Document

Exhibit 99.1

News Release

|

|

|

|

|

|

|

|

|

| Contact: |

|

Paul Adams

Corporate Communications

410-470-4167

Emily Duncan

Investor Relations

833-447-2783

|

CONSTELLATION REPORTS THIRD QUARTER 2022 RESULTS

Earnings Release Highlights

•GAAP Net Loss of ($188) million and Adjusted EBITDA (non-GAAP) of $592 million for the third quarter of 2022

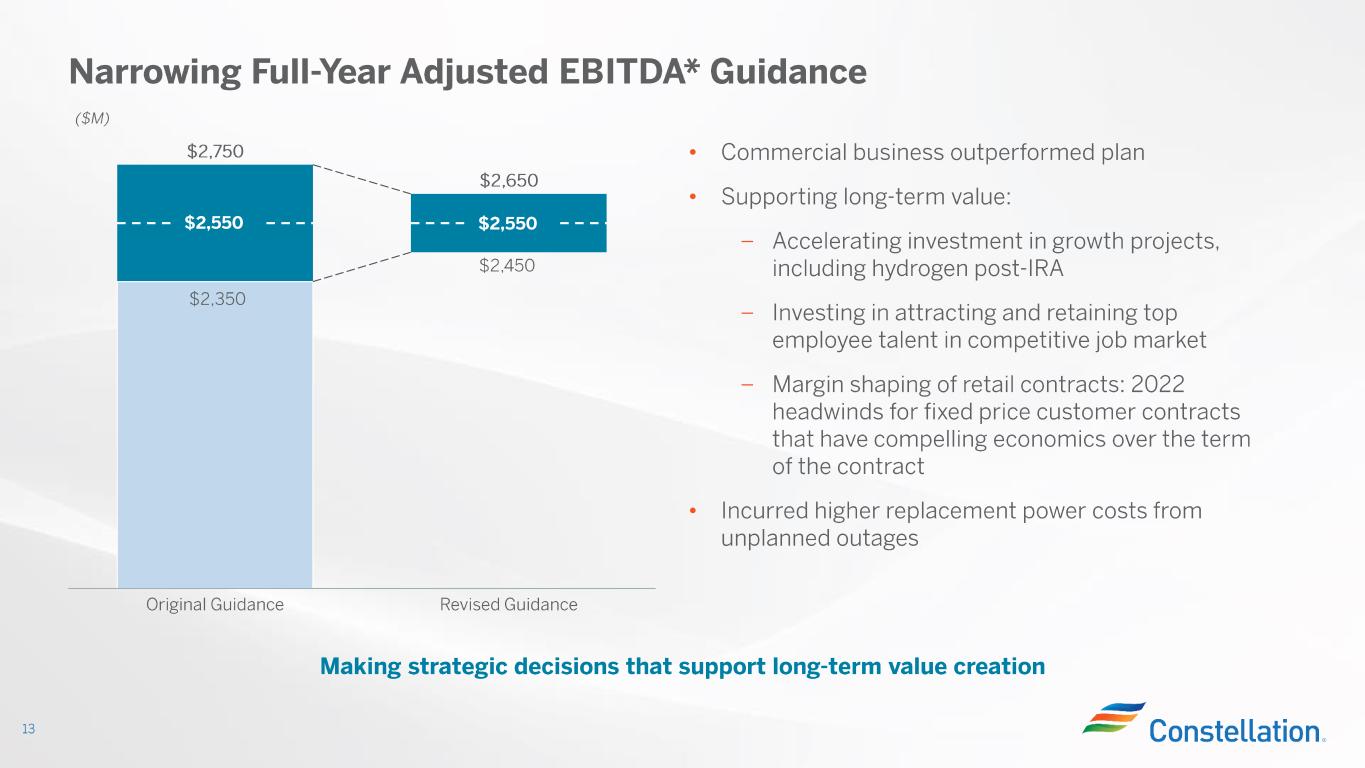

•Narrowing guidance range for full year 2022 Adjusted EBITDA (non-GAAP) from $2,350 million - $2,750 million to $2,450 million - $2,650 million

•Inflation Reduction Act signed into law, a recognition from Federal policymakers of the importance of nuclear energy in fighting the climate crisis

•Our issuer credit rating upgraded by Standard & Poor’s (S&P) from BBB- to BBB while maintaining positive outlook, reflecting view that the business risk profile has and will continue to improve

•Notified the Nuclear Regulatory Commission (NRC) of our intent to seek license renewals for our Clinton and Dresden units

•Published our first Sustainability Report detailing our strategy to lead the clean energy transition

•Executed agreement with City of Chicago supporting 300 MW of renewables development and helping Chicago to become one of the largest U.S. cities to commit to clean energy

Baltimore (Nov. 8, 2022) — Constellation Energy Corporation (Nasdaq: CEG) today reported its financial results for the third quarter of 2022.

“We reported solid quarterly financial and operational results, and our long-term outlook has strengthened significantly with passage of the landmark Inflation Reduction Act, which will allow us to create value and drive America’s clean energy transition,” said Joe Dominguez, president and CEO of Constellation. “Support for carbon-free energy in the legislation creates opportunities for us to extend the life of our nuclear fleet past mid-century and pursue hydrogen production to slash emissions from difficult-to-decarbonize sectors of the economy. Now there are both state and federal policies that recognize the essential role our zero-carbon nuclear assets must play in achieving our nation’s climate goals, preserving jobs and ensuring a secure energy supply.”

“The commercial business continues to post better-than-expected results, and our nuclear fleet remains the most reliable and cost-efficient in the business despite unplanned outages during the quarter,” said Dan Eggers, chief financial officer of Constellation.

“S&P upgraded our credit rating to BBB due to our strong balance sheet and the clear support for carbon-free energy in the IRA. Adjusted third-quarter EBITDA of $592 million was in line with our expectations, and we are narrowing our full-year EBITDA range to $2.45 billion to $2.65 billion.”

Third Quarter 2022

Our GAAP Net Loss for the third quarter of 2022 was ($188) million, down from $607 million GAAP Net Income in the third quarter of 2021. Adjusted EBITDA (non-GAAP) for the third quarter of 2022 decreased to $592 million from $967 million in the third quarter of 2021. For the reconciliations of GAAP Net (Loss) Income to Adjusted EBITDA (non-GAAP), refer to the tables beginning on page 3.

Adjusted EBITDA (non-GAAP) in the third quarter of 2022 primarily reflects:

•Decreased capacity revenues, increased labor, contracting and material costs and the absence of gains on CTV investments realized in the prior year.

Recent Developments and Third Quarter Highlights

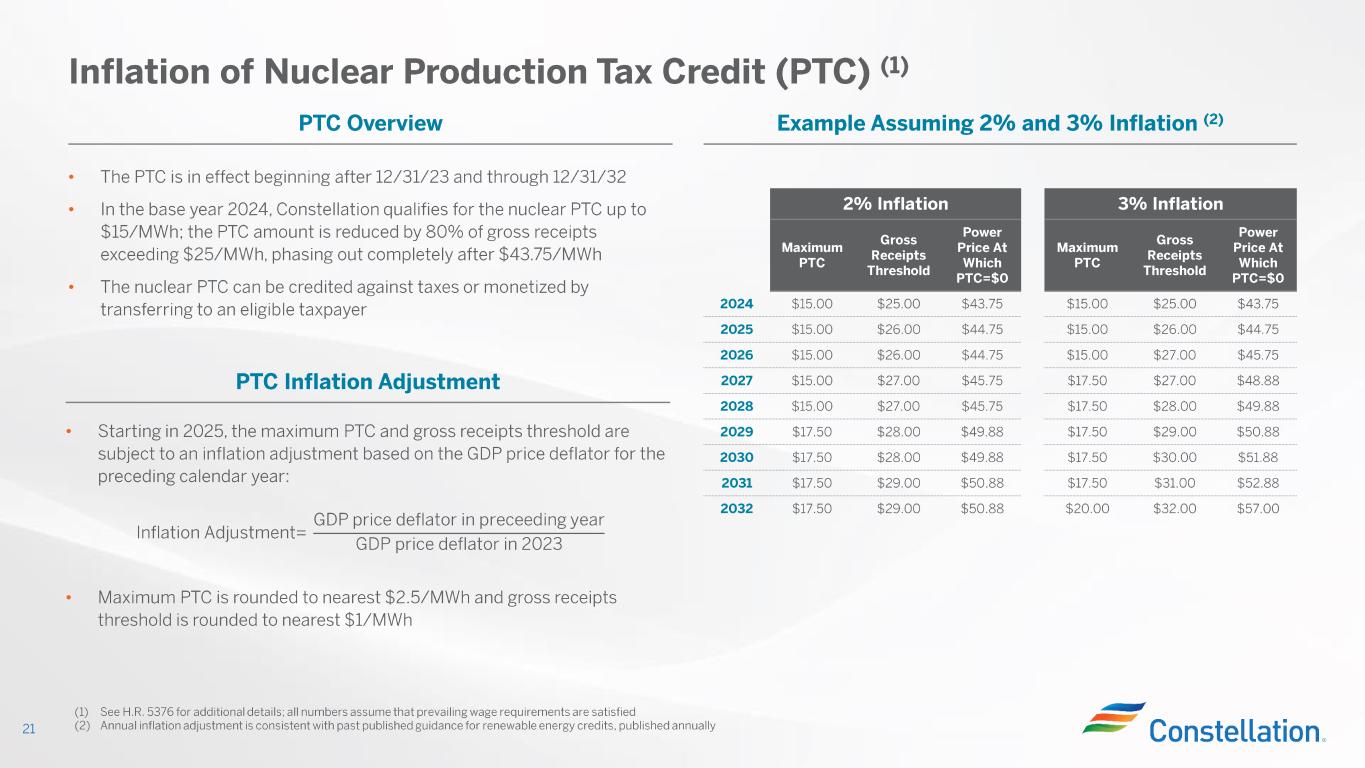

•Inflation Reduction Act Signed into Law: On Aug. 16, 2022, Congress passed and President Biden signed into law the Inflation Reduction Act of 2022, which, among other things, includes federal tax credits, certain of which are transferable or fully refundable, for clean energy technologies including existing nuclear plants and hydrogen production facilities. The Nuclear Production Tax Credit (PTC) recognizes the contributions of carbon-free nuclear power by providing a federal tax credit of up to $15/MWh, subject to phase-out, beginning in 2024 and continuing through 2032. The Hydrogen PTC provides a 10-year federal tax credit of up to $3/kilogram for clean hydrogen produced after 2022 from facilities that begin construction prior to 2033. Both the Nuclear and Hydrogen PTCs include adjustments for inflation. The Hydrogen PTC creates additional opportunities for our nuclear fleet to enable decarbonization of other industries through the production of clean hydrogen. With this policy support, we expect that many of our nuclear assets will operate through the end of the Nuclear PTC period.

•Our issuer credit rating upgraded to BBB with positive outlook: On Oct. 13, 2022, S&P rating services raised our issuer credit rating (ICR) to ‘BBB’ from ‘BBB-’, reflecting S&P’s view of a material improvement in our business risk profile. S&P cited the passage of the Inflation Reduction Act of 2022 as a material credit positive for us. In S&P’s view, the nuclear production tax credits in the legislation provide long-term visibility into the cash flows for our nuclear fleet and benefit potential future hydrogen production.

•Seeking license renewals for Clinton and Dresden Nuclear Power Plants: On Oct. 31, 2022, we announced our intent to seek renewal of the operating licenses for our Clinton and Dresden nuclear power plants. These renewals, if granted, would allow the plants to operate for an additional 20 years. Clinton could operate until 2047 and Dresden could operate until 2049 (Unit 2) and 2051 (Unit 3). The continued operation of the two zero-carbon plants is enabled by state and federal legislation that recognizes the unique environmental and economic value of nuclear energy.

•Published our first Sustainability Report detailing our strategy to lead the clean energy transition and fight the climate crisis: On Sept. 7, 2022, we released our first sustainability report, highlighting our efforts to accelerate the transition to a carbon-free future, mitigate the climate crisis and support energy equity and environmental justice. The report details our innovative clean energy center model, powered by always-on, carbon-free nuclear plants, that will bring together new and emerging technologies to help decarbonize other polluting sectors of the economy. Additionally, the report outlines the need to begin transitioning toward a more accurate carbon accounting approach, along with the tools we are helping to pioneer, such as the hourly carbon-free energy matching platform to help our customers achieve true-zero emissions.

•Executed long-term agreement with the City of Chicago supporting 300 MW of renewables development through our Constellation Offsite Renewables (CORe) product: On Aug. 8, 2022, we announced an agreement with the City of Chicago to help meet the City’s commitment to purchase renewable energy for all its facilities and operations by 2025. In addition to enabling the development of Swift Current Energy’s 590 MW Double Black Diamond solar project, the agreement makes the City of Chicago one of the largest U.S. cities to commit to clean energy and will help reduce the City’s carbon footprint by more than 290,000 metric tons per year.

•Our leaders joined State and Federal officials to celebrate progress on nation’s first nuclear-powered clean hydrogen facility: On Sept. 28, 2022, leaders from the U.S. Department of Energy (DOE), the New York State Energy Research and Development Authority (NYSERDA), and the New York State Public Service Commission (PSC) joined our leaders and employees at Nine Mile Point Nuclear Generating Station (NMP) to celebrate progress on the nation’s first nuclear-powered clean hydrogen production facility, which will begin production by the end of the year. Last year, as part of a $5.8 million award, DOE approved moving forward with construction and installation of an electrolyzer system at NMP that will separate hydrogen and oxygen molecules in water to produce carbon-free hydrogen. In addition, NYSERDA recently announced $12.5 million in funding to help demonstrate hydrogen fuel cell technology at the plant to provide long-duration energy storage for the electric grid. The hydrogen fuel cell project at NMP is currently being designed and is expected to be operational in 2025. These projects will demonstrate the viability of hydrogen electrolyzer and fuel cell technologies, setting the stage for possible deployment at other clean energy centers in our nuclear fleet. As part of our broader decarbonization strategy, we are currently working with public and private entities representing every phase in the hydrogen value chain to pursue development of regional hydrogen production and distribution hubs, including participation in the Midwest Alliance for Clean Hydrogen or "MachH2" hydrogen hub.

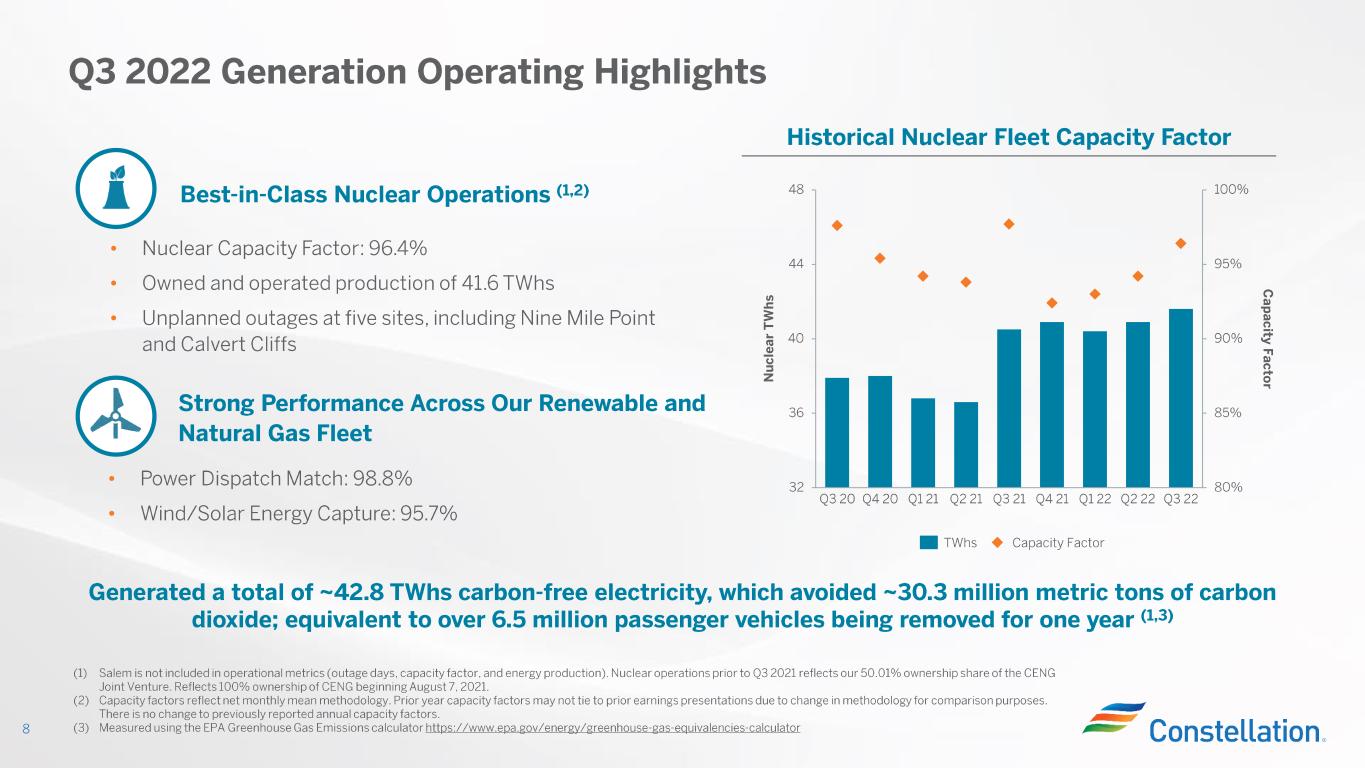

•Nuclear Operations: Our nuclear fleet, including our owned output from the Salem Generating Station, produced 43,794 gigawatt-hours (GWhs) in the third quarter of 2022, compared with 44,350 GWhs in the third quarter of 2021. Excluding Salem, our nuclear plants at ownership achieved a 96.4% capacity factor for the third quarter of 2022, compared with 97.7%1 for the third quarter of 2021. There were five planned refueling outage days in the third quarter of 2022 and 22 in the third quarter of 2021. There were 26 non-refueling outage days in the third quarter of 2022 and none in the third quarter of 2021.

•Natural Gas, Oil, and Renewables Operations: The dispatch match rate for our gas and hydro fleet was 98.8% in the third quarter of 2022, compared with 99.4% in the third quarter of 2021. Energy capture for the wind and solar fleet was 95.7% in the third quarter of 2022, compared with 95.8% in the third quarter of 2021.

________

1Prior year capacity factor was previously reported as 96.0%. The update reflects a change to the ratio from using the full average annual mean capacity to the net monthly mean capacity when calculating capacity factor. There is no change to actual output and the full year capacity factor would be the same under both methodologies.

GAAP/Adjusted EBITDA (non-GAAP) Reconciliation

Adjusted EBITDA (non-GAAP) for the third quarter of 2022 and 2021, respectively, does not include the following items that were included in our reported GAAP Net (Loss) Income:

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

| GAAP Net (Loss) Income Attributable to Common Shareholders |

$ |

(188) |

|

$ |

607 |

|

| Income Taxes |

(149) |

|

177 |

|

| Depreciation and Amortization |

262 |

|

866 |

|

| Interest Expense, Net |

75 |

|

77 |

|

| Unrealized Loss (Gain) on Fair Value Adjustments |

550 |

|

(614) |

|

|

|

|

| Asset Impairments |

— |

|

45 |

|

| Plant Retirements and Divestitures |

5 |

|

(62) |

|

| Decommissioning-Related Activities |

88 |

|

(130) |

|

| Pension & OPEB Non-Service Costs |

(27) |

|

(11) |

|

| Separation Costs |

30 |

|

16 |

|

|

|

|

|

|

|

| COVID-19 Direct Costs |

— |

|

5 |

|

| Acquisition Related Costs |

— |

|

11 |

|

| ERP System Implementation Costs |

5 |

|

5 |

|

| Change in Environmental Liabilities |

3 |

|

5 |

|

|

|

|

| Cost Management Program |

— |

|

4 |

|

| Prior Merger Commitment |

(50) |

|

— |

|

| Noncontrolling Interests |

(12) |

|

(34) |

|

| Adjusted EBITDA (non-GAAP) |

$ |

592 |

|

$ |

967 |

|

Webcast Information

We will discuss third quarter 2022 earnings in a conference call scheduled for today at 10 a.m. Eastern Time. The webcast and associated materials can be accessed at https://investors.constellationenergy.com.

About Constellation

Constellation Energy Corporation (Nasdaq: CEG) is the nation’s largest producer of clean, carbon-free energy and a leading supplier of energy products and services to millions of homes, institutional customers, the public sector, community aggregations and businesses, including three fourths of Fortune 100 companies. Headquartered in Baltimore, our fleet of nuclear, hydro, wind and solar facilities has the generating capacity to power the equivalent of approximately 15 million homes, providing 10 percent of the nation's carbon-free electricity. Our fleet is helping to accelerate the nation’s transition to clean energy with more than 32,400 megawatts of capacity and annual output that is nearly 90 percent carbon-free. We have set a goal to achieve 100 percent carbon-free power generation by 2040 by leveraging innovative technology and enhancing our diverse mix of hydro, wind and solar resources paired with the nation’s largest nuclear fleet. Follow Constellation on LinkedIn and Twitter.

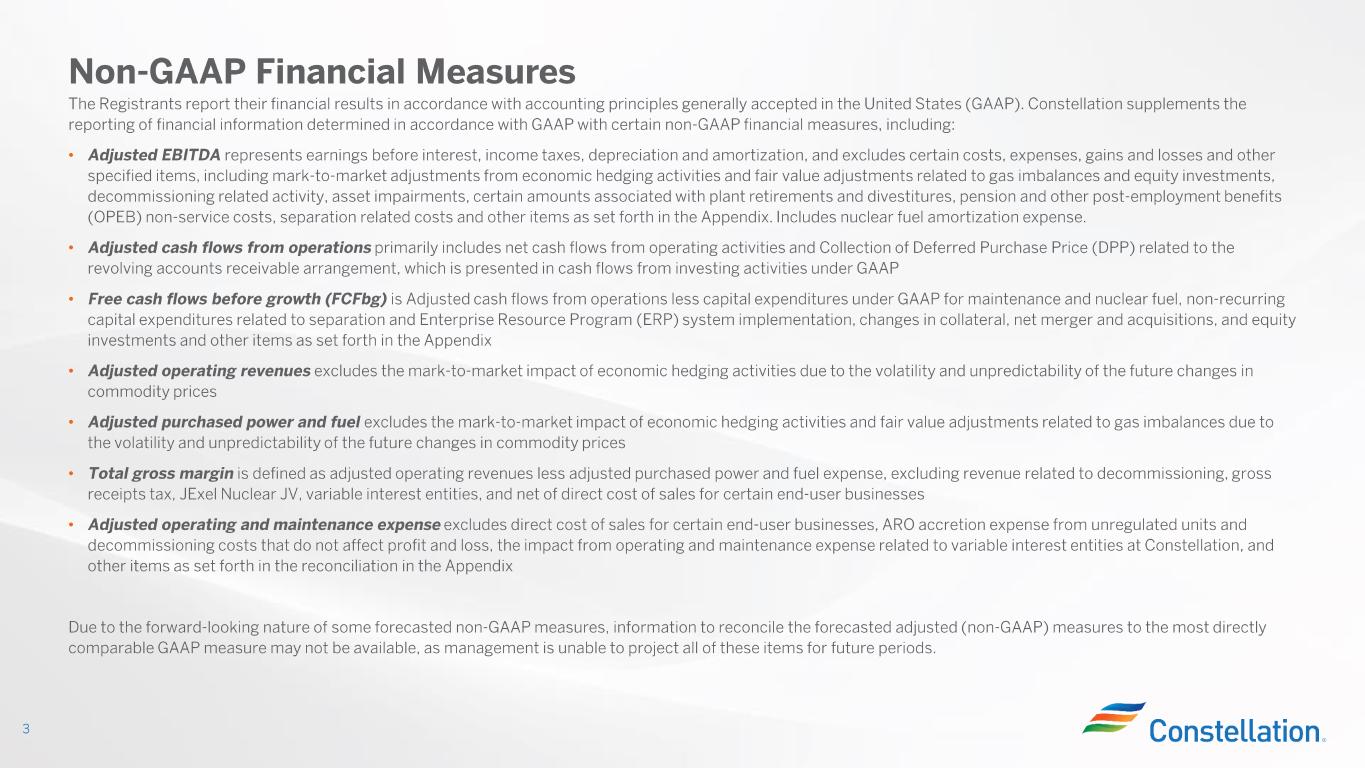

Non-GAAP Financial Measures

In analyzing and planning for our business, we supplement our use of net income as determined under generally accepted accounting principles in the United States (GAAP), with Adjusted EBITDA (non-GAAP) as a performance measure. Adjusted EBITDA (non-GAAP) reflects an additional way of viewing our business that, when viewed with our GAAP results and the accompanying reconciliation to GAAP net income included above, may provide a more complete understanding of factors and trends affecting our business.

Adjusted EBITDA (non-GAAP) should not be relied upon to the exclusion of GAAP financial measures and is, by definition, an incomplete understanding of our business, and must be considered in conjunction with GAAP measures. In addition, Adjusted EBITDA (non-GAAP) is neither a standardized financial measure, nor a presentation defined under GAAP and may not be comparable to other companies’ presentations or deemed more useful than the GAAP information provided elsewhere in this press release and earnings release attachments. We have provided the non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. Adjusted EBITDA (non-GAAP) should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP Net Income measure provided in this earnings release and attachments. This press release and earnings release attachments provide reconciliations of Adjusted EBITDA (non-GAAP) to the most directly comparable financial measures calculated and presented in accordance with GAAP, are posted on our website: www.ConstellationEnergy.com, and have been furnished to the Securities and Exchange Commission on Form 8-K on November 8, 2022.

Cautionary Statements Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements.

The factors that could cause actual results to differ materially from the forward-looking statements made by Constellation Energy Corporation and Constellation Energy Generation, LLC, (Registrants) include those factors discussed herein, as well as the items discussed in (1) the Registrants' 2021 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 19, Commitments and Contingencies; (2) the Registrants' Third Quarter 2022 Quarterly Report on Form 10-Q (to be filed on November 8, 2022) in (a) Part II, ITEM 1A. Risk Factors, (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part I, ITEM 1. Financial Statements: Note 15, Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants.

Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this press release. Neither of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this press release.

Earnings Release Attachments

Table of Contents

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Operations

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2022 |

|

Nine Months Ended September 30, 2022 |

| Operating revenues |

|

|

|

$ |

6,051 |

|

|

$ |

17,107 |

|

| Operating expenses |

|

|

|

|

|

|

| Purchased power and fuel |

|

|

|

4,695 |

|

|

11,754 |

|

| Operating and maintenance |

|

|

|

989 |

|

|

3,466 |

|

| Depreciation and amortization |

|

|

|

262 |

|

|

818 |

|

| Taxes other than income taxes |

|

|

|

145 |

|

|

415 |

|

| Total operating expenses |

|

|

|

6,091 |

|

|

16,453 |

|

| (Loss) gain on sales of assets and businesses |

|

|

|

(1) |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) income |

|

|

|

(41) |

|

|

667 |

|

| Other income and (deductions) |

|

|

|

|

|

|

| Interest expense, net |

|

|

|

(75) |

|

|

(187) |

|

| Other, net |

|

|

|

(196) |

|

|

(1,169) |

|

| Total other income and (deductions) |

|

|

|

(271) |

|

|

(1,356) |

|

| Loss before income taxes |

|

|

|

(312) |

|

|

(689) |

|

| Income taxes |

|

|

|

(123) |

|

|

(504) |

|

| Equity in losses of unconsolidated affiliates |

|

|

|

(4) |

|

|

(10) |

|

| Net loss |

|

|

|

(193) |

|

|

(195) |

|

| Net loss attributable to noncontrolling interests |

|

|

|

(5) |

|

|

(1) |

|

| Net loss attributable to common shareholders |

|

|

|

$ |

(188) |

|

|

$ |

(194) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2021 |

|

Nine Months Ended September 30, 2021 |

| Operating revenues |

|

|

|

$ |

4,406 |

|

|

$ |

14,117 |

|

| Operating expenses |

|

|

|

|

|

|

| Purchased power and fuel |

|

|

|

1,546 |

|

|

8,103 |

|

| Operating and maintenance |

|

|

|

938 |

|

|

3,413 |

|

| Depreciation and amortization |

|

|

|

866 |

|

|

2,735 |

|

| Taxes other than income taxes |

|

|

|

115 |

|

|

354 |

|

| Total operating expenses |

|

|

|

3,465 |

|

|

14,605 |

|

| Gain on sales of assets and businesses |

|

|

|

65 |

|

|

144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

|

1,006 |

|

|

(344) |

|

| Other income and (deductions) |

|

|

|

|

|

|

| Interest expense, net |

|

|

|

(77) |

|

|

(225) |

|

| Other, net |

|

|

|

(115) |

|

|

561 |

|

| Total other income and (deductions) |

|

|

|

(192) |

|

|

336 |

|

| Income (loss) before income taxes |

|

|

|

814 |

|

|

(8) |

|

| Income taxes |

|

|

|

177 |

|

|

108 |

|

| Equity in losses of unconsolidated affiliates |

|

|

|

(4) |

|

|

(6) |

|

| Net income (loss) |

|

|

|

633 |

|

|

(122) |

|

| Net income attributable to noncontrolling interests |

|

|

|

26 |

|

|

125 |

|

| Net income (loss) attributable to common shareholders |

|

|

|

$ |

607 |

|

|

$ |

(247) |

|

|

|

|

|

|

|

|

| Change in Net income (loss) from 2021 to 2022 |

|

|

|

$ |

(795) |

|

|

$ |

53 |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Balance Sheets

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2022 |

|

December 31, 2021 |

| Assets |

|

|

|

|

| Current assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,192 |

|

|

$ |

504 |

|

| Restricted cash and cash equivalents |

|

111 |

|

|

72 |

|

|

|

|

|

|

| Accounts receivable |

|

|

|

|

Customer accounts receivable (net of allowance for credit losses of $55 as of September 30, 2022 and December 31, 2021) |

|

1,819 |

|

|

1,669 |

|

Other accounts receivable (net of allowance for credit losses of $5 as of September 30, 2022 and December 31, 2021) |

|

579 |

|

|

592 |

|

| Mark-to-market derivative assets |

|

2,557 |

|

|

2,169 |

|

| Receivables from affiliates |

|

— |

|

|

160 |

|

| Inventories, net |

|

|

|

|

| Natural gas, oil and emission allowances |

|

422 |

|

|

284 |

|

| Materials and supplies |

|

1,042 |

|

|

1,004 |

|

| Renewable energy credits |

|

524 |

|

|

520 |

|

|

|

|

|

|

| Other |

|

1,607 |

|

|

1,007 |

|

| Total current assets |

|

9,853 |

|

|

7,981 |

|

| Property, plant, and equipment, net |

|

19,705 |

|

|

19,612 |

|

| Deferred debits and other assets |

|

|

|

|

| Nuclear decommissioning trust funds |

|

13,453 |

|

|

15,938 |

|

| Investments |

|

193 |

|

|

174 |

|

|

|

|

|

|

| Mark-to-market derivative assets |

|

1,252 |

|

|

949 |

|

| Prepaid pension asset |

|

— |

|

|

1,683 |

|

| Deferred income taxes |

|

23 |

|

|

32 |

|

| Other |

|

2,137 |

|

|

1,717 |

|

| Total deferred debits and other assets |

|

17,058 |

|

|

20,493 |

|

| Total assets |

|

$ |

46,616 |

|

|

$ |

48,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2022 |

|

December 31, 2021 |

| Liabilities and shareholders’ equity |

|

|

|

|

| Current liabilities |

|

|

|

|

| Short-term borrowings |

|

$ |

693 |

|

|

$ |

2,082 |

|

| Long-term debt due within one year |

|

181 |

|

|

1,220 |

|

| Accounts payable |

|

2,597 |

|

|

1,757 |

|

| Accrued expenses |

|

933 |

|

|

737 |

|

| Payables to affiliates |

|

— |

|

|

131 |

|

| Mark-to-market derivative liabilities |

|

2,392 |

|

|

981 |

|

| Renewable energy credit obligation |

|

773 |

|

|

777 |

|

|

|

|

|

|

| Other |

|

318 |

|

|

311 |

|

| Total current liabilities |

|

7,887 |

|

|

7,996 |

|

| Long-term debt |

|

4,480 |

|

|

4,575 |

|

| Long-term debt to affiliates |

|

— |

|

|

319 |

|

| Deferred credits and other liabilities |

|

|

|

|

| Deferred income taxes and unamortized investment tax credits |

|

2,647 |

|

|

3,703 |

|

| Asset retirement obligations |

|

12,564 |

|

|

12,819 |

|

| Pension obligations |

|

636 |

|

|

— |

|

| Non-pension postretirement benefit obligations |

|

861 |

|

|

847 |

|

| Spent nuclear fuel obligation |

|

1,219 |

|

|

1,210 |

|

| Payables to affiliates |

|

— |

|

|

3,357 |

|

| Payable related to Regulatory Agreement Units |

|

2,658 |

|

|

— |

|

| Mark-to-market derivative liabilities |

|

1,244 |

|

|

513 |

|

| Other |

|

1,251 |

|

|

1,133 |

|

| Total deferred credits and other liabilities |

|

23,080 |

|

|

23,582 |

|

| Total liabilities |

|

35,447 |

|

|

36,472 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

| Predecessor Member's Equity |

|

— |

|

|

11,250 |

|

| Common stock |

|

13,255 |

|

|

— |

|

| Retained deficit |

|

(483) |

|

|

— |

|

| Accumulated other comprehensive loss, net |

|

(1,969) |

|

|

(31) |

|

| Total shareholders’ equity |

|

10,803 |

|

|

11,219 |

|

| Noncontrolling interests |

|

366 |

|

|

395 |

|

| Total equity |

|

11,169 |

|

|

11,614 |

|

| Total liabilities and shareholders’ equity |

|

$ |

46,616 |

|

|

$ |

48,086 |

|

Constellation Energy Corporation and Subsidiary Companies

Consolidated Statements of Cash Flows

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

| |

|

2022 |

|

2021 |

| Cash flows from operating activities |

|

|

|

|

| Net loss |

|

$ |

(195) |

|

|

$ |

(122) |

|

| Adjustments to reconcile net loss to net cash flows provided by operating activities: |

|

|

|

|

| Depreciation, amortization, and accretion, including nuclear fuel and energy contract amortization |

|

1,810 |

|

|

3,951 |

|

| Asset impairments |

|

— |

|

|

537 |

|

|

|

|

|

|

| Gain on sales of assets and businesses |

|

(13) |

|

|

(144) |

|

|

|

|

|

|

| Deferred income taxes and amortization of investment tax credits |

|

(915) |

|

|

(204) |

|

| Net fair value changes related to derivatives |

|

544 |

|

|

(1,244) |

|

| Net realized and unrealized losses (gains) on NDT funds |

|

1,032 |

|

|

(383) |

|

| Net unrealized loss on CTV investments |

|

27 |

|

|

83 |

|

| Other non-cash operating activities |

|

304 |

|

|

(582) |

|

| Changes in assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

(150) |

|

|

(207) |

|

| Receivables from and payables to affiliates, net |

|

20 |

|

|

82 |

|

| Inventories |

|

(166) |

|

|

(29) |

|

| Accounts payable and accrued expenses |

|

789 |

|

|

357 |

|

| Option premiums paid, net |

|

(163) |

|

|

(186) |

|

| Collateral received, net |

|

766 |

|

|

1,974 |

|

| Income taxes |

|

364 |

|

|

177 |

|

| Pension and non-pension postretirement benefit contributions |

|

(229) |

|

|

(237) |

|

| Other assets and liabilities |

|

(3,756) |

|

|

(2,849) |

|

| Net cash flows provided by operating activities |

|

69 |

|

|

974 |

|

| Cash flows from investing activities |

|

|

|

|

| Capital expenditures |

|

(1,090) |

|

|

(1,086) |

|

| Proceeds from NDT fund sales |

|

3,034 |

|

|

5,766 |

|

| Investment in NDT funds |

|

(3,212) |

|

|

(5,900) |

|

| Collection of DPP, net |

|

3,095 |

|

|

3,052 |

|

|

|

|

|

|

| Proceeds from sales of assets and businesses |

|

41 |

|

|

802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other investing activities |

|

3 |

|

|

5 |

|

| Net cash flows provided by investing activities |

|

1,871 |

|

|

2,639 |

|

| Cash flows from financing activities |

|

|

|

|

| Change in short-term borrowings |

|

(209) |

|

|

(340) |

|

| Proceeds from short-term borrowings with maturities greater than 90 days |

|

— |

|

|

880 |

|

| Repayments of short-term borrowings with maturities greater than 90 days |

|

(1,180) |

|

|

— |

|

| Issuance of long-term debt |

|

9 |

|

|

152 |

|

| Retirement of long-term debt |

|

(1,143) |

|

|

(89) |

|

|

|

|

|

|

| Retirement of long-term debt to affiliate |

|

(258) |

|

|

— |

|

| Changes in money pool with Exelon |

|

— |

|

|

(285) |

|

| Acquisition of CENG noncontrolling interest |

|

— |

|

|

(885) |

|

| Distributions to Exelon |

|

— |

|

|

(1,373) |

|

|

|

|

|

|

| Contribution from Exelon |

|

1,750 |

|

|

64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends paid on common stock |

|

(139) |

|

|

— |

|

| Other financing activities |

|

(43) |

|

|

(45) |

|

| Net cash flows used in financing activities |

|

(1,213) |

|

|

(1,921) |

|

| Increase in cash, restricted cash, and cash equivalents |

|

727 |

|

|

1,692 |

|

| Cash, restricted cash, and cash equivalents at beginning of period |

|

576 |

|

|

327 |

|

| Cash, restricted cash, and cash equivalents at end of period |

|

$ |

1,303 |

|

|

$ |

2,019 |

|

Constellation Energy Corporation

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (non-GAAP) and Analysis of Earnings

Three Months Ended September 30, 2022 and 2021

(unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

| 2021 GAAP Net Income Attributable to Common Shareholders |

|

$ |

607 |

|

| Income Taxes |

|

177 |

|

| Depreciation and Amortization (1) |

|

866 |

|

| Interest Expense, Net |

|

77 |

|

| Unrealized Gain on Fair Value Adjustments (2) |

|

(614) |

|

| Asset Impairments (3) |

|

45 |

|

| Plant Retirements and Divestitures (4) |

|

(62) |

|

| Decommissioning-Related Activities (5) |

|

(130) |

|

| Pension & OPEB Non-Service Costs |

|

(11) |

|

| Separation Costs (6) |

|

16 |

|

| COVID-19 Direct Costs (7) |

|

5 |

|

| Acquisition Related Costs (8) |

|

11 |

|

| ERP System Implementation Costs (9) |

|

5 |

|

| Change in Environmental Liabilities |

|

5 |

|

| Cost Management Program |

|

4 |

|

| Noncontrolling Interests (10) |

|

(34) |

|

| 2021 Adjusted EBITDA (non-GAAP) |

|

$ |

967 |

|

|

|

|

| Year Over Year Effects on Adjusted EBITDA (non-GAAP): |

|

|

|

|

|

|

| February 2021 Extreme Weather Event |

|

$ |

(6) |

|

| Market and Portfolio Conditions (13) |

|

(70) |

|

| Nuclear Fuel Cost (14) |

|

17 |

|

| Capacity Revenue (15) |

|

(124) |

|

| Labor, Contracting and Materials (16) |

|

(125) |

|

| Nuclear Outages (17) |

|

(1) |

|

| Impact of CTV Investments (18) |

|

(76) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (19) |

|

(43) |

|

| Noncontrolling Interests (20) |

|

53 |

|

|

|

|

| Total Year Over Year Effects on Adjusted EBITDA (non-GAAP) |

|

$ |

(375) |

|

|

|

|

| 2022 GAAP Net Loss Attributable to Common Shareholders |

|

$ |

(188) |

|

| Income Taxes (11) |

|

(149) |

|

| Depreciation and Amortization |

|

262 |

|

| Interest Expense, Net |

|

75 |

|

| Unrealized Loss on Fair Value Adjustments (2) |

|

550 |

|

|

|

|

| Plant Retirements and Divestitures |

|

5 |

|

| Decommissioning-Related Activities (5) |

|

88 |

|

| Pension & OPEB Non-Service Costs |

|

(27) |

|

| Separation Costs (6) |

|

30 |

|

|

|

|

|

|

|

| ERP System Implementation Costs (9) |

|

5 |

|

| Change in Environmental Liabilities |

|

3 |

|

|

|

|

| Prior Merger Commitment (12) |

|

(50) |

|

| Noncontrolling Interests (10) |

|

(12) |

|

| 2022 Adjusted EBITDA (non-GAAP) |

|

$ |

592 |

|

(1)Includes the accelerated depreciation associated with early plant retirements.

(2)Includes mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(3)Reflects an impairment of a wind project.

(4)Primarily due to reversal of one-time charges resulting from the reversal of the previous decision to retire Byron and Dresden in 2021.

(5)Reflects all gains and losses associated with Nuclear Decommissioning Trusts (NDT), Asset Retirement Obligation (ARO) accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(6)Represents certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(7)Represents direct costs related to COVID-19 consisting primarily of costs to acquire personal protective equipment, costs for cleaning supplies and services, and costs to hire healthcare professionals to monitor the health of employees.

(8)Reflects costs related to the acquisition of Electricite de France SA's (EDF's) interest in Constellation Energy Nuclear Group, LLC (CENG), which was completed in the third quarter of 2021.

(9)Reflects costs related to a multi-year Enterprise Resource Program (ERP) system implementation.

(10)Represents elimination of the noncontrolling interest related to certain adjustments. In 2022, primarily relates to Constellation Renewables Partners, LLC (CRP) and in 2021, primarily relates to CENG and the noncontrolling interest portion of a wind project impairment recognized within CRP.

(11)Includes amounts contractually owed to Exelon under the tax matters agreement reflected in Other, net.

(12)Reversal of a charge related to a prior 2012 merger commitment.

(13)Reflects lower portfolio optimization compared to prior year.

(14)Primarily reflects a decrease in fuel prices.

(15)Reflects decreased capacity revenues in the Mid-Atlantic, Midwest, New York and Other Power Regions.

(16)Primarily reflects increased employee-related costs, including labor, stock-based compensation, and other incentives, etc.

(17)Reflects volume and operating and maintenance impact of nuclear outages, including Salem.

(18)Primarily reflects the absence of gains on Constellation Technology Ventures (CTV) investments realized in prior year.

(19)Includes certain Taxes other than income taxes and increased fees on credit facilities.

(20)Reflects elimination of the noncontrolling interest from results of activity, primarily relating to CRP in 2022 and CENG and CRP in 2021. We acquired the noncontrolling interest in CENG on August 6, 2021.

Constellation Energy Corporation

Reconciliation of GAAP Net Loss to Adjusted EBITDA (non-GAAP) and Analysis of Earnings

Nine Months Ended September 30, 2022 and 2021

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

| 2021 GAAP Net Loss Attributable to Common Shareholders |

|

$ |

(247) |

|

| Income Taxes |

|

108 |

|

| Depreciation and Amortization (1) |

|

2,735 |

|

| Interest Expense, Net |

|

225 |

|

| Unrealized Gain on Fair Value Adjustments (2) |

|

(1,191) |

|

| Asset Impairments (3) |

|

537 |

|

| Plant Retirements and Divestitures (4) |

|

(15) |

|

| Decommissioning-Related Activities (5) |

|

(1,014) |

|

| Pension & OPEB Non-Service Costs |

|

(36) |

|

| Separation Costs (6) |

|

25 |

|

| COVID-19 Direct Costs (7) |

|

24 |

|

| Acquisition Related Costs (8) |

|

21 |

|

| ERP System Implementation Costs (9) |

|

10 |

|

| Change in Environmental Liabilities |

|

7 |

|

| Cost Management Program |

|

9 |

|

| Noncontrolling Interests (10) |

|

(40) |

|

| 2021 Adjusted EBITDA (non-GAAP) |

|

$ |

1,158 |

|

|

|

|

| Year Over Year Effects on Adjusted EBITDA (non-GAAP): |

| February 2021 Extreme Weather Event |

|

$ |

1,227 |

|

|

|

|

| Market and Portfolio Conditions (13) |

|

203 |

|

| Nuclear Fuel Cost (14) |

|

89 |

|

| Capacity Revenue (15) |

|

(260) |

|

| Labor, Contracting and Materials (16) |

|

(161) |

|

| Nuclear Outages (17) |

|

(107) |

|

| Impact of CTV Investments (18) |

|

(74) |

|

|

|

|

|

|

|

|

|

|

| Other (19) |

|

(142) |

|

| Noncontrolling Interests (20) |

|

129 |

|

|

|

|

| Total Year Over Year Effects on Adjusted EBITDA (non-GAAP) |

|

$ |

904 |

|

|

|

|

| 2022 GAAP Net Loss Attributable to Common Shareholders |

|

$ |

(194) |

|

| Income Taxes (11) |

|

(472) |

|

| Depreciation and Amortization |

|

818 |

|

| Interest Expense, Net |

|

187 |

|

| Unrealized Loss on Fair Value Adjustments (2) |

|

645 |

|

|

|

|

| Plant Retirements and Divestitures |

|

(3) |

|

| Decommissioning-Related Activities (5) |

|

1,126 |

|

| Pension & OPEB Non-Service Costs |

|

(85) |

|

| Separation Costs (6) |

|

99 |

|

|

|

|

|

|

|

| ERP System Implementation Costs (9) |

|

16 |

|

| Change in Environmental Liabilities |

|

12 |

|

|

|

|

| Prior Merger Commitment (12) |

|

(50) |

|

| Noncontrolling Interests (10) |

|

(37) |

|

| 2022 Adjusted EBITDA (non-GAAP) |

|

$ |

2,062 |

|

(1)Includes the accelerated depreciation associated with early plant retirements.

(2)Includes mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(3)Reflects an impairment in the New England asset group, an impairment as a result of the sale of the Albany Green Energy biomass facility, and an impairment of a wind project.

(4)Primarily reflects nuclear fuel amortization for Byron and Dresden, partially offset by a gain on sale of our solar business and a reversal of one-time charges resulting from the reversal of the previous decision to retire Byron and Dresden in 2021.

(5)Reflects all gains and losses associated with NDT, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(6)Represents certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(7)Represents direct costs related to COVID-19 consisting primarily of costs to acquire personal protective equipment, costs for cleaning supplies and services, and costs to hire healthcare professionals to monitor the health of employees.

(8)Reflects costs related to the acquisition of EDF's interest in CENG, which was completed in the third quarter of 2021.

(9)Reflects costs related to a multi-year ERP system implementation.

(10)Represents elimination of the noncontrolling interest related to certain adjustments. In 2022, primarily relates to CRP and in 2021, primarily relates to CENG and the noncontrolling interest portion of a wind project impairment recognized within CRP.

(11)Includes amounts contractually owed to Exelon under the tax matters agreement reflected in Other, net.

(12)Reversal of a charge related to a prior 2012 merger commitment.

(13)Primarily reflects higher realized energy prices.

(14)Primarily reflects a decrease in fuel prices.

(15)Reflects decreased capacity revenues in the Mid-Atlantic, Midwest, New York and Other Power Regions.

(16)Primarily reflects increased employee-related costs, including labor, stock-based compensation, and other incentives, etc.

(17)Reflects volume and operating and maintenance impact of nuclear outages, including Salem.

(18)Primarily relates to the absence of gains on CTV investments realized in prior year.

(19)Includes certain Taxes other than income taxes, increases to reserves for future claims associated with asbestos-related personal injury actions and increased fees on credit facilities.

(20)Reflects elimination of the noncontrolling interest from results of activity, primarily relating to CRP in 2022 and CENG and CRP in 2021. We acquired the noncontrolling interest in CENG on August 6, 2021.

Constellation Energy Corporation

GAAP Consolidated Statements of Operations and

Adjusted EBITDA (non-GAAP) Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, 2022 |

|

|

|

Three Months Ended September 30, 2021 |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

| Operating revenues |

$ |

6,051 |

|

|

$ |

680 |

|

|

(b),(c) |

|

|

|

$ |

4,406 |

|

|

$ |

634 |

|

|

(b),(c) |

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

4,695 |

|

|

132 |

|

|

(b) |

|

|

|

1,546 |

|

|

1,386 |

|

|

(b),(d) |

|

|

| Operating and maintenance |

989 |

|

|

191 |

|

|

(c),(d),(h),(i),(k),(r) |

|

|

|

938 |

|

|

96 |

|

|

(c),(d),(e),(f),(g),(h),(i),(j),(k),(p) |

|

|

| Depreciation and amortization |

262 |

|

|

(262) |

|

|

(l) |

|

|

|

866 |

|

|

(866) |

|

|

(l) |

|

|

| Taxes other than income taxes |

145 |

|

|

— |

|

|

|

|

|

|

115 |

|

|

— |

|

|

|

|

|

| Total operating expenses |

6,091 |

|

|

|

|

|

|

|

|

3,465 |

|

|

|

|

|

|

|

| (Loss) gain on sales of assets and businesses |

(1) |

|

|

1 |

|

|

(d) |

|

|

|

65 |

|

|

1 |

|

|

(d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) income |

(41) |

|

|

|

|

|

|

|

|

1,006 |

|

|

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

(75) |

|

|

75 |

|

|

(m) |

|

|

|

(77) |

|

|

77 |

|

|

(m) |

|

|

| Other, net |

(196) |

|

|

220 |

|

|

(b),(c),(j),(q) |

|

|

|

(115) |

|

|

121 |

|

|

(b),(c),(d) |

|

|

| Total other income and (deductions) |

(271) |

|

|

|

|

|

|

|

|

(192) |

|

|

|

|

|

|

|

| (Loss) income before income taxes |

(312) |

|

|

|

|

|

|

|

|

814 |

|

|

|

|

|

|

|

| Income taxes |

(123) |

|

|

123 |

|

|

(n) |

|

|

|

177 |

|

|

(177) |

|

|

(n) |

|

|

| Equity in losses of unconsolidated affiliates |

(4) |

|

|

— |

|

|

|

|

|

|

(4) |

|

|

— |

|

|

|

|

|

| Net (loss) income |

(193) |

|

|

|

|

|

|

|

|

633 |

|

|

|

|

|

|

|

| Net (loss) income attributable to noncontrolling interests |

(5) |

|

|

12 |

|

|

(o) |

|

|

|

26 |

|

|

34 |

|

|

(o) |

|

|

| Net (loss) income attributable to common shareholders |

$ |

(188) |

|

|

|

|

|

|

|

|

$ |

607 |

|

|

|

|

|

|

|

| Effective tax rate |

39.4 |

% |

|

|

|

|

|

|

|

21.7 |

% |

|

|

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.57) |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

| Diluted |

$ |

(0.57) |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

327 |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

| Diluted |

328 |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with NDTs, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)Adjustments related to plant retirements and divestitures.

(e)In 2021, adjustment primarily for reorganization and severance costs related to cost management programs.

(f)In 2021, adjustment for direct costs related to COVID-19 consisting primarily of costs to acquire personal protective equipment, costs for cleaning supplies and services, and costs to hire healthcare professionals to monitor the health of employees.

(g)In 2021, adjustment for costs related to the acquisition of EDF's interest in CENG, which was completed in the third quarter of 2021.

(h)Adjustment for costs related to a multi-year ERP system implementation.

(i)Adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(j)Adjustment for Pension and Other Postretirement Employee Benefits (OPEB) Non-Service costs. Historically, we were allocated our portion of pension and OPEB non-service costs from Exelon, which was included in Operating and maintenance expense. Effective February 1, 2022, the non-service credit (cost) components are included in Other, net.

(k)Adjustment for certain changes in environmental liabilities.

(l)Adjustment for depreciation and amortization expense.

(m)Adjustment for interest expense.

(n)Adjustment for income taxes.

(o)Adjustment for elimination of the noncontrolling interest related to certain adjustments. In 2022, primarily relates to CRP and in 2021, primarily relates to CENG and the noncontrolling interest portion of a wind project impairment recognized within CRP.

(p)Reflects an impairment of a wind project.

(q)In 2022, includes amounts contractually owed to Exelon under the tax matters agreement.

(r)Reversal of a charge related to a prior 2012 merger commitment.

Constellation Energy

GAAP Consolidated Statements of Operations and

Adjusted (non-GAAP) EBITDA Reconciling Adjustments

(unaudited)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2022 |

|

|

|

Nine Months Ended September 30, 2021 |

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

|

GAAP (a) |

|

Non-GAAP Adjustments |

|

|

|

|

| Operating revenues |

$ |

17,107 |

|

|

$ |

1,896 |

|

|

(b),(c) |

|

|

|

$ |

14,117 |

|

|

$ |

955 |

|

|

(b),(c) |

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased power and fuel |

11,754 |

|

|

1,263 |

|

|

(b) |

|

|

|

8,103 |

|

|

2,084 |

|

|

(b),(d) |

|

|

Operating and maintenance |

3,466 |

|

|

57 |

|

|

(c),(d),(h),(i),(j),(k) (r) |

|

|

|

3,413 |

|

|

(111) |

|

|

(c),(d),(e),(f),(g),(h),(i),(j),(k),(p) |

|

|

Depreciation and amortization |

818 |

|

|

(818) |

|

|

(l) |

|

|

|

2,735 |

|

|

(2,735) |

|

|

(l) |

|

|

Taxes other than income taxes |

415 |

|

|

(2) |

|

|

(h) |

|

|

|

354 |

|

|

— |

|

|

|

|

|

Total operating expenses |

16,453 |

|

|

|

|

|

|

|

|

14,605 |

|

|

|

|

|

|

|

| Gain on sales of assets and businesses |

13 |

|

|

1 |

|

|

(d) |

|

|

|

144 |

|

|

(68) |

|

|

(d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

667 |

|

|

|

|

|

|

|

|

(344) |

|

|

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

(187) |

|

|

187 |

|

|

(m) |

|

|

|

(225) |

|

|

225 |

|

|

(m) |

|

|

Other, net |

(1,169) |

|

|

1,213 |

|

|

(b),(c),(d), (i),(j),(q) |

|

|

|

561 |

|

|

(537) |

|

|

(b),(c),(d) |

|

|

| Total other income and (deductions) |

(1,356) |

|

|

|

|

|

|

|

|

336 |

|

|

|

|

|

|

|

| Loss before income taxes |

(689) |

|

|

|

|

|

|

|

|

(8) |

|

|

|

|

|

|

|

| Income taxes |

(504) |

|

|

504 |

|

|

(n) |

|

|

|

108 |

|

|

(108) |

|

|

(n) |

|

|

| Equity in losses of unconsolidated affiliates |

(10) |

|

|

— |

|

|

|

|

|

|

(6) |

|

|

— |

|

|

|

|

|

| Net loss |

(195) |

|

|

|

|

|

|

|

|

(122) |

|

|

|

|

|

|

|

| Net (loss) income attributable to noncontrolling interests |

(1) |

|

|

37 |

|

|

(o) |

|

|

|

125 |

|

|

40 |

|

|

(o) |

|

|

| Net loss attributable to common shareholders |

$ |

(194) |

|

|

|

|

|

|

|

|

$ |

(247) |

|

|

|

|

|

|

|

Effective tax rate(q) |

73.1 |

% |

|

|

|

|

|

|

|

(1,350.0) |

% |

|

|

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.59) |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

| Diluted |

$ |

(0.59) |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

327 |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

| Diluted |

328 |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

__________

(a)Results reported in accordance with GAAP.

(b)Adjustment for mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments.

(c)Adjustment for all gains and losses associated with NDTs, ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units.

(d)Adjustments related to plant retirements and divestitures.

(e)In 2021, adjustment primarily for reorganization and severance costs related to cost management programs.

(f)In 2021, adjustment for direct costs related to COVID-19 consisting primarily of costs to acquire personal protective equipment, costs for cleaning supplies and services, and costs to hire healthcare professionals to monitor the health of employees.

(g)In 2021, adjustment for costs related to the acquisition of EDF's interest in CENG, which was completed in the third quarter of 2021.

(h)Adjustment for costs related to a multi-year ERP system implementation.

(i)Adjustment for certain incremental costs related to the separation (system-related costs, third-party costs paid to advisors, consultants, lawyers, and other experts assisting in the separation), including a portion of the amounts billed to us pursuant to the TSA.

(j)Adjustment for Pension and OPEB Non-Service costs. Historically, we were allocated our portion of pension and OPEB non-service costs from Exelon, which was included in Operating and maintenance expense. Effective February 1, 2022, the non-service credit (cost) components are included in Other, net.

(k)Adjustment for certain changes in environmental liabilities.

(l)Adjustment for depreciation and amortization expense.

(m)Adjustment for interest expense.

(n)Adjustment for income taxes.

(o)Adjustment for elimination of the noncontrolling interest related to certain adjustments. In 2022, primarily relates to CRP and in 2021, primarily relates to CENG and the noncontrolling interest portion of a wind project impairment recognized within CRP.

(p)Reflects an impairment of a wind project.

(q)In 2022, includes amounts contractually owed to Exelon under the tax matters agreement.

(r)Reversal of a charge related to a prior 2012 merger commitment.

Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

| Supply Source (GWhs) |

|

|

|

|

|

|

|

|

|

|

|

|

Nuclear Generation(a) |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

13,540 |

|

|

13,753 |

|

|

39,272 |

|

|

40,203 |

|

|

|

|

|

| Midwest |

|

24,275 |

|

|

23,909 |

|

|

71,079 |

|

|

70,363 |

|

|

|

|

|

New York(b) |

|

5,979 |

|

|

6,688 |

|

|

18,563 |

|

|

19,820 |

|

|

|

|

|

| Total Nuclear Generation |

|

43,794 |

|

|

44,350 |

|

|

128,914 |

|

|

130,386 |

|

|

|

|

|

| Natural Gas, Oil, and Renewables |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

230 |

|

|

491 |

|

|

1,573 |

|

|

1,675 |

|

|

|

|

|

| Midwest |

|

126 |

|

|

177 |

|

|

774 |

|

|

763 |

|

|

|

|

|

| New York |

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

|

|

|

| ERCOT |

|

4,987 |

|

|

4,670 |

|

|

10,873 |

|

|

10,250 |

|

|

|

|

|

Other Power Regions(c) |

|

2,401 |

|

|

2,409 |

|

|

7,179 |

|

|

7,641 |

|

|

|

|

|

| Total Natural Gas, Oil, and Renewables |

|

7,744 |

|

|

7,747 |

|

|

20,399 |

|

|

20,330 |

|

|

|

|

|

| Purchased Power |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

6,508 |

|

|

4,565 |

|

|

12,164 |

|

|

12,123 |

|

|

|

|

|

| Midwest |

|

74 |

|

|

77 |

|

|

425 |

|

|

386 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ERCOT |

|

705 |

|

|

595 |

|

|

2,855 |

|

|

2,626 |

|

|

|

|

|

Other Power Regions(c) |

|

13,869 |

|

|

13,585 |

|

|

39,964 |

|

|

38,778 |

|

|

|

|

|

| Total Purchased Power |

|

21,156 |

|

|

18,822 |

|

|

55,408 |

|

|

53,913 |

|

|

|

|

|

| Total Supply/Sales by Region |

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Atlantic |

|

20,278 |

|

|

18,809 |

|

|

53,009 |

|

|

54,001 |

|

|

|

|

|

| Midwest |

|

24,475 |

|

|

24,163 |

|

|

72,278 |

|

|

71,512 |

|

|

|

|

|

New York(b) |

|

5,979 |

|

|

6,688 |

|

|

18,563 |

|

|

19,821 |

|

|

|

|

|

| ERCOT |

|

5,692 |

|

|

5,265 |

|

|

13,728 |

|

|

12,876 |

|

|

|

|

|

Other Power Regions(c) |

|

16,270 |

|

|

15,994 |

|

|

47,143 |

|

|

46,419 |

|

|

|

|

|

| Total Supply/Sales by Region |

|

72,694 |

|

|

70,919 |

|

|

204,721 |

|

|

204,629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

Outage Days(d) |

|

|

|

|

|

|

|

|

|

|

|

|

| Refueling |

|

5 |

|

|

22 |

|

|

147 |

|

|

172 |

|

|

|

|

|

| Non-refueling |

|

26 |

|

|

— |

|

|

51 |

|

|

10 |

|

|

|

|

|

| Total Outage Days |

|

31 |

|

|

22 |

|

|

198 |

|

|

182 |

|

|

|

|

|

__________

(a)Includes the proportionate share of output where we have an undivided ownership interest in jointly-owned generating plants. Includes the total output for fully owned plants and the total output for CENG prior to the acquisition of EDF’s interest on August 6, 2021 as CENG was fully consolidated.

(b)2021 values have been revised from those previously reported to correctly reflect our 82% undivided ownership interest in Nine Mile Point Unit 2.

(c)Other Power Regions includes New England, South, West, and Canada.

(d)Outage days exclude Salem.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| ZEC Reference Prices |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

| State (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| New Jersey (Mid-Atlantic) |

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

$ |

10.00 |

|

|

|

|

|

| Illinois (Midwest) |

|

12.01 |

|

|

16.50 |

|

|

14.50 |

|

|

16.50 |

|

|

|

|

|

| New York (New York) |

|

21.38 |

|

|

21.38 |

|

|

21.38 |

|

|

20.78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| Capacity Reference Prices |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

| Location (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| Eastern Mid-Atlantic Area Council (Mid-Atlantic) |

|

$ |

97.86 |

|

|

$ |

165.73 |

|

|

$ |

135.57 |

|

|

$ |

178.03 |

|

|

|

|

|

| ComEd (Midwest) |

|

68.96 |

|

|

195.55 |

|

|

139.29 |

|

|

191.42 |

|

|

|

|

|

| Rest of State (New York) |

|

108.22 |

|

|

164.40 |

|

|

89.67 |

|

|

98.47 |

|

|

|

|

|

| Southeast New England (Other) |

|

126.67 |

|

|

154.37 |

|

|

142.06 |

|

|

166.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| Electricity Reference Prices |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

| Location (Region) |

|

|

|

|

|

|

|

|

|

|

|

|

| PJM West (Mid-Atlantic) |

|

$ |

90.43 |

|

|

$ |

41.81 |

|

|

$ |

74.33 |

|

|

$ |

33.78 |

|

|

|

|

|

| ComEd (Midwest) |

|

81.99 |

|

|

39.70 |

|

|

62.90 |

|

|

31.87 |

|

|

|

|

|

| Central (New York) |

|

74.96 |

|

|

36.29 |

|

|

60.89 |

|

|

26.68 |

|

|

|

|

|

| North (ERCOT) |

|

97.58 |

|

|

39.18 |

|

|

68.47 |

|

|

193.18 |

|

|

|

|

|

Southeast Massachusetts (Other)(a) |

|

86.27 |

|

|

43.82 |

|

|

89.01 |

|

|

41.18 |

|

|

|

|

|

__________

(a)Reflects New England, which comprises the majority of the activity in the Other region.