0001879016false2023FY0.5.333.333.333.2.2.2.2.2.333.333.33300018790162023-01-012023-12-3100018790162023-06-30iso4217:USD00018790162024-02-26xbrli:shares00018790162023-12-3100018790162022-12-310001879016us-gaap:RelatedPartyMember2023-12-310001879016us-gaap:RelatedPartyMember2022-12-31iso4217:USDxbrli:shares00018790162022-01-012022-12-310001879016us-gaap:CommonStockMember2021-12-310001879016us-gaap:AdditionalPaidInCapitalMember2021-12-310001879016us-gaap:RetainedEarningsMember2021-12-310001879016us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001879016us-gaap:NoncontrollingInterestMember2021-12-3100018790162021-12-310001879016us-gaap:RetainedEarningsMember2022-01-012022-12-310001879016us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001879016us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001879016us-gaap:CommonStockMember2022-01-012022-12-310001879016us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001879016us-gaap:CommonStockMember2022-12-310001879016us-gaap:AdditionalPaidInCapitalMember2022-12-310001879016us-gaap:RetainedEarningsMember2022-12-310001879016us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001879016us-gaap:NoncontrollingInterestMember2022-12-310001879016us-gaap:RetainedEarningsMember2023-01-012023-12-310001879016us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001879016us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001879016us-gaap:CommonStockMemberie:PublicStockOfferingAndSubscriptionAgreementMember2023-01-012023-12-310001879016ie:PublicStockOfferingAndSubscriptionAgreementMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001879016ie:PublicStockOfferingAndSubscriptionAgreementMember2023-01-012023-12-310001879016us-gaap:CommonStockMember2023-01-012023-12-310001879016us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001879016us-gaap:CommonStockMember2023-12-310001879016us-gaap:AdditionalPaidInCapitalMember2023-12-310001879016us-gaap:RetainedEarningsMember2023-12-310001879016us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001879016us-gaap:NoncontrollingInterestMember2023-12-310001879016ie:MaadenMember2023-12-31xbrli:pure0001879016srt:SubsidiariesMemberie:VrbEnergyIncMember2023-12-310001879016srt:SubsidiariesMemberie:VrbEnergyIncMember2022-12-310001879016srt:SubsidiariesMemberie:ComputationalGeosciencesIncMember2023-12-310001879016srt:SubsidiariesMemberie:ComputationalGeosciencesIncMember2022-12-310001879016srt:SubsidiariesMemberie:CordobaMineralsCorpMember2023-12-310001879016srt:SubsidiariesMemberie:CordobaMineralsCorpMember2022-12-310001879016srt:SubsidiariesMemberie:KaizenMember2023-12-310001879016srt:SubsidiariesMemberie:KaizenMember2022-12-3100018790162022-06-300001879016srt:MinimumMemberie:EquipmentAndVehiclesMember2023-12-310001879016ie:EquipmentAndVehiclesMembersrt:MaximumMember2023-12-310001879016srt:MinimumMemberus-gaap:ComputerEquipmentMember2023-12-310001879016us-gaap:ComputerEquipmentMembersrt:MaximumMember2023-12-310001879016srt:MinimumMemberie:PatentAndLicenseMember2023-12-310001879016ie:PatentAndLicenseMembersrt:MaximumMember2023-12-310001879016us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2023-12-310001879016us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2023-12-310001879016us-gaap:IntellectualPropertyMember2023-12-31ie:unit0001879016us-gaap:ShortTermInvestmentsMember2023-12-310001879016us-gaap:ShortTermInvestmentsMember2022-12-310001879016ie:MaadenMember2021-12-310001879016ie:SamaNickelCorporationSNCMember2021-12-310001879016ie:Go2LithiumMember2021-12-310001879016ie:SamaResourcesIncMember2021-12-310001879016ie:SRQMember2021-12-310001879016ie:FjordlandExplorationIncMember2021-12-310001879016ie:SamaNickelCorporationSNCMember2022-01-012022-12-310001879016ie:SamaResourcesIncMember2022-01-012022-12-310001879016ie:SRQMember2022-01-012022-12-310001879016ie:FjordlandExplorationIncMember2022-01-012022-12-310001879016ie:MaadenMember2022-01-012022-12-310001879016ie:Go2LithiumMember2022-01-012022-12-310001879016ie:MaadenMember2022-12-310001879016ie:SamaNickelCorporationSNCMember2022-12-310001879016ie:Go2LithiumMember2022-12-310001879016ie:SamaResourcesIncMember2022-12-310001879016ie:SRQMember2022-12-310001879016ie:FjordlandExplorationIncMember2022-12-310001879016ie:MaadenMember2023-01-012023-12-310001879016ie:SamaNickelCorporationSNCMember2023-01-012023-12-310001879016ie:Go2LithiumMember2023-01-012023-12-310001879016ie:SRQMember2023-01-012023-12-310001879016ie:SamaResourcesIncMember2023-01-012023-12-310001879016ie:FjordlandExplorationIncMember2023-01-012023-12-310001879016ie:SamaNickelCorporationSNCMember2023-12-310001879016ie:Go2LithiumMember2023-12-310001879016ie:SamaResourcesIncMember2023-12-310001879016ie:SRQMember2023-12-310001879016ie:FjordlandExplorationIncMember2023-12-310001879016ie:MaadenMember2023-05-15utr:sqkm0001879016ie:MaadenMember2023-07-012023-07-310001879016ie:MaadenMember2023-07-31ie:typhoonie:numberOfDirector0001879016ie:SamaResourcesIncMember2023-12-310001879016ie:SamaResourcesIncMember2022-12-310001879016ie:SamaNickelCorporationSNCMembersrt:MaximumMember2023-12-310001879016ie:Go2LithiumMemberie:CGIAndCleanTeQWaterLimitedMember2023-04-060001879016ie:SantaCruzProjectMember2021-12-310001879016ie:TinticProjectMember2021-12-310001879016ie:SanMatiasProjectMember2021-12-310001879016ie:PinayaProjectMember2021-12-310001879016ie:OtherProjectMember2021-12-310001879016ie:SantaCruzProjectMember2022-01-012022-12-310001879016ie:TinticProjectMember2022-01-012022-12-310001879016ie:SanMatiasProjectMember2022-01-012022-12-310001879016ie:PinayaProjectMember2022-01-012022-12-310001879016ie:OtherProjectMember2022-01-012022-12-310001879016ie:SantaCruzProjectMember2022-12-310001879016ie:TinticProjectMember2022-12-310001879016ie:SanMatiasProjectMember2022-12-310001879016ie:PinayaProjectMember2022-12-310001879016ie:OtherProjectMember2022-12-310001879016ie:SantaCruzProjectMember2023-01-012023-12-310001879016ie:TinticProjectMember2023-01-012023-12-310001879016ie:SanMatiasProjectMember2023-01-012023-12-310001879016ie:PinayaProjectMember2023-01-012023-12-310001879016ie:OtherProjectMember2023-01-012023-12-310001879016ie:SantaCruzProjectMember2023-12-310001879016ie:TinticProjectMember2023-12-310001879016ie:SanMatiasProjectMember2023-12-310001879016ie:PinayaProjectMember2023-12-310001879016ie:OtherProjectMember2023-12-310001879016ie:SantaCruzUSAMember2023-05-23utr:acre0001879016ie:SantaCruzUSAMember2023-05-232023-05-230001879016ie:SantaCruzUSAMemberie:SantaCruzProjectPromissoryNoteMember2023-05-2300018790162021-10-012021-10-3100018790162022-04-012022-04-3000018790162022-06-302022-06-300001879016ie:SantaCruzProjectMemberie:DRHEMember2021-10-272021-10-270001879016ie:SantaCruzProjectMemberie:DRHEMember2021-10-270001879016ie:SantaCruzProjectMemberie:DRHEMember2021-10-272021-10-310001879016ie:SantaCruzProjectMemberie:DRHEMember2023-01-012023-12-310001879016ie:SantaCruzProjectMemberie:DRHEMember2023-12-310001879016ie:CAROptionAgreementMember2023-01-012023-12-310001879016ie:SantaCruzProjectMember2022-09-012022-09-300001879016ie:TinticProjectMember2023-12-310001879016ie:AlacranDepositAndSatelliteDepositsMemberie:CordobaMember2023-12-310001879016ie:PinayaProjectMemberie:KaizenMember2023-12-310001879016us-gaap:NonrelatedPartyMember2023-12-310001879016us-gaap:NonrelatedPartyMember2022-12-310001879016us-gaap:PrimeRateMemberie:SantaCruzProjectPromissoryNoteMember2023-05-232023-05-230001879016ie:SantaCruzProjectPromissoryNoteMember2023-11-012023-11-300001879016ie:SantaCruzProjectPromissoryNoteMember2023-05-23ie:installment0001879016ie:SantaCruzProjectPromissoryNoteMember2023-05-232023-05-230001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMember2021-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2021-12-310001879016ie:ConvertibleBondsMember2021-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMember2022-01-012022-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2022-01-012022-12-310001879016ie:ConvertibleBondsMember2022-01-012022-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMember2022-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2022-12-310001879016ie:ConvertibleBondsMember2022-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMember2023-01-012023-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2023-01-012023-12-310001879016ie:ConvertibleBondsMember2023-01-012023-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMember2023-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2023-12-310001879016ie:ConvertibleBondsMember2023-12-310001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMemberus-gaap:CommonStockMember2022-06-302022-06-300001879016ie:UnsecuredConvertiblePromissoryNotesSeriesOneMemberus-gaap:CommonStockMember2022-06-300001879016ie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2022-04-050001879016us-gaap:CommonStockMemberie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2022-06-302022-06-300001879016us-gaap:CommonStockMemberie:UnsecuredConvertiblePromissoryNotesSeriesTwoMember2022-06-300001879016ie:VRBConvertibleBondMember2021-07-082021-07-080001879016ie:VRBConvertibleBondMember2021-07-080001879016ie:VRBConvertibleBondMembersrt:MaximumMember2021-07-082021-07-080001879016ie:MaadenMember2023-07-062023-07-060001879016ie:IvanhoeElectricMemberie:MaadenMember2023-07-060001879016ie:MaadenMember2023-07-060001879016ie:IvanhoeElectricMemberie:MaadenMembersrt:MaximumMember2023-07-060001879016ie:PublicStockOfferingMember2023-09-182023-09-180001879016ie:PublicStockOfferingMember2023-09-180001879016ie:IvanhoeElectricMemberie:MaadenMemberie:MaadenMember2023-07-060001879016us-gaap:PrivatePlacementMemberie:MaadenMember2023-10-312023-10-310001879016us-gaap:PrivatePlacementMemberie:MaadenMember2023-10-310001879016us-gaap:CommonStockMemberus-gaap:IPOMember2022-06-302022-06-300001879016us-gaap:CommonStockMemberus-gaap:IPOMember2022-06-300001879016us-gaap:IPOMember2022-06-302022-06-300001879016ie:CentralArizonaResourcesMemberus-gaap:CommonStockMember2022-06-302022-06-300001879016ie:IvanhoeElectricIncentivePlanMember2023-01-012023-12-310001879016ie:IvanhoeElectricIncentivePlanMember2022-01-012022-12-310001879016ie:KaizenIncentivePlanMember2023-01-012023-12-310001879016ie:KaizenIncentivePlanMember2022-01-012022-12-310001879016ie:CordobaIncentivePlanMember2023-01-012023-12-310001879016ie:CordobaIncentivePlanMember2022-01-012022-12-310001879016ie:VRBIncentivePlanMember2023-01-012023-12-310001879016ie:VRBIncentivePlanMember2022-01-012022-12-310001879016ie:CGIIncentivePlanMember2023-01-012023-12-310001879016ie:CGIIncentivePlanMember2022-01-012022-12-310001879016us-gaap:CostOfSalesMember2023-01-012023-12-310001879016us-gaap:CostOfSalesMember2022-01-012022-12-310001879016ie:ExplorationExpenseMember2023-01-012023-12-310001879016ie:ExplorationExpenseMember2022-01-012022-12-310001879016us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001879016us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001879016us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001879016us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001879016ie:LongTermIncentivePlanMember2023-12-310001879016us-gaap:EmployeeStockOptionMember2023-02-012023-02-010001879016us-gaap:EmployeeStockOptionMember2023-03-012023-03-010001879016us-gaap:EmployeeStockOptionMember2023-07-012023-07-010001879016us-gaap:EmployeeStockOptionMember2023-08-092023-08-090001879016us-gaap:EmployeeStockOptionMember2023-12-012023-12-010001879016us-gaap:EmployeeStockOptionMember2022-11-212022-11-290001879016us-gaap:EmployeeStockOptionMember2023-01-012023-12-31ie:tranche0001879016us-gaap:EmployeeStockOptionMember2023-12-310001879016us-gaap:EmployeeStockOptionMember2022-12-310001879016us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001879016us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMember2023-01-010001879016us-gaap:RestrictedStockUnitsRSUMember2022-11-212022-11-210001879016us-gaap:RestrictedStockUnitsRSUMember2022-11-210001879016us-gaap:RestrictedStockUnitsRSUMember2021-12-310001879016us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001879016us-gaap:RestrictedStockUnitsRSUMember2022-12-310001879016us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001879016us-gaap:RestrictedStockUnitsRSUMember2023-12-310001879016us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2022-11-212022-11-210001879016us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2022-11-212022-11-210001879016us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:EmployeeStockOptionMember2022-11-212022-11-210001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMemberie:ShareBasedPaymentArrangementTrancheFiveMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMemberie:ShareBasedPaymentArrangementTrancheFourMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-01-010001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-11-212022-11-210001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-11-212022-11-210001879016us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-11-212022-11-210001879016ie:SoftwareLicensingMember2023-01-012023-12-310001879016ie:SoftwareLicensingMember2022-01-012022-12-310001879016ie:DataProcessingServicesMember2023-01-012023-12-310001879016ie:DataProcessingServicesMember2022-01-012022-12-310001879016ie:RenewableEnergyStorageSystemsMember2023-01-012023-12-310001879016ie:RenewableEnergyStorageSystemsMember2022-01-012022-12-310001879016ie:SoftwareLicenseAgreementMember2021-10-152021-10-150001879016ie:RenewableEnergyStorageSystemsMember2023-12-310001879016ie:RenewableEnergyStorageSystemsMember2022-12-310001879016us-gaap:SalesRevenueNetMemberie:LargestCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001879016us-gaap:SalesRevenueNetMemberie:LargestCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001879016ie:SantaCruzMember2023-01-012023-12-310001879016ie:SantaCruzMember2022-01-012022-12-310001879016ie:SanMatiasMember2023-01-012023-12-310001879016ie:SanMatiasMember2022-01-012022-12-310001879016ie:TINTICMember2023-01-012023-12-310001879016ie:TINTICMember2022-01-012022-12-310001879016ie:HogHeavenUSAMember2023-01-012023-12-310001879016ie:HogHeavenUSAMember2022-01-012022-12-310001879016ie:LincolnMember2023-01-012023-12-310001879016ie:LincolnMember2022-01-012022-12-310001879016ie:WhiteHillUSAMember2023-01-012023-12-310001879016ie:WhiteHillUSAMember2022-01-012022-12-310001879016ie:CarolinaUSAMember2023-01-012023-12-310001879016ie:CarolinaUSAMember2022-01-012022-12-310001879016ie:PINYMember2023-01-012023-12-310001879016ie:PINYMember2022-01-012022-12-310001879016ie:ProjectGenerationAndOtherMember2023-01-012023-12-310001879016ie:ProjectGenerationAndOtherMember2022-01-012022-12-310001879016ie:IvoryCoastProjectIvoryCoastMember2023-12-31iso4217:CAD0001879016ie:IvoryCoastProjectIvoryCoastMember2023-12-310001879016ie:HogHeavenUSAMember2023-12-310001879016ie:HogHeavenUSAMember2023-12-310001879016ie:PerseveranceUSAMember2023-12-310001879016ie:PerseveranceUSAMember2023-12-310001879016ie:CarolinaUSAMember2023-12-310001879016ie:CarolinaUSAMember2023-12-310001879016ie:WhiteHallProjectMember2023-12-310001879016ie:WhiteHallProjectMember2023-12-310001879016ie:WhiteHallProjectMember2023-01-012023-12-310001879016ie:CordobaMemberie:AlacranProjectMember2023-05-082023-05-080001879016ie:CMHMemberie:JCHXMiningManagementCoLtdMember2023-05-080001879016ie:AlacranProjectMemberie:JCHXMiningManagementCoLtdMember2023-05-0800018790162023-05-080001879016ie:FirstInstallmentMemberie:JCHXMiningManagementCoLtdMemberie:CMHMember2023-05-082023-05-080001879016ie:SecondInstallmentMemberie:JCHXMiningManagementCoLtdMemberie:CMHMember2023-05-082023-05-080001879016ie:SecondInstallmentMemberie:JCHXMiningManagementCoLtdMemberie:CMHMember2023-12-012023-12-310001879016ie:SecondInstallmentMemberie:JCHXMiningManagementCoLtdMemberus-gaap:SubsequentEventMemberie:CMHMember2024-01-012024-01-310001879016ie:ThirdInstallmentMemberie:JCHXMiningManagementCoLtdMemberie:CMHMember2023-05-082023-05-080001879016ie:ThirdInstallmentNotPaidMemberie:CMHMemberie:JCHXMiningManagementCoLtdMember2023-05-080001879016ie:ThirdInstallmentNotPaidMemberie:CMHMemberie:CordobaMember2023-05-0800018790162023-05-082023-05-080001879016ie:KaizenMember2021-12-310001879016ie:VRBMember2021-12-310001879016ie:CordobaMember2021-12-310001879016ie:CGIMember2021-12-310001879016ie:KaizenMember2022-01-012022-12-310001879016ie:VRBMember2022-01-012022-12-310001879016ie:CordobaMember2022-01-012022-12-310001879016ie:CGIMember2022-01-012022-12-310001879016ie:KaizenMember2022-12-310001879016ie:VRBMember2022-12-310001879016ie:CordobaMember2022-12-310001879016ie:CGIMember2022-12-310001879016ie:KaizenMember2023-01-012023-12-310001879016ie:VRBMember2023-01-012023-12-310001879016ie:CordobaMember2023-01-012023-12-310001879016ie:CGIMember2023-01-012023-12-310001879016ie:KaizenMember2023-12-310001879016ie:VRBMember2023-12-310001879016ie:CordobaMember2023-12-310001879016ie:CGIMember2023-12-310001879016ie:KaizenMember2023-12-310001879016ie:VRBMember2023-12-310001879016ie:CordobaMember2023-12-310001879016ie:CGIMember2023-12-310001879016ie:KaizenMembersrt:NonGuarantorSubsidiariesMember2023-12-310001879016ie:VRBMembersrt:NonGuarantorSubsidiariesMember2023-12-310001879016srt:NonGuarantorSubsidiariesMemberie:CordobaMember2023-12-310001879016srt:NonGuarantorSubsidiariesMemberie:CGIMember2023-12-310001879016srt:NonGuarantorSubsidiariesMember2023-12-310001879016ie:VRBMember2023-12-310001879016us-gaap:DomesticCountryMember2023-12-310001879016us-gaap:ForeignCountryMemberus-gaap:CanadaRevenueAgencyMember2023-12-310001879016us-gaap:StateAdministrationOfTaxationChinaMemberus-gaap:ForeignCountryMember2023-12-310001879016us-gaap:ForeignCountryMemberie:TheNationalDirectorateOfTaxesAndCustomsColombiaMember2023-12-310001879016us-gaap:ForeignCountryMemberie:TheNationalSuperintendencyOfCustomsAndTaxAdministrationPeruMember2023-12-310001879016us-gaap:InlandRevenueSingaporeIRASMemberus-gaap:ForeignCountryMember2023-12-310001879016ie:GlobalMiningMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:GlobalMiningMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:GlobalMiningMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001879016ie:GlobalMiningMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001879016ie:IvanhoeCapitalAviationMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:IvanhoeCapitalAviationMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:IvanhoeCapitalAviationMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001879016ie:IvanhoeCapitalAviationMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001879016us-gaap:RelatedPartyMember2023-01-012023-12-310001879016us-gaap:RelatedPartyMember2022-01-012022-12-310001879016ie:MaadenMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:MaadenMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:GlobalMiningMemberie:GlobalMiningMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2022-10-242022-10-24ie:transmitter0001879016ie:IPulseIncMemberie:PurchasePriceOfTransmittersMember2022-10-242022-10-240001879016ie:IPulseIncMemberus-gaap:RelatedPartyMember2022-10-012022-10-310001879016ie:CordobaMemberie:CordobaMemberie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2023-12-310001879016ie:CordobaMemberie:CordobaMemberie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:JCHXBridgeLoanMemberie:CordobaMemberus-gaap:RelatedPartyMember2023-11-300001879016ie:CordobaMemberus-gaap:BridgeLoanMemberie:JCHXMiningManagementCoLtdMemberie:JCHXBridgeLoanMemberus-gaap:RelatedPartyMember2023-11-300001879016ie:SecondInstallmentMemberie:JCHXBridgeLoanMemberie:CordobaMemberus-gaap:RelatedPartyMember2023-11-300001879016us-gaap:SubsequentEventMemberie:JCHXBridgeLoanMemberie:CordobaMemberus-gaap:RelatedPartyMember2024-01-012024-01-310001879016ie:JCHXBridgeLoanMemberie:CordobaMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:CordobaMemberus-gaap:BridgeLoanMemberie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2022-12-012022-12-310001879016ie:CordobaMemberie:BridgeLoanFirst12MonthsMemberus-gaap:BridgeLoanMemberie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2022-12-310001879016ie:CordobaMemberus-gaap:BridgeLoanMemberie:BridgeLoanRemaining6MonthsMemberie:JCHXMiningManagementCoLtdMemberus-gaap:RelatedPartyMember2022-12-310001879016us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001879016us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001879016us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001879016us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001879016us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001879016us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001879016us-gaap:NotesPayableOtherPayablesMember2021-12-310001879016us-gaap:NotesPayableOtherPayablesMember2022-01-012022-12-310001879016us-gaap:NotesPayableOtherPayablesMember2022-12-310001879016us-gaap:NotesPayableOtherPayablesMember2023-01-012023-12-310001879016us-gaap:NotesPayableOtherPayablesMember2023-12-31ie:segment0001879016us-gaap:OperatingSegmentsMemberie:CriticalMetalsSegmentMember2023-01-012023-12-310001879016us-gaap:OperatingSegmentsMemberie:DataProcessingSegmentMember2023-01-012023-12-310001879016us-gaap:OperatingSegmentsMemberie:EnergyStorageSegmentMember2023-01-012023-12-310001879016us-gaap:OperatingSegmentsMember2023-01-012023-12-310001879016ie:CriticalMetalsSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001879016ie:DataProcessingSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001879016ie:EnergyStorageSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001879016us-gaap:IntersegmentEliminationMember2023-01-012023-12-310001879016us-gaap:OperatingSegmentsMemberie:CriticalMetalsSegmentMember2023-12-310001879016us-gaap:OperatingSegmentsMemberie:DataProcessingSegmentMember2023-12-310001879016us-gaap:OperatingSegmentsMemberie:EnergyStorageSegmentMember2023-12-310001879016us-gaap:OperatingSegmentsMember2023-12-310001879016us-gaap:OperatingSegmentsMemberie:CriticalMetalsSegmentMember2022-01-012022-12-310001879016us-gaap:OperatingSegmentsMemberie:DataProcessingSegmentMember2022-01-012022-12-310001879016us-gaap:OperatingSegmentsMemberie:EnergyStorageSegmentMember2022-01-012022-12-310001879016us-gaap:OperatingSegmentsMember2022-01-012022-12-310001879016ie:CriticalMetalsSegmentMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001879016ie:DataProcessingSegmentMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001879016ie:EnergyStorageSegmentMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001879016us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001879016us-gaap:OperatingSegmentsMemberie:CriticalMetalsSegmentMember2022-12-310001879016us-gaap:OperatingSegmentsMemberie:DataProcessingSegmentMember2022-12-310001879016us-gaap:OperatingSegmentsMemberie:EnergyStorageSegmentMember2022-12-310001879016us-gaap:OperatingSegmentsMember2022-12-310001879016country:CA2023-01-012023-12-310001879016country:CA2022-01-012022-12-310001879016country:CN2023-01-012023-12-310001879016country:CN2022-01-012022-12-310001879016country:US2023-12-310001879016country:US2022-12-310001879016country:CO2023-12-310001879016country:CO2022-12-310001879016country:PE2023-12-310001879016country:PE2022-12-310001879016country:CN2023-12-310001879016country:CN2022-12-310001879016ie:OtherCountriesExcludingUSAColombiaPeruAndChinaMember2023-12-310001879016ie:OtherCountriesExcludingUSAColombiaPeruAndChinaMember2022-12-310001879016ie:IPulseIncMember2022-10-242022-10-240001879016srt:SubsidiariesMemberie:KaizenMemberus-gaap:SubsequentEventMember2024-02-050001879016srt:SubsidiariesMemberie:KaizenMemberus-gaap:SubsequentEventMember2024-02-060001879016srt:SubsidiariesMemberie:KaizenMemberus-gaap:SubsequentEventMember2024-02-062024-02-0600018790162023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-41436

Ivanhoe Electric Inc.

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

|

Delaware |

32-0633823 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.) |

|

|

|

450 E Rio Salado Parkway, Suite 130

Tempe, Arizona

|

85281 |

(Address of principal executive offices) |

(Zip Code) |

|

|

Registrant's telephone number, including area code (480) 656-5821

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

IE |

NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

Accelerated filer |

o |

Non-accelerated filer |

o |

Smaller reporting company |

x |

|

|

Emerging growth company |

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. YES x NO o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on NYSE American as of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $969.4 million.

The number of shares of Registrant’s Common Stock outstanding as of February 26, 2024 was 120,306,414.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed within 120 days of December 31, 2023 in connection with its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III, Items 11-14 of this Form 10-K.

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended, (the "Exchange Act"), that involve risks and uncertainties, including statements based on our current expectations, assumptions, estimates and projections about future events, our business, financial condition, results of operations and prospects, our industry and the regulatory environment in which we operate. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, or other comparable terms intended to identify statements about the future. The forward-looking statements included herein are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. These risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control, include, but are not limited to those made below under “Summary of Risk Factors” and in Item 1A. Risk Factors in this Annual Report.

You should carefully consider these risks, as well as the additional risks described in other documents we file with the Securities and Exchange Commission (“SEC”). We also operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

The forward-looking statements included herein are based on current expectations of our management based on available information and are believed to be reasonable. In light of the significant risks and uncertainties inherent in the forward-looking statements included in this Annual Report, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. You should read this Annual Report and the documents we file with the SEC, with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by the cautionary statements referenced above.

Glossary of Technical Terms

Certain terms and abbreviations used in this prospectus are defined below:

“Ag” means the chemical symbol for the element silver.

“Au” means the chemical symbol for the element gold.

“Breccias” are rocks composed of broken fragments of minerals or rocks cemented together by a finer grained matrix.

“Coeval” means having the same age or date of origin.

“Collar Locations” are the geographic coordinates of the surface location of a drill hole.

“Concentrate” is the product of a physical concentration process, such as flotation or gravity concentration, which involves separating ore minerals from unwanted waste rock. Concentrates require subsequent processing (such as smelting or leaching) to break down or dissolve the ore minerals and obtain the desired elements, usually metals.

“CRD” or “Carbonate Replacement Deposits” means high-temperature Ag-Pb-Zn deposits in carbonate rocks such as limestone.

“Cu” means the chemical symbol for the element copper.

“DC/IP” means an induced polarization geophysical survey that uses Direct Current Resistivity to recover conductivity and chargeability distribution.

“Dilution” is an estimate of the amount of waste or low-grade mineralized rock which will be mined with the ore as part of normal mining practices in extracting an ore body.

“Exploration” is prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore.

“Feasibility Study” is a comprehensive technical and economic study of the selected development option for a mineral project, which includes detailed assessments of all applicable Modifying Factors, together with any other relevant operational factors, and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is economically viable. The results of the study may serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project.

“Grade” means the concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t) or ounces per ton (oz/t). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from the deposit.

“g/t” means grams per tonne.

“Hypogene” means processes occurring at depth; especially, the primary hydrothermal processes that form a mineral deposit.

“ICP-MS” means inductively coupled plasma mass spectrometry.

“Indicated Mineral Resource” or “Indicated Resource” is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a Probable Mineral Reserve.

“Induced Polarization Survey” means a method of ground geophysical surveying employing an electrical current to determine indications of mineralization.

“Inferred Mineral Resources” or “Inferred Resources” is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the Modifying Factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a Mineral Reserve.

“Initial Assessment” is a preliminary technical and economic study of the economic potential of all or parts of mineralization to support the disclosure of Mineral Resources. The Initial Assessment must be prepared by a Qualified Person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An Initial Assessment is required for disclosure of Mineral Resources but cannot be used as the basis for disclosure of Mineral Reserves.

“Intrusive Belt” means means a band of igneous rocks that have formed parallel to and due to the subduction of a plate and can range up to several 100’s of km in length.

“km” means kilometer.

“km2” means square kilometers.

“kt” means kilotonnes.

“kW” means kilowatts.

“m” means meter.

“m2” means square meters.

“Ma” means mega-annum or million years.

“masl” is meters above sea level.

“Mill” is a processing facility where ore is finely ground and thereafter undergoes physical or chemical treatments to extract the valuable metals.

“Mineral Reserve” is an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the Qualified Person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

“Mineral Resource” is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

“Modifying Factors” are the factors that a Qualified Person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A Qualified Person must apply and evaluate Modifying Factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include, but are not restricted to: mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the Modifying Factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project.

“Moz” means million troy ounces.

“Mt” means mega-tonnes or a million tonnes.

“Mtpa” means million tonnes per annum.

“MW” means megawatts or a million watts.

“MWh” means megawatt hours.

“NI 43-101” means National Instrument 43-101 - Standards of Disclosure for Mineral Projects adopted by the Canadian Securities Administrators.

“NSR” means Net Smelter Return, which refers to the proceeds returned from the smelter and/or refinery to the mine owner, taken as the sale price of the metal products less certain transportation, treatment and refining costs.

“Ore” is rock, generally containing metallic or non-metallic minerals and non-ore minerals, that can be mined and processed at a profit.

“Ore Body” is a sufficiently large amount of ore that can be mined economically.

"oz" means troy ounces or 31.1035 grams

“Pb” means the chemical symbol for the element lead.

“Preliminary Feasibility Study” or “Pre-Feasibility Study” means a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a Qualified Person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. A Pre-Feasibility Study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the Modifying Factors and the evaluation of any other relevant factors that are sufficient for a Qualified Person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. A Pre-Feasibility Study is less comprehensive and results in a lower confidence level than a Feasibility Study. A Pre-Feasibility Study is more comprehensive and results in a higher confidence level than an Initial Assessment.

“Probable Mineral Reserve” is the economically mineable part of an Indicated Mineral Resource, and in some circumstances a Measured Mineral Resource.

“Proven Mineral Reserve” is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource.

“QA/QC” means quality assurance/quality control.

“Qualified Person” has the meaning ascribed thereto in Subpart 1300 of Regulation S-K.

“Re” means the chemical symbol for the element rhenium.

“Reclamation” is the process by which lands disturbed as a result of mining activity are modified to support beneficial land use. Reclamation activity may include the removal of buildings, equipment, machinery and other physical remnants of mining, closure of tailings, leach pads and other features, and contouring, covering and re-vegetation of waste rock and other disturbed areas.

“Recovery Rate” is a term used in process metallurgy to indicate the proportion of valuable material physically recovered in the processing of ore. It is generally stated as a percentage of material recovered compared to the material originally present.

“Refining” is the final stage of metal production in which impurities are removed from the molten metal.

“Sampling” is a naturally occurring area where metals and elements leached from nearby rocks have accumulated at surface, typically in the form of oxide minerals.

“Specific Gravity” means density.

“Smelting” is an intermediate stage metallurgical process in which metal is separated from impurities by using thermal or chemical separation techniques.

“Stringers” are narrow veins or irregular filaments of a mineral or minerals traversing a rock mass.

“Supergene” means a process by which mineralization is enriched by the circulation of groundwater and the weathering process; significant in porphyry-copper and iron oxide-copper-gold deposits, where zones of much higher-grade mineralization may be found.

“Tailings” is the material that remains after all economically and technically recovered precious metals have been removed from the ore during processing.

“t” or “Tonne” means a metric ton or 2,204.6 pounds.

“Ton” means a short ton which is equivalent to 2,000 pounds, unless otherwise specified.

“tpa” means tonnes per annum.

“Trenching” is a long, narrow excavation through overburden to expose a vein, structure, or rock surface.

“Veins” are fissures, faults, or cracks in a rock that are filled by minerals.

“VTEM” means Versatile Time Domain Electromagnetic system that can record the conductivity of rock and can be performed by plane.

“Waste” is rock which is not ore. Waste typically refers to that rock which has to be removed during the normal course of mining in order to get at the ore.

“Zn” means the chemical symbol for the element zinc.

Summary of Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition and results of operations. You should carefully consider the risks discussed in this Annual Report under the section titled “Risk Factors,” which are summarized below.

Risks Related to our Mining Businesses and the Mining Industry

•We operate no mines, and the development of our mineral projects into mines is highly speculative in nature, may be unsuccessful, and may never result in the development of an operating mine.

•Mineral exploration activities have a high risk of failure and may never result in finding Ore Bodies sufficient to develop a producing mine.

•We have no history of mineral production and may never engage in mineral production.

•We have a history of negative operating cash flows and net losses and we may never achieve or sustain profitability.

•The mineral resource calculations made at our material mineral projects and other projects are only estimates and may not reflect the amount of minerals that may ultimately be extracted from those projects.

•Mineral resource estimates may change adversely and such changes may negatively impact the viability of developing a mineral project into a mine.

•Lack of reliability and inaccuracies of historical information could hinder our exploration plans.

•The prices of the minerals for which we are principally exploring (copper, nickel, vanadium, cobalt, platinum group elements, gold and silver) change on a daily basis, and a substantial or extended decline in the prices of these minerals could materially and adversely affect our ability to raise capital, conduct exploration activities, and develop or operate a mine.

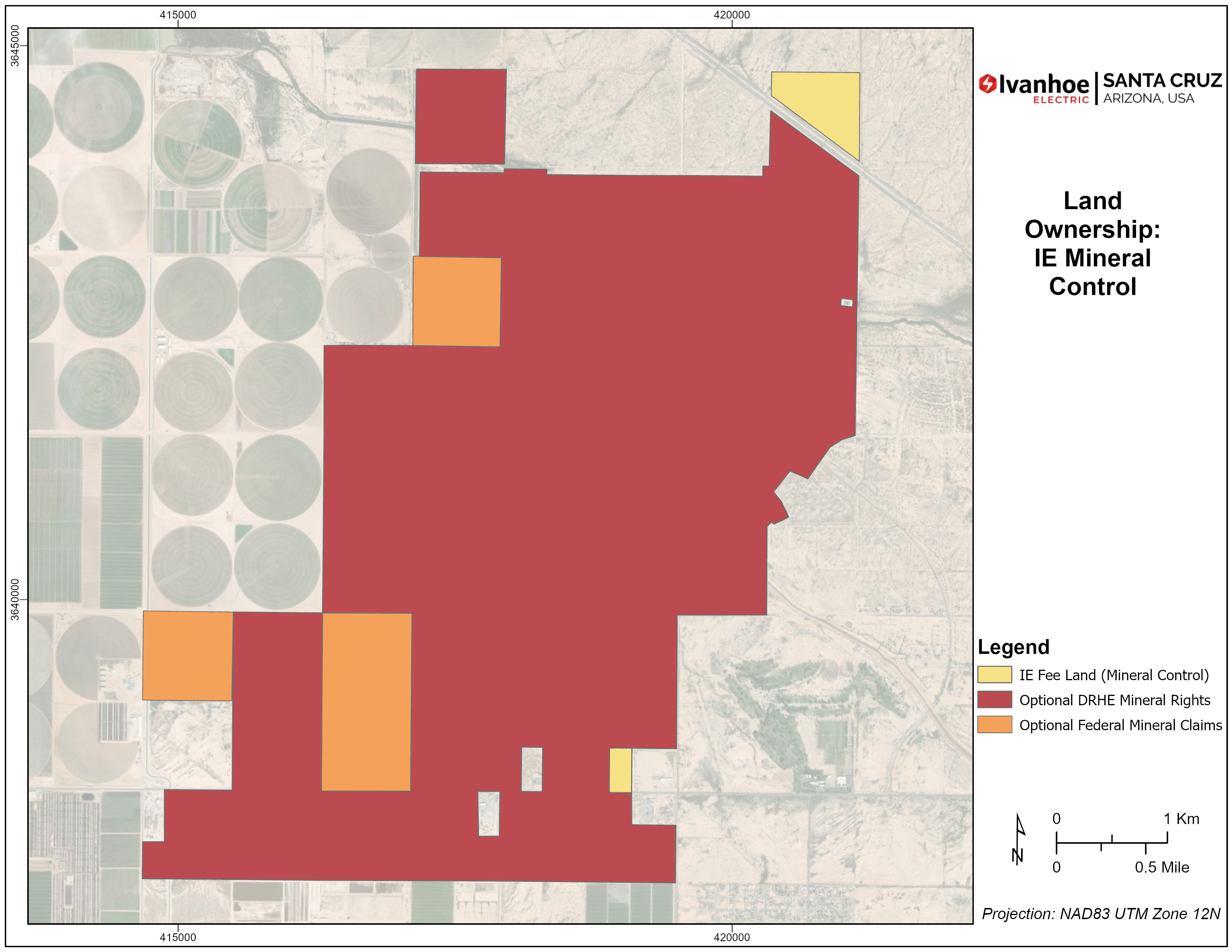

•We do not own all of the mineral subsurface rights at the Santa Cruz and Tintic Projects, and we do not own all of the surface rights at the Tintic Project.

•Our indebtedness and grant of security interests in certain of our assets could adversely affect our business.

•Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and future development activities may not result in profitable mining operations.

•We are or will be required to obtain, maintain and renew environmental, construction and mining permits, which is often a costly and time-consuming process and ultimately may not be possible to achieve.

•We are subject to environmental and health and safety laws, regulations and permits that may subject us to material costs, liabilities and obligations.

•Land reclamation and exploration restoration requirements may be burdensome and costly.

•The development of one or more of our mineral projects into an operating mine will be subject to all of the risks associated with establishing and operating new mining operations.

•Our future capital and operating cost estimates at any of our mining projects may not be accurate.

•We may face opposition from organizations that oppose mining which may disrupt or delay our mining projects.

•Our operations involve significant risks and hazards inherent to the mining industry.

•A significant portion of any future revenue from our operations is expected to come from a small number of mines, such that any adverse developments at these mines could have a more significant or lasting impact on our results of operations than if our business was less concentrated.

•Joint ventures and other partnerships in relation to our properties may expose us to risks.

•We operate in a highly competitive industry.

•Higher metal prices in past years have encouraged increased mining exploration, development and construction activity, which has increased demand for, and cost of, exploration, development and construction services and equipment.

•The title to properties within some of our mineral projects may be uncertain or defective, which could put our investment in such mineral projects at risk.

•Failure to make mandatory payments required under earn-in, option and similar arrangements related to mineral projects may result in a loss of our opportunity and/or right to acquire an interest in such mineral projects.

•Suitable infrastructure may not be available for exploration or development of mineral properties or damage to existing infrastructure may occur.

•Our future mining operations may require access to abundant water sources which may not be available.

•An increase in prices of power and water supplies, including infrastructure, could negatively affect our future operating costs, financial condition, and ability to develop and operate a mine.

•Our success depends on developing and maintaining relationships with local communities and stakeholders.

•The impacts of climate change may adversely affect our operations and/or result in increased costs to comply with changes in regulations.

•Our subsidiary, Cordoba, is involved in lengthy litigation, which may adversely affect the value of our investment in it and its mineral projects.

•Our subsidiary Cordoba operates in a jurisdiction, Colombia, which has heightened security risks.

•Our subsidiary Kaizen operates in a jurisdiction, Peru, which has recently experienced an increase in political instability and violence.

•Illegal mining activities may negatively impact our ability to explore, develop and operate some mineral projects.

Risks Specific to VRB

•VRB may be unable to obtain sufficient suitable feedstock for vanadium production required to produce its VRB-ESS®.

•We currently purchase certain key raw materials and components from third parties, some of which we only source from one supplier or from a limited number of suppliers.

•Substantial and increasingly intense competition may harm VRB’s business.

•Developments in alternative technology may adversely affect the demand for VRB’s battery products.

•VRB manufactures and markets vanadium-based battery systems. If a viable substitute product or chemistry to vanadium-based battery systems emerges and gains market acceptance, our business, financial condition and results of operations will be materially and adversely affected. Furthermore, our failure to keep up with rapid technological changes and evolving industry standards within the battery market may cause our products to become obsolete and less marketable, resulting in loss of market share to our competitors.

•VRB may experience significant delays in the design, production and launch of its battery projects, which could harm our business, prospects, financial condition and operating results.

•VRB batteries rely on software and hardware that is highly technical, and if these systems contain errors, bugs or vulnerabilities, or if we are unsuccessful in addressing or mitigating technical limitations in our systems, our business could be adversely affected.

•VRB may not be able to substantially increase its manufacturing output in order to fulfill orders from its customers.

•VRB’s failure to cost-effectively manufacture our batteries in quantities which satisfy our customers’ demands and product specifications and their expectations for product quality and reliable delivery could damage our customer relationships and result in significant lost business opportunities for us.

•Changes in the policies of the Government of the People’s Republic of China (“PRC”) or its laws, or intervention or control by the PRC Government may materially affect VRB and its assets.

•Any future revocation of approvals or any future failure to obtain approvals applicable to our business or any adverse changes in foreign investment policies of the PRC government may have a material adverse impact on our business, financial condition and results of operations.

•The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

•PRC regulations of loans to PRC entities and direct investment in PRC entities by offshore holding companies may delay or prevent us from making loans or additional capital contributions to VRB.

•Uncertainties with respect to the PRC legal system could limit available legal protections.

•VRB may be negatively impacted by the state of PRC-United States relations.

Risks Related to Intellectual Property

•If we are unable to successfully obtain, maintain, protect, enforce or otherwise manage our intellectual property and proprietary rights, we may incur significant expenses and our business may be adversely affected.

•We may not be able to protect our intellectual property rights in the PRC.

•We may be exposed to infringement or misappropriation claims by third parties, which, if determined adversely to us, could cause us to lose significant rights and to be unable to continue providing our existing product offerings.

Risks Related to Our Business Generally

•We will require substantial capital investment in the future and we may be unable to raise additional capital on favorable terms or at all.

•Currency fluctuations may affect our results of operation and financial condition.

•Our insurance may not provide adequate coverage in the event of a loss.

•We are dependent on the leadership of Robert Friedland, our founder and Executive Chairman, and the services of our executive management team and key employees.

•Our directors and officers may have conflicts of interest as a result of their relationships with other mining companies that are not affiliated with us.

•We may have difficulty recruiting and retaining employees.

•Any acquisitions we make may not be successful or achieve the expected benefits.

•Our information technology systems may be vulnerable to cyber-attack or other disruption, which could place our systems at risk for data loss, operational failure or compromise of confidential information.

•We may be subject to claims and legal proceedings that could materially and adversely impact our business, financial condition or results of operations.

•We are subject to the risk of labor disputes, which could adversely affect our business.

•Our activities and business could be adversely affected by the effects of health epidemics, including the COVID-19 pandemic, in regions where we conduct our business operations.

•While our equity ownership in our listed company Cordoba may be significant, we may not be able to exert control or direction over the company or its business.

Risks Related to Government Regulations and International Operations

•We have subsidiaries, mineral projects, investments in mineral projects or exploration activities in the United States, Canada, Australia, Colombia, Peru, Ivory Coast and Saudi Arabia where the governments extensively regulate mineral exploration and mining operations, imposing significant actual and potential costs on us.

•Our activities outside of the United States are subject to additional political, economic and other uncertainties not necessarily present for activities taking place within the United States.

•Our foreign mining projects and investments are subject to risk typically associated with operating in foreign countries.

•Uncertainty in governmental agency interpretation or court interpretation and the application of applicable laws and regulations in any jurisdictions where we operate or have investments could result in unintended non-compliance.

•Proposed changes to United States federal mining and public land law could impose, among other things, royalties and fees paid to the United States government by mining companies and royalty holders.

•We are subject to and may become liable for any violations of anti-corruption and anti-bribery laws.

•Changes to United States and foreign tax laws could adversely affect our results of operations.

Risks Related to our Common Stock

•Future sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plans, could result in additional dilution of the percentage ownership of our stockholders and could cause the price of our common stock to decline.

•If a substantial number of our shares of common stock are sold, or it is perceived that they will be sold, in the public market, the market price of our common stock could decline.

•Ma’aden holds certain top-up rights that could lead to further dilution or adversely affect our stock price.

•The price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our common stock.

•If securities or industry analysts do not publish research or reports about us, or if they downgrade our common stock, the price of our common stock could decline.

•The market price of our common stock is subject to fluctuations and may not reflect our long-term value at any given time, and we may be subject to securities litigation as a result.

•Our amended and restated certificate of incorporation and amended and restated bylaws contain provisions that may make the acquisition of our company more difficult.

•Our Board of Directors is authorized to issue and designate shares of our preferred stock in additional series without stockholder approval.

•Our amended and restated certificate of incorporation designates specific state or federal courts as the exclusive forum for certain litigation that may be initiated by our stockholders, which could limit stockholders’ ability to obtain a favorable judicial forum for disputes with us.

•We do not currently intend to pay dividends on our common stock and consequently, the ability to achieve a return on investment will depend on appreciation in the price of our common stock.

•We may incur significant additional costs and expenses, including costs and expenses associated with obligations relating to being a public company, which will require significant resources and management attention and may divert focus from our business operations, particularly after we are no longer eligible to report under smaller reporting company standards.

•This Annual Report was prepared pursuant to the standards applicable to a smaller reporting company, and the reduced disclosure requirements applicable to smaller reporting companies may make our common stock less attractive to investors.

•If we are unable to implement and maintain effective internal controls over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports.

•Non-U.S. holders may be subject to United States federal income tax on gain on the sale or other taxable disposition of shares of our common stock.

•A significant number of the members of our Board of Directors and executive officers and certain of the experts named in this Annual Report are non-U.S. residents, and you may not be able to enforce civil liabilities against these persons.

Transition from Emerging Growth Company and Smaller Reporting Company Status

Due to the market value of our equity securities that was held by non-affiliates on June 30, 2023 exceeding $700 million, we have become a “large accelerated filer” as defined under the Exchange Act, and have ceased to be an “emerging growth company” and a “smaller reporting company”. Accordingly, for purposes of this Annual Report, we no longer qualify for the accommodations granted to an emerging growth company and are required to comply with the requirements applicable to a large accelerated filer. Due to a transitional period approved by the SEC for former smaller reporting companies, this Annual Report continues to take advantage of the reduced disclosure obligations relating to a smaller reporting company. We anticipate that the proxy statement for our 2024 annual meeting of stockholders will also take advantage of the reduced disclosure obligations related to a smaller reporting company.

Part I

Item 1. Business

Overview

We are a United States domiciled minerals exploration company with a focus on developing mines from mineral deposits principally located in the United States. We seek to support American supply chain independence by finding and delivering the critical metals necessary for electrification of the economy, with a focus on copper. We believe the United States is significantly under explored and has the potential to yield major new discoveries of these metals.

We are committed to the sustainable development of our projects by embedding Environmental, Social and Governance (“ESG”) criteria in our decision-making framework from the earliest stages of project exploration and development. We continue to build upon our team’s strong ESG track record for leveraging best practices to establish Ivanhoe Electric as a leader in the mining sector. Key considerations that will influence our decision making include, but are not limited to, using clean and renewable energy in our future mining operations, following best practices to meet health, safety and environmental standards, optimizing our water resources, protecting local cultural heritage and biodiversity, minimizing our environmental footprint, as well as ensuring workforce diversity and hiring from local communities. Most importantly, the minerals that are the focus of our exploration and development efforts play a critical role by supporting electrification and enabling the clean energy transition.

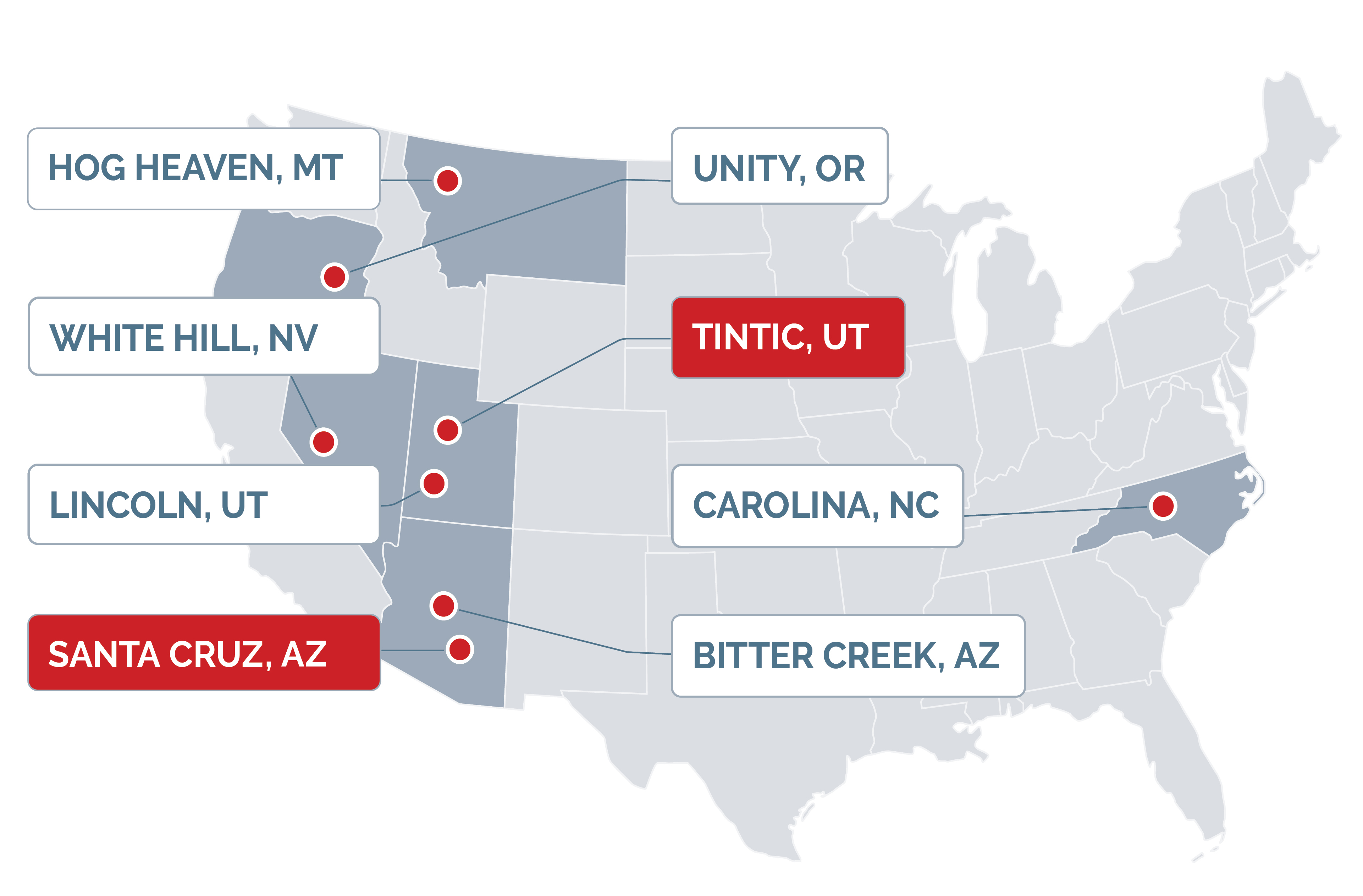

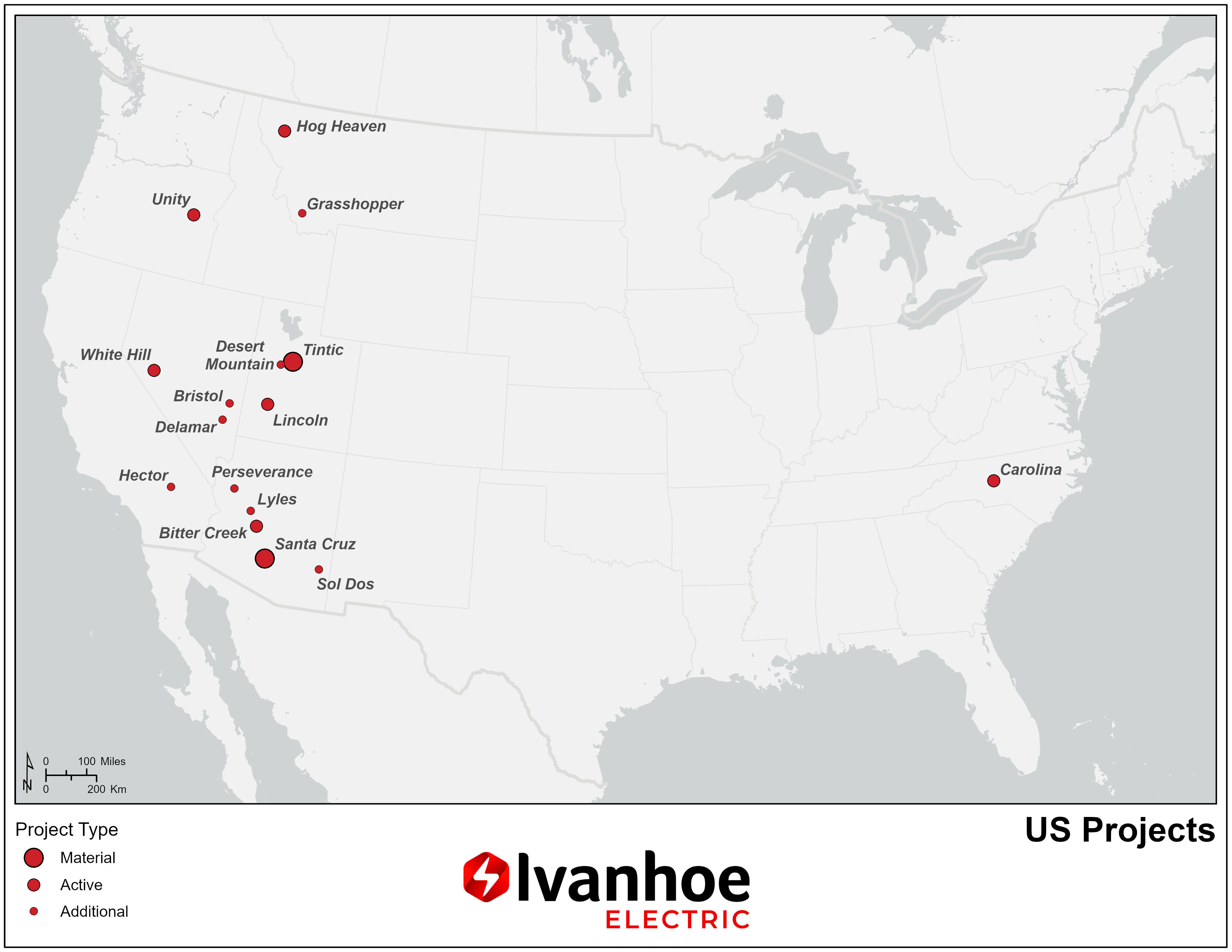

Our United States Mineral Projects

Our two material mineral projects are the Santa Cruz Project in Arizona and the Tintic Project in Utah.

Santa Cruz Project

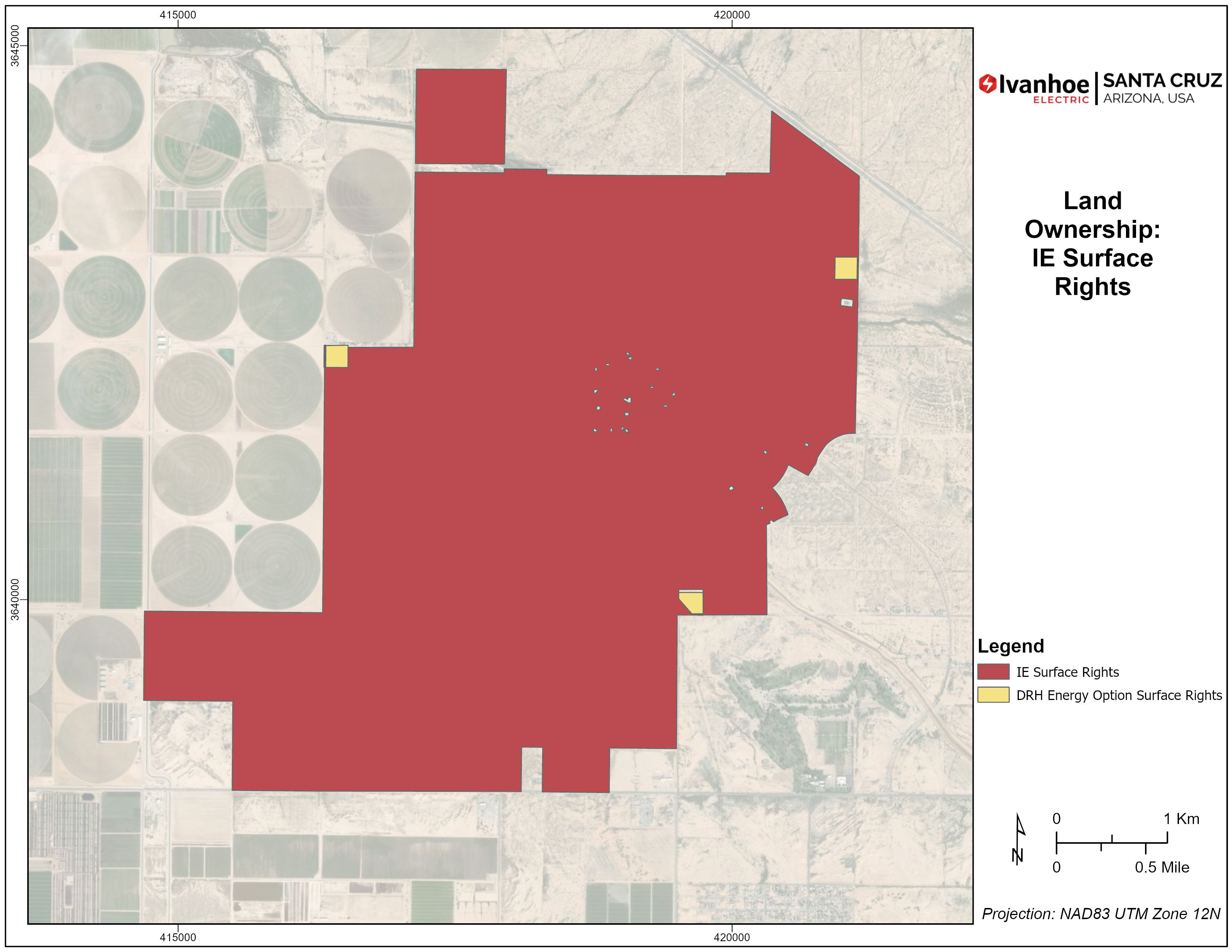

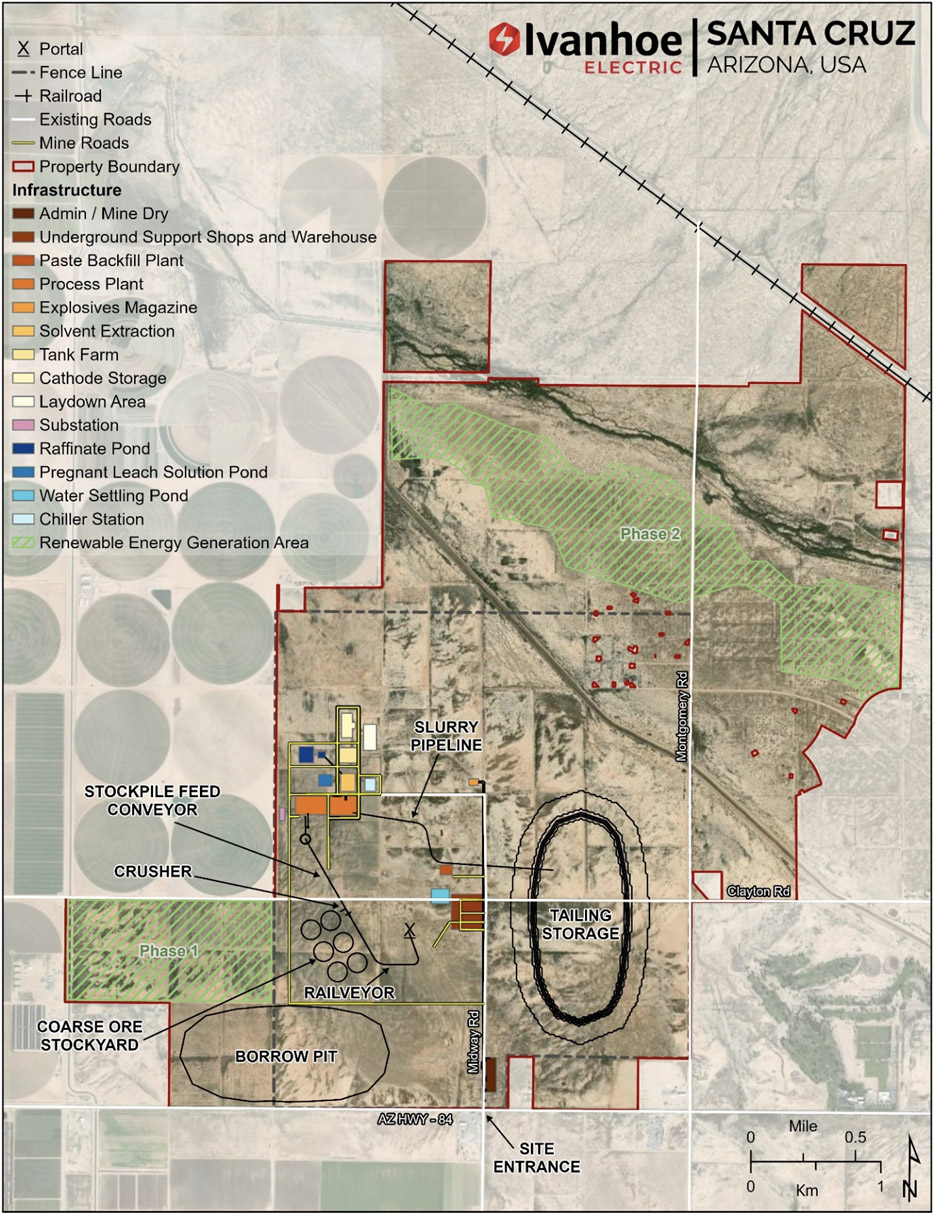

The Santa Cruz Project is a copper exploration project situated in a prolific mining region that hosts some of the largest copper mines in the United States. The Project encompasses 5,975 acres on private land and includes associated water rights. The project location provides excellent infrastructure, including access to rail, interstate highways, and electric transmission lines.

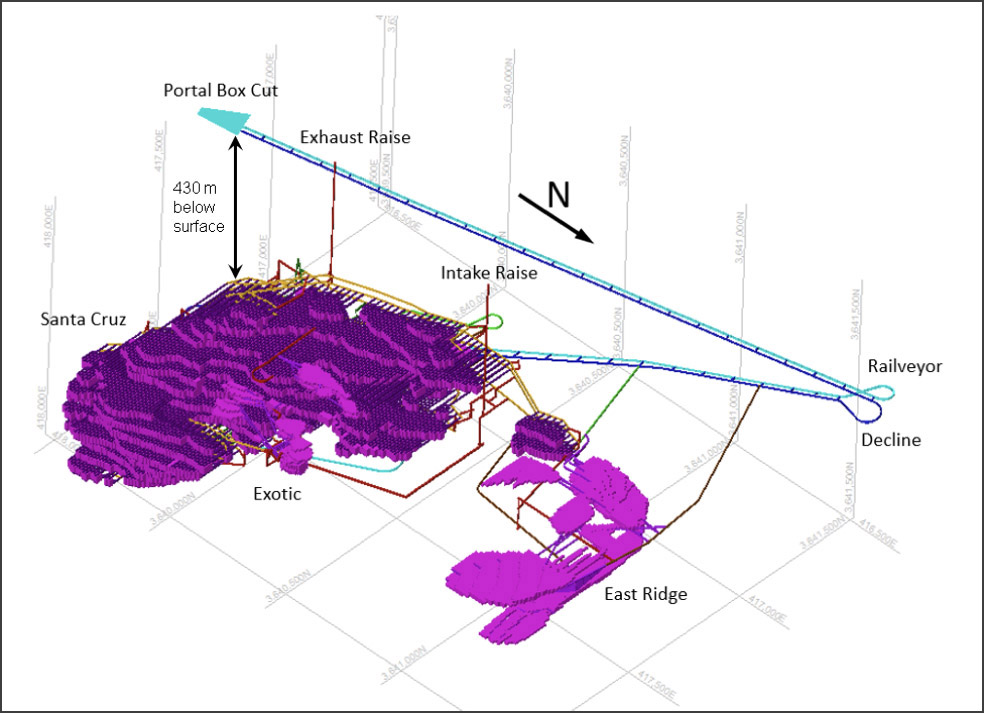

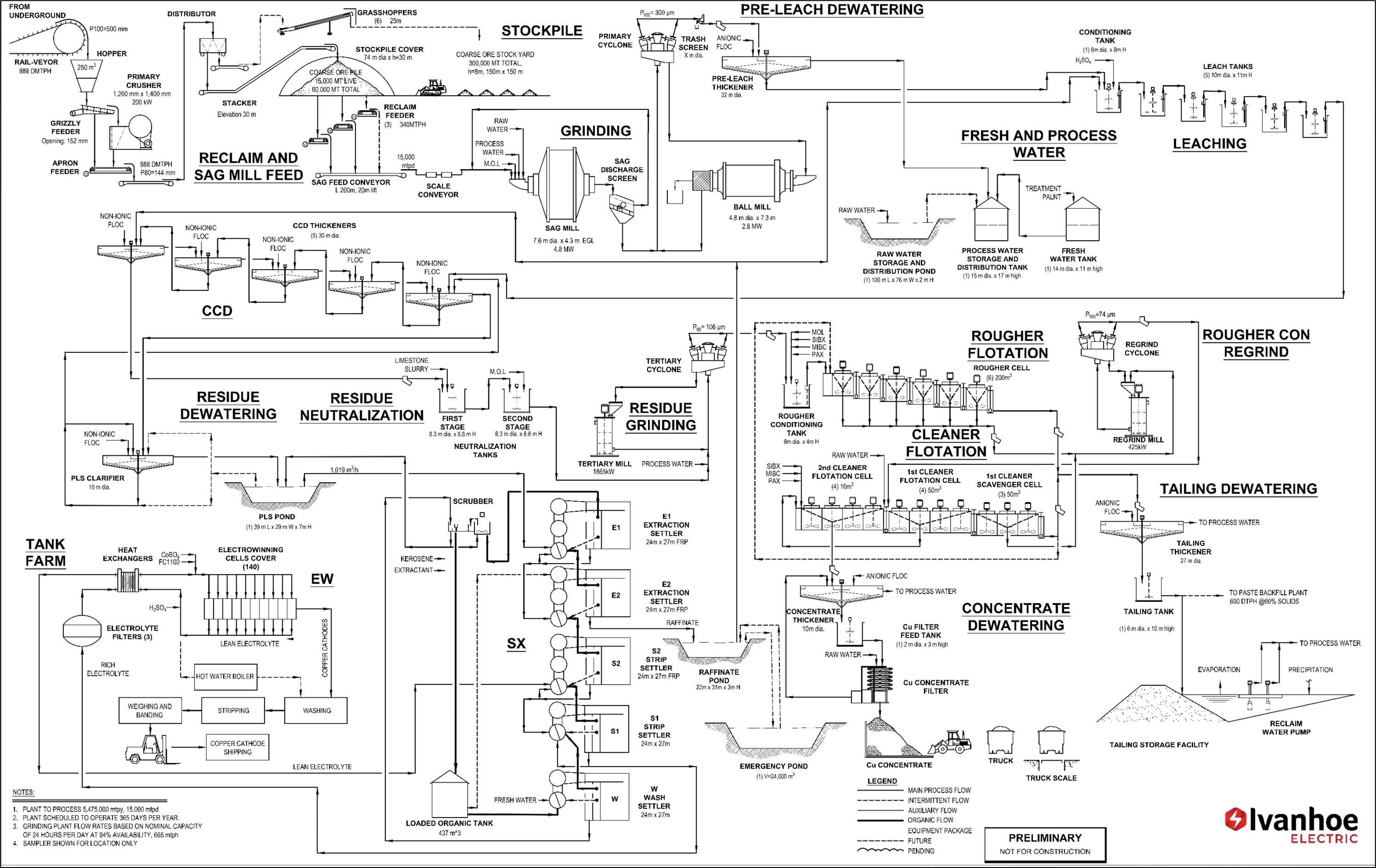

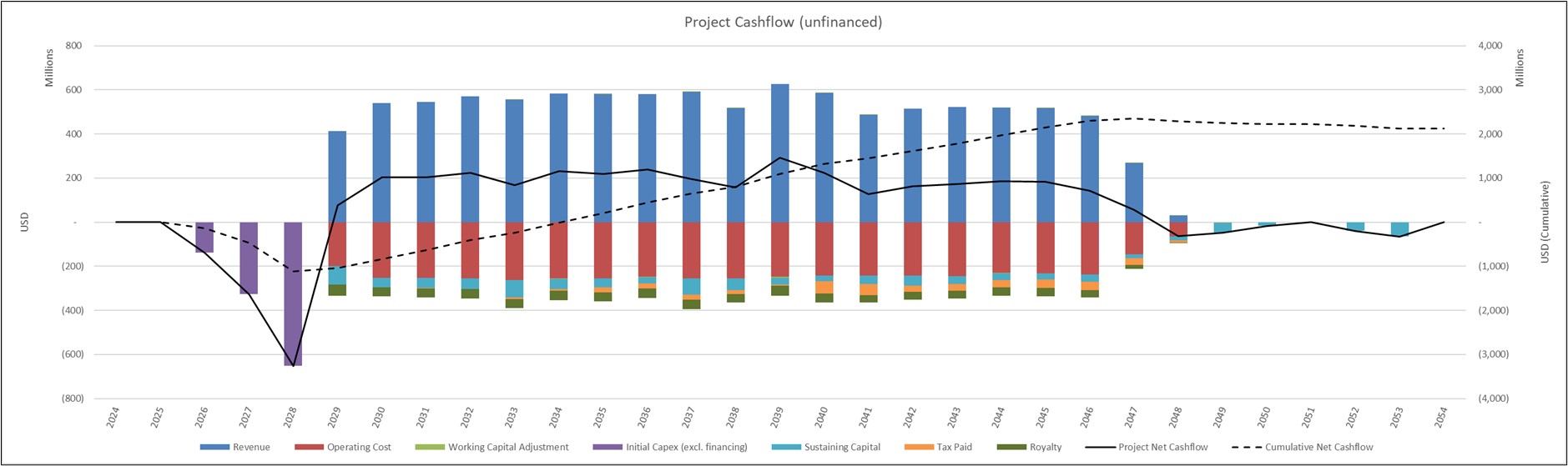

The Initial Assessment for the Santa Cruz Project, completed in September 2023, focuses on a small surface footprint, underground copper mine with an average of 5.5 million tonnes mined annually, exclusively from the high-grade exotic, oxide and enriched domains of the Santa Cruz and East Ridge Deposits. The Initial Assessment estimates life of mine (“LOM”) copper production of 1.6 million tonnes over a 20-year mine life, with projected cash costs of $1.36 per pound of copper produced.

We are advancing environmental, technical, and economic studies for an underground high-grade copper mining operation with a focus on minimizing the surface footprint of the mine while at the same time incorporating leading technologies to improve efficiencies and costs. We are designing a technologically advanced mine that we expect to result in low carbon dioxide emissions per pound of copper produced and be a leading example of responsibly produced domestic copper.

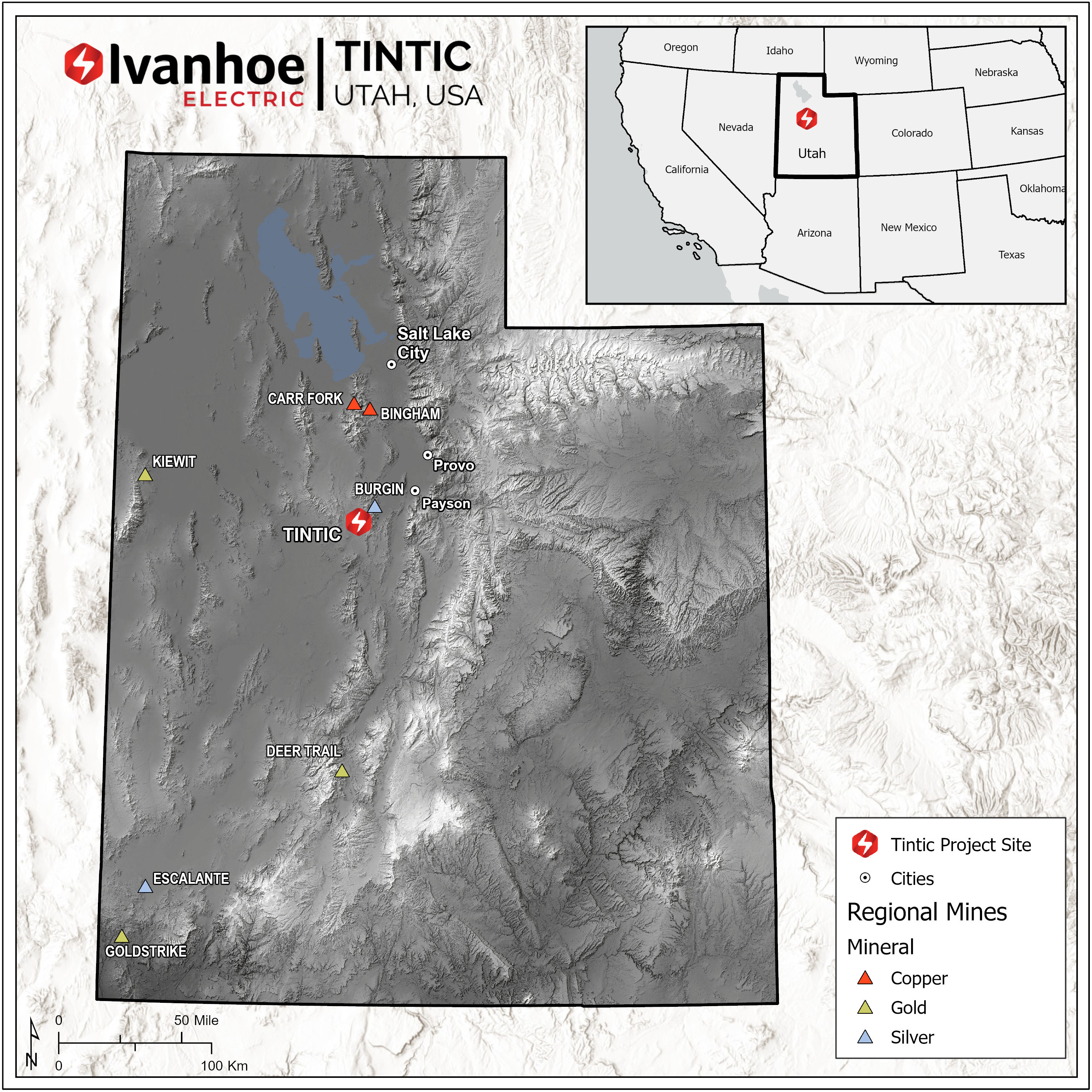

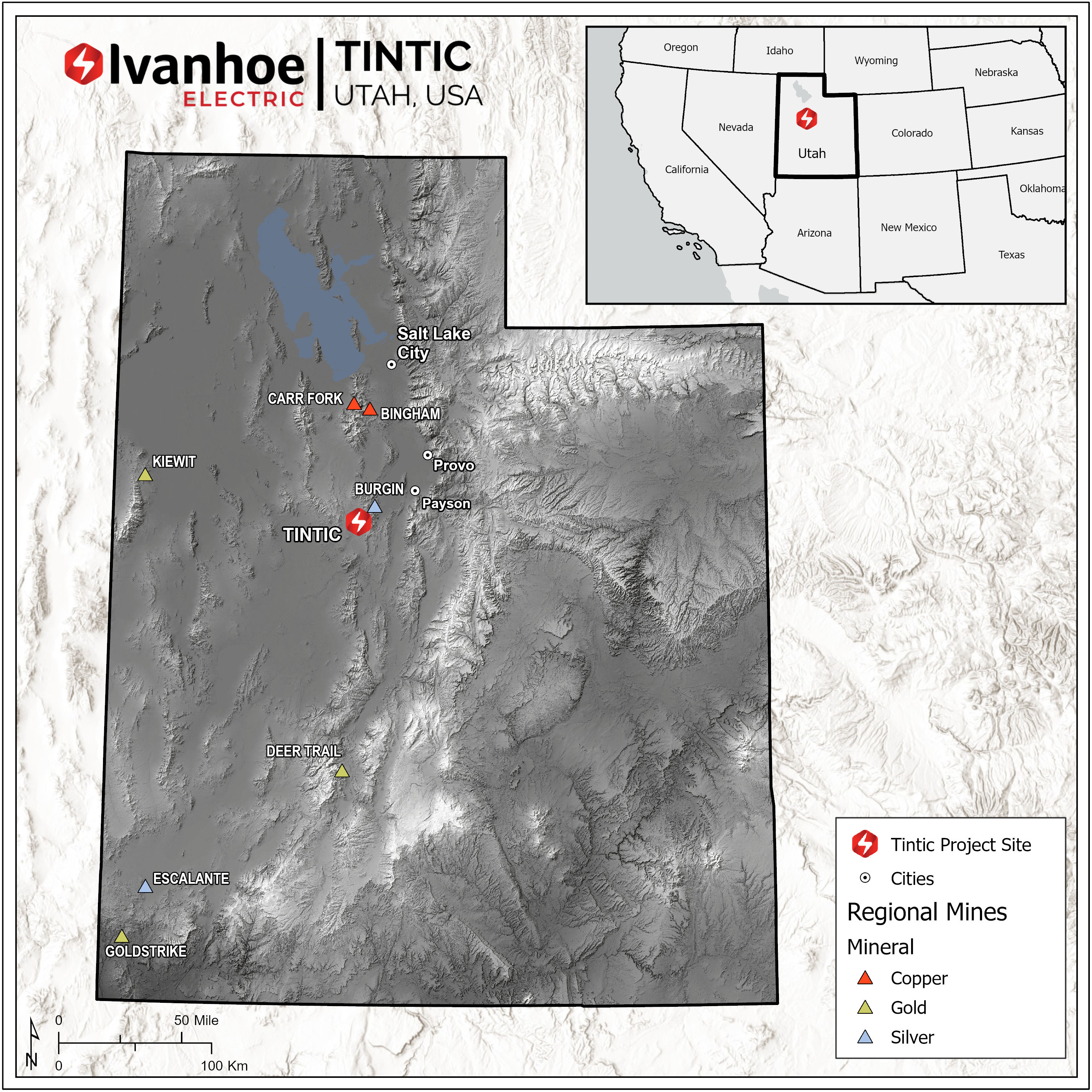

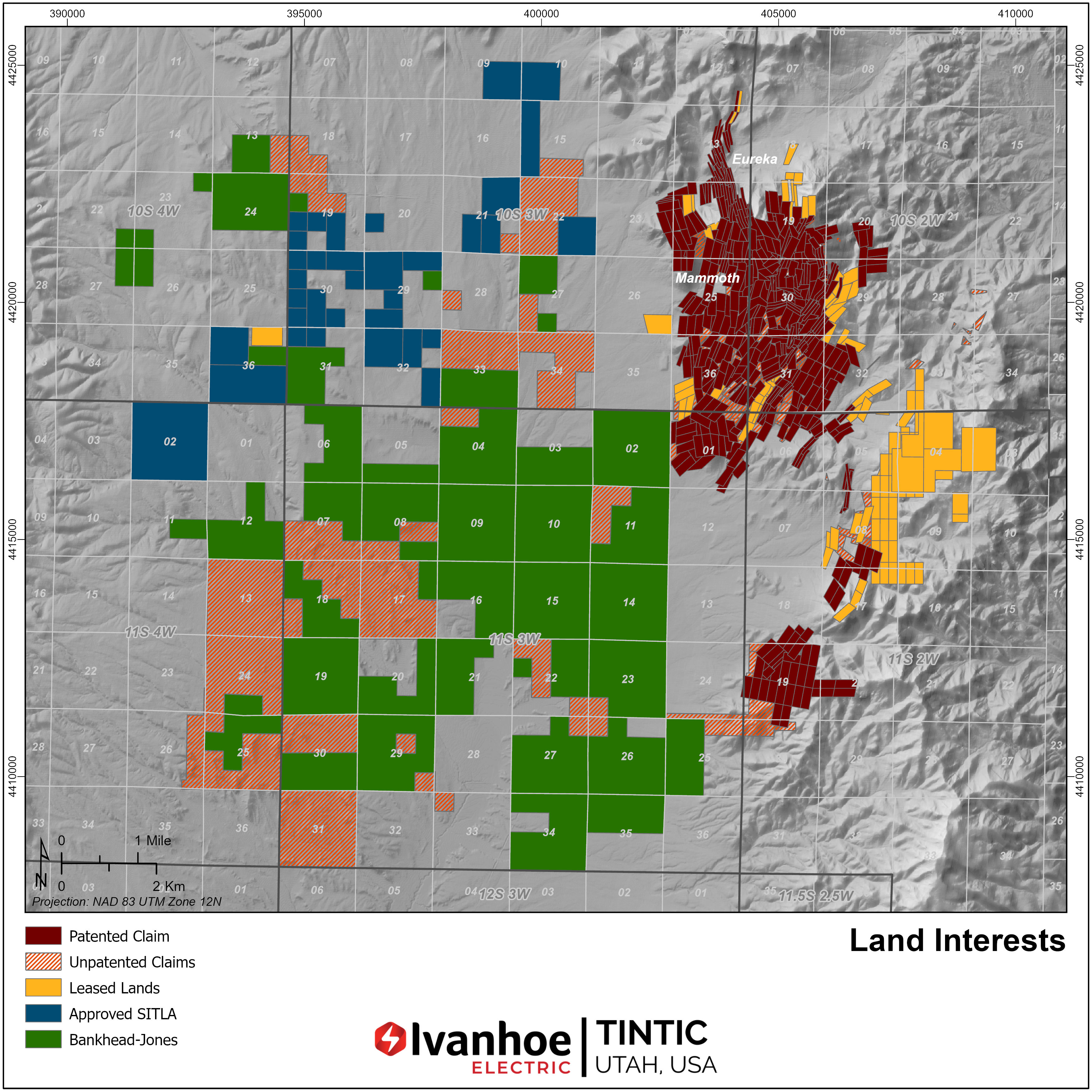

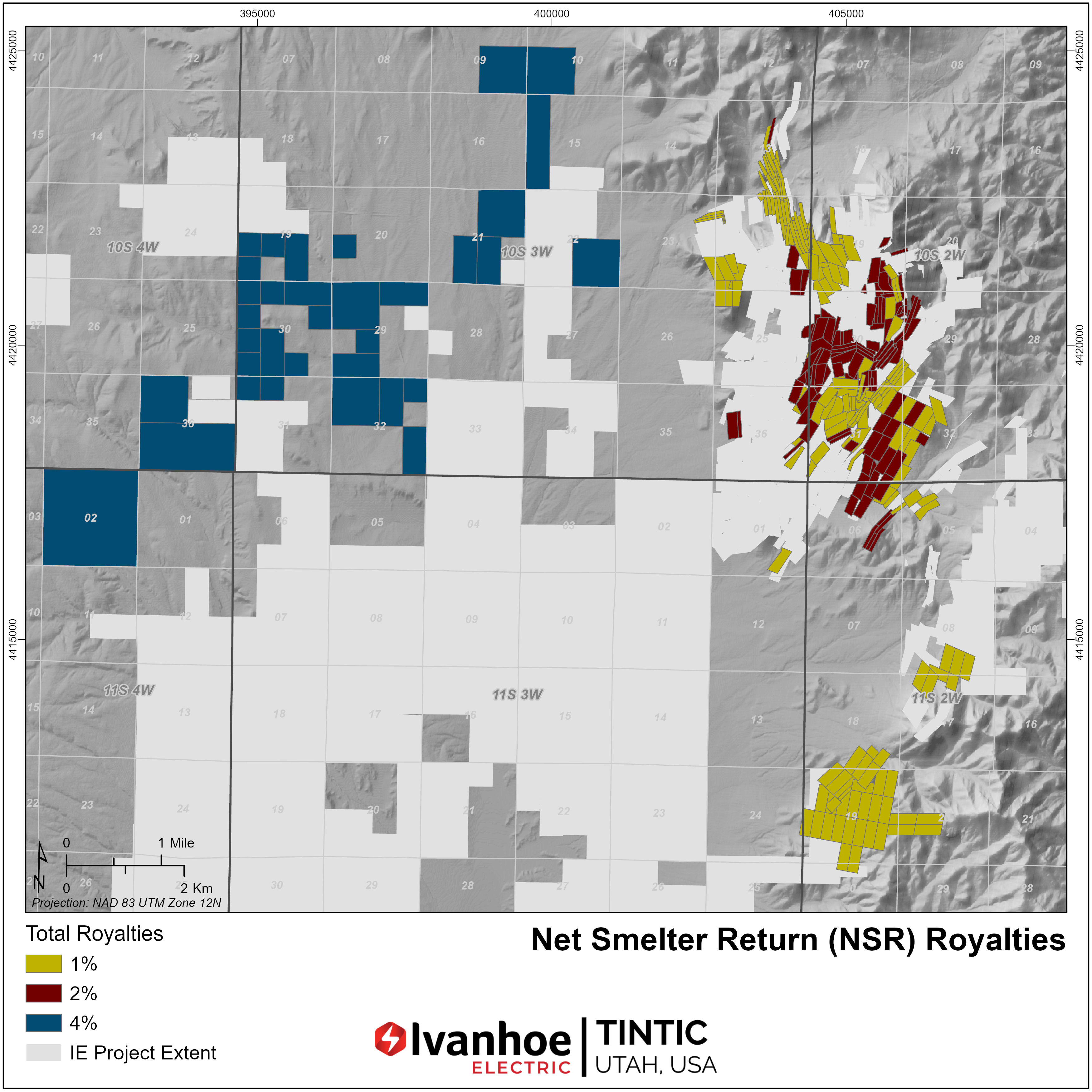

Tintic Project

Tintic is an exploration project located 95 kilometres (“km”) south of Salt Lake City in a historically significant silver producing district that also produced significant amounts of copper and gold. We believe the Tintic district has the potential to host a world-class copper-gold porphyry deposit. We own a majority of the surface land and mineral rights constituting the Tintic Project and we have option agreements in place to own the remaining surface land and mineral rights at Tintic.

Drilling in 2023 has advanced our understanding of the geology of this complex area and is guiding our ongoing exploration in 2024.

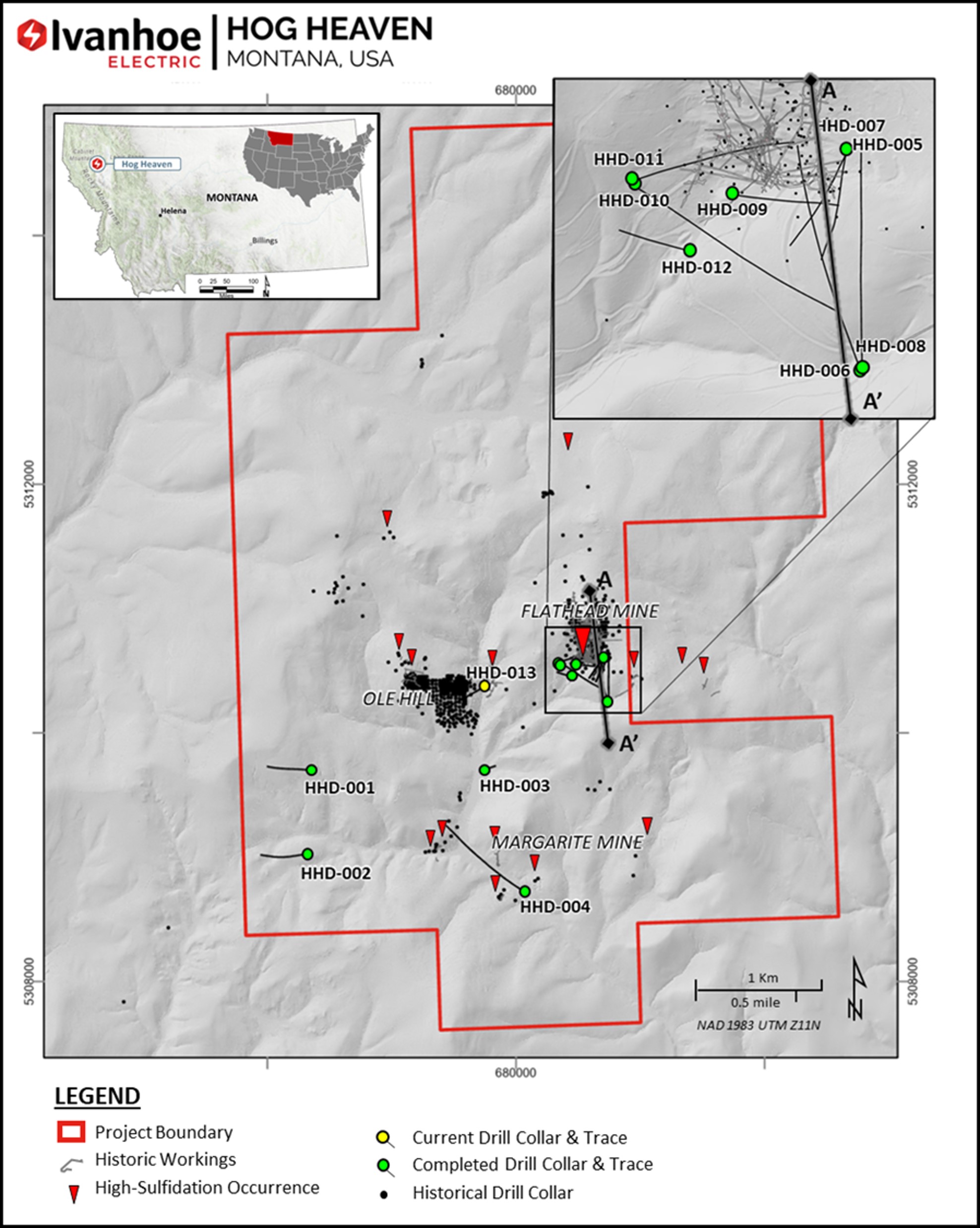

Our other mineral projects in the United States include the Hog Heaven Copper-Silver-Gold Project (“Hog Heaven”), located in Montana, where we have been actively drilling since June 2023. We also hold a portfolio of exploration projects throughout the United States, including projects in North Carolina, Nevada, and Oregon.

For purposes of Subpart 1300 of Regulation S-K (“S-K 1300”), we are defined as an exploration stage issuer because our two material properties, Santa Cruz and Tintic, are at the exploration stage and do not have any declared Mineral Reserves. Our other United States mineral properties are also in the exploration stage.

Map: United States Mineral Projects

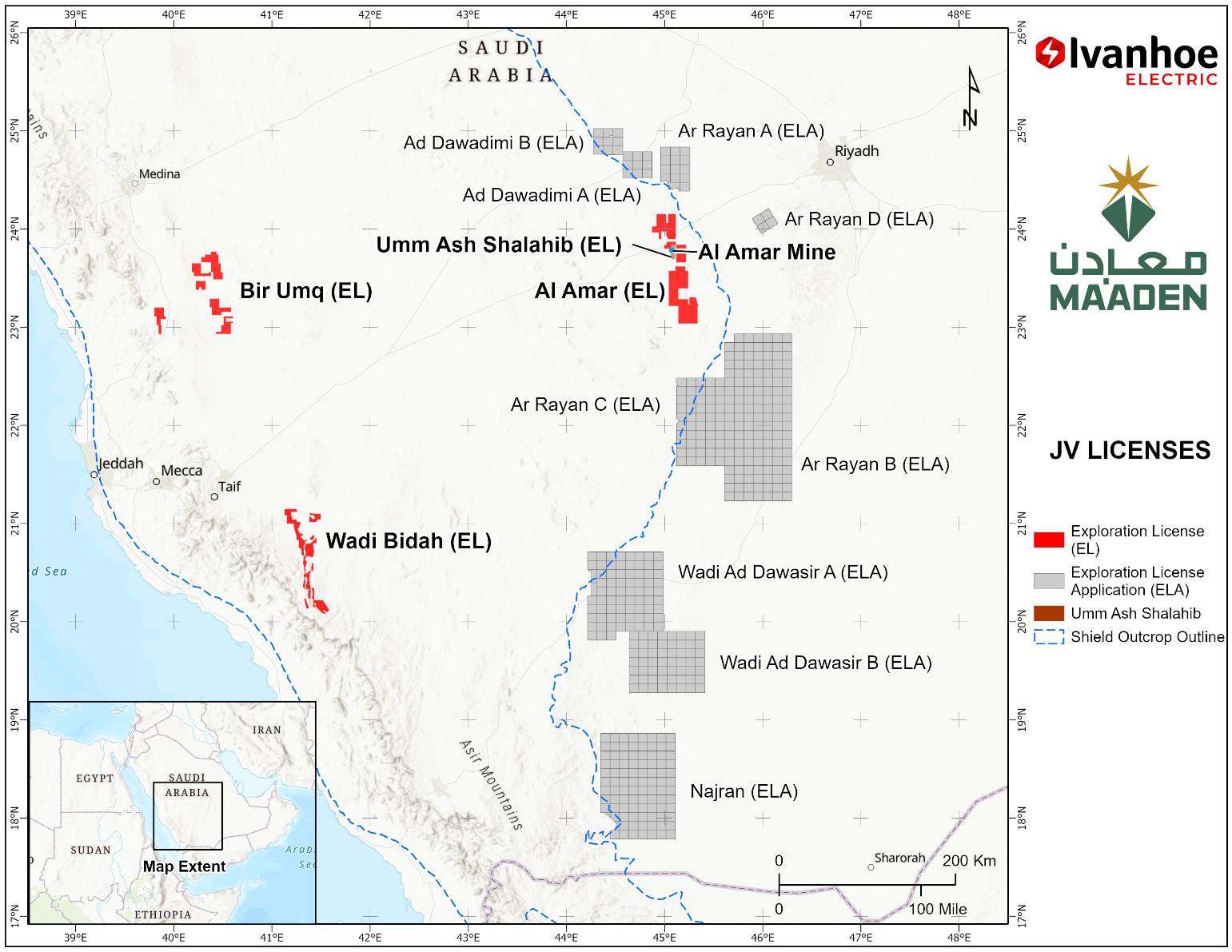

Ma’aden Ivanhoe Electric Exploration and Development Limited Company

In 2023, we established an exploration joint venture with the Saudi Arabian Mining Company (“Ma’aden”) (“Joint Venture”), The Joint Venture is owned 50/50 by Ivanhoe Electric and Ma’aden and has an initial term of five years, which may be extended up to 10 years upon mutual agreement of the parties. The Joint Venture is operating through the newly established limited liability company established under Saudi Arabian law (“Saudi JVCo”). Ma’aden has made available approximately 48,500 km2 of land under an exploration license (or license application) within Saudi Arabia for exploration by the Joint Venture. We contributed $66.4 million of the proceeds from the sale of our common shares to Ma’aden to fund Saudi JVCo and the Joint Venture, and provide Saudi JVCo with a royalty-free license to use Typhoon™ within Saudi Arabia for the purpose of mineral exploration. The license will remain exclusive to the Joint Venture in Saudi Arabia and effective during the term of the Joint Venture. Saudi JVCo has purchased three new generation Typhoon™ units from the Company’s former parent, I-Pulse, for an aggregate contract price not to exceed $13 million. The first new machine was delivered in the first quarter of 2024. The Joint Venture has also entered into a services agreement with Computational Geosciences Inc. (“CGI”), our 94% owned subsidiary, pursuant to which CGI is responsible for the supply of the services for the analysis of data and processing of the full spectrum of geophysical datasets produced by the Typhoon™ systems.

The Joint Venture is governed by a board of directors and technical committee comprised of an equal number of representatives from each company. The technical committee supervises the exploration activities of the Joint Venture including an initial “land identification stage” where the land Ma’aden has made available will be reviewed and reduced to the most prospective areas for Typhoon deployment. This stage will be followed by generative exploration and drilling stages aimed at identifying mineral resources of an economically viable scale. We are the operator during the exploration phase. Ma’aden will assume operatorship if an economically viable deposit is found and is designated by the Joint Venture for further development. We will also provide training and development to an agreed number of employees of the Joint Venture, on mineral exploration, geology, and the operation of the Typhoon™ units. The Joint Venture is not terminable, other than upon the occurrence of an event of default, by either party until the end of the exploration phase.

Other International Mineral Projects

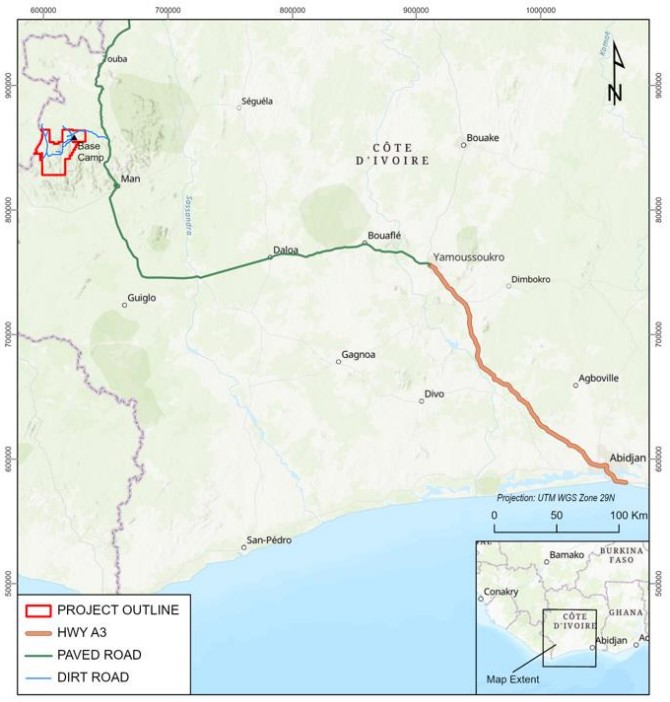

Our other mineral projects outside of the United States include the Alacran Project in Colombia, the Ivory Coast Project in Ivory Coast, and the Pinaya Project in Peru.

The Alacran Project (also known as the San Matias Project) is owned by our publicly-traded subsidiary Cordoba Minerals Corp. (“Cordoba”). At December 31, 2023, we owned 62.8% of Cordoba’s issued and outstanding shares. The Alacran Project is being developed jointly between Cordoba and JCHX Mining Management Co., Ltd. (“JCHX”).

Alacran is located in the Municipality of Puerto Libertador, Department of Córdoba, Colombia, and is approximately 200 km north of the city of Medellín. The Alacran Project hosts the El Alacrán, Costa Azul, Montiel East, and Montiel West deposits across various mining titles.

A new Feasibility Study was announced on December 18, 2023, “NI 43-101 Technical Report, Feasibility Study, Alacran Project, in Colombia.” Initial capital cost is estimated to be approximately $420.4 million for the construction of a conventional truck-shovel open pit mine. The Project is anticipated to hold an after-tax Net Present Value (“NPV”) of $360 million with an Internal Rate of Return (“IRR”) of 23.8% and a payback period of 3 years. The Project’s mine life is projected to be 14.0 years in addition to the estimated two years of construction and pre-production mining, during which, freshly mined ore will be stockpiled alongside historical tailings. The estimated LOM cash costs for copper, net of by-product credits, is $1.35/lb with by-product credits at $1.31/lb, and a total estimated LOM cash cost at $2.66/lb (cash costs excludes sustaining capital).

The Ivory Coast Nickel-Copper Project, in Ivory Coast is focused on the Samapleu-Grata deposits and is operated through a joint venture, the Samapleu Nickel Corporation Inc., with our partner, Sama Resources. At December 31, 2023, we owned 30% of the joint venture with the option to earn up to a 60% interest.

A new report titled “NI 43-101 Technical Report, Mineral Resource Estimate for the Samapleu and Grata Deposits Project” with an effective date of June 27, 2023 was released August 14, 2023. The Project now includes the Grata deposit nearly doubling the mineral resources compared with the 2020 preliminary economic assessment.

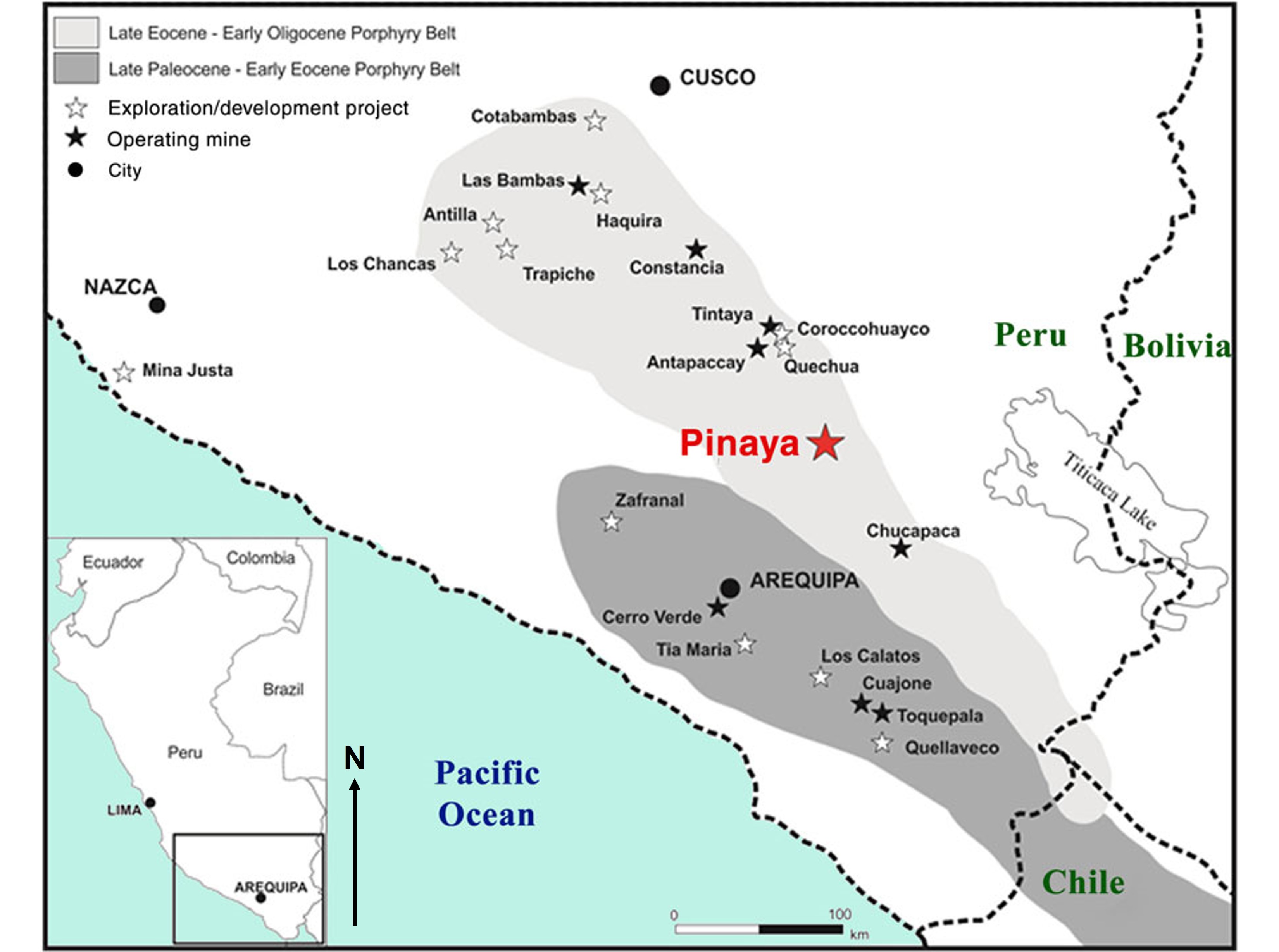

The Pinaya Gold-Copper Project, which is wholly-owned by our subsidiary Kaizen, covers approximately 101 km2 of granted title, plus an additional 28 km2 under application and includes more than 10 km of underexplored strike length in southeastern Peru. The Project is an intermediate stage exploration project and includes a NI 43-101 Mineral Resource Estimate titled Pinaya Gold-Copper Project, Caylloma and Lampa Provinces, Peru, NI 43-101 Technical Report with an effective date of April 26, 2016. On February 6, 2024, we completed an arrangement pursuant to which we acquired all of the remaining issued and outstanding common shares of Kaizen.

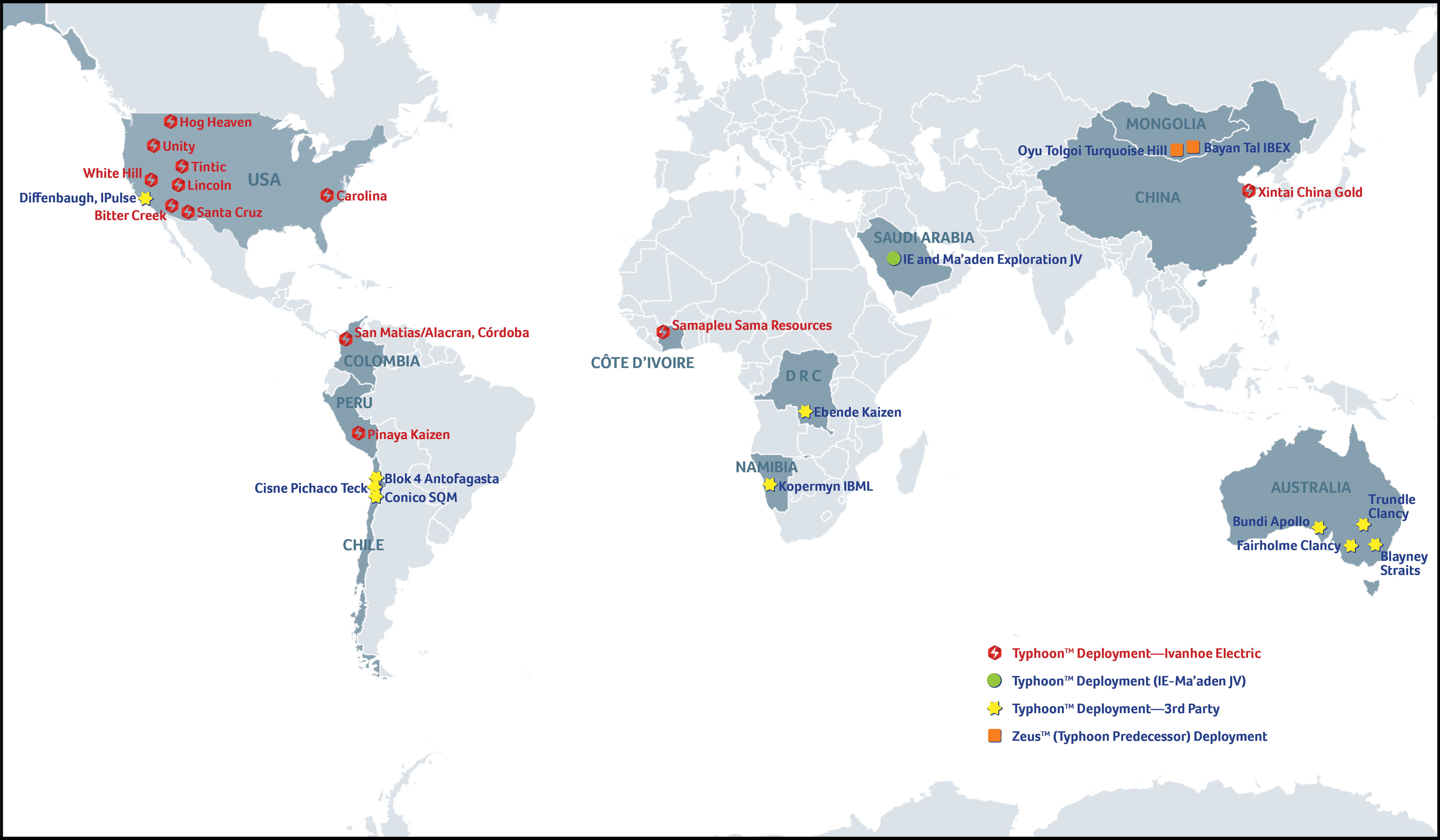

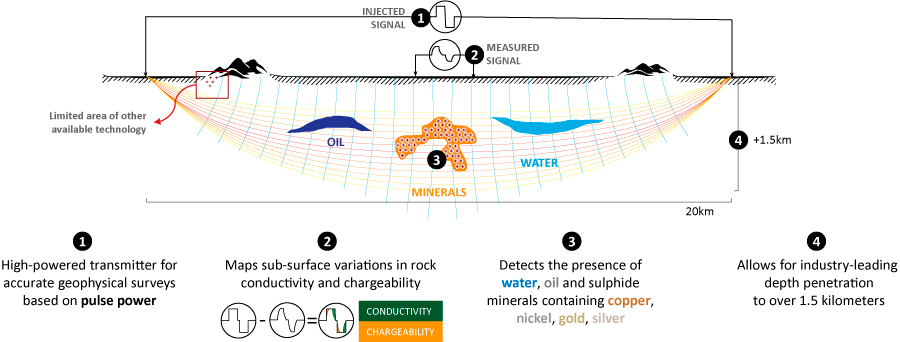

Typhoon and Computational Geosciences

In addition to our portfolio of mineral projects, we own, through a wholly-owned subsidiary, patents to a proprietary exploration technology known as Typhoon™. We also own a 94% controlling interest in a data inversion business, Computational Geosciences Inc. (“CGI”). CGI was founded in 2010 to commercialize innovative technology developed at the University of British Columbia, Canada to improve and enhance mineral exploration.

The Typhoon™ technology allows us to cost effectively and efficiently generate geophysical images of large-scale mineral deposits to depths of one and a half kilometers or more. CGI software technology consists of sophisticated codes to process geophysical data and build three-dimensional (“3D”) subsurface images that could indicate the presence of various sulfide metals and minerals.

Typhoon™ can and has been used successfully to accelerate and de-risk the exploration process enabling a higher frequency of resource discovery and lowering total exploration costs. Typhoon™ has proven to be an important exploration tool during its deployment at Santa Cruz and Tintic. In July 2022, we completed a 26.5 km2 (6,500-acre) Typhoon™ 3D induced polarization and resistivity geophysical survey at Santa Cruz which identified multiple large-scale anomalies. The Texaco Ridge Exploration Area was identified in a Typhoon™ survey in September 2022. Ivanhoe Electric drilled 10 holes totaling 8,606 meters (“m”) with a single rig at Texaco Ridge during the first half of 2023. The intention of this drilling was to step out into areas beyond the drilled Texaco Deposit that showed high mineralization potential based on Typhoon™ survey results. Hole SCC-122 at Texaco Ridge intersected broad primary sulfides with an intercept of 327 m @ 0.81% total copper (from 564 m), using a 0.39% total copper cut-off. This intercept includes several zones at the same 0.8% total copper cut-off grade as the nearby Texaco mineral resource. Typhoon™ has also been utilized at many of our other projects. Current and historical deployment of Typhoon™ by us, High Power Exploration Inc. (“HPX”) and third-party clients is shown on the map below.

Map: Current and historical deployment of Typhoon™ by us, HPX, and third-party clients.

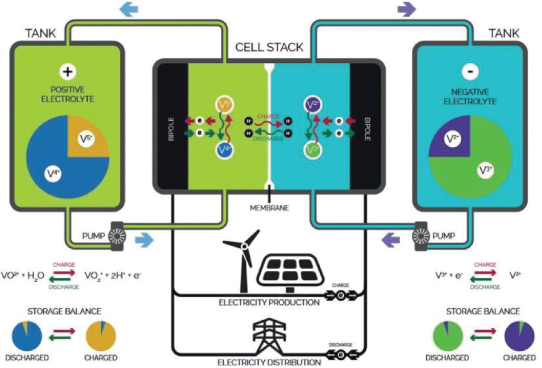

VRB Energy

VRB Energy, Inc. (“VRB”) is primarily engaged in the design, manufacture, installation, and operation of large-scale energy storage systems using vanadium redox batteries. VRB’s major product is VRB-ESS®.

Vanadium redox batteries are a type of rechargeable flow battery that employs vanadium ions as the charge carriers. We believe they are safe, scalable and have the lowest lifecycle cost of energy compared to other types of batteries, making them ideal for grid-scale energy storage. VRB’s goal is to deliver the best technology at the lowest cost to large-scale utility energy storage projects globally. VRB has over 500 MWh of energy storage capacity installed or in development and has completed over one million hours of testing and operation. Ongoing research and development and project experience have allowed VRB to produce larger, more cost-effective and efficient systems in each successive battery generation. VRB intends to produce VRB-ESS® using vanadium recycled from industrial waste. In July 2021, BCPG Public Company Limited (“BCPG”), one of Asia- Pacific’s largest renewable energy companies, invested $24 million in convertible bonds issued by VRB. As of December 31, 2023, we owned approximately 90.0% of the outstanding shares of VRB.

Mineral Projects

Our portfolio of highly prospective mineral projects, predominantly focused on copper and other metals needed for the clean energy transition, has been assembled by Robert Friedland and his team over the past decade.

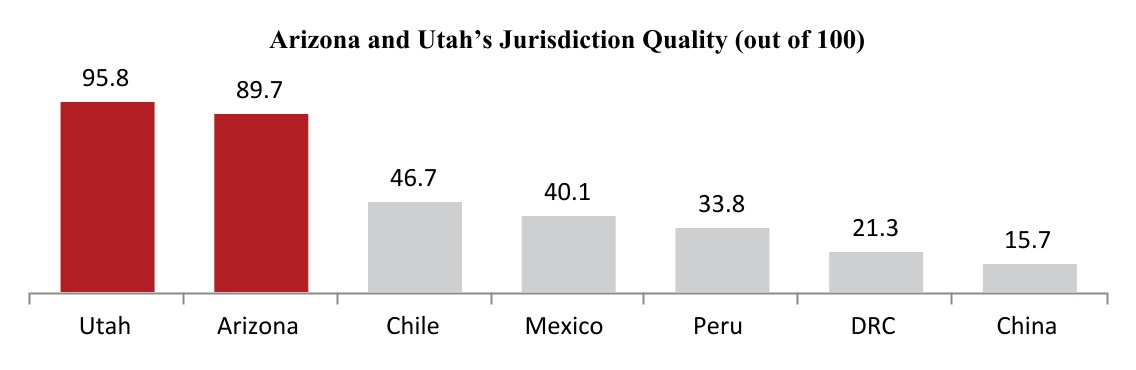

Our two material mineral projects are the Santa Cruz and Tintic Projects, which are situated in the high-quality copper producing jurisdictions of Arizona and Utah, respectively. According to the Fraser Institute’s Annual Survey of Mining Companies, Utah and Arizona rank as some of the most attractive copper mining investment jurisdictions compared to other major copper mining jurisdictions around the world.

___________

Source: Fraser Institute 2022 Policy Perception Index

Quality Assurance/Quality Control

Throughout all of our mineral exploration properties, quality assurance and quality control (“QA/QC”) measures are in place to ensure the reliability and trustworthiness of our exploration data. These measures include written standard operating procedures and independent verifications of aspects such as drilling, surveying, sampling, assaying, data management, and database integrity. Appropriate documentation of QC measures and regular analysis of QC data is essential as a safeguard for project data and form the basis for the QA program implemented during exploration.

Analytical QC measures involve internal and external laboratory procedures implemented to monitor the precision and accuracy of the sample preparation and assay data. These measures are also important to identify potential sample sequencing errors and to monitor for contamination of samples.

We submit a blank, standard, or duplicate sample on every seventh sample. Sampling and analytical QA/QC protocols typically involve taking duplicate samples and inserting QC samples (certified reference material (CRM) and blanks) to monitor the assay results' reliability throughout the drill program.

Samples are securely shipped to reputable analytical laboratories with global quality management systems that meets all requirements of the international standards ISO/IEC 17025:2017 and ISO 9001:2015. The independent labs that we use have robust internal QA/QC program to monitor and ensure quality of assay and other analytical results.

United States

Santa Cruz Project, Arizona, USA (the “Santa Cruz Project”)

As used herein, references to the “Santa Cruz Initial Assessment” or “IA” is to the “S-K 1300 Initial Assessment & Technical Report Summary, Santa Cruz Project, Arizona”, by qualified persons SRK Consulting (U.S.), Inc., KCB Consultants Ltd., Life Cycle Geo, LLC, M3 Engineering and Technology Corp., Nordmin Engineering Ltd. (“Nordmin”), Call & Nicholas, Inc., Tetra Tech, Inc., INTERA Incorporated, Haley & Aldrich, Inc., and Met Engineering, LLC (collectively, the “Santa Cruz Qualified Persons”), dated September 6, 2023 and still current as of December 31, 2023. It was prepared in accordance with the requirements of S-K 1300. None of the Santa Cruz Qualified Persons is affiliated with us or any other entity that has an ownership, royalty or other interest in the Santa Cruz Project. The Technical Report Summary on the Santa Cruz Project, Arizona, U.S.A. is included as Exhibit 96.1 hereto. Scientific and technical information in this section is based upon, or in some cases extracted from these reports.