Document

Portillo’s Inc. Announces Fourth Quarter and Fiscal Year 2024 Financial Results

Chicago, IL— February 25, 2025—Portillo’s Inc. (“Portillo’s” or the “Company”) (NASDAQ: PTLO), the restaurant concept known for its menu of Chicago-style favorites, today reported financial results for the fourth quarter and fiscal year ended December 29, 2024.

“We ended the year with solid momentum, supported by key initiatives that will drive our long-term growth,” said Michael Osanloo, President and Chief Executive Officer of Portillo’s. “As we head into 2025, we’re focused on accelerating traffic, enhancing operational excellence, and expanding our geographic footprint to deliver value to our team members, guests and shareholders.”

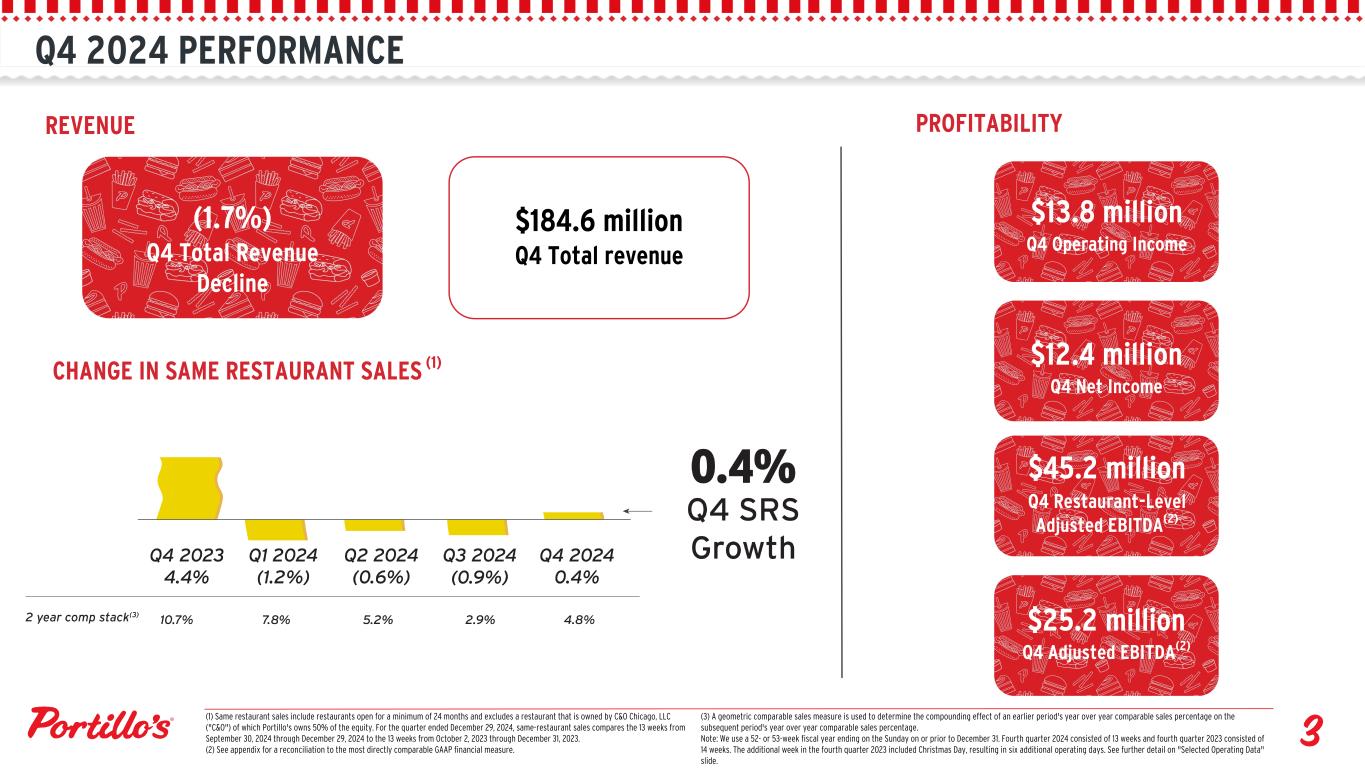

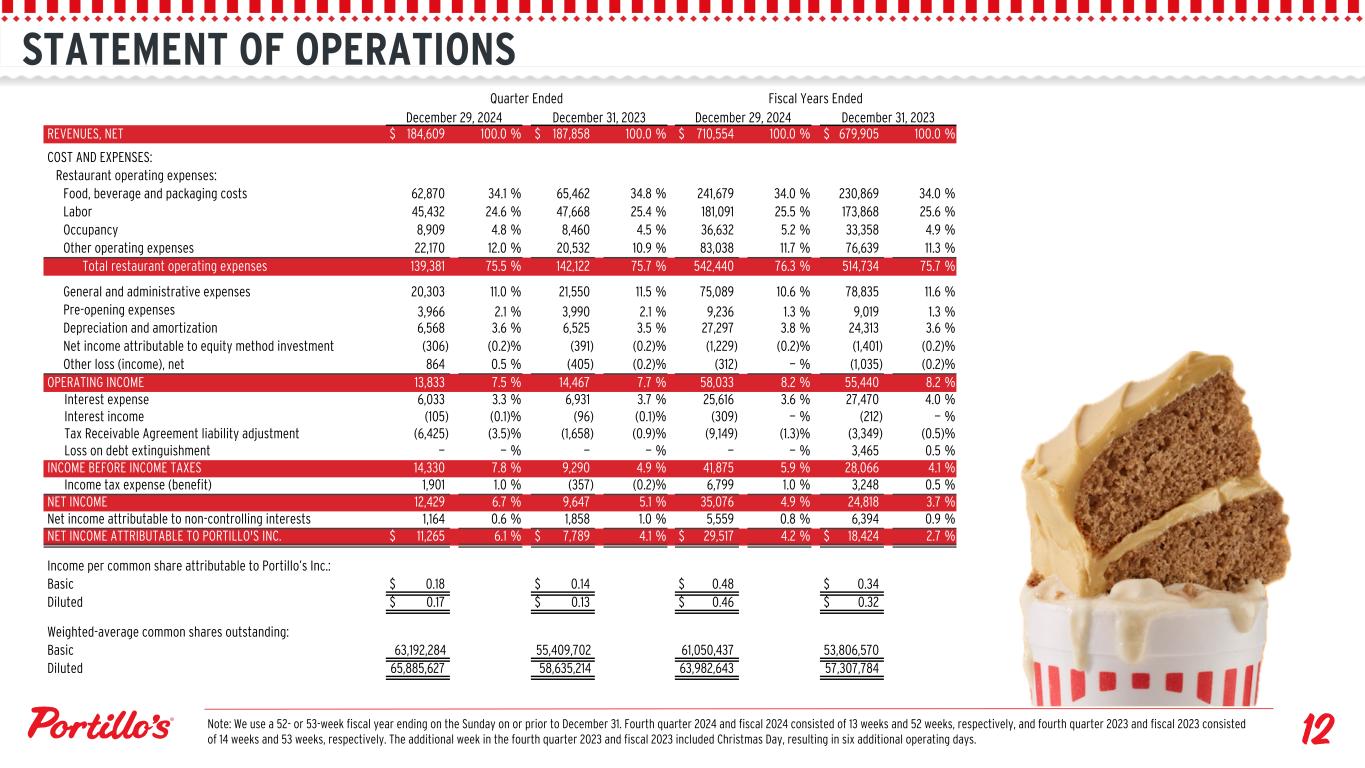

Financial Highlights for the Fourth Quarter 2024 (13 weeks)(1) vs. Prior Year (14 weeks)(1):

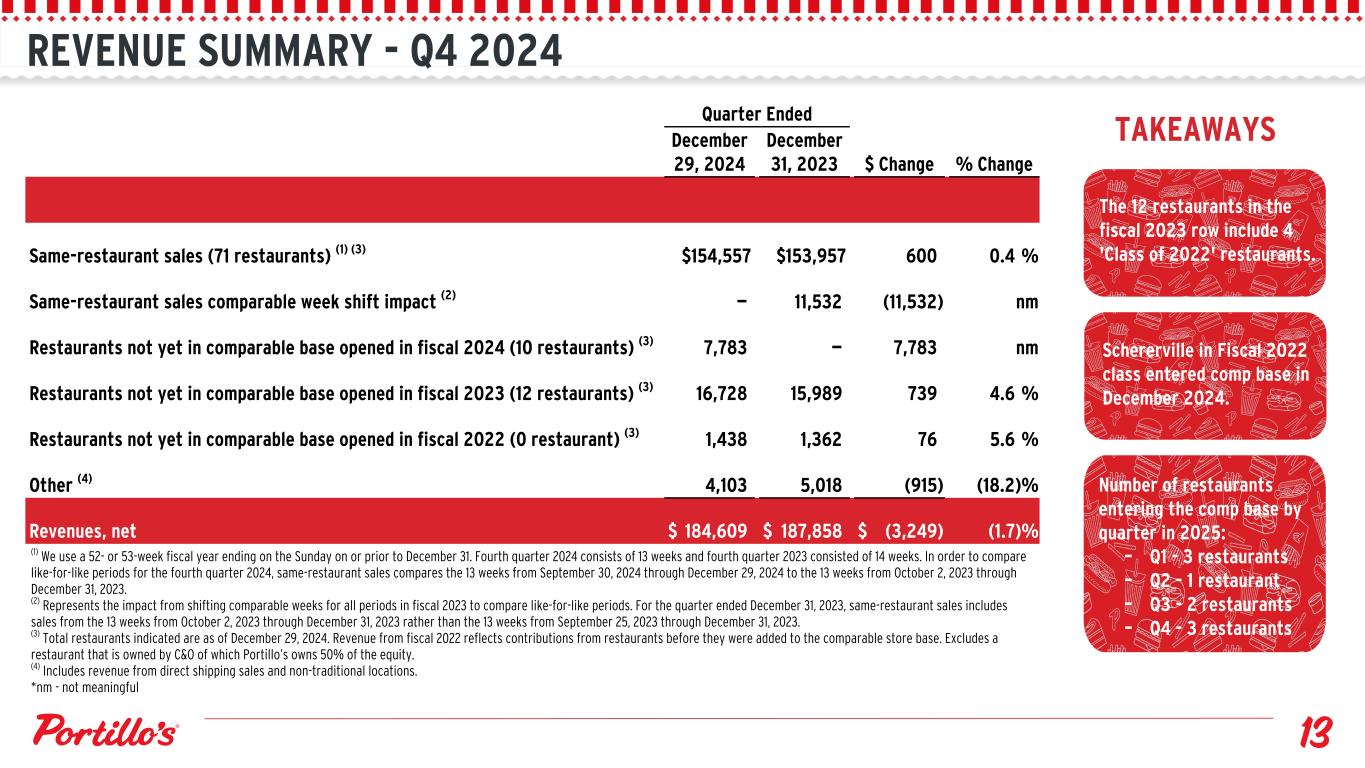

•Total revenue decreased 1.7% or $3.2 million to $184.6 million;

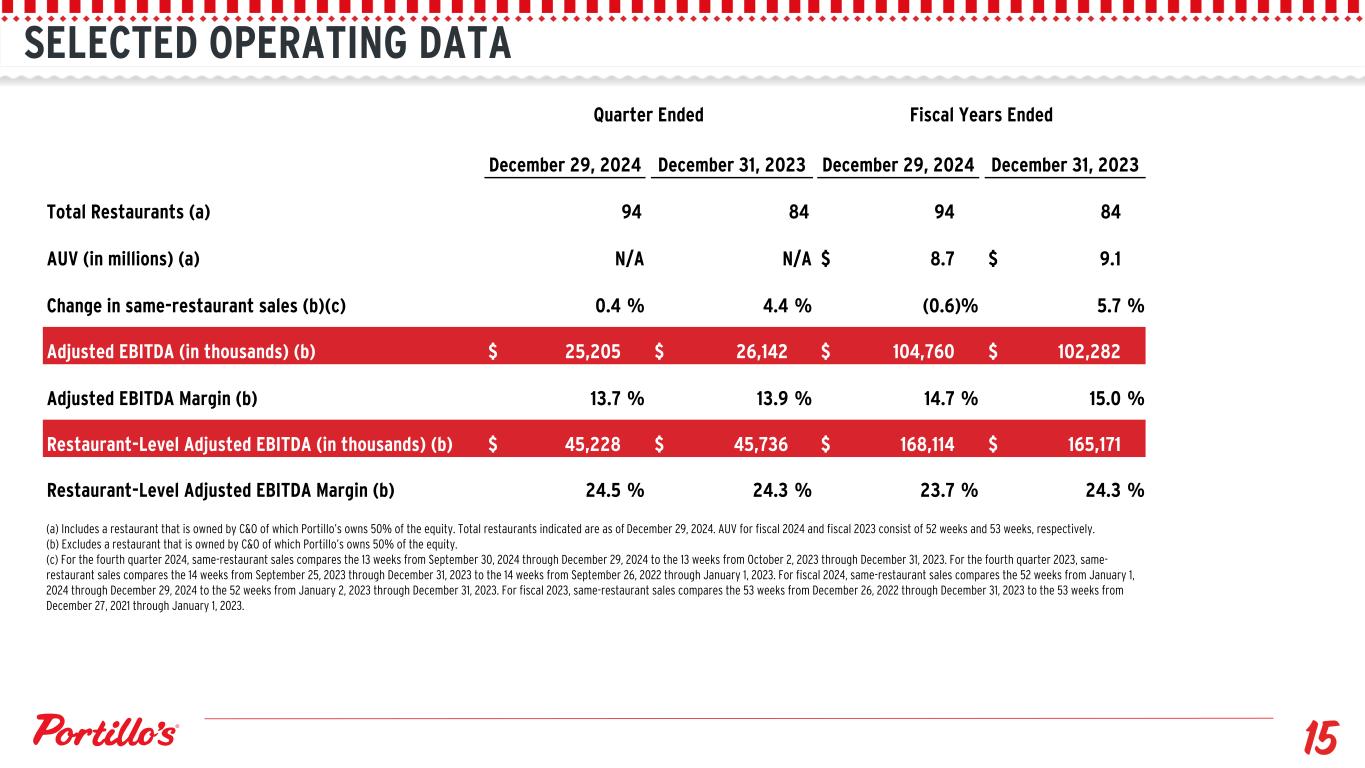

•Same-restaurant sales(2) increased 0.4%;

•Operating income decreased $0.6 million to $13.8 million;

•Net income increased $2.8 million to $12.4 million;

•Restaurant-Level Adjusted EBITDA(4) decreased $0.5 million to $45.2 million; and

•Adjusted EBITDA(4) decreased $0.9 million to $25.2 million.

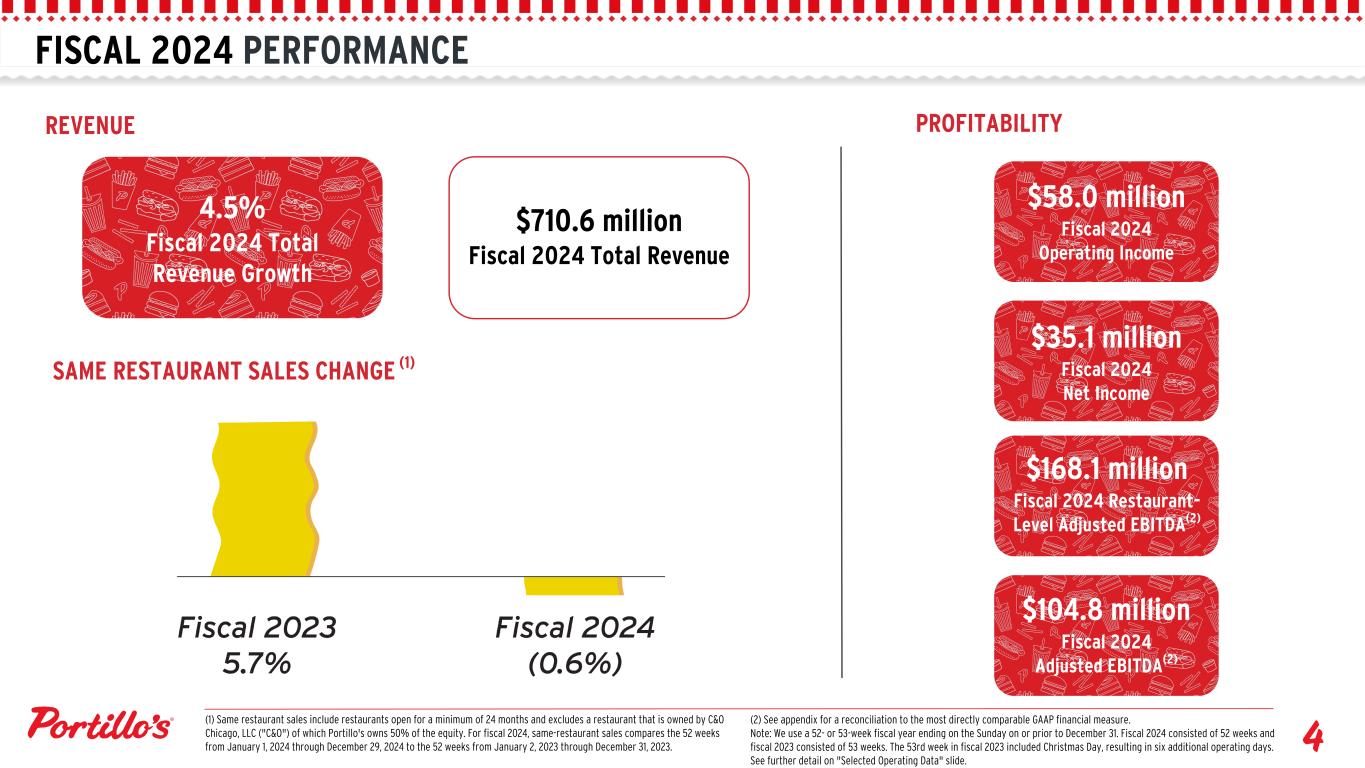

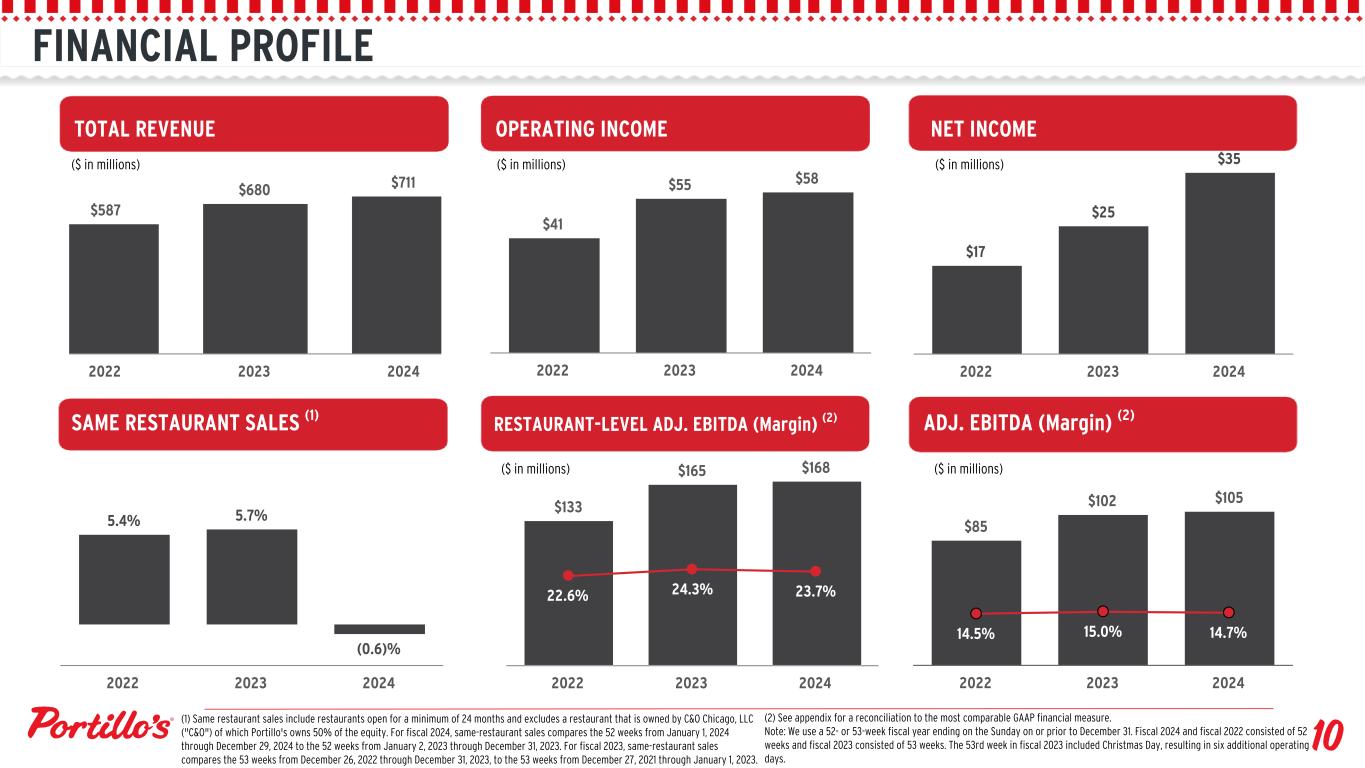

Financial Highlights for Fiscal Year 2024 (52 weeks)(1) vs. Prior Year (53 weeks)(1):

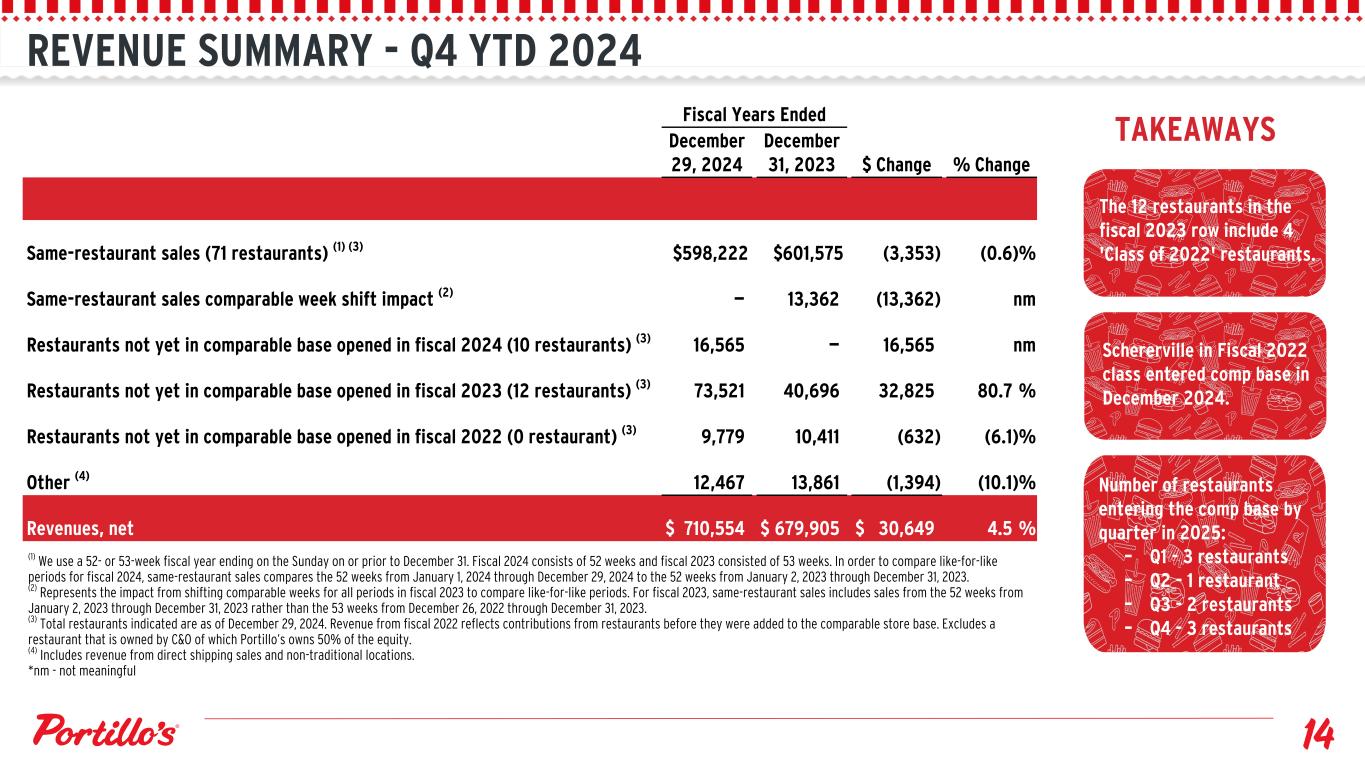

•Total revenue increased 4.5% or $30.6 million to $710.6 million;

•Same-restaurant sales(3) decreased 0.6%;

•Operating income increased $2.6 million to $58.0 million;

•Net income increased $10.3 million to $35.1 million;

•Restaurant-Level Adjusted EBITDA(4) increased $2.9 million to $168.1 million; and

•Adjusted EBITDA(4) increased $2.5 million to $104.8 million.

Impact of 53rd Week in Fourth Quarter 2023(1) and Fiscal Year 2023(1):

•Total revenue includes an impact of approximately $13.9 million in both the fourth quarter 2023 and fiscal year 2023.

•Operating income includes an impact of approximately $1.6 million in both the fourth quarter 2023 and fiscal year 2023.

•Net income includes an impact of approximately $1.2 million in both the fourth quarter 2023 and fiscal year 2023.

•Restaurant-Level Adjusted EBITDA includes an impact of approximately $3.5 million in both the fourth quarter 2023 and fiscal year 2023.

•Adjusted EBITDA includes an impact of approximately $2.4 million in both the fourth quarter 2023 and fiscal year 2023.

(1) We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fourth quarter 2024 and fiscal year 2024 (“fiscal 2024”) consisted of 13 weeks and 52 weeks, respectively, and fourth quarter 2023 and fiscal year 2023 (“fiscal 2023”) consisted of 14 weeks and 53 weeks, respectively. The additional week (the “53rd week”) in the fourth quarter 2023 and fiscal 2023 included Christmas day, resulting in six additional operating days.

(2) For the fourth quarter 2024, same-restaurant sales compares the 13 weeks from September 30, 2024 through December 29, 2024 to the 13 weeks from October 2, 2023 through December 31, 2023.

(3 ) For fiscal 2024, same-restaurant sales compares the 52 weeks from January 1, 2024 through December 29, 2024 to the 52 weeks from January 2, 2023 through December 31, 2023.

(4) Adjusted EBITDA and Restaurant-Level Adjusted EBITDA are non-GAAP measures. Please see definitions and the reconciliations of these non-GAAP measures accompanying this release.

Recent Developments and Trends

In fiscal 2024, total revenue, operating income, net income, Restaurant-Level Adjusted EBITDA, and Adjusted EBITDA all improved versus the prior year. We believe this improvement stemmed from maintaining concentration on our four strategic pillars, which guide our short-term objectives and form the basis for long-term growth.

In fiscal 2024, total revenue grew 4.5%, primarily due to new restaurant openings in 2024 and 2023. Same-restaurant sales declined 0.6% during fiscal 2024, compared to an increase of 5.7% during fiscal 2023. During the fourth quarter of 2024, total revenue declined 1.7%. Same-restaurant sales growth was 0.4% compared to same-restaurant sales growth of 4.4% during the fourth quarter of 2023. The fourth quarter of 2023 and fiscal 2023 includes the impact of the 53rd week.

In the fourth quarter of 2024 and fiscal 2024, we continued to see commodity inflation stabilize versus 2023 levels. Commodity inflation was 1.8% and 4.2% in the fourth quarter of 2024 and fiscal 2024, respectively, compared to 4.4% and 5.5% in the fourth quarter of 2023 and fiscal 2023, respectively. In fiscal 2024, we experienced a decrease of 0.1% in labor expenses, as a percentage of revenue, compared to fiscal 2023 primarily due to an increase in average check and lower variable-based compensation, partially offset by lower transactions and additional wage investments. To mitigate inflationary cost pressures, we implemented targeted menu price adjustments in 2024, including a 1.5% increase in January, another 1.5% increase at the end of March, and a 1.0% increase in June. We also increased certain menu prices by approximately 1.5% in January 2025.

Development Highlights

In fiscal 2024, we opened 10 new restaurants in the Arizona, Florida, Illinois, Michigan, and Texas markets, for a total of 94 restaurants, including a restaurant owned by C&O. Two restaurants in the Texas market were our Restaurant of the Future (“ROTF”) concept, a 6,250 square foot prototype restaurant. We also opened our seventh restaurant in the Dallas-Fort Worth market to meet our goal of achieving minimum scale (6-8 restaurants) within 24 months of our first opening. We also made significant strides in the Houston, Texas market with the opening of three new restaurants in the fourth quarter of 2024. Below are the 10 restaurants opened since the beginning of fiscal 2024:

|

|

|

|

|

|

|

|

|

| Location |

Opening Month |

Fiscal Quarter Opened |

Denton, Texas |

March 2024 |

Q1 2024 |

Surprise, Arizona |

May 2024 |

Q2 2024 |

Livonia, Michigan |

July 2024 |

Q3 2024 |

Mansfield, Texas |

August 2024 |

Q3 2024 |

| Richmond, Texas |

October 2024 |

Q4 2024 |

Katy, Texas |

December 2024 |

Q4 2024 |

Orlando, Florida |

December 2024 |

Q4 2024 |

Houston, Texas (ROTF) |

December 2024 |

Q4 2024 |

Grapevine, Texas (ROTF) |

December 2024 |

Q4 2024 |

Orland Park, Illinois |

December 2024 |

Q4 2024 |

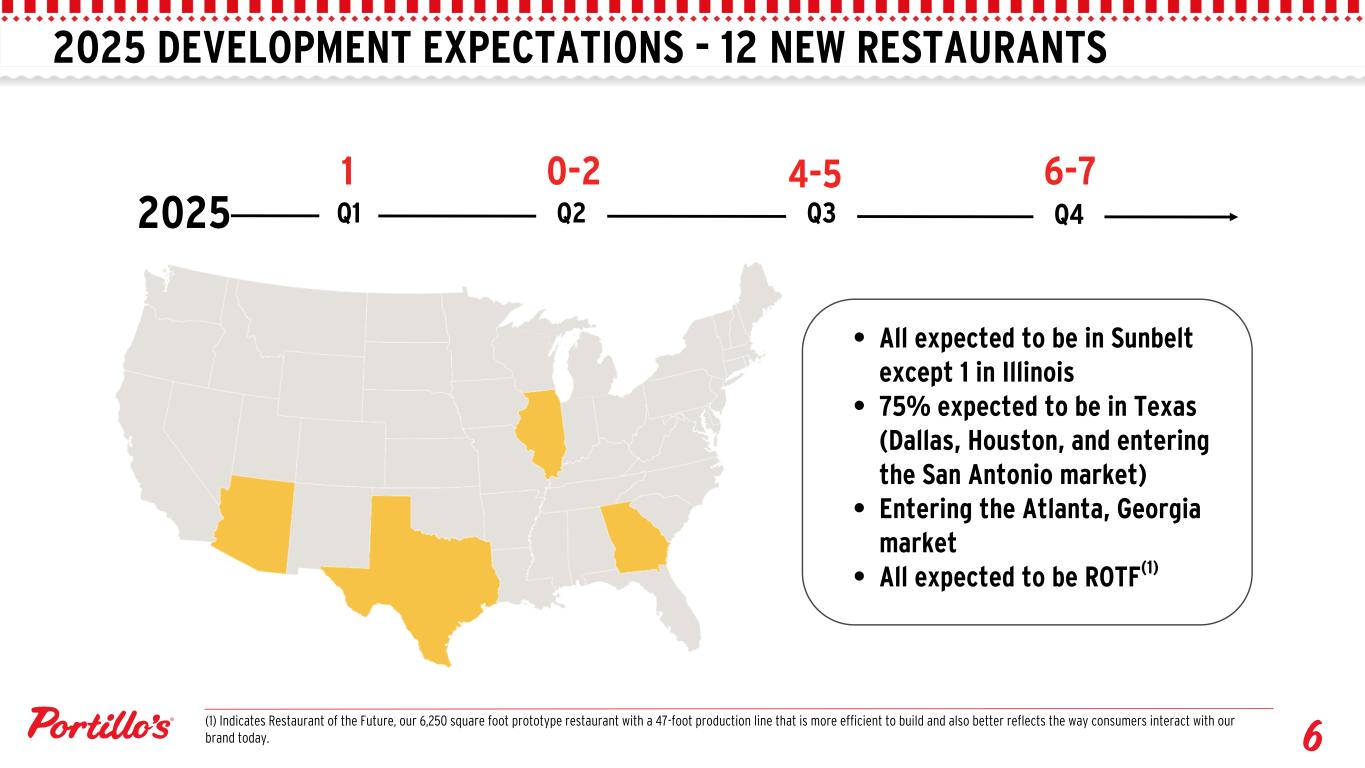

In fiscal 2025, we are planning to open 12 new restaurants. Our near-term restaurant growth strategy is focused on leveraging our proven unit economic model primarily in markets outside Chicagoland with favorable macro-economic tailwinds where we already have a presence. Particularly, our short-term focus continues to be in the Sunbelt, primarily in Texas, with plans to enter the Atlanta, Georgia market. Simultaneously, we will continue to fill-in existing markets, including Chicagoland and adjacent markets as opportunities come available.

Review of Fourth Quarter 2024 Financial Results

Revenues for the quarter ended December 29, 2024 were $184.6 million compared to $187.9 million for the quarter ended December 31, 2023, a decrease of $3.2 million or 1.7%. Revenue was negatively impacted by $13.9 million due to the additional operating week in the fourth quarter 2023, partially offset by the positive impact of the opening of ten restaurants in fiscal 2024 and six restaurants in the fourth quarter of 2023 and an increase in our same-restaurant sales of 0.4%, or $0.6 million in the quarter. The same-restaurant sales increase was attributable to an increase in average check of 4.1%, partially offset by a 3.7% decrease in transactions.

The higher average check was driven by an approximate 4.7% increase in certain menu prices, partially offset by product mix. Restaurants not in our Comparable Restaurant Base (defined below) contributed $8.6 million of the total year-over-year change. For the purpose of calculating same-restaurant sales for the quarter ended December 29, 2024, sales for 71 restaurants that were open for at least 24 full fiscal periods were included in the Comparable Restaurant Base.

Total restaurant operating expenses for the fourth quarter ended December 29, 2024 were $139.4 million compared to $142.1 million for the fourth quarter ended December 31, 2023, a decrease of $2.7 million or 1.9%. The decrease was primarily driven by the additional operating week in the fourth quarter of 2023, partially offset by the opening of six restaurants in the fourth quarter of 2023 and ten restaurants in fiscal 2024. Additionally, food, beverage and packaging costs were negatively impacted by a 1.8% increase in commodity prices. The increase in labor expense was driven by incremental investments to support our team members, partially offset by lower variable-based compensation. Lastly, the increase in other operating expenses was due to the aforementioned restaurant openings and increases in repairs and maintenance, partially offset by a decrease in insurance expense.

General and administrative expenses for the fourth quarter ended December 29, 2024 were $20.3 million compared to $21.6 million for the fourth quarter ended December 31, 2023, a decrease of $1.2 million or 5.8%. This decrease was primarily driven by lower variable-based and equity compensation, partially offset by an increase in advertising expenses driven by the Chicagoland ad campaign and professional fees.

Operating income for the fourth quarter ended December 29, 2024 was $13.8 million compared to $14.5 million for the fourth quarter ended December 31, 2023, a decrease of $0.6 million primarily due to the aforementioned change in revenue and expenses and a technology asset impairment charge recorded in the fourth quarter of 2024.

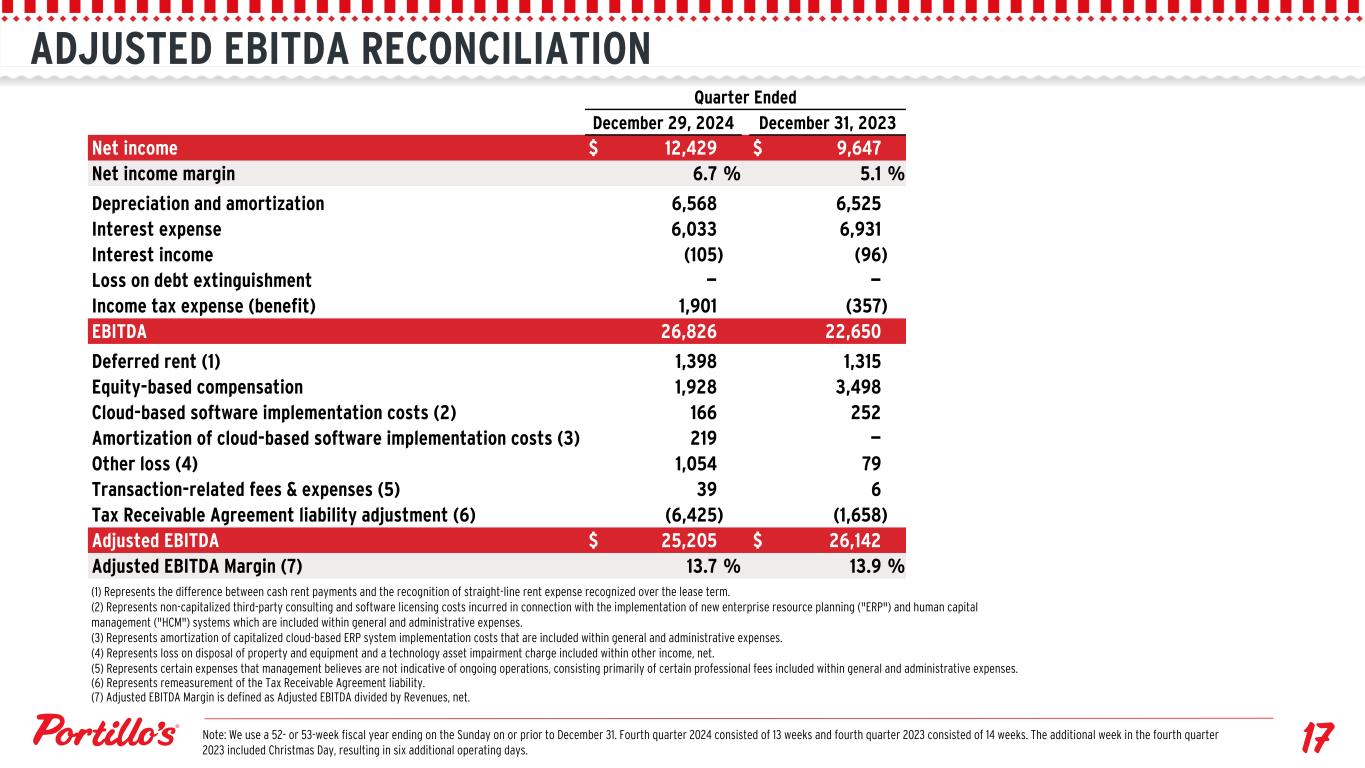

Net income for the fourth quarter ended December 29, 2024 was $12.4 million compared to a net income of $9.6 million for the fourth quarter ended December 31, 2023, an increase of $2.8 million. The increase in net income was primarily due to an increase in our Tax Receivable Agreement liability adjustment of $4.8 million and a decrease in interest expense of $0.9 million, partially offset by an increase in income tax expense of $2.3 million and a decrease in operating income of $0.6 million due to the aforementioned factors.

Restaurant-Level Adjusted EBITDA* for the fourth quarter ended December 29, 2024 was $45.2 million compared to $45.7 million for the quarter ended December 31, 2023, a decrease of $0.5 million or 1.1%

Adjusted EBITDA* for the fourth quarter ended December 29, 2024 was $25.2 million compared to $26.1 million for the quarter ended December 31, 2023, a decrease of $0.9 million or 3.6%.

*A reconciliation of Restaurant-Level Adjusted EBITDA and Adjusted EBITDA and the nearest GAAP financial measure is included under “Non-GAAP Measures” in the accompanying financial data below.

Review of Fiscal Year 2024 Financial Results

Revenues for fiscal 2024 were $710.6 million compared to $679.9 million for fiscal 2023, an increase of $30.6 million or 4.5%. The increase in revenues was primarily attributed to the opening of ten restaurants during fiscal 2024 and twelve restaurants in fiscal 2023, partially offset by a negative impact of $13.9 million due to the additional operating week in fiscal 2023 and a decrease in our same-restaurant sales. Same-restaurant sales decreased 0.6%, or $3.4 million. The same-restaurant sales decline was attributable to a 3.2% decrease in transactions, partially offset by an increase in average check of 2.6%. The higher average check was primarily driven by an approximate 4.6% increase in menu prices partially offset by product mix. Restaurants not in our Comparable Restaurant Base contributed $48.8 million of the total year-over-year increase. For the purpose of calculating same-restaurant sales as of December 29, 2024, sales for 71 restaurants were included in the Comparable Restaurant Base (as defined below) as of the end of fiscal 2024.

Total restaurant operating expenses for fiscal 2024 were $542.4 million compared to $514.7 million for fiscal 2023, an increase of $27.7 million or 5.4%. The increase in restaurant operating expenses was driven by the opening of ten restaurants in fiscal 2024 and the opening of twelve restaurants in fiscal 2023. Additionally, food, beverage and packaging costs was negatively impacted by a 4.2% increase in commodity prices, partially offset by lower third-party delivery commissions. The increase in labor expense was driven by incremental investments to support our team members, including annual rate increases, partially offset by lower variable-based compensation. Other operating expenses increased in repair and maintenance expenses, IT expenses, and utilities, partially offset by a decrease in operating supplies and advertising expenses.

General and administrative expenses for fiscal 2024 were $75.1 million compared to $78.8 million for fiscal 2023, a decrease of $3.7 million or 4.8%. This decrease was primarily driven by lower equity and variable-based compensation and insurance expenses, partially offset by an increase in advertising expenses driven by the Chicagoland ad campaign and professional fees and software license fees related to our enterprise resource planning (“ERP”) and human capital management (“HCM”) system implementations.

Operating income for fiscal 2024 was $58.0 million compared to $55.4 million for fiscal 2023, an increase of $2.6 million due to the aforementioned change in revenue and expenses and a technology asset impairment charge recorded in the fourth quarter of 2024.

Net income for fiscal 2024 was $35.1 million compared to $24.8 million for fiscal 2023, an increase of $10.3 million. The increase in net income was primarily due to the factors driving the aforementioned increase in operating income, a $5.8 million increase in the Tax Receivable Agreement liability adjustment, a $3.5 million loss on debt extinguishment included in fiscal 2023 and a decrease in interest expense of $1.9 million, partially offset by an increase in income tax expense of $3.6 million.

Restaurant-Level Adjusted EBITDA* for fiscal 2024 was $168.1 million compared to $165.2 million for fiscal 2023, an increase of $2.9 million or 1.8%.

Adjusted EBITDA* for fiscal 2024 was $104.8 million compared to $102.3 million for fiscal 2023, an increase of $2.5 million or 2.4%.

*A reconciliation of Restaurant-Level Adjusted EBITDA and Adjusted EBITDA and the nearest GAAP financial measure is included under “Non-GAAP Measures” in the accompanying financial data below.

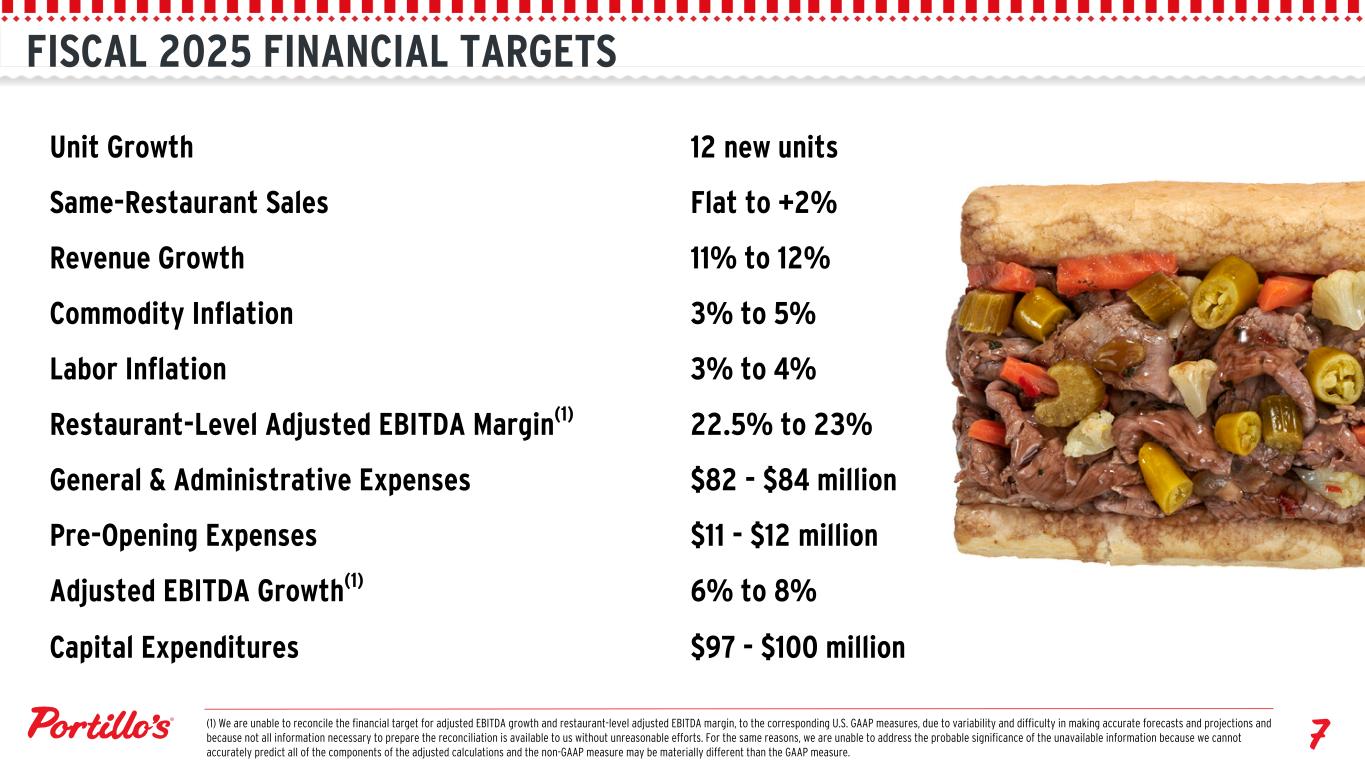

Fiscal 2025 Financial Targets

Based on current expectations, we are providing financial targets for fiscal 2025 as follows:

|

|

|

|

|

|

|

|

|

|

|

Current Target |

Unit growth |

|

|

12 new units |

Same-restaurant sales |

|

|

Flat to +2% |

Revenue growth |

|

|

11% to 12% |

Commodity inflation |

|

|

3% to 5% |

Labor inflation |

|

|

3% to 4% |

Restaurant-level adjusted EBITDA margin* |

|

|

22.5% to 23% |

General and administrative expenses |

|

|

$82 - $84 million |

Pre-opening expenses |

|

|

$11 - $12 million |

Adjusted EBITDA growth* |

|

|

6% to 8% |

Capital expenditures |

|

|

$97 - $100 million |

*We are unable to reconcile the financial target for adjusted EBITDA growth and restaurant-level adjusted EBITDA margin to net income/loss growth and operating income/loss margin, the respective corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts.

For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure.

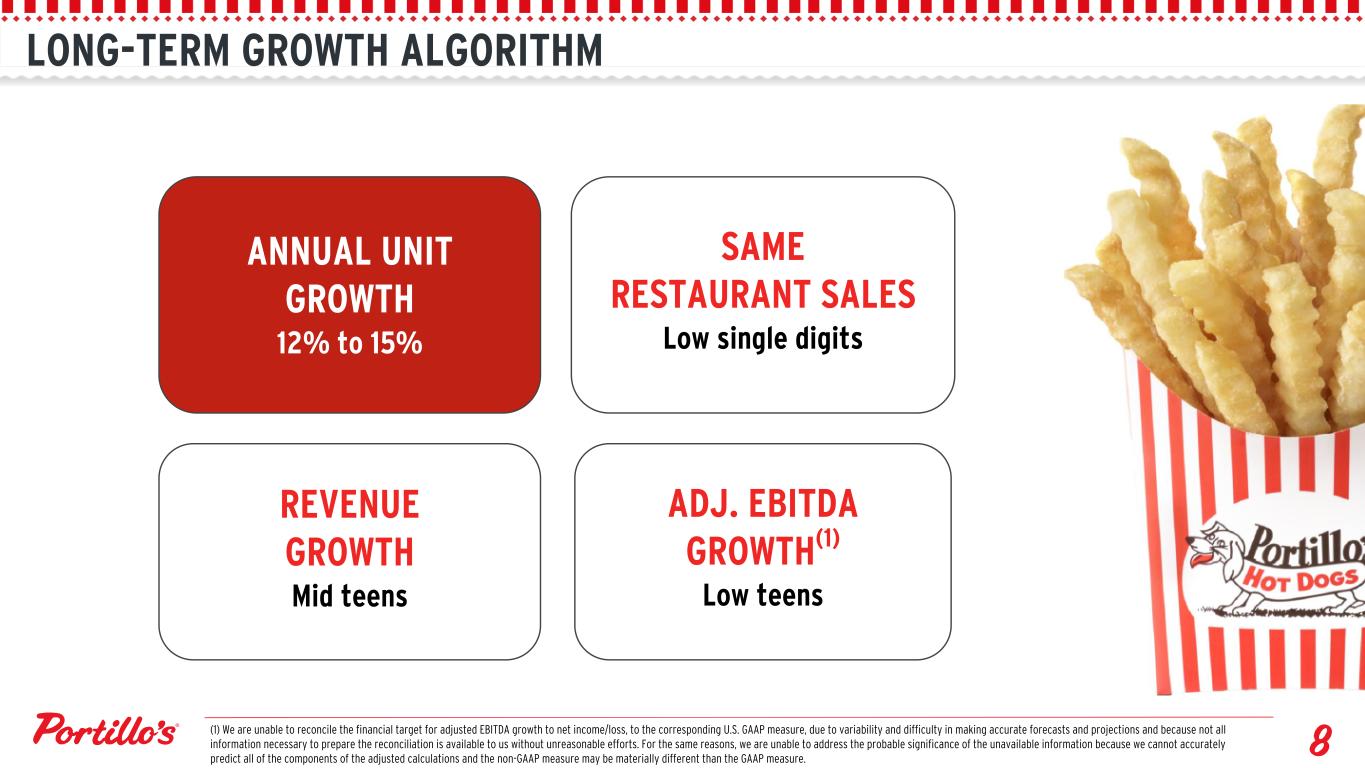

Long-Term Financial Targets

|

|

|

|

|

|

Annual unit growth |

12% - 15% |

Same-restaurant sales |

Low single digits |

Revenue growth |

Mid teens |

Adjusted EBITDA growth* |

Low teens |

*We are unable to reconcile the long-term outlook for Adjusted EBITDA growth to net income/loss, the corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure.

The following definitions apply to these terms as used in this release:

Change in Same-Restaurant Sales - The change in same-restaurant sales is the percentage change in year-over-year revenue (excluding gift card breakage) for the Comparable Restaurant Base, which is defined as the number of restaurants open for at least 24 full fiscal periods. For the years ended December 29, 2024 and December 31, 2023, there were 71 and 68 restaurants in our Comparable Restaurant Base, respectively.

A change in same-restaurant sales is the result of a change in restaurant transactions, average guest check, or a combination of the two. We gather daily sales data and regularly analyze the guest transaction counts and the mix of menu items sold to strategically evaluate menu pricing and demand. Measuring our change in same-restaurant sales allows management to evaluate the performance of our existing restaurant base. We believe this measure provides a consistent comparison of restaurant sales results and trends across periods within our core, established restaurant base, unaffected by results of restaurant openings and enables investors to better understand and evaluate the Company’s historical and prospective operating performance.

Average Unit Volume - AUV is the total revenue (excluding gift card breakage) recognized in the Comparable Restaurant Base, including C&O, divided by the number of restaurants in the Comparable Restaurant Base, including C&O, by period.

This key performance indicator allows management to assess changes in consumer spending patterns at our restaurants and the overall performance of our restaurant base.

Adjusted EBITDA and Adjusted EBITDA Margin - Adjusted EBITDA represents net income (loss) before depreciation and amortization, interest expense, interest income, and income taxes, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing core operating performance as identified in the reconciliation of net income (loss), the most directly comparable GAAP measure to Adjusted EBITDA. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of revenues, net. See also “Non-GAAP Financial Measures.”

Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin - Restaurant-Level Adjusted EBITDA is defined as revenue, less restaurant operating expenses, which include food, beverage and packaging costs, labor expenses, occupancy expenses and other operating expenses. Restaurant-Level Adjusted EBITDA excludes corporate level expenses and depreciation and amortization on restaurant property and equipment. Restaurant-Level Adjusted EBITDA Margin represents Restaurant-Level Adjusted EBITDA as a percentage of revenues, net. See also “Non-GAAP Financial Measures.”

For more information about the Company’s Non-GAAP measures, how they are calculated and reconciled and why management believes that they are useful, see “Non-GAAP Financial Measures” below.

Earnings Conference Call

The Company will host a conference call to discuss its financial results for the fourth quarter and fiscal year ended December 29, 2024 as well as a 2025 financial outlook on Tuesday, February 25, 2025, at 10:00 AM ET. The conference call can be accessed live over the phone by dialing 877-407-3982. A telephone replay will be available shortly after the call has concluded and can be accessed by dialing 412-317-6671; the passcode is 13748473. The webcast will be available at www.portillos.com under the investors section and will be archived on the site shortly after the call has concluded.

About Portillo’s

In 1963, Dick Portillo invested $1,100 into a small trailer to open the first Portillo’s hot dog stand in Villa Park, IL, which he called “The Dog House.” Years later, Portillo’s (NASDAQ: PTLO) has grown to more than 90 restaurants across 10 states. Portillo’s is best known for its Chicago-style hot dogs, Italian beef sandwiches, char-grilled burgers, fresh salads and famous chocolate cake.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). All statements other than statements of historical fact are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business, and are based on currently available operating, financial and competitive information which are subject to various risks and uncertainties, so you should not place undue reliance on forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "commit," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following:

•risks related to or arising from our organizational structure;

•risks of food-borne illness and food safety and other health concerns about our food;

•risks relating to the economy and financial markets, including inflation, fluctuating interest rates, stock market activity, or other factors;

•the impact of unionization activities of our team members on our reputation, operations and profitability;

•risks associated with our reliance on certain information technology systems, including our new enterprise resource planning system, and potential failures or interruptions;

•risks associated with data, privacy, cyber security and the use and implementation of information technology systems, including our digital ordering and payment platforms for our delivery business;

•risks associated with increased adoption, implementation and use of artificial intelligence technologies across our business;

•the impact of competition, including from our competitors in the restaurant industry or our own restaurants;

•the increasingly competitive labor market and our ability to attract and retain the best talent and qualified employees;

•the impact of federal, state or local government regulations relating to privacy, data protection, advertising and consumer protection, building and zoning requirements, labor and employment matters, costs of or ability to open new restaurants, or the sale of food and alcoholic beverages;

•inability to achieve our growth strategy, such as the availability of suitable new restaurant sites in existing and new markets and opening of new restaurants at the anticipated rate and on the anticipated timeline;

•the impact of consumer sentiment and other economic factors on our sales;

•increases in food and other operating costs, tariffs and import taxes, and supply shortages; and

•other risks identified in our filings with the Securities and Exchange Commission (the “SEC’).

All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this press release in the context of the risks and uncertainties disclosed in the Company’s most recent Annual Report on Form 10-K, filed with the SEC. All of the Company’s SEC filings are available on the SEC’s website at www.sec.gov. The forward-looking statements included in this press release are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Investor Contact:

investors@portillos.com

Media Contact:

ICR, Inc.

portillosPR@icrinc.com

PORTILLO’S INC

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except common share and per common share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Years Ended |

|

December 29, 2024 |

|

December 31, 2023 |

|

December 29, 2024 |

|

December 31, 2023 |

| REVENUES, NET |

$ |

184,609 |

|

|

100.0 |

% |

|

$ |

187,858 |

|

|

100.0 |

% |

|

$ |

710,554 |

|

|

100.0 |

% |

|

$ |

679,905 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST AND EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Food, beverage and packaging costs |

62,870 |

|

|

34.1 |

% |

|

65,462 |

|

|

34.8 |

% |

|

241,679 |

|

|

34.0 |

% |

|

230,869 |

|

|

34.0 |

% |

| Labor |

45,432 |

|

|

24.6 |

% |

|

47,668 |

|

|

25.4 |

% |

|

181,091 |

|

|

25.5 |

% |

|

173,868 |

|

|

25.6 |

% |

| Occupancy |

8,909 |

|

|

4.8 |

% |

|

8,460 |

|

|

4.5 |

% |

|

36,632 |

|

|

5.2 |

% |

|

33,358 |

|

|

4.9 |

% |

| Other operating expenses |

22,170 |

|

|

12.0 |

% |

|

20,532 |

|

|

10.9 |

% |

|

83,038 |

|

|

11.7 |

% |

|

76,639 |

|

|

11.3 |

% |

| Total restaurant operating expenses |

139,381 |

|

|

75.5 |

% |

|

142,122 |

|

|

75.7 |

% |

|

542,440 |

|

|

76.3 |

% |

|

514,734 |

|

|

75.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative expenses |

20,303 |

|

|

11.0 |

% |

|

21,550 |

|

|

11.5 |

% |

|

75,089 |

|

|

10.6 |

% |

|

78,835 |

|

|

11.6 |

% |

| Pre-opening expenses |

3,966 |

|

|

2.1 |

% |

|

3,990 |

|

|

2.1 |

% |

|

9,236 |

|

|

1.3 |

% |

|

9,019 |

|

|

1.3 |

% |

| Depreciation and amortization |

6,568 |

|

|

3.6 |

% |

|

6,525 |

|

|

3.5 |

% |

|

27,297 |

|

|

3.8 |

% |

|

24,313 |

|

|

3.6 |

% |

| Net income attributable to equity method investment |

(306) |

|

|

(0.2) |

% |

|

(391) |

|

|

(0.2) |

% |

|

(1,229) |

|

|

(0.2) |

% |

|

(1,401) |

|

|

(0.2) |

% |

Other loss (income), net |

864 |

|

|

0.5 |

% |

|

(405) |

|

|

(0.2) |

% |

|

(312) |

|

|

— |

% |

|

(1,035) |

|

|

(0.2) |

% |

OPERATING INCOME |

13,833 |

|

|

7.5 |

% |

|

14,467 |

|

|

7.7 |

% |

|

58,033 |

|

|

8.2 |

% |

|

55,440 |

|

|

8.2 |

% |

| Interest expense |

6,033 |

|

|

3.3 |

% |

|

6,931 |

|

|

3.7 |

% |

|

25,616 |

|

|

3.6 |

% |

|

27,470 |

|

|

4.0 |

% |

| Interest income |

(105) |

|

|

(0.1) |

% |

|

(96) |

|

|

(0.1) |

% |

|

(309) |

|

|

— |

% |

|

(212) |

|

|

— |

% |

Tax Receivable Agreement liability adjustment |

(6,425) |

|

|

(3.5) |

% |

|

(1,658) |

|

|

(0.9) |

% |

|

(9,149) |

|

|

(1.3) |

% |

|

(3,349) |

|

|

(0.5) |

% |

| Loss on debt extinguishment |

— |

|

|

— |

% |

|

— |

|

|

— |

% |

|

— |

|

|

— |

% |

|

3,465 |

|

|

0.5 |

% |

INCOME BEFORE INCOME TAXES |

14,330 |

|

|

7.8 |

% |

|

9,290 |

|

|

4.9 |

% |

|

41,875 |

|

|

5.9 |

% |

|

28,066 |

|

|

4.1 |

% |

Income tax expense (benefit) |

1,901 |

|

|

1.0 |

% |

|

(357) |

|

|

(0.2) |

% |

|

6,799 |

|

|

1.0 |

% |

|

3,248 |

|

|

0.5 |

% |

NET INCOME |

12,429 |

|

|

6.7 |

% |

|

9,647 |

|

|

5.1 |

% |

|

35,076 |

|

|

4.9 |

% |

|

24,818 |

|

|

3.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to non-controlling interests |

1,164 |

|

|

0.6 |

% |

|

1,858 |

|

|

1.0 |

% |

|

5,559 |

|

|

0.8 |

% |

|

6,394 |

|

|

0.9 |

% |

NET INCOME ATTRIBUTABLE TO PORTILLO'S INC. |

$ |

11,265 |

|

|

6.1 |

% |

|

$ |

7,789 |

|

|

4.1 |

% |

|

$ |

29,517 |

|

|

4.2 |

% |

|

$ |

18,424 |

|

|

2.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per common share attributable to Portillo’s Inc.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.18 |

|

|

|

|

$ |

0.14 |

|

|

|

|

$ |

0.48 |

|

|

|

|

$ |

0.34 |

|

|

|

| Diluted |

$ |

0.17 |

|

|

|

|

$ |

0.13 |

|

|

|

|

$ |

0.46 |

|

|

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

63,192,284 |

|

|

|

|

55,409,702 |

|

|

|

|

61,050,437 |

|

|

|

|

53,806,570 |

|

|

|

| Diluted |

65,885,627 |

|

|

|

|

58,635,214 |

|

|

|

|

63,982,643 |

|

|

|

|

57,307,784 |

|

|

|

Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fourth quarter 2024 and fiscal 2024 consisted of 13 weeks and 52 weeks, respectively, and fourth quarter 2023 and fiscal 2023 consisted of 14 weeks and 53 weeks, respectively. The additional week in the fourth quarter 2023 and fiscal 2023 included Christmas day, resulting in six additional operating days.

PORTILLO’S INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except common share and per common share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 29, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| CURRENT ASSETS: |

|

|

|

| Cash and cash equivalents and restricted cash |

$ |

22,876 |

|

|

$ |

10,438 |

|

|

|

|

|

Accounts and tenant improvement receivables |

14,794 |

|

|

14,183 |

|

Inventories |

7,915 |

|

|

8,733 |

|

| Prepaid expenses |

7,066 |

|

|

8,565 |

|

| Total current assets |

52,651 |

|

|

41,919 |

|

| Property and equipment, net |

358,975 |

|

|

295,793 |

|

| Operating lease assets |

222,390 |

|

|

193,825 |

|

| Goodwill |

394,298 |

|

|

394,298 |

|

| Trade names |

223,925 |

|

|

223,925 |

|

| Other intangible assets, net |

26,098 |

|

|

28,911 |

|

| Equity method investment |

16,056 |

|

|

16,684 |

|

| Deferred tax assets |

197,409 |

|

|

184,701 |

|

| Other assets |

8,284 |

|

|

5,485 |

|

| Total other assets |

866,070 |

|

|

854,004 |

|

| TOTAL ASSETS |

$ |

1,500,086 |

|

|

$ |

1,385,541 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable |

$ |

45,516 |

|

|

$ |

33,189 |

|

| Current portion of long-term debt |

11,250 |

|

|

7,500 |

|

| Short-term debt |

25,000 |

|

|

15,000 |

|

| Current portion of Tax Receivable Agreement liability |

7,686 |

|

|

4,428 |

|

|

|

|

|

Deferred revenue |

7,032 |

|

|

7,180 |

|

| Short-term lease liability |

6,013 |

|

|

5,577 |

|

| Accrued expenses |

33,072 |

|

|

32,039 |

|

| Total current liabilities |

135,569 |

|

|

104,913 |

|

| LONG-TERM LIABILITIES: |

|

|

|

| Long-term debt, net of current portion |

275,422 |

|

|

283,923 |

|

|

|

|

|

| Tax Receivable Agreement liability |

316,893 |

|

|

295,390 |

|

| Long-term lease liability |

278,540 |

|

|

238,414 |

|

| Other long-term liabilities |

3,559 |

|

|

2,791 |

|

| Total long-term liabilities |

874,414 |

|

|

820,518 |

|

| Total liabilities |

1,009,983 |

|

|

925,431 |

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

Preferred stock, $0.01 par value per share, 10,000,000 shares authorized, none issued and outstanding |

— |

|

|

— |

|

Class A common stock, $0.01 par value per share, 380,000,000 shares authorized, and 63,674,579 and 55,502,375 shares issued and outstanding as of December 29, 2024 and December 31, 2023, respectively |

637 |

|

|

555 |

|

Class B common stock, $0.00001 par value per share, 50,000,000 shares authorized, and 10,732,800 and 17,472,926 shares issued and outstanding as of December 29, 2024 and December 31, 2023, respectively |

— |

|

|

— |

|

| Additional paid-in-capital |

357,295 |

|

|

308,212 |

|

Retained earnings |

43,129 |

|

|

13,612 |

|

| Total stockholders' equity attributable to Portillo's Inc. |

401,061 |

|

|

322,379 |

|

| Non-controlling interest |

89,042 |

|

|

137,731 |

|

| Total stockholders' equity |

490,103 |

|

|

460,110 |

|

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ |

1,500,086 |

|

|

$ |

1,385,541 |

|

PORTILLO’S INC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Years Ended |

|

December 29, 2024 |

|

December 31, 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

Net income |

$ |

35,076 |

|

|

$ |

24,818 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

27,297 |

|

|

24,313 |

|

| Amortization of debt issuance costs and discount |

873 |

|

|

1,001 |

|

| Loss on sales of assets |

528 |

|

|

592 |

|

| Equity-based compensation |

11,151 |

|

|

15,542 |

|

|

|

|

|

Deferred income tax expense |

6,771 |

|

|

3,249 |

|

| Tax Receivable Agreement liability adjustment |

(9,149) |

|

|

(3,349) |

|

|

|

|

|

| Gift card breakage |

(852) |

|

|

(917) |

|

| Asset impairment |

657 |

|

|

— |

|

| Loss on debt extinguishment |

— |

|

|

3,465 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivables |

862 |

|

|

(679) |

|

| Receivables from related parties |

(46) |

|

|

(82) |

|

| Inventory |

818 |

|

|

(1,346) |

|

| Other current assets |

357 |

|

|

(3,643) |

|

| Operating lease asset |

8,469 |

|

|

7,402 |

|

| Accounts payable |

11,284 |

|

|

209 |

|

| Accrued expenses and other liabilities |

1,827 |

|

|

3,021 |

|

Operating lease liabilities |

(3,178) |

|

|

(2,033) |

|

| Deferred lease incentives |

5,553 |

|

|

1,501 |

|

| Other assets and liabilities |

(258) |

|

|

(2,283) |

|

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

98,040 |

|

|

70,781 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| Purchase of property and equipment |

(88,191) |

|

|

(87,918) |

|

|

|

|

|

| Proceeds from the sale of property and equipment |

77 |

|

|

81 |

|

| NET CASH USED IN INVESTING ACTIVITIES |

(88,114) |

|

|

(87,837) |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

Proceeds from short-term debt, net |

10,000 |

|

|

15,000 |

|

| Proceeds from long-term debt |

— |

|

|

300,000 |

|

| Payments of long-term debt |

(5,625) |

|

|

(328,053) |

|

|

|

|

|

|

|

|

|

| Proceeds from equity offering, net of underwriting discounts |

114,960 |

|

|

179,306 |

|

| Repurchase of outstanding equity / Portillo's OpCo units |

(114,960) |

|

|

(179,306) |

|

| Distributions paid to non-controlling interest holders |

(838) |

|

|

(399) |

|

| Proceeds from stock option exercises |

4,332 |

|

|

1,879 |

|

| Employee withholding taxes related to net settled equity awards |

(1,433) |

|

|

(1,505) |

|

| Proceeds from Employee Stock Purchase Plan purchases |

508 |

|

|

527 |

|

| Payments of Tax Receivable Agreement liability |

(4,432) |

|

|

(813) |

|

| Payment of deferred financing costs |

— |

|

|

(3,569) |

|

|

|

|

|

NET CASH PROVIDED (USED) IN FINANCING ACTIVITIES |

2,512 |

|

|

(16,933) |

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH |

12,438 |

|

|

(33,989) |

|

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF THE PERIOD |

10,438 |

|

|

44,427 |

|

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF THE PERIOD |

$ |

22,876 |

|

|

$ |

10,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fiscal 2024 consisted of 52 weeks and fiscal 2023 consisted of 53 weeks. The 53rd week in fiscal 2023 included Christmas day, resulting in six additional operating days.

PORTILLO’S INC

SELECTED OPERATING DATA AND NON-GAAP FINANCIAL MEASURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Years Ended |

|

December 29, 2024 |

|

December 31, 2023 |

|

December 29, 2024 |

|

December 31, 2023 |

| Total Restaurants (a) |

94 |

|

84 |

|

94 |

|

84 |

| AUV (in millions) (a) |

N/A |

|

N/A |

|

$ |

8.7 |

|

|

$ |

9.1 |

|

| Change in same-restaurant sales (b)(c) |

0.4 |

% |

|

4.4 |

% |

|

(0.6)% |

|

5.7% |

| Adjusted EBITDA (in thousands) (b) |

$ |

25,205 |

|

|

$ |

26,142 |

|

|

$ |

104,760 |

|

|

$ |

102,282 |

|

| Adjusted EBITDA Margin (b) |

13.7 |

% |

|

13.9 |

% |

|

14.7% |

|

15.0% |

| Restaurant-Level Adjusted EBITDA (in thousands) (b) |

$ |

45,228 |

|

|

$ |

45,736 |

|

|

$ |

168,114 |

|

|

$ |

165,171 |

|

| Restaurant-Level Adjusted EBITDA Margin (b) |

24.5 |

% |

|

24.3 |

% |

|

23.7% |

|

24.3% |

Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fourth quarter 2024 and fiscal 2024 consisted of 13 weeks and 52 weeks, respectively, and fourth quarter 2023 and fiscal 2023 consisted of 14 weeks and 53 weeks, respectively. The additional week in the fourth quarter 2023 and fiscal 2023 included Christmas day, resulting in six additional operating days.

(a) Includes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. Total restaurants indicated are as of December 29, 2024. AUV for fiscal 2024 and fiscal 2023 consist of 52 weeks and 53 weeks, respectively.

(b) Excludes a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity.

(c) For the fourth quarter 2024, same-restaurant sales compares the 13 weeks from September 30, 2024 through December 29, 2024 to the 13 weeks from October 2, 2023 through December 31, 2023. For the fourth quarter 2023, same-restaurant sales compares the 14 weeks from September 25, 2023 through December 31, 2023 to the 14 weeks from September 26, 2022 through January 1, 2023. For fiscal 2024, same-restaurant sales compares the 52 weeks from January 1, 2024 through December 29, 2024 to the 52 weeks from January 2, 2023 through December 31, 2023. For fiscal 2023, same-restaurant sales compares the 53 weeks from December 26, 2022 through December 31, 2023 to the 53 weeks from December 27, 2021 through January 1, 2023.

PORTILLO’S INC.

NON-GAAP FINANCIAL MEASURES

To supplement the consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: Adjusted EBITDA and Adjusted EBITDA Margin, and Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin. Accordingly, Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are not required by, nor presented in accordance with GAAP, but rather are supplemental measures of operating performance of our restaurants. You should be aware that these measures are not indicative of overall results for the Company and that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. These measures are supplemental measures of operating performance and our calculations thereof may not be comparable to similar measures reported by other companies. These measures are important measures to evaluate the performance and profitability of our restaurants, individually and in the aggregate, but also have important limitations as analytical tools and should not be considered in isolation as substitutes for analysis of our results as reported under GAAP.

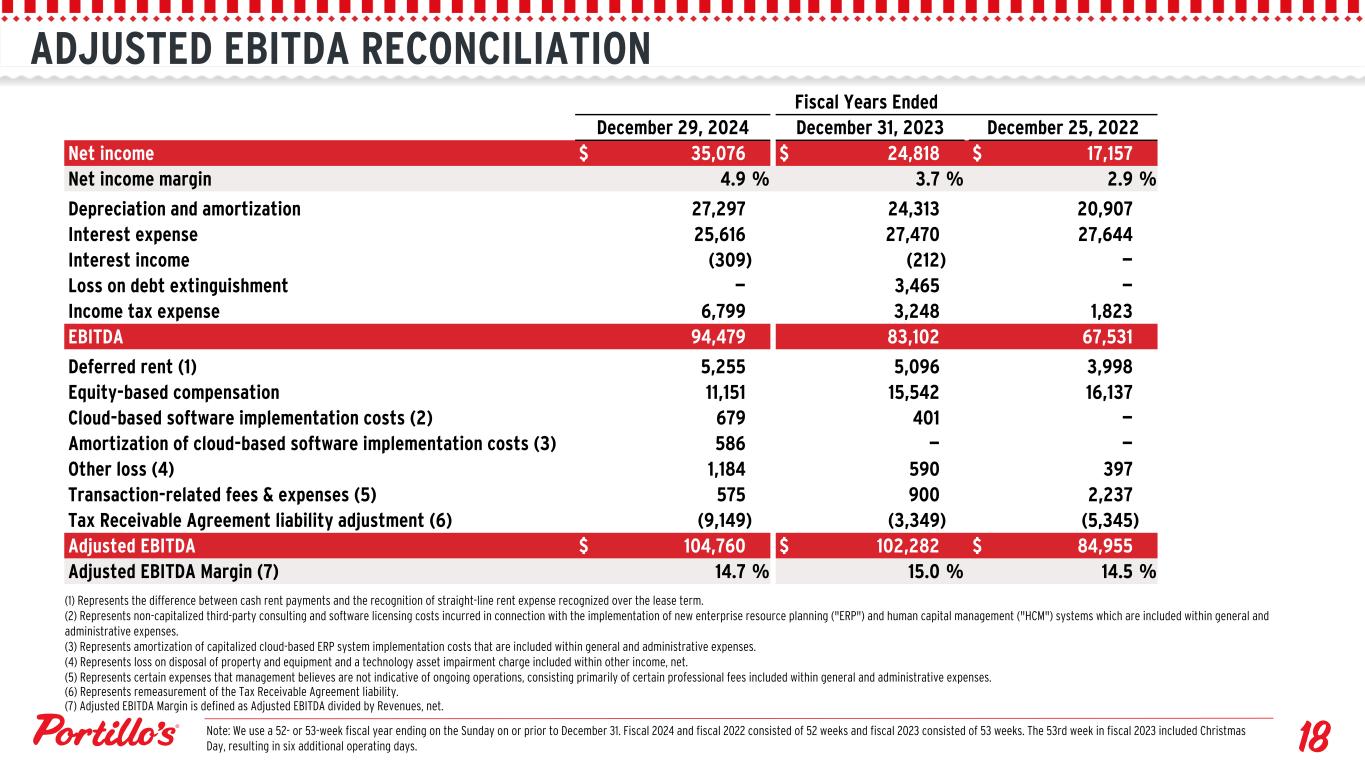

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA represents net income (loss) before depreciation and amortization, interest expense, interest income, and income taxes, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing core operating performance as identified in the reconciliation of net income (loss), the most directly comparable GAAP measure to Adjusted EBITDA. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of total revenues.

We use Adjusted EBITDA and Adjusted EBITDA Margin (i) to evaluate our operating results and the effectiveness of our business strategies, (ii) internally as benchmarks to compare our performance to that of our competitors and (iii) as factors in evaluating management’s performance when determining incentive compensation.

We believe that Adjusted EBITDA and Adjusted EBITDA Margin are important measures of operating performance because they eliminate the impact of expenses that do not relate to our core operating performance.

We are unable to reconcile the long-term outlook for Adjusted EBITDA to net income (loss), the corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all of the components of the adjusted calculations and the non-GAAP measure may be materially different than the GAAP measure.

Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin

Restaurant-Level Adjusted EBITDA is defined as revenue, less restaurant operating expenses, which include cost of goods sold (excluding depreciation and amortization), labor expenses, occupancy expenses and other operating expenses. Restaurant-Level Adjusted EBITDA excludes corporate level expenses and depreciation and amortization on restaurant property and equipment. Restaurant-Level Adjusted EBITDA Margin represents Restaurant-Level Adjusted EBITDA as a percentage of revenue.

We believe that Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin are important measures to evaluate the performance and profitability of our restaurants, individually and in the aggregate.

See below for a reconciliation of net income, the most directly comparable GAAP measure, to Adjusted EBITDA and Adjusted EBITDA Margin (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Years Ended |

|

December 29, 2024 |

|

December 31, 2023 |

|

December 29, 2024 |

|

December 31, 2023 |

Net income |

$ |

12,429 |

|

|

$ |

9,647 |

|

|

$ |

35,076 |

|

|

$ |

24,818 |

|

Net income margin |

6.7 |

% |

|

5.1 |

% |

|

4.9 |

% |

|

3.7 |

% |

| Depreciation and amortization |

6,568 |

|

|

6,525 |

|

|

27,297 |

|

|

24,313 |

|

| Interest expense |

6,033 |

|

|

6,931 |

|

|

25,616 |

|

|

27,470 |

|

Interest income |

(105) |

|

|

(96) |

|

|

(309) |

|

|

(212) |

|

| Loss on debt extinguishment |

— |

|

|

— |

|

|

— |

|

|

3,465 |

|

Income tax expense (benefit) |

1,901 |

|

|

(357) |

|

|

6,799 |

|

|

3,248 |

|

| EBITDA |

26,826 |

|

|

22,650 |

|

|

94,479 |

|

|

83,102 |

|

| Deferred rent (1) |

1,398 |

|

|

1,315 |

|

|

5,255 |

|

|

5,096 |

|

| Equity-based compensation |

1,928 |

|

|

3,498 |

|

|

11,151 |

|

|

15,542 |

|

| Cloud-based software implementation costs (2) |

166 |

|

|

252 |

|

|

679 |

|

|

401 |

|

| Amortization of cloud-based software implementation costs (3) |

219 |

|

|

— |

|

|

586 |

|

|

— |

|

| Other loss (4) |

1,054 |

|

|

79 |

|

|

1,184 |

|

|

590 |

|

| Transaction-related fees and expenses (5) |

39 |

|

|

6 |

|

|

575 |

|

|

900 |

|

| Tax Receivable Agreement liability adjustment (6) |

(6,425) |

|

|

(1,658) |

|

|

(9,149) |

|

|

(3,349) |

|

| Adjusted EBITDA |

$ |

25,205 |

|

|

$ |

26,142 |

|

|

$ |

104,760 |

|

|

$ |

102,282 |

|

Adjusted EBITDA Margin (7) |

13.7 |

% |

|

13.9 |

% |

|

14.7 |

% |

|

15.0 |

% |

Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fourth quarter 2024 and fiscal 2024 consisted of 13 weeks and 52 weeks, respectively, and fourth quarter 2023 and fiscal 2023 consisted of 14 weeks and 53 weeks, respectively. The additional week in the fourth quarter 2023 and fiscal 2023 included Christmas day, resulting in six additional operating days.

(1) Represents the difference between cash rent payments and the recognition of straight-line rent expense recognized over the lease term.

(2) Represents non-capitalized third-party consulting and software licensing costs incurred in connection with the implementation of new enterprise resource planning ("ERP") and human capital management ("HCM") systems which are included within general and administrative expenses.

(3) Represents amortization of capitalized cloud-based ERP system implementation costs that are included within general and administrative expenses.

(4) Represents loss on disposal of property and equipment and a technology asset impairment charge included within other income, net.

(5) Represents certain expenses that management believes are not indicative of ongoing operations, consisting primarily of certain professional fees included within general and administrative expenses.

(6) Represents remeasurement of the Tax Receivable Agreement liability.

(7) Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenues, net.

See below for a reconciliation of operating income, the most directly comparable GAAP measure, to Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Years Ended |

|

December 29, 2024 |

|

December 31, 2023 |

|

December 29, 2024 |

|

December 31, 2023 |

Operating income |

$ |

13,833 |

|

|

$ |

14,467 |

|

|

$ |

58,033 |

|

|

$ |

55,440 |

|

| Operating income margin |

7.5 |

% |

|

7.7 |

% |

|

8.2 |

% |

|

8.2 |

% |

| Plus: |

|

|

|

|

|

|

|

| General and administrative expenses |

20,303 |

|

|

21,550 |

|

|

75,089 |

|

|

78,835 |

|

| Pre-opening expenses |

3,966 |

|

|

3,990 |

|

|

9,236 |

|

|

9,019 |

|

| Depreciation and amortization |

6,568 |

|

|

6,525 |

|

|

27,297 |

|

|

24,313 |

|

| Net income attributable to equity method investment |

(306) |

|

|

(391) |

|

|

(1,229) |

|

|

(1,401) |

|

Other loss (income), net |

864 |

|

|

(405) |

|

|

(312) |

|

|

(1,035) |

|

| Restaurant-Level Adjusted EBITDA |

$ |

45,228 |

|

|

$ |

45,736 |

|

|

$ |

168,114 |

|

|

$ |

165,171 |

|

| Restaurant-Level Adjusted EBITDA Margin (1) |

24.5 |

% |

|

24.3 |

% |

|

23.7 |

% |

|

24.3 |

% |

Note: We use a 52- or 53-week fiscal year ending on the Sunday on or prior to December 31. Fourth quarter 2024 and fiscal 2024 consisted of 13 weeks and 52 weeks, respectively, and fourth quarter 2023 and fiscal 2023 consisted of 14 weeks and 53 weeks, respectively. The additional week in the fourth quarter 2023 and fiscal 2023 included Christmas day, resulting in six additional operating days.

(1) Restaurant-Level Adjusted EBITDA Margin is defined as Restaurant-Level Adjusted EBITDA divided by Revenues, net