UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: October 1, 2024

(Date of earliest event reported)

| Commission File Number |

Exact Name of Registrant as specified in its charter |

State or Other Jurisdiction of Incorporation or Organization | IRS Employer Identification Number | |||

| 001-12609 | PG&E CORPORATION | California | 94-3234914 | |||

| 001-02348 | PACIFIC GAS AND ELECTRIC COMPANY | California | 94-0742640 |

|

|

|

| 300 Lakeside Drive | 300 Lakeside Drive | |

| Oakland, California 94612 | Oakland, California 94612 | |

| (Address of principal executive offices) (Zip Code) | (Address of principal executive offices) (Zip Code) | |

| (415) 973-1000 | (415) 973-7000 | |

| (Registrant’s telephone number, including area code) | (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, no par value | PCG | The New York Stock Exchange |

| First preferred stock, cumulative, par value $25 per share, 6% nonredeemable | PCG-PA | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 5.50% nonredeemable | PCG-PB | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 5% nonredeemable | PCG-PC | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 5% redeemable | PCG-PD | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 5% series A redeemable | PCG-PE | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 4.80% redeemable | PCG-PG | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 4.50% redeemable | PCG-PH | NYSE American LLC |

| First preferred stock, cumulative, par value $25 per share, 4.36% redeemable | PCG-PI | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company | PG&E Corporation | ☐ |

| Emerging growth company | Pacific Gas and Electric Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| PG&E Corporation | ☐ |

| Pacific Gas and Electric Company | ☐ |

Item 7.01 Regulation FD Disclosure.

On October 1, 2024, PG&E Corporation made available a presentation (the “Presentation”) in connection with upcoming meetings with investors at the Wolfe Research Utilities, Midstream & Clean Energy Conference 2024. A copy of the Presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in this Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 is being furnished hereby and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the filings of PG&E Corporation or Pacific Gas and Electric Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filings. The filing of this Current Report on Form 8-K (including the exhibit hereto or any information included herein or therein) shall not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number | Description |

| 99.1 | Slide presentation dated October 1, 2024 |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned thereunto duly authorized.

| PG&E CORPORATION | |||

| Date: October 1, 2024 | By: | /s/ JOHN R. SIMON | |

| Name: John R. Simon | |||

| Title: Executive Vice President, General Counsel and Chief Ethics & Compliance Officer |

|||

| PACIFIC GAS AND ELECTRIC COMPANY | |||

| Date: October 1, 2024 | By: | /s/ BRIAN M. WONG | |

| Name: Brian M. Wong | |||

| Title: Vice President, General Counsel and Corporate Secretary |

|||

Exhibit 99.1

Wolfe Research Utilities, Midstream & Clean Energy Conference 2024 October 1, 2024 Delivering For Customers AND Investors 1

2 This presentation contains statements regarding PG&E Corporation’s and Pacific Gas and Electric Company’s (the “Utility”) fut ure performance, including expectations, objectives, and forecasts about rate base growth, capital expenditures, cost savings, and customer bills. These statements and other statements that are not purely historical constitute forward - lookin g statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward - loo king statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are no t limited to, risks and uncertainties associated with: • wildfires that have occurred or may occur in the Utility’s service area , including the extent of the Utility’s liability in connection with the 2019 Kincade fire, the 2021 Dixie fire, the 2022 Mosquito fire, and future wildfires; • the Utility’s ability to recover wildfire - related costs, including costs for the 2021 Dixie fire, from the Wildfire Fund (includ ing the Utility’s maintenance of a valid safety certificate and whether the Wildfire Fund has sufficient remaining funds) and through the WEMA and FERC TO rate cases; • the Utility’s implementation of its wildfire mitigation programs, including PSPS, EPSS, situational awareness and response, t he undergrounding initiative, and the programs’ effectiveness; • the Utility’s ability to safely and reliably operate, maintain, construct, and decommission its facilities; • changes in the electric power and natural gas industries driven by technological advancements and a decarbonized economy; • a cyber incident, cybersecurity breach, or physical attack; • severe weather events, extended drought, and climate change, particularly their impact on the likelihood and severity of wild fir es; • the impact of legislative and regulatory developments, including those regarding wildfires, the environment, California’s cle an energy goals, the nuclear industry, extended operations at Diablo Canyon nuclear power plant, regulation of utilities’ transactions with their affiliates, municipalization, privacy, and taxes ; • the timing and outcome of FERC and CPUC proceedings, including regarding ratemaking, cost recovery , and other matters; • the outcome of self - reports, agency compliance reports, investigations, or other enforcement actions; • PG&E Corporation and the Utility’s substantial indebtedness, which may adversely affect their financial health and limit thei r o perating flexibility; • the timing and outcome of PG&E Corporation’s and the Utility’s litigation, including securities class action claims, and wild fir e - related litigation; • the Utility’s ability to manage its costs effectively, timely recover costs through rates, and achieve projected savings and the extent of excess unrecoverable costs; • the tax treatment of certain assets and liabilities, including whether PG&E Corporation or the Utility undergoes an “ownershi p c hange” that limits certain tax attributes; • the impact of growing distributed and renewable generation resources, and changing customer demand for its natural gas and el ect ric services; and • the other factors disclosed in PG&E Corporation’s and the Utility’s joint Annual Report on Form 10 - K for the year ended December 31, 2023, their joint Quarterly Report on Form 10 - Q for the quarter ended June 30, 2024 (the “Form 10 - Q”), and other reports filed with the SEC, which are available on PG&E Corporation’s w ebsite at www.pgecorp.com and on the SEC’s website at www.sec.gov. Undefined, capitalized terms have the meanings set forth in the Form 10 - Q. Unless otherwise indicated, the statements in this pr esentation are made as of October 1, 2024. PG&E Corporation and the Utility undertake no obligation to update information contained herein. This presentation was attached to PG&E Corporation’s and the Utility’s joint Current Report on Form 8 - K that was furnished to the SEC on October 1, 2024, and is also available on PG&E Corporation’s website at www.pgecorp.com. Forward - Looking Statements

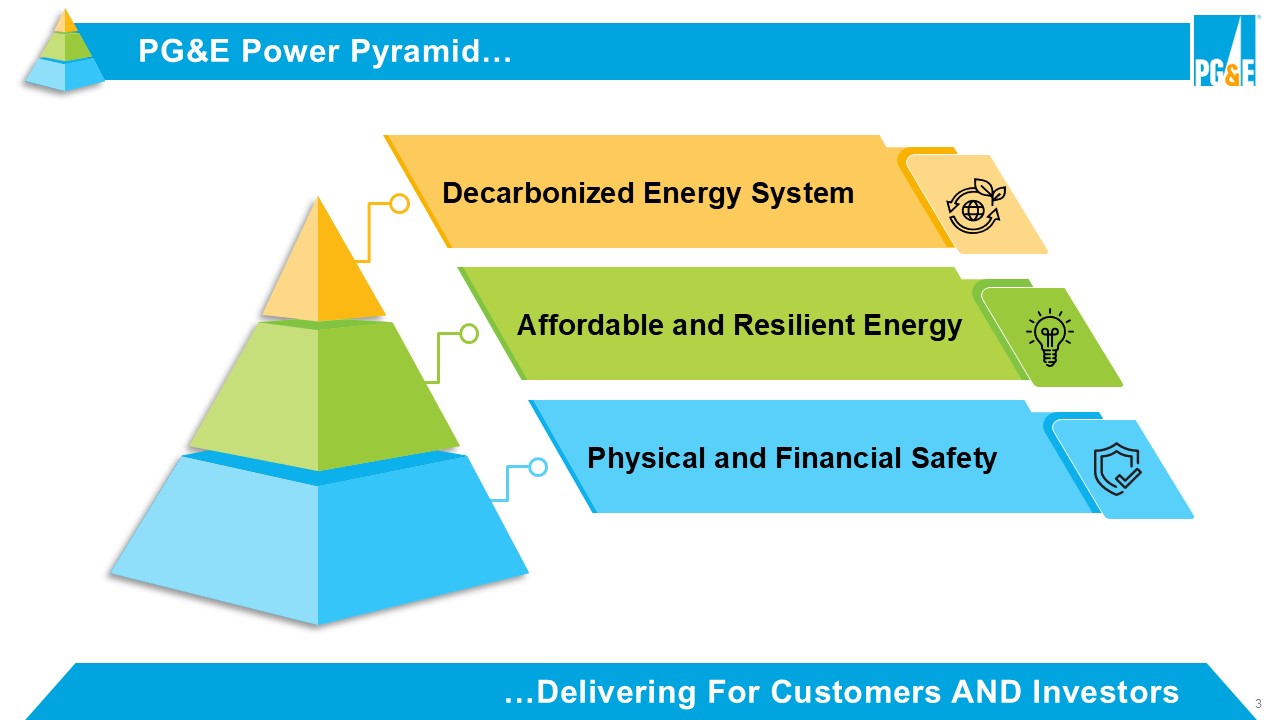

3 …Delivering For Customers AND Investors PG&E Power Pyramid… Physical and Financial Safety Decarbonized Energy System Affordable and Resilient Energy

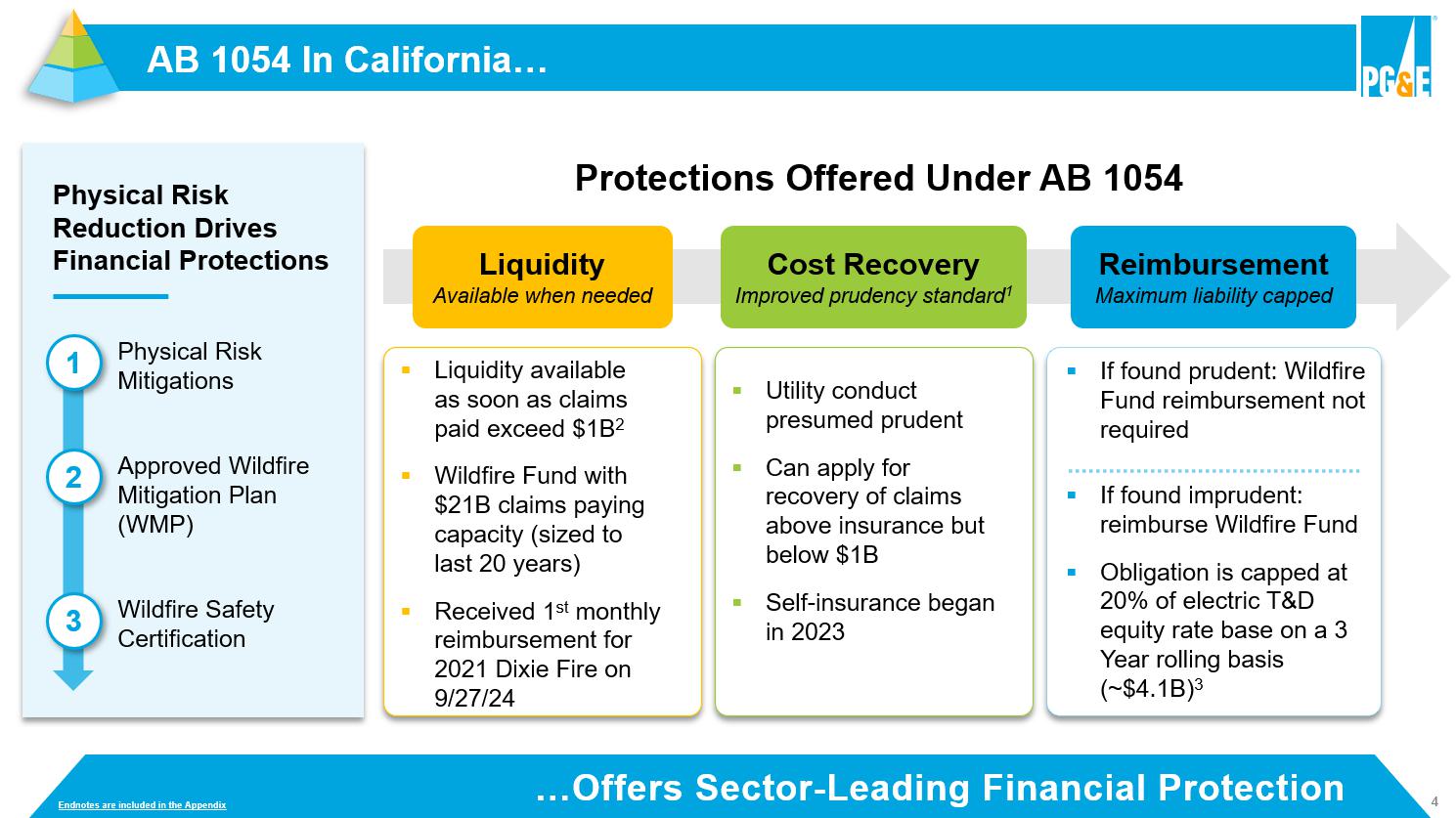

4 AB 1054 I n California… Exhibit E: PG&E Corporation's 2020 and 2021 Earnings Guidance Protections Offered Under AB 1054 …Offers Sector - Leading Financial Protection ▪ Liquidity available as soon as claims paid exceed $1B 2 ▪ Wildfire Fund with $21B claims paying capacity (sized to last 20 years) ▪ Received 1 st monthly reimbursement for 2021 Dixie Fire on 9/27 Liquidity Available when needed ▪ Utility conduct presumed prudent ▪ Can apply for recovery of claims above insurance but below $1B ▪ Self - insurance began in 2023 Cost Recovery Improved prudency standard 1 Reimbursement Maximum liability capped ▪ If found prudent: Wildfire Fund reimbursement not required ▪ If found imprudent: reimburse Wildfire Fund ▪ Obligation is capped at 20% of electric T&D equity rate base on a 3 Year rolling basis (~$4.1B) 3 Physical Risk Reduction Drives Financial Protections 1 Physical Risk Mitigations 2 Approved Wildfire Mitigation Plan (WMP) 3 Wildfire Safety Certification Endnotes are included in the Appendix

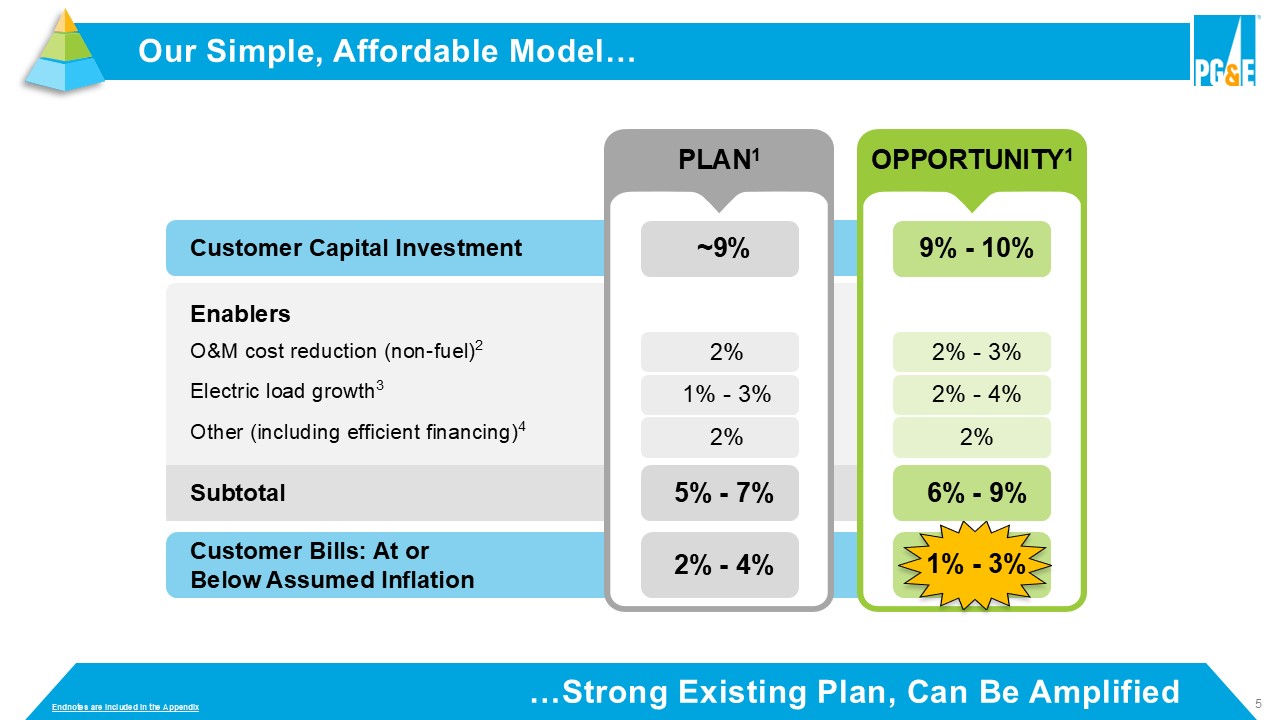

5 Subtotal Enablers O&M cost reduction (non - fuel) 2 Electric load growth 3 Other (including efficient financing) 4 Customer Capital Investment Customer Bills: At or Below Assumed Inflation Our Simple, Affordable Model… 2% 1% - 3% 2% ~9% 5% - 7% 2% - 4% PLAN 1 …Strong Existing Plan, Can Be Amplified 2% - 3% 2% - 4% 2% 9% - 10% 6% - 9% 1% - 3% 2% - 3% 2% - 4% 2% 9% - 10% 6% - 9% 1% - 3% OPPORTUNITY 1 Endnotes are included in the Appendix 1 % - 3%

6 Appendix 1: Presentation Endnotes Slide 4: AB 1054 In California 1. Prior to the enactment of AB 1054, utilities bore the burden of proving that their conduct was reasonable in order to obtain rec overy of costs through rates. AB 1054 changed the standard so that the conduct of a utility is deemed reasonable unless a party to the proceeding creates a serious doubt as to the reasonableness of the utility’s conduct. Reasonable conduct is no t l imited to the optimum practice, method, or act to the exclusion of others, but rather encompasses a spectrum of possible practices, methods, or acts consistent with utility system needs, the interest of the ratepayers, and the requiremen ts of governmental agencies of competent jurisdiction. 2. For fires in any calendar year. 3. Cap does not apply if Utility found to have acted with conscious or willful disregard of the rights and safety of others. Amo unt reflects 2024 electric transmission and distribution equity rate base. Slide 5: Our Simple, Affordable Model 1. These numbers are illustrative approximations and should not be interpreted as a guarantee of future performance. 2. The Utility’s cost reduction strategies include increased efficiency and waste elimination driven by implementing the Lean op era ting system, improving its work management, identifying additional opportunities to improve its capital - to - expense ratio, and an improved organizational design. Factors that may cause the Utility’s actual results to differ materially from i ts forecasts include whether the Utility can control its operating costs within the authorized levels of spending and timely recover its costs through rates; whether the Utility can achieve projected savings; the extent to which the Utility incurs un rec overable costs that are higher than the forecasts of such costs; and changes in cost forecasts or the scope and timing of planned work resulting from changes in customer demand for electricity and natural gas or other reasons. 2% reduction calculate d based on the prior year’s operating and maintenance costs, excluding non - core items; balancing account deferrals; redeployment above base plan; property taxes; write - offs for canceled work and the aborted Pacific Generation transac tion; and certain state - mandated programs where the Utility’s role is to facilitate achieving public policy goals regarding energy efficiency, the cost of which the Utility recovers. Reductions available for redeployment. 3. Expected drivers of forecasted electric load growth include electric vehicle adoption, data centers, and building electrifica tio n. 4. Factors that may cause the Utility’s actual results to differ materially from its forecasts include the ability of PG&E Corpo rat ion and the Utility to access capital markets and other sources of debt and equity financing in a timely manner on acceptable terms; their ability to raise financing through securitization transactions; actions by credit rating agencies to dow ngrade PG&E Corporation’s or the Utility’s credit ratings; the supply and price of electricity, natural gas, and nuclear fuel ; its use of self - insurance for wildfire liability insurance; and the impact of any changes in federal or state tax laws, policies , regulations, or their interpretation, and PG&E Corporation’s and the Utility’s ability to obtain efficient tax treatment . Slide titles are hyperlinks