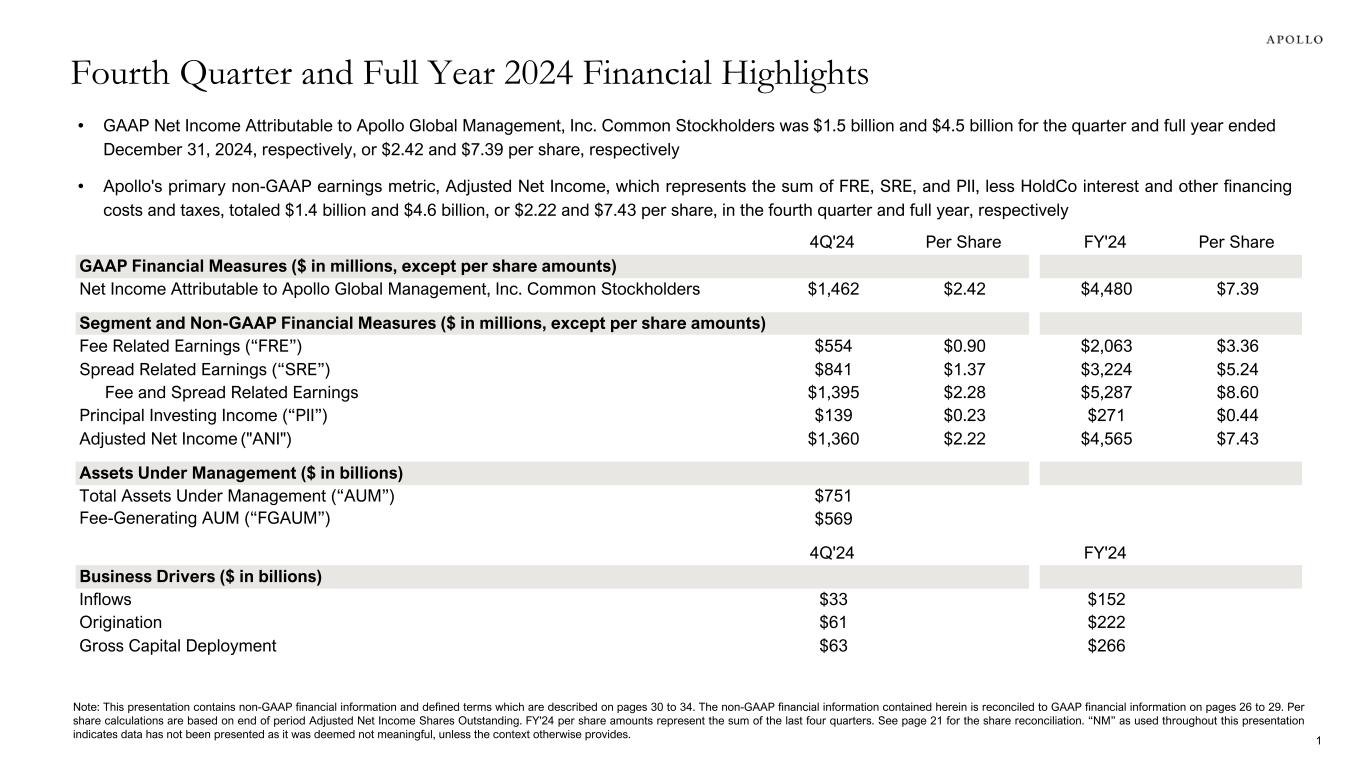

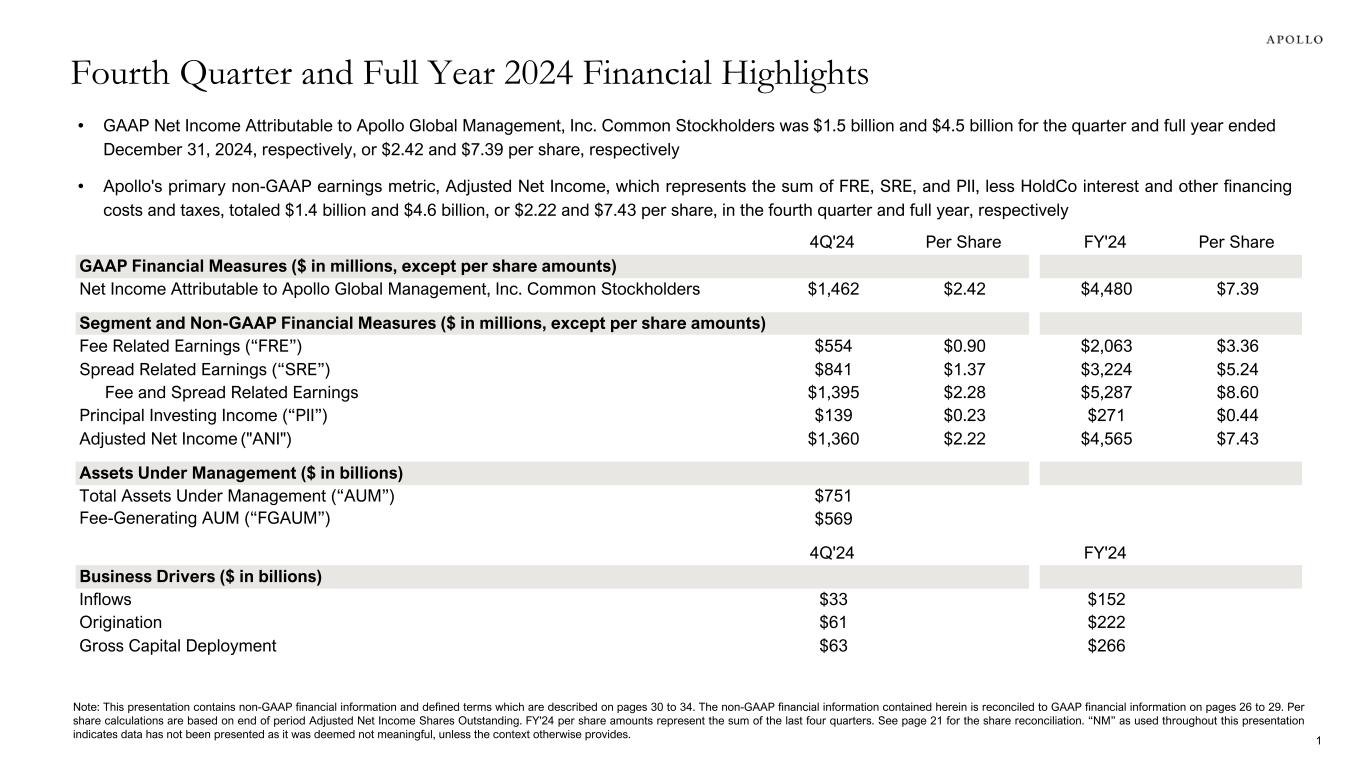

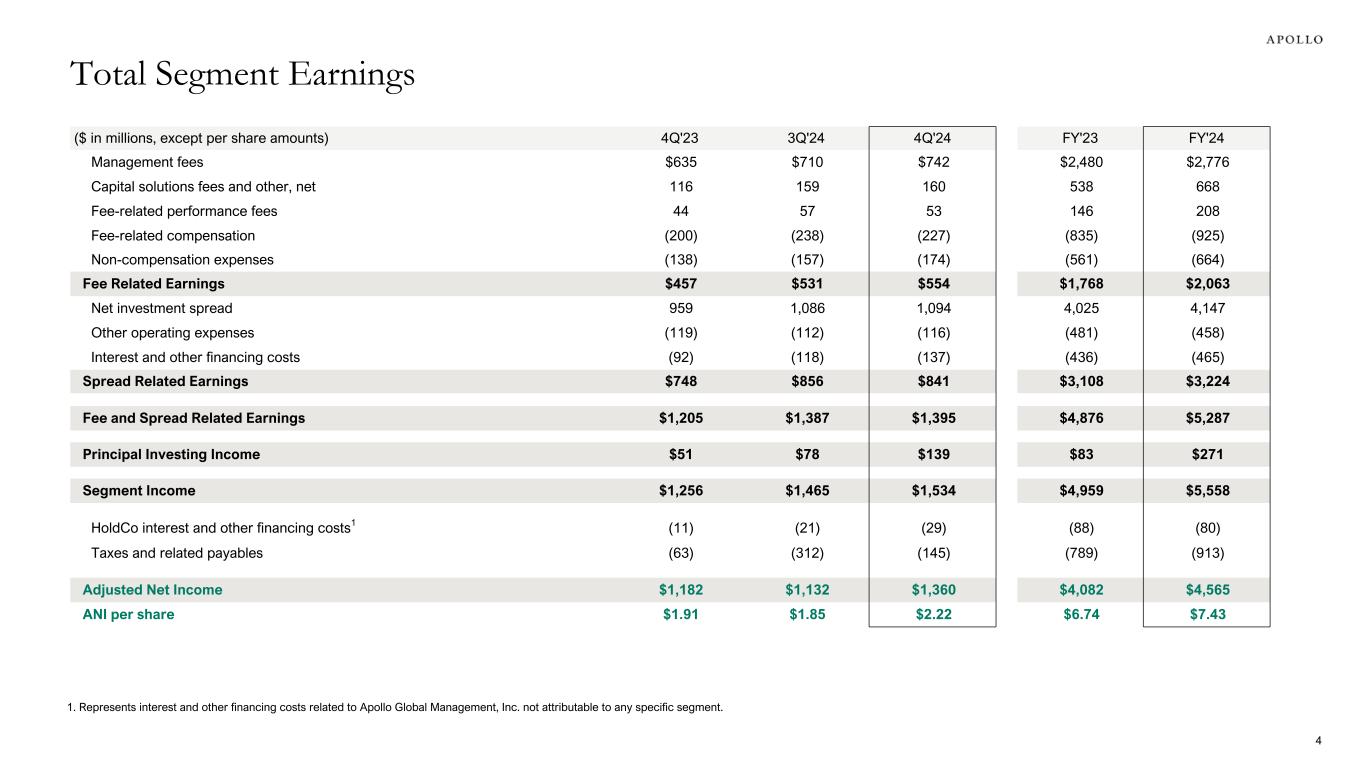

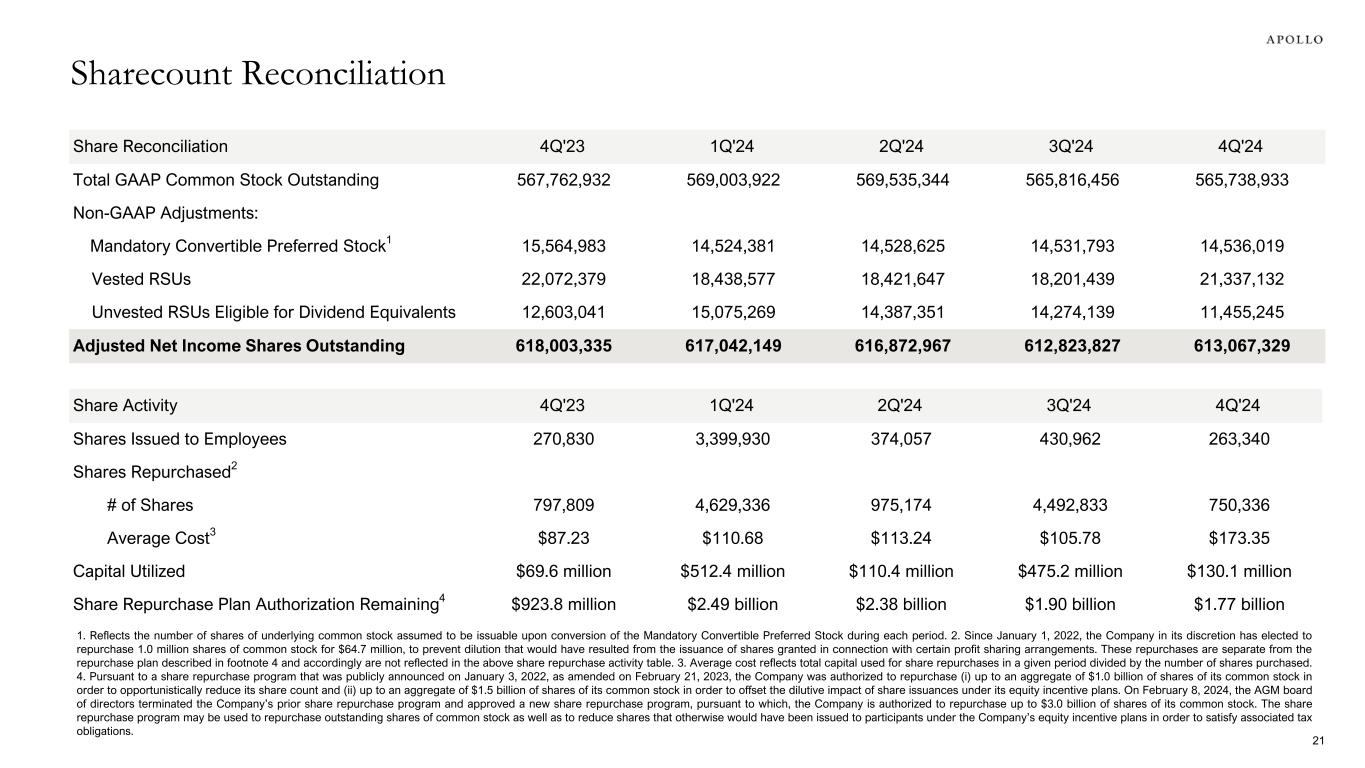

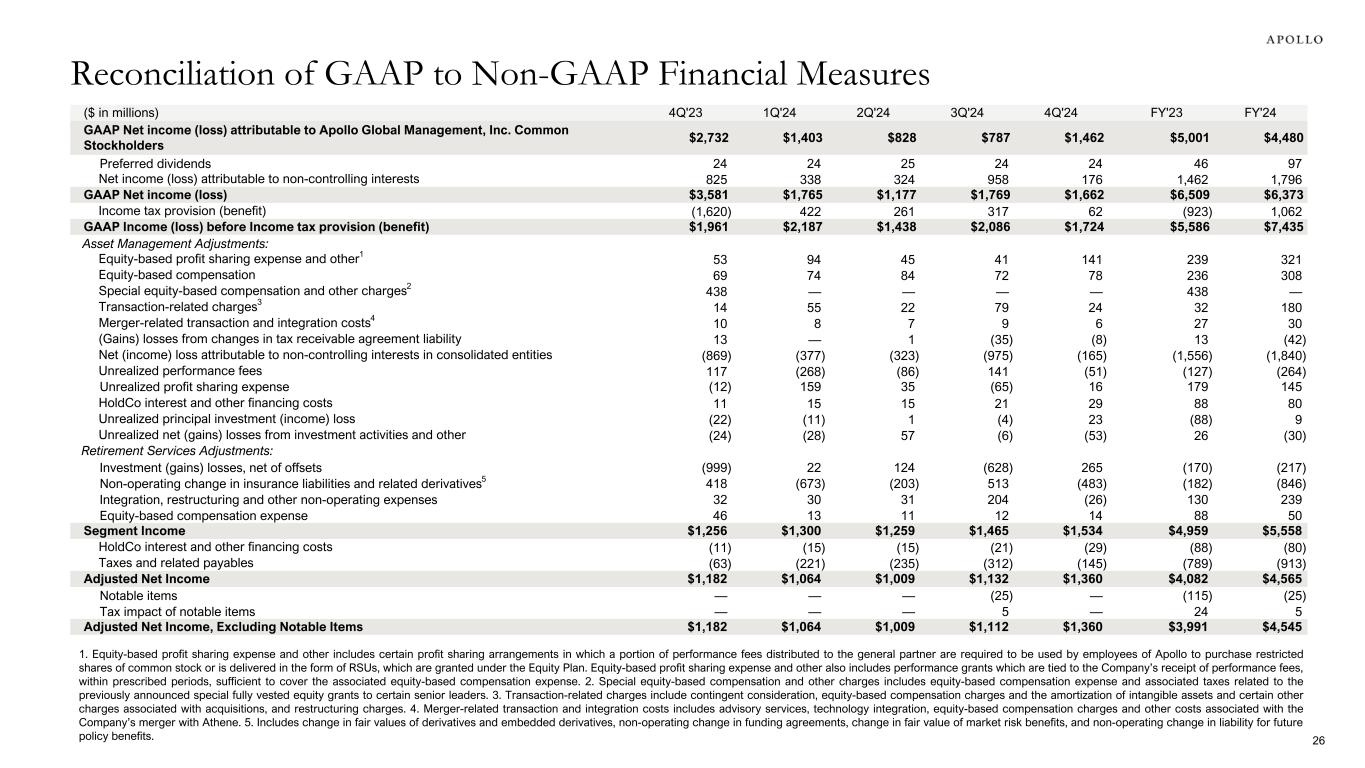

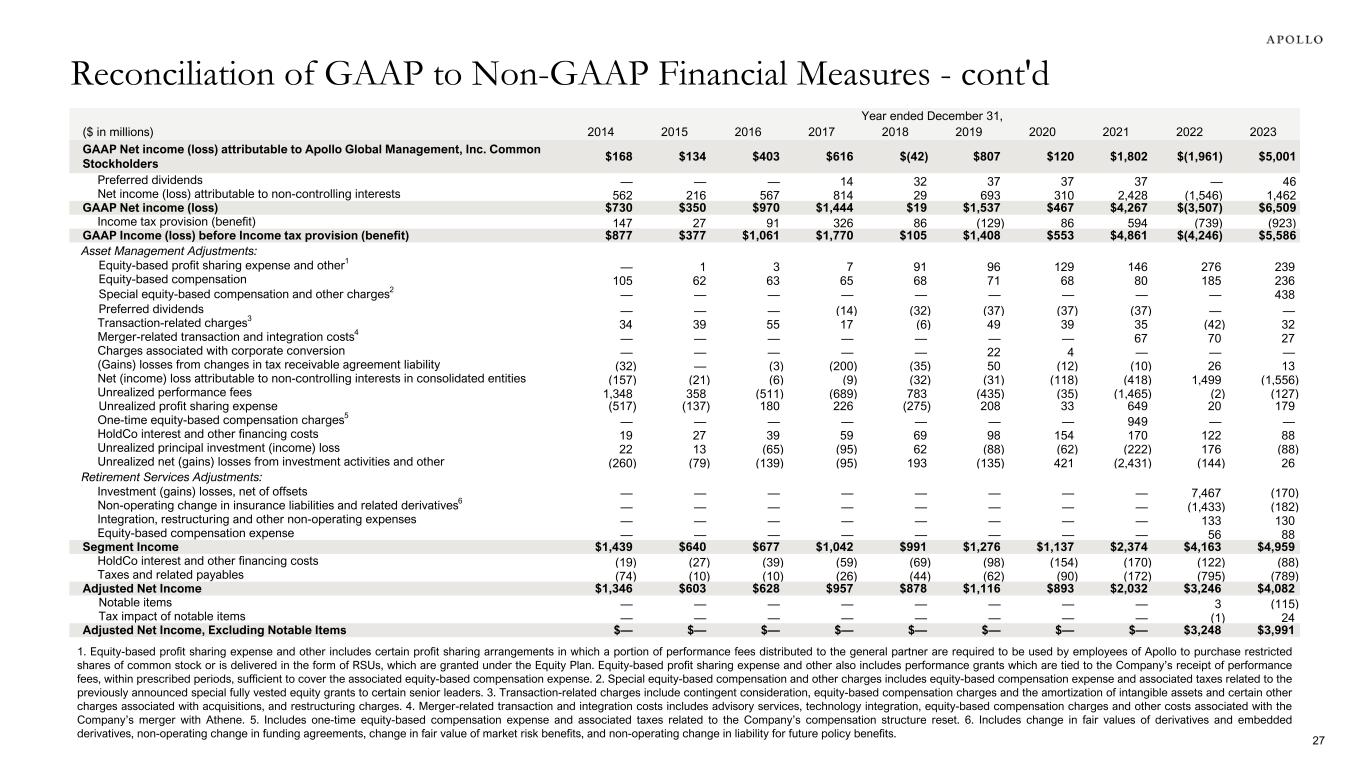

4Q'24 Per Share FY'24 Per Share GAAP Financial Measures ($ in millions, except per share amounts) Net Income Attributable to Apollo Global Management, Inc. Common Stockholders $1,462 $2.42 $4,480 $7.39 Segment and Non-GAAP Financial Measures ($ in millions, except per share amounts) Fee Related Earnings (“FRE”) $554 $0.90 $2,063 $3.36 Spread Related Earnings (“SRE”) $841 $1.37 $3,224 $5.24 Fee and Spread Related Earnings $1,395 $2.28 $5,287 $8.60 Principal Investing Income (“PII”) $139 $0.23 $271 $0.44 Adjusted Net Income ("ANI") $1,360 $2.22 $4,565 $7.43 Assets Under Management ($ in billions) Total Assets Under Management (“AUM”) $751 Fee-Generating AUM (“FGAUM”) $569 4Q'24 FY'24 Business Drivers ($ in billions) Inflows $33 $152 Origination $61 $222 Gross Capital Deployment $63 $266 Fourth Quarter and Full Year 2024 Financial Highlights • GAAP Net Income Attributable to Apollo Global Management, Inc. Common Stockholders was $1.5 billion and $4.5 billion for the quarter and full year ended December 31, 2024, respectively, or $2.42 and $7.39 per share, respectively • Apollo's primary non-GAAP earnings metric, Adjusted Net Income, which represents the sum of FRE, SRE, and PII, less HoldCo interest and other financing costs and taxes, totaled $1.4 billion and $4.6 billion, or $2.22 and $7.43 per share, in the fourth quarter and full year, respectively Note: This presentation contains non-GAAP financial information and defined terms which are described on pages 30 to 34. The non-GAAP financial information contained herein is reconciled to GAAP financial information on pages 26 to 29. Per share calculations are based on end of period Adjusted Net Income Shares Outstanding. FY'24 per share amounts represent the sum of the last four quarters. See page 21 for the share reconciliation. “NM” as used throughout this presentation indicates data has not been presented as it was deemed not meaningful, unless the context otherwise provides. 1

(In millions, except per share amounts) 4Q'23 3Q'24 4Q'24 FY'23 FY'24 Revenues Asset Management Management fees $444 $476 $523 $1,772 $1,899 Advisory and transaction fees, net 141 181 205 623 822 Investment income (loss) 150 230 395 1,032 1,305 Incentive fees 21 35 42 80 150 Retirement Services Premiums 3,586 389 155 12,749 1,318 Product charges 226 267 260 848 1,016 Net investment income 3,354 4,101 4,237 12,080 15,718 Investment related gains (losses) 2,621 1,539 (1,037) 1,428 2,045 Revenues of consolidated variable interest entities 495 552 493 1,441 1,822 Other revenues 8 3 10 591 19 Total Revenues 11,046 7,773 5,283 32,644 26,114 Expenses Asset Management Compensation and benefits (979) (605) (732) (2,722) (2,608) Interest expense (47) (55) (67) (145) (226) General, administrative and other (229) (326) (285) (872) (1,170) Retirement Services Interest sensitive contract benefits (2,595) (2,599) (1,642) (6,229) (8,949) Future policy and other policy benefits (4,088) (793) (623) (14,434) (3,054) Market risk benefits remeasurement gains (losses) (570) (524) 456 (404) 102 Amortization of deferred acquisition costs, deferred sales inducements and value of business acquired (186) (244) (263) (688) (941) Policy and other operating expenses (481) (670) (535) (1,837) (2,136) Total Expenses (9,175) (5,816) (3,691) (27,331) (18,982) Other Income (Loss) – Asset Management Net gains (losses) from investment activities 21 15 25 7 58 Net gains (losses) from investment activities of consolidated variable interest entities 35 44 20 130 90 Other income (loss), net 34 70 87 136 155 Total Other Income (Loss) 90 129 132 273 303 Income (loss) before income tax (provision) benefit 1,961 2,086 1,724 5,586 7,435 Income tax (provision) benefit1 1,620 (317) (62) 923 (1,062) Net income (loss) 3,581 1,769 1,662 6,509 6,373 Net (income) loss attributable to non-controlling interests (825) (958) (176) (1,462) (1,796) Net income (loss) attributable to Apollo Global Management, Inc. 2,756 811 1,486 5,047 4,577 Preferred stock dividends (24) (24) (24) (46) (97) Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $2,732 $787 $1,462 $5,001 $4,480 Earnings (Loss) per share Net income (loss) attributable to Common Stockholders - Basic $4.53 $1.30 $2.42 $8.32 $7.39 Net income (loss) attributable to Common Stockholders - Diluted $4.44 $1.29 $2.39 $8.28 $7.33 Weighted average shares outstanding - Basic 584 585 584 581 586 Weighted average shares outstanding - Diluted 601 589 603 589 604 GAAP Income Statement (Unaudited) 21. 4Q'23 and FY'23 include a one-time tax benefit of $1.8 billion resulting from the establishment of deferred tax assets related to the Government of Bermuda's enactment of the Corporate Income Tax Act of 2023 ("Bermuda CIT"). 4Q’24 and FY’24 include an estimated income tax benefit related to the Bermuda CIT and the actual tax impact reported in the Company’s Annual Report on Form 10-K may differ, possibly materially, from this estimate.

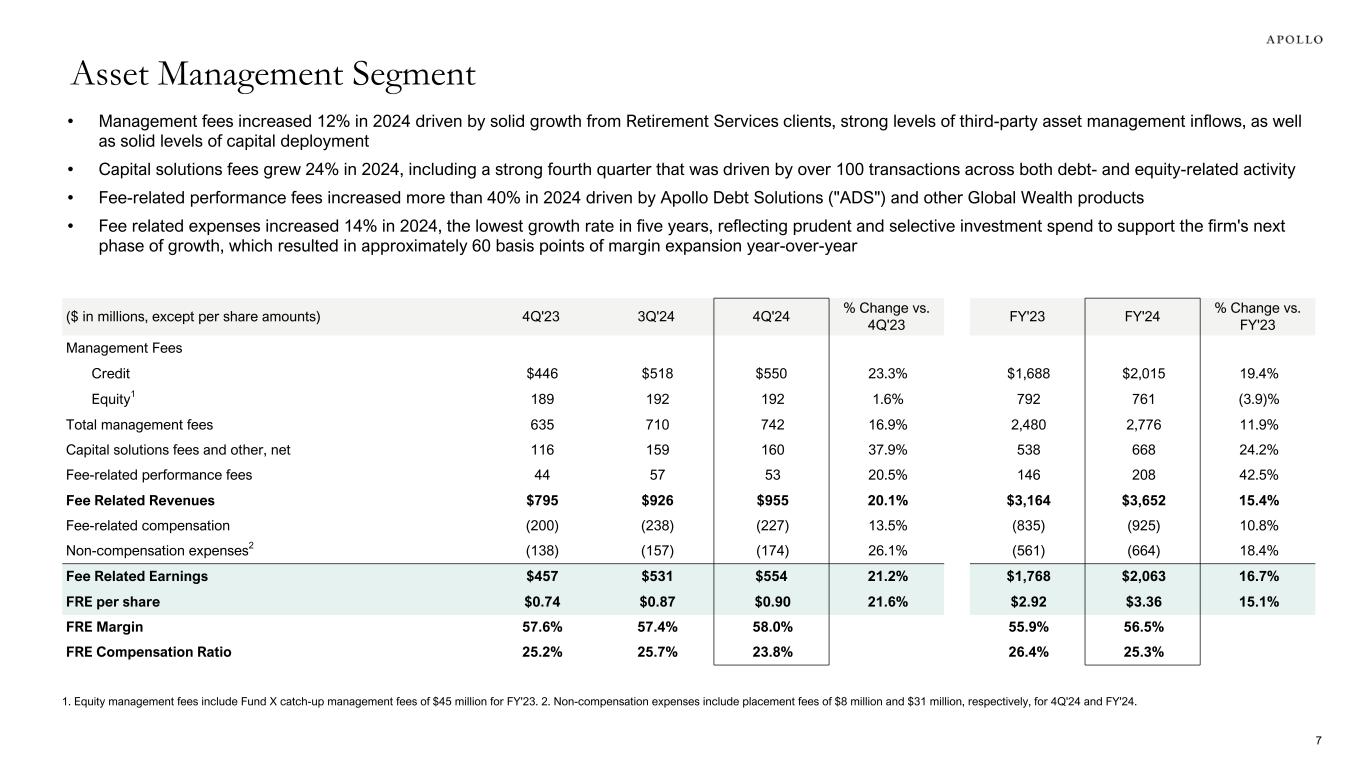

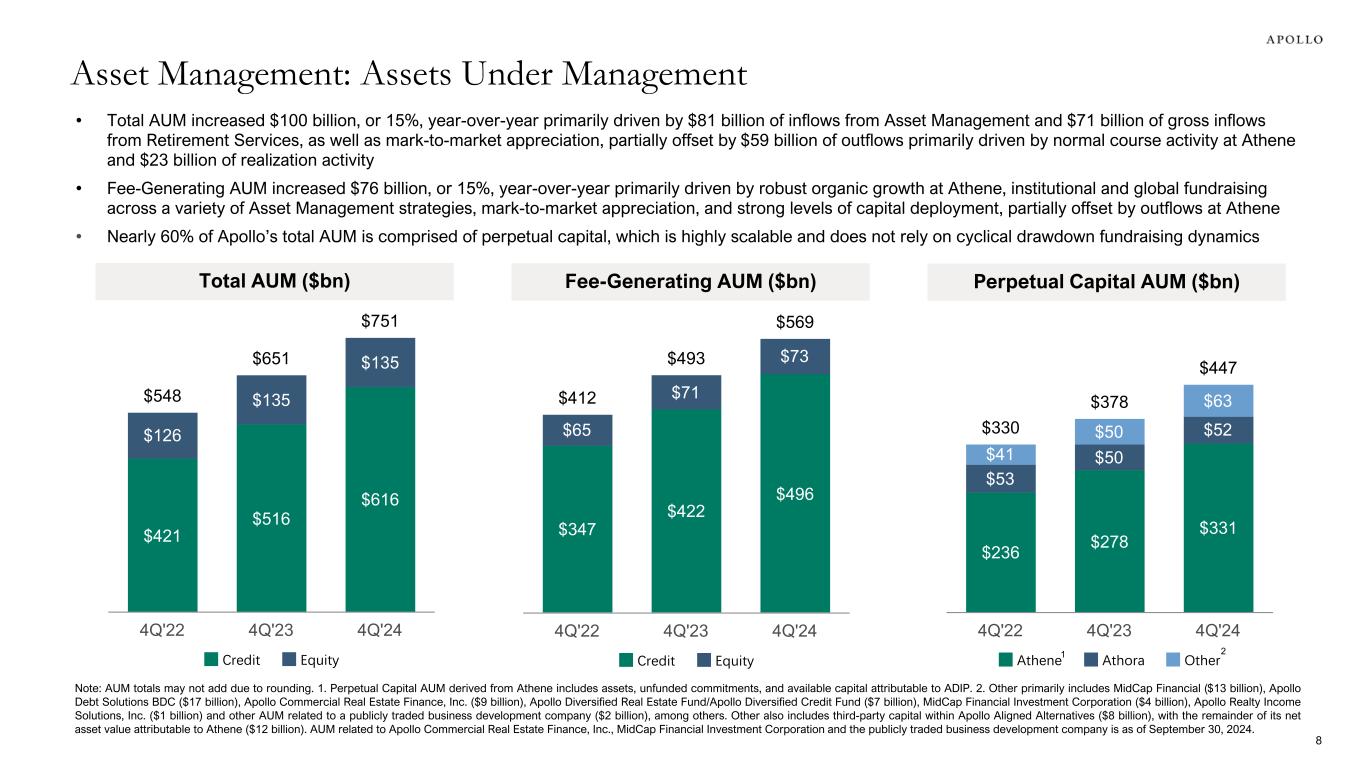

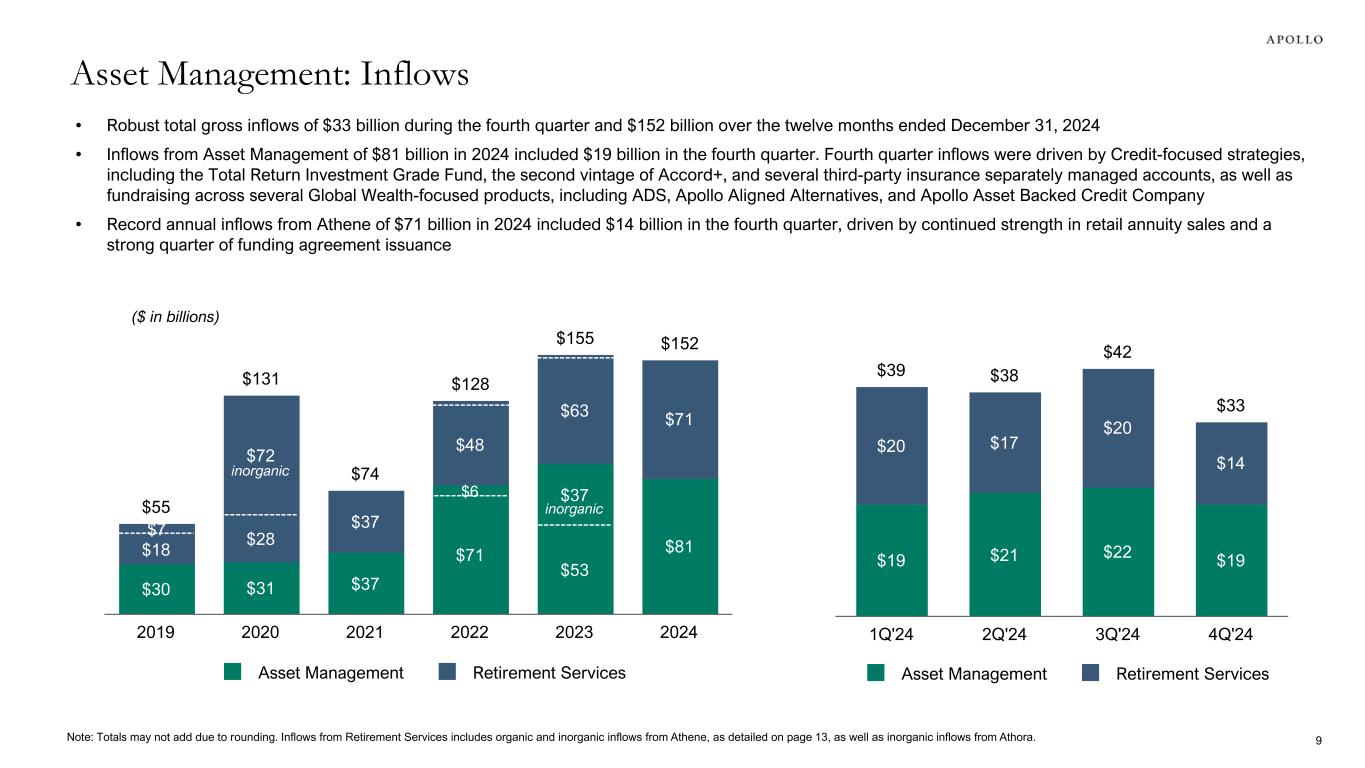

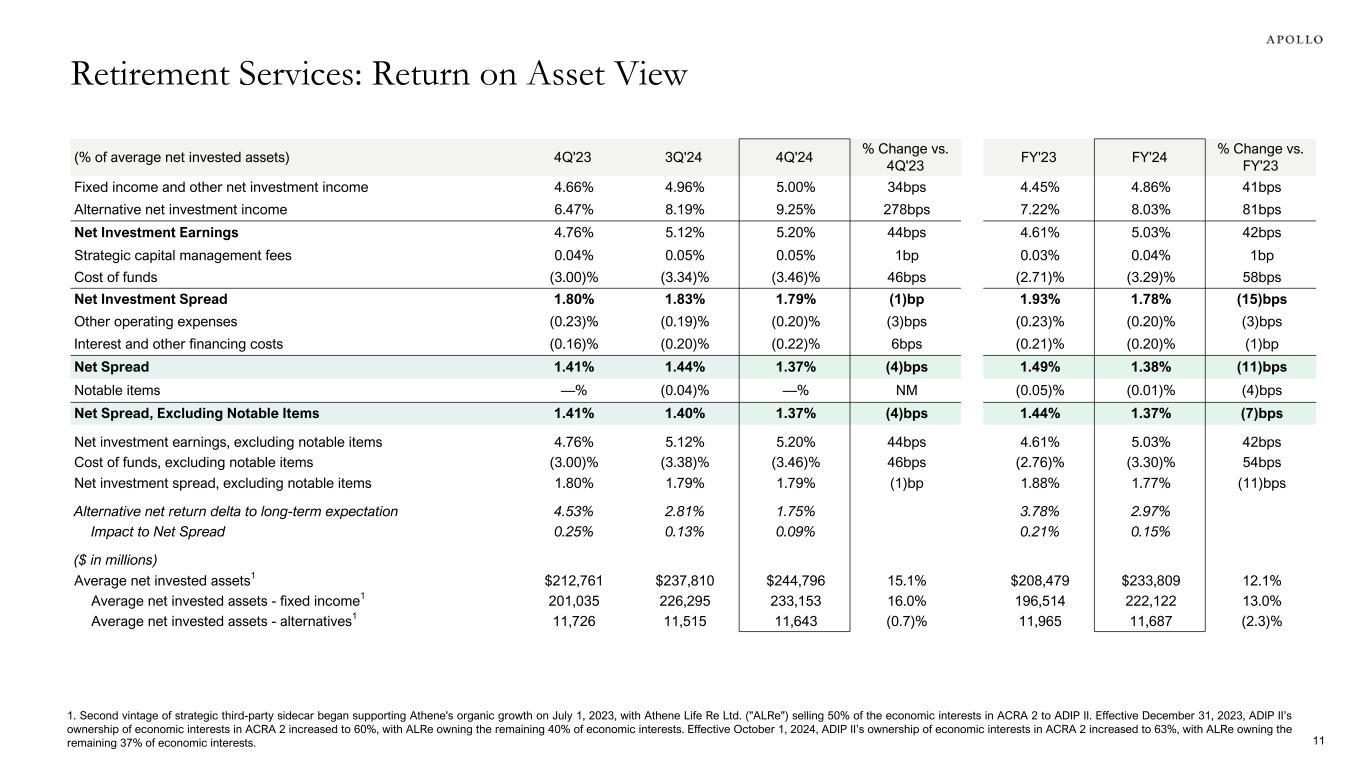

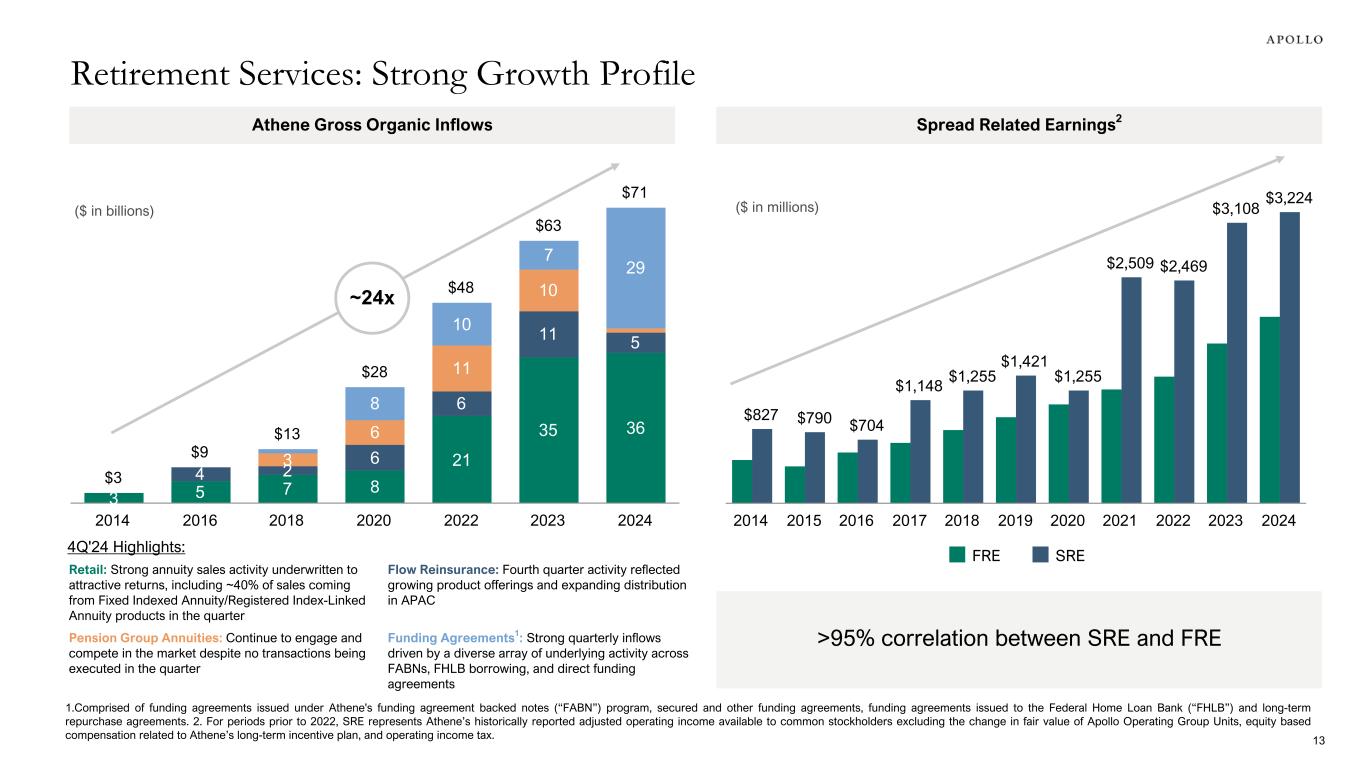

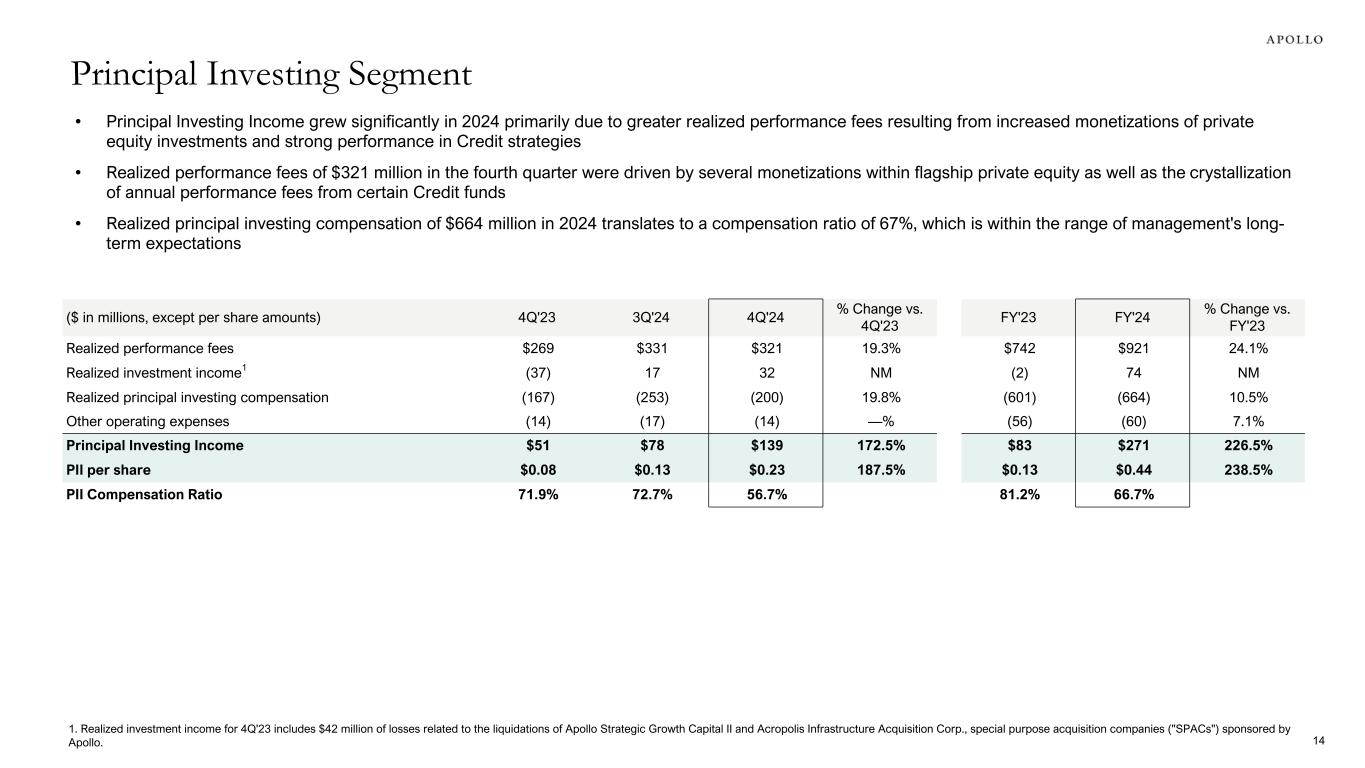

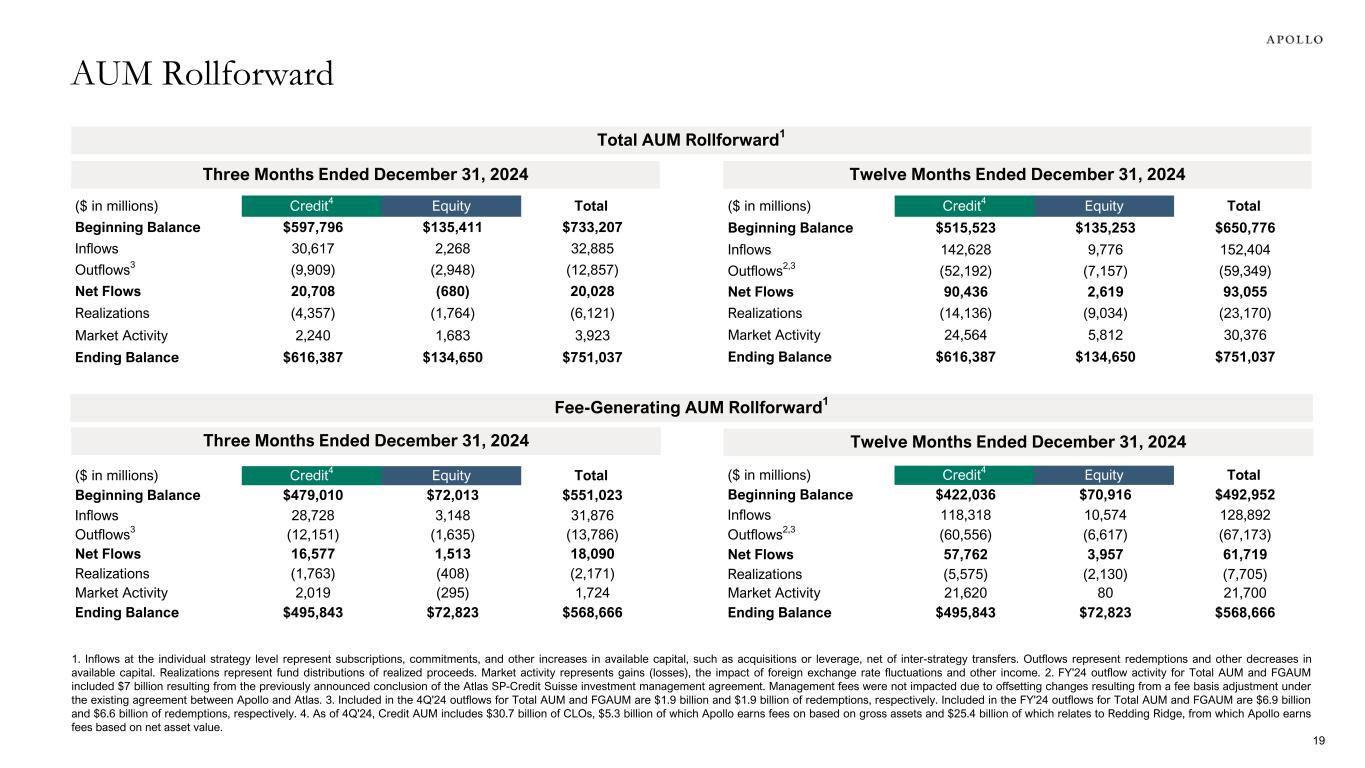

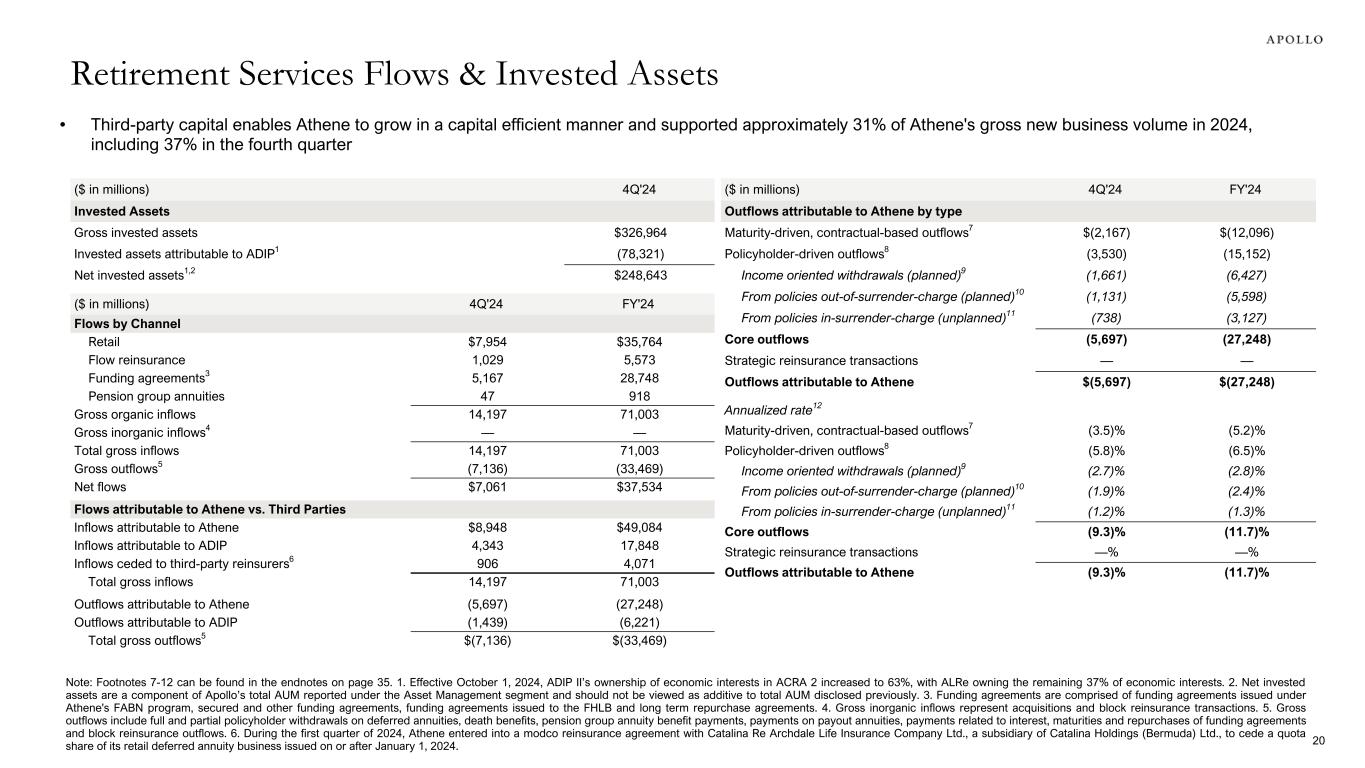

Fourth quarter results complete a strong year of growth and execution against 2024 targets • Record quarterly and annual FRE of $554 million and $2.1 billion, respectively, driven by strong growth in fee related revenues and disciplined expense growth • Quarterly and annual SRE totaling $841 million and $3.2 billion, respectively, reflecting robust organic growth and higher alternative net investment income • Together, FRE and SRE totaled $1.4 billion in the fourth quarter and $5.3 billion in 2024, showcasing the growth and strength of the combined earnings streams • Total AUM of $751 billion benefited from inflows of $33 billion in the fourth quarter and $152 billion in 2024, driving a 15% increase year-over-year Continued execution on three strategic growth pillars • Origination: Origination volume totaled $61 billion in the fourth quarter and $222 billion in 2024, with platforms and high grade capital solutions contributing more than half of total origination volume for the full year • Global Wealth: Raised a record $12 billion of capital in 2024 from a combination of successful product launches, ongoing distribution expansion, and continued education focused on providing solutions for individual investors • Capital Solutions: Record full-year fee revenue of $668 million demonstrates Apollo's growing capabilities to provide scaled, flexible capital solutions and asset origination to an increasing number of clients Strategically allocating capital to drive stockholder value • Share Repurchases: Repurchased more than $1.2 billion of common stock in 2024, including $501 million of opportunistic share repurchases • Dividends: Distributed more than $1 billion of common stock dividends in 2024 and intend to increase the annual amount 10% from $1.85 per share to $2.04 per share of common stock commencing with the first quarter 2025 dividend1 • Investments: Allocated $130 million of strategic capital to fund various investments supporting future growth Fourth Quarter and Full Year 2024 Business Highlights ✓ ✓ 31. The declaration and payment of any dividends are at the sole discretion of the Apollo Global Management, Inc. board of directors, which may change the dividend policy at any time, including, without limitation to, to eliminate the dividend entirely.

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン