Document

2023 Annual Information Form

March 28, 2024

|

|

|

|

|

|

| TABLE OF CONTENTS |

|

1. Important Information about this Document |

5 |

1.1 Reporting Currency |

5 |

1.2 Historic Metals Prices |

5 |

1.3 Technical Information |

5 |

1.4 Forward-Looking Information |

6 |

1.5 Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources |

8 |

2. About Centerra |

9 |

2.1 Our Properties |

9 |

2.2 Inter-Corporate Relationships |

10 |

2.3 Recent Developments |

11 |

2.4 Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets |

13 |

Controls Relating to Corporate Structure Risk |

13 |

Procedures of the Board of Directors of the Company |

14 |

2.5 Centerra’s Business |

16 |

Business Operations |

16 |

Marketing and Distribution |

17 |

Gold Doré Produced at Öksüt Mine |

17 |

Copper/Gold Concentrate Produced at Mount Milligan Mine |

18 |

Molybdenum Industry |

18 |

| 2023 and 2022 Production and Revenue |

19 |

Competitive Conditions |

19 |

Mineral Reserves and Resources |

19 |

Sources, Pricing and Availability of Materials, Parts and Equipment |

25 |

Financial and Operational Effects of Environmental Protection Requirements |

25 |

2.6 Responsible Mining |

27 |

Our Approach |

27 |

Governance |

28 |

Our Employees |

29 |

Social Performance |

30 |

3. Centerra’s Properties |

33 |

3.1 Operating Mines |

33 |

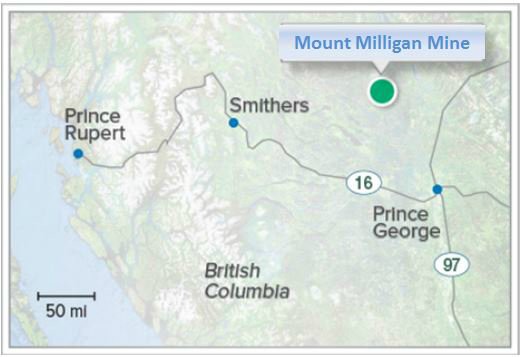

Mount Milligan Mine |

33 |

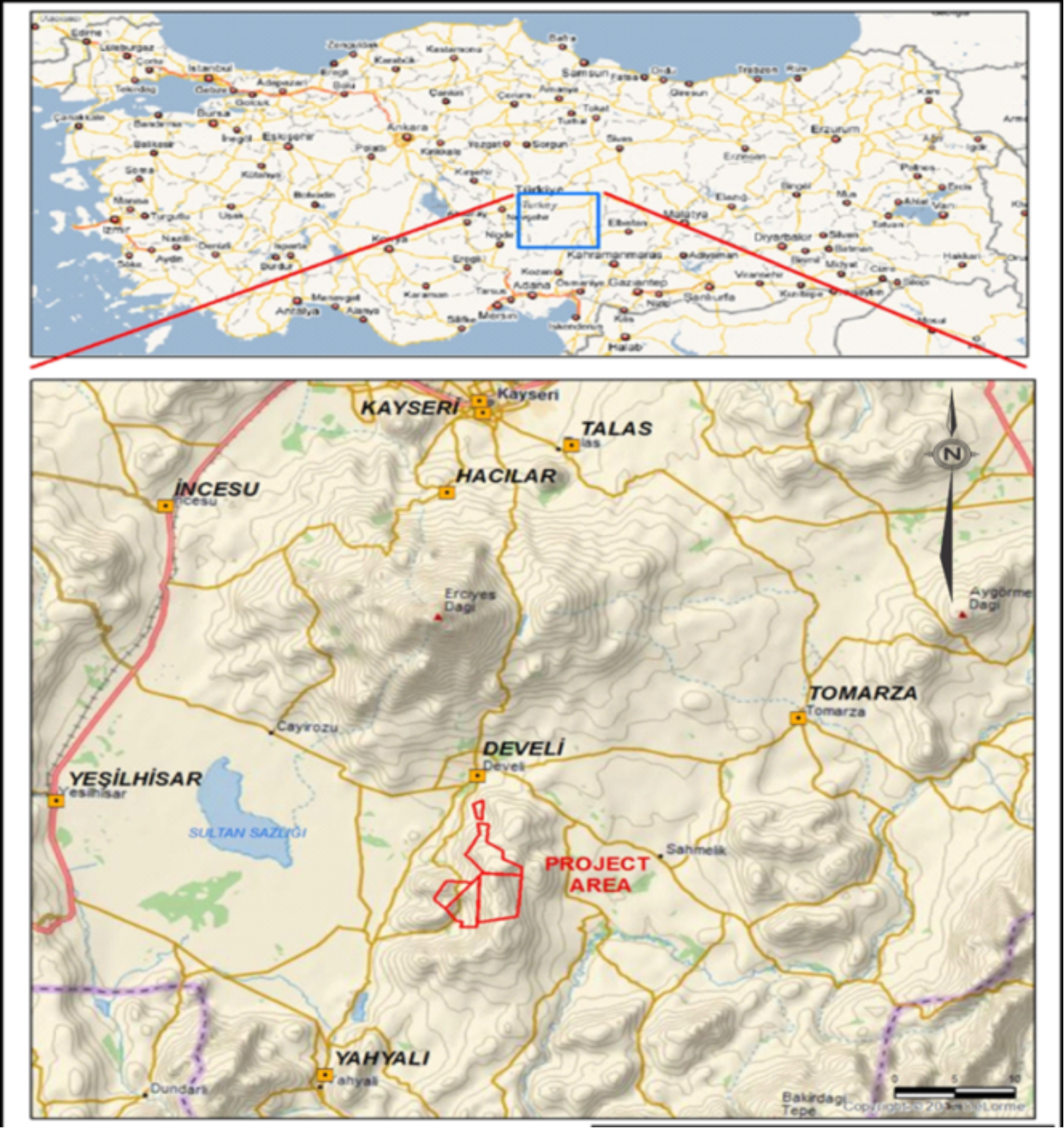

Öksüt Mine |

42 |

| 3.2 Molybdenum |

50 |

Endako Mine |

50 |

Thompson Creek Mine |

50 |

| Langeloth Metallurgical Facility |

51 |

3.2 Other Properties |

51 |

| Goldfield Project |

51 |

Kemess Project |

51 |

|

|

|

|

|

|

|

|

4. Governance |

52 |

4.1 Directors and Officers |

52 |

Directors |

53 |

Executive Officers |

54 |

Other Information About Our Directors and Officers |

54 |

4.2 Committees |

55 |

Audit Committee |

55 |

Audit Committee Charter |

56 |

Composition of the Audit Committee |

56 |

External Audit Pre-Approval Procedures |

56 |

Fees Paid to External Auditors |

57 |

4.3 Interest of Management and Others in Material Transactions |

57 |

5. Risk Factors |

57 |

5.1 Strategic Risks |

57 |

Country, Political & Regulatory |

57 |

Disputes with the Kyrgyz Republic and Kyrgyzaltyn Relating to the Kumtor Mine |

60 |

Legal and Other |

60 |

Strategy and Planning |

62 |

Natural Phenomena |

65 |

Competition |

65 |

5.2 Financial Risks |

65 |

Commodity Market |

65 |

Economy, Credit and Liquidity |

67 |

Insurance |

68 |

Tax and Royalties |

68 |

Counterparty |

69 |

5.3 Operational Risks |

69 |

Health, Safety and Environment |

69 |

Asset Management |

72 |

Human Resources |

72 |

Supply Chain |

73 |

Information Technology Systems |

73 |

6. Investor information |

74 |

6.1 Description of Share Capital |

74 |

Common Shares |

74 |

Class A Non-Voting Shares |

74 |

Preference Shares |

74 |

6.2 Market for Our Securities |

75 |

Trading Price and Volume |

75 |

Registrar and Transfer Agent |

75 |

6.3 Dividend Policy |

75 |

6.4 Material Contracts |

76 |

Mount Milligan Streaming Arrangement |

76 |

| Additional Agreement with Royal Gold |

76 |

6.5 Legal Proceedings and Regulatory Actions |

77 |

Centerra Gold Inc.

2023 Annual Information Form Page 3

|

|

|

|

|

|

6.6 Interests of Experts |

77 |

7. Glossary of Geological and Mining Terms |

78 |

Schedule A Audit Committee Charter |

82 |

Centerra Gold Inc.

2023 Annual Information Form Page 4

1. IMPORTANT INFORMATION ABOUT THIS DOCUMENT

|

|

|

|

|

|

This annual information form (“AIF”) provides important information about Centerra Gold Inc. It describes our history, our markets, our operations and projects, our mineral reserves and resources, our regulatory environment, the risks we face in our business and the market for our shares, among other things. Unless otherwise indicated, information in this AIF is provided as of December 31, 2023. |

Throughout this document, the terms we, us, our, Centerra and the Company mean Centerra Gold Inc. and its direct and indirect subsidiaries. |

1.1 Reporting Currency

All dollar amounts in this AIF are expressed in United States dollars except as otherwise indicated. References to $ or dollars are to United States dollars and references to C$ are to Canadian dollars. For reporting purposes, we prepare our financial statements in United States dollars and in conformity with accounting principles generally accepted in Canada, being International Financial Reporting Standards, as issued by the International Accounting Standards Board.

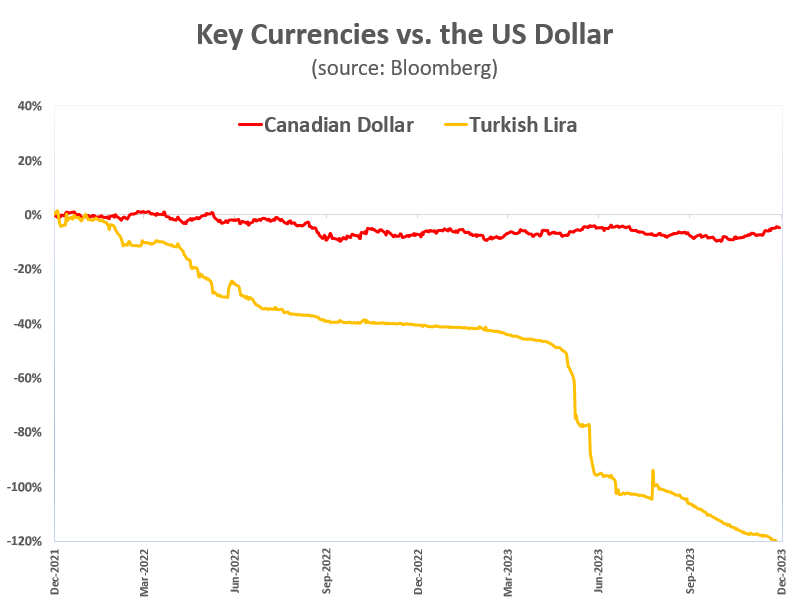

The average exchange rate in 2023 for U.S. dollars to Canadian dollars, based on the Bloomberg L.P. closing rate for the 12 months ending December 29, 2023 (the last business day), was one U.S. dollar per C$1.32.

1.2 Historic Metals Prices

The price of gold, copper and molybdenum fluctuates. The following table shows the average annual price for gold, copper, and molybdenum from 2014 to 2023, and for the period up to March 1, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 up to March 1, 2024 |

Average Gold Price ($/oz)(1) |

1,266 |

1,160 |

1,251 |

1,258 |

1,268 |

1,393 |

1,770 |

1,798 |

1,800 |

1,942 |

2,029 |

Average Copper Price ($/lb.)(2) |

3.11 |

2.49 |

2.21 |

2.80 |

2.96 |

2.72 |

2.80 |

4.23 |

3.99 |

3.85 |

3.78 |

|

Average Molybdenum Oxide Price

($/lb.)(3)

|

11.38 |

6.63 |

6.50 |

8.19 |

11.93 |

11.35 |

8.68 |

15.94 |

18.77 |

24.19 |

19.90 |

(1)London Bullion Market Association annual average daily afternoon gold price fixing.

(2)London Metal Exchange Copper Cash-Settlement.

(3)Platts Metals Week.

1.3 Technical Information

The disclosure in this AIF of a scientific or technical nature for our Mount Milligan Mine and Öksüt Mine is based on technical reports prepared for these properties in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators. The technical information has been updated with current information, where applicable. Information regarding qualified persons is as of the effective date of the relevant technical report.

•The technical report for the Mount Milligan Mine, with an effective date of December 31, 2021 (filed on November 7, 2022), (the “Mount Milligan Technical Report”) was prepared by Bruno Borntraeger, Gordon Zurowski, Cheyenne Sica, Tengfei Yue, Curtis Clarke, David Luzi, Brian Thomas, and Jennifer Simper. Each of these persons is a qualified person for purposes of NI 43-101. The authors were independent of Centerra at the time of filing, except for Ms. Sica and Mr. Yue.

•The technical report for the Öksüt Mine, Türkiye with an effective date of June 30, 2015 (filed on September 3, 2015) (the “Öksüt Technical Report”) was prepared by Gordon D. Reid, Peter Woodhouse, Malcolm Stallman, Mustafa Cihan, Pierre Landry, Tyler Hilkewich, Tommaso Roberto Raponi, Kevin D’Souza and Chris Sharpe. At the time of the filing of the Öksüt Technical Report, each of these persons was a qualified person for the purposes of NI 43-101, and none of these individuals were independent of Centerra at the time of the Öksüt Technical Report.

Centerra Gold Inc.

2023 Annual Information Form Page 5

The technical reports have been filed on SEDAR+ at www.sedarplus.com.

The scientific and technical information related to mineral reserves contained in this AIF was reviewed and approved by Jean-Francois St-Onge, Professional Engineer, member of the Professional Engineer of Ontario (PEO) and Centerra’s Senior Director, Technical Services. Mr. St-Onge is a Qualified Person within the meaning of NI 43-101.

The scientific and technical information related to mineral resources contained in this AIF was reviewed and approved by Lars Weiershäuser, PhD, PGeo, and Centerra’s Director of Geology. Dr. Weiershäuser is a Qualified Person within the meaning of NI 43-101.

Exploration information and related scientific and technical information in this AIF regarding Centerra’s Mount Milligan Mine and Kemess Project exploration programs were prepared, reviewed, verified, and compiled by Cheyenne Sica, a member of the Engineers & Geoscientists British Columbia and Centerra’s Exploration Manager – Canada, who is a qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used.

Exploration information and related scientific and technical information in this AIF regarding Centerra’s Öksüt exploration program was prepared, reviewed, verified, and compiled by our geological and staff under the supervision of Richard Adofo, Member of the Association of Professional Geoscientists Ontario and Vice President, Exploration & Resource at Centerra Gold Inc. Mr. Adofo is a qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories, and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used.

All other scientific and technical information in this AIF, including without limitation, costs (operating and capital costs), metallurgical recovery (except as it may relate to our exploration program), mine production (historical and guidance), grades and mill throughput were prepared, reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO) and Centerra’s Executive Vice President and Chief Operating Officer and, Anna Malevich, Professional Engineer, and Centerra’s Senior Director, Projects. Mr. Chawrun and Ms. Malevich are qualified persons for the purposes of NI 43-101.

All scientific and technical information in this AIF is prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) and NI 43-101 (where relevant).

A glossary of geological and mining terms has been included at the end of this AIF for ease of reference.

1.4 Forward-Looking Information

This document contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking statements. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “anticipate”, “believe”, “budget”, “contemplate”, “continue”, “estimate”, “expect”, “evaluate”, “finalizing”, “forecast”, “goal”, “intend”, “may”, “ongoing”, “plan”, “potential”, “preliminary”, “project”, “restart”, “target”, “understand” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms. Such statements include, but may not be limited to: statements regarding 2024 guidance and expectations, including production, cash flow, costs including care and maintenance and reclamation costs, capital expenditures, depreciation, depletion and amortization, taxes and cash flows; exploration potential, budgets, focuses, programs, targets and projected exploration results; gold and copper prices; a Preliminary Economic Assessment at Mount Milligan and any related evaluation of resources or a life of mine beyond 2035; a feasibility study regarding a potential restart of the Thompson Creek Mine; an initial resource estimate at the Goldfield Project including the success of exploration programs or metallurgical testwork; the Company’s strategic plan; the optimization program at Mount Milligan including any improvements to occupational health and safety, the mine and the plant and any potential costs savings resulting from the same; the expected gold and copper production at the Mount Milligan Mine and gold production at Öksüt Mine in 2024; the new multi-year contract with the existing mining and hauling services provider at the Öksüt Mine; royalty

Centerra Gold Inc.

2023 Annual Information Form Page 6

rates and taxes, including withholding taxes related to repatriation of earnings from Türkiye; project development costs at Thompson Creek Mine and the Goldfield Project; the decommissioning of the Kemess South TSF sedimentation pond and associated works; financial hedges; and other statements that express management’s expectations or estimates of future plans and performance, operational, geological or financial results, estimates or amounts not yet determinable and assumptions of management. The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies.

Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Russian and Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anticorruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper, molybdenum and other mineral prices; the use of provisionally-priced sales contracts for production at the Mount Milligan Mine; reliance on a few key customers for the gold-copper concentrate at the Mount Milligan Mine; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; persistent inflationary pressures on key input prices; the impact of restrictive covenants in the Company’s credit facilities which may, among other things, restrict the Company from pursuing certain business activities or making distributions from its subsidiaries; changes to tax regimes; the Company’s ability to obtain future financing; sensitivity to fuel price volatility; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; the ability to obtain adequate insurance coverage; and changes to taxation laws in the jurisdictions where the Company operates and (C) unanticipated ground and water conditions; risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including: the stability of the pit walls at the Company’s operations leading to structural cave-ins, wall failures or rock-slides; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water, where applicable; periodic interruptions due to inclement or hazardous weather conditions or operating conditions and other force majeure events; the risk of having sufficient water to continue operations at the Mount Milligan Mine and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks, whether caused by decisions of third-party providers or force majeure events (including, but not limited to: labour action, flooding, landslides, seismic activity, wildfires, earthquakes, pandemics, or other global events such as wars); lower than expected ore grades or recovery rates; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic or pandemic; seismic activity, including earthquakes; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; regulations regarding greenhouse gas emissions and climate change; significant volatility of molybdenum prices resulting in material working capital changes and unfavourable pressure on viability of the molybdenum business; the Company’s ability to accurately predict decommissioning and reclamation costs and the assumptions they rely upon; the Company’s ability to attract and

Centerra Gold Inc.

2023 Annual Information Form Page 7

retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; risk of cyber incidents such as cybercrime, malware or ransomware, data breaches, fines and penalties; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns, and project resources. For additional risk factors, please see section titled “Risks Factors” in this AIF.

The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this document. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law. There can be no assurances that forward-looking information and statements will prove to be accurate, as many factors and future events, both known and unknown could cause actual results, performance or achievements to vary or differ materially from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained herein or incorporated by reference. Accordingly, all such factors should be considered carefully when making decisions with respect to Centerra, and prospective investors should not place undue reliance on forward-looking information.

1.5 Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding the Company’s mineral properties, including with respect to mineral reserve and mineral resource estimates included in this AIF, have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States’ securities laws. The terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Definition Standards. These definitions differ from the definitions in subpart 1300 of Regulation S-K (“Subpart 1300”). Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards set forth in Subpart 1300. U.S. investors are also cautioned that while the United States Securities and Exchange Commission (“SEC”) recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under Subpart 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the Subpart 1300 provisions and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to reporting pursuant to the Subpart 1300 provisions, which differ from the requirements of NI 43-101 and the CIM Definition Standards. For the above reasons, the mineral reserve and mineral resource estimates and related information in this AIF may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Centerra Gold Inc.

2023 Annual Information Form Page 8

2. ABOUT CENTERRA

|

|

|

|

|

|

|

We are a Canadian-based gold mining company focused on operating, developing, exploring, and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide.

Our head office is in Toronto, Ontario (Canada). We also have offices in other locations such as in Ankara (Türkiye); Langeloth, Pennsylvania (USA); Challis, Idaho (USA) and Goldfield, Nevada (USA).

We have approximately 1,236 employees.

We are publicly listed on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU.

|

Centerra Gold Inc.

1 University Avenue

Suite 1800

Toronto, Ontario

Canada M5J 2P1

Telephone: 416-204-1953

Website: www.centerragold.com

|

|

|

|

|

|

|

|

|

2.1 Our Properties

The table below sets out our properties as of the date of this AIF. We have two producing properties: the Mount Milligan Mine in British Columbia, Canada and the Öksüt Mine in Türkiye. We own a 100% interest in each of the following properties except for (i) the Endako Mine in which we own a 75% joint venture interest (the remaining 25% is held by Sojitz Moly Resources, Inc., a subsidiary of Sojitz Corporation) (the “Endako Mine Joint Venture”), and (ii) optioned interests in various exploration projects which we are still in the process of earning.

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Name |

Location |

Metal |

| Operating Mines |

Mount Milligan (the “Mount Milligan Mine”) |

Canada |

Gold/Copper |

Öksüt (the “Öksüt Mine”) |

Türkiye |

Gold |

| Advanced Evaluation |

Thompson Creek Mine (the “TC Mine”) |

United States |

Molybdenum |

| Advanced Exploration |

Goldfield District Project (the “Goldfield Project”) |

United States |

Gold |

| Exploration Projects |

Various owned exploration projects and options to earn interest in projects owned by third parties. |

Türkiye, Canada and the United States |

Gold/Copper |

| Care and Maintenance |

Endako Mine (the “Endako Mine”) |

Canada |

Molybdenum |

Kemess (the “Kemess Project”) |

Canada |

Gold/Copper/Silver |

We also own 100% of the Langeloth Metallurgical Facility, which is in Langeloth, Pennsylvania and purchases molybdenum concentrates from third parties to convert to upgraded products, which are then sold into the metallurgical and chemical markets.

Centerra Gold Inc.

2023 Annual Information Form Page 9

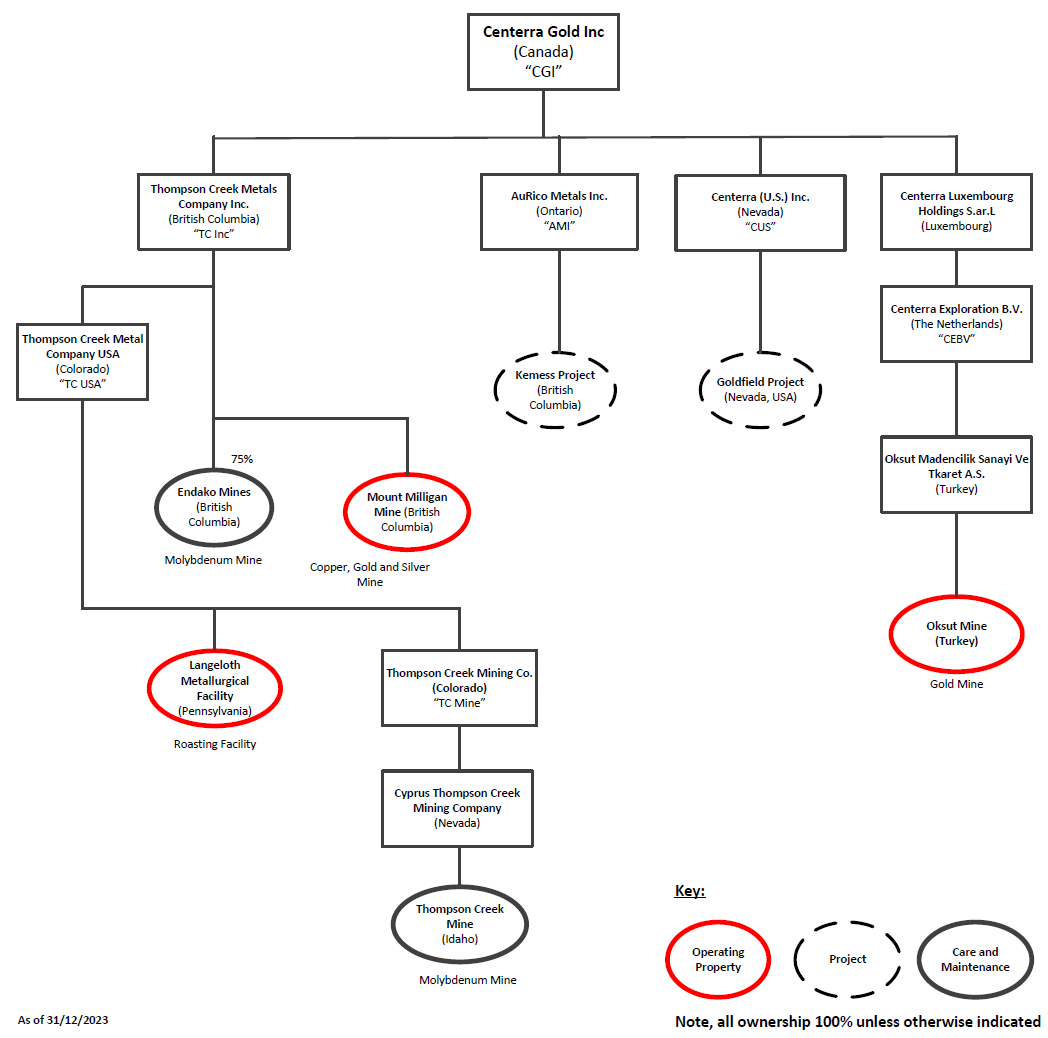

2.2 Inter-Corporate Relationships

Our principal subsidiaries, along with their jurisdiction of incorporation, continuation or organization, are set out below as at December 31, 2023. Each of our principal subsidiaries are 100% owned, unless otherwise noted.

(1)Centerra was incorporated under the Canada Business Corporations Act by articles of incorporation dated November 7, 2002, under the name 4122216 Canada Limited. Centerra changed its name on December 13, 2002 to Kumtor Mountain Holdings Corporation, and on December 5, 2003 to Centerra Gold Inc.

(2)Centerra owns an indirect 75% joint venture interest in the Endako Mine.

(3)Other subsidiaries, including those through which we hold our interest in exploration properties (including those in which we are earning an optioned interest), have not been included in the above chart because (i) their respective assets represent less than 10% of the consolidated assets of Centerra, and less than 10% of the consolidated sales and operating revenue of Centerra; and (ii) the consolidated assets and revenues of such excluded subsidiaries are less than 20% of the consolidated assets and consolidated revenue of Centerra, respectively. These subsidiaries are wholly owned, directly or indirectly, by Centerra.

Centerra Gold Inc.

2023 Annual Information Form Page 10

2.3 Recent Developments

The following is a summary of key developments over the past three years that have influenced the general development of our business.

•On April 12, 2021, we announced that the Company had received approval to list its Common Shares on the New York Stock Exchange with trading to commence on April 15, 2021 under the symbol CGAU.

•Prior to May 15, 2021, the Company owned and operated the Kumtor Mine, located in the Kyrgyz Republic, through its wholly-owned subsidiary, Kumtor Gold Company CJSC (“KGC”), however, effective May 15, 2021, the Kumtor Mine was classified as a discontinued operation in the Company’s financial statements.

•On May 17, 2021, Mr. Tengiz A.U. Bolturuk resigned from Centerra’s Board of Directors.

•On January 19, 2021, the Company completed the sale of its 50% interest in the Greenstone Gold Mines Partnership (the “Partnership”) to the Orion Mine Finance Group (“Orion”) for an upfront cash payment on closing of approximately $210 million (including adjustments) and conditional consideration of up to approximately $75 million (assuming $1,500 gold price) payable in cash or refined gold upon the Partnership’s Hardrock Mine Project meeting certain construction and production milestones. As a result of the construction decision for the project, the first of such contingent payments was received at the end of 2023. The obligations of Orion regarding payment of the conditional consideration have been guaranteed by the Partnership and secured against the Hardrock Mine Project.

•In January 2022, the Company obtained an amendment to its provincial environmental assessment certificate to authorize a long-term water supply for the Mount Milligan Mine.

•On February 22, 2022, Centerra announced that it had entered into an agreement to acquire Gemfield Resources LLC, owner of the Goldfield Project, from Waterton Nevada Splitter, LLC for total consideration comprised of $175 million in cash at closing and a $31.5 million deferred milestone payment. The Company announced the closing of its acquisition of the Goldfield Project on February 28, 2022.

•On March 18, 2022, the Company announced a temporary suspension of gold doré bar production at the Öksüt Mine due to mercury having been detected in the gold room of the ADR plant. The affected areas were professionally cleaned, and any contaminated material was removed and properly disposed of. An engineered solution was developed with the assistance of external consultants to ensure that mercury levels are detected, monitored and captured to prevent exposure to personnel and to safeguard the environment. The Company completed construction of a mercury abatement system in early 2023 to allow processing of mercury bearing ores.

•In May 2022 the Öksüt Mine was inspected by the Turkish Minister of Environment, Urbanization and Climate Change (the “Ministry of Environment”) and the Company was informed that the Öksüt Mine had a number of deficiencies relating to its environmental impact assessment (“EIA”). The Company worked to address the majority of the deficiencies and following several further discussions with the Ministry of Environment, (i) the Company determined that an updated EIA should be prepared and submitted to clarify various production and other capacity limits and to align the EIA production levels with current operating plans; (ii) the Öksüt Mine suspended leaching of ore on the heap leach pad and ceased using activated carbon on site effective late August 2022 though mining, crushing and stacking activities continued in line with existing EIA limits for the remainder of 2022.

•On May 4, 2022, Ms. Wendy Kei was appointed to the Company’s Board of Directors and Mr. Dan Desjardins retired as the Company’s Vice President and Chief Operating Officer.

•On July 29, 2022, Centerra announced that it had completed a transaction contemplated by the Global Arrangement Agreement dated April 4, 2022 (the “Arrangement Agreement”) with, among others, Kyrgyzaltyn JSC (“Kyrgyzaltyn”) and the Kyrgyz Republic to effect a separation of the parties, including through the disposition of Centerra’s ownership of the Kumtor Mine and its investment in the Kyrgyz Republic, the purchase for cancellation by Centerra of Kyrgyzaltyn’s 77,401,766 Common Shares, the termination of Kyrgyzaltyn’s involvement in the Company, and the resolution of disputes (the “Transaction”). As a result of the completion of the Transaction, Centerra has repurchased and cancelled all of Kyrgyzaltyn’s 77,401,766 Common Shares in exchange for, among other things, Centerra’s 100% equity interest in its two Kyrgyz subsidiaries, and indirectly, the Kumtor Mine, with Kyrgyzaltyn and the Kyrgyz Republic assuming all responsibility for the Kumtor mine, including all reclamation and environmental obligations, and aggregate cash payments of approximately $93

Centerra Gold Inc.

2023 Annual Information Form Page 11

million (a portion of which was withheld on account of Canadian withholding taxes payable by Kyrgyzaltyn and a portion of which was paid to the Company’s financial advisors as transaction costs). The Company announced the completion of the Arrangement Agreement on July 29, 2022. Further details on the terms of the Arrangement Agreement and the Transaction can be found in Centerra’s April 4, 2022 news release and in Centerra’s management information circular in respect of the special meeting of Centerra shareholders held on July 25, 2022.

•On July 29, 2022, in connection the Arrangement Agreement, Kyrgyzaltyn’s two director nominees, Dushen Kasenov and Nurlan Kyshtobaev, resigned from Centerra’s Board of Directors.

•On October 4, 2022, the Company announced a mine life extension for the Mount Milligan Mine by over four years extending operations into 2033.

•On August 17, 2022, Centerra announced that Paul Chawrun would be appointed as Chief Operating Officer, effective September 6, 2022.

•On September 6, 2022, Centerra announced that Paul Wright had replaced Scott Perry as President & Chief Executive Officer of Centerra. Mr. Wright, a director of Centerra, would act as interim President & Chief Executive Officer to manage the Company through a leadership transition period, as the Board works with an executive search firm to select Centerra’s long-term Chief Executive Officer.

•On October 11, 2022, the Company announced that the TSX accepted its notice of intention to proceed with a normal course issuer bid (the “2022 NCIB”) pursuant to which it was authorized to purchase for cancellation up to 15,610,813 Common Shares, representing 10% of the public float, during the twelve-month period commencing on October 13, 2022 and ending on October 12, 2023. Daily purchases were limited to 226,201 Common Shares, other than purchases made under block purchase exemptions. The Company relied on an automatic purchase plan during the 2022 NCIB to allow for purchases by the Company of Common Shares during certain predetermined blackout periods, subject to applicable securities laws and stock exchange rules. Under the 2022 NCIB, a total of 5,298,200 Common Shares of the Company were repurchased through the facilities of the TSX and alternative Canadian trading systems at a volume weighted average price of C$7.44 per Common Share. Common Shares purchased by Centerra under the 2022 NCIB were subsequently cancelled. Shareholders can obtain a copy of the 2022 NCIB notice accepted by the TSX, without charge, by contacting the Company.

•On March 13, 2023, the Company announced that Paul Tomory had been appointed President & Chief Executive Officer of Centerra effective May 1, 2023.

•The Öksüt Mine’s updated EIA was approved by the Ministry of Environment in May 2023 resulting in Öksüt resuming full operations in early June 2023.

•In May 2023, the Company appointed Hélène Timpano as its new Executive Vice-President, Strategy & Corporate Development.

•On July 31, 2023, as a result of a continuing strategic review of the Goldfield Project, the Company intends to focus exploration activities on oxide and transition material, principally in the Gemfield and nearby deposits that could result in more simplified ore processing methods, a flow sheet with lower capital costs and increased returns on the project when compared to the known sulphide ore at the Goldfield Project. The Company will take additional time to perform exploration activities in its large, under-explored land position, targeting oxide mineralization that could be incorporated into the initial resource estimate when completed. The Company is targeting an initial resource estimate by the end of 2024.

•Effective September 11, 2023, the Company entered into a four-year extension of its $400 million revolving credit facility (the "Credit Facility"), now maturing on September 8, 2027. The Credit Facility is led by The Bank of Nova Scotia and National Bank Financial Markets and is supported by a syndicate of international financial institutions.

•On September 18, 2023, the Company announced the results of a prefeasibility study on the restart of mining at the TC Mine, including an optimized mine plan with 11-year mine life. In line with the Company’s disciplined approach to capital allocation, Centerra expects to phase the operations restart at the TC Mine. Early work activities primarily include limited scope refurbishment of existing mining mobile equipment fleet and purchase of additional mobile equipment, stripping activities and technical studies. The Company has commenced a feasibility study for the TC Mine, which is expected to be completed by mid-2024. Upon completion of the feasibility study, the Company expects to approve a limited notice to proceed, authorizing $100 to $125 million of capital for pre-

Centerra Gold Inc.

2023 Annual Information Form Page 12

stripping within current permitting authorizations, purchase of long lead items and initiation of plant refurbishments.

•On November 3, 2023, the Company announced that the TSX accepted the renewal of its normal course issuer bid (the “2023 NCIB”) for the twelve-month period commencing on November 7, 2023 and ending on November 6, 2024. Under the 2023 NCIB, Centerra may purchase for cancellation up to an aggregate of 18,293,896 Common Shares, representing 10% of the public float. Daily purchases are limited to 191,219 Common Shares, other than purchases made under block purchase exemptions. The Company entered into an automatic purchase plan in connection with the 2023 NCIB to facilitate purchases by the Company of Common Shares during certain predetermined blackout periods, subject to applicable securities laws and stock exchange rules. Any purchases made under the 2023 NCIB will be made at market price at the time of purchase through the facilities of the TSX and/or alternative Canadian trading systems in accordance with applicable securities laws and stock exchange rules. Common Shares purchased by Centerra under the 2023 NCIB will be cancelled. Shareholders can obtain a copy of the 2023 NCIB notice accepted by the TSX, without charge, by contacting the Company.

•In the fourth quarter of 2023, Centerra embarked on a site-wide optimization program at Mount Milligan, focused on a holistic assessment of occupational health and safety, as well as improvements in mine and plant operations. This program is focused on all aspects of the operation to maximize the potential of the orebody.

•On January 22, 2024 Centerra announced that Ryan Snyder will succeed Darren Millman and be promoted to Executive Vice President and Chief Financial Officer, effective April 8, 2024.

•On February 13, 2024, the Company entered into an Additional Agreement (as defined below) with RGLD Gold AG and Royal Gold Inc. (collectively, “Royal Gold”), relating to the Mount Milligan Mine, which, among other things, resulted in a life of mine extension to 2035 and established favourable parameters for potential future mine life extensions. Centerra commenced a Preliminary Economic Assessment (“PEA”) to include significant drilling completed at the Mount Milligan Mine to the west of the pit not currently included in the existing resource, plus inclusion of existing resources, most of which are classified in the measured and indicated categories. The PEA will also evaluate several capital projects to support further expansion of Mount Milligan’s life, including options for a new tailings storage facility and potential process plant upgrades. The Company will also be starting the associated work on permitting and engagement with its First Nations partners and local stakeholders. The PEA is expected to be completed in the first half of 2025. For further information on this Additional Agreement, see the section entitled “Material Contracts”.

2.4 Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets

Controls Relating to Corporate Structure Risk

We have implemented a system of corporate governance, internal controls over financial reporting, and disclosure controls and procedures that apply at all levels of the Company and its subsidiaries. These systems are overseen by the Company’s Board and implemented by the Company’s senior management. The relevant features of these systems include:

Control Over Subsidiaries

Centerra’s corporate structure has been designed to ensure that the Company controls or has a measure of direct oversight over the operations of its subsidiaries. All of our subsidiaries are directly or indirectly wholly-owned by the Company with the exception of shareholdings in other publicly traded and privately held companies which represent less than 10% of the consolidated assets of Centerra, and less than 10% of the consolidated sales and operating revenue of Centerra.

The directors of Centerra’s wholly-owned subsidiaries are ultimately accountable to Centerra as the shareholder appointing them, and to Centerra’s Board and senior management. As well, the annual budget, capital investment and exploration program in respect of the Company’s mineral properties are established by the Company and approved by the Board. Members of management of all subsidiaries are also subject to written delegation of financial authority rules (adopted by the board of directors of each subsidiary) which limit their ability to bind such company. Our internal audit group also regularly conducts examinations of Centerra’s operating sites and subsidiaries and reports directly to the Audit Committee on compliance with various matters.

We have a 75% interest in the Endako Mine Joint Venture which was formed on June 12, 1997 pursuant to the terms of the Exploration, Development and Mine Operating Agreement between Thompson Creek Metals Company Inc. (“Thompson Creek”) and Sojitz Moly Resources, Inc. (“Sojitz”), as amended (the “Endako Mine Joint Venture Agreement”). Sojitz

Centerra Gold Inc.

2023 Annual Information Form Page 13

owns the remaining 25% interest in the Endako Mine Joint Venture. Our 75% interest in the contractual joint venture is held through our wholly owned subsidiary, Thompson Creek. We appoint all officers and directors of Thompson Creek. We are the manager of the Endako Mine Joint Venture with overall management responsibility for operations. As manager, we prepare annual budgets and production plans and submit them to Sojitz for approval. Oversight is provided by a joint venture committee whose members are appointed by Thompson Creek and Sojitz.

Signing officers for subsidiary foreign bank accounts (of our wholly owned subsidiaries) are either employees of Centerra or directors of the subsidiaries. In accordance with the Company’s internal policies, all subsidiaries must notify the Company’s corporate treasury department of any changes in their local bank accounts including requests for changes to authority over the subsidiaries’ foreign bank accounts. Monetary limits are established internally by the Company as well as with the respective banking institution. Quarterly, authorizations over bank accounts are reviewed and revised as necessary. Changes are communicated to the banking institution by the Company and the applicable subsidiary to ensure appropriate individuals are identified as having authority over the bank accounts.

Strategic Direction

Centerra’s Board is responsible for the overall stewardship of the Company and, as such, supervises the management of the business and affairs of the Company. More specifically, the Board is responsible for reviewing the strategic business plans and corporate objectives, and approving acquisitions, dispositions, investments, capital expenditures, financings. and other transactions and matters that are material to the Company including those of its material subsidiaries.

Internal Control Over Financial Reporting

The Company prepares its consolidated financial statements and managements’ discussion and analysis (“MD&A”) on a quarterly and annual basis, using IFRS as issued by the International Accounting Standards Board, which require financial information and disclosures from its subsidiaries. The Company implements internal controls over the preparation of its financial statements and other financial disclosures to provide reasonable assurance that its financial reporting is reliable and that the quarterly and annual financial statements and MD&A are being prepared in accordance with IFRS and relevant securities laws. These internal controls include the following:

i.The Company has established a monthly and quarterly reporting package relating to its subsidiaries that standardizes the information required from the subsidiaries in order to complete the consolidated financial statements and MD&A. Management of the Company has direct access to relevant financial management of its subsidiaries in order to verify and clarify all information required.

ii.All public documents and statements relating to the Company and its subsidiaries containing material information (including financial information) are reviewed by members of the in-house legal department and our internal disclosure committee comprised of the President & Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), Chief Operating Officer, General Counsel and Vice President, Investor Relations before such material information is disclosed, to make sure that all material information has been considered by management of the Company and properly disclosed. Where appropriate, the disclosure committee will also convene a subset of other employees to ensure that our public documents and statements do not contain any misrepresentations, as such term is defined in applicable Canadian securities laws.

iii.As more fully described below, the Company’s Audit Committee obtains confirmation from the CEO and CFO as to the matters addressed in the quarterly and annual certifications required under National Instrument 52-109 – Certification of Disclosure in the Company’s Annual and Interim Filings (“NI 52-109”), including its review of internal controls over financial reporting and disclosure controls and procedures.

iv.The Company’s Audit Committee reviews and approves the Company’s quarterly and annual financial statements and MD&A and recommends their approval to the Board for approval prior to their publication or release.

v.The Company’s Audit Committee assesses and evaluates the adequacy of the procedures in place for the review of the Company’s public disclosure of financial information extracted or derived from the Company’s financial statements by way of reports from management and its internal and external auditors.

Centerra Gold Inc.

2023 Annual Information Form Page 14

vi.Although not specifically a management control, the Company engages its external auditor to perform reviews of the Company’s quarterly financial statements and an audit of the annual consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board.

Disclosure Controls and Procedures

The Company’s Audit Committee’s responsibilities include oversight of the Company’s internal control systems and disclosure controls and procedures including those systems to monitor compliance with legal, ethical and regulatory requirements.

CEO and CFO Certifications

In order for the Company’s CEO and CFO to be in a position to attest to the matters addressed in the quarterly and annual certifications required by NI 52-109, the Company has developed internal procedures and responsibilities throughout the organization for its regular periodic and timely reporting. These processes are designed to provide assurances that information that may constitute material information will reach the appropriate individuals who draft and/or review public documents and statements relating to the Company. During 2023, we engaged an external accounting firm to carry out a review of our internal controls over financial reporting.

Pursuant to regulations adopted by the U.S. Securities and Exchange Commission, under the Sarbanes-Oxley Act of 2002 and those of the Canadian Securities Administrators, Centerra’s management evaluates the effectiveness of the design and operation of the Company’s disclosure controls and procedures and internal control over financial reporting. This evaluation is done under the supervision of, and with the participation of, the CEO and CFO.

These systems of corporate governance, internal control over financial reporting and disclosure controls and procedures are designed to ensure that, among other things, the Company has access to all material information about its subsidiaries.

Procedures of the Board of Directors of the Company

Oversight of the Company’s Risks

We have implemented an enterprise risk management program which applies to all of our operations, projects and corporate offices with a goal to ensure risk-informed decision making. The program is based on leading international risk management standards and industry best practice. It employs both a “bottom-up” and “top-down” approach to identify and address risks from all sources that threaten the achievement of our strategic and business objectives or provide opportunities to exploit. As such, our risk program encompasses a broad range of risks including technical, financial, commercial, social, reputational, environmental, governance, health and safety, political and human resources related risks. The Board of Directors has oversight responsibilities for the policies, processes and systems for the identification, assessment, and management of the Company’s principal strategic, financial, and operational risks. Each of the Board’s standing committees is responsible for overseeing risks related to their area of responsibility and reviewing the policies, standards and actions undertaken to mitigate such risks. The Company’s executive team meets regularly to review the risks facing the organization and to discuss the implementation and effectiveness of mitigation actions and regularly provides updates to the Board and its committees on the same.

Fund Transfers from the Company’s Subsidiaries to Centerra

Funds are transferred by the Company’s subsidiaries to the Company by way of wire transfer for a variety of purposes, including chargeback of costs undertaken on behalf of the subsidiaries via intercompany invoices by the Company; repayment of loans related to project funding; and dividend declaration/payment by the subsidiaries. The method of transfer is dependent on the funding arrangement established between the Company and the subsidiary. In some cases, loan agreements are established with corresponding terms and conditions. In other cases, dividends are declared and paid based on the profitability and available liquidity of the applicable subsidiary.

Records Management of the Company’s Subsidiaries

The original minute books, corporate seal and corporate records of each of the Company’s subsidiaries are kept at each subsidiary’s respective registered office. All material documents are available in the local language of the subsidiary and in English.

Centerra Gold Inc.

2023 Annual Information Form Page 15

Approval of Related Party Transactions

Centerra’s Audit Committee oversees, reviews, evaluates and considers material transactions and matters involving related parties.

2.5 Centerra’s Business

|

|

|

|

|

|

|

We are a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide.

We have two operating properties: the Mount Milligan Mine in British Columbia, Canada and the Öksüt Mine in Türkiye.

We also own a molybdenum business, which includes our TC Mine in Idaho, United States, the Endako Mine (we own a 75% interest) in British Columbia, Canada and the Langeloth Metallurgical Processing Facility in Pennsylvania, United States. Both the TC Mine and the Endako Mine are currently on care and maintenance.

|

For more information

You can find more information about Centerra on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov.

See our 2023 financial statements and MD&A for additional financial information.

See our most recent management information circular for additional information, including how our directors and officers are compensated and any loans to them, principal holders of our securities, and securities authorized for issuance under our equity compensation plans.

|

We also own the Goldfield Project, an advanced exploration project in Nevada, United States and the Kemess Project in north-central British Columbia which is currently on care and maintenance.

We have exploration interests in Canada, the United States and Türkiye, which are owned (directly or indirectly) by Centerra, and properties in Canada, Türkiye and the United States in which we are earning interests pursuant to option agreements with the respective property owners.

Business Operations

Our principal business operations of gold/copper production span the six major stages of the mining cycle, from early-stage exploration to mine closure and reclamation.

|

|

|

|

|

|

| Exploration |

Our exploration programs are focused on increasing our mineral reserves and resources. These programs include: drilling at, or in, the immediate vicinity of our operating mine(s) to replace mined mineral reserves; drilling programs on advanced stage projects where mineralization has been identified; and grassroots exploration on projects where mineralization has not been identified. Our exploration and business development teams actively pursue new project opportunities worldwide. |

| Development and Construction |

If our exploration programs are successful in identifying a mineral resource, the prospects for economic extraction of the resource will be analyzed through a series of technical studies. These may include metallurgical studies, scoping studies, environmental studies, mine and processing design, preliminary economic assessment studies, pre-feasibility studies and feasibility studies. Pre-feasibility and feasibility studies may be undertaken concurrently with permitting for the project. Once feasibility studies and permitting processes are concluded, financing for the project is arranged, followed by the commencement of detailed engineering and construction of the mine site and processing facilities. |

| Mining |

Ore and waste rock are removed from deposits by open pit or underground methods – our two operating mines currently use only an open pit method. The ore is then transported to a processing facility/mill to extract metal (depending on the mine). The waste rock is placed on an engineered waste rock dump for subsequent rehabilitation or used in the construction of the tailings storage facility. |

Centerra Gold Inc.

2023 Annual Information Form Page 16

|

|

|

|

|

|

| Processing |

Mined ore is processed using different methods depending on its characteristics. This may include heap leaching, crushing, milling, flotation, roasting, and CIL or CIP methods for gold and copper extraction. After having extracted the metal, the remaining processed waste materials are placed in a tailings storage facility (except in the case of heap leach processing). |

| Refining and Gold Sales |

At our Öksüt Mine, recovered gold is processed at our ADR plant (processing facility) into doré bars which are then delivered to a refinery for further refining to market delivery standards. At our Mount Milligan Mine, we produce a gold-copper concentrate which is sold to third parties including smelters and traders for further refining. |

| Closure and Reclamation |

As a responsible mining company, we plan how we are going to reclaim the areas we mine before we start construction. In some cases, we reclaim at the same time as we extract to expedite the process. In other cases, it is not possible to reclaim during the extraction process and therefore, efforts are deferred until after mining is completed. After mining has permanently ceased, we carry out the permitted closure activities or continue to reclaim (as applicable) and monitor the land. We also regularly update our final closure plans to reflect any changes in operations or regulatory requirements. Our high standards for reclamation comply with both local and international standards. |

Marketing and Distribution

Our principal products are gold, copper, and to a lesser extent, molybdenum and ferromolybdenum products. Our Öksüt Mine produces gold doré bars. Our Mount Milligan Mine produces a copper-gold concentrate, and our Langeloth Metallurgical Processing Facility purchases molybdenum concentrates from third parties to convert to upgraded products, which are then sold into the metallurgical and chemical markets.

Gold Industry

The two principal uses of gold are bullion investment and product fabrication. A broad range of end uses is included within the fabrication category, the most significant of which is the production of jewelry. Other fabrication uses include official coins, electronics, miscellaneous industrial and decorative uses, medals, and medallions.

Copper Industry

Copper is an excellent conductor of electricity and heat and these properties result in the principal applications for copper consumption. Refined copper is used in the generation and transmission of electricity as well as industrial machinery and consumer products that have electrical and electronic applications.

Gold Doré Produced at Öksüt Mine

All gold doré produced at the Öksüt Mine is processed at refining facilities within Türkiye. Under Turkish legislation, the Central Bank of the Republic of Türkiye has a first right to purchase gold produced by mining operations in Türkiye. The sales price is fixed based on the gold spot price. If the gold doré is not purchased by the Central Bank of the Republic of Türkiye, it is sold to a buyer via the refining facility on the Borsa Istanbul at spot prices.

Copper/Gold Concentrate Produced at Mount Milligan Mine

Concentrate Sales

Copper/gold concentrate produced by the Mount Milligan Mine in Canada is sold to various smelters and off-take purchasers. We are currently party to three multi-year concentrate sales agreements for the sale of copper/gold concentrate produced at the Mount Milligan Mine. Pursuant to these agreements, we have agreed to sell an aggregate of approximately 120,000 tonnes in 2024, 120,000 tonnes in 2025 and 110,000 tonnes in 2026 and 100,000 tonnes in 2027.

Pricing under these concentrate sales agreements is determined by reference to specified published reference prices during the applicable quotation periods. Payment for the concentrate is based on the price for the agreed copper and gold content of the parcels delivered, less smelting and refining charges and certain other deductions, if applicable. The copper smelting and refining charges are negotiated and agreed by the parties for each contract year based on terms generally acknowledged as industry benchmark terms. The gold refining charges are as specified in the agreements.

Centerra Gold Inc.

2023 Annual Information Form Page 17

We intend to either extend our current multi-year agreements as the terms expire, or we may enter into additional multi-year sales agreements. To the extent that production is expected to exceed the volume committed under these agreements, we will sell the additional volume under short-term contracts or on a spot basis.

Mount Milligan Streaming Arrangement and Additional Agreement with Royal Gold

We are subject to a streaming arrangement with Royal Gold pursuant to which Royal Gold is entitled to receive 35% of the gold and 18.75% of the copper production at our Mount Milligan Mine in exchange for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered, respectively (the “Mount Milligan Streaming Arrangement”). The Mount Milligan Streaming Arrangement required Royal Gold to make upfront payments totaling $781.5 million from 2010 to 2013 to Thompson Creek for the rights to receive future gold production. The arrangement was renegotiated by Centerra in conjunction with its acquisition of Thompson Creek. To satisfy our obligations under the Mount Milligan Streaming Arrangement, in connection with copper and gold concentrate sale from the Mount Milligan Mine, we purchase gold and copper in the market for delivery to Royal Gold based on a portion of the gold ounces and pounds of copper sold.

On February 13, 2024, the Company entered into an additional agreement with Royal Gold, relating to the Mount Milligan Mine (the “Additional Agreement”). Starting in approximately 2030, the Additional Agreement, taken together with the Mount Milligan Streaming Arrangement, will have the effect of increasing payments for Mount Milligan gold and copper production sold to Royal Gold under the Mount Milligan Streaming Arrangement, among other things. After achieving the First Threshold Date (as defined below), gold payments received will be the lower of $850/oz and 50% of the spot price while copper payments will be 50% of the spot price. After achieving the Second Threshold (Gold) Date (as defined below) or the Second Threshold (Copper) Date (as defined below), as applicable, gold payments received will be the lower of $1050/oz and 66% of the spot price, while copper payments received will be 66% of the spot price, respectively. The existing Mount Milligan Streaming Arrangement, as amended, is not affected by the Additional Agreement. For further information on the Additional Agreement, see the section entitled “Material Contracts” below.

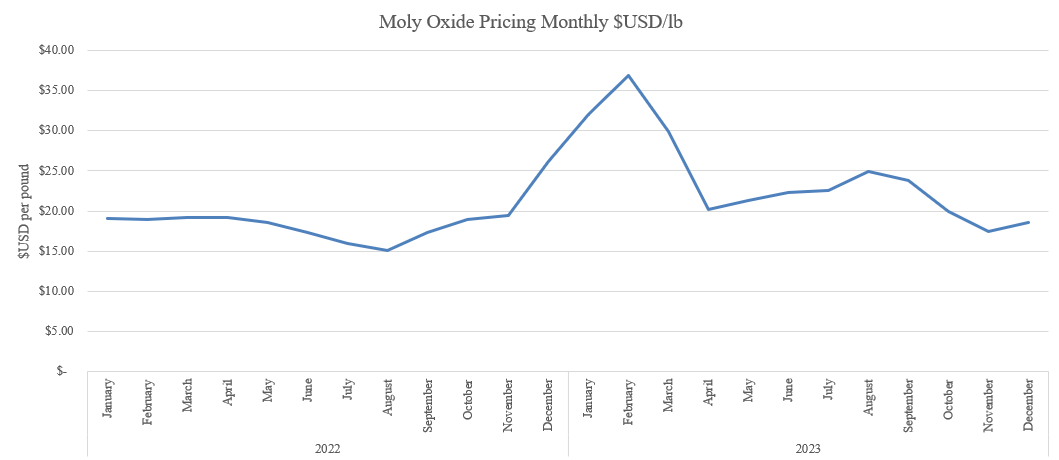

Molybdenum Industry

Our Langeloth Metallurgical Facility purchases molybdenum concentrates from third parties to convert to upgraded products, which are then sold into the metallurgical and chemical markets. Our principal molybdenum products are molybdic oxide (also known as roasted molybdenum concentrate) and ferromolybdenum. Other products we produce include high soluble technical oxide and pure molybdenum trioxide.

Molybdenum is an industrial metal principally used for metallurgical applications as a ferro-alloy in steels where high strength, temperature-resistant or corrosion-resistant properties are sought. The addition of molybdenum enhances the strength, toughness and wear and corrosion-resistance in steels when added as an alloy. Molybdenum is used in major industries including chemical and petro-chemical processing, oil and gas for drilling and pipelines, power generation, automotive and aerospace. It is also required for several green energy applications, especially wind, geothermal, and nuclear. Molybdenum is also widely used in non-metallurgical applications such as petroleum refining catalysts, lubricants, flame-retardants in plastics, water treatment and as a pigment.

Centerra Gold Inc.

2023 Annual Information Form Page 18

2023 and 2022 Production and Revenue

|

|

|

|

|

|

|

|

|

|

2023 |

2022 |

Total (1) |

|

|

Gold sold (oz) |

348,399 |

242,193 |

Payable copper sold (‘000 lbs.) |

60,109 |

73,392 |

Revenue ($ millions) |

1,094.9 |

850.2 |

Mount Milligan Mine (2) |

|

|

Payable Gold Sold (oz) |

152,460 |

187,490 |

Payable Copper Sold (‘000 lbs.) |

60,109 |

73,392 |

Gold Sales ($ millions) |

218.2 |

248.6 |

Copper Sales ($ millions) |

181.0 |

216.5 |

Öksüt Mine – Gold |

|

|

Gold sold (oz) |

195,939 |

54,704 |

Gold Sales ($ millions) |

380.9 |

101.6 |

| Langeloth – Molybdenum |

|

|

Molybdenum sold (‘000 lbs.) |

11,235 |

13,448 |

Molybdenum Sales ($ millions) |

294.9 |

264.5 |

(1)Mount Milligan sales volumes are presented on a 100% basis. Under the Mount Milligan Streaming Arrangement, Royal Gold is entitled to 35% of payable gold ounces and 18.75% of payable copper. Royal Gold currently pays $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered.

Our revenues from the sale of our products are dependent on the world market price of gold, copper and molybdenum. World market prices for our products have fluctuated historically and are affected by numerous factors beyond our control. See the sections of this AIF entitled “Historic Metal Prices” and “Risk Factors” for additional information.

Competitive Conditions

The mining industry is intensely competitive, particularly in the acquisition of mineral reserves and resources. In comparison with diversified mining companies, our competitive position is subject to unique competitive advantages and disadvantages related to the price of gold, copper and molybdenum.

Mineral Reserves and Resources

Our mineral reserves and resources are fundamental to the Company and serve as the foundation for our future production and project development.

We have interests in several properties. The tables in this section show our estimates of the proven and probable reserves, measured and indicated resources and inferred resources at those properties.

We estimate and disclose mineral reserves and resources in five categories, using the definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum, and in accordance with NI 43-101. You can find out more about these categories at www.cim.org. See the “Glossary of Geological and Mining Terms” for complete definitions of mineral reserves and mineral resources.

For a further discussion of the key assumptions, methodologies and parameters used in the estimation of mineral reserves and mineral resources, see the section of this AIF entitled “Centerra’s Properties”.

About Mineral Resources

Mineral resources are not mineral reserves and do not have demonstrated economic viability but do have reasonable prospect for economic extraction. They fall into three categories: measured, indicated, and inferred. Our reported mineral resources do not include mineral reserves. Measured and indicated mineral resources are sufficiently well-defined to allow

Centerra Gold Inc.

2023 Annual Information Form Page 19

geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the mineral resource. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve. Inferred mineral resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred mineral resources are too speculative geologically to have economic considerations applied to them. There is no certainty that mineral resources of any category will be upgraded to mineral reserves.

Important Information About Mineral Reserve and Resource Estimates

Although we have carefully prepared and verified the mineral reserve and resource figures in this AIF, the figures are estimates based in part on forward-looking information.

Estimates are based on our knowledge, mining experience, analysis of drilling results, the quality of available data and management’s best judgment. They are, however, imprecise by nature, may change over time, and include many variables and assumptions including geological interpretation, commodity prices and currency exchange rates, recovery rates, and operating and capital costs.

There is no assurance that the indicated levels of metal will be produced, and we may have to re-estimate our mineral reserves based on actual production experience. Changes in the metal price, production costs or recovery rates could make it unprofitable for us to operate or develop a particular site or sites for a period of time. See the sections of this AIF entitled “Forward-looking Information”, “Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources” and “Risk Factors”.

Centerra Gold Inc.

2023 Annual Information Form Page 20

Table 1

Centerra Gold –Inc. - 2023 Year-End Mineral Reserve and

Mineral Resource Summary – Gold (1)

(as of December 31, 2023)

(see additional footnotes on page 24)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven and Probable Gold Mineral Reserves |

|

Proven |

Probable |

Total Proven and Probable |

| Property |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Mount Milligan (4) |

215,640 |

0.34 |

2,387 |

34,386 |

0.39 |

435 |

250,025 |

0.35 |

2,822 |

| Öksüt |

1,140 |

1.10 |

40 |

24,116 |

1.00 |

779 |

25,255 |

1.01 |

819 |

| Total |

216,780 |

0.35 |

2,427 |

58,502 |

0.64 |

1,214 |

275,280 |

0.41 |

3,641 |

|

Measured and Indicated Gold Mineral Resources (2) |

|

Measured |

Indicated |

Total Measured and Indicated |

| Property |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

Mount Milligan (4) |

118,289 |

0.25 |

966 |

141,571 |

0.30 |

1,367 |

259,860 |

0.27 |

2,333 |

| Öksüt |

907 |

0.45 |

13 |

5,844 |

0.56 |

106 |

6,752 |

0.55 |

119 |

| Kemess Open Pit |

- |

- |

- |

111,682 |

0.27 |

980 |

111,682 |

0.27 |

980 |

| Kemess Underground |

- |

- |

- |

139,920 |

0.50 |

2,265 |

139,920 |

0.50 |

2,265 |

| Kemess East |

- |

- |

- |

93,454 |

0.39 |

1,182 |

93,454 |

0.39 |

1,182 |

| Total |

119,197 |

0.26 |

979 |

492,471 |

0.37 |

5,901 |

611,668 |

0.35 |

6,880 |

|

Inferred Gold Mineral Resources (3) |

|

|

|

|

|

|

| Property |

Tonnes

(kt)

|

Grade

(g/t)

|

Contained Gold (k oz) |

|

|

|

|

|

|

Mount Milligan (4) |

7,795 |

0.34 |

84 |

|

|

|

|

|

|

| Öksüt |

348 |

0.78 |

9 |

|

|

|

|

|

|

| Kemess Open Pit |

13,691 |

0.26 |

116 |

|

|

|

|

|

|

| Kemess Underground |

- |

- |

- |

|

|

|

|

|

|

| Kemess East |

- |

- |

- |

|

|

|

|

|

|

| Total |

21,833 |

0.30 |

209 |

|

|

|

|

|

|

(1)Centerra’s equity interests as of this news release are as follows: Mount Milligan 100%, Öksüt 100%, Kemess Open Pit, Kemess Underground and Kemess East 100%. Mineral reserves and resources for these properties are presented on a 100% basis. Numbers may not add up due to rounding.

(2)Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability.

(3)Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

(4)Production at Mount Milligan is subject to a streaming agreement with RGLD Gold AG and Royal Gold, Inc. (collectively, “Royal Gold”) which entitles Royal Gold to 35% of gold sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay a reduced price per ounce of gold delivered. Mineral reserves and resources for the Mount Milligan property are presented on a 100% basis.

Centerra Gold Inc.

2023 Annual Information Form Page 21

Table 2

Centerra Gold Inc. - 2023 Year-End Mineral Reserve and

Mineral Resource Summary - Other Metals (1)

(as of December 31, 2023)

(see additional footnotes on page 24)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property

|

Tonnes

(kt)

|

Copper

Grade

(%) |

Contained Copper (Mlbs) |

Molybdenum

Grade

(%) |

Contained Molybdenum

(Mlbs) |

Silver

Grade

(g/t) |

Contained Silver

(k oz) |

| Proven Mineral Reserves |

Mount Milligan (4) |

215,640 |

0.17 |

828 |

- |

- |

- |

- |

| Probable Mineral Reserves |

Mount Milligan (4) |

34,386 |

0.18 |

134 |

- |

- |

- |

- |

|

| Total Proven and Probable Mineral Reserves |

Mount Milligan (4) |

250,025 |

0.17 |

961 |

- |

- |

- |

- |

| Total Copper |

250,025 |

0.17 |

961 |

- |

- |

- |

- |

|

Measured Mineral Resources (2) |

Mount Milligan (4) |

118,289 |

0.17 |

433 |

- |

- |

- |

- |

| Kemess Open Pit |

- |

- |

- |

- |

- |

- |

- |

| Kemess Underground |

- |

- |

- |

- |

- |

- |

- |

| Kemess East |

- |

- |

- |

- |

- |

- |

- |

| Thompson Creek |

57,645 |

- |

- |

0.07 |

92 |

- |

- |

| Endako |

47,100 |

- |

- |

0.05 |

48 |

- |

- |

|

Indicated Mineral Resources (2) |

Mount Milligan (4) |

141,571 |

0.13 |

418 |

- |

- |

- |

- |

| Kemess Open Pit |

111,682 |

0.14 |

337 |

- |

- |

1.19 |

4,262 |

| Kemess Underground |

139,920 |

0.25 |

779 |

- |

- |

1.90 |

8,544 |

| Kemess East |

93,454 |

0.30 |

628 |

- |

- |

1.66 |

5,000 |

| Thompson Creek |

59,498 |

- |

- |

0.07 |

85 |

- |

- |

| Endako |

122,175 |

- |

- |

0.04 |

118 |

- |

- |

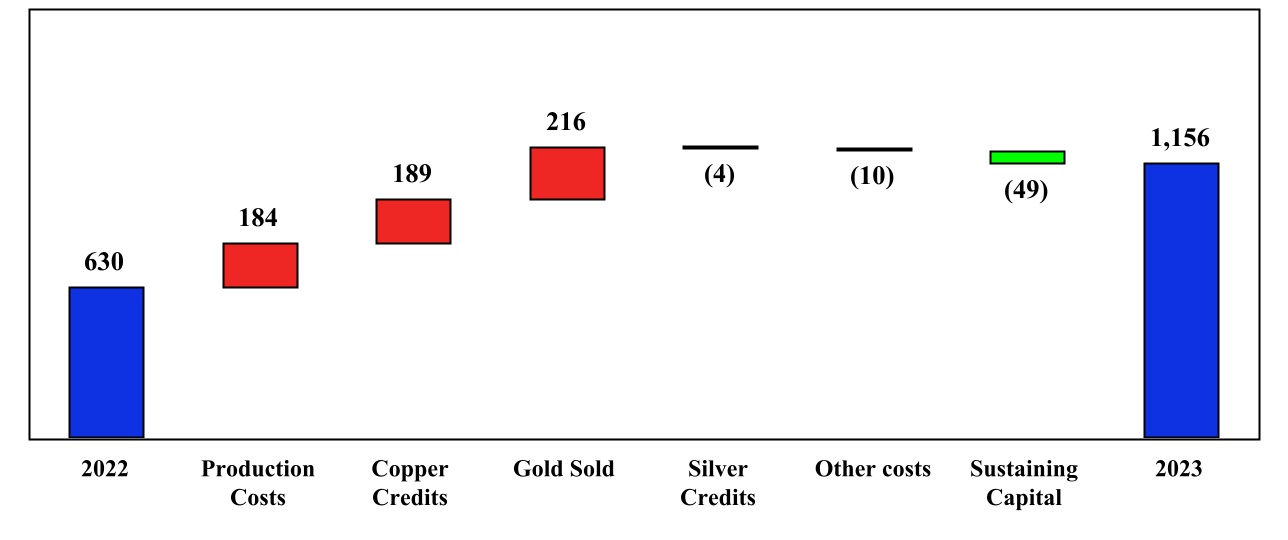

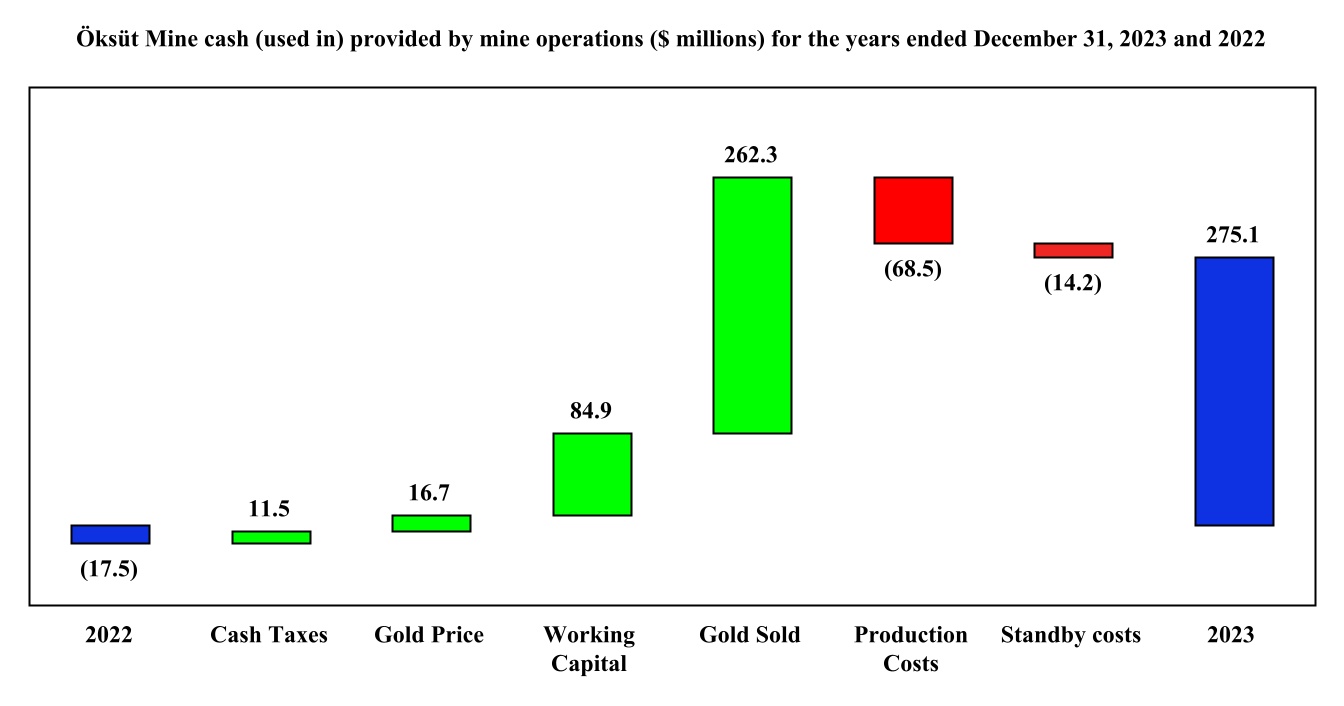

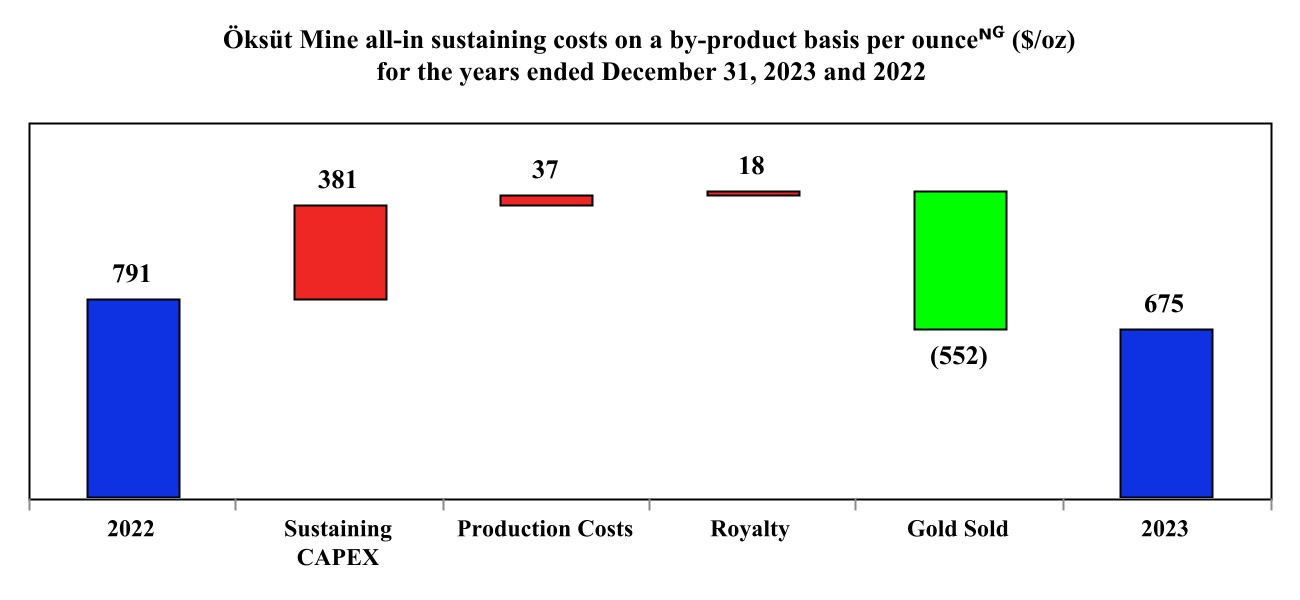

|