2024 6/14/2024 6/28/2024 $ 0.21 Third Quarter 9/13/2024 9/16/2024 9/30/2024 $ 0.21 Fourth Quarter 12/16/2024 12/17/2024 12/31/2024 $ 0.22 2025 First Quarter 3/14/2025 3/17/2025 3/31/2025 $ 0.22 Second Quarter 6/13/2025 6/16/2025 6/30/2025 $ 0.22 Third Quarter 9/15/2025 9/16/2025 9/30/2025 $ 0.22 Corporate Headquarters Research Analyst Coverage F&G Annuities & Life, Inc. Wes Carmichael 801 Grand Avenue, Suite 2600 Autonomous Research Des Moines, IA 50309 (646) 561-6250 wcarmichael@autonomous.com Investor Contact Lisa Foxworthy-Parker Alex Scott SVP, Investor and External Relations Barclays Capital, Inc. Investor.relations@fglife.com (212) 526-1561 (515) 330-3307 alex.scott@barclays.com Transfer Agent John Barnidge Continental Stock Transfer and Trust Company Piper Sandler Companies 1 State Street, 30th Floor (312) 281-3412 New York, NY 10004 john.barnidge@psc.com Phone: (212) 509-4000 http://www.continentalstock.com F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 16

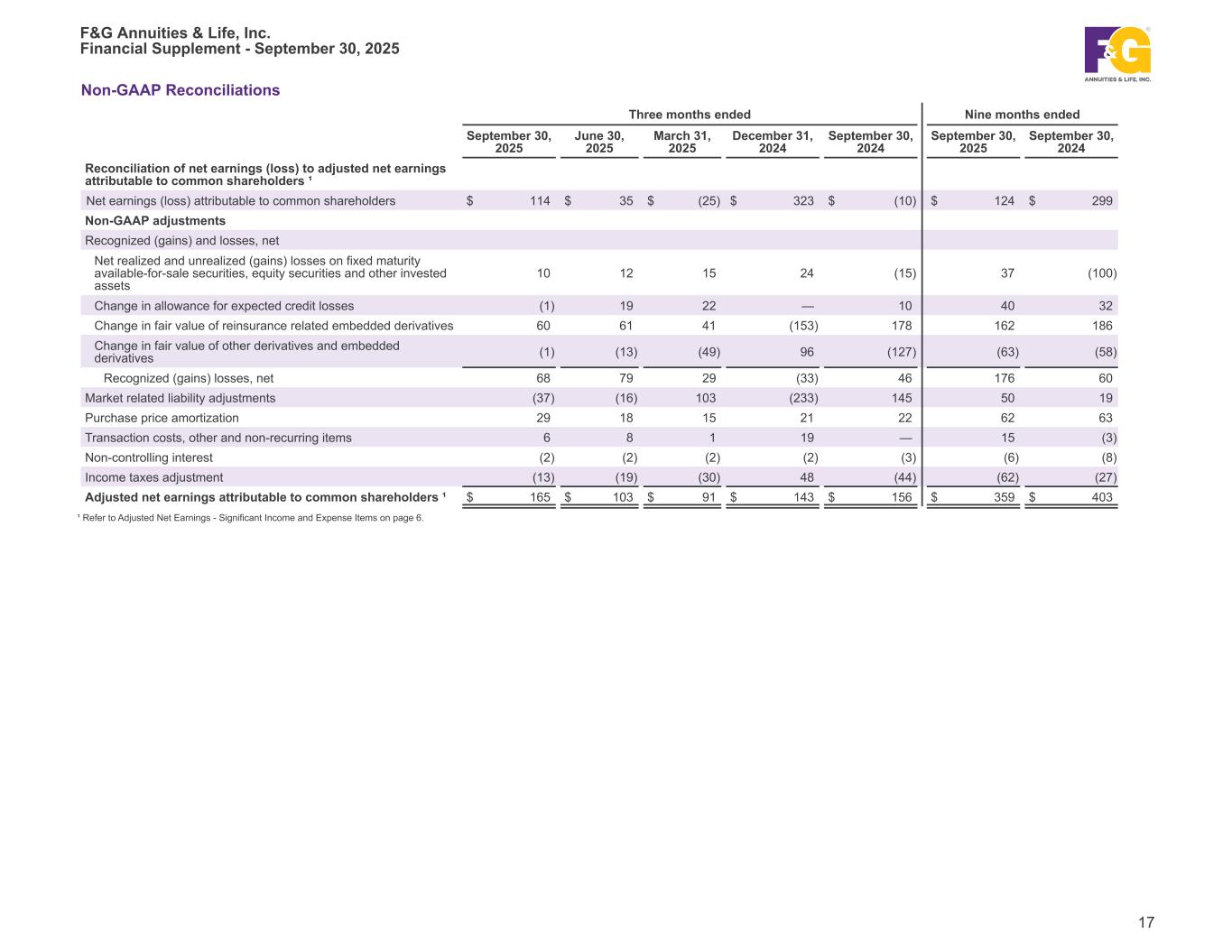

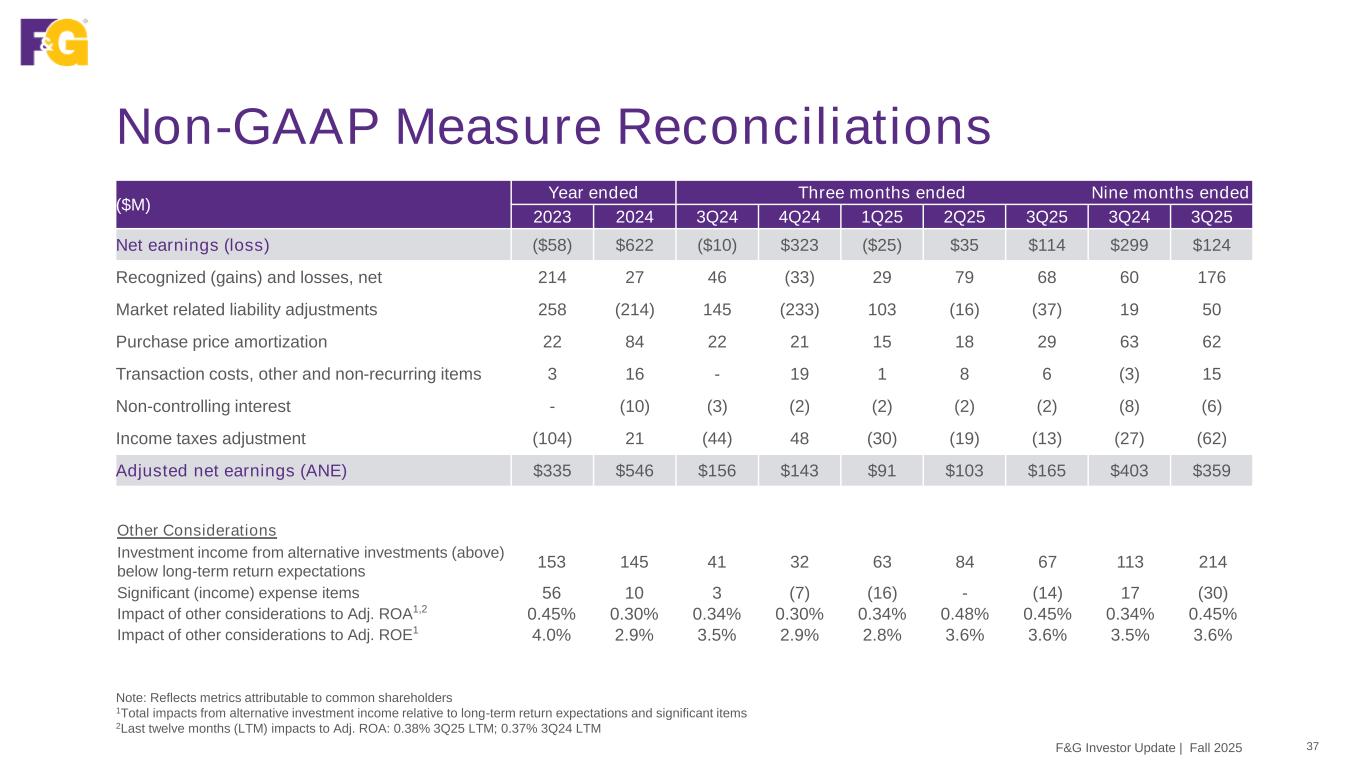

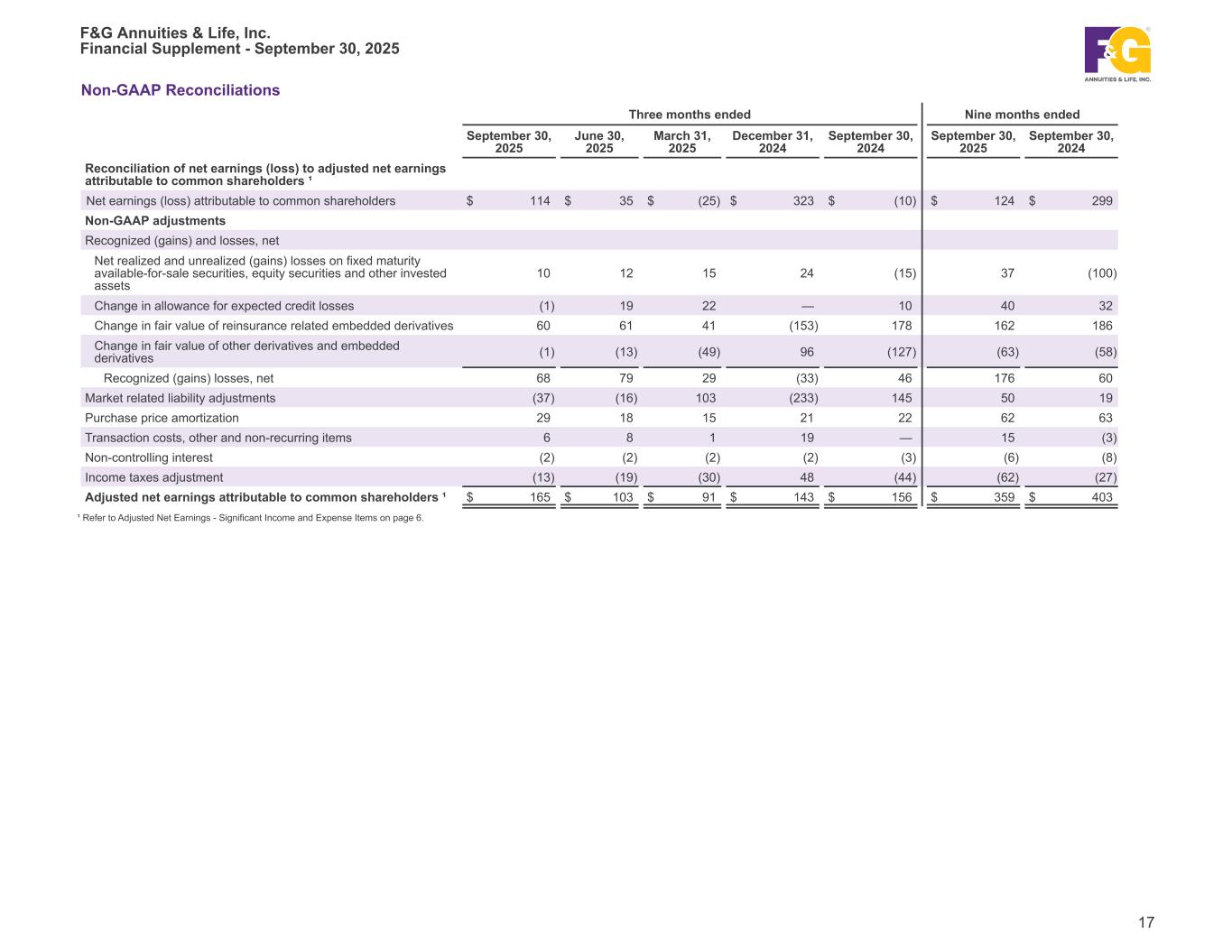

Non-GAAP Reconciliations Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Reconciliation of net earnings (loss) to adjusted net earnings attributable to common shareholders ¹ Net earnings (loss) attributable to common shareholders $ 114 $ 35 $ (25) $ 323 $ (10) $ 124 $ 299 Non-GAAP adjustments Recognized (gains) and losses, net Net realized and unrealized (gains) losses on fixed maturity available-for-sale securities, equity securities and other invested assets 10 12 15 24 (15) 37 (100) Change in allowance for expected credit losses (1) 19 22 — 10 40 32 Change in fair value of reinsurance related embedded derivatives 60 61 41 (153) 178 162 186 Change in fair value of other derivatives and embedded derivatives (1) (13) (49) 96 (127) (63) (58) Recognized (gains) losses, net 68 79 29 (33) 46 176 60 Market related liability adjustments (37) (16) 103 (233) 145 50 19 Purchase price amortization 29 18 15 21 22 62 63 Transaction costs, other and non-recurring items 6 8 1 19 — 15 (3) Non-controlling interest (2) (2) (2) (2) (3) (6) (8) Income taxes adjustment (13) (19) (30) 48 (44) (62) (27) Adjusted net earnings attributable to common shareholders ¹ $ 165 $ 103 $ 91 $ 143 $ — $ 156 $ 359 $ 403 ¹ Refer to Adjusted Net Earnings - Significant Income and Expense Items on page 6. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 17

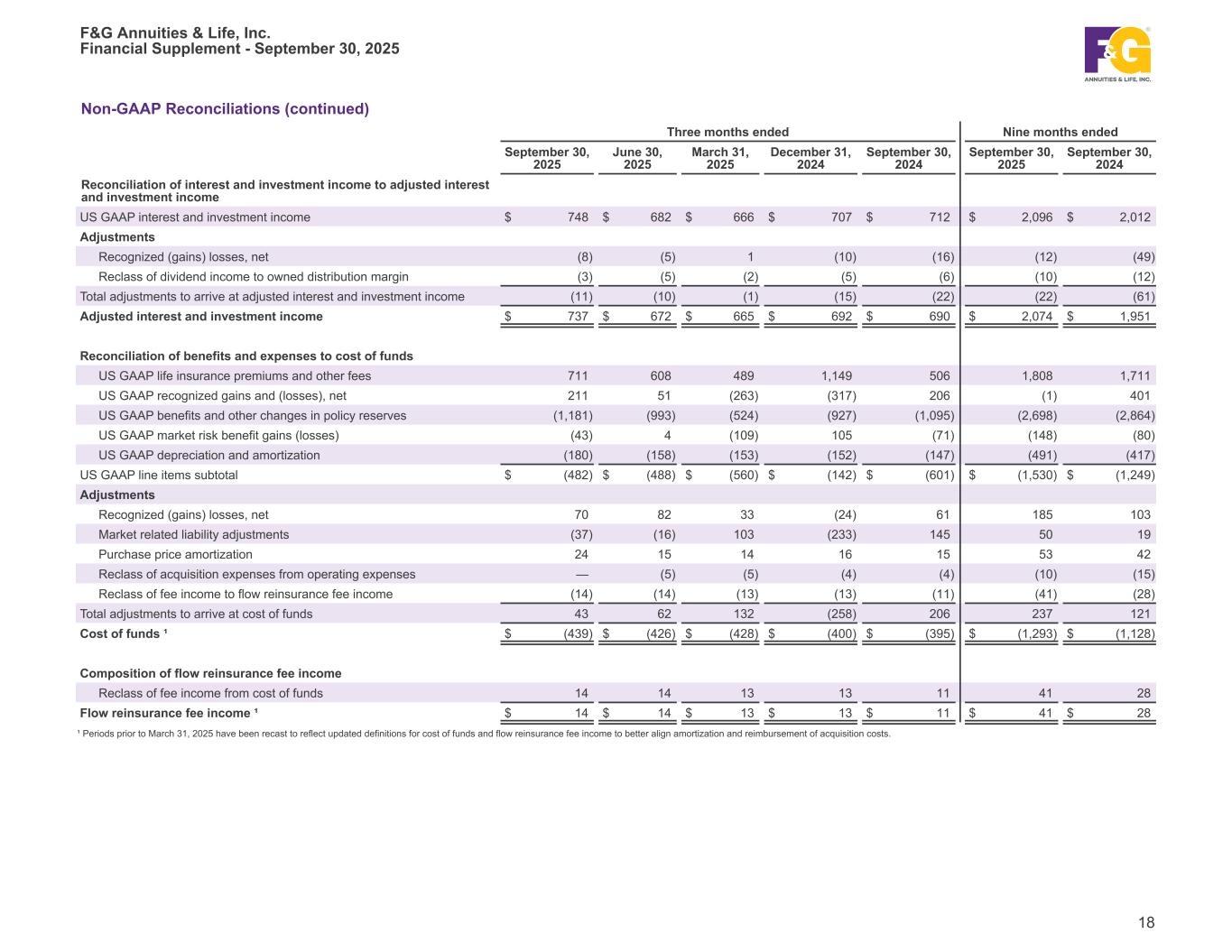

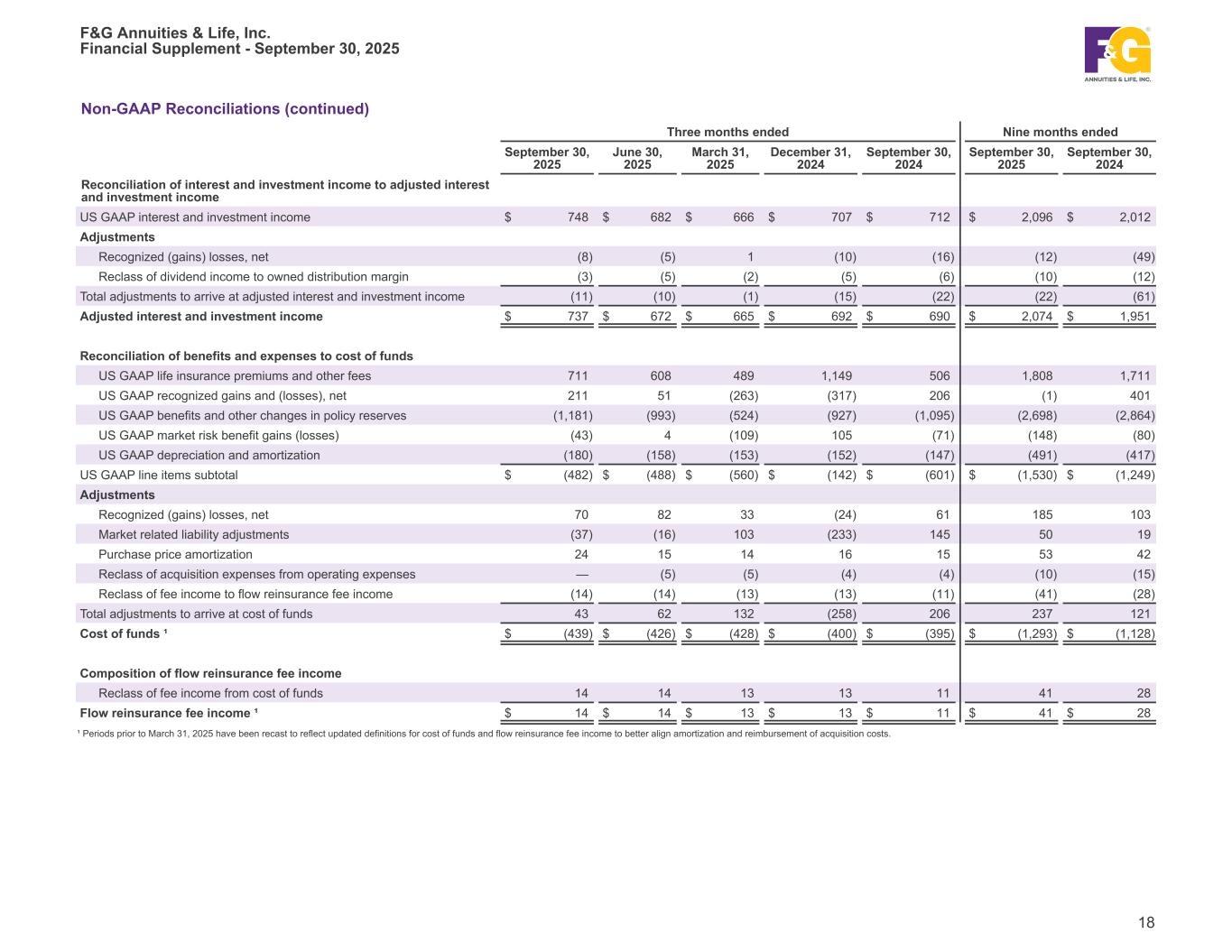

Non-GAAP Reconciliations (continued) Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Reconciliation of interest and investment income to adjusted interest and investment income US GAAP interest and investment income $ 748 $ 682 $ 666 $ 707 $ 712 $ 2,096 $ 2,012 Adjustments Recognized (gains) losses, net (8) (5) 1 (10) (16) (12) (49) Reclass of dividend income to owned distribution margin (3) (5) (2) (5) (6) (10) (12) Total adjustments to arrive at adjusted interest and investment income (11) (10) (1) (15) (22) (22) (61) Adjusted interest and investment income $ 737 $ 672 $ 665 $ 692 $ 690 $ 2,074 $ 1,951 Reconciliation of benefits and expenses to cost of funds US GAAP life insurance premiums and other fees 711 608 489 1,149 506 1,808 1,711 US GAAP recognized gains and (losses), net 211 51 (263) (317) 206 (1) 401 US GAAP benefits and other changes in policy reserves (1,181) (993) (524) (927) (1,095) (2,698) (2,864) US GAAP market risk benefit gains (losses) (43) 4 (109) 105 (71) (148) (80) US GAAP depreciation and amortization (180) (158) (153) (152) (147) (491) (417) US GAAP line items subtotal $ (482) $ (488) $ (560) $ (142) $ (601) $ (1,530) $ (1,249) Adjustments Recognized (gains) losses, net 70 82 33 (24) 61 185 103 Market related liability adjustments (37) (16) 103 (233) 145 50 19 Purchase price amortization 24 15 14 16 15 53 42 Reclass of acquisition expenses from operating expenses — (5) (5) (4) (4) (10) (15) Reclass of fee income to flow reinsurance fee income (14) (14) (13) (13) (11) (41) (28) Total adjustments to arrive at cost of funds 43 62 132 (258) 206 237 121 Cost of funds ¹ $ (439) $ (426) $ (428) $ (400) $ (395) $ (1,293) $ (1,128) Composition of flow reinsurance fee income Reclass of fee income from cost of funds 14 14 13 13 11 41 28 Flow reinsurance fee income ¹ $ 14 $ 14 $ 13 $ 13 $ 11 $ 41 $ 28 ¹ Periods prior to March 31, 2025 have been recast to reflect updated definitions for cost of funds and flow reinsurance fee income to better align amortization and reimbursement of acquisition costs. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 18

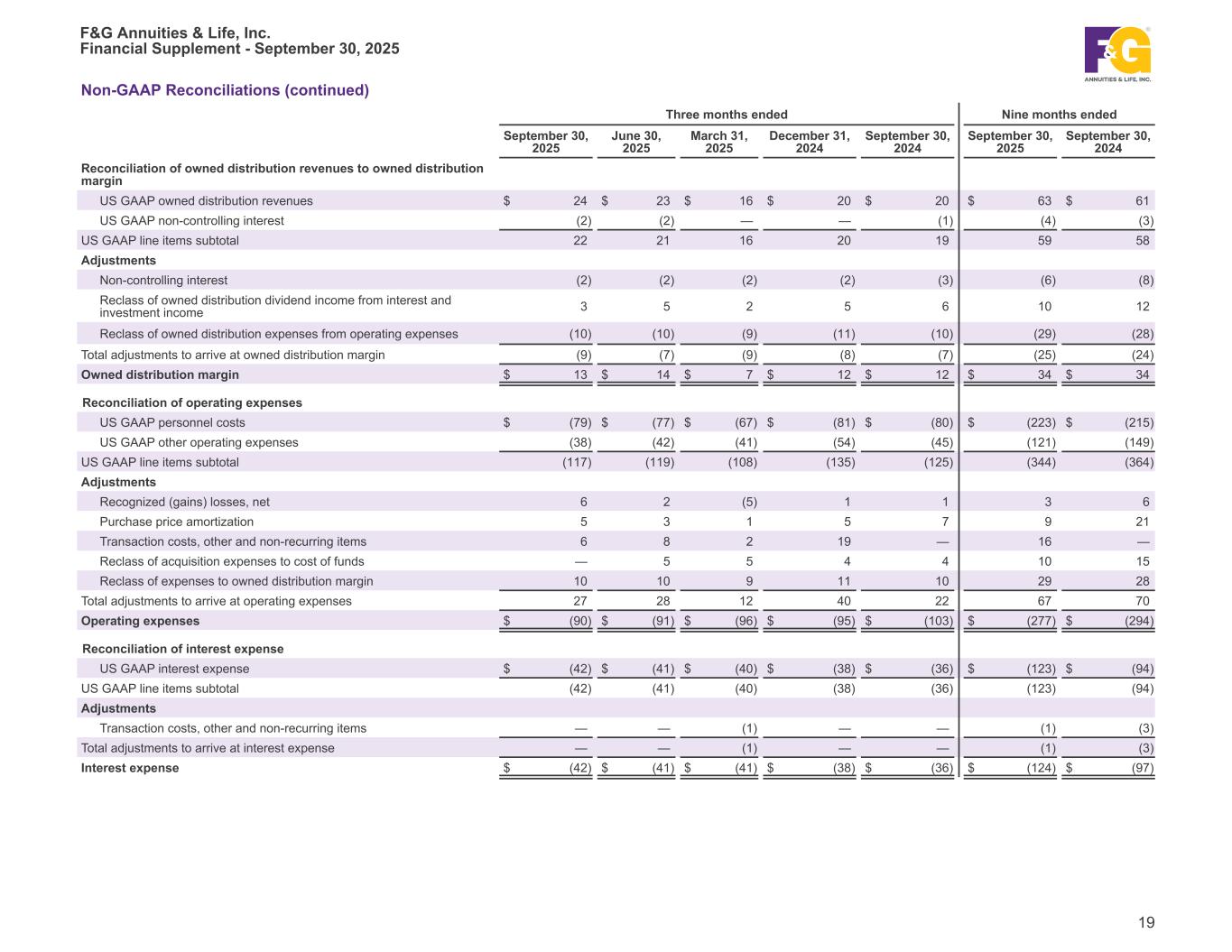

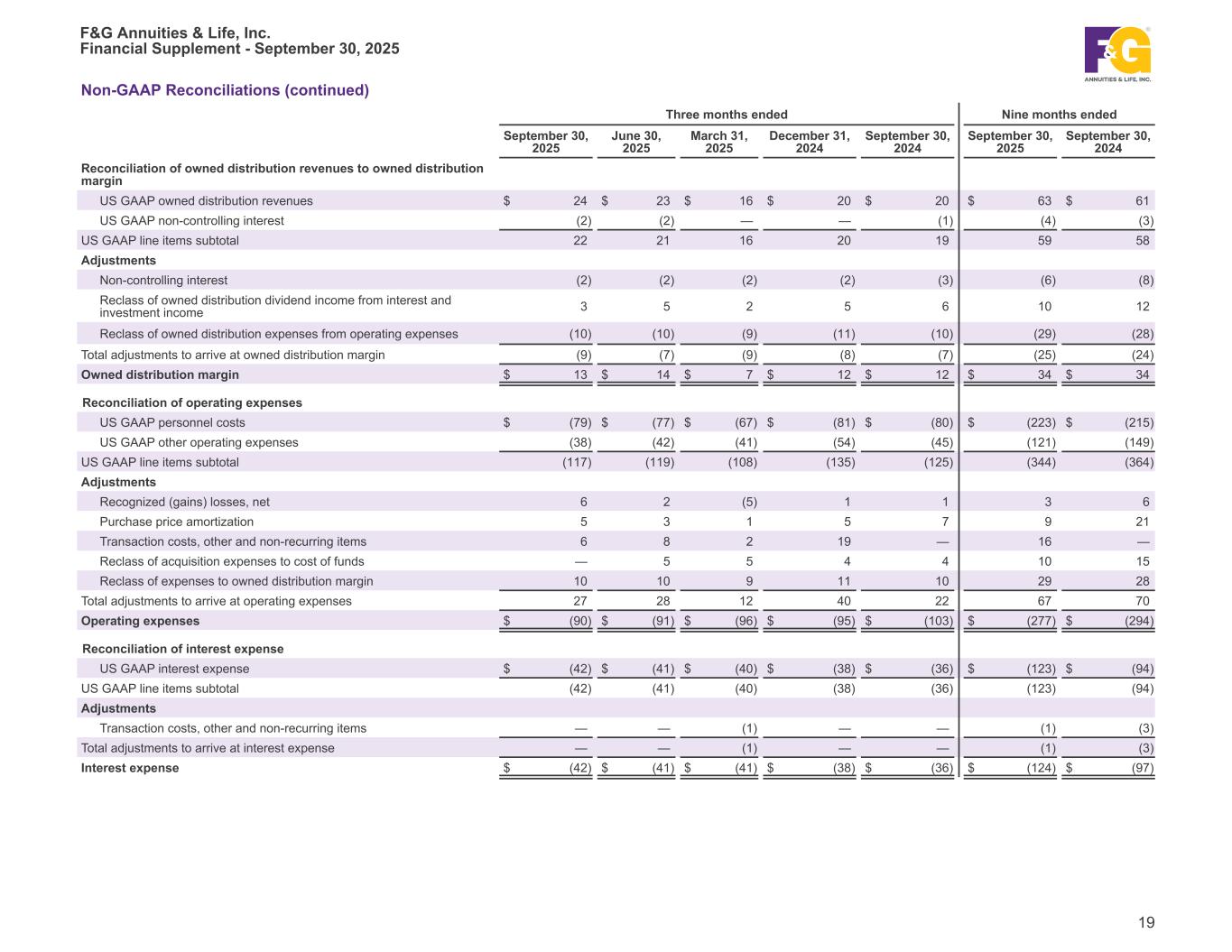

Non-GAAP Reconciliations (continued) Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Reconciliation of owned distribution revenues to owned distribution margin US GAAP owned distribution revenues $ 24 $ 23 $ 16 $ 20 $ 20 $ 63 $ 61 US GAAP non-controlling interest (2) (2) — — (1) (4) (3) US GAAP line items subtotal 22 21 16 20 19 59 58 Adjustments Non-controlling interest (2) (2) (2) (2) (3) (6) (8) Reclass of owned distribution dividend income from interest and investment income 3 5 2 5 6 10 12 Reclass of owned distribution expenses from operating expenses (10) (10) (9) (11) (10) (29) (28) Total adjustments to arrive at owned distribution margin (9) (7) (9) (8) (7) (25) (24) Owned distribution margin $ 13 $ 14 $ 7 $ 12 $ 12 $ 34 $ 34 Reconciliation of operating expenses US GAAP personnel costs $ (79) $ (77) $ (67) $ (81) $ (80) $ (223) $ (215) US GAAP other operating expenses (38) (42) (41) (54) (45) (121) (149) US GAAP line items subtotal (117) (119) (108) (135) (125) (344) (364) Adjustments Recognized (gains) losses, net 6 2 (5) 1 1 3 6 Purchase price amortization 5 3 1 5 7 9 21 Transaction costs, other and non-recurring items 6 8 2 19 — 16 — Reclass of acquisition expenses to cost of funds — 5 5 4 4 10 15 Reclass of expenses to owned distribution margin 10 10 9 11 10 29 28 Total adjustments to arrive at operating expenses 27 28 12 40 22 67 70 Operating expenses $ (90) $ (91) $ (96) $ (95) $ (103) $ (277) $ (294) Reconciliation of interest expense US GAAP interest expense $ (42) $ (41) $ (40) $ (38) $ (36) $ (123) $ (94) US GAAP line items subtotal (42) (41) (40) (38) (36) (123) (94) Adjustments Transaction costs, other and non-recurring items — — (1) — — (1) (3) Total adjustments to arrive at interest expense — — (1) — — (1) (3) Interest expense $ (42) $ (41) $ (41) $ (38) $ (36) $ (124) $ (97) F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 19

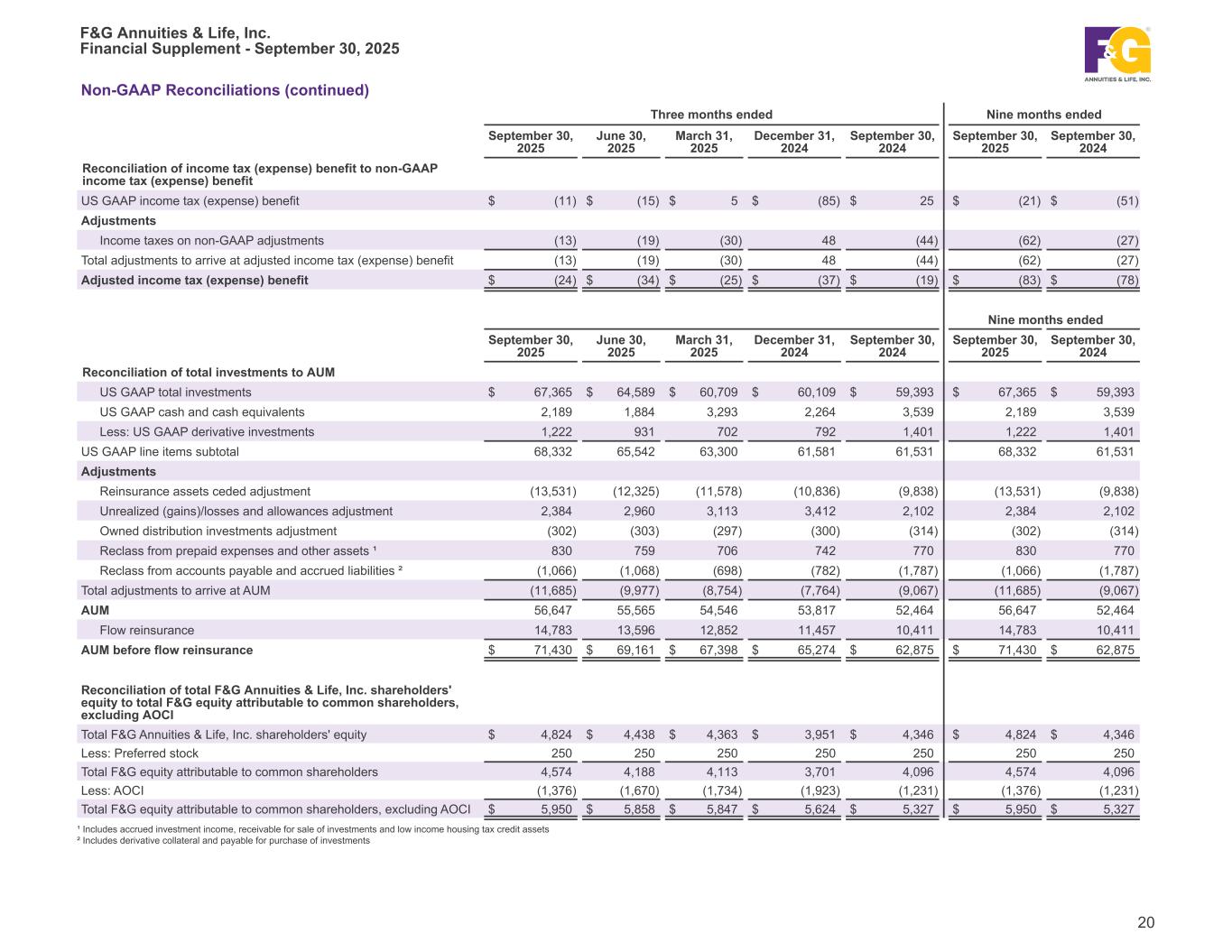

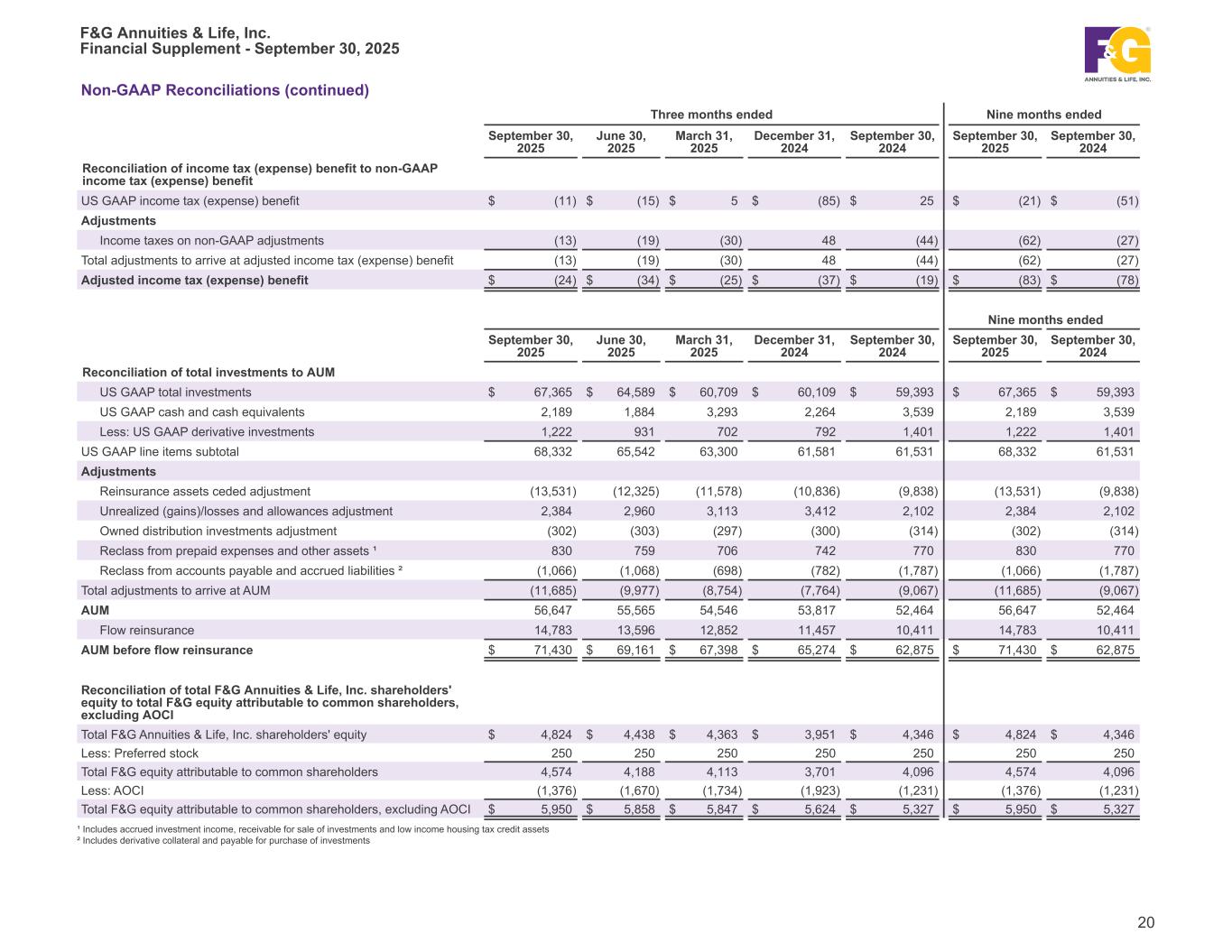

Non-GAAP Reconciliations (continued) Three months ended Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Reconciliation of income tax (expense) benefit to non-GAAP income tax (expense) benefit US GAAP income tax (expense) benefit $ (11) $ (15) $ 5 $ (85) $ 25 $ (21) $ (51) Adjustments Income taxes on non-GAAP adjustments (13) (19) (30) 48 (44) (62) (27) Total adjustments to arrive at adjusted income tax (expense) benefit (13) (19) (30) 48 (44) (62) (27) Adjusted income tax (expense) benefit $ (24) $ (34) $ (25) $ (37) $ (19) $ (83) $ (78) Nine months ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 September 30, 2025 September 30, 2024 Reconciliation of total investments to AUM US GAAP total investments $ 67,365 $ 64,589 $ 60,709 $ 60,109 $ 59,393 $ 67,365 $ 59,393 US GAAP cash and cash equivalents 2,189 1,884 3,293 2,264 3,539 2,189 3,539 Less: US GAAP derivative investments 1,222 931 702 792 1,401 1,222 1,401 US GAAP line items subtotal 68,332 65,542 63,300 61,581 61,531 68,332 61,531 Adjustments Reinsurance assets ceded adjustment (13,531) (12,325) (11,578) (10,836) (9,838) (13,531) (9,838) Unrealized (gains)/losses and allowances adjustment 2,384 2,960 3,113 3,412 2,102 2,384 2,102 Owned distribution investments adjustment (302) (303) (297) (300) (314) (302) (314) Reclass from prepaid expenses and other assets ¹ 830 759 706 742 770 830 770 Reclass from accounts payable and accrued liabilities ² (1,066) (1,068) (698) (782) (1,787) (1,066) (1,787) Total adjustments to arrive at AUM (11,685) (9,977) (8,754) (7,764) (9,067) (11,685) (9,067) AUM 56,647 55,565 54,546 53,817 52,464 56,647 52,464 Flow reinsurance 14,783 13,596 12,852 11,457 10,411 14,783 10,411 AUM before flow reinsurance $ 71,430 $ 69,161 $ 67,398 $ 65,274 $ 62,875 $ 71,430 $ 62,875 Reconciliation of total F&G Annuities & Life, Inc. shareholders' equity to total F&G equity attributable to common shareholders, excluding AOCI Total F&G Annuities & Life, Inc. shareholders' equity $ 4,824 $ 4,438 $ 4,363 $ 3,951 $ 4,346 $ 4,824 $ 4,346 Less: Preferred stock 250 250 250 250 250 250 250 Total F&G equity attributable to common shareholders 4,574 4,188 4,113 3,701 4,096 4,574 4,096 Less: AOCI (1,376) (1,670) (1,734) (1,923) (1,231) (1,376) (1,231) Total F&G equity attributable to common shareholders, excluding AOCI $ 5,950 $ 5,858 $ 5,847 $ 5,624 $ 5,327 $ 5,950 $ 5,327 ¹ Includes accrued investment income, receivable for sale of investments and low income housing tax credit assets ² Includes derivative collateral and payable for purchase of investments F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 20

Non-GAAP Measures Definitions Non-GAAP Measures Generally Accepted Accounting Principles ("GAAP") is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, this document includes non-GAAP financial measures, which the Company believes are useful to help investors better understand its financial performance, competitive position and prospects for the future. Management believes these non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Our non-GAAP measures may not be comparable to similarly titled measures of other organizations because other organizations may not calculate such non-GAAP measures in the same manner as we do. The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. By disclosing these non-GAAP financial measures, the Company believes it offers investors a greater understanding of, and an enhanced level of transparency into, the means by which the Company’s management operates the Company. Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP net earnings, net earnings attributable to common shareholders, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are provided within. The following represents the definitions of non-GAAP measures used by F&G: Adjusted Net Earnings attributable to common shareholders Adjusted net earnings attributable to common shareholders is a non-GAAP economic measure we use to evaluate financial performance each period. Adjusted net earnings attributable to common shareholders is calculated by adjusting net earnings (loss) attributable to common shareholders to eliminate: (i) Recognized (gains) and losses, net: the impact of net investment gains/losses, including changes in allowance for expected credit losses and other than temporary impairment (“OTTI”) losses, recognized in operations; and the effects of changes in fair value of the reinsurance related embedded derivative and other derivatives, including interest rate swaps and forwards; (ii) Market related liability adjustments: the impacts related to changes in the fair value, including both realized and unrealized gains and losses, of index product related derivatives and embedded derivatives, net of hedging cost; the impact of initial pension risk transfer deferred profit liability losses, including amortization from previously deferred pension risk transfer deferred profit liability losses; and the changes in the fair value of market risk benefits by deferring current period changes and amortizing that amount over the life of the market risk benefit; (iii) Purchase price amortization: the impacts related to the amortization of certain intangibles (internally developed software, trademarks and value of distribution asset and the change in fair value of liabilities recognized as a result of acquisition activities); (iv) Transaction costs: the impacts related to acquisition, integration and merger related items; (v) Other and “non-recurring,” “infrequent” or “unusual items”: Other adjustments include removing any charges associated with U.S. guaranty fund assessments as these charges neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance, but result from external situations not controlled by the Company. Further, Management excludes certain items determined to be “non-recurring,” “infrequent” or “unusual” from adjusted net earnings when incurred if it is determined these expenses are not a reflection of the core business and when the nature of the item is such that it is not reasonably likely to recur within two years and/or there was not a similar item in the preceding two years; (vi) Non-controlling interest on non-GAAP adjustments: the portion of the non-GAAP adjustments attributable to the equity interest of entities that F&G does not wholly own; and (vii) Income taxes: the income tax impact related to the above-mentioned adjustments is measured using an effective tax rate, as appropriate by tax jurisdiction. While these adjustments are an integral part of the overall performance of F&G, market conditions and/or the non-operating nature of these items can overshadow the underlying performance of the core business. Accordingly, management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Adjusted net earnings should not be used as a substitute for net earnings (loss). However, we believe the adjustments made to net earnings (loss) in order to derive adjusted net earnings provide an understanding of our overall results of operations. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 21

Non-GAAP Measures Definitions (continued) Adjusted Weighted Average Diluted Shares Outstanding Adjusted weighted average diluted shares outstanding is the same as weighted average diluted shares outstanding except for periods in which our preferred stocks are calculated to be dilutive to either net earnings attributable to common shareholders or adjusted net earnings attributable to common shareholders, but not both, or there is a net earnings loss attributable to common shareholders on a GAAP basis, but positive adjusted net earnings attributable to common shareholders using the non-GAAP measure. The above exceptions are made to include relevant diluted shares when dilution occurs and exclude relevant diluted shares when dilution does not occur for adjusted net earnings attributable to common shareholders. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Adjusted Net Earnings attributable to common shareholders per Diluted Share Adjusted net earnings attributable to common shareholders per diluted share is calculated as adjusted net earnings plus preferred stock dividend (if the preferred stock has created dilution). This sum is then divided by the adjusted weighted-average diluted shares outstanding. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Adjusted Return on Assets attributable to Common Shareholders Adjusted return on assets attributable to common shareholders is calculated by dividing year-to-date annualized adjusted net earnings attributable to common shareholders by year-to-date AAUM. Return on assets is comprised of net investment income, less cost of funds, flow reinsurance fee income, owned distribution margin and less expenses (including operating expenses, interest expense and income taxes) consistent with our adjusted net earnings definition and related adjustments. Cost of funds includes liability costs related to cost of crediting as well as other liability costs. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing financial performance and profitability earned on AAUM. Adjusted Return on Average Common Shareholder Equity, excluding AOCI Adjusted return on average common shareholder equity is calculated by dividing the rolling four quarters adjusted net earnings attributable to common shareholders, by total average F&G equity attributable to common shareholders, excluding AOCI. Average equity attributable to common shareholders, excluding AOCI for the twelve month rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be a useful internally and for investors and analysts to assess the level return driven by the Company's adjusted earnings. Assets Under Management (AUM) AUM is comprised of the following components and is reported net of reinsurance assets ceded in accordance with GAAP: (i) total invested assets at amortized cost, excluding investments in unconsolidated affiliates, owned distribution and derivatives; (ii) investments in unconsolidated affiliates at carrying value; (iii) related party loans and investments; (iv) accrued investment income; (v) the net payable/receivable for the purchase/sale of investments; and (vi) cash and cash equivalents excluding derivative collateral at the end of the period. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio that is retained. AUM before Flow Reinsurance AUM before Flow Reinsurance is comprised of AUM plus flow reinsured assets, including certain block reinsured assets that have the characteristics of flow reinsured assets. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio including reinsured assets. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 22

Non-GAAP Measures Definitions (continued) Average Assets Under Management (AAUM) (Quarterly and YTD) AAUM is calculated as AUM at the beginning of the period and the end of each month in the period, divided by the total number of months in the period plus one. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on retained assets. Book Value per Common Share, excluding AOCI Book value per Common share, excluding AOCI is calculated as total F&G equity attributable to common shareholders divided by the total number of shares of common stock outstanding. Management considers this to be a useful measure internally and for investors and analysts to assess the capital position of the Company. Return on Average F&G common shareholder Equity, excluding AOCI Return on average F&G common shareholder equity, excluding AOCI is calculated by dividing the rolling four quarters net earnings (loss) attributable to common shareholders, by total average F&G equity attributable to common shareholders, excluding AOCI. Average F&G equity attributable to common shareholders, excluding AOCI for the twelve month rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Sales Annuity, IUL, funding agreement and non-life contingent PRT sales are not derived from any specific GAAP income statement accounts or line items and should not be viewed as a substitute for any financial measure determined in accordance with GAAP. Sales from these products are recorded as deposit liabilities (i.e., contractholder funds) within the Company's consolidated financial statements in accordance with GAAP. Life contingent PRT sales are recorded as premiums in revenues within the consolidated financial statements. Management believes that presentation of sales, as measured for management purposes, enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition. Total Capitalization, excluding AOCI Total capitalization, excluding AOCI is based on total equity excluding the effect of AOCI and the total aggregate principal amount of debt. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts to help assess the capital position of the Company. Debt-to-Capitalization Ratio, excluding AOCI Debt-to-capitalization ratio is computed by dividing total aggregate principal amount of debt by total capitalization (total debt plus total equity, excluding AOCI). Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing its capital position. Total Equity, excluding AOCI Total equity, excluding AOCI is based on total equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts assessing the level of earned equity on total equity. Total F&G Equity attributable to common shareholders, excluding AOCI Total F&G equity attributable to common shareholder, excluding AOCI is based on total F&G Annuities & Life, Inc. shareholders' equity excluding the effect of AOCI and preferred stocks, including additional paid-in-capital. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Yield on AAUM Yield on AAUM is calculated by dividing annualized GAAP net investment income by AAUM. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the level of return earned on AAUM. F&G Annuities & Life, Inc. Financial Supplement - September 30, 2025 23