Document

SIMILARWEB ANNOUNCES THIRD QUARTER 2025 RESULTS

Revenue growth of 11% in the third quarter

Eighth consecutive quarter of positive free cash flow

Customer base increased by 15%

TEL AVIV, ISRAEL -- November 11, 2025 -- Similarweb Ltd. (NYSE: SMWB) ("Similarweb" or the "Company"), a leading digital data and analytics company powering critical business decisions, today announced financial results for its third quarter ended September 30, 2025. The Company published a letter to shareholders from management discussing these results, which can be accessed at the link: https://ir.similarweb.com/financials/quarterly-results, located on the Company's investor relations website.

“We are proud of the third quarter financial results that reflect our focus on disciplined execution and sustained demand for our Digital Data. RPO increased by 26% year-on-year and customer count increased by 15%, in addition to the 11% revenue growth in the quarter,” stated Or Offer, Co-Founder and CEO of Similarweb. “Commercial interest in our Generative AI data and solutions remains strong and revenues from Generative AI data and solutions are among our fastest growing revenue streams this quarter.” Offer concluded, “We are just beginning to tap into the vast potential of our data and the addressable markets we serve.”

Third Quarter 2025 Financial Highlights

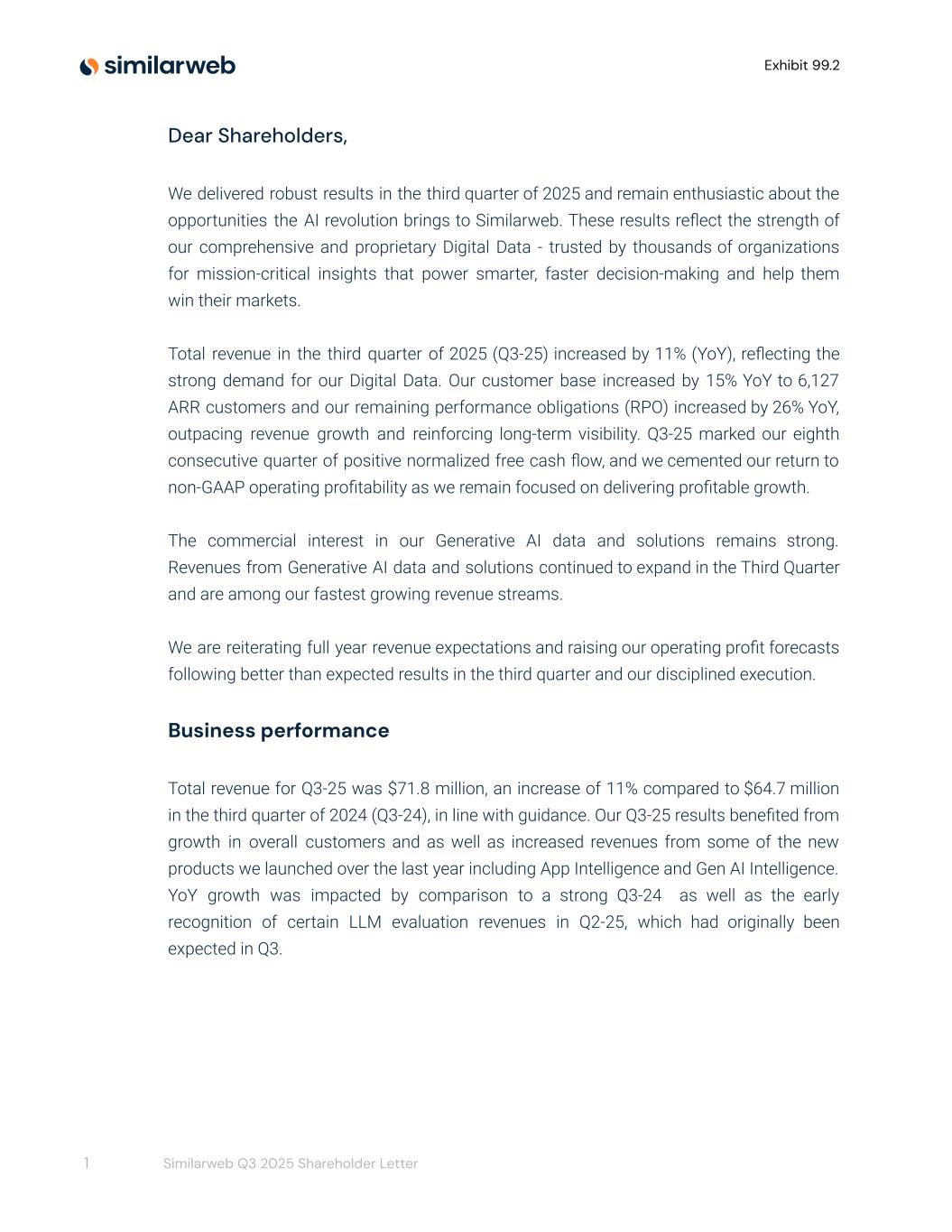

•Total revenue was $71.8 million, an increase of 11% compared to $64.7 million for the third quarter of 2024.

•GAAP loss from operations was $(2.7) million or (4)% of revenue, compared to $(2.5) million or (4)% of revenue for the third quarter of 2024.

•GAAP net loss was $(4.3) million compared to a net loss of $(2.6) million for the third quarter of 2024.

•GAAP net loss per share was $(0.05), compared to $(0.03) for the third quarter of 2024.

•Non-GAAP operating profit was $4.6 million or 6% of revenue, compared to $4.4 million or 7% of revenue for the third quarter of 2024.

•Non-GAAP net income was $4.4 million or 6% of revenue, compared to $4.0 million or 6% of revenue for the third quarter of 2024.

•Non-GAAP basic and diluted net income per share was $0.05, consistent with $0.05 for the third quarter of 2024.

•Cash and cash equivalents totalled $65.5 million as of September 30, 2025, compared to $63.9 million as of December 31, 2024.

•Net cash provided by operating activities was $3.5 million, compared to $9.3 million for the third quarter of 2024.

•Free cash flow was $3.0 million, compared to $8.7 million for the third quarter of 2024.

•Normalized free cash flow was $3.0 million, compared to $9.0 million for the third quarter of 2024.

Recent Business Highlights

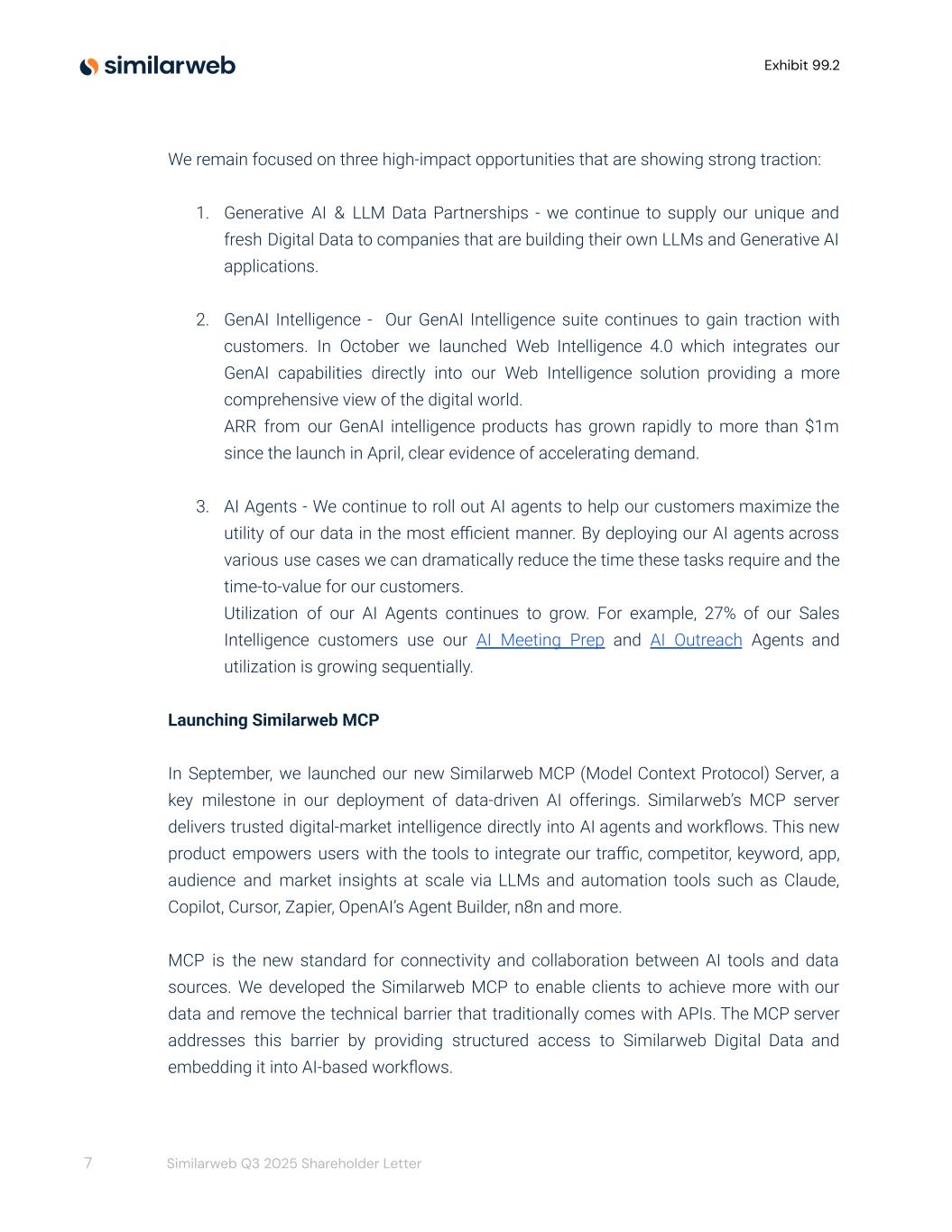

•Grew number of customers to 6,127 as of September 30, 2025, an increase of 15% compared to September 30, 2024.

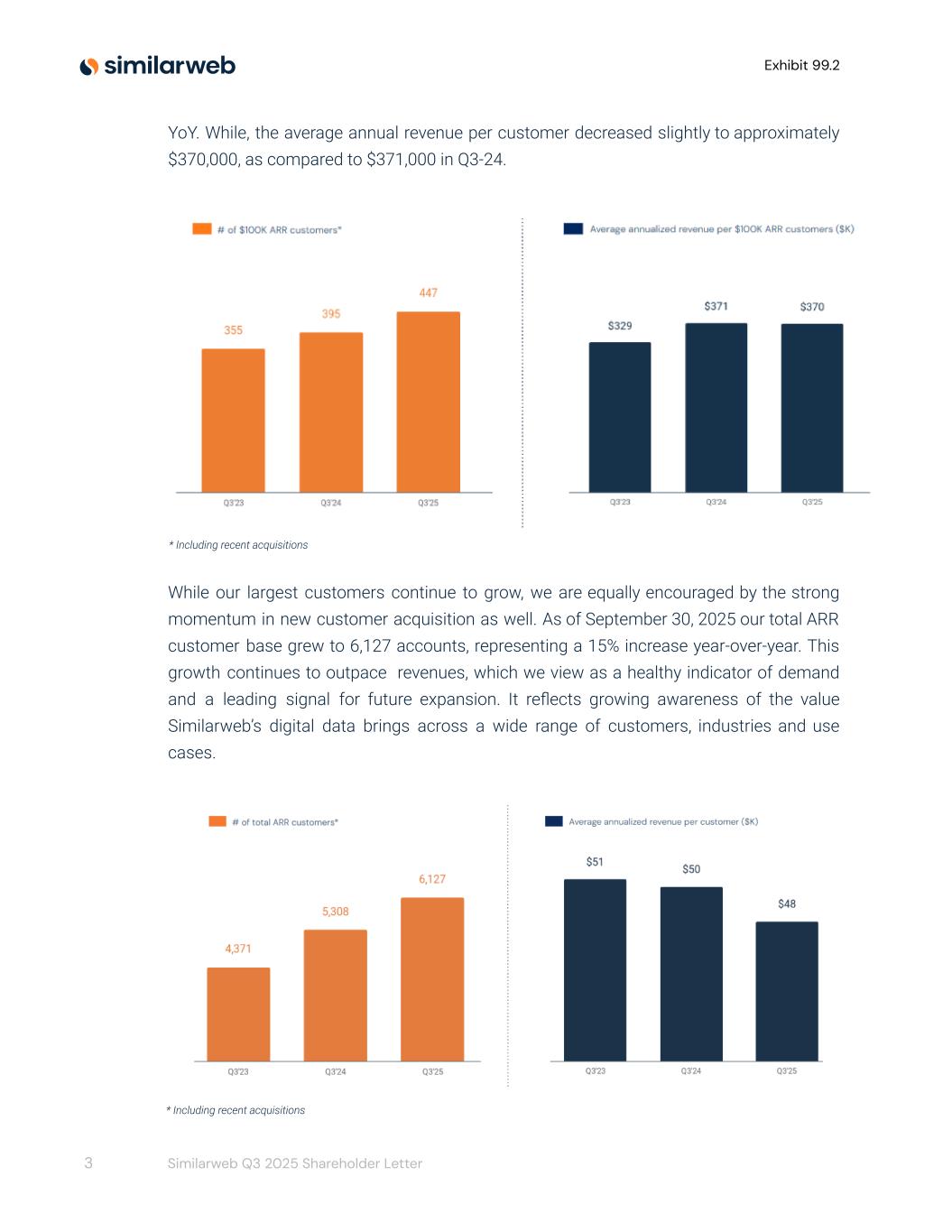

•Grew number of customers with ARR of $100,000 or more to 447 as of September 30, 2025, an increase of 13% compared to September 30, 2024.

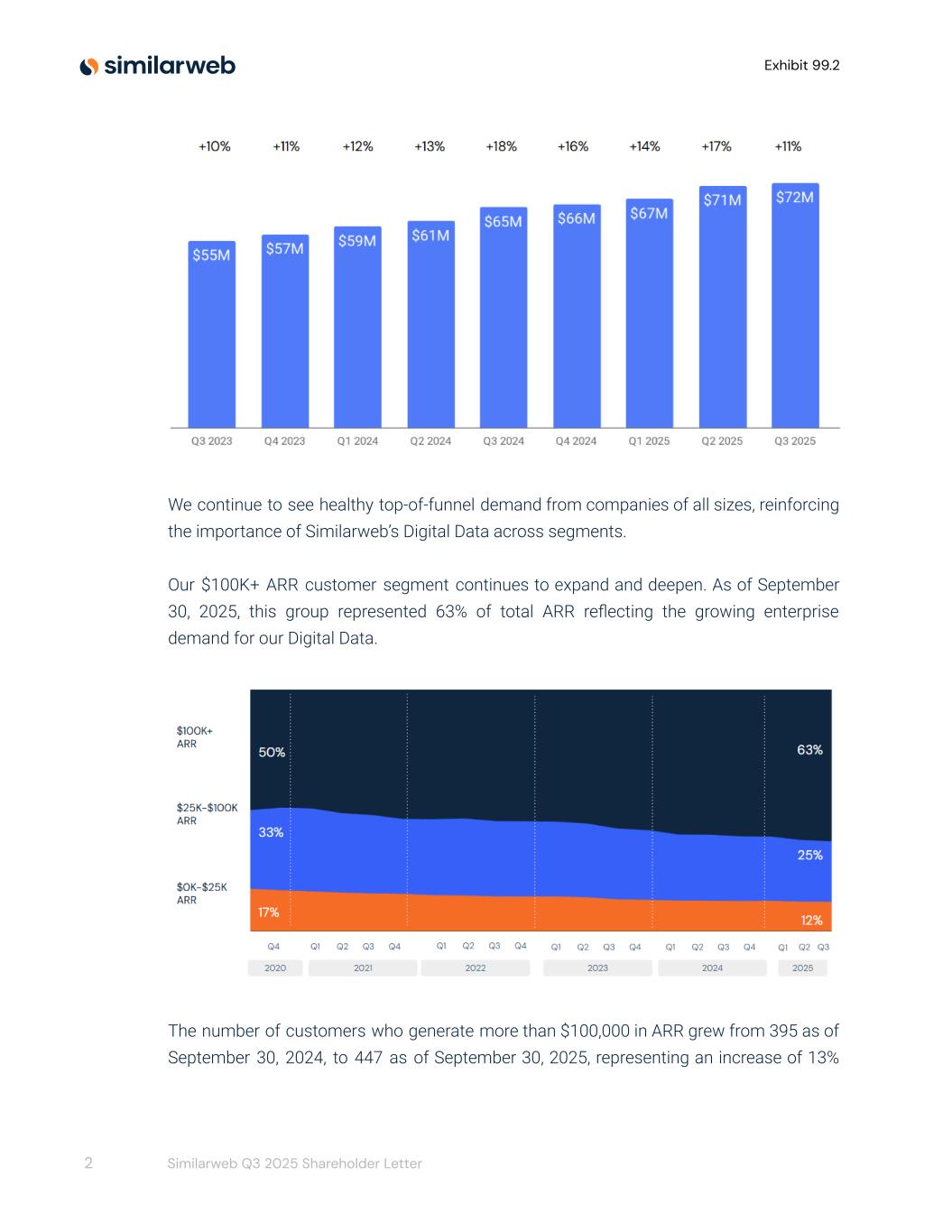

•Customers with ARR of $100,000 or more contributed 63% of the total ARR as of September 30, 2025, increased from 60% as of September 30, 2024.

•Dollar-based net retention rate, or NRR, for customers with ARR of $100,000 or more was 105% in the third quarter of 2025, compared to 111% in the third quarter of 2024.

•Overall NRR was 98% in the third quarter of 2025, compared to 101% in the third quarter of 2024.

•58% of our overall ARR is contracted under multi-year subscriptions as of September 30, 2025, increased from 45% as of September 30, 2024.

•Remaining performance obligations, or RPO, increased 26% year-over-year, to $267.6 million as of September 30, 2025, as compared to $212.5 million as of September 30, 2024.

“Ran Vered will start at Similarweb as CFO in December. Ran brings more than two decades of finance experience with a proven track record in driving growth, efficiency, and strategic transformation. He has served as CFO at three companies, including two public companies that trade in the US and a SaaS Data company. We are super excited that he is joining us,” stated Or Offer, Co-Founder and CEO of Similarweb. “I would like to thank Jason Schwartz for his 10 years of service as CFO of Similarweb and wish him success in the future.”

Financial Outlook

•FY 2025 Guidance

◦Total revenue for fiscal year 2025 estimated between $285.0 million and $288.0 million, representing approximately 15% growth year-over-year at the mid-point of the range.

◦Non-GAAP operating profit for fiscal year 2025 estimated between $8.5 million and $9.5 million, an increase from our previous estimate.

The Company’s 2025 financial outlook is based upon a number of assumptions that are subject to change and many of which are outside the Company’s control. Actual results may vary from these assumptions, and the Company’s expectations may change. There can be no assurance that the Company will achieve these results.

The Company does not provide guidance for operating loss, the most directly comparable GAAP measure to non-GAAP operating loss, and similarly cannot provide a reconciliation of this measure to its closest GAAP equivalent without unreasonable effort due to the unavailability of reliable estimates for certain items. These items are not within the Company’s control and may vary greatly between periods and could significantly impact future financial results.

Conference Call Information

The financial results and business highlights will be discussed on a conference call and webcast scheduled at 8:30 a.m. Eastern Time on Wednesday, November 12, 2025. A live webcast of the call can be accessed from Similarweb’s Investor Relations website at https://ir.similarweb.com. An archived webcast of the conference call will also be made available on the Similarweb website following the call. The live call may also be accessed via telephone at (877) 407-0726 toll-free and at (201) 689-7806 internationally.

About Similarweb: Similarweb powers businesses to win their markets with Digital Data. By providing essential web and app data, analytics, and insights, we empower our users to discover business opportunities, identify competitive threats, optimize strategy, acquire the right customers, and increase monetization. Similarweb products are integrated into users’ workflow, powered by advanced technology, and based on leading comprehensive Digital Data.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for 2025 described under "Financial Outlook". Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. These forward-looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward-looking statements and are subject to a number of known and unknown risks, uncertainties, other factors and assumptions that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with: (i) our expectations regarding our revenue, expenses and other operating results; (ii) our ability to acquire new customers and successfully retain existing customers; (iii) our ability to increase usage of our solutions and upsell and cross-sell additional solutions; (iv) our ability to sustain profitability; (v) anticipated trends, growth rates, rising interest rates, rising global inflation and current macroeconomic conditions, challenges in our business and in the markets in which we operate, and the impact of the October 2023 attack by Hamas and other terrorist organizations, and Israel's subsequent war against them, on geopolitical and macroeconomic conditions or on our company and business; (vi) future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements; (vii) the costs and success of our sales and marketing efforts and our ability to promote our brand; (viii) our reliance on key personnel and our ability to identify, recruit and retain skilled personnel; (ix) our ability to effectively manage our growth, including continued international expansion; (x) our reliance on certain third party platforms and sources for the collection of data necessary for our solutions; (xi) our ability to protect our intellectual property rights and any costs associated therewith; (xii) our ability to identify and complete acquisitions that complement and expand our reach and platform; (xiii) our ability to comply or remain in compliance with laws and regulations that currently apply or become applicable to our business, including in Israel, the United States, the European Union, the United Kingdom and other jurisdictions where we elect to do business; (xiv) our ability to compete effectively with existing competitors and new market entrants; and (xv) the growth rates of the markets in which we compete.

These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on February 27, 2025, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur.

Forward-looking statements represent our beliefs and assumptions only as of the date of this press release. Except as required by law, we undertake no duty to update any forward-looking statements contained in this release as a result of new information, future events, changes in expectations or otherwise.

Non-GAAP Financial Measures

This press release contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP or as a measure of liquidity. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's new headquarters, payments received in connection with these capital investments and deferred payments related to business combinations. Non-GAAP operating income (loss), non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating margin, non-GAAP research and development expenses, non-GAAP sales and marketing expenses,non-GAAP general and administrative expenses, non-GAAP net income (loss) and non-GAAP net income (loss) per share represent the comparable GAAP financial figure operating income (loss) or expense, less share-based compensation, adjustments and payments related to business combinations, amortization of intangible assets and certain other non-recurring items, non-operating foreign exchange gains or losses and the relevant net tax effect as applicable and indicated in the below tables.

Other Metrics

Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year ago period, expressed as a percentage.

We define Annual Recurring Revenue (ARR) as the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. A contract is included in ARR for a particular period if it is active at the end of the applicable period and is excluded if it is not active at the end of the applicable period. Multi-year contracts are annualized by dividing the total committed contract value by the number of months in the subscription term and then multiplying by 12. ARR excludes non-recurring revenues, non-subscription revenues, revenues that are one-time in nature or revenues from subscriptions to our offerings for a period that is less than an annual subscription term.

ARR is an operational measure that management uses to evaluate the scale of our annual subscription contracts. While ARR is useful in assessing the scale of our contracted subscription business, it is not necessarily indicative of future GAAP revenue, which is subject to factors such as customer renewals, expansions, contractions, churn and upsell or cross-sell opportunities. Since ARR is not a defined measure under GAAP, investors should not consider ARR as a substitute for revenue recognized under GAAP or for other GAAP-related measures such as remaining performance obligations or deferred revenue. ARR differs from revenue recognized in accordance with GAAP because GAAP revenue is recognized as performance obligations are satisfied, includes non-recurring revenues, such as revenue that is one-time in nature, subscriptions with less than an annual term, non-subscription revenue and the effects of contract modifications.

Press Contact:

David Carr

Similarweb

press@similarweb.com

Investor Contact:

Rami Myerson

Similarweb

rami.myerson@similarweb.com

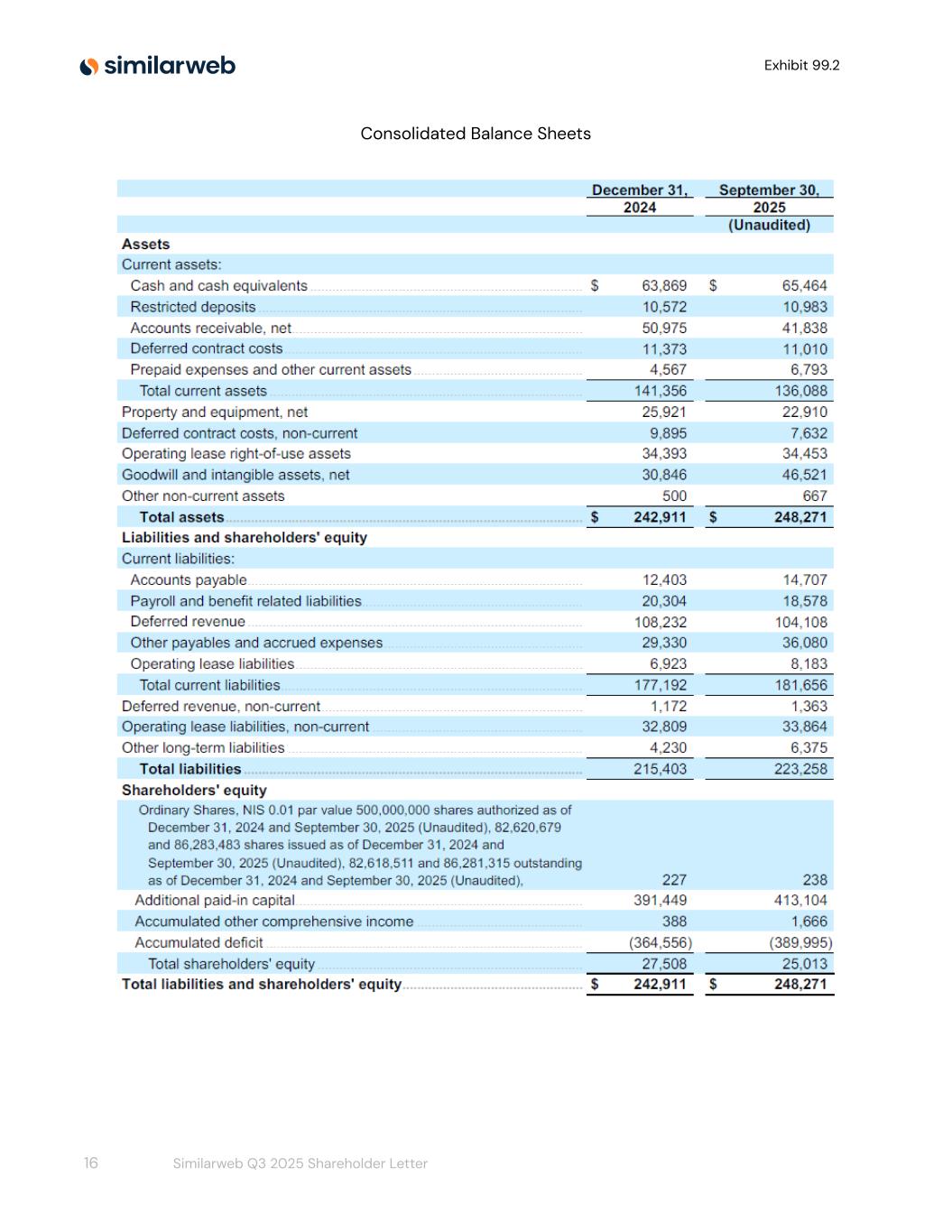

Similarweb Ltd.

Consolidated Balance Sheets

U.S. dollars in thousands (except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

September 30, |

|

2024 |

|

2025 |

|

|

|

(Unaudited) |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

63,869 |

|

|

$ |

65,464 |

|

| Restricted deposits |

10,572 |

|

|

10,983 |

|

| Accounts receivable, net |

50,975 |

|

|

41,838 |

|

| Deferred contract costs |

11,373 |

|

|

11,010 |

|

| Prepaid expenses and other current assets |

4,567 |

|

|

6,793 |

|

| Total current assets |

141,356 |

|

|

136,088 |

|

| Property and equipment, net |

25,921 |

|

|

22,910 |

|

| Deferred contract costs, non-current |

9,895 |

|

|

7,632 |

|

| Operating lease right-of-use assets |

34,393 |

|

|

34,453 |

|

| Goodwill and intangible assets, net |

30,846 |

|

|

46,521 |

|

| Other non-current assets |

500 |

|

|

667 |

|

| Total assets |

$ |

242,911 |

|

|

$ |

248,271 |

|

| Liabilities and shareholders' equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

12,403 |

|

|

14,707 |

|

| Payroll and benefit related liabilities |

20,304 |

|

|

18,578 |

|

| Deferred revenue |

108,232 |

|

|

104,108 |

|

| Other payables and accrued expenses |

29,330 |

|

|

36,080 |

|

| Operating lease liabilities |

6,923 |

|

|

8,183 |

|

| Total current liabilities |

177,192 |

|

|

181,656 |

|

| Deferred revenue, non-current |

1,172 |

|

|

1,363 |

|

| Operating lease liabilities, non-current |

32,809 |

|

|

33,864 |

|

| Other long-term liabilities |

4,230 |

|

|

6,375 |

|

| Total liabilities |

215,403 |

|

|

223,258 |

|

| Shareholders' equity |

|

|

|

Ordinary Shares, NIS 0.01 par value 500,000,000 shares authorized as of December 31, 2024 and September 30, 2025 (Unaudited), 82,620,679 and 86,283,483 shares issued as of December 31, 2024 and September 30, 2025 (Unaudited), 82,618,511 and 86,281,315 outstanding as of December 31, 2024 and September 30, 2025 (Unaudited), respectively; |

227 |

|

|

238 |

|

| Additional paid-in capital |

391,449 |

|

|

413,104 |

|

| Accumulated other comprehensive income |

388 |

|

|

1,666 |

|

| Accumulated deficit |

(364,556) |

|

|

(389,995) |

|

| Total shareholders' equity |

27,508 |

|

|

25,013 |

|

| Total liabilities and shareholders' equity |

$ |

242,911 |

|

|

$ |

248,271 |

|

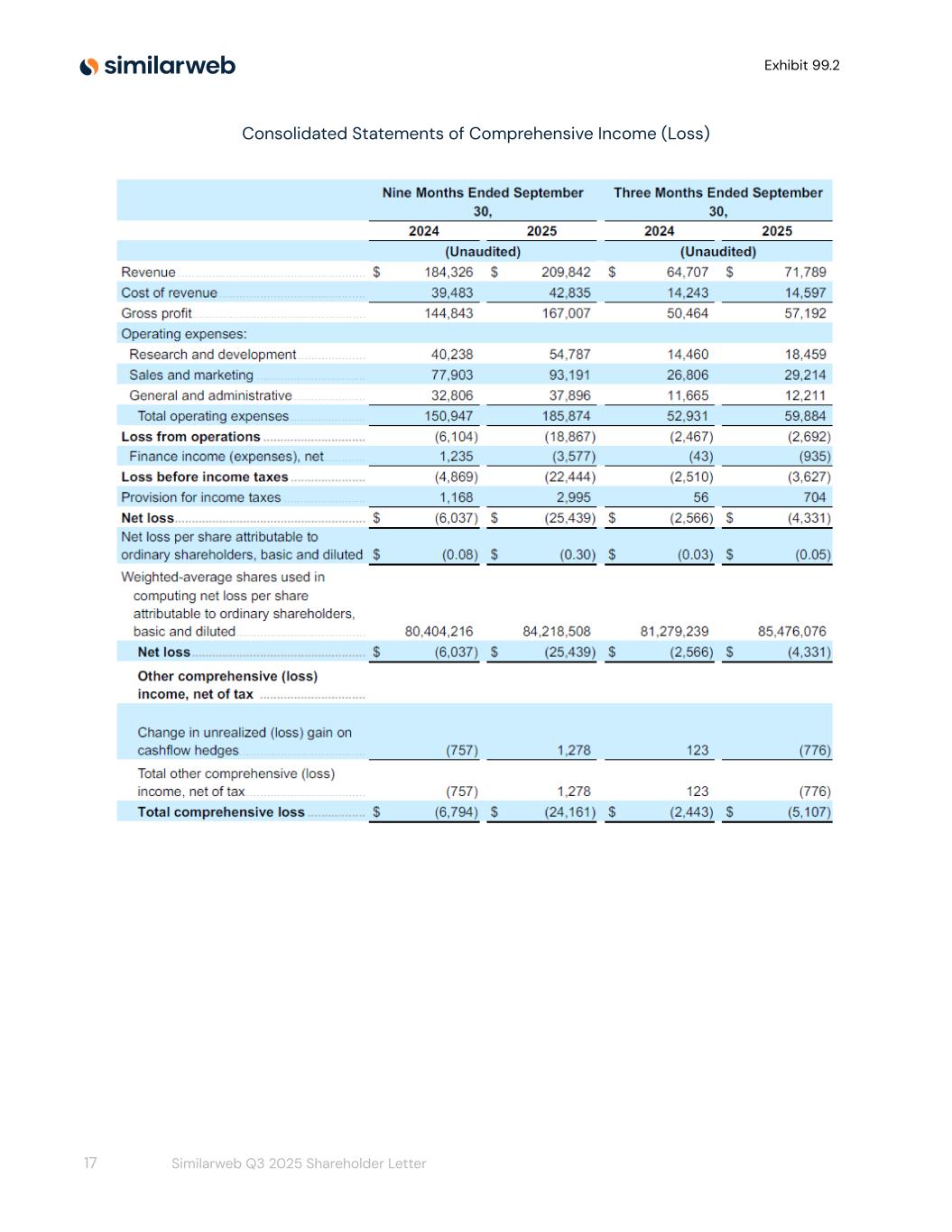

Similarweb Ltd.

Consolidated Statements of Comprehensive Income (Loss)

U.S. dollars in thousands (except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

(Unaudited) |

|

(Unaudited) |

| Revenue |

$ |

184,326 |

|

|

$ |

209,842 |

|

|

$ |

64,707 |

|

|

$ |

71,789 |

|

| Cost of revenue |

39,483 |

|

|

42,835 |

|

|

14,243 |

|

|

14,597 |

|

| Gross profit |

144,843 |

|

|

167,007 |

|

|

50,464 |

|

|

57,192 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development |

40,238 |

|

|

54,787 |

|

|

14,460 |

|

|

18,459 |

|

| Sales and marketing |

77,903 |

|

|

93,191 |

|

|

26,806 |

|

|

29,214 |

|

| General and administrative |

32,806 |

|

|

37,896 |

|

|

11,665 |

|

|

12,211 |

|

| Total operating expenses |

150,947 |

|

|

185,874 |

|

|

52,931 |

|

|

59,884 |

|

| Loss from operations |

(6,104) |

|

|

(18,867) |

|

|

(2,467) |

|

|

(2,692) |

|

| Finance income (expenses), net |

1,235 |

|

|

(3,577) |

|

|

(43) |

|

|

(935) |

|

| Loss before income taxes |

(4,869) |

|

|

(22,444) |

|

|

(2,510) |

|

|

(3,627) |

|

| Provision for income taxes |

1,168 |

|

|

2,995 |

|

|

56 |

|

|

704 |

|

| Net loss |

$ |

(6,037) |

|

|

$ |

(25,439) |

|

|

$ |

(2,566) |

|

|

$ |

(4,331) |

|

| Net loss per share attributable to ordinary shareholders, basic and diluted |

$ |

(0.08) |

|

|

$ |

(0.30) |

|

|

$ |

(0.03) |

|

|

$ |

(0.05) |

|

| Weighted-average shares used in computing net loss per share attributable to ordinary shareholders, basic and diluted |

80,404,216 |

|

|

84,218,508 |

|

|

81,279,239 |

|

|

85,476,076 |

|

| Net loss |

$ |

(6,037) |

|

|

$ |

(25,439) |

|

|

$ |

(2,566) |

|

|

$ |

(4,331) |

|

| Other comprehensive (loss) income, net of tax |

|

|

|

|

|

|

|

| Change in unrealized (loss) gain on cashflow hedges |

(757) |

|

|

1,278 |

|

|

123 |

|

|

(776) |

|

| Total other comprehensive (loss) income, net of tax |

(757) |

|

|

1,278 |

|

|

123 |

|

|

(776) |

|

| Total comprehensive loss |

$ |

(6,794) |

|

|

$ |

(24,161) |

|

|

$ |

(2,443) |

|

|

$ |

(5,107) |

|

|

|

|

|

|

|

|

|

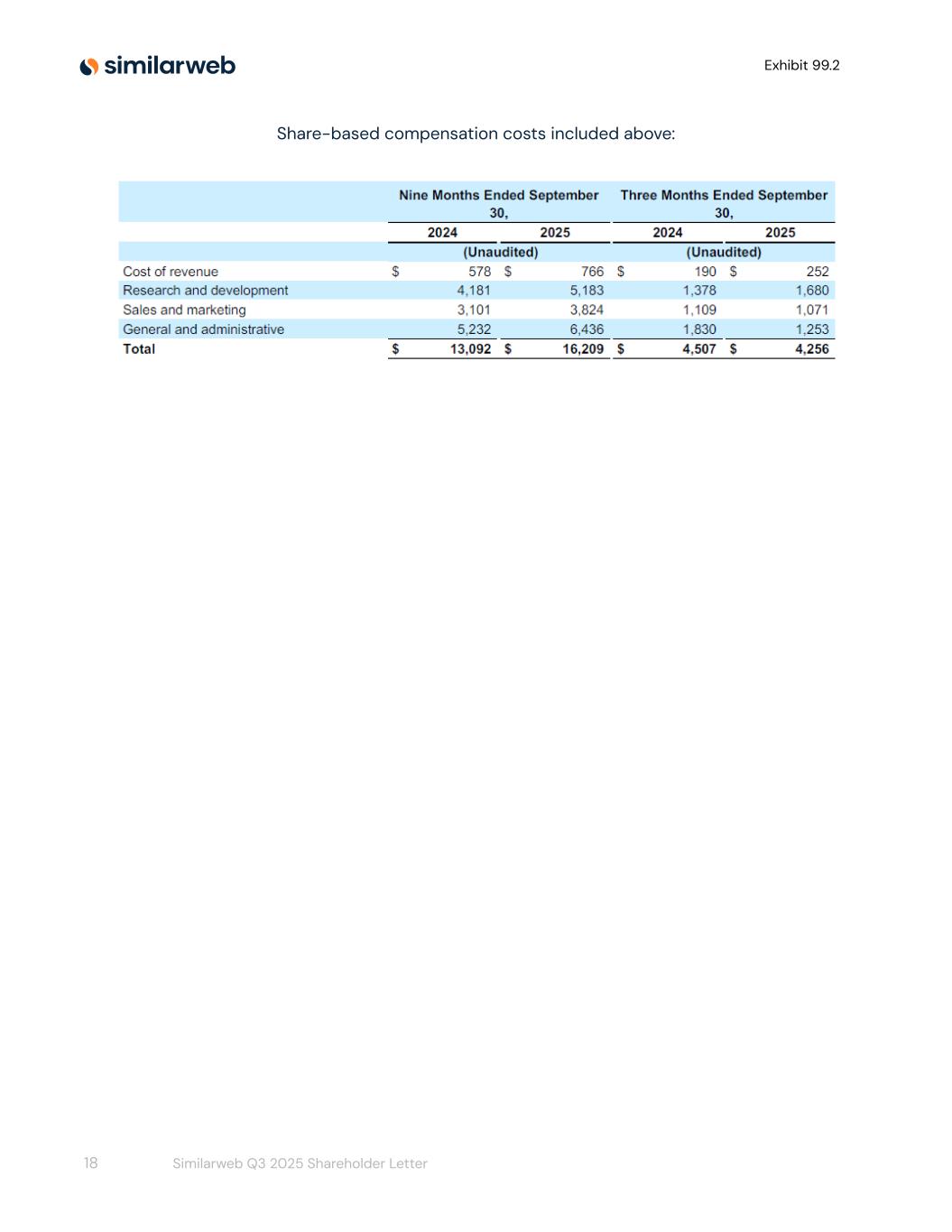

Share-based compensation costs included above:

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

(Unaudited) |

(Unaudited) |

| Cost of revenue |

$ |

578 |

|

|

$ |

766 |

|

|

$ |

190 |

|

|

$ |

252 |

|

| Research and development |

4,181 |

|

|

5,183 |

|

|

1,378 |

|

|

1,680 |

|

| Sales and marketing |

3,101 |

|

|

3,824 |

|

|

1,109 |

|

|

1,071 |

|

| General and administrative |

5,232 |

|

|

6,436 |

|

|

1,830 |

|

|

1,253 |

|

| Total |

$ |

13,092 |

|

|

$ |

16,209 |

|

|

$ |

4,507 |

|

|

$ |

4,256 |

|

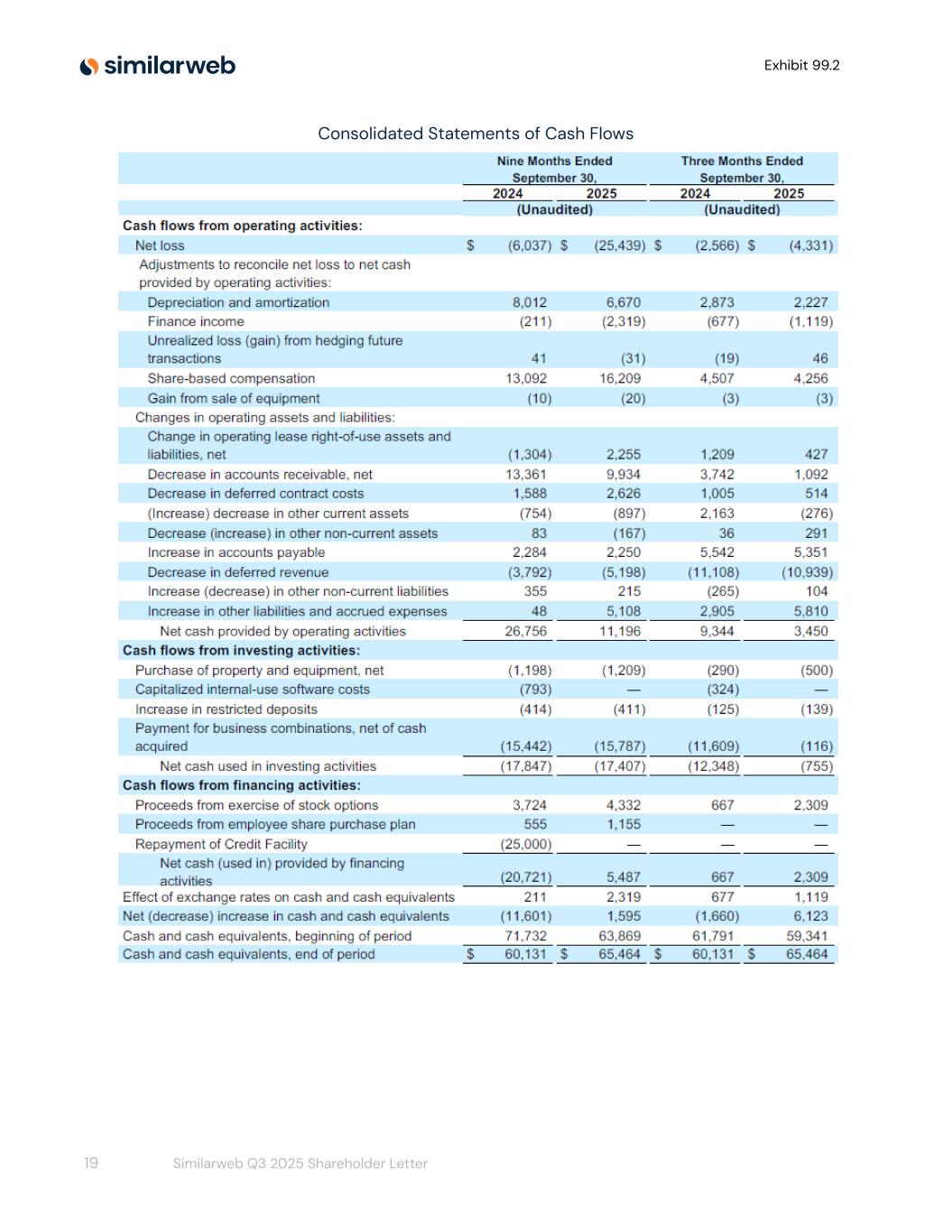

Similarweb Ltd.

Consolidated Statements of Cash Flows

U.S. dollars in thousands

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(Unaudited) |

|

(Unaudited) |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

$ |

(6,037) |

|

|

$ |

(25,439) |

|

|

$ |

(2,566) |

|

|

$ |

(4,331) |

|

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

8,012 |

|

|

6,670 |

|

|

2,873 |

|

|

2,227 |

|

|

| Finance income |

(211) |

|

|

(2,319) |

|

|

(677) |

|

|

(1,119) |

|

|

| Unrealized loss (gain) from hedging future transactions |

41 |

|

|

(31) |

|

|

(19) |

|

|

46 |

|

|

| Share-based compensation |

13,092 |

|

|

16,209 |

|

|

4,507 |

|

|

4,256 |

|

|

| Gain from sale of equipment |

(10) |

|

|

(20) |

|

|

(3) |

|

|

(3) |

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Change in operating lease right-of-use assets and liabilities, net |

(1,304) |

|

|

2,255 |

|

|

1,209 |

|

|

427 |

|

|

| Decrease in accounts receivable, net |

13,361 |

|

|

9,934 |

|

|

3,742 |

|

|

1,092 |

|

|

| Decrease in deferred contract costs |

1,588 |

|

|

2,626 |

|

|

1,005 |

|

|

514 |

|

|

| (Increase) decrease in other current assets |

(754) |

|

|

(897) |

|

|

2,163 |

|

|

(276) |

|

|

| Decrease (increase) in other non-current assets |

83 |

|

|

(167) |

|

|

36 |

|

|

291 |

|

|

| Increase in accounts payable |

2,284 |

|

|

2,250 |

|

|

5,542 |

|

|

5,351 |

|

|

| Decrease in deferred revenue |

(3,792) |

|

|

(5,198) |

|

|

(11,108) |

|

|

(10,939) |

|

|

| Increase (decrease) in other non-current liabilities |

355 |

|

|

215 |

|

|

(265) |

|

|

104 |

|

|

| Increase in other liabilities and accrued expenses |

48 |

|

|

5,108 |

|

|

2,905 |

|

|

5,810 |

|

|

| Net cash provided by operating activities |

26,756 |

|

|

11,196 |

|

|

9,344 |

|

|

3,450 |

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchase of property and equipment, net |

(1,198) |

|

|

(1,209) |

|

|

(290) |

|

|

(500) |

|

|

| Capitalized internal-use software costs |

(793) |

|

|

— |

|

|

(324) |

|

|

— |

|

|

| Increase in restricted deposits |

(414) |

|

|

(411) |

|

|

(125) |

|

|

(139) |

|

|

| Payment for business combinations, net of cash acquired |

(15,442) |

|

|

(15,787) |

|

|

(11,609) |

|

|

(116) |

|

|

| Net cash used in investing activities |

(17,847) |

|

|

(17,407) |

|

|

(12,348) |

|

|

(755) |

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from exercise of stock options |

3,724 |

|

|

4,332 |

|

|

667 |

|

|

2,309 |

|

|

| Proceeds from employee share purchase plan |

555 |

|

|

1,155 |

|

|

— |

|

|

— |

|

|

| Repayment of Credit Facility |

(25,000) |

|

|

— |

|

|

— |

|

|

— |

|

|

| Net cash (used in) provided by financing activities |

(20,721) |

|

|

5,487 |

|

|

667 |

|

|

2,309 |

|

|

| Effect of exchange rates on cash and cash equivalents |

211 |

|

|

2,319 |

|

|

677 |

|

|

1,119 |

|

|

| Net (decrease) increase in cash and cash equivalents |

(11,601) |

|

|

1,595 |

|

|

(1,660) |

|

|

6,123 |

|

|

| Cash and cash equivalents, beginning of period |

71,732 |

|

|

63,869 |

|

|

61,791 |

|

|

59,341 |

|

|

| Cash and cash equivalents, end of period |

$ |

60,131 |

|

|

$ |

65,464 |

|

|

$ |

60,131 |

|

|

$ |

65,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

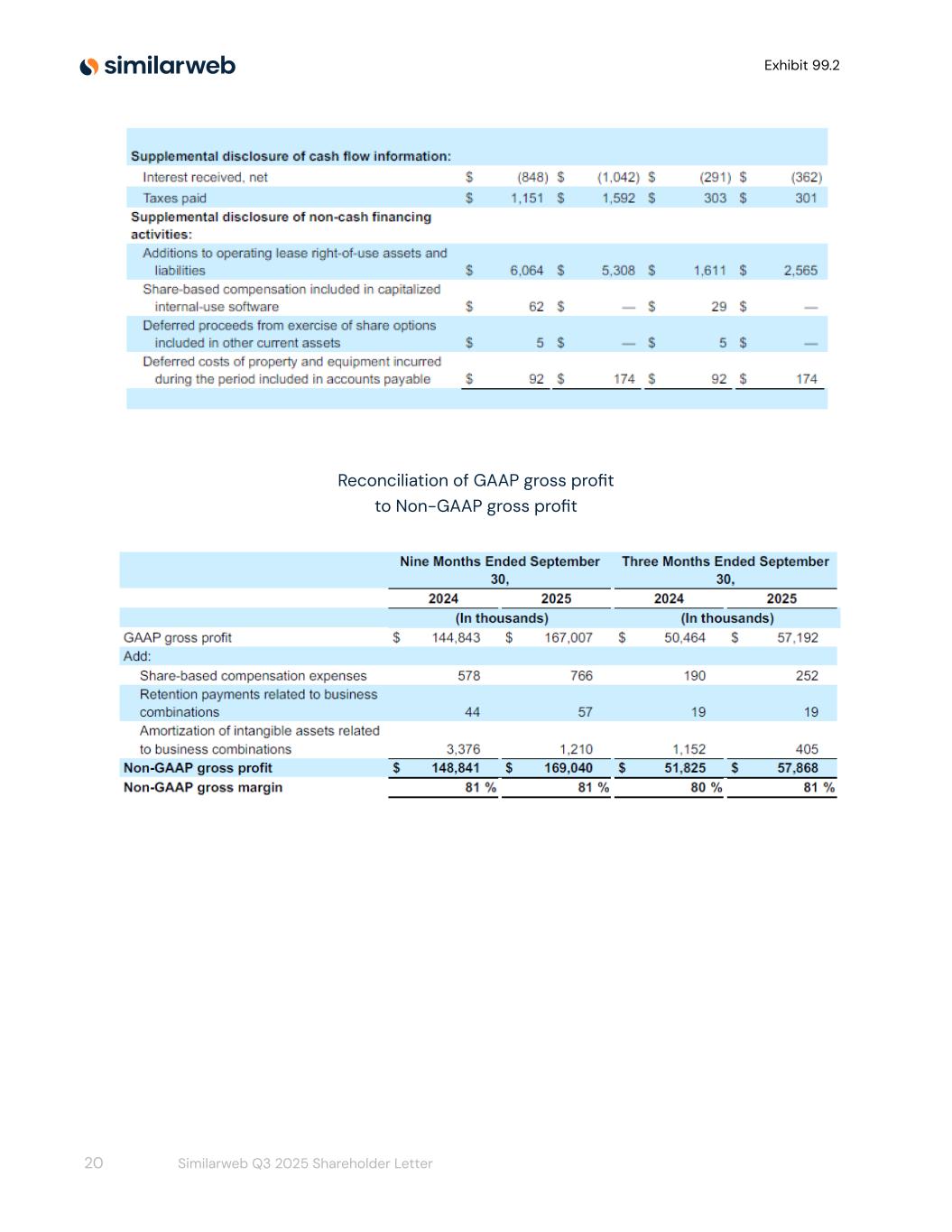

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Interest received, net |

$ |

(848) |

|

|

$ |

(1,042) |

|

|

$ |

(291) |

|

|

$ |

(362) |

|

|

| Taxes paid |

$ |

1,151 |

|

|

$ |

1,592 |

|

|

$ |

303 |

|

|

$ |

301 |

|

|

| Supplemental disclosure of non-cash financing activities: |

|

|

|

|

|

|

|

|

| Additions to operating lease right-of-use assets and liabilities |

$ |

6,064 |

|

|

$ |

5,308 |

|

|

$ |

1,611 |

|

|

$ |

2,565 |

|

|

| Share-based compensation included in capitalized internal-use software |

$ |

62 |

|

|

$ |

— |

|

|

$ |

29 |

|

|

$ |

— |

|

|

| Deferred proceeds from exercise of share options included in other current assets |

$ |

5 |

|

|

$ |

— |

|

|

$ |

5 |

|

|

$ |

— |

|

|

| Deferred costs of property and equipment incurred during the period included in accounts payable |

$ |

92 |

|

|

$ |

174 |

|

|

$ |

92 |

|

|

$ |

174 |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

Reconciliation of GAAP gross profit to non-GAAP gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(In thousands) |

(In thousands) |

| GAAP gross profit |

$ |

144,843 |

|

|

$ |

167,007 |

|

|

$ |

50,464 |

|

|

$ |

57,192 |

|

|

| Add: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

578 |

|

|

766 |

|

|

190 |

|

|

252 |

|

|

| Retention payments related to business combinations |

44 |

|

|

57 |

|

|

19 |

|

|

19 |

|

|

| Amortization of intangible assets related to business combinations |

3,376 |

|

|

1,210 |

|

|

1,152 |

|

|

405 |

|

|

| Non-GAAP gross profit |

$ |

148,841 |

|

|

$ |

169,040 |

|

|

$ |

51,825 |

|

|

$ |

57,868 |

|

|

| Non-GAAP gross margin |

81 |

% |

|

81 |

% |

|

80 |

% |

|

81 |

% |

|

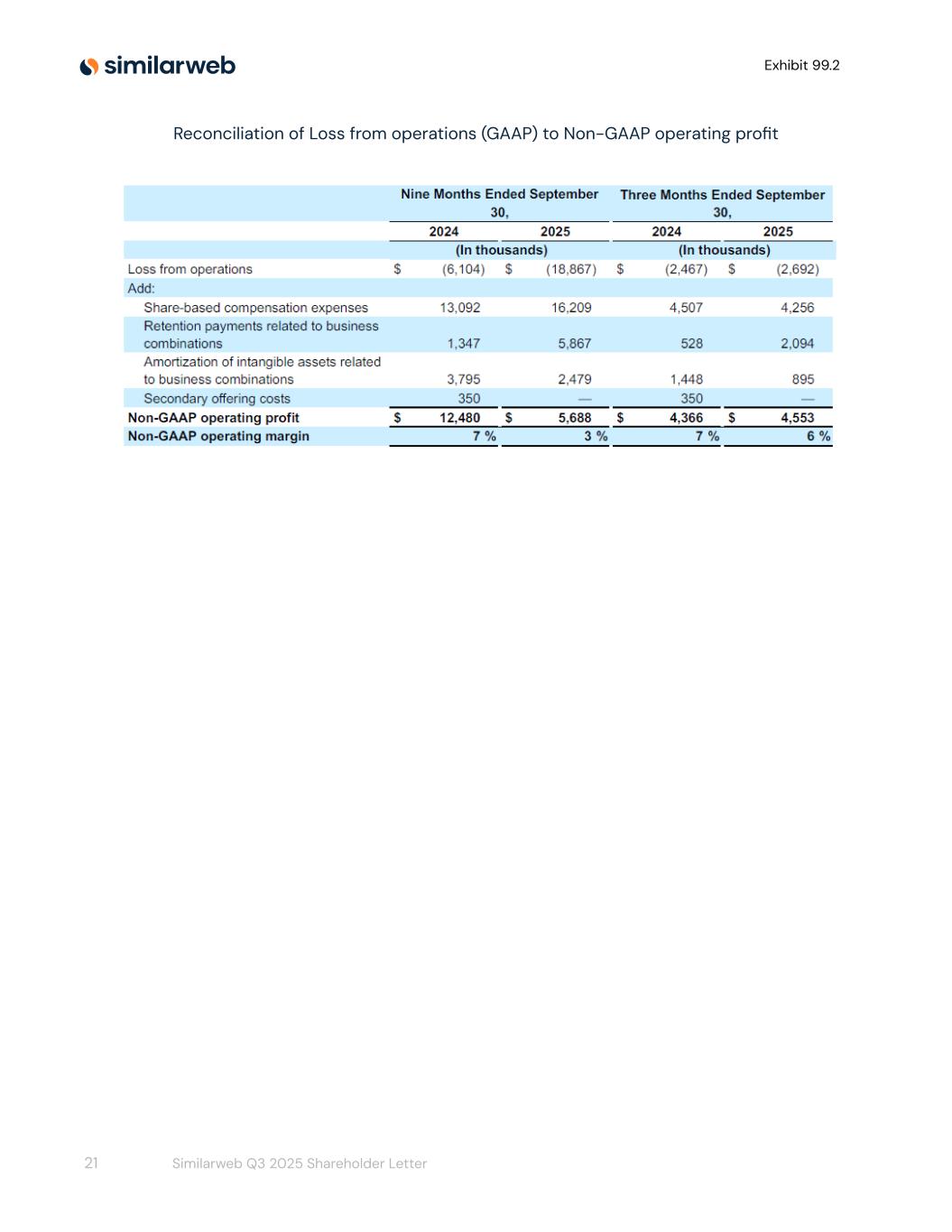

Reconciliation of Loss from operations (GAAP) to Non-GAAP operating profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(In thousands) |

(In thousands) |

| Loss from operations |

$ |

(6,104) |

|

|

$ |

(18,867) |

|

|

$ |

(2,467) |

|

|

$ |

(2,692) |

|

|

| Add: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

13,092 |

|

|

16,209 |

|

|

4,507 |

|

|

4,256 |

|

|

| Retention payments related to business combinations |

1,347 |

|

|

5,867 |

|

|

528 |

|

|

2,094 |

|

|

| Amortization of intangible assets related to business combinations |

3,795 |

|

|

2,479 |

|

|

1,448 |

|

|

895 |

|

|

| Secondary offering costs |

350 |

|

|

— |

|

|

350 |

|

|

— |

|

|

| Non-GAAP operating profit |

$ |

12,480 |

|

|

$ |

5,688 |

|

|

$ |

4,366 |

|

|

$ |

4,553 |

|

|

| Non-GAAP operating margin |

7 |

% |

|

3 |

% |

|

7 |

% |

|

6 |

% |

|

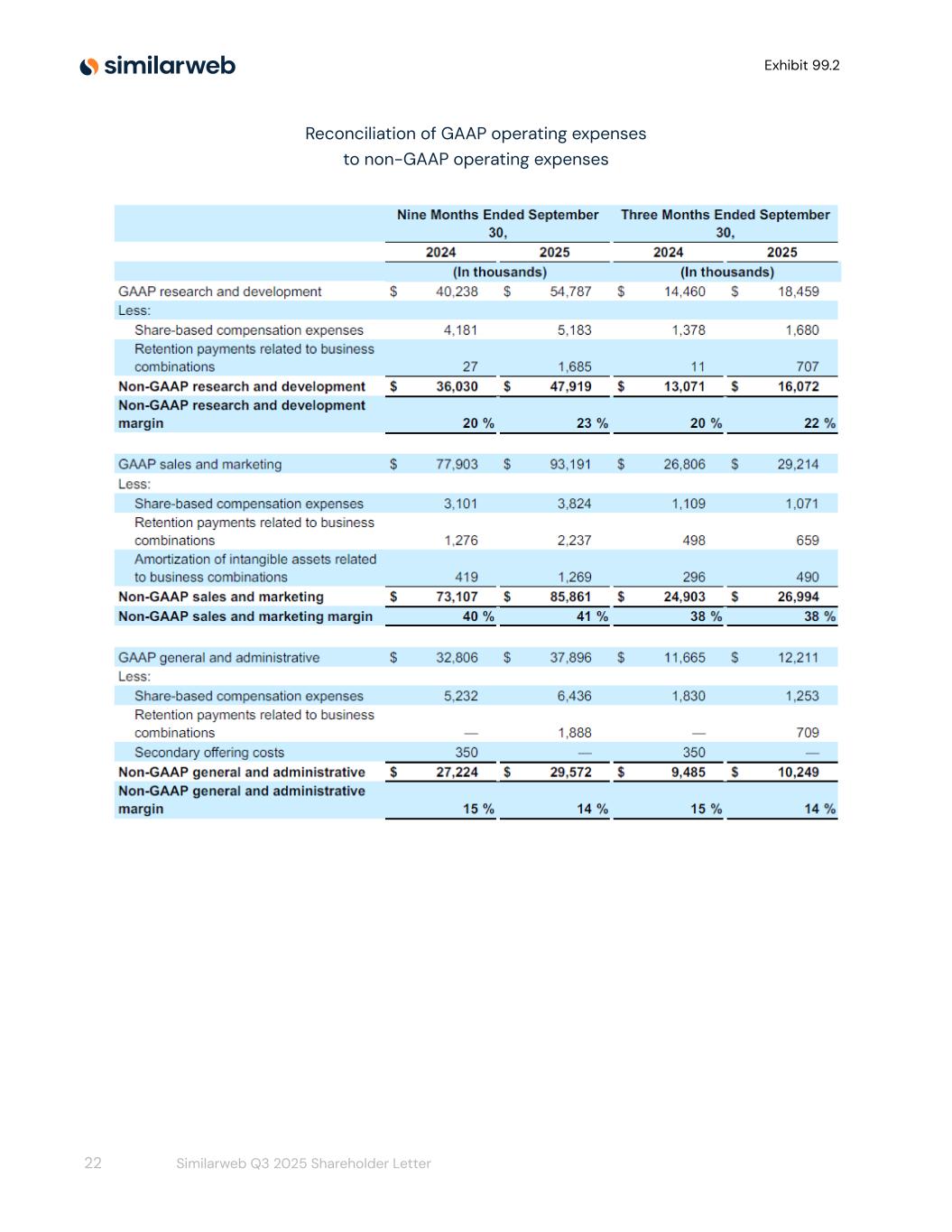

Reconciliation of GAAP operating expenses to non-GAAP operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(In thousands) |

(In thousands) |

| GAAP research and development |

$ |

40,238 |

|

|

$ |

54,787 |

|

|

$ |

14,460 |

|

|

$ |

18,459 |

|

|

| Less: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

4,181 |

|

|

5,183 |

|

|

1,378 |

|

|

1,680 |

|

|

| Retention payments related to business combinations |

27 |

|

|

1,685 |

|

|

11 |

|

|

707 |

|

|

| Non-GAAP research and development |

$ |

36,030 |

|

|

$ |

47,919 |

|

|

$ |

13,071 |

|

|

$ |

16,072 |

|

|

| Non-GAAP research and development margin |

20 |

% |

|

23 |

% |

|

20 |

% |

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

| GAAP sales and marketing |

$ |

77,903 |

|

|

$ |

93,191 |

|

|

$ |

26,806 |

|

|

$ |

29,214 |

|

|

| Less: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

3,101 |

|

|

3,824 |

|

|

1,109 |

|

|

1,071 |

|

|

| Retention payments related to business combinations |

1,276 |

|

|

2,237 |

|

|

498 |

|

|

659 |

|

|

| Amortization of intangible assets related to business combinations |

419 |

|

|

1,269 |

|

|

296 |

|

|

490 |

|

|

| Non-GAAP sales and marketing |

$ |

73,107 |

|

|

$ |

85,861 |

|

|

$ |

24,903 |

|

|

$ |

26,994 |

|

|

| Non-GAAP sales and marketing margin |

40 |

% |

|

41 |

% |

|

38 |

% |

|

38 |

% |

|

|

|

|

|

|

|

|

|

|

| GAAP general and administrative |

$ |

32,806 |

|

|

$ |

37,896 |

|

|

$ |

11,665 |

|

|

$ |

12,211 |

|

|

| Less: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

5,232 |

|

|

6,436 |

|

|

1,830 |

|

|

1,253 |

|

|

| Retention payments related to business combinations |

— |

|

|

1,888 |

|

|

— |

|

|

709 |

|

|

| Secondary offering costs |

350 |

|

|

— |

|

|

350 |

|

|

— |

|

|

| Non-GAAP general and administrative |

$ |

27,224 |

|

|

$ |

29,572 |

|

|

$ |

9,485 |

|

|

$ |

10,249 |

|

|

| Non-GAAP general and administrative margin |

15 |

% |

|

14 |

% |

|

15 |

% |

|

14 |

% |

|

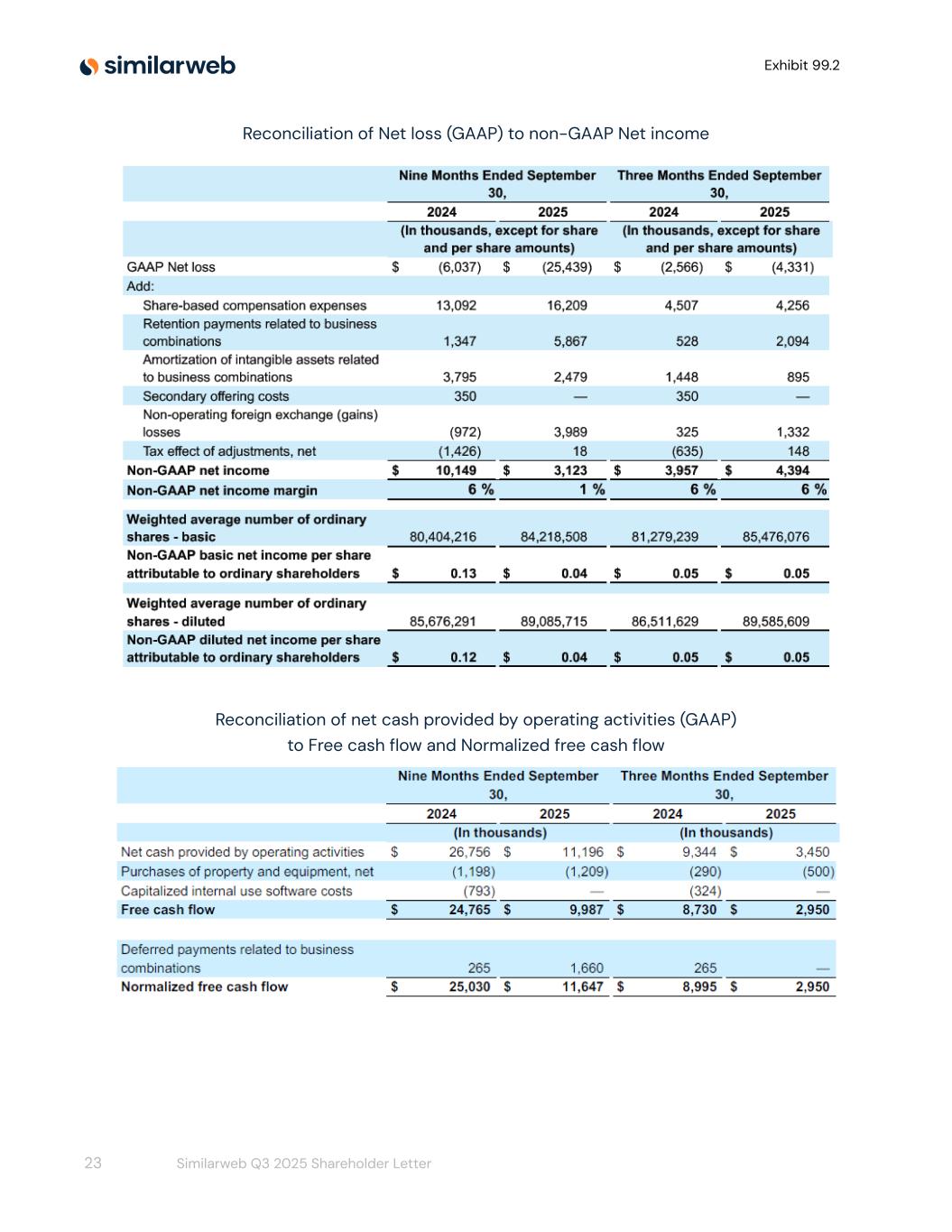

Reconciliation of Net loss (GAAP) to non-GAAP Net income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(In thousands, except for share and per share amounts) |

(In thousands, except for share and per share amounts) |

| GAAP Net loss |

$ |

(6,037) |

|

|

$ |

(25,439) |

|

|

$ |

(2,566) |

|

|

$ |

(4,331) |

|

|

| Add: |

|

|

|

|

|

|

|

|

| Share-based compensation expenses |

13,092 |

|

|

16,209 |

|

|

4,507 |

|

|

4,256 |

|

|

| Retention payments related to business combinations |

1,347 |

|

|

5,867 |

|

|

528 |

|

|

2,094 |

|

|

| Amortization of intangible assets related to business combinations |

3,795 |

|

|

2,479 |

|

|

1,448 |

|

|

895 |

|

|

| Secondary offering costs |

350 |

|

|

— |

|

|

350 |

|

|

— |

|

|

| Non-operating foreign exchange (gains) losses |

(972) |

|

|

3,989 |

|

|

325 |

|

|

1,332 |

|

|

| Tax effect of adjustments, net |

(1,426) |

|

|

18 |

|

|

(635) |

|

|

148 |

|

|

| Non-GAAP net income |

$ |

10,149 |

|

|

$ |

3,123 |

|

|

$ |

3,957 |

|

|

$ |

4,394 |

|

|

| Non-GAAP net income margin |

6 |

% |

|

1 |

% |

|

6 |

% |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

| Weighted average number of ordinary shares - basic |

80,404,216 |

|

|

84,218,508 |

|

|

81,279,239 |

|

|

85,476,076 |

|

|

| Non-GAAP basic net income per share attributable to ordinary shareholders |

$ |

0.13 |

|

|

$ |

0.04 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of ordinary shares - diluted |

85,676,291 |

|

|

89,085,715 |

|

|

86,511,629 |

|

|

89,585,609 |

|

|

| Non-GAAP diluted net income per share attributable to ordinary shareholders |

$ |

0.12 |

|

|

$ |

0.04 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

|

Reconciliation of Net cash provided by operating activities (GAAP) to Free cash flow and Normalized free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

Three Months Ended September 30, |

|

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

|

(In thousands) |

(In thousands) |

| Net cash provided by operating activities |

$ |

26,756 |

|

|

$ |

11,196 |

|

|

$ |

9,344 |

|

|

$ |

3,450 |

|

|

| Purchases of property and equipment, net |

(1,198) |

|

|

(1,209) |

|

|

(290) |

|

|

(500) |

|

|

| Capitalized internal use software costs |

(793) |

|

|

— |

|

|

(324) |

|

|

— |

|

|

| Free cash flow |

$ |

24,765 |

|

|

$ |

9,987 |

|

|

$ |

8,730 |

|

|

$ |

2,950 |

|

|

|

|

|

|

|

|

|

|

|

| Deferred payments related to business combinations |

265 |

|

|

1,660 |

|

|

265 |

|

|

— |

|

|

| Normalized free cash flow |

$ |

25,030 |

|

|

$ |

11,647 |

|

|

$ |

8,995 |

|

|

$ |

2,950 |

|

|