EXECUTION VERSION CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***]. EQUITY PURCHASE FACILITY AGREEMENT THIS EQUITY PURCHASE FACILITY AGREEMENT (this “Agreement”), dated as of October 23, 2025, is made by and between [***], or its registered assigns (the “Investor”) and NAUTICUS ROBOTICS, INC., a Delaware corporation (the “Company”). The Investor and the Company may be referred to herein individually as a “Party” and collectively as the “Parties.” WHEREAS, the Parties desire that, upon the terms and subject to the conditions contained herein, the Company shall have the right to issue and sell to the Investor, from time to time as provided herein, and the Investor shall purchase from the Company, up to an aggregate of $250 million (the “Commitment Amount”) in newly issued shares of the Company’s common stock, par value $0.0001 per share (the “Common Shares”); WHEREAS, the Common Shares are listed on The Nasdaq Capital Market under the symbol “KITT”; WHEREAS, the offer and sale of the Common Shares issuable hereunder will be made in reliance upon Section 4(a)(2) under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”), or upon such other exemption from the registration requirements of the Securities Act as may be available with respect to any or all of the transactions to be made hereunder; and WHEREAS, the Parties are concurrently entering into a Registration Rights Agreement in the form attached as Exhibit A hereto (the “Registration Rights Agreement”), pursuant to which the Company shall register the resale of the Registrable Securities (as defined in the Registration Rights Agreement), upon the terms and subject to the conditions set forth therein. NOW, THEREFORE, the Parties hereto agree as follows: Article I. Certain Definitions Section 1.01. For purposes of this Agreement, capitalized terms not otherwise defined in this Agreement shall have the respective meanings indicated below, such meanings to be applicable equally to both the singular and plural forms of such terms: (a) “Accredited Investor” shall have the meaning set forth in Section 3.05. (b) “Additional Issuance Restricted Period” shall mean the period beginning on the date of this Agreement through, and including, three (3) calendar months after a Lapsed Registration Termination or any termination pursuant to Section 9.01(b). (c) “Adjusted Advance Amount” shall have the meaning set forth in Section 2.02(i). (d) “Advance” shall mean any issuance and sale of Advance Shares by the Company to the Investor pursuant to this Agreement. (e) “Advance Date” means the first Trading Day immediately after the expiration of the applicable Pricing Period for each Advance. (f) “Advance Halt” means, on any day during the Pricing Period (i) the Company notifies the Investor that a Material Outside Event has occurred or shall have occurred, (ii) the Company notifies the Investor of a Black Out Period, or (iii) the Investor learns that an Equity Condition Failure exists.

2 (g) “Advance Notice” shall mean a written notice in the form of Exhibit B attached hereto to the Investor executed by an officer of the Company and setting forth the number of Advance Shares that the Company desires to issue and sell to the Investor. (h) “Advance Notice Confirmation” means, in connection with an Advance Notice selecting either an Accelerated Purchase Pricing Period, an Extended Purchase Pricing Period or an Overtime Purchase Pricing Period, written confirmation by the Investor to the Company (which may be delivered by e-mail), at the Investor’s discretion, accepting such Advance Notice, subject to the terms and adjustments herein, and, where applicable, specifying the time the Pricing Period begins (at Investor’s discretion) for such Advance Notice. (i) “Advance Notice Date” means each date the Company is deemed to have delivered (in accordance with Section 2.01(b) of this Agreement) an Advance Notice to the Investor, subject to the terms of this Agreement. (j) “Advance Shares” shall mean the Common Shares that the Company shall issue and sell to the Investor pursuant to the terms of this Agreement. (k) “Affiliate” shall have the meaning set forth in Section 3.07. (l) “After Market Trading Day” means a Trading Day during which the close of Regular Trading Hours on the Principal Market ends at 4:00 p.m. New York City time and trading on the Principal Market continues after the close of the Principal Market until 8:00 p.m. New York City time in the form of after-market trading. (m) “After Market Notice Hours” means, on an After Market Trading Day, the period of time from 4:00 p.m. New York City time until 7:30 p.m. New York City time. (n) “After Market Trading Hours” means, on an After Market Trading Day, the period of time from 4:00 p.m. New York City time until 8:00 p.m. New York City time. (o) “After Market Pricing Hours” means the trading hours during any Trading Day that the Principal Market is open, beginning at the start of Regular Trading Hours on such Trading Day and ending at the conclusion of the After Market Trading Hours on such Trading Day. (p) “Aggregate Purchase Price" means the product of (i) the Purchase Price and (ii) the Adjusted Advance Amount. (q) “Agreement” shall have the meaning set forth in the preamble of this Agreement. (r) “Applicable Laws” shall mean all applicable laws, statutes, rules, regulations, orders, executive orders, directives, policies, guidelines and codes having the force of law, whether local, national, or international, as amended from time to time, including without limitation (i) all applicable laws that relate to money laundering, terrorist financing, financial record keeping and reporting, (ii) all applicable laws that relate to anti-bribery, anti- corruption, books and records and internal controls, including the United States Foreign Corrupt Practices Act of 1977, and (iii) any Sanctions laws. (s) “Applicable VWAP” means the Daily VWAP, Extended Daily VWAP, Hourly VWAP, Extended Hourly VWAP or Overtime VWAP, as applicable. (t) “Approved Stock Plan” means any employee benefit plan which has been approved by the board of directors of the Company prior to or subsequent to the date hereof pursuant to which Common Shares and standard options to purchase Common Shares may be issued to any employee, officer or director for services provided to the Company in their capacity as such. (u) “Bankruptcy Law” means Title 11, U.S. Code, or any similar federal, state or similar laws for the relief of debtors.

3 (v) “Black Out Period” shall have the meaning set forth in Section 6.04(a). (w) “Block Trades” means any privately negotiated transaction involving the sale or resale of Common Shares, executed outside of the public exchange (including trades executed through alternative trading systems, dark pools, or direct negotiation), involving at least 10,000 Common Shares, including trades where a broker-dealer attempts to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction. Such trades may be conducted without substantial marketing efforts prior to pricing and may include same-day trades, overnight trades or similar transactions. (x) “Bona Fide Offer” shall have the meaning set forth in Section 6.22. (y) “Closing” shall have the meaning set forth in Section 2.04. (z) “Commitment Amount” shall have the meaning set forth in the recitals of this Agreement. (aa) “Commitment Period” shall mean the period commencing on the date of this Agreement and expiring upon the date of termination of this Agreement in accordance with Section 9.01. (bb) “Commitment Shares” shall have the meaning set forth in Section 11.04. (cc) “Common Share Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Shares, including, without limitation, any debt, preferred shares, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Shares. (dd) “Common Shares” shall have the meaning set forth in the recitals of this Agreement. (ee) “Company” shall have the meaning set forth in the preamble of this Agreement. (ff) “Company Indemnitees” shall have the meaning set forth in Section 5.02. (gg) “Condition Satisfaction Date” shall have the meaning set forth in Annex I. (hh) “Confirmation Deadline” means, in connection with (i) an Advance Notice selecting an Accelerated Purchase Pricing Period or Extended Purchase Pricing Period, 4:00 p.m. New York City time (or the conclusion of Regular Trading Hours on the Principal Market, if earlier) on the Trading Day of the applicable Pricing Period, and (ii) an Advance Notice selecting an Overtime Purchase Pricing Period, 8:00 p.m. New York City time on the After Market Trading Day of the applicable Pricing Period. (ii) “Contingent Obligation” means, as to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to any Indebtedness, lease, dividend or other obligation of another Person if the primary purpose or intent of the Person incurring such liability, or the primary effect thereof, is to provide assurance to the obligee of such liability that such liability will be paid or discharged, or that any agreements relating thereto will be complied with, or that the holders of such liability will be protected (in whole or in part) against loss with respect thereto. (jj) “Convertible Securities” shall mean any capital stock or other security of the Company or any of its Subsidiaries that is at any time and under any circumstances directly or indirectly convertible into, exercisable or exchangeable for, or which otherwise entitles the holder thereof to acquire, any capital stock or other security of the Company (including, without limitation, Common Shares) or any of its Subsidiaries. (kk) “Current Report” shall have the meaning set forth in Section 6.15. (ll) “Custodian” means any receiver, trustee, assignee, liquidator or similar official under any Bankruptcy Law.

4 (mm) “Daily Traded Amount” means the daily trading volume of the Common Shares on the Principal Market during Regular Trading Hours as reported by the Reporting Service. (nn) “Daily VWAP” means, for any Trading Day, the VWAP for such Trading Day during Regular Trading Hours as reported by the Reporting Service. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (oo) “Disclosure Schedules” shall have the meaning set forth in Article IV. (pp) “Effective Date” means the first Trading Day immediately following the date hereof. (qq) “Environmental Laws” shall have the meaning set forth in Section 4.14. (rr) “Equity Condition Failure” means a Trading Day during a Pricing Period on which (A) the Company or any of its respective directors, officers, employees or agents has disclosed any material non-public information about the Company to the Investor (unless a public announcement thereof is made by the Company in the manner contemplated by Regulation FD prior to the opening of trading on the Principal Market), or (B) any of the conditions set forth in subparagraphs (b), (c), (f), (h), (i), (n), (o), or (p) to Annex I to this Agreement are not satisfied. (ss) “Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. (tt) “Exchange Cap” shall have the meaning set forth in Section 2.02(c). (uu) “Excluded Day” means a day on which there is no VWAP for the Common Shares. (vv) “Excluded Securities” means (i) Common Shares or options to purchase Common Shares issued to directors, officers or employees of the Company or its Subsidiaries for services rendered to the Company in their capacity as such pursuant to an Approved Stock Plan, provided that the exercise price of any such options is not lowered, none of such options are amended to increase the number of shares issuable thereunder and none of the terms or conditions of any such options are otherwise materially changed in any manner that adversely affects the Investor; (ii) Common Shares issued upon the conversion or exercise of Convertible Securities (other than options to purchase Common Shares issued pursuant to an Approved Stock Plan that are covered by clause (i) above) issued prior to the date of this Agreement, provided that the conversion, exercise or other method of issuance (as the case may be) of any such Convertible Security is made solely pursuant to the conversion, exercise or other method of issuance (as the case may be) provisions of such Convertible Security that were in effect on the date immediately prior to the date of this Agreement, the conversion, exercise or issuance price of any such Convertible Securities (other than options to purchase Common Shares issued pursuant to an Approved Stock Plan that are covered by clause (i) above) is not lowered, none of such Convertible Securities (other than standard options to purchase Common Shares issued pursuant to an Approved Stock Plan that are covered by clause (i) above) are amended to increase the number of shares issuable thereunder and none of the terms or conditions of any such Convertible Securities (other than options to purchase Common Shares issued pursuant to an Approved Stock Plan that are covered by clause (i) above) are otherwise materially changed in any manner that adversely affects the Investor; (iii) any issuance of Common Stock pursuant to an “at-the-market” offering of Common Stock with a registered broker-dealer under a currently effective registration statement on Form S-3 (the “ATM”), provided, however, that Common Shares may not be sold pursuant to the ATM on any Trading Day on which the Company delivers an Advance Notice to the Investor or a Pricing Period is in effect; and (iv) any Common Shares issued or issuable in connection with any acquisitions (whether by merger, consolidation, purchase of equity, purchase of assets, reorganization or otherwise), mergers, consolidations, or reorganizations approved by a majority of the disinterested directors of the Company, provided that any such issuance shall only be to a Person (or to the equityholders of a Person) which is, itself or through its subsidiaries, an operating company or an owner of an asset in a business complementary with the business of the Company and shall provide to the Company additional benefits in addition to the investment of funds, but shall not include a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities.

5 (ww) “Extended Daily VWAP” means, for any Trading Day, the Extended VWAP for such Trading Day during Extended Trading Hours as reported by the Reporting Service. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (xx) “Extended Hourly VWAP” means, for any Trading Day, the Extended VWAP during any given one- hour interval beginning at 4:00 a.m. New York City time through 4:00 p.m. New York City time, as reported by the Reporting Service. In the event that, for the relevant Pricing Period, the Extended Trading Hours results in a fractional hour, then the last fractional hour of trading of the Extended Trading Hours on such Trading Day will count as the final “one-hour” interval of such Trading Day. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (yy) “Extended Trading Hours” means the trading hours during any Trading Day that the Principal Market is open, beginning at 4:00 a.m. New York City time and ending 4:00 p.m. New York City time (or at the time the Principal Market closes, if earlier) on such Trading Day. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (zz) “Extended VWAP” means, for any Trading Day that the Common Shares is then listed or quoted on a Principal Market, the volume weighted average price of the Common Shares for the applicable measurement period on the Principal Market during the Extended Trading Hours on such Trading Day as reported by the Reporting Service. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such measurement period. (aaa) “GAAP” shall have the meaning set forth in Section 4.07. (bbb) “GDPR” shall have the meaning set forth in Section 4.36. (ccc) “Hazardous Materials” shall have the meaning set forth in Section 4.14. (ddd) “HIPAA” shall have the meaning set forth in Section 4.36. (eee) “Hourly VWAP” means, for any Trading Day, the VWAP during any given one-hour interval beginning at 9:30 a.m. New York City time through 4:00 p.m. New York City time (or the close of trading on the Principal Market, if earlier), as reported by the Reporting Service. The last 30 minutes (or fraction of an hour) of the Regular Trading Hours of such Trading Day will count as the final “one-hour” interval of such Trading Day. (fff) “Indebtedness” means (i) all indebtedness for borrowed money, (ii) all obligations issued, undertaken or assumed as the deferred purchase price of property or services (including, without limitation, “capital leases” in accordance with GAAP) (other than trade payables entered into in the ordinary course of business consistent with past practice), (iii) all reimbursement or payment obligations with respect to letters of credit, surety bonds and other similar instruments, (iv) all obligations evidenced by notes, bonds, debentures or similar instruments, including obligations so evidenced incurred in connection with the acquisition of property, assets or businesses, (v) all indebtedness created or arising under any conditional sale or other title retention agreement, or incurred as financing, in either case with respect to any property or assets acquired with the proceeds of such indebtedness (even though the rights and remedies of the seller or bank under such agreement in the event of default are limited to repossession or sale of such property), (vi) all monetary obligations under any leasing or similar arrangement which, in connection with GAAP, consistently applied for the periods covered thereby, is classified as a capital lease, (vii) all indebtedness referred to in clauses (i) through (vi) above secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any lien upon or in any property or assets (including accounts and contract rights) owned by any Person, even though the Person which owns such assets or property has not assumed or become liable for the payment of such indebtedness, and (viii) all Contingent Obligations in respect of indebtedness or obligations of others of the kinds referred to in clauses (i) through (vii) above. (ggg) “Indemnified Liabilities” shall have the meaning set forth in Section 5.01.

6 (hhh) “Insolvent” shall mean, whether on a consolidated or individual basis, (i) the Company and its Subsidiaries are unable to pay their debts and liabilities, subordinated, contingent or otherwise, as such debts and liabilities become absolute and matured, (ii) the present fair saleable value of the Company’s and its Subsidiaries’ assets is less than the amount required to pay the Company’s and its Subsidiaries’ total Indebtedness or (iii) the Company and its Subsidiaries intend to incur or believe that they will incur debts that would be beyond their ability to pay as such debts mature. Neither the Company nor any of its Subsidiaries has engaged in any business or in any transaction, and is not about to engage in any business or in any transaction, for which the Company’s or such Subsidiary’s remaining assets constitute unreasonably small capital with which to conduct the business in which it is engaged as such business is now conducted and is proposed to be conducted. (iii) “Investor” shall have the meaning set forth in the preamble of this Agreement. (jjj) “Investor Indemnitees” shall have the meaning set forth Section 5.01. (kkk) “IT Systems” shall have the meaning set forth in Section 4.36. (lll) “Lapsed Registration Termination” shall have the meaning set forth in 9.01(a). (mmm) “Limitation Date” shall have the meaning set forth in Section 6.21(b)(i). (nnn) “Market Price” shall mean the Accelerated Purchase Market Price, Regular Purchase Market Price, Extended Purchase Market Price or Overtime Purchase Market Price, as applicable (in each case, to be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split or other similar transaction that occurs on or after the date of the Original Agreement): (i) “Accelerated Purchase Market Price” for an Accelerated Purchase Pricing Period, the lower of (i) the lowest price the Common Shares traded during the Regular Trading Hours of the Trading Day applicable to the Accelerated Purchase Pricing Period and (ii) the lowest Hourly VWAP of the Common Shares during the Regular Trading Hours of the Trading Day applicable to the Accelerated Purchase Pricing Period; (ii) “Regular Purchase Market Price” for a Regular Purchase Pricing Period the lower of (i) the lowest price the Common Shares traded during the relevant Pricing Period; and (ii) the lowest Daily VWAP of the Common Shares during the relevant Regular Purchase Pricing Period. (For avoidance of doubt, the Regular Purchase Pricing Period includes any Excluded Day during the relevant Pricing Period); (iii) “Extended Purchase Market Price” for an Extended Purchase Pricing Period, the lower of (i) the lowest price the Common Shares traded during the Extended Trading Hours on the Trading Day applicable to the Extended Purchase Pricing Period and (ii) the lowest Extended Hourly VWAP of the Common Shares on the Trading Day applicable to the Extended Purchase Pricing Period; and (iv) “Overtime Purchase Market Price” for an Overtime Purchase Pricing Period, the lower of (i) the lowest price the Common Shares traded during the After Market Pricing Hours on the Trading Day applicable to the Overtime Purchase Pricing Period and (ii) the lowest Overtime Hourly VWAP of the Common Shares during the Trading Day applicable to the Overtime Purchase Pricing Period. (ooo) “Material Adverse Effect” means any material adverse effect on (i) the business, properties, assets, liabilities, operations (including results thereof), condition (financial or otherwise) or prospects of the Company or any Subsidiary, individually or taken as a whole, (ii) the transactions contemplated hereby or in any of the other Transaction Documents or any other agreements or instruments to be entered into in connection herewith or therewith or (iii) the authority or ability of the Company or any of its Subsidiaries to perform any of their respective obligations under any of the Transaction Documents. (ppp) “Material Outside Event” shall have the meaning set forth Section 6.11.

7 (qqq) “Maximum Advance Amount” means the Accelerated Purchase Maximum Advance Amount, Regular Purchase Maximum Advance Amount or Extended Purchase Maximum Advance Amount, as applicable, provided, however, notwithstanding anything herein to the contrary, the Maximum Advance Amount shall not exceed the limitations set forth in Section 2.02 of this Agreement: (i) “Accelerated Purchase Maximum Advance Amount” in respect of each Advance Notice with an Accelerated Purchase Pricing Period, an amount of Common Shares equal to the lower of (i) four hundred percent (400%) of the median Daily Traded Amount during the ten (10) consecutive Trading Days immediately preceding an Advance Notice Date, and (ii) such number of Common Shares equal to $2,500,000 as of the date of each Advance Notice (determined based on the last closing price of the Common Shares on the Principal Market prior to delivery of such Advance Notice), or such other amount of Common Shares as agreed upon by the Parties in writing, which may be made via e-mail; (ii) “Regular Purchase Maximum Advance Amount” in respect of each Advance Notice with a Regular Purchase Pricing Period, an amount of Common Shares equal to the lower of (i) one hundred percent (100%) the median Daily Traded Amount during the ten (10) consecutive Trading Days immediately preceding an Advance Notice Date, and (ii) such number of Common Shares equal to $1,000,000 as of the date of each Advance Notice (determined based on the last closing price of the Common Shares on the Principal Market prior to delivery of such Advance Notice); (iii) “Extended Purchase Maximum Advance Amount” in respect of each Advance Notice with an Extended Purchase Pricing Period, an amount of Common Shares equal to the lower of (i) four hundred percent (400%) of the median Daily Traded Amount during the ten (10) consecutive Trading Days immediately preceding an Advance Notice Date, and (ii) such number of Common Shares equal to $2,500,000 as of the date of each Advance Notice (determined based on the last closing price of the Common Shares on the Principal Market prior to delivery of such Advance Notice), or such other amount of Common Shares as agreed upon by the Parties in writing, which may be made via e-mail; and (iv) “Overtime Purchase Maximum Advance Amount” in respect of each Advance Notice with an Overtime Purchase Pricing Period, an amount of Common Shares equal to the lower of (i) four hundred percent (400%) of the median Daily Traded Amount during the ten (10) consecutive Trading Days immediately preceding an Advance Notice Date, and (ii) such number of Common Shares equal to $2,500,000 as of the date of each Advance Notice (determined based on the last closing price of the Common Shares on the Principal Market prior to delivery of such Advance Notice), or such other amount of Common Shares as agreed upon by the Parties in writing, which may be made via e-mail. (rrr) “Money Laundering Laws” shall have the meaning set forth in Section 4.32. (sss) “OFAC” shall have the meaning set forth in Section 4.31. (ttt) “Offer Notice” shall have the meaning set forth in Section 6.22. (uuu) “Ownership Limitation” shall have the meaning set forth in Section 2.02(a). (vvv) “Overtime Daily VWAP” means, for any After Market Trading Day, the Overtime VWAP for such After Market Trading Day during the After Market Trading Hours, starting at the beginning of the Overtime Purchase Pricing Period and ending at 8:00 p.m., as reported by the Reporting Service. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (www) “Overtime Hourly VWAP” means, for any Trading Day, the Overtime VWAP during any given one- hour interval beginning at the start of Regular Trading Hours through the conclusion of After Market Trading Hours, as reported by the Reporting Service. In the event that, for the relevant Pricing Period, the After Market Pricing Hours results in a fractional hour, then the last fractional hour of trading of the After Market Pricing Hours on such Trading Day will count as the final “one-hour” interval of such Trading Day. All such determinations shall be appropriately

8 adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period. (xxx) “Overtime VWAP” means, for any After Market Trading Day, the volume weighted average price of the Common Shares on the Principal Market during the After Market Pricing Hours as reported by the Reporting Service for the applicable measurement period but in no event after the conclusion of the After Market Trading Hours, provided, however, that for purposes of calculating the volume weighted average price of the Common Shares, the “Overtime VWAP” shall exclude Block Trades. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such measurement period. (yyy) “Party” and “Parties” shall each have the meaning set forth in the recitals of this Agreement. (zzz) “Person” shall mean an individual, a corporation, a partnership, a limited liability company, a trust or other entity or organization, including a government or political subdivision or an agency or instrumentality thereof. (aaaa) “Personal Data” shall have the meaning set forth in Section 4.36. (bbbb) “Plan of Distribution” shall mean the section of a Registration Statement disclosing the plan of distribution of the Shares. (cccc) “Pricing Period” shall mean either the Accelerated Purchase Pricing Period, the Regular Purchase Pricing Period, the Extended Purchase Pricing Period or the Overtime Purchase Pricing Period, as applicable: (i) “Accelerated Purchase Pricing Period” means, with respect to an Advance Notice selecting an Accelerated Purchase Pricing Period, the period commencing at the Accelerated Deemed Delivered Time (or the start of Regular Trading Hours on the Principal Market on such Trading Day, if later) and ending at 4:00 p.m. New York City time (or the close of Regular Trading Hours on the Principal Market, if earlier) on the applicable date of the Accelerated Deemed Delivered Time; provided however, that in the event of an Advance Halt, the Accelerated Purchase Pricing Period shall expire at the time of such Advance Halt; (ii) “Regular Purchase Pricing Period” means, with respect to an Advance Notice selecting a Regular Purchase Pricing Period, the Regular Trading Hours of the three consecutive Trading Days commencing at the applicable Deemed Delivered Time; provided, however, that in the event of an Advance Halt, the Regular Purchase Pricing Period shall end at the time of such Advance Halt; (iii) “Extended Purchase Pricing Period” means, with respect to an Advance Notice selecting an Extended Purchase Pricing Period, the period commencing at the Extended Deemed Delivered Time and ending at 4:00 p.m. New York City time (or the close of Regular Trading Hours on the Principal Market, if earlier) on the applicable date of the Extended Deemed Delivered Time; provided however, that in the event of an Advance Halt, the Extended Purchase Pricing Period shall expire at the time of such Advance Halt; and (iv) “Overtime Purchase Pricing Period” means, with respect to an Advance Notice selecting an Overtime Purchase Pricing Period, the period commencing at the Overtime Deemed Delivered Time and ending at the conclusion of the After Market Pricing Hours on the date of the Deemed Delivered Time; provided however, that in the event of an Advance Halt, the Overtime Purchase Pricing Period shall expire at the time of such Advance Halt. (dddd) “Principal Market” shall mean the Nasdaq Capital Market, provided however, that in the event the Common Shares are ever listed or traded on any of the Trading Markets, then the “Principal Market” shall mean such Trading Market on which the Common Shares are then listed or traded to the extent such other market or exchange is the principal trading market or exchange for the Common Shares. (eeee) “Prospectus” shall mean any prospectus (including, without limitation, all amendments and supplements thereto) used by the Company in connection with a Registration Statement, including documents incorporated by reference therein.

9 (ffff) “Prospectus Supplement” shall mean any prospectus supplement to a Prospectus filed with the SEC pursuant to Rule 424(b) under the Securities Act, including documents incorporated by reference therein. (gggg) “Purchase Price” shall mean the price per Advance Share in respect of any Advance Notice: (i) For an Advance Notice selecting an Accelerated Purchase Pricing Period or Extended Purchase Pricing Period, the applicable Market Price multiplied by one hundred percent (100%); (ii) For an Advance Notice selecting a Regular Purchase Pricing Period, the applicable Regular Purchase Market Price multiplied by one hundred percent (100%); and (iii) For an Advance Notice selecting an Overtime Purchase Pricing Period, the applicable Overtime Purchase Market Price multiplied by one hundred percent (100%). (hhhh) “Real Property” shall mean the real property, leases in real property, facilities or other interests in real property owned or held by the Company or any of its Subsidiaries. (iiii) “Registrable Securities” shall have the meaning set forth in the Registration Rights Agreement. (jjjj) “Registration Limitation” shall have the meaning set forth in Section 2.02(b). (kkkk) “Registration Rights Agreement” shall have the meaning set forth in the recitals of this Agreement. (llll) “Registration Statement” shall have the meaning set forth in the Registration Rights Agreement. (mmmm) “Regular Trading Hours” means the regular trading hours during any Trading Day that the Principal Market is open, starting 9:30 a.m. New York City time and ending 4:00 p.m. New York City time (or at the time the Principal Market closes, if earlier) on such Trading Day (for avoidance of doubt, Regular Trading Hours excludes pre-market and post-market trading). (nnnn) “Regulation D” shall mean the provisions of Regulation D promulgated under the Securities Act. (oooo) “Reporting Service” means either Bloomberg L.P. or FactSet Research Systems Inc., as determined by the Investor from time to time. (pppp) “Required Approvals” shall have the meaning set forth in Section 4.02. (qqqq) “Reservation Estimate” shall have the meaning set forth in Section 6.26. (rrrr) “Restricted Period” shall have the meaning set forth in Section 6.19. (ssss) “Restricted Person” shall have the meaning set forth Section 6.19. (tttt) “Rule 144” shall have the meaning set forth in Section 6.08. (uuuu) “Sanctions” shall have the meaning set forth in Section 4.31. (vvvv) “Sanctioned Countries” shall have the meaning set forth in Section 4.31. (wwww) “SEC” shall mean the U.S. Securities and Exchange Commission. (xxxx) “SEC Documents” means (1) any registration statement filed by the Company with the SEC, including the financial statements, schedules, exhibits and all other documents filed as a part thereof or incorporated therein and all information deemed to be a part thereof as of the effective date of such registration statement under the Securities Act, (2) any proxy statement or prospectus filed by the Company with the SEC, including all documents

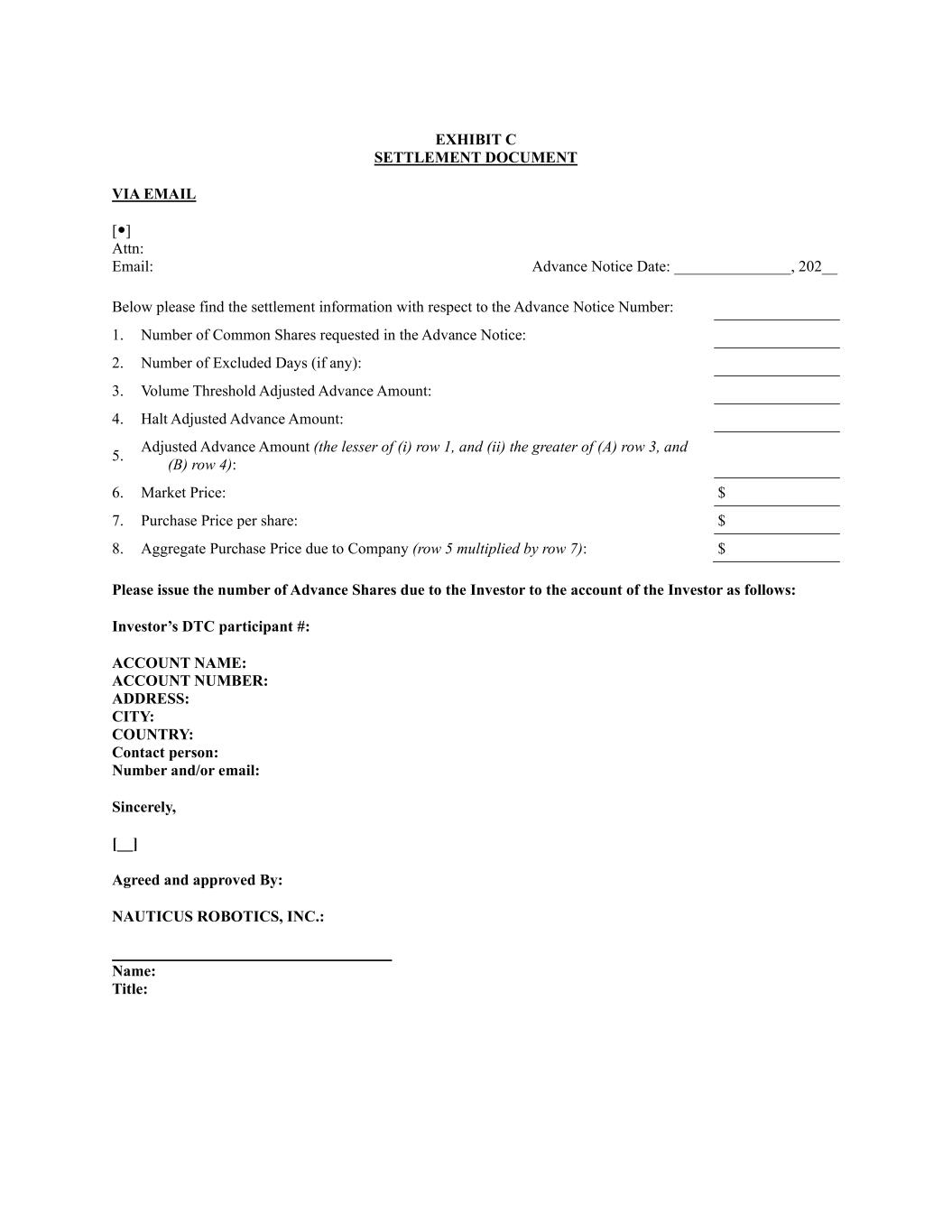

10 incorporated or deemed incorporated therein by reference, whether or not included in a registration statement, in the form in which such proxy statement or prospectus has most recently been filed with the SEC pursuant to Rule 424(b) under the Securities Act, (3) all reports, periodic reports, schedules, registrations, forms, statements, information and other documents filed with or furnished to the SEC by the Company pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act during the two years prior to the date hereof, including, without limitation, the Current Report, (4) each Registration Statement, as the same may be amended from time to time, the Prospectus contained therein and each Prospectus Supplement thereto and (5) all information contained in such filings and all documents and disclosures that have been and heretofore shall be incorporated by reference therein. (yyyy) “Securities Act” shall have the meaning set forth in the recitals of this Agreement. (zzzz) “Settlement Document” in respect of an Advance Notice delivered by the Company, shall mean a settlement document in the form set out on Exhibit C. (aaaaa) “Stockholder Approval” shall have the meaning set forth in Section 6.25. (bbbbb) “Shares” means the Common Shares to be issued from time to time hereunder pursuant to an Advance. (ccccc) “Subsequent Placement” means the issuance, offer, sale, grant any option or right to purchase, or otherwise disposition of (or announcement of any issuance, offer, sale, grant of any option or right to purchase or other disposition of) any equity security or equity-linked or related security (including, without limitation, any “equity security” (as that term is defined under Rule 405 promulgated under the Securities Act)), any Convertible Securities, any debt, any preferred stock or any purchase rights (any such issuance, offer, sale, grant, disposition or announcement (whether occurring during the Additional Issuance Restricted Period or at any time thereafter)). (ddddd) “Subsidiaries” means any Person in which (I) the accounts of which would be consolidated with those of the Company in the Company’s consolidated financial statements if such financial statements were prepared in accordance with GAAP or (II) the Company, directly or indirectly, (i) owns any of the outstanding capital stock or holds any equity or similar interest of such Person or (ii) controls or operates all or any part of the business, operations or administration of such Person, and each of the foregoing, is individually referred to herein as a “Subsidiary”. (eeeee) “Trading Day” means any day during which the Principal Market shall be open for business. (fffff) “Trading Market” shall mean the New York Stock Exchange, the NYSE American, the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market, or the NYSE Euronext, whichever is at the time the principal trading exchange or market for the Common Shares. (ggggg) “Transaction Documents” means, collectively, this Agreement, the Registration Rights Agreement and each of the other agreements and instruments entered into or delivered by any of the parties hereto in connection with the transactions contemplated hereby and thereby, as may be amended from time to time. (hhhhh) “Transactions” shall have the meaning set forth in the recitals. (iiiii) “Transfer Agent” means Continental Stock Transfer & Trust Company, the current transfer agent of the Company, with a mailing address of One State Street, 30th Floor, New York, New York 10004 and a facsimile number of (212) 616-7612, and any successor transfer agent of the Company. (jjjjj) “Variable Rate Transaction” means a transaction in which the Company (i) issues or sells any Common Shares or Common Share Equivalents that are convertible into, exchangeable or exercisable for, or include the right to receive additional Common Shares or Common Share Equivalents either (A) at a conversion price, exercise price, exchange rate or other price that is based upon and/or varies with the trading prices of or quotations for the Common Shares at any time after the initial issuance of such equity or debt securities (including, without limitation, pursuant to any “cashless exercise” provision), or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such equity or debt security or upon the occurrence of

11 specified or contingent events directly or indirectly related to the business of the Company or the market for the Common Shares (including, without limitation, any “full ratchet,” “share ratchet,” “price ratchet,” or “weighted average” anti-dilution provisions, but not including any standard anti-dilution protection for any reorganization, recapitalization, non-cash dividend, share split, reverse share split or other similar transaction), (ii) issues or sells any equity or debt securities, including without limitation, Common Shares or Common Share Equivalents, either (A) at a price that is subject to being reset at some future date after the initial issuance of such debt or equity security or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company or the market for the Common Shares (other than standard anti-dilution protection for any reorganization, recapitalization, non- cash dividend, share split, reverse share split or other similar transaction), or (B) that is subject to or contains any put, call, redemption, buy-back, price- reset or other similar provision or mechanism (including, without limitation, a “Black-Scholes” put or call right) that provides for the issuance of additional equity securities of the Company or the payment of cash by the Company, or (iii) enters into any agreement, including, but not limited to, an at-the-market offering or “equity line of credit” (that is not an Excluded Securities) or other continuous offering or similar offering of Common Shares or Common Share Equivalents whereby the Company may sell Common Shares or Common Share Equivalents at a future determined price. (kkkkk) “Volume Limit” means, (i) For an Advance Notice selecting either an Accelerated Purchase Pricing Period or Extended Purchase Pricing Period, the trading volume of the Common Shares on the Principal Market, excluding any Block Trades, during the applicable Pricing Period as reported by the Reporting Service multiplied by ten percent (10%); (ii) For an Advance Notice selecting a Regular Purchase Pricing Period, the trading volume of the Common Shares on the Principal Market, excluding any Block Trades, during the Regular Trading Hours of such Pricing Period (excluding any Excluded Day, if applicable) as reported by the Reporting Service multiplied by ten percent (10%); and (iii) For an Advance Notice selecting an Overtime Purchase Pricing Period, the trading volume of the Common Shares on the Principal Market, excluding any Block Trades, during the applicable Pricing Period as reported by the Reporting Service multiplied by ten percent (10%). (lllll) “Volume Threshold” means a number of Shares equal to the quotient of the number of Advance Shares requested by the Company in an Advance Notice divided by 0.10. (mmmmm) “Volume Adjusted Advance Amount” shall have the meaning set forth in Section 2.02(e). (nnnnn) “Volume Threshold Failure” shall have the meaning set forth in Section 2.02(e). (ooooo) “VWAP” means, for any Trading Day that the Common Shares is then listed or quoted on the Principal Market, the volume weighted average price of the Common Shares for applicable measurement period on the Principal Market during the Regular Trading Hours of the Principal Market as reported by the Reporting Service. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such measurement period. Article II. Advances Section 2.01. Advances; Mechanics. Upon the terms and subject to the conditions of this Agreement, at any time during the Commitment Period, the Company, in its sole discretion, shall have the right, but not the obligation, to issue and sell to the Investor, and the Investor shall subscribe for and purchase from the Company, Advance Shares by the delivery to the Investor of Advance Notices, on the following terms: (a) Advance Notice. At any time during the Commitment Period the Company may require the Investor to purchase Common Shares by delivering an Advance Notice to the Investor, subject to the satisfaction or waiver by the Investor of the conditions set forth herein and in Annex I, and in accordance with the following provisions:

12 (i) the Company shall, in its sole discretion, select the number of Advance Shares, not to exceed the Maximum Advance Amount, it desires to issue and sell to the Investor in each Advance Notice and the time it desires to deliver each Advance Notice; (ii) there shall be no mandatory minimum Advances and there shall be no non-usages fee for not utilizing the Commitment Amount or any part thereof; and (iii) in the event that the bid price for the Common Shares is at or below $1.00 (the “Trigger Price”), an Advance Notice shall not be deemed delivered without the prior written consent of the Investor. Notwithstanding anything to the contrary herein, the Trigger Price shall not be adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction, (b) Date and Time of Delivery of Advance Notice. (i) Accelerated Purchase Pricing Period. An Advance Notice sent in accordance with the terms herein and selecting an Accelerated Purchase Pricing Period shall be deemed delivered if such notice is received by the Investor via e-mail on a Trading Day and the Investor delivers to the Company an Advance Notice Confirmation for such Advance Notice, at the Investor’s discretion and (i) if such Advance Notice is received by the Investor via e- mail before 9:00 a.m. New York City time on such Trading Day and the Investor delivers to the Company an Advance Notice Confirmation, such Advance Notice shall be deemed delivered on such Trading Day at the start of Regular Trading Hours of the Principal Market on such Trading Day, (ii) if such Advance Notice is received via e-mail after 9:00 a.m. New York City time and before 4:00 p.m. New York City time on such Trading Day and the Investor delivers to the Company an Advance Notice Confirmation, such Advance Notice shall be deemed delivered on such Trading Day at the time specified by the Investor in the Advance Notice Confirmation, or (iii) if such notice is received via e- mail after 4:00 p.m. New York City time and the Investor delivers to the Company an Advance Notice Confirmation, such Advance Notice shall be deemed delivered as of the start of Regular Trading Hours of the Principal Market on the immediately succeeding Trading Day (each instance, as applicable, the “Accelerated Deemed Delivered Time”). (ii) Regular Purchase Pricing Period. An Advance Notice sent in accordance with the terms herein and selecting a Regular Purchase Pricing Period shall be deemed delivered on (i) the Trading Day it is received by the Investor if such notice is received by e-mail at or before 9:00 a.m. New York City time (or at such later time if agreed to by the Investor in its discretion), or (ii) the immediately succeeding Trading Day if it is received by e-mail after 9:00 a.m. New York City time (each instance, as applicable, the “Regular Deemed Delivered Time”). In the event that the Company delivers a valid Advance Notice selecting an (i) Accelerated Purchase Pricing Period or Extended Purchase Pricing Period on a Trading Day prior to 9:00 a.m. New York City time, or (ii) Overtime Purchase Pricing Period on an After Market Trading Day during After Market Notice Hours, and in either instance, as applicable, the Investor has not sent an Advance Notice Confirmation prior to the Confirmation Deadline, the Advance Notice shall be accepted or rescinded as provided in Section 2.01(b)(v). (iii) Extended Purchase Pricing Period. An Advance Notice sent in accordance with the terms herein and selecting an Extended Purchase Pricing Period shall be deemed delivered if such notice is received by the Investor via e-mail on a Trading Day and the Investor delivers to the Company an Advance Notice Confirmation for such Advance Notice, at the Investor’s discretion and (i) if such Advance Notice is received by the Investor via e-mail before 4:00 p.m. New York City time on such Trading Day and the Investor delivers to the Company an Advance Notice Confirmation, such Advance Notice shall be deemed delivered on such Trading Day at the time specified by the Investor in the Advance Notice Confirmation, or (ii) if such notice is received via e-mail after 4:00 p.m. New York City time, such Advance Notice shall be deemed delivered on the immediately succeeding Trading Day, at the time specified by the Investor in the Advance Notice Confirmation (each instance, as applicable, the “Extended Deemed Delivered Time” and, together with the Accelerated Deemed Delivered Time and Regular Deemed Delivered Time, the “Deemed Delivered Time”). In the event that the Company delivers an Advance Notice selecting an Extended Purchase Pricing Period on a Trading Day prior to 9:00 a.m. New York City time on a Trading Day, and the Investor has not sent an Advance Notice Confirmation prior to the Confirmation Deadline, the Advance Notice shall be accepted or rescinded as provided in the Advance Notice. (iv) Overtime Purchase Pricing Period. An Advance Notice sent in accordance with the terms herein and selecting an Overtime Purchase Pricing Period shall be deemed delivered if such notice is received by the

13 Investor via e-mail on an After Market Trading Day and during the After Market Notice Hours, and (A) if the Investor delivers to the Company an Advance Notice Confirmation for such Advance Notice, at the Investor’s discretion, such Advance Notice shall be deemed delivered on such After Market Trading Day at the time specified by the Investor in the Advance Notice Confirmation (each instance, as applicable, the “Overtime Deemed Delivered Time” and, together with the Accelerated Deemed Delivered Time, Regular Deemed Delivered Time and Extended Deemed Delivered Time, the “Deemed Delivered Time”), or (B) if the Investor does not deliver to the Company an Advance Notice Confirmation for such Advance Notice prior to the Confirmation Deadline, the Advance Notice shall be accepted or rescinded as provided in Section 2.01(b)(v). (v) Automatic Adjustment to Regular Purchase Pricing Period. (A) If the Company delivers an Advance Notice on a Trading Day selecting either an Accelerated Purchase Pricing Period or Extended Purchase Pricing Period and such Advance Notice is received by Investor before 9:00 a.m. New York City time on such Trading Day, in the event the Investor does not deliver an Advance Notice Confirmation to the Company prior to the Confirmation Deadline and the Company is eligible to deliver an Advance Notice with a Regular Purchase Pricing Period, then such Advance Notice with the Accelerated Purchase Pricing Period or Extended Purchase Pricing Period shall automatically be deemed to have been delivered selecting a Regular Purchase Pricing Period with the “Deemed Delivered Time” being the start of Regular Trading Hours on the Trading Day immediately succeeding the Confirmation Deadline, provided, however, that if the Investor has not delivered an Advance Notice Confirmation to the Company, the Company may rescind such Advance Notice before 12:00 p.m. New York City time on the date of the Confirmation Deadline. (B) If the Company delivers an Advance Notice on an After Market Trading Day selecting an Overtime Purchase Pricing Period and such Advance Notice is received by Investor during the After Market Notice Hours on such After Market Trading Day, in the event the Investor has not delivered an Advance Notice Confirmation to the Company prior to the Confirmation Deadline and the Company is eligible to deliver an Advance Notice with a Regular Purchase Pricing Period, then such Advance Notice with the Overtime Purchase Pricing Period shall automatically be deemed to have been delivered selecting a Regular Purchase Pricing Period with the “Deemed Delivered Time” being the start of Regular Trading Hours on the Trading Day immediately succeeding the Confirmation Deadline, provided, however, that if the Investor has not delivered an Advance Notice Confirmation to the Company, the Company may rescind such Advance Notice before 12:00 p.m. New York City time on the date of the Confirmation Deadline. Section 2.02. Advance Limitations, Regulatory. Regardless of the Advance requested in an Advance Notice, the final number of Shares to be issued and sold pursuant to such Advance Notice shall be reduced (if at all) in accordance with each of the following limitations: (a) Ownership Limitation; Commitment Amount. At the request of the Company, the Investor will inform the Company in writing of the number of Common Shares the Investor currently beneficially owns. At the request of the Investor, the Company shall promptly confirm orally or in writing to the Investor the number of Common Shares then outstanding. Notwithstanding anything to the contrary contained in this Agreement, the Investor shall not be obligated to purchase or acquire, and shall not purchase or acquire, any Common Shares under this Agreement which, when aggregated with all other Common Shares beneficially owned by the Investor and its Affiliates (as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership by the Investor and its Affiliates (on an aggregated basis) to exceed 9.99% of the then outstanding voting power or number of Common Shares (the “Ownership Limitation”). In connection with each Advance Notice, any portion of an Advance that would (i) cause the Investor to exceed the Ownership Limitation or (ii) cause the aggregate number of Shares issued and sold to the Investor hereunder to exceed the Commitment Amount shall automatically be withdrawn with no further action required by the Company, and such Advance Notice shall be deemed automatically modified to reduce the Advance by an amount equal to such withdrawn portion; provided that in the event of any such automatic withdrawal and automatic modification, the Investor will promptly notify the Company of such event. The Investor, upon notice to the Company, may increase or decrease the Ownership Limitation provisions of this Section 2.02, provided that the Ownership Limitation in no event exceeds 9.99% of the number of Common Shares outstanding immediately after giving effect to the issuance of Shares held by the Investor and the Ownership Limitation provisions of this Section 2.02 shall continue to apply. Any increase in the Ownership

14 Limitation will not be effective until the sixty-first (61st) day after such notice is delivered to the Company. Since the Investor will not be obligated to report to the Company the number of Shares it may hold at the time of an Advance Notice, unless the Advance Notice at issue would result in the issuance of Shares in excess of the Ownership Limitation without regard to any other shares which may be beneficially owned by the Investor or an Affiliate thereof, the Investor shall have the authority and obligation to determine whether the restriction contained in this Section 2.02 will limit any particular Advance Notice and to the extent that the Investor determines that the limitation contained in this Section 2.02 applies, the determination of which portion of the principal amount of the applicable Advance Notice shall be the responsibility and obligation of the Investor. (b) Registration Limitation. In no event shall an Advance exceed the amount registered in respect of the transactions contemplated hereby under the Registration Statement then in effect (the “Registration Limitation”). In connection with each Advance Notice, any portion of an Advance that would exceed the Registration Limitation shall automatically be withdrawn with no further action required by the Company and such Advance Notice shall be deemed automatically modified to reduce the aggregate amount of the requested Advance by an amount equal to such withdrawn portion; provided that in the event of any such automatic withdrawal and automatic modification, the Investor will promptly notify the Company of such event. (c) Compliance with Rules of Principal Market. Notwithstanding anything to the contrary herein, the Company shall not effect any sales under this Agreement and the Investor shall not have the obligation to purchase Shares under this Agreement to the extent (but only to the extent) that after giving effect to such purchase and sale the aggregate number of Common Shares issued under this Agreement would exceed 19.99% of the aggregate number of Common Shares issued and outstanding as of the execution date of this Agreement, which number shall be reduced, on a share-for-share basis, by the number of Common Shares issued or issuable pursuant to any transaction or series of transactions that may be aggregated with the transactions contemplated by this Agreement under the applicable rules of the Principal Market (such maximum number of shares, the “Exchange Cap”) unless the Company has obtained Stockholder Approval for the issuance of Common Shares pursuant to this Agreement in excess of the Exchange Cap in accordance with the applicable rules of the Principal Market. In connection with each Advance Notice, any portion of an Advance that would exceed the Exchange Cap shall automatically be withdrawn with no further action required by the Company and such Advance Notice shall be deemed automatically modified to reduce the aggregate amount of the requested Advance by an amount equal to such withdrawn portion in respect of each Advance Notice. (d) [Reserved]. (e) Volume Threshold Limitation In connection with any Advance Notice, if the total number of Common Shares traded on the Principal Market during the applicable Pricing Period (excluding any Block Trades and, in the case of a Regular Purchase Pricing Period, any Excluded Days in the case of), is less than the applicable Volume Threshold (the “Volume Threshold Failure”), then the number of Advance Shares issued and sold pursuant to such Advance Notice shall automatically be reduced to the greater of (i) the applicable Volume Limit and (ii) the number of Shares sold by the Investor during such Pricing Period (the “Volume Adjusted Advance Amount”), but in each case not to exceed the amount requested in the Advance Notice or any limitations set forth in Section 2.02. (f) [Reserved]. (g) [Reserved]. (h) Advance Halt. Notwithstanding anything to the contrary in this Agreement, if on any day during the Pricing Period an Advance Halt exists, the parties agree that the Pricing Period of the pending Advance shall end and the final number of Common Shares to be purchased by the Investor at the Closing for such Advance shall be equal to the number of Common Shares sold by the Investor during the applicable Pricing Period prior to the notification from the Company of such Advance Halt, but in each case not to exceed the amount requested in the Advance Notice (the “Halt Adjusted Advance Amount”). (i) Adjusted Advance Amount. For avoidance of doubt, in connection with a given Pricing Period for which a Volume Adjusted Advance Amount or a Halt Adjusted Advance Amount applies, the Advance Shares for such Pricing Period shall be automatically adjusted to the lower of (i) the Volume Adjusted Advance Amount, and (ii) the

15 Halt Adjusted Advance Amount, but in each case not to exceed the amount requested in the Advance Notice or any limitations set forth in Section 2.02 (the “Adjusted Advance Amount”). Section 2.03. Unconditional Contract. Notwithstanding any other provision in this Agreement, the Company and the Investor acknowledge and agree that upon the Investor’s receipt of a valid Advance Notice from the Company the Parties shall be deemed to have entered into an unconditional contract binding on both Parties for the purchase and sale of Advance Shares pursuant to such Advance Notice in accordance with the terms of this Agreement and (i) subject to Applicable Laws and (ii) subject to Section 6.20, the Investor may sell Common Shares after receipt of an Advance Notice, including during a Pricing Period. Section 2.04. Closings. The closing of each Advance and each sale and purchase of Advance Shares (each, a “Closing”) shall take place as soon as practicable on each applicable Advance Date in accordance with the procedures set forth below. The Company acknowledges that the final number of Common Shares to be issued and sold pursuant to an Advance Notice and the Purchase Price will not be known at the time an Advance Notice is delivered but shall be determined on each Closing based on the daily prices of the Common Shares that are the inputs to the determination of the Purchase Price, the Volume Threshold and the Adjusted Advance Amount. In connection with each Closing, the Company and the Investor shall fulfill each of its obligations as set forth below: (a) On or prior to each Advance Date, the Investor shall deliver to the Company a Settlement Document along with a report by the Reporting Service, indicating the applicable Market Price for the applicable Trading Days during the Pricing Period, in each case in accordance with the terms and conditions of this Agreement. (b) Promptly after receipt of the Settlement Document with respect to each Advance (and, in any event, not later than one Trading Day after such receipt), the Company will, or will cause its transfer agent to, electronically transfer such number of Advance Shares to be purchased by the Investor (as set forth in the Settlement Document) by crediting the Investor’s account or its designee’s account at The Depository Trust Company through its Deposit Withdrawal at Custodian System or by such other means of delivery as may be mutually agreed upon by the parties hereto, and transmit notification to the Investor that such share transfer has been requested. Within one (1) Trading Day following the receipt of the Advance Shares by the Investor, the Investor shall pay to the Company the Aggregate Purchase Price of the Advance Shares (as set forth in the Settlement Document), in cash via wire transfer of immediately available funds to an account designated by the Company in writing and transmit notification to the Company that such funds transfer has been requested. No fractional shares shall be issued, and any fractional amounts shall be rounded to the next higher whole number of shares. To facilitate the transfer of the Common Shares by the Investor, the Common Shares will not bear any restrictive legends so long as there is an effective Registration Statement covering the resale of such Common Shares (it being understood and agreed by the Investor that notwithstanding the lack of restrictive legends, the Investor may only sell such Common Shares pursuant to the Plan of Distribution set forth in the Prospectus included in the Registration Statement and otherwise in compliance with the requirements of the Securities Act (including any applicable prospectus delivery requirements) or pursuant to an available exemption). (c) On or prior to the applicable Advance Date, each of the Company and the Investor shall deliver to the other all documents, instruments and writings expressly required to be delivered by either of them pursuant to this Agreement in order to implement and effect the transactions contemplated herein. (d) Notwithstanding anything to the contrary in this Agreement, if on any day during the Pricing Period (i) the Company notifies the Investor that a Material Outside Event has occurred, or (ii) the Company notifies the Investor of a Black Out Period, the parties hereto agree that any pending Advance shall end and the final number of Advance Shares to be purchased by the Investor at the Closing for such Advance shall be equal to the number of Common Shares sold by the Investor during the applicable Pricing Period prior to the notification from the Company of a Material Outside Event or Black Out Period.

16 Section 2.05. Hardship. (a) In the event the Investor sells Common Shares after receipt, or deemed receipt, of an Advance Notice and the Company fails to perform its obligations as mandated in this Agreement, the Company agrees that in addition to and in no way limiting the rights and obligations set forth in Article V hereto and in addition to any other remedy to which the Investor is entitled at law or in equity, including, without limitation, specific performance, it will hold the Investor harmless against any loss, claim, damage, or expense (including reasonable legal fees and expenses), as incurred, arising out of or in connection with such default by the Company and acknowledges that irreparable damage may occur in the event of any such default. It is accordingly agreed that the Investor shall be entitled to an injunction or injunctions to prevent such breaches of this Agreement and to specifically enforce (subject to Applicable Laws and the rules of the Principal Market), without the posting of a bond or other security, the terms and provisions of this Agreement. (b) In the event the Company provides an Advance Notice and the Investor fails to perform its obligations as mandated in Section 2.02, the Investor agrees that in addition to and in no way limiting the rights and obligations set forth in Article V hereto and in addition to any other remedy to which the Company is entitled at law or in equity, including, without limitation, specific performance, it will hold the Company harmless against any loss, claim, damage, or expense (including reasonable legal fees and expenses), as incurred, arising out of or in connection with such default by the Investor and acknowledges that irreparable damage may occur in the event of any such default. It is accordingly agreed that the Company shall be entitled to an injunction or injunctions to prevent such breaches of this Agreement and to specifically enforce (subject to the Securities Act and the rules of the Principal Market), without the posting of a bond or other security, the terms and provisions of this Agreement. Article III. Representations and Warranties of the Investor The Investor hereby represents and warrants to the Company, as of the date hereof, as of each Advance Notice Date and as of the date of each Closing that: Section 3.01. Organization and Authorization. The Investor is duly organized, validly existing and in good standing under the laws of the State of Delaware and has the requisite corporate power and authority to enter into and perform its obligations under the Transaction Documents to which it is a party and to purchase or acquire Common Shares in accordance with the terms hereof. The decision to invest and the execution and delivery of the Transaction Documents to which it is a party by the Investor, the performance by the Investor of its obligations hereunder and the consummation by the Investor of the transactions contemplated hereby have been duly authorized and require no other proceedings on the part of the Investor. The undersigned has the right, power and authority to execute and deliver the Transaction Documents to which it is a party and all other instruments on behalf of the Investor or its stockholders. This Agreement and the Transaction Documents to which it is a party have been duly executed and delivered by the Investor and, assuming the execution and delivery hereof and acceptance thereof by the Company, will constitute the legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with its terms. Section 3.02. Evaluation of Risks. The Investor has such knowledge and experience in financial, tax and business matters as to be capable of evaluating the merits and risks of, and bearing the economic risks entailed by, an investment in the Common Shares and of protecting its interests in connection with the transactions contemplated hereby. The Investor acknowledges and agrees that its investment in the Company involves a high degree of risk, and that the Investor may lose all or a part of its investment. Section 3.03. No Legal, Investment or Tax Advice from the Company. The Investor acknowledges that it had the opportunity to review the Transaction Documents and the transactions contemplated by the Transaction Documents with its own legal counsel and investment and tax advisors. The Investor is relying solely on such counsel and advisors and not on any statements or representations of the Company or any of the Company’s representatives or agents for legal, tax, investment or other advice with respect to the Investor’s acquisition of Common Shares hereunder, the transactions contemplated by this Agreement or the laws of any jurisdiction, and the Investor acknowledges that the Investor may lose all or a part of its investment. Section 3.04. Investment Purpose. The Investor is acquiring the Common Shares for its own account, for investment purposes and not with a view towards, or for resale in connection with, the public sale or distribution

17 thereof, except pursuant to sales registered under or exempt from the registration requirements of the Securities Act; provided, however, that by making the representations herein, the Investor does not agree, or make any representation or warranty, to hold any of the Shares for any minimum or other specific term and reserves the right to dispose of the Shares at any time in accordance with, or pursuant to, a Registration Statement filed pursuant to this Agreement or an applicable exemption under the Securities Act. The Investor does not presently have any agreement or understanding, directly or indirectly, with any Person to sell or distribute any of the Shares. The Investor acknowledges that it will be disclosed as an “underwriter” and a “selling stockholder” in each Registration Statement and in any Prospectus contained therein to the extent required by applicable law and to the extent the Prospectus is related to the resale of Registrable Securities. The Investor is acquiring the Shares hereunder in the ordinary course of its business. Section 3.05. Accredited Investor. The Investor is an “Accredited Investor” as that term is defined in Rule 501(a)(3) of Regulation D. Section 3.06. Information. The Investor and its advisors (and its counsel), if any, have been furnished with all materials relating to the business, finances and operations of the Company and information the Investor deemed material to making an informed investment decision. The Investor and its advisors (and its counsel), if any, have been afforded the opportunity to ask questions of the Company and its management and have received answers to such questions. Neither such inquiries nor any other due diligence investigations conducted by such Investor or its advisors (and its counsel), if any, or its representatives shall modify, amend or affect the Investor’s right to rely on the Company’s representations and warranties contained in this Agreement. The Investor acknowledges and agrees that the Company has not made to the Investor, and the Investor acknowledges and agrees it has not relied upon, any representations and warranties of the Company, its employees or any third party other than the representations and warranties of the Company contained in this Agreement. The Investor understands that its investment involves a high degree of risk. The Investor has sought such accounting, legal and tax advice, as it has considered necessary to make an informed investment decision with respect to the transactions contemplated hereby. Section 3.07. Not an Affiliate. The Investor is not an officer, director or a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with the Company or any “Affiliate” of the Company (as that term is defined in Rule 405 promulgated under the Securities Act). Section 3.08. No Prior Short Sales. At no time prior to the date of this Agreement has the Investor, its sole member, any of their respective officers, or any entity managed or controlled by the Investor or its sole member, engaged in or effected, in any manner whatsoever, directly or indirectly, for its own principal account, any (i) “short sale” (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of the Common Shares or (ii) hedging transaction, in either case which establishes a net short position with respect to the Common Shares that remains in effect as of the date of this Agreement. Section 3.09. General Solicitation. Neither the Investor, nor any of its Affiliates, nor any person acting on its or their behalf, has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D) in connection with any offer or sale of the Common Shares by the Investor. Article IV. Representations and Warranties of the Company Except where specifically set forth below with respect to certain specified representations and warranties or in a disclosure schedule delivered by the Company to the Investor concurrently with this Agreement, which is hereby incorporated by reference in, and constitutes an integral part of, this Agreement (the “Disclosure Schedules”), the Company hereby represents and warrants to the Investor that, as of the date hereof, as of each Advance Notice Date and as of the date of each Closing: Section 4.01. Organization and Qualification. The Company and each of its Subsidiaries are entities duly formed, validly existing and in good standing under the laws of the jurisdiction in which they are formed and have the requisite power and authority to own their properties and to carry on their business as now being conducted. The Company and each of its Subsidiaries is duly qualified to do business and is in good standing in every jurisdiction in which the nature of the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse Effect.

18 Section 4.02. Authorization, Enforcement, Compliance with Other Instruments. The Company has the requisite corporate power and authority to enter into and perform its obligations under this Agreement and the other Transaction Documents and to issue the Shares in accordance with the terms hereof and thereof. The execution and delivery of this Agreement and the other Transaction Documents by the Company and its Subsidiaries, and the consummation by the Company and its Subsidiaries of the transactions contemplated hereby and thereby, including, without limitation, have been duly authorized by the Company’s board of directors or other governing body, as applicable, and (other than (i) the filing with the SEC of a Form D with respect to the transactions contemplated hereby and the Current Report, (ii) with respect to the applicable Closing, confirmation that Stockholder Approval has been obtained, if applicable, (iii) with respect to any applicable Closings, the filing of an additional listing application with the Principal Market, and (iv) any other filings as may be required by any state securities agencies (collectively, the “Required Approvals”)) and no further filing, consent or authorization is required by the Company, its Subsidiaries, their respective boards of directors or their stockholders or other governing body. This Agreement and the other Transaction Documents to which the Company is a party have been (or, when executed and delivered, will be) duly executed and delivered by the Company and, assuming the execution and delivery thereof and acceptance by the Investor, constitute (or, when duly executed and delivered, will be) the legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their respective terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or other laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies and except as rights to indemnification and to contribution may be limited by federal or state securities law. Except for the Required Approvals, neither the Company nor any Subsidiary is required to obtain any consent from, authorization or order of, or make any filing or registration with, any Governmental Entity (as defined below) or any regulatory or self- regulatory agency or any other Person in order for it to execute, deliver or perform any of its respective obligations under or contemplated by the Transaction Documents, in each case, in accordance with the terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Company or any Subsidiary is required to obtain pursuant to the preceding sentence have been or will be obtained or effected on or prior to such Closing, and neither the Company nor any of its Subsidiaries are aware of any facts or circumstances which might prevent the Company or any of its Subsidiaries from obtaining or effecting any of the registration, application or filings contemplated by the Transaction Documents. Except as disclosed in Schedule 4.02, the Company is not in violation of the requirements of the Principal Market and has no knowledge of any facts or circumstances which could reasonably lead to delisting or suspension of the Common Shares. “Governmental Entity” means any nation, state, county, city, town, village, district, or other political jurisdiction of any nature, federal, state, local, municipal, foreign, or other government, governmental or quasi-governmental authority of any nature (including any governmental agency, branch, department, official, or entity and any court or other tribunal), multinational organization or body; or body exercising, or entitled to exercise, any administrative, executive, judicial, legislative, police, regulatory, or taxing authority or power of any nature or instrumentality of any of the foregoing, including any entity or enterprise owned or controlled by a government or a public international organization or any of the foregoing. Section 4.03. Authorization of the Common Shares. The issuance of the Common Shares has been duly authorized and, upon issuance in accordance with the terms of the Transaction Documents and against payment therefore as provided herein, the Common Shares shall be validly issued, fully paid and non-assessable and free from all preemptive or similar rights, mortgages, defects, claims, liens, pledges, charges, taxes, rights of first refusal, encumbrances, security interests and other encumbrances with respect to the issuance thereof. Section 4.04. No Conflict. The execution, delivery and performance of the Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby (including, without limitation, the issuance of the Common Shares) will not (i) result in a violation of the certificate of incorporation or other organizational documents of the Company or its Subsidiaries (with respect to consummation, as the same may be amended prior to the date on which any of the transactions contemplated hereby are consummated), (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company or its Subsidiaries is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations) applicable to the Company or its Subsidiaries or by which any property or asset of the Company or its Subsidiaries is bound or affected except, in the case of clause (ii) or (iii) above, to the extent such violations that would not reasonably be expected to have a Material Adverse Effect.