Lineage Investor Presentation May 2025

Disclaimer 2 Forward-Looking Statements. Certain statements contained in this Presentation, other than historical facts, may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Lineage operates, and beliefs of, and assumptions made by, the Company and involve uncertainties that could significantly affect Lineage’s financial results. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “can,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “measures,” “poised,” “focus,” “seek,” “objective,” “goal,” “vision,” “drive,” “opportunity,” “target,” “strategy,” “expect,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “tomorrow,” “long-term,” “should,” “could,” “would,” “might,” “help,” “aimed”, or other similar words. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Presentation. Such statements include, but are not limited to statements about Lineage’s plans, strategies, initiatives, and prospects and statements about its future results of operations, capital expenditures and liquidity. Such statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those projected or anticipated, including, without limitation: general business and economic conditions; the impact of tariffs and global trade disruptions on us and our customers; continued volatility and uncertainty in the credit markets and broader financial markets, including potential fluctuations in the Consumer Price Index and changes in foreign currency exchange rates; other risks inherent in the real estate business, including customer defaults, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; the availability of suitable acquisitions and our ability to acquire those properties or businesses on favorable terms; our success in implementing our business strategy and our ability to identify, underwrite, finance, consummate, integrate and manage diversifying acquisitions or investments; our ability to meet budgeted or stabilized returns on our development and expansion projects within expected time frames, or at all; our ability to manage our expanded operations, including expansion into new markets or business lines; our failure to realize the intended benefits from, or disruptions to our plans and operations or unknown or contingent liabilities related to, our recent and future acquisitions; our failure to successfully integrate and operate acquired or developed properties or businesses; our ability to renew significant customer contracts; the impact of supply chain disruptions, including the impact on labor availability, raw material availability, manufacturing and food production and transportation; difficulties managing an international business and acquiring or operating properties in foreign jurisdictions and unfamiliar metropolitan areas; changes in political conditions, geopolitical turmoil, political instability, civil disturbances, restrictive governmental actions or nationalization in the countries in which we operate; the degree and nature of our competition; our failure to generate sufficient cash flows to service our outstanding indebtedness; our ability to access debt and equity capital markets; continued increases and volatility in interest rates; increased power, labor or construction costs; changes in consumer demand or preferences for products we store in our warehouses; decreased storage rates or increased vacancy rates; labor shortages or our inability to attract and retain talent; changes in, or the failure or inability to comply with, government regulation; a failure of our information technology systems, systems conversions and integrations, cybersecurity attacks or a breach of our information security systems, networks or processes; our failure to maintain our status as a real estate investment trust for U.S. federal income tax purposes; changes in local, state, federal and international laws and regulations, including related to taxation, tariffs, real estate and zoning laws, and increases in real property tax rates; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect us, and any other risks discussed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2024. Should one of more of the risks or uncertainties described above occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Forward-looking statements in this Presentation speak only as of the date of this Presentation, and undue reliance should not be placed on such statements. We undertake no obligation to, nor do we intend to, update, or otherwise revise, any such statements that may become untrue because of subsequent events. While the forward-looking statements are considered reasonable by the Company, they are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and cannot be predicted with accuracy and may not be realized. There can be no assurance that the forward-looking statements can or will be attained or maintained. Actual operating results may vary materially from the forward-looking statements included in this Presentation. The forward-looking statements included in this Presentation have been included for purposes of illustration only, and no assurance can be given that the actual results will correspond with the results contemplated in the forward-looking statements. Market Data. We use market data throughout this Presentation that has generally been obtained from external, independent, and publicly available information and industry publications. None of Lineage, its affiliates, advisers, or representatives have verified such independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives make any representations as to the accuracy or completeness of that data or to update such data after the date of this presentation. Such data involves risk and uncertainties and are subject to change based on various factors. Capacity and market share data provided by the Global Cold Chain Alliance, or GCCA, reflects capacity of companies that report to GCCA. North American GCCA data includes GCCA’s estimate of capacity owned and operated by U.S. customers themselves based on data from U.S. Department of Agriculture surveys. Global GCCA data also reflects GCCA’s estimate of capacity of companies that do not report to GCCA. Non-GAAP Measures. This Presentation includes certain financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Such non-GAAP financial measures should not be considered alternatives to net income as a performance measure or cash flows from operations as reported on Lineage’s statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. You should be aware that Lineage’s presentation of these and other non-GAAP financial measures in this Presentation may not be comparable to similarly-titled measures used by other companies. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Lineage believes that in addition to using GAAP results, non- GAAP financial measures can provide meaningful insight in evaluating the Lineage's financial performance and the effectiveness of its business strategies. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the Appendix to this Presentation.

Key Investment Highlights 3 Cold storage is the critical infrastructure of the global food supply chain – a large, growing, recession-resistant market Superior same warehouse growth supported by a strong Integrated Solutions segment and operational excellence enabled by technology Global leader in a fragmented industry with meaningful scale and network benefits that is diversified across geographies, customers and commodities Award winning and mission driven company with experienced management team and Board that are focused on doing good while doing well High-quality assets in highly desirable and strategic locations around the world Significant global external growth opportunities to compound capital via a large pipeline of potential future greenfields, expansions and acquisitions at attractive returns

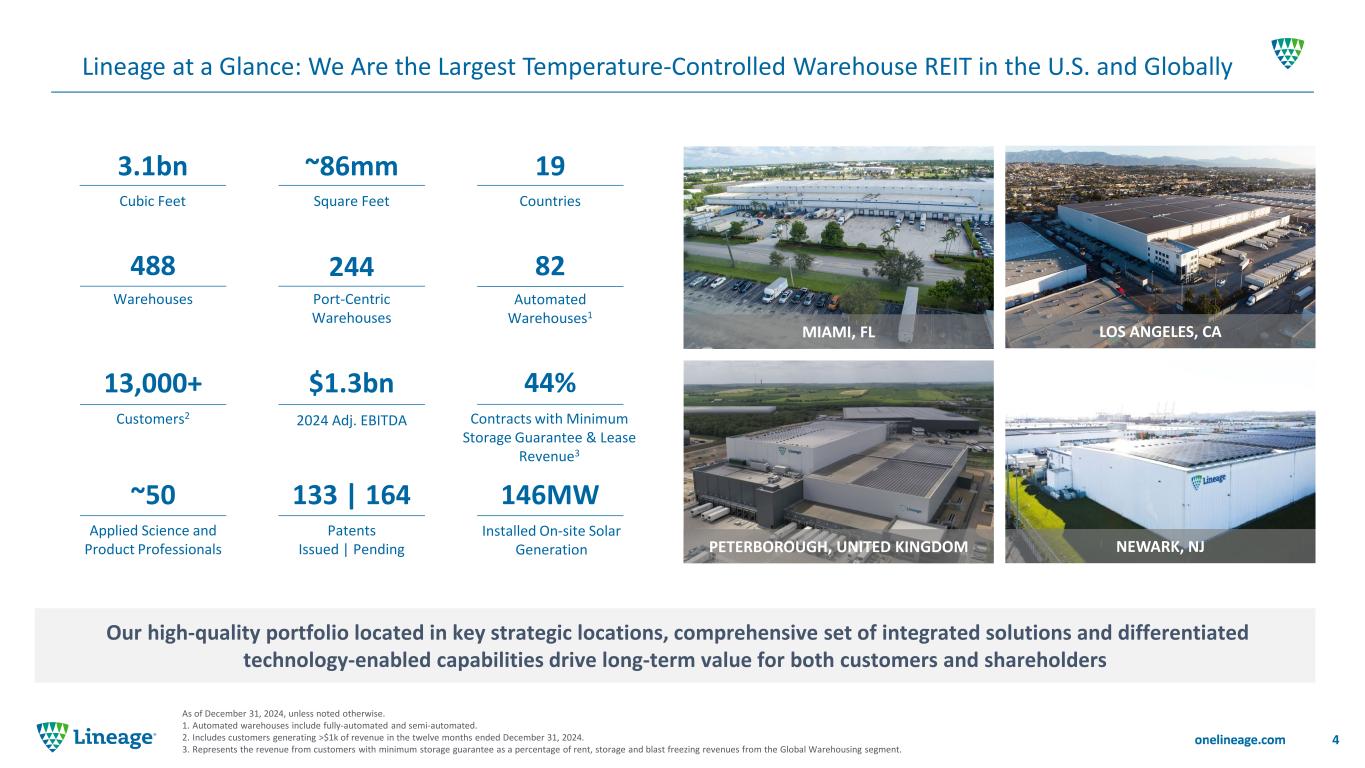

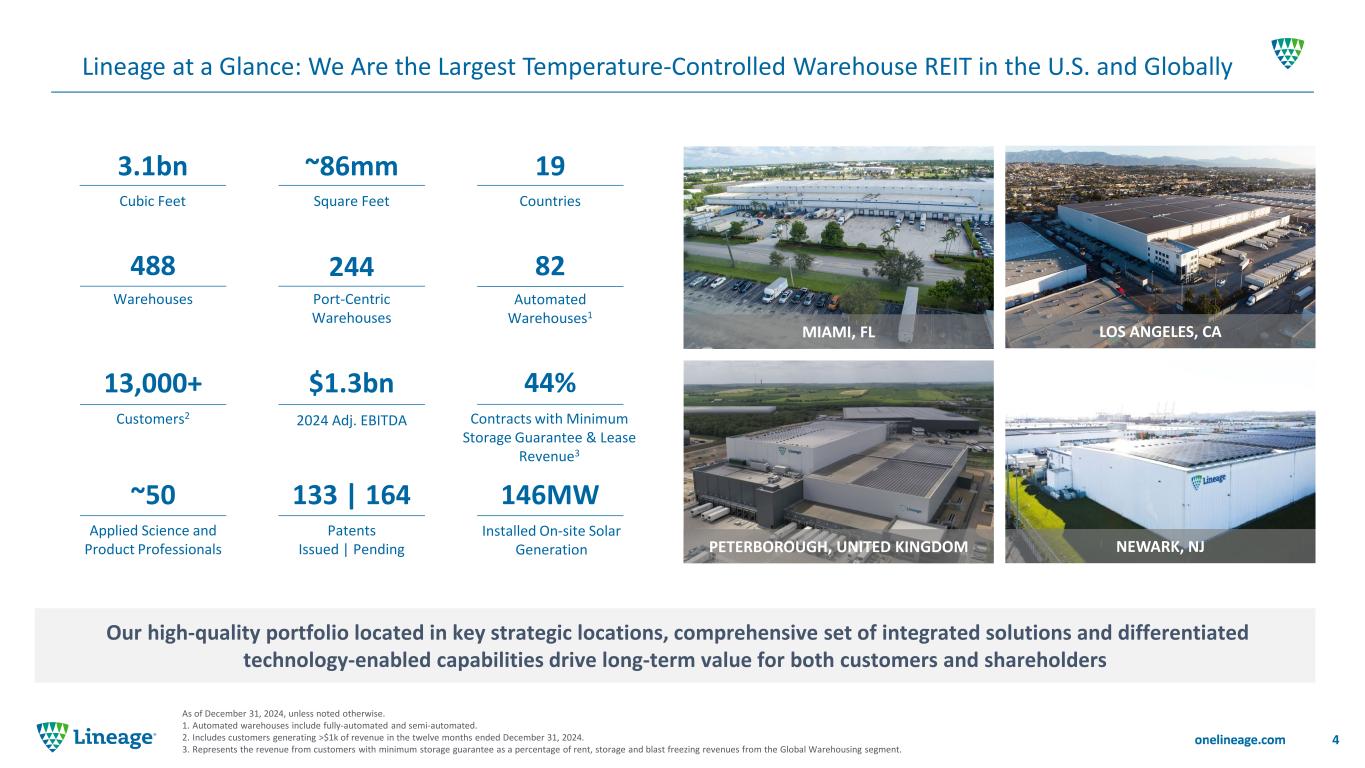

Lineage at a Glance: We Are the Largest Temperature-Controlled Warehouse REIT in the U.S. and Globally 4 As of December 31, 2024, unless noted otherwise. 1. Automated warehouses include fully-automated and semi-automated. 2. Includes customers generating >$1k of revenue in the twelve months ended December 31, 2024. 3. Represents the revenue from customers with minimum storage guarantee as a percentage of rent, storage and blast freezing revenues from the Global Warehousing segment. MIAMI, FL PETERBOROUGH, UNITED KINGDOM Our high-quality portfolio located in key strategic locations, comprehensive set of integrated solutions and differentiated technology-enabled capabilities drive long-term value for both customers and shareholders Cubic Feet 3.1bn Square Feet ~86mm Countries 19 Automated Warehouses1 82 Warehouses 488 Port-Centric Warehouses 244 Installed On-site Solar Generation 146MW Patents Issued | Pending 133 | 164 Applied Science and Product Professionals ~50 2024 Adj. EBITDA $1.3bn Customers2 13,000+ LOS ANGELES, CA NEWARK, NJ Contracts with Minimum Storage Guarantee & Lease Revenue3 44%

Completed largest IPO of the year and largest REIT IPO of all time Our Compounding Growth Is Marked by Consistently Achieving Strategic Milestones 5 1. Year-end cubic feet capacity for each respective year. 2. Per Global Cold Chain Alliance (“GCCA”) website. 3. Reflects approximate time periods for economic events. Total Cubic Feet1 Start of platform with a single warehouse in Seattle Branded as Lineage Became 3rd largest U.S. cold storage company2 Nationwide energy management program Became 2nd largest U.S. cold storage company2 Began integrating platform and systems, including ERP Hired CEO Greg Lehmkuhl Launched Network Optimization and Capital Deployment teams Became largest cold storage company globally2 Fast Company recognizes Lineage as #1 Data Science Company Won U.S. Department of Energy Better Practice Award Entered Vietnam Entered Spain, France, Germany and Italy Entered Singapore Intensified focus on talent development Established unified data lake Launched metricsOne Entered Australia, Canada, Denmark, New Zealand, Norway, Poland, and Sri Lanka Launched Lineage Link Converted to a REIT Hired Sudarsan Thattai as CIO & launched data science team Entered U.K. & Continental Europe Launched Novi HQ & centralized Integrated Solutions operations Global Financial Crisis3 COVID-19 Pandemic3European Debt Crisis3 Trident 391 / 392 iStar Properties Gramercy Properties Professional Freezing Services Selected Ryder Warehousing Assets Rob Crisci hired as CFO ~44% Adjusted EBITDA CAGR (2008-2024) Selected Midwest Refrigerated Warehousing Assets Burris Warehousing Business 7mm 12mm 44mm 147mm 264mm 302mm 602mm 665mm 710mm 839mm 979mm 1.7bn 2.1bn 2.5bn 2.9bn 3.0bn 3.1bn 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

The Lineage Difference: Leading with Purpose and Values 6 Purpose To transform the food supply chain to eliminate waste and help feed the world Values Respect Innovation Bold Servant Leadership Safe Trust

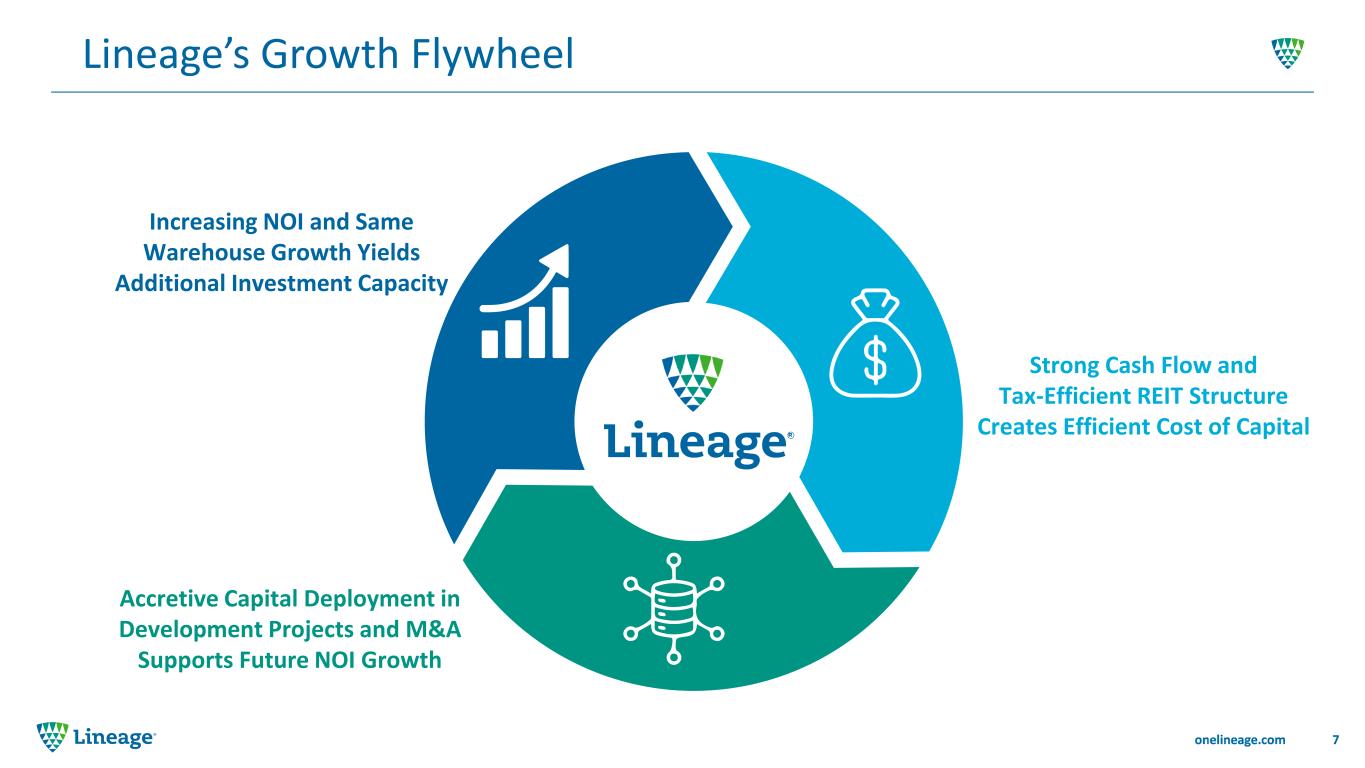

Lineage’s Growth Flywheel 7 Accretive Capital Deployment in Development Projects and M&A Supports Future NOI Growth Strong Cash Flow and Tax-Efficient REIT Structure Creates Efficient Cost of Capital Increasing NOI and Same Warehouse Growth Yields Additional Investment Capacity

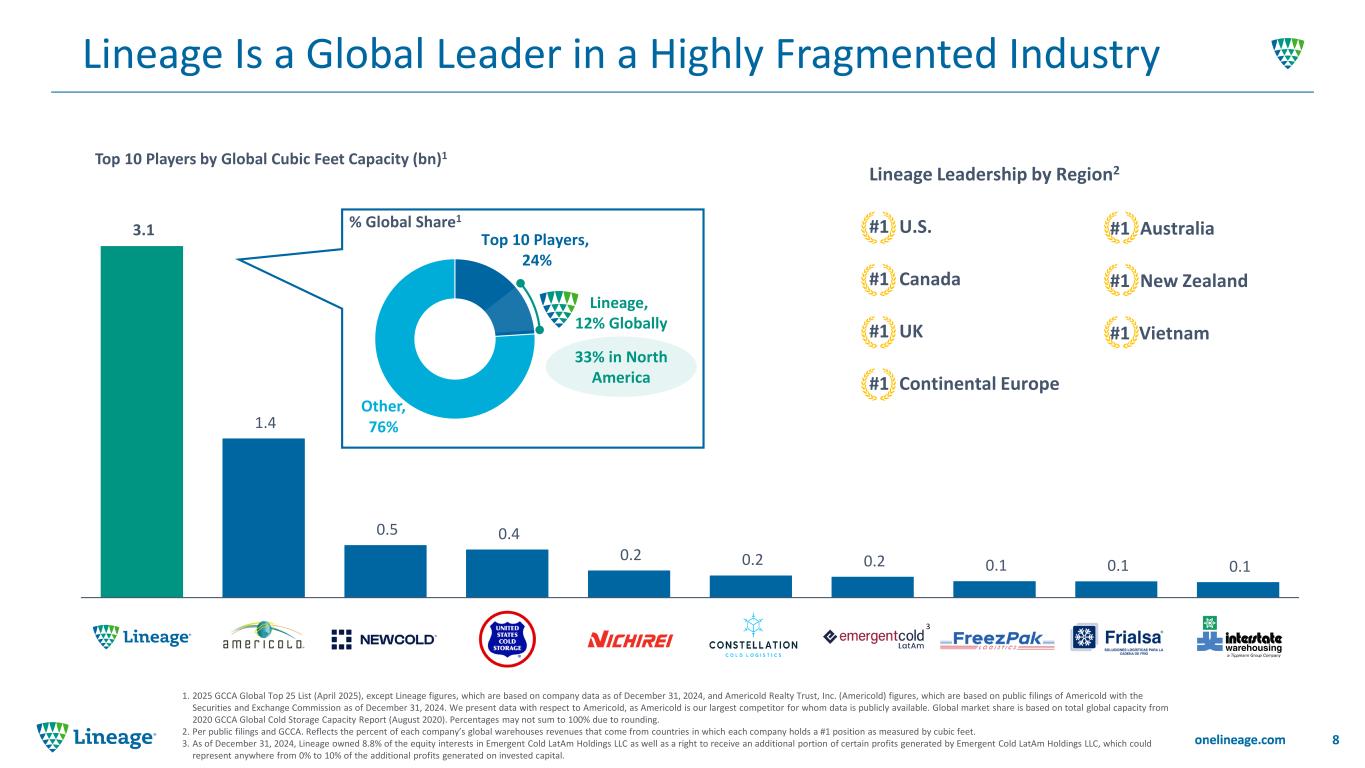

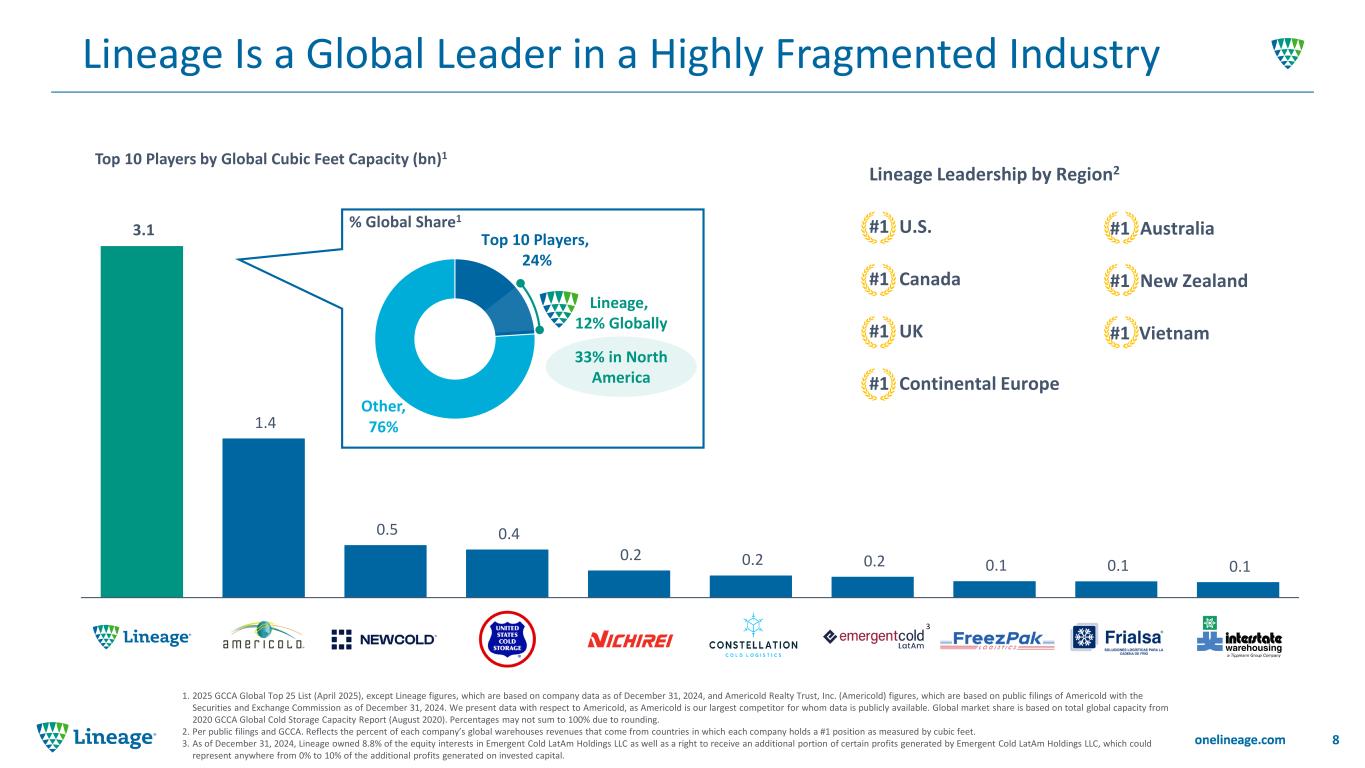

Lineage Is a Global Leader in a Highly Fragmented Industry 8 1. 2025 GCCA Global Top 25 List (April 2025), except Lineage figures, which are based on company data as of December 31, 2024, and Americold Realty Trust, Inc. (Americold) figures, which are based on public filings of Americold with the Securities and Exchange Commission as of December 31, 2024. We present data with respect to Americold, as Americold is our largest competitor for whom data is publicly available. Global market share is based on total global capacity from 2020 GCCA Global Cold Storage Capacity Report (August 2020). Percentages may not sum to 100% due to rounding. 2. Per public filings and GCCA. Reflects the percent of each company’s global warehouses revenues that come from countries in which each company holds a #1 position as measured by cubic feet. 3. As of December 31, 2024, Lineage owned 8.8% of the equity interests in Emergent Cold LatAm Holdings LLC as well as a right to receive an additional portion of certain profits generated by Emergent Cold LatAm Holdings LLC, which could represent anywhere from 0% to 10% of the additional profits generated on invested capital. 3.1 1.4 0.5 0.4 0.2 0.2 0.2 0.1 0.1 0.1 Lineage Leadership by Region2 #1 U.S. #1 Canada #1 UK #1 Continental Europe Top 10 Players by Global Cubic Feet Capacity (bn)1 Other, 76% Lineage, 12% Globally 3 Top 10 Players, 24% % Global Share1 33% in North America #1 Australia #1 New Zealand #1 Vietnam

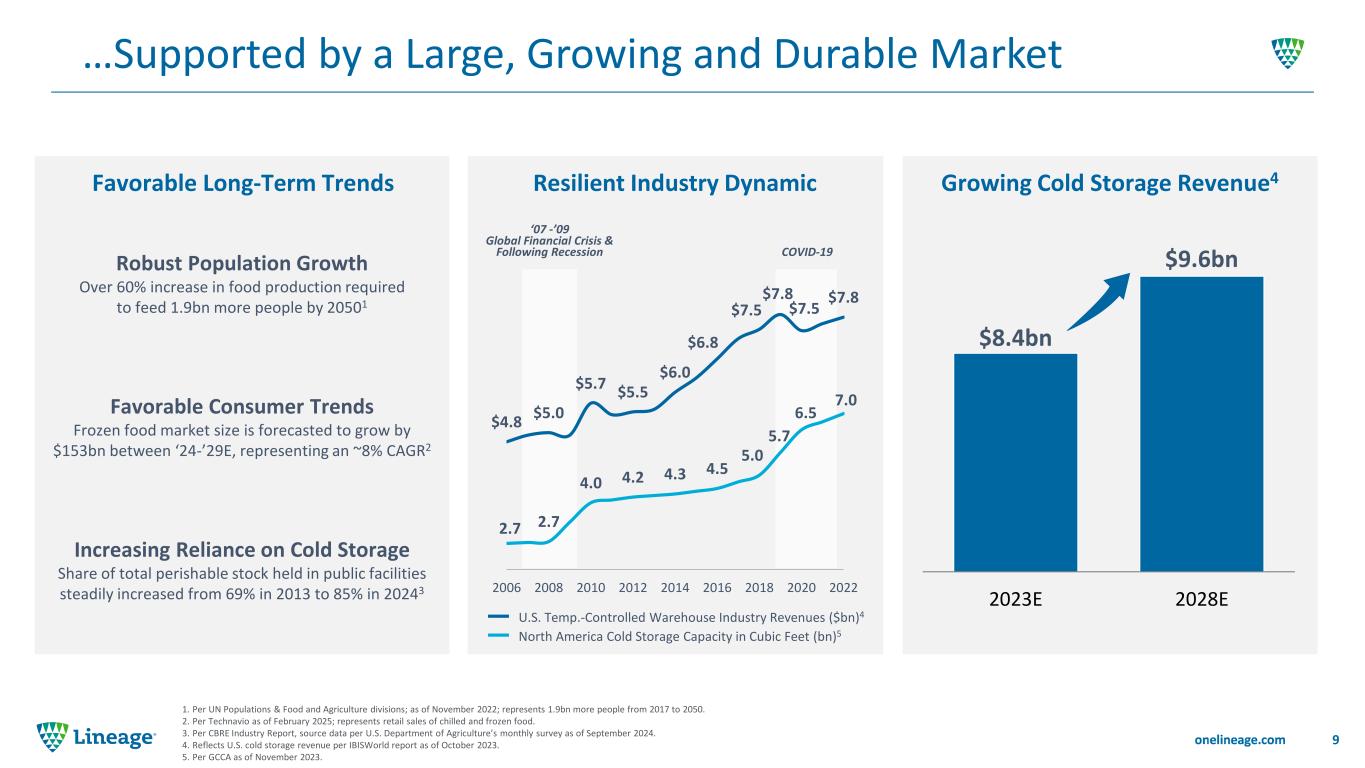

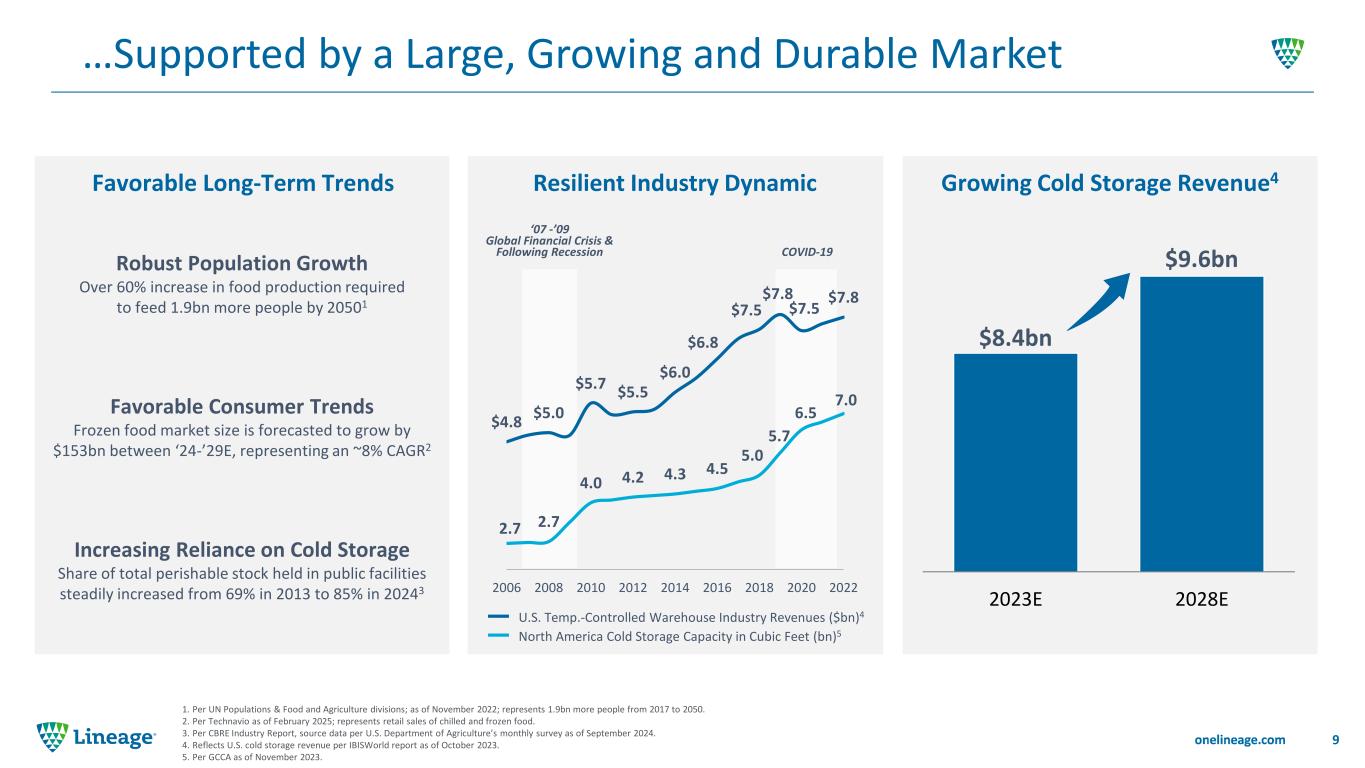

…Supported by a Large, Growing and Durable Market 9 1. Per UN Populations & Food and Agriculture divisions; as of November 2022; represents 1.9bn more people from 2017 to 2050. 2. Per Technavio as of February 2025; represents retail sales of chilled and frozen food. 3. Per CBRE Industry Report, source data per U.S. Department of Agriculture’s monthly survey as of September 2024. 4. Reflects U.S. cold storage revenue per IBISWorld report as of October 2023. 5. Per GCCA as of November 2023. $8.4bn $9.6bn 2023E 2028E Growing Cold Storage Revenue4 Robust Population Growth Over 60% increase in food production required to feed 1.9bn more people by 20501 Favorable Consumer Trends Frozen food market size is forecasted to grow by $153bn between ‘24-’29E, representing an ~8% CAGR2 Increasing Reliance on Cold Storage Share of total perishable stock held in public facilities steadily increased from 69% in 2013 to 85% in 20243 Favorable Long-Term Trends $4.8 $5.0 $5.7 $5.5 $6.0 $6.8 $7.5 $7.8 $7.5 $7.8 2.7 2.7 4.0 4.2 4.3 4.5 5.0 5.7 6.5 7.0 2006 2008 2010 2012 2014 2016 2018 2020 2022 U.S. Temp.-Controlled Warehouse Industry Revenues ($bn)4 North America Cold Storage Capacity in Cubic Feet (bn)5 Resilient Industry Dynamic ‘07 -’09 Global Financial Crisis & Following Recession COVID-19

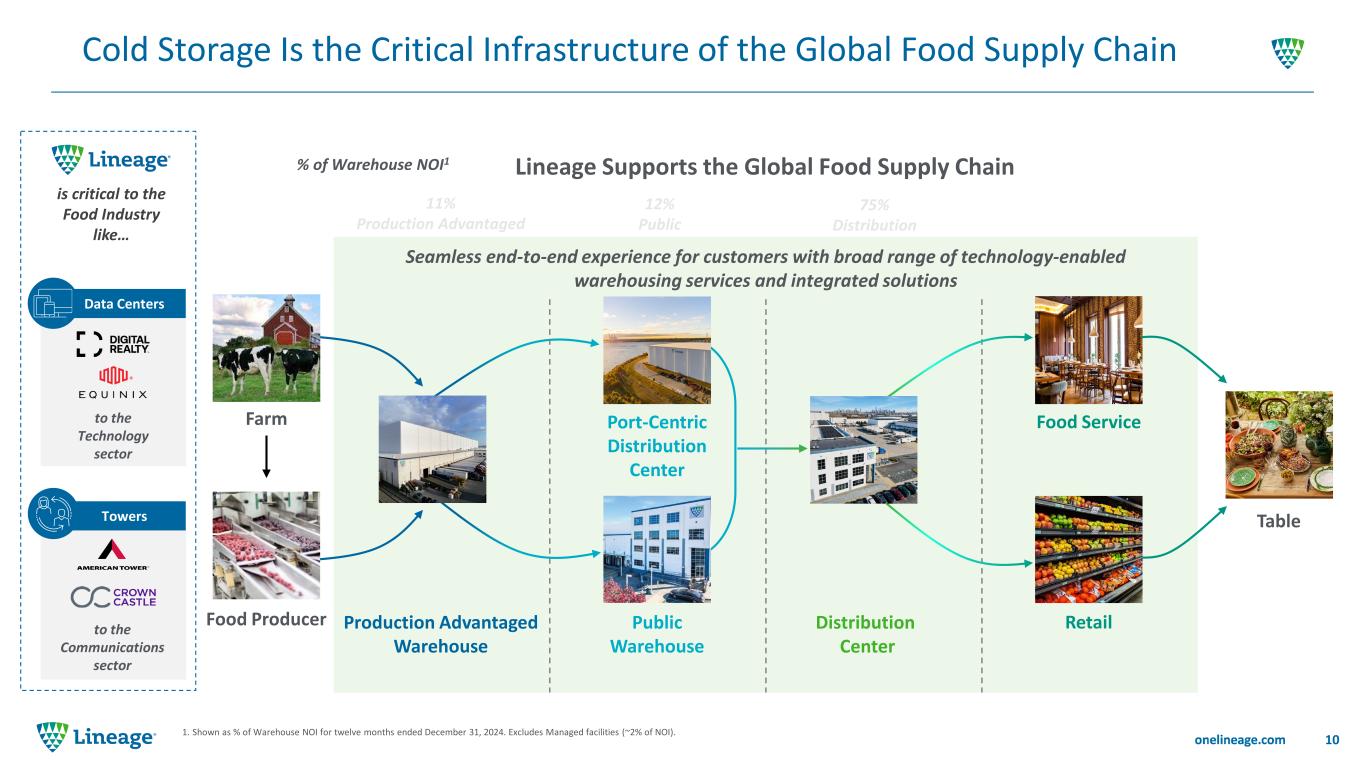

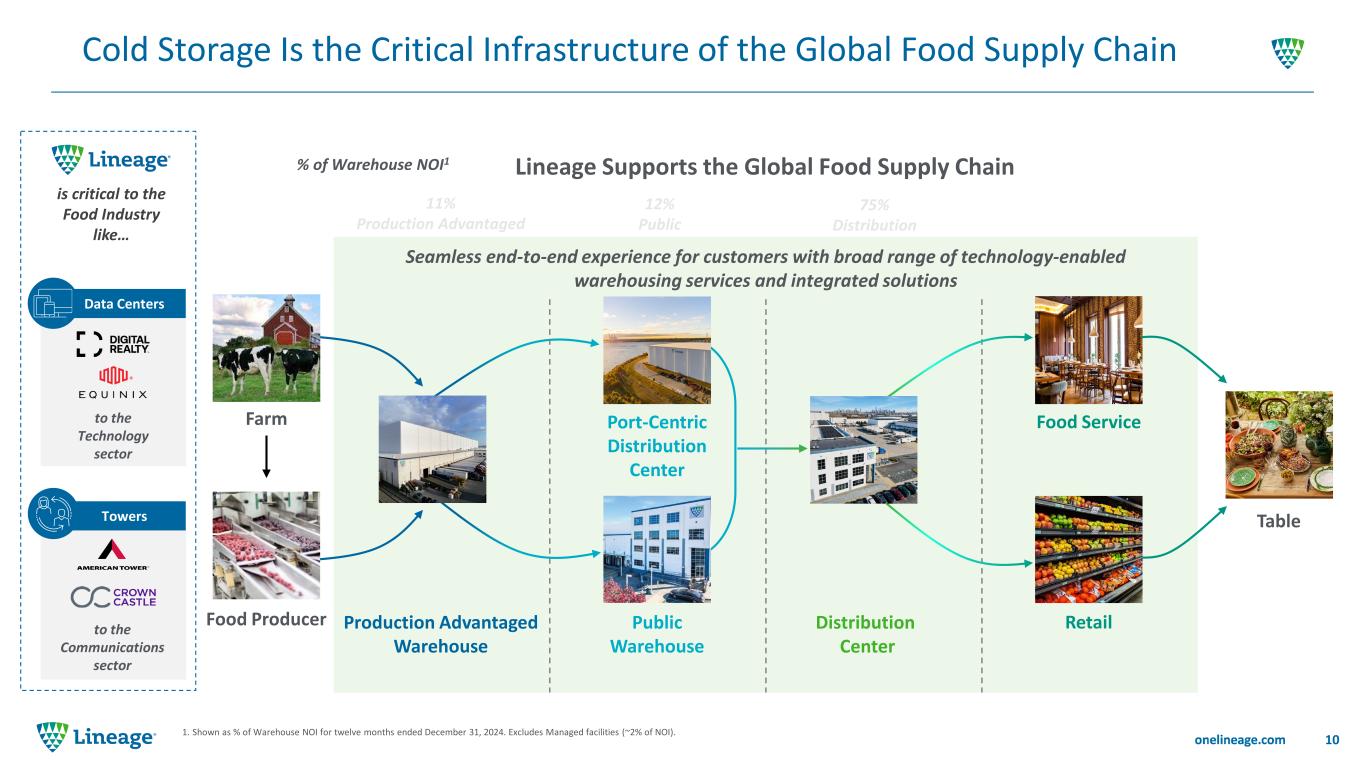

Cold Storage Is the Critical Infrastructure of the Global Food Supply Chain 10 1. Shown as % of Warehouse NOI for twelve months ended December 31, 2024. Excludes Managed facilities (~2% of NOI). Lineage Supports the Global Food Supply Chain Producer Consumer% of Warehouse NOI1 11% Production Advantaged 12% Public 75% Distribution Production Advantaged Warehouse Table Farm Food Producer Public Warehouse Port-Centric Distribution Center Distribution Center Food Service Retail is critical to the Food Industry like… Seamless end-to-end experience for customers with broad range of technology-enabled warehousing services and integrated solutions to the Technology sector Data Centers to the Communications sector Towers Consumer

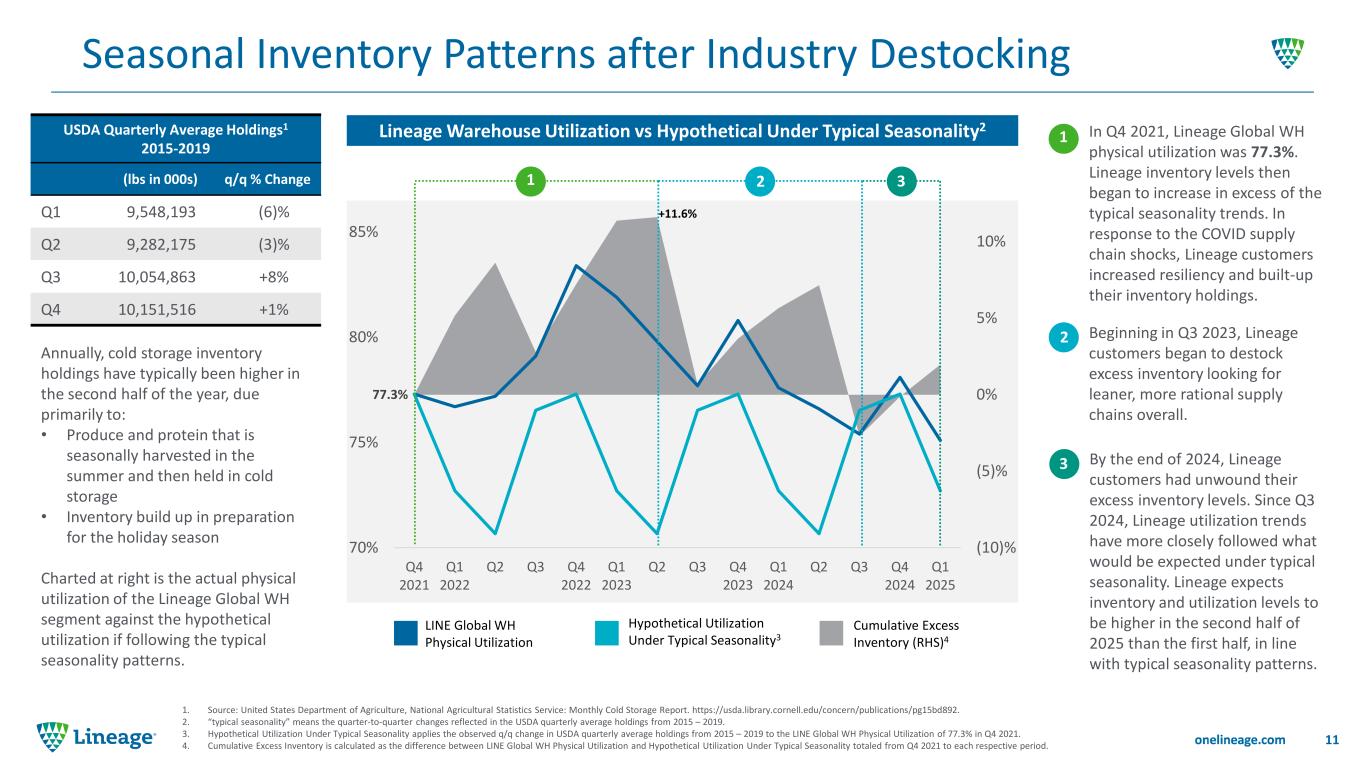

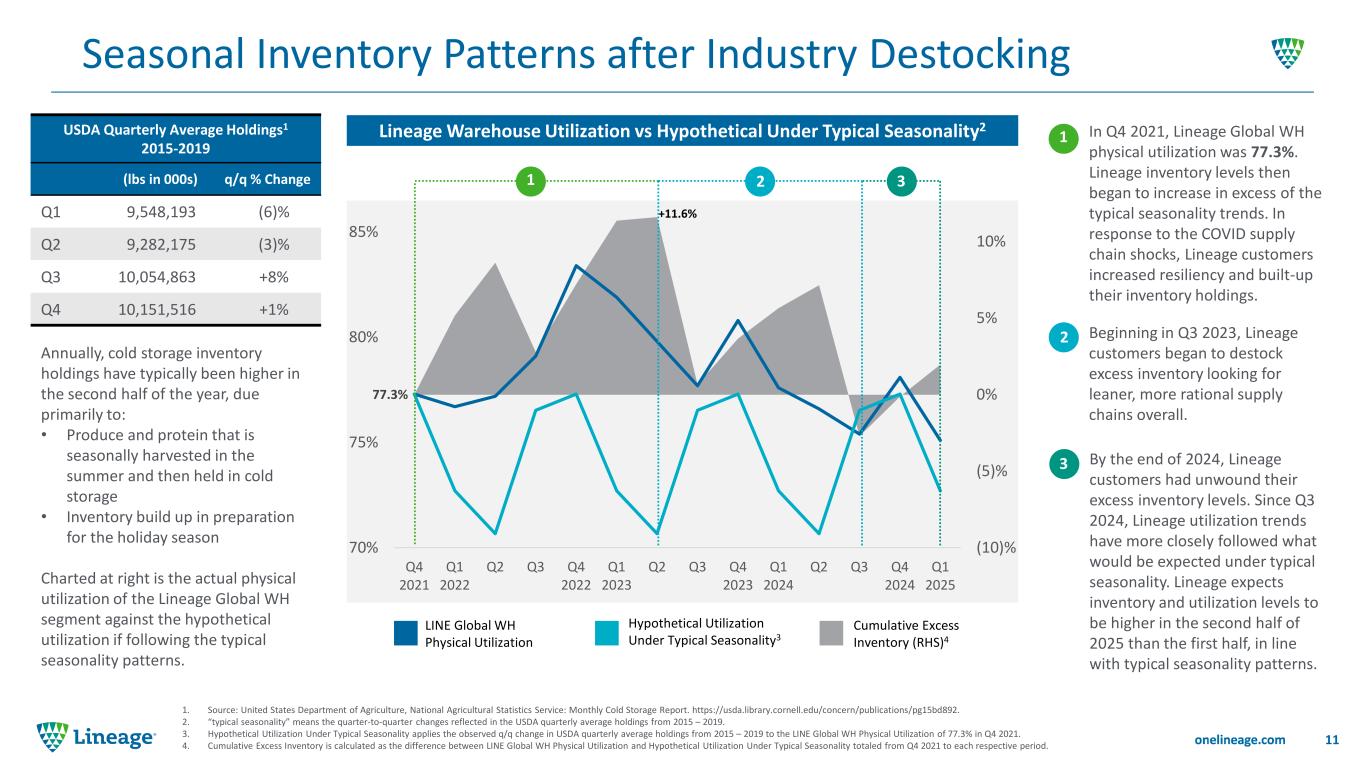

Seasonal Inventory Patterns after Industry Destocking 1. Source: United States Department of Agriculture, National Agricultural Statistics Service: Monthly Cold Storage Report. https://usda.library.cornell.edu/concern/publications/pg15bd892. 2. “typical seasonality” means the quarter-to-quarter changes reflected in the USDA quarterly average holdings from 2015 – 2019. 3. Hypothetical Utilization Under Typical Seasonality applies the observed q/q change in USDA quarterly average holdings from 2015 – 2019 to the LINE Global WH Physical Utilization of 77.3% in Q4 2021. 4. Cumulative Excess Inventory is calculated as the difference between LINE Global WH Physical Utilization and Hypothetical Utilization Under Typical Seasonality totaled from Q4 2021 to each respective period. In Q4 2021, Lineage Global WH physical utilization was 77.3%. Lineage inventory levels then began to increase in excess of the typical seasonality trends. In response to the COVID supply chain shocks, Lineage customers increased resiliency and built-up their inventory holdings. Beginning in Q3 2023, Lineage customers began to destock excess inventory looking for leaner, more rational supply chains overall. By the end of 2024, Lineage customers had unwound their excess inventory levels. Since Q3 2024, Lineage utilization trends have more closely followed what would be expected under typical seasonality. Lineage expects inventory and utilization levels to be higher in the second half of 2025 than the first half, in line with typical seasonality patterns. 77.3% (10)% (5)% 0% 5% 10% 70% 75% 80% 85% Q4 2021 Q1 2022 Q2 Q3 Q4 2022 Q1 2023 Q2 Q3 Q4 2023 Q1 2024 Q2 Q3 Q4 2024 Q1 2025 +11.6% 1 USDA Quarterly Average Holdings1 2015-2019 (lbs in 000s) q/q % Change Q1 9,548,193 (6)% Q2 9,282,175 (3)% Q3 10,054,863 +8% Q4 10,151,516 +1% Annually, cold storage inventory holdings have typically been higher in the second half of the year, due primarily to: • Produce and protein that is seasonally harvested in the summer and then held in cold storage • Inventory build up in preparation for the holiday season Charted at right is the actual physical utilization of the Lineage Global WH segment against the hypothetical utilization if following the typical seasonality patterns. Cumulative Excess Inventory (RHS)4 LINE Global WH Physical Utilization Hypothetical Utilization Under Typical Seasonality3 Lineage Warehouse Utilization vs Hypothetical Under Typical Seasonality2 2 3 1 2 3 11

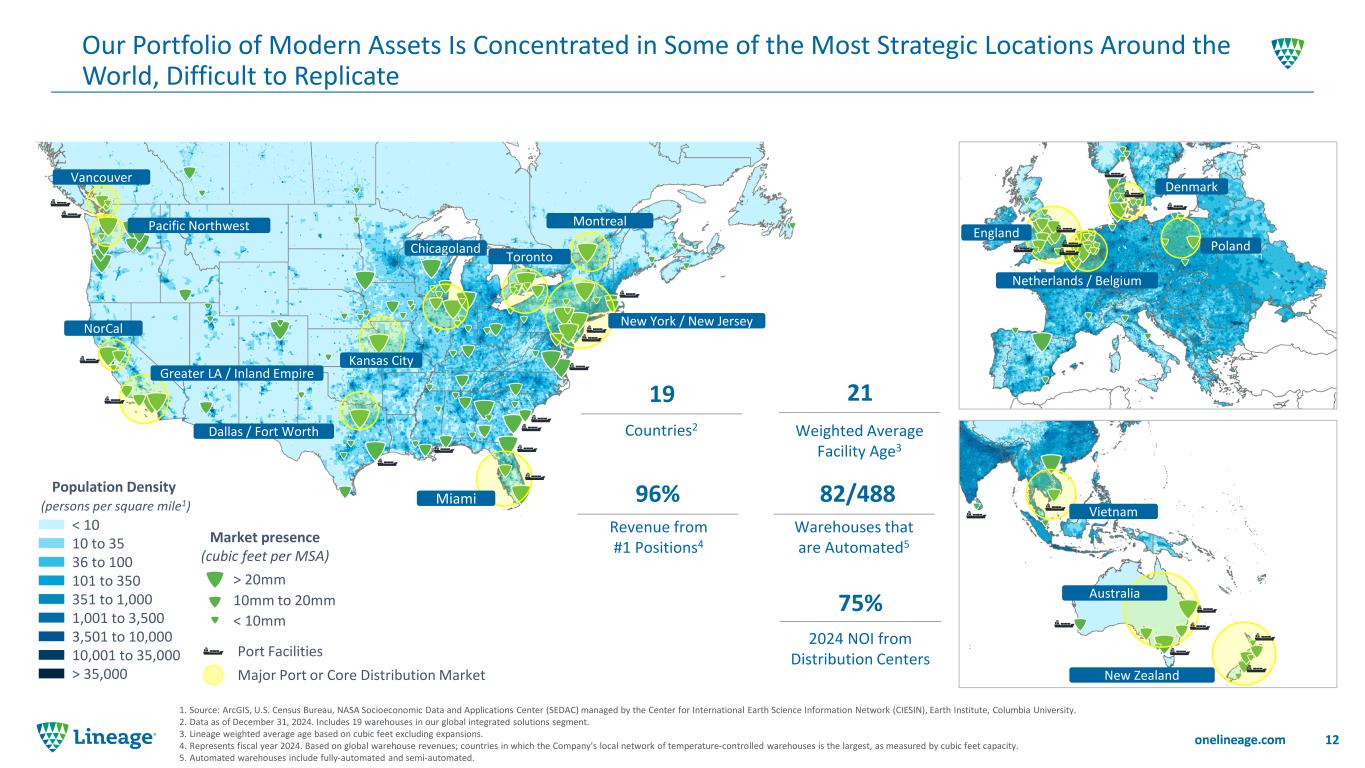

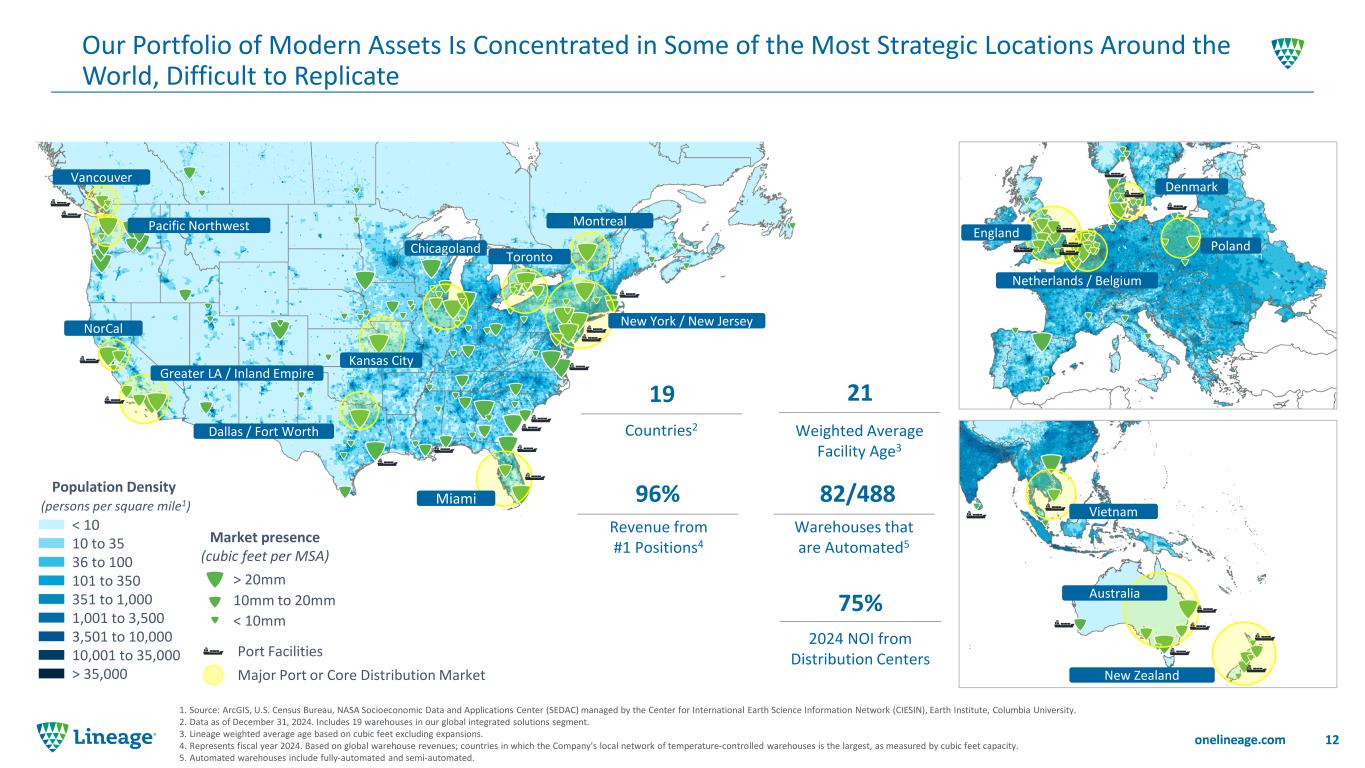

Our Portfolio of Modern Assets Is Concentrated in Some of the Most Strategic Locations Around the World, Difficult to Replicate 12 1. Source: ArcGIS, U.S. Census Bureau, NASA Socioeconomic Data and Applications Center (SEDAC) managed by the Center for International Earth Science Information Network (CIESIN), Earth Institute, Columbia University. 2. Data as of December 31, 2024. Includes 19 warehouses in our global integrated solutions segment. 3. Lineage weighted average age based on cubic feet excluding expansions. 4. Represents fiscal year 2024. Based on global warehouse revenues; countries in which the Company’s local network of temperature-controlled warehouses is the largest, as measured by cubic feet capacity. 5. Automated warehouses include fully-automated and semi-automated. Miami Chicagoland Greater LA / Inland Empire Pacific Northwest NorCal Montreal Toronto Vancouver Dallas / Fort Worth Kansas City < 10 10 to 35 36 to 100 101 to 350 351 to 1,000 1,001 to 3,500 3,501 to 10,000 10,001 to 35,000 > 35,000 Population Density (persons per square mile1) Major Port or Core Distribution Market 10mm to 20mm > 20mm < 10mm Market presence (cubic feet per MSA) Vietnam Australia New Zealand England Netherlands / Belgium Poland Denmark Port Facilities New York / New Jersey Countries2 Warehouses that are Automated5 82/488 2024 NOI from Distribution Centers 75% 19 Weighted Average Facility Age3 Revenue from #1 Positions4 96% 21

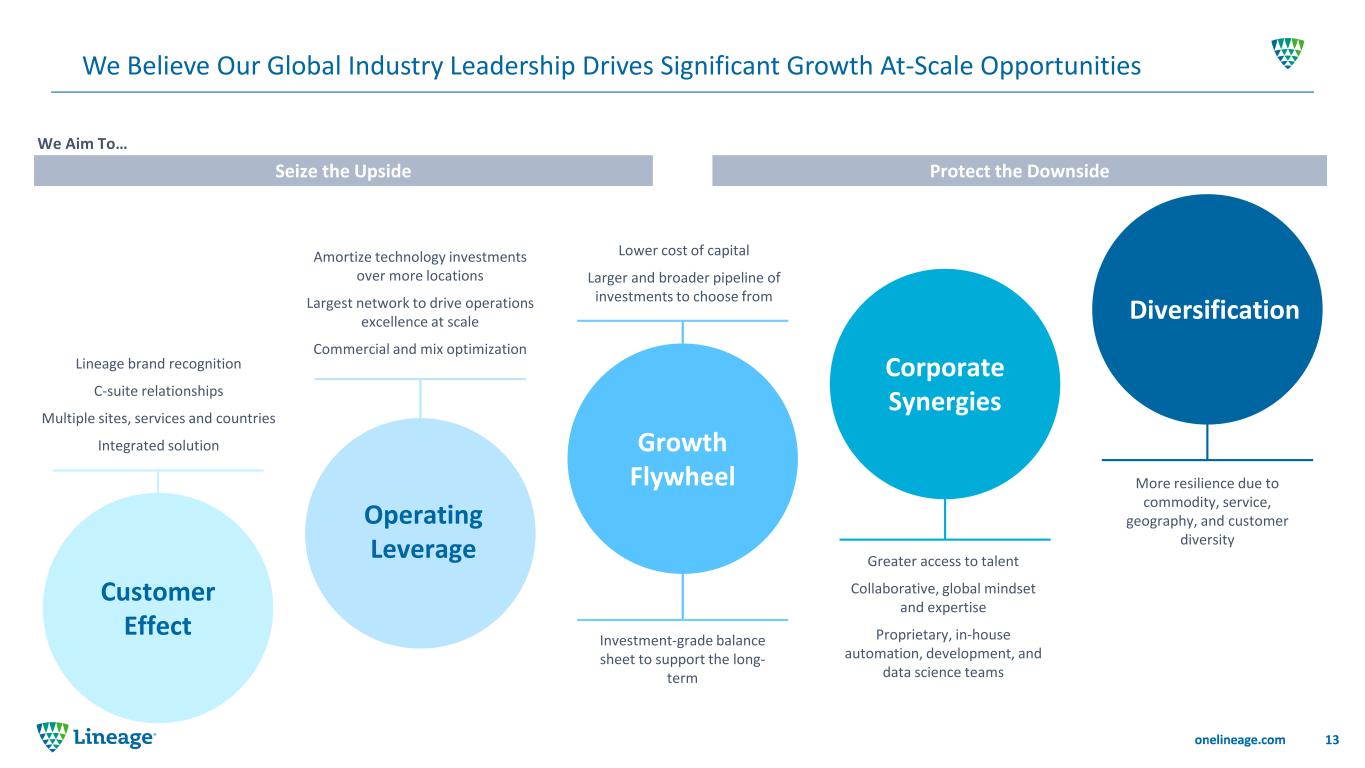

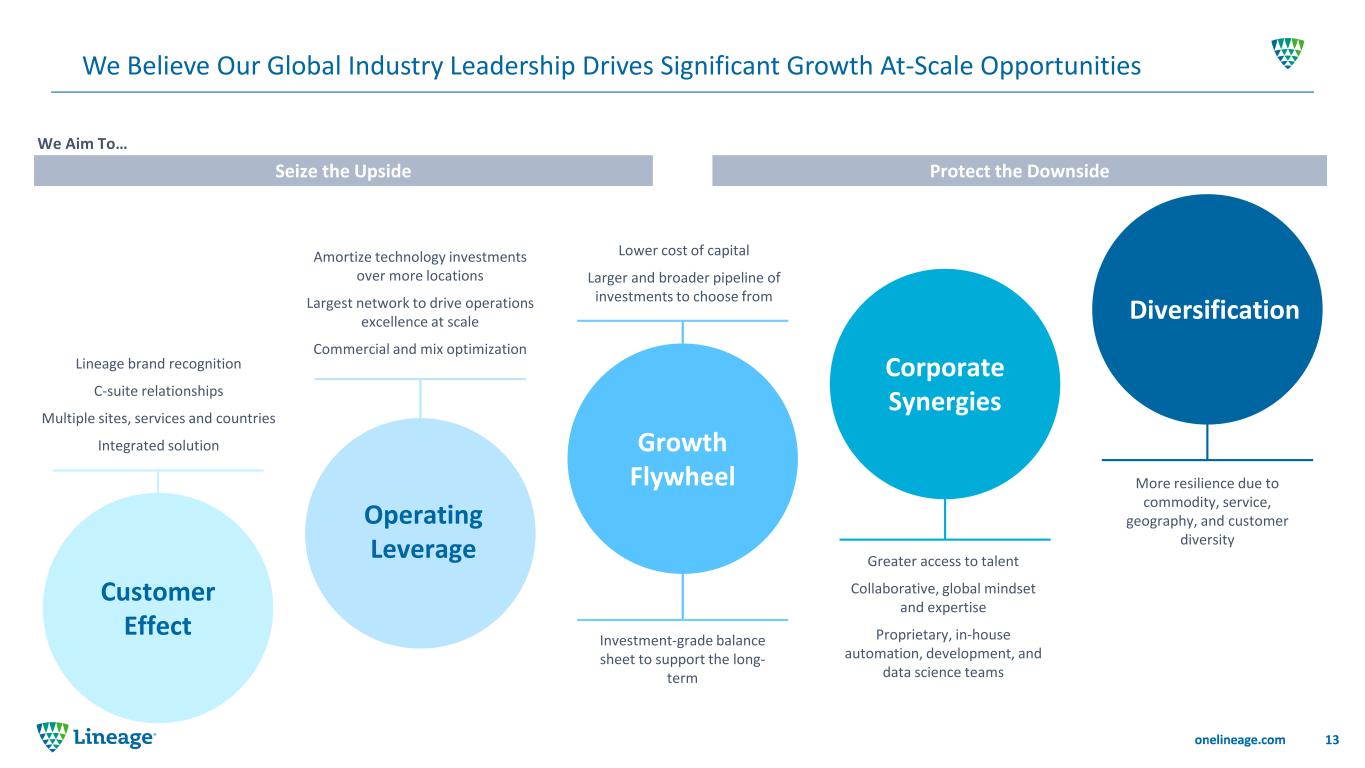

We Believe Our Global Industry Leadership Drives Significant Growth At-Scale Opportunities 13 Customer Effect Growth Flywheel Operating Leverage Corporate Synergies Seize the Upside Protect the Downside Lineage brand recognition C-suite relationships Multiple sites, services and countries Integrated solution Amortize technology investments over more locations Largest network to drive operations excellence at scale Commercial and mix optimization Lower cost of capital Larger and broader pipeline of investments to choose from Investment-grade balance sheet to support the long- term Greater access to talent Collaborative, global mindset and expertise Proprietary, in-house automation, development, and data science teams More resilience due to commodity, service, geography, and customer diversity Diversification We Aim To…

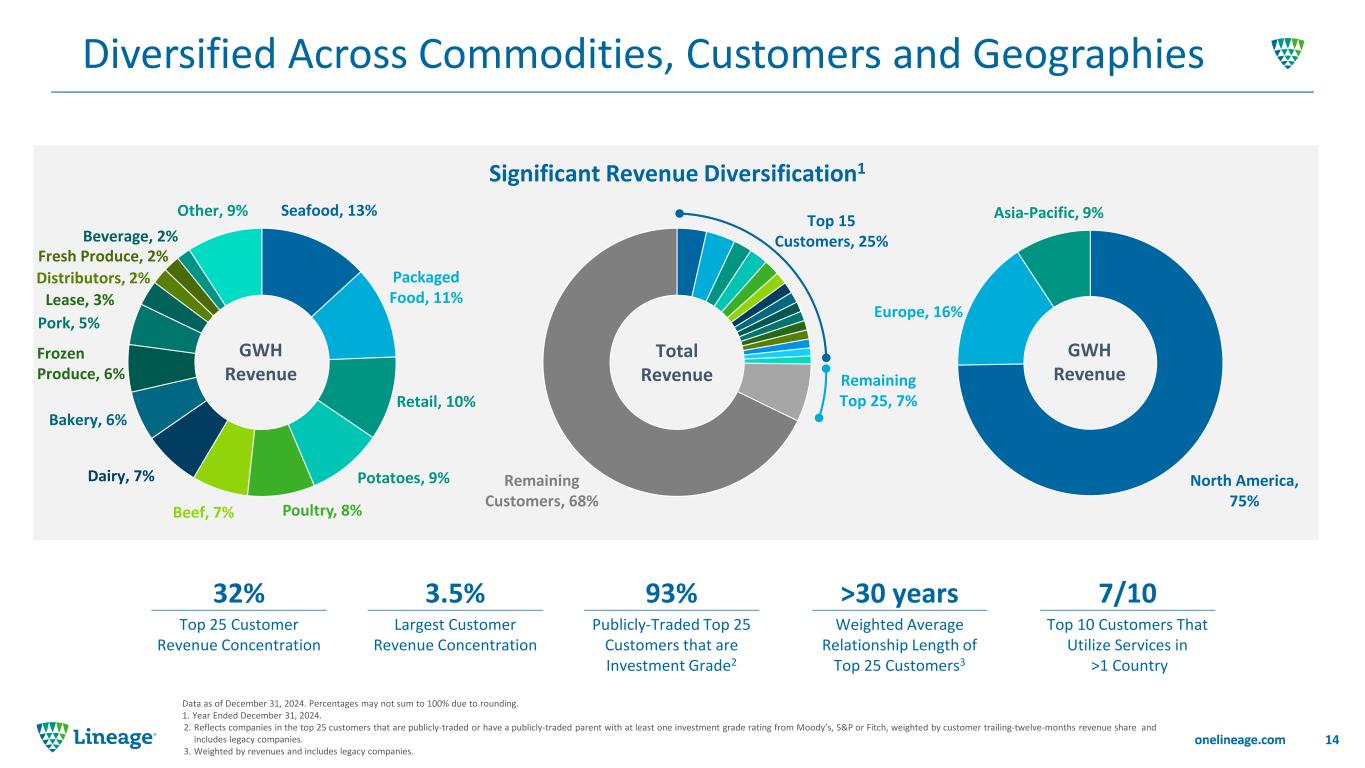

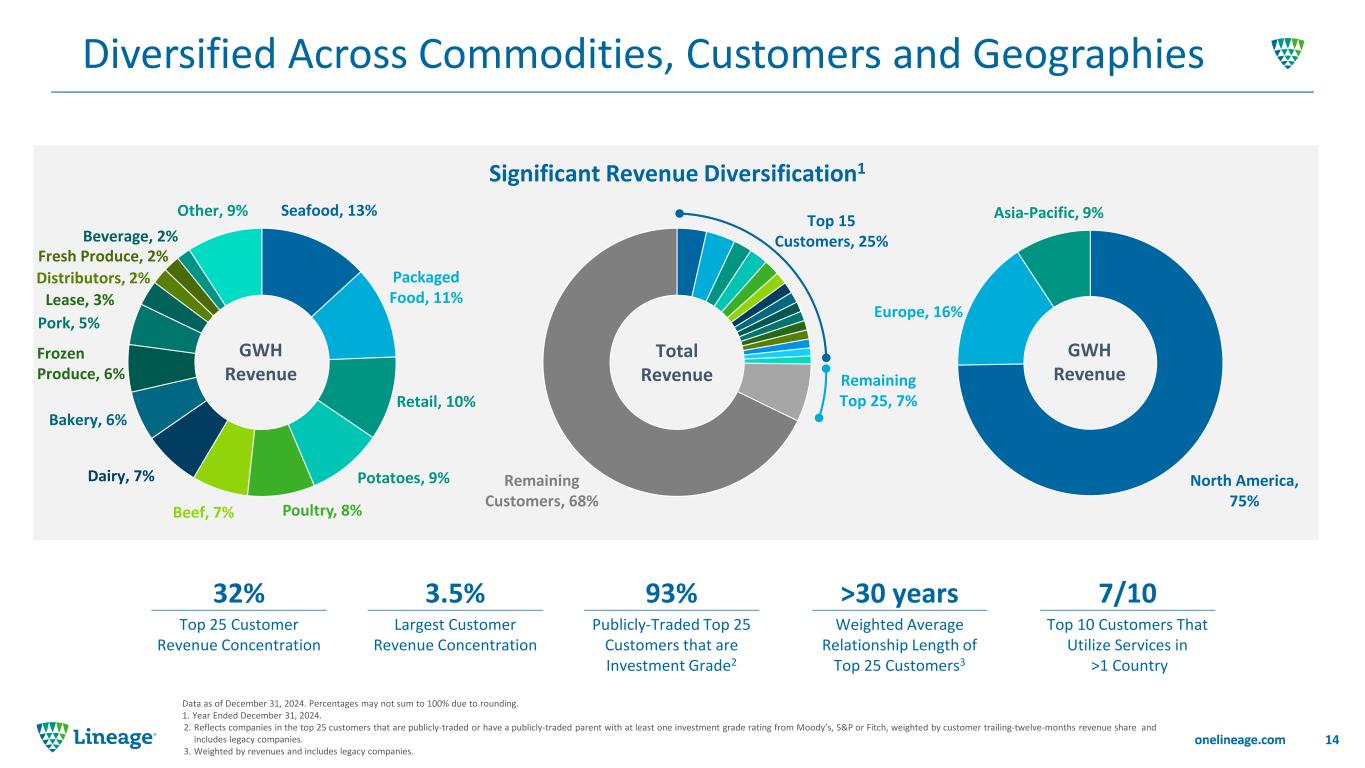

Diversified Across Commodities, Customers and Geographies 14 Data as of December 31, 2024. Percentages may not sum to 100% due to rounding. 1. Year Ended December 31, 2024. 2. Reflects companies in the top 25 customers that are publicly-traded or have a publicly-traded parent with at least one investment grade rating from Moody’s, S&P or Fitch, weighted by customer trailing-twelve-months revenue share and includes legacy companies. 3. Weighted by revenues and includes legacy companies. Significant Revenue Diversification1 Top 25 Customer Revenue Concentration 32% Top 10 Customers That Utilize Services in >1 Country 7/10 Weighted Average Relationship Length of Top 25 Customers3 >30 years Publicly-Traded Top 25 Customers that are Investment Grade2 93% Largest Customer Revenue Concentration 3.5% Remaining Top 25, 7% Poultry, 8% GWH Revenue Bakery, 6% Dairy, 7% Other, 9% Retail, 10% Beef, 7% Seafood, 13% Packaged Food, 11% Frozen Produce, 6% Lease, 3% Distributors, 2% Pork, 5% Fresh Produce, 2% Beverage, 2% GWH Revenue North America, 75% Europe, 16% Asia-Pacific, 9% Total Revenue Top 15 Customers, 25% Remaining Customers, 68% Potatoes, 9%

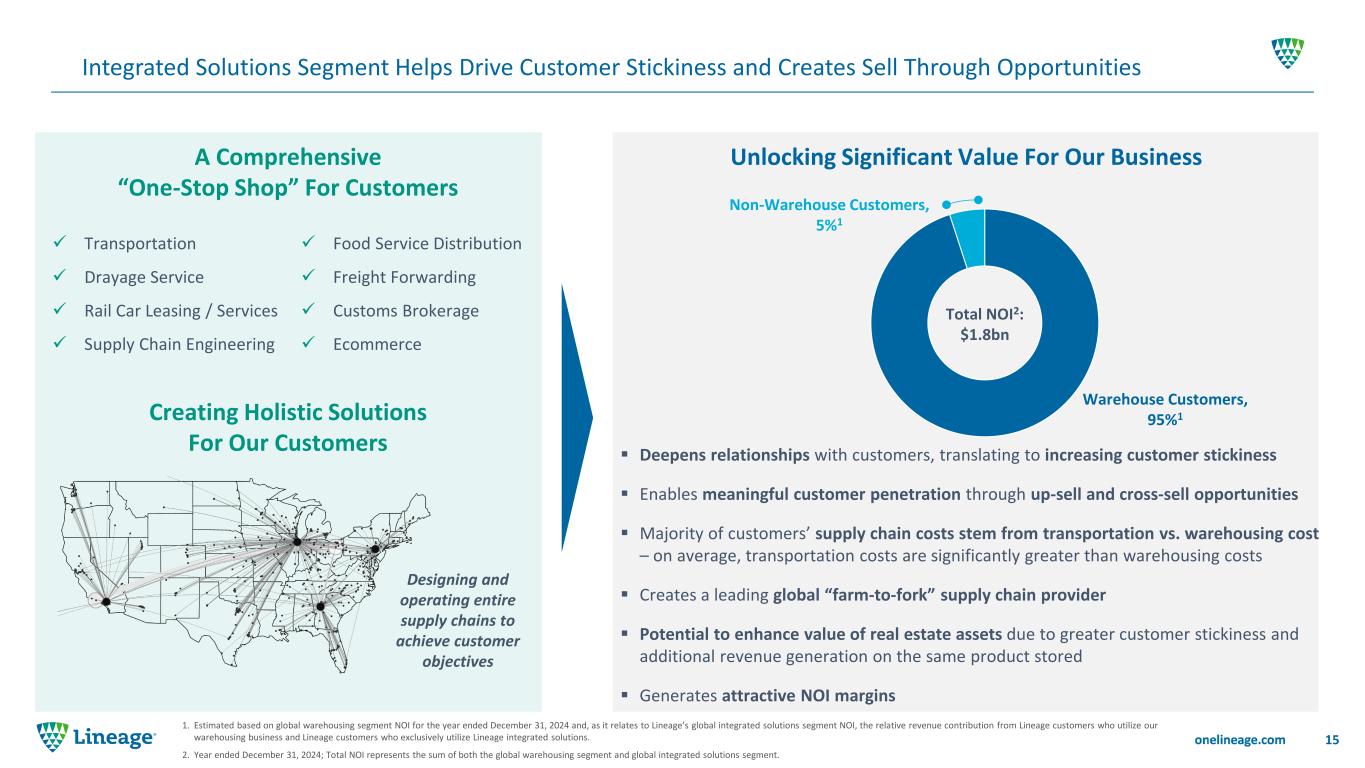

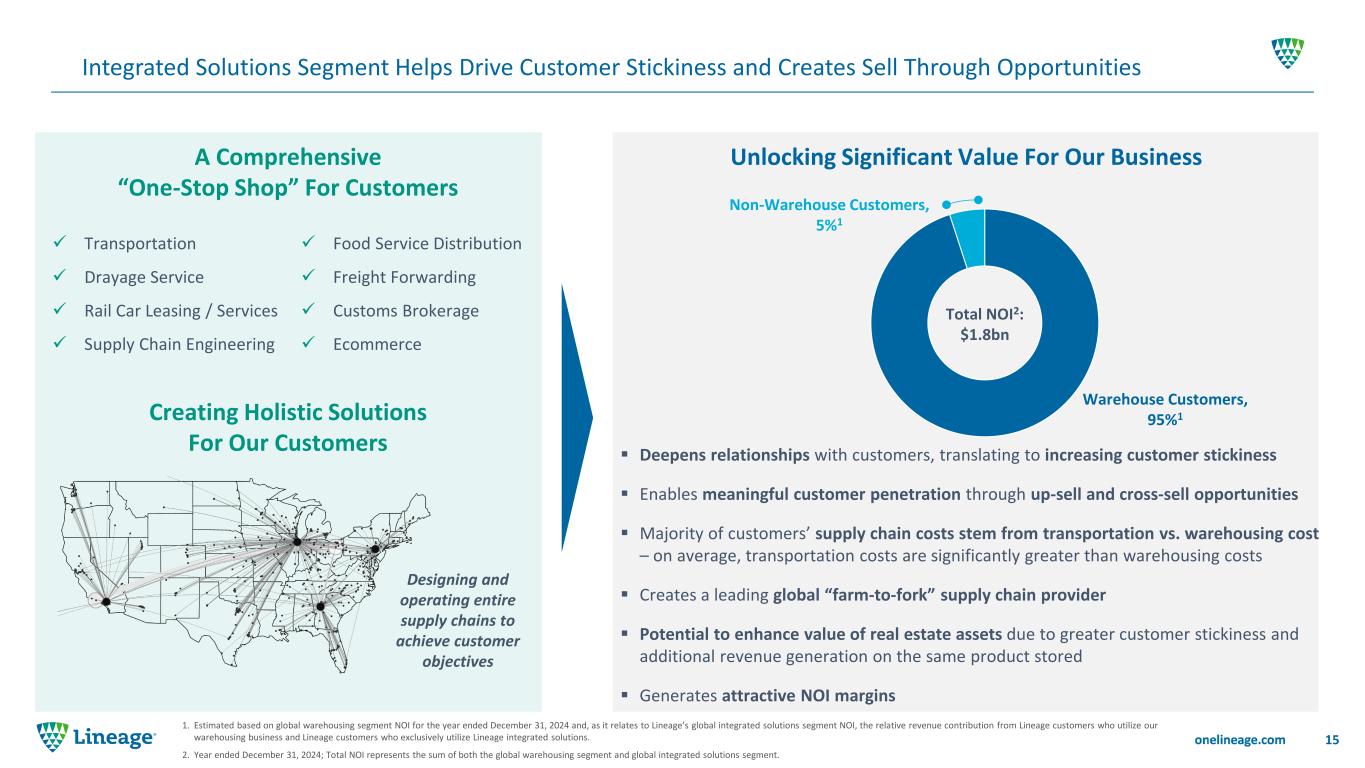

Integrated Solutions Segment Helps Drive Customer Stickiness and Creates Sell Through Opportunities 15 1. Estimated based on global warehousing segment NOI for the year ended December 31, 2024 and, as it relates to Lineage’s global integrated solutions segment NOI, the relative revenue contribution from Lineage customers who utilize our warehousing business and Lineage customers who exclusively utilize Lineage integrated solutions. 2. Year ended December 31, 2024; Total NOI represents the sum of both the global warehousing segment and global integrated solutions segment. Unlocking Significant Value For Our Business Deepens relationships with customers, translating to increasing customer stickiness Enables meaningful customer penetration through up-sell and cross-sell opportunities Majority of customers’ supply chain costs stem from transportation vs. warehousing cost – on average, transportation costs are significantly greater than warehousing costs Creates a leading global “farm-to-fork” supply chain provider Potential to enhance value of real estate assets due to greater customer stickiness and additional revenue generation on the same product stored Generates attractive NOI margins Food Service Distribution Freight Forwarding Customs Brokerage Ecommerce A Comprehensive “One-Stop Shop” For Customers Designing and operating entire supply chains to achieve customer objectives Creating Holistic Solutions For Our Customers Transportation Drayage Service Rail Car Leasing / Services Supply Chain Engineering Total NOI2: $1.8bn Non-Warehouse Customers, 5%1 Warehouse Customers, 95%1

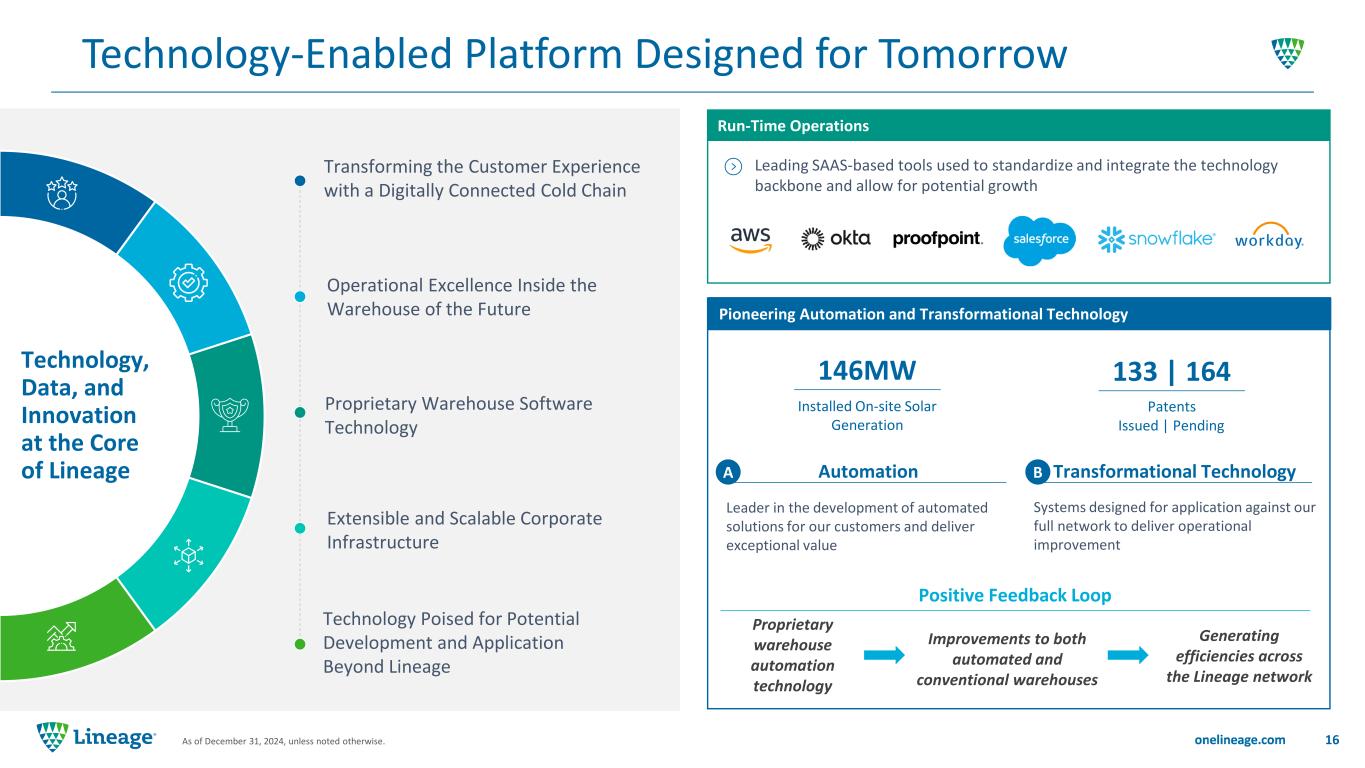

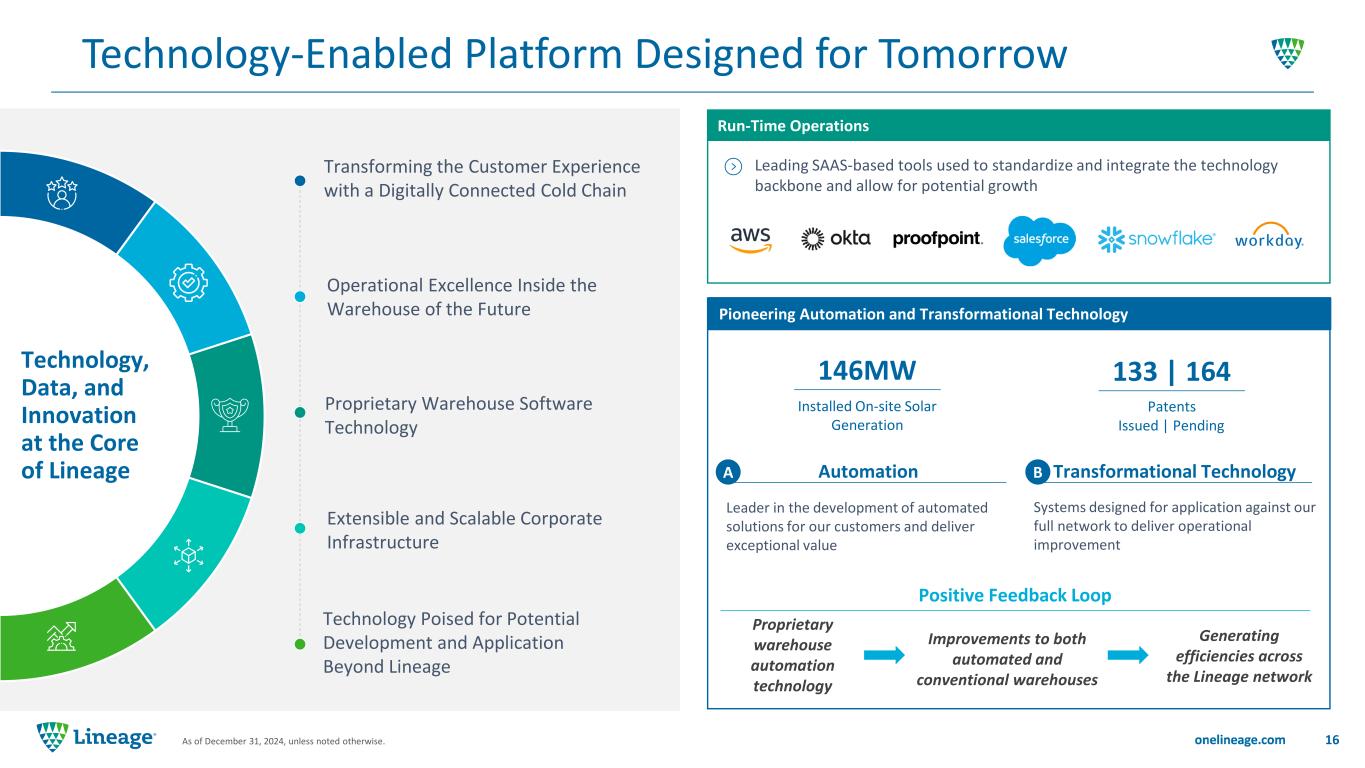

Technology-Enabled Platform Designed for Tomorrow 16As of December 31, 2024, unless noted otherwise. Leading SAAS-based tools used to standardize and integrate the technology backbone and allow for potential growth Pioneering Automation and Transformational Technology Run-Time Operations A BAutomation Transformational Technology Systems designed for application against our full network to deliver operational improvement Leader in the development of automated solutions for our customers and deliver exceptional value Proprietary warehouse automation technology Extensible and Scalable Corporate Infrastructure Proprietary Warehouse Software Technology Transforming the Customer Experience with a Digitally Connected Cold Chain Operational Excellence Inside the Warehouse of the Future Technology Poised for Potential Development and Application Beyond Lineage Positive Feedback Loop Improvements to both automated and conventional warehouses Generating efficiencies across the Lineage network Installed On-site Solar Generation 146MW Patents 133 | 164 Issued | Pending Technology, Data, and Innovation at the Core of Lineage

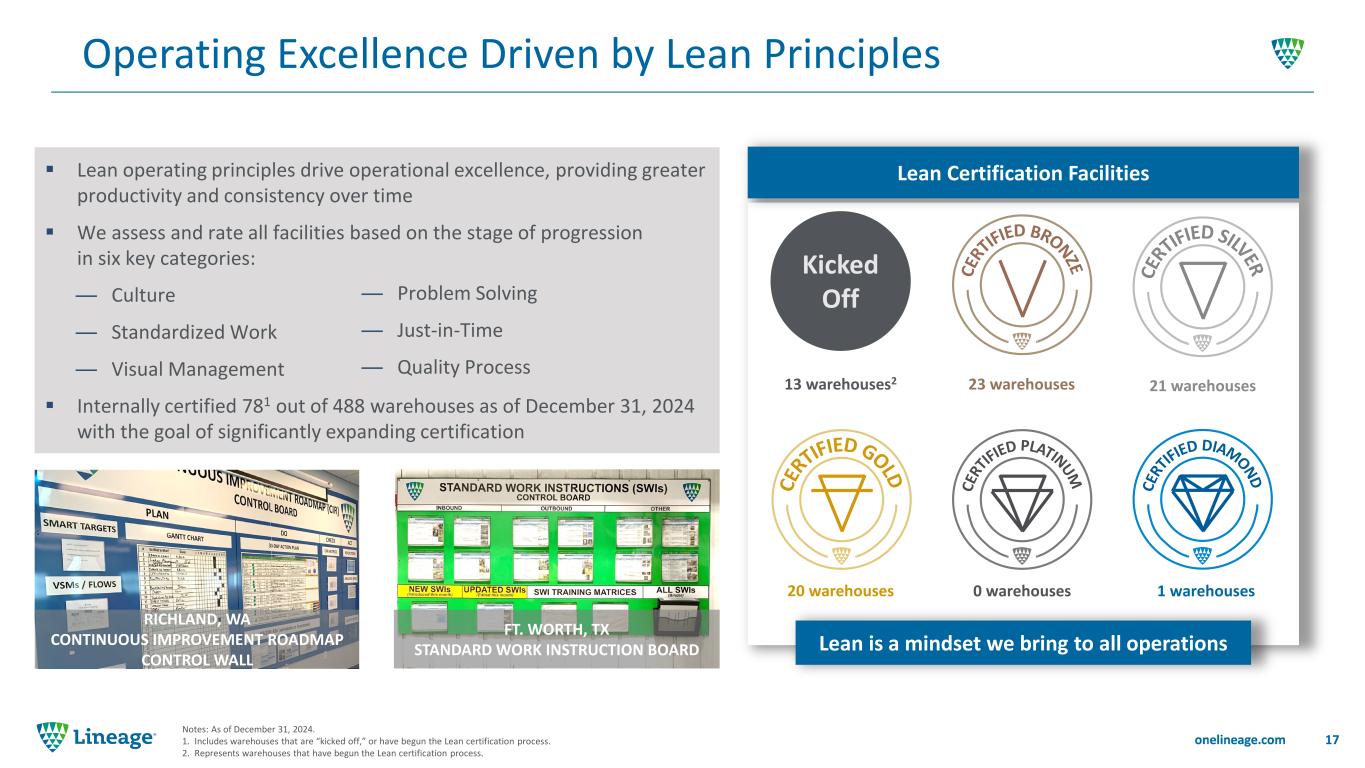

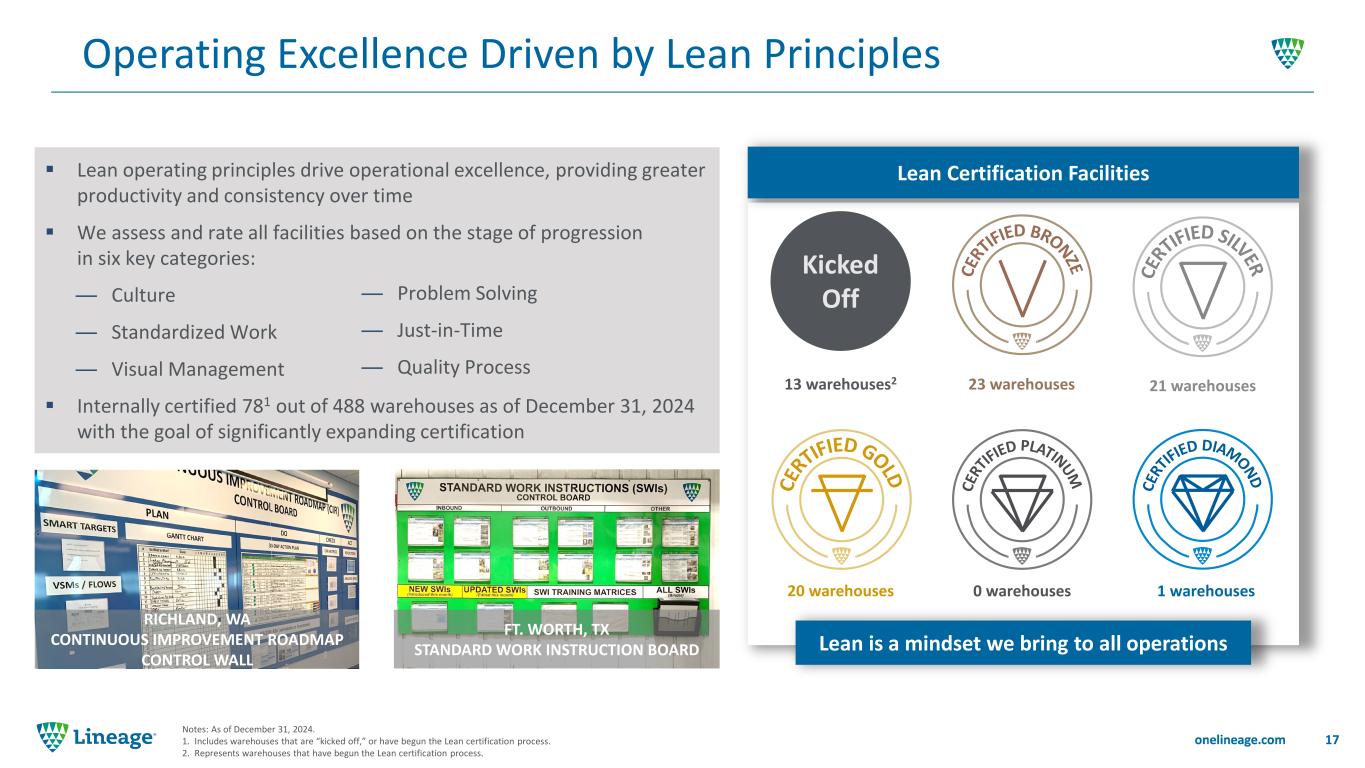

Operating Excellence Driven by Lean Principles 17 Notes: As of December 31, 2024. 1. Includes warehouses that are “kicked off,” or have begun the Lean certification process. 2. Represents warehouses that have begun the Lean certification process. Lean Certification Facilities Lean operating principles drive operational excellence, providing greater productivity and consistency over time We assess and rate all facilities based on the stage of progression in six key categories: — Culture — Standardized Work — Visual Management Internally certified 781 out of 488 warehouses as of December 31, 2024 with the goal of significantly expanding certification — Problem Solving — Just-in-Time — Quality Process Kicked Off 13 warehouses2 23 warehouses 21 warehouses 0 warehouses 20 warehouses 1 warehouses Lean is a mindset we bring to all operations RICHLAND, WA CONTINUOUS IMPROVEMENT ROADMAP CONTROL WALL FT. WORTH, TX STANDARD WORK INSTRUCTION BOARD

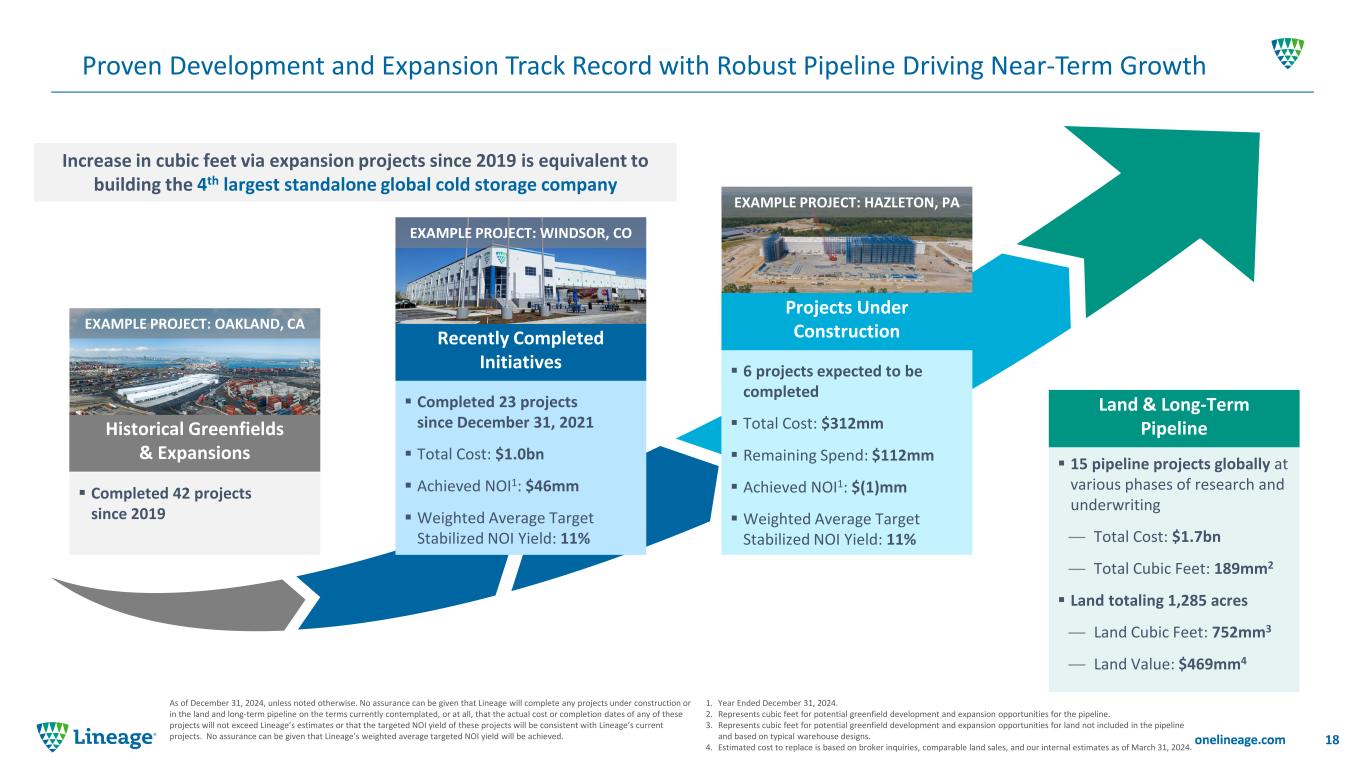

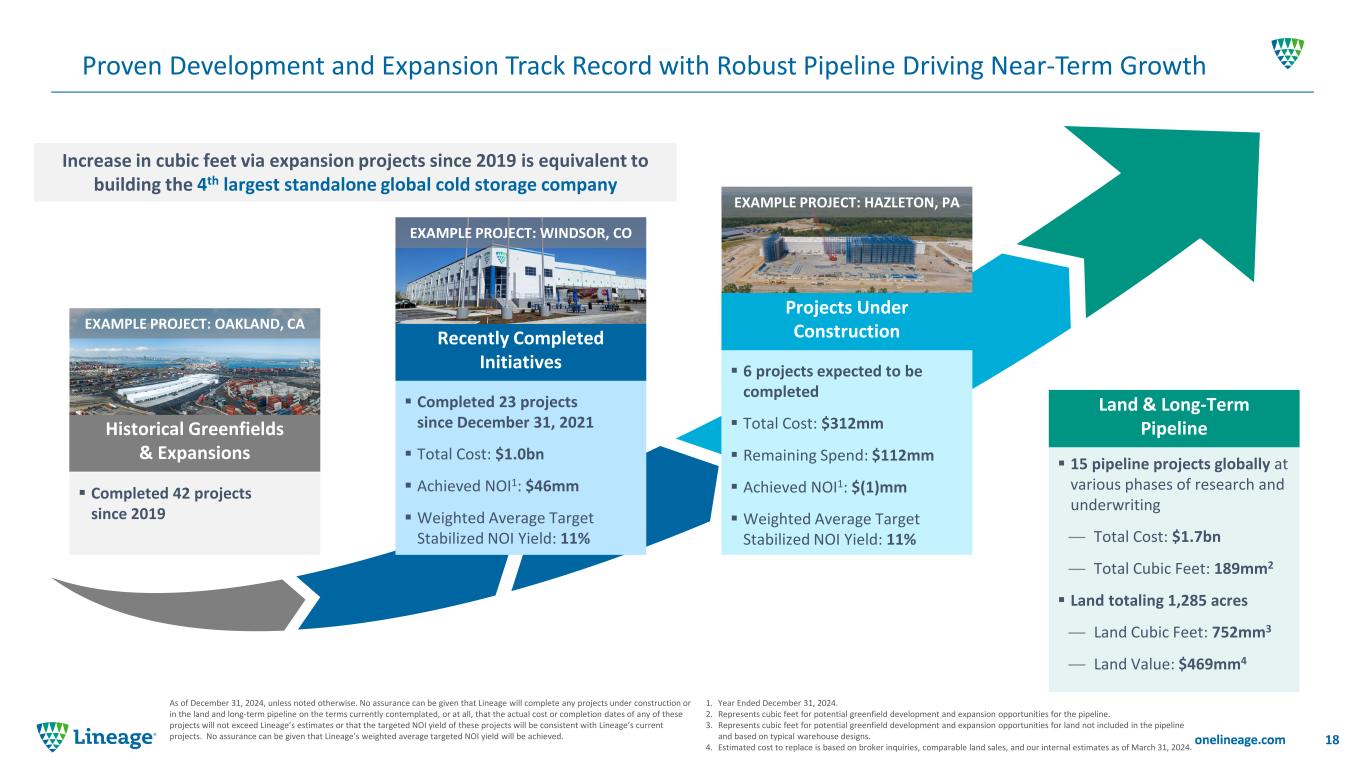

Proven Development and Expansion Track Record with Robust Pipeline Driving Near-Term Growth 18 Completed 42 projects since 2019 Historical Greenfields & Expansions EXAMPLE PROJECT: OAKLAND, CA Completed 23 projects since December 31, 2021 Total Cost: $1.0bn Achieved NOI1: $46mm Weighted Average Target Stabilized NOI Yield: 11% Recently Completed Initiatives EXAMPLE PROJECT: WINDSOR, CO 6 projects expected to be completed Total Cost: $312mm Remaining Spend: $112mm Achieved NOI1: $(1)mm Weighted Average Target Stabilized NOI Yield: 11% EXAMPLE PROJECT: HAZLETON, PA Projects Under Construction Increase in cubic feet via expansion projects since 2019 is equivalent to building the 4th largest standalone global cold storage company Land & Long-Term Pipeline 15 pipeline projects globally at various phases of research and underwriting — Total Cost: $1.7bn — Total Cubic Feet: 189mm2 Land totaling 1,285 acres — Land Cubic Feet: 752mm3 — Land Value: $469mm4 As of December 31, 2024, unless noted otherwise. No assurance can be given that Lineage will complete any projects under construction or in the land and long-term pipeline on the terms currently contemplated, or at all, that the actual cost or completion dates of any of these projects will not exceed Lineage’s estimates or that the targeted NOI yield of these projects will be consistent with Lineage’s current projects. No assurance can be given that Lineage’s weighted average targeted NOI yield will be achieved. 1. Year Ended December 31, 2024. 2. Represents cubic feet for potential greenfield development and expansion opportunities for the pipeline. 3. Represents cubic feet for potential greenfield development and expansion opportunities for land not included in the pipeline and based on typical warehouse designs. 4. Estimated cost to replace is based on broker inquiries, comparable land sales, and our internal estimates as of March 31, 2024.

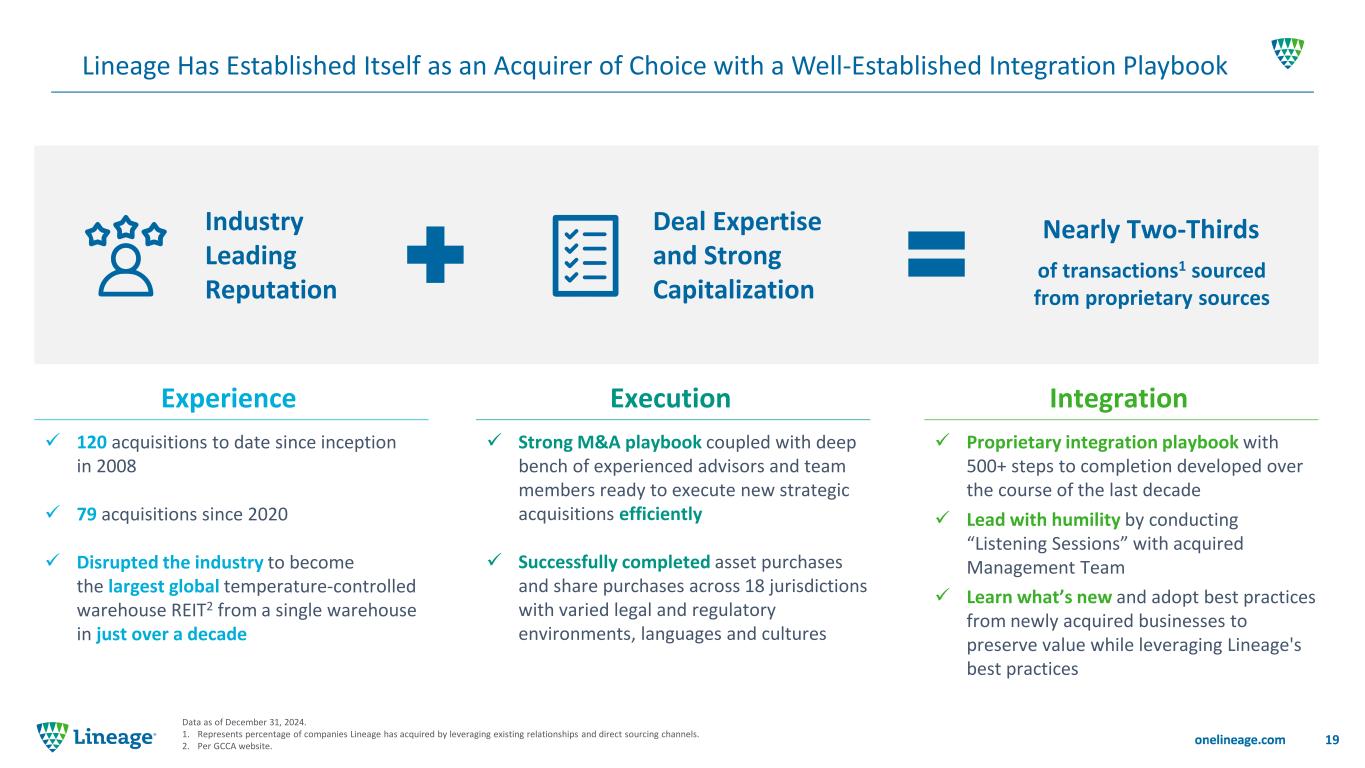

Lineage Has Established Itself as an Acquirer of Choice with a Well-Established Integration Playbook 19 Data as of December 31, 2024. 1. Represents percentage of companies Lineage has acquired by leveraging existing relationships and direct sourcing channels. 2. Per GCCA website. Experience 120 acquisitions to date since inception in 2008 79 acquisitions since 2020 Disrupted the industry to become the largest global temperature-controlled warehouse REIT2 from a single warehouse in just over a decade Integration Proprietary integration playbook with 500+ steps to completion developed over the course of the last decade Lead with humility by conducting “Listening Sessions” with acquired Management Team Learn what’s new and adopt best practices from newly acquired businesses to preserve value while leveraging Lineage's best practices Execution Strong M&A playbook coupled with deep bench of experienced advisors and team members ready to execute new strategic acquisitions efficiently Successfully completed asset purchases and share purchases across 18 jurisdictions with varied legal and regulatory environments, languages and cultures Industry Leading Reputation of transactions1 sourced from proprietary sources Deal Expertise and Strong Capitalization Nearly Two-Thirds

Focused on Doing Good While Doing Well 20 Feed the World Launched Lineage Foundation for Good & “Share a Meal” Campaign to limit waste and provide relief to those in need Climate Change Deeply committed to sustainability strategy and reporting. Climate pledge signatory to achieve net-zero annual carbon by 2040 Great Place to Work Supporting team-members by enhancing safety, and promoting Inclusion and Belonging through Employee Resource Groups x Employee Resource Groups Our Commitment to Solar

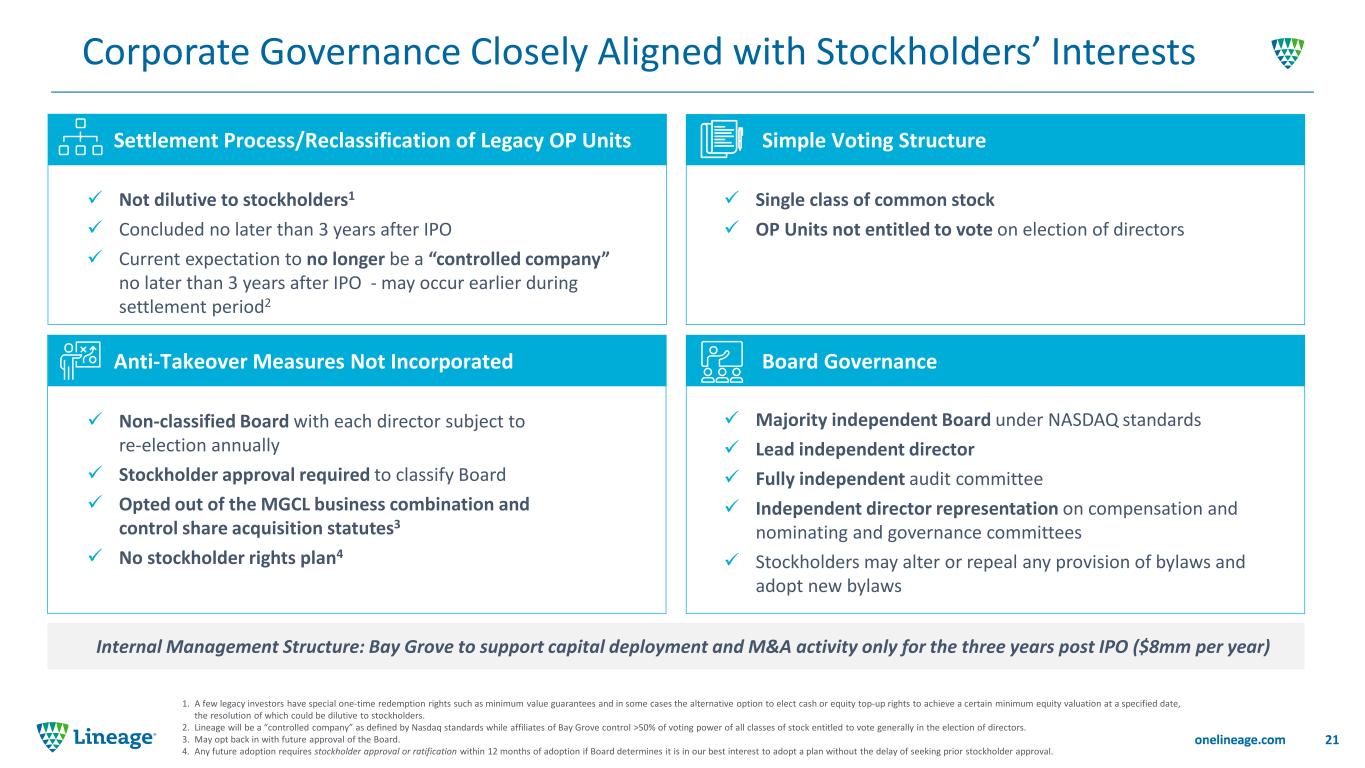

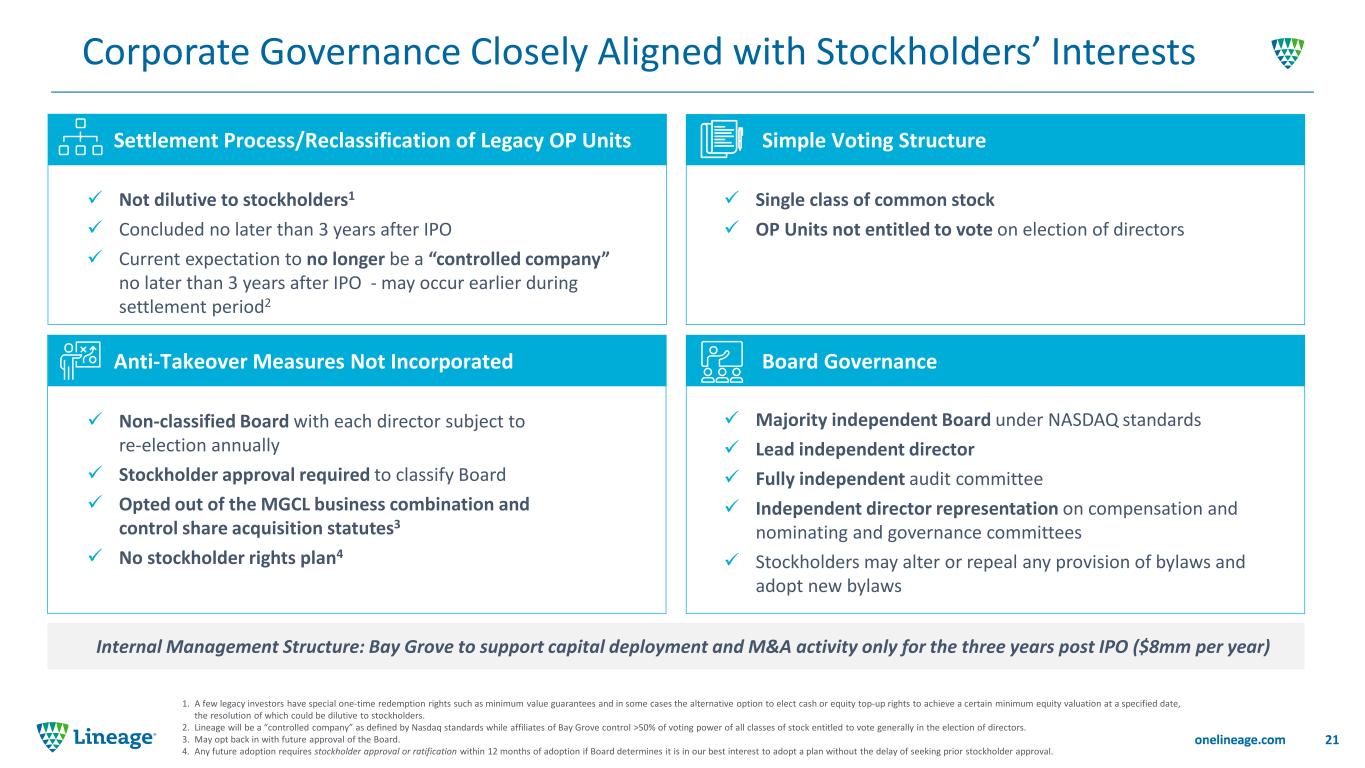

Corporate Governance Closely Aligned with Stockholders’ Interests 21 1. A few legacy investors have special one-time redemption rights such as minimum value guarantees and in some cases the alternative option to elect cash or equity top-up rights to achieve a certain minimum equity valuation at a specified date, the resolution of which could be dilutive to stockholders. 2. Lineage will be a “controlled company” as defined by Nasdaq standards while affiliates of Bay Grove control >50% of voting power of all classes of stock entitled to vote generally in the election of directors. 3. May opt back in with future approval of the Board. 4. Any future adoption requires stockholder approval or ratification within 12 months of adoption if Board determines it is in our best interest to adopt a plan without the delay of seeking prior stockholder approval. Internal Management Structure: Bay Grove to support capital deployment and M&A activity only for the three years post IPO ($8mm per year) Settlement Process/Reclassification of Legacy OP Units Not dilutive to stockholders1 Concluded no later than 3 years after IPO Current expectation to no longer be a “controlled company” no later than 3 years after IPO - may occur earlier during settlement period2 Anti-Takeover Measures Not Incorporated Simple Voting Structure Board Governance Non-classified Board with each director subject to re-election annually Stockholder approval required to classify Board Opted out of the MGCL business combination and control share acquisition statutes3 No stockholder rights plan4 Single class of common stock OP Units not entitled to vote on election of directors Majority independent Board under NASDAQ standards Lead independent director Fully independent audit committee Independent director representation on compensation and nominating and governance committees Stockholders may alter or repeal any provision of bylaws and adopt new bylaws

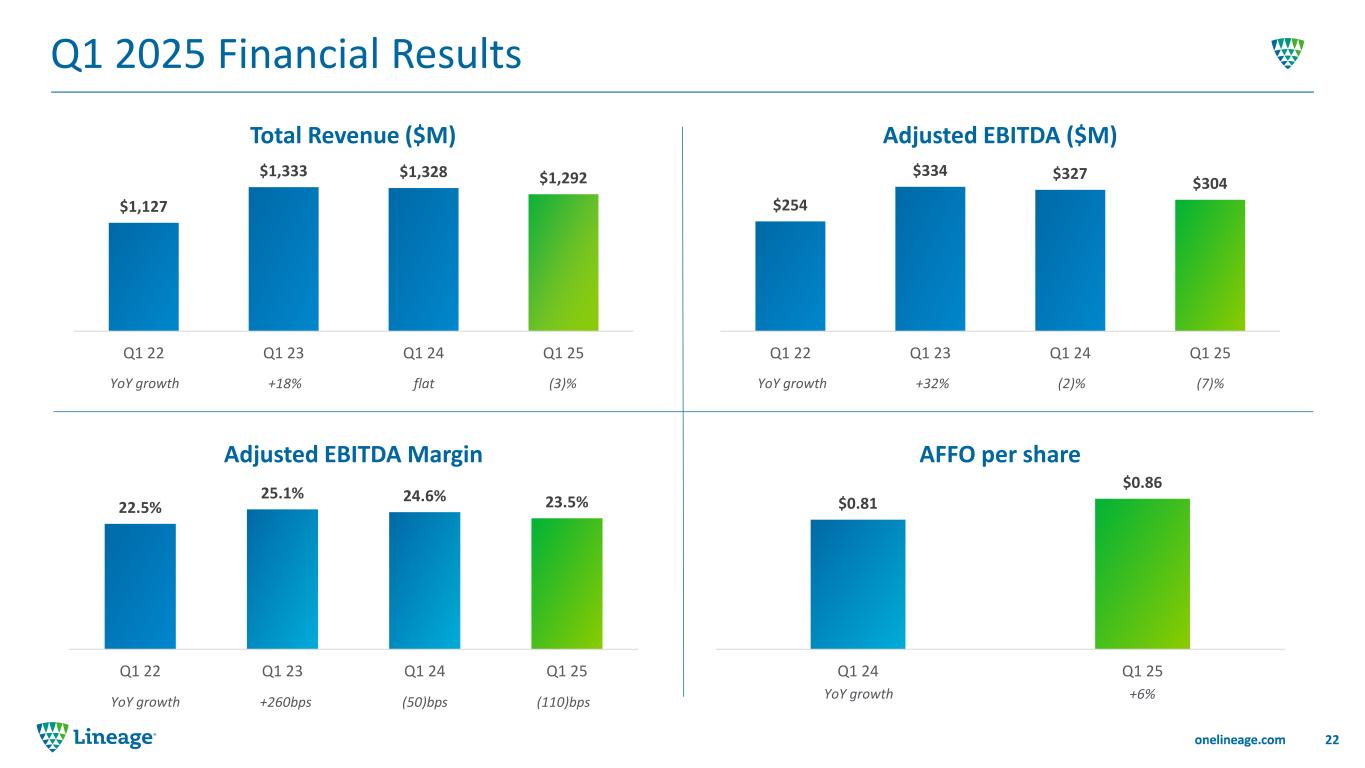

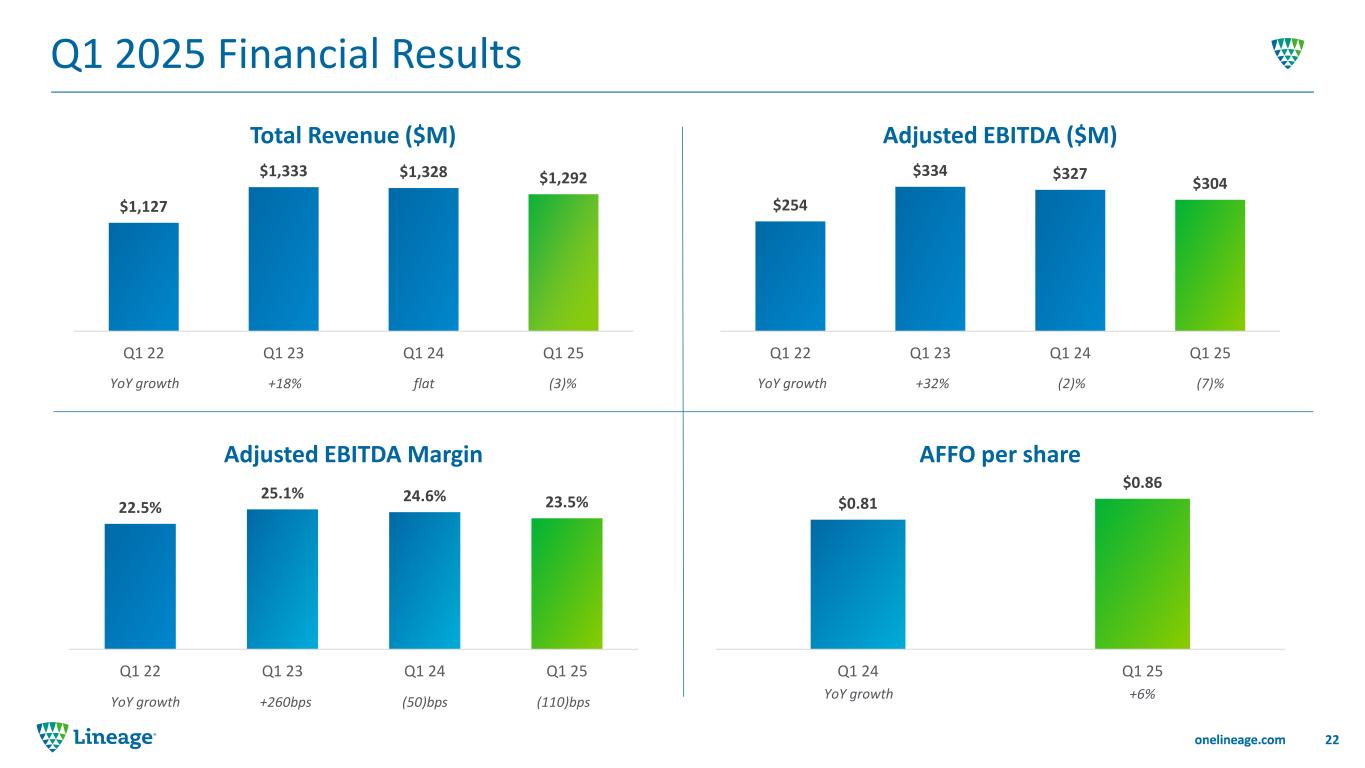

Q1 2025 Financial Results 22 Total Revenue ($M) Adjusted EBITDA ($M) Adjusted EBITDA Margin AFFO per share $254 $334 $327 $304 Q1 22 Q1 23 Q1 24 Q1 25 22.5% 25.1% 24.6% 23.5% Q1 22 Q1 23 Q1 24 Q1 25 $1,127 $1,333 $1,328 $1,292 Q1 22 Q1 23 Q1 24 Q1 25 (3)%flatYoY growth +18% (7)%(2)%YoY growth +32% (110)bps(50)bpsYoY growth +260bps $0.81 $0.86 Q1 24 Q1 25 +6%YoY growth

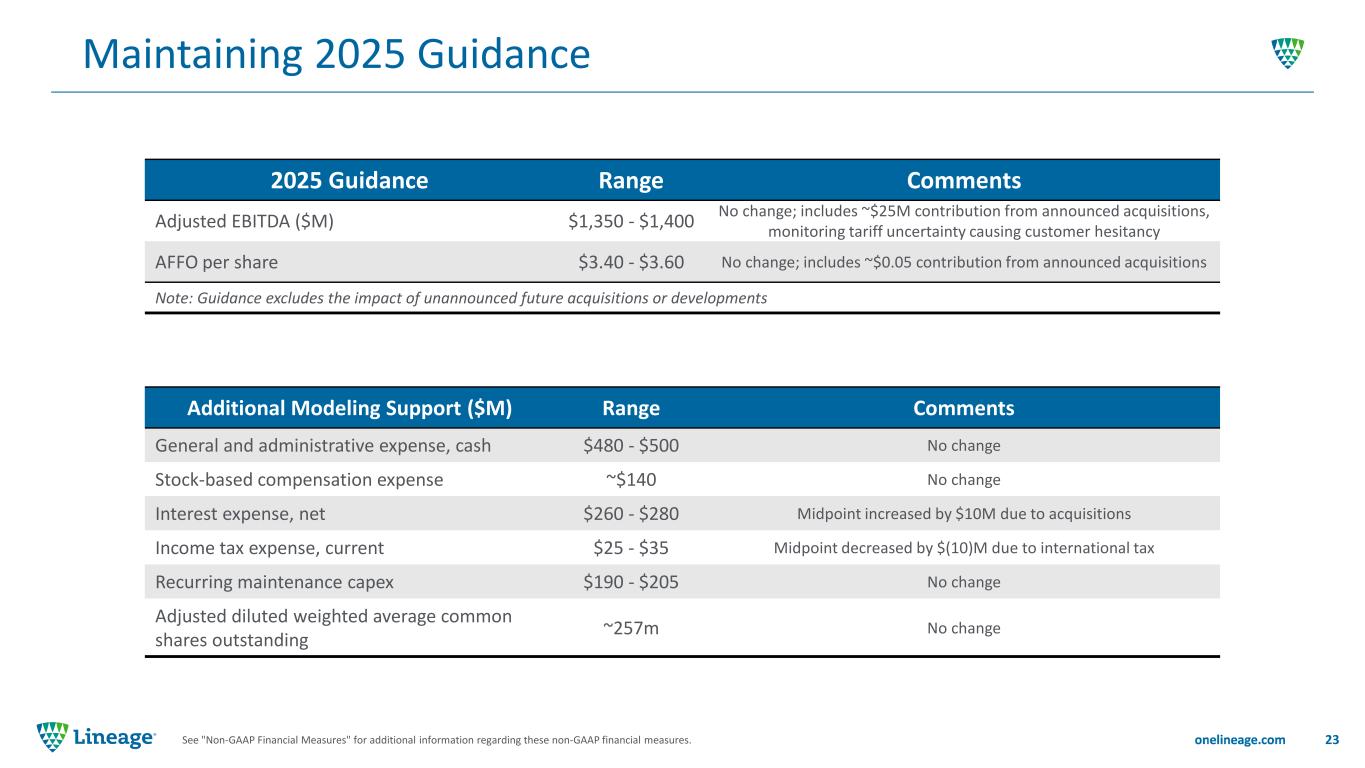

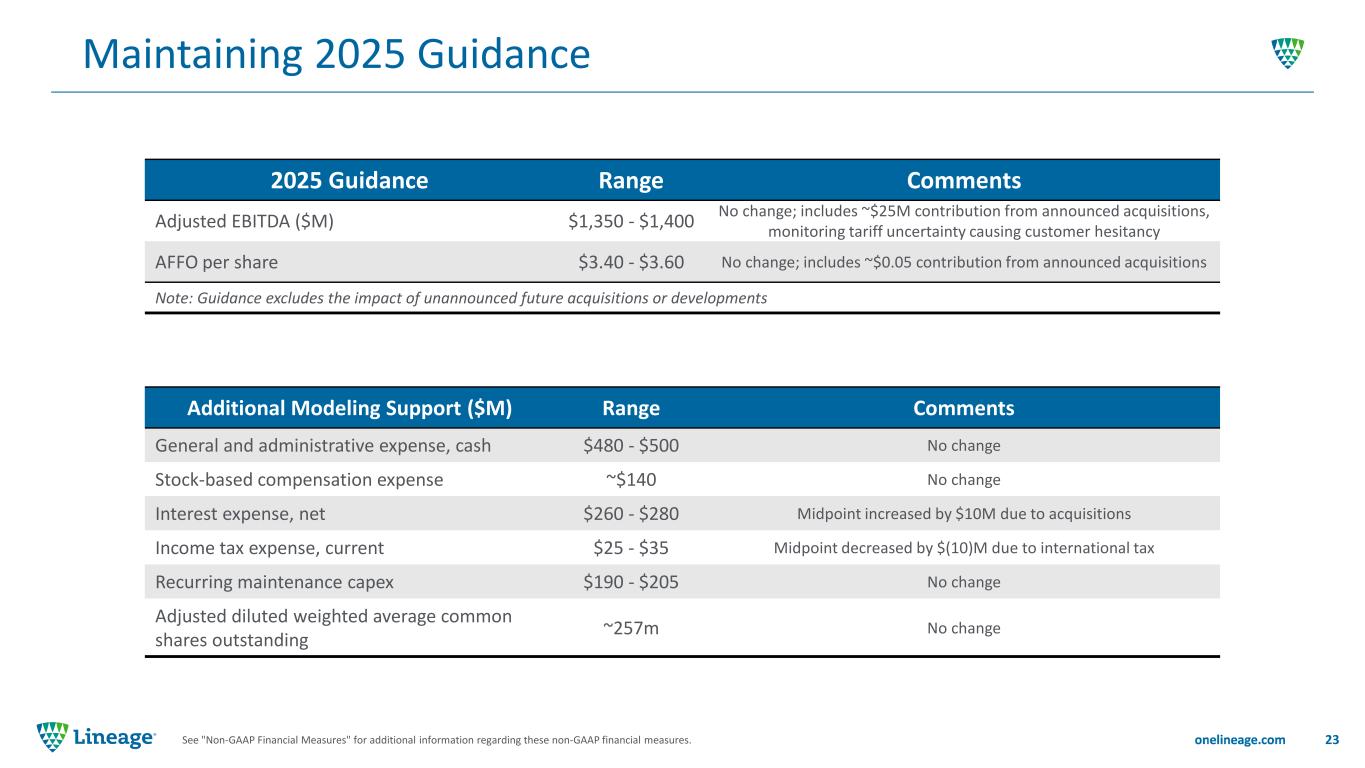

23 Maintaining 2025 Guidance See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 2025 Guidance Range Comments Adjusted EBITDA ($M) $1,350 - $1,400 No change; includes ~$25M contribution from announced acquisitions, monitoring tariff uncertainty causing customer hesitancy AFFO per share $3.40 - $3.60 No change; includes ~$0.05 contribution from announced acquisitions Note: Guidance excludes the impact of unannounced future acquisitions or developments Additional Modeling Support ($M) Range Comments General and administrative expense, cash $480 - $500 No change Stock-based compensation expense ~$140 No change Interest expense, net $260 - $280 Midpoint increased by $10M due to acquisitions Income tax expense, current $25 - $35 Midpoint decreased by $(10)M due to international tax Recurring maintenance capex $190 - $205 No change Adjusted diluted weighted average common shares outstanding ~257m No change

Appendix: Non-GAAP Reconciliations 24

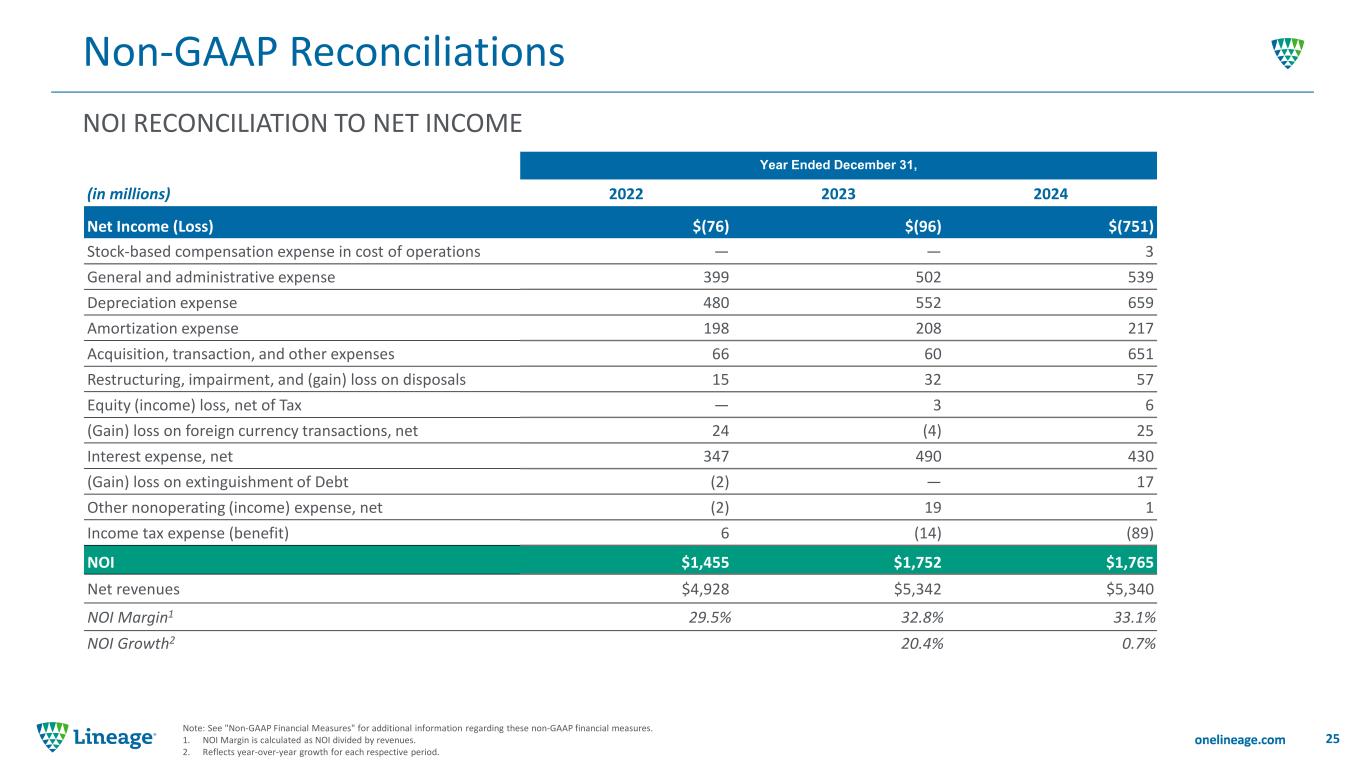

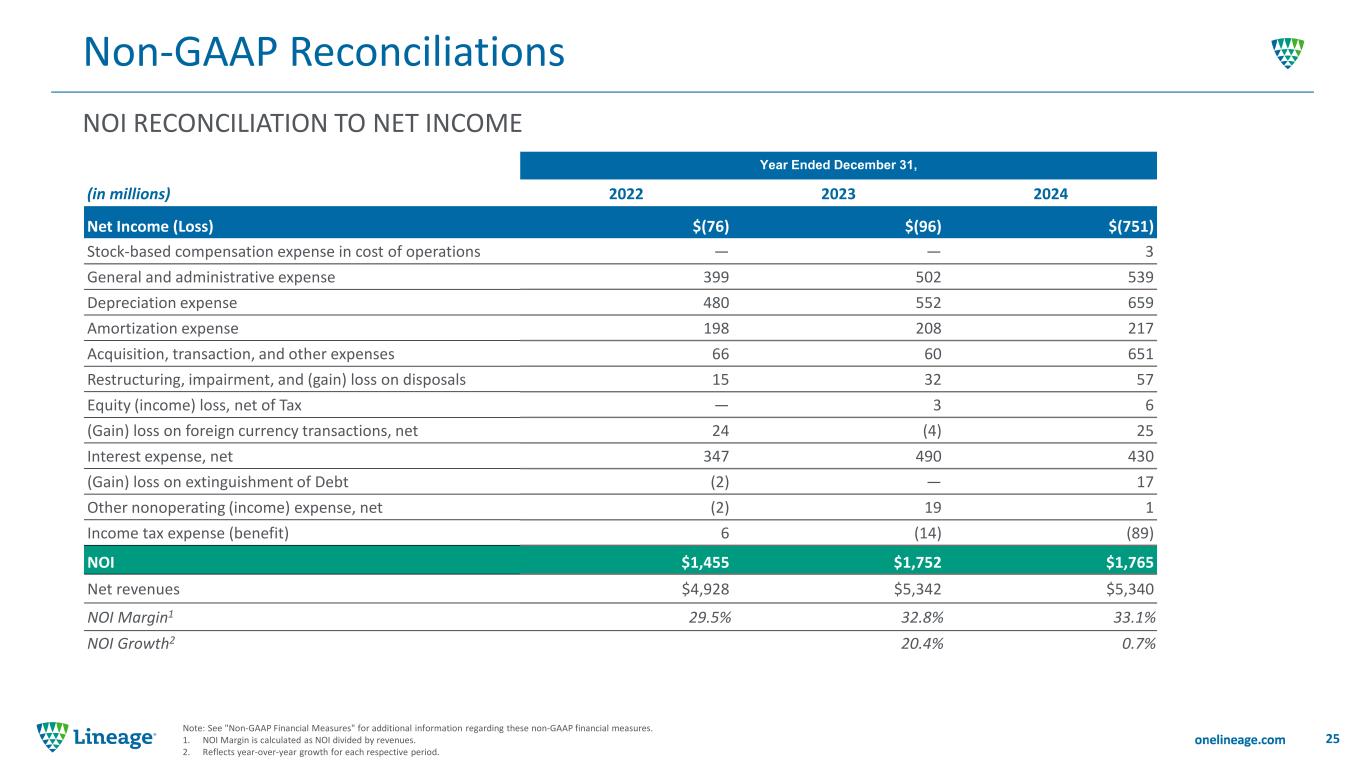

NOI RECONCILIATION TO NET INCOME Non-GAAP Reconciliations 25 Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 1. NOI Margin is calculated as NOI divided by revenues. 2. Reflects year-over-year growth for each respective period. Year Ended December 31, (in millions) 2022 2023 2024 Net Income (Loss) $(76) $(96) $(751) Stock-based compensation expense in cost of operations — — 3 General and administrative expense 399 502 539 Depreciation expense 480 552 659 Amortization expense 198 208 217 Acquisition, transaction, and other expenses 66 60 651 Restructuring, impairment, and (gain) loss on disposals 15 32 57 Equity (income) loss, net of Tax — 3 6 (Gain) loss on foreign currency transactions, net 24 (4) 25 Interest expense, net 347 490 430 (Gain) loss on extinguishment of Debt (2) — 17 Other nonoperating (income) expense, net (2) 19 1 Income tax expense (benefit) 6 (14) (89) NOI $1,455 $1,752 $1,765 Net revenues $4,928 $5,342 $5,340 NOI Margin1 29.5% 32.8% 33.1% NOI Growth2 20.4% 0.7%

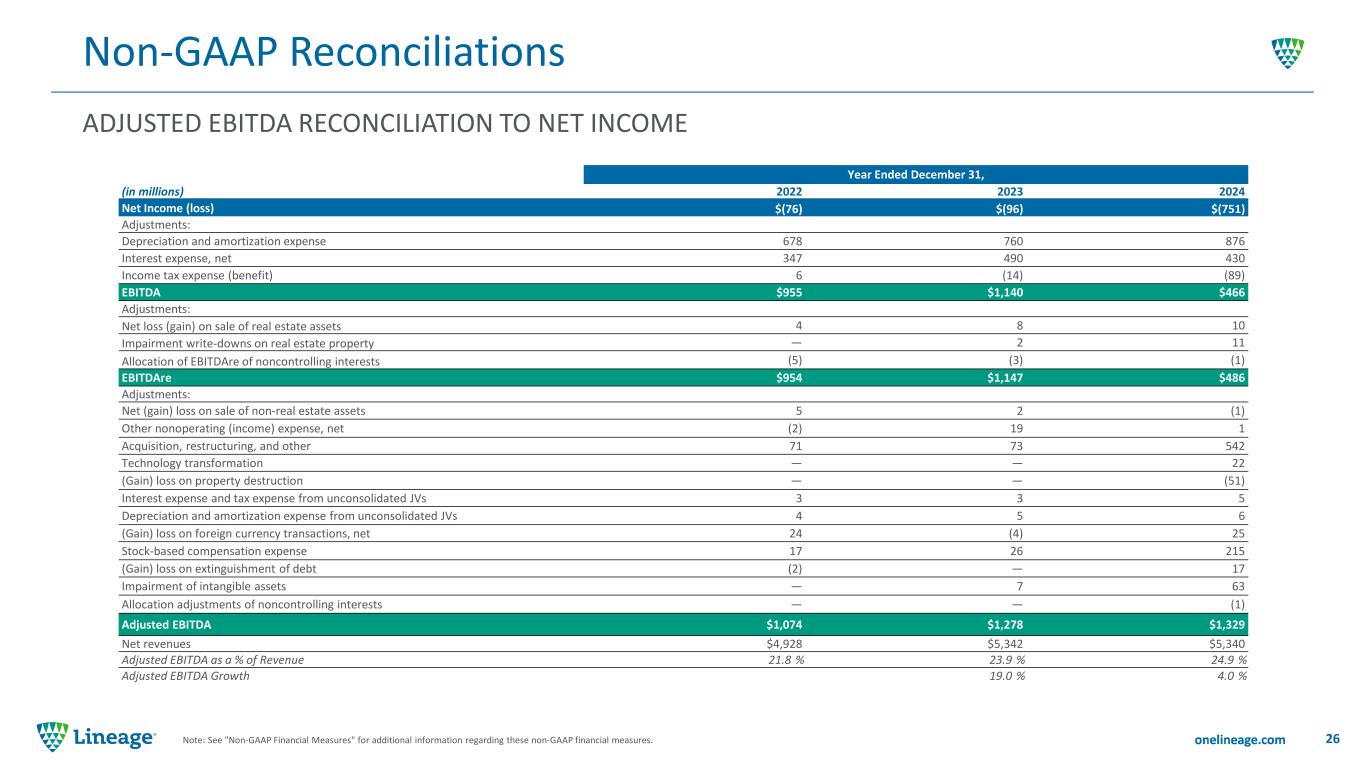

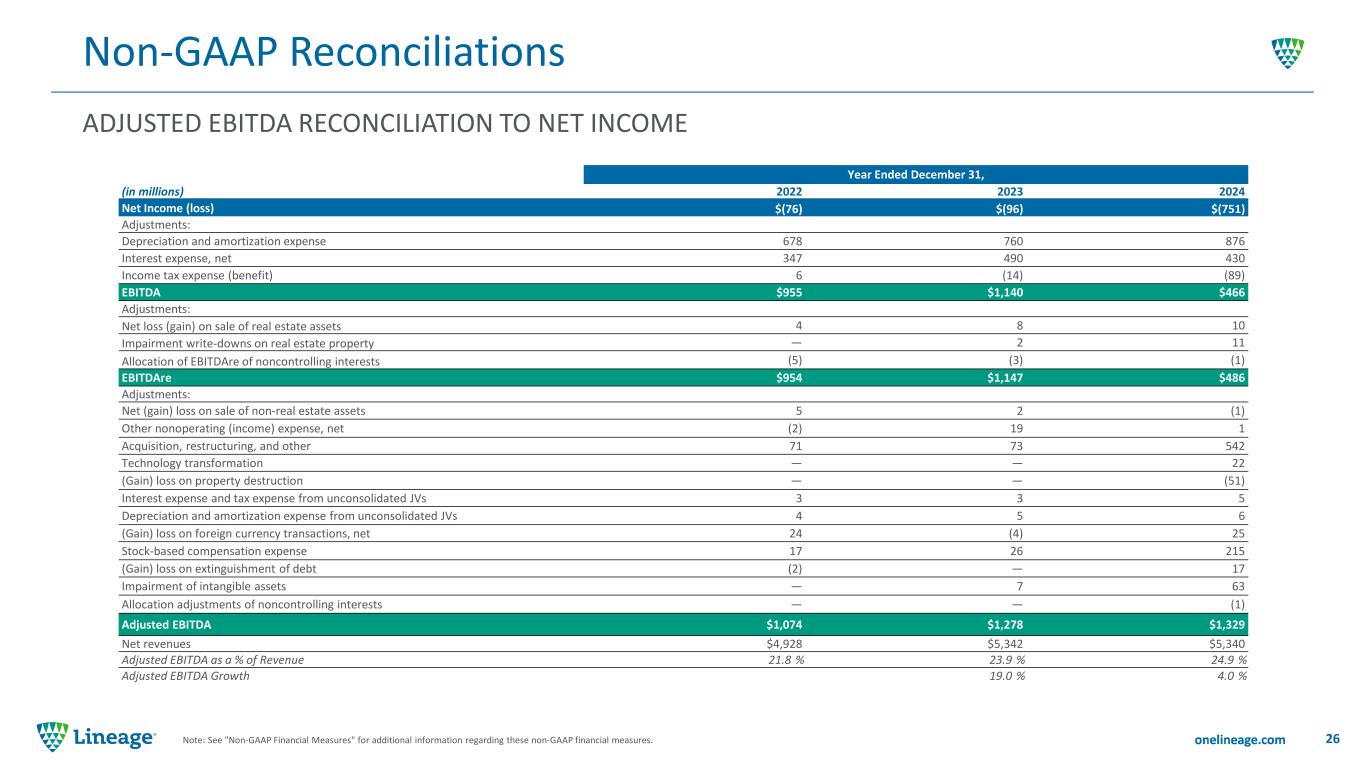

ADJUSTED EBITDA RECONCILIATION TO NET INCOME Non-GAAP Reconciliations 26Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Year Ended December 31, (in millions) 2022 2023 2024 Net Income (loss) $(76) $(96) $(751) Adjustments: Depreciation and amortization expense 678 760 876 Interest expense, net 347 490 430 Income tax expense (benefit) 6 (14) (89) EBITDA $955 $1,140 $466 Adjustments: Net loss (gain) on sale of real estate assets 4 8 10 Impairment write-downs on real estate property — 2 11 Allocation of EBITDAre of noncontrolling interests (5) (3) (1) EBITDAre $954 $1,147 $486 Adjustments: Net (gain) loss on sale of non-real estate assets 5 2 (1) Other nonoperating (income) expense, net (2) 19 1 Acquisition, restructuring, and other 71 73 542 Technology transformation — — 22 (Gain) loss on property destruction — — (51) Interest expense and tax expense from unconsolidated JVs 3 3 5 Depreciation and amortization expense from unconsolidated JVs 4 5 6 (Gain) loss on foreign currency transactions, net 24 (4) 25 Stock-based compensation expense 17 26 215 (Gain) loss on extinguishment of debt (2) — 17 Impairment of intangible assets — 7 63 Allocation adjustments of noncontrolling interests — — (1) Adjusted EBITDA $1,074 $1,278 $1,329 Net revenues $4,928 $5,342 $5,340 Adjusted EBITDA as a % of Revenue 21.8 % 23.9 % 24.9 % Adjusted EBITDA Growth 19.0 % 4.0 %

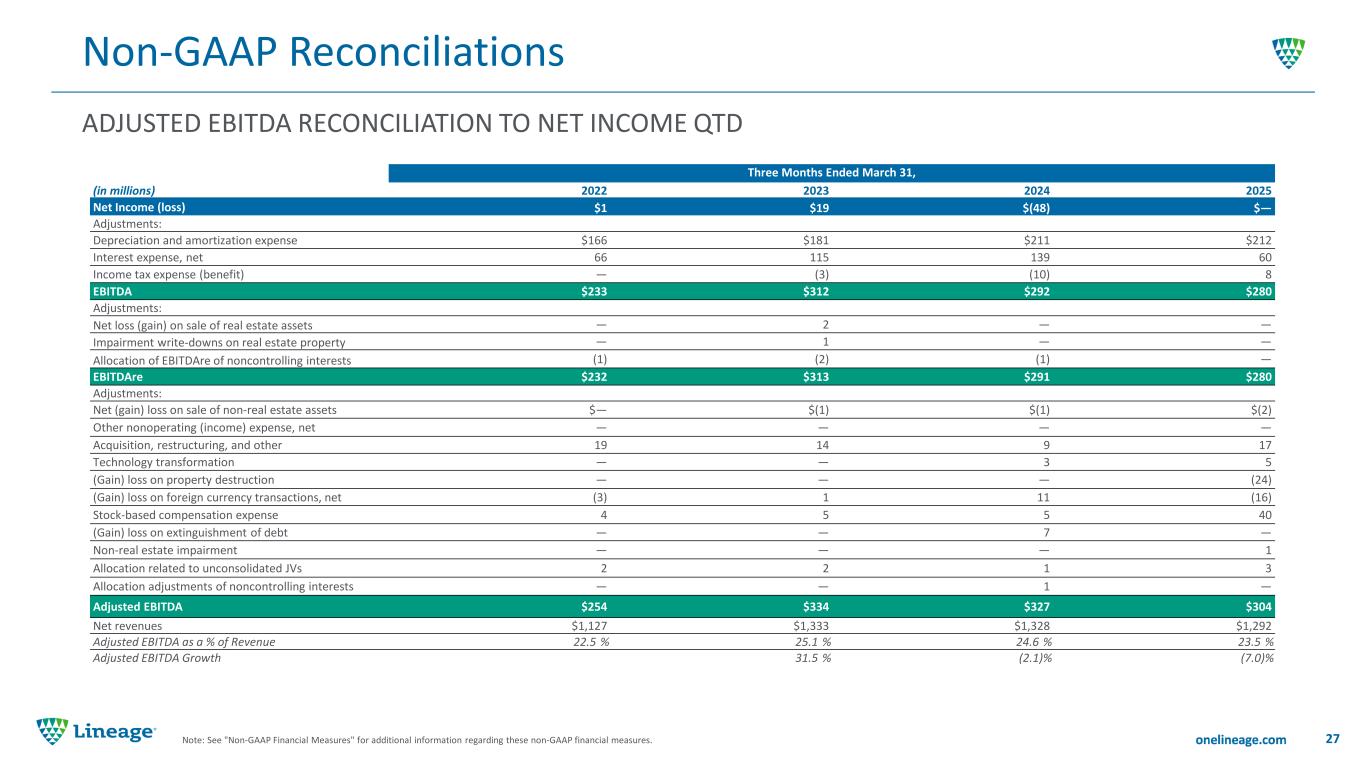

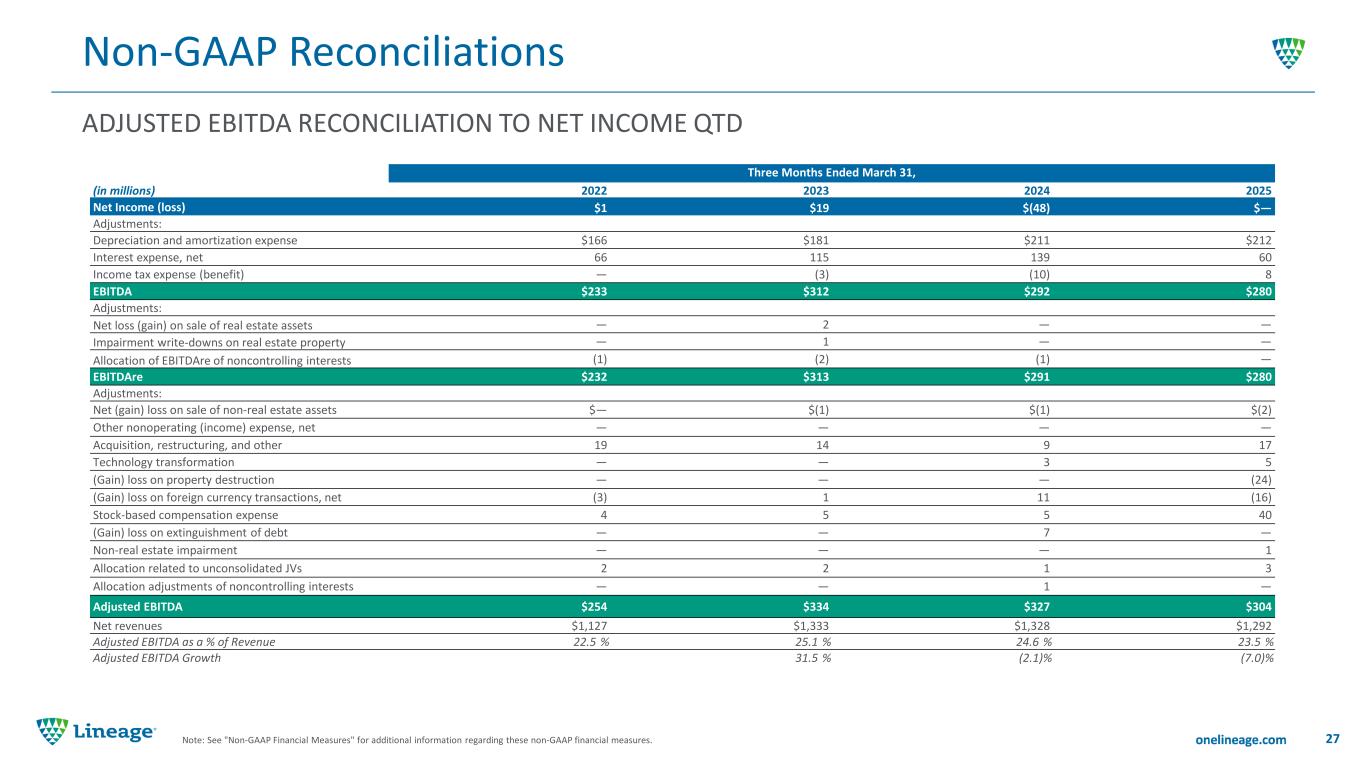

ADJUSTED EBITDA RECONCILIATION TO NET INCOME QTD Non-GAAP Reconciliations Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended March 31, (in millions) 2022 2023 2024 2025 Net Income (loss) $1 $19 $(48) $— Adjustments: Depreciation and amortization expense $166 $181 $211 $212 Interest expense, net 66 115 139 60 Income tax expense (benefit) — (3) (10) 8 EBITDA $233 $312 $292 $280 Adjustments: Net loss (gain) on sale of real estate assets — 2 — — Impairment write-downs on real estate property — 1 — — Allocation of EBITDAre of noncontrolling interests (1) (2) (1) — EBITDAre $232 $313 $291 $280 Adjustments: Net (gain) loss on sale of non-real estate assets $— $(1) $(1) $(2) Other nonoperating (income) expense, net — — — — Acquisition, restructuring, and other 19 14 9 17 Technology transformation — — 3 5 (Gain) loss on property destruction — — — (24) (Gain) loss on foreign currency transactions, net (3) 1 11 (16) Stock-based compensation expense 4 5 5 40 (Gain) loss on extinguishment of debt — — 7 — Non-real estate impairment — — — 1 Allocation related to unconsolidated JVs 2 2 1 3 Allocation adjustments of noncontrolling interests — — 1 — Adjusted EBITDA $254 $334 $327 $304 Net revenues $1,127 $1,333 $1,328 $1,292 Adjusted EBITDA as a % of Revenue 22.5 % 25.1 % 24.6 % 23.5 % Adjusted EBITDA Growth 31.5 % (2.1)% (7.0)% 27

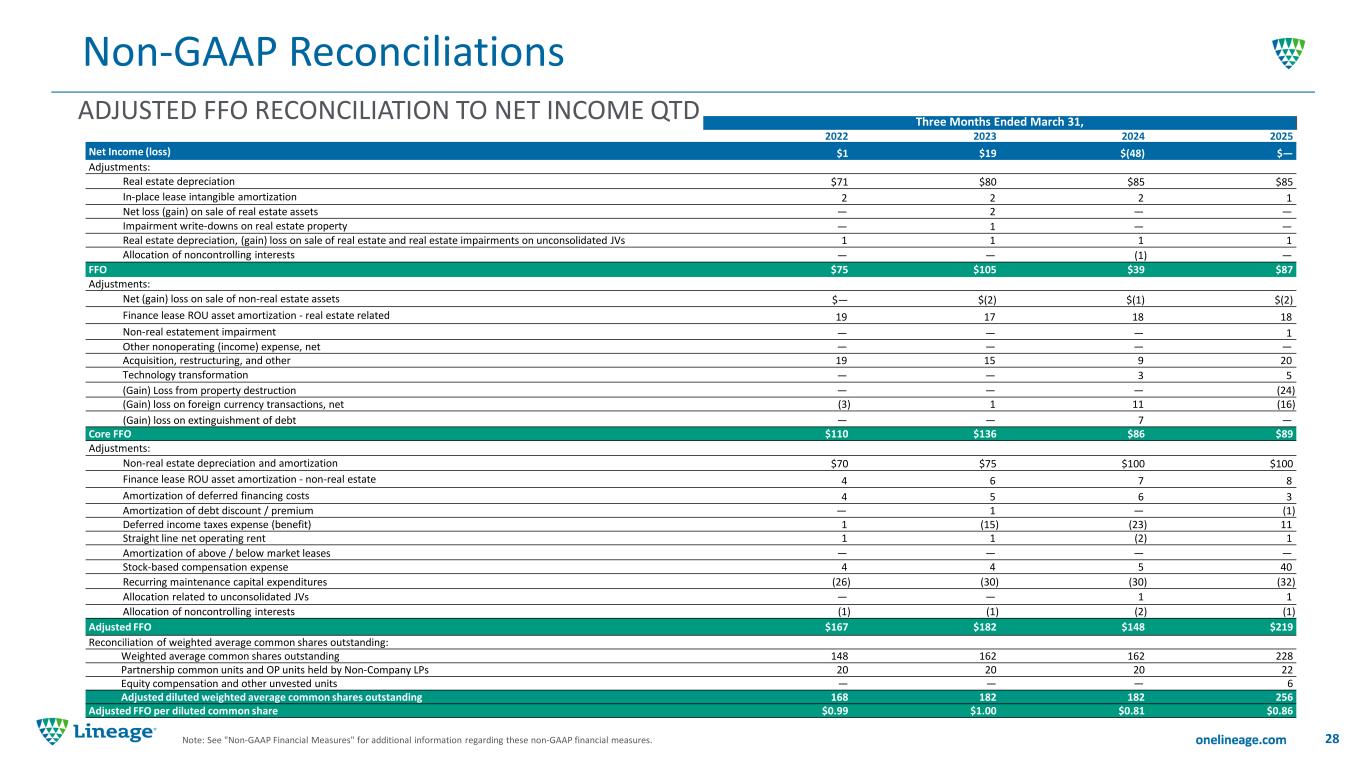

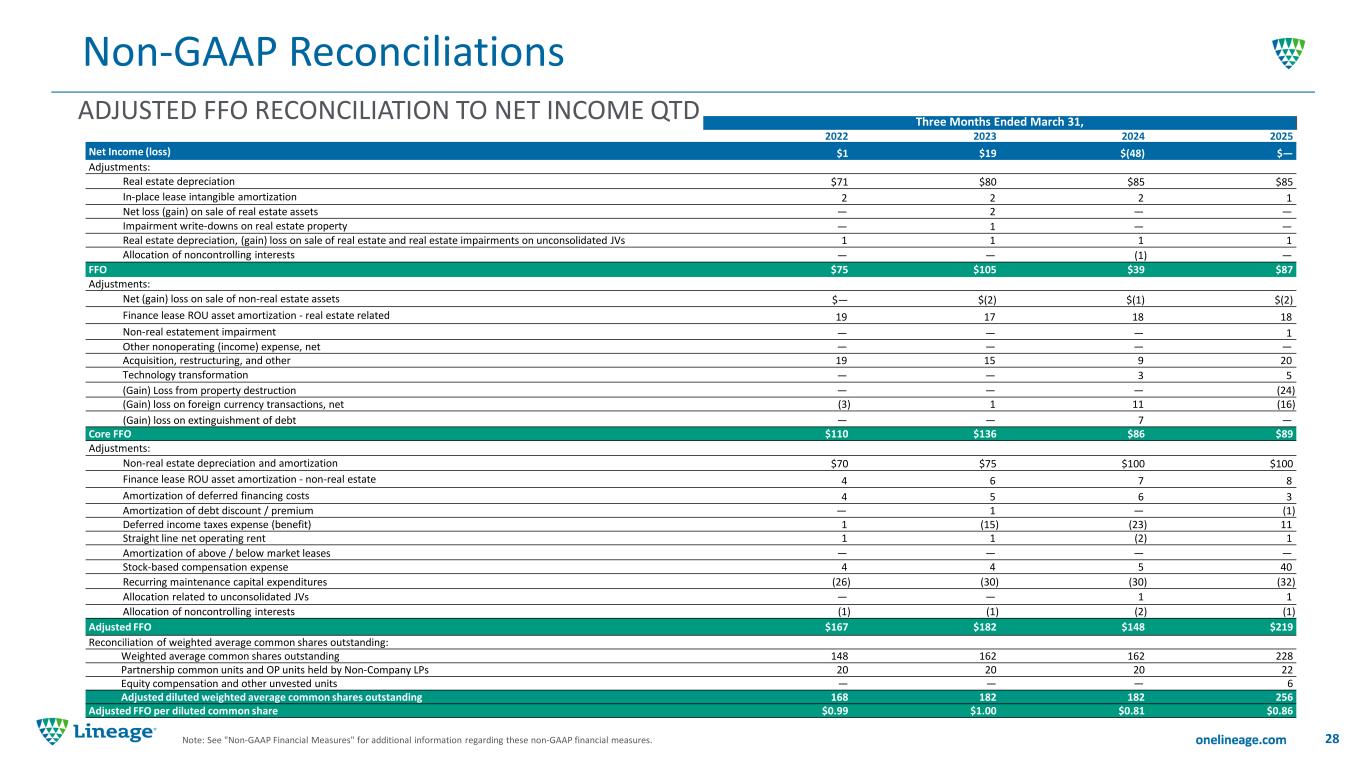

ADJUSTED FFO RECONCILIATION TO NET INCOME QTD Non-GAAP Reconciliations 28Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended March 31, 2022 2023 2024 2025 Net Income (loss) $1 $19 $(48) $— Adjustments: Real estate depreciation $71 $80 $85 $85 In-place lease intangible amortization 2 2 2 1 Net loss (gain) on sale of real estate assets — 2 — — Impairment write-downs on real estate property — 1 — — Real estate depreciation, (gain) loss on sale of real estate and real estate impairments on unconsolidated JVs 1 1 1 1 Allocation of noncontrolling interests — — (1) — FFO $75 $105 $39 $87 Adjustments: Net (gain) loss on sale of non-real estate assets $— $(2) $(1) $(2) Finance lease ROU asset amortization - real estate related 19 17 18 18 Non-real estatement impairment — — — 1 Other nonoperating (income) expense, net — — — — Acquisition, restructuring, and other 19 15 9 20 Technology transformation — — 3 5 (Gain) Loss from property destruction — — — (24) (Gain) loss on foreign currency transactions, net (3) 1 11 (16) (Gain) loss on extinguishment of debt — — 7 — Core FFO $110 $136 $86 $89 Adjustments: Non-real estate depreciation and amortization $70 $75 $100 $100 Finance lease ROU asset amortization - non-real estate 4 6 7 8 Amortization of deferred financing costs 4 5 6 3 Amortization of debt discount / premium — 1 — (1) Deferred income taxes expense (benefit) 1 (15) (23) 11 Straight line net operating rent 1 1 (2) 1 Amortization of above / below market leases — — — — Stock-based compensation expense 4 4 5 40 Recurring maintenance capital expenditures (26) (30) (30) (32) Allocation related to unconsolidated JVs — — 1 1 Allocation of noncontrolling interests (1) (1) (2) (1) Adjusted FFO $167 $182 $148 $219 Reconciliation of weighted average common shares outstanding: Weighted average common shares outstanding 148 162 162 228 Partnership common units and OP units held by Non-Company LPs 20 20 20 22 Equity compensation and other unvested units — — — 6 Adjusted diluted weighted average common shares outstanding 168 182 182 256 Adjusted FFO per diluted common share $0.99 $1.00 $0.81 $0.86

We use the following non-GAAP financial measures as supplemental performance measures of our business: segment NOI, FFO, Core FFO, Adjusted FFO, EBITDA, EBITDAre, Adjusted EBITDA, Adjusted EBITDA margin, and net debt. We also use same warehouse and non-same warehouse metrics. We calculate total segment NOI as our total revenues less our cost of operations (excluding any depreciation and amortization, general and administrative expense, stock-based compensation expense, restructuring and impairment expense, gain and loss on sale of assets, and acquisition, transaction, and other expense. We use segment NOI to evaluate our segments for purposes of making operating decisions and assessing performance in accordance with ASC 280, Segment Reporting. We believe segment NOI is helpful to investors as a supplemental performance measure to net income because it assists both investors and management in understanding the core operations of our business. There is no industry definition of segment NOI and, as a result, other REITs may calculate segment NOI or other similarly-captioned metrics in a manner different than we do. We calculate “same warehouse NOI” as revenues for the same warehouse population less its cost of operations (excluding any depreciation and amortization, general and administrative expenses, stock-based compensation expense, restructuring and impairment expense, gains and losses on sale of assets, and acquisition, transaction, and other expense). We evaluate the performance of the warehouses we own, lease, or manage using a “same warehouse” analysis, and we believe that same warehouse NOI is helpful to investors as a supplemental performance measure because it includes the operating performance from the population of properties that is consistent from period to period, thereby eliminating the effects of changes in the composition of our warehouse portfolio on performance measures. We calculate EBITDA for Real Estate, or EBITDAre, in accordance with the standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT, defined as earnings before interest income or expense, taxes, depreciation and amortization, net loss or gain on sale of real estate, net of withholding taxes, impairment write-downs on real estate property, and adjustments to reflect our share of EBITDAre of partially owned entities. EBITDAre is a measure commonly used in our industry, and we present EBITDAre to enhance investor understanding of our operating performance. We believe that EBITDAre provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and useful life of related assets among otherwise comparable companies We also calculate our Adjusted EBITDA as EBITDAre further adjusted for the effects of gain or loss on the sale of non-real estate assets, gain or loss on the destruction of property (net of insurance proceeds), other nonoperating income or expense, acquisition, restructuring, and other expense, foreign currency exchange gain or loss, stock-based compensation expense, loss or gain on debt extinguishment and modification, impairment of investments in non-real estate, technology transformation, and reduction in EBITDAre from partially owned entities. We believe that the presentation of Adjusted EBITDA provides a measurement of our operations that is meaningful to investors because it excludes the effects of certain items that are otherwise included in EBITDAre but which we do not believe are indicative of our core business operations. EBITDAre and Adjusted EBITDA are not measurements of financial performance under GAAP, and our EBITDAre and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDAre and Adjusted EBITDA as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Our calculations of EBITDAre and Adjusted EBITDA have limitations as analytical tools, including the following: • these measures do not reflect our historical or future cash requirements for maintenance capital expenditures or growth and expansion capital expenditures; • these measures do not reflect changes in, or cash requirements for, our working capital needs; • these measures do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; • these measures do not reflect our tax expense or the cash requirements to pay our taxes; and • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and these measures do not reflect any cash requirements for such replacements. We use EBITDA, EBITDAre and Adjusted EBITDA as measures of our operating performance and not as measures of liquidity. We also calculate Adjusted EBITDA margin, which represents Adjusted EBITDA as a percentage of Net revenues and which provides an additional way to compare the above described measure of our operations across periods. (continued on following slide) Non-GAAP Financial Measures 29

(continued) We calculate funds from operations, or FFO, in accordance with the standards established by the Board of Governors of the NAREIT. NAREIT defines FFO as net income or loss determined in accordance with GAAP, excluding extraordinary items as defined under GAAP and gains or losses from sales of previously depreciated operating real estate assets, plus specified non-cash items, such as real estate asset depreciation and amortization, in-place lease intangible amortization, real estate asset impairment, and our share of reconciling items for partially owned entities. We believe that FFO is helpful to investors as a supplemental performance measure because it excludes the effect of depreciation, amortization, and gains or losses from sales of real estate, all of which are based on historical costs, which implicitly assumes that the value of real estate diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. We calculate core funds from operations, or Core FFO, as FFO adjusted for the effects of gain or loss on the sale of non-real estate assets, gain or loss on the destruction of property (net of insurance proceeds), finance lease ROU asset amortization real estate, non-real estate impairments, acquisition, restructuring and other, other nonoperating income or expense, loss on debt extinguishment and modifications and the effects of gain or loss on foreign currency exchange. We also adjust for the impact attributable to non-real estate impairments on unconsolidated joint ventures and natural disaster. We believe that Core FFO is helpful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our core business operations. We believe Core FFO can facilitate comparisons of operating performance between periods, while also providing a more meaningful predictor of future earnings potential. However, because FFO and Core FFO add back real estate depreciation and amortization and do not capture the level of recurring maintenance capital expenditures necessary to maintain the operating performance of our properties, both of which have material economic impacts on our results from operations, we believe the utility of FFO and Core FFO as a measure of our performance may be limited. We calculate adjusted funds from operations, or Adjusted FFO, as Core FFO adjusted for the effects of amortization of deferred financing costs, amortization of debt discount/premium amortization of above or below market leases, straight-line net operating rent, provision or benefit from deferred income taxes, stock-based compensation expense from grants under our equity incentive plans, non-real estate depreciation and amortization, non-real estate finance lease ROU asset amortization, and recurring maintenance capital expenditures. We also adjust for Adjusted FFO attributable to our share of reconciling items of partially owned entities. We believe that Adjusted FFO is helpful to investors as a meaningful supplemental comparative performance measure of our ability to make incremental capital investments in our business and to assess our ability to fund distribution requirements from our operating activities. FFO, Core FFO, Adjusted FFO, and Adjusted FFO per diluted share are used by management, investors and industry analysts as supplemental measures of operating performance of equity REITs. FFO, Core FFO, Adjusted FFO, and Adjusted FFO per diluted share should be evaluated along with GAAP net income and net income per diluted share (the most directly comparable GAAP measures) in evaluating our operating performance. FFO, Core FFO, and Adjusted FFO do not represent net income or cash flows from operating activities in accordance with GAAP and are not indicative of our results of operations or cash flows from operating activities as disclosed in our condensed consolidated financial statements included elsewhere in this Quarterly Report. FFO, Core FFO, and Adjusted FFO should be considered as supplements, but not alternatives, to our net income or cash flows from operating activities as indicators of our operating performance. Moreover, other REITs may not calculate FFO in accordance with the NAREIT definition or may interpret the NAREIT definition differently than we do. Accordingly, our FFO may not be comparable to FFO as calculated by other REITs. In addition, there is no industry definition of Core FFO or Adjusted FFO and, as a result, other REITs may also calculate Core FFO or Adjusted FFO, or other similarly-captioned metrics, in a manner different than we do. We are not able to provide forward-looking guidance for certain financial data that would make a reconciliation from the most comparable GAAP measure to non-GAAP financial measure for forward-looking Adjusted FFO per share and Adjusted EBITDA possible without unreasonable effort. This is due to unpredictable nature of relevant reconciling items from factors such as acquisitions, divestitures, impairments, natural disaster events, restructurings, debt issuances that have not yet occurred, or other events that are out of our control and cannot be forecasted. The impact of such adjustments could be significant. Non-GAAP Financial Measures 30

C O N TA C T Thank you 31 Evan Barbosa VP, Investor Relations ir@onelineage.com