Exhibit 4.2 LINEAGE EUROPE FINCO B.V. LINEAGE, INC., LINEAGE OP, LP, THE SUBSIDIARY GUARANTORS NAMED HEREIN, U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION AS TRUSTEE, AND U.S. BANK EUROPE DAC AS PAYING AGENT FIRST SUPPLEMENTAL INDENTURE DATED AS OF NOVEMBER 26, 2025 TO INDENTURE DATED NOVEMBER 26, 2025 €700,000,000 OF 4.125% SENIOR NOTES DUE 2031

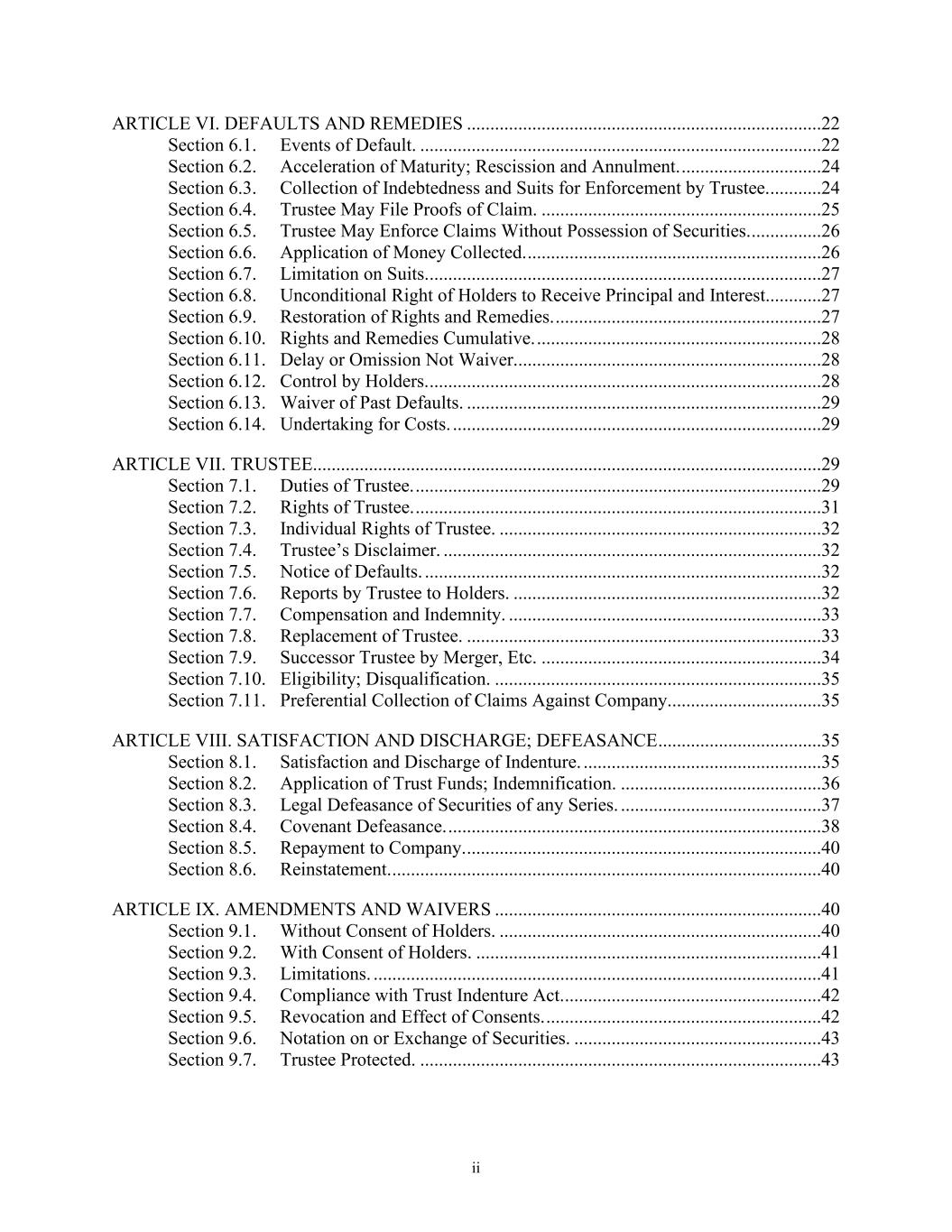

i CONTENTS Page Article I RELATION TO BASE INDENTURE; DEFINITIONS .............................................1 Section 1.1 Relation to Base Indenture. ...................................................................... 1 Section 1.2 Definitions. ................................................................................................. 2 Article II TERMS OF THE SECURITIES ...............................................................................15 Section 2.1 Title of the Securities. ............................................................................. 15 Section 2.2 Price. ......................................................................................................... 15 Section 2.3 Limitation on Initial Aggregate Principal Amount; Further Issuances. ................................................................................................. 16 Section 2.4 Interest and Interest Rates; Stated Maturity of Notes. ....................... 16 Section 2.5 Method of Payment. ................................................................................ 16 Section 2.6 Currency; Unavailability of Euros. ....................................................... 17 Section 2.7 Additional Notes. ..................................................................................... 18 Section 2.8 Redemption. ............................................................................................. 18 Section 2.9 No Sinking Fund. .................................................................................... 18 Section 2.10 Additional Amounts. ............................................................................... 18 Section 2.11 Registrar, Transfer Agent and Paying Agent....................................... 20 Article III FORM OF THE SECURITIES ................................................................................21 Section 3.1 Global Form. ........................................................................................... 21 Section 3.2 Transfer and Exchange. ......................................................................... 22 Article IV REDEMPTION OF NOTES .....................................................................................29 Section 4.1 Optional Redemption of Notes. .............................................................. 29 Section 4.2 Redemption for Tax Reasons. ................................................................ 30 Section 4.3 Calculation of Redemption Price; Selection of Notes, Notice of Optional Redemption.............................................................................. 30 Section 4.4 Payment of Notes Called for Redemption by the Company. .............. 31 Article V GUARANTEE .............................................................................................................31 Section 5.1 Note Guarantee. ...................................................................................... 31 Section 5.2 Limitation of Guarantors’ Liability. ..................................................... 32 Section 5.3 Execution and Delivery of Note Guarantee. ......................................... 33 Section 5.4 Application of Certain Terms and Provisions to the Guarantors............................................................................................... 33 Section 5.5 Automatic Release of Subsidiary Guarantors from Guarantee. ........ 33 Article VI ADDITIONAL COVENANTS .................................................................................34 Section 6.1 Limitations on the Incurrence of Debt. ................................................. 34 Section 6.2 Maintenance of Total Unencumbered Assets. ...................................... 36 Section 6.3 Existence. ................................................................................................. 36 Section 6.4 Merger, Consolidation or Sale. .............................................................. 36 Section 6.5 Maintenance of Properties. .................................................................... 37

ii Section 6.6 Insurance. ................................................................................................ 37 Section 6.7 Payment of Taxes and Other Claims. ................................................... 38 Section 6.8 Provision of Financial Information. ...................................................... 38 Section 6.9 Future Subsidiary Guarantors. ............................................................. 39 Section 6.10 General. .................................................................................................... 39 Article VII DEFAULTS AND REMEDIES ..............................................................................40 Section 7.1 Events of Default. .................................................................................... 40 Section 7.2 Acceleration of Maturity; Rescission and Annulment. ....................... 41 Article VIII AMENDMENTS AND WAIVERS .......................................................................42 Section 8.1 Without Consent of Holders. ................................................................. 42 Section 8.2 With Consent of Holders. ....................................................................... 44 Section 8.3 Substituted Issuer.................................................................................... 45 Section 8.4 Trustee Protected. ................................................................................... 45 Article IX MEETINGS OF HOLDERS OF NOTES................................................................45 Section 9.1 Purposes for Which Meetings May Be Called. ..................................... 45 Section 9.2 Call, Notice and Place of Meetings. ....................................................... 46 Section 9.3 Persons Entitled to Vote at Meetings. ................................................... 46 Section 9.4 Quorum; Action. ..................................................................................... 46 Section 9.5 Determination of Voting Rights; Conduct and Adjournment of Meetings. .................................................................................................. 47 Section 9.6 Counting Votes and Recording Action of Meetings. ........................... 48 Article X MISCELLANEOUS PROVISIONS ..........................................................................48 Section 10.1 Evidence of Compliance with Conditions Precedent, Certificates to Trustee. ........................................................................... 48 Section 10.2 No Recourse Against Others. ................................................................. 49 Section 10.3 Trust Indenture Act Controls. ............................................................... 49 Section 10.4 Governing Law; Waiver of Jury Trial; Consent to Jurisdiction. ....... 49 Section 10.5 Counterparts. .......................................................................................... 50 Section 10.6 Successors. ............................................................................................... 51 Section 10.7 Severability. ............................................................................................. 51 Section 10.8 Table of Contents, Headings, Etc. ......................................................... 52 Section 10.9 Ratifications. ............................................................................................ 52 Section 10.10 Effectiveness. ........................................................................................... 52 Section 10.11 The Trustee. ............................................................................................. 52 Section 10.12 Reference to Interest; Exchange Notes. ................................................ 52 Section 10.13 Intercreditor Agreement ........................................................................ 53 Section 10.14 Bank Resolution and Recovery Directive and Other Regulatory Matters ................................................................................. 53

1 THIS FIRST SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”) is entered into as of November 26, 2025 among Lineage Europe Finco B.V., a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) organized under the laws of the Netherlands (the “Company”), Lineage, Inc., a Maryland corporation (the “Parent”), Lineage OP, LP, a Maryland limited partnership (“Lineage OP”), the Subsidiary Guarantors (as defined herein, and together with the Parent and Lineage OP, the “Guarantors”), U.S. Bank Trust Company, National Association, a national banking association, as trustee (the “Trustee”), and U.S. Bank Europe DAC, as paying agent (the “Paying Agent”). WITNESSETH: WHEREAS, the Company, the Parent, Lineage OP and the Trustee are parties to that certain Indenture, dated as of November 26, 2025 (the “Base Indenture”, and as supplemented by this Supplemental Indenture, the “Indenture”), to provide for the issuance of Securities to be issued in one or more series; WHEREAS, Section 2.2 of the Base Indenture provides for various matters with respect to any Series of Securities issued under the Base Indenture to be established in an indenture supplemental to the Base Indenture; WHEREAS, the Company and each Guarantor desires to execute this Supplemental Indenture to, in accordance with Section 9.1(h) and 9.1(f) of the Base Indenture, establish a new series of Securities under the Base Indenture to be known as the “4.125% Senior Notes due 2031” (the “Notes”), in an initial aggregate principal amount of €700,000,000 and to comply with the applicable procedures of the applicable Depositary where the Notes are to be deposited; WHEREAS, the board of directors of the Parent, on behalf of the Parent and in its capacity as general partner of Lineage OP, on behalf of Lineage OP and in its capacity as the direct or indirect general partner, managing member or stockholder, as applicable, of the Company and each Subsidiary Guarantor, has duly adopted resolutions authorizing the Company and the Guarantors to execute and deliver this Supplemental Indenture; and WHEREAS, all of the other conditions and requirements necessary to make this Supplemental Indenture, when duly executed and delivered, a valid and binding agreement in accordance with its terms and for the purposes herein expressed, have been performed and fulfilled. THEREFORE, for and in consideration of the premises and the purchase of the Series of Securities provided for herein by the Holders thereof, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders of Securities of such Series, as follows: ARTICLE I RELATION TO BASE INDENTURE; DEFINITIONS Section 1.1 Relation to Base Indenture. This Supplemental Indenture constitutes an integral part of the Base Indenture. Notwithstanding any other provision of this Supplemental Indenture, all provisions of this Supplemental Indenture are expressly and solely for the benefit of the Holders of the Notes and

2 any such provisions shall not be deemed to apply to any other Securities issued under the Base Indenture and shall not be deemed to amend, modify or supplement the Base Indenture for any purpose other than with respect to the Notes. Section 1.2 Definitions. For all purposes of this Supplemental Indenture, except as otherwise expressly provided for or unless the context otherwise requires: (a) Capitalized terms used but not defined herein shall have the respective meanings assigned to them in the Base Indenture; and (b) All references herein to Articles and Sections, unless otherwise specified, refer to the corresponding Articles and Sections of this Supplemental Indenture as they amend or supplement the Base Indenture, and not the Base Indenture or any other document. “Acquired Debt” means Debt of a Person: (1) existing at the time such Person is merged or consolidated with or into Lineage OP or any of its Subsidiaries or becomes a Subsidiary of Lineage OP; or (2) assumed by Lineage OP or any of its Subsidiaries in connection with the acquisition of assets from such Person, in each case, other than Debt incurred in connection with, or in contemplation of, the Person becoming a Subsidiary or the acquisition. Acquired Debt shall be deemed to be incurred on the date the acquired Person is merged or consolidated with or into Lineage OP or any of its Subsidiaries or becomes a Subsidiary of Lineage OP or the date of the related acquisition, as the case may be. “Additional Amounts” shall have the meaning ascribed thereto in Section 2.10. “Additional Notes” means additional Notes (other than the Initial Notes) issued under the Indenture in accordance with Sections 2.3, 2.7 and 8.1 hereof, as part of the same series as the Initial Notes. “Affiliate” of any specified person means any other person directly or indirectly controlling or controlled by or under common control with such specified person. For the purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”), as used with respect to any person, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such person, whether through the ownership of voting securities or by agreement or otherwise. “Agent” means any Registrar, co-registrar, Transfer Agent, Paying Agent or additional paying agent and authenticating agent.

3 “Applicable Procedures” means, with respect to any transfer or exchange of or for beneficial interests in any Global Note, the rules and procedures of the Depositary that apply to such transfer or exchange. “Authentication Order” means a Company Order delivered to the Trustee to authenticate and deliver the Notes, signed in the name of the Company by an Officer of the Company. “Bankruptcy Law” shall have the meaning ascribed thereto in Section 7.1. “Business Day” means any day, other than a Saturday, Sunday or any other day on which banking institutions in New York, New York, London, United Kingdom or the place of payment are authorized or obligated by law or executive order to close and on which the Trans-European Automated Real-Time Gross Settlement Express Transfer system (known as T2) or any successor or replacement thereto, is open. “Capitalized Property Value” means, with respect to any Person, the sum of (1) with respect to Properties that are owned or subject to a ground lease, (i) Property EBITDA of such person for such Properties for the four full consecutive fiscal quarters ended on the last day of the then most recently ended fiscal quarter covered in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC, as the case may be, divided by (ii) 7.0%, plus (2) with respect to Properties that are Leased Properties, (i) Property EBITDA of such person for such Properties for the four full consecutive fiscal quarters ended on the last day of the then most recently ended fiscal quarter covered in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC, as the case may be, divided by (ii) 9.0%; provided that, with respect to any Property that has been a Stabilized Property for at least one full fiscal quarter but less than four full consecutive fiscal quarters as of such date, the Capitalized Property Value of such Property shall be calculated using the Property EBITDA for the most recent full fiscal quarter or quarters commencing with the first full fiscal quarter following the date on which such Property became a Stabilized Property and ending on the last day of the then most recently ended fiscal quarter covered in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC, as the case may be, that is attributable to such Property on an annualized basis. “CBOI” means the Central Bank of Ireland. “CFC” means a controlled foreign corporation within the meaning of Section 957 of the Code. “CFC Holding Company” means any Subsidiary that has no material assets other than equity interests or indebtedness of one or more CFCs. “Clearstream” means Clearstream Banking, S.A. “Code” means the U.S. Internal Revenue Code of 1986, as amended. “Common Depositary” means the Person that is designated by the Depositary to act as the Common Depositary for the Global Notes. U.S. Bank Europe DAC shall be the initial Common Depositary until a successor shall have been appointed and become such pursuant to the applicable

4 provisions of this Indenture, and thereafter, “Common Depositary” shall mean or include such successor. “Company Order” means a written order signed in the name of the Company by an Officer of the Company and delivered to the Trustee. “Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation a German government bond (Bundesanleihe) whose maturity is closest to the Par Call Date, or if an independent investment bank selected by the Company in its discretion determines that such similar bond is not in issue, such other German government bond as such independent investment bank may, with the advice of three brokers of, and/or market makers in, German government bonds selected by such independent investment bank, determine to be appropriate for determining the Comparable Government Bond Rate. “Comparable Government Bond Rate” means, with respect to any redemption date, the price, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded upwards), at which the gross redemption yield on the notes, if they were to be purchased at such price on the third business day prior to the date fixed for redemption, would be equal to the gross redemption yield on such business day of the Comparable Government Bond on the basis of the middle market price of the Comparable Government Bond prevailing at 11:00 a.m. (London time) on such business day as determined by an independent investment bank selected by the Company. “Corporate Trust Office” means the designated office of the Trustee at which at any time its corporate trust business relating to this Supplemental Indenture shall be administered, which office at the date hereof is located at 633 West 5th Street, 24th Floor, Los Angeles, CA 90071, United States of America, Attention: B. Scarbrough (Lineage Notes Administrator), or such other address as the Trustee may designate from time to time by notice to the Holders and the Company, or the designated corporate trust office of any successor Trustee (or such other address as such successor Trustee may designate from time to time by notice to the Holders and the Company). “Customary Recourse Exceptions” means, with respect to any Debt, personal recourse that is limited to fraud, misrepresentation, misapplication of cash, waste, environmental claims and liabilities, prohibited transfers, violations of single-purpose entity covenants, voluntary insolvency proceedings and other circumstances customarily excluded by institutional lenders from exculpation provisions and/or included in separate guaranty or indemnification agreements in non-recourse financing of real property. “Debt” means, without duplication, with respect to any person, such person’s Pro Rata Share of the aggregate principal amount of indebtedness in respect of: (1) borrowed money evidenced by bonds, notes, debentures or similar instruments, as determined in accordance with GAAP, (2) indebtedness secured by any mortgage, pledge, lien, charge, encumbrance or any security interest existing on Property or other assets owned by such person or any of its Subsidiaries directly, or indirectly through unconsolidated joint ventures, as determined in accordance with GAAP,

5 (3) reimbursement obligations in connection with any letters of credit actually issued and called, and (4) any lease of property by such person or any of its Subsidiaries as lessee which is reflected in such person’s balance sheet as a finance lease, in accordance with GAAP; provided, that Debt also includes, to the extent not otherwise included, any obligation by such Person or any of its Subsidiaries to be liable for, or to pay, as obligor, guarantor or otherwise, items of indebtedness of another Person (other than Lineage OP or any Subsidiary) described in clauses (1) through (4) above (or, in the case of any such obligation made jointly with another Person other than obligations to be liable for the Debt of another Person solely as a result of Customary Recourse Exceptions (it being understood that Debt shall be deemed to be incurred by such person whenever such Person shall create, assume, guarantee or otherwise become liable in respect thereof), such Person’s or its Subsidiary’s allocable portion of such obligation based on its ownership interest in the related real estate assets or such other applicable assets); and provided, further, that Debt excludes Intercompany Debt and operating lease liabilities reflected in such Person’s balance sheet in accordance with GAAP. “Defaulted Interest” shall have the meaning ascribed thereto in Section 2.5. “Definitive Note” means a certificated Note registered in the name of the Holder thereof and issued in accordance with Section 3.2, substantially in the form of Exhibit A1 or Exhibit A2 hereto except that such Note shall not bear the Global Note legend and shall not have the “Schedule of Exchanges of Interests in the Global Note” attached thereto. “Depositary” means, with respect to the Notes, any of Euroclear and Clearstream, their respective nominees and any successor thereto. “Development Property” means a Property acquired or otherwise held for development or redevelopment on which the improvements related to the development or redevelopment have not been completed on the date of determination; provided, that such Property shall cease to be a Development Property, and shall thereafter be considered a “Stabilized Property,” upon the first to occur of (i) the date that is six full consecutive fiscal quarters following substantial completion (including issuance of a temporary or permanent certificate of occupancy for the improvements under construction permitting the use and occupancy for their regular intended uses) of such Property and (ii) the first day of the first fiscal quarter following the date on which such Development Property has achieved an Occupancy Rate of at least 85%. For avoidance of doubt, any Property that is not (and has never been) a Development Property shall be considered a “Stabilized Property” from the first day of the first fiscal quarter following the date on which such Property has achieved an Occupancy Rate of at least 85%, and any vacant land adjacent to and forming part of a Property may become a Development Property if, as of any date of determination, the same is being developed with a new, improved or expanded facility. Similarly, a Stabilized Property may become a Development Property if, as of the date of determination, the same is being replaced, restored, remodeled or rebuilt where the purpose and effect of such work is to provide a functionally new, improved or expanded facility.

6 “EBITDA” means, with respect to any Person, for any period and without duplication, net income (loss) of such Person for such period excluding the impact of the following amounts with respect to any Person (but only to the extent included in determining net income (loss) for such period): (1) depreciation and amortization expense (including amortization of right-of-use assets associated with finance leases of property), amortization of deferred charges and other non-cash charges; (2) Interest Expense; (3) income tax expense; (4) impairments, prepayment penalties and all transaction costs and fees incurred in connection with any capital markets offering, debt or equity financing or amendment thereto, business combination, acquisition (including integration costs), disposition, recapitalization or similar transaction (regardless of whether such transaction is completed); (5) extraordinary, non-recurring or other unusual items, as determined by us in good faith, including without limitation, property valuation losses, gains and losses from the sale of assets, gains or losses from the early extinguishment of indebtedness, write-offs and forgiveness of indebtedness, redemption or exchange of indebtedness, lease terminations and foreign currency translation gains or losses; (6) severance and other non-recurring restructuring charges; (7) the income, expense, gain or loss attributable to transactions involving derivative instruments that do not qualify for hedge accounting in accordance with GAAP; (8) the effect of any charge resulting from a change in accounting principles in determining net income (loss); (9) amounts expensed pursuant to the terms of the Operating Agreement; and (10) equity in net income of non-controlling interests. EBITDA will be adjusted, without duplication, to give pro forma effect, in the case of any acquisition or disposition of any asset or group of assets or other placement of any asset or group of assets in service or removal of any asset or group of assets from service by Lineage OP or any of its Subsidiaries since the first day of the applicable period to the date of determination, whether by merger, stock purchase or sale or asset purchase or sale or otherwise, to include or exclude, as the case may be, any EBITDA earned or eliminated as a result of such acquisition, disposition, placement in service or removal from service as if such acquisition, disposition, placement in service or removal from service had occurred as of the first day of such period. “Equity Interests” means, with respect to any Person, any share of capital stock of (or other ownership or profit interests in) such Person, any warrant, option or other right for the purchase or other acquisition from such Person of any share of capital stock of (or other ownership

7 or profit interests in) such Person, any security convertible into or exchangeable for any share of capital stock of (or other ownership or profit interests in) such Person or warrant, right or option for the purchase or other acquisition from such Person of such shares (or such other interests), and any other ownership or profit interest in such Person (including, without limitation, partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such share, warrant, option, right or other interest is authorized or otherwise existing on any date of determination. “Euroclear” means Euroclear S.A./N.V., as operator of the Euroclear system. “European Government Obligations” means (A) any security that is (1) a direct and unconditional obligation of the European Union, (2) backed by the European Union’s budgetary and cash resources and by the European Commission’s right to call for additional resources from member states, (3) a direct obligation of any member state of the European Union, for the payment of which the full-faith-and-credit of such country is pledged or (4) an obligation of a person controlled or supervised by and acting as an agency or instrumentality of any such country, the payment of which is unconditionally guaranteed as a full-faith-and-credit obligation by such country, which, in any case under the preceding clauses (1) through (4), is not callable or redeemable at the option of the issuer thereof and (B) certificates, depositary receipts or other instruments which evidence a direct ownership interest in obligations described in clause (A) above or in any specific principal or interest payments due in respect thereof. With respect to the Notes, European Government Obligations will constitute Foreign Government Obligations under the Base Indenture. “Event of Default” shall have the meaning ascribed thereto in Section 7.1. “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. “Excluded Subsidiary” means any Subsidiary that is (i) a CFC or CFC Holding Company, (ii) a Subsidiary of a CFC, (iii) any other entity if the provision of a guarantee by such entity would reasonably be expected to result in material adverse tax consequences to the Parent or its Subsidiaries as reasonably determined by the Parent or (iv) prohibited, by applicable law, rule or regulation or by any contractual obligation existing on the date of this Supplemental Indenture or existing at the time of acquisition thereof after the date of this Supplemental Indenture (so long as such prohibition did not arise as part of such acquisition), in each case, from guaranteeing the notes or which would require governmental (including regulatory) consent, approval, license or authorization to provide a guarantee unless such consent, approval, license or authorization has been received (but without obligation to seek the same). “Fair Market Value” means, (i) with respect to a security listed (or an unlisted convertible security that is convertible into a security listed) on Nasdaq or have trading privileges on the New York Stock Exchange, the NYSE American, or another recognized national United States securities exchange, the London Stock Exchange, Euronext or another recognized European securities exchange, the price of such security as reported on such exchange or market by any widely recognized reporting method customarily relied upon by financial institutions, and (ii) with respect to any other asset, book value (determined in accordance with GAAP).

8 “FATCA” shall have the meaning ascribed thereto in Section 2.10. “GAAP” means accounting principles generally accepted in the United States of America, consistently applied, as in effect from time to time. “Global Integrated Solutions Segment” means, with respect to any Person, the businesses comprising the global integrated solutions segment (as may be renamed, amended, supplemented or otherwise modified from time to time) of such Person reported in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC. “Global Note Legend” means the legend set forth in Section 3.2(f), which is required to be placed on all Global Notes issued under the Indenture. “Global Notes” means, individually and collectively, each of the Notes deposited with or on behalf of and registered in the name of the Common Depositary or its nominee, substantially in the form of Exhibit A1 or Exhibit A2 hereto and that bears the Global Note Legend and that has the “Schedule of Exchanges of Interests in the Global Note” attached thereto, issued in accordance with the Indenture. “Holders” shall have the meaning ascribed thereto in Section 2.4. “Incur” means, with respect to any Debt or other obligation of any Person, to create, assume, guarantee or otherwise become liable in respect of such Debt or other obligation, and “Incurrence” and “Incurred” have the meanings correlative to the foregoing. “Indenture” means the Base Indenture, as supplemented by this Supplemental Indenture, and as further supplemented, amended or restated. “Indirect Participant” means a Person who holds a beneficial interest in a Global Note through a Participant. “Initial Notes” means the €700,000,000 aggregate principal amount of Notes issued under this Supplemental Indenture on the date hereof. “Integrated Solutions Value” means, with respect to any Person, (i) the sum of the portion of EBITDA attributable to each of the businesses comprising the Global Integrated Solutions Segment of such Person for the four full consecutive fiscal quarters ended on the last day of the then most recently ended fiscal quarter covered in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC, multiplied by (ii) 8.5; provided, however, that if the Global Integrated Solutions Segment of such Person is no longer reported in such annual or quarterly report, Lineage OP shall calculate Integrated Solutions Value based on the sum of the portion of EBITDA attributable to each of the businesses that previously comprised the Global Integrated Solutions Segment prior to such date as determined by the Parent in good faith. “Intercompany Debt” means, as of any date, Debt to which the only parties are any of the Parent, Lineage OP or any of their respective Subsidiaries.

9 “Intercreditor Agreement” means that certain Intercreditor Agreement, dated as of August 20, 2021, among JPMorgan Chase Bank, N.A., as administrative agent, for each of the lenders under the Principal Credit Agreement (as defined therein), each of the holders of our senior unsecured notes and any Additional Creditors (as defined therein) party thereto. “interest” means, when used with reference to the Notes, any interest payable under the terms of the Notes. “Interest Expense” means, with respect to any Person, for any period, such Person’s Pro Rata Share of interest expense for such period, with other adjustments as are necessary to exclude: (i) the effect of items classified as extraordinary items, in accordance with GAAP; (ii) non-cash amortization or write-off of debt issuance costs or debt discount; (iii) prepayment penalties; (iv) non-cash swap ineffectiveness charges and (v) any additional interest with respect to failure to comply with any registration rights agreement owing with respect to any securities. “Interest Payment Date” shall have the meaning ascribed thereto in Section 2.4. “Leased Property” means any Property that operates as a temperature-controlled warehouse or is Development Property or undeveloped land and that is leased by a person pursuant to a lease (other than a ground lease). “Lien” means any mortgage, deed of trust, lien, charge, pledge, security interest, security agreement, or other encumbrance of any kind other than a Permitted Lien or any interest which is a Lien by virtue only of the operation of section 12(3) of the Personal Property Securities Act 2009 (Cth) (Australia) which does not in substance secure the payment or performance of an obligation. “Lineage OP” has the meaning assigned to it in the preamble to this Supplemental Indenture. “Marketable Securities” means: (i) common or preferred Equity Interests which are listed on Nasdaq or have trading privileges on the New York Stock Exchange, the NYSE American, or another recognized national United States securities exchange, the London Stock Exchange, Euronext or another recognized European securities exchange; (ii) convertible securities which can be converted at any time into common or preferred Equity Interests of the type described in the immediately preceding clause (i); and (iii) securities evidencing indebtedness issued by persons which have an investment grade credit rating by a nationally recognized statistical rating organization; provided that Marketable Securities shall not include any securities that are considered cash equivalents. “Nasdaq” means the Nasdaq Global Market. “Non-Recourse Debt” means Debt of a joint venture or Subsidiary of Lineage OP (or an entity in which Lineage OP is the general partner or managing member) that is directly or indirectly secured by real estate assets or other real estate-related assets (including equity interests) of the joint venture or Subsidiary of Lineage OP (or entity in which Lineage OP is the general partner or managing member) that is the borrower and is non-recourse to the Parent, Lineage OP or any Subsidiary of Lineage OP (other than pursuant to a Permitted Non-Recourse Guarantee and other

10 than with respect to the joint venture or Subsidiary of Lineage OP (or entity in which Lineage OP is the general partner or managing member) that is the borrower); provided, further, that, if any such Debt is partially recourse to Lineage, Lineage OP or any Subsidiary of Lineage OP (other than pursuant to a Permitted Non-Recourse Guarantee and other than with respect to the joint venture or Subsidiary of Lineage OP (or entity in which Lineage OP is the general partner or managing member) that is the borrower) and therefore does not meet the criteria set forth above, only the portion of such Debt that does meet the criteria set forth above shall constitute “Non-Recourse Debt.” “Note Guarantee” means the guarantee by each of the Guarantors of the Company’s obligations under the Indenture and the Notes, executed pursuant to the provisions of this Supplemental Indenture. “Notes” has the meaning assigned to it in the preamble to this Supplemental Indenture. The Initial Notes and the Additional Notes shall be treated as a single class for all purposes under the Indenture, and unless the context otherwise requires, all references to the Notes shall include the Initial Notes and any Additional Notes. “Occupancy Rate” means at any time, with respect to any Property, the ratio, expressed as a percentage, of (i) the rentable operating square footage of such Property actually leased by tenants paying rent at rates not materially less than rates generally prevailing at the time the applicable lease was entered into, pursuant to binding leases as to which no default or Event of Default has occurred and is continuing to (ii) the aggregate rentable operating square footage of such Property. “Offering Memorandum” means the final offering memorandum of the Company, dated November 19, 2025. “Officer” means the Chair of the Board of Directors, any Co-Executive Chairman, the Chief Executive Officer, the President, the Chief Financial Officer, the Chief Legal Officer, the General Counsel, any Deputy or Assistant General Counsel, the Treasurer or any Assistant Treasurer, the Controller or any Assistant Controller, the Corporate Secretary or any Assistant Corporate Secretary, Director and Regional Vice President and any Executive Vice President, Senior Vice President or Vice President of the Parent or any Guarantor, as the case may be, or any board member or Authorized Signatory of the Company. “Officer’s Certificate” means a certificate signed by any Officer of the Company, the Parent or any Guarantor, as applicable. “Operating Agreement” means, collectively, (i) that certain Seventh Amended and Restated Operating Services Agreement, dated as of August 3, 2020, by and between Lineage Logistics Holdings, LLC and Bay Grove Management Company, LLC, (ii) that certain Sixteenth Amended and Restated Operating Agreement, dated as of October 11, 2023, by and between Lineage OP and Bay Grove Management Company, LLC, (iii) that certain Transition Services Agreement, dated July 24, 2024, by and between Lineage Logistics Holdings, LLC and Bay Grove Management Company, LLC, and (iv) that certain Expense Reimbursement and Indemnification Agreement, dated July 24, 2024, by and among the Parent, BG Lineage Holdings, LLC, BG

11 Lineage Holdings LHR, LLC and Bay Grove Management Company, LLC, in each case, as the same may be amended, supplemented or otherwise modified from time to time, and any successor agreement thereto (whether by renewal, replacement or otherwise) that the Parent in good faith designates to be an operating agreement (taking into account the nature of the agreement and such other factors as the Parent deems reasonable in light of the circumstances), such designation (or the designation that at a given time there is no operating agreement) to be made by an Officer’s Certificate delivered to the Trustee. “Opinion of Counsel” means a written opinion of legal counsel, who is acceptable to the Trustee. The counsel may be an employee of or counsel to the Company or the Parent. The opinion may contain customary limitations, conditions and exceptions. “Par Call Date” means September 26, 2031. “Parent” has the meaning assigned to it in the preamble to this Supplemental Indenture. “Participant” means, with respect to the Depositary, a Person who has an account with the Depositary, respectively. “Paying Agent” has the meaning assigned to it in the preamble to this Supplemental Indenture. “Permitted Lien” means an operating lease, any Lien securing taxes, assessments and similar charges, any mechanics’ lien and other similar Lien and any Lien that secures Debt of the Parent, Lineage OP or any of their respective Subsidiaries owed to Lineage OP or any Guarantor. “Permitted Non-Recourse Guarantees” means customary completion or budget guarantees or indemnities (including by means of separate indemnification agreements and carve-out guarantees) provided under Non-Recourse Debt in the ordinary course of business by the Parent, Lineage OP or any Subsidiary of Lineage OP in financing transactions that are directly or indirectly secured by real estate assets or other real estate-related assets (including equity interests) of a Subsidiary of Lineage OP (or entity in which Lineage OP is the general partner or managing member), in each case that is the borrower in such financing, but is non-recourse to the Parent, Lineage OP or any of Lineage OP’s other Subsidiaries, except for customary completion or budget guarantees or indemnities (including by means of separate indemnification agreements or carve-out guarantees) as are consistent with customary industry practice (such as environmental indemnities and recourse triggers based on violation of transfer restrictions and other customary exceptions to nonrecourse liability). “Person” means any individual, corporation, limited liability company, partnership, joint venture, association, joint-stock company, trust, unincorporated organization, government or any agency or political subdivision thereof or any other entity. “principal” means the principal of the Notes plus, when appropriate, the premium, if any, on, and any Additional Amounts in respect of, the Notes. “Principal Credit Agreement” means the Amended and Restated Revolving Credit and Term Loan Agreement, dated as of February 15, 2024, by and among Lineage Logistics, LLC, the

12 borrowers party thereto, Lineage Logistics Holdings, LLC, the Parent, Lineage OP, JPMorgan Chase Bank, N.A., as administrative agent, and the other lending institutions party thereto, as the same may be amended, supplemented or otherwise modified from time to time, and any successor credit agreement thereto (whether by renewal, replacement, refinancing or otherwise) that the Parent in good faith designates to be the Parent’s principal credit agreement (taking into account the maximum principal amount of the credit facility provided thereunder, the recourse nature of the agreement and such other factors as the Parent deems reasonable in light of the circumstances), such designation (or the designation that at a given time there is no principal credit agreement) to be made by an Officer’s Certificate delivered to the trustee. “Private Placement Legend” means the legend set forth in Section 3.2(g)(2) hereof to be placed on all Notes issued under this Supplemental Indenture except where otherwise permitted by the provisions of this Supplemental Indenture. “Pro Rata Share” means, with respect to any Person, any applicable figure or measure of such Person and its Subsidiaries on a consolidated basis, less any portion attributable to non-controlling interests, plus such Person’s or its Subsidiaries’ allocable portion of such figure or measure, based on their ownership interest, of unconsolidated joint ventures. “Property” means a parcel (or group of related parcels) of real property. “Property EBITDA” means, with respect to any Person, for any period, such Person’s Pro Rata Share of EBITDA for such period adjusted to add back the impact of corporate level general and administrative expenses. “QIB” means a “qualified institutional buyer” as defined in Rule 144A. “Record Date” shall have the meaning ascribed thereto in Section 2.4. “Redemption Date” means, with respect to any Note or portion thereof to be redeemed in accordance with the provisions of Section 4.1 or 4.2, the date fixed for such redemption in accordance with the provisions of Section 4.1 or 4.2, as applicable. “Redemption Price” means, with respect to any Note or portion thereof to be redeemed in accordance with the provisions of Section 4.1 or 4.2, the redemption price (expressed as a percentage of principal amount and rounded to three decimal places) calculated in accordance with the applicable provision of Section 4.1 or 4.2. “Registration Rights Agreement” means the Registration Rights Agreement, dated as of November 26, 2025, among the Company, the Guarantors and the other parties named on the signature pages thereof, as such agreement may be amended, modified or supplemented from time to time. “Regulation S” means Regulation S promulgated under the Securities Act. “Regulation S Global Note” means a Regulation S Temporary Global Note or Regulation S Permanent Global Note, as appropriate.

13 “Regulation S Permanent Global Note” means a permanent Global Note in the form of Exhibit A1 hereto bearing the Global Note Legend and the Private Placement Legend and deposited with or on behalf of and registered in the name of the Common Depositary or its nominee, issued in a denomination equal to the outstanding principal amount of the Regulation S Temporary Global Note upon expiration of the Restricted Period. “Regulation S Temporary Global Note” means a temporary Global Note in the form of Exhibit A2 hereto deposited with or on behalf of and registered in the name of the Common Depositary or its nominee, issued in a denomination equal to the outstanding principal amount of the Notes initially sold in reliance on Rule 903 of Regulation S. “Relevant Taxing Jurisdiction” means the Netherlands or the United States (or, in each case, any political subdivision of or taxing authority thereof or therein having power to tax). “Restricted Period” means the 40-day distribution compliance period as defined in Regulation S. “Rule 144” means Rule 144 promulgated under the Securities Act. “Rule 144A” means Rule 144A promulgated under the Securities Act. “Rule 903” means Rule 903 promulgated under the Securities Act. “Rule 904” means Rule 904 promulgated under the Securities Act. “SEC” means the Securities and Exchange Commission. “Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, as in effect from time to time. “Significant Subsidiary” of any specified Person means any Subsidiary in which such Person has invested at least $100.0 million in capital. “Stabilized Property” has the meaning specified in the definition of “Development Property.” “Subsidiary” means, for any Person (but excluding an individual, government or any agency or political subdivision thereof), any corporation, partnership, limited liability company or other entity of which at least a majority of the Equity Interests having by the terms thereof ordinary voting power to elect a majority of the board of directors or other individuals performing similar functions of such corporation, partnership, limited liability company or other entity (without regard to the occurrence of any contingency) is at the time directly or indirectly owned or controlled by such Person or one or more Subsidiaries of such Person or by such Person and one or more Subsidiaries of such Person, and shall include all Persons the accounts of which are consolidated with those of such Person pursuant to GAAP. “Subsidiary Guarantor” means Lineage Logistics Holdings, LLC and each Subsidiary of the Parent that guarantees or is otherwise obligated in respect of the Principal Credit Agreement

14 (other than the Company, Lineage OP and any Excluded Subsidiary). As of the date of this Supplemental Indenture, “Subsidiary Guarantor” means each of Lineage Logistics Holdings, LLC, Lineage Logistics, LLC, Lineage Logistics Services, LLC, Lineage Logistics Canada Holdings, LLC, Lineage AUS RE Holdings, LLC, Lineage Columbia Mezz, LLC, Lineage Logistics MTC, LLC, Lineage WA Columbia RE, LLC, Lineage Logistics Canada Holdings Ltd., Boreas Logistics Holdings B.V., Lineage Treasury Europe B.V., Emergent Cold Midco Pty Ltd. “Taxes” shall have the meaning ascribed thereto in Section 2.10. “Total Assets” means, with respect to any Person, as of any date, the sum (without duplication) of: (1) the Capitalized Property Value of such Person and its Subsidiaries, excluding Capitalized Property Value attributable to Properties acquired or disposed of by such Person or Subsidiary during the four full consecutive fiscal quarters ending on such date and Development Properties; (2) the Integrated Solutions Value of such person and its Subsidiaries; (3) all cash and cash equivalents (excluding tenant deposits and other cash and cash equivalents the disposition of which is restricted) of such Person and its Subsidiaries at such time; (4) the Pro Rata Share of such Person or its Subsidiaries of the current undepreciated book value of Development Properties held by such Person or Subsidiary and all land held for development by such Person or Subsidiary; (5) the Pro Rata Share of the purchase price paid by such Person or any of its Subsidiaries (less the Pro Rata Share of any amounts paid to such Person or such Subsidiary as a purchase price adjustment, held in escrow, retained as a contingency reserve, or in connection with other similar arrangements, and without regard to allocations of property purchase prices pursuant to Statement of Financial Accounting Standards No. 141 or other provisions of GAAP) for any Property or business acquired by Lineage OP or such Subsidiary during the four full consecutive fiscal quarters ending on such date; (6) the contractual purchase price of Properties of such Person and its Subsidiaries subject to purchase obligations, repurchase obligations, forward commitments and unfunded obligations to the extent such obligations and commitments are included in determinations of Debt; and (7) the Fair Market Value of all Marketable Securities owned by such Person or any of its Subsidiaries, plus all other assets of such Person and its Subsidiaries (the value of which is determined in accordance with GAAP but excluding assets classified as non-lease intangibles under GAAP), provided, however, that such other assets shall not include the right-of-use assets associated with an operating lease in accordance with GAAP. In determining the Total Assets of Lineage OP, Lineage OP shall have the option to include Capitalized Property Value under clause (a) above from any such Properties that are otherwise subject to valuation under clause (d) or (e) above; provided that, if such election is made with

15 respect to any Property subject to valuation under clause (e) above and such Property is owned for at least one full fiscal quarter but less than four full consecutive fiscal quarters as of such date, the Capitalized Property Value of such Property shall be calculated using the Property EBITDA for the most recent full fiscal quarter or quarters commencing with the first full fiscal quarter following the date on which such Property was acquired and ending on the last day of the then most recently ended fiscal quarter covered in the Parent’s annual or quarterly report most recently furnished to Holders of the Notes or filed with the SEC, as the case may be, that is attributable to such Property on an annualized basis; provided, further, that if such election is made, any value attributable to such Properties under clause (d) or (e) above shall be excluded from the determination of the amount under clause (d) or (e). For avoidance of doubt, an individual parcel of Property can be the site of one or more Properties, and separate portions of the same parcel of Property can (i) contribute to Property EBITDA in calculating Capitalized Property Value in clause (a) above, (ii) be a Development Property or (iii) be land held for development, in each case, as determined by us in good faith. “Total Unencumbered Assets” means, as of any date, those assets within Total Assets that are not subject to a Lien; provided that in determining Total Unencumbered Assets, all investments in unconsolidated entities shall be excluded. “Uniform Fraudulent Conveyance Act” means any applicable federal, provincial or state fraudulent conveyance legislation and any successor legislation. “Uniform Fraudulent Transfer Act” means any applicable federal, provincial or state fraudulent transfer legislation and any successor legislation. “Unsecured Debt” means Debt that is not secured by a Lien on any property or assets of Lineage OP or any of its Subsidiaries. “U.S. Government Obligations” means securities which are direct obligations of, or guaranteed by, the United States of America for the payment of which its full faith and credit is pledged and which are not callable or redeemable at the option of the issuer thereof, and shall also include a depositary receipt issued by a bank or trust company as custodian with respect to any such U.S. Government Obligation or a specific payment of interest on or principal of any such U.S. Government Obligation held by such custodian for the account of the holder of a depository receipt, provided that (except as required by law) such custodian is not authorized to make any deduction from the amount payable to the holder of such depositary receipt from any amount received by the custodian in respect of the U.S. Government Obligation evidenced by such depositary receipt. ARTICLE II TERMS OF THE SECURITIES Section 2.1 Title of the Securities. There shall be a Series of Securities designated the “4.125% Senior Notes due 2031.” Section 2.2 Price.

16 The Initial Notes shall be issued at a public offering price of 99.324% of the principal amount thereof, other than any offering discounts pursuant to the initial offering and resale of the Notes. Section 2.3 Limitation on Initial Aggregate Principal Amount; Further Issuances. The aggregate principal amount of the Notes initially shall be limited to €700,000,000. The Company may, without notice to or consent of the Holders, issue Additional Notes from time to time in the future in an unlimited principal amount, subject to compliance with the terms of the Indenture. Nothing contained in this Section 2.3 or elsewhere in this Supplemental Indenture, or in the Notes, is intended to or shall limit execution by the Company or authentication or delivery by the Trustee of Notes under the circumstances contemplated by Sections 2.7, 2.8, 2.11, 3.6 or 9.6 of the Base Indenture. Section 2.4 Interest and Interest Rates; Stated Maturity of Notes. (a) The Notes shall bear interest at the rate of 4.125% per year. Interest on the Notes will accrue from November 26, 2025 and will be payable annually in arrears on November 26 of each year, commencing on November 26, 2026 (each such date being an “Interest Payment Date”), to the persons in whose names the Notes are registered in the security register (the “Holders”) at the close of business on the Business Day immediately preceding the applicable Interest Payment Date (each such date being a “Record Date”). Interest on the Notes will be computed on the basis of the actual number of days in the period for which interest is being calculated and the actual number of days from and including the last date on which interest was paid on the notes (or November 26, 2025 if no interest has been paid on the Notes), to but excluding the next scheduled Interest Payment Date. This payment convention is referred to as ACTUAL/ACTUAL (ICMA) as defined in the rulebook of the International Capital Market Association. (b) If any Interest Payment Date, Redemption Date or Stated Maturity falls on a day that is not a Business Day, the required payment of principal and/or interest may be made on the next succeeding Business Day as if it were made on the date the payment was due, and no interest shall accrue or be payable to Holders on such payment for the period from and after that Interest Payment Date, Redemption Date or Stated Maturity, as the case may be, to the date of such payment on the next succeeding Business Day. (c) The Stated Maturity of the Notes shall be November 26, 2031. Section 2.5 Method of Payment. Principal and interest shall be payable at the Corporate Trust Office of the Paying Agent in Dublin, Ireland. The Company shall pay interest (i) on any Notes in certificated form by check mailed to the address of the Holder entitled thereto; provided, however, that a Holder of any Notes in certificated form in the aggregate principal amount of more than €3.0 million may specify by written notice to the Company (with a copy to the Trustee) that it pay interest by wire transfer of immediately available funds to the account specified by the Holder in such notice, or (ii) on any

17 Global Note by wire transfer of immediately available funds to the account of the Common Depositary or its nominee. Any interest on any Note which is payable, but is not punctually paid or duly provided for, on any Interest Payment Date (herein called “Defaulted Interest”) shall forthwith cease to be payable to the Holder registered as such on the relevant Record Date, and such Defaulted Interest shall be paid by the Company, at its election in each case, as provided in clause (a) or (b) below: (a) The Company may elect to make payment of any Defaulted Interest to the persons in whose names the Notes are registered at 5:00 p.m., London time, on a special record date for the payment of such Defaulted Interest, which shall be fixed in the following manner. The Company shall notify the Trustee in writing of the amount of Defaulted Interest proposed to be paid on each Note and the date of the proposed payment (which shall be not less than 25 calendar days after the receipt by the Trustee of such notice, unless the Trustee shall consent to an earlier date), and at the same time the Company shall deposit with the Trustee or the Paying Agent an amount of money equal to the aggregate amount to be paid in respect of such Defaulted Interest or shall make arrangements satisfactory to the Trustee or the Paying Agent for such deposit on or prior to the date of the proposed payment, such money when deposited to be held in trust for the benefit of the persons entitled to such Defaulted Interest as in this clause provided. Thereupon the Company shall fix a special record date for the payment of such Defaulted Interest which shall be not more than 15 calendar days and not less than 10 calendar days prior to the date of the proposed payment, and not less than 10 calendar days after the receipt by the Trustee of the notice of the proposed payment (unless the Trustee shall consent to an earlier date). The Company shall promptly notify the Trustee of such special record date and shall cause notice of the proposed payment of such Defaulted Interest and the special record date therefor to be sent to each Holder at its address as it appears in the register, not less than 10 calendar days prior to such special record date. Notice of the proposed payment of such Defaulted Interest and the special record date therefor having been so mailed, such Defaulted Interest shall be paid to the persons in whose names the Notes are registered at 5:00 p.m., London time, on such special record date and shall no longer be payable pursuant to the following clause (b) of this Section 2.5. (b) The Company may make payment of any Defaulted Interest in any other lawful manner not inconsistent with the requirements of any securities exchange or automated quotation system on which the Notes may be listed or designated for issuance, and upon such notice as may be required by such exchange or automated quotation system, if, after notice given by the Company to the Trustee of the proposed payment pursuant to this clause, such manner of payment shall be deemed practicable by the Trustee. Section 2.6 Currency; Unavailability of Euros. Principal and interest on the Notes shall be payable in euros. If the euro is unavailable to the Company due to the imposition of exchange controls or other circumstances beyond the Company’s control or if the euro is no longer being used by the then member states of the European Monetary Union that have previously adopted the euro as their currency or for the settlement of transactions by public institutions of or within the international banking community, then all payments in respect of the Notes will be made in U.S. dollars, and any payments that would be made in European Government Obligations will be made in U.S. Government Obligations, in each case, until the euro is again available to the Company or so used. The amount payable on any date

18 in euros will be converted into U.S. dollars at the rate mandated by the U.S. Federal Reserve Board as of the close of business on the second Business Day prior to the relevant payment date or, in the event the U.S. Federal Reserve Board has not mandated a rate of conversion, on the basis of the most recent U.S. dollar/euro exchange rate published in The Wall Street Journal on or prior to the second Business Day prior to the relevant payment date, or in the event The Wall Street Journal has not published such exchange rate, such rate as determined in our sole discretion on the basis of the most recently available market exchange rate for the euro. Neither the Trustee nor the Paying Agent shall have any responsibility for monitoring exchange rates or effecting conversions. Section 2.7 Additional Notes. The Company will be entitled, without the consent of, or notice to, any Holders of the Notes, upon delivery of an Officer’s Certificate, Opinion of Counsel and Authentication Order, subject to its compliance with Section 6.1, to issue Additional Notes under the Indenture that will have identical terms to the Initial Notes issued on the date of the Indenture other than with respect to the date of issuance, issue price and, if applicable, the date from which interest on such Additional Notes will begin to accrue and the initial interest payment date; provided, however, that if and for so long as such Additional Notes will not be fungible with the Initial Notes for U.S. federal income tax or securities law purposes, such Additional Notes will have a separate ISIN. Such Additional Notes will rank equally and ratable in right of payment and will be treated as a single series for all purposes under the Indenture. With respect to any Additional Notes, the Company will set forth in a resolution of the board of directors of the Parent acting on behalf of the Company and an Officer’s Certificate, a copy of each of which will be delivered to the Trustee, the following information: (a) the aggregate principal amount of such Additional Notes to be authenticated and delivered pursuant to the Indenture; and (b) the issue price, the issue date, the ISIN of such Additional Notes, the date from which interest shall accrue and the initial interest payment date. Section 2.8 Redemption. The Notes may be redeemed at the option of the Company prior to the Stated Maturity as provided in Article IV. Section 2.9 No Sinking Fund. The provisions of Article XI of the Base Indenture shall not be applicable to the Notes. Section 2.10 Additional Amounts. (a) All payments of principal and interest in respect of the Notes will be made free and clear of, and without deduction or withholding for or on account of, any present or future taxes, duties, assessments or other governmental charges of whatsoever nature (collectively, “Taxes”) required to be deducted or withheld, unless such withholding or deduction is then required by law or the official interpretation or administration thereof.

19 (b) In the event any withholding or deduction on payments in respect of the Notes for or on account of any present or future Tax is required to be deducted or withheld by the Netherlands, the Company will pay such additional amounts on the Notes as will result in receipt by each Holder of such amounts (after all such withholding or deduction, including on any additional amounts) as would have been received by such Holder had no such withholding or deduction been required (collectively, “Additional Amounts”). Neither the Company or any Guarantor will be required, however, to make any payment of additional amounts for or on account of: (1) any Tax imposed by the United States (or any political subdivision or taxing authority thereof or therein having power to tax); (2) any Tax that would not have been imposed but for (1) the existence of any present or former connection (other than a connection arising solely from the ownership of those Notes or the receipt of payments in respect of those Notes) between a Holder (or the beneficial owner for whose benefit such Holder holds such Note), or between a fiduciary, settlor, beneficiary of, member or shareholder of, or possessor of a power over, that Holder or beneficial owner (if that Holder or beneficial owner is an estate, trust, partnership or corporation) and the Relevant Taxing Jurisdiction, including that Holder or beneficial owner, or that fiduciary, settlor, beneficiary, member, shareholder or possessor, being or having been a citizen or resident or treated as a resident of the Relevant Taxing Jurisdiction or being or having been engaged in a trade or business or present in the Relevant Taxing Jurisdiction or having had a permanent establishment in the Relevant Taxing Jurisdiction or (2) the presentation of a note for payment on a date more than 30 days after the later of the date on which that payment becomes due and payable and the date on which payment is duly provided for; (3) any estate, inheritance, gift, sales, transfer, capital gains, excise, personal property, wealth or similar tax, assessment or other governmental charge; (4) any Tax which is payable otherwise than by withholding or deducting from payment of principal of or interest on such Notes; (5) any Tax required to be withheld by any paying agent from any payment of principal of or interest on any Note if that payment can be made without withholding by at least one other paying agent; (6) any Tax which would not have been imposed but for the failure to (a) comply with certification, identification or information reporting requirements concerning the nationality, residence, identity or connection with a Relevant Taxing Jurisdiction of, or other information relating to, the Holder or beneficial owner of such note, if compliance is required by the Relevant Taxing Jurisdiction for not falling under the scope of such Taxes, or as a precondition to relief or exemption from such Taxes (including the submission of an applicable IRS Form W 8 (with any required attachments)) or (b) comply with any information gathering and reporting requirements or to take any similar action (including entering into any agreement with the IRS), in each case, that are required

20 to obtain the maximum available exemption from withholding by a Relevant Taxing Jurisdiction that is available to payments received by or on behalf of the Holder; (7) any Tax imposed on interest due to the Holder’s or beneficial owner’s status as (1) a 10-percent shareholder (as defined in Section 871(h)(3)(B) of the Code and the regulations that may be promulgated thereunder) of us, (2) a controlled foreign corporation that is related to the Parent or any of its Subsidiaries within the meaning of Section 864(d)(4) of the Code, or (3) a bank receiving interest described in Section 881(c)(3)(A) of the Code; (8) any backup withholding; (9) any Tax required to be withheld or deducted under Sections 1471 through 1474 of the Code (or any amended or successor version of such Sections that is substantively comparable) (such Sections commonly referred to as the Foreign Account Tax Compliance Act, or “FATCA”), any regulations or other guidance thereunder, or any agreement (including any intergovernmental agreement) entered into in connection therewith; or any law, regulation or other official guidance enacted in any jurisdiction implementing FATCA or an intergovernmental agreement in respect of FATCA; (10) any Taxes that are imposed or withheld by reason of a change in law, regulation, or administrative or judicial interpretation that becomes effective more than 15 days after the payment becomes due or is duly provided for, whichever occurs later; (11) any Tax that is imposed or required to be withheld or deducted pursuant to the Dutch Withholding Tax Act 2021 (Wet bronbelasting 2021); or (12) in the case of any combination of the above-listed items; nor will the Company or any Guarantor pay any Additional Amounts to any person that is not the sole beneficial owner of such Notes, or a portion of such Notes, or that is a fiduciary or partnership or a limited liability company, to the extent that a beneficiary or settlor with respect to that fiduciary or a member of that partnership or limited liability company or a beneficial owner thereof would not have been entitled to the payment of those additional amounts had that beneficiary, settlor, member or beneficial owner been the Holder of those Notes. (c) The Notes are subject in all cases to any tax, fiscal or other law or regulation or administrative or judicial interpretation applicable to the Notes. Except as specifically provided under this Section 2.10, neither the Company nor any Guarantor will be required to make any payment for any tax, assessment or other governmental charge imposed by any government or a political subdivision or taxing authority of or in any government or political subdivision. (d) Any reference in the terms of the Notes to any amounts in respect of the Notes shall be deemed also to refer to any Additional Amounts which may be payable under this Section 2.10. Section 2.11 Registrar, Transfer Agent and Paying Agent.

21 The Trustee shall initially serve as Registrar and Transfer Agent for the Notes. The Paying Agent for the Notes shall initially be U.S. Bank Europe DAC pursuant to a Paying Agency Agreement, dated as of November 26, 2025, between the Company and the Paying Agent. ARTICLE III FORM OF THE SECURITIES Section 3.1 Global Form. Upon the original issuance, the Notes shall be represented by one or more Global Notes without coupons. The Notes shall not be issuable in definitive form except as provided in Section 3.2(a) of this Supplemental Indenture. The Notes and the Trustee’s certificate of authentication shall be substantially in the form attached as Exhibit A1 and Exhibit A2 hereto. The Company shall issue the Notes in minimum denominations of €100,000 and in integral multiples of €1,000 in excess thereof and shall deposit the Global Notes with, or on behalf of, the Common Depositary, and register the Global Securities in the name of the Common Depositary or its nominee, as the case may be, for the accounts of, and in respect of interests held through, the Depositary, subject to Sections 2.7 and 2.14 of the Base Indenture. The Company shall execute and the Trustee shall, in accordance with Section 2.3 of the Base Indenture, authenticate and hold each Global Note as custodian for the Common Depositary. Each Global Note will represent the outstanding Notes as will be specified therein and each shall provide that it represents the aggregate principal amount of outstanding Notes from time to time endorsed thereon and that the aggregate principal amount of outstanding Notes represented thereby may from time to time be reduced or increased, as appropriate, to reflect exchanges and redemptions. Any endorsement of a Global Note to reflect the amount of any increase or decrease in the aggregate principal amount of outstanding Notes represented thereby will be made by the Registrar or the custodian, at the direction of the Trustee. The terms and provisions contained in the form of Note attached as Exhibit A1 and Exhibit A2 hereto shall constitute, and are hereby expressly made, a part of the Indenture and, to the extent applicable, the Company, each Guarantor and the Trustee, by their execution and delivery of this Supplemental Indenture, expressly agree to such terms and provisions and to be bound thereby. Participants of the Depositary shall have no rights either under the Indenture or with respect to the Global Notes. The Common Depositary or its nominee, as applicable, shall be treated by the Company, each Guarantor, the Trustee and any agent of the Company, such Guarantor or the Trustee as the absolute owner and Holder of such Global Notes for all purposes under the Indenture. Notwithstanding the foregoing, nothing herein shall prevent the Company, any Guarantor or the Trustee from giving effect to any written certification, proxy or other authorization furnished by the Depositary or its nominee, as applicable, or impair, as between the Depositary and its participants, the operation of customary practices of such Depositary governing the exercise of the rights of an owner of a beneficial interest in the Global Notes. Notes offered and sold in reliance on Regulation S will be issued initially in the form of the Regulation S Temporary Global Note, which will be deposited on behalf of the purchasers of the Notes represented thereby with the Trustee, as custodian for the Depositary, and registered in the name of the Depositary or the nominee of the Depositary for the accounts of designated agents

22 holding on behalf of Euroclear or Clearstream, duly executed by the Company and authenticated by the Trustee as hereinafter provided. The Restricted Period will be terminated upon the receipt by the Trustee of: (i) a written certificate from the Depositary, together with copies of certificates from Euroclear and Clearstream certifying that they have received certification of non- United States beneficial ownership of 100% of the aggregate principal amount of the Regulation S Temporary Global Note (except to the extent of any beneficial owners thereof who acquired an interest therein during the Restricted Period pursuant to another exemption from registration under the Securities Act and who will take delivery of a beneficial ownership interest in a 144A Global Note bearing a Private Placement Legend, all as contemplated by Section 3.2(c) hereof); and (ii) an Officer’s Certificate of the Company. Following the termination of the Restricted Period, beneficial interests in the Regulation S Temporary Global Note will be exchanged for beneficial interests in the Regulation S Permanent Global Note pursuant to the Applicable Procedures. Upon receipt of a Company Order, simultaneously with the authentication of the Regulation S Permanent Global Note, the Trustee will cancel the Regulation S Temporary Global Note. The aggregate principal amount of the Regulation S Temporary Global Note and the Regulation S Permanent Global Note may from time to time be increased or decreased by adjustments made on the records of the Trustee and the Depositary or its nominee, as the case may be, in connection with transfers of interests therein as hereinafter provided. The provisions of the “Operating Procedures of the Euroclear System” and “Terms and Conditions Governing Use of Euroclear” and the “General Terms and Conditions of Clearstream Banking” and “Customer Handbook” of Clearstream will be applicable to transfers of beneficial interests in the Global Notes that are held by Participants through Euroclear or Clearstream. Section 3.2 Transfer and Exchange. (a) Transfer and Exchange of Global Notes. A Global Note may not be transferred except as a whole by the Common Depositary to a nominee of the Common Depositary, by a nominee of the Common Depositary to the Common Depositary or to another nominee of the Common Depositary, or by the Common Depositary or any such nominee to a successor Common Depositary or a nominee of such successor Common Depositary. All Global Notes will be exchanged by the Company for Definitive Notes if: (1) the Company delivers to the Trustee notice from the Depositary or the Common Depositary that it is unwilling or unable to continue to act as Depositary or Common Depositary, as applicable, or that it is no longer a clearing agency registered under the Exchange Act and, in either case, a successor Depositary or Common Depositary is not appointed by the Company within 90 days after the date of such notice from the Depositary or Common Depositary; or