| UNITED STATES | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

| ORION OFFICE REIT INC. | ||||||||||||||||||||||||||

| (Exact name of Registrant as specified in its charter) | ||||||||||||||||||||||||||

| Maryland | 001-40873 | 87-1656425 | ||||||||||||||||||||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||||||||||||||

| 2398 E. Camelback Road, Suite 1060 | ||||||||||||||

| Phoenix, | AZ | 85016 | ||||||||||||

| (Address of principal executive offices, including zip code) | ||||||||||||||

| (602) | 698-1002 | |||||||||||||||||||||||||||||||

| (Registrant’s telephone number, including area code) | ||||||||||||||||||||||||||||||||

| N/A | ||||||||||||||

| (Former name or former address, if changed since last report) | ||||||||||||||

| Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: | |||||||||||

| Title of each class: | Trading symbol(s): | Name of each exchange on which registered: | |||||||||

| Common Stock | $0.001 par value per share | ONL | New York Stock Exchange | ||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

ORION OFFICE REIT INC. |

||||||||

| By: | /s/ Gavin B. Brandon | |||||||

| Name: | Gavin B. Brandon | |||||||

| Title: | Chief Financial Officer, Executive Vice President and Treasurer | |||||||

| Location | New Lease or Renewal | Square Feet | Term | Expected Commencement or Previous Expiration | New Expected Expiration | ||||||||||||

| Covington, KY | Renewal | 413 | 4.0 years | July 2024 | July 2028 | ||||||||||||

| Parsippany, NJ | New Lease | 56 | 15.4 years | August 2025 | December 2040 | ||||||||||||

| The Woodlands, TX | New Lease | 1 | 2.3 years | July 2024 | September 2026 | ||||||||||||

| Low | High | |||||||||||||

| Core FFO per share | $0.97 | - | $1.01 | |||||||||||

| General and Administrative Expenses | $19.5 million | - | $20.5 million | |||||||||||

| Net Debt to Adjusted EBITDA | 6.2x | - | 6.6x | |||||||||||

| (Unaudited) | ||||||||||||||

| June 30, 2024 | December 31, 2023 | |||||||||||||

| Assets | ||||||||||||||

| Real estate investments, at cost: | ||||||||||||||

| Land | $ | 222,730 | $ | 223,264 | ||||||||||

| Buildings, fixtures and improvements | 1,060,726 | 1,097,132 | ||||||||||||

| Total real estate investments, at cost | 1,283,456 | 1,320,396 | ||||||||||||

| Less: accumulated depreciation | 172,476 | 158,791 | ||||||||||||

| Total real estate investments, net | 1,110,980 | 1,161,605 | ||||||||||||

| Accounts receivable, net | 23,122 | 24,663 | ||||||||||||

| Intangible lease assets, net | 97,977 | 126,364 | ||||||||||||

| Cash and cash equivalents | 24,224 | 22,473 | ||||||||||||

| Other assets, net | 83,550 | 88,828 | ||||||||||||

| Total assets | $ | 1,339,853 | $ | 1,423,933 | ||||||||||

| Liabilities and Equity | ||||||||||||||

| Mortgages payable, net | $ | 353,200 | $ | 352,856 | ||||||||||

| Credit facility revolver | 107,000 | 116,000 | ||||||||||||

| Accounts payable and accrued expenses | 26,941 | 30,479 | ||||||||||||

| Below-market lease liabilities, net | 5,536 | 8,074 | ||||||||||||

| Distributions payable | 5,595 | 5,578 | ||||||||||||

| Other liabilities, net | 24,090 | 23,943 | ||||||||||||

| Total liabilities | 522,362 | 536,930 | ||||||||||||

| Common stock | 56 | 56 | ||||||||||||

| Additional paid-in capital | 1,146,199 | 1,144,636 | ||||||||||||

| Accumulated other comprehensive loss | (14) | (264) | ||||||||||||

| Accumulated deficit | (330,136) | (258,805) | ||||||||||||

| Total stockholders' equity | 816,105 | 885,623 | ||||||||||||

| Non-controlling interest | 1,386 | 1,380 | ||||||||||||

| Total equity | 817,491 | 887,003 | ||||||||||||

| Total liabilities and equity | $ | 1,339,853 | $ | 1,423,933 | ||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Rental | $ | 39,923 | $ | 51,824 | $ | 86,918 | $ | 101,814 | ||||||||||||||||||

| Fee income from unconsolidated joint venture | 201 | 200 | 403 | 400 | ||||||||||||||||||||||

| Total revenues | 40,124 | 52,024 | 87,321 | 102,214 | ||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Property operating | 15,757 | 15,487 | 31,756 | 30,831 | ||||||||||||||||||||||

| General and administrative | 4,544 | 4,565 | 9,493 | 8,874 | ||||||||||||||||||||||

| Depreciation and amortization | 38,614 | 27,877 | 63,118 | 56,043 | ||||||||||||||||||||||

| Impairments | 5,680 | 11,819 | 25,365 | 15,573 | ||||||||||||||||||||||

| Transaction related | 167 | 150 | 277 | 255 | ||||||||||||||||||||||

| Total operating expenses | 64,762 | 59,898 | 130,009 | 111,576 | ||||||||||||||||||||||

| Other (expenses) income: | ||||||||||||||||||||||||||

| Interest expense, net | (8,058) | (7,222) | (16,204) | (14,361) | ||||||||||||||||||||||

| Loss on extinguishment of debt, net | (1,078) | (504) | (1,078) | (504) | ||||||||||||||||||||||

| Other income, net | 209 | 165 | 372 | 201 | ||||||||||||||||||||||

| Equity in loss of unconsolidated joint venture, net | (163) | (95) | (279) | (218) | ||||||||||||||||||||||

| Total other (expenses) income, net | (9,090) | (7,656) | (17,189) | (14,882) | ||||||||||||||||||||||

| Loss before taxes | (33,728) | (15,530) | (59,877) | (24,244) | ||||||||||||||||||||||

| Provision for income taxes | (73) | (185) | (150) | (345) | ||||||||||||||||||||||

| Net loss | (33,801) | (15,715) | (60,027) | (24,589) | ||||||||||||||||||||||

| Net income attributable to non-controlling interest | — | (15) | (6) | (26) | ||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (15,730) | $ | (60,033) | $ | (24,615) | ||||||||||||||||||

| Weighted-average shares outstanding - basic and diluted | 55,910 | 56,680 | 55,857 | 56,661 | ||||||||||||||||||||||

| Basic and diluted net loss per share attributable to common stockholders | $ | (0.60) | $ | (0.28) | $ | (1.07) | $ | (0.43) | ||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (15,730) | $ | (60,033) | $ | (24,615) | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Depreciation and amortization of real estate assets | 38,582 | 27,852 | 63,054 | 55,994 | ||||||||||||||||||||||

| Impairment of real estate | 5,680 | 11,819 | 25,365 | 15,573 | ||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 464 | 463 | 928 | 925 | ||||||||||||||||||||||

| FFO attributable to common stockholders | $ | 10,925 | $ | 24,404 | $ | 29,314 | $ | 47,877 | ||||||||||||||||||

| Transaction related | 167 | 150 | 277 | 255 | ||||||||||||||||||||||

| Amortization of deferred financing costs | 914 | 1,060 | 1,838 | 2,108 | ||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 99 | 247 | 201 | ||||||||||||||||||||||

| Equity-based compensation | 935 | 689 | 1,725 | 1,215 | ||||||||||||||||||||||

| Loss on extinguishment of debt, net | 1,078 | 504 | 1,078 | 504 | ||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 28 | 29 | 57 | 58 | ||||||||||||||||||||||

| Core FFO attributable to common stockholders | $ | 14,171 | $ | 26,935 | $ | 34,536 | $ | 52,218 | ||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (274) | (966) | (489) | ||||||||||||||||||||||

| Straight-line rental revenue | 240 | (2,275) | (309) | (4,959) | ||||||||||||||||||||||

| Unconsolidated Joint Venture basis difference amortization | 113 | 114 | 227 | 247 | ||||||||||||||||||||||

| Capital expenditures and leasing costs | (6,319) | (2,172) | (9,764) | (5,510) | ||||||||||||||||||||||

| Other adjustments, net | 74 | 74 | 182 | 205 | ||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | (22) | (41) | (43) | (81) | ||||||||||||||||||||||

| FAD attributable to common stockholders | $ | 7,828 | $ | 22,361 | $ | 23,863 | $ | 41,631 | ||||||||||||||||||

| Weighted-average shares outstanding - basic | 55,910 | 56,680 | 55,857 | 56,661 | ||||||||||||||||||||||

Effect of weighted-average dilutive securities (1) |

99 | 11 | 37 | 12 | ||||||||||||||||||||||

| Weighted-average shares outstanding - diluted | 56,009 | 56,691 | 55,894 | 56,673 | ||||||||||||||||||||||

| FFO attributable to common stockholders per diluted share | $ | 0.20 | $ | 0.43 | $ | 0.52 | $ | 0.84 | ||||||||||||||||||

| Core FFO attributable to common stockholders per diluted share | $ | 0.25 | $ | 0.48 | $ | 0.62 | $ | 0.92 | ||||||||||||||||||

| FAD attributable to common stockholders per diluted share | $ | 0.14 | $ | 0.39 | $ | 0.43 | $ | 0.73 | ||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (15,730) | $ | (60,033) | $ | (24,615) | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Interest expense | 8,058 | 7,222 | 16,204 | 14,361 | ||||||||||||||||||||||

| Depreciation and amortization | 38,614 | 27,877 | 63,118 | 56,043 | ||||||||||||||||||||||

| Provision for income taxes | 73 | 185 | 150 | 345 | ||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 902 | 861 | 1,762 | 1,715 | ||||||||||||||||||||||

| EBITDA | $ | 13,846 | $ | 20,415 | $ | 21,201 | $ | 47,849 | ||||||||||||||||||

| Impairment of real estate | 5,680 | 11,819 | 25,365 | 15,573 | ||||||||||||||||||||||

| EBITDAre | $ | 19,526 | $ | 32,234 | $ | 46,566 | $ | 63,422 | ||||||||||||||||||

| Transaction related | 167 | 150 | 277 | 255 | ||||||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (274) | (966) | (489) | ||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 100 | 247 | 201 | ||||||||||||||||||||||

| Loss on extinguishment and forgiveness of debt, net | 1,078 | 504 | 1,078 | 504 | ||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | (8) | (8) | (15) | (15) | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 20,458 | $ | 32,706 | $ | 47,187 | $ | 63,878 | ||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| Interest expense - as reported | $ | 8,058 | $ | 7,222 | $ | 16,204 | $ | 14,361 | ||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Amortization of deferred financing costs and other non-cash charges | (914) | (1,059) | (1,838) | (2,108) | ||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture Interest Expense, excluding non-cash amortization |

409 | 366 | 775 | 729 | ||||||||||||||||||||||

| Interest Expense, excluding non-cash amortization | $ | 7,553 | $ | 6,529 | $ | 15,141 | $ | 12,982 | ||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| Interest Coverage Ratio | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) |

$ | 7,553 | $ | 6,529 | $ | 15,141 | $ | 12,982 | ||||||||||||||||||

Adjusted EBITDA (2) |

20,458 | 32,706 | 47,187 | 63,878 | ||||||||||||||||||||||

| Interest Coverage Ratio | 2.71x | 5.01x | 3.12x | 4.92x | ||||||||||||||||||||||

| Fixed Charge Coverage Ratio | ||||||||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) |

$ | 7,553 | $ | 6,529 | $ | 15,141 | $ | 12,982 | ||||||||||||||||||

| Secured debt principal amortization | — | — | — | — | ||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture adjustments for secured debt principal amortization |

46 | — | 46 | — | ||||||||||||||||||||||

| Total fixed charges | 7,599 | 6,529 | 15,187 | 12,982 | ||||||||||||||||||||||

Adjusted EBITDA (2) |

20,458 | 32,706 | 47,187 | 63,878 | ||||||||||||||||||||||

| Fixed Charge Coverage Ratio | 2.69x | 5.01x | 3.11x | 4.92x | ||||||||||||||||||||||

| Net Debt | June 30, 2024 | December 31, 2023 | ||||||||||||

| Mortgages payable, net | $ | 353,200 | $ | 352,856 | ||||||||||

| Credit facility revolver | 107,000 | 116,000 | ||||||||||||

| Total debt - as reported | 460,200 | 468,856 | ||||||||||||

| Deferred financing costs, net | 1,800 | 2,144 | ||||||||||||

| Principal Outstanding | 462,000 | 471,000 | ||||||||||||

Proportionate share of Unconsolidated Joint Venture Principal Outstanding |

27,286 | 27,332 | ||||||||||||

| Adjusted Principal Outstanding | 489,286 | 498,332 | ||||||||||||

| Cash and cash equivalents | (24,224) | (22,473) | ||||||||||||

Proportionate share of Unconsolidated Joint Venture cash and cash equivalents |

(720) | (650) | ||||||||||||

| Net Debt | $ | 464,342 | $ | 475,209 | ||||||||||

| June 30, 2024 | December 31, 2023 | |||||||||||||

| Total real estate investments, at cost - as reported | $ | 1,283,456 | $ | 1,320,396 | ||||||||||

| Adjustments: | ||||||||||||||

| Gross intangible lease assets | 307,744 | 333,658 | ||||||||||||

| Gross intangible lease liabilities | (29,779) | (31,250) | ||||||||||||

Non-Operating Properties total real estate investments, at cost (1) |

(11,113) | — | ||||||||||||

Proportionate share of Unconsolidated Joint Venture Gross Real Estate Investments |

45,552 | 45,548 | ||||||||||||

Gross Real Estate Investments (1) |

$ | 1,595,860 | $ | 1,668,352 | ||||||||||

| June 30, 2024 | December 31, 2023 | |||||||||||||

| Net Debt Ratios | ||||||||||||||

Net Debt (2) |

$ | 464,342 | $ | 475,209 | ||||||||||

| Annualized Most Recent Quarter Adjusted EBITDA | 81,832 | 98,588 | ||||||||||||

| Net Debt to Annualized Quarter-to-Date Adjusted EBITDA Ratio | 5.67x | 4.82x | ||||||||||||

Net Debt (2) |

$ | 464,342 | $ | 475,209 | ||||||||||

Annualized Year-to-Date Adjusted EBITDA (3) |

94,374 | 118,542 | ||||||||||||

Net Debt to Annualized Year-to-Date Adjusted EBITDA Ratio (3) |

4.92x | 4.01x | ||||||||||||

Net Debt (2) |

$ | 464,342 | $ | 475,209 | ||||||||||

Gross Real Estate Investments (1) (2) |

1,595,860 | 1,668,352 | ||||||||||||

| Net Debt Leverage Ratio | 29.1 | % | 28.5 | % | ||||||||||

| Unencumbered Assets/Real Estate Assets | ||||||||||||||

| Unencumbered Gross Real Estate Investments | $ | 983,429 | $ | 1,060,660 | ||||||||||

Gross Real Estate Investments (1) (2) |

1,595,860 | 1,668,352 | ||||||||||||

| Unencumbered Asset Ratio | 61.6 | % | 63.6 | % | ||||||||||

| Low | High | |||||||||||||

| Diluted net loss per share attributable to common stockholders | $ | (1.07) | $ | (1.03) | ||||||||||

Depreciation and amortization of real estate assets |

1.84 | 1.84 | ||||||||||||

| Proportionate share of adjustments for Unconsolidated Joint Venture | 0.03 | 0.03 | ||||||||||||

| FFO attributable to common stockholders per diluted share | 0.80 | 0.84 | ||||||||||||

Adjustments (1) |

0.17 | 0.17 | ||||||||||||

| Core FFO attributable to common stockholders per diluted share | $ | 0.97 | $ | 1.01 | ||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

| Orion Supplemental Information | |||||

June 30, 2024 |

|||||

| Section | Page | ||||

| About the Data | |||||

| Forward-Looking Statements | |||||

| Company Overview | |||||

| Balance Sheets | |||||

| Statements of Operations | |||||

| Funds From Operations (FFO), Core FFO and Funds Available for Distribution (FAD) | |||||

| EBITDA, EBITDAre and Adjusted EBITDA | |||||

| Capital Structure | |||||

| Debt Detail | |||||

| Ratio Analysis | |||||

| Credit Facility Revolver Covenants | |||||

| Net Operating Income (NOI) and Cash NOI | |||||

| Leasing Activity | |||||

| Vacant Property Operating Expenses | |||||

| Dispositions | |||||

| Diversification Statistics: Real Estate Portfolio | |||||

| Tenants Comprising Over 1% of Annualized Base Rent | |||||

| Tenant Industry Diversification | |||||

| Lease Expirations | |||||

| Lease Summary | |||||

| Operating Property Geographic Diversification | |||||

| Operating Property Type | |||||

| Full Portfolio | |||||

| Non-Operating Properties | |||||

| Unconsolidated Joint Venture Investment Summary | |||||

| Definitions | |||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

| About the Data | ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

| Forward-Looking Statements | ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Company Overview

(unaudited)

| ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

| Company Overview (cont.) | ||

| Senior Management | Board of Directors | |||||||

| Paul H. McDowell, Chief Executive Officer, President | Reginald H. Gilyard, Non-Executive Chairman, Independent Director | |||||||

| Gavin B. Brandon, Executive Vice President, Chief Financial Officer and Treasurer | Kathleen R. Allen, Ph.D., Independent Director | |||||||

| Christopher H. Day, Executive Vice President, Chief Operating Officer | Richard J. Lieb, Independent Director | |||||||

| Gary E. Landriau, Executive Vice President, Chief Investment Officer | Gregory J. Whyte, Independent Director | |||||||

| Paul C. Hughes, General Counsel and Secretary | Paul H. McDowell, Chief Executive Officer, President and Director | |||||||

| Revea L. Schmidt, Senior Vice President, Chief Accounting Officer | ||||||||

| 2398 E. Camelback Road, Suite 1060 | 122 E. 42nd Street, Suite 5100 | |||||||

| Phoenix, AZ 85016 | New York, NY 10168 | |||||||

| 602-698-1002 | ||||||||

| www.ONLREIT.com | ||||||||

| Computershare Trust Company, N.A. | ||

| 462 South 4th Street, Suite 1600 | ||

| Louisville, KY 40202 | ||

| 855-866-0787 | ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Balance Sheets

(unaudited, in thousands)

| ||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Real estate investments, at cost: | ||||||||||||||||||||||||||||||||

| Land | $ | 222,730 | $ | 223,439 | $ | 223,264 | $ | 227,203 | $ | 229,105 | ||||||||||||||||||||||

| Buildings, fixtures and improvements | 1,060,726 | 1,081,788 | 1,097,132 | 1,106,383 | 1,111,646 | |||||||||||||||||||||||||||

| Total real estate investments, at cost | 1,283,456 | 1,305,227 | 1,320,396 | 1,333,586 | 1,340,751 | |||||||||||||||||||||||||||

| Less: accumulated depreciation | 172,476 | 165,490 | 158,791 | 156,904 | 149,147 | |||||||||||||||||||||||||||

| Total real estate investments, net | 1,110,980 | 1,139,737 | 1,161,605 | 1,176,682 | 1,191,604 | |||||||||||||||||||||||||||

| Accounts receivable, net | 23,122 | 24,942 | 24,663 | 26,911 | 24,960 | |||||||||||||||||||||||||||

| Intangible lease assets, net | 97,977 | 110,145 | 126,364 | 144,304 | 161,885 | |||||||||||||||||||||||||||

| Cash and cash equivalents | 24,224 | 23,618 | 22,473 | 32,286 | 42,209 | |||||||||||||||||||||||||||

| Real estate assets held for sale, net | — | — | — | 3,818 | 16,251 | |||||||||||||||||||||||||||

| Other assets, net | 83,550 | 87,077 | 88,828 | 120,390 | 90,998 | |||||||||||||||||||||||||||

| Total assets | $ | 1,339,853 | $ | 1,385,519 | $ | 1,423,933 | $ | 1,504,391 | $ | 1,527,907 | ||||||||||||||||||||||

| Liabilities and Equity | ||||||||||||||||||||||||||||||||

| Mortgages payable, net | $ | 353,200 | $ | 353,028 | $ | 352,856 | $ | 352,683 | $ | 352,509 | ||||||||||||||||||||||

| Credit facility revolver | 107,000 | 116,000 | 116,000 | 175,000 | 175,000 | |||||||||||||||||||||||||||

| Accounts payable and accrued expenses | 26,941 | 23,732 | 30,479 | 30,570 | 22,326 | |||||||||||||||||||||||||||

| Below-market lease liabilities, net | 5,536 | 6,753 | 8,074 | 9,481 | 10,996 | |||||||||||||||||||||||||||

| Distributions payable | 5,595 | 5,587 | 5,578 | 5,578 | 5,670 | |||||||||||||||||||||||||||

| Other liabilities, net | 24,090 | 24,468 | 23,943 | 21,811 | 23,682 | |||||||||||||||||||||||||||

| Total liabilities | 522,362 | 529,568 | 536,930 | 595,123 | 590,183 | |||||||||||||||||||||||||||

| Common stock | 56 | 56 | 56 | 56 | 57 | |||||||||||||||||||||||||||

| Additional paid-in capital | 1,146,199 | 1,145,264 | 1,144,636 | 1,143,825 | 1,148,155 | |||||||||||||||||||||||||||

Accumulated other comprehensive (loss) income |

(14) | (45) | (264) | 986 | 3,026 | |||||||||||||||||||||||||||

| Accumulated deficit | (330,136) | (290,710) | (258,805) | (237,026) | (214,929) | |||||||||||||||||||||||||||

| Total stockholders' equity | 816,105 | 854,565 | 885,623 | 907,841 | 936,309 | |||||||||||||||||||||||||||

| Non-controlling interest | 1,386 | 1,386 | 1,380 | 1,427 | 1,415 | |||||||||||||||||||||||||||

| Total equity | 817,491 | 855,951 | 887,003 | 909,268 | 937,724 | |||||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,339,853 | $ | 1,385,519 | $ | 1,423,933 | $ | 1,504,391 | $ | 1,527,907 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Statements of Operations

(unaudited, in thousands, except per share data)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Rental | $ | 39,923 | $ | 46,995 | $ | 43,551 | $ | 48,876 | $ | 51,824 | ||||||||||||||||||||||

| Fee income from unconsolidated joint venture | 201 | 202 | 200 | 200 | 200 | |||||||||||||||||||||||||||

| Total revenues | 40,124 | 47,197 | 43,751 | 49,076 | 52,024 | |||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||

| Property operating | 15,757 | 15,999 | 14,446 | 15,506 | 15,487 | |||||||||||||||||||||||||||

| General and administrative | 4,544 | 4,949 | 5,479 | 4,367 | 4,565 | |||||||||||||||||||||||||||

| Depreciation and amortization | 38,614 | 24,504 | 26,055 | 27,013 | 27,877 | |||||||||||||||||||||||||||

| Impairments | 5,680 | 19,685 | 6,136 | 11,403 | 11,819 | |||||||||||||||||||||||||||

| Transaction related | 167 | 110 | 148 | 101 | 150 | |||||||||||||||||||||||||||

| Total operating expenses | 64,762 | 65,247 | 52,264 | 58,390 | 59,898 | |||||||||||||||||||||||||||

| Other (expenses) income: | ||||||||||||||||||||||||||||||||

| Interest expense, net | (8,058) | (8,146) | (7,928) | (7,380) | (7,222) | |||||||||||||||||||||||||||

| Gain on disposition of real estate assets | — | — | 13 | 18 | — | |||||||||||||||||||||||||||

| Loss on extinguishment of debt, net | (1,078) | — | — | — | (504) | |||||||||||||||||||||||||||

| Other income, net | 209 | 163 | 273 | 437 | 165 | |||||||||||||||||||||||||||

| Equity in loss of unconsolidated joint venture, net | (163) | (116) | (109) | (108) | (95) | |||||||||||||||||||||||||||

| Total other (expenses) income, net | (9,090) | (8,099) | (7,751) | (7,033) | (7,656) | |||||||||||||||||||||||||||

| Loss before taxes | (33,728) | (26,149) | (16,264) | (16,347) | (15,530) | |||||||||||||||||||||||||||

| Provision for income taxes | (73) | (77) | 49 | (160) | (185) | |||||||||||||||||||||||||||

| Net loss | (33,801) | (26,226) | (16,215) | (16,507) | (15,715) | |||||||||||||||||||||||||||

| Net (income) loss attributable to non-controlling interest | — | (6) | 47 | (12) | (15) | |||||||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (26,232) | $ | (16,168) | $ | (16,519) | $ | (15,730) | ||||||||||||||||||||||

| Weighted-average shares outstanding - basic and diluted | 55,910 | 55,803 | 55,782 | 56,543 | 56,680 | |||||||||||||||||||||||||||

| Basic and diluted net loss per share attributable to common stockholders | $ | (0.60) | $ | (0.47) | $ | (0.29) | $ | (0.29) | $ | (0.28) | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Funds From Operations (FFO), Core FFO and Funds Available for Distribution (FAD)

(unaudited, in thousands, except per share data)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (26,232) | $ | (16,168) | $ | (16,519) | $ | (15,730) | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Depreciation and amortization of real estate assets | 38,582 | 24,472 | 26,029 | 26,988 | 27,852 | |||||||||||||||||||||||||||

| Gain on disposition of real estate assets | — | — | (13) | (18) | — | |||||||||||||||||||||||||||

| Impairment of real estate | 5,680 | 19,685 | 6,136 | 11,403 | 11,819 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 464 | 464 | 463 | 463 | 463 | |||||||||||||||||||||||||||

| FFO attributable to common stockholders | $ | 10,925 | $ | 18,389 | $ | 16,447 | $ | 22,317 | $ | 24,404 | ||||||||||||||||||||||

| Transaction related | 167 | 110 | 148 | 101 | 150 | |||||||||||||||||||||||||||

| Amortization of deferred financing costs | 914 | 924 | 933 | 933 | 1,060 | |||||||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 123 | 115 | (14) | 99 | |||||||||||||||||||||||||||

| Equity-based compensation | 935 | 790 | 826 | 687 | 689 | |||||||||||||||||||||||||||

| Loss on extinguishment of debt, net | 1,078 | — | — | — | 504 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 28 | 29 | 30 | 29 | 29 | |||||||||||||||||||||||||||

| Core FFO attributable to common stockholders | $ | 14,171 | $ | 20,365 | $ | 18,499 | $ | 24,053 | $ | 26,935 | ||||||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (537) | (361) | (346) | (274) | |||||||||||||||||||||||||||

| Straight-line rental revenue | 240 | (549) | 679 | (1,369) | (2,275) | |||||||||||||||||||||||||||

| Unconsolidated Joint Venture basis difference amortization | 113 | 114 | 114 | 113 | 114 | |||||||||||||||||||||||||||

| Capital expenditures and leasing costs | (6,319) | (3,445) | (7,443) | (8,359) | (2,172) | |||||||||||||||||||||||||||

| Other adjustments, net | 74 | 108 | 116 | 66 | 74 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for the items above, as applicable | (22) | (21) | (36) | (40) | (41) | |||||||||||||||||||||||||||

| FAD attributable to common stockholders | $ | 7,828 | $ | 16,035 | $ | 11,568 | $ | 14,118 | $ | 22,361 | ||||||||||||||||||||||

| Weighted-average shares outstanding - basic | 55,910 | 55,803 | 55,782 | 56,543 | 56,680 | |||||||||||||||||||||||||||

Effect of weighted-average dilutive securities (1) |

99 | 55 | 37 | 26 | 11 | |||||||||||||||||||||||||||

| Weighted-average shares outstanding - diluted | 56,009 | 55,858 | 55,819 | 56,569 | 56,691 | |||||||||||||||||||||||||||

| FFO attributable to common stockholders per diluted share | $ | 0.20 | $ | 0.33 | $ | 0.29 | $ | 0.39 | $ | 0.43 | ||||||||||||||||||||||

| Core FFO attributable to common stockholders per diluted share | $ | 0.25 | $ | 0.36 | $ | 0.33 | $ | 0.43 | $ | 0.48 | ||||||||||||||||||||||

| FAD attributable to common stockholders per diluted share | $ | 0.14 | $ | 0.29 | $ | 0.21 | $ | 0.25 | $ | 0.39 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

EBITDA, EBITDAre and Adjusted EBITDA

(unaudited, in thousands)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Net loss attributable to common stockholders | $ | (33,801) | $ | (26,232) | $ | (16,168) | $ | (16,519) | $ | (15,730) | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Interest expense | 8,058 | 8,146 | 7,928 | 7,380 | 7,222 | |||||||||||||||||||||||||||

| Depreciation and amortization | 38,614 | 24,504 | 26,055 | 27,013 | 27,877 | |||||||||||||||||||||||||||

| Provision for income taxes | 73 | 77 | (49) | 160 | 185 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | 902 | 860 | 864 | 864 | 861 | |||||||||||||||||||||||||||

| EBITDA | $ | 13,846 | $ | 7,355 | $ | 18,630 | $ | 18,898 | $ | 20,415 | ||||||||||||||||||||||

| Gain on disposition of real estate assets | — | — | (13) | (18) | — | |||||||||||||||||||||||||||

| Impairment of real estate | 5,680 | 19,685 | 6,136 | 11,403 | 11,819 | |||||||||||||||||||||||||||

| EBITDAre | $ | 19,526 | $ | 27,040 | $ | 24,753 | $ | 30,283 | $ | 32,234 | ||||||||||||||||||||||

| Transaction related | 167 | 110 | 148 | 101 | 150 | |||||||||||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (537) | (361) | (346) | (274) | |||||||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 123 | 115 | (14) | 100 | |||||||||||||||||||||||||||

| Loss on extinguishment of debt, net | 1,078 | — | — | — | 504 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for items above, as applicable | (8) | (7) | (8) | (7) | (8) | |||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 20,458 | $ | 26,729 | $ | 24,647 | $ | 30,017 | $ | 32,706 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Capital Structure

(unaudited, dollars and shares in thousands, except per share amounts)

| ||

| Common equity | 29.1% | ||||||||||

| Mortgages payable | 51.4% | ||||||||||

Credit facility revolver (4) |

15.5% | ||||||||||

| Proportionate share of Unconsolidated Joint Venture debt | 4.0% | ||||||||||

| Fixed | 72.6 | % | |||

Variable (4) |

27.4 | % | |||

| Orion Capitalization Table | |||||||||||||||||

| June 30, 2024 | |||||||||||||||||

| Common stock outstanding | 55,948 | ||||||||||||||||

| Stock price | $ | 3.59 | |||||||||||||||

| Implied Equity Market Capitalization | $ | 200,853 | |||||||||||||||

| Wtd. Avg. Maturity (Years) |

Interest Rate (1) |

June 30, 2024 | |||||||||||||||

| Mortgages payable | 2.6 | 4.97 | % | $ | 355,000 | ||||||||||||

Proportionate share of Unconsolidated Joint Venture debt (2) |

0.4 | 6.93 | % | 27,286 | |||||||||||||

| Total secured debt | 2.5 | 5.11 | % | $ | 382,286 | ||||||||||||

Total unsecured credit facility revolver (3) (4) |

1.9 | 8.66 | % | $ | 107,000 | ||||||||||||

| Total Principal Outstanding | 2.3 | 5.89 | % | $ | 489,286 | ||||||||||||

| Total Capitalization | $ | 690,139 | |||||||||||||||

| Cash and cash equivalents | 24,224 | ||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture cash and cash equivalents | 720 | ||||||||||||||||

| Enterprise Value | $ | 665,195 | |||||||||||||||

| Net Debt/Enterprise Value | 69.8 | % | |||||||||||||||

| Net Debt/Gross Real Estate Investments | 29.1 | % | |||||||||||||||

| Fixed Charge Coverage Ratio | 2.69x | ||||||||||||||||

Liquidity (5) |

$ | 267,944 | |||||||||||||||

| Net Debt/Annualized Most Recent Quarter Adjusted EBITDA | 5.67x | ||||||||||||||||

| Net Debt/Annualized Year-to-Date Adjusted EBITDA | 4.92x | ||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Debt Detail

(unaudited, dollars in thousands)

| ||

| Principal Payments Due | Total | 2024 | 2025 | 2026 | 2027 | |||||||||||||||||||||||||||

Credit facility revolver (1) |

$ | 107,000 | $ | — | $ | — | $ | 107,000 | $ | — | ||||||||||||||||||||||

| Mortgages payable | 355,000 | — | — | — | 355,000 | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture debt (2) |

27,286 | 27,286 | — | — | — | |||||||||||||||||||||||||||

| Total Principal Outstanding | $ | 489,286 | $ | 27,286 | $ | — | $ | 107,000 | $ | 355,000 | ||||||||||||||||||||||

| Debt Type | Percentage of Principal Outstanding | Interest Rate (3) |

Weighted-Average Years to Maturity | |||||||||||||||||

Credit facility revolver (1) |

21.9 | % | 8.66 | % | 1.9 | |||||||||||||||

| Mortgages payable | 72.6 | % | 4.97 | % | 2.6 | |||||||||||||||

Proportionate share of Unconsolidated Joint Venture debt (2) |

5.5 | % | 6.93 | % | 0.4 | |||||||||||||||

| Total | 100.0 | % | 5.89 | % | 2.3 | |||||||||||||||

| Total unsecured debt | 21.9 | % | 8.66 | % | 1.9 | |||||||||||||||

| Total secured debt | 78.1 | % | 5.11 | % | 2.5 | |||||||||||||||

| Total | 100.0 | % | 5.89 | % | 2.3 | |||||||||||||||

| Total fixed-rate debt | 72.6 | % | 4.97 | % | 2.6 | |||||||||||||||

| Total variable-rate debt | 27.4 | % | 8.31 | % | 1.6 | |||||||||||||||

| Total | 100.0 | % | 5.89 | % | 2.3 | |||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Ratio Analysis

(unaudited, dollars in thousands)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Interest Coverage Ratio | ||||||||||||||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) |

$ | 7,553 | $ | 7,588 | $ | 7,365 | $ | 6,818 | $ | 6,529 | ||||||||||||||||||||||

Adjusted EBITDA (2) |

20,458 | 26,729 | 24,647 | 30,017 | 32,706 | |||||||||||||||||||||||||||

| Interest Coverage Ratio | 2.71x | 3.52x | 3.35x | 4.40x | 5.01x | |||||||||||||||||||||||||||

| Fixed Charge Coverage Ratio | ||||||||||||||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) |

$ | 7,553 | $ | 7,588 | $ | 7,365 | $ | 6,818 | $ | 6,529 | ||||||||||||||||||||||

| Secured debt principal amortization | — | — | — | — | — | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture adjustments for secured debt principal amortization | 46 | — | — | — | — | |||||||||||||||||||||||||||

| Total fixed charges | 7,599 | 7,588 | 7,365 | 6,818 | 6,529 | |||||||||||||||||||||||||||

Adjusted EBITDA (2) |

20,458 | 26,729 | 24,647 | 30,017 | 32,706 | |||||||||||||||||||||||||||

| Fixed Charge Coverage Ratio | 2.69x | 3.52x | 3.35x | 4.40x | 5.01x | |||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Net Debt Ratios | ||||||||||||||||||||||||||||||||

Net Debt (1) |

$ | 464,342 | $ | 474,081 | $ | 475,209 | $ | 491,140 | $ | 514,418 | ||||||||||||||||||||||

| Annualized Most Recent Quarter Adjusted EBITDA | 81,832 | 106,916 | 98,588 | 120,068 | 130,824 | |||||||||||||||||||||||||||

Net Debt to Annualized Most Recent Quarter Adjusted EBITDA Ratio |

5.67x | 4.43x | 4.82x | 4.09x | 3.93x | |||||||||||||||||||||||||||

Net Debt (1) |

$ | 464,342 | $ | 474,081 | $ | 475,209 | $ | 491,140 | $ | 514,418 | ||||||||||||||||||||||

Annualized Year-to-Date Adjusted EBITDA (2) |

94,374 | 106,916 | 118,542 | 125,193 | 127,756 | |||||||||||||||||||||||||||

| Net Debt to Annualized Year-to-Date Adjusted EBITDA Ratio | 4.92x | 4.43x | 4.01x | 3.92x | 4.03x | |||||||||||||||||||||||||||

Net Debt (1) |

$ | 464,342 | $ | 474,081 | $ | 475,209 | $ | 491,140 | $ | 514,418 | ||||||||||||||||||||||

Gross Real Estate Investments (1) |

1,595,860 | 1,632,914 | 1,668,352 | 1,694,527 | 1,700,301 | |||||||||||||||||||||||||||

| Net Debt Leverage Ratio | 29.1 | % | 29.0 | % | 28.5 | % | 29.0 | % | 30.3 | % | ||||||||||||||||||||||

| Unencumbered Assets/Real Estate Assets | ||||||||||||||||||||||||||||||||

Unencumbered Gross Real Estate Investments (1) |

$ | 983,429 | $ | 1,021,402 | $ | 1,060,660 | $ | 1,088,604 | $ | 1,096,518 | ||||||||||||||||||||||

Gross Real Estate Investments (1) |

1,595,860 | 1,632,914 | 1,668,352 | 1,694,527 | 1,700,301 | |||||||||||||||||||||||||||

| Unencumbered Asset Ratio | 61.6 | % | 62.6 | % | 63.6 | % | 64.2 | % | 64.5 | % | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Credit Facility Revolver Covenants

(unaudited)

| ||

| Credit Facility Revolver Financial Covenants | Required | June 30, 2024 | ||||||||||||

| Ratio of total indebtedness to total asset value | ≤ 60% | 37.8% | ||||||||||||

| Ratio of adjusted EBITDA to fixed charges | ≥ 1.5x | 2.81x | ||||||||||||

| Ratio of secured indebtedness to total asset value | ≤ 40% | 30.1% | ||||||||||||

| Ratio of unsecured indebtedness to unencumbered asset value | ≤ 60% (1) |

12.4% | ||||||||||||

| Ratio of unencumbered adjusted NOI to unsecured interest expense | ≥ 2.00x | 5.80x | ||||||||||||

| Unencumbered asset value | ≥ $500.0 million | $781.7 million | ||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Net Operating Income (NOI) and Cash NOI

(unaudited, dollars in thousands)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Rental revenue: | ||||||||||||||||||||||||||||||||

| Cash rental revenue | $ | 30,306 | $ | 31,678 | $ | 33,466 | $ | 35,491 | $ | 36,410 | ||||||||||||||||||||||

| Fixed reimbursements | 1,445 | 1,446 | 1,436 | 1,737 | 1,399 | |||||||||||||||||||||||||||

| Variable reimbursements | 7,469 | 11,196 | 7,646 | 9,203 | 10,679 | |||||||||||||||||||||||||||

| Straight-line rental revenue | (240) | 549 | (679) | 1,369 | 2,275 | |||||||||||||||||||||||||||

| Amortization of above and below market leases, net | 429 | 537 | 361 | 346 | 274 | |||||||||||||||||||||||||||

| Amortization of deferred lease incentives, net | (124) | (123) | (115) | 14 | (100) | |||||||||||||||||||||||||||

| Other rental revenue | 638 | 1,712 | 1,436 | 716 | 887 | |||||||||||||||||||||||||||

| Total rental revenue | 39,923 | 46,995 | 43,551 | 48,876 | 51,824 | |||||||||||||||||||||||||||

| Property operating expense | (15,757) | (15,999) | (14,446) | (15,506) | (15,487) | |||||||||||||||||||||||||||

| NOI | $ | 24,166 | $ | 30,996 | $ | 29,105 | $ | 33,370 | $ | 36,337 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Straight-line rental revenue | 240 | (549) | 679 | (1,369) | (2,275) | |||||||||||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (537) | (361) | (346) | (274) | |||||||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 123 | 115 | (14) | 100 | |||||||||||||||||||||||||||

| Other non-cash adjustments | 48 | 48 | 49 | 47 | 48 | |||||||||||||||||||||||||||

| Proportionate share of Unconsolidated Joint Venture Cash NOI | 855 | 880 | 868 | 863 | 861 | |||||||||||||||||||||||||||

| Cash NOI | $ | 25,004 | $ | 30,961 | $ | 30,455 | $ | 32,551 | $ | 34,797 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Leasing Activity

(unaudited, square feet and dollars in thousands)

| ||

Three Months Ended June 30, 2024 |

||||||||||||||||||||

| New Leases | Renewals | Total | ||||||||||||||||||

| Number of leases | 2 | 1 | 3 | |||||||||||||||||

| Rentable square feet leased | 57 | 413 | 470 | |||||||||||||||||

Weighted average rental rate change (cash basis) (1) (2) |

N/A | 1.1 | % | 1.1 | % | |||||||||||||||

Tenant rent concessions and leasing costs (3) |

$ | 11,510 | $ | 791 | $ | 12,301 | ||||||||||||||

Tenant rent concessions and leasing costs per rentable square foot (4) |

$ | 201.15 | $ | 1.91 | $ | 26.14 | ||||||||||||||

Weighted average lease term (by rentable square feet) (years) (5) |

15.1 | 4.0 | 5.3 | |||||||||||||||||

| Tenant rent concessions and leasing costs per rentable square foot per year | $ | 13.34 | $ | 0.48 | $ | 4.89 | ||||||||||||||

Three Months Ended June 30, 2023 |

||||||||||||||||||||

| New Leases | Renewals | Total | ||||||||||||||||||

| Number of leases | 1 | 1 | 2 | |||||||||||||||||

| Rentable square feet leased | 3 | 44 | 47 | |||||||||||||||||

Weighted average rental rate change (cash basis) (1) (2) |

(18.2) | % | 8.0 | % | 6.7 | % | ||||||||||||||

Tenant rent concessions and leasing costs (3) |

$ | 43 | $ | 81 | $ | 124 | ||||||||||||||

Tenant rent concessions and leasing costs per rentable square foot (4) |

$ | 14.07 | $ | 1.85 | $ | 2.66 | ||||||||||||||

Weighted average lease term (by rentable square feet) (years) (5) |

3.0 | 3.0 | 3.0 | |||||||||||||||||

| Tenant rent concessions and leasing costs per rentable square foot per year | $ | 4.69 | $ | 0.62 | $ | 0.89 | ||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Leasing Activity (cont.)

(unaudited, square feet and dollars in thousands)

| ||

| Six Months Ended June 30, 2024 | ||||||||||||||||||||

| New Leases | Renewals | Total | ||||||||||||||||||

| Number of leases | 4 | 4 | 8 | |||||||||||||||||

| Rentable square feet leased | 149 | 429 | 578 | |||||||||||||||||

Weighted average rental rate change (cash basis) (1) (2) |

N/A | 2.2 | % | 2.2 | % | |||||||||||||||

Tenant rent concessions and leasing costs (3) |

$ | 19,942 | $ | 1,479 | $ | 21,421 | ||||||||||||||

Tenant rent concessions and leasing costs per rentable square foot (4) |

$ | 133.47 | $ | 3.45 | $ | 37.01 | ||||||||||||||

Weighted average lease term (by rentable square feet) (years) (5) |

10.2 | 4.3 | 5.8 | |||||||||||||||||

| Tenant rent concessions and leasing costs per rentable square foot per year | $ | 13.06 | $ | 0.81 | $ | 6.39 | ||||||||||||||

| Six Months Ended June 30, 2023 | ||||||||||||||||||||

| New Leases | Renewals | Total | ||||||||||||||||||

| Number of leases | 3 | 3 | 6 | |||||||||||||||||

| Rentable square feet leased | 18 | 111 | 129 | |||||||||||||||||

Weighted average rental rate change (cash basis) (1) (2) |

(19.8) | % | 17.3 | % | 13.5 | % | ||||||||||||||

Tenant rent concessions and leasing costs (3) |

$ | 799 | $ | 1,065 | $ | 1,864 | ||||||||||||||

Tenant rent concessions and leasing costs per rentable square foot (4) |

$ | 44.19 | $ | 9.62 | $ | 14.48 | ||||||||||||||

Weighted average lease term (by rentable square feet) (years) (5) |

7.8 | 9.8 | 9.5 | |||||||||||||||||

| Tenant rent concessions and leasing costs per rentable square foot per year | $ | 5.65 | $ | 0.98 | $ | 1.52 | ||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Vacant Property Operating Expenses

(unaudited, in thousands for the six months ended June 30, 2024)

| ||

| Square Feet | Total Expenses | |||||||||||||

| Operating Properties | ||||||||||||||

| Fully vacant - full period | 813 | $ | 3,055 | |||||||||||

Fully vacant - partial period (1) |

596 | 1,550 | ||||||||||||

Fully vacant subtotal (2) |

1,409 | 4,605 | ||||||||||||

Partially vacant (3) |

352 | 1,452 | ||||||||||||

| Total | 1,761 | $ | 6,057 | |||||||||||

| Non-Operating Properties | ||||||||||||||

| Fully vacant - full period | N/A | $ | 2,267 | |||||||||||

| Grand Total | $ | 8,324 | ||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Dispositions

(unaudited, square feet and dollars in thousands)

| ||

Date Sold |

Property Location |

Square Feet |

Gross Sale Price |

Lease Term (Years) | ||||||||||||||||||||||

| 05/29/2024 | St. Charles, MO | 96 | $2,100 | Vacant | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Diversification Statistics: Real Estate Portfolio

(unaudited, percentages based on portfolio Annualized Base Rent as of June 30, 2024, other than Occupancy Rate and Leased Rate which are based on Rentable Square Feet as of June 30, 2024)

| ||

|

Statistics

(square feet and dollars in thousands)

| ||||||||

| Operating Properties | 69 | |||||||

| Unconsolidated Joint Venture Properties | 6 | |||||||

| Rentable Square Feet | 8,202 | |||||||

| Annualized Base Rent | $ | 129,790 | ||||||

| Occupancy Rate | 79.7 | % | ||||||

| Leased Rate | 81.4 | % | ||||||

| Weighted Average Remaining Lease Term | 4.2 | |||||||

| Investment-Grade Tenants | 72.3 | % | ||||||

| NN leases | 66.5 | % | ||||||

| NNN leases | 12.5 | % | ||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

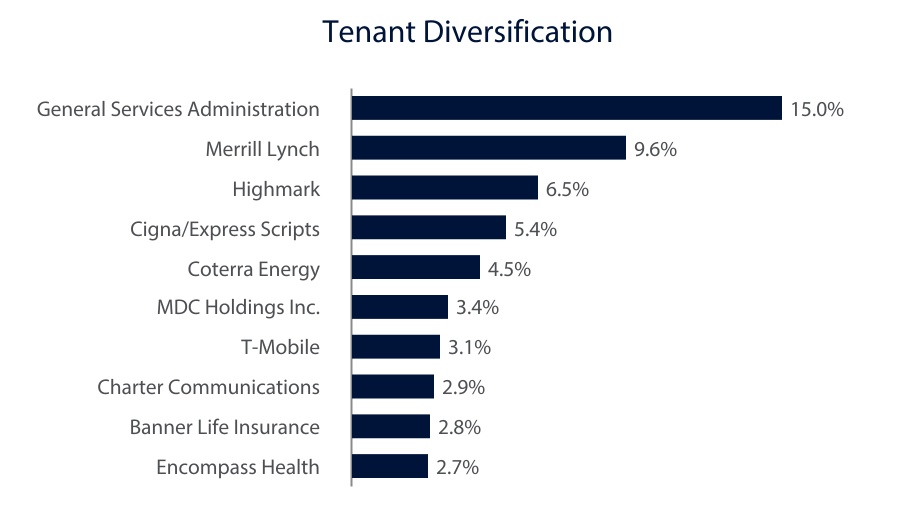

Tenants Comprising Over 1% of Annualized Base Rent

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Tenant | Number of Leases | Occupied Square Feet | Occupied Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | Credit Rating | ||||||||||||||||||||||||||||||||

| General Services Administration | 15 | 725 | 8.8 | % | $ | 19,516 | 15.0 | % | AA+ | |||||||||||||||||||||||||||||

| Merrill Lynch | 1 | 482 | 5.9 | % | 12,465 | 9.6 | % | A- | ||||||||||||||||||||||||||||||

| Highmark Western & Northeastern NY | 1 | 430 | 5.2 | % | 8,450 | 6.5 | % | NR | ||||||||||||||||||||||||||||||

| Cigna/Express Scripts | 3 | 365 | 4.5 | % | 7,009 | 5.4 | % | A- | ||||||||||||||||||||||||||||||

| Coterra Energy | 1 | 309 | 3.8 | % | 5,866 | 4.5 | % | BBB | ||||||||||||||||||||||||||||||

| MDC Holdings Inc. | 1 | 144 | 1.8 | % | 4,385 | 3.4 | % | BBB | ||||||||||||||||||||||||||||||

| T-Mobile | 3 | 217 | 2.6 | % | 4,020 | 3.1 | % | BBB | ||||||||||||||||||||||||||||||

| Charter Communications | 2 | 264 | 3.2 | % | 3,803 | 2.9 | % | BB+ | ||||||||||||||||||||||||||||||

| Banner Life Insurance | 1 | 116 | 1.4 | % | 3,581 | 2.8 | % | A | ||||||||||||||||||||||||||||||

| Encompass Health | 1 | 65 | 0.8 | % | 3,505 | 2.7 | % | BB- | ||||||||||||||||||||||||||||||

| Top Ten Tenants | 29 | 3,117 | 38.0 | % | 72,600 | 55.9 | % | |||||||||||||||||||||||||||||||

| Remaining Tenants: | ||||||||||||||||||||||||||||||||||||||

| Collins Aerospace | 1 | 207 | 2.5 | % | 3,440 | 2.7 | % | BBB+ | ||||||||||||||||||||||||||||||

| Home Depot/HD Supply | 2 | 153 | 1.9 | % | 3,173 | 2.4 | % | A | ||||||||||||||||||||||||||||||

| AT&T | 1 | 203 | 2.5 | % | 3,023 | 2.3 | % | BBB | ||||||||||||||||||||||||||||||

| Ingram Micro | 1 | 170 | 2.1 | % | 2,898 | 2.2 | % | BB- | ||||||||||||||||||||||||||||||

| Linde | 1 | 175 | 2.1 | % | 2,800 | 2.2 | % | A | ||||||||||||||||||||||||||||||

| Maximus | 2 | 168 | 2.0 | % | 2,610 | 2.0 | % | BB+ | ||||||||||||||||||||||||||||||

| Citigroup | 1 | 64 | 0.8 | % | 2,459 | 1.9 | % | BBB+ | ||||||||||||||||||||||||||||||

| Hasbro | 1 | 136 | 1.7 | % | 2,446 | 1.9 | % | BBB | ||||||||||||||||||||||||||||||

| CVS/Aetna | 1 | 127 | 1.6 | % | 2,334 | 1.8 | % | BBB | ||||||||||||||||||||||||||||||

| NetJets | 1 | 140 | 1.7 | % | 2,015 | 1.6 | % | NR | ||||||||||||||||||||||||||||||

| Pulte Mortgage | 1 | 95 | 1.2 | % | 2,005 | 1.6 | % | BBB | ||||||||||||||||||||||||||||||

| Elementis | 1 | 66 | 0.8 | % | 1,980 | 1.5 | % | NR | ||||||||||||||||||||||||||||||

| FedEx | 1 | 90 | 1.1 | % | 1,744 | 1.3 | % | BBB | ||||||||||||||||||||||||||||||

| GE Vernova | 1 | 152 | 1.9 | % | 1,713 | 1.3 | % | BBB+ | ||||||||||||||||||||||||||||||

| AGCO | 1 | 126 | 1.5 | % | 1,607 | 1.2 | % | BBB- | ||||||||||||||||||||||||||||||

| Intermec | 1 | 81 | 1.0 | % | 1,503 | 1.2 | % | A | ||||||||||||||||||||||||||||||

| Abbott Laboratories | 1 | 131 | 1.6 | % | 1,412 | 1.1 | % | AA- | ||||||||||||||||||||||||||||||

| Becton Dickinson | 1 | 72 | 0.9 | % | 1,397 | 1.1 | % | BBB | ||||||||||||||||||||||||||||||

| Ifm Efector | 1 | 45 | 0.6 | % | 1,316 | 1.0 | % | NR | ||||||||||||||||||||||||||||||

| Life Insurance Company of N.A. | 1 | 54 | 0.7 | % | 1,262 | 1.0 | % | AA+ | ||||||||||||||||||||||||||||||

| Total | 51 | 5,572 | 68.2 | % | $ | 115,737 | 89.2 | % | ||||||||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

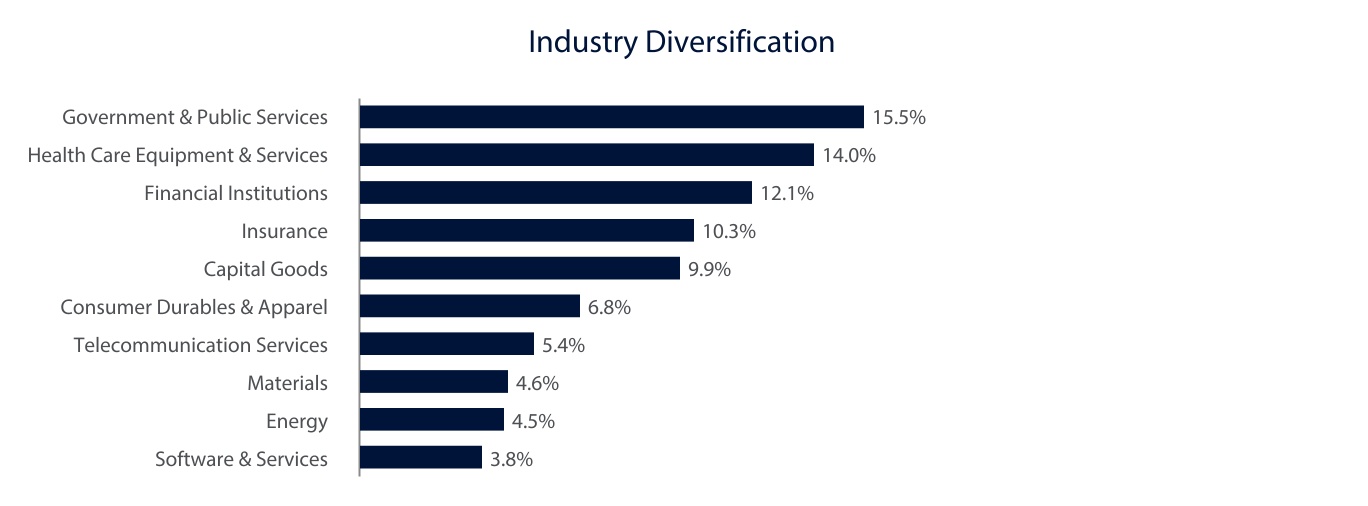

Tenant Industry Diversification

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Industry | Number of Leases (1) |

Occupied Square Feet | Occupied Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| Government & Public Services | 17 | 769 | 9.4 | % | $ | 20,064 | 15.5 | % | ||||||||||||||||||||||||

| Health Care Equipment & Services | 11 | 937 | 11.4 | % | 18,213 | 14.0 | % | |||||||||||||||||||||||||

| Financial Institutions | 3 | 616 | 7.5 | % | 15,720 | 12.1 | % | |||||||||||||||||||||||||

| Insurance | 3 | 600 | 7.3 | % | 13,292 | 10.3 | % | |||||||||||||||||||||||||

| Capital Goods | 10 | 846 | 10.3 | % | 12,790 | 9.9 | % | |||||||||||||||||||||||||

| Consumer Durables & Apparel | 3 | 375 | 4.6 | % | 8,835 | 6.8 | % | |||||||||||||||||||||||||

| Telecommunication Services | 5 | 419 | 5.1 | % | 7,043 | 5.4 | % | |||||||||||||||||||||||||

| Materials | 4 | 366 | 4.5 | % | 5,959 | 4.6 | % | |||||||||||||||||||||||||

| Energy | 1 | 309 | 3.8 | % | 5,866 | 4.5 | % | |||||||||||||||||||||||||

| Software & Services | 4 | 265 | 3.2 | % | 4,971 | 3.8 | % | |||||||||||||||||||||||||

| Top Ten Tenant Industries | 61 | 5,502 | 67.1 | % | 112,753 | 86.9 | % | |||||||||||||||||||||||||

| Remaining Tenant Industries: | ||||||||||||||||||||||||||||||||

| Commercial & Professional Services | 10 | 293 | 3.6 | % | 4,847 | 3.7 | % | |||||||||||||||||||||||||

| Transportation | 4 | 279 | 3.4 | % | 4,530 | 3.5 | % | |||||||||||||||||||||||||

| Media & Entertainment | 2 | 264 | 3.2 | % | 3,803 | 2.9 | % | |||||||||||||||||||||||||

| Retailing | 3 | 157 | 1.9 | % | 3,247 | 2.5 | % | |||||||||||||||||||||||||

| Utilities | 1 | 26 | 0.3 | % | 394 | 0.3 | % | |||||||||||||||||||||||||

| Restaurant | 4 | 13 | 0.2 | % | 168 | 0.1 | % | |||||||||||||||||||||||||

| Real Estate | 1 | 3 | — | % | 48 | 0.1 | % | |||||||||||||||||||||||||

| Total | 86 | 6,537 | 79.7 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Lease Expirations

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Year of Expiration | Number of Leases Expiring (1) |

Occupied Square Feet |

Occupied Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| 2024 | 8 | 885 | 10.8 | % | $ | 16,453 | 12.7 | % | ||||||||||||||||||||||||

| 2025 | 11 | 944 | 11.5 | % | 17,628 | 13.6 | % | |||||||||||||||||||||||||

| 2026 | 16 | 803 | 9.8 | % | 18,894 | 14.6 | % | |||||||||||||||||||||||||

| 2027 | 13 | 973 | 11.9 | % | 16,284 | 12.5 | % | |||||||||||||||||||||||||

| 2028 | 12 | 992 | 12.1 | % | 20,789 | 16.0 | % | |||||||||||||||||||||||||

| 2029 | 5 | 398 | 4.9 | % | 6,171 | 4.8 | % | |||||||||||||||||||||||||

| 2030 | 4 | 142 | 1.7 | % | 5,275 | 4.1 | % | |||||||||||||||||||||||||

| 2031 | 1 | 11 | 0.1 | % | 429 | 0.3 | % | |||||||||||||||||||||||||

| 2032 | 3 | 300 | 3.7 | % | 3,875 | 3.0 | % | |||||||||||||||||||||||||

| 2033 | 3 | 358 | 4.4 | % | 6,273 | 4.8 | % | |||||||||||||||||||||||||

| Thereafter | 10 | 731 | 8.8 | % | 17,719 | 13.6 | % | |||||||||||||||||||||||||

| Total | 86 | 6,537 | 79.7 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Lease Summary

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Rent Escalations | Number of Leases (1) |

Occupied Square Feet |

Occupied Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| Fixed Dollar or Percent Increase | 63 | 5,592 | 68.2 | % | $ | 105,332 | 81.2 | % | ||||||||||||||||||||||||

| Flat | 7 | 111 | 1.4 | % | 1,722 | 1.3 | % | |||||||||||||||||||||||||

| GSA CPI | 14 | 689 | 8.3 | % | 18,775 | 14.5 | % | |||||||||||||||||||||||||

| CPI | 2 | 145 | 1.8 | % | 3,961 | 3.0 | % | |||||||||||||||||||||||||

| Total | 86 | 6,537 | 79.7 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

| Tenant Expense Obligations | Number of Leases (1) |

Occupied Square Feet |

Occupied Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| NN | 52 | 4,627 | 56.4 | % | $ | 86,296 | 66.5 | % | ||||||||||||||||||||||||

| Modified Gross | 19 | 971 | 11.8 | % | 27,114 | 20.9 | % | |||||||||||||||||||||||||

| NNN | 12 | 931 | 11.4 | % | 16,283 | 12.5 | % | |||||||||||||||||||||||||

| Gross | 3 | 8 | 0.1 | % | 97 | 0.1 | % | |||||||||||||||||||||||||

| Total | 86 | 6,537 | 79.7 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

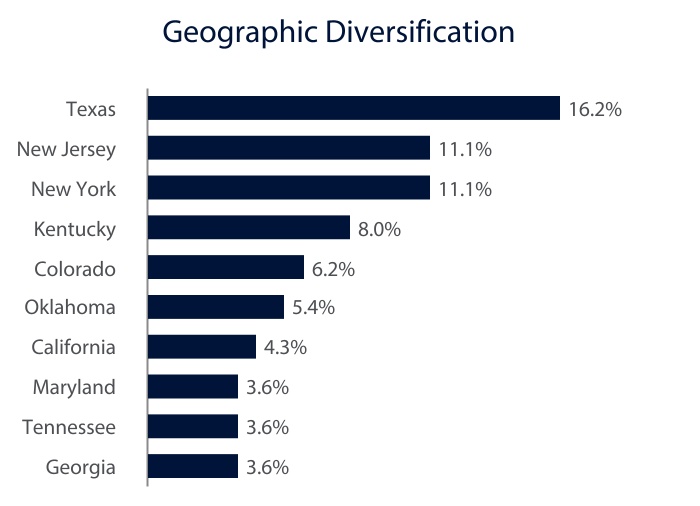

Operating Property Geographic Diversification

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Location | Number of Properties | Rentable Square Feet | Rentable Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| Texas | 15 | 1,352 | 16.5 | % | $ | 21,079 | 16.2 | % | ||||||||||||||||||||||||

| New Jersey | 3 | 714 | 8.7 | % | 14,445 | 11.1 | % | |||||||||||||||||||||||||

| New York | 6 | 781 | 9.5 | % | 14,407 | 11.1 | % | |||||||||||||||||||||||||

| Kentucky | 2 | 458 | 5.6 | % | 10,355 | 8.0 | % | |||||||||||||||||||||||||

| Colorado | 4 | 571 | 7.0 | % | 8,103 | 6.2 | % | |||||||||||||||||||||||||

| Oklahoma | 3 | 585 | 7.1 | % | 6,996 | 5.4 | % | |||||||||||||||||||||||||

| California | 3 | 244 | 3.0 | % | 5,538 | 4.3 | % | |||||||||||||||||||||||||

| Maryland | 2 | 236 | 2.9 | % | 4,667 | 3.6 | % | |||||||||||||||||||||||||

| Tennessee | 4 | 240 | 2.9 | % | 4,667 | 3.6 | % | |||||||||||||||||||||||||

| Georgia | 3 | 284 | 3.5 | % | 4,635 | 3.6 | % | |||||||||||||||||||||||||

| Top Ten States | 45 | 5,465 | 66.7 | % | 94,892 | 73.1 | % | |||||||||||||||||||||||||

| Remaining States: | ||||||||||||||||||||||||||||||||

| Virginia | 2 | 240 | 2.9 | % | 4,623 | 3.6 | % | |||||||||||||||||||||||||

| Ohio | 3 | 237 | 2.9 | % | 3,579 | 2.8 | % | |||||||||||||||||||||||||

| Rhode Island | 2 | 206 | 2.5 | % | 3,243 | 2.5 | % | |||||||||||||||||||||||||

| Missouri | 2 | 207 | 2.5 | % | 2,981 | 2.3 | % | |||||||||||||||||||||||||

| South Carolina | 1 | 64 | 0.8 | % | 2,459 | 1.9 | % | |||||||||||||||||||||||||

| Wisconsin | 1 | 155 | 1.9 | % | 2,357 | 1.8 | % | |||||||||||||||||||||||||

| Arizona | 1 | 91 | 1.1 | % | 2,282 | 1.8 | % | |||||||||||||||||||||||||

| Illinois | 2 | 163 | 2.0 | % | 2,224 | 1.7 | % | |||||||||||||||||||||||||

| Iowa | 2 | 92 | 1.1 | % | 1,999 | 1.5 | % | |||||||||||||||||||||||||

| West Virginia | 1 | 63 | 0.8 | % | 1,457 | 1.1 | % | |||||||||||||||||||||||||

| Nebraska | 2 | 180 | 2.2 | % | 1,366 | 1.0 | % | |||||||||||||||||||||||||

| Pennsylvania | 2 | 233 | 2.8 | % | 1,316 | 1.0 | % | |||||||||||||||||||||||||

| Oregon | 1 | 69 | 0.8 | % | 1,165 | 0.9 | % | |||||||||||||||||||||||||

| Kansas | 2 | 196 | 2.4 | % | 1,075 | 0.8 | % | |||||||||||||||||||||||||

| Idaho | 1 | 35 | 0.4 | % | 741 | 0.6 | % | |||||||||||||||||||||||||

| Massachusetts | 2 | 378 | 4.6 | % | 727 | 0.6 | % | |||||||||||||||||||||||||

| Indiana | 1 | 83 | 1.0 | % | 581 | 0.4 | % | |||||||||||||||||||||||||

| Minnesota | 1 | 39 | 0.5 | % | 493 | 0.4 | % | |||||||||||||||||||||||||

| Florida | 1 | 6 | 0.1 | % | 230 | 0.2 | % | |||||||||||||||||||||||||

| Total | 75 | 8,202 | 100.0 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Operating Property Type

(unaudited, square feet and dollars in thousands as of June 30, 2024)

| ||

| Property Type | Number of Properties | Rentable Square Feet | Rentable Square Feet as a % of Total Portfolio | Annualized Base Rent | Annualized Base Rent as a % of Total Portfolio | |||||||||||||||||||||||||||

| Traditional Office | 47 | 6,268 | 76.5 | % | $ | 92,201 | 71.0 | % | ||||||||||||||||||||||||

| Governmental Office | 16 | 789 | 9.6 | % | 20,154 | 15.5 | % | |||||||||||||||||||||||||

| Medical Office | 2 | 155 | 1.9 | % | 5,787 | 4.5 | % | |||||||||||||||||||||||||

| Flex/Laboratory and R&D | 3 | 171 | 2.1 | % | 3,752 | 2.9 | % | |||||||||||||||||||||||||

| Flex/Industrial | 7 | 819 | 9.9 | % | 7,896 | 6.1 | % | |||||||||||||||||||||||||

| Total | 75 | 8,202 | 100.0 | % | $ | 129,790 | 100.0 | % | ||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Full Portfolio (1)

(unaudited, as of June 30, 2024)

| ||

| Industry | Address | Rentable Square Feet | Occupancy Rate | Leased Rate | Weighted Average Remaining Lease Term | Annualized Base Rent | ||||||||||||||||||||||||||||||||

| Commercial & Professional Services | 4335 Paredes Line Road Brownsville, TX | 78 | 100.0 | % | 100.0 | % | 3.9 | $ | 1,535 | |||||||||||||||||||||||||||||

| Telecommunication Services | 3750 Wheeler Road Augusta, GA | 78 | 100.0 | % | 100.0 | % | 3.3 | 1,712 | ||||||||||||||||||||||||||||||

| Telecommunication Services | 4080 27th Court SE Salem, OR | 69 | 100.0 | % | 100.0 | % | 2.8 | 1,165 | ||||||||||||||||||||||||||||||

| Financial Institutions | 11 Ewall Street Mount Pleasant, SC | 64 | 100.0 | % | 100.0 | % | 1.3 | 2,459 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 8455 University Place Drive St. Louis, MO | 181 | 100.0 | % | 100.0 | % | 4.5 | 2,587 | ||||||||||||||||||||||||||||||

| Government & Public Services | 2305 Hudson Boulevard Brownsville, TX | 11 | 100.0 | % | 100.0 | % | 9.6 | 347 | ||||||||||||||||||||||||||||||

| Government & Public Services | 257 Bosley Industrial Park Parkersburg, WV | 63 | 100.0 | % | 100.0 | % | 14.9 | 1,457 | ||||||||||||||||||||||||||||||

| Government & Public Services | 2805 Pine Mill Road Paris, TX | 11 | 100.0 | % | 100.0 | % | 7.2 | 429 | ||||||||||||||||||||||||||||||

| Government & Public Services | 3381 U.S. Highway 277 Eagle Pass, TX | 20 | 100.0 | % | 100.0 | % | 13.8 | 550 | ||||||||||||||||||||||||||||||

| Government & Public Services | 2475 Cliff Creek Crossing Drive Dallas, TX | 17 | 100.0 | % | 100.0 | % | 0.3 | 788 | ||||||||||||||||||||||||||||||

| Government & Public Services | 3644 Avtech Parkway Redding, CA | 44 | 100.0 | % | 100.0 | % | 2.3 | 1,347 | ||||||||||||||||||||||||||||||

| Government & Public Services | 5100 W 36th Street Minneapolis, MN | 39 | 100.0 | % | 100.0 | % | 5.8 | 493 | ||||||||||||||||||||||||||||||

| Government & Public Services | 4551 State Route 11 (E) Malone, NY | 29 | 100.0 | % | 100.0 | % | 2.0 | 1,036 | ||||||||||||||||||||||||||||||

| Government & Public Services | 2600 Voyager Avenue Sioux City, IA | 11 | 100.0 | % | 100.0 | % | 2.1 | 497 | ||||||||||||||||||||||||||||||

| Government & Public Services | 135 Circle Lane Knoxville, TN | 26 | 100.0 | % | 100.0 | % | 2.1 | 736 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 2304 State Highway 121 Bedford, TX | 65 | 100.0 | % | 100.0 | % | 6.3 | 3,505 | ||||||||||||||||||||||||||||||

| Government & Public Services | 3369 U.S. Highway 277 Eagle Pass, TX | 9 | 100.0 | % | 100.0 | % | 14.6 | 307 | ||||||||||||||||||||||||||||||

| Transportation | 942 S. Shady Grove Road Memphis, TN | 90 | 100.0 | % | 100.0 | % | 10.5 | 1,744 | ||||||||||||||||||||||||||||||

| Transportation | 4151 Bridgeway Avenue Columbus, OH | 140 | 100.0 | % | 100.0 | % | 7.8 | 2,015 | ||||||||||||||||||||||||||||||

| Capital Goods | 601 Third Street SE Cedar Rapids, IA | 81 | 100.0 | % | 100.0 | % | 3.7 | 1,502 | ||||||||||||||||||||||||||||||

| Consumer Durables & Apparel | 15 LaSalle Square Providence, RI | 136 | 100.0 | % | 100.0 | % | 0.6 | 2,446 | ||||||||||||||||||||||||||||||

| Materials | 100 Sci Park Boulevard East Windsor, NJ | 66 | 100.0 | % | 100.0 | % | 2.8 | 1,980 | ||||||||||||||||||||||||||||||

| Media & Entertainment | 6005 Fair Lakes Road East Syracuse, NY | 109 | 100.0 | % | 100.0 | % | 1.4 | 1,447 | ||||||||||||||||||||||||||||||

| Government & Public Services | 310 Canaveral Groves Boulevard Cocoa, FL | 6 | 100.0 | % | 100.0 | % | 0.7 | 230 | ||||||||||||||||||||||||||||||

| Government & Public Services | 103 & 104 Airport Road Grangeville, ID | 35 | 100.0 | % | 100.0 | % | 3.3 | 741 | ||||||||||||||||||||||||||||||

| Government & Public Services | 2901 Alta Mesa Boulevard Fort Worth, TX | 16 | 100.0 | % | 100.0 | % | 1.6 | 588 | ||||||||||||||||||||||||||||||

| Government & Public Services | 59 Dunning Way Plattsburgh, NY | 13 | 100.0 | % | 100.0 | % | 9.3 | 576 | ||||||||||||||||||||||||||||||

| Financial Institutions | 480 Jefferson Boulevard Warwick, RI | 70 | 100.0 | % | 100.0 | % | — | 797 | ||||||||||||||||||||||||||||||

| Capital Goods | 1800 Nelson Road Longmont, CO | 152 | 100.0 | % | 100.0 | % | 0.3 | 1,713 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 1850 Norman Drive North Waukegan, IL | 130 | 100.0 | % | 100.0 | % | 8.0 | 1,412 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 1333 - 1385 East Shaw Avenue Fresno, CA | 127 | 100.0 | % | 100.0 | % | 2.5 | 2,334 | ||||||||||||||||||||||||||||||

| Telecommunication Services | 2270 Lakeside Boulevard Richardson, TX | 203 | 100.0 | % | 100.0 | % | 2.8 | 3,023 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 5859 Farinon Drive San Antonio, TX | 96 | 75.8 | % | 75.8 | % | 1.8 | 1,397 | ||||||||||||||||||||||||||||||

| Energy | 202 S. Cheyenne Tulsa, OK | 330 | 97.1 | % | 97.1 | % | 1.1 | 5,971 | ||||||||||||||||||||||||||||||

| Vacant | 7475 S. Joliet Street Englewood, CO | 60 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Consumer Durables & Apparel | 4340 & 4350 South Monaco Street Denver, CO | 264 | 54.7 | % | 54.7 | % | 2.3 | 4,385 | ||||||||||||||||||||||||||||||

| Vacant | 2250 Lakeside Boulevard Richardson, TX | 116 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Commercial & Professional Services | 3833 Greenway Drive Lawrence, KS | 90 | 100.0 | % | 100.0 | % | 3.9 | 1,075 | ||||||||||||||||||||||||||||||

| Vacant | 2201 Noria Road Lawrence, KS | 106 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Materials | 1585 Sawdust Road The Woodlands, TX | 175 | 100.0 | % | 100.0 | % | 8.9 | 2,800 | ||||||||||||||||||||||||||||||

| Consumer Durables & Apparel | 7390 S. Iola Street Englewood, CO | 95 | 100.0 | % | 100.0 | % | 1.1 | 2,005 | ||||||||||||||||||||||||||||||

| Vacant | 41 Moores Road Malvern, PA | 188 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Media & Entertainment | 1254 - 1320 N. Dr. MLK Jr. Drive Milwaukee, WI | 155 | 100.0 | % | 100.0 | % | 3.0 | 2,357 | ||||||||||||||||||||||||||||||

| Telecommunication Services | 695 Grassmere Park Nashville, TN | 69 | 100.0 | % | 100.0 | % | 2.6 | 1,143 | ||||||||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

| Industry | Address | Rentable Square Feet | Occupancy Rate | Leased Rate | Weighted Average Remaining Lease Term | Annualized Base Rent | ||||||||||||||||||||||||||||||||

| Commercial & Professional Services | 1575 Sawdust Road The Woodlands, TX | 153 | 78.6 | % | 78.6 | % | 3.7 | 2,410 | ||||||||||||||||||||||||||||||

| Retailing | 101 Riverview Parkway Santee, CA | 73 | 100.0 | % | 100.0 | % | 4.4 | 1,857 | ||||||||||||||||||||||||||||||

| Materials | 6752 Baymeadow Drive Glen Burnie, MD | 120 | 100.0 | % | 100.0 | % | 2.5 | 1,086 | ||||||||||||||||||||||||||||||

| Vacant | 6655 North MacArthur Boulevard Irving, TX | 172 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Capital Goods | 2087 East 71st Street Tulsa, OK | 108 | 100.0 | % | 100.0 | % | 0.8 | 1,025 | ||||||||||||||||||||||||||||||

| Government & Public Services | 333 Scott Street Covington, KY | 438 | 96.7 | % | 96.7 | % | 4.1 | 10,032 | ||||||||||||||||||||||||||||||

| Software & Services | 1759 Wehrle Drive Amherst, NY | 170 | 100.0 | % | 100.0 | % | 9.3 | 2,898 | ||||||||||||||||||||||||||||||

| Commercial & Professional Services | 6377 Emerald Drive Dublin, OH | 68 | 100.0 | % | 100.0 | % | 0.4 | 1,116 | ||||||||||||||||||||||||||||||

| Capital Goods | 22640 Davis Drive Sterling, VA | 207 | 100.0 | % | 100.0 | % | 4.8 | 3,440 | ||||||||||||||||||||||||||||||

| Capital Goods | 1100 Atwater Drive, Lot 11A Malvern, PA | 45 | 100.0 | % | 100.0 | % | 4.1 | 1,316 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 7353 Company Drive Indianapolis, IN | 83 | 100.0 | % | 100.0 | % | 1.8 | 581 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 1640 Dallas Parkway Plano, TX | 210 | 70.5 | % | 70.5 | % | 1.4 | 3,400 | ||||||||||||||||||||||||||||||

| Capital Goods | 1705 Kellie Drive Blair, NE | 30 | 100.0 | % | 100.0 | % | 0.5 | 523 | ||||||||||||||||||||||||||||||

| Vacant | 3100 Quail Springs Parkway Oklahoma City, OK | 147 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Software & Services | 777 Research Road Lincoln, NE | 150 | 39.4 | % | 96.5 | % | 3.8 | 843 | ||||||||||||||||||||||||||||||

| Insurance | 249 - 257 West Genesee Street Buffalo, NY | 430 | 100.0 | % | 100.0 | % | 0.1 | 8,450 | ||||||||||||||||||||||||||||||

| Insurance | 3275 Bennett Creek Avenue Urbana, MD | 116 | 100.0 | % | 100.0 | % | 2.2 | 3,581 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 100 Airpark Center Drive East Nashville, TN | 55 | 100.0 | % | 100.0 | % | 1.3 | 1,044 | ||||||||||||||||||||||||||||||

| Retailing | 3074 Chastain Meadows Parkway NW Kennesaw, GA | 80 | 100.0 | % | 100.0 | % | 3.8 | 1,317 | ||||||||||||||||||||||||||||||

| Capital Goods | 4205 River Green Parkway Duluth, GA | 126 | 100.0 | % | 100.0 | % | 2.1 | 1,606 | ||||||||||||||||||||||||||||||

| Vacant | 8 Sylvan Way Parsippany, NJ | 166 | — | % | 33.6 | % | — | — | ||||||||||||||||||||||||||||||

| Vacant | 174 & 176 Middlesex Turnpike Bedford, MA | 328 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Financial Institutions | 1500 - 1600 Merrill Lynch Drive Hopewell, NJ | 482 | 100.0 | % | 100.0 | % | 11.4 | 12,465 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 3003 N. 3rd Street Phoenix, AZ | 91 | 100.0 | % | 100.0 | % | 0.4 | 2,282 | ||||||||||||||||||||||||||||||

| Vacant | 395 S. Youngs Road Amherst, NY | 30 | — | % | — | % | — | — | ||||||||||||||||||||||||||||||

| Capital Goods | 70 Mechanic Street Foxboro, MA | 50 | 100.0 | % | 100.0 | % | 3.4 | 727 | ||||||||||||||||||||||||||||||

| Health Care Equipment & Services | 577 Aptakisic Road Lincolnshire, IL | 33 | 100.0 | % | 100.0 | % | 2.3 | 812 | ||||||||||||||||||||||||||||||

| Transportation | 360 Westar Boulevard Westerville, OH | 29 | 100.0 | % | 100.0 | % | 7.5 | 448 | ||||||||||||||||||||||||||||||

| Software & Services | 12975 Worldgate Drive Herndon, VA | 33 | 100.0 | % | 100.0 | % | 5.6 | 1,183 | ||||||||||||||||||||||||||||||

| Transportation | 580 Atlas Air Way Erlanger, KY | 20 | 100.0 | % | 100.0 | % | 11.8 | 323 | ||||||||||||||||||||||||||||||

| Utilities | 700 Market Street St. Louis, MO | 26 | 100.0 | % | 100.0 | % | 10.7 | 394 | ||||||||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Non-Operating Properties

(unaudited, dollars in thousands as of June 30, 2024)

| ||

| Address | Category | Acres | Net Carrying Value | |||||||||||||||||

1411 - 1435 Lake Cook Road Deerfield, IL (1) |

Land | 37.4 | $ | 11,113 | ||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Unconsolidated Joint Venture Investment Summary

(unaudited, square feet and dollars in thousands)

| ||

Legal Ownership Percentage (1) |

Tenant Industry | Pro Rata Share of Gross Real Estate Investments | Pro Rata Share of Rentable Square Feet | Pro Rata Share of Annualized Base Rent | Pro Rata Share of Principal Outstanding | |||||||||||||||||||||||||||||||||

| Schneider Electric - Foxboro, MA | 20% | Capital Goods | $ | 8,336 | 50 | $ | 727 | $ | 5,081 | |||||||||||||||||||||||||||||

| Sysmex - Lincolnshire, IL | 20% | Health Care Equipment & Services | 9,239 | 33 | 812 | 5,439 | ||||||||||||||||||||||||||||||||

| DHL - Westerville, OH | 20% | Transportation | 6,676 | 29 | 448 | 3,965 | ||||||||||||||||||||||||||||||||

| Peraton - Herndon, VA | 20% | Software & Services | 9,812 | 33 | 1,183 | 5,990 | ||||||||||||||||||||||||||||||||

| Atlas Air - Erlanger, KY | 20% | Transportation | 5,330 | 20 | 323 | 3,157 | ||||||||||||||||||||||||||||||||

| Spire Energy - St. Louis, MO | 20% | Utilities | 6,159 | 26 | 394 | 3,654 | ||||||||||||||||||||||||||||||||

| $ | 45,552 | 191 | $ | 3,887 | $ | 27,286 | ||||||||||||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Total real estate investments, at cost - as reported | $ | 1,283,456 | $ | 1,305,227 | $ | 1,320,396 | $ | 1,333,586 | $ | 1,340,751 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Gross intangible lease assets | 307,744 | 311,914 | 333,658 | 346,643 | 345,416 | |||||||||||||||||||||||||||

| Gross intangible lease liabilities | (29,779) | (29,779) | (31,250) | (31,250) | (31,317) | |||||||||||||||||||||||||||

| Non-Operating Properties total real estate investments, at cost | (11,113) | — | — | — | — | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture Gross Real Estate Investments |

45,552 | 45,552 | 45,548 | 45,548 | 45,451 | |||||||||||||||||||||||||||

| Gross Real Estate Investments | $ | 1,595,860 | $ | 1,632,914 | $ | 1,668,352 | $ | 1,694,527 | $ | 1,700,301 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Interest expense, net - as reported | $ | 8,058 | $ | 8,146 | $ | 7,928 | $ | 7,380 | $ | 7,222 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Amortization of deferred financing costs and other non-cash charges | (914) | (924) | (933) | (933) | (1,059) | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture Interest Expense, excluding non-cash amortization |

409 | 366 | 370 | 371 | 366 | |||||||||||||||||||||||||||

| Interest Expense, excluding non-cash amortization | $ | 7,553 | $ | 7,588 | $ | 7,365 | $ | 6,818 | $ | 6,529 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 |

||||||||||||||||||||||||||||

| Mortgages payable, net | $ | 353,200 | $ | 353,028 | $ | 352,856 | $ | 352,683 | $ | 352,509 | ||||||||||||||||||||||

| Credit facility revolver | 107,000 | 116,000 | 116,000 | 175,000 | 175,000 | |||||||||||||||||||||||||||

| Total debt - as reported | 460,200 | 469,028 | 468,856 | 527,683 | 527,509 | |||||||||||||||||||||||||||

| Deferred financing costs, net | 1,800 | 1,972 | 2,144 | 2,317 | 2,491 | |||||||||||||||||||||||||||

| Principal Outstanding | 462,000 | 471,000 | 471,000 | 530,000 | 530,000 | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture Principal Outstanding |

27,286 | 27,332 | 27,332 | 27,332 | 27,332 | |||||||||||||||||||||||||||

| Adjusted Principal Outstanding | $ | 489,286 | $ | 498,332 | $ | 498,332 | $ | 557,332 | $ | 557,332 | ||||||||||||||||||||||

| Cash and cash equivalents | (24,224) | (23,618) | (22,473) | (32,286) | (42,209) | |||||||||||||||||||||||||||

| Restricted cash deposited with credit facility lenders | — | — | — | (33,198) | — | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture cash and cash equivalents |

(720) | (633) | (650) | (708) | (705) | |||||||||||||||||||||||||||

| Net Debt | $ | 464,342 | $ | 474,081 | $ | 475,209 | $ | 491,140 | $ | 514,418 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | ||||||||||||||||||||||||||||

| Total revenues | $ | 40,124 | $ | 47,197 | $ | 43,751 | $ | 49,076 | $ | 52,024 | ||||||||||||||||||||||

| Less: total operating expenses | (64,762) | (65,247) | (52,264) | (58,390) | (59,898) | |||||||||||||||||||||||||||

| Fee income from unconsolidated joint venture | (201) | (202) | (200) | (200) | (200) | |||||||||||||||||||||||||||

| Transaction related | 167 | 110 | 148 | 101 | 150 | |||||||||||||||||||||||||||

| General and administrative | 4,544 | 4,949 | 5,479 | 4,367 | 4,565 | |||||||||||||||||||||||||||

| Depreciation and amortization | 38,614 | 24,504 | 26,055 | 27,013 | 27,877 | |||||||||||||||||||||||||||

| Impairment of real estate | 5,680 | 19,685 | 6,136 | 11,403 | 11,819 | |||||||||||||||||||||||||||

| NOI | 24,166 | 30,996 | 29,105 | 33,370 | 36,337 | |||||||||||||||||||||||||||

| Straight-line rental revenue | 240 | (549) | 679 | (1,369) | (2,275) | |||||||||||||||||||||||||||

| Amortization of above and below market leases, net | (429) | (537) | (361) | (346) | (274) | |||||||||||||||||||||||||||

| Amortization of deferred lease incentives, net | 124 | 123 | 115 | (14) | 100 | |||||||||||||||||||||||||||

| Other non-cash adjustments | 48 | 48 | 49 | 47 | 48 | |||||||||||||||||||||||||||

Proportionate share of Unconsolidated Joint Venture Cash NOI |

855 | 880 | 868 | 863 | 861 | |||||||||||||||||||||||||||

| Cash NOI | $ | 25,004 | $ | 30,961 | $ | 30,455 | $ | 32,551 | $ | 34,797 | ||||||||||||||||||||||

Q2 2024 SUPPLEMENTAL INFORMATION | ||||||||

|

Definitions (cont.)

(unaudited, in thousands, except share and per share data)

| ||