Document

CYBIN INC.

STATEMENT OF EXECUTIVE COMPENSATION

For the financial year ended March 31, 2023

This statement of executive compensation (the “Statement”) for Cybin Inc. (the “Corporation”), dated August 18, 2023, is presented in accordance with National Instrument 51-102 – Continuous Disclosure Obligations and Form 51-102F6 – Statement of Executive Compensation.

This Statement will be included in the Corporation’s information circular to be mailed to its shareholders in connection with the Corporation’s 2023 annual meeting of shareholders. All amounts in this Statement are expressed in Canadian dollars unless otherwise noted.

COMPENSATION DISCUSSION AND ANALYSIS

The general objectives of the Corporation’s compensation strategy are to: (a) compensate management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long-term shareholder value; (b) align management’s interests with the long-term interests of shareholders; and (c) attract and retain highly qualified executive officers.

Management Contracts

The following is a description of the management contracts for the Named Executive Officers (as defined below):

Douglas Drysdale

Douglas Drysdale currently receives a base salary of US$500,000 per annum for his services as Chief Executive Officer of the Corporation. He has entered into an employment agreement (the “CEO Employment Agreement”) with the Corporation which is for an indefinite term and includes provisions relating to, among other things, base salary, eligibility for benefits, an annual performance bonus and equity awards. As per the CEO Employment Agreement, Mr. Drysdale is eligible to be considered for an annual performance bonus, currently for up to 65% of Mr. Drysdale’s base salary and shall be based on criteria established by the Board (defined below) and the Compensation Committee (defined below).

In the event that the CEO Employment Agreement is terminated without cause, the Corporation will pay to Mr. Drysdale a cash severance payment equal to six months base salary. Mr. Drysdale may terminate the CEO Employment Agreement by providing 30 days’ written notice to the Corporation. Assuming termination without cause occurred on the date of this Statement, the estimated severance payment to Mr. Drysdale would have been approximately US$250,000.

Greg Cavers, Eric So, Paul Glavine, and Aaron Bartlone

The following Named Executive Officers (as defined herein), serving in the following capacities, currently receive the following annual salaries:

1.Greg Cavers currently receives C$250,000 per annum for his services as Chief Financial Officer of the Corporation;

2.Eric So currently receives C$480,000 per annum for his services as President of the Corporation;

3.Paul Glavine currently receives C$480,000 per annum for his services as Chief Growth Officer of the Corporation; and

4.Aaron Bartlone currently receives US$300,000 per annum for his services as Chief Operating Officer of a subsidiary of the Corporation.

Each of such Named Executive Officers has entered into an agreement with the Corporation which is for an indefinite term and includes standard provisions relating to, among other things, base salary, eligibility for employee benefits, equity awards and confidentiality and intellectual property rights.

Mr. Cavers’ employment agreement provides that the Corporation may terminate his employment without cause provided, however, that if the Corporation terminates his employment without cause, the Corporation will provide Mr. Cavers with three months’ notice of termination (or pay in lieu), plus an additional one months’ notice (or pay in lieu) for each year of completed service with the Corporation. Assuming termination without cause occurred on the date of this Statement, the estimated severance payment to Mr. Cavers would have been approximately C$125,000.

Mr. So and Mr. Glavine’s consulting agreements provide that their respective agreements may be terminated on 24 months’ notice and upon payment of all accrued fees and other fees that would be due during such 24 month period. The agreements do not contain severance or change of control provisions.

Mr. Bartlone’s agreement provides that the Corporation may terminate his employment without cause provided, however, that if the Corporation terminates his employment without cause, the Corporation will provide Mr. Bartlone with eight months’ notice of termination (or pay in lieu), plus an additional one months’ notice (or pay in lieu) for each year of completed service with the Corporation, up to a maximum of twelve months. Assuming termination without cause occurred on the date of this Statement, the estimated severance payment to Mr. Bartlone would have been approximately US$250,000.

Elements of Compensation

The compensation of Named Executive Officers (as such term is defined below) is comprised of the following elements: (a) base salary; and (b) long-term equity incentives, consisting of Awards (as such term is defined below) granted under the Corporation’s equity incentive plan (the “Equity Incentive Plan”). These principal elements of compensation are described in further detail below.

1. Base Salary

Each Named Executive Officer (as such term is defined below) receives a base salary, which constitutes a significant portion of the Named Executive Officer’s compensation package. Base salary is provided in recognition for discharging day-to-day duties and responsibilities and reflects the Named Executive Officer’s performance over time, as well as that individual’s particular experience and qualifications. A Named Executive Officer’s base salary is reviewed by the board of directors of the Corporation (the “Board”) or the compensation committee of the Board (the “Compensation Committee”) on an annual basis and may be adjusted to take into account performance contributions for the year and to reflect sustained performance contributions over a number of years. At the discretion of the Board or the Compensation Committee, each of the Named Executive Officers is eligible to receive performance bonuses, which are contingent on the Named Executive Officer achieving certain performance objectives set annually by the Compensation Committee.

2. Equity Incentive Plan

On August 13, 2020, the Corporation received shareholder approval of the Equity Incentive Plan and on November 5, 2020, it was adopted by the Board. On August 16, 2021, certain amended to the Equity Incentive Plan were approved to better align the Equity Incentive Plan with policies of the Exchange. The Equity Incentive Plan permits the granting of (i) stock options (“Non-Qualified Stock Options”) and incentive stock options (“Incentive Stock Options” and, collectively with the Non-Qualified Stock Options, the “Options”), (ii) stock appreciation rights (“SARs”), (iii) restricted share awards (“Restricted Shares”), (iv) restricted share units (“RSUs”), (v) performance awards (“Performance Awards”), (vi) dividend equivalents (“Dividend Equivalents”) and (vii) other share based awards (collectively, the “Awards”). Awards are granted by either the Board or the Compensation Committee.

The Equity Incentive Plan is intended to promote the interests of the Corporation and its shareholders by aiding the Corporation in attracting and retaining employees, officers, consultants, advisors and non-employee directors capable of assuring the future success of the Corporation, to offer such persons incentives to put forth maximum efforts for the success of the Corporation’s business and to compensate such persons through various share and cash based arrangements and provide them with opportunities for share ownership in the Corporation, thereby aligning the interests of such persons with the shareholders.

Shares Subject to the Equity Incentive Plan

The Equity Incentive Plan is a rolling plan which, subject to the adjustment provisions provided for therein (including a subdivision or consolidation of the common shares of the Corporation (the “Common Shares”)), provides that the aggregate maximum number of Common Shares that may be issued under all Awards under the Equity Incentive Plan shall not exceed 20% of the Corporation’s issued and outstanding Common Shares from time to time, such number being 46,936,646 as at the date of this Statement. Notwithstanding the foregoing, the aggregate number of Common Shares that may be issued pursuant to awards of Incentive Stock Options shall not exceed 22,266,002.

The Equity Incentive Plan is considered an “evergreen” plan, since the Common Shares covered by Awards which have been exercised, settled or terminated shall be available for subsequent grants under the Equity Incentive Plan and the number of Awards available to grant increases as the number of issued and outstanding Common Shares increases.

As at the date of this Statement, a total of 40,826,675 Common Shares are issuable pursuant to Options granted under the Equity Incentive Plan, representing approximately 17.4% of the Corporation’s issued and outstanding Common Shares. An aggregate of 6,109,971 Common Shares (plus any Awards forfeited or cancelled) are available for issuance under the Equity Incentive Plan, representing approximately 2.6% of the Corporation’s issued and outstanding Common Shares as at the date of this Statement. As of the date of this Statement, a total of 12,985,400 Common Shares are issuable pursuant to Incentive Stock Options granted under the Equity Incentive Plan.

Eligibility

Any of the Corporation’s employees, officers, consultants, advisors and non-employee directors or any affiliate or person to whom an offer of employment or engagement with the Corporation is extended, are eligible to participate in the Equity Incentive Plan (the “Participants”). The basis of participation of an individual under the Equity Incentive Plan, and the type and amount of any Award that an individual will be entitled to receive under the Equity Incentive Plan, will be determined by the Compensation Committee based on its judgment as to the best interests of the Corporation and its shareholders, and therefore cannot be determined in advance.

If a Participant ceases to be an Eligible Person for any reason, whether for cause or otherwise, the Participant may, within 90 days following the date on which it ceased to be an Eligible Person, an investor relations person or holder of Incentive Stock Options, exercise any Option that was exercisable on the date the Participant ceased to be an Eligible Person. The Compensation Committee may extend such 90 day period subject to obtaining any approval required by the Exchange and subject to a maximum extension to the original expiry date of such Options. Any Option that was not exercisable on the date the Participant ceased to be an Eligible Person will be deemed to expire on such date, unless extended pursuant to the Equity Incentive Plan. Any Option that was exercisable on the date the Participant ceased to be an Eligible Person will be deemed to expire immediately following the 90 day period unless extended pursuant to the Equity Incentive Plan.

Administration of the Equity Incentive Plan

The Equity Incentive Plan shall be administered by the Compensation Committee. The Compensation Committee shall have full power and authority to designate Participant, the time or times at which awards may be granted, the conditions under which awards may be granted or forfeited to the Corporation, the number of Common Shares to be covered by any award, the exercise price of any award, whether restrictions or limitations are to be imposed on the Common Shares issuable pursuant to grants of any award, and the nature of any such restrictions or limitations, any acceleration of exercisability or vesting, or waiver of termination regarding any award, based on such factors as the Compensation Committee may determine.

In addition, the Compensation Committee interprets the Equity Incentive Plan and may adopt guidelines and other rules and regulations relating to the Equity Incentive Plan, and make all other determinations and take all other actions necessary or advisable for the implementation and administration of the Equity Incentive Plan.

Types of Awards

Options

Under the terms of the Equity Incentive Plan, unless the Compensation Committee determines otherwise in the case of an Option substituted for another Option in connection with a corporate transaction, the exercise price of the Options may not be lower than the greater of the closing market price of the Common Shares on the NEO Exchange Inc., now operating as Cboe Canada (the “NEO”) on (a) the trading day prior to the date of grant of the Options and (b) the date of grant of the Options. Options granted under the Equity Incentive Plan will be subject to such terms, including the exercise price and the conditions and timing of exercise, as may be determined by the Compensation Committee and specified in the applicable award agreement. The maximum term of an Option granted under the Equity Incentive Plan will be ten years from the date of grant. Payment in respect of the exercise of an Option may not be made, in whole or in part, with a promissory note.

Unless otherwise specified by the Compensation Committee the time of granting an Option and set forth in the particular Award Agreement, an exercise notice must be accompanied by payment of the exercise price. A participant may, in lieu of exercising an Option pursuant to an exercise notice, elect to surrender such Option to the Corporation (a “Cashless Exercise”) in consideration for an amount from the Corporation equal to (i) the Fair Market Value (as defined in the Equity Incentive Plan) of the Common Shares issuable on the exercise of such Option (or portion thereof) as of the date such Option (or portion thereof) is exercised, less (ii) the aggregate exercise price of the Option (or portion thereof) surrendered relating to such Common Shares (the “In-the-Money Amount”) by written notice to the Corporation indicating the number of Options such participant wishes to exercise using the Cashless Exercise, and such other information that the Corporation may require. Subject to the provisions of the Equity Incentive Plan, the Corporation will satisfy payment of the In-the-Money Amount by delivering to the participant such number of Common Shares having a fair market value equal to the In-the-Money Amount.

Restricted Shares and RSUs

Awards of Restricted Shares and RSUs shall be subject to such restrictions as the Compensation Committee may impose (including, without limitation, any limitation on the right to vote or the right to receive any dividend or other right or property with respect thereto), which restrictions may lapse separately or in combination at such time or times, in such installments or otherwise as the Compensation Committee may deem appropriate. Upon a Participant’s termination of employment or service or resignation or removal as a director (in either case, as determined under criteria established by the Compensation and Nominating Committee) during the applicable restriction period, all Restricted Shares and all RSUs held by such Participant at such time shall be forfeited and reacquired by the Corporation for cancellation at no cost to the Corporation; provided, however, that the Compensation Committee may waive in whole or in part any or all remaining restrictions with respect to shares of Restricted Share or RSUs. Pursuant to the policies of the NEO, the value ascribed to the Common Shares covered by the Restricted Share or RSU may not be lower than the greater of the closing market price of the Common Shares on (a) the trading day prior to the date of grant of the Restricted Shares or RSUs, and (b) the date of grant of the Restricted Shares or RSUs. Any Restricted Share or RSU granted under the Equity Incentive Plan shall be issued at the time such Awards are granted and may be evidenced in such manner as the Compensation Committee may deem appropriate.

Stock Appreciation Rights

A SAR granted under the Equity Incentive Plan shall confer on the Participant a right to receive upon exercise, the excess of (i) the Fair Market Value of one Common Share on the date of exercise over (ii) the grant price of the SAR as specified by the Compensation Committee (which price shall not be less than 100% of the Fair Market Value of one Common Share on the date of grant of the SAR); provided, however, that, subject to applicable law and stock exchange rules, the Compensation Committee may designate a grant price below Fair Market Value on the date of grant if the SAR is granted in substitution for a stock appreciation right previously granted by an entity that is acquired by or merged with the Corporation or an Affiliate. Notwithstanding the foregoing, pursuant to the rules of the NEO, Common Shares issued in connection with SARs may not be priced lower than the greater of the closing market prices of the Common Shares on (a) the trading day prior to the date of grant of the SAR, and (b) the date of grant of the SAR. Subject to the terms of the Equity Incentive Plan, the policies of the NEO and any applicable Award Agreement, the grant price, term, methods of exercise, dates of exercise, methods of settlement, equity compensation and any other terms and conditions of any SAR shall be as determined by the Compensation Committee. The Compensation Committee may impose such conditions or restrictions on the exercise of any SAR as it may deem appropriate. No SAR may be exercised more than ten years from the grant date.

Performance Awards

A Performance Award granted under the Equity Incentive Plan (i) may be denominated or payable in cash, Common Shares (including without limitation, Restricted Share and RSUs), other securities, other Awards or other property and (ii) shall confer on the holder thereof the right to receive payments, in whole or in part, upon the achievement of one or more objective performance goals during such performance periods as the Compensation Committee shall establish. Notwithstanding the foregoing, pursuant to the rules of the NEO, Performance Awards may not be priced lower than the greater of the closing market prices of the Common Shares on (a) the trading day prior to the date of grant of the Performance Award, and (b) the date of grant of the Performance Award. Subject to the terms of the Equity Incentive Plan and the policies of the NEO, the performance goals to be achieved during any performance period, the length of any performance period, the amount of any Performance Award granted, the amount of any payment or transfer to be made pursuant to any Performance Award and any other terms and conditions of any Performance Award shall be determined by the Compensation Committee.

Dividend Equivalents

A Dividend Equivalent granted under the Equity Incentive Plan allows Participants to receive payments (in cash, Common Shares, other securities, other Awards or other property as determined in the discretion of the Compensation Committee) equivalent to the amount of cash dividends paid by the Corporation to holders of Common Shares with respect to a number of Common Shares as determined by the Compensation Committee. Subject to the terms of the Equity Incentive Plan, the policies of the NEO and any applicable Award Agreement, such Dividend Equivalents may have such terms and conditions as the Compensation Committee shall determine. Notwithstanding the foregoing, (i) the Compensation Committee may not grant Dividend Equivalents to Eligible Persons in connection with grants of Options, SARs or other Awards the value of which is based solely on an increase in the value of the Common Shares after the date of grant of such Award, and (ii) dividend and Dividend Equivalent amounts may be accrued but shall not be paid unless and until the date on which all conditions or restrictions relating to such Award have been satisfied, waived or lapsed. Subject to the terms of the Equity Incentive Plan, the policies of the NEO and any applicable award agreement, such Dividend Equivalents may have such terms and conditions as the Compensation Committee shall determine, provided that pursuant to the rules of the NEO, Dividend Equivalents may not be priced lower than the greater of the closing market prices of the Common Shares on (a) the trading day prior to the date of grant of the Dividend Equivalent, and (b) the date of grant of the Dividend Equivalent.

Other Share-Based Awards

In addition, Awards may be granted under the Equity Incentive Plan that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to, Common Shares (including, without limitation, securities convertible into Common Shares), as are deemed by the Compensation Committee to be consistent with the purpose of the Equity Incentive Plan in accordance with applicable regulations, provided that pursuant to the rules of the NEO, such Awards may not be priced lower than the greater of the closing market prices of the Common Shares on (a) the trading day prior to the date of grant of the Award, and (b) the date of grant of the Award.

Term

While the Equity Incentive Plan does not stipulate a specific term for Awards granted thereunder, awards may not expire beyond 10 years from its date of grant, except where shareholder approval is received or where an expiry date would have fallen within a blackout period of the Corporation. All awards must vest and settle in accordance with the provisions of the Equity Incentive Plan and any applicable award agreement, which award agreement may include an expiry date for a specific award.

In the event an Award expires, at a time when a scheduled blackout is in place or an undisclosed material change or material fact in the affairs of the Corporation exists, the expiry of such award will be the date that is 10 business days after which such scheduled blackout terminates or there is no longer such undisclosed material change or material fact.

Non-Transferability of Awards

No Award and no right under any such Award shall be transferable by a Participant other than by will or by the laws of descent and distribution, and no Award (other than fully vested and unrestricted Shares issued pursuant to any Award) or right under any such Award may be pledged, alienated, attached or otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance thereof shall be void and unenforceable against the Corporation or any Affiliate. The Compensation Committee may also establish procedures as it deems appropriate for a Participant to designate a person or persons, as beneficiary or beneficiaries, to exercise the rights of the Participant and receive any property distributable with respect to any Award in the event of the Participant’s death. In the event of a Participant’s death, any unexercised, options issued to such Participant shall be exercisable within a period of one year next succeeding the year in which the Participant died, unless such exercise period is extended by the Compensation Committee and approval is obtained from the stock exchange on which the Shares then trade, as applicable.

Compensation of Directors

Independent members of the Board are paid C$50,000 annually, which amount is paid quarterly. In addition, the independent lead director receives an additional annual cash fee of C$15,000. Directors of the Corporation are also compensated for their services through the granting of stock options and other equity incentives, and may also be reimbursed for out-of-pocket expenses incurred in carrying out their duties as directors.

Officers of the Corporation who also act as directors will not receive any additional compensation for services rendered in such capacity, other than as paid by the Corporation in their capacity as officers.

Compensation Risk

The Board and, as applicable, the Compensation Committee, considers and assesses the implications of risks associated with the Corporation’s compensation policies and practices and devotes such time and resources as is believed to be necessary in the circumstances.

The Corporation’s practice of compensating its officers primarily through a mix of salary, bonus and stock options is designed to mitigate risk by: (i) ensuring that the Corporation retains such officers; and (ii) aligning the interests of its officers with the short-term and long-term objectives of the Corporation and its shareholders. As at the date of this Statement, the Board had not identified risks arising from the Corporation’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Corporation.

Financial Instruments

Pursuant to the terms of the Corporation’s Insider Trading Policy, the Corporation’s officers and directors are prohibited from purchasing financial instruments, such as prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by an officer or director.

Compensation Governance

In order to assist the Board in fulfilling its oversight responsibilities with respect to compensation matters, the Board has established the Compensation Committee and has reviewed and approved the Compensation Committee’s Charter. The Compensation Committee is composed of Eric So, Mark Lawson and Grant Froese. Mr. So is not considered “independent”, as such term is defined in National Instrument 58-101 – Disclosure of Corporate Governance Practices.

The Compensation Committee meets on compensation matters as and when required with respect to executive compensation. The primary goal of the Compensation Committee as it relates to compensation matters is to ensure that the compensation provided to the Named Executive Officers and the Corporation’s other executive officers is determined with regard to the Corporation’s business strategies and objectives, such that the financial interest of the executive officers is aligned with the financial interest of shareholders, and to ensure that their compensation is fair and reasonable and sufficient to attract and retain qualified and experienced executives. The Compensation Committee is given the authority to engage and compensate any outside advisor that it determines to be necessary to carry out its duties.

As a whole, the members of the Compensation Committee have direct experience and skills relevant to their responsibilities in executive compensation, including with respect to enabling the Compensation Committee in making informed decisions on the suitability of the Corporation’s compensation policies and practices. All three members have experience on the board of directors and related committees of other public companies.

Grant Froese – Grant Froese completed a 38-year career with Canadian retail giant Loblaw Companies Limited where he last served as Chief Operating Officer until his retirement. During his career at Loblaw, he led operations, merchandising and had oversight of supply chain, ecommerce, and marketing functions. Most recently, Grant was the CEO of Harvest One., where he was responsible for oversight of all aspects of the company’s production, operations and financial matters including, the review and approval of quarterly and annual financial statements, AIF, MD&A, and related corporate disclosures. Mr. Froese is the principal consultant at Grey Wolf Management Services Inc. and sits on the board of several companies. Mr. Froese has a Diploma in Business Administration.

Mark Lawson – Mr. Lawson was previously an investment banker with Morgan Stanley in New York where he was involved in the execution of over C$6 billion worth of mergers and acquisitions, C$8 billion worth of debt offerings and C$500 million of equity financings in the healthcare, energy, technology, and media & telecom sector. Mr. Lawson is currently the Head of Carbon Acquisition for Invert, a company that funds global carbon reduction and removal projects, and is building a platform that puts the power to fight climate change in your hands. He received his Bachelor of Arts in Statistical Sciences from The University of Western Ontario, Canada, and his MBA in Finance from The Richard Ivey School of Business, University of Western Ontario, Canada. Mr. Lawson was previously the Chief Financial Officer of a TSXV listed company.

Eric So – Mr. So is a veteran owner and operator of various public and private companies over the last 15 years and has led C-level corporate strategy, development and finance at all stages of the business life cycle from start-up to high growth and multinational.

He began his career practicing in the areas of corporate commercial, securities, finance and mergers and acquisitions at Torys LLP.

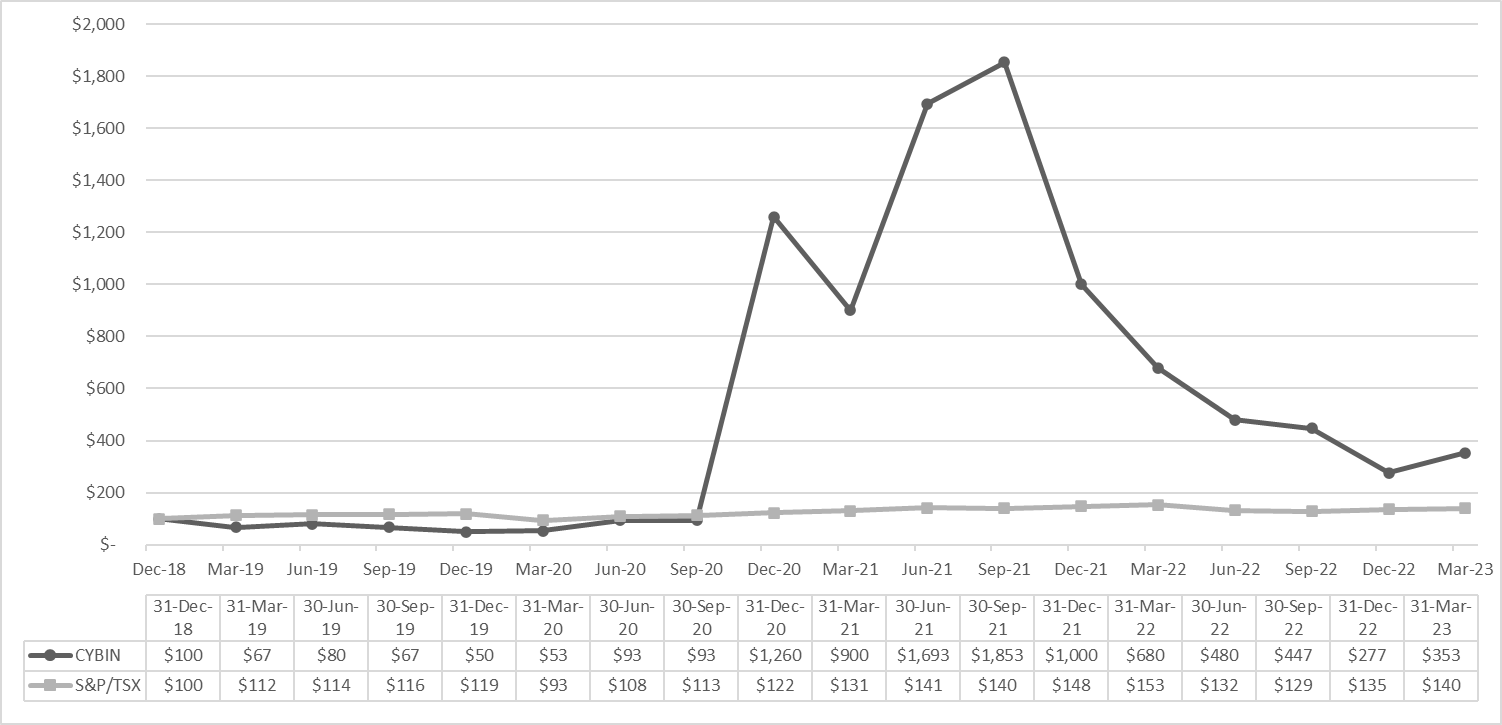

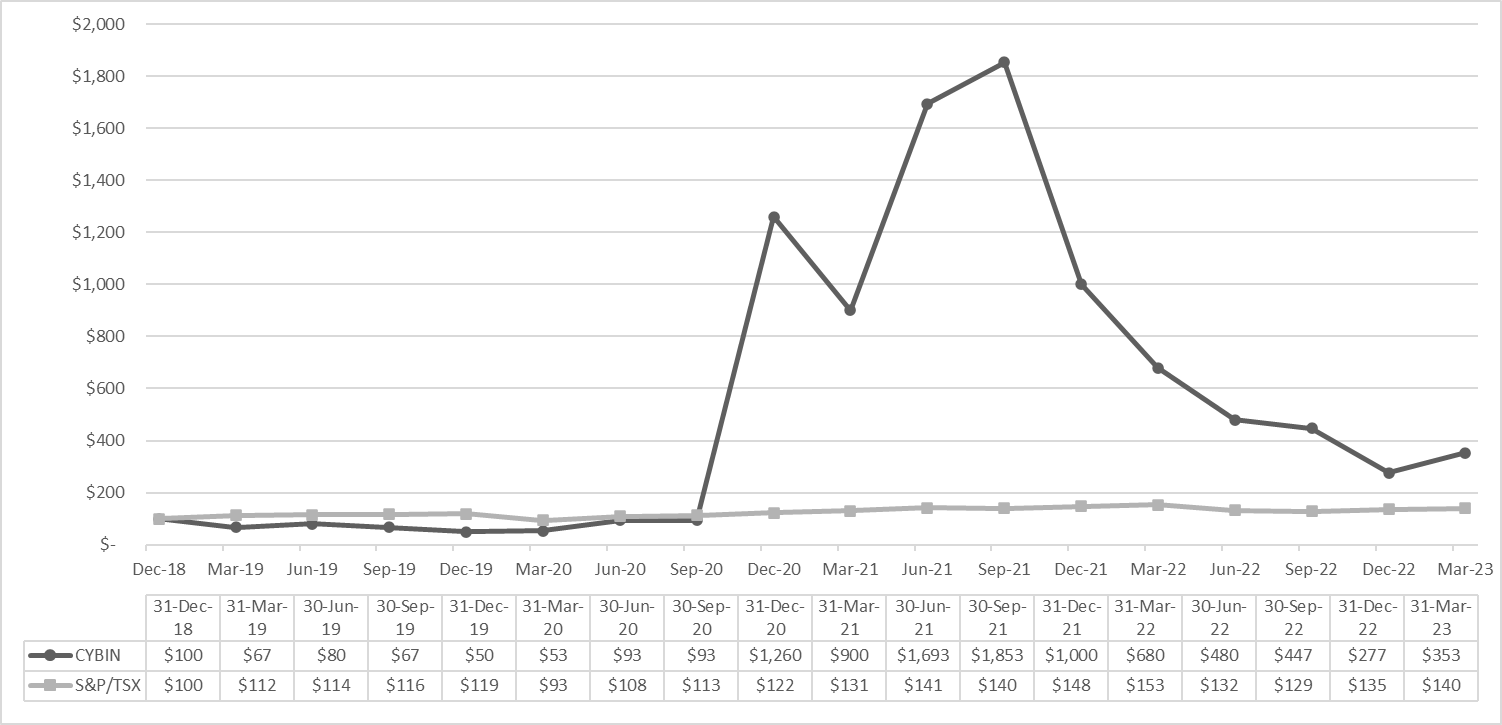

PERFORMANCE GRAPH

The following graph compares the percentage change in the cumulative shareholder return on the Common Shares compared to the cumulative total return of the S&P/TSX Composite Index for the period commencing on December 31, 2018 to March 31, 2023 based on the price of the Common Shares, assuming a C$100 investment on December 31, 2018 and reinvestment of dividends. From December 31, 2018 to June 29, 2020 (the date the Common Shares were halted in connection with the announcement of the reverse take-over of the Corporation by Cybin Corp. (the “Transaction”)), the performance reflected is that of Clarmin Explorations Inc., the Corporation’s predecessor business, and is not reflective of the Corporation’s business or performance since the completion of the Transaction on November 5, 2020 and the listing of its Common Shares on the Exchange on November 10, 2020.

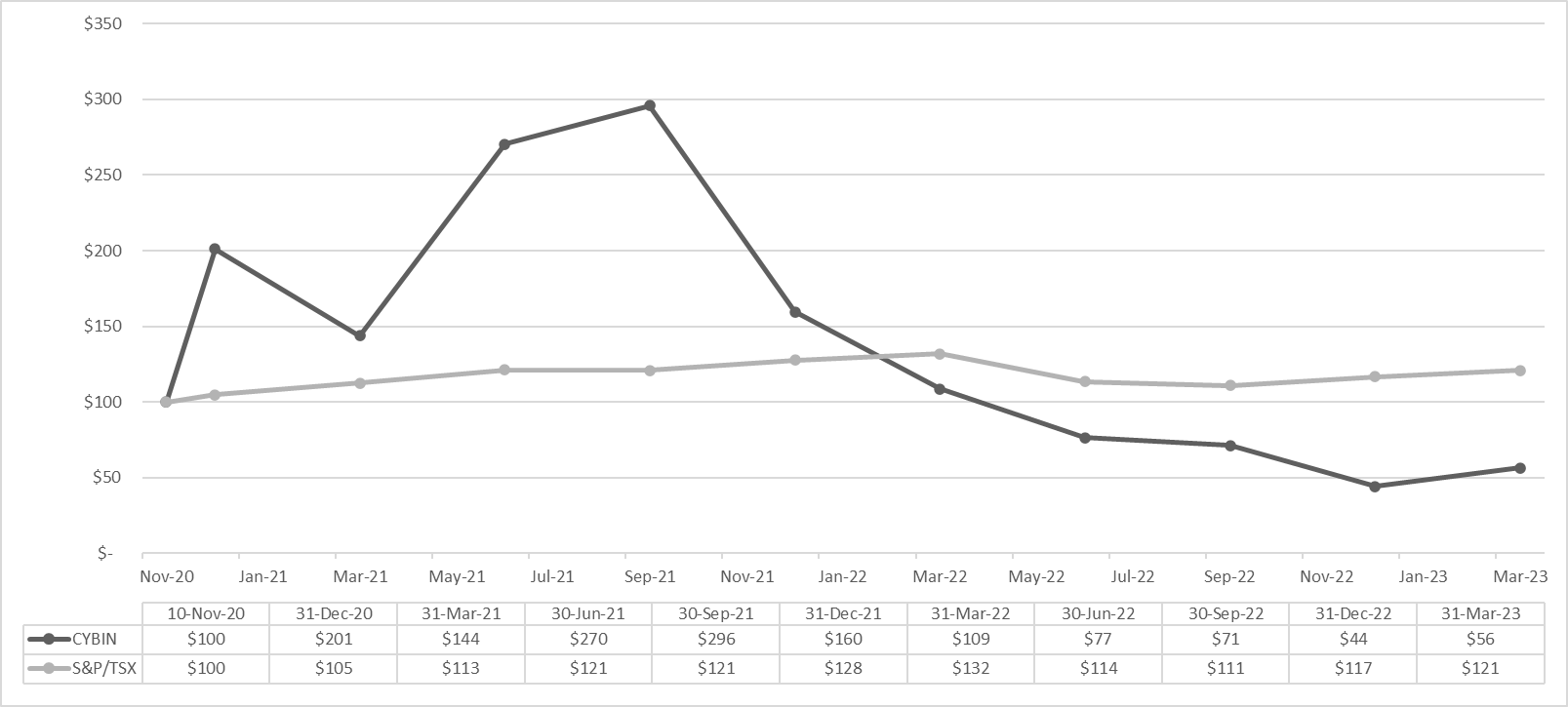

The Corporation’s total shareholder return for the period from the completion of the Transaction to March 31, 2023 was -44%. Between 2020 and 2023, the Corporation completed a series of financings that provided it with a net cash position as at March 31, 2023 of C$16.6 million. The Board has not, as of the date of this Statement, determined any incentive payments based on the Corporation’s results for 2023, including its total shareholders’ return, but it is anticipated that as part of the compensation and governance review, the Board will consider and approve incentive payments that take into account these factors. As the completion of the Transaction marked the beginning of the current business of the Corporation, the Corporation considers its share performance since completion of the Transaction to be pertinent to its shareholders. Therefore, the next graph compares the percentage change in the cumulative shareholder return on the Common Shares commencing with the listing of the Common Shares on the Exchange on November 10, 2020 to March 31, 2023, compared to the cumulative total return of the S&P/TSX Composite Index for the same period, assuming a C$100 investment on November 10, 2020 and reinvestment of dividends.

SUMMARY COMPENSATION TABLE

Named Executive Officers

In this Statement, a “Named Executive Officer” means: (a) the Chief Executive Officer of the Corporation at any time during the 2023 fiscal year; (b) the Chief Financial Officer of the Corporation at any time during the 2023 fiscal year; (c) the three other most highly compensated executive officers of the Corporation at the end of the financial year ended March 31, 2023 whose total compensation, individually, was greater than C$150,000; and (d) each individual who would be a Named Executive Officer but for the fact that the individual was neither an executive officer of the Corporation or its subsidiaries, nor serving in a similar capacity, at the end of the financial year ended March 31, 2023.

For the financial year ended March 31, 2023, the Corporation had the following Named Executive Officers: (a) Doug Drysdale, Chief Executive Officer; (b) Greg Cavers, Chief Financial Officer; (c) Eric So, President; (d) Paul Glavine, Chief Growth Officer; and (e) Aaron Bartlone, Chief Operating Officer. The following table presents the compensation earned by the Named Executive Officers for the years ended March 31, 2023, 2022 and 2021. All amounts are in Canadian dollars.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and principal position |

Year(1) |

Salary/Fee

(C$) |

Share-based awards

(C$) |

Option-based awards

(C$)(2) |

Non-equity incentive plan compensation

(C$) |

Pension value

(C$) |

All other compensa-tion

(C$) |

Total compensa-tion

(C$) |

| Annual incentive plans |

Long-term incentive plans |

|

Douglas Drysdale,(3)

Chief Executive Officer

|

2023

2022

2021

|

661,600

549,319

276,648(4)

|

-

-

-

|

-

1,805,921

1,607,422

|

169,000

150,000

340,832(4)

|

-

-

-

|

-

-

-

|

3,573

-

-

|

834,173

2,505,240

2,224,902

|

|

Greg Cavers,(5)

Chief Financial Officer

|

2023

2022

2021

|

250,000

223,750

158,670

|

-

-

-

|

-

478,212

229,432

|

75,000

40,000

50,000

|

-

-

-

|

-

-

-

|

4,200

2,800

-

|

329,200

744,762

438,102

|

|

Eric So,(6)

President

|

2023

2022

2021

|

480,000

480,000

290,000

|

-

-

-

|

-

534,533

804,435

|

144,000

150,000

999,722(10)

|

-

-

-

|

-

-

-

|

-

-

-

|

624,000

1,164,533

2,094,157

|

|

Paul Glavine,(7)

Chief Growth Officer

|

2023

2022

2021

|

480,000

480,000

290,000

|

-

-

-

|

-

534,533

804,435

|

144,000

150,000

999,722(10)

|

-

-

-

|

-

-

-

|

-

-

-

|

624,000

1,164,533

2,094,157

|

|

Aaron Bartlone, (8)

Chief Operating Officer

|

2023

2022

2021

|

396,960

374,880

91,169

|

-

-

-

|

-

523,936

612,464

|

115,000

-

-

|

-

-

-

|

-

-

-

|

3,573

2,249

-

|

515,533

901,065

703,633

|

Notes:

(1) In connection with closing of the Transaction, the Corporation changed its year-end from July 31 to March 31.

(2) Calculated based on the Black-Scholes model for option valuation.

(3) Mr. Drysdale commenced employment with Cybin Corp. in August 2020 and was appointed as Chief Executive Officer of the Corporation effective November 5, 2020. Mr. Drysdale’s salary is paid in U.S. dollars and has been converted to Canadian dollars for the purpose of this Statement using the Bank of Canada daily exchange rate as of March 31. For the period ended March 31, 2023, an exchange rate of 1.3232 was applied.

(4) The period of compensation during the 2021 financial year for Mr. Drysdale was less than 12 months; on an annualized basis, his base salary would have been C$385,631.

(5) Prior to November 5, 2020, Mr. Cavers was the Chief Financial Officer of Cybin Corp. In connection with the Transaction, Cybin Corp. became a wholly-owned subsidiary of the Corporation. The salaries above include those paid to Mr. Cavers by both the Corporation and Cybin Corp. Mr. Cavers was appointed as Chief Financial Officer of the Corporation effective November 5, 2020.

(6) Prior to November 5, 2020, Mr. So was the President of Cybin Corp. In connection with the Transaction, Cybin Corp. became a wholly-owned subsidiary of the Corporation. The salaries above include those paid to Mr. So by both the Corporation and Cybin Corp. Mr. So was appointed as President of the Corporation effective November 5, 2020.

(7) Prior to November 5, 2020, Mr. Glavine was the Chief Operating Officer of Cybin Corp. In connection with the Transaction, Cybin Corp. became a wholly-owned subsidiary of the Corporation. The salaries above include those paid to Mr. Glavine by both the Corporation and Cybin Corp. Mr. Glavine was appointed as Chief Operating Officer of the Corporation effective November 5, 2020. On March 29, 2021, Mr. Glavine ceased to be the Chief Operating Officer and was appointed as Chief Growth Officer of the Corporation.

(8) Mr. Bartlone commenced employment with Cybin Corp. in December 2020 and was appointed Chief Operating Officer of a subsidiary of the Corporation on March 25, 2021. Mr. Bartlone’s salary is paid in U.S. dollars and has been converted to Canadian dollars for the purpose of this Statement using the Bank of Canada daily exchange rate as of March 31. For the period ended March 31, 2023, an exchange rate of 1.3232 was applied.

(9) The period of compensation during the 2021 financial year for Mr. Bartlone was less than 12 months; on an annualized basis, his base salary would have been C$304,944, applying the Bank of Canada daily exchange rate as of March 31, 2021 of 1.2575.

(10) Amount includes C$724,722 related to warrants issued on June 15, 2020 with an exercise price of C$0.25. The warrants vested on issuance and expire on June 15, 2025. Fair value calculated based on the Black-Scholes model for warrant valuation. The fair value of the warrants has been calculated based on the following weighted average assumptions (the grant date fair value equals the accounting fair value for stock options):

|

|

|

|

|

|

| Grant Date: |

June 15, 2020 |

| Risk free interest rate |

1.82% |

| Dividend yield |

0% |

| Volatility factor |

95% |

| Average expected life |

5 |

| Fair value (rounded) |

C$0.18 |

INCENTIVE PLAN AWARDS

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth all share-based and option-based awards outstanding for the Named Executive Officers as of March 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option-Based Awards |

Share-Based Awards |

| Name |

Number of securities underlying unexercised options

(#) |

Option exercise price

(C$) |

Option expiration date |

Value of unexercised in-the-money options(1)

(C$) |

Number of shares or units of shares that have not vested

(#) |

Market or payout value of share based awards that have not vested

(C$) |

Market or payout value of vested share-based awards not paid out or distributed

(C$) |

|

Douglas Drysdale,

Chief Executive Officer

|

3,000,000

800,000

169,000

|

C$0.75

C$2.90

C$1.13

|

October 12, 2025

June 28, 2026

March 4, 2027

|

-

-

-

|

- |

- |

- |

|

Greg Cavers,

Chief Financial Officer

|

150,000

150,000

200,000

75,000

|

C$0.25

C$1.89

C$2.90

C$1.13

|

June 15, 2025

December 28, 2025

June 28, 2026

March 4, 2027

|

42,000

-

-

-

|

- |

- |

- |

|

Eric So,

President

|

1,500,000

200,000

144,000

|

C$0.75

C$2.90

C$1.13

|

November 4, 2025

June 28, 2026

March 4, 2027

|

-

-

-

|

- |

- |

- |

|

Paul Glavine,

Chief Growth Officer

|

1,500,000

200,000

144,000

|

C$0.75

C$2.90

C$1.13

|

November 4, 2025

June 28, 2026

March 4, 2027

|

-

-

-

|

- |

- |

- |

|

Aaron Bartlone

Chief Operating Officer

|

225,000

225,000

300,000

115,000

|

C$1.89

C$1.36

C$2.48

C$1.13

|

January 2, 2026

March 28, 2026

August 18, 2026

March 4, 2027

|

-

-

-

-

|

- |

- |

- |

Note:

(1) The “value of unexercised in-the-money options” is calculated based on the difference between the closing price of C$0.53 for the Common Shares on the Exchange on the last trading day of the year ended March 31, 2023 and the exercise price of the options, multiplied by the number of unexercised options.

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth the value of all incentive plan awards vested or earned for each Named Executive Officer during the year ended March 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Option-based awards – Value vested during the year(1)

(C$)

|

Share-based awards – Value vested during the year

(C$)

|

Non-equity incentive plan compensation – Value earned during the year

(C$)

|

|

Douglas Drysdale,

Chief Executive Officer

|

- |

- |

169,000 |

|

Greg Cavers,

Chief Financial Officer

|

- |

- |

75,000 |

|

Eric So,

President

|

5,625 |

- |

144,000 |

|

Paul Glavine,

Chief Growth Officer

|

5,625 |

- |

144,000 |

|

Aaron Bartlone,

Chief Operating Officer

|

- |

- |

115,000 |

Note:

(1) The “value vested during the year” is calculated as the aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date based on the difference between the closing price for the Common Shares on the Exchange, as applicable, as of the date of vesting (or the most recent closing price on the exchange, if applicable) and the exercise price of the options, multiplied by the number of vested options.

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets forth all amounts of compensation provided to the directors of the Corporation (other than directors who are also Named Executive Officers) during the financial year ended March 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Fees

Earned

(C$)

|

Share-based awards

(C$) |

Option-based awards

(C$) |

All other compensation

(C$) |

Total

(C$) |

| Grant Froese |

50,000 |

- |

- |

- |

50,000 |

| Eric Hoskins |

50,000 |

- |

- |

- |

50,000 |

| Mark Lawson |

50,000 |

- |

- |

- |

50,000 |

| Theresa Firestone |

65,000 |

- |

- |

- |

65,000 |

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth all awards outstanding for each of the directors of the Corporation (other than directors who are also Named Executive Officers) as of March 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option-Based Awards |

Share-Based Awards |

| Name |

Number of securities underlying unexercised options

(#) |

Option exercise price

(C$) |

Option expiration

date |

Value of unexercised in-the-money options(1)

(C$) |

Number of shares or units of shares that have not vested

(#) |

Market or payout value of share based awards that have not vested(2)

(C$) |

Market or payout value of vested share-based awards not paid out or distributed

(C$) |

| Grant Froese |

195,000 |

C$1.89 |

December 28, 2025 |

- |

- |

- |

- |

| Eric Hoskins |

195,000 |

C$1.89 |

December 28, 2025 |

- |

- |

- |

- |

| Mark Lawson |

220,000 |

C$1.89 |

December 28, 2025 |

- |

- |

- |

- |

| Theresa Firestone |

195,000 |

C$2.87 |

September 27, 2026 |

- |

- |

- |

- |

Notes:

(1) The “value of unexercised in-the-money options” is calculated based on the difference between the closing price of C$0.53 for the Common Shares on the Exchange on the last trading day of the year ended March 31, 2023 and the exercise price of the options, multiplied by the number of unexercised options.

(2) The “market or payout value of share-based awards that have not vested” is calculated based on the closing price of C$0.53 for the Common Shares on the Exchange on the last trading day of the year ended March 31, 2023 multiplied by the number of Common Shares that have not vested.

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth the value of all incentive plan awards vested or earned by each director of the Corporation (other than directors who are also named Executive Officers) during the year ended March 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Option-based awards – Value vested during the year

(C$) |

Share-based awards – Value vested during

the year(1)

(C$) |

Non-equity incentive plan compensation – Value earned during the year

(C$) |

| Grant Froese |

- |

- |

- |

| Eric Hoskins |

- |

- |

- |

| Mark Lawson |

- |

- |

- |

| Theresa Firestone |

- |

- |

- |

Note:

(1) The “value vested during the year” is calculated based on the difference between the closing price for the Common Shares on the Exchange as of the date of vesting (or the most recent closing price on the Exchange) and the exercise price of the options, multiplied by the number of vested options.