GalaxyOne platform; and (17) those other risks contained in filings we make with the Securities and Exchange Commission (the “SEC”)

from time to time, including in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, filed with the SEC on August 5,

2025 and available on Galaxy’s profile at www.sec.gov (our “Form 10-Q”). Factors that could cause actual results to differ materially

from those described in such forward-looking statements include, but are not limited to, financing and construction terms and

conditions, a decline in the digital asset market or general economic conditions; the possibility that our addressable market is smaller

than we have anticipated and/or that we may not gain share of the stated addressable market; the failure or delay in the adoption of

digital assets and the blockchain ecosystem; a delay or failure in developing infrastructure for our business or our businesses achieving

our mandates; delays or other challenges in the mining and AI/HPC infrastructure business related to hosting, power or construction;

any challenges faced with respect to exploits, considerations with respect to liquidity and capital planning; and changes in applicable

law or regulation and adverse regulatory developments. Should one or more of these risks or uncertainties materialize, they could

cause our actual results to differ materially from the forward-looking statements. Except as required by law, we assume no obligation to

update or revise any forward-looking statements whether as a result of new information, future events or otherwise, or to update the

reasons if actual results differ materially from those anticipated in the forward-looking statements. You should not take any statement

regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not

put undue reliance on these statements.

This press release and our earnings call contain certain preliminary information about our performance in the third quarter of 2025. This

information is preliminary and represents the most current information available to management. The Company’s actual consolidated

financial statements may differ materially as a result of the completion of normal quarterly accounting procedures and adjustments or

due to other risks contained in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025. Although the Company

believes the expectations reflected in this press release are based upon reasonable assumptions, the Company can give no assurance

that actual results will not differ materially from these expectations.

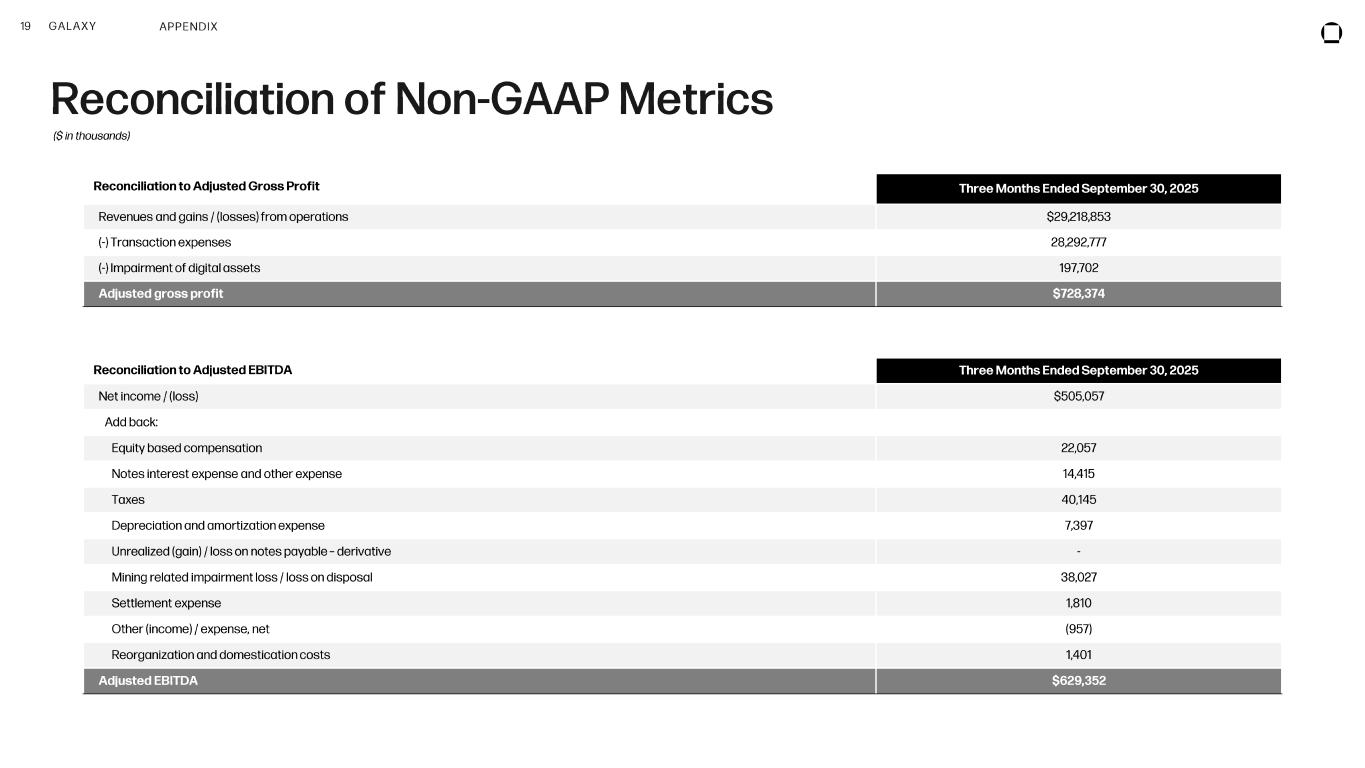

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, this press release and the accompanying tables contain adjusted gross

profit, adjusted EBITDA, and EBITDA margin, which are non-GAAP financial measures. Adjusted gross profit, adjusted EBITDA, and

EBITDA margin are unaudited, presented as supplemental disclosure and should not be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in accordance with GAAP.

Please see pages 10 and 11 for a reconciliation of adjusted gross profit to revenues and gains / (losses) from operations (including for

our individual segments) during the three months ended September 30, 2025 and 2024 and during the three months ended June 30,

2025 and of adjusted EBITDA to net income (loss) (including for our individual segments) during the nine months ended September 30,

2025 and 2024 and during the six months ended June 30, 2025.

It is important to note that the particular items we exclude from, or include in, adjusted gross profit, adjusted EBITDA, and EBITDA

margin may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the

same industry. We also periodically review our non-GAAP financial measures and may revise these measures to reflect changes in our

business or otherwise.

We believe adjusted gross profit is a helpful non-GAAP financial measure to our management and investors because it eliminates the

impact of the directly attributable transaction expenses. As such, it provides useful information about our financial performance,

enhances the overall understanding of our past performance and future prospects, allows for greater transparency with respect to

important metrics used by our management for financial, risk management and operational decision-making and provides an additional

tool for investors to use to understand and compare our operating results across accounting periods.

Adjusted EBITDA is a non-GAAP financial measure that is used by management, in addition to GAAP financial measures, to

understand and compare our operating results across accounting periods, for risk management and operational decision-making. This

non-GAAP measure provides investors with additional information in evaluating the Company’s operating performance. Adjusted

EBITDA represents Net income / (loss) excluding (i) equity based compensation, (ii) notes interest expense, (iii) taxes, (iv) depreciation

and amortization expense, (v) gains and losses on the embedded derivative on our exchangeable notes which ceased to exist upon

consolidation as a result of the Reorganization Transactions, (vi) mining-related impairment loss / loss on disposal of mining equipment,

(vii) settlement expense, (viii) other (income) / expense, net and (ix) and reorganization and domestication costs. The above items are

excluded from our Adjusted EBITDA because these items are non-cash in nature, or because the amount and timing of these items are

unpredictable, are not driven by core results of operations, and render comparisons with prior periods and competitors less meaningful.

EBITDA Margin is defined as EBITDA, divided by revenue minus pass through expenses for the same period. This non-GAAP financial

measure is commonly used as an analytical indicator of performance by investors within the industries in which we operate. EBITDA

margin is not a measure of financial performance under GAAP. Items excluded from EBITDA Margin are significant components in

understanding and assessing financial performance. EBITDA Margin should not be considered in isolation or as an alternative to or a

substitute for financial statement data presented in Galaxy’s Digital’s consolidated financial statements as indicators of financial

performance or liquidity (which, in the case of EBITDA margin, is net income margin).

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool.

© Copyright Galaxy Digital 2025. All rights reserved.