Document

Exhibit 99.1

News Release

|

|

|

|

|

|

|

|

|

| Contact: |

|

Paul Adams

Corporate Communications

410-470-9700

Emily Duncan

Investor Relations

833-447-2783

|

CONSTELLATION REPORTS SECOND QUARTER 2023 RESULTS

Earnings Release Highlights

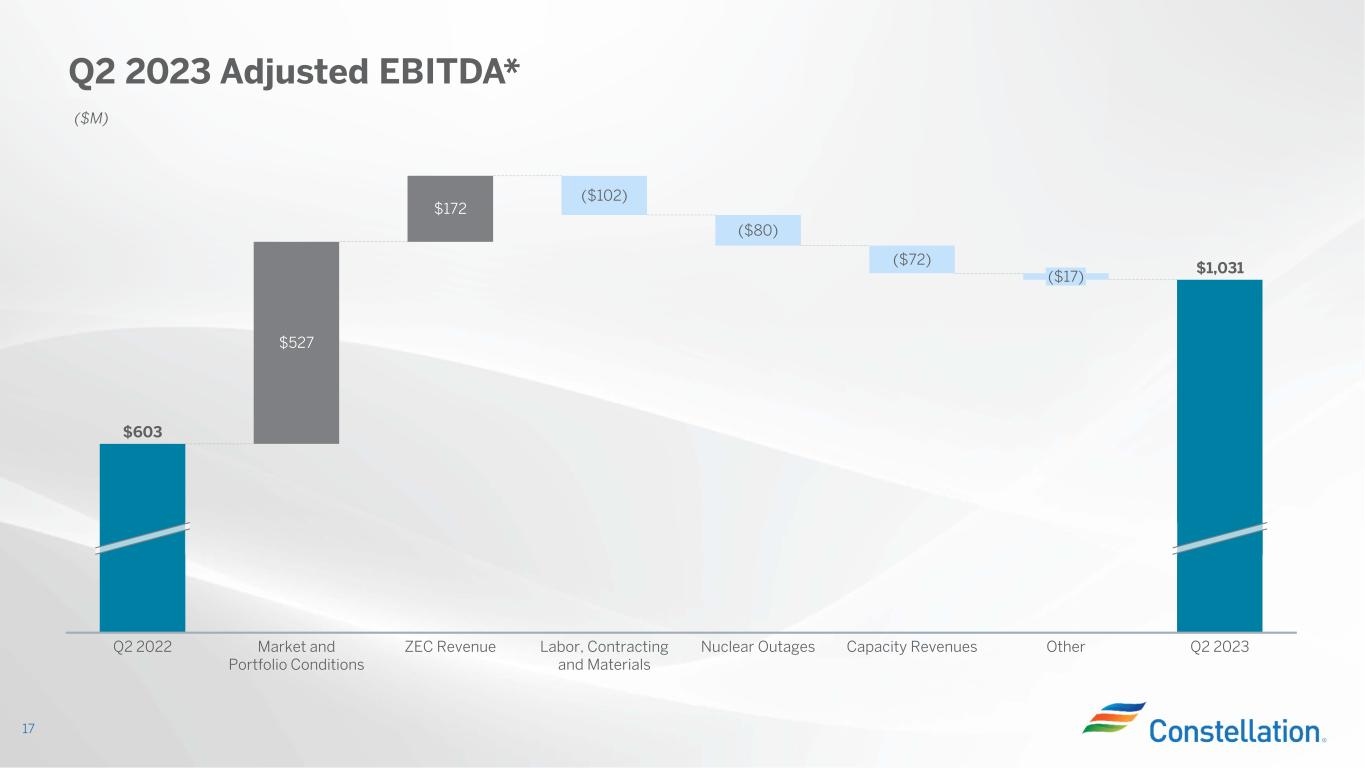

•GAAP Net Income of $833 million and Adjusted EBITDA (non-GAAP) of $1,031 million for the second quarter of 2023

•Raising guidance range for full year 2023 Adjusted EBITDA (non-GAAP) to $3,300 million to $3,700 million

•Delivering on our commitment to shareholders – announced acquisition of NRG’s 44% stake in South Texas Project Electric Generating Station (STP); commenced project to repower our Criterion wind facility; and repurchased over $250 million of shares in the second quarter, now having completed half of our $1.0 billion share repurchase program

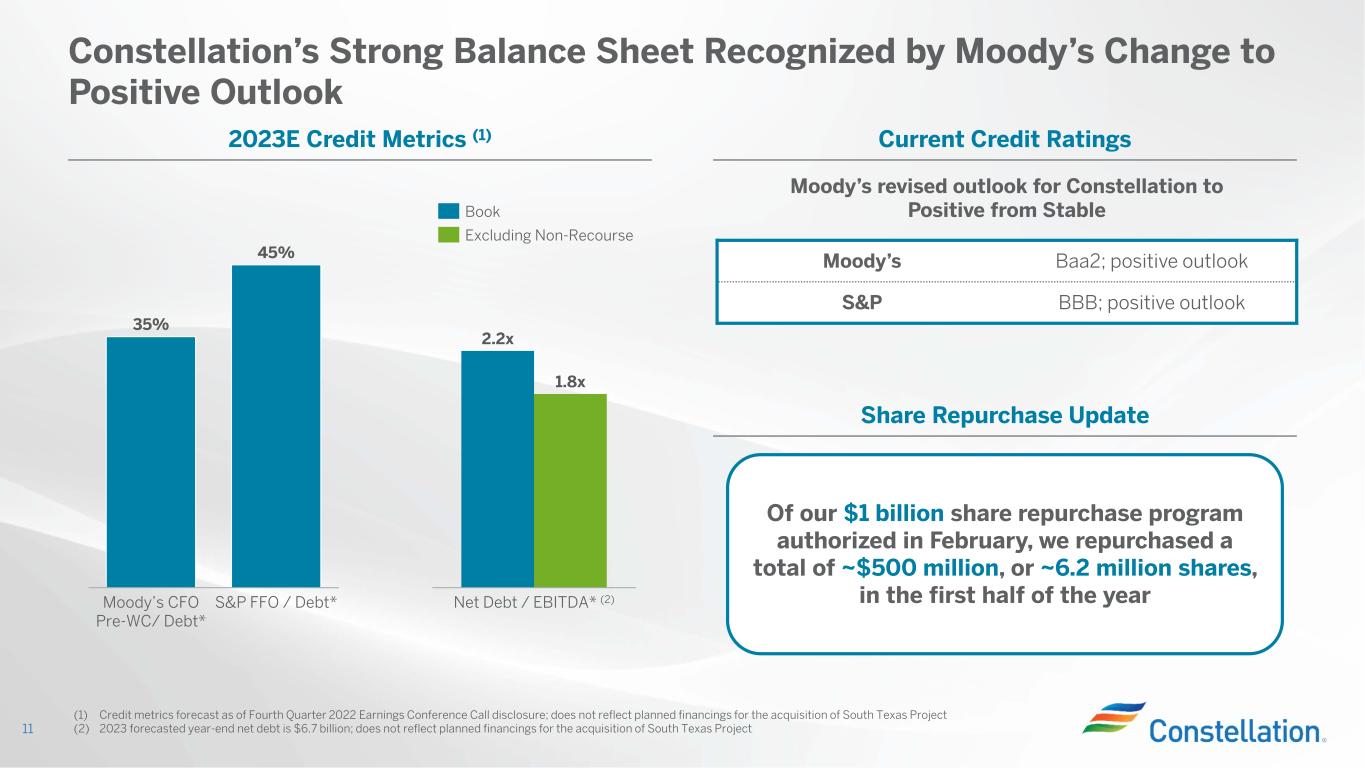

•Moody’s raised outlook on credit ratings from stable to positive, reflecting continued strength in the balance sheet

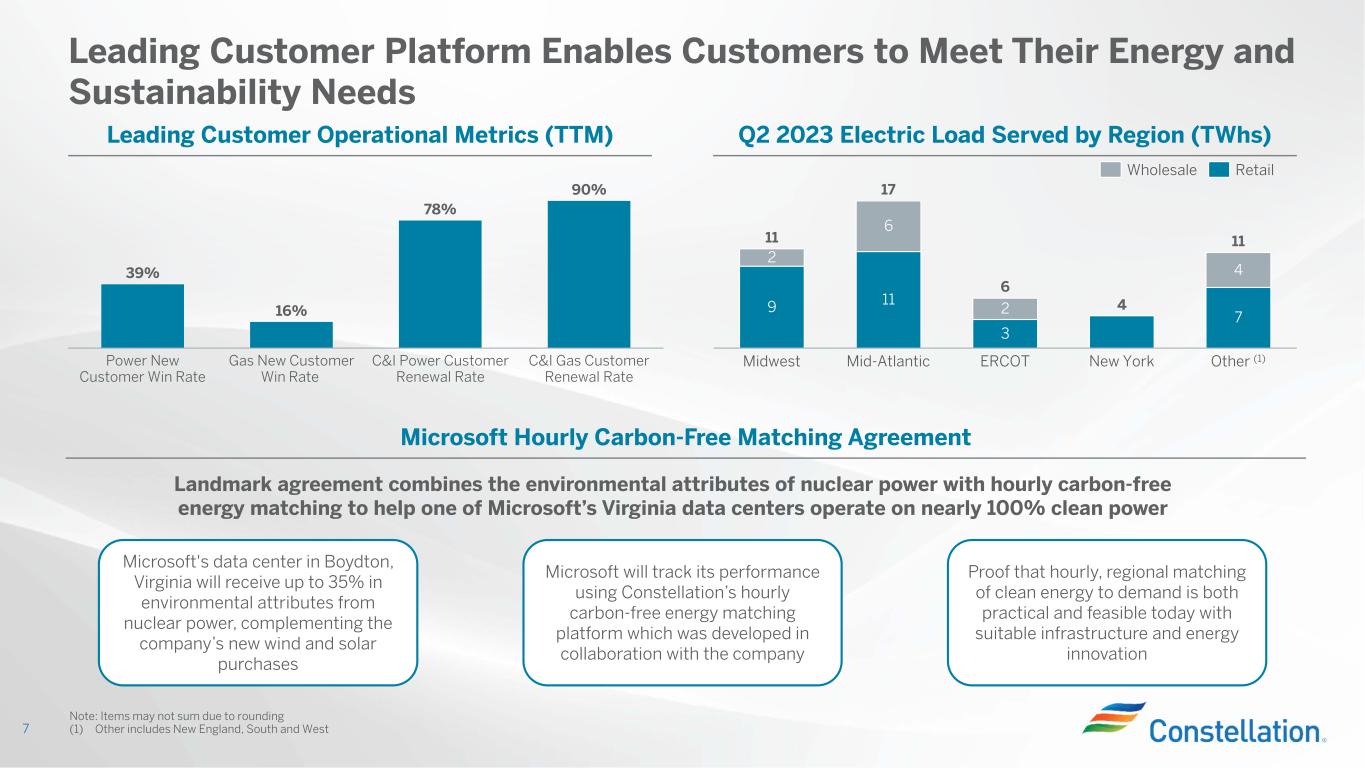

•Reached landmark agreement with Microsoft that will allow Microsoft to track power usage using Constellation’s hourly carbon-free energy (CFE) matching platform

•Exhibiting role as a leader in the clean energy transition by setting an industry record for blending hydrogen with natural gas at our Hillabee Generating Station

Baltimore (Aug. 3, 2023) — Constellation Energy Corporation (Nasdaq: CEG) today reported its financial results for the second quarter of 2023.

“Constellation continues to deliver strong operational and financial performance across the business, while giving customers the visibility and certainty they need to manage energy costs during a time of market volatility and creating value for our shareholders,” said Joe Dominguez, president and CEO, Constellation. “During a summer of record-setting heat, our nuclear fleet continues to deliver clean, reliable and affordable electricity to the communities we serve in every hour of every day of the year, making it an essential tool in meeting our customers’ carbon reduction goals. In a first for our industry, we recently signed a landmark agreement with Microsoft to provide one of its data centers with environmental attributes from nuclear energy as part of a strategy to power its operations with clean energy around the clock, demonstrating the unique value of nuclear as a sustainable climate solution.”

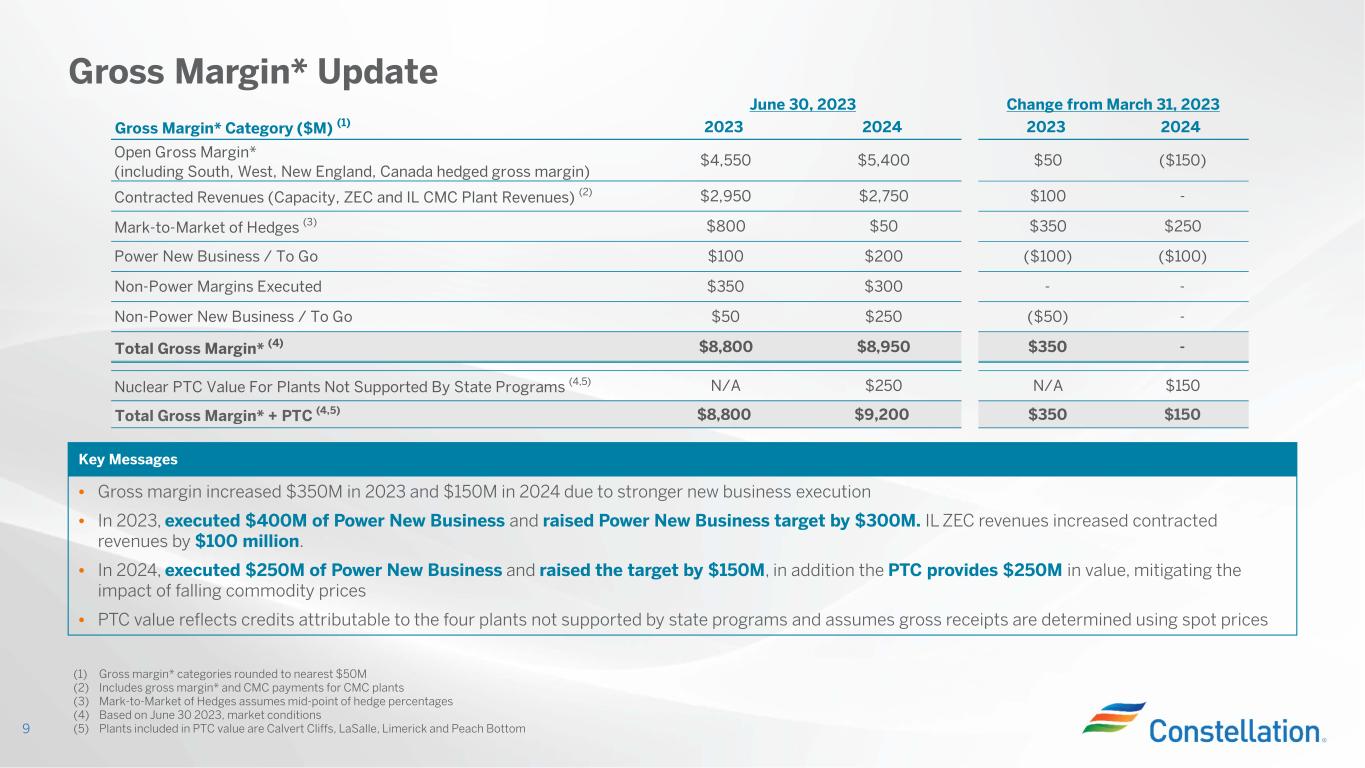

“We earned in excess of $1 billion in adjusted EBITDA in the second quarter, marking a significant increase year-over-year,” said Dan Eggers, executive vice president and chief financial officer. “Our commercial team continues to capture significant value in the market through higher customer margins, successful load auction wins and by optimizing across our load-serving and generation positions. Our strong investment-grade balance sheet remains a critical competitive advantage, allowing us to create additional value where others cannot. As a result of this strong performance, we are raising our adjusted EBITDA guidance range to $3.3 billion to $3.7 billion from $2.9 billion to $3.3 billion, which raises the midpoint by $400 million.”

Second Quarter 2023

Our GAAP Net Income for the second quarter of 2023 increased to $833 million from ($111) million GAAP Net Loss in the second quarter of 2022. Adjusted EBITDA (non-GAAP) for the second quarter of 2023 increased to $1,031 million from $603 million in the second quarter of 2022. For the reconciliations of GAAP Net Income (Loss) to Adjusted EBITDA (non-GAAP), refer to the tables beginning on page 3.

Adjusted EBITDA (non-GAAP) in the second quarter of 2023 primarily reflects:

•Favorable market and portfolio conditions and ZEC revenue; partially offset by unfavorable labor, contracting, and materials, unfavorable nuclear outage impacts and decreased capacity revenues.

Recent Developments and Second Quarter Highlights

•Delivering on Our Capital Allocation Promises: In alignment with our capital and strategic plan we have agreed to acquire NRG Energy Inc.’s 44% ownership stake in the South Texas Project Nuclear Generating Station, a 2,645-megawatt, dual-unit nuclear plant located about 90 miles southwest of Houston, for $1.75 billion. We expect to issue approximately $500 million of incremental debt to finance the transaction, with the remainder of the purchase price being funded by existing cash and previously planned debt issuances. This acquisition is complementary to and aligned strategically with our existing clean energy business operations. Absent any delays, we expect to close within 2023.

We have commenced a project to repower our Criterion wind facility in Oakland, Md. The repower will increase the efficiency and output of the facility, resulting in the delivery of more carbon-free electricity to the region for many years to come. The project is part of our previously announced $350 million effort to increase the output and lifespan of our renewable energy portfolio.

We’ve also continued our share repurchase program, repurchasing nearly 3 million shares for a total of $252 million in the second quarter 2023. To date, we have successfully repurchased approximately 6.2 million shares for a combined $503 million.

•Moody’s credit ratings raised to positive outlook: On May 10, 2023, Moody’s Investor Service reaffirmed our senior unsecured issuer ratings (Baa2) and short-term rating (Prime-2) while raising the outlook from stable to positive. Moody’s cites the expected improvement of our credit metrics, revenue stability provided by the nuclear production tax credit, and our commitment to managing debt levels as rationale for putting the ratings on positive outlook.

•Hourly Carbon-Free Energy Matching Agreement: We’ve entered into an agreement with Microsoft to significantly reduce the carbon footprint of one of its data centers in Boydton, Virginia. Under the agreement, the facility will receive up to 35 percent in environmental attributes from nuclear power, complementing the company’s new wind and solar purchases. This agreement puts Microsoft very close to its goal of operating the data center on 100 percent carbon-free electricity around the clock, further proof that hourly, regional matching of clean energy to demand is both practical and feasible today with suitable infrastructure and energy innovation.

•Industry Record for Hydrogen Blending: We have set an industry record for blending high concentrations of hydrogen with natural gas, further proof that hydrogen can be an effective tool to lower greenhouse gas emissions. Working with Siemens Energy and the Electric Power Research Institute, the hydrogen blending test was conducted in May 2023 at our Hillabee Generating Station, a 753-megawatt combined-cycle natural gas plant in central Alabama that began operating in 2010. The test showed that with only minor modifications, an existing natural gas plant of that age can safely operate on a blend of 38.8 percent hydrogen, nearly doubling the previous blending record for similar generators. The testing results at Hillabee demonstrate that hydrogen produced with clean energy can be an effective tool to help achieve the nation’s climate goals.

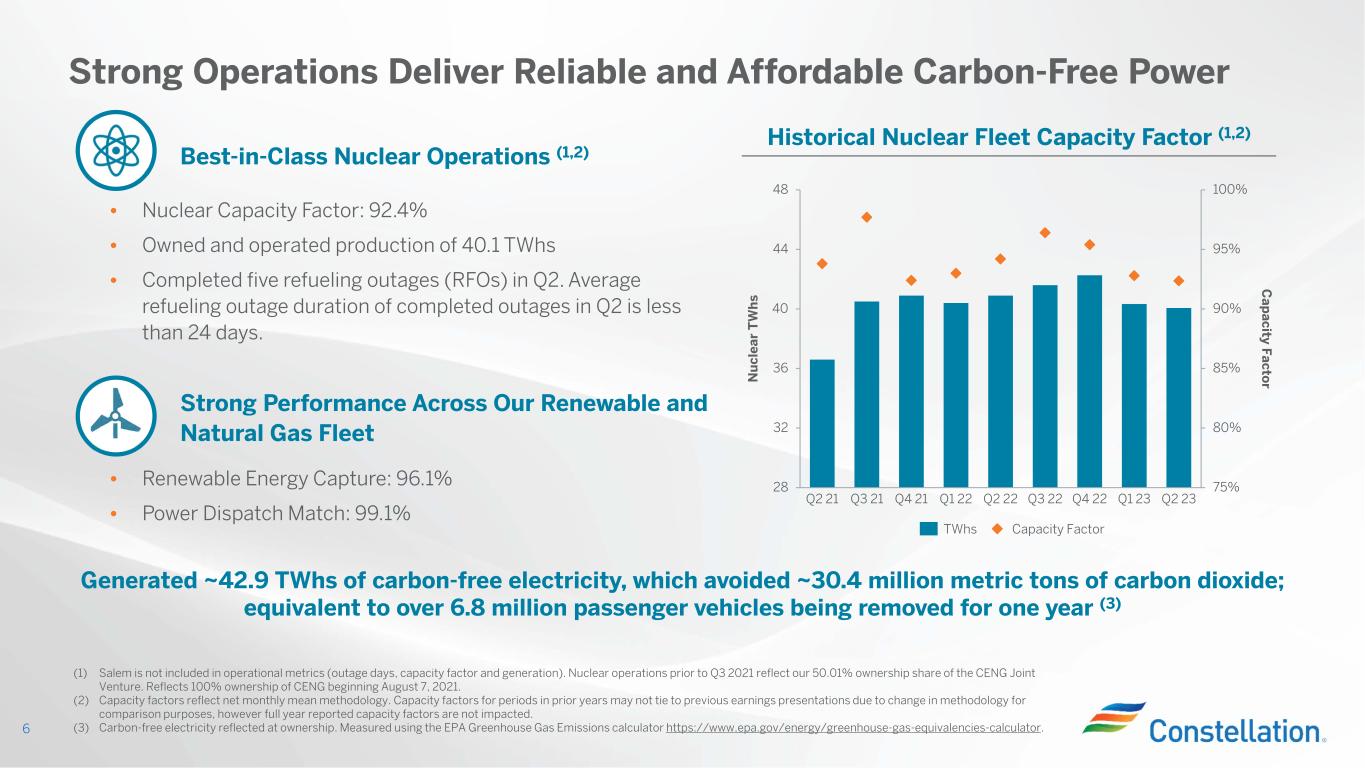

•Nuclear Operations: Our nuclear fleet, including our owned output from the Salem Generating Station, produced 41,895 gigawatt-hours (GWhs) in the second quarter of 2023, compared with 42,522 GWhs in the second quarter of 2022. Excluding Salem, our nuclear plants at ownership achieved a 92.4% capacity factor for the second quarter of 2023, compared with 94.2% for the second quarter of 2022. There were 94 planned refueling outage days in the second quarter of 2023 and 66 in the second quarter of 2022. There were 25 non-refueling outage days in the second quarter of 2023 and 15 in the second quarter of 2022.

•Natural Gas, Oil, and Renewables Operations: The dispatch match rate for our fleet was 99.1% in the second quarter of 2023, compared with 99.6% in the second quarter of 2022. Renewable energy capture for our fleet was 96.1% in the second quarter of 2023, compared with 96.3%1 in the second quarter of 2022.

GAAP/Adjusted EBITDA (non-GAAP) Reconciliation

Adjusted EBITDA (non-GAAP) for the second quarter of 2023 and 2022, respectively, does not include the following items that were included in our reported GAAP Net Income (Loss):

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended June 30, 2023 |

Three Months Ended June 30, 2022 |

| GAAP Net Income (Loss) Attributable to Common Shareholders |

$ |

833 |

|

$ |

(111) |

|

| Income Taxes |

342 |

|

(270) |

|

| Depreciation and Amortization |

274 |

|

277 |

|

| Interest Expense, Net |

103 |

|

56 |

|

| Unrealized Gain on Fair Value Adjustments |

(426) |

|

(24) |

|

|

|

|

| Plant Retirements and Divestitures |

— |

|

(8) |

|

| Decommissioning-Related Activities |

(116) |

|

684 |

|

| Pension & OPEB Non-Service Costs |

(14) |

|

(33) |

|

| Separation Costs |

36 |

|

31 |

|

|

|

|

| ERP System Implementation Costs |

10 |

|

5 |

|

| Change in Environmental Liabilities |

1 |

|

8 |

|

|

|

|

| Noncontrolling Interests |

(12) |

|

(12) |

|

| Adjusted EBITDA (non-GAAP) |

$ |

1,031 |

|

$ |

603 |

|

________

1Prior year energy capture was previously reported as 95.3%. The update reflects a change to include the Conowingo run-of-river hydroelectric operational performance within renewable energy capture, and remove the performance from dispatch match. This update did not result in an impact to the dispatch match

Webcast Information

We will discuss second quarter 2023 earnings in a conference call scheduled for today at 10 a.m. Eastern Time. The webcast and associated materials can be accessed at https://investors.constellationenergy.

About Constellation

A Fortune 200 company headquartered in Baltimore, Constellation Energy Corporation (Nasdaq: CEG) is the nation’s largest producer of clean, carbon-free energy and a leading supplier of energy products and services to businesses, homes, community aggregations and public sector customers across the continental United States, including three fourths of Fortune 100 companies. With annual output that is nearly 90% carbon-free, our hydro, wind and solar facilities paired with the nation’s largest nuclear fleet have the generating capacity to power the equivalent of 15 million homes, providing approximately 11% of the nation’s clean energy. We are further accelerating the nation’s transition to a carbon-free future by helping our customers reach their sustainability goals, setting our own ambitious goal of achieving 100% carbon-free generation by 2040, and by investing in promising emerging technologies to eliminate carbon emissions across all sectors of the economy. Follow Constellation on LinkedIn and Twitter.

Non-GAAP Financial Measures

In analyzing and planning for our business, we supplement our use of net income as determined under generally accepted accounting principles in the United States (GAAP), with Adjusted EBITDA (non-GAAP) as a performance measure. Adjusted EBITDA (non-GAAP) reflects an additional way of viewing our business that, when viewed with our GAAP results and the accompanying reconciliation to GAAP net income included above, may provide a more complete understanding of factors and trends affecting our business. Adjusted EBITDA (non-GAAP) should not be relied upon to the exclusion of GAAP financial measures and is, by definition, an incomplete understanding of our business, and must be considered in conjunction with GAAP measures. In addition, Adjusted EBITDA (non-GAAP) is neither a standardized financial measure, nor a presentation defined under GAAP and may not be comparable to other companies’ presentations or deemed more useful than the GAAP information provided elsewhere in this press release and earnings release attachments. We have provided the non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. Adjusted EBITDA (non-GAAP) should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP Net Income measure provided in this earnings release and attachments. A reconciliation of projected Adjusted EBITDA, which is a forward-looking non-GAAP financial measure, to the most directly comparable GAAP financial measure, is not provided because we are unable to provide such reconciliation without unreasonable effort. The inability to provide each reconciliation is due to the unpredictability of the amounts and timing of events affecting the items we exclude from the non-GAAP measure. This press release and earnings release attachments provide reconciliations of Adjusted EBITDA (non-GAAP) to the most directly comparable financial measures calculated and presented in accordance with GAAP, are posted on our website: www.ConstellationEnergy.com, and have been furnished to the Securities and Exchange Commission on Form 8-K on August 3, 2023.

Cautionary Statements Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements.

The factors that could cause actual results to differ materially from the forward-looking statements made by Constellation Energy Corporation and Constellation Energy Generation, LLC, (Registrants) include those factors discussed herein, as well as the items discussed in (1) the Registrants' 2022 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 19, Commitments and Contingencies; (2) the Registrants' Second Quarter 2023 Quarterly Report on Form 10-Q (to be filed on August 3, 2023) in (a) Part II, ITEM 1A. Risk Factors, (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part I, ITEM 1. Financial Statements: Note 13, Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants.

Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this press release. Neither Registrant undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this press release.

Earnings Release Attachments

Table of Contents

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Operations

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2023 |

|

Six Months Ended June 30, 2023 |

| Operating revenues |

$ |

5,446 |

|

|

$ |

13,011 |

|

| Operating expenses |

|

|

|

| Purchased power and fuel |

2,887 |

|

|

8,616 |

|

| Operating and maintenance |

1,477 |

|

|

2,908 |

|

| Depreciation and amortization |

274 |

|

|

542 |

|

| Taxes other than income taxes |

139 |

|

|

271 |

|

| Total operating expenses |

4,777 |

|

|

12,337 |

|

| Gain on sales of assets and businesses |

— |

|

|

26 |

|

|

|

|

|

|

|

|

|

| Operating income |

669 |

|

|

700 |

|

| Other income and (deductions) |

|

|

|

| Interest expense, net |

(103) |

|

|

(210) |

|

| Other, net |

605 |

|

|

919 |

|

| Total other income and (deductions) |

502 |

|

|

709 |

|

| Income before income taxes |

1,171 |

|

|

1,409 |

|

| Income taxes |

342 |

|

|

472 |

|

| Equity in losses of unconsolidated affiliates |

(5) |

|

|

(11) |

|

| Net income |

824 |

|

|

926 |

|

| Net (loss) attributable to noncontrolling interests |

(9) |

|

|

(3) |

|

| Net income attributable to common shareholders |

$ |

833 |

|

|

$ |

929 |

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2022 |

|

Six Months Ended June 30, 2022 |

| Operating revenues |

$ |

5,465 |

|

|

$ |

11,056 |

|

| Operating expenses |

|

|

|

| Purchased power and fuel |

3,508 |

|

|

7,059 |

|

| Operating and maintenance |

1,273 |

|

|

2,477 |

|

| Depreciation and amortization |

277 |

|

|

557 |

|

| Taxes other than income taxes |

133 |

|

|

268 |

|

| Total operating expenses |

5,191 |

|

|

10,361 |

|

| (Loss) gain on sales of assets and businesses |

(2) |

|

|

13 |

|

|

|

|

|

|

|

|

|

| Operating income |

272 |

|

|

708 |

|

| Other income and (deductions) |

|

|

|

| Interest expense, net |

(56) |

|

|

(112) |

|

| Other, net |

(654) |

|

|

(973) |

|

| Total other income and (deductions) |

(710) |

|

|

(1,085) |

|

| Loss before income taxes |

(438) |

|

|

(377) |

|

| Income taxes |

(328) |

|

|

(381) |

|

| Equity in losses of unconsolidated affiliates |

(3) |

|

|

(6) |

|

| Net loss |

(113) |

|

|

(2) |

|

| Net (loss) income attributable to noncontrolling interests |

(2) |

|

|

3 |

|

| Net loss attributable to common shareholders |

$ |

(111) |

|

|

$ |

(5) |

|

|

|

|

|

| Change in Net income (loss) attributable to common shareholders from 2022 to 2023 |

$ |

944 |

|

|

$ |

934 |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Balance Sheets

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

269 |

|

|

$ |

422 |

|

| Restricted cash and cash equivalents |

56 |

|

|

106 |

|

|

|

|

|

| Accounts receivable |

|

|

|

Customer accounts receivable (net of allowance for credit losses of $51 and $46 as of June 30, 2023 and December 31, 2022, respectively) |

1,306 |

|

|

2,585 |

|

Other accounts receivable (net of allowance for credit losses of $5 as of June 30, 2023 and December 31, 2022) |

646 |

|

|

731 |

|

| Mark-to-market derivative assets |

1,733 |

|

|

2,368 |

|

|

|

|

|

| Inventories, net |

|

|

|

| Natural gas, oil, and emission allowances |

278 |

|

|

429 |

|

| Materials and supplies |

1,109 |

|

|

1,076 |

|

| Renewable energy credits |

436 |

|

|

617 |

|

|

|

|

|

| Other |

1,742 |

|

|

1,026 |

|

| Total current assets |

7,575 |

|

|

9,360 |

|

| Property, plant, and equipment, net |

20,239 |

|

|

19,822 |

|

| Deferred debits and other assets |

|

|

|

| Nuclear decommissioning trust funds |

14,821 |

|

|

14,114 |

|

| Investments |

647 |

|

|

202 |

|

|

|

|

|

| Mark-to-market derivative assets |

1,067 |

|

|

1,261 |

|

|

|

|

|

| Deferred income taxes |

43 |

|

|

44 |

|

| Other |

2,167 |

|

|

2,106 |

|

| Total deferred debits and other assets |

18,745 |

|

|

17,727 |

|

| Total assets |

$ |

46,559 |

|

|

$ |

46,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

| Liabilities and shareholders’ equity |

|

|

|

| Current liabilities |

|

|

|

| Short-term borrowings |

$ |

935 |

|

|

$ |

1,159 |

|

| Long-term debt due within one year |

110 |

|

|

143 |

|

| Accounts payable |

1,260 |

|

|

2,828 |

|

| Accrued expenses |

744 |

|

|

906 |

|

|

|

|

|

| Mark-to-market derivative liabilities |

1,179 |

|

|

1,558 |

|

| Renewable energy credit obligation |

673 |

|

|

901 |

|

|

|

|

|

| Other |

324 |

|

|

344 |

|

| Total current liabilities |

5,225 |

|

|

7,839 |

|

| Long-term debt |

6,156 |

|

|

4,466 |

|

|

|

|

|

| Deferred credits and other liabilities |

|

|

|

| Deferred income taxes and unamortized investment tax credits |

3,203 |

|

|

3,031 |

|

| Asset retirement obligations |

12,971 |

|

|

12,699 |

|

| Pension obligations |

638 |

|

|

605 |

|

| Non-pension postretirement benefit obligations |

638 |

|

|

609 |

|

| Spent nuclear fuel obligation |

1,260 |

|

|

1,230 |

|

|

|

|

|

| Payable related to Regulatory Agreement Units |

3,120 |

|

|

2,897 |

|

| Mark-to-market derivative liabilities |

613 |

|

|

983 |

|

| Other |

1,123 |

|

|

1,178 |

|

| Total deferred credits and other liabilities |

23,566 |

|

|

23,232 |

|

| Total liabilities |

34,947 |

|

|

35,537 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

| Common stock |

12,808 |

|

|

13,274 |

|

| Retained earnings (deficit) |

248 |

|

|

(496) |

|

| Accumulated other comprehensive loss, net |

(1,800) |

|

|

(1,760) |

|

| Total shareholders’ equity |

11,256 |

|

|

11,018 |

|

| Noncontrolling interests |

356 |

|

|

354 |

|

| Total equity |

11,612 |

|

|

11,372 |

|

| Total liabilities and shareholders’ equity |

$ |

46,559 |

|

|

$ |

46,909 |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Cash Flows

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

| Cash flows from operating activities |

|

|

|

|

| Net income (loss) |

|

$ |

926 |

|

|

$ |

(2) |

|

| Adjustments to reconcile net income (loss) to net cash flows (used in) provided by operating activities |

|

|

|

|

| Depreciation, amortization, and accretion, including nuclear fuel and energy contract amortization |

|

1,219 |

|

|

1,207 |

|

|

|

|

|

|

|

|

|

|

|

| Gain on sales of assets and businesses |

|

(26) |

|

|

(13) |

|

|

|

|

|

|

| Deferred income taxes and amortization of ITCs |

|

189 |

|

|

(707) |

|

| Net fair value changes related to derivatives |

|

281 |

|

|

31 |

|

| Net realized and unrealized (gains) losses on NDT funds |

|

(270) |

|

|

800 |

|

| Net realized and unrealized (gains) losses on equity investments |

|

(414) |

|

|

25 |

|

| Other non-cash operating activities |

|

103 |

|

|

459 |

|

| Changes in assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

1,298 |

|

|

60 |

|

| Receivables from and payables to affiliates, net |

|

— |

|

|

20 |

|

| Inventories |

|

124 |

|

|

(88) |

|

| Accounts payable and accrued expenses |

|

(1,725) |

|

|

385 |

|

| Option premiums paid, net |

|

(48) |

|

|

(167) |

|

| Collateral (posted) received, net |

|

(474) |

|

|

1,123 |

|

| Income taxes |

|

160 |

|

|

289 |

|

| Pension and non-pension postretirement benefit contributions |

|

(18) |

|

|

(213) |

|

| Other assets and liabilities |

|

(2,451) |

|

|

(1,946) |

|

| Net cash flows (used in) provided by operating activities |

|

(1,126) |

|

|

1,263 |

|

| Cash flows from investing activities |

|

|

|

|

| Capital expenditures |

|

(1,336) |

|

|

(800) |

|

| Proceeds from NDT fund sales |

|

3,116 |

|

|

2,188 |

|

| Investment in NDT funds |

|

(3,203) |

|

|

(2,323) |

|

| Collection of DPP, net |

|

1,582 |

|

|

1,595 |

|

|

|

|

|

|

| Proceeds from sales of assets and businesses |

|

24 |

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other investing activities |

|

(12) |

|

|

2 |

|

| Net cash flows provided by investing activities |

|

171 |

|

|

701 |

|

| Cash flows from financing activities |

|

|

|

|

| Change in short-term borrowings |

|

(524) |

|

|

(702) |

|

| Proceeds from short-term borrowings with maturities greater than 90 days |

|

500 |

|

|

— |

|

| Repayments of short-term borrowings with maturities greater than 90 days |

|

(200) |

|

|

(1,180) |

|

| Issuance of long-term debt |

|

1,791 |

|

|

6 |

|

| Retirement of long-term debt |

|

(121) |

|

|

(1,109) |

|

|

|

|

|

|

| Retirement of long-term debt to affiliate |

|

— |

|

|

(258) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contributions from Exelon |

|

— |

|

|

1,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid on common stock |

|

(185) |

|

|

(93) |

|

| Repurchases of common stock |

|

(499) |

|

|

— |

|

| Other financing activities |

|

(10) |

|

|

(28) |

|

| Net cash flows provided by (used in) financing activities |

|

752 |

|

|

(1,614) |

|

| (Decrease) increase in cash, restricted cash, and cash equivalents |

|

(203) |

|

|

350 |

|

| Cash, restricted cash, and cash equivalents at beginning of period |

|

528 |

|

|

576 |

|

| Cash, restricted cash, and cash equivalents at end of period |

|

$ |

325 |

|

|

$ |

926 |

|

Constellation Energy Corporation

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (non-GAAP) and Analysis of Earnings

Three Months Ended June 30, 2023 and 2022

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

2022 GAAP Net Loss Attributable to Common Shareholders |

|

$ |

(111) |

|

| Income Taxes (1) |

|

(270) |

|

| Depreciation and Amortization |

|

277 |

|

| Interest Expense, Net |

|

56 |

|

| Unrealized Gain on Fair Value Adjustments (2) |

|

(24) |

|

|

|

|

| Plant Retirements and Divestitures |

|

(8) |

|

| Decommissioning-Related Activities (3) |

|

684 |

|

| Pension & OPEB Non-Service Costs |

|

(33) |

|

| Separation Costs (4) |

|

31 |

|

|

|

|

| ERP System Implementation Costs (5) |

|

5 |

|

| Change in Environmental Liabilities |

|

8 |

|

|

|

|

| Noncontrolling Interests (6) |

|

(12) |

|

2022 Adjusted EBITDA (non-GAAP) |

|

$ |

603 |

|

|

|

|

| Year Over Year Effects on Adjusted EBITDA (non-GAAP): |

| Market and Portfolio Conditions (7) |

|

527 |

|

| ZEC Revenue (8) |

|

172 |

|

|

|

|

|

|

|

| Labor, Contracting and Materials (9) |

|

(102) |

|

| Capacity Revenue (10) |

|

(72) |

|

| Nuclear Outages (11) |

|

(80) |

|

|

|

|

|

|

|

| Other |

|

(17) |

|

|

|

|

| Total Year Over Year Effects on Adjusted EBITDA (non-GAAP) |

|

$ |

428 |

|

|

|

|

2023 GAAP Net Income Attributable to Common Shareholders |

|

$ |

833 |

|

| Income Taxes |

|

342 |

|

| Depreciation and Amortization |

|

274 |

|

| Interest Expense, Net |

|

103 |

|

| Unrealized Gain on Fair Value Adjustments (2) |

|

(426) |

|

|

|

|

|

|

|

| Decommissioning-Related Activities (3) |

|

(116) |

|

| Pension & OPEB Non-Service Costs |

|

(14) |

|

| Separation Costs (4) |

|

36 |

|

|

|

|

| ERP System Implementation Costs (5) |

|

10 |

|

| Change in Environmental Liabilities |

|

1 |

|

|

|

|

|

|

|

| Noncontrolling Interests (6) |

|

(12) |

|

2023 Adjusted EBITDA (non-GAAP) |

|

$ |

1,031 |

|

(1)In 2022, includes amounts contractually owed to Exelon under the Tax Matters Agreement (TMA) reflected in Other, net.

(2)Includes mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(3)Reflects all gains and losses associated with Nuclear Decommissioning Trusts (NDT), Asset Retirement Obligation (ARO) accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(4)Represents certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the Transition Services Agreement (TSA).

(5)Reflects costs related to a multi-year Enterprise Resource Program (ERP) system implementation.

(6)Represents elimination of the noncontrolling interest related to certain adjustments.

(7)Favorable market and portfolio conditions primarily driven by higher contracted prices and generation-to-load optimization.

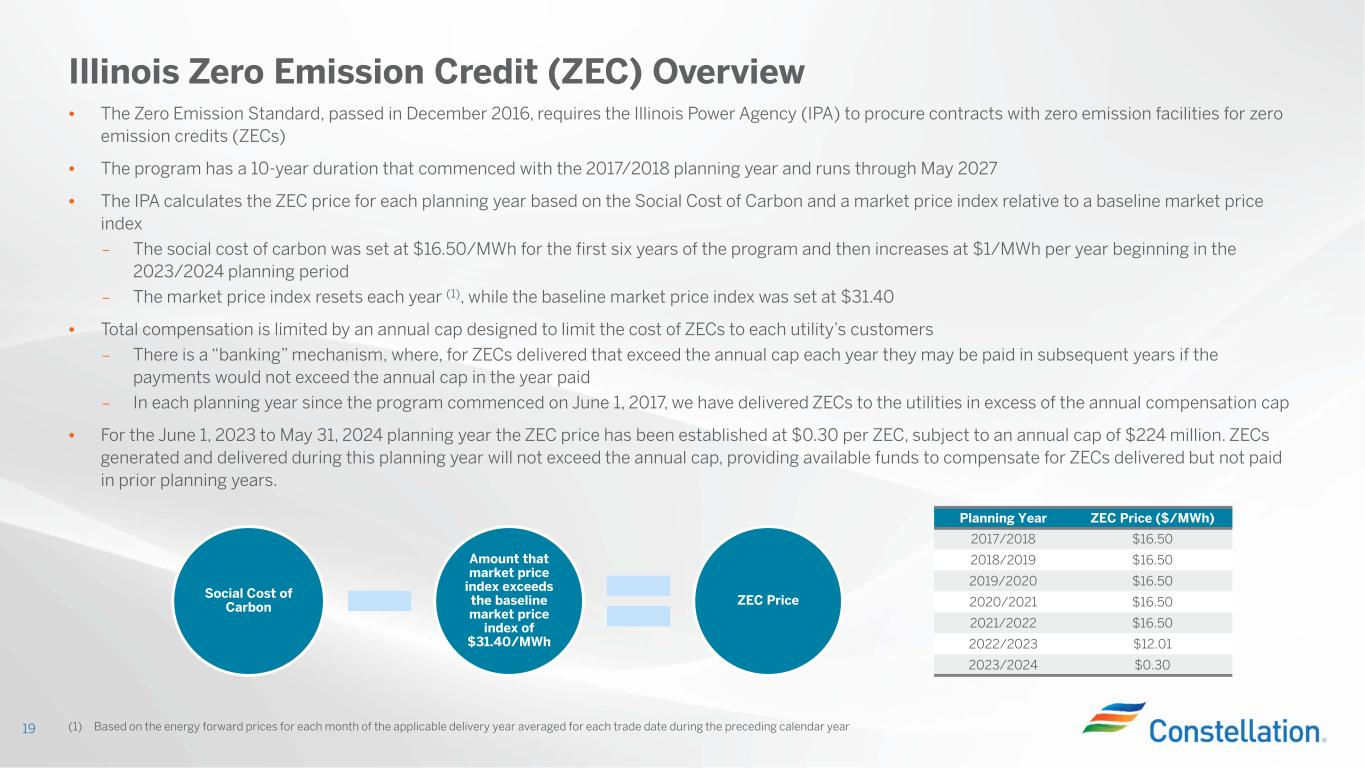

(8)Includes revenue recognized for ZECs delivered under the Illinois ZEC program in prior planning years

(9)Primarily reflects increased employee-related costs, including labor and other incentives, and certain non-essential maintenance work.

(10)Reflects decreased capacity revenues primarily in the Midwest and Mid-Atlantic.

(11)Reflects volume and operating and maintenance impact of nuclear outages.

Constellation Energy Corporation

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (non-GAAP) and Analysis of Earnings

Six Months Ended June 30, 2023 and 2022

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

2022 GAAP Net Loss Attributable to Common Shareholders |

$ |

(5) |

|

| Income Taxes (1) |

(323) |

|

| Depreciation and Amortization |

557 |

|

| Interest Expense, Net |

112 |

|

Unrealized Loss on Fair Value Adjustments (2) |

94 |

|

|

|

| Plant Retirements and Divestitures |

(8) |

|

Decommissioning-Related Activities (3) |

1,038 |

|

| Pension & OPEB Non-Service Costs |

(58) |

|

Separation Costs (4) |

68 |

|

|

|

ERP System Implementation Costs (5) |

11 |

|

| Change in Environmental Liabilities |

8 |

|

|

|

| Noncontrolling Interests (6) |

(25) |

|

2022 Adjusted EBITDA (non-GAAP) |

$ |

1,469 |

|

|

|

| Year Over Year Effects on Adjusted EBITDA (non-GAAP): |

| Market and Portfolio Conditions (7) |

555 |

|

| ZEC Revenue (8) |

179 |

|

|

|

| Labor, Contracting and Materials (9) |

(215) |

|

| Capacity Revenue (10) |

(176) |

|

| Nuclear Outages (11) |

(125) |

|

|

|

|

|

|

|

| Other |

1 |

|

|

|

| Total Year Over Year Effects on Adjusted EBITDA (non-GAAP) |

$ |

219 |

|

|

|

| 2023 GAAP Net Income Attributable to Common Shareholders |

$ |

929 |

|

| Income Taxes |

472 |

|

| Depreciation and Amortization |

542 |

|

| Interest Expense, Net |

210 |

|

| Unrealized Gain on Fair Value Adjustments (2) |

(129) |

|

|

|

| Plant Retirements and Divestitures |

(27) |

|

| Decommissioning-Related Activities (3) |

(356) |

|

| Pension & OPEB Non-Service Costs |

(27) |

|

| Separation Costs (4) |

66 |

|

|

|

| ERP System Implementation Costs (5) |

15 |

|

| Change in Environmental Liabilities |

17 |

|

|

|

| Noncontrolling Interests (6) |

(24) |

|

| 2023 Adjusted EBITDA (non-GAAP) |

$ |

1,688 |

|

(1)In 2022, includes amounts contractually owed to Exelon under the TMA reflected in Other, net.

(2)Includes mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(3)Reflects all gains and losses associated with NDTs, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(4)Represents certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(5)Reflects costs related to a multi-year ERP system implementation.

(6)Represents elimination of the noncontrolling interest related to certain adjustments.

(7)Favorable market and portfolio conditions primarily driven by higher contracted prices and generation-to-load optimization.

(8)Includes revenue recognized for ZECs delivered under the Illinois ZEC program in prior planning years

(9)Primarily reflects increased employee-related costs, including labor and other incentives, and certain non-essential maintenance work.

(10)Reflects decreased capacity revenues primarily in the Midwest and Mid-Atlantic.

(11)Reflects volume and operating and maintenance impact of nuclear outages.

Constellation Energy Corporation

GAAP Consolidated Statements of Operations and

Adjusted EBITDA (non-GAAP) Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, 2023 |

|

|

|

Three Months Ended June 30, 2022 |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

| Operating revenues |

$ |

5,446 |

|

|

$ |

(212) |

|

|

(b),(c) |

|

|

|

$ |

5,465 |

|

|

$ |

298 |

|

|

(b),(c) |

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

2,887 |

|

|

(202) |

|

|

(b) |

|

|

|

3,508 |

|

|

328 |

|

|

(b) |

|

|

| Operating and maintenance |

1,477 |

|

|

(89) |

|

|

(c),(d),(f),(l) |

|

|

|

1,273 |

|

|

(80) |

|

|

(c),(d),(f),(g) |

|

|

| Depreciation and amortization |

274 |

|

|

(274) |

|

|

(h) |

|

|

|

277 |

|

|

(277) |

|

|

(h) |

|

|

| Taxes other than income taxes |

139 |

|

|

— |

|

|

|

|

|

|

133 |

|

|

— |

|

|

|

|

|

| Total operating expenses |

4,777 |

|

|

|

|

|

|

|

|

5,191 |

|

|

|

|

|

|

|

| Loss on sales of assets and businesses |

— |

|

|

— |

|

|

|

|

|

|

(2) |

|

|

2 |

|

|

(g) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

669 |

|

|

|

|

|

|

|

|

272 |

|

|

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

(103) |

|

|

103 |

|

|

(i) |

|

|

|

(56) |

|

|

56 |

|

|

(i) |

|

|

| Other, net |

605 |

|

|

(588) |

|

|

(b),(c),(e) |

|

|

|

(654) |

|

|

669 |

|

|

(b),(c),(d), (e), (g),(j),(m) |

|

|

| Total other income and (deductions) |

502 |

|

|

|

|

|

|

|

|

(710) |

|

|

|

|

|

|

|

| Income (loss) before income taxes |

1,171 |

|

|

|

|

|

|

|

|

(438) |

|

|

|

|

|

|

|

| Income taxes |

342 |

|

|

(342) |

|

|

(j) |

|

|

|

(328) |

|

|

328 |

|

|

(j) |

|

|

| Equity in losses of unconsolidated affiliates |

(5) |

|

|

— |

|

|

|

|

|

|

(3) |

|

|

— |

|

|

|

|

|

| Net income (loss) |

824 |

|

|

|

|

|

|

|

|

(113) |

|

|

|

|

|

|

|

| Net loss attributable to noncontrolling interests |

(9) |

|

|

12 |

|

|

(k) |

|

|

|

(2) |

|

|

12 |

|

|

(k) |

|

|

| Net income (loss) attributable to common shareholders |

$ |

833 |

|

|

|

|

|

|

|

|

$ |

(111) |

|

|

|

|

|

|

|

| Effective tax rate |

29.2 |

% |

|

|

|

|

|

|

|

74.9 |

% |

|

|

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

2.57 |

|

|

|

|

|

|

|

|

$ |

(0.34) |

|

|

|

|

|

|

|

| Diluted |

$ |

2.56 |

|

|

|

|

|

|

|

|

$ |

(0.34) |

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

324 |

|

|

|

|

|

|

|

|

327 |

|

|

|

|

|

|

|

| Diluted |

325 |

|

|

|

|

|

|

|

|

328 |

|

|

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with NDTs, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)Adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(e)Adjustment for Pension and Other Postretirement Employee Benefits (OPEB) Non-Service costs.

(f)Adjustment for costs related to a multi-year ERP system implementation

(g)Adjustments related to plant retirements and divestitures.

(h)Adjustment for depreciation and amortization expense.

(i)Adjustment for interest expense.

(j)Adjustment for income taxes.

(k)Adjustment for elimination of the noncontrolling interest related to certain adjustments.

(l)Adjustment for changes in environmental liabilities.

(m)In 2022, includes amounts contractually owed to Exelon under the tax matters agreement.

Constellation Energy Corporation

GAAP Consolidated Statements of Operations and

Adjusted EBITDA (non-GAAP) Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2023 |

|

|

|

Six Months Ended June 30, 2022 |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

| Operating revenues |

$ |

13,011 |

|

|

$ |

(1,142) |

|

|

(b),(c) |

|

|

|

$ |

11,056 |

|

|

$ |

1,217 |

|

|

(b),(c) |

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased power and fuel |

8,616 |

|

|

(1,428) |

|

|

(b) |

|

|

|

7,059 |

|

|

1,131 |

|

|

(b) |

|

|

Operating and maintenance |

2,908 |

|

|

(181) |

|

|

(c),(d),(f),(l) |

|

|

|

2,477 |

|

|

(131) |

|

|

(c),(d),(e),(f),(g),(l) |

|

|

Depreciation and amortization |

542 |

|

|

(542) |

|

|

(h) |

|

|

|

557 |

|

|

(557) |

|

|

(h) |

|

|

Taxes other than income taxes |

271 |

|

|

— |

|

|

|

|

|

|

268 |

|

|

(2) |

|

|

(d) |

|

|

Total operating expenses |

12,337 |

|

|

|

|

|

|

|

|

10,361 |

|

|

|

|

|

|

|

| Gain on sales of assets and businesses |

26 |

|

|

(26) |

|

|

(g) |

|

|

|

13 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

700 |

|

|

|

|

|

|

|

|

708 |

|

|

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

(210) |

|

|

210 |

|

|

(i) |

|

|

|

(112) |

|

|

112 |

|

|

(i) |

|

|

Other, net |

919 |

|

|

(882) |

|

|

(c),(e) |

|

|

|

(973) |

|

|

992 |

|

|

(b),(c),(d), (e),(g),(j),(m) |

|

|

| Total other income and (deductions) |

709 |

|

|

|

|

|

|

|

|

(1,085) |

|

|

|

|

|

|

|

| Income (loss) before income taxes |

1,409 |

|

|

|

|

|

|

|

|

(377) |

|

|

|

|

|

|

|

| Income taxes |

472 |

|

|

(472) |

|

|

(j) |

|

|

|

(381) |

|

|

381 |

|

|

(j) |

|

|

| Equity in losses of unconsolidated affiliates |

(11) |

|

|

— |

|

|

|

|

|

|

(6) |

|

|

— |

|

|

|

|

|

| Net income (loss) |

926 |

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

| Net (loss) income attributable to noncontrolling interests |

(3) |

|

|

24 |

|

|

(k) |

|

|

|

3 |

|

|

25 |

|

|

(k) |

|

|

| Net income (loss) attributable to common shareholders |

$ |

929 |

|

|

|

|

|

|

|

|

$ |

(5) |

|

|

|

|

|

|

|

| Effective tax rate |

33.5 |

% |

|

|

|

|

|

|

|

101.1 |

% |

|

|

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

2.85 |

|

|

|

|

|

|

|

|

$ |

(0.02) |

|

|

|

|

|

|

|

| Diluted |

$ |

2.84 |

|

|

|

|

|

|

|

|

$ |

(0.02) |

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

326 |

|

|

|

|

|

|

|

|

327 |

|

|

|

|

|

|

|

| Diluted |

327 |

|

|

|

|

|

|

|

|

328 |

|

|

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with NDTs, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)Adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(e)Adjustment for Pension and Other Postretirement Employee Benefits (OPEB) Non-Service costs.

(f)Adjustment for costs related to a multi-year ERP system implementation

(g)Adjustments related to plant retirements and divestitures.

(h)Adjustment for depreciation and amortization expense.

(i)Adjustment for interest expense.

(j)Adjustment for income taxes.

(k)Adjustment for elimination of the noncontrolling interest related to certain adjustments.

(l)Adjustment for changes in environmental liabilities.

(m)In 2022, includes amounts contractually owed to Exelon under the tax matters agreement.

Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Supply Source (GWhs) |

|

|

|

|

|

|

|

|

|

|

|

|

Nuclear Generation(a) |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

12,837 |

|

|

12,609 |

|

|

26,018 |

|

|

25,732 |

|

|

|

|

|

| Midwest |

|

22,966 |

|

|

23,342 |

|

|

45,952 |

|

|

46,804 |

|

|

|

|

|

| New York |

|

6,092 |

|

|

6,571 |

|

|

12,389 |

|

|

12,584 |

|

|

|

|

|

| Total Nuclear Generation |

|

41,895 |

|

|

42,522 |

|

|

84,359 |

|

|

85,120 |

|

|

|

|

|

| Natural Gas, Oil, and Renewables |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

384 |

|

|

616 |

|

|

1,106 |

|

|

1,343 |

|

|

|

|

|

| Midwest |

|

221 |

|

|

281 |

|

|

560 |

|

|

649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERCOT |

|

4,042 |

|

|

2,913 |

|

|

7,141 |

|

|

5,887 |

|

|

|

|

|

Other Power Regions(b) |

|

1,713 |

|

|

1,874 |

|

|

4,616 |

|

|

4,777 |

|

|

|

|

|

| Total Natural Gas, Oil, and Renewables |

|

6,360 |

|

|

5,684 |

|

|

13,423 |

|

|

12,656 |

|

|

|

|

|

| Purchased Power |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

3,428 |

|

|

2,898 |

|

|

7,448 |

|

|

5,656 |

|

|

|

|

|

| Midwest |

|

200 |

|

|

156 |

|

|

623 |

|

|

351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERCOT |

|

1,597 |

|

|

1,413 |

|

|

2,949 |

|

|

2,149 |

|

|

|

|

|

Other Power Regions(b) |

|

9,736 |

|

|

12,436 |

|

|

19,658 |

|

|

26,096 |

|

|

|

|

|

| Total Purchased Power |

|

14,961 |

|

|

16,903 |

|

|

30,678 |

|

|

34,252 |

|

|

|

|

|

| Total Supply/Sales by Region |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

16,649 |

|

|

16,123 |

|

|

34,572 |

|

|

32,731 |

|

|

|

|

|

| Midwest |

|

23,387 |

|

|

23,779 |

|

|

47,135 |

|

|

47,804 |

|

|

|

|

|

| New York |

|

6,092 |

|

|

6,571 |

|

|

12,389 |

|

|

12,584 |

|

|

|

|

|

| ERCOT |

|

5,639 |

|

|

4,326 |

|

|

10,090 |

|

|

8,036 |

|

|

|

|

|

Other Power Regions(b) |

|

11,449 |

|

|

14,310 |

|

|

24,274 |

|

|

30,873 |

|

|

|

|

|

| Total Supply/Sales by Region |

|

63,216 |

|

|

65,109 |

|

|

128,460 |

|

|

132,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

Outage Days(c) |

|

|

|

|

|

|

|

|

|

|

|

|

| Refueling |

|

94 |

|

|

66 |

|

|

180 |

|

|

142 |

|

|

|

|

|

| Non-refueling |

|

25 |

|

|

15 |

|

|

34 |

|

|

25 |

|

|

|

|

|

| Total Outage Days |

|

119 |

|

|

81 |

|

|

214 |

|

|

167 |

|

|

|

|

|

__________

(a)Includes the proportionate share of output where we have an undivided ownership interest in jointly-owned generating plants and the total output for fully owned plants.

(b)Other Power Regions includes New England, South, West, and Canada.

(c)Outage days exclude Salem.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

| ZEC Reference Prices |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| State (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| New Jersey (Mid-Atlantic) |

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

|

|

|

| Illinois (Midwest) |

|

8.11 |

|

|

15.00 |

|

|

10.06 |

|

|

15.75 |

|

|

|

|

|

| New York (New York) |

|

18.27 |

|

|

21.38 |

|

|

19.83 |

|

|

21.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

| Capacity Reference Prices |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Location (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| Eastern Mid-Atlantic Area Council (Mid-Atlantic) |

|

$ |

81.74 |

|

|

$ |

143.11 |

|

|

$ |

89.80 |

|

|

$ |

154.42 |

|

|

|

|

|

| ComEd (Midwest) |

|

57.35 |

|

|

153.35 |

|

|

63.16 |

|

|

174.45 |

|

|

|

|

|

| Rest of State (New York) |

|

138.89 |

|

|

75.67 |

|

|

121.28 |

|

|

80.39 |

|

|

|

|

|

| Southeast New England (Other) |

|

106.67 |

|

|

145.13 |

|

|

116.67 |

|

|

149.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

| Electricity Reference Prices |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Location (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| PJM West (Mid-Atlantic) |

|

$ |

29.43 |

|

|

$ |

77.17 |

|

|

$ |

31.27 |

|

|

$ |

66.28 |

|

|

|

|

|

| ComEd (Midwest) |

|

22.62 |

|

|

66.46 |

|

|

24.71 |

|

|

53.36 |

|

|

|

|

|

| Central (New York) |

|

20.82 |

|

|

41.75 |

|

|

25.49 |

|

|

53.85 |

|

|

|

|

|

| North (ERCOT) |

|

40.39 |

|

|

70.79 |

|

|

31.82 |

|

|

53.92 |

|

|

|

|

|

Southeast Massachusetts (Other)(a) |

|

29.17 |

|

|

69.15 |

|

|

40.51 |

|

|

90.38 |

|

|

|

|

|

__________

(a)Reflects New England, which comprises the majority of the activity in the Other region.