Document

Exhibit 99.4

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (this “MD&A”) for IREN Limited should be read together with our unaudited interim consolidated financial statements for the three and nine months ended March 31, 2025 and the related notes thereto included elsewhere in the Report on Form 6-K of which this MD&A forms a part (this “Form 6-K”), and our audited consolidated financial statements as of and for the fiscal year ended June 30, 2024 and the related notes included in our Annual Report on Form 20-F for the year ended June 30, 2024, as amended on Form 20-F/A, (as so amended, our “Annual Report”), which is available through the U.S. Securities and Exchange Commission’s (“SEC”) Electronic Data Gathering and Analysis Retrieval (“EDGAR”) system at http://www.sec.gov. This MD&A is based on our financial information prepared in accordance with the IFRS, as issued by the IASB, which may differ in material respects from generally accepted accounting principles in other jurisdictions, including U.S. GAAP.

All references to “U.S. dollars,” “dollars,” “$,” “USD” or “US$” are to the U.S. dollar. All references to “Australian dollars,” “AUD” or “A$” are to the Australian dollar, the official currency of Australia. All references to “Canadian dollars,” “CAD” or “C$” are to the Canadian dollar, the official currency of Canada. All references to “IFRS” are to International Financial Reporting Standards, as issued by the International Accounting Standards Board, or the “IASB”.

Unless otherwise indicated or the context otherwise requires, all references in this MD&A to the terms “the Company,” “the Group,” “our,” “us,” and “we” refer to IREN Limited and its subsidiaries.

The consolidated financial statements which accompany this MD&A and are included in this Form 6-K are presented in U.S. dollars, which is IREN Limited’s presentation currency. We prepared our unaudited interim consolidated financial statements for the three and nine months ended March 31, 2025 and 2024 in accordance with IFRS, as issued by the IASB. Unless otherwise noted, our financial information presented herein is stated in U.S. dollars, our presentation currency.

Amounts in this MD&A have been rounded off to the nearest thousand dollars, or in certain cases, the nearest dollar.

Forward-Looking Statements

This MD&A contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve substantial risks and uncertainties. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies and trends we expect to affect our business. These statements often include words such as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “potential,” “could,” “would,” “may,” “will,” “forecast,” and other similar expressions. These forward-looking statements are contained throughout this MD&A. We base these forward-looking statements on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances and at such time. As you read and consider this MD&A, you should understand that these statements are not guarantees of future performance or results. The forward-looking statements are subject to and involve risks, uncertainties and assumptions and you should not place undue reliance on these forward-looking statements . Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our actual financial results or results of operations, and could cause actual results to differ materially from those expressed in the forward-looking statements. Factors that may materially affect such forward-looking statements include, but are not limited to:

•Bitcoin price and foreign currency exchange rate fluctuations;

•our ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet our capital needs and facilitate our expansion plans;

•the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require us to comply with onerous covenants or restrictions, and our ability to service our debt obligations, any of which could restrict our business operations and adversely impact our financial condition, cash flows and results of operations;

•our ability to successfully execute on our growth strategies and operating plans, including our ability to continue to develop our existing data center sites, design and deploy direct-to-chip liquid cooling systems, and diversify and expand into the market for high performance computing (“HPC”) solutions (including the market for cloud services (“AI Cloud Services”) and potential colocation services);

•our limited experience with respect to new markets we have entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services and potential colocation services);

•expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network;

•expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services and potential colocation services) we offer;

•our ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to our strategy to expand into markets for HPC solutions (including AI Cloud Services and potential colocation services);

•our ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of our HPC solutions (including AI Cloud Services and potential colocation services) and other counterparties;

•the risk that any current or future customers, including customers of our HPC solutions (including AI Cloud Services and potential colocation services) or other counterparties, may terminate, default on or underperform their contractual obligations;

•Bitcoin global hashrate fluctuations;

•our ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all;

•delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects;

•our reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and our ability to maintain relationships with such parties;

•expectations regarding availability and pricing of electricity;

•our participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators;

•the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to us;

•any variance between the actual operating performance of our miner hardware achieved compared to the nameplate performance including hashrate;

•our ability to curtail our electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices;

•actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which we operate;

•the availability, suitability, reliability and cost of internet connections at our facilities;

•our ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services and potential colocation services) we offer, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware;

•expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services and potential colocation services) we offer);

•delays, increases in costs or reductions in the supply of equipment used in our operations including as a result of tariffs and duties, and certain equipment being in high demand due to global supply chain constraints;

•changing political and geopolitical conditions, including changing international trade policies and the implementation of wide-ranging, reciprocal and retaliatory tariffs and trade restrictions;

•our ability to operate in an evolving regulatory environment;

•our ability to successfully operate and maintain our property and infrastructure;

•reliability and performance of our infrastructure compared to expectations;

•malicious attacks on our property, infrastructure or IT systems;

•our ability to maintain in good standing the operating and other permits and licenses required for our operations and business;

•our ability to obtain, maintain, protect and enforce our intellectual property rights and confidential information;

•any intellectual property infringement and product liability claims;

•whether the secular trends we expect to drive growth in our business materialize to the degree we expect them to, or at all;

•any pending or future acquisitions, dispositions, joint ventures or other strategic transactions;

•the occurrence of any environmental, health and safety incidents at our sites, and any material costs relating to environmental, health and safety requirements or liabilities;

•damage to our property and infrastructure and the risk that any insurance we maintain may not fully cover all potential exposures;

•ongoing proceedings relating to the default by two of the Company’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default, and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom;

•our failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions;

•any failure of our compliance and risk management methods;

•any laws, regulations and ethical standards that may relate to our business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services we offer, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws;

•our ability to attract, motivate and retain senior management and qualified employees;

•increased risks to our global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things;

•climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect our business, financial condition and results of operations;

•public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response;

•our ability to remain competitive in dynamic and rapidly evolving industries;

•damage to our brand and reputation;

•our ability to remediate our existing material weakness and to establish and maintain an effective system of internal controls;

•expectations relating to environmental, social or governance issues or reporting;

•the costs of being a public company;

•the increased regulatory and compliance costs of us ceasing to be a foreign private issuer and an emerging growth company, as a result of which we will be required, among other things, to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC commencing with our next fiscal year, and we will also be required to prepare our financial statements in accordance with U.S. GAAP rather than IFRS and to modify certain of our policies to comply with corporate governance practices required of a U.S. domestic issuer;

•that we do not currently pay any cash dividends on our ordinary shares, and may not in the foreseeable future and, accordingly, your ability to achieve a return on your investment in our ordinary shares will depend on appreciation, if any, in the price of our ordinary shares; and

•other risk factors disclosed under “Item 3.D. Key Information—Risk Factors” in our Annual Report, as such factors may be updated from time to time in our other filings with the SEC, including under the caption “Risk Factors” in this Management's Discussion and Analysis of Financial Condition and Results of Operations, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of the Company’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this MD&A. Any forward-looking statement that the Company makes in this MD&A speaks only as of the date of such statement. Except as required by law, the Company disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

We are a leading owner and operator of next-generation data centers powered by 100% renewable energy (whether from clean or renewable energy sources or through the purchase of renewable energy certificates (“RECs”)). Our data centers are purpose-built for power dense computing applications and today support a combination of ASICs for Bitcoin mining and GPUs for AI workloads.

Our Bitcoin mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of our specialized computers called ASICs (which we refer to as “Bitcoin miners”) and exchanging these Bitcoin for fiat currencies, such as U.S. dollars or Canadian dollars.

We have been mining Bitcoin since 2019. We typically liquidate all the Bitcoin we mine daily and therefore did not have any Bitcoin held on our balance sheet as of March 31, 2025. To date we have utilized Kraken, a U.S.-based digital asset trading platform, to liquidate the Bitcoin we mine. The mining pools that we utilize for the purposes of our Bitcoin mining transfer the Bitcoin that we have mined to Kraken on a daily basis. Such Bitcoin is then exchanged for fiat currency on the Kraken exchange or via its over-the-counter trading desk. We have a backup U.S.-based digital asset trading platform, Coinbase, although we have not utilized Coinbase as of March 31, 2025.

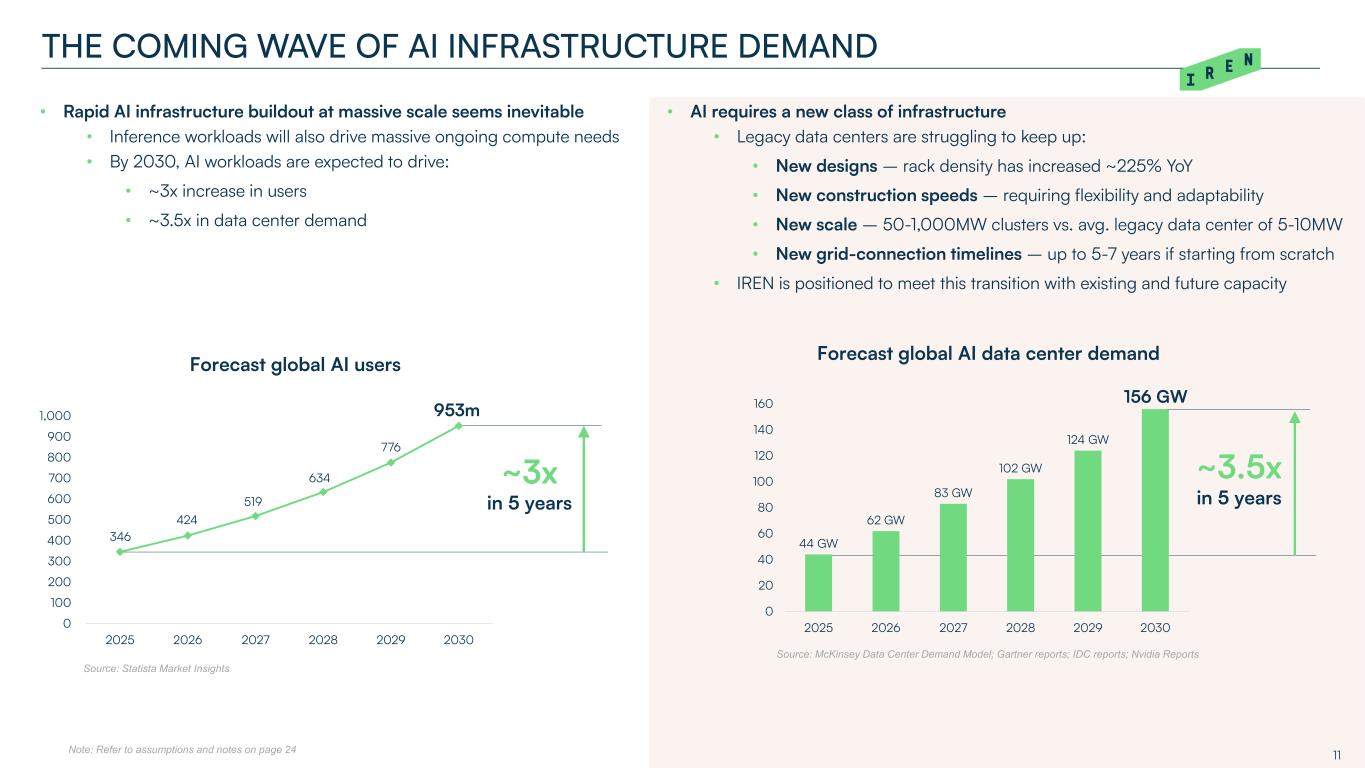

We are also pursuing a strategy to expand and diversify our revenue streams into new markets. Pursuant to that strategy, we are increasing our focus on diversification into HPC solutions, including the provision of AI Cloud Services and potential colocation services.

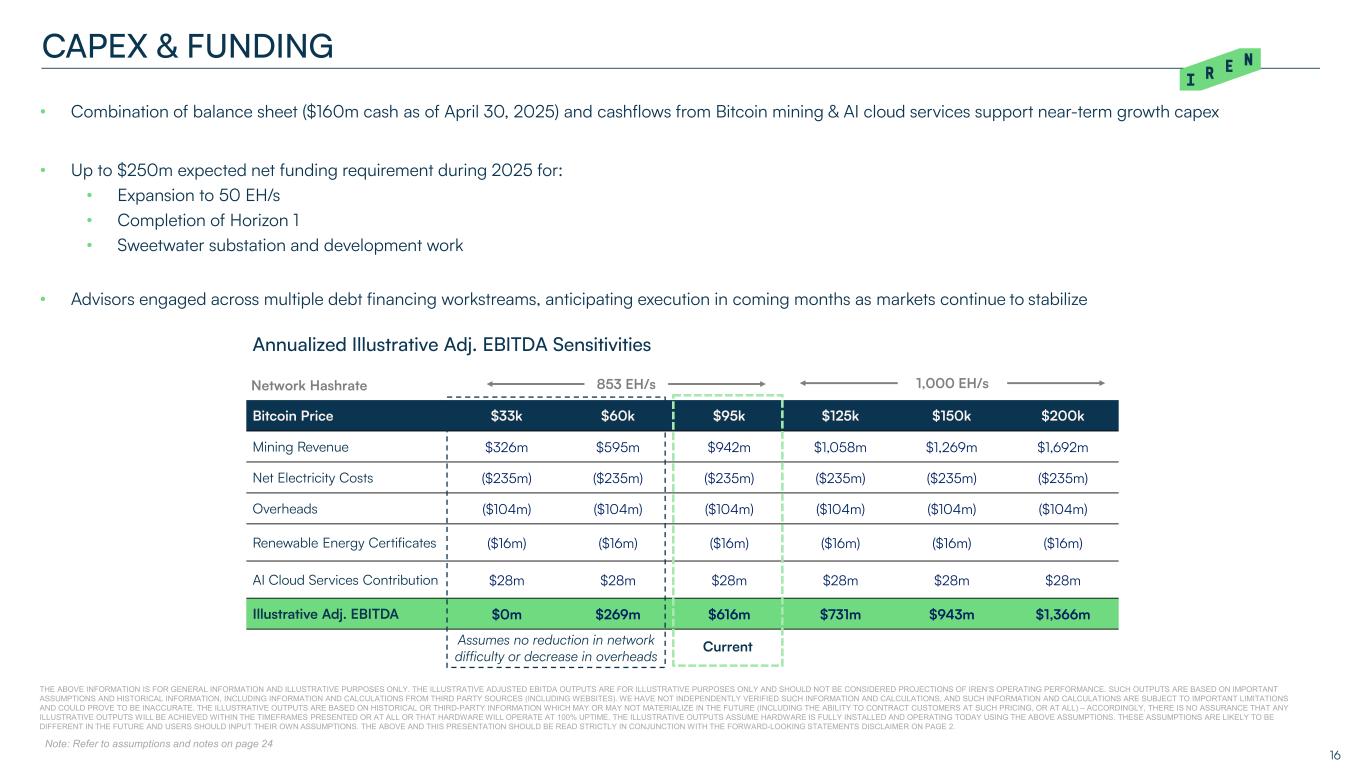

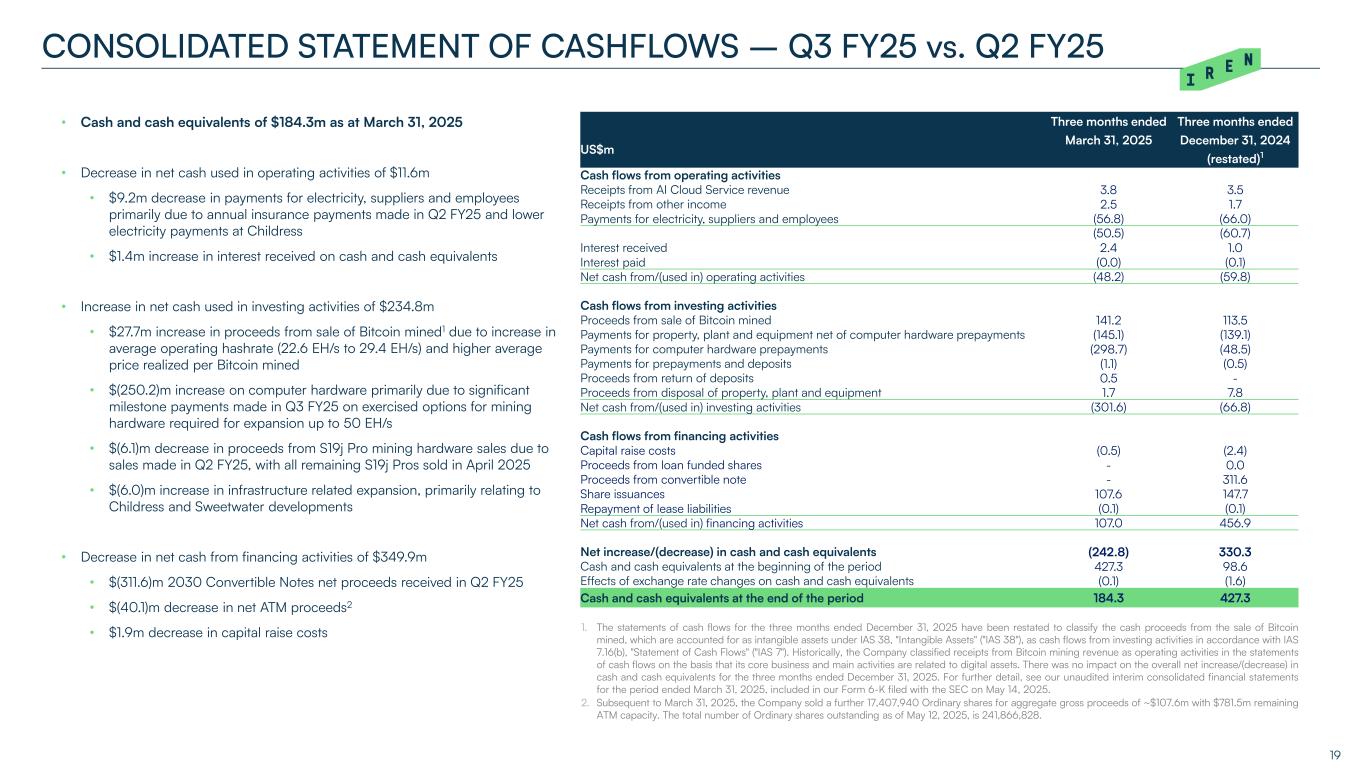

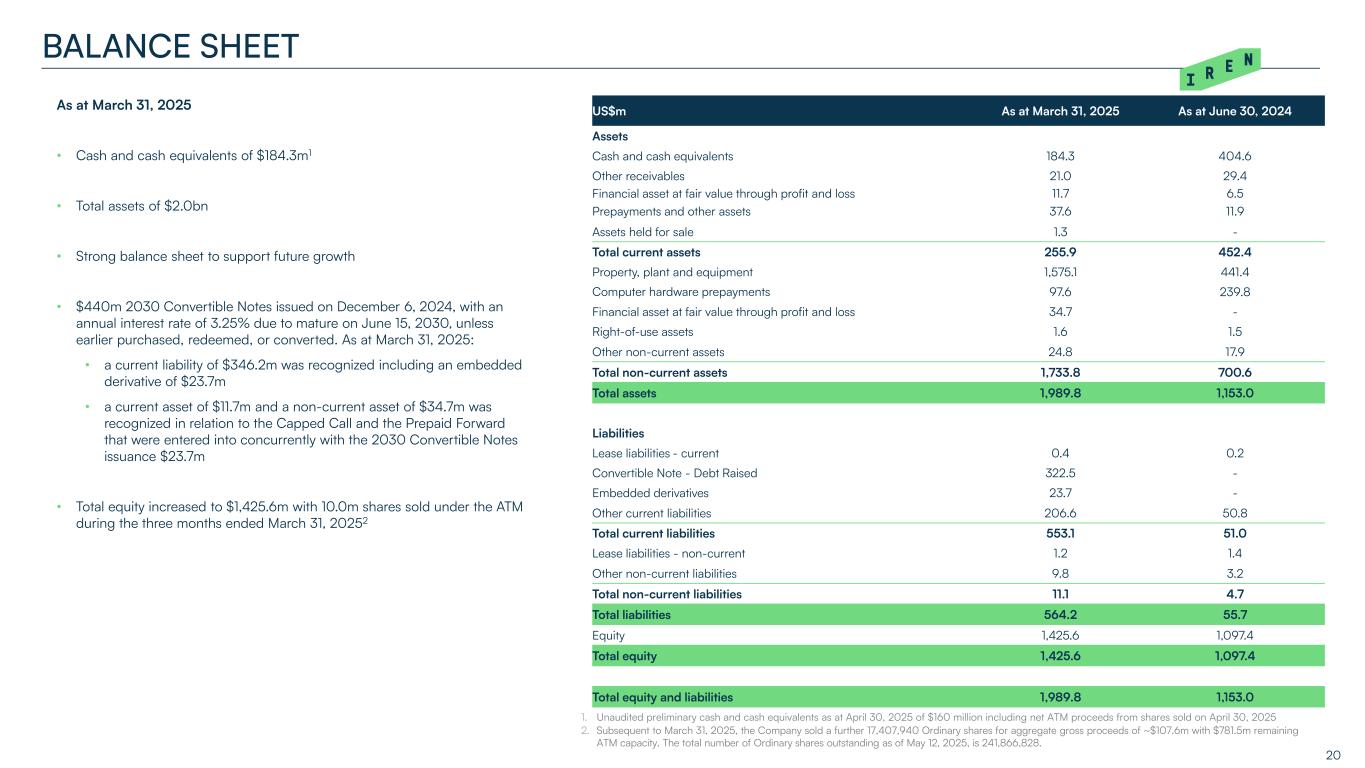

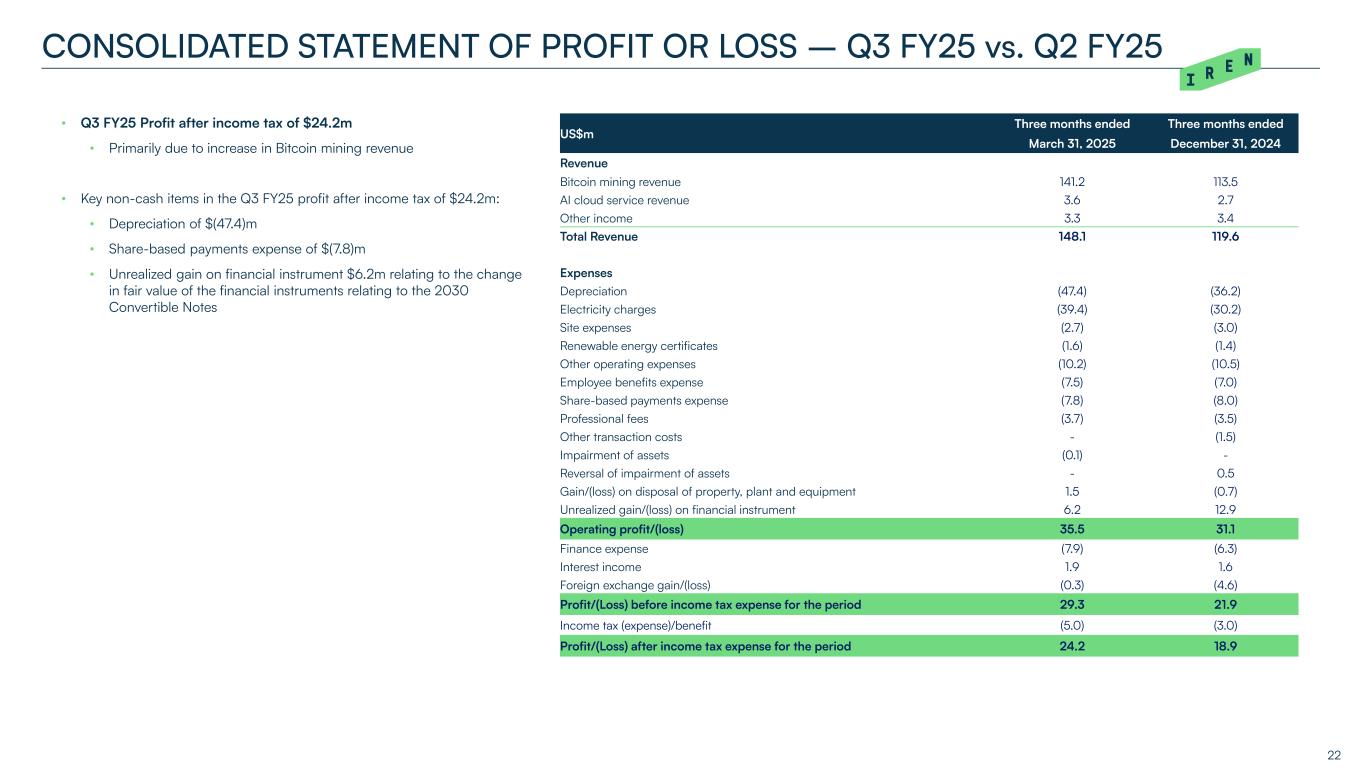

Our cash and cash equivalents were $184.3 million as of March 31, 2025. Our total revenue was $322.1 million and $131.3 million for the nine months ended March 31, 2025 and 2024, respectively, and $148.1 million and $54.3 million for the three months ended March 31, 2025 and 2024, respectively. We generated a loss after income tax expense of $8.6 million and $1.9 million for the nine months ended March 31, 2025 and 2024, respectively, and a profit of $24.2 million and $8.6 million for the three months ended March 31, 2025 and 2024, respectively. We generated EBITDA of $126.8 million and $22.5 million for the nine months ended March 31, 2025 and 2024, respectively, and $82.7 million and $19.4 million for the three months ended March 31, 2025 and 2024, respectively. We generated Adjusted EBITDA of $148.5 million and $42.5 million for the nine months ended March 31, 2025 and 2024, respectively, and $83.3 million and $21.8 million for the three months ended March 31, 2025 and 2024, respectively. EBITDA and Adjusted EBITDA are financial measures not defined by IFRS. For a definition of EBITDA and Adjusted EBITDA, an explanation of our management’s use of these measures and a reconciliation of EBITDA and Adjusted EBITDA to profit/(loss) after income tax expense, see “Key Indicators of Performance and Financial Conditions.”

Our Data Centers

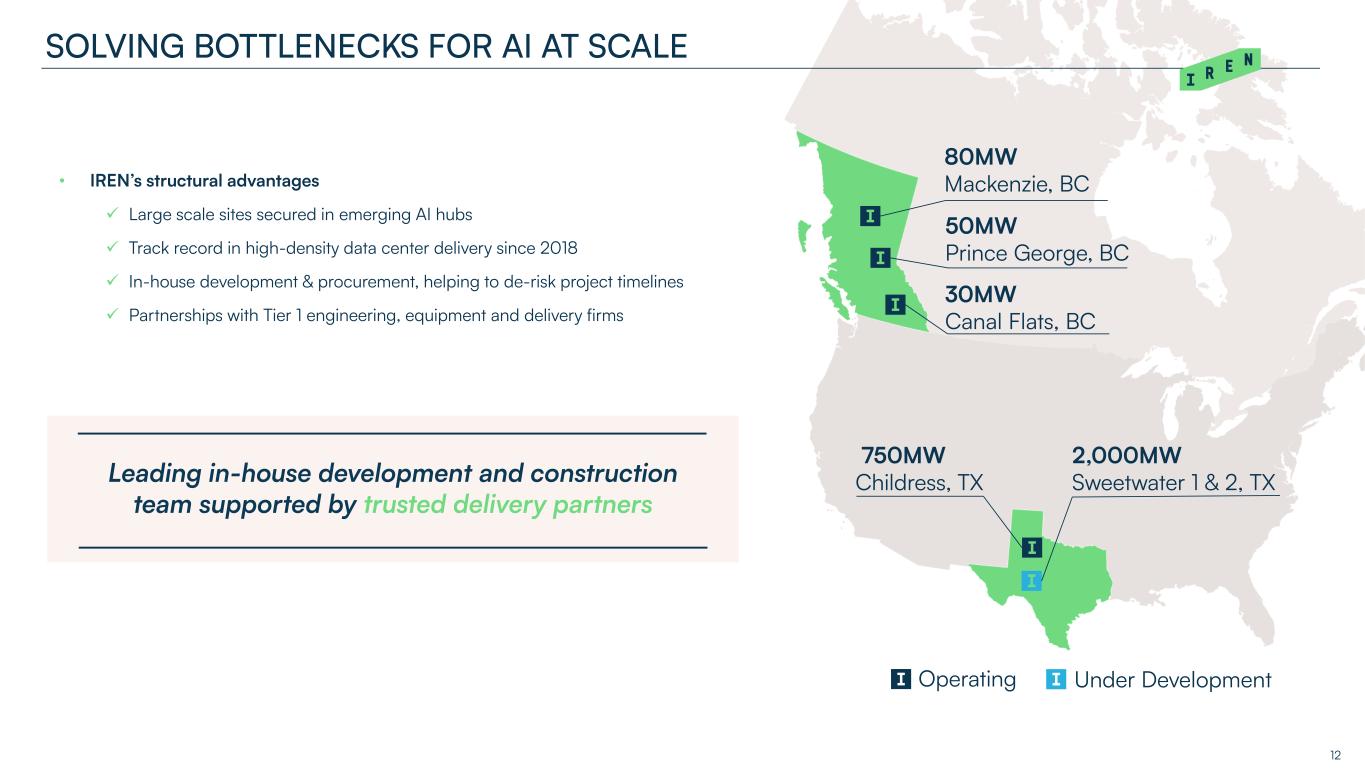

We are a vertically integrated business, and currently own and operate our computing hardware consisting of Bitcoin mining ASICs and AI Cloud Services GPUs, as well as our electrical infrastructure and data centers. We target development of data centers in regions where there are low-cost, abundant, and attractive renewable energy sources. We have ownership of our proprietary data centers and electrical infrastructure, as well as the land at our sites. This provides us with additional security and operational control over our assets. We believe data center ownership also allows our business to benefit from more sustainable cash flows and operational flexibility in comparison with operators that rely upon third-party hosting services or short-term land leases which may be subject to termination rights, profit sharing arrangements and/or potential changes to contractual terms such as pricing. We assess opportunities to utilize our available data center capacity and our power capacity on an ongoing basis, including via potential third party hosting and alternative revenue sources. We also focus on grid-connected power access which we believe not only helps facilitate a more reliable, long-term supply of power, but also provides us with the ability to support the energy markets in which we operate (for example, through potential participation in demand response, ancillary services provision, and load management in deregulated markets such as Texas).

We have three data center sites in British Columbia, Canada (“BC”). Our Canal Flats site was acquired from PodTech Innovation Inc. and certain of its related parties in January 2020, and has been operating since 2019. As of March 31, 2025, it had approximately 30MW of data center capacity and hashrate capacity of approximately 1.6 EH/s. Our Mackenzie site has been operating since April 2022 and, as of March 31, 2025, had approximately 80MW of data center capacity and hashrate capacity of approximately 5.2 EH/s. Our Prince George site has been operating since September 2022 and, as of March 31, 2025, had approximately 50MW of data center capacity and hashrate capacity of approximately 3.1 EH/s. Our deployment of 1,896 NVIDIA H100 and H200 GPUs is also located at our Prince George site.

Each of our sites in British Columbia are connected to the British Columbia Hydro and Power Authority (“BC Hydro”) electricity transmission network and have been 100% powered by renewable energy since commencement of operations (currently approximately 98% sourced from clean or renewable sources, including through hydroelectric sources, as reported by BC Hydro and approximately 2% accounted for by the purchase of RECs). BC Hydro retains the environmental attributes from the renewable energy they sell us. Our contracts with BC Hydro have an initial term of one year and, unless terminated at the end of the initial term shall extend until terminated in accordance with the terms of the agreement upon six months’ notice.

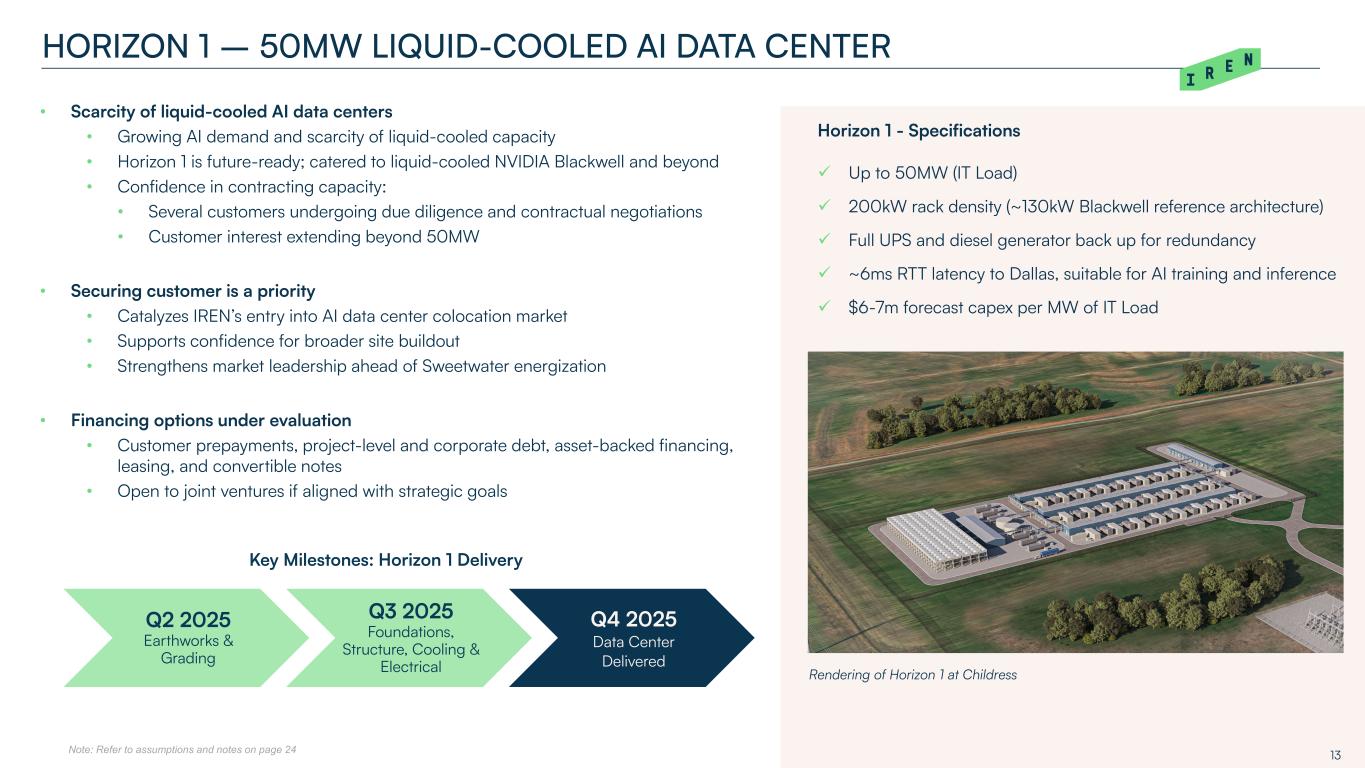

We have three data center sites in the renewables-heavy region of West Texas, United States. Our 750MW site in Childress has been operating since April 2023 and, as of March 31, 2025, had 500MW of data center capacity and hashrate capacity of approximately 27.1 EH/s. As of March 31, 2025, we have purchased RECs in respect of 100% of our energy consumption to date at our Childress site. We are currently undertaking an expansion of our data center capacity at Childress, targeting 650MW to support our hashrate expansion to 50 EH/s in the first half of 2025 and a direct-to-chip liquid cooling deployment to support an IT load of up to 50MW (based on rack density of 200kW, subject to customer requirements) for potential growth opportunities for HPC solutions at our Childress site.

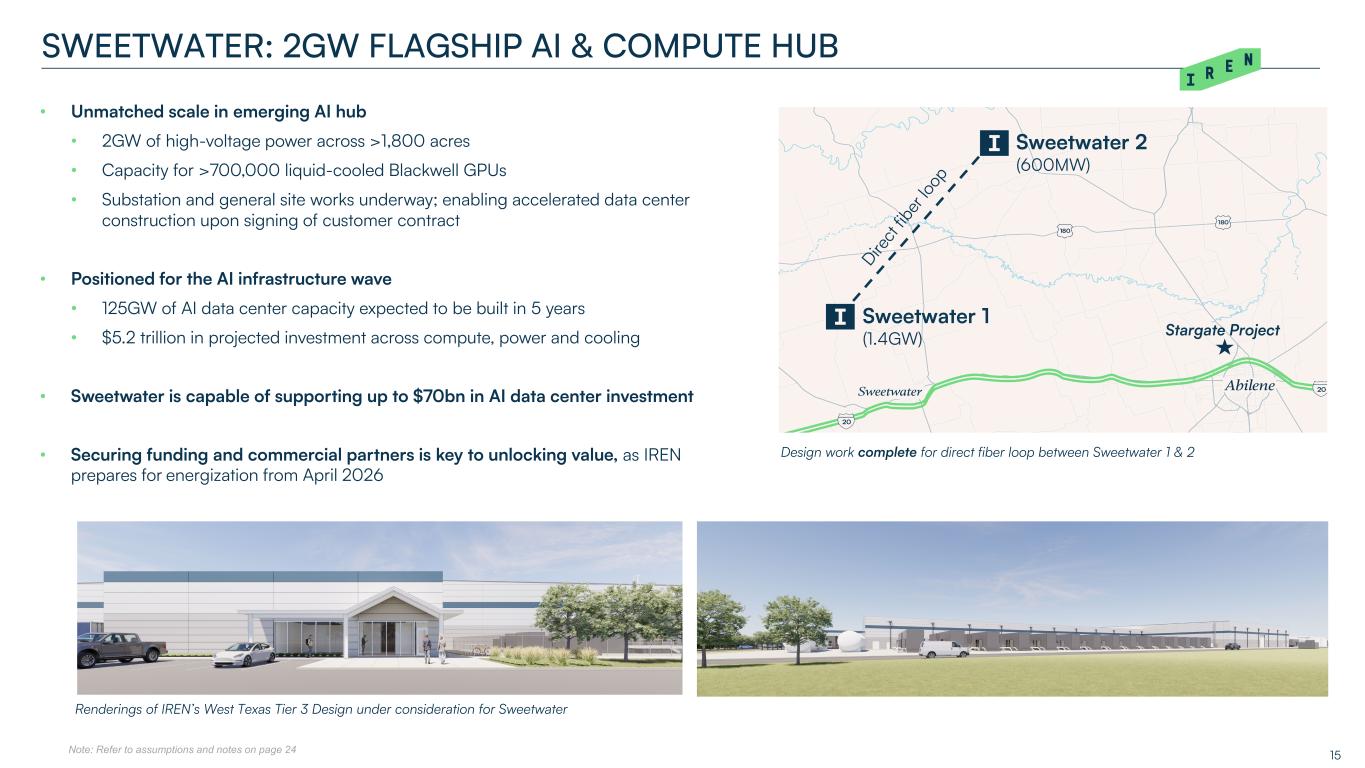

Our 1,400MW Sweetwater 1 and 600MW Sweetwater 2 sites are under development and located approximately 40 miles miles from Abilene, Texas. As of March 31, 2025 we had paid $11.7 million of connection deposits to connect Sweetwater 1 directly to the Electricity Reliability Council of Texas (“ERCOT”) grid. We expect to pay up to $26.9 million in connection deposits and up to $4.1 million in non-refundable connection costs over the next 12 months, primarily related to our Sweetwater 2 site.

We are targeting a substation energization date of April 2026 and late 2027 for Sweetwater 1 and Sweetwater 2, respectively. Design works are underway for a direct fiber loop between Sweetwater 1 and Sweetwater 2.

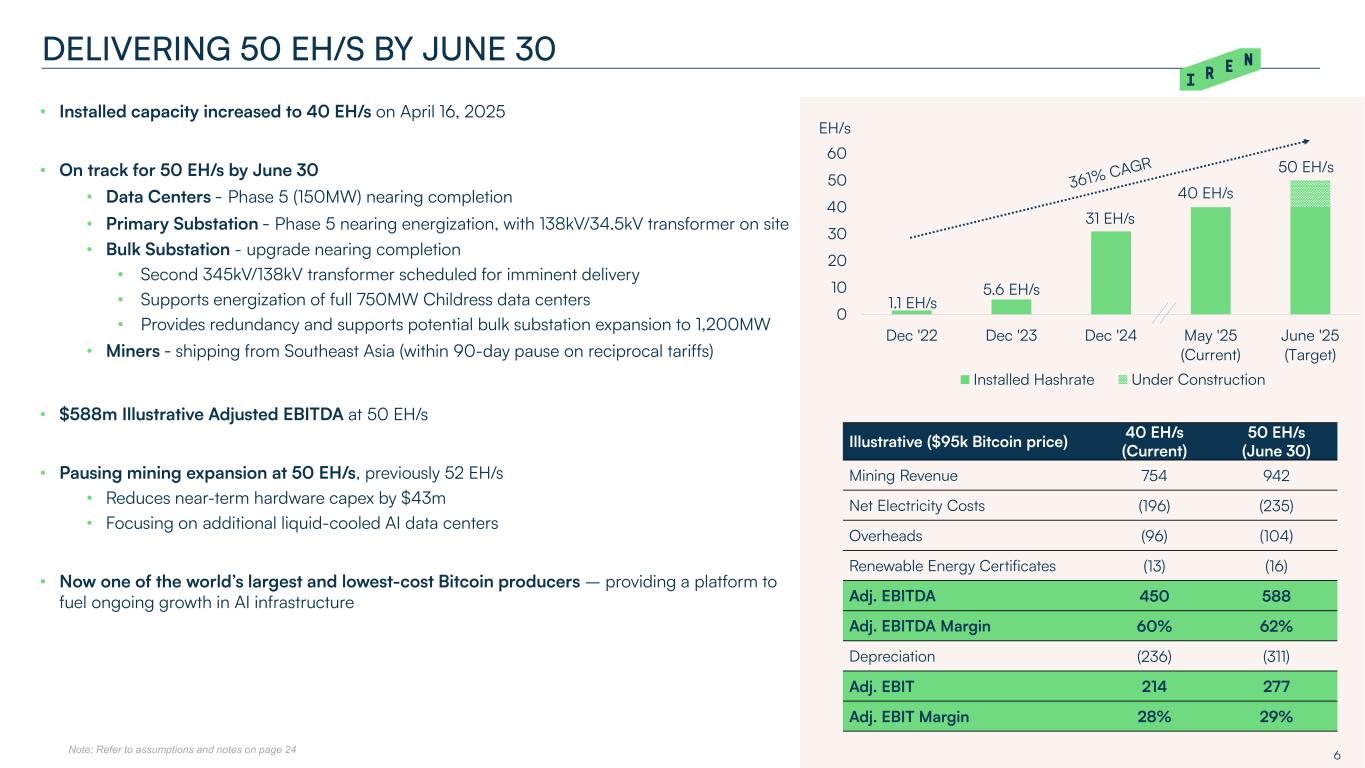

As of March 31, 2025, we had approximately 660MW of data center capacity and installed hashrate capacity of approximately 37 EH/s across our sites in BC (160MW) and Texas (500MW). In addition, as of March 31, 2025, we had 1,896 NVIDIA H100 and H200 GPUs installed and operational at our Prince George site. Subsequent to March 31, 2025, we have expanded our total installed hashrate capacity across our sites in BC and Texas from 37 EH/s to 40 EH/s.

Our Growth Strategies

Our current focus is on expanding our targeted installed hashrate capacity to 50 EH/s in the first half of 2025 and pursuing a strategy to expand and diversify our revenue streams into new markets. We intend to pause Bitcoin mining expansion upon completion of the 50 EH/s buildout to narrow our focus on potential growth opportunities for HPC solutions, including AI Cloud Services and potential colocation services.

Pursuant to that strategy, we have acquired 1,896 NVIDIA H100 and H200 GPUs which are deployed at our Prince George data center and are being used to provide AI Cloud Services to a number of customers. We are exploring the potential opportunity to replace Bitcoin ASICs with GPUs under cloud or colocation service contracts at some of our data centers. We are advancing the design of direct-to-chip liquid cooling systems, including an initial 75MW direct-to-chip liquid cooling deployment at Childress with power redundancy (such as back up power generators and uninterruptible power supply systems) to support potential growth opportunities for HPC solutions at Childress. Furthermore, we are developing our 1,400MW Sweetwater 1 and 600MW Sweetwater 2 projects, including designing a direct fiber loop between the two sites to potentially create a 2GW data center hub for HPC solutions, including AI Cloud Services and potential colocation services.

We continue to explore monetization opportunities across our power, land, and data center portfolio, including asset sales, colocation, joint ventures, build-to-suit data centers, and GPU acquisitions to expand HPC capabilities. The Company is working with multiple advisers, brokers, and partners on a broader range of opportunities. There can be no assurance that we will be successful in completing any such transaction, including because there may not be counterparties willing to enter into a transaction, we may not receive sufficient consideration for the relevant transaction or it may not be able to be effected within a reasonable timeframe. Some transactions, if completed, may reduce the size of our business which we may not be able to replace.

Beyond our announced projects, we continue to explore a multi-gigawatt data center development pipeline across North America and the Asia Pacific.

Recent Developments

Functional Currency

Effective July 1, 2024, the Parent Company has changed its functional currency from AUD to USD. This change reflects the increase in USD-denominated activities and US-based investments, including capital raising in USD, capital and operational expenditures and revenues. The change has been accounted for prospectively, and prior period comparative figures have not been restated, in accordance with IAS 21.

HPC Solutions

Our growth strategies include pursuing a strategy to expand and diversify our revenue streams into new markets. Pursuant to that strategy, we intend to pause our Bitcoin mining expansion upon completion of our hashrate expansion to 50 EH/s and we are increasing our focus on diversification into HPC solutions, including the provision of AI Cloud Services and potential data center colocation services.

Hardware Purchases

In August 2023, we entered into a purchase agreement for 248 NVIDIA H100 GPUs for a total purchase price of approximately $10 million, which have been deployed at our Prince George site. As of March 31, 2025, we had paid the full $10 million related to this agreement. In February 2024, we entered into a further purchase agreement for 568 NVIDIA H100 GPUs for a total purchase price of approximately $22 million. As of March 31, 2025, we had paid the full purchase price owing under this agreement. In September 2024, we entered into a further purchase agreement for 1,080 NVIDIA H200 GPUs for a total purchase price of approximately $43 million. As of March 31, 2025, we had paid the full purchase price owing under this agreement.

On October 6, 2023, we entered into a miner purchase agreement with Bitmain Technologies Delaware Limited (“Bitmain”) (“October 2023 Agreement”) to acquire 7,002 Bitmain S21 miners with a total hashrate of 1.4 EH/s for $14.0/ TH and a total purchase price of $19.6 million.

As of March 31, 2025 we have paid the full purchase price due under this agreement.

On November 26, 2023, we entered into a miner purchase agreement with Bitmain (the “November 2023 Agreement”) to acquire 7,000 Bitmain T21 miners with a total hashrate of 1.3 EH/s for $14.0/TH and a total purchase price of $18.6 million, with an option to increase to 15,380 Bitmain T21 miners with an additional hashrate of 1.6 EH/s (for an additional $22.3 million) that was exercised on December 7, 2023. As of March 31, 2025, we have paid the full $40.9 million relating to the November 2023 Agreement including $18.6 million on the purchase of miners and $22.3 million on the exercised option.

On January 10, 2024, we entered into a miner purchase agreement, which we subsequently amended on May 9, 2024 (as amended, the “January 2024 Agreement”) with Bitmain to acquire 5,000 Bitmain T21 miners with a total hashrate of 1.0 EH/s for $14.0/TH and a total purchase price of $13.3 million, and paid a non-refundable deposit of $12.8 million as an initial 10% down payment for the option to acquire up to a further 48,000 Bitmain T21 miners or S21 Pro miners for an increased total purchase price of $212.3 million, or a combination of both T21 and S21 Pro miners. As of March 31, 2025, we had exercised in full the option to purchase all 48,000 additional S21 Pro miners for a total hashrate of 11.2 EH/s, and we had paid $13.3 million in relation to the purchase of 5,000 T21 miners, $185.7 million in relation to the 48,000 miners for which we have exercised our option to purchase, $8.5 million pursuant to a non-refundable deposit required to be paid in connection with the May 9, 2024 amendment and the remaining balance of $26.6 million with respect to such 48,000 miners is due by July 2025.

On May 9, 2024, we entered into a miner purchase agreement, and subsequently entered a supplemental upgrade agreement on January 2, 2025 (as supplemented, the “May 2024 Agreement”) with Bitmain to acquire 51,480 Bitmain S21 Pro miners with a total hashrate of 12.0 EH/s for $18.9/TH and a total purchase price of $227.7 million and paid a non-refundable deposit of $22.8 million as an initial 10% down payment for the option to acquire a further 51,480 Bitmain S21 Pro miners (with a total hashrate of 12.0 EH/s). As of March 31, 2025, we had exercised the option to purchase 47,980 additional miners, consisting of 17,980 S21 Pro miners and 30,000 S21 XP miners for a total hashrate of 12.3 EH/s, and we had paid $182.1 million in relation to the purchase of 51,480 Bitmain S21 Pro miners, $159.1 million on the 47,980 miners for which we have exercised our option to purchase, $1.6 million on the 3,500 miners for which we have not yet exercised our option to purchase, and the remaining balance of $45.6 million for the purchase of 51,480 Bitmain S21 Pro is due by May 2025 and $119.3 million for the purchase of the additional 47,980 miners is due by October 2025.

On August 16, 2024, we entered into a miner purchase agreement with Bitmain (the “August 2024 Agreement”) to acquire 39,000 Bitmain S21 XP miners with a total hashrate of 10.5 EH/s for $21.5/TH and a total purchase price of $226.4 million. As of March 31, 2025, we have paid $181.1 million relating to the August 2024 Agreement, and the remaining balance of $45.3 million for the purchase of such 39,000 miners is due by July 2025.

On January 22, 2025, we entered into agreements with Bitmain to upgrade part of our existing mining fleet with 9,025 S21 XP miners (the “Upgrade Agreements” and, together with the October 2023 Agreement, the November 2023 Agreement, the January 2024 Agreement, the May 2024 Agreement and the August 2024 Agreement, the “Bitmain Agreements”). The 9,025 S21 XP miners have a total hashrate of 2.4 EH/s, resulting in a net increased hashrate of 0.7 EH/s. This net hashrate increase is not included in the installed hashrate capacity as of December 31, 2024. As of March 31, 2025, we have paid a net additional cash outlay for the S21 XP miners of $35,840,000.

The Bitmain Agreements are not able to be terminated by either party, are non-refundable except due to Bitmain’s delay sending a shipping notification for the miners to us and default interest of 12% is charged on any unpaid amounts under each batch.

We have, in the past, faced minor disruptions to deliveries of miners under the Bitmain Agreements, and may in the future face further disruptions to deliveries and transportation of miners and other hardware and equipment, including as a result of geopolitical factors such as the imposition of tariffs and trade restrictions relating to certain countries, including Malaysia, Indonesia, Thailand, China and Canada. Increased costs of trade and cross-border transports as well as detainment, seizure and/or forfeiture of miners and other hardware and equipment by the U.S. Customs and Border Protection or other governmental agencies could potentially limit the availability of, and increase the costs we incur to acquire and transport, miners and other hardware and equipment and could disrupt our operations.

Factors Affecting Our Performance

Market Value of Bitcoin

We primarily derive our revenues from Bitcoin mining. We earn rewards from Bitcoin mining that are paid in Bitcoin. We currently liquidate rewards that we earn from mining Bitcoin in exchange for fiat currencies such as USD or CAD, typically on a daily basis. Because the rewards we earn from mining Bitcoin are paid in Bitcoin, our operating and financial results are tied to fluctuations in the value of Bitcoin. In addition, positive or negative changes in the global hashrate impact mining difficulty and therefore the rewards we earn from mining Bitcoins may as a result materially affect our revenue and margins.

In a declining Bitcoin price environment, the Bitcoin mining protocol may provide a natural downside protection for low-cost Bitcoin miners through an adjustment to the number of Bitcoin mined. For example, when the Bitcoin price falls, the ability for higher cost miners to pay their operating costs may be impacted, which in turn may lead over time to higher cost miners switching off their operations (for example, if their marginal cost of power makes it unprofitable to continue mining, they may exit the network). As a result, in such circumstances the global hashrate may fall, and remaining low-cost miners may benefit from an increased percentage share of the fixed Bitcoin network rewards.

Conversely, in a rising Bitcoin price environment, additional mining machines may be deployed by miners, leading to increased global hashrate in the overall network. In periods of rising Bitcoin prices we may increase our capital expenditures in mining machines and related infrastructure to take advantage of potentially faster return on investments, subject to availability of capital and market conditions. However, we also note that the global hashrate may also increase or decrease irrespective of changes in the Bitcoin price.

While the supply of Bitcoin is capped at 21 million, the price of Bitcoin fluctuates not just because of traditional notions of supply and demand but also because of the dynamic nature of the market for Bitcoin. Having been created in just a little over a decade as of the date of this Form 6-K, the market for Bitcoin is rapidly changing and subject to global regulatory, tax, political, environmental, cybersecurity, and market factors beyond our control. For a discussion of other factors that could lead to material adverse changes in the market value of Bitcoin, which could in turn result in substantial damage to or even the failure of our business, see “Item 3. Key Information—Risk Factors—Risks Related to our Business” in our Annual Report for further information.

Further, the rewards for each Bitcoin mined is subject to “halving” adjustments at predetermined intervals. At the outset, the reward for mining each block was set at 50 Bitcoins and this was cut in half to 25 Bitcoins on November 28, 2012 at block 210,000, cut in half to 12.5 Bitcoins on July 9, 2016 at block 420,000, cut in half to 6.25 Bitcoins on May 11, 2020 at block 630,000, and cut in half again to 3.125 Bitcoins on April 20, 2024 at block 840,000. The next two halving events for Bitcoin are expected to take place in 2028 at block 1,050,000 (when the reward will reduce to 1.5625 Bitcoins), and in 2032 at block 1,260,000 (when the reward will reduce to 0.78125 Bitcoins). As the rewards for each Bitcoin mined reduce, the Bitcoin we earn relative to our hashrate capacity decrease. As a result, these adjustments have had, and will continue to have, material effects on our operating and financial results.

Efficiency of Mining Machines

As global mining capacity increases, we will need to correspondingly increase our total hashrate capacity in order to maintain our proportionate share relative to the overall global hashrate —all else being equal—to maintain the same amount of Bitcoin mining revenue. Our Bitcoin mining operations currently utilize Bitmain S21 XP miners, S21 Pro miners, S21 miners, T21 miners, S19 XP miners and S19j Pro miners. To remain cost competitive compared to other mining sector participants, in addition to targeting cost effective sources of energy and operating efficient data center infrastructure, we expect we will need to maintain an energy efficient mining fleet, which will require capital outlays to purchase new miners so that we can make periodic upgrades to our existing mining fleet.

In certain periods, there may be disruption in global supply chain leading to shortage of advanced mining machines that meet our standard of quality and efficiency. To maintain our competitive edge over the long-term, we strive to maintain strong relationships with suppliers and vendors across the supply chain so that our fleet of miners is competitive.

Ability to Secure Low-Cost Electricity, particularly Renewable Power

Bitcoin mining and HPC activities consume extensive energy, including for both the mining and cooling aspects of our operations. In particular, we believe the increasing difficulty of the network, driven by more miners and higher global hashrate, and the periodic halving adjustments of Bitcoin reward rates, as well as the global demand for HPC solutions for various programs, including AI Cloud Services, and the need for reliability and quick uptime speeds in such industry, will drive the increasing importance of power efficiency in Bitcoin mining and HPC activities over the long-term.

Certain governments and regulators are increasingly focused on the energy and environmental impact of Bitcoin mining and HPC activities. This has led, and could lead, to new governmental measures regulating, restricting or prohibiting the use of electricity for Bitcoin mining and HPC activities, or Bitcoin mining or HPC activities generally. See “Item 3. Key Information—Risk Factors—Any electricity outage, limitation of electricity supply, including as a result of political pressure or regulation, or increase in electricity costs may result in material impacts to our operations and financial performance” and “Item 3. Key Information—Risk Factors— Risks Related to Regulations and Regulatory Frameworks” in our Annual Report for further information. Bitcoin mining and HPC activities are energy-intensive, which may restrict the geographic locations of miners and operations, in particular, to locations with renewable sources of power. Government regulators may potentially restrict the ability of electricity suppliers to provide electricity to Bitcoin miners or HPC operators, including us, or Bitcoin mining or HPC activities generally. For example, the British Columbia Court of Appeal has recently upheld the Government of British Columbia’s moratorium on new and early-stage BC Hydro connection requests from cryptocurrency mining projects. The price we pay for electricity depends on numerous factors including sources of generation, regulatory environment, electricity market structure, commodity prices, instantaneous supply/demand balances, counterparty and procurement method. These factors may be subject to change over time and result in increased power costs. In regulated markets, such as in BC, suppliers of renewable power rely on regulators to approve raises in rates, resulting in fluctuations subject to requests for rate increases and their approval thereof; in deregulated markets, such as in Texas, prices of renewable power will fluctuate with the wholesale market, which is often driven by price fluctuations in commodities such as natural gas. In addition, developments in the United States, including actions taken by the new Trump Administration, such as a series of executive orders aimed at, among other things, pausing approvals of wind power projects, pausing funding of programs aimed at promoting renewable energy and increasing oil and gas production, as well the Department of Energy’s cancellation of certain grants for clean energy projects, signal a policy shift away from supporting renewable energy production. There have also been legislative proposals and other legal developments targeting renewable energy and large electrical loads in certain states, including Texas. While the impacts of these actions and any future developments cannot be fully predicted at this time, any reductions or modifications to, or the elimination of, laws, programs or incentives that provide electricity to Bitcoin miners or HPC operators or that support renewable energy, or the implementation of more arduous requirements for renewable energy projects, could potentially limit the availability of, and increase the costs we incur for, electricity, and particularly renewable energy, in the United States.

Competitive Environment

We compete with a variety of Bitcoin miners globally, including individual hobbyists, mining pools and public and private companies, as well as HPC providers including large and well-funded companies. We believe that, even if the price of Bitcoin decreases, the Bitcoin mining market will continue to draw new miners and increase the scale and sophistication of competition in the Bitcoin mining industry, while the HPC industry continues to draw companies with significant resources to dedicate to growing their HPC business as well as expertise in the industry. Increasing competition generally results in increase to the global hashrate, which in turn would generally lead to a reduction in the percentage share of the fixed Bitcoin network rewards that Bitcoin miners, including the Company, would earn, and may result in larger and more established HPC providers increasing their resource allocation and attention to the industry, which could make our ability to compete, including to attract and maintain customers, more difficult. In addition, the new Trump Administration in the United States has suggested it may introduce different regulatory treatment for digital assets, including Bitcoin, that are mined within the United States compared to those that are mined outside of the United States. As a result, we may face increased competition specifically within the United States for low-cost energy and mining hardware from those attempting to benefit from any potential favorable treatment from mining within the United States.

Market Events Impacting the Digital Asset Industry

In the past, market events in the digital asset industry have negatively impacted market sentiment towards the broader digital asset industry. There have also been declines from time to time in the value of digital assets generally, including the value of Bitcoin, in connection with these events, which have impacted the Group from a financial and operational perspective. We expect that any such declines that may occur in the future would also impact the business and operations of the Group, and if such declines are significant, they could result in reduced revenue and operating cash flows and increased net operating losses, and could also negatively impact our ability to raise additional financing.

Market Events Impacting Digital Asset Trading Platforms

In the past, market events in the digital asset markets have involved and/or impacted certain digital asset trading platforms. As described under “Item 3.D. Key Information—Risk Factors” in our Annual Report, the mining pools, that we utilize for the purposes of our Bitcoin mining, currently transfer the Bitcoin we mine to Kraken, a digital asset trading platform, on a daily basis.

Such Bitcoin is then exchanged for fiat currency on the Kraken exchange or via its over-the-counter trading desk on a daily basis. Because we currently exchange the Bitcoin we mine for fiat currency on a daily basis, we believe we have limited exposure to fluctuations in the value of Bitcoin with respect to the Bitcoin that we mine once we have mined such Bitcoin. In addition, we currently aim to withdraw fiat currency proceeds from Kraken on a daily basis utilizing Etana Custody, a third-party custodian, to facilitate the transfer of such proceeds to one or more of our banks or other financial institutions. As a result, we have only limited amounts of Bitcoin and fiat currency with Kraken and Etana Custody at any time, and accordingly we believe we have limited exposure to potential risks related to excessive redemptions or withdrawals of digital assets or fiat currencies from, or suspension of redemptions or withdrawals of digital assets or fiat currencies from, Kraken, Etana Custody or any other digital asset trading platform or custodian we may use in the future for purposes of liquidating the Bitcoin we mine on a daily basis. However, if Kraken, Etana Custody or any such other digital asset trading platform or custodian suffers excessive redemptions or withdrawals of digital assets or fiat currencies, or suspends redemptions or withdrawals of digital assets or fiat currencies, as applicable, any Bitcoin we have transferred to such platform that has not yet been exchanged for fiat currency, as well as any fiat currency that we have not yet withdrawn, as applicable, would be at risk.

In addition, if any such event were to occur with respect to Kraken, Etana Custody or any such other digital asset trading platform or custodian we utilize to liquidate the Bitcoin we mine, we may be required to, or may otherwise determine it is appropriate to, or if for any reason we decide to, switch to an alternative digital asset trading platform and/or custodian, as applicable. We do not currently use any other digital asset trading platforms or custodians to liquidate the Bitcoin we mine. While we expect to continue to utilize Kraken and Etana Custody, there are numerous alternative digital asset trading platforms that operate exchanges and/or over-the-counter trading desks with similar functionality to Kraken, and there are also several alternative funds transfer arrangements for facilitating the transfer of fiat currency proceeds from Kraken either with or without the use of a third-party custodian. We have onboarded Coinbase as an alternative digital asset trading platform to liquidate Bitcoin that we mine, although we have not utilized the Coinbase platform as of March 31, 2025. We may explore opportunities with alternative digital asset trading platforms, over-the-counter trading desks and custodians, and believe we have the ability to switch to Coinbase or alternative digital asset trading platforms and/or funds transfer arrangements to liquidate Bitcoin we mine and transfer the fiat currency proceeds without material expense or delay. As a result, we do not believe our business is substantially dependent on the Kraken digital asset trading platform or Etana Custody third-party custodian services.

However, digital asset trading platforms and third-party custodians, including Kraken and Etana Custody, are subject to a number of risks outside our control which could impact our business. In particular, during any intervening period in which we are switching digital asset trading platforms and/or third-party custodians, we could be exposed to credit risk with respect to any Bitcoin or fiat currency held by them. In addition, we could be exposed to fluctuations in the value of Bitcoin with respect to the Bitcoin that we mine during such period or that was previously mined but has not yet been exchanged for fiat currency.

Ability to Expand HPC Solutions and Secure Customers

Our growth strategies include pursuing a strategy to expand and diversify our revenue streams into new markets. Pursuant to that strategy, we are increasing our focus on diversification into HPC solutions, including the provision of AI Cloud Services and potential colocation services. We believe we may be able to leverage our existing infrastructure and expertise to continue to expand our AI Cloud Services offering and target a range of customers across various sectors. We are exploring the potential opportunity to replace Bitcoin ASICs with GPUs under cloud or colocation service contracts at some of our data centers. We are advancing the design of direct-to-chip liquid cooling systems, including to support an initial IT load of up to 50MW (based on rack density of 200kW, subject to customer requirements) liquid-cooled deployment at Childress. As we enter into new markets for HPC solutions (including the market for AI Cloud Services and potential colocation services), we will face new sources of competition, new business models and new customer relationships. Our ability to secure and retain customers on commercially reasonable terms or at all, and specifically our ability to attract and retain customers under contracts that generate recurring revenue, will affect our expansion into HPC solutions. Our strategy may not be successful as a result of a number of factors described under “Item 3.D. Risk Factors—Risks Related to Our Business—Our increased focus on HPC solutions (including AI Cloud Services) may not be successful and may result in adverse consequences to our business, results of operations and financial condition” in our Annual Report. Our efforts to explore the diversification of our revenue streams may distract management, require significant additional capital, expose us to new competition and market dynamics, and increase our cost of doing business.

Impact of Tariffs

During the third fiscal quarter of 2025, the United States announced the intention to impose tariffs on various countries, including an across-the-board 10% tariff on all countries and individualized higher tariffs on certain countries, including countries from which we have historically sourced miners (including Malaysia, Indonesia, and Thailand) and other hardware and equipment.

Several of such tariffs have come into effect as of the date of this report, which could result in higher prices in order to obtain miners and other hardware and equipment, as well as limit the availability of miners and other hardware and equipment and could impact our timelines for installation, energization and expected revenue. In addition to those tariffs which have already come into effect, additional tariffs and trade restrictions have been suggested and others may be suggested in the future, which, if they were enacted, could further impact our business. Uncertainty around geopolitical conditions and international trade policies may continue to effect the movement and costs of goods, materials, services and capital. Further, we have received notices disputing the origin of Bitcoin miners imported during 2024 and 2025 from Indonesia, Thailand and Malaysia, claiming the origin of such miners is China and that an additional 25% tariff is applicable to certain shipments imported during such period. While we believe these disputes are without merit including based on representations from the seller and we intend to challenge them, if we are unsuccessful we would owe additional tariffs with respect to the import of such miners which could be material and could materially impact our business, prospects, operations and financial performance. See “Risk Factors—Changing political and geopolitical conditions, including changing international trade policies and the implementation of wide-ranging, reciprocal and retaliatory tariffs and trade restrictions, could adversely impact our business, prospects, operations and financial performance” in this MD&A.

Key Indicators of Performance and Financial Condition

Key operating and financial metrics that we use, in addition to our IFRS consolidated financial statements, to assess the performance of our business are set forth below for the three and nine months ended March 31, 2025 and 2024, include:

EBITDA

EBITDA is not presented in accordance with IFRS, and is defined as profit/(loss) after income tax expense, excluding finance expense, interest income, depreciation and income tax expense/(benefit), which are important components of our IFRS profit/(loss) after income tax expense. As a capital-intensive business, EBITDA excludes the impact of the cost of depreciation of computer hardware equipment and other fixed assets, which allows us to measure the liquidity of our business on a current basis and we believe provides a useful tool for comparison to our competitors in a similar industry. We believe EBITDA is a useful metric for assessing operating performance before the impact of non-cash and other items. Our presentation of EBITDA should not be construed as an inference that our future results will be unaffected by these items.

We believe EBITDA and EBITDA Margin have limitations as analytical tools. These measures should not be considered as alternatives to profit/(loss) after income tax expense, as applicable, determined in accordance with IFRS. They are supplemental measures of our operating performance only, and as a result you should not consider these measures in isolation from, or as a substitute analysis for, our profit/(loss) after income tax as determined in accordance with IFRS, which we consider to be the most comparable IFRS financial measure. For example, we expect depreciation of our fixed assets will be a large recurring expense over the course of the useful life of our assets. EBITDA and EBITDA Margin do not have any standardized meaning prescribed by IFRS and therefore are not necessarily comparable to similarly titled measures used by other companies, limiting their usefulness as a comparative tool.

The following table shows a reconciliation of EBITDA to profit/(loss) after income tax expense, the most comparable IFRS measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months

ended |

|

Three months

ended |

|

Nine months ended |

|

Nine months ended |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

Profit/(loss) after income tax expense for the period |

24,227 |

|

|

8,638 |

|

|

(8,605) |

|

|

(1,889) |

|

| Add/(deduct) the following: |

|

|

|

|

|

|

|

| Finance expense |

7,868 |

|

|

126 |

|

|

14,185 |

|

|

190 |

|

| Interest income |

(1,926) |

|

|

(1,500) |

|

|

(5,801) |

|

|

(2,878) |

|

| Depreciation |

47,448 |

|

|

8,692 |

|

|

117,655 |

|

|

23,870 |

|

Income tax expense/(benefit) |

5,040 |

|

|

3,473 |

|

|

9,318 |

|

|

3,228 |

|

| EBITDA |

82,657 |

|

|

19,429 |

|

|

126,752 |

|

|

22,521 |

|

|

|

|

|

|

|

|

|

| Total Revenue |

148,098 |

|

|

54,349 |

|

|

322,082 |

|

|

131,320 |

|

|

|

|

|

|

|

|

|

Profit/(Loss) after income tax expense margin (1) |

16 |

% |

|

16 |

% |

|

(3) |

% |

|

(1) |

% |

|

|

|

|

|

|

|

|

| EBITDA margin (2) |

56 |

% |

|

36 |

% |

|

39 |

% |

|

17 |

% |

|

|

|

|

|

|

(1) |

Profit/(Loss) after income tax expense margin is calculated as Profit/(Loss) after income tax expense divided by Total Revenue. |

(2) |

EBITDA margin is calculated as EBITDA divided by Total Revenue. |

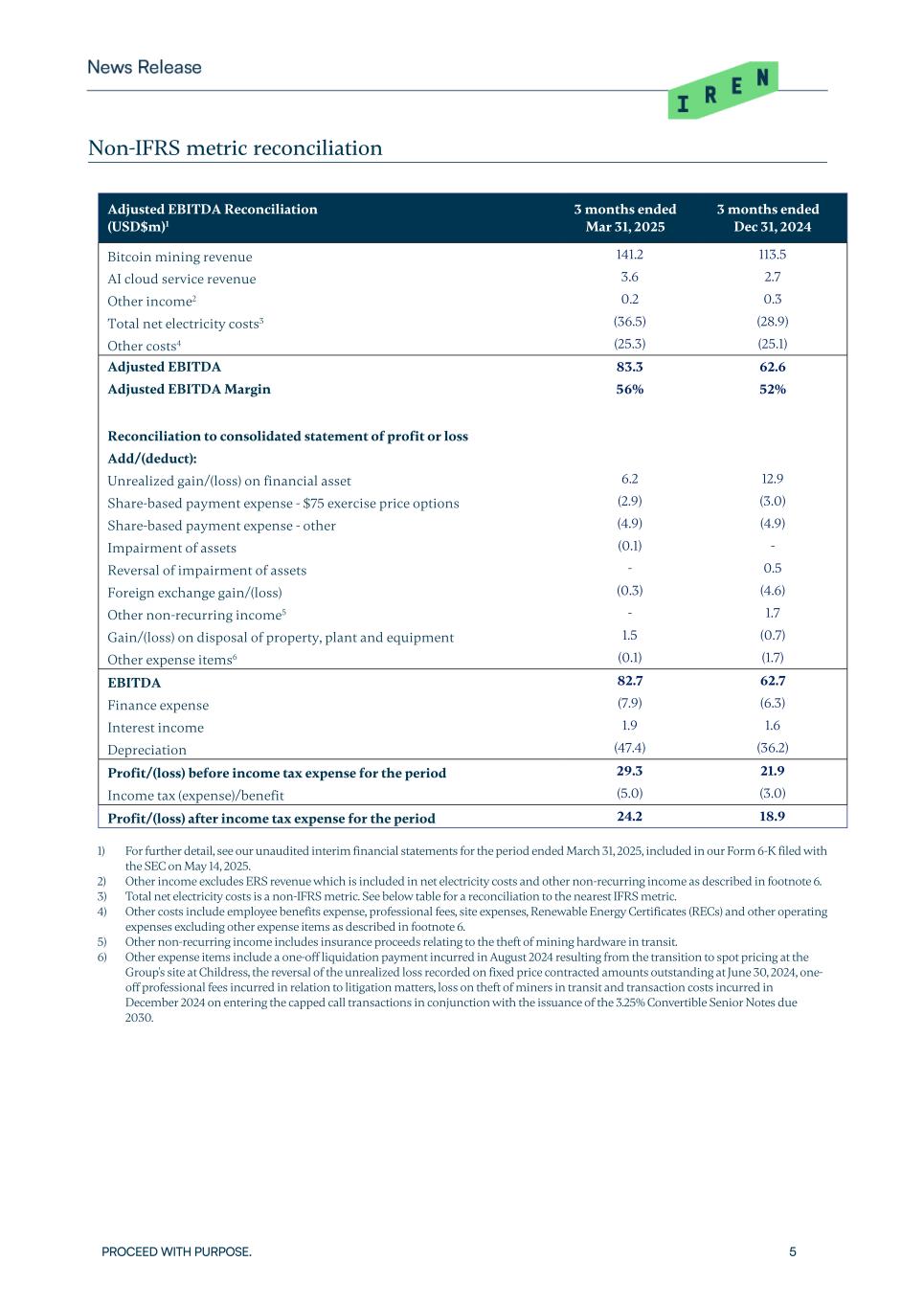

Adjusted EBITDA

Adjusted EBITDA is not presented in accordance with IFRS, and is defined as EBITDA as further adjusted to exclude share-based payments expense, foreign exchange gains/losses, impairment of assets, certain other non-recurring income, gain/loss on disposal of property, plant and equipment, gain on disposal of subsidiaries, unrealized fair value gains/losses on financial instruments, and certain other expense items. We believe Adjusted EBITDA is a useful metric because it allows us to monitor the profitability of our business on a current basis and removes expenses which do not impact our ongoing profitability and which can vary significantly in comparison to other companies. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these items.

We believe Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools. These measures should not be considered as alternatives to profit/(loss) after income tax expense, as applicable, determined in accordance with IFRS. They are supplemental measures of our operating performance only, and as a result you should not consider these measures in isolation from, or as a substitute analysis for, our profit/(loss) after income tax as determined in accordance with IFRS, which we consider to be the most comparable IFRS financial measure. For example, we expect depreciation of our fixed assets will be a large recurring expense over the course of the useful life of our assets, and that share-based compensation is an important part of compensating certain employees, officers and directors. Adjusted EBITDA and Adjusted EBITDA margin do not have any standardized meaning prescribed by IFRS and therefore are not necessarily comparable to similarly titled measures used by other companies, limiting their usefulness as a comparative tool.

The following table shows a reconciliation of Adjusted EBITDA to profit/(loss) after income tax expense, the most comparable IFRS measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months

ended |

|

Three months

ended |

|

Nine months ended |

|

Nine months ended |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

| Profit/(loss) after income tax expense for the period |

24,227 |

|

|

8,638 |

|

|

(8,605) |

|

|

(1,889) |

|

| Add/(deduct) the following: |

|

|

|

|

|

|

|

| Finance expense |

7,868 |

|

|

126 |

|

|

14,185 |

|

|

190 |

|

| Interest income |

(1,926) |

|

|

(1,500) |

|

|

(5,801) |

|

|

(2,878) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

47,448 |

|

|

8,692 |

|

|

117,655 |

|

|

23,870 |

|

| Income tax expense/(benefit) |

5,040 |

|

|

3,473 |

|

|

9,318 |

|

|

3,228 |

|

| EBITDA |

82,657 |

|

|

19,429 |

|

|

126,752 |

|

|

22,521 |

|

|

|

|

|

|

|

|

|

| Total Revenue |

148,098 |

|

|

54,349 |

|

|

322,082 |

|

|

131,320 |

|

|

|

|

|

|

|

|

|

Profit/(Loss) after income tax expense margin (1) |

16 |

% |

|

16 |

% |

|

(3) |

% |

|

(1) |

% |

|

|

|

|

|

|

|

|

| EBITDA margin (2) |

56 |

% |

|

36 |

% |

|

39 |

% |

|

17 |

% |

Add/(deduct) the following: |

|

|

|

|

|

|

|

| Unrealized (gain)/loss on financial instrument |

(6,200) |

|

|

1,091 |

|

|

(19,100) |

|

|

1,349 |

|

| Non-cash share-based payment expense – $75 exercise price options |

2,879 |

|

|

2,873 |

|

|

8,879 |

|

|

8,682 |

|

| Non-cash share-based payment expense – other |

4,891 |

|

|

2,944 |

|

|

15,050 |

|

|

8,940 |

|

| Impairment of assets (3) |

95 |

|

|

- |

|

|

9,618 |

|

|

- |

|

| Reversal of impairment of assets (4) |

- |

|

|

- |

|

|

(516) |

|

|

(108) |

|

| Other non-recurring income (5) |

- |

|

|

- |

|

|

(1,699) |

|

|

- |

|

| Foreign exchange (gain)/loss |

318 |

|

|

(4,714) |

|

|

3,681 |

|

|

(2,265) |

|

| (Gain)/loss on disposal of property, plant and equipment |

(1,525) |

|

|

(1) |

|

|

(1,678) |

|

|

(16) |

|

| Other expense items (6) |

137 |

|

|

218 |

|

|

7,492 |

|

|

3,404 |

|

| Adjusted EBITDA |

83,252 |

|

|

21,840 |

|

|

148,479 |

|

|

42,507 |

|

| Adjusted EBITDA margin (7) |

56 |

% |

|

40 |

% |

|

46 |

% |

|

32 |

% |

|

|

|

|

|

|

(1) |

Profit/(Loss) after income tax expense margin is calculated as Profit/(Loss) after income expense divided by Total Revenue. |

(2) |

EBITDA margin is calculated as EBITDA divided by Total Revenue. |

(3) |

Impairment of assets for the nine months ended March 31, 2025 and 2024 was $9.6 million and nil, respectively. See “—Components of our Results of Operations—Expenses—Impairment of assets” for further information. |

(4) |

Reversal of impairment of assets for the nine months ended March 31, 2025 and 2024 was $0.5 million and $0.1 million, respectively. See “—Components of our Results of Operations—Expenses—Impairment of assets” for further information. |

(5) |

Other non-recurring income include insurance proceeds relating to the theft of mining hardware in transit. |

(6) |

Other expense items include a one-off liquidation payment incurred in August 2024 resulting from the transition to spot pricing at the Group's site at Childress, the reversal of the unrealized loss recorded on fixed price contracted amounts outstanding at June 30, 2024, one-off professional fees incurred in relation to litigation matters, loss on theft of miners in transit and transaction costs incurred in December 2024 on entering the capped call transactions in conjunction with the issuance of the 3.25% Convertible Senior Notes due 2030 (the “Convertible Notes”). |

(7) |

Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Total Revenue. |

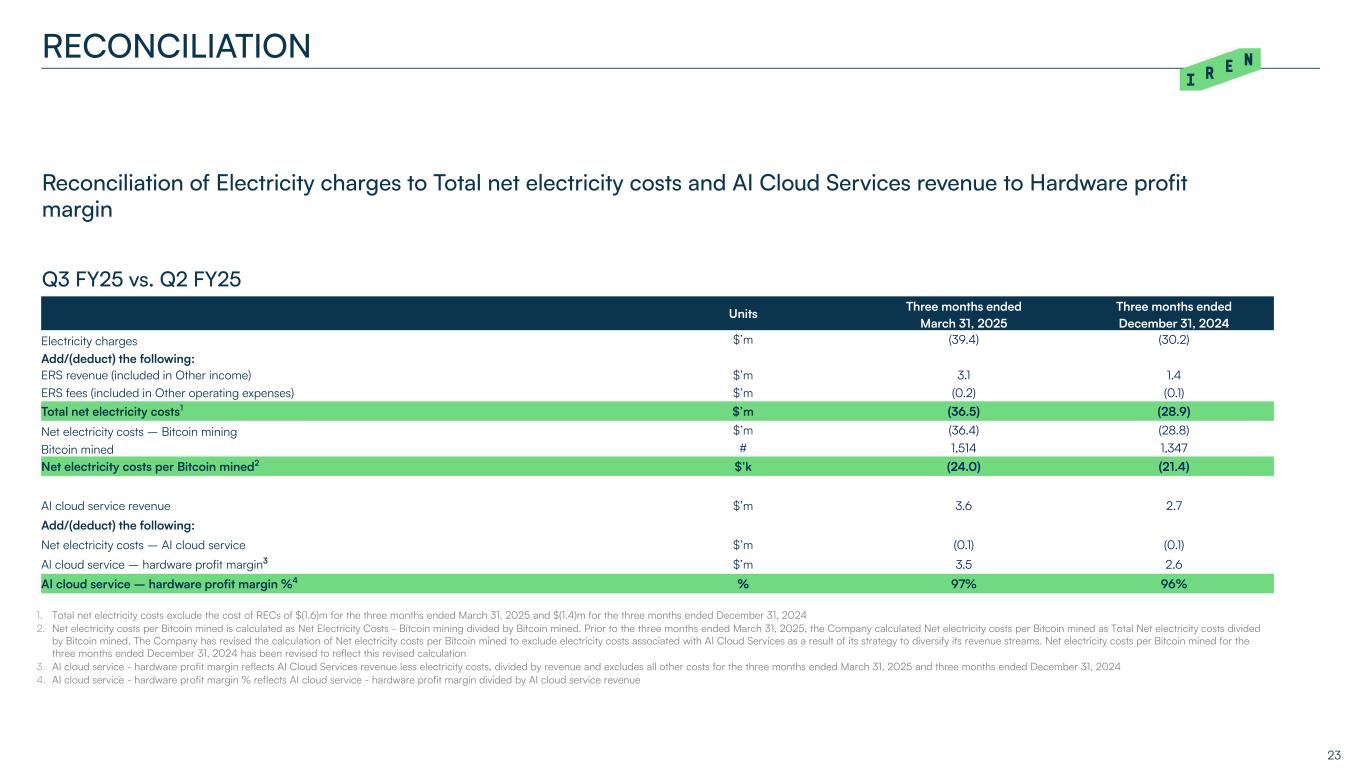

Net electricity costs

Total net electricity costs and Net electricity costs per Bitcoin mined are not presented in accordance with IFRS. Total net electricity costs is defined as the sum of electricity charges, ERS revenue, ERS fees, realized gain/(loss) on financial asset excluding a one-off liquidation payment incurred in August 2024 resulting from the transition to spot pricing at the Group's site at Childress and the reversal of the unrealized loss recorded on fixed price contracted amounts outstanding at June 30, 2024. The liquidation payment and reversal of the unrealized loss are included in the Realized gain/(loss) on financial asset (as described in more detail in Note 9 of the unaudited interim consolidated financial statements included in this Form 6-K), while Emergency Response Service ("ERS") revenue is included in Other income and ERS fees are included in Other operating expenses (as described in more detail in Note 5 and 6 of the unaudited interim consolidated financial statements included in this Form 6-K). Total net electricity costs exclude the cost of RECs. Net electricity costs per Bitcoin mined is defined as Total net electricity costs less net electricity costs attributable to AI Cloud Services, divided by the total Bitcoin mined for the relevant fiscal period.

A key measure of the performance factor of our business is our ability to secure low-cost power, and similarly a key measure of the performance of our Bitcoin mining operations is the amount of power used to mine each Bitcoin. Total net electricity costs and Net electricity costs per Bitcoin mined allows us to measure the costs of electricity of our business on a current basis and we believe provides a useful tool for comparison to our competitors in a similar industry. We believe Total net electricity costs and Net electricity costs per Bitcoin mined are a useful metrics for assessing operating performance including any gain/(loss) on the electricity purchased and subsequently resold, and earnings for our participation in demand response programs.

We believe Total net electricity costs and Net electricity costs per Bitcoin mined have limitations as an analytical tool. These measures should not be considered as alternatives to electricity charges, as applicable, determined in accordance with IFRS. They are supplemental measures of our operating performance only, and as a result you should not consider these measures in isolation from, or as a substitute analysis for, our electricity charges as determined in accordance with IFRS, which we consider to be the most comparable IFRS financial measure. Total net electricity costs and Net electricity costs per Bitcoin mined do not have any standardized meaning prescribed by IFRS and therefore are not necessarily comparable to similarly titled measures used by other companies, limiting their usefulness as a comparative tool.

The following table shows a reconciliation of Total net electricity costs and Net electricity costs per Bitcoin mined to the most comparable IFRS financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months

ended |

|

Three months

ended |

|

Nine months ended |

|

Nine months ended |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

Mar 31, 2025 |

|

Mar 31, 2024 |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

|

($ thousands) |

| Electricity charges |

(39,401) |

|

|

(19,834) |

|

|

(99,394) |

|

|

(55,944) |

|

| Add/(deduct) the following: |

|

|

|

|

|

|

|

| Realized gain/(loss) on financial asset |

- |

|

|

91 |

|

|

(4,215) |

|

|

3,210 |

|

| One off liquidation payment (included in Realized gain/(loss) on financial asset) (1) |

- |

|

|

- |

|

|

7,210 |

|

|

- |

|

| Reversal of unrealized loss (included in Realized gain/(loss) on financial asset) (2) |

- |

|

|

- |

|

|

(3,448) |

|

|

- |

|

| ERS revenue (included in Other income) |

3,090 |

|

|

399 |

|

|

6,121 |

|

|

926 |

|

| ERS fees (included in Other operating expenses) |

(185) |

|

|

(24) |

|

|

(367) |

|

|

(56) |

|

| Total Net Electricity Costs |

(36,496) |

|

|

(19,368) |

|

|

(94,093) |

|

|

(51,864) |

|

| Net Electricity Costs - Bitcoin mining |

(36,408) |

|

|

(19,357) |

|

|

(93,909) |

|

|

(51,853) |

|

| Bitcoin mined |

1,514 |

|

|

1,003 |

|

|

3,674 |

|

|

3,371 |

|

| Net electricity costs per Bitcoin mined (3) |

(24,048) |

|

|

(19,299) |

|

|

(25,560) |

|

|

(15,382) |

|

|

|

|

|

|

|

(1) |

One-off liquidation payment includes the amount paid to exit positions previously entered into under a fixed price and fixed quantity contract, on transition to a spot price and actual usage contract. |

(2) |

Reversal of unrealized loss is calculated as the unrealized loss on financial asset as at June 30, 2024. |

(3) |

Net electricity costs per Bitcoin mined is calculated as Net Electricity Costs - Bitcoin mining divided by Bitcoin mined. Prior to the three months ended March 31, 2025, the Company calculated Net electricity costs per Bitcoin mined as Total Net electricity costs divided by Bitcoin mined. The Company has revised the calculation of Net electricity costs per Bitcoin mined to exclude electricity costs associated with AI Cloud Services as a result of its strategy to diversify its revenue streams. Net electricity costs per Bitcoin mined for prior periods presented in this MD&A has been revised to reflect this revised calculation. |

The Net electricity costs per Bitcoin mined increased from $15,382 for the nine months ended March 31, 2024 to $25,560 for the nine months ended March 31, 2025 primarily due to the halving event which occurred in April 2024 and an increase in the average global hashrate.

The Net electricity costs per Bitcoin mined increased from $19,299 for the three months ended March 31, 2024 to $24,048 for the three months ended March 31, 2025 primarily due to the halving event which occurred in April 2024 and an increase in the average global hashrate.

Components of our Results of Operations

Revenue

Bitcoin mining revenue

The Group operates data center infrastructure supporting the verification and validation of Bitcoin blockchain transactions in exchange for Bitcoin, referred to as “Bitcoin mining”. The Company has entered into arrangements with mining pools, whereby computing services are provided to the mining pools to perform hash calculations in exchange for non-cash consideration in the form of Bitcoin. The provision of services to perform hash calculations is the only performance obligation in the contract with the mining pool operators.

The Company has the right to decide the point in time and duration for which it will provide hash computation services to the mining pools. The contracts are terminable at any time by either party without substantive compensation to the other party for such termination. Upon termination, the mining pool operator (i.e., the customer) is required to pay the Company any amount due related to previously satisfied performance obligations. Since either party is able to terminate the agreement at any time without penalty, the contract is continually renewed throughout the day, resulting in a contract with a duration of less than 24 hours.

In the mining pools which the Company participated in during the periods, the Company is not directly exposed to the pool’s success in mining blocks. The Company is rewarded in Bitcoin for the hashrate it contributes to these mining pools. The reward for the hashrate contributed by the Company is based on the current network difficulty and global daily revenues from transaction fees, less mining pool fees.

The fair value of the non-cash consideration is determined using the quantity of Bitcoin received multiplied by the spot price of the Bitcoin price on the day received. The spot price data is sourced from the website of Kraken, the trading platform over which we exchange the Bitcoin we have mined (“Kraken”).

Management considers the prices quoted on Kraken to be a Level 1 input under IFRS 13 Fair Value Measurement. The Group did not hold any Bitcoin on hand as at March 31, 2025 (March 31, 2024: Nil).

AI Cloud Service revenue

The Group generates AI Cloud Service revenue through the provision of HPC solutions (including AI Cloud Services) to customers. Revenue is measured at the fair value of the consideration received or receivable for services, net of discounts and sales taxes.

Other income

Other income has been earned for our participation in demand response programs at the Group's site in Childress, Texas, the proceeds from the sale of other assets, the gain on termination of leases and other non-recurring revenue including insurance proceeds related to the theft of mining hardware in transit.

Expenses

Our expenses are characterized by the nature of the expense, with the main expense categories set out below.

Depreciation

We capitalize the cost of our buildings, plant and equipment and computer hardware. Depreciation expense is recorded on a straight-line basis to nil over the estimated useful life of the underlying assets. Our buildings are currently depreciated over 20 years, mining hardware is depreciated over 4 years, HPC hardware is depreciated over 5 years, and plant and equipment is depreciated over 3-10 years depending on the expected life of the underlying asset.

Electricity charges

Electricity charges primarily consist of the cost of electricity to power our data center sites. The price of electricity in BC is subject to a regulated tariff that may be adjusted by the supplier from time to time, resulting in increases or decreases in the cost of electricity we purchase. In Texas, the electricity market is deregulated and operates through a competitive wholesale market.

Electricity prices in Texas are subject to many factors, such as, for example, fluctuations in commodity prices including the price of fossil fuels and other energy sources. Electricity at Childress, Texas is sourced from the Electricity Reliability Council of Texas (“ERCOT”), the organization that operates Texas’ electrical grid. We may participate in demand response programs, load curtailment in response to prices, or other programs, as part of our electricity procurement strategies in Texas, including the use of automated systems to reduce our power consumption in response to market signals.

Site expenses

Site expenses represent property taxes, repairs and maintenance, equipment rental, security, utilities and other general expenses required to operate the sites.

Renewable energy certificates

Renewable energy certificates represent the fees associated with the purchase of RECs required for Group's data centers to be powered by 100% renewable energy.

Other operating expenses

Other operating expenses represent insurance, marketing, charitable donations, a provision for non-refundable goods and services tax ("GST") on services exported to the Australian parent by certain Canadian subsidiaries, provincial sales tax ("PST"), legal costs, loss on theft of mining hardware in transit and general business expenses required to operate the business.

Employee benefits expense

Employee benefits expense represents salary and other employee costs, including superannuation and other similar payments and associated employee taxes.

Share-based payments expense

Share-based payments expense represents the amortization of share-based compensation arrangements that have been granted to directors, executive offers and management. These arrangements include, loan-funded share arrangements granted to management, options and restricted stock units issued to directors, executive officers and management.

Impairment of assets

Impairment of assets represents impairment expense recorded on mining hardware, mining hardware prepayments, goodwill, development assets, assets held for sale and other assets.

Reversal of impairment of assets

Reversal of impairment of assets represent the reversal of an impairment loss recognized on mining hardware, mining hardware prepayments, development assets and other assets in prior periods.

Professional fees

Professional fees represent legal fees, audit fees, and fees paid to tax, regulatory and other advisers.

Other transaction costs

Other transaction costs represents costs associated with entering into the capped call transactions. See note 15 of the unaudited interim consolidated financial statements included in this Form 6-K for further information.

Gain/(loss) on disposal of property, plant and equipment

The net gain/(loss) on disposal of property, plant and equipment includes net gain/(loss) on disposal of mining hardware and other property, plant and equipment.

Realized gain/(loss) on financial asset

Realized gain/(loss) on financial asset represents a gain/(loss) on the electricity purchased and subsequently resold under a power supply agreement at the Group’s Childress site and the costs associated with the close out of the financial asset on transition from a fixed price and fixed quantity contract to a spot price and actual usage contract. See note 9 of the unaudited interim consolidated financial statements included in this Form 6-K for further information.

Unrealized gain/(loss) on financial instruments

Unrealized gain/(loss) on financial instruments represents the change in the fair value of the Convertible Notes and related financial instruments and the change in the fair value of the financial asset recorded in relation to electricity purchased for future usage periods. See note 15 and note 9 respectively of the unaudited interim consolidated financial statements included in this Form 6-K for further information.

Finance expense

Finance expense consists primarily of interest expense on lease liabilities and amortization of capitalized borrowing costs related to the Convertible Notes, and capital raising costs allocated to the embedded derivative in the Convertible Notes transaction, which were immediately expensed.

Interest income

Interest income includes interest generated on short-term cash deposits with regulated financial institutions.

Foreign exchange gain/(loss)

Foreign exchange gain/(loss) includes realized and unrealized foreign exchange movements on monetary assets and liabilities denominated in foreign currencies.

Income tax (expense)/benefit

We are liable to pay tax in a number of jurisdictions, including Australia, Canada and the United States. Tax liabilities arise to the extent that we do not have sufficient prior year tax losses to offset future taxable income in these jurisdictions.

Results of Operations