00018407062024FYFALSEP3YP1YP5YP10Yxbrli:sharesxbrli:pureiso4217:USDiso4217:USDxbrli:sharesiso4217:CHFxbrli:sharessoph:segmentsoph:leaseutr:sqftsoph:membersoph:plansoph:yearsoph:instrumentiso4217:CHFsoph:personneliso4217:USDiso4217:CHFiso4217:USDiso4217:EURiso4217:USDiso4217:GBPiso4217:USDiso4217:BRL00018407062024-01-012024-12-310001840706dei:BusinessContactMember2024-01-012024-12-3100018407062024-12-310001840706soph:ShareBasedPaymentArrangementVestingTrancheTwoMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2024-12-3100018407062023-01-012023-12-3100018407062022-01-012022-12-3100018407062023-12-310001840706ifrs-full:IssuedCapitalMember2021-12-310001840706ifrs-full:TreasurySharesMember2021-12-310001840706ifrs-full:SharePremiumMember2021-12-310001840706ifrs-full:OtherReservesMember2021-12-310001840706ifrs-full:RetainedEarningsMember2021-12-3100018407062021-12-310001840706ifrs-full:RetainedEarningsMember2022-01-012022-12-310001840706ifrs-full:OtherReservesMember2022-01-012022-12-310001840706ifrs-full:TreasurySharesMember2022-01-012022-12-310001840706ifrs-full:SharePremiumMember2022-01-012022-12-310001840706ifrs-full:IssuedCapitalMember2022-01-012022-12-310001840706ifrs-full:IssuedCapitalMember2022-12-310001840706ifrs-full:TreasurySharesMember2022-12-310001840706ifrs-full:SharePremiumMember2022-12-310001840706ifrs-full:OtherReservesMember2022-12-310001840706ifrs-full:RetainedEarningsMember2022-12-3100018407062022-12-310001840706ifrs-full:RetainedEarningsMember2023-01-012023-12-310001840706ifrs-full:OtherReservesMember2023-01-012023-12-310001840706ifrs-full:TreasurySharesMember2023-01-012023-12-310001840706ifrs-full:SharePremiumMember2023-01-012023-12-310001840706ifrs-full:IssuedCapitalMember2023-01-012023-12-310001840706ifrs-full:IssuedCapitalMember2023-12-310001840706ifrs-full:TreasurySharesMember2023-12-310001840706ifrs-full:SharePremiumMember2023-12-310001840706ifrs-full:OtherReservesMember2023-12-310001840706ifrs-full:RetainedEarningsMember2023-12-310001840706ifrs-full:RetainedEarningsMember2024-01-012024-12-310001840706ifrs-full:OtherReservesMember2024-01-012024-12-310001840706ifrs-full:TreasurySharesMember2024-01-012024-12-310001840706ifrs-full:SharePremiumMember2024-01-012024-12-310001840706ifrs-full:IssuedCapitalMember2024-01-012024-12-310001840706ifrs-full:IssuedCapitalMember2024-12-310001840706ifrs-full:TreasurySharesMember2024-12-310001840706ifrs-full:SharePremiumMember2024-12-310001840706ifrs-full:OtherReservesMember2024-12-310001840706ifrs-full:RetainedEarningsMember2024-12-310001840706soph:SophiaGeneticsSASMember2024-01-012024-12-310001840706soph:SophiaGeneticLimitedMember2024-01-012024-12-310001840706soph:SophiaGeneticsIncMember2024-01-012024-12-310001840706soph:SophiaGeneticsIntermediacaoDeNegociosLTDAMember2024-01-012024-12-310001840706soph:SophiaGeneticsPtyLtdMember2024-01-012024-12-310001840706soph:SophiaGeneticsSRLMember2024-01-012024-12-310001840706ifrs-full:IssuedCapitalMember2022-01-012022-03-310001840706ifrs-full:IssuedCapitalMember2023-04-012023-06-300001840706ifrs-full:IssuedCapitalMember2024-07-012024-09-300001840706country:CH2024-12-310001840706country:CH2023-12-310001840706country:FR2024-12-310001840706country:FR2023-12-310001840706country:US2024-12-310001840706country:US2023-12-310001840706country:BR2024-12-310001840706country:BR2023-12-310001840706ifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706ifrs-full:TopOfRangeMember2024-01-012024-12-310001840706country:CH2024-01-012024-12-310001840706country:CH2023-01-012023-12-310001840706country:CH2022-01-012022-12-310001840706country:FR2024-01-012024-12-310001840706country:FR2023-01-012023-12-310001840706country:FR2022-01-012022-12-310001840706country:IT2024-01-012024-12-310001840706country:IT2023-01-012023-12-310001840706country:IT2022-01-012022-12-310001840706country:ES2024-01-012024-12-310001840706country:ES2023-01-012023-12-310001840706country:ES2022-01-012022-12-310001840706soph:OtherCountriesInEuropeMiddleEastAndAfricaMember2024-01-012024-12-310001840706soph:OtherCountriesInEuropeMiddleEastAndAfricaMember2023-01-012023-12-310001840706soph:OtherCountriesInEuropeMiddleEastAndAfricaMember2022-01-012022-12-310001840706soph:EuropeTheMiddleEastAndAfricaMember2024-01-012024-12-310001840706soph:EuropeTheMiddleEastAndAfricaMember2023-01-012023-12-310001840706soph:EuropeTheMiddleEastAndAfricaMember2022-01-012022-12-310001840706country:US2024-01-012024-12-310001840706country:US2023-01-012023-12-310001840706country:US2022-01-012022-12-310001840706soph:OtherCountriesInNorthAmericaMember2024-01-012024-12-310001840706soph:OtherCountriesInNorthAmericaMember2023-01-012023-12-310001840706soph:OtherCountriesInNorthAmericaMember2022-01-012022-12-310001840706srt:NorthAmericaMember2024-01-012024-12-310001840706srt:NorthAmericaMember2023-01-012023-12-310001840706srt:NorthAmericaMember2022-01-012022-12-310001840706srt:LatinAmericaMember2024-01-012024-12-310001840706srt:LatinAmericaMember2023-01-012023-12-310001840706srt:LatinAmericaMember2022-01-012022-12-310001840706srt:AsiaPacificMember2024-01-012024-12-310001840706srt:AsiaPacificMember2023-01-012023-12-310001840706srt:AsiaPacificMember2022-01-012022-12-310001840706soph:SOPHiADDMPlatformMember2024-01-012024-12-310001840706soph:SOPHiADDMPlatformMember2023-01-012023-12-310001840706soph:SOPHiADDMPlatformMember2022-01-012022-12-310001840706soph:WorkflowEquipmentAndServicesMember2024-01-012024-12-310001840706soph:WorkflowEquipmentAndServicesMember2023-01-012023-12-310001840706soph:WorkflowEquipmentAndServicesMember2022-01-012022-12-310001840706soph:CustomerOneMember2024-01-012024-12-310001840706soph:ResearchAndDevelopmentAndInnovationMember2024-01-012024-12-310001840706soph:ResearchAndDevelopmentAndInnovationMember2023-01-012023-12-310001840706soph:ResearchAndDevelopmentAndInnovationMember2022-01-012022-12-310001840706ifrs-full:CostOfSalesMember2024-01-012024-12-310001840706ifrs-full:CostOfSalesMember2023-01-012023-12-310001840706ifrs-full:CostOfSalesMember2022-01-012022-12-310001840706soph:ResearchAndDevelopmentExpense1Member2024-01-012024-12-310001840706soph:ResearchAndDevelopmentExpense1Member2023-01-012023-12-310001840706soph:ResearchAndDevelopmentExpense1Member2022-01-012022-12-310001840706soph:SellingAndMarketingExpense1Member2024-01-012024-12-310001840706soph:SellingAndMarketingExpense1Member2023-01-012023-12-310001840706soph:SellingAndMarketingExpense1Member2022-01-012022-12-310001840706soph:GeneralAndAdministrativeExpense1Member2024-01-012024-12-310001840706soph:GeneralAndAdministrativeExpense1Member2023-01-012023-12-310001840706soph:GeneralAndAdministrativeExpense1Member2022-01-012022-12-310001840706country:FRifrs-full:UnusedTaxLossesMember2022-12-012022-12-310001840706soph:DepreciationAndAmortizationRelatedTemporaryDifferencesMember2023-12-310001840706soph:AccruedPensionRelatedTemporaryDifferencesMember2023-12-310001840706soph:RightOfUseAssetsRelatedTemporaryDifferencesMember2023-12-310001840706soph:LeaseLiabilitiesRelatedTemporaryDifferencesMember2023-12-310001840706ifrs-full:OtherTemporaryDifferencesMember2023-12-310001840706ifrs-full:UnusedTaxLossesMember2023-12-310001840706soph:DepreciationAndAmortizationRelatedTemporaryDifferencesMember2024-01-012024-12-310001840706soph:AccruedPensionRelatedTemporaryDifferencesMember2024-01-012024-12-310001840706soph:RightOfUseAssetsRelatedTemporaryDifferencesMember2024-01-012024-12-310001840706soph:LeaseLiabilitiesRelatedTemporaryDifferencesMember2024-01-012024-12-310001840706ifrs-full:OtherTemporaryDifferencesMember2024-01-012024-12-310001840706ifrs-full:UnusedTaxLossesMember2024-01-012024-12-310001840706soph:DepreciationAndAmortizationRelatedTemporaryDifferencesMember2024-12-310001840706soph:AccruedPensionRelatedTemporaryDifferencesMember2024-12-310001840706soph:RightOfUseAssetsRelatedTemporaryDifferencesMember2024-12-310001840706soph:LeaseLiabilitiesRelatedTemporaryDifferencesMember2024-12-310001840706ifrs-full:OtherTemporaryDifferencesMember2024-12-310001840706ifrs-full:UnusedTaxLossesMember2024-12-310001840706soph:DepreciationAndAmortizationRelatedTemporaryDifferencesMember2022-12-310001840706soph:AccruedPensionRelatedTemporaryDifferencesMember2022-12-310001840706soph:RightOfUseAssetsRelatedTemporaryDifferencesMember2022-12-310001840706soph:LeaseLiabilitiesRelatedTemporaryDifferencesMember2022-12-310001840706ifrs-full:OtherTemporaryDifferencesMember2022-12-310001840706ifrs-full:UnusedTaxLossesMember2022-12-310001840706soph:DepreciationAndAmortizationRelatedTemporaryDifferencesMember2023-01-012023-12-310001840706soph:AccruedPensionRelatedTemporaryDifferencesMember2023-01-012023-12-310001840706soph:RightOfUseAssetsRelatedTemporaryDifferencesMember2023-01-012023-12-310001840706soph:LeaseLiabilitiesRelatedTemporaryDifferencesMember2023-01-012023-12-310001840706ifrs-full:OtherTemporaryDifferencesMember2023-01-012023-12-310001840706ifrs-full:UnusedTaxLossesMember2023-01-012023-12-310001840706ifrs-full:TemporaryDifferenceMember2024-01-012024-12-310001840706ifrs-full:TemporaryDifferenceMember2023-01-012023-12-310001840706soph:SophiaGeneticsSASMember2023-01-012023-12-310001840706ifrs-full:OrdinarySharesMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:TradeReceivablesMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:TradeReceivablesMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ContractAssetsMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ContractAssetsMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseReceivablesMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseReceivablesMember2023-12-310001840706ifrs-full:AccumulatedImpairmentMembersoph:FinancialAssetsAccountsReceivableMember2024-12-310001840706ifrs-full:AccumulatedImpairmentMembersoph:FinancialAssetsAccountsReceivableMember2023-12-310001840706soph:FinancialAssetsAccountsReceivableMember2024-12-310001840706soph:FinancialAssetsAccountsReceivableMember2023-12-310001840706ifrs-full:AccumulatedImpairmentMembersoph:FinancialAssetsAccountsReceivableMember2022-12-310001840706ifrs-full:AccumulatedImpairmentMembersoph:FinancialAssetsAccountsReceivableMember2024-01-012024-12-310001840706ifrs-full:AccumulatedImpairmentMembersoph:FinancialAssetsAccountsReceivableMember2023-01-012023-12-310001840706ifrs-full:ComputerEquipmentMemberifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706ifrs-full:ComputerEquipmentMemberifrs-full:TopOfRangeMember2024-01-012024-12-310001840706ifrs-full:MachineryMember2024-01-012024-12-310001840706ifrs-full:FixturesAndFittingsMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2023-12-310001840706ifrs-full:GrossCarryingAmountMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2024-12-310001840706ifrs-full:GrossCarryingAmountMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:MachineryMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:MachineryMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:MachineryMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-12-310001840706ifrs-full:LeaseholdImprovementsMember2024-12-310001840706ifrs-full:MachineryMember2024-12-310001840706ifrs-full:ComputerEquipmentMember2024-12-310001840706ifrs-full:FixturesAndFittingsMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2022-12-310001840706ifrs-full:GrossCarryingAmountMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:MachineryMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:FixturesAndFittingsMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:MachineryMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:MachineryMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:FixturesAndFittingsMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001840706ifrs-full:LeaseholdImprovementsMember2023-12-310001840706ifrs-full:MachineryMember2023-12-310001840706ifrs-full:ComputerEquipmentMember2023-12-310001840706ifrs-full:FixturesAndFittingsMember2023-12-310001840706ifrs-full:ComputerSoftwareMember2024-01-012024-12-310001840706ifrs-full:CapitalisedDevelopmentExpenditureMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:CapitalisedDevelopmentExpenditureMember2023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:CapitalisedDevelopmentExpenditureMember2024-01-012024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:CapitalisedDevelopmentExpenditureMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:GoodwillMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:CapitalisedDevelopmentExpenditureMember2023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:GoodwillMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:CapitalisedDevelopmentExpenditureMember2024-01-012024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:GoodwillMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:CapitalisedDevelopmentExpenditureMember2024-12-310001840706ifrs-full:GoodwillMember2024-12-310001840706ifrs-full:ComputerSoftwareMember2024-12-310001840706ifrs-full:CapitalisedDevelopmentExpenditureMember2024-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:CapitalisedDevelopmentExpenditureMember2022-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:GoodwillMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310001840706ifrs-full:GrossCarryingAmountMemberifrs-full:CapitalisedDevelopmentExpenditureMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:GoodwillMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:CapitalisedDevelopmentExpenditureMember2022-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:GoodwillMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310001840706ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:CapitalisedDevelopmentExpenditureMember2023-01-012023-12-310001840706ifrs-full:GoodwillMember2023-12-310001840706ifrs-full:ComputerSoftwareMember2023-12-310001840706ifrs-full:CapitalisedDevelopmentExpenditureMember2023-12-310001840706soph:OfficeSpaceMember2024-01-012024-12-310001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2021-03-032021-03-030001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2022-01-252022-01-250001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2021-07-012021-07-010001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2022-01-012022-01-010001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2023-02-012023-02-010001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2021-12-310001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2022-12-310001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2023-12-310001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2022-01-250001840706soph:OfficeSpaceMembersoph:RolleSwitzerlandMember2024-01-012024-12-310001840706soph:OfficeSpaceMembersoph:BostonMassachusettsMember2024-06-272024-06-270001840706soph:OfficeSpaceMembersoph:BostonMassachusettsMember2024-09-300001840706soph:OfficeSpaceMembersoph:BostonMassachusettsMember2024-09-012024-09-300001840706soph:OfficeSpaceMembersoph:BidartFranceMember2023-06-012023-06-010001840706soph:OfficeSpaceMembersoph:BidartFranceMember2023-06-010001840706soph:OfficeSpaceMembersoph:BidartFranceMember2023-12-310001840706soph:OfficeSpaceMembersoph:BidartFranceMember2024-12-310001840706ifrs-full:BottomOfRangeMembersoph:OfficeSpaceMember2024-01-012024-12-310001840706ifrs-full:TopOfRangeMembersoph:OfficeSpaceMember2024-01-012024-12-310001840706soph:ConsumerPriceIndicesInSwitzerlandAndFranceMember2024-12-310001840706soph:ConsumerPriceIndicesInSwitzerlandAndFranceMember2023-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2022-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2022-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-01-012024-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2024-01-012024-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-01-012023-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-01-012023-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2024-12-310001840706soph:SwissPensionPlanMember2024-12-310001840706soph:FrenchPensionPlanMember2024-12-310001840706soph:SwissPensionPlanMember2023-12-310001840706soph:FrenchPensionPlanMember2023-12-310001840706ifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2022-01-012022-12-310001840706ifrs-full:WhollyUnfundedDefinedBenefitPlansMember2022-01-012022-12-310001840706soph:SwissPensionPlanMember2024-01-012024-12-310001840706soph:SwissPensionPlanMember2023-01-012023-12-310001840706soph:FrenchPensionPlanMember2024-01-012024-12-310001840706soph:FrenchPensionPlanMember2023-01-012023-12-310001840706ifrs-full:ActuarialAssumptionOfDiscountRatesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfDiscountRatesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706soph:ActuarialAssumptionOfExpectedInterestRatesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706soph:ActuarialAssumptionOfExpectedInterestRatesMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfInflationMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfInflationMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:ActuarialAssumptionOfLifeExpectancyAfterRetirementMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfLifeExpectancyAfterRetirementMemberifrs-full:WhollyOrPartlyFundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:ActuarialAssumptionOfDiscountRatesMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfDiscountRatesMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2024-12-310001840706ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMemberifrs-full:WhollyUnfundedDefinedBenefitPlansMember2023-12-310001840706soph:A2013IncentiveShareOptionPlanMember2020-01-012024-12-310001840706soph:A2019IncentiveShareOptionPlanMember2022-01-012024-12-310001840706soph:A2013IncentiveShareOptionPlanMember2024-01-012024-12-310001840706soph:A2019IncentiveShareOptionPlanMember2024-01-012024-12-310001840706soph:A2019IncentiveShareOptionPlanMember2021-04-222021-04-220001840706soph:A2019IncentiveShareOptionPlanMember2021-05-012022-01-190001840706soph:A2013IncentiveShareOptionPlanMember2023-12-310001840706soph:A2013IncentiveShareOptionPlanMember2023-01-012023-12-310001840706soph:A2013IncentiveShareOptionPlanMember2024-12-310001840706soph:A2013IncentiveShareOptionPlanMember2022-12-310001840706soph:A2013IncentiveShareOptionPlanMember2022-01-012022-12-310001840706soph:A2013IncentiveShareOptionPlanMember2021-12-310001840706soph:A2013IncentiveShareOptionPlanMember2021-01-012021-12-310001840706soph:A2019IncentiveShareOptionPlanMember2023-12-310001840706soph:A2019IncentiveShareOptionPlanMember2023-01-012023-12-310001840706soph:A2019IncentiveShareOptionPlanMember2024-12-310001840706soph:A2019IncentiveShareOptionPlanMember2022-12-310001840706soph:A2019IncentiveShareOptionPlanMember2022-01-012022-12-310001840706soph:A2019IncentiveShareOptionPlanMember2021-12-310001840706soph:A2019IncentiveShareOptionPlanMember2021-01-012021-12-310001840706soph:A2021EmployeeIncentivePlanMember2023-12-310001840706soph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706soph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706soph:A2021EmployeeIncentivePlanMember2024-12-310001840706soph:A2021EmployeeIncentivePlanMember2022-12-310001840706soph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706soph:A2021EmployeeIncentivePlanMember2021-12-310001840706soph:A2021EmployeeIncentivePlanMember2021-01-012021-12-310001840706ifrs-full:BottomOfRangeMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706ifrs-full:TopOfRangeMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706ifrs-full:BottomOfRangeMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706ifrs-full:TopOfRangeMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706ifrs-full:BottomOfRangeMembersoph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706ifrs-full:TopOfRangeMembersoph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706soph:RestrictedStockUnitsMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheOneMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheThreeMembersoph:A2021EmployeeIncentivePlanMember2024-01-012024-12-310001840706soph:RestrictedStockUnitsMember2023-12-310001840706soph:RestrictedStockUnitsMember2024-01-012024-12-310001840706soph:RestrictedStockUnitsMember2024-12-310001840706soph:RestrictedStockUnitsMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheOneMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheTwoMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheThreeMembersoph:A2021EmployeeIncentivePlanMember2023-01-012023-12-310001840706soph:RestrictedStockUnitsMember2022-12-310001840706soph:RestrictedStockUnitsMember2023-01-012023-12-310001840706soph:RestrictedStockUnitsMembersoph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheOneMembersoph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706soph:RestrictedStockUnitsMembersoph:ShareBasedPaymentArrangementVestingTrancheThreeMembersoph:A2021EmployeeIncentivePlanMember2022-01-012022-12-310001840706soph:RestrictedStockUnitsMember2021-12-310001840706soph:RestrictedStockUnitsMember2022-01-012022-12-310001840706soph:ResearchAndDevelopmentExpense1Member2024-01-012024-12-310001840706soph:ResearchAndDevelopmentExpense1Member2023-01-012023-12-310001840706soph:ResearchAndDevelopmentExpense1Member2022-01-012022-12-310001840706soph:SalesAndMarketingExpenseMember2024-01-012024-12-310001840706soph:SalesAndMarketingExpenseMember2023-01-012023-12-310001840706soph:SalesAndMarketingExpenseMember2022-01-012022-12-310001840706soph:GeneralAndAdministrativeExpense1Member2024-01-012024-12-310001840706soph:GeneralAndAdministrativeExpense1Member2023-01-012023-12-310001840706soph:GeneralAndAdministrativeExpense1Member2022-01-012022-12-310001840706soph:PerceptiveCreditAgreementMember2024-05-020001840706soph:PerceptiveCreditAgreementTrancheAMember2024-05-020001840706soph:PerceptiveCreditAgreementTrancheBMember2024-05-020001840706soph:TermSecuredOvernightFinancingRateSOFRMembersoph:PerceptiveCreditAgreementMember2024-05-020001840706soph:TermSecuredOvernightFinancingRateSOFRUponDefaultMembersoph:PerceptiveCreditAgreementMember2024-05-020001840706soph:PerceptiveCreditAgreementMember2024-01-012024-12-310001840706ifrs-full:OrdinarySharesMembersoph:PerceptiveCreditHoldingsIVLPMember2024-05-020001840706soph:WarrantRightsTrancheOneMemberifrs-full:OrdinarySharesMembersoph:PerceptiveCreditHoldingsIVLPMember2024-05-020001840706soph:WarrantRightsTrancheTwoMemberifrs-full:OrdinarySharesMembersoph:PerceptiveCreditHoldingsIVLPMember2024-05-020001840706soph:PerceptiveCreditAgreementTrancheAMember2024-05-022024-05-020001840706soph:PerceptiveCreditAgreementTrancheAMembersrt:ScenarioForecastMember2025-03-310001840706soph:WarrantLiabilityMember2024-05-020001840706soph:WarrantLiabilityMembersoph:ExercisePriceMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:SharePriceMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMemberifrs-full:InterestRateMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:ExpectedVolatilityMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:ExpectedTermMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:DividendYieldMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:BlackScholesPricingModelValueMeasurementInputMember2024-05-020001840706soph:WarrantLiabilityMembersoph:ExercisePriceMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMembersoph:SharePriceMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMemberifrs-full:InterestRateMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMembersoph:ExpectedVolatilityMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMembersoph:ExpectedTermMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMembersoph:DividendYieldMeasurementInputMember2024-12-310001840706soph:WarrantLiabilityMembersoph:BlackScholesPricingModelValueMeasurementInputMember2024-12-310001840706soph:PerceptiveCreditAgreementMember2024-05-022024-05-020001840706soph:PerceptiveCreditAgreementMembersoph:PerceptiveCreditHoldingsWarrantsMember2024-12-310001840706soph:PerceptiveCreditAgreementMember2024-12-310001840706ifrs-full:GrossCarryingAmountMembersoph:PerceptiveCreditAgreementMember2023-12-310001840706soph:CreditAgreementExistingMembersoph:CreditSuisseSAMember2024-04-232024-04-230001840706soph:CreditAgreementNewMembersoph:CreditSuisseSAMember2024-04-230001840706soph:CreditAgreementNewMembersoph:CreditSuisseSAMember2024-12-3100018407062022-11-010001840706soph:CashAndCashEquivalentMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001840706soph:CashAndCashEquivalentMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001840706soph:FinancialAssetsAccountsReceivableMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001840706soph:FinancialAssetsAccountsReceivableMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001840706soph:OtherFinancialNonCurrentAssetsMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001840706soph:OtherFinancialNonCurrentAssetsMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001840706ifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001840706ifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:AccountsPayablesMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:AccountsPayablesMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:AccruedExpensesMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:AccruedExpensesMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LeaseLiabilitiesMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LeaseLiabilitiesMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LongtermBorrowingsMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LongtermBorrowingsMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMember2023-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:WarrantObligationsMember2024-12-310001840706ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembersoph:WarrantObligationsMember2023-12-310001840706ifrs-full:Level1OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level2OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level3OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level1OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level2OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level3OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level1OfFairValueHierarchyMembersoph:WarrantLiabilityMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level2OfFairValueHierarchyMembersoph:WarrantLiabilityMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level3OfFairValueHierarchyMembersoph:WarrantLiabilityMemberifrs-full:RecurringFairValueMeasurementMember2024-12-310001840706ifrs-full:Level1OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:Level2OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:Level3OfFairValueHierarchyMembersoph:CashAndCashEquivalents1Memberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:Level1OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:Level2OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:Level3OfFairValueHierarchyMemberifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706ifrs-full:RecurringFairValueMeasurementMember2023-12-310001840706soph:CashAndCashEquivalentsAndTermDepositsMember2024-12-310001840706soph:CashAndCashEquivalentsAndTermDepositsMember2023-12-310001840706ifrs-full:NotLaterThanOneYearMember2024-12-310001840706ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2024-12-310001840706ifrs-full:LaterThanFiveYearsMember2024-12-310001840706ifrs-full:NotLaterThanOneYearMember2023-12-310001840706ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2023-12-310001840706ifrs-full:LaterThanFiveYearsMember2023-12-310001840706soph:FunctionalCurrencyMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:TopOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:TopOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:TopOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:TopOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:TopOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyEURAndCHFMemberifrs-full:TopOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:TopOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:TopOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyGBPAndCHFMemberifrs-full:TopOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:BottomOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:TopOfRangeMember2024-01-012024-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:TopOfRangeMember2023-01-012023-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:TopOfRangeMember2022-01-012022-12-310001840706soph:FunctionalCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001840706soph:PresentationCurrencyMember2024-01-012024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:BottomOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:TopOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:BottomOfRangeMember2023-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndCHFMemberifrs-full:TopOfRangeMember2023-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:TopOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:BottomOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:TopOfRangeMember2023-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndEURMemberifrs-full:BottomOfRangeMember2023-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndGBPMemberifrs-full:TopOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndGBPMemberifrs-full:BottomOfRangeMember2024-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndGBPMemberifrs-full:TopOfRangeMember2023-12-310001840706soph:PresentationCurrencyMembersoph:DifferencesOfCurrencyUSDAndGBPMemberifrs-full:BottomOfRangeMember2023-12-310001840706ifrs-full:GrossCarryingAmountMembersoph:PerceptiveCreditAgreementMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

|

|

|

|

|

|

| o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(For the fiscal year ended December 31, 2024)

OR

|

|

|

|

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

|

|

|

|

| o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-40627

SOPHiA GENETICS SA

(Exact name of Registrant as specified in its charter)

Switzerland

(Jurisdiction of incorporation or organization)

La Pièce 12

CH-1180 Rolle

Switzerland

+41 21 694 10 60

(Address of principal executive offices)

George Cardoza

SOPHiA GENETICS, Inc.

401 Park Drive Suite 505

Boston, MA 02215

(617) 982-1210

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Ordinary shares, par value CHF 0.05 per share |

|

SOPH |

|

The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report. Ordinary shares, nominal value CHF 0.05 per share: 66,687,085

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

o |

|

Accelerated filer |

x |

|

|

|

|

|

| Non-accelerated Filer |

o |

|

Emerging growth company |

x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

|

|

U.S. GAAP o |

International Financial Reporting Standards as issued by the International Accounting Standards Board x |

Other o |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

TABLE OF CONTENTS

ABOUT THIS ANNUAL REPORT

Unless otherwise indicated or the context otherwise requires, all references in this Annual Report to “SOPHiA GENETICS,” “SOPH,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to SOPHiA GENETICS SA and its consolidated subsidiaries.

Trademarks

We own various trademark registrations and applications, and unregistered trademarks, including for “SOPHiA GENETICS,” “SOPHiA DDMTM,” “Alamut,” “SOPHiA Trial Match,” “SOPHiA Insights,” “SOPHiA CDx,” “SOPHiA Awareness” and our corporate logo. All other trade names, trademarks and service marks of other companies appearing in this Annual Report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Presentation of Financial Information

Our consolidated financial statements are presented in U.S. dollars and have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IASB”). None of the consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The terms “dollar,” “USD” and “$” refer to U.S. dollars and the terms “Swiss franc” and “CHF” refer to the legal currency of Switzerland, unless otherwise indicated. We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, any numerical discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Our fiscal year ends on December 31. References in this Annual Report to a fiscal year relate to our fiscal year ended on December 31 of that calendar year.

Market and Industry Data

This Annual Report contains industry, market and competitive position data that are based on general and industry publications, surveys and studies conducted by third parties, some of which may not be publicly available, and our own internal estimates and research. Third-party publications, surveys and studies generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we are not aware of any misstatements regarding the industry, market and competitive position data presented herein, these data involve a number of assumptions and limitations and contain projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute forward-looking statements. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, market opportunity, business strategy, technology, collaborations and partnerships, as well as plans and objectives of management for future operations are forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate,” “will” and “potential,” among others.

Forward-looking statements appear in a number of places in this Annual Report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified in the section titled “Item 3. Key Information—D. Risk Factors” in this Annual Report. These forward-looking statements include, among others:

•our expectations regarding our revenue, gross margin, expenses, other operating results, and cash usage;

•our plans regarding further development of our SOPHiA DDM Platform and its expansion into additional features, applications and data modalities;

•future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements, future revenues, expenses, reimbursement rates and needs for additional financing;

•our expectations regarding the market size for our platform, applications, products, and services and the market acceptance they will be able to achieve;

•our expectations regarding changes in the healthcare systems in different jurisdictions, in particular with respect to the manner in which electronic health records are collected, distributed and accessed by various stakeholders;

•the timing or outcome of any domestic and international regulatory submissions;

•impact from future regulatory, judicial, and legislative changes or developments in the United States and foreign countries;

•our ability to acquire new customers and successfully engage and retain customers;

•the costs and success of our marketing efforts, and our ability to promote our brand;

•our ability to increase demand for our applications, products, and services, obtain favorable coverage and reimbursement determinations from third-party payors and expand geographically;

•our expectations of the reliability, accuracy and performance of our applications, products, and services, as well as expectations of the benefits to patients, medical personnel and providers of our applications, products, and services;

•our expectations regarding our ability, and that of our manufacturers, to manufacture our products;

•our efforts to successfully develop and commercialize our applications, products, and services;

•our competitive position and the development of and projections relating to our competitors or our industry;

•our ability to identify and successfully enter into strategic collaborations in the future, and our assumptions regarding any potential revenue that we may generate thereunder;

•our ability to obtain, maintain, protect and enforce intellectual property protection for our technology, applications, products, and services, and the scope of such protection;

•our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property or proprietary rights of third parties;

•our ability to attract and retain qualified key management and technical personnel; and

•our expectations regarding the time during which we will be an emerging growth company under the Jumpstart our Business Startups Act of 2012 (“JOBS Act”) and a foreign private issuer.

These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of risks, uncertainties and assumptions described in the sections in this Annual Report titled “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” and elsewhere in this Annual Report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

PART I

Item 3. Key Information

D. Risk Factors

Our business faces significant risks and uncertainties. You should carefully consider all of the information set forth in this Annual Report and in other documents we file with or furnish to the SEC, including the following risk factors, before deciding to invest in or to maintain an investment in our securities. If any of the events or developments described below were to occur, our business, results of operations, financial condition and prospects could suffer materially and the trading price of our ordinary shares could decline. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

•We may not be successful in expanding features, applications and data modalities of our SOPHiA DDM Platform and related solutions, applications, products, and services.

•We may experience challenges with the acquisition, development, enhancement and deployment of technology necessary for our data analytics platform technologies.

•If we are unable to expand our sales and marketing capabilities, including through additional strategic relationships, in a cost-effective manner, we may not be able to grow our revenue.

•The coverage and reimbursement status of newly developed applications and products, such as data analytics platforms and related solutions, applications, products, and services, particularly in a new category of diagnostics and therapeutics, is uncertain. An inability to obtain or maintain adequate coverage and reimbursement could limit the commercial potential of our SOPHiA DDM Platform and related solutions, applications, products, and services.

•If we cannot maintain our current relationships and enter into new relationships with hospitals, reference and specialty laboratories and biopharmaceutical companies, our revenue prospects could be reduced.

•We are highly dependent on our senior management team and other qualified personnel, and our business could be harmed if we are unable to retain and attract such personnel.

•Our industry is subject to rapid change, which could make our SOPHiA DDM Platform and related solutions, applications, products, and services obsolete. If we are unable to continue to innovate and improve our SOPHiA DDM Platform and related solutions, applications, products, and services, we could fail to attract new customers and expand our market share and we could lose existing customers and market share.

•We face competition from many sources, some of whom have much greater financial resources, and we may be unable to compete successfully.

•Cybersecurity or data privacy breaches, other unauthorized or improper access, or (distributed) denial service lack of access (e.g., ransomware, persistent DoS/DDoS) could result in additional costs, loss of revenue, significant liabilities, harm to our brand and decreased use of our SOPHiA DDM Platform and related solutions, applications, products, or services.

•If we are not able to obtain, maintain, defend and enforce patent and other intellectual property protection or if the scope of such patent and other intellectual property protection is not sufficiently broad, our competitors could develop and commercialize applications, products, services and technology similar or identical to ours.

•We license patent rights from third-party owners. If such owners do not properly or successfully obtain, maintain, defend and enforce the patents underlying such licenses, or if they retain or license to others any competing rights, our competitive position and business prospects may be adversely affected. If we fail to comply with our obligations in the agreements under which we license intellectual property rights from third parties or otherwise experience disruptions to our relationships with any of our licensors, we could lose license rights that are important to our business.

•We have incurred net losses since our inception and expect to continue to incur losses for the foreseeable future. We may never achieve or sustain profitability.

Risks Related to the Development of Our SOPHiA DDM Platform and Related Solutions, Applications, Products, and Services

We may not be successful in expanding features, applications and data modalities of our SOPHiA DDM Platform and related solutions, applications, products, and services.

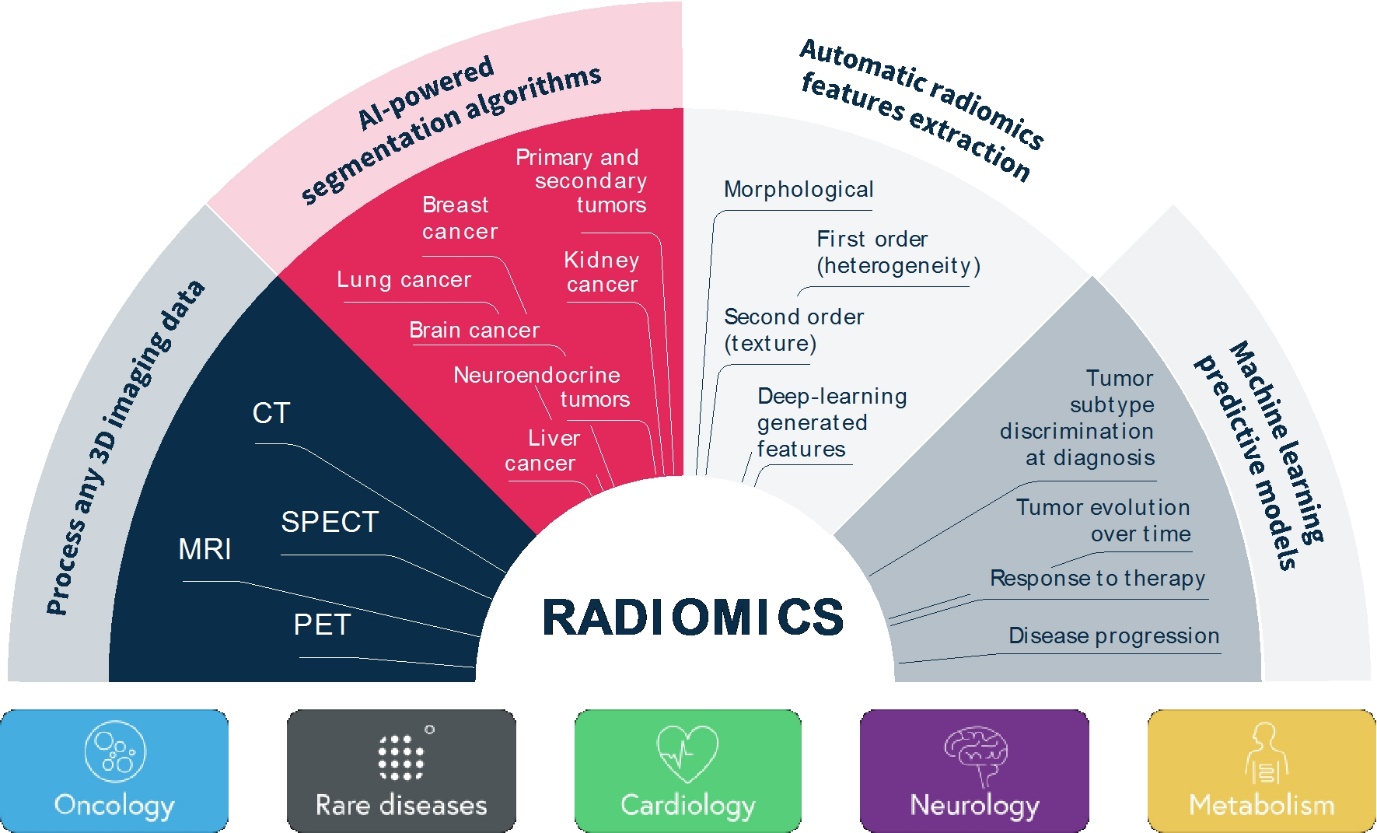

Our SOPHiA DDM Platform offers a broad range of genomics applications across oncology, rare diseases, infectious diseases, cardiology, neurology, metabolism and other disease areas. A major part of our long-term strategy is bringing new high-impact content to our customers through updates to our platform, which may include expanding our platform with additional features, applications and data modalities and related solutions, applications, products, and services. However, enhancing our platform and developing new related solutions, applications, products, and services poses various risks and challenges, including the inability to develop features, applications, data modalities and services that achieve the desired results, analytical accuracy and utility; the need to alter our platform, solutions, applications, products, or services; the time and resources required for platform, solution, application, service, and product development; uncertainty regarding and potential limitation in the scope of new features, solutions, applications, data modalities, products, or services; and the potential need to obtain U.S. Food and Drug Administration (the “FDA”), European Medicines Agency (the “EMA”), United Kingdom (the “U.K.”) Medicines and Healthcare products Regulatory Agency (the “MHRA”) and other regulatory clearances, authorizations or approvals. Even if we successfully develop a feature, application, data modality, solution, service or product and receive any necessary regulatory clearance, authorization or approval, such feature, application, data modality, solution, service or product may never achieve significant market acceptance among various stakeholders and be commercially successful. The expenses or losses associated with unsuccessful platform innovation or expansion could adversely affect our business revenue growth and results of operations.

This risk may be heightened as we generally sell our platform, solutions, applications, products, and services in industries that are characterized by rapid technological changes, frequent new application and product introductions and changing industry standards. Operating in and servicing such industries require us to develop platform enhancements based on technological innovation on a timely basis. In addition, whereas we purposefully built our SOPHiA DDM Platform in a decentralized manner and strategically positioned it as a “universal operating-system” for multimodal data analytics in order to provide for a broad range of application, product, and service expansion opportunities, certain jurisdictions, such as the Netherlands and the U.K., have implemented or is expected to implement centralized services architectures for electronic healthcare records (“EHR”) where all patient data passes through a single, often government-run, entity rather than being shared directly between the healthcare providers. The widespread implementation of such centralized systems may limit the adoption and development of our platform.

Strong platform, application, product, and service performance, security and reliability are necessary to maintain and grow our business.

We need to maintain and continuously improve the performance, security and reliability of our SOPHiA DDM Platform and related solutions, applications, products, and services. Our platform, solutions, applications, and other products may contain errors or defects, and while we have made efforts to test them and are not aware of any widespread material errors, defects or other performance-related issues, there can be no assurance that our platform, solutions, applications, products, and services do not or will not have performance problems. As we continue to launch more platform features, applications, data modalities, solutions, products, and services, these risks may increase. Poor performance, security and reliability could adversely impact our customers and lead to customer dissatisfaction, adversely affect our reputation and revenues and increase our application, service, and product care, and distribution costs and working capital requirements.

In particular, our SOPHiA DDM Platform and related solutions, applications, products, and services use artificial intelligence, machine learning, data analytics and similar tools that collect, aggregate and analyze data (collectively, “Data Tools”).

The use of such Data Tools poses risks such as incomplete or inaccurate data, human error, or lack of appropriate controls and processes, the technologies underlying how we store and leverage data and their use cases are subject to a variety of laws. Uncertainty around new and emerging Data Tools may require additional investment in the development of proprietary datasets, machine learning, large language models and systems to test for accuracy, bias and other variables and computing capabilities.

We may experience challenges with the acquisition, development, enhancement and deployment of technology necessary for our data analytics platform technologies.

Our business requires sophisticated computer systems and software in order to accurately and efficiently capture, service and process increasing volumes of health data, in particular a growing number of genomic profiles generated by our customers through various NGS test kits, sequencers and sample materials from different manufacturers. Some of the technologies are changing rapidly and we must continue to adapt to these changes in a timely and effective manner at an acceptable cost. There can be no assurance that we will be able to develop, acquire, enhance, deploy or integrate new technologies, including technologies needed to integrate new genomics test kits into our data analytics platform, that these new technologies will be effective and efficient, will meet our needs or achieve our expected goals or that we will be able to do so as quickly or cost-effectively as our competitors. Significant technological change could render our data analytics platform and technologies obsolete and incompatible with new or improved genomics test kits. In addition, we may face challenges in expanding into markets without suitable cloud infrastructure compatible with our SOPHiA DDM Platform. Our continued success will depend on our ability to adapt to changing technologies, manage and process ever-increasing amounts of data and information and improve the performance features of our data analytics platform technologies in response to an ever-changing patient population. We may experience difficulties that could delay or prevent the successful design, development, testing and introduction of new versions of our data analytics platform technologies, limiting our ability to identify new solutions, applications, products, and services. Any of these challenges could have a material adverse effect on our operating results and financial condition.

Any failure to offer high-quality support for our applications, products, and services may adversely affect our relationships with customers and collaborators and negatively impact our reputation and our business, financial condition and results of operations.

In implementing and using our SOPHiA DDM Platform and related solutions, applications, products, and services, our customers and collaborators depend on our support to resolve issues in a timely manner. We may be unable to respond quickly enough to accommodate short-term increases in demand for customer support. Increased customer demand for support could increase costs and adversely affect our financial condition and results of operations. In addition, we need highly trained technical support personnel. Hiring technical support personnel is very competitive in our industry due to the limited number of people available with the necessary scientific and technical backgrounds and ability to understand our technology at a technical level. Our sales are highly dependent on our reputation and on positive recommendations from our customers, users, care collaborators, providers, laboratories, hospitals and clinics. If we do not maintain high-quality customer support, or if the market perceives that we do not maintain high-quality customer support, our reputation and our business, financial condition and results of operations could be adversely affected.

Delays in the commencement and successful completion of multimodal clinical studies, and negative or ambiguous data generated from such studies, could increase costs and delay or prevent regulatory approval of our SOPHiA DDM Platform and related solutions, applications, and products.

To further improve our SOPHiA DDM Platform and its capabilities, for example by developing new predictive algorithmic models that we can deploy on our platform, we are sponsoring and intend to continue to sponsor observational multimodal clinical studies in various disease areas. These clinical studies are subject to numerous risks. Events that may prevent successful or timely commencement and completion of multimodal clinical studies include:

•delays in receiving the required regulatory clearance from the appropriate regulatory authorities to commence the studies, delays in reaching an agreement on acceptable terms with prospective contract research organizations (“CROs”) and participating sites and difficulties in obtaining required Institutional Review Board (“IRB”) or ethics committee approval at each participating site;

•challenges in recruiting and enrolling suitable patients that meet the study criteria to participate in the studies, which challenges may be heightened for any clinical study that seeks to enroll patients with characteristics that are found in a small population;

•our CROs or participating sites failing to comply with regulatory requirements or meet their contractual obligations to us, which risk may be heightened by our reliance on third parties;

•lower than anticipated patient retention rates and difficulties in maintaining contact with patients, resulting in incomplete data;

•changes in regulatory requirements and guidance;

•lack of adequate funding to continue the study; or

•delays and disruptions as a result of unforeseen external events.

Furthermore, there can be no assurance that any multimodal clinical study will produce the data necessary to support further development of our platform in a particular disease area or to support any potential regulatory submission. Even if a study is completed, the data generated may be negative, ambiguous or otherwise insufficient. To obtain sufficient data, we may be required to conduct additional studies beyond those that we currently plan for, which would increase our costs and delay potential regulatory submissions and commercialization activities.

If we do not have the support of key opinion leaders or clinical data using our applications and products is not published in peer-reviewed journals, it may be difficult to drive adoption of our applications and products.

We have established relationships with leading thought leaders. If these key opinion leaders determine that our SOPHiA DDM Platform and related solutions, applications, products, and services are not accurate or that alternative technologies, applications, products, and services are more accurate or more cost-effective, or if we fail to establish new relationships with key opinion leaders in different markets, geographies and among various stakeholders, we may see lower demand for our SOPHiA DDM Platform and related solutions, applications, products, and services, which would limit our revenue growth and our ability to achieve profitability.

The publication of clinical data using our applications and products in peer-reviewed journals is also crucial to our success. We are unable to control when, if ever, results of current or future trials and projects are published, which may delay or limit adoption of our SOPHiA DDM Platform and related solutions, applications, products, and services. Such peer-reviewed publications may be limited by many factors, including delays in the completion of, poor design of, or lack of compelling data from, clinical studies, as well as delays in the review, acceptance and publication process. If our SOPHiA DDM Platform and related solutions, applications, products, and services do not receive sufficient favorable exposure in peer-reviewed publications, the rate of adoption of our SOPHiA DDM Platform and related solutions, applications, products, and services among medical personnel and positive reimbursement coverage determinations for them could be adversely affected.

Risks Related to Commercialization

If we are unable to expand our sales and marketing capabilities, including through additional strategic relationships, in a cost-effective manner, we may not be able to grow our revenue.

Our future sales will depend in large part on our ability to develop, train and retain our sales force, to increase the scope of our marketing efforts, including into markets and geographies where our presence is currently limited, and to maintain our current strategic relationships and enter into new strategic relationships.

We are continuously expanding our sales and marketing infrastructure. Retaining and training qualified sales and marketing personnel requires significant time, expense and attention. Competition for such personnel is intense. It often takes several months or more before a sales representative is fully trained and productive, depending on the target market or geography. Our sales force may subject us to higher fixed costs than those incurred by our competitors that utilize independent third parties, which could place us at a competitive disadvantage.

In addition, we currently have multiple strategic relationships with third-party providers of solutions, applications, products, and services that can be bundled with our SOPHiA DDM Platform and offer our SOPHiA DDM Platform and related solutions, applications, products, and services through various global and local distributors. There is no guarantee that we will be successful in maintaining our existing arrangements or entering into new arrangements on favorable terms. Most of our distribution relationships are non-exclusive and permit such distributors to distribute competing applications and products. As such, our distributors may not commit the necessary resources to market our applications and products to the level of our expectations or may choose to favor marketing the applications and products of our competitors. If current or future distributors do not perform adequately or we are unable to enter into effective arrangements with distributors in particular geographies, we may not achieve revenue growth and realize our expansion strategy.

Sales and marketing activities in the healthcare space are subject to various rules and regulations. In addition, our marketing messaging can be complex and nuanced, and there may be errors or misunderstandings in our sales force’s communication of such messaging. As we continue to grow our sales and marketing efforts, we face an increased need to continuously monitor and improve our policies, processes and procedures to maintain compliance with a growing number and variety of laws and regulations. To the extent that there is any violation, whether actual, perceived or alleged, of our policies or applicable laws and regulations, we could incur additional training and compliance costs, receive inquiries from third parties or be held liable or otherwise responsible for such acts of noncompliance. Any of the foregoing could adversely affect our business, reputation and results of operations.

The commercial success of our SOPHiA DDM Platform and current and future applications, products, and services depend on attaining significant market acceptance.

Our commercial success depends, in part, on market acceptance of our SOPHiA DDM Platform and our applications, products, and services. We cannot predict how quickly, if at all, our SOPHiA DDM Platform and related solutions, applications, products, and services will attain significant market acceptance or, if accepted, how frequently they will be used. These constituents must believe that our SOPHiA DDM Platform and related solutions, applications, products, and services offer benefits over other available alternatives. The degree of market acceptance of our SOPHiA DDM Platform and related solutions, applications, products, and services depends on a number of factors, including:

•whether there is adequate utilization of our SOPHiA DDM Platform and related solutions, applications, products, and services based on their potential and perceived advantages over those of our competitors;

•the safety, accuracy and ease of use of our SOPHiA DDM Platform and related solutions, applications, products, and services relative to those currently on the market;

•our ability to develop, commercialize and obtain regulatory clearance or approval for in vitro diagnostic (“IVD”) applications and products for diagnostic use and our compliance with the FDA’s “Distribution of In Vitro Diagnostic Products Labeled for Research Use Only or Investigational Use Only” (the “RUO Guidance”) and other laws and regulations governing Research Use Only (“RUO”) and IVD applications and products in the United States (“U.S.”), and other geographies;

•our ability to be compliant with the phased introduction of the European Union (EU) IVD Regulation 2017/746 including new product submissions;

•the clinical flexibility, operational versatility and technology agnostic nature of our SOPHiA DDM Platform and related solutions, applications, products, and services;

•the prices at which we and our distributors offer our SOPHiA DDM Platform and related solutions, applications, products, and services;

•the effectiveness of our sales and marketing efforts;

•our ability to provide incremental data that show the clinical benefits and cost-effectiveness, and operational benefits, of our SOPHiA DDM Platform and related solutions, applications, products, and services;

•our ability to build and maintain robust data sets with respect to patient populations, both in geographic regions that we have historically served and in geographic regions that we may seek to enter or further penetrate in the future;

•the coverage and reimbursement acceptance of our applications, products, and services;

•pricing pressure, including from group purchasing organizations (“GPOs”), seeking to obtain discounts on our SOPHiA DDM Platform and related solutions, applications, products, and services based on the collective bargaining power of the GPO members;

•negative publicity regarding our or our competitors’ platforms, applications, products, and services; and

•the accuracy of our SOPHiA DDM Platform and related solutions, applications, products, and services relative to those of our competitors.