0001840776FALSEFY202312/31P3YP1YP1YP3Yhttp://fasb.org/us-gaap/2023#LiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LiabilitiesCurrentP2Y00018407762023-01-012023-12-310001840776us-gaap:CommonClassAMember2023-01-012023-12-310001840776us-gaap:WarrantMember2023-01-012023-12-3100018407762023-06-30iso4217:USD0001840776us-gaap:CommonClassAMember2024-03-01xbrli:shares0001840776hgty:CommonClassVMember2024-03-010001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2023-01-012023-12-31xbrli:pure0001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2022-01-012022-12-310001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2021-01-012021-12-3100018407762021-12-020001840776us-gaap:SubsequentEventMemberhgty:ConsolidatedNationalInsuranceCompanyCNICMember2024-01-122024-01-1200018407762022-01-012022-12-3100018407762023-12-310001840776hgty:SpeedDigitalAndBroadArrowMember2023-12-310001840776hgty:PrivatePlacementWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-12-31iso4217:USDxbrli:shares0001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-12-310001840776hgty:PIPEWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-12-310001840776us-gaap:MeasurementInputSharePriceMemberhgty:PrivatePlacementWarrantsMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-12-310001840776us-gaap:MeasurementInputSharePriceMemberhgty:PIPEWarrantsMember2023-12-310001840776us-gaap:MeasurementInputPriceVolatilityMemberhgty:PrivatePlacementWarrantsMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001840776us-gaap:MeasurementInputPriceVolatilityMemberhgty:PIPEWarrantsMember2023-12-310001840776hgty:PrivatePlacementWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-31hgty:year0001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001840776hgty:PIPEWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-12-310001840776hgty:PrivatePlacementWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001840776hgty:PIPEWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001840776us-gaap:MeasurementInputExpectedDividendRateMemberhgty:PrivatePlacementWarrantsMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-12-310001840776us-gaap:MeasurementInputExpectedDividendRateMemberhgty:PIPEWarrantsMember2023-12-310001840776hgty:CommissionRevenueAndFeeRevenueMember2023-01-012023-12-310001840776hgty:CommissionRevenueAndFeeRevenueMember2022-01-012022-12-310001840776hgty:CommissionRevenueAndFeeRevenueMember2021-01-012021-12-3100018407762021-01-012021-12-310001840776hgty:MembershipAndOtherRevenueMember2023-01-012023-12-310001840776hgty:MembershipAndOtherRevenueMember2022-01-012022-12-310001840776hgty:MembershipAndOtherRevenueMember2021-01-012021-12-310001840776us-gaap:CommonClassAMember2022-01-012022-12-310001840776us-gaap:CommonClassAMember2021-01-012021-12-3100018407762022-12-310001840776us-gaap:CommonClassAMember2022-12-310001840776us-gaap:CommonClassAMember2023-12-310001840776hgty:CommonClassVMember2022-12-310001840776hgty:CommonClassVMember2023-12-310001840776us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001840776hgty:CommonClassVMemberus-gaap:CommonStockMember2022-12-310001840776us-gaap:AdditionalPaidInCapitalMember2022-12-310001840776us-gaap:RetainedEarningsMember2022-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001840776us-gaap:ParentMember2022-12-310001840776us-gaap:NoncontrollingInterestMember2022-12-310001840776us-gaap:RetainedEarningsMember2023-01-012023-12-310001840776us-gaap:ParentMember2023-01-012023-12-310001840776us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001840776us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-01-012023-12-310001840776us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001840776us-gaap:SeriesAPreferredStockMemberus-gaap:PreferredStockMember2023-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001840776hgty:CommonClassVMemberus-gaap:CommonStockMember2023-12-310001840776us-gaap:AdditionalPaidInCapitalMember2023-12-310001840776us-gaap:RetainedEarningsMember2023-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001840776us-gaap:ParentMember2023-12-310001840776us-gaap:NoncontrollingInterestMember2023-12-3100018407762020-12-310001840776us-gaap:MemberUnitsMember2020-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001840776hgty:CommonClassVMemberus-gaap:CommonStockMember2020-12-310001840776us-gaap:AdditionalPaidInCapitalMember2020-12-310001840776us-gaap:RetainedEarningsMember2020-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001840776us-gaap:ParentMember2020-12-310001840776us-gaap:NoncontrollingInterestMember2020-12-310001840776us-gaap:RetainedEarningsMember2021-01-012021-12-310001840776us-gaap:ParentMember2021-01-012021-12-310001840776us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001840776us-gaap:MemberUnitsMember2021-01-012021-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-12-310001840776hgty:CommonClassVMemberus-gaap:CommonStockMember2021-01-012021-12-310001840776us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-3100018407762021-12-310001840776us-gaap:MemberUnitsMember2021-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001840776hgty:CommonClassVMemberus-gaap:CommonStockMember2021-12-310001840776us-gaap:AdditionalPaidInCapitalMember2021-12-310001840776us-gaap:RetainedEarningsMember2021-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001840776us-gaap:ParentMember2021-12-310001840776us-gaap:NoncontrollingInterestMember2021-12-310001840776us-gaap:RetainedEarningsMember2022-01-012022-12-310001840776us-gaap:ParentMember2022-01-012022-12-310001840776us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001840776us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001840776us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001840776us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001840776srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2021-12-310001840776us-gaap:ParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001840776srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:NoncontrollingInterestMember2021-12-310001840776srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001840776us-gaap:MemberUnitsMember2022-12-310001840776srt:ParentCompanyMember2023-01-012023-12-310001840776srt:ParentCompanyMember2022-01-012022-12-310001840776srt:ParentCompanyMember2021-01-012021-12-310001840776hgty:TheHagertyGroupLLCMember2023-01-012023-12-310001840776hgty:TheHagertyGroupLLCMember2022-01-012022-12-310001840776hgty:MemberHubsHoldingLLCMemberhgty:TheHagertyGroupLLCMember2023-01-012023-12-310001840776hgty:MemberHubsHoldingLLCMemberhgty:TheHagertyGroupLLCMember2022-01-012022-12-310001840776us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001840776us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-31hgty:segment0001840776hgty:BroadArrowGroupIncMember2023-01-012023-12-310001840776srt:MinimumMemberus-gaap:ComputerEquipmentMember2023-12-310001840776us-gaap:AutomobilesMembersrt:MaximumMember2023-12-310001840776us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001840776srt:MinimumMember2023-12-310001840776srt:MaximumMember2023-12-310001840776us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310001840776us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310001840776us-gaap:SalesRevenueNetMemberhgty:TheHagertyGroupLLCMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001840776hgty:LaborAndRelatedExpenseMemberMember2023-01-012023-12-310001840776hgty:LaborAndRelatedExpenseMemberMember2022-01-012022-12-310001840776hgty:LaborAndRelatedExpenseMemberMember2021-01-012021-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberhgty:CommissionAndFeeRevenueMember2023-01-012023-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberhgty:CommissionAndFeeRevenueMember2023-01-012023-12-310001840776hgty:CommissionAndFeeRevenueMember2023-01-012023-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-12-310001840776hgty:ContingentCommissionMember2023-01-012023-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberus-gaap:MembershipMember2023-01-012023-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberus-gaap:MembershipMember2023-01-012023-12-310001840776us-gaap:MembershipMember2023-01-012023-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-12-310001840776us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001840776us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberhgty:CommissionAndFeeRevenueMember2022-01-012022-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberhgty:CommissionAndFeeRevenueMember2022-01-012022-12-310001840776hgty:CommissionAndFeeRevenueMember2022-01-012022-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelThroughIntermediaryMember2022-01-012022-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelDirectlyToConsumerMember2022-01-012022-12-310001840776hgty:ContingentCommissionMember2022-01-012022-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberus-gaap:MembershipMember2022-01-012022-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberus-gaap:MembershipMember2022-01-012022-12-310001840776us-gaap:MembershipMember2022-01-012022-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelThroughIntermediaryMember2022-01-012022-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelDirectlyToConsumerMember2022-01-012022-12-310001840776us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001840776us-gaap:SalesChannelThroughIntermediaryMember2022-01-012022-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMember2022-01-012022-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberhgty:CommissionAndFeeRevenueMember2021-01-012021-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberhgty:CommissionAndFeeRevenueMember2021-01-012021-12-310001840776hgty:CommissionAndFeeRevenueMember2021-01-012021-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-12-310001840776hgty:ContingentCommissionMemberus-gaap:SalesChannelDirectlyToConsumerMember2021-01-012021-12-310001840776hgty:ContingentCommissionMember2021-01-012021-12-310001840776us-gaap:SalesChannelThroughIntermediaryMemberus-gaap:MembershipMember2021-01-012021-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMemberus-gaap:MembershipMember2021-01-012021-12-310001840776us-gaap:MembershipMember2021-01-012021-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-12-310001840776us-gaap:ProductAndServiceOtherMemberus-gaap:SalesChannelDirectlyToConsumerMember2021-01-012021-12-310001840776us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001840776us-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-12-310001840776us-gaap:SalesChannelDirectlyToConsumerMember2021-01-012021-12-310001840776country:UShgty:CommissionAndFeeRevenueMember2023-01-012023-12-310001840776country:CAhgty:CommissionAndFeeRevenueMember2023-01-012023-12-310001840776hgty:CommissionAndFeeRevenueMembersrt:EuropeMember2023-01-012023-12-310001840776country:UShgty:ContingentCommissionMember2023-01-012023-12-310001840776country:CAhgty:ContingentCommissionMember2023-01-012023-12-310001840776hgty:ContingentCommissionMembersrt:EuropeMember2023-01-012023-12-310001840776country:USus-gaap:MembershipMember2023-01-012023-12-310001840776country:CAus-gaap:MembershipMember2023-01-012023-12-310001840776us-gaap:MembershipMembersrt:EuropeMember2023-01-012023-12-310001840776country:USus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001840776us-gaap:ProductAndServiceOtherMembercountry:CA2023-01-012023-12-310001840776us-gaap:ProductAndServiceOtherMembersrt:EuropeMember2023-01-012023-12-310001840776country:US2023-01-012023-12-310001840776country:CA2023-01-012023-12-310001840776srt:EuropeMember2023-01-012023-12-310001840776country:UShgty:CommissionAndFeeRevenueMember2022-01-012022-12-310001840776country:CAhgty:CommissionAndFeeRevenueMember2022-01-012022-12-310001840776hgty:CommissionAndFeeRevenueMembersrt:EuropeMember2022-01-012022-12-310001840776country:UShgty:ContingentCommissionMember2022-01-012022-12-310001840776country:CAhgty:ContingentCommissionMember2022-01-012022-12-310001840776hgty:ContingentCommissionMembersrt:EuropeMember2022-01-012022-12-310001840776country:USus-gaap:MembershipMember2022-01-012022-12-310001840776country:CAus-gaap:MembershipMember2022-01-012022-12-310001840776us-gaap:MembershipMembersrt:EuropeMember2022-01-012022-12-310001840776country:USus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001840776us-gaap:ProductAndServiceOtherMembercountry:CA2022-01-012022-12-310001840776us-gaap:ProductAndServiceOtherMembersrt:EuropeMember2022-01-012022-12-310001840776country:US2022-01-012022-12-310001840776country:CA2022-01-012022-12-310001840776srt:EuropeMember2022-01-012022-12-310001840776country:UShgty:CommissionAndFeeRevenueMember2021-01-012021-12-310001840776country:CAhgty:CommissionAndFeeRevenueMember2021-01-012021-12-310001840776hgty:CommissionAndFeeRevenueMembersrt:EuropeMember2021-01-012021-12-310001840776country:UShgty:ContingentCommissionMember2021-01-012021-12-310001840776country:CAhgty:ContingentCommissionMember2021-01-012021-12-310001840776hgty:ContingentCommissionMembersrt:EuropeMember2021-01-012021-12-310001840776country:USus-gaap:MembershipMember2021-01-012021-12-310001840776country:CAus-gaap:MembershipMember2021-01-012021-12-310001840776us-gaap:MembershipMembersrt:EuropeMember2021-01-012021-12-310001840776country:USus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001840776us-gaap:ProductAndServiceOtherMembercountry:CA2021-01-012021-12-310001840776us-gaap:ProductAndServiceOtherMembersrt:EuropeMember2021-01-012021-12-310001840776country:US2021-01-012021-12-310001840776country:CA2021-01-012021-12-310001840776srt:EuropeMember2021-01-012021-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2023-12-180001840776us-gaap:ShortTermContractWithCustomerMember2023-01-012023-12-310001840776us-gaap:FinanceReceivablesMemberus-gaap:CustomerConcentrationRiskMember2023-12-310001840776us-gaap:FinanceReceivablesMemberus-gaap:CustomerConcentrationRiskMemberhgty:Borrower1Member2023-01-012023-12-310001840776us-gaap:FinanceReceivablesMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001840776us-gaap:LandAndLandImprovementsMember2023-12-310001840776us-gaap:LandAndLandImprovementsMember2022-12-310001840776us-gaap:BuildingMember2023-12-310001840776us-gaap:BuildingMember2022-12-310001840776us-gaap:LeaseholdImprovementsMember2023-12-310001840776us-gaap:LeaseholdImprovementsMember2022-12-310001840776us-gaap:FurnitureAndFixturesMember2023-12-310001840776us-gaap:FurnitureAndFixturesMember2022-12-310001840776hgty:ComputerEquipmentAndSoftwareMember2023-12-310001840776hgty:ComputerEquipmentAndSoftwareMember2022-12-310001840776us-gaap:AutomobilesMember2023-12-310001840776us-gaap:AutomobilesMember2022-12-3100018407762022-01-012022-01-010001840776hgty:MemberHubsHoldingLLCMember2023-07-012023-09-300001840776hgty:HagertyDriveShareLLCMember2023-07-012023-09-3000018407762021-12-022021-12-020001840776hgty:PIPEWarrantsMember2021-12-020001840776hgty:HagertyHoldingCorpMember2021-12-022021-12-020001840776us-gaap:MemberUnitsMemberhgty:HagertyHoldingCorpMember2021-12-022021-12-020001840776hgty:CommonClassVMemberhgty:HagertyHoldingCorpMember2021-12-022021-12-020001840776hgty:MarkelMemberus-gaap:MemberUnitsMember2021-12-022021-12-020001840776hgty:MarkelMemberhgty:CommonClassVMember2021-12-022021-12-020001840776hgty:AldelMemberus-gaap:CommonClassAMember2021-12-022021-12-310001840776hgty:AldelMemberus-gaap:CommonClassAMember2021-12-010001840776hgty:AldelMemberus-gaap:CommonClassAMember2021-12-020001840776hgty:AldelMemberus-gaap:CommonClassAMember2021-12-022021-12-020001840776us-gaap:CommonClassAMember2021-12-020001840776hgty:CommonClassVMember2021-12-020001840776us-gaap:AdditionalPaidInCapitalMember2021-12-020001840776hgty:BroadArrowGroupIncMember2022-01-012022-01-310001840776hgty:BroadArrowGroupIncMember2022-01-310001840776hgty:BroadArrowGroupIncMember2022-08-310001840776hgty:BroadArrowGroupIncMember2022-08-162022-08-160001840776hgty:BroadArrowGroupIncMember2022-08-160001840776hgty:BroadArrowGroupIncMember2022-08-012022-08-310001840776hgty:BroadArrowGroupIncMember2022-07-012022-09-300001840776us-gaap:TradeNamesMemberhgty:BroadArrowGroupIncMember2022-08-310001840776us-gaap:TradeNamesMemberhgty:BroadArrowGroupIncMember2022-08-012022-08-310001840776hgty:SpeedDigitalLLCMember2022-04-012022-04-300001840776hgty:SpeedDigitalLLCMember2022-04-300001840776hgty:SpeedDigitalLLCMembersrt:DirectorMember2022-04-012022-04-300001840776hgty:MemberHubsHoldingLLCMember2023-09-290001840776hgty:MemberHubsHoldingLLCMemberhgty:HagertyVenturesLLCMember2023-09-292023-09-290001840776hgty:MemberHubsHoldingLLCMember2023-07-012023-09-300001840776hgty:HagertyDriveShareLLCMember2023-10-092023-10-090001840776hgty:HagertyDriveShareLLCMember2023-07-012023-09-300001840776srt:WeightedAverageMemberus-gaap:CustomerContractsMember2023-12-310001840776us-gaap:CustomerContractsMember2023-12-310001840776us-gaap:CustomerContractsMember2022-12-310001840776us-gaap:ComputerSoftwareIntangibleAssetMembersrt:WeightedAverageMember2023-12-310001840776us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001840776us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001840776srt:WeightedAverageMemberus-gaap:TrademarksAndTradeNamesMember2023-12-310001840776us-gaap:TrademarksAndTradeNamesMember2023-12-310001840776us-gaap:TrademarksAndTradeNamesMember2022-12-310001840776us-gaap:CustomerRelatedIntangibleAssetsMembersrt:WeightedAverageMember2023-12-310001840776us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310001840776us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310001840776srt:WeightedAverageMemberus-gaap:OtherIntangibleAssetsMember2023-12-310001840776us-gaap:OtherIntangibleAssetsMember2023-12-310001840776us-gaap:OtherIntangibleAssetsMember2022-12-310001840776hgty:MemberHubsHoldingLLCMemberus-gaap:CustomerRelatedIntangibleAssetsMember2023-07-012023-09-300001840776hgty:AutoInsurancePolicyMember2023-12-310001840776hgty:AutoInsurancePolicyMember2022-12-310001840776hgty:MarineInsurancePolicyMember2023-12-310001840776hgty:MarineInsurancePolicyMember2022-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2019-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2020-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2021-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2022-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2019Member2023-12-31hgty:claim0001840776us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberhgty:AutoInsurancePolicyMember2020-12-310001840776us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberhgty:AutoInsurancePolicyMember2021-12-310001840776us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberhgty:AutoInsurancePolicyMember2022-12-310001840776us-gaap:ShortDurationInsuranceContractAccidentYear2020Memberhgty:AutoInsurancePolicyMember2023-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2021-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2022-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2021Member2023-12-310001840776us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberhgty:AutoInsurancePolicyMember2022-12-310001840776us-gaap:ShortDurationInsuranceContractAccidentYear2022Memberhgty:AutoInsurancePolicyMember2023-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2023Member2022-12-310001840776hgty:AutoInsurancePolicyMemberus-gaap:ShortDurationInsuranceContractAccidentYear2023Member2023-12-310001840776hgty:VariousReinsurersMember2023-01-012023-12-31hgty:letter_of_credit0001840776Catastrophe Reinsurance Layer One2023-01-012023-12-310001840776Catastrophe Reinsurance Layer Two2023-01-012023-12-310001840776hgty:VariousReinsurersMemberCatastrophe Program - High Net Worth2023-01-012023-01-010001840776hgty:EvanstonInsuranceCompanyMemberus-gaap:SubsequentEventMemberCatastrophe Program - High Net Worth2024-01-012024-01-010001840776us-gaap:SubsequentEventMemberhgty:VariousReinsurersMemberCatastrophe Program - High Net Worth2024-01-012024-01-010001840776us-gaap:LineOfCreditMemberhgty:StateFarmTermLoanFacilityMember2023-09-190001840776hgty:ReductionInForceMember2022-01-012022-12-310001840776hgty:VoluntaryRetirementProgramMember2022-01-012022-12-310001840776hgty:ReductionInForceMember2023-01-012023-12-310001840776us-gaap:InterestRateSwapMember2023-12-31hgty:swap0001840776us-gaap:InterestRateSwapMember2022-12-310001840776hgty:PublicWarrantsMember2023-12-310001840776hgty:PublicWarrantsMember2022-12-310001840776hgty:PrivatePlacementWarrantsMember2023-12-310001840776hgty:PrivatePlacementWarrantsMember2022-12-310001840776hgty:UnderwriterWarrantsMember2023-12-310001840776hgty:UnderwriterWarrantsMember2022-12-310001840776hgty:OTMWarrantsMember2023-12-310001840776hgty:OTMWarrantsMember2022-12-310001840776hgty:PIPEWarrantsMember2023-12-310001840776hgty:PIPEWarrantsMember2022-12-310001840776us-gaap:MeasurementInputExpectedDividendRateMember2023-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberhgty:PrivatePlacementWarrantsMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberhgty:PrivatePlacementWarrantsMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberhgty:PrivatePlacementWarrantsMember2023-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberhgty:PrivatePlacementWarrantsMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberhgty:PIPEWarrantsMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberhgty:PIPEWarrantsMember2023-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberhgty:PIPEWarrantsMember2023-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberhgty:PIPEWarrantsMember2023-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001840776us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001840776hgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberhgty:PrivatePlacementWarrantsMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberhgty:PrivatePlacementWarrantsMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberhgty:PrivatePlacementWarrantsMember2022-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberhgty:PrivatePlacementWarrantsMember2022-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001840776hgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:UnderwriterWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001840776hgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001840776us-gaap:FairValueInputsLevel3Memberhgty:OTMWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberhgty:PIPEWarrantsMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberhgty:PIPEWarrantsMember2022-12-310001840776us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberhgty:PIPEWarrantsMember2022-12-310001840776us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberhgty:PIPEWarrantsMember2022-12-310001840776hgty:PrivatePlacementWarrantsMemberhgty:WarrantLiabilitiesMember2021-12-310001840776hgty:UnderwriterWarrantsMemberhgty:WarrantLiabilitiesMember2021-12-310001840776hgty:OTMWarrantsMemberhgty:WarrantLiabilitiesMember2021-12-310001840776hgty:WarrantLiabilitiesMemberhgty:PIPEWarrantsMember2021-12-310001840776hgty:WarrantLiabilitiesMember2021-12-310001840776hgty:PrivatePlacementWarrantsMemberhgty:WarrantLiabilitiesMember2022-01-012022-12-310001840776hgty:UnderwriterWarrantsMemberhgty:WarrantLiabilitiesMember2022-01-012022-12-310001840776hgty:OTMWarrantsMemberhgty:WarrantLiabilitiesMember2022-01-012022-12-310001840776hgty:WarrantLiabilitiesMemberhgty:PIPEWarrantsMember2022-01-012022-12-310001840776hgty:WarrantLiabilitiesMember2022-01-012022-12-310001840776hgty:PrivatePlacementWarrantsMemberhgty:WarrantLiabilitiesMember2022-12-310001840776hgty:UnderwriterWarrantsMemberhgty:WarrantLiabilitiesMember2022-12-310001840776hgty:OTMWarrantsMemberhgty:WarrantLiabilitiesMember2022-12-310001840776hgty:WarrantLiabilitiesMemberhgty:PIPEWarrantsMember2022-12-310001840776hgty:WarrantLiabilitiesMember2022-12-310001840776hgty:PrivatePlacementWarrantsMemberhgty:WarrantLiabilitiesMember2023-01-012023-12-310001840776hgty:UnderwriterWarrantsMemberhgty:WarrantLiabilitiesMember2023-01-012023-12-310001840776hgty:OTMWarrantsMemberhgty:WarrantLiabilitiesMember2023-01-012023-12-310001840776hgty:WarrantLiabilitiesMemberhgty:PIPEWarrantsMember2023-01-012023-12-310001840776hgty:WarrantLiabilitiesMember2023-01-012023-12-310001840776hgty:PrivatePlacementWarrantsMemberhgty:WarrantLiabilitiesMember2023-12-310001840776hgty:UnderwriterWarrantsMemberhgty:WarrantLiabilitiesMember2023-12-310001840776hgty:OTMWarrantsMemberhgty:WarrantLiabilitiesMember2023-12-310001840776hgty:WarrantLiabilitiesMemberhgty:PIPEWarrantsMember2023-12-310001840776hgty:WarrantLiabilitiesMember2023-12-310001840776hgty:PIPEWarrantsMember2022-01-012022-12-310001840776hgty:PIPEWarrantsMember2023-01-012023-12-310001840776us-gaap:FixedIncomeSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001840776us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001840776us-gaap:FixedIncomeSecuritiesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001840776us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2022-12-310001840776us-gaap:RevolvingCreditFacilityMemberhgty:JPMCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001840776us-gaap:RevolvingCreditFacilityMemberhgty:JPMCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001840776hgty:BACCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001840776hgty:BACCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001840776us-gaap:LineOfCreditMemberhgty:StateFarmTermLoanFacilityMember2023-12-310001840776us-gaap:LineOfCreditMemberhgty:StateFarmTermLoanFacilityMember2022-12-310001840776us-gaap:NotesPayableOtherPayablesMember2023-12-310001840776us-gaap:NotesPayableOtherPayablesMember2022-12-310001840776us-gaap:LetterOfCreditMemberhgty:JPMCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001840776us-gaap:RevolvingCreditFacilityMemberhgty:JPMCreditFacilityMemberus-gaap:ForeignLineOfCreditMember2023-12-310001840776hgty:BACCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-210001840776hgty:BACCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001840776country:GBus-gaap:NotesPayableOtherPayablesMember2023-12-310001840776country:GBus-gaap:NotesPayableOtherPayablesMember2022-12-310001840776srt:MinimumMembercountry:GBus-gaap:NotesPayableOtherPayablesMember2023-12-310001840776country:GBsrt:MaximumMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001840776us-gaap:SeriesAPreferredStockMember2023-06-232023-06-230001840776us-gaap:SeriesAPreferredStockMember2023-06-230001840776us-gaap:SeriesAPreferredStockMember2023-12-310001840776us-gaap:SeriesAPreferredStockMember2023-01-012023-12-31hgty:consecutiveTradingDay0001840776us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:CommonClassAMember2023-01-012023-12-310001840776us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:CommonClassAMember2023-01-012023-12-310001840776us-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeriesAPreferredStockMemberhgty:ChangeOfControlMember2023-01-012023-12-310001840776us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SeriesAPreferredStockMemberhgty:ChangeOfControlMember2023-01-012023-12-310001840776us-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SeriesAPreferredStockMemberhgty:ChangeOfControlMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:SeriesAPreferredStockMember2023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:DebtInstrumentRedemptionPeriodFourMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:SeriesAPreferredStockMemberus-gaap:DebtInstrumentRedemptionPeriodFiveMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberhgty:DebtInstrumentRedemptionPeriodSixMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberus-gaap:SeriesAPreferredStockMemberhgty:DebtInstrumentRedemptionPeriodSevenMember2023-01-012023-12-310001840776hgty:FundamentalTransactionMemberhgty:DebtInstrumentRedemptionPeriodEightMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776us-gaap:DebtInstrumentRedemptionPeriodFourMemberhgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMemberus-gaap:DebtInstrumentRedemptionPeriodFiveMember2023-01-012023-12-310001840776hgty:DebtInstrumentRedemptionPeriodSixMemberhgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776hgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMemberhgty:DebtInstrumentRedemptionPeriodSevenMember2023-01-012023-12-310001840776hgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMemberhgty:DebtInstrumentRedemptionPeriodThirteenMember2023-01-012023-12-310001840776hgty:OptionalTermRedemptionMemberus-gaap:SeriesAPreferredStockMemberhgty:DebtInstrumentRedemptionPeriodFourteenMember2023-01-012023-12-31hgty:vote0001840776hgty:CommonClassVMember2023-01-012023-12-310001840776us-gaap:ConvertiblePreferredStockMember2023-12-310001840776hgty:TheHagertyGroupLLCMember2023-12-310001840776hgty:TheHagertyGroupLLCMember2022-12-3100018407762022-01-012022-03-230001840776us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-230001840776us-gaap:RetainedEarningsMember2022-01-012022-03-2300018407762022-03-230001840776us-gaap:RetainedEarningsMember2022-03-232022-03-230001840776us-gaap:AdditionalPaidInCapitalMember2022-03-232022-03-230001840776us-gaap:NoncontrollingInterestMember2022-03-232022-03-230001840776hgty:HagertyGroupUnitsMember2023-01-012023-12-310001840776hgty:HagertyGroupUnitsMember2022-01-012022-12-310001840776hgty:HagertyGroupUnitsMember2021-01-012021-12-310001840776us-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001840776us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001840776us-gaap:SeriesAPreferredStockMember2021-01-012021-12-310001840776us-gaap:StockCompensationPlanMember2023-01-012023-12-310001840776us-gaap:StockCompensationPlanMember2022-01-012022-12-310001840776us-gaap:StockCompensationPlanMember2021-01-012021-12-310001840776us-gaap:WarrantMember2023-01-012023-12-310001840776us-gaap:WarrantMember2022-01-012022-12-310001840776us-gaap:WarrantMember2021-01-012021-12-310001840776hgty:A2021StockIncentivePlanMemberus-gaap:CommonClassAMember2021-12-310001840776hgty:A2021StockIncentivePlanMember2023-12-310001840776us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001840776us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001840776us-gaap:PerformanceSharesMember2023-01-012023-12-310001840776us-gaap:PerformanceSharesMember2022-01-012022-12-310001840776hgty:EmployeeStockPurchasePlanMember2023-01-012023-12-310001840776hgty:EmployeeStockPurchasePlanMember2022-01-012022-12-310001840776us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310001840776us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-12-310001840776us-gaap:RestrictedStockUnitsRSUMember2023-12-310001840776us-gaap:RestrictedStockUnitsRSUMember2022-12-310001840776us-gaap:PerformanceSharesMember2022-04-012022-04-300001840776us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMember2022-04-012022-04-300001840776us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMember2022-04-30utr:D0001840776us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMember2022-04-012022-04-300001840776us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMember2022-04-300001840776us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:PerformanceSharesMember2022-04-012022-04-300001840776us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:PerformanceSharesMember2022-04-300001840776srt:MinimumMemberus-gaap:PerformanceSharesMember2022-04-012022-04-300001840776srt:MaximumMemberus-gaap:PerformanceSharesMember2022-04-012022-04-300001840776us-gaap:PerformanceSharesMember2023-12-310001840776us-gaap:PerformanceSharesMember2022-12-310001840776hgty:EmployeeStockPurchasePlanMemberus-gaap:CommonClassAMember2021-01-012021-03-310001840776hgty:EmployeeStockPurchasePlanOneMemberus-gaap:CommonClassAMember2021-01-012021-03-310001840776hgty:EmployeeStockPurchasePlanTwoMemberus-gaap:CommonClassAMember2021-01-012021-03-310001840776hgty:EmployeeStockPurchasePlanMemberus-gaap:CommonClassAMember2023-01-012023-12-310001840776hgty:EmployeeStockPurchasePlanMemberus-gaap:CommonClassAMember2023-12-310001840776us-gaap:ForeignCountryMember2023-12-310001840776us-gaap:ForeignCountryMember2022-12-310001840776hgty:Expiring2036Member2023-12-310001840776hgty:Expiring2037Member2023-12-310001840776hgty:Expiring2038Member2023-12-310001840776hgty:Expiring2039Member2023-12-310001840776hgty:Expiring2040Member2023-12-310001840776hgty:Expiring2041Member2023-12-310001840776hgty:Expiring2042Member2023-12-310001840776hgty:Expiring2043Member2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:HagertyIncMemberus-gaap:CommonClassAMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:HagertyIncMemberhgty:StateFarmMemberus-gaap:CommonClassAMember2023-12-310001840776hgty:MarkelMemberhgty:CommonClassVMembersrt:AffiliatedEntityMemberhgty:HagertyIncMember2023-12-310001840776hgty:CommonClassVMembersrt:AffiliatedEntityMemberhgty:HagertyIncMemberhgty:StateFarmMember2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:HagertyIncMemberus-gaap:SeriesAPreferredStockMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:HagertyIncMemberus-gaap:SeriesAPreferredStockMemberhgty:StateFarmMember2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:HagertyIncMemberhgty:HagertyGroupUnitsMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:HagertyIncMemberhgty:HagertyGroupUnitsMemberhgty:StateFarmMember2023-12-310001840776us-gaap:ParentMemberhgty:MarkelMembersrt:AffiliatedEntityMemberhgty:HagertyIncMember2023-12-310001840776us-gaap:ParentMembersrt:AffiliatedEntityMemberhgty:HagertyIncMemberhgty:StateFarmMember2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberus-gaap:NoncontrollingInterestMemberhgty:HagertyIncMember2023-12-310001840776srt:AffiliatedEntityMemberus-gaap:NoncontrollingInterestMemberhgty:HagertyIncMemberhgty:StateFarmMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:StateFarmMember2020-01-012020-12-310001840776srt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:StateFarmMember2023-09-30hgty:state0001840776srt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:StateFarmMember2020-12-310001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2023-03-012023-03-010001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMemberhgty:StateFarmMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMemberhgty:StateFarmMember2023-01-012023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2023-12-182023-12-180001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMembersrt:MinimumMember2023-12-180001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMembersrt:MaximumMember2023-12-180001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2022-12-310001840776hgty:DueToRelatedPartiesMemberhgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:RelatedPartyConcentrationRiskMember2023-01-012023-12-310001840776hgty:DueToRelatedPartiesMemberhgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:RelatedPartyConcentrationRiskMember2022-01-012022-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2023-01-012023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2022-01-012022-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMember2021-01-012021-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:RelatedPartyConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:RelatedPartyConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:AllianceAgreementMemberhgty:RelatedPartyConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMembercountry:GB2023-01-012023-12-310001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMembercountry:GB2022-01-012022-12-310001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2022-12-312022-12-310001840776hgty:ReinsuranceAgreementMembersrt:AffiliatedEntityMember2023-01-012023-01-010001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMember2023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMember2022-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMember2023-01-012023-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMember2022-01-012022-12-310001840776hgty:MarkelMembersrt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMember2021-01-012021-12-310001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMemberhgty:EvanstonMember2023-12-310001840776srt:AffiliatedEntityMemberhgty:ReinsuranceAgreementMemberhgty:EvanstonMember2022-12-310001840776srt:ParentCompanyMember2023-12-310001840776srt:ParentCompanyMember2022-12-310001840776srt:ParentCompanyMemberus-gaap:CommonClassAMember2022-12-310001840776srt:ParentCompanyMemberus-gaap:CommonClassAMember2023-12-310001840776hgty:CommonClassVMembersrt:ParentCompanyMember2022-12-310001840776hgty:CommonClassVMembersrt:ParentCompanyMember2023-12-310001840776srt:ParentCompanyMember2021-12-310001840776srt:ParentCompanyMember2020-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001840776us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-3100018407762023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to _______

Commission file number: 001-40244

HAGERTY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware |

|

86-1213144 |

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

121 Drivers Edge, Traverse City, Michigan |

|

49684 |

| (Address of principal executive offices) |

|

(Zip code) |

|

|

|

|

(800) 922-4050 |

|

|

Registrant's telephone number, including area code |

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

HGTY |

|

The New York Stock Exchange |

Warrants, each whole warrant exercisable for one share

of Class A common stock, each at an exercise price of

$11.50 per share |

|

HGTY.WS |

|

The New York Stock Exchange |

|

|

|

|

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $9.36 for shares of the Registrant’s Class A Common Stock as reported by the New York Stock Exchange, was approximately $231.8 million. Shares of common stock beneficially owned by each executive officer, director, and holders of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 84,655,539 shares of Class A Common Stock outstanding and 251,033,906 shares of Class V Common Stock outstanding as of March 1, 2024.

Documents incorporated by reference:

Portions of the registrant's definitive Proxy Statement for its 2024 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2023, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

Table of Contents

Where You Can Find More Information

In this Annual Report on Form 10-K (this "Annual Report"), "we," "our," "us," "Hagerty," "HGTY," and the "Company" refer to Hagerty, Inc., formerly known as Aldel Financial Inc. ("Aldel"), and its consolidated subsidiaries including The Hagerty Group, LLC ("The Hagerty Group"), unless the context requires otherwise. We file annual, quarterly, and current reports, proxy statements and other information with the United States Securities and Exchange Commission (the "SEC"). General information about us can be found at investor.hagerty.com. Our Annual Report, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our website at investor.hagerty.com as soon as reasonably practicable after we file them with, or furnish them to, the SEC. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements, and other information regarding SEC registrants, including Hagerty, Inc.

We use our investor relations website, investor.hagerty.com, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media channels. Information contained on or accessible through, including any reports available on, our website or social media channels is not a part of, and is not incorporated by reference into, this Annual Report or any other report or document we file with the SEC. Any reference to our website in this Form 10-K is intended to be an inactive textual reference only.

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report, as well as information included in oral statements or other written statements made by us, contain statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Annual Report other than statements of historical fact, are forward-looking statements, including statements regarding our future operating results and financial position, our business strategy and plans, products, services, and technology offerings, market conditions, growth and trends, expansion plans and opportunities, and our objectives for future operations. Forward-looking statements can be identified by words such as "anticipate," "believe," "envision," "estimate," "expect," "intend," "may," "plan," "predict," "project," "target," "potential," "will," "would," "could," "should," "continue," "ongoing," "contemplate," and other similar expressions, although not all forward-looking statements contain these identifying words.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in Part I, Item 1A. "Risk Factors" in this Annual Report. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements include, among other things, our ability to:

•compete effectively within our industry and attract and retain our insurance policyholders and paid HDC subscribers (collectively, "Members");

•maintain key strategic relationships with our insurance distribution and underwriting carrier partners;

•prevent, monitor, and detect fraudulent activity;

•manage risks associated with disruptions, interruptions, outages or other issues with our technology platforms or our use of third-party services;

•accelerate the adoption of our membership products as well as any new insurance programs and products we offer;

•manage the cyclical nature of the insurance business, including through any periods of recession, economic downturn or inflation;

•address unexpected increases in the frequency or severity of claims;

•comply with the numerous laws and regulations applicable to our business, including state, federal and foreign laws relating to insurance and rate increases, privacy, the internet, and accounting matters;

•manage risks associated with being a controlled company; and

•successfully defend any litigation, government inquiries, and investigations.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, performance, or events and circumstances reflected in the forward-looking statements will occur. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the effect of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. The forward-looking statements in this Annual Report represent our views as of the date of this Annual Report. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Annual Report or to conform these statements to actual results or revised expectations.

PART I

ITEM 1: BUSINESS

Company Overview

We are a market leader in providing insurance for classic cars and enthusiast vehicles. Through our insurance model, we act as a Managing General Agent ("MGA") by underwriting, selling and servicing classic car and enthusiast vehicle insurance policies. Then, due to our consistent track record of delivering strong underwriting results, we reinsure a large portion of the risks written by our MGA subsidiaries through our wholly owned subsidiary, Hagerty Reinsurance Limited ("Hagerty Re"). In addition, we offer Hagerty Drivers Club ("HDC") memberships, which can be bundled with our insurance policies and give subscribers access to an array of products and services, including Hagerty Drivers Club Magazine, automotive enthusiast events, our proprietary vehicle valuation tool, emergency roadside assistance, and special vehicle-related discounts. Lastly, to complement our insurance and membership offerings, we also offer Hagerty Marketplace ("Marketplace"), where car enthusiasts can buy, sell, and finance collector cars. Through these offerings, our goal is to be the world's most trusted and preferred brand for enthusiasts to protect, buy and sell, and enjoy the special cars that are their passion.

The backbone of our ecosystem is our fast-growing insurance business. People take excellent care of the things they love, and we take great pride in protecting and preserving their treasured vehicles. For almost 40 years, we have consistently grown our insurance business and currently insure approximately 2.4 million classic cars and enthusiast vehicles. We have built a strong reputation for providing excellent customer service through our passionate member service center, resulting in a Net Promoter Score ("NPS") of at least 82 in recent years, an insurance policy retention rate close to 90%, and a typical policy life of approximately nine years.

HDC and Marketplace, as well as our media and entertainment platforms, work synergistically with our insurance business to drive retention and loyalty and enable auto enthusiasts to protect, buy and sell, and enjoy their special cars, whether it be on the road, on the track, in the garage, at an event, or through our media content. We believe the combination of these complementary offerings creates an enthusiast-centered ecosystem of products and services, generating multiple points of monetization, resulting in an attractive recurring revenue business model with relatively low customer acquisition costs that benefit from increasing scale.

With a rich heritage spanning over 40 years, the first Hagerty company was founded in 1984. Hagerty, Inc., a Delaware corporation, was formed in 2020 and became a public company traded on the New York Stock Exchange ("NYSE") in 2021.

Industry and Market Opportunity

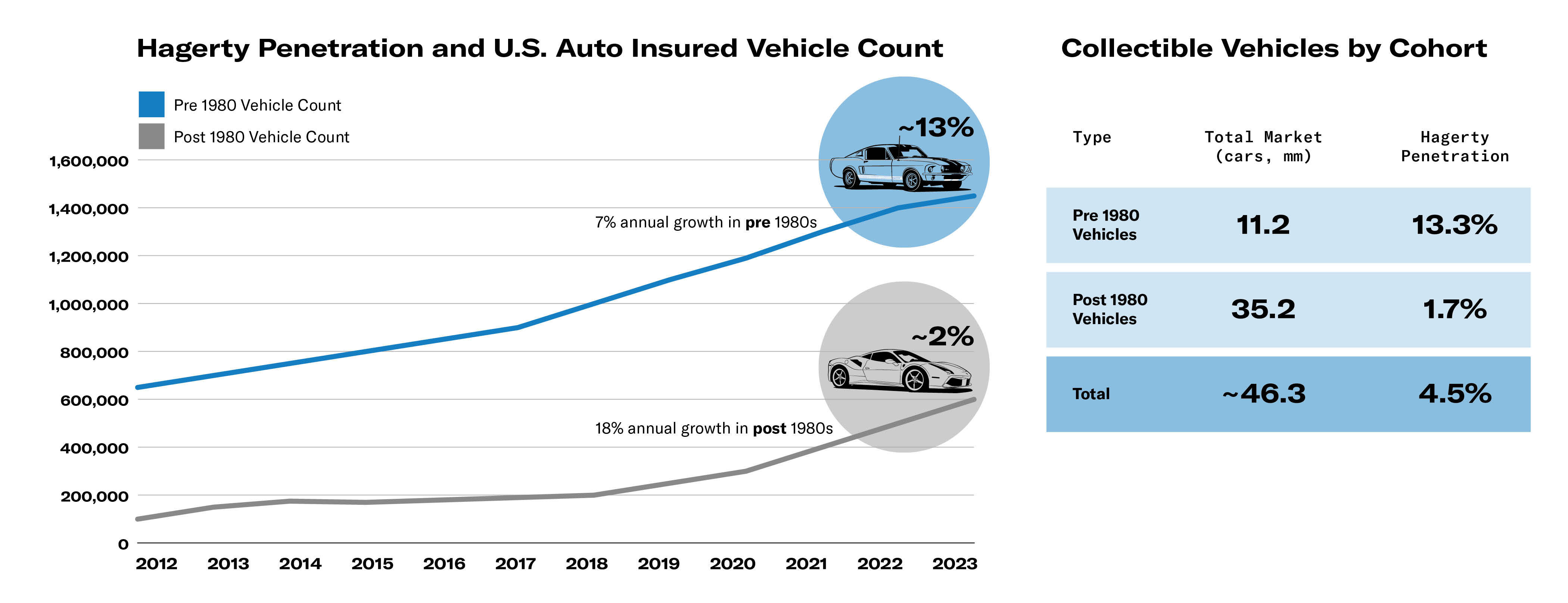

We love cars and we are not alone, as evidenced by the large and growing collector car market. We estimate that there are approximately 46 million insurable collector cars in the United States ("U.S."), of which approximately 11 million are pre-1981 and 35 million are post-1980 collectibles. On this basis, we estimate that the U.S. market translates into $18 billion of annual premium for insurable collector cars based on our average vehicle premium of approximately $381 per year. Over the last decade, we have increased our written premium by a compound annual growth rate ("CAGR") of 13%, powered primarily by strong growth in the number of our insurance policies in force. While we have become one of the leading providers of insurance for pre-1981 classics, with an estimated market share of 13.3% in that cohort, we estimate our market share for post-1980 collectibles is only 1.7%, resulting in an overall collector car market share of under 5%. We believe that our strong brand and value proposition focused on our "Guaranteed Value" insurance policies position us well to capture a larger share of this growing market over the coming decade.

In order to fully capitalize on this opportunity, we perform a data-driven Member and vehicle analysis to understand vehicle ownership data, demographic data, vehicle usage, and values. Based upon this analysis, we are able to identify key vehicle markets, explore additional opportunities within these markets, overlay demographic and usage data to enrich our approach and leverage the information to better serve the auto enthusiast community.

Business Model and Competitive Strengths

The Hagerty brand has been carefully curated over the last four decades by providing Members with excellent customer service through our passionate team of automotive experts. We have become known as an auto enthusiast brand for car people, by car people. We believe that consumers who feel a part of an enthusiast community or club are more engaged and have higher renewal rates than those who simply purchase a good or service. With an insurance policy retention rate of nearly 90% and an average policy life of nine years, we have demonstrated a strong recurring revenue model that benefits from a combination of high insurance policy retention, new Member growth, and increases in premium rates driven, in part, by increasing valuation.

The enthusiast community created by our insurance, membership and Marketplace offerings is enhanced by our media and entertainment platforms, as well as our renowned car events, which generate positive ongoing engagement with current Members, as well as interest from prospective members, in our brand, products and services. Our media content features the work of talented automotive content creators, journalists, and storytellers who bring the automotive world to life in exciting and unexpected ways across a variety of digital, print, and video media formats. Our media team covers entertainment, news, market information, and vehicle valuation trends, all of which helps generate an engaged audience that drives retention and brings new Members into our ecosystem.

Our enthusiast-centered ecosystem is built for car lovers, enabling them to protect, buy and sell, and enjoy the special cars that are their passion, thereby increasing our share of their discretionary spending. We believe that this enthusiast-centered business model, with a focus on community and engagement, is a significant advantage over competitors who, without strong affinity or engagement, are left to compete mainly on price.

Insurance

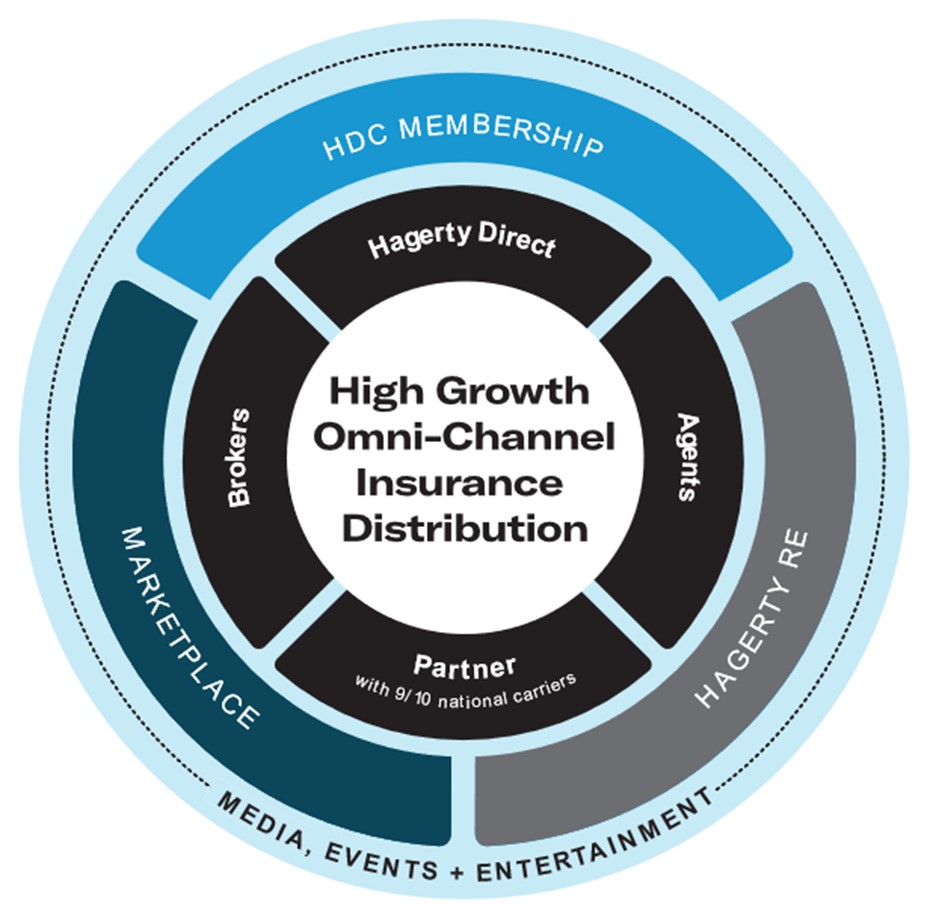

We provide insurance for approximately 2.4 million classic cars and enthusiast vehicles. Our insurance business model positions us to control the pricing and underwriting of the insurance policies, benefit from steady commission income and engage directly with consumers. We operate an omnichannel distribution model, including our direct sales channel serviced by our employee agents, our vast network of independent agents and brokers, and our insurance distribution partners. We believe this system of cooperation and partnership creates a win-win situation that allows us to capture more of the collector car and enthusiast vehicle insurance market.

Our insurance business generates two types of revenue: (1) commissions and fees earned by our MGA subsidiaries from the underwriting, sale and servicing of classic car and enthusiast vehicle insurance policies, and (2) insurance premiums earned for the risk assumed by Hagerty Re.

We utilize our data science capabilities to benefit both our MGA activities, as well as our risk-taking activities through Hagerty Re. Some examples of how we utilize data science include:

•Underwriting and Risk Assessment: Decades of data allow us to accurately assess the risk associated with insuring collector cars through actuarial analysis, which leads to more efficient underwriting and appropriate pricing.

•Market Analysis: Machine learning algorithms are designed to analyze data on collector car sales and values to identify trends and initiate automated marketing, sales and servicing workflows.

•Customer Service: AI-powered tools provide instant and accurate responses to Member inquiries, freeing up our member service agents to handle more complex issues and improve the Member experience.

•Claims Processing: Streamlining the claims process by automating routine tasks and flagging potential fraud.

We are investing substantial resources in research and development to enhance our platform, develop new products and features, and improve the speed, scalability, and security of our platform infrastructure. Our research and development organization consists of world-class engineering, product, data, and design teams. These teams work collaboratively to bring our products to life, from conception and validation to implementation.

Managing General Agent

We earn commission revenue from the underwriting, sale, and servicing of classic car and enthusiast vehicle insurance policies on behalf of our insurance carrier partners. Our insurance products are unique due to our omnichannel distribution approach, meaning we sell our insurance wherever our policyholders need us. This omnichannel approach allows us to offer our insurance products across three channels: (1) directly to consumers; (2) through independent agents and brokers; and (3) through strategic distribution partnerships with large traditional auto insurers. Historically, our MGA subsidiaries have earned a base commission of approximately 32% of written premium, as well as an additional contingent underwriting commission ("CUC") of up to 10%.

In December 2023, our alliance agreement and associated agency agreement with Markel Group, Inc. ("Markel"), which generated approximately 95% of our total commission revenue in 2023, was amended to increase the base commission rate on our personal lines U.S. auto business to 37% and to adjust the profit share commission factors to scale annually from -5% to a maximum of +5% of written premium, with 80% of the expected CUC being paid monthly, beginning in 2024. Refer to the section titled "Markel Alliance" below. Markel is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Our insurance offerings are centered around our "Guaranteed Value" insurance policy which differentiates our coverage from the standard auto insurance market by insuring covered vehicles at their agreed upon value, rather than the depreciated value typically provided by standard auto coverage. We work closely with our Members to determine the right amount of coverage for their vehicle, utilizing Hagerty Valuation Tools ("HVT"), which has been built over decades of collecting vehicle sales information. If a vehicle experiences a covered total loss, we pay the full amount of the vehicle's insured value without any depreciation.

In addition, our MGA subsidiaries also handle the claims for our insurance products to ensure our Members receive a high level of service focused on the unique requirements of repairing vintage and rare vehicles.

For the years ended December 31, 2023, 2022, and 2021, MGA commission and fee revenue represented 37%, 39%, and 44%, respectively, of our total revenue.

Direct Sales Channel

Our direct sales channel is serviced by our employee agents working across all 50 states and three countries to drive new business flow. Approximately 45% of our total U.S. auto written premium is generated through direct sales. As discussed above under "Business Model and Competitive Strengths", we have created an auto enthusiast ecosystem that connects with Members across multiple points of engagement whereas typical insurance companies engage with their customers only at the point of purchase and upon renewal.

Independent Agent and Broker Channel

Approximately 33% of our total U.S. auto written premium is generated by our relationships with over 49,000 independent agents and brokers, including the independent agents in our partnership channel, as discussed below. These independent agents and brokers represent all top 10 brokers in the U.S. by revenue. We are often told by agents and brokers that partnering with us brings value and joy to their enthusiast clients that is unmatched in the industry. Our high-engagement and experiential approach to the market is often co-branded by independent agents and brokers to deliver auto enthusiasts an experience the agent or broker could not deliver themselves. As a result, both brands benefit symbiotically through longer-lasting and more intimate customer relationships.

Partnership Channel

We also market our insurance products through our insurance distribution partners, who account for approximately 22% of our U.S. auto total written premium. This channel consists of partnerships with 9 of the top 10 largest auto insurers, as ranked by the National Association of Insurance Commissioners based upon 2022 direct premiums written, including State Farm Mutual Automobile Insurance Company ("State Farm"). Under these arrangements, we generally make our specialty insurance products and related services available to the carrier's agents, who then refer or present Hagerty to their customers. Our track record of expertise and growth creates opportunities for cultivating strong, mutually beneficial partnerships that allow us to continue to meaningfully grow our share of the collector car market in the U.S.

Most insurance companies offer and compete for multi-line insurance: auto, homeowners, umbrella, watercraft, aircraft, and other exclusive collectibles. Our focus on collector car products and services reduces competitive threats for partners and raises their confidence in transacting with us. Furthermore, we focus our investments on developing capabilities that serve the interests of the car enthusiast market. This depth and discipline of focus has enabled us to maintain a "neutral" and non-threatening partner of choice position with the highest quality automobile insurance companies in the market as we help them reduce the risk of losing a customer and the total value of the bundled insurance and membership offerings.

Our approach to partnerships enables complementary growth. Our business model is attractive to our partners because we offer a full-service solution for their customers and their special cars. We handle product development and pricing, sales and service, underwriting, and claims services on behalf of our carrier partners, and we offer Member benefits tailored to the enthusiast all through our proprietary technology and by our sales and service teams. For partners, our focus on the collector car space allows them to focus on other parts of their business portfolios. We then align financial interests so both parties benefit from the relationship, which creates strong and more durable institutional bonds. When our partners win and grow, we do as well. We take great care to build partnerships with companies who share our intense focus on customer service.

Strategic Agreements

State Farm Alliance

Hagerty has a 10-year master alliance agreement with State Farm under which State Farm's customers, through State Farm agents, are able to access Hagerty's features and services. This program began issuing policies in four initial states in September 2023. Under this agreement, State Farm paid Hagerty an advanced commission of $20.0 million in 2020, which is being recognized as "Commission and fee revenue" over the remaining life of the arrangement.

In conjunction with the master alliance agreement, the Company also entered into a managing general underwriter agreement whereby the State Farm Classic+ policy is offered through State Farm Classic Insurance Company, a wholly owned subsidiary of State Farm. The State Farm Classic+ policy is available to new and existing State Farm customers through their agents on a state-by-state basis. Hagerty is paid a commission under the managing general underwriter agreement and ancillary agreements for servicing the State Farm Classic+ policies. Additionally, we have the opportunity to offer HDC membership to State Farm Classic+ customers which provides Hagerty an additional revenue opportunity.

State Farm is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Markel Alliance

Markel is the ultimate parent company of Essentia Insurance Company ("Essentia"), which serves as the dedicated carrier for the specialty classic and collector vehicle insurance policies sold by our U.S. MGA subsidiaries. Essentia is exclusive to our U.S. MGA subsidiaries and only writes insurance policies we produce. Under this arrangement, we are licensed and appointed as Essentia’s MGA and are authorized to develop insurance products, underwrite, bill, and perform claims services for policies written through Essentia. State laws govern many of the activities under this relationship and our MGA subsidiaries must maintain the appropriate licensing as a producer and, where required, as an MGA, plus additional requirements in some states for claims adjusting.

Essentia cedes premiums and risk through quota share reinsurance agreements to three of our key insurance distribution partners with the remaining retained premium being ceded to its affiliate, Evanston Insurance Company ("Evanston"). Evanston, in turn, cedes a portion of the business it reinsures from Essentia to Hagerty Re. For Evanston to take credit for reinsurance under applicable state law, Hagerty Re maintains funds in trust for the benefit of Evanston.

On December 18, 2023, the Markel Alliance Agreement was amended to, among other things, (i) include a new definition of "Enthusiast Business", and remove Enthusiast Business from both definitions of "Restricted Business" and "Alliance Business"; (ii) delay the Company's acquisition rights to Essentia until 2026 at the earliest and 2030 at the latest and; (iii) grant the Company a new waiver to pursue a strategic opportunity with a third party insurance company. In connection with the amendments to the Markel Alliance Agreement, the Company and Markel also amended the agency agreement referenced in the Markel Alliance Agreement to increase the base commission rate on our personal lines U.S. auto business to 37% and to adjust the profit share commission factors to scale annually from -5% to a maximum of +5% of written premium, with 80% of the expected CUC being paid monthly, beginning in 2024. The Markel and Hagerty agreements governing the relationship expire at the end of 2030 and include extension periods.

Markel is a related party to the Company. Refer to Note 23 — Related-Party Transactions in Item 8 of Part II of this Annual Report for additional information.

Aviva Canada Alliance

Aviva Canada Inc. ("Aviva") is the parent company of Elite Insurance Company which serves as the carrier for our Canadian MGA subsidiary ("Hagerty Canada") collector vehicle insurance program. The relationship with Aviva in Canada is exclusive with respect to specialty, enthusiast, classic, and collector vehicle insurance, with the exception of the Quebec province, where a third-party insurance agency carries the appropriate licenses and authority to submit business to Elite Insurance Company. Elite Insurance Company and Hagerty Re have a reinsurance quota share agreement. The terms of the Aviva agreements expire in 2030 and include a 5-year extension. Canadian provincial laws govern many of the activities under this relationship and, in addition to appropriate carrier licensing requirements, Hagerty Canada must maintain the appropriate licensing.

Hagerty Re

Because we have confidence in the risks underwritten by our MGA subsidiaries, we reinsure a large portion of that risk and share in the underwriting profit through Hagerty Re, which is registered as a Class 3A reinsurer under the Bermuda Insurance Act of 1978. For the years ended December 31, 2023, 2022, and 2021, Hagerty Re's U.S. quota share, or assumed risk, was approximately 80%, 70%, and 60%, respectively. We anticipate that Hagerty Re's U.S. quota share will remain at 80% going forward.

Hagerty Re allows us to efficiently deploy capital and create steady, consistent underwriting results due to our deliberate approach to managing risk and employing actuarial discipline to the underwriting process, which has resulted in an attractive average loss ratio of 43% over the last three years. This compares favorably to the overall auto insurance industry average of approximately 69%, excluding loss adjustment expenses.

For the years ended December 31, 2023, 2022, and 2021, Hagerty Re earned premium represented 53%, 51%, and 48%, respectively, of our total revenue.

Membership

We offer HDC memberships to our insurance policyholders as a way to strengthen the bonds of those relationships. As of December 31, 2023, approximately three-quarters of new insurance policyholders also purchase a subscription to HDC. In addition, we offer HDC memberships as a stand-alone product to continue to build the broader enthusiast community. Our focus on HDC membership offerings is intended to build a community of car lovers that are loyal to the Hagerty brand due to the multiple valuable points of engagement we provide.